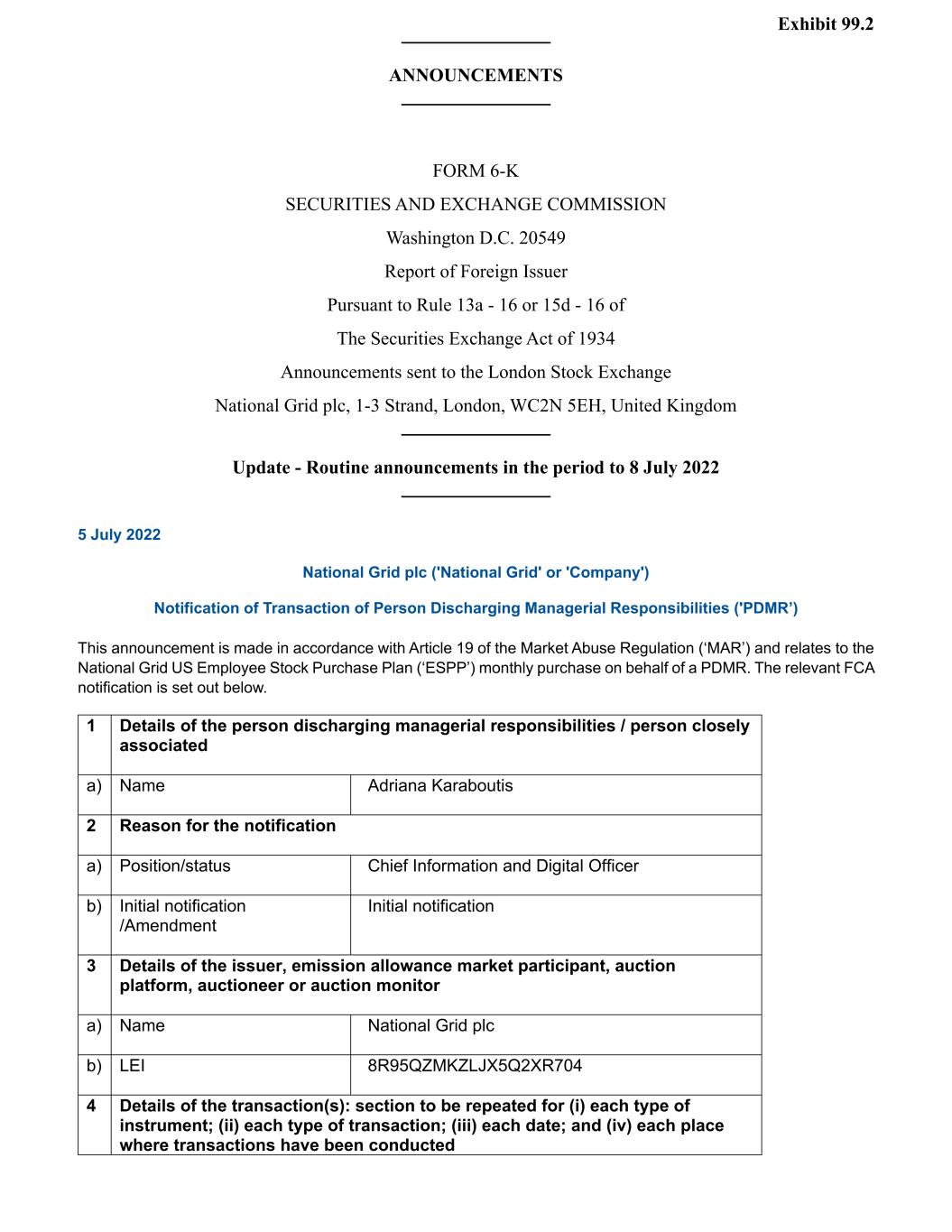

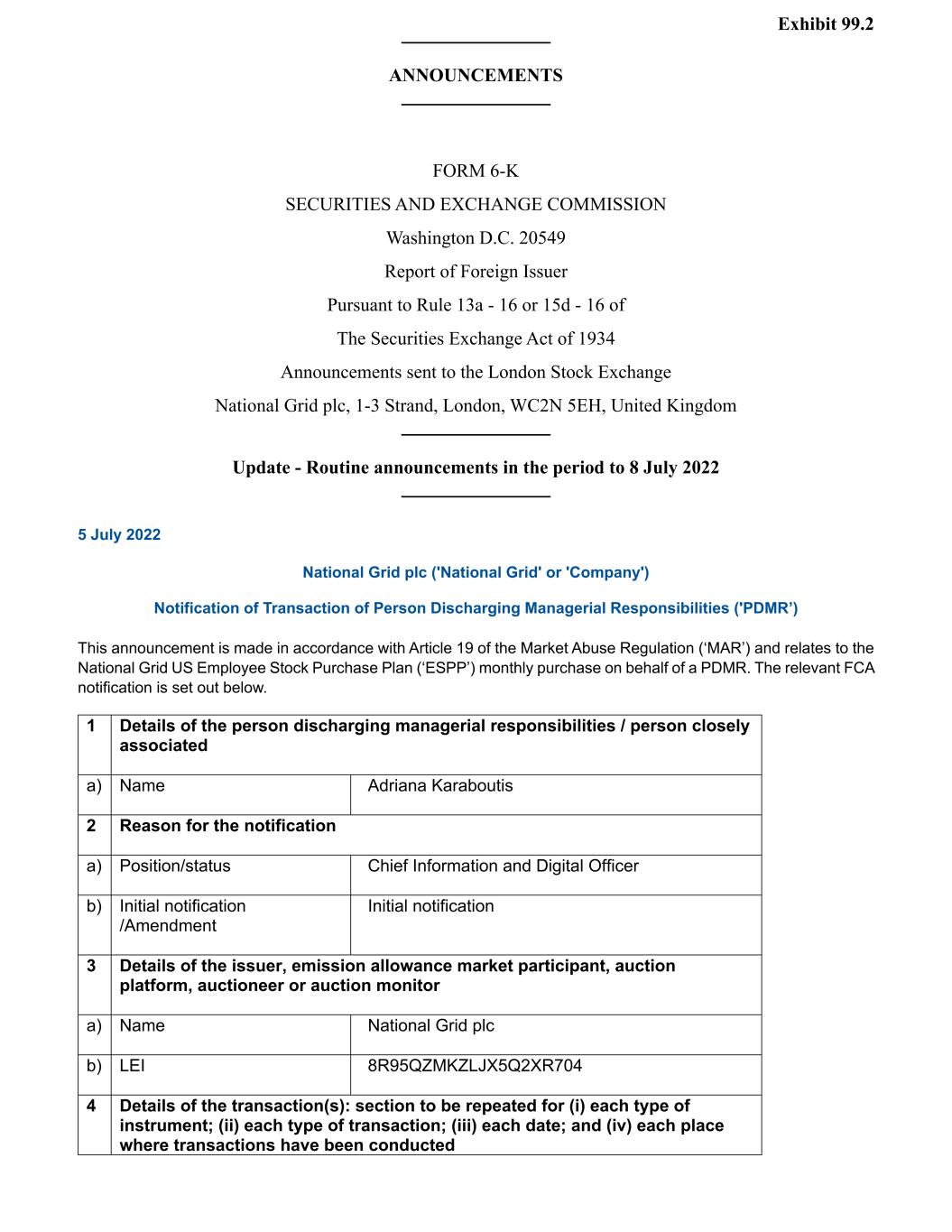

Exhibit 99.2 ANNOUNCEMENTS FORM 6-K SECURITIES AND EXCHANGE COMMISSION Washington D.C. 20549 Report of Foreign Issuer Pursuant to Rule 13a - 16 or 15d - 16 of The Securities Exchange Act of 1934 Announcements sent to the London Stock Exchange National Grid plc, 1-3 Strand, London, WC2N 5EH, United Kingdom Update - Routine announcements in the period to 8 July 2022 5 July 2022 National Grid plc ('National Grid' or 'Company') Notification of Transaction of Person Discharging Managerial Responsibilities ('PDMR’) This announcement is made in accordance with Article 19 of the Market Abuse Regulation (‘MAR’) and relates to the National Grid US Employee Stock Purchase Plan (‘ESPP’) monthly purchase on behalf of a PDMR. The relevant FCA notification is set out below. 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Adriana Karaboutis 2 Reason for the notification a) Position/status Chief Information and Digital Officer b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted

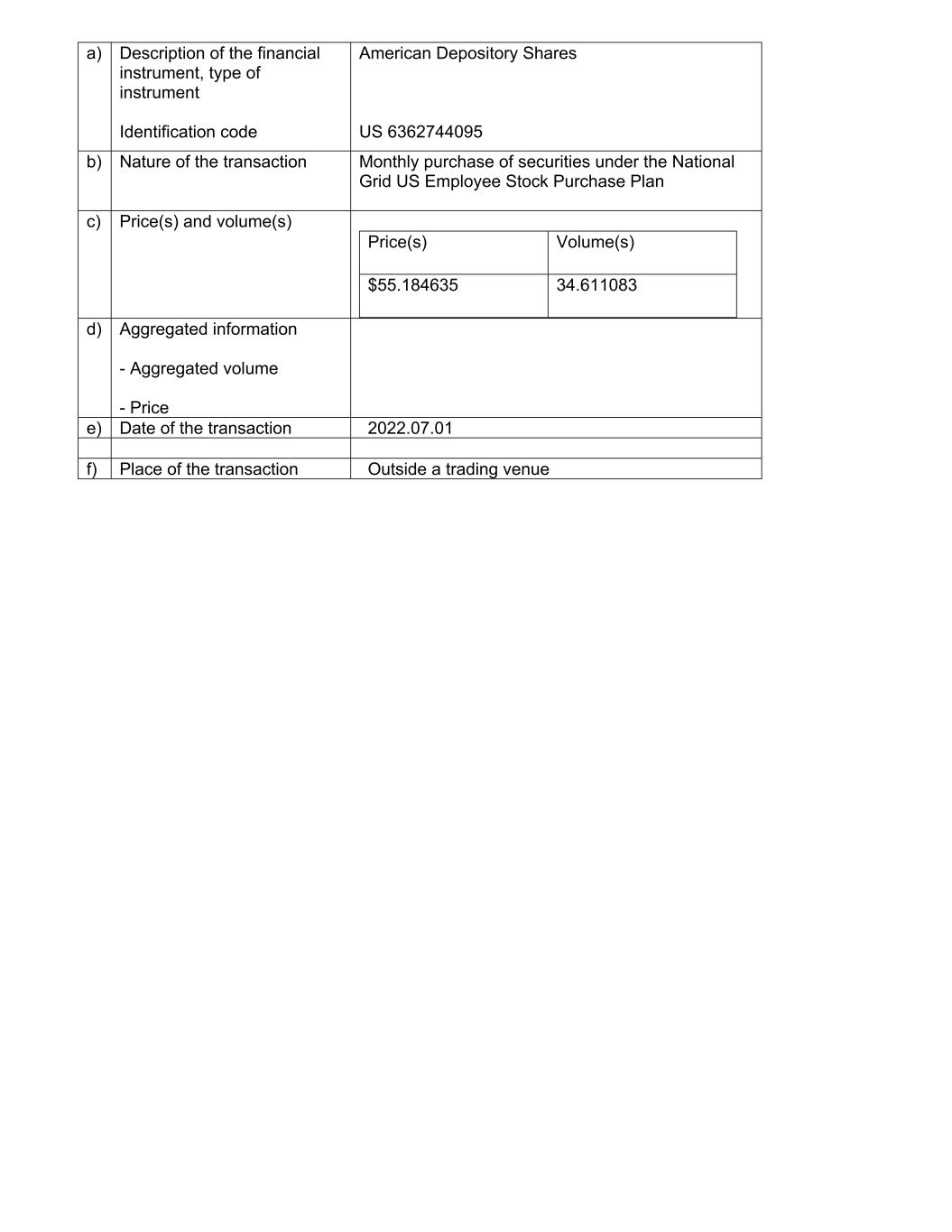

a) Description of the financial instrument, type of instrument Identification code American Depository Shares US 6362744095 b) Nature of the transaction Monthly purchase of securities under the National Grid US Employee Stock Purchase Plan c) Price(s) and volume(s) Price(s) Volume(s) $55.184635 34.611083 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2022.07.01 f) Place of the transaction Outside a trading venue

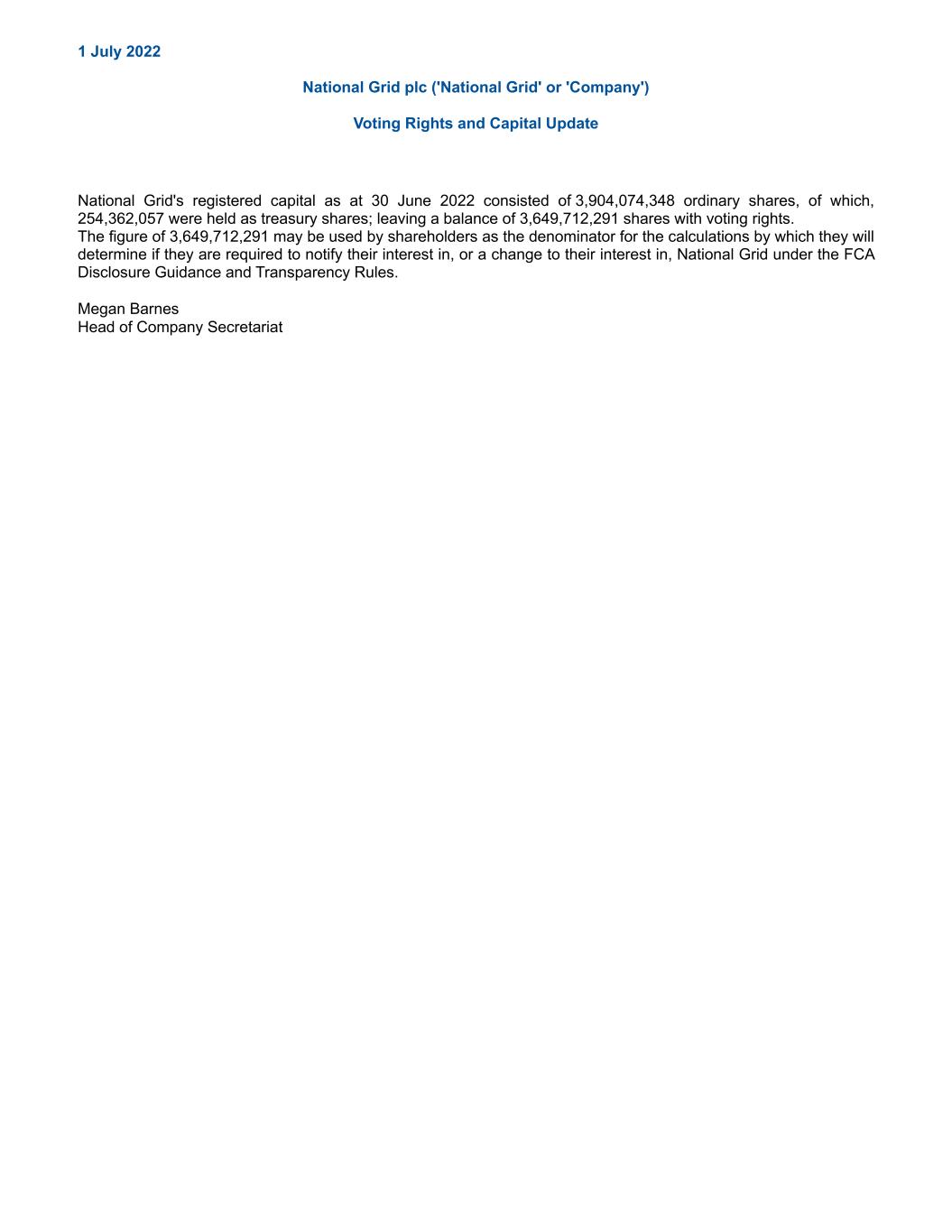

1 July 2022 National Grid plc ('National Grid' or 'Company') Voting Rights and Capital Update National Grid's registered capital as at 30 June 2022 consisted of 3,904,074,348 ordinary shares, of which, 254,362,057 were held as treasury shares; leaving a balance of 3,649,712,291 shares with voting rights. The figure of 3,649,712,291 may be used by shareholders as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, National Grid under the FCA Disclosure Guidance and Transparency Rules. Megan Barnes Head of Company Secretariat

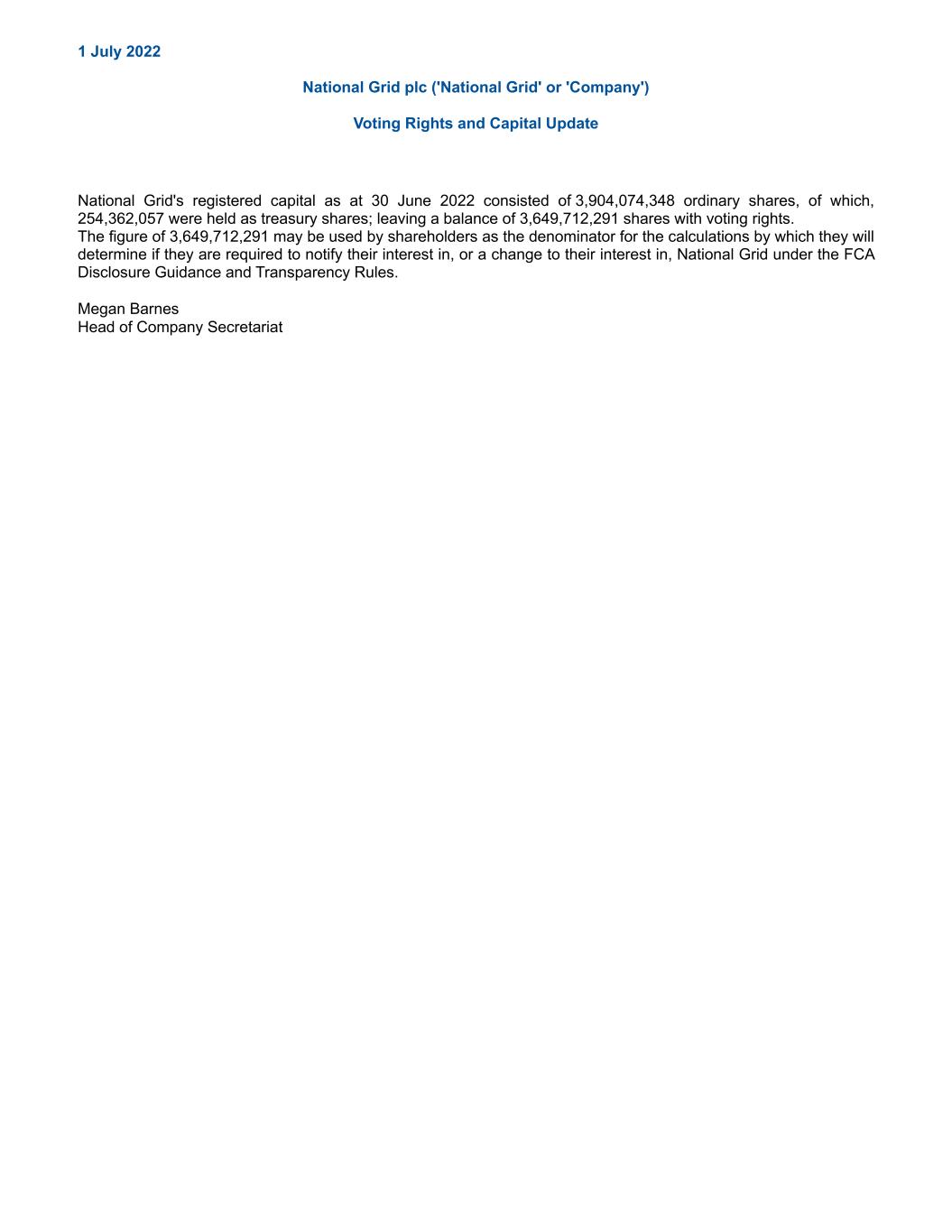

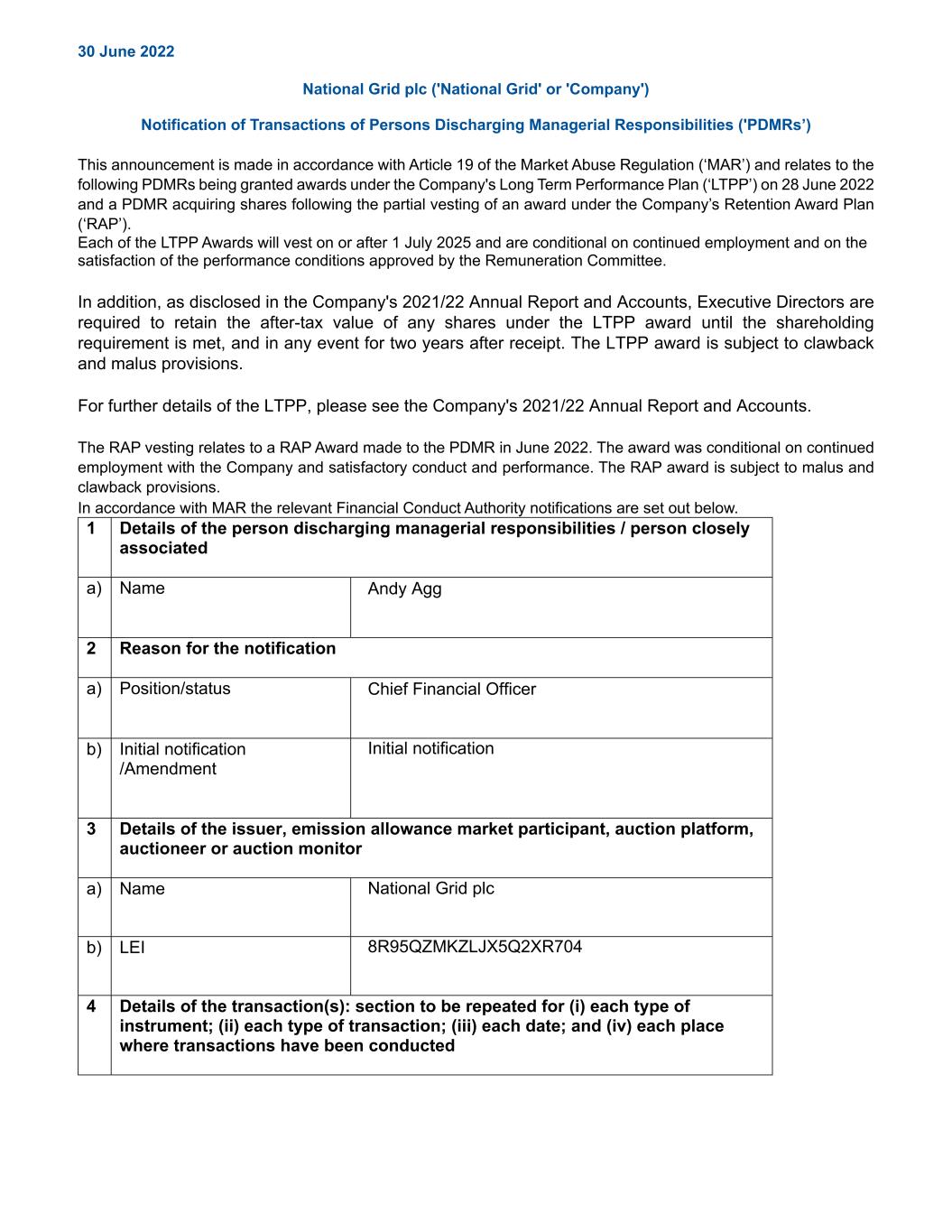

30 June 2022 National Grid plc ('National Grid' or 'Company') Notification of Transactions of Persons Discharging Managerial Responsibilities ('PDMRs’) This announcement is made in accordance with Article 19 of the Market Abuse Regulation (‘MAR’) and relates to the following PDMRs being granted awards under the Company's Long Term Performance Plan (‘LTPP’) on 28 June 2022 and a PDMR acquiring shares following the partial vesting of an award under the Company’s Retention Award Plan (‘RAP’). Each of the LTPP Awards will vest on or after 1 July 2025 and are conditional on continued employment and on the satisfaction of the performance conditions approved by the Remuneration Committee. In addition, as disclosed in the Company's 2021/22 Annual Report and Accounts, Executive Directors are required to retain the after-tax value of any shares under the LTPP award until the shareholding requirement is met, and in any event for two years after receipt. The LTPP award is subject to clawback and malus provisions. For further details of the LTPP, please see the Company's 2021/22 Annual Report and Accounts. The RAP vesting relates to a RAP Award made to the PDMR in June 2022. The award was conditional on continued employment with the Company and satisfactory conduct and performance. The RAP award is subject to malus and clawback provisions. In accordance with MAR the relevant Financial Conduct Authority notifications are set out below. 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Andy Agg 2 Reason for the notification a) Position/status Chief Financial Officer b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted

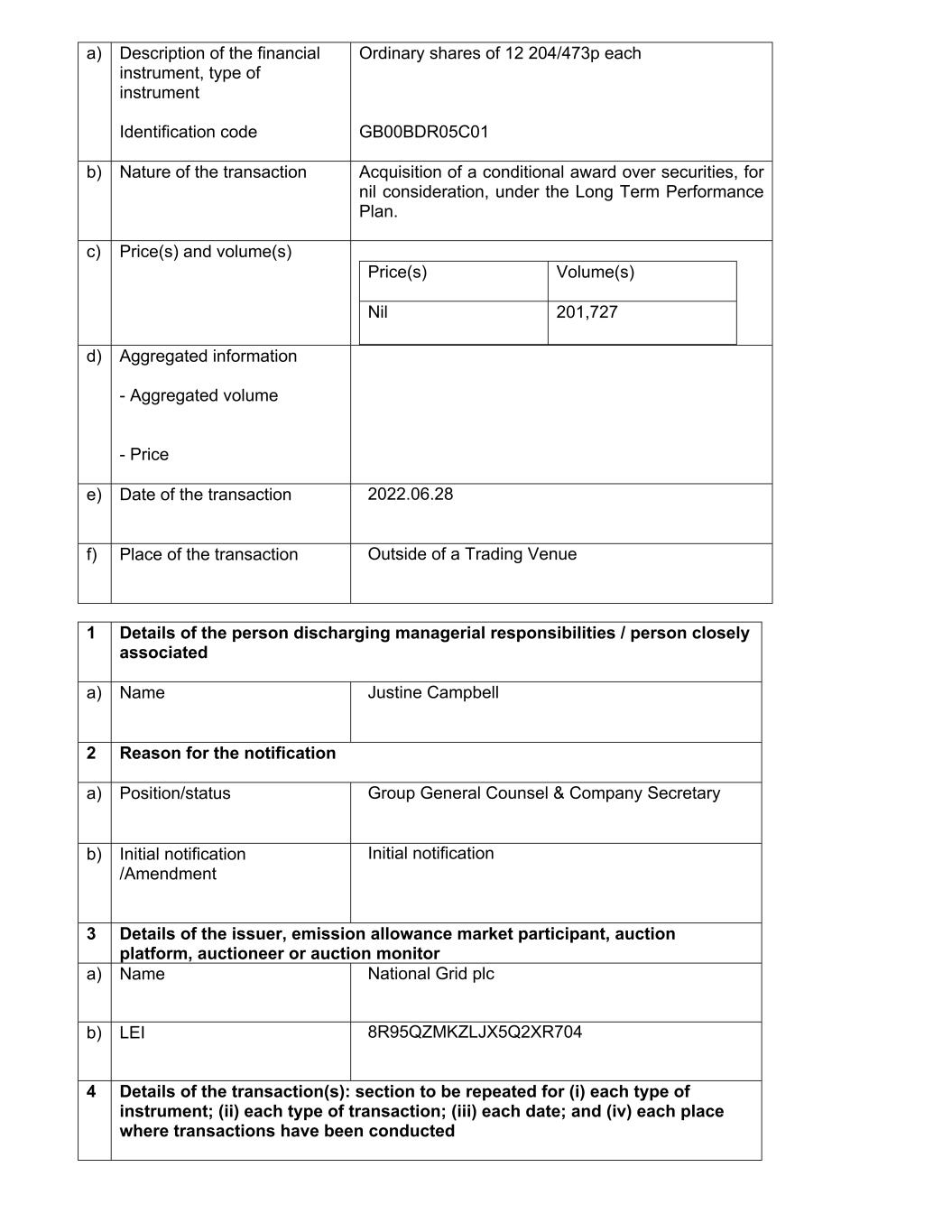

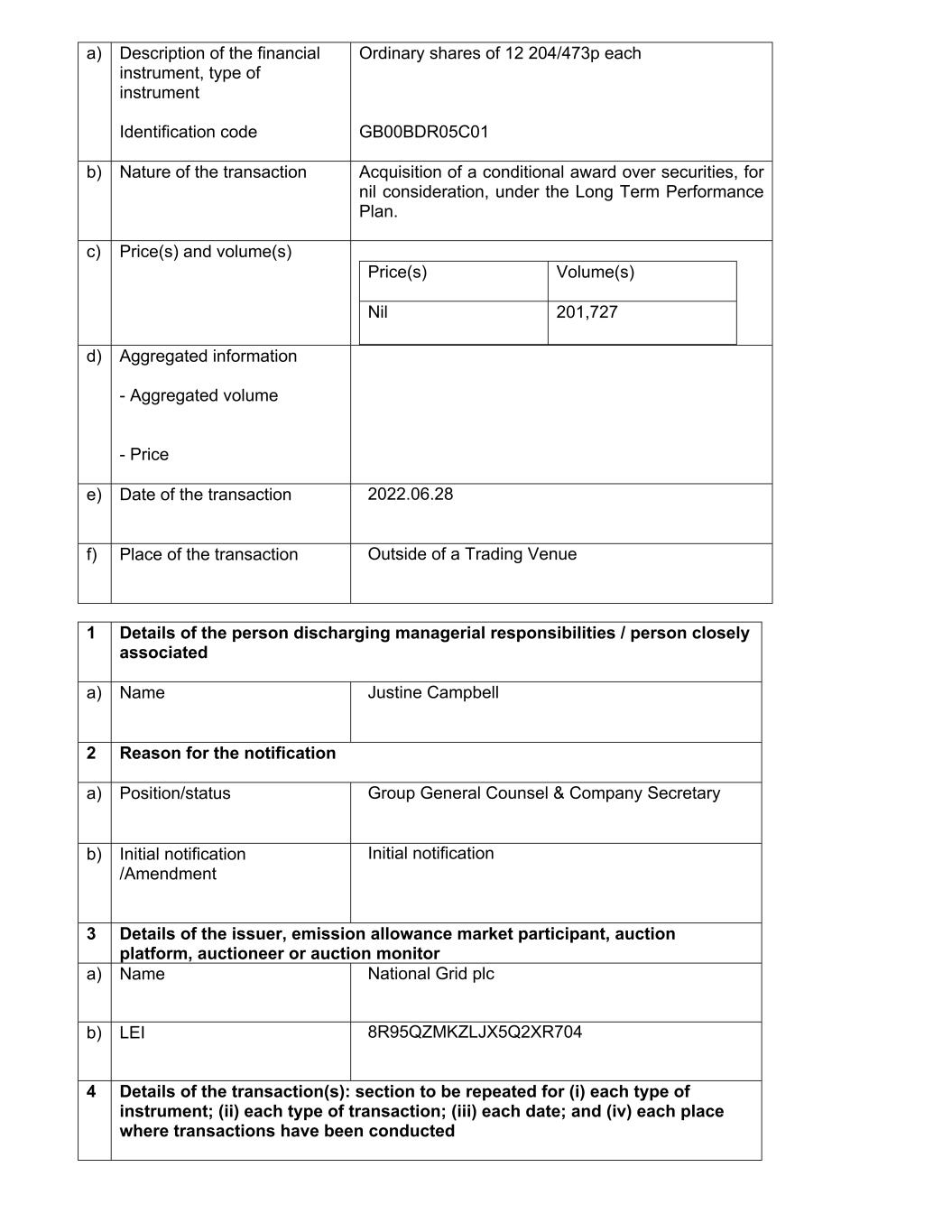

a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01 b) Nature of the transaction Acquisition of a conditional award over securities, for nil consideration, under the Long Term Performance Plan. c) Price(s) and volume(s) Price(s) Volume(s) Nil 201,727 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2022.06.28 f) Place of the transaction Outside of a Trading Venue 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Justine Campbell 2 Reason for the notification a) Position/status Group General Counsel & Company Secretary b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted

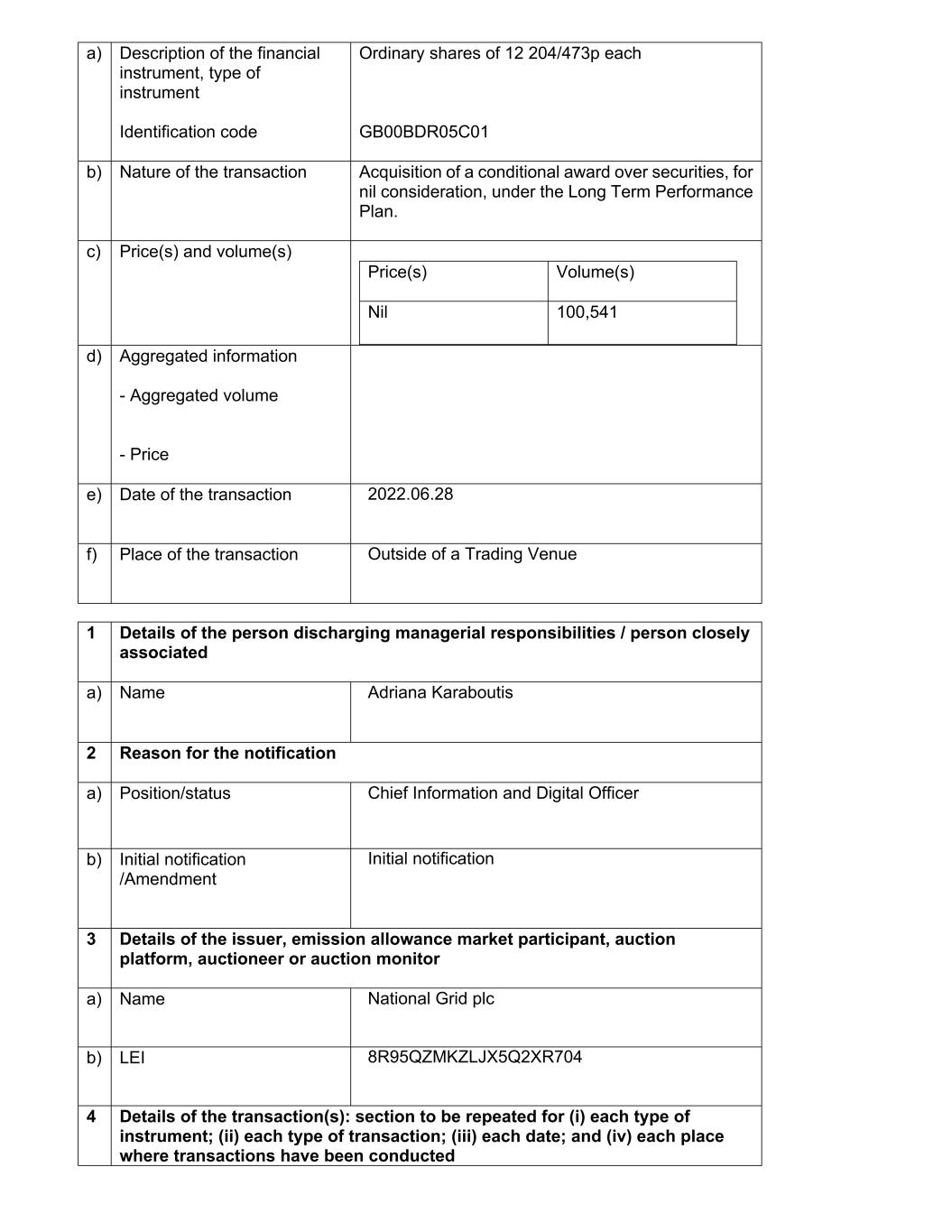

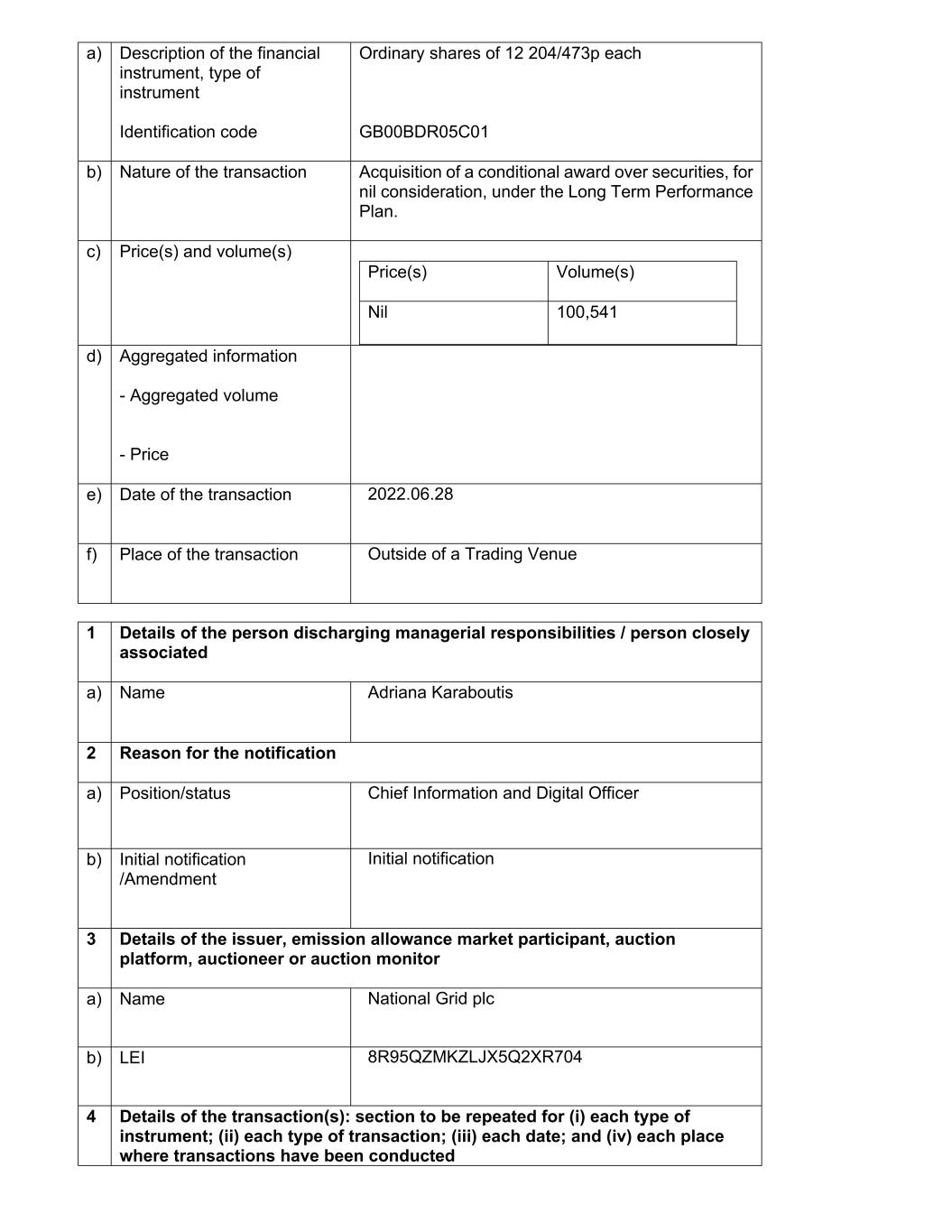

a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01 b) Nature of the transaction Acquisition of a conditional award over securities, for nil consideration, under the Long Term Performance Plan. c) Price(s) and volume(s) Price(s) Volume(s) Nil 100,541 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2022.06.28 f) Place of the transaction Outside of a Trading Venue 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Adriana Karaboutis 2 Reason for the notification a) Position/status Chief Information and Digital Officer b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted

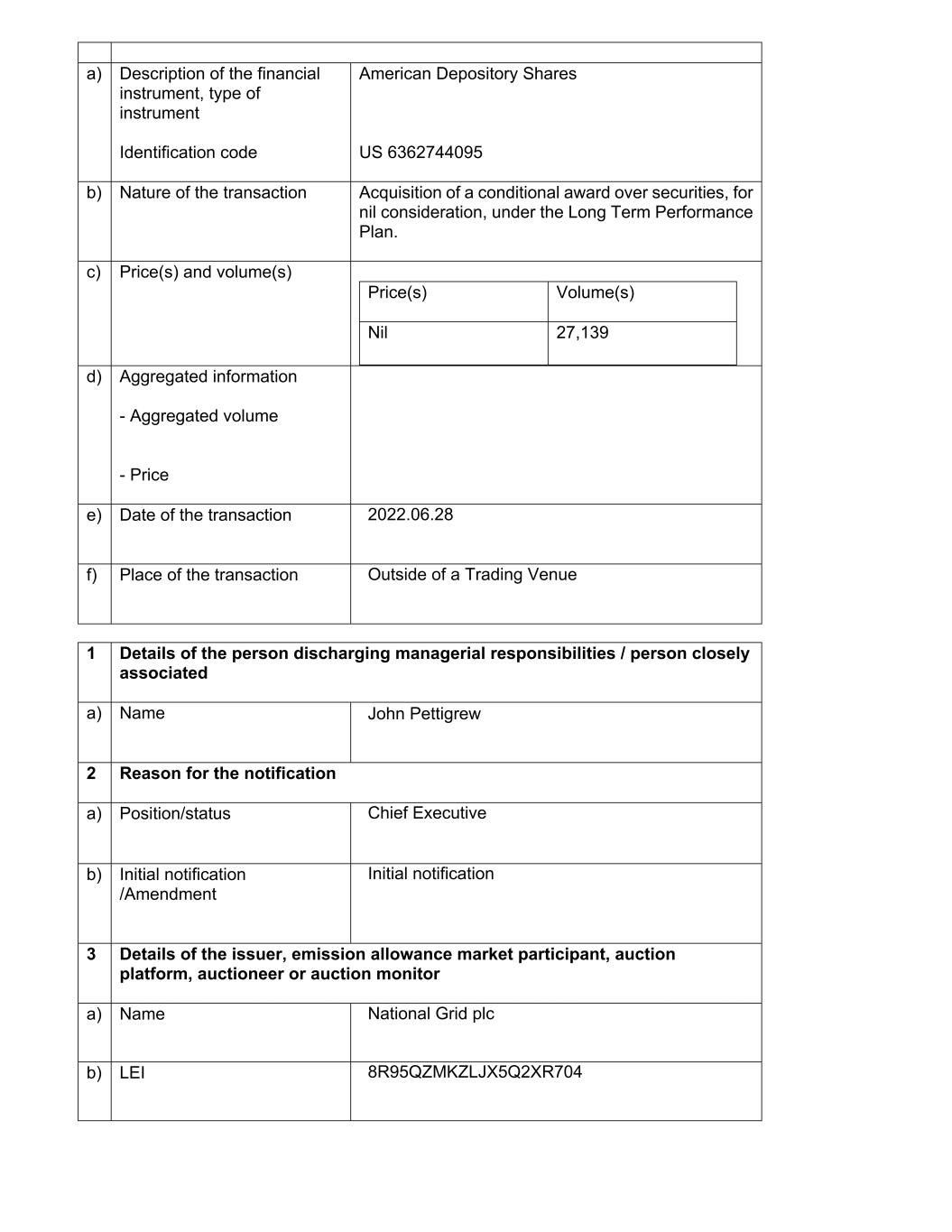

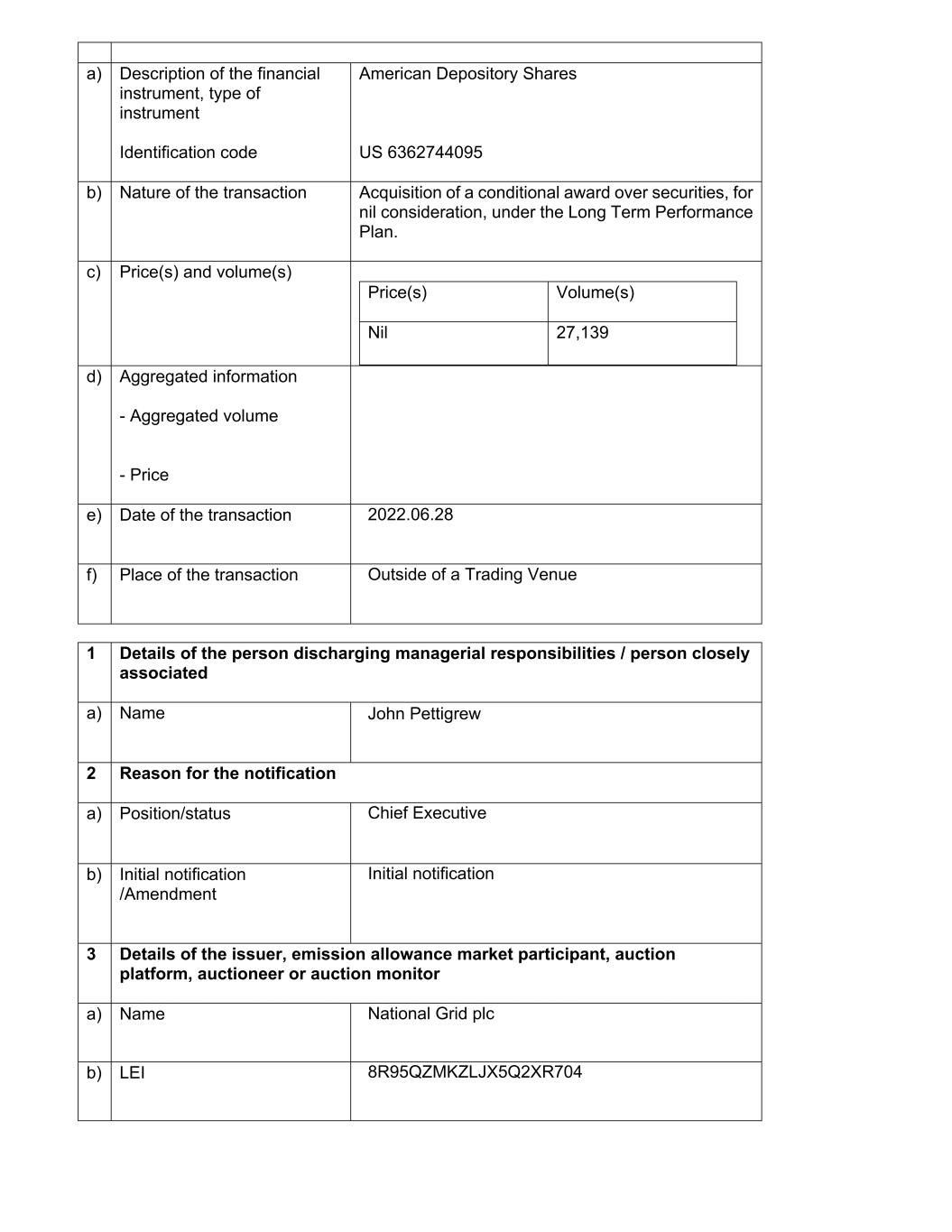

a) Description of the financial instrument, type of instrument Identification code American Depository Shares US 6362744095 b) Nature of the transaction Acquisition of a conditional award over securities, for nil consideration, under the Long Term Performance Plan. c) Price(s) and volume(s) Price(s) Volume(s) Nil 27,139 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2022.06.28 f) Place of the transaction Outside of a Trading Venue 1 Details of the person discharging managerial responsibilities / person closely associated a) Name John Pettigrew 2 Reason for the notification a) Position/status Chief Executive b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704

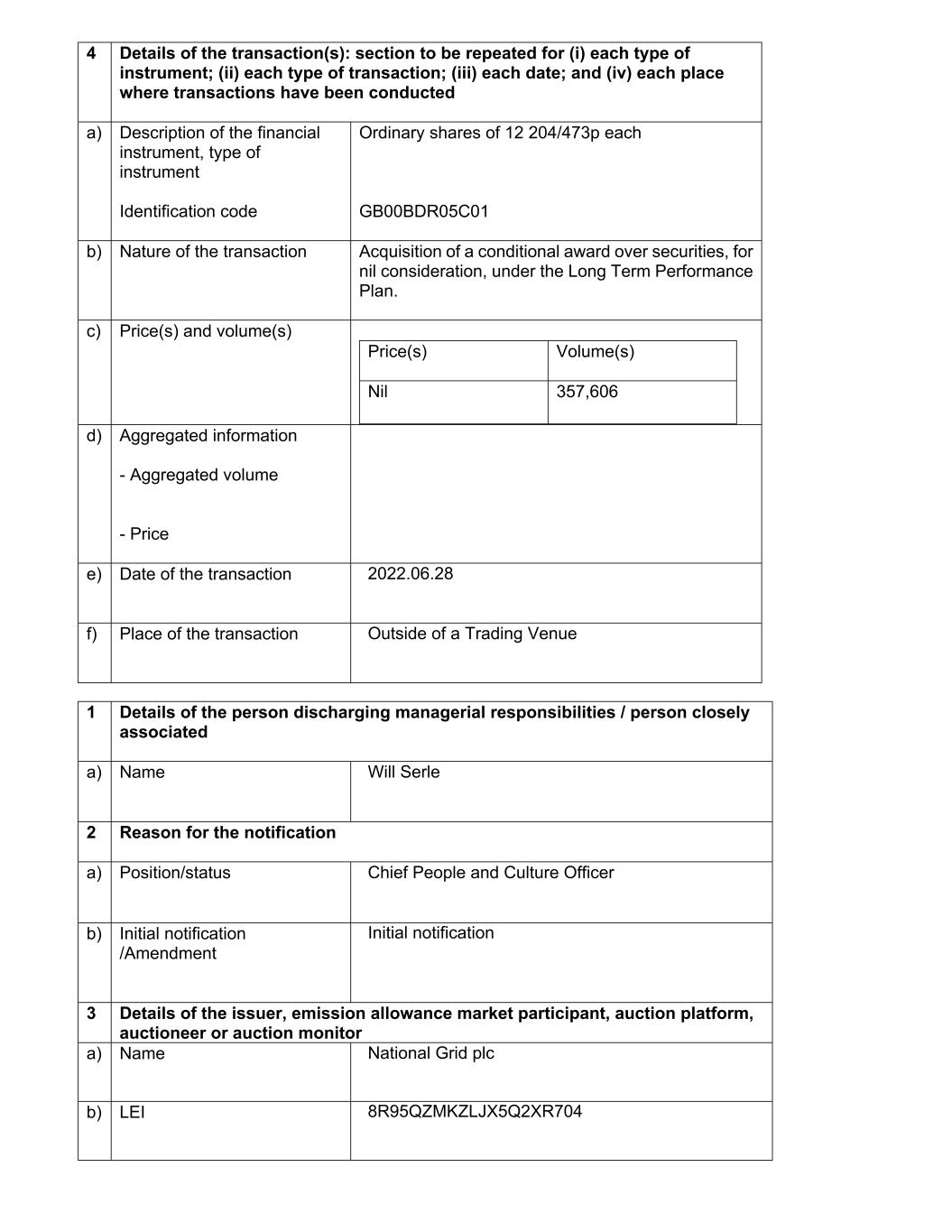

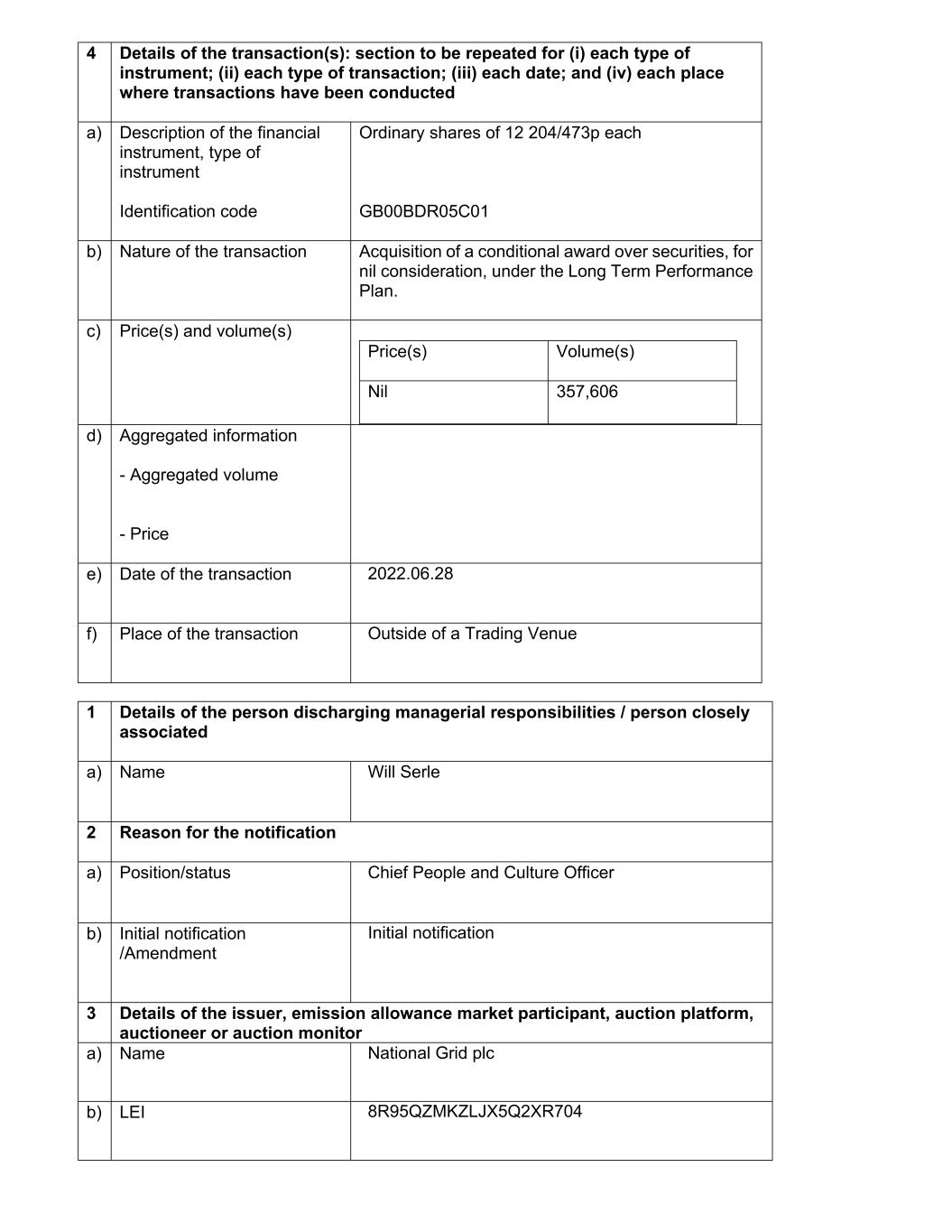

4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01 b) Nature of the transaction Acquisition of a conditional award over securities, for nil consideration, under the Long Term Performance Plan. c) Price(s) and volume(s) Price(s) Volume(s) Nil 357,606 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2022.06.28 f) Place of the transaction Outside of a Trading Venue 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Will Serle 2 Reason for the notification a) Position/status Chief People and Culture Officer b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704

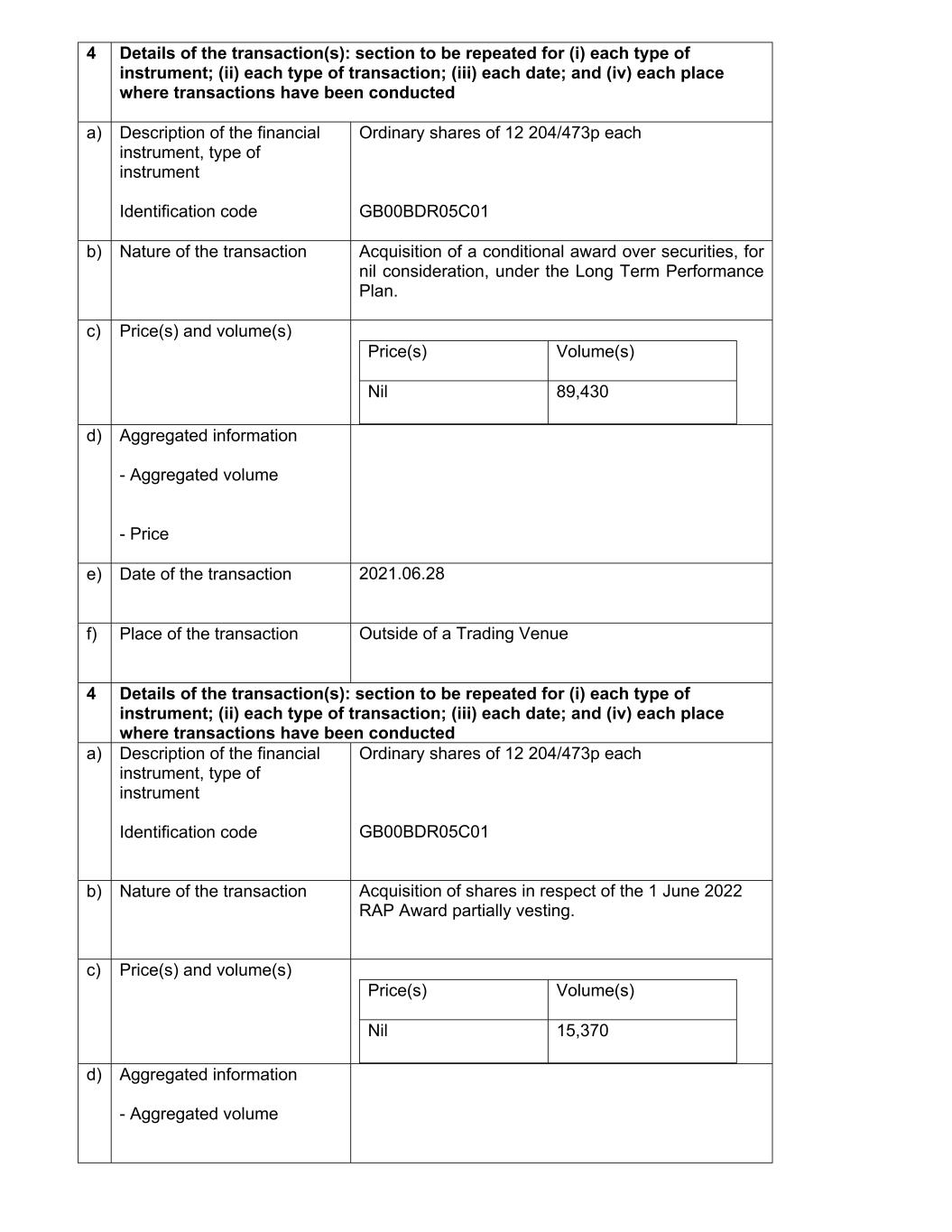

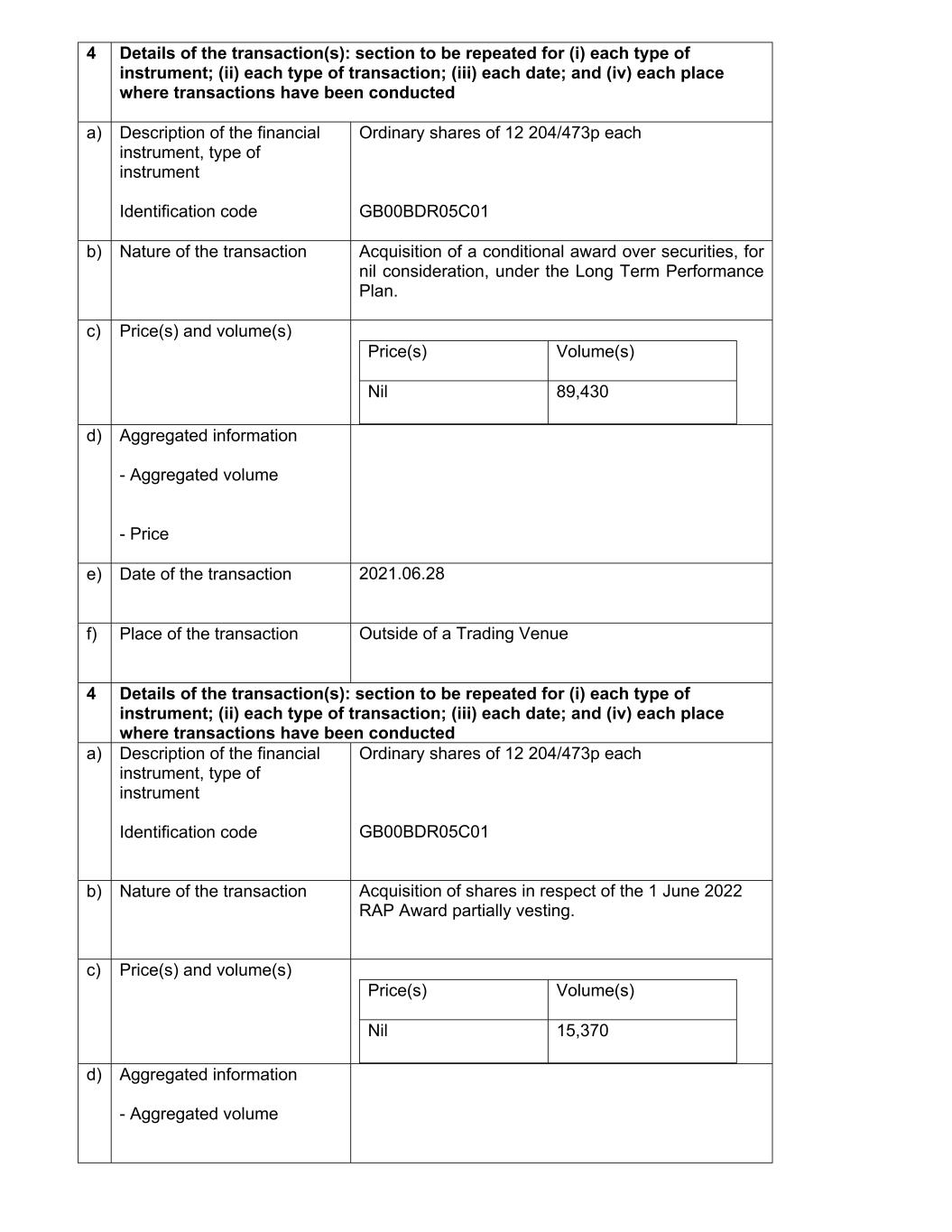

4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01 b) Nature of the transaction Acquisition of a conditional award over securities, for nil consideration, under the Long Term Performance Plan. c) Price(s) and volume(s) Price(s) Volume(s) Nil 89,430 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2021.06.28 f) Place of the transaction Outside of a Trading Venue 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01 b) Nature of the transaction Acquisition of shares in respect of the 1 June 2022 RAP Award partially vesting. c) Price(s) and volume(s) Price(s) Volume(s) Nil 15,370 d) Aggregated information - Aggregated volume

- Price e) Date of the transaction 2021.06.28 f) Place of the transaction London Stock Exchange (XLON) 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01 b) Nature of the transaction Automatic disposal of shares resulting from RAP Award exercise to cover tax liabilities. c) Price(s) and volume(s) Price(s) Volume(s) GBP 10.667258 7,597 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2022.06.28 f) Place of the transaction London Stock Exchange (XLON) 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Ben Wilson 2 Reason for the notification a) Position/status Chief Strategy & External Affairs Officer

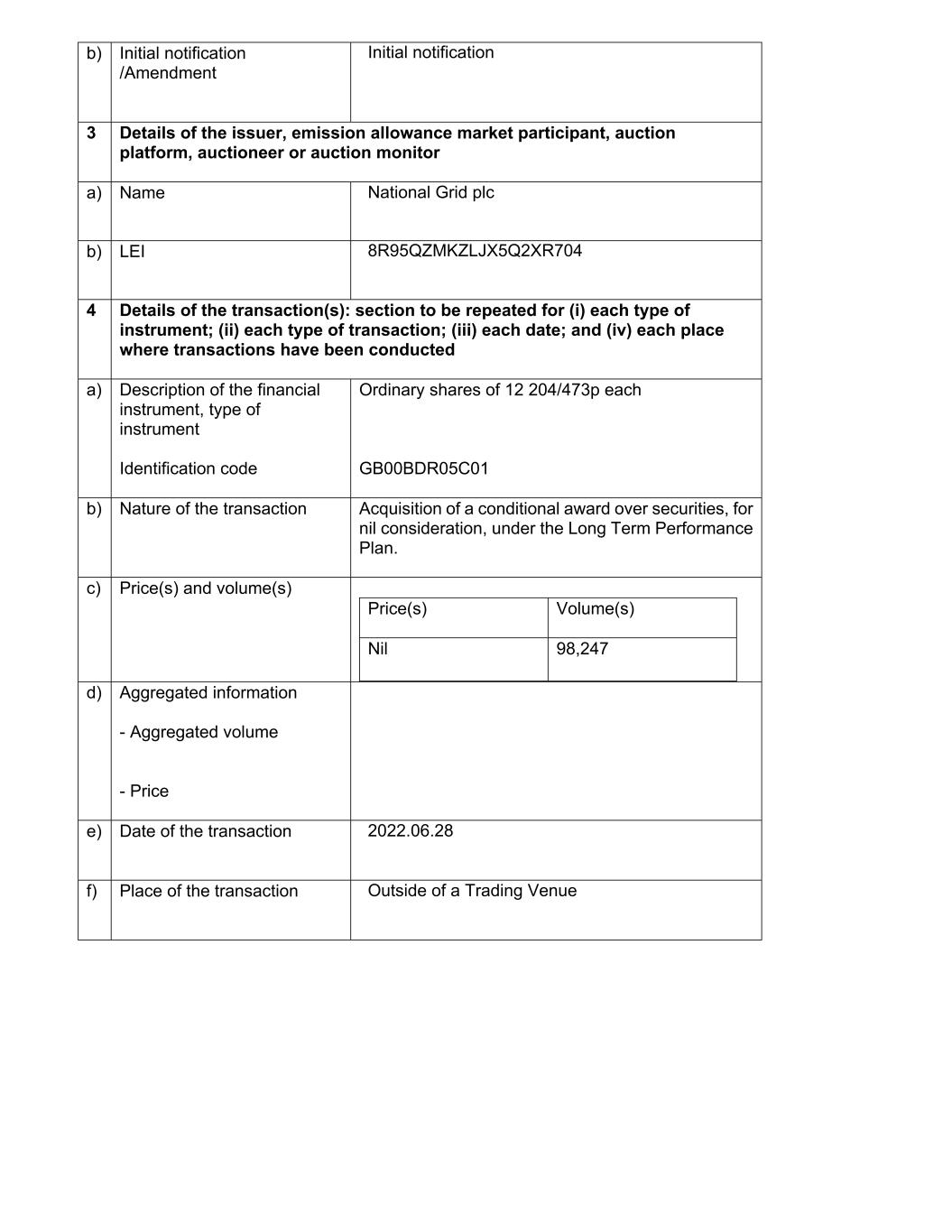

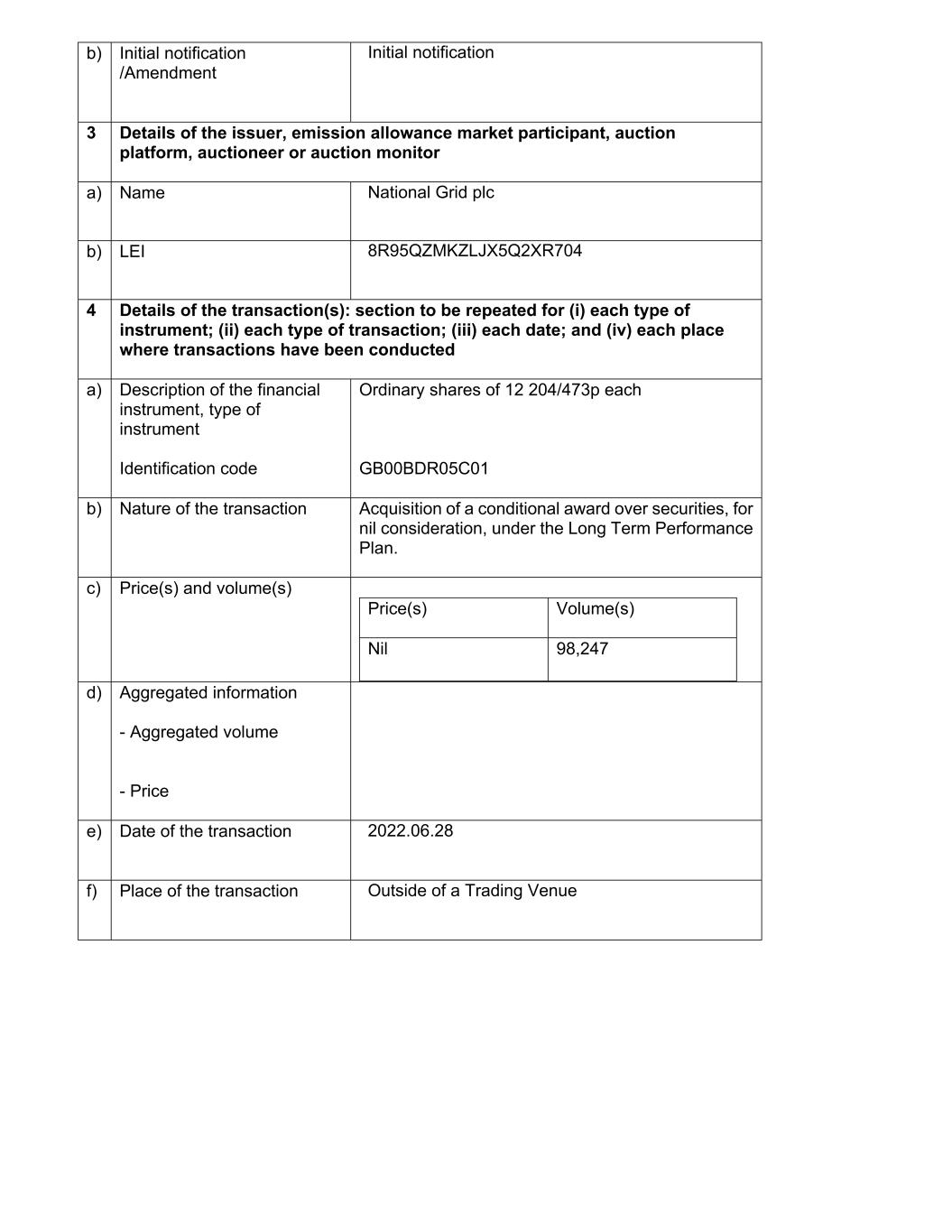

b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01 b) Nature of the transaction Acquisition of a conditional award over securities, for nil consideration, under the Long Term Performance Plan. c) Price(s) and volume(s) Price(s) Volume(s) Nil 98,247 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2022.06.28 f) Place of the transaction Outside of a Trading Venue

28 June 2022 Responsible Business Report 21/22: ESG Investor Webinar John Pettigrew, Chief Executive, will today present the key highlights from our Responsible Business Report 21/22 published on 7 June 2022. Following presentation of the highlights for the year, he will be joined by Duncan Burt, Chief Sustainability Officer for a Q&A session to answer investors queries. The event will provide an overview of our responsible business performance and evidence the steps the Group is taking to ensure a clean, fair and affordable energy future. Please https://streamstudio.world-television.com/CCUIv3/registration.aspx?ticket=786-1014-32720&target=en-default- &status=ondemand&browser=ns-0-1-0-0-0 to join us virtually for today’s webinar, which will begin at 14.00 (BST). To submit questions ahead of and during the webinar, please use the ‘Ask a question’ tab at the bottom of the webcast platform https://streamstudio.world-television.com/CCUIv3/registration.aspx?ticket=786-1014- 32720&target=en-default-&status=ondemand&browser=ns-0-1-0-0-0 No material updates on current trading will be provided. All materials, including slides and the video recording, will be made available on the https://www.nationalgrid.com/investors following the webinar. CONTACTS Event support Please email: webcastsupport@wtvglobal.com National Grid Investors and Analysts Nick Ashworth +44 (0) 7814 355 590 Angela Broad +44 (0) 7825 351 918 James Flanagan +44 (0) 7970 778 952 Jonathan Clay +44 (0) 7899 928 247

CAUTIONARY STATEMENT This announcement contains certain statements that are neither reported financial results nor other historical information. These statements are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include information with respect to National Grid’s (the Company) financial condition, its results of operations and businesses, strategy, plans and objectives. Words such as ‘aims’, ‘anticipates’, ‘expects’, ‘should’, ‘intends’, ‘plans’, ‘believes’, ‘outlook’, ‘seeks’, ‘estimates’, ‘targets’, ‘may’, ‘will’, ‘continue’, ‘project’ and similar expressions, as well as statements in the future tense, identify forward-looking statements. This document also references climate-related targets and climate-related risks which differ from conventional financial risks in that they are complex, novel and tend to involve projection over long term scenarios which are subject to significant uncertainty and change. These forward- looking statements are not guarantees of National Grid’s future performance and are subject to assumptions, risks and uncertainties that could cause actual future results to differ materially from those expressed in or implied by such forward-looking statements or targets. Many of these assumptions, risks and uncertainties relate to factors that are beyond National Grid’s ability to control, predict or estimate precisely, such as changes in laws or regulations, including any arising as a result of the United Kingdom’s exit from the European Union, announcements from and decisions by governmental bodies or regulators, including those relating to the RIIO-T2 and RIIO-ED2 price controls; the timing of construction and delivery by third parties of new generation projects requiring connection; breaches of, or changes in, environmental, climate change and health and safety laws or regulations, including breaches or other incidents arising from the potentially harmful nature of its activities; network failure or interruption (including any that result in safety and/or environmental events), the inability to carry out critical non network operations and damage to infrastructure, due to adverse weather conditions including the impact of major storms as well as the results of climate change, due to counterparties being unable to deliver physical commodities, or due to the failure of or unauthorised access to or deliberate breaches of National Grid’s IT systems and supporting technology; failure to adequately forecast and respond to disruptions in energy supply; performance against regulatory targets and standards and against National Grid’s peers with the aim of delivering stakeholder expectations regarding costs and efficiency savings, as well as against targets and standards designed to deliver net zero; and customers and counterparties (including financial institutions) failing to perform their obligations to the Company. Other factors that could cause actual results to differ materially from those described in this announcement include fluctuations in exchange rates, interest rates and commodity price indices; restrictions and conditions (including filing requirements) in National Grid’s borrowing and debt arrangements, funding costs and access to financing; regulatory requirements for the Company to maintain financial resources in certain parts of its business and restrictions on some subsidiaries’ transactions such as paying dividends, lending or levying charges; the delayed timing of recoveries and payments in National Grid’s regulated businesses, including as a result of the COVID-19 pandemic, and whether aspects of its activities are contestable; the funding requirements and performance of National Grid’s pension schemes and other post-retirement benefit schemes; the failure to attract, develop and retain employees with the necessary competencies, including leadership and business capabilities, and any significant disputes arising with National Grid’s employees or the breach of laws or regulations by its employees; the failure to respond to market developments, including competition for onshore transmission; the threats and opportunities presented by emerging technology; the failure by the Company to respond to, or meet its own commitments as a leader in relation to, climate change development activities relating to energy transition, including the integration of distributed energy resources; and the need to grow the Company’s business to deliver its strategy, as well as incorrect or unforeseen assumptions or conclusions (including unanticipated costs and liabilities) relating to business development activity, including the integration of WPD, and the sale of a 60% stake in its UK gas transmission and metering business. For further details regarding these and other assumptions, risks and uncertainties that may impact National Grid, please read the Strategic Report section and the ‘Risk factors’ on pages 253 to 256 of National Grid’s most recent Annual Report and Accounts. In addition, new factors emerge from time to time and National Grid cannot assess the potential impact of any such factor on its activities or the extent to which any factor, or combination of factors, may cause actual future results to differ materially from those contained in any forward-looking statement. Except as may be required by law or regulation, the Company undertakes no obligation to update any of its forward-looking statements, which speak only as of the date of this announcement.

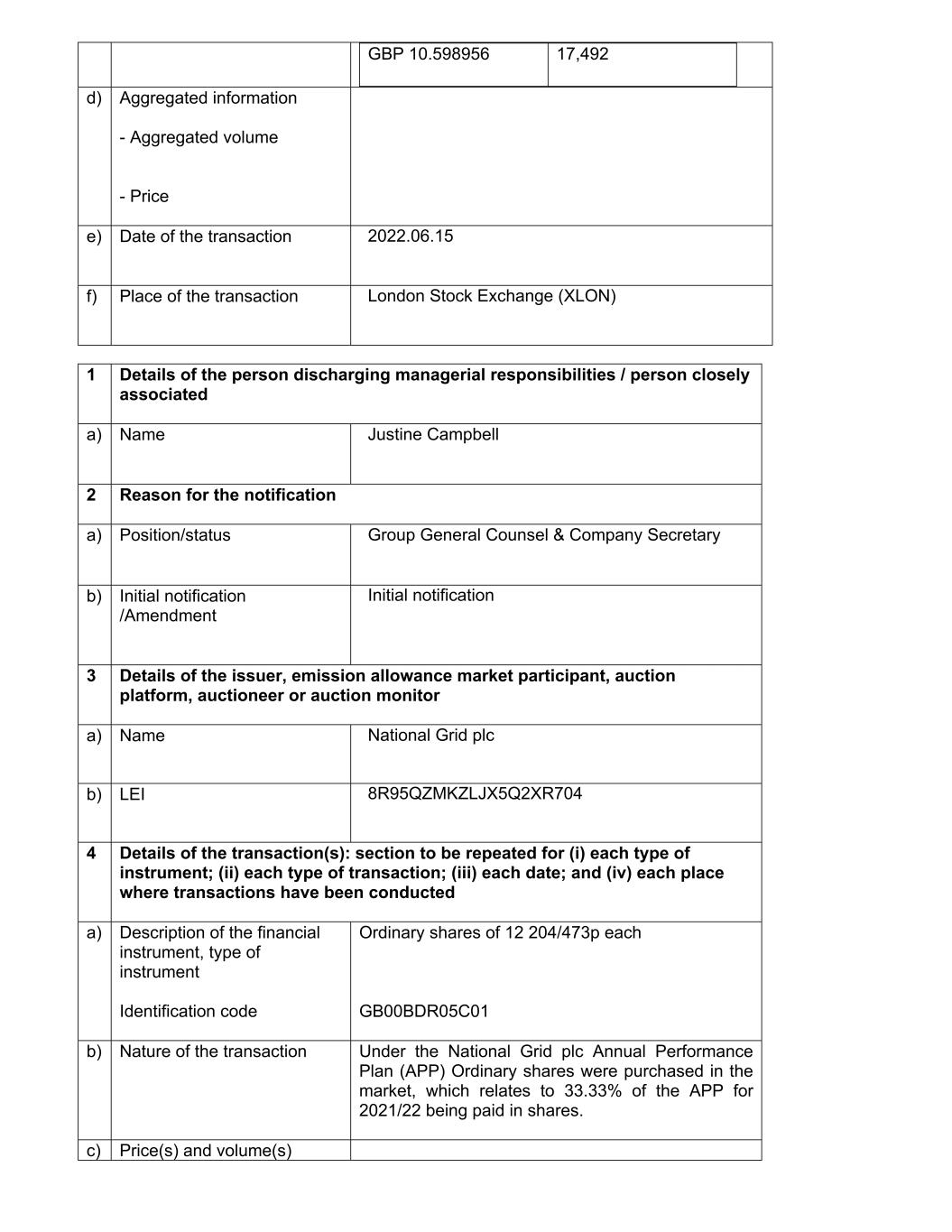

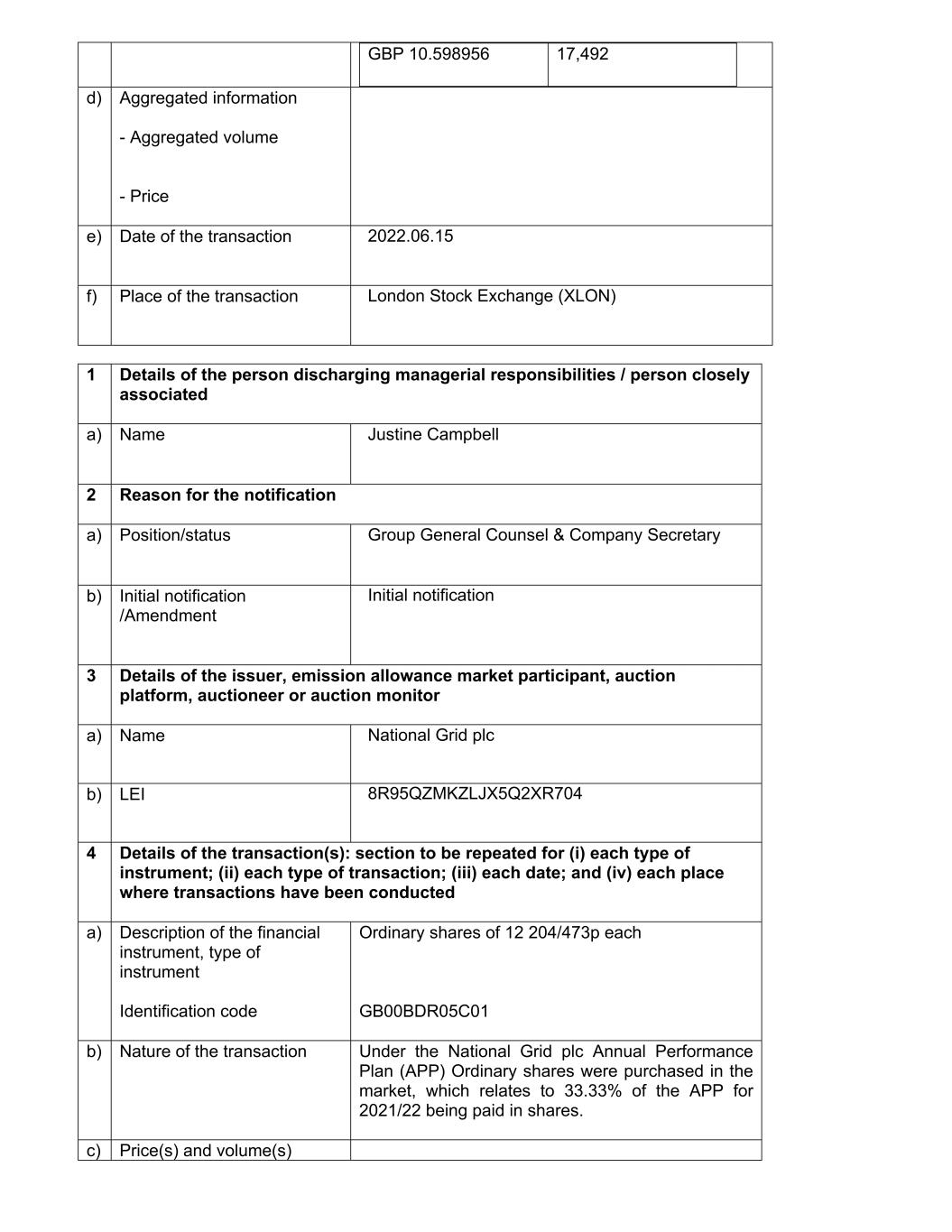

17 June 2022 National Grid plc ('National Grid' or 'Company') Notification of Transactions of Persons Discharging Managerial Responsibilities ('PDMRs’) This announcement is made in accordance with Article 19 of the Market Abuse Regulation (MAR) and relates to the following Executive Directors and PDMRs being granted awards under the Company's Annual Performance Plan (APP) on 15 June 2022, which relates to a percentage of the award for 2021/22 being paid in shares, and which (after tax on the gross award) must be retained until the shareholding requirement is met, and in any event for two years after receipt. This award is subject to clawback and malus provisions. For further details of the APP, please see the Company's 2021/22 Annual Report and Accounts. In accordance with MAR the relevant Financial Conduct Authority (FCA) notifications are set out below. 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Andy Agg 2 Reason for the notification a) Position/status Chief Financial Officer b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01 b) Nature of the transaction Under the National Grid plc Annual Performance Plan (APP) Ordinary shares were purchased in the market, which relates to 50% of the APP for 2021/22 being paid in shares. c) Price(s) and volume(s) Price(s) Volume(s)

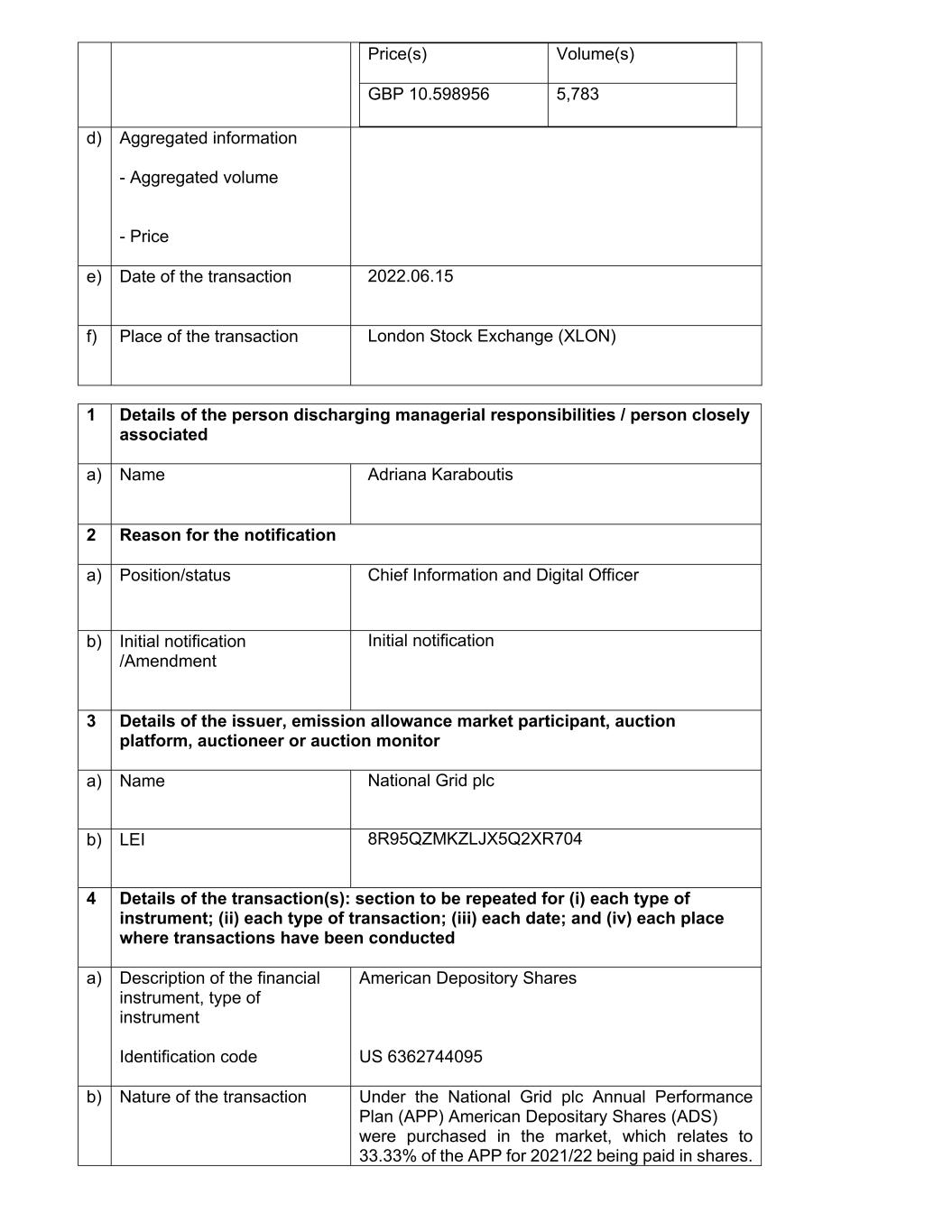

GBP 10.598956 17,492 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2022.06.15 f) Place of the transaction London Stock Exchange (XLON) 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Justine Campbell 2 Reason for the notification a) Position/status Group General Counsel & Company Secretary b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01 b) Nature of the transaction Under the National Grid plc Annual Performance Plan (APP) Ordinary shares were purchased in the market, which relates to 33.33% of the APP for 2021/22 being paid in shares. c) Price(s) and volume(s)

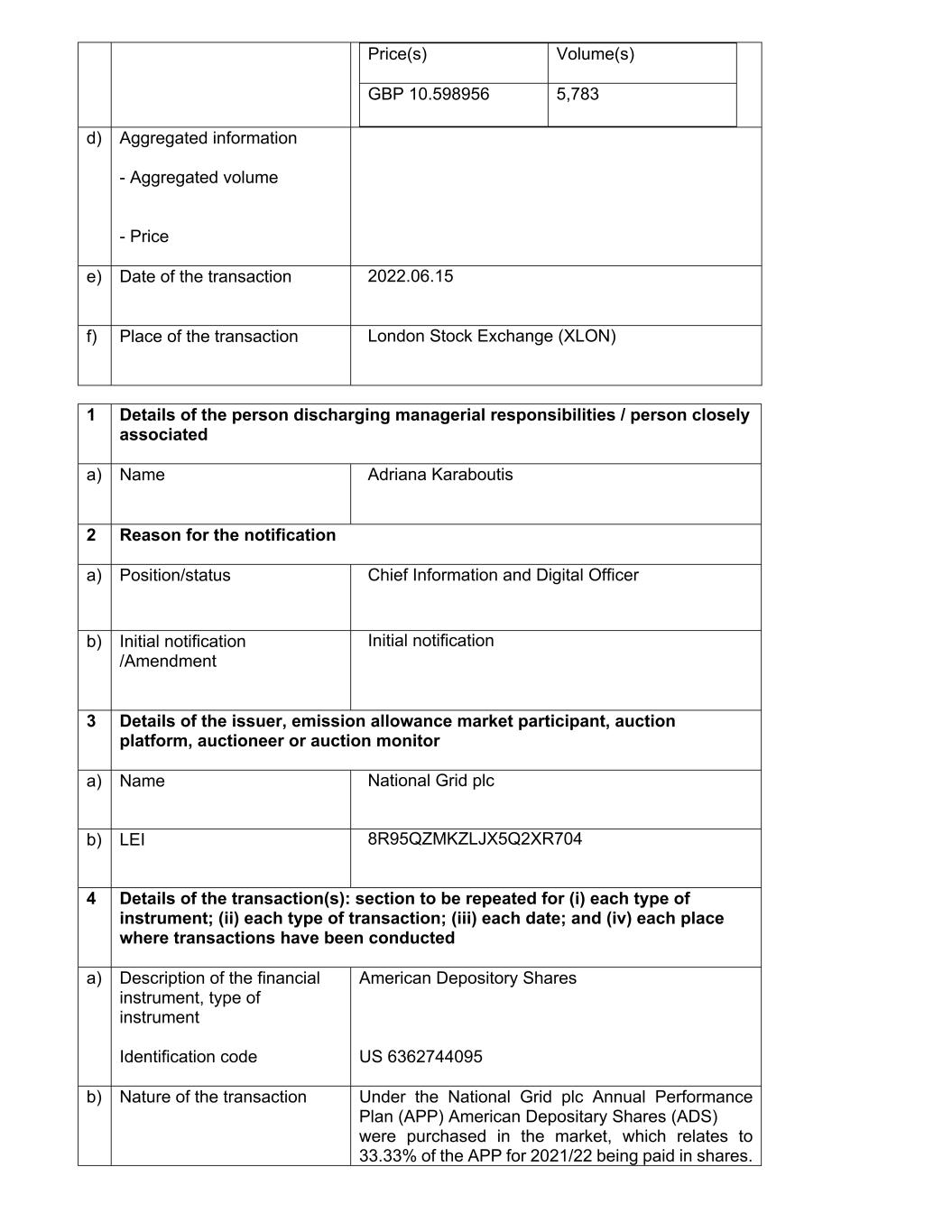

Price(s) Volume(s) GBP 10.598956 5,783 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2022.06.15 f) Place of the transaction London Stock Exchange (XLON) 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Adriana Karaboutis 2 Reason for the notification a) Position/status Chief Information and Digital Officer b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code American Depository Shares US 6362744095 b) Nature of the transaction Under the National Grid plc Annual Performance Plan (APP) American Depositary Shares (ADS) were purchased in the market, which relates to 33.33% of the APP for 2021/22 being paid in shares.

c) Price(s) and volume(s) Price(s) Volume(s) USD 64.96 2,344 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2022.06.15 f) Place of the transaction Outside of a Trading Venue 1 Details of the person discharging managerial responsibilities / person closely associated a) Name John Pettigrew 2 Reason for the notification a) Position/status Chief Executive b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01 b) Nature of the transaction Under the National Grid plc Annual Performance Plan (APP) Ordinary shares were purchased in the

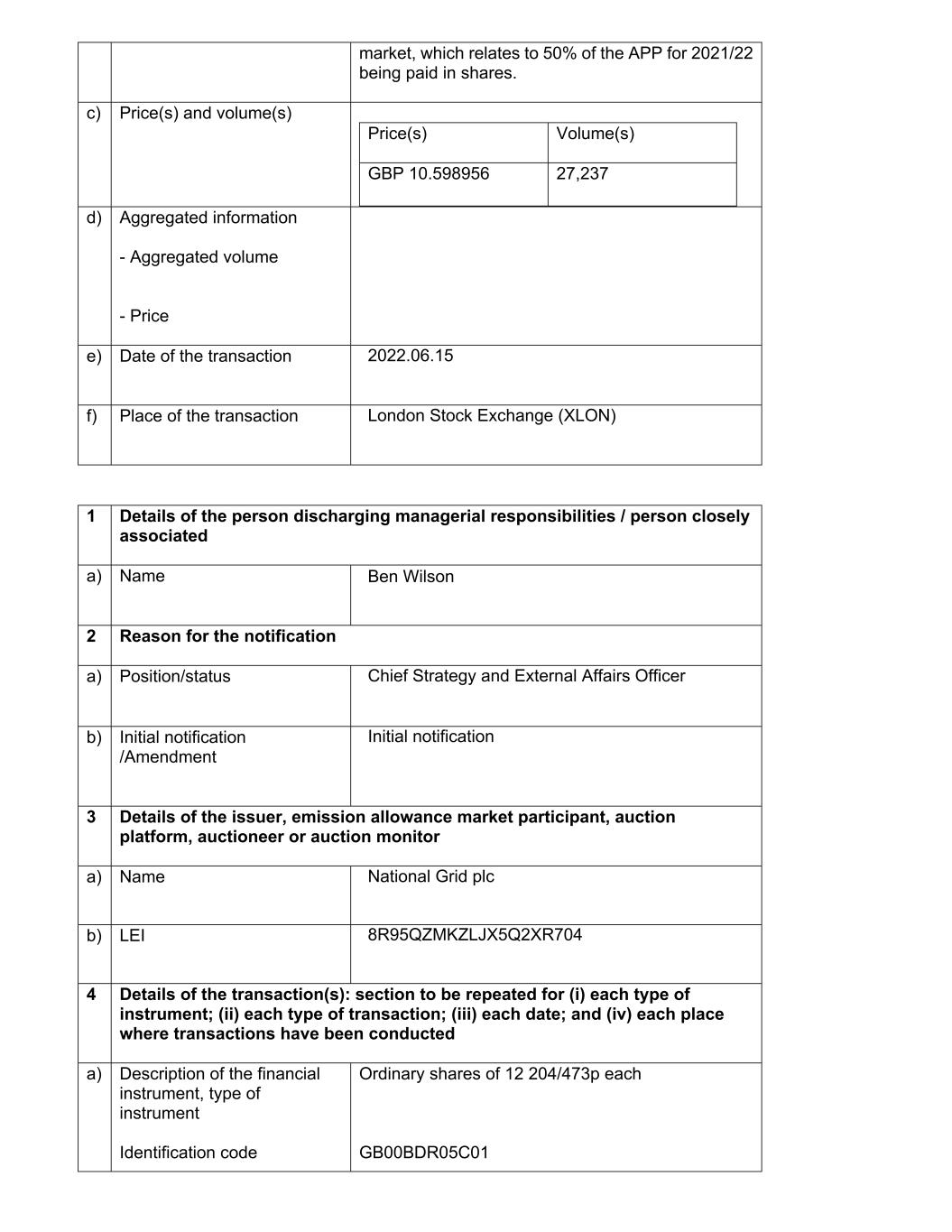

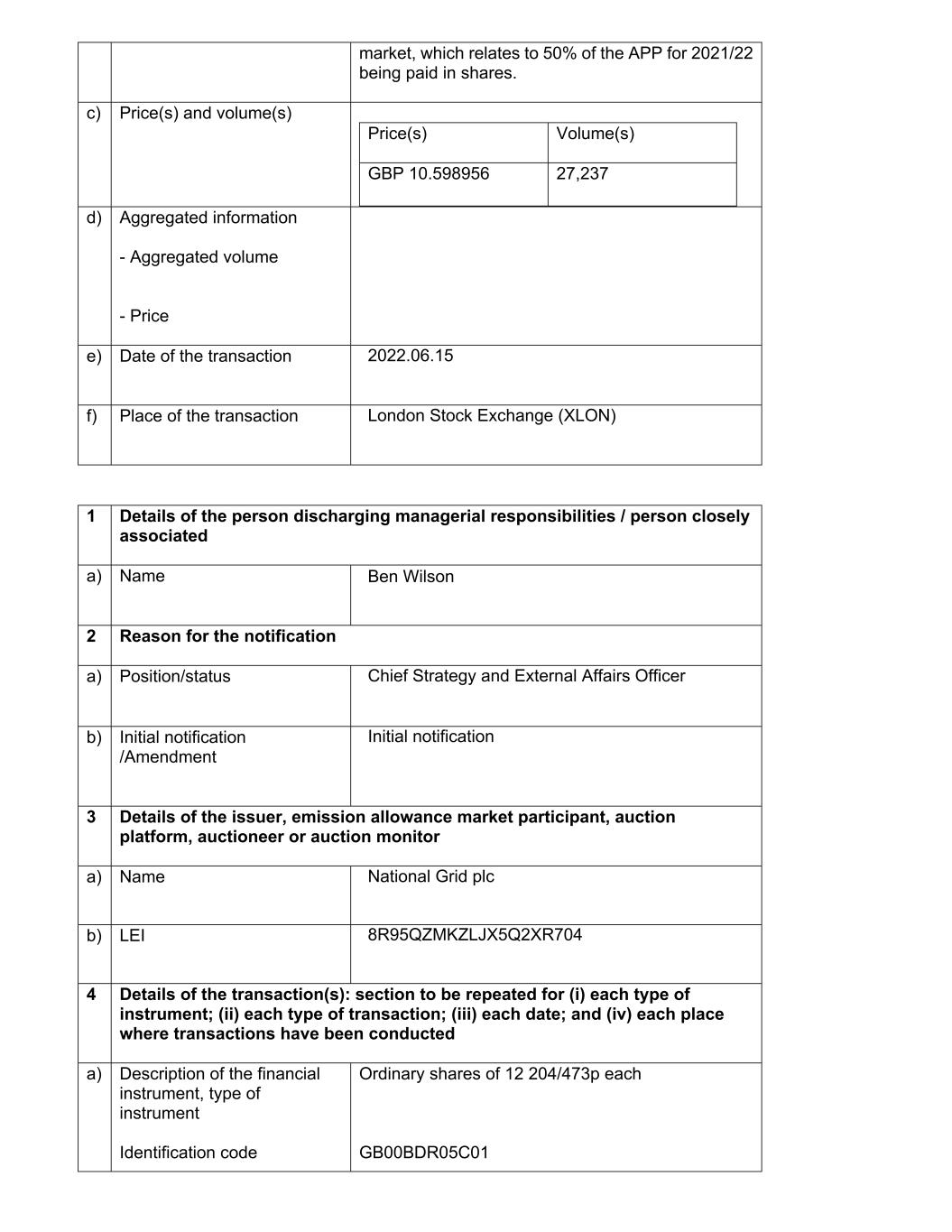

market, which relates to 50% of the APP for 2021/22 being paid in shares. c) Price(s) and volume(s) Price(s) Volume(s) GBP 10.598956 27,237 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2022.06.15 f) Place of the transaction London Stock Exchange (XLON) 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Ben Wilson 2 Reason for the notification a) Position/status Chief Strategy and External Affairs Officer b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01

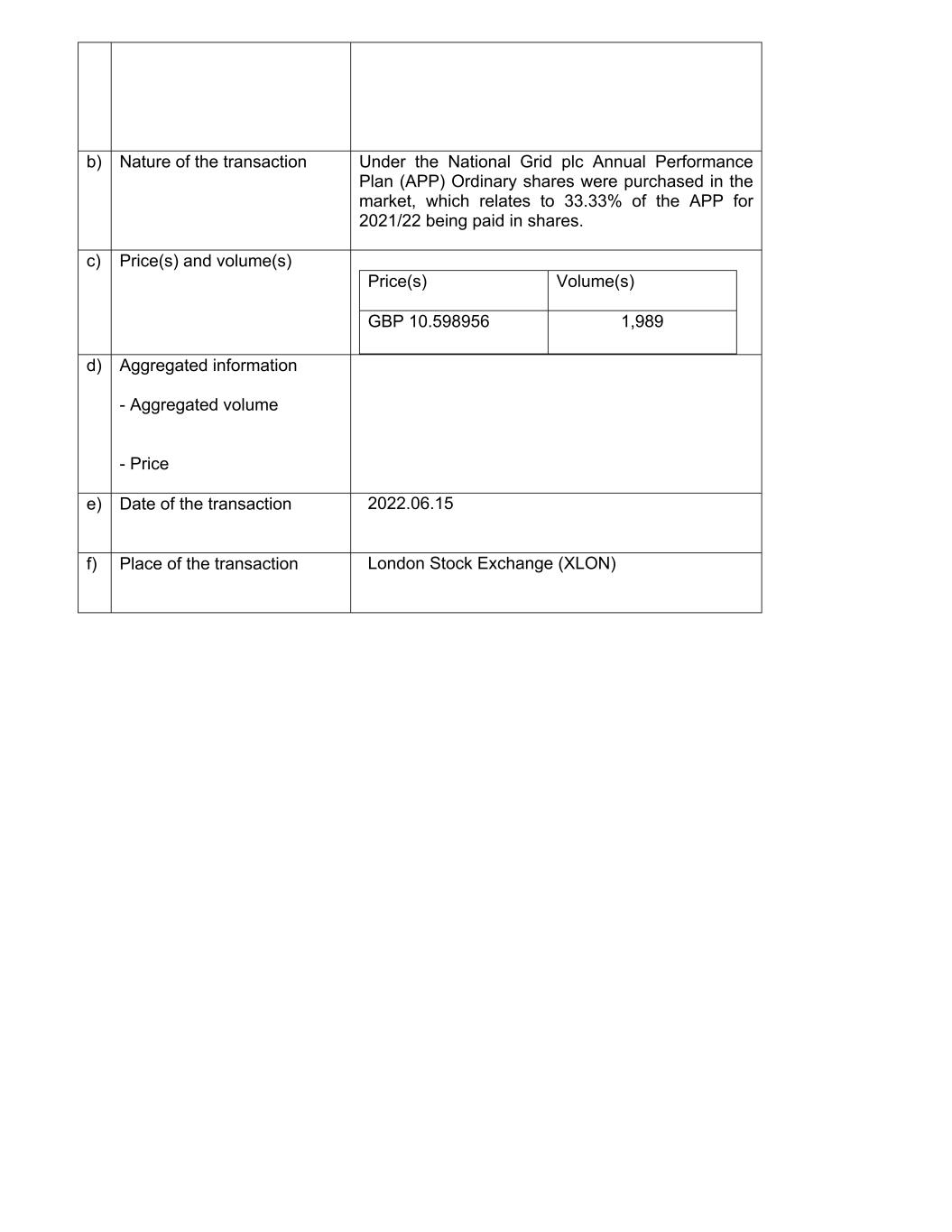

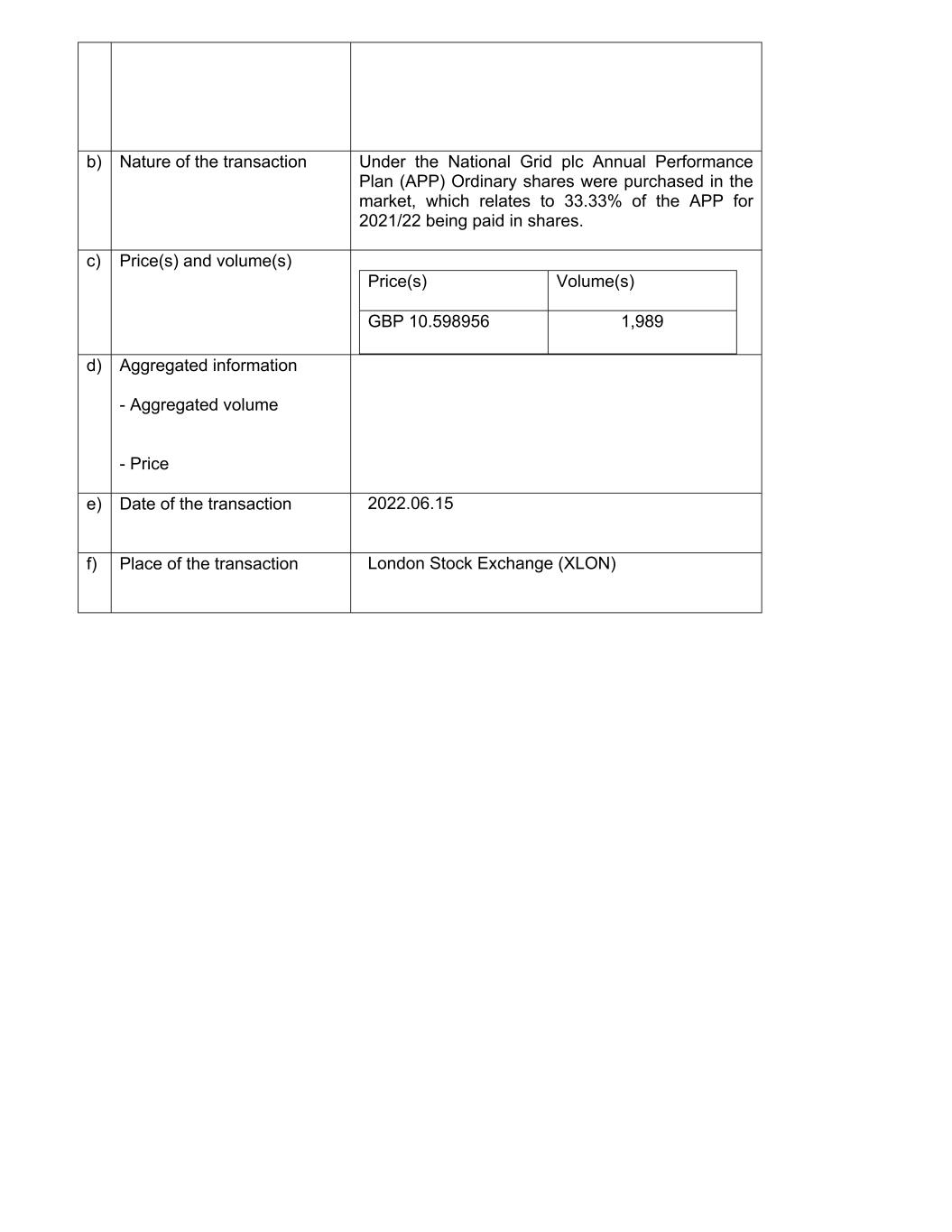

b) Nature of the transaction Under the National Grid plc Annual Performance Plan (APP) Ordinary shares were purchased in the market, which relates to 33.33% of the APP for 2021/22 being paid in shares. c) Price(s) and volume(s) Price(s) Volume(s) GBP 10.598956 1,989 d) Aggregated information - Aggregated volume - Price e) Date of the transaction 2022.06.15 f) Place of the transaction London Stock Exchange (XLON)

15 June 2022 National Grid plc ('National Grid' or 'Company') Director’s Other Appointment In accordance with Listing Rule 9.6.14(2), National Grid notes that Jonathan Dawson, a Non-executive Director, was appointed as Senior Independent Non-executive Director of AssetCo plc, a London Stock Exchange AIM listed company, with effect from 15 June 2022. This follows AssetCo plc’s acquisition of River and Mercantile Group plc, Jonathan Dawson stepped down as Chairman of River and Mercantile Group plc on 14 June 2022. There have been no other changes to the information set out in LR 9.6.13R (2) to LR 9.6.13R (6). Megan Barnes Head of Company Secretariat

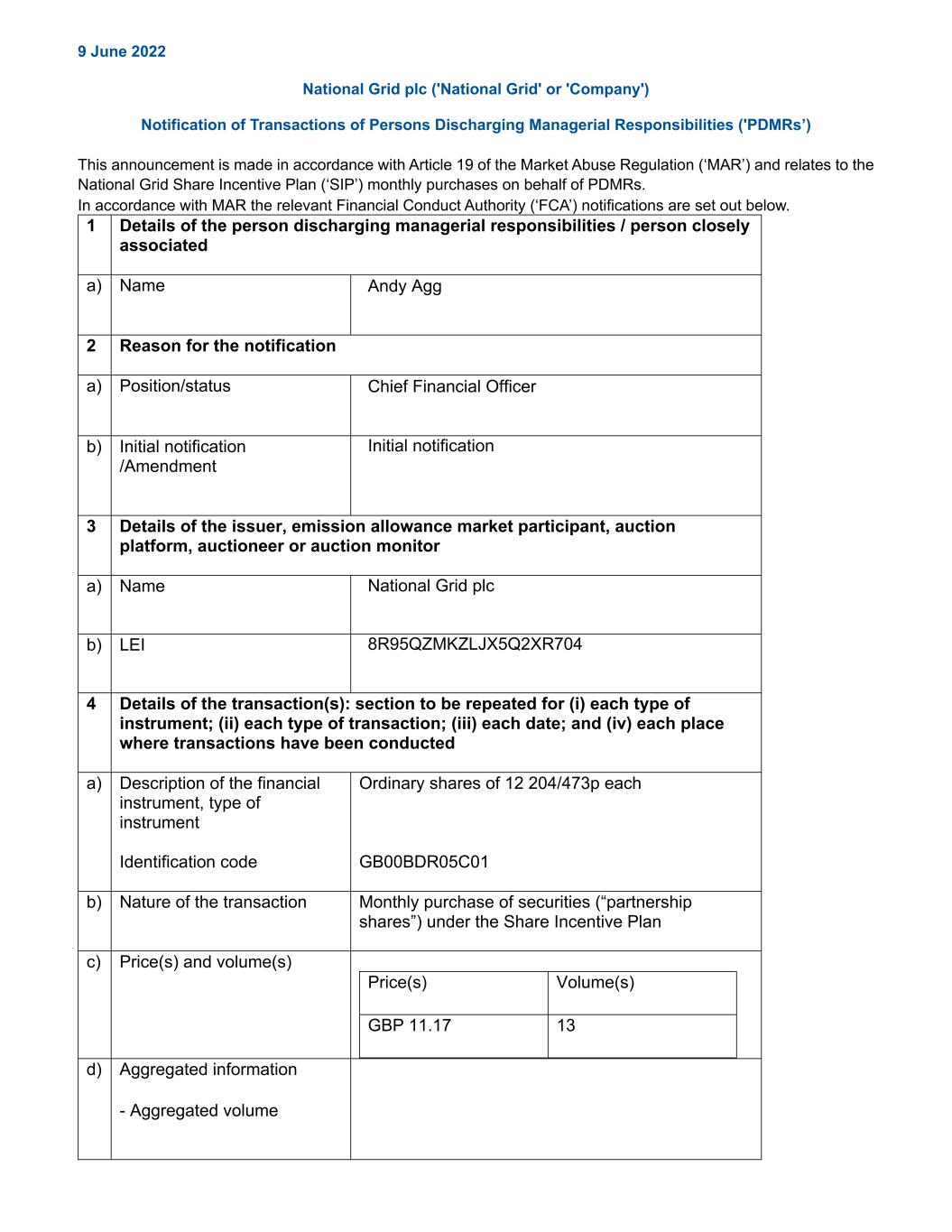

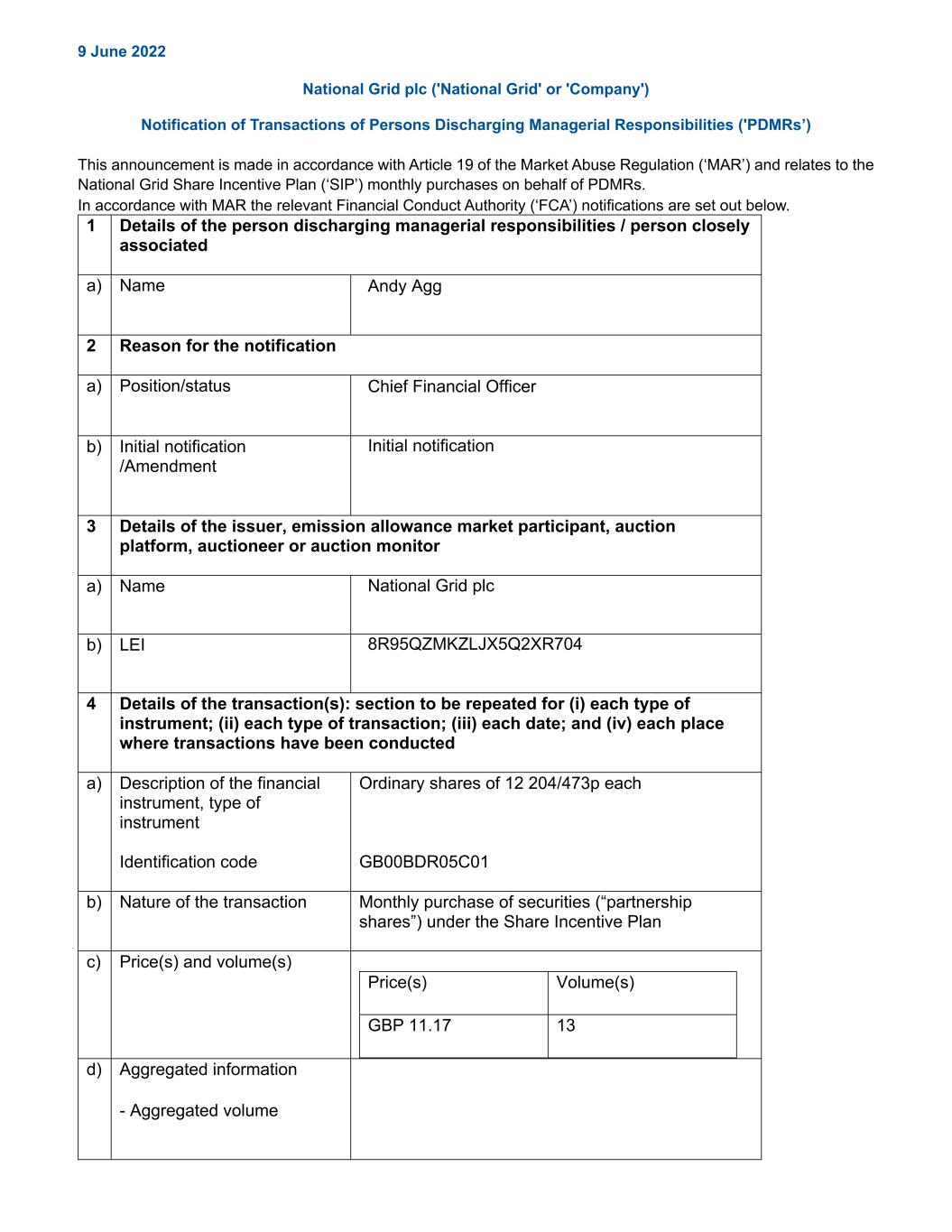

9 June 2022 National Grid plc ('National Grid' or 'Company') Notification of Transactions of Persons Discharging Managerial Responsibilities ('PDMRs’) This announcement is made in accordance with Article 19 of the Market Abuse Regulation (‘MAR’) and relates to the National Grid Share Incentive Plan (‘SIP’) monthly purchases on behalf of PDMRs. In accordance with MAR the relevant Financial Conduct Authority (‘FCA’) notifications are set out below. 1 Details of the person discharging managerial responsibilities / person closely associated a) Name Andy Agg 2 Reason for the notification a) Position/status Chief Financial Officer b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01 b) Nature of the transaction Monthly purchase of securities (“partnership shares”) under the Share Incentive Plan c) Price(s) and volume(s) Price(s) Volume(s) GBP 11.17 13 d) Aggregated information - Aggregated volume

- Price e) Date of the transaction 2022.06.07 f) Place of the transaction London Stock Exchange (XLON) 1 Details of the person discharging managerial responsibilities / person closely associated a) Name John Pettigrew 2 Reason for the notification a) Position/status Chief Executive Officer b) Initial notification /Amendment Initial notification 3 Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor a) Name National Grid plc b) LEI 8R95QZMKZLJX5Q2XR704 4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted a) Description of the financial instrument, type of instrument Identification code Ordinary shares of 12 204/473p each GB00BDR05C01 b) Nature of the transaction Monthly purchase of securities (“partnership shares”) under the Share Incentive Plan c) Price(s) and volume(s) Price(s) Volume(s) GBP 11.17 14 d) Aggregated information - Aggregated volume

- Price e) Date of the transaction 2022.06.07 f) Place of the transaction London Stock Exchange (XLON)

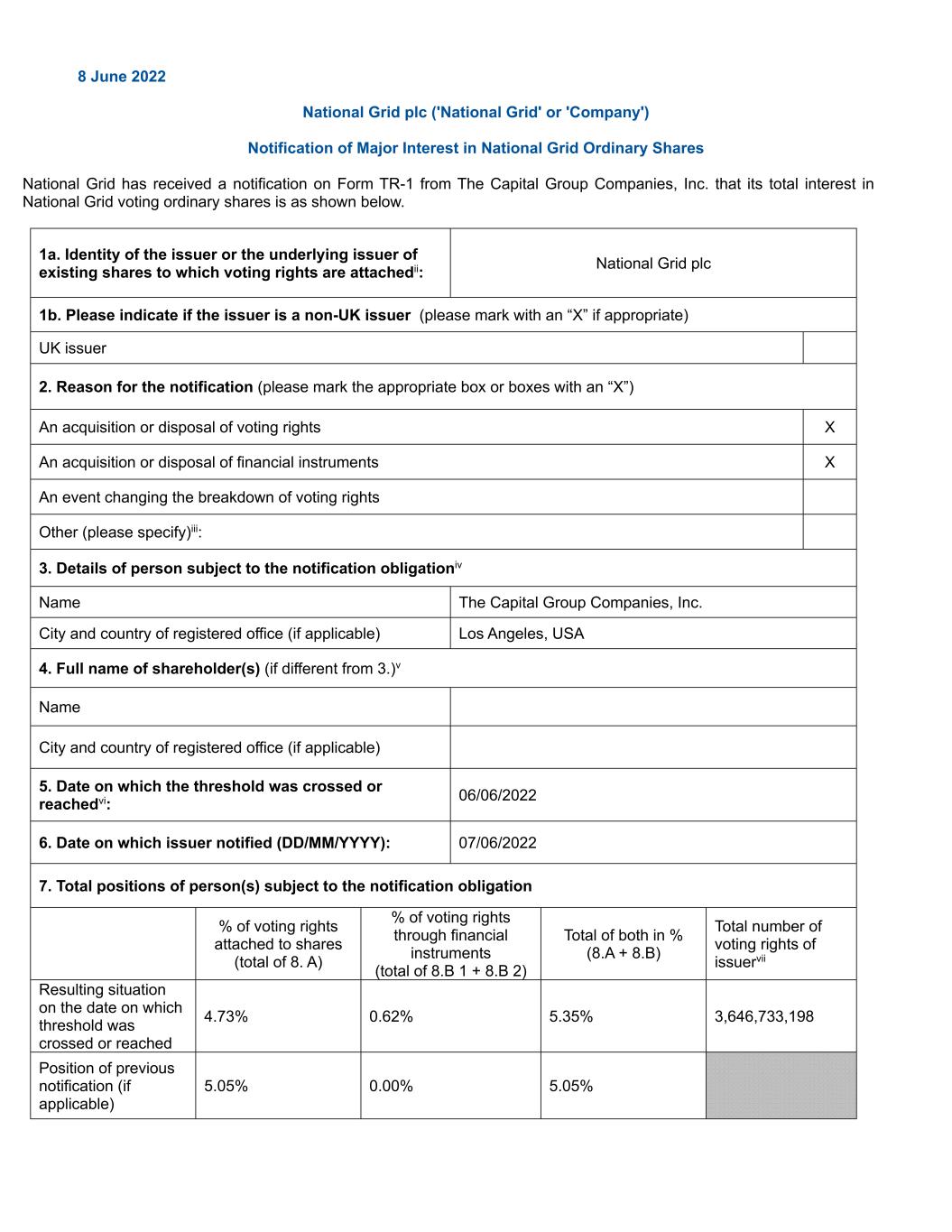

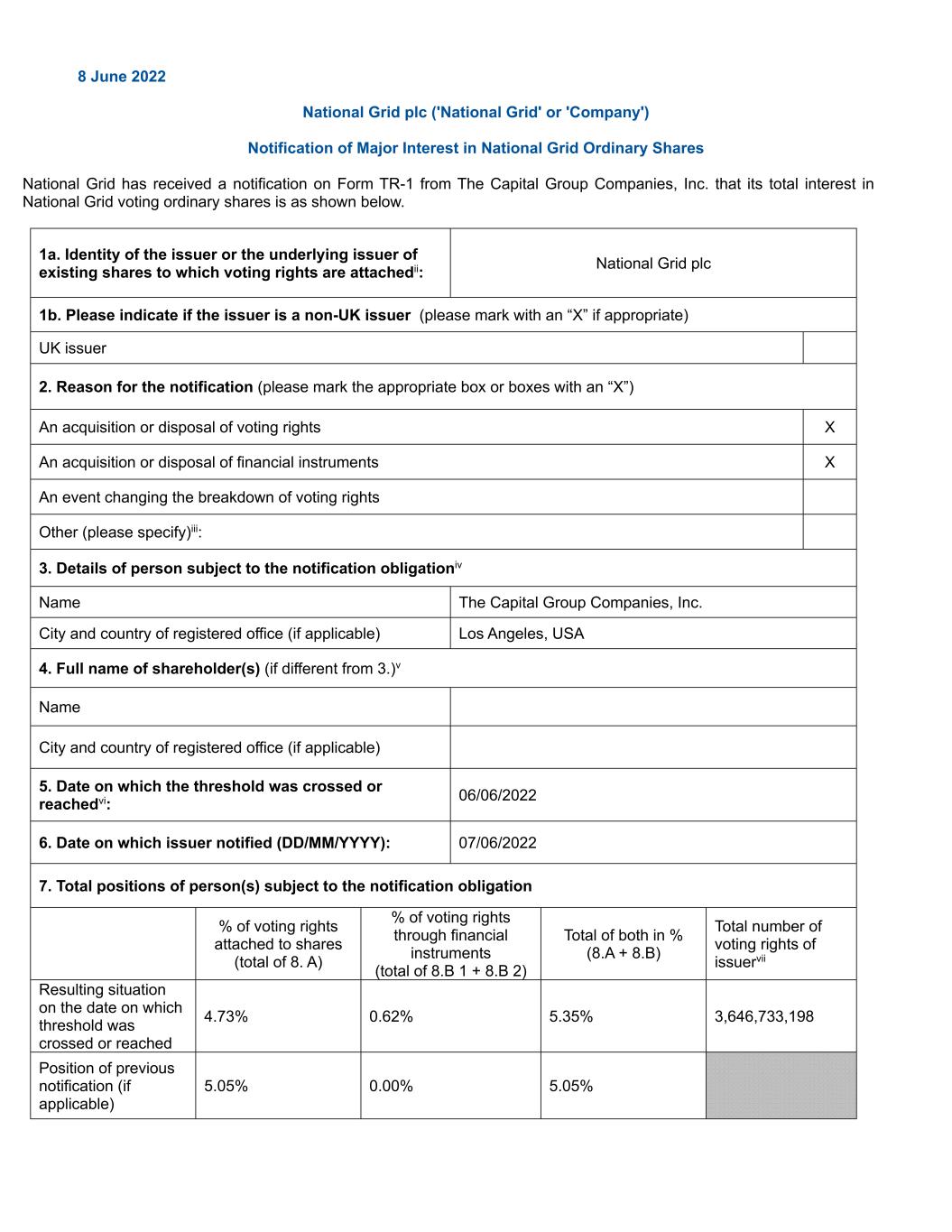

8 June 2022 National Grid plc ('National Grid' or 'Company') Notification of Major Interest in National Grid Ordinary Shares National Grid has received a notification on Form TR-1 from The Capital Group Companies, Inc. that its total interest in National Grid voting ordinary shares is as shown below. 1a. Identity of the issuer or the underlying issuer of existing shares to which voting rights are attachedii: National Grid plc 1b. Please indicate if the issuer is a non-UK issuer (please mark with an “X” if appropriate) UK issuer 2. Reason for the notification (please mark the appropriate box or boxes with an “X”) An acquisition or disposal of voting rights X An acquisition or disposal of financial instruments X An event changing the breakdown of voting rights Other (please specify)iii: 3. Details of person subject to the notification obligationiv Name The Capital Group Companies, Inc. City and country of registered office (if applicable) Los Angeles, USA 4. Full name of shareholder(s) (if different from 3.)v Name City and country of registered office (if applicable) 5. Date on which the threshold was crossed or reachedvi: 06/06/2022 6. Date on which issuer notified (DD/MM/YYYY): 07/06/2022 7. Total positions of person(s) subject to the notification obligation % of voting rights attached to shares (total of 8. A) % of voting rights through financial instruments (total of 8.B 1 + 8.B 2) Total of both in % (8.A + 8.B) Total number of voting rights of issuervii Resulting situation on the date on which threshold was crossed or reached 4.73% 0.62% 5.35% 3,646,733,198 Position of previous notification (if applicable) 5.05% 0.00% 5.05%

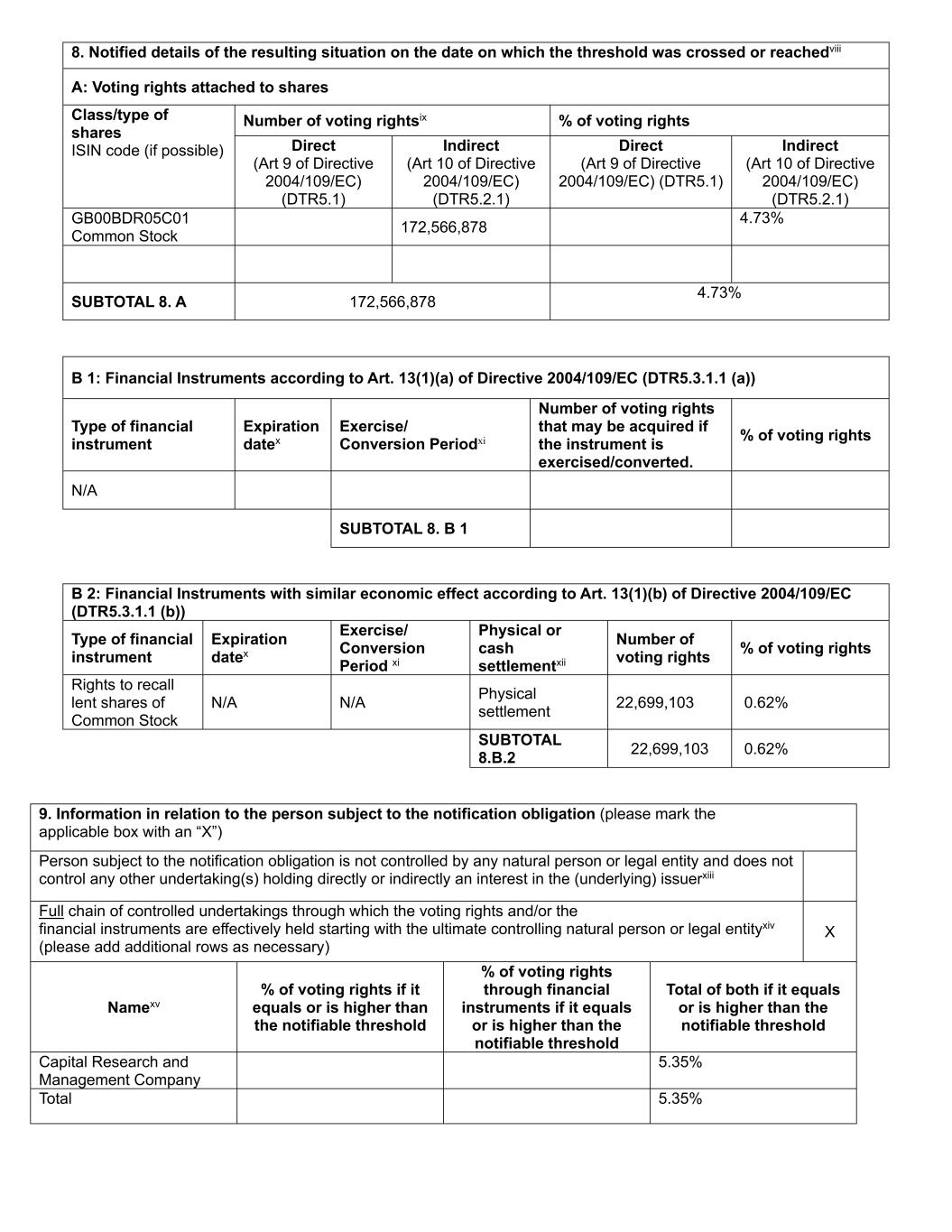

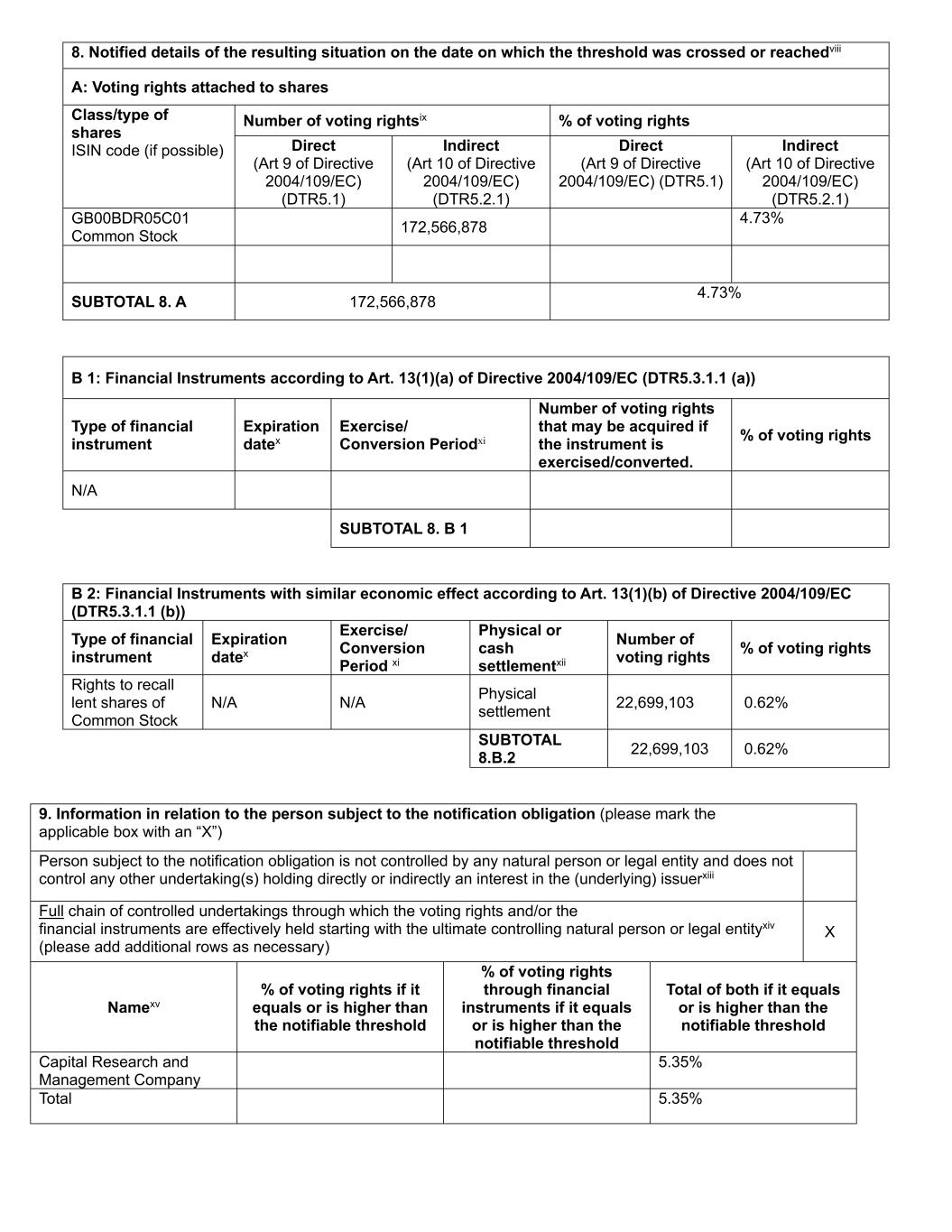

8. Notified details of the resulting situation on the date on which the threshold was crossed or reachedviii A: Voting rights attached to shares Class/type of shares ISIN code (if possible) Number of voting rightsix % of voting rights Direct (Art 9 of Directive 2004/109/EC) (DTR5.1) Indirect (Art 10 of Directive 2004/109/EC) (DTR5.2.1) Direct (Art 9 of Directive 2004/109/EC) (DTR5.1) Indirect (Art 10 of Directive 2004/109/EC) (DTR5.2.1) GB00BDR05C01 Common Stock 172,566,878 4.73% SUBTOTAL 8. A 172,566,878 4.73% B 1: Financial Instruments according to Art. 13(1)(a) of Directive 2004/109/EC (DTR5.3.1.1 (a)) Type of financial instrument Expiration datex Exercise/ Conversion Periodxi Number of voting rights that may be acquired if the instrument is exercised/converted. % of voting rights N/A SUBTOTAL 8. B 1 B 2: Financial Instruments with similar economic effect according to Art. 13(1)(b) of Directive 2004/109/EC (DTR5.3.1.1 (b)) Type of financial instrument Expiration datex Exercise/ Conversion Period xi Physical or cash settlementxii Number of voting rights % of voting rights Rights to recall lent shares of Common Stock N/A N/A Physical settlement 22,699,103 0.62% SUBTOTAL 8.B.2 22,699,103 0.62% 9. Information in relation to the person subject to the notification obligation (please mark the applicable box with an “X”) Person subject to the notification obligation is not controlled by any natural person or legal entity and does not control any other undertaking(s) holding directly or indirectly an interest in the (underlying) issuerxiii Full chain of controlled undertakings through which the voting rights and/or the financial instruments are effectively held starting with the ultimate controlling natural person or legal entityxiv (please add additional rows as necessary) X Namexv % of voting rights if it equals or is higher than the notifiable threshold % of voting rights through financial instruments if it equals or is higher than the notifiable threshold Total of both if it equals or is higher than the notifiable threshold Capital Research and Management Company 5.35% Total 5.35%

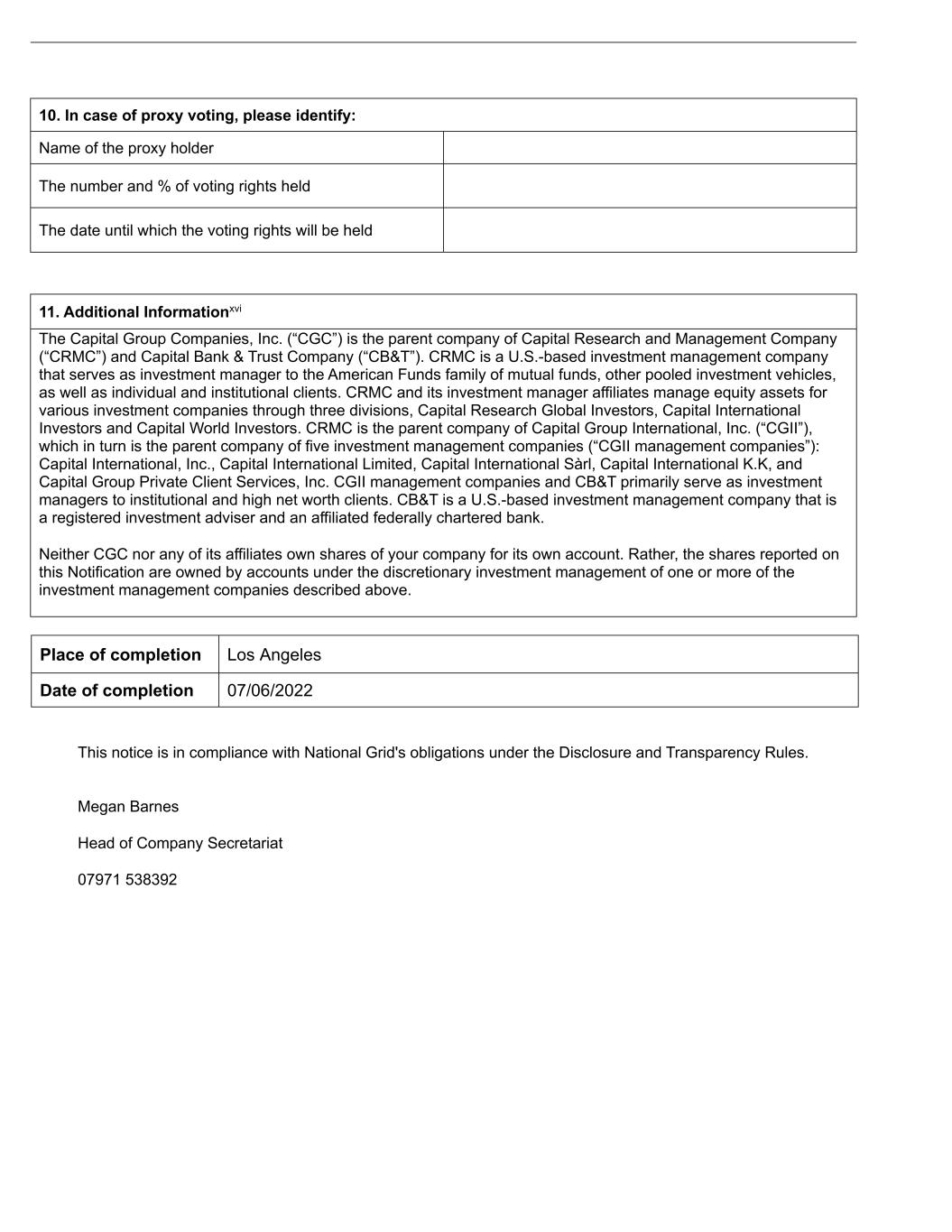

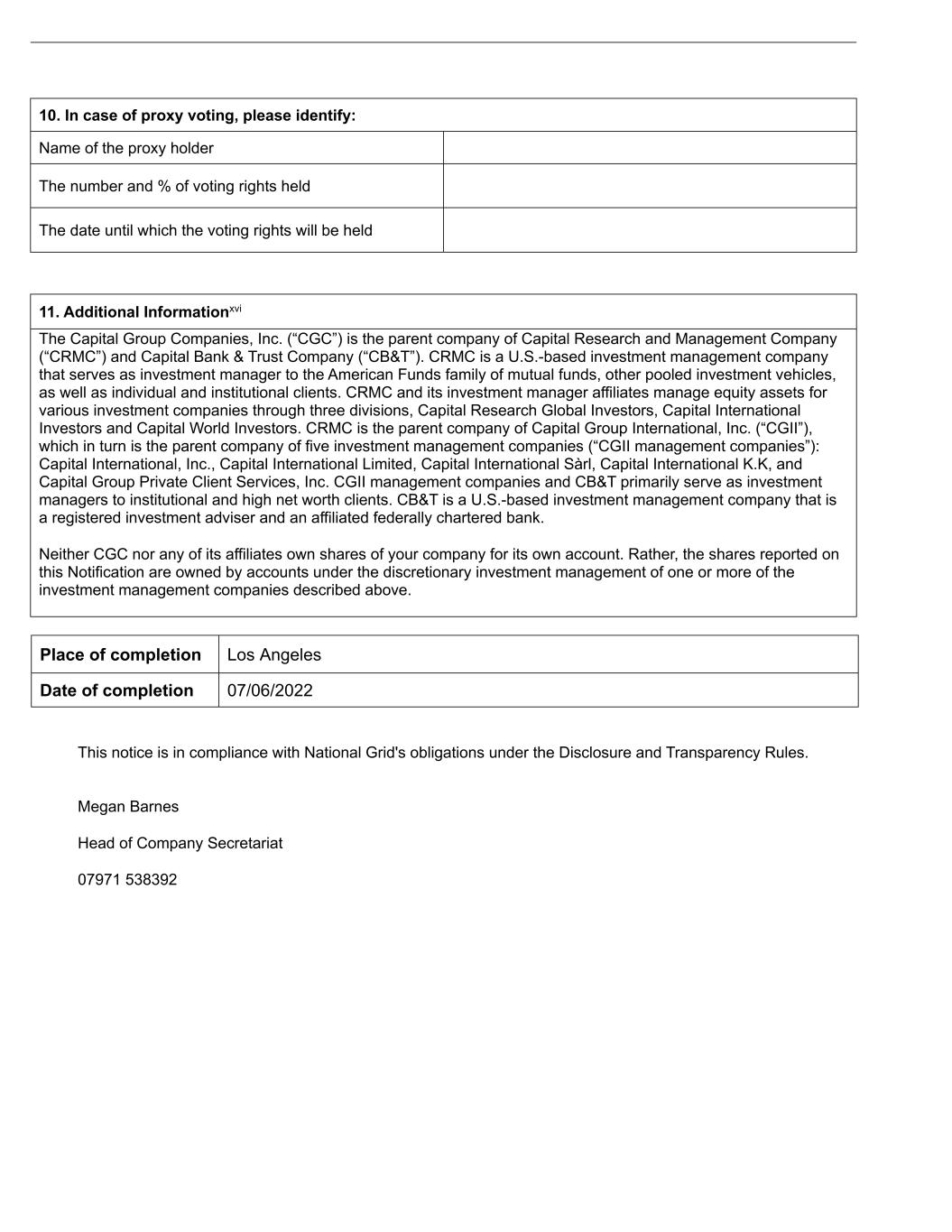

10. In case of proxy voting, please identify: Name of the proxy holder The number and % of voting rights held The date until which the voting rights will be held 11. Additional Informationxvi The Capital Group Companies, Inc. (“CGC”) is the parent company of Capital Research and Management Company (“CRMC”) and Capital Bank & Trust Company (“CB&T”). CRMC is a U.S.-based investment management company that serves as investment manager to the American Funds family of mutual funds, other pooled investment vehicles, as well as individual and institutional clients. CRMC and its investment manager affiliates manage equity assets for various investment companies through three divisions, Capital Research Global Investors, Capital International Investors and Capital World Investors. CRMC is the parent company of Capital Group International, Inc. (“CGII”), which in turn is the parent company of five investment management companies (“CGII management companies”): Capital International, Inc., Capital International Limited, Capital International Sàrl, Capital International K.K, and Capital Group Private Client Services, Inc. CGII management companies and CB&T primarily serve as investment managers to institutional and high net worth clients. CB&T is a U.S.-based investment management company that is a registered investment adviser and an affiliated federally chartered bank. Neither CGC nor any of its affiliates own shares of your company for its own account. Rather, the shares reported on this Notification are owned by accounts under the discretionary investment management of one or more of the investment management companies described above. Place of completion Los Angeles Date of completion 07/06/2022 This notice is in compliance with National Grid's obligations under the Disclosure and Transparency Rules. Megan Barnes Head of Company Secretariat 07971 538392