2

Forward-Looking Statements &

Supplemental Information

Forward-Looking Statements

Certain expectations and projections regarding our future performance referenced in this presentation, in other reports or statements we file with the SEC or otherwise release to the public, and

on our website, are forward-looking statements. Senior officers and other employees may also make verbal statements to analysts, investors, regulators, the media and others that are forward-

looking. Forward-looking statements involve matters that are not historical facts, such as statements regarding our future operations, prospects, strategies, financial condition, economic

performance (including growth and earnings), industry conditions and demand for our products and services. Because these statements involve anticipated events or conditions, forward-looking

statements often include words such as "anticipate," "assume," "believe," "can," "could," "estimate," "expect," "forecast," "future," "goal," "indicate," "intend," "may," "outlook," "plan," "potential,"

"predict," "project," "seek," "should," "target," "would," or similar expressions. Forward-looking statements contained in this presentation include, without limitation, statements regarding future

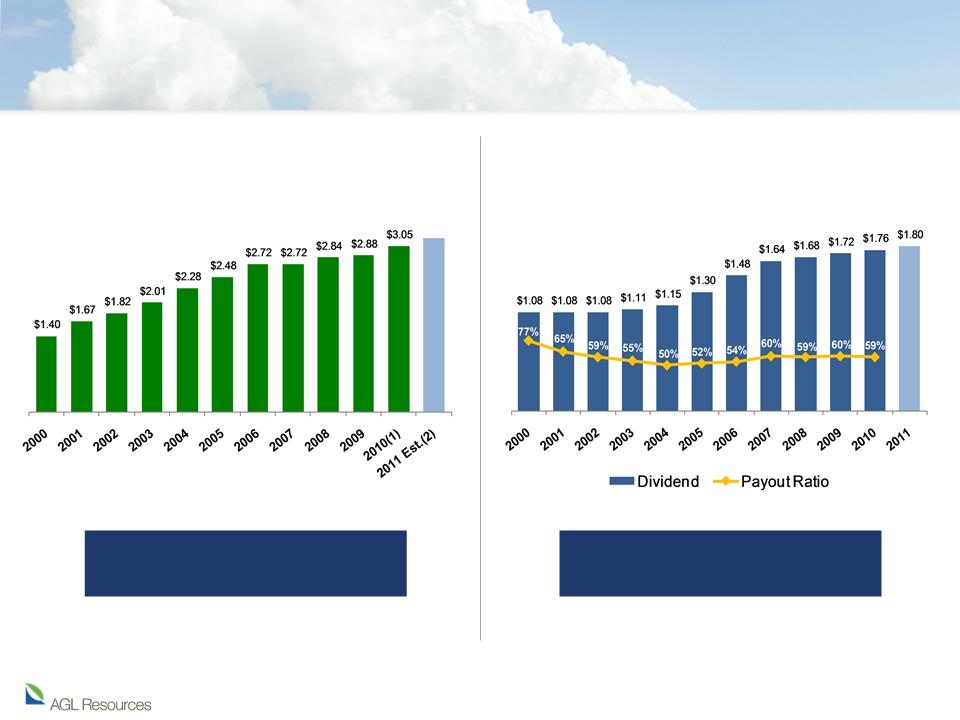

earnings per share, dividend growth and EBIT contribution, our priorities for 2011 and the proposed merger with Nicor Inc. Our expectations are not guarantees and are based on currently

available competitive, financial and economic data along with our operating plans. While we believe our expectations are reasonable in view of the currently available information, our

expectations are subject to future events, risks and uncertainties, and there are several factors - many beyond our control - that could cause results to differ significantly from our expectations.

Such events, risks and uncertainties include, but are not limited to, changes in price, supply and demand for natural gas and related products; the impact of changes in state and federal

legislation and regulation including changes related to climate change; actions taken by government agencies on rates and other matters; concentration of credit risk; utility and energy industry

consolidation; the impact on cost and timeliness of construction projects by government and other approvals, development project delays, adequacy of supply of diversified vendors, unexpected

change in project costs, including the cost of funds to finance these projects; the impact of acquisitions and divestitures; direct or indirect effects on our business, financial condition or liquidity

resulting from a change in our credit ratings or the credit ratings of our counterparties or competitors; interest rate fluctuations; financial market conditions, including recent disruptions in the

capital markets and lending environment and the current economic downturn; general economic conditions; uncertainties about environmental issues and the related impact of such issues; the

impact of changes in weather, including climate change, on the temperature-sensitive portions of our business; the impact of natural disasters such as hurricanes on the supply and price of

natural gas; acts of war or terrorism; and other factors which are provided in detail in our filings with the Securities and Exchange Commission. Forward-looking statements are only as of the

date they are made, and we do not undertake to update these statements to reflect subsequent changes.

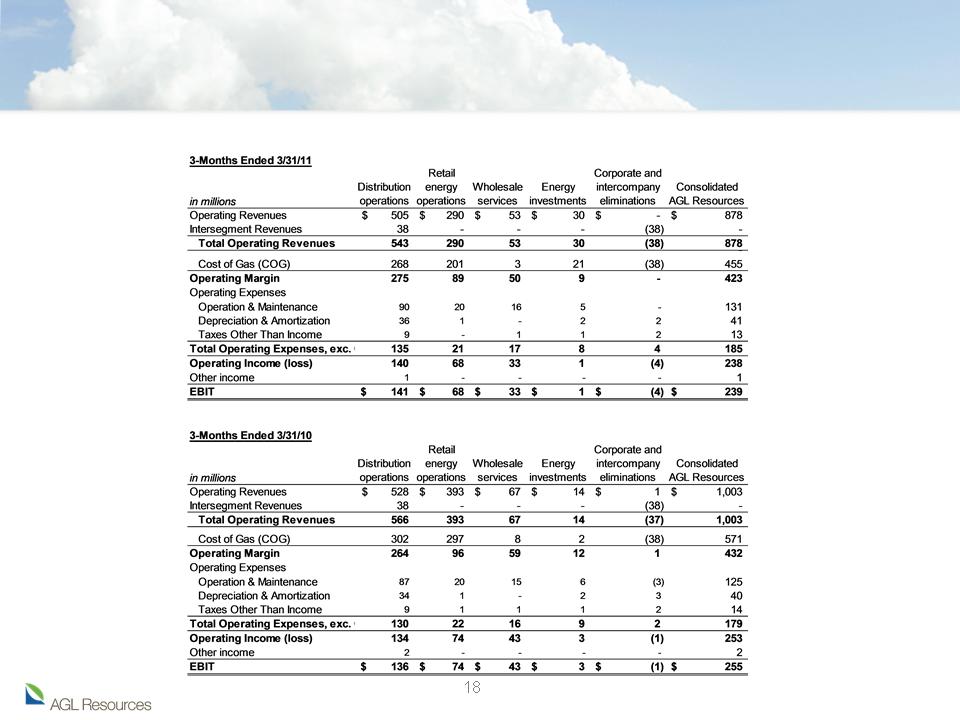

Supplemental Information

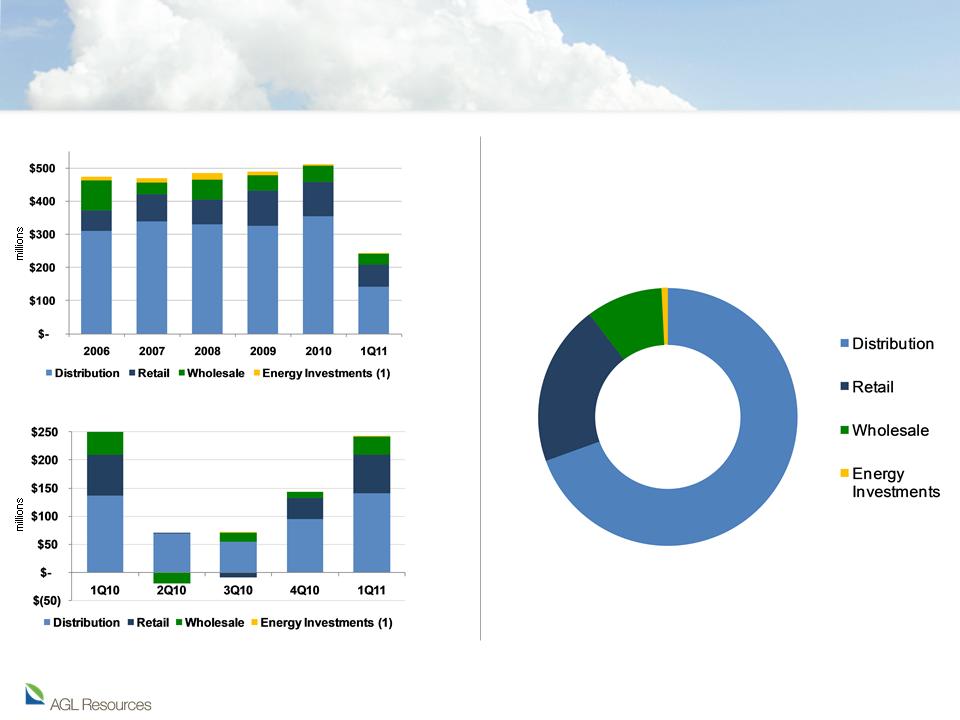

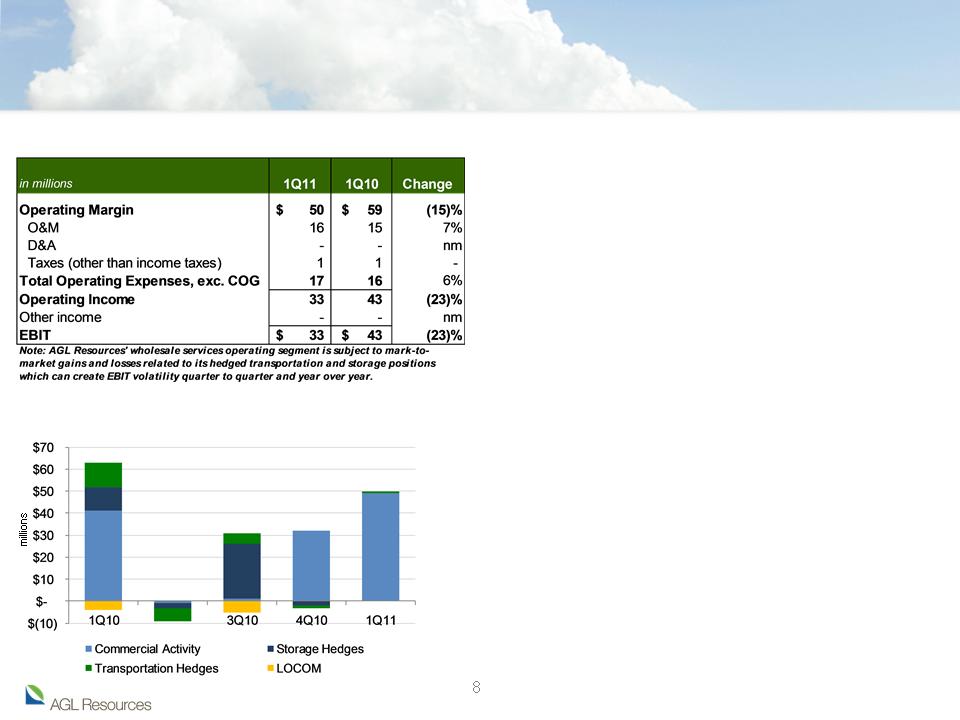

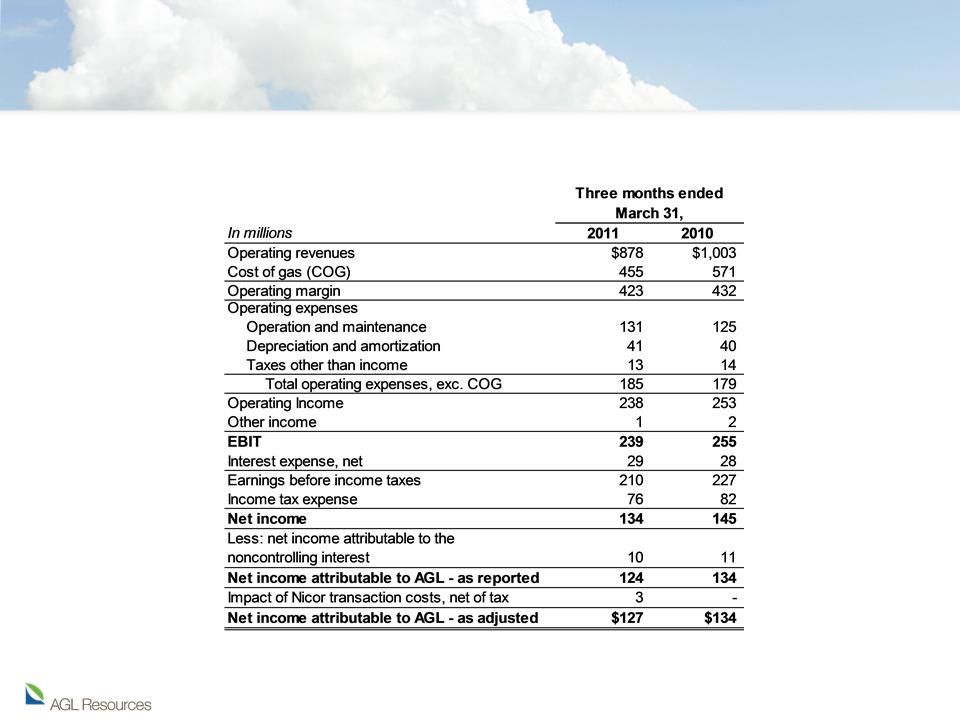

Company management evaluates segment financial performance based on earnings before interest and taxes (EBIT), which includes the effects of corporate expense allocations and on

operating margin. EBIT is a non-GAAP (accounting principles generally accepted in the United States of America) financial measure that includes operating income, other income and

expenses. Items that are not included in EBIT are financing costs, including debt and interest expense and income taxes. The company evaluates each of these items on a consolidated level

and believes EBIT is a useful measurement of our performance because it provides information that can be used to evaluate the effectiveness of our businesses from an operational

perspective, exclusive of the costs to finance those activities and exclusive of income taxes, neither of which is directly relevant to the efficiency of those operations. Operating margin is a non-

GAAP measure calculated as operating revenues minus cost of gas, excluding operation and maintenance expense, depreciation and amortization, and taxes other than income taxes. These

items are included in the company's calculation of operating income. The company believes operating margin is a better indicator than operating revenues of the contribution resulting from

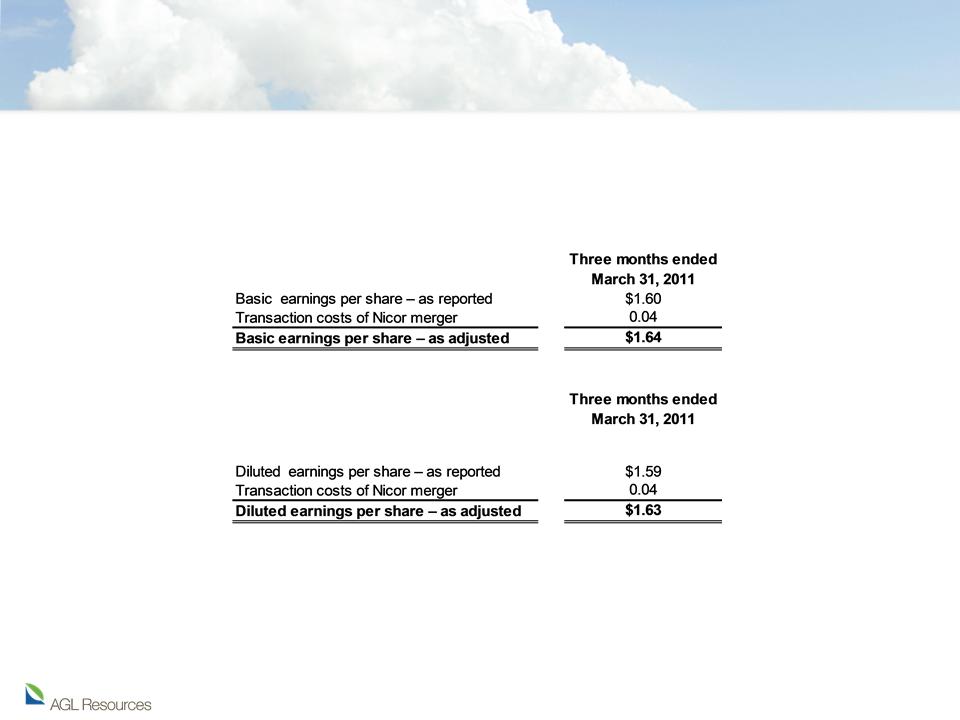

customer growth, since cost of gas is generally passed directly through to customers. In addition, in this presentation, the company has presented its earnings per share excluding expenses

incurred with respect to the proposed Nicor merger. As the company does not routinely engage in transactions of the magnitude of the proposed Nicor merger, and consequently does not

regularly incur transaction related expenses with correlative size, the company believes presenting EPS excluding Nicor merger expenses provides investors with an additional measure of the

company’s core operating performance. EBIT, operating margin and EPS excluding merger expenses should not be considered as alternatives to, or more meaningful indicators of, the

company's operating performance than operating income, net income attributable to AGL Resources Inc. or EPS as determined in accordance with GAAP. In addition, the company's EBIT,

operating margin and non-GAAP EPS may not be comparable to similarly titled measures of another company. We also present certain non-GAAP financial measures excluding the effects of

our proposed merger with Nicor. Because we complete material mergers and acquisitions only occasionally, we believe excluding these effects from certain measures is useful because they

allow investors to more easily evaluate and compare the performance of the Company's core businesses from period to period. Reconciliations of non-GAAP financial measures referenced in

this presentation are available on the company’s Web site at www.aglresources.com

®