UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

AFFILIATED MANAGERS GROUP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

AFFILIATED MANAGERS GROUP, INC.

777 South Flagler Drive

West Palm Beach, Florida 33401

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON May 25, 2023

NOTICE IS HEREBY GIVEN that the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of Affiliated Managers Group, Inc. (the “Company”) will be held on May 25, 2023, at 9:00 a.m. Eastern Daylight Time at the Company’s office at 600 Hale Street, Prides Crossing, Massachusetts 01965, for the following purposes:

| 1. | To elect eight directors of the Company to serve until the 2024 Annual Meeting of Stockholders and until their respective successors are duly elected and qualified. |

| 2. | To approve, by a non‑binding advisory vote, the compensation of the Company’s named executive officers. |

| 3. | To approve, by a non-binding advisory vote, the frequency of future advisory votes regarding the compensation of the Company’s named executive officers. |

| 4. | To ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the current fiscal year. |

| 5. | To consider and act upon any other matters that may properly be brought before the Annual Meeting and at any adjournments or postponements thereof. |

This year, we have again reduced our environmental impact by providing proxy materials to you online pursuant to Securities and Exchange Commission rules. On or about April 14, 2023, we will mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access the Proxy Statement and our 2022 Annual Report on Form 10‑K online. The Notice, which cannot itself be used to vote your shares, also provides instructions on how to vote online and how to request a paper copy of the proxy materials, if you so desire. Whether you receive the Notice or paper copies of our proxy materials, the Proxy Statement and 2022 Annual Report on Form 10‑K are available to you at www.proxyvote.com.

The Company’s Board of Directors fixed the close of business on April 3, 2023 as the record date for determining the stockholders entitled to notice of, and to vote at, the Annual Meeting and at any adjournments or postponements thereof. Your vote is very important. Please carefully review the Proxy Statement and submit your proxy online, by telephone, or by mail, whether or not you plan to attend the Annual Meeting. If you hold your shares in street name through a broker, bank, or other nominee, please follow the instructions you receive from them to vote your shares.

|

| By Order of the Board of Directors. |

|

|

|

|

|

|

|

| Kavita Padiyar |

|

| Managing Director, Chief Corporate Counsel, and Corporate Secretary |

West Palm Beach, Florida |

|

|

April 14, 2023 |

|

|

AFFILIATED MANAGERS GROUP, INC.

777 South Flagler Drive

West Palm Beach, Florida 33401

PROXY STATEMENT

FOR 2023 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 25, 2023

April 14, 2023

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Affiliated Managers Group, Inc. (“AMG”, the “Company”, “we”, or “us”) for use at our 2023 Annual Meeting of Stockholders to be held on May 25, 2023, at 9:00 a.m. Eastern Daylight Time at the Company’s office at 600 Hale Street, Prides Crossing, Massachusetts 01965 and at any adjournments or postponements thereof (the “Annual Meeting”). At the Annual Meeting, stockholders will be asked to elect eight directors, approve, by a non‑binding advisory vote, the compensation of the Company’s named executive officers (as defined in the “Executive Compensation Tables” section of this Proxy Statement), approve, by a non-binding advisory vote, the frequency of future advisory votes regarding the compensation of the Company’s named executive officers, ratify the selection of PricewaterhouseCoopers LLP (“PwC”) as our independent registered public accounting firm for the current fiscal year, and consider and act upon any other matters properly brought before them.

Important Notice Regarding the Availability of Proxy Materials. This year, we have again reduced our environmental impact by providing proxy materials to you online in accordance with Securities and Exchange Commission (“SEC”) rules. On or about April 14, 2023, we will mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access this Proxy Statement and our 2022 Annual Report on Form 10‑K online. The Notice, which cannot itself be used to vote your shares, also provides instructions on how to vote online and how to request a paper copy of the proxy materials, if you so desire. Whether you received the Notice or paper copies of our proxy materials, the Proxy Statement and 2022 Annual Report on Form 10‑K are available to you at www.proxyvote.com.

Stockholders of record of the Company’s common stock at the close of business on the record date of April 3, 2023 will be entitled to notice of the Annual Meeting and to one vote per share on each matter presented at the Annual Meeting. As of the record date, there were 36,101,886 shares of common stock outstanding and entitled to vote at the Annual Meeting.

The presence, in person or by proxy, of holders of at least a majority of the total number of shares of common stock outstanding and entitled to vote at the Annual Meeting is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non‑votes, if any, will be counted as present and entitled to vote for purposes of establishing a quorum.

A “broker non‑vote” is a proxy from a broker or other nominee indicating that such person has not received instructions from the beneficial owner on a particular matter with respect to which the broker or other nominee does not have discretionary voting power. Brokers have the discretion to vote their clients’ proxies only on matters deemed “routine” by the New York Stock Exchange (“NYSE”).

At this year’s Annual Meeting, the election of directors (Proposal 1), the advisory vote on executive compensation (Proposal 2), and the advisory vote on the frequency of future executive compensation advisory votes (Proposal 3) are non‑routine matters, and only the ratification of our auditors (Proposal 4) is a routine matter. It is important that you instruct your broker as to how you wish to have your shares voted on these proposals, even if you wish to vote as recommended by the Board of Directors.

Stockholders are requested to submit a proxy online or by telephone, or by returning a completed, signed, and dated proxy card or voting instruction form. If you vote online or by telephone, you should not return a proxy card or voting instruction form. Shares represented by a properly submitted proxy received prior to the vote at the Annual Meeting and not revoked will be voted at the Annual Meeting as directed by the proxy. If a properly executed proxy or voting instruction form is submitted without any instructions indicated, the proxy will be voted FOR the election of each of the nominees for director, FOR the approval of the advisory vote on executive compensation, for the ONE-YEAR option on the advisory vote on the frequency of future executive compensation advisory votes, and FOR the ratification of the selection of PwC as our independent registered public accounting firm for the current fiscal year. If other matters are presented, proxies will be voted in accordance with the discretion of the proxy holders on such other matters.

2

A stockholder of record may revoke a proxy at any time before it has been voted by filing a written revocation with the Secretary of the Company at the Company’s principal executive office at 777 South Flagler Drive, West Palm Beach, Florida 33401‑6152, by submitting a duly executed proxy bearing a later date, or by appearing in person and voting by ballot at the Annual Meeting. A stockholder of record who voted online or by telephone may also change his or her vote with a timely and valid later online or telephone vote. Any stockholder of record as of the record date may attend the Annual Meeting whether or not a proxy has previously been given, but the presence (without further action) of a stockholder at the Annual Meeting will not constitute revocation of a previously given proxy. If you hold your shares in street name and would like to change your voting instructions, please follow the instructions provided to you by your broker, bank, or other intermediary.

A stockholder may vote in person at the Annual Meeting upon presenting picture identification and any one of the following: an account statement, the Notice, or a proxy card. If you hold your shares in street name, you will need to obtain a proxy from your bank or broker in order to vote in person, and you must bring a brokerage statement or letter from your broker, bank, or other intermediary reflecting stock ownership, along with picture identification. The address of the Company’s office in Prides Crossing, Massachusetts is set forth above for stockholders who plan to vote in person at the Annual Meeting.

3

PROXY STATEMENT SUMMARY

This summary highlights certain information from our Proxy Statement for the 2023 Annual Meeting of Stockholders. You should read the entire Proxy Statement carefully before voting.

2023 Annual Meeting of Stockholders | |||

Meeting Information | Agenda Items | Recommendation | Additional Detail |

May 25, 2023

Affiliated Managers Group, Inc. 600 Hale Street Prides Crossing, Massachusetts 01965 |

Proposal 1—Election of Directors |

FOR each Nominee |

Page 14 |

Proposal 2—Advisory Vote to Approve Executive Compensation (Say-on-Pay) |

FOR |

Page 55 | |

Proposal 3—Advisory Vote on the Frequency of Future Say-on-Pay Votes |

ONE-YEAR |

Page 56 | |

Proposal 4—Ratification of Selection of Independent Registered Public Accounting Firm |

FOR |

Page 57 | |

|

Company Overview |

AMG is a leading partner to independent investment management firms globally. Our strategy is to generate long-term value by investing in a diverse array of high-quality independent partner-owned firms, referred to as “Affiliates,” through a proven partnership approach, and allocating resources across our unique opportunity set to the areas of highest growth and return. AMG’s innovative partnership approach enables each Affiliate’s management team to own significant equity in their firm while maintaining operational and investment autonomy. In addition, AMG offers its Affiliates growth capital, product development, distribution, and other strategic value-added capabilities, which enhance the long-term prospects of these independent businesses and enable them to align equity incentives across generations of principals to build enduring franchises. |

2022 Performance Summary | |

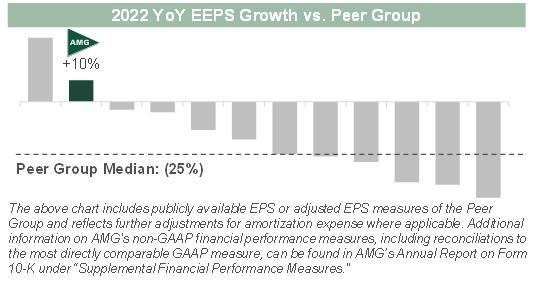

AMG achieved outstanding results in 2022, delivering 10% growth in Economic earnings per share over the previous year against the backdrop of a challenging operating environment, and 12% compound annual growth over the preceding 3 years, as highlighted in the tables below. Annual earnings per share growth was driven by the disciplined execution of AMG’s growth and capital allocation strategies, excellent Affiliate investment performance, and increasing momentum across the business. We remain focused on further evolving our business toward areas that we believe will benefit from long-term secular trends, and will continue to exercise discipline in allocating capital to generate long-term earnings growth and create shareholder value.

| |

• Record Economic earnings per share (“EEPS”) of $20.14 grew +10% relative to the prior year, with a CAGR of +12% over the 3-year period • Adjusted EBITDA of $1,060.3 million—consistent with prior year and a CAGR of +8% over the 3-year period

| • Record GAAP Earnings per share (diluted) of $25.35 reflected the successful culmination of our partnership with Baring Private Equity Asia (“BPEA”), which generated a $576 million gain, or $11.83 GAAP earnings per share (diluted). Excluding the BPEA transaction impact, earnings per share (diluted) grew +4% to $13.52 in 2022 |

(1) Reflects adjustment to exclude $11.83 GAAP earnings per share (diluted) for FY 2022 as a result of gains associated with the BPEA transaction, net of taxes. Additional information on non-GAAP financial performance measures, including reconciliations to the most directly comparable GAAP measure, can be found in AMG’s Annual Report on Form 10-K under “Supplemental Financial Performance Measures.” | |

4

2022 Performance Summary (cont.) | ||

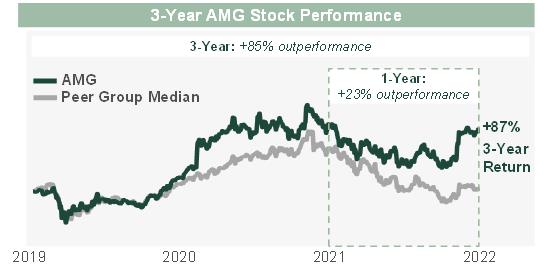

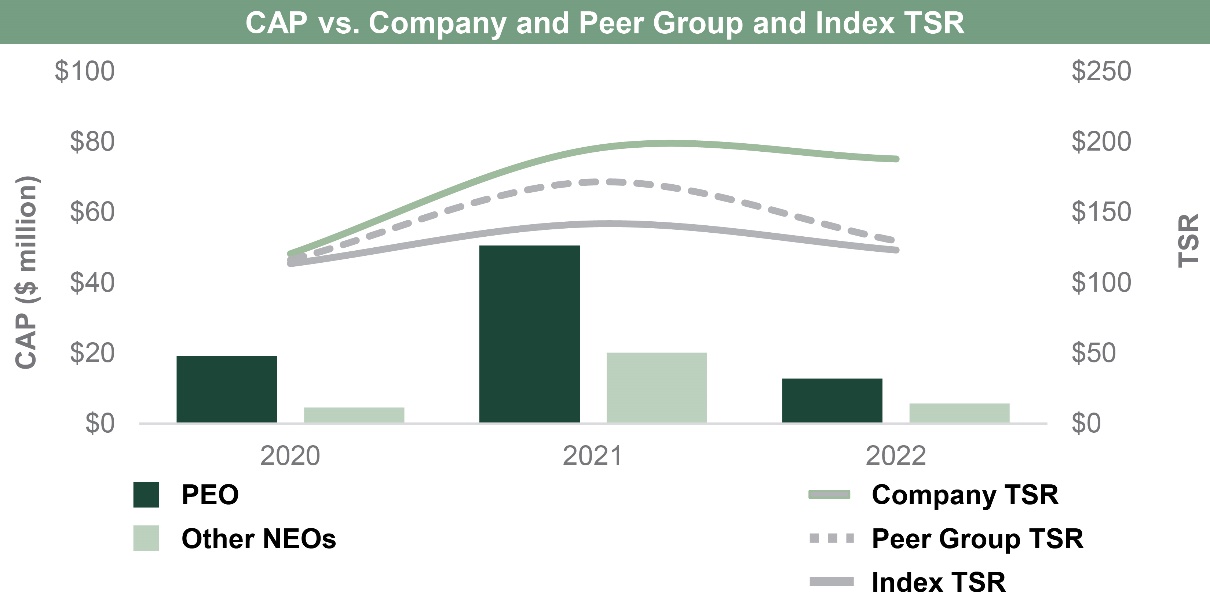

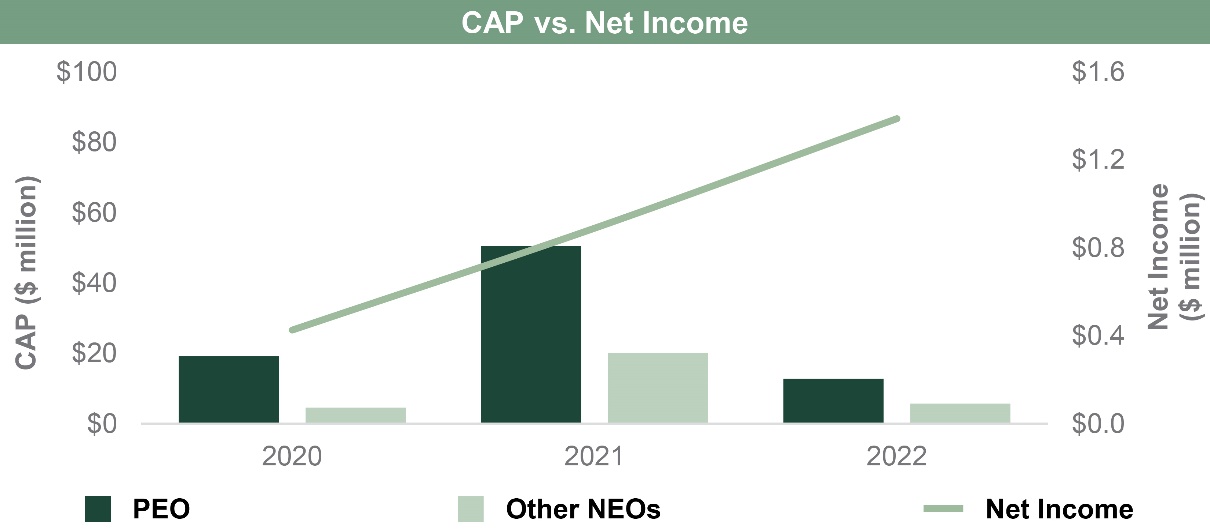

Stockholder Return and Relative Earnings Growth | Stockholder return significantly outperformed Peer Group over 1- and 3-year periods; strong earnings growth in 2022 also significantly outpaced Peer Group and demonstrated differentiated nature of business model • Stockholder return of (4%) in 2022 significantly outperformed Peer Group median and reflected year-over-year EEPS growth of +10% (significantly above Peer Group median of negative 25%), strong Affiliate investment performance, and the positive impact of AMG’s growth and capital allocation strategy despite a challenging industry backdrop • 1- and 3- year stockholder return of (4%) and +87%, respectively, represent approximately +23% and +85% of outperformance, respectively, relative to Peer Group median. Stockholder return over the respective periods significantly exceeded the pre-set relative targets

|

|

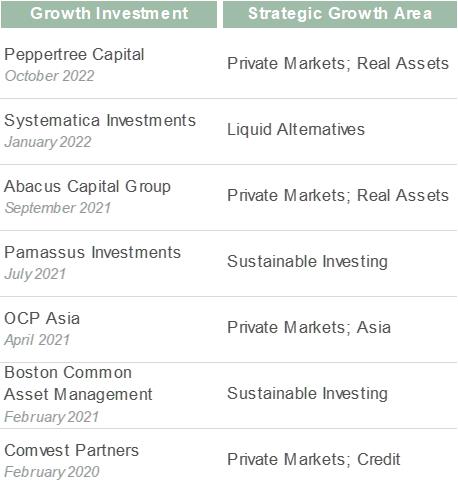

Growth Investments: New Affiliates | In 2022, AMG’s executive team continued to operate in alignment with the Company’s foundational values of entrepreneurial spirit, ownership mindset, and disciplined execution – and further advanced the Company’s strategy and evolved the business through growth investments. AMG was one of the most active investors in independent asset managers over the preceding 3 years, with significant new Affiliate investments in areas of secular growth and client demand • Executed on additional investment in top-performing liquid alternative Affiliate Systematica, and new partnership with private markets manager Peppertree in 2022, following completion of five new Affiliate investments operating in secular growth areas in 2020 – 2021 • Strong activity levels through periods of market dislocation reflect appetite for AMG’s unique and broad array of partnership solutions for independent firms, the strength of AMG’s existing long-term proprietary relationships, and three-decade track record of successful partnerships

|

|

Growth Investments: AMG Centralized Capabilities | Continued to actively collaborate and engage with Affiliates to magnify their efforts and enhance their growth opportunities through product development, seed capital, and distribution support • Continued to enhance and further align capital formation platforms and activities more directly with Affiliates; ongoing realignment of AMG’s sales professionals and resources to focus on the greatest growth opportunities for Affiliates and enhancing client outcomes • Active engagement with numerous Affiliates on succession planning and long-term business strategy, including supporting the successful combination of First Quadrant with Systematica in 2022 • Actively collaborating with Affiliates on product development, including investing seed and acceleration capital to support new products in areas of increasing client demand | |

5

2022 Performance Summary (cont.) | ||

Shareholder Value Creation: BPEA Transaction | Successful culmination of AMG’s partnership with BPEA (BPEA combined with EQT AB in Q4 2022) • AMG received more than $800 million in gross proceeds, the majority of which has been deployed into growth investments, additional share repurchases, debt repayment, and general corporate purposes • Resulted in after-tax gain of $576 million • Showcased the potential of AMG’s partnership with Affiliates in supporting the achievement of an Affiliate’s long-term strategic objectives, and resulted in significant realized value for AMG shareholders and an excellent strategic outcome for all stakeholders. AMG’s partnership with BPEA maintained a strong alignment of interests, supported BPEA’s ability to achieve a long-term strategic objective, and created value for all stakeholders | |

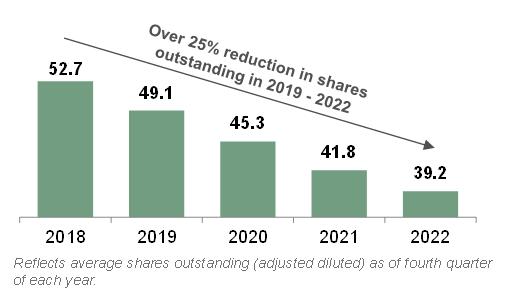

Capital Allocation: Affiliate Investments and Capital Return | Executed on two Affiliate investments and returned $475 million in capital to stockholders, while maintaining strong and flexible balance sheet • Invested in one new Affiliate and made additional investment in 2022, both operating in areas of secular growth • Further reduced shares outstanding by approximately 6% in 2022 and by more than 25% since 2019 • In addition to $475 million in open market repurchases, AMG entered into a $225 million accelerated share repurchase program in the fourth quarter of 2022 |

|

Human Capital and Sustainability | Advancement across a broad scope of human capital management and sustainability initiatives • All employees were granted AMG stock during performance years 2021 – 2022, further affirming AMG’s core value of ownership mindset, and aligning 100% of AMG’s human capital base with shareholder value creation through stock ownership • Strong employee satisfaction (approximately 90%) measured through AMG’s annual formal engagement survey, which the Company attributes to its focus and commitment to employees, its entrepreneurial culture and partnership orientation, and the organization’s meaningful involvement with communities surrounding our offices • Focused on AMG’s position as a corporate citizen; corporate philanthropy initiatives included contributions to a variety of non-profit organizations, directly and through employee gift-matching and volunteer-hour matching; 87% of employees and 100% of Executive Committee members participated in corporate philanthropy initiatives in 2022 • Completed annual inventory and secured third-party attestation of AMG’s GhG emissions; achieved medium-term emissions reduction targets established in 2018 • Efforts recognized in strong scores with multiple corporate sustainability ratings providers; named to Barron’s “100 Most Sustainable U.S. Companies” in each of 2022 (#79) and 2023 (#48) • Three Affiliates dedicated to sustainable investing, with ethos rooted in each firm since inception

| |

6

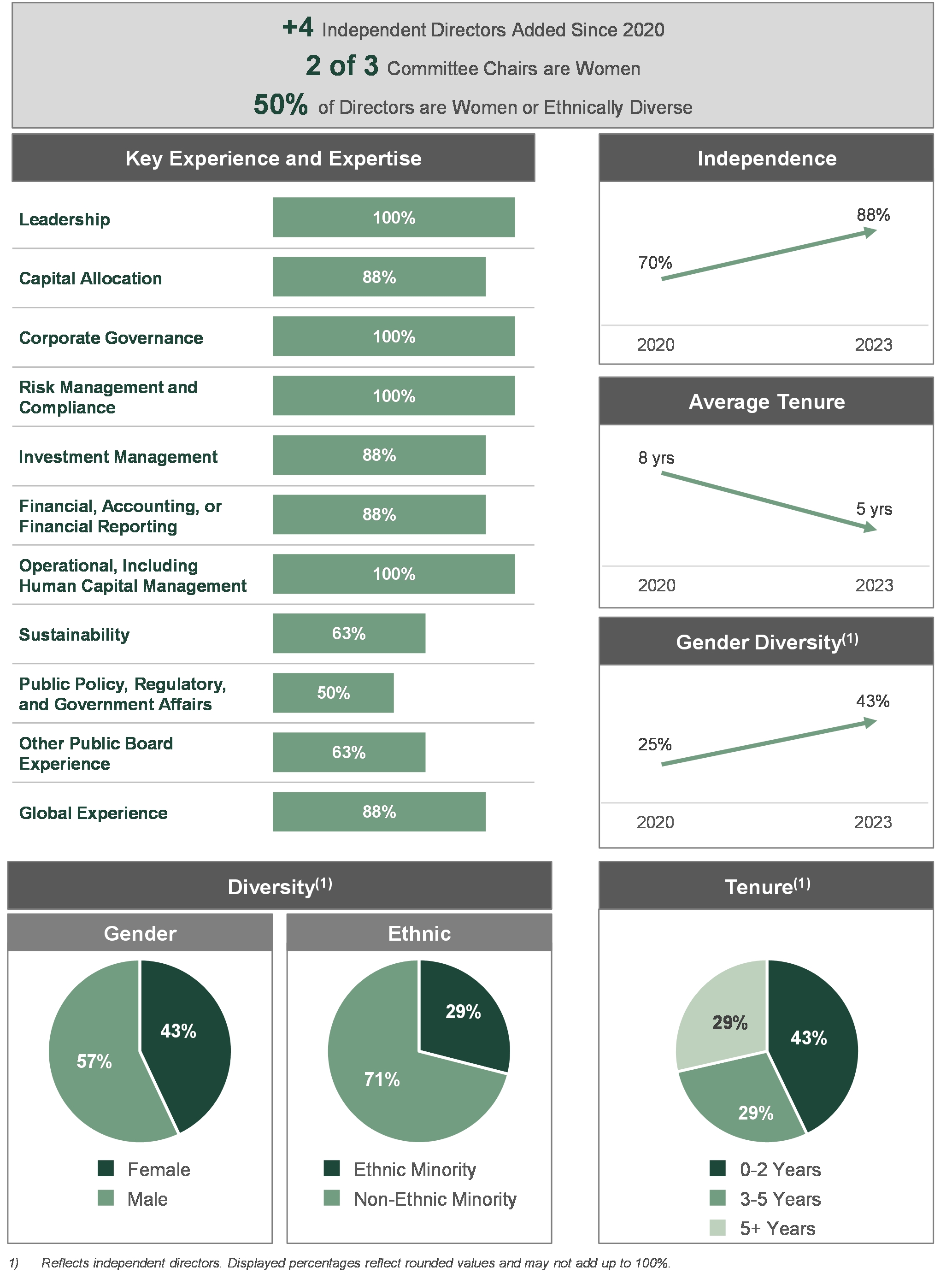

Governance Highlights | ||

Highly Independent and Diverse Board | • All Board committees are composed entirely of independent directors • The CEO is the only non-independent director • Directors bring a wide array of qualifications, skills, and attributes to AMG’s Board; see “Director Experience and Skills Overview” on page 16 | • 43% of independent directors are women, with three women serving on the Board; two of three Board committees are chaired by women • 29% of independent directors are ethnic minorities |

Non-Executive Board Chair | • Transitioned to a non-executive, independent Board Chair in 2020; structure provides effective checks and balances to ensure the exercise of independent judgment by the Board | • Board Chair does not chair any committee |

Significant Board Refreshment | • Four of the seven independent directors are new since 2020 • New Chairs of all three Board committees, and new members placed on each committee, since 2020 • Fully reconstituted Compensation Committee in 2020 | • Half of new directors are women or ethnically diverse • Average director age of 59; average tenure of 5 years • Long-tenured independent directors in leadership roles |

Director Accountability, Development, and Engagement | • 98% average director attendance rate at all Board and committee meetings in 2022 • Comprehensive orientation for new directors; ongoing development programs, with additional training for directors in new leadership roles | • Annual Board and committee self-evaluations and individual director assessments • Annual election of directors at majority vote standard (no staggered board) |

No Overboarding | • Nominating and Governance Committee assesses director time commitments in reviewing nominee candidates | • Only one director serves on additional public company boards (none serves on more than two other boards) |

Active Shareholder Engagement | • Active engagement, with regular shareholder outreach • Strong track record of integration of shareholder feedback into corporate governance practices and compensation program design over many years | • In 2022 and 2023YTD, AMG held approximately 100 meetings with stockholders representing approximately 55% of our voting shares, on topics including corporate strategy, corporate governance, executive compensation, and sustainability |

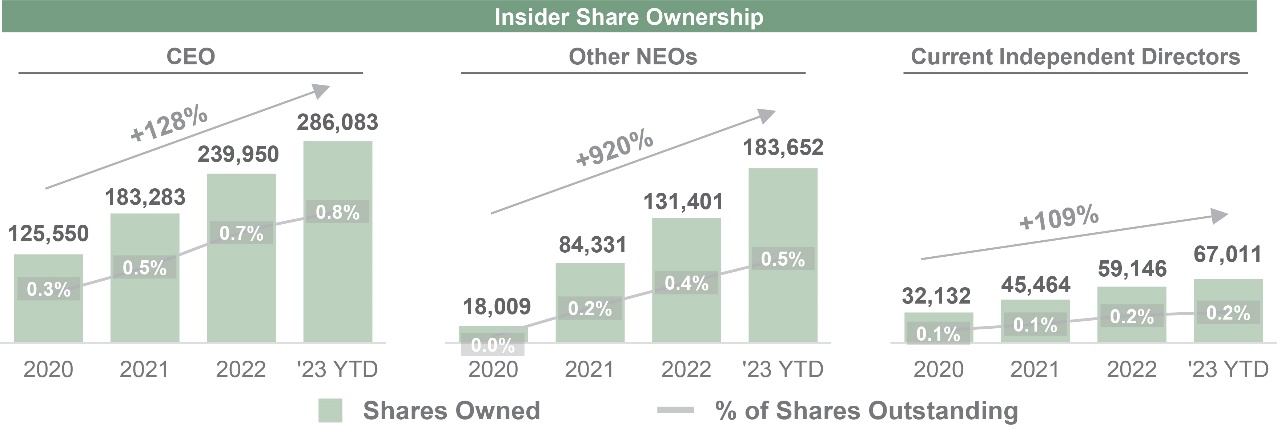

Strong Shareholder Alignment: Policies and Initiatives | • Equity Ownership Guidelines require 10x annual base salary for CEO (7x for other NEOs) and 5x annual base fees for independent directors; CEO and other NEOs are subject to an additional Equity Holding Policy described on page 33 • Our directors and executives have collectively purchased more than 110,000 shares in the open market since 2019, totaling approximately $11 million notional value at time of purchase • Ownership by executives and independent directors more than doubled over last 3 years | • CEO holds shares of AMG stock that significantly exceed the required level, having purchased 52,000 shares in the open market since appointment as CEO, across seven distinct purchases, totaling $4.2 million notional value at time of purchase • A majority of our current independent directors, including our Board Chair, have purchased shares in the open market; independent directors collectively purchased more than 54,000 shares since 2019 |

| ||

Prioritization of Sustainability Factors | • Board has oversight responsibility for corporate sustainability practices (see “Sustainability Highlights,” pages 25-27) and principal responsibility for enterprise risk management, an area where AMG enhanced resources since 2020; a majority of directors have risk management experience | • A cross‑functional Sustainability Committee is responsible for policies, controls, and practices around environmental, health and safety, and social risks and initiatives; reports to the Board at least annually and includes members of AMG’s senior management team |

7

2022 Compensation Program Enhancements and Program Overview | |

AMG meets with our stockholders extensively throughout the year as part of our investor outreach, and we have a demonstrated history of integrating shareholder feedback into our executive compensation program design. In 2022, 97% of the votes cast by stockholders supported our Say-on-Pay proposal, expressing strong support for our re-designed executive compensation program and its demonstrated pay-for-performance linkage, as well as the significant integration of shareholder feedback. • Following the extensive program re-design for performance year 2021, the approach was widely well-received, producing strong shareholder support for the simplified, transparent incentive determination process driven by pre-set, objective, rigorous metric targets; new compensation payout targets; and formulaic determination of compensation amounts and mix • The Committee implemented modest modifications based on shareholder feedback to further enhance the program for performance year 2022. The effect of the modifications, in aggregate, modestly reduced the ultimate payout to each executive relative to what the performance year 2022 payout would have been using the prior year’s incentive determination process

| |

Stockholder Comments | AMG Response |

Streamline number of targets used in the determination of incentive awards; increase weighting of each individual metric | • Reduced total number of metric targets to 10 from 13, with a focus on simplifying scorecard assessment and further aligning incentive pay with objective quantitative metrics with the highest impact, related to AMG management’s ability to create shareholder value across capital allocation decisions • Objective metrics now account for 100% of the ultimate Performance Assessment score • Financial metrics each account for 10.7% of the overall Performance Assessment, relative to 7.8% in performance year 2021 |

Increase weighting of financial metrics in the determination of incentive awards to further link pay with financial and stock performance | • Increased total weighting of financial and shareholder value creation metrics to 75% (from 70%), with a corresponding reduction in total weighting of metrics related to strategic and organizational initiatives to 25% (from 30%)

|

Continue to set rigorous financial targets | • Increased difficulty of absolute Annual Management Fee EBITDA and Annual EEPS targets relative to target-setting approach outlined in previous year’s Proxy Statement |

Continue to monitor Peer Group to reflect AMG’s business model and evolving industry | • Further streamlined Peer Group (removed Ameriprise Financial, Inc. (“Ameriprise”)) to continue to align peer market capitalizations and business scope with that of AMG • As of year-end 2022, Peer Group median market capitalization was $4.1 billion as compared to AMG market capitalization of $6.2 billion. All of the members of the Peer Group operate investment management organizations and compete for talent in our industry |

8

2022 Annual Incentive Compensation Determination Process |

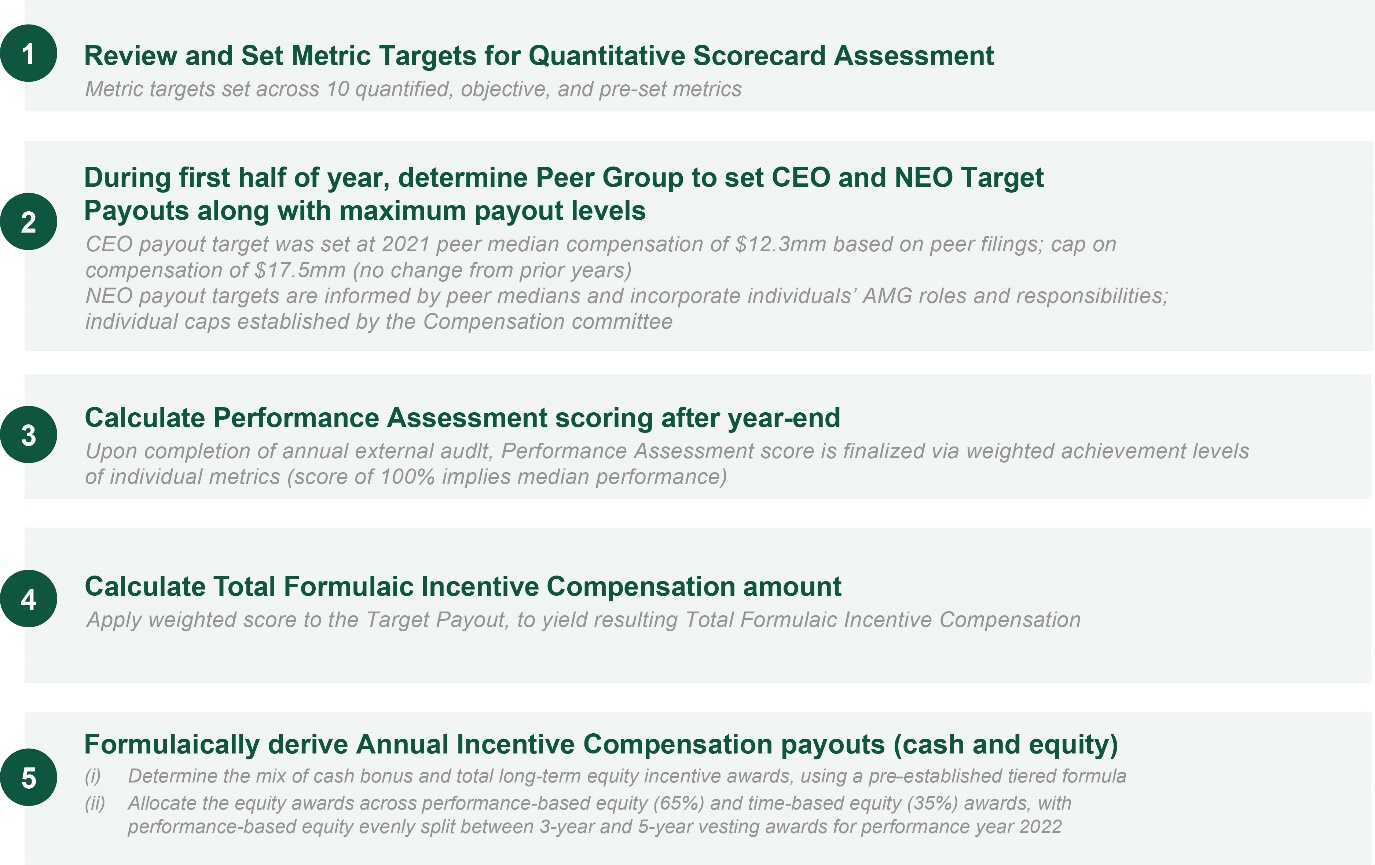

Overview of Enhanced Performance Assessment Process |

• Below is a summary of the Compensation Committee’s Performance Assessment process to establish the Annual Incentive Compensation for our CEO and other NEOs • Three of these five steps are formulaic; the Compensation Committee sets the Peer Group and target metrics and caps – For 2022, to reflect AMG’s ongoing evolution, the Compensation Committee further updated our Peer Group, which had the effect of reducing the median market capitalization of the Peer Group, as of December 31, 2022, by 33% to $4.1 billion, relative to AMG’s market capitalization of $6.2 billion – The Target Payout was set at $12.3 million for our CEO in 2022, based on the median of Peer Group compensation

|

9

2022 Annual Incentive Compensation Determination Results |

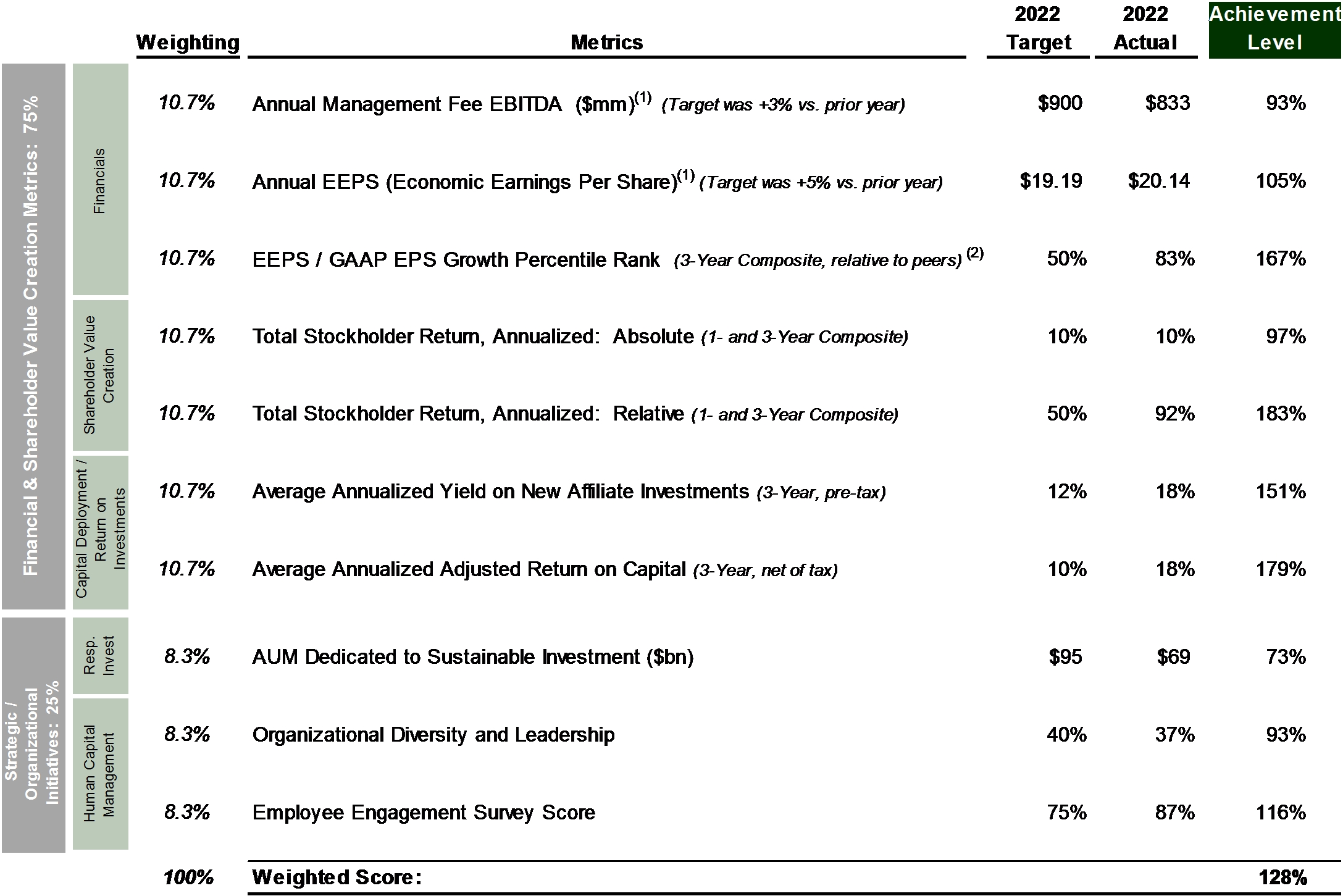

2022 Performance Assessment Scorecard Results |

• The Compensation Committee designed the scoring of each metric based on the objective to pay median compensation for median performance. To the extent that the CEO and other NEOs deliver exceptional performance, an individual metric will yield a score of greater than 100% (subject to a cap implemented by the Committee of 200% on the achievement of any individual metric); accordingly, for below-median or below-target performance, as applicable, an individual metric will yield a score of less than 100%. In 5 of 10 metrics (#3 – #7), poor performance may yield a score of 0%, indicating a natural threshold value for half of the scorecard metrics • With the Company’s excellent 2022 results, including its relative shareholder return, achievement levels were strong relative to pre-set targets, generating an Overall Performance Assessment Score of 128%, indicating above-Peer-Median compensation to be awarded

• Having calculated the results of the Performance Assessment scorecard, the Committee reviewed the output from the weighted average score applied to the target CEO compensation, which produced total incentive compensation awards for 2022 consistent with the design of the plan. As a result, the Compensation Committee deemed it unnecessary to apply a discretionary overlay to the output

(1) Reported GAAP EPS (diluted) of $25.35 for FY 2022. AMG's 2022 GAAP EPS scorecard metric was adjusted to exclude $11.83 GAAP EPS (diluted) as a result of gains associated with the BPEA transaction, net of taxes.

Please refer to the “Compensation Discussion and Analysis” section of this Proxy Statement for additional information.

|

10

2022 Annual Incentive Compensation Determination Results (cont.) |

Formulaic Derivation of Incentive Compensation and Mix of Incentive Awards |

• The Overall Performance Assessment Score of 128% was applied to the Target Payout, producing Total Formulaic Incentive Compensation of $15.0 million for the CEO • Annual Incentive Compensation was then allocated between cash bonus and long-term equity awards using a pre-established tiered formula which caps cash awards at 50% of Annual Incentive Compensation, and in which the proportion of equity awards increases as Annual Incentive Compensation increases. The allocation resulted in a formulaic cash bonus of $6.0 million (40%) and a formulaic equity incentive award amount of $9.0 million (60%) • The formulaic equity incentive award amount was granted 35% in the form of Long-Term Deferred Equity Awards and 65% in the form of Long-Term Performance Achievement Awards. For performance year 2022, Long-Term Performance Achievement Awards were granted using two distinct forward-looking performance periods, with 50% of awards featuring a three-year measurement period and 50% of awards featuring a five-year measurement period

(1) Cash Incentive Award determined via a tiered formula: First $5 million in incentive compensation is split 50% cash and 50% equity; next $5 million is split 40% cash and 60% equity; any incentive compensation thereafter is split 30% cash and 70% equity.

|

11

Questions and Answers | |

Question | AMG Response |

How did the Committee determine that this approach was appropriate and rigorous? What was the rationale for the changes made to the Performance Assessment metrics and weightings? | • Implemented Best Practices: The Compensation Committee integrated many years of shareholder feedback to re-design the incentive determination process for performance year 2021, resulting in an objective, formulaic, streamlined approach which incorporates compensation targets, performance metric targets across financial, TSR, and operating measures in a single quantitative Performance Assessment. The Committee broadened the Peer Group, implemented a pre-set formula governing the mix of cash and equity incentive awards, and continued to employ the Average Return on Equity (“Average ROE”) metric as a performance hurdle governing payout of performance-based equity awards • Relative Performance Drives Relative Compensation: The approach is designed to yield incentive compensation payouts relative to a peer benchmark (in 2021 and 2022, the benchmark for CEO compensation was set at the median of Peer Group CEO compensation) and relative to median peer performance • Strong Shareholder Support: The redesigned incentive program was supported by 97% of shares voted by shareholders in 2022, indicating strong affirmation of the appropriate and rigorous nature of the Committee’s approach. In 2022, the Committee implemented additional shareholder feedback to further (i) streamline the Performance Assessment, (ii) increase rigor in setting earnings-related targets, (iii) increase the objectivity of the Performance Assessment by increasing the weighting of financial- and TSR-related metric targets, and (iv) refine the Peer Group |

What is the philosophy behind the compensation targets? How were the CEO and other NEO targets set? | • Target payout amounts are set annually based on peer benchmarking, where available, and reflect input from our independent compensation consultant • For performance years 2021 and 2022, the CEO compensation target was set at the median of prior fiscal year peer CEO compensation. By targeting the median of peer CEOs, the Compensation Committee determined that the formulaic Performance Assessment would effectively reward above-median financial, stockholder return, and operating performance with above-median incentive compensation (and indicate below-median incentive compensation for below-median financial, stockholder return, and operating performance) • For other named executive officers, the target payouts were informed by peer benchmarking where available, but were not set directly at peer medians, because of the distinctive nature of the given role at AMG, wherein the executive’s role is broader than would be suggested by the role title, or because the role is unique to AMG |

Why were these metrics chosen? How were targets set? | • The metrics were chosen following an extensive review of key drivers of shareholder return and the Company’s strategic goals, and management’s ability to create value • Please refer to pages 39–40 for detailed descriptions of the financial, stockholder return, and operating metrics, the rationale for choosing each metric, and the target-setting methodology of each metric |

Why is this Peer Group appropriate for AMG? What was the rationale for the peer group changes? | • The Compensation Committee regularly reviews our Peer Group to ensure its ongoing relevance. In determining the Company’s Peer Group on an annual basis, the Compensation Committee considers both industry and company-specific dynamics to identify the peers with which we compete for client assets, stockholders, and talent. The Committee evaluates the Peer Group to ensure that it reflects the Company’s growth, overall changes in the asset management industry, and the business models, size, and scope of our competitors • For performance year 2021, the Committee expanded and evolved AMG’s Peer Group to include peers with market capitalizations and business scope (including alternative-focused investment firms) aligned with the ongoing evolution of AMG’s business, and to replace peers impacted by industry consolidation. The effect of these changes was to reduce the median market capitalization across the Peer Group by approximately 40% • For 2022, the Committee further refined the Peer Group by removing one peer company, Ameriprise, which had the effect of reducing the median market capitalization of the Peer Group, as of December 31, 2022, by 33% to $4.1 billion, relative to AMG’s market capitalization of $6.2 billion |

12

What was the net impact of the changes to the incentive determination process in 2022 (across peer group, metric targets, weightings) on CEO compensation? | • The net impact of the changes in the incentive determination process for performance year 2022 was a modest reduction of approximately one percentage point in incentive compensation, relative to what the payout would have been using the 2021 incentive determination process • The removal of Ameriprise resulted in a reduction in the peer median used to set target payouts, and the increased difficulty of absolute Annual Management Fee EBITDA and Annual EEPS targets reduced the Overall Performance Assessment Score. These changes more than offset a modest increase in the Overall Performance Assessment Score as a result of weighting changes and streamlining of metrics |

Why is Average ROE the performance metric utilized in performance-based equity awards? Should the awards use additional metrics? How does the metric align with shareholder value creation over the performance period? | • Average ROE aligns management incentives with two distinct goals: (i) growing Economic earnings and (ii) effective stewardship of shareholder capital, over a long-term period. The Average ROE ratio provides shareholders with objective insight into the efficiency with which AMG’s management team allocates capital and uses stockholder equity to generate earnings, and should be measured against Cost of Equity • Average ROE incorporates multiple financial metrics. Average ROE is defined as the annual average of the Company’s Economic net income (calculated on a pre-compensation basis) over a specified measurement period, divided by the quarterly average of the Company’s stockholder’s equity, controlling interest over such period (excluding accumulated other comprehensive income, impairments recorded subsequent to the grant date, and other transactions and investments included in GAAP Net income but that do not impact Economic net income), reflected as a percentage • Return on Equity (ROE) is often used by other financial services companies as an objective measure of management’s effectiveness at using stockholder equity to generate earnings and to encourage responsible long-term planning |

13

PROPOSAL 1: ELECTION OF DIRECTORS

Introduction

Our Board of Directors currently consists of eight members, all of whom are expected to be elected at the Annual Meeting to serve until the 2024 Annual Meeting of Stockholders and until their respective successors are duly elected and qualified. The Board of Directors, upon the recommendation of the Nominating and Governance Committee, has nominated Karen L. Alvingham, Tracy A. Atkinson, Dwight D. Churchill, Jay C. Horgen, Reuben Jeffery III, Félix V. Matos Rodríguez, Tracy P. Palandjian, and David C. Ryan (collectively, the “Nominees”) to serve as directors. Each of the Nominees is currently serving as a director of the Company. As more fully discussed below in the “Corporate Governance Matters and Meetings of the Board of Directors and Committees” section of this Proxy Statement, the Board of Directors has determined that seven of its eight Nominees, Lady Alvingham, Ms. Atkinson, Mr. Churchill, Mr. Jeffery, Dr. Matos Rodríguez, Ms. Palandjian, and Mr. Ryan have no material relationship with the Company and, therefore, are independent for purposes of NYSE listing standards. The Board of Directors expects that each of the Nominees will, if elected, serve as a director for the new term. However, if any person nominated by the Board of Directors is unable to accept election, the proxies will be voted for the election of such other person or persons as the Board of Directors may recommend.

The Company’s by‑laws (as amended and restated, the “By‑laws”) provide for majority voting in uncontested director elections. Under the majority voting standard, directors are elected by a majority of the votes cast, which means that the number of shares voted “for” a director must exceed the number of shares voted “against” that director. In a contested election (a situation in which the number of nominees exceeds the number of directors to be elected), the standard for the election of directors will be a plurality of the votes cast. Abstentions and broker non‑votes will have no effect on the outcome of the vote on the election of directors.

Under our Corporate Governance Guidelines, the Nominating and Governance Committee has established procedures for any director who is not elected to tender his or her offer to resign. Upon receiving the director’s offer to resign, the Nominating and Governance Committee will recommend to the Board of Directors whether to accept or reject the offer to resign, or whether other action should be taken. The Nominating and Governance Committee and the Board of Directors, in making their decisions, may consider any factor or information that they deem relevant. The Board of Directors, taking into account the Nominating and Governance Committee’s recommendation, will act on the tendered resignation within ninety days following certification of the election results. A director whose resignation is under consideration must abstain from participating in any recommendation or decision regarding his or her resignation.

Recommendation of the Board of Directors

The Board of Directors believes that the election of each of the Nominees is in the best interests of the Company and its stockholders and, therefore, unanimously recommends that stockholders vote FOR the election of each of the Nominees.

14

Information Regarding the Nominees

The following table sets forth the name, age (as of April 1, 2023), tenure, and other information of each Nominee, along with the committees of the Board of Directors on which each Nominee currently serves.

Director Nominee Information: Committee Memberships | ||||||||||||||

Name |

| Age |

| Compensation Committee |

| Nominating and Governance Committee |

| Audit Committee |

| Independence |

| Tenure (Years) |

| Other Public Company Boards |

Karen L. Alvingham |

| 60 |

|

|

| ✓ |

|

|

| ✓ |

| 5 |

| — |

Tracy A. Atkinson |

| 58 |

|

|

|

|

| ✓ (Chair) |

| ✓ |

| 2 |

| 2 |

Dwight D. Churchill Board Chair |

| 69 |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| 13 |

| — |

Jay C. Horgen President and Chief Executive Officer |

| 52 |

|

|

|

|

|

|

|

|

| 4 |

| — |

Reuben Jeffery III |

| 69 |

| ✓ (Chair) |

|

|

| ✓ |

| ✓ |

| 3 |

| — |

Félix V. Matos Rodríguez |

| 61 |

| ✓ |

| ✓ |

|

|

| ✓ |

| 2 |

| — |

Tracy P. Palandjian |

| 52 |

| ✓ |

| ✓ (Chair) |

|

|

| ✓ |

| 11 |

| — |

David C. Ryan |

| 53 |

|

|

|

|

| ✓ |

| ✓ |

| 1 |

| — |

|

| Average Age of 59 |

| 100% Independent; All New Members and New Chair since 2020 |

| 100% Independent; 3 New Members and New Chair since 2020 |

| 100% Independent; 100% Financial Experts; 3 New Members and New Chair since 2020 |

| 7 of 8 Nominees are Independent |

| 4 New Members since 2020 |

| No Overboarding |

|

|

|

|

|

|

|

|

|

|

|

|

15

The Nominees bring a wide array of qualifications, skills, and attributes to our Board of Directors that support its oversight role on behalf of our stockholders. The most relevant of these qualifications and skills are summarized in the table below:

Director Experience and Skills Overview | ||||

Leadership |

| Directors who have held significant leadership positions provide a practical understanding of organizations, processes, strategy, risk management, and other factors that promote growth |

| All |

Capital allocation |

| Our continued success depends in large part on a disciplined approach to capital allocation, as we seek to deploy resources in the areas of highest growth and return in our business to capitalize on growth opportunities, before efficiently returning excess capital to our stockholders; directors with experience managing capital contribute to the advancement of this strategy to enhance long-term value creation |

| 7 of 8 |

Corporate governance |

| We place a high standard on strong corporate governance, and adopt best practices through the active monitoring of evolving trends and developments, and through routine Board self-assessments and enhancements to our governance policies, committee charters, and board practices, as well as through active shareholder engagement and ongoing board refreshment, and we seek directors with demonstrated knowledge and practical experience in corporate governance, fiduciary roles, and stakeholder engagement |

| All |

Risk management and compliance |

| Risk management is critical to the stability, security, and success of our business, and we seek directors with regulatory and compliance expertise, as well as experience managing and overseeing risk in public and private companies and in other contexts |

| All |

Investment management |

| Directors with investment management experience provide the Board with an enhanced understanding and assessment of our business strategy and bring valuable perspective on topics that are uniquely relevant to our industry |

| 7 of 8 |

Financial, accounting, or financial reporting |

| We use a broad set of financial metrics to measure our operating and strategic performance, and we seek directors with an understanding of finance and financial reporting processes |

| 7 of 8 Directors |

Operational, including human capital management |

| Directors with experience in operations are able to assess and advise management on the formulation and execution of our business strategy, including the efficient allocation and utilization of our and our Affiliates’ human capital and other operating resources, and the re-allocation of those resources over time through all stages of market cycles |

| All

|

Sustainability |

| Directors who have experience in managing sustainability issues are able to assist the Board in overseeing and advising management to ensure that strategic business imperatives and long-term value creation for stockholders are achieved within a responsible long-term business plan. Directors who have experience in sustainable investment are able to advise management in increasing AMG’s exposure to this secular growth area |

| 5 of 8 |

Public policy, regulatory, and government affairs |

| Directors with experience in governmental, regulatory, and related organizations provide valuable insight into governmental actions and socioeconomic trends, as well as the highly regulated industry in which we and our Affiliates operate |

| 4 of 8 |

Other public board experience |

| Directors with experience serving on other public company and publicly traded fund boards provide valuable operations and management perspectives, including insights on governance trends and practices and other issues affecting public companies generally |

| 5 of 8 |

Global experience |

| Directors with global business experience, including managing and growing organizations worldwide, and investing and operating experience in international and emerging markets, provide valuable insights on growth trends in these markets |

| 7 of 8 |

16

The following biographical summaries provide additional information on the business experience, principal occupation and past employment, and directorships of each Nominee during at least the last five years.

Director Biographical Information | |

Karen L. Alvingham Nominating and Governance Committee | Karen L. Alvingham has been a director of the Company since January 2018. She served until June 2017 as Managing Partner of Genesis Investment Management, LLP, a boutique investment management firm and an AMG Affiliate since 2004. Lady Alvingham joined the firm in 1990 and was appointed Managing Partner in 2003. Prior to joining Genesis, she was a senior investment manager at Touche Remnant Investment Management Ltd and Lloyds Investment Management Ltd. She began her career at Grieveson Grant & Co. She currently serves on the board of directors of International Market Management Ltd. We believe Lady Alvingham’s qualifications to serve on our Board of Directors include her substantial experience in the investment management industry, including as a senior executive in a leading investment management firm. |

Tracy A. Atkinson Audit Committee (Chair) | Tracy A. Atkinson has been a director of the Company since August 2020. Prior to her retirement from State Street Corporation in March 2020, Ms. Atkinson served as an executive vice president, having held a number of senior finance and risk management roles including Chief Administrative Officer, Chief Compliance Officer, and Treasurer. Prior to joining State Street Corporation, she held leadership positions at MFS Investment Management and was a Partner at PricewaterhouseCoopers. She currently serves on the boards of directors of the United States Steel Corporation and Raytheon Technologies. We believe Ms. Atkinson’s qualifications to serve on our Board of Directors include her significant leadership experience from her career in the accounting and asset management industries, as well as a track record of service on public company boards. |

Dwight D. Churchill Board Chair Compensation Committee, Nominating and Governance Committee, & Audit Committee | Dwight D. Churchill has been a director of the Company since February 2010, and has served as independent Board Chair since August 2020. Mr. Churchill held a number of senior positions at Fidelity Investments before retiring from the firm in 2009. Having joined Fidelity in 1993, he served as the head of the Fixed Income Division, head of Equity Portfolio Management and President of Investment Services. While at Fidelity, Mr. Churchill also served as the elected chair of the Board of Governors for the CFA Institute, a 190,000-member association, and from June 2014 to January 2015, he served as interim President and Chief Executive Officer at the CFA Institute. Prior to joining Fidelity, Mr. Churchill served as a Managing Director of Prudential Financial, Inc., as President and Chief Executive Officer of CSI Asset Management, Inc., a subsidiary of Prudential Financial, Inc., and held senior roles at Loomis, Sayles & Company and the Ohio Public Employees Retirement System. Mr. Churchill currently serves on the Board of Trustees and as Chair of the Audit Committee of State Street Global Advisors SPDR ETF Mutual Funds and as a staff consultant at The Public Employees Retirement System of Idaho. We believe that Mr. Churchill’s qualifications to serve on our Board of Directors includes his extensive experience in the investment management industry. |

Jay C. Horgen President and Chief Executive Officer | Jay C. Horgen is the President and Chief Executive Officer of the Company and joined the Board of Directors in May 2019. Mr. Horgen was appointed President and CEO in 2019, having previously served as Chief Financial Officer from 2011 to 2019. Previously, Mr. Horgen served as Executive Vice President of the Company in New Investments. Prior to joining AMG in 2007, Mr. Horgen was a founder and Managing Director of Eastside Partners, a private equity firm. Prior to that, Mr. Horgen served as a Managing Director in the Financial Institutions Group at Merrill Lynch, Pierce, Fenner & Smith Incorporated. From 1993 to 2000, he worked as an investment banker in the Financial Institutions Group at Goldman, Sachs & Co. Mr. Horgen received a B.A. from Yale University. We believe that Mr. Horgen’s qualifications to serve on our Board of Directors include his direct knowledge of the Company’s strategy and operations through his 16 years of service at the Company, including as President & Chief Executive Officer, and Chief Financial Officer, and his 30 years of extensive experience in the financial services, private equity, and investment management industries. |

17

Reuben Jeffery III Audit Committee & Compensation Committee (Chair) | Reuben Jeffery III has been a director of the Company since April 2020. Mr. Jeffery served as President and Chief Executive Officer and member of the board of Rockefeller & Co. and Rockefeller Financial Services, Inc. from 2010 to 2018. He previously served seven years in the U.S. government in a variety of positions, including as Under Secretary of State for Economic, Energy and Agricultural Affairs; Chairman of the U.S. Commodity Futures Trading Commission; and as Special Assistant to the President on the staff of the National Security Council (2002-2009). At Goldman, Sachs & Co., Mr. Jeffery was Managing Partner of the firm’s Paris office and of its European Financial Institutions Group in London. He began his career as a corporate attorney with Davis Polk & Wardwell LLP. Currently, Mr. Jeffery serves on the board of directors of PartnerRe Ltd., and as an independent director and chairman of the board of SMBC Americas Holdings, Inc. Mr. Jeffery is also chairman of the board of Riverstone Credit Opportunities Income Plc (RCOI) and a board member of CSE Insurance Group, an indirect wholly-owned subsidiary of Covéa, a global insurer headquartered in France. He is also a board member of the Financial Services Volunteer Corps (FSVC), a not-for-profit that supports economic development by strengthening financial sectors in developing countries. Mr. Jeffery served as a non-executive director at Barclays Plc from 2010 to 2019. He received a B.A. in Political Science from Yale University and an M.B.A. and J.D. from Stanford University. We believe that Mr. Jeffery’s qualifications to serve on our Board of Directors include his extensive financial services experience, particularly within investment banking and wealth management, and his knowledge and experience with the U.S. and global political and regulatory environments. |

Félix V. Matos Rodríguez Compensation Committee & Nominating and Governance Committee | Félix V. Matos Rodríguez has been a director of the Company since January 2021. Dr. Matos Rodríguez is the Chancellor of the City University of New York (CUNY). Prior to his appointment as Chancellor in May 2019, Dr. Matos Rodríguez was president of CUNY’s Queens College and of CUNY’s Eugenio María de Hostos Community College in the Bronx. Dr. Matos Rodríguez has served as a teacher, administrator, and former Cabinet secretary for the Commonwealth of Puerto Rico. He currently serves as board and executive committee chair of Research Foundation CUNY, co-chair of New York City Regional Economic Development Council, and as vice chair of the board of directors of the American Council on Education. Additionally, he serves on the boards of Phipps Houses, the United Way of New York City, and the Association for a Better New York (ABNY), as well as on the steering committee of Research Alliance for New York City Schools. Dr. Matos Rodríguez holds a B.A. from Yale University and received a doctorate in history from Columbia University. We believe that Dr. Matos Rodríguez’s qualifications to serve on our Board of Directors include his long track record as an innovator in both academia and the public sector and his leadership in a large, decentralized human-capital-based organization operating through a network of distinct institutions. |

Tracy P. Palandjian Compensation Committee & Nominating and Governance Committee (Chair) | Tracy P. Palandjian has been a director of the Company since March 2012. Ms. Palandjian is the Chief Executive Officer, co-founder and a member of the Board of Directors of Social Finance, Inc., a nonprofit organization focused on developing and managing investments that generate social impact and financial return. Prior to establishing Social Finance, Ms. Palandjian served as a Managing Director at The Parthenon Group, a global strategy consulting firm. At Parthenon, she established and led the Nonprofit Practice and consulted to foundations and nonprofit organizations in the U.S. and globally. Prior to Parthenon, Ms. Palandjian worked at McKinsey & Company and at Wellington Management Company, LLP. Ms. Palandjian is currently a member of the Harvard Corporation, vice-chair of the U.S. Impact Investing Alliance, and a trustee of the Global Steering Group on Impact Investing. She serves on the Boards of Pershing Square Holdings, Ltd., The Boston Foundation and the Surdna Foundation (and chairs its Investment Committee). Ms. Palandjian is also a member of the American Academy of Arts and Sciences. We believe that Ms. Palandjian’s qualifications to serve on our Board of Directors include her extensive global financial management, consulting, and advisory experience. |

David C. Ryan Audit Committee | David C. Ryan has been a director of the Company since July 2021. Mr. Ryan is a corporate advisor to Singapore-based Temasek Holdings, and serves on the board of Mapletree Investments Pte Ltd., a Singapore-based real estate development, investment, capital and property management company, and previously served on the boards of ADT Inc. and Tiga Acquisition Corp. Mr. Ryan’s 22-year career at Goldman Sachs & Co., where he was a partner, spanned a variety of roles in Asia and the United States. From 2011 to 2013, he served as President of Goldman Sachs Asia (chairing its management committee) and was a member of the Management Committee of Goldman Sachs & Co. We believe that Mr. Ryan’s qualifications to serve on our Board of Directors include his substantial global financial services experience, particularly his extensive knowledge of the Asian region. |

18

Board of Directors Experience, Diversity, and Refreshment |

19

Governance Highlights |

| ► | Highly independent, diverse Board; world-class, experienced directors with a range of skills and backgrounds |

| ► | Non-Executive, Independent Board Chair |

| ► | Women in Leadership Roles on the Board |

| ► | No Overboarding |

| ► | Policies to Promote Long-Term Director and Executive Equity Ownership |

| ► | 98% Average Director Attendance at Board and Committee Meetings in 2022 |

| ► | Significant Board Refreshment since 2020 |

| ► | Publicly-Disclosed Corporate Governance Guidelines |

| ► | Majority Vote Standard in Uncontested Director Elections |

| ► | No Staggered Board |

| ► | No “Poison Pill” |

| ► | “Double-Trigger” Equity Award Vesting Upon Change in Control |

| ► | Annual Say-on-Pay Vote |

| ► | Active Engagement with Shareholders |

2022 Director Engagement |

Board and Committee Meetings | |

9 | Board Meetings |

18 | Committee Meetings |

98% | Average attendance rate at meetings of the full Board of Directors and its committees |

Shareholder Engagement (2022-2023YTD) |

Shareholder Outreach |

| Responsiveness |

• Proactive outreach to stockholders representing over 55% of voting shares • Held approximately 100 meetings with more than 50 current and prospective stockholders, including half of our top 30 largest holders |

| • Demonstrated integration of shareholder feedback into corporate governance practices and compensation program design over multiple years • Expanded shareholder engagement in recent years on topics including corporate strategy, sustainability, and executive compensation; feedback reflected in our compensation program enhancements applied to performance year 2021 and performance year 2022 compensation program design |

2022 Compensation Committee Actions in Response to Shareholder Feedback |

• Further enhanced AMG’s formulaic five-step Performance Assessment process for determining executive incentive compensation, which includes 10 performance metric targets (streamlined from 13 targets in prior year) across an array of pre-set financial and strategic metric targets, with achievement caps for each metric • Increased weightings of financial metrics in the determination of incentive awards to further link pay with financial and stock performance • Continued to set rigorous financial targets, including by increasing the difficulty of absolute earnings targets relative to the target-setting approach outlined in prior-year Proxy Statement • Further refined Peer Group to better reflect AMG’s business model and evolving industry • Further enhanced metrics related to Strategic and Organizational Initiatives |

20

Corporate Governance Matters and Meetings of the Board of Directors and Committees

Board of Directors: During 2022, the full Board of Directors met nine times. Each incumbent member of the Board of Directors in 2022 attended an average of 98% of the total number of meetings of the full Board of Directors and all standing committees of the Board of Directors on which such director served. We do not have a formal policy regarding director attendance at our Annual Meeting of Stockholders. One director attended the 2022 Annual Meeting of Stockholders.

At least annually, the Board of Directors evaluates the independence of our directors in light of the standards established by NYSE. A majority of our Board of Directors must be independent within the meaning of NYSE listing standards. After its most recent evaluation of director independence, the Board of Directors affirmatively determined that seven of our eight current directors, Lady Alvingham, Ms. Atkinson, Mr. Churchill, Mr. Jeffery, Dr. Matos Rodríguez, Ms. Palandjian, and Mr. Ryan, are “independent” for purposes of NYSE listing standards. The Board of Directors made its determinations based upon individual evaluations of these directors’ employment or board of directors affiliations, compensation history, and any commercial, family, or other relationships with the Company. There were no transactions between any director and the Company for the Board of Directors’ consideration in determining the independence of any independent director. Members of the Board of Directors serve as directors, trustees, or in similar capacities (but not as executive officers or employees) for non-profit organizations to which we may make charitable contributions from time to time. Contributions to these organizations did not exceed either $120,000 or 1% of each of those organizations’ annual consolidated gross revenues during their last completed fiscal years.

The standing committees of the Board of Directors are the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee. Only independent directors within the meaning of NYSE listing standards serve on these committees. Other members of the Board of Directors may attend committee meetings from time to time at the invitation of the respective committee. Each committee acts pursuant to a written charter adopted by the respective committee. The members and chairs of each committee are set forth above in the table titled “Director Nominee Information: Committee Memberships,” and a description of each committee is set forth below.

Audit Committee: Each of the members meets the independence standards applicable to audit committees under the Sarbanes‑Oxley Act of 2002 and NYSE listing standards and is an audit committee financial expert, as defined by the SEC. The Audit Committee’s purpose is to assist the Board of Directors in oversight of our internal controls and financial statements and the audit process. The Audit Committee held eight meetings during 2022.

Compensation Committee: Each member meets the independence requirements applicable to compensation committees under NYSE listing standards. The Compensation Committee is responsible for overseeing our general compensation policies and establishing and reviewing the compensation plans and benefit programs applicable to our executive officers. In that capacity, the Compensation Committee also administers our incentive plans, and has sole authority to approve the compensation of our named executive officers and the performance goals related to such plans and programs. The Compensation Committee held five meetings during 2022, and conferred on additional occasions throughout the year to discuss changes and enhancements to the executive compensation program.

Nominating and Governance Committee: The Nominating and Governance Committee is primarily responsible for recommending criteria to the Board of Directors for Board and committee membership, identifying and evaluating director candidates, overseeing the annual self‑assessment of the Board of Directors and its committees and of the Chief Executive Officer, overseeing Chief Executive Officer and other key executive succession planning, and maintaining our Corporate Governance Guidelines. The Nominating and Governance Committee held five meetings during 2022.

Board Composition and Refreshment Process: The Nominating and Governance Committee may solicit director candidate recommendations from a number of sources, including directors, executive officers, and third‑party search firms. The Nominating and Governance Committee will consider for nomination any director candidates, including director candidates recommended by our stockholders, who are deemed qualified by the Nominating and Governance Committee in light of the qualifications and criteria for Board of Directors membership described below, or such other criteria as approved by the Board of Directors or a committee thereof from time to time. Stockholder recommendations must be submitted to the Nominating and Governance Committee in accordance with the requirements set forth in the By‑laws, including those discussed in the “Other Matters—Stockholder Proposals” section of this Proxy Statement, and any procedures established from time to time by the Nominating and Governance Committee. The Nominating and Governance Committee does not have a specific policy regarding the consideration of stockholder recommendations for director candidates and considers this appropriate because it evaluates recommendations without regard to their source. The Nominating and Governance Committee evaluates any potential conflicts of interest on a case‑by‑case basis, to the extent they may arise.

21

The Board of Directors believes that a diverse mix of perspectives and expertise enhances its overall effectiveness. When considering candidates for directorship, including nominees currently serving as directors of the Company, the Nominating and Governance Committee takes into account a number of factors, including the following qualifications: the nominee must have the highest personal and professional integrity and have demonstrated exceptional ability and judgment and the attributes necessary (in conjunction with the other members of the Board of Directors) to best serve the long‑term interests of the Company and its stockholders. In addition, the Nominating and Governance Committee reviews from time to time the skills and characteristics necessary and appropriate for directors in light of the then-current composition of the Board of Directors, including the following factors:

Director Candidate Qualifications and Attributes | |

• Business and leadership experience, including experience managing and growing organizations worldwide |

• Knowledge of the financial services industry and, in particular, the asset management industry

|

• Demonstrated experience with prudent and strategic capital allocation, as we seek to deploy resources to the areas of highest growth and return in our business |

• Understanding of organizations, processes, strategy, risk management, and other factors that promote growth, including experience in managing sustainability issues

|

• Understanding of finance and financial reporting processes

|

• Diversity, including ethnic, gender, geographic, and experiential diversity |

In considering diversity, the Nominating and Governance Committee considers diversity of background and experience, as well as ethnicity, gender, and other forms of diversity. The Nominating and Governance Committee recognizes the importance of gender and ethnic diversity, in particular, as important factors to consider when evaluating the composition of the Board of Directors. The Nominating and Governance Committee does not have a formal policy regarding diversity in identifying nominees for a directorship, but rather considers it among the various factors relevant to the consideration of any particular nominee. Further, the Board of Directors considers diversity as part of the annual Board and committee self-assessments. The Nominating and Governance Committee reviews our Corporate Governance Guidelines at least annually to ensure that we continue to meet best corporate governance practice standards. Nominating practices are adjusted, as needed, to ensure that the Board of Directors reflects the appropriate mix of skills and experience, and that such practices promote diversity of background and experience, as well as ethnicity, gender, and other forms of diversity.

Since 2020, the Board of Directors has had the opportunity for meaningful refreshment, with the retirement of five independent directors and the appointment of four new independent directors. These additions to the Board followed a process that included evaluating more than 40 candidates since 2020, a number of whom met with members of the Nominating and Governance Committee and other directors, as well as members of management, as part of our nomination process. That process is led by the Nominating and Governance Committee and Board Chair, and includes an evaluation of the current composition of the Board in order to focus on candidates with diverse skills and experiences that would enhance the Board’s collective capabilities and bring new perspectives. The full Board of Directors considers each candidate’s qualifications, and determines whether to nominate the candidate to serve on our Board of Directors.

The current Board of Directors comprises individuals with a substantial variety of skills and expertise, as shown in the “Director Experience and Skills Overview” table above, including with respect to investment management and financial services; international business; government; and not-for-profit organizations. The Nominating and Governance Committee believes it is important to maintain a mix of experienced directors with a deep understanding of the Company and newer directors who bring a fresh perspective. The following are highlights on the composition of our current Board of Directors:

Board of Directors Composition | |

• Women represent 43% of independent directors, with three women serving on the Board

|

• 29% of independent directors are ethnic minorities

|

• Four new independent directors since 2020; half of these are women or ethnically diverse

|

• Transitioned to a non-executive, independent Board Chair in 2020; Board Chair does not chair any committee |

• New Chairs of all Board committees since 2020; two of three committees chaired by women, including one ethnic minority

|

• New members on all Committees since 2020, including a fully reconstituted Compensation Committee

|

• Long-tenured independent directors in leadership roles

|

• Average director nominee age of 59

|

22

Succession Planning: The Nominating and Governance Committee has primary responsibility for Chief Executive Officer and other key executive succession planning. Succession planning and executive development are fundamental components of the Board of Directors’ governance responsibilities, and are regularly discussed by the Committee with management present as well as in executive sessions.

The Board has demonstrated the depth and effectiveness of its succession planning through a recent period of organizational evolution as the Company completed a generational transition to its current Chief Executive Officer, Jay C. Horgen. In May 2018, the Company announced that Sean Healey, the Company’s Chief Executive Officer and Chairman at the time, had been diagnosed with amyotrophic lateral sclerosis (a terminal motor neuron disease known as ALS), and initiated its long-term succession plan. In May 2019, the Board appointed Mr. Horgen, Chief Financial Officer at the time, as President and Chief Executive Officer, and Thomas M. Wojcik joined the Company as Chief Financial Officer. The approach provided continuity of leadership in a time of unexpected transition and drew on the strengths and experiences of the Company’s most senior executives. The independent directors continue to serve as a source of strategic strength for the Company and for Mr. Horgen and the balance of the executive management team, bringing significant diversity in skills, experiences, and perspectives. The independent directors and Mr. Horgen continue to focus on developing and expanding the senior management team, to maintain a breadth and depth of talent that ensures that AMG is well-positioned to continue to refine and execute against its strategy.

Board Size: The Nominating and Governance Committee assesses the size and composition of the Board of Directors each year. Consistent with our Corporate Governance Guidelines, the Nominating and Governance Committee believes that the current size of our Board of Directors, eight members, is appropriate given the size and complexity of the Company and the markets in which we operate. The Nominating and Governance Committee will continue to assess the Board’s needs and other relevant circumstances, and may change the size or composition of the Board of Directors in the future if it believes that doing so would be in the best interests of the Company and its stockholders.

Executive Sessions of Independent Directors: Our independent directors regularly meet in scheduled executive sessions without management present. In accordance with the charter of the Nominating and Governance Committee and the By-laws, Mr. Churchill, the Board Chair, is responsible for calling and chairing the executive sessions, including during the annual Board of Directors offsite, and communicating with the Company’s Chief Executive Officer. Each committee of the Board also meets without management present, in sessions led by the Chair of the relevant committee.

Board and Committee Self‑Assessments and Individual Director Assessments: Regular evaluations of the committees and the full Board of Directors are critical in ensuring the effective functioning of our Board of Directors, including in assessing candidates for directorship. To this end, the Chair of the Nominating and Governance Committee, supported by the Committee, oversees the annual self-assessment of the Board of Directors and of each committee of the Board of Directors. Directors assess performance and consider various structural and procedural matters, including the annual selection process for director nominees and communications and interactions with management generally. The Nominating and Governance Committee periodically reviews the format of the Board of Directors and committee self-assessment processes to ensure that actionable feedback is solicited on the operation of the Board of Directors and director performance. The Nominating and Governance Committee also oversees annual individual director assessments as part of the recommendation process for director nominees. The table below provides a general overview of the annual self-assessment and director assessment processes.

Board and Committee Self-Assessments and Individual Director Assessments | |

Questionnaire |

• Evaluation questionnaire solicits director feedback on a variety of procedural and substantive topics

|

Executive Session |

• Executive session discussion of Board and committee self-assessments led by the Chair of the Nominating and Governance Committee

|

Individual Director Assessments |

• Individual director assessments support an annual evaluation of the Board’s composition to ensure that our Board as a whole continues to reflect the appropriate mix of skills and experience

|

Board Summary |

• Summary of Board and committee self-assessments results presented by the Chair of the Nominating and Governance Committee, followed by a discussion of the full Board

|

Feedback Incorporated |

• Policies and practices updated as appropriate, as a result of director feedback

|

23

Chief Executive Officer Evaluation: The Board Chair oversees an annual performance evaluation of our Chief Executive Officer. As part of this assessment, the Board Chair solicits director feedback on a variety of performance considerations. The Board Chair then synthesizes the directors’ feedback and discusses the results with our Chief Executive Officer in a one-on-one meeting. The Board Chair reports on the results of the evaluation at an executive session of the Board of Directors.

Director On‑Boarding and Training: When a new independent director joins the Board of Directors, we provide an orientation program that includes personal briefings by senior management on the Company’s operations, strategic plans, financial statements, governance, and key policies and practices. New directors also undergo in-depth training on the work of each committee of the Board of Directors. Throughout their tenure on the Board of Directors, each director is expected to maintain the necessary knowledge and information to perform his or her responsibilities as a director. To assist the directors in understanding the Company and its industry and maintaining the level of expertise required for directors, the Company may, from time to time, offer Company-sponsored continuing education programs or presentations, including sessions on select topics during the annual Board of Directors offsite. Additional training is also provided when a director assumes a leadership role, such as becoming the chair of a committee.

Leadership Structure: The Company follows best practices with respect to the Board’s leadership structure, reflecting collective feedback received from stockholders, as well as commentary from proxy advisory firms, over a multi-year period. While the Company does not have a fixed policy with respect to the independence of the Board Chair, the Company’s By-Laws provide that if at any time the Board Chair is not affirmatively determined to be independent, the Board must appoint a Lead Independent Director and provide for specific enumerated duties of the Lead Independent Director in that circumstance. In circumstances where the Board Chair is independent (as is the case currently), the Lead Independent Director role is not required. This approach provides for effective checks and balances to ensure the exercise of independent judgment by the Board and the ability of the independent directors to work effectively in the board setting.