UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

| |

FORM 10-Q |

| |

(Mark One) | |

þ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF |

THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the Quarterly Period Ended September 30, 2006 |

| |

OR |

| |

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF |

THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the transition period from to |

| |

| Commission File Number 1-14174 |

| |

AGL RESOURCES INC. |

| (Exact name of registrant as specified in its charter) |

| |

Georgia | 58-2210952 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

Ten Peachtree Place NE, Atlanta, Georgia 30309 |

| (Address and zip code of principal executive offices) |

| |

404-584-4000 |

| (Registrant's telephone number, including area code) |

| |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨ |

| |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. (Check one): Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer ¨ |

| |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes ¨ No þ |

| |

| Indicate the number of shares outstanding of each of the issuer's classes of common stock as of the latest practicable date. |

Class | Outstanding as of October 20, 2006 |

| Common Stock, $5.00 Par Value | 77,696,090 |

AGL RESOURCES INC.

Quarterly Report on Form 10-Q

For the Quarter Ended September 30, 2006

Item Number | | Page(s) |

| | | |

| | PART I - FINANCIAL INFORMATION | 3-50 |

| | | |

| 1 | Condensed Consolidated Financial Statements (Unaudited) | 3-6 |

| | Condensed Consolidated Balance Sheets | 3 |

| | Condensed Consolidated Statements of Income | 4 |

| | Condensed Consolidated Statements of Common Shareholders’ Equity and Comprehensive Income | 5 |

| | Condensed Consolidated Statements of Cash Flows | 6 |

| | Notes to Condensed Consolidated Financial Statements | 7-21 |

| | Note 1 - Accounting Policies and Methods of Application | 7-9 |

| | Note 2 - Risk Management | 10 |

| | Note 3 - Regulatory Assets and Liabilities | 11 |

| | Note 4 - Employee Benefit Plans | 12 |

| | Note 5 - Stock-based Compensation Plans | 12-15 |

| | Note 6 - Common Shareholders’ Equity | 15 |

| | Note 7 - Debt | 16 |

| | Note 8 - Commitments and Contingencies | 17 |

| | Note 9 - Segment Information | 18-21 |

| 2 | Management's Discussion and Analysis of Financial Condition and Results of Operations | 22-45 |

| | Forward-Looking Statements | 22 |

| | Overview | 22-23 |

| | Results of Operations | 23-41 |

| | AGL Resources | 23-29 |

| | Distribution Operations | 29-31 |

| | Retail Energy Operations | 31-34 |

| | Wholesale Services | 34-39 |

| | Energy Investments | 39-40 |

| | Corporate | 41 |

| | Liquidity and Capital Resources | 42-45 |

| | Critical Accounting Policies and Estimates | 45 |

| | Accounting Developments | 45 |

| 3 | Quantitative and Qualitative Disclosures About Market Risk | 46-49 |

| 4 | Controls and Procedures | 50 |

| | | |

| | PART II - OTHER INFORMATION | 50-52 |

| | | |

| 1 | Legal Proceedings | 50 |

| 2 | Unregistered Sales of Equity Securities and Use of Proceeds | 51 |

| 6 | Exhibits | 52 |

| | | |

| | SIGNATURE | 53 |

PART I - Financial Information Item 1. Financial Statements | |

| |

CONDENSED CONSOLIDATED BALANCE SHEETS | |

(UNAUDITED) | |

| | | | | | | | |

In millions, except share data | | September 30, 2006 | | December 31, 2005 | | September 30, 2005 | |

Current assets | | | | | | | | | | |

| Cash and cash equivalents | | $ | 14 | | $ | 32 | | $ | 58 | |

| Receivables (less allowance for uncollectible accounts of $16 at Sep. 30, 2006, $15 at Dec. 31, 2005 and $13 at Sep. 30, 2005) | | | 500 | | | 1,220 | | | 839 | |

| Inventories | | | 627 | | | 543 | | | 518 | |

| Unrecovered environmental remediation costs - current | | | 28 | | | 31 | | | 29 | |

| Unrecovered pipeline replacement program costs - current | | | 26 | | | 27 | | | 24 | |

| Energy marketing and risk management assets | | | 174 | | | 103 | | | 161 | |

| Other | | | 143 | | | 78 | | | 190 | |

| Total current assets | | | 1,512 | | | 2,034 | | | 1,819 | |

Property, plant and equipment | | | | | | | | | | |

| Property, plant and equipment | | | 4,943 | | | 4,791 | | | 4,727 | |

| Less accumulated depreciation | | | 1,538 | | | 1,458 | | | 1,424 | |

| Property, plant and equipment-net | | | 3,405 | | | 3,333 | | | 3,303 | |

Deferred debits and other assets | | | | | | | | | | |

| Goodwill | | | 425 | | | 420 | | | 405 | |

| Unrecovered pipeline replacement program costs | | | 258 | | | 276 | | | 331 | |

| Unrecovered environmental remediation costs | | | 151 | | | 165 | | | 180 | |

| Other | | | 89 | | | 85 | | | 112 | |

| Total deferred debits and other assets | | | 923 | | | 946 | | | 1,028 | |

Total assets | | $ | 5,840 | | $ | 6,313 | | $ | 6,150 | |

Current liabilities | | | | | | | | | | |

| Payables | | $ | 540 | | $ | 1,041 | | $ | 820 | |

| Short-term debt | | | 441 | | | 522 | | | 344 | |

| Accrued expenses | | | 88 | | | 105 | | | 118 | |

| Energy marketing and risk management liabilities | | | 59 | | | 117 | | | 318 | |

| Accrued pipeline replacement program costs - current | | | 35 | | | 30 | | | 47 | |

| Accrued environmental remediation costs - current | | | 14 | | | 13 | | | 8 | |

| Other | | | 139 | | | 133 | | | 152 | |

| Total current liabilities | | | 1,316 | | | 1,961 | | | 1,807 | |

Accumulated deferred income taxes | | | 535 | | | 423 | | | 412 | |

Long-term liabilities | | | | | | | | | | |

| Accrued pipeline replacement program costs | | | 212 | | | 235 | | | 270 | |

| Accumulated removal costs | | | 160 | | | 156 | | | 155 | |

| Accrued pension obligations | | | 93 | | | 88 | | | 87 | |

| Accrued environmental remediation costs | | | 88 | | | 84 | | | 90 | |

| Accrued postretirement benefit costs | | | 45 | | | 52 | | | 54 | |

| Other | | | 139 | | | 162 | | | 177 | |

| Total long-term liabilities | | | 737 | | | 777 | | | 833 | |

Commitments and contingencies (Note 8) | | | | | | | | | | |

Minority interest | | | 37 | | | 38 | | | 31 | |

Capitalization | | | | | | | | | | |

| Long-term debt | | | 1,634 | | | 1,615 | | | 1,616 | |

| Common shareholders’ equity, $5 par value; 750,000,000 shares authorized | | | 1,581 | | | 1,499 | | | 1,451 | |

| Total capitalization | | | 3,215 | | | 3,114 | | | 3,067 | |

Total liabilities and capitalization | | $ | 5,840 | | $ | 6,313 | | $ | 6,150 | |

See Notes to Condensed Consolidated Financial Statements (Unaudited).

AGL RESOURCES INC. AND SUBSIDIARIES | |

CONDENSED CONSOLIDATED STATEMENTS OF INCOME | |

(UNAUDITED) | |

| | | | |

| | | Three months ended | | Nine months ended | |

| | | September 30, | | September 30, | |

| | 2006 | | 2005 | | 2006 | | 2005 | |

| Operating revenues | | $ | 434 | | $ | 393 | | $ | 1,914 | | $ | 1,736 | |

| Operating expenses | | | | | | | | | | | | | |

| Cost of gas | | | 190 | | | 191 | | | 1,064 | | | 972 | |

| Operation and maintenance | | | 111 | | | 106 | | | 341 | | | 334 | |

| Depreciation and amortization | | | 33 | | | 33 | | | 101 | | | 99 | |

| Taxes other than income | | | 10 | | | 9 | | | 30 | | | 30 | |

| Total operating expenses | | | 344 | | | 339 | | | 1,536 | | | 1,435 | |

| Operating income | | | 90 | | | 54 | | | 378 | | | 301 | |

| Other (expense) income | | | - | | | - | | | (2 | ) | | 2 | |

| Interest expense | | | (32 | ) | | (27 | ) | | (91 | ) | | (79 | ) |

| Minority interest | | | - | | | (2 | ) | | (19 | ) | | (18 | ) |

| Earnings before income taxes | | | 58 | | | 25 | | | 266 | | | 206 | |

| Income taxes | | | 22 | | | 10 | | | 101 | | | 79 | |

| Net income | | $ | 36 | | $ | 15 | | $ | 165 | | $ | 127 | |

| | | | | | | | | | | | | | |

| Basic earnings per common share | | $ | 0.46 | | $ | 0.19 | | $ | 2.13 | | $ | 1.64 | |

| Diluted earnings per common share | | $ | 0.46 | | $ | 0.19 | | $ | 2.12 | | $ | 1.62 | |

| Cash dividends paid per common share | | $ | 0.37 | | $ | 0.31 | | $ | 1.11 | | $ | 0.93 | |

| Weighted-average number of common shares outstanding | | | | | | | | | | | | | |

| Basic | | | 77.5 | | | 77.5 | | | 77.6 | | | 77.2 | |

| Diluted | | | 77.9 | | | 78.1 | | | 78.1 | | | 77.8 | |

See Notes to Condensed Consolidated Financial Statements (Unaudited).

AGL RESOURCES INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF COMMON SHAREHOLDERS’ EQUITY AND COMPREHENSIVE INCOME (UNAUDITED) | |

| | | | | | | | | | | Accumulated | | | | | |

| | | | | | | Premium on | | | | other | | Shares | | | |

| | | Common Stock | | common | | Retained | | comprehensive | | Held in | | | |

In millions, except per share amount | | Shares | | Amount | | shares | | Earnings | | income | | Treasury | | Total | |

| Balance as of December 31, 2005 | | | 77.8 | | $ | 389 | | $ | 655 | | $ | 508 | | $ | (53 | ) | $ | - | | $ | 1,499 | |

| Comprehensive income: | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | | - | | | - | | | - | | | 165 | | | - | | | - | | | 165 | |

| Unrealized gain from hedging activities (net of taxes of $5) | | | - | | | - | | | - | | | - | | | 10 | | | - | | | 10 | |

| Total comprehensive income | | | | | | | | | | | | | | | | | | | | | 175 | |

| Dividends on common shares ($1.11 per share) | | | - | | | - | | | 1 | | | (87 | ) | | - | | | 2 | | | (84 | ) |

| Benefit, dividend reinvestment and share purchase plans | | | 0.3 | | | 1 | | | 2 | | | - | | | - | | | - | | | 3 | |

| Issuance of treasury shares | | | 0.4 | | | - | | | (3 | ) | | (2 | ) | | - | | | 13 | | | 8 | |

| Purchase of treasury shares | | | (0.7 | ) | | - | | | - | | | - | | | - | | | (26 | ) | | (26 | ) |

| Stock-based compensation expense (net of tax benefit of $2) | | | - | | | - | | | 6 | | | - | | | - | | | - | | | 6 | |

| Balance as of September 30, 2006 | | | 77.8 | | $ | 390 | | $ | 661 | | $ | 584 | | $ | (43 | ) | $ | (11 | ) | $ | 1,581 | |

See Notes to Condensed Consolidated Financial Statements (Unaudited).

| |

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | |

(UNAUDITED) | |

| | | | |

| | | Nine months ended | |

| | | September 30, | |

In millions | | 2006 | | 2005 | |

Cash flows provided by (used in) operating activities | | | | | |

| Net income | | $ | 165 | | $ | 127 | |

| Adjustments to reconcile net income to net cash flow provided by operating activities | | | | | | | |

| Depreciation and amortization | | | 101 | | | 99 | |

| Minority interest | | | 19 | | | 18 | |

| Deferred income taxes | | | 112 | | | (25 | ) |

| Change in risk management assets and liabilities | | | (129 | ) | | 140 | |

| Changes in certain assets and liabilities | | | | | | | |

| Receivables | | | 720 | | | 43 | |

| Inventories | | | (84 | ) | | (187 | ) |

| Payables | | | (501 | ) | | 94 | |

| Other | | | (62 | ) | | (121 | ) |

| Net cash flow provided by operating activities | | | 341 | | | 188 | |

Cash flows provided by (used in) investing activities | | | | | | | |

| Property, plant and equipment expenditures | | | (190 | ) | | (194 | ) |

| Sale of ownership interest in Saltville Gas Storage Company, LLC | | | - | | | 66 | |

| Other | | | 5 | | | 8 | |

| Net cash flow used in investing activities | | | (185 | ) | | (120 | ) |

Cash flows provided by (used in) financing activities | | | | | | | |

| Payment of notes payable to Trusts | | | (150 | ) | | - | |

| Payments and borrowings of short-term debt | | | (81 | ) | | 11 | |

| Dividends paid on common shares | | | (84 | ) | | (72 | ) |

| Distributions to minority interest | | | (22 | ) | | (19 | ) |

| Purchase of treasury shares | | | (26 | ) | | - | |

| Issuance of senior notes | | | 175 | | | - | |

| Sale of treasury shares | | | 8 | | | - | |

| Sale of common stock | | | 3 | | | 20 | |

| Other | | | 3 | | | 1 | |

| Net cash flow used in financing activities | | | (174 | ) | | (59 | ) |

| Net (decrease) increase in cash and cash equivalents | | | (18 | ) | | 9 | |

| Cash and cash equivalents at beginning of period | | | 32 | | | 49 | |

| Cash and cash equivalents at end of period | | $ | 14 | | $ | 58 | |

Cash paid during the period for | | | | | | | |

| Interest (net of allowance for funds used during construction) | | $ | 78 | | $ | 62 | |

| Income taxes | | $ | 33 | | $ | 48 | |

See Notes to Condensed Consolidated Financial Statements (Unaudited).

AGL RESOURCES INC. AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

Note 1

Accounting Policies and Methods of Application

General

AGL Resources Inc. is an energy services holding company that conducts substantially all of its operations through its subsidiaries. Unless the context requires otherwise, references to “we,” “us,” “our” or the “company” are intended to mean consolidated AGL Resources Inc. and its subsidiaries (AGL Resources).

We have prepared the accompanying unaudited condensed consolidated financial statements under the rules of the Securities and Exchange Commission (SEC). Under such rules and regulations, we have condensed or omitted certain information and notes normally included in financial statements prepared in conformity with accounting principles generally accepted in the United States of America (GAAP). However, the condensed consolidated financial statements reflect all adjustments that are, in the opinion of management, necessary for a fair presentation of our financial results for the interim periods. You should read these condensed consolidated financial statements in conjunction with our consolidated financial statements and related notes included in our Annual Report on Form 10-K, as amended, for the year ended December 31, 2005, filed with the SEC on June 1, 2006.

Due to the seasonal nature of our business, our results of operations for the three and nine months ended September 30, 2006 and 2005 and our financial position as of December 31, 2005 and September 30, 2006 and 2005 are not necessarily indicative of the results of operations and financial condition to be expected as of or for any other period.

Basis of Presentation

Our condensed consolidated financial statements include our accounts, the accounts of our majority-owned and controlled subsidiaries and the accounts of variable interest entities for which we are the primary beneficiary. All significant intercompany items have been eliminated in consolidation. Certain amounts from prior periods have been reclassified and revised to conform to the current period presentation. Specifically, $63 million of negative salvage previously presented at December 31, 2005 and September 30, 2005 in accumulated depreciation has been presented in accumulated removal costs for all balance sheet dates presented herein.

We currently own a non-controlling 70% financial interest in SouthStar Energy Services LLC (SouthStar), and Piedmont Natural Gas Company (Piedmont) owns the remaining 30%. Our 70% interest is non-controlling because all significant management decisions require approval by both owners.

We are the primary beneficiary of SouthStar’s activities and have determined that SouthStar is a variable interest entity as defined by the Financial Accounting Standards Board (FASB) Interpretation No. 46, “Consolidation of Variable Interest Entities,” as revised in December 2003 (FIN 46R). We determined that SouthStar was a variable interest entity because our equal voting rights with Piedmont are not proportional to our economic obligation to absorb 75% of any losses or residual returns from SouthStar. In addition, SouthStar obtains substantially all its transportation capacity for delivery of natural gas through our wholly owned subsidiary, Atlanta Gas Light Company (Atlanta Gas Light).

Prior to our sale of our 50% interest in Saltville Gas Storage Company, LLC (Saltville) in August 2005, we used the equity method to account for and report our interest in Saltville. Saltville was a joint venture with Duke Energy Corporation to develop a high-deliverability natural gas storage facility in Saltville, Virginia. We used the equity method because we exercised significant influence over, but did not control, the entity and because we were not the primary beneficiary as defined by FIN 46R.

Inventories

Sequent Energy Management, L.P. (Sequent) and SouthStar account for their natural gas inventories at the lower of weighted average cost or market. Sequent and SouthStar evaluate the average cost of their natural gas inventories against market prices and determine whether any declines in market prices below the average cost are other than temporary. For any declines considered to be other than temporary, adjustments are recorded to reduce the weighted average cost of the natural gas inventory to market. Consequently, as a result of declining natural gas prices Sequent recorded adjustments of $20 million for the three months, and $33 million for the nine months ended September 30, 2006, against its cost of sales to reduce the value of its inventory to market value. Sequent and SouthStar were not required to make similar adjustments in the same periods last year.

Comprehensive Income

Our comprehensive income includes net income plus other comprehensive income (OCI). This includes other gains and losses affecting shareholders’ equity that are excluded from net income under GAAP. Such items consist primarily of unrealized gains and losses on certain derivatives designated as cash flow hedges. The following tables illustrate our OCI activity for the three and nine months ended September 30, 2006 and 2005.

| | | Three months ended | |

| | | September 30, | |

In millions | | 2006 | | 2005 | |

| Cash flow hedges (1): | | | | | | | |

| Net derivative unrealized gains (losses) arising during the period (net of taxes of $3 in 2006 and $1 in 2005) | | $ | 6 | | $ | (1 | ) |

| Less reclassification of realized losses (gains) included in income (net of taxes of $1 in 2006 and $2 in 2005) | | | 1 | | | (3 | ) |

| Total | | $ | 7 | | $ | (4 | ) |

| | | Nine months ended | |

| | | September 30, | |

In millions | | 2006 | | 2005 | |

| Cash flow hedges (1): | | | | | | | |

| Net derivative unrealized gains (losses) arising during the period (net of taxes of $6 in 2006 and $1 in 2005) | | $ | 12 | | $ | (2 | ) |

| Less reclassification of realized gains included in income (net of taxes of $1 in 2006 and $4 in 2005) | | | (2 | ) | | (6 | ) |

| Total | | $ | 10 | | $ | (8 | ) |

Earnings per Common Share

We compute basic earnings per common share by dividing our net income by the weighted-average number of common shares outstanding daily. Diluted earnings per common share reflect the potential reduction in earnings per common share that could occur when potential dilutive common shares are added to common shares outstanding.

We derive our potential dilutive common shares by calculating the number of shares issuable under restricted stock, restricted share units and stock options. The future issuance of shares underlying the restricted stock and restricted share units depends on the satisfaction of certain performance criteria. The future issuance of shares underlying the outstanding stock options depends upon whether the exercise prices of the stock options are less than the average market price of the common shares for the respective periods. The following table shows the calculation of our diluted shares, assuming restricted stock and restricted stock units currently awarded under the plan ultimately vest and stock options currently exercisable at prices below the average market prices are exercised.

| | | Three months ended September 30, | |

In millions | | 2006 | | 2005 | |

| Denominator for basic earnings per share (1) | | | 77.5 | | | 77.5 | |

| Assumed exercise of restricted stock, restricted stock units and stock options | | | 0.4 | | | 0.6 | |

| Denominator for diluted earnings per share | | | 77.9 | | | 78.1 | |

| (1) | Daily weighted-average shares outstanding |

| | | Nine months ended September 30, | |

In millions | | 2006 | | 2005 | |

| Denominator for basic earnings per share (1) | | | 77.6 | | | 77.2 | |

| Assumed exercise of restricted stock, restricted stock units and stock options | | | 0.5 | | | 0.6 | |

| Denominator for diluted earnings per share | | | 78.1 | | | 77.8 | |

| (1) | Daily weighted-average shares outstanding |

Accounting pronouncements issued but not yet adopted

FIN 48 In July 2006, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standard (SFAS) Interpretation No. (FIN) 48, “Accounting for Uncertainty in Income Taxes - an interpretation of SFAS Statement No. 109” (FIN 48).

FIN 48 applies to all “tax positions” accounted for under SFAS No. 109, “Accounting for Income Taxes” (SFAS 109). FIN 48 refers to the term “tax position” as a position taken in a previously filed tax return or a position expected to be taken in a future tax return that is reflected in measuring current or deferred income tax assets and liabilities reported in the financial statements. FIN 48 further clarifies the term “tax position” to include (1) a decision not to file a tax return in a particular jurisdiction for which a return might be required, (2) an allocation or a shift of income between taxing jurisdictions, (3) the characterization of income or a decision to exclude reporting taxable income in a tax return, or (4) a decision to classify a transaction, entity, or other position in a tax return as tax exempt.

FIN 48 clarifies that a tax benefit may be reflected in the financial statements only if it is “more likely than not” that the company will be able to sustain the tax return position, based on its technical merits. If a tax benefit meets this criterion, it should be measured and recognized based on the largest amount of benefit that is cumulatively greater than fifty percent likely to be realized. This is a change from current practice where companies may recognize a tax benefit if it is probable a tax position will be sustained.

FIN 48 also requires that we make qualitative and quantitative disclosures, including discussion of reasonable possible changes that might occur in the unrecognized tax benefits over the next 12 months; a description of open tax years by major jurisdictions; and a roll-forward of all unrecognized tax benefits, presented as a reconciliation of the beginning and ending balances of the unrecognized tax benefits on an aggregated basis.

This statement will be effective for us on January 1, 2007 and will require us to record any change in net assets that results from the adoption of FIN 48 as an adjustment to the opening balance of retained earnings. We are evaluating the impact that the adoption of FIN 48 will have on our consolidated results of operations, cash flows and financial position.

SFAS 157 In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (SFAS 157). SFAS 157 establishes a framework for measuring fair value and requires expanded disclosures about fair value measurements.

SFAS 157 bases fair value on the price in a transaction between market participants to sell an asset or transfer a liability in the principal or most advantageous market available for the asset or liability. SFAS 157 primarily focuses on the price at which to sell an asset or transfer a liability in order to exit such activity as opposed to the price to purchase the asset or transfer the liability in order to enter such activity.

SFAS 157 will be effective for us on January 1, 2008. All valuation adjustments will be recognized as a cumulative-effect adjustment to the opening balance of retained earnings for the fiscal year in which SFAS 157 is initially applied. We are currently evaluating the impact that SFAS 157 will have on our consolidated results of operations, cash flows and financial position.

SFAS 158 In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans” (SFAS 158). SFAS 158 requires that we recognize all obligations related to defined benefit pensions and other postretirement benefits. This statement will require that we quantify the plan’s funding status as an asset or a liability on our consolidated balance sheets.

SFAS 158 requires that we measure the plan’s assets and obligations that determine our funded status as of the end of the fiscal year. We will also be required to recognize as a component of OCI the changes in funded status that occurred during the year that are not recognized as part of net periodic benefit cost as explained in SFAS No. 87, “Employers’ Accounting for Pensions,” or SFAS No. 106, “Employers’ Accounting for Postretirement Benefits Other Than Pensions.”

We will adopt SFAS 158 on December 31, 2006. We are currently assessing the impact SFAS 158 will have on our consolidated financial statements. Based on the funded status of our defined benefit pension and postretirement benefit plans as of December 31, 2005, (our most recent measurement date) we would report an increase to our OCI of $15 - $20 million, an increase of $15 - $20 million to accrued pension obligations and a reduction of $5 - $10 million to accumulated deferred income taxes. We will finalize these amounts and make the appropriate adjustments for the 2006 activity when we receive a new actuarial report for the year ending December 31, 2006. Based on the range of estimated adjustments through December 31, 2005, we do not expect our adoption of SFAS 158 on December 31, 2006, to have an impact on our earnings.

Note 2

Risk Management

Our risk management activities are monitored by our Risk Management Committee (RMC). The RMC consists of members of senior management and is charged with reviewing our risk management activities and overseeing enforcement of our risk management policies. Our risk management policies limit the use of derivative financial instruments and physical transactions within predefined risk tolerances associated with pre-existing or anticipated physical natural gas sales and purchases and system use and storage. We use the following derivative financial instruments and physical transactions to manage commodity price and weather risks:

| · | storage and transportation capacity transactions |

In September 2006, SouthStar entered into weather derivative contracts as an economic hedge of operating margins in the event of warmer-than-normal weather in the upcoming heating season, primarily from November through March. SouthStar accounts for these contracts using the intrinsic value method under the guidelines of Emerging Issues Task Force 99-02, “Accounting for Weather Derivatives.” SouthStar had no weather derivatives outstanding as of September 30, 2005 and December 31, 2005.

There have been no other significant changes to our risk management activities, as described in Note 4 to our Consolidated Financial Statements in Item 8 of our Annual Report on Form 10-K, as amended, for the year ended December 31, 2005.

Regulatory Assets and Liabilities

We have recorded regulatory assets and liabilities in our consolidated balance sheets in accordance with SFAS No. 71, “Accounting for the Effects of Certain Types of Regulation.” There have been no significant changes to the nature of our regulatory assets and liabilities since December 31, 2005. Our regulatory assets and liabilities at December 31, 2005 are described in Note 5 to our Consolidated Financial Statements in Item 8 of our Annual Report on Form 10-K, as amended, for the year ended December 31, 2005. Our regulatory assets, associated assets, regulatory liabilities, and associated liabilities are summarized in the table below:

In millions | | Sept. 30, 2006 | | Dec. 31, 2005 | | Sept. 30, 2005 | |

Regulatory assets | | | | | | | |

| Unrecovered pipeline replacement program costs | | $ | 284 | | $ | 303 | | $ | 355 | |

| Unrecovered environmental remediation costs (ERC) | | | 179 | | | 196 | | | 209 | |

| Unrecovered postretirement benefit costs | | | 13 | | | 14 | | | 14 | |

| Unrecovered seasonal rates | | | 10 | | | 11 | | | 10 | |

| Elizabethtown Gas hedging program | | | 20 | | | - | | | - | |

| Unrecovered purchased gas adjustment | | | 8 | | | 8 | | | 4 | |

| Other | | | 15 | | | 10 | | | 8 | |

Total regulatory assets | | $ | 529 | | $ | 542 | | $ | 600 | |

Associated assets | | | | | | | | | | |

| Elizabethtown Gas hedging program | | $ | - | | $ | 17 | | $ | 43 | |

Total regulatory and associated assets | | $ | 529 | | $ | 559 | | $ | 643 | |

Regulatory liabilities | | | | | | | | | | |

| Accumulated removal costs | | $ | 160 | | $ | 156 | | $ | 155 | |

| Deferred purchased gas adjustment | | | 16 | | | 40 | | | 45 | |

| Unamortized investment tax credit | | | 18 | | | 19 | | | 19 | |

| Regulatory tax liability | | | 17 | | | 17 | | | 13 | |

| Elizabethtown Gas hedging program | | | - | | | 17 | | | 43 | |

| Other | | | 2 | | | 6 | | | 7 | |

Total regulatory liabilities | | | 213 | | | 255 | | | 282 | |

Associated liabilities | | | | | | | | | | |

| PRP costs | | | 247 | | | 265 | | | 317 | |

| ERC | | | 93 | | | 88 | | | 94 | |

| Elizabethtown Gas hedging program | | | 20 | | | - | | | - | |

Total associated liabilities | | | 360 | | | 353 | | | 411 | |

Total regulatory and associated liabilities | | $ | 573 | | $ | 608 | | $ | 693 | |

Employee Benefit Plans

Pension Benefits We sponsor two tax qualified defined benefit retirement plans for our eligible employees: the AGL Resources Inc. Retirement Plan and the NUI Corporation Retirement Plan. A defined benefit plan specifies the amount of benefits an eligible participant eventually will receive using information about the participant. The following are the combined cost components of our two pension plans for the periods indicated:

| | | Three months ended | |

| | | September 30, | |

In millions | | 2006 | | 2005 | |

| Service cost | | $ | 1 | | $ | 2 | |

| Interest cost | | | 5 | | | 7 | |

| Expected return on plan assets | | | (7 | ) | | (8 | ) |

| Recognized actuarial loss | | | 2 | | | 2 | |

| Net cost | | $ | 1 | | $ | 3 | |

| | | Nine months ended | |

| | | September 30, | |

In millions | | 2006 | | 2005 | |

| Service cost | | $ | 5 | | $ | 7 | |

| Interest cost | | | 18 | | | 20 | |

| Expected return on plan assets | | | (23 | ) | | (24 | ) |

| Net amortization | | | (1 | ) | | (1 | ) |

| Recognized actuarial loss | | | 6 | | | 5 | |

| Net cost | | $ | 5 | | $ | 7 | |

Our employees do not contribute to the retirement plans. We fund the plans by contributing at least the minimum amount required by applicable regulations and as recommended by our actuary. However, we may also contribute in excess of the minimum required amount. We calculate the minimum amount of funding using the projected unit credit cost method. We are not required to make any contribution to our pension plans in 2006, but we made a voluntary contribution of $5 million to the AGL Resources Inc. Retirement Plan in October 2006.

Postretirement Benefits We sponsor two defined benefit postretirement health care plans for our eligible employees: the AGL Resources Inc. Postretirement Health Care Plan and the NUI Corporation Postretirement Health Care Plan. Eligibility for these benefits is based on age and years of service. The following are the combined cost components of these two postretirement benefit plans for the periods indicated:

| | | Three months ended | |

| | | September 30, | |

In millions | | 2006 | | 2005 | |

| Service cost | | $ | - | | $ | - | |

| Interest cost | | | 1 | | | 1 | |

| Expected return on plan assets | | | (1 | ) | | (1 | ) |

| Prior service cost | | | (1 | ) | | (1 | ) |

| Net cost | | $ | (1 | ) | $ | (1 | ) |

| | | Nine months ended | |

| | | September 30, | |

In millions | | 2006 | | 2005 | |

| Service cost | | $ | - | | $ | 1 | |

| Interest cost | | | 4 | | | 4 | |

| Expected return on plan assets | | | (3 | ) | | (3 | ) |

| Prior service cost | | | (3 | ) | | (3 | ) |

| Recognized actuarial loss | | | 1 | | | 1 | |

| Net cost | | $ | (1 | ) | $ | - | |

Note 5

Stock-based Compensation Plans

Effective January 1, 2006, we adopted SFAS 123(R), “Share Based Payment” (SFAS 123R), using the modified prospective application transition method; accordingly, financial results for the prior periods presented were not retroactively adjusted to reflect the effects of SFAS 123R.

Prior to January 1, 2006, we accounted for our share-based payment transactions in accordance with SFAS No. 123, “Accounting for Stock-Based Compensation,” as amended by SFAS No. 148, “Accounting for Stock-Based Compensation- Transition and Disclosure.” This allowed us to follow Accounting Principles Board (APB) Opinion No. 25, “Accounting for Stock Issued to Employees” (APB 25) and related interpretations in accounting for our stock-based compensation plans.

SFAS 123R requires us to measure and recognize stock-based compensation expense in our financial statements based on the estimated fair value at the date of grant for our share-based awards, which include performance shares and stock options. Performance share awards contain market conditions. Both performance share and stock option awards contain a service condition. In accordance with SFAS 123R, we recognize compensation expense over the requisite service period for:

| · | awards granted on or after January 1, 2006; and |

| · | unvested awards previously granted and outstanding as of January 1, 2006. |

In addition, we estimate forfeitures over the requisite service period when recognizing compensation expense. These estimates are adjusted to the extent that actual forfeitures differ, or are expected to materially differ, from such estimates.

In 2005, we did not record compensation expense related to our stock option grants in our financial statements, which is consistent with the APB 25 requirements. However, at the end of each reporting period, we recorded compensation expense over the requisite service period for our other stock-based and cash unit awards. The following tables provide additional information on compensation costs and income tax benefits related to our compensation awards. We recorded these amounts in our condensed consolidated statements of income for the three and nine months ended September 30, 2006 and 2005.

| | | Three months ended | |

| | | September 30, | |

In millions | | 2006 | | 2005 | |

| Compensation costs | | $ | 2 | | $ | 1 | |

| Income tax benefits | | | 1 | | | 2 | |

| | | Nine months ended | |

| | | September 30, |

In millions | | | 2006 | | | 2005 | |

| Compensation costs | | $ | 7 | | $ | 5 | |

| Income tax benefits | | | 2 | | | 4 | |

Prior to our adoption of SFAS 123R, benefits of tax deductions in excess of recognized compensation costs were reported as operating cash flows. SFAS 123R requires excess tax benefits to be reported as a financing cash inflow rather than as a reduction of taxes paid. For the nine months ended September 30, 2006, our cash flow used in financing activities included an immaterial amount for benefits of tax deductions in excess of recognized compensation costs. For the same period last year, we included $4 million of such benefits in cash flow provided by operating activities.

If stock-based compensation expense for the three and nine months ended September 30, 2005 had been recorded based on the fair value of the awards at the grant dates consistent with the method prescribed by SFAS 123, which has been superseded by SFAS 123R, our net income and earnings per share for the three and nine months ended September 30, 2005 would have been reduced to the amounts shown in the following table:

| | | Three months ended | |

In millions, except per share amounts | | September 30, 2005 | |

| Net income, as reported | | $ | 15 | |

| Deduct: Total stock-based employee compensation expense determined under fair value-based method for all awards, net of related tax effect | | | (1 | ) |

| Pro-forma net income | | $ | 14 | |

| | | | | |

| Earnings per share: | | | | |

| Basic - as reported | | $ | 0.19 | |

| Basic - pro-forma | | $ | 0.18 | |

| | | | | |

| Diluted - as reported | | $ | 0.19 | |

| Diluted - pro-forma | | $ | 0.18 | |

| | | Nine months ended | |

In millions, except per share amounts | | September 30, 2005 | |

| Net income, as reported | | $ | 127 | |

| Deduct: Total stock-based employee compensation expense determined under fair value-based method for all awards, net of related tax effect | | | (2 | ) |

| Pro-forma net income | | $ | 125 | |

| | | | | |

| Earnings per share: | | | | |

| Basic - as reported | | $ | 1.64 | |

| Basic - pro-forma | | $ | 1.62 | |

| | | | | |

| Diluted - as reported | | $ | 1.62 | |

| Diluted - pro-forma | | $ | 1.60 | |

Incentive and Nonqualified Stock Options

We grant incentive and nonqualified stock options with a strike price equal to the fair market value on the date of the grant. Stock options generally have a three-year vesting period. As of September 30, 2006, our Board of Directors had authorized 10 million shares to be granted as stock options. Nonqualified options generally become fully exercisable not earlier than six months after the date of grant and generally expire 10 years after the date of grant. Participants realize value from option grants only to the extent that the fair market value of our common stock on the date of exercise of the option exceeds the fair market value of the common stock on the date of the grant. Compensation expense associated with stock options is generally recorded over the option vesting period; however, for unvested options that are granted to employees who are retirement eligible, the remaining compensation expense is recorded in the current period rather than over the remaining vesting period.

As of September 30, 2006, we had $4 million of total unrecognized compensation costs related to stock options. These costs are expected to be recognized over the remaining average requisite service period of approximately 2 years. Cash received from stock option exercises for the nine months ended September 30, 2006 was $9 million, and the income tax benefit from stock option exercises was $2 million. The following tables summarize activity during the nine months ended September 30, 2006 related to grants of stock options for key employees and nonemployee directors.

| Stock Options | | | | | | | | | |

| | | Number of Options | | Weighted Average Exercise Price | | Weighted Average Remaining Life (in years) | | Aggregate Intrinsic Value (in millions) | |

| Outstanding - December 31, 2005 | | | 2,221,245 | | $ | 27.79 | | | 6.8 | | | | |

| Granted | | | 906,898 | | | 35.79 | | | 9.4 | | | | |

| Exercised | | | (367,305 | ) | | 24.84 | | | 5.2 | | | | |

| Forfeited | | | (261,418 | ) | | 34.91 | | | 8.7 | | | | |

| Outstanding - September 30, 2006 | | | 2,499,420 | | $ | 30.39 | | | 7.4 | | $ | 15 | |

| | | | | | | | | | | | | | |

| Exercisable - September 30, 2006 | | | 1,178,163 | | $ | 25.20 | | | 5.4 | | $ | 13 | |

| Unvested Stock Options | | | | | | | | | |

| | | Number of Unvested Options | | Weighted Average Exercise Price | | Weighted Average Remaining Vesting Period (in years) | | Weighted Average Fair Value | |

| Outstanding - December 31, 2005 | | | 945,556 | | $ | 33.64 | | | 2.1 | | $ | 4.72 | |

| Granted | | | 906,898 | | | 35.79 | | | 2.4 | | | 4.79 | |

| Forfeited | | | (252,099 | ) | | 34.96 | | | 1.7 | | | 4.96 | |

| Vested | | | (279,098 | ) | | 32.91 | | | - | | | 4.55 | |

| Outstanding - September 30, 2006 | | | 1,321,257 | | $ | 35.02 | | | 2.0 | | $ | 4.76 | |

In accordance with the fair value method of determining compensation expense, we use the Black-Scholes option pricing model. Below are the ranges for per share value and information about the underlying assumptions used in developing the grant date value for each of the grants made during the nine months ended September 30, 2006 and 2005.

| | | Nine months ended September 30, | |

| | | 2006 | | 2005 | |

| Expected life (years) | | | 7 | | | 7 | |

| Risk-free interest rate % (1) | | | 4.4 - 5.1 | | | 3.9 - 4.2 | |

| Expected volatility % (2) | | | 15.0 - 15.9 | | | 17.1-17.3 | |

| Dividend yield % (4) | | | 3.8 - 4.2 | | | 3.2 - 3.8 | |

| | | | | | | | |

| Fair value of options granted (3) | | | $4.64 - $5.76 | | | $5.16 - $6.19 | |

| (1) | US Treasury constant maturity - 7 years |

(2) Volatility is measured over 7 years, the expected life of the options, Weighted average for the nine months ended September 30, 2006 and 2005 were 15.8% and 17.2%, respectively.

(3) Represents per share value.

(4) Weighted average dividend yields for the nine months ended September 30, 2006 and 2005 were 4.1% and 3.4%, respectively

Intrinsic value for options is defined as the difference between the current market value and the grant price. Total intrinsic value of options exercised during the nine months ended September 30, 2006 and 2005 was $4 million and $10 million, respectively. We use shares purchased under our share repurchase program to satisfy share-based exercises to the extent that repurchased shares are available. Otherwise, we issue new shares from our authorized common stock.

Stock and Restricted Stock Awards

Stock Awards Under the 1996 Non-Employee Directors Equity Compensation Plan (Directors Plan), each non-employee director receives an annual retainer. The amount and form of the annual retainer are fixed by resolution of the Board of Directors. Effective in January 2006, the annual retainer was increased from $60,000 to $90,000, of which (1) $30,000 is payable in cash or, at the election of each director, in shares of our common stock or is deferred and invested in common stock equivalents under the 1998 Common Stock Equivalent Plan for Non-Employee Directors (CSE Plan) and (2) $60,000 is payable, at the election of each director, in shares of our common stock or deferred under the CSE Plan. Upon initial election to our Board of Directors, each non-employee director receives 1,000 shares of common stock as of the first day of his or her service. Shares issued under the Directors Plan are 100% vested and nonforfeitable as of the date of grant.

Restricted Stock Awards In general, we refer to an award of our common stock that is subject to time-based vesting or achievement of performance measures as “restricted stock.” Restricted stock awards are subject to certain transfer restrictions and forfeiture upon termination of employment. The following table summarizes activity during the nine months ended September 30, 2006 related to restricted stock awards for our key employees.

| Restricted Stock Awards | | Shares of Restricted Stock | | Weighted Average Remaining Vesting Period (in years) | | Weighted Average Fair Value | |

| Outstanding - December 31, 2005 | | | 120,728 | | | 2.3 | | $ | 34.33 | |

| Issued | | | 193,395 | | | 2.4 | | | 35.63 | |

| Forfeited | | | (30,466 | ) | | 1.8 | | | 34.44 | |

| Vested | | | (34,597 | ) | | - | | | 34.37 | |

| Outstanding - September 30, 2006 | | | 249,060 | | | 2.2 | | $ | 35.32 | |

Performance Units A performance unit is an award of the right to receive either (1) shares of our common stock or (2) cash, subject in each case to the achievement of certain pre-established performance criteria. Performance units are subject to certain transfer restrictions and forfeiture upon termination of employment. In the first quarter of 2006, we granted restricted stock units and performance units to a select group of officers as described below.

Restricted Stock Units A restricted stock unit is an award that represents the opportunity to receive a specified number of shares of our common stock, subject to the achievement of certain pre-established performance criteria.

In February 2006, we granted to a select group of officers restricted stock units for a total of 64,700 shares of common stock under the Long-Term Incentive Plan (1999) (LTIP), 61,800 of which were outstanding as of September 30, 2006. These restricted stock units have a 12-month performance measurement period and a performance measure that relates to a basic earnings per share goal.

Performance Cash Units A performance cash unit is an award that represents the opportunity to receive a cash award, subject to the achievement of certain pre-established performance criteria.

In January 2006, we granted performance cash units to a select group of officers under the LTIP. The performance cash units represent a maximum aggregate payout of $2 million. The performance cash units have a 36-month performance measurement period and a performance measure that relates to our average annual growth in basic earnings per share plus the average dividend yield. As of September 30, 2006, we had recorded a liability of less than $1 million for these performance cash units.

Stock Appreciation Rights (SARs) SARs are awards payable in cash, having an exercise price equal to the fair market value of our common stock on the date of grant. SARs generally become fully exercisable not earlier than 12 months after the date of grant and generally expire six years after that date. Participants realize value from SAR grants only to the extent that the fair market value of our common stock on the date of exercise of the SAR exceeds the fair market value of the common stock on the date of the grant. At September 30, 2006, we had approximately 27,000 SARs outstanding.

Note 6

Common Shareholders’ Equity

Share Repurchase Program In February 2006, our Board of Directors authorized a plan to purchase up to eight million shares of our outstanding common stock over a five-year period. These purchases are intended principally to offset share issuances under our employee and non-employee director incentive compensation plans and our dividend reinvestment and stock purchase plans. Stock purchases under this program may be made in the open market or in private transactions at times and in amounts that we deem appropriate. There is no guarantee as to the exact number of shares that we will purchase, and we can terminate or limit the program at any time. We will hold the purchased shares as treasury shares. During the nine months ended September 30, 2006, we repurchased 730,500 shares at a weighted average price of $36.19.

Note 7

Debt

Our issuance of long-term and short-term debt, including various forms of securities, is subject to customary approval or authorization by state and federal regulatory bodies, including state public service commissions and the SEC. Our financing consists of the short and long-term debt indicated in the following table.

| | | | | | | Outstanding as of: | |

Dollars in millions | | Year(s) due | | Int. rate (1) | | Sept.30, 2006 | | Dec. 31, 2005 | | Sept.30, 2005 | |

Short-term debt | | | | | | | | | | | | | | | | |

| Commercial paper | | | 2006 | | | 5.4%(2 | ) | $ | 420 | | $ | 485 | | $ | 318 | |

| Sequent lines of credit | | | 2006 - 2007 | | | 5.7%(3 | ) | | 1 | | | - | | | 25 | |

| Pivotal Utility Holdings, Inc. line of credit | | | 2006 | | | 5.8%(4 | ) | | 19 | | | - | | | - | |

| Capital leases | | | 2006 | | | 4.9 | % | | 1 | | | 1 | | | 1 | |

| SouthStar line of credit | | | 2006 | | | - | | | - | | | 36 | | | - | |

Total short-term debt | | | | | | 5.4%(5 | ) | $ | 441 | | $ | 522 | | $ | 344 | |

Long-term debt | | | | | | | | | | | | | | | | |

| Senior notes | | | 2011-2034 | | | 4.5 - 7.1 | % | $ | 1,150 | | $ | 975 | | $ | 975 | |

| Medium-term notes | | | 2012-2027 | | | 6.6 - 9.1 | % | | 208 | | | 208 | | | 208 | |

| Gas facility revenue bonds, net of unamortized issuance costs | | | 2022-2033 | | | 3.5 - 5.7 | % | | 199 | | | 199 | | | 199 | |

| Notes payable to Trusts | | | 2037 | | | 8.2 | % | | 77 | | | 232 | | | 232 | |

| Capital leases | | | 2013 | | | 4.9 | % | | 6 | | | 6 | | | 7 | |

| Interest rate swaps | | | 2011 | | | 9.0 | % | | (6 | ) | | (5 | ) | | (5 | ) |

Total long-term debt | | | | | | 6.1%(5 | ) | $ | 1,634 | | $ | 1,615 | | $ | 1,616 | |

| | | | | | | | | | | | | | | | | |

Total short-term and long-term debt | | | | | | 6.0%(5 | ) | $ | 2,075 | | $ | 2,137 | | $ | 1,960 | |

| (1) | As of September 30, 2006. |

| (2) | The daily weighted average rate was 5.0% for the nine months ended September 30, 2006. |

| (3) | The daily weighted average rate was 5.5% for the nine months ended September 30, 2006. |

| (4) | The daily weighted average rate was 5.6% for the nine months ended September 30, 2006. |

| (5) | Weighted average interest rate, including interest rate swaps if applicable and excluding debt issuance and other financing related costs. |

Commercial paper In August 2006, we replaced our previous credit facility with a new credit facility that supports our commercial paper program. Under the terms of the new credit facility, the aggregate principal amount available has been increased from $850 million to $1 billion and we have the option to increase the aggregate principal amount available for borrowing to $1.25 billion on not more than three occasions during each calendar year. This credit facility expires August 31, 2011.

Lines of Credit In 2006, we extended Sequent’s two lines of credit through June 2007 and August 2007. In addition, we extended Pivotal Utility Holdings, Inc. line of credit through August 2007. These unsecured lines of credit are unconditionally guaranteed by us.

Long-term debt In May 2001, AGL Capital Trust II (Trust) issued and sold $150 million of 8.00% capital securities and used the proceeds to purchase $150 million principal amount of 8.00% junior subordinated deferrable interest debentures from us. In May 2006, we used the proceeds from the sale of commercial paper to redeem the $150 million of junior subordinated debentures and to pay a $5 million note representing our investment in the Trust, previously included in notes payable to Trusts. In June 2006, we issued $175 million of 10-year senior notes at an interest rate of 6.375% and used the net proceeds of $174 million to repay the commercial paper.

In the third quarter of 2005 and the second quarter of 2006, in anticipation of our $175 million senior notes offering in June 2006, we entered into treasury lock derivative agreements to hedge our exposure to increases in interest rates. We received an $11 million settlement payment from our counterparties, which we will amortize over the next 10 years through interest expense. These derivatives reduced the annual interest rate on our 6.375% senior notes by approximately 60 basis points.

Commitments and Contingencies

Contractual Obligations and Commitments We have incurred various contractual obligations and financial commitments in the normal course of our operations and financing activities. Contractual obligations include future cash payments required under existing contractual arrangements, such as debt and lease agreements. These obligations result from both general financing activities and from commercial arrangements that are directly supported by related revenue-producing activities. There were no significant changes to our contractual obligations described in Note 10 to our Consolidated Financial Statements in Item 8 of our Annual Report on Form 10-K, as amended, for the year ended December 31, 2005.

We also have incurred various financial commitments in the normal course of business. Contingent financial commitments represent obligations that become payable only if certain predefined events occur. This covers financial guarantees and includes the nature of the guarantee and the maximum potential amount of future payments that are required of us as the guarantor. The following table illustrates our contingent financial commitments as of September 30, 2006.

| | | | | Commitments due before Dec. 31, | |

| | | | |

In millions | | | Total | | | 2006 | | | 2007 & thereafter | |

| Standby letters of credit and performance and surety bonds | | $ | 23 | | $ | 11 | | $ | 12 | |

Litigation We are involved in litigation arising in the normal course of business. We believe the ultimate resolution of such litigation will not have a material adverse effect on our results of operations, financial position or cash flows.

Columbia Gas Transmission In January 2004, Virginia Natural Gas, Inc. (Virginia Natural Gas) filed a complaint with the Federal Energy Regulatory Commission (FERC) against Columbia Gas Transmission (Columbia), a subsidiary of NiSource Inc. Among other things, the complaint alleged that, beginning in January 2003, Virginia Natural Gas experienced a number of critical service problems with Columbia that interrupted deliveries of natural gas to some industrial customers and increased prices paid by Virginia Natural Gas’ customers. Virginia Natural Gas was seeking approximately $37 million in damages, the majority of which would be distributed to its customers. In September 2006, Virginia Natural Gas and Columbia reached a settlement. The terms of the settlement are confidential and did not have a material impact on our results of operations, cash flows and financial position. The majority of the benefits under the settlement will be passed through to Virginia Natural Gas customers as reductions in the cost of natural gas.

State of Louisiana In September 2006, Pivotal Jefferson Island Storage & Hub, LLC, (Pivotal Jefferson Island) filed suit against the State of Louisiana to maintain its lease to complete an ongoing natural gas storage expansion project in Louisiana. The project would add two salt dome storage caverns under Lake Peigneur to the two caverns currently owned and operated by Pivotal Jefferson Island.

The suit is in response to a letter Pivotal Jefferson Island received in August 2006 from the Office of Mineral Resources of the Louisiana Department of Natural Resources (DNR). The DNR informed Pivotal Jefferson Island that its mineral lease which authorizes salt extraction to create two new storage caverns - at Lake Peigneur has been terminated. The DNR identified two bases for the termination: (1) failure to make certain mining leasehold payments in a timely manner, and (2) the absence of salt mining operations for six months.

In its suit Pivotal Jefferson Island alleges that the DNR accepted all leasehold payments without reservation and never provided Pivotal Jefferson Island with notice and opportunity to cure as required by State law. As to the second basis for termination, the suit contends that Pivotal Jefferson Island’s lease with the State of Louisiana was amended in 2004 so that mining operations are no longer required to maintain the lease. We continue to seek resolution of this dispute and have yet to serve the complaint formally on the State. Service of the complaint would formally commence the litigation process, including discovery and scheduling of a hearing on the issues identified in the complaint. It is not possible at this time to predict whether the dispute can be settled or, if not, what the results of the litigation would be.

Segment Information

Our four operating segments are:

| · | Distribution operations, which consist primarily of: |

| o | Chattanooga Gas Company (Chattanooga Gas) |

| · | Retail energy operations, which consist primarily of SouthStar |

| · | Wholesale services, which consist primarily of Sequent |

| · | Energy investments, which consist primarily of: |

| o | Pivotal Jefferson Island |

| o | Pivotal Propane of Virginia, Inc. (Pivotal Propane) |

| o | AGL Networks, LLC (AGL Networks) |

We treat corporate, our fifth segment, as a non-operating business segment, and it includes AGL Resources Inc., AGL Services Company, investments in nonregulated financing subsidiaries and the effect of intercompany eliminations. We eliminated intercompany sales for the three and nine months ended September 30, 2006 and 2005 from our condensed consolidated statements of income.

We evaluate segment performance based primarily on the non-GAAP measure of earnings before interest and taxes (EBIT), which includes the effects of corporate expense allocations. EBIT includes operating income, other income and minority interest. Items that we do not include in EBIT are financing costs, including interest and debt expense and income taxes. We evaluate these items on a consolidated level. We believe EBIT is a useful measurement of our performance because it provides information that can be used to evaluate the effectiveness of our businesses from an operational perspective, exclusive of the costs to finance those activities and exclusive of income taxes, neither of which we believe is directly relevant to the operational performance of those operations.

You should not consider EBIT an alternative to, or a more meaningful indicator of, our operating performance than operating income or net income as determined in accordance with GAAP. In addition, our EBIT may not be comparable to a similarly titled measure of another company. The reconciliations of EBIT to operating income and net income for the three and nine months ended September 30, 2006 and 2005 are presented below.

| | | Three months ended September 30, | |

In millions | | 2006 | | 2005 | |

| Operating revenues | | $ | 434 | | $ | 393 | |

| Operating expenses | | | 344 | | | 339 | |

| Operating income | | | 90 | | | 54 | |

| Minority interest | | | - | | | (2 | ) |

| EBIT | | | 90 | | | 52 | |

| Interest expense | | | 32 | | | 27 | |

| Earnings before income taxes | | | 58 | | | 25 | |

| Income taxes | | | 22 | | | 10 | |

| Net income | | $ | 36 | | $ | 15 | |

| | | Nine months ended September 30, | |

In millions | | 2006 | | 2005 | |

| Operating revenues | | $ | 1,914 | | $ | 1,736 | |

| Operating expenses | | | 1,536 | | | 1,435 | |

| Operating income | | | 378 | | | 301 | |

| Other (expense) income | | | (2 | ) | | 2 | |

| Minority interest | | | (19 | ) | | (18 | ) |

| EBIT | | | 357 | | | 285 | |

| Interest expense | | | 91 | | | 79 | |

| Earnings before income taxes | | | 266 | | | 206 | |

| Income taxes | | | 101 | | | 79 | |

| Net income | | $ | 165 | | $ | 127 | |

Summarized income statement information and property, plant and equipment expenditures as of and for the three and nine months ended September 30, 2006 and 2005 by segment are shown in the following tables:

| Three months ended September 30, 2006 | | | | | | | |

In millions | | Distribution operations | | Retail energy operations | | Wholesale services | | Energy investments | | Corporate and intercompany eliminations | | Consolidated AGL Resources | |

| Operating revenues from external parties | | $ | 218 | | $ | 132 | | $ | 74 | | $ | 10 | | $ | - | | $ | 434 | |

| Intercompany revenues (1) | | | 35 | | | - | | | - | | | - | | | (35 | ) | | - | |

| Total operating revenues | | | 253 | | | 132 | | | 74 | | | 10 | | | (35 | ) | | 434 | |

| Operating expenses | | | | | | | | | | | | | | | | | | | |

| Cost of gas | | | 86 | | | 119 | | | 20 | | | - | | | (35 | ) | | 190 | |

| Operation and maintenance | | | 82 | | | 14 | | | 13 | | | 5 | | | (3 | ) | | 111 | |

| Depreciation and amortization | | | 28 | | | 1 | | | 1 | | | 2 | | | 1 | | | 33 | |

| Taxes other than income taxes | | | 7 | | | 1 | | | - | | | - | | | 2 | | | 10 | |

| Total operating expenses | | | 203 | | | 135 | | | 34 | | | 7 | | | (35 | ) | | 344 | |

| Operating income (loss) | | | 50 | | | (3 | ) | | 40 | | | 3 | | | - | | | 90 | |

| Other income (expense) | | | - | | | 1 | | | - | | | - | | | (1 | ) | | - | |

| EBIT | | $ | 50 | | $ | (2 | ) | $ | 40 | | $ | 3 | | $ | (1 | ) | $ | 90 | |

| | | | | | | | | | | | | | | | | | | | |

| Property, plant and equipment expenditures | | $ | 48 | | $ | 3 | | $ | 1 | | $ | 13 | | $ | 12 | | $ | 77 | |

| Three months ended September 30, 2005 | | | | | | | |

In millions | | Distribution operations | | Retail energy operations | | Wholesale services | | Energy investments | | Corporate and intercompany eliminations | | Consolidated AGL Resources | |

| Operating revenues from external parties | | $ | 225 | | $ | 153 | | $ | 1 | | $ | 14 | | $ | - | | $ | 393 | |

| Intercompany revenues (1) | | | 38 | | | - | | | - | | | - | | | (38 | ) | | - | |

| Total operating revenues | | | 263 | | | 153 | | | 1 | | | 14 | | | (38 | ) | | 393 | |

| Operating expenses | | | | | | | | | | | | | | | | | | | |

| Cost of gas | | | 95 | | | 129 | | | - | | | 4 | | | (37 | ) | | 191 | |

| Operation and maintenance | | | 85 | | | 13 | | | 6 | | | 4 | | | (2 | ) | | 106 | |

| Depreciation and amortization | | | 28 | | | 1 | | | 1 | | | 1 | | | 2 | | | 33 | |

| Taxes other than income taxes | | | 7 | | | 1 | | | - | | | - | | | 1 | | | 9 | |

| Total operating expenses | | | 215 | | | 144 | | | 7 | | | 9 | | | (36 | ) | | 339 | |

| Operating income (loss) | | | 48 | | | 9 | | | (6 | ) | | 5 | | | (2 | ) | | 54 | |

| Other income (expense) | | | 1 | | | - | | | - | | | - | | | (1 | ) | | - | |

| Minority interest | | | - | | | (2 | ) | | - | | | - | | | - | | | (2 | ) |

| EBIT | | $ | 49 | | $ | 7 | | $ | (6 | ) | $ | 5 | | $ | (3 | ) | $ | 52 | |

| | | | | | | | | | | | | | | | | | | | |

| Property, plant and equipment expenditures | | $ | 51 | | $ | - | | $ | - | | $ | 1 | | $ | 12 | | $ | 64 | |

| (1) | Wholesale services total operating revenues include intercompany revenues of $110 million and $201 million for the three months ended September 30, 2006 and 2005, respectively. |

| Nine months ended September 30, 2006 | | | | | | | | | |

In millions | | Distribution operations | | Retail energy operations | | Wholesale services | | Energy investments | | Corporate and intercompany eliminations | | Consolidated AGL Resources | |

| Operating revenues from external parties | | $ | 1,068 | | $ | 675 | | $ | 141 | | $ | 30 | | $ | - | | $ | 1,914 | |

| Intercompany revenues (1) | | | 118 | | | - | | | - | | | - | | | (118 | ) | | - | |

| Total operating revenues | | | 1,186 | | | 675 | | | 141 | | | 30 | | | (118 | ) | | 1,914 | |

| Operating expenses | | | | | | | | | | | | | | | | | | | |

| Cost of gas | | | 594 | | | 551 | | | 33 | | | 4 | | | (118 | ) | | 1,064 | |

| Operation and maintenance | | | 251 | | | 48 | | | 33 | | | 14 | | | (5 | ) | | 341 | |

| Depreciation and amortization | | | 86 | | | 3 | | | 2 | | | 4 | | | 6 | | | 101 | |

| Taxes other than income taxes | | | 24 | | | 1 | | | - | | | 1 | | | 4 | | | 30 | |

| Total operating expenses | | | 955 | | | 603 | | | 68 | | | 23 | | | (113 | ) | | 1,536 | |

| Operating income (loss) | | | 231 | | | 72 | | | 73 | | | 7 | | | (5 | ) | | 378 | |

| Other income (expense) | | | 1 | | | (1 | ) | | - | | | - | | | (2 | ) | | (2 | ) |

| Minority interest | | | - | | | (19 | ) | | - | | | - | | | - | | | (19 | ) |

| EBIT | | $ | 232 | | $ | 52 | | $ | 73 | | $ | 7 | | $ | (7 | ) | $ | 357 | |

| | | | | | | | | | | | | | | | | | | | |

| Property, plant and equipment expenditures | | $ | 126 | | $ | 6 | | $ | 2 | | $ | 20 | | $ | 36 | | $ | 190 | |

| Nine months ended September 30, 2005 | | | | | | | | | |

In millions | | Distribution operations | | Retail energy operations | | Wholesale services | | Energy investments | | Corporate and intercompany eliminations | | Consolidated AGL Resources | |

| Operating revenues from external parties | | $ | 1,045 | | $ | 627 | | $ | 21 | | $ | 43 | | $ | - | | $ | 1,736 | |

| Intercompany revenues (1) | | | 145 | | | - | | | - | | | - | | | (145 | ) | | - | |

| Total operating revenues | | | 1,190 | | | 627 | | | 21 | | | 43 | | | (145 | ) | | 1,736 | |

| Operating expenses | | | | | | | | | | | | | | | | | | | |

| Cost of gas | | | 590 | | | 513 | | | - | | | 12 | | | (143 | ) | | 972 | |

| Operation and maintenance | | | 269 | | | 40 | | | 19 | | | 12 | | | (6 | ) | | 334 | |

| Depreciation and amortization | | | 85 | | | 2 | | | 2 | | | 4 | | | 6 | | | 99 | |

| Taxes other than income taxes | | | 24 | | | 1 | | | - | | | 1 | | | 4 | | | 30 | |

| Total operating expenses | | | 968 | | | 556 | | | 21 | | | 29 | | | (139 | ) | | 1,435 | |

| Operating income (loss) | | | 222 | | | 71 | | | - | | | 14 | | | (6 | ) | | 301 | |

| Other income (expense) | | | 2 | | | - | | | - | | | 1 | | | (1 | ) | | 2 | |

| Minority interest | | | - | | | (18 | ) | | - | | | - | | | - | | | (18 | ) |

| EBIT | | $ | 224 | | $ | 53 | | $ | - | | $ | 15 | | $ | (7 | ) | $ | 285 | |

| | | | | | | | | | | | | | | | | | | | |

| Property, plant and equipment expenditures | | $ | 160 | | $ | 2 | | $ | 1 | | $ | 7 | | $ | 24 | | $ | 194 | |

(1) Wholesale services total operating revenues include intercompany revenues of $404 million and $450 million for the nine months ended September 30, 2006 and 2005, respectively.

Balance sheet information as of September 30, 2006 and 2005 and December 31, 2005 by segment is shown in the following tables:

| As of September 30, 2006 | | | | | | | | | | | | | |

In millions | | Distribution operations | | Retail energy operations | | Wholesale services | | Energy investments | | Corporate and intercompany eliminations (2) | | Consolidated AGL Resources | |

| | | | | | | | | | | | | | |

| Goodwill | | $ | 411 | | $ | - | | $ | - | | $ | 14 | | $ | - | | $ | 425 | |

| Identifiable and total assets (1) | | $ | 4,573 | | $ | 226 | | $ | 715 | | $ | 374 | | $ | (48 | ) | $ | 5,840 | |

| As of December 31, 2005 | | | | | | | | | | | | | |

In millions | | Distribution operations | | Retail energy operations | | Wholesale services | | Energy investments | | Corporate and intercompany eliminations (2) | | Consolidated AGL Resources | |

| | | | | | | | | | | | | | | | | | | | |

| Goodwill | | $ | 406 | | $ | - | | $ | - | | $ | 14 | | $ | - | | $ | 420 | |

| Identifiable and total assets (1) | | $ | 4,780 | | $ | 343 | | $ | 1,058 | | $ | 350 | | $ | (218 | ) | $ | 6,313 | |

| As of September 30, 2005 | | | | | | | | | | | | | |

In millions | | Distribution operations | | Retail energy operations | | Wholesale services | | Energy investments | | Corporate and intercompany eliminations (2) | | Consolidated AGL Resources | |

| | | | | | | | | | | | | | | | | | | | |

| Goodwill | | $ | 391 | | $ | - | | $ | - | | $ | 14 | | $ | - | | $ | 405 | |

| Identifiable and total assets (1) | | $ | 4,660 | | $ | 228 | | $ | 1,108 | | $ | 348 | | $ | (194 | ) | $ | 6,150 | |

| (1) | Identifiable assets are those assets used in each segment’s operations. |

| (2) | Our corporate segment’s assets consist primarily of intercompany eliminations, cash and cash equivalents and property, plant and equipment. |

ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

FORWARD-LOOKING STATEMENTS

Certain expectations and projections regarding our future performance referenced in this Management’s Discussion and Analysis of Financial Condition and Results of Operations section and elsewhere in this report, as well as in other reports and proxy statements we file with the Securities and Exchange Commission (SEC), are forward-looking statements. Officers and other employees may also make verbal statements to analysts, investors, regulators, the media and others that are forward-looking.

Forward-looking statements involve matters that are not historical facts, and because these statements involve anticipated events or conditions, forward-looking statements often include words such as "anticipate", "assume", “believe”, "can", "could", "estimate", "expect", "forecast", "future", "indicate", "intend", "may", “outlook”, "plan", "predict", "project”, "seek", "should", "target", "will", "would", or similar expressions. Our expectations are not guarantees and are based on currently available competitive, financial and economic data along with our operating plans. While we believe that our expectations are reasonable in view of the currently available information, our expectations are subject to future events, risks and uncertainties, and there are several factors - many beyond our control - that could cause our results to differ significantly from our expectations.

Such events, risks and uncertainties include, but are not limited to, changes in price, supply and demand for natural gas and related products; the impact of changes in state and federal legislation and regulation; actions taken by government agencies on rates and other matters; concentration of credit risk; utility and energy industry consolidation; the impact of acquisitions and divestitures; direct or indirect effects on our business, financial condition or liquidity resulting from a change in our credit ratings or the credit ratings of our counterparties or competitors; interest rate fluctuations; financial market conditions and general economic conditions; uncertainties about environmental issues and the related impact of such issues; the impact of changes in weather on the temperature-sensitive portions of our business; the impact of natural disasters such as hurricanes on the supply and price of natural gas; acts of war or terrorism; and other factors that are described in detail in our filings with the SEC.

We caution readers that, in addition to the important factors described elsewhere in this report, the factors set forth in “Risk Factors” in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our Annual Report on Form 10-K, as amended on June 1, 2006, for the year ended December 31, 2005, among others, could cause our business, results of operations or financial condition in 2006 and thereafter to differ significantly from those expressed in any forward-looking statements. There also may be other factors that we cannot anticipate or that are not described in our Form 10-K, as amended, or in this report that could cause results to differ significantly from our expectations.

Forward-looking statements are only as of the date they are made, and we do not update these statements to reflect subsequent circumstances or events.

We are a Fortune 1000 energy services holding company whose principal business is the distribution of natural gas in six states - Florida, Georgia, Maryland, New Jersey, Tennessee and Virginia. Our six utilities serve approximately 2.3 million end-use customers, making us the largest distributor of natural gas in the southeastern and mid-Atlantic regions of the United States based on customer count. We also are involved in various related businesses, including retail natural gas marketing to end-use customers primarily in Georgia; natural gas asset management and related logistics activities for our own utilities as well as for other nonaffiliated companies; natural gas storage and related arbitrage activities; operation of high-deliverability underground natural gas storage assets; and construction and operation of telecommunications conduit and fiber infrastructure within selected metropolitan areas. We manage these businesses through four operating segments - distribution operations, retail energy operations, wholesale services and energy investments - and a nonoperating corporate segment.

The distribution operations segment is the largest component of our business and is regulated by regulatory agencies in six states. These agencies approve rates designed to provide us the opportunity to generate revenues to recover the cost of natural gas delivered to our customers and our fixed and variable costs such as depreciation, interest, maintenance and overhead costs, and to earn a reasonable return for our shareholders. With the exception of Atlanta Gas Light Company (Atlanta Gas Light), our largest utility, the earnings of our regulated utilities are weather sensitive to varying degrees. Although various regulatory mechanisms provide us a reasonable opportunity to recover our fixed costs regardless of natural gas volumes sold, the effect of weather manifests itself in terms of higher earnings during periods of colder weather and lower earnings in warmer weather. Atlanta Gas Light charges rates to its customers primarily on monthly fixed charges. Our retail energy operations segment, which consists of SouthStar Energy Services LLC (SouthStar), also is weather sensitive and uses a variety of hedging strategies to mitigate potential weather impacts. Our Sequent Energy Management, L.P. (Sequent) subsidiary within our wholesale services segment is weather sensitive, with typically increased earnings opportunities during periods of extreme weather conditions, which generally produce greater price volatility.

Regulatory Environment

In August 2005, the Energy Policy Act of 2005 (Energy Act) was enacted. The Energy Act authorized, among other things, the repeal of the Public Utility Holding Company Act of 1935, as amended (PUHCA). The effective date of the PUHCA repeal was February 8, 2006. The Energy Act gives the Federal Energy Regulatory Commission (FERC) increased authority over utility merger and acquisition activity, removes `many of the geographic and structural restrictions on the ownership of public utilities and eliminates certain regulatory burdens. Some of the SEC reporting requirements, financing authorizations and affiliate relationship approvals that previously applied to us under the PUHCA were replaced by the requirements of the Energy Act. In addition, the Energy Act requires a public utility holding company to maintain its books and records and make them available to the FERC and to comply with certain reporting requirements.

The FERC may exempt a class of entities or class of transactions if the FERC finds that they are not relevant to the jurisdictional rate of a public utility or natural gas company. In February 2006, we requested exemption from the FERC, and in April 2006 our exemption from the regulations and reporting requirements under the Energy Act became effective.

Results of Operations

AGL Resources

Customer Natural Gas Demand During last year’s heating season, we experienced declines in per-household natural gas use, resulting in operating margin erosion. These declines were largely due to warmer weather - which was on average 11% warmer than in the prior year and historically higher natural gas prices. The higher natural gas prices resulted in an average 34% increase in our residential customers’ natural gas bills, and were primarily the result of market concerns about the sufficiency of the supply of natural gas due to disruptions in the availability of natural gas supplies resulting from hurricanes Katrina and Rita in 2005, and other factors.

Additionally, our underlying business of supplying natural gas to retail customers continues to be negatively impacted by the addition of newer, more energy-efficient housing and efficiency improvements in natural gas appliances. These declines are somewhat offset by the growing trend for larger homes that require more energy to heat despite the use of more efficient appliances.

In the nine months ended September 30, 2006, these factors also impacted our earnings before interest and taxes (EBIT) as a result of higher expenses that were incurred for bad debt, as well as lower volumes of natural gas deliveries to our customers as a result of customer conservation.

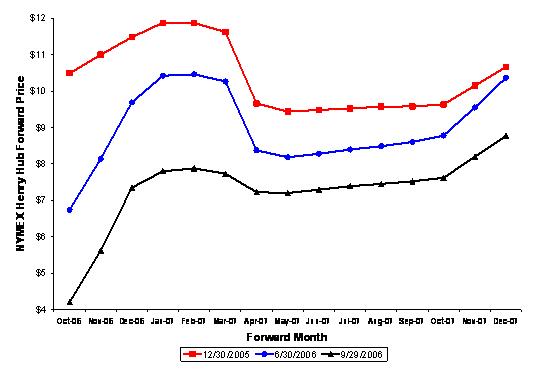

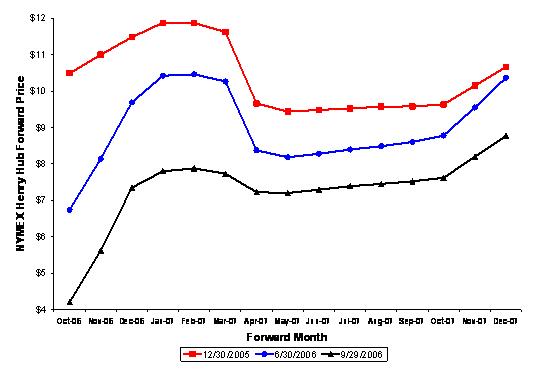

Currently natural gas prices are approximately 38% lower than last year and are expected to be lower during the upcoming heating season primarily from November through March. These lower natural gas prices may ease the impact of conservation experienced during the prior heating season and could result in a return to normalized consumption. As a result, we would expect that our operating margins and EBIT would be positively impacted relative to what we have experienced thus far during 2006.