Exhibit 99.2 ANNOUNCEMENTS FORM 6-K SECURITIES AND EXCHANGE COMMISSION Washington D.C. 20549 Report of Foreign Issuer Pursuant to Rule 13a - 16 or 15d - 16 of The Securities Exchange Act of 1934 Announcements sent to the London Stock Exchange National Grid plc, 1-3 Strand, London, WC2N 5EH, United Kingdom Update - Routine announcements in the period to 6 January 2022

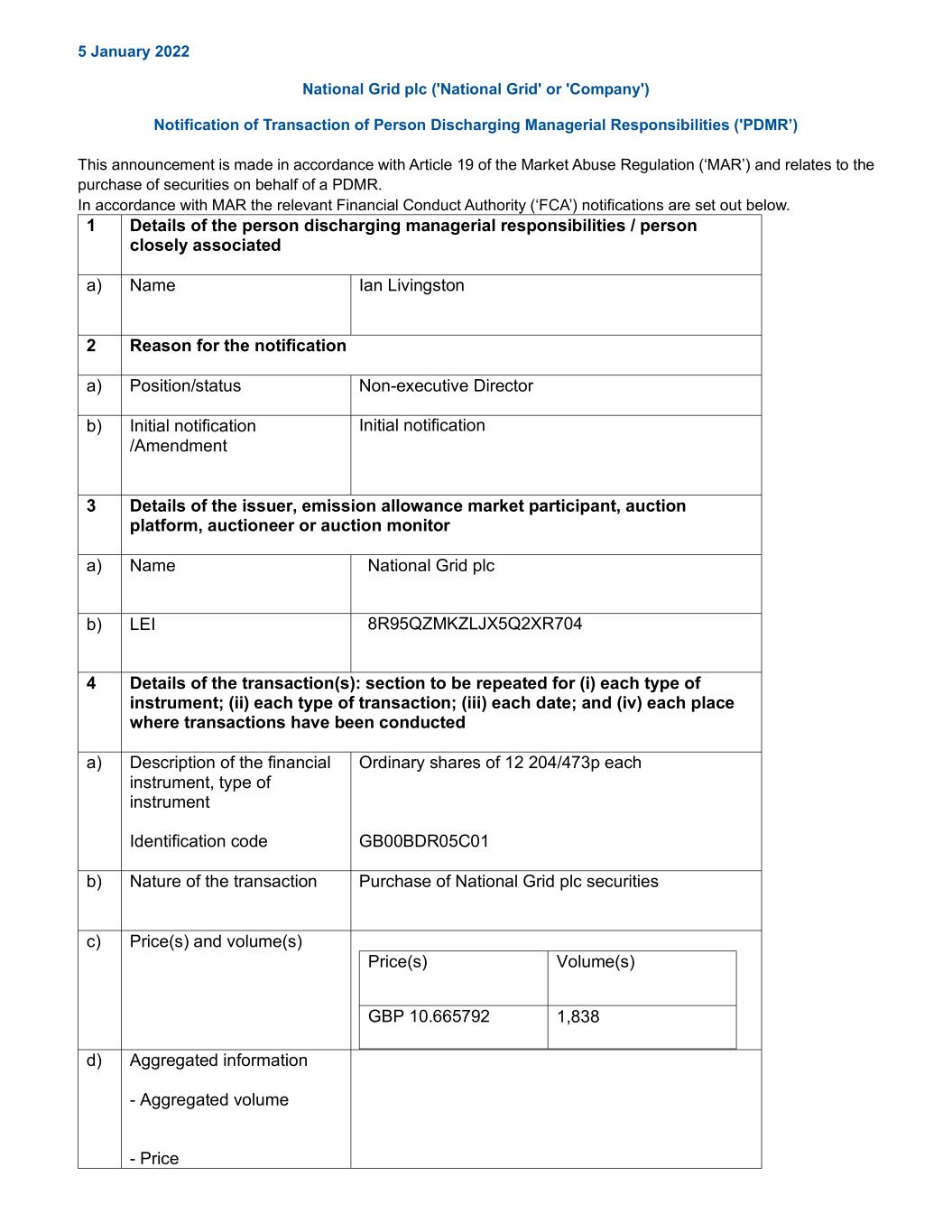

5 January 2022 National Grid plc ('National Grid' or 'Company') Notification of Transaction of Person Discharging Managerial Responsibilities ('PDMR’) This announcement is made in accordance with Article 19 of the Market Abuse Regulation (‘MAR’) and relates to the purchase of securities on behalf of a PDMR. In accordance with MAR the relevant Financial Conduct Authority (‘FCA’) notifications are set out below. 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Ian Livingston 2 Reason for the notification a) Position/status Non-executive Director b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01 b) Nature of the transaction Purchase of National Grid plc securities c) Price(s) and volume(s) Price(s) Volume(s) GBP 10.665792 1,838 d) Aggregated information - Aggregated volume - Price

e) Date of the transaction 2022.01.05 f) Place of the transaction London Stock Exchange (XLON)

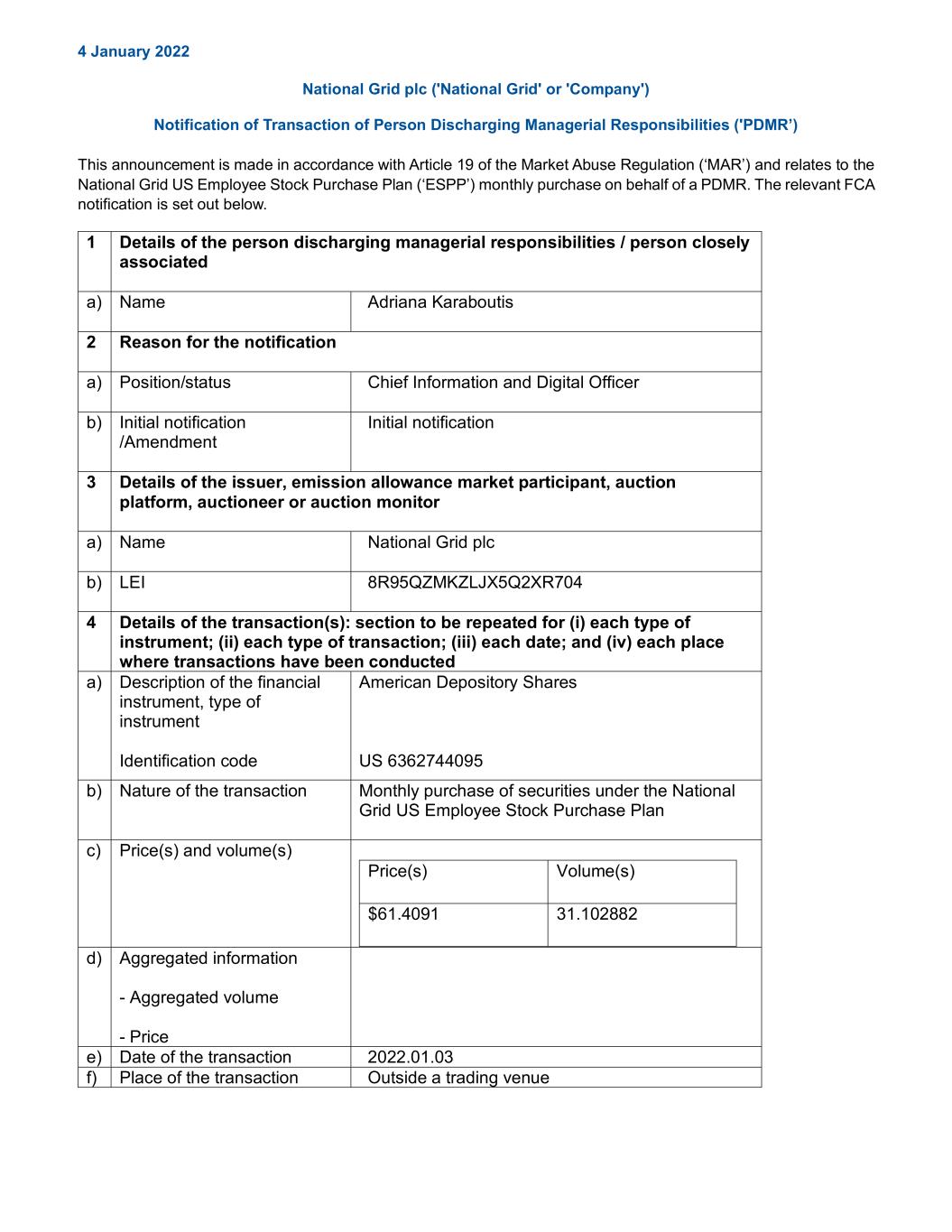

4 January 2022 National Grid plc ('National Grid' or 'Company') Notification of Transaction of Person Discharging Managerial Responsibilities ('PDMR’) This announcement is made in accordance with Article 19 of the Market Abuse Regulation (‘MAR’) and relates to the National Grid US Employee Stock Purchase Plan (‘ESPP’) monthly purchase on behalf of a PDMR. The relevant FCA notification is set out below. 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Adriana Karaboutis 2 Reason for the notification a) Position/status Chief Information and Digital Officer b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code American Depository Shares US 6362744095 b) Nature of the transaction Monthly purchase of securities under the National Grid US Employee Stock Purchase Plan c) Price(s) and volume(s) Price(s) Volume(s) $61.4091 31.102882 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2022.01.03 f) Place of the transaction Outside a trading venue

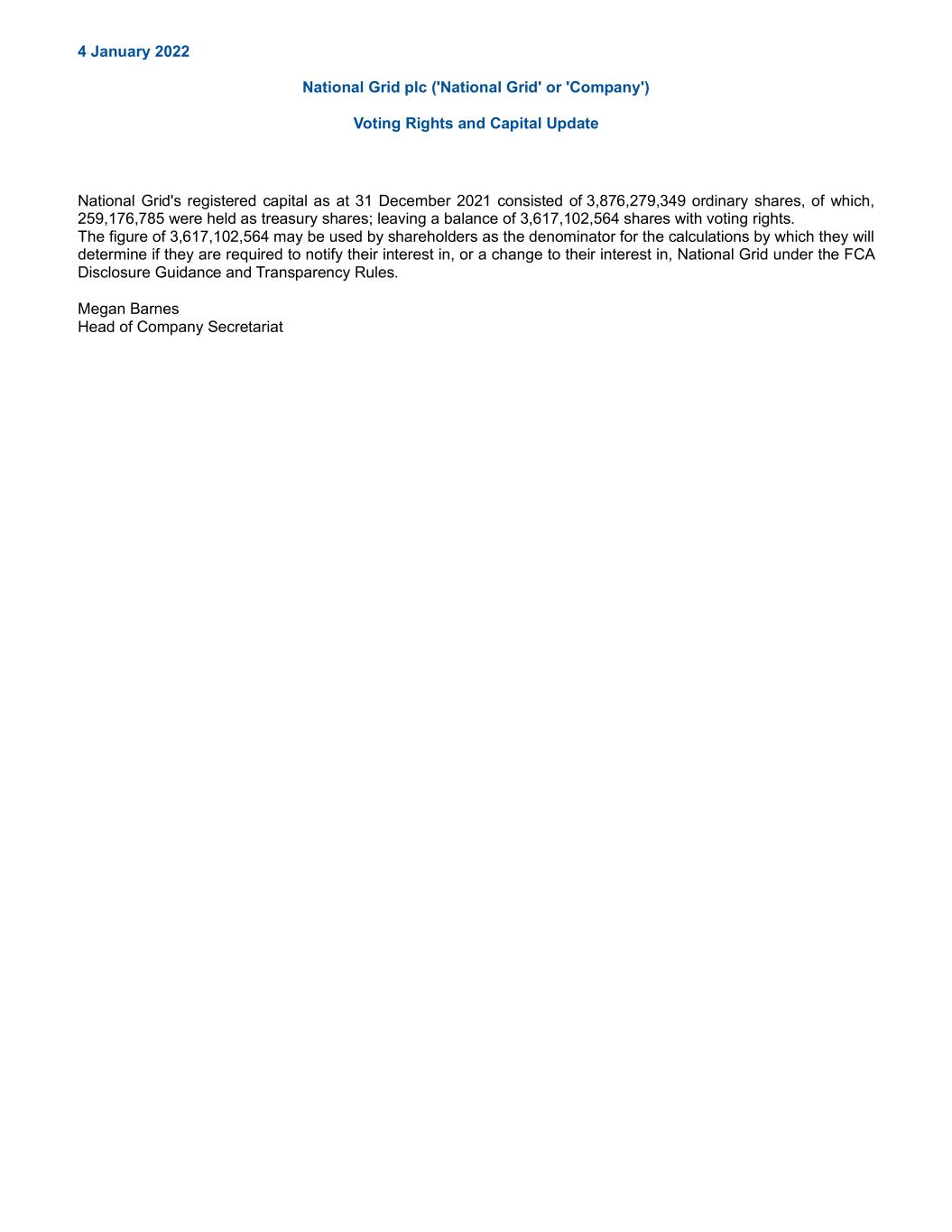

4 January 2022 National Grid plc ('National Grid' or 'Company') Voting Rights and Capital Update National Grid's registered capital as at 31 December 2021 consisted of 3,876,279,349 ordinary shares, of which, 259,176,785 were held as treasury shares; leaving a balance of 3,617,102,564 shares with voting rights. The figure of 3,617,102,564 may be used by shareholders as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, National Grid under the FCA Disclosure Guidance and Transparency Rules. Megan Barnes Head of Company Secretariat

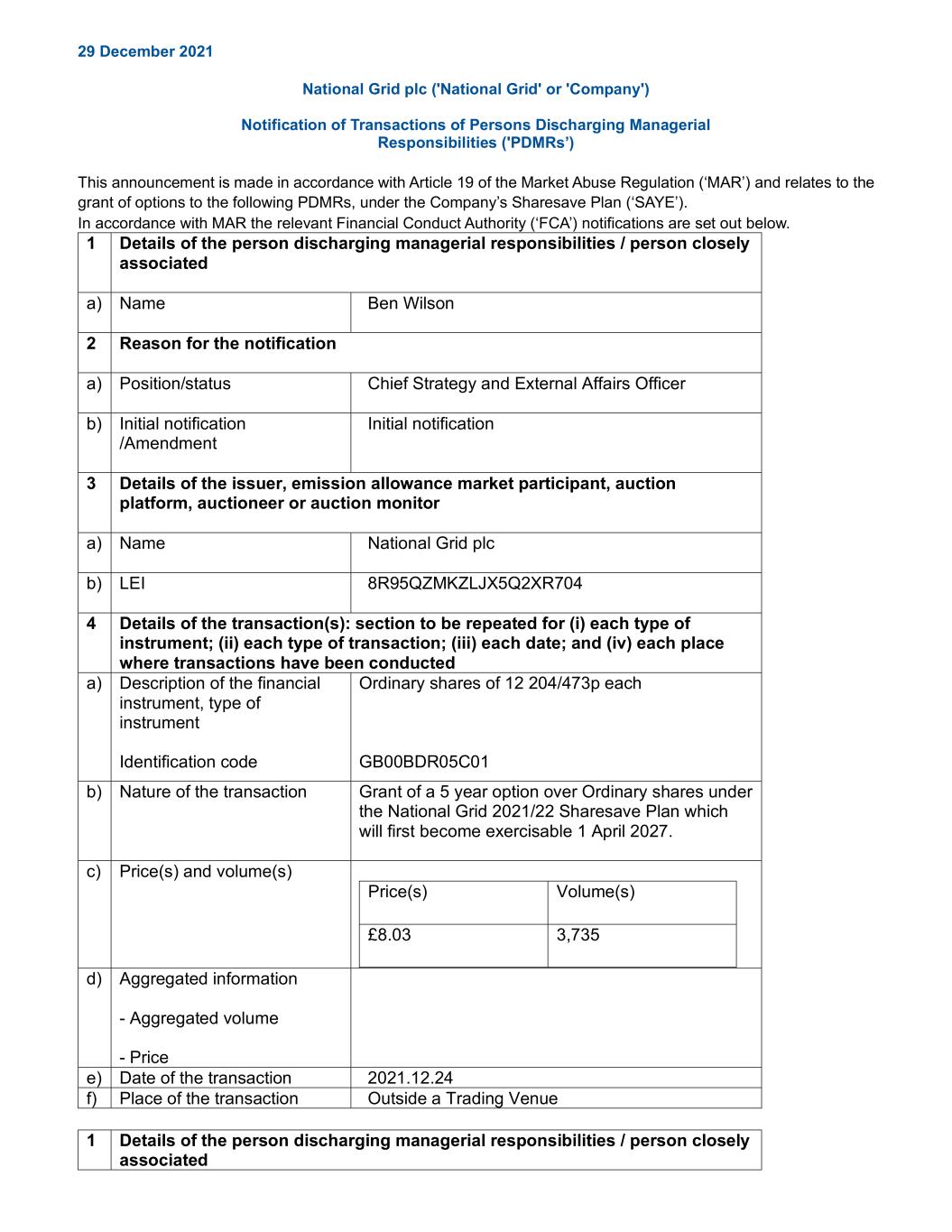

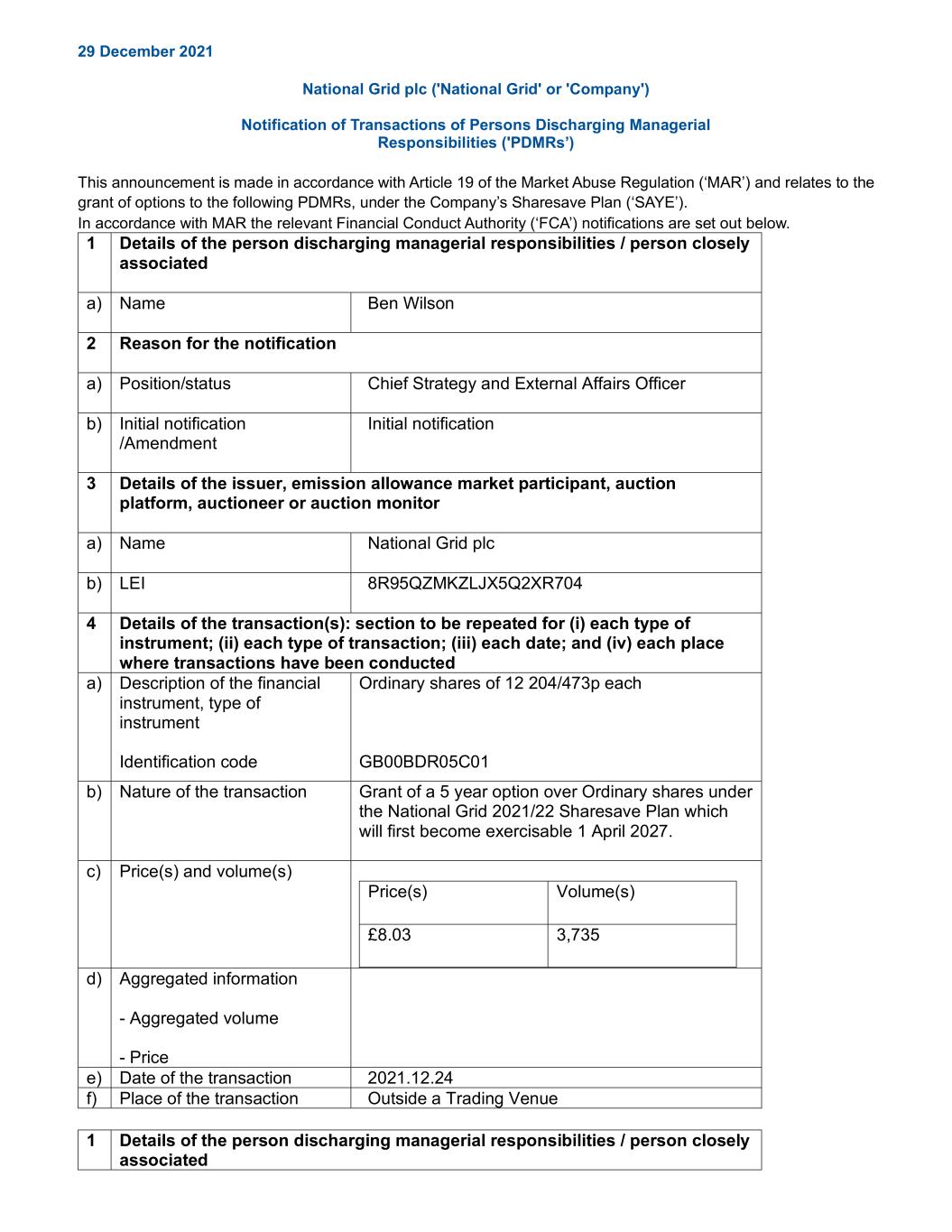

29 December 2021 National Grid plc ('National Grid' or 'Company') Notification of Transactions of Persons Discharging Managerial Responsibilities ('PDMRs’) This announcement is made in accordance with Article 19 of the Market Abuse Regulation (‘MAR’) and relates to the grant of options to the following PDMRs, under the Company’s Sharesave Plan (‘SAYE’). In accordance with MAR the relevant Financial Conduct Authority (‘FCA’) notifications are set out below. 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Ben Wilson 2 Reason for the notification a) Position/status Chief Strategy and External Affairs Officer b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01 b) Nature of the transaction Grant of a 5 year option over Ordinary shares under the National Grid 2021/22 Sharesave Plan which will first become exercisable 1 April 2027. c) Price(s) and volume(s) Price(s) Volume(s) £8.03 3,735 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2021.12.24 f) Place of the transaction Outside a Trading Venue 1 Details of the person discharging managerial responsibilities / person closely associated

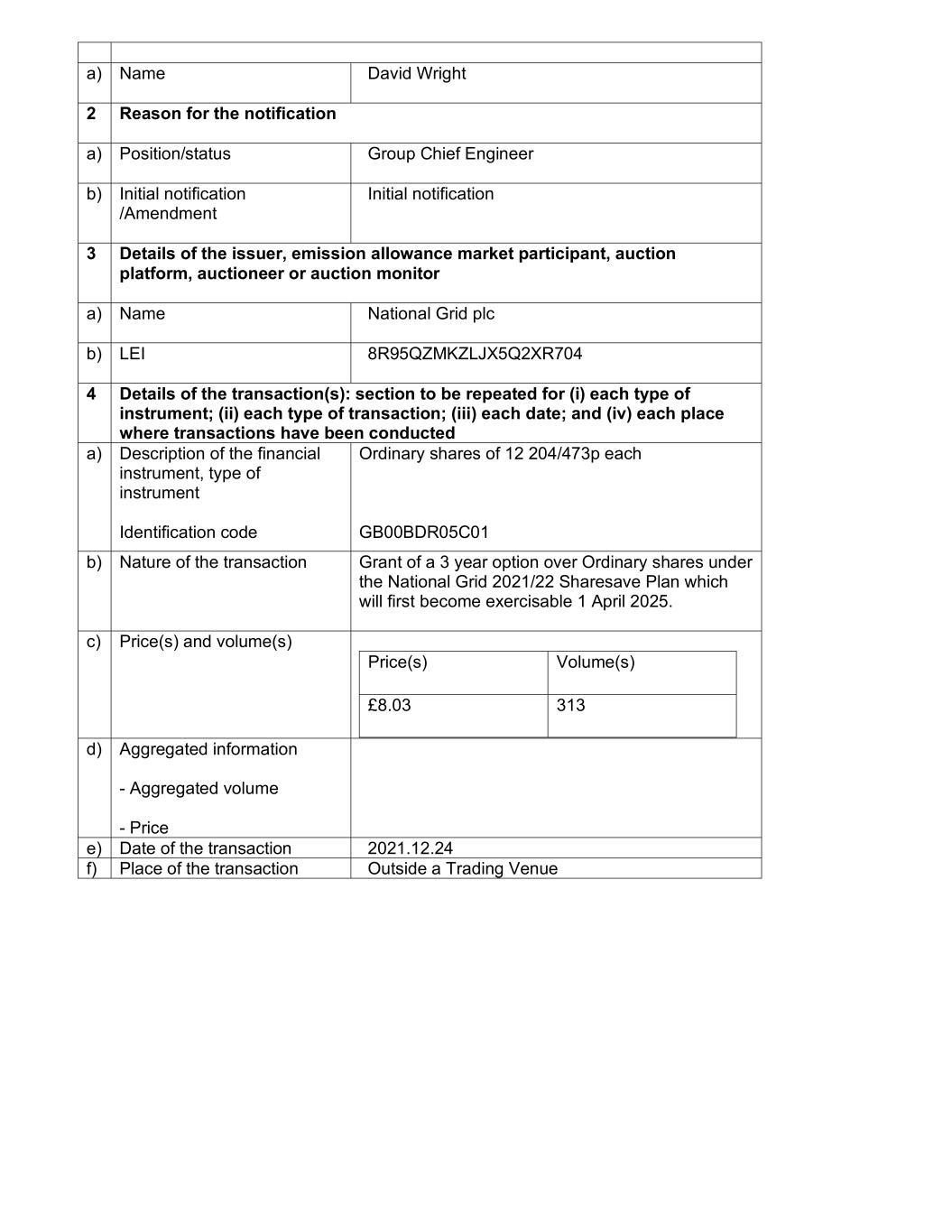

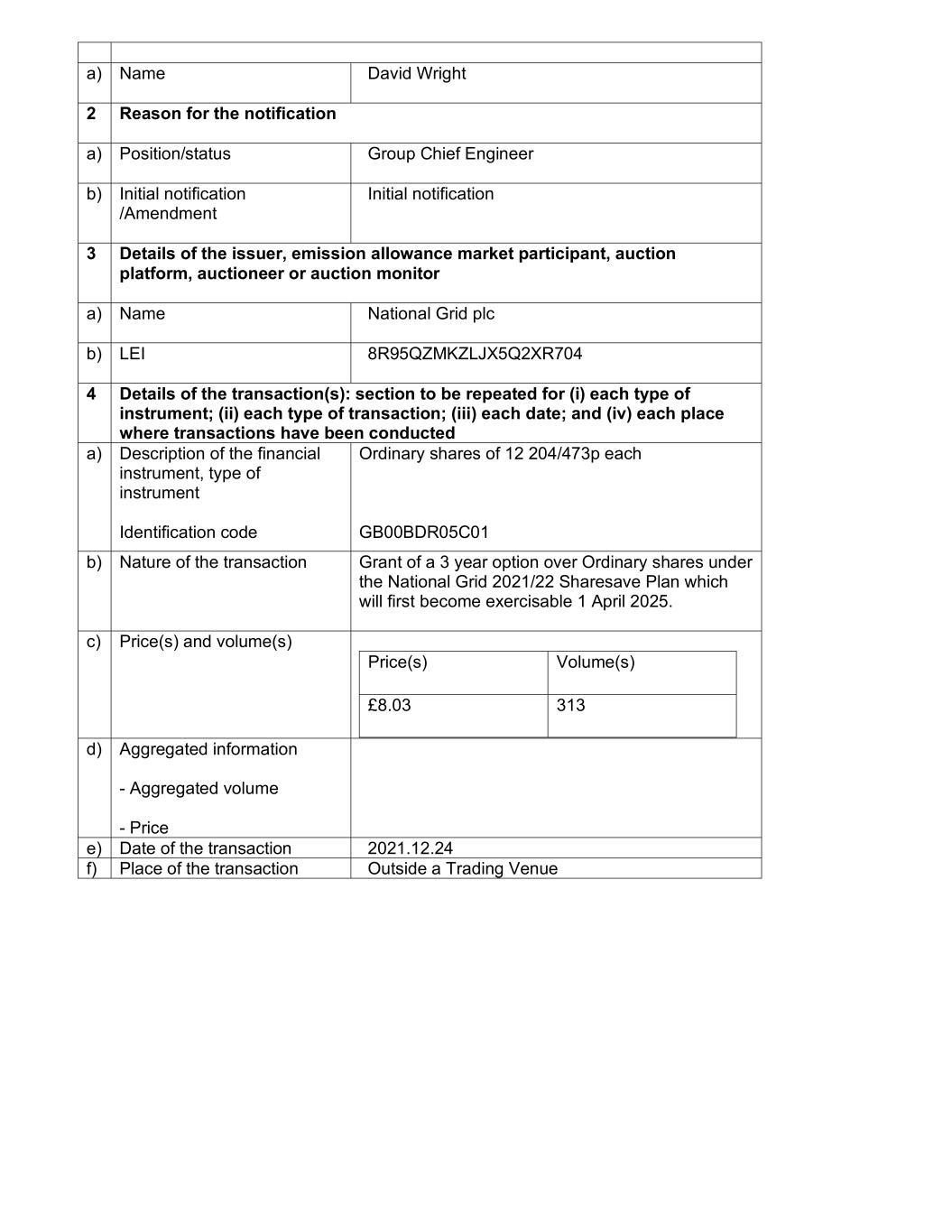

a) Name David Wright 2 Reason for the notification a) Position/status Group Chief Engineer b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01 b) Nature of the transaction Grant of a 3 year option over Ordinary shares under the National Grid 2021/22 Sharesave Plan which will first become exercisable 1 April 2025. c) Price(s) and volume(s) Price(s) Volume(s) £8.03 313 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2021.12.24 f) Place of the transaction Outside a Trading Venue

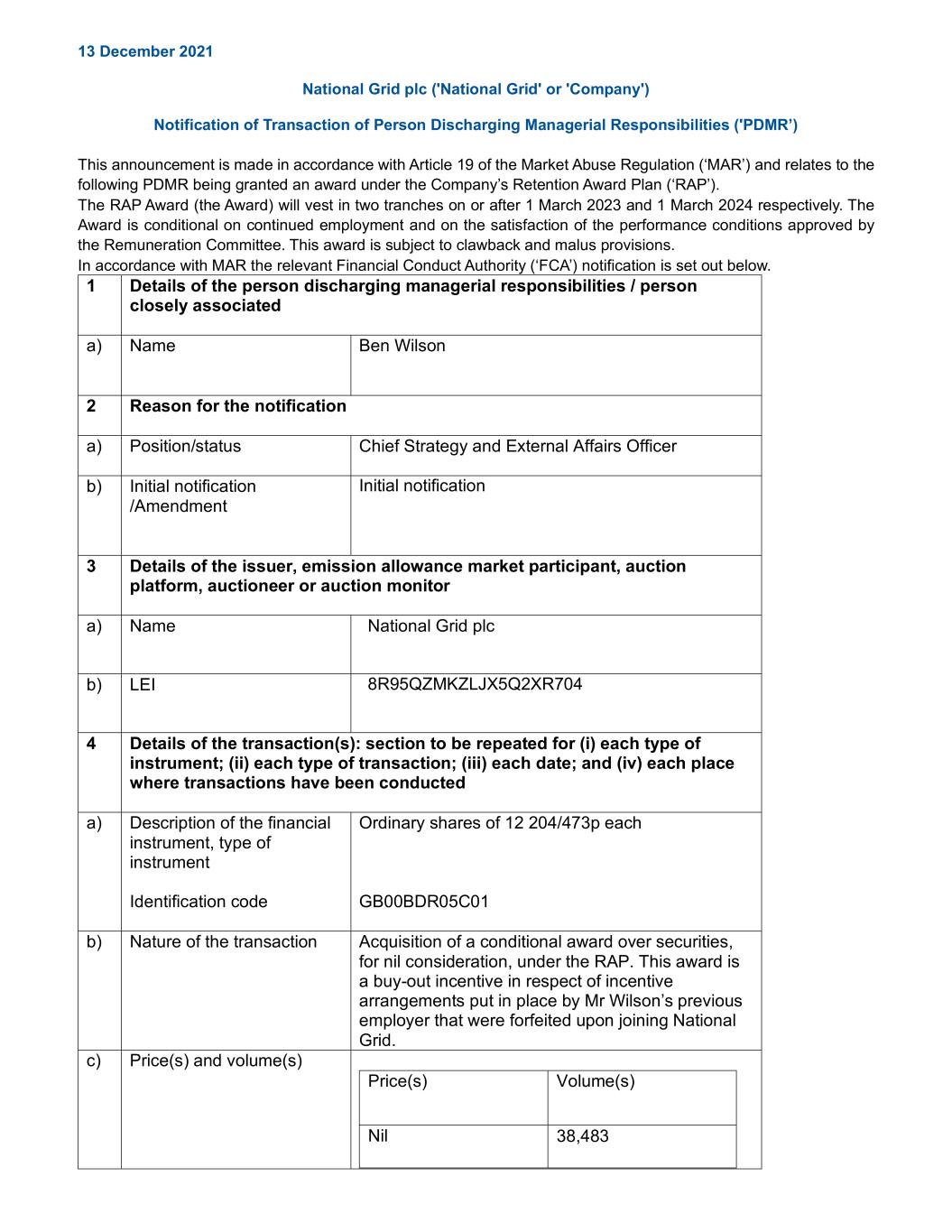

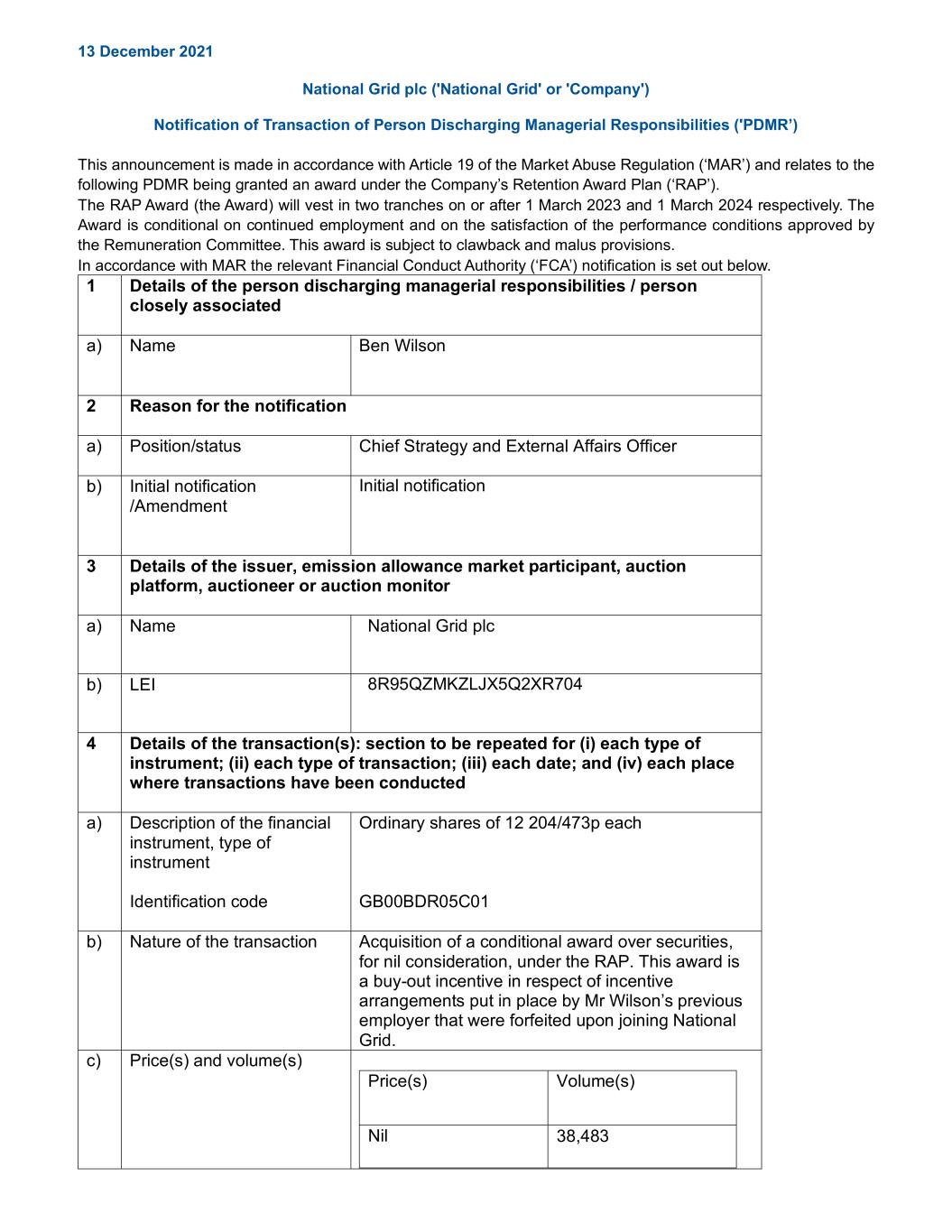

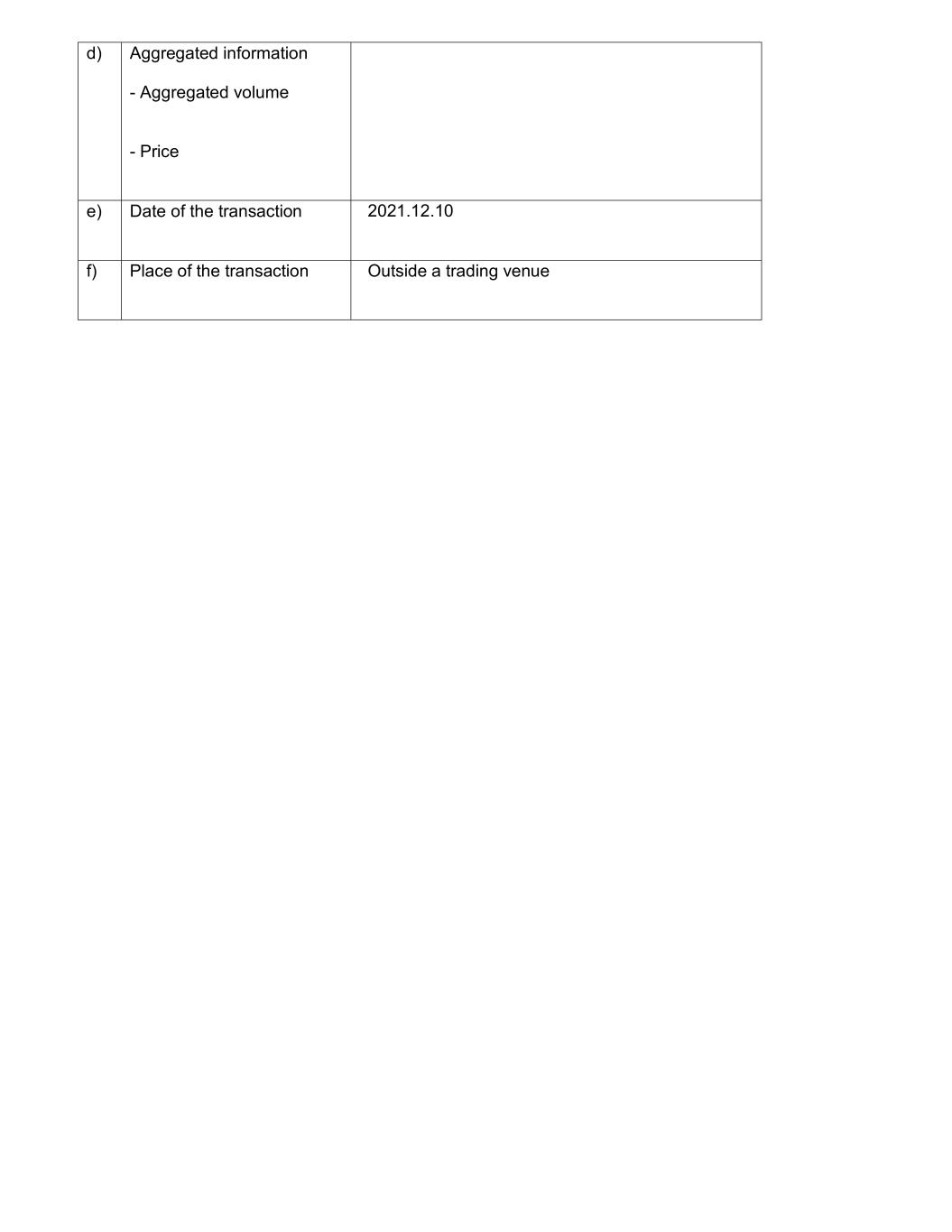

13 December 2021 National Grid plc ('National Grid' or 'Company') Notification of Transaction of Person Discharging Managerial Responsibilities ('PDMR’) This announcement is made in accordance with Article 19 of the Market Abuse Regulation (‘MAR’) and relates to the following PDMR being granted an award under the Company’s Retention Award Plan (‘RAP’). The RAP Award (the Award) will vest in two tranches on or after 1 March 2023 and 1 March 2024 respectively. The Award is conditional on continued employment and on the satisfaction of the performance conditions approved by the Remuneration Committee. This award is subject to clawback and malus provisions. In accordance with MAR the relevant Financial Conduct Authority (‘FCA’) notification is set out below. 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Ben Wilson 2 Reason for the notification a) Position/status Chief Strategy and External Affairs Officer b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01 b) Nature of the transaction Acquisition of a conditional award over securities, for nil consideration, under the RAP. This award is a buy-out incentive in respect of incentive arrangements put in place by Mr Wilson’s previous employer that were forfeited upon joining National Grid. c) Price(s) and volume(s) Price(s) Volume(s) Nil 38,483

d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2021.12.10 f) Place of the transaction Outside a trading venue

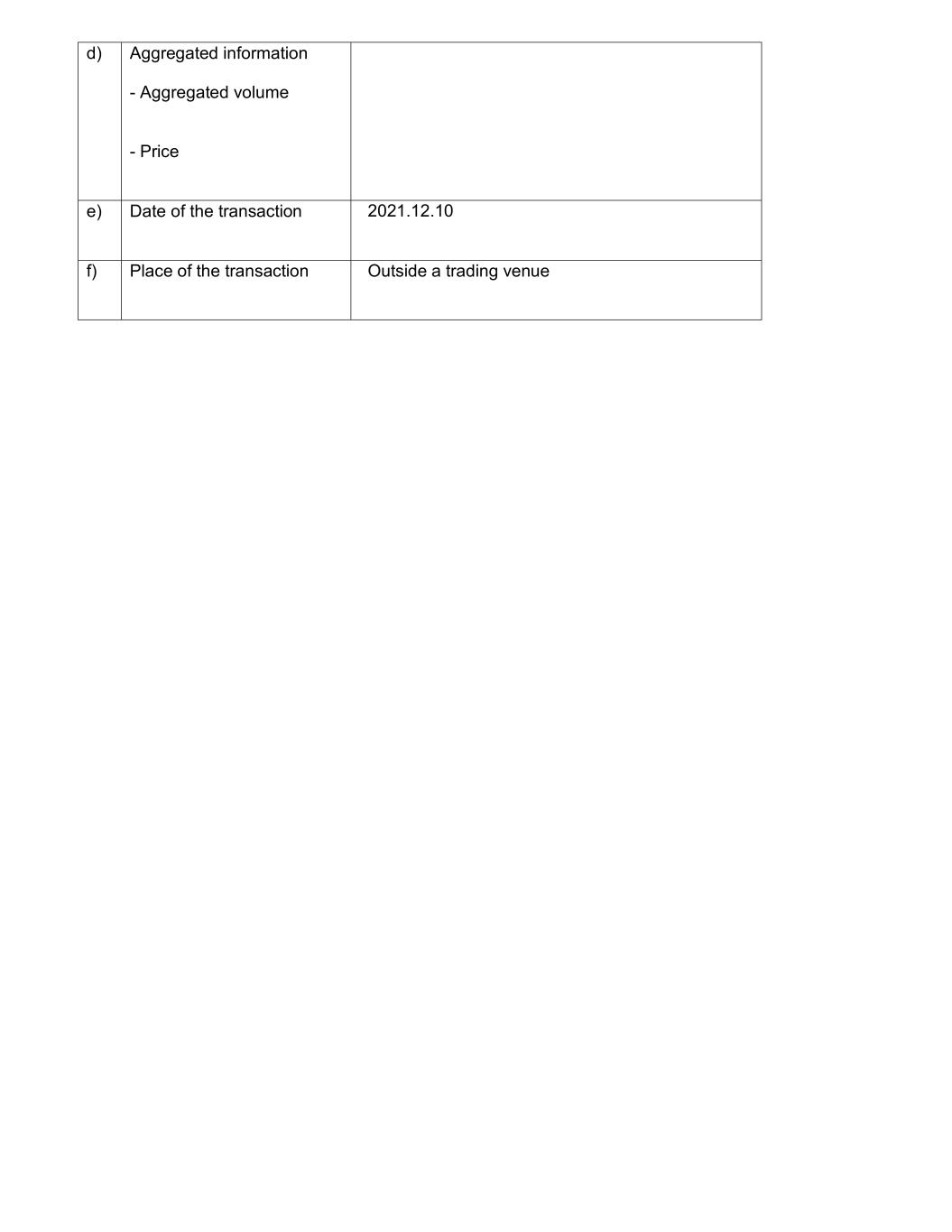

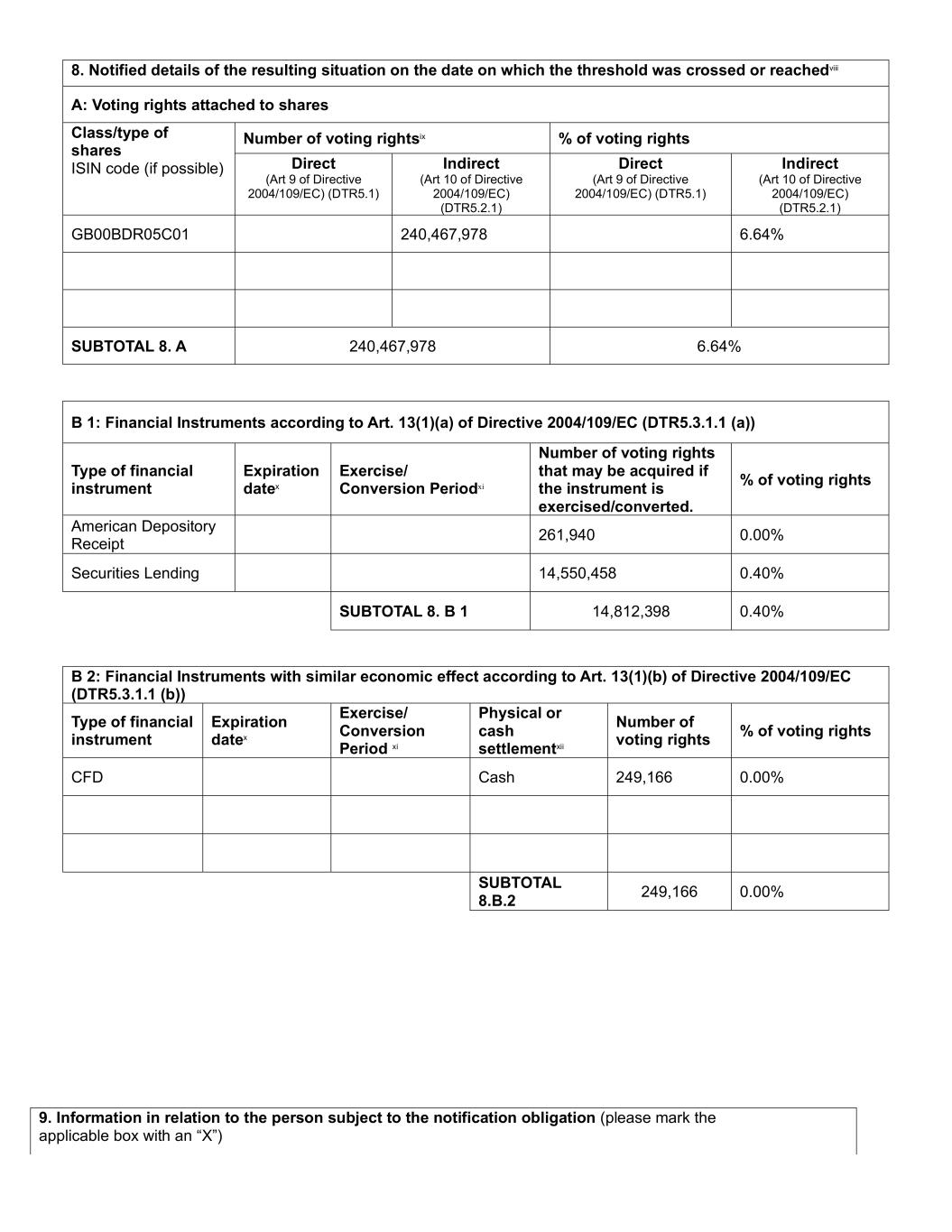

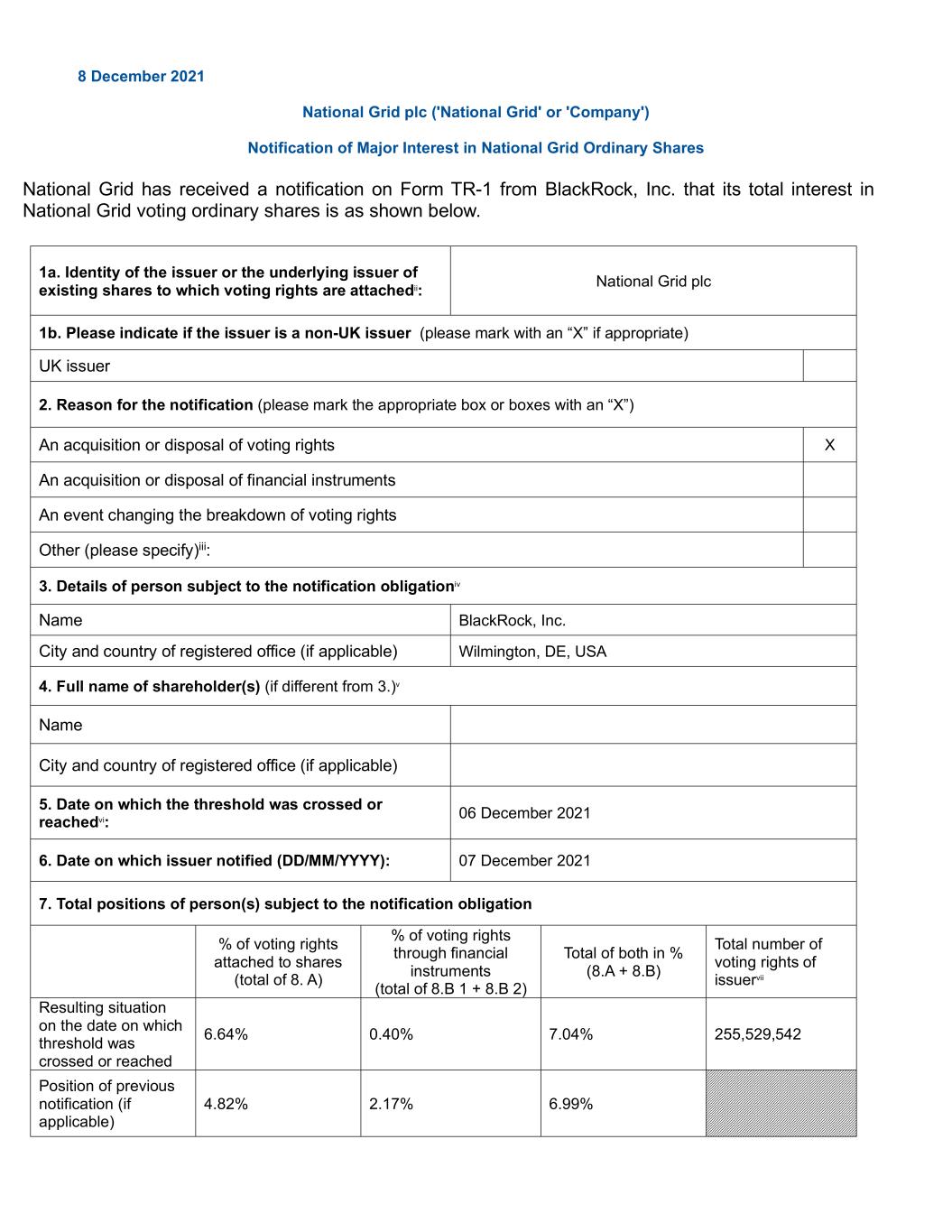

8 December 2021 National Grid plc ('National Grid' or 'Company') Notification of Major Interest in National Grid Ordinary Shares National Grid has received a notification on Form TR-1 from BlackRock, Inc. that its total interest in National Grid voting ordinary shares is as shown below. 1a. Identity of the issuer or the underlying issuer of existing shares to which voting rights are attachedii: National Grid plc 1b. Please indicate if the issuer is a non-UK issuer (please mark with an “X” if appropriate) UK issuer 2. Reason for the notification (please mark the appropriate box or boxes with an “X”) An acquisition or disposal of voting rights X An acquisition or disposal of financial instruments An event changing the breakdown of voting rights Other (please specify)iii: 3. Details of person subject to the notification obligationiv Name BlackRock, Inc. City and country of registered office (if applicable) Wilmington, DE, USA 4. Full name of shareholder(s) (if different from 3.)v Name City and country of registered office (if applicable) 5. Date on which the threshold was crossed or reachedvi: 06 December 2021 6. Date on which issuer notified (DD/MM/YYYY): 07 December 2021 7. Total positions of person(s) subject to the notification obligation % of voting rights attached to shares (total of 8. A) % of voting rights through financial instruments (total of 8.B 1 + 8.B 2) Total of both in % (8.A + 8.B) Total number of voting rights of issuervii Resulting situation on the date on which threshold was crossed or reached 6.64% 0.40% 7.04% 255,529,542 Position of previous notification (if applicable) 4.82% 2.17% 6.99%

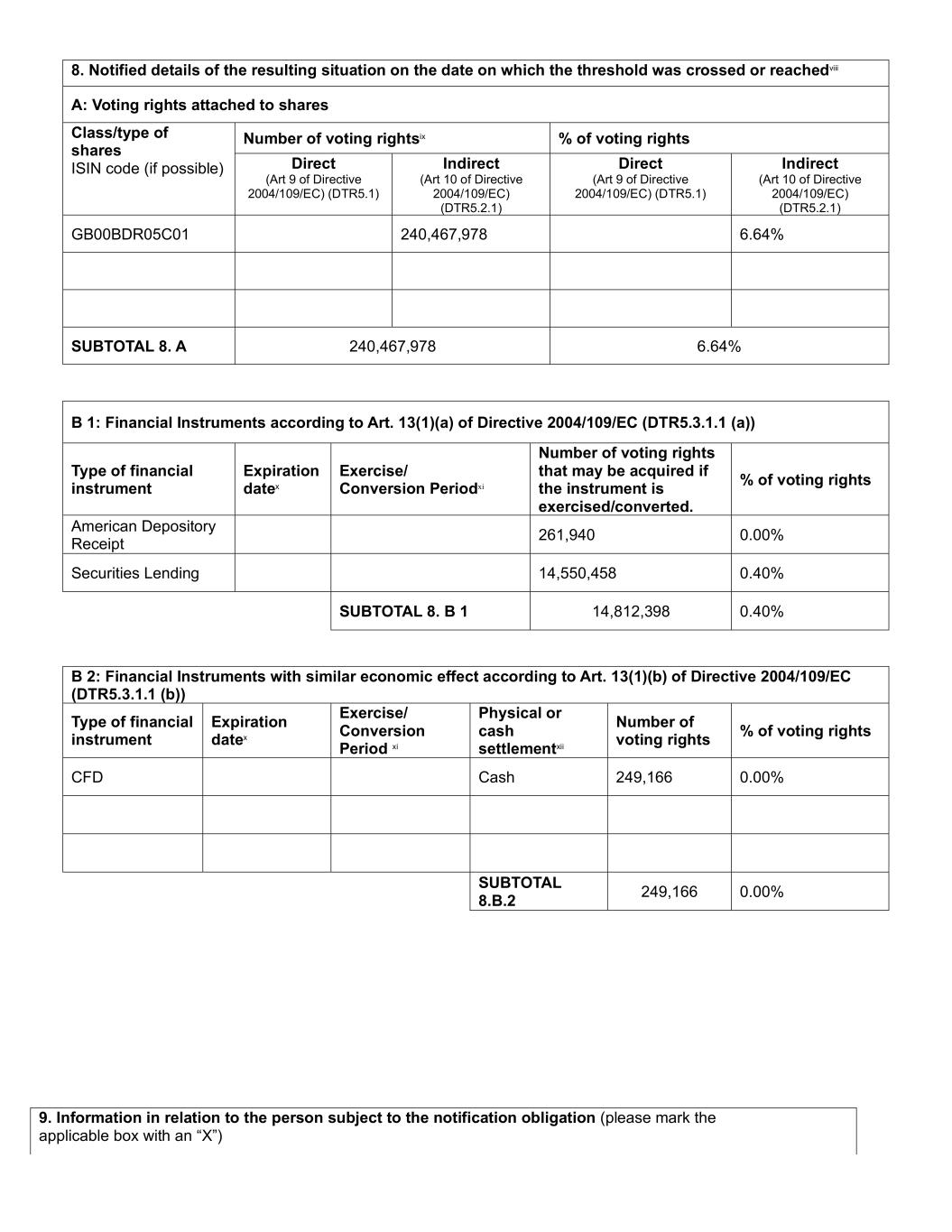

8. Notified details of the resulting situation on the date on which the threshold was crossed or reachedviii A: Voting rights attached to shares Class/type of shares ISIN code (if possible) Number of voting rightsix % of voting rights Direct (Art 9 of Directive 2004/109/EC) (DTR5.1) Indirect (Art 10 of Directive 2004/109/EC) (DTR5.2.1) Direct (Art 9 of Directive 2004/109/EC) (DTR5.1) Indirect (Art 10 of Directive 2004/109/EC) (DTR5.2.1) GB00BDR05C01 240,467,978 6.64% SUBTOTAL 8. A 240,467,978 6.64% B 1: Financial Instruments according to Art. 13(1)(a) of Directive 2004/109/EC (DTR5.3.1.1 (a)) Type of financial instrument Expiration datex Exercise/ Conversion Periodxi Number of voting rights that may be acquired if the instrument is exercised/converted. % of voting rights American Depository Receipt 261,940 0.00% Securities Lending 14,550,458 0.40% SUBTOTAL 8. B 1 14,812,398 0.40% B 2: Financial Instruments with similar economic effect according to Art. 13(1)(b) of Directive 2004/109/EC (DTR5.3.1.1 (b)) Type of financial instrument Expiration datex Exercise/ Conversion Period xi Physical or cash settlementxii Number of voting rights % of voting rights CFD Cash 249,166 0.00% SUBTOTAL 8.B.2 249,166 0.00% 9. Information in relation to the person subject to the notification obligation (please mark the applicable box with an “X”)

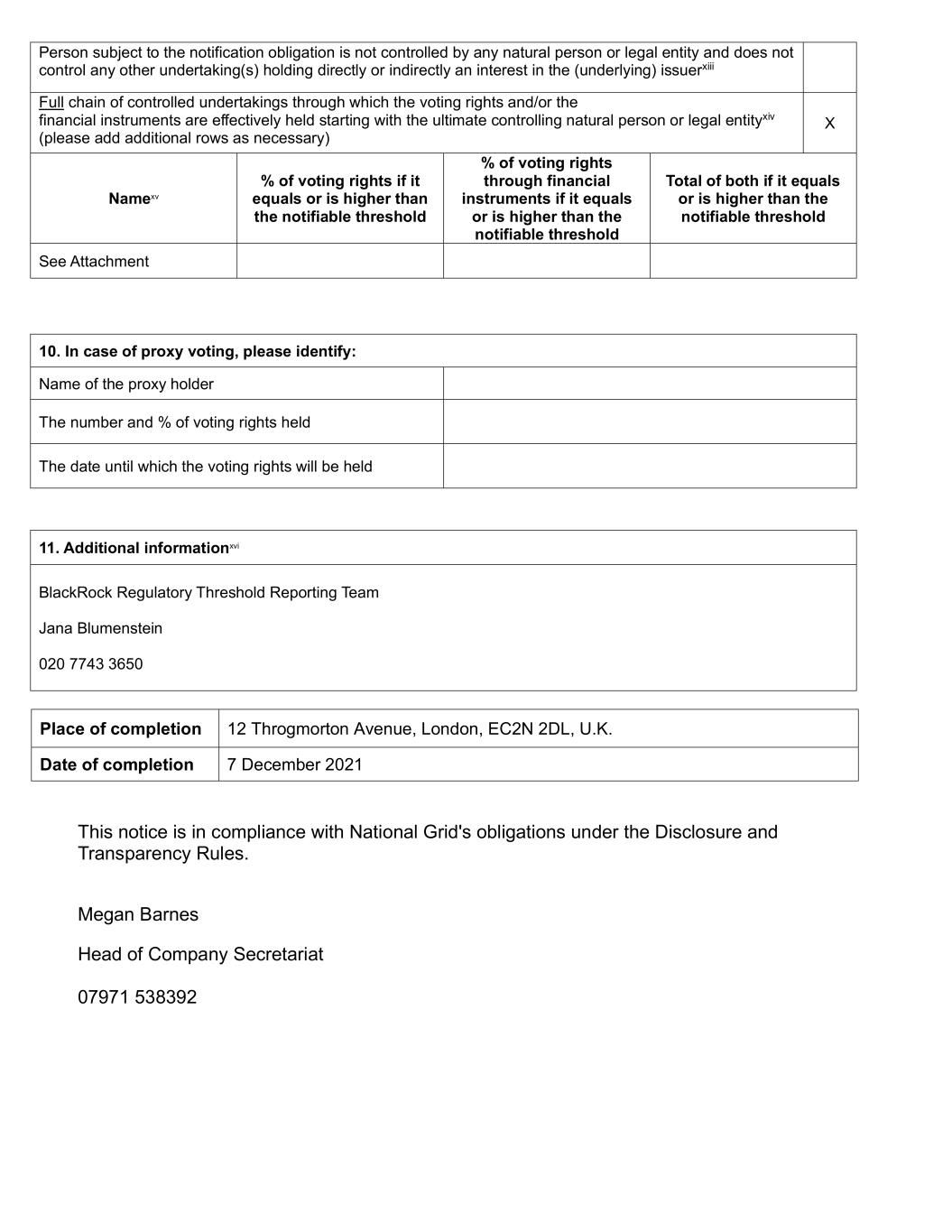

Person subject to the notification obligation is not controlled by any natural person or legal entity and does not control any other undertaking(s) holding directly or indirectly an interest in the (underlying) issuerxiii Full chain of controlled undertakings through which the voting rights and/or the financial instruments are effectively held starting with the ultimate controlling natural person or legal entityxiv (please add additional rows as necessary) X Namexv % of voting rights if it equals or is higher than the notifiable threshold % of voting rights through financial instruments if it equals or is higher than the notifiable threshold Total of both if it equals or is higher than the notifiable threshold See Attachment 10. In case of proxy voting, please identify: Name of the proxy holder The number and % of voting rights held The date until which the voting rights will be held 11. Additional informationxvi BlackRock Regulatory Threshold Reporting Team Jana Blumenstein 020 7743 3650 Place of completion 12 Throgmorton Avenue, London, EC2N 2DL, U.K. Date of completion 7 December 2021 This notice is in compliance with National Grid's obligations under the Disclosure and Transparency Rules. Megan Barnes Head of Company Secretariat 07971 538392

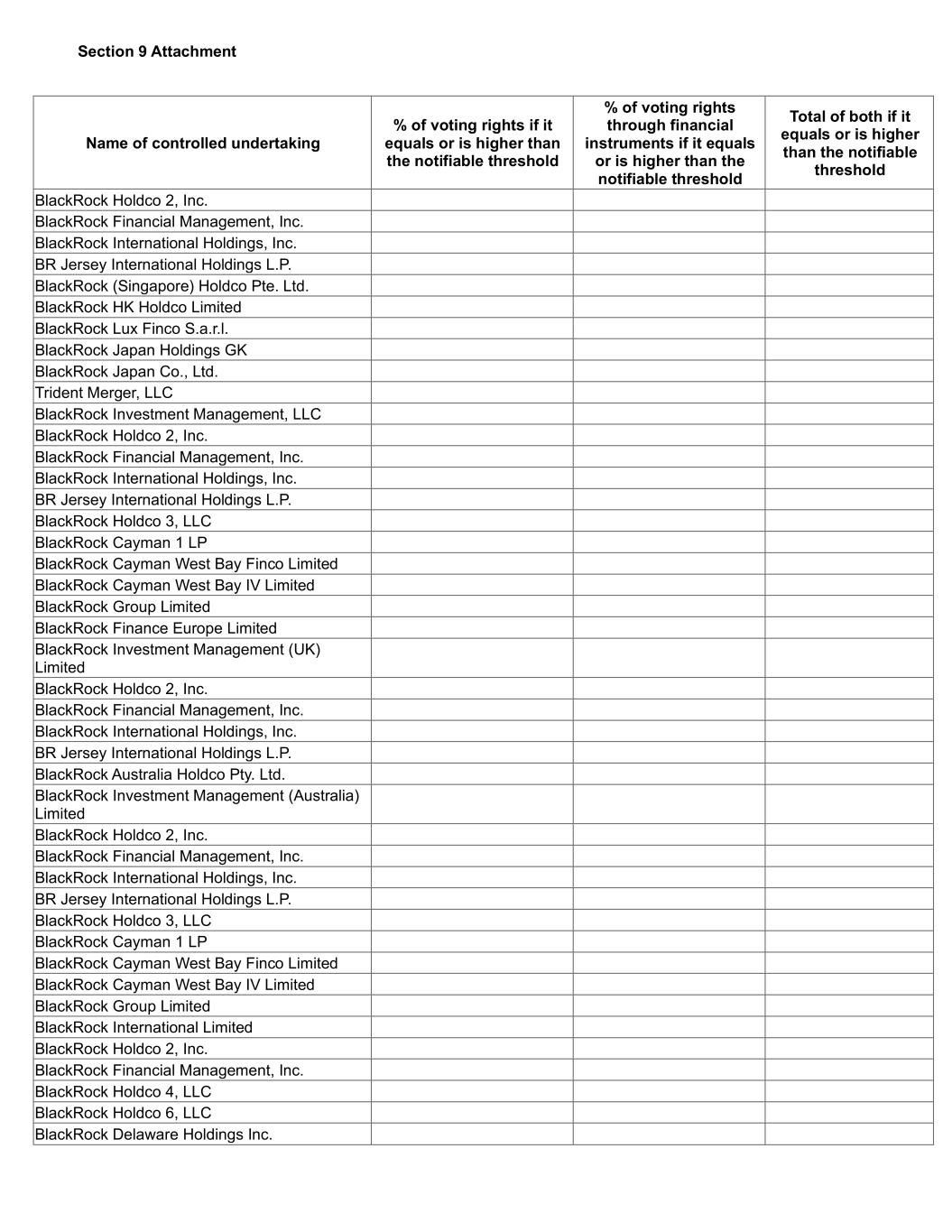

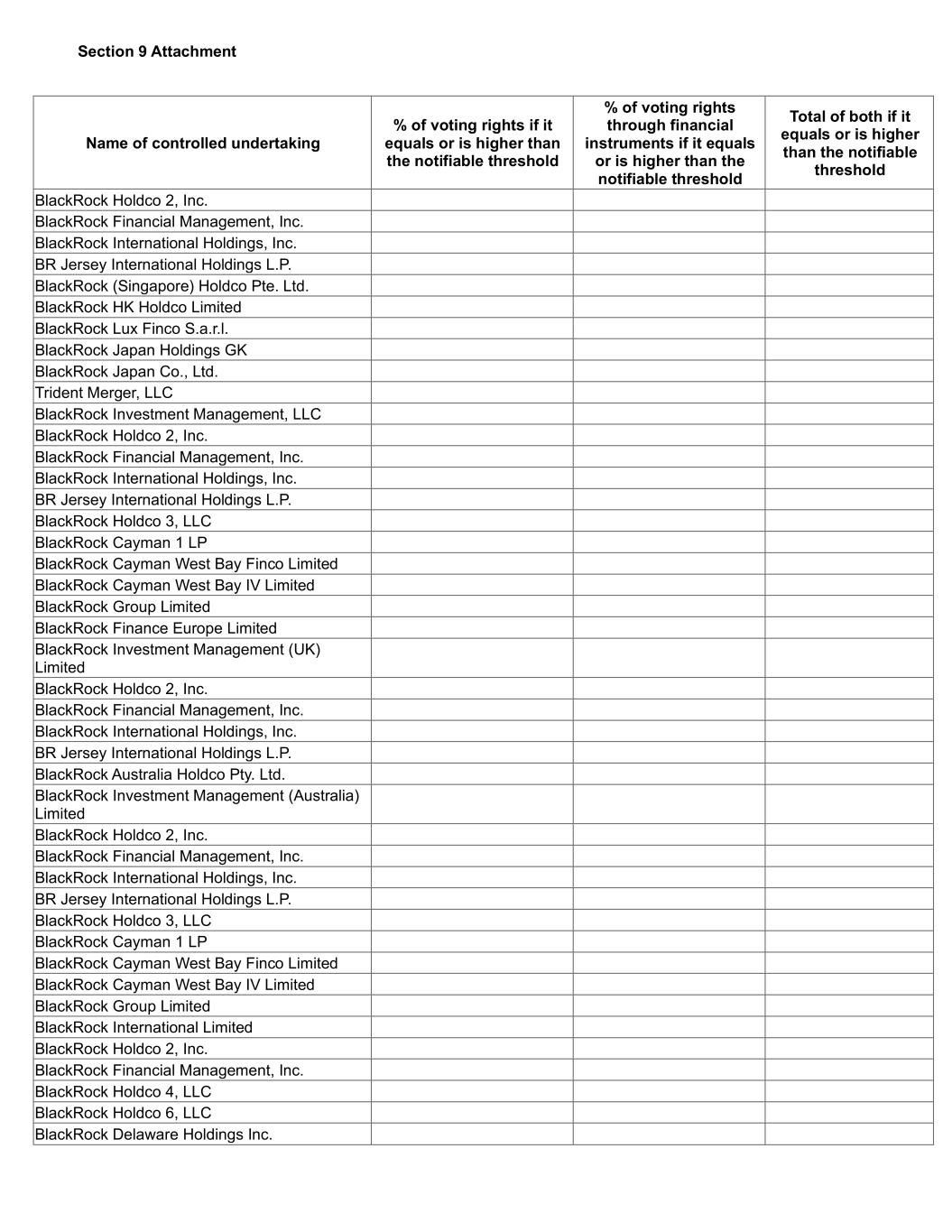

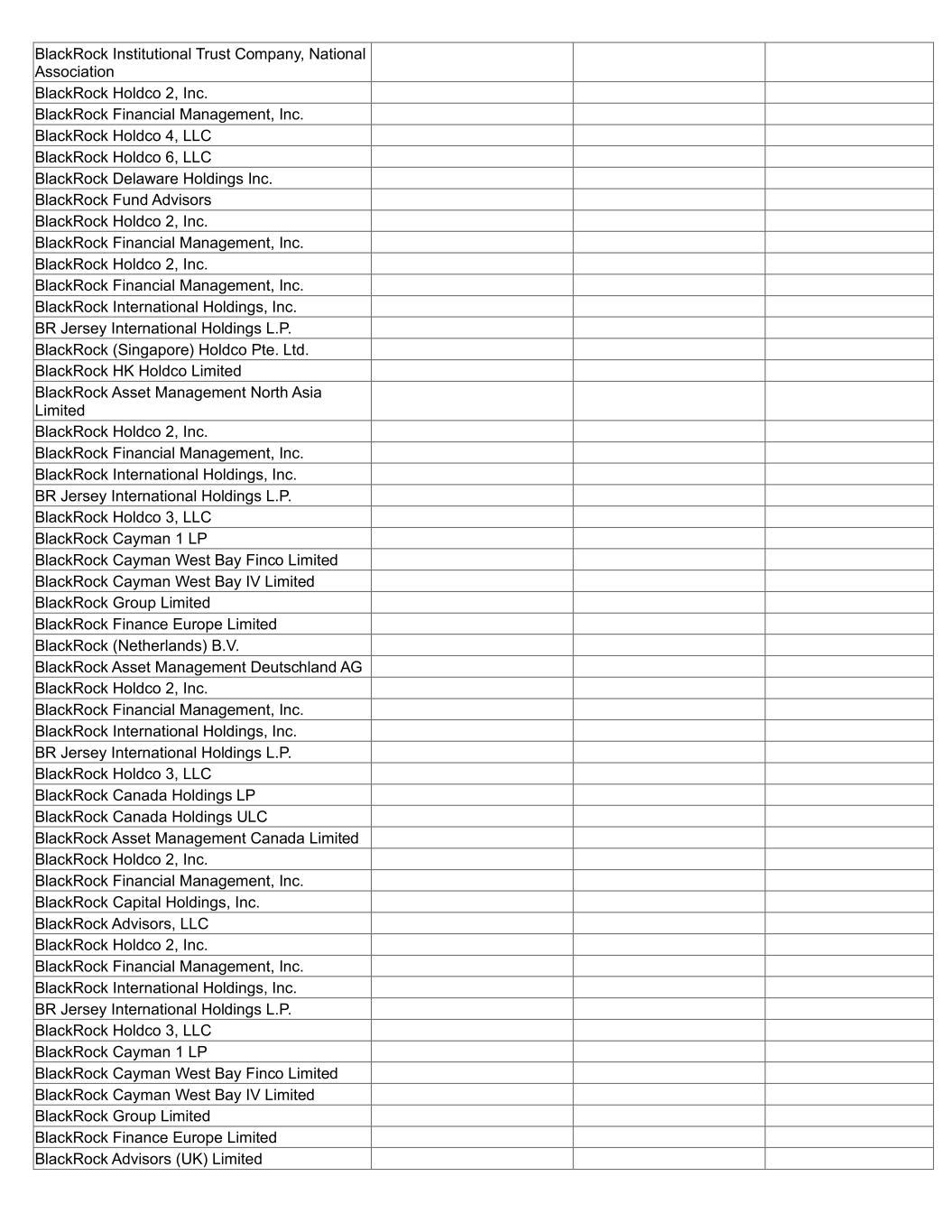

Section 9 Attachment Name of controlled undertaking % of voting rights if it equals or is higher than the notifiable threshold % of voting rights through financial instruments if it equals or is higher than the notifiable threshold Total of both if it equals or is higher than the notifiable threshold BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock (Singapore) Holdco Pte. Ltd. BlackRock HK Holdco Limited BlackRock Lux Finco S.a.r.l. BlackRock Japan Holdings GK BlackRock Japan Co., Ltd. Trident Merger, LLC BlackRock Investment Management, LLC BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Limited BlackRock Group Limited BlackRock Finance Europe Limited BlackRock Investment Management (UK) Limited BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Australia Holdco Pty. Ltd. BlackRock Investment Management (Australia) Limited BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Limited BlackRock Group Limited BlackRock International Limited BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock Holdco 4, LLC BlackRock Holdco 6, LLC BlackRock Delaware Holdings Inc.

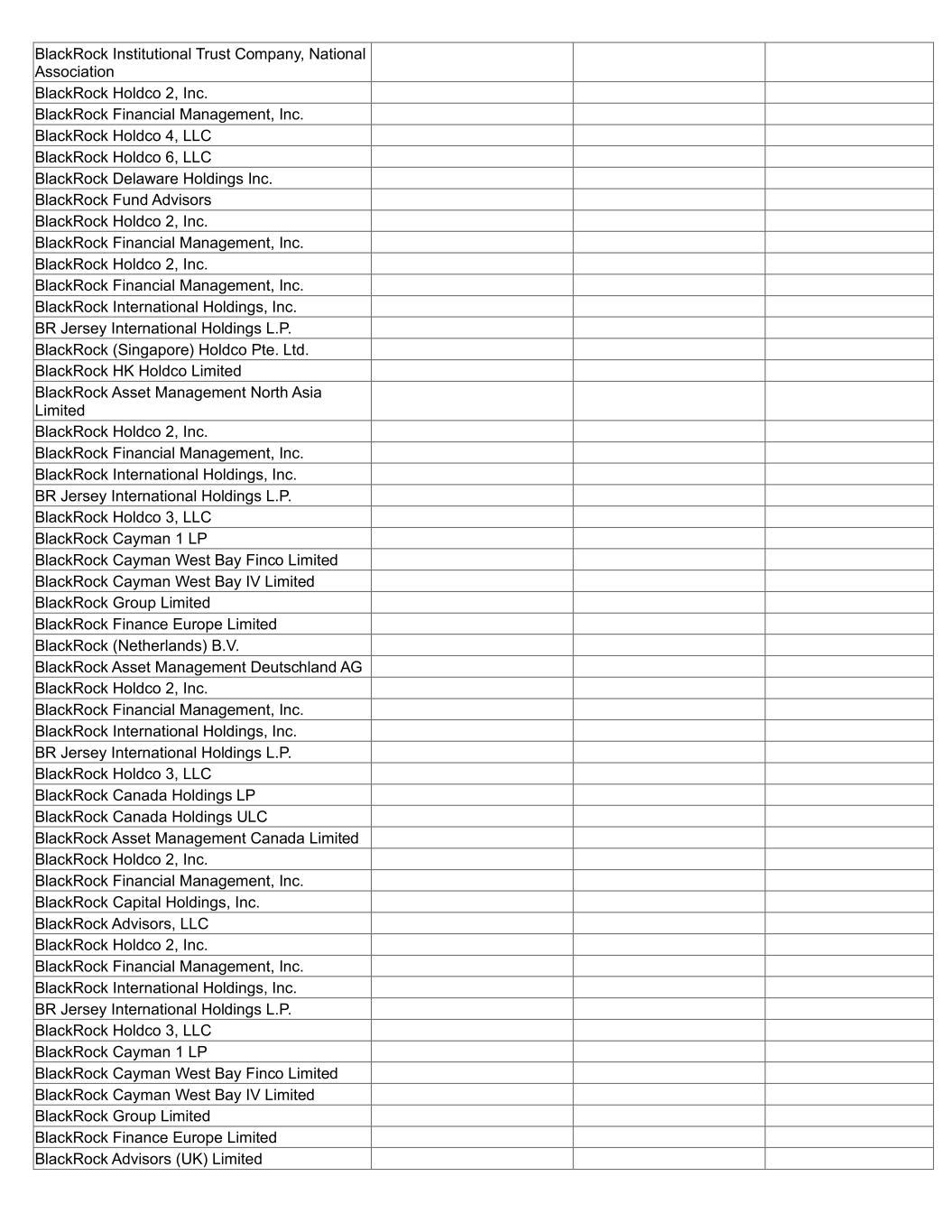

BlackRock Institutional Trust Company, National Association BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock Holdco 4, LLC BlackRock Holdco 6, LLC BlackRock Delaware Holdings Inc. BlackRock Fund Advisors BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock (Singapore) Holdco Pte. Ltd. BlackRock HK Holdco Limited BlackRock Asset Management North Asia Limited BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Limited BlackRock Group Limited BlackRock Finance Europe Limited BlackRock (Netherlands) B.V. BlackRock Asset Management Deutschland AG BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Canada Holdings LP BlackRock Canada Holdings ULC BlackRock Asset Management Canada Limited BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock Capital Holdings, Inc. BlackRock Advisors, LLC BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock Holdco 3, LLC BlackRock Cayman 1 LP BlackRock Cayman West Bay Finco Limited BlackRock Cayman West Bay IV Limited BlackRock Group Limited BlackRock Finance Europe Limited BlackRock Advisors (UK) Limited

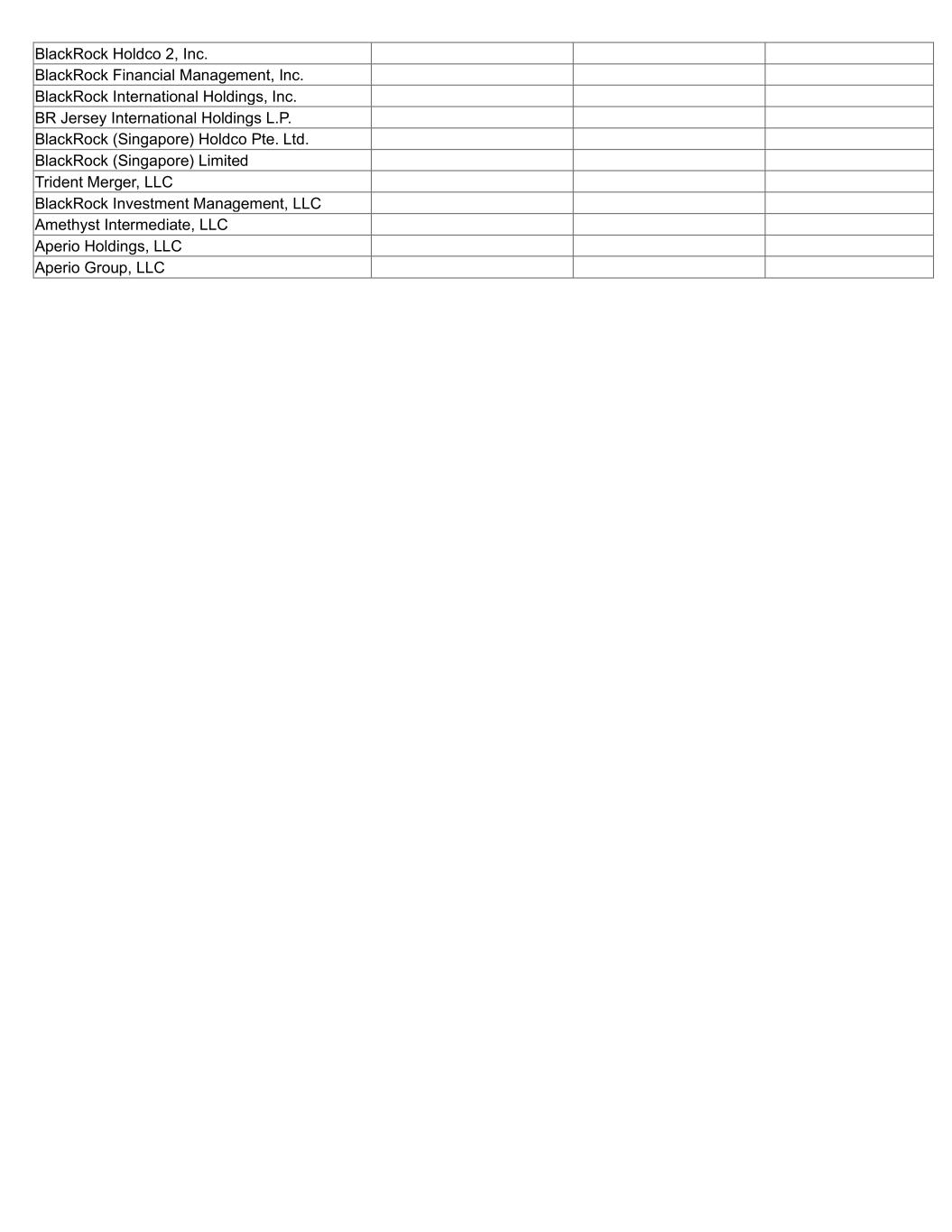

BlackRock Holdco 2, Inc. BlackRock Financial Management, Inc. BlackRock International Holdings, Inc. BR Jersey International Holdings L.P. BlackRock (Singapore) Holdco Pte. Ltd. BlackRock (Singapore) Limited Trident Merger, LLC BlackRock Investment Management, LLC Amethyst Intermediate, LLC Aperio Holdings, LLC Aperio Group, LLC

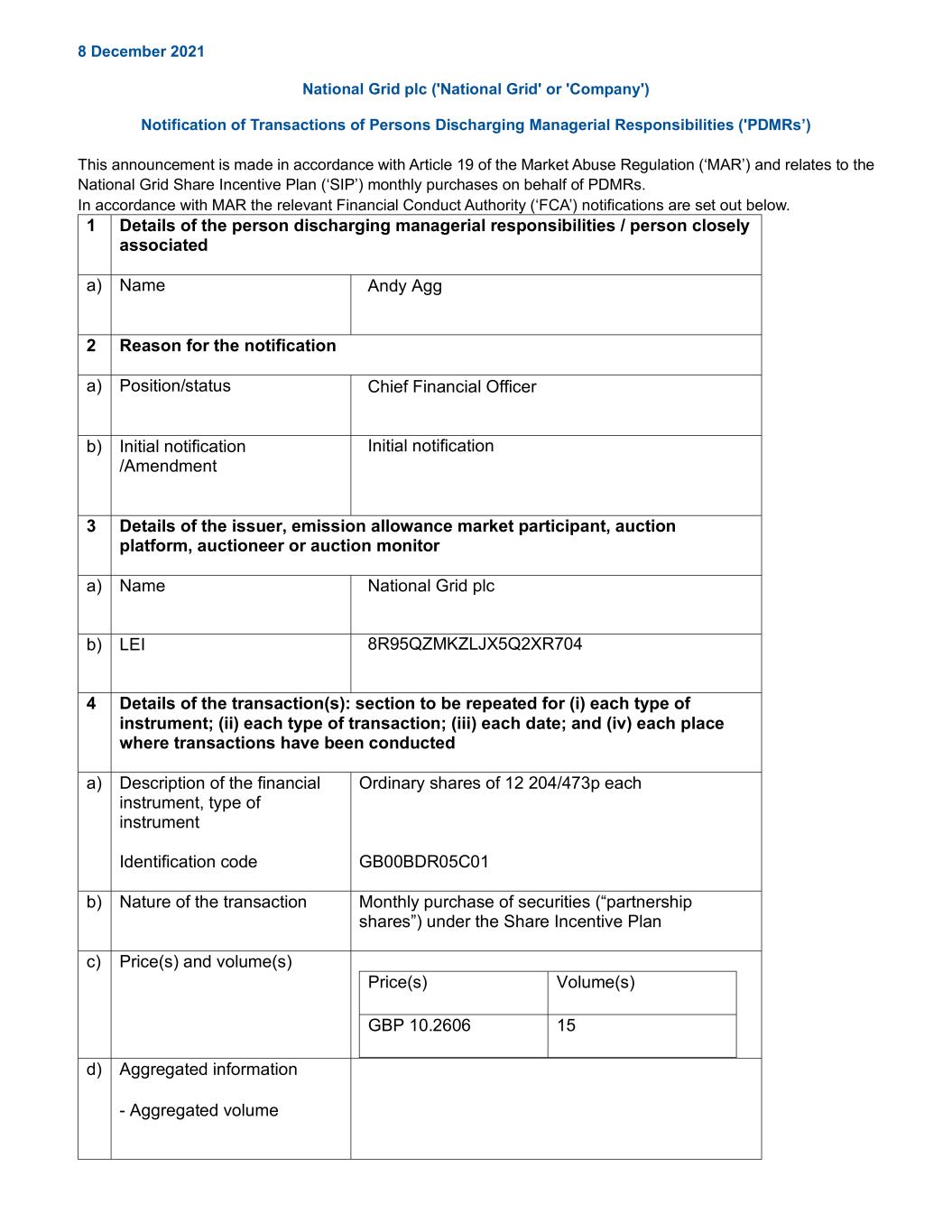

8 December 2021 National Grid plc ('National Grid' or 'Company') Notification of Transactions of Persons Discharging Managerial Responsibilities ('PDMRs’) This announcement is made in accordance with Article 19 of the Market Abuse Regulation (‘MAR’) and relates to the National Grid Share Incentive Plan (‘SIP’) monthly purchases on behalf of PDMRs. In accordance with MAR the relevant Financial Conduct Authority (‘FCA’) notifications are set out below. 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Andy Agg 2 Reason for the notification a) Position/status Chief Financial Officer b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01 b) Nature of the transaction Monthly purchase of securities (“partnership shares”) under the Share Incentive Plan c) Price(s) and volume(s) Price(s) Volume(s) GBP 10.2606 15 d) Aggregated information - Aggregated volume

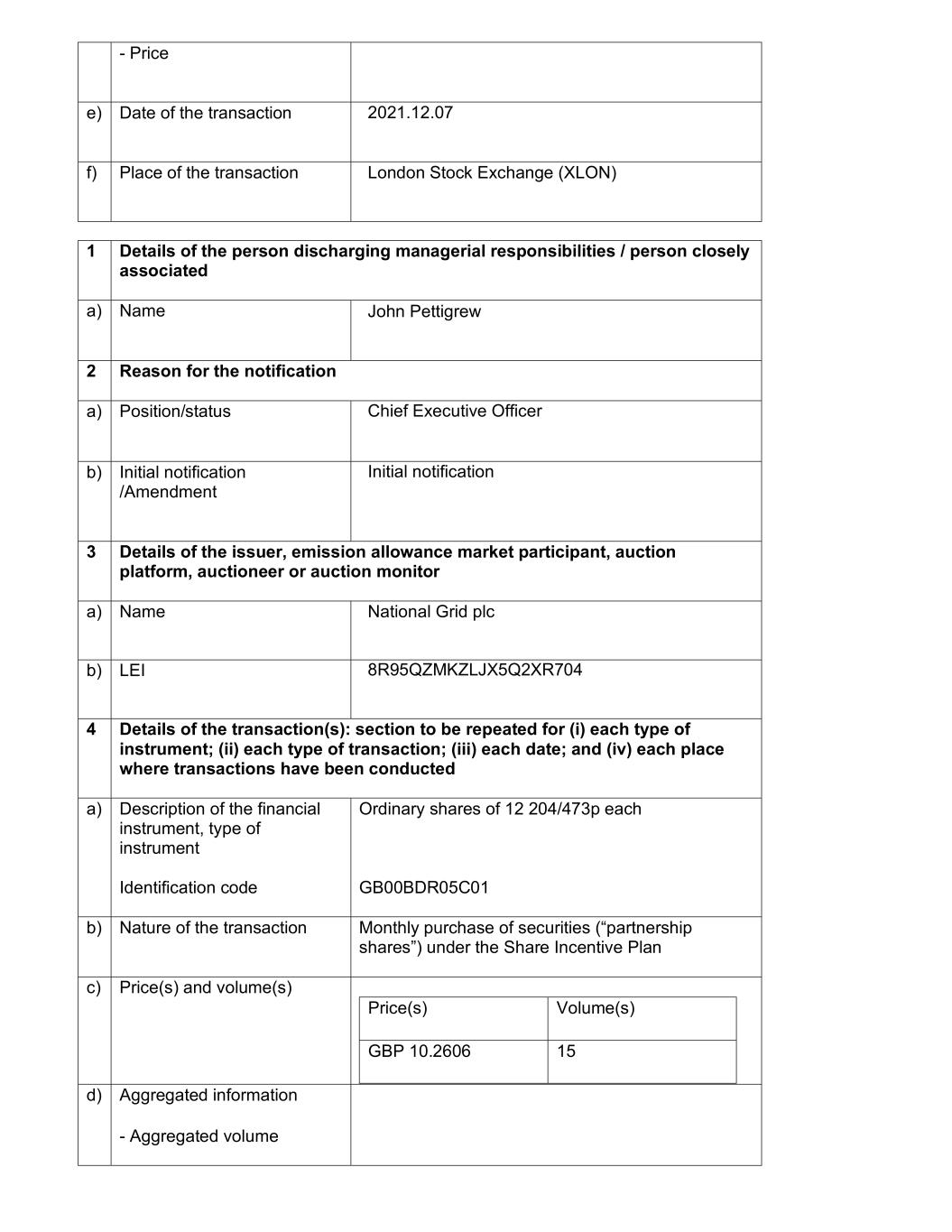

- Price e) Date of the transaction 2021.12.07 f) Place of the transaction London Stock Exchange (XLON) 1 Details of the person discharging managerial responsibilities / person closely associated a) Name John Pettigrew 2 Reason for the notification a) Position/status Chief Executive Officer b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01 b) Nature of the transaction Monthly purchase of securities (“partnership shares”) under the Share Incentive Plan c) Price(s) and volume(s) Price(s) Volume(s) GBP 10.2606 15 d) Aggregated information - Aggregated volume

- Price e) Date of the transaction 2021.12.07 f) Place of the transaction London Stock Exchange (XLON) 1 Details of the person discharging managerial responsibilities / person closely associated a) Name David Wright 2 Reason for the notification a) Position/status Group Chief Engineer b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01 b) Nature of the transaction Monthly purchase of securities (“partnership shares”) under the Share Incentive Plan c) Price(s) and volume(s) Price(s) Volume(s) GBP 10.2606 12 d) Aggregated information - Aggregated volume

- Price e) Date of the transaction 2021.12.07 f) Place of the transaction London Stock Exchange (XLON)

06 December 2021 National Grid plc ('National Grid' or 'Company') Notification of Transactions of Persons Discharging Managerial Responsibilities ('PDMRs’) This announcement is made in accordance with Article 19 of the Market Abuse Regulation (‘MAR’) and relates to the following PDMR being granted an award under the Company's Long Term Performance Plan (‘LTPP’) on 2 December 2021. The LTPP Award will vest on or after 1 July 2024 and is conditional on continued employment and on the satisfaction of the performance conditions approved by the Remuneration Committee. This award is subject to clawback and malus provisions. For further details of the LTPP, please see the Company's 2020/21 Annual Report and Accounts. In accordance with MAR the relevant Financial Conduct Authority notifications are set out below. 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Ben Wilson 2 Reason for the notification a) Position/status Chief Strategy and External Affairs Officer b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01 b) Nature of the transaction Acquisition of a conditional award over securities, for nil consideration, under the Long Term Performance Plan. c) Price(s) and volume(s) Price(s) Volume(s)

Nil 103,146 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2021.12.02 f) Place of the transaction Outside of a Trading Venue

3 December 2021 National Grid plc ('National Grid' or 'Company') Notification of Transaction of Persons Discharging Managerial Responsibilities ('PDMR’) This announcement is made in accordance with Article 19 of the Market Abuse Regulation (‘MAR’) and relates to the National Grid US Employee Stock Purchase Plan (‘ESPP’) monthly purchase on behalf of a PDMR. The relevant FCA notification is set out below. 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Adriana Karaboutis 2 Reason for the notification a) Position/status Chief Information and Digital Officer b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code American Depository Shares US 6362744095 b) Nature of the transaction Monthly purchase of securities under the National Grid US Employee Stock Purchase Plan c) Price(s) and volume(s) Price(s) Volume(s) $56.815105 10.584157 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2021.12.01 f) Place of the transaction Outside a trading venue

1 December 2021 National Grid plc ('National Grid' or 'Company') Voting Rights and Capital Update National Grid's registered capital as at 30 November 2021 consisted of 3,876,279,349 ordinary shares, of which, 259,184,055 were held as treasury shares; leaving a balance of 3,617,095,294 shares with voting rights. The figure of 3,617,095,294 may be used by shareholders as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, National Grid under the FCA Disclosure Guidance and Transparency Rules. Megan Barnes Head of Company Secretariat

23 November 2021 National Grid plc ('National Grid' or 'Company') Notification of Transaction of Person Discharging Managerial Responsibilities ('PDMR’) This announcement is made in accordance with Article 19 of the Market Abuse Regulation (‘MAR’) and relates to the sale of securities on behalf of a PDMR. In accordance with MAR the relevant FCA notification is set out below. 1 Details of the person discharging managerial responsibilities / person closely associated a) Name David Wright 2 Reason for the notification a) Position/status Group Chief Engineer b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01 b) Nature of the transaction Sale of National Grid plc securities c) Price(s) and volume(s) Price(s) Volume(s) GBP 9.8371 14,000 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2021.11.22 f) Place of the transaction London Stock Exchange (XLON)