| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-171508-06 |

| | | |

May 8, 2013

Free Writing Prospectus

Structural and Collateral Term Sheet

$1,197,467,027

(Approximate Mortgage Pool Balance)

$1,061,255,000

(Offered Certificates)

GS Mortgage Securities Trust 2013-GCJ12

As Issuing Entity

GS Mortgage Securities Corporation II

As Depositor

Commercial Mortgage Pass-Through Certificates

Series 2013-GCJ12

Jefferies LoanCore LLC

Citigroup Global Markets Realty Corp.

Goldman Sachs Mortgage Company

MC-Five Mile Commercial Mortgage Finance LLC

Archetype Mortgage Funding I LLC

As Sponsors

IMPORTANT NOTICE REGARDING THE CONDITIONS FOR THIS OFFERING OF ASSET-BACKED SECURITIES

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-171508) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Jefferies LLC, Citigroup Global Markets Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation being made that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| Goldman, Sachs & Co. | Jefferies |

| | Citigroup |

| |

| Co-Lead Managers and Joint Bookrunners |

The securities offered by this structural and collateral term sheet (this “Term Sheet”) are described in greater detail in the prospectus included as part of our registration statement (SEC File No. 333-171508) (the “Base Prospectus”) and a separate free writing prospectus, each to be dated May 8, 2013 (the “Free Writing Prospectus”). The Base Prospectus and the Free Writing Prospectus contain material information that is not contained in this Term Sheet (including without limitation a detailed discussion of risks associated with an investment in the offered securities under the heading “Risk Factors” in each of the Base Prospectus and the Free Writing Prospectus). The Base Prospectus and the Free Writing Prospectus are available upon request from Goldman, Sachs & Co., Jefferies LLC or Citigroup Global Markets Inc. Capitalized terms used but not otherwise defined in this Term Sheet have the respective meanings assigned to those terms in the Free Writing Prospectus or, if not defined in the Free Writing Prospectus, in the Base Prospectus. This Term Sheet is subject to change.

The Securities May Not Be a Suitable Investment for You

The securities offered by this Term Sheet are not suitable investments for all investors. In particular, you should not purchase any class of securities unless you understand and are able to bear the prepayment, credit, liquidity and market risks associated with that class of securities. For those reasons and for the reasons set forth under the heading “Risk Factors” in each of the Base Prospectus and the Free Writing Prospectus, the yield to maturity and the aggregate amount and timing of distributions on the offered securities are subject to material variability from period to period and give rise to the potential for significant loss over the life of those securities. The interaction of these factors and their effects are impossible to predict and are likely to change from time to time. As a result, an investment in the offered securities involves substantial risks and uncertainties and should be considered only by sophisticated institutional investors with substantial investment experience with similar types of securities and who have conducted appropriate due diligence on the mortgage loans and the securities. Potential investors are advised and encouraged to review the Base Prospectus and the Free Writing Prospectus in full and to consult with their legal, tax, accounting and other advisors prior to making any investment in the offered securities described in this Term Sheet.

This Term Sheet is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The information contained in this Term Sheet may not pertain to any securities that will actually be sold. The information contained in this Term Sheet may be based on assumptions regarding market conditions and other matters as reflected in this Term Sheet. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and this Term Sheet should not be relied upon for such purposes. We and our affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of this Term Sheet may, from time to time, have long or short positions in, and buy or sell, the securities mentioned in this Term Sheet or derivatives thereof (including options). Information contained in this Term Sheet is current as of the date appearing on this Term Sheet only. Information in this Term Sheet regarding the securities and the mortgage loans backing any securities discussed in this Term Sheet supersedes all prior information regarding such securities and mortgage loans. None of Goldman, Sachs & Co., Jefferies LLC or Citigroup Global Markets Inc. provides accounting, tax or legal advice.

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-171508) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Jefferies LLC, Citigroup Global Markets Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

NOTICE TO NEW HAMPSHIRE RESIDENTS

NEITHER THE FACT THAT A REGISTRATION STATEMENT OR AN APPLICATION FOR A LICENSE HAS BEEN FILED WITH THE STATE OF NEW HAMPSHIRE UNDER CHAPTER 421-B OF THE NEW HAMPSHIRE REVISED STATUTES (“RSA 421-B”), NOR THE FACT THAT A SECURITY IS EFFECTIVELY REGISTERED OR A PERSON IS LICENSED IN THE STATE OF NEW HAMPSHIRE CONSTITUTES A FINDING BY THE SECRETARY OF STATE OF NEW HAMPSHIRE THAT ANY DOCUMENT FILED UNDER RSA 421-B IS TRUE, COMPLETE, AND NOT MISLEADING. NEITHER ANY SUCH FACT NOR THE FACT THAT ANY EXEMPTION OR EXCEPTION IS AVAILABLE FOR A SECURITY OR A TRANSACTION MEANS THAT THE SECRETARY OF STATE HAS PASSED IN ANY WAY UPON THE MERITS OR QUALIFICATIONS OF, OR RECOMMENDED OR GIVEN APPROVAL TO, ANY PERSON, SECURITY, OR TRANSACTION. IT IS UNLAWFUL TO MAKE, OR CAUSE TO BE MADE, TO ANY PROSPECTIVE PURCHASER, CUSTOMER, OR CLIENT ANY REPRESENTATION INCONSISTENT WITH THE PROVISIONS OF THIS PARAGRAPH.

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-171508) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Jefferies LLC, Citigroup Global Markets Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| | Expected Ratings (S&P / Fitch)(1) | | Initial Certificate Principal

Amount or Notional

Amount(2) | | Approximate

Initial Credit Support | | Initial Pass-Through

Rate(3) | | Pass-

Through

Rate

Description | | Expected Wtd. Avg.

Life

(Yrs)(4) | | Expected

Principal

Window(4) |

| Class A-1 | | AAA(sf) / AAA(sf) | | $ | 84,631,000 | | | 30.000%(5) | | [ ]% | | (6) | | 2.54 | | | 06/13 – 01/18 |

| Class A-2 | | AAA(sf) / AAA(sf) | | $ | 134,221,000 | | | 30.000%(5) | | [ ]% | | (6) | | 4.83 | | | 01/18 – 05/18 |

| Class A-3 | | AAA(sf) / AAA(sf) | | $ | 200,000,000 | | | 30.000%(5) | | [ ]% | | (6) | | 9.74 | | | 11/22 – 04/23 |

| Class A-4 | | AAA(sf) / AAA(sf) | | $ | 313,849,000 | | | 30.000%(5) | | [ ]% | | (6) | | 9.89 | | | 04/23 – 05/23 |

| Class A-AB | | AAA(sf) / AAA(sf) | | $ | 105,525,000 | | | 30.000%(5) | | [ ]% | | (6) | | 7.27 | | | 05/18 – 11/22 |

| Class X-A | | AAA(sf) / AAA(sf) | | $ | 919,055,000 | (7) | | N/A | | [ ]% | | Variable IO(8) | | N/A | | | N/A |

| Class X-B | | A-(sf) / A-(sf) | | $ | 142,200,000 | (7) | | N/A | | [ ]% | | Variable IO(8) | | N/A | | | N/A |

| Class A-S | | AAA(sf) / AAA(sf) | | $ | 80,829,000 | | | 23.250% | | [ ]% | | (6) | | 9.94 | | | 05/23 – 05/23 |

| Class B | | AA-(sf) / AA-(sf) | | $ | 86,817,000 | | | 16.000% | | [ ]% | | (6) | | 9.94 | | | 05/23 – 05/23 |

| Class C | | A-(sf) / A-(sf) | | $ | 55,383,000 | | | 11.375% | | [ ]% | | (6) | | 9.94 | | | 05/23 – 05/23 |

| | Expected Ratings (S&P / Fitch)(1) | | Initial Certificate Principal

Amount or Notional

Amount(2) | | Approximate

Initial Credit Support | | Initial Pass-Through

Rate(3) | | Pass-

Through

Rate

Description | | Expected Wtd. Avg.

Life

(Yrs)(4) | | Expected

Principal

Window(4) |

| Class X-C | | NR / NR | | $ | 86,817,027 | (7) | | N/A | | [ ]% | | Variable IO(8) | | N/A | | | N/A |

| Class D | | BBB-(sf) / BBB-(sf) | | $ | 49,395,000 | | | 7.250% | | [ ]% | | (6) | | 9.94 | | | 05/23 – 05/23 |

| Class E | | BB(sf) / BB(sf) | | $ | 32,931,000 | | | 4.500% | | [ ]% | | (6) | | 9.94 | | | 05/23 – 05/23 |

| Class F | | BB-(sf) / B(sf) | | $ | 11,974,000 | | | 3.500% | | [ ]% | | (6) | | 9.94 | | | 05/23 – 05/23 |

| Class G | | NR / NR | | $ | 41,912,027 | | | 0.000% | | [ ]% | | (6) | | 9.94 | | | 05/23 – 05/23 |

Class R(9) | | NR / NR | | | N/A | | | N/A | | N/A | | N/A | | N/A | | | N/A |

| (1) | It is a condition of issuance that the offered certificates receive the ratings set forth above. The anticipated ratings shown are those of Standard & Poor’s Ratings Services, a Standard & Poor’s Financial Services LLC business (“S&P”) and Fitch, Inc. (“Fitch”). Subject to the discussion under “Ratings” in the Free Writing Prospectus, the ratings on the certificates address the likelihood of the timely receipt by holders of all payments of interest to which they are entitled on each distribution date and the ultimate receipt by holders of all payments of principal to which they are entitled on or before the applicable rated final distribution date. Certain nationally recognized statistical rating organizations, as defined in Section 3(a)(62) of the Securities Exchange Act of 1934, as amended, that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, to rate the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” in the Free Writing Prospectus. S&P and Fitch have informed us that the “sf” designation in the ratings represents an identifier of structured finance product ratings. For additional information about this identifier, prospective investors can go to the related rating agency’s website. |

| (2) | Approximate, subject to a variance of plus or minus 5%. |

| (3) | Approximate per annum rate as of the closing date. |

| (4) | Assuming no prepayments and based on the Modeling Assumptions set forth under “Yield, Prepayment and Maturity Considerations” in the Free Writing Prospectus. |

| (5) | The credit support percentages set forth for the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-AB certificates are represented in the aggregate. |

| (6) | For any distribution date, the pass-through rates on the Class A-1, Class A-2, Class A-3, Class A-4, Class A-AB, Class A-S, Class B, Class C, Class D, Class E, Class F and Class G certificates will each be a per annum rate equal to one of (i) a fixed rate, (ii) the weighted average of the net interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as of their respective due dates in the month preceding the month in which the related distribution date occurs, (iii) a rate equal to the lesser of a specified pass-through rate and the rate specified in clause (ii), or (iv) the rate specified in clause (ii) less a specified percentage. |

| (7) | The Class X-A, Class X-B and Class X-C certificates will not have principal amounts and will not be entitled to receive distributions of principal. Interest will accrue on the Class X-A, Class X-B and Class X-C certificates at their respective pass-through rates based upon their respective notional amounts. The notional amount of the Class X-A certificates will be equal to the aggregate principal amounts of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-AB and Class A-S certificates from time to time. The notional amount of the Class X-B certificates will be equal to the aggregate principal amounts of the Class B and Class C certificates from time to time. The notional amount of the Class X-C certificates will be equal to the aggregate principal amounts of the Class E, Class F and Class G certificates from time to time. |

| (8) | The pass-through rate on the Class X-A certificates will generally be a per annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (ii) the weighted average of the pass-through rates of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-AB and Class A-S certificates, as described in the Free Writing Prospectus. The pass-through rate on the Class X-B certificates will generally be a per annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (ii) the weighted average of the pass-through rates of the Class B and Class C certificates, as described in the Free Writing Prospectus. The pass-through rate on the Class X-C certificates will generally be a per annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (ii) the weighted average of the pass-through rates of the Class E, Class F and Class G certificates, as described in the Free Writing Prospectus. |

| (9) | The Class R certificates will not have a certificate principal amount, notional amount, pass-through rate, rating or rated final distribution date. The Class R certificates will represent the residual interest in each of two separate REMICs, as further described in the Free Writing Prospectus. The Class R certificates will not be entitled to distributions of principal or interest. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-171508) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Jefferies LLC, Citigroup Global Markets Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| MORTGAGE POOL CHARACTERISTICS |

| Mortgage Pool Characteristics |

| Initial Pool Balance | | $1,197,467,027 |

| Number of Mortgage Loans | | 78 |

| Number of Mortgaged Properties | | 106 |

| Average Cut-off Date Mortgage Loan Balance | | $15,352,141 |

| Weighted Average Mortgage Interest Rate | | 4.5097% |

| Weighted Average Remaining Term to Maturity (months) | | 112 |

| Weighted Average Remaining Amortization Term (months) | | 346 |

Weighted Average Cut-off Date LTV Ratio(1) | | 68.2% |

Weighted Average Maturity Date LTV Ratio(2) | | 55.3% |

Weighted Average Underwritten Debt Service Coverage Ratio(3) | | 1.58x |

Weighted Average Debt Yield on Underwritten NOI(4) | | 10.6% |

| % of Mortgage Loans with Additional Debt | | 19.5% |

| % of Mortgaged Properties with Single Tenants | | 4.8% |

| (1) | Unless otherwise indicated, the Cut-off Date LTV Ratio is calculated utilizing the “as-is” appraised value. |

| (2) | Unless otherwise indicated, the Maturity Date LTV Ratio is calculated utilizing the “as-is” appraised value. With respect to 11 mortgage loans representing approximately 15.8% of the initial pool balance, the respective Maturity Date LTV Ratios were each calculated using the related “as stabilized” appraised value. See “Description of the Mortgage Pool – Certain Calculations and Definitions” in the Free Writing Prospectus for a description of Maturity Date LTV Ratio. |

| (3) | Unless otherwise indicated, the Underwritten Debt Service Coverage Ratio is calculated by taking the Underwritten Net Cash Flow from the related mortgaged property or mortgaged properties and dividing by the annual debt service for such mortgage loan, as adjusted in the case of mortgage loans with a partial interest only period by using the first 12 amortizing payments due instead of the actual interest only payment. See “Description of the Mortgage Pool – Certain Calculations and Definitions” in the Free Writing Prospectus for a description of Underwritten Debt Service Coverage Ratio. |

| (4) | Unless otherwise indicated, the Debt Yield on Underwritten NOI is the related mortgaged property’s Underwritten NOI divided by the Cut-off Date Balance of the mortgage loan, and the Debt Yield on Underwritten NCF is the related mortgaged property’s Underwritten NCF divided by the Cut-off Date Balance of the mortgage loan. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-171508) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Jefferies LLC, Citigroup Global Markets Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| KEY FEATURES OF THE CERTIFICATES |

Co-Lead Managers and Joint Bookrunners: | Goldman, Sachs & Co. Jefferies LLC Citigroup Global Markets Inc. |

| Depositor: | GS Mortgage Securities Corporation II |

| Initial Pool Balance: | $1,197,467,027 |

| Master Servicer: | Wells Fargo Bank, National Association |

| Special Servicer: | Rialto Capital Advisors, LLC |

| Certificate Administrator: | Wells Fargo Bank, National Association |

| Trustee: | Deutsche Bank Trust Company Americas |

| Operating Advisor: | Situs Holdings, LLC |

| Pricing: | Week of May 13, 2013 |

| Closing Date: | May 30, 2013 |

| Cut-off Date: | For each mortgage loan, the related due date for such mortgage loan in May 2013 (or, in the case of any mortgage loan that has its first due date in June 2013, the date that would have been its due date in May 2013 under the terms of that mortgage loan if a monthly payment were scheduled to be due in that month) |

| Determination Date: | The 6th day of each month or next business day |

| Distribution Date: | The 4th business day after the Determination Date, commencing in June 2013 |

| Interest Accrual: | Preceding calendar month |

| ERISA Eligible: | The offered certificates are expected to be ERISA eligible |

| SMMEA Eligible: | No |

| Payment Structure: | Sequential Pay |

| Day Count: | 30/360 |

| Tax Structure: | REMIC |

| Rated Final Distribution Date: | June 2046 |

| Cleanup Call: | 1.0% |

| Minimum Denominations: | $10,000 minimum for the offered certificates (except with respect to Class X-A and Class X-B: $1,000,000 minimum); $1 thereafter for all the offered certificates |

| Delivery: | Book-entry through DTC |

| Bond Information: | Cash flows are expected to be modeled by TREPP, INTEX and BLOOMBERG |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-171508) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Jefferies LLC, Citigroup Global Markets Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

■ | $1,197,467,027 (Approximate) New-Issue Multi-Borrower CMBS: |

| | — | Overview: The mortgage pool consists of 78 fixed-rate commercial mortgage loans that have an aggregate Cut-off Date Balance of $1,197,467,027 (the “Initial Pool Balance”), have an average mortgage loan Cut-off Date Balance of $15,352,141 and are secured by 106 mortgaged properties located throughout 29 states and the District of Columbia |

| | — | LTV: 68.2% weighted average Cut-off Date LTV Ratio |

| | — | DSCR: 1.58x weighted average Underwritten Debt Service Coverage Ratio |

| | — | Debt Yield: 10.6% weighted average Debt Yield on Underwritten NOI |

| | — | Credit Support: 30.000% credit support to Class A-1 / A-2 / A-3 / A-4 / A-AB |

■ | Loan Structural Features: |

| | — | Amortization: 100.0% of the mortgage loans by Initial Pool Balance have scheduled amortization: |

| | – | 65.1% of the mortgage loans by Initial Pool Balance have amortization for the entire term with a balloon payment due at maturity |

| | – | 34.9% of the mortgage loans by Initial Pool Balance have scheduled amortization following a partial interest only period with a balloon payment due at maturity |

| | — | Hard Lockboxes: 60.3% of the mortgage loans by Initial Pool Balance have a Hard Lockbox in place |

| | — | Cash Traps: 91.7% of the mortgage loans by Initial Pool Balance have cash traps triggered by certain declines in cash flow, all at levels equal to or greater than a 1.00x coverage, that fund an excess cash flow reserve |

| | — | Reserves: The mortgage loans require amounts to be escrowed for reserves as follows: |

| | – | Real Estate Taxes: 73 mortgage loans representing 88.3% of the Initial Pool Balance |

| | – | Insurance: 64 mortgage loans representing 75.6% of the Initial Pool Balance |

| | – | Replacement Reserves (Including FF&E Reserves): 73 mortgage loans representing 83.5% of Initial Pool Balance |

| | – | Tenant Improvements / Leasing Commissions: 38 mortgage loans representing 73.2% of the allocated Initial Pool Balance of office, retail, industrial and mixed use properties only |

| | — | Predominantly Defeasance: 85.6% of the mortgage loans by Initial Pool Balance permit defeasance after an initial lockout period |

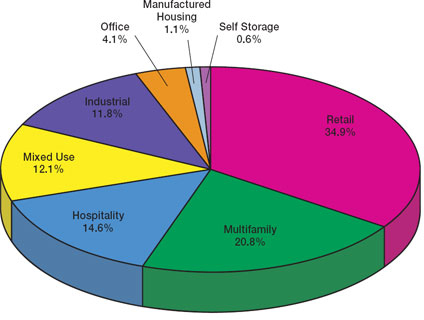

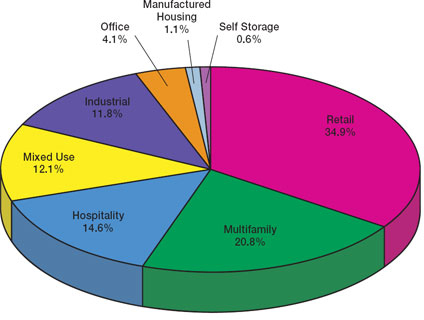

■ | Multiple-Asset Types > 5.0% of the Initial Pool Balance: |

| | — | Retail: 34.9% of the mortgaged properties by allocated Initial Pool Balance are retail properties (16.6% are anchored retail properties, 11.7% are lifestyle center properties) |

| | — | Multifamily: 20.8% of the mortgaged properties by allocated Initial Pool Balance are multifamily properties |

| | — | Hospitality: 14.6% of the mortgaged properties by allocated Initial Pool Balance are hospitality properties |

| | — | Mixed Use: 12.1% of the mortgaged properties by allocated Initial Pool Balance are mixed use properties |

| | — | Industrial: 11.8% of the mortgaged properties by allocated Initial Pool Balance are industrial properties |

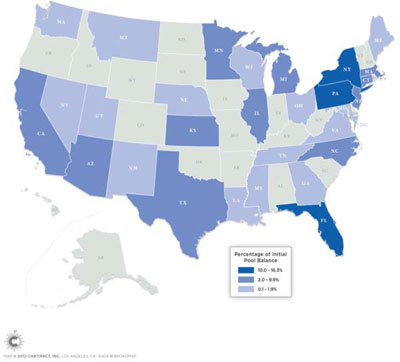

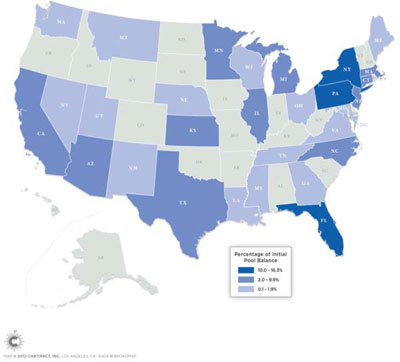

■ | Geographic Diversity: The 106 mortgaged properties are located throughout 29 states and the District of Columbia, with only three states having greater than 10.0% of the allocated Initial Pool Balance: New York (16.3%), Pennsylvania (13.4%) and Florida (12.4%) |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-171508) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Jefferies LLC, Citigroup Global Markets Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| Mortgage Loans by Loan Seller | |

| | | | | | Aggregate Cut-off

Date Balance | | | |

| Jefferies LoanCore LLC | | 24 | | | 30 | | | $ | 448,251,421 | | | 37.4 | % | |

| Citigroup Global Markets Realty Corp. | | 30 | | | 34 | | | | 376,112,651 | | | 31.4 | | |

| Goldman Sachs Mortgage Company | | 8 | | | 8 | | | | 211,702,000 | | | 17.7 | | |

| MC-Five Mile Commercial Mortgage Finance LLC | | 10 | | | 14 | | | | 83,272,652 | | | 7.0 | | |

| Archetype Mortgage Funding I LLC | | 6 | | | 20 | | | | 78,128,304 | | | 6.5 | | |

| Total | | 78 | | | 106 | | | $ | 1,197,467,027 | | | 100.0 | % | |

| Ten Largest Mortgage Loans |

| | Cut-off Date

Balance | | | | | | Property Size SF / Rooms /

Units | | Cut-off Date

Balance Per

SF / Room /

Unit | | | | | | |

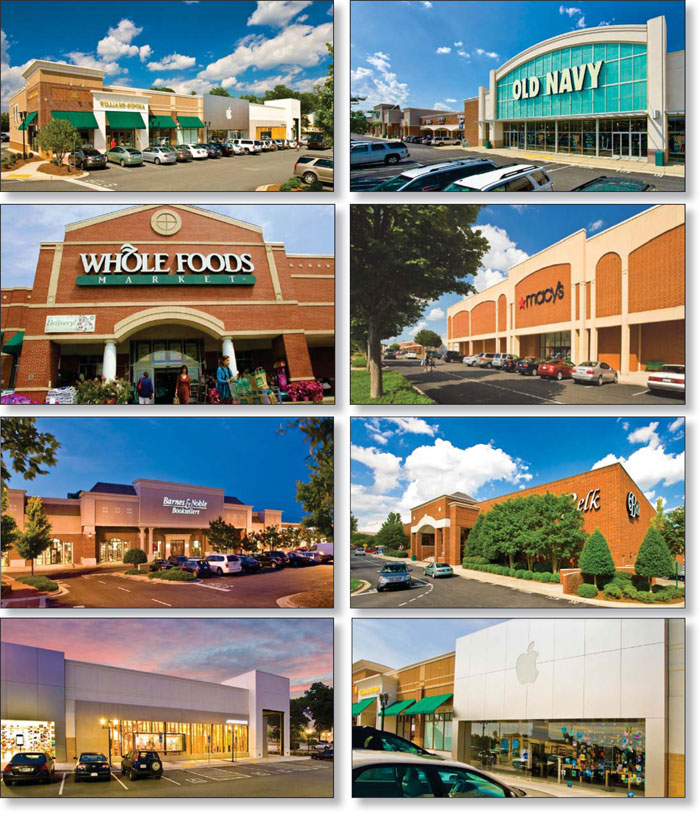

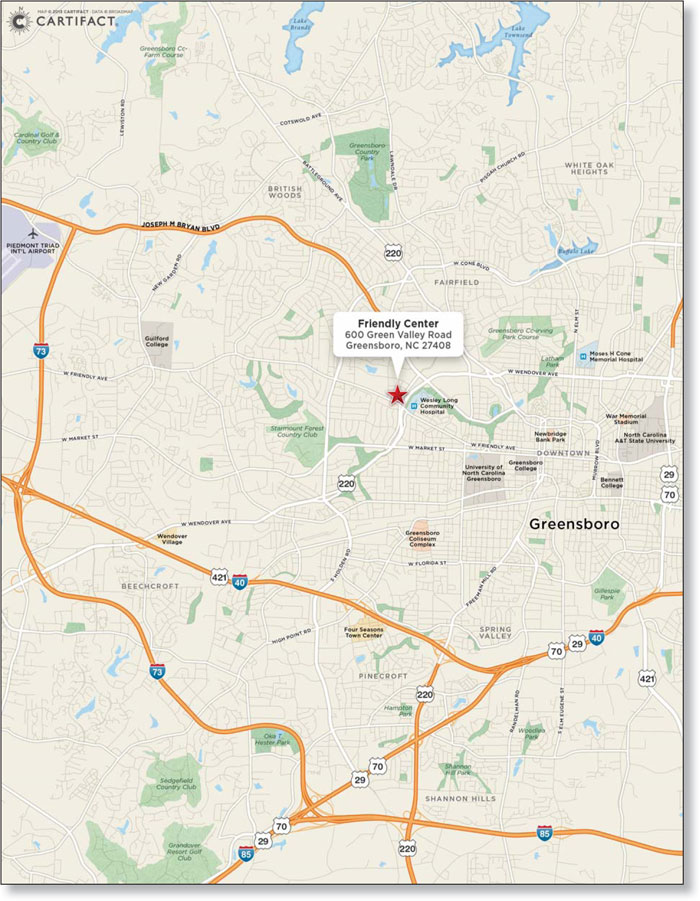

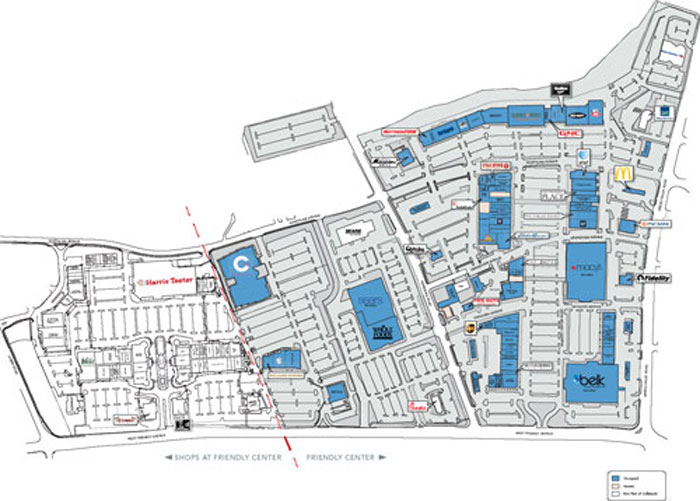

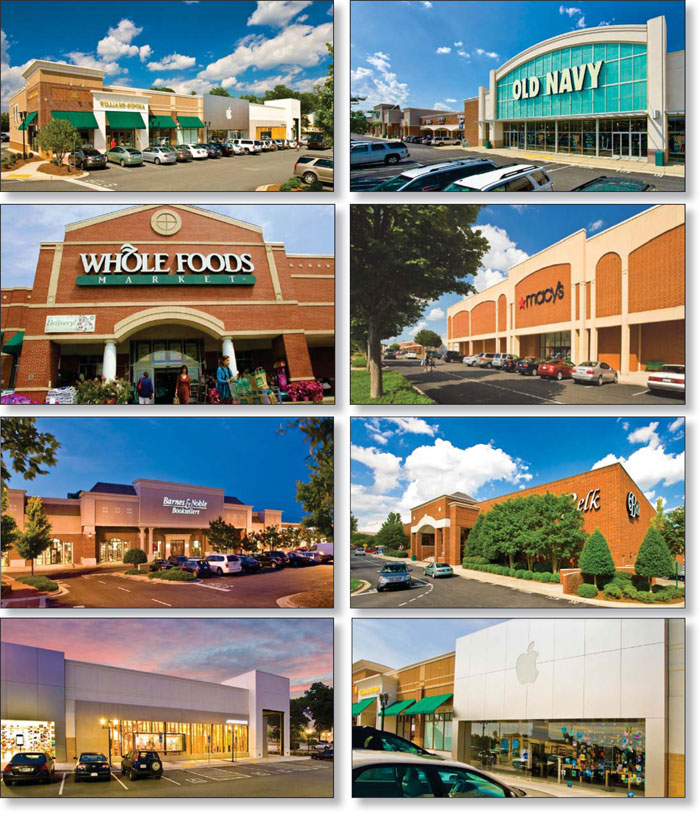

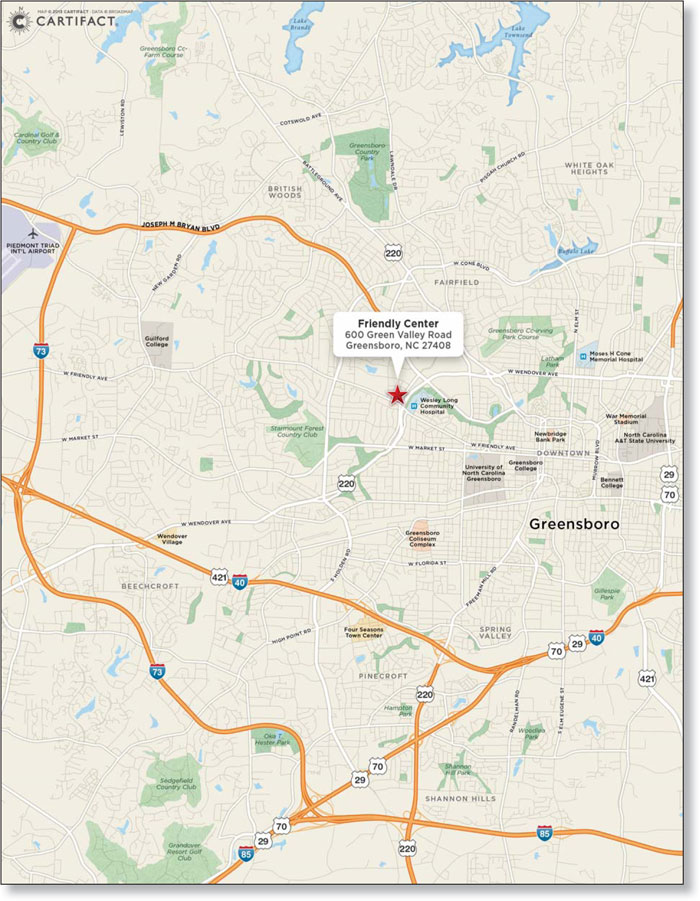

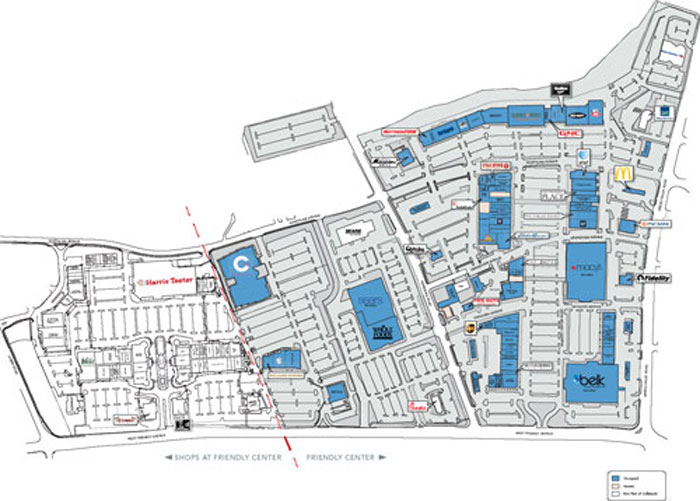

| Friendly Center | | | $100,000,000 | | | 8.4 | % | | Retail | | 994,891 | | | $101 | | | 2.02x | | 11.7 | % | | 58.8% |

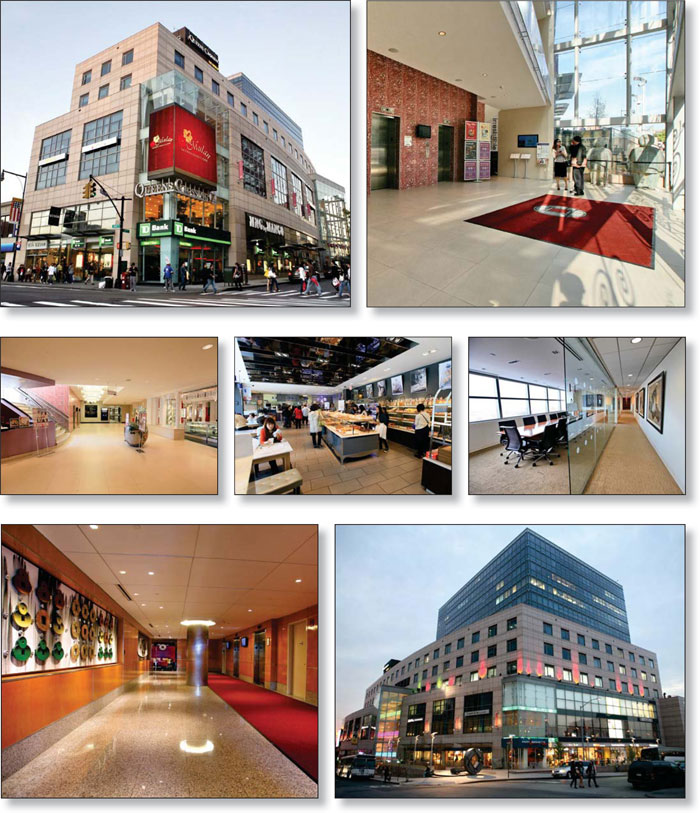

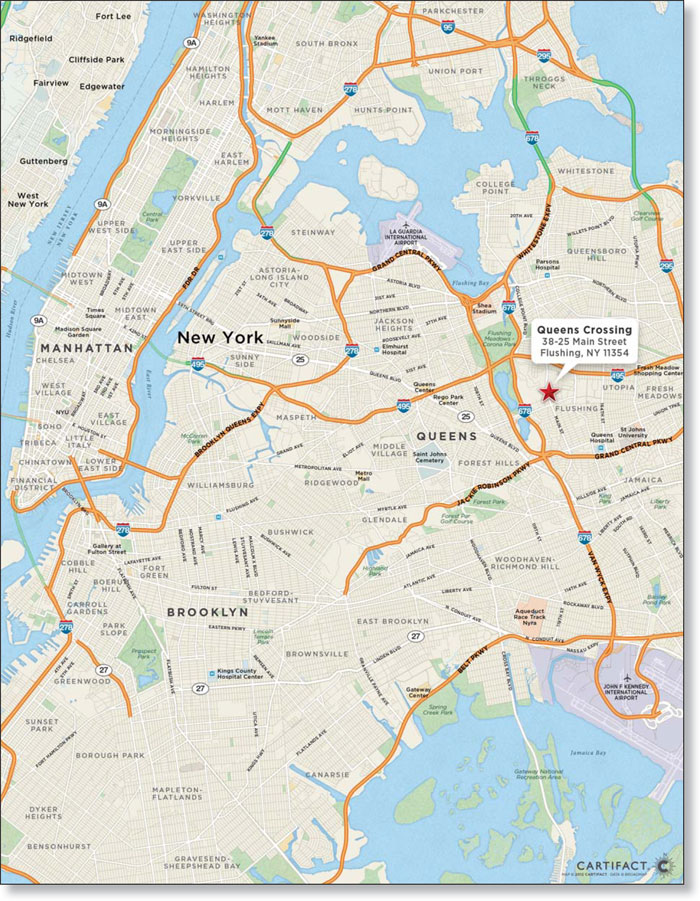

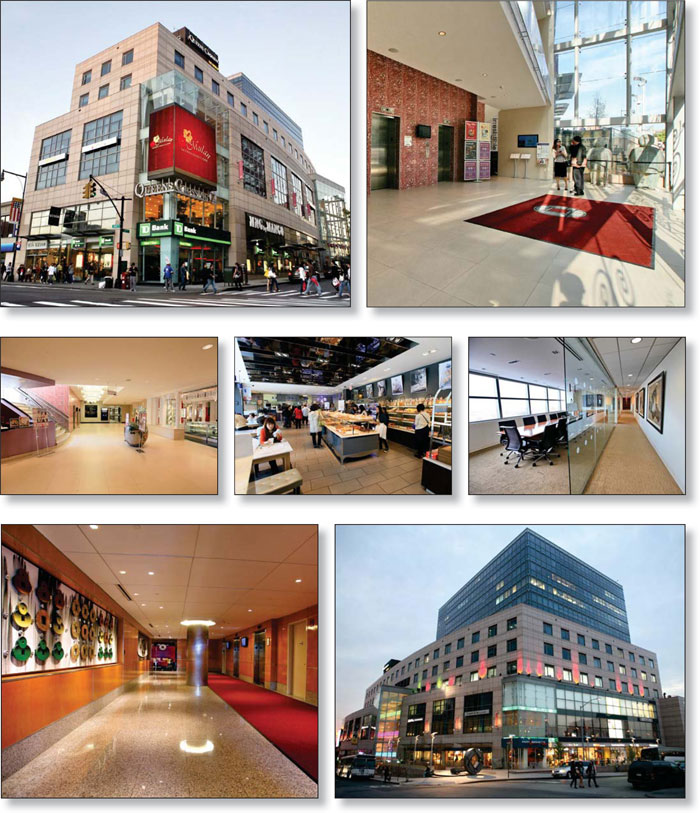

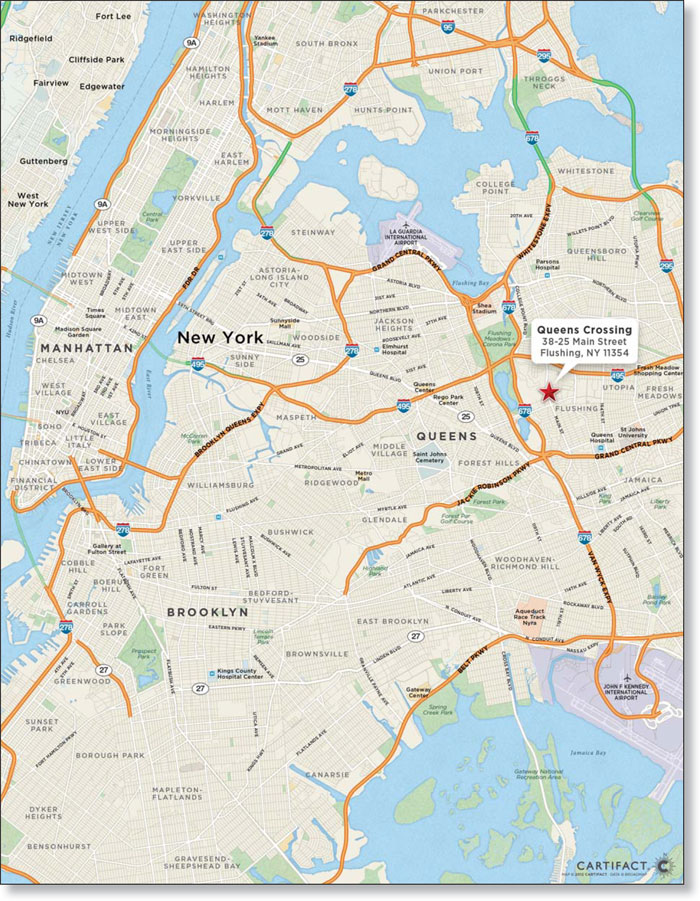

| Queens Crossing | | | 75,000,000 | | | 6.3 | | | Mixed Use | | 179,186 | | | $419 | | | 1.48x | | 9.7 | % | | 67.0% |

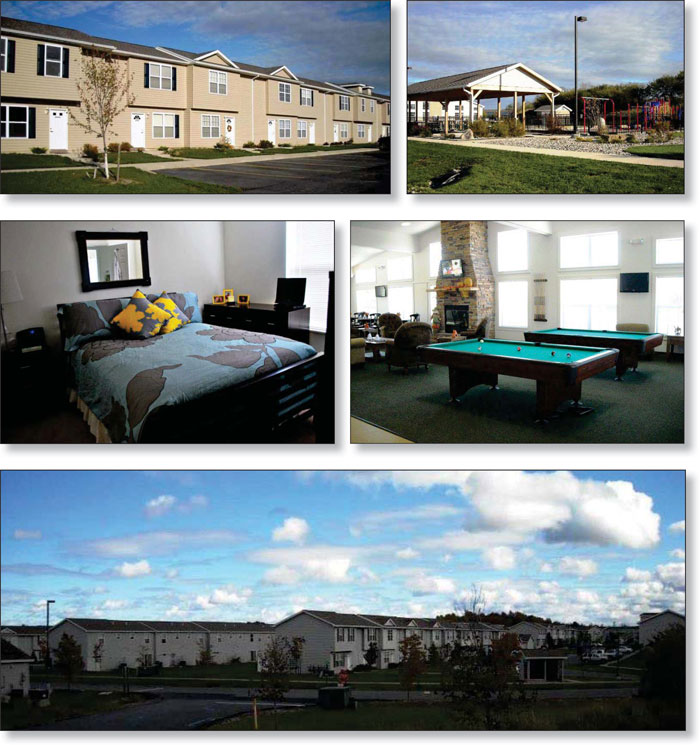

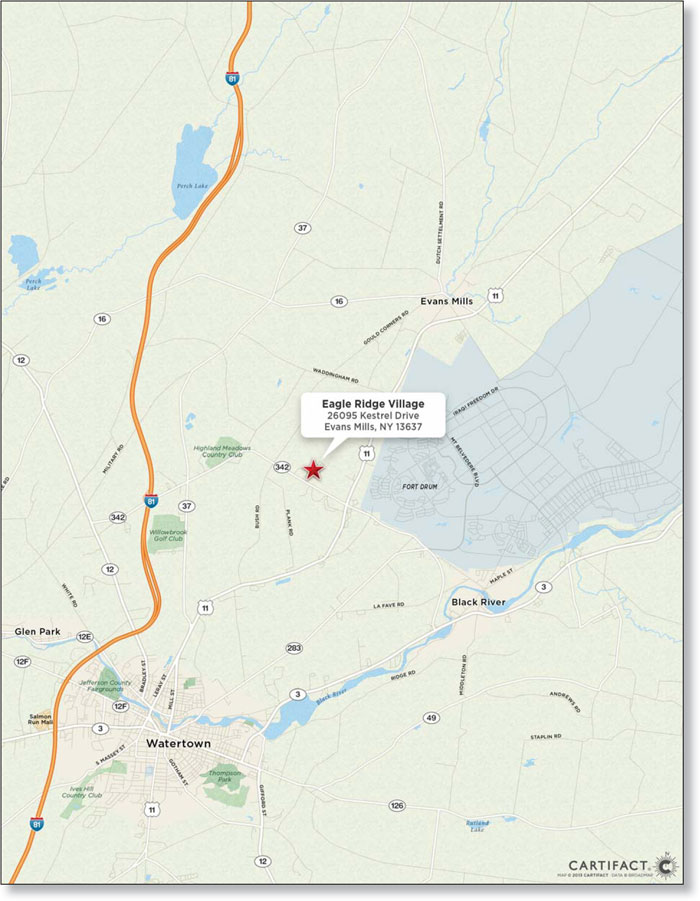

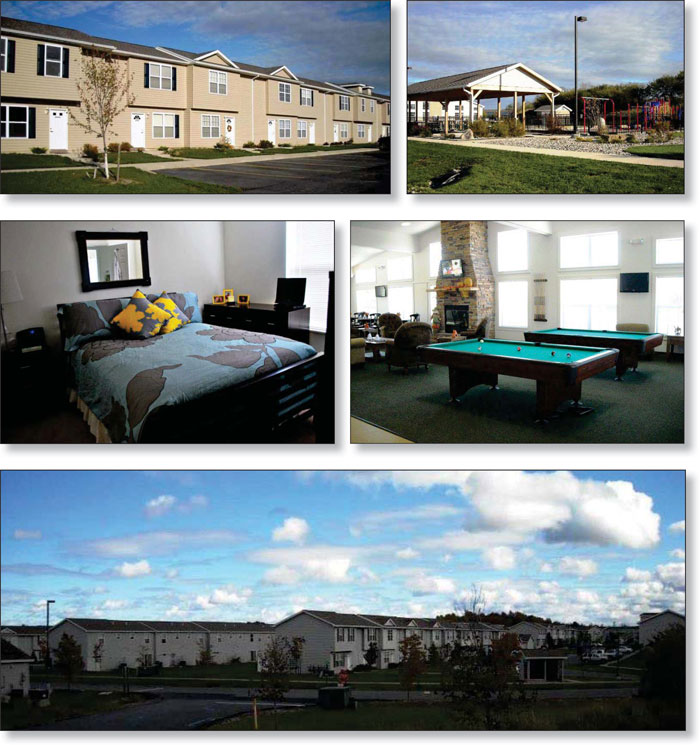

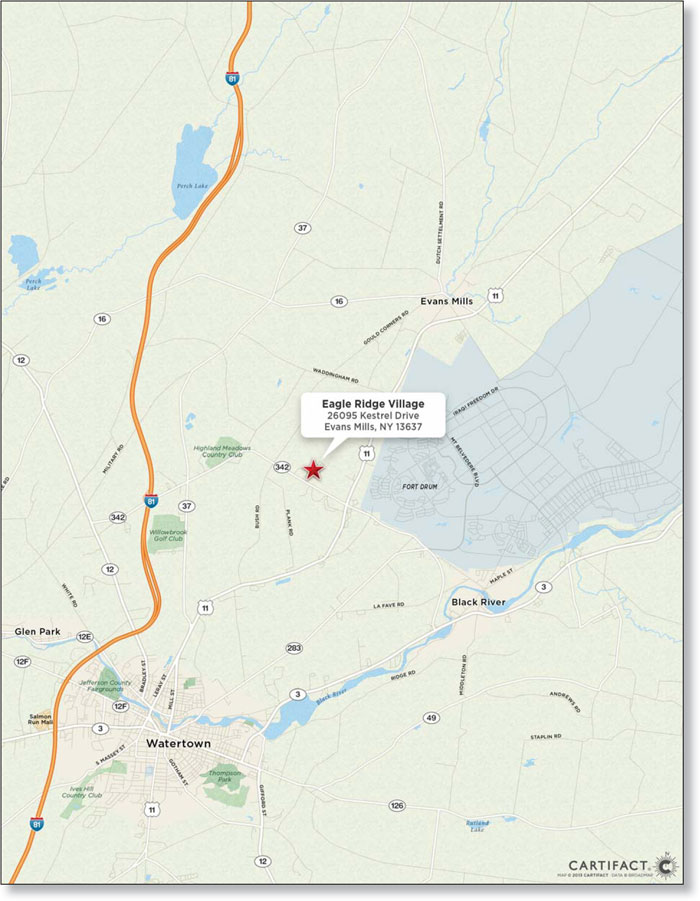

| Eagle Ridge Village | | | 61,869,623 | | | 5.2 | | | Multifamily | | 648 | | | $95,478 | | | 1.43x | | 9.9 | % | | 73.2% |

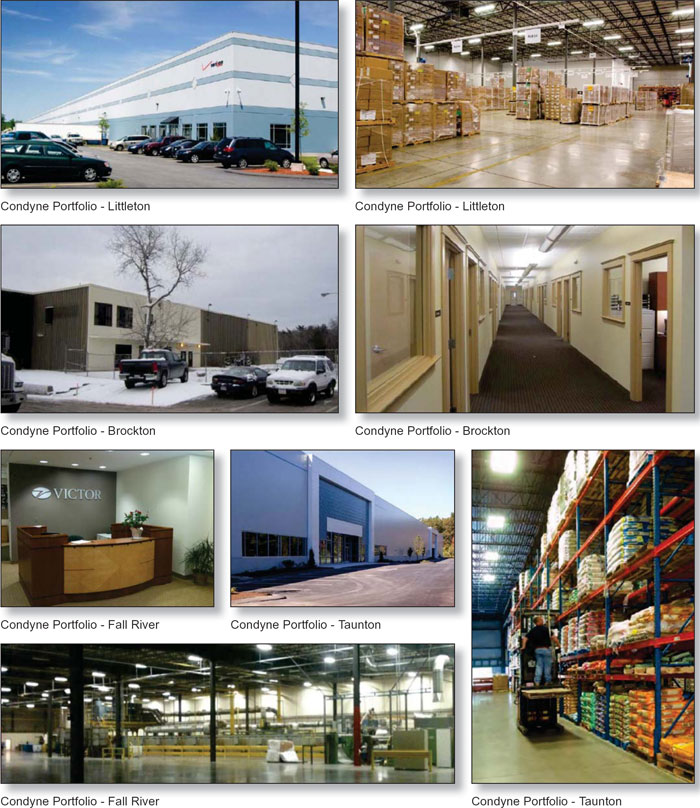

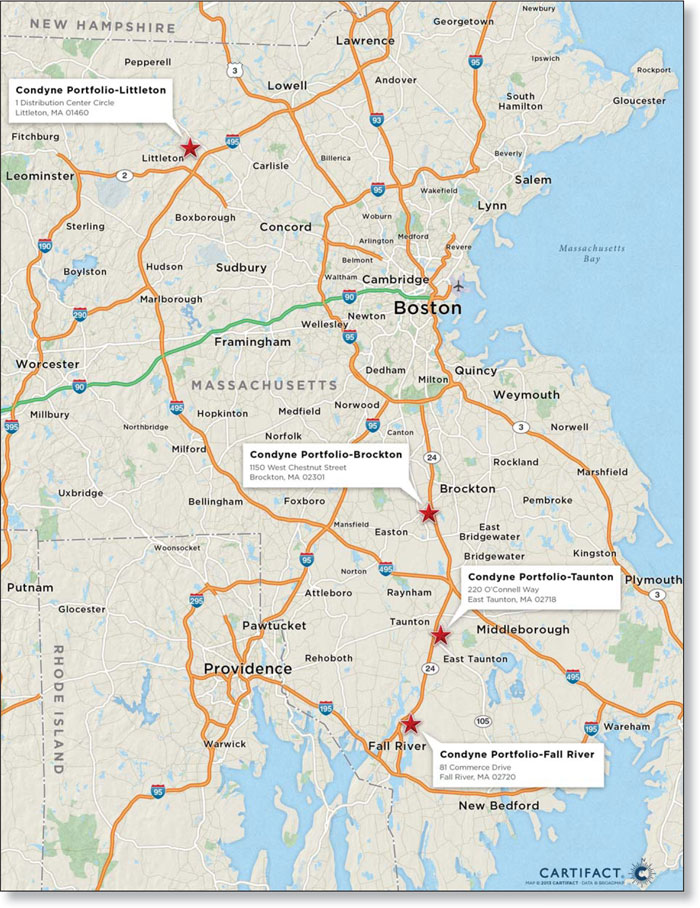

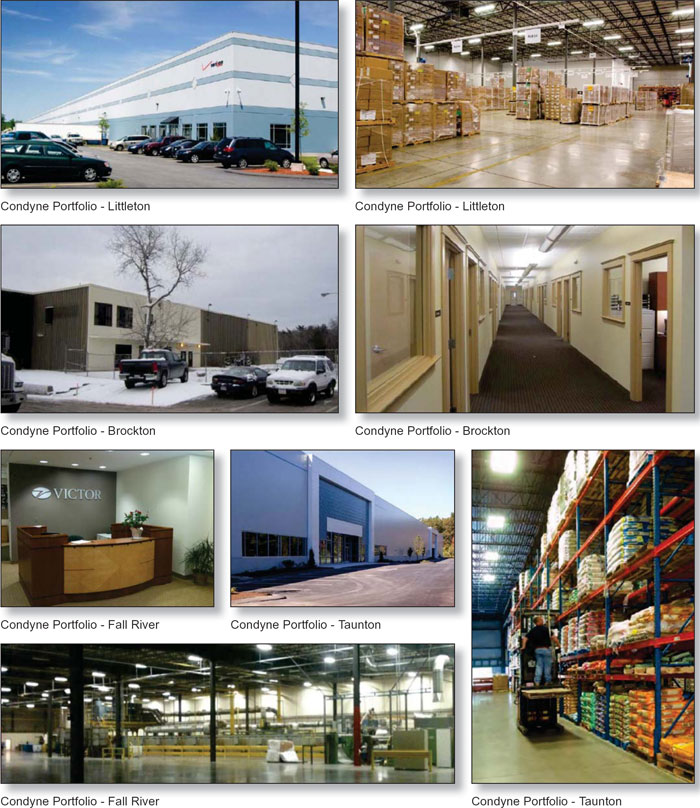

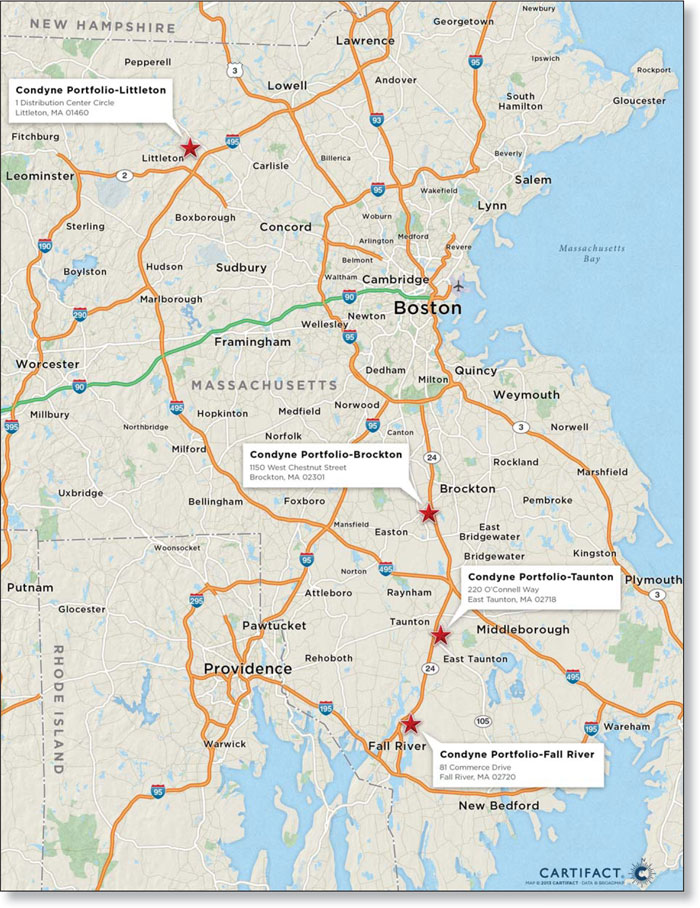

| Condyne Industrial Portfolio | | | 57,000,000 | | | 4.8 | | | Industrial | | 1,510,588 | | | $38 | | | 1.40x | | 10.3 | % | | 63.3% |

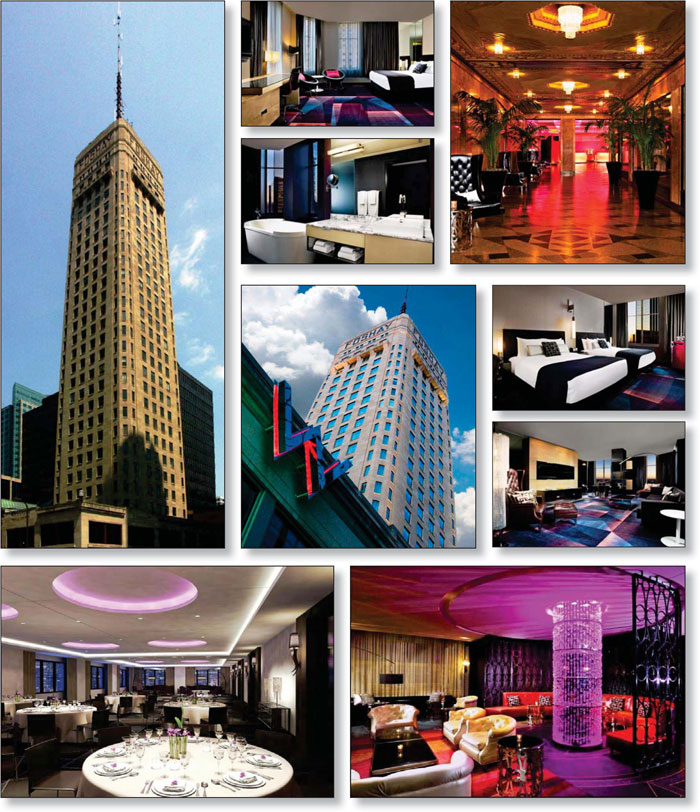

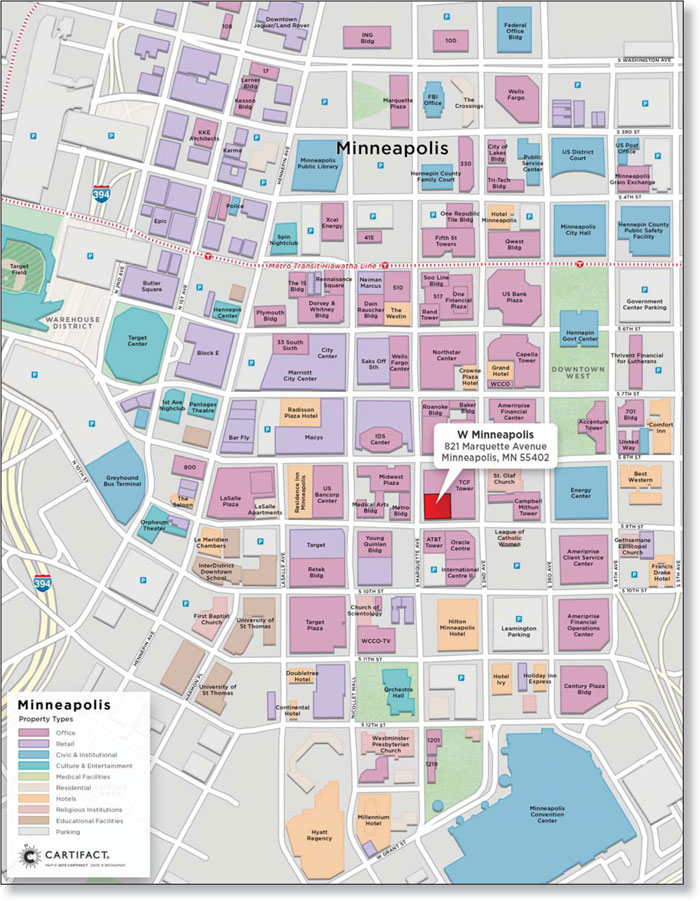

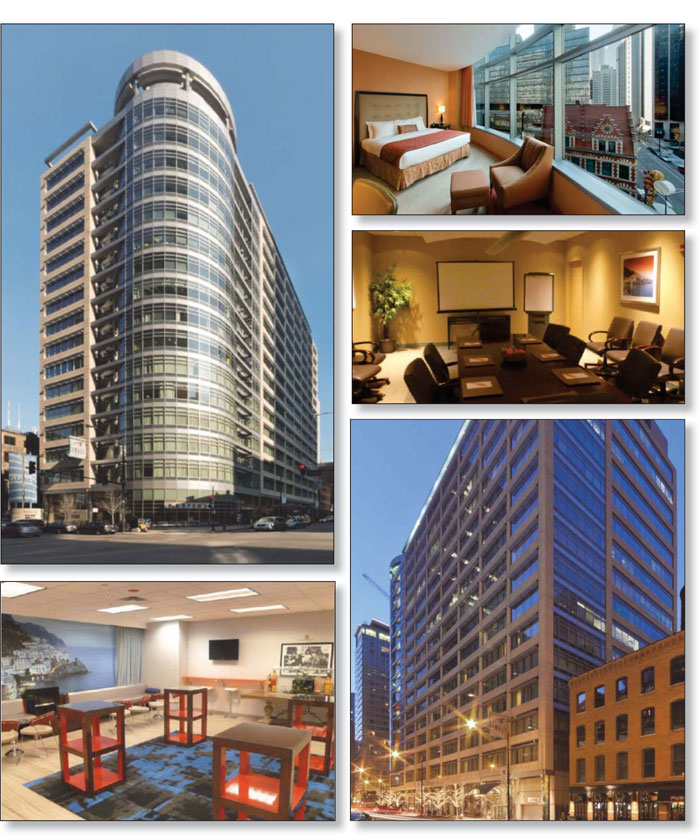

| W Minneapolis | | | 51,000,000 | | | 4.3 | | | Hospitality | | 229 | | | $222,707 | | | 1.48x | | 11.5 | % | | 68.0% |

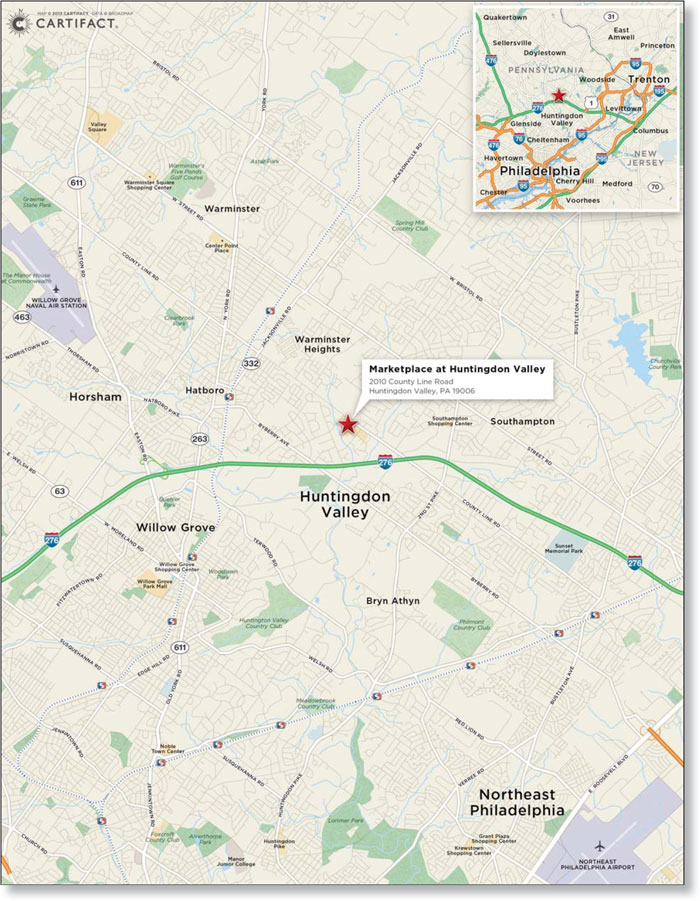

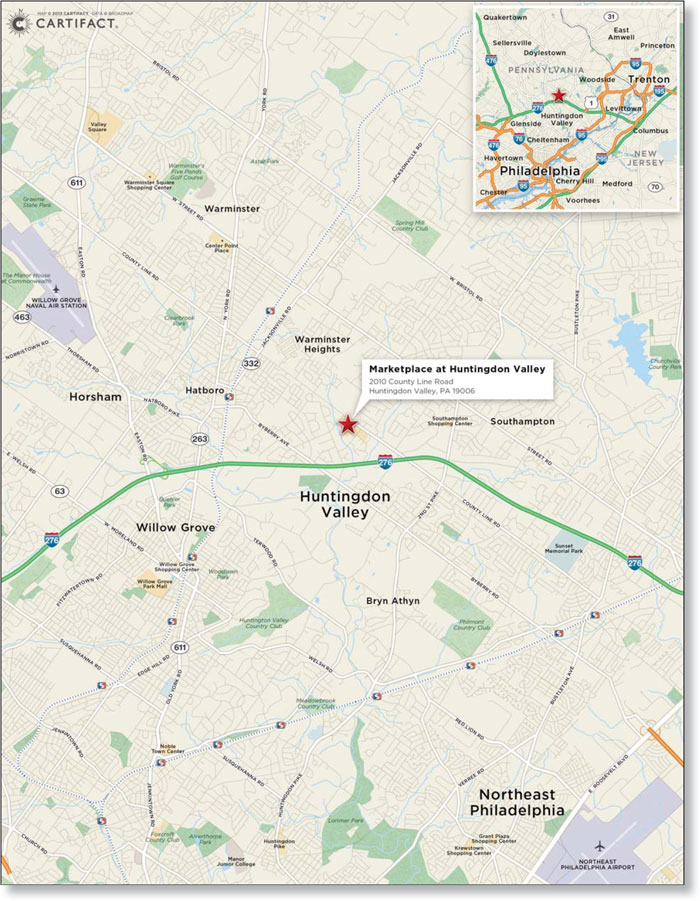

| Marketplace at Huntingdon Valley | | | 40,750,000 | | | 3.4 | | | Retail | | 254,349 | | | $160 | | | 1.43x | | 8.9 | % | | 78.4% |

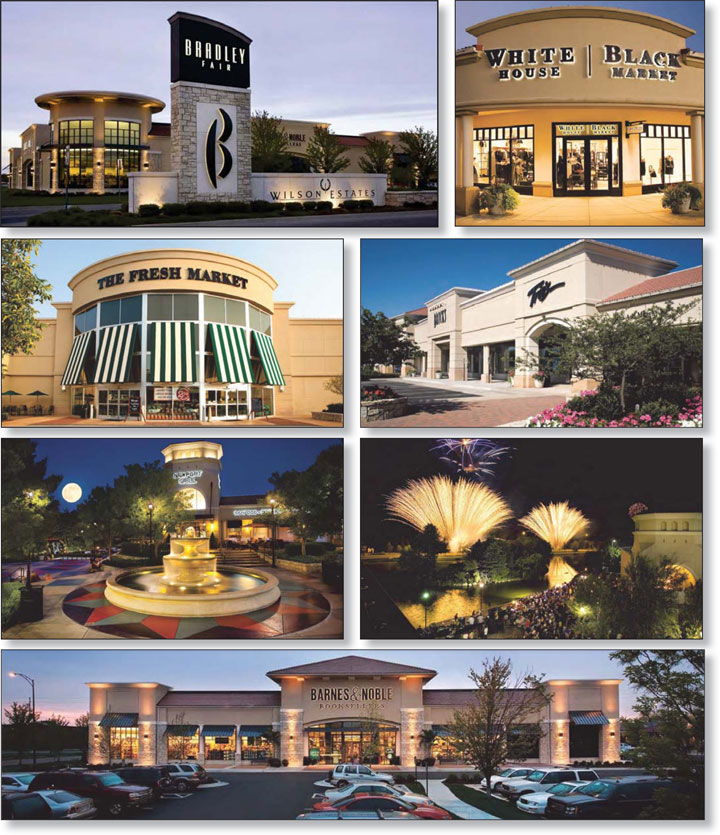

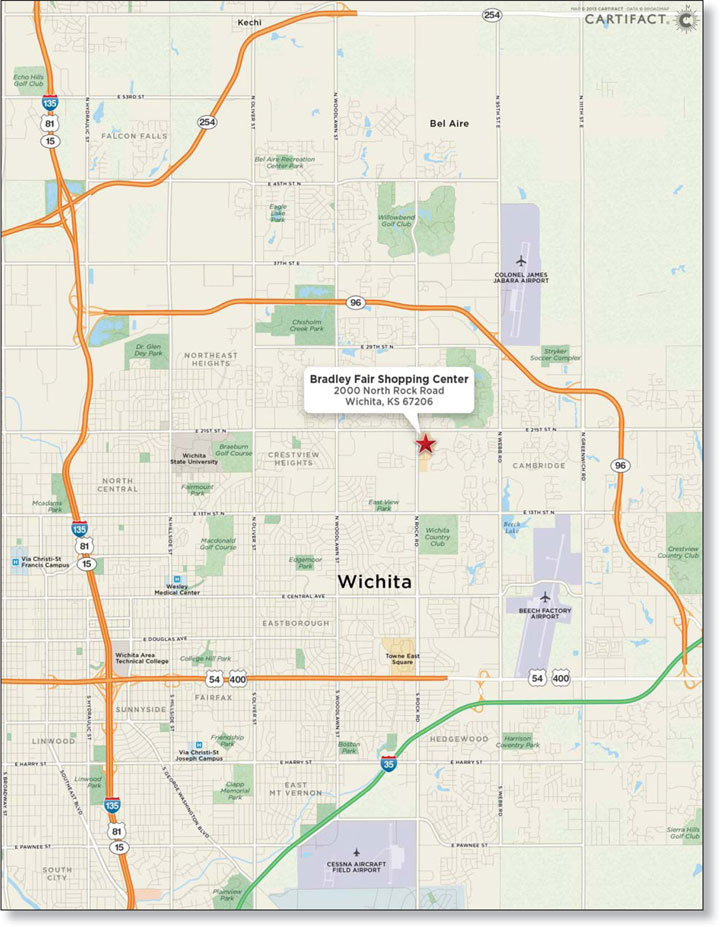

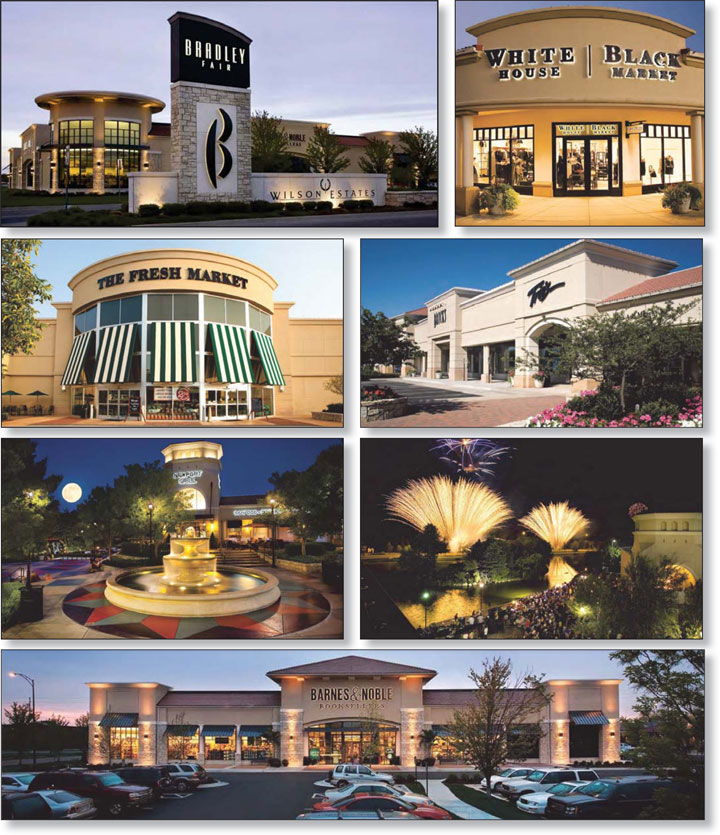

| Bradley Fair Shopping Center | | | 40,000,000 | | | 3.3 | | | Retail | | 278,552 | | | $144 | | | 2.02x | | 11.8 | % | | 58.7% |

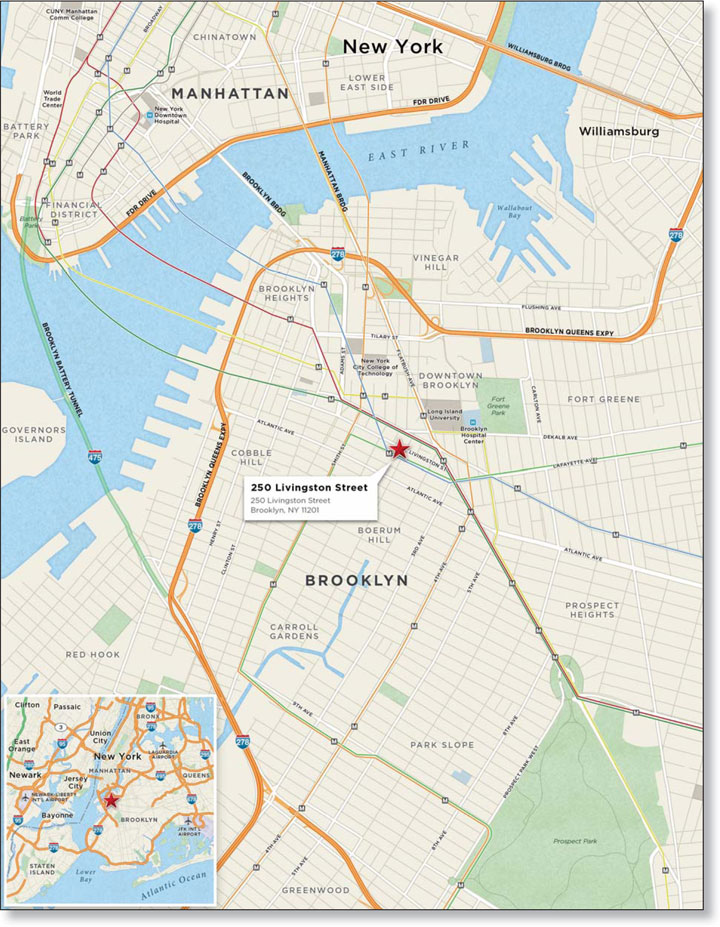

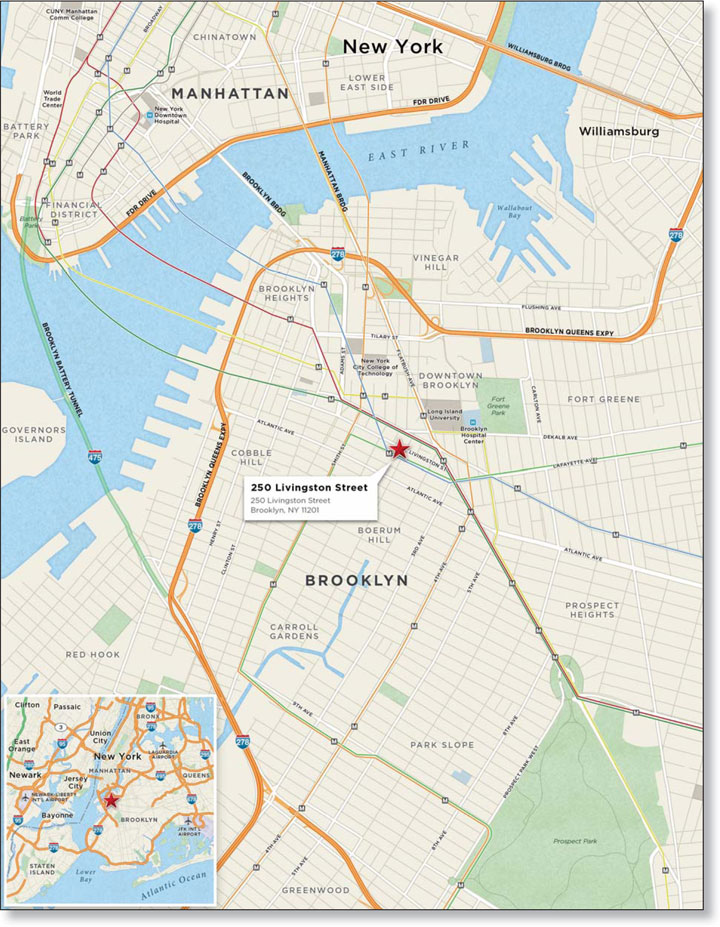

| 250 Livingston Street | | | 37,500,000 | | | 3.1 | | | Mixed Use | | 292,463 | | | $128 | | | 1.67x | | 10.4 | % | | 59.5% |

| Amalfi Hotel | | | 34,500,000 | | | 2.9 | | | Hospitality | | 215 | | | $160,465 | | | 1.70x | | 11.6 | % | | 70.7% |

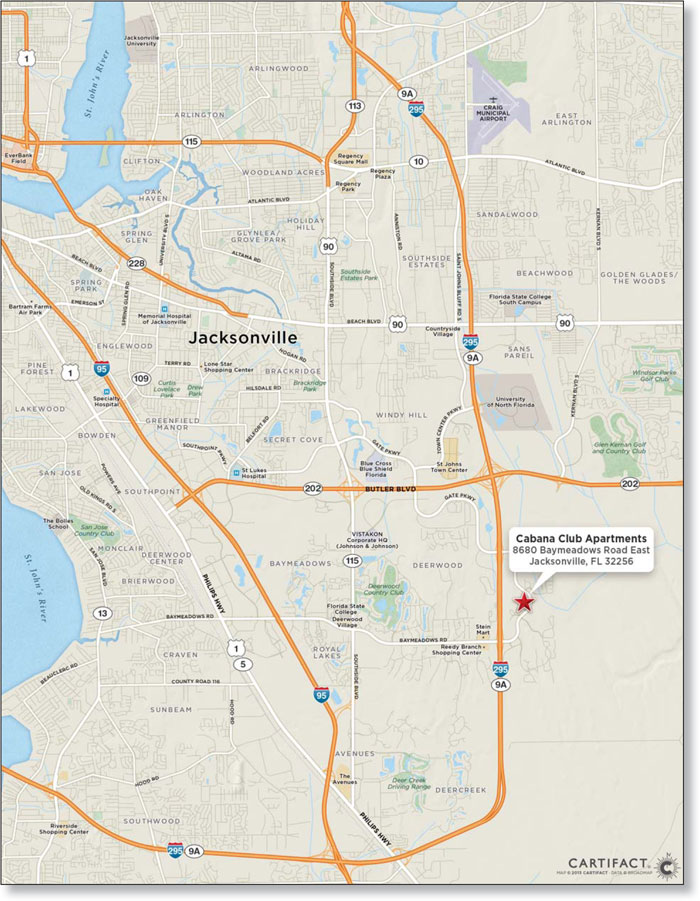

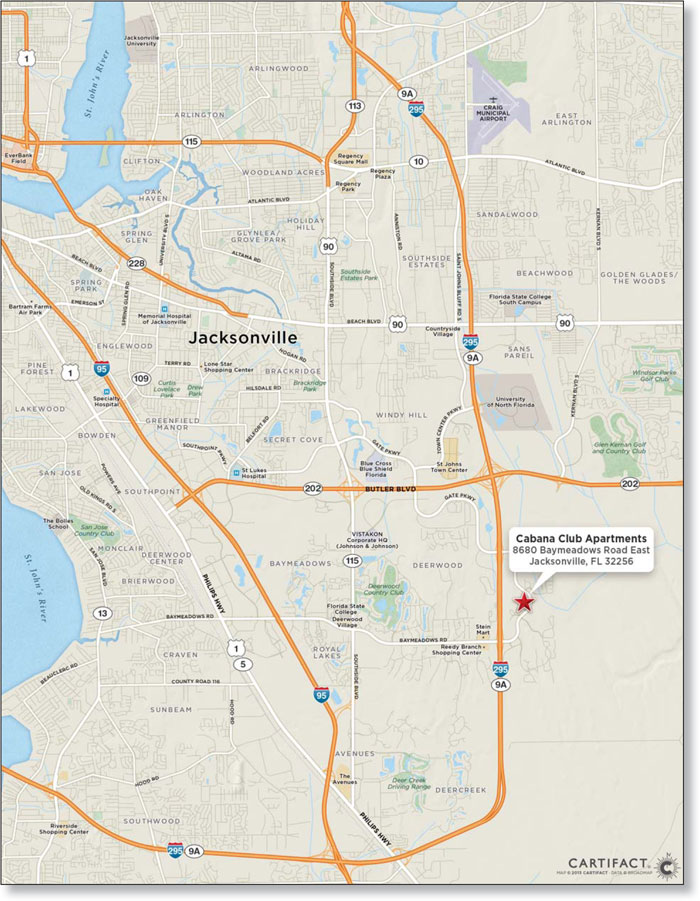

| Cabana Club Apartments | | | | | | | | | Multifamily | | 252 | | | $127,579 | | | | | | % | | |

| Top 10 Total / Wtd. Avg. | | | $529,769,623 | | | 44.2 | % | | | | | | | | | | 1.62x | | 10.5 | % | | 66.1% |

| Remaining Total / Wtd. Avg. | | | | | | | | | | | | | | | | | | | | % | | |

| Total / Wtd. Avg. | | | $1,197,467,027 | | | 100.0 | % | | | | | | | | | | 1.58x | | 10.6 | % | | 68.2% |

Mortgage Loans with Existing Mezzanine or Other Financing(1) |

| | | | Mezzanine Debt Cut-off Date Balance | | Other Debt

Cut-off Date Balance | | Cut-off Date Total Debt Balance | | | | Cut-off Date Mortgage Loan LTV | | | | | | |

Queens Crossing(2)(3) | | $75,000,000 | | $10,000,000 | | | NA | | | $85,000,000 | | | 5.7794 | % | | 67.0% | | 75.9% | | 1.48x | | 1.10x |

Condyne Industrial Portfolio(4) | | $57,000,000 | | $2,000,000 | | | NA | | | $59,000,000 | | | 5.2903 | % | | 63.3% | | 65.5% | | 1.40x | | 1.32x |

W Minneapolis(2) | | $51,000,000 | | $6,500,000 | | | NA | | | $57,500,000 | | | 5.4620 | % | | 68.0% | | 76.7% | | 1.48x | | 1.31x |

Amalfi Hotel(5) | | $34,500,000 | | NA | | | $20,000,000 | | | NA | | | NA | | | NA | | NA | | NA | | NA |

Commerce Park(2)(6)(7) | | $25,871,928 | | $4,947,514 | | | NA | | | $30,819,442 | | | 5.9900 | % | | 68.5% | | 78.6% | | 1.56x | | 1.08x |

Village at Pittsburgh Mills(8) | | $24,750,000 | | $1,750,000 | | | NA | | | $26,500,000 | | | 5.0547 | % | | 75.0% | | 80.3% | | 1.39x | | 1.26x |

| | (1) | Does not reflect certain pledges of indirect equity in the borrowers under the W Minneapolis mortgage loan, the Fairplain Plaza mortgage loan and the Village at Waterford mortgage loan discussed under “Description of the Mortgage Pool—Statistical Characteristics of the Mortgage Loans—Additional Indebtedness” in the Free Writing Prospectus. |

| | (2) | Related mezzanine loan is initially held by Jefferies LoanCore LLC, or its affiliate, and secured by the mezzanine borrower’s interests in the related mortgage borrower. |

| | (3) | Until November 5, 2014, the related mezzanine loan will have a fixed interest rate of 13.50% per annum; and during the period commencing on November 6, 2014 and continuing until maturity, the related mezzanine loan will have an interest rate equal to the sum of (i) 13.00% plus (ii) the greater of (x) LIBOR for the applicable interest accrual period and (y) 0.50%. The Total Debt Interest Rate and the Total Debt DSCR reflect the current 13.50% per annum interest rate. |

| | (4) | In addition, affiliates of the related mortgage borrower are indebted to RBS Citizens, National Association, for a loan in the original principal amount of $2,000,000, which is secured by a pledge of the affiliates’ approximately 99.84% ownership interests in Condyne Manager II, LLC, the owner of an approximately 26.1% indirect equity ownership interest in the related mortgage borrower. The outstanding balance of the loan as of the origination of the related Mortgage Loan was $1,625,000. |

| | (5) | An affiliate of the related borrower is the obligor under a $20,000,000 line of credit financing facility held by an institutional lender which is secured by a pledge of all of the assets of the affiliated entity, which includes an approximately 21.622% direct equity ownership interest in the related borrower. |

| | (6) | Related mezzanine loan is also secured by a first mortgage on a vacant land parcel owned by the borrower under the related mezzanine loan. The Cut-off Date Total Debt LTV has been calculated taking into account the appraised value of such vacant land parcel in addition to the appraised value of the Commerce Park mortgaged property. Such vacant land parcel does not secure the Commerce Park mortgage loan, however. |

| | (7) | The related mezzanine loan accrues interest according to a schedule of increasing per annum interest rates, which scheduled rates are based on the difference between (a) the monthly interest component due under a hypothetical $31.0 million loan with a 25-year amortization schedule based on a 5.99% per annum interest rate and a $199,543.98 monthly P&I payment and (b) the monthly interest component due under the Commerce Park mortgage Loan. The related mezzanine loan provides for the payment of principal based on the difference between (a) the monthly principal component due under a hypothetical $31.0 million loan with a 25-year amortization schedule based on a 5.99% per annum interest rate and a $199,543.98 monthly P&I payment and (b) the monthly principal component due under the Commerce Park mortgage Loan. The Total Debt Interest Rate reflects the mezzanine interest rate applicable to the scheduled payment of interest on the June 2013 payment date and the Total Debt DSCR reflects the monthly P&I payment for the related mezzanine loan due on the June 2013 due date. |

| | (8) | Related mezzanine loan is initially held by VAPMML, LLC and secured by the mezzanine borrower’s interests in the related mortgage borrower. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-171508) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Jefferies LLC, Citigroup Global Markets Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| COLLATERAL OVERVIEW (continued) |

Previously Securitized Mortgaged Properties(1) | | | | | | | | |

| | | | | | | | | | Cut-off Date

Balance /

Allocated

Cut-off Date

Balance | | | | |

| Marketplace at Huntingdon Valley | | CGMRC | | Huntingdon Valley | | PA | | Retail | | $40,750,000 | | | 3.4 | % | | GCCFC 2003-C2 |

| Bradley Fair Shopping Center | | GSMC | | Wichita | | KS | | Retail | | $40,000,000 | | | 3.3 | % | | GCCFC 2004-GG1 |

| Woodhawk Club Apartments | | MC FiveMile | | Pittsburgh | | PA | | Multifamily | | $29,500,000 | | | 2.5 | % | | MSC 2003-IQ6 |

| Commerce Park | | JLC | | Danbury | | CT | | Industrial | | $25,871,928 | | | 2.2 | % | | LBUBS 2005-C3 |

| A&P Mahwah | | CGMRC | | Mahwah | | NJ | | Retail | | $25,000,000 | | | 2.1 | % | | MSC 2004-HQ4 |

| Paoli Medical Office Park | | CGMRC | | Paoli | | PA | | Office | | $14,462,147 | | | 1.2 | % | | LBUBS 2003-C1 |

| Coral Springs Trade Center | | JLC | | Coral Springs | | FL | | Mixed Use | | $14,424,396 | | | 1.2 | % | | BACM 2003-2 |

| Timberlake Apartments | | JLC | | Sarasota | | FL | | Multifamily | | $13,440,759 | | | 1.1 | % | | CSFB 2004-C4 |

| Willow Oaks Apartments | | JLC | | Bryan | | TX | | Multifamily | | $12,900,000 | | | 1.1 | % | | JPMCC 2007-LDP12 |

| Ross Plaza | | GSMC | | Naples | | FL | | Retail | | $11,300,000 | | | 0.9 | % | | MSC 2003-IQ4 |

| Riverstone Apartments | | JLC | | Bryan | | TX | | Multifamily | | $10,100,000 | | | 0.8 | % | | LBUBS 2007-C6 |

| Madison Pointe Apartments | | JLC | | College Station | | TX | | Multifamily | | $8,870,920 | | | 0.7 | % | | CSFB 2004-C4 |

| Entrada Apartments | | MC FiveMile | | Rio Rancho | | NM | | Multifamily | | $7,975,000 | | | 0.7 | % | | CSFB 2002-CKN2 |

| Arrowhead Apartments | | MC FiveMile | | Albuquerque | | NM | | Multifamily | | $7,975,000 | | | 0.7 | % | | CSFB 2002-CP3 |

| Bennett Street Retail | | JLC | | Atlanta | | GA | | Retail | | $7,116,362 | | | 0.6 | % | | CSFB 2003-C3 |

| Professional Village of West Bloomfield | | AMF I | | West Bloomfield | | MI | | Office | | $6,438,304 | | | 0.5 | % | | GECMC 2003-C1 |

| Woods on the Fairway | | JLC | | Humble | | TX | | Multifamily | | $6,236,299 | | | 0.5 | % | | CSFB 2002-CP3 |

| Village at Waterford | | JLC | | Midlothian | | VA | | Retail | | $4,861,397 | | | 0.4 | % | | NASC 1998-D6 |

| Station at Vinings | | JLC | | Atlanta | | GA | | Retail | | $4,495,320 | | | 0.4 | % | | CSFB 2004-C1 |

| Grogan’s Mill Center | | MC FiveMile | | Spring | | TX | | Retail | | $4,120,000 | | | 0.3 | % | | CSFB 2003-C4 |

| 3275 West Hillsboro | | CGMRC | | Deerfield Beach | | FL | | Office | | $3,340,490 | | | 0.3 | % | | SOVC 2007-C1 |

| Flamingo Village | | JLC | | Pasco | | WA | | Manufactured Housing | | $3,250,000 | | | 0.3 | % | | NASC 1998-D6 |

| Santa Grande MHC | | MC FiveMile | | Glendale | | AZ | | Manufactured Housing | | $2,691,418 | | | 0.2 | % | | CSFB 2003-C4 |

| Rite Aid Virginia Beach | | MC FiveMile | | Virginia Beach | | VA | | Retail | | $2,650,000 | | | 0.2 | % | | BSCMS 2005-T20 |

| | (1) | The table above includes mortgaged properties securing mortgage loans for which the most recent prior financing of all or a significant portion of such mortgaged property was included in a securitization. Information under “Previous Securitization” represents the most recent such securitization with respect to each of those mortgaged properties. The information in the above table is based solely on information provided by the related borrower or obtained through searches of a third-party database, and has not otherwise been confirmed by the mortgage loan sellers. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-171508) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Jefferies LLC, Citigroup Global Markets Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| COLLATERAL OVERVIEW (continued) |

Property Types

| | Number of Mortgaged Properties | | Aggregate Cut-off

Date Balance(1) | | | | Wtd. Avg. Underwritten

NCF DSCR(2) | | Wtd. Avg.

Cut-off Date

LTV Ratio(2) | | Wtd. Avg. Debt Yield on Underwritten NOI(2) |

| Retail | | 27 | | | $418,185,679 | | | 34.9 | % | | 1.68x | | 67.9% | | 10.5 | % |

| Anchored | | 12 | | | 198,234,767 | | | 16.6 | | | 1.47x | | 73.7% | | 9.7 | % |

| Lifestyle Center | | 2 | | | 140,000,000 | | | 11.7 | | | 2.02x | | 58.8% | | 11.7 | % |

| Unanchored | | 7 | | | 38,859,676 | | | 3.2 | | | 1.67x | | 70.0% | | 11.0 | % |

| Single Tenant Retail | | 4 | | | 32,671,235 | | | 2.7 | | | 1.54x | | 68.2% | | 9.7 | % |

| Shadow Anchored | | 2 | | | 8,420,000 | | | 0.7 | | | 1.72x | | 71.4% | | 11.5 | % |

| Multifamily | | 20 | | | $248,843,969 | | | 20.8 | % | | 1.41x | | 71.3% | | 9.7 | % |

| Garden | | 15 | | | 165,025,186 | | | 13.8 | | | 1.39x | | 70.5% | | 9.5 | % |

| Military Housing | | 1 | | | 61,869,623 | | | 5.2 | | | 1.43x | | 73.2% | | 9.9 | % |

| Mid-Rise | | 3 | | | 18,303,846 | | | 1.5 | | | 1.45x | | 71.7% | | 10.4 | % |

| Student Housing | | 1 | | | 3,645,314 | | | 0.3 | | | 1.73x | | 75.2% | | 11.3 | % |

| Hospitality | | 14 | | | $174,767,683 | | | 14.6 | % | | 1.62x | | 66.8% | | 12.4 | % |

| Full Service | | 3 | | | 101,750,000 | | | 8.5 | | | 1.56x | | 67.9% | | 11.9 | % |

| Limited Service | | 9 | | | 63,313,239 | | | 5.3 | | | 1.72x | | 66.1% | | 13.1 | % |

| Extended Stay | | 2 | | | 9,704,444 | | | 0.8 | | | 1.58x | | 60.0% | | 13.5 | % |

| Mixed Use | | 7 | | | $144,864,651 | | | 12.1 | % | | 1.54x | | 64.7% | | 10.1 | % |

| Retail / Parking Garage / Office | | 1 | | | 75,000,000 | | | 6.3 | | | 1.48x | | 67.0% | | 9.7 | % |

| Multifamily / Office / Retail | | 1 | | | 37,500,000 | | | 3.1 | | | 1.67x | | 59.5% | | 10.4 | % |

| Retail / Office | | 3 | | | 26,602,073 | | | 2.2 | | | 1.54x | | 66.2% | | 11.1 | % |

| Multifamily / Retail | | 2 | | | 5,762,581 | | | 0.5 | | | 1.43x | | 60.4% | | 8.6 | % |

| Industrial | | 22 | | | $141,174,335 | | | 11.8 | % | | 1.52x | | 68.5% | | 10.5 | % |

| Warehouse | | 8 | | | 70,299,621 | | | 5.9 | | | 1.43x | | 65.3% | | 10.1 | % |

| Flex | | 13 | | | 55,874,715 | | | 4.7 | | | 1.59x | | 71.2% | | 10.8 | % |

| Warehouse/Distribution | | 1 | | | 15,000,000 | | | 1.3 | | | 1.71x | | 73.9% | | 10.7 | % |

| Office | | 7 | | | $49,623,779 | | | 4.1 | % | | 1.64x | | 70.0% | | 11.3 | % |

| Medical | | 3 | | | 26,100,450 | | | 2.2 | | | 1.69x | | 70.9% | | 11.4 | % |

| General Suburban | | 4 | | | 23,523,328 | | | 2.0 | | | 1.59x | | 69.0% | | 11.1 | % |

| Manufactured Housing | | 8 | | | $13,041,418 | | | 1.1 | % | | 1.88x | | 58.7% | | 13.6 | % |

| Self Storage | | 1 | | | $6,965,511 | | | 0.6 | % | | 1.59x | | 76.5% | | 9.9 | % |

| | | | | | | | | % | | | | | | | % |

| | (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| | (2) | Weighted average based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-171508) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Jefferies LLC, Citigroup Global Markets Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| COLLATERAL OVERVIEW (continued) |

Geographic Distribution

| | Number of Mortgaged Properties | | Aggregate Cut-off

Date Balance(1) | | | | | | | | | | % of Total Underwritten

NOI |

| New York | | 8 | | | $194,887,300 | | | 16.3 | % | | $295,200,000 | | | 16.6 | % | | $19,304,218 | | | 15.2 | % |

| Pennsylvania | | 20 | | | 160,427,657 | | | 13.4 | | | 214,500,000 | | | 12.1 | | | 15,974,700 | | | 12.5 | |

| Florida | | 13 | | | 148,307,784 | | | 12.4 | | | 209,705,000 | | | 11.8 | | | 15,289,312 | | | 12.0 | |

| North Carolina | | 4 | | | 118,749,100 | | | 9.9 | | | 198,120,000 | | | 11.2 | | | 13,884,255 | | | 10.9 | |

| Texas | | 13 | | | 98,048,136 | | | 8.2 | | | 139,125,000 | | | 7.8 | | | 10,750,750 | | | 8.4 | |

| Massachusetts | | 4 | | | 57,000,000 | | | 4.8 | | | 90,100,000 | | | 5.1 | | | 5,861,706 | | | 4.6 | |

| Illinois | | 4 | | | 51,965,189 | | | 4.3 | | | 72,435,000 | | | 4.1 | | | 5,758,079 | | | 4.5 | |

| Minnesota | | 1 | | | 51,000,000 | | | 4.3 | | | 75,000,000 | | | 4.2 | | | 5,889,229 | | | 4.6 | |

| Kansas | | 1 | | | 40,000,000 | | | 3.3 | | | 68,200,000 | | | 3.8 | | | 4,717,512 | | | 3.7 | |

| Michigan | | 3 | | | 31,026,961 | | | 2.6 | | | 43,140,000 | | | 2.4 | | | 3,314,571 | | | 2.6 | |

| Arizona | | 3 | | | 30,441,418 | | | 2.5 | | | 43,260,000 | | | 2.4 | | | 2,909,590 | | | 2.3 | |

| New Jersey | | 2 | | | 28,692,968 | | | 2.4 | | | 40,700,000 | | | 2.3 | | | 2,774,830 | | | 2.2 | |

| Connecticut | | 1 | | | 25,871,928 | | | 2.2 | | | 37,750,000 | | | 2.1 | | | 2,738,090 | | | 2.2 | |

| California | | 2 | | | 23,970,000 | | | 2.0 | | | 33,600,000 | | | 1.9 | | | 2,418,385 | | | 1.9 | |

| Virginia | | 3 | | | 18,611,397 | | | 1.6 | | | 28,400,000 | | | 1.6 | | | 2,327,557 | | | 1.8 | |

| Ohio | | 3 | | | 18,165,314 | | | 1.5 | | | 24,970,000 | | | 1.4 | | | 1,845,099 | | | 1.4 | |

| Georgia | | 3 | | | 16,511,681 | | | 1.4 | | | 25,720,000 | | | 1.4 | | | 2,045,379 | | | 1.6 | |

| New Mexico | | 2 | | | 15,950,000 | | | 1.3 | | | 30,900,000 | | | 1.7 | | | 1,585,104 | | | 1.2 | |

| Maryland | | 2 | | | 13,500,000 | | | 1.1 | | | 19,600,000 | | | 1.1 | | | 1,297,993 | | | 1.0 | |

| Utah | | 1 | | | 9,000,000 | | | 0.8 | | | 12,300,000 | | | 0.7 | | | 1,031,251 | | | 0.8 | |

| Maine | | 1 | | | 7,862,000 | | | 0.7 | | | 11,200,000 | | | 0.6 | | | 990,375 | | | 0.8 | |

| Tennessee | | 2 | | | 6,588,420 | | | 0.6 | | | 10,000,000 | | | 0.6 | | | 660,920 | | | 0.5 | |

| Nebraska | | 2 | | | 5,737,365 | | | 0.5 | | | 10,150,000 | | | 0.6 | | | 797,227 | | | 0.6 | |

| District of Columbia | | 1 | | | 5,050,000 | | | 0.4 | | | 6,900,000 | | | 0.4 | | | 561,023 | | | 0.4 | |

| Louisiana | | 1 | | | 4,800,000 | | | 0.4 | | | 7,700,000 | | | 0.4 | | | 606,708 | | | 0.5 | |

| Mississippi | | 1 | | | 4,600,000 | | | 0.4 | | | 7,400,000 | | | 0.4 | | | 581,900 | | | 0.5 | |

| Nevada | | 1 | | | 4,302,408 | | | 0.4 | | | 5,750,000 | | | 0.3 | | | 405,730 | | | 0.3 | |

| Washington | | 1 | | | 3,250,000 | | | 0.3 | | | 6,400,000 | | | 0.4 | | | 455,414 | | | 0.4 | |

| Wisconsin | | 2 | | | 2,350,000 | | | 0.2 | | | 3,340,000 | | | 0.2 | | | 295,104 | | | 0.2 | |

| Montana | | | | | | | | | | | | | | | | | | | | | |

| Total | | 106 | | | $1,197,467,027 | | | 100.0 | % | | $1,774,285,000 | | | 100.0 | % | | $127,291,846 | | | 100.0 | % |

| (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-171508) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Jefferies LLC, Citigroup Global Markets Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| | Distribution of Cut-off Date Balances | | | | | | | | Distribution of Cut-off Date LTV Ratios(1) | | | |

| | | | | | | | % of | | | | | | | | | | % of | |

| | | | Number of | | | | Initial | | | | | | Number of | | | | Initial | |

| | Range of Cut-off Date | | Mortgage | | Cut-off Date | | Pool | | | | Range of Cut-off | | Mortgage | | | | Pool | |

| | Balances ($) | | Loans | | Balance | | Balance | | | | Date LTV (%) | | Loans | | Cut-off Date Balance | | Balance | |

| | 2,443,816 - 3,000,000 | | 4 | | | $10,646,468 | | 0.9 | % | | | | 43.4 - 45.0 | | 1 | | | $5,500,000 | | 0.5 | % | |

| | 3,000,001 - 5,000,000 | | 20 | | | 84,578,341 | | 7.1 | | | | | 45.1 - 55.0 | | 3 | | | 25,637,365 | | 2.1 | | |

| | 5,000,001 - 10,000,000 | | 25 | | | 184,059,767 | | 15.4 | | | | | 55.1 - 60.0 | | 9 | | | 209,371,955 | | 17.5 | | |

| | 10,000,001 - 15,000,000 | | 5 | | | 66,286,542 | | 5.5 | | | | | 60.1 - 65.0 | | 9 | | | 117,212,458 | | 9.8 | | |

| | 15,000,001 - 20,000,000 | | 4 | | | 70,620,000 | | 5.9 | | | | | 65.1 - 70.0 | | 14 | | | 228,131,036 | | 19.1 | | |

| | 20,000,001 - 25,000,000 | | 6 | | | 140,834,359 | | 11.8 | | | | | 70.1 - 75.0 | | 37 | | | 531,414,730 | | 44.4 | | |

| | 25,000,001 - 30,000,000 | | 4 | | | 110,671,928 | | 9.2 | | | | | 75.1 - 78.4 | | 5 | | | 80,199,483 | | 6.7 | | |

| | 30,000,001 - 40,000,000 | | 4 | | | 144,150,000 | | 12.0 | | | | | Total | | 78 | | | $1,197,467,027 | | 100.0 | % | |

| | 40,000,001 - 60,000,000 | | 3 | | | 148,750,000 | | 12.4 | | | | | (1) See footnote (1) to the table entitled “Mortgage Pool Characteristics” | |

| | 60,000,001 - 100,000,000 | | 3 | | | 236,869,623 | | 19.8 | | | | | above. |

| | Total | | 78 | | | $1,197,467,027 | | 100.0 | % | | | | | | | | | | | |

| | | | | | | | | | | | | Distribution of Maturity Date LTV Ratios(1) | |

| | Distribution of Underwritten DSCRs(1) | | | | | | | | | | | | | | % of | |

| | | | | | | | % of | | | | | | Number of | | | | Initial | |

| | | | Number of | | | | Initial | | | | Range of Maturity | | Mortgage | | | | Pool | |

| | | | Mortgage | | Cut-off Date | | Pool | | | | Date LTV (%) | | Loans | | Cut-off Date Balance | | Balance | |

| | Range of UW DSCR (x) | | Loans | | Balance | | Balance | | | | 30.2 - 35.0 | | 2 | | | $10,487,365 | | 0.9 | % | |

| | 1.28 - 1.40 | | 16 | | | $270,047,218 | | 22.6 | % | | | | 35.1 - 40.0 | | 4 | | | 29,644,311 | | 2.5 | | |

| | 1.41 - 1.50 | | 10 | | | 280,966,777 | | 23.5 | | | | | 40.1 - 45.0 | | 3 | | | 34,912,000 | | 2.9 | | |

| | 1.51 - 1.60 | | 19 | | | 204,028,096 | | 17.0 | | | | | 45.1 - 50.0 | | 10 | | | 183,305,115 | | 15.3 | | |

| | 1.61 - 1.70 | | 16 | | | 188,092,746 | | 15.7 | | | | | 50.1 - 55.0 | | 17 | | | 259,341,311 | | 21.7 | | |

| | 1.71 - 1.80 | | 8 | | | 73,427,825 | | 6.1 | | | | | 55.1 - 60.0 | | 25 | | | 368,123,595 | | 30.7 | | |

| | 1.81 - 1.90 | | 5 | | | 30,504,365 | | 2.5 | | | | | 60.1 - 66.0 | | 17 | | | 311,653,331 | | 26.0 | | |

| | 1.91 – 2.26 | | 4 | | | 150,400,000 | | 12.6 | | | | | Total | | 78 | | | $1,197,467,027 | | 100.0 | % | |

| | Total | | 78 | | | $1,197,467,027 | | 100.0 | % | | | | (1) Maturity Date LTV Ratio is calculated on the basis of the “as stabilized” | |

| | (1) See footnote (3) to the table entitled “Mortgage Pool Characteristics” | | | | appraised value for 11 of the mortgage loans. See footnote (2) to the table | |

| | above. | | | | | | | | | | entitled “Mortgage Pool Characteristics” above. | | | |

| | | | | | | | | | | | | | | | | | | |

| | Distribution of Amortization Types(1) | | | | Distribution of Loan Purpose | | | | | |

| | | | | | | | % of | | | | | | | | | | % of | |

| | | | Number of | | | | Initial | | | | | | Number of | | | | Initial | |

| | | | Mortgage | | Cut-off Date | | Pool | | | | | | Mortgage | | | | Pool | |

| | Amortization Type | | Loans | | Balance | | Balance | | | | Loan Purpose | | Loans | | Cut-off Date Balance | | Balance | |

| | Amortizing (30 Years) | | 42 | | | $558,148,936 | | 46.6 | % | | | | Refinance | | 62 | | | $991,558,947 | | 82.8 | % | |

| | Amortizing (25 Years) | | 18 | | | 167,436,415 | | 14.0 | | | | | Recapitalization | | 4 | | | 121,170,000 | | 10.1 | | |

| | Amortizing (20 Years) | | 5 | | | 34,631,676 | | 2.9 | | | | | Acquisition | | 12 | | | 84,738,081 | | 7.1 | | |

| | Amortizing (27.5 Years) | | | | | 18,750,000 | | 1.6 | | | | | Total | | 78 | | | $1,197,467,027 | | 100.0 | % | |

| | Interest Only, Then | | | | | | | | | | | | | | | | | | | | | |

| | Amortizing(2) | | 12 | | | 418,500,000 | | 34.9 | | | | | Distribution of Mortgage Interest Rates | |

| | Total | | 78 | | | $1,197,467,027 | | 100.0 | % | | | | | | | | | | % of | |

| | (1) All of the mortgage loans will have balloon payments at maturity date. | | | | | | Number of | | | | Initial | |

| | (2) Original partial interest only periods range from 3 to 36 months. | | | | Range of Mortgage | | Mortgage | | | | Pool | |

| | | | | | | | | | | | Interest Rates (%) | | Loans | | Cut-off Date Balance | | Balance | |

| | Distribution of Lockboxes | | | | | | | | 3.470 - 4.000 | | 8 | | | $228,570,000 | | 19.1 | % | |

| | | | | | | | % of | | | | 4.001 - 4.250 | | | | | 166,958,510 | | 13.9 | | |

| | | | Number of | | | | Initial | | | | 4.251 - 4.500 | | 21 | | | 220,902,729 | | 18.4 | | |

| | | | Mortgage | | Cut-off Date | | Pool | | | | 4.501 - 4.750 | | | | | 208,711,333 | | 17.4 | | |

| | Lockbox Type | | Loans | | Balance | | Balance | | | | 4.751 - 5.000 | | | | | 129,396,708 | | 10.8 | | |

| | Hard | | 38 | | | $722,382,027 | | 60.3 | % | | | | 5.001 - 5.250 | | | | | 99,291,879 | | 8.3 | | |

| | Soft | | 15 | | | 239,195,468 | | 20.0 | | | | | 5.251 - 5.500 | | | | | 118,708,280 | | 9.9 | | |

| | Springing | | 19 | | | 163,805,442 | | 13.7 | | | | | 5.501 - 6.192 | | | | | 24,927,587 | | 2.1 | | |

| | None | | 4 | | | 58,381,681 | | 4.9 | | | | | Total | | | | | $1,197,467,027 | | 100.0 | % | |

| | Soft Springing | | 2 | | | 13,702,408 | | 1.1 | | | | | | | | | | | | | | |

| | Total | | 78 | | | $1,197,467,027 | | 100.0 | % | | | | | | | | | | | |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-171508) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Jefferies LLC, Citigroup Global Markets Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

| | Distribution of Debt Yield on Underwritten NOI(1) | | | | | | Distribution of Original Amortization Terms(1) | | | |

| | | | | | | | % of | | | | | | | | | | % of | |

| | Range of | | Number of | | | | Initial | | | | Range of Original | | Number of | | | | Initial | |

| | Debt Yields on | | Mortgage | | | | Pool | | | | Amortization | | Mortgage | | | | Pool | |

| | Underwritten NOI (%) | | Loans | | Cut-off Date Balance | | Balance | | | | Terms (months) | | Loans | | Cut-off Date Balance | | Balance | |

| | 8.1 - 9.0 | | 6 | | | $139,040,000 | | 11.6 | % | | | | 240 - 300 | | 23 | | | $202,068,091 | | 16.9 | % | |

| | 9.1 - 10.0 | | 21 | | | 356,338,432 | | 29.8 | | | | | 301 - 360 | | 55 | | | 995,398,936 | | 83.1 | | |

| | 10.1 - 11.0 | | 18 | | | 240,763,945 | | 20.1 | | | | | Total | | 78 | | | $1,197,467,027 | | 100.0 | % | |

| | 11.1 - 12.0 | | 17 | | | 335,163,091 | | 28.0 | | | | | (1) All of the mortgage loans will have balloon payments at maturity. | | | | |

| | 12.1 - 13.0 | | 10 | | | 85,240,095 | | 7.1 | | | | | | | | | | | | |

| | 13.1 - 14.0 | | 2 | | | 18,900,000 | | 1.6 | | | | | Distribution of Remaining Amortization Terms(1) | | | |

| | 14.1 - 16.2 | | 4 | | | 22,021,465 | | 1.8 | | | | | Range of | | | | | | % of | |

| | Total | | 78 | | | $1,197,467,027 | | 100.0 | % | | | | Remaining | | Number of | | | | Initial | |

| | | | | | | | | Amortization | | Mortgage | | | | Pool | |

| | (1) See footnote (4) to the table entitled “Mortgage Pool Characteristics” | | | | Terms (months) | | Loans | | Cut-off Date Balance | | Balance | |

| | above. | | | | | | | | | | 237 - 300 | | 23 | | | $202,068,091 | | 16.9 | % | |

| | | | | | | | | | | | 301 - 360 | | 55 | | | 995,398,936 | | 83.1 | | |

| | Distribution of Debt Yield on Underwritten NCF(1) | | | | | | Total | | 78 | | | $1,197,467,027 | | 100.0 | % | |

| | | | | | | | % of | | | | (1) All of the mortgage loans will have balloon payments at maturity. | | | |

| | Range of | | Number of | | | | Initial | | | | | | | | | | | |

| | Debt Yields on | | Mortgage | | | | Pool | | | | Distribution of Prepayment Provisions | |

| | Underwritten NCF (%) | | Loans | | Cut-off Date Balance | | Balance | | | | | | % of | |

| | 8.1 - 9.0 | | 15 | | | $267,980,875 | | 22.4 | % | | | | | | Number of | | | | Initial | |

| | 9.1 - 10.0 | | 29 | | | 542,326,431 | | 45.3 | | | | | Prepayment | | Mortgage | | | | Pool | |

| | 10.1 - 11.0 | | 20 | | | 273,160,162 | | 22.8 | | | | | Provision | | Loans | | Cut-off Date Balance | | Balance | |

| | 11.1 - 12.0 | | 9 | | | 89,328,095 | | 7.5 | | | | | Defeasance | | 74 | | | $1,024,977,157 | | 85.6 | % | |

| | 12.1 - 13.0 | | 3 | | | 12,537,365 | | 1.0 | | | | | Yield Maintenance | | 4 | | | 172,489,870 | | 14.4 | | |

| | 13.1 - 15.0 | | 1 | | | 6,634,100 | | 0.6 | | | | | Total | | 78 | | | $1,197,467,027 | | 100.0 | % | |

| | 15.1 - 15.7 | | 1 | | | 5,500,000 | | 0.5 | | | | | | | | | | | | |

| | Total | | 78 | | | $1,197,467,027 | | 100.0 | % | | | | Distribution of Escrow Types | |

| | (1) See footnote (4) to the table entitled “Mortgage Pool Characteristics” | | | | | | | | | | % of | |

| | above. | | | | | | | | | | | | Number of | | | | Initial | |

| | | | | | | | | | | | | | Mortgage | | | | Pool | |

| | Mortgage Loans with Original Partial Interest Only Periods | | | | Escrow Type | | Loans | | Cut-off Date Balance | | Balance | |

| | Range of Original | | | | | | % of | | | | Replacement | | | | | | | |

| | Partial Interest | | Number of | | | | Initial | | | | Reserves(1) | | 73 | | | $999,353,211 | | 83.5 | % | |

| | Only Period | | Mortgage | | | | Pool | | | | Real Estate Tax | | 73 | | | $1,057,391,778 | | 88.3 | % | |

| | (months) | | Loans | | Cut-off Date Balance | | Balance | | | | Insurance | | 64 | | | $905,196,965 | | 75.6 | % | |

| | 3 - 12 | | 3 | | | $100,500,000 | | 8.4 | % | | | | TI/LC(2) | | 38 | | | $551,911,792 | | 73.2 | % | |

| | 13 - 24 | | 6 | | | $151,700,000 | | 12.7 | % | | | | (1) Includes mortgage loans with FF&E reserves. | |

| | 25 - 36 | | 3 | | | $166,300,000 | | 13.9 | % | | | | (2) Percentage of total retail, mixed use, industrial and office properties only. | |

| | | | | | | | | | | | | | | | | | | |

| | Distribution of Original Terms to Maturity | | | | | | | | | | | | | |

| | | | | | | | % of | | | | | | | | | | | |

| | Range of Original | | Number of | | | | Initial | | | | | | | | | | | |

| | Term to Maturity | | Mortgage | | | | Pool | | | | | | | | | | | |

| | (months) | | Loans | | Cut-off Date Balance | | Balance | | | | | | | | | | | |

| | 60 | | 6 | | | $135,211,179 | | 11.3 | % | | | | | | | | | | | |

| | 120 | | 72 | | | 1,062,255,848 | | 88.7 | | | | | | | | | | | | |

| | Total | | 78 | | | $1,197,467,027 | | 100.0 | % | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | Distribution of Remaining Terms to Maturity | | | | | | | | | | | | | |

| | | | | | | | % of | | | | | | | | | | | |

| | Range of | | Number of | | | | Initial | | | | | | | | | | | |

| | Remaining Terms to | | Mortgage | | | | Pool | | | | | | | | | | | |

| | Maturity (months) | | Loans | | Cut-off Date Balance | | Balance | | | | | | | | | | | |

| | 56 - 60 | | 6 | | | $135,211,179 | | 11.3 | % | | | | | | | | | | | |

| | 61 - 120 | | 72 | | | 1,062,255,848 | | 88.7 | | | | | | | | | | | | |

| | Total | | 78 | | | $1,197,467,027 | | 100.0 | % | | | | | | | | | | | |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that condition is not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-171508) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., Jefferies LLC, Citigroup Global Markets Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.