| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-226082-09 |

| | | |

December 10, 2020

Free Writing Prospectus

Structural and Collateral Term Sheet

$826,330,787

(Approximate Mortgage Pool Balance)

$685,684,000

(Offered Certificates)

GS Mortgage Securities Trust 2020-GSA2

As Issuing Entity

GS Mortgage Securities Corporation II

As Depositor

Commercial Mortgage Pass-Through Certificates

Series 2020-GSA2

Goldman Sachs Mortgage Company

Citi Real Estate Funding Inc.

Starwood Mortgage Capital LLC

Argentic Real Estate Finance LLC

Societe Generale Financial Corporation

As Sponsors and Mortgage Loan Sellers

IMPORTANT NOTICE REGARDING THE CONDITIONS FOR THIS OFFERING OF ASSET-BACKED SECURITIES

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor, Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., SG Americas Securities, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) the fact that there is no representation being made that these materials are accurate or complete and that these materials may not be updated or (3) these materials possibly being confidential, are, in each case, not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| Goldman Sachs & Co. LLC | Société Générale | Citigroup |

| Co-Lead Managers and Joint Bookrunners |

| | | |

| | | | | |

The securities offered by this structural and collateral term sheet (this “Term Sheet”) are described in greater detail in the preliminary prospectus included as part of our Registration Statement (SEC File No. 333-226082) (the “Preliminary Prospectus”) anticipated to be dated December 11, 2020. The Preliminary Prospectus contains material information that is not contained in this Term Sheet (including without limitation a detailed discussion of risks associated with an investment in the offered securities under the headings “Summary of Risk Factors” and “Risk Factors” in the Preliminary Prospectus). The Preliminary Prospectus is available upon request from Goldman Sachs & Co. LLC, Citigroup Global Markets Inc. or SG Americas Securities, LLC. Capitalized terms used but not otherwise defined in this Term Sheet have the respective meanings assigned to those terms in the Preliminary Prospectus. This Term Sheet is subject to change.

The Securities May Not Be a Suitable Investment for You

The securities offered by this Term Sheet are not suitable investments for all investors. In particular, you should not purchase any class of securities unless you understand and are able to bear the prepayment, credit, liquidity and market risks associated with that class of securities. For those reasons and for the reasons set forth under the headings “Summary of Risk Factors” and “Risk Factors” in the Preliminary Prospectus, the yield to maturity and the aggregate amount and timing of distributions on the offered securities are subject to material variability from period to period and give rise to the potential for significant loss over the life of those securities. The interaction of these factors and their effects are impossible to predict and are likely to change from time to time. As a result, an investment in the offered securities involves substantial risks and uncertainties and should be considered only by sophisticated institutional investors with substantial investment experience with similar types of securities and who have conducted appropriate due diligence on the mortgage loans and the securities. Potential investors are advised and encouraged to review the Preliminary Prospectus in full and to consult with their legal, tax, accounting and other advisors prior to making any investment in the offered securities described in this Term Sheet.

This Term Sheet is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The information contained in this Term Sheet may not pertain to any securities that will actually be sold. The information contained in this Term Sheet may be based on assumptions regarding market conditions and other matters as reflected in this Term Sheet. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and this Term Sheet should not be relied upon for such purposes. We and our affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of this Term Sheet may, from time to time, have long or short positions in, and buy or sell, the securities mentioned in this Term Sheet or derivatives thereof (including options). Information contained in this Term Sheet is current as of the date appearing on this Term Sheet only. Information in this Term Sheet regarding the securities and the mortgage loans backing any securities discussed in this Term Sheet supersedes all prior information regarding such securities and mortgage loans. None of Goldman Sachs & Co. LLC, Citigroup Global Markets Inc. or SG Americas Securities, LLC provides accounting, tax or legal advice.

The issuing entity will be relying upon an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”), contained in Section 3(c)(5) of the Investment Company Act or Rule 3a-7 under the Investment Company Act, although there may be additional exclusions or exemptions available to the issuing entity. The issuing entity is being structured so as not to constitute a “covered fund” for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in “Risk Factors—Other Risks Relating to the Certificates—Legal and Regulatory Provisions Affecting Investors Could Adversely Affect the Liquidity of the Offered Certificates” in the Preliminary Prospectus). See also “Legal Investment” in the Preliminary Prospectus.

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., SG Americas Securities, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

2

CERTIFICATE SUMMARY

OFFERED CERTIFICATES

| Offered Class | | Expected Ratings

(S&P / Fitch / KBRA)(1) | | Approximate Initial Certificate Balance or Notional Amount(2) | | Approximate Initial Credit Support(3) | | Initial Pass-

Through Rate | | Pass-Through Rate Description | |

Wtd. Avg.

Life (Yrs)(4)

| | Principal

Window(4) | |

| Class A-1 | | AAA(sf) / AAAsf / AAA(sf) | | $ | 17,052,000 | | | 30.000% | | [ ]% | | (5) | | 2.40 | | 01/21 – 03/25 | |

| Class A-2 | | AAA(sf) / AAAsf / AAA(sf) | | $ | 10,429,000 | | | 30.000% | | [ ]% | | (5) | | 4.20 | | 03/25 – 03/25 | |

| Class A-3 | | AAA(sf) / AAAsf / AAA(sf) | | $ | 13,754,000 | | | 30.000% | | [ ]% | | (5) | | 6.93 | | 11/27 – 12/27 | |

| Class A-4 | | AAA(sf) / AAAsf / AAA(sf) | | (6) | | 30.000% | | [ ]% | | (5) | | (6) | | (6) | |

| Class A-5 | | AAA(sf) / AAAsf / AAA(sf) | | (6) | | 30.000% | | [ ]% | | (5) | | (6) | | (6) | |

| Class A-AB | | AAA(sf) / AAAsf / AAA(sf) | | $ | 32,358,000 | | | 30.000% | | [ ]% | | (5) | | 6.41 | | 03/25 – 06/29 | |

| Class X-A | | NR / AAAsf / AAA(sf) | | $ | 612,360,000 | (7) | | N/A | | [ ]% | | Variable IO(8) | | N/A | | N/A | |

| Class X-B | | NR / A-sf / AAA(sf) | | $ | 73,324,000 | (7) | | N/A | | [ ]% | | Variable IO(8) | | N/A | | N/A | |

| Class A-S | | NR / AAAsf / AAA(sf) | | $ | 57,471,000 | | | 22.750% | | [ ]% | | (5) | | 9.95 | | 12/30 – 12/30 | |

| Class B | | NR / AA-sf / AA(sf) | | $ | 35,671,000 | | | 18.250% | | [ ]% | | (5) | | 9.95 | | 12/30 – 12/30 | |

| Class C | | NR / A-sf / A(sf) | | $ | 37,653,000 | | | 13.500% | | [ ]% | | (5) | | 10.00 | | 12/30 – 01/31 | |

NON-OFFERED CERTIFICATES

| Non-Offered Class | | Expected Ratings

(S&P / Fitch / KBRA)(1) | | Approximate Initial Certificate Balance or Notional Amount(2) | | Approximate Initial Credit Support(3) | | Initial Pass-Through Rate | | Pass-Through Rate Description | |

Wtd. Avg. Life (Yrs)(4)

| | Principal Window(4) | |

| Class D | | NR / BBBsf / BBB+(sf) | | $ | 26,754,000 | | | 10.125% | | [ ]% | | (5) | | 10.03 | | 01/31 – 01/31 | |

| Class X-D | | NR / BBB-sf / BBB-(sf) | | $ | 46,571,000 | (7) | | N/A | | [ ]% | | Variable IO(8) | | N/A | | N/A | |

| Class E | | NR / BBB-sf / BBB-(sf) | | $ | 19,817,000 | | | 7.625% | | [ ]% | | (5) | | 10.03 | | 01/31 – 01/31 | |

| Class F(9) | | NR / BB-sf / BB-(sf) | | $ | 19,818,000 | | | 5.125% | | [ ]% | | (5) | | 10.03 | | 01/31 – 01/31 | |

| Class G-RR(9) | | NR / Bsf / B-(sf) | | $ | 7,927,000 | | | 4.125% | | [ ]% | | (5) | | 10.03 | | 01/31 – 01/31 | |

| Class H-RR(9) | | NR / NR / NR | | $ | 32,699,123 | | | 0.000% | | [ ]% | | (5) | | 10.03 | | 01/31 – 01/31 | |

| Class S(10) | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A | |

| Class R(11) | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A | |

| (1) | It is a condition of issuance that the offered certificates and certain classes of non-offered certificates receive the ratings set forth above. The anticipated ratings of the certificates shown are those of Standard & Poor’s Financial Services LLC (“S&P”), Fitch Ratings, Inc. (“Fitch”) and Kroll Bond Rating Agency, LLC (“KBRA”, and together with S&P and Fitch, the “Rating Agencies”). Subject to the discussion under “Ratings” in the Preliminary Prospectus, the ratings on the certificates address the likelihood of the timely receipt by holders of all payments of interest to which they are entitled on each distribution date and, except in the case of the interest only certificates, the ultimate receipt by holders of all payments of principal to which they are entitled on or before the applicable rated final distribution date. Certain nationally recognized statistical rating organizations, as defined in Section 3(a)(62) of the Securities Exchange Act of 1934, as amended, that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, or otherwise to rate the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” in the Preliminary Prospectus. The Rating Agencies have informed us that the “sf” designation in their ratings represents an identifier of structured finance product ratings. For additional information about this identifier, prospective investors can go to the related Rating Agency’s website. The depositor and the underwriters have not verified, do not adopt and do not accept responsibility for any statements made by the related Rating Agencies on those websites. Credit ratings referenced throughout this Term Sheet are forward-looking opinions about credit risk and express a rating agency’s opinion about the willingness and ability of an issuer of securities to meet its financial obligations in full and on time. Ratings are not indications of investment merit and are not buy, sell or hold recommendations, a measure of asset value or an indication of the suitability of an investment. |

| (2) | Approximate, subject to a variance of plus or minus 5%. The notional amount of each class of the Class X-A, Class X-B and Class X-D certificates (collectively the “Class X certificates”) is subject to change depending upon the final pricing of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5, Class A-AB, Class A-S, Class B, Class C, Class D, Class E, Class F, Class G-RR and Class H-RR certificates (collectively, the “principal balance certificates” and, together with the Class X and Class S certificates, the “non-VRR certificates”) as follows: (1) if as a result of such pricing the pass-through rate of any class of principal balance certificates whose certificate balance comprises such notional amount is equal to the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), the certificate balance of such class of principal balance certificates may not be part of, and reduce accordingly, such notional amount of the related Class X certificates (or, if as a result of such pricing the pass-through rate of the related Class X certificates is equal to zero, such Class X certificates may not be issued on the closing date), and/or (2) if as a result of such pricing the pass-through rate of any class of principal balance certificates that does not comprise such notional amount of the related Class X certificates is less than the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), such class of principal balance certificates may become a part of, and increase accordingly, such notional amount of the related Class X certificates. In addition, the certificate balance of each class of principal balance certificates (and correspondingly, the initial notional amount of each class of Class X certificates) is subject to change as described in footnote (2) under the table titled “VRR Interest Summary” below. |

| (3) | The initial credit support percentages set forth for the certificates are approximate and, for the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5 and Class A-AB certificates, are represented in the aggregate. The approximate initial credit support percentages shown in the table above do not take into account the VRR interest. However, losses incurred on the mortgage loans will be allocated between the VRR interest and the principal balance certificates, pro rata in accordance with their respective outstanding balances. See “Credit Risk Retention” and “Description of the Certificates” in the Preliminary Prospectus. |

| (4) | The weighted average life and period during which distributions of principal would be received as set forth in the foregoing table with respect to each class of certificates having a certificate balance are based on the assumptions set forth under “Yield, Prepayment and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus and on the assumptions that there are no prepayments, modifications or losses in respect of the mortgage loans or whole loans and that there are no extensions or forbearances of maturity dates or anticipated repayment dates of the mortgage loans or whole loans. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., SG Americas Securities, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

3

| CERTIFICATE SUMMARY (continued) |

| (5) | For each distribution date, the pass-through rates of each class of principal balance certificates will generally be a per annum rate equal to one of (i) a fixed rate, (ii) the weighted average of the net mortgage interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as of their respective due dates in the month preceding the month in which the related distribution date occurs (the “WAC Rate”), (iii) the lesser of a specified pass-through rate and the WAC Rate, or (iv) the WAC Rate less a specified percentage. |

| (6) | The exact initial certificate balances of the Class A-4 and Class A-5 certificates are unknown and will be determined based on the final pricing of those classes of certificates. However, the respective initial certificate balances, assumed final distribution dates, weighted average lives and principal windows of the Class A-4 and Class A-5 certificates are expected to be within the applicable ranges reflected in the following chart. The initial aggregate certificate balance of the Class A-4 and Class A-5 certificates is expected to be approximately $481,296,000, subject to a variance of plus or minus 5%. |

Class of Certificates | Expected Range of Initial Certificate Balance | Expected Range of Assumed Final Distribution Date | Expected Range of Wtd. Avg. Life (Yrs) | Expected Range of Principal Window |

| Class A-4 | $0 – $200,000,000 | N/A – March 2030 | N/A – 9.08 | N/A / 06/29 – 03/30 |

| Class A-5 | $281,296,000 – $481,296,000 | December 2030 | 9.83 – 9.52 | 03/30 – 12/30 / 06/29 – 12/30 |

| (7) | The Class X certificates will not have certificate balances and will not be entitled to receive distributions of principal. Interest will accrue on each class of the Class X certificates at its respective pass-through rate based upon its respective notional amount. The notional amount of each class of the Class X certificates will be equal to the aggregate certificate balances of the related class(es) of certificates (the “related Class X class”) indicated below. |

| Class | | Related Class X Classes |

| Class X-A | | Class A-1, Class A-2, Class A-3, Class A-4, Class A-5, Class A-AB and Class A-S certificates |

| Class X-B | | Class B and Class C certificates |

| Class X-D | | Class D and Class E certificates |

| (8) | The pass-through rate of each class of the Class X certificates for any distribution date will equal the excess, if any, of (i) the WAC Rate, over (ii) the pass-through rate (or the weighted average of the pass-through rates, if applicable) of the related Class X class(es) for that distribution date, as described in the Preliminary Prospectus. |

| (9) | The initial certificate balance of each of the Class F, Class G-RR and Class H-RR certificates is subject to change based on final pricing of all non-VRR certificates and the final determination of the amounts of the Class G-RR and Class H-RR certificates (collectively, the “HRR Certificates”) that will be retained by the retaining third-party purchaser and the final determination of the amount of the VRR interest (as defined below) that will be retained as described under “Credit Risk Retention” in the Preliminary Prospectus to satisfy the U.S. risk retention requirements of Goldman Sachs Mortgage Company, as retaining sponsor. For more information regarding the methodology and key inputs and assumptions used to determine the sizing of the HRR Certificates, see “Credit Risk Retention” in the Preliminary Prospectus. |

| (10) | The Class S certificates will not have a certificate balance, notional amount, pass-through rate, rating or rated final distribution date. Excess interest accruing after the related anticipated repayment date on any mortgage loan with an anticipated repayment date will, to the extent collected, be allocated to the Class S certificates and the VRR interest, as described under “Description of the Certificates—Distributions—Excess Interest” in the Preliminary Prospectus. The Class S certificates will not be entitled to distributions in respect of principal or interest other than excess interest. See “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—ARD Loan” in the Preliminary Prospectus. |

| (11) | The Class R certificates will not have a certificate balance, notional amount, pass-through rate, rating or rated final distribution date. The Class R certificates will represent the residual interests in each of two separate real estate mortgage investment conduits (each, a “REMIC”), as further described in the Preliminary Prospectus. The Class R certificates will not be entitled to distributions of principal or interest. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., SG Americas Securities, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

4

| CERTIFICATE SUMMARY (continued) |

VRR INTEREST SUMMARY

Non-Offered Eligible Vertical Interest(1) | Approximate

Initial VRR Interest Balance(1)(2) | Approximate Initial VRR Interest Rate | VRR Interest Rate Description | Wtd. Avg. Life (Yrs)(3) | Principal Window(3) |

| RR Interest | $22,622,314 | [__]% | (4) | 9.27 | 01/21 – 01/31 |

| Class RR Certificates | $11,009,350 | [__]% | (4) | 9.27 | 01/21 – 01/31 |

| (1) | Each of the Class RR certificates and the RR interest will collectively constitute an “eligible vertical interest” (as such term is defined in the Credit Risk Retention Rules) and is expected to be acquired and retained by the applicable sponsors (or their “majority-owned affiliates”, as such term is defined in the Credit Risk Retention Rules) as described under “Credit Risk Retention” in the Preliminary Prospectus. The Class RR certificates and the RR interest collectively comprise the “VRR interest”. The VRR interest represents the right to receive a specified percentage (to be determined as described in footnote (2) below) of all amounts collected on the mortgage loans (net of all expenses of the issuing entity) that are available for distribution to the certificates and the RR interest on each Distribution Date, as further described under “Credit Risk Retention” in the Preliminary Prospectus. |

| (2) | The initial aggregate VRR interest balance is subject to change depending on the final pricing of all non-VRR certificates and the final determination of the amount of the HRR certificates that will be retained by the retaining third-party purchaser and the final determination of the amount of the VRR interest that will be retained as described under “Credit Risk Retention” in the Preliminary Prospectus to satisfy the U.S. risk retention requirements of Goldman Sachs Mortgage Company, as retaining sponsor. If the initial VRR interest balance is reduced, the initial certificate balance of each class of principal balance certificates (and correspondingly, the initial notional amount of each class of Class X certificates) will be increased on a pro rata basis (based on the initial certificate balance set forth in the table above) in an aggregate amount equal to such reduction in the initial VRR interest balance. If the initial VRR interest balance is increased, the initial certificate balance of each class of principal balance certificates (and correspondingly, the initial notional amount of each class of Class X certificates) will be decreased on a pro rata basis (based on the initial certificate balance set forth in the table above) in an aggregate amount equal to such increase in the initial VRR interest balance. For a further description, see “Credit Risk Retention” in the Preliminary Prospectus. |

| (3) | The weighted average life and period during which distributions of principal would be received as set forth in the foregoing table with respect to the VRR interest are based on the assumptions described in “Yield, Prepayment and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus and on the assumptions that there are no prepayments, modifications or losses in respect of the mortgage loans or whole loans and that there are no extensions or forbearances of maturity dates or anticipated repayment dates of the mortgage loans or whole loans. |

| (4) | Although it does not have a specified pass-through rate (other than for tax reporting purposes), the effective interest rate for the RR interest and the Class RR certificates will be a per annum rate equal to the weighted average of the net mortgage interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as of their respective due dates in the month preceding the month in which the related distribution date occurs. |

The Class D, Class X-D, Class E, Class F, Class G-RR, Class H-RR, Class RR, Class S and Class R certificates and the RR interest are not offered by this Term Sheet. Any information in this Term Sheet concerning such non-offered certificates or the RR Interest is presented solely to enhance your understanding of the offered certificates.

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., SG Americas Securities, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

5

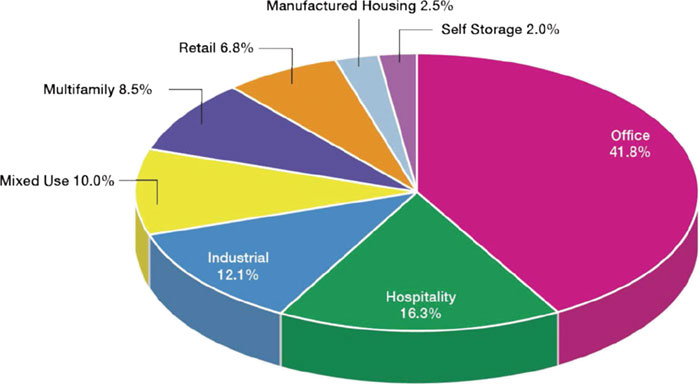

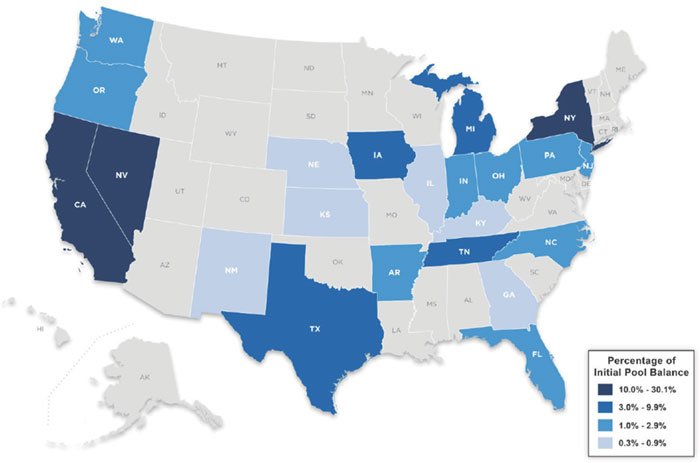

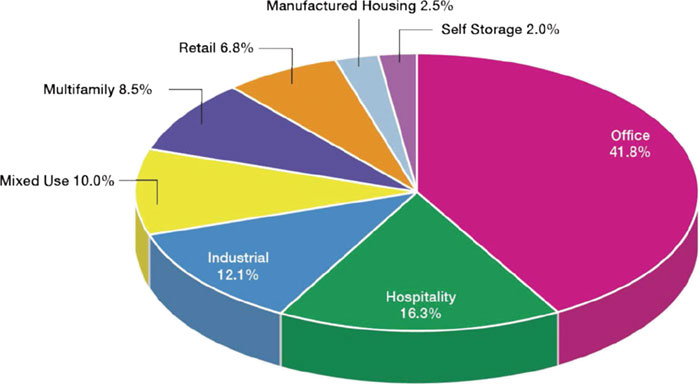

| MORTGAGE POOL CHARACTERISTICS |

| Mortgage Pool Characteristics(1) |

| Initial Pool Balance(2) | $826,330,787 |

| Number of Mortgage Loans | 46 |

| Number of Mortgaged Properties | 89 |

| Average Cut-off Date Mortgage Loan Balance | $17,963,713 |

| Weighted Average Mortgage Interest Rate | 3.63083% |

| Weighted Average Remaining Term to Maturity Date/ARD (months)(3)(4) | 115 |

| Weighted Average Remaining Amortization Term (months)(3)(4) | 359 |

| Weighted Average Cut-off Date LTV Ratio(5)(6)(7) | 58.5% |

| Weighted Average Maturity Date/ARD LTV Ratio(3)(4)(7)(8) | 53.7% |

| Weighted Average Underwritten Debt Service Coverage Ratio(9) | 2.50x |

| Weighted Average Debt Yield on Underwritten NOI(6)(7)(9) | 11.2% |

| % of Mortgage Loans with Mezzanine Debt | 0.0% |

| % of Mortgage Loans with Subordinate Debt(10) | 10.9% |

| % of Mortgage Loans with Preferred Equity | 0.0% |

| % of Mortgage Loans with Single Tenants(11) | 11.9% |

| (1) | With respect to 15 mortgage loans, representing approximately 62.2% of the initial pool balance, with one or more related pari passu companion loan(s) as set forth in the “Whole Loan Summary” table below, the loan-to-value ratio, debt service coverage ratio, debt yield and balance per SF, unit or room calculations presented in this Term Sheet include the related pari passu companion loan(s) unless otherwise indicated. With respect to two mortgage loans, representing approximately 10.9% of the initial pool balance, with one or more related subordinate companion loan(s) as set forth in the “Whole Loan Summary” table below, the loan-to-value ratio, debt service coverage ratio, debt yield and balance per SF, pads or unit calculations presented in this Term Sheet are calculated without regard to the related subordinate companion loan(s). Other than as specifically noted, the loan-to-value ratio, debt service coverage ratio, debt yield and mortgage loan rate information for each mortgage loan is presented in this Term Sheet without regard to any other indebtedness (whether or not secured by the related mortgaged property, ownership interests in the related borrower or otherwise) that currently exists or that may be incurred by the related borrower or its owners in the future, in order to present statistics for the related mortgage loan without combination with the other indebtedness. |

| (2) | Subject to a permitted variance of plus or minus 5%. |

| (3) | With respect to four mortgage loans, representing approximately 18.0% of the initial pool balance, the initial due dates for such mortgage loans occur after January 2021. On the Closing Date, the related mortgage loan seller(s) will contribute an initial interest deposit amount to the issuing entity to cover an amount that represents one month’s interest that would have accrued with respect to each such mortgage loan at the related interest rate with respect to the assumed January 2021 payment date. Information presented in this Term Sheet reflects the contractual loan terms, however, each such mortgage loan is being treated as having an initial due date in January 2021. |

| (4) | With respect to one mortgage loan, representing approximately 7.9% of the initial pool balance, the mortgage loan has an anticipated repayment date and, unless otherwise indicated, is presented as if it matured on its anticipated repayment date. |

| (5) | Unless otherwise indicated, the Cut-off Date LTV Ratio is calculated utilizing the “as-is” appraised value. With respect to three mortgage loans (6.5% of the initial pool balance) the respective Cut-off Date LTV Ratio was calculated based upon a valuation other than an “as-is” value of each related mortgaged property. The weighted average Cut-off Date LTV Ratio for the mortgage pool without making any adjustments is 58.7%. See “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus for a description of Cut-off Date LTV Ratio. |

| (6) | The Weighted Average Cut-off Date LTV Ratio and Debt Yield on Underwritten NOI on the Phoenix Industrial Portfolio V mortgage loan are calculated based on a Cut-off Date Balance net of a $4,000,000 achievement reserve. |

| (7) | The Weighted Average Cut-off Date LTV Ratio and the Weighted Average Maturity Date/ARD LTV Ratio on the Houston Multifamily Portfolio mortgage loan are each calculated based on (i) a Cut-off Date Balance net of a $1,500,000 holdback reserve and (ii) the aggregate “as-is” portfolio appraised value, inclusive of an approximately 3.0% portfolio premium, as of October 28, 2020, unless otherwise indicated, the Maturity Date/ARD LTV Ratio is calculated utilizing the “as-is” appraised value. In addition, the Debt Yield on UW NOI is calculated based on a Cut-off Date Balance net of the $1,500,000 holdback reserve. |

| (8) | Unless otherwise indicated, the Maturity Date/ARD LTV Ratio is calculated utilizing the “as-is” appraised value. With respect to three mortgage loans (6.5% of the initial pool balance) the respective Maturity Date/ARD LTV Ratios were calculated using a valuation other than an “as-is” value of each related mortgaged property. The weighted average Maturity Date/ARD LTV Ratio for the mortgage pool without making such adjustments is 53.9%. See “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus for a description of Maturity Date/ARD LTV Ratio. |

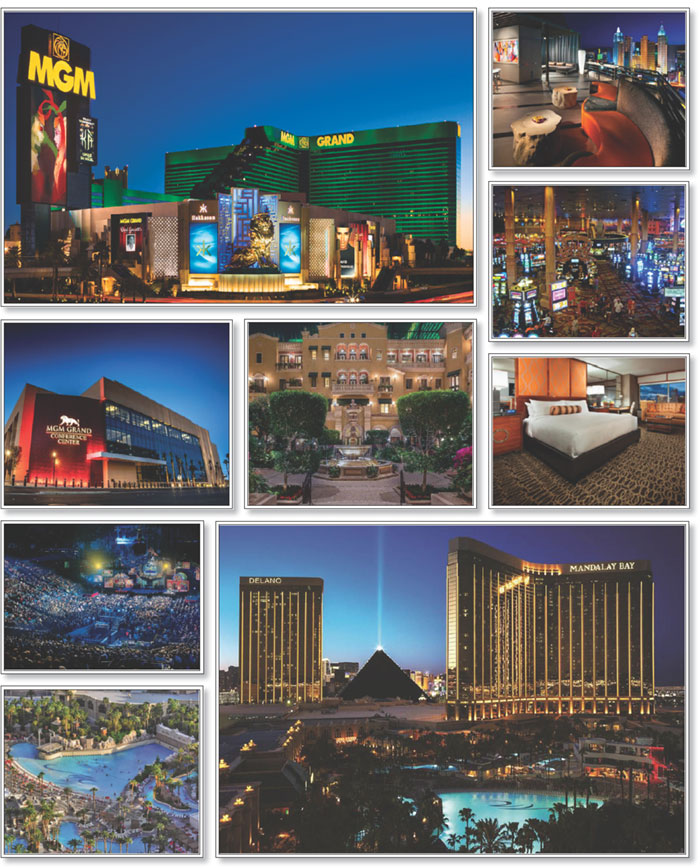

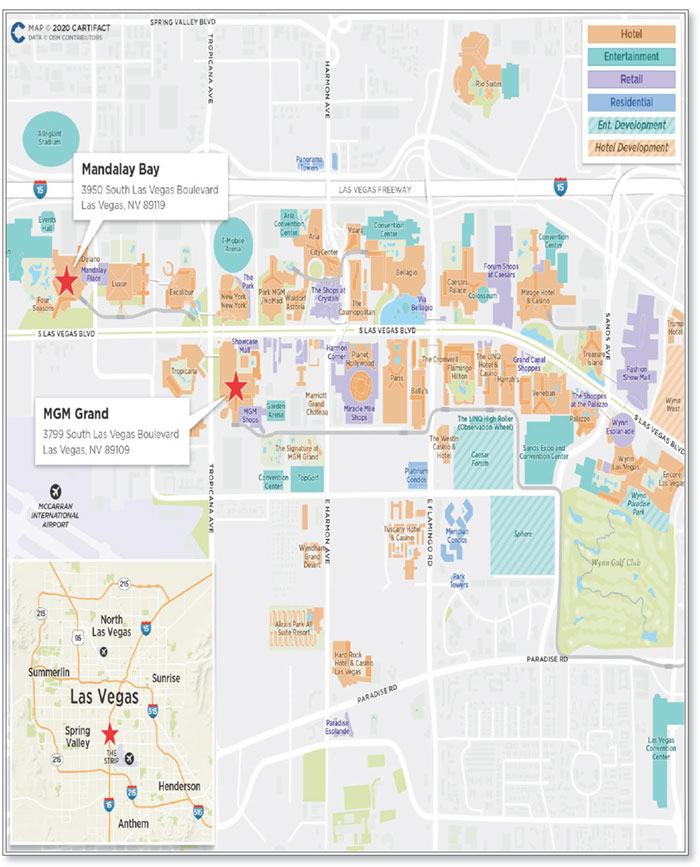

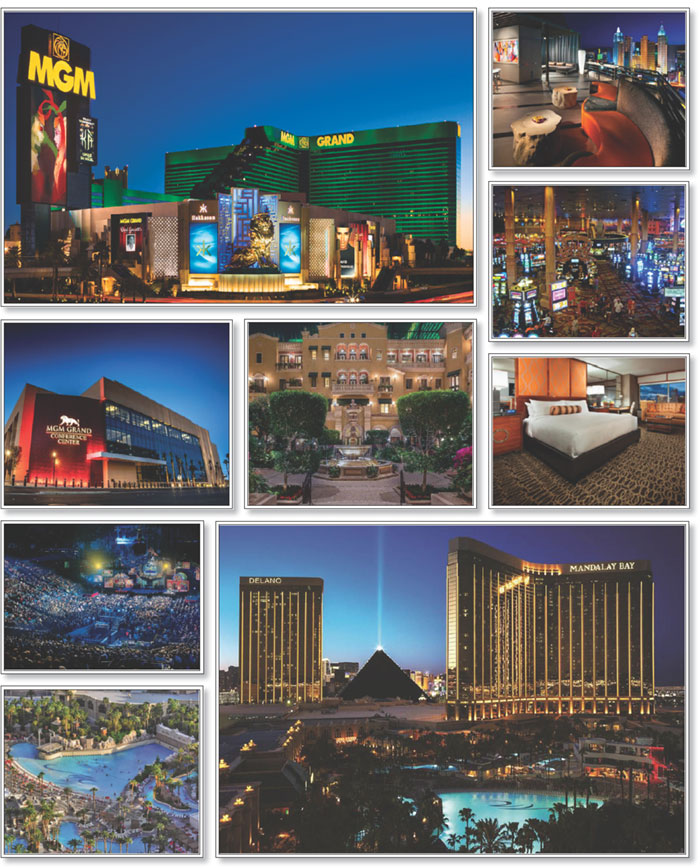

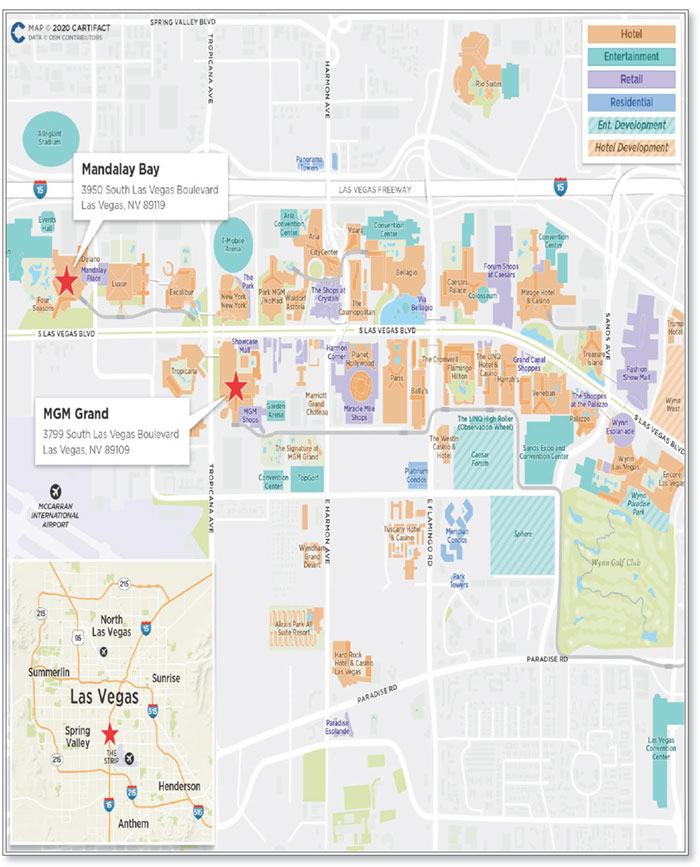

| (9) | The UW NCF DSCR and Debt Yield on Underwritten NOI on the MGM Grand & Mandalay Bay mortgage loan is calculated based on the master lease annual rent of $292,000,000. |

| (10) | The MGM Grand & Mandalay Bay mortgage loan has multiple subordinate companion loans that are generally subordinate in right of payment to the related mortgage loan (the “MGM Grand & Mandalay Bay Subordinate Companion Loans”). The MGM Grand & Mandalay Bay Subordinate Companion Loans have an aggregate outstanding principal balance of $1,365,800,000 as of the Cut-off Date, and are currently held in the BX 2020-VIVA, BX 2020-VIV2 and BX 2020-VIV3 securitization transactions. See “Description of the Mortgage Pool—The Whole Loans” and “Description of the Mortgage Pool—Additional Indebtedness” in the Preliminary Prospectus. |

| (11) | Excludes mortgage loans that are secured by multiple properties with multiple tenants. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., SG Americas Securities, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

6

| ■ | The following table contains information regarding the status of the mortgage loans and mortgaged properties provided by the respective borrowers as of the date set forth in the “Information as of Date” column. The cumulative effects of the COVID-19 emergency on the global economy may cause tenants to be unable to pay their rent and borrowers to be unable to pay debt service under the mortgage loans. As a result, we cannot assure you that the information in the following table is indicative of future performance or that tenants or borrowers will not seek rent or debt service relief (including forbearance arrangements) or other lease or loan modifications in the future. Such actions may lead to shortfalls and losses on the certificates. The information in the following table was based on reports and data aggregated from the related borrower’s existing financial and operational reporting systems and in certain circumstances was produced on an interim or ad hoc basis or was provided by the related borrower verbally. While we have no reason to believe the information presented is not accurate, we cannot assure you that it will not change or be updated in the future. See “Risk Factors—Special Risks—Current Coronavirus Pandemic Has Adversely Affected the Global Economy and Will Likely Adversely Affect the Performance of the Mortgage Loans” and “Description of the Mortgage Pool—COVID Considerations” in the Preliminary Prospectus. |

| Property Name | Mortgage Loan Seller | Property Type | Information as of Date | First Due Date | October Debt Service Payment Received

(Y/N) | November Debt Service Payment Received

(Y/N) | December Debt Service Payment Received

(Y/N) | Forbearance or Other Debt Service Relief Requested

(Y/N) | Other Loan Modification Requested

(Y/N) | Lease Modification or Rent Relief Requested

(Y/N) | Occupied SF or Unit Count Making Full October Rent Payment

(%) | UW October Base Rent Paid (%) | Occupied SF or Unit Count Making Full November Rent Payment

(%) | UW November Base Rent Paid (%) |

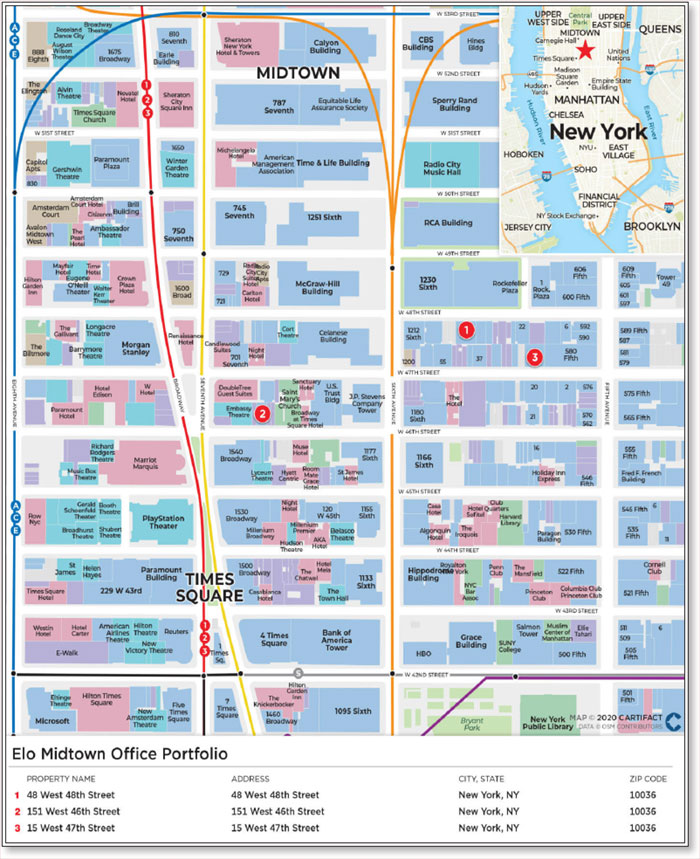

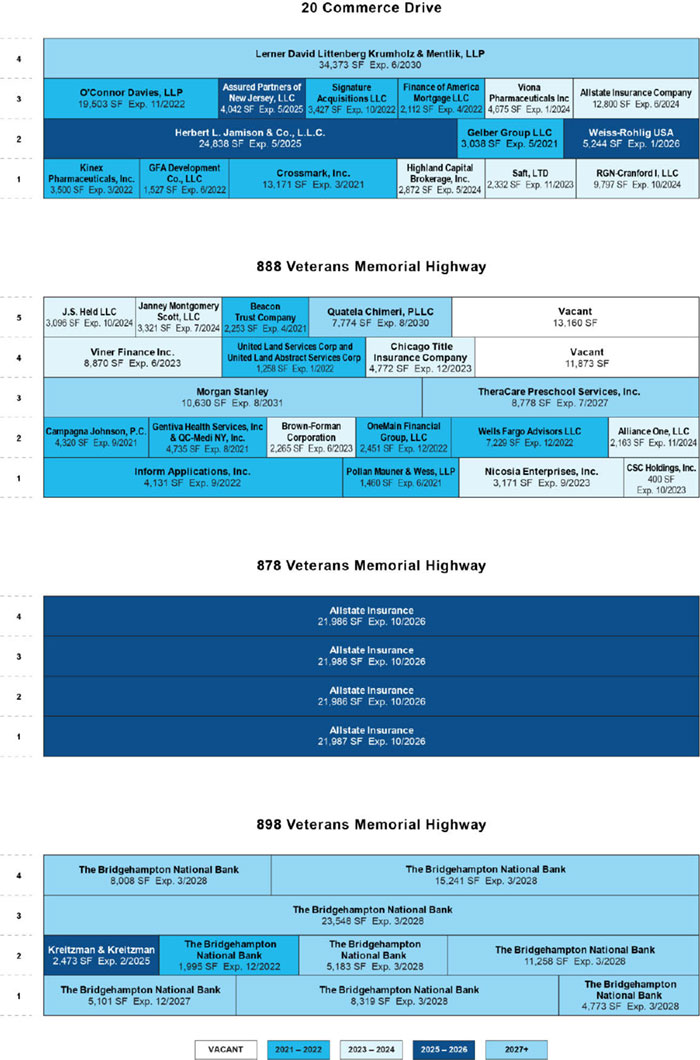

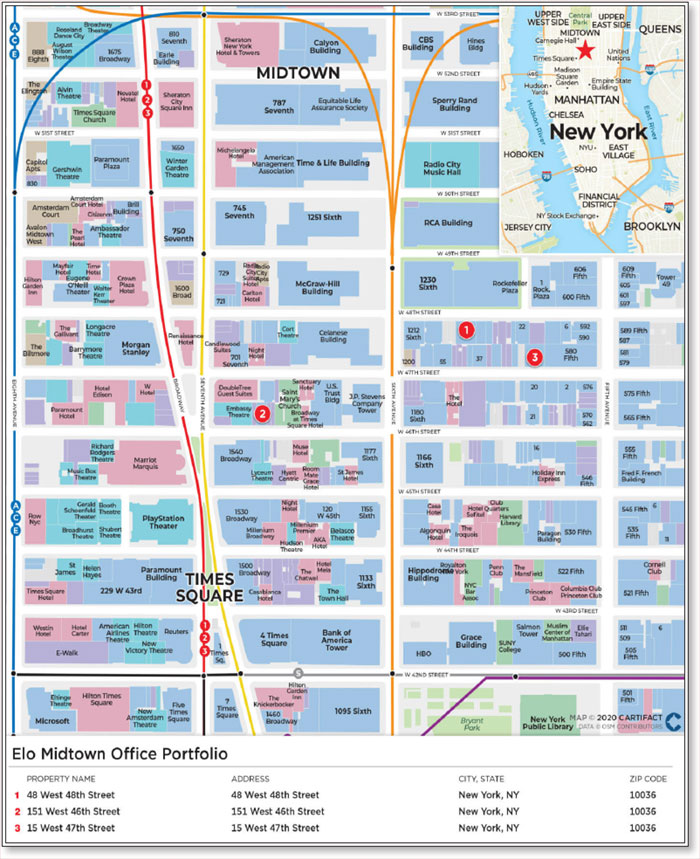

| 1 | Elo Midtown Office Portfolio(1) | CREFI | Office | 12/6/2020 | 1/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

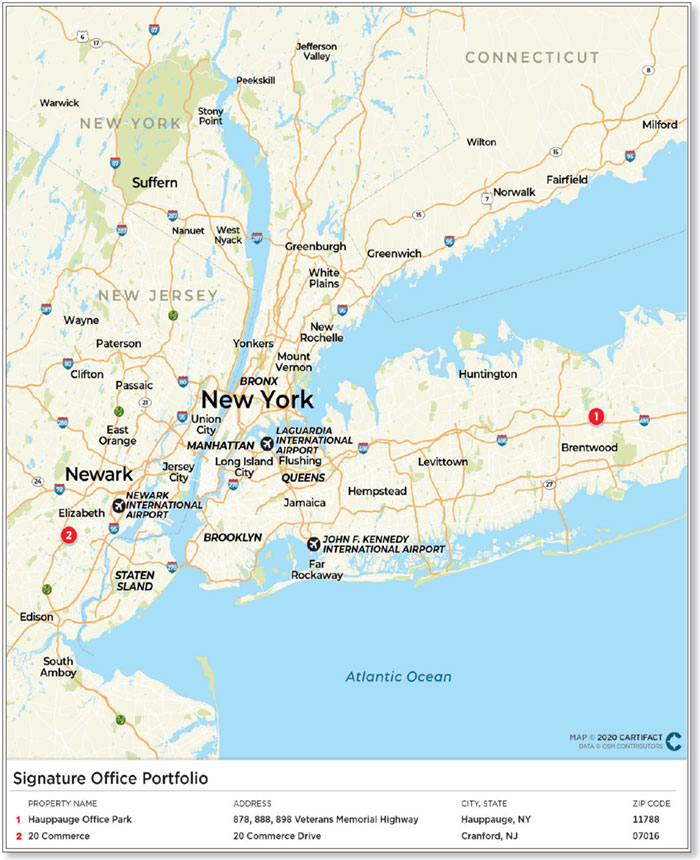

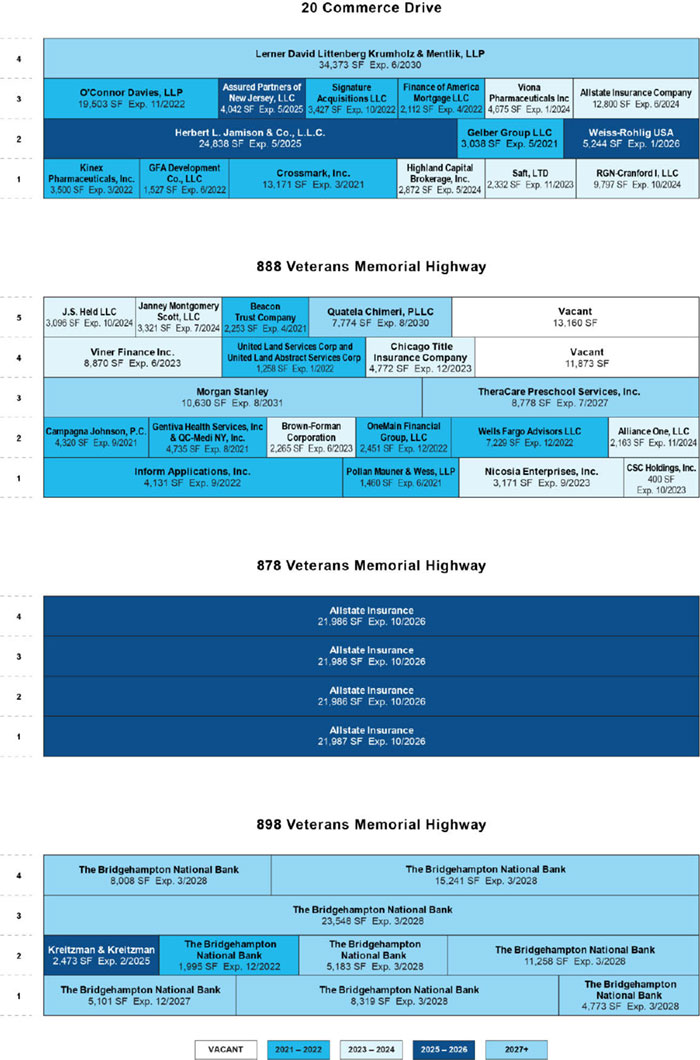

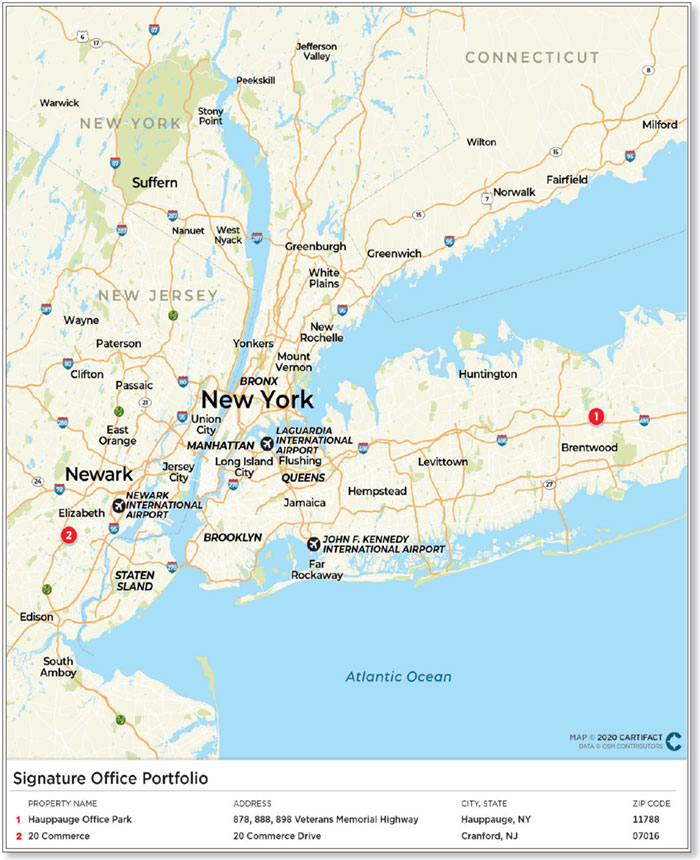

| 2 | Signature Office Portfolio | CREFI, SMC | Office | 12/6/2020 | 1/6/2021 | NAP | NAP | NAP | N | N | N | 98.3% | 98.1% | 98.3% | 98.1% |

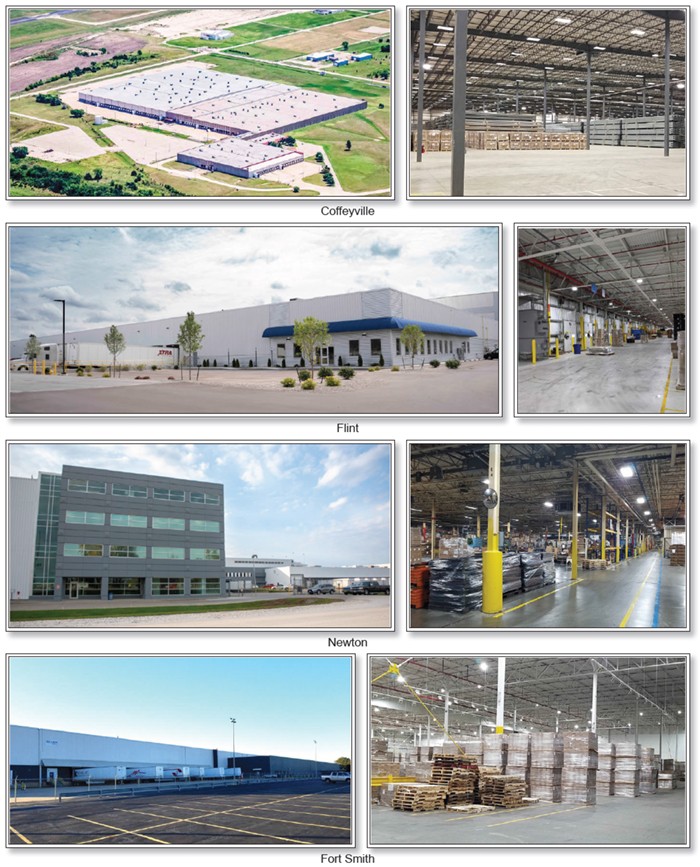

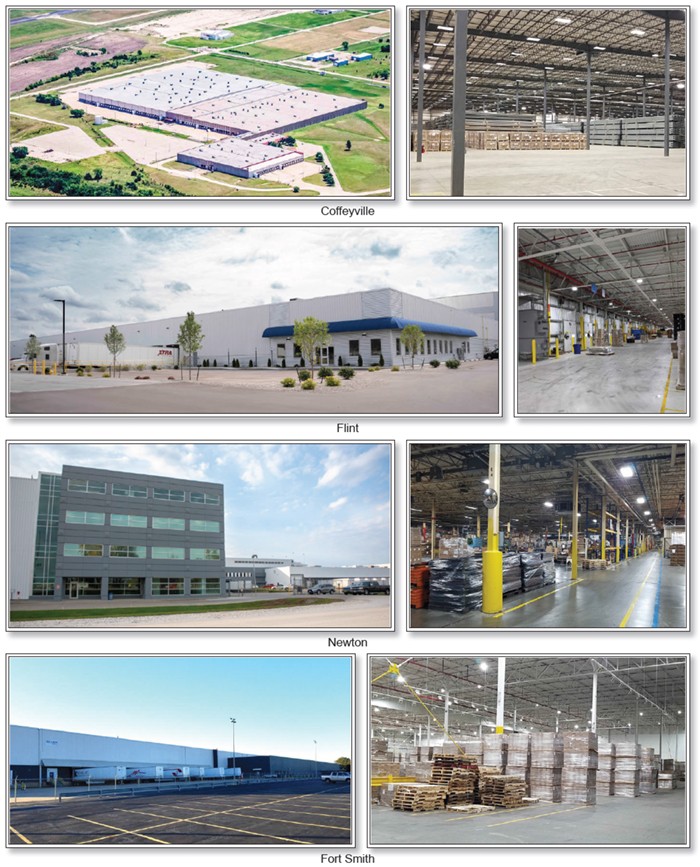

| 3 | Phoenix Industrial Portfolio V | AREF | Industrial | 11/27/2020 | 1/6/2021 | NAP(2) | NAP(2) | NAP(2) | N | N | N | 98.6%(3) | 99.8%(3) | 98.6%(3) | 99.6%(3) |

| 4 | MGM Grand & Mandalay Bay | CREFI | Hospitality | 12/6/2020 | 4/5/2020 | Y | Y | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

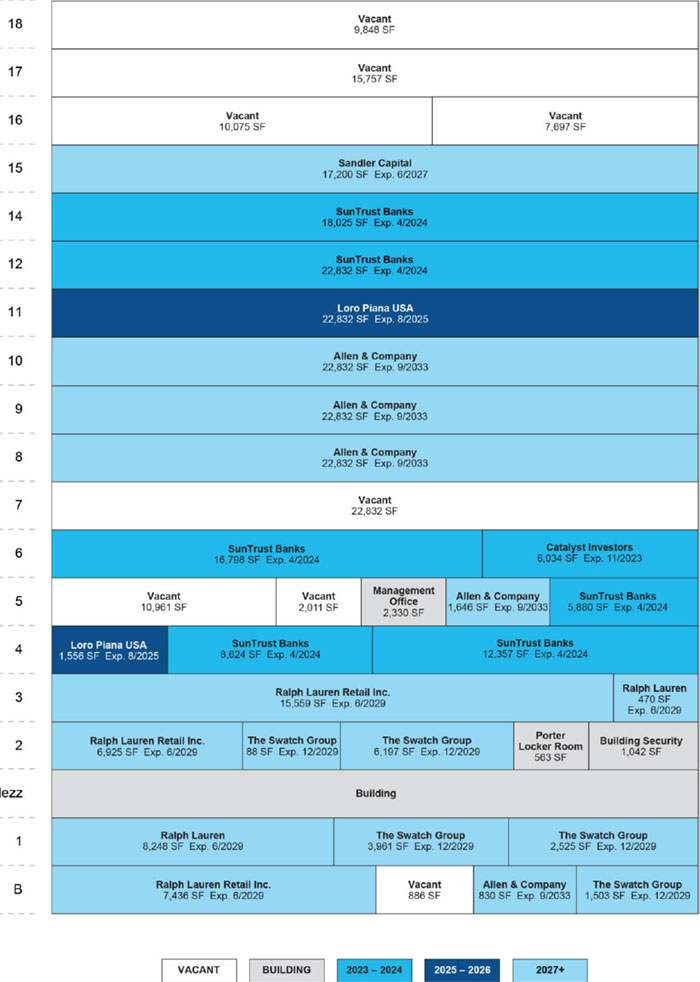

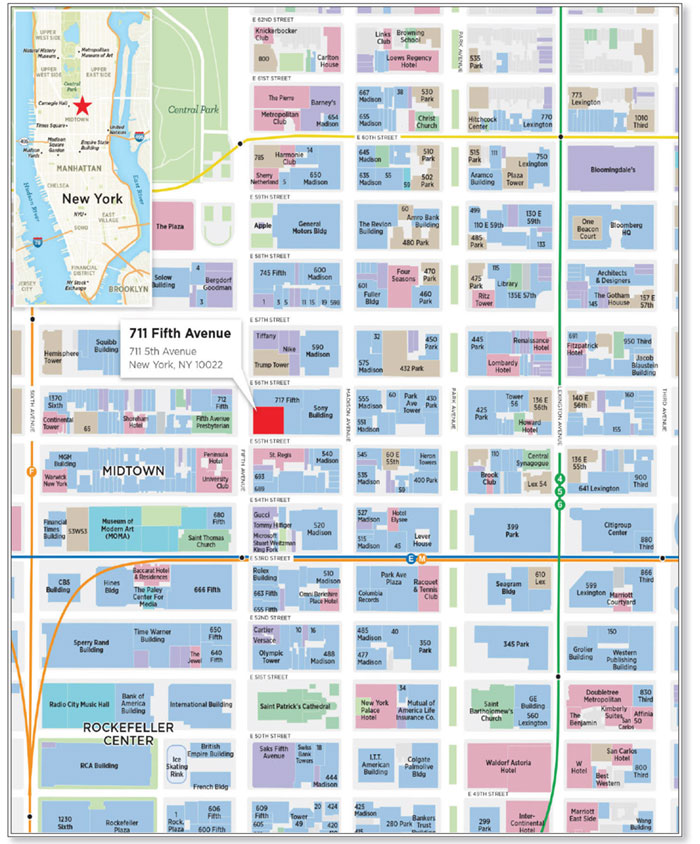

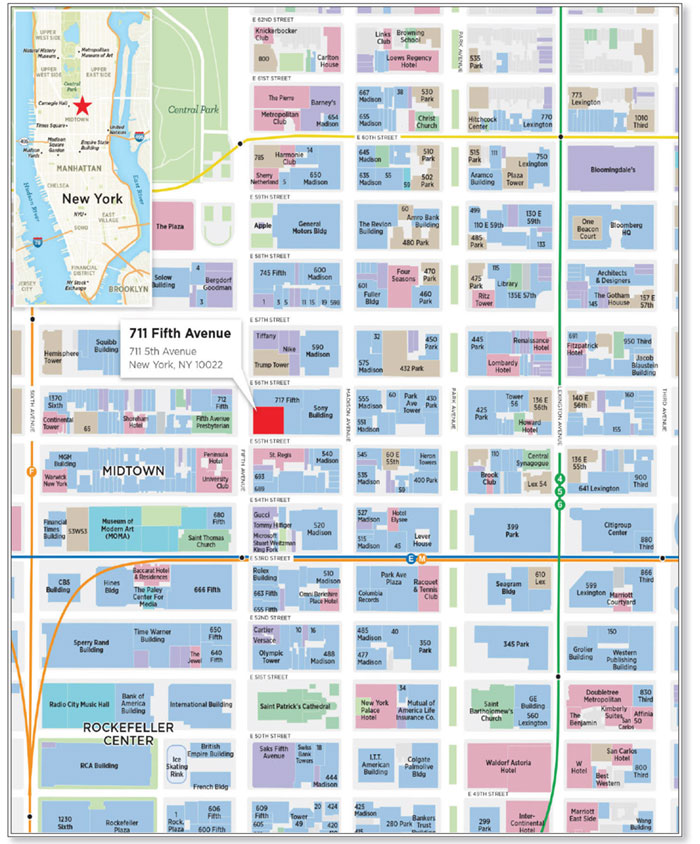

| 5 | 711 Fifth Avenue | GSMC | Mixed Use | 12/1/2020 | 4/6/2020 | Y | Y | Y | N | N | Y(4) | 100.0%(4) | 100.0%(4) | 100.0%(4) | 100.0%(4) |

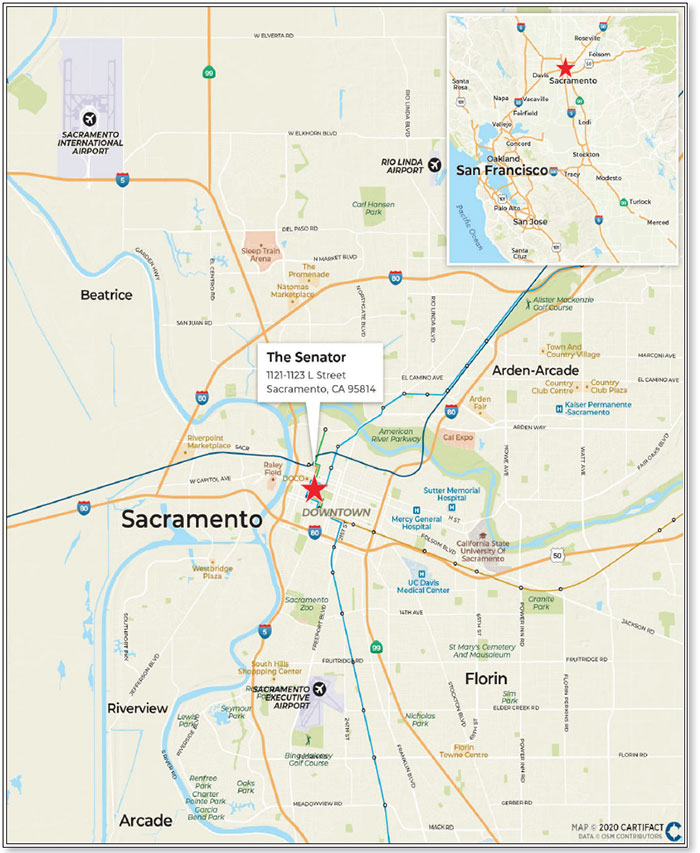

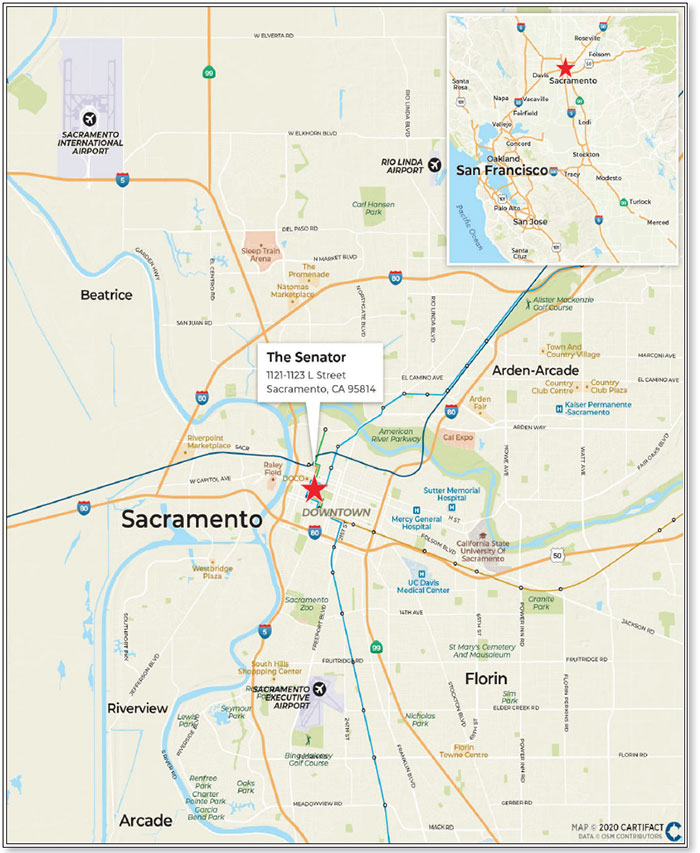

| 6 | The Senator | SMC | Office | 12/3/2020 | 1/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 7 | Appletree Business Park | SMC | Office | 12/3/2020 | 1/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 96.7% | 99.8% | 99.8% |

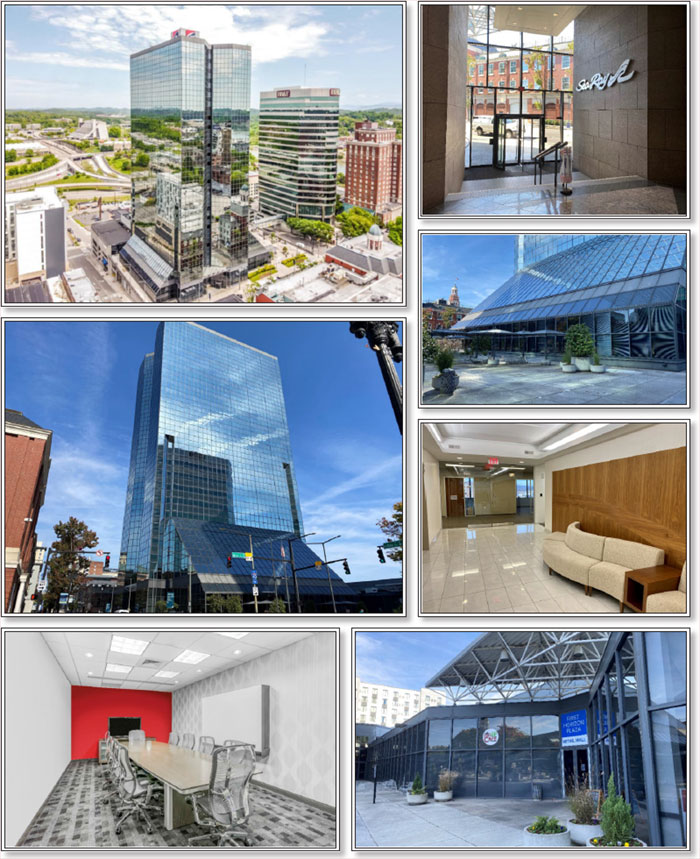

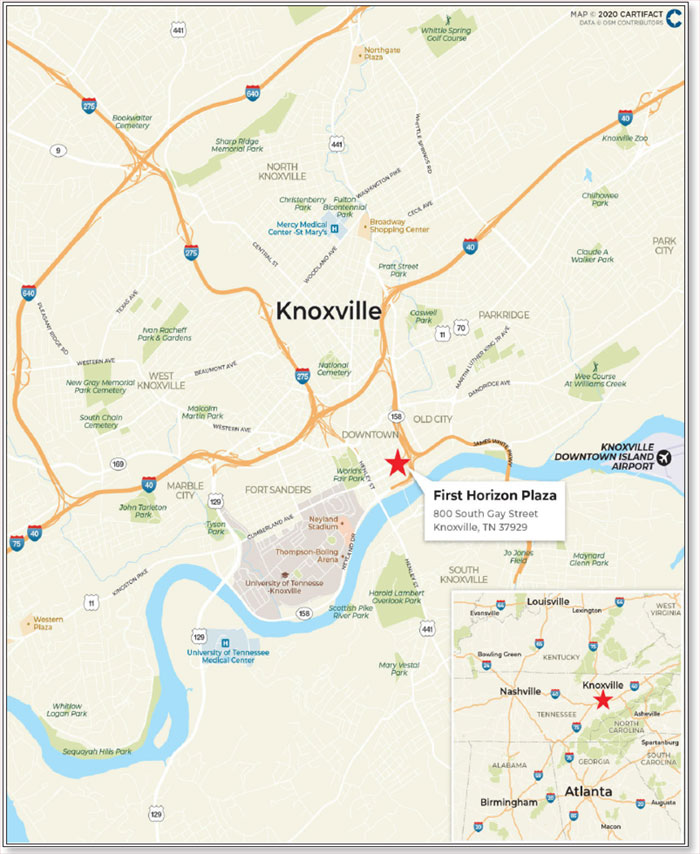

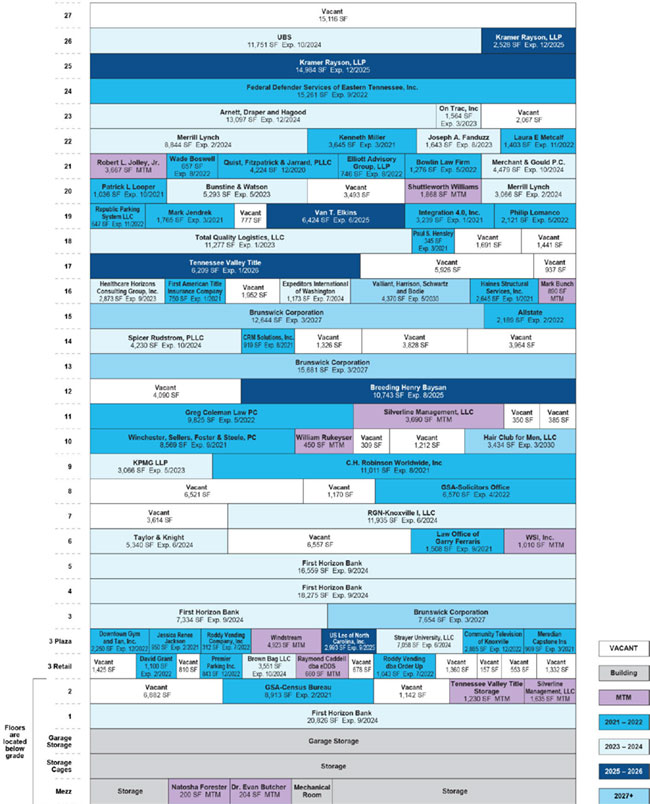

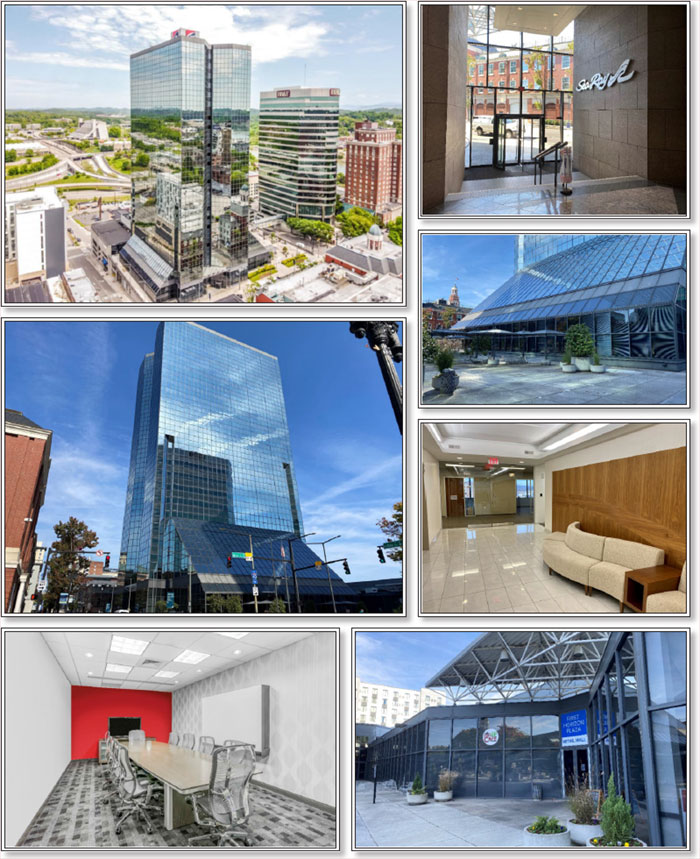

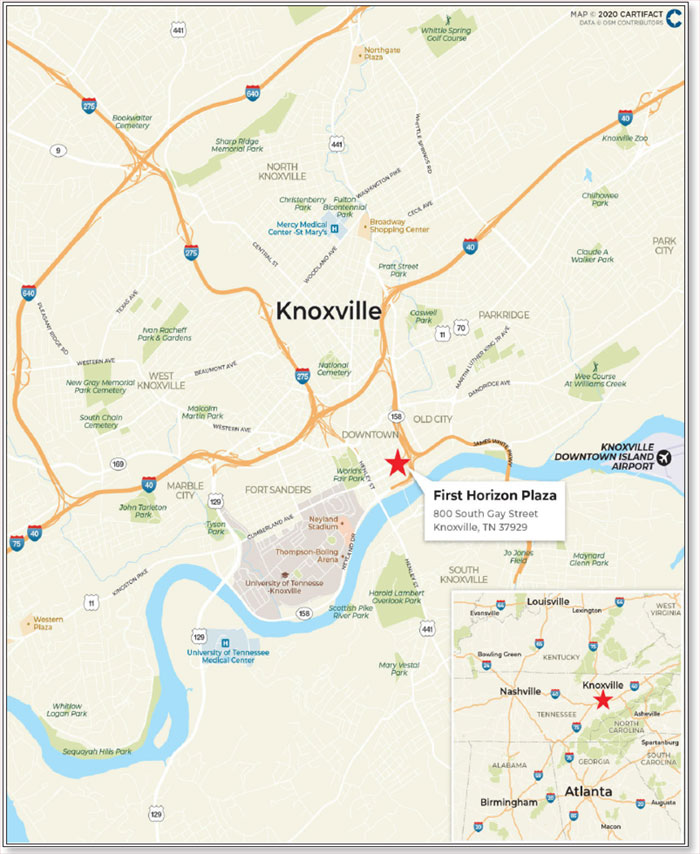

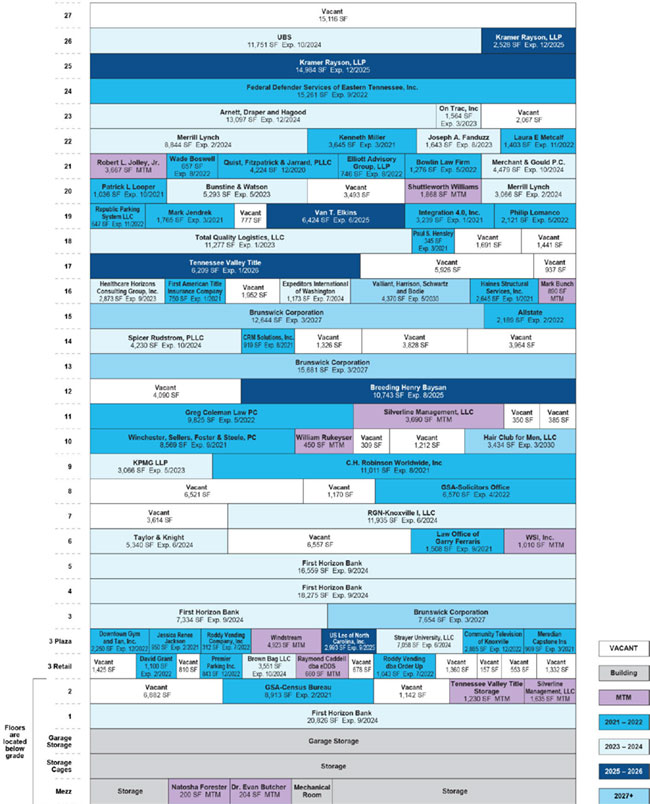

| 8 | First Horizon Plaza(5) | CREFI | Office | 12/6/2020 | 1/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

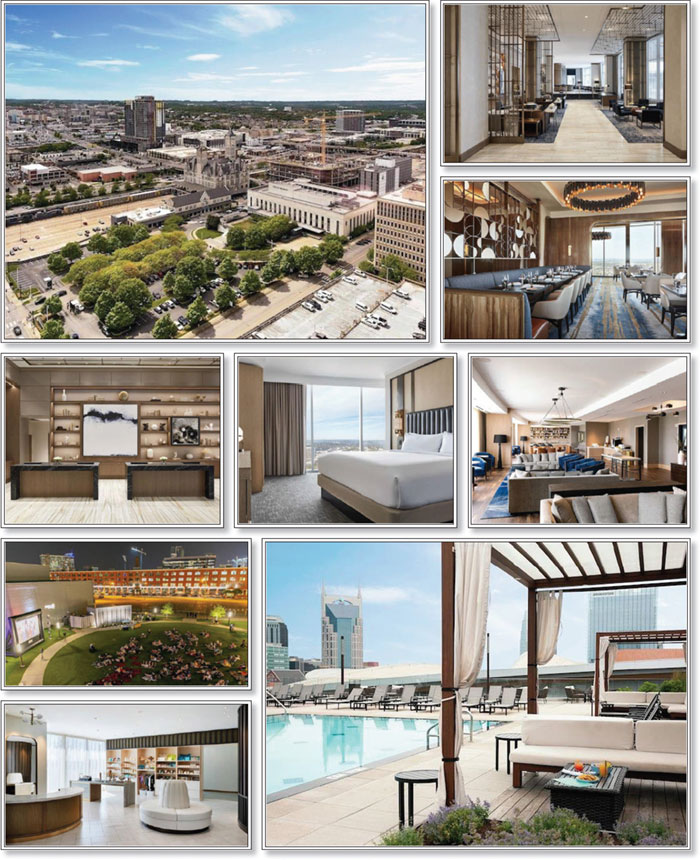

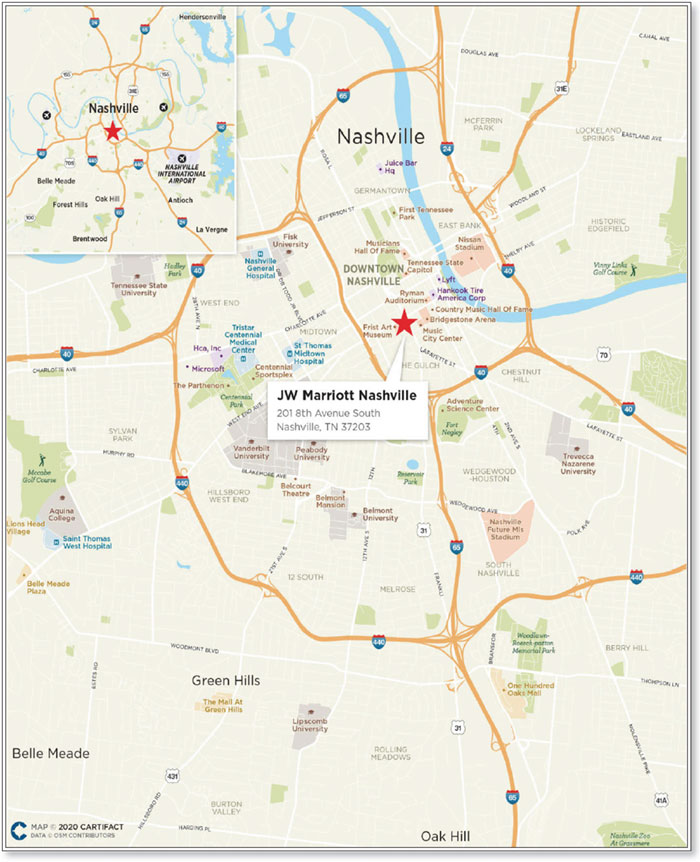

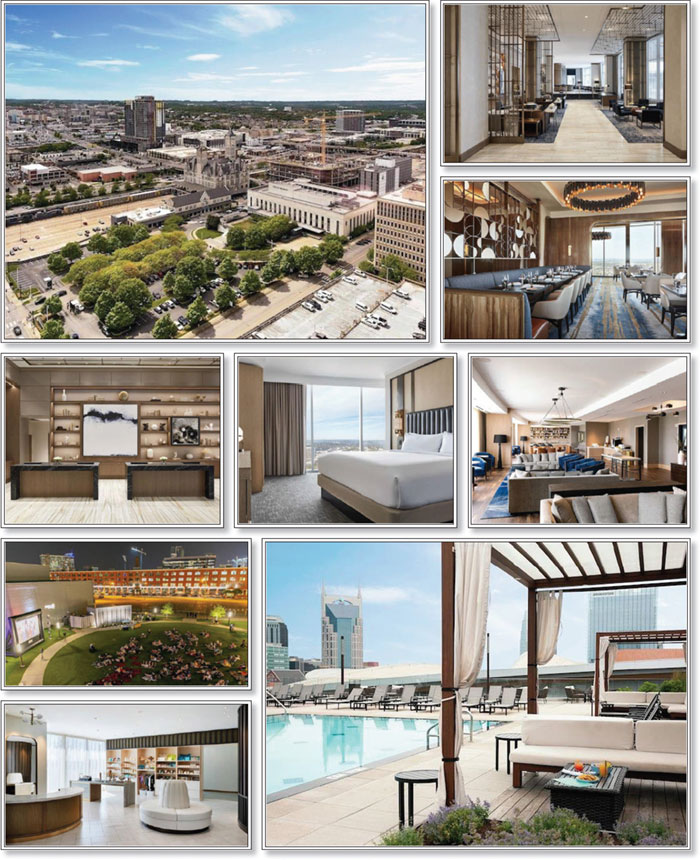

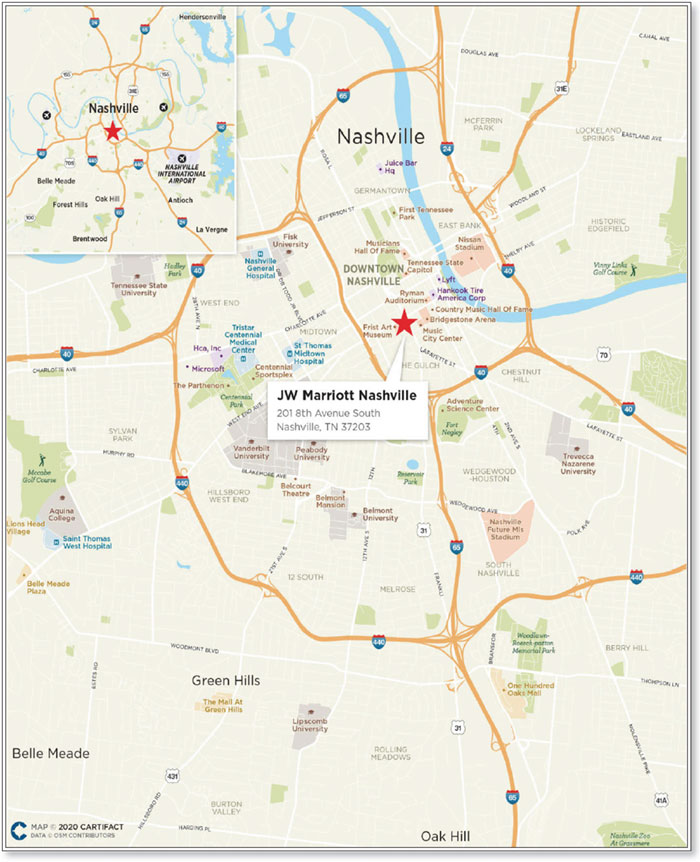

| 9 | JW Marriott Nashville | GSMC | Hospitality | 11/30/2020 | 4/6/2020 | Y(6) | Y(6) | Y(6) | Y(6) | Y(6) | Y(6) | NAP | NAP | NAP | NAP |

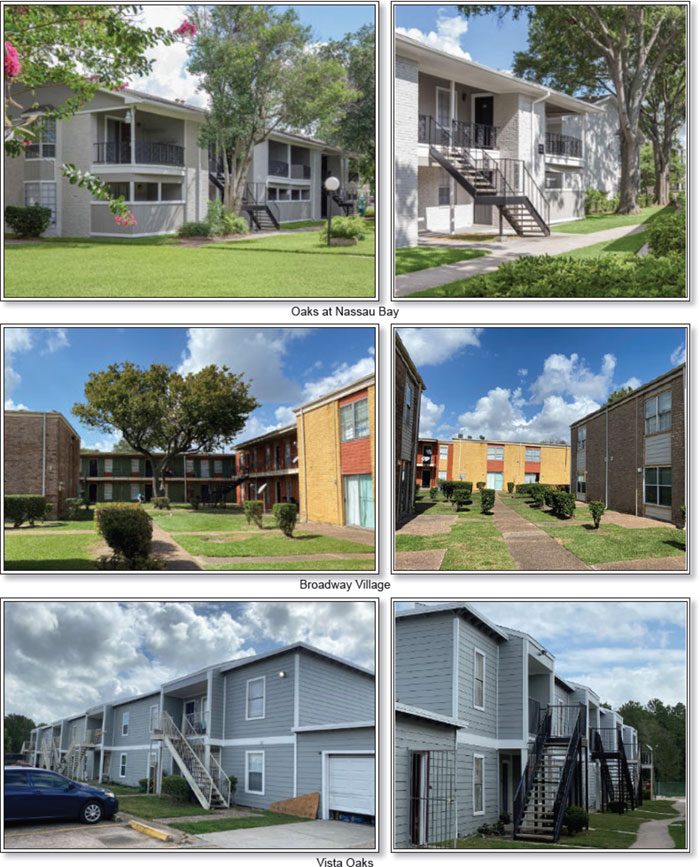

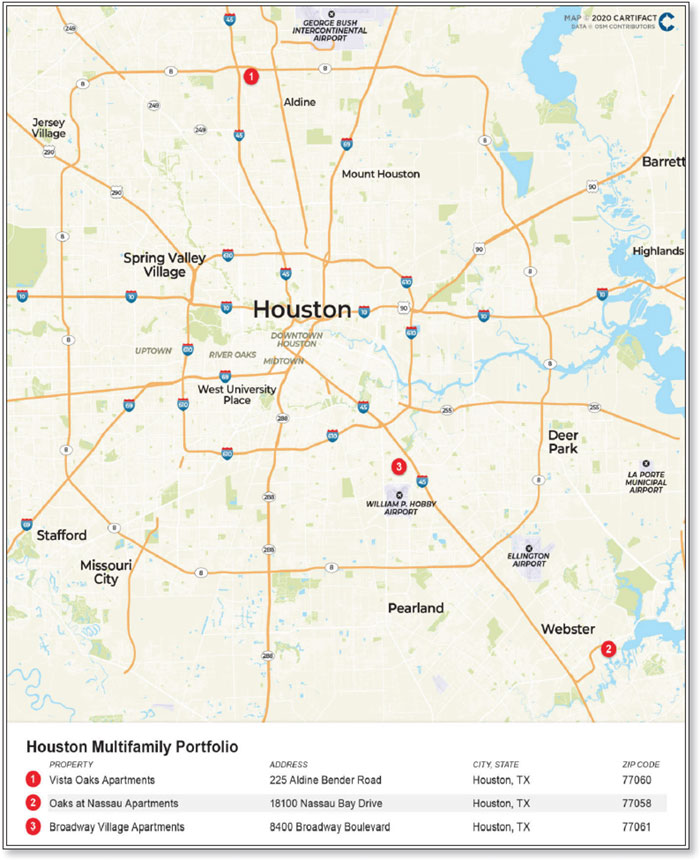

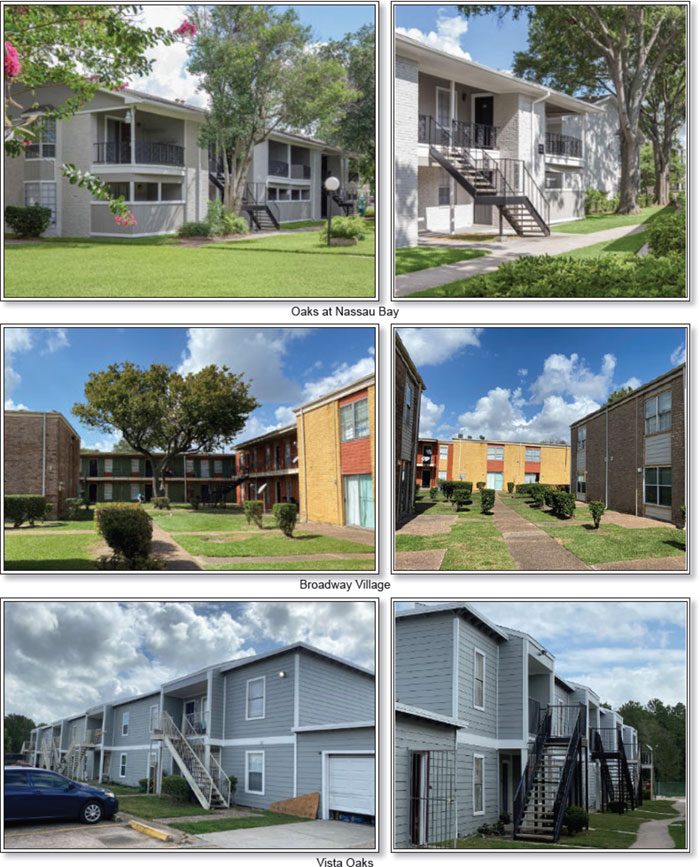

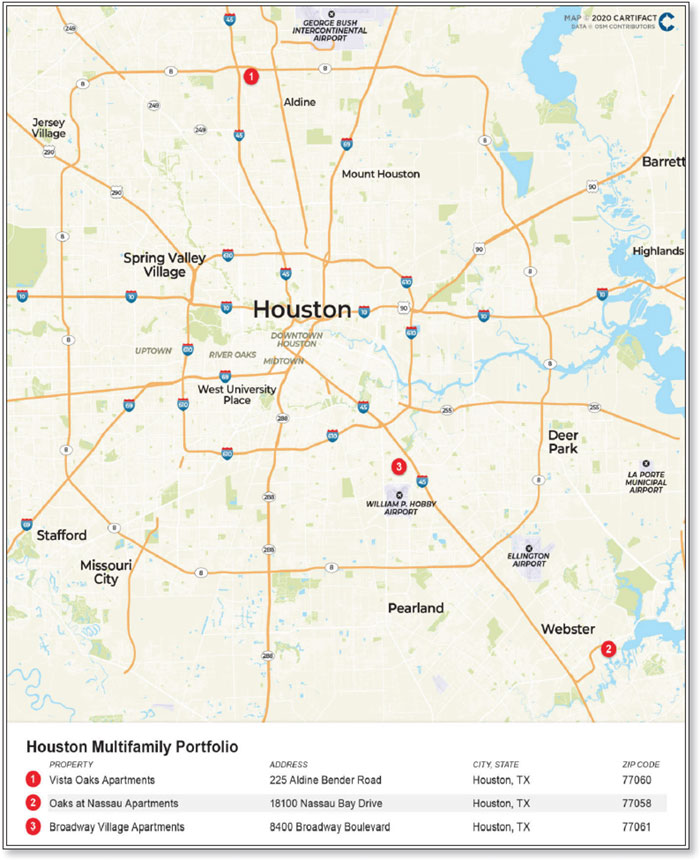

| 10 | Houston Multifamily Portfolio | SMC | Multifamily | 12/5/2020 | 1/6/2021 | NAP | NAP | NAP | N | N | N | 96.8% | 97.4% | NAP | NAP |

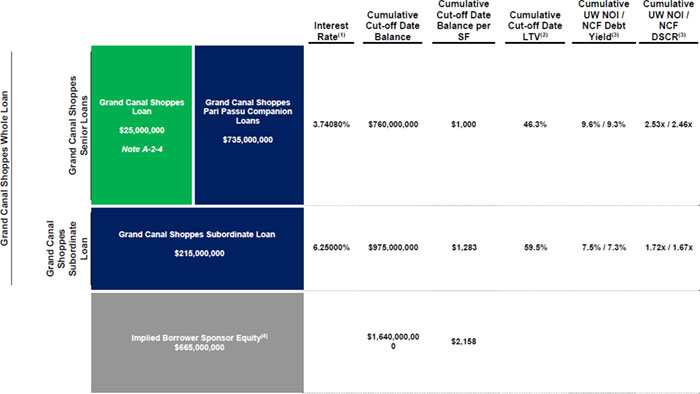

| 11 | Grand Canal Shoppes | AREF | Retail | 12/7/2020 | 8/1/2019 | Y | Y | Y | Y(7) | N | Y | NAP(8) | NAP(8) | NAP(8) | NAP(8) |

| 12 | 32-42 Broadway(9) | CREFI | Office | 12/6/2020 | 12/6/2020 | NAP | NAP | Y | N | N | N | 98.5% | 98.5% | 76.1% | 76.1% |

| 13 | Hotel ZaZa Houston Museum District | CREFI | Hospitality | 12/6/2020 | 4/6/2020 | Y | Y | Y | N | Y | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 14 | SoCal & South Miami Medical Office Portfolio | SMC | Office | 12/5/2020 | 11/6/2020 | NAP | Y | Y | N | N | Y(10) | 100.0% | 100.0% | 98.4% | 98.7% |

| 15 | Bayshore Villa MHC | SGFC | Manufactured Housing | 12/1/2020 | 1/1/2021 | NAP | NAP | NAP | N | N | N | 95.8% | 97.5% | 95.8% | 95.5% |

| 16 | Cabinetworks Portfolio | GSMC | Industrial | 10/15/2020 | 12/6/2020 | NAP | NAP | Y | N | N | N | 100.0%(11) | 100.0%(11) | 100.0%(11) | 100.0%(11) |

| 17 | Philadelphia & Brooklyn Multifamily Portfolio | SGFC | Various | 12/1/2020 | 1/5/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 18 | King City SV | SGFC | Multifamily | 12/1/2020 | 10/1/2020 | Y | Y | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 19 | Pacifica Plaza | SGFC | Office | 12/1/2020 | 1/1/2021 | NAP | NAP | NAP | N | N | Y(12) | 96.1% | 100.0% | 96.1% | 100.0% |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., SG Americas Securities, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

7

| COVID-19 UPDATE (continued) |

# | Property Name | Mortgage Loan Seller | Property Type | Information as of Date | First Due Date | October Debt Service Payment Received

(Y/N) | November Debt Service Payment Received

(Y/N) | December Debt Service Payment Received

(Y/N) | Forbearance or Other Debt Service Relief Requested

(Y/N) | Other Loan Modification Requested

(Y/N) | Lease Modification or Rent Relief Requested

(Y/N) | Occupied SF or Unit Count Making Full October Rent Payment

(%) | UW October Base Rent Paid (%) | Occupied SF or Unit Count Making Full November Rent Payment

(%) | UW November Base Rent Paid (%) |

| 20 | Parkway Office | SGFC | Office | 12/1/2020 | 1/1/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 21 | Redmond Town Center(13) | CREFI | Mixed Use | 12/6/2020 | 4/6/2020 | Y | Y | Y | N | N | N | 72.4% | 68.5% | 66.3% | 68.2% |

| 22 | White Oak Crossing | GSMC | Retail | 12/1/2020 | 1/6/2020 | Y | Y | Y | N | N | Y(14) | 92.9% | 91.0% | 93.1% | 91.5% |

| 23 | UM Student Housing Portfolio | SMC | Multifamily | 12/8/2020 | 1/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 24 | IOM Villas | AREF | Multifamily | 11/12/2020 | 1/6/2021 | NAP(2) | NAP(2) | NAP(2) | N | N | N | 92.5%(15) | 92.14%(15) | 88.9%(15) | 88.9%(15) |

| 25 | Paramount Town Center | AREF | Retail | 11/23/2020 | 4/6/2020 | Y | Y | Y | N | Y(16) | Y(17) | 95.6%(17) | 79.5%(17) | 95.6%(17) | 79.5%(17) |

| 26 | La Quinta Downtown Waco | SMC | Hospitality | 12/4/2020 | 4/6/2020 | Y | Y | Y | N | N | N | NAP(18) | NAP(18) | NAP(18) | NAP(18) |

| 27 | 375 Warm Springs | SMC | Office | 12/5/2020 | 12/6/2020 | NAP | NAP | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 28 | 4850 Eucalyptus Avenue | CREFI | Industrial | 12/6/2020 | 1/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 29 | 6925 Lake Ellenor Drive | AREF | Office | 12/2/2020 | 10/6/2020 | Y | Y | Y | N | N | Y(19) | 89.2% | 91.7% | 91.6% | 92.8% |

| 30 | South Bronx Medical Office | AREF | Office | 12/1/2020 | 1/6/2021 | NAP(2) | NAP(2) | NAP(2) | N | N | Y(20) | 100.0% | 100.0% | 100.0% | 100.0% |

| 31 | Upper West Side Mixed-Use | AREF | Mixed Use | 11/9/2020 | 12/6/2020 | NAP(2) | NAP(2) | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 32 | 2416 Merchant Street | SGFC | Industrial | 12/1/2020 | 1/1/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 33 | 4781 Broadway | AREF | Mixed Use | 12/1/2020 | 1/6/2021 | NAP(2) | NAP(2) | NAP(2) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 34 | 2803 NE Loop 410 | SMC | Industrial | 12/5/2020 | 12/6/2020 | NAP | NAP | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 35 | 7th Street Mixed Use | SMC | Mixed Use | 12/5/2020 | 1/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 36 | Hampton Inn Alamogordo | SGFC | Hospitality | 12/1/2020 | 5/1/2020 | Y | Y | Y | N | N | N | NAP | NAP | NAP | NAP |

| 37 | McCarthy Ranch | SMC | Retail | 12/1/2020 | 3/6/2020 | Y | Y | Y | N | N | Y(21) | 69.0%(20) | 82.0%(20) | NAP | NAP |

| 38 | Storage Xxtra Hwy 155 | SMC | Self Storage | 12/1/2020 | 12/6/2020 | NAP | NAP | Y | N | N | N | 96.0% | 95.0% | 94.0% | 92.0% |

| 39 | 1404 West University | SMC | Retail | 12/5/2020 | 7/6/2019 | Y | Y | Y | N | Y | Y(22) | 100.0% | 100.0% | 100.0% | 100.0% |

| 40 | Big Space Storage | AREF | Self Storage | 11/31/2020 | 10/6/2020 | Y | Y | Y | N | N | N | 98.6% | 96.7% | 96.7%(23) | 91.4%(23) |

| 41 | Freedom Storage Dallas | SGFC | Self Storage | 12/1/2020 | 1/1/2021 | NAP | NAP | NAP | N | N | N | 97.8% | 98.2% | 97.4% | 97.2% |

| 42 | Smitty’s MHP | SMC | Manufactured Housing | 12/1/2020 | 12/6/2020 | NAP | NAP | Y | N | N | N | NAP(24) | NAP(24) | NAP(24) | NAP(24) |

| 43 | Georgetown Square | AREF | Mixed Use | 11/10/2020 | 5/6/2020 | Y | Y | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 44 | West Bellfort Self Storage | AREF | Self Storage | 11/24/2020 | 12/6/2020 | NAP(2) | NAP(2) | Y | N | N | N | 98.8% | 97.2% | 98.5%(25) | 94.8%(25) |

| 45 | Lake Village MHP and Sunnyside Village MHP | SMC | Manufactured Housing | 12/1/2020 | 1/6/2021 | NAP | NAP | NAP | N | N | N | NAP(26) | NAP(26) | NAP(26) | NAP(26) |

| 46 | Drive-Up Self Storage | SMC | Self Storage | 12/5/2020 | 1/6/2021 | NAP | NAP | NAP | N | N | N | 97.1% | 97.8% | 96.0% | 95.0% |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., SG Americas Securities, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

8

| COVID-19 UPDATE (continued) |

| (1) | Elo Midtown Office Portfolio - UW Base Rent Paid (%) for October and November are greater than 100.0% at the Elo Midtown Office Portfolio Properties as collections include the payback of rents that were previously deferred due to the COVID-19 pandemic. |

| (2) | Phoenix Industrial Portfolio V, IOM Villas, South Bronx Medical Office, Upper West Side Mixed-Use, 4781 Broadway, West Bellfort Self Storage - the mortgage loans have first due dates on January 6, 2021. |

| (3) | Phoenix Industrial Portfolio V - the second largest tenant at the Fort Smith property, Mars Petcare (7.0% of NRA and 8.0% of UW Base Rent) has up to 90 days to pay its monthly rent pursuant to the terms of its lease. The borrower sponsor indicated that Mars Petcare has been paying rent in three-month installments on a quarterly basis and has paid July through September rent in full on October 1, 2020. Given the 90-day grace period allowed for payments under the lease, rent for October and November are not due until December 29, 2020 and January 30, 2021, respectively. As such, Mars Petcare’s square footage and base rent were excluded in the calculations for both October and November. Furthermore, the borrower sponsor reported that Global Fiberglass Solutions which leases 3.9% of NRA has been delinquent on rent. The lender has underwritten the space leased to Global Fiberglass Solutions as vacant in the underwriting and has excluded the associated rent and square footage from the October and November calculations. |

| (4) | 711 Fifth Avenue - Includes one tenant, representing 4.2% of the SF and 37.3% of UW Base Rent of the 711 Fifth Avenue property who paid their rent in accordance with an agreement to pay 50% abated rent for the months of April, May and June. The abated rent will be paid back 50% by the end of 2020 and the remainder by the end of Q1 2021. |

| (5) | First Horizon Plaza - UW Base Rent Paid (%) for October and November are greater than 100.0% at the First Horizon Plaza Property as collections include the payback of rents that were previously deferred due to the COVID-19 pandemic. |

| (6) | JW Marriott Nashville –In April 2020, the JW Marriott Nashville Whole Loan was modified to permit the use of FF&E reserve funds to pay debt service, and the borrower sponsor provided a guaranty for (i) debt service payments through October 2020, and (ii) taxes and insurance payments that the guarantor is liable for to the extent they are due and payable prior to the earlier to occur of (1) a conclusion of the JW Marriott Nashville Trigger Period or (2) the date on which the JW Marriott Nashville Whole Loan has been indefeasibly paid in full in cash. In October 2020, the JW Marriott Nashville Whole Loan was further modified to waive the requirement to fund the FF&E reserve until April 2021, waive the cash management debt yield trigger through the second quarter of 2022, and otherwise permanently decrease the debt yield trigger level from 10% to 7.5%, in exchange for the borrower funding an 18-month debt service reserve to be applied to monthly payments from October 2020 through March 2022. Certain FF&E reserve funds have been used to pay debt service; therefore, the JW Marriot Nashville Whole Loan is in a cash management trigger period. |

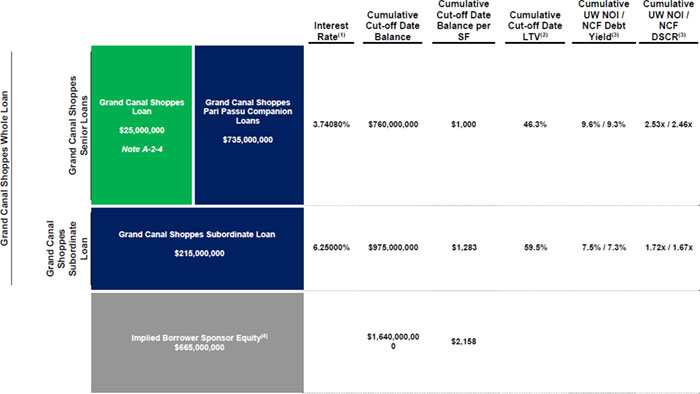

| (7) | Grand Canal Shoppes - With respect to the Grand Canal Shoppes mortgage loan, the borrower sponsor provided written requests to Midland Loan Services, the Master Servicer which services the MSC 2019-H7 transaction in which the controlling-note of the Grand Canal Shoppes Whole Loan was contributed to (“Grand Canal Shoppes Servicer”), on April 22, 2020 and May 6, 2020 to seek consent to modify certain terms and conditions of the loan agreement. Such loan modification requests were not granted by the Grand Canal Shoppes Servicer. Furthermore, the Grand Canal Shoppes Servicer indicated that no other request for forbearance or other debt service relief was received from the borrower sponsor as of December 6, 2020. As of December 6, 2020, the Grand Canal Shoppes mortgage loan was current and has remained current since the origination of the Grand Canal Shoppes Whole Loan. |

| (8) | Grand Canal Shoppes - With respect to the Grand Canal Shoppes mortgage loan, information on lease modification or rent relief requested and October and November rent collections were not made readily available to the loan seller. Pursuant to the Grand Canal Shoppes loan agreement, the borrower cannot enter into any amendment or modification of any Material Lease (as defined in the loan agreement) without the prior written consent of the lender. As of December 9, 2020, the Grand Canal Shoppes Servicer, indicated that no consent requests for lease amendments or modifications on Material Leases were received from the borrower sponsor between March 1, 2020 and December 9, 2020. On December 10, 2020, the Grand Canal Shoppes Servicer provided the loan seller with a borrower-provided accounts receivable report dated as of November 25, 2020. 1-30 day and 31-60 day delinquent base rent were estimated to be approximately $2.7 million and $2.7 million, respectively for tenants that were included in the September 30, 2020 rent roll. The Grand Canal Shoppes Servicer also provided borrower-certified financials based on the trailing-three months as of September 30, 2020. The total occupancy revenue as noted in the aforementioned financials was 83.3% of the borrower sponsor’s budget for the same time period. The loan seller did not independently verify or make any assumptions or adjustments to the information provided by the Grand Canal Shoppes Servicer. Furthermore, based on the list of operating stores available on the Grand Canal Shoppes mortgage property’s website as of December 6, 2020, tenants representing approximately 87.9% of NRA and 90.9% of underwritten base rent were open for business. Lastly, the Grand Canal Shoppes Whole Loan was structured with a hard lockbox and springing cash management which has not been triggered and is not currently active as of December 6, 2020. |

| (9) | 32-42 Broadway – due to the granularity of the 32-42 Broadway property rent roll, the Occupied SF or Unit Count Making Full October and November Payment (%) was unable to be obtained and has been set to match the UW Base Rent Paid (%) for those months. |

| (10) | Two tenants (4.3% of NRA and 6.0% of UW Base Rent) received COVID-19 related rent relief and two tenants (1.2% of NRA) ceased operations due to the impact of the COVID-19 pandemic, which tenants have been underwritten as vacant. No rent was forgiven; all COVID-19 relief requests consisted of applying security deposits towards base rent or deferring one to two months of base rent. Both tenants have paid back all deferred rent owed. |

| (11) | Cabinetworks Portfolio – Single tenant occupying 100.0% of NRA. The tenant pays rent quarterly and all rent through to December 31, 2020 has been paid. |

| (12) | Pacifica Plaza – Three tenants (7.8% of NRA and 7.5% of UW Base Rent) requested and received COVID-19-related rent relief. An additional tenant (3.8% of NRA) ceased operations due to COVID-19-related impacts, and was underwritten as vacant. No rent has been forgiven. All COVID-19 relief requests consisted of deferring one to three months of base rent with repayment due on or before June 30, 2021. Total outstanding deferred rent is $10,100.50 as of the Cut-Off Date. |

| (13) | Redmond Town Center - Represents the amount of borrower collections. |

| (14) | White Oak Crossing – Eight tenants, representing approximately 51.2% of the UW Base Rent have requested rent relief. |

| (15) | IOM Villas - the calculations shown reflect the percentage of account receivables collected in the respective months. The November figures were as of November 12, 2020. |

| (16) | Paramount Town Center - the borrower and lender executed an amendment to the loan agreement on December 4, 2020 to modify the credit rating threshold of a major tenant, or its parent company, that triggers a lease sweep period from A- to BBB-, due to the COVID-related downgrade by S&P of Ross Stores, the parent company of Ross Dress for Less, in March 2020. In addition, the amendment extended the lease sweep trigger date from six months to 12 months for the expiration of a major tenant’s lease, instituted an on-going TI/LC of $1.00 per PSF and eliminated the TI/LC reserve cap (previously $950,000). |

| (17) | Paramount Town Center - the largest tenant, Ross Dress for Less (49.1% of NRA and 35.0% of UW base rent), exercised an option to extend its lease to January 31, 2027. In exchange for the lease renewal, Ross Dress for Less received abated rent for May and June 2020 and deferral of 50% of base rent from July 2020 through February 2021. The deferred rent is required to be paid in 10 equal monthly installments commencing in March 2021. As Ross Dress for Less paid its rent pursuant to the terms of its lease extension, its square footage was included in the Occupied SF Making Full October and November Rent Payments. Furthermore, the borrower sponsor reported that two tenants (4.4% of NRA and 5.3% of UW base rent), did not pay full rent in October or November. |

| (18) | La Quinta Downtown Waco - Not available due to the nature of the property type. |

| (19) | 6925 Lake Ellenor Drive - BimmerTech North America Inc, representing approximately 1.5% of UW rent and 1.3% of NRA, executed a lease modification in June 2020 to defer $1,325 of May and June rent payments. As of November 2020, the deferred amounts were repaid and the tenant returned to paying scheduled rent. The borrower sponsor indicated that two tenants representing 10.3% of NRA and 9.7% of UW Base Rent did not pay October rent. The borrower sponsor indicated that three tenants representing 7.2% of NRA and 7.2% of UW Base Rent did not pay November rent. |

| (20) | South Bronx Medical Office - the largest tenant, Acacia Network (56.6% of NRA and 45.1% of UW base rent) deferred rent for the months of April through June 2020, which is expected to be repaid in 12 installments commencing in July 2020. Acacia Network has paid full rent since July 2020. No other tenant requested or received rent relief. |

| (21) | McCarthy Ranch - Sportsmans Warehouse vacated in April. Additionally, there is a deferral agreement in place with Big Al’s in which Big Al’s is paying 50% of its rent through December. Excluding these two tenants, 100% of rent received was received in October. Due to the timing of the borrower sponsor’s accounting process, prior month’s collection information is typically not made available until the third week of the following month. |

| (22) | 1404 West University - Two tenants (Just Salad and Nekter Juice Bar) ceased paying rent for between five and six months. The borrower sponsor negotiated lease modifications with the related tenants and both tenants commenced full rental payments in October 2020. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., SG Americas Securities, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

9

| COVID-19 UPDATE (continued) |

| (23) | Big Space Storage - the Occupied Unit Count Making Full November Rent Payment and UW November Base Rent Paid figures include units that are 31-90 days delinquent. Including only those units that are 31-60 days delinquent, the Occupied SF Making Full November Rent Payments and UW November Base Rent Paid figures would be 97.8% and 96.5%, respectively. |

| (24) | Smitty’s MHP – The mortgaged property was acquired by the borrower sponsor in February of 2020. Collection information was requested from the borrower sponsor subsequent to the October 23, 2020 origination of the mortgage loan but has not been made available. |

| (25) | West Bellfort Self Storage - the Occupied Unit Count Making Full November Rent Payment and UW November Base Rent Paid figures include units that are 31-90 days delinquent. Including only those units that are 31-60 days delinquent, the Occupied SF Making Full November Rent Payments and UW November Base Rent Paid figures would be 99.4% and 98.3%, respectively. |

| (26) | Lake Village MHP and Sunnyside Village MHP – Both properties were acquired in conjunction with the origination of the mortgage loan on November 24, 2020 and collection information was not made available by the seller. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., SG Americas Securities, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

10

| KEY FEATURES OF THE CERTIFICATES |

| Co-Lead Managers and Joint Bookrunners: | Goldman Sachs & Co. LLC Citigroup Global Markets Inc. SG Americas Securities, LLC |

| | |

| Depositor: | GS Mortgage Securities Corporation II |

| | |

| Initial Pool Balance: | $826,330,787 |

| | |

| Master Servicer: | Midland Loan Services, a Division of PNC Bank, National Association |

| | |

| Special Servicer: | LNR Partners, LLC |

| | |

| Certificate Administrator: | Wells Fargo Bank, National Association |

| | |

| Trustee: | Wells Fargo Bank, National Association |

| | |

| Operating Advisor: | Pentalpha Surveillance LLC |

| | |

| Asset Representations Reviewer: | Pentalpha Surveillance LLC |

| | |

| U.S. Credit Risk Retention: | For a discussion of the manner by which Goldman Sachs Mortgage Company, as retaining sponsor, intends to satisfy the credit risk requirements of the Credit Risk Retention Rules, see “Credit Risk Retention” in the Preliminary Prospectus. |

| | |

| Pricing: | Week of December 14, 2020 |

| | |

| Closing Date: | December 29, 2020 |

| | |

| Cut-off Date: | For each mortgage loan, the related due date for such mortgage loan in December 2020 (or, in the case of any mortgage loan that has its first due date after December 2020, the date that would have been its due date in December 2020 under the terms of that mortgage loan if a monthly payment were scheduled to be due in that month). |

| | |

| Determination Date: | The 6th day of each month or next business day, commencing in January 2021 |

| | |

| Distribution Date: | The 4th business day after the Determination Date, commencing in January 2021 |

| | |

| Interest Accrual: | Preceding calendar month |

| | |

| ERISA Eligible: | The offered certificates are expected to be ERISA eligible |

| | |

| SMMEA Eligible: | No |

| | |

| Payment Structure: | Sequential Pay |

| | |

| Day Count: | 30/360 |

| | |

| Tax Structure: | REMIC |

| | |

| Rated Final Distribution Date: | December 2053 for the offered certificates |

| | |

| Cleanup Call: | 1.0% |

| | |

| Minimum Denominations: | $10,000 minimum for the offered certificates (except with respect to the Class X-A and Class X-B certificates: $1,000,000 minimum); integral multiples of $1 thereafter for all the offered certificates |

| | |

| Delivery: | Book-entry through DTC |

| | |

| Bond Information: | Cash flows are expected to be modeled by TREPP, INTEX and BLOOMBERG |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., SG Americas Securities, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

11

(THIS PAGE INTENTIONALLY LEFT BLANK)

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.