| Avda El Golf 150 piso 14 Las Condes Santiago,Chile | Tel.: (56-2) 461 7200 Fax: (56-2) 461 7541 www.arauco.cl

|

VIA EDGAR

Tia Jenkins

Senior Assistant Chief Accountant

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549-7010

| Re: | Arauco and Constitution Pulp, Inc Form 20-F for Fiscal Year Ended December 31, 2010 Filed June 22, 2011, File No. 033-99720 |

Dear Ms. Jenkins:

By letter dated September 16, 2011, the staff of the Securities and Exchange Commission (the “Staff”) provided certain comments to Arauco and Constitution Pulp, Inc. (“Arauco”) in respect of Arauco’s annual report on Form 20-F for the fiscal year 2010 (the “Arauco 20-F”), which was filed with the Securities and Exchange Commission (the “Commission”) on June 22, 2011. For your convenience, each of these comments is reproduced below in italics and is immediately followed by Arauco’s response. To the extent that any of the following responses includes a proposed revision to the Arauco 20-F, we kindly ask that the Staff notify Arauco in writing of their agreement with the proposed revision or any further questions or comments.

Form 20-F for the Fiscal Year Ended December 31, 2010

1. Selected Consolidated Financial Data, page 2

We note you presented non-GAAP financial measures EBIT, EBITDA and Adjusted EBITDA. Adjusted EBITDA appears to exclude some cash expenses. Please revise to provide a statement disclosing the reasons why management believes that presentation of non-GAAP measures provide useful information to investors and if and how you use these measures. Please provide further clarification of how you compute stumpage and net insurance coverage and whether these adjustments exclude any cash expenses. Please explain why excluding these items is useful to measure your core business and how it complies with Item 10(e) of Regulation S-K or eliminate such measures from your disclosures. Also refer to question 102.09 of the C&DI on Non-GAAP Financial Measures.

Securities and Exchange Commission, p. 2

We propose to include the following revised supplementary statement in future filings:

“We believe that the presentation of non-GAAP financial measures provides useful information to investors, analysts, credit rating agencies and other users because it assists them to evaluate the performance of Arauco against its competitors, as indicators of operational profitability. We use EBIT, EBITDA and Adjusted EBITDA as non-GAAP performance measures. Management considers Adjusted EBITDA to be a meaningful supplement to net income primarily because as a performance measure it excludes stumpage, depreciation and amortization expense which are not actual cash costs, and which amounts are largely independent of the underlying cost efficiency of our operating facilities. In addition, Adjusted EBITDA incorporates the net gain obtained from the business interruption during 2010, which partially offsets a non-recurring negative effect on our gross profit.

Stumpage represents the fair value of the wood harvested and sold which is included in our cost of sales of our own plantations (purchases of wood from third parties are cash expenses not included in Stumpage). Stumpage is commonly excluded in our industry from non-GAAP measures for analysts’ comparative information. The net insurance coverage represents the net effect of the cash expenses and reimbursements received from insurance claims related to the business interruption that was derived from the earthquake and tsunami of February 27, 2010, as mentioned above.

In evaluating the operating performance, we believe that each of those non-GAAP measures should be considered together with and should not be considered in isolation, or as a substitute for, the analysis of our results as reported under GAAP. Some of the limitations of those non-GAAP measures are that EBIT, EBITDA and Adjusted EBITDA do not reflect: (i) our cash expenditures, or future requirements, for capital expenditures or contractual commitments; (ii) changes in, or cash requirements for, working capital needs; (iii) the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our outstanding debt.

Because of these limitations, EBIT, EBITDA and Adjusted EBITDA should only be considered as a supplemental performance measure and should not be considered as a measure of liquidity or cash available to us to invest in the growth of our business. See the Statement of Cash Flows set out in our consolidated financial statements included herein.

Because all companies do not calculate EBITDA or Adjusted EBITDA in the same manner, EBITDA and Adjusted EBITDA as calculated by us may differ from Adjusted EBITDA or EBITDA as calculated by other companies. We compensate for these limitations by using EBITDA and Adjusted EBITDA as a supplemental measure of our performance and by relying primarily on our GAAP financial statements.”

We believe that the exclusion of stumpage is in compliance with requirements of regulation 10(e) of Regulation S-K since we do not use EBIT, EBITDA or Adjusted EBITDA as liquidity measures; therefore guidelines set forth in question 102.09 of the C&DI on Non-GAAP Financial Measures are not applicable in this case.

Securities and Exchange Commission, p. 3

Financial Statements

Notes to Financial Statements

Note 23

2. To enhance a reader’s understanding, please revise to provide the components of “other non-current financial liabilities” totaling $2,909,429 and $2,678,010 as of December 31, 2010 and 2009 respectively and reconcile to total financial liabilities disclosure in Note 23.

In the Arauco 20-F, immediately before the section captioned “Fair Value Financial Assets with Changes in Income and Loss (Negotiation),” Arauco proposes to include the following disclosure in future filings:

“The following table details Arauco’s Other Financial Liabilities, Current and Non-Current, and Trades and Other Payables as of December 31, 2010 and 2009:

Securities and Exchange Commission, p. 4

Note 2d- Disclosures of Other Information, page F-20

3. We note your disclosures of expenses by nature which only includes distribution costs. Please tell us how you considered providing the additional disclosures required by paragraphs 104 - 105 of IAS 1.

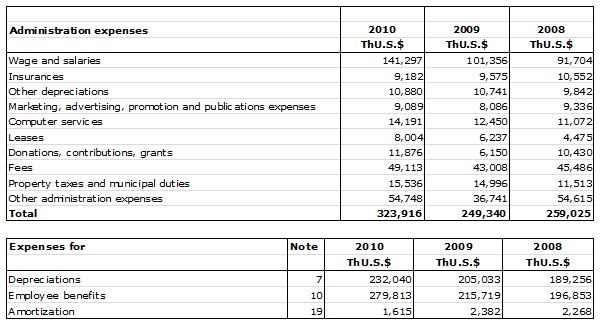

On pages F-20 and F-21 of the Arauco 20-F, Arauco’s disclosure of expenses by nature includes the following categories: distribution expenses, administration expenses and expenses relating to depreciation, employee benefits and amortization. As a result, Arauco believes that the Arauco 20-F complies with paragraphs 104 and 105 of IAS 1. Notwithstanding, for your convenience we provide below a more detailed break-down of those expenses for the years ended December 31, 2010. 2009 and 2008, that will be included in future filings:

Securities and Exchange Commission, p. 5

Note 20 - Biological Assets, page F-57

4. We note your disclosures regarding biological assets. Please revise to provide detailed disclosures relating to the components of biological assets and related activities as required by paragraphs 40-56 of IAS 41, as applicable. In this regard, please address the following:

| ● | To provide reader with a better understanding, please revise to provide a description and the related amounts of each group of biological assets as of the end of each period. Please include a quantified description of each group of biological assets, distinguishing between mature and immature biological assets. |

| ● | Please disclose non-financial measures or estimates of the physical quantities of:(i) each group of the entity’s biological assets at the end of the period; and (ii) output during the period. |

| ● | Disclose the aggregate gain or loss arising during the current period on initial recognition of biological assets and from the change in fair value less estimated point of sale costs of biological assets. |

| ● | We note your reconciliation of biological assets includes a change in the fair value of biological assets. To enhance reader understanding of your business in apprising current period performance and future prospects, please disclose separately gains arising from changes in fair value less costs to sell attributable to (a) physical changes and (b) price changes. Refer to paragraph 51 of IAS 41. |

Securities and Exchange Commission, p. 6

Arauco’s sole group of biological assets is our forest plantations, which consist primarily of radiata and taeda pine, and to a smaller extent, eucalyptus.

Biological assets are mainly our own pine and eucalyptus plantations, which are species of the same group of biological assets, consumables with common production processes and similar characteristics, which are managed and controlled together with maintenance activities and/or protection techniques to harvest care to maximize production and forest use, only differing in the number of years they are harvested. We also use the same valuation method for each species, as explained in detail in Note 20 to the financial statements included in the 20-F on p. F-57.

As disclosed on p. F-58 of the Arauco 20-F, as of December 31, 2010 and 2009, the balances of (i) current biological assets (representing those assets which had reached conditions for harvesting or “mature”) were ThU.S.$344,096 and ThU.S.$310,832, respectively and (ii) non-current biological assets (representing those assets which are still in a growing phase or “immature”) were ThU.S.$3,446,862 and ThU.S.$3,446,696, respectively.

Regarding the non-financial measures or estimates of the physical quantities, we believe our disclosure complies with requirements established by IAS 41 and we refer the Staff to the first and second paragraph of Note 20 to the financial statements included in the Arauco 20-F for non-financial measures of (i) Arauco’s sole group of biological assets as of December 31, 2010 and (ii) the production volume derived from these assets during 2010.

In accordance with the nature of the biological assets related to the forestry business, there is no initial measurement of the biological assets as the initial recognition corresponds to the plantation costs, which are considered to be representative of their fair value; therefore, there is no aggregate gain or loss arising from the initial recognition of biological assets that has to be considered.

The gains arising from changes in fair value less estimated costs at point of sale were ThU.S.$221,501 for the year ended December 31, 2010 (ThU.S.$155,532 for the year ended December 31, 2009) as disclosed in Note 20 to the financial statements. Of this total amount, ThU.S.$222,019 relates to an increase in price (ThU.S.$118,016 for the year ended December 31,2009) and ThU.S.$518 to a decrease in volume ( increase of ThU.S.$37,516 for the year ended December 31,2009).

Provided that the disclosure of the aforementioned break-down is recommended by IAS 41 par. 51 but is not technically mandatory and represents strategic information to the Company that is not commonly disclosed in our industry, we kindly request not to incorporate it in our Form 20-F.

Securities and Exchange Commission, p. 7

5. We note your assumptions in determining the fair value of biological assets on page F-57. We also note that the majority of your biological assets are sold to company owned industrial centers. Please revise to discuss the sales margin assumptions in the valuation of the products that are harvested in the forests to be sold internally.

Please clarify the percentage of biological assets sold directly to third parties and discuss how comparable the sales margin assumptions are with the internal sales.

As for the determination of margins on products sold internally, sales prices used do not differ significantly from those known in the market price.

As of December 31, 2010, a 94.4% (93.4% at December 31, 2009) of Arauco’s biological assets were sold internally to company-owned industrial centers and the remaining 5.6% (6.6% at December 31, 2009) were sold to third parties. Sales margin assumptions used for products sold internally do not vary in any significant manner from those used for products sold to third parties.

Section 302 Certification

6. We note that Section 302 certification (Exhibit 12.2) is signed by Comptroller Director. Please note that Section 302 certification should be signed by Principal Financial Officer of the Company pursuant to Exchange Act Rules 13a-14(a) and 15d-14(a). Please confirm whether Comptroller Director is also the Principal Financial Officer of the Company. Otherwise, please revise the Section 302 certification as necessary.

As Comptroller Director, Robinson Tajmuch serves as Arauco's principal financial officer responsible for the financial statements and any other financial information included in the Arauco 20-F. Furthermore, as stated in the Section 302 certification filed as Exhibit 12.2 to the Arauco 20-F (the "certification"), Mr. Tajmuch is also the principal financial officer responsible for (i) establishing and maintaining disclosure controls and procedures and internal control over financial reporting, as set forth in paragraph 4(a) through (d) of the certification and (ii) corresponding with Arauco's auditors and board of directors regarding any significant deficiencies and/or material weaknesses in the design or operation of internal control over financial reporting and any fraud involving Arauco's management or other employees who have a significant role in Arauco's internal control over financial reporting, as set forth in paragraph 5 of the certification.

* * *

Securities and Exchange Commission, p. 8

We acknowledge that (i) we are responsible for the adequacy and accuracy of the disclosure in our filing, (ii) Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and (iii) we may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

If you have any questions regarding the foregoing responses or require any additional information, please do not hesitate to contact our outside counsel, Jaime A. El Koury, at (+54)(11) 5556-8923 and Joshua M. Kalish at (212) 225-2502, or me at (+56) (2) 461-7221.

| | Arauco and Constitution Pulp, Inc. |

| | |

| | /s/ Gianfranco Truffello By: Gianfranco Truffello Chief Financial Officer |

| cc: | Mr. Brian K. Bhandari Mr. Raj Rajan Mr. Nasreen Mohammed Securities and Exchange Commission Mr. Robinson Tajmuch Arauco and Constitution Pulp, Inc. Mr. Jaime A. El Koury Mr. Joshua M. Kalish Cleary Gottlieb Steen & Hamilton LLP |