| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-226082-10 |

| | | |

April 9, 2021

Free Writing Prospectus

Structural and Collateral Term Sheet

$1,209,397,625

(Approximate Mortgage Pool Balance)

$1,013,928,000

(Offered Certificates)

Benchmark 2021-B25 Mortgage Trust

As Issuing Entity

GS Mortgage Securities Corporation II

As Depositor

Commercial Mortgage Pass-Through Certificates

Series 2021-B25

Goldman Sachs Mortgage Company

Citi Real Estate Funding Inc.

German American Capital Corporation

JPMorgan Chase Bank, National Association

As Sponsors and Mortgage Loan Sellers

IMPORTANT NOTICE REGARDING THE CONDITIONS FOR THIS OFFERING OF ASSET-BACKED SECURITIES

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor, Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., J.P. Morgan Securities LLC, Deutsche Bank Securities Inc., Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) the fact that there is no representation being made that these materials are accurate or complete and that these materials may not be updated or (3) these materials possibly being confidential, are, in each case, not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| Goldman Sachs & Co. LLC | J.P. Morgan | Deutsche Bank Securities | Citigroup |

| Co-Lead Managers and Joint Bookrunners |

| | | |

| Academy Securities | | Drexel Hamilton |

| Co-Managers | | Co-Managers |

| | | | | | | | |

The securities offered by this structural and collateral term sheet (this “Term Sheet”) are described in greater detail in the preliminary prospectus included as part of our Registration Statement (SEC File No. 333-226082) (the “Preliminary Prospectus”) anticipated to be dated April 9, 2021. The Preliminary Prospectus contains material information that is not contained in this Term Sheet (including without limitation a detailed discussion of risks associated with an investment in the offered securities under the heading “Risk Factors” in the Preliminary Prospectus). The Preliminary Prospectus is available upon request from Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., J.P. Morgan Securities LLC, Deutsche Bank Securities Inc., Academy Securities, Inc. or Drexel Hamilton, LLC. Capitalized terms used but not otherwise defined in this Term Sheet have the respective meanings assigned to those terms in the Preliminary Prospectus. This Term Sheet is subject to change.

The Securities May Not Be a Suitable Investment for You

The securities offered by this Term Sheet are not suitable investments for all investors. In particular, you should not purchase any class of securities unless you understand and are able to bear the prepayment, credit, liquidity and market risks associated with that class of securities. For those reasons and for the reasons set forth under the heading “Risk Factors” in the Preliminary Prospectus, the yield to maturity and the aggregate amount and timing of distributions on the offered securities are subject to material variability from period to period and give rise to the potential for significant loss over the life of those securities. The interaction of these factors and their effects are impossible to predict and are likely to change from time to time. As a result, an investment in the offered securities involves substantial risks and uncertainties and should be considered only by sophisticated institutional investors with substantial investment experience with similar types of securities and who have conducted appropriate due diligence on the mortgage loans and the securities. Potential investors are advised and encouraged to review the Preliminary Prospectus in full and to consult with their legal, tax, accounting and other advisors prior to making any investment in the offered securities described in this Term Sheet.

This Term Sheet is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The information contained in this Term Sheet may not pertain to any securities that will actually be sold. The information contained in this Term Sheet may be based on assumptions regarding market conditions and other matters as reflected in this Term Sheet. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and this Term Sheet should not be relied upon for such purposes. We and our affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of this Term Sheet may, from time to time, have long or short positions in, and buy or sell, the securities mentioned in this Term Sheet or derivatives thereof (including options). Information contained in this Term Sheet is current as of the date appearing on this Term Sheet only. Information in this Term Sheet regarding the securities and the mortgage loans backing any securities discussed in this Term Sheet supersedes all prior information regarding such securities and mortgage loans. None of Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., J.P. Morgan Securities LLC, Deutsche Bank Securities Inc., Academy Securities, Inc. or Drexel Hamilton, LLC provides accounting, tax or legal advice.

The issuing entity will be relying upon an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”), contained in Section 3(c)(5) of the Investment Company Act or Rule 3a-7 under the Investment Company Act, although there may be additional exclusions or exemptions available to the issuing entity. The issuing entity is being structured so as not to constitute a “covered fund” for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in “Risk Factors—Other Risks Relating to the Certificates—Legal and Regulatory Provisions Affecting Investors Could Adversely Affect the Liquidity of the Offered Certificates” in the Preliminary Prospectus). See also “Legal Investment” in the Preliminary Prospectus.

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., J.P. Morgan Securities LLC, Deutsche Bank Securities Inc., Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

2

CERTIFICATE SUMMARY

OFFERED CERTIFICATES

| Offered Class | | Expected Ratings

(S&P / Fitch / KBRA)(1) | | Approximate Initial

Certificate Balance

or Notional

Amount(2) | | Approximate Initial Credit Support(3) | | Initial Pass-Through Rate | | Pass-Through Rate Description | |

Wtd. Avg. Life (Yrs)(4)

| | Principal Window(4) | |

| Class A-1 | | AAA(sf) / AAAsf / AAA(sf) | | $ | 22,751,000 | | | 30.000% | | [ ]% | | (5) | | 2.74 | | 05/21 – 03/26 | |

| Class A-2 | | AAA(sf) / AAAsf / AAA(sf) | | $ | 18,335,000 | | | 30.000% | | [ ]% | | (5) | | 4.88 | | 03/26 – 03/26 | |

| Class A-3 | | AAA(sf) / AAAsf / AAA(sf) | | $ | 38,075,000 | | | 30.000% | | [ ]% | | (5) | | 6.96 | | 04/28 – 04/28 | |

| Class A-4 | | AAA(sf) / AAAsf / AAA(sf) | | | (6) | | | 30.000% | | [ ]% | | (5) | | (6) | | (6) | |

| Class A-5 | | AAA(sf) / AAAsf / AAA(sf) | | | (6) | | | 30.000% | | [ ]% | | (5) | | (6) | | (6) | |

| Class A-SB | | AAA(sf) / AAAsf / AAA(sf) | | $ | 35,940,000 | | | 30.000% | | [ ]% | | (5) | | 7.43 | | 03/26 - 03/31 | |

| Class X-A | | AA-(sf) / AAAsf / AAA(sf) | | $ | 920,578,000 | (7) | | N/A | | [ ]% | | Variable IO(8) | | N/A | | N/A | |

| Class X-B | | NR / A-sf / AAA(sf) | | $ | 93,350,000 | (7) | | N/A | | [ ]% | | Variable IO(8) | | N/A | | N/A | |

| Class A-S | | AA-(sf) / AAAsf / AAA(sf) | | $ | 116,329,000 | | | 19.875% | | [ ]% | | (5) | | 9.96 | | 04/31 – 04/31 | |

| Class B | | NR / AA-sf / AA-(sf) | | $ | 48,829,000 | | | 15.625% | | [ ]% | | (5) | | 9.96 | | 04/31 – 04/31 | |

| Class C | | NR / A-sf / A-(sf) | | $ | 44,521,000 | | | 11.750% | | [ ]% | | (5) | | 9.96 | | 04/31 – 04/31 | |

NON-OFFERED POOLED CERTIFICATES

| Non-Offered Class | | Expected Ratings

(S&P / Fitch / KBRA)(1) | | Approximate Initial

Certificate Balance

or Notional

Amount(2) | | Approximate Initial Credit Support(3) | | Initial Pass-Through Rate | | Pass-Through Rate Description | |

Wtd. Avg. Life (Yrs)(4)

| | Principal Window(4) | |

| Class X-D | | NR / BBB-sf / BBB-(sf) | | $ | 60,319,000 | (7) | | N/A | | [ ]% | | Variable IO(8) | | N/A | | N/A | |

| Class X-F | | NR / BB-sf / BB-(sf) | | $ | 24,415,000 | (7) | | N/A | | [ ]% | | Variable IO(8) | | N/A | | N/A | |

| Class X-G | | NR / B-sf / B-(sf) | | $ | 11,489,000 | (7) | | N/A | | [ ]% | | Variable IO(8) | | N/A | | N/A | |

| Class X-H | | NR / NR / NR | | $ | 38,776,742 | (7) | | N/A | | [ ]% | | Variable IO(8) | | N/A | | N/A | |

| Class D | | NR / BBBsf / BBB+(sf) | | $ | 33,032,000 | | | 8.875% | | [ ]% | | (5) | | 9.96 | | 04/31 – 04/31 | |

| Class E | | NR / BBB-sf / BBB-(sf) | | $ | 27,287,000 | | | 6.500% | | [ ]% | | (5) | | 9.96 | | 04/31 – 04/31 | |

| Class F | | NR / BB-sf / BB-(sf) | | $ | 24,415,000 | | | 4.375% | | [ ]% | | (5) | | 9.96 | | 04/31 – 04/31 | |

| Class G | | NR / B-sf / B-(sf) | | $ | 11,489,000 | | | 3.375% | | [ ]% | | (5) | | 9.96 | | 04/31 – 04/31 | |

| Class H | | NR / NR / NR | | $ | 38,776,742 | | | 0.000% | | [ ]% | | (5) | | 9.96 | | 04/31 – 04/31 | |

| Class S(9) | | N/A | | | N/A | | | N/A | | N/A | | N/A | | N/A | | N/A | |

| Class R(10) | | N/A | | | N/A | | | N/A | | N/A | | N/A | | N/A | | N/A | |

NON-OFFERED LOAN SPECIFIC CERTIFICATES

| Non-Offered Class | | Expected Ratings | | Approximate Initial Certificate Balance(2) | | Approximate Initial Credit Support(3) | | Initial Pass-Through Rate | | Pass-Through Rate Description | |

Wtd. Avg. Life (Yrs)(4)

| | Principal Window(4) | |

| Class ST-A(11) | | NR | | $ | 11,875,000 | | | 0.000% | | [ ]% | | (12) | | 9.96 | | 04/31 – 04/31 | |

| Class ST-VR(11) | | NR | | $ | 625,000 | | | N/A | | (13) | | (12) | | 9.96 | | 04/31 – 04/31 | |

| | | | | | | | | | | | | | | | | | |

| Non-Offered Class | | Expected Ratings

(DBRS Morningstar)(1) | | Approximate Initial Certificate Balance(2) | | Approximate Initial Credit Support(3) | | Initial Pass-Through Rate | | Pass-Through Rate Description | |

Wtd. Avg. Life (Yrs)(4)

| | Principal Window(4) | |

| Class 300P-A(11) | | AA(low)(sf) | | $ | 13,196,000 | | | 36.386% | | [ ]% | | (12) | | 8.96 | | 04/30 – 04/30 | |

| Class 300P-B(11) | | A(low)(sf) | | $ | 43,433,000 | | | 25.249% | | [ ]% | | (12) | | 8.96 | | 04/30 – 04/30 | |

| Class 300P-C(11) | | BBB(low)(sf) | | $ | 43,809,000 | | | 14.016% | | [ ]% | | (12) | | 8.96 | | 04/30 – 04/30 | |

| Class 300P-D(11) | | BB(low)(sf) | | $ | 41,917,000 | | | 3.268% | | [ ]% | | (12) | | 8.96 | | 04/30 – 04/30 | |

| Class 300P-E(11) | | B(high)(sf) | | $ | 3,495,000 | | | 2.372% | | [ ]% | | (12) | | 8.96 | | 04/30 – 04/30 | |

| Class 300P-RR(11) | | B(high)(sf) | | $ | 9,250,000 | | | 0.000% | | [ ]% | | (12) | | 8.96 | | 04/30 – 04/30 | |

| (1) | It is a condition of issuance that the offered certificates and certain classes of non-offered certificates receive the ratings set forth above. The anticipated ratings of the certificates shown are those of Standard & Poor’s Financial Services LLC (“S&P”), Fitch Ratings, Inc. (“Fitch”), Kroll Bond Rating Agency, LLC (“KBRA”) and DBRS, Inc. (“DBRS Morningstar” and, and together with S&P, Fitch and KBRA, the “Rating Agencies”). Subject to the discussion under “Ratings” in the Preliminary Prospectus, the ratings on the certificates address the likelihood of the timely receipt by holders of all payments of interest to which they are entitled on each distribution date and, except in the case of the interest only certificates, the ultimate receipt by holders of all payments of principal to which they are entitled on or before the applicable rated final distribution date. Certain nationally recognized statistical rating organizations, as defined in Section 3(a)(62) of the Securities Exchange Act of 1934, as amended, that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, or otherwise to rate the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., J.P. Morgan Securities LLC, Deutsche Bank Securities Inc., Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

3

| CERTIFICATE SUMMARY (continued) |

| | May Affect ERISA Eligibility; Ratings May Be Downgraded” in the Preliminary Prospectus. The Rating Agencies have informed us that the “sf” designation in their ratings represents an identifier of structured finance product ratings. For additional information about this identifier, prospective investors can go to the related Rating Agency’s website. The depositor and the underwriters have not verified, do not adopt and do not accept responsibility for any statements made by the related Rating Agencies on those websites. Credit ratings referenced throughout this Term Sheet are forward-looking opinions about credit risk and express a rating agency’s opinion about the willingness and ability of an issuer of securities to meet its financial obligations in full and on time. Ratings are not indications of investment merit and are not buy, sell or hold recommendations, a measure of asset value or an indication of the suitability of an investment. |

| (2) | Approximate, subject to a variance of plus or minus 5%. The notional amount of each class of the Class X-A, Class X-B, Class X-D, Class X-F, Class X-G and Class X-H certificates (collectively the “Class X certificates”) is subject to change depending upon the final pricing of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5, Class A-SB, Class A-S, Class B, Class C, Class D, Class E, Class F, Class G and Class H certificates (collectively, the “pooled principal balance certificates” and, together with the Class X and Class S certificates, the “pooled non-VRR certificates”) as follows: (1) if as a result of such pricing the pass-through rate of any class of pooled principal balance certificates whose certificate balance comprises such notional amount is equal to the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), the certificate balance of such class of pooled principal balance certificates may not be part of, and reduce accordingly, such notional amount of the related Class X certificates (or, if as a result of such pricing the pass-through rate of the related Class X certificates is equal to zero, such Class X certificates may not be issued on the closing date), and/or (2) if as a result of such pricing the pass-through rate of any class of pooled principal balance certificates that does not comprise such notional amount of the related Class X certificates is less than the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), such class of pooled principal balance certificates may become a part of, and increase accordingly, such notional amount of the related Class X certificates. |

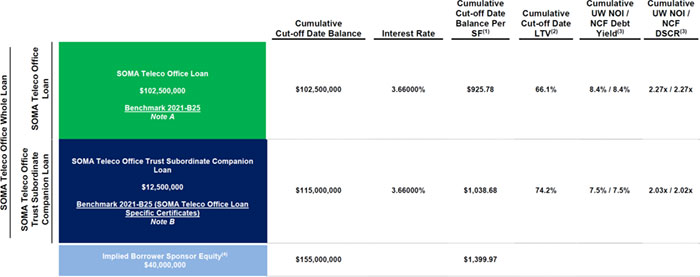

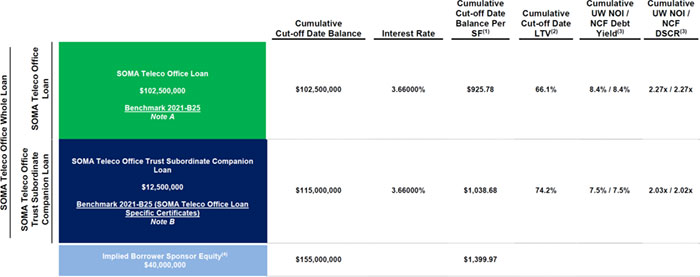

| (3) | The initial credit support percentages set forth for the certificates are approximate and, for the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5 and Class A-SB certificates, are represented in the aggregate. The approximate initial credit support percentage for each class of pooled principal balance certificates (together with the Class X certificates, the Class S certificates and Class RR certificates, the “pooled certificates”) does not include the subordination provided by the subordinate companion loan related to the SOMA Teleco Office mortgage loan (the “SOMA Teleco Office trust subordinate companion loan”) or the subordinate companion loan related to the Amazon Seattle mortgage loan (the “Amazon Seattle trust subordinate companion loan” and, together with the SOMA Teleco Office trust subordinate companion loan, the “trust subordinate companion loans”). None of the Class ST-A or Class ST-VR certificates (collectively, the “SOMA Teleco Office loan-specific certificates”), or Class 300P-A, Class 300P-B, Class 300P-C, Class 300P-D, Class 300P-E or Class 300P-RR certificates (collectively, the “Amazon Seattle loan-specific certificates” and, together with the SOMA Teleco Office loan-specific certificates, the “loan-specific certificates”) will provide credit support to any class of pooled certificates except to the extent of the subordination of the related trust subordinate companion loan (in which the related loan-specific certificates each represent an interest) to the SOMA Teleco Office mortgage loan or the Amazon Seattle mortgage loan, as applicable, and any related pari passu companion loans. Additionally, the approximate initial credit support percentages shown in the table above do not take into account the pooled VRR interest. However, losses incurred on the mortgage loans will be allocated between the pooled VRR interest and the pooled principal balance certificates, pro rata in accordance with their respective outstanding balances. See “Credit Risk Retention” and “Description of the Certificates” in the Preliminary Prospectus. |

| (4) | The weighted average life and period during which distributions of principal would be received as set forth in the foregoing table with respect to each class of certificates having a certificate balance are based on the assumptions set forth under “Yield, Prepayment and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus and on the assumptions that there are no prepayments, modifications or losses in respect of the mortgage loans or whole loans and that there are no extensions or forbearances of maturity dates or anticipated repayment dates of the mortgage loans or whole loans. |

| (5) | For each distribution date, the pass-through rates of each class of pooled principal balance certificates will generally be a per annum rate equal to one of (i) a fixed rate, (ii) the weighted average of the net mortgage interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as of their respective due dates in the month preceding the month in which the related distribution date occurs (the “WAC Rate”), (iii) the lesser of a specified pass-through rate and the WAC Rate, or (iv) the WAC Rate less a specified percentage. |

| (6) | The exact initial certificate balances of the Class A-4 and Class A-5 certificates are unknown and will be determined based on the final pricing of those classes of certificates. However, the respective initial certificate balances, assumed final distribution dates, weighted average lives and principal windows of the Class A-4 and Class A-5 certificates are expected to be within the applicable ranges reflected in the following chart. The initial aggregate certificate balance of the Class A-4 and Class A-5 certificates is expected to be approximately $689,148,000, subject to a variance of plus or minus 5%. |

Class of Certificates | Expected Range of Initial Certificate Balance | Expected Range of Assumed Final Distribution Date | Expected Range of Wtd. Avg. Life (Yrs) | Expected Range of Principal Window |

| Class A-4 | $0 – $340,000,000 | NAP – March 2031 | NAP – 9.26 | NAP / 11/29 – 03/31 |

| Class A-5 | $349,148,000 – $689,148,000 | April 2031 | 9.61 – 9.94 | 03/31 – 04/31 / 11/29 – 04/31 |

| (7) | The Class X certificates will not have certificate balances and will not be entitled to receive distributions of principal. Interest will accrue on each class of the Class X certificates at its respective pass-through rate based upon its respective notional amount. The notional amount of each class of the Class X certificates will be equal to the aggregate certificate balances of the related class(es) of certificates (the “related Class X class”) indicated below. |

| | Class | | Related Class X Class(es) | |

| | Class X-A | | Class A-1, Class A-2, Clas A-3, Class A-4, Class A-5, Class A-SB and Class A-S certificates | |

| | Class X-B | | Class B and Class C certificates | |

| | Class X-D | | Class D and Class E certificates | |

| | Class X-F | | Class F certificates | |

| | Class X-G | | Class G certificates | |

| | Class X-H | | Class H certificates | |

| (8) | The pass-through rate of each class of the Class X certificates for any distribution date will equal the excess, if any, of (i) the WAC Rate, over (ii) the pass-through rate (or the weighted average of the pass-through rates, if applicable) of the related Class X class(es) for that distribution date, as described in the Preliminary Prospectus. |

| (9) | The Class S certificates will not have a certificate balance, notional amount, pass-through rate, rating or assumed final distribution date. Excess interest accruing after the related anticipated repayment date on any mortgage loan with an anticipated repayment date will, to the extent collected, be allocated to the Class S certificates and the pooled VRR interest, as described under “Description of the Certificates—Distributions—Excess Interest” in the Preliminary Prospectus. The Class S certificates will not be entitled to distributions in respect of principal or interest other than excess interest. See “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—ARD Loans” in the Preliminary Prospectus. |

| (10) | The Class R certificates will not have a certificate balance, notional amount, pass-through rate, rating or rated final distribution date. The Class R certificates will represent the residual interests in each of five separate real estate mortgage investment conduits (each, a “REMIC”), as further described in the Preliminary Prospectus. The Class R certificates will not be entitled to distributions of principal or interest. |

| (11) | The SOMA Teleco Office loan-specific certificates will only be entitled to receive distributions from, and will only incur losses with respect to, the SOMA Teleco Office trust subordinate companion loan. The Amazon Seattle loan-specific certificates will only be entitled to receive distributions from, and will only incur losses with |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., J.P. Morgan Securities LLC, Deutsche Bank Securities Inc., Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

4

| CERTIFICATE SUMMARY (continued) |

| | respect to, the Amazon Seattle trust subordinate companion loan. Each trust subordinate companion loan is included as an asset of the issuing entity but is not part of the mortgage pool backing the pooled certificates. No class of pooled certificates will have any interest in either trust subordinate companion loan. See “Description of the Mortgage Pool—The Whole Loans—The Serviced AB Whole Loans—SOMA Teleco Office Whole Loan” and “—Amazon Seattle Whole Loan” in the Preliminary Prospectus. |

| (12) | For any distribution date, the pass-through rates of the loan-specific certificates (other than the Class ST-VR certificates) will, in the case of each such class, be a per annum rate equal to one of (i) a fixed rate, (ii) the net interest rate on the related trust subordinate companion loan (adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as of its due date in the month preceding the month in which the related distribution date occurs or (iii) the rate described in clause (ii) less a specified percentage. The Amazon Seattle loan-specific certificates will also be entitled to excess interest received with respect to the Amazon Seattle trust subordinate companion loan. |

| (13) | Although it does not have a specified pass-through rate, the effective interest rate on the Class ST-VR certificates will be a per annum rate equal to the net interest rate on the SOMA Teleco Office trust subordinate companion loan (adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as of its due date in the month preceding the month in which the related distribution date occurs. |

POOLED VRR INTEREST SUMMARY

Non-Offered Eligible Vertical Interest(1) | Approximate

Initial Pooled VRR Interest Balance | Approximate Initial Pooled VRR Interest Rate | Pooled VRR Interest Rate Description | Wtd. Avg. Life (Yrs)(2) | Principal Window(2) |

| Pooled RR Interest | $42,862,034 | [__]% | (3) | 9.35 | 05/21 – 04/31 |

| Class RR Certificates | $17,607,848 | [__]% | (3) | 9.35 | 05/21 – 04/31 |

| (1) | Each of the Class RR certificates and the pooled RR interest will constitute an “eligible vertical interest” (as such term is defined in the Credit Risk Retention Rules) and is expected to be acquired and retained by the applicable sponsors (or their “majority-owned affiliates”, as such term is defined in the Credit Risk Retention Rules) as described under “Credit Risk Retention” in the Preliminary Prospectus. The Class RR certificates and the pooled RR interest collectively comprise the “pooled VRR interest”. The pooled VRR interest represents the right to receive a specified percentage of all amounts collected on the mortgage loans (net of all expenses of the issuing entity) that are available for distribution to the pooled certificates and the pooled RR interest on each Distribution Date, as further described under “Credit Risk Retention” in the Preliminary Prospectus. |

| (2) | The weighted average life and period during which distributions of principal would be received as set forth in the foregoing table with respect to the pooled VRR interest are based on the assumptions described in “Yield, Prepayment and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus and on the assumptions that there are no prepayments, modifications or losses in respect of the mortgage loans or whole loans and that there are no extensions or forbearances of maturity dates or anticipated repayment dates of the mortgage loans or whole loans. |

| (3) | Although it does not have a specified pass-through rate (other than for tax reporting purposes), the effective interest rate for the pooled RR interest and the Class RR certificates will be a per annum rate equal to the weighted average of the net mortgage interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as of their respective due dates in the month preceding the month in which the related distribution date occurs. |

The Class X-D, Class X-F, Class X-G, Class X-H, Class D, Class E, Class F, Class G, Class H, Class RR, Class S and Class R, Class ST-A, Class ST-VR, Class 300P-A, Class 300P-B, Class 300P-C, Class 300P-D, Class 300P-E and Class 300P-RR certificates and the pooled RR interest are not offered by this Term Sheet. Any information in this Term Sheet concerning such non-offered certificates or the pooled RR interest is presented solely to enhance your understanding of the offered certificates.

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., J.P. Morgan Securities LLC, Deutsche Bank Securities Inc., Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

5

| MORTGAGE POOL CHARACTERISTICS |

| Mortgage Pool Characteristics(1) |

| Initial Pool Balance(2) | $1,209,397,625 |

| Number of Mortgage Loans | 47 |

| Number of Mortgaged Properties | 76 |

| Average Cut-off Date Mortgage Loan Balance | $25,731,864 |

| Weighted Average Mortgage Interest Rate | 3.58041% |

| Weighted Average Remaining Term to Maturity Date/ARD (months)(3) | 115 |

| Weighted Average Remaining Amortization Term (months)(3) | 358 |

| Weighted Average Cut-off Date LTV Ratio(4) | 55.9% |

| Weighted Average Maturity Date/ARD LTV Ratio(3)(5) | 52.8% |

| Weighted Average Underwritten Debt Service Coverage Ratio(6)(7) | 2.68x |

| Weighted Average Debt Yield on Underwritten NOI | 10.8% |

| % of Mortgage Loans with Mezzanine Debt | 21.4% |

| % of Mortgage Loans with Subordinate Debt(8) | 30.8% |

| % of Mortgage Loans with Preferred Equity | 0.0% |

| % of Mortgage Loans with Single Tenants(9) | 26.4% |

| (1) | With respect to 12 mortgage loans, representing approximately 40.2% of the initial pool balance, with one or more related pari passu companion loan(s) as set forth in the “Whole Loan Summary” table below, the loan-to-value ratio, debt service coverage ratio, debt yield and balance per SF, unit or room calculations presented in this Term Sheet include the related pari passu companion loan(s) unless otherwise indicated. With respect to five mortgage loans, representing approximately 30.8% of the initial pool balance, with one or more related subordinate companion loan(s) as set forth in the “Whole Loan Summary” table below, the loan-to-value ratio, debt service coverage ratio, debt yield and balance per SF, pads or unit calculations presented in this Term Sheet are calculated without regard to the related subordinate companion loan(s). Other than as specifically noted, the loan-to-value ratio, debt service coverage ratio, debt yield and mortgage loan rate information for each mortgage loan is presented in this Term Sheet without regard to any other indebtedness (whether or not secured by the related mortgaged property, ownership interests in the related borrower or otherwise) that currently exists or that may be incurred by the related borrower or its owners in the future, in order to present statistics for the related mortgage loan without combination with the other indebtedness. |

| (2) | Subject to a permitted variance of plus or minus 5%. |

| (3) | With respect to two mortgage loans, representing approximately 17.4% of the initial pool balance, each mortgage loan has an anticipated repayment date and, unless otherwise indicated, is presented as if it matured on its anticipated repayment date. |

| (4) | Unless otherwise indicated, the Cut-off Date LTV Ratio is calculated utilizing the “as-is” appraised value (which in certain cases may reflect a portfolio premium valuation). With respect to six mortgage loans (33.6% of the initial pool balance) the respective Cut-off Date LTV Ratio was calculated based upon a valuation other than an “as-is” value of each related mortgaged property. The weighted average Cut-off Date LTV Ratio for the mortgage pool without making any adjustments is 57.2%. See “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus for a description of Cut-off Date LTV Ratio. |

| (5) | Unless otherwise indicated, the Maturity Date/ARD LTV Ratio is calculated utilizing the “as-is” appraised value. With respect to six mortgage loans (33.6% of the initial pool balance) the respective Maturity Date/ARD LTV Ratios were calculated using a valuation other than an “as-is” value of each related mortgaged property assuming certain reserves were pre-funded. The weighted average Maturity Date/ARD LTV Ratio for the mortgage pool without making such adjustments is 54.1%. See “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus for a description of Maturity Date/ARD LTV Ratio. |

| (6) | Unless otherwise indicated, the UW NCF DSCR is generally calculated using the average of the principal and interest payments for the first twelve payment periods of the mortgage loan following the cut-off date; provided that (i) in the case of a mortgage loan that provides for interest-only payments through maturity or its anticipated repayment date, such items are calculated based on the interest payments scheduled to be due on the first due date following the cut-off date and the 11 due dates thereafter for such mortgage loan and (ii) in the case of a mortgage loan that provides for an initial interest-only period that ends prior to maturity or its anticipated repayment date and provides for scheduled amortization payments thereafter, such items are calculated based on the monthly payment of principal and interest payable immediately following the expiration of the interest-only period. |

| (7) | With respect to one mortgage loan, representing approximately 0.8% of the initial pool balance, which amortizes based on a non-standard amortization schedule, annual debt service for the underwritten debt service coverage ratio was calculated based on the sum of the first 12 principal and interest payments on the mortgage loan following the closing date. |

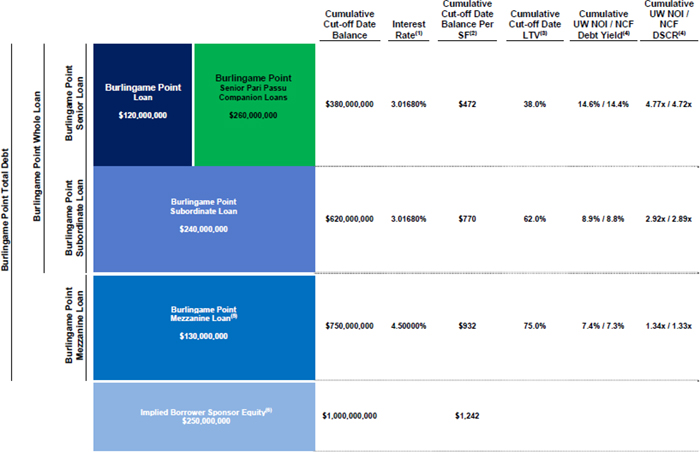

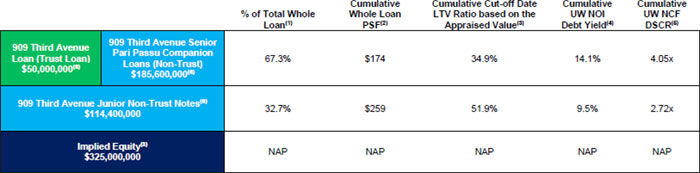

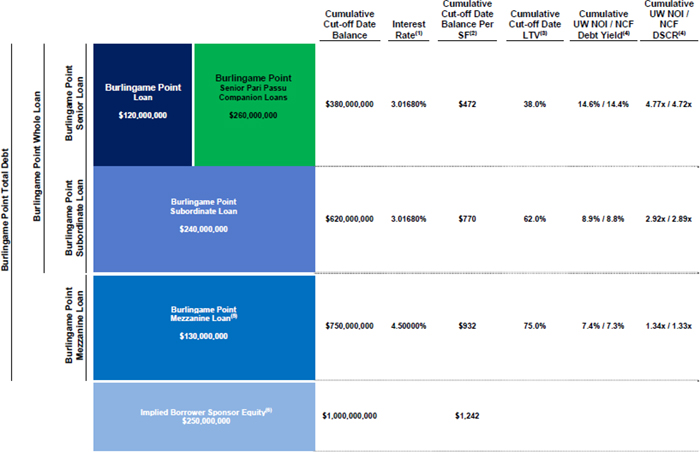

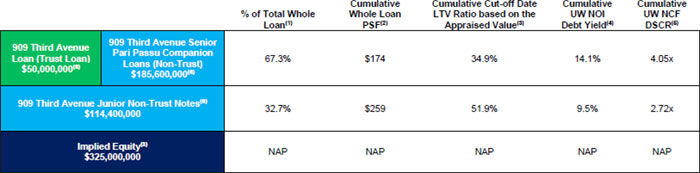

| (8) | Each of the Burlingame Point, SOMA Teleco Office, Amazon Seattle, 909 Third Avenue and At Home – Willow Grove mortgage loans have one or more subordinate companion loans that are generally subordinate in right of payment to the respective related mortgage loans (the “Burlingame Point Subordinate Companion Loans”, “SOMA Teleco Office Subordinate Companion Loan”, “Amazon Seattle Subordinate Companion Loan”, “909 Third Avenue Subordinate Companion Loans” and “At Home – Willow Grove Subordinate Companion Loan”). The Burlingame Point Subordinate Companion Loans have an aggregate outstanding principal balance of $240,000,000 as of the Cut-off Date, and will be held in the BGME 2021-VR securitization transaction. The SOMA Teleco Office Subordinate Companion Loan has an outstanding principal balance of $12,500,000, and will be included as an asset of the issuing entity but not part of the mortgage pool backing classes of certificates other than the classes of SOMA Teleco Office loan-specific certificates. The Amazon Seattle Subordinate Companion Loan has an outstanding principal balance of $155,100,000, and will be included as an asset of the issuing entity but not part of the mortgage pool backing classes of certificates other than the classes of Amazon Seattle loan-specific certificates. The 909 Third Avenue Subordinate Companion Loans have an aggregate outstanding principal balance of $114,400,000 as of the Cut-off Date, and are expected to be held in the NYC 2021-909 securitization transaction. The At Home – Willow Grove Subordinate Companion Loan has an outstanding principal balance of $2,000,000 as of the Cut-off Date, is currently held Goldman Sachs Bank USA, and is expected to transferred to RREF IV Debt AIV, LP (or its affiliate) on or before the Closing Date. See “Description of the Mortgage Pool—The Whole Loans” and “Description of the Mortgage Pool—Additional Indebtedness” in the Preliminary Prospectus. |

| (9) | Excludes mortgage loans that are secured by multiple properties with multiple tenants. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., J.P. Morgan Securities LLC, Deutsche Bank Securities Inc., Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

6

| ■ | The following table contains information regarding the status of the mortgage loans and mortgaged properties provided by the respective borrowers as of the date set forth in the “Information as of Date” column. The cumulative effects of the COVID-19 emergency on the global economy may cause tenants to be unable to pay their rent and borrowers to be unable to pay debt service under the mortgage loans. As a result, we cannot assure you that the information in the following table is indicative of future performance or that tenants or borrowers will not seek rent or debt service relief (including forbearance arrangements) or other lease or loan modifications in the future. Such actions may lead to shortfalls and losses on the certificates. See “Risk Factors—Special Risks—Current Coronavirus Pandemic May Adversely Affect the Global Economy and the Performance of the Mortgage Loans” and “Description of the Mortgage Pool—COVID Considerations” in the Preliminary Prospectus. |

Loan # | Property Name | Mortgage Loan Seller | Property Type | Information as of Date | First Due Date | February Debt Service Payment Received

(Y/N) | March Debt Service Payment Received

(Y/N) | April Debt Service Payment Received

(Y/N) | Forbearance or Other Debt Service Relief Requested

(Y/N) | Other Loan Modification Requested

(Y/N) | Lease Modification or Rent Relief Requested

(Y/N) | Occupied SF or Unit Count Making Full February Rent Payment

(%) | UW February Base Rent Paid (%) | Occupied SF or Unit Count Making Full March Rent Payment

(%) | UW March Base Rent Paid (%) |

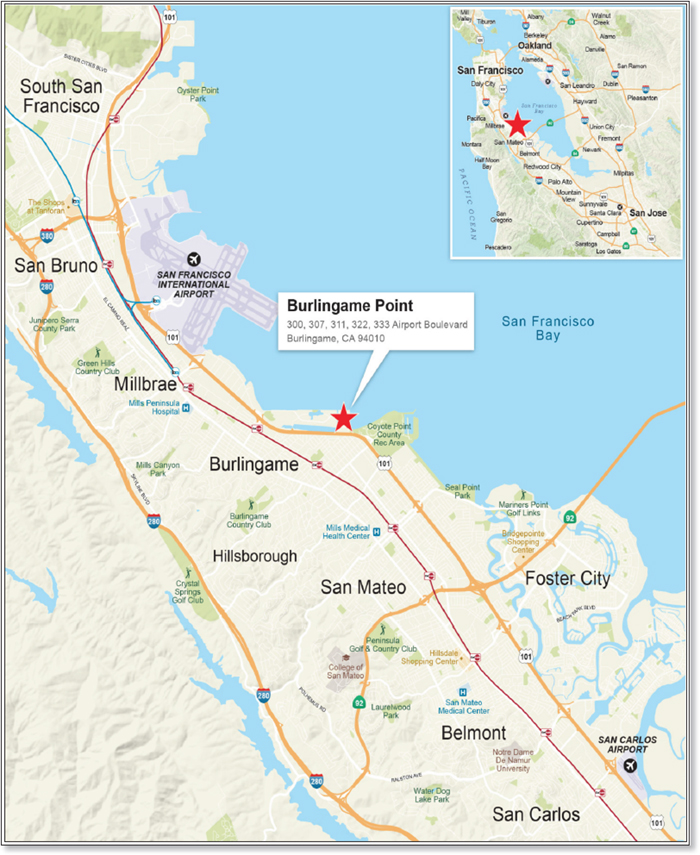

| 1 | Burlingame Point | GSMC, GACC, JPMCB | Office | 3/31/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

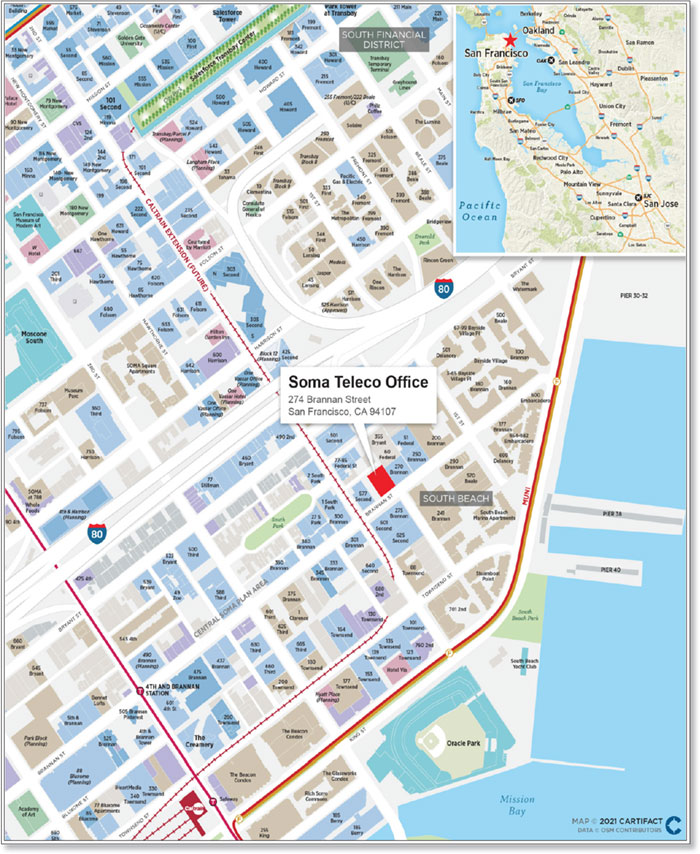

| 2 | Soma Teleco Office | GACC | Office | 3/29/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | Y(1) | 100.0% | 100.0% | 100.0% | 100.0% |

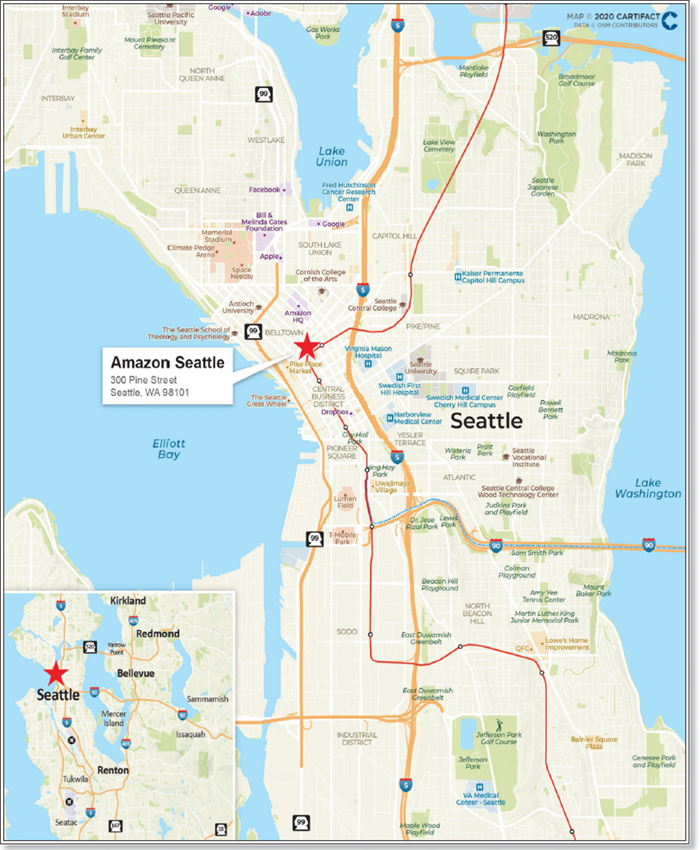

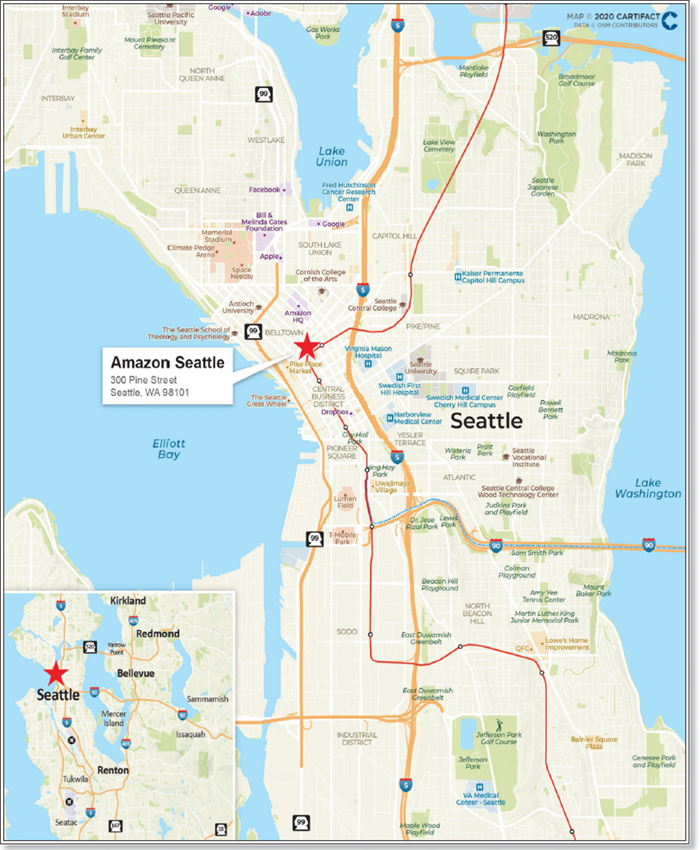

| 3 | Amazon Seattle | GACC | Office | 3/26/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | Y(2) | 99.6% | 99.6% | 99.6% | 99.6% |

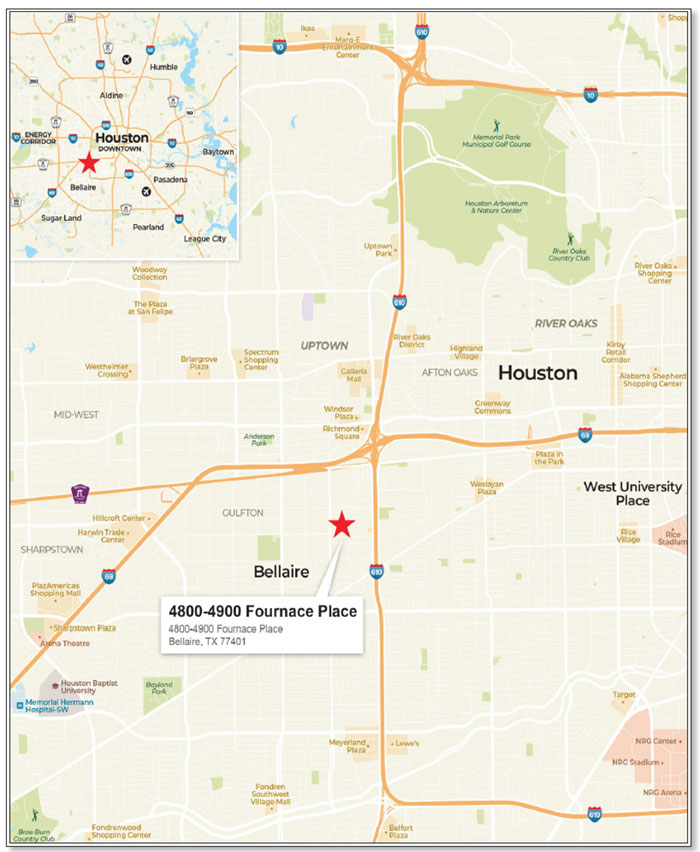

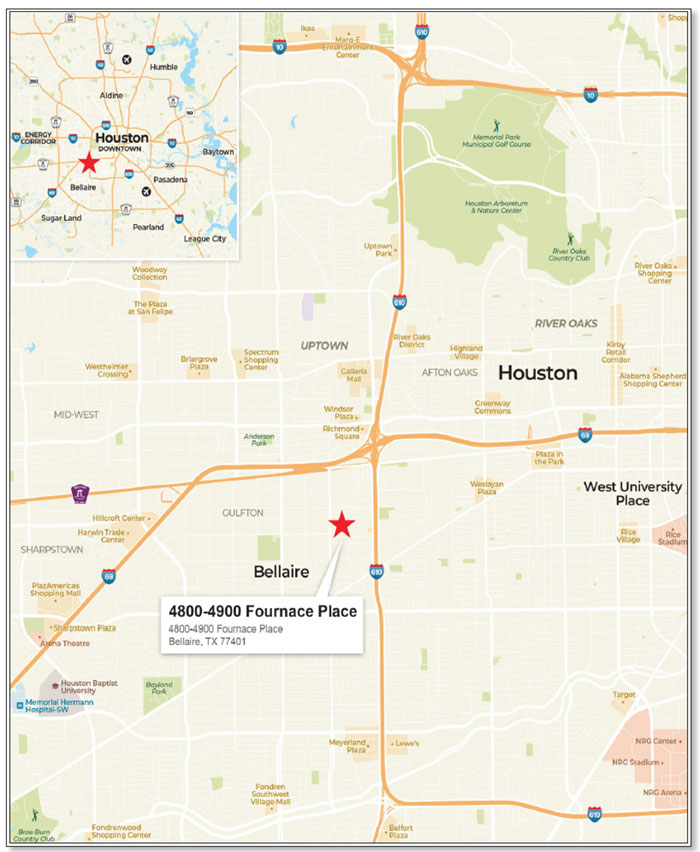

| 4 | 4800-4900 Fournace Place | GSMC | Office | 3/31/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

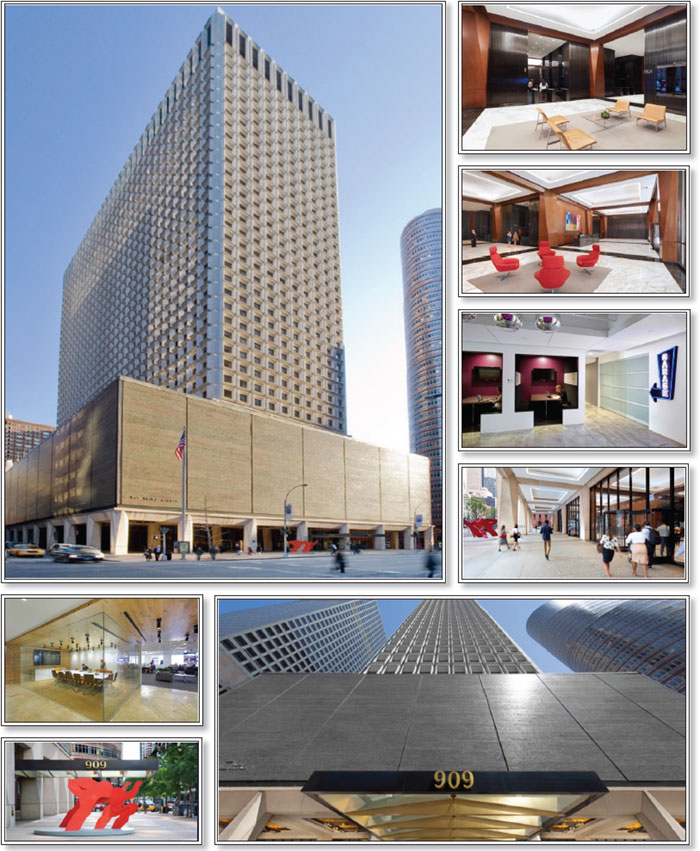

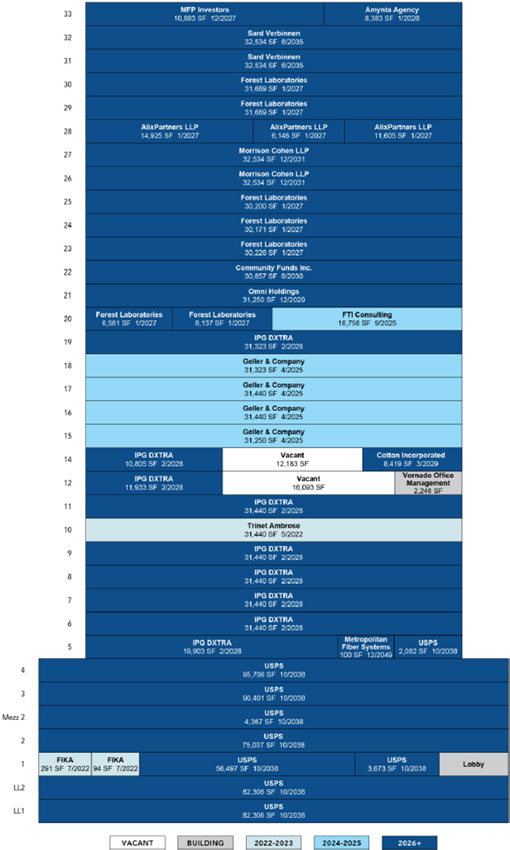

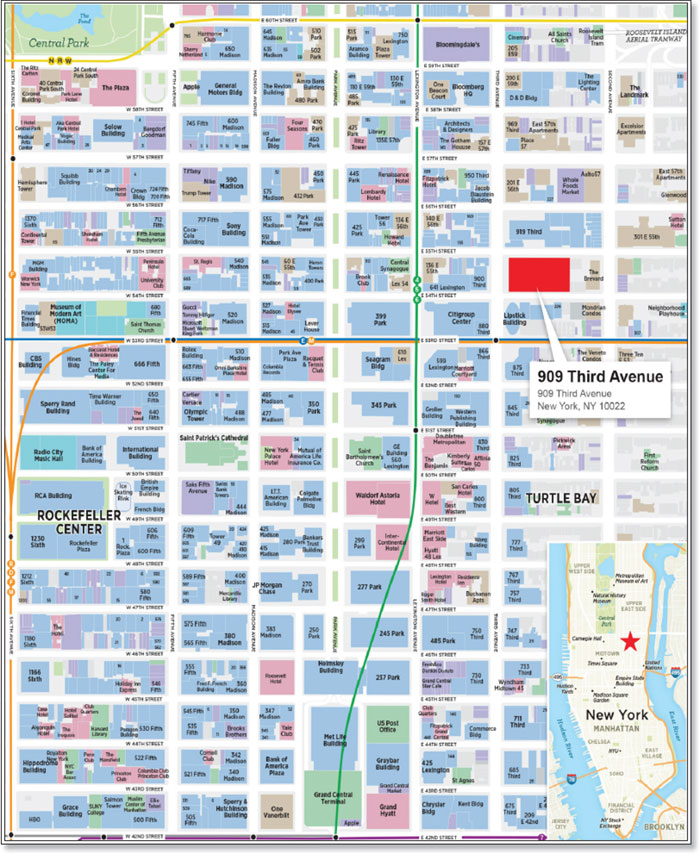

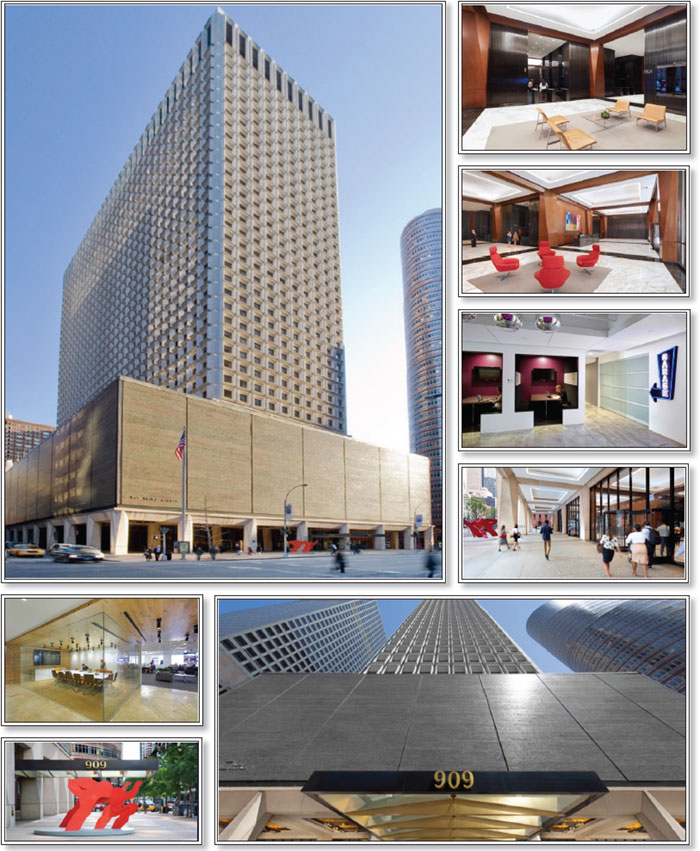

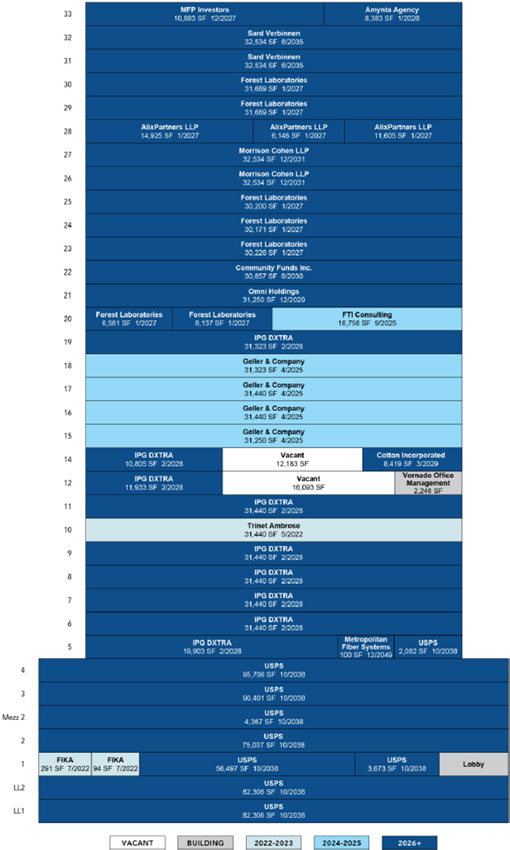

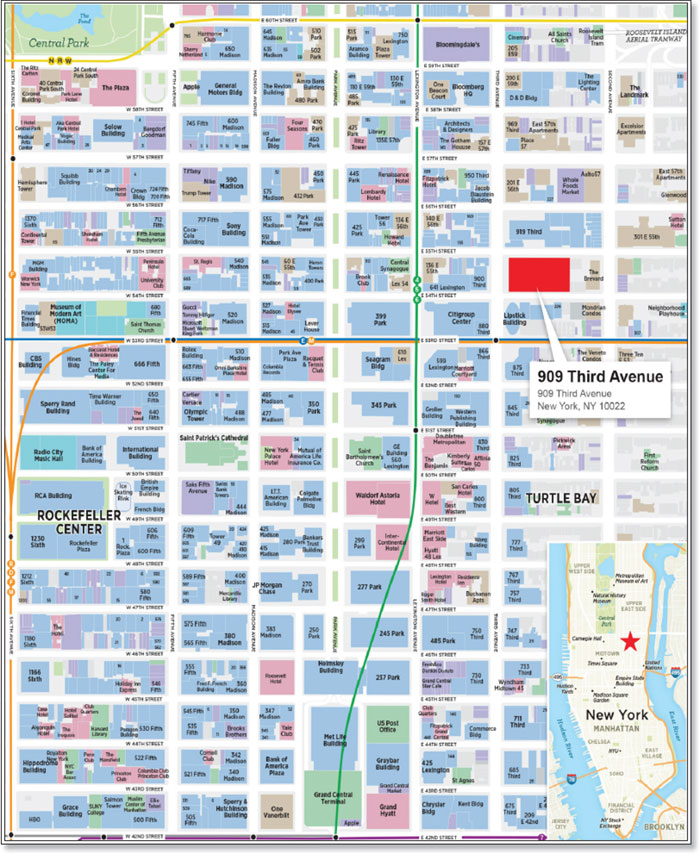

| 5 | 909 Third Avenue | CREFI | Office | 4/6/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | N | 99.9% | 99.9% | 99.9% | 99.9% |

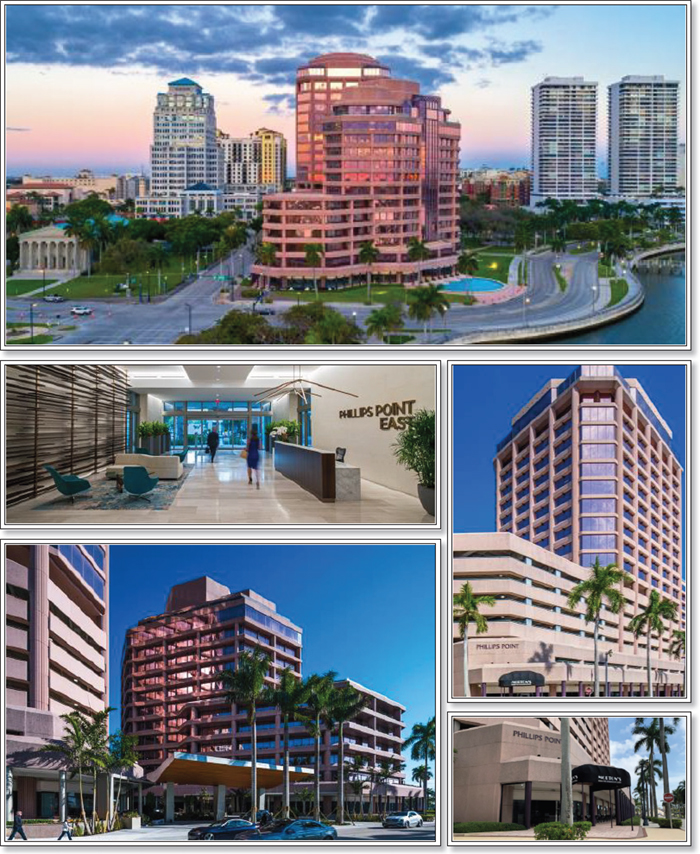

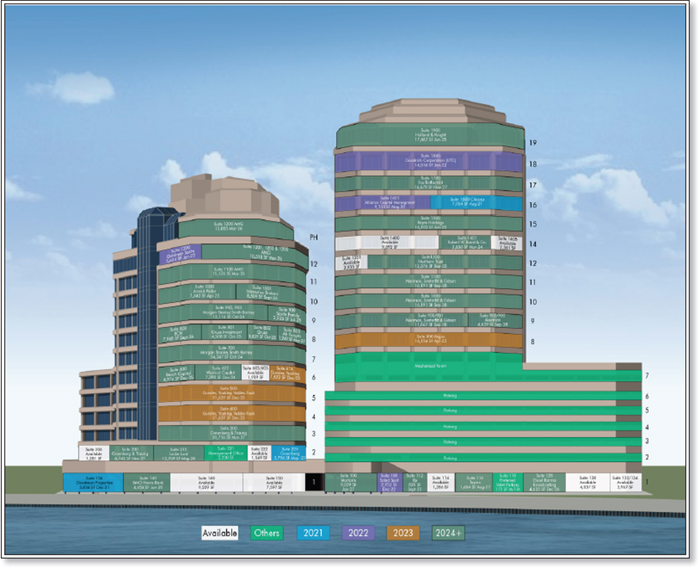

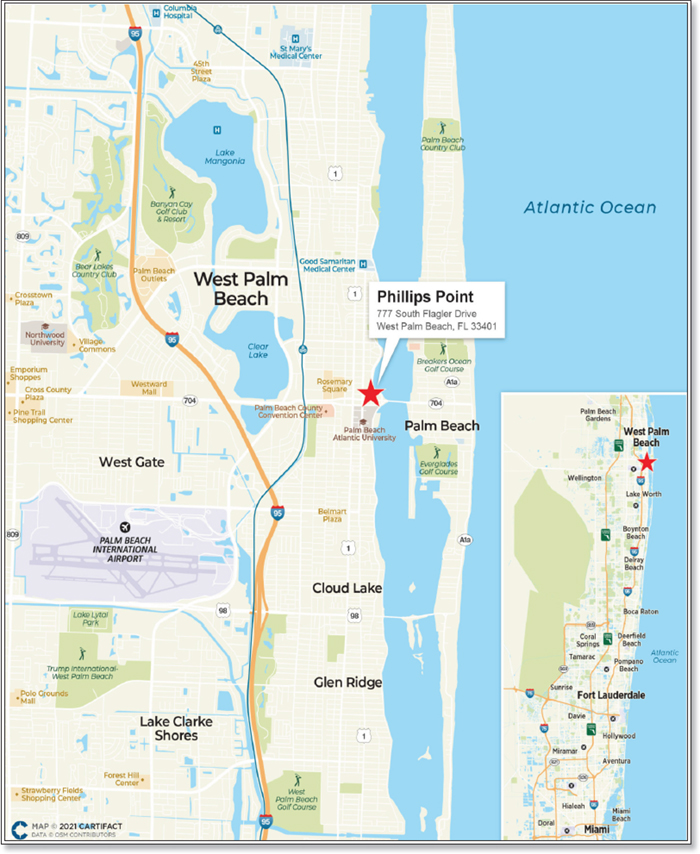

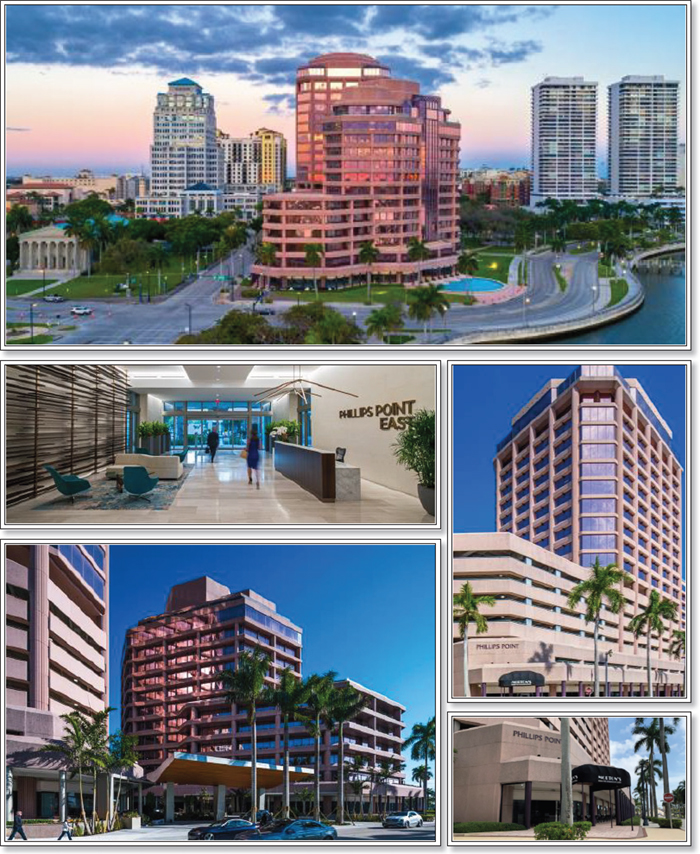

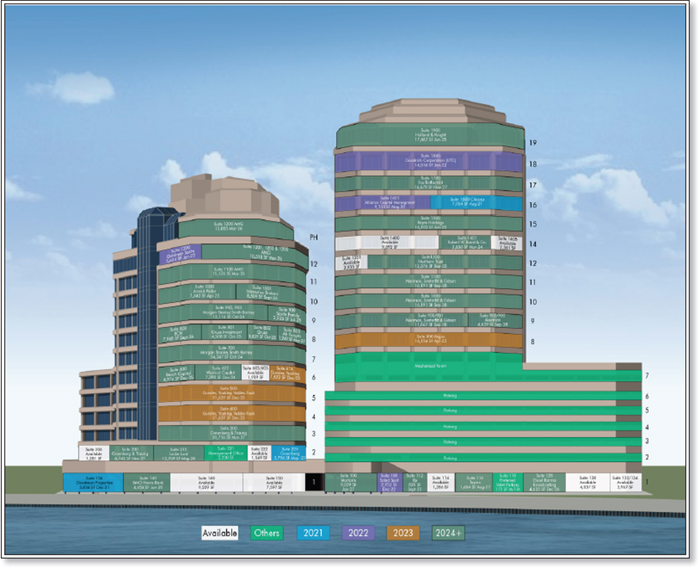

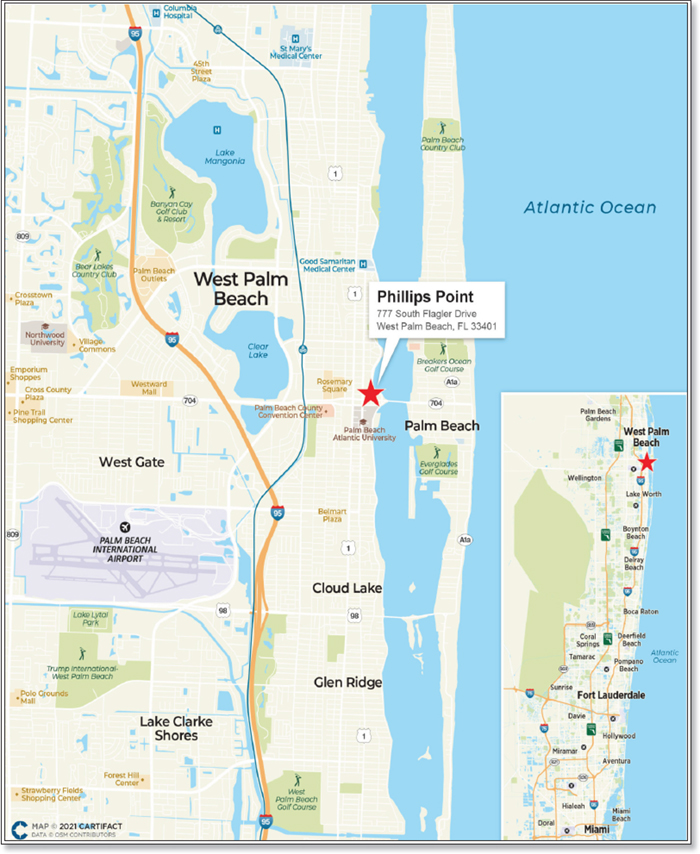

| 6 | Phillips Point | GSMC | Office | 4/1/2021 | 3/6/2021 | NAP | Y | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

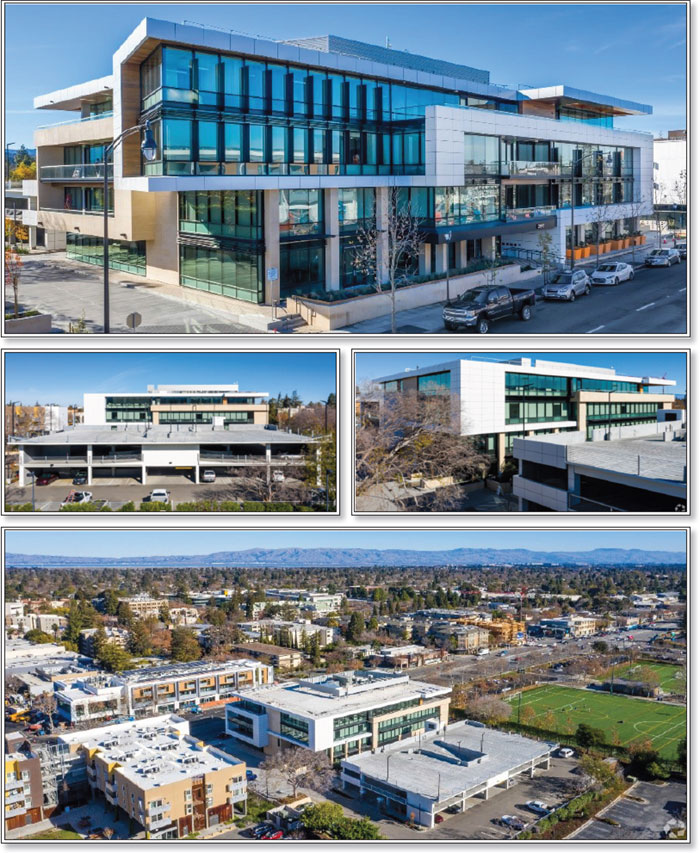

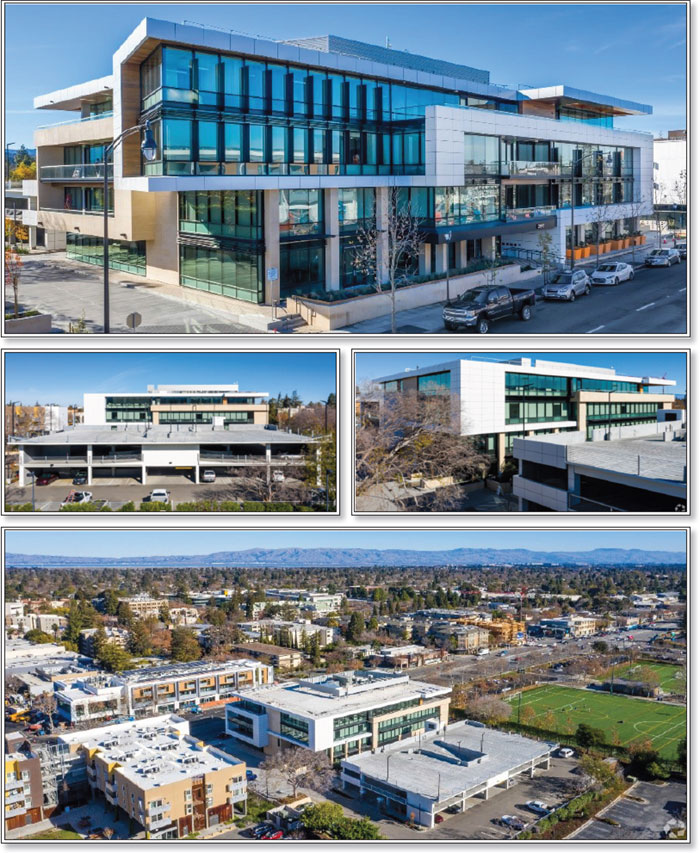

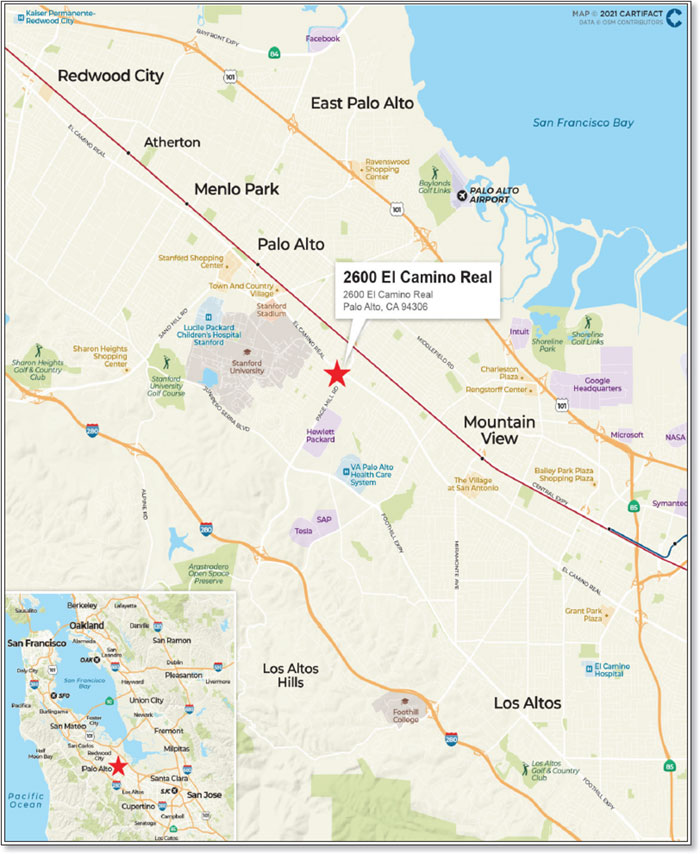

| 7 | 2600 El Camino Real | GSMC | Office | 3/19/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

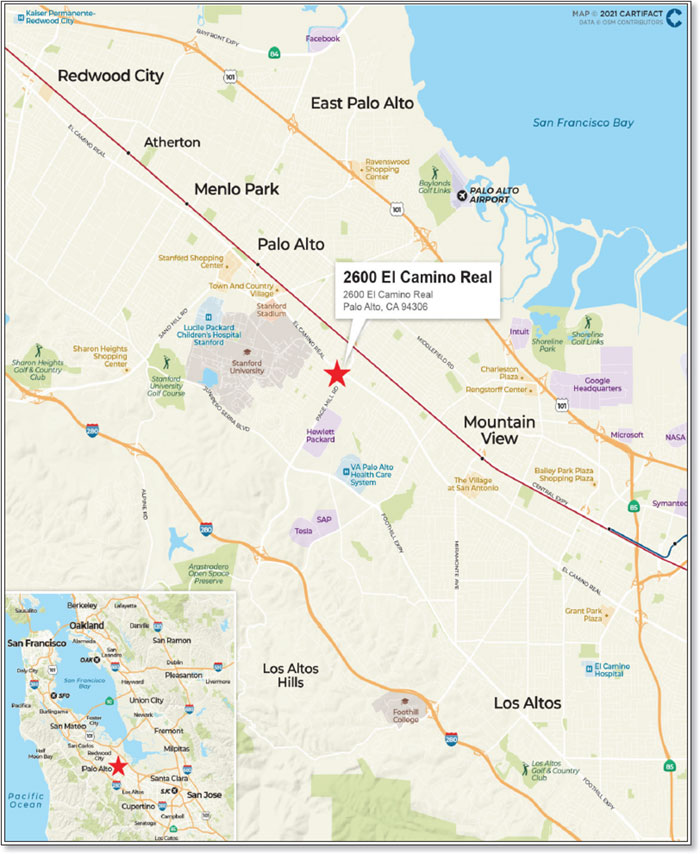

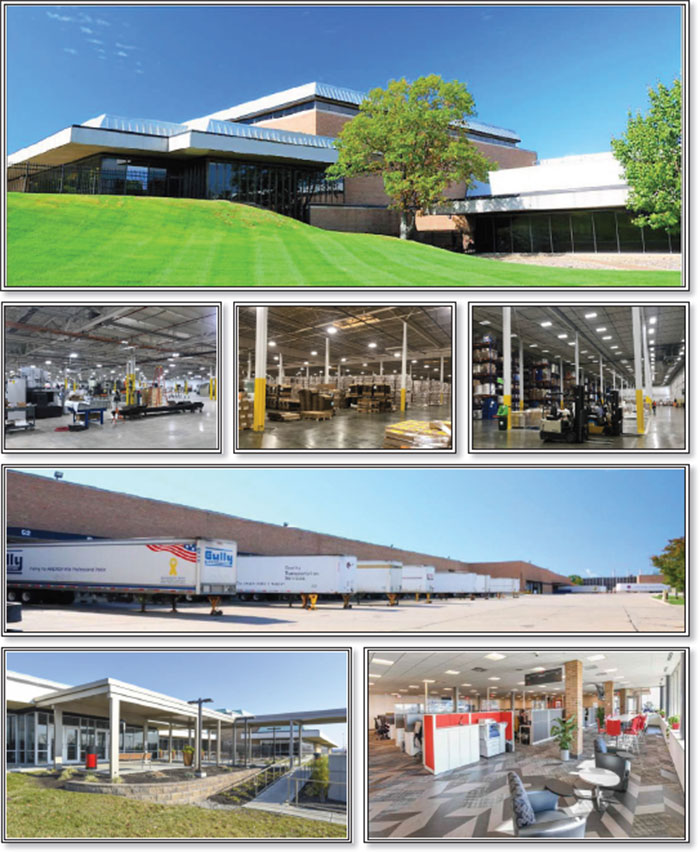

| 8 | 175 Progress Place | CREFI | Industrial | 4/6/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

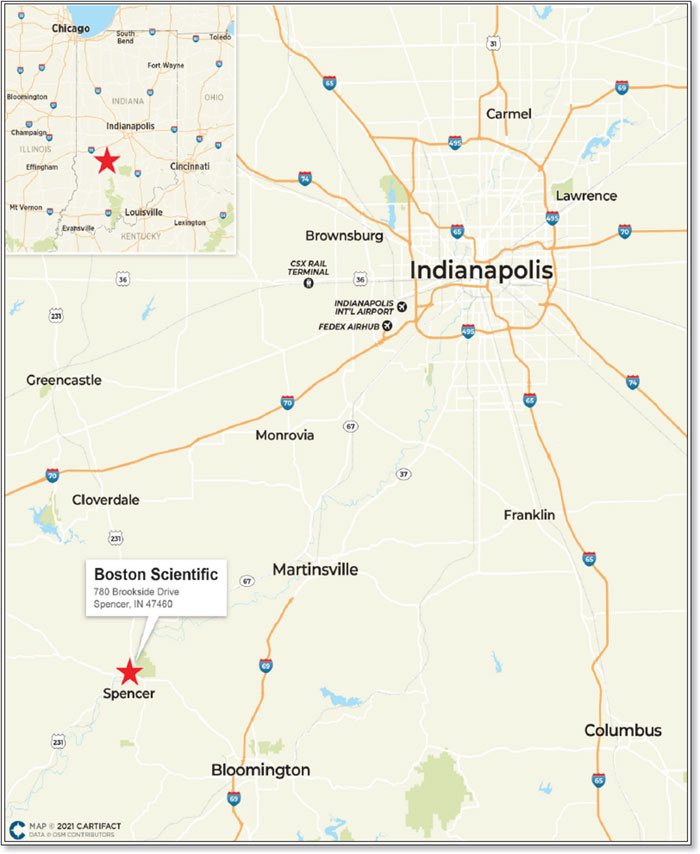

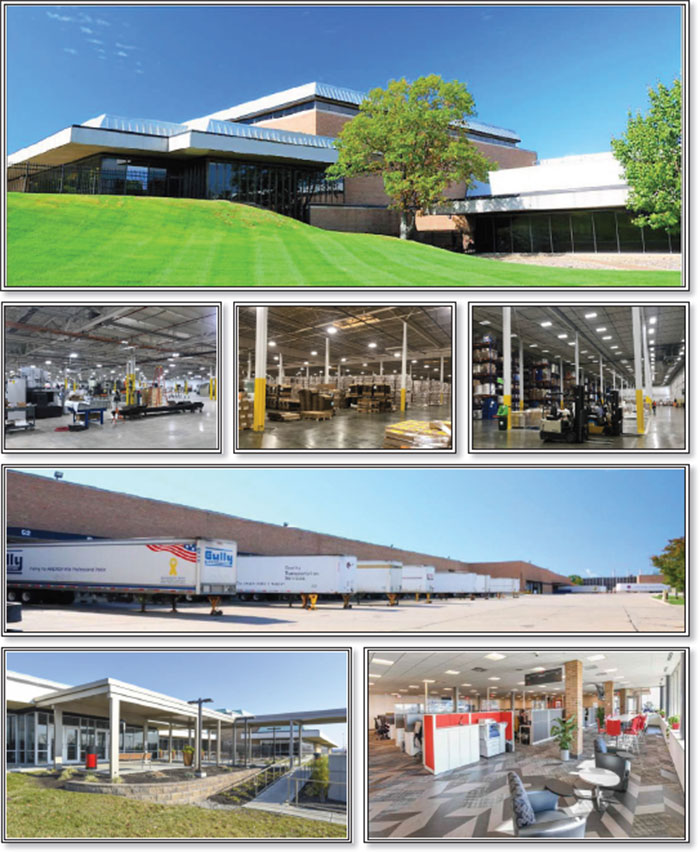

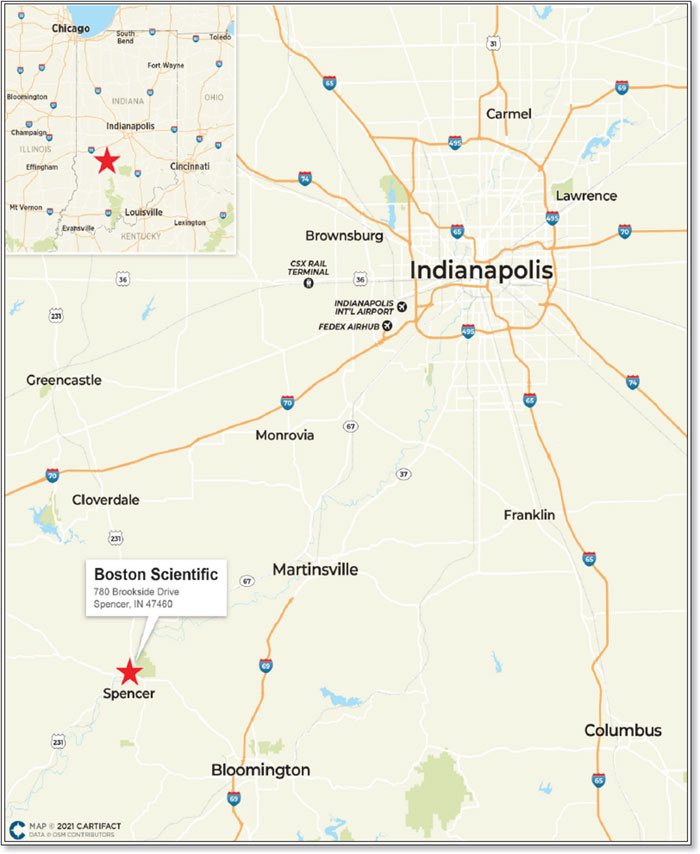

| 9 | Boston Scientific | GACC | Industrial | 3/29/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

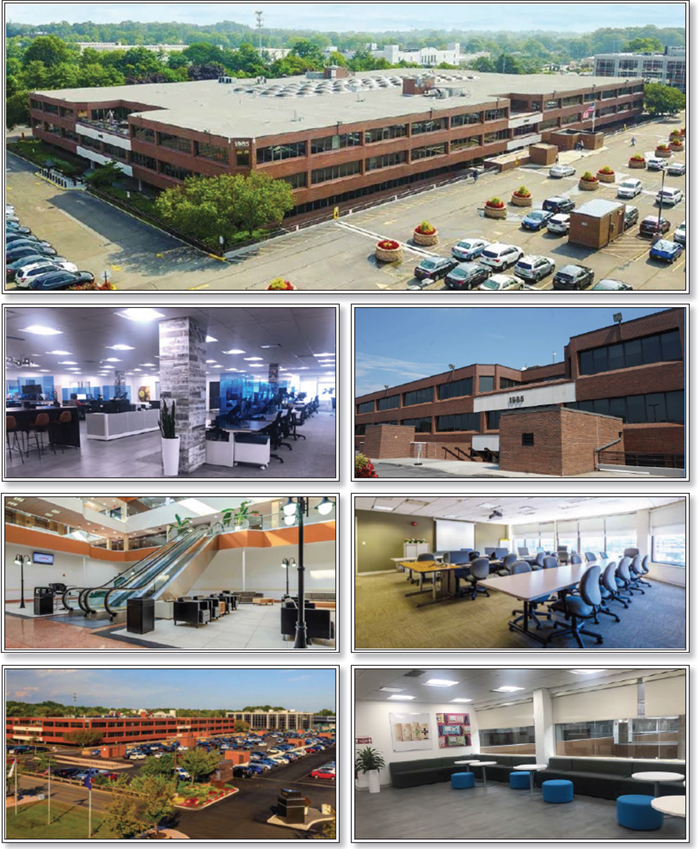

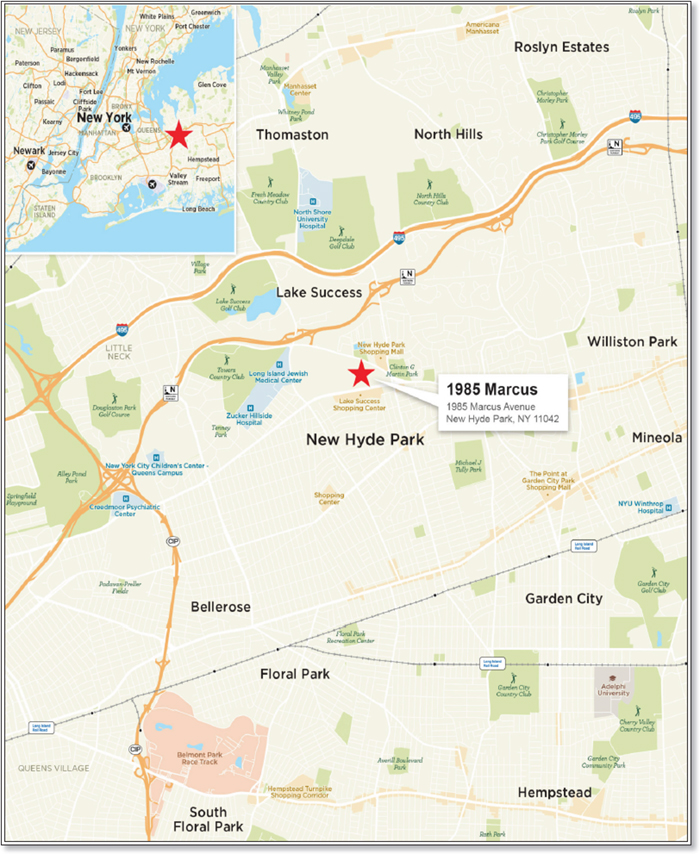

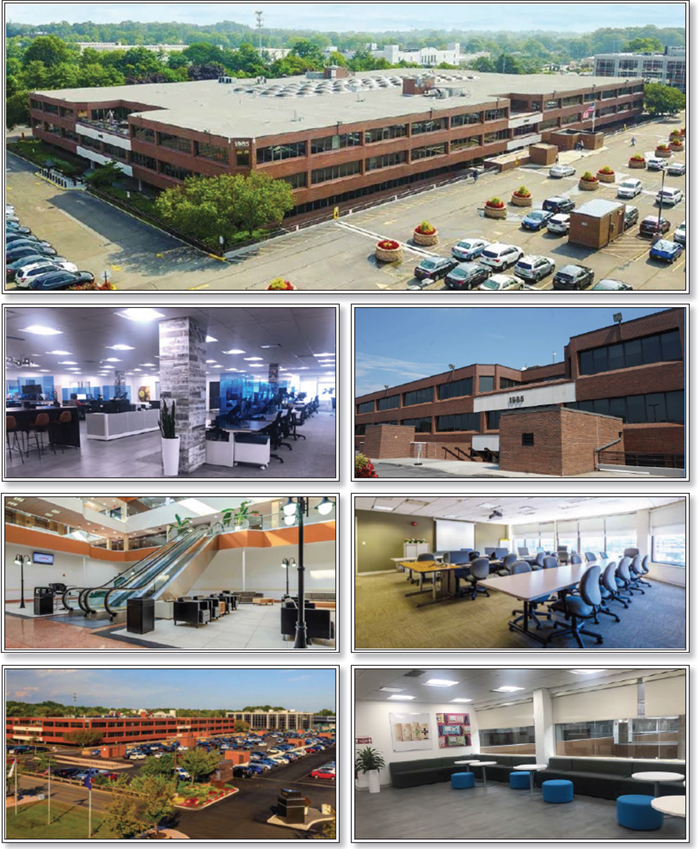

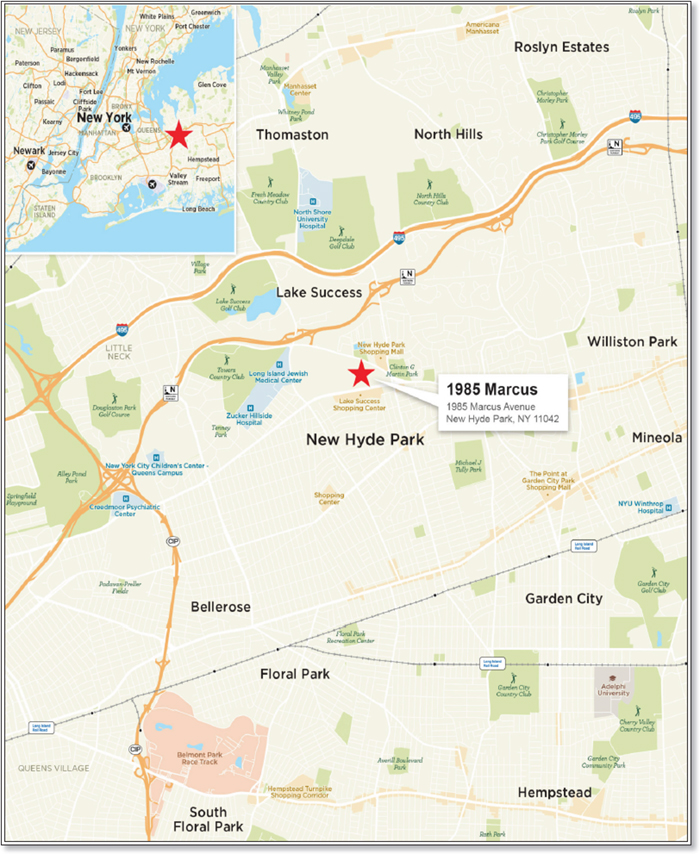

| 10 | 1985 Marcus | GSMC | Office | 3/10/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 11 | 2501 Seaport | CREFI | Office | 4/6/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | Y(3) | 96.8% | 97.5% | 96.8% | 97.5% |

| 12 | 100 Bradley | GACC | Self Storage | 3/29/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | Y(4) | 87.0% | 87.0% | 88.0% | 88.0% |

| 13 | 618 Bushwick | JPMCB | Multifamily | 4/1/2021 | 5/1/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 99.0% | 96.9% |

| 14 | Amazon Campbellsville Fulfillment Center | CREFI | Industrial | 4/6/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 15 | 30 Hudson Yards 67 | JPMCB | Office | 4/1/2021 | 4/7/2021 | NAP | NAP | Y(5) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 16 | Nautica Pointe | GSMC | Multifamily | 3/31/2021 | 4/6/2021 | NAP | NAP | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 17 | The Galleria Office Towers | CREFI, JPMCB | Office | 4/6/2021 | 4/6/2021 | NAP | NAP | Y | N | N | Y | 96.6% | 99.9% | 98.6% | 99.4% |

| 18 | GE Aviation New Hampshire | GSMC | Industrial | 4/7/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | NAP | 100.0% | 100.0% | 100.0% | 100.0% |

| 19 | 2000 Collins Avenue | JPMCB | Retail | 4/1/2021 | 5/1/2021 | NAP | NAP | NAP | N | N | Y(6) | 100.0% | 100.0% | 100.0% | 100.0% |

| 20 | U.S. Industrial Portfolio VI | GSMC | Industrial | 4/7/2021 | 4/6/2021 | NAP | NAP | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 21 | JW Marriott Nashville | GSMC | Hospitality | 3/31/2021 | 4/6/2020 | Y(7) | Y(7) | Y(7) | Y(7) | Y(7) | NAP | NAP | NAP | NAP | NAP |

| 22 | The Promontory | JPMCB | Office | 4/1/2021 | 5/1/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., J.P. Morgan Securities LLC, Deutsche Bank Securities Inc., Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

7

| COVID-19 UPDATE (continued) |

Loan # | Property Name | Mortgage Loan Seller | Property Type | Information as of Date | First Due Date | February Debt Service Payment Received

(Y/N) | March Debt Service Payment Received

(Y/N) | April Debt Service Payment Received

(Y/N) | Forbearance or Other Debt Service Relief Requested

(Y/N) | Other Loan Modification Requested

(Y/N) | Lease Modification or Rent Relief Requested

(Y/N) | Occupied SF or Unit Count Making Full February Rent Payment

(%) | UW February Base Rent Paid (%) | Occupied SF or Unit Count Making Full March Rent Payment

(%) | UW March Base Rent Paid (%) |

| 23 | 18 Spencer Street | CREFI | Office | 4/6/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 24 | Boca Office Portfolio | CREFI | Mixed Use | 4/6/2021 | 4/6/2021 | NAP | NAP | Y | N | N | Y | 97.2% | 97.2% | 98.4% | 98.4% |

| 25 | Cabinetworks Portfolio | GSMC | Industrial | 4/7/2021 | 12/6/2020 | Y | Y | Y | N | N | NAP | 100.0% | 100.0% | 100.0% | 100.0% |

| 26 | Live Nation Downtown LA | CREFI | Retail | 4/6/2021 | 4/6/2020 | Y(8) | Y(8) | Y(8) | Y(8) | Y(8) | Y(8) | 100.0% | 100.0% | 100.0% | 100.0% |

| 27 | Kokot Portfolio | CREFI | Multifamily | 4/6/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | N | 96.2% | 96.2% | 96.2% | 96.2% |

| 28 | 16-18 Squadron Boulevard | CREFI | Office | 4/6/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | Y | 99.6% | 100.0% | 100.0% | 100.0% |

| 29 | Expressway Marketplace | GACC | Retail | 3/10/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | Y(9) | 100.0% | 100.0% | 100.0% | 100.0% |

| 30 | 7828 Georgia Avenue NW | CREFI | Retail | 4/6/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 31 | 141 Livingston | CREFI | Office | 4/6/2021 | 4/6/2021 | NAP | NAP | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 32 | 2233 Nostrand Avenue | CREFI | Mixed Use | 4/6/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 33 | Birmingham Mixed Use Portfolio | GACC | Various | 4/6/2021 | 4/6/2021 | NAP | NAP | Y | N | N | N | 98.5% | 98.0% | 98.5% | 98.0% |

| 34 | 1111 Southern Minerals Road | JPMCB | Mixed Use | 4/1/2021 | 5/1/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 35 | At Home - Willow Grove | GSMC | Retail | 3/31/2021 | 12/6/2019 | Y | Y | Y | N | Y(10) | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 36 | VanWest MI Portfolio | CREFI | Self Storage | 4/6/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 37 | Teel Plastics Portfolio | GACC | Industrial | 3/11/2021 | 2/6/2021 | Y | Y | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 38 | Signal Hill Gateway | GACC | Retail | 3/30/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | Y(11) | 100.0% | 100.0% | 100.0% | 100.0% |

| 39 | Rouzan Marketplace | CREFI | Retail | 4/6/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 40 | Radiance Technologies | CREFI | Office | 4/6/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 41 | 475 Grand Street | CREFI | Multifamily | 4/6/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 42 | Mile High Multifamily Portfolio | JPMCB | Multifamily | 4/1/2021 | 5/1/2021 | NAP | NAP | NAP | N | N | N | NAV | 89.8% | NAV | NAV |

| 43 | Mid Cape Flex | CREFI | Industrial | 4/6/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | Y(12) | 90.8% | 92.2% | 90.8% | 92.2% |

| 44 | 500 W Superior | CREFI | Retail | 4/6/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | Y(13) | 100.0% | 100.0% | 100.0% | 100.0% |

| 45 | PDX Front Ave Industrial | CREFI | Industrial | 4/6/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 46 | 2517 North Ontario | CREFI | Industrial | 4/6/2021 | 5/6/2021 | NAP | NAP | NAP | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 47 | 4 Storage - Red Lion | CREFI | Self Storage | 4/6/2021 | 4/6/2021 | NAP | NAP | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

(Footnotes on table on the following page)

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., J.P. Morgan Securities LLC, Deutsche Bank Securities Inc., Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

8

| COVID-19 UPDATE (continued) |

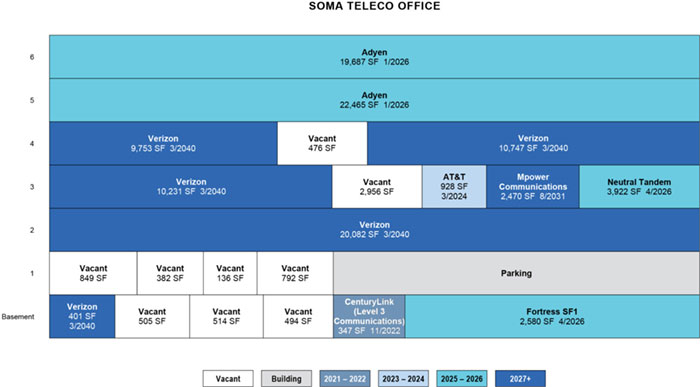

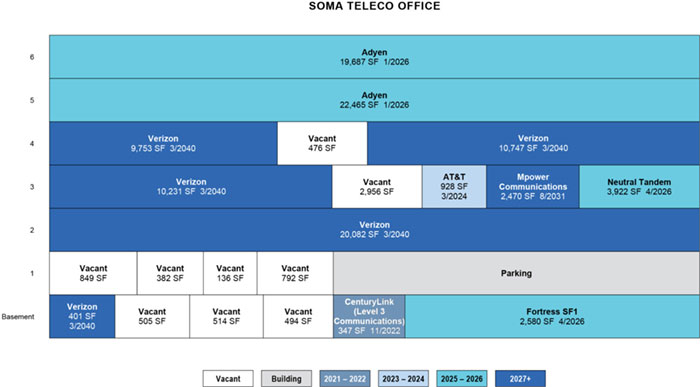

| (1) | Soma Teleco Office – One tenant (476 SF; 0.4% of the NRA; 0.0% of UW Base Rent) requested and was granted rent relief in the form of deferred rent from April through June 2020. Following the deferred rent period, the tenant discontinued paying rent and is expected to vacate upon its lease expiration. The tenant is not included in the lender’s underwritten rent. |

| (2) | Amazon Seattle – One tenant (2,418 SF; 0.3% of NRA; 0.3% of UW Base Rent), requested and was granted rent relief for the months of April through July 2020, and the abated period was extended for a total of twelve months through March 31, 2021. |

| (3) | 2501 Seaport – Two tenants at the 2501 Seaport Mortgaged Property requested short-term rent deferrals due to the COVID-19 pandemic. These tenants account for 2.5% of base rent and 3.2% of net rentable area. |

| (4) | 100 Bradley – One tenant (34,001 cubic feet.; 7.2% of managed storage NRA; 14.8% of managed storage UW Base Rent) requested and was granted rent relief from May through July 2020, but no discounts were given, and repayment was made in full from September to December 2020. |

| (5) | 30 Hudson Yards 67 – The property is open and operational; however, Facebook (the subtenant) is currently completing build-out of its space. Related (the prime tenant) commenced paying rent in January 2021. |

| (6) | 2000 Collins Avenue – Certain of the tenants were granted deferred rent or rent abatements in 2020, none of which is still ongoing. In addition (a) Bagatelle entered into a lease modification in October 2020 whereby the tenant pays percentage rent equal to 10% of gross sales until September 30, 2021, after which the rent payment requirement will revert to a fixed rent payment; (b) Future Mode of Miami was granted a 50% rent abatement for the month of March 2021; and (c) Hennah International was permitted to pay percentage rent equal to 10% of gross sales for the months of January, February and March of 2021. |

| (7) | JW Marriott Nashville – In April 2020, the mortgage loan was modified to permit the use of FF&E reserve funds to pay debt service, and the borrower sponsor provided a 6-month guaranty for debt service, taxes and insurance payments that expired in October 2020. In October 2020, the mortgage loan was further modified to waive the requirement to fund the FF&E reserve until April 2021, waive the cash management debt yield trigger through the second quarter of 2022, and otherwise permanently decrease the debt yield trigger level from 10% to 7.5%, in exchange for the borrower funding an 18-monthdebt service reserve to be applied to monthly payments from October 2020 through March 2022. |

| (8) | LiveNation Downtown LA – in March 2020, the sole tenant, Live Nation Worldwide, went dark and failed to make the rent payment due in April 2020. On or about April 6, 2020, the lender delivered a notice to the borrower regarding the occurrence of a specified tenant trigger period arising under the Mortgage Loan documents due to Live Nation Worldwide suspending operations and failing to pay the rent due in April 2020. The borrower thereafter failed to make the debt service payment due in April 2020. On April 30, 2020 the lender, borrower and related guarantor entered into a side letter agreement whereby the lender agreed, notwithstanding the existence of a trigger period, to disburse debt service reserve funds to the borrower on a one-time basis for the payment of the debt service due in April 2020. The side letter agreement also permitted the borrower to enter into a lease amendment with Live Nation Worldwide pursuant to which an upstream entity of the tenant, Live Nation Entertainment, Inc., would provide a guaranty of the related lease in exchange for: (i) a waiver of the obligation of Live Nation Worldwide to make the unpaid April 2020 rent payment to the borrower, (ii) a rent abatement in the amount of approximately $420,000 through October 2020, and (iii) a reduction of monthly base rent from $148,000 to $140,000. The Live Nation Downtown LA Mortgage Loan is currently in a cash flow trigger due to both (x) Live Nation Worldwide being dark in its space and (y) Live Nation Entertainment, Inc., which at the time of origination was rated Ba3/BB by S&P/Moody’s, being downgraded two notches below the minimum credit rating of BB-/Ba3 to its current rating of B2/B+. There may be other defaults, events of defaults and/or additional trigger periods and specified tenant trigger periods under the related Live Nation Downtown LA Mortgage Loan that may now or hereafter exist, but, as of the Closing Date, the lender has not exercised any of its remedies with respect thereto. |

| (9) | Expressway Marketplace – Four tenants requested and received rent relief in 2020 including: (i) one tenant (14,000 SF; 7.4% of UW Base Rent) received a rent reduction from April through August 2020; (ii) one tenant (6,000 SF; 4.7% of UW Base Rent) received a 50% base rent deferral from April through June 2020, which the tenant has since paid back in full, (iii) one tenant (11,250 SF; 7.7% of UW Base Rent) received a five month rent abatement from April through August 2020; (iv) one tenant (1,304 SF, 1.6% of UW Base Rent) received a two month rent deferral, which has since been paid back in full. |

| (10) | At Home - Willow Grove – In April 2020, the loan was modified to split the $12.15 million loan into an A Note of $10.15 million and a B Note of $2.00 million. The coupon on the A and B Note remains the same. |

| (11) | Signal Hill Gateway – One tenant (30,247 SF; 53.6% of NRA; 43.3% of UW Base Rent) requested and received a 75.0% rent deferral from May through October 2020 with the requirement to repay the deferred rent in 11 equal monthly installments commencing on February 1, 2021 and continuing on the first day of each month thereafter. One tenant (15,000 SF; 26.6% of NRA; 40.0% of UW Base Rent) requested and was denied rent relief. |

| (12) | Mid Cape Flex – One tenant at the Mid Cape Flex Mortgaged Property has requested rent relief. This tenant accounts for 9.2% of net rentable area and 7.8 of base rent. The loan is structured with a $100,000 upfront TI/LC reserve to account for any potential roll of this tenant. |

| (13) | 500 W Superior – The tenant was granted eight months of base rent deferment from May 2020 thru December 2020, with the tenant agreeing to pay back the deferment in 24 equal monthly installments between January 2021 and December 2022. The tenant also received a seven-month deferment of operating expenses, which they must also pay back by December 2022. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., J.P. Morgan Securities LLC, Deutsche Bank Securities Inc., Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

9

| KEY FEATURES OF THE CERTIFICATES |

| Co-Lead Managers and Joint Bookrunners: | | Goldman Sachs & Co. LLC Citigroup Global Markets Inc. J.P. Morgan Securities LLC Deutsche Bank Securities Inc. |

| Co-Managers: | | Academy Securities, Inc. Drexel Hamilton, LLC |

| Depositor: | | GS Mortgage Securities Corporation II |

| Initial Pool Balance: | | $1,209,397,625 |

| Master Servicer: | | Midland Loan Services, a Division of PNC Bank, National Association |

| Special Servicer: | | Rialto Capital Advisors, LLC (other than with respect to the Amazon Seattle whole loan) and Situs Holdings, LLC (with respect to the Amazon Seattle whole loan) |

| Certificate Administrator: | | Wells Fargo Bank, National Association |

| Trustee: | | Wells Fargo Bank, National Association |

| Operating Advisor: | | Pentalpha Surveillance LLC |

| Asset Representations Reviewer: | | Pentalpha Surveillance LLC |

| U.S. Credit Risk Retention: | | For a discussion of the manner by which Goldman Sachs Mortgage Company, as retaining sponsor, intends to satisfy the credit risk requirements of the Credit Risk Retention Rules, see “Credit Risk Retention” in the Preliminary Prospectus. |

| Pricing: | | Week of April 12, 2021 |

| Closing Date: | | April 29, 2021 |

| Cut-off Date: | | For each mortgage loan, the related due date for such mortgage loan in April 2021 (or, in the case of any mortgage loan that has its first due date after April 2021, the date that would have been its due date in April 2021 under the terms of that mortgage loan if a monthly payment were scheduled to be due in that month). |

| Determination Date: | | The 11th day of each month or next business day, commencing in May 2021 |

| Distribution Date: | | The 4th business day after the Determination Date, commencing in May 2021 |

| Interest Accrual: | | Preceding calendar month |

| ERISA Eligible: | | The offered certificates are expected to be ERISA eligible |

| SMMEA Eligible: | | No |

| Payment Structure: | | Sequential Pay |

| | | |

| Day Count: | | 30/360 |

| | | |

| Tax Structure: | | REMIC |

| | | |

| Rated Final Distribution Date: | | April 2054 for the offered certificates |

| | | |

| Cleanup Call: | | 1.0% |

| | | |

| Minimum Denominations: | | $10,000 minimum for the offered certificates (except with respect to the Class X-A and Class X-B certificates: $1,000,000 minimum); integral multiples of $1 thereafter for all the offered certificates |

| Delivery: | | Book-entry through DTC |

| | | |

| Bond Information: | | Cash flows are expected to be modeled by TREPP, INTEX and BLOOMBERG |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226082) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., J.P. Morgan Securities LLC, Deutsche Bank Securities Inc., Academy Securities, Inc., Drexel Hamilton, LLC, any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

10

| ■ | $1,148,927,742 (Approximate) New-Issue Multi-Borrower CMBS, which excludes the Non-Offered Eligible Vertical Interest: |

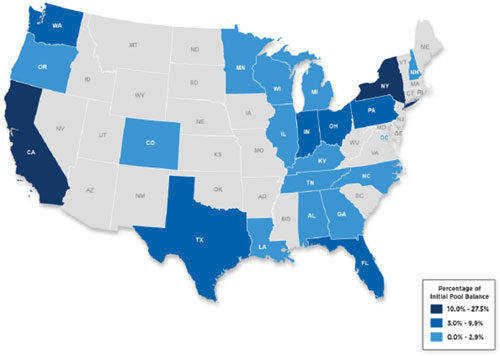

| — | Overview: The mortgage pool consists of 47 fixed-rate commercial mortgage loans that have an aggregate Cut-off Date Balance of $1,209,397,625 (the “Initial Pool Balance”), have an average mortgage loan Cut-off Date Balance of $25,731,864 and are secured by 76 mortgaged properties located throughout 21 states and the District of Columbia |

| — | LTV: 55.9% weighted average Cut-off Date LTV Ratio |

| — | DSCR: 2.68x weighted average Underwritten NCF Debt Service Coverage Ratio |

| — | Debt Yield: 10.8% weighted average Debt Yield on Underwritten NOI |

| — | Credit Support: 30.000% credit support to Class A-1 / A-2 / A-3 / A-4 / A-5 / A-SB |

| ■ | Loan Structural Features: |

| — | Amortization: 29.1% of the mortgage loans by Initial Pool Balance have scheduled amortization as follows: |

| – | 14.5% of the mortgage loans by Initial Pool Balance have scheduled amortization following a partial interest only period with a balloon payment due at maturity |

| – | 14.6% of the mortgage loans by Initial Pool Balance have scheduled amortization for the entire term with a balloon payment due at maturity |

| — | Hard Lockboxes: 82.1% of the mortgage loans by Initial Pool Balance have a Hard Lockbox in place |

| — | Cash Traps: 100.0% of the mortgage loans by Initial Pool Balance have cash traps triggered by certain declines in cash flow, all at levels equal to or greater than a 1.05x coverage, that fund an excess cash flow reserve |

| — | Reserves: The mortgage loans require amounts to be escrowed for reserves as follows: |

| – | Real Estate Taxes: 33 mortgage loans representing 58.9% of the Initial Pool Balance |

| – | Insurance: 16 mortgage loans representing 20.9% of the Initial Pool Balance |

| – | Replacement Reserves: 34 mortgage loans representing 59.4% of the Initial Pool Balance |

| – | Tenant Improvements / Leasing Commissions: 24 mortgage loans representing 60.1% of the portion of the Initial Pool Balance that is secured by retail, office, mixed use and industrial properties only |

| — | Predominantly Defeasance: 74.9% of the mortgage loans by Initial Pool Balance permit defeasance after an initial lockout period |

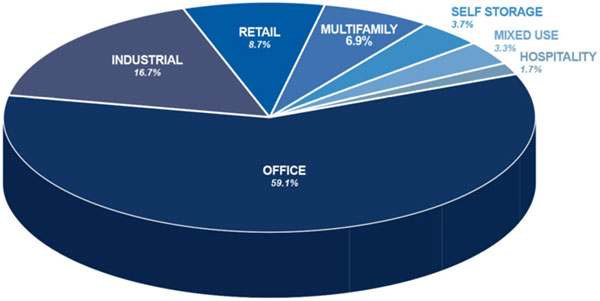

| ■ | Multiple-Asset Types > 5.0% of the Initial Pool Balance: |

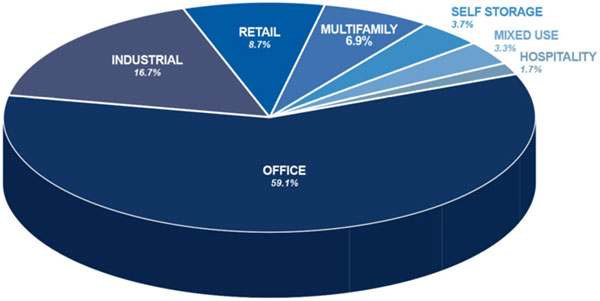

| — | Office: 59.1% of the mortgaged properties by allocated Initial Pool Balance are office properties |

| — | Industrial: 16.7% of the mortgaged properties by allocated Initial Pool Balance are industrial properties |

| — | Retail: 8.7% of the mortgaged properties by allocated Initial Pool Balance are retail properties (3.7% are anchored retail properties) |

| — | Multifamily: 6.9% of the mortgaged properties by allocated Initial Pool Balance are multifamily properties |

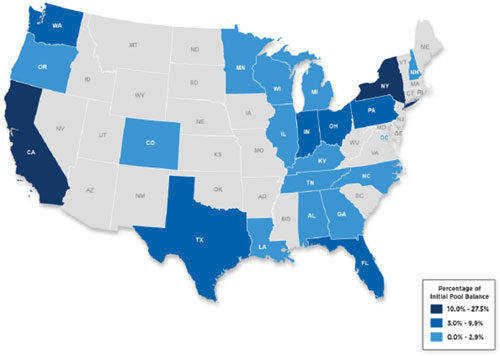

| ■ | Geographic Diversity: The 76 mortgaged properties are located throughout 21 states and the District of Columbia with two states having greater than 10.0% of the allocated Initial Pool Balance: California (27.5%) and New York (21.0%) |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.