| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-226082-04 |

| | | |

September 9, 2019

Free Writing Prospectus

Structural and Collateral Term Sheet

$1,060,426,720

(Approximate Mortgage Pool Balance)

$912,734,000

(Offered Certificates)

GS Mortgage Securities Trust 2019-GC42

As Issuing Entity

GS Mortgage Securities Corporation II

As Depositor

Commercial Mortgage Pass-Through Certificates

Series 2019-GC42

Goldman Sachs Mortgage Company

Citi Real Estate Funding Inc.

German American Capital Corporation

As Sponsors and Mortgage Loan Sellers

IMPORTANT NOTICE REGARDING THE CONDITIONS FOR THIS OFFERING OF ASSET-BACKED SECURITIES

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor, Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., AmeriVet Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) the fact that there is no representation being made that these materials are accurate or complete and that these materials may not be updated or (3) these materials possibly being confidential, are, in each case, not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| Goldman Sachs & Co. LLC | Deutsche Bank Securities | Citigroup |

| Co-Lead Managers and Joint Bookrunners |

| | | |

| AmeriVet Securities | | Drexel Hamilton |

| Co-Managers |

The securities offered by this structural and collateral term sheet (this “Term Sheet”) are described in greater detail in the preliminary prospectus included as part of our Registration Statement (SEC File No. 333-226082) (the “Preliminary Prospectus”) anticipated to be dated September 9, 2019. The Preliminary Prospectus contains material information that is not contained in this Term Sheet (including without limitation a detailed discussion of risks associated with an investment in the offered securities under the heading “Risk Factors” in the Preliminary Prospectus). The Preliminary Prospectus is available upon request from Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., AmeriVet Securities, Inc. or Drexel Hamilton, LLC. Capitalized terms used but not otherwise defined in this Term Sheet have the respective meanings assigned to those terms in the Preliminary Prospectus. This Term Sheet is subject to change.

The Securities May Not Be a Suitable Investment for You

The securities offered by this Term Sheet are not suitable investments for all investors. In particular, you should not purchase any class of securities unless you understand and are able to bear the prepayment, credit, liquidity and market risks associated with that class of securities. For those reasons and for the reasons set forth under the heading “Risk Factors” in the Preliminary Prospectus, the yield to maturity and the aggregate amount and timing of distributions on the offered securities are subject to material variability from period to period and give rise to the potential for significant loss over the life of those securities. The interaction of these factors and their effects are impossible to predict and are likely to change from time to time. As a result, an investment in the offered securities involves substantial risks and uncertainties and should be considered only by sophisticated institutional investors with substantial investment experience with similar types of securities and who have conducted appropriate due diligence on the mortgage loans and the securities. Potential investors are advised and encouraged to review the Preliminary Prospectus in full and to consult with their legal, tax, accounting and other advisors prior to making any investment in the offered securities described in this Term Sheet.

This Term Sheet is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The information contained in this Term Sheet may not pertain to any securities that will actually be sold. The information contained in this Term Sheet may be based on assumptions regarding market conditions and other matters as reflected in this Term Sheet. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and this Term Sheet should not be relied upon for such purposes. We and our affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of this Term Sheet may, from time to time, have long or short positions in, and buy or sell, the securities mentioned in this Term Sheet or derivatives thereof (including options). Information contained in this Term Sheet is current as of the date appearing on this Term Sheet only. Information in this Term Sheet regarding the securities and the mortgage loans backing any securities discussed in this Term Sheet supersedes all prior information regarding such securities and mortgage loans. None of Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., AmeriVet Securities, Inc. or Drexel Hamilton, LLC provides accounting, tax or legal advice.

The issuing entity will be relying upon an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”), contained in Section 3(c)(5) of the Investment Company Act or Rule 3a-7 under the Investment Company Act, although there may be additional exclusions or exemptions available to the issuing entity. The issuing entity is being structured so as not to constitute a “covered fund” for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in “Risk Factors—Other Risks Relating to the Certificates—Legal and Regulatory Provisions Affecting Investors Could Adversely Affect the Liquidity of the Offered Certificates” in the Preliminary Prospectus). See also “Legal Investment” in the Preliminary Prospectus.

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., AmeriVet Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

3

CERTIFICATE SUMMARY

CERTIFICATE SUMMARY OFFERED CERTIFICATES |

Offered Class | | Expected Ratings

(S&P / Fitch / DBRS)(1) | | Approximate Initial

Certificate Balance

or Notional Amount(2) | | Approximate

Initial Credit

Support(3) | | Initial Pass-

Through Rate | | Pass-Through Rate Description | |

Wtd. Avg. Life (Yrs)(4)

| | Principal Window(4) |

| Class A-1 | | AAA(sf) / AAAsf / AAA(sf) | | $ | 11,528,000 | | | 30.000% | | [ ]% | | (5) | | 2.58 | | 10/19 – 06/24 |

| Class A-2 | | AAA(sf) / AAAsf / AAA(sf) | | $ | 117,422,000 | | | 30.000% | | [ ]% | | (5) | | 4.85 | | 06/24 – 09/24 |

| Class A-3 | | AAA(sf) / AAAsf / AAA(sf) | | | (6) | | | 30.000% | | [ ]% | | (5) | | (6) | | (6) |

| Class A-4 | | AAA(sf) / AAAsf / AAA(sf) | | | (6) | | | 30.000% | | [ ]% | | (5) | | (6) | | (6) |

| Class A-AB | | AAA(sf) / AAAsf / AAA(sf) | | $ | 20,849,000 | | | 30.000% | | [ ]% | | (5) | | 7.46 | | 09/24 – 07/29 |

| Class X-A | | AAA(sf) / AAAsf / AAA(sf) | | $ | 823,402,000 | (7) | | N/A | | [ ]% | | Variable IO(8) | | N/A | | N/A |

| Class X-B | | NR / A-sf / A(sf) | | $ | 89,332,000 | (7) | | N/A | | [ ]% | | Variable IO(8) | | N/A | | N/A |

| Class A-S | | AAA(sf) / AAAsf / AAA(sf) | | $ | 98,394,000 | | | 20.500% | | [ ]% | | (5) | | 9.95 | | 09/29 – 09/29 |

| Class B | | AA-(sf) / AA-sf / AA(sf) | | $ | 45,313,000 | | | 16.125% | | [ ]% | | (5) | | 9.95 | | 09/29 – 09/29 |

| Class C | | NR / A-sf / A(low)(sf) | | $ | 44,019,000 | | | 11.875% | | [ ]% | | (5) | | 9.95 | | 09/29 – 09/29 |

| |

| NON-OFFERED CERTIFICATES |

Non-Offered Class | | Expected Ratings

(S&P / Fitch / DBRS)(1) | | Approximate Initial Certificate Balance or Notional Amount(2) | | Approximate Initial Credit Support(3) | | Initial Pass-Through Rate | | Pass-Through Rate Description | |

Wtd. Avg. Life (Yrs)(4)

| | Principal Window(4) |

| Class D | | NR / BBBsf / BBB(high)(sf) | | $ | 28,482,000 | | | 9.125% | | [ ]% | | (5) | | 9.95 | | 09/29 – 09/29 |

| Class X-D(9) | | NR / BBB-sf / BBB(sf) | | $ | 50,491,000 | (7) | | N/A | | [ ]% | | Variable IO(8) | | N/A | | N/A |

| Class E(9) | | NR / BBB-sf / BBB(low)(sf) | | $ | 22,009,000 | | | 7.000% | | [ ]% | | (5) | | 9.95 | | 09/29 – 09/29 |

| Class F-RR(9) | | NR / BB-sf / BB(sf) | | $ | 22,010,000 | | | 4.875% | | [ ]% | | (5) | | 9.95 | | 09/29 – 09/29 |

| Class G-RR(9) | | NR / B-sf / B(high)(sf) | | $ | 10,357,000 | | | 3.875% | | [ ]% | | (5) | | 9.95 | | 09/29 – 09/29 |

| Class H-RR(9) | | NR / NR / NR | | $ | 40,134,720 | | | 0.000% | | [ ]% | | (5) | | 9.95 | | 09/29 – 09/29 |

| Class S(10) | | N/A | | | N/A | | | N/A | | N/A | | N/A | | N/A | | N/A |

| Class R(11) | | N/A | | | N/A | | | N/A | | N/A | | N/A | | N/A | | N/A |

| (1) | It is a condition of issuance that the offered certificates and certain classes of non-offered certificates receive the ratings set forth above. The anticipated ratings of the certificates shown are those of S&P Global Ratings, acting through Standard & Poor’s Financial Services LLC (“S&P”), Fitch Ratings, Inc. (“Fitch”) and DBRS, Inc. (“DBRS” and together with S&P and Fitch, the “Rating Agencies”). Subject to the discussion under “Ratings” in the Preliminary Prospectus, the ratings on the certificates address the likelihood of the timely receipt by holders of all payments of interest to which they are entitled on each distribution date and, except in the case of the interest only certificates, the ultimate receipt by holders of all payments of principal to which they are entitled on or before the applicable rated final distribution date. Certain nationally recognized statistical rating organizations, as defined in Section 3(a)(62) of the Securities Exchange Act of 1934, as amended, that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, or otherwise to rate the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” in the Preliminary Prospectus. The Rating Agencies have informed us that the “sf” designation in their ratings represents an identifier of structured finance product ratings. For additional information about this identifier, prospective investors can go to the related Rating Agency’s website. The depositor and the underwriters have not verified, do not adopt and do not accept responsibility for any statements made by the related Rating Agencies on those websites. Credit ratings referenced throughout this Term Sheet are forward-looking opinions about credit risk and express a rating agency’s opinion about the willingness and ability of an issuer of securities to meet its financial obligations in full and on time. Ratings are not indications of investment merit and are not buy, sell or hold recommendations, a measure of asset value or an indication of the suitability of an investment. |

| (2) | Approximate, subject to a variance of plus or minus 5%. The notional amount of each class of the Class X-A, Class X-B and Class X-D certificates (collectively the “Class X certificates”) is subject to change depending upon the final pricing of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-AB, Class A-S, Class B, Class C, Class D, Class E, Class F-RR, Class G-RR and Class H-RR certificates (collectively, the “principal balance certificates” and, together with the Class X certificates and the Class S certificates, the “Non-VRR certificates”), as follows: (1) if as a result of such pricing the pass-through rate of any class of principal balance certificates whose certificate balance comprises such notional amount is equal to the WAC Rate (defined below), the certificate balance of such class of principal balance certificates may not be part of, and reduce accordingly, such notional amount of the related Class X certificates (or, if as a result of such pricing the pass-through rate of the related Class X certificates is equal to zero, such Class X certificates may not be issued on the closing date), and/or (2) if as a result of such pricing the pass-through rate of any class of principal balance certificates that does not comprise such notional amount of the related Class X certificates is less than the WAC Rate, such class of principal balance certificates may become a part of, and increase accordingly, such notional amount of the related Class X certificates. |

| (3) | The initial credit support percentages set forth for the certificates are approximate and, for the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-AB certificates, are represented in the aggregate. The approximate initial credit support percentages shown in the table above do not take into account the VRR interest. However, losses incurred on the mortgage loans will be allocated between the VRR interest and the principal balance certificates,pro rata in accordance with their respective outstanding balances. See “Credit Risk Retention” and “Description of the Certificates” in the Preliminary Prospectus. |

| (4) | The weighted average life and period during which distributions of principal would be received as set forth in the foregoing table with respect to each class of principal balance certificates are based on the assumptions set forth under “Yield, Prepayment and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus and on the assumptions that there are no prepayments, modifications or losses in respect of the mortgage loans or whole loans and that there are no extensions or forbearances of maturity dates or anticipated repayment dates of the mortgage loans or whole loans. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., AmeriVet Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

4

CERTIFICATE SUMMARY (continued)

| (5) | For each distribution date, the pass-through rates on each class of principal balance certificates will generally be aper annum rate equal to one of (i) a fixed rate, (ii) the weighted average of the net mortgage interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as of their respective due dates in the month preceding the month in which the related distribution date occurs (the “WAC Rate”), (iii) the lesser of a specified pass-through rate and the WAC Rate, or (iv) the WAC Rate less a specified percentage. |

| (6) | The exact initial certificate balances of the Class A-3 and Class A-4 certificates are unknown and will be determined based on the final pricing of those classes of certificates. However, the respective initial certificate balances, weighted average lives and principal windows of the Class A-3 and Class A-4 certificates are expected to be within the applicable ranges reflected in the following chart. The aggregate initial certificate balance of the Class A-3 and Class A-4 certificates is expected to be approximately $575,209,000, subject to a variance of plus or minus 5%. |

Class of Certificates | Expected Range of Initial Certificate Balance | Expected Range of Wtd. Avg. Life (Yrs) | Expected Range of Principal Window |

| Class A-3 | $100,000,000 – $270,000,000 | 9.79 – 9.82 | 07/29 – 07/29 / 07/29 – 08/29 |

| Class A-4 | $305,209,000 – $475,209,000 | 9.86 – 9.88 | 07/29 – 09/29 / 08/29 – 09/29 |

| (7) | The Class X certificates will not have certificate balances and will not be entitled to receive distributions of principal. Interest will accrue on each of the Class X certificates at its respective pass-through rate based upon its respective notional amount. The notional amount of each of the Class X certificates will be equal to the aggregate certificate balances of the related class(es) of certificates (the “related Class X class”) indicated below. |

| Class | | Related Class X Class |

| Class X-A | | Class A-1, Class A-2, Class A-3, Class A-4, Class A-AB and Class A-S certificates |

| Class X-B | | Class B and Class C certificates |

| Class X-D | | Class D and Class E certificates |

| (8) | The pass-through rate of each of the Class X certificates for any distribution date will equal the excess, if any, of (i) the WAC Rate, over (ii) the pass-through rate (or the weighted average of the pass-through rates, if applicable) of the related Class X class(es) for that distribution date, as described in the Preliminary Prospectus. |

| (9) | The initial certificate balance of each of the Class E,Class F-RR, Class G-RR and Class H-RRcertificates, and the initial notional amount of the Class X-D certificates, are subject to change based on final pricing of all certificates and the final determination of the Class F-RR, Class G-RR and Class H-RR certificates (collectively, the “HRR Certificates”) that will be retained by the retaining third-party purchaser and the final determination of the VRR Interest (as defined below) that will be retained as described under “Credit Risk Retention” in the Preliminary Prospectus to satisfy the U.S. risk retention requirements of Goldman Sachs Mortgage Company, as retaining sponsor. For more information regarding the methodology and key inputs and assumptions used to determine the sizing of the HRR Certificates, see “Credit Risk Retention” in the Preliminary Prospectus. |

| (10) | The Class S certificates will not have a certificate balance, notional amount, pass-through rate, rating or rated final distribution date. Excess interest accruing after the related anticipated repayment date on any mortgage loan with an anticipated repayment date will, to the extent collected, be allocated to the Class S certificates and the VRR Interest, as described under “Description of the Certificates—Distributions—Excess Interest” in the Preliminary Prospectus. The Class S certificates will not be entitled to distributions in respect of principal or interest other than excess interest. See “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—ARD Loan” in the Preliminary Prospectus. |

| (11) | The Class R certificates will not have a certificate balance, notional amount, pass-through rate, rating or rated final distribution date. The Class R certificates will represent the residual interests in each of two separate REMICs, as further described in the Preliminary Prospectus. The Class R certificates will not be entitled to distributions of principal or interest. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., AmeriVet Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

5

CERTIFICATE SUMMARY (continued)

VRR INTEREST SUMMARY

Non-Offered Eligible Vertical

Interest(1) | Approximate

Initial VRR Interest

Balance(2) | Approximate

Initial VRR

Interest Rate | VRR Interest

Rate Description | Wtd. Avg. Life

(Yrs)(3) | Principal

Window(3) |

| RR Interest | $19,759,775 | [__]% | (4) | 9.19 | 10/19 – 09/29 |

| Class RR Certificates | $4,940,225 | [__]% | (4) | 9.19 | 10/19 – 09/29 |

| (1) | The Class RR certificates and the RR Interest, which are not offered pursuant to this Term Sheet, collectively comprise the “VRR Interest”. Any information in this Term Sheet concerning the VRR Interest is presented solely to enhance your understanding of the offered certificates. The VRR Interest will constitute an “eligible vertical interest” (as such term is defined in the Credit Risk Retention Rules) and is expected to be acquired and retained by the applicable sponsors as described under “Credit Risk Retention” in the Preliminary Prospectus. The VRR Interest represents the right to receive a specified percentage (to be determined as described in footnote (2) below) of all amounts collected on the mortgage loans (net of all expenses of the issuing entity) that are available for distribution to the Non-VRR certificates and the VRR interest on each Distribution Date, as further described under “Credit Risk Retention” in the Preliminary Prospectus. The owner of the RR Interest is referred to in this Term Sheet as the “RR Interest Owner” and the owners of the Class RR certificates and the RR Interest are referred to in this Term Sheet as the “VRR Interest Owners”. |

| (2) | The initial aggregate VRR Interest balance is subject to change based on final pricing of all certificates and the final determination of the HRR Certificates thatwill be retained by the retaining third-party purchaser and the final determination of the VRR Interest that will be retained as described under “Credit Risk Retention” in the Preliminary Prospectus to satisfy the U.S. risk retention requirements of Goldman Sachs Mortgage Company, as retaining sponsor. If the initial VRR Interest balance is reduced, the initial certificate balance of each class of principal balance certificates (and correspondingly, the initial notional amount of each class of Class X certificates) will be increased on apro rata basis (based on the initial certificate balance set forth in the table above) in an aggregate amount equal to such reduction in the initial VRR Interest balance. If the initial VRR interest balance is increased, the initial certificate balance of each class of principal balance certificates (and correspondingly, the initial notional amount of each class of Class X certificates) will be decreased on apro rata basis (based on the initial certificate balance set forth in the table above) in an aggregate amount equal to such increase in the initial VRR Interest balance. For a further description, see “Credit Risk Retention” in the Preliminary Prospectus. |

| (3) | The weighted average life and period during which distributions of principal would be received as set forth in the foregoing table with respect to the VRR Interest are based on the assumptions set forth under “Yield, Prepayment and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus and on the assumptions that there are no prepayments, modifications or losses in respect of the mortgage loans or whole loans and that there are no extensions or forbearances of maturity dates or anticipated repayment dates of the mortgage loans or whole loans. |

| (4) | Although it does not have a specified pass-through rate (other than for tax reporting purposes), the effective interest rate for the Class RR Certificates and the RR Interest will be aper annumrate equal to the WAC Rate. |

The Class D, Class X-D, Class E, Class F-RR, Class G-RR, Class H-RR, Class S and Class R certificates and the VRR Interest are not offered by this Term Sheet. Any information in this Term Sheet concerning such non-offered certificates and the VRR Interest is presented solely to enhance your understanding of the offered certificates.

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., AmeriVet Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

6

MORTGAGE POOL CHARACTERISTICS

| Mortgage Pool Characteristics(1) |

| Initial Pool Balance(2) | $1,060,426,720 |

| Number of Mortgage Loans | 36 |

| Number of Mortgaged Properties | 94 |

| Average Cut-off Date Mortgage Loan Balance | $29,456,298 |

| Weighted Average Mortgage Interest Rate | 3.75997% |

| Weighted Average Remaining Term to Maturity Date/ARD (months)(3) | 112 |

| Weighted Average Remaining Amortization Term (months) | 344 |

| Weighted Average Cut-off Date LTV Ratio(4) | 58.8% |

| Weighted Average Maturity Date/ARD LTV Ratio(3)(5) | 56.6% |

| Weighted Average Underwritten Debt Service Coverage Ratio(6) | 2.66x |

| Weighted Average Debt Yield on Underwritten NOI(7) | 11.1% |

| % of Mortgage Loans with Mezzanine Debt(8) | 13.6% |

| % of Mortgage Loans with Subordinate Debt(9) | 19.4% |

| % of Mortgage Loans with Preferred Equity | 6.1% |

| % of Mortgage Loans with Single Tenants(10) | 33.8% |

| (1) | With respect to 17 mortgage loans, representing approximately 63.5% of the initial pool balance, with one or more relatedpari passu companion loan(s) as set forth in the “Whole Loan Summary” table below, the loan-to-value ratio, debt service coverage ratio, debt yield and balance per SF, unit or room calculations presented in this Term Sheet include the relatedpari passu companion loan(s) unless otherwise indicated. With respect to five mortgage loans, representing approximately 19.4% of the initial pool balance, with one or more related subordinate companion loan(s) as set forth in the “Whole Loan Summary” table below, the loan-to-value ratio, debt service coverage ratio, debt yield and balance per SF, pads or unit calculations presented in this Term Sheet are calculated without regard to the related subordinate companion loan(s). Other than as specifically noted, the loan-to-value ratio, debt service coverage ratio, debt yield and mortgage loan rate information for each mortgage loan is presented in this Term Sheet without regard to any other indebtedness (whether or not secured by the related mortgaged property, ownership interests in the related borrower or otherwise) that currently exists or that may be incurred by the related borrower or its owners in the future, in order to present statistics for the related mortgage loan without combination with the other indebtedness. |

| (2) | Subject to a permitted variance of plus or minus 5%. |

| (3) | One mortgage loan, representing approximately 6.2% of the initial pool balance has an anticipated repayment date and unless otherwise indicated is presented as if it matured on its anticipated repayment date. |

| (4) | Unless otherwise indicated, the Cut-off Date LTV Ratio is calculated utilizing the “as-is” appraised value (which in certain cases may reflect a portfolio premium valuation). With respect to two mortgage loans (6.6% of the initial pool balance) the Cut-off Date LTV Ratio was calculated based upon a valuation other than an “as-is” value of each related mortgaged property. The weighted average Cut-off Date LTV Ratio for the mortgage pool without making any adjustments is 59.1%. |

| (5) | Unless otherwise indicated, the Maturity Date/ARD LTV Ratio is calculated utilizing the “as-is” appraised value. With respect to two mortgage loans (6.6% of the initial pool balance) the respective Maturity Date/ARD LTV Ratios were calculated using an “as stabilized” or “prospective as stabilized” appraised value assuming certain reserves were pre-funded instead of the related “as-is” appraised value. The weighted average Maturity Date/ARD LTV Ratio for the mortgage pool without making such adjustments is 56.9%. See “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus for a description of Maturity Date/ARD LTV Ratio. |

| (6) | Unless otherwise indicated, the Underwritten Debt Service Coverage Ratio for each mortgage loan is calculated by dividing the Underwritten Net Cash Flow from the related mortgaged property or mortgaged properties by the annual debt service for such mortgage loan, as adjusted in the case of mortgage loans with a partial interest only period by using the first 12 amortizing payments due instead of the actual interest only payment. See “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus for a description of Underwritten Debt Service Coverage Ratio. |

| (7) | Unless otherwise indicated, the Debt Yield on Underwritten NOI for each mortgage loan is the related mortgaged property’s Underwritten NOI divided by the Cut-off Date Balance of such mortgage loan, and the Debt Yield on Underwritten NCF for each mortgage loan is the related mortgaged property’s Underwritten NCF divided by the Cut-off Date Balance of such mortgage loan. |

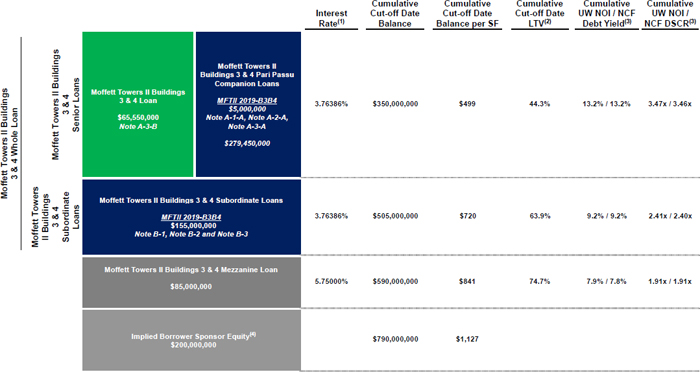

| (8) | The Moffett Towers II Buildings 3 & 4, Woodlands Mall and Cross Bay Plaza mortgage loans have additional existing subordinate mezzanine loans held by certain limited liability companies owned by certain individuals who also own an indirect interest in the borrowers.See “Description of the Mortgage Pool—The Whole Loans” and “Description of the Mortgage Pool—Additional Indebtedness” in the Preliminary Prospectus. |

| (9) | Each of theMoffett Towers II Buildings 3 & 4, Woodlands Mall, Diamondback Industrial Portfolio 1, 30 Hudson Yards and Grand Canal Shoppesmortgage loans have subordinate companion loans that are generally subordinate in right of payment to the respective related mortgage loans (the “Moffett Towers II Buildings 3 & 4 Subordinate Companion Loans,” the “Woodlands Mall Subordinate Companion Loan”, the “Diamondback Industrial Portfolio 1 Subordinate Companion Loan” the “30 Hudson Yards Subordinate Companion Loans” and the “Grand Canal Shoppes Subordinate Companion Loans”). TheMoffett Towers II Buildings 3 & 4Subordinate Companion Loans have an aggregate outstanding principal balance of $155,000,000 as of the Cut-off Date, and are currently held in the MFTII 2019-B3B4 securitization transaction. The Woodlands Mall Subordinate Companion Loan has an outstanding principal balance of $177,400,000 as of the Cut-off Date, and is currently held in the Benchmark 2019-B12 securitization transaction “loan specific certificates”. The Diamondback Industrial Portfolio 1 Subordinate Companion Loan has an outstanding principal balance of $60,250,000 as of the Cut-off Date, and is currently held in the GSMS 2019-GC40 securitization transaction “loan specific certificates”. The30 Hudson YardsSubordinate Companion Loans have an aggregate outstanding principal balance of $310,000,000 as of the Cut-off Date, and are currently held in the Hudson Yards 2019-30HY securitization transaction. The Grand Canal Shoppes Subordinate Companion Loans have an aggregate outstanding principal balance of $215,000,000 as of the Cut-off Date, and are currently held by an unrelated third party investor. See “Description of the Mortgage Pool—The Whole Loans” and “Description of the Mortgage Pool—Additional Indebtedness” in the Preliminary Prospectus. |

| (10) | Excludes mortgage loans that are secured by multiple properties with multiple tenants. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., AmeriVet Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

7

KEY FEATURES OF THE CERTIFICATES

| Co-Lead Managers and Joint Bookrunners: | Goldman Sachs & Co. LLC Citigroup Global Markets Inc. Deutsche Bank Securities Inc. |

| | |

| Co-Managers: | AmeriVet Securities, Inc. Drexel Hamilton, LLC |

| | |

| Depositor: | GS Mortgage Securities Corporation II |

| | |

| Initial Pool Balance: | $1,060,426,720 |

| | |

| Master Servicer: | Midland Loan Services, a Division of PNC Bank, National Association |

| | |

| Special Servicer: | Midland Loan Services, a Division of PNC Bank, National Association |

| | |

| Certificate Administrator: | Wells Fargo Bank, National Association |

| | |

| Trustee: | Wells Fargo Bank, National Association |

| | |

| Operating Advisor: | Park Bridge Lender Services LLC |

| | |

| Asset Representations Reviewer: | Park Bridge Lender Services LLC |

| | |

| U.S. Credit Risk Retention: | For a discussion of the manner by which Goldman Sachs Mortgage Company, as retaining sponsor, intends to satisfy the credit risk requirements of the Credit Risk Retention Rules, see “Credit Risk Retention” in the Preliminary Prospectus. |

| | |

| Pricing: | Week of September 9, 2019 |

| | |

| Closing Date: | September 27, 2019 |

| | |

| Cut-off Date: | For each mortgage loan, the related due date for such mortgage loan in September 2019 (or, in the case of any mortgage loan that has its first due date in October 2019, the date that would have been its due date in September 2019 under the terms of that mortgage loan if a monthly payment were scheduled to be due in that month). |

| | |

| Determination Date: | The 6th day of each month or next business day, commencing in October 2019 |

| | |

| Distribution Date: | The 4th business day after the Determination Date, commencing in October 2019 |

| | |

| Interest Accrual: | Preceding calendar month |

| | |

| ERISA Eligible: | The offered certificates are expected to be ERISA eligible |

| | |

| SMMEA Eligible: | No |

| | |

| Payment Structure: | Sequential Pay |

| | |

| Day Count: | 30/360 |

| | |

| Tax Structure: | REMIC |

| | |

| Rated Final Distribution Date: | September 2052 |

| | |

| Cleanup Call: | 1.0% |

| | |

| Minimum Denominations: | $10,000 minimum for the offered certificates (except with respect to each class of Class X certificates: $1,000,000 minimum); integral multiples of $1 thereafter for all the offered certificates |

| | |

| Delivery: | Book-entry through DTC |

| | |

| Bond Information: | Cash flows are expected to be modeled by TREPP, INTEX and BLOOMBERG |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., AmeriVet Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

8

TRANSACTION HIGHLIGHTS

| ■ | $912,734,000 (Approximate) New-Issue Multi-Borrower CMBS: |

| — | Overview: The mortgage pool consists of 36 fixed-rate commercial mortgage loans that have an aggregate Cut-off Date Balance of $1,060,426,720 (the “Initial Pool Balance”), have an average mortgage loan Cut-off Date Balance of $29,456,298 and are secured by 94 mortgaged properties located throughout 22 states |

| — | LTV: 58.8% weighted average Cut-off Date LTV Ratio |

| — | DSCR: 2.66x weighted average Underwritten NCF Debt Service Coverage Ratio |

| — | Debt Yield: 11.1% weighted average Debt Yield on Underwritten NOI |

| — | Credit Support: 30.000% credit support to Class A-1 / A-2 / A-3 / A-4 / A-AB |

| ■ | Loan Structural Features: |

| — | Amortization:18.3% of the mortgage loans by Initial Pool Balance have scheduled amortization as follows: |

| – | 8.8% of the mortgage loans by Initial Pool Balance have scheduled amortization following a partial interest only period with a balloon payment due at maturity |

| – | 9.5% of the mortgage loans by Initial Pool Balance have scheduled amortization for the entire term with a balloon payment due at maturity or the anticipated repayment date, as applicable |

| — | Hard Lockboxes: 79.4% of the mortgage loans by Initial Pool Balance have a Hard Lockbox in place |

| — | Cash Traps: 100.0% of the mortgage loans by Initial Pool Balance have cash traps triggered by certain declines in cash flow, all at levels equal to or greater than a 1.10x coverage, that fund an excess cash flow reserve |

| — | Reserves: The mortgage loans require amounts to be escrowed for reserves as follows: |

| – | Real Estate Taxes: 22 mortgage loans representing 53.9% of the Initial Pool Balance |

| – | Insurance: 15 mortgage loans representing 28.4% of the Initial Pool Balance |

| – | Replacement Reserves (Including FF&E Reserves): 25 mortgage loans representing 58.1% of the Initial Pool Balance |

| – | Tenant Improvements / Leasing Commissions: 18 mortgage loans representing 58.4% of the portion of the Initial Pool Balance that is secured by retail, office, mixed use and industrial properties only |

| — | Predominantly Defeasance: 66.3% of the mortgage loans by Initial Pool Balance permit defeasance after an initial lockout period |

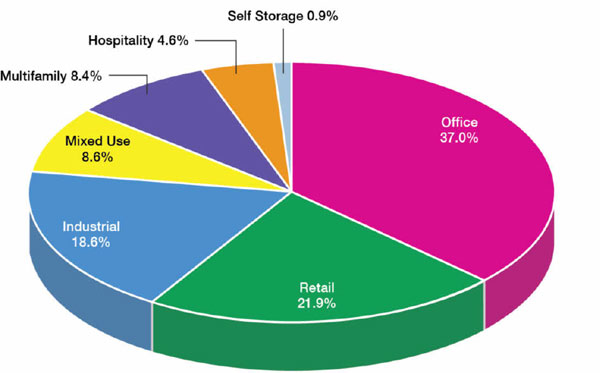

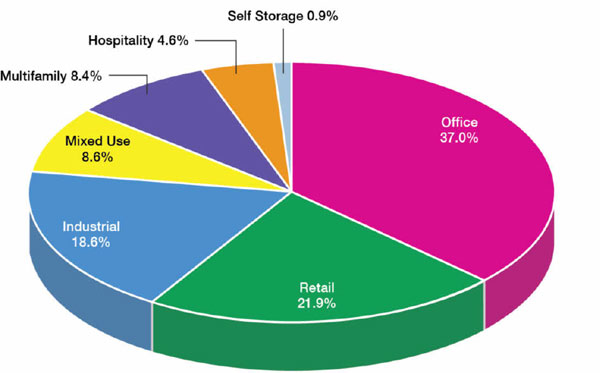

| ■ | Multiple-Asset Types > 5.0% of the Initial Pool Balance: |

| — | Office: 37.0% of the mortgaged properties by allocated Initial Pool Balance are office properties |

| — | Retail: 21.9% of the mortgaged properties by allocated Initial Pool Balance are retail properties (11.5% are anchored retail properties) |

| — | Industrial: 18.6% of the mortgaged properties by allocated Initial Pool Balance are industrial properties |

| — | Mixed Use: 8.6% of the mortgaged properties by allocated Initial Pool Balance are mixed use properties |

| — | Multifamily: 8.4% of the mortgaged properties by allocated Initial Pool Balance are multifamily properties |

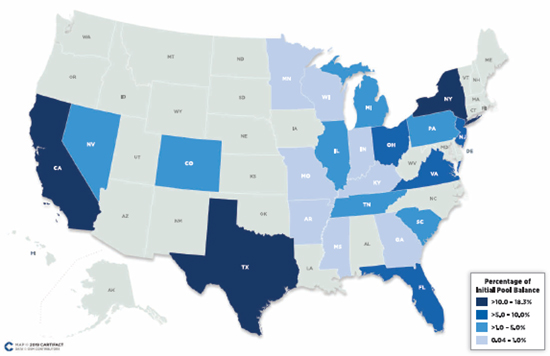

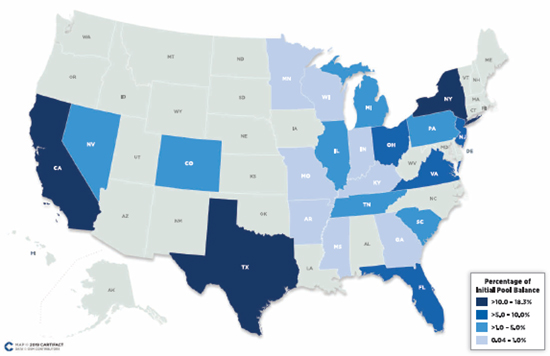

| ■ | Geographic Diversity: The 94 mortgaged properties are located throughout 22 states with three states having greater than 10.0% of the allocated Initial Pool Balance: Texas (18.3%), New York (17.3%) and California (16.0%). |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., AmeriVet Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

9

Mortgage Loans by Mortgage Loan Seller

| Mortgage Loan Seller | | Mortgage Loans | | Mortgaged Properties | | Aggregate Cut-off Date Balance | | % of Initial Pool Balance |

| Goldman Sachs Mortgage Company | | 21 | | | 73 | | | $651,650,000 | | | 61.5 | % |

| Citi Real Estate Funding Inc. | | 10 | | | 11 | | | 212,095,000 | | | 20.0 | |

| German American Capital Corporation | | 5 | | | 10 | | | 196,681,720 | | | 18.5 | |

| Total | | 36 | | | 94 | | | $1,060,426,720 | | | 100.0 | % |

Ten Largest Mortgage Loans

Mortgage Loan Name | | Cut-off Date Balance | | % of Initial Pool Balance | | Property

Type | | Property Size

SF / Unit | | Loan

Purpose | | UW NCF

DSCR | | UW

NOI Debt

Yield | | Cut-off Date

LTV Ratio |

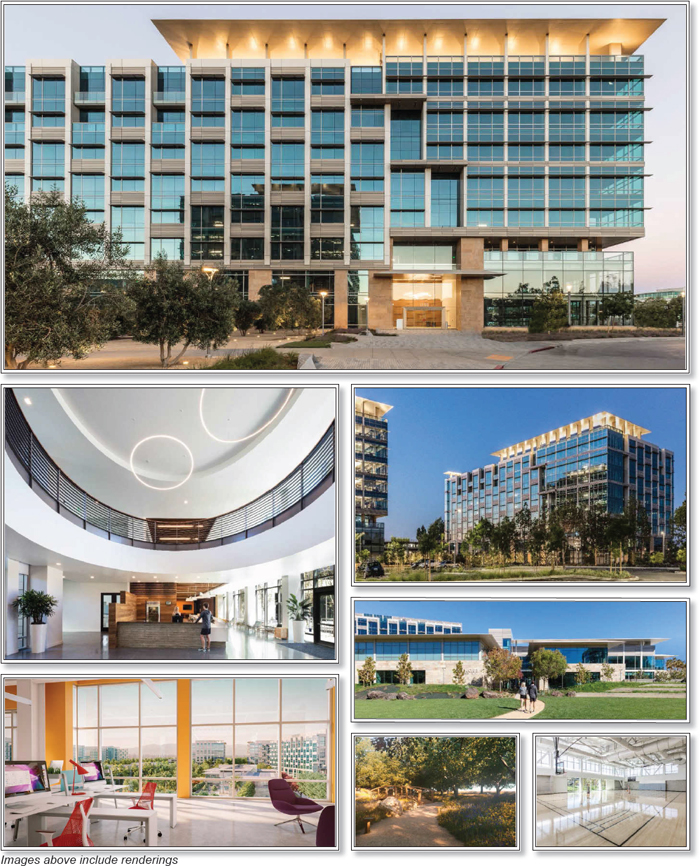

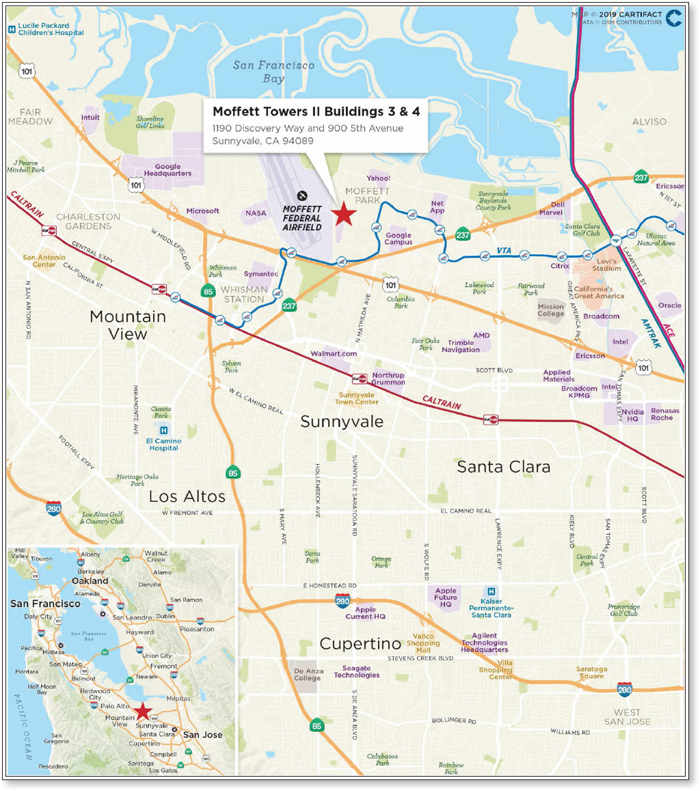

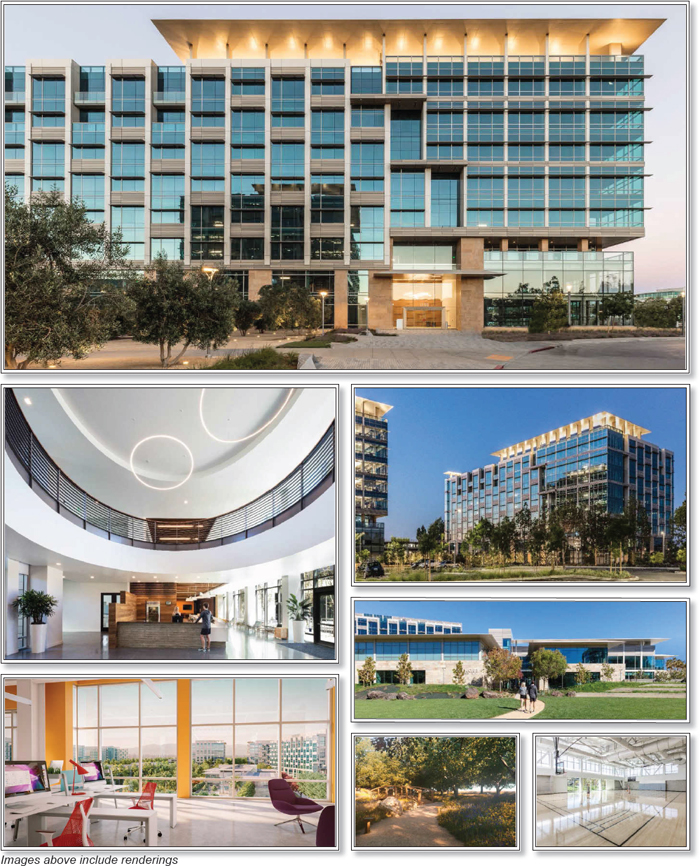

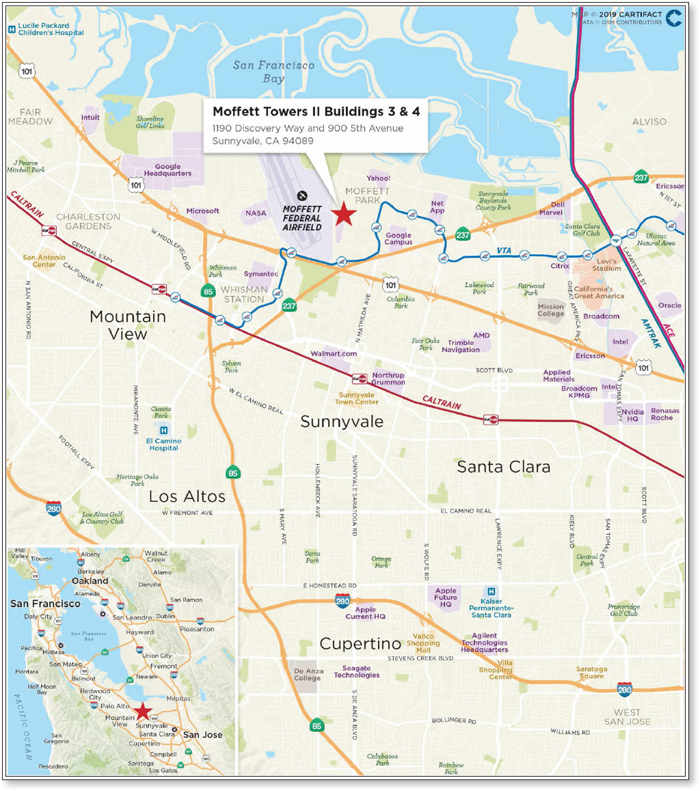

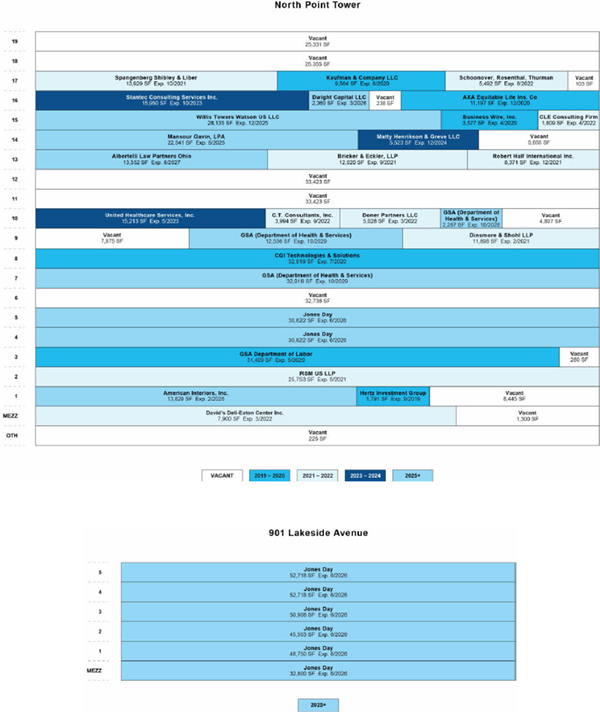

| Moffett Towers II Buildings 3 & 4 | | $65,550,000 | | 6.2 | % | | Office | | 701,266 | | | Refinance | | 3.46 | x | | 13.2 | % | | 44.3 | % |

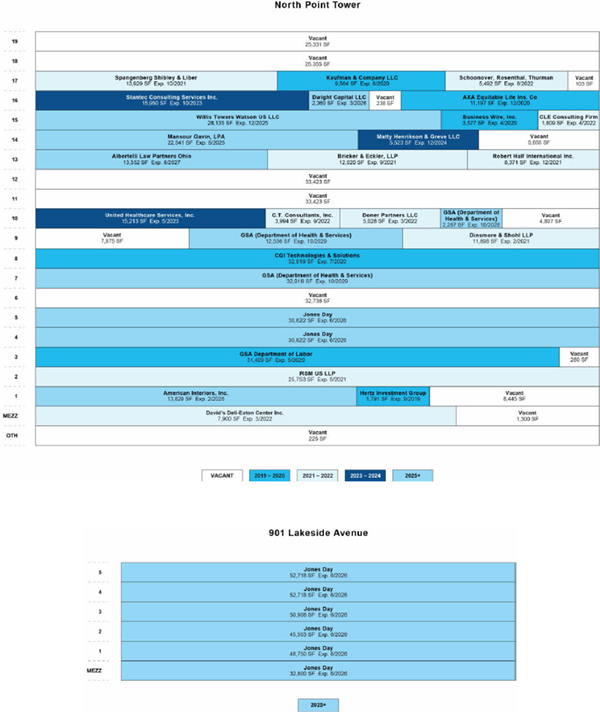

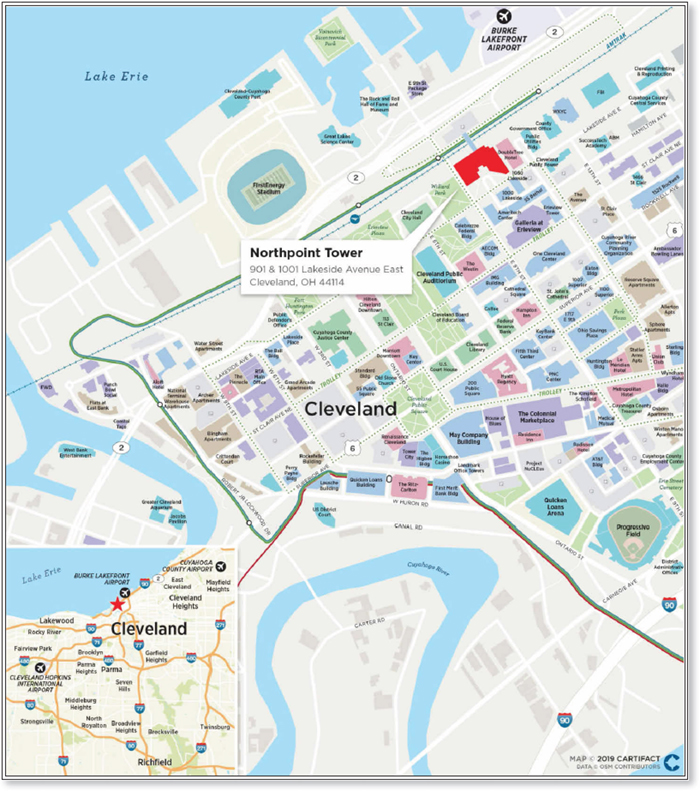

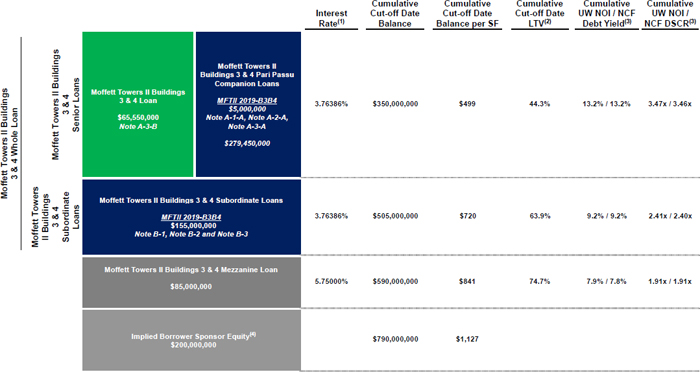

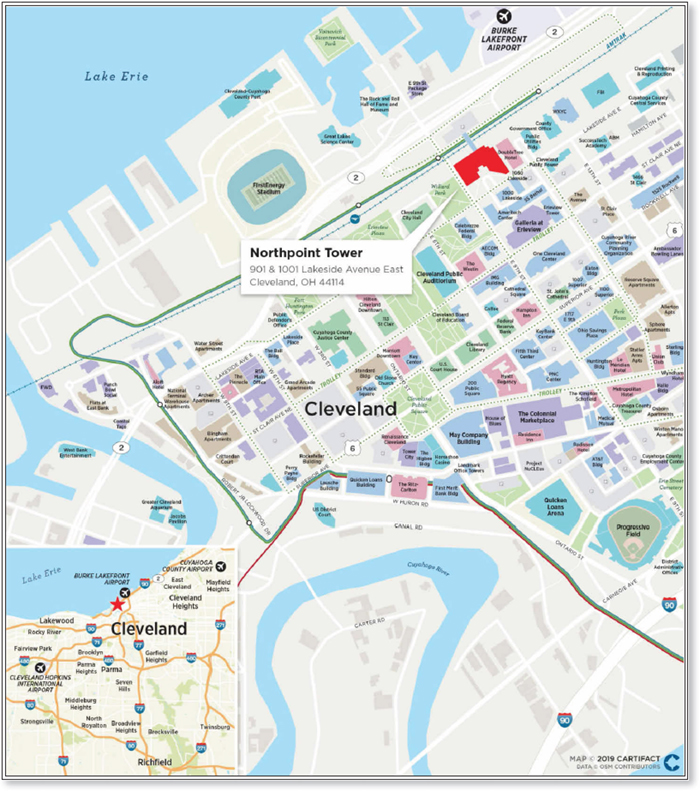

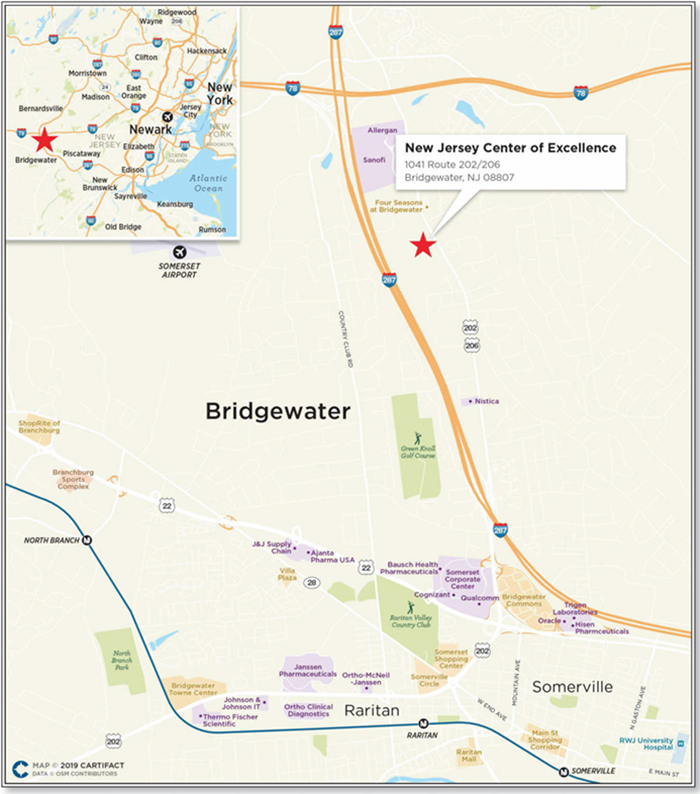

| Northpoint Tower | | 65,500,000 | | 6.2 | | | Office | | 873,335 | | | Refinance | | 3.31 | x | | 11.3 | % | | 62.3 | % |

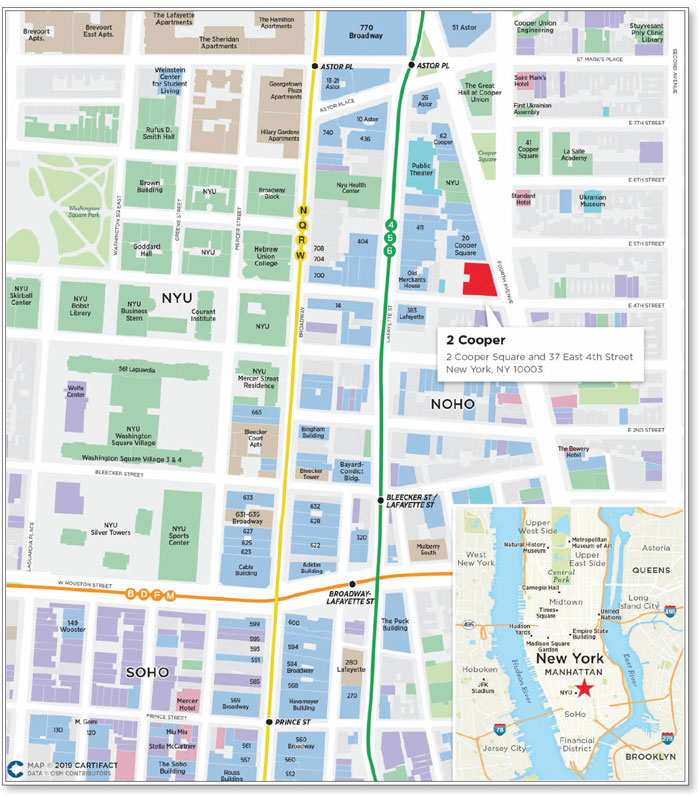

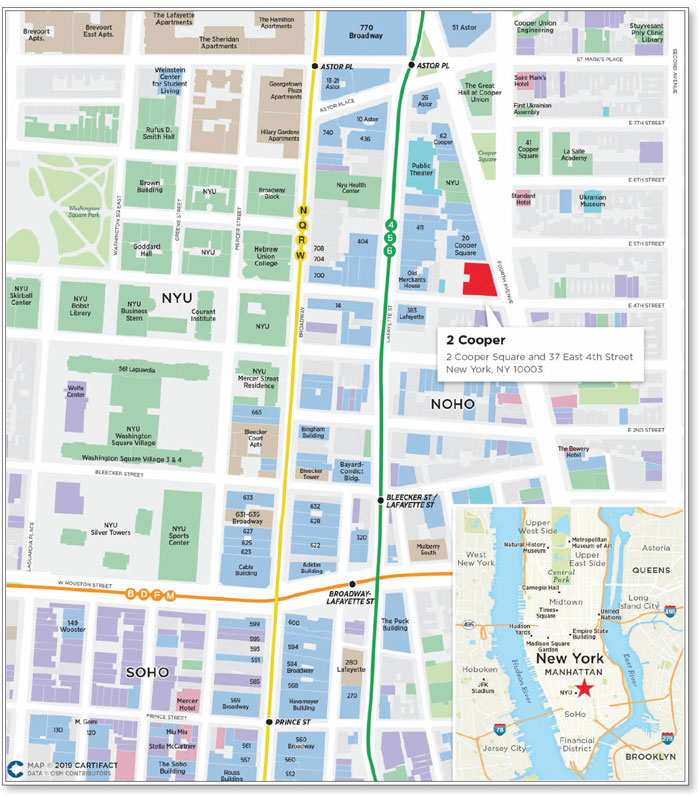

| 2 Cooper | | 65,000,000 | | 6.1 | | | Multifamily | | 143 | | | Acquisition | | 2.28 | x | | 9.5 | % | | 51.3 | % |

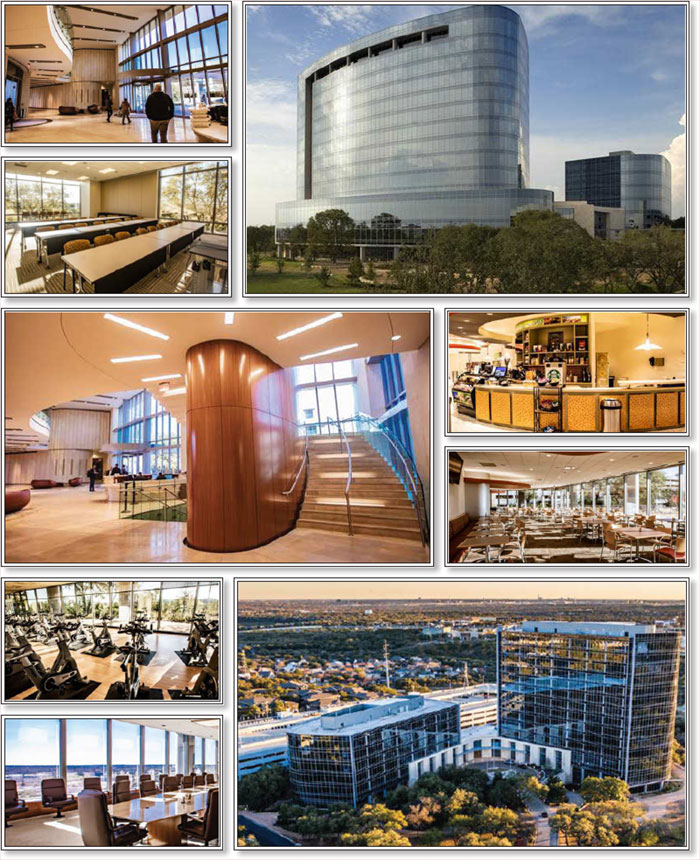

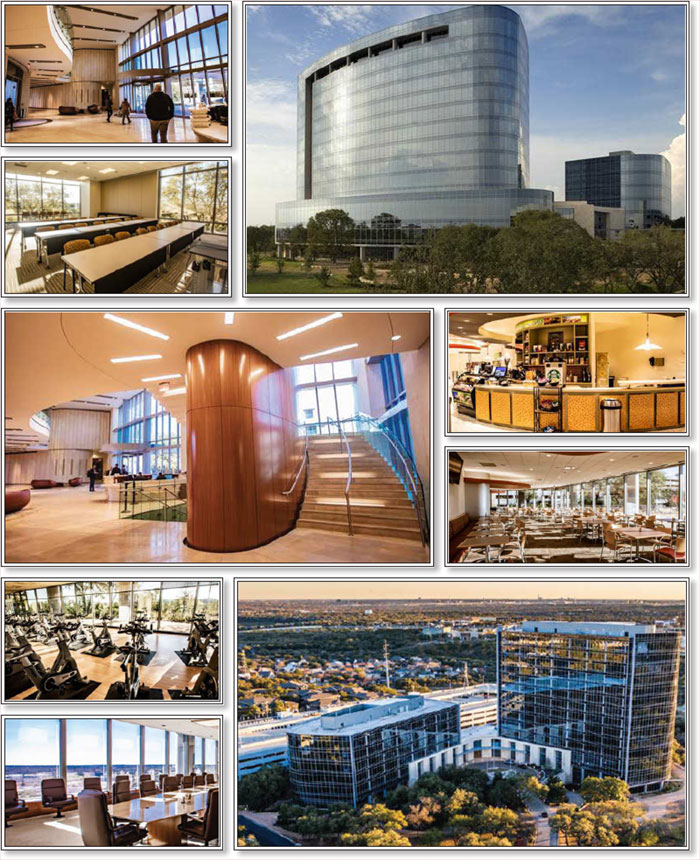

| 19100 Ridgewood | | 55,000,000 | | 5.2 | | | Office | | 618,017 | | | Acquisition | | 2.42 | x | | 9.9 | % | | 69.8 | % |

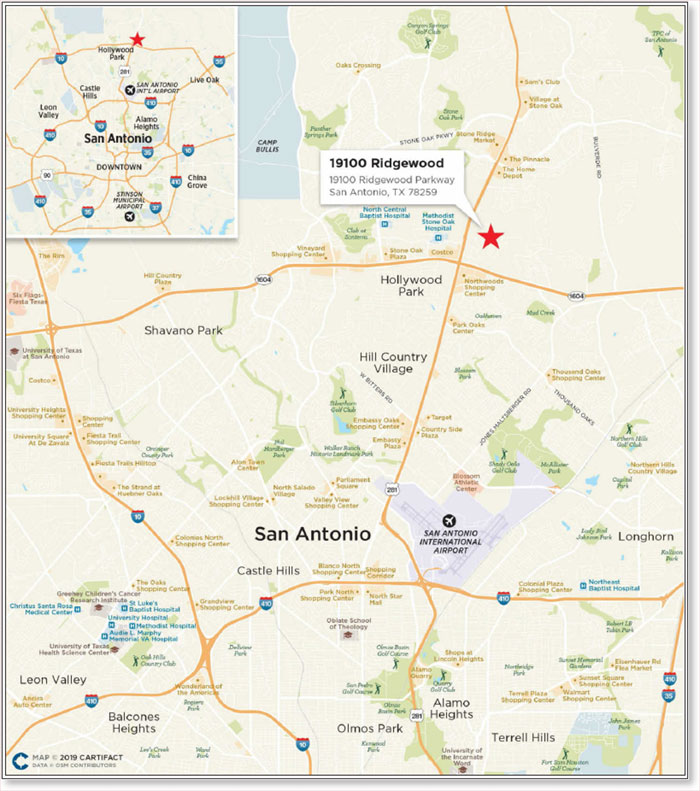

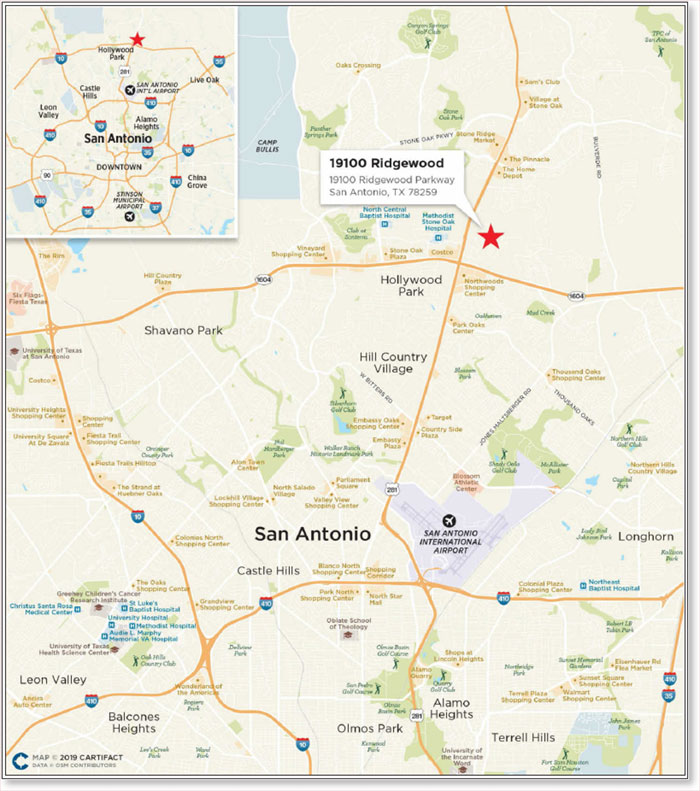

| New Jersey Center of Excellence | | 54,720,000 | | 5.2 | | | Mixed Use | | 785,598 | | | Acquisition | | 3.24 | x | | 13.6 | % | | 59.6 | % |

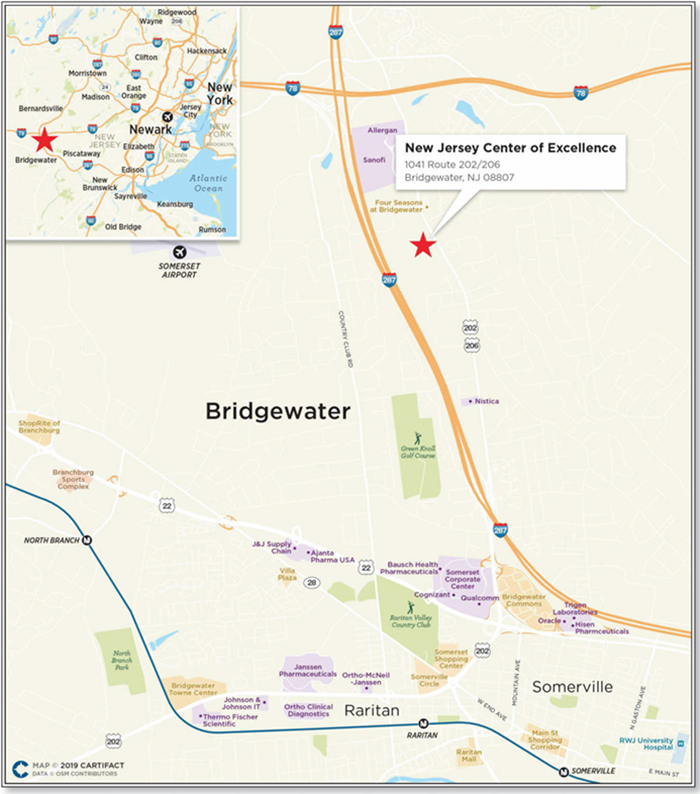

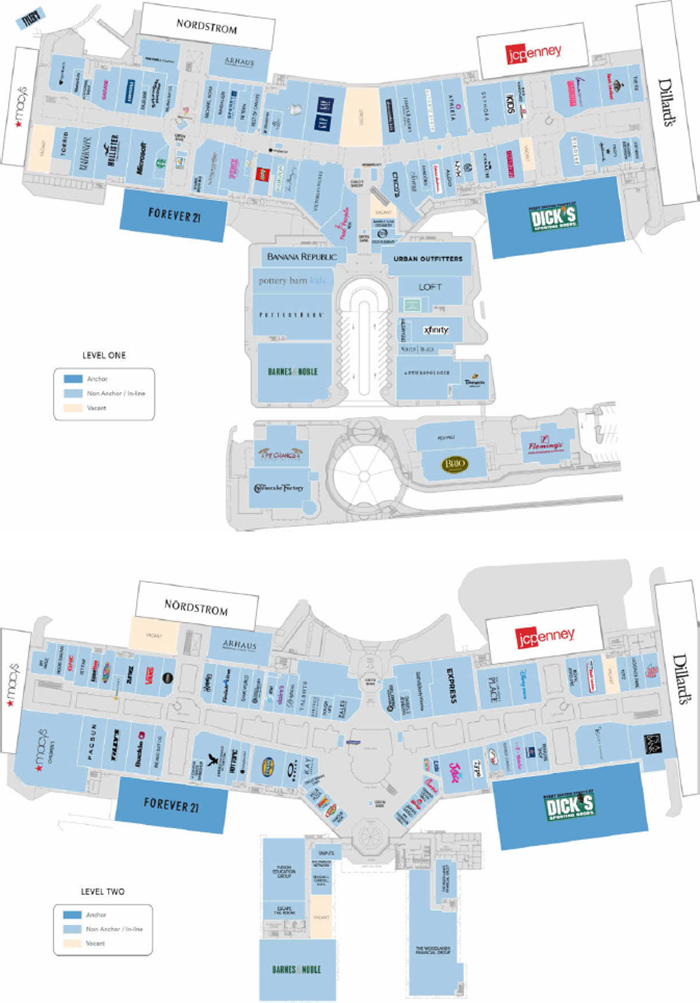

| Woodlands Mall | | 50,000,000 | | 4.7 | | | Retail | | 758,231 | | | Refinance | | 3.95 | x | | 17.4 | % | | 26.0 | % |

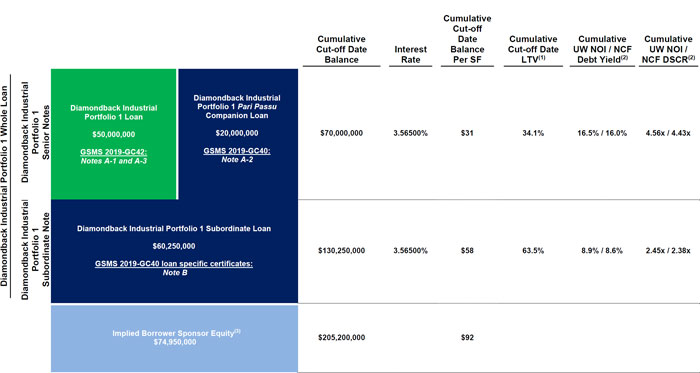

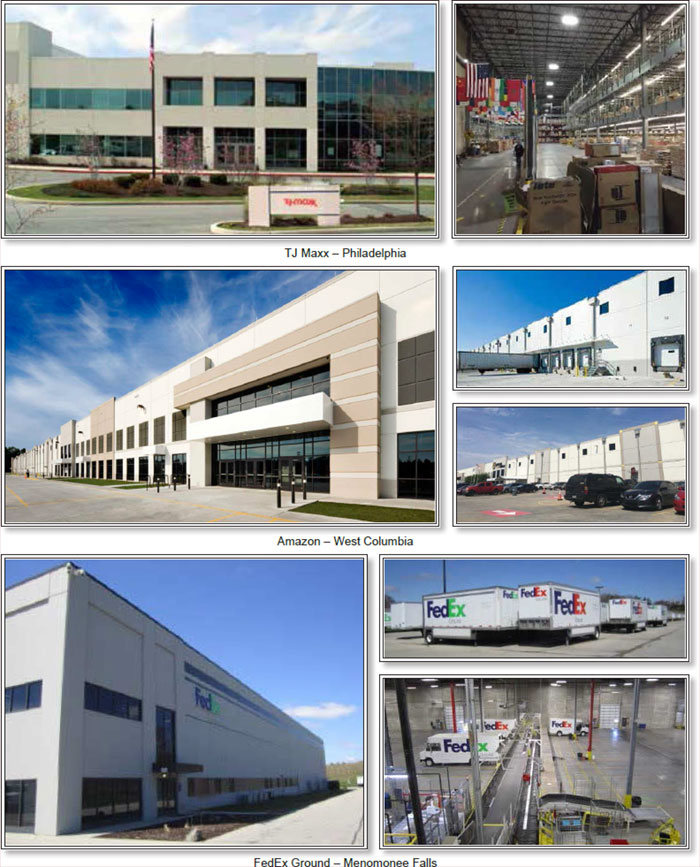

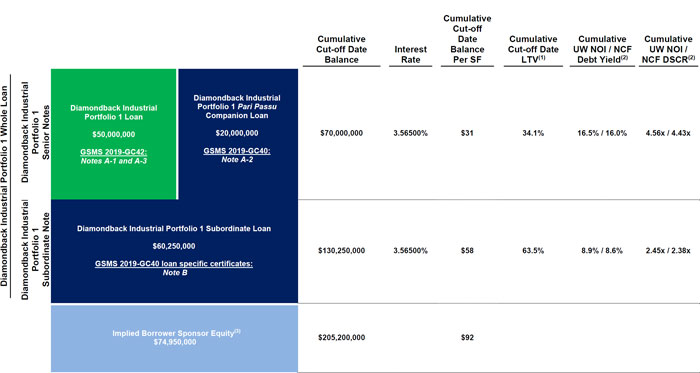

| Diamondback Industrial Portfolio 1 | | 50,000,000 | | 4.7 | | | Industrial | | 2,234,598 | | | Acquisition | | 4.43 | x | | 16.5 | % | | 34.1 | % |

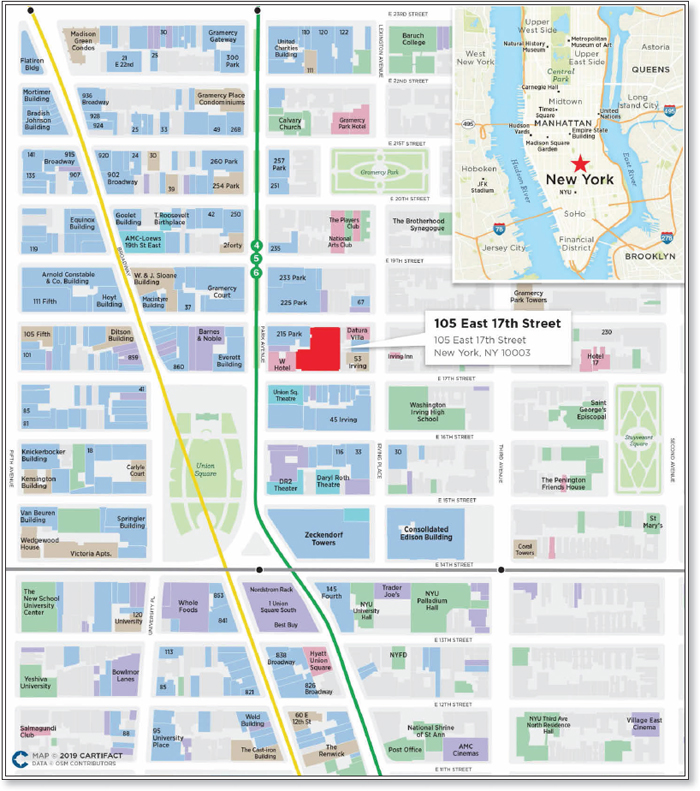

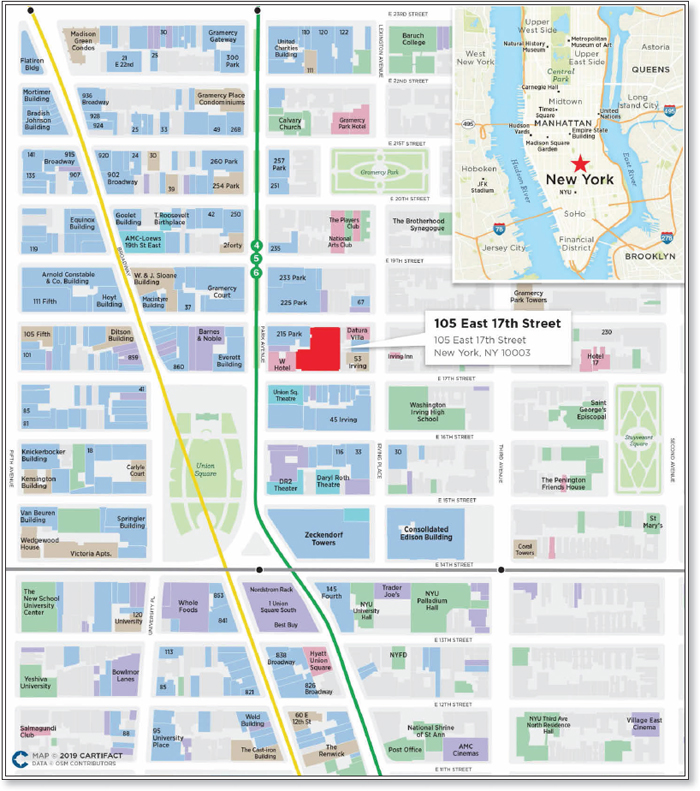

| 105 East 17th Street | | 49,500,000 | | 4.7 | | | Office | | 125,000 | | | Refinance | | 2.02 | x | | 6.5 | % | | 73.3 | % |

| USAA Office Portfolio | | 45,000,000 | | 4.2 | | | Office | | 881,490 | | | Acquisition | | 2.84 | x | | 9.8 | % | | 63.8 | % |

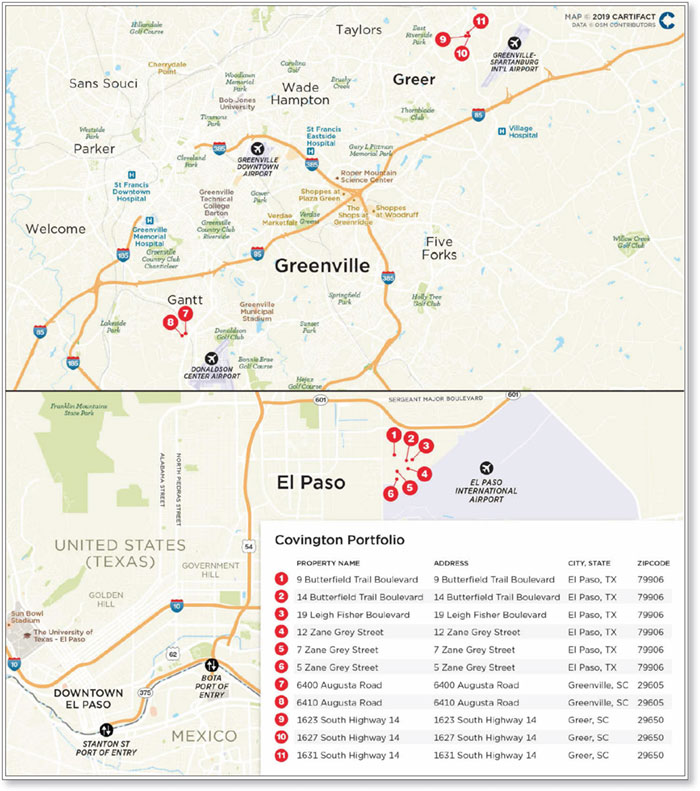

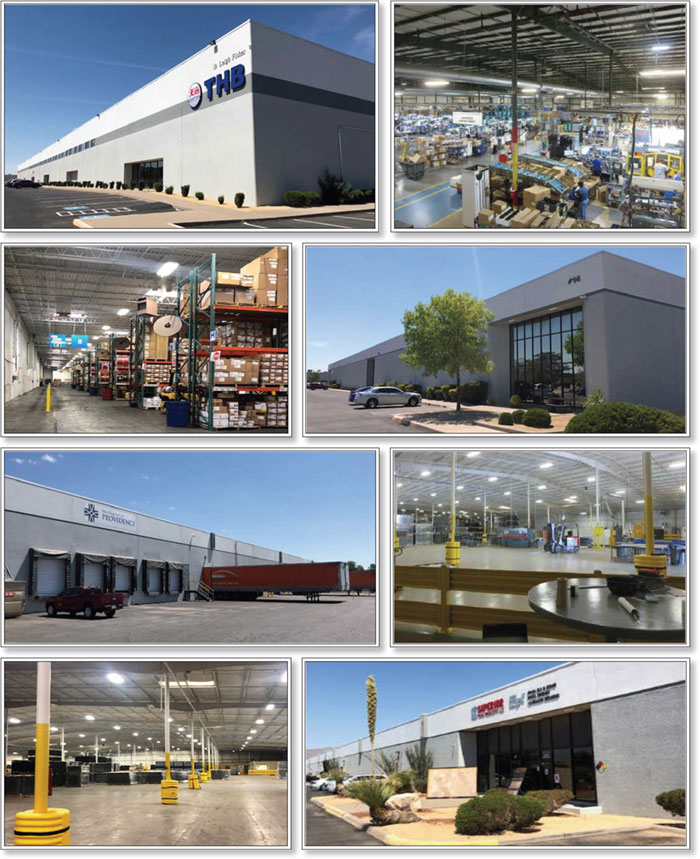

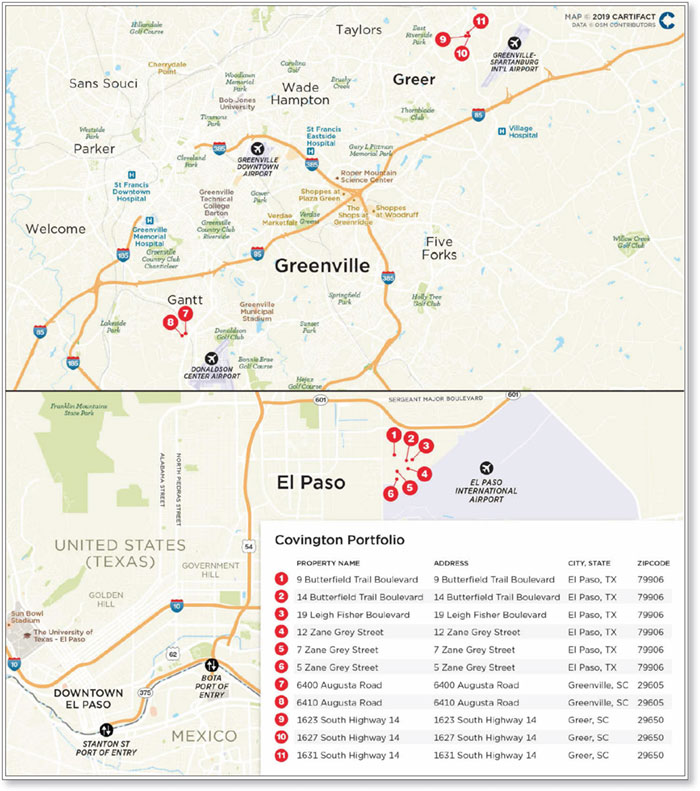

| Covington Portfolio | | 36,200,000 | | 3.4 | | | Industrial | | 1,206,288 | | | Refinance | | 1.43 | x | | 9.7 | % | | 70.0 | % |

| Top 10 Total / Wtd. Avg. | | $536,470,000 | | 50.6 | % | | | | | | | | | 2.98 | x | | 11.8 | % | | 54.9 | % |

| Remaining Total / Wtd. Avg. | | 523,956,720 | | 49.4 | | | | | | | | | | 2.33 | x | | 10.3 | % | | 62.9 | % |

| Total / Wtd. Avg. | | $1,060,426,720 | | 100.0 | % | | | | | | | | | 2.66 | x | | 11.1 | % | | 58.8 | % |

| | | | | | | | | | | | | | | | | | | | | | |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., AmeriVet Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

10

| COLLATERAL OVERVIEW (continued) |

Whole Loan Summary

Mortgage Loan Name | Mortgage Loan Cut-off Date Balance | % of Initial Pool Balance | Number ofPari Passu Companion Loans(1) | Aggregate Pari Passu Companion Loan Cut-off Date Balance | Aggregate Subordinate Companion Loan Cut-off Date Balance(1) | Whole Loan Cut-off Date Balance | Controlling Pooling & Servicing Agreement (“Controlling PSA”) | Master Servicer | Special Servicer |

| Moffett Towers II Buildings 3 & 4(2) | $65,550,000 | 6.2% | 10 | $284,450,000 | $155,000,000 | $505,000,000 | MFTII 2019-B3B4 | Keybank | Situs |

| Northpoint Tower | 65,500,000 | 6.2% | 1 | $25,000,000 | - | $90,500,000 | GSMS 2019-GC42 | Midland | Midland |

| 19100 Ridgewood | 55,000,000 | 5.2% | 2 | $85,000,000 | - | $140,000,000 | GSMS 2019-GC42 | Midland | Midland |

| New Jersey Center of Excellence | 54,720,000 | 5.2% | 1 | $36,480,000 | - | $91,200,000 | GSMS 2019-GC42 | Midland | Midland |

| Woodlands Mall(3) | 50,000,000 | 4.7% | 7 | $197,600,000 | $177,400,000 | $425,000,000 | BMARK 2019-B12 | Midland | Pac Life |

| Diamondback Industrial Portfolio 1(4) | 50,000,000 | 4.7% | 1 | $20,000,000 | $60,250,000 | $130,250,000 | GSMS 2019-GC40 | Midland | Midland |

| 105 East 17th Street(5) | 49,500,000 | 4.7% | 1 | $60,500,000 | - | $110,000,000 | GSMS 2019-GC42 | Midland | Midland |

| USAA Office Portfolio | 45,000,000 | 4.2% | 4 | $197,400,000 | - | $242,400,000 | CGCMT 2019-GC41 | Midland | Rialto |

| U.S. Industrial Portfolio V | 32,800,000 | 3.1% | 2 | $97,558,000 | - | $130,358,000 | CGCMT 2019-GC41 | Midland | Rialto |

| Powered Shell Portfolio - Manassas | 32,250,000 | 3.0% | 1 | $51,550,000 | - | $83,800,000 | CGCMT 2019-GC41 | Midland | Midland |

| Millennium Park Plaza | 30,000,000 | 2.8% | 3 | $180,000,000 | - | $210,000,000 | CGCMT 2019-GC41 | Midland | Rialto |

| Pharr Town Center | 30,000,000 | 2.8% | 1 | $40,000,000 | - | $70,000,000 | CD 2019-CD8 | Midland | Midland |

| Powered Shell Portfolio – Ashburn | 29,000,000 | 2.7% | 1 | $40,800,000 | - | $69,800,000 | CGCMT 2019-GC41 | Midland | Rialto |

| 222 Kearny Street | 23,750,000 | 2.2% | 1 | $23,750,000 | - | $47,500,000 | GSMS 2019-GC42 | Midland | Midland |

| 30 Hudson Yards | 20,000,000 | 1.9% | 28 | $1,100,000,000 | $310,000,000 | $1,430,000,000 | Hudson Yards 2019-HY | Wells | Situs |

| Grand Canal Shoppes(6) | 20,000,000 | 1.9% | 22 | $740,000,000 | $215,000,000 | $975,000,000 | MSC 2019-H7 | Midland | LNR |

| Midland Office Portfolio(7) | 20,000,000 | 1.9% | 1 | $49,500,000 | - | $69,500,000 | GSMS 2019-GC42 | Midland | Midland |

| (1) | Each companion loan ispari passu in right of payment to its related mortgage loan. Each subordinate companion loan is subordinate in right of payment to its related mortgage loan. |

| (2) | The initial controlling holder for the Moffett Towers II Buildings 3 & 4 mortgage loan is PMIT Master Fund, LLC, as the Moffett Towers II Buildings 3 & 4 controlling class representative. Pursuant to the related co-lender agreement, following the occurrence (and during the continuance) of a Moffett Towers II Buildings 3 & 4 control appraisal period, (i) the holder of note A-1-B will be the controlling holder for the Moffett Towers II Buildings 3 & 4 Whole Loan and (ii) the Moffett Towers II Buildings 3 & 4 Whole Loan will be serviced by the master servicer and, if necessary, the special servicer under the trust and servicing agreement for the securitization that holds note A-1-A. Note A-1-B was included in the BBCMS 2019-C4 securitization, and therefore, the controlling class representative (or equivalent party) under the BBCMS 2019-C4 securitization is expected to exercise the rights of the controlling holder with respect to the Moffett Towers II Buildings 3 & 4 mortgage loan, and the Controlling PSA is expected to remain MFTII 209-B3B4. |

| (3) | The initial controlling holder for the Woodlands Mall mortgage loan is Pacific Life Insurance Company, as the Woodlands Mall controlling class representative. Pursuant to the related co-lender agreement, following the occurrence (and during the continuance) of a Woodlands Mall control appraisal period, the holder of note A-1-1 will be the controlling holder for the Woodlands Mall Whole Loan. Note A-1-1 was included in the BMARK 2019-B12 securitization, and therefore, the controlling class representative (or equivalent party) under the BMARK 2019-B12 securitization is expected to exercise the rights of the controlling holder with respect to the Woodlands Mall mortgage loan. |

| (4) | The initial controlling holder for the Diamondback Industrial Portfolio 1 mortgage loan is FMR LLC, as the Diamondback Industrial Portfolio 1 controlling class representative. Pursuant to the related co-lender agreement, following the occurrence (and during the continuance) of a Diamondback Industrial Portfolio 1 control appraisal period, (i) the holder of note A-1 will be the controlling holder for the Diamondback Industrial Portfolio 1 Whole Loan and (ii) the Diamondback Industrial Portfolio 1 Whole Loan will be serviced by the master servicer and, if necessary, the special servicer under the pooling and servicing agreement for the securitization that holds note A-2. Note A-1 is being included in this GSMS 2019-GC42 securitization, and therefore, following the occurrence (and during the continuance) of a Diamondback Industrial Portfolio 1 control appraisal period, the controlling class representative is expected to exercise the rights of the controlling holder with respect to the Diamondback Industrial Portfolio 1 mortgage loan, and the Controlling PSA is expected to remain GSMS 2019-GC40. |

| (5) | The 105 East 17th Street mortgage loan has onepari passu companion loan with an aggregate outstanding principal balance of $60,500,000. Note A-1 with an outstanding principal balance as of the Cut-off Date of $60,500,000 is currently held by Morgan Stanley Bank National Association (“MSBNA”) and is expected to be contributed to one or more future securitization trusts. The 105 East 17th Street whole loan will initially be master serviced and, if necessary, specially serviced by the master servicer and special servicer for this securitization. Upon the securitization of the note A-1 105 East 17th Street companion loan held by MSBNA, the 105 East 17th Street whole loan is expected to be serviced by the master servicer and, if necessary, the special servicer under the pooling and servicing agreement for such securitization (which pooling and servicing agreement will then be the Controlling PSA for the 105 East 17th Street whole loan). Neither the master servicer nor the special servicer for such securitization has been identified. |

| (6) | The initial controlling holder for the Grand Canal Shoppes mortgage loan is the holder of the related subordinate companion loan (currently held by CPPIB Credit Investments II Inc.). Pursuant to the related co-lender agreement, following the occurrence (and during the continuance) of a Grand Canal Shoppes control appraisal period, the holder of note A-1-1 will be the controlling holder for the Grand Canal Shoppes Whole Loan. Note A-1-1 was included in the MSC 2019-H7 securitization, and therefore, the controlling class representative (or equivalent party) under the MSC 2019-H7 securitization is expected to exercise the rights of the controlling holder with respect to the Grand Canal Shoppes mortgage loan. |

| (7) | The Midland Office Portfolio mortgage loan has onepari passu companion loan with an aggregate outstanding principal balance of $49,500,000. Note A-1 with an outstanding principal balance as of the Cut-off Date of $49,500,000 is currently held by Goldman Sachs Bank USA and is expected to be contributed to one or more future securitization trusts. The Midland Office Portfolio whole loan will initially be master serviced and, if necessary, specially serviced, by the master servicer and special servicer for this securitization. Upon the securitization of the note A-1 Midland Office Portfolio companion loan held by Goldman Sachs Bank USA, the Midland Office Portfolio whole loan is expected to be serviced by the master servicer and, if necessary, the special servicer, under the pooling and servicing agreement for such securitization (which pooling and servicing agreement will then be the Controlling PSA for the Midland Office Portfolio whole loan). Neither the master servicer nor the special servicer for such securitization has been identified. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., AmeriVet Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

11

| COLLATERAL OVERVIEW (continued) |

Mortgage Loans with Existing Mezzanine Debt

Mortgage Loan Name | Mortgage Loan Cut-off Date Balance | Mezzanine

Debt Cut-off Date Balance | Total Debt Cut-off Date

Balance(1) | Wtd. Avg. Cut-off Date Total Debt Interest

Rate(1) | Cut-off Date Mortgage Loan LTV Ratio | Cut-off Date Total Debt LTV

Ratio(1) | Cut-off Date Mortgage Loan UW NCF DSCR | Cut-off Date Total Debt UW NCF DSCR(1) |

| Moffett Towers II Buildings 3 & 4 | $65,550,000 | $85,000,000 | $590,000,000 | 4.0500% | 44.3% | 74.7% | 3.46x | 1.91x |

| Woodlands Mall | $50,000,000 | $39,755,339 | $464,755,339 | 4.3630% | 26.0% | 48.7% | 3.95x | 1.79x |

| Cross Bay Plaza | $29,000,000 | $6,000,000 | $35,000,000 | 5.0787% | 60.4% | 72.9% | 1.93x | 1.31x |

| (1) | Calculated including the mezzanine debt. The Total Debt Interest Rate to full precision for the Woodland Malls Loan and the Cross Bay Plaza Loan is 4.36301075268817% and 5.07874285714286%, respectively. All “Total Debt”, “LTV Ratio” and “UW NCF DSCR” calculations also include any relatedpari passu companion loan(s). |

Previously Securitized Mortgaged Properties(1)

Mortgaged Property Name | City | State | Property Type | Cut-off Date Balance / Allocated Cut-off Date Balance(2) | % of Initial Pool Balance | Previous Securitization |

| Northpoint Tower | Cleveland | Ohio | Office | $65,500,000 | 6.2% | JPMCC 2017-FL10 |

| 105 East 17th Street | New York | New York | Office | $49,500,000 | 4.7% | MSC 2011-C3 |

| Capitol Commons | Lansing | Michigan | Office | $32,500,000 | 3.1% | JPMCC 2006-CB16 |

| Agora at Port Richey | Port Richey | Florida | Multifamily | $24,000,000 | 2.3% | FREMF 2017-KF37 |

| Grand Canal Shoppes | Las Vegas | Nevada | Retail | $20,000,000 | 1.9% | GSMS 2012-SHOP |

| Milestone Shopping Center | Castle Rock | Colorado | Retail | $15,000,000 | 1.4% | WFRBS 2013-C11 |

| 6400 Augusta Road | Greenville | South Carolina | Industrial | $5,882,472 | 0.6% | GSMS 2014-GC20 |

| 6410 Augusta Road | Greenville | South Carolina | Industrial | $5,503,294 | 0.5% | GSMS 2014-GC20 |

| 1623 South Highway 14 | Greer | South Carolina | Industrial | $3,786,791 | 0.4% | GSMS 2014-GC20 |

| 1627 South Highway 14 | Greer | South Carolina | Industrial | $3,554,614 | 0.3% | GSMS 2014-GC20 |

| 1631 South Highway 14 | Greer | South Carolina | Industrial | $3,417,034 | 0.3% | GSMS 2014-GC20 |

| | | | | | | |

| (1) | The table above includes mortgaged properties securing mortgage loans for which the most recent prior financing of all or a significant portion of each such mortgaged property was included in a securitization. Information under “Previous Securitization” represents the most recent such securitization with respect to each of those mortgaged properties. The information in the above table is based solely on information provided by the related borrower or obtained through searches of a third-party database, and has not otherwise been confirmed by the related mortgage loan seller. |

| (2) | Reflects the allocated loan amount in cases where the applicable mortgaged property is one of a portfolio of mortgaged properties securing a particular mortgage loan. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., AmeriVet Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

12

(THIS PAGE INTENTIONALLY LEFT BLANK)

| COLLATERAL OVERVIEW (continued) |

Property Types

Property Type / Detail | | Number of Mortgaged Properties | | Aggregate Cut-off Date Balance(1) | | % of Initial Pool Balance(1) | | Wtd. Avg. Underwritten NCF DSCR(2) | | Wtd. Avg. Cut-off Date LTV Ratio(2) | | Wtd. Avg. Debt Yield on Underwritten

NOI(2)(3) |

| Office | | 17 | | | $392,200,000 | | | 37.0 | % | | 2.77 | x | | 62.2 | % | | 10.7 | % |

| CBD | | 8 | | | 205,882,820 | | | 19.4 | | | 2.65 | x | | 65.1 | % | | 10.3 | |

| General Suburban | | 9 | | | 186,317,180 | | | 17.6 | | | 2.90 | x | | 59.0 | % | | 11.1 | |

| Retail | | 11 | | | $232,407,900 | | | 21.9 | % | | 2.73 | x | | 53.6 | % | | 11.6 | % |

| Anchored | | 5 | | | 122,407,900 | | | 11.5 | | | 2.34 | x | | 63.9 | % | | 10.0 | |

| Super Regional Mall | | 1 | | | 50,000,000 | | | 4.7 | | | 3.95 | x | | 26.0 | % | | 17.4 | |

| Specialty Retail | | 1 | | | 20,000,000 | | | 1.9 | | | 2.46 | x | | 46.3 | % | | 9.6 | |

| Shadow Anchored | | 2 | | | 20,000,000 | | | 1.9 | | | 2.70 | x | | 60.7 | % | | 10.9 | |

| Single Tenant Retail | | 1 | | | 12,500,000 | | | 1.2 | | | 2.65 | x | | 58.4 | % | | 10.3 | |

| Unanchored | | 1 | | | 7,500,000 | | | 0.7 | | | 2.02 | x | | 60.5 | % | | 8.3 | |

| Industrial | | 55 | | | $197,431,720 | | | 18.6 | % | | 2.76 | x | | 55.7 | % | | 11.6 | % |

| Warehouse/Distribution | | 33 | | | 106,953,634 | | | 10.1 | | | 3.02 | x | | 52.2 | % | | 13.0 | |

| Data Center | | 7 | | | 61,250,000 | | | 5.8 | | | 2.60 | x | | 57.0 | % | | 9.8 | |

| Manufacturing/Distribution | | 3 | | | 14,745,506 | | | 1.4 | | | 1.80 | x | | 67.5 | % | | 10.4 | |

| Manufacturing | | 10 | | | 9,264,437 | | | 0.9 | | | 2.49 | x | | 64.4 | % | | 10.3 | |

| Cold Storage | | 1 | | | 3,664,663 | | | 0.3 | | | 2.49 | x | | 64.4 | % | | 10.3 | |

| Manufacturing /Warehouse | | 1 | | | 1,553,480 | | | 0.1 | | | 2.49 | x | | 64.4 | % | | 10.3 | |

| Mixed Use | | 3 | | | $91,012,100 | | | 8.6 | % | | 2.81 | x | | 61.7 | % | | 11.5 | % |

| Office/R&D/Laboratory | | 1 | | | 54,720,000 | | | 5.2 | | | 3.24 | x | | 59.6 | % | | 13.6 | |

| Multifamily/Office/Retail | | 1 | | | 30,000,000 | | | 2.8 | | | 2.01 | x | | 65.8 | % | | 7.5 | |

| Office/Retail | | 1 | | | 6,292,100 | | | 0.6 | | | 2.84 | x | | 60.2 | % | | 11.8 | |

| Multifamily | | 2 | | | $89,000,000 | | | 8.4 | % | | 2.20 | x | | 55.3 | % | | 9.2 | % |

| High Rise | | 1 | | | 65,000,000 | | | 6.1 | | | 2.28 | x | | 51.3 | % | | 9.5 | |

| Garden | | 1 | | | 24,000,000 | | | 2.3 | | | 1.98 | x | | 66.1 | % | | 8.3 | |

| Hospitality | | 3 | | | $48,500,000 | | | 4.6 | % | | 1.88 | x | | 68.6 | % | | 12.4 | % |

| Limited Service | | 3 | | | 48,500,000 | | | 4.6 | | | 1.88 | x | | 68.6 | % | | 12.4 | |

| Self Storage | | 3 | | | $9,875,000 | | | 0.9 | % | | 1.53 | x | | 70.6 | % | | 9.1 | % |

| Self Storage | | 3 | | | 9,875,000 | | | 0.9 | | | 1.53 | x | | 70.6 | % | | 9.1 | |

| Total / Avg. / Wtd. Avg. | | 94 | | | $1,060,426,720 | | | 100.0 | % | | 2.66 | x | | 58.8 | % | | 11.1 | % |

| (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| (2) | Weighted average based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| (3) | For one mortgage loan secured by more than one mortgaged property with multiple detailed property types for which property level cash flows were not available, Underwritten NOI was allocatedpro ratabased on the allocated loan amount. |