Exhibit 99.2 ANNOUNCEMENTS FORM 6-K SECURITIES AND EXCHANGE COMMISSION Washington D.C. 20549 Report of Foreign Issuer Pursuant to Rule 13a - 16 or 15d - 16 of The Securities Exchange Act of 1934 Announcements sent to the London Stock Exchange National Grid plc, 1-3 Strand, London, WC2N 5EH, United Kingdom Update - Routine announcements in the period to 10 December 2018

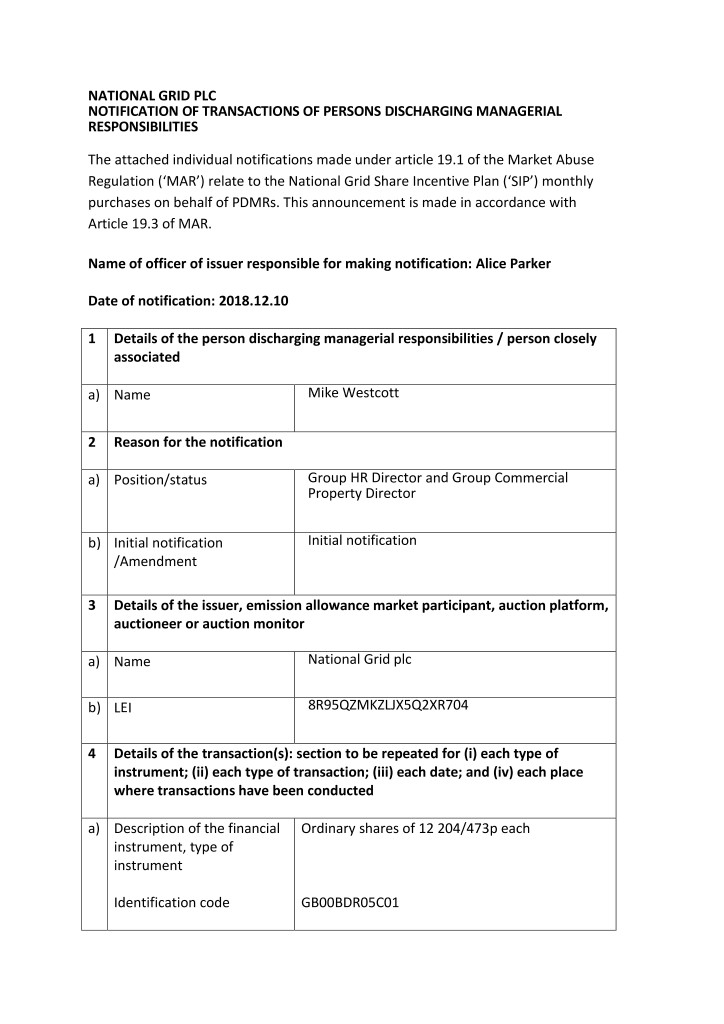

NATIONAL GRID PLC NOTIFICATION OF TRANSACTIONS OF PERSONS DISCHARGING MANAGERIAL RESPONSIBILITIES The attached individual notifications made under article 19.1 of the Market Abuse Regulation (‘MAR’) relate to the National Grid Share Incentive Plan (‘SIP’) monthly purchases on behalf of PDMRs. This announcement is made in accordance with Article 19.3 of MAR. Name of officer of issuer responsible for making notification: Alice Parker Date of notification: 2018.12.10 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Mike Westcott 2 Reason for the notification a) Position/status Group HR Director and Group Commercial Property Director b) Initial notification Initial notification /Amendment 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial Ordinary shares of 12 204/473p each instrument, type of instrument Identification code GB00BDR05C01

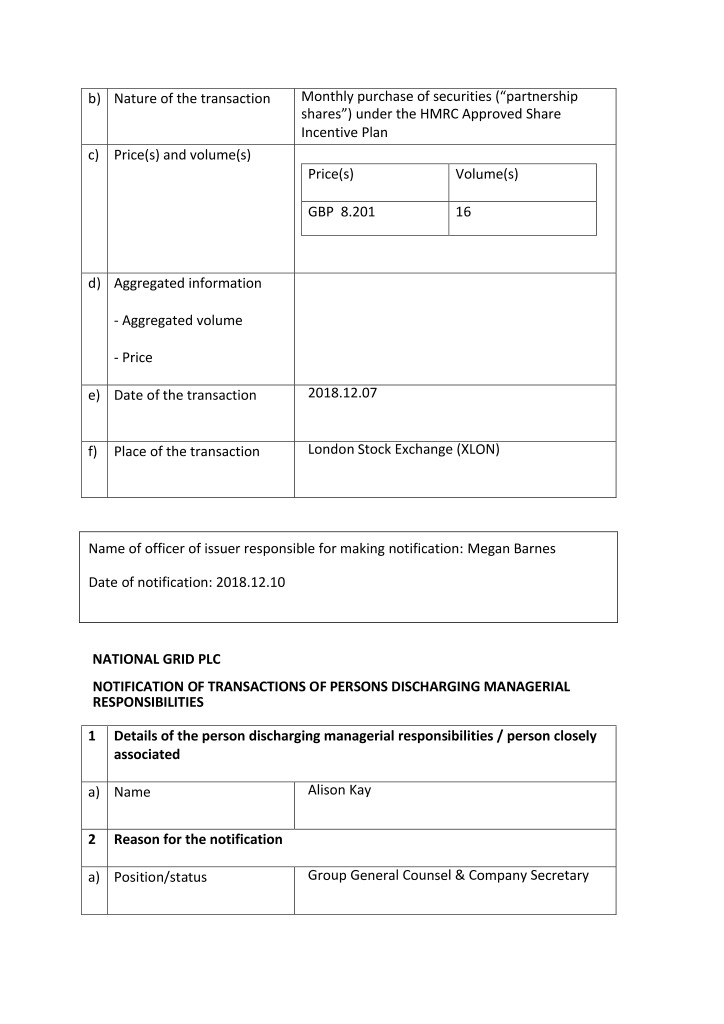

b) Nature of the transaction Monthly purchase of securities (“partnership shares”) under the HMRC Approved Share Incentive Plan c) Price(s) and volume(s) Price(s) Volume(s) GBP 8.201 16 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2018.12.07 f) Place of the transaction London Stock Exchange (XLON) Name of officer of issuer responsible for making notification: Megan Barnes Date of notification: 2018.12.10 NATIONAL GRID PLC NOTIFICATION OF TRANSACTIONS OF PERSONS DISCHARGING MANAGERIAL RESPONSIBILITIES 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Alison Kay 2 Reason for the notification a) Position/status Group General Counsel & Company Secretary

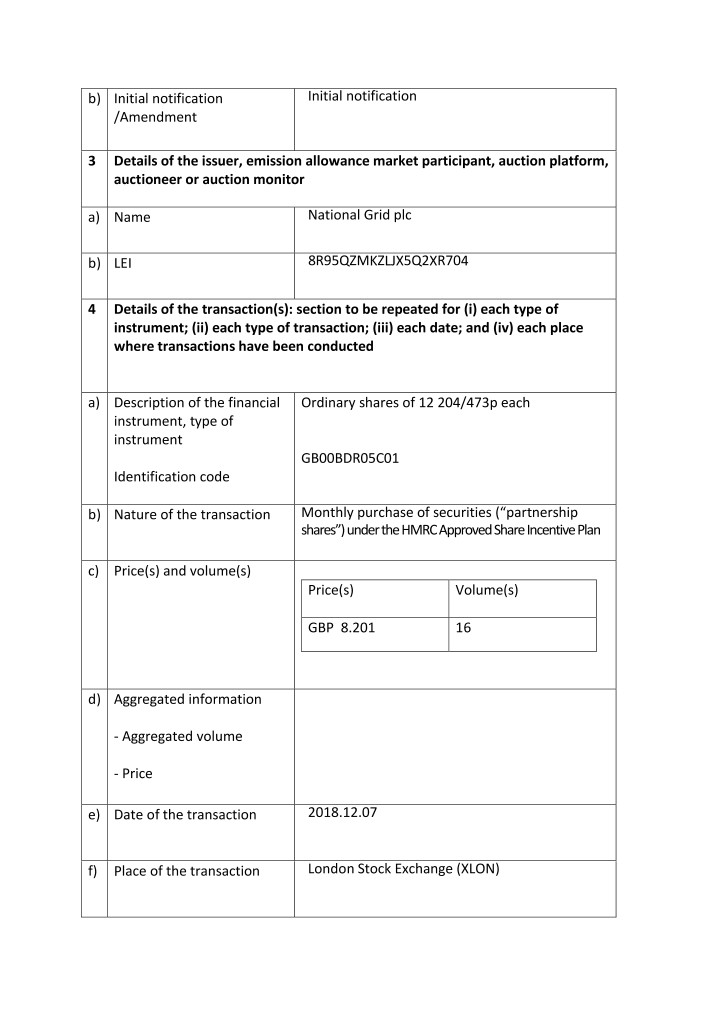

b) Initial notification Initial notification /Amendment 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial Ordinary shares of 12 204/473p each instrument, type of instrument GB00BDR05C01 Identification code b) Nature of the transaction Monthly purchase of securities (“partnership shares”) under the HMRC Approved Share Incentive Plan c) Price(s) and volume(s) Price(s) Volume(s) GBP 8.201 16 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2018.12.07 f) Place of the transaction London Stock Exchange (XLON)

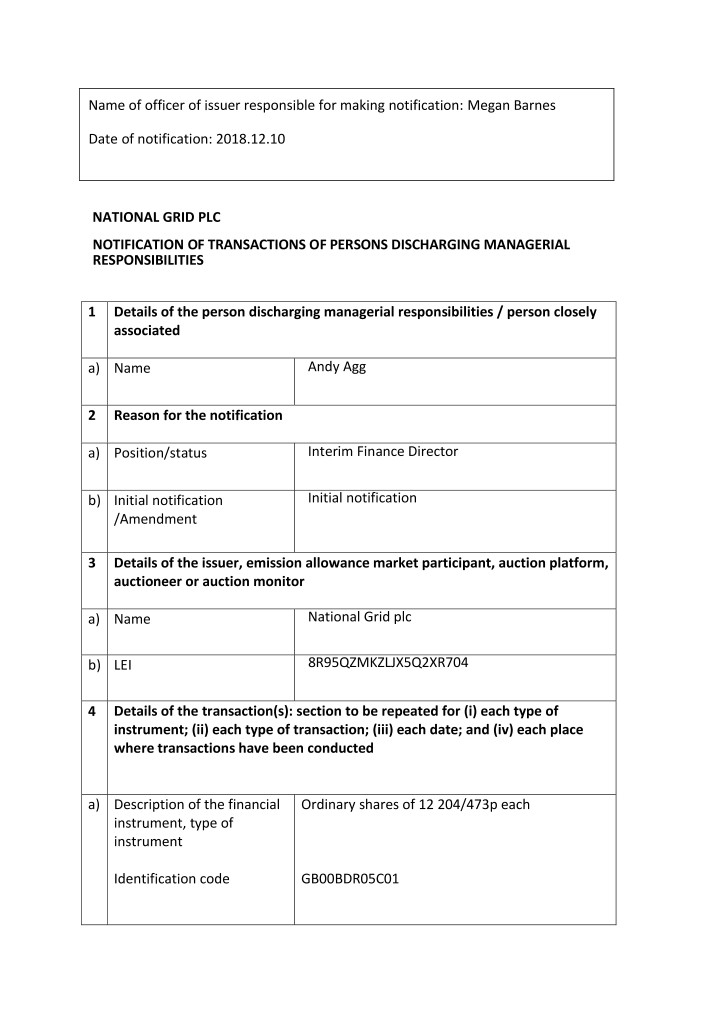

Name of officer of issuer responsible for making notification: Megan Barnes Date of notification: 2018.12.10 NATIONAL GRID PLC NOTIFICATION OF TRANSACTIONS OF PERSONS DISCHARGING MANAGERIAL RESPONSIBILITIES 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Andy Agg 2 Reason for the notification a) Position/status Interim Finance Director b) Initial notification Initial notification /Amendment 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial Ordinary shares of 12 204/473p each instrument, type of instrument Identification code GB00BDR05C01

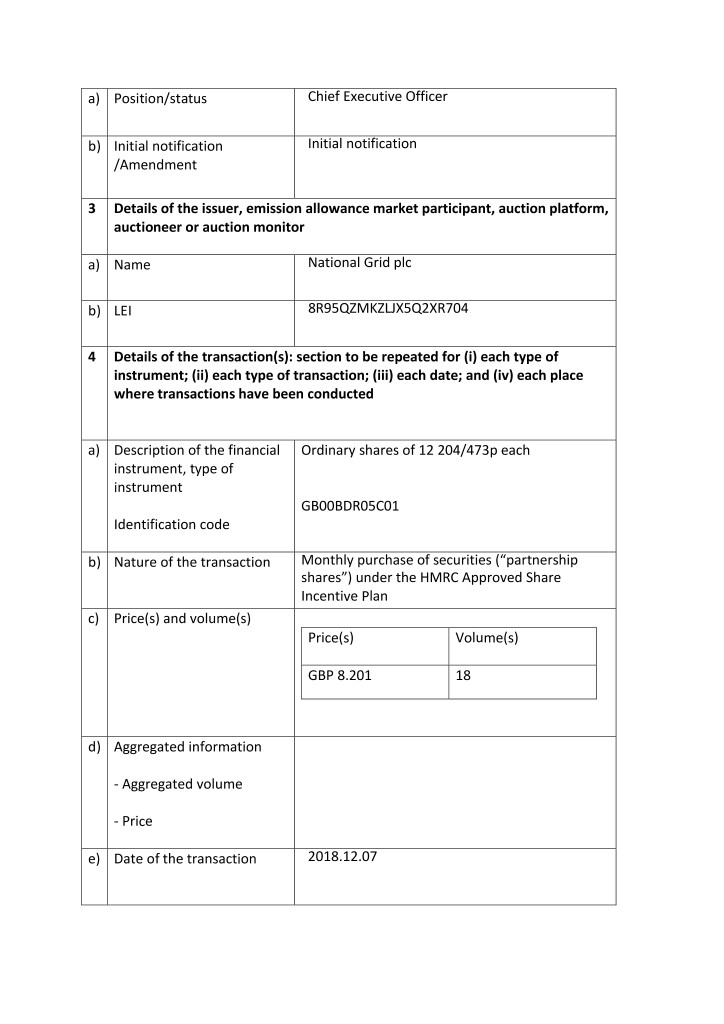

b) Nature of the transaction Monthly purchase of securities (“partnership shares”) under the HMRC Approved Share Incentive Plan c) Price(s) and volume(s) Price(s) Volume(s) GBP 8.201 18 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2018.12.07 f) Place of the transaction London Stock Exchange (XLON) Name of officer of issuer responsible for making notification: Megan Barnes Date of notification: 2018.12.10 NATIONAL GRID PLC NOTIFICATION OF TRANSACTIONS OF PERSONS DISCHARGING MANAGERIAL RESPONSIBILITIES 1 Details of the person discharging managerial responsibilities / person closely associated a) Name John Pettigrew 2 Reason for the notification

a) Position/status Chief Executive Officer b) Initial notification Initial notification /Amendment 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial Ordinary shares of 12 204/473p each instrument, type of instrument GB00BDR05C01 Identification code b) Nature of the transaction Monthly purchase of securities (“partnership shares”) under the HMRC Approved Share Incentive Plan c) Price(s) and volume(s) Price(s) Volume(s) GBP 8.201 18 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2018.12.07

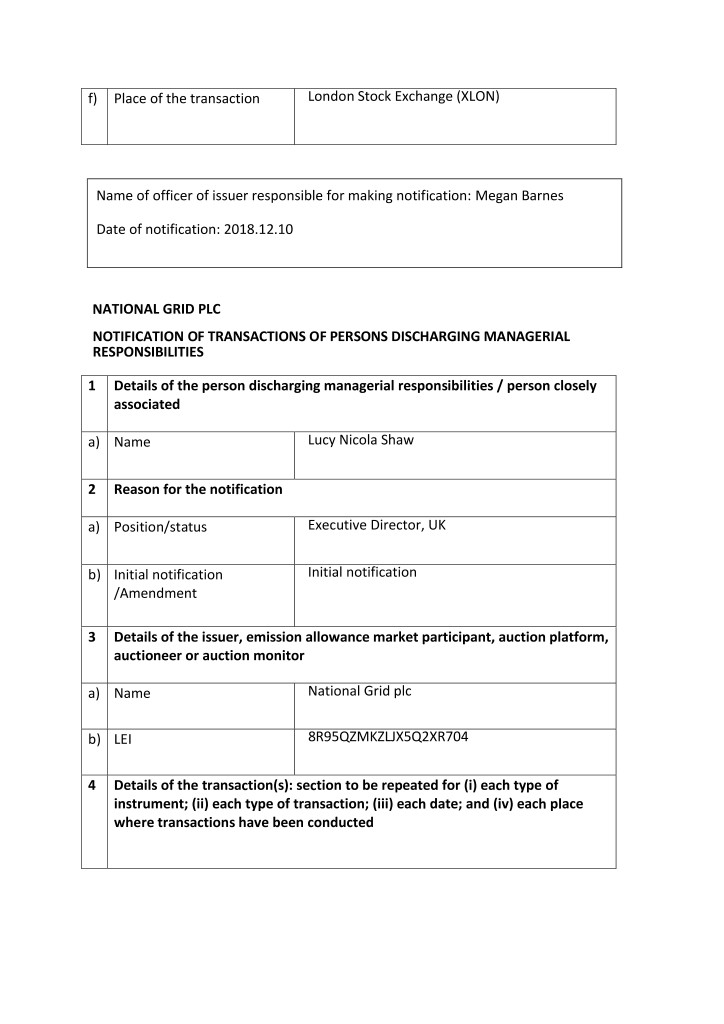

f) Place of the transaction London Stock Exchange (XLON) Name of officer of issuer responsible for making notification: Megan Barnes Date of notification: 2018.12.10 NATIONAL GRID PLC NOTIFICATION OF TRANSACTIONS OF PERSONS DISCHARGING MANAGERIAL RESPONSIBILITIES 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Lucy Nicola Shaw 2 Reason for the notification a) Position/status Executive Director, UK b) Initial notification Initial notification /Amendment 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted

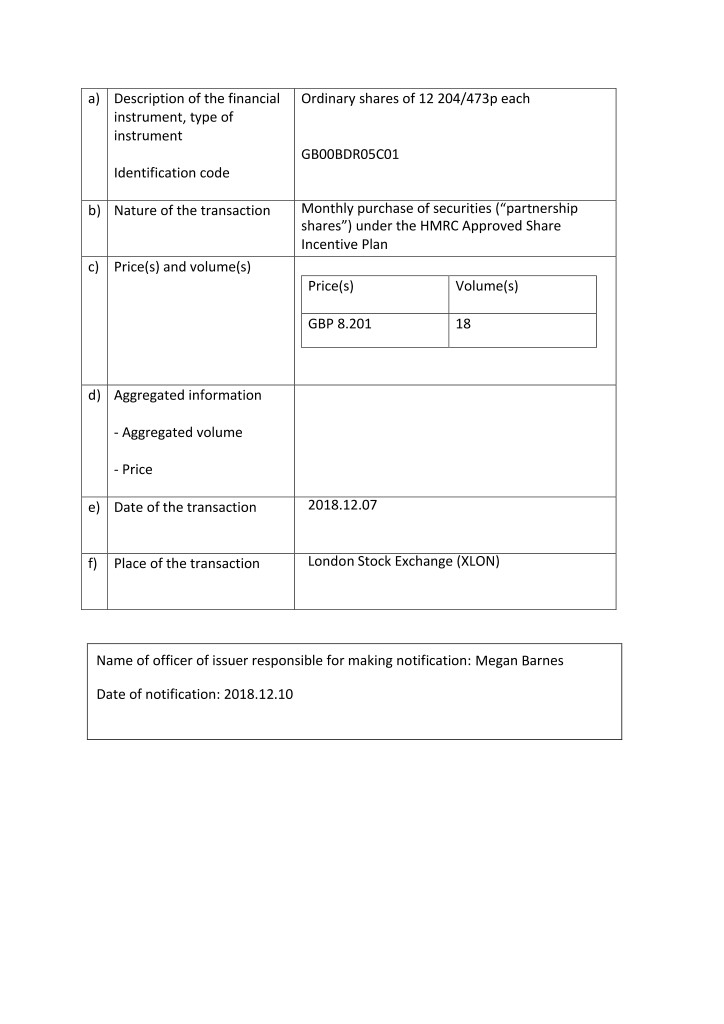

a) Description of the financial Ordinary shares of 12 204/473p each instrument, type of instrument GB00BDR05C01 Identification code b) Nature of the transaction Monthly purchase of securities (“partnership shares”) under the HMRC Approved Share Incentive Plan c) Price(s) and volume(s) Price(s) Volume(s) GBP 8.201 18 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2018.12.07 f) Place of the transaction London Stock Exchange (XLON) Name of officer of issuer responsible for making notification: Megan Barnes Date of notification: 2018.12.10

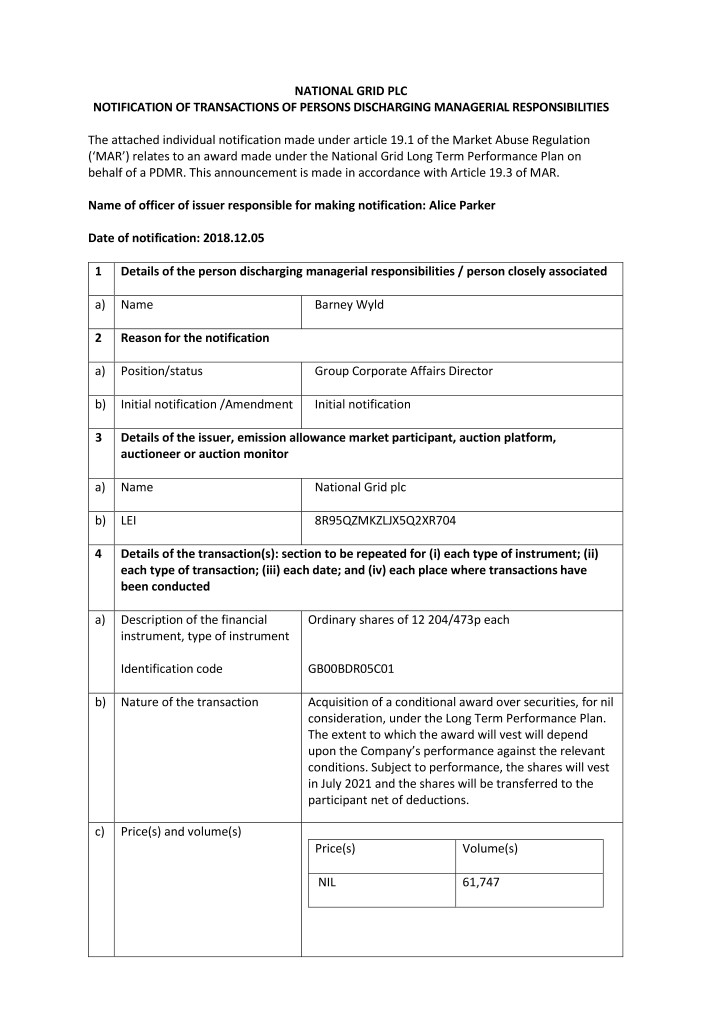

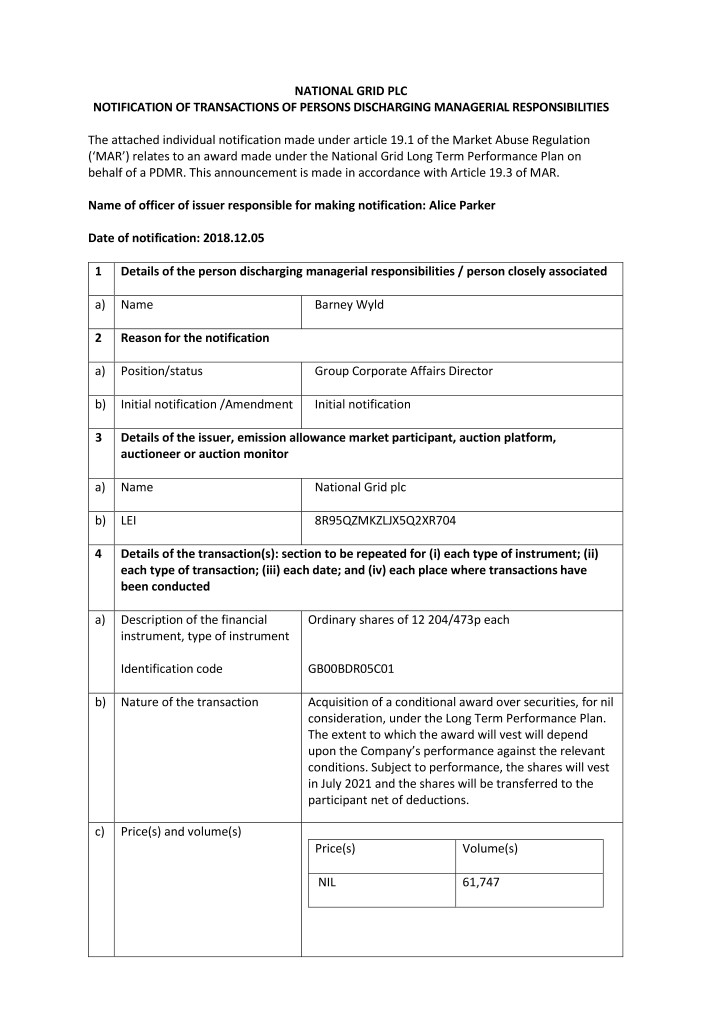

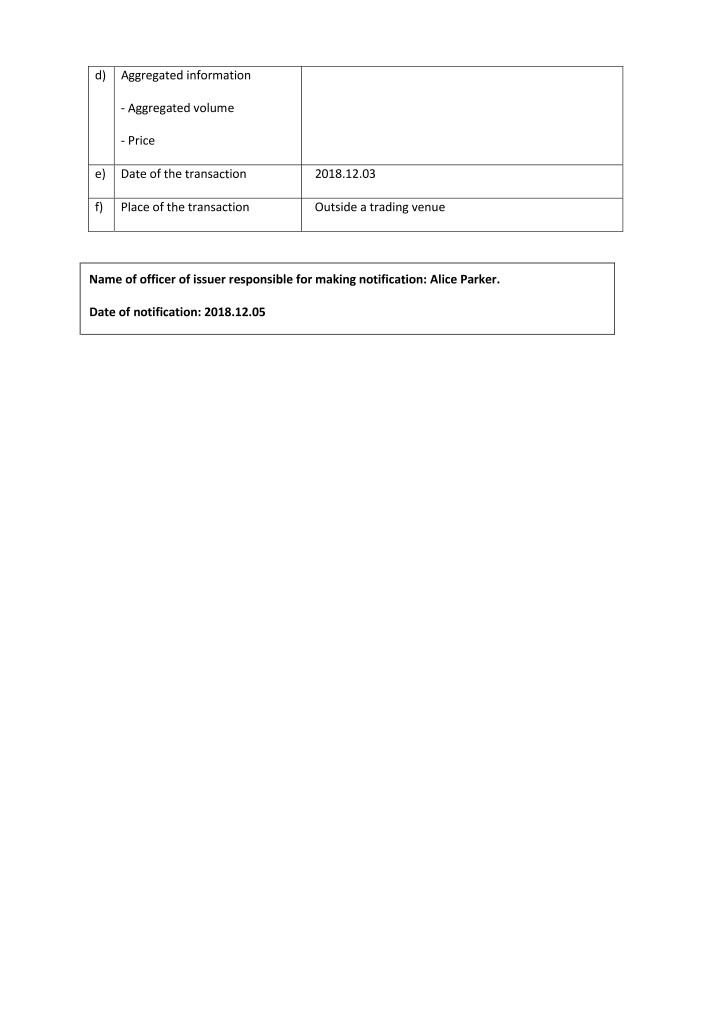

NATIONAL GRID PLC NOTIFICATION OF TRANSACTIONS OF PERSONS DISCHARGING MANAGERIAL RESPONSIBILITIES The attached individual notification made under article 19.1 of the Market Abuse Regulation (‘MAR’) relates to an award made under the National Grid Long Term Performance Plan on behalf of a PDMR. This announcement is made in accordance with Article 19.3 of MAR. Name of officer of issuer responsible for making notification: Alice Parker Date of notification: 2018.12.05 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Barney Wyld 2 Reason for the notification a) Position/status Group Corporate Affairs Director b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial Ordinary shares of 12 204/473p each instrument, type of instrument Identification code GB00BDR05C01 b) Nature of the transaction Acquisition of a conditional award over securities, for nil consideration, under the Long Term Performance Plan. The extent to which the award will vest will depend upon the Company’s performance against the relevant conditions. Subject to performance, the shares will vest in July 2021 and the shares will be transferred to the participant net of deductions. c) Price(s) and volume(s) Price(s) Volume(s) NIL 61,747

d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2018.12.03 f) Place of the transaction Outside a trading venue Name of officer of issuer responsible for making notification: Alice Parker. Date of notification: 2018.12.05

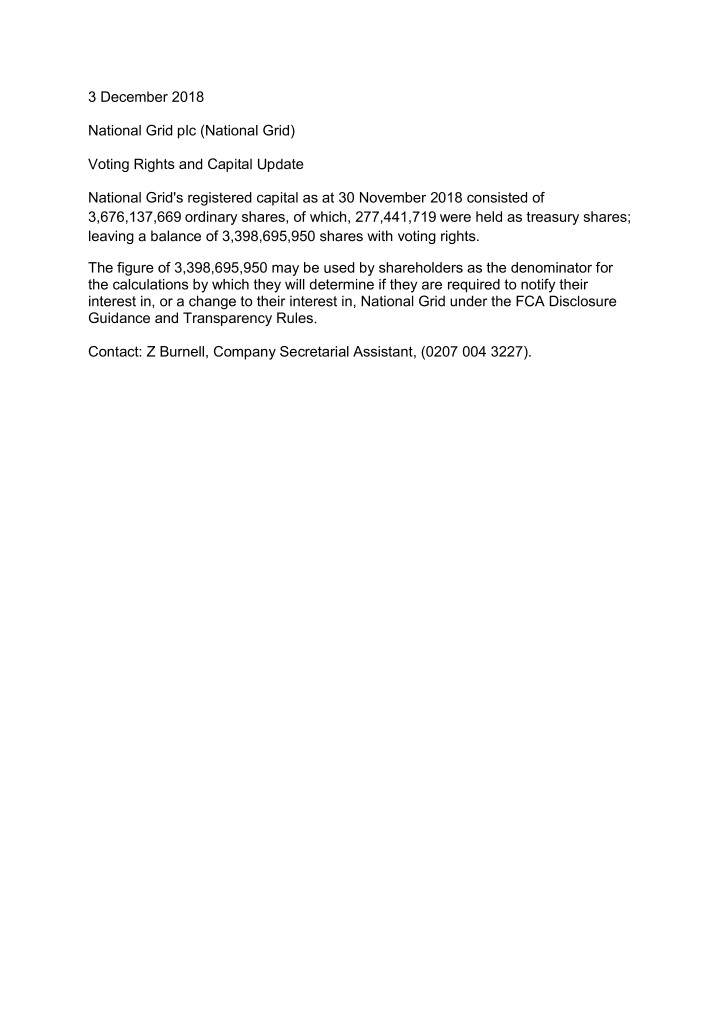

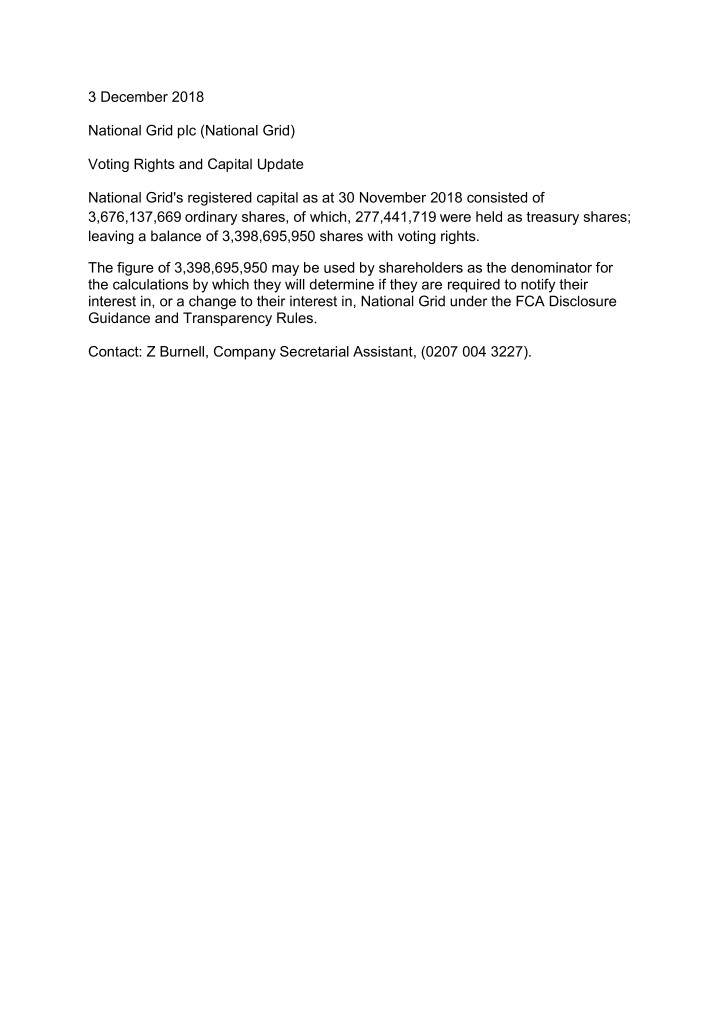

3 December 2018 National Grid plc (National Grid) Voting Rights and Capital Update National Grid's registered capital as at 30 November 2018 consisted of 3,676,137,669 ordinary shares, of which, 277,441,719 were held as treasury shares; leaving a balance of 3,398,695,950 shares with voting rights. The figure of 3,398,695,950 may be used by shareholders as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, National Grid under the FCA Disclosure Guidance and Transparency Rules. Contact: Z Burnell, Company Secretarial Assistant, (0207 004 3227).

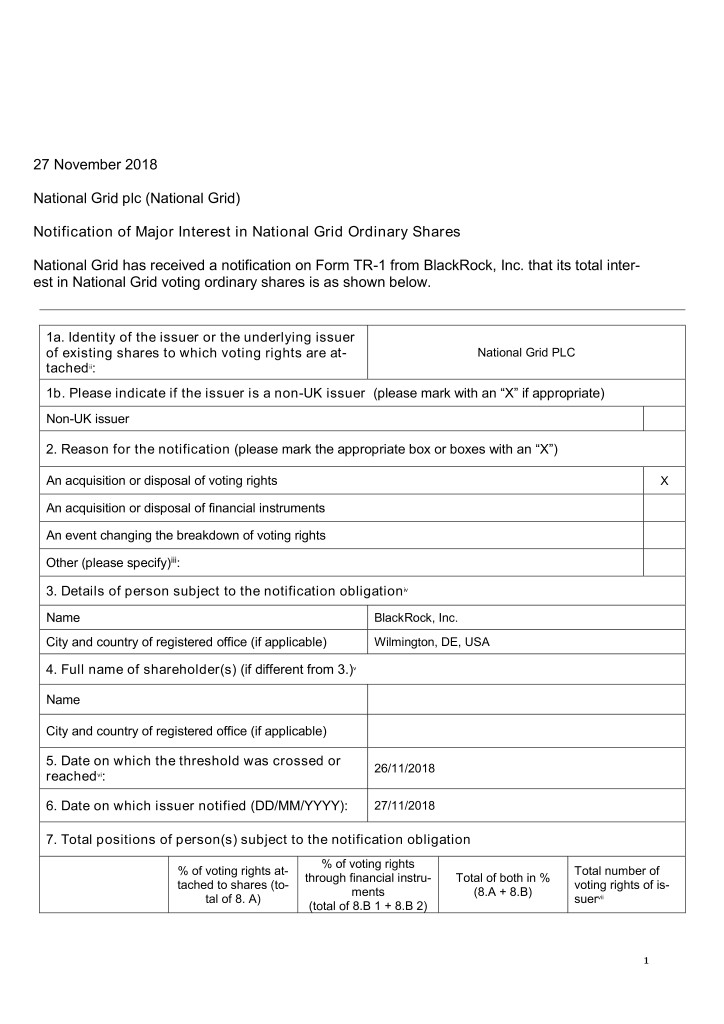

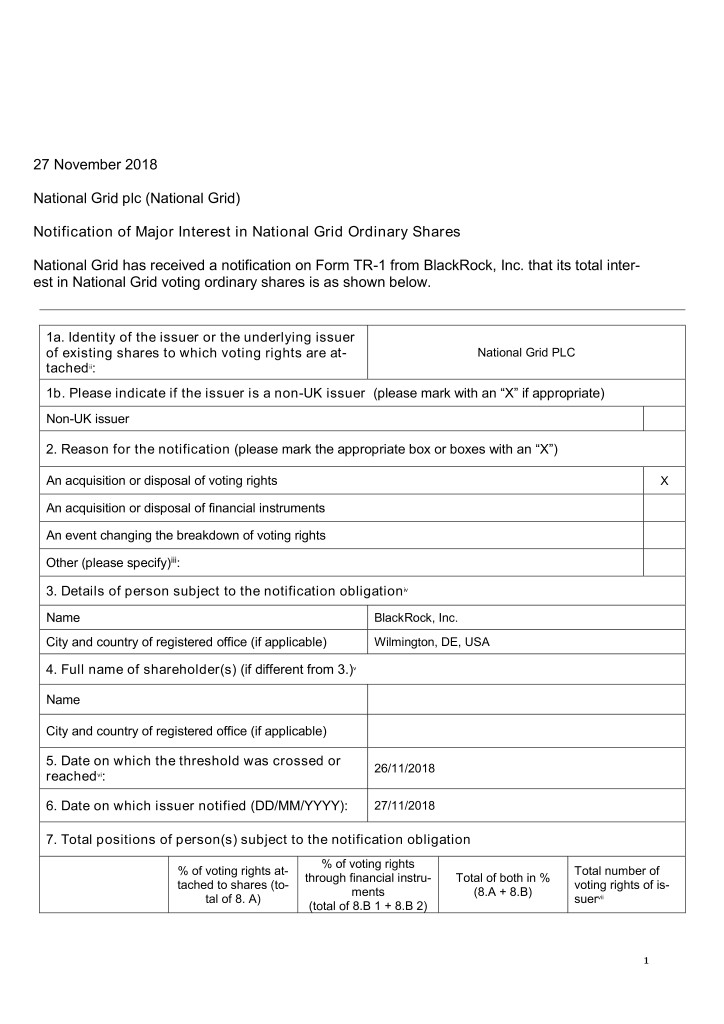

27 November 2018 National Grid plc (National Grid) Notification of Major Interest in National Grid Ordinary Shares National Grid has received a notification on Form TR-1 from BlackRock, Inc. that its total inter- est in National Grid voting ordinary shares is as shown below. 1a. Identity of the issuer or the underlying issuer of existing shares to which voting rights are at- National Grid PLC tachedii: 1b. Please indicate if the issuer is a non-UK issuer (please mark with an “X” if appropriate) Non-UK issuer 2. Reason for the notification (please mark the appropriate box or boxes with an “X”) An acquisition or disposal of voting rights X An acquisition or disposal of financial instruments An event changing the breakdown of voting rights Other (please specify)iii: 3. Details of person subject to the notification obligationiv Name BlackRock, Inc. City and country of registered office (if applicable) Wilmington, DE, USA 4. Full name of shareholder(s) (if different from 3.)v Name City and country of registered office (if applicable) 5. Date on which the threshold was crossed or 26/11/2018 reachedvi: 6. Date on which issuer notified (DD/MM/YYYY): 27/11/2018 7. Total positions of person(s) subject to the notification obligation % of voting rights % of voting rights at- Total number of through financial instru- Total of both in % tached to shares (to- voting rights of is- ments (8.A + 8.B) tal of 8. A) suervii (total of 8.B 1 + 8.B 2) 1

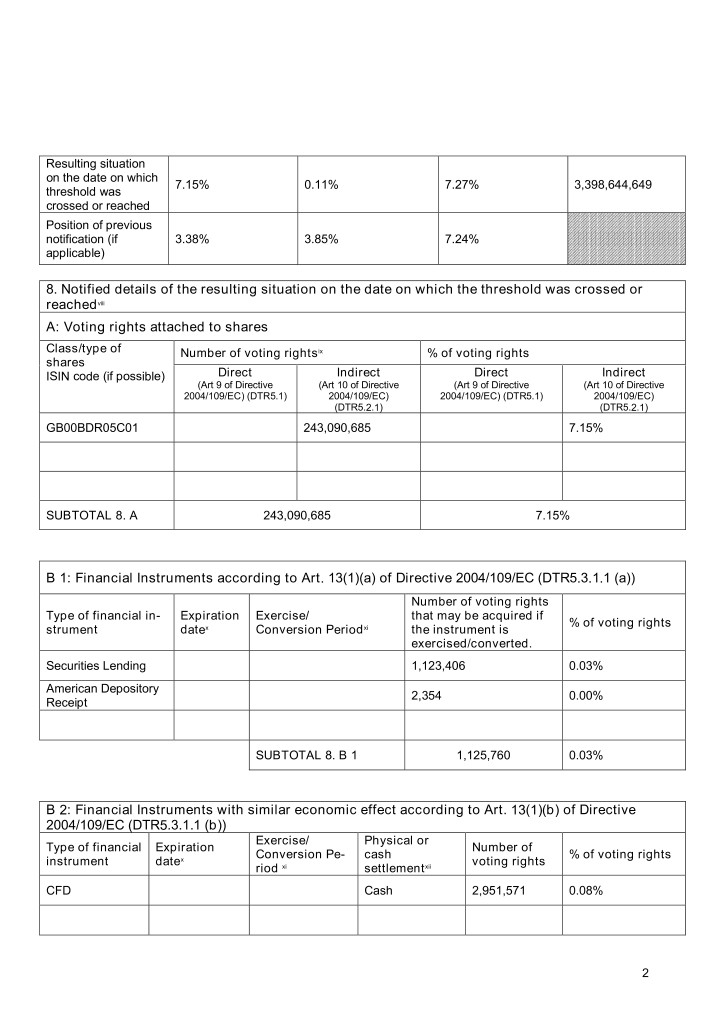

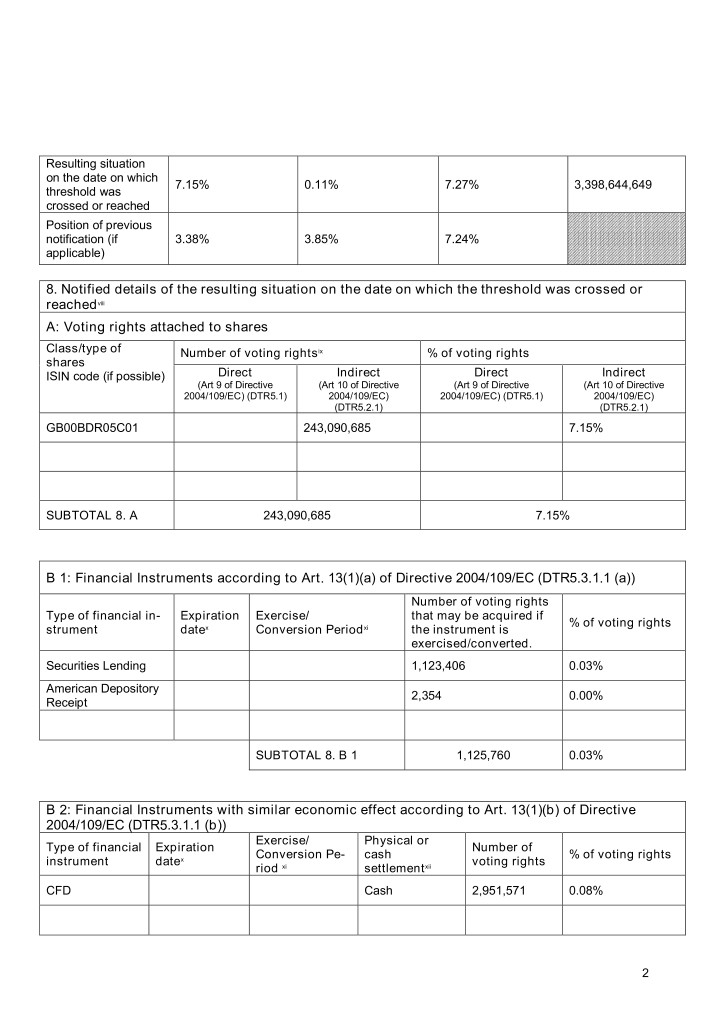

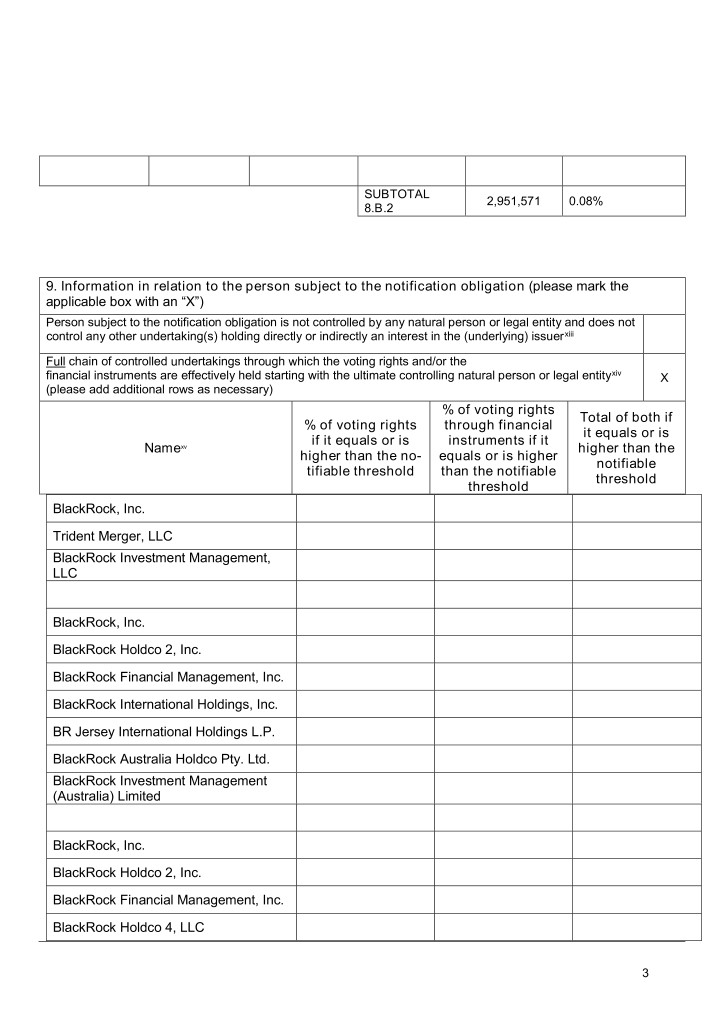

Resulting situation on the date on which 7.15% 0.11% 7.27% 3,398,644,649 threshold was crossed or reached Position of previous notification (if 3.38% 3.85% 7.24% applicable) 8. Notified details of the resulting situation on the date on which the threshold was crossed or reachedviii A: Voting rights attached to shares Class/type of Number of voting rightsix % of voting rights shares ISIN code (if possible) Direct Indirect Direct Indirect (Art 9 of Directive (Art 10 of Directive (Art 9 of Directive (Art 10 of Directive 2004/109/EC) (DTR5.1) 2004/109/EC) 2004/109/EC) (DTR5.1) 2004/109/EC) (DTR5.2.1) (DTR5.2.1) GB00BDR05C01 243,090,685 7.15% SUBTOTAL 8. A 243,090,685 7.15% B 1: Financial Instruments according to Art. 13(1)(a) of Directive 2004/109/EC (DTR5.3.1.1 (a)) Number of voting rights Type of financial in- Expiration Exercise/ that may be acquired if % of voting rights strument datex Conversion Periodxi the instrument is exercised/converted. Securities Lending 1,123,406 0.03% American Depository 2,354 0.00% Receipt SUBTOTAL 8. B 1 1,125,760 0.03% B 2: Financial Instruments with similar economic effect according to Art. 13(1)(b) of Directive 2004/109/EC (DTR5.3.1.1 (b)) Exercise/ Physical or Type of financial Expiration Number of Conversion Pe- cash % of voting rights instrument datex voting rights riod xi settlementxii CFD Cash 2,951,571 0.08% 2

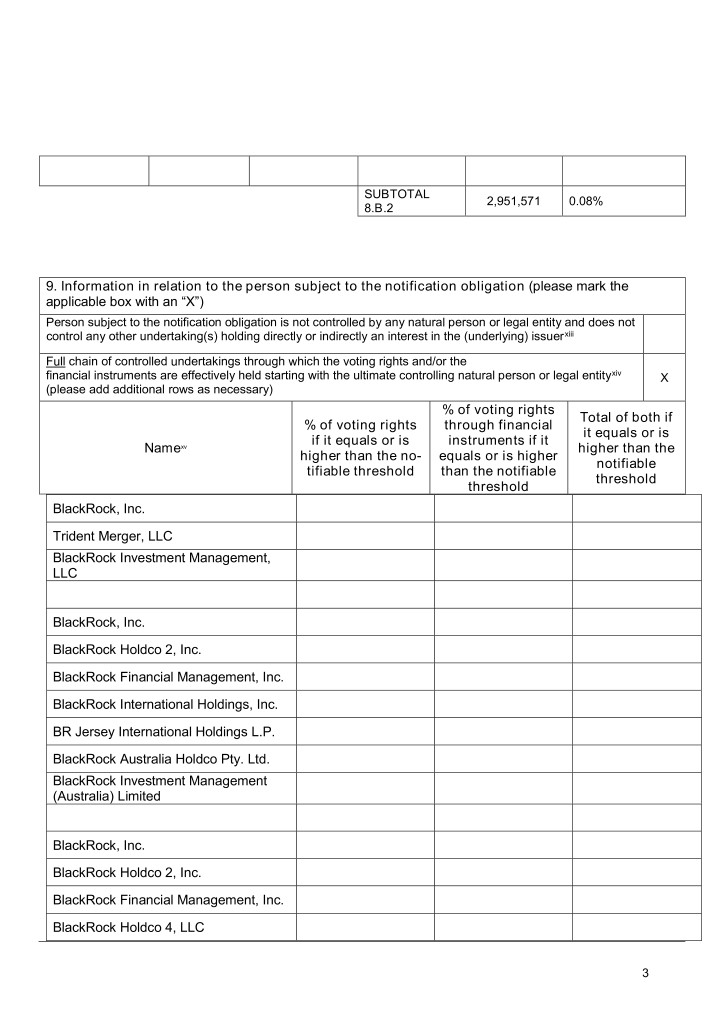

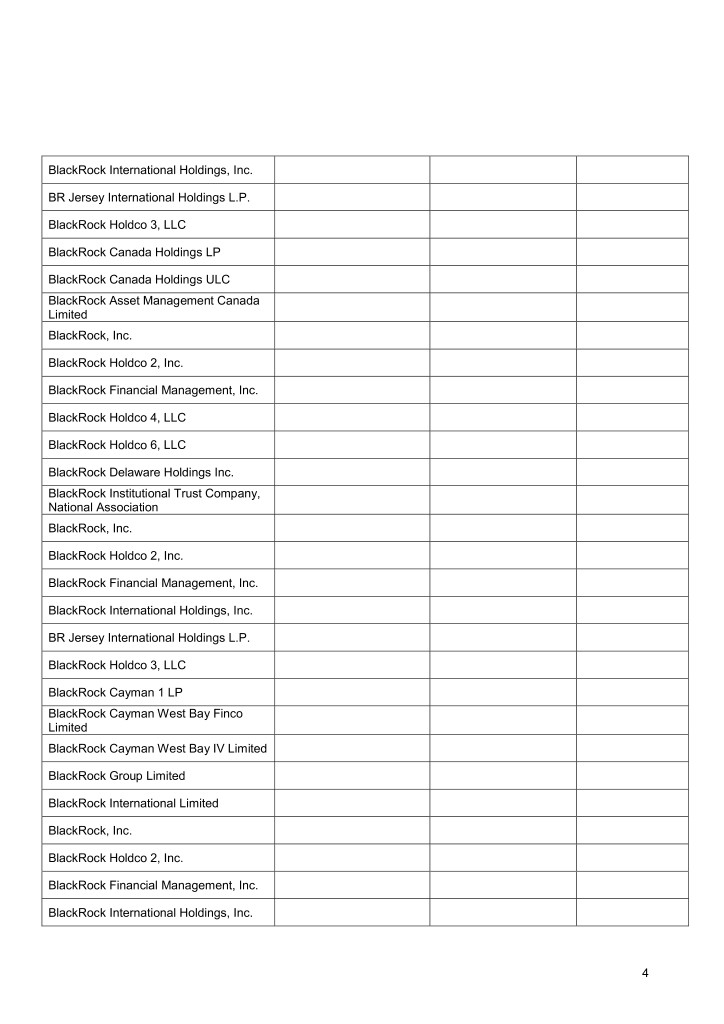

SUBTOTAL 2,951,571 0.08% 8.B.2 9. Information in relation to the person subject to the notification obligation (please mark the applicable box with an “X”) Person subject to the notification obligation is not controlled by any natural person or legal entity and does not control any other undertaking(s) holding directly or indirectly an interest in the (underlying) issuerxiii Full chain of controlled undertakings through which the voting rights and/or the financial instruments are effectively held starting with the ultimate controlling natural person or legal entityxiv X (please add additional rows as necessary) % of voting rights Total of both if % of voting rights through financial it equals or is if it equals or is instruments if it Namexv higher than the higher than the no- equals or is higher notifiable tifiable threshold than the notifiable threshold threshold BlackRock, Inc. Trident Merger, LLC BlackRock Investment Management, LLC BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Australia Holdco Pty. Ltd. BlackRock Investment Management (Australia) Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock Holdco 4, LLC 3

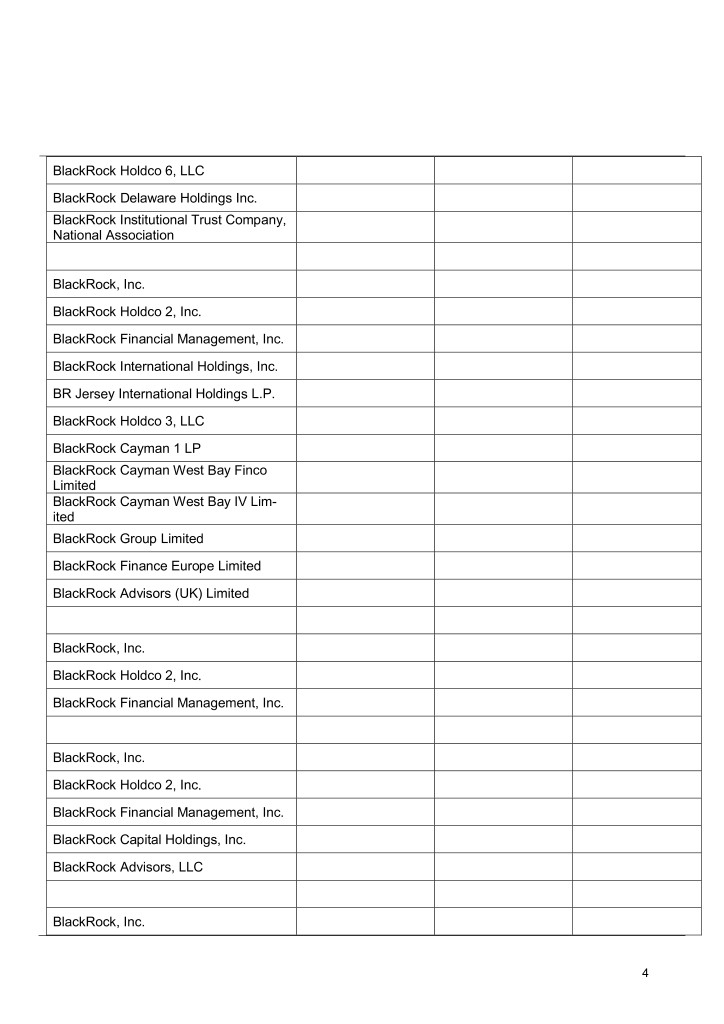

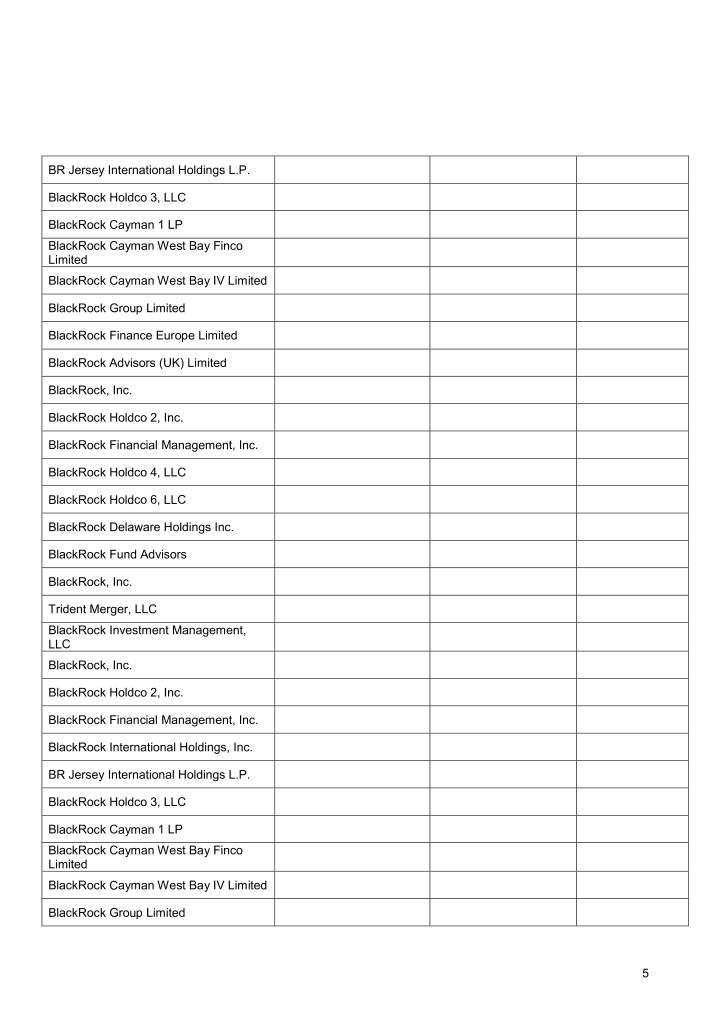

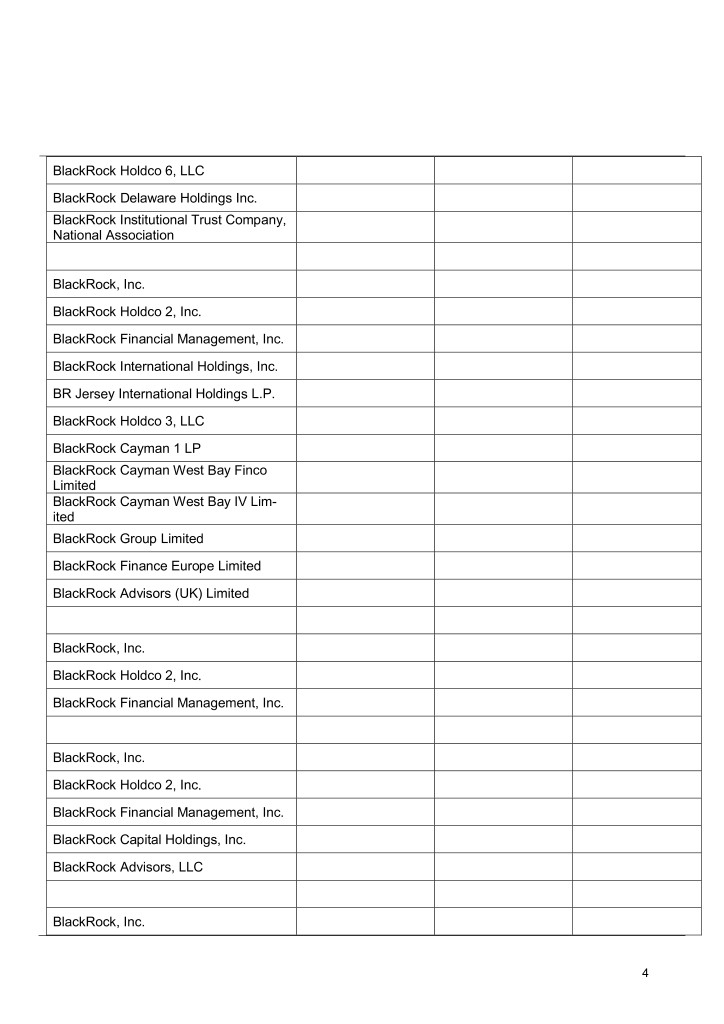

BlackRock Holdco 6, LLC BlackRock Delaware Holdings Inc. BlackRock Institutional Trust Company, National Association BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Lim- ited BlackRock Group Limited BlackRock Finance Europe Limited BlackRock Advisors (UK) Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock Capital Holdings, Inc. BlackRock Advisors, LLC BlackRock, Inc. 4

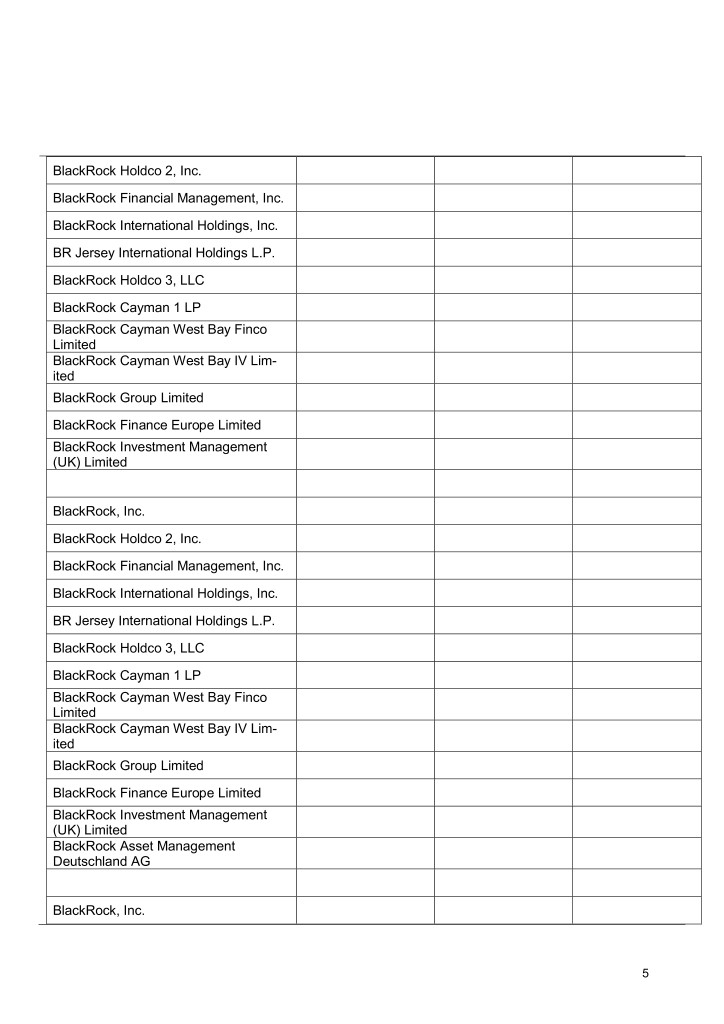

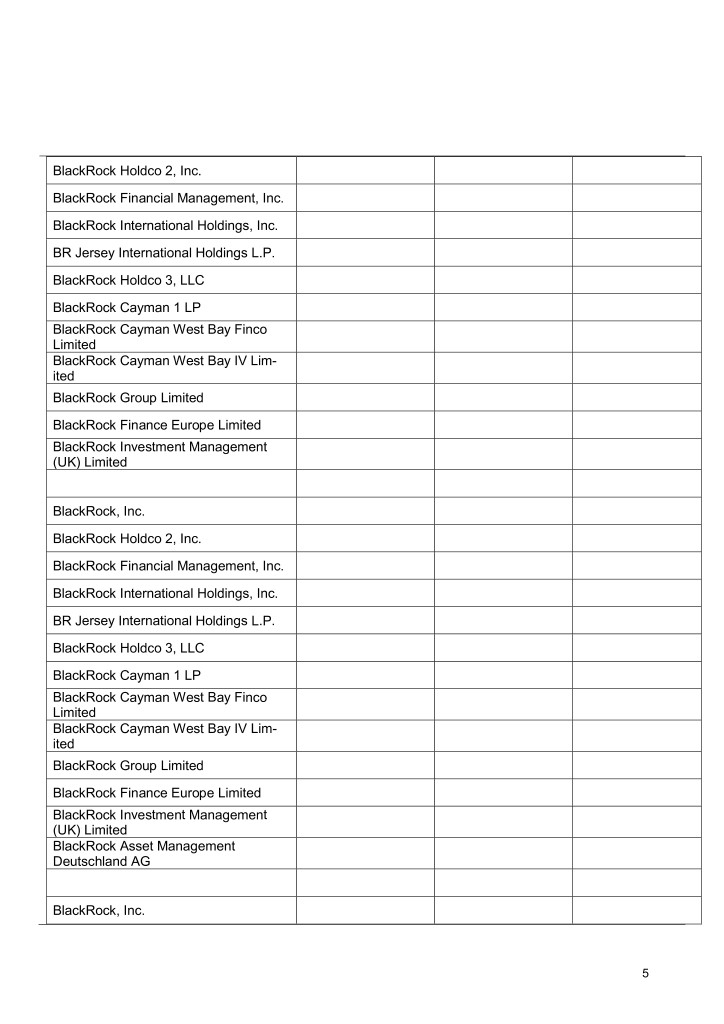

BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Lim- ited BlackRock Group Limited BlackRock Finance Europe Limited BlackRock Investment Management (UK) Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Lim- ited BlackRock Group Limited BlackRock Finance Europe Limited BlackRock Investment Management (UK) Limited BlackRock Asset Management Deutschland AG BlackRock, Inc. 5

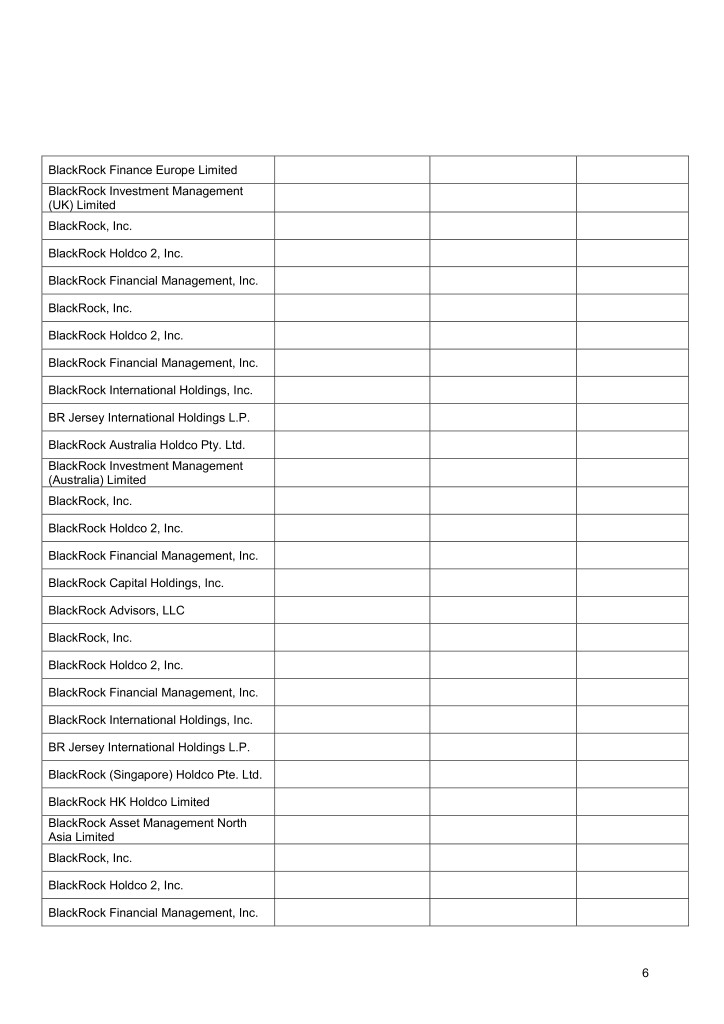

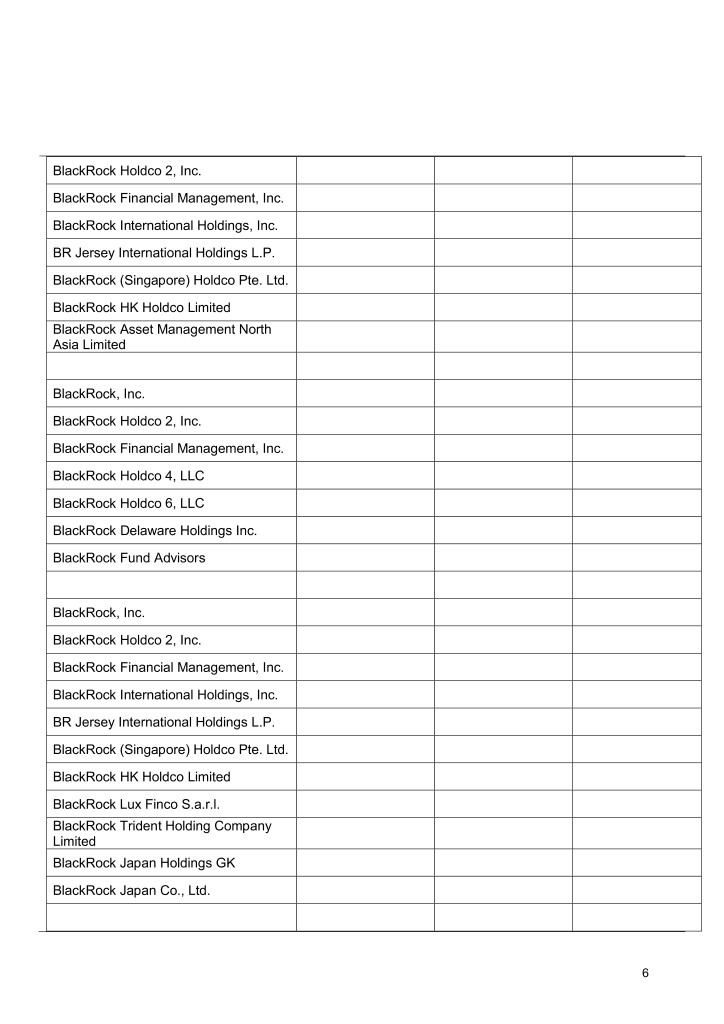

BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock (Singapore) Holdco Pte. Ltd. BlackRock HK Holdco Limited BlackRock Asset Management North Asia Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock Holdco 4, LLC BlackRock Holdco 6, LLC BlackRock Delaware Holdings Inc. BlackRock Fund Advisors BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock (Singapore) Holdco Pte. Ltd. BlackRock HK Holdco Limited BlackRock Lux Finco S.a.r.l. BlackRock Trident Holding Company Limited BlackRock Japan Holdings GK BlackRock Japan Co., Ltd. 6

BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Canada Holdings LP BlackRock Canada Holdings ULC BlackRock Asset Management Canada Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Lim- ited BlackRock Group Limited BlackRock International Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock (Singapore) Holdco Pte. Ltd. 7

BlackRock (Singapore) Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Lim- ited BlackRock Group Limited BlackRock Finance Europe Limited BlackRock (Netherlands) B.V. 10. In case of proxy voting, please identify: Name of the proxy holder The number and % of voting rights held The date until which the voting rights will be held 11. Additional informationxvi BlackRock Regulatory Threshold Reporting Team James Michael 020 7743 3650 Place of completion 12 Throgmorton Avenue, London, EC2N 2DL, U.K. 8

Date of completion 27 November, 2018 This notice is in compliance with National Grid's obligations under the Disclosure and Transparency Rules. Alice Parker Senior Assistant Company Secretary 020 7004 3228 9

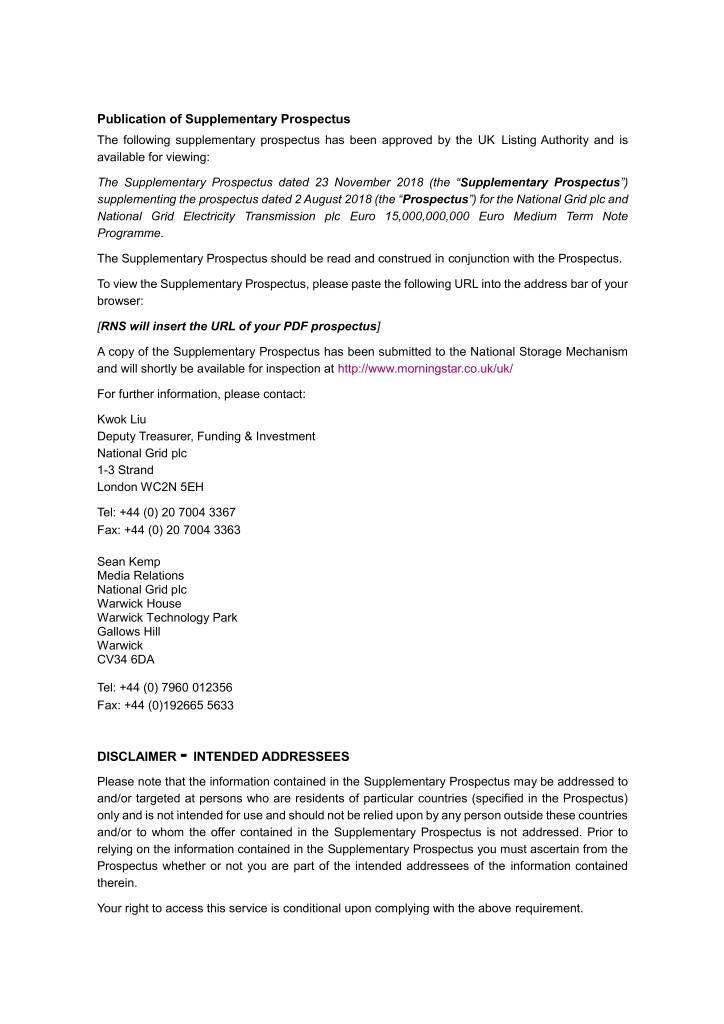

Publication of Supplementary Prospectus The following supplementary prospectus has been approved by the UK Listing Authority and is available for viewing: The Supplementary Prospectus dated 23 November 2018 (the “Supplementary Prospectus”) supplementing the prospectus dated 2 August 2018 (the “Prospectus”) for the National Grid plc and National Grid Electricity Transmission plc Euro 15,000,000,000 Euro Medium Term Note Programme. The Supplementary Prospectus should be read and construed in conjunction with the Prospectus. To view the Supplementary Prospectus, please paste the following URL into the address bar of your browser: [RNS will insert the URL of your PDF prospectus] A copy of the Supplementary Prospectus has been submitted to the National Storage Mechanism and will shortly be available for inspection at http://www.morningstar.co.uk/uk/ For further information, please contact: Kwok Liu Deputy Treasurer, Funding & Investment National Grid plc 1-3 Strand London WC2N 5EH Tel: +44 (0) 20 7004 3367 Fax: +44 (0) 20 7004 3363 Sean Kemp Media Relations National Grid plc Warwick House Warwick Technology Park Gallows Hill Warwick CV34 6DA Tel: +44 (0) 7960 012356 Fax: +44 (0)192665 5633 DISCLAIMER - INTENDED ADDRESSEES Please note that the information contained in the Supplementary Prospectus may be addressed to and/or targeted at persons who are residents of particular countries (specified in the Prospectus) only and is not intended for use and should not be relied upon by any person outside these countries and/or to whom the offer contained in the Supplementary Prospectus is not addressed. Prior to relying on the information contained in the Supplementary Prospectus you must ascertain from the Prospectus whether or not you are part of the intended addressees of the information contained therein. Your right to access this service is conditional upon complying with the above requirement.

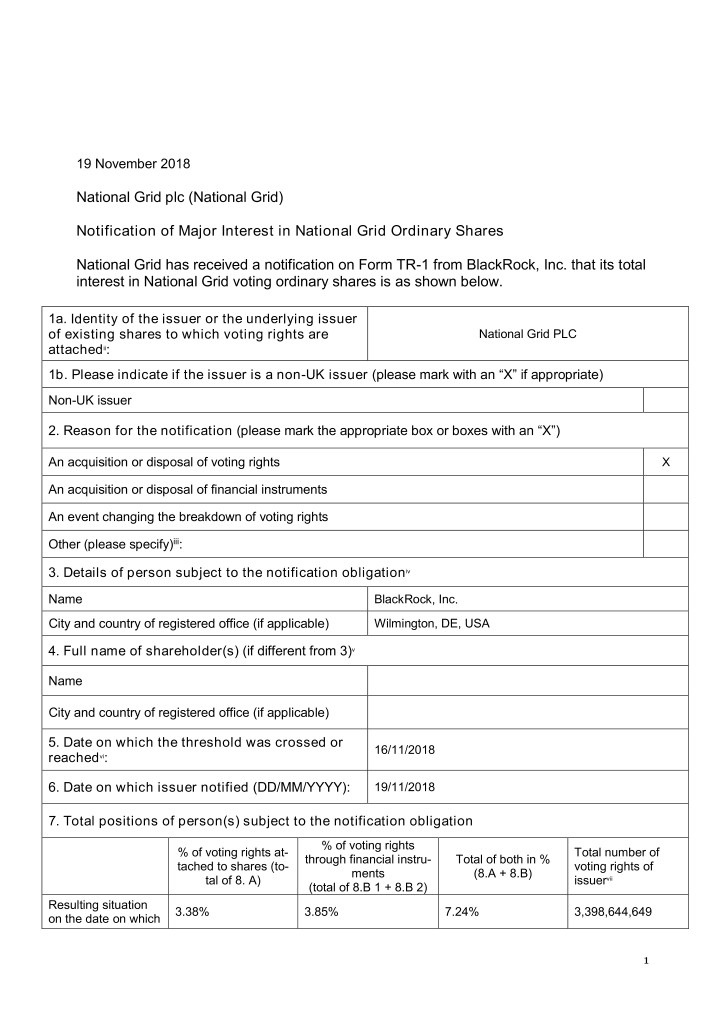

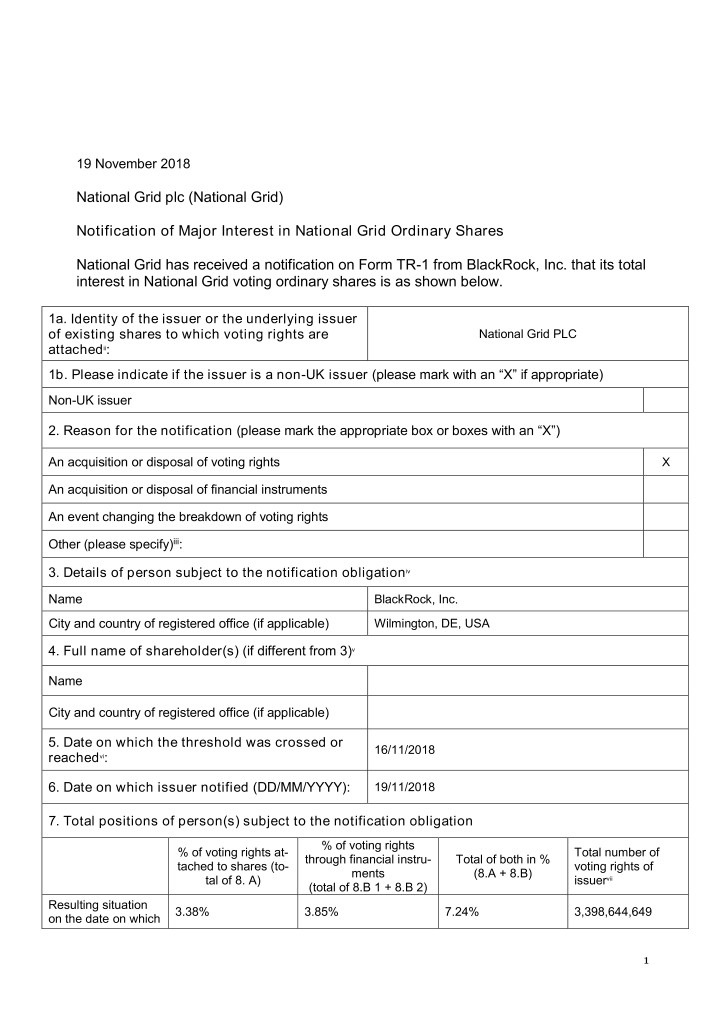

19 November 2018 National Grid plc (National Grid) Notification of Major Interest in National Grid Ordinary Shares National Grid has received a notification on Form TR-1 from BlackRock, Inc. that its total interest in National Grid voting ordinary shares is as shown below. 1a. Identity of the issuer or the underlying issuer of existing shares to which voting rights are National Grid PLC attachedii: 1b. Please indicate if the issuer is a non-UK issuer (please mark with an “X” if appropriate) Non-UK issuer 2. Reason for the notification (please mark the appropriate box or boxes with an “X”) An acquisition or disposal of voting rights X An acquisition or disposal of financial instruments An event changing the breakdown of voting rights Other (please specify)iii: 3. Details of person subject to the notification obligationiv Name BlackRock, Inc. City and country of registered office (if applicable) Wilmington, DE, USA 4. Full name of shareholder(s) (if different from 3)v Name City and country of registered office (if applicable) 5. Date on which the threshold was crossed or 16/11/2018 reachedvi: 6. Date on which issuer notified (DD/MM/YYYY): 19/11/2018 7. Total positions of person(s) subject to the notification obligation % of voting rights % of voting rights at- Total number of through financial instru- Total of both in % tached to shares (to- voting rights of ments (8.A + 8.B) tal of 8. A) issuervii (total of 8.B 1 + 8.B 2) Resulting situation 3.38% 3.85% 7.24% 3,398,644,649 on the date on which 1

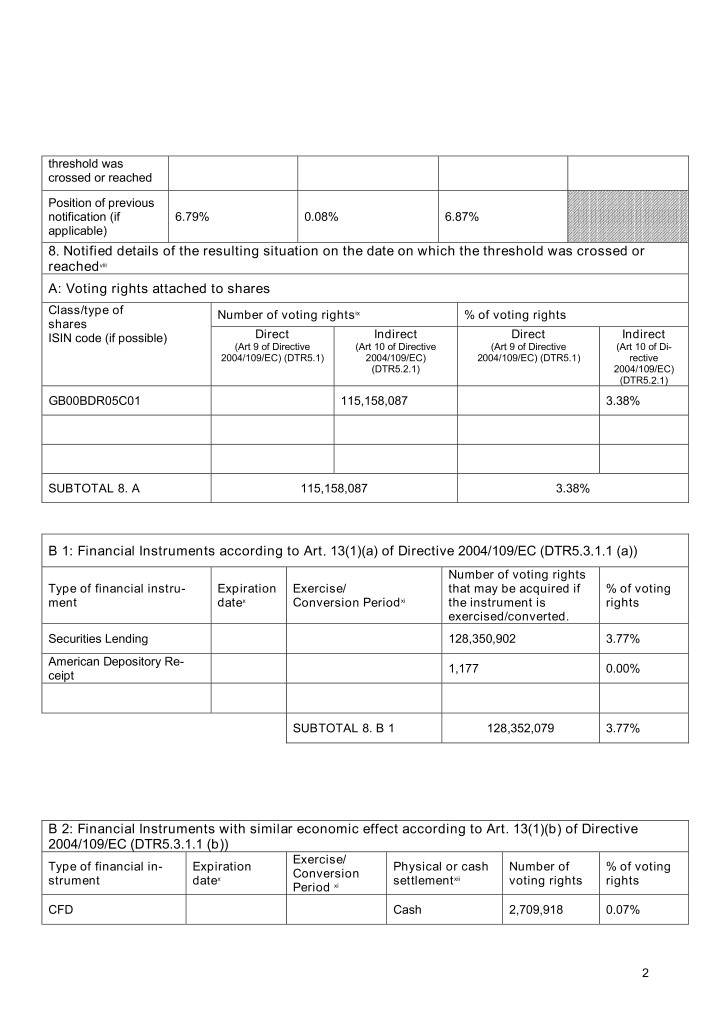

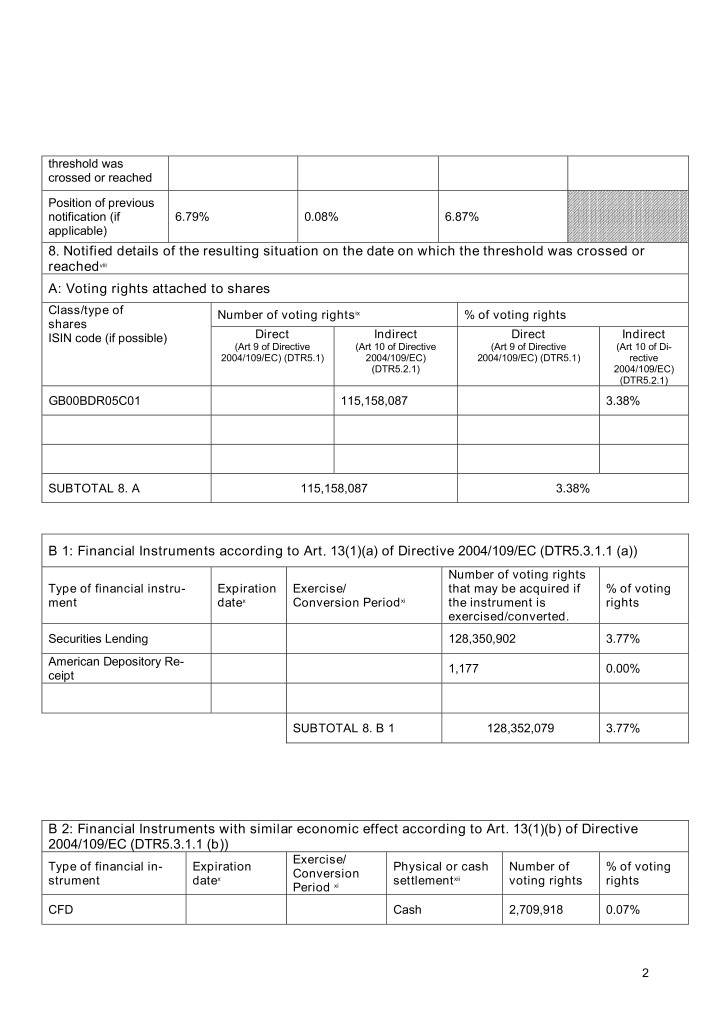

threshold was crossed or reached Position of previous notification (if 6.79% 0.08% 6.87% applicable) 8. Notified details of the resulting situation on the date on which the threshold was crossed or reachedviii A: Voting rights attached to shares Class/type of Number of voting rightsix % of voting rights shares ISIN code (if possible) Direct Indirect Direct Indirect (Art 9 of Directive (Art 10 of Directive (Art 9 of Directive (Art 10 of Di- 2004/109/EC) (DTR5.1) 2004/109/EC) 2004/109/EC) (DTR5.1) rective (DTR5.2.1) 2004/109/EC) (DTR5.2.1) GB00BDR05C01 115,158,087 3.38% SUBTOTAL 8. A 115,158,087 3.38% B 1: Financial Instruments according to Art. 13(1)(a) of Directive 2004/109/EC (DTR5.3.1.1 (a)) Number of voting rights Type of financial instru- Expiration Exercise/ that may be acquired if % of voting ment datex Conversion Periodxi the instrument is rights exercised/converted. Securities Lending 128,350,902 3.77% American Depository Re- 1,177 0.00% ceipt SUBTOTAL 8. B 1 128,352,079 3.77% B 2: Financial Instruments with similar economic effect according to Art. 13(1)(b) of Directive 2004/109/EC (DTR5.3.1.1 (b)) Exercise/ Type of financial in- Expiration Physical or cash Number of % of voting Conversion strument datex settlementxii voting rights rights Period xi CFD Cash 2,709,918 0.07% 2

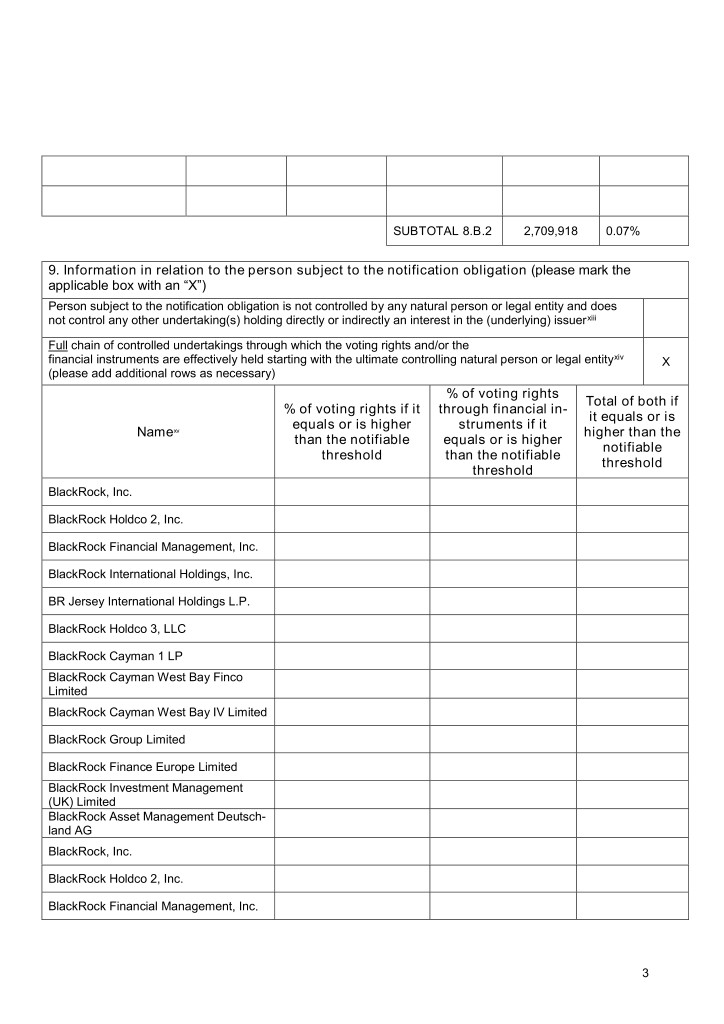

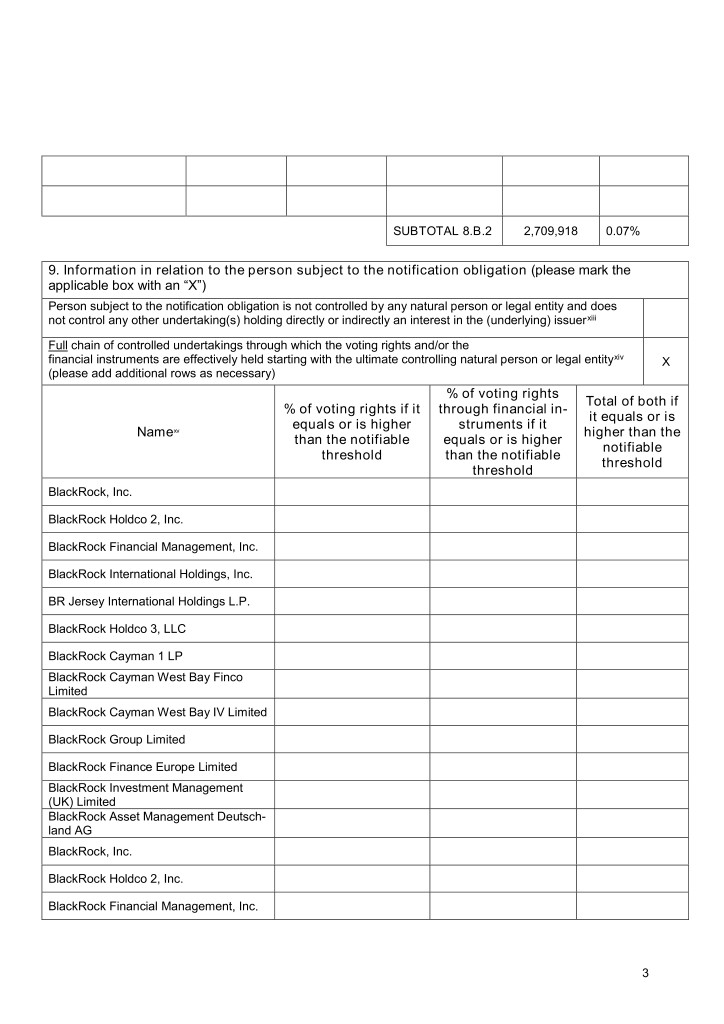

SUBTOTAL 8.B.2 2,709,918 0.07% 9. Information in relation to the person subject to the notification obligation (please mark the applicable box with an “X”) Person subject to the notification obligation is not controlled by any natural person or legal entity and does not control any other undertaking(s) holding directly or indirectly an interest in the (underlying) issuerxiii Full chain of controlled undertakings through which the voting rights and/or the financial instruments are effectively held starting with the ultimate controlling natural person or legal entityxiv X (please add additional rows as necessary) % of voting rights Total of both if % of voting rights if it through financial in- it equals or is equals or is higher struments if it Namexv higher than the than the notifiable equals or is higher notifiable threshold than the notifiable threshold threshold BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Limited BlackRock Group Limited BlackRock Finance Europe Limited BlackRock Investment Management (UK) Limited BlackRock Asset Management Deutsch- land AG BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. 3

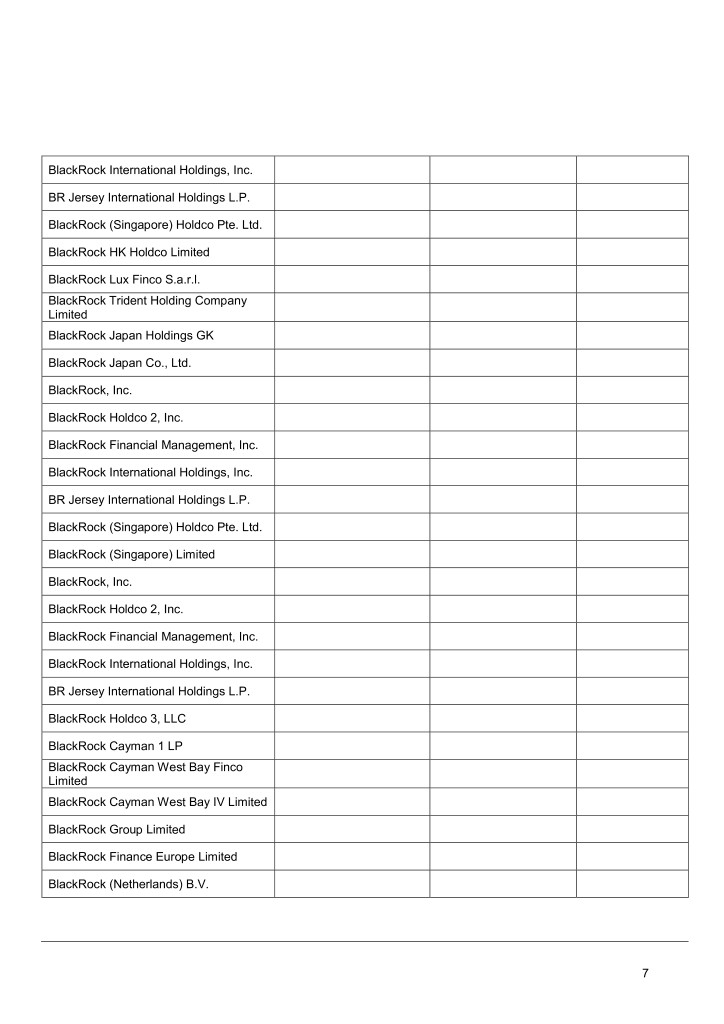

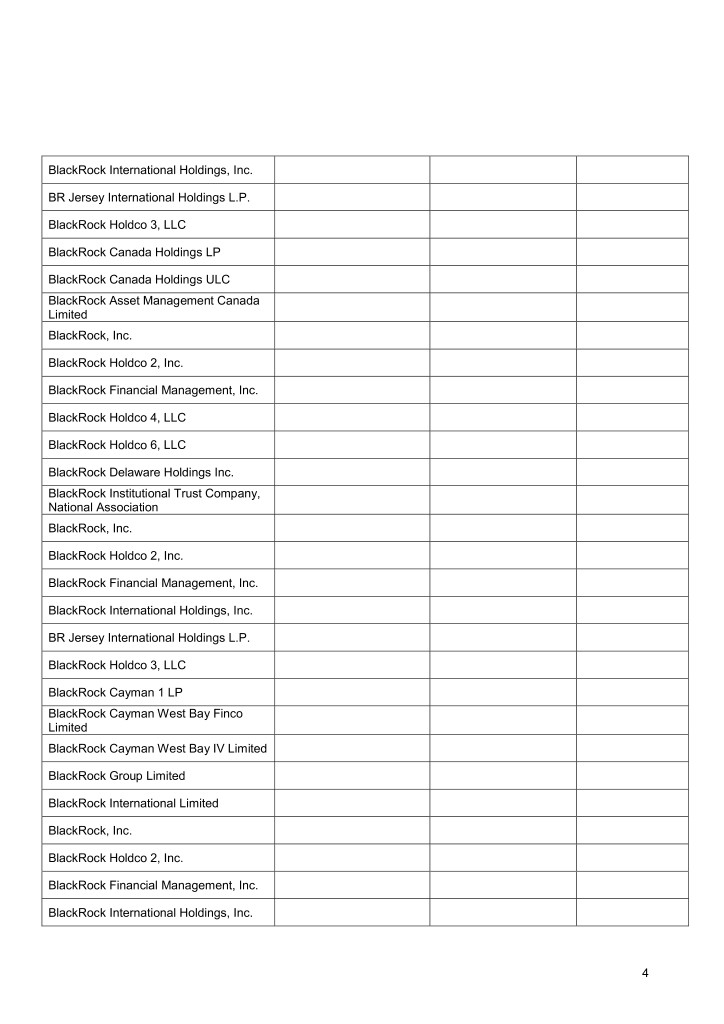

BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Canada Holdings LP BlackRock Canada Holdings ULC BlackRock Asset Management Canada Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock Holdco 4, LLC BlackRock Holdco 6, LLC BlackRock Delaware Holdings Inc. BlackRock Institutional Trust Company, National Association BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Limited BlackRock Group Limited BlackRock International Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. 4

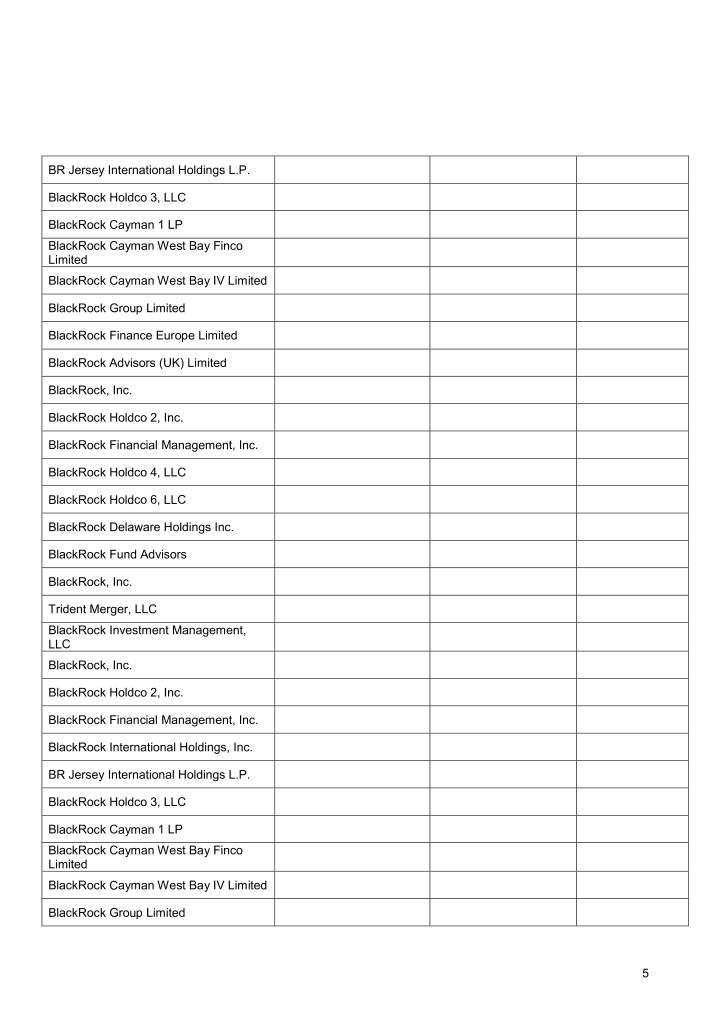

BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Limited BlackRock Group Limited BlackRock Finance Europe Limited BlackRock Advisors (UK) Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock Holdco 4, LLC BlackRock Holdco 6, LLC BlackRock Delaware Holdings Inc. BlackRock Fund Advisors BlackRock, Inc. Trident Merger, LLC BlackRock Investment Management, LLC BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Limited BlackRock Group Limited 5

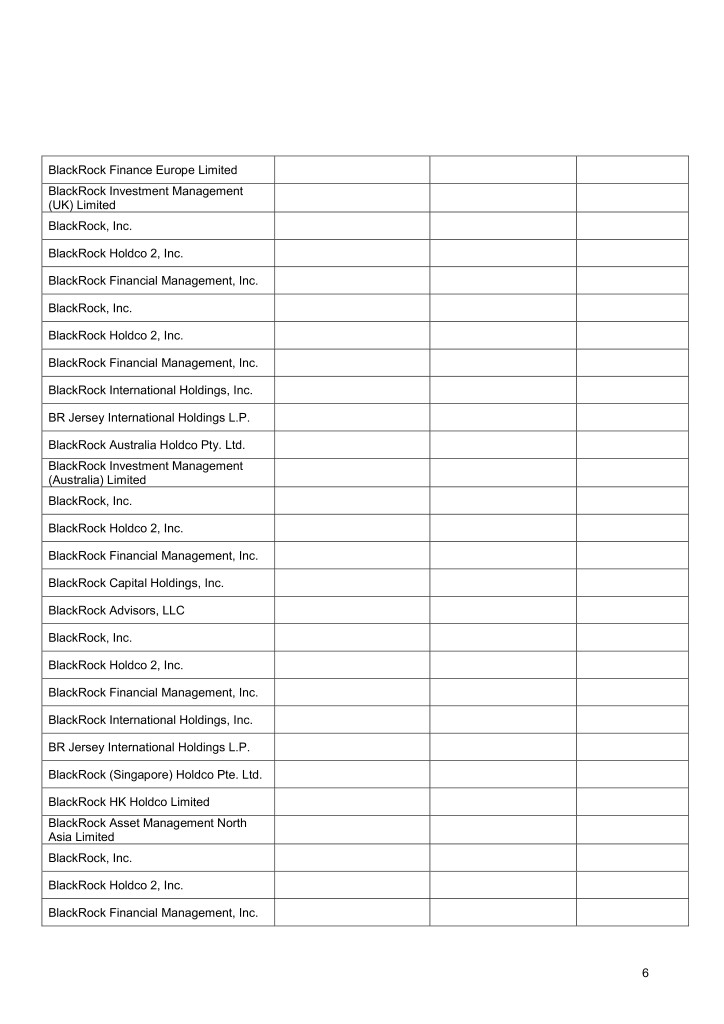

BlackRock Finance Europe Limited BlackRock Investment Management (UK) Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Australia Holdco Pty. Ltd. BlackRock Investment Management (Australia) Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock Capital Holdings, Inc. BlackRock Advisors, LLC BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock (Singapore) Holdco Pte. Ltd. BlackRock HK Holdco Limited BlackRock Asset Management North Asia Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. 6

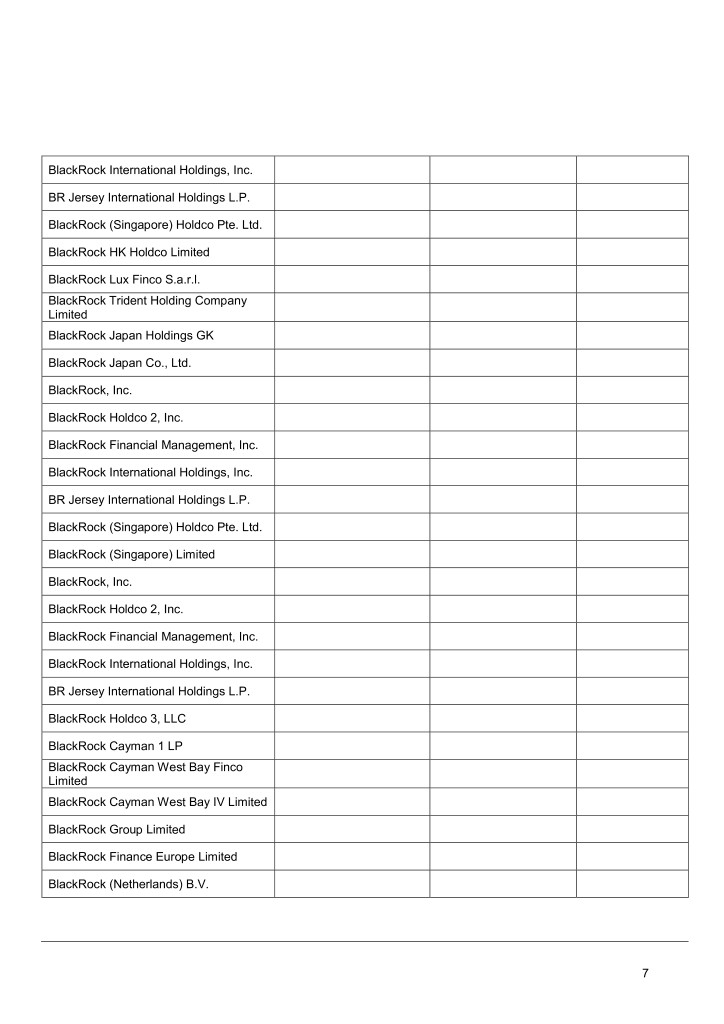

BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock (Singapore) Holdco Pte. Ltd. BlackRock HK Holdco Limited BlackRock Lux Finco S.a.r.l. BlackRock Trident Holding Company Limited BlackRock Japan Holdings GK BlackRock Japan Co., Ltd. BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock (Singapore) Holdco Pte. Ltd. BlackRock (Singapore) Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Limited BlackRock Group Limited BlackRock Finance Europe Limited BlackRock (Netherlands) B.V. 7

10. In case of proxy voting, please identify: Name of the proxy holder The number and % of voting rights held The date until which the voting rights will be held 11. Additional informationxvi BlackRock Regulatory Threshold Reporting Team Andrew Manchester 020 7743 3650 Place of completion 12 Throgmorton Avenue, London, EC2N 2DL, U.K. Date of completion 19 November, 2018 This notice is in compliance with National Grid's obligations under the Disclosure and Tranparency Rules. Megan Barnes Senior Assistant Company Secretary 020 7004 3325 8

16 November 2018 National Grid plc New regulatory filings in Massachusetts and New York National Grid has made two filings to regulators in Massachusetts and New York. These filings are in line with our strategy to deliver investments that drive greater efficiency and improved services for customers, whilst also supporting regulators in achieving their clean energy goals. Both filings highlight new growth opportunities arising from the changing energy landscape. Massachusetts Electric National Grid has filed a request with the Massachusetts Department of Public Utilities (DPU) to update electricity distribution rates for its Massachusetts Electric business. The rate filing requests an approximate $70 million per annum increase in revenue to cover increased operating costs and investments and a Return on Equity of 10.5%. It supports annual capital expenditure of $300 million starting in the first year of the plan and, if approved, will commence in October 2019. As part of the filing, National Grid is proposing a new Performance Based Rate Mechanism (PBRM) that will link annual revenue increase to inflation, but also take into account improvements in the efficiency of the business. The filing includes a request for significant investment in electric vehicle charging infrastructure in Massachusetts. This would be a five year, $167 million investment to provide over 17,000 new charging points across the state. In addition, it includes a proposal for a $50 million utility scale 14MW / 56MWh energy storage investment. Both of these proposals would be recovered through existing regulatory mechanisms outside the requested $70 million revenue increase. This rate filing is expected to conclude in September 2019, with new rates effective 1 October 2019. Niagara Mohawk (New York) AMI proposal National Grid has also filed a capital investment request for $650 million with the New York Public Service Commission (PSC). This is to install 1.7 million electric Advanced Metering Infrastructure (AMI) meters, and 640,000 gas modules, across our Niagara Mohawk business between 2021 and 2024. AMI is a smart meter technology that offers customers greater control over their energy use, and is part of New York State's clean energy goal of reducing greenhouse gas emissions by 80% on 1990 levels by 2050.

Investors and Analysts Aarti Singhal +44 (0) 20 7004 3170 (d) +44 (0) 7989 492 447 (m) James Flanagan +44 (0) 20 7004 3129 (d) +44 (0) 7970 778 952 (m) Tom Edwards +44 (0) 20 7004 3460 (d) +44 (0) 7976 962 791 (m) Will Jackson +44 (0) 20 7004 3166 (d) +44 (0) 7584 206 578 (m) Media Sean Kemp +44 (0) 7960 012356 (m) Massachusetts Electric Factsheet For additional information, please follow the link to the fact sheet section of the National Grid Investor Relations website: Link here