UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR (15d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year endedDecember 31, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report________________

For the transition period from __________________ to __________________

Commission file number001-32468

MOUNTAIN PROVINCE DIAMONDS INC.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

Ontario

(Jurisdiction of incorporation or organization)

161 Bay Street, Suite 2315, PO Box 216, Toronto, Ontario Canada M5J 2S1

(Address of principal executive offices)

Bruce Ramsden – 416-361-3562

Fax: 416-603-8565; Email: b.ramsden@mountainprovince.com

161 Bay Street, Suite 2315, PO Box 216, Toronto, Ontario Canada M5J 2S1

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | | Name of each exchange on which registered |

| Common Shares no par value | | NASDAQ |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Not Applicable

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

135,204,550

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

¨ Yes x No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports)

¨ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer x | Non-accelerated filer ¨ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ¨ | | International Financial Reporting Standards x | | Other ¨ |

| | | as issued by the International Accounting | | |

| | | Standards Board | | |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

¨ Item 17 ¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨ Yes x No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

¨ Yes ¨ No

Not Applicable

TABLE OF CONTENTS

GLOSSARY

2002 AgreementorGahcho Kué Joint Venture Agreementormeans the joint venture agreement entered into by Mountain Province Diamonds Inc., Camphor Ventures Inc., and De Beers Canada Exploration Inc. on October 24, 2002, but which took effect from January 1, 2002, and which was amended and restated on July 3, 2009;

2009 Agreementor Gahcho Kué Amended and Restated Joint Arrangement-Agreementmeans the Gahcho Kué Joint Venture Agreement as amended and restated, and entered into by Mountain Province Diamonds Inc., Camphor Ventures Inc., and De Beers Canada Inc. on July 3, 2009;

2009 Technical Report means the Technical Report dated as of April 20, 2009 entitled "Gahcho Kué Kimberlite Project NI 43-101 Technical Report, Northwest Territories, Canada" prepared for the Company by AMEC Americas Limited;

2010 Technical Report, Definitive Feasibility Study,or Feasibility Studymeans the “Gahcho Kué Project, Definitive Feasibility Study, National Instrument (“NI”) 43-101 Technical Report” dated December 1, 2010 (with Information effective as of October 15, 2010) as prepared and completed by JDS Energy and Mining Inc., and filed by the Company on SEDAR on December 3, 2010;

2013 Technical Report, Update of the Mineral Resource Estimate for the Tuzo Kimberlite,means the “Gahcho Kué Project, Update of the Mineral Resource Estimate for the Tuzo Kimberlite, National Instrument (“NI”) 43-101 Technical Report” dated July 2, 2013 as prepared and completed by Mineral Services Canada Inc., and filed by the Company on SEDAR on August 14, 2013;

2014 Technical Report or 2014 Feasibility Studymeans the “Gahcho Kué Project, 2014 Feasibility Study Report NI 43-101 Technical Report” dated May 13, 2014 as amended May 27, 2014 (with Information effective as of March 31, 2014) as prepared and completed by JDS Energy and Mining Inc. and Hatch Ltd, and filed by the Company on SEDAR on May 28, 2014;

2014 Feasibility Study or 2014 Technical Reportmeans the “Gahcho Kué Project, 2014 Feasibility Study Report NI 43-101 Technical Report” dated May 13, 2014 as amended May 27, 2014 (with information effective as of March 31, 2014) as prepared and completed by JDS Energy and Mining Inc. and Hatch Ltd, and filed by the Company on SEDAR on May 28, 2014;

Affiliate has the meaning given to affiliated bodies corporate under the Business Corporations Act (Ontario);

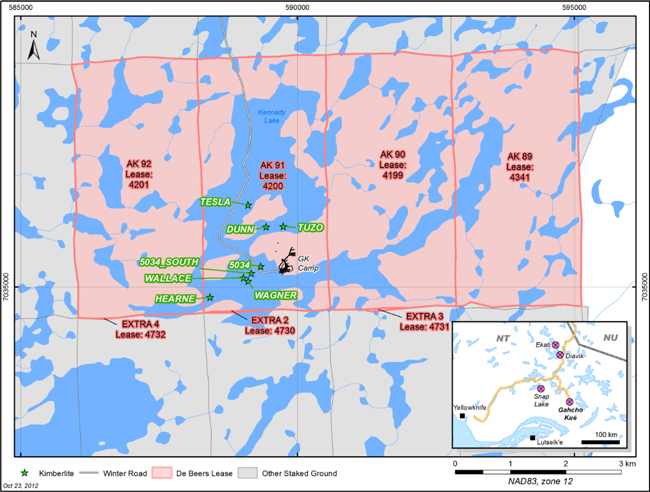

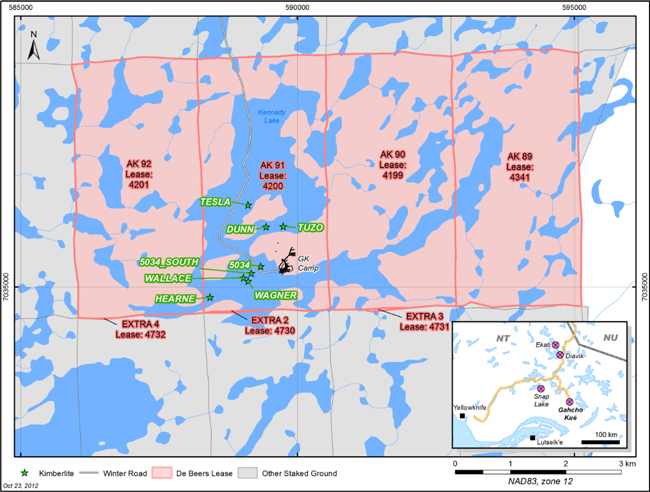

AK Property means the claims known as the "AK claims" held by the Gahcho Kué Arrangement;

AK-CJ Propertiesmeans, collectively, the AK Property and CJ Property;

AMECmeans AMEC Americas Limited;

AMEX or NYSE AMEXmeans the American Stock Exchange prior to the take-over of the American Stock Exchange LLC by the New York Stock Exchange, and subsequently renamed NYSE Amex, then renamed NYSE MKT;

CJ Property means the claims known as the "CJ claims", which have now lapsed, previously held by MPV;

Arrangement means the arrangement between the Company and Glenmore which was effected as of June 30, 2000;

Arrangement Agreementmeans the Arrangement Agreement dated as of May 10, 2000, and made between MPV and Glenmore, including the Schedules to that Agreement;

Business Corporations Act (Ontario) means the R.S.O. 1990, CHAPTER B.16, as amended from time to time;

CDNX means the Canadian Venture Exchange Inc., formerly the Vancouver Stock Exchange, and now known as the TSX Venture Exchange;

Camphoror Camphor Venturesmeans Camphor Ventures Inc.;

Canadian National Instrument 43-101means theNational Instrument 43-101 (Standards of Disclosure for Mineral Projects)adopted by the Canadian Securities Administrators;

Code means the United StatesInternal Revenue Code of 1986, as amended;

Company,MPVorRegistrant means Mountain Province Diamonds Inc.;

De Beers means De Beers Consolidated Mines Ltd.;

De Beers Canada orMonopros means De Beers Canada Inc., formerly known as De Beers Canada Exploration Inc., and before that as Monopros Limited, a wholly-owned subsidiary of De Beers;

Desktop Study means the preliminary technical assessment of the Gahcho Kué resource conducted by De Beers Consolidated Mines Ltd. in 2000 (and updated in 2003, 2005, 2006, and 2008) and the Independent Qualified Persons’ review of the Desktop Study provided by AMEC;

Definitive Feasibility Study, Feasibility Study,or 2010 Technical Reportmeans the “Gahcho Kué Project, Definitive Feasibility Study, National Instrument (“NI”) 43-101 Technical Report” dated December 1, 2010 (with Information effective as of October 15, 2010) as prepared and completed by JDS Energy and Mining Inc., and filed by the Company on SEDAR on December 3, 2010;

Exchange Act means the U.S.SecuritiesExchange Act of 1934, as amended;

Feasibility Study, Definitive Feasibility Study,or 2010 Technical Reportmeans the “Gahcho Kué Project, Definitive Feasibility Study, National Instrument (“NI”) 43-101 Technical Report” dated December 1, 2010 (with Information effective as of October 15, 2010) as prepared and completed by JDS Energy and Mining Inc., and filed by the Company on SEDAR on December 3, 2010;

GAAP means Canadian generally accepted accounting principles;

Gahcho Kué Amended and Restated Joint Arrangement-Agreementor 2009. Agreementmeans the Gahcho Kué Joint Venture Agreement as amended and restated, and entered into by Mountain Province Diamonds Inc., Camphor Ventures Inc., and De Beers Canada Inc. on July 3, 2009;

Gahcho Kué Joint Arrangementor Joint Arrangementmeans the joint Arrangement between Mountain Province Diamonds Inc., Camphor Ventures Inc., and De Beers Canada, for the Gahcho Kué Project, and as currently governed by the 2009 Agreement;

Gahcho Kué Joint Arrangement-Agreementor 2002 Agreementmeans the joint arrangement agreement entered into by Mountain Province Diamonds Inc., Camphor Ventures Inc., and De Beers Canada Exploration Inc. on October 24, 2002, but which took effect from January 1, 2002, and which was amended and restated on July 3, 2009;

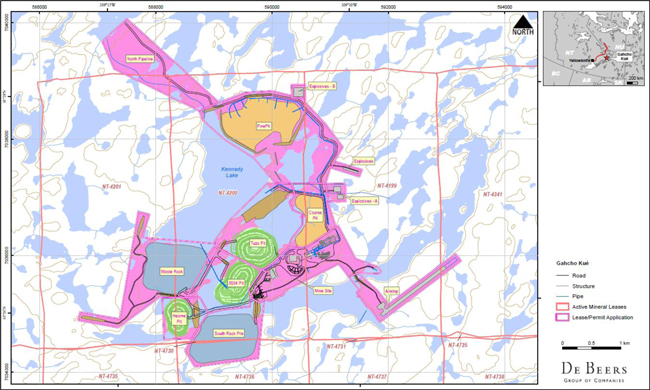

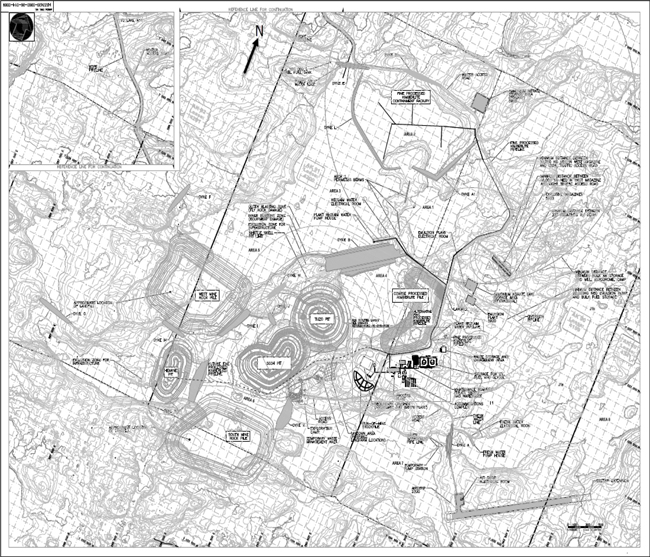

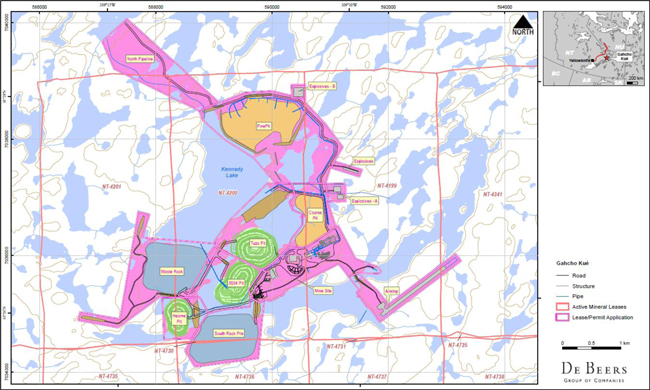

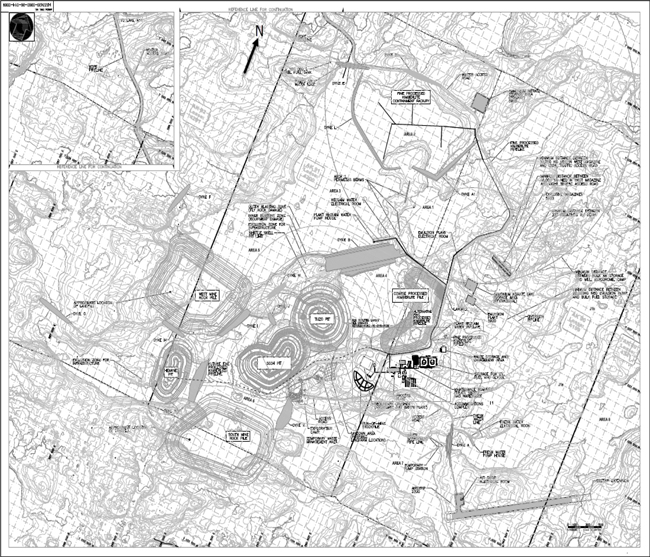

Gahcho KuéProject,located on Kennady Lake, also referred to as the “Kennady Lake Project”, and comprising four mineral leases that are 100% owned by De Beers Canada Inc. (“De Beers Canada”), which holds them on behalf of the Gahcho Kué Joint Arrangement. The participating interest of each of the joint venture parties is governed by the 2009 Agreement;

Glenmore means Glenmore Highlands Inc., a company incorporated under theBusiness Corporations Act(Alberta) and which, pursuant to the Arrangement, amalgamated with the Company's wholly-owned subsidiary, Mountain Glen Mining Inc., to form an amalgamated company, also known as Mountain Glen Mining Inc.;

Glenmore Shares means the common shares of Glenmore, as the same existed before the Arrangement took effect and "Glenmore Share" means any of them;

Glenmore Shareholder means a holder of Glenmore Shares;

IFRSmeans International Financial Reporting Standards, as issued by the International Accounting Standards Board - a system of generally accepted accounting principles, as applied to Mountain Province’s financial statements beginning with its transition effective January 1, 2010;

JDSmeans JDS Energy and Mining Inc.;

Joint Information Circular means the joint information circular of the Company and Glenmore dated May 10, 2000 for the Extraordinary General Meeting and Special Meeting of the Company and Glenmore respectively to approve the Arrangement;

Joint Arrangementor Gahcho Kué Joint Arrangementmeans the joint arrangement between Mountain Province Diamonds Inc., Camphor Ventures Inc., and De Beers Canada, for the Gahcho Kué Project, and as currently governed by the 2009 Agreement;

Kennady Arrangementmeans the arrangement between the Company and Kennady Diamonds Inc. which was effected as of July 6, 2012;

Kennady Arrangement Agreementmeans the Kennady Arrangement Agreement dated as of March 12, 2012, and made between the Company and Kennady Diamonds Inc., including the schedules to that agreement;

Kennady North Projectmeans the mining leases (4330, 4466, 4467, and 4468) and eight mineral claims staked in 2010 (Kwezi 01 to Kwezi 08) which were 100% owned by Mountain Province in the area around the Gahcho Kué Project and Kennady Lake, and which were transferred to Kennady Diamonds Inc. under the plan of arrangement between Kennady Diamonds Inc. and Mountain Province effective July 6, 2012;

Letter Agreement means the letter agreement dated March 6, 1997 among Mountain Province Mining Inc., Camphor Ventures Inc., Glenmore Highlands Inc., 444965 B.C. Ltd. and Monopros as amended or supplemented by: an agreement dated April 10, 1997 among Mountain Province Mining Inc., Camphor Ventures Inc., Glenmore Highlands Inc., 444965 B.C. Ltd. and Monopros; an assurance given to De Beers by the other parties., dated July, 1997; an agreement given to De Beers by the other parties dated November 1, 1997 and two agreements each dated December 17, 1999 among the parties;

Monopros orDe Beers Canada means De Beers Canada Inc., formerly known as Monopros Limited, a wholly-owned subsidiary of De Beers and also formally known as De Beers Canada Exploration Inc.;

Mountain Glen means Mountain Glen Mining Inc., a wholly-owned subsidiary (now dissolved) of the Company;

MPV, Mountain Province, Company orRegistrantmeans Mountain Province Diamonds Inc.;

MPV Sharesmeans the common shares of MPV, andMPV Share means any of them;

NASDAQmeansthe National Association of Securities Dealers Automatic Quotation System, now the Nasdaq Stock Exchange;

NYSE MKTmeans the New York Stock Exchange MKT, renamed from NYSE Amex;

Old MPVmeans MPV prior to its amalgamation with 444965 B.C. Ltd.;

OTCBB means the OTC bulletin board;

PFIC means Passive Foreign Investment Company under the Code;

Qualified Personas defined by Canadian National Instrument 43-101 (Standards of Disclosure for Mineral Projects), means an individual who:

(1) is an engineer or geoscientist with a university degree, or equivalent accreditation, in an area of geosciences, or engineering, relating to mineral exploration or mining;

(2) has at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these, that is relevant to his or her professional degree or area of practice;

(3) has experience relevant to the subject matter of the mineral project and the technical report; and

(4) is in good standing with a professional association; and

(5) in the case of a professional association in a foreign jurisdiction, has a membership designation that:

(i) requires attainment of a position of responsibility in their profession that requires the exercise of independent judgment; and

(ii) requires:

A. a favourable confidential peer evaluation of the individual’s character, professional judgment, experience, and ethical fitness; or

B. a recommendation for membership by at least two peers, and demonstrated prominence or expertise in the field of mineral exploration or mining;

Except where specifically indicated otherwise, scientific and technical information included in this report on Form 20F regarding the Company’s mineral projects has been reviewed by Carl Verley, a Director of the Company and a Qualified Person as defined by National Instrument 43-101.

TSX means the Toronto Stock Exchange;

VSE means the Vancouver Stock Exchange, subsequently renamed the Canadian Venture Exchange, and now known as the TSX Venture Exchange.

GLOSSARY OF TECHNICAL TERMS

| Adit | | A horizontal or nearly horizontal passage driven from the surface for the working of a mine. |

| | | |

| Archean | | The earliest eon of geological history or the corresponding system of rocks. |

| | | |

| Area of Interest | | A geographic area surrounding a specific mineral property in which more than one party has an interest and within which new acquisitions must be offered to the other party or which become subject automatically to the terms and conditions of the existing agreement between the parties. Typically, the area of interest is expressed in terms of a radius of a finite number of kilometers from each point on the outside boundary of the original mineral property. |

| | | |

| Bulk Sample | | Evaluation program of a diamondiferous kimberlite pipe in which a large amount of kimberlite (at least 100 tonnes) is recovered from a pipe. |

| | | |

| Carat | | A unit of weight for diamonds, pearls, and other gems. The metric carat, equal to 0.2 gram or 200 milligram, is standard in the principal diamond-producing countries of the world. |

| | | |

| Caustic Fusion | | An analytical process for diamonds by which rocks are dissolved at temperatures between 450-600°C. Diamonds remain undissolved by this process and are recovered from the residue that remains. |

| | | |

| Craton | | A stable relatively immobile area of the earth's crust that forms the nuclear mass of a continent or the central basin in an ocean. |

| | | |

| Diabase | | A fine-grained rock of the composition of gabbro but with an ophitic texture. |

| | | |

| Dyke | | A body of igneous rock, tabular in form, formed through the injection of magma. |

| | | |

| Feasibility Study | | As defined by Canadian National Instrument 43-101, means a comprehensive study of a deposit in which all geological, engineering, operating, economic and other relevant factors are considered in sufficient detail that it could reasonably serve as the basis for a final decision by a financial institution to finance the development of the deposit for mineral production. |

| | | |

| Gneiss | | A banded rock formed during high grade regional metamorphism. It includes a number of different rock types having different origins. It commonly has alternating bands of schistose and granulose material. |

| | | |

| Indicator mineral | | Minerals such as garnet, ilmenite, chromite and chrome diopside, which are used in exploration to indicate the presence of kimberlites. |

| Jurassic | | The period of the Mesozoic era between the Triassic and the Cretaceous or the corresponding system of rocks marked by the presence of dinosaurs and the first appearance of birds. |

| | | |

| Kimberlite | | A dark-colored intrusive biotite-peridotite igneous rock that can contain diamonds. It contains the diamonds known to occur in the rock matrix where they originally formed (more than 100 km deep in the earth). |

| | | |

| Macrodiamond | | A diamond, two dimensions of which exceed 0.5 millimeters (mm). |

| | | |

| Microdiamond | | Generally refers to diamonds smaller than approximately 0.5 mm, which are recovered from acid dissolution of kimberlite rock. |

| | | |

| Mineral Reserve | | Means the economically mineable part of a Measured Mineral Resource or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined. |

| | | |

| | | THE TERMS "MINERAL RESERVE," "PROVEN MINERAL RESERVE" AND "PROBABLE MINERAL RESERVE" USED IN THIS REPORT ARE CANADIAN MINING TERMS AS DEFINED IN ACCORDANCE WITH NATIONAL INSTRUMENT 43-101 - STANDARDS OF DISCLOSURE FOR MINERAL PROJECTS WHICH INCORPORATES THE DEFINITIONS AND GUIDELINES SET OUT IN THE CANADIAN INSTITUTE OF MINING, METALLURGY AND PETROLEUM (THE "CIM") DEFINITION STANDARDS FOR MINERAL RESOURCES AND MINERAL RESERVES (THE “CIM DEFINITION STANDARDS”) AS ADOPTED BY THE CIM COUNCIL ON DECEMBER 11, 2005. IN THE UNITED STATES, A MINERAL RESERVE IS DEFINED AS A PART OF A MINERAL DEPOSIT WHICH COULD BE ECONOMICALLY AND LEGALLY EXTRACTED OR PRODUCED AT THE TIME THE MINERAL RESERVE DETERMINATION IS MADE. |

| | | |

| | | Under United States standards: |

| | | |

| | | "Reserve" means that part of a mineral deposit which can be economically and legally extracted or produced at the time of the reserve determination. |

| | | |

| | | "Economically," as used in the definition of reserve, implies that profitable extraction or production has been established or analytically demonstrated to be viable and justifiable under reasonable investment and market assumptions. |

| | | |

| | | "Legally," as used in the definition of reserve, does not imply that all permits needed for mining and processing have been obtained or that other legal issues have been completely resolved. However, for a reserve to exist, there should be a reasonable certainty based on applicable laws and regulations that issuance of permits or resolution of legal issues can be accomplished in a timely manner. |

| | | Mineral Reserves are categorized as follows on the basis of the degree of confidence in the estimate of the quantity and grade of the deposit. |

| | | |

| | | "Proven Mineral Reserve" means, in accordance with CIM Definition Standards, the economically viable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate at the time of reporting, that economic extraction is justified. |

| | | |

| | | The definition for "proven mineral reserves" under CIM Definition Standards differs from the standards in the United States, where proven or measured reserves are defined as reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geographic character is so well defined that size, shape, depth and mineral content of reserves are well established. |

| | | |

| | | "Probable Mineral Reserve" means, in accordance with CIM Definition Standards, the economically mineable part of an Indicated, and in some circumstances a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. |

| | | |

| | | The definition for "probable mineral reserves" under CIM Definition Standards differs from the standards in the United States, where probable reserves are defined as reserves for which quantity and grade and/or quality are computed from information similar to that of proven reserves (under United States standards), but the sites for inspection, sampling, and measurement are further apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation. |

| | | |

| Mineral Resource | | Under CIM Definition Standards, a Mineral Resource is a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extractions. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. |

| | | THE TERMS "MINERAL RESOURCE", "MEASURED MINERAL RESOURCE", "INDICATED MINERAL RESOURCE", "INFERRED MINERAL RESOURCE" USED IN THIS REPORT ARE CANADIAN MINING TERMS AS DEFINED IN ACCORDANCE WITH NATIONAL INSTRUMENT 43-101 - STANDARDS OF DISCLOSURE FOR MINERAL PROJECTS UNDER THE GUIDELINES SET OUT IN THE CIM DEFINITION STANDARDS. THE COMPANY ADVISES U.S. INVESTORS THAT WHILE SUCH TERMS ARE RECOGNIZED AND PERMITTED UNDER CANADIAN REGULATIONS, THE U.S. SECURITIES AND EXCHANGE COMMISSION DOES NOT RECOGNIZE THEM. THESE ARE NOT DEFINED TERMS UNDER THE UNITED STATES STANDARDS AND MAY NOT GENERALLY BE USED IN DOCUMENTS FILED WITH THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION BY U.S. COMPANIES. AS SUCH, INFORMATION CONTAINED IN THIS REPORT CONCERNING DESCRIPTIONS OF MINERALIZATION AND RESOURCES MAY NOT BE COMPARABLE TO INFORMATION MADE PUBLIC BY U.S. COMPANIES SUBJECT TO THE REPORTING AND DISCLOSURE REQUIREMENTS OF THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION. |

| | | |

| | | "Inferred Mineral Resource" means, under CIM Definition Standards, that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. U.S. INVESTORS ARE CAUTIONED NOT TO ASSUME THAT ANY PART OR ALL OF AN INFERRED RESOURCE EXISTS, OR IS ECONOMICALLY OR LEGALLY MINEABLE. |

| | | |

| | | "Indicated Mineral Resource" means, under CIM Definition Standards, that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. U.S. INVESTORS ARE CAUTIONED NOT TO ASSUME THAT ANY PART OR ALL OF THE MINERAL DEPOSITS IN THIS CATEGORY WILL EVER BE CONVERTED INTO RESERVES. |

| | | |

| | | "Measured Mineral Resource" means, under CIM Definition standards that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drillholes that are spaced closely enough to confirm both geological and grade continuity. U.S. INVESTORS ARE CAUTIONED NOT TO ASSUME THAT ANY PART OR ALL OF THE MINERAL DEPOSITS IN THIS CATEGORY WILL EVER BE CONVERTED INTO RESERVES. |

| Operator | | The party in a joint venture which carries out the operations of the joint venture subject at all times to the direction and control of the management committee. |

| | | |

| Ordovician | | The period between the Cambrian and the Silurian or the corresponding system of rocks. |

| | | |

| Overburden | | A general term for any material covering or obscuring rocks from view. |

| | | |

| Paleozoic | | An era of geological history that extends from the beginning of the Cambrian to the close of the Permian and is marked by the culmination of nearly all classes of invertebrates except the insects and in the later epochs by the appearance of terrestrial plants, amphibians, and reptiles. |

| | | |

| Pipe | | A kimberlite deposit that is usually, but not necessarily, carrot-shaped. |

| | | |

| Preliminary Feasibility Study | | Under the CIM Definition Standards, means a comprehensive study of the viability of a mineral project that has advanced to a stage where the mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, has been established, and which, if an effective method of mineral processing has been determined, includes a financial analysis based on reasonable assumptions of technical, engineering, operating, economic factors and the evaluation of other relevant factors which are sufficient for a Qualified Person acting reasonably, to determine if all or part of the Mineral Resource may be classified as a Mineral Reserve. |

| | | |

| Proterozoic | | The eon of geologic time or the corresponding system of rocks that includes the interval between the Archean and Phanerozoic eons, perhaps exceeds in length all of subsequent geological time, and is marked by rocks that contain fossils indicating the first appearance of eukaryotic organisms (as algae). |

| | | |

| Reverse Circulation Drill | | A rotary percussion drill in which the drilling mud and cuttings return to the surface through the drill pipe. |

| | | |

| Sill | | Tabular igneous rock that parallels the bedding or foliation of the country rock. |

| | | |

| Stringers | | The narrow veins or veinlets, often parallel to each other, and often found in a shear zone. |

| | | |

| Tertiary | | The Tertiary period or system of rocks. |

| Till Sample | | A sample of soil taken as part of a regional exploration program and examined for indicator minerals. |

| | | |

| Xenolith | | A foreign inclusion in an igneous rock. |

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 concerning the Company's exploration, operations, planned acquisitions and other matters. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Statements concerning mineral resource estimates may also be deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if the property is developed, and based on certain assumptions that the mineral deposit can be economically exploited. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be "forward-looking statements." Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation:

| § | risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; |

| § | results of initial feasibility, pre-feasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; |

| § | mining exploration risks, including risks related to accidents, equipment breakdowns or other unanticipated difficulties with or interruptions in production; |

| § | the potential for delays in exploration activities or the completion of feasibility studies; |

| § | risks related to the inherent uncertainty of exploration and cost estimates and the potential for unexpected costs and expenses; |

| § | risks related to foreign exchange fluctuations and prices of diamonds; |

| § | risks related to commodity price fluctuations; |

| § | the uncertainty of profitability based upon the Company's history of losses; |

| § | risks related to failure of the Company and/or its joint venture partner to obtain adequate financing on a timely basis and on acceptable terms, particularly given recent volatility in the global financial markets; |

| § | development and production risks including and particularly risks for weather conducive to the building and use of the Tibbitt to Contwoyto Winter Road; |

| § | risks related to environmental regulation, permitting and liability; |

| § | political and regulatory risks associated with mining and exploration; |

| § | geological and technical conditions at the Company’s Gahcho Kué Project being adequate to permit development; |

| § | the ability to develop and operate the Company’s Gahcho Kué Project on an economic basis and in accordance with applicable timelines; |

| § | aboriginal rights and title; |

| § | failure of plant, equipment, processes and transportation services to operate as anticipated; |

| § | possible variations in ore grade or recovery rates, permitting timelines, capital expenditures, reclamation activities, land titles, and social and political developments, and other risks of the mining industry; and |

| § | other risks and uncertainties related to the Company's prospects, properties and business strategy. |

Some of the important risks and uncertainties that could affect forward-looking statements are described further in this Annual Report under the headings "Risk Factors", "History and Development of Company," "Business Overview," "Property, plants and equipment," and "Operating and Financial Review and Prospects". Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Forward -looking statements are made based on management's beliefs, estimates and opinions on the date the statements are made, and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Investors are cautioned against attributing undue certainty to forward-looking statements.

Forward-looking information is based on certain factors and assumptions regarding, among other things, exploration, permitting, construction, mining, and production at the Gahcho Kué Project and any other property as well as world and U.S. economic conditions and the future worldwide demand for diamonds. Specifically, in making statements regarding expected mineral recovery, diamond prices and expectations concerning the diamond industry, the Company has made assumptions regarding, among other things, foreign exchange rates, continuing recovery of world and U.S. economic conditions, our ability to successfully implement our exploration, construction and mining plans, the success of permitting the Gahcho Kué Project, and overall demand for diamonds. While the Company considers these assumptions to be reasonable based on the information currently available to it, they may prove to be incorrect. See “Risk Factors”.

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING RESOURCE AND RESERVE ESTIMATES – MINING PROPERTIES

This Annual Report on Form 20-F has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM Definition Standards”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in United States Securities and Exchange Commission (“SEC”) Industry Guide 7 (the “SEC Guidelines”) under the United States Securities Act of 1993, as amended (the “Securities Act”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this Annual Report on Form 20-F and the documents incorporated by reference herein contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

NOTE REGARDING FINANCIAL STATEMENTS AND EXHIBITS

The financial statements and exhibits referred to herein are filed with this report on Form 20-F in the United States. This report is also filed in Canada as an Annual Information Form.Canadian investors should also refer to the annual consolidated financial statements of the Company as at December 31, 2013, as filed with the applicable Canadian Securities regulators on SEDAR (the Canadian Securities Administrators' System for Electronic Document Analysis and Retrieval) under "Audited Annual Financial Statements - English".

METRIC EQUIVALENTS

For ease of reference, the following factors for converting metric measurements into imperial equivalents are provided:

| To Convert From Metric | | To Imperial | | Multiply by |

| Hectares | | Acres | | 2.471 |

| Metres | | Feet (ft.) | | 3.281 |

| Kilometres (km.) | | Miles | | 0.621 |

| Tonnes | | Tons (2000 pounds) | | 1.102 |

| Grams/tonne | | Ounces (troy/ton) | | 0.029 |

PART I

| Item 1. | Identity of Directors, Senior Management and Advisors |

Not Applicable

| Item 2. | Offer Statistics and Expected Timetable |

Not Applicable

| A. | Selected financial data. |

You should read the following selected financial data together with Item 5, "Operating and Financial Review and Prospects", the Consolidated Financial Statements in Item 18 and the other information in this Annual Report. The selected financial data presented below is derived from our Consolidated Financial Statements.

The Company's consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

The Company's financial statements are set forth in Canadian dollars.

The consolidated financial information in the below tables for the years ended 2012, 2013 and 2014 was prepared in accordance with IFRS as issued by the IASB.

| For the year ending (except as noted) |

All in CDN$1,000's except Earnings

(loss) per Share and Number of

Common Shares | | Dec. 31,

2014 | | | Dec. 31,

2013 | | | Dec. 31,

2012 | | | Dec. 31,

2011 | | | Dec. 31,

2010 | |

| Operating Revenue | | | nil | | | | nil | | | | nil | | | | nil | | | | nil | |

| Working Capital | | | 46,796 | | | | 35,133 | | | | 46,654 | | | | 15,064,475 | | | | 29,451,180 | |

| Net Loss | | | (4,394 | ) | | | (26,604 | ) | | | (3,338 | ) | | | (12,028,416 | ) | | | (9,767,149 | ) |

| Basic and diluted loss per share | | | (0.04 | ) | | | (0.28 | ) | | | (0.04 | ) | | | (0.15 | ) | | | (0.14 | ) |

| Total Assets | | | 300,995 | | | | 110,367 | | | | 95,590 | | | | 66,556,514 | | | | 71,236,108 | |

| Share Capital | | | 377,614 | | | | 209,820 | | | | 180,170 | | | | 142,359,398 | | | | 132,476,036 | |

| Net Assets - | | | 254,910 | | | | 91,193 | | | | 87,195 | | | | 63,310,382 | | | | 66,475,718 | |

| Number of Common Shares issued | | | 135,204,550 | | | | 100,501,351 | | | | 94,168,151 | | | | 80,345,558 | | | | 77,416,057 | |

No dividends have been declared in any of the years presented above.

Exchange Rate Information

All dollar amounts set forth in this report are in Canadian dollars, except where otherwise indicated. The following tables set forth, (i) for the five most recent financial years, the average rate (the "Average Rate") of exchange for the Canadian dollar, expressed in U.S. dollars, calculated by using the average of the U.S. noon exchange rates per the Bank of Canada for each trading day of the fiscal year; and (ii) the high and low exchange rates for each of the previous six calendar months for the Canadian dollar, expressed per the Bank of Canada.

The Average Rate is set out for each of the periods indicated in the table below.

| Dec-14 | | | Dec-13 | | | Dec-12 | | | Dec-11 | | | Dec-10 | |

| US$ | 0.8668 | | | US$ | 0.9402 | | | US$ | 0.9949 | | | US$ | 0.9891 | | | US$ | 0.9704 | |

The high and low exchange rates for each month during the previous six months are as follows:

| Month | | High (US$) | | | Low (US$) | |

| February 2015 | | | 0.8081 | | | | 0.7911 | |

| January 2015 | | | 0.8511 | | | | 0.7867 | |

| December 2014 | | | 0.8828 | | | | 0.8579 | |

| November 2014 | | | 0.89 | | | | 0.8741 | |

| October 2014 | | | 0.9006 | | | | 0.8845 | |

| September 2014 | | | 0.9196 | | | | 0.8929 | |

On March 25, 2015, the closing rate in Canadian dollars as per the Bank of Canada (the "Exchange Rate") was $1 Canadian = US$0.7989.

| B. | Capitalization and indebtedness. |

Not Applicable

| C. | Reasons for the offer and use of proceeds. |

Not Applicable

The Company, and thus the securities of the Company, should be considered a highly speculative investment and investors should carefully consider all of the information disclosed in this Annual Report prior to making an investment in the Company. In addition to the other information presented in this Annual Report, the following risk factors should be given special consideration when evaluating an investment in any of the Company's securities. Any or all of these risks could have a material adverse effect on the Company’s business, financial condition, results of operations, cash flows and on the market price of its common stock.

a) The Company's limited operating history makes it difficult to evaluate the Company's current business and forecast future results.

The Company has only a limited operating history on which to base an evaluation of the Company's current business and prospects, each of which should be considered in light of the risks, expenses and problems frequently encountered in the early stages of growth of all companies, and in mining companies in particular. The Company has not commenced mining operations and is still in the development stage of the Gahcho Kué Project. The Company may not be able to obtain all of the permits which are necessary for it to commence operations. The Company’s mining operations may not be successful. As a result of this limited operating history, period-to-period comparisons of the Company’s operating results may not be meaningful and the results for any particular period should not be relied upon as an indication of future performance.

(b) The diamond mining business is speculative and the Company may not be successful in implementing its plans to establish a successful and profitable diamond mining business

Resource exploration and possible development is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but from finding mineral deposits which, though present, are insufficient in quantity and quality to return a profit from production. Diamonds acquired or discovered by the Company may be required to be sold at a price which is reflective of the market at that time.

(c) The Company has no significant source of operating cash flow and failure to generate revenues in the future could cause the Company to go out business.

The Company currently has no significant source of operating cash flow. The Company has limited financial resources. The Company's ability to achieve and maintain profitability and positive cash flow is dependent upon the Company's ability to develop and achieve profitable operations at the Gahcho Kué mine. The Company currently does not generate any cash flow. The Company’s annual operating costs, excluding its share of costs of the development of the Gahcho Kué Project, are approximately $3.0 million.

| | (d) The Company is in the development stage for the Gahcho Kué Project and may never become profitable. |

The Company's Gahcho Kué Project is in the development stage. The Company’s future mining operation may never become profitable.

(e) The preliminary process testing may not be accurate in predicting the actual presence and recoverability of diamonds on Company properties.

Process testing is limited to small scale testing based on a number of laboratory test programs, trade-off studies and design evaluations. There can be no assurance that diamonds recovered in small scale tests will be duplicated in large scale tests under on-site conditions or in production scale. Difficulties may be experienced in obtaining the expected diamond recoveries when scaling up to a production scale process plant.

(f) The Company may not have adequate funds to explore properties other than the Gahcho Kué Project.

The Company may not have the ability to pay for exploration or development costs on any other properties it may acquire. If such funds were available, there is no assurance that expending such funds would result in discovery of any diamondiferous kimberlite.

(g) The Company has a history of losses and is likely to continue to incur losses for the foreseeable future.

The Company has a history of losses and is likely to continue to incur losses for the foreseeable future. During the fiscal years ended December 31, 2014, 2013, and 2012, the Company incurred net losses.

| · | $4.394 million loss for the year ended December 31, 2014 |

| · | $26.604 million loss for the year ended December 31, 2013; and |

| · | $3.338 million loss for the year ended December 31, 2012. |

As of December 31, 2014, the Company had an accumulated deficit of $125.212 million. There can be no assurance that the Company will ever be profitable.

None of the Company's properties have advanced to the commercial production stage, and the Company has no history of earnings or cash flow from operations and, as an exploration and development company, has only a history of losses.

(h) The Company may never recover the amounts it has capitalized for mineral property costs.

The recoverability of the amounts capitalized for mineral properties in the Company's consolidated financial statements is dependent upon the ability of the Company to complete exploration and development, the discovery of economically recoverable reserves, and, if warranted, upon future profitable production or proceeds from disposition of some or all of the Company's mineral properties.

| | (i) The Company’s failure to raise required financing in the future could cause the Company to go out of business. |

As of December 31, 2014, the Company had cash and short-term investments of approximately $81.0 million and working capital of approximately $46.8 million. During the past two fiscal years ended December 31, 2014 and December 31, 2013, the Company used approximately $39.4 million in cash flows in operating activities including approximately $6.8 million during the year ended December 31, 2014, and $32.6 million during the year ended December 31, 2013.

The Company's administrative and other expenses are expected to be approximately $3.3 million for the next year, in addition to an estimated $223.4 million for the Company’s proportional share of expenses for the Gahcho Kué joint Arrangement for 2015.

In order to advance the development of the Gahcho Kué Project, the Company during 2014 raised $173,769,812 by way of private placements and anticipates finalizing a project debt facility of US$370 million as well as a cost overrun facility of US$75 million to fund the Company’s proportional share of expenses for the development of the Gahcho Kué Project by early April 2015, however there is no certainty that this financing will be available.

If the Gahcho Kué Project is delayed or the project debt facility of US$370 million is not completed, the cost overrun facility will not be sufficient to complete the project and the Company may be required to raise additional capital through equity and/or debt financings on terms that may be dilutive to its shareholders’ interests in the Company and the value of their common shares. The Company may consider share offerings, private placements, rights offerings, credit and debt facilities, as well as the exercise of outstanding options or other arrangements to meet its capital requirements in the future. Such arrangements may have a material adverse effect on the Company’s business or results of operations. As well, there is no guarantee that the Company will be able to raise additional capital, or to raise additional capital on terms and conditions which it finds acceptable. If the Company is not able to raise sufficient capital, it may not be able to grow the Company, or it may be forced to cease doing business.

(j) Gahcho Kué Project probable reserves.

The Gahcho Kué Project is the Company’s only property and is in the development stage. The Gahcho Kué Project has probable reserves in three of the four kimberlite bodies at Kennady Lake. See “Item 4D - Property, plants and equipment - Principal Properties”. It is not guaranteed that these reserves when mined will be economic.

| | (k) If the Company does not hold good title to properties, its ability to explore and eventually mine them could be prevented or restricted. |

The Company’s business depends upon having clear title to its properties and its ability to explore, develop and mine its properties without undue restriction. If any of its properties are subject to prior unregistered agreements that restrict the use of the properties, or if it does not hold title to the properties as it believes it does, its ability to explore, develop and mine on those properties could be limited or prevented completely. This would have a material adverse effect on the Company and its results of operation.

(l) Diamond prices can fluctuate significantly, and as a result, the Company’s results of operation may fluctuate significantly.

The market for rough diamonds is subject to strong influence from demand in the United States, Japan, China and India, which are the largest markets for polished diamonds, and supply from major producers such as Alrosa of Russia and Debswana of Botswana. The price of diamonds has historically fluctuated. The price of diamonds dropped sharply after September 11, 2001. Between 2003 and 2006 diamond prices increased on average by approximately 15%. In 2007, rough diamond prices increased by an average of 25%, and in the first five months of 2008, by a further 11%. From about mid-2008 to mid-April 2009, rough diamond prices fell sharply with concerns of the global economic environment of the time. By mid-April 2009, rough diamond prices rebounded to pre-global recession levels. During 2010, rough diamond prices increased by approximately 30%. This strengthening continued through the first half of 2011 when diamond prices reached historic highs. During the second half of 2011, diamond prices dropped sharply resulting in an overall net increase for the twelve months of approximately 17%. According to industry leaders, in 2012 rough diamond prices dropped by approximately 12 percent and remained largely unchanged through 2013. During 2014, rough diamond prices were generally flat year over year. While the supply/demand fundamentals for diamonds would indicate good price support and steadily rising prices in the future, such fluctuations make it difficult to predict future diamond prices with a high degree of certainty. To mitigate against this, the Company uses conservative modeled diamond prices in its economic studies and mine planning. Nonetheless, the Company’s future results of operation may fluctuate significantly if rough diamond price volatility continues into the future.

(m) The Company may incur significant costs to comply with Environmental and Government Regulation

The current and anticipated future operations of the Company, including development activities and commencement of production on its properties, require permits from various federal, territorial and local governmental authorities and such operations are and will be governed by laws and regulations governing prospecting, development, mining, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in the development and operation of mines and related facilities generally experience increased costs, and delays in development, production and other schedules as a result of the need to comply with applicable laws, regulations and permits. The Company's development activities and its potential mining and processing operations in Canada are subject to various Canadian Federal and Territorial laws governing land use, the protection of the environment, prospecting, development, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, mine safety and other matters.

Such exploration, development and operation activities are also subject to substantial regulation under these laws by governmental agencies and may require that the Company obtain permits from various governmental agencies. The Company believes it is in substantial compliance with all material laws and regulations which currently apply to its activities. There can be no assurance, however, that all permits which the Company may require for construction of mining facilities and conduct of mining operations will be obtainable on reasonable terms or that such laws and regulations, or that new legislation or modifications to existing legislation, would not have an adverse effect on any exploration, development or mining activities which the Company might undertake.

Further detail on governmental regulation may be found in “Item 4 - Business Review - Government Regulation”, below.

Failure to comply with applicable laws, regulations and permit requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violation of applicable laws or regulations. The amount of funds required to comply with all environmental regulations and to pay for compensation in the event of a breach of such laws may exceed the Company's ability to pay such amounts.

Amendments to current laws, regulations and permits governing operations and activities of mining companies, or more stringent implementation of existing or new laws, could have a material adverse impact on the Company and cause increases in capital expenditures or production costs or reduction in levels of production at producing properties or require abandonment or delays in development of new mining facilities.

(n) Climate and transportation costs may increase and have a negative effect on the Company’s results of operation.

The Gahcho Kué Project is subject to climate and transportation risks because of its remote northern location. Such factors can add to the costs of development and operation, thereby increasing costs and negatively affecting profitability. The availability of weather conducive to building and operating the Tibbitt to Contwoyto Winter Road is particularly critical to the development of the mine, and production.

(o) The Company is dependent upon its joint arrangement partner for the success of the Gahcho Kué Project.

The Company, and the success of the Gahcho Kué Project, are dependent on the efforts, expertise and capital resources of our joint arrangement partner, De Beers Canada, and its parent De Beers. De Beers Canada is the project operator and is responsible for exploring, permitting, developing and operating the Gahcho Kué Project. In addition, De Beers Canada is providing its share of financing for the Gahcho Kué Project. The Company is dependent on De Beers Canada for accurate information about the Gahcho Kué Project, and the proper and timely progress of permitting and development.

(p) Operating Hazards and Risks

Diamond exploration and mining involves many risks. Operations in which the Company has a direct or indirect interest will be subject to all the hazards and risks (such as accidents, injuries, and hazardous waste) normally incidental to exploration, development and production of resources, any of which could result in work stoppages, damage to property and possible environmental damage.

(q) There are numerous factors beyond the control of the Company that may affect the marketability of any diamonds discovered.

Factors beyond the control of the Company may affect the marketability of any diamonds produced. Significant price movements over short periods of time may be affected by numerous factors beyond the control of the Company, including international economic and political trends, expectations of inflation, currency exchange fluctuations (specifically, the U.S. dollar relative to the Canadian dollar and other currencies), interest rates and global and/or regional consumption patterns. The effect of these factors on the prices of diamonds and therefore the economic viability of any of the Company's projects cannot accurately be predicted.

(r)The Company's expectations reflected in forward-looking statements may prove to be incorrect.

This Form 20-F includes "forward-looking statements". A shareholder or prospective shareholder should bear this in mind when assessing the Company's business. All statements, other than statements of historical facts, included in this annual report, including, without limitation, the statements under and located elsewhere herein regarding industry prospects and the Company's financial position are forward-looking statements. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, such expectations may prove to be incorrect.

(s) The Mineral Resources Industry is intensely competitive and the Company competes with many companies with greater financial means and technical facilities.

The resource industry is intensely competitive in all of its phases, and the Company competes with many companies possessing greater financial resources and technical facilities. Competition could adversely affect the Company's ability to acquire suitable producing properties or prospects for exploration in the future.

(t) Aboriginal Rights and Title

Governments in Canada must consult with aboriginal peoples with respect to grants of mineral rights and the issuance of or amendment to project authorizations. Consultation regarding rights or claimed rights of aboriginal people may require accommodations, including undertakings with respect to employment and other matters. This may affect the Company’s timetable and costs of development of mineral properties. Aboriginal rights or title claims could affect the Company’s existing operations, in addition to its future acquisitions. These legal requirements, among other things, may affect the Company’s ability to develop the Gahcho Kué Project and other mineral properties or may materially delay the development of such properties.

(u) Future equity financings which the Company may undertake would cause shareholders’ interests in the Company to be diluted.

The Company intends to obtain required financing for the development of the Gahcho Kue project through a senior secured term loan facility of up to US$370 million (the “Facility”) and by issuing common shares by way of a rights offering for gross proceeds of $95 million. The Company believes that on the completion of the project debt financing expected to take place by early April 2015, that together with the equity, the Company will be able to fund its proportionate share of the development of the Gahcho Kué diamond mine and does not expect to seek additional equity financing, however if the Company is required to seek additional equity financing, the issuance of additional shares will dilute the interests of the Company's current shareholders. The amount of the dilution would depend on the number of new shares issued and the price at which they are issued. The Company has raised funds in recent years through share, option and warrant issuances. As of December 31, 2014, the Company had cash and short-term investments of approximately $81.0 million and working capital of approximately $46.8 million. To develop the Gahcho Kué mine, and perform exploration on any other properties acquired, the Company will need to investigate sources of additional liquidity to increase the cash balances required in the future. These additional sources include, but are not limited to, share offerings, private placements, rights offerings, credit and debt facilities, as well as the exercise of outstanding options. There can be no assurance that the Company will be able to raise additional funds as needed, or that funds raised, if any, would be on terms and conditions acceptable to the Company. The Company’s annual cash administrative operating costs, excluding the costs directly associated with the Gahcho Kué Project, are approximately $3.0 million.

(v) If outstanding options to buy Company stock are exercised, existing shareholders’ interests in the Company will be diluted.

As at March 26, 2015, there were 1,400,000 options (including options not fully vested) outstanding with exercise prices ranging from $4.06 to $6.13 (expiring at various dates). The stock options, if fully exercised, would increase the number of shares outstanding by 1,400,000. Such options, if fully exercised, would constitute about 0.01% (out of 135,204,550 shares (136,604,550 issued and outstanding, plus total outstanding options)) of the Company's resulting share capital as at March 26, 2015. It is unlikely that outstanding options would be exercised unless the market price of the Company's common shares exceeds the exercise price at the date of exercise. The exercise of such options and the subsequent resale of such Common shares in the public market could adversely affect the prevailing market price and the Company's ability to raise equity capital in the future at a time and price which it deems appropriate. The Company may also enter into commitments in the future which would require the issuance of additional common shares and the Company may grant new share purchase warrants and stock options. Any share issuances from the Company's treasury will result in dilution to existing shareholders.

(w) Members of our Management and Board of Directors may have outside interests which conflict with the Company or its shareholders.

The President and CEO and Director, Patrick Evans, and the Vice President Finance, CFO and Corporate Secretary, Bruce Ramsden, have Consulting Agreements with the Company (see “Item 6C - Board Practices”). In addition, certain officers and directors of the Company are associated with other natural resource companies that acquire interests in mineral properties. Such associations may give rise to conflicts of interest from time to time.

(x) If the Company is not able to attract and maintain qualified key management personnel, it may not be able to successfully implement its planned business activities and growth.

The nature of the Company's business, its ability to continue its exploration, development and permitting activities and to thereby develop a competitive edge in its marketplace depends, in large part, on its ability to attract and maintain qualified key management personnel. Competition for such personnel is intense, and there can be no assurance that the Company will be able to attract and retain such personnel. The Company's development to date has depended, and in the future will continue to depend, on the efforts of Patrick Evans. See “Item 7B -Related party transactions” and “Item 6C - Board Practices”. Loss of the key person could have a material adverse effect on the Company. The Company does not maintain key-man life insurance on Patrick Evans.

(y) The Company’s stock price is subject to significant fluctuations.

Prices for the Company's shares on the TSX and on the NYSE MKT (formerly NYSE Amex) and NASDAQ, have been extremely volatile. The Company commenced trading on the NASDAQ on December 31, 2014. The price for the Company's common shares on the TSX ranged from $4.85 (low) and $6.08 (high) during the fiscal year ended December 31, 2014, and from $3.88 (low) to $5.87 (high) during the fiscal year ended December 31, 2013. The price on the NYSE MKT/NASDAQ ranged from $4.16 US (low) and $5.58 US (high) during the fiscal year ended December 31, 2014, and from $3.83 US (low) to $5.59 US (high) during the fiscal year ended December 31, 2013. Any investment in the Company's securities is therefore subject to considerable fluctuations in value.

(z) The Company has not paid dividends in the past and does not anticipate paying them in the foreseeable future.

Since its inception, the Company has not paid any cash dividends on its common stock and does not anticipate paying any cash dividends on its common stock until significant cash flow is generated. Without dividends on its common stock, shareholders will be able to profit from an investment only if the price of the stock appreciates before the shareholder sells it.

(aa) Currency rate fluctuations may have a material effect on our financial position, results of operations, and timing of the development of the Company’s properties.

Feasibility and other studies conducted to evaluate the Company's properties are typically denominated in U.S. dollars, and the Company conducts a significant portion of its operations and incurs a significant portion of its administrative and operating costs in Canadian dollars. The exchange rate for converting U.S. dollars into Canadian dollars has fluctuated in recent years. Accordingly, the Company is subject to fluctuations in the rates of currency exchange between the U.S. dollar and the Canadian dollar, and these fluctuations in the rates of currency exchange may materially affect the Company's financial position, results of operations and timing of the development of its properties. In particular, a strong Canadian dollar relative to the US dollar would negatively impact the Gahcho Kué Project.

(bb) Historically, the Company has been dependent on the support of De Beers and there is no assurance that their support will continue in the future.

The exploration of the Gahcho Kué Project has historically been funded by De Beers Canada. As well, De Beers Canada is the Operator of the Project, and has an equity investment in the Company. With the execution of the 2009 Agreement, De Beers and the Company share funding responsibility for the Gahcho Kué Project. Under the 2009 Agreement, the Company and De Beers are required to fund their share of costs for future operations. As well, the Company is required to make certain repayments of agreed historic costs of the Gahcho Kué Project, funded by De Beers, if and when certain events occur. If either party is unable to fund their share of historic costs, or, if the Company defaults on its required payments of historic costs if and when they are due, in addition to interest on late or defaulted payments, marketing rights can be diluted for the defaulting party. As well, there is no assurance that the Company will have the required funds on hand when the payments are required to be made. Finally, there is no assurance that the level of support provided by De Beers will continue in the future. In addition, during the development phase, if either party is unable to fund its proportionate share, this party me be diluted.

(cc) It will be difficult for any shareholder of the Company to commence legal action against the Company’s executives. Enforcing judgments against them or the Company will be difficult.

As the Company is a Canadian company, it may be difficult for U.S. shareholders of the Company to effect service of process on the Company or to realize on judgments obtained against the Company in the United States. Some of the Company’s directors and officers are residents of Canada and a significant part of the Company’s assets are, or will be, located outside of the United States. As a result, it may be difficult for shareholders resident in the United States to effect service of process within the United States upon the Company, directors, officers or experts who are not residents of the United States, or to realize in the United States judgments of courts of the United States predicated upon civil liability of any of the Company directors or officers under the United States federal securities laws. If a judgment is obtained in the U.S. courts based on civil liability provisions of the U.S. federal securities laws against the Company or its directors or officers, it will be difficult to enforce the judgment in the Canadian courts against the Company and any of the Company's non-U.S. resident executive officers or directors. Accordingly, United States shareholders may be forced to bring actions against the Company and its respective directors and officers under Canadian law and in Canadian courts in order to enforce any claims that they may have against the Company or the Company’s directors and officers. Subject to necessary registration, as an extra provincial company, under applicable provincial corporate statutes in the case of a corporate shareholder, Canadian courts do not restrict the ability of non-resident persons to sue in their courts. Nevertheless it may be difficult for United States shareholders to bring an original action in the Canadian courts to enforce liabilities based on the U.S. federal securities laws against the Company and any of the Company's Canadian executive officers or directors.

(dd) The MPV Shares may be delisted from NASDAQ, and if this occurs, shareholders may have difficulty converting their investment into cash efficiently.

NASDAQ has established certain standards for the continued listing of a security on this exchange. If the MPV Shares were to be excluded from NASDAQ, the prices of the MPV Shares and the ability of shareholders to sell such stock would be adversely affected. If the Company were to be delisted, the Company would be required to comply with the initial listing requirements to be relisted on NASDAQ.

(ee) The Company is likely a "passive foreign investment company" which may have adverse U.S. federal income tax consequences for U.S. shareholders.

U.S. investors in the Common Shares should be aware that the Company believes it was classified as a PFIC during the tax year ended December 31, 2014, and based on current business plans and financial expectations, the Company believes that it will be a PFIC for the tax year ending December 31, 2015, and may be a PFIC in subsequent tax years. If the Company is a PFIC for any year during a U.S. shareholder’s holding period, then such U.S. shareholder generally will be required to treat any gain realized upon a disposition of Common Shares, or any so-called “excess distribution” received on its Common Shares, as ordinary income, and to pay an interest charge on a portion of such gain or distributions, unless the shareholder makes a timely and effective "qualified electing fund" election (“QEF Election”) or a "mark-to-market" election with respect to the Common Shares. A U.S. shareholder who makes a QEF Election generally must report on a current basis its share of the Company's net capital gain and ordinary earnings for any year in which the Company is a PFIC, whether or not the Company distributes any amounts to its shareholders. However, U.S. shareholders should be aware that there can be no assurance that the Company will satisfy record keeping requirements that apply to a qualified electing fund, or that the Company will supply U.S. shareholders with information that such U.S. shareholders require to report under the QEF Election rules, in the event that the Company is a PFIC and a U.S. shareholder wishes to make a QEF Election. Thus, U.S. shareholders may not be able to make a QEF Election with respect to their Common Shares. A U.S. shareholder who makes the mark-to-market election generally must include as ordinary income each year the excess of the fair market value of the Common Shares over the taxpayer’s basis therein. This paragraph is qualified in its entirety by the discussion below under the heading “United States Federal Income Tax Consequences.” Each U.S. shareholder should consult its own tax advisor regarding the PFIC rules and the U.S. federal income tax consequences of the acquisition, ownership, and disposition of Common Shares.

| Item 4. | Information on the Company |

| A. | History and development of the company. |

The Corporate Organization

Mountain Province Diamonds Inc., formerly Mountain Province Mining Inc., was formed on November 1, 1997 by the amalgamation (the "MPV Amalgamation") of Mountain Province Mining Inc. ("Old MPV") and 444965 B.C. Ltd. ("444965") pursuant to an amalgamation agreement (the "MPV Amalgamation Agreement") dated as of August 21, 1997.

Under the terms of the MPV Amalgamation Agreement, as at November 1, 1997, each Old MPV share was exchanged for one MPV Share and each 444965 share was exchanged for approximately 0.80 of one MPV Share. The conversion ratios reflected the respective interests of Old MPV and 444965 in the AK-CJ Properties prior to the date of the MPV Amalgamation.

Old MPV was incorporated under the laws of British Columbia on December 2, 1986 under the British ColumbiaCompany Actand was engaged in the exploration of precious and base mineral resource properties until the date of the MPV Amalgamation. Prior to the date of the MPV Amalgamation, Old MPV held an undivided 50% interest in the AK-CJ Properties and an interest in each of the other properties which are currently held by MPV, as described below.

444965, a wholly-owned subsidiary of Glenmore Highlands Inc., (Glenmore being a former controlling shareholder of the Company as defined under theSecurities Act, British Columbia) prior to the MPV Amalgamation, was incorporated under the laws of British Columbia on August 20, 1993. Prior to the MPV Amalgamation, 444965's only material asset consisted of a 40% undivided interest in the AK-CJ Properties.

As of March 31, 2000, the Company had one wholly-owned subsidiary, Mountain Province Mining Corp. (USA), which has since been voluntarily dissolved.

On April 4, 2000, the Company incorporated a wholly-owned subsidiary, Mountain Glen Mining Inc. in Alberta. Pursuant to an arrangement agreement (the "Arrangement Agreement") with Glenmore dated May 10, 2000, Glenmore was amalgamated with Mountain Glen effective as of June 30, 2000 to form a wholly-owned subsidiary (also known as "Mountain Glen Mining Inc.") of the Company. All Glenmore Shares were exchanged for common shares in the Company on the basis of 0.5734401 MPV Shares to one Glenmore Share, and Glenmore Shares were concurrently cancelled. All of the assets of Glenmore became assets of Mountain Glen, including 16,015,696 MPV Shares previously held by Glenmore.

Glenmore had two wholly-owned subsidiaries, Baltic Minerals BV, incorporated in the Netherlands, and Baltic Minerals Finland OY, incorporated in Finland. Pursuant to the Arrangement Agreement, these companies became wholly-owned subsidiaries of the Company.