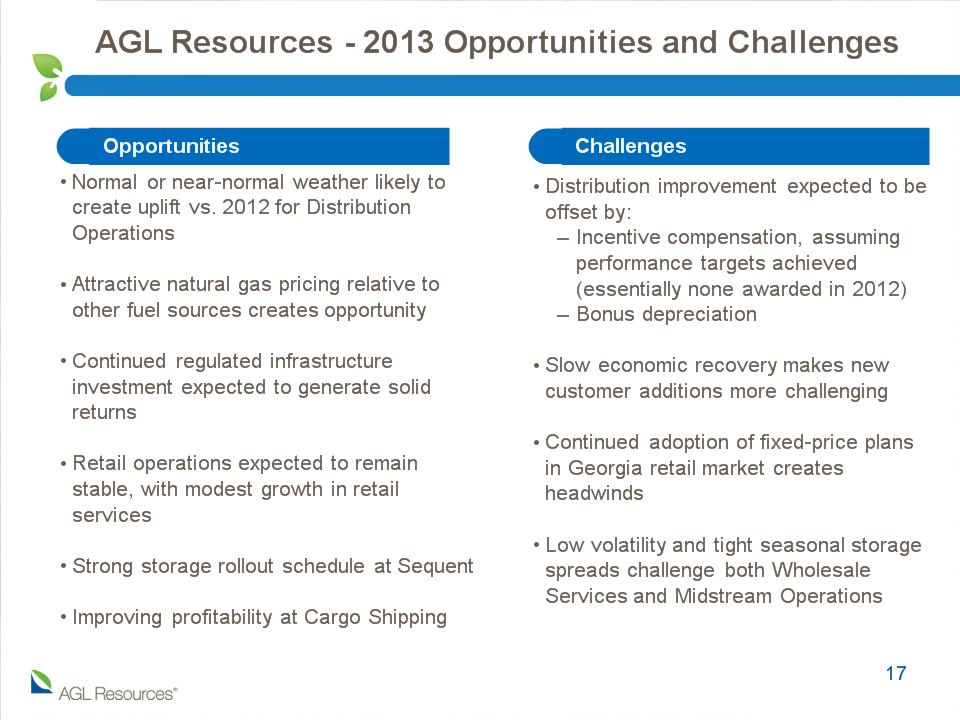

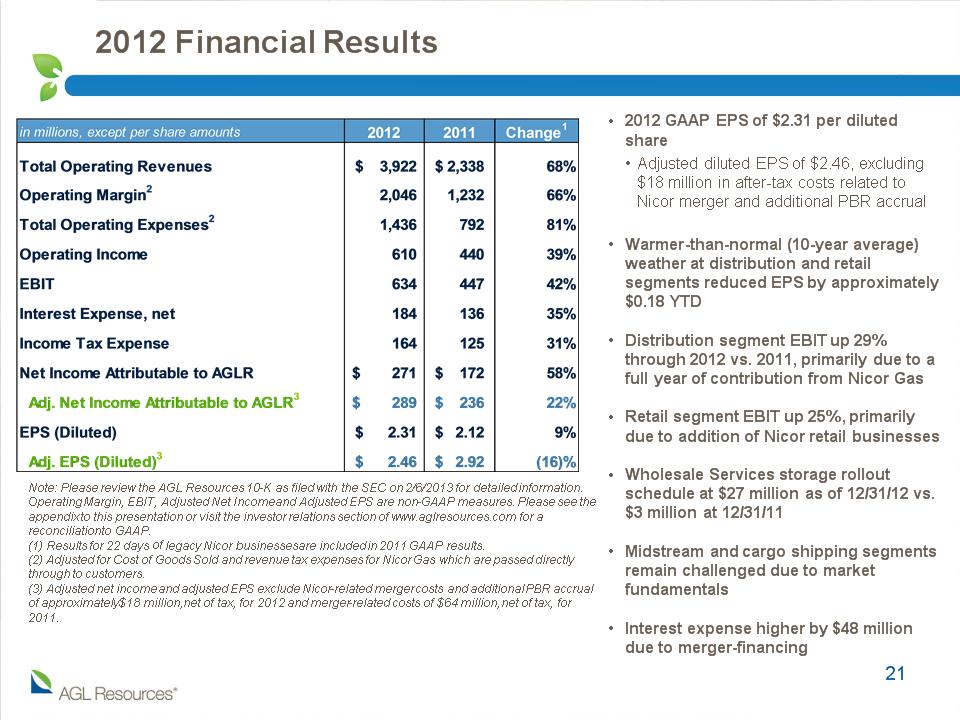

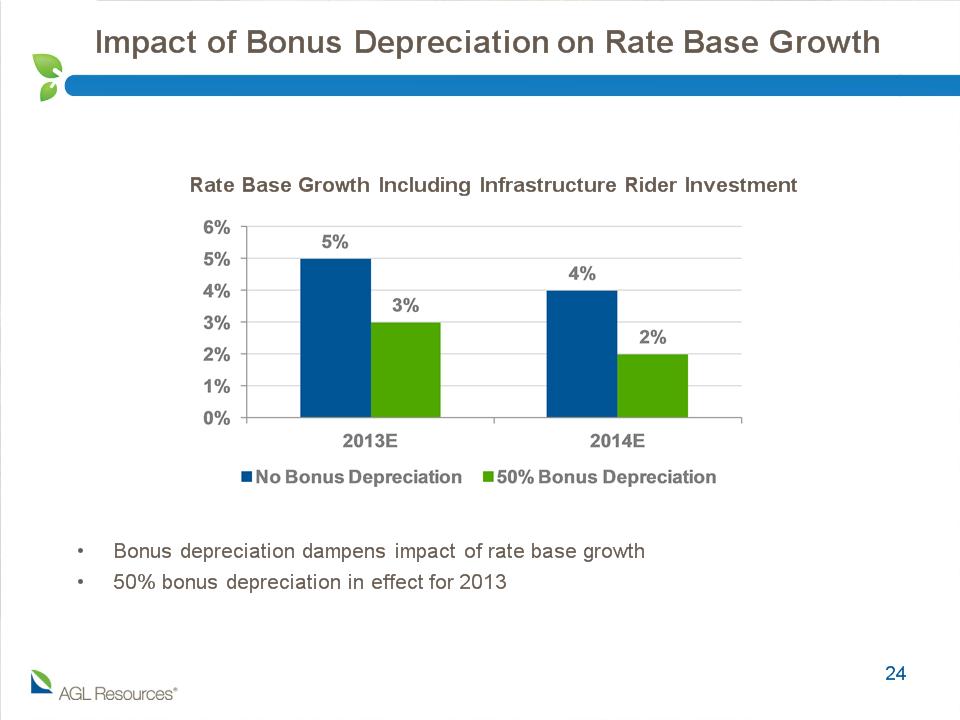

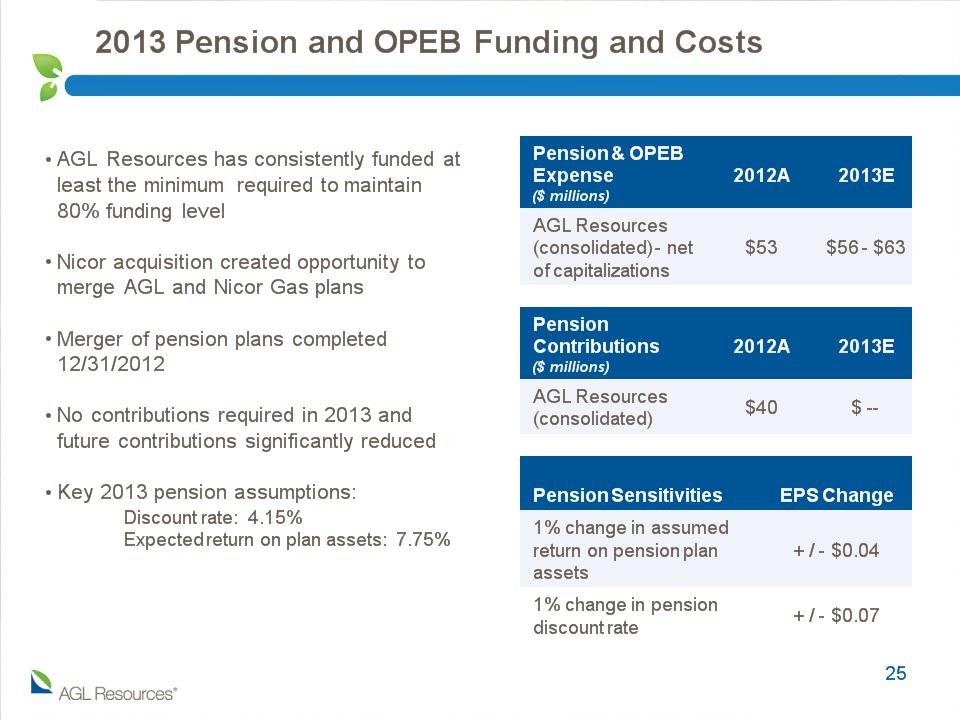

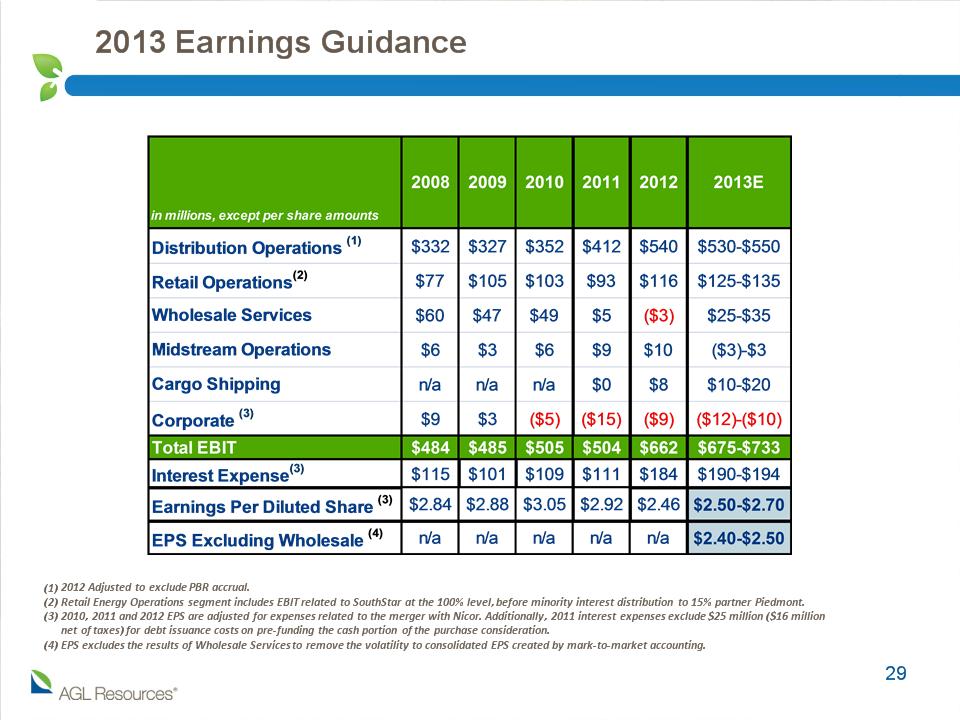

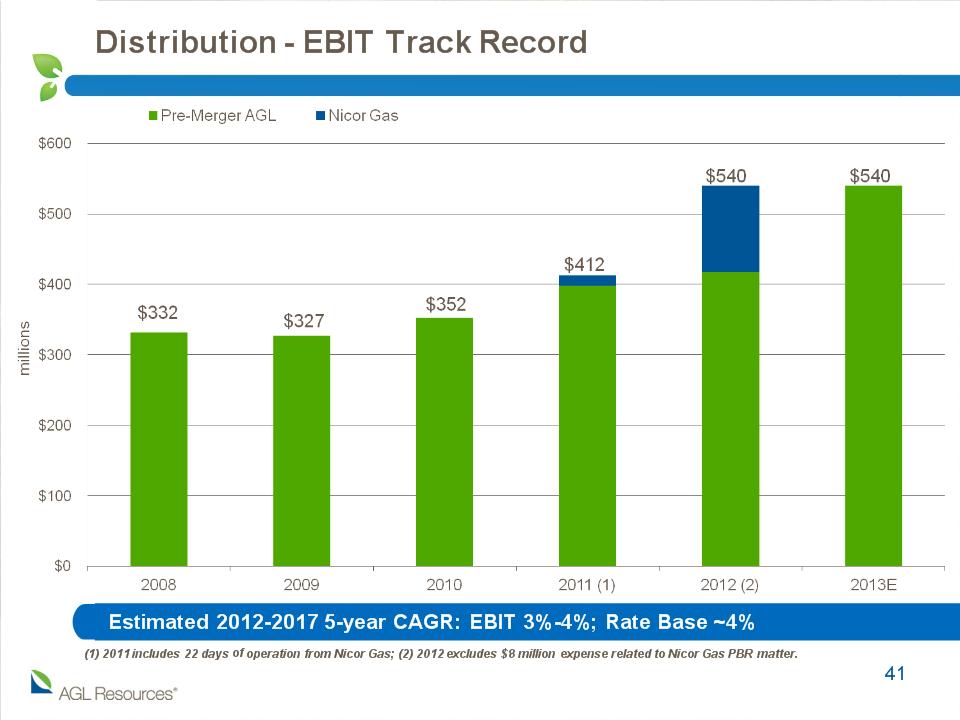

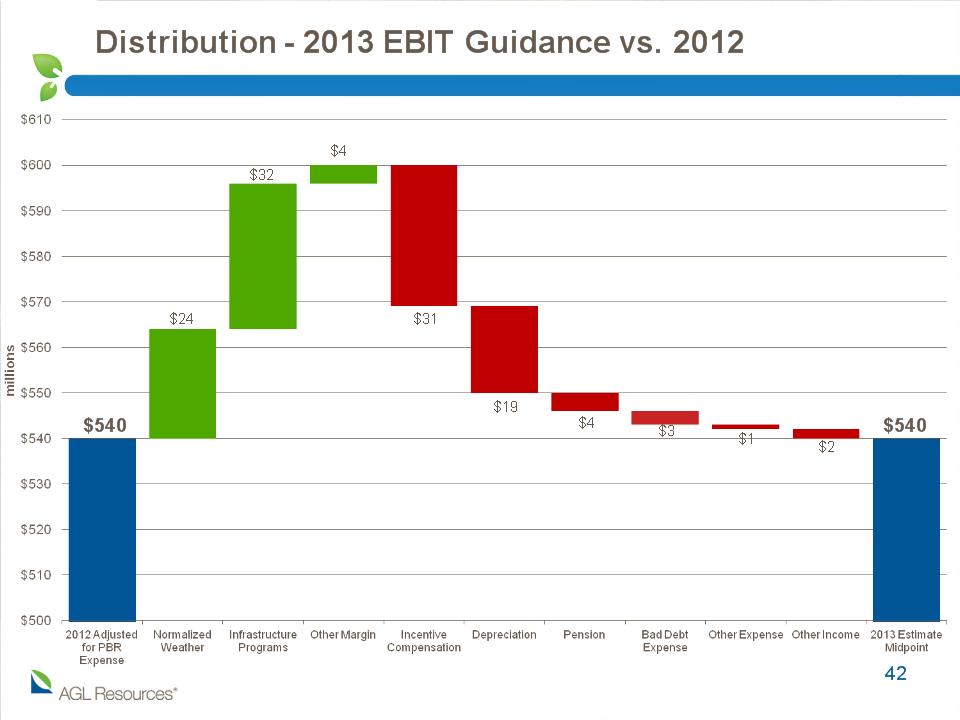

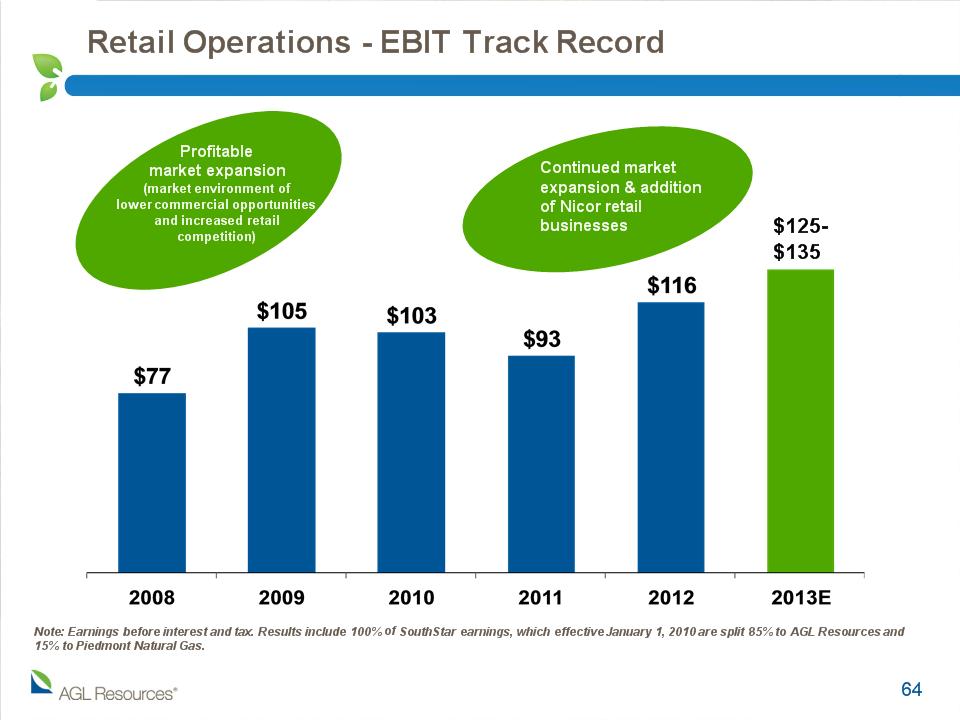

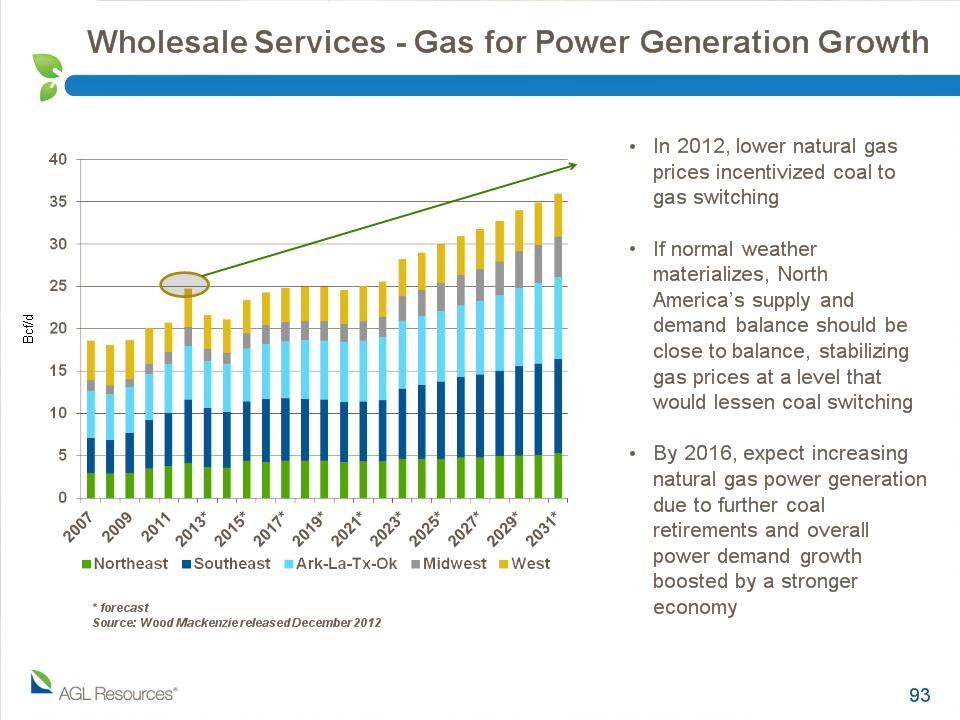

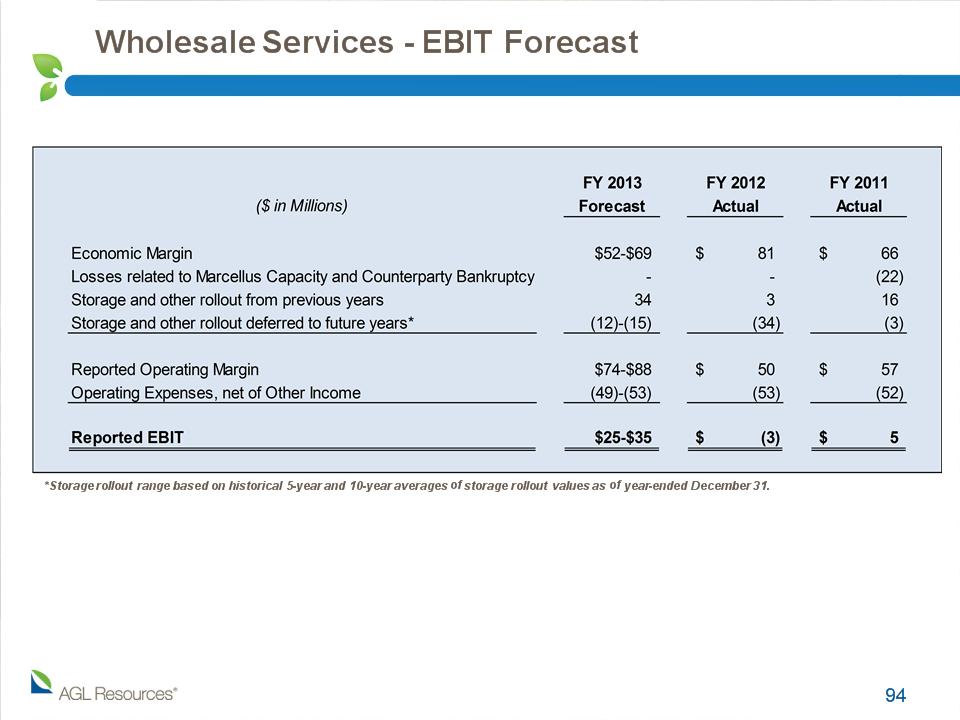

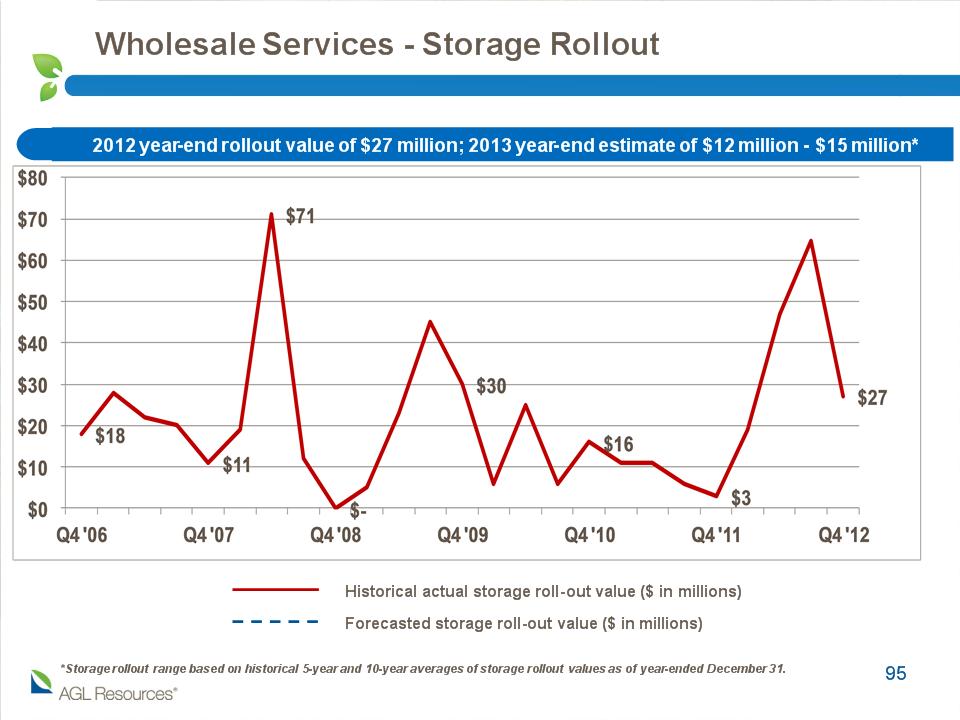

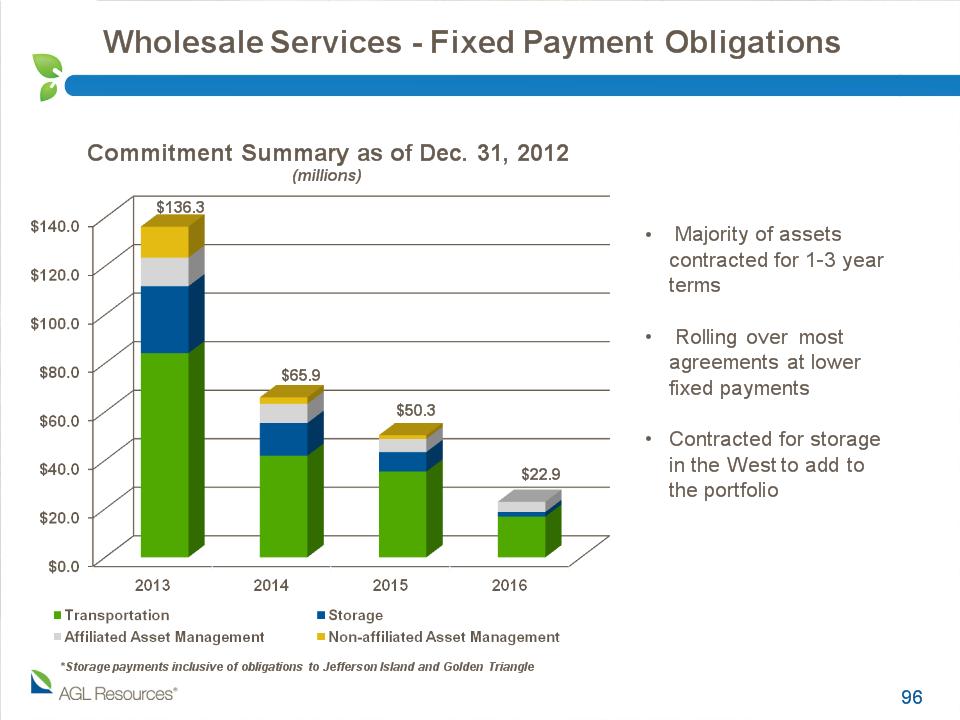

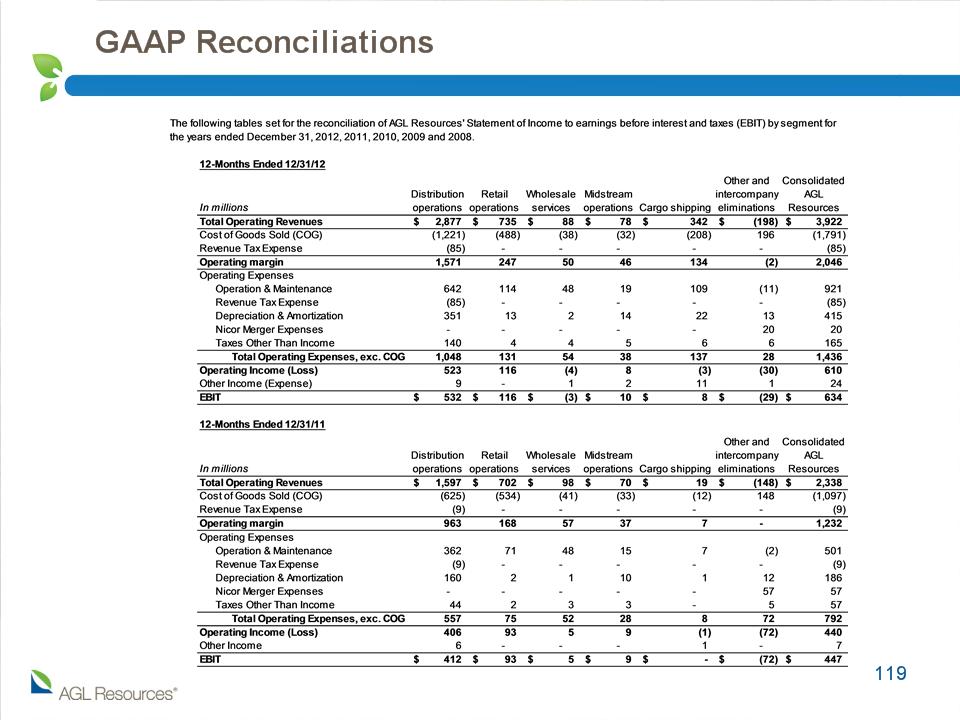

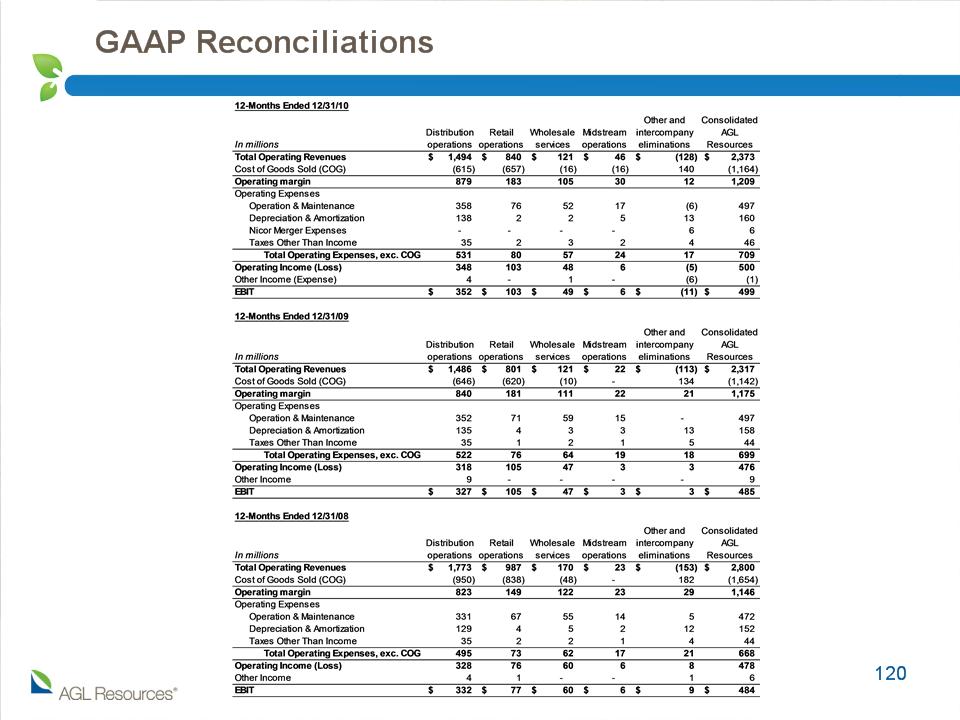

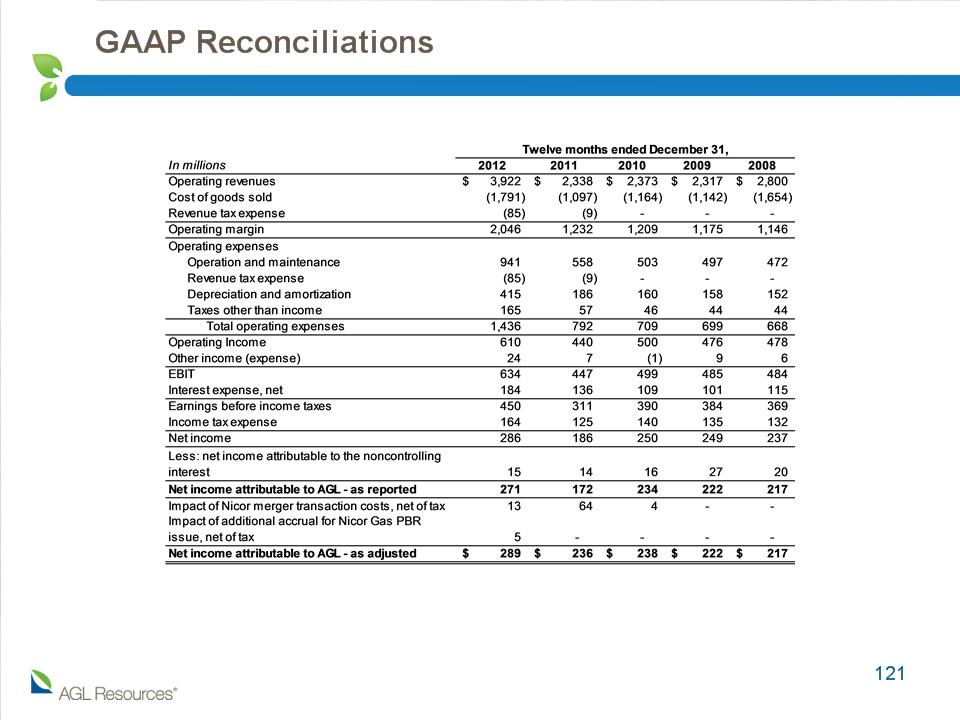

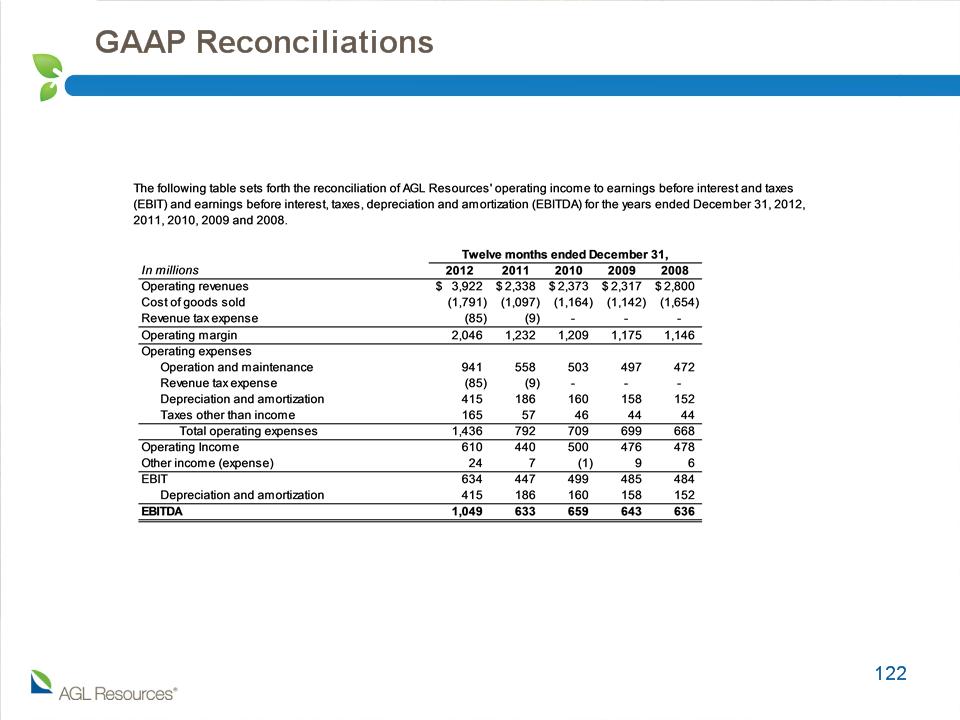

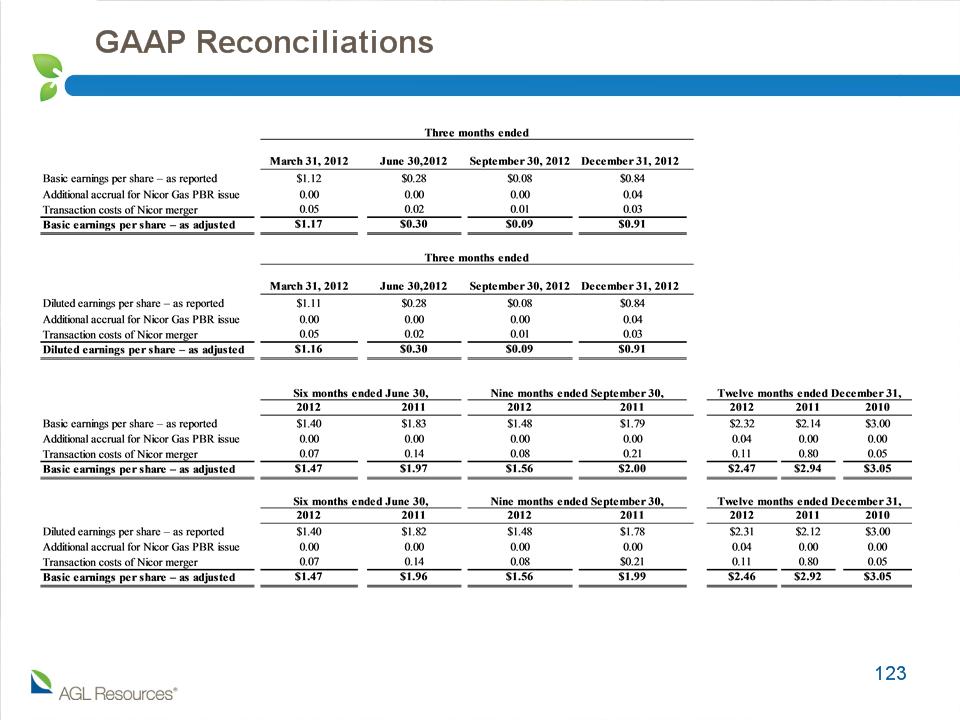

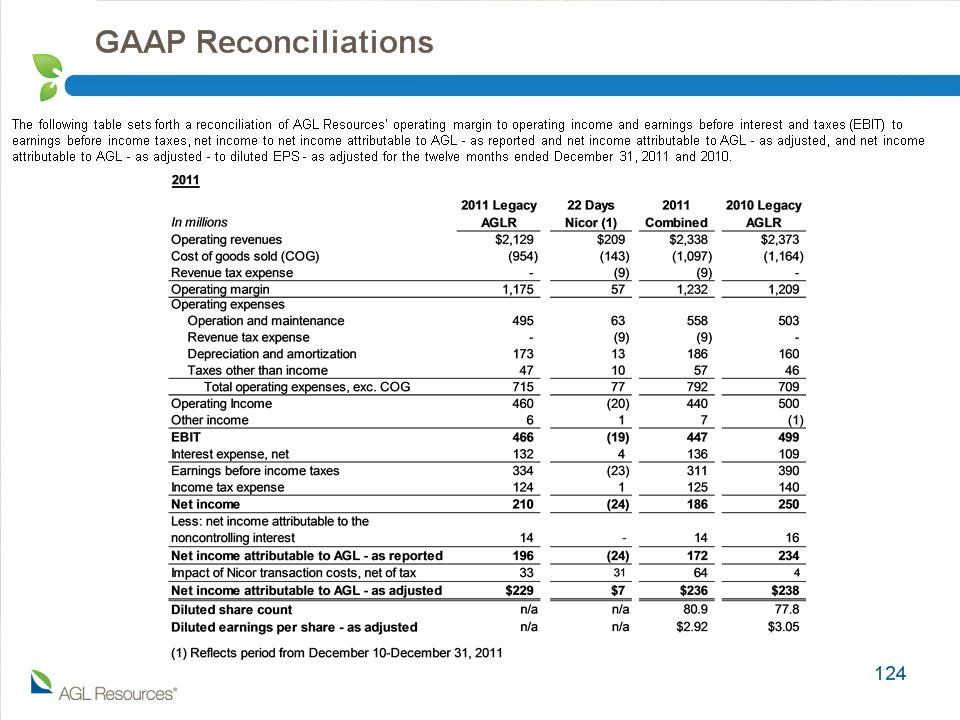

Cautionary Statements and Supplemental Information * Forward-Looking Statements Certain expectations and projections regarding our future performance referenced in this presentation, in other reports or statements we file with the SEC or otherwise release to the public, and on our website, are forward-looking statements. Senior officers and other employees may also make verbal statements to analysts, investors, regulators, the media and others that are forward-looking. Forward-looking statements involve matters that are not historical facts, such as statements regarding our future operations, prospects, strategies, financial condition, economic performance (including growth and earnings), industry conditions and demand for our products and services. Because these statements involve anticipated events or conditions, forward-looking statements often include words such as "anticipate," "assume," "believe," "can," "could," "estimate," "expect," "forecast," "future," "goal," "indicate," "intend," "may," "outlook," "plan," "potential," "predict," "project," "seek," "should," "target," "would," or similar expressions. Forward-looking statements contained in this presentation include, without limitation, statements regarding future earnings per share, segment EBIT and related guidance, capital expenditures, impact of bonus depreciation, pension and OPEB expenses, growth of our retail services business, dividend growth, contracted capacity rates, expected increase in natural gas power generation, expected storage rollout schedule and value and our opportunities and priorities for 2013. Our expectations are not guarantees and are based on currently available competitive, financial and economic data along with our operating plans. While we believe our expectations are reasonable in view of the currently available information, our expectations are subject to future events, risks and uncertainties, and there are several factors - many beyond our control - that could cause results to differ significantly from our expectations. Such events, risks and uncertainties include, but are not limited to, changes in price, supply and demand for natural gas and related products; the impact of changes in state and federal legislation and regulation, including changes related to climate change; actions taken by government agencies on rates and other matters, including regulatory approval of new partnerships; concentration of credit risk; utility and energy industry consolidation; the impact on cost and timeliness of construction projects by government and other approvals; development project delays; adequacy of supply of diversified vendors; unexpected change in project costs, including the cost of funds to finance these projects; the impact of acquisitions and divestitures, including the Nicor merger; limits on natural gas pipeline capacity; direct or indirect effects on our business, financial condition or liquidity resulting from a change in our credit ratings or the credit ratings of our counterparties or competitors; interest rate fluctuations; financial market conditions, including disruptions in the capital markets and lending environment and the current economic uncertainty; general economic conditions; uncertainties about environmental issues and the related impact of such issues; the impact of changes in weather, including climate change, on the temperature-sensitive portions of our business; the impact of natural disasters such as hurricanes on the supply and price of natural gas; the outcome of litigation; acts of war or terrorism; and other factors which are provided in detail in our filings with the Securities and Exchange Commission. Forward-looking statements are only as of the date they are made, and we do not undertake to update these statements to reflect subsequent changes. Supplemental Information Company management evaluates segment financial performance based on earnings before interest and taxes (EBIT), which includes the effects of corporate expense allocations and on operating margin. EBIT is a non-GAAP (accounting principles generally accepted in the United States of America) financial measure that includes operating income, other income and expenses. Items that are not included in EBIT are financing costs, including debt and interest expense and income taxes. The company evaluates each of these items on a consolidated level and believes EBIT is a useful measurement of our performance because it provides information that can be used to evaluate the effectiveness of our businesses from an operational perspective, exclusive of the costs to finance those activities and exclusive of income taxes, neither of which is directly relevant to the efficiency of those operations. In addition to EBIT, the company also uses the non-GAAP financial measure of earnings before interest, taxes, depreciation and amortization (EBITDA) to evaluate segment financial performance. Management believes that EBITDA may provide additional information with respect to the Company's performance or ability to meet its future debt service, capital expenditures and working capital requirements. Operating margin is a non-GAAP measure calculated as operating revenues minus cost of goods sold and revenue taxes, excluding operation and maintenance expense, depreciation and amortization, and taxes other than income taxes. These items are included in the company's calculation of operating income. The company believes operating margin is a better indicator than operating revenues of the contribution resulting from customer growth, since cost of goods sold and revenue taxes are generally passed directly through to customers. In addition, in this presentation, the company has presented a non-GAAP measure of both its net income and its earnings per share each adjusted to exclude expenses incurred with respect to the Nicor Inc. (Nicor) merger and expenses regarding an additional accrual for the Nicor Gas performance-based rate (PBR) issue. As the company does not routinely engage in transactions of the magnitude of the Nicor merger, and consequently does not regularly incur transaction related expenses with correlative size, the company believes presenting net income and EPS excluding Nicor merger expenses provides investors with an additional measure of the company’s core operating performance. Additionally, the company has excluded the additional accrual for the Nicor Gas PBR issue as it was a one-time expense that is not expected to be recurring. EBIT, EBITDA, operating margin, adjusted net income and adjusted EPS should not be considered as alternatives to, or more meaningful indicators of, the company's operating performance than operating income, net income attributable to AGL Resources Inc. or EPS as determined in accordance with GAAP. In addition, the company's EBIT, EBITDA, operating margin, adjusted net income and adjusted EPS may not be comparable to similarly titled measures of another company. Reconciliations of non-GAAP financial measures referenced in this presentation are available on the company’s Web site at www.aglresources.com