2

Safe Harbor Pages

prairielight\02. Presentations\Investor

Relations Pres\Investor

Presentation_Final Draft_12.7.pptx

Forward Looking Statements

To the extent any statements made in this presentation contain information that is not historical, these statements are forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (collectively, “forward-

looking statements”).

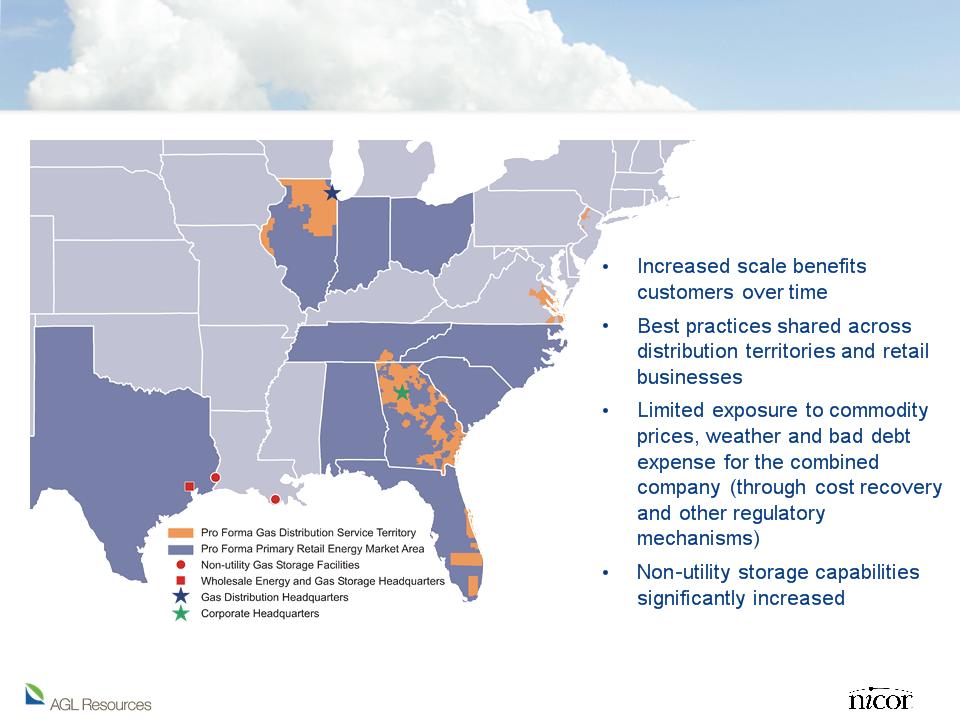

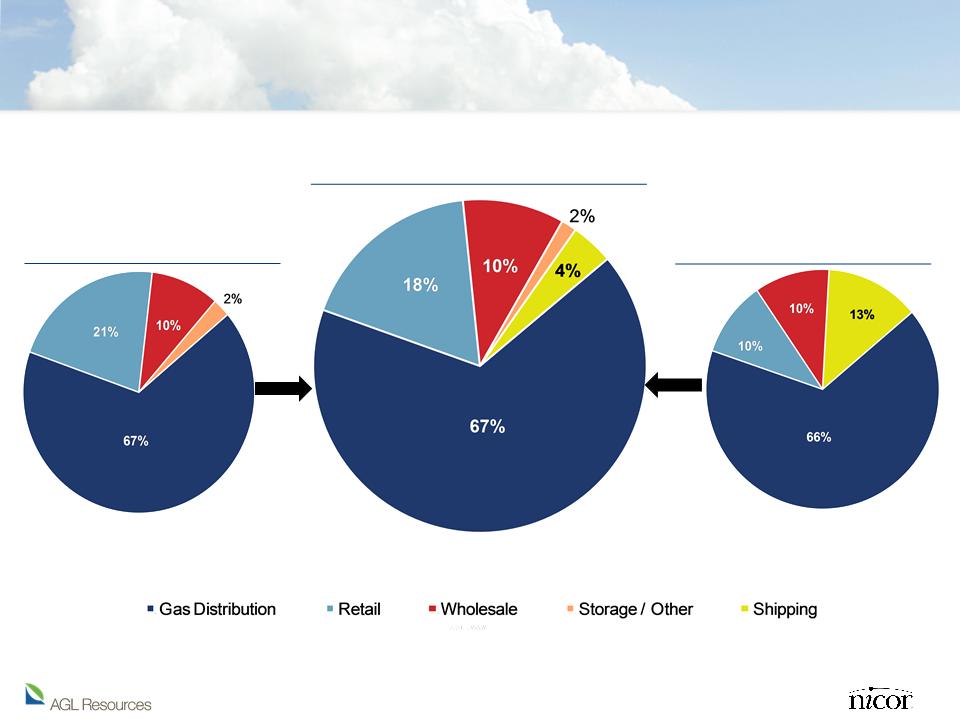

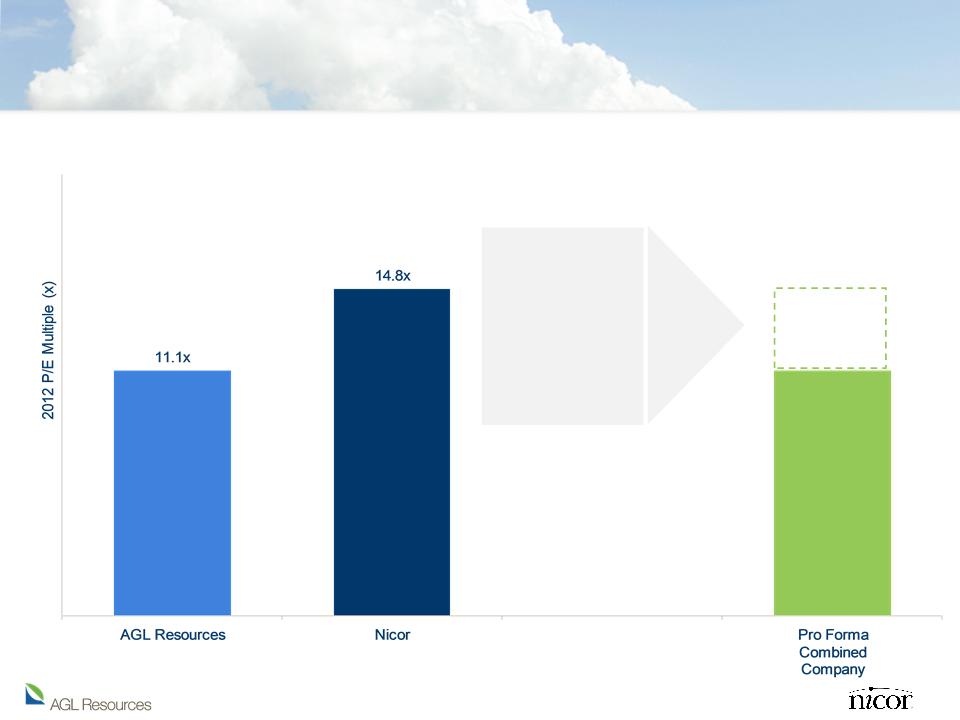

These forward-looking statements relate to, among other things, the expected benefits of the proposed merger such as efficiencies, cost savings, tax benefits,

enhanced revenues and cash flow, growth potential, market profile and financial strength; the competitive ability and position of the combined company; and the

expected timing of the completion of the transaction. Forward-looking statements can generally be identified by the use of words such as “believe”, “anticipate”,

“expect”, “estimate”, “intend”, “continue”, “plan”, “project”, “will”, “may”, “should”, “could”, “would”, “target”, “potential” and other similar expressions. In addition, any

statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. Although certain of

these statements set out herein are indicated above, all of the statements in this presentation that contain forward-looking statements are qualified by these

cautionary statements. Although AGL Resources and Nicor believe that the expectations reflected in such forward-looking statements are reasonable, such

statements involve risks and uncertainties, and undue reliance should not be placed on such statements. Certain material factors or assumptions are applied in

making forward-looking statements, including, but not limited to, factors and assumptions regarding the items outlined above. Actual results may differ materially

from those expressed or implied in such statements. Important factors that could cause actual results to differ materially from these expectations include, among

other things, the following: the failure to receive, on a timely basis or otherwise, the required approvals by AGL Resources and Nicor stockholders and

government or regulatory agencies (including the terms of such approvals); the risk that a condition to closing of the merger may not be satisfied; the possibility

that the anticipated benefits and synergies from the proposed merger cannot be fully realized or may take longer to realize than expected; the possibility that costs

or difficulties related to the integration of AGL Resources and Nicor operations will be greater than expected; the ability of the combined company to retain and

hire key personnel and maintain relationships with customers, suppliers or other business partners; the impact of legislative, regulatory, competitive and

technological changes; the risk that the credit ratings of the combined company may be different from what the companies expect; and other risk factors relating to

the energy industry, as detailed from time to time in each of AGL Resources’ and Nicor’s reports filed with the Securities and Exchange Commission (“SEC”).

There can be no assurance that the proposed merger will in fact be consummated.

Additional information about these factors and about the material factors or assumptions underlying such forward-looking statements may be found in AGL

Resources’ and Nicor’s release regarding the merger, as well as under Item 1.A. in each of AGL Resources’ and Nicor’s Annual Report on Form 10-K for the fiscal

year ended 2009, and Item 1.A in each of AGL Resources’ and Nicor’s most recent Quarterly Report on Form 10-Q for the quarterly period ended September 30,

2010. AGL Resources and Nicor caution that the foregoing list of important factors that may affect future results is not exhaustive. When relying on forward-

looking statements to make decisions with respect to AGL Resources and Nicor, investors and others should carefully consider the foregoing factors and other

uncertainties and potential events. All subsequent written and oral forward looking statements concerning the proposed merger or other matters attributable to

AGL Resources or Nicor or persons acting on their behalf are expressly qualified by the cautionary statements referenced above. The forward-looking statements

contained herein speak only as of the date of this presentation. Neither AGL Resources nor Nicor undertakes any obligation to update or revise any forward-

looking statement, except as may be required by law.