| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-261764-05 |

December 11, 2024

| Structural and Collateral Term Sheet |

| (Approximate Mortgage Pool Balance) |

| (Approximate Offered Certificates) |

GS Mortgage Securities Corporation II Depositor |

Commercial Mortgage Pass-Through Certificates

Series 2024-V12 |

Goldman Sachs Mortgage Company Citi Real Estate Funding Inc. German American Capital Corporation Bank of Montreal Barclays Capital Real Estate Inc. |

| As Sponsors and Mortgage Loan Sellers |

Goldman Sachs

& Co. LLC | Deutsche Bank

Securities | BMO Capital

Markets | Barclays | Citigroup |

Co-Lead Managers and Joint Bookrunners

| Academy Securities | CastleOak Securities, L.P. |

Co-Managers

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | | |

IMPORTANT NOTICE REGARDING THE CONDITIONS FOR THIS OFFERING OF ASSET-BACKED SECURITIES

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery.

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor, Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) the fact that there is no representation being made that these materials are accurate or complete and that these materials may not be updated or (3) these materials possibly being confidential, are, in each case, not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

The securities offered by this structural and collateral term sheet (this “Term Sheet”) are described in greater detail in the preliminary prospectus included as part of our Registration Statement (SEC File No. 333-261764) (the “Preliminary Prospectus”) anticipated to be dated December 11, 2024. The Preliminary Prospectus contains material information that is not contained in this Term Sheet (including without limitation a detailed discussion of risks associated with an investment in the offered securities under the heading “Risk Factors” in the Preliminary Prospectus). The Preliminary Prospectus is available upon request from Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc. or CastleOak Securities, L.P. Capitalized terms used but not otherwise defined in this Term Sheet have the respective meanings assigned to those terms in the Preliminary Prospectus. This Term Sheet is subject to change.

The Securities May Not Be a Suitable Investment for You

The securities offered by this Term Sheet are not suitable investments for all investors. In particular, you should not purchase any class of securities unless you understand and are able to bear the prepayment, credit, liquidity and market risks associated with that class of securities. For those reasons and for the reasons set forth under the heading “Risk Factors” in the Preliminary Prospectus, the yield to maturity and the aggregate amount and timing of distributions on the offered securities are subject to material variability from period to period and give rise to the potential for significant loss over the life of those securities. The interaction of these factors and their effects are impossible to predict and are likely to change from time to time. As a result, an investment in the offered securities involves substantial risks and uncertainties and should be considered only by sophisticated institutional investors with substantial investment experience with similar types of securities and who have conducted appropriate due diligence on the mortgage loans and the securities. Potential investors are advised and encouraged to review the Preliminary Prospectus in full and to consult with their legal, tax, accounting and other advisors prior to making any investment in the offered securities described in this Term Sheet.

This Term Sheet is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The information contained in this Term Sheet may not pertain to any securities that will actually be sold. The information contained in this Term Sheet may be based on assumptions regarding market conditions and other matters as reflected in this Term Sheet. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and this Term Sheet should not be relied upon for such purposes. We and our affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of this Term Sheet may, from time to time, have long or short positions in, and buy or sell, the securities mentioned in this Term Sheet or derivatives thereof (including options). Information contained in this Term Sheet is current as of the date appearing on this Term Sheet only. Information in this Term Sheet regarding the securities and the mortgage loans backing any securities discussed in this Term Sheet supersedes all prior information regarding such securities and mortgage loans. None of Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc. or CastleOak Securities, L.P. provides accounting, tax or legal advice.

The issuing entity will be relying upon an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”), contained in Section 3(c)(5) of the Investment Company Act or Rule 3a-7 under the Investment Company Act, although there may be additional exclusions or exemptions available to the issuing entity. The issuing entity is being structured so as not to constitute a “covered fund” for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in “Risk Factors—General Risk Factors—Legal and Regulatory Provisions Affecting Investors Could Adversely Affect the Liquidity of the Offered Certificates” in the Preliminary Prospectus). See also “Legal Investment” in the Preliminary Prospectus.

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 2 | |

CERTIFICATE SUMMARY OFFERED CERTIFICATES |

Offered Class | Expected Ratings

(Moody’s / Fitch / KBRA)(1) | Approximate Initial Certificate Balance or Notional Amount(2) | Approximate Initial Credit Support(3) | Initial Pass-Through Rate | Pass-Through Rate Description |

Wtd. Avg. Life (Yrs)(4)

| Principal Window(4) |

| Class A-1 | Aaa(sf) / AAAsf / AAA(sf) | $ | 209,000 | | 30.000% | [ ]% | (5) | 2.41 | 01/25 – 07/29 |

| Class A-2 | Aaa(sf) / AAAsf / AAA(sf) | | (6) | | 30.000% | [ ]% | (5) | (6) | (6) |

| Class A-3 | Aaa(sf) / AAAsf / AAA(sf) | | (6) | | 30.000% | [ ]% | (5) | (6) | (6) |

| Class X-A | NR / AAAsf / AAA(sf) | $ | 573,454,000 | (7) | N/A | [ ]% | Variable IO(8) | N/A | N/A |

| Class X-B | NR / AA-sf / AAA(sf) | $ | 36,623,000 | (7) | N/A | [ ]% | Variable IO(8) | N/A | N/A |

| Class A-S | NR / AAAsf / AAA(sf) | $ | 73,245,000 | | 19.750% | [ ]% | (5) | 4.96 | 12/29 – 12/29 |

| Class B | NR / AA-sf / AA-(sf) | $ | 36,623,000 | | 14.625% | [ ]% | (5) | 4.96 | 12/29 – 12/29 |

| |

Non-Offered Class | Expected Ratings

(Moody’s / Fitch / KBRA)(1) | Approximate Initial Certificate Balance or Notional Amount(2) | Approximate Initial Credit Support(3) | Initial Pass-Through Rate | Pass-Through Rate Description |

Wtd. Avg. Life (Yrs)(4)

| Principal Window(4) |

| Class C | NR / A-sf / A-(sf) | $ | 27,690,000 | | 10.750% | [ ]% | (5) | 4.96 | 12/29 – 12/29 |

| Class D | NR / BBBsf / BBB+(sf) | $ | 15,185,000 | | 8.625% | [ ]% | (5) | 4.96 | 12/29 – 12/29 |

| Class E | NR / BBB-sf / BBB(sf) | $ | 7,146,000 | | 7.625% | [ ]% | (5) | 4.96 | 12/29 – 12/29 |

| Class F | NR / BBsf / BBB-(sf) | $ | 8,039,000 | | 6.500% | [ ]% | (5) | 4.96 | 12/29 – 12/29 |

| Class G | NR / BB-sf / BB+(sf) | $ | 7,146,000 | | 5.500% | [ ]% | (5) | 4.96 | 12/29 – 12/29 |

| Class J | NR / B-sf / B+(sf) | $ | 9,825,000 | | 4.125% | [ ]% | (5) | 4.96 | 12/29 – 12/29 |

| Class K | NR / NR / NR | $ | 29,477,250 | | 0.000% | [ ]% | (5) | 4.96 | 12/29 – 12/29 |

| Class R(9) | N/A | | N/A | | N/A | N/A | N/A | N/A | N/A |

| | | | | | | | |

| (1) | It is a condition of issuance that the offered certificates and certain classes of non-offered certificates receive the ratings set forth above. The anticipated ratings of the certificates shown are those of Moody’s Investors Service, Inc. (“Moody’s”), Fitch Ratings, Inc. (“Fitch”) and Kroll Bond Rating Agency, LLC (“KBRA” and, together with Moody’s and Fitch, the “Rating Agencies”). Subject to the discussion under “Ratings” in the Preliminary Prospectus, the ratings on the certificates address the likelihood of the timely receipt by holders of all payments of interest to which they are entitled on each distribution date and, except in the case of the interest only certificates, the ultimate receipt by holders of all payments of principal to which they are entitled on or before the applicable rated final distribution date. Certain nationally recognized statistical rating organizations, as defined in Section 3(a)(62) of the Securities Exchange Act of 1934, as amended, that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, or otherwise to rate the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” in the Preliminary Prospectus. The Rating Agencies have informed us that the “sf” designation in their ratings represents an identifier of structured finance product ratings. For additional information about this identifier, prospective investors can go to the related Rating Agency’s website. The depositor and the underwriters have not verified, do not adopt and do not accept responsibility for any statements made by the related Rating Agencies on those websites. Credit ratings referenced throughout this Term Sheet are forward-looking opinions about credit risk and express a rating agency’s opinion about the willingness and ability of an issuer of securities to meet its financial obligations in full and on time. Ratings are not indications of investment merit and are not buy, sell or hold recommendations, a measure of asset value or an indication of the suitability of an investment. |

| (2) | Approximate, subject to a variance of plus or minus 5%. The notional amount of each class of the Class X-A and Class X-B certificates (collectively the “Class X certificates”) is subject to change depending upon the final pricing of the Class A-1, Class A-2, Class A-3, Class A-S, Class B, Class C, Class D, Class E, Class F, Class G, Class J and Class K certificates (collectively, the “principal balance certificates” and, together with the Class X certificates, the “non-VRR certificates”) as follows: (1) if as a result of such pricing the pass-through rate of any class of principal balance certificates whose certificate balance comprises such notional amount is equal to the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), the certificate balance of such class of principal balance certificates may not be part of, and reduce accordingly, such notional amount of the related Class X certificates (or, if as a result of such pricing the pass-through rate of the related Class X certificates is equal to zero, such Class X certificates may not be issued on the closing date), and/or (2) if as a result of such pricing the pass-through rate of any class of principal balance certificates that does not comprise such notional amount of the related Class X certificates is less than the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), such class of principal balance certificates may become a part of, and increase accordingly, such notional amount of the related Class X certificates. |

| (3) | The initial credit support percentages set forth for the certificates are approximate and, for the Class A-1, Class A-2 and Class A-3 certificates, are represented in the aggregate. The approximate initial credit support percentages shown in the table above do not take into account the VRR interest. However, losses incurred on the mortgage loans will be allocated between the VRR interest and the principal balance certificates, pro rata, in accordance with their respective outstanding balances. See “Credit Risk Retention” and “Description of the Certificates” in the Preliminary Prospectus. |

| (4) | The weighted average life and period during which distributions of principal would be received as set forth in the foregoing table with respect to each class of certificates having a certificate balance are based on the assumptions set forth under “Yield, Prepayment and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus and on the assumptions that there are no prepayments, modifications or losses in respect of the mortgage loans or whole loans and that there are no extensions or forbearances of maturity dates of the mortgage loans or whole loans. |

| (5) | For each distribution date, the pass-through rates of each class of principal balance certificates will generally be a per annum rate equal to one of (i) a fixed rate, (ii) the weighted average of the net mortgage interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as of their respective due dates in the month preceding the month in which the related distribution date occurs (the “WAC Rate”), (iii) the lesser of a specified pass-through rate and the WAC Rate, or (iv) the WAC Rate less a specified percentage. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 3 | |

| CERTIFICATE SUMMARY (continued) |

| (6) | The exact initial certificate balances of the Class A-2 and Class A-3 certificates are unknown and will be determined based on the final pricing of those classes of certificates. However, the respective initial certificate balance, weighted average life and principal window of the Class A-2 and Class A-3 certificates are expected to be within the applicable ranges reflected in the following chart. The initial aggregate certificate balance of the Class A-2 and Class A-3 certificates is expected to be approximately $500,000,000, subject to a variance of plus or minus 5%. |

Class of Certificates | Expected Range of Initial Certificate Balance | Expected Range of Wtd. Avg. Life (Yrs) | Expected Range of Principal Window |

| Class A-2 | $0 – $200,000,000 | NAP – 4.83 | NAP / 07/29 – 11/29 |

| Class A-3 | $300,000,000 – $500,000,000 | 4.91 – 4.88 | 11/29 – 12/29 / 07/29 – 12/29 |

| (7) | The Class X certificates will not have certificate balances and will not be entitled to receive distributions of principal. Interest will accrue on each class of the Class X certificates at its respective pass-through rate based upon its respective notional amount. The notional amount of each class of the Class X certificates will be equal to the aggregate certificate balances of the related classes of certificates (the “related Class X class”) indicated below. |

Class of Certificates | Related Class X Class(es) |

| Class X-A | Class A-1, Class A-2, Class A-3 and Class A-S certificates |

| Class X-B | Class B |

| (8) | The pass-through rate of each class of the Class X certificates for any distribution date will equal the excess, if any, of (i) the WAC Rate, over (ii) the pass-through rate (or the weighted average of the pass-through rates, if applicable) of the related Class X class(es) for that distribution date, as described in the Preliminary Prospectus. |

| (9) | The Class R certificates will not have a certificate balance, notional amount, pass-through rate, rating or rated final distribution date. The Class R certificates will represent the residual interests in each of two separate real estate mortgage investment conduits (each, a “REMIC”), as further described in the Preliminary Prospectus. The Class R certificates will not be entitled to distributions of principal or interest. |

VRR INTEREST SUMMARY

Non-Offered Eligible Vertical Interests(1) | Approximate

Initial VRR Interest Balance | Approximate Initial VRR Interest Rate | VRR Interest Rate Description | Wtd. Avg. Life (Yrs)(2) | Principal Window(2) |

| RR Interest | $24,274,750 | [ ]% | (3) | 4.90 | 01/25 – 12/29 |

| Class RR Certificates | $13,335,000 | [ ]% | (3) | 4.90 | 01/25 – 12/29 |

| (1) | Each of the RR interest and the Class RR certificates will constitute an “eligible vertical interest” (as such term is defined in the Credit Risk Retention Rules) (the Class RR certificates and the RR interest collectively, the “VRR Interest”) and is expected to be acquired and retained by the applicable sponsors (or their “majority-owned affiliates”, as such term is defined in the Credit Risk Retention Rules) as described under “Credit Risk Retention” in the Preliminary Prospectus. The VRR interest represents the right to receive approximately 5.0% of all amounts collected on the mortgage loans (net of all expenses of the issuing entity) that are available for distribution to the certificates (other than the Class R certificates) and the RR interest on each Distribution Date, as further described under “Credit Risk Retention” in the Preliminary Prospectus. |

| (2) | The weighted average life and period during which distributions of principal would be received as set forth in the foregoing table with respect to the VRR interest are based on the assumptions described in “Yield, Prepayment and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus and on the assumptions that there are no prepayments, modifications or losses in respect of the mortgage loans or whole loans and that there are no extensions or forbearances of maturity dates or anticipated repayment dates of the mortgage loans or whole loans. |

| (3) | Although it does not have a specified pass-through rate (other than for tax reporting purposes), the effective interest rate for the RR interest and the Class RR certificates will be a per annum rate equal to the weighted average of the net mortgage interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as of their respective due dates in the month preceding the month in which the related distribution date occurs. |

The Class C, Class D, Class E, Class F, Class G, Class J, Class K, Class R and Class RR certificates and the RR Interest are not offered by this Term Sheet. Any information in this Term Sheet concerning such non-offered certificates or the RR interest is presented solely to enhance your understanding of the offered certificates.

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 4 | |

| KEY FEATURES OF SECURITIZATION |

| Mortgage Pool Characteristics(1) |

| Initial Pool Balance(2) | $752,195,000 |

| Number of Mortgage Loans | 31 |

| Number of Mortgaged Properties | 156 |

| Average Cut-off Date Mortgage Loan Balance | $24,264,355 |

| Weighted Average Mortgage Interest Rate | 6.64031% |

| Weighted Average Remaining Term to Maturity Date (months) | 59 |

| Weighted Average Remaining Amortization Term (months) | 360 |

| Weighted Average Cut-off Date LTV Ratio(3) | 58.4% |

| Weighted Average Maturity Date LTV Ratio(4) | 58.4% |

| Weighted Average Underwritten NCF Debt Service Coverage Ratio | 1.74x |

| Weighted Average Debt Yield on Underwritten NOI | 12.7% |

| % of Mortgage Loans with Mezzanine Debt | 0.0% |

| % of Mortgage Loans with Subordinate Debt(5) | 6.6% |

| % of Mortgage Loans with Preferred Equity | 0.0% |

| % of Mortgage Loans with Single Tenants(6) | 4.2% |

| (1) | With respect to eight mortgage loans, representing approximately 41.7% of the initial pool balance, with one or more related pari passu companion loan(s) as set forth in the “Whole Loan Summary” table below, the loan-to-value ratio, debt service coverage ratio, debt yield and balance per SF, rooms or unit calculations presented in this Term Sheet include the related pari passu companion loan(s) unless otherwise indicated. With respect to two mortgage loans, representing approximately 6.6% of the initial pool balance, with one or more related subordinate companion loan(s) as set forth in the “Whole Loan Summary” table below, the loan-to-value ratio, debt service coverage ratio, debt yield and balance per SF or unit calculations presented in this Term Sheet are calculated without regard to the related subordinate companion loan(s). Other than as specifically noted, the loan-to-value ratio, debt service coverage ratio, debt yield and mortgage loan rate information for each mortgage loan is presented in this Term Sheet without regard to any other indebtedness (whether or not secured by the related mortgaged property, ownership interests in the related borrower or otherwise) that currently exists or that may be incurred by the related borrower or its owners in the future, in order to present statistics for the related mortgage loan without combination with the other indebtedness. |

| (2) | Subject to a variance of plus or minus 5%. |

| (3) | Unless otherwise indicated, the Cut-off Date LTV Ratio is calculated utilizing the “as-is” appraised value (which in certain cases may reflect a portfolio premium valuation). With respect to four mortgage loans (13.6% of the initial pool balance) the respective Cut-off Date LTV Ratio was calculated based upon a valuation other than an “as-is” value of each related mortgaged property. The weighted average Cut-off Date LTV Ratio for the mortgage pool without making any adjustments is 58.8%. See “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus for a description of Cut-off Date LTV Ratio. |

| (4) | Unless otherwise indicated, the Maturity Date LTV Ratio is calculated utilizing the “as-is” appraised value. With respect to four mortgage loans (13.6% of the initial pool balance) the respective Maturity Date LTV Ratios were calculated using a valuation other than an “as-is” value of each related mortgaged property. The weighted average Maturity Date LTV Ratio for the mortgage pool without making such adjustments is 58.8%. See “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus for a description of Maturity Date LTV Ratio. |

| (5) | The CBM Portfolio mortgage loan is part of a whole loan that includes one subordinate companion note that is generally subordinate in right of payment to the related mortgage loan (collectively, the “CBM Portfolio Subordinate Companion Loan”). The CBM Portfolio Subordinate Companion Loan has an outstanding principal balance of $457,000,000 as of the Cut-off Date. See “Description of the Mortgage Pool—The Whole Loans” and “Description of the Mortgage Pool—Additional Indebtedness” in the Preliminary Prospectus. The ICONIQ Multifamily Portfolio mortgage loan is part of a whole loan that includes two subordinate companion notes that are generally subordinate in right of payment to the related mortgage loan (collectively, the “ICONIQ Multifamily Portfolio Subordinate Companion Loan”). The ICONIQ Multifamily Portfolio Subordinate Companion Loan has an aggregate outstanding principal balance of $225,000,000 as of the Cut-off Date. See “Description of the Mortgage Pool—The Whole Loans” and “Description of the Mortgage Pool—Additional Indebtedness” in the Preliminary Prospectus. |

| (6) | Excludes mortgage loans that are secured by multiple properties with multiple tenants. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 5 | |

| KEY FEATURES OF SECURITIZATION (continued) |

Co-Lead Managers and

Joint Bookrunners: | Goldman Sachs & Co. LLC Citigroup Global Markets Inc. Deutsche Bank Securities Inc. BMO Capital Markets Corp. Barclays Capital Inc. |

| Co-Managers: | Academy Securities, Inc. CastleOak Securities, L.P. |

| Depositor: | GS Mortgage Securities Corporation II |

| Initial Pool Balance: | $752,195,000 |

| Master Servicer: | Wells Fargo Bank, National Association |

| Special Servicer: | K-Star Asset Management LLC |

| Certificate Administrator: | Computershare Trust Company, National Association |

| Trustee: | Computershare Trust Company, National Association |

| Operating Advisor: | Park Bridge Lender Services LLC |

| Asset Representations Reviewer: | Park Bridge Lender Services LLC |

| U.S. Credit Risk Retention: | For a discussion of the manner by which Goldman Sachs Mortgage Company, as retaining sponsor, intends to satisfy the credit risk requirements of the Credit Risk Retention Rules, see “Credit Risk Retention” in the Preliminary Prospectus. |

| Pricing: | Week of December 16, 2024 |

| Closing Date: | December 31, 2024 |

| Cut-off Date: | For each mortgage loan, the related due date for such mortgage loan in December 2024 (or, in the case of any mortgage loan that has its first due date after December 2024, the date that would have been its due date in December 2024 under the terms of that mortgage loan if a monthly payment were scheduled to be due in that month). |

| Determination Date: | The 11th day of each month or next business day, commencing in January 2025 |

| Distribution Date: | The 4th business day after the Determination Date, commencing in January 2025 |

| Interest Accrual: | Preceding calendar month |

| ERISA Eligible: | The offered certificates are expected to be ERISA eligible |

| SMMEA Eligible: | No |

| Payment Structure: | Sequential Pay |

| Day Count: | 30/360 |

| Tax Structure: | REMIC |

| Rated Final Distribution Date: | December 2057 |

| Cleanup Call: | 1.0% |

| Minimum Denominations: | $10,000 minimum for the offered certificates (except with respect to the Class X-A and Class X-B certificates: $1,000,000 minimum); integral multiples of $1 thereafter for all the offered certificates |

| Delivery: | Book-entry through DTC |

| Bond Information: | Cash flows are expected to be modeled by TREPP, INTEX and BLOOMBERG |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 6 | |

| n | $610,077,000 (Approximate) New-Issue Multi-Borrower CMBS: |

| | — | Overview: The mortgage pool consists of 31 fixed-rate commercial mortgage loans that have an aggregate Cut-off Date Balance of $752,195,000 (the “Initial Pool Balance”), have an average mortgage loan Cut-off Date Balance of $24,264,355 and are secured by 156 mortgaged properties located throughout 31 states |

| | — | LTV: 58.4% weighted average Cut-off Date LTV Ratio |

| | — | DSCR: 1.74x weighted average Underwritten NCF Debt Service Coverage Ratio |

| — | Debt Yield: 12.7% weighted average Debt Yield on Underwritten NOI |

| — | Credit Support: 30.000% credit support to Class A-1 / A-2 / A-3 |

| n | Loan Structural Features: |

| — | Amortization: 0.6% of the mortgage loans by Initial Pool Balance have scheduled amortization as follows: |

| - | 0.6% of the mortgage loans by Initial Pool Balance have scheduled amortization for the entire term with a balloon payment due at maturity |

| — | Hard Lockboxes: 40.8% of the mortgage loans by Initial Pool Balance have a Hard Lockbox in place |

| — | Cash Traps: 100.0% of the mortgage loans by Initial Pool Balance have cash traps triggered by certain declines in cash flow, all at levels equal to or greater than a 1.10x DSCR and 6.00% Debt Yield on Underwritten NOI, that fund an excess cash flow reserve |

| — | Reserves: The mortgage loans require amounts to be escrowed for reserves as follows: |

| - | Real Estate Taxes: 28 mortgage loans representing 85.7% of the Initial Pool Balance |

| - | Insurance: 17 mortgage loans representing 40.2% of the Initial Pool Balance |

| - | Replacement Reserves: 25 mortgage loans representing 76.6% of the Initial Pool Balance |

| - | Tenant Improvements / Leasing Commissions: 4 mortgage loans representing 41.7% of the portion of the Initial Pool Balance that is secured by retail, office, mixed use and industrial properties only |

| — | Predominantly Defeasance: 93.1% of the mortgage loans by Initial Pool Balance permit defeasance after an initial lockout period |

| n | Multiple-Asset Types > 5.0% of the Initial Pool Balance: |

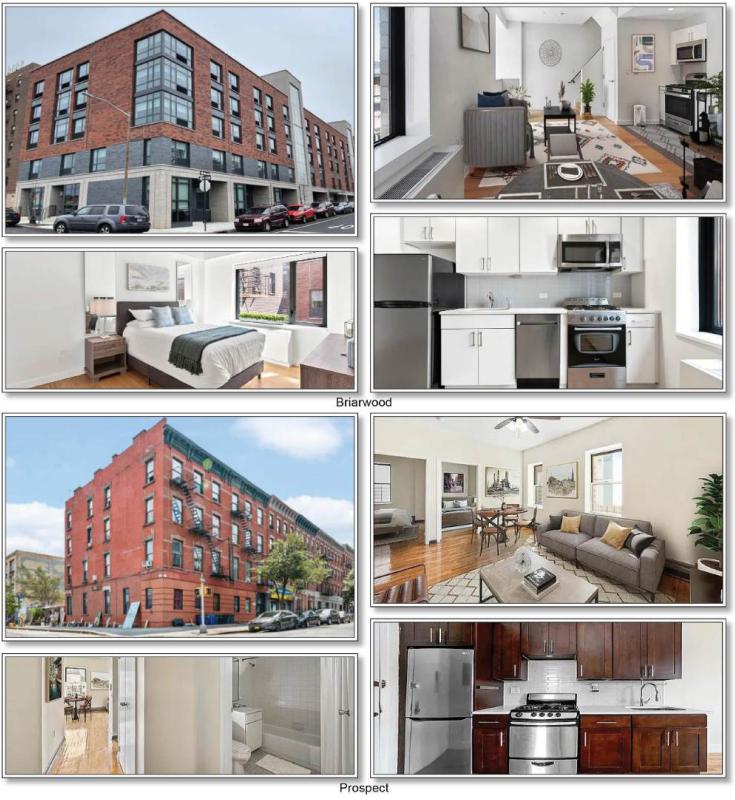

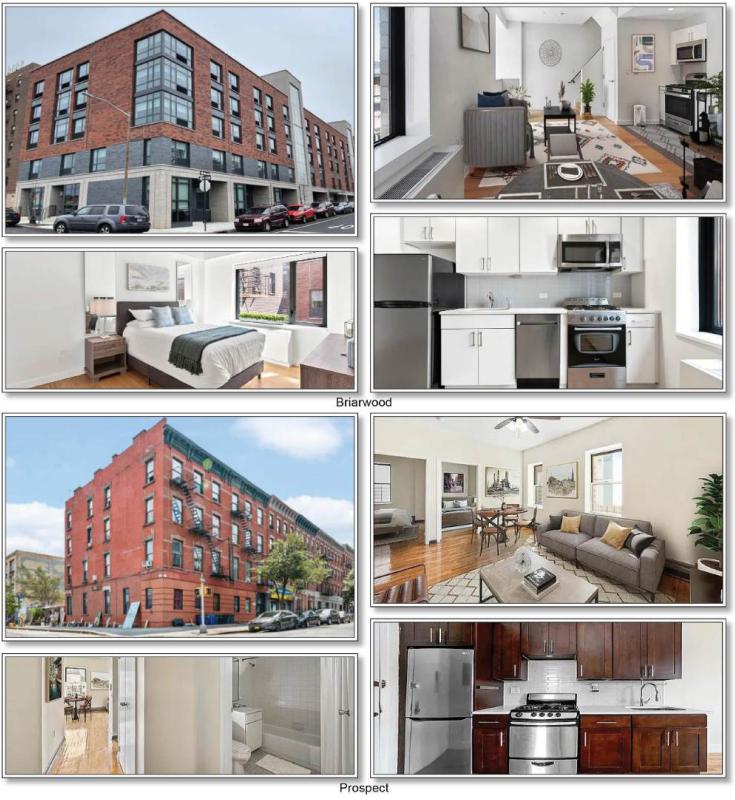

| | — | Multifamily: 27.3% of the mortgaged properties by allocated Initial Pool Balance are multifamily properties |

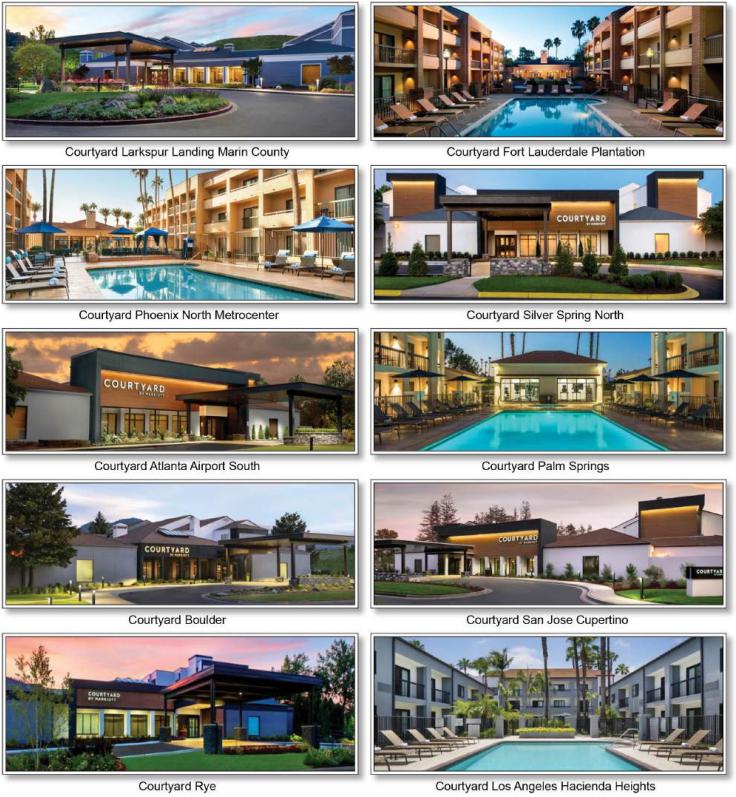

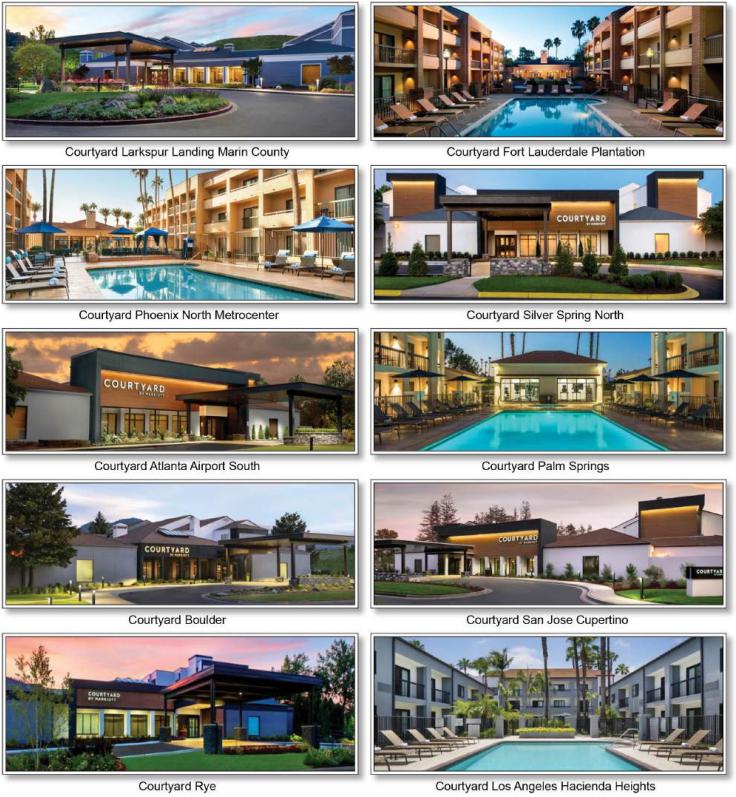

| | — | Hospitality: 25.8% of the mortgaged properties by allocated Initial Pool Balance are hospitality properties |

| | — | Retail: 22.1% of the mortgaged properties by allocated Initial Pool Balance are retail properties (10.7% are anchored retail properties) |

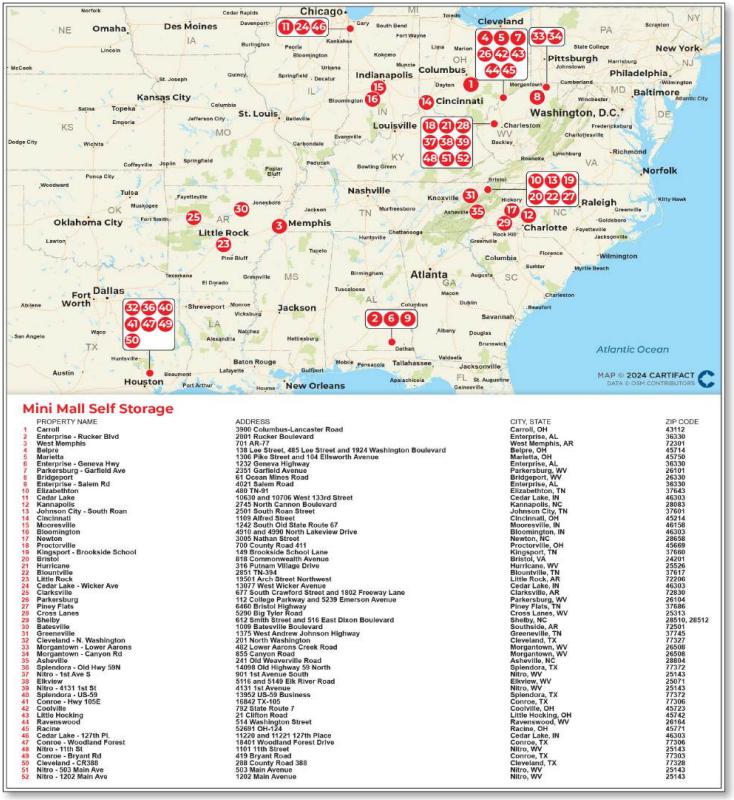

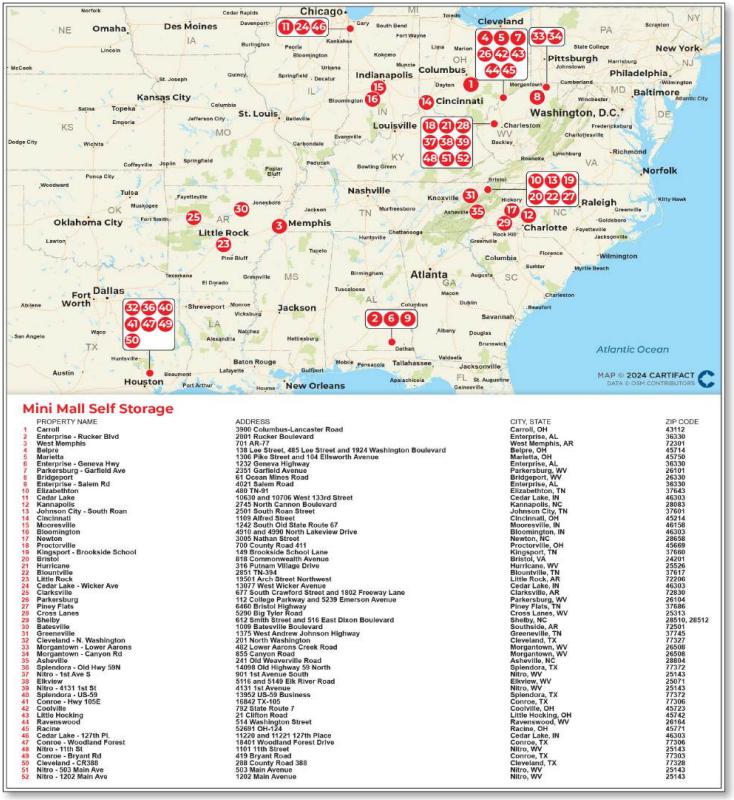

| | — | Self Storage: 9.2% of the mortgaged properties by allocated Initial Pool Balance are self storage properties |

| | — | Manufactured Housing: 8.6% of the mortgaged properties by allocated Initial Pool Balance are office properties |

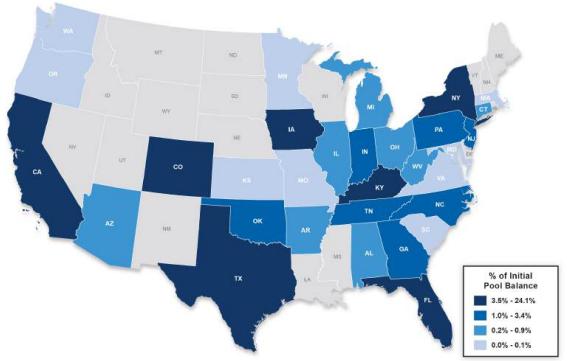

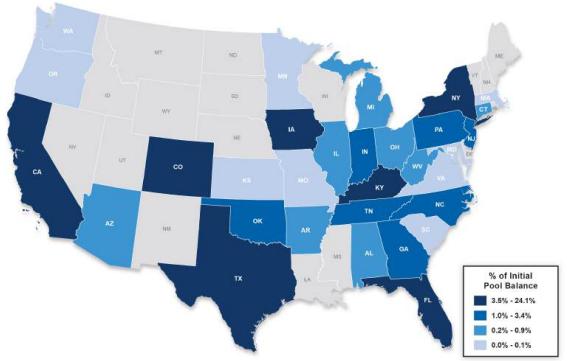

| n | Geographic Diversity: The mortgaged properties are located throughout 31 states with three states having greater than 10.0% of the allocated Initial Pool Balance: New York (24.1%), Colorado (17.0%) and Florida (12.0%) |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 7 | |

| COLLATERAL OVERVIEW (continued) |

Mortgage Loans by Mortgage Loan Seller

Mortgage Loan Seller | Mortgage Loans | Mortgaged Properties | Aggregate Cut-off Date Balance | % of Initial Pool Balance |

| Goldman Sachs Mortgage Company | 8 | 9 | $206,830,000 | 27.5 | % |

| Citi Real Estate Funding Inc. | 9 | 76 | 266,700,000 | 35.5 | |

| German American Capital Corporation | 7 | 64 | 119,065,000 | 15.8 | |

| Bank of Montreal | 3 | 3 | 49,200,000 | 6.5 | |

| Barclays Capital Real Estate Inc. | 3 | 3 | 35,400,000 | 4.7 | |

| German American Capital Corporation / Goldman Sachs Mortgage Company / Bank of Montreal | 1 | 1 | 75,000,000 | 10.0 | |

| Total | 31 | 156 | $752,195,000 | 100.0 | % |

Ten Largest Mortgage Loans

Mortgage Loan Name | Cut-off Date Balance | % of Initial Pool Balance | Property Type | Property Size

SF/Units/ Rooms/ Pads | Loan Purpose | UW NCF

DSCR | UW

NOI Debt Yield | Cut-off Date LTV Ratio |

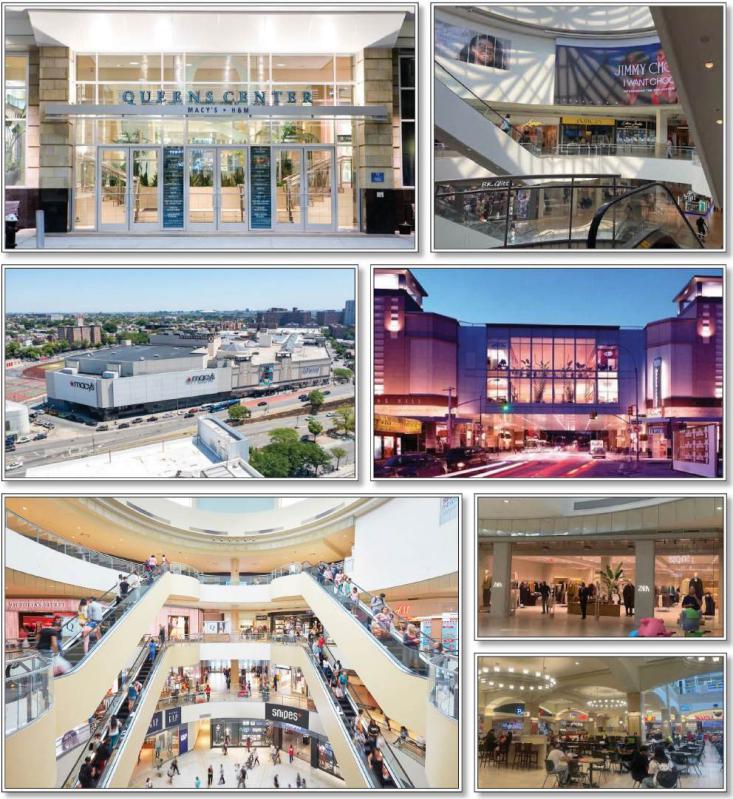

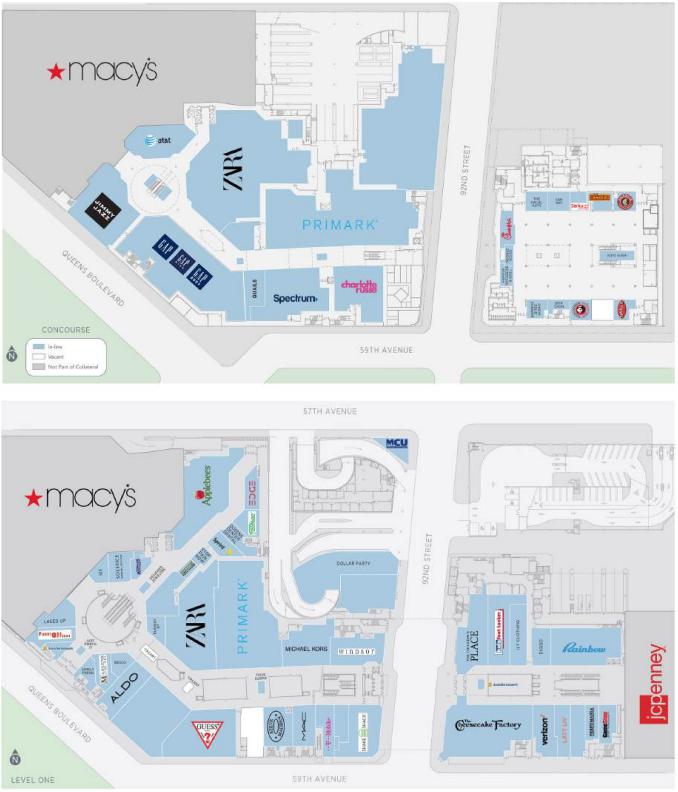

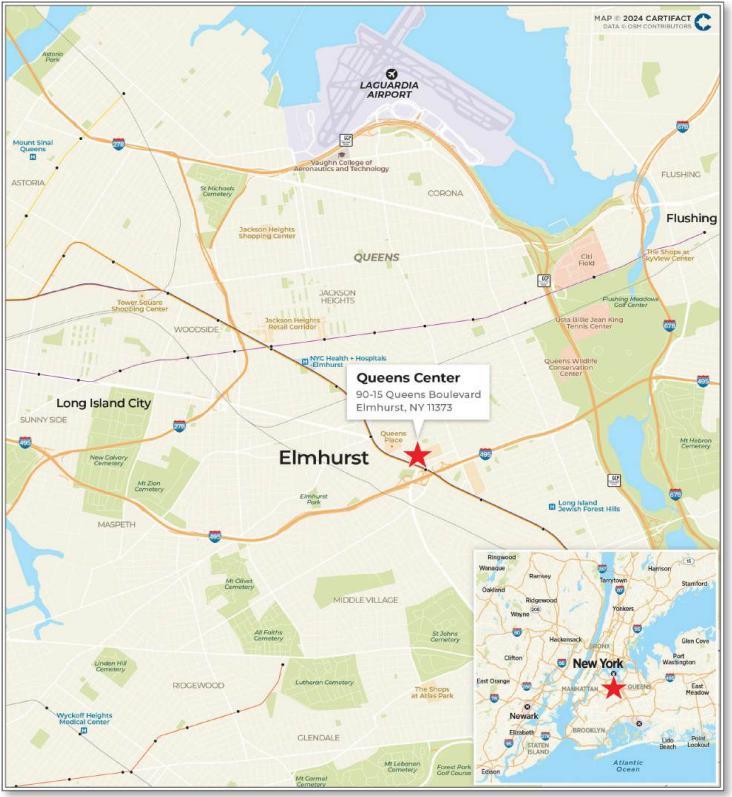

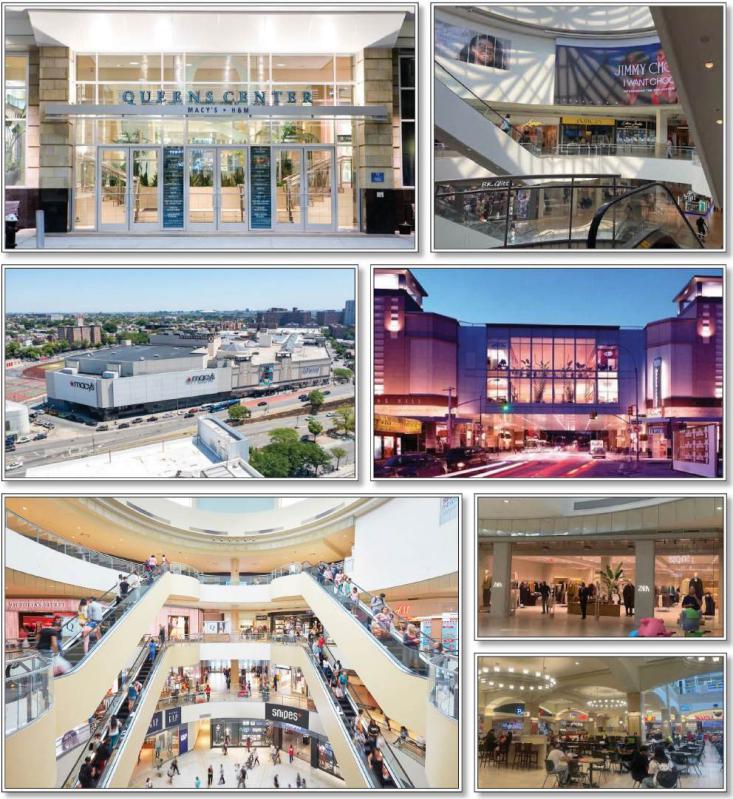

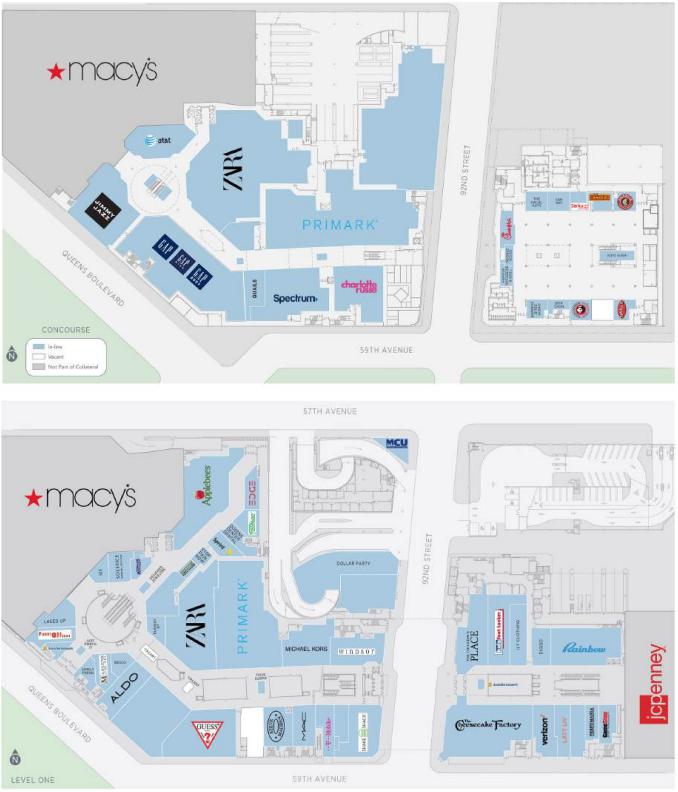

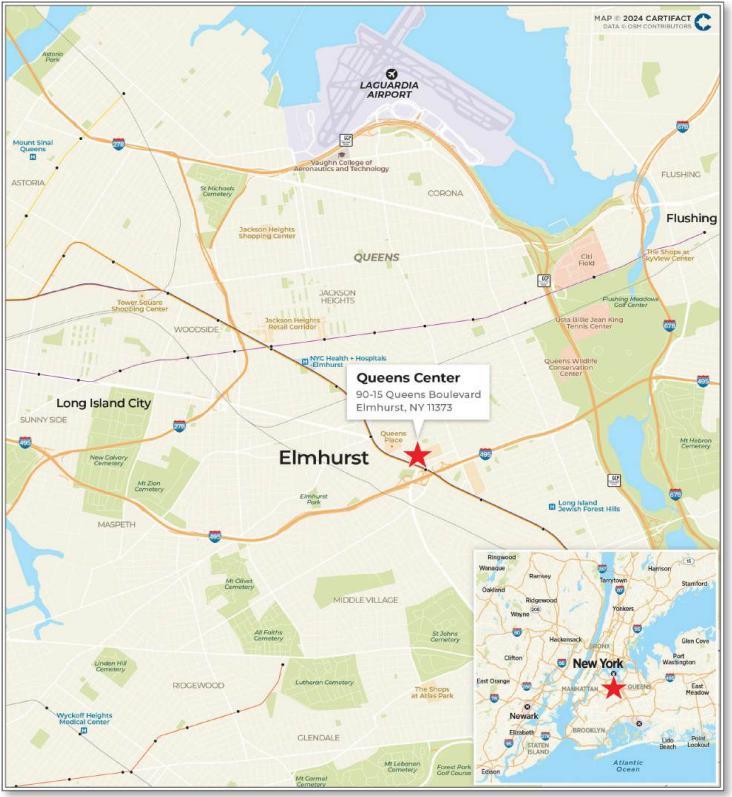

| Queens Center | $75,000,000 | | 9.97 | % | Retail | 412,033 | Refinance | 1.84x | 10.2% | 49.5% |

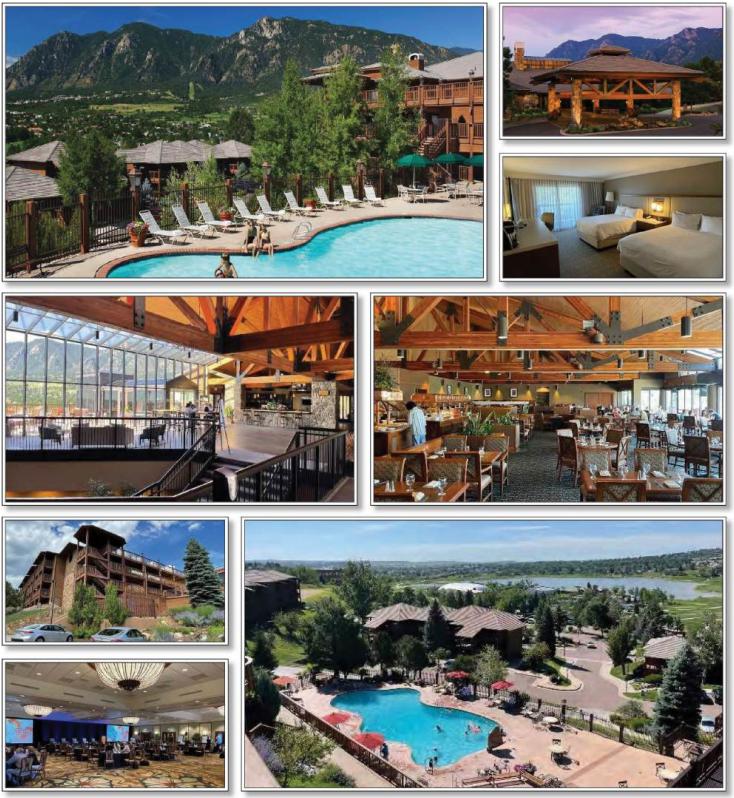

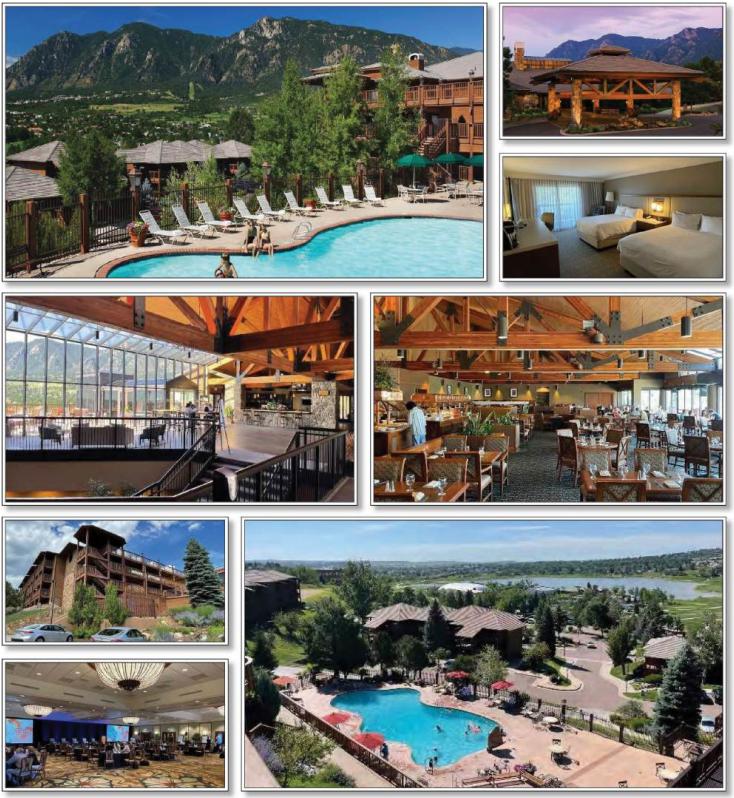

| Cheyenne Mountain Resort | 75,000,000 | | 9.9 | 7 | Hospitality | 316 | Refinance | 1.56x | 13.4% | 60.2% |

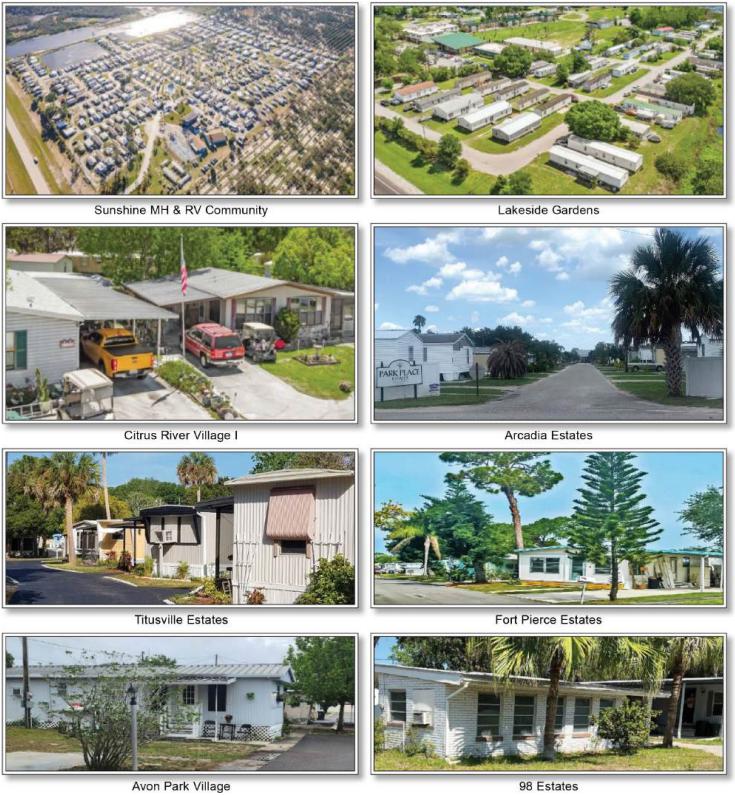

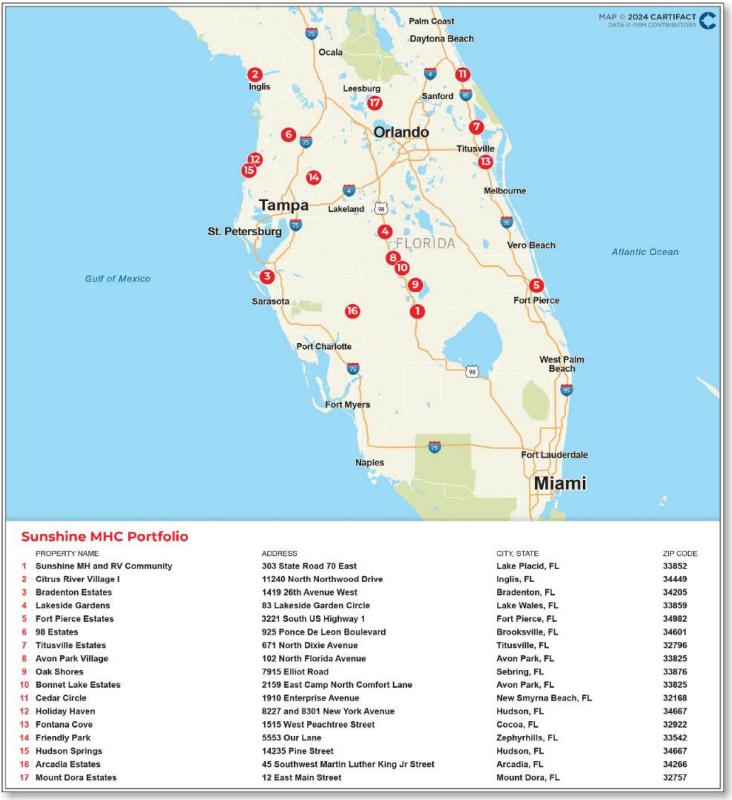

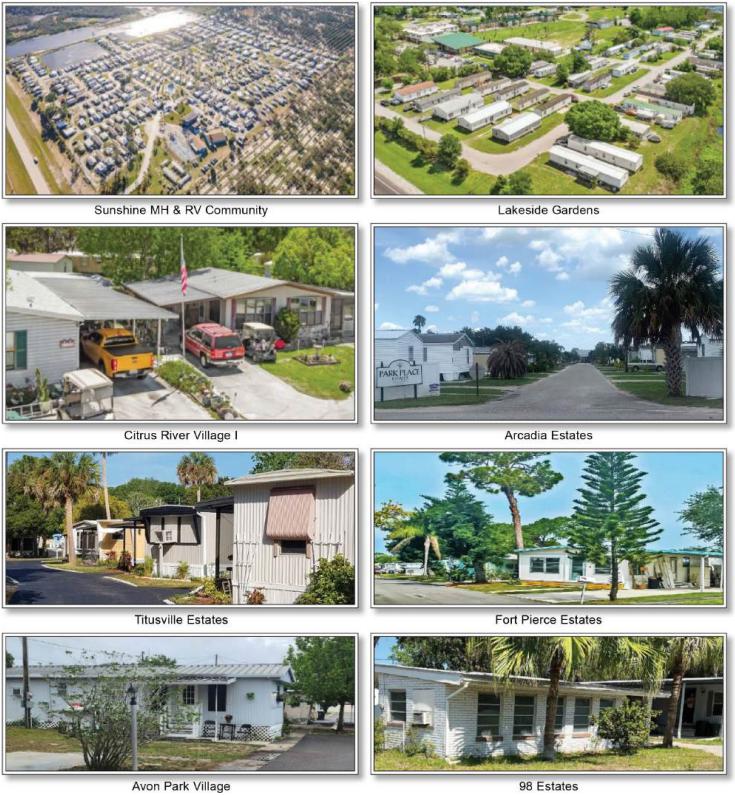

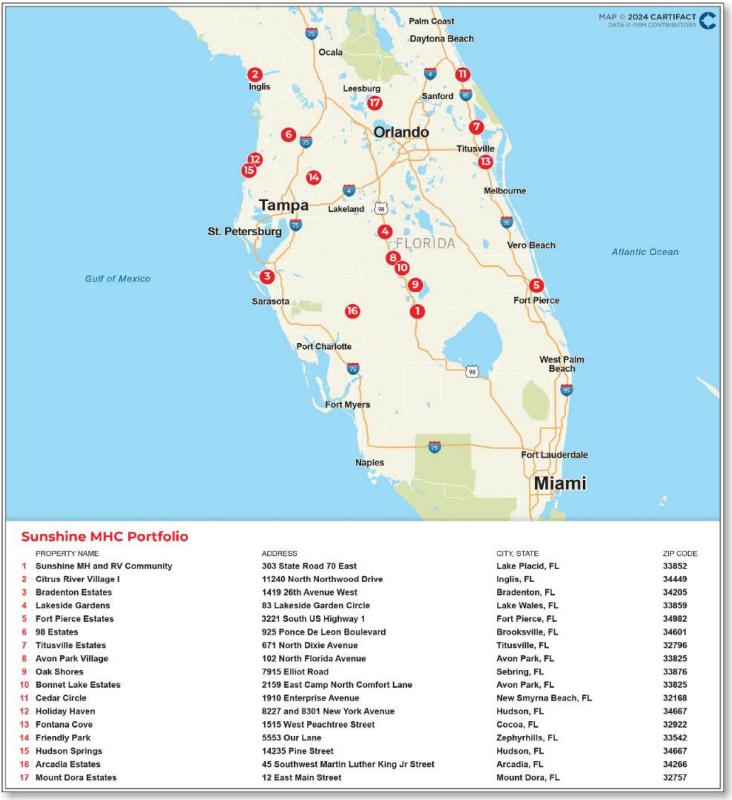

| Sunshine MHC Portfolio | 65,000,000 | | 8.6 | | Manufactured Housing | 1,286 | Refinance | 1.41x | 9.5% | 61.6% |

| Hamburg Pavilion | 54,500,000 | | 7.2 | | Retail | 874,095 | Acquisition | 1.79x | 13.5% | 67.0% |

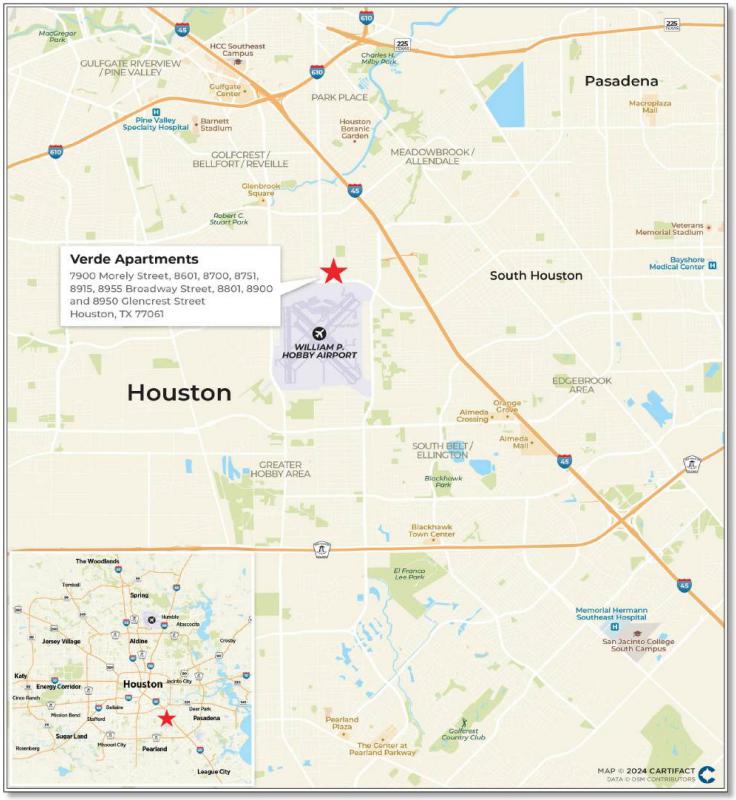

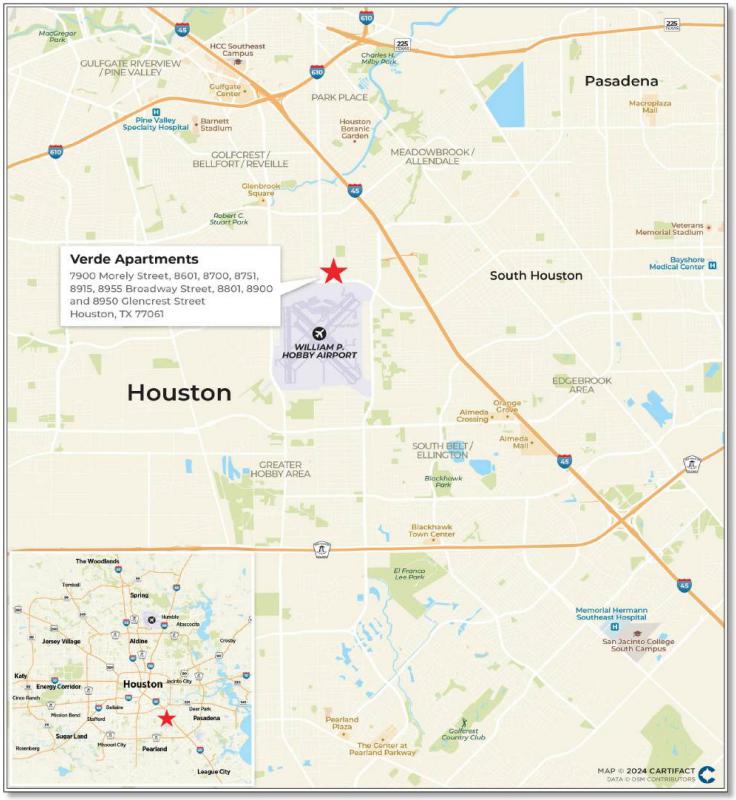

| Verde Apartments | 48,000,000 | | 6.4 | | Multifamily | 2,245 | Refinance | 1.33x | 9.9% | 61.4% |

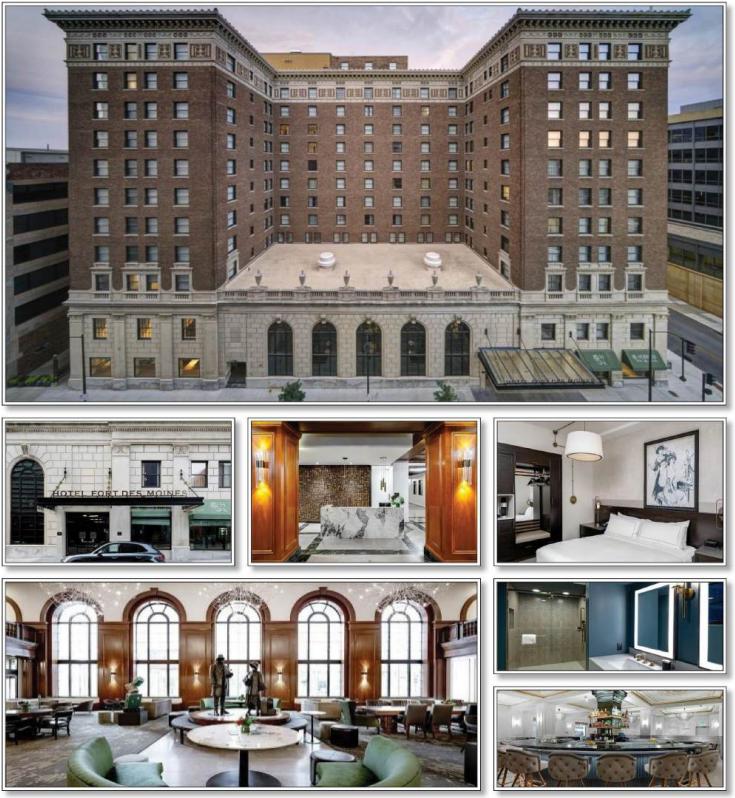

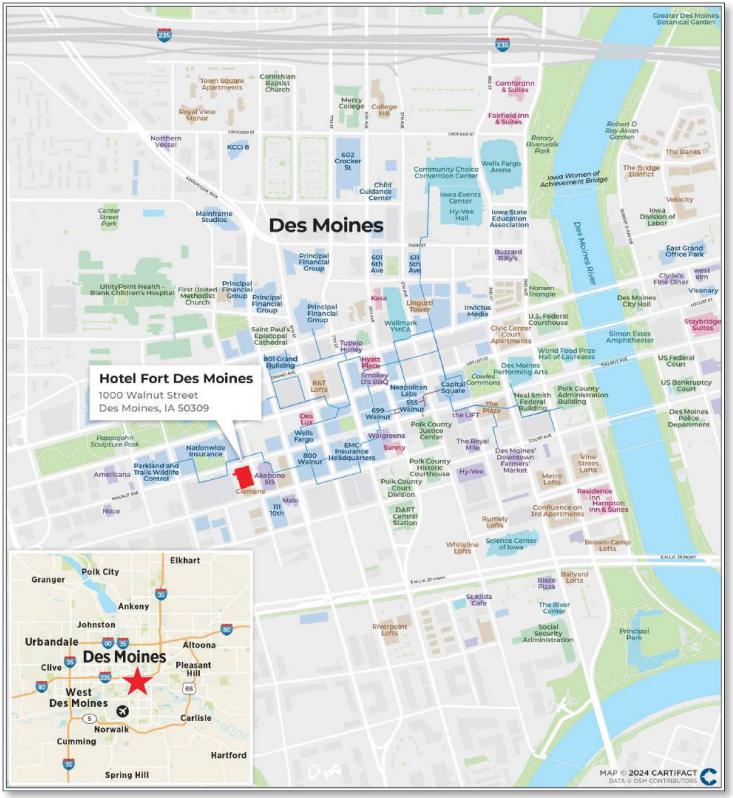

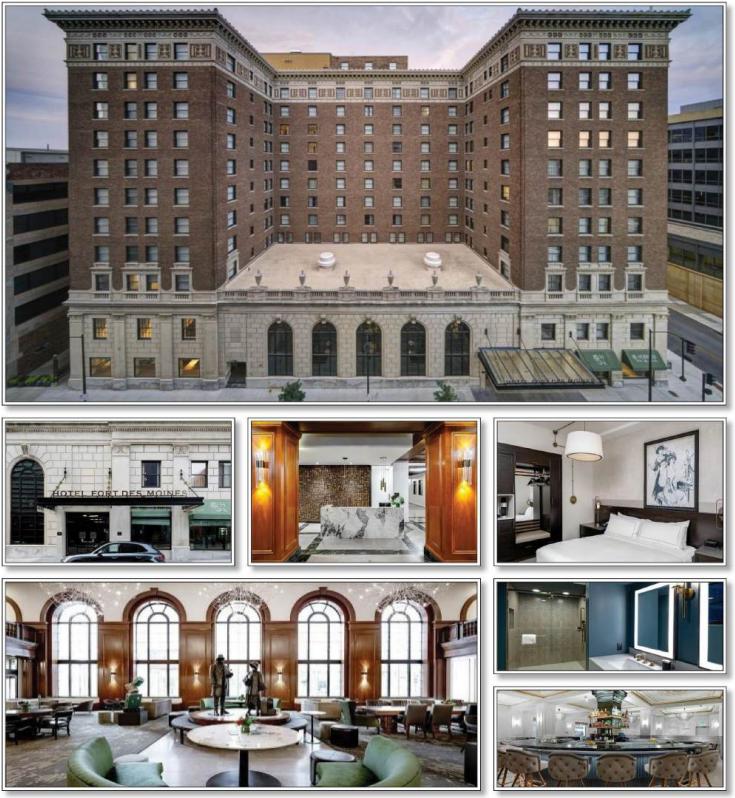

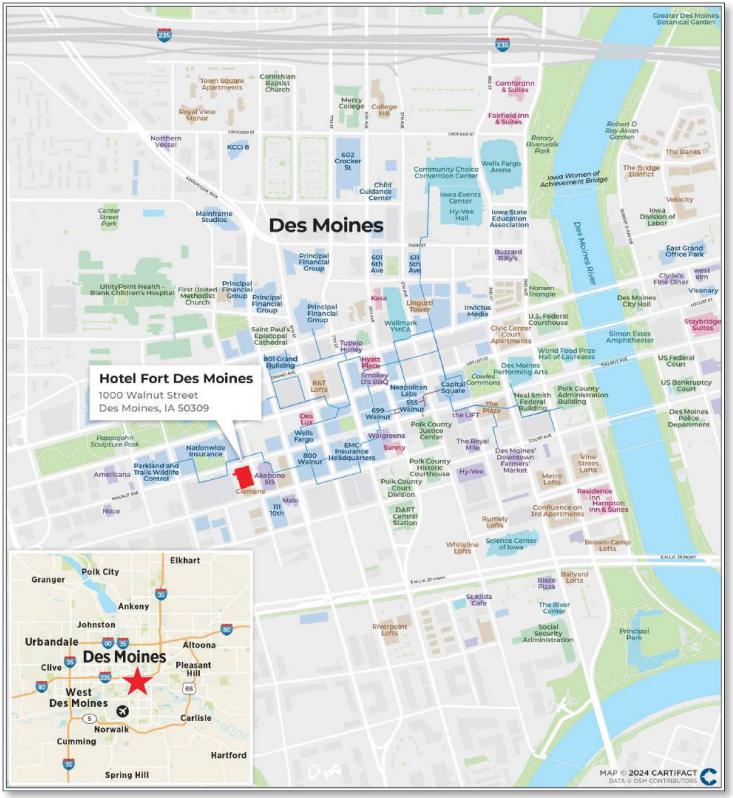

| Hotel Fort Des Moines | 38,500,000 | | 5.1 | | Hospitality | 287 | Refinance | 1.80x | 14.8% | 52.0% |

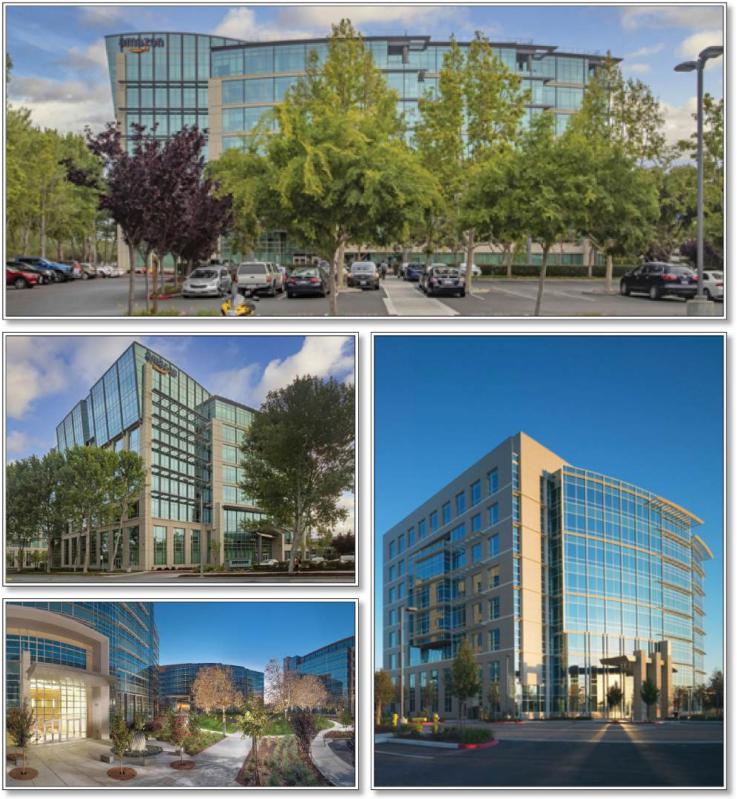

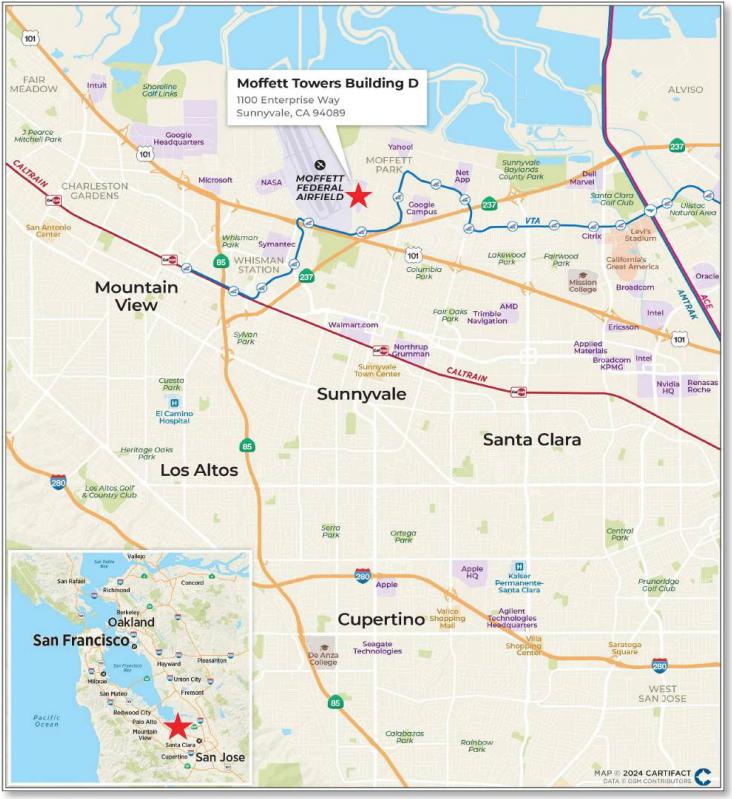

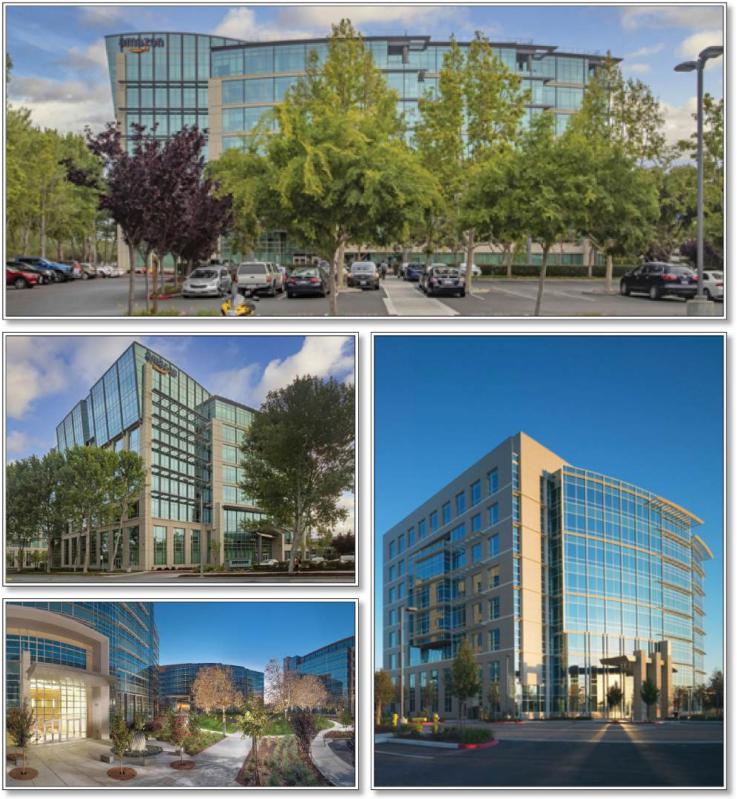

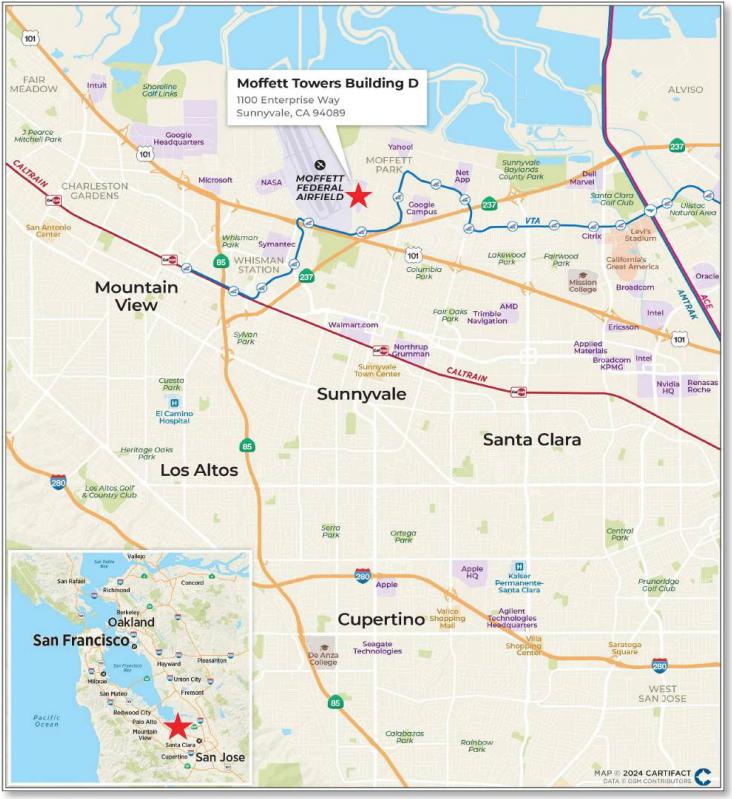

| Moffett Towers Building D | 31,500,000 | | 4.2 | | Office | 357,481 | Recapitalization | 1.83x | 13.2% | 48.3% |

| CBM Portfolio | 30,000,000 | | 4.0 | | Hospitality | 7,677 | Refinance | 4.51x | 38.9% | 20.0% |

| Mini Mall Self Storage | 27,750,000 | | 3.7 | | Self Storage | 2,460,347 | Refinance | 1.71x | 10.5% | 73.8% |

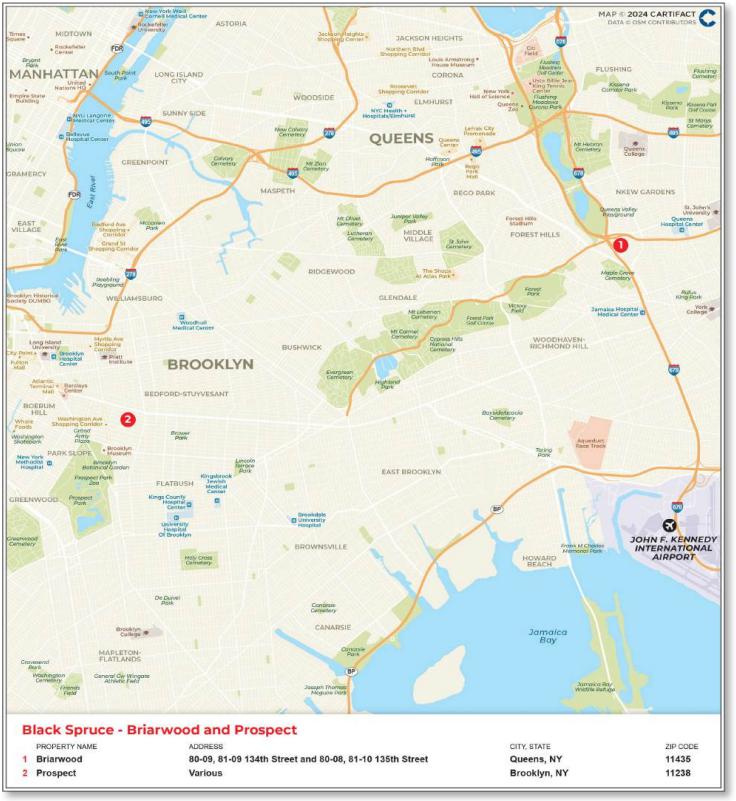

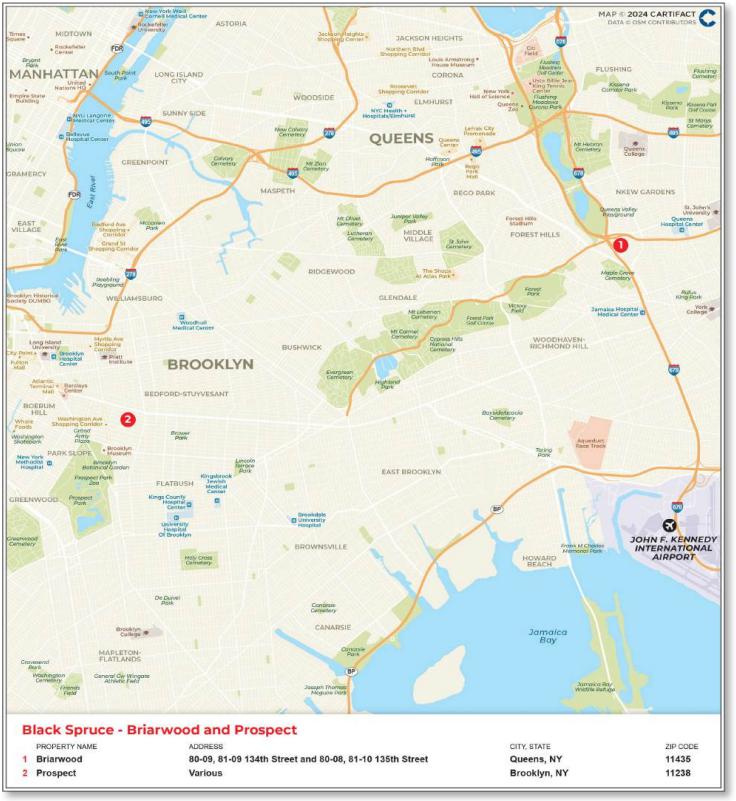

| Black Spruce - Briarwood and Prospect | 27,230,000 | | 3.6 | | Multifamily | 488 | Refinance | 1.20x | 8.1% | 70.0% |

| Top 10 Total / Wtd. Avg. | $472,480,000 | | 62.8 | % | | | | 1.80x | 13.3% | 56.9% |

| Remaining Total / Wtd. Avg. | 279,715,000 | | 37.2 | | | | | 1.63x | 11.7% | 60.9% |

| Total / Wtd. Avg. | $752,195,000 | | 100.0 | % | | | | 1.74x | 12.7% | 58.4% |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 8 | |

| COLLATERAL OVERVIEW (continued) |

Whole Loan Summary

Mortgage Loan Name | Mortgage Loan Cut-off Date Balance | % of Initial Pool Balance | Number of Pari Passu Companion Loans(1) | Aggregate Pari Passu Companion Loan Cut-off Date Balance(1) | Aggregate Subordinate Companion Loan Cut-off Date Balance(1) | Whole Loan Cut-off Date Balance | Controlling Pooling/Trust & Servicing Agreement (“Controlling PSA”) | Master Servicer | Special Servicer |

| Queens Center | $75,000,000 | | | 9.97% | 27 | $450,000,000 | NAP | $525,000,000 | BBCMS 2024-5C31(2) | Midland | LNR |

| Hamburg Pavilion | $54,500,000 | | | 7.2% | 1 | $40,000,000 | NAP | $94,500,000 | Benchmark 2024-V12 | Wells Fargo | K-Star |

| Verde Apartments | $48,000,000 | | | 6.4% | 1 | $30,000,000 | NAP | $78,000,000 | Benchmark 2024-V12 | Wells Fargo | K-Star |

| Moffett Towers Building D | $31,500,000 | | | 4.2% | 11 | $113,500,000 | NAP | $145,000,000 | Benchmark 2024-V10 | Midland | Rialto |

| CBM Portfolio | $30,000,000 | | | 4.0% | 4 | $190,000,000 | $457,000,000 | $677,000,000 | COMM 2024-CBM | KeyBank | KeyBank |

| Mini Mall Self Storage | $27,750,000 | | | 3.7% | 7 | $152,250,000 | NAP | $180,000,000 | WFCM 2024-5C2 | Wells Fargo | Rialto |

| Black Spruce - Briarwood and Prospect | $27,230,000 | | | 3.6% | 1 | $64,000,000 | NAP | $91,230,000 | BMO 2024-5C8(3) | Wells Fargo | Greystone |

| ICONIQ Multifamily Portfolio | $20,000,000 | | | 2.7% | 9 | $280,000,000 | $225,000,000 | $525,000,000 | ICNQ 2024-MF | Wells Fargo | KeyBank |

| (1) | Each companion loan is pari passu in right of payment to its related mortgage loan. Each subordinate companion loan is subordinate in right of payment to its related mortgage loan. |

| (2) | The BBCMS 2024-5C31 transaction is expected to close on or prior to the Closing Date of the Benchmark 2024-V12 transaction. |

| (3) | The BMO 2024-5C8 transaction is expected to close on or prior to the Closing Date of the Benchmark 2024-V12 transaction. |

Mortgage Loans with Existing Mezzanine Debt

Mortgage Loan Name | Mortgage Loan Cut-off Date Balance | Mezzanine Debt Cut-off Date Balance | Total Debt Cut-off Date Balance | Wtd. Avg. Cut-off Date Total Debt Interest Rate | Cut-off Date Mortgage Loan LTV Ratio | Cut-off Date Total Debt LTV Ratio | Cut-off Date Mortgage Loan UW NCF DSCR | Cut-off Date Total Debt UW NCF DSCR |

| None | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 9 | |

| COLLATERAL OVERVIEW (continued) |

Previously Securitized Mortgaged Properties(1)

Mortgaged Property Name | City | State | Property Type | Cut-off Date Balance / Allocated Cut-off Date Balance | % of Initial Pool Balance | Previous Securitization |

| Bradenton Estates | Bradenton | Florida | Manufactured Housing | $5,900,000 | | 0.8% | WFCM 2017-C40 |

| Moffett Towers Building D | Sunnyvale | California | Office | $31,500,000 | | 4.2% | COMM 2014-CR14 |

| Larkspur Landing Marin County | Larkspur | California | Hospitality | $1,400,295 | | 0.2% | COMM 2020-CBM |

| San Mateo Foster City | San Mateo | California | Hospitality | $1,244,756 | | 0.2% | COMM 2020-CBM |

| Lincroft Red Bank | Red Bank | New Jersey | Hospitality | $1,104,727 | | 0.1% | COMM 2020-CBM |

| Rye | Rye | New York | Hospitality | $1,073,264 | | 0.1% | COMM 2020-CBM |

| Los Angeles Torrance Palos Verdes | Torrance | California | Hospitality | $1,042,245 | | 0.1% | COMM 2020-CBM |

| San Jose Cupertino | Cupertino | California | Hospitality | $995,716 | | 0.1% | COMM 2020-CBM |

| Boulder | Boulder | Colorado | Hospitality | $933,235 | | 0.1% | COMM 2020-CBM |

| Palm Springs | Palm Springs | California | Hospitality | $886,263 | | 0.1% | COMM 2020-CBM |

| Los Angeles Hacienda Heights | Hacienda Heights | California | Hospitality | $855,687 | | 0.1% | COMM 2020-CBM |

| Seattle South Center | Tukwila | Washington | Hospitality | $840,177 | | 0.1% | COMM 2020-CBM |

| West Palm Beach | West Palm Beach | Florida | Hospitality | $715,657 | | 0.1% | COMM 2020-CBM |

| Norwalk | Norwalk | Connecticut | Hospitality | $715,657 | | 0.1% | COMM 2020-CBM |

| Tampa Westshore | Tampa | Florida | Hospitality | $715,657 | | 0.1% | COMM 2020-CBM |

| Boston Andover | Andover | Massachusetts | Hospitality | $684,638 | | 0.1% | COMM 2020-CBM |

| Nashville Airport | Nashville | Tennessee | Hospitality | $669,129 | | 0.1% | COMM 2020-CBM |

| St. Petersburg Clearwater | Clearwater | Florida | Hospitality | $653,176 | | 0.1% | COMM 2020-CBM |

| Raleigh Cary | Cary | North Carolina | Hospitality | $653,176 | | 0.1% | COMM 2020-CBM |

| New Haven Wallingford | Wallingford | Connecticut | Hospitality | $653,176 | | 0.1% | COMM 2020-CBM |

| Detroit Livonia | Livonia | Michigan | Hospitality | $606,647 | | 0.1% | COMM 2020-CBM |

| Phoenix Mesa | Mesa | Arizona | Hospitality | $606,647 | | 0.1% | COMM 2020-CBM |

| Phoenix North Metrocenter | Phoenix | Arizona | Hospitality | $575,628 | | 0.1% | COMM 2020-CBM |

| Annapolis | Annapolis | Maryland | Hospitality | $575,628 | | 0.1% | COMM 2020-CBM |

| Ft. Lauderdale Plantation | Fort Lauderdale | Florida | Hospitality | $560,118 | | 0.1% | COMM 2020-CBM |

| Detroit Metro Airport | Romulus | Michigan | Hospitality | $560,118 | | 0.1% | COMM 2020-CBM |

| St. Louis Creve Coeur | St. Louis | Missouri | Hospitality | $544,609 | | 0.1% | COMM 2020-CBM |

| Chicago Oakbrook Terrace | Oakbrook Terrace | Illinois | Hospitality | $544,609 | | 0.1% | COMM 2020-CBM |

| Chicago Lincolnshire | Lincolnshire | Illinois | Hospitality | $529,099 | | 0.1% | COMM 2020-CBM |

| Chicago Waukegan Gurnee | Waukegan | Illinois | Hospitality | $513,589 | | 0.1% | COMM 2020-CBM |

| Birmingham Homewood | Birmingham | Alabama | Hospitality | $513,589 | | 0.1% | COMM 2020-CBM |

| Portland Beaverton | Beaverton | Oregon | Hospitality | $497,637 | | 0.1% | COMM 2020-CBM |

| Greenville Haywood Mall | Greenville | South Carolina | Hospitality | $497,637 | | 0.1% | COMM 2020-CBM |

| Denver Tech Center | Englewood | Colorado | Hospitality | $482,127 | | 0.1% | COMM 2020-CBM |

| Bakersfield | Bakersfield | California | Hospitality | $482,127 | | 0.1% | COMM 2020-CBM |

| Charlottesville North | Charlottesville | Virginia | Hospitality | $482,127 | | 0.1% | COMM 2020-CBM |

| Atlanta Airport South | Atlanta | Georgia | Hospitality | $482,127 | | 0.1% | COMM 2020-CBM |

| St. Louis Westport Plaza | St. Louis | Missouri | Hospitality | $466,617 | | 0.1% | COMM 2020-CBM |

| Atlanta Perimeter Center | Atlanta | Georgia | Hospitality | $466,617 | | 0.1% | COMM 2020-CBM |

| Kansas City Overland Park Metcalf | Overland Park | Kansas | Hospitality | $435,598 | | 0.1% | COMM 2020-CBM |

| San Antonio Downtown Market Square | San Antonio | Texas | Hospitality | $435,598 | | 0.1% | COMM 2020-CBM |

| Silver Spring North | Silver Spring | Maryland | Hospitality | $435,598 | | 0.1% | COMM 2020-CBM |

| Indianapolis Castleton | Indianapolis | Indiana | Hospitality | $433,826 | | 0.1% | COMM 2020-CBM |

| Memphis Airport | Memphis | Tennessee | Hospitality | $389,069 | | 0.1% | COMM 2020-CBM |

| Chicago Highland Park | Highland Park | Illinois | Hospitality | $352,733 | | 0.0% | COMM 2020-CBM |

| Minneapolis St Paul Airport | Mendota Heights | Minnesota | Hospitality | $352,733 | | 0.0% | COMM 2020-CBM |

| Dallas Plano Parkway | Plano | Texas | Hospitality | $298,227 | | 0.0% | COMM 2020-CBM |

| Atlanta Duluth/Gwinnett Place | Duluth | Georgia | Hospitality | $271,196 | | 0.0% | COMM 2020-CBM |

| Poughkeepsie | Poughkeepsie | New York | Hospitality | $264,549 | | 0.0% | COMM 2020-CBM |

| Denver Stapleton | Denver | Colorado | Hospitality | $254,801 | | 0.0% | COMM 2020-CBM |

| Dallas Richardson at Spring Valley | Richardson | Texas | Hospitality | $252,142 | | 0.0% | COMM 2020-CBM |

| Charlotte South Park | Charlotte | North Carolina | Hospitality | $0 | | 0.0% | COMM 2020-CBM |

| Fresno | Fresno | California | Hospitality | $0 | | 0.0% | COMM 2020-CBM |

| Philadelphia Devon | Wayne | Pennsylvania | Hospitality | $0 | | 0.0% | COMM 2020-CBM |

| 2785 Broadway | New York | New York | Mixed Use | $21,000,000 | | 2.8% | BSPRT 2022-FL9 |

| Hilton Brentwood Nashville | Brentwood | Tennessee | Hospitality | $18,250,000 | | 2.4% | COMM 2015-PC1 |

| Guardian Storage Superior | Superior | Colorado | Self Storage | $13,200,000 | | 1.8% | JPMBB 2014-C26 |

| Northside Station | Charlotte | North Carolina | Retail | $10,600,000 | | 1.4% | BMARK 2020-B16 |

| Andover Bay Apartments | Saint Petersburg | Florida | Multifamily | $6,520,000 | | 0.9% | DBJPM 2017-C6 |

| (1) | The table above includes mortgaged properties securing mortgage loans for which the most recent prior financing of all or a significant portion of each such mortgaged property was included in a securitization. Information under “Previous Securitization” represents the most recent such securitization with respect to each of those mortgaged properties. The information in the above table is based solely on information provided by the related borrower or obtained through searches of a third-party database, and has not otherwise been confirmed by the related mortgage loan seller. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 10 | |

| COLLATERAL OVERVIEW (continued) |

Property Types

Property Type / Detail | Number of Mortgaged Properties | Aggregate Cut-off Date Balance(1) | % of Initial Pool Balance(1) | Wtd. Avg. Underwritten NCF DSCR(2) | Wtd. Avg. Cut-off Date LTV Ratio(2) | Wtd. Avg. Debt Yield on Underwritten NOI(2) |

| Multifamily | 19 | $205,150,000 | 27.3 | % | 1.43 | x | 62.1 | % | 9.9 | % |

| Mid Rise | 9 | 91,196,667 | 12.1 | | 1.36 | | 65.0 | | 9.5 | |

| Garden | 4 | 84,020,000 | 11.2 | | 1.34 | | 63.1 | | 9.5 | |

| High Rise | 3 | 15,733,333 | 2.1 | | 2.43 | | 36.1 | | 14.6 | |

| Low Rise | 3 | 14,200,000 | 1.9 | | 1.25 | | 66.2 | | 9.1 | |

| Hospitality | 57 | $193,950,000 | 25.8 | % | 2.12 | x | 53.3 | % | 18.1 | % |

| Full Service | 4 | 141,950,000 | 18.9 | | 1.69 | | 57.1 | | 14.4 | |

| Select Service | 52 | 30,000,000 | 4.0 | | 4.51 | | 20.0 | | 38.9 | |

| Extended Stay/Limited Service | 1 | 22,000,000 | 2.9 | | 1.58 | | 74.1 | | 13.7 | |

| Retail | 5 | $166,245,000 | 22.1 | % | 1.75 | x | 58.7 | % | 11.5 | % |

| Anchored | 3 | 80,645,000 | 10.7 | | 1.69 | | 67.1 | | 12.7 | |

| Super Regional Mall | 1 | 75,000,000 | 10.0 | | 1.84 | | 49.5 | | 10.2 | |

| Unanchored | 1 | 10,600,000 | 1.4 | | 1.61 | | 59.9 | | 11.6 | |

| Self Storage | 56 | $69,350,000 | 9.2 | % | 1.97 | x | 60.4 | % | 12.4 | % |

| Self Storage | 56 | 69,350,000 | 9.2 | | 1.97 | | 60.4 | | 12.4 | |

| Manufactured Housing | 17 | $65,000,000 | 8.6 | % | 1.41 | x | 61.6 | % | 9.5 | % |

| Manufactured Housing | 17 | 65,000,000 | 8.6 | | 1.41 | | 61.6 | | 9.5 | |

| Office | 1 | $31,500,000 | 4.2 | % | 1.83 | x | 48.3 | % | 13.2 | % |

| Suburban | 1 | 31,500,000 | 4.2 | | 1.83 | | 48.3 | | 13.2 | |

| Mixed Use | 1 | $21,000,000 | 2.8 | % | 1.28 | x | 66.5 | % | 8.3 | % |

| Multifamily/Retail | 1 | 21,000,000 | 2.8 | | 1.28 | | 66.5 | | 8.3 | |

| Total / Wtd. Avg. | 156 | $752,195,000 | 100.0 | % | 1.74 | x | 58.4 | % | 12.7 | % |

| (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| (2) | Weighted average based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 11 | |

| COLLATERAL OVERVIEW (continued) |

Geographic Distribution

Property Location | Number of Mortgaged Properties | Aggregate Cut-off Date Balance(1) | % of Initial Pool Balance(1) | Aggregate Appraised Value(2) | % of Total Appraised Value | Underwritten NOI(2) | % of Total Underwritten NOI |

| New York | 12 | $180,967,814 | 24.1 | % | $1,343,790,000 | | 29.3 | % | $72,447,624 | | 24.1 | % |

| Colorado | 8 | 127,889,210 | 17.0 | | 554,175,000 | | 12.1 | | 32,655,547 | | 10.9 | |

| Florida | 24 | 90,485,799 | 12.0 | | 322,765,000 | | 7.0 | | 20,262,531 | | 6.7 | |

| Texas | 14 | 65,955,048 | 8.8 | | 264,350,000 | | 5.8 | | 15,398,439 | | 5.1 | |

| Kentucky | 1 | 54,500,000 | 7.2 | | 141,100,000 | | 3.1 | | 12,748,750 | | 4.2 | |

| California | 10 | 51,107,090 | 6.8 | | 593,050,000 | | 12.9 | | 43,043,289 | | 14.3 | |

| Iowa | 1 | 38,500,000 | 5.1 | | 74,000,000 | | 1.6 | | 5,717,204 | | 1.9 | |

| Tennessee | 10 | 25,416,025 | 3.4 | | 232,100,000 | | 5.1 | | 17,989,063 | | 6.0 | |

| Indiana | 7 | 18,284,097 | 2.4 | | 66,450,000 | | 1.5 | | 3,558,768 | | 1.2 | |

| Pennsylvania | 2 | 17,500,000 | 2.3 | | 42,800,000 | | 0.9 | | 4,373,308 | | 1.5 | |

| North Carolina | 7 | 13,112,426 | 1.7 | | 69,350,000 | | 1.5 | | 6,630,160 | | 2.2 | |

| Oklahoma | 1 | 12,300,000 | 1.6 | | 17,600,000 | | 0.4 | | 1,525,258 | | 0.5 | |

| New Jersey | 2 | 11,304,727 | 1.5 | | 53,500,000 | | 1.2 | | 6,422,553 | | 2.1 | |

| Georgia | 4 | 8,519,941 | 1.1 | | 51,260,000 | | 1.1 | | 3,383,197 | | 1.1 | |

| Illinois | 5 | 7,006,696 | 0.9 | | 272,800,000 | | 6.0 | | 16,005,040 | | 5.3 | |

| Ohio | 8 | 6,464,979 | 0.9 | | 53,250,000 | | 1.2 | | 4,280,224 | | 1.4 | |

| West Virginia | 14 | 4,908,667 | 0.7 | | 37,975,000 | | 0.8 | | 4,432,916 | | 1.5 | |

| Alabama | 4 | 4,627,527 | 0.6 | | 50,550,000 | | 1.1 | | 4,617,642 | | 1.5 | |

| Arkansas | 4 | 3,324,604 | 0.4 | | 27,700,000 | | 0.6 | | 2,065,647 | | 0.7 | |

| Connecticut | 2 | 1,368,833 | 0.2 | | 44,000,000 | | 1.0 | | 4,167,494 | | 1.4 | |

| Arizona | 2 | 1,182,275 | 0.2 | | 38,000,000 | | 0.8 | | 3,130,147 | | 1.0 | |

| Michigan | 2 | 1,166,765 | 0.2 | | 37,500,000 | | 0.8 | | 2,601,358 | | 0.9 | |

| Missouri | 2 | 1,011,226 | 0.1 | | 32,500,000 | | 0.7 | | 1,019,762 | | 0.3 | |

| Maryland | 2 | 1,011,226 | 0.1 | | 32,500,000 | | 0.7 | | 3,185,585 | | 1.1 | |

| Virginia | 2 | 971,606 | 0.1 | | 19,275,000 | | 0.4 | | 1,089,405 | | 0.4 | |

| Washington | 1 | 840,177 | 0.1 | | 27,000,000 | | 0.6 | | 2,332,772 | | 0.8 | |

| Massachusetts | 1 | 684,638 | 0.1 | | 22,000,000 | | 0.5 | | 1,849,670 | | 0.6 | |

| South Carolina | 1 | 497,637 | 0.1 | | 16,000,000 | | 0.3 | | 1,667,684 | | 0.6 | |

| Oregon | 1 | 497,637 | 0.1 | | 16,000,000 | | 0.3 | | 769,022 | | 0.3 | |

| Kansas | 1 | 435,598 | 0.1 | | 14,000,000 | | 0.3 | | 590,402 | | 0.2 | |

| Minnesota | 1 | 352,733 | 0.0 | | 13,000,000 | | 0.3 | | 549,694 | | 0.2 | |

| Total | 156 | $752,195,000 | 100.0 | % | $4,580,340,000 | | 100.0 | % | $300,510,153 | | 100.0 | % |

| (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| (2) | Aggregate Appraised Values and Underwritten NOI reflect the aggregate values without any reduction for the pari passu companion loan(s). |

The securities offered by these materials are being offered when, as and if issued. In particular, you are advised that the offered securities, and the asset pool backing them, are subject to modification or revision (including, among other things, the possibility that one or more classes of securities may be split, combined or eliminated) at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the offered securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the offered securities and the underlying transaction having the characteristics described in these materials. If we determine that the above conditions are not satisfied in any material respect, we will notify you, and neither the issuer nor any of the underwriters will have any obligation to you to deliver all or any portion of the securities which you have committed to purchase, and there will be no liability between us as a consequence of the non-delivery. The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-261764) (the “Registration Statement”) for the offering to which this communication relates. Before you invest, you should read the prospectus in the Registration Statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., Deutsche Bank Securities Inc., BMO Capital Markets Corp., Barclays Capital Inc., Academy Securities, Inc., CastleOak Securities, L.P., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-866-471-2526 or if you email a request to prospectus-ny@gs.com. |

| | 12 | |

| COLLATERAL OVERVIEW (continued) |

| Distribution of Cut-off Date Balances |

Range of Cut-off Date Balances ($) | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance |

| 4,500,000 - 14,999,999 | 14 | | $141,465,000 | | 18.8 | % |

| 15,000,000 - 24,999,999 | 7 | | 138,250,000 | | 18.4 | |

| 25,000,000 - 39,999,999 | 5 | | 154,980,000 | | 20.6 | |

| 40,000,000 - 69,999,999 | 3 | | 167,500,000 | | 22.3 | |

| 70,000,000 - 75,000,000 | 2 | | 150,000,000 | | 19.9 | |

| Total | 31 | | $752,195,000 | | 100.0 | % |

| |

| |

| Distribution of Underwritten NCF DSCRs(1) |

Range of UW NCF DSCR (x) | Number of Mortgage Loans | Cut-off Date Balance | % of Initial Pool Balance |

| 1.20 - 1.30 | 7 | | $98,030,000 | | 13% | |

| 1.31 - 1.40 | 5 | | 114,545,000 | | 15.2 | |

| 1.41 - 1.70 | 10 | | 239,470,000 | | 31.8 | |