| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-207677-06 |

| | | |

August 4, 2017

Free Writing Prospectus

Structural and Collateral Term Sheet

$1,081,643,735

(Approximate Mortgage Pool Balance)

$930,213,000

(Offered Certificates)

GS Mortgage Securities Trust 2017-GS7

As Issuing Entity

GS Mortgage Securities Corporation II

As Depositor

Commercial Mortgage Pass-Through Certificates

Series 2017-GS7

Goldman Sachs Mortgage Company

As Sponsor and Mortgage Loan Seller

IMPORTANT NOTICE REGARDING THE CONDITIONS FOR THIS OFFERING OF ASSET-BACKED SECURITIES

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207677) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor, Goldman Sachs & Co. LLC, Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) the fact that there is no representation being made that these materials are accurate or complete and that these materials may not be updated or (3) these materials possibly being confidential, are, in each case, not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| | Goldman Sachs & Co. LLC | |

| Lead Manager and Sole Bookrunner |

| | | |

| Academy Securities | | Drexel Hamilton |

| Co-Managers |

The securities offered by this structural and collateral term sheet (this “Term Sheet”) are described in greater detail in the preliminary prospectus included as part of our Registration Statement (SEC File No. 333-207677) (the “Preliminary Prospectus”) anticipated to be dated August 4, 2017. The Preliminary Prospectus contains material information that is not contained in this Term Sheet (including without limitation a detailed discussion of risks associated with an investment in the offered securities under the heading“Risk Factors” in the Preliminary Prospectus). The Preliminary Prospectus is available upon request from Goldman Sachs & Co. LLC, Academy Securities, Inc. or Drexel Hamilton, LLC. Capitalized terms used but not otherwise defined in this Term Sheet have the respective meanings assigned to those terms in the Preliminary Prospectus. This Term Sheet is subject to change.

The Securities May Not Be a Suitable Investment for You

The securities offered by this Term Sheet are not suitable investments for all investors. In particular, you should not purchase any class of securities unless you understand and are able to bear the prepayment, credit, liquidity and market risks associated with that class of securities. For those reasons and for the reasons set forth under the heading “Risk Factors” in the Preliminary Prospectus, the yield to maturity and the aggregate amount and timing of distributions on the offered securities are subject to material variability from period to period and give rise to the potential for significant loss over the life of those securities. The interaction of these factors and their effects are impossible to predict and are likely to change from time to time. As a result, an investment in the offered securities involves substantial risks and uncertainties and should be considered only by sophisticated institutional investors with substantial investment experience with similar types of securities and who have conducted appropriate due diligence on the mortgage loans and the securities. Potential investors are advised and encouraged to review the Preliminary Prospectus in full and to consult with their legal, tax, accounting and other advisors prior to making any investment in the offered securities described in this Term Sheet.

This Term Sheet is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The information contained in this Term Sheet may not pertain to any securities that will actually be sold. The information contained in this Term Sheet may be based on assumptions regarding market conditions and other matters as reflected in this Term Sheet. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and this Term Sheet should not be relied upon for such purposes. We and our affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of this Term Sheet may, from time to time, have long or short positions in, and buy or sell, the securities mentioned in this Term Sheet or derivatives thereof (including options). Information contained in this Term Sheet is current as of the date appearing on this Term Sheet only. Information in this Term Sheet regarding the securities and the mortgage loans backing any securities discussed in this Term Sheet supersedes all prior information regarding such securities and mortgage loans. None of Goldman Sachs & Co. LLC, Academy Securities, Inc. or Drexel Hamilton, LLC provides accounting, tax or legal advice.

The issuing entity will be relying upon an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”), contained in Section 3(c)(5) of the Investment Company Act or Rule 3a-7 under the Investment Company Act, although there may be additional exclusions or exemptions available to the issuing entity. The issuing entity is being structured so as not to constitute a “covered fund” for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in “Risk Factors—Other Risks Relating to the Certificates—Legal and Regulatory Provisions Affecting Investors Could Adversely Affect the Liquidity of the Offered Certificates” in the Preliminary Prospectus). See also “Legal Investment” in the Preliminary Prospectus.

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207677) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

3

CERTIFICATE SUMMARY OFFERED CERTIFICATES |

Offered Class | | Expected Ratings

(Fitch / KBRA / Moody’s)(1) | | Approximate Initial Certificate Balance

or Notional Amount(2) | | Approximate Initial Credit Support(3) | | Initial Pass-

Through Rate | | Pass-Through Rate Description | |

Wtd. Avg. Life (Yrs)(4)

| | Principal Window(4) |

| Class A-1 | | AAAsf / AAA(sf) / Aaa(sf) | | $ 18,155,000 | | 30.000% | | [ ]% | | (5) | | 2.87 | | 09/17 – 06/22 |

| Class A-2 | | AAAsf / AAA(sf) / Aaa(sf) | | $ 56,176,000 | | 30.000% | | [ ]% | | (5) | | 4.86 | | 06/22 – 07/22 |

| Class A-3 | | AAAsf / AAA(sf) / Aaa(sf) | | $ 315,000,000 | | 30.000% | | [ ]% | | (5) | | 9.66 | | 03/27 – 05/27 |

| Class A-4 | | AAAsf / AAA(sf) / Aaa(sf) | | $ 340,612,000 | | 30.000% | | [ ]% | | (5) | | 9.79 | | 05/27 – 07/27 |

| Class A-AB | | AAAsf / AAA(sf) / Aaa(sf) | | $ 27,207,000 | | 30.000% | | [ ]% | | (5) | | 7.30 | | 07/22 – 03/27 |

| Class X-A | | AAAsf / AAA(sf) / Aa1(sf) | | $ 831,513,000(6) | | N/A | | [ ]% | | Variable IO(7) | | N/A | | N/A |

| Class X-B | | A-sf / AAA(sf) / NR | | $ 98,700,000(6) | | N/A | | [ ]% | | Variable IO(7) | | N/A | | N/A |

| Class A-S | | AAAsf / AAA(sf) / Aa3(sf) | | $ 74,363,000 | | 23.125% | | [ ]% | | (5) | | 9.88 | | 07/27 – 07/27 |

| Class B | | AA-sf / AA(sf) / NR | | $ 47,322,000 | | 18.750% | | [ ]% | | (5) | | 9.88 | | 07/27 – 07/27 |

| Class C | | A-sf / A(sf) / NR | | $ 51,378,000 | | 14.000% | | [ ]% | | (5) | | 9.88 | | 07/27 – 07/27 |

| |

| NON-OFFERED CERTIFICATES |

Non-Offered Class | | Expected Ratings

(Fitch / KBRA / Moody’s)(1) | | Approximate Initial Certificate Balance

or Notional Amount(2) | | Approximate Initial Credit Support(3) | | Initial Pass-

Through Rate | | Pass-Through Rate Description | |

Wtd. Avg. Life (Yrs)(4)

| | Principal Window(4) |

| Class D | | BBB+sf / A-(sf) / NR | | $ 20,281,000 | | 12.125% | | [ ]% | | (5) | | 9.88 | | 07/27 – 07/27 |

| Class X-D(8) | | BBB-sf / BBB+(sf) / NR | | $ 37,133,000(6) | | N/A | | [ ]% | | Variable IO(7) | | N/A | | N/A |

| Class E(8) | | BBB-sf / BBB+(sf) / NR | | $ 16,852,000 | | 10.567% | | [ ]% | | (5) | | 9.91 | | 07/27 – 08/27 |

| Class F-RR(8) | | BBB-sf / BBB(sf) / NR | | $ 21,005,000 | | 8.625% | | [ ]% | | (5) | | 9.96 | | 08/27 – 08/27 |

| Class G-RR(8) | | BB-sf / BB(sf) / NR | | $ 27,042,000 | | 6.125% | | [ ]% | | (5) | | 9.96 | | 08/27 – 08/27 |

| Class H-RR(8) | | B-sf / B+(sf) / NR | | $ 12,168,000 | | 5.000% | | [ ]% | | (5) | | 9.96 | | 08/27 – 08/27 |

| Class J-RR(8) | | NR / NR / NR | | $ 54,082,734 | | 0.000% | | [ ]% | | (5) | | 9.96 | | 08/27 – 08/27 |

| Class R(9) | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A |

| | | | | | | | | | | | | | | |

| (1) | It is a condition of issuance that the offered certificates receive the ratings set forth above. The anticipated ratings of the certificates shown are those of Fitch Ratings, Inc. (“Fitch”), Kroll Bond Rating Agency, Inc. (“KBRA”) and Moody’s Investors Service, Inc. (“Moody’s” and together with Fitch and KBRA, the “Rating Agencies”). Subject to the discussion under “Ratings” in the Preliminary Prospectus, the ratings on the certificates address the likelihood of the timely receipt by holders of all payments of interest to which they are entitled on each distribution date and, except in the case of the interest only certificates, the ultimate receipt by holders of all payments of principal to which they are entitled on or before the applicable rated final distribution date. Certain nationally recognized statistical rating organizations, as defined in Section 3(a)(62) of the Securities Exchange Act of 1934, as amended, that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, or otherwise to rate the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” in the Preliminary Prospectus. The related Rating Agencies have informed us that the “sf” designation in their ratings represents an identifier of structured finance product ratings. For additional information about this identifier, prospective investors can go to the related Rating Agency’s website. The depositor and the underwriters have not verified, do not adopt and do not accept responsibility for any statements made by the related Rating Agencies on those websites. Credit ratings referenced throughout this Term Sheet are forward-looking opinions about credit risk and express a rating agency’s opinion about the willingness and ability of an issuer of securities to meet its financial obligations in full and on time. Ratings are not indications of investment merit and are not buy, sell or hold recommendations, a measure of asset value or an indication of the suitability of an investment. |

| (2) | Approximate, subject to a variance of plus or minus 5%. The notional amount of each class of the Class X-A, Class X-B and Class X-D certificates (collectively the “Class X certificates”), is subject to change depending upon the final pricing of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-AB, Class A-S, Class B, Class C, Class D, Class E, Class F-RR, Class G-RR, Class H-RR and Class J-RR certificates (collectively, the “principal balance certificates”), as follows: (1) if as a result of such pricing the pass-through rate of any class of principal balance certificates whose certificate balance comprises such notional amount is equal to the weightedaverageof the net mortgage interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), the certificate balance of such class of principal balance certificates may not be part of, and reduce accordingly, such notional amount of the related Class X certificates (or, if as a result of such pricing the pass-through rate of the related Class X certificates is equal to zero, such Class X certificates may not be issued on the closing date), and/or (2) if as a result of such pricing the pass-through rate of any class of principal balance certificates that does not comprise such notional amount of the related Class X certificates is equal to less than the weighted average of the net mortgage interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), such class of principal balance certificates may become a part of, and increase accordingly, such notional amount of the related Class X certificates. |

| (3) | The initial credit support percentages set forth for the certificates are approximate and, for the Class A-1, Class A-2, Class A-3 Class A-4 and Class A-AB certificates, are represented in the aggregate. |

| (4) | The weighted average life and period during which distributions of principal would be received as set forth in the foregoing table with respect to each class of certificates having a certificate balance are based on the assumptions set forth under “Yield, Prepayment and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus and on the assumptions that there are no prepayments, modifications or losses in respect of the mortgage loans or whole loans and that there are no extensions or forbearances of maturity dates of the mortgage loans or whole loans. |

| (5) | For each distribution date, the pass-through rates on the Class A-1, Class A-2, Class A-3,Class A-4,Class A-AB, Class A-S, Class B, Class C, Class D, Class E, Class F-RR, Class G-RR, Class H-RR and Class J-RR certificates will each generally be aper annum rate equal to one of (i) a fixed rate, (ii) the weighted average of the net mortgage interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as of their respective due dates in the month preceding the month in which the related distribution date occurs, (iii) the lesser of a specified pass-through rate and the rate described in clause (ii), or (iv) the rate described in clause (ii) less a specified percentage. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207677) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

4

| CERTIFICATE SUMMARY (continued) |

| (6) | The Class X certificates will not have certificate balances and will not be entitled to receive distributions of principal. Interest will accrue on each of the Class X certificates at its respective pass-through rate based upon its respective notional amount. The notional amount of each of the Class X certificates will be equal to the aggregate certificate balances of the related class(es) of certificates (the “related certificates”) indicated below. |

| Class | | Related Certificates |

| Class X-A | | Class A-1, Class A-2, Class A-3, Class A-4,Class A-AB and Class A-S certificates |

| Class X-B | | Class B and Class C certificates |

| Class X-D | | Class D and Class E certificates |

| (7) | The pass-through rate of each of the Class X certificates for any distribution date will equal the excess, if any, of (i) the weighted average of the net mortgage interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as of their respective due dates in the month preceding the month in which the related distribution date occurs, over (ii) the pass-through rate (or the weighted average of the pass-through rates as applicable) of the related certificates for that distribution date, as described in the Preliminary Prospectus. |

| (8) | The initial certificate balance of each of the Class E, Class F-RR, Class G-RR, Class H-RR and Class J-RR certificates, and the initial notional amount of the Class X-D certificates, are subject to change based on final pricing of all certificates and the final determination of the Class F-RR, Class G-RR, Class H-RR and Class J-RR certificates (collectively, the “HRR Certificates”) that will be retained by the retaining third-party purchaser to satisfy the sponsor’s U.S. risk retention requirements. For more information regarding the methodology and key inputs and assumptions used to determine the sizing of the HRR Certificates, see “Credit Risk Retention” in the Preliminary Prospectus. |

| (9) | The Class R certificates will not have a certificate balance, notional amount, pass-through rate, rating or rated final distribution date. The Class R certificates will represent the residual interests in each of two separate REMICs, as further described in the Preliminary Prospectus. The Class R certificates will not be entitled to distributions of principal or interest. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207677) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

5

| MORTGAGE POOL CHARACTERISTICS |

| Mortgage Pool Characteristics(1) |

| Initial Pool Balance(2) | $1,081,643,735 |

| Number of Mortgage Loans | 32 |

| Number of Mortgaged Properties | 35 |

| Average Cut-off Date Mortgage Loan Balance | $33,801,367 |

| Weighted Average Mortgage Interest Rate | 4.44440% |

| Weighted Average Remaining Term to Maturity (months) | 115 |

| Weighted Average Remaining Amortization Term (months) | 359 |

| Weighted Average Cut-off Date LTV Ratio(3) | 57.4% |

| Weighted Average Maturity Date LTV Ratio(4) | 53.3% |

| Weighted Average Underwritten Debt Service Coverage Ratio(5) | 2.20x |

| Weighted Average Debt Yield on Underwritten NOI(6) | 11.3% |

| % of Mortgage Loans with Mezzanine Debt(7) | 30.9% |

| % of Mortgage Loans with Subordinate Debt(8) | 16.4% |

| % of Mortgage Loans with Preferred Equity | 14.5% |

| % of Mortgage Loans with Single Tenants | 13.0% |

| (1) | Each of the twelve mortgage loans, representing approximately 62.0% of the initial pool balance, listed in the “Companion Loan Summary” table below has one or more relatedpari passu companion loans, and the loan-to-value ratio, debt service coverage ratio, debt yield and balance per SF calculations presented in this Term Sheet include the relatedpari passu companion loan(s) unless otherwise indicated. With respect to two mortgage loans, representing approximately 16.4% of the initial pool balance, with one or more related subordinate companion loan(s) as set forth in the “Companion Loan Summary” table below, the loan-to-value ratio, debt service coverage ratio, debt yield and balance per SF calculations presented in this Term Sheet are calculated without regard to the related subordinate companion loan(s). Other than as specifically noted, the loan-to-value ratio, debt service coverage ratio, debt yield and mortgage loan rate information for each mortgage loan is presented in this Term Sheet without regard to any other indebtedness (whether or not secured by the related mortgaged property, ownership interests in the related borrower or otherwise) that currently exists or that may be incurred by the related borrower or its owners in the future, in order to present statistics for the related mortgage loan without combination with the other indebtedness. |

| (2) | Subject to a permitted variance of plus or minus 5%. |

| (3) | Unless otherwise indicated, the Cut-off Date LTV Ratio is calculated utilizing the “as-is” appraised value (which, in certain cases, may reflect a portfolio premium valuation). With respect to three mortgage loans, representing approximately 13.7% of the initial pool balance, the Cut-off Date LTV Ratio was calculated using a hypothetical “as-is” appraised value assuming (i) an “as-is” appraised value plus related property improvement plan (“PIP”) costs, (ii) an “as-is” appraised value plus related PIP costs and capital improvement holdback or (iii) the Cut-off Date Balance of a mortgage loan less a reserve taken at origination. The weighted average Cut-off Date LTV Ratio for the mortgage pool without making any adjustments is 58.9%. See “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus for a description of Cut-off Date LTV Ratio. |

| (4) | Unless otherwise indicated, the Maturity Date LTV Ratio is calculated utilizing the “as-is” appraised value. With respect to nine mortgage loans, representing approximately 44.0% of the aggregate principal balance of the pool of mortgage loans as of the Cut-off Date, the respective Maturity Date LTV Ratios were calculated using an “as stabilized” or “prospective as stabilized” appraised value assuming certain reserves were pre-funded instead of the related “as-is” appraised value. The weighted average Maturity Date LTV Ratio for the mortgage pool without making such adjustments is 55.6%. See“Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus for a description of Maturity Date LTV Ratio. |

| (5) | Unless otherwise indicated, the Underwritten Debt Service Coverage Ratio for each mortgage loan is calculated by dividing the Underwritten Net Cash Flow from the related mortgaged property or mortgaged properties by the annual debt service for such mortgage loan, as adjusted in the case of mortgage loans with a partial interest only period by using the first 12 amortizing payments due instead of the actual interest only payment. See “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus for a description of Underwritten Debt Service Coverage Ratio. |

| (6) | Unless otherwise indicated, the Debt Yield on Underwritten NOI for each mortgage loan is the related mortgaged property’s Underwritten NOI divided by the Cut-off Date Balance of such mortgage loan, and the Debt Yield on Underwritten NCF for each mortgage loan is the related mortgaged property’s Underwritten NCF divided by the Cut-off Date Balance of such mortgage loan. With respect to one mortgage loan, representing 5.5% of the initial pool balance, the respective Debt Yield on Underwritten NOI and Debt Yield on Underwritten NCF were calculated using the Cut-off Date Balance of a mortgage loan less the $10,000,000 earnout reserve taken at origination. The weighted average Debt Yield on Underwritten NOI and weighted average Debt Yield on Underwritten NCF for the mortgage pool without making this adjustment are 11.2% and 10.4%, respectively. See“Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus for descriptions of Debt Yield on Underwritten NOI and Debt Yield on Underwritten NCF. |

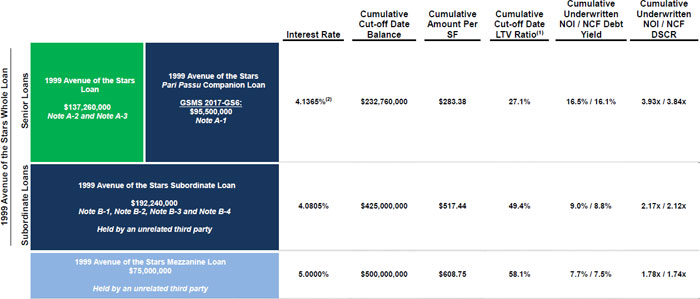

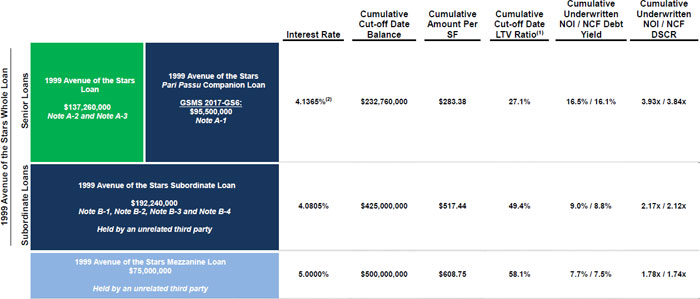

| (7) | The 1999 Avenue of the Stars, Long Island Prime Portfolio - Uniondale, Long Island Prime Portfolio - Melville and Olympic Tower mortgage loans have additional existing subordinate mezzanine loans held by certain limited liability companies owned by certain individuals who also own an indirect interest in the borrowers. The 1999 Avenue of the Stars mezzanine loan has an outstanding principal balance of $71,120,923 made to the direct parent of the mezzanine borrower.See “Description of the Mortgage Pool—The Whole Loans” and “Description of the Mortgage Pool—Additional Indebtedness” in the Preliminary Prospectus. |

| (8) | The 1999 Avenue of the Stars and Olympic Tower mortgage loans have one or more subordinate companion loans that are generally subordinate in right of payment to the respective related mortgage loans (the “1999 Avenue of the Stars Subordinate Companion Loans” and the “Olympic Tower Subordinate Companion Loans”). The 1999 Avenue of the Stars Subordinate Companion Loans, evidenced by note B-1, note B-2, note B-3 and note B-4, have an aggregate outstanding principal balance of $192,240,000 as of the Cut-off Date, and were sold to an unrelated third party investor. The Olympic Tower Subordinate Companion Loans, evidenced by note B-1, note B-2 and note B-3, have an aggregate outstanding principal balance of $149,000,000 as of the Cut-off Date, and were contributed to the OT 2017-OT securitization transaction. See “Description of the Mortgage Pool—The Whole Loans” and “Description of the Mortgage Pool—Additional Indebtedness” in the Preliminary Prospectus. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207677) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

6

| KEY FEATURES OF THE CERTIFICATES |

| Lead Manager and Sole Bookrunner: | Goldman Sachs & Co. LLC |

| Co-Managers: | Academy Securities, Inc. Drexel Hamilton, LLC |

| Depositor: | GS Mortgage Securities Corporation II |

| Initial Pool Balance: | $1,081,643,735 |

| Master Servicer: | Wells Fargo Bank, National Association |

| Special Servicer: | Rialto Capital Advisors, LLC |

| Certificate Administrator: | Wells Fargo Bank, National Association |

| Trustee: | Wilmington Trust, National Association |

| Operating Advisor: | Park Bridge Lender Services LLC |

| Asset Representations Reviewer: | Park Bridge Lender Services LLC |

| U.S. Credit Risk Retention: | For a discussion of the manner by which Goldman Sachs Mortgage Company, as sponsor, intends to satisfy the credit risk requirements of the Credit Risk Retention Rules, see “Credit Risk Retention” in the Preliminary Prospectus. |

| Pricing: | Week of August 7, 2017

|

| Closing Date: | August 24, 2017 |

| Cut-off Date: | For each mortgage loan, the related due date for such mortgage loan in August 2017 (or, in the case of any mortgage loan that has its first due date in September 2017, the date that would have been its due date in August 2017 under the terms of that mortgage loan if a monthly payment were scheduled to be due in that month). |

| Determination Date: | The 6th day of each month or next business day, commencing in September 2017 |

| | |

| Distribution Date: | The 4th business day after the Determination Date, commencing in September 2017 |

| | |

| Interest Accrual: | Preceding calendar month |

| ERISA Eligible: | The offered certificates are expected to be ERISA eligible |

| SMMEA Eligible: | No |

| Payment Structure: | Sequential Pay |

| | |

| Day Count: | 30/360 |

| | |

| Tax Structure: | REMIC |

| | |

| Rated Final Distribution Date: | August 2050 |

| Cleanup Call: | 1.0% |

| | |

| Minimum Denominations: | $10,000 minimum for the offered certificates (except with respect to each class of Class X certificates: $1,000,000 minimum); integral multiples of $1 thereafter for all the offered certificates |

| Delivery: | Book-entry through DTC |

| | |

| Bond Information: | Cash flows are expected to be modeled by TREPP, INTEX and BLOOMBERG |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207677) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

7

| ■ | $1,081,643,734 (Approximate) New-Issue Multi-Borrower CMBS: |

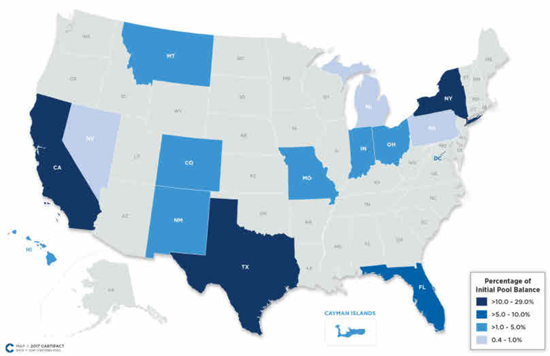

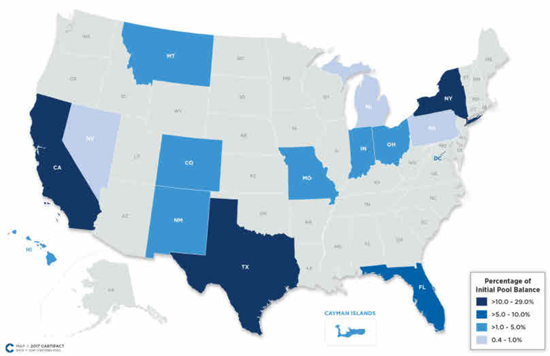

| — | Overview: The mortgage pool consists of 32 fixed-rate commercial mortgage loans that have an aggregate Cut-off Date Balance of $1,081,643,735 (the “Initial Pool Balance”), have an average mortgage loan Cut-off Date Balance of $33,801,367 and are secured by 35 mortgaged properties located throughout 14 states, the District of Columbia and the Cayman Islands |

| — | LTV: 57.4% weighted average Cut-off Date LTV Ratio |

| — | DSCR: 2.20x weighted average Underwritten NCF Debt Service Coverage Ratio |

| — | Debt Yield: 11.3% weighted average Debt Yield on Underwritten NOI |

| — | Credit Support: 30.000% credit support to Class A-1 / A-2 / A-3 / A-4 / A-AB |

| ■ | Loan Structural Features: |

| — | Amortization:35.3% of the mortgage loans by Initial Pool Balance have scheduled amortization as follows: |

| – | 19.6% of the mortgage loans by Initial Pool Balance have scheduled amortization following a partial interest only period with a balloon payment due at maturity |

| – | 15.6% of the mortgage loans by Initial Pool Balance have scheduled amortization for the entire term with a balloon payment due at maturity |

| — | Hard Lockboxes: 75.5% of the mortgage loans by Initial Pool Balance have a Hard Lockbox in place |

| — | Cash Traps: 100.0% of the mortgage loans by Initial Pool Balance have cash traps triggered by certain declines in cash flow, all at levels equal to or greater than a 1.10x coverage, that fund an excess cash flow reserve |

| — | Reserves: The mortgage loans require amounts to be escrowed for reserves as follows: |

| – | Real Estate Taxes: 22 mortgage loans representing 49.6% of the Initial Pool Balance |

| – | Insurance: 5 mortgage loans representing 16.7% of the Initial Pool Balance |

| – | Replacement Reserves (Including FF&E Reserves): 23 mortgage loans representing 53.1% of the Initial Pool Balance |

| – | Tenant Improvements / Leasing Commissions: 17 mortgage loans representing 47.3% of the portion of the Initial Pool Balance that is secured by office, mixed use and retail properties only |

| — | Predominantly Defeasance: 92.9% of the mortgage loans by Initial Pool Balance permit defeasance after an initial lockout period |

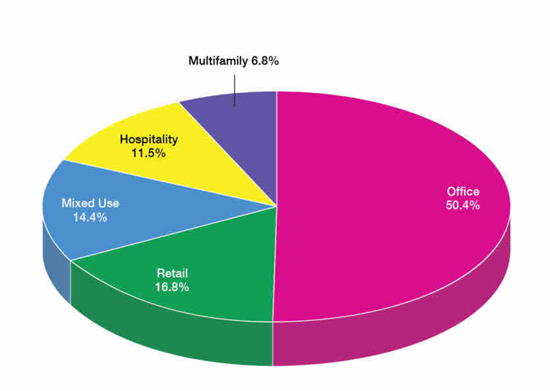

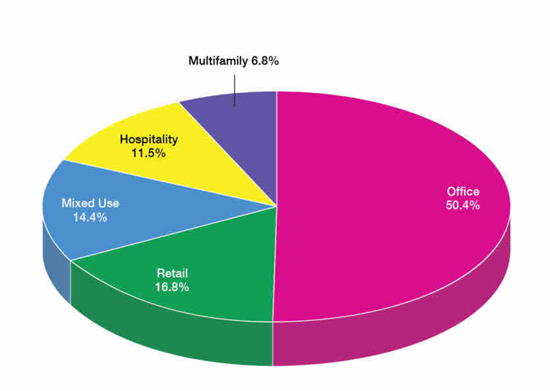

| ■ | Multiple-Asset Types > 5.0% of the Initial Pool Balance: |

| — | Office: 50.4% of the mortgaged properties by allocated Initial Pool Balance are office properties |

| — | Retail: 16.8% of the mortgaged properties by allocated Initial Pool Balance are retail properties (12.3% are anchored retail properties) |

| — | Mixed Use: 14.4% of the mortgaged properties by allocated Initial Pool Balance are mixed use properties |

| — | Hospitality: 11.5% of the mortgaged properties by allocated Initial Pool Balance are hospitality properties |

| — | Multifamily: 6.8% of the mortgaged properties by allocated Initial Pool Balance are multifamily properties |

| ■ | Geographic Diversity: The 35 mortgaged properties are located throughout 14 states, the District of Columbia and the Cayman Islands, with only three states having greater than 10.0% of the allocated Initial Pool Balance: New York (29.0%), California (26.0%) and Texas (10.3%). |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207677) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

8

Mortgage Loan Seller | | Mortgage Loans | | Mortgaged Properties | | Aggregate Cut-off Date Balance | | % of Initial

Pool Balance |

| Goldman Sachs Mortgage Company | | 32 | | 35 | | $1,081,643,735 | | 100.0% |

| Total | | 32 | | 35 | | $1,081,643,735 | | 100.0% |

| Ten Largest Mortgage Loans |

Mortgage Loan Name | | Cut-off Date Balance | | % of

Initial Pool Balance | | Property Type | | Property Size

SF / Room | | Cut-off Date Balance Per SF / Room | | UW NCF

DSCR | | UW

NOI Debt Yield | | Cut-off

Date LTV Ratio |

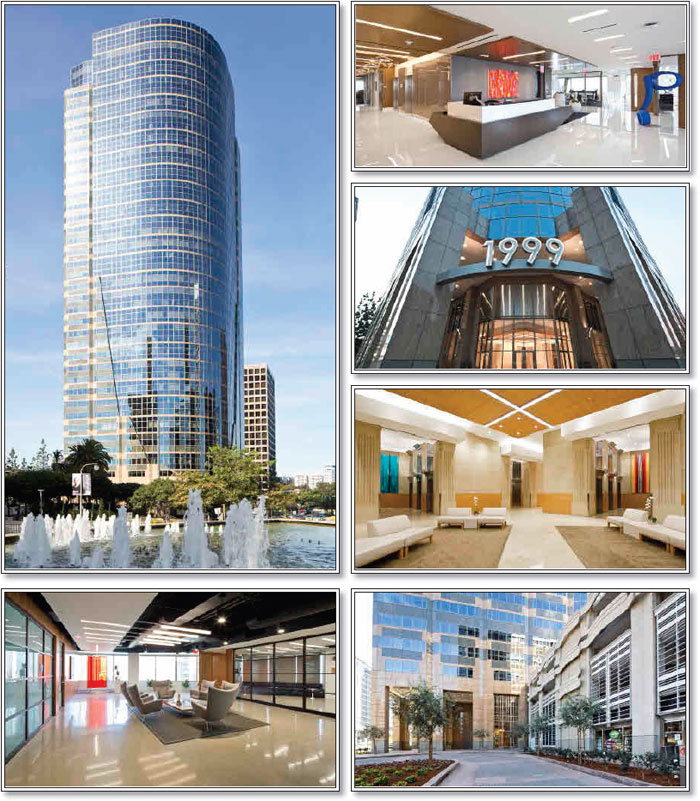

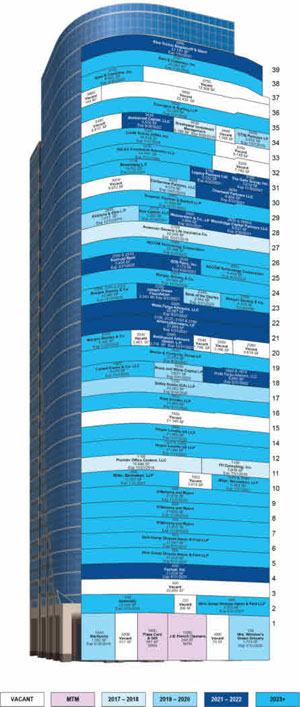

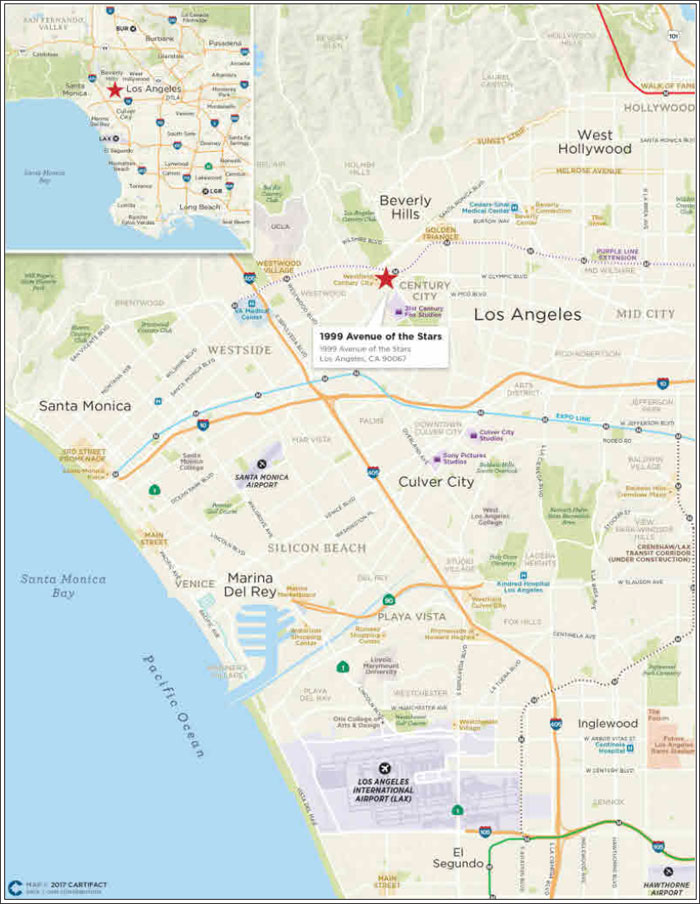

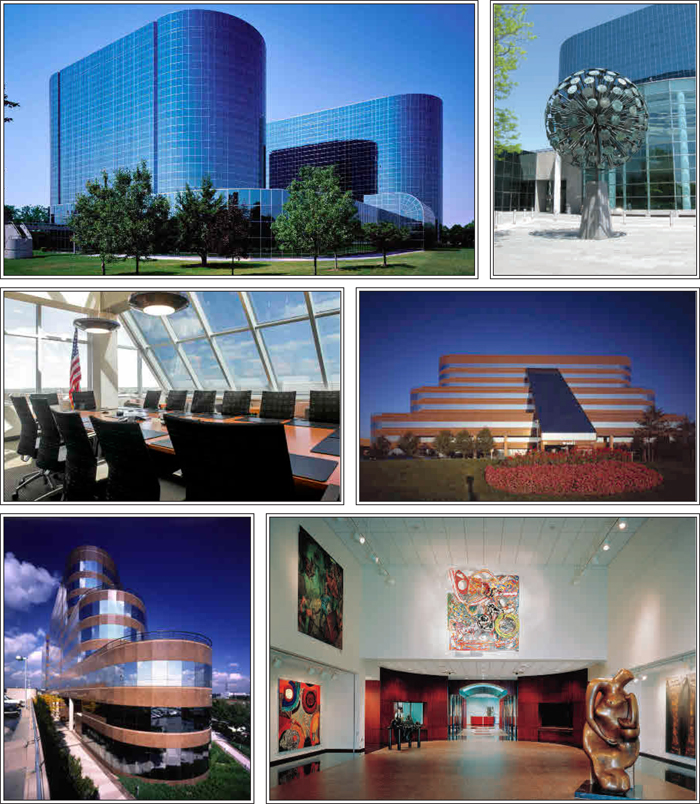

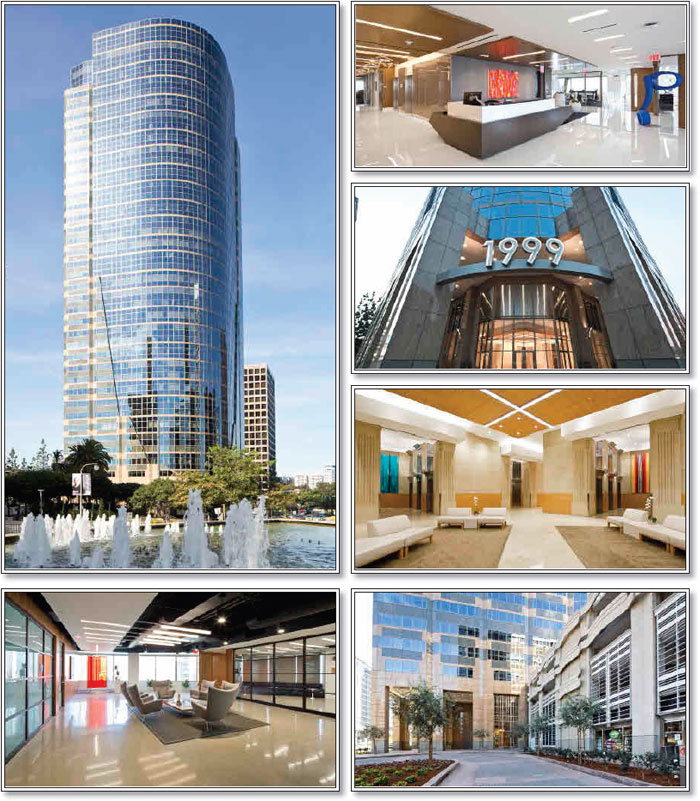

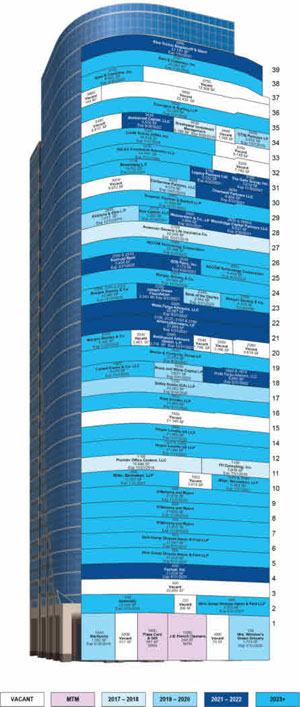

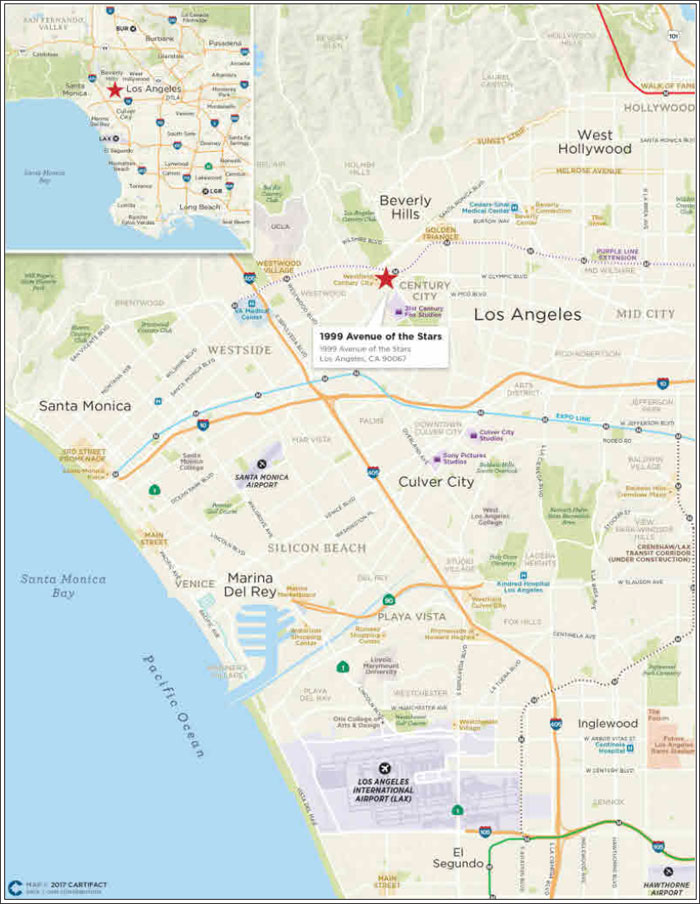

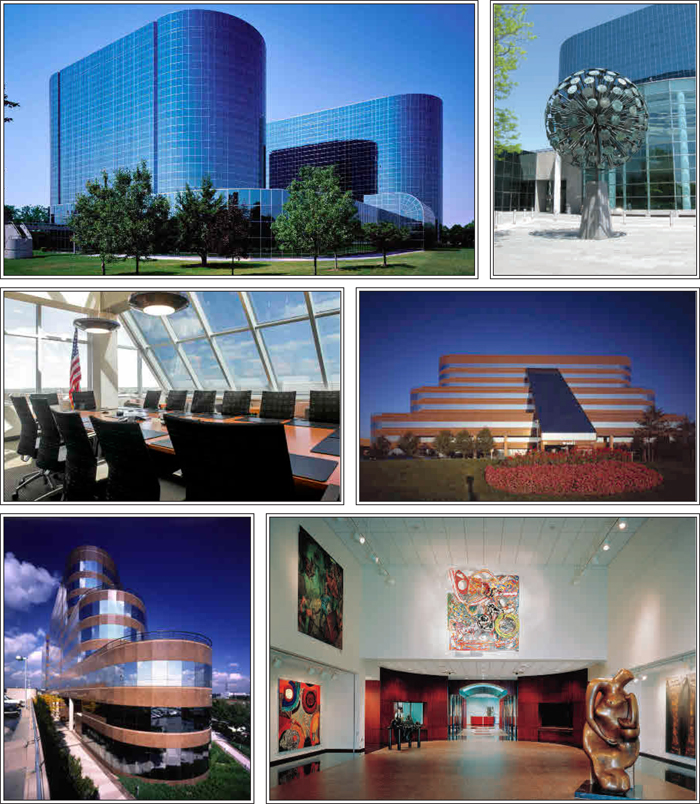

| 1999 Avenue of the Stars | | $137,260,000 | | 12.7% | | Office | | 821,357 | | $283 | | 3.84x | | 16.5% | | 27.1% |

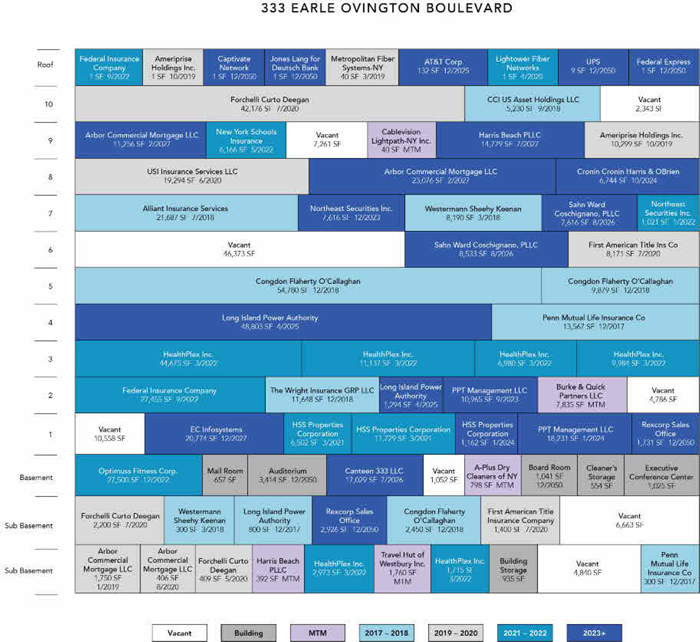

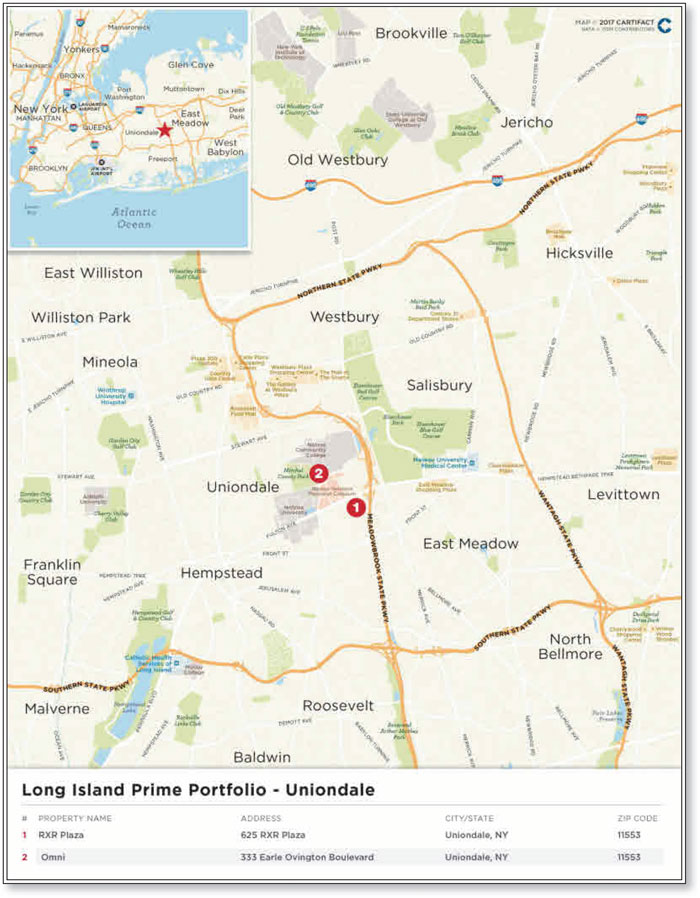

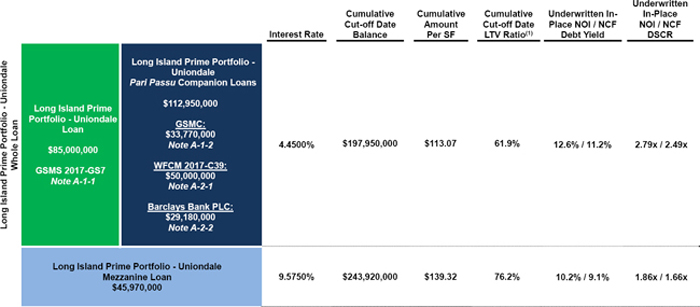

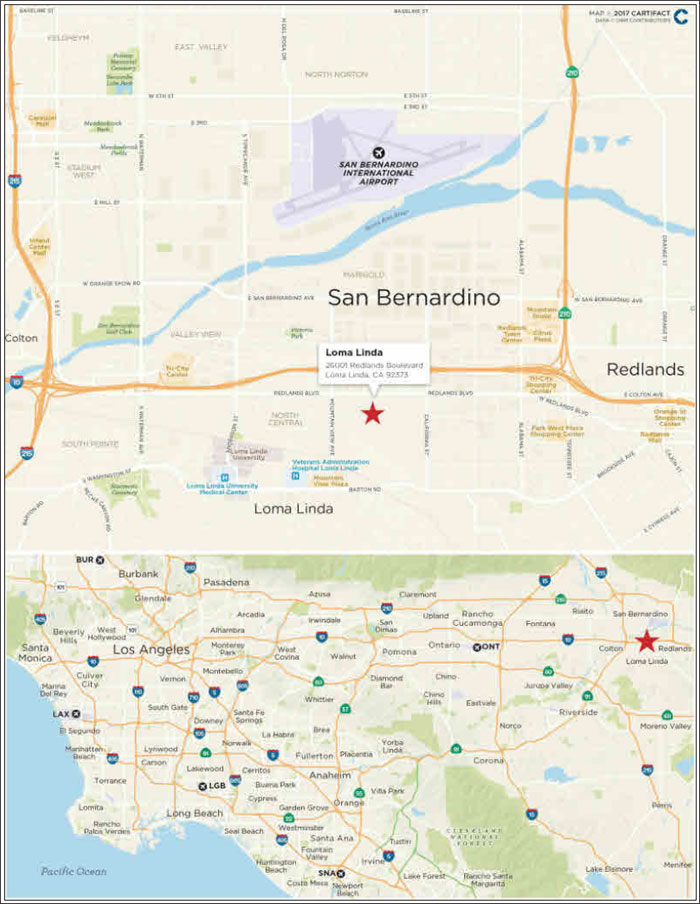

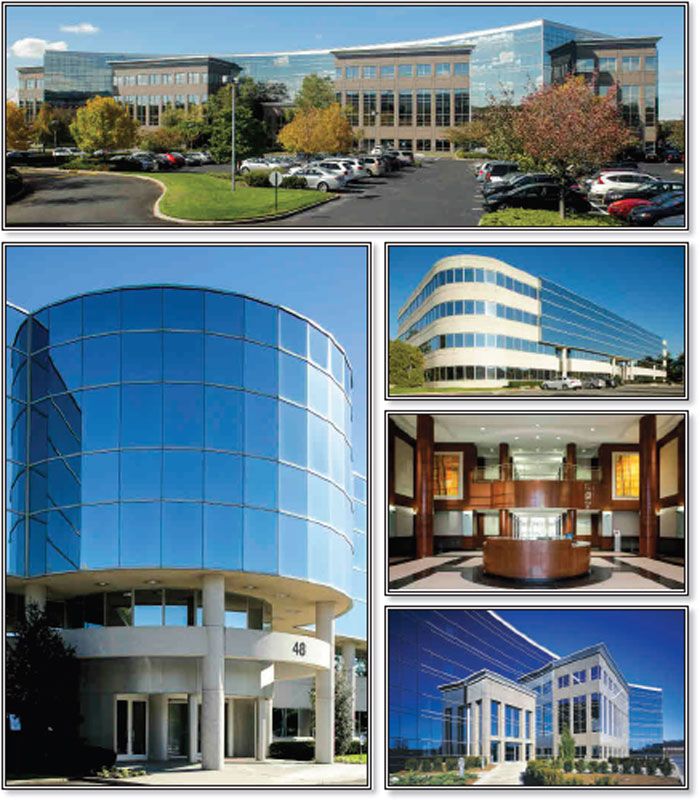

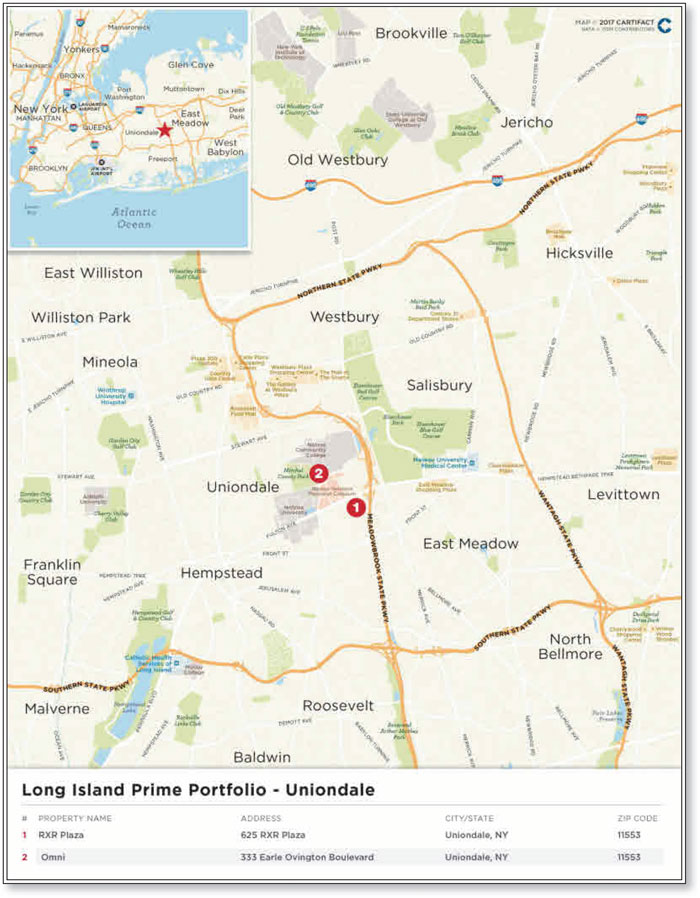

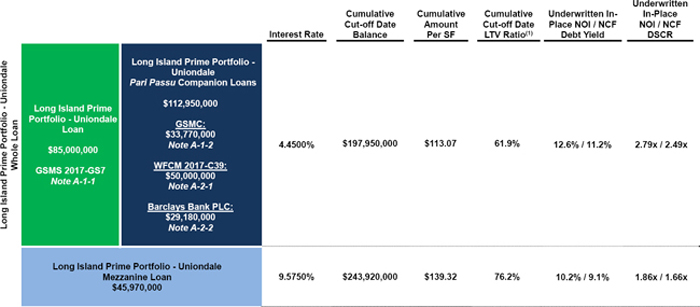

| Long Island Prime Portfolio - Uniondale | | 85,000,000 | | 7.9 | | Office | | 1,750,761 | | $113 | | 2.49x | | 12.6% | | 61.9% |

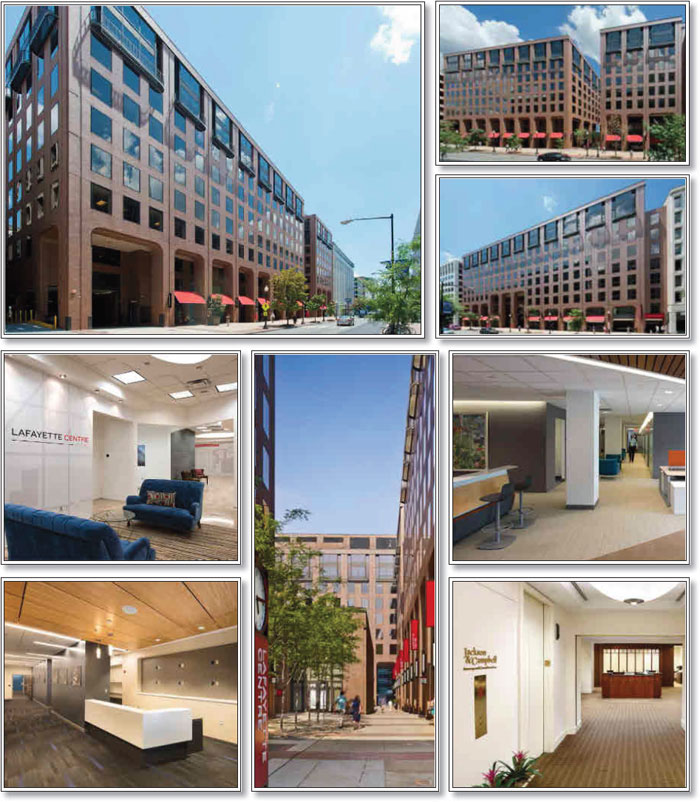

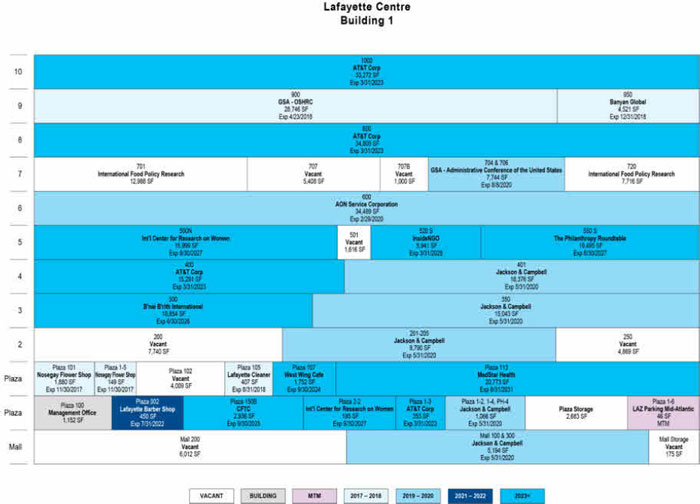

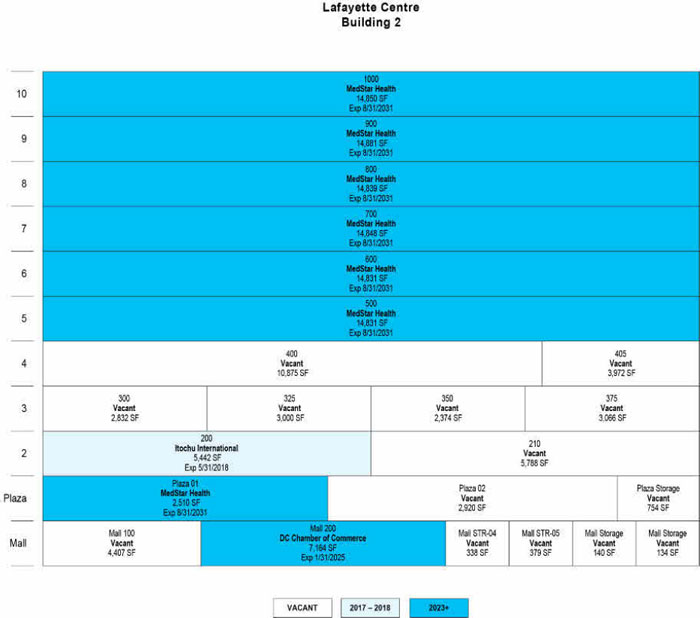

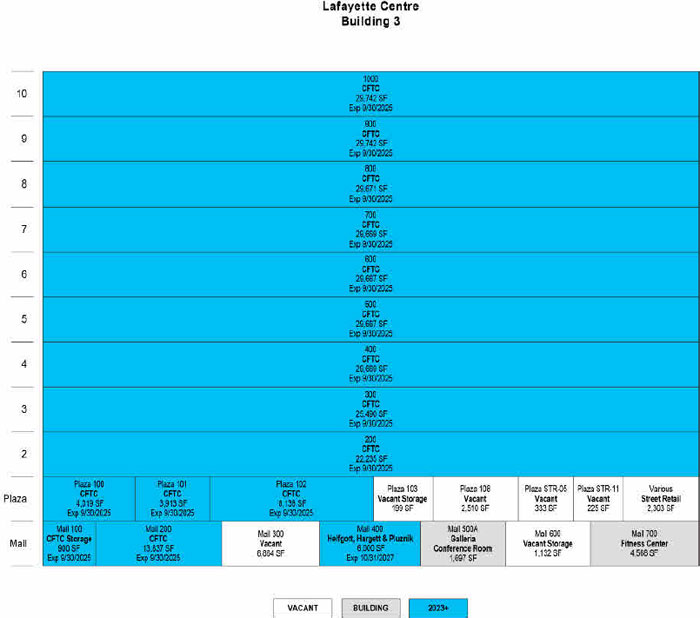

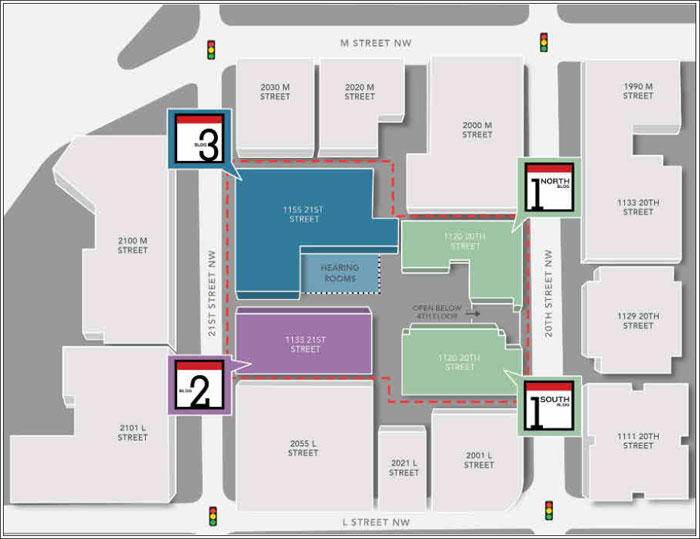

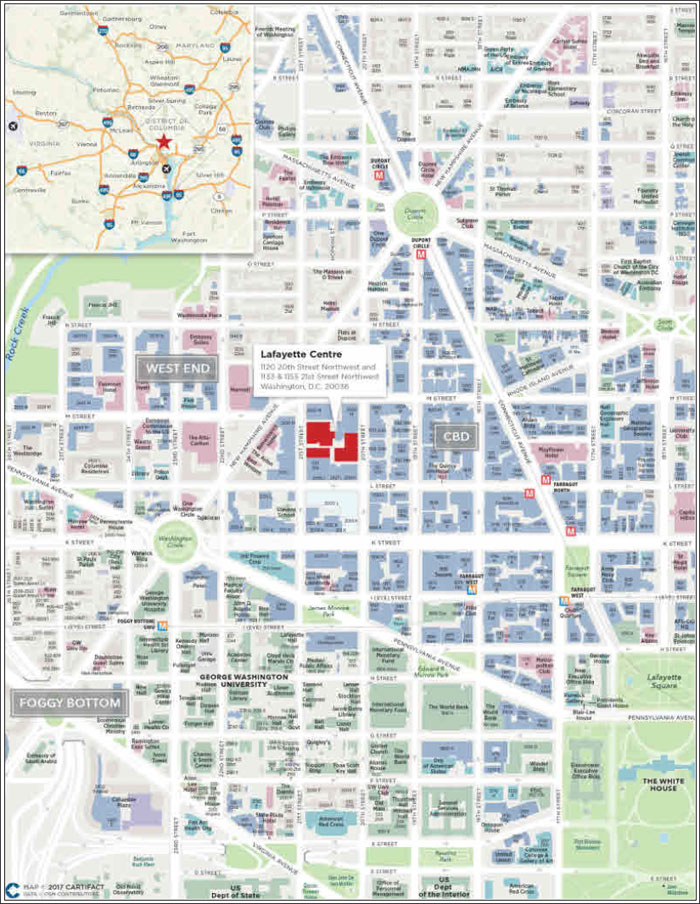

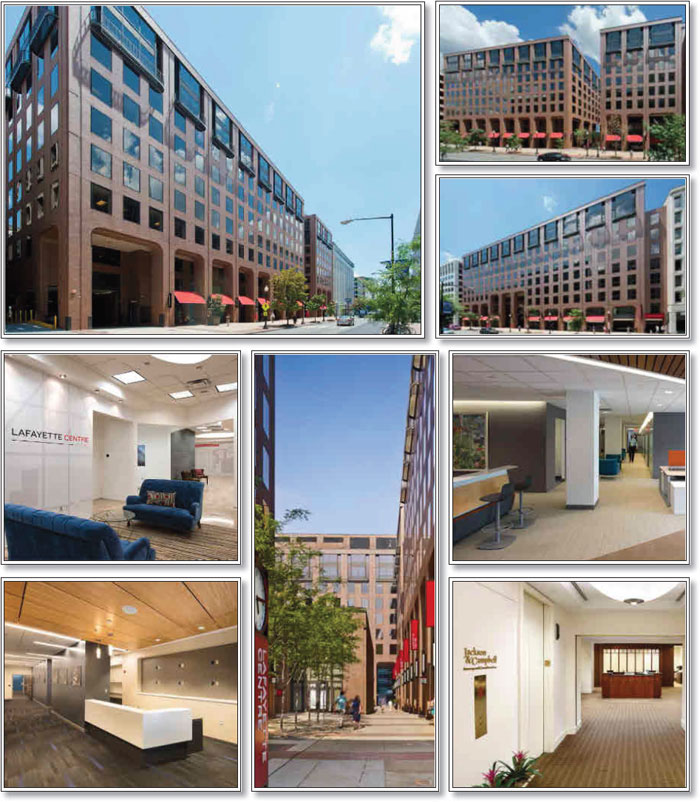

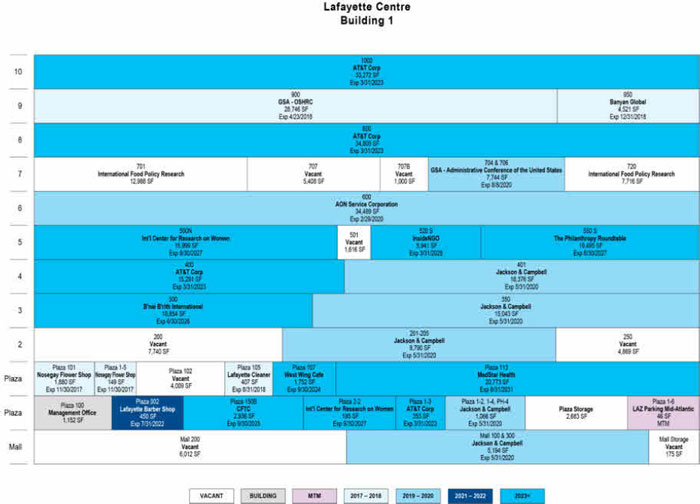

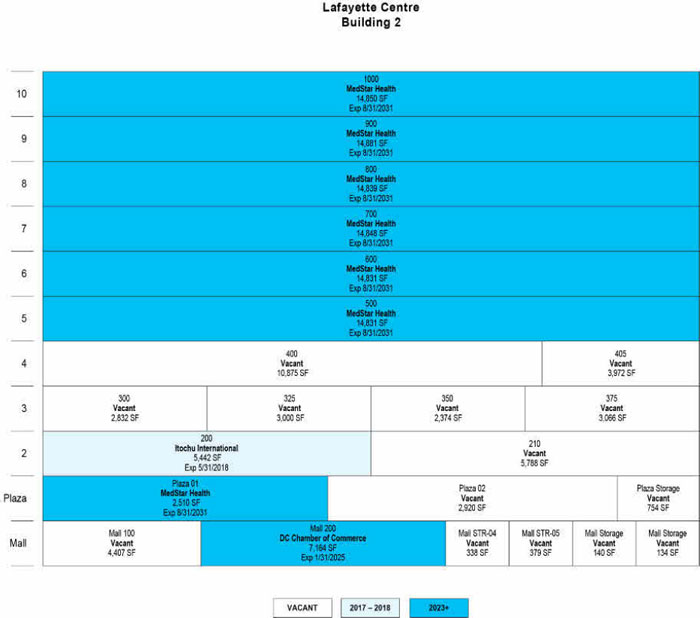

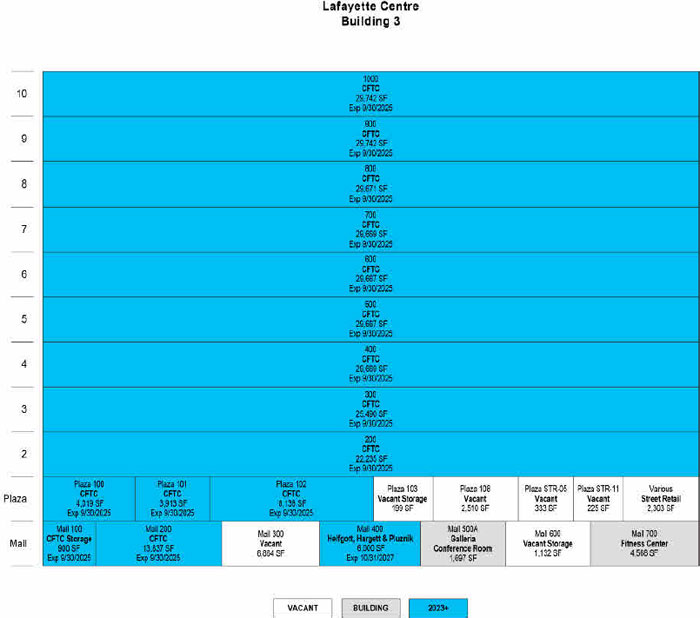

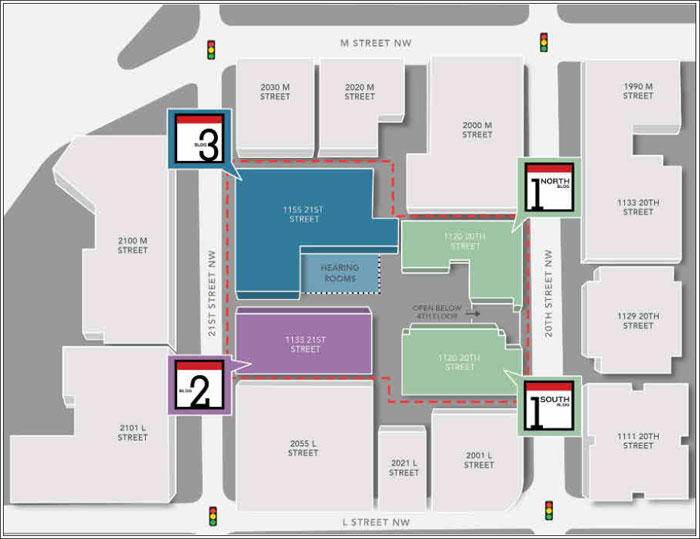

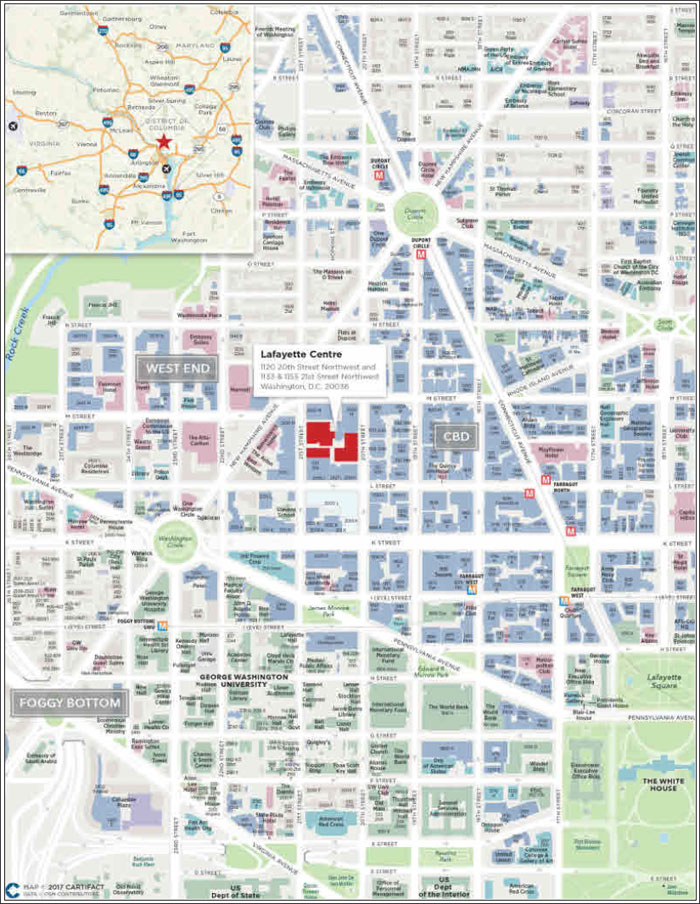

| Lafayette Centre | | 80,250,000 | | 7.4 | | Office | | 793,553 | | $306 | | 2.27x | | 10.1% | | 60.1% |

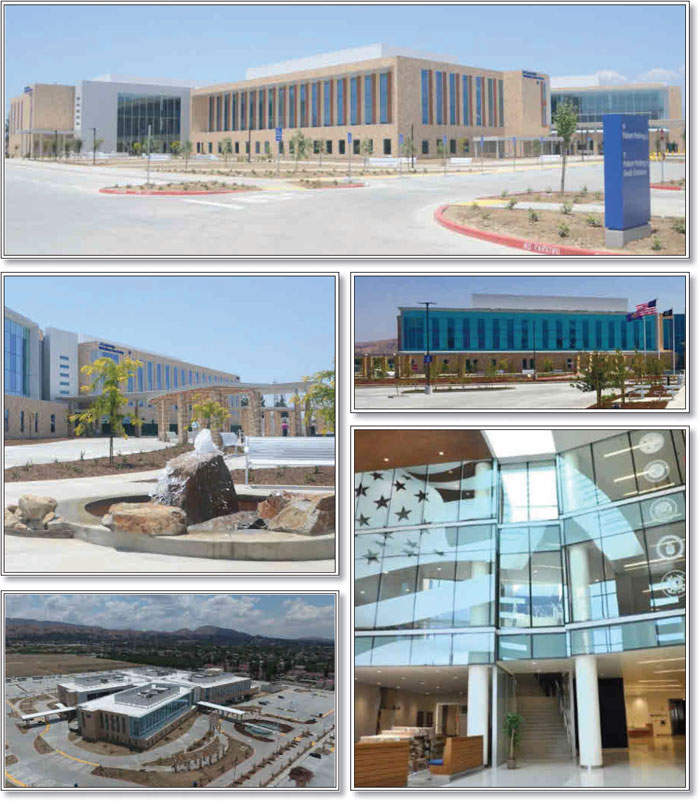

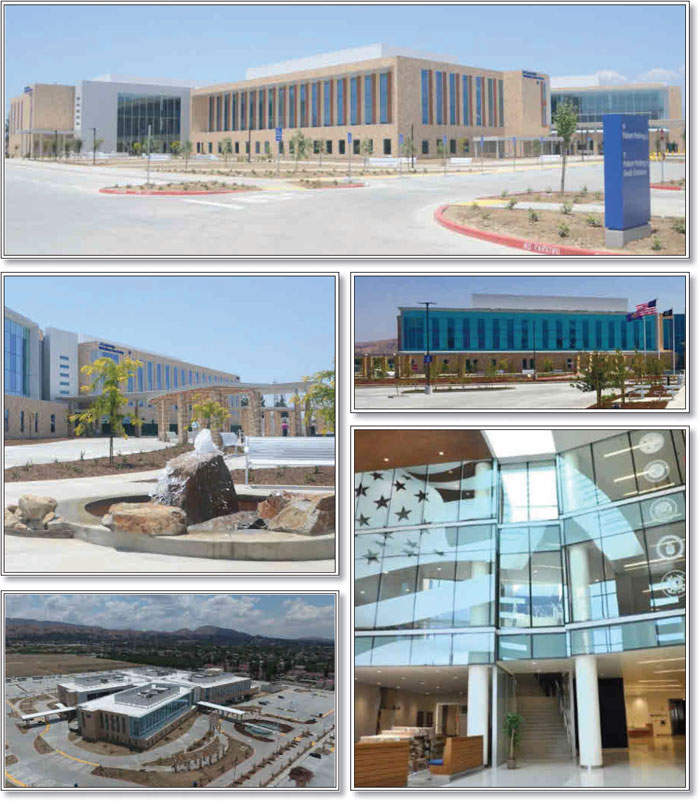

| Loma Linda | | 80,000,000 | | 7.4 | | Office | | 327,614 | | $389 | | 2.56x | | 9.5% | | 59.3% |

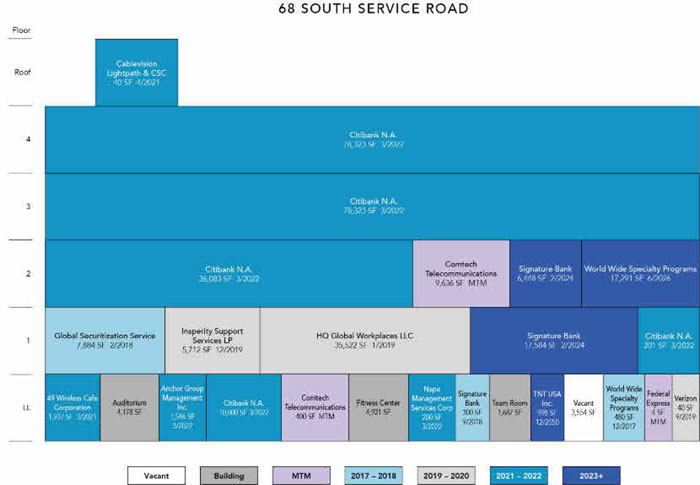

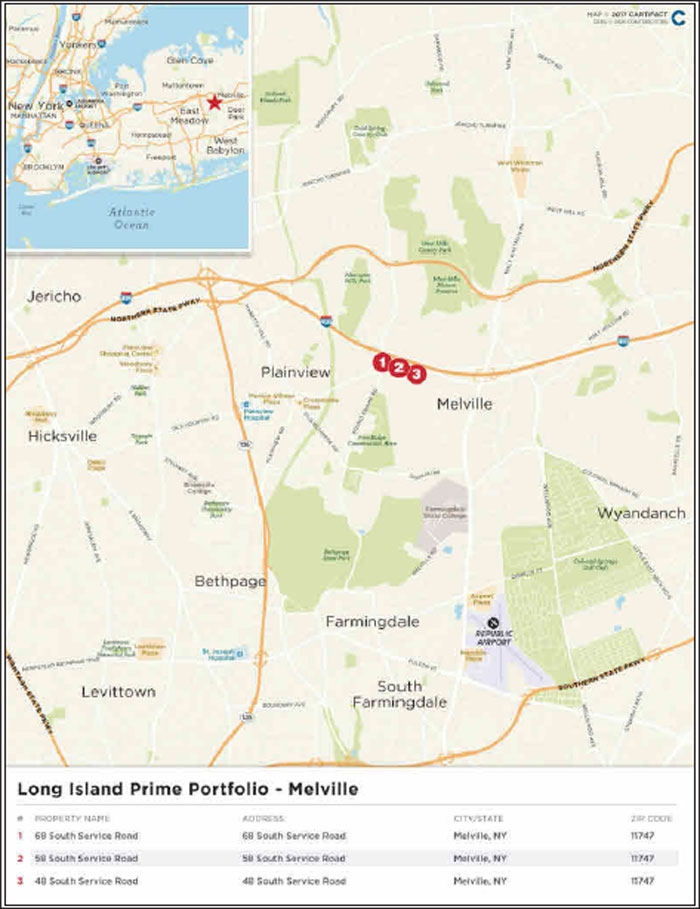

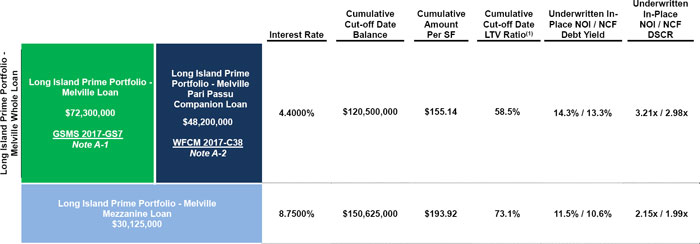

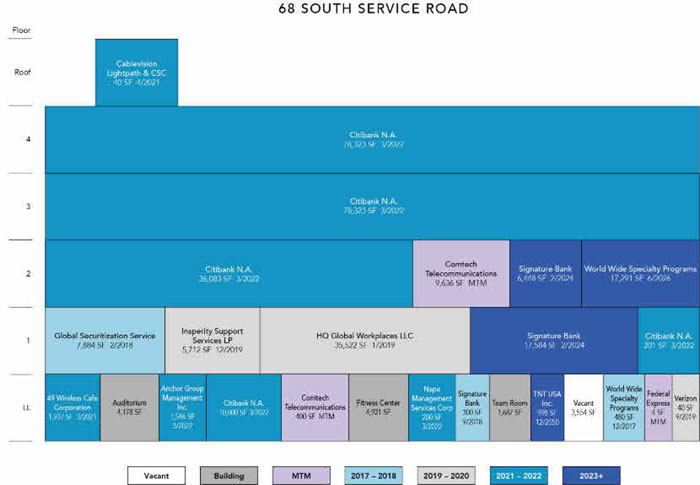

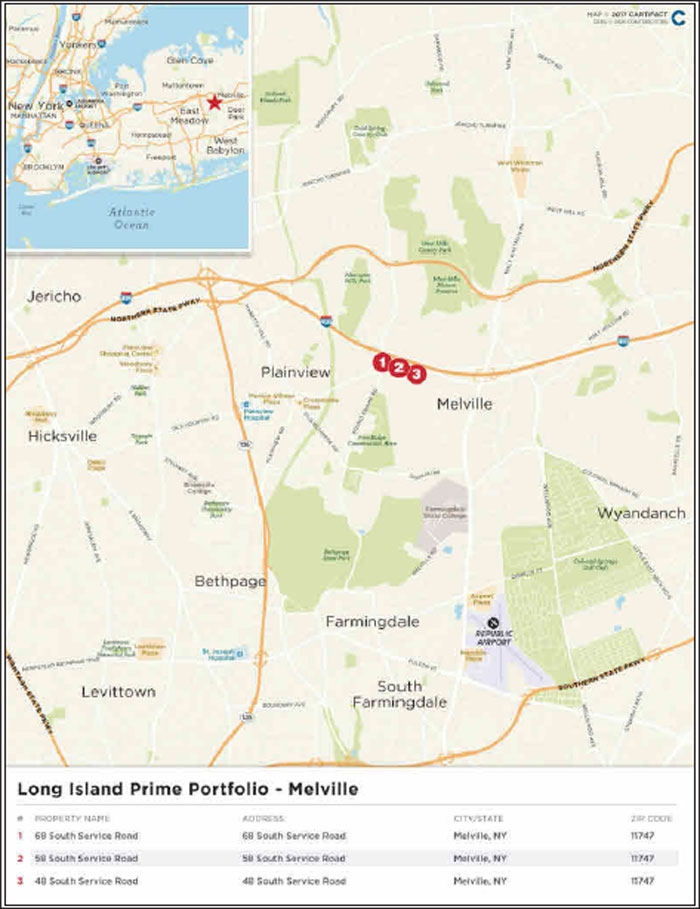

| Long Island Prime Portfolio - Melville | | 72,300,000 | | 6.7 | | Office | | 776,720 | | $155 | | 2.98x | | 14.3% | | 58.5% |

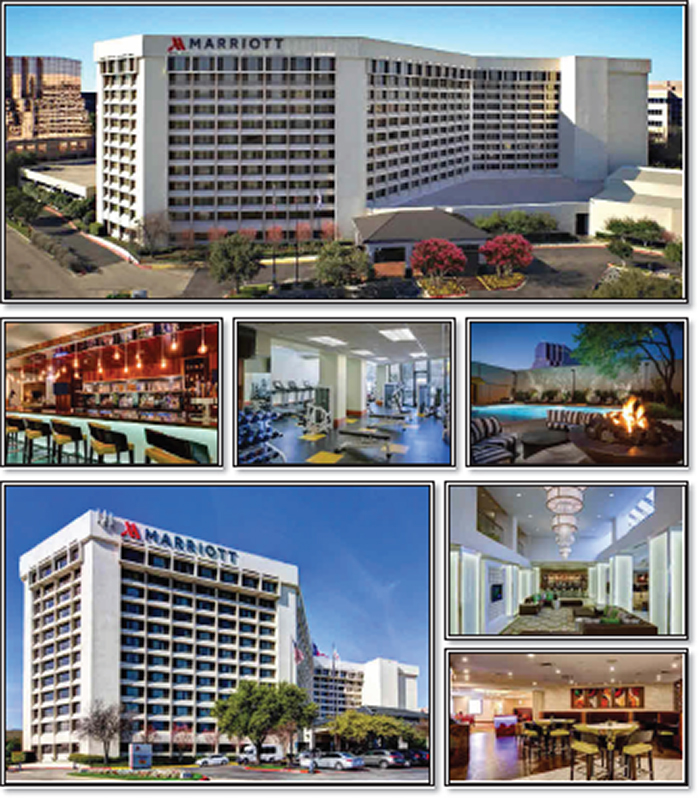

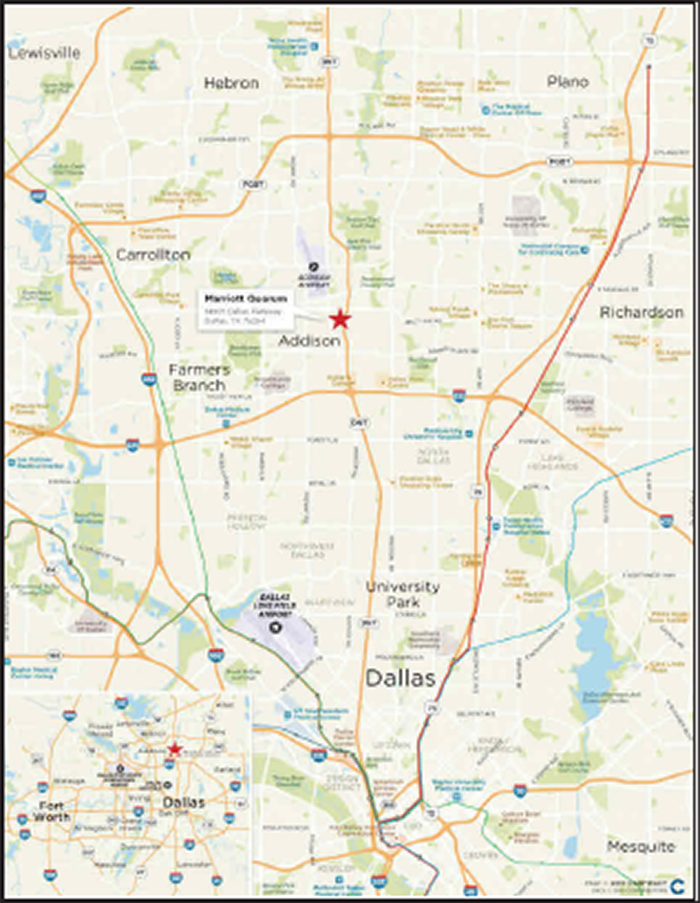

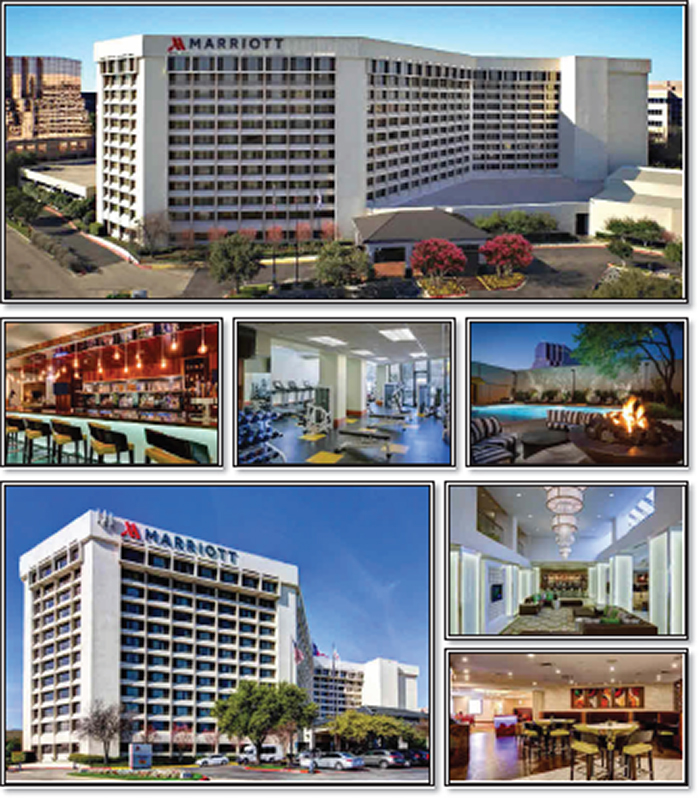

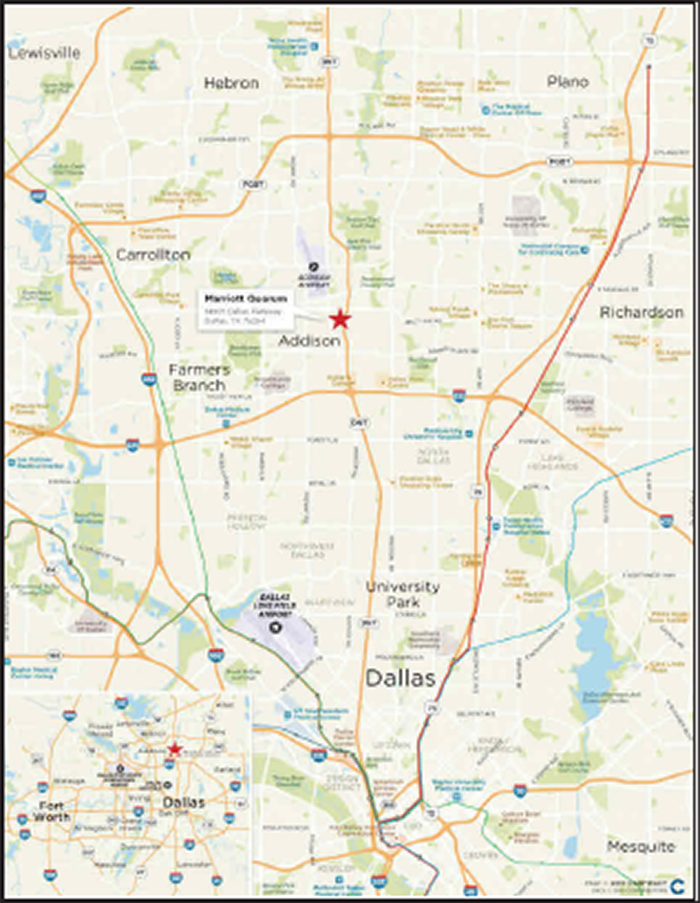

| Marriott Quorum | | 62,938,187 | | 5.8 | | Hospitality | | 547 | | $115,061 | | 1.60x | | 12.7% | | 70.2% |

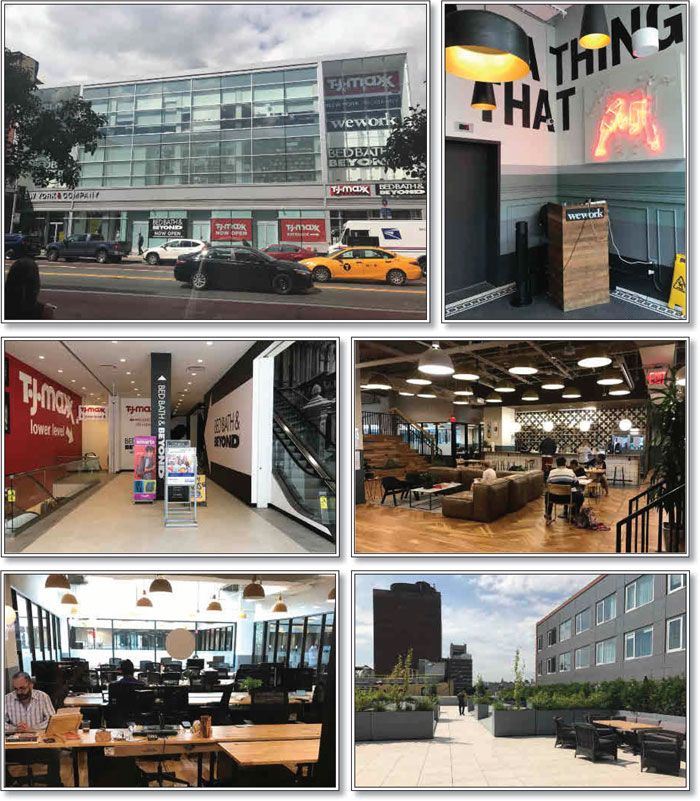

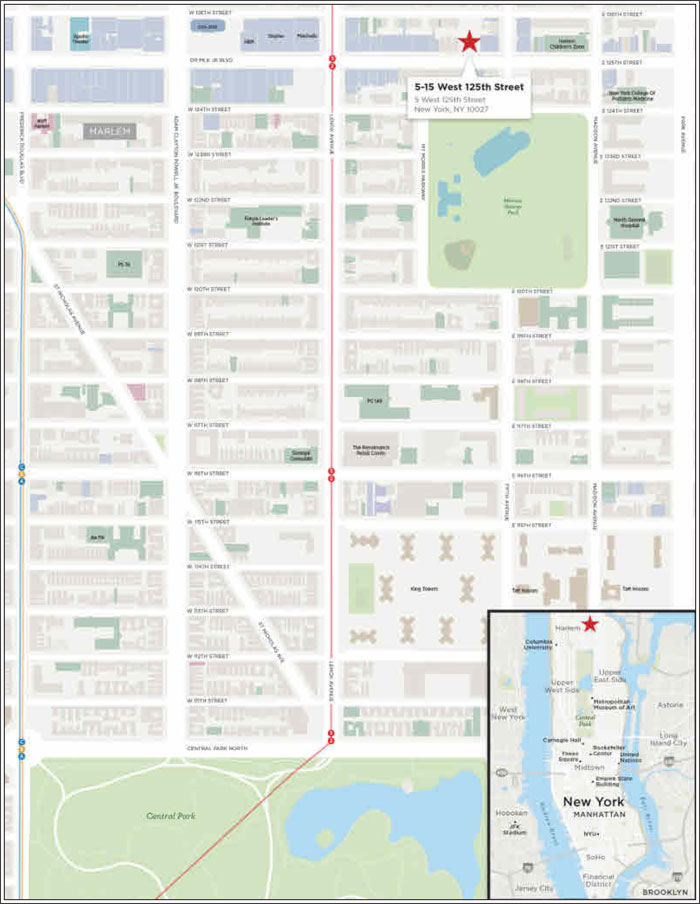

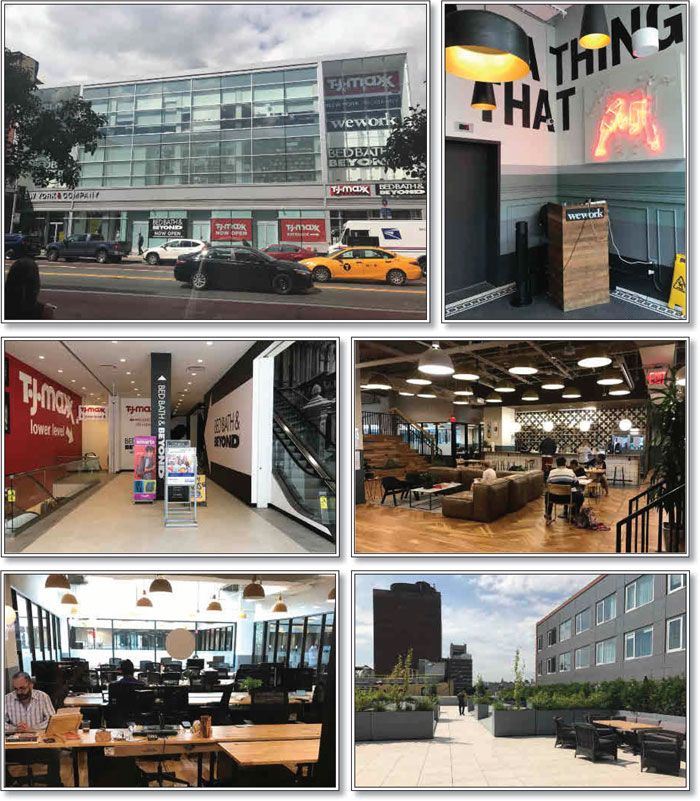

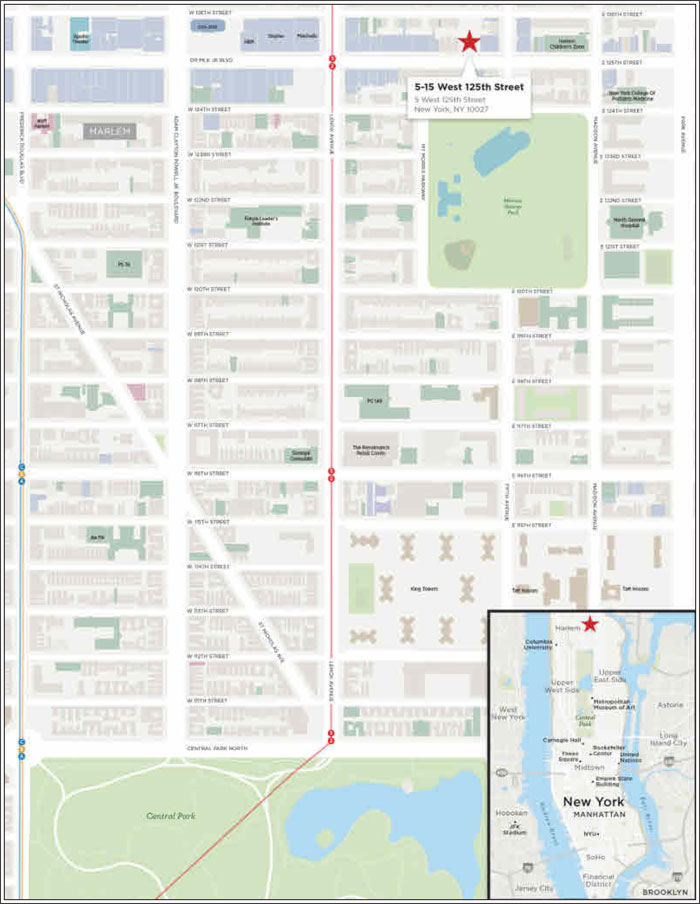

| 5-15 West 125th Street | | 59,000,000 | | 5.5 | | Mixed Use | | 119,341 | | $494 | | 1.13x | | 6.6% | | 52.1% |

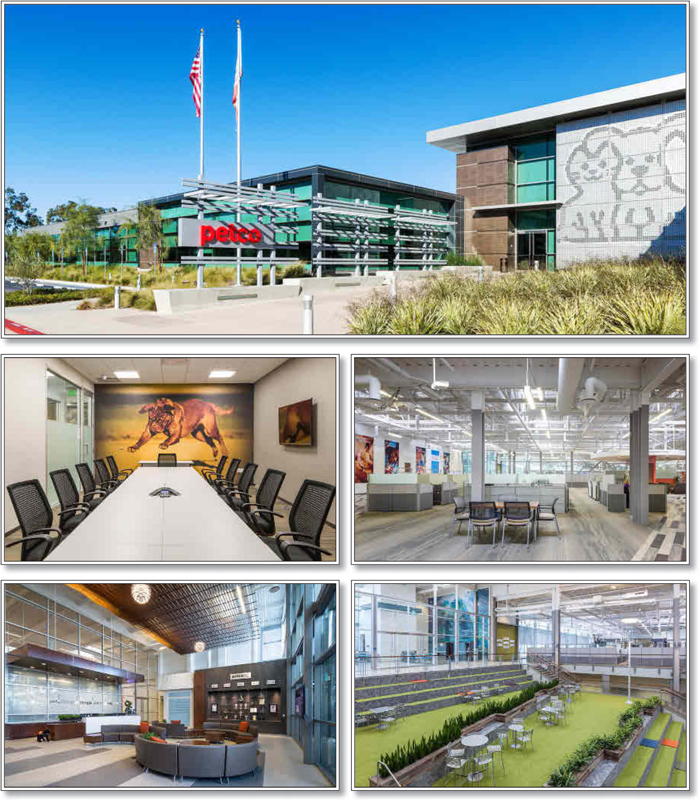

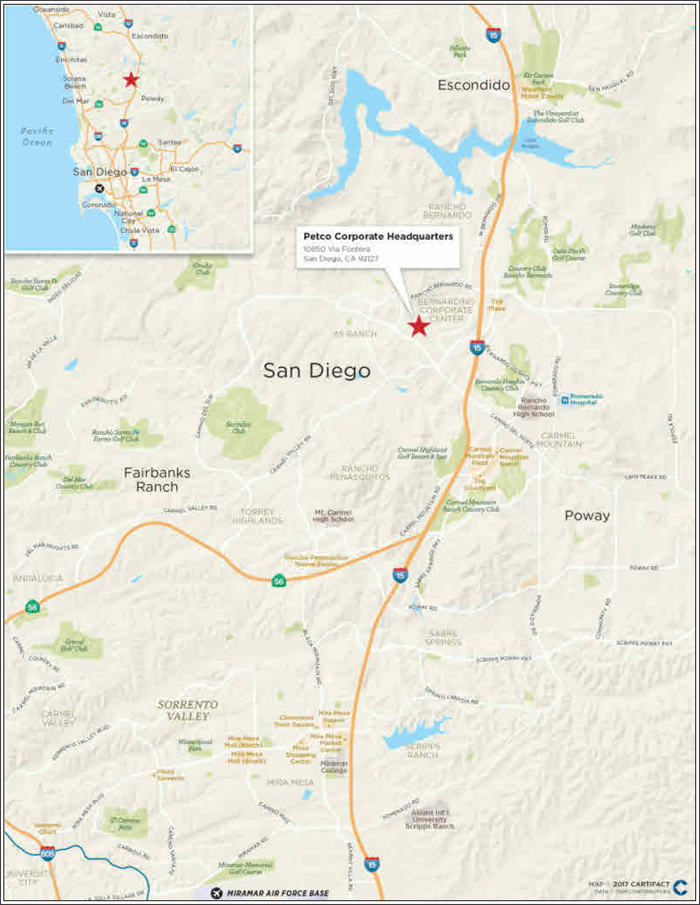

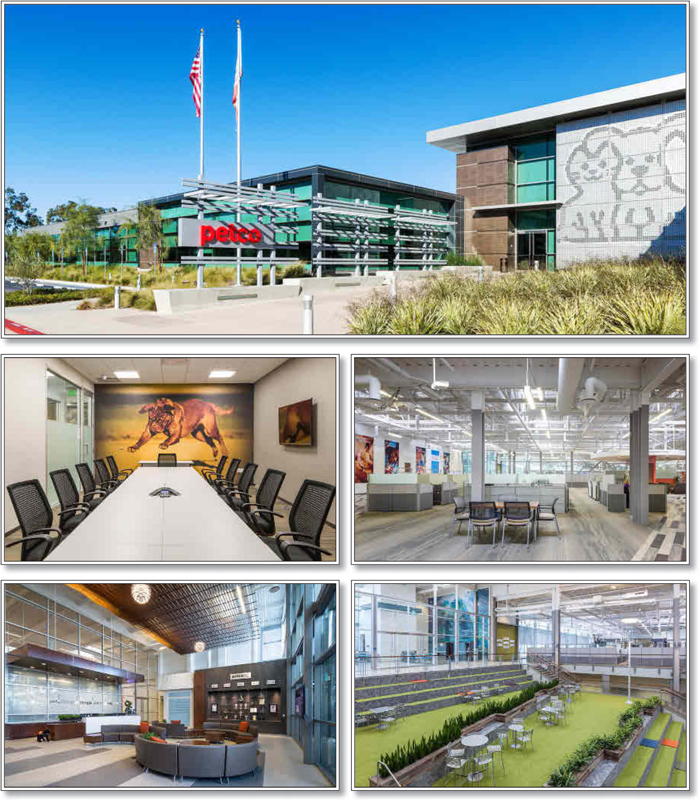

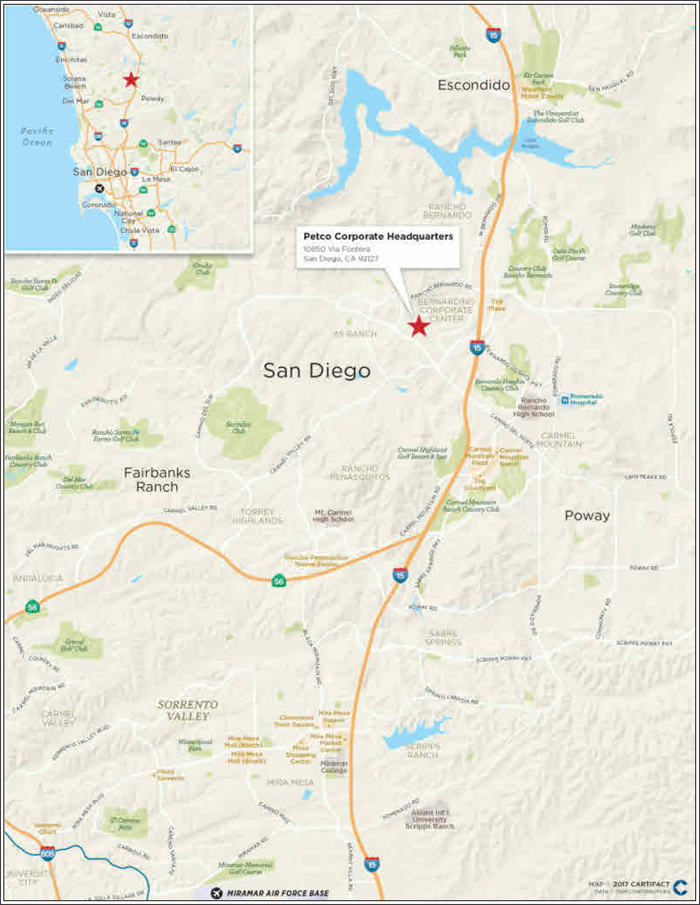

| Petco Corporate Headquarters | | 41,000,000 | | 3.8 | | Office | | 257,040 | | $278 | | 2.26x | | 9.9% | | 65.0% |

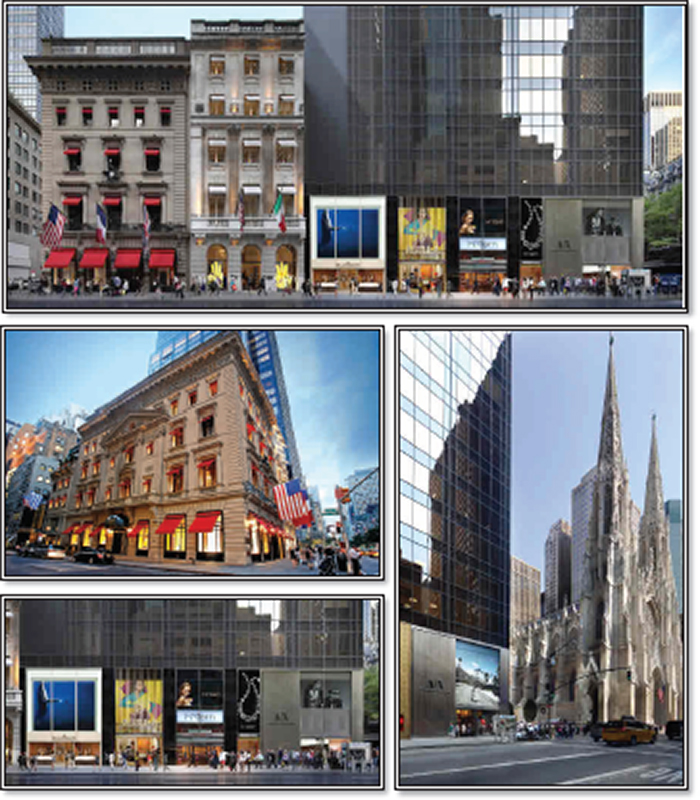

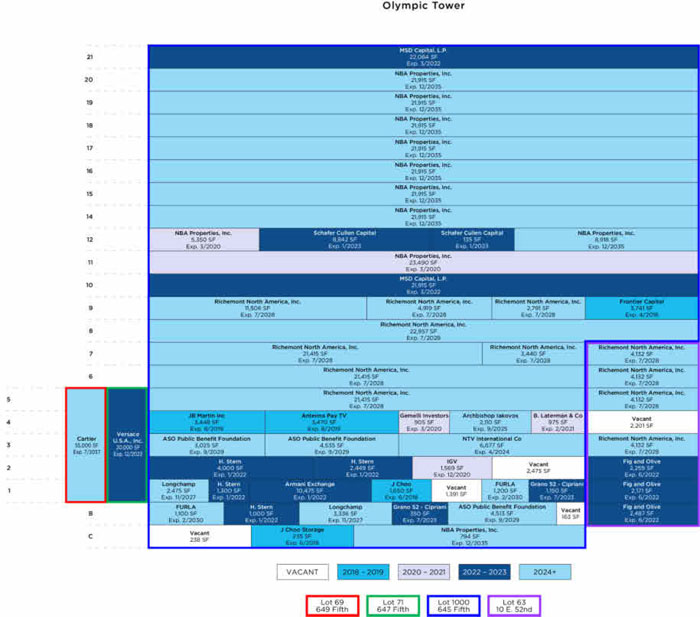

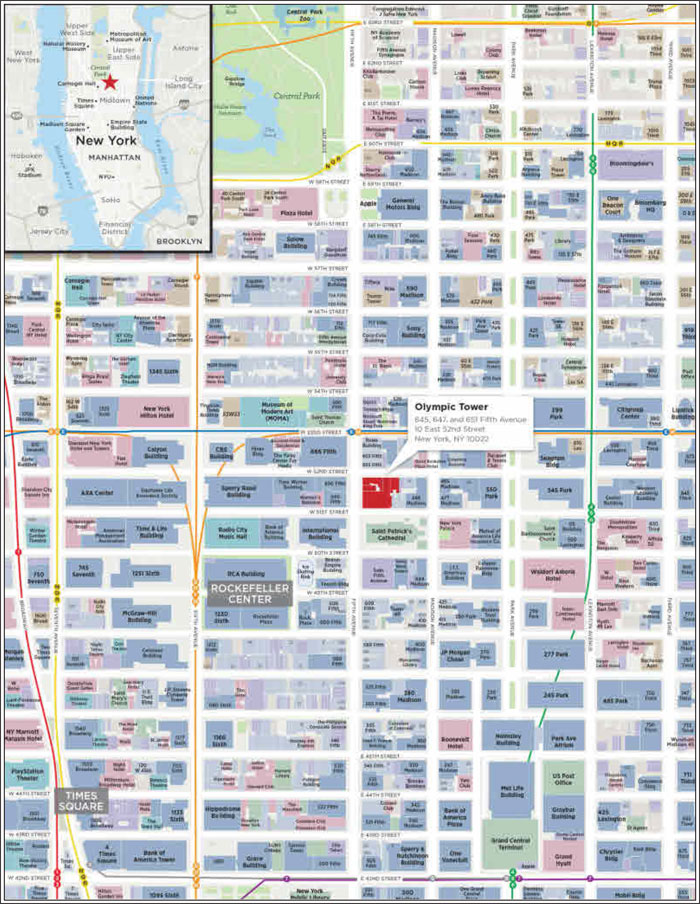

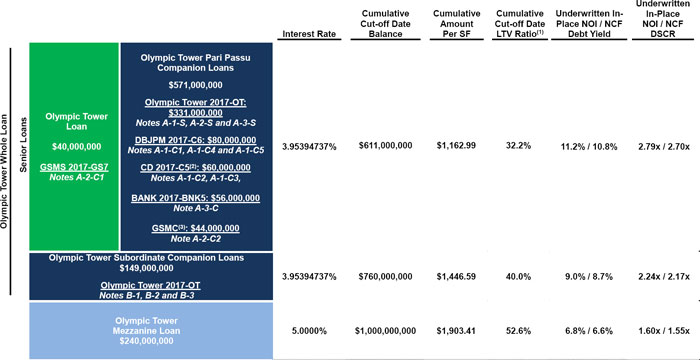

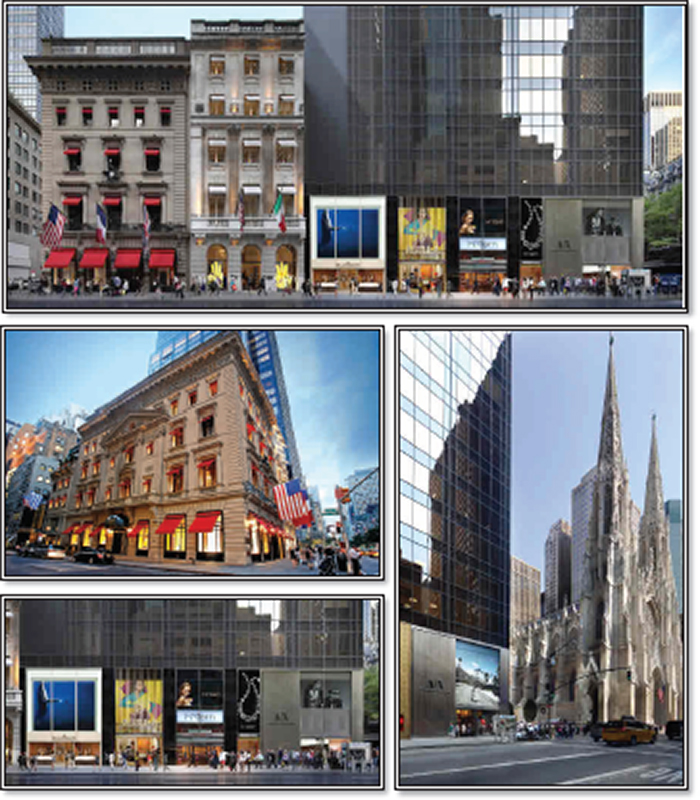

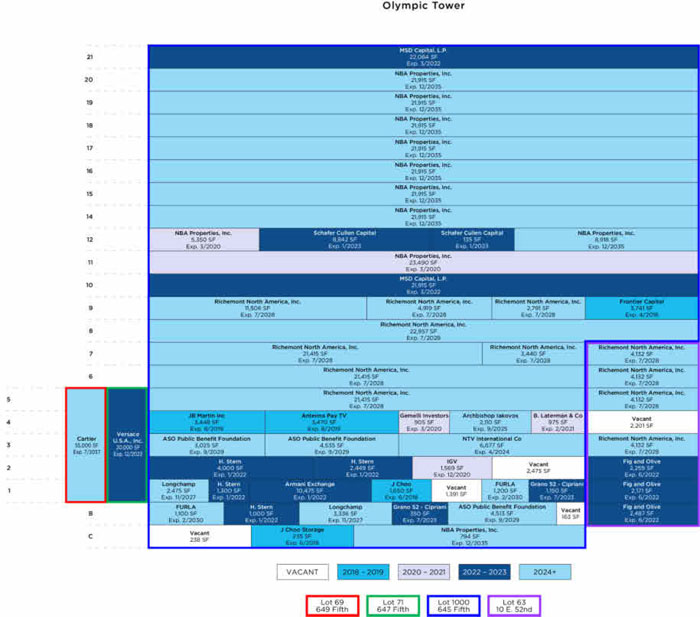

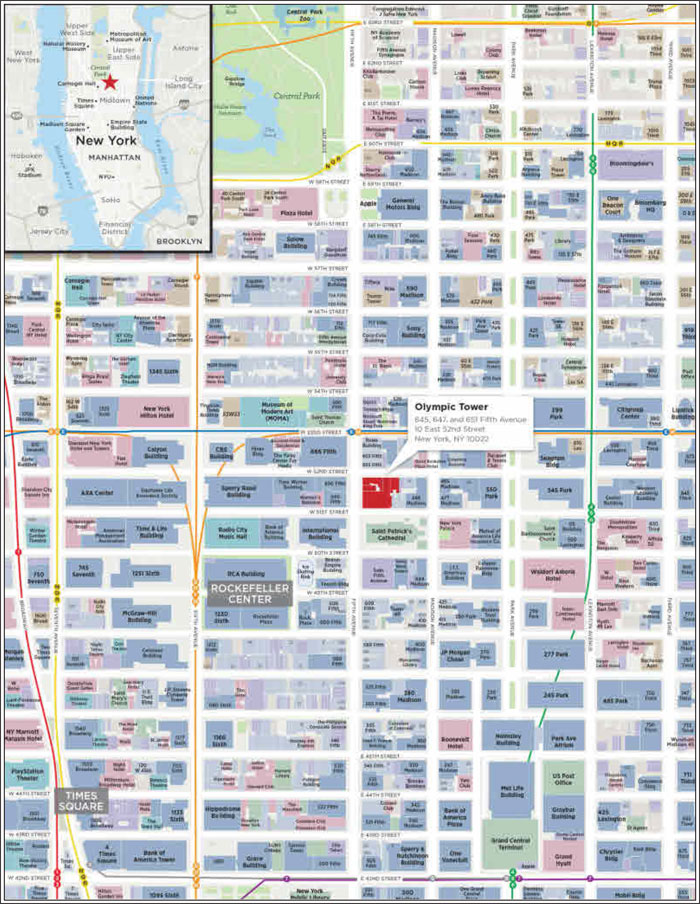

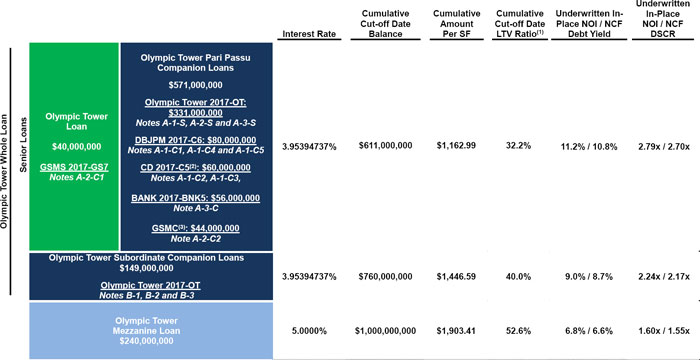

| Olympic Tower | | 40,000,000 | | 3.7 | | Mixed Use | | 525,372 | | $1,163 | | 2.70x | | 11.2% | | 32.2% |

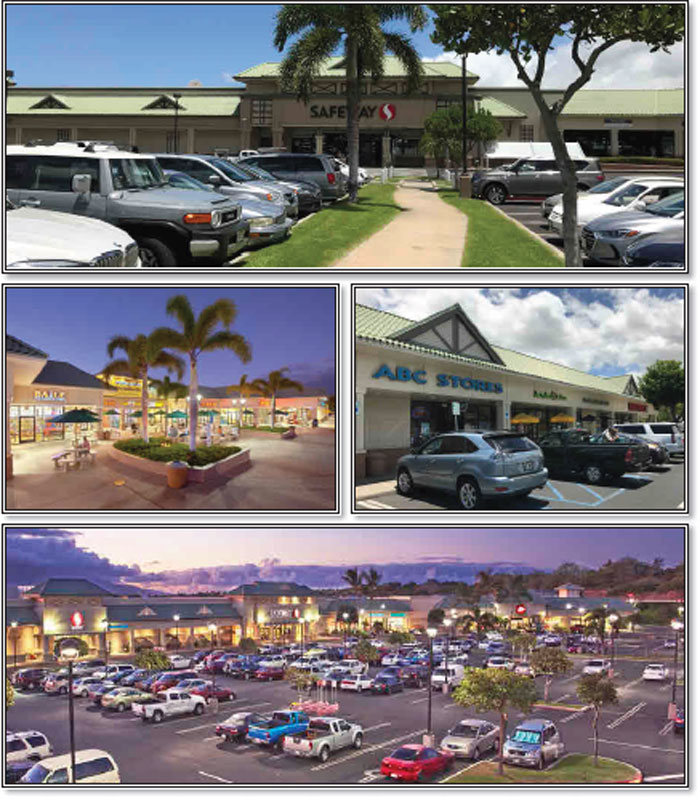

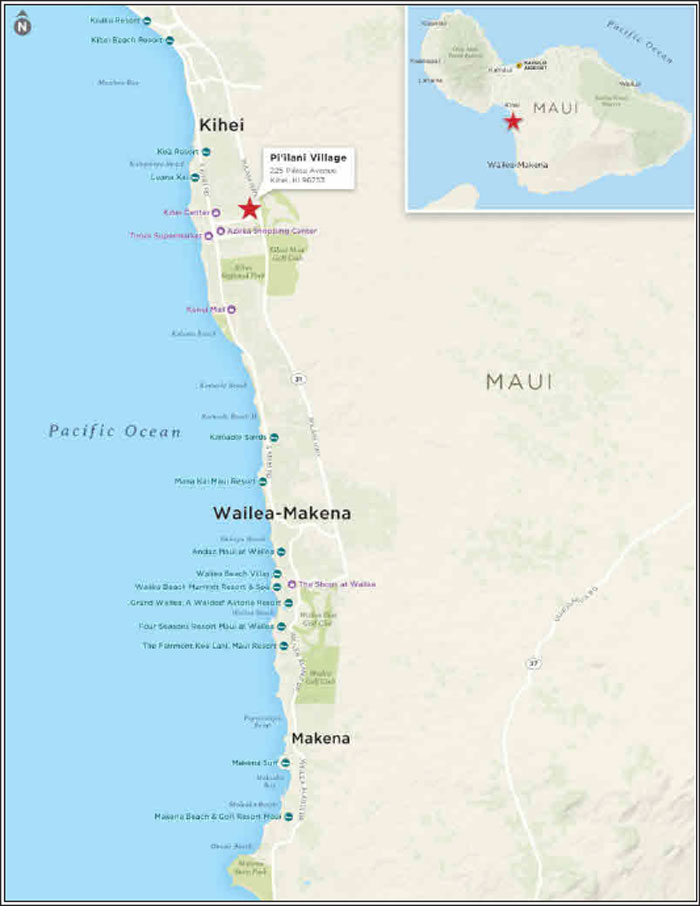

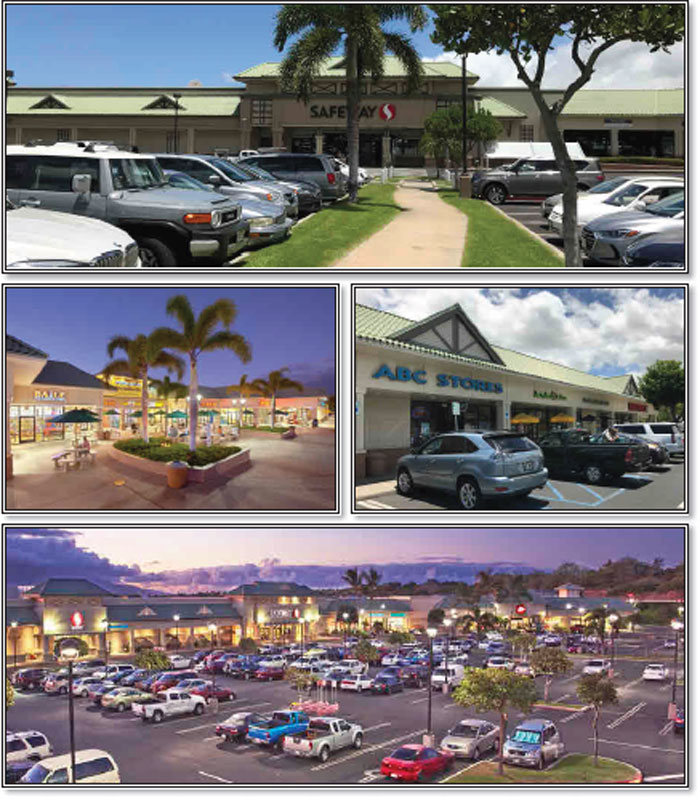

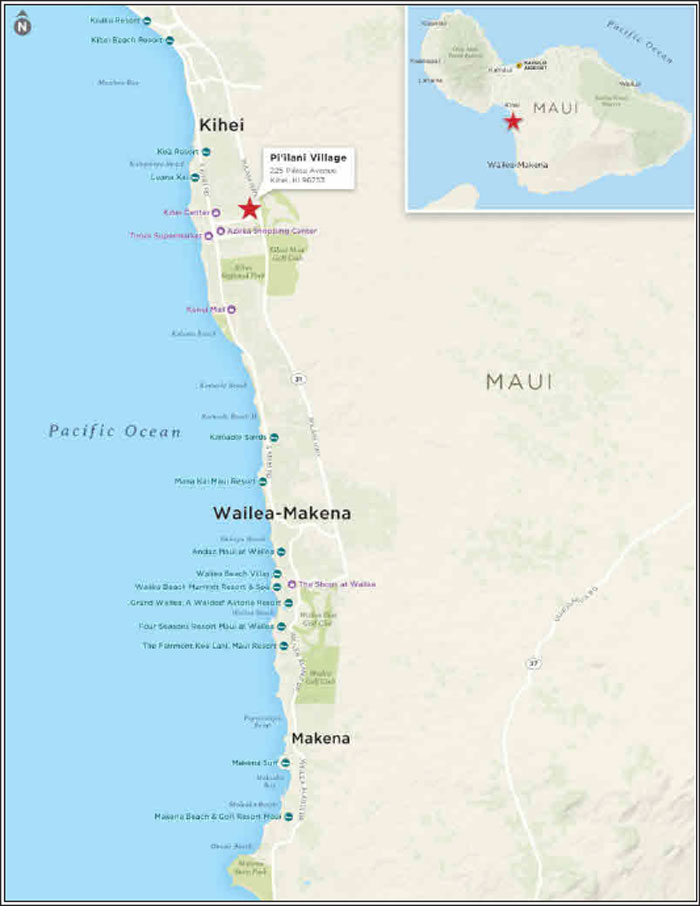

| Pi’ilani Village | | 37,500,000 | | 3.5 | | Retail | | 66,308 | | $566 | | 1.93x | | 8.6% | | 59.5% |

| Top 10 Total / Wtd. Avg. | | $695,248,187 | | 64.3% | | | | | | | | 2.56x | | 11.9% | | 52.4% |

| Remaining Total / Wtd. Avg. | | 386,395,548 | | 35.7 | | | | | | | | 1.53x | | 10.1% | | 66.4% |

| Total / Wtd. Avg. | | $1,081,643,735 | | 100.0% | | | | | | | | 2.20x | | 11.3% | | 57.4% |

Mortgage Loan Name | Mortgage Loan Cut-off Date Balance | % of Initial Pool Balance | Number of

Pari Passu Companion Loans(1) | Pari Passu Companion

Loan Cut-off

Date Balance | Subordinate Companion Loan Cut-off Date Balance(1) | Whole Loan Cut-off Date Balance | Controlling

Pooling & Servicing Agreement (“Controlling PSA”) | Master Servicer | Special Servicer |

| 1999 Avenue of the Stars(2) | $137,260,000 | 12.7% | 1 | $95,500,000 | $192,240,000 | $425,000,000 | GSMS 2017-GS6 | Midland | Midland |

| Long Island Prime Portfolio - Uniondale | $85,000,000 | 7.9% | 3 | $112,950,000 | | $197,950,000 | GSMS 2017-GS7 | Wells | Rialto |

| Lafayette Centre | $80,250,000 | 7.4% | 2 | $162,750,000 | | $243,000,000 | GSMS 2017-GS5 | Midland | Rialto |

| Loma Linda | $80,000,000 | 7.4% | 1 | $47,500,000 | | $127,500,000 | GSMS 2017-GS7 | Wells | Rialto |

| Long Island Prime Portfolio - Melville | $72,300,000 | 6.7% | 1 | $48,200,000 | | $120,500,000 | GSMS 2017-GS7 | Wells | Rialto |

| Petco Corporate Headquarters | $41,000,000 | 3.8% | 1 | $30,500,000 | | $71,500,000 | GSMS 2017-GS7 | Wells | Rialto |

| Olympic Tower(3) | $40,000,000 | 3.7% | 10 | $571,000,000 | $149,000,000 | $760,000,000 | OT 2017-OT | KeyBank | KeyBank |

| 90 Fifth Avenue | $37,000,000 | 3.4% | 2 | $67,500,000 | | $104,500,000 | GSMS 2017-GS7 | Wells | Rialto |

| Marriott Grand Cayman | $34,966,615 | 3.2% | 2 | $44,957,076 | | $79,923,691 | (4) | (4) | (4) |

| Shops at Boardman | $23,000,000 | 2.1% | 1 | $19,600,000 | | $42,600,000 | GSMS 2017-GS7 | Wells | Rialto |

| CH2M Global Headquarters | $20,000,000 | 1.8% | 1 | $60,000,000 | | $80,000,000 | GSMS 2017-GS6 | Midland | Midland |

| One West 34th Street(5) | $20,000,000 | 1.8% | 3 | $130,000,000 | | $150,000,000 | BANK 2017-BNK4 | Midland | Rialto |

| (1) | Each companion loan ispari passu in right of payment to its related mortgage loan and senior in right of payment to any related subordinate companion loan. |

| (2) | The 1999 Avenue of the Stars mortgage loan has onepari passu companion loan with an outstanding principal balance of $95,500,000 and four subordinate companion loans with an aggregate outstanding principal balance of $192,240,000. |

| (3) | The Olympic Tower mortgage loan has 10pari passucompanion loans with an aggregate outstanding principal balance of $571,000,000 and three subordinate companion loans with an outstanding principal balance of $149,000,000. |

| (4) | The Marriott Grand Cayman mortgage loan has twopari passu companion loans with an aggregate outstanding principal balance of $45,000,000. Bothpari passu companion loans with an outstanding principal balance as of the Cut-off Date of $35,000,000 (note A-1) and $10,000,000 (note A-2) are currently held by Cantor Commercial Real Estate Lending L.P. (“CCRE”), and are expected to be contributed to one or more future securitization trusts. The Marriott Grand Cayman whole loan will initially be master serviced and, if necessary, specially serviced, by the master servicer and special servicer for this securitization. Upon the securitization of the note A-1 Marriott Grand Cayman companion loan held by CCRE, the Marriott Grand Cayman whole loan is expected to be serviced by the master servicer and, if necessary, the special servicer, under the pooling and servicing agreement for such securitization (which pooling and servicing agreement will then be the Controlling PSA for the Marriott Grand Cayman whole loan). Neither the master servicer nor the special servicer for such securitization has been identified. |

| (5) | The One West 34th Street mortgage loan has threepari passu companion loans with an aggregate outstanding principal balance of $130,000,000. Onepari passu companion loan with an outstanding principal balance as of the Cut-off Date of $60,000,000 was contributed to the BANK 2017-BNK4 securitization trust, onepari passucompanion loan with an outstanding principal balance as of the Cut-off Date of $30,000,000 was contributed to the UBS 2017-C1 securitization trust, and onepari passucompanion loan with an outstanding principal balance as of the Cut-off Date of $40,000,000 was contributed to the GSMS 2017-GS6 securitization trust. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207677) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

9

| COLLATERAL OVERVIEW (continued) |

Mortgage Loans with Existing Mezzanine Debt

| Mortgage Loan Name | Mortgage

Loan

Cut-off Date Balance | Mezzanine Debt

Cut-off

Date Balance | Total Debt

Cut-off Date Balance(1) | Wtd. Avg. Cut-off Date Total Debt Interest Rate(1) | Cut-off Date Mortgage Loan LTV Ratio | Cut-

off Date Total Debt LTV

Ratio(1) | Cut-off Date Mortgage Loan

UW NCF DSCR | Cut-off

Date

Total Debt UW NCF DSCR(1) |

| 1999 Avenue of the Stars(2) | $137,260,000 | $75,000,000 | $500,000,000 | 4.1112% | 27.1% | 58.1% | 3.84x | 1.74x |

| Long Island Prime Portfolio - Uniondale | $85,000,000 | $45,970,000 | $243,920,000 | 4.4500% | 61.9% | 76.2% | 2.49x | 1.66x |

| Long Island Prime Portfolio – Melville | $72,300,000 | $30,125,000 | $150,625,000 | 4.4000% | 58.5% | 73.1% | 2.98x | 1.99x |

| Olympic Tower | $40,000,000 | $240,000,000 | $1,000,000,000 | 3.9539% | 32.2% | 52.6% | 2.70x | 1.55x |

| (1) | Calculated including the mezzanine debt. |

| (2) | The 1999 Avenue of the Stars mortgage loan has one $75,000,000 mezzanine loan that was sold to an unrelated third party. In addition to the mezzanine loan noted above, there is an existing subordinate mezzanine loan held by certain limited liability companies owned by certain individuals who also own an indirect interest in the borrower with an outstanding principal balance of $71,120,923 made to the direct parent of the mezzanine borrower. See “Description of the Mortgage Pool—Additional Indebtedness” in the Preliminary Prospectus. |

Previously Securitized Mortgaged Properties(1)

Mortgaged Property Name | City | State | Property Type | Cut-off Date Balance /

Allocated Cut-off Date Balance(2) | % of Initial Pool

Balance | Previous Securitization |

| Lafayette Centre | Washington | District of Columbia | Office | $80,250,000 | 7.4% | (3) |

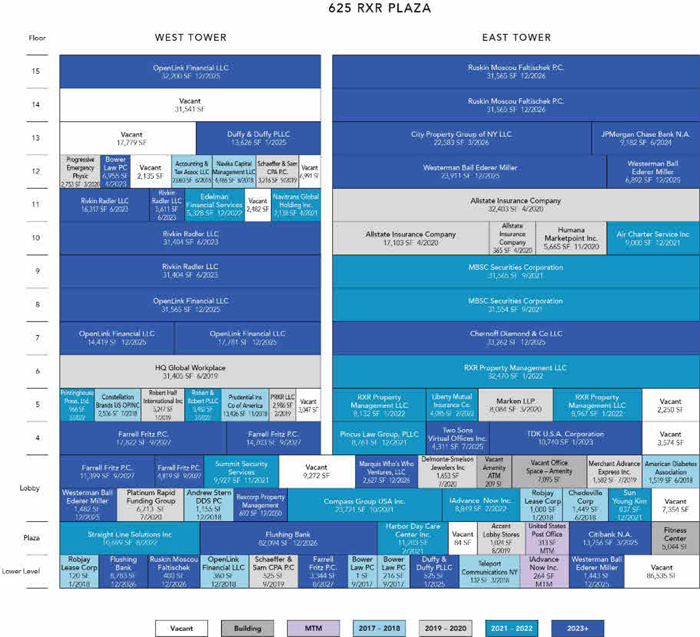

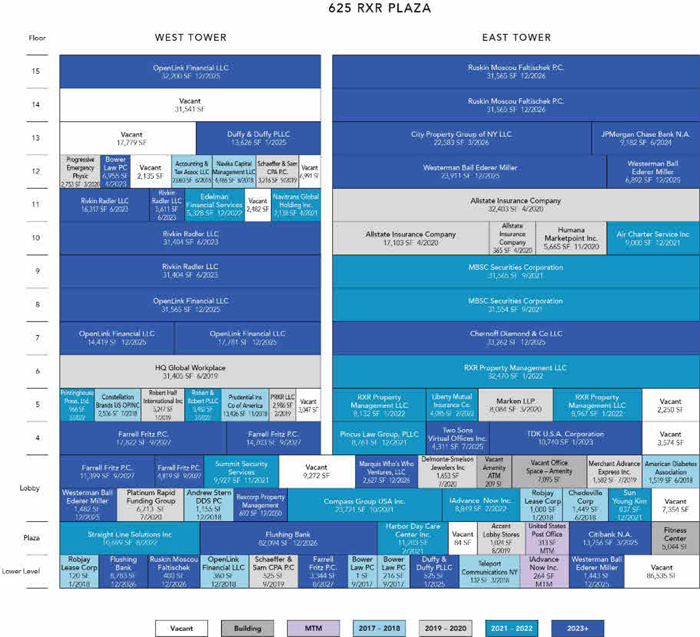

| RXR Plaza | Uniondale | New York | Office | $50,604,951 | 4.7% | GSMS 2007-GG10 |

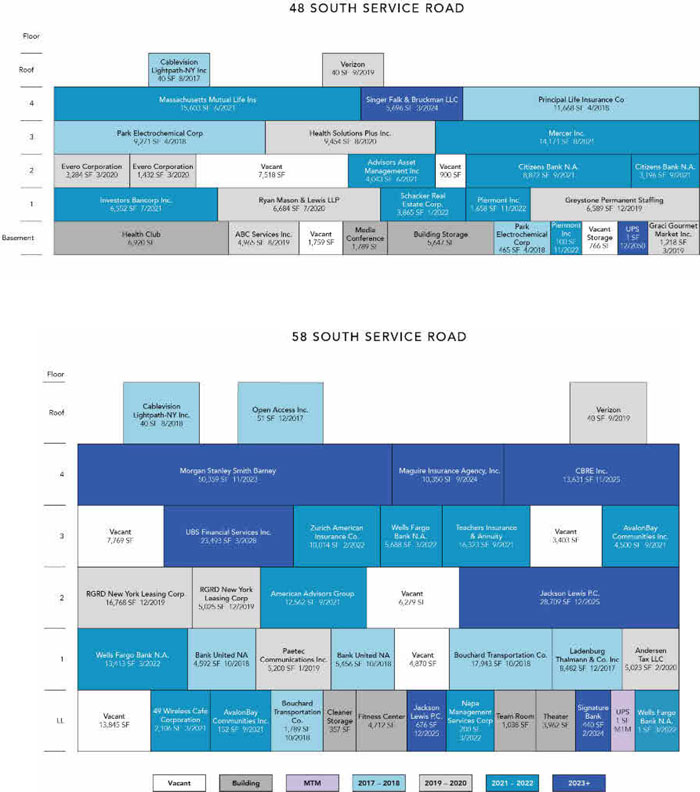

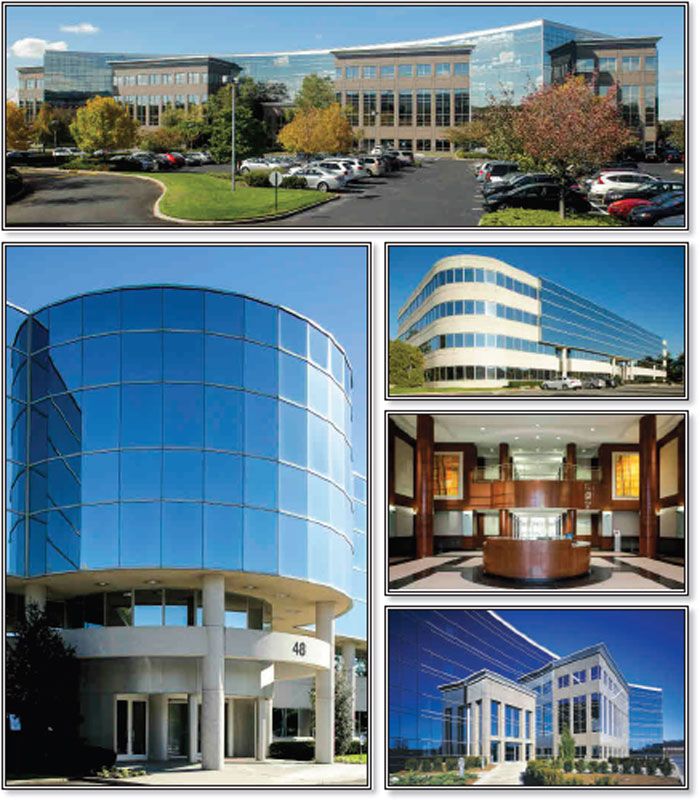

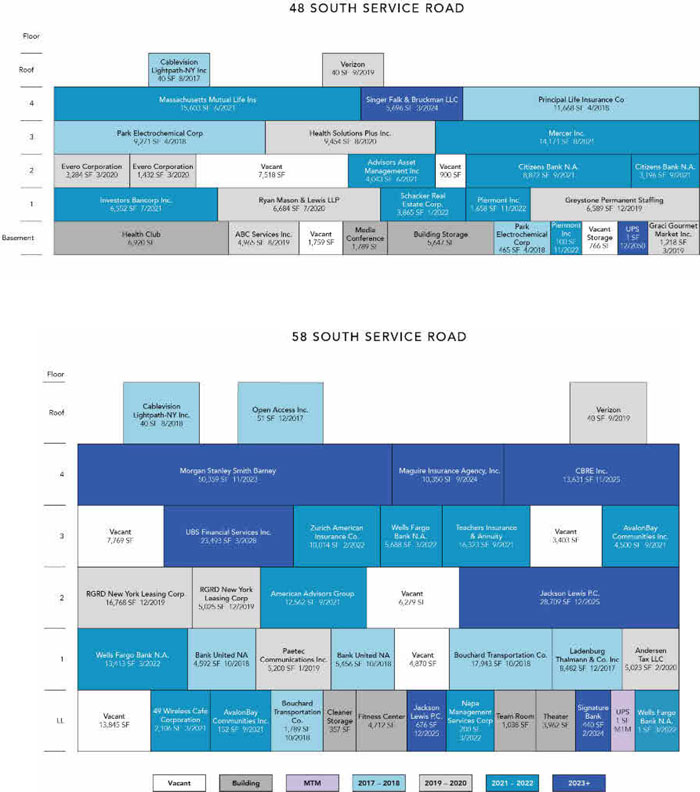

| 68 South Service Road | Melville | New York | Office | $35,100,000 | 3.2% | GCCFC 2007-GG9 |

| Marriott Grand Cayman | Grand Cayman | Cayman Islands | Hospitality | $34,966,615 | 3.2% | WFRBS 2012-C9 |

| Omni | Uniondale | New York | Office | $34,395,049 | 3.2% | GCCFC 2007-GG9 |

| 58 South Service Road | Melville | New York | Office | $29,820,000 | 2.8% | GCCFC 2007-GG9 |

| Shops at Boardman | Boardman | Ohio | Retail | $23,000,000 | 2.1% | JPMCC 2007-CB19, JPMCC 2007-LD11 |

| Balcones Woods Shopping Center | Austin | Texas | Retail | $19,752,203 | 1.8% | JPMCC 2007-LD12 |

| Willow Bend Apartments | Houston | Texas | Multifamily | $14,800,000 | 1.4% | WFRBS 2012-C10 |

| Greenville Avenue | Dallas | Texas | Office | $13,968,885 | 1.3% | JPMCC 2007-CB20 |

| Adelanto Market Plaza | Adelanto | California | Retail | $12,000,000 | 1.1% | MLCFC 2007-7 |

| Laguna Seca | Las Cruces | New Mexico | Retail | $11,000,000 | 1.0% | GCCFC 2007-GG11 |

| 48 South Service Road | Melville | New York | Office | $7,380,000 | 0.7% | GCCFC 2007-GG9 |

| Quail Plaza | Albuquerque | New Mexico | Retail | $5,500,000 | 0.5% | GSMS 2007-GG10 |

| Towne Centre Offices | Pittsburgh | Pennsylvania | Office | $4,550,000 | 0.4% | BSCMS 2007-PW17 |

| (1) | The table above includes mortgaged properties securing mortgage loans for which the most recent prior financing of all or a significant portion of such mortgaged property was included in a securitization. Information under “Previous Securitization” represents the most recent such securitization with respect to each of those mortgaged properties. The information in the above table is based solely on information provided by the related borrower or obtained through searches of a third-party database, and has not otherwise been confirmed by the mortgage loan seller. |

| (2) | Reflects the allocated loan amount in cases where the applicable mortgaged property is one of a portfolio of mortgaged properties securing a particular mortgage loan. |

| (3) | The Lafayette Centre mortgaged property was included in the following transactions: BSCMS 2007-PW16, BACM 2007-2, MSC 2007-HQ12, MSC 2007-IQ14, WBCMT 2007-C31 and WBCMT 2007-C32. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207677) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

10

(THIS PAGE INTENTIONALLY LEFT BLANK)

| COLLATERAL OVERVIEW (continued) |

Property Types

Property Type / Detail | Number of Mortgaged Properties | Aggregate Cut-off Date Balance(1) | % of Initial

Pool

Balance(1) | Wtd. Avg. Underwritten NCF DSCR(2) | Wtd. Avg. Cut-off Date LTV Ratio(2) | Wtd. Avg. Debt Yield on Underwritten NOI(2) |

| Office | 13 | $545,551,226 | 50.4% | 2.76x | 53.1% | 12.5% |

| General Suburban | 9 | 243,491,226 | 22.5 | 2.40x | 63.0% | 12.1% |

| CBD | 2 | 217,510,000 | 20.1 | 3.26x | 39.3% | 14.1% |

| Medical | 2 | 84,550,000 | 7.8 | 2.51x | 59.9% | 9.6% |

| Retail | 11 | $181,912,203 | 16.8% | 1.61x | 68.7% | 9.4% |

| Anchored | 8 | 133,552,203 | 12.3 | 1.50x | 71.4% | 9.4% |

| Shadow Anchored | 2 | 43,000,000 | 4.0 | 1.90x | 60.5% | 8.9% |

| Unanchored | 1 | 5,360,000 | 0.5 | 1.81x | 65.8% | 13.3% |

| Mixed Use | 4 | $156,000,000 | 14.4% | 1.62x | 48.6% | 7.7% |

| Office/Retail | 3 | 97,000,000 | 9.0 | 1.92x | 46.5% | 8.3% |

| Retail/Office/Multifamily | 1 | 59,000,000 | 5.5 | 1.13x | 52.1% | 6.6% |

| Hospitality - Full Service | 3 | $124,130,306 | 11.5% | 1.73x | 64.6% | 14.4% |

| Multifamily | 4 | $74,050,000 | 6.8% | 1.45x | 68.5% | 9.1% |

| Garden | 3 | 69,050,000 | 6.4 | 1.39x | 70.2% | 8.8% |

| Senior Housing | 1 | 5,000,000 | 0.5 | 2.29x | 44.6% | 14.2% |

| Total/Avg./Wtd.Avg. | 35 | $1,081,643,735 | 100.0% | 2.20x | 57.4% | 11.3% |

| (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| (2) | Weighted average based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207677) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

12

| COLLATERAL OVERVIEW (continued) |

Geographic Distribution

Property Location | | Number of Mortgaged Properties | | Aggregate Cut-off Date Balance(1) | | % of Initial

Pool

Balance(1) | | Aggregate Appraised

Value(2) | | % of Total Appraised Value | | Underwritten NOI(2) | | % of Total Underwritten

NOI |

| New York | | 9 | | $313,300,000 | | 29.0% | | $2,980,000,000 | | 55.3% | | $129,085,666 | | 47.4% |

| California | | 5 | | 281,260,000 | | 26.0 | | 1,217,500,000 | | 22.6 | | 59,721,568 | | 21.9 |

| Texas | | 4 | | 111,459,274 | | 10.3 | | 149,750,000 | | 2.8 | | 12,571,042 | | 4.6 |

| District of Columbia | | 1 | | 80,250,000 | | 7.4 | | 404,000,000 | | 7.5 | | 24,548,617 | | 9.0 |

| Florida | | 2 | | 54,250,000 | | 5.0 | | 76,800,000 | | 1.4 | | 4,540,067 | | 1.7 |

| Ohio | | 2 | | 40,500,000 | | 3.7 | | 80,300,000 | | 1.5 | | 5,340,019 | | 2.0 |

| Hawaii | | 1 | | 37,500,000 | | 3.5 | | 63,000,000 | | 1.2 | | 3,223,171 | | 1.2 |

| Cayman Islands | | 1 | | 34,966,615 | | 3.2 | | 142,000,000 | | 2.6 | | 12,882,616 | | 4.7 |

| Missouri | | 1 | | 26,225,505 | | 2.4 | | 31,800,000 | | 0.6 | | 4,246,068 | | 1.6 |

| Colorado | | 2 | | 25,360,000 | | 2.3 | | 130,350,000 | | 2.4 | | 8,004,814 | | 2.9 |

| Indiana | | 1 | | 24,000,000 | | 2.2 | | 34,000,000 | | 0.6 | | 2,165,832 | | 0.8 |

| New Mexico | | 2 | | 16,500,000 | | 1.5 | | 26,800,000 | | 0.5 | | 1,983,752 | | 0.7 |

| Montana | | 1 | | 15,300,000 | | 1.4 | | 21,100,000 | | 0.4 | | 1,352,485 | | 0.5 |

| Michigan | | 1 | | 11,222,341 | | 1.0 | | 15,000,000 | | 0.3 | | 1,323,564 | | 0.5 |

| Nevada | | 1 | | 5,000,000 | | 0.5 | | 11,200,000 | | 0.2 | | 709,888 | | 0.3 |

| Pennsylvania | | 1 | | 4,550,000 | | 0.4 | | 6,500,000 | | 0.1 | | 493,086 | | 0.2 |

| Total | | 35 | | $1,081,643,735 | | 100.0% | | $5,390,100,000 | | 100.0% | | $272,192,254 | | 100.0% |

| (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| (2) | Aggregate Appraised Values and Underwritten NOI reflect the aggregate values without any reduction for thepari passu companion loan(s). |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207677) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

13

| COLLATERAL OVERVIE (continued) |

| | Distribution of Cut-off Date Balances | |

| | Range of Cut-off Date Balances ($) | | Number of

Mortgage

Loans | | Cut-off Date

Balance | | % of

Initial

Pool

Balance | |

| | 4,550,000 - 10,000,000 | | 4 | | | $20,410,000 | | | 1.9 | % | |

| | 10,000,001 - 20,000,000 | | 11 | | | 166,543,429 | | | 15.4 | | |

| | 20,000,001 - 30,000,000 | | 5 | | | 127,475,505 | | | 11.8 | | |

| | 30,000,001 - 40,000,000 | | 4 | | | 149,466,615 | | | 13.8 | | |

| | 40,000,001 - 60,000,000 | | 2 | | | 100,000,000 | | | 9.2 | | |

| | 60,000,001 - 80,000,000 | | 3 | | | 215,238,187 | | | 19.9 | | |

| | 80,000,001 - 100,000,000 | | 2 | | | 165,250,000 | | | 15.3 | | |

| | 100,000,001 - 137,260,000 | | 1 | | | 137,260,000 | | | 12.7 | | |

| | Total | | 32 | | | $1,081,643,735 | | | 100.0 | % | |

| | | | | | | | | | | | |

| | Distribution of Underwritten NCF DSCRs(1) | |

| | Range of UW NCF DSCR (x) | | Number of

Mortgage

Loans | | Cut-off Date

Balance | | % of

Initial

Pool

Balance | |

| | 1.13 - 1.30 | | 4 | | | $108,268,885 | | | 10.0 | % | |

| | 1.31 - 1.40 | | 7 | | | 158,502,203 | | | 14.7 | | |

| | 1.41 - 1.50 | | 2 | | | 49,000,000 | | | 4.5 | | |

| | 1.51 - 1.60 | | 4 | | | 93,288,187 | | | 8.6 | | |

| | 1.61 - 2.00 | | 6 | | | 120,774,461 | | | 11.2 | | |

| | 2.01 - 2.40 | | 3 | | | 126,250,000 | | | 11.7 | | |

| | 2.41 - 3.00 | | 5 | | | 288,300,000 | | | 26.7 | | |

| | 3.01 - 3.84 | | 1 | | | 137,260,000 | | | 12.7 | | |

| | Total | | 32 | | | $1,081,643,735 | | | 100.0 | % | |

| | (1) See footnotes (1) and (5) to the table entitled “Mortgage Pool Characteristics” above. | |

| | | | | | | | | | | | |

| | Distribution of Amortization Types(1) | |

| | Amortization Type | | Number of

Mortgage

Loans | | Cut-off Date

Balance | | % of

Initial

Pool

Balance | |

| | Interest Only | | 12 | | | $700,310,000 | | | 64.7 | % | |

| | Interest Only, Then Amortizing(2) | | 14 | | | 212,260,000 | | | 19.6 | | |

| | Amortizing (30 Years) | | 6 | | | 169,073,735 | | | 15.6 | | |

| | Total | | 32 | | | $1,081,643,735 | | | 100.0 | % | |

| | (1) All of the mortgage loans will have balloon payments at maturity date. | |

| | (2) Original partial interest only periods range from 12 to 60 months. | |

| | | | | | | | | | | | |

| | Distribution of Lockboxes | |

| | Lockbox Type | | Number of

Mortgage Loans | | Cut-off Date

Balance | | % of

Initial

Pool

Balance | |

| | Hard | | 17 | | | $816,850,306 | | | 75.5 | % | |

| | Springing | | 13 | | | 210,543,429 | | | 19.5 | | |

| | Soft | | 2 | | | 54,250,000 | | | 5.0 | | |

| | Total | | 32 | | | $1,081,643,735 | | | 100.0 | % | |

| | Distribution of Cut-off Date LTV Ratios(1) | | |

| | Range of Cut-off

Date LTV (%) | | Number of

Mortgage

Loans | | Cut-off Date

Balance | | % of

Initial

Pool

Balance | |

| | 27.1 - 30.0 | | 1 | | | $137,260,000 | | | 12.7 | % | |

| | 30.1 - 40.0 | | 1 | | | 40,000,000 | | | 3.7 | | |

| | 40.1 - 50.0 | | 1 | | | 5,000,000 | | | 0.5 | | |

| | 50.1 - 60.0 | | 8 | | | 351,766,615 | | | 32.5 | | |

| | 60.1 - 65.0 | | 4 | | | 232,475,505 | | | 21.5 | | |

| | 65.1 - 70.0 | | 6 | | | 62,210,000 | | | 5.8 | | |

| | 70.1 - 75.3 | | 11 | | | 252,931,615 | | | 23.4 | | |

| | Total | | 32 | | | $1,081,643,735 | | | 100.0 | % | |

| | (1) See footnotes (1) and (3) to the table entitled “Mortgage Pool Characteristics” above. | |

| | | | | | | | | | | | |

| | Distribution of Maturity Date LTV Ratios(1) | |

| | Range of Maturity

Date LTV (%) | | Number of

Mortgage Loans | | Cut-off Date Balance | | % of

Initial

Pool

Balance | |

| | 24.0 - 30.0 | | 1 | | | $137,260,000 | | | 12.7 | % | |

| | 30.1 - 40.0 | | 1 | | | 40,000,000 | | | 3.7 | | |

| | 40.1 - 50.0 | | 3 | | | 66,192,120 | | | 6.1 | | |

| | 50.1 - 55.0 | | 3 | | | 119,938,187 | | | 11.1 | | |

| | 55.1 - 60.0 | | 9 | | | 377,302,203 | | | 34.9 | | |

| | 60.1 - 65.0 | | 13 | | | 315,982,341 | | | 29.2 | | |

| | 65.1 - 68.8 | | 2 | | | 24,968,885 | | | 2.3 | | |

| | Total | | 32 | | | $1,081,643,735 | | | 100.0 | % | |

| | (1) See footnotes (1) and (4) to the table entitled “Mortgage Pool Characteristics” above. | |

| | | | | | | | | | | | |

| | Distribution of Loan Purpose | |

| | Loan Purpose | | Number of

Mortgage

Loans | | Cut-off Date Balance | | % of

Initial

Pool

Balance | |

| | Refinance | | 23 | | | $617,610,044 | | | 57.1 | % | |

| | Acquisition | | 8 | | | 326,773,691 | | | 30.2 | | |

| | Recapitalization | | 1 | | | 137,260,000 | | | 12.7 | | |

| | Total | | 32 | | | $1,081,643,735 | | | 100.0 | % | |

| | | | | | | | | | | | |

| | Distribution of Mortgage Interest Rates | |

| | Range of Mortgage

Interest Rates (%) | | Number of

Mortgage

Loans | | Cut-off Date Balance | | % of

Initial

Pool

Balance | |

| | 3.590 - 4.000 | | 2 | | | $120,000,000 | | | 11.1 | % | |

| | 4.001 - 4.250 | | 6 | | | 280,010,000 | | | 25.9 | | |

| | 4.251 - 4.500 | | 8 | | | 365,050,000 | | | 33.7 | | |

| | 4.501 - 4.750 | | 8 | | | 120,324,544 | | | 11.1 | | |

| | 4.751 - 5.000 | | 4 | | | 58,160,000 | | | 5.4 | | |

| | 5.001 - 5.537 | | 4 | | | 138,099,191 | | | 12.8 | | |

| | Total | | 32 | | | $1,081,643,735 | | | 100.0 | % | |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207677) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

14

| COLLATERAL OVERVIE (continued) |

| | Distribution of Debt Yield on Underwritten NOI(1) | |

| | Range of Debt Yields on Underwritten NOI (%) | | Number of

Mortgage

Loans | | Cut-off Date Balance | | % of

Initial

Pool

Balance | |

| | 5.8 - 7.0 | | 3 | | | $116,000,000 | | | 10.7 | % | |

| | 7.1 - 9.0 | | 9 | | | 197,518,885 | | | 18.3 | | |

| | 9.1 - 10.0 | | 4 | | | 160,752,203 | | | 14.9 | | |

| | 10.1 - 11.0 | | 5 | | | 116,100,000 | | | 10.7 | | |

| | 11.1 - 12.0 | | 2 | | | 51,222,341 | | | 4.7 | | |

| | 12.1 - 13.0 | | 3 | | | 158,938,187 | | | 14.7 | | |

| | 13.1 - 16.0 | | 3 | | | 82,660,000 | | | 7.6 | | |

| | 16.1 - 16.5 | | 3 | | | 198,452,120 | | | 18.3 | | |

| | Total | | 32 | | | $1,081,643,735 | | | 100.0 | % | |

| | (1) See footnotes (1) and (6) to the table entitled “Mortgage Pool Characteristics” above. | |

| | | | | | | | | | | | |

| | Distribution of Debt Yield on Underwritten NCF(1) | |

| | Range of Debt Yields on Underwritten NCF (%) | | Number of

Mortgage

Loans | | Cut-off Date Balance | | % of

Initial

Pool

Balance | |

| | 5.4 - 7.0 | | 3 | | | $116,000,000 | | | 10.7 | % | |

| | 7.1 - 8.0 | | 1 | | | 30,000,000 | | | 2.8 | | |

| | 8.1 - 9.0 | | 10 | | | 207,271,088 | | | 19.2 | | |

| | 9.1 - 10.0 | | 6 | | | 231,600,000 | | | 21.4 | | |

| | 10.1 - 11.0 | | 3 | | | 108,438,187 | | | 10.0 | | |

| | 11.1 - 13.0 | | 6 | | | 173,774,461 | | | 16.1 | | |

| | 13.1 - 16.1 | | 3 | | | 214,560,000 | | | 19.8 | | |

| | Total | | 32 | | | $1,081,643,735 | | | 100.0 | % | |

| | (1) See footnotes (1) and (6) to the table entitled “Mortgage Pool Characteristics” above. | |

| | | | | | | | | | | | |

| | Mortgage Loans with Original Partial Interest Only Periods | |

| | Original Partial Interest Only Period (months) | | Number of

Mortgage

Loans | | Cut-off Date

Balance | | % of Initial

Pool

Balance | |

| | 12 | | 1 | | | $5,360,000 | | | 0.5 | % | |

| | 24 | | 4 | | | $50,050,000 | | | 4.6 | % | |

| | 36 | | 7 | | | $121,550,000 | | | 11.2 | % | |

| | 60 | | 2 | | | $35,300,000 | | | 3.3 | % | |

| | | | | | | | | | | | |

| | Distribution of Original Terms to Maturity | |

| | Original Term to Maturity (months) | | Number of

Mortgage

Loans | | Cut-off Date

Balance | | % of Initial

Pool

Balance | |

| | 60 | | 4 | | | $59,295,500 | | | 5.5 | % | |

| | 120 - 121 | | 28 | | | 1,022,348,235 | | | 94.5 | | |

| | Total | | 32 | | | $1,081,643,735 | | | 100.0 | % | |

| | | | | | | | | | | | |

| | Distribution of Remaining Terms to Maturity | |

| | Range of Remaining Terms to Maturity (months) | | Number of Mortgage Loans | | Cut-off Date Balance | | % of Initial Pool Balance | |

| | 58 - 60 | | 4 | | | $59,295,500 | | | 5.5 | % | |

| | 61 - 120 | | 28 | | | 1,022,348,235 | | | 94.5 | | |

| | Total | | 32 | | | $1,081,643,735 | | | 100.0 | % | |

| | Distribution of Original Amortization Terms(1) |

| | Original Amortization Term (months) | | Number of Mortgage

Loans | | Cut-off Date Balance | | % of

Initial

Pool

Balance | |

| | Interest Only | | 12 | | | $700,310,000 | | | 64.7 | % | |

| | 360 | | 20 | | | 381,333,735 | | | 35.3 | | |

| | Total | | 32 | | | $1,081,643,735 | | | 100.0 | % | |

| | (1) All of the mortgage loans will have balloon payments at maturity. | |

| | | | | | | | | | | | |