| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-226082-03 |

| | | |

The issuer has filed a registration statement (including a prospectus) with the SEC (registration statement file no. 333-226082) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or you e-mail a request to prospectus-ny@gs.com. The securities may not be suitable for all investors. Goldman Sachs & Co. LLC and the other underwriters and their respective affiliates may acquire, hold or sell positions in these securities, or in related derivatives, and may have an investment or commercial banking relationship with the issuer.

This material is for your information, and neither Goldman Sachs & Co. LLC nor the other underwriters are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

The information contained herein will be superseded by similar information delivered to you prior to the time of sale. The information should be reviewed only in conjunction with the entire Preliminary Prospectus relating to the GS Mortgage Securities Trust 2019-GC40, Commercial Mortgage Pass-Through Certificates, Series 2019-GC40 (the “Offering Document”). All of the information contained herein is subject to the same limitations and qualifications contained in the Offering Document. Prior to making any investment decision, prospective investors are strongly urged to read the Offering Document in its entirety.

This document contains forward-looking statements. Those statements are subject to certain risks and uncertainties that could cause the success of collections and the actual cash flow generated to differ materially from the information set forth herein. While such information reflects projections prepared in good faith based upon methods and data that are believed to be reasonable and accurate as of the dates thereof, the issuer undertakes no obligation to revise these forward-looking statements to reflect subsequent events or circumstances. Individuals should not place undue reliance on forward-looking statements and are advised to make their own independent analysis and determination with respect to the forecasted periods, which reflect the issuer’s view only as of the date hereof.

Diamondback industrial portfolio 1

Diamondback industrial portfolio 1

Diamondback industrial portfolio 1

| Mortgaged Property Information | | Mortgage Loan Information |

| Number of Mortgaged Properties | 3 | | Loan Seller | | GACC |

| Location (City/State)(1) | Various | | Cut-off Date Principal Balance(3) | | $20,000,000 |

| Property Type(1) | Industrial | | Cut-off Date Principal Balance per SF(2) | | $31.33 |

| Size (SF) | 2,234,598 | | Percentage of Initial Pool Balance | | 2.2% |

| Total Occupancy as of 6/1/2019 | 100.0% | | Number of Related Mortgage Loans(4) | | 2 |

| Owned Occupancy as of 6/1/2019 | 100.0% | | Type of Security | Fee Simple |

| Year Built / Latest Renovation(1) | Various / NAP | | Mortgage Rate | | 3.5650% |

| Appraised Value(1) | $205,200,000 | | Original Term to Maturity (Months) | | 60 |

| | | | Original Amortization Term (Months) | | NAP |

| | | | Original Interest Only Period (Months) | | 60 |

| | | | | | |

| Underwritten Revenues | $12,161,250 | | | | |

| Underwritten Expenses | $620,709 | | Escrows(5) |

| Underwritten Net Operating Income (NOI) | $11,540,541 | | | Upfront | Monthly |

| Underwritten Net Cash Flow (NCF) | $11,205,352 | | Taxes | $0 | $0 |

| Cut-off Date LTV Ratio(2) | 34.1% | | Insurance | $0 | $0 |

| Maturity Date LTV Ratio(2) | 34.1% | | Replacement Reserve | $0 | $0 |

| DSCR Based on Underwritten NOI / NCF(2) | 4.56x / 4.43x | | TI/LC | $0 | $0 |

| Debt Yield Based on Underwritten NOI / NCF(2) | 16.5% / 16.0% | | Other | $3,557,777 | $0 |

| | | | | | |

| Sources and Uses |

| Sources | $ | % | Uses | $ | % |

| Whole Loan Amount | $130,250,000 | 63.2% | Purchase Price | $197,577,043 | 95.8% |

| Principal’s New Cash Contribution | 75,931,173 | 36.8 | Origination Costs | 5,046,353 | 2.4 |

| | | | Upfront Reserves | 3,557,777 | 1.7 |

| | | | | | |

| Total Sources | $206,181,173 | 100.0% | Total Uses | $206,181,173 | 100.0% |

| (1) | See“—The Mortgaged Properties” below. |

| (2) | Calculated based on the aggregate outstanding principal balance as of the Cut-off Date of the Diamondback Industrial Portfolio 1 Senior Notes (as defined below) and excludes the Diamondback Industrial Portfolio 1 Subordinate Note (as defined below). |

| (3) | The Diamondback Industrial Portfolio 1 Loan (as defined below) consists of Note A-2 and is part of the Diamondback Industrial Portfolio 1 Whole Loan (as defined below) evidenced by three seniorpari passu notes and one subordinate note, with an aggregate outstanding principal balance as of the Cut-off Date of $130,250,000. For additional information, see“—The Mortgage Loan” below. |

| (4) | The borrowers for the Diamondback Industrial Portfolio 1 Whole Loan are under the same ownership as the borrowers for the Diamondback Industrial Portfolio 2 Whole Loan. |

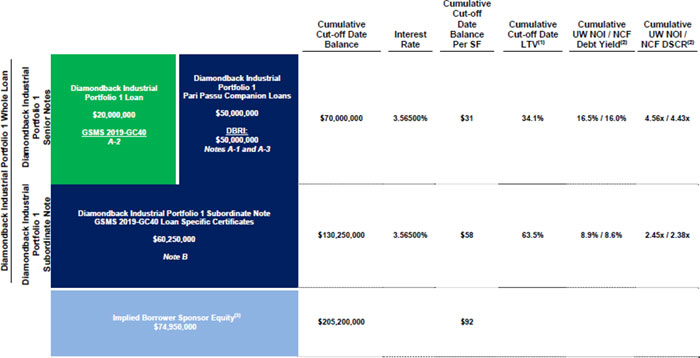

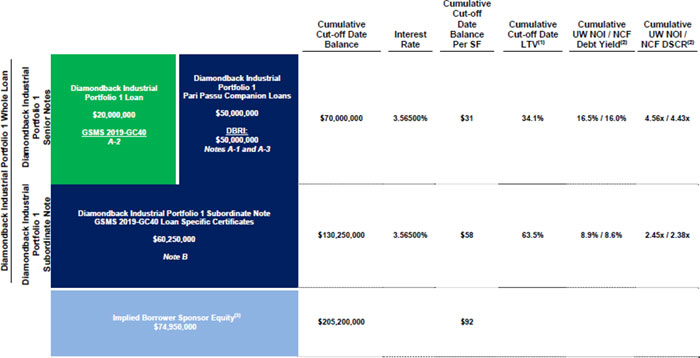

| ■ | The Mortgage Loan. The mortgage loan (the “Diamondback Industrial Portfolio 1 Loan”) is part of a whole loan (the “Diamondback Industrial Portfolio 1 Whole Loan”) consisting of three seniorpari passu promissory notes (Note A-1, Note A-2 and Note A-3) with an aggregate original principal balance of $70,000,000 (the “Diamondback Industrial Portfolio 1 Senior Notes”) and one subordinate promissory note (Note B) with an original principal balance of $60,250,000 (the “Diamondback Industrial Portfolio 1 Subordinate Note”). The Diamondback Industrial Portfolio 1 Whole Loan has an aggregate principal balance of $130,250,000 and is secured by a first mortgage encumbering the borrowers’ fee simple interests in a three-property industrial portfolio located in South Carolina, Pennsylvania and Wisconsin, comprising 2,234,598 SF of net rentable area (the “Diamondback Industrial Portfolio 1 Properties”). The Diamondback Industrial Portfolio 1 Loan, which will be included in GSMS 2019-GC40 securitization transaction, is evidenced by Note A-2, has an outstanding principal balance as of the Cut-off Date of $20,000,000 and represents approximately 2.2% of the Initial Pool Balance. The Diamondback Industrial Portfolio 1 Subordinate Note will be an asset of the trust but will not be pooled together with the other Mortgage Loans, and payments of interest and principal received in respect of the Diamondback Industrial Portfolio 1 Subordinate Note will be available to make distributions in respect of eight loan specific classes of certificates only. |

The Diamondback Industrial Portfolio 1 Senior Notes, have an interest rate of 3.56500%per annum and the Diamondback Industrial Portfolio 1 Subordinate Note has an interest rate of 3.56500%per annum, resulting in a weighted average interest rate of 3.56500%per annum on the Diamondback Industrial Portfolio 1 Whole Loan. The proceeds of the Diamondback Industrial Portfolio 1 Whole Loan and a new cash contribution from the borrower sponsor were primarily used tofund the acquisition of the Diamondback Industrial Portfolio 1 Properties, fund upfront reserves and pay origination costs. The aggregate purchase price for the three properties equaled approximately $197.6 million.

The Diamondback Industrial Portfolio 1 Whole Loan has an initial term of 60 months and has a remaining term of 59 months as of the Cut-off Date. The Diamondback Industrial Portfolio 1 Whole Loan requires monthly payments of interest only for the term of the Diamondback Industrial Portfolio 1 Whole Loan. The scheduled maturity date of the Diamondback Industrial Portfolio 1 Whole Loan is the due date in June 2024. At any time after the earlier to occur of (i) May 30, 2022 or (ii) the second anniversary of the securitization closing date of the last note to be securitized, the Diamondback Industrial Portfolio 1 Whole Loan may be defeased with certain “government securities” as permitted under the Diamondback Industrial Portfolio 1 Whole Loan documents. Voluntary prepayment of the Diamondback

Diamondback industrial portfolio 1

Industrial Portfolio 1 Whole Loan is permitted on or after the due date occurring in February 2024 without payment of any prepayment premium.

The following table outlines the threepari passu notes and one subordinate B note evidencing the Diamondback Industrial Portfolio 1 Whole Loan:

| Note | | Original Balance | | Cut-off Date Balance | | Note Holder | | Controlling Piece |

| | | | | | | | | |

| Note A-1 | | $40,000,000 | | $40,000,000 | | DBRI | | No |

| Note A-2 | | 20,000,000 | | 20,000,000 | | GSMS 2019-GC40 “pooled certificates” | | No |

| Note A-3 | | 10,000,000 | | 10,000,000 | | DBRI | | No |

| Note B | | 60,250,000 | | 60,250,000 | | GSMS 2019-GC40 “loan specific certificates”(1) | | Yes |

| Total | | $130,250,000 | | $130,250,000 | | | | |

| (1) | The holder of the Diamondback Industrial Portfolio 1 Subordinate Note will have the right to appoint the special servicer of the Diamondback Industrial Portfolio 1 Whole Loan and to direct certain decisions with respect to the Diamondback Industrial Portfolio 1 Whole Loan, unless a control appraisal event exists under the related co-lender agreement; provided that after the occurrence of a control appraisal event with respect to the Diamondback Industrial Portfolio 1 Subordinate Note, the holder of the Diamondback Industrial Portfolio 1 Note A-1 will have such rights. For so long as the Diamondback Industrial Portfolio 1 Subordinate Note is included in the GSMS 2019-GC40 securitization, and a control appraisal event does not exist, such rights will be exercised by the Directing Holder of the GSMS 2019-GC40 loan specific certificates. |

Diamondback Industrial Portfolio 1 Total Debt Capital Structure

| (1) | Based on the appraised value of $205,200,000 as of April 2019. |

| (2) | Based on the UW NOI of $11,540,541 and the UW NCF of $11,205,352. |

| (3) | Based on the appraised value of $205,200,000, the Implied Borrower Sponsor Equity is $74,950,000. |

Diamondback industrial portfolio 1

| ■ | The Mortgaged Properties.The Diamondback Industrial Portfolio 1 Properties are comprised of three industrial properties built between 2001 and 2015. The Diamondback Industrial Portfolio 1 Properties include 2,234,598 SF of industrial space across three locations in South Carolina, Pennsylvania and Wisconsin. |

The following table presents certain information relating to the Diamondback Industrial Portfolio 1 Properties:

Property Name | | City | | State | | Allocated Whole Loan Amount | | % of Allocated Whole Loan Amount | | Total GLA | | Year Built | | As-Is Appraised Value | | UW Base Rent(1) |

| TJ Maxx - Philadelphia | | Philadelphia | | Pennsylvania | | $66,500,000 | | 51.1% | | 1,015,500 | | 2001 | | $102,100,000 | | $5,335,183 |

| Amazon - West Columbia | | West Columbia | | South Carolina | | 50,750,000 | | 39.0 | | 1,016,148 | | 2012 | | 79,600,000 | | 4,642,972 |

| FedEx Ground - Menomonee Falls | | Menomonee Falls | | Wisconsin | | 13,000,000 | | 10.0 | | 202,950 | | 2015 | | 23,500,000 | | 1,412,157 |

| Total | | | | | | $130,250,000 | | 100.0% | | 2,234,598 | | | | $205,200,000 | | $11,390,312 |

| (1) | Based on the underwritten rent roll as of June 1, 2019. |

TJ Maxx - Philadelphia

The largest property by allocated loan amount, TJ Maxx - Philadelphia, is a single-story, 1,015,500 SF industrial building located at 2760 Red Lion Road in Philadelphia, Pennsylvania. The improvements consist of a warehouse distribution facility with approximately 3.0% office space. The building features 134 dock-high doors and two drive-in doors, with 32’-45’ clearance heights. Parking consists of 1,200 surface spaces for a parking ratio of approximately 1.2 spaces per 1,000 SF of net rentable area and two truck courts: 1,695’ x 210’ and 900’ x 150’.

The property was developed in 2001 and is 100.0% leased to TJ Maxx, which signed a 20-year triple net lease with annual rent increases of 1.5% and an expiration date in December 2034. TJ Maxx’s parent company, The TJX Companies, Inc. (NYSE: TJX) (rated A2/A+ by Moody’s/S&P) guarantees the TJ Maxx lease. The TJ Maxx lease has no termination options and two, seven-year renewal options at fair market rent.

The TJX Companies, Inc. is an off-price apparel and home fashions retailer in the United States and worldwide and is ranked 85 among Fortune 500 companies. In 2018, The TJX Companies, Inc. reported approximately $39 billion in revenues, and had more than 4,300 stores in nine countries, three e-commerce sites, and approximately 270,000 associates. The TJX Companies, Inc. operates TJ Maxx and Marshalls (combined, Marmaxx), HomeGoods, Sierra, and Homesense in the United States; Winners, HomeSense, and Marshalls (combined, TJX Canada) in Canada; and T.K. Maxx in the United Kingdom, Ireland, Germany, Poland, Austria, the Netherlands, and Australia, as well as Homesense in the U.K. and Ireland (combined, TJX International).

Amazon – West Columbia

The second largest property by allocated loan amount, Amazon – West Columbia, is a single-story, 1,016,148 SF industrial distribution warehouse located at 4400 12th Street Extension in West Columbia, South Carolina. The improvements were constructed in 2012 and feature 65 dock-high doors, and four drive-in doors, all with 32’ clearance heights. Parking consists of 2,427 surface spaces for a parking ratio of approximately 2.4 spaces per 1,000 SF of net rentable area and a truck court that can accommodate 115 trailers.

Amazon – West Columbia is currently 100.0% occupied by Amazon, which has been in occupancy since 2012. Amazon’s parent company, Amazon.com, Inc. (NYSE: AMZN) (rated A+/A3/AA- by Fitch/Moody’s/S&P) guarantees the Amazon lease. This Amazon location is an auto-sort facility and fulfills internet orders for small inventoried items of 30 lbs or less. Auto-sort facilities have larger mezzanine space compared to non-sort facilities in order to accommodate a process that utilizes two and three story shelving units that are stacked three high. The property was originally built-to-suit for Amazon, which signed a 15 year lease through September 2026. The Amazon lease has no termination options and has four, five-year renewal options at fair market rent. Amazon has a right of first offer to purchase the property. See “Description of the Mortgage Pool—Tenant Issues—Purchase Options and Rights of First Refusal” in the Preliminary Prospectus.

The tenant, Amazon, entered into a Fee In Lieu Of Taxes agreement (“FILOT Agreement”) pursuant to which the related borrower and Amazon, the sole tenant of the Amazon – West Columbia property, must make certain payments in lieu of ad valorem real estate taxes, and as to Amazon only, in lieu of taxes on personal property. The FILOT Agreement provides that tax liability is based on a fixed millage rate applied to a 6.0% assessment ratio of the market value of personal, business, and property assessment. Depreciation is applied to these items annually; therefore the assessment and liability decline each year. The FILOT Agreement expires, with respect to each stage of the Amazon

Diamondback industrial portfolio 1

– West Columbia Property placed in service, approximately 20 years after such stage is placed in service, but in no event later than 2037, and may be terminated earlier under certain circumstances. In addition, the FILOT Agreement is in effect only so long as Amazon is leasing the Amazon – West Columbia property. According to the appraisal, the 2018 total FILOT liability was $928,342, compared to an estimated current tax liability of $1,163,247 absent the FILOT. Amazon is required under its lease to pay all real estate taxes.

Amazon.com, Inc. operates retail websites and offers programs that enable third parties to sell products on their websites. Amazon's main website offers millions of books, as well as other media, home furnishings, apparel, pet supplies, office products, and hundreds of other product categories. As of the fiscal year 2018, Amazon.com, Inc.’s reported revenues were approximately $232.9 billion and reported net income was approximately $10.1 billion.

FedEx Ground – Menomonee Falls

The third largest property by allocated loan amount, FedEx Ground – Menomonee Falls, is a single-story, 202,950 SF industrial distribution warehouse located at N96W14849 County Line Road in Menomonee Falls, Wisconsin. The FedEx Ground – Menomonee Falls property was built in 2015 and features 58 dock-high doors, and seven drive-in doors, all with 36’ clearance. Parking consists of 507 surface spaces for a parking ratio of approximately 2.5 spaces per 1,000 SF of net rentable area and 131 trailer parking spaces. The FedEx Ground – Menomonee Falls property is 100.0% occupied by FedEx Ground, which has been in occupancy since 2015 when the tenant signed a 15-year lease through July 2030. The lease has no termination options and provides for two, five-year renewal options at fair market rent.

FedEx Ground is a subsidiary of FedEx Corporation (NYSE: FDX) (rated Baa2/BBB by Moody’s/S&P), which provides customers and businesses worldwide with a broad portfolio of transportation, e-commerce and business services. As of 2018, FedEx Corporation reported total revenues of approximately $65.5 billion. FedEx Ground provides low-cost, day-certain service to every business address in the United States, Canada and Puerto Rico, as well as residential delivery to U.S. residences through FedEx Home Delivery. The FedEx Ground segment also includes FedEx SmartPost, Inc., which specializes in the consolidation and delivery of high volumes of low-weight, less time-sensitive business-to-consumer packages.

The following table presents certain information relating to the major tenants at the Diamondback Industrial Portfolio 1 Properties:

Largest Tenants Based on Underwritten Base Rent(1)

Tenant Name | | Credit Rating (Fitch/MIS/S&P)(2) | | Tenant GLA | | % of Portfolio GLA | | UW Base Rent | | % of Total UW Base Rent | | UW Base Rent

$ per SF | | Lease Expiration | | Renewal / Extension Options |

| TJ Maxx | | NR / A2 / A+ | | 1,015,500 | | | 45.4 | % | | $5,335,183 | | | 46.8 | % | | $5.25 | | | 12/31/2034 | | 2, 7-year options |

| Amazon | | A+ / A3 / AA- | | 1,016,148 | | | 45.5 | | | 4,642,972 | | | 40.8 | | | 4.57 | | | 9/30/2026 | | 4, 5-year options |

| FedEx Ground | | NR / Baa2 / BBB | | 202,950 | | | 9.1 | | | 1,412,157 | | | 12.4 | | | 6.96 | | | 7/31/2030 | | 2, 5-year options |

| Largest Tenants | | | | 2,234,598 | | | 100.0 | % | | $11,390,312 | | | 100.0 | % | | $5.10 | | | | | |

| Vacant | | | | 0 | | | 0.0 | | | 0 | | | 0.0 | | | 0.00 | | | | | |

| Total / Wtd. Avg. All Tenants | | 2,234,598 | | | 100.0 | % | | $11,390,312 | | | 100.0 | % | | $5.10 | | | | | |

| (1) | Based on the underwritten rent rolls as of June 1, 2019. |

| (2) | Certain ratings are those of the parent company whether or not the parent company guarantees the lease. |

Diamondback industrial portfolio 1

The following table presents certain information relating to the lease rollover schedule at the Diamondback Industrial Portfolio 1 Properties, based on initial lease expiration dates:

Lease Expiration Schedule(1)

Year Ending December 31 | | Expiring Owned GLA | | % of Owned GLA | | Cumulative % of Owned GLA | | UW Base Rent | | % of Total UW Base Rent | | UW Base Rent $ per SF | | # of Expiring Tenants |

| MTM | | 0 | | | 0.0 | % | | 0.0 | % | | $0 | | | 0.0 | % | | $0.00 | | | 0 | |

| 2019 | | 0 | | | 0.0 | | | 0.0 | % | | 0 | | | 0.0 | | | 0.00 | | | 0 | |

| 2020 | | 0 | | | 0.0 | | | 0.0 | % | | 0 | | | 0.0 | | | 0.00 | | | 0 | |

| 2021 | | 0 | | | 0.0 | | | 0.0 | % | | 0 | | | 0.0 | | | 0.00 | | | 0 | |

| 2022 | | 0 | | | 0.0 | | | 0.0 | % | | 0 | | | 0.0 | | | 0.00 | | | 0 | |

| 2023 | | 0 | | | 0.0 | | | 0.0 | % | | 0 | | | 0.0 | | | 0.00 | | | 0 | |

| 2024 | | 0 | | | 0.0 | | | 0.0 | % | | 0 | | | 0.0 | | | 0.00 | | | 0 | |

| 2025 | | 0 | | | 0.0 | | | 0.0 | % | | 0 | | | 0.0 | | | 0.00 | | | 0 | |

| 2026 | | 1,016,148 | | | 45.5 | | | 45.5 | % | | 4,642,972 | | | 40.8 | | | 4.57 | | | 1 | |

| 2027 | | 0 | | | 0.0 | | | 45.5 | % | | 0 | | | 0.0 | | | 0.00 | | | 0 | |

| 2028 | | 0 | | | 0.0 | | | 45.5 | % | | 0 | | | 0.0 | | | 0.00 | | | 0 | |

| 2029 | | 0 | | | 0.0 | | | 45.5 | % | | 0 | | | 0.0 | | | 0.00 | | | 0 | |

| 2030 & Thereafter | | 1,218,450 | | | 54.5 | | | 100.0 | % | | 6,747,340 | | | 59.2 | | | 5.54 | | | 2 | |

| Vacant | | 0 | | | 0.0 | | | 100.0 | % | | 0 | | | 0.0 | | | 0.00 | | | 0 | |

| Total / Wtd. Avg. | | 2,234,598 | | | 100.0 | % | | | | | $11,390,312 | | | 100.0 | % | | $5.10 | | | 3 | |

| (1) | Calculated based on the approximate SF occupied by each tenant. |

The following table presents certain information relating to historical leasing at the Diamondback Industrial Portfolio 1 Properties:

Historical Leased %(1)

Property | 2016 | 2017 | 2018 | As of 6/1/2019 |

| TJ Maxx - Philadelphia | 100.0% | 100.0% | 100.0% | 100.0% |

| Amazon - West Columbia | 100.0% | 100.0% | 100.0% | 100.0% |

| FedEx Ground - Menomonee Falls | 100.0% | 100.0% | 100.0% | 100.0% |

| (1) | Historical occupancies are as of December 31 of each respective year unless otherwise specified. |

| ■ | Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the historical operating performance and Underwritten Net Cash Flow at the Diamondback Industrial Portfolio 1 Properties: |

Cash Flow Analysis(1)

| | | 2016 | | 2017 | | 2018 | | Underwritten | | Underwritten $ per SF |

| Base Rent(2) | | $10,727,244 | | | $11,077,461 | | | $11,243,902 | | | $11,390,312 | | | $5.10 | |

| Credit Tenant Rent Steps(3) | | 0 | | | 0 | | | 0 | | | 443,349 | | | 0.20 | |

| Potential Income from Vacant Space | | 0 | | | 0 | | | 0 | | | 0 | | | 0.00 | |

| Gross Potential Rent | | $10,727,244 | | | $11,077,461 | | | $11,243,902 | | | $11,833,660 | | | $5.30 | |

| Reimbursements | | 949,928 | | | 694,413 | | | 532,533 | | | 618,348 | | | 0.28 | |

| Other Income | | 322,645 | | | 418,450 | | | 390,001 | | | 221,198 | | | 0.10 | |

| Total Gross Income | | $11,999,817 | | | $12,190,324 | | | $12,166,436 | | | $12,673,207 | | | $5.67 | |

| Economic Vacancy & Credit Loss(4) | | 0 | | | 0 | | | 0 | | | (511,956 | ) | | (0.23 | ) |

| Effective Gross Income | | $11,999,817 | | | $12,190,324 | | | $12,166,436 | | | $12,161,250 | | | $5.44 | |

| | | | | | | | | | | | | | | | |

| Real Estate Taxes(5) | | $215,562 | | | $229,018 | | | $223,827 | | | $238,248 | | | $0.11 | |

| Insurance | | 59,073 | | | 64,808 | | | 57,304 | | | 22,076 | | | 0.01 | |

| Management Fee | | 0 | | | 0 | | | 0 | | | 327,128 | | | 0.15 | |

| Other Operating Expenses | | 699,684 | | | 409,633 | | | 352,981 | | | 33,257 | | | 0.01 | |

| Total Operating Expenses | | $974,318 | | | $703,459 | | | $634,113 | | | $620,709 | | | $0.28 | |

| | | | | | | | | | | | | | | | |

| Net Operating Income | | $11,025,499 | | | $11,486,866 | | | $11,532,323 | | | $11,540,541 | | | $5.16 | |

| Replacement Reserves | | 0 | | | 0 | | | 0 | | | 335,190 | | | 0.15 | |

| TI/LC | | 0 | | | 0 | | | 0 | | | 0 | | | 0.00 | |

| Net Cash Flow | | $11,025,499 | | | $11,486,866 | | | $11,532,323 | | | $11,205,352 | | | $5.01 | |

| | | | | | | | | | | | | | | | |

| (1) | Certain items such as interest expense, interest income, lease cancellation income, depreciation, amortization, debt service payments and any other non-recurring or non-operating items are not considered for the underwritten cash flow. |

| (2) | Underwritten Base Rent is based on the underwritten rent rolls as of June 1, 2019. |

| (3) | Represents straightline average rent for tenants TJ Maxx, Amazon and FedEx Ground. |

| (4) | Underwritten Vacancy & Credit Loss represents an economic vacancy of 4.0%. |

| (5) | The Amazon – West Columbia property currently receives a tax incentive via a FILOT (Fee In Lieu Of Taxes) program. See "—Description of the Mortgage Pool—Real Estate and Other Tax Considerations” in the Preliminary Prospectus. |

Diamondback industrial portfolio 1

| ■ | Appraisal. According to the appraisals, the Diamondback Industrial Portfolio 1 Properties had an aggregate “as-is” appraised value of $205,200,000 as of dates ranging from April 23, 2019 through April 25, 2019. The appraisals also concluded an aggregate “go dark” value of $139,500,000 (TJ Maxx – Philadelphia: $73,700,000; Amazon – West Columbia - $53,000,000; FedEx Ground – Menomonee Falls: $12,800,000). |

| ■ | Environmental Matters. According to the Phase I environmental reports, dated from February 20, 2019 through March 12, 2019, there are no recognized environmental conditions or recommendations for further action at the Diamondback Industrial Portfolio 1 Properties. |

| ■ | Market Overview and Competition. |

TJ Maxx - Philadelphia (51.1% of Cut-off Date Allocated Loan Amount)

The TJ Maxx - Philadelphia property is located in the Montgomery County submarket. As of the fourth quarter of 2018, the submarket had inventory of approximately 9.3 million SF, a vacancy rate of 8.0% and direct weighted average rent of $5.85 PSF, the highest of the five submarkets within the Philadelphia warehouse/industrial submarket.

The following table presents certain information relating to comparable leases for the TJ Maxx - Philadelphia property:

Industrial Lease Comparables(1)

Property Name | Location | Lease Type | Quoted Rate per SF | Tenant | Lease Size (SF) | Lease Date | Approx. Lease Term (Years) |

| TJ Maxx - Philadelphia | Philadelphia, PA | Net | $5.25 | TJ Maxx | 1,015,500 | Jan 2015 | 20.0 |

| Amazon Distribution Center | Burlington, NJ | Net | $5.50 | Amazon.com | 1,016,000 | Feb 2019 | 10.0 |

| Amazon.com Building | West Deptford, NJ | Net | $5.69 | Amazon.com | 652,411 | Sept 2018 | 15.0 |

| 425 Rising Sun Road | Bordentown, NJ | Net | $6.00 | Imperial Dade | 333,548 | Aug 2018 | 10.0 |

| 4275 Fritch Drive | Bethlehem, PA | Net | $5.85 | Kuehne & Nagel | 228,000 | Jun 2018 | 3.0 |

| Majestic Bethlehem Center | Bethlehem, PA | Net | $6.10 | McKesson Corp. | 508,821 | Apr 2018 | 10.0 |

| Uline Building | Breinigsville, PA | Net | $5.69 | Coca-Cola | 363,000 | Jul 2017 | 5.0 |

| 3000 AM Drive | Quakertown, PA | Net | $4.60 | XPO Logistics | 194,600 | Mar 2017 | 2.0 |

| Weighted Average(2) | | | $5.67 | | 470,911 | | 9.5 |

| | | | | | | | | |

| (2) | Weighted Average excludes the TJ Maxx – Philadelphia property. |

The appraisal concluded a market rent rate of $5.25 PSF NNN for the TJ Maxx - Philadelphia property.

Amazon – West Columbia (39.0% of Cut-off Date Allocated Loan Amount)

The Amazon – West Columbia property is located in the Cayce/West Columbia submarket. As of the first quarter of 2019, the Cayce/West Columbia industrial submarket contained inventory of approximately 14.4 million SF, with a direct vacancy rate of 4.5% and average rental rate of $4.92 PSF.

The following table presents certain information relating to comparable leases for the Amazon – West Columbia property:

Industrial Lease Comparables(1)

Property Name | Location | Lease Type | Quoted Rate per SF | Tenant | Lease Size (SF) | Lease Date | Approx. Lease Term (Years) |

| Amazon – West Columbia | West Columbia, SC | Net | $4.57 | Amazon | 1,016,148 | Oct 2011 | 15.0 |

| Midway Logistics IV | West Columbia, SC | Net | 4.75 | Offering | 200,000 | Apr 2019 | 5.0 |

| Rite Aid Distribution Center | Spartanburg, SC | Net | 4.31 | Rite Aid | 901,350 | Apr 2016 | 15.0 |

| August Grove | Piedmont, SC | Net | 4.35 | Android Industries | 252,385 | Jan 2018 | 6.0 |

| Velocity I | Greer, SC | Net | 4.75 | BMW | 297,607 | May 2018 | 4.0 |

| Staples Distribution Center | Charlotte, NC | Net | 4.96 | Staples, Inc. | 599,018 | June 2018 | 12.0 |

| Weighted Average(2) | | | $4.58 | | 450,072 | | 10.8 |

| | | | | | | | | |

| (2) | Weighted Average excludes the Amazon – West Columbia property. |

The appraisal concluded a market rent rate of $4.50 PSF NNN for the Amazon – West Columbia property.

Diamondback industrial portfolio 1

FedEx Ground – Menomonee Falls (10.0% of Cut-off Date Allocated Loan Amount)

The FedEx Ground – Menomonee Falls property is located in the NE/Menomonee Falls submarket. As of year-end 2018, the NE/Menomonee Falls industrial submarket had an inventory of approximately 16.0 million SF, with an overall vacancy rate of 1.5% and asking rent of $5.72 PSF.

The following table presents certain information relating to comparable leases for the FedEx Ground – Menomonee Falls property:

Industrial Lease Comparables(1)

Property Name | Location | Lease Type | Quoted Rate per SF | Tenant | Lease Size (SF) | Lease Date | Approx. Lease Term (Years) |

| FedEx Ground | Menomonee Falls, WI | Net | $6.96 | FedEx Ground | 202,950 | Aug 2015 | 15.0 |

| Business Park of Kenosha | Kenosha, WI | Net | 5.35 | Snap-on | 250,048 | Apr 2019 | 3.0 |

| 5201 International Drive | Cudahy, WI | Net | 5.25 | R.R. Donnelley | 153,300 | Sept 2018 | 10.3 |

| N102W19400 Willow Creek Way | Germantown, WI | Net | 5.40 | Discount Ramps | 160,810 | Aug 2018 | 15.0 |

| Mt. Pleasant Business Park | Sturtevant, WI | Net | 4.50 | Goodwill | 248,000 | Nov 2017 | 10.0 |

| 901 Northview Road | Waukesha, WI | Net | 5.13 | Kirby Built Products | 116,176 | May 2017 | 7.1 |

| 5150 S International Drive | Cudahy, WI | Net | 5.12 | Rexnord | 150,465 | Apr 2017 | 3.0 |

| Weighted Average(2) | | | $5.09 | | 179,800 | | 7.9 |

| (2) | Weighted Average excludes the FedEx Ground – Menomonee Falls property. |

The appraisal concluded a market rent rate of $5.25 PSF NNN for the FedEx Ground – Menomonee Falls property.

| ■ | The Borrowers. The borrowers are VEREIT/OW Philadelphia PA, LLC, VEREIT/OW West Columbia, SC, LLC and VEREIT/OW Menomonee Falls WI, LLC, each a newly formed Delaware limited liability company structured to be bankruptcy remote with two independent directors in its organizational structure. Legal counsel to the borrowers delivered a non-consolidation opinion in connection with the origination of the Diamondback Industrial Portfolio 1 Whole Loan. The borrowers are indirectly owned 20% by VEREIT Operating Partnership, L.P. (which is 97.6% owned by VEREIT, Inc. and 2.4% owned by certain non-affiliated investors and certain former directors, officers and employees of ARC Real Estate Partners, LLC) and 80% by a Korean investment trust. The borrowers for the Diamondback Industrial Portfolio 1 Whole Loan are under the same ownership as the borrowers for the Diamondback Industrial Portfolio 2 Whole Loan. The Diamondback Industrial Portfolio 1 Properties were acquired from affiliates of VEREIT, Inc. There is no non-recourse carve-out guarantor or separate environmental indemnitor for the Diamondback Industrial Portfolio 1 Whole Loan. |

| ■ | Escrows. On the origination date of the Diamondback Industrial Portfolio 1 Whole Loan, the borrowers funded reserves of $3,557,777 for outstanding roof repair work at the TJ Maxx – Philadelphia property. |

On each due date, the borrowers will be required to fund the following reserves: (i) if a Trigger Period (as defined below) has occurred, one-twelfth of the taxes that the lender estimates will be payable over the next-ensuing 12-month period, (provided that if no event of default is continuing, the borrowers’ requirement to make such deposits will be waived with respect to any property where (a) the entire property is leased to one or more IG Tenants (as defined below), (b) such IG Tenant(s) is obligated under its lease to pay all real estate taxes for such property directly to the applicable governmental authority and does so before delinquency and (c) the applicable lease remains in full force and effect and no event of default exists thereunder), (ii) if a Trigger Period under the Diamondback Industrial Portfolio 1 Whole Loan documents has occurred and is continuing, one-twelfth of the amount that the lender estimates will be necessary to pay insurance premiums for the renewal of coverage (provided that (1) such deposits will be waived if the Diamondback Industrial Portfolio 1 Properties are covered under an acceptable blanket policy and (2) if no event of default is continuing, the borrowers’ requirement to make such deposits will be waived with respect to any property where (a) the entire property is leased to one or more IG Tenants, (b) such IG Tenant(s) is obligated under its lease to pay all insurance premiums for such property directly to the insurer and does so as they become due and payable and (c) the applicable lease remains in full force and effect and no event of default exists thereunder), (iii) if a Trigger Period under the Diamondback Industrial Portfolio 1 Whole Loan documents has occurred and is continuing, a monthly replacement reserve deposit equal to one-twelfth of $0.02 PSF (initially $4,062.58), and (iv) if a Trigger Period under the Diamondback Industrial Portfolio 1 Whole Loan documents has occurred and is continuing, a monthly rollover reserve deposit equal to one-twelfth of $0.25 PSF (initially $46,554.13).

Diamondback industrial portfolio 1

An “IG Tenant” means a tenant under a lease at any of the Diamondback Industrial Portfolio 1 Properties (i)(x) with a rating of “BBB-” (or the applicable equivalent rating) or better by one of Moody’s, S&P or Fitch or (y) if such tenant is not rated by any of Moody’s, S&P or Fitch, has a rating of “BBB-” (or the applicable equivalent rating) or better by one or more of DBRS, Morningstar, KBRAandno nationally-recognized statistical rating organization that is rating such tenant has given a rating of less than “BBB-” (or the applicable equivalent rating) or (ii) is a tenant that is wholly-owned by a parent that satisfies the conditions set forth in clause (i).

| ■ | Lockbox and Cash Management. The Diamondback Industrial Portfolio 1 Whole Loan documents require a lender-controlled hard lockbox account with in-place cash management. The borrowers are required to cause tenants to deposit rents directly into the lockbox account. In addition, the borrowers and the property manager are required to deposit all rents and gross revenue from the Diamondback Industrial Portfolio 1 Property into such lockbox account within two business days of receipt. Twice per month, all funds in the lockbox account are required to be swept into a lender-controlled cash management account and applied to make required deposits into the tax and insurance reserves, if any, as described above under “—Escrows,” to pay debt service on the Diamondback Industrial Portfolio 1 Whole Loan, to make required deposits into the replacement and rollover reserves, if any, as described above under “—Escrows,” to pay operating expenses set forth in the annual budget (which must be reasonably approved by the lender during a Trigger Period) and lender-approved extraordinary expenses, and to pay any remainder (i) if a Lease Sweep Period is in effect, to a lease sweep reserve to be applied to expenses of reletting the applicable tenant space, (ii) if no Lease Sweep Period is in effect, and any other Trigger Period is in effect, to a cash collateral account to be held as additional security for the Diamondback Industrial Portfolio 1 Whole Loan during the continuance of such Trigger Period and (iii) if no Trigger Period is in effect, to the borrowers. |

A “Trigger Period” means a period commencing upon (i) the commencement of an event of default under the Diamondback Industrial Portfolio 1 Whole Loan documents, (ii) the debt service coverage ratio of the Diamondback Industrial Portfolio 1 Whole Loan falling below 1.10x, or (iii) the occurrence of a Lease Sweep Period (as defined below).

A Trigger Period will expire upon (a) in the case of a Trigger Period caused by the event described in clause (i) above, such event of default being cured (and the cure having been accepted by the lender), (ii) in the case of a Trigger Period caused by the event described in clause (ii) above, upon the debt service coverage ratio being equal to or greater than 1.10x for two consecutive calendar quarters, and in the case of a Trigger Period caused by the event in clause (iii) above, the expiration of the Lease Sweep Period in accordance with the definition of Lease Sweep Period below. The borrower may cure a Trigger Period caused by clause (ii) above by delivering to the lender cash or a letter of credit meeting the requirements of the loan documents in an amount which, if applied to repay the outstanding principal balance of the Diamondback Industrial Portfolio 1 Whole Loan would cause the debt service coverage ratio to equal 1.10x.

A “Lease Sweep Period” will commence, (a) upon the earlier of (i) the date that is nine months prior to the expiration of a Sweep Lease (as defined below) or (ii) upon the latest date required under the Sweep Lease by which the Sweep Tenant (as defined below) is required to give notice of its exercise of a renewal option thereunder (and such renewal has not been so exercised); (b) upon the early termination, early cancellation or early surrender of a Sweep Lease or upon borrowers' receipt of notice by a Sweep Tenant of its intent to effect an early termination, early cancellation or early surrender of its Sweep Lease; (c) solely with respect to any Sweep Tenant that is not an IG Tenant, if a Sweep Tenant has ceased operating its business at the related property (other than in connection with (x) a temporary vacation of the space for a period of no longer than 12 months following a casualty or condemnation at the applicable Diamondback Industrial Portfolio 1 Property, provided that the borrower or the applicable Sweep Tenant is continuously and diligently pursuing completion of a restoration of such property during such 12 month period and (y) a temporary vacation of, or cessation of business at, the space for a period of not more than 90 days in connection with renovation or build-out of the space or other permitted alteration) at substantially all of its space at the Diamondback Industrial Portfolio 1 Property; (d) upon a monetary or material non-monetary default under a Sweep Lease by a Sweep Tenant beyond any applicable notice and cure period or (e) upon a bankruptcy or insolvency proceeding of a Sweep Tenant or its parent. A Lease Sweep Period will end upon (i) with respect to clause (a), (b), (c) and (d) above, (x) (a) at least 75% of the Sweep Lease space being leased pursuant to a qualified lease, which lease results in a debt yield of at least 8.0% or (b) the entirety of the Sweep Lease space is being leased pursuant to one or more qualified leases and (y) in the lender’s reasonable judgement, sufficient funds have accumulated in the lease sweep reserve to cover all anticipated leasing expenses, free rent periods and any shortfalls in debt service or operating expenses as a result of any anticipated down time prior to commencement of payments under such qualified leases (“Sufficient Funds”); (ii) with respect to clause (a) above, the date the Sweep Tenant exercises its renewal or extension option; (iii) with respect to clause (b) above, the date the Sweep Lease Tenant retracts its notice to surrender or cancel its lease; (iv) with respect to clause (c) above, the date on which the tenant has recommenced its business at the related property for a period of at least 30 days; (v) with respect to clause (d) above, the date the

Diamondback industrial portfolio 1

monetary or material non-material default has been cured and no other monetary or material non-monetary default under such Sweep Lease occurs for a period of three consecutive months following such cure; and (vi) with respect to clause (e) above, either the bankruptcy or insolvency proceeding has terminated and the Sweep Lease has been affirmed, assumed or assigned in a manner reasonably satisfactory to the lender or (x) at least 75% of the Sweep Lease space is leased pursuant to a qualified lease, the leasing results in a debt yield of at least 8.0% and (y) Sufficient Funds have been accumulated in the lease sweep reserve.

A "Sweep Lease" means each of (i) the TJ Maxx lease, (ii) the Amazon lease, (iii) to the extent one or more of the Diamondback Industrial Portfolio 1 Properties are released in accordance with the terms of the loan documents and the FedEx Ground - Menomonee Falls property remains subject to the lien of the mortgage, the FedEx Ground lease and (iv) any replacement lease covering a majority of the space currently demised under such Sweep Lease.

A "Sweep Tenant" means any tenant under a Sweep Lease.

| ■ | Property Management. The Diamondback Industrial Portfolio 1 Properties are managed by VEREIT Realty Advisors, LLC, an affiliate of the borrowers pursuant to management agreements between such manager and a parent company of the borrowers. Under the Diamondback Industrial Portfolio 1 Whole Loan documents, the lender has the right to require the borrowers to replace the property manager with (x) an unaffiliated qualified manager selected by the borrowers or (y) another property manager chosen by the borrowers and approved by the lender (provided, that such approval may be conditioned upon the borrowers delivering a rating agency confirmation as to such new property manager and management agreement) upon the occurrence of any one or more of the following events: (i) at any time following the occurrence of an event of default, (ii) if the property manager is in default under any management agreement beyond any applicable notice and cure period, (iii) if the property manager has become insolvent or a debtor in any bankruptcy or insolvency proceeding, or (iv) if at any time the property manager has engaged in gross negligence, fraud, willful misconduct or misappropriation of funds. |

| ■ | Mezzanine or Secured Subordinate Indebtedness. Not permitted. |

| ■ | Release of Collateral. Provided that no event of default is then continuing under the Diamondback Industrial Portfolio 1 Whole Loan, the Diamondback Industrial Portfolio 1 Whole Loan documents permit a partial release of one or more of the individual Diamondback Industrial Portfolio 1 Properties at any time after the earlier to occur of (i) May 30, 2022 or (ii) the second anniversary of the securitization closing date of the last note to be securitized, subject to certain conditions, including, without limitation, the following: (i) the sale of such individual property is pursuant to an arm's-length agreement with an unaffiliated third party; (ii) the related borrowers defease a portion of the Diamondback Industrial Portfolio 1 Whole Loan equal to the applicable release price (as described below); (iii) after giving effect to such release, the debt service coverage ratio for the remaining Diamondback Industrial 1 Properties will be no less than the greater of (1) the debt service coverage ratio of all of the Diamondback Industrial Portfolio 1 Properties (including the individual property to be released) immediately preceding such release and (2) 1.40x; (iv) after giving effect to such release, the loan-to-value ratio for the remaining Diamondback Industrial Portfolio 1 Properties is not greater than the lesser of (1) the loan-to-value ratio of all of the Diamondback Industrial Portfolio 1 Properties (including the individual property to be released) immediately preceding such release and (2) 65.0%; and (v) after giving effect to the release, the ratio of the unpaid principal balance of the Diamondback Industrial Portfolio 1 Whole Loan to the value of the remaining Diamondback Industrial Portfolio 1 Properties (such value to be determined by the lender in its reasonable discretion based on a commercially reasonable valuation method permitted to a REMIC trust and which excludes the value of personal property or going concern value, if any) is no more than 125%. The release price for the first release is 110% of the allocated loan amount of the individual property being released, for the second release is 115% of the allocated loan amount of the individual property being released, and for the release of the final individual property is the remaining principal balance of the Diamondback Industrial Portfolio 1 Whole Loan. |

| ■ | Terrorism Insurance. The borrowers are required to maintain an “all-risk” insurance policy without an exclusion of terrorism in an amount equal to the full replacement cost of the Diamondback Industrial Portfolio 1 Properties, plus 24 months of business interruption coverage. If TRIPRA is no longer in effect, then the borrowers’ requirement to purchase terrorism insurance will be capped at an amount equal to two times the amount of the insurance premium payable in respect of the property and business interruption/rental loss insurance required under the Diamondback Industrial Portfolio 1 Whole Loan documents. See “Risk Factors—Terrorism Insurance May Not Be Available for All Mortgaged Properties” in the Preliminary Prospectus. |