| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-191331-10 |

| | | |

The information in this free writing prospectus is preliminary and may be supplemented or changed. These securities may not be sold nor may offers to buy be accepted prior to the time a final prospectus is delivered. This free writing prospectus and the accompanying prospectus are not an offering to sell these securities and are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

THIS FREE WRITING PROSPECTUS, DATED OCTOBER 5, 2015

MAY BE AMENDED OR SUPPLEMENTED PRIOR TO TIME OF SALE

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including the prospectus) with the SEC (SEC File No. 333-191331) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman, Sachs & Co., any other underwriter, or any dealer participating in this offering will arrange to send to you the prospectus if you request it by calling toll-free 1-866-471-2526 or by email to prospectus-ny@gs.com.

Free Writing Prospectus supplementing the Prospectus dated October 5, 2015

$777,332,000 (Approximate)

GS Mortgage Securities Trust 2015-GC34

as Issuing Entity

GS Mortgage Securities Corporation II

as Depositor

Citigroup Global Markets Realty Corp.

Goldman Sachs Mortgage Company

MC-Five Mile Commercial Mortgage Finance LLC

Starwood Mortgage Funding I LLC

Cantor Commercial Real Estate Lending, L.P.

as Sponsors

Commercial Mortgage Pass-Through Certificates, Series 2015-GC34

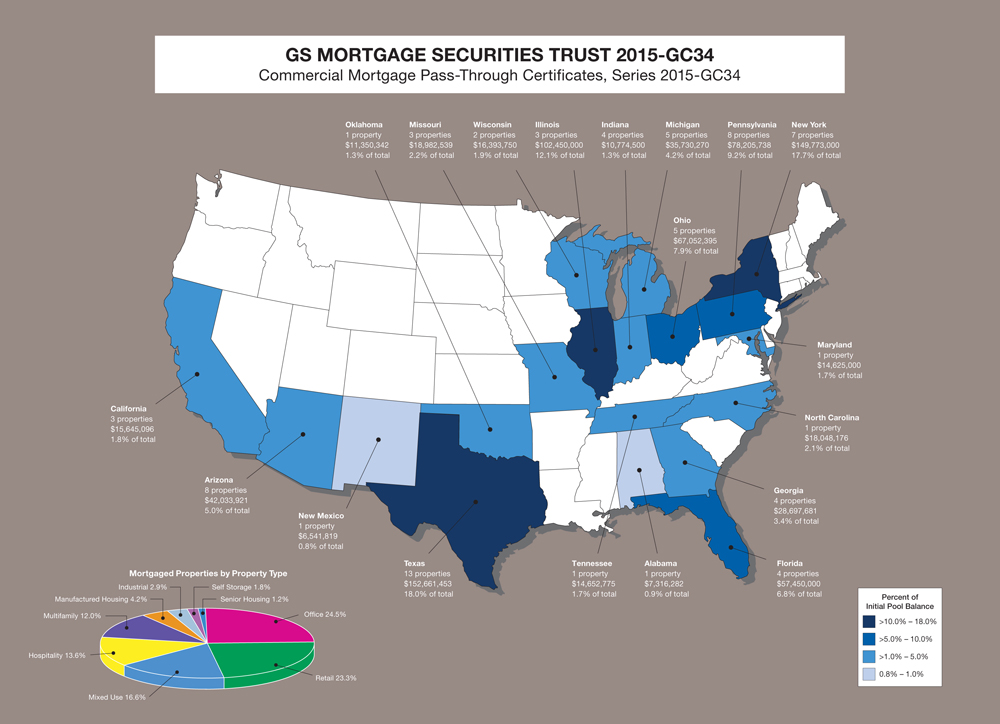

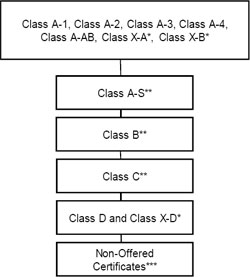

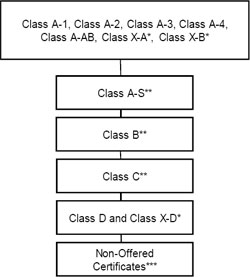

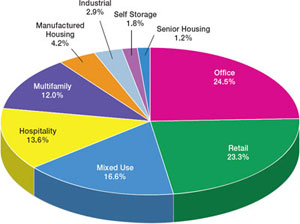

The Commercial Mortgage Pass-Through Certificates, Series 2015-GC34 will consist of 18 classes of certificates, 13 of which GS Mortgage Securities Corporation II is offering pursuant to this free writing prospectus. The Series 2015-GC34 certificates will represent the beneficial ownership interests in the issuing entity, which will be GS Mortgage Securities Trust 2015-GC34. The issuing entity’s main assets will be a pool of 57 fixed rate mortgage loans secured by first liens (except with respect to one mortgage loan that is partially secured by a second lien as described in this free writing prospectus) on various types of commercial, multifamily and manufactured housing community properties.

| | | | | | | | | | | | | |

Classes of

Offered Certificates | | Initial Certificate Principal

Amount or Notional

Amount(1) | | Initial

Pass-Through Rate(2) | | Pass-Through

Rate

Description | | Expected Ratings

(Moody’s/Fitch/KBRA)(3) | | Rated Final Distribution

Date |

| Class A-1 | | $ | 30,283,000 | | | [___]% | | (4) | | Aaa(sf) / AAAsf / AAA(sf) | | October 2048 |

| Class A-2 | | $ | 28,822,000 | | | [___]% | | (4) | | Aaa(sf) / AAAsf / AAA(sf) | | October 2048 |

| Class A-3 | | $ | 185,000,000 | | | [___]% | | (4) | | Aaa(sf) / AAAsf / AAA(sf) | | October 2048 |

| Class A-4 | | $ | 284,382,000 | | | [___]% | | (4) | | Aaa(sf) / AAAsf / AAA(sf) | | October 2048 |

| Class A-AB | | $ | 65,382,000 | | | [___]% | | (4) | | Aaa(sf) / AAAsf / AAA(sf) | | October 2048 |

| Class X-A | | $ | 634,167,000 | (5) | | [___]% | | Variable IO(6) | | Aa1(sf) / AAAsf / AAA(sf) | | October 2048 |

| Class X-B | | $ | 48,782,000 | (5) | | [___]% | | Variable IO(6) | | NR / AA-sf / AAA(sf) | | October 2048 |

| Class A-S(7) | | $ | 40,298,000 | (8) | | [___]% | | (4) | | Aa2(sf) / AAAsf / AAA(sf) | | October 2048 |

| Class B(7) | | $ | 48,782,000 | (8) | | [___]% | | (4) | | NR / AA-sf / AA-(sf) | | October 2048 |

| Class PEZ(7) | | $ | 131,499,000 | (8) | | (9) | | (9) | | NR / A-sf / A-(sf) | | October 2048 |

| Class C(7) | | $ | 42,419,000 | (8) | | [___]% | | (4) | | NR / A-sf / A-(sf) | | October 2048 |

| Class D | | $ | 51,964,000 | | | [___]% | | (4) | | NR / BBB-sf / BBB-(sf) | | October 2048 |

| Class X-D | | $ | 51,964,000 | (5) | | [___]% | | Variable IO(6) | | NR / BBB-sf / BBB-(sf) | | October 2048 |

| (Footnotes to table begin on page 15) | |

You should carefully consider the risk factors beginning on page 69 of this free writing prospectus and page 4 of the prospectus. Neither the Series 2015-GC34 certificates nor the underlying mortgage loans are insured or guaranteed by any governmental agency or instrumentality or any other person or entity. The Series 2015-GC34 certificates will represent interests in and obligations of the issuing entity and will not represent the obligations of the depositor, the sponsors or any of their affiliates. | The Securities and Exchange Commission and state securities regulators have not approved or disapproved of the offered certificates or determined if this free writing prospectus or the accompanying prospectus are truthful or complete. Any representation to the contrary is a criminal offense. The depositor will not list the offered certificates on any securities exchange or any automated quotation system of any national securities association. Distributions to holders of the certificates of amounts to which they are entitled will be made monthly, commencing in November 2015. Credit enhancement will be provided by certain classes of subordinate certificates that will be subordinate to certain classes of senior certificates as described under “Description of the Offered Certificates—Subordination” in this free writing prospectus. |

The offered certificates will be offered by Goldman, Sachs & Co., Citigroup Global Markets Inc., Cantor Fitzgerald & Co. and Drexel Hamilton, LLC when, as and if issued by the issuing entity, delivered to and accepted by the underwriters and subject to each underwriter’s right to reject orders in whole or in part. The underwriters will offer the offered certificates to prospective investors from time to time in negotiated transactions or otherwise at varying prices determined at the time of sale, plus, in certain cases, accrued interest, determined at the time of sale. The underwriters expect to deliver the offered certificates to purchasers in book-entry form only through the facilities of The Depository Trust Company in the United States and Clearstream Banking, société anonyme and Euroclear Bank SA/NV, as operator of the Euroclear System in Europe against payment in New York, New York on or about October 23, 2015.

The issuing entity will be relying upon an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”), contained in Section 3(c)(5) of the Investment Company Act or Rule 3a-7 under the Investment Company Act, although there may be additional exclusions or exemptions available to the issuing entity. The issuing entity is being structured so as not to constitute a “covered fund” for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in “Risk Factors—Legal and Regulatory Provisions Affecting Investors Could Adversely Affect the Liquidity of the Offered Certificates” in this free writing prospectus). See also “Legal Investment” in this free writing prospectus.

| Goldman, Sachs & Co. | Citigroup |

| Co-Lead Managers and Joint Bookrunners |

| |

| Cantor Fitzgerald & Co. | Drexel Hamilton |

| Co-Managers |

| |

| October[__], 2015 |

TABLE OF CONTENTS

| | | | | | | |

| SUMMARY OF FREE WRITING | | | | Concentrations Based on Property Type, | | |

| PROSPECTUS | | 17 | | Geography, Related Borrowers and | | |

| RISK FACTORS | | 69 | | Other Factors May Disproportionately | | |

| The Offered Certificates May Not Be a | | | | Increase Losses | | 86 |

| Suitable Investment for You | | 69 | | Risks Relating to Enforceability of Cross- | | |

| The Offered Certificates Are Limited | | | | Collateralization | | 88 |

| Obligations | | 69 | | The Performance of a Mortgage Loan | | |

| The Volatile Economy, Credit Crisis and | | | | and Its Related Mortgaged Property | | |

| Downturn in the Real Estate Market | | | | Depends in Part on Who Controls the | | |

| Have Adversely Affected and | | | | Borrower and Mortgaged Property | | 89 |

| May Continue To Adversely Affect the | | | | The Borrower’s Form of Entity | | |

| Value of CMBS | | 69 | | May Cause Special Risks | | 89 |

| External Factors May Adversely Affect | | | | A Bankruptcy Proceeding May Result in | | |

| the Value and Liquidity of Your | | | | Losses and Delays in Realizing on the | | |

| Investment | | 70 | | Mortgage Loans | | 90 |

| The Certificates May Have Limited | | | | Mortgage Loans Are Non-recourse and | | |

| Liquidity and the Market Value of the | | | | Are Not Insured or Guaranteed | | 91 |

| Certificates May Decline | | 71 | | Adverse Environmental Conditions at or | | |

| There Are Risks Relating to the | | | | Near Mortgaged Properties May Result | | |

| Exchangeable Certificates | | 72 | | in Losses | | 92 |

| Subordination of Exchangeable | | | | Risks Related to Redevelopment, | | |

| Certificates | | 73 | | Expansion and Renovation at | | |

| Limited Information Causes Uncertainty | | 73 | | Mortgaged Properties | | 92 |

| Legal and Regulatory Provisions | | | | Risks Relating to Costs of Compliance | | |

| Affecting Investors Could Adversely | | | | with Applicable Laws and Regulations | | 93 |

| Affect the Liquidity of the Offered | | | | Litigation Regarding the Mortgaged | | |

| Certificates | | 74 | | Properties or Borrowers May Impair | | |

| Your Yield May Be Affected by Defaults, | | | | Your Distributions | | 93 |

| Prepayments and Other Factors | | 76 | | Other Financings or Ability To Incur Other | | |

| Nationally Recognized Statistical Rating | | | | Financings Entails Risk | | 93 |

| Organizations May Assign Different | | | | Risks of Anticipated Repayment Date | | |

| Ratings to the Certificates; Ratings of | | | | Loans | | 94 |

| the Certificates Reflect Only the Views | | | | Borrower May Be Unable To Repay | | |

| of the Applicable Rating Agencies as of | | | | Remaining Principal Balance on | | |

| the Dates Such Ratings Were Issued; | | | | Maturity Date or Anticipated | | |

| Ratings May Affect ERISA Eligibility; | | | | Repayment Date; Longer Amortization | | |

| Ratings May Be Downgraded | | 79 | | Schedules and Interest-Only Provisions | | |

| Commercial, Multifamily and | | | | Increase Risk | | 95 |

| Manufactured Housing Community | | | | Risks Relating to Interest on Advances | | |

| Lending Is Dependent on Net | | | | and Special Servicing Compensation | | 96 |

| Operating Income | | 80 | | Increases in Real Estate Taxes | | |

| Underwritten Net Cash Flow Could Be | | | | May Reduce Available Funds | | 96 |

| Based On Incorrect or Failed | | | | Some Mortgaged Properties May Not Be | | |

| Assumptions | | 81 | | Readily Convertible to Alternative Uses | | 96 |

| The Mortgage Loans Have Not Been | | | | Risks Related to Zoning Non-Compliance | | |

| Reunderwritten by Us; Some Mortgage | | | | and Use Restrictions | | 97 |

| Loans May Not Have Complied With | | | | Risks Relating to Inspections of | | |

| Another Originator’s Underwriting | | | | Properties | | 98 |

| Criteria | | 82 | | Insurance May Not Be Available or | | |

| Static Pool Data Would Not Be Indicative | | | | Adequate | | 98 |

| of the Performance of this Pool | | 82 | | Terrorism Insurance May Be Unavailable | | |

| Appraisals May Not Reflect Current or | | | | or Insufficient | | 99 |

| Future Market Value of Each Property | | 83 | | Risks Associated with Blanket Insurance | | |

| Performance of the Certificates Will Be | | | | Policies or Self-Insurance | | 100 |

| Highly Dependent on the Performance | | | | State and Local Mortgage Recording | | |

| of Tenants and Tenant Leases | | 84 | | Taxes May Apply Upon a Foreclosure | | |

| | | | | | | |

| or Deed in Lieu of Foreclosure and | | | | Book-Entry Registration Will Mean You | | |

| Reduce Net Proceeds | | 100 | | Will Not Be Recognized as a Holder of | | |

| Risks Relating to a Bankruptcy of an | | | | Record | | 118 |

| Originator, a Sponsor or the Depositor, | | | | Tax Matters and Changes in Tax Law | | |

| or a Receivership or Conservatorship | | | | May Adversely Impact the Mortgage | | |

| of Goldman Sachs Bank USA | | 100 | | Loans or Your Investment | | 118 |

| Interests and Incentives of the | | | | Combination or “Layering” of Multiple | | |

| Originators, the Sponsors and Their | | | | Risks May Significantly Increase Risk | | |

| Affiliates May Not Be Aligned With | | | | of Loss | | 120 |

| Your Interests | | 102 | | DESCRIPTION OF THE MORTGAGE POOL | | 121 |

| Interests and Incentives of the | | | | General | | 121 |

| Underwriter Entities May Not Be | | | | Certain Calculations and Definitions | | 122 |

| Aligned With Your Interests | | 103 | | Statistical Characteristics of the Mortgage | | |

| Potential Conflicts of Interest of the | | | | Loans | | 131 |

| Servicers | | 105 | | Environmental Considerations | | 147 |

| Potential Conflicts of Interest of the | | | | Litigation and Other Considerations | | 150 |

| Operating Advisor | | 107 | | Redevelopment, Renovation and | | |

| Potential Conflicts of Interest of the | | | | Expansion | | 152 |

| Controlling Class Representative and | | | | Default History, Bankruptcy Issues and | | |

| the Companion Loan Holders | | 108 | | Other Proceedings | | 154 |

| Potential Conflicts of Interest in the | | | | Tenant Issues | | 155 |

| Selection of the Underlying Mortgage | | | | Insurance Considerations | | 164 |

| Loans | | 110 | | Use Restrictions | | 165 |

| Conflicts of Interest May Occur as a | | | | Appraised Value | | 165 |

| Result of the Rights of the Applicable | | | | Non-recourse Carveout Limitations | | 166 |

| Controlling Class Representative To | | | | Real Estate and Other Tax | | |

| Terminate the Special Servicer of the | | | | Considerations | | 167 |

| Applicable Whole Loans | | 111 | | Certain Terms of the Mortgage Loans | | 168 |

| Other Potential Conflicts of Interest May | | | | The Whole Loans | | 177 |

| Affect Your Investment | | 111 | | Significant Obligor | | 199 |

| The Special Servicer May Be Directed To | | | | Representations and Warranties | | 199 |

| Take Actions by an Entity That Has No | | | | Sale of Mortgage Loans; Mortgage File | | |

| Duty or Liability to Other | | | | Delivery | | 200 |

| Certificateholders | | 112 | | Cures, Repurchases and Substitutions | | 201 |

| The Servicing of the Hyatt Place Texas | | | | Additional Information | | 203 |

| Portfolio Whole Loan Will Shift to | | | | TRANSACTION PARTIES | | 204 |

| Others | | 112 | | The Sponsors | | 204 |

| Your Lack of Control Over the Issuing | | | | Compensation of the Sponsors | | 219 |

| Entity and Servicing of the Mortgage | | | | The Depositor | | 219 |

| Loans Can Create Risks | | 113 | | The Originators | | 220 |

| Rights of the Controlling Class | | | | The Issuing Entity | | 243 |

| Representatives Under Each Other | | | | The Trustee and Certificate Administrator | | 244 |

| PSA Could Adversely Affect Your | | | | Trustee and Certificate Administrator Fee | | 247 |

| Investment | | 114 | | The Operating Advisor | | 248 |

| You Will Not Have any Control Over the | | | | Servicers | | 249 |

| Servicing of the Non-Serviced Loans | | 115 | | Servicing Compensation, Operating | | |

| The Requirement of the Special Servicer | | | | Advisor Compensation and Payment of | | |

| to Obtain FIRREA-Compliant | | | | Expenses | | 266 |

| Appraisals May Result in an Increased | | | | Affiliates and Certain Relationships | | 276 |

| Cost to the Issuing Entity | | 115 | | DESCRIPTION OF THE OFFERED | | |

| Rights of the Operating Advisor and the | | | | CERTIFICATES | | 280 |

| Controlling Class Representative Could | | | | General | | 280 |

| Adversely Affect Your Investment | | 116 | | Exchanges of Exchangeable Certificates | | 283 |

| The Serviced Whole Loans Pose Special | | | | Distributions | | 285 |

| Risks | | 116 | | Subordination | | 300 |

| Sponsors May Not Be Able To Make | | | | Appraisal Reductions | | 301 |

| Required Repurchases or Substitutions | | | | Voting Rights | | 305 |

| of Defective Mortgage Loans | | 117 | | Delivery, Form, Transfer and | | |

| | | | | Denomination | | 307 |

| | | | | | | |

| Certificateholder Communication | | 311 | | Reports to Certificateholders; Available | | |

| YIELD, PREPAYMENT AND MATURITY | | | | Information | | 376 |

| CONSIDERATIONS | | 311 | | Servicing of the Non-Serviced Loans | | 382 |

| Yield | | 311 | | MATERIAL FEDERAL INCOME TAX | | |

| Yield on the Class X-A, Class X-B and | | | | CONSEQUENCES | | 389 |

| Class X-D Certificates | | 315 | | General | | 389 |

| Weighted Average Life of the Offered | | | | Tax Status of Offered Certificates | | 391 |

| Certificates | | 315 | | Taxation of Offered Certificates | | 391 |

| Price/Yield Tables | | 321 | | Taxation of the Exchangeable | | |

| THE POOLING AND SERVICING | | | | Certificates | | 393 |

| AGREEMENT | | 326 | | Further Information | | 393 |

| General | | 326 | | STATE AND LOCAL TAX | | |

| Servicing of the Whole Loans | | 326 | | CONSIDERATIONS | | 394 |

| Assignment of the Mortgage Loans | | 327 | | ERISA CONSIDERATIONS | | 394 |

| Servicing of the Mortgage Loans | | 328 | | LEGAL INVESTMENT | | 396 |

| Advances | | 332 | | CERTAIN LEGAL ASPECTS OF THE | | |

| Accounts | | 336 | | MORTGAGE LOANS | | 397 |

| Application of Penalty Charges and | | | | RATINGS | | 398 |

| Modification Fees | | 338 | | LEGAL MATTERS | | 400 |

| Withdrawals from the Collection Account | | 339 | | INDEX OF SIGNIFICANT DEFINITIONS | | 401 |

| Enforcement of “Due-On-Sale” and “Due- | | | | | | |

| On-Encumbrance” Clauses | | 340 | | ANNEX A – STATISTICAL | | |

| Inspections | | 341 | | CHARACTERISTICS OF THE | | |

| Evidence as to Compliance | | 342 | | MORTGAGE LOANS | | A-1 |

| Certain Matters Regarding the Depositor, | | | | ANNEX B – STRUCTURAL AND | | |

| the Master Servicer, the Special | | | | COLLATERAL TERM SHEET | | B-1 |

| Servicer and the Operating Advisor | | 343 | | ANNEX C – MORTGAGE POOL | | |

| Servicer Termination Events | | 345 | | INFORMATION | | C-1 |

| Rights Upon Servicer Termination Event | | 347 | | ANNEX D – FORM OF DISTRIBUTION | | |

| Waivers of Servicer Termination Events | | 348 | | DATE STATEMENT | | D-1 |

| Termination of the Special Servicer | | 348 | | ANNEX E-1 – SPONSOR | | |

| Amendment | | 350 | | REPRESENTATIONS AND | | |

| Realization Upon Mortgage Loans | | 353 | | WARRANTIES | | E-1-1 |

| Controlling Class Representative | | 359 | | ANNEX E-2 – EXCEPTIONS TO SPONSOR | | |

| Operating Advisor | | 365 | | REPRESENTATIONS AND | | |

| Asset Status Reports | | 371 | | WARRANTIES | | E-2-1 |

| Rating Agency Confirmations | | 373 | | ANNEX F – CLASS A-AB SCHEDULED | | |

| Termination; Retirement of Certificates | | 375 | | PRINCIPAL BALANCE SCHEDULE | | F-1 |

| Optional Termination; Optional Mortgage | | | | | | |

| Loan Purchase | | 375 | | | | |

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

THE OFFERED CERTIFICATES REFERRED TO IN THESE MATERIALS, AND THE ASSET POOL BACKING THEM, ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING THE POSSIBILITY THAT ONE OR MORE CLASSES OF OFFERED CERTIFICATES MAY BE SPLIT, COMBINED OR ELIMINATED AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS) AND ARE OFFERED ON A “WHEN, AS AND IF ISSUED” BASIS. YOU UNDERSTAND THAT, WHEN YOU ARE CONSIDERING THE PURCHASE OF THE OFFERED CERTIFICATES, A CONTRACT OF SALE WILL COME INTO BEING NO SOONER THAN THE DATE ON WHICH THE RELEVANT CLASS OF OFFERED CERTIFICATES HAS BEEN PRICED AND THE UNDERWRITERS HAVE CONFIRMED THE ALLOCATION OF OFFERED CERTIFICATES TO BE MADE TO INVESTORS. ANY “INDICATIONS OF INTEREST” EXPRESSED BY YOU, AND ANY “SOFT CIRCLES” GENERATED BY THE UNDERWRITERS, WILL NOT CREATE BINDING CONTRACTUAL OBLIGATIONS FOR YOU, ON THE ONE HAND, OR THE UNDERWRITERS, THE DEPOSITOR OR ANY OF THEIR RESPECTIVE AGENTS OR AFFILIATES, ON THE OTHER HAND.

AS A RESULT OF THE FOREGOING, YOU MAY COMMIT TO PURCHASE OFFERED CERTIFICATES THAT HAVE CHARACTERISTICS THAT MAY CHANGE, AND YOU ARE ADVISED THAT ALL OR A PORTION OF THE OFFERED CERTIFICATES MAY NOT BE ISSUED WITH ALL OF THE CHARACTERISTICS DESCRIBED IN THESE MATERIALS. THE UNDERWRITERS’ OBLIGATIONS TO SELL OFFERED CERTIFICATES TO YOU IS CONDITIONED ON THE OFFERED CERTIFICATES THAT ARE ACTUALLY ISSUED AND THE TRANSACTION HAVING THE CHARACTERISTICS DESCRIBED IN THESE MATERIALS. IF THE UNDERWRITERS DETERMINE THAT A CONDITION IS NOT SATISFIED IN ANY MATERIAL RESPECT, YOU WILL BE NOTIFIED, AND NEITHER THE DEPOSITOR NOR ANY UNDERWRITER WILL HAVE ANY OBLIGATION TO YOU TO DELIVER ANY PORTION OF THE OFFERED CERTIFICATES WHICH YOU HAVE COMMITTED TO PURCHASE, AND THERE WILL BE NO LIABILITY BETWEEN THE UNDERWRITERS, THE DEPOSITOR OR ANY OF THEIR RESPECTIVE AGENTS OR AFFILIATES, ON THE ONE HAND, AND YOU, ON THE OTHER HAND, AS A CONSEQUENCE OF THE NON-DELIVERY.

YOU HAVE REQUESTED THAT THE UNDERWRITERS PROVIDE TO YOU INFORMATION IN CONNECTION WITH YOUR CONSIDERATION OF THE PURCHASE OF CERTAIN OFFERED CERTIFICATES DESCRIBED IN THIS FREE WRITING PROSPECTUS. THIS FREE WRITING PROSPECTUS IS BEING PROVIDED TO YOU FOR INFORMATION PURPOSES ONLY IN RESPONSE TO YOUR SPECIFIC REQUEST. THE UNDERWRITERS DESCRIBED IN THIS FREE WRITING PROSPECTUS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THIS FREE WRITING PROSPECTUS. THE UNDERWRITERS AND/OR THEIR EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CONTRACT OR CERTIFICATE DISCUSSED IN THIS FREE WRITING PROSPECTUS.

THE INFORMATION CONTAINED IN THIS FREE WRITING PROSPECTUS SUPERSEDES ANY PREVIOUS INFORMATION DELIVERED TO YOU AND MAY BE SUPERSEDED BY INFORMATION DELIVERED TO YOU PRIOR TO THE TIME OF SALE.

THIS FREE WRITING PROSPECTUS DOES NOT CONTAIN ALL INFORMATION THAT IS REQUIRED TO BE INCLUDED IN THE BASE PROSPECTUS AND THE FINAL PROSPECTUS SUPPLEMENT.

IMPORTANT NOTICE ABOUT INFORMATION PRESENTED IN THIS

FREE WRITING PROSPECTUS AND THE ACCOMPANYING PROSPECTUS

Information about the offered certificates is contained in two separate documents that progressively provide more detail: (a) the accompanying prospectus, which provides general information, some of which may not apply to the offered certificates and (b) this free writing prospectus, which describes the specific terms of the offered certificates.The terms of the offered certificates contained in this free writing prospectus, including the annexes to this free writing prospectus, are intended to supplement the terms contained in the accompanying prospectus. References in the accompanying prospectus to “prospectus supplement” should, in general, be treated as references to this free writing prospectus insofar as they relate to the certificates offered by this free writing prospectus.

We have filed with the Securities and Exchange Commission a registration statement under the Securities Act of 1933, as amended, with respect to the offered certificates. However, this free writing prospectus does not contain all of the information contained in our registration statement, nor does it contain all information that is required to be included in a prospectus required to be filed as part of a registration statement. For further information regarding the documents referred to in this free writing prospectus, you should refer to our registration statement and the exhibits to it. Our registration statement and the exhibits to it can be inspected and copied at prescribed rates at the public reference facilities maintained by the Securities and Exchange Commission at its Public Reference Room, 100 F Street, N.E., Washington, D.C. 20549, on official business days between the hours of 10:00 a.m. and 3:00 p.m. You may obtain information on the operation of the Public Reference Room by calling the Securities and Exchange Commission at 1-800-SEC-0330. Copies of these materials can also be obtained electronically through the Securities and Exchange Commission’s internet website (http://www.sec.gov).

You should rely only on the information contained in this free writing prospectus and the prospectus. We have not authorized anyone to provide you with information that is different from that contained in this free writing prospectus and the prospectus. The information contained in this free writing prospectus is accurate only as of the date of this free writing prospectus.

This free writing prospectus begins with two introductory sections describing the Series 2015-GC34 certificates and the issuing entity in abbreviated form:

| · | the“Certificate Summary”, commencing on page 15 of this free writing prospectus, which sets forth important statistical information relating to the Series 2015-GC34 certificates; and |

| · | the“Summary of Free Writing Prospectus”, commencing on page 17 of this free writing prospectus, which gives a brief introduction to the key features of the Series 2015-GC34 certificates and a description of the underlying mortgage loans. |

Additionally, “Risk Factors”, commencing onpage 69of this free writing prospectus, describes the material risks that apply to the Series 2015-GC34 certificates which are in addition to those described in the prospectus with respect to the securities issued by the issuing entity generally.

This free writing prospectus and the accompanying prospectus include cross references to sections in these materials where you can find further related discussions. The Table of Contents in this free writing prospectus and the prospectus identify the pages where these sections are located.

Certain capitalized terms are defined and used in this free writing prospectus and the prospectus to assist you in understanding the terms of the offered certificates and this offering. The capitalized terms used in this free writing prospectus are defined on the pages indicated under the caption “Index of Significant Definitions” commencing onpage 401of this free writing prospectus. The capitalized terms used in the prospectus are defined on the pages indicated under the caption “Index of Defined Terms” commencing on page 114 of the prospectus.

In this free writing prospectus:

| · | the terms “depositor”, “we”, “us” and “our” refer to GS Mortgage Securities Corporation II. |

| · | references to “lender” with respect to the mortgage loans generally should be construed to mean, from and after the date of initial issuance of the offered certificates, the trustee on behalf of the trust as the holder of record title to the mortgage loans or the master servicer or special servicer, as applicable, with respect to the obligations and rights of the lender as described under “The Pooling and Servicing Agreement” in this free writing prospectus. |

The Annexes attached to this free writing prospectus are incorporated into and made a part of this free writing prospectus.

THERE IS CURRENTLY NO SECONDARY MARKET FOR THE OFFERED CERTIFICATES. WE CANNOT ASSURE YOU THAT A SECONDARY MARKET WILL DEVELOP OR, IF A SECONDARY MARKET DOES DEVELOP, THAT IT WILL PROVIDE HOLDERS OF THE OFFERED CERTIFICATES WITH LIQUIDITY OF INVESTMENT OR THAT IT WILL CONTINUE FOR THE TERM OF THE OFFERED CERTIFICATES. THE UNDERWRITERS CURRENTLY INTEND TO MAKE A MARKET IN THE OFFERED CERTIFICATES, BUT ARE UNDER NO OBLIGATION TO DO SO. ACCORDINGLY, PURCHASERS MUST BE PREPARED TO BEAR THE RISKS OF THEIR INVESTMENTS FOR AN INDEFINITE PERIOD. SEE “RISK FACTORS—THE CERTIFICATES MAY HAVE LIMITED LIQUIDITY AND THE MARKET VALUE OF THE CERTIFICATES MAY DECLINE” IN THIS FREE WRITING PROSPECTUS.

THIS FREE WRITING PROSPECTUS IS NOT AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY STATE OR OTHER JURISDICTION WHERE SUCH OFFER, SOLICITATION OR SALE IS NOT PERMITTED.

THE OFFERED CERTIFICATES DO NOT REPRESENT AN INTEREST IN OR OBLIGATION OF THE DEPOSITOR, THE SPONSORS, THE ORIGINATORS, THE MASTER SERVICER, THE SPECIAL SERVICER, THE TRUSTEE, THE CERTIFICATE ADMINISTRATOR, THE OPERATING ADVISOR, THE CONTROLLING CLASS REPRESENTATIVE, THE COMPANION LOAN HOLDERS, THE UNDERWRITERS OR ANY OF THEIR RESPECTIVE AFFILIATES. NEITHER THE OFFERED CERTIFICATES NOR THE MORTGAGE LOANS ARE INSURED OR GUARANTEED BY ANY GOVERNMENTAL AGENCY OR INSTRUMENTALITY OR PRIVATE INSURER.

THE YIELD TO MATURITY ON THE CLASS X-A CERTIFICATES WILL BE ESPECIALLY SENSITIVE TO THE RATE AND TIMING OF REDUCTIONS MADE TO THE CERTIFICATE PRINCIPAL AMOUNTS OF THE CLASS A-1, CLASS A-2, CLASS A-3, CLASS A-4 AND CLASS A-AB CERTIFICATES AND THE CLASS A-S TRUST COMPONENT, INCLUDING BY REASON OF DELINQUENCIES AND LOSSES ON THE MORTGAGE LOANS DUE TO LIQUIDATIONS, PRINCIPAL PAYMENTS (INCLUDING BOTH VOLUNTARY AND INVOLUNTARY PREPAYMENTS, DELINQUENCIES, DEFAULTS AND LIQUIDATIONS) ON THE MORTGAGE LOANS AND PAYMENTS WITH RESPECT TO PURCHASES AND REPURCHASES THEREOF, WHICH MAY FLUCTUATE SIGNIFICANTLY FROM TIME TO TIME. A RATE OF PRINCIPAL PAYMENTS AND LIQUIDATIONS ON THE MORTGAGE LOANS THAT IS MORE RAPID THAN EXPECTED BY INVESTORS MAY HAVE A MATERIAL ADVERSE EFFECT ON THE YIELD TO MATURITY OF THE CLASS X-A CERTIFICATES AND MAY RESULT IN HOLDERS NOT FULLY RECOUPING THEIR INITIAL INVESTMENTS. THE YIELD TO MATURITY OF THE CLASS X-A CERTIFICATES MAY BE ADVERSELY AFFECTED BY THE PREPAYMENT OF MORTGAGE LOANS WITH HIGHER NET MORTGAGE LOAN RATES. SEE “YIELD, PREPAYMENT AND MATURITY CONSIDERATIONS—YIELD ON THE CLASS X-A, CLASS X-B AND CLASS X-D CERTIFICATES” IN THIS FREE WRITING PROSPECTUS.

THE YIELD TO MATURITY ON THE CLASS X-B CERTIFICATES WILL BE ESPECIALLY SENSITIVE TO THE RATE AND TIMING OF REDUCTIONS MADE TO THE CERTIFICATE PRINCIPAL AMOUNT OF THE CLASS B TRUST COMPONENT, INCLUDING BY REASON OF DELINQUENCIES AND LOSSES ON THE MORTGAGE LOANS DUE TO LIQUIDATIONS, PRINCIPAL PAYMENTS

(INCLUDING BOTH VOLUNTARY AND INVOLUNTARY PREPAYMENTS, DELINQUENCIES, DEFAULTS AND LIQUIDATIONS) ON THE MORTGAGE LOANS AND PAYMENTS WITH RESPECT TO PURCHASES AND REPURCHASES THEREOF, WHICH MAY FLUCTUATE SIGNIFICANTLY FROM TIME TO TIME. A RATE OF PRINCIPAL PAYMENTS AND LIQUIDATIONS ON THE MORTGAGE LOANS THAT IS MORE RAPID THAN EXPECTED BY INVESTORS MAY HAVE A MATERIAL ADVERSE EFFECT ON THE YIELD TO MATURITY OF THE CLASS X-B CERTIFICATES AND MAY RESULT IN HOLDERS NOT FULLY RECOUPING THEIR INITIAL INVESTMENTS. THE YIELD TO MATURITY OF THE CLASS X-B CERTIFICATES MAY BE ADVERSELY AFFECTED BY THE PREPAYMENT OF MORTGAGE LOANS WITH HIGHER NET MORTGAGE LOAN RATES. SEE “YIELD, PREPAYMENT AND MATURITY CONSIDERATIONS—YIELD ON THE CLASS X-A, CLASS X-B AND CLASS X-D CERTIFICATES” IN THIS FREE WRITING PROSPECTUS.

THE YIELD TO MATURITY ON THE CLASS X-D CERTIFICATES WILL BE ESPECIALLY SENSITIVE TO THE RATE AND TIMING OF REDUCTIONS MADE TO THE CERTIFICATE PRINCIPAL AMOUNT OF THE CLASS D CERTIFICATES, INCLUDING BY REASON OF DELINQUENCIES AND LOSSES ON THE MORTGAGE LOANS DUE TO LIQUIDATIONS, PRINCIPAL PAYMENTS (INCLUDING BOTH VOLUNTARY AND INVOLUNTARY PREPAYMENTS, DELINQUENCIES, DEFAULTS AND LIQUIDATIONS) ON THE MORTGAGE LOANS AND PAYMENTS WITH RESPECT TO PURCHASES AND REPURCHASES THEREOF, WHICH MAY FLUCTUATE SIGNIFICANTLY FROM TIME TO TIME. A RATE OF PRINCIPAL PAYMENTS AND LIQUIDATIONS ON THE MORTGAGE LOANS THAT IS MORE RAPID THAN EXPECTED BY INVESTORS MAY HAVE A MATERIAL ADVERSE EFFECT ON THE YIELD TO MATURITY OF THE CLASS X-D CERTIFICATES AND MAY RESULT IN HOLDERS NOT FULLY RECOUPING THEIR INITIAL INVESTMENTS. THE YIELD TO MATURITY OF THE CLASS X-D CERTIFICATES MAY BE ADVERSELY AFFECTED BY THE PREPAYMENT OF MORTGAGE LOANS WITH HIGHER NET MORTGAGE LOAN RATES. SEE “YIELD, PREPAYMENT AND MATURITY CONSIDERATIONS—YIELD ON THE CLASS X-A, CLASS X-B AND CLASS X-D CERTIFICATES” IN THIS FREE WRITING PROSPECTUS.

UNITED KINGDOM

EACH UNDERWRITER HAS REPRESENTED AND AGREED THAT:

(A) IN THE UNITED KINGDOM, IT HAS ONLY COMMUNICATED OR CAUSED TO BE COMMUNICATED AND WILL ONLY COMMUNICATE OR CAUSE TO BE COMMUNICATED AN INVITATION OR INDUCEMENT TO ENGAGE IN INVESTMENT ACTIVITY (WITHIN THE MEANING OF SECTION 21 OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (THE “FSMA”)) RECEIVED BY IT IN CONNECTION WITH THE ISSUE OR SALE OF THE OFFERED CERTIFICATES IN CIRCUMSTANCES IN WHICH SECTION 21(1) OF THE FSMA DOES NOT APPLY TO THE DEPOSITOR OR THE ISSUING ENTITY; AND

(B) IT HAS COMPLIED AND WILL COMPLY WITH ALL APPLICABLE PROVISIONS OF THE FSMA WITH RESPECT TO ANYTHING DONE BY IT IN RELATION TO THE OFFERED CERTIFICATES IN, FROM OR OTHERWISE INVOLVING THE UNITED KINGDOM.

NOTICE TO UNITED KINGDOM INVESTORS

THE ISSUING ENTITY MAY CONSTITUTE A “COLLECTIVE INVESTMENT SCHEME” AS DEFINED BY SECTION 235 OF THE FSMA THAT IS NOT A “RECOGNIZED COLLECTIVE INVESTMENT SCHEME” FOR THE PURPOSES OF THE FSMA AND THAT HAS NOT BEEN AUTHORIZED OR OTHERWISE APPROVED. AS AN UNREGULATED SCHEME, THE OFFERED CERTIFICATES CANNOT BE MARKETED IN THE UNITED KINGDOM TO THE GENERAL PUBLIC, EXCEPT IN ACCORDANCE WITH THE FSMA.

THE DISTRIBUTION OF THIS FREE WRITING PROSPECTUS (A) IF MADE BY A PERSON WHO IS NOT AN AUTHORIZED PERSON UNDER THE FSMA, IS BEING MADE ONLY TO, OR DIRECTED ONLY AT, PERSONS WHO (I) ARE OUTSIDE THE UNITED KINGDOM, OR (II) HAVE PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS AND QUALIFY AS INVESTMENT PROFESSIONALS IN ACCORDANCE WITH ARTICLE 19(5) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2001 (THE “FINANCIAL PROMOTION ORDER”), OR (III) ARE PERSONS FALLING WITHIN ARTICLE 49(2)(A) THROUGH (D) (“HIGH NET WORTH COMPANIES, UNINCORPORATED ASSOCIATIONS, ETC.”) OF THE FINANCIAL PROMOTION ORDER (ALL SUCH PERSONS TOGETHER BEING REFERRED TO AS “FPO PERSONS”); AND (B) IF MADE BY A PERSON WHO IS AN AUTHORIZED PERSON UNDER THE FSMA, IS BEING MADE ONLY TO, OR DIRECTED ONLY AT, PERSONS WHO (I) ARE OUTSIDE THE UNITED KINGDOM, OR (II) HAVE PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS AND QUALIFY AS INVESTMENT PROFESSIONALS IN ACCORDANCE WITH ARTICLE 14(5) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (PROMOTION OF COLLECTIVE INVESTMENT SCHEMES) (EXEMPTIONS) ORDER 2001 (THE “PROMOTION OF COLLECTIVE INVESTMENT SCHEMES EXEMPTIONS ORDER”), OR (III) ARE PERSONS FALLING WITHIN ARTICLE 22(2)(A) THROUGH (D) (“HIGH NET WORTH COMPANIES, UNINCORPORATED ASSOCIATIONS, ETC.”) OF THE PROMOTION OF COLLECTIVE INVESTMENT SCHEMES EXEMPTIONS ORDER (ALL SUCH PERSONS TOGETHER BEING REFERRED TO AS “PCIS PERSONS” AND, TOGETHER WITH THE FPO PERSONS, THE “RELEVANT PERSONS”).

THIS FREE WRITING PROSPECTUS MUST NOT BE ACTED ON OR RELIED ON BY PERSONS WHO ARE NOT RELEVANT PERSONS. ANY INVESTMENT OR INVESTMENT ACTIVITY TO WHICH THIS FREE WRITING PROSPECTUS RELATES, INCLUDING THE OFFERED CERTIFICATES, IS AVAILABLE ONLY TO RELEVANT PERSONS AND WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS. ANY PERSONS OTHER THAN RELEVANT PERSONS SHOULD NOT ACT OR RELY ON THIS FREE WRITING PROSPECTUS.

POTENTIAL INVESTORS IN THE UNITED KINGDOM ARE ADVISED THAT ALL, OR MOST, OF THE PROTECTIONS AFFORDED BY THE UNITED KINGDOM REGULATORY SYSTEM WILL NOT APPLY TO AN INVESTMENT IN THE OFFERED CERTIFICATES AND THAT COMPENSATION WILL NOT BE AVAILABLE UNDER THE UNITED KINGDOM FINANCIAL SERVICES COMPENSATION SCHEME.

EUROPEAN ECONOMIC AREA

This FREE WRITING PROSPECTUS has been prepared on the basis that any offer of certificates in any Member State of the European Economic Area which has implemented the Prospectus Directive (each, a “Relevant Member State”) will be made pursuant to an exemption under the Prospectus Directive (as defined below) from the requirement to publish a prospectus for offers of certificates. Accordingly any person making or intending to make an offer in that Relevant Member State of certificates which are the subject of an offering contemplated in this free writing prospectus as completed by final terms in relation to the offer of those certificates may only do so in circumstances in which no obligation arises for the DEPOSITOR, THE issuing entity or an underwriter to publish a prospectus pursuant to Article 3 of the Prospectus Directive in relation to such offer.

NONE OF THE DEPOSITOR, the issuing entity or any of the underwriters has authorized, nor does any of them authorize, the making of any offer of certificates in circumstances in which an obligation arises for THE DEPOSITOR, the issuing entity or an underwriter to publish or supplement a prospectus for such offer.

For the purposes of this provision and the provision immediately below, the expression “Prospectus Directive” means Directive 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the Relevant Member State), and includes any relevant implementing measure in the Relevant Member State and the expression “2010 PD Amending Directive” means Directive 2010/73/EU.

EUROPEAN ECONOMIC AREA SELLING RESTRICTIONS

In relation to each Relevant Member State, each underwriter has represented and agreed that, with effect from and including the date on which the Prospectus Directive is implemented in that Relevant Member State, it has not made and will not make an offer of the certificates which are the subject of the offering contemplated by this free writing prospectus to the public in that Relevant Member State other than:

(a) to any legal entity which is a “qualified investor” as defined in the Prospectus Directive;

(b) to fewer than 150 natural or legal persons (other than “qualified investors” as defined in the Prospectus Directive) subject to obtaining the prior consent of the relevant underwriter or underwriters nominated by the issuing entity for any such offer; or

(c) in any other circumstances falling within article 3(2) of the Prospectus Directive;

PROVIDEDTHAT NO SUCH OFFER OF THE OFFERED CERTIFICATES REFERRED TO IN CLAUSES (A) TO (C) ABOVE SHALL REQUIRE THE DEPOSITOR, THE ISSUING ENTITY OR ANY UNDERWRITER TO PUBLISH A PROSPECTUS PURSUANT TO ARTICLE 3 OF THE PROSPECTUS DIRECTIVE.

For the purposes of the prior paragraph, the expression an “offer of the certificates which are the subject of the offering contemplated by this free writing prospectus to the public” in relation to any offered certificate in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer and the certificates to be offered so as to enable an investor to decide to purchase or subscribe to the offered certificates, as the same may be varied in that RELEVANT Member State by any measure implementing the Prospectus Directive in that RELEVANT Member State.

HONG KONG

NO PERSON HAS ISSUED OR HAD IN ITS POSSESSION FOR THE PURPOSES OF ISSUE, OR WILL ISSUE OR HAVE IN ITS POSSESSION FOR THE PURPOSES OF ISSUE, WHETHER IN HONG KONG OR ELSEWHERE, ANY ADVERTISEMENT, INVITATION OR DOCUMENT RELATING TO THE OFFERED CERTIFICATES, WHICH IS DIRECTED AT, OR THE CONTENTS OF WHICH ARE LIKELY TO BE ACCESSED OR READ BY, THE PUBLIC OF HONG KONG (EXCEPT IF PERMITTED TO DO SO UNDER THE SECURITIES LAWS OF HONG KONG) OTHER THAN WITH RESPECT TO OFFERED CERTIFICATES WHICH ARE OR ARE INTENDED TO BE DISPOSED OF ONLY TO PERSONS OUTSIDE HONG KONG OR ONLY TO “PROFESSIONAL INVESTORS” WITHIN THE MEANING OF THE SECURITIES AND FUTURES ORDINANCE (CAP. 571) OF HONG KONG AND ANY RULES MADE UNDER THAT ORDINANCE.

THE OFFERED CERTIFICATES (IF THEY ARE NOT A “STRUCTURED PRODUCT” AS DEFINED IN THE SECURITIES AND FUTURES ORDINANCE (CAP. 571) OF HONG KONG) HAVE NOT BEEN OFFERED OR SOLD AND WILL NOT BE OFFERED OR SOLD, BY MEANS OF ANY DOCUMENT, OTHER THAN (A) TO “PROFESSIONAL INVESTORS” AS DEFINED IN THE SECURITIES AND FUTURES ORDINANCE (CAP. 571, LAWS OF HONG KONG) AND ANY RULES MADE UNDER THAT ORDINANCE, OR (B) IN OTHER CIRCUMSTANCES WHICH DO NOT RESULT IN THE DOCUMENT BEING A “PROSPECTUS” AS DEFINED IN THE COMPANIES (WINDING UP AND MISCELLANEOUS PROVISIONS) ORDINANCE (CAP. 32, LAWS OF HONG KONG) OR WHICH DO NOT CONSTITUTE AN OFFER TO THE PUBLIC WITHIN THE MEANING OF THAT ORDINANCE. FURTHER, THE CONTENTS OF THIS FREE WRITING PROSPECTUS HAVE NOT BEEN REVIEWED BY ANY REGULATORY AUTHORITY IN HONG KONG. YOU ARE ADVISED TO EXERCISE CAUTION IN RELATION TO THE OFFERING CONTEMPLATED IN THIS FREE WRITING PROSPECTUS. IF YOU ARE IN ANY DOUBT ABOUT ANY OF THE CONTENTS OF THIS FREE WRITING PROSPECTUS, YOU SHOULD OBTAIN INDEPENDENT PROFESSIONAL ADVICE.

SINGAPORE

THIS FREE WRITING PROSPECTUS HAS NOT BEEN AND WILL NOT BE REGISTERED AS A PROSPECTUS WITH THE MONETARY AUTHORITY OF SINGAPORE. ACCORDINGLY, THIS FREE WRITING PROSPECTUS AND ANY OTHER DOCUMENT OR MATERIAL IN CONNECTION WITH THE OFFER OR SALE, OR INVITATION FOR SUBSCRIPTION OR PURCHASE, OF THE OFFERED CERTIFICATES MAY NOT BE CIRCULATED OR DISTRIBUTED, NOR MAY THE OFFERED CERTIFICATES BE OFFERED OR SOLD, OR BE MADE THE SUBJECT OF AN INVITATION FOR SUBSCRIPTION OR PURCHASE, WHETHER DIRECTLY OR INDIRECTLY, TO PERSONS IN SINGAPORE OTHER THAN (I) TO AN INSTITUTIONAL INVESTOR UNDER SECTION 274 UNDER THE SECURITIES AND FUTURES ACT, CHAPTER 289 OF SINGAPORE (THE “SFA”), (II) TO A RELEVANT PERSON (AS DEFINED IN SECTION 275(2) OF THE SFA), OR ANY PERSON PURSUANT TO SECTION 275(1A) OF THE SFA, IN ACCORDANCE WITH THE CONDITIONS SPECIFIED IN SECTION 275 OF THE SFA OR (III) OTHERWISE PURSUANT TO, AND IN ACCORDANCE WITH THE CONDITIONS OF, ANY OTHER APPLICABLE PROVISION OF THE SFA.

WHERE THE OFFERED CERTIFICATES ARE SUBSCRIBED OR PURCHASED UNDER SECTION 275 OF THE SFA BY A RELEVANT PERSON WHICH IS: (A) A CORPORATION (WHICH IS NOT AN ACCREDITED INVESTOR (AS DEFINED IN SECTION 4A OF THE SFA)) THE SOLE BUSINESS OF WHICH IS TO HOLD INVESTMENTS AND THE ENTIRE SHARE CAPITAL OF WHICH IS OWNED BY ONE OR MORE INDIVIDUALS, EACH OF WHOM IS AN ACCREDITED INVESTOR; OR (B) A TRUST (WHERE THE TRUSTEE IS NOT AN ACCREDITED INVESTOR) WHOSE SOLE PURPOSE IS TO HOLD INVESTMENTS AND EACH BENEFICIARY IS AN ACCREDITED INVESTOR, SHARES, DEBENTURES AND UNITS OF SHARES AND DEBENTURES OF THAT CORPORATION OR THE BENEFICIARIES’ RIGHTS AND INTEREST (HOWSOEVER DESCRIBED) IN THAT TRUST SHALL NOT BE TRANSFERABLE FOR 6 MONTHS AFTER THAT CORPORATION OR THAT TRUST HAS ACQUIRED THE OFFERED CERTIFICATES UNDER SECTION 275 OF THE SFA EXCEPT: (1) TO AN INSTITUTIONAL INVESTOR UNDER SECTION 274 OF THE SFA OR TO A RELEVANT PERSON (AS DEFINED IN SECTION 275(2) OF THE SFA), OR TO ANY PERSON PURSUANT TO AN OFFER THAT IS MADE ON TERMS THAT SUCH SHARES, DEBENTURES AND UNITS OF SHARES AND DEBENTURES OF THAT CORPORATION OR SUCH RIGHTS OR INTEREST IN THAT TRUST ARE ACQUIRED AT A CONSIDERATION OF NOT LESS THAN 200,000 SINGAPORE DOLLARS (OR ITS EQUIVALENT IN A FOREIGN CURRENCY) FOR EACH TRANSACTION, WHETHER SUCH AMOUNT IS TO BE PAID FOR IN CASH OR BY EXCHANGE OF SECURITIES OR OTHER ASSETS, AND FURTHER FOR CORPORATIONS, IN ACCORDANCE WITH THE CONDITIONS SPECIFIED IN SECTION 275(1A) OF THE SFA; (2) WHERE NO CONSIDERATION IS GIVEN FOR THE TRANSFER; (3) BY OPERATION OF LAW; OR (4) AS SPECIFIED IN SECTION 276(7) OF THE SFA.

JAPAN

THE OFFERED CERTIFICATES HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE FINANCIAL INSTRUMENTS AND EXCHANGE LAW OF JAPAN, AS AMENDED (THE “FIEL”), AND DISCLOSURE UNDER THE FIEL HAS NOT BEEN AND WILL NOT BE MADE WITH RESPECT TO THE OFFERED CERTIFICATES. ACCORDINGLY, EACH UNDERWRITER HAS REPRESENTED AND AGREED THAT IT HAS NOT, DIRECTLY OR INDIRECTLY, OFFERED OR SOLD AND WILL NOT, DIRECTLY OR INDIRECTLY, OFFER OR SELL ANY CERTIFICATES IN JAPAN OR TO, OR FOR THE BENEFIT OF, ANY RESIDENT OF JAPAN (WHICH TERM AS USED IN THIS FREE WRITING PROSPECTUS MEANS ANY PERSON RESIDENT IN JAPAN, INCLUDING ANY CORPORATION OR OTHER ENTITY ORGANIZED UNDER THE LAWS OF JAPAN) OR TO OTHERS FOR RE-OFFERING OR RE-SALE, DIRECTLY OR INDIRECTLY, IN JAPAN OR TO, OR FOR THE BENEFIT OF, ANY RESIDENT OF JAPAN EXCEPT PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF, AND OTHERWISE IN COMPLIANCE WITH, THE FIEL AND OTHER RELEVANT LAWS, REGULATIONS AND MINISTERIAL GUIDELINES OF JAPAN. AS PART OF THIS OFFERING OF THE OFFERED CERTIFICATES, THE UNDERWRITERS MAY OFFER THE OFFERED CERTIFICATES IN JAPAN TO UP TO 49 OFFEREES IN ACCORDANCE WITH THE ABOVE PROVISIONS.

FORWARD-LOOKING STATEMENTS

In this free writing prospectus and the prospectus, we use certain forward-looking statements. These forward-looking statements are found in the material, including each of the tables, set forth under “Risk Factors” and “Yield, Prepayment and Maturity Considerations” in this free writing prospectus. Forward-looking statements are also found elsewhere in this free writing prospectus and prospectus and include words like “expects”, “intends”, “anticipates”, “estimates” and other similar words. These statements are intended to convey our projections or expectations as of the date of this free writing prospectus. These statements are inherently subject to a variety of risks and uncertainties. Actual results could differ materially from those we anticipate due to changes in, among other things:

| · | economic conditions and industry competition, |

| · | political and/or social conditions, and |

| · | the law and government regulatory initiatives. |

We will not update or revise any forward-looking statement to reflect changes in our expectations or changes in the conditions or circumstances on which these statements were originally based.

Certificate Summary

| | | | | | | | | | | | | | | | | | |

| Classes of Certificates | | Initial Certificate

Principal Amount or Notional Amount(1) | | Approximate Credit Support | | Initial Pass-Through Rate(2) | | Pass-Through Rate Description | | Expected Ratings

(Moody’s/Fitch/KBRA)(3) | | Expected Weighted Avg. Life (yrs.)(10) | | Expected Principal Window(10) |

| Offered Certificates | | | | | | | | | | | | | | | | | |

| Class A-1 | | $ | 30,283,000 | | | 30.000 | %(11) | | [____]% | | (4) | | Aaa(sf) / AAAsf / AAA(sf) | | 2.90 | | 11/15 – 10/20 |

| Class A-2 | | $ | 28,822,000 | | | 30.000 | %(11) | | [____]% | | (4) | | Aaa(sf) / AAAsf / AAA(sf) | | 4.96 | | 10/20 – 10/20 |

| Class A-3 | | $ | 185,000,000 | | | 30.000 | %(11) | | [____]% | | (4) | | Aaa(sf) / AAAsf / AAA(sf) | | 9.81 | | 07/25 – 09/25 |

| Class A-4 | | $ | 284,382,000 | | | 30.000 | %(11) | | [____]% | | (4) | | Aaa(sf) / AAAsf / AAA(sf) | | 9.88 | | 09/25 – 09/25 |

| Class A-AB | | $ | 65,382,000 | | | 30.000 | %(11) | | [____]% | | (4) | | Aaa(sf) / AAAsf / AAA(sf) | | 7.42 | | 10/20 – 07/25 |

| Class X-A | | $ | 634,167,000 | (5) | | N/A | | | [____]% | | Variable IO(6) | | Aa1(sf) / AAAsf / AAA(sf) | | N/A | | N/A |

| Class X-B | | $ | 48,782,000 | (5) | | N/A | | | [____]% | | Variable IO(6) | | NR / AA-sf / AAA(sf) | | N/A | | N/A |

| Class A-S(7) | | $ | 40,298,000 | (8) | | 25.250 | % | | [____]% | | (4) | | Aa2(sf) / AAAsf / AAA(sf) | | 9.93 | | 09/25 – 10/25 |

| Class B(7) | | $ | 48,782,000 | (8) | | 19.500 | % | | [____]% | | (4) | | NR / AA-sf / AA-(sf) | | 9.96 | | 10/25 – 10/25 |

| Class PEZ(7) | | $ | 131,499,000 | (8) | | 14.500 | %(12) | | (9) | | (9) | | NR / A-sf / A-(sf) | | 9.95 | | 09/25 – 10/25 |

| Class C(7) | | $ | 42,419,000 | (8) | | 14.500 | %(12) | | [____]% | | (4) | | NR / A-sf / A-(sf) | | 9.96 | | 10/25 – 10/25 |

| Class D | | $ | 51,964,000 | | | 8.375 | % | | [____]% | | (4) | | NR / BBB-sf / BBB-(sf) | | 9.96 | | 10/25 – 10/25 |

| Class X-D | | $ | 51,964,000 | (5) | | N/A | | | [____]% | | Variable IO(6) | | NR / BBB-sf / BBB-(sf) | | N/A | | N/A |

| Non-Offered Certificates | | | | | | | | | | | | | | | | | |

| Class E | | $ | 23,331,000 | | | 5.625 | % | | [____]% | | (4) | | NR / BB- / BB- | | 9.96 | | 10/25 – 10/25 |

| Class F | | $ | 8,483,000 | | | 4.625 | % | | [____]% | | (4) | | NR / B- / B- | | 9.96 | | 10/25 – 10/25 |

| Class G | | $ | 39,238,739 | | | 0.000 | % | | [____]% | | (4) | | NR / NR / NR | | 9.96 | | 10/25 – 10/25 |

| Class S(13) | | | N/A | | | N/A | | | N/A | | N/A | | N/A | | N/A | | N/A |

| Class R(14) | | | N/A | | | N/A | | | N/A | | N/A | | N/A | | N/A | | N/A |

| (1) | Approximate, subject to a variance of plus or minus 5%. |

| (2) | Approximateper annum rate as of the closing date. |

| (3) | It is a condition of issuance that the offered certificates receive the ratings set forth above. Ratings shown are those of Moody’s Investors Service, Inc., Fitch Ratings, Inc. and Kroll Bond Rating Agency, Inc. Subject to the discussion under “Ratings” in this free writing prospectus, the ratings on the certificates address the likelihood of the timely receipt by holders of all payments of interest to which they are entitled on each distribution date and, except in the case of the interest only certificates, the ultimate receipt by holders of all payments of principal to which they are entitled on or before the applicable rated final distribution date. Certain nationally recognized statistical rating organizations, as defined in Section 3(a)(62) of the Securities Exchange Act of 1934, as amended, that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, or otherwise to rate the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” in this free writing prospectus. Moody’s Investors Service, Inc., Fitch Ratings, Inc. and Kroll Bond Rating Agency, Inc. have informed us that the “sf” designation in the ratings represents an identifier of structured finance product ratings. For additional information about this identifier, prospective investors can go to the related rating agency’s website. The depositor and the underwriters have not verified, do not adopt and do not accept responsibility for any statements made by the rating agencies on those websites. Credit ratings referenced throughout this free writing prospectus are forward-looking opinions about credit risk and express a rating agency’s opinion about the willingness and ability of an issuer of securities to meet its financial obligations in full and on time. Ratings are not indications of investment merit and are not buy, sell or hold recommendations, a measure of asset value or an indication of the suitability of an investment. |

| (4) | For any distribution date, the pass-through rates of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-AB, Class A-S, Class B, Class C, Class D, Class E, Class F and Class G certificates will each be a per annum rate equal to one of (i) a fixed rate, (ii) the weighted average of the net interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360 day year consisting of twelve 30 day months) as of their respective due dates in the month preceding the month in which the related distribution date occurs, (iii) the lesser of a specified pass-through rate and the rate described in clause (ii), or (iv) the rate described in clause (ii) less a specified percentage. |

| (5) | The Class X-A, Class X-B and Class X-D certificates, sometimes collectively referred to as the “Class X certificates”, will not have certificate principal amounts and will not be entitled to receive distributions of principal. Interest will accrue on the Class X-A, Class X-B and Class X-D certificates at their respective pass-through rates based upon their respective notional amounts. The notional amount of the Class X-A certificates will be equal to the aggregate certificate principal amounts of the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-AB certificates and the Class A-S trust component. The notional amount of the Class X-B certificates will be equal to the certificate principal amount of the Class B trust component. The notional amount of the Class X-D certificates will be equal to the certificate principal amount of the Class D certificates. |

| (6) | The pass-through rate of the Class X-A certificates will generally be a per annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (ii) the weighted average of the pass-through rates of the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-AB certificates and the Class A-S trust component, as described in this free writing prospectus. The pass-through rate of the Class X-B certificates will generally be a per annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (ii) the pass-through rate of the Class B trust component, as described in this free writing prospectus. The pass-through rate of the Class X-D certificates will generally be a per annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (ii) the pass-through rate of the Class D certificates, as described in this free writing prospectus. |

| (7) | The Class A-S, Class B and Class C certificates may be exchanged for Class PEZ certificates, and Class PEZ certificates may be exchanged for the Class A-S, Class B and Class C certificates. |

| (8) | On the closing date, the issuing entity will issue the Class A-S, Class B and Class C trust components, which will have outstanding principal balances on the closing date of $40,298,000, $48,782,000 and $42,419,000, respectively. The Class A-S, Class B, Class PEZ and Class C certificates will, at all times, represent undivided beneficial ownership interests in the portion of a grantor trust that will hold such trust components. Each class of the Class A-S, Class B, Class PEZ and Class C certificates will, at all times, represent a beneficial interest in a percentage of the outstanding principal balance of the Class A-S, Class B and/or Class C trust components. Following any exchange of Class A-S, Class B and Class C certificates for Class PEZ certificates or any exchange of Class PEZ certificates for Class A-S, Class B and Class C certificates, the percentage interest of the outstanding principal balances of the Class A-S, Class B and Class C trust components that is represented by the Class A-S, Class B, Class PEZ and Class C certificates will be increased or decreased accordingly. The initial certificate principal amount of each class of the Class A-S, Class B and Class C certificates shown in the table on the cover page of this free writing prospectus, in the table above and on the back cover of this free writing prospectus represents the maximum certificate principal amount of such class without giving effect to any issuance of Class PEZ certificates. The initial certificate principal amount of the Class PEZ certificates shown in the table on the cover page of this free writing prospectus, in the table above and on the back cover of this free writing prospectus is equal to the aggregate of the maximum initial certificate principal amounts of the Class A-S, Class B and Class C certificates, representing the maximum certificate principal amount of the Class PEZ certificates that could be issued in an exchange. The actual certificate principal amount of any class of the Class A-S, Class B, Class PEZ and Class C certificates issued on the closing date may be less than the maximum certificate principal amount of that class and may be zero. The certificate principal amounts of the Class A-S, Class B and Class C certificates to be issued on the closing date will be reduced, in required proportions, by an amount equal to the certificate principal amount of the Class PEZ certificates issued on the closing date. |

| (9) | The Class PEZ certificates will not have a pass-through rate, but will be entitled to receive the sum of the interest distributable on the percentage interests of the Class A-S, Class B and Class C trust components represented by the Class PEZ certificates. The pass-through rates on the Class A-S, Class B and Class C trust components will at all times be the same as the pass-through rates of the Class A-S, Class B and Class C certificates, respectively. |

| (10) | Assuming no prepayments prior to the maturity date or anticipated repayment date, as applicable, for each mortgage loan and based on the modeling assumptions described under “Yield, Prepayment and Maturity Considerations” in this free writing prospectus. |

| (11) | The credit support percentages set forth for the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-AB certificates are represented in the aggregate. |

| (12) | The initial subordination levels for the Class C and Class PEZ certificates are equal to the subordination level of the underlying Class C trust component. |

| (13) | The Class S certificates will not have a certificate principal amount, notional amount, pass-through rate, rating or rated final distribution date. The Class S certificates will only be entitled to distributions of excess interest accrued on the mortgage loan with an anticipated repayment date. See “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—ARD Loan” in this free writing prospectus. |

| (14) | The Class R certificates will not have a certificate principal amount, notional amount, pass-through rate, rating or rated final distribution date. The Class R certificates will represent the residual interests in each of two separate REMICs, as further described in this free writing prospectus. The Class R certificates will not be entitled to distributions of principal or interest. |

The Class E, Class F, Class G, Class S and Class R certificates are not offered by this free writing prospectus.

| | | |

| Summary of Free Writing Prospectus |

| |

| The following is only a summary. Detailed information appears elsewhere in this free writing prospectus and in the accompanying prospectus. That information includes, among other things, detailed mortgage loan information and calculations of cash flows on the offered certificates. To understand all of the terms of the offered certificates, read carefully this entire document and the accompanying prospectus. See “Index of Significant Definitions” in this free writing prospectus and “Index of Defined Terms” in the prospectus for definitions of capitalized terms. |

| |

| Title, Registration and Denomination of Certificates |

| |

| The certificates to be issued are known as the GS Mortgage Securities Trust 2015-GC34, Commercial Mortgage Pass-Through Certificates, Series 2015-GC34. The offered certificates will be issued in book-entry form through The Depository Trust Company, or DTC, and its participants. You may hold your certificates through (i) DTC in the United States or (ii) Clearstream Banking, société anonyme or Euroclear Bank, as operator of the Euroclear System in Europe. Transfers within DTC, Clearstream Banking, société anonyme or Euroclear Bank, as operator of the Euroclear System, will be made in accordance with the usual rules and operating procedures of those systems. See “Description of the Offered Certificates—Delivery, Form, Transfer and Denomination” in this free writing prospectus and “Description of the Certificates—General” in the prospectus. All the offered certificates will be issued in registered form without coupons. The offered certificates (other than the Class X-A, Class X-B and Class X-D certificates) that are initially offered and sold will be issued in minimum denominations of $10,000 and integral multiples of $1 in excess of $10,000. The Class X-A, Class X-B and Class X-D certificates will be issued in minimum denominations of authorized initial notional amount of not less than $1,000,000 and in integral multiples of $1 in excess of $1,000,000. |

| |

| Transaction Parties and Significant Dates, Events and Periods |

| | | | |

| Issuing Entity | | GS Mortgage Securities Trust 2015-GC34, a New York common law trust to be established on the closing date of the securitization under the pooling and servicing agreement. For more detailed information, see “Transaction Parties—The Issuing Entity” in this free writing prospectus. |

| | | | |

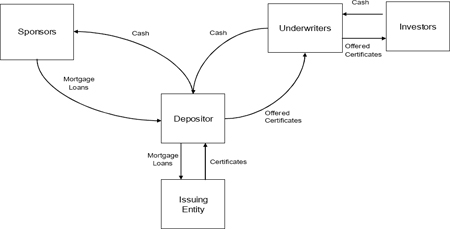

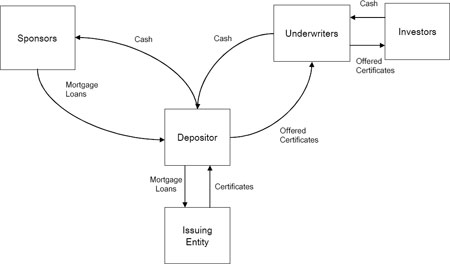

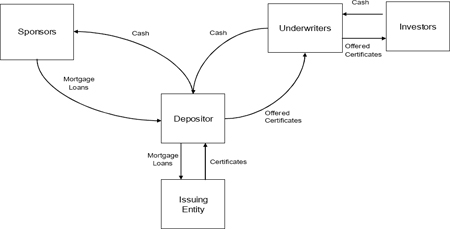

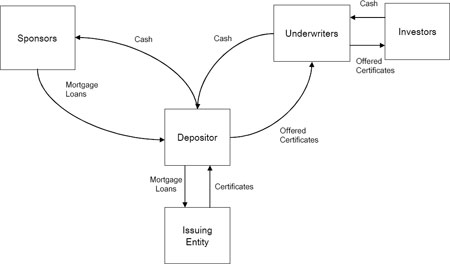

| Depositor | | GS Mortgage Securities Corporation II, a Delaware corporation. As depositor, GS Mortgage Securities Corporation II will acquire the mortgage loans from the sponsors and transfer them to the issuing entity. The depositor’s address is 200 West Street, New York, New York 10282 and its telephone number is (212) 902-1000. See “Transaction Parties—The Depositor” in this free writing prospectus and “The Depositor” in the prospectus. |

| | | | |

| Sponsors | | The mortgage loans will be sold to the depositor by the following sponsors, which have organized and initiated the transaction in which the certificates will be issued: |

| | | | |

| | | · | Citigroup Global Markets Realty Corp., a New York corporation (35.1% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date); |

| | | | |

| | | · | Goldman Sachs Mortgage Company, a New York limited partnership (28.9% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date); |

| | | | |

| | | · | MC-Five Mile Commercial Mortgage Finance LLC, a Delaware limited liability company (13.2% of the aggregate |

| | | | |

| | | | |

| | | | principal balance of the pool of mortgage loans as of the cut-off date); |

| | | | |

| | | · | Starwood Mortgage Funding I LLC, a Delaware limited liability company (12.2% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date); and |

| | | | |

| | | · | Cantor Commercial Real Estate Lending, L.P., a Delaware limited partnership (10.6% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date). |

| | | | |

| | | See “Transaction Parties—The Sponsors” in this free writing prospectus. |

| | | | |

| Originators | | The mortgage loans were originated by the entities set forth in the following chart: |

| | | | | | | | | | |

| | Originator | | Sponsor | | Number of

Mortgage

Loans | | % of

Initial

Pool

Balance |

| | Citigroup Global Markets Realty Corp. | | Citigroup Global Markets Realty Corp | | 12 | | | 35.1 | % |

| | Goldman Sachs Mortgage Company | | Goldman Sachs Mortgage Company | | 11 | | | 25.0 | |

| | MC-Five Mile Commercial Mortgage Finance LLC | | MC-Five Mile Commercial Mortgage Finance LLC | | 9 | | | 13.2 | |

| | Starwood Mortgage Capital LLC | | Starwood Mortgage Funding I LLC | | 11 | | | 12.2 | |

| | Cantor Commercial Real Estate Lending, L.P. | | Cantor Commercial Real Estate Lending, L.P. | | 10 | | | 10.6 | |

| | GS Commercial Real Estate LP | | Goldman Sachs Mortgage Company | | 4 | | | 3.9 | |

| | Total | | | | 57 | | | 100.0 | % |

| | | See “Transaction Parties—The Originators” in this free writing prospectus. |

| | | |

| Trustee | | U.S. Bank National Association, a national banking association. The corporate trust office of U.S. Bank National Association is located at 190 South LaSalle, 7th Floor, Mail Code: MK-IL-SLC7 Chicago, Illinois 60603, Attention: GSMS 2015-GC34 and for certificate transfer services, at 111 Fillmore Avenue, St. Paul, Minnesota 55107, Attention: Bondholder Services – GSMS 2015-GC34 and a custodial office at 1133 Rankin Street, Suite 100, St. Paul, Minnesota 55116, and its telephone number is (866) 252-4360. Following the transfer of the underlying mortgage loans into the issuing entity, the trustee, on behalf of the issuing entity, will become the mortgagee of record with respect to each mortgage loan (but not the non-serviced loans (as discussed under“—The Mortgage Loans—The Whole Loans” below)) transferred to the issuing entity. In addition, subject to the terms of the pooling and servicing agreement, the trustee will be primarily responsible for back-up advancing. |

| | | |

| | | The mortgagee of record with respect to the Illinois Center whole loan and the Hammons Hotel Portfolio whole loan is Deutsche Bank Trust Company Americas, as trustee under the CGCMT 2015-GC33 pooling and servicing agreement (referred to in this free writing prospectus as the “CGCMT 2015-GC33 trustee”). |

| | | |

| | | |

| | | The mortgagee of record with respect to the Hyatt Place Texas Portfolio whole loan is expected to be Wilmington Trust, National Association, as trustee under the JPMBB 2015-C32 pooling and servicing agreement (referred to in this free writing prospectus as the “JPMBB 2015-C32 trustee”) |

| | | |

| | | The CGCMT 2015-GC33 trustee and the JPMBB 2015-C32 trustee are also each referred to in this free writing prospectus as an “Other trustee”. |

| | | |

| | | See “Transaction Parties—The Trustee and Certificate Administrator” in this free writing prospectus. |

| | | |

| Certificate Administrator | | U.S. Bank National Association, a national banking association, will initially act as certificate administrator, custodian, paying agent, certificate registrar and authenticating agent. The corporate trust office of U.S. Bank National Association is located at 190 South LaSalle, 7th Floor, Mail Code: MK-IL-SLC7 Chicago, Illinois 60603, Attention: GSMS 2015-GC34 and for certificate transfer services, at 111 Fillmore Avenue, St. Paul, Minnesota 55107, Attention: Bondholder Services – GSMC 2015-GC34 and a custodial office at 1133 Rankin Street, Suite 100, St. Paul, Minnesota 55116, Attention: GSMS 2015-GC34. |

| | | |

| | | The certificate administrator related to the Illinois Center whole loan and the Hammons Hotel Portfolio whole loan under the CGCMT 2015-GC33 pooling and servicing agreement (referred to in this free writing prospectus as the “CGCMT 2015-GC33 certificate administrator”) is Citibank, N.A. |

| | | |

| | | The custodian related to the Illinois Center whole loan and the Hammons Hotel Portfolio whole loan under the CGCMT 2015-GC33 pooling and servicing agreement is Deutsche Bank Trust Company Americas. |

| | | |

| | | The certificate administrator and custodian related to the Hyatt Place Texas Portfolio whole loan under the JPMBB 2015-C32 pooling and servicing agreement (referred to in this free writing prospectus as the “JPMBB 2015-C32 certificate administrator”) is expected to be Wells Fargo Bank, National Association. |

| | | |

| | | The CGCMT 2015-GC33 certificate administrator and the JPMBB 2015-C32 certificate administrator are also each referred to in this free writing prospectus as an “Other certificate administrator”. |

| | | |

| | | See “Transaction Parties—The Trustee and Certificate Administrator” in this free writing prospectus. |

| | | |

| Operating Advisor | | Pentalpha Surveillance LLC, a Delaware limited liability company, will act as the initial operating advisor under the pooling and servicing agreement with respect to all of the mortgage loans (other than the non-serviced loans). At any time that (i) none of the classes of Class E, Class F and Class G certificates has an outstanding certificate principal amount (as notionally reduced by appraisal reductions allocable to such class) that is at least equal to 25% of the initial certificate principal amount of that class of certificates or (ii) a control |

| | | |

| | | |

| | | termination event is deemed to occur as described under “The Pooling and Servicing Agreement—Controlling Class Representative—General” in this free writing prospectus (each, a “Control Termination Event”), the operating advisor will generally review the special servicer’s operational practices in respect of specially serviced loans to formulate an opinion as to whether or not those operational practices generally satisfy the servicing standard with respect to the resolution and/or liquidation of specially serviced loans. In addition, at any time after the occurrence and during the continuance of a Control Termination Event, the operating advisor will consult on a non-binding basis with the special servicer with regard to certain major decisions with respect to the mortgage loans (other than with respect to the non-serviced loans) to the extent described in this free writing prospectus and provided in the pooling and servicing agreement. |

| | | |

| | | At any time after the occurrence and during the continuance of a Control Termination Event, the operating advisor will be required to review certain operational activities related to specially serviced loans in general on a platform-level basis. Based on the operating advisor’s review of certain information described in this free writing prospectus, the operating advisor will be required (if any mortgage loans (other than the non-serviced loans) were specially serviced loans during the prior calendar year) to prepare an annual report to be provided to the trustee and the certificate administrator (and made available through the certificate administrator’s website) setting forth its assessment of the special servicer’s performance of its duties under the pooling and servicing agreement on a platform-level basis with respect to the resolution or liquidation of specially serviced loans. Notwithstanding the foregoing, no operating advisor annual report will be required from the operating advisor with respect to the special servicer if during the prior calendar year no asset status report was prepared by the special servicer in connection with a specially serviced loan or REO property. |

| | | |

| | | At any time that (i) none of the classes of Class E, Class F and Class G certificates has an outstanding certificate principal amount, without regard to the application of any appraisal reductions, that is equal to or greater than 25% of the initial certificate principal amount of that class of certificates or (ii) a consultation termination event is deemed to occur as described under “The Pooling and Servicing Agreement—Controlling Class Representative—General” in this free writing prospectus (each, a “Consultation Termination Event”), the operating advisor may recommend the replacement of the special servicer if the operating advisor determines that the special servicer is not performing its duties as required under the pooling and servicing agreement or is otherwise not acting in accordance with the servicing standard, as described under “The Pooling and Servicing Agreement—Termination of the Special Servicer” in this free writing prospectus. |

| | | |

| | | |

| | | In addition, if none of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-AB, Class A-S, Class B, Class PEZ, Class C or Class D certificates are outstanding, then the controlling class representative may terminate all of the rights and obligations of the operating advisor under the pooling and servicing agreement (other than any rights or obligations that accrued prior to such termination, including accrued and unpaid compensation and indemnification rights that arose out of events that occurred prior to such termination) without the payment of any termination fee,provided,however, that the operating advisor will continue to receive the operating advisor fee until the termination of the trust fund. |

| | | |

| | | If none of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-AB, Class A-S, Class B, Class PEZ, Class C or Class D certificates are outstanding, then the operating advisor may resign from its obligations and duties under the pooling and servicing agreement without payment of any penalty. No successor operating advisor will be required to be appointed in connection with, or as a condition to, such resignation. |

| | | |

| | | Additionally, if the holders of at least 15% of the voting rights of the certificates other than the Class X, Class S and Class R certificates (but only those classes of certificates that, in each case, have an outstanding certificate principal amount, as notionally reduced by any appraisal reductions allocable to such class, equal to or greater than 25% of the initial certificate principal amount of such class, as reduced by payments of principal, and considering each class of the Class A-S, Class B and Class C certificates together with the Class PEZ certificates’ applicable percentage interest of the related Class A-S, Class B or Class C trust component as a single “class” for such purpose) request a vote to replace the operating advisor, then the operating advisor may be replaced by the holders of more than 50% of the voting rights of the certificates other than the Class X, Class S and Class R certificates (but only those classes of certificates that, in each case, have an outstanding certificate principal amount, as notionally reduced by any appraisal reductions allocable to such class, equal to or greater than 25% of the initial certificate principal amount of such class, as reduced by payments of principal, and considering each class of the Class A-S, Class B and Class C certificates together with the Class PEZ certificates’ applicable percentage interest of the related Class A-S, Class B or Class C trust component as a single “class” for such purpose) that exercise their right to vote;provided that holders of at least 50% of the voting rights of such certificates exercise their right to vote. See “The Pooling and Servicing Agreement—Operating Advisor—Termination of the Operating Advisor Without Cause” in this free writing prospectus. |

| | | |

| | | The operating advisor related to the Illinois Center whole loan and the Hammons Hotel Portfolio whole loan under the CGCMT 2015-GC33 pooling and servicing agreement (referred to in this free writing prospectus as the “CGCMT 2015-GC33 operating advisor”) is Situs Holdings, LLC. |

| | | |

| | | |

| | | The senior trust advisor related to the Hyatt Place Texas Portfolio whole loan under the JPMBB 2015-C32 pooling and servicing agreement (referred to in this free writing prospectus as the “JPMBB 2015-C32 operating advisor”) is expected to be Pentalpha Surveillance LLC. |

| | | |

| | | The CGCMT 2015-GC33 operating advisor and the JPMBB 2015-C32 operating advisor are also each referred to in this free writing prospectus as an “Other operating advisor”. |

| | | |

| | | For additional information regarding the responsibilities of the operating advisor, see “The Pooling and Servicing Agreement—Operating Advisor”, “Description of the Mortgage Pool—The Whole Loans”and“Transaction Parties—The Operating Advisor” in this free writing prospectus. |

| | | |

| Master Servicer | | Wells Fargo Bank, National Association, a national banking association. Except as otherwise described below with respect to the non-serviced loans, the master servicer will initially service all of the mortgage loans and the serviced companion loan (as discussed under “—The Mortgage Loans—The Whole Loans” below) either directly or through a sub-servicer pursuant to the pooling and servicing agreement. The principal west coast commercial mortgage master servicing offices of Wells Fargo Bank, National Association, are located at MAC-A0227-020, 1901 Harrison Street, Oakland, California 94612. The principal east coast commercial mortgage master servicing offices of Wells Fargo Bank, National Association are located at MAC-D1086-120, 550 South Tryon Street, Charlotte, North Carolina 28202. |

| | | |

| | | The primary servicer of the Illinois Center whole loan and the Hammons Hotel Portfolio whole loan under the CGCMT 2015-GC33 pooling and servicing agreement (referred to in this free writing prospectus as the “CGCMT 2015 GC33 master servicer”) is Wells Fargo Bank, National Association. |

| | | |

| | | The Hyatt Place Texas Portfolio companion loan is expected to be contributed into the JPMBB 2015-C32 securitization trust. Until the Hyatt Place Texas Portfolio companion loan is included in the other securitization trust, the Hyatt Place Texas Portfolio whole loan will be primary serviced by the master servicer under the pooling and servicing agreement for this transaction. It is expected that after the securitization of the Hyatt Place Texas Portfolio companion loan, the Hyatt Place Texas Portfolio whole loan will be primary serviced by the master servicer under the JPMBB 2015-C32 pooling and servicing agreement (referred to in this free writing prospectus as the “JPMBB 2015-C32 master servicer”), which is expected to be Wells Fargo Bank, National Association. |

| | | |

| | | The CGCMT 2015-GC33 master servicer and the JPMBB 2015-C32 master servicer are also each referred to in this free writing prospectus as an “Other master servicer”. |

| | | |

| | | |

| | | See “Transaction Parties—Servicers—TheMaster Servicer” and “—Servicing Compensation, Operating Advisor Compensation and Payment of Expenses”in this free writing prospectus. |

| | | |