Exhibit 99.2 ANNOUNCEMENTS FORM 6-K SECURITIES AND EXCHANGE COMMISSION Washington D.C. 20549 Report of Foreign Issuer Pursuant to Rule 13a - 16 or 15d - 16 of The Securities Exchange Act of 1934 Announcements sent to the London Stock Exchange National Grid plc, 1-3 Strand, London, WC2N 5EH, United Kingdom Update - Routine announcements in the period to 16 December 2019

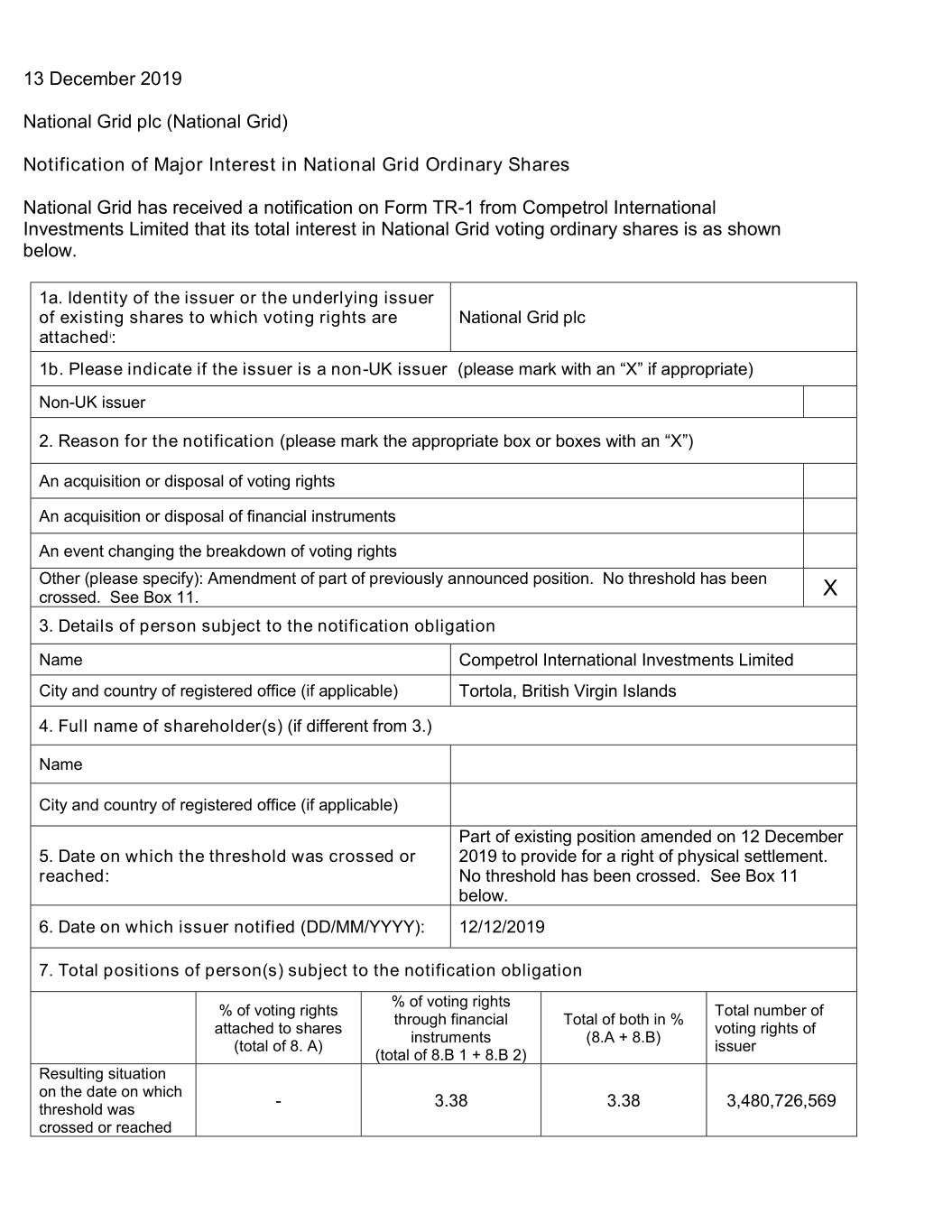

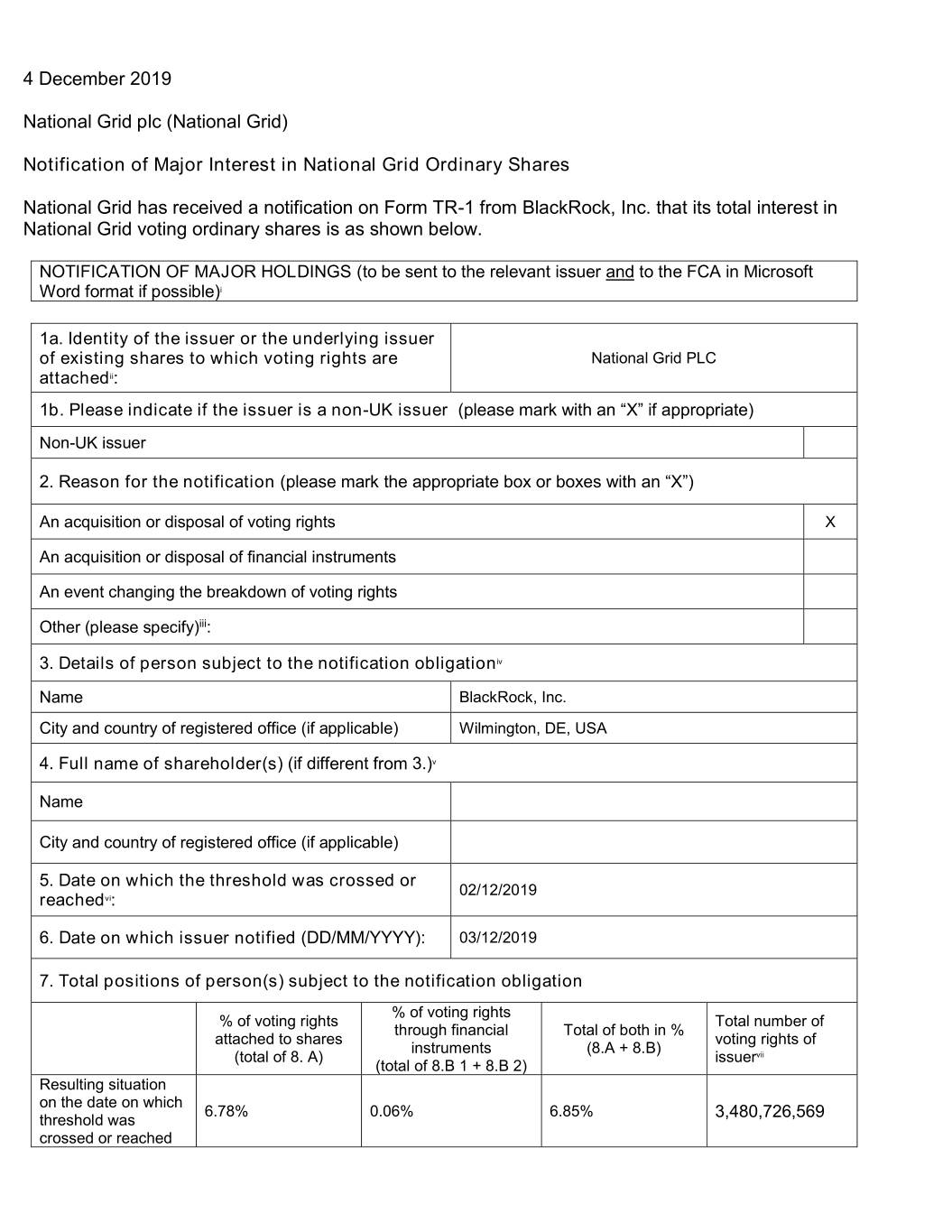

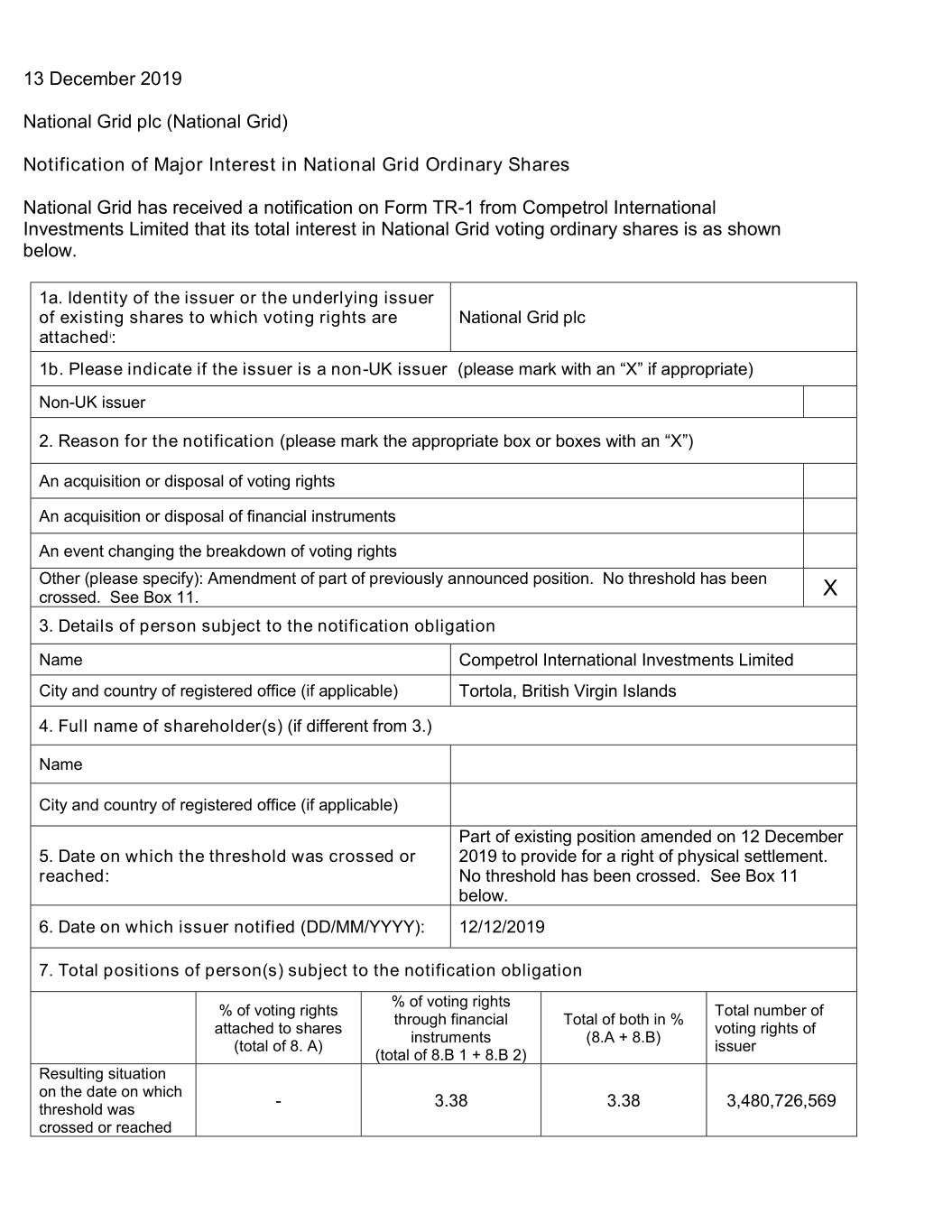

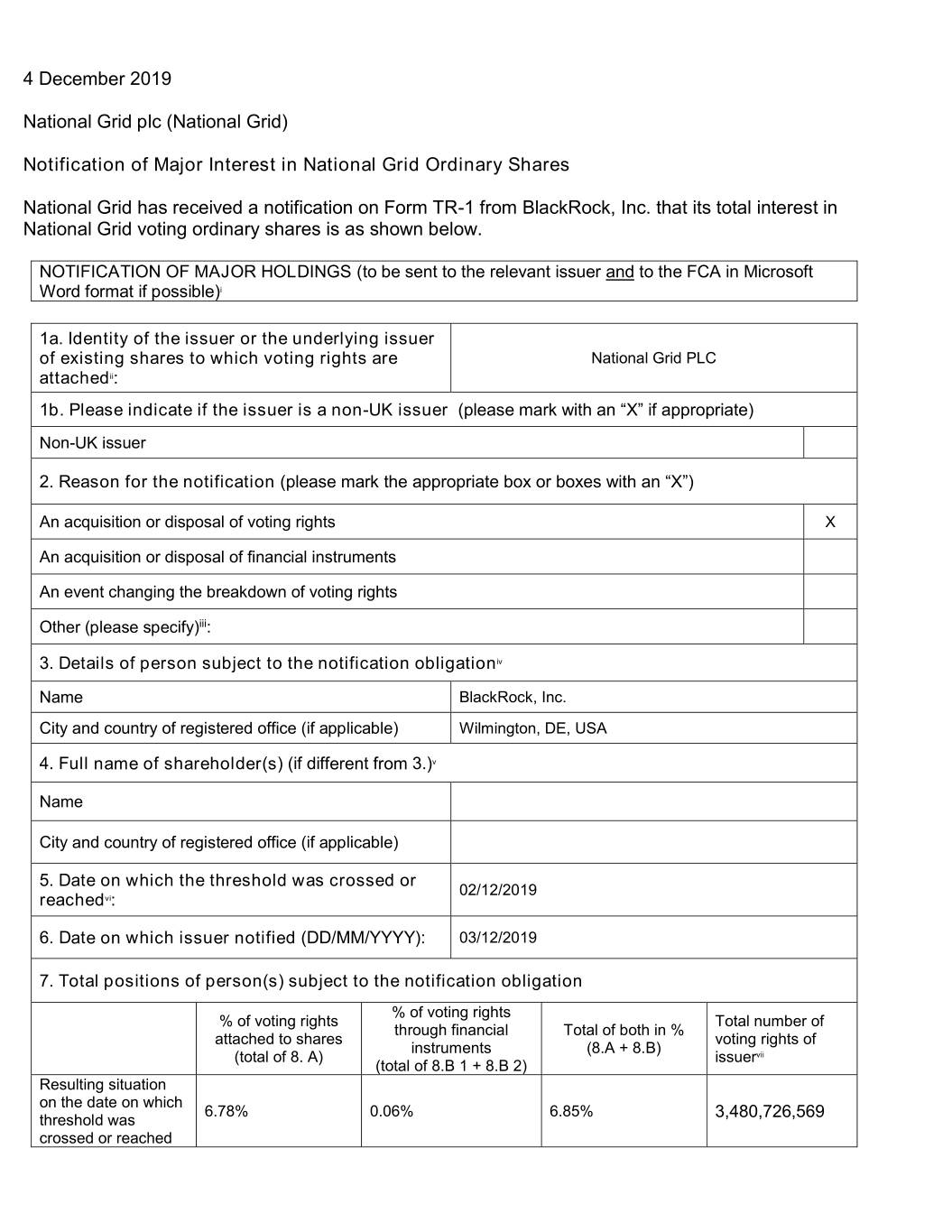

13 December 2019 National Grid plc (National Grid) Notification of Major Interest in National Grid Ordinary Shares National Grid has received a notification on Form TR-1 from Competrol International Investments Limited that its total interest in National Grid voting ordinary shares is as shown below. 1a. Identity of the issuer or the underlying issuer of existing shares to which voting rights are National Grid plc attachedi: 1b. Please indicate if the issuer is a non-UK issuer (please mark with an “X” if appropriate) Non-UK issuer 2. Reason for the notification (please mark the appropriate box or boxes with an “X”) An acquisition or disposal of voting rights An acquisition or disposal of financial instruments An event changing the breakdown of voting rights Other (please specify): Amendment of part of previously announced position. No threshold has been crossed. See Box 11. X 3. Details of person subject to the notification obligation Name Competrol International Investments Limited City and country of registered office (if applicable) Tortola, British Virgin Islands 4. Full name of shareholder(s) (if different from 3.) Name City and country of registered office (if applicable) Part of existing position amended on 12 December 5. Date on which the threshold was crossed or 2019 to provide for a right of physical settlement. reached: No threshold has been crossed. See Box 11 below. 6. Date on which issuer notified (DD/MM/YYYY): 12/12/2019 7. Total positions of person(s) subject to the notification obligation % of voting rights % of voting rights Total number of through financial Total of both in % attached to shares voting rights of instruments (8.A + 8.B) (total of 8. A) issuer (total of 8.B 1 + 8.B 2) Resulting situation on the date on which - 3.38 3.38 3,480,726,569 threshold was crossed or reached

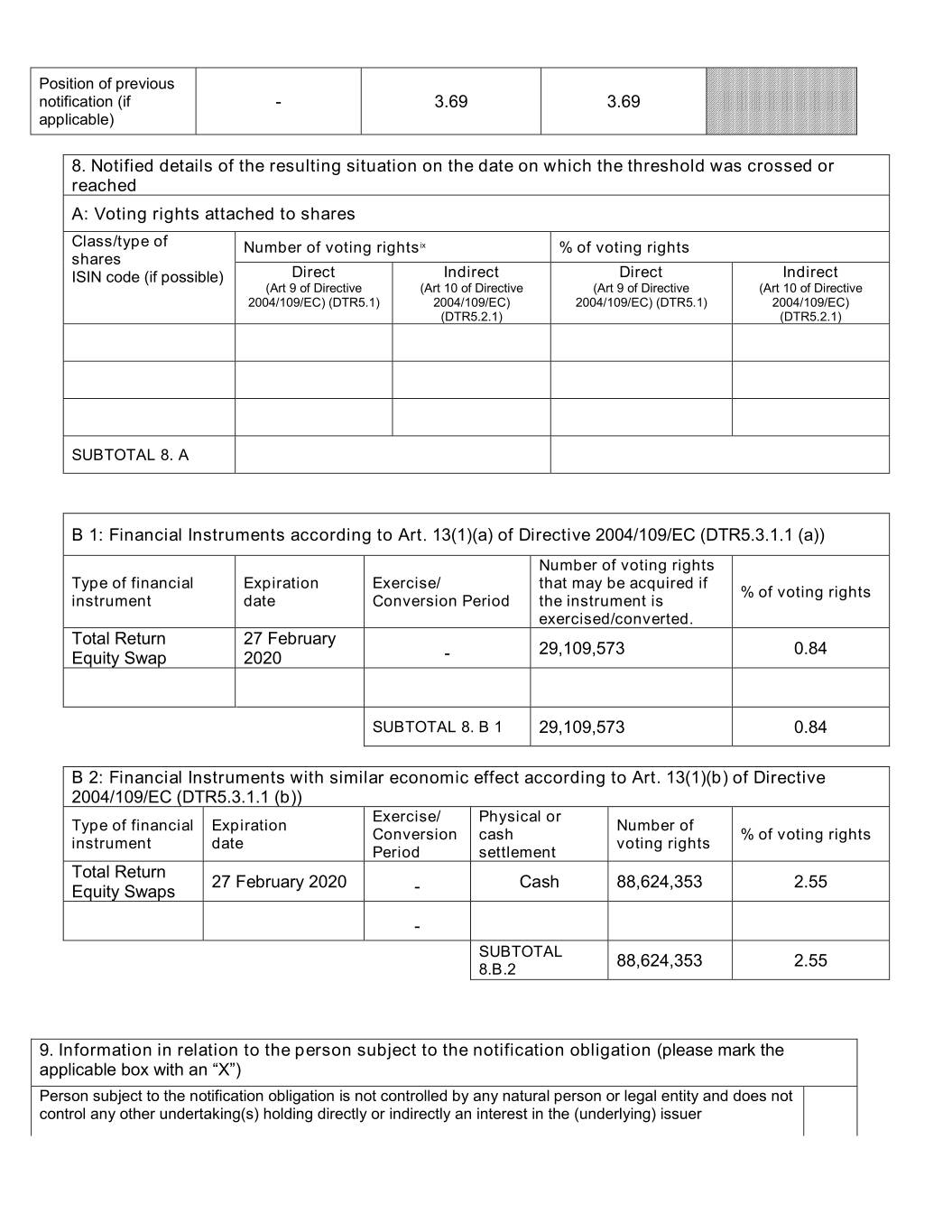

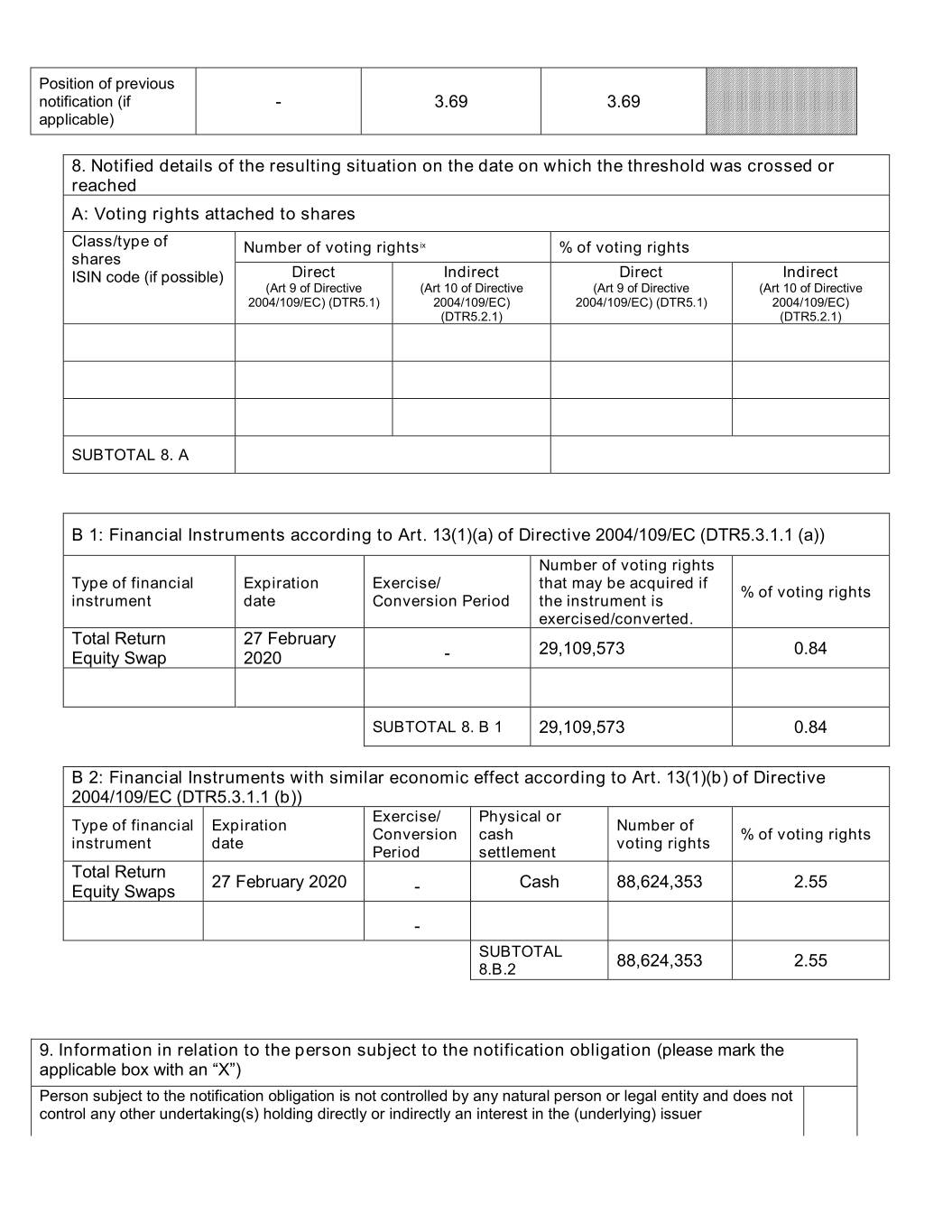

Position of previous notification (if - 3.69 3.69 applicable) 8. Notified details of the resulting situation on the date on which the threshold was crossed or reached A: Voting rights attached to shares Class/type of Number of voting rightsix % of voting rights shares ISIN code (if possible) Direct Indirect Direct Indirect (Art 9 of Directive (Art 10 of Directive (Art 9 of Directive (Art 10 of Directive 2004/109/EC) (DTR5.1) 2004/109/EC) 2004/109/EC) (DTR5.1) 2004/109/EC) (DTR5.2.1) (DTR5.2.1) SUBTOTAL 8. A B 1: Financial Instruments according to Art. 13(1)(a) of Directive 2004/109/EC (DTR5.3.1.1 (a)) Number of voting rights Type of financial Expiration Exercise/ that may be acquired if % of voting rights instrument date Conversion Period the instrument is exercised/converted. Total Return 27 February 29,109,573 0.84 Equity Swap 2020 - SUBTOTAL 8. B 1 29,109,573 0.84 B 2: Financial Instruments with similar economic effect according to Art. 13(1)(b) of Directive 2004/109/EC (DTR5.3.1.1 (b)) Exercise/ Physical or Type of financial Expiration Number of Conversion cash % of voting rights instrument date voting rights Period settlement Total Return 27 February 2020 Cash 88,624,353 2.55 Equity Swaps - - SUBTOTAL 88,624,353 2.55 8.B.2 9. Information in relation to the person subject to the notification obligation (please mark the applicable box with an “X”) Person subject to the notification obligation is not controlled by any natural person or legal entity and does not control any other undertaking(s) holding directly or indirectly an interest in the (underlying) issuer

Full chain of controlled undertakings through which the voting rights and/or the financial instruments are effectively held starting with the ultimate controlling natural person or legal entity X (please add additional rows as necessary) % of voting % of voting rights Total of both if it rights if it equals through financial equals or is higher Name or is higher than instruments if it equals than the notifiable the notifiable or is higher than the threshold threshold notifiable threshold Olayan Investments Company - 3.38 3.38 Establishment Competrol Establishment - 3.38 3.38 Competrol International - 3.38 3.38 Investments Limited 10. In case of proxy voting, please identify: Name of the proxy holder The number and % of voting rights held The date until which the voting rights will be held 11. Additional informationxvi This notification is as a result of the introduction of an option for physical settlement to part of the existing position. There has been no change to the number of shares referable to the aggregate position of Competrol International Investments Limited and no threshold has been crossed. Place of completion London, UK Date of completion 12 December 2019 This notice is in compliance with National Grid's obligations under the Disclosure and Transparency Rules. Zoë Burnell Company Secretarial Assistant 020 7004 3227

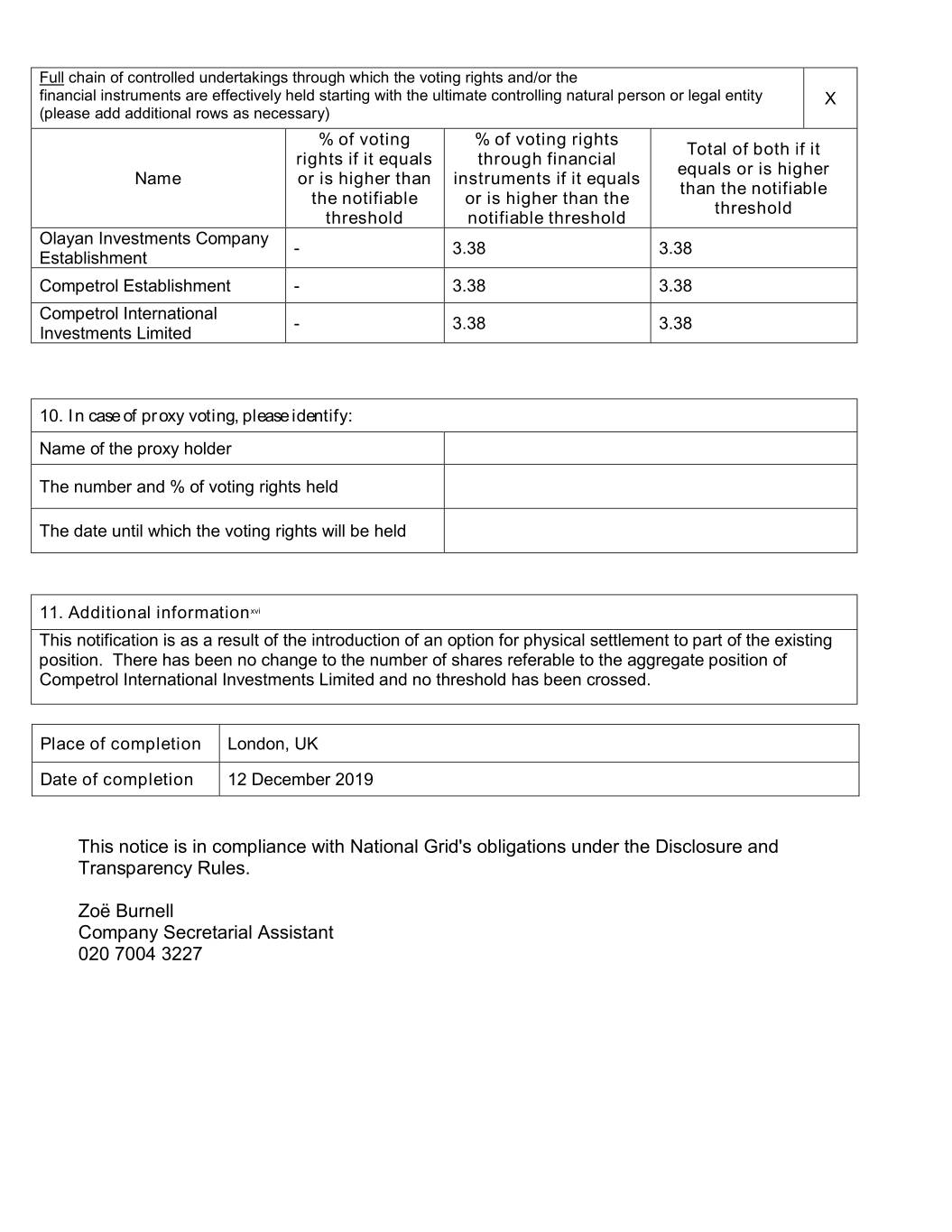

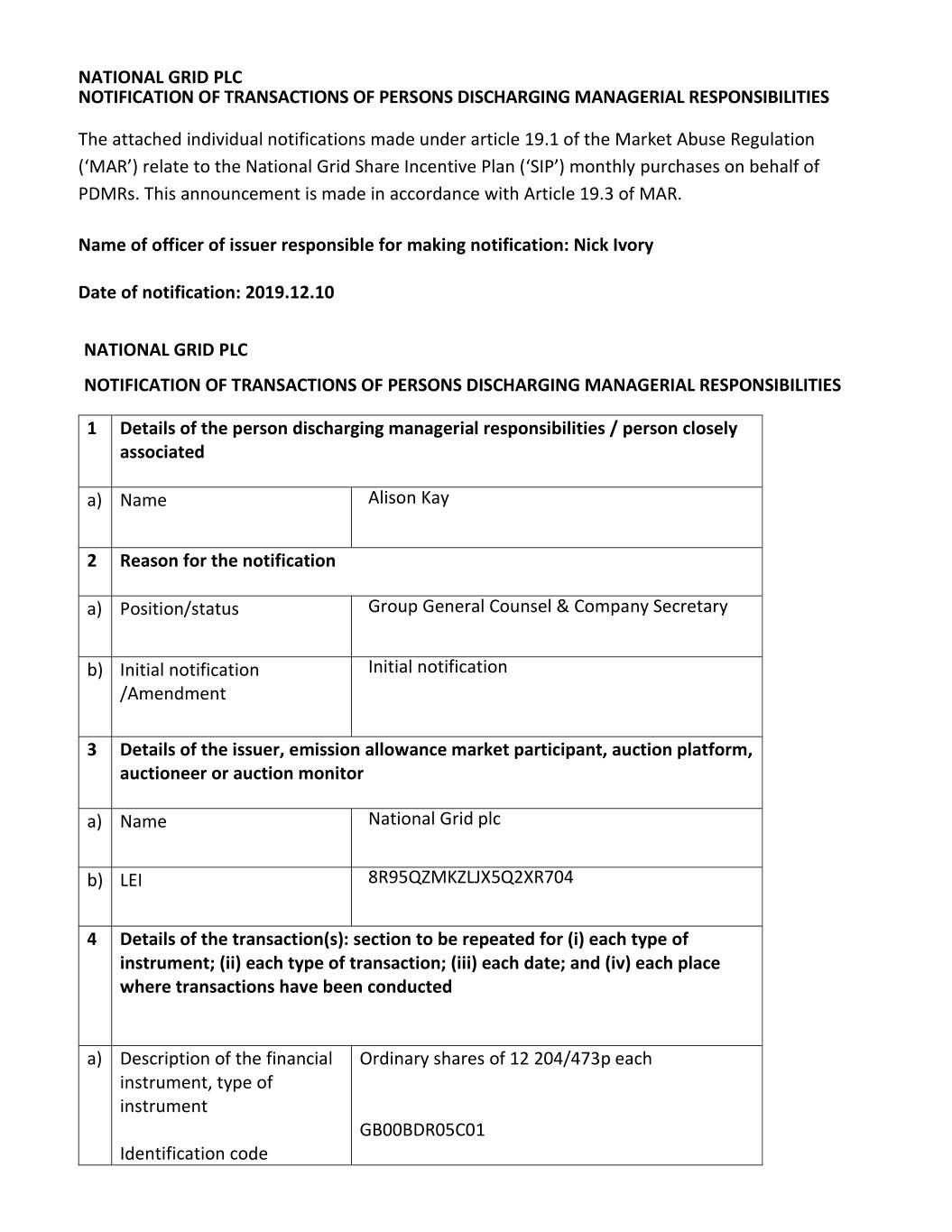

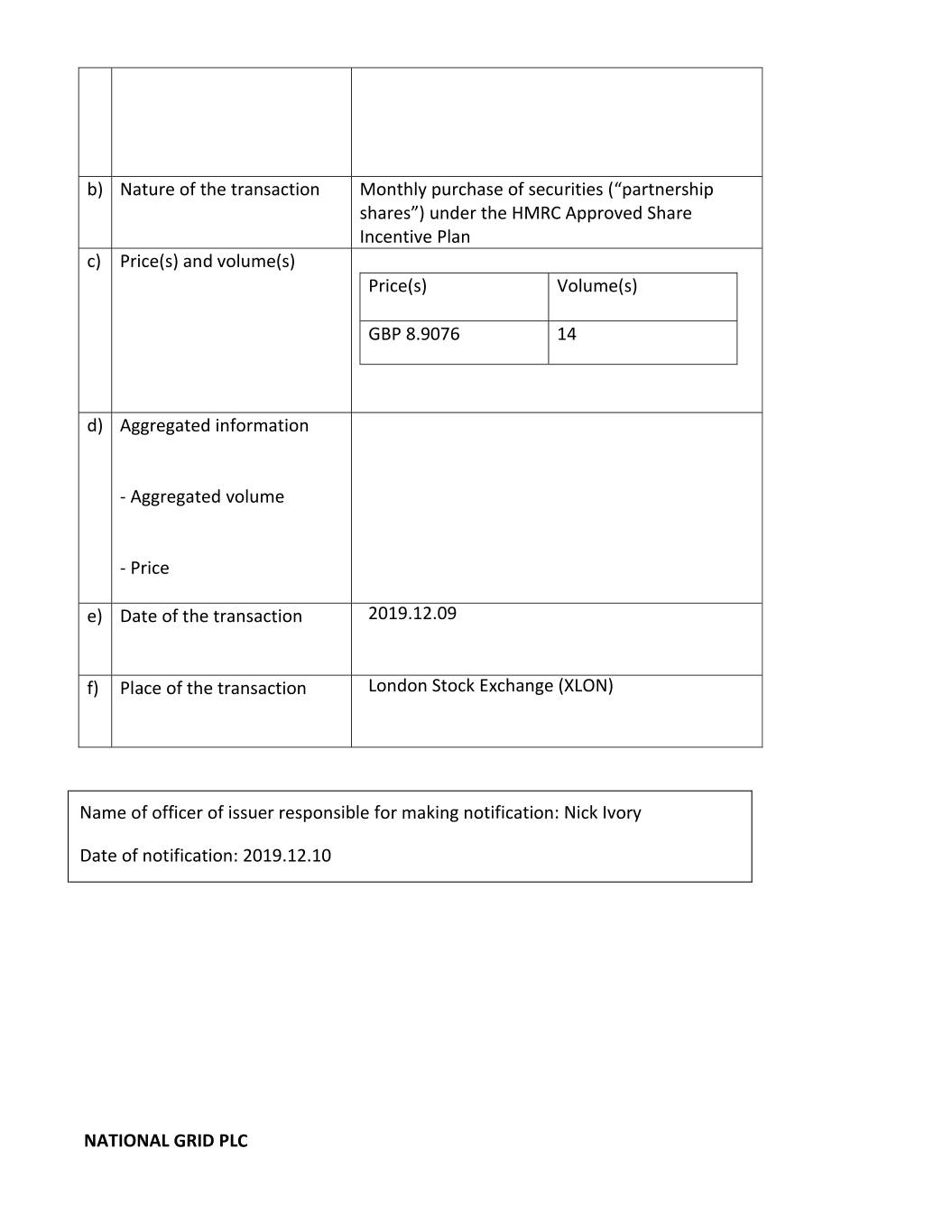

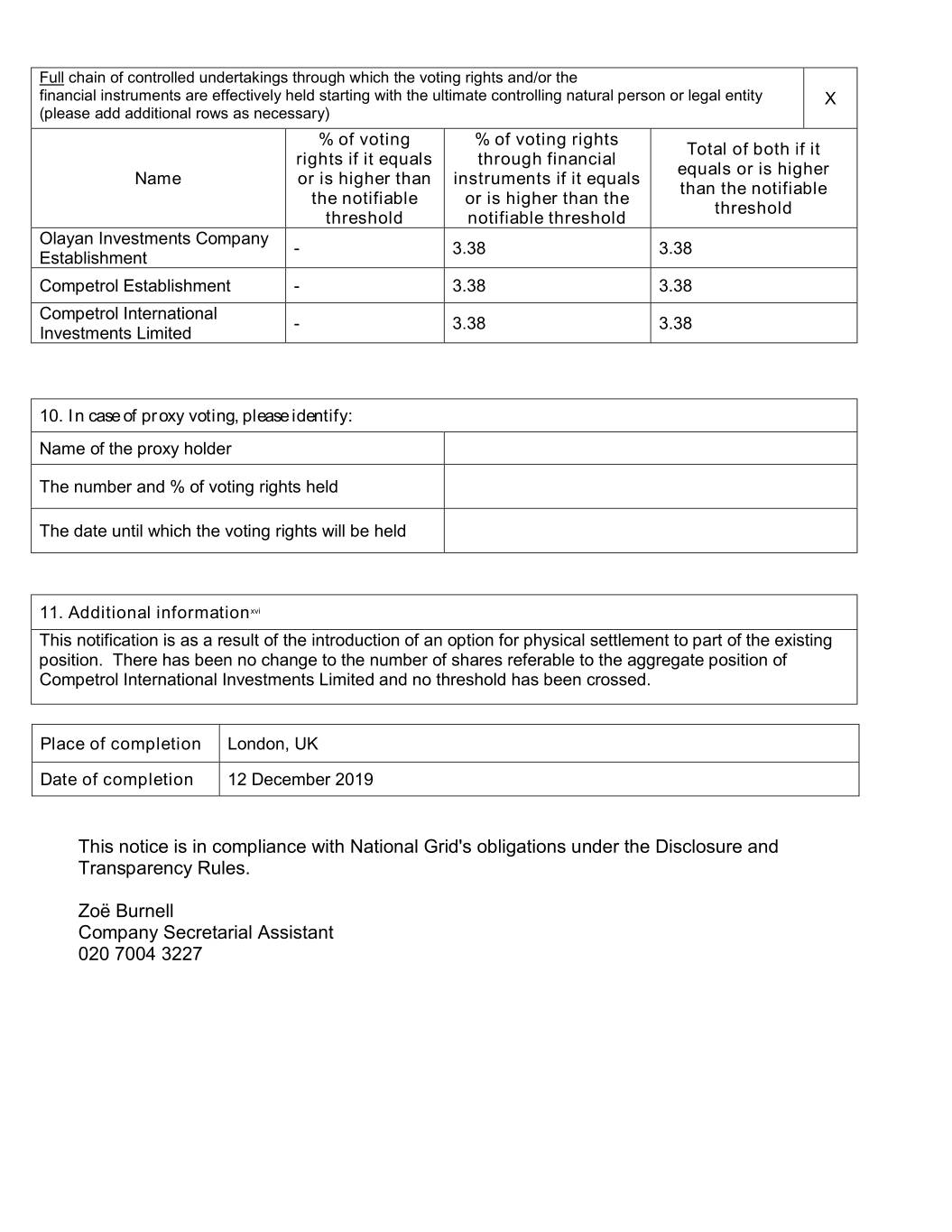

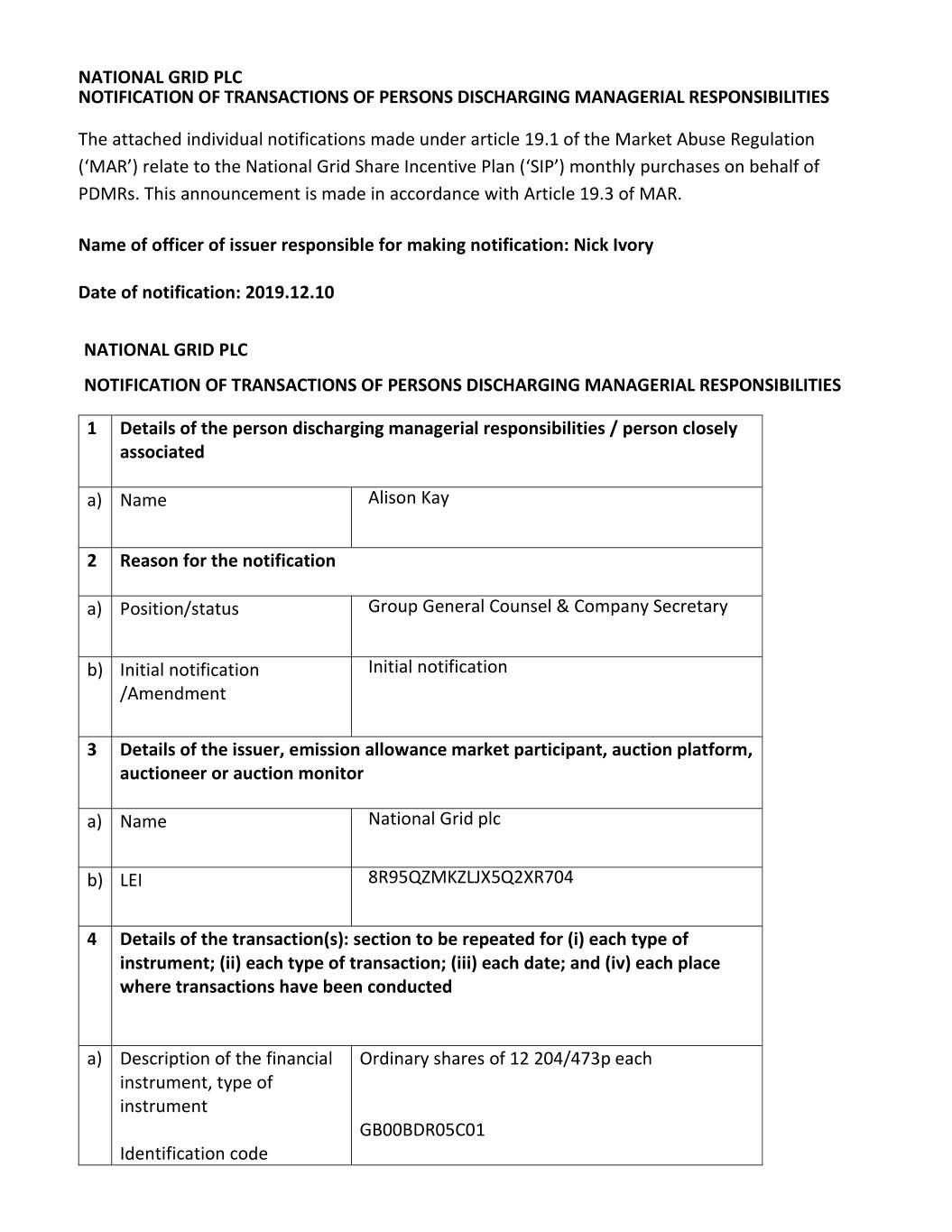

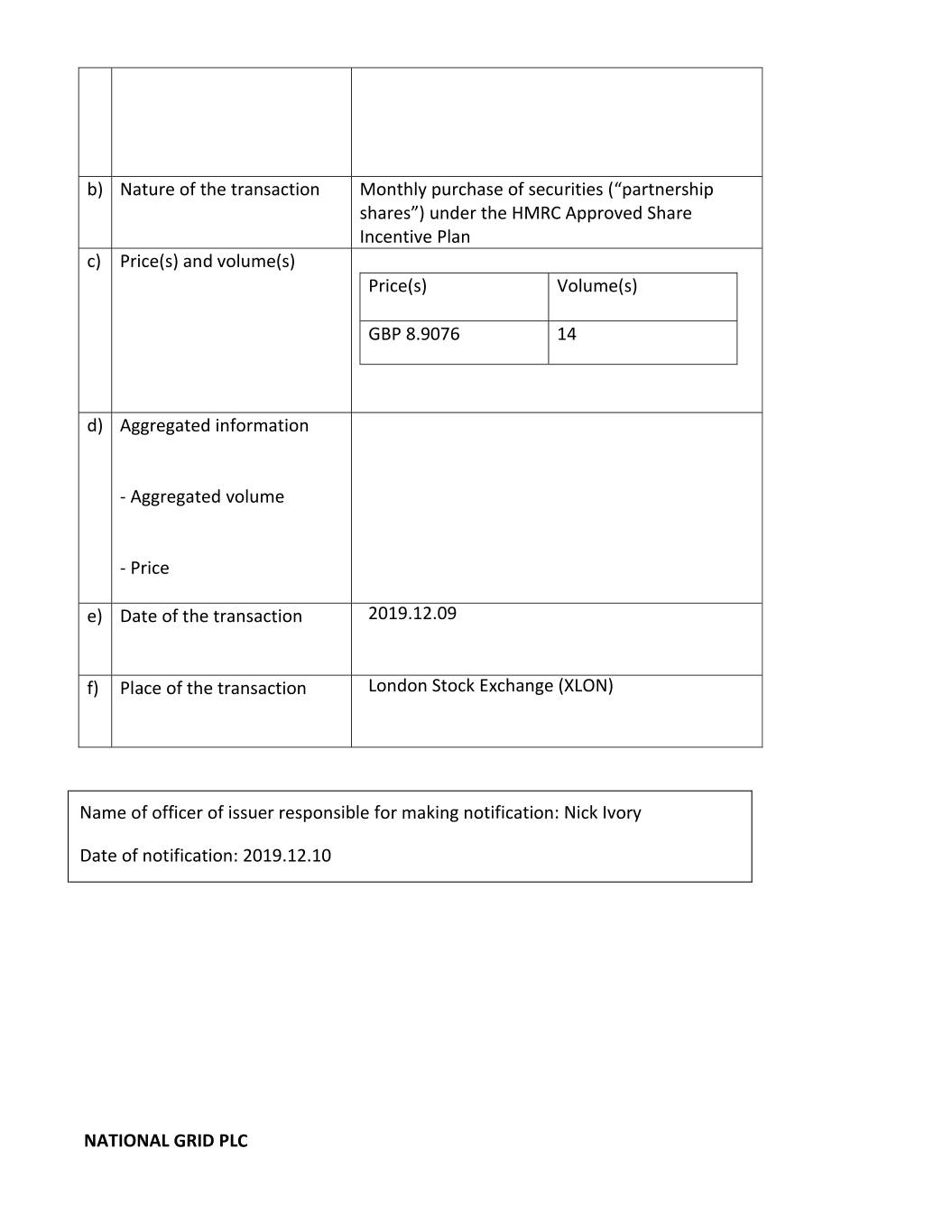

NATIONAL GRID PLC NOTIFICATION OF TRANSACTIONS OF PERSONS DISCHARGING MANAGERIAL RESPONSIBILITIES The attached individual notifications made under article 19.1 of the Market Abuse Regulation (‘MAR’) relate to the National Grid Share Incentive Plan (‘SIP’) monthly purchases on behalf of PDMRs. This announcement is made in accordance with Article 19.3 of MAR. Name of officer of issuer responsible for making notification: Nick Ivory Date of notification: 2019.12.10 NATIONAL GRID PLC NOTIFICATION OF TRANSACTIONS OF PERSONS DISCHARGING MANAGERIAL RESPONSIBILITIES 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Alison Kay 2 Reason for the notification a) Position/status Group General Counsel & Company Secretary b) Initial notification Initial notification /Amendment 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial Ordinary shares of 12 204/473p each instrument, type of instrument GB00BDR05C01 Identification code

b) Nature of the transaction Monthly purchase of securities (“partnership shares”) under the HMRC Approved Share Incentive Plan c) Price(s) and volume(s) Price(s) Volume(s) GBP 8.9076 14 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2019.12.09 f) Place of the transaction London Stock Exchange (XLON) Name of officer of issuer responsible for making notification: Nick Ivory Date of notification: 2019.12.10 NATIONAL GRID PLC

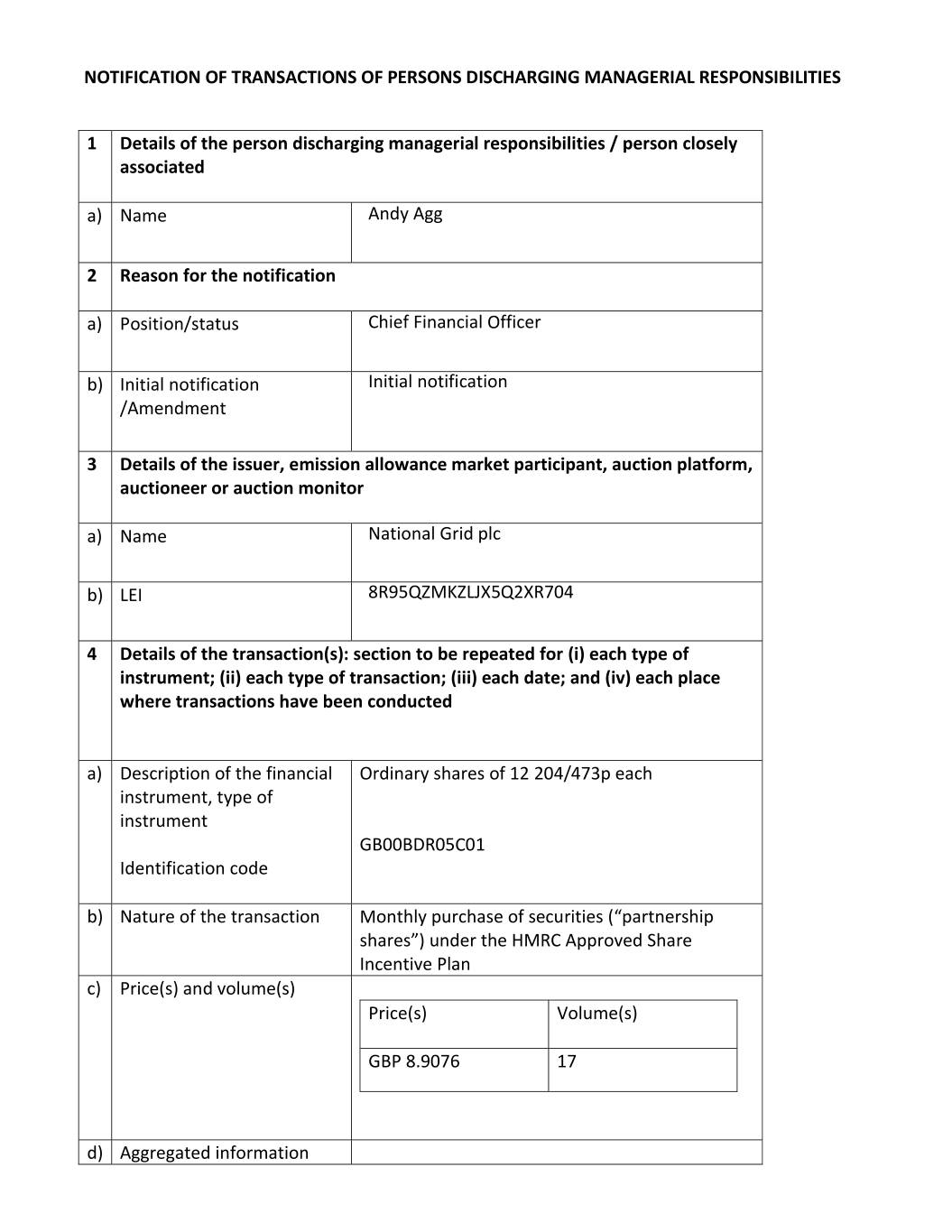

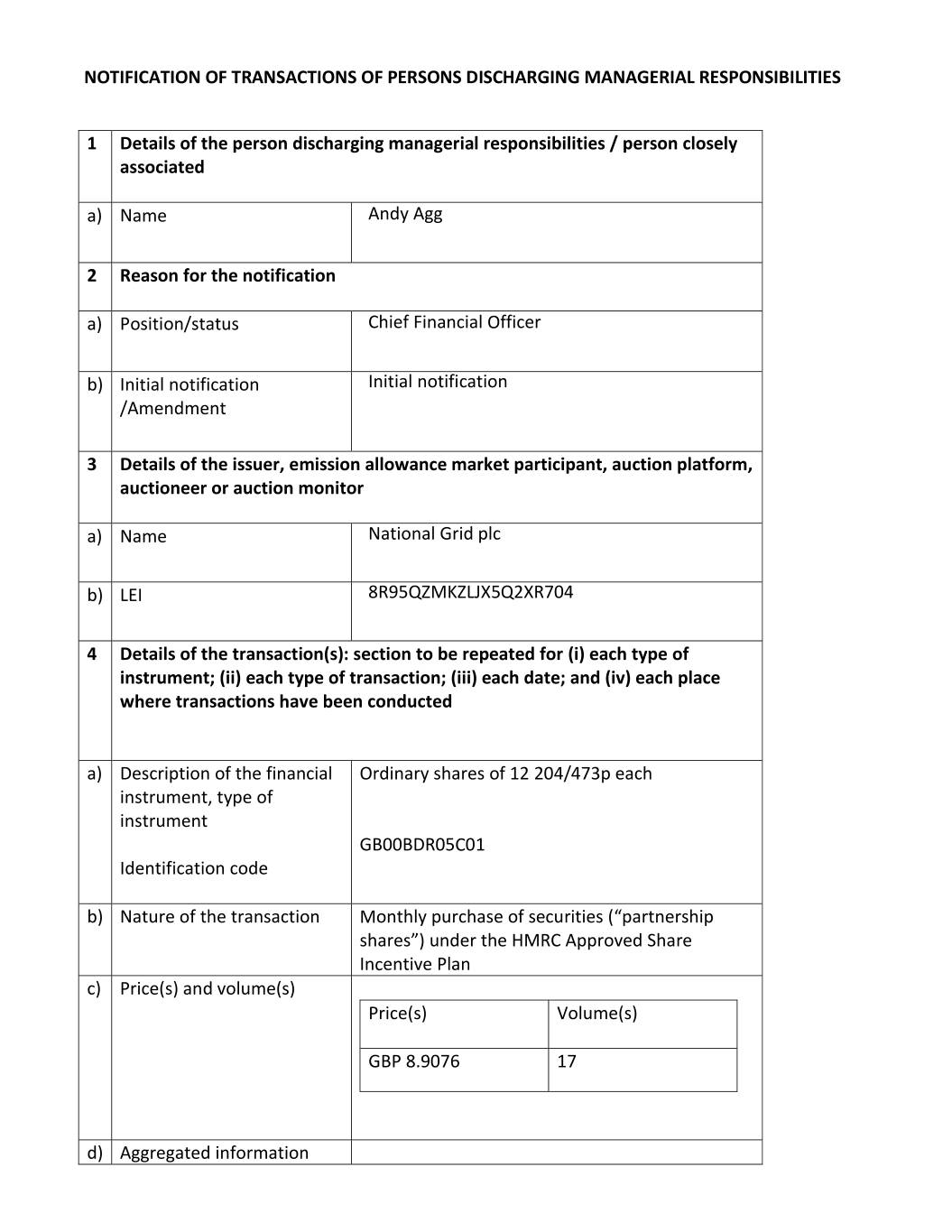

NOTIFICATION OF TRANSACTIONS OF PERSONS DISCHARGING MANAGERIAL RESPONSIBILITIES 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Andy Agg 2 Reason for the notification a) Position/status Chief Financial Officer b) Initial notification Initial notification /Amendment 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial Ordinary shares of 12 204/473p each instrument, type of instrument GB00BDR05C01 Identification code b) Nature of the transaction Monthly purchase of securities (“partnership shares”) under the HMRC Approved Share Incentive Plan c) Price(s) and volume(s) Price(s) Volume(s) GBP 8.9076 17 d) Aggregated information

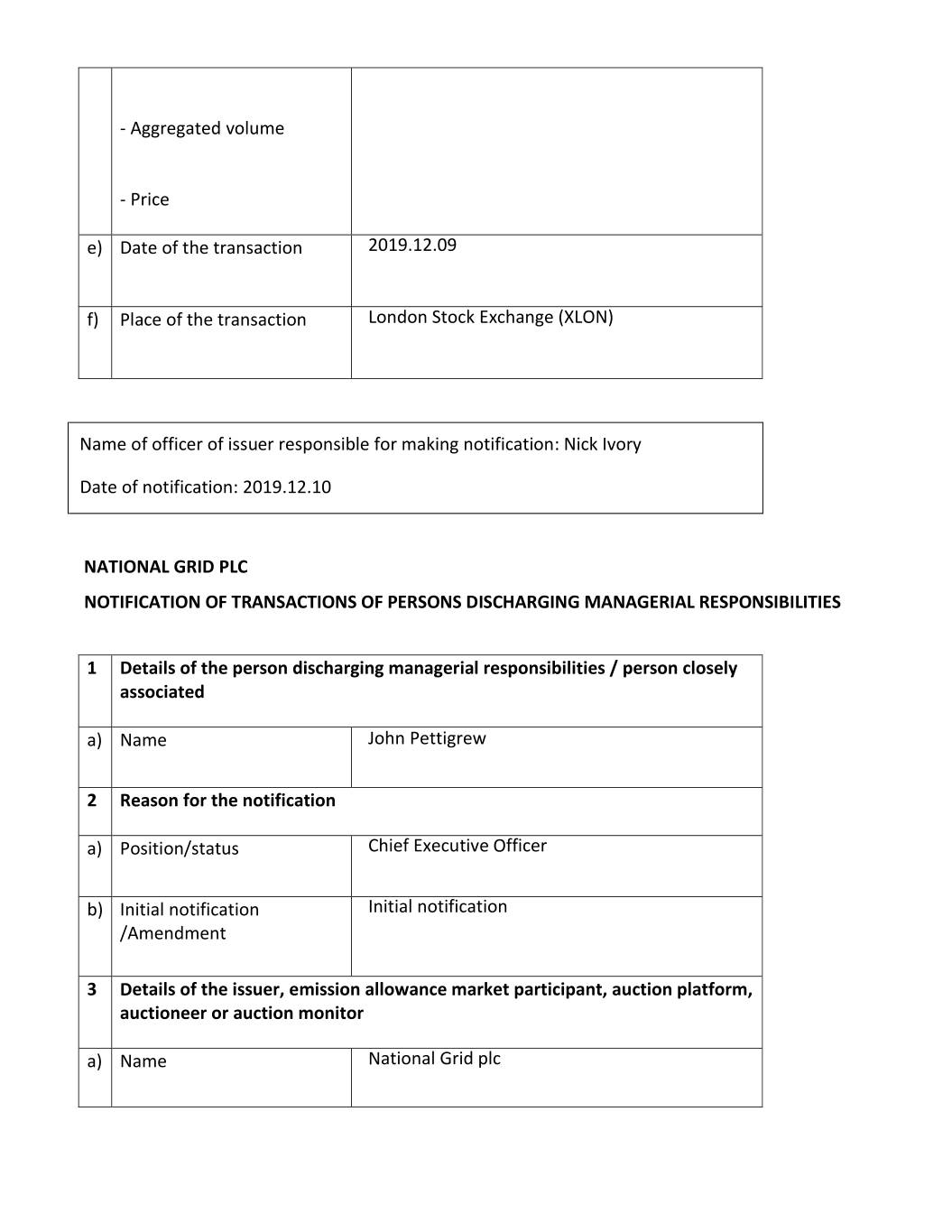

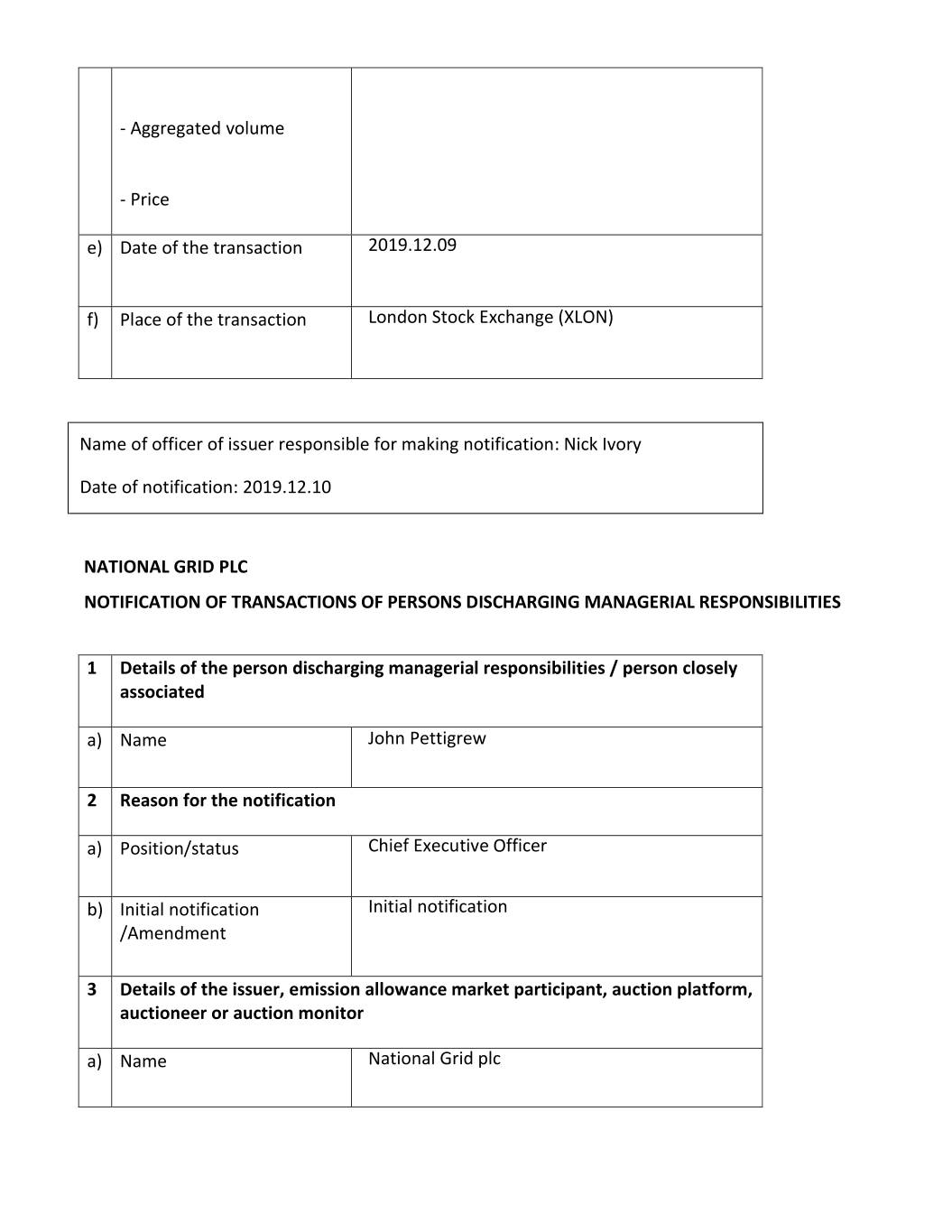

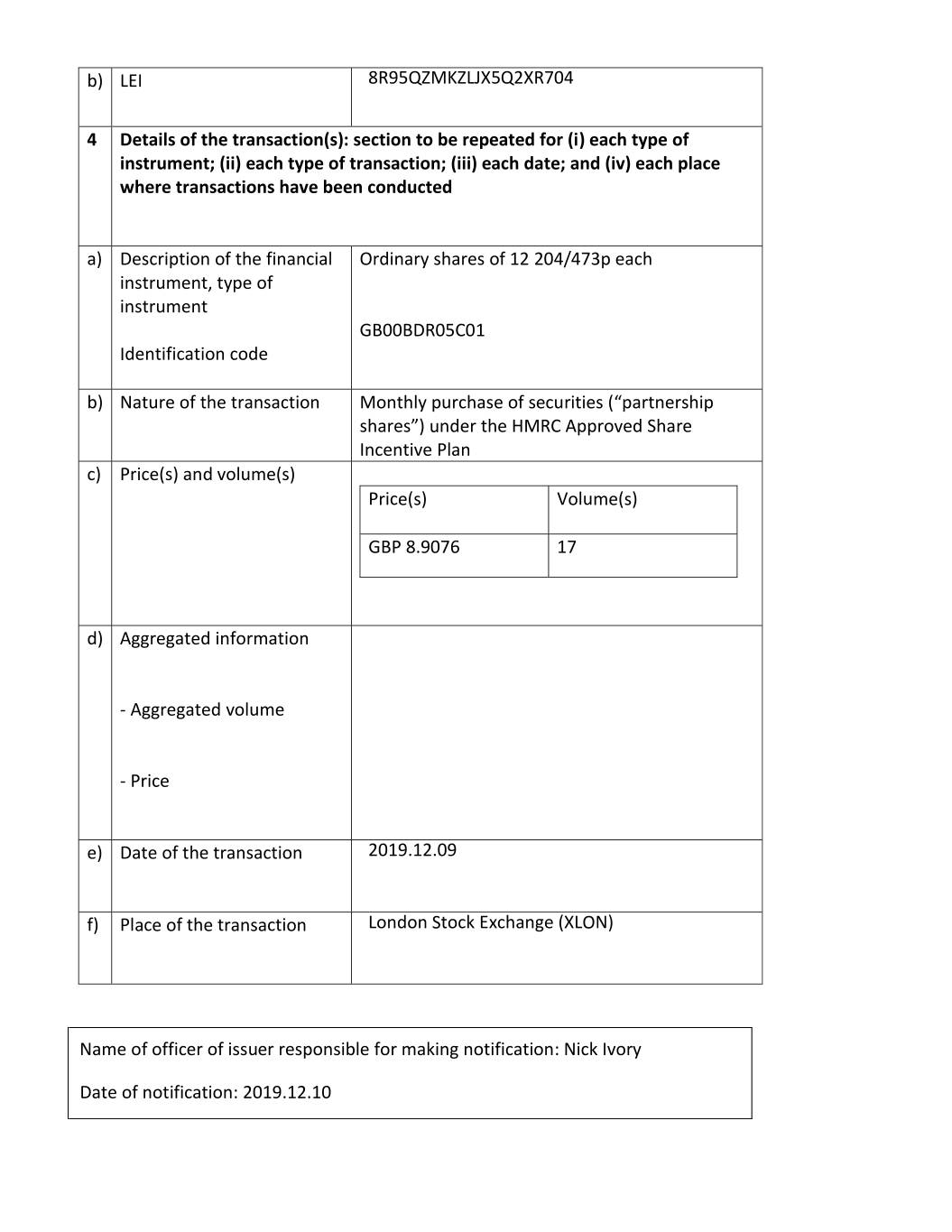

- Aggregated volume - Price e) Date of the transaction 2019.12.09 f) Place of the transaction London Stock Exchange (XLON) Name of officer of issuer responsible for making notification: Nick Ivory Date of notification: 2019.12.10 NATIONAL GRID PLC NOTIFICATION OF TRANSACTIONS OF PERSONS DISCHARGING MANAGERIAL RESPONSIBILITIES 1 Details of the person discharging managerial responsibilities / person closely associated a) Name John Pettigrew 2 Reason for the notification a) Position/status Chief Executive Officer b) Initial notification Initial notification /Amendment 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc

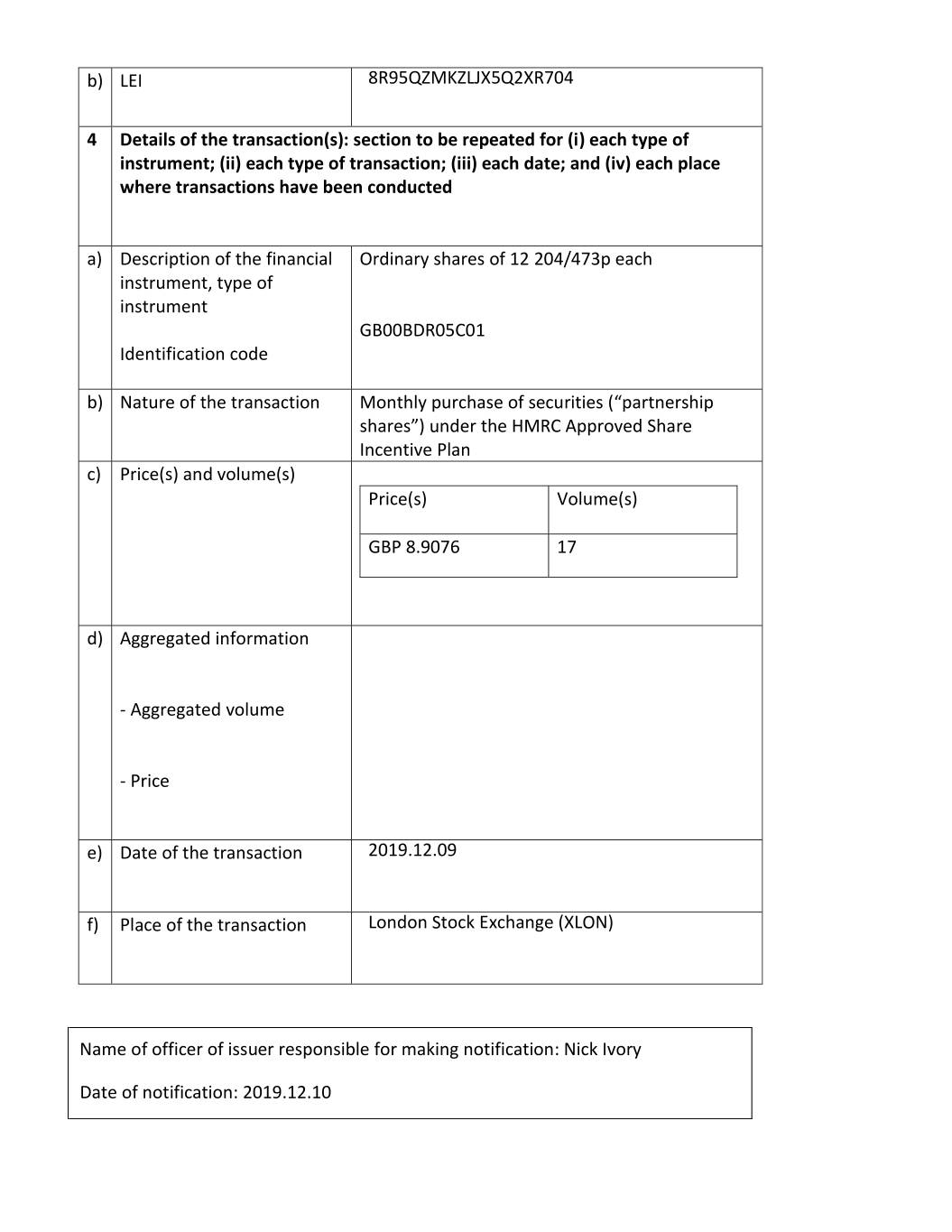

b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial Ordinary shares of 12 204/473p each instrument, type of instrument GB00BDR05C01 Identification code b) Nature of the transaction Monthly purchase of securities (“partnership shares”) under the HMRC Approved Share Incentive Plan c) Price(s) and volume(s) Price(s) Volume(s) GBP 8.9076 17 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2019.12.09 f) Place of the transaction London Stock Exchange (XLON) Name of officer of issuer responsible for making notification: Nick Ivory Date of notification: 2019.12.10

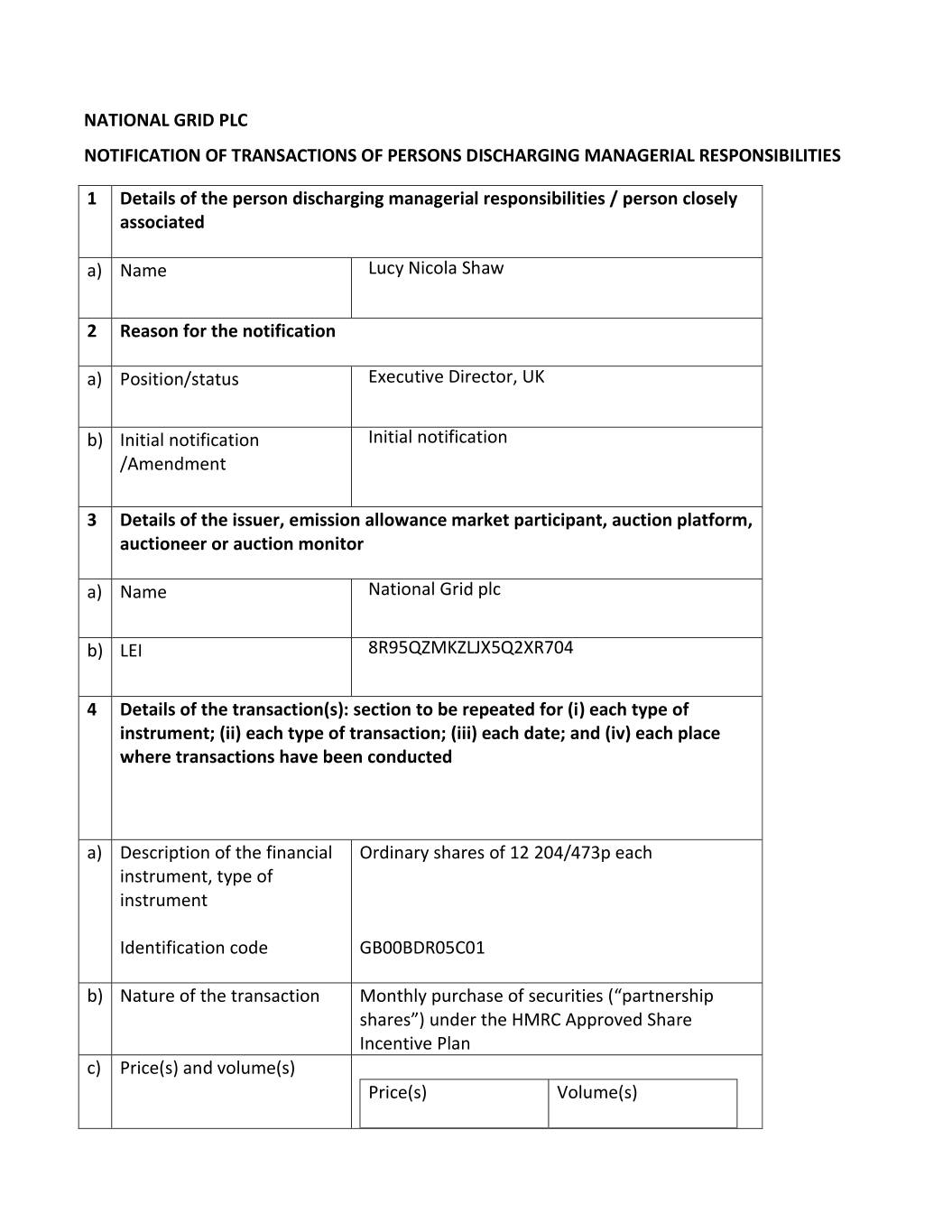

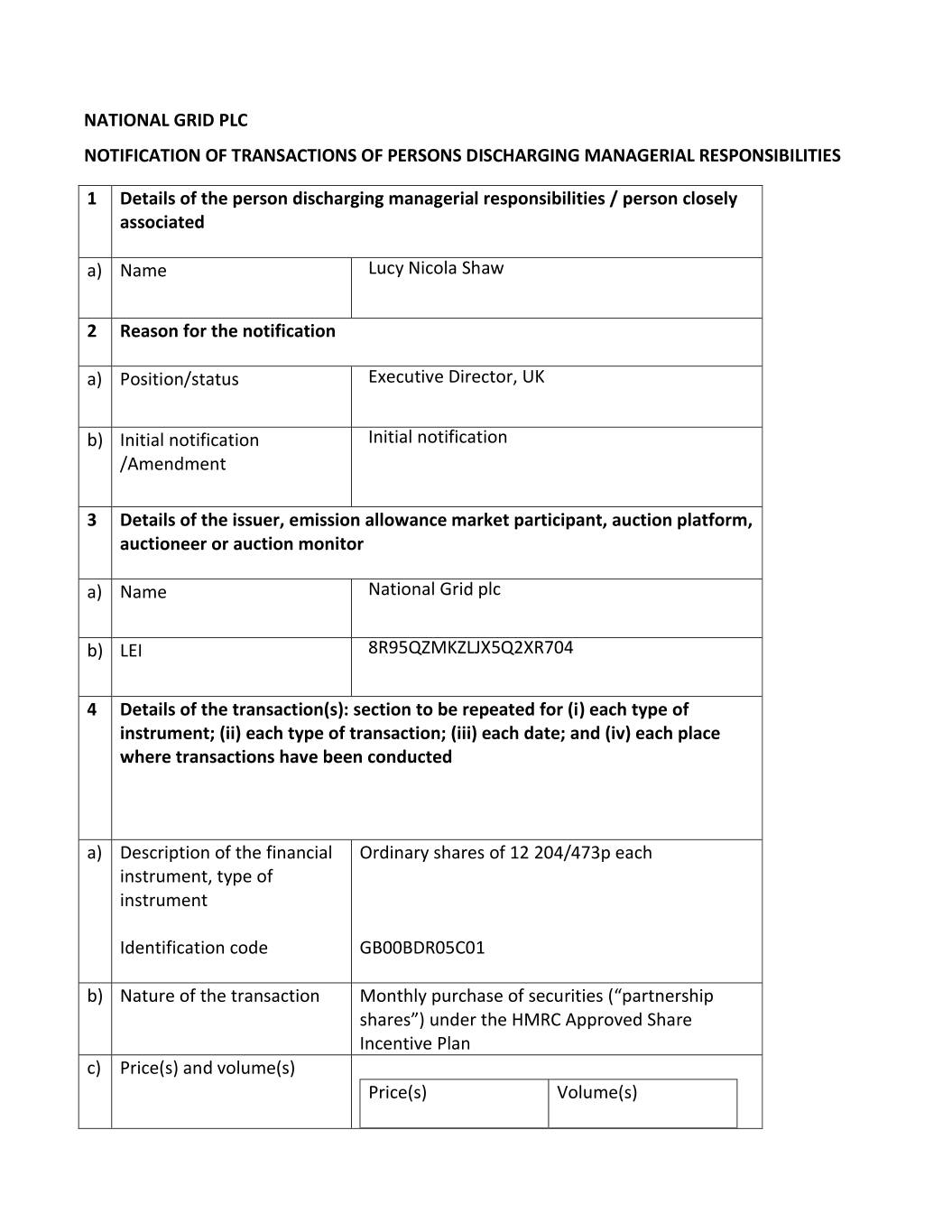

NATIONAL GRID PLC NOTIFICATION OF TRANSACTIONS OF PERSONS DISCHARGING MANAGERIAL RESPONSIBILITIES 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Lucy Nicola Shaw 2 Reason for the notification a) Position/status Executive Director, UK b) Initial notification Initial notification /Amendment 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial Ordinary shares of 12 204/473p each instrument, type of instrument Identification code GB00BDR05C01 b) Nature of the transaction Monthly purchase of securities (“partnership shares”) under the HMRC Approved Share Incentive Plan c) Price(s) and volume(s) Price(s) Volume(s)

GBP 8.9076 16 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2019.12.09 f) Place of the transaction London Stock Exchange (XLON) Name of officer of issuer responsible for making notification: Nick Ivory Date of notification: 2019.12.10

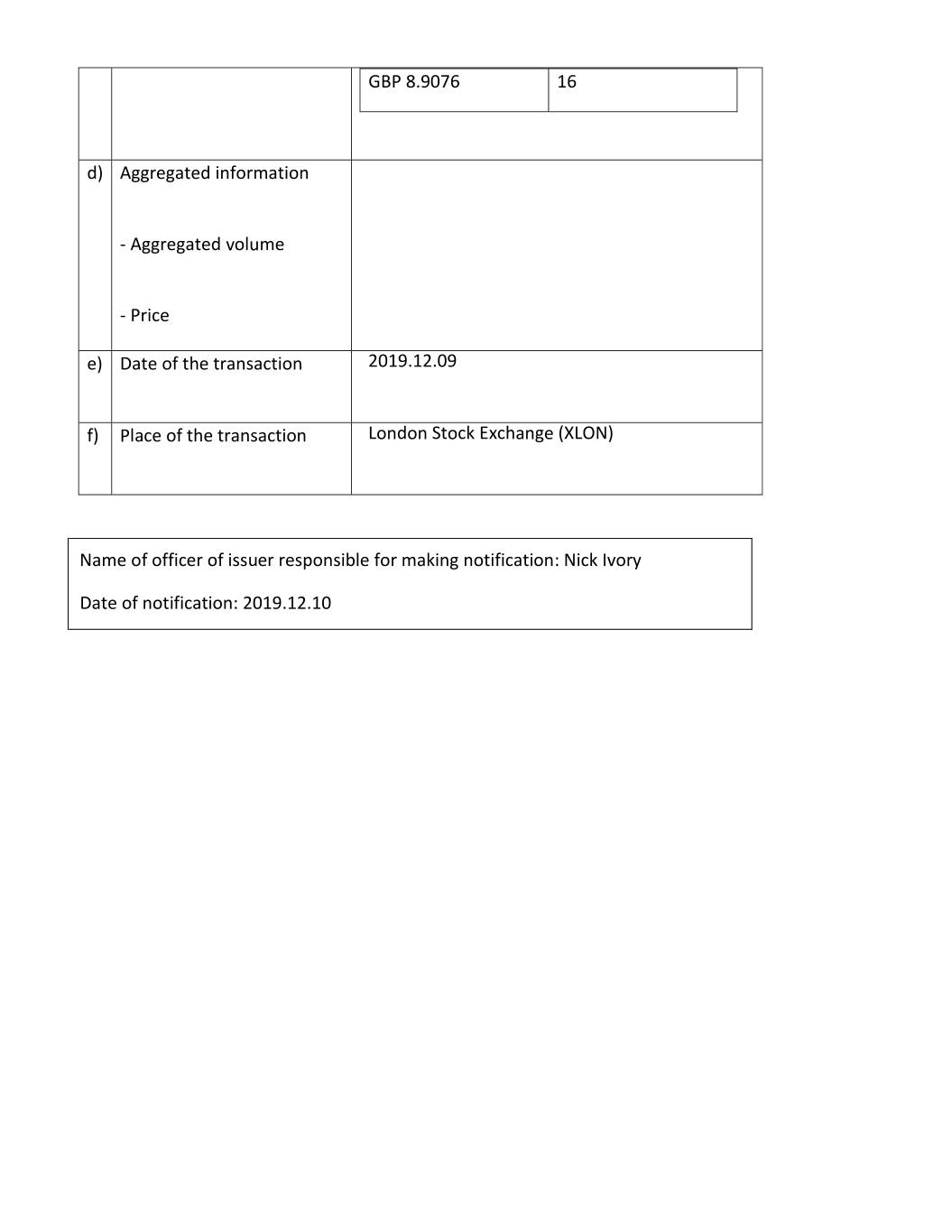

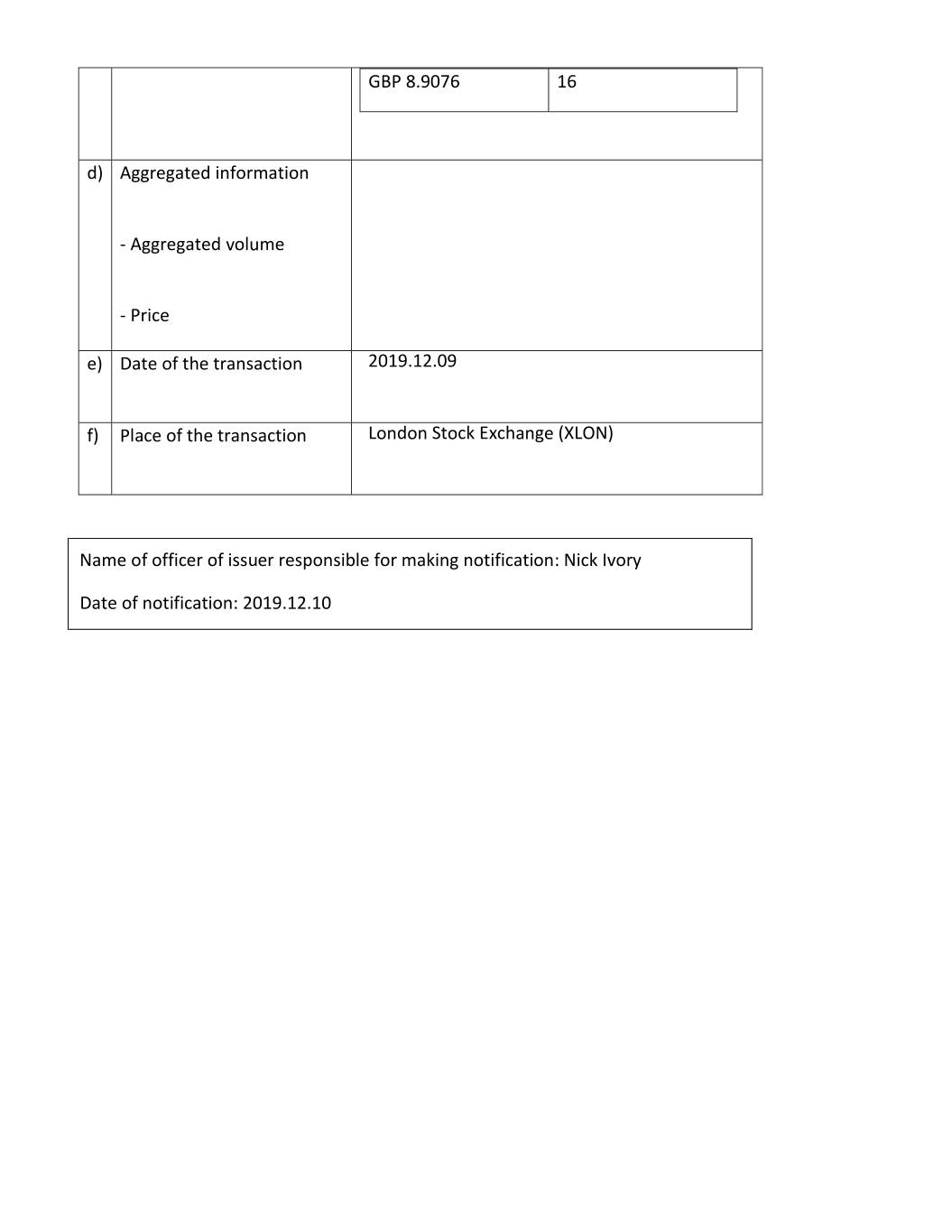

09 December 2019 National Grid plc National Grid Submits Final RIIO-2 Business Plans National Grid has today submitted its final business plans to Ofgem for its UK Electricity and Gas Transmission businesses, as well as the Electricity System Operator, for the 2021-2026 RIIO-2 period. These plans have been developed following extensive engagement with customers, industry stakeholders, non-domestic consumers and households across the country. Our Electricity Transmission plan has a baseline totex spend of £7.1bn over the five years. It assumes connection of 15.3GW of customer capacity, providing the UK with clean power and flexible storage, as well as continued investment to maintain reliability and resilience. Our Gas Transmission plan has a baseline totex spend of £2.8bn over the five year plan. It assumes an increase in asset health and cyber related investment, as well as a programme of work needed to test and prove hydrogen conversion options. The baseline spend, under our financial framework, would see consumer bills reduced slightly in real terms for both Electricity and Gas Transmission. The plans include the financial framework that we believe will be necessary to incentivise the investment required to maintain and build the flexible grids of the future. We provide more evidence to demonstrate why we believe a real 6.5% (CPI stripped) allowed cost of equity is the right level to deliver this in RIIO-2. With a growing societal focus on the speed of decarbonisation and the challenges in meeting the UK's 2050 net zero emissions target, the plans provide options for additional anticipatory investment to facilitate additional wind generation and develop a national EV rapid charging network. This is an exciting time for the energy industry, and we remain committed to delivering and maintaining world class networks that provide the means to lower carbon emissions, and to meeting net zero targets, that will be to the benefit of all consumers. We look forward to engaging further with all our stakeholders as we explain and debate our plans, including through the open forums in March and April 2020, ahead of initial determinations from Ofgem in summer 2020, and final determinations in late 2020. For additional information, please follow this link https://investors.nationalgrid.com/riio-2 to the RIIO-2 section of our investor website. Investors and Analysts Aarti Singhal +44 (0) 20 7004 3170 (d) +44 (0) 7989 492 447 (m) Nick Ashworth +44 (0) 20 7004 3166 (d) +44 (0) 7584 206 578 (m) Jon Clay +44 (0) 20 7004 3460 (d) +44 (0) 7899 928 247 (m) James Flanagan +44 (0) 20 7004 3129 (d) +44 (0) 7970 778 952 (m) Media

Molly Neal +44 (0) 7583 102 727 (m) CAUTIONARY STATEMENT This announcement contains certain statements that are neither reported financial results nor other historical information. These statements are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include information with respect to National Grid's financial condition, its results of operations and businesses, strategy, plans and objectives. Words such as 'aims', 'anticipates', 'expects', 'should', 'intends', 'plans', 'believes', 'outlook', 'seeks', 'estimates', 'targets', 'may', 'will', 'continue', 'project' and similar expressions, as well as statements in the future tense, identify forward-looking statements. These forward-looking statements are not guarantees of National Grid's future performance and are subject to assumptions, risks and uncertainties that could cause actual future results to differ materially from those expressed in or implied by such forward-looking statements. Many of these assumptions, risks and uncertainties relate to factors that are beyond National Grid's ability to control or estimate precisely, such as changes in laws or regulations, including any arising as a result of the United Kingdom's exit from the European Union; announcements from and decisions by governmental bodies or regulators, including proposals relating to the RIIO-T2 price controls as well as increased political and economic uncertainty; the timing of construction and delivery by third parties of new generation projects requiring connection; breaches of, or changes in, environmental, climate change and health and safety laws or regulations, including breaches or other incidents arising from the potentially harmful nature of its activities; network failure or interruption, the inability to carry out critical non network operations and damage to infrastructure, due to adverse weather conditions including the impact of major storms as well as the results of climate change, due to counterparties being unable to deliver physical commodities, or due to the failure of or unauthorised access to or deliberate breaches of National Grid's IT systems and supporting technology; failure to adequately forecast and respond to disruptions in energy supplies; performance against regulatory targets and standards and against National Grid's peers with the aim of delivering stakeholder expectations regarding costs and efficiency savings; and customers and counterparties (including financial institutions) failing to perform their obligations to the Company. Other factors that could cause actual results to differ materially from those described in this announcement include fluctuations in exchange rates, interest rates and commodity price indices; restrictions and conditions (including filing requirements) in National Grid's borrowing and debt arrangements, funding costs and access to financing; regulatory requirements for the Company to maintain financial resources in certain parts of its business and restrictions on some subsidiaries' transactions such as paying dividends, lending or levying charges; the delayed timing of recoveries and payments in National Grid's regulated businesses and whether aspects of its activities are contestable; the funding requirements and performance of National Grid's pension schemes and other post-retirement benefit schemes; the failure to attract, develop and retain employees with the necessary competencies, including leadership and business capabilities, and any significant disputes arising with National Grid's employees or the breach of laws or regulations by its employees; and the failure to respond to market developments, including competition for onshore transmission, the threats and opportunities presented by emerging technology, development activities relating to changes in the energy mix and the integration of distributed energy resources, and the need to grow the Company's business to deliver its strategy, as well as incorrect or unforeseen assumptions or conclusions (including unanticipated costs and liabilities) relating to business development activity. For further details regarding these and other assumptions, risks and uncertainties that may impact National Grid, please read the Strategic Report section and the 'Risk factors' on pages 212 to 225 of National Grid's most recent Annual Report and Accounts. In addition, new factors emerge from time to time and National Grid cannot assess the potential impact of any such factor on its activities or the extent to which any factor, or combination of factors, may cause actual future results to differ materially from those contained in any forward-looking statement. Except as may be required by law or regulation, the Company undertakes no obligation to update any of its forward-looking statements, which speak only as of the date of this announcement.

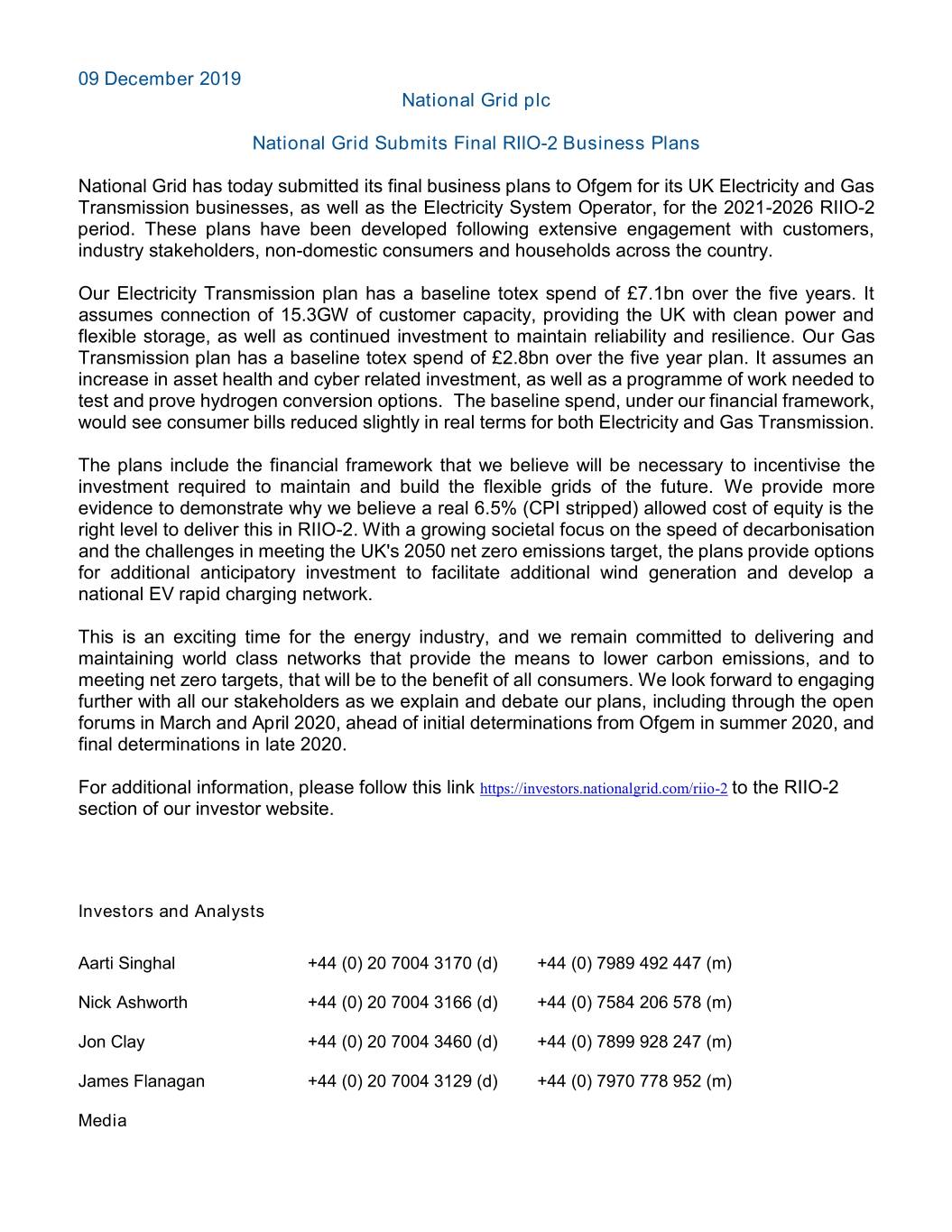

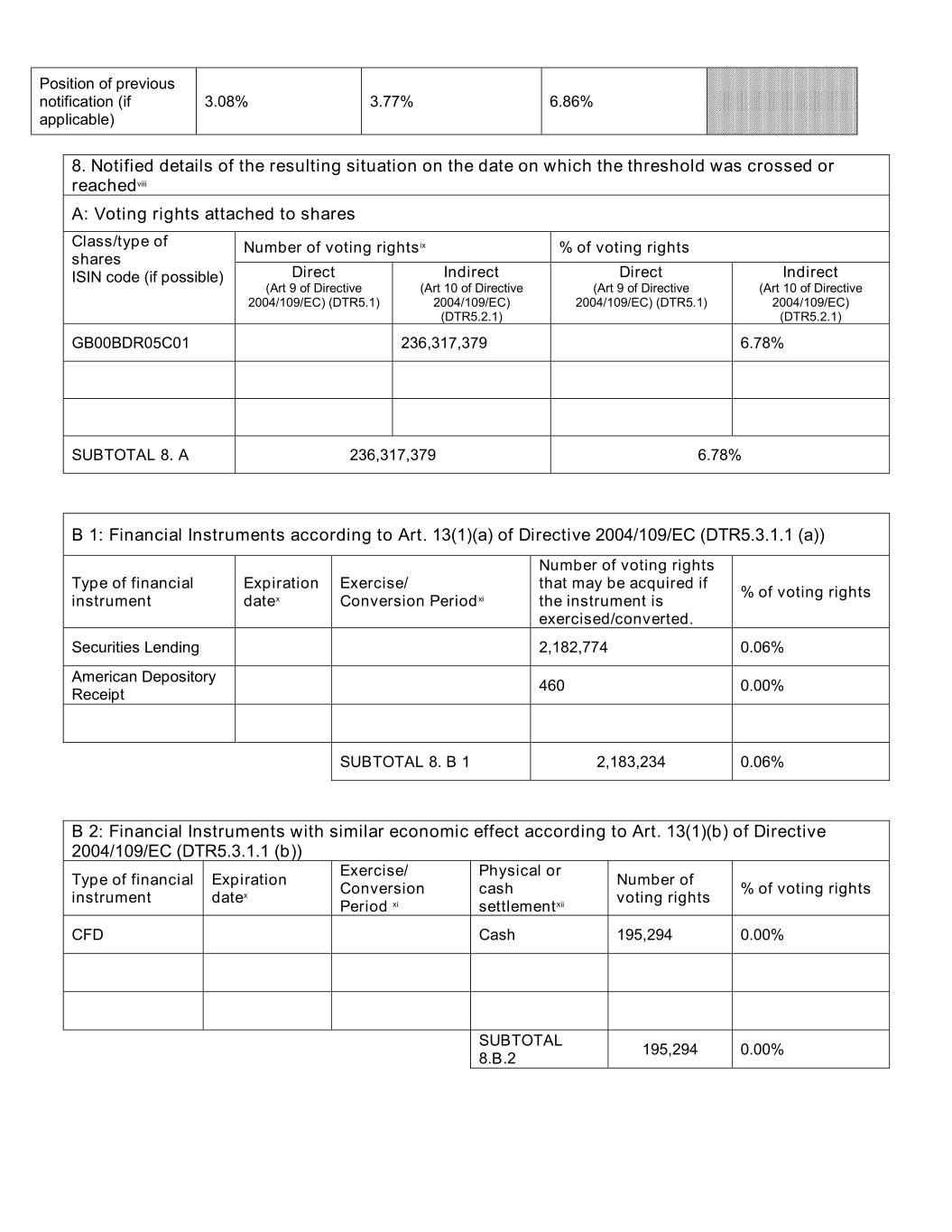

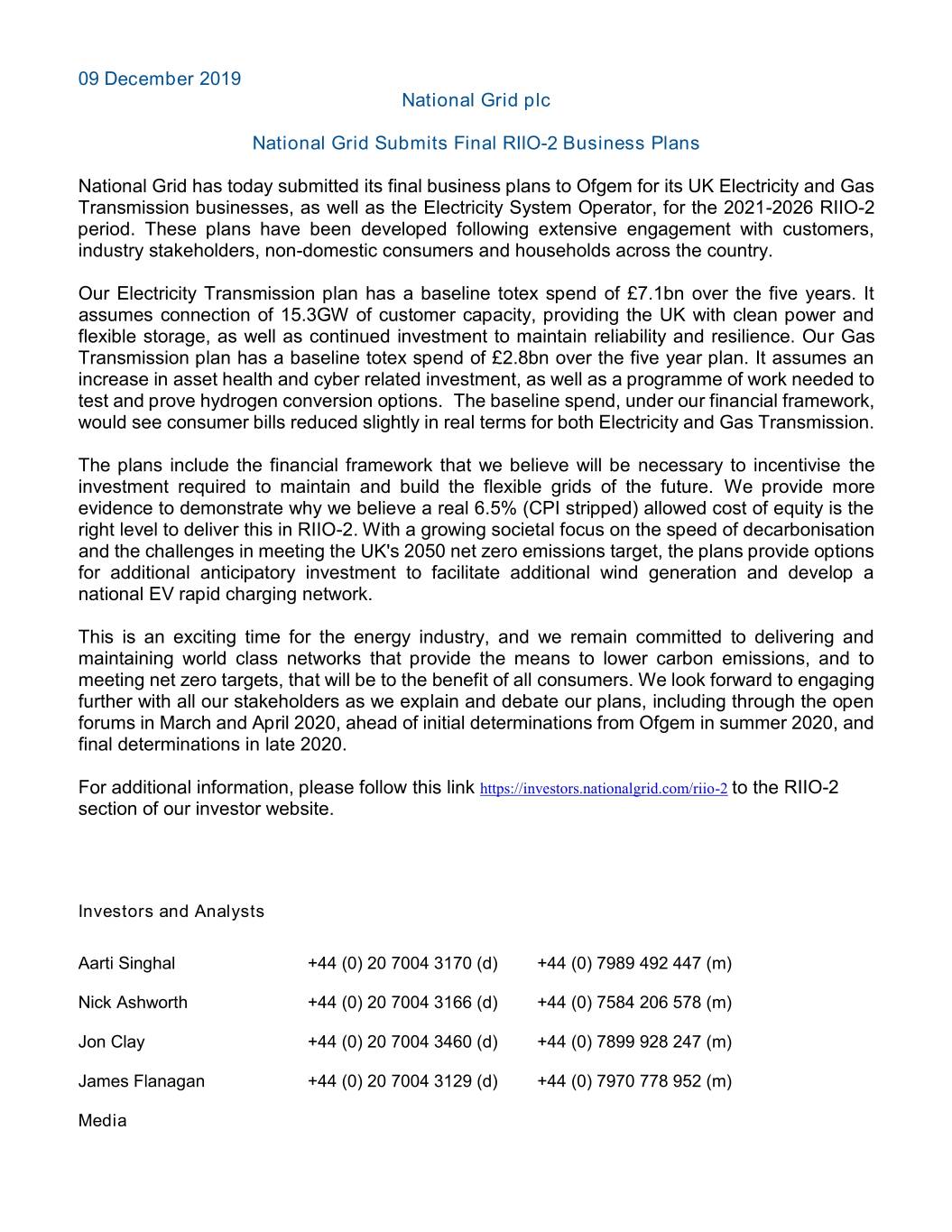

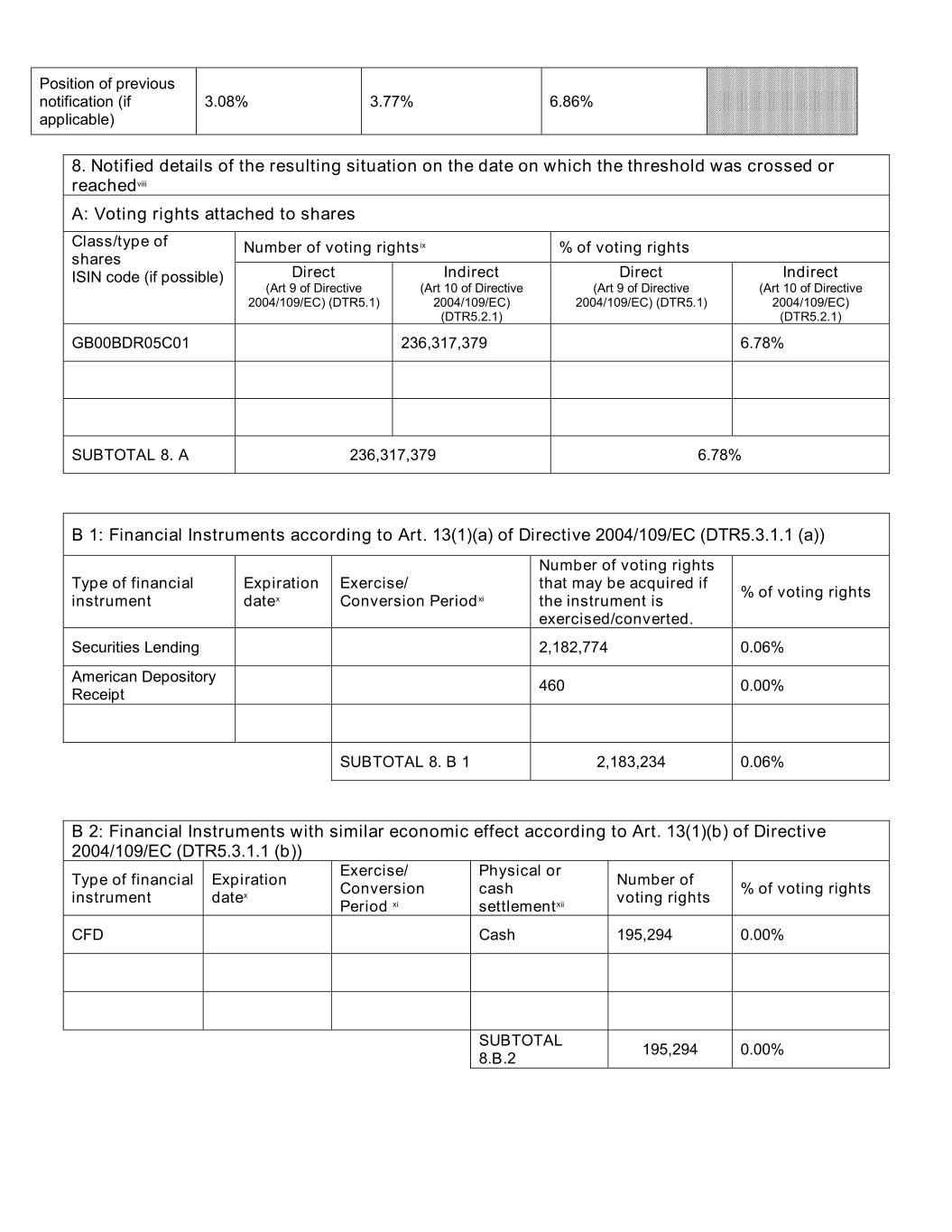

4 December 2019 National Grid plc (National Grid) Notification of Major Interest in National Grid Ordinary Shares National Grid has received a notification on Form TR-1 from BlackRock, Inc. that its total interest in National Grid voting ordinary shares is as shown below. NOTIFICATION OF MAJOR HOLDINGS (to be sent to the relevant issuer and to the FCA in Microsoft Word format if possible)i 1a. Identity of the issuer or the underlying issuer of existing shares to which voting rights are National Grid PLC attachedii: 1b. Please indicate if the issuer is a non-UK issuer (please mark with an “X” if appropriate) Non-UK issuer 2. Reason for the notification (please mark the appropriate box or boxes with an “X”) An acquisition or disposal of voting rights X An acquisition or disposal of financial instruments An event changing the breakdown of voting rights Other (please specify)iii: 3. Details of person subject to the notification obligationiv Name BlackRock, Inc. City and country of registered office (if applicable) Wilmington, DE, USA 4. Full name of shareholder(s) (if different from 3.)v Name City and country of registered office (if applicable) 5. Date on which the threshold was crossed or 02/12/2019 reachedvi: 6. Date on which issuer notified (DD/MM/YYYY): 03/12/2019 7. Total positions of person(s) subject to the notification obligation % of voting rights % of voting rights Total number of through financial Total of both in % attached to shares voting rights of instruments (8.A + 8.B) (total of 8. A) issuervii (total of 8.B 1 + 8.B 2) Resulting situation on the date on which 6.78% 0.06% 6.85% 3,480,726,569 threshold was crossed or reached

Position of previous notification (if 3.08% 3.77% 6.86% applicable) 8. Notified details of the resulting situation on the date on which the threshold was crossed or reachedviii A: Voting rights attached to shares Class/type of Number of voting rightsix % of voting rights shares ISIN code (if possible) Direct Indirect Direct Indirect (Art 9 of Directive (Art 10 of Directive (Art 9 of Directive (Art 10 of Directive 2004/109/EC) (DTR5.1) 2004/109/EC) 2004/109/EC) (DTR5.1) 2004/109/EC) (DTR5.2.1) (DTR5.2.1) GB00BDR05C01 236,317,379 6.78% SUBTOTAL 8. A 236,317,379 6.78% B 1: Financial Instruments according to Art. 13(1)(a) of Directive 2004/109/EC (DTR5.3.1.1 (a)) Number of voting rights Type of financial Expiration Exercise/ that may be acquired if % of voting rights instrument datex Conversion Periodxi the instrument is exercised/converted. Securities Lending 2,182,774 0.06% American Depository 460 0.00% Receipt SUBTOTAL 8. B 1 2,183,234 0.06% B 2: Financial Instruments with similar economic effect according to Art. 13(1)(b) of Directive 2004/109/EC (DTR5.3.1.1 (b)) Exercise/ Physical or Type of financial Expiration Number of Conversion cash % of voting rights instrument datex voting rights Period xi settlementxii CFD Cash 195,294 0.00% SUBTOTAL 195,294 0.00% 8.B.2

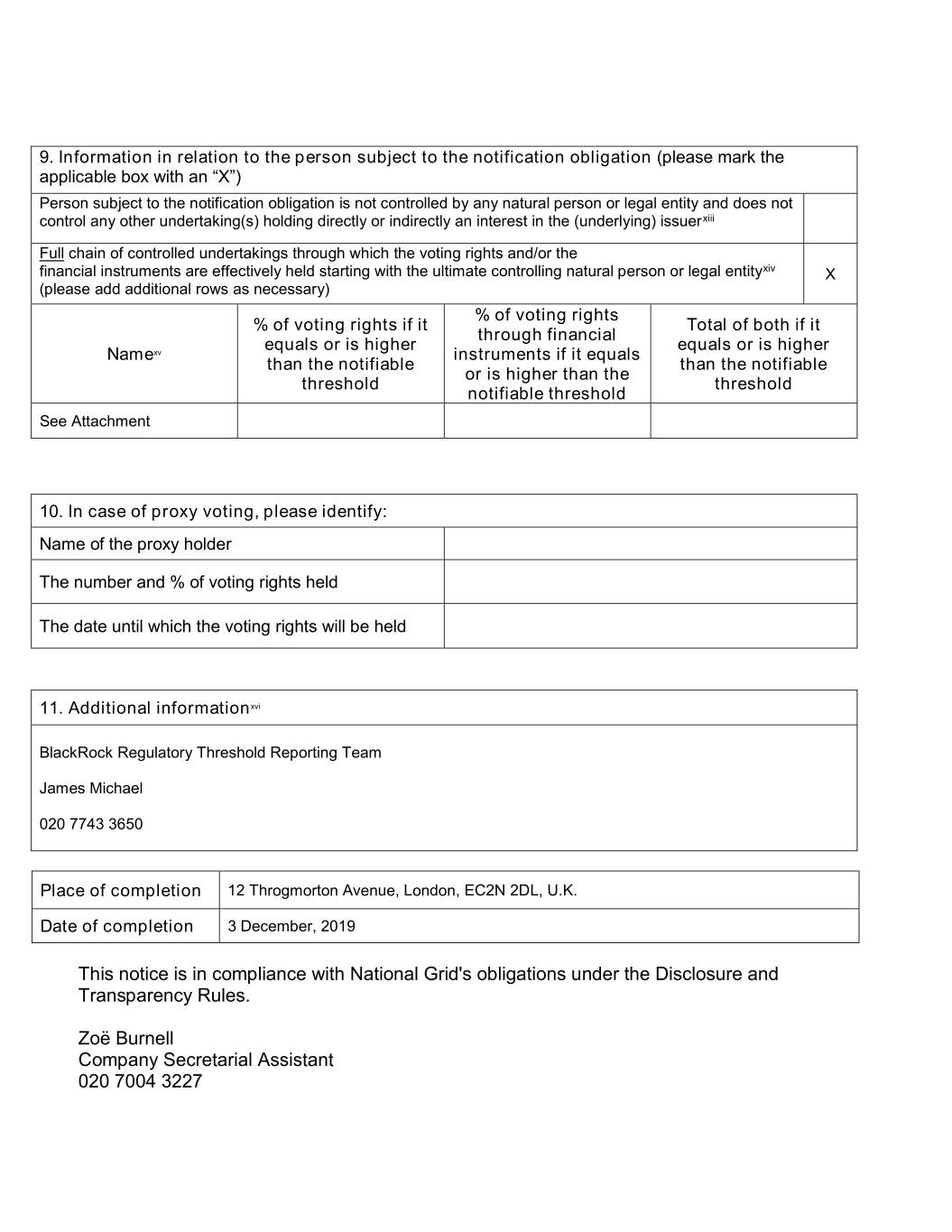

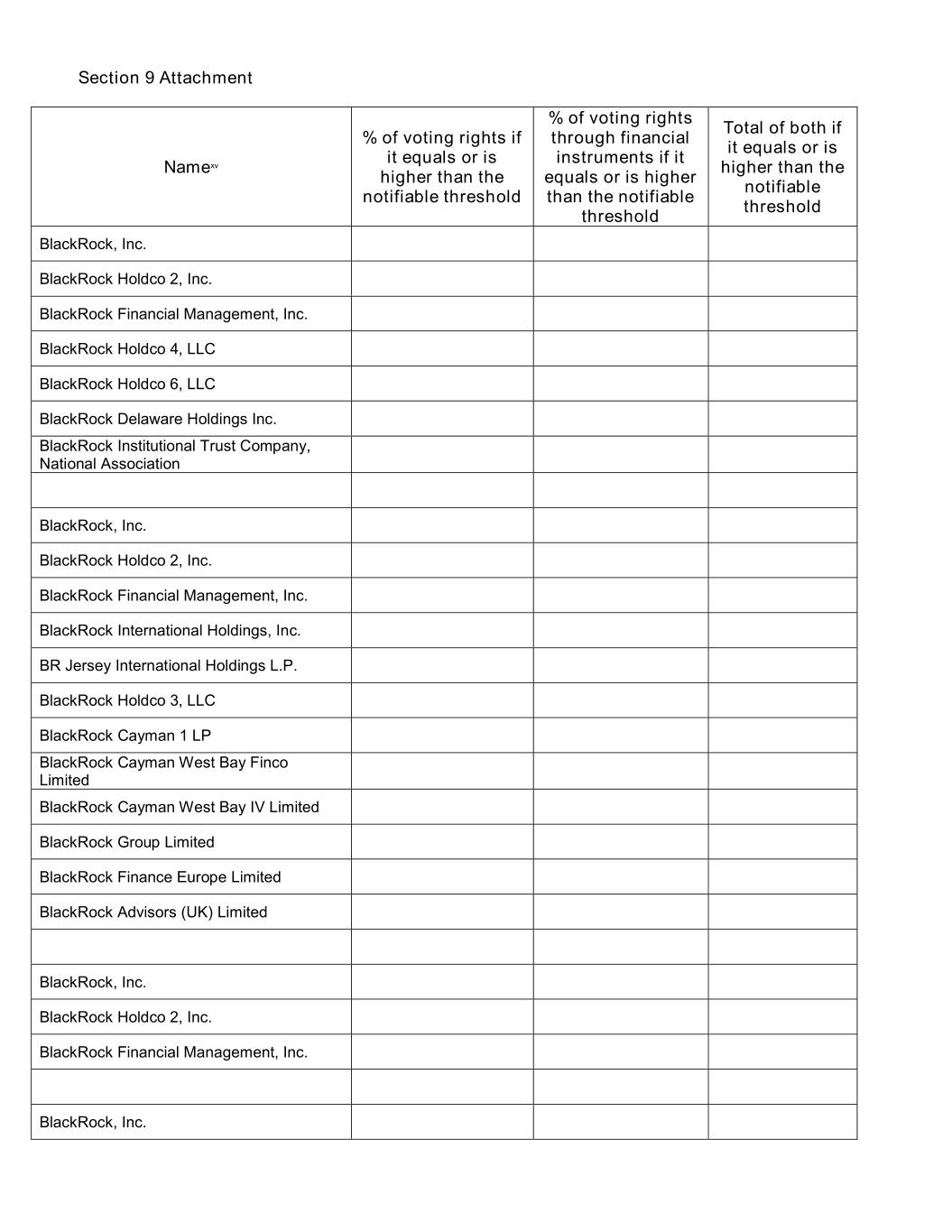

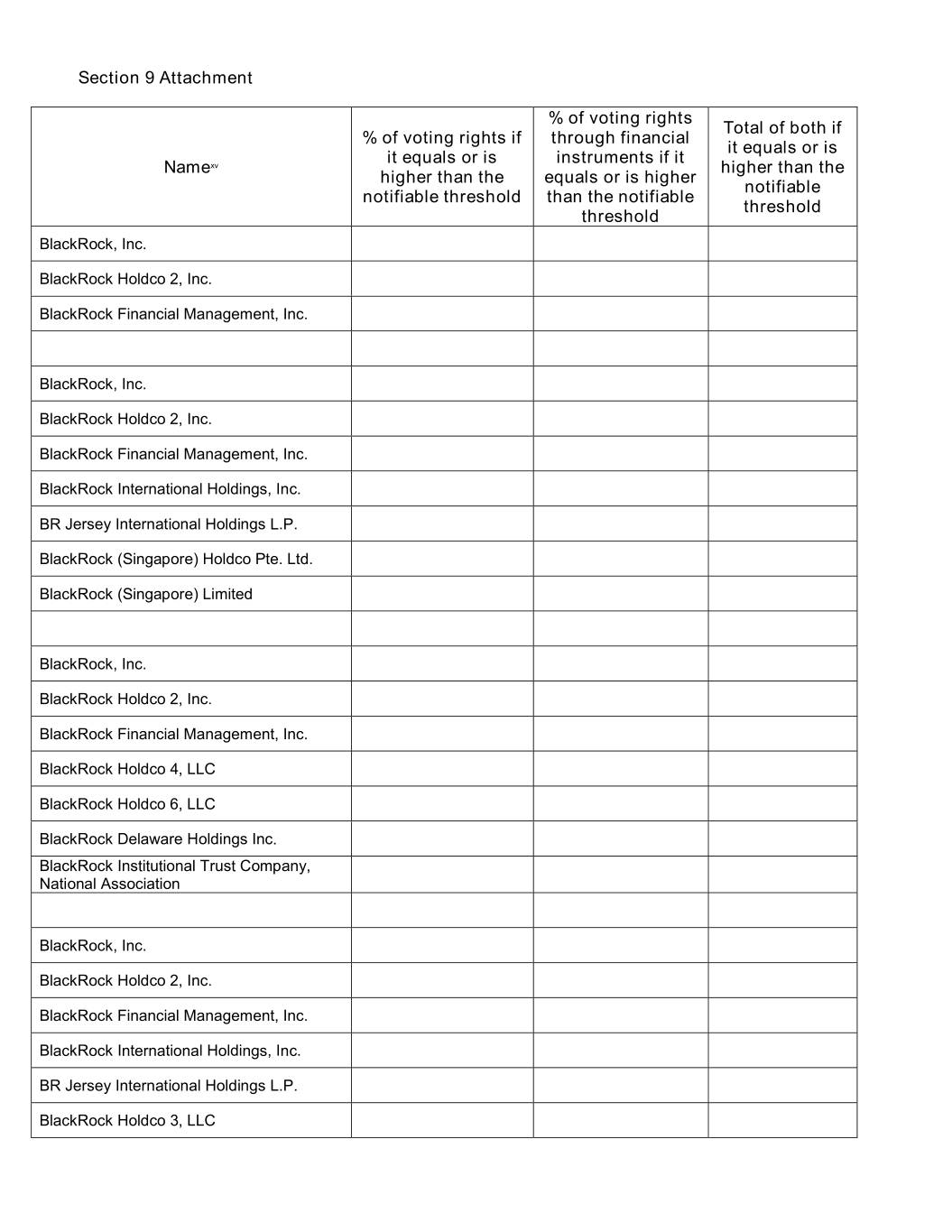

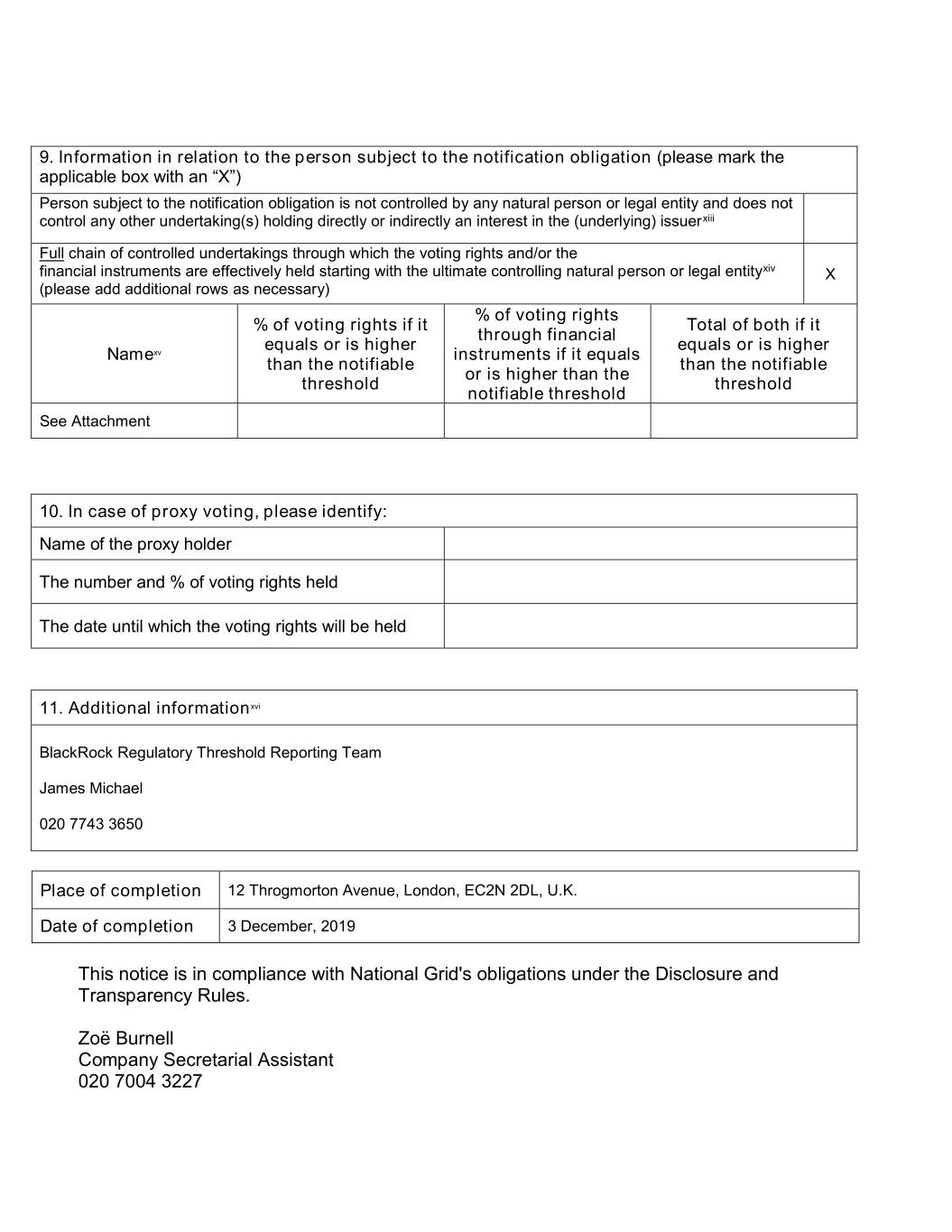

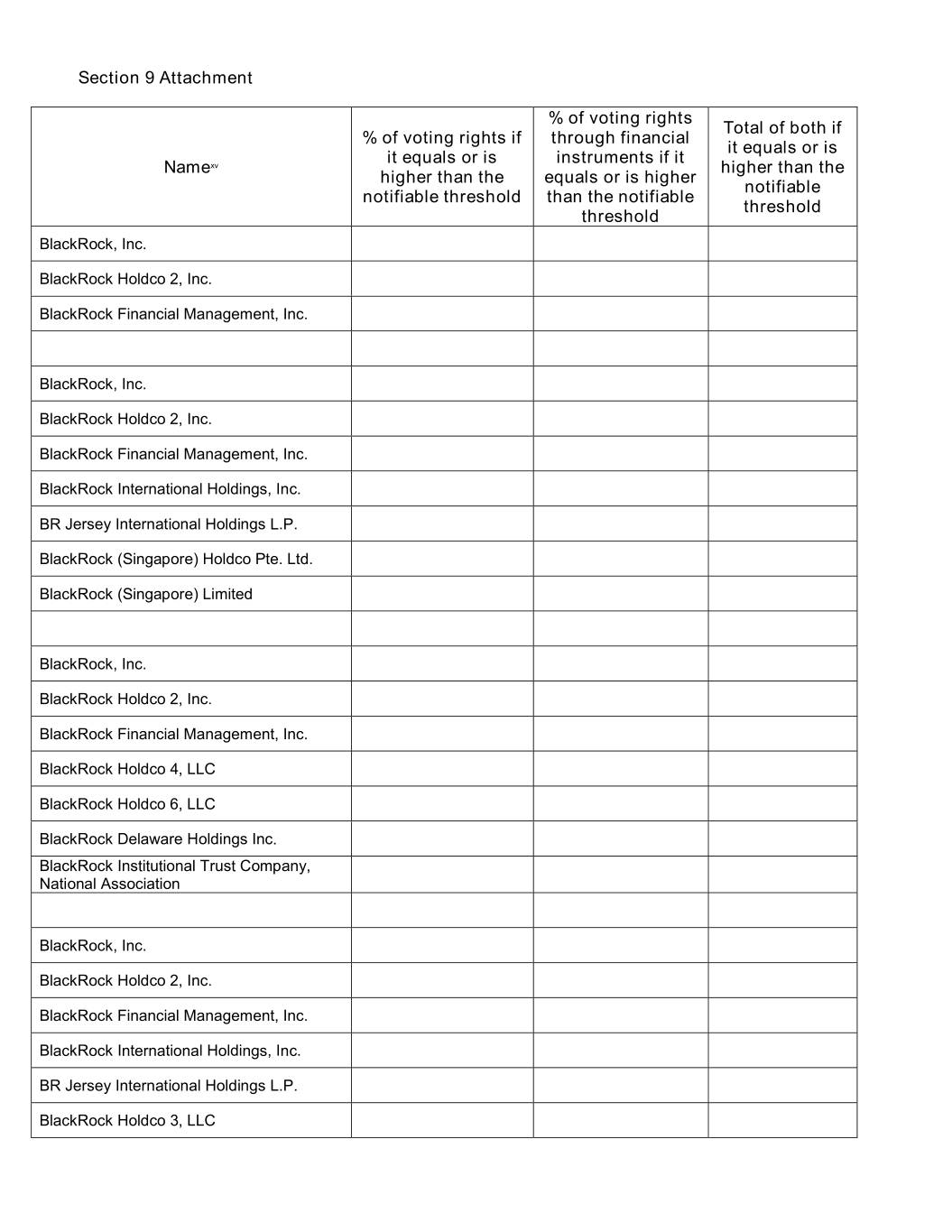

9. Information in relation to the person subject to the notification obligation (please mark the applicable box with an “X”) Person subject to the notification obligation is not controlled by any natural person or legal entity and does not control any other undertaking(s) holding directly or indirectly an interest in the (underlying) issuerxiii Full chain of controlled undertakings through which the voting rights and/or the financial instruments are effectively held starting with the ultimate controlling natural person or legal entityxiv X (please add additional rows as necessary) % of voting rights % of voting rights if it Total of both if it through financial equals or is higher equals or is higher Namexv instruments if it equals than the notifiable than the notifiable or is higher than the threshold threshold notifiable threshold See Attachment 10. In case of proxy voting, please identify: Name of the proxy holder The number and % of voting rights held The date until which the voting rights will be held 11. Additional informationxvi BlackRock Regulatory Threshold Reporting Team James Michael 020 7743 3650 Place of completion 12 Throgmorton Avenue, London, EC2N 2DL, U.K. Date of completion 3 December, 2019 This notice is in compliance with National Grid's obligations under the Disclosure and Transparency Rules. Zoë Burnell Company Secretarial Assistant 020 7004 3227

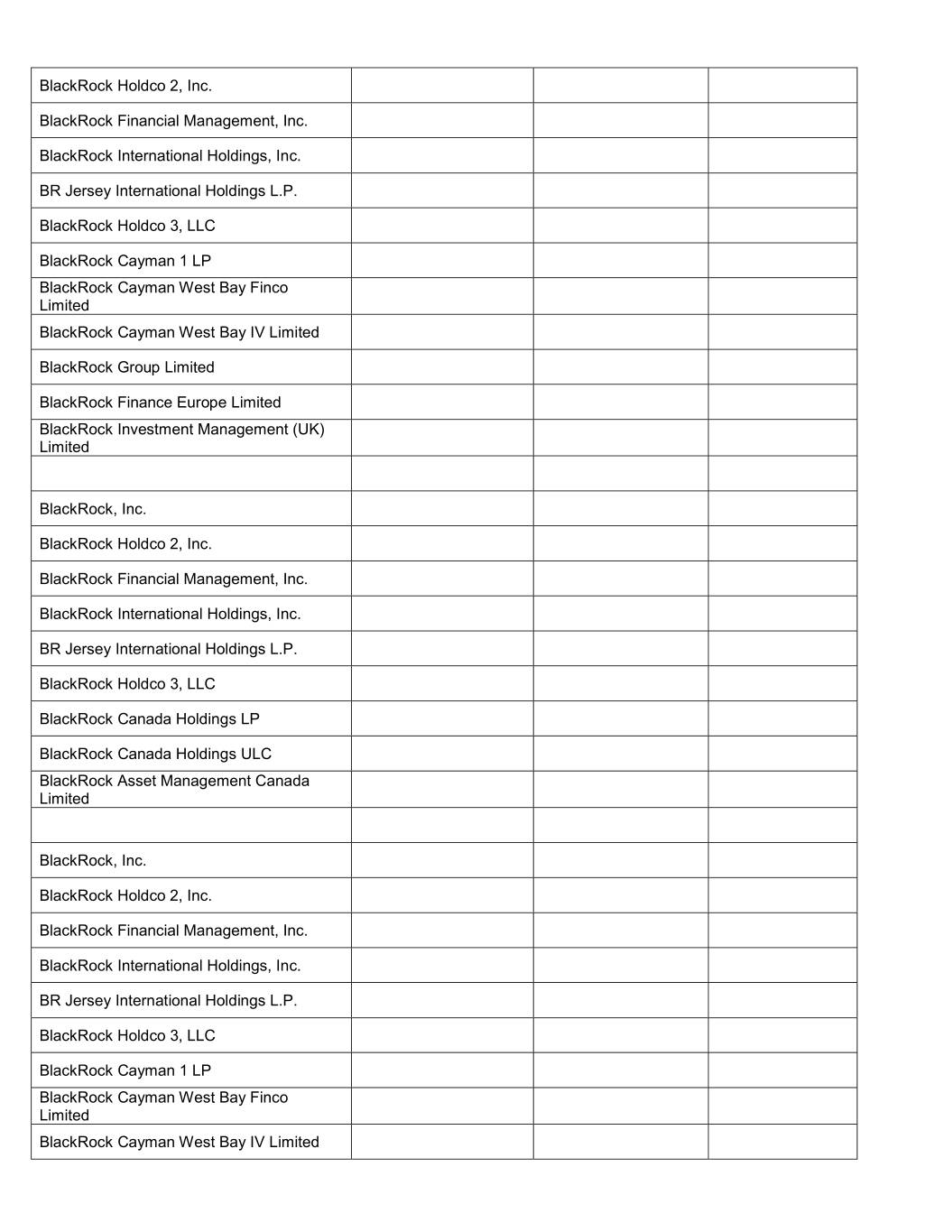

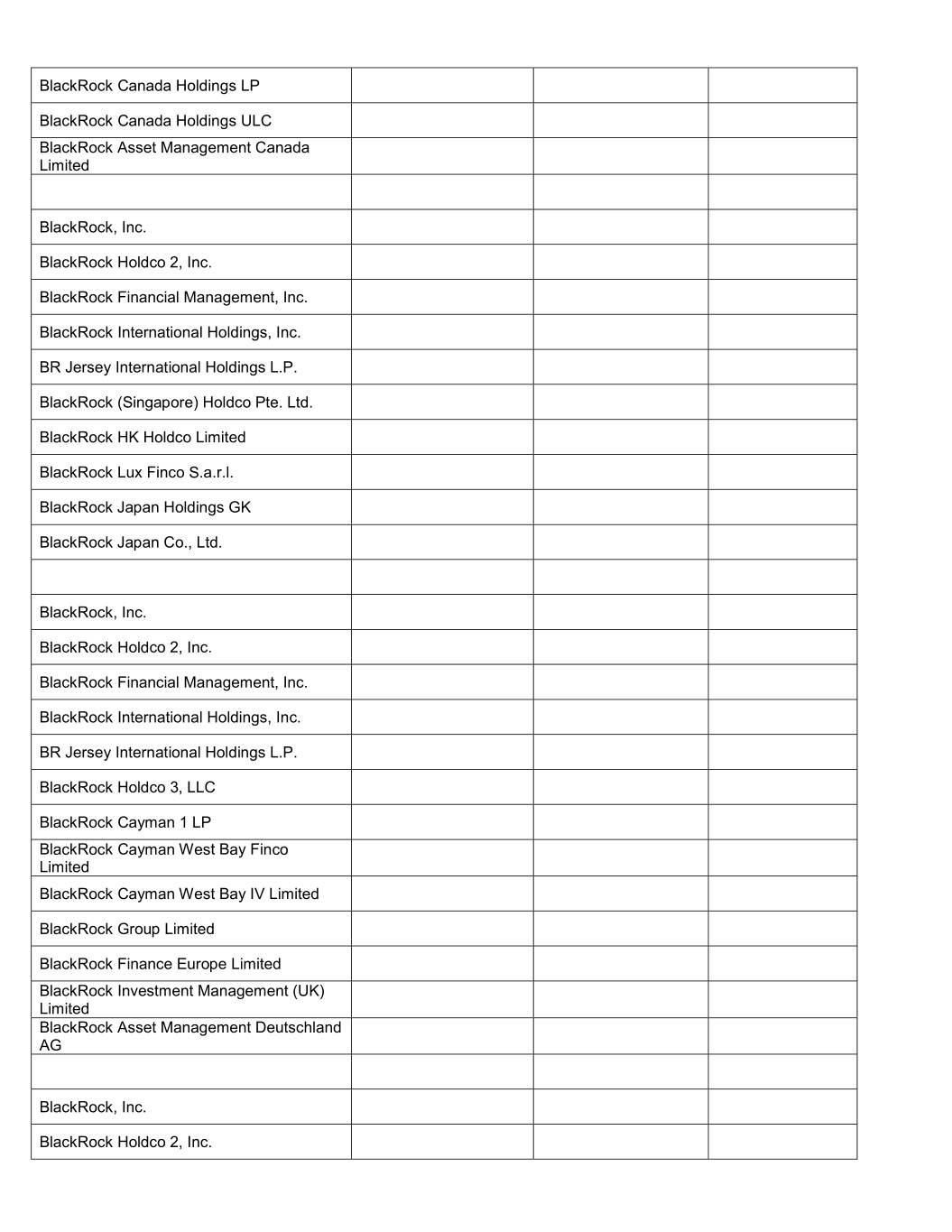

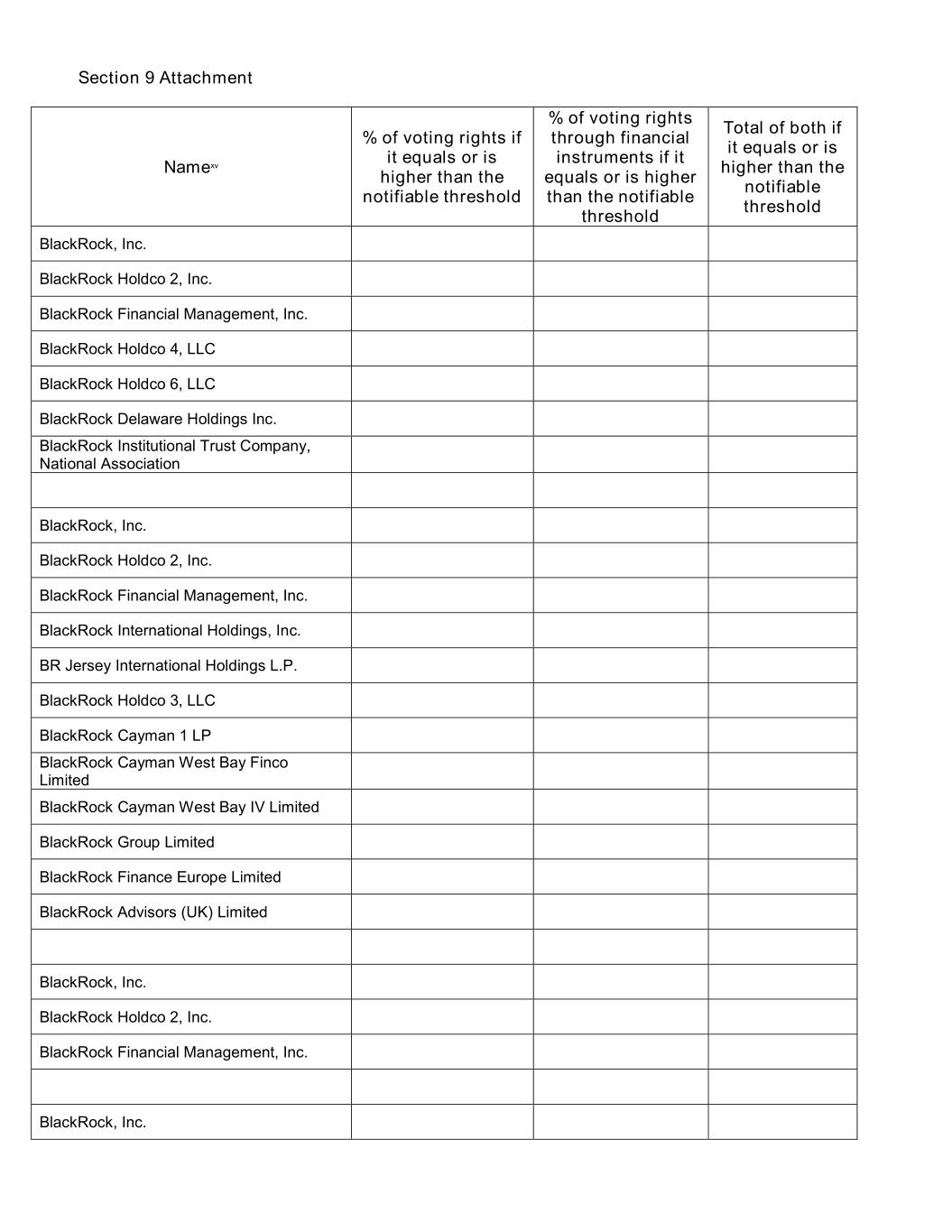

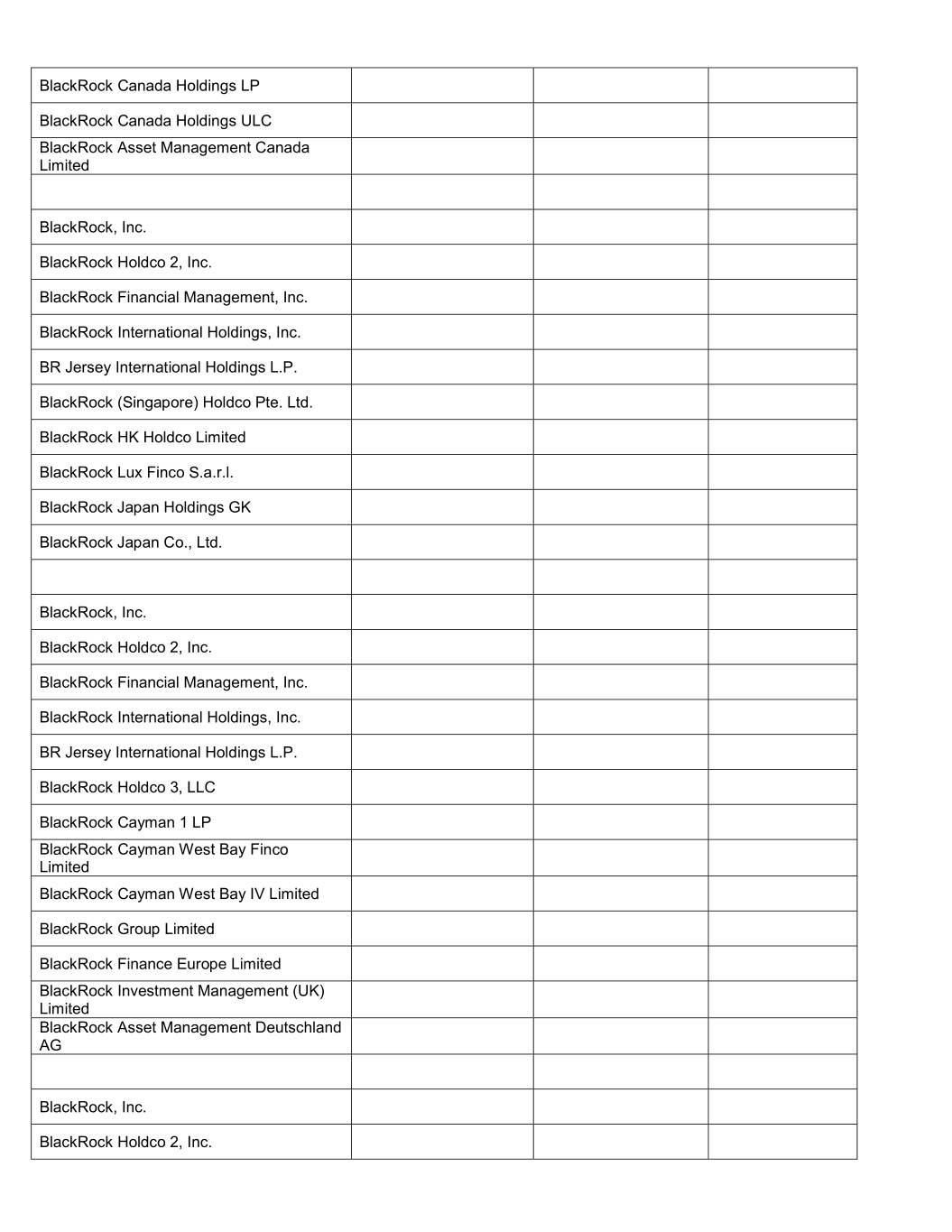

Section 9 Attachment % of voting rights Total of both if % of voting rights if through financial it equals or is it equals or is instruments if it Namexv higher than the higher than the equals or is higher notifiable notifiable threshold than the notifiable threshold threshold BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock Holdco 4, LLC BlackRock Holdco 6, LLC BlackRock Delaware Holdings Inc. BlackRock Institutional Trust Company, National Association BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Limited BlackRock Group Limited BlackRock Finance Europe Limited BlackRock Advisors (UK) Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock, Inc.

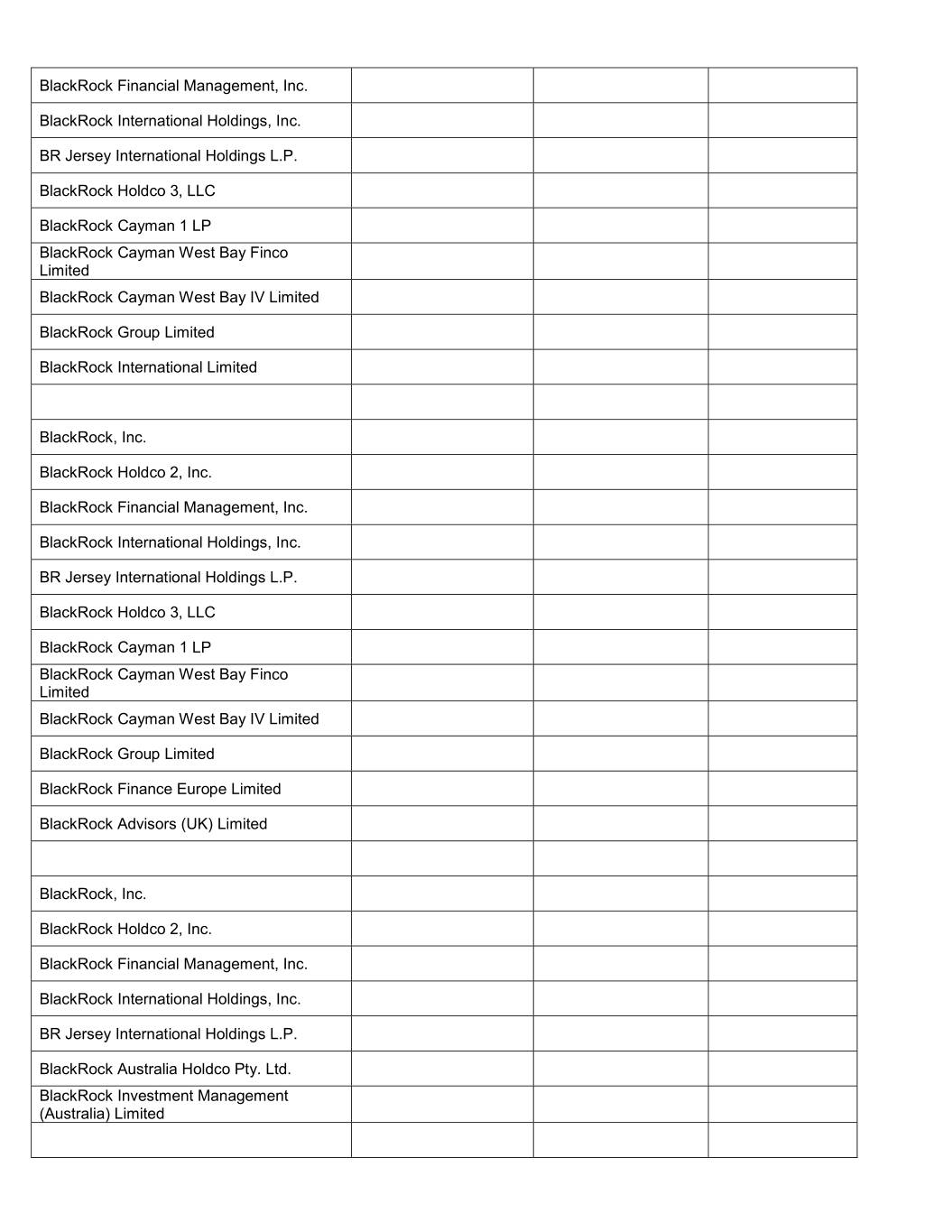

BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Limited BlackRock Group Limited BlackRock Finance Europe Limited BlackRock Investment Management (UK) Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Canada Holdings LP BlackRock Canada Holdings ULC BlackRock Asset Management Canada Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Limited

BlackRock Group Limited BlackRock International Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock (Singapore) Holdco Pte. Ltd. BlackRock (Singapore) Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock (Singapore) Holdco Pte. Ltd. BlackRock HK Holdco Limited BlackRock Lux Finco S.a.r.l. BlackRock Japan Holdings GK BlackRock Japan Co., Ltd. BlackRock, Inc. Trident Merger, LLC BlackRock Investment Management, LLC BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock Capital Holdings, Inc. BlackRock Advisors, LLC

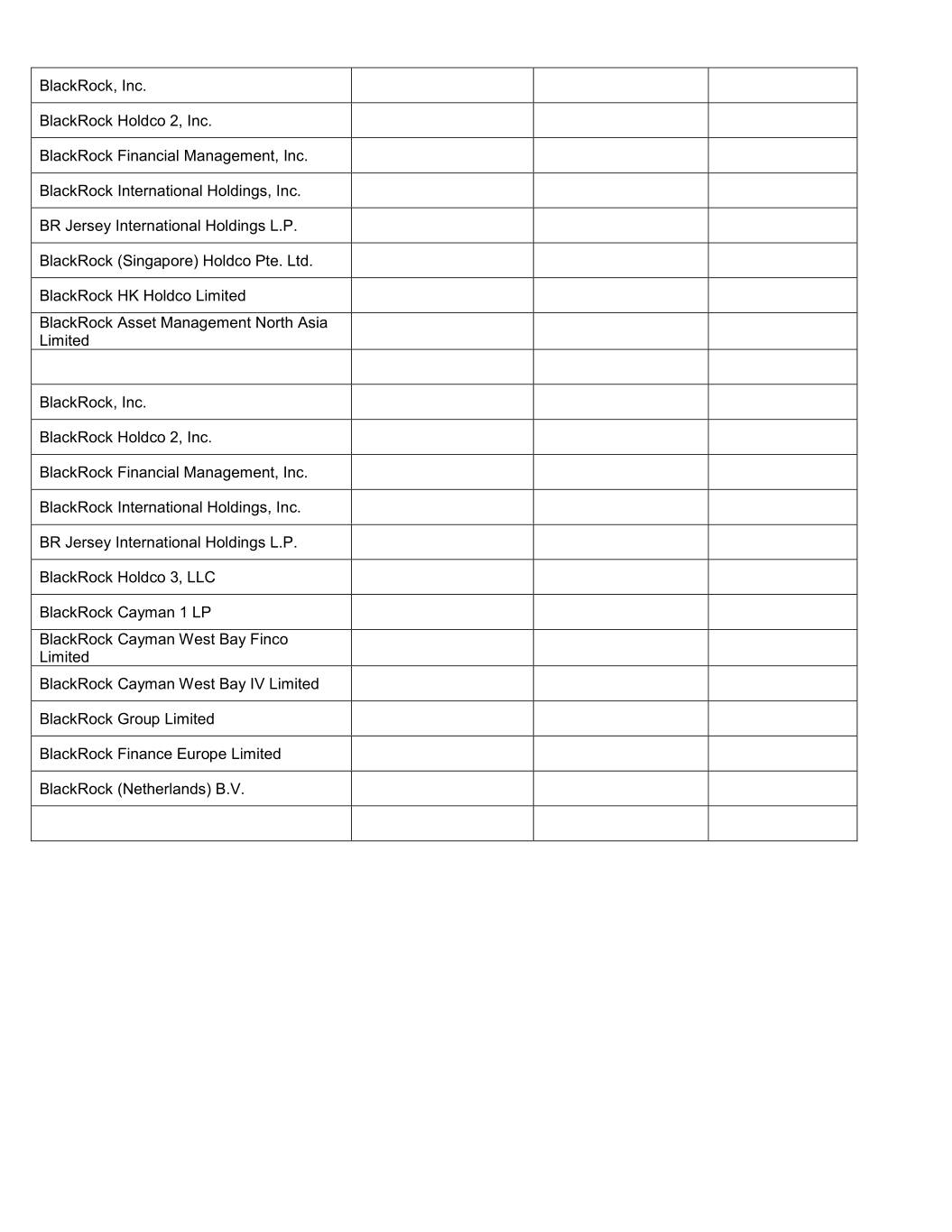

BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Limited BlackRock Group Limited BlackRock Finance Europe Limited BlackRock Investment Management (UK) Limited BlackRock Asset Management Deutschland AG BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock Holdco 4, LLC BlackRock Holdco 6, LLC BlackRock Delaware Holdings Inc. BlackRock Fund Advisors BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Australia Holdco Pty. Ltd. BlackRock Investment Management (Australia) Limited

BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock (Singapore) Holdco Pte. Ltd. BlackRock HK Holdco Limited BlackRock Asset Management North Asia Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Limited BlackRock Group Limited BlackRock Finance Europe Limited BlackRock (Netherlands) B.V.

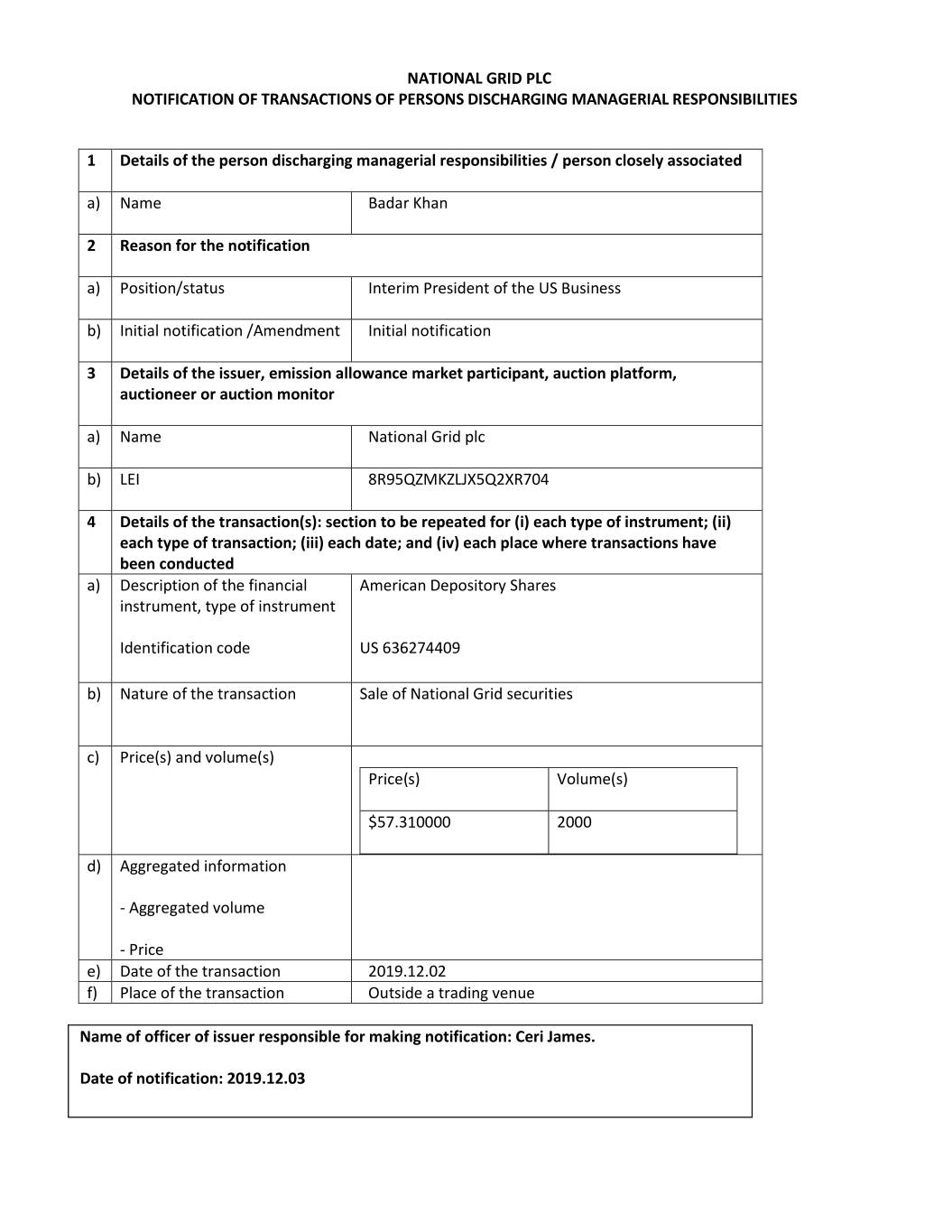

NATIONAL GRID PLC NOTIFICATION OF TRANSACTIONS OF PERSONS DISCHARGING MANAGERIAL RESPONSIBILITIES 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Badar Khan 2 Reason for the notification a) Position/status Interim President of the US Business b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial American Depository Shares instrument, type of instrument Identification code US 636274409 b) Nature of the transaction Sale of National Grid securities c) Price(s) and volume(s) Price(s) Volume(s) $57.310000 2000 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2019.12.02 f) Place of the transaction Outside a trading venue Name of officer of issuer responsible for making notification: Ceri James. Date of notification: 2019.12.03

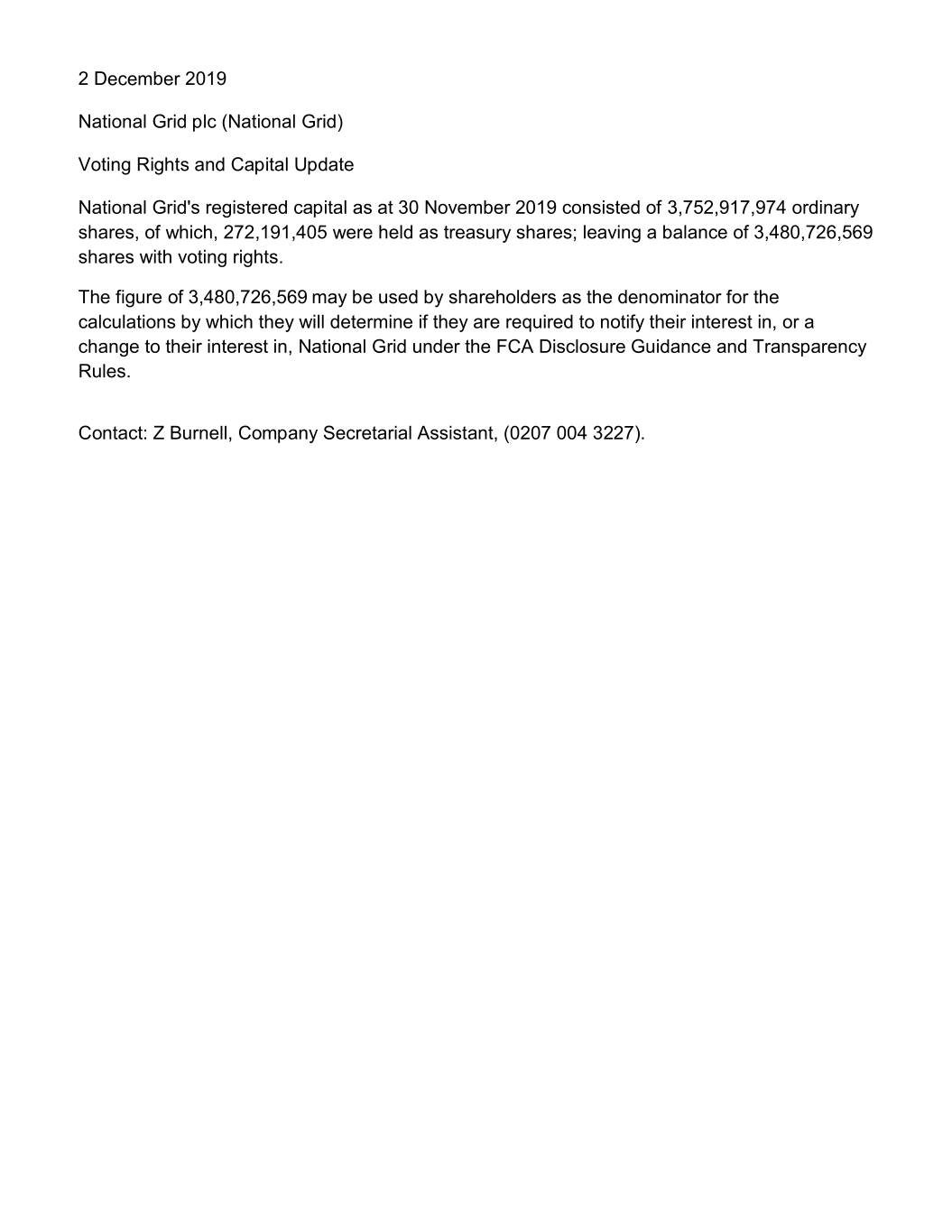

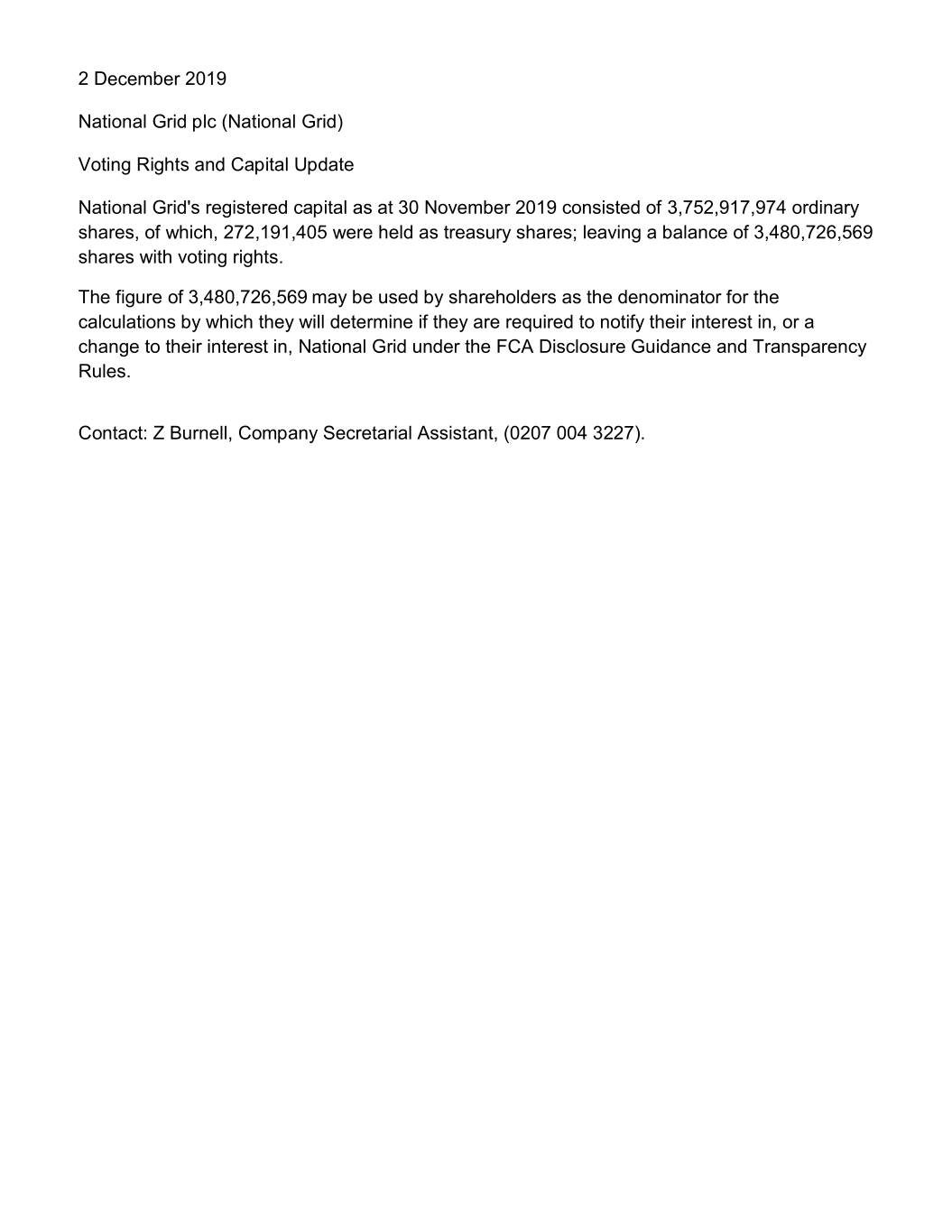

2 December 2019 National Grid plc (National Grid) Voting Rights and Capital Update National Grid's registered capital as at 30 November 2019 consisted of 3,752,917,974 ordinary shares, of which, 272,191,405 were held as treasury shares; leaving a balance of 3,480,726,569 shares with voting rights. The figure of 3,480,726,569 may be used by shareholders as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, National Grid under the FCA Disclosure Guidance and Transparency Rules. Contact: Z Burnell, Company Secretarial Assistant, (0207 004 3227).

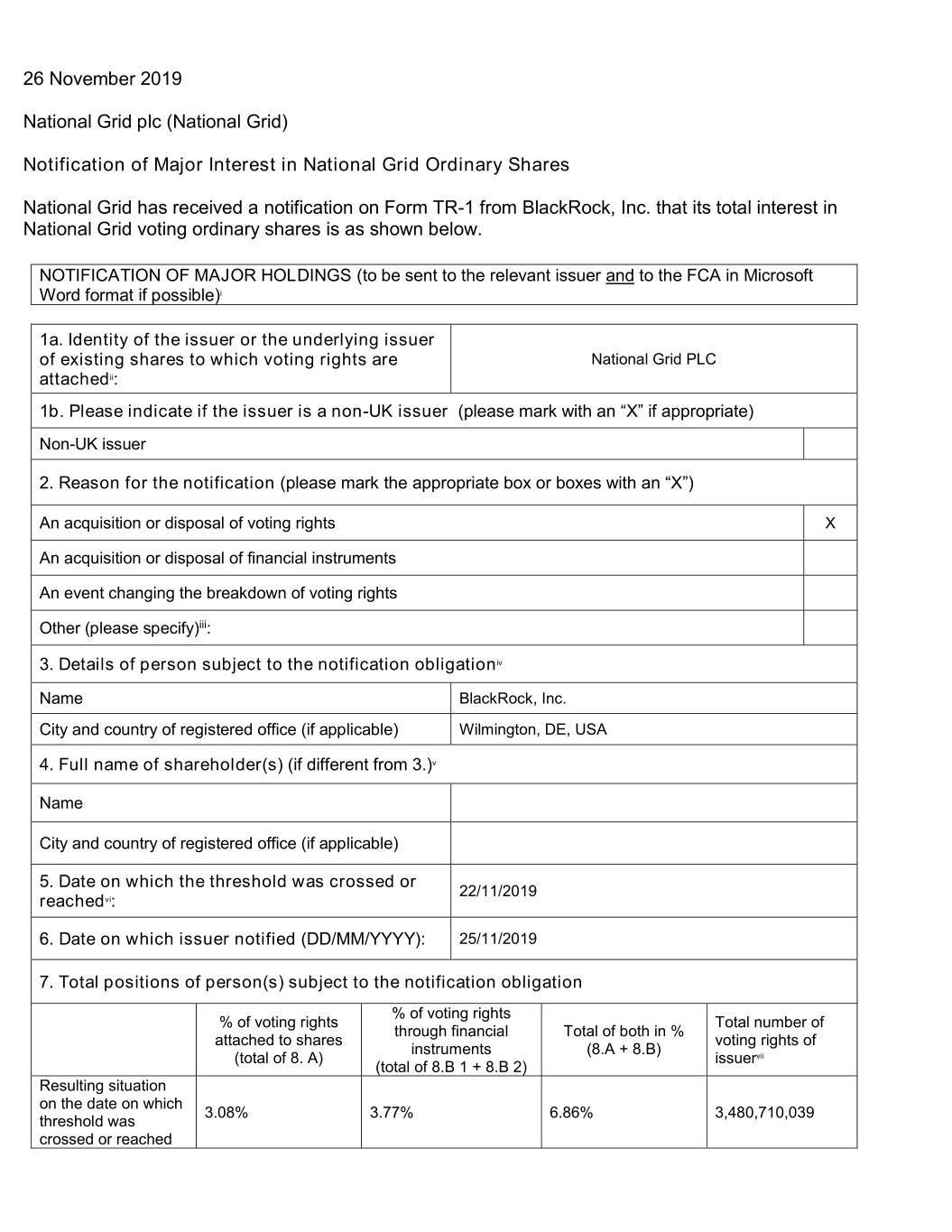

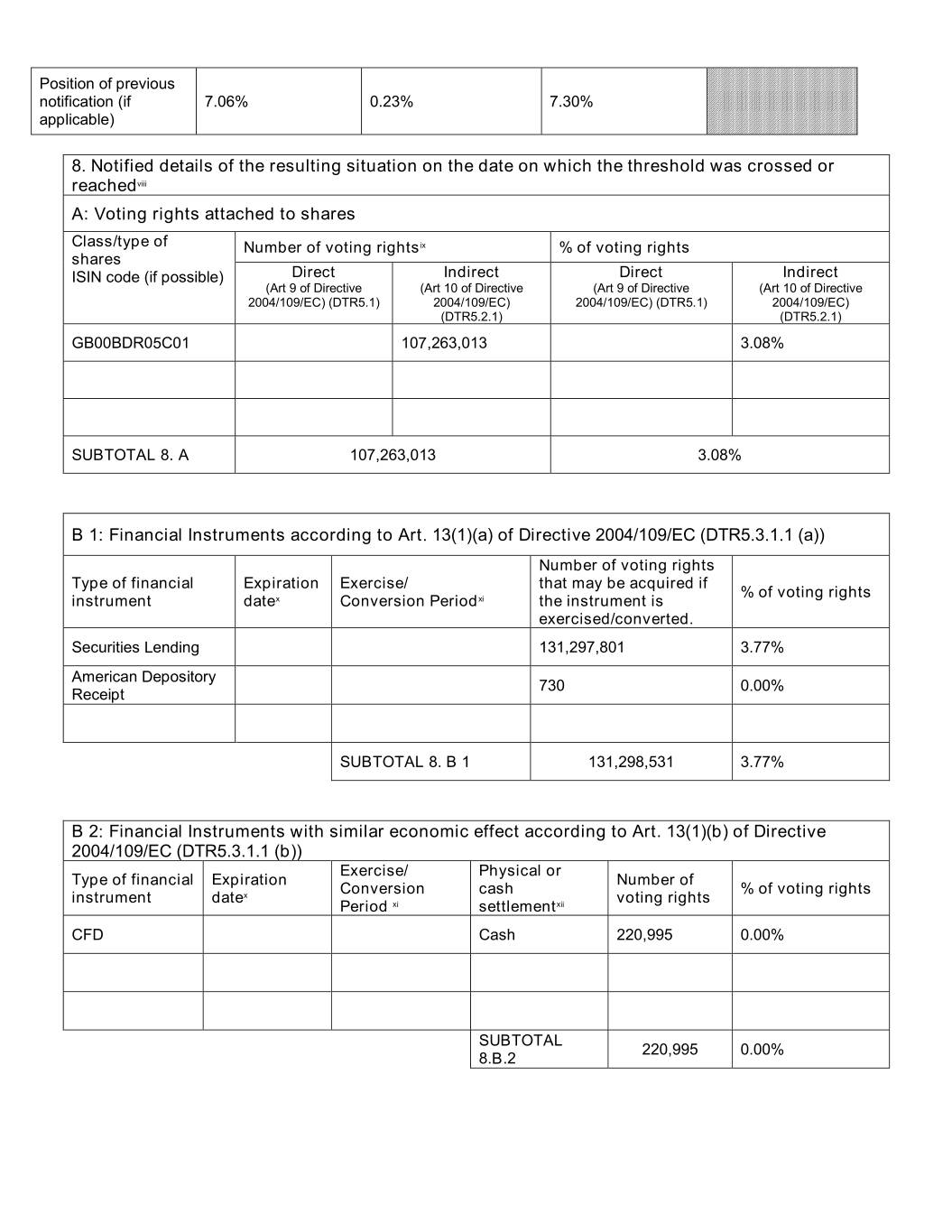

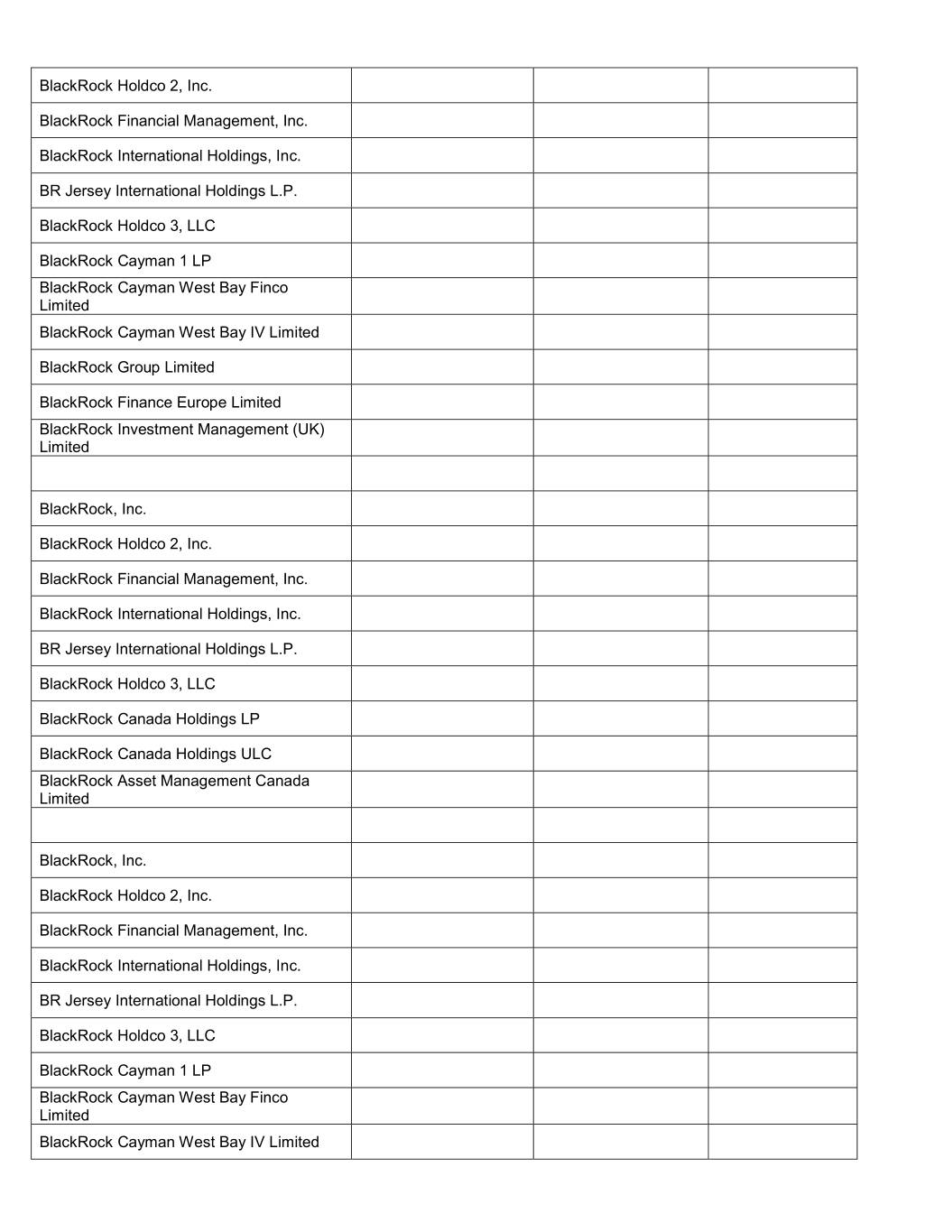

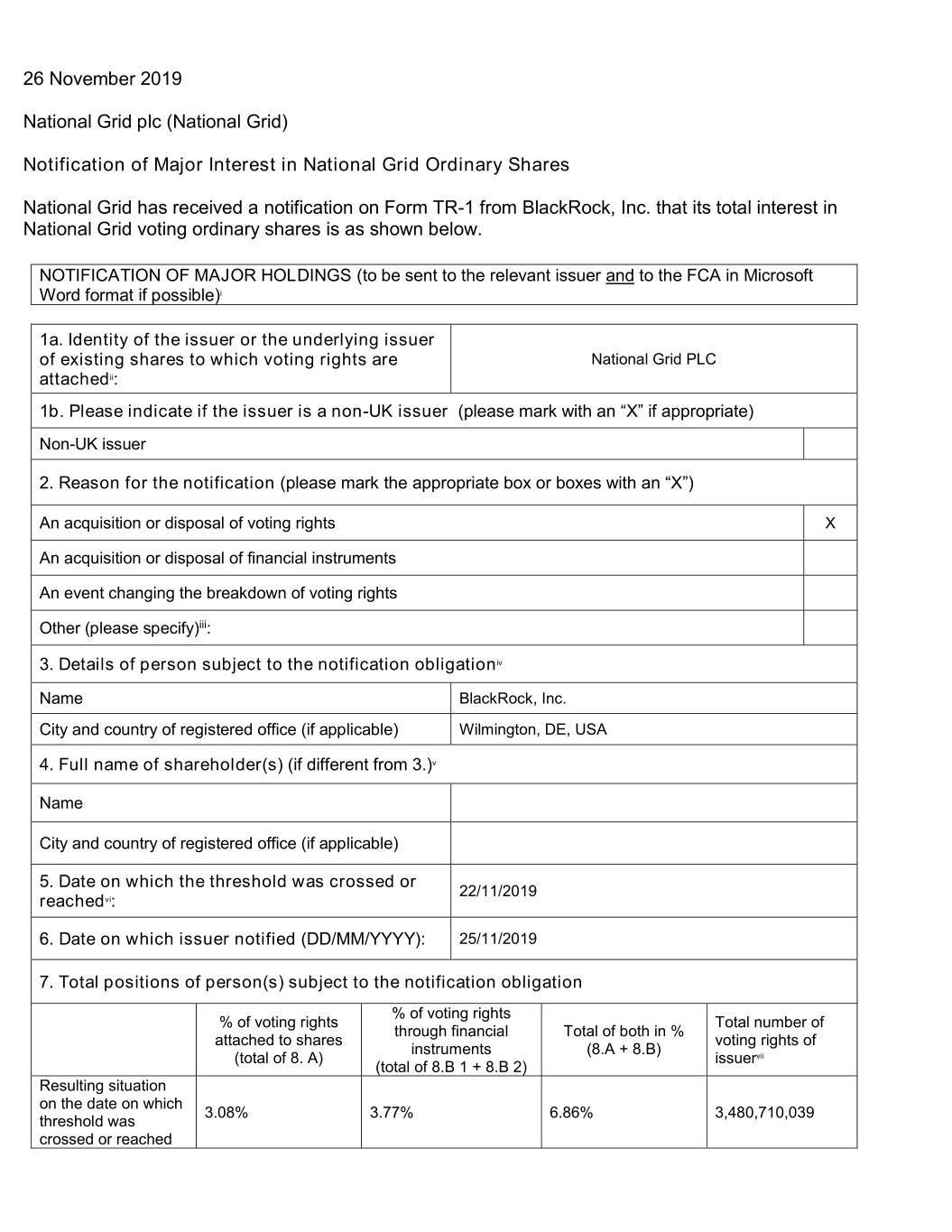

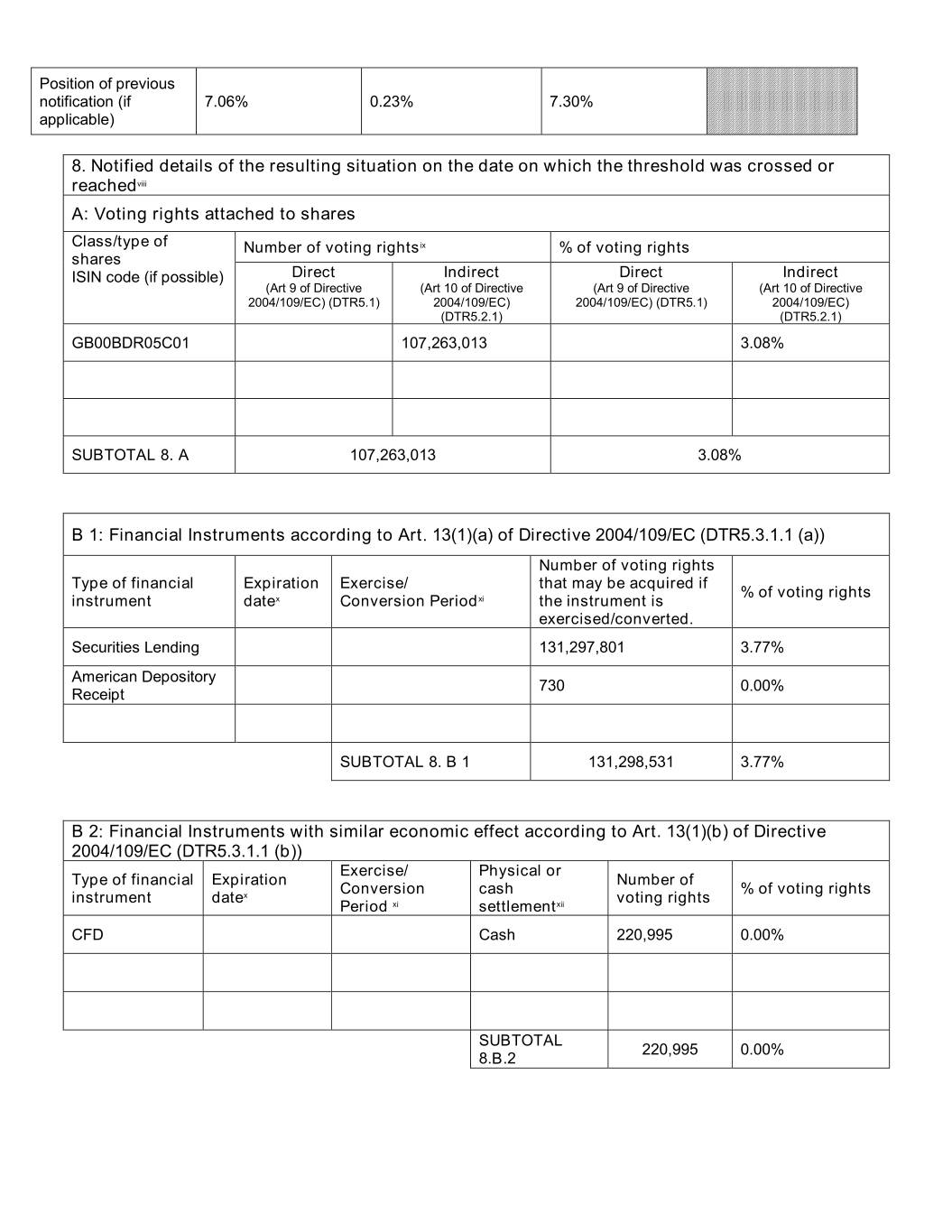

26 November 2019 National Grid plc (National Grid) Notification of Major Interest in National Grid Ordinary Shares National Grid has received a notification on Form TR-1 from BlackRock, Inc. that its total interest in National Grid voting ordinary shares is as shown below. NOTIFICATION OF MAJOR HOLDINGS (to be sent to the relevant issuer and to the FCA in Microsoft Word format if possible)i 1a. Identity of the issuer or the underlying issuer of existing shares to which voting rights are National Grid PLC attachedii: 1b. Please indicate if the issuer is a non-UK issuer (please mark with an “X” if appropriate) Non-UK issuer 2. Reason for the notification (please mark the appropriate box or boxes with an “X”) An acquisition or disposal of voting rights X An acquisition or disposal of financial instruments An event changing the breakdown of voting rights Other (please specify)iii: 3. Details of person subject to the notification obligationiv Name BlackRock, Inc. City and country of registered office (if applicable) Wilmington, DE, USA 4. Full name of shareholder(s) (if different from 3.)v Name City and country of registered office (if applicable) 5. Date on which the threshold was crossed or 22/11/2019 reachedvi: 6. Date on which issuer notified (DD/MM/YYYY): 25/11/2019 7. Total positions of person(s) subject to the notification obligation % of voting rights % of voting rights Total number of through financial Total of both in % attached to shares voting rights of instruments (8.A + 8.B) (total of 8. A) issuervii (total of 8.B 1 + 8.B 2) Resulting situation on the date on which 3.08% 3.77% 6.86% 3,480,710,039 threshold was crossed or reached

Position of previous notification (if 7.06% 0.23% 7.30% applicable) 8. Notified details of the resulting situation on the date on which the threshold was crossed or reachedviii A: Voting rights attached to shares Class/type of Number of voting rightsix % of voting rights shares ISIN code (if possible) Direct Indirect Direct Indirect (Art 9 of Directive (Art 10 of Directive (Art 9 of Directive (Art 10 of Directive 2004/109/EC) (DTR5.1) 2004/109/EC) 2004/109/EC) (DTR5.1) 2004/109/EC) (DTR5.2.1) (DTR5.2.1) GB00BDR05C01 107,263,013 3.08% SUBTOTAL 8. A 107,263,013 3.08% B 1: Financial Instruments according to Art. 13(1)(a) of Directive 2004/109/EC (DTR5.3.1.1 (a)) Number of voting rights Type of financial Expiration Exercise/ that may be acquired if % of voting rights instrument datex Conversion Periodxi the instrument is exercised/converted. Securities Lending 131,297,801 3.77% American Depository 730 0.00% Receipt SUBTOTAL 8. B 1 131,298,531 3.77% B 2: Financial Instruments with similar economic effect according to Art. 13(1)(b) of Directive 2004/109/EC (DTR5.3.1.1 (b)) Exercise/ Physical or Type of financial Expiration Number of Conversion cash % of voting rights instrument datex voting rights Period xi settlementxii CFD Cash 220,995 0.00% SUBTOTAL 220,995 0.00% 8.B.2

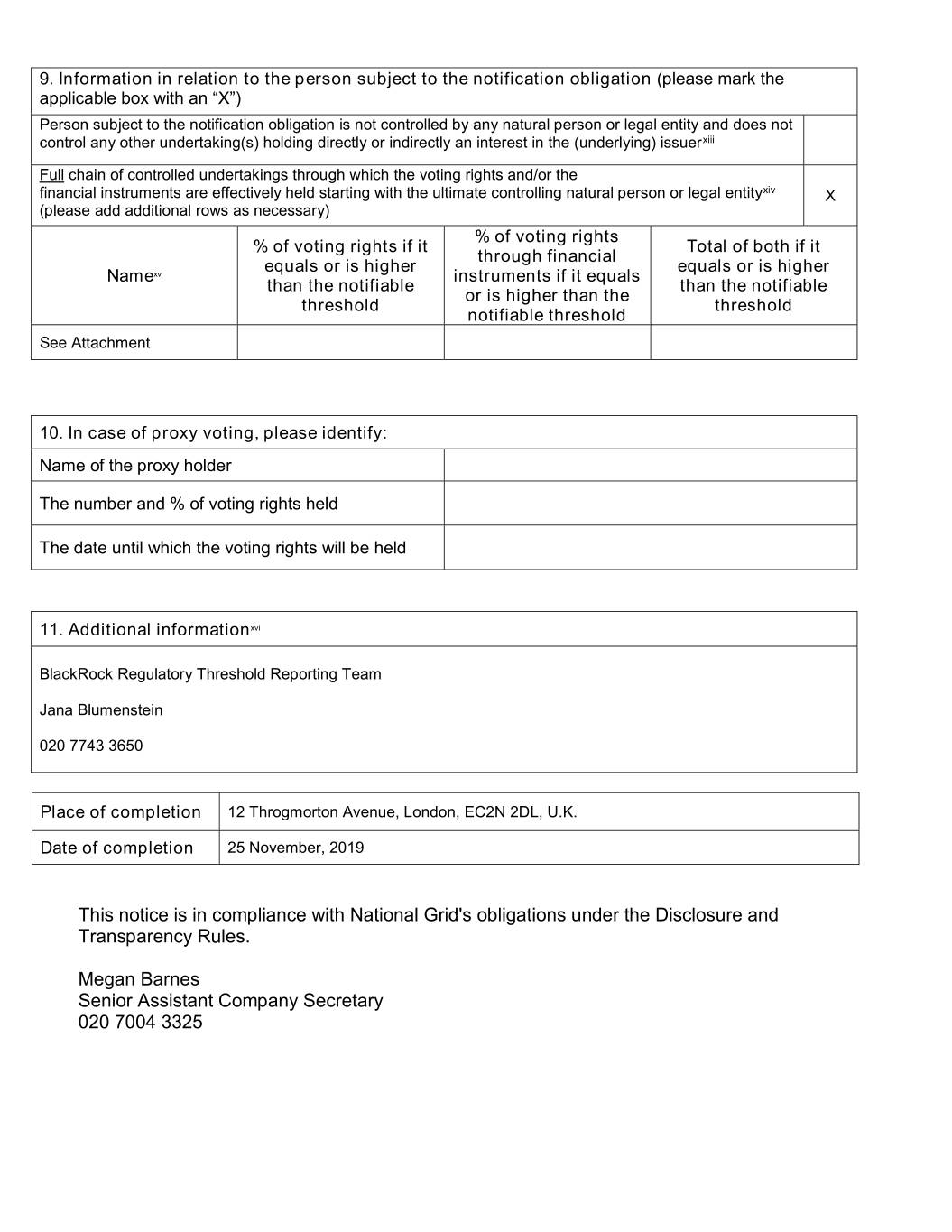

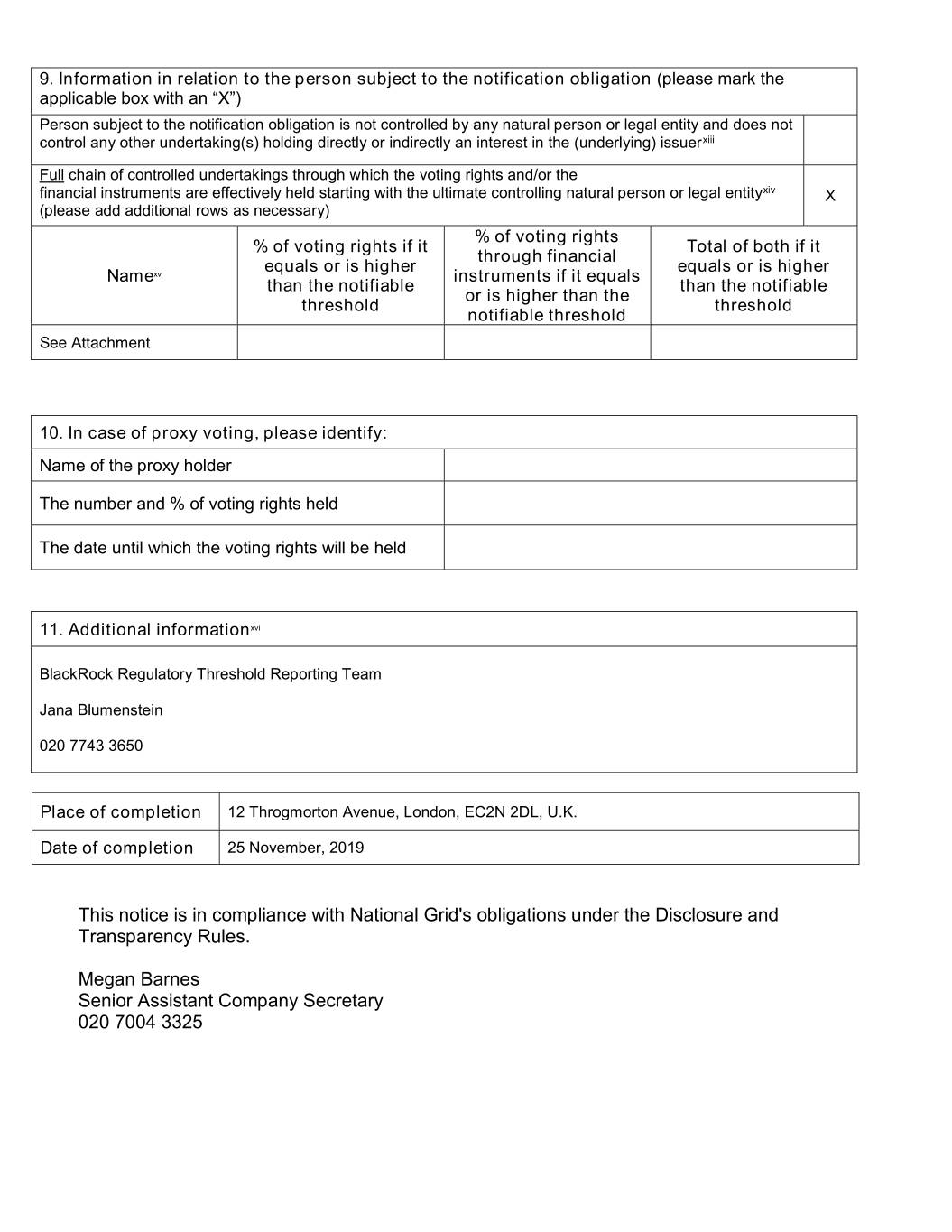

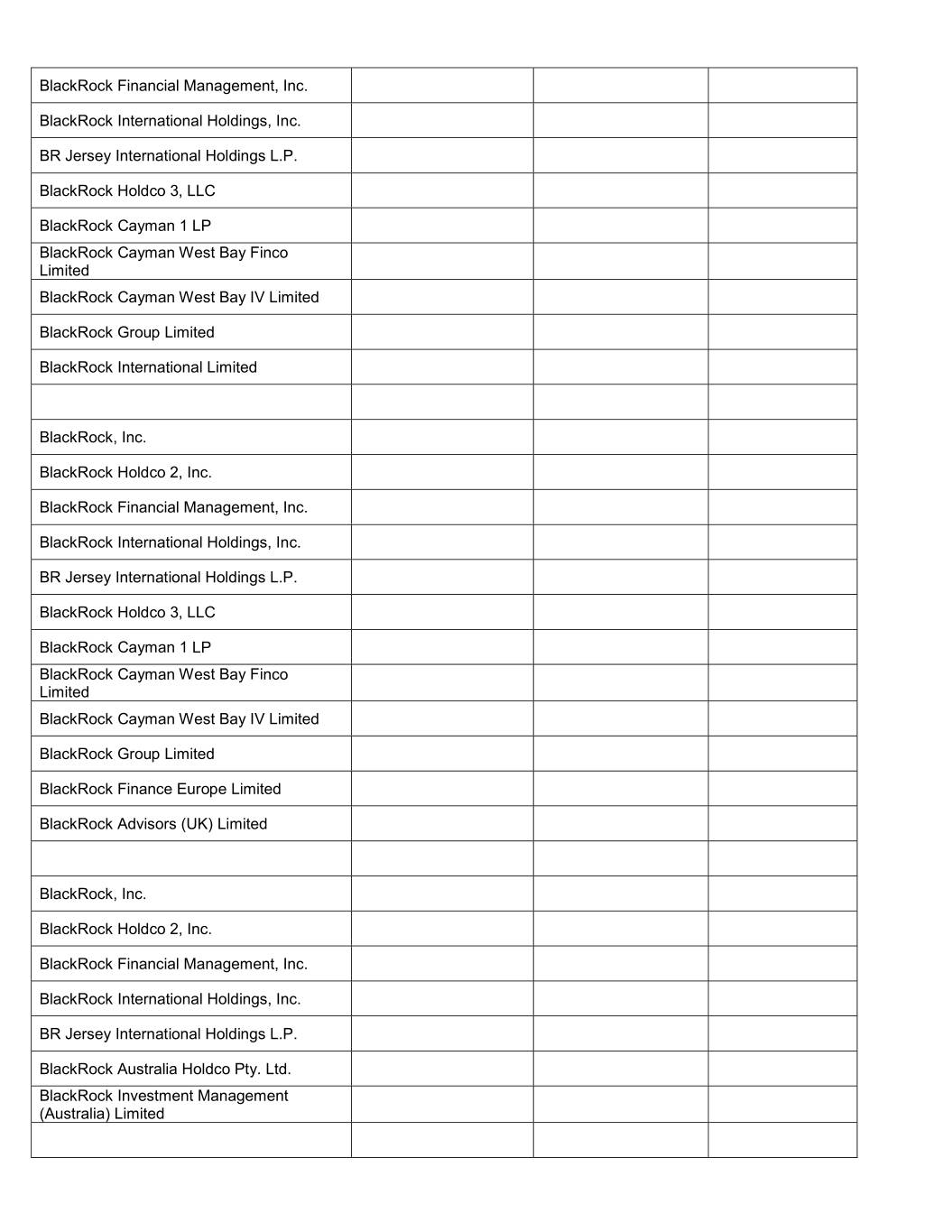

9. Information in relation to the person subject to the notification obligation (please mark the applicable box with an “X”) Person subject to the notification obligation is not controlled by any natural person or legal entity and does not control any other undertaking(s) holding directly or indirectly an interest in the (underlying) issuerxiii Full chain of controlled undertakings through which the voting rights and/or the financial instruments are effectively held starting with the ultimate controlling natural person or legal entityxiv X (please add additional rows as necessary) % of voting rights % of voting rights if it Total of both if it through financial equals or is higher equals or is higher Namexv instruments if it equals than the notifiable than the notifiable or is higher than the threshold threshold notifiable threshold See Attachment 10. In case of proxy voting, please identify: Name of the proxy holder The number and % of voting rights held The date until which the voting rights will be held 11. Additional informationxvi BlackRock Regulatory Threshold Reporting Team Jana Blumenstein 020 7743 3650 Place of completion 12 Throgmorton Avenue, London, EC2N 2DL, U.K. Date of completion 25 November, 2019 This notice is in compliance with National Grid's obligations under the Disclosure and Transparency Rules. Megan Barnes Senior Assistant Company Secretary 020 7004 3325

Section 9 Attachment % of voting rights Total of both if % of voting rights if through financial it equals or is it equals or is instruments if it Namexv higher than the higher than the equals or is higher notifiable notifiable threshold than the notifiable threshold threshold BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock (Singapore) Holdco Pte. Ltd. BlackRock (Singapore) Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock Holdco 4, LLC BlackRock Holdco 6, LLC BlackRock Delaware Holdings Inc. BlackRock Institutional Trust Company, National Association BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC

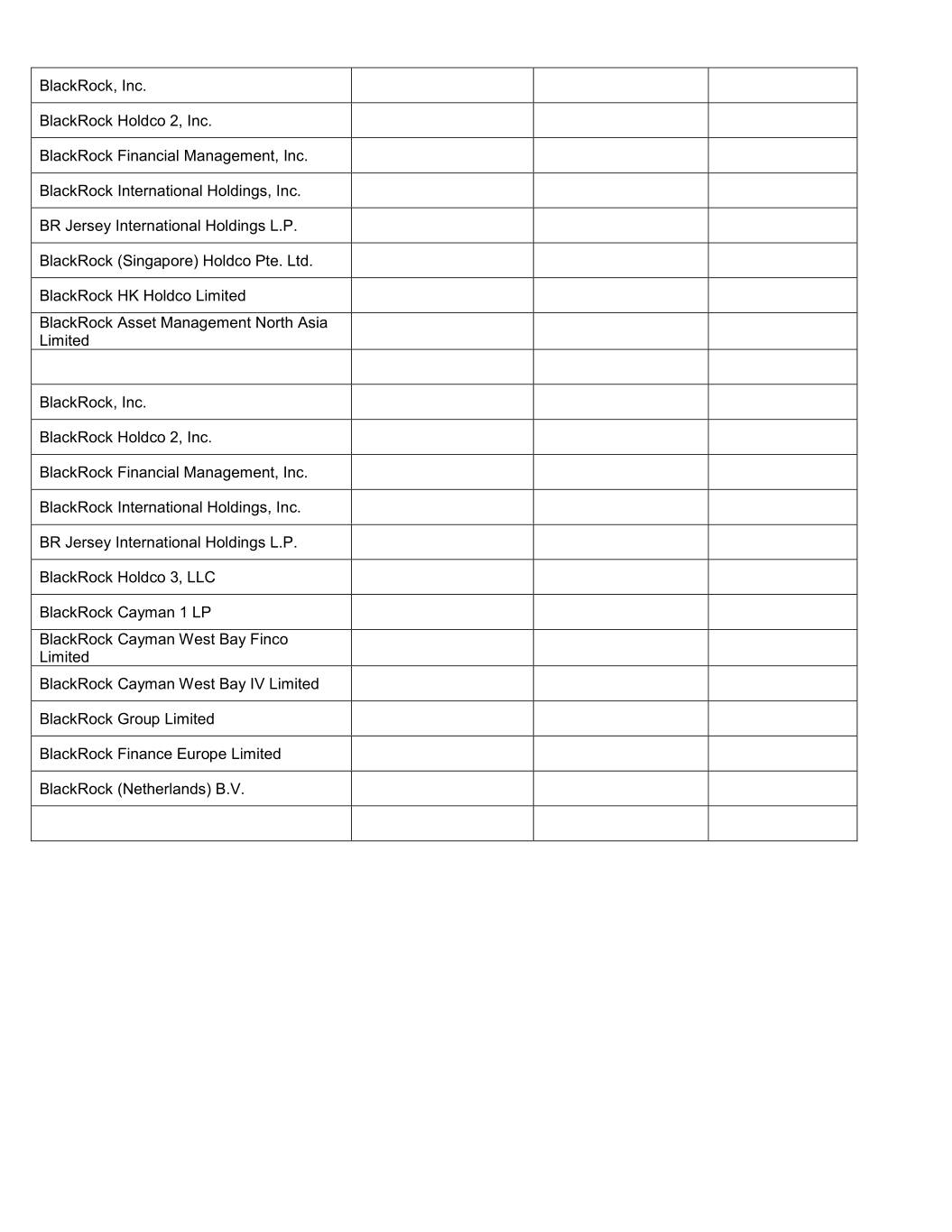

BlackRock Canada Holdings LP BlackRock Canada Holdings ULC BlackRock Asset Management Canada Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock (Singapore) Holdco Pte. Ltd. BlackRock HK Holdco Limited BlackRock Lux Finco S.a.r.l. BlackRock Japan Holdings GK BlackRock Japan Co., Ltd. BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Limited BlackRock Group Limited BlackRock Finance Europe Limited BlackRock Investment Management (UK) Limited BlackRock Asset Management Deutschland AG BlackRock, Inc. BlackRock Holdco 2, Inc.

BlackRock Financial Management, Inc. BlackRock Holdco 4, LLC BlackRock Holdco 6, LLC BlackRock Delaware Holdings Inc. BlackRock Fund Advisors BlackRock, Inc. Trident Merger, LLC BlackRock Investment Management, LLC BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock Capital Holdings, Inc. BlackRock Advisors, LLC BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Limited BlackRock Group Limited BlackRock Finance Europe Limited BlackRock Investment Management (UK) Limited BlackRock, Inc. BlackRock Holdco 2, Inc.

BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Limited BlackRock Group Limited BlackRock International Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Limited BlackRock Group Limited BlackRock Finance Europe Limited BlackRock Advisors (UK) Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Australia Holdco Pty. Ltd. BlackRock Investment Management (Australia) Limited

BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock (Singapore) Holdco Pte. Ltd. BlackRock HK Holdco Limited BlackRock Asset Management North Asia Limited BlackRock, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Limited BlackRock Group Limited BlackRock Finance Europe Limited BlackRock (Netherlands) B.V.