. . . OceanFirst Financial Corp. Investor Presentation September 2021 Exhibit 99.1

. . . Forward Looking Statements In addition to historical information, this presentation/release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 which are based on certain assumptions and describe future plans, strategies and expectations of the Company. These forward-looking statements are generally identified by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “will,” “should,” “may,” “view,” “opportunity,” “potential,” or similar expressions or expressions of confidence. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations of the Company and its subsidiaries include, but are not limited to: the impact of the COVID-19 pandemic on our operations and financial results and those of our customers, changes in interest rates, general economic conditions, levels of unemployment in the Bank’s lending area, real estate market values in the Bank’s lending area, future natural disasters and increases to flood insurance premiums, the level of prepayments on loans and mortgage-backed securities, legislative/regulatory changes, monetary and fiscal policies of the U.S. Government including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System, the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand for financial services in the Company’s market area, accounting principles and guidelines and the Bank’s ability to successfully integrate acquired operations. These risks and uncertainties are further discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020, under Item 1A - Risk Factors and elsewhere, and subsequent securities filings and should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. No offer or solicitation: The presentation does not constitute or form part of, and should not be construed as, an offer to sell or issue, or the solicitation of an offer to purchase, subscribe to or acquire, securities of the Company, or an inducement to enter into investment activity in the United States or in any other jurisdiction in which such offer, solicitation, inducement or sale would be unlawful prior to registration, exemption from registration or qualification under the securities laws of such jurisdiction. No part of this Presentation, nor the fact of its distribution, should form the basis of, or be relied on in connection with, any contract or commitment or investment decision whatsoever. I N V E S T O R P R E S E N T A T I O N 2 S E P T E M B E R | 2 0 2 1 . . .

. . . . . . S E P T E M B E R | 2 0 2 1 I N V E S T O R P R E S E N T A T I O N • NASDAQ: OCFC • Market Cap: $1.28 billion1 • Bank Holding Company with National Bank Subsidiary • Founded in 1902 • Total Assets of $11.5 billion2 • 58 Full-Service Branches in New Jersey and Metropolitan New York City2 1 As of August 25, 2021 2 As of June 30, 2021 OceanFirst Financial Corp. VA PA NY MA CT RI MD DC DE NJ NH ME VT Central & Northern New Jersey Region Southern New Jersey Region Greater Philadelphia Region New York Region Boston Region Baltimore / D.C. Region

. . . Investment Thesis – Well Positioned for the Post-COVID-19 Environment • Strength of Balance Sheet • Balance sheet de-risked with executed loan sales, resolution of substantially all full forbearance loans, and extinguishment of high-cost borrowings • Low-Cost and Durable Deposit Base • Cost of deposits remain low at 27 basis points (bps) and is projected to fall modestly • Digital Innovation • Digital products and customer experience on par with national banks and FinTechs, outpacing regional and community banks • Disciplined and Strategic M&A • Acquired attractive and underappreciated assets in exurban markets at favorable prices • Bench Strength • Deep banking, regulatory, M&A, and integration experience • Demonstrated strong pandemic response • Conservative Risk Culture • Commitment to management of credit, interest rate, and regulatory/compliance risk • Insider Ownership • Meaningful insider ownership aligned with shareholder interest 4 . . . S E P T E M B E R | 2 0 2 1 I N V E S T O R P R E S E N T A T I O N

. . . I N V E S T O R P R E S E N T A T I O N 5 Second Quarter 2021 Results Financial Results • Net interest margin of 2.89% • Loan originations of $447 million in Q21 • Record loan pipeline of $629 million at June 30, 2021 • Total deposit costs decreased by 10 bps from Q1 to 27 bps Strategic and Operational Focus • Expanded commercial banking team to support organic growth and deploy excess liquidity • Board of Directors approved repurchase of an additional 3 million shares2 • Optimize branch network to increase efficiencies and improve average deposits by branch to approximately $250 million3 • Considering M&A opportunities as they arise to improve operating scale • COVID-19 on-going initiatives for employees, customers, and community • Committing resources to core businesses, loan growth, and digital services . . . 1 Excludes PPP loan originations of $13 million 2 Repurchased 500,000 shares at a weighted average cost of $21.93 in Q2 3 Includes sale of two branches in Q4 2021 and 20 deposit gathering location consolidations in late 2021/early 2022 S E P T E M B E R | 2 0 2 1

. . . 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Net Interest Margin2 Fed Funds Effective Rate OceanFirst Bank Peer Group Average Operational Highlights • Non-interest-bearing deposits are 26% of average balance of total deposits1 • An extraordinary surplus of liquidity will temporarily weigh on margins until the excess cash can be prudently deployed I N V E S T O R P R E S E N T A T I O N 6 Net Interest Margin 2016 2017 2018 2019 0.08 2020 1 Based on average balances for the three months ended June 30, 2021 2 Source: Bank Reg Data as of June 30, 2021 * OceanFirst Bank Q2 NIM includes excess liquidity 2.96* 3.09 . . . S E P T E M B E R | 2 0 2 1 2021

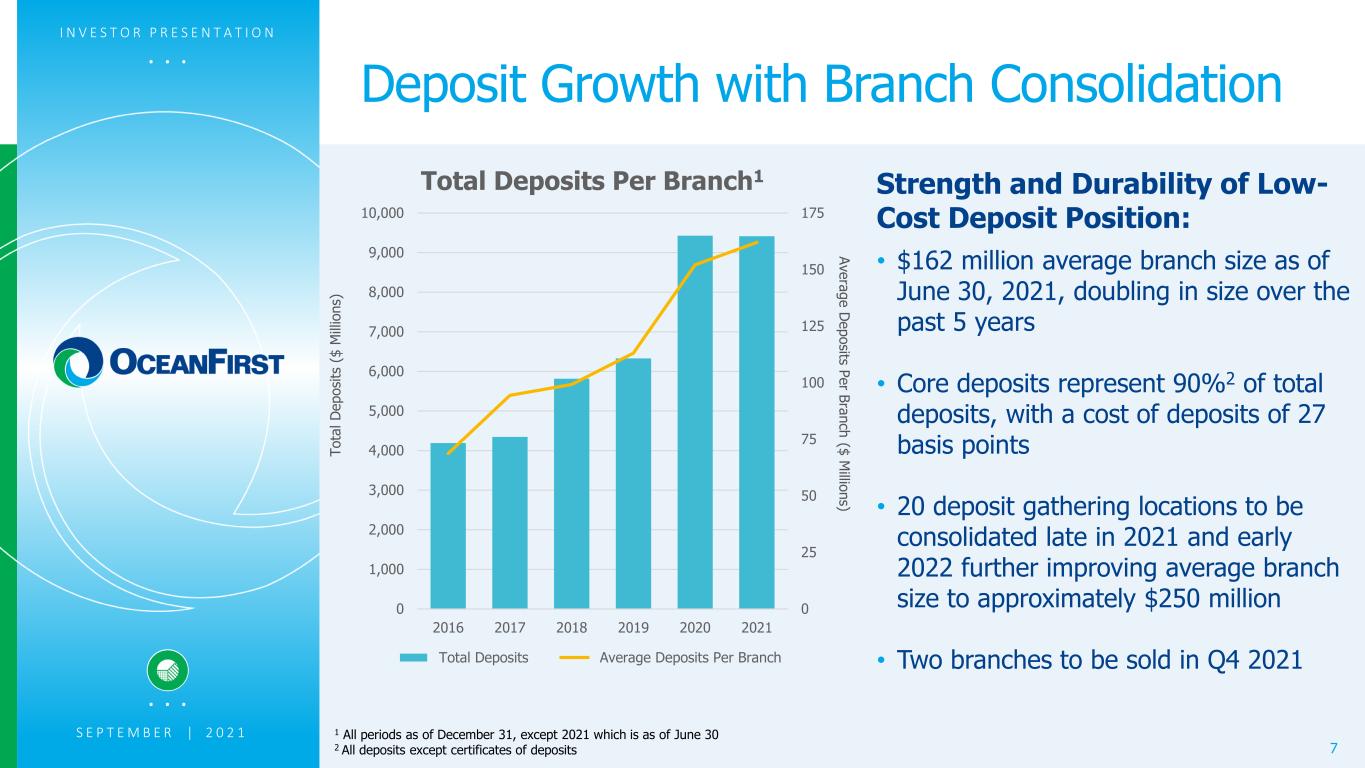

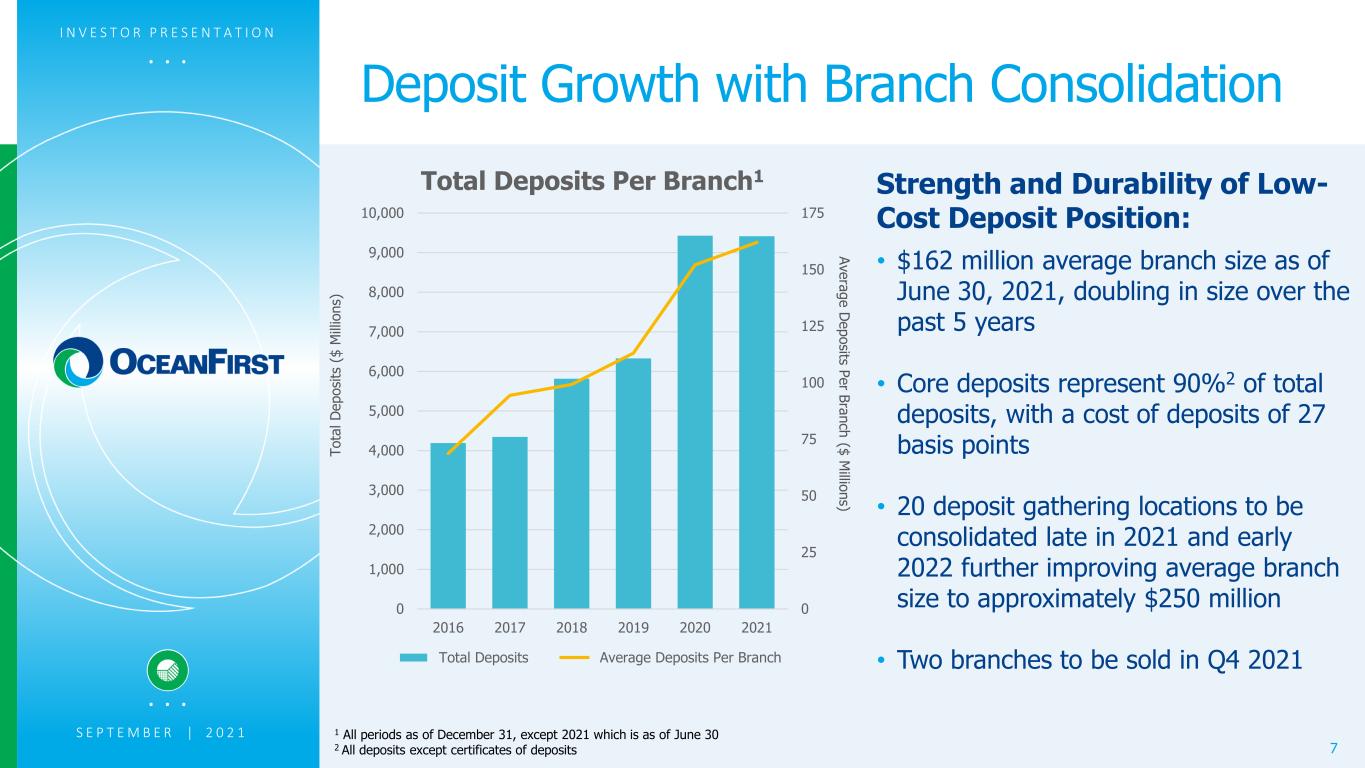

. . . I N V E S T O R P R E S E N T A T I O N 7 Deposit Growth with Branch Consolidation Strength and Durability of Low- Cost Deposit Position: • $162 million average branch size as of June 30, 2021, doubling in size over the past 5 years • Core deposits represent 90%2 of total deposits, with a cost of deposits of 27 basis points • 20 deposit gathering locations to be consolidated late in 2021 and early 2022 further improving average branch size to approximately $250 million • Two branches to be sold in Q4 2021 1 All periods as of December 31, except 2021 which is as of June 30 2 All deposits except certificates of deposits To ta l D ep os its ($ M illi on s) 0 25 50 75 100 125 150 175 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,000 2016 2017 2018 2019 2020 2021 Total Deposits Per Branch1 Total Deposits Average Deposits Per Branch Average Deposits Per Branch ($ M illions) . . . S E P T E M B E R | 2 0 2 1

. . . I N V E S T O R P R E S E N T A T I O N 8 Loan Composition Emphasizes Commercial1 . . . 1 All periods as of December 31, except 2021 which is as of June 30 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 2021 2020 2019 2018 2017 2016 Total Loans Outstanding Residential Home Equity & Consumer Investor CRE Owner Occupied CRE C&I Loans (in millions) 32% 68% Loans by Customer Segment Consumer Commercial Consumer Commercial 43% Central 27% New York 20% Philadelphia Southern 9% 1% Commercial Loans by Region Baltimore S E P T E M B E R | 2 0 2 1

. . . 0.00% 0.15% 0.30% 0.45% 0.60% 0.75% 0.90% 1.05% 1.20% 1.35% 1.50% 2016 2017 2018 2019 2020 2021 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% Co re R et ur n on T an gi bl e St oc kh ol de rs ’ E qu ity Core Return on Tangible Stockholders' Equity Core Return on Assets 1, 3 1 I N V E S T O R P R E S E N T A T I O N 9 Generating Consistent & Attractive Returns 1 For 2016 to 2021, excludes merger related expenses. For 2016, also excludes Federal Home Loan Bank (“FHLB”) prepayment fees and loss on sale of investment securities. For 2017 to 2021, also excludes the effect of branch consolidation expense. For 2017 and 2018, also excludes the effect of additional income tax expense (benefit) related to the Tax Cuts and Jobs Act. For 2019, also excludes the effect of compensation expense due to the retirement of an executive officer, non-recurring professional fees, and income tax benefit related to change in New Jersey tax code. For 2020, also excludes FHLB prepayment fees, gain on sale of PPP loans and the Two River and Country opening credit loss expense under the CECL model. For 2020 and 2021, also excludes net gain on equity investments. 2 For 2020, returns adversely impacted by COVID-19 3 For 2021, Q2 year to date results are annualized 1 1 1 1, 2 . . . Core Return on Assets S E P T E M B E R | 2 0 2 1

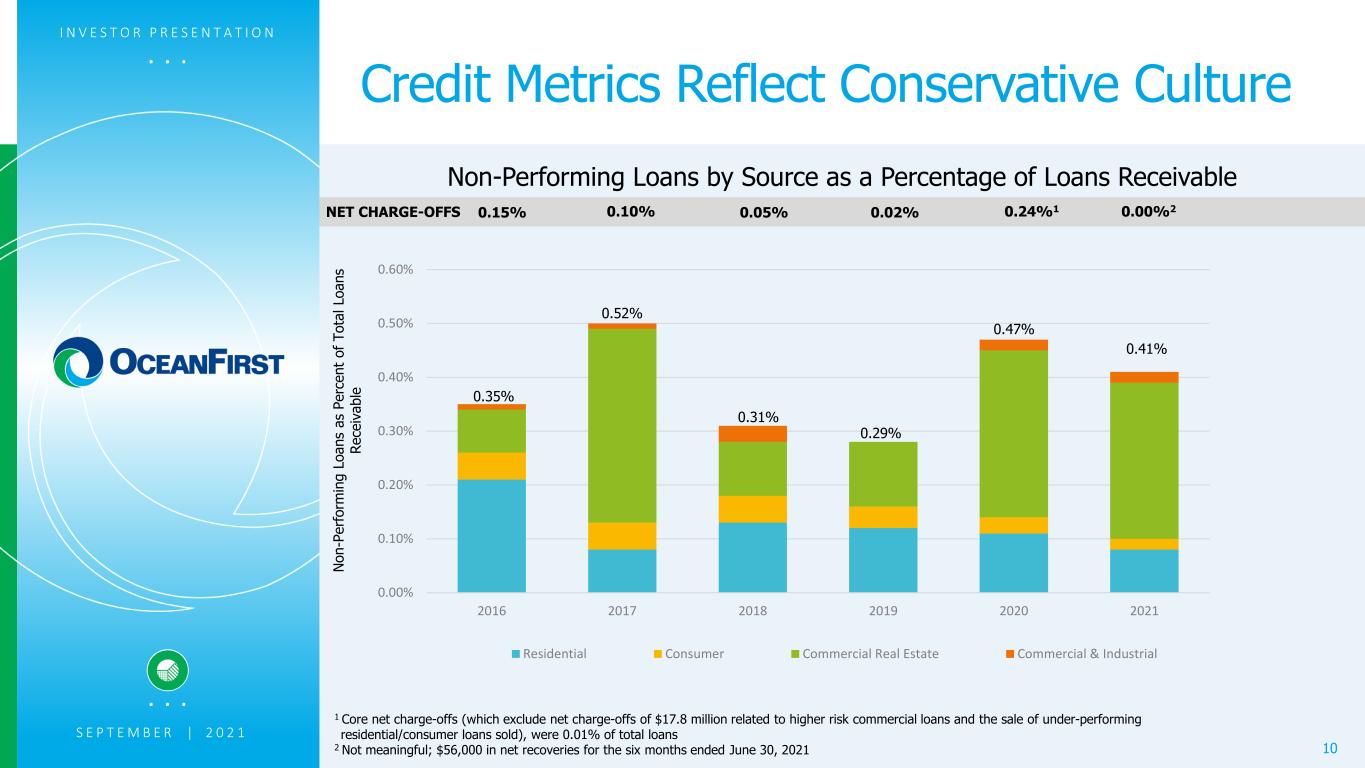

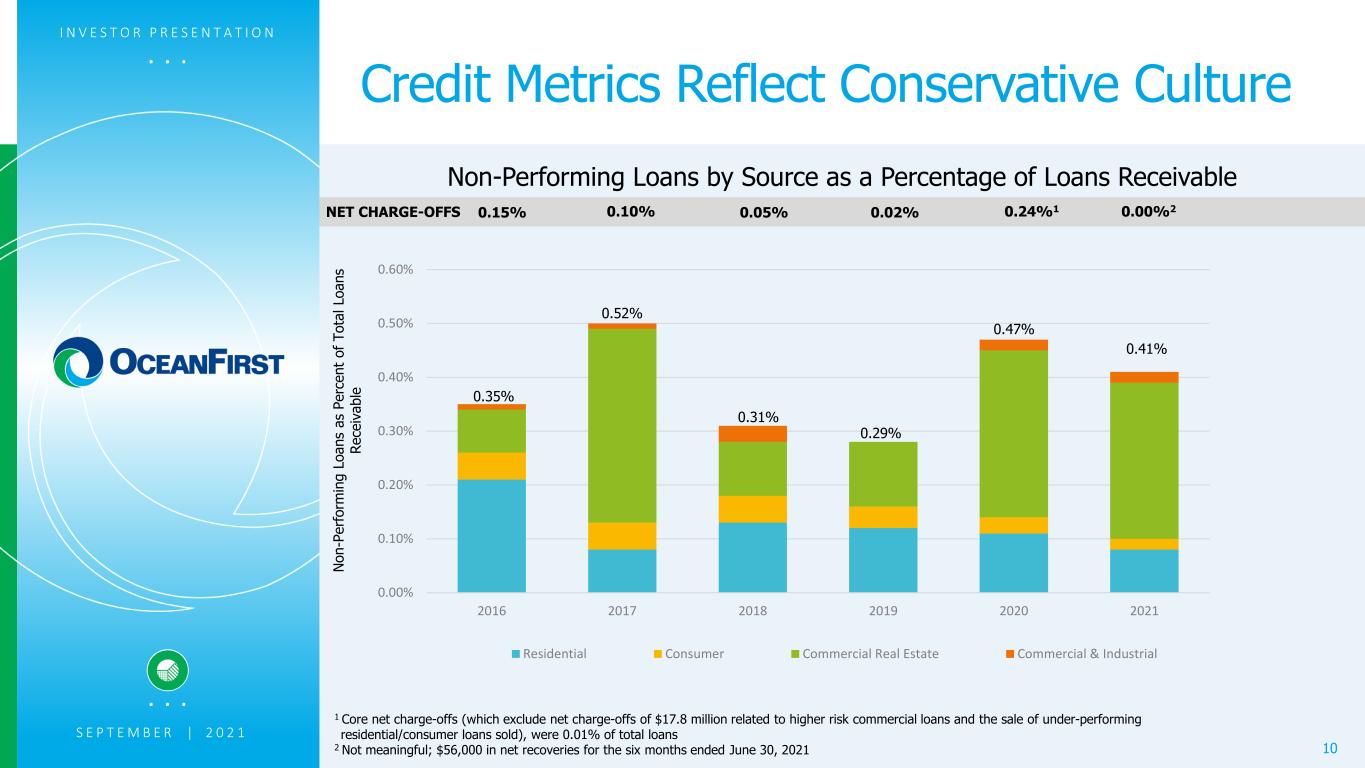

. . . I N V E S T O R P R E S E N T A T I O N 10 Credit Metrics Reflect Conservative Culture No n- Pe rfo rm in g Lo an s as P er ce nt o f T ot al L oa ns Re ce iva bl e 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 2016 2017 2018 2019 2020 2021 Residential Consumer Commercial Real Estate Commercial & Industrial 0.41% 0.35% 0.52% 0.29% 0.31% 0.15% 0.10% 0.05% 0.02%NET CHARGE-OFFS 0.47% 0.24%1 Non-Performing Loans by Source as a Percentage of Loans Receivable 0.00%2 . . . 1 Core net charge-offs (which exclude net charge-offs of $17.8 million related to higher risk commercial loans and the sale of under-performing residential/consumer loans sold), were 0.01% of total loans 2 Not meaningful; $56,000 in net recoveries for the six months ended June 30, 2021 S E P T E M B E R | 2 0 2 1

. . . I N V E S T O R P R E S E N T A T I O N 11 Asset Growth Supplemented by Strategic M&A Opportunistic Acquisitions of Local Community Banks Target Closing Date Transaction Value Total Assets Colonial American Bank July 31, 2015 ~$12 million $142 million Cape Bancorp May 2, 2016 ~$196 million $1,518 million Ocean Shore Holding Co. November 30, 2016 ~$146 million $1,097 million Sun Bancorp, Inc. January 31, 2018 ~$475 million $2,044 million Capital Bank of New Jersey January 31, 2019 ~$77 million $495 million Two River Bancorp January 1, 2020 ~$197 million $1,109 million Country Bank Holding Company Inc. January 1, 2020 ~$113 million $798 million Weighted average1: Price/Tangible Book Value 158%; Core Deposit Premium 9.0% 1 At time of announcement . . . S E P T E M B E R | 2 0 2 1

. . . I N V E S T O R P R E S E N T A T I O N 12 . . . S E P T E M B E R | 2 0 2 1 Northeast and Mid-Atlantic Expansion Opportunities • New Jersey is an attractive market1 • Statewide total population of 9.3 million • Most densely populated state • 11th most populous state • Median household income of $82,545 • Significant opportunities for acquisitions to build customer base • Support expansion in Pennsylvania, Metropolitan New York, Boston, Baltimore, and Washington D.C. VA PA NY MA CT RI MD DC DE NJ NH ME VT Central & Northern New Jersey Region Southern New Jersey Region Greater Philadelphia Region New York Region Boston Region Baltimore / D.C. Region Northeast U.S., DE, MD + D.C. Metro provides access to ~20% of the U.S. population1 1 U.S. Census Bureau

. . . I N V E S T O R P R E S E N T A T I O N 13 Regional Opportunities for M&A Regional banking data as of June 30, 2020 Source: FDIC New York City Metro Area • 4 Banks with Assets Between $400 million and $1 billion • 7 Banks with Assets Between $1 billion and $10 billion New Jersey • 11 Banks with Assets Between $400 million and $1 billion • 15 Banks with Assets Between $1 billion and $10 billion Headquarters OceanFirst Bank Branches OceanFirst Bank Loan Offices Philadelphia Area • 5 Banks with Assets Between $400 million and $1 billion • 10 Banks with Assets Between $1 billion and $10 billion 10% of the total population of the United States resides within a 2-hour drive of Headquarters . . . S E P T E M B E R | 2 0 2 1

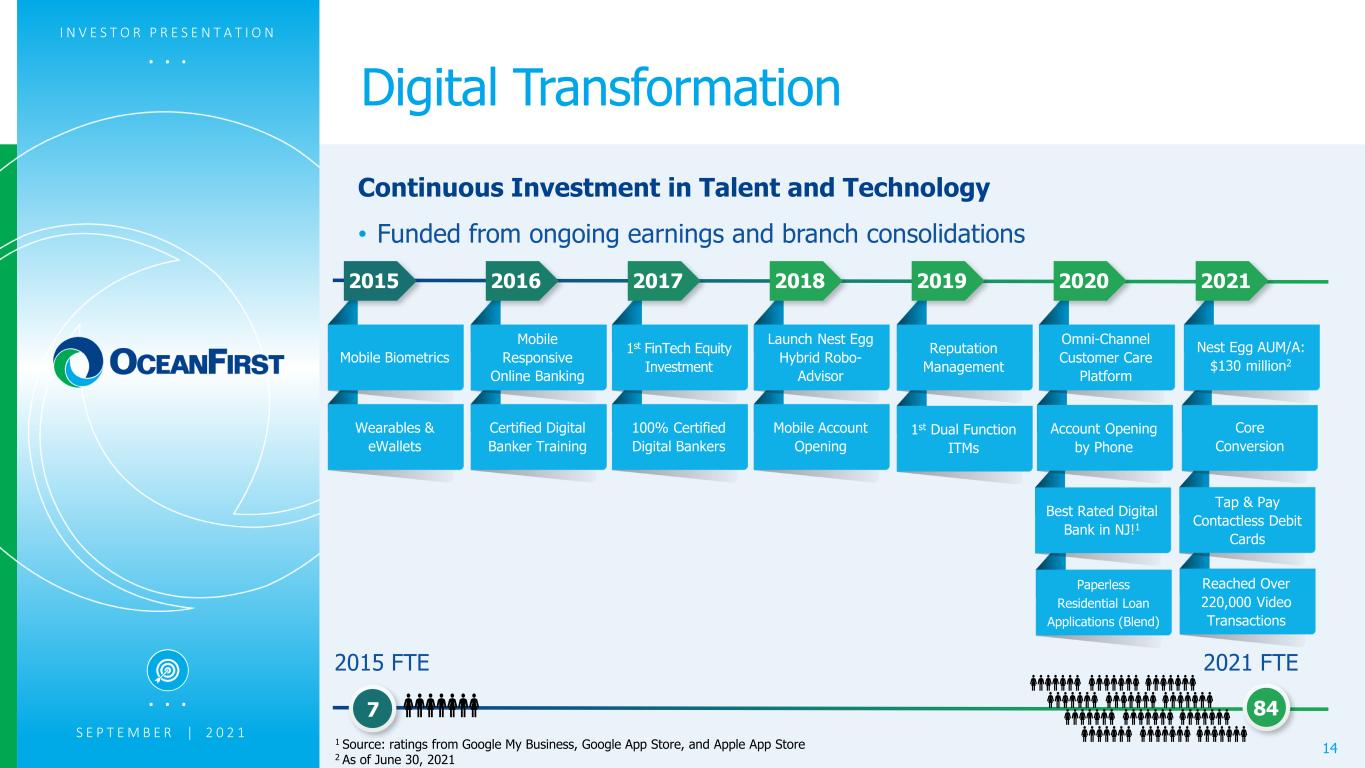

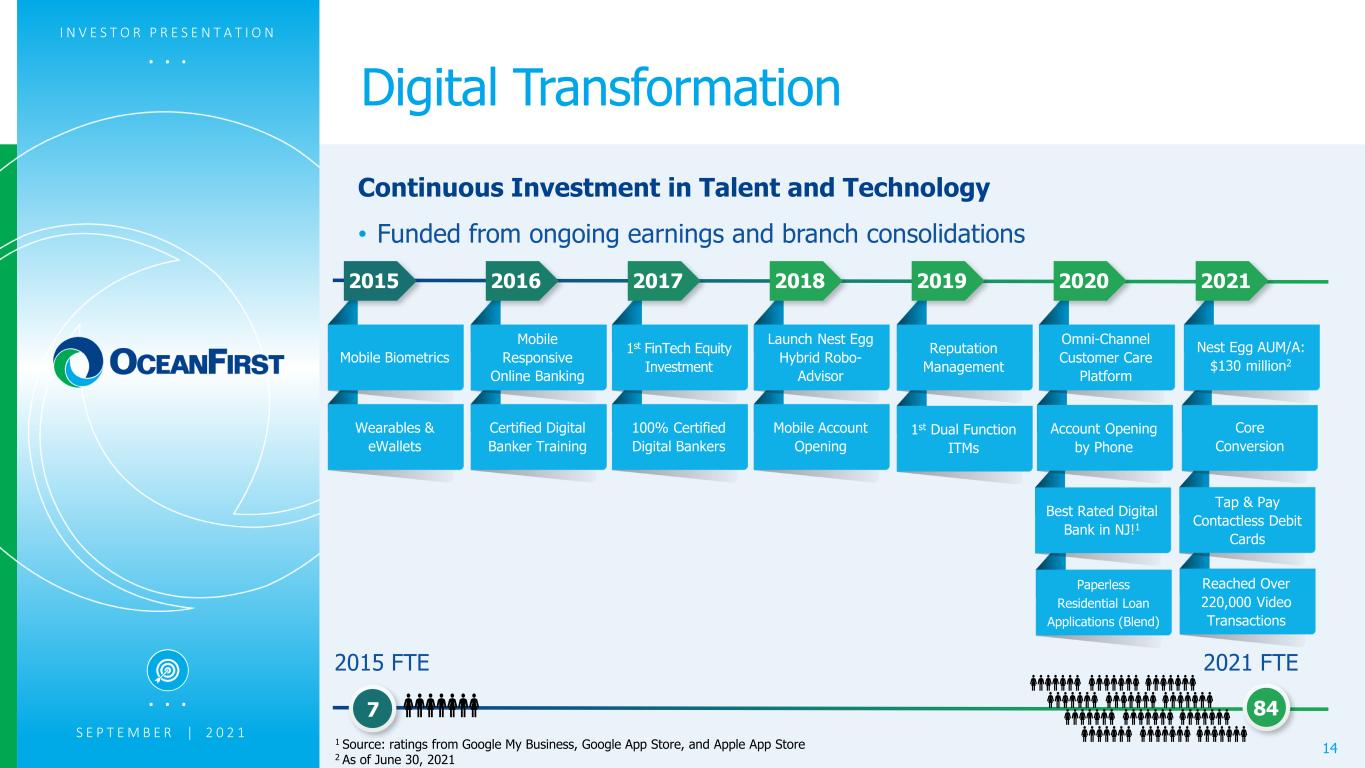

. . . Nest Egg AUM/A: $130 million2 2015 FTE 2021 FTE Continuous Investment in Talent and Technology • Funded from ongoing earnings and branch consolidations Digital Transformation I N V E S T O R P R E S E N T A T I O N 14 7 84 Paperless Residential Loan Applications (Blend) Best Rated Digital Bank in NJ!1 Account Opening by Phone 1st Dual Function ITMs Wearables & eWallets Mobile Account Opening Reputation Management 100% Certified Digital Bankers Certified Digital Banker Training Launch Nest Egg Hybrid Robo- Advisor 1st FinTech Equity Investment Mobile Responsive Online Banking Mobile Biometrics Omni-Channel Customer Care Platform . . . 1 Source: ratings from Google My Business, Google App Store, and Apple App Store 2 As of June 30, 2021 Reached Over 220,000 Video Transactions S E P T E M B E R | 2 0 2 1 Core Conversion Tap & Pay Contactless Debit Cards 2015 2016 2017 2018 2019 2020 2021

. . . Digital Capabilities & Customer Ratings I N V E S T O R P R E S E N T A T I O N Source: iTunes App and Google App as of July 6th, 2021Source: S&P Global 2020 US Mobile Banking Report 14 12 11 11 OceanFirst National / Regional FinTechs / Digital Large MidAtlantic Mobile Capabilities Survey (# of features, out of 18) • A few notables include: • BofA 17 • Chase 16 • USAA 14 • TD 8 • A few notables include: • USAA 4.8 • Chime 4.7 • Chase 4.7 • M&T 4.4. . . 15 4.8 4.5 4.3 4.5 4.3 OceanFirst National / Regional Large MidAtlantic FinTechs / Digital Proxy Peer Group Mobile App Customer Ratings (Apple & Google) # Ratings = 7,373 Median # Ratings = 2,595 S E P T E M B E R | 2 0 2 1

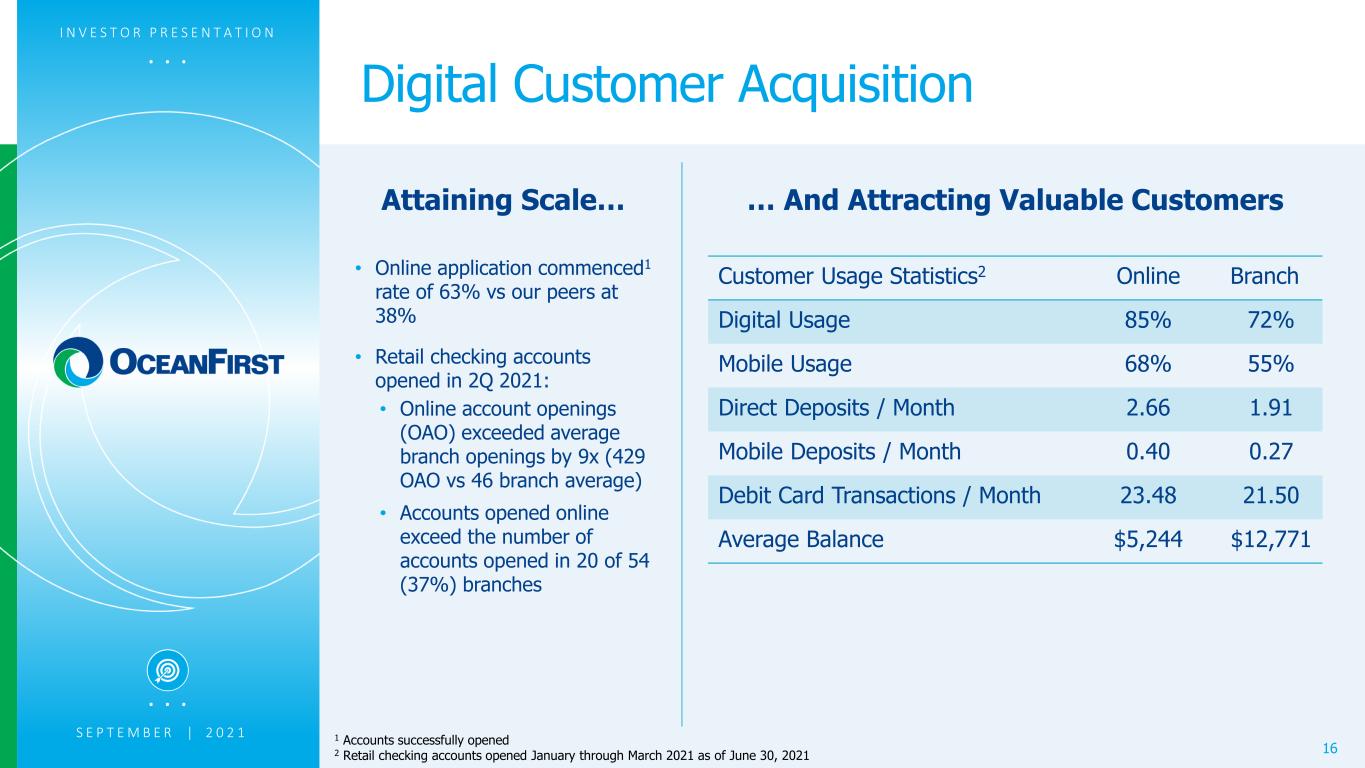

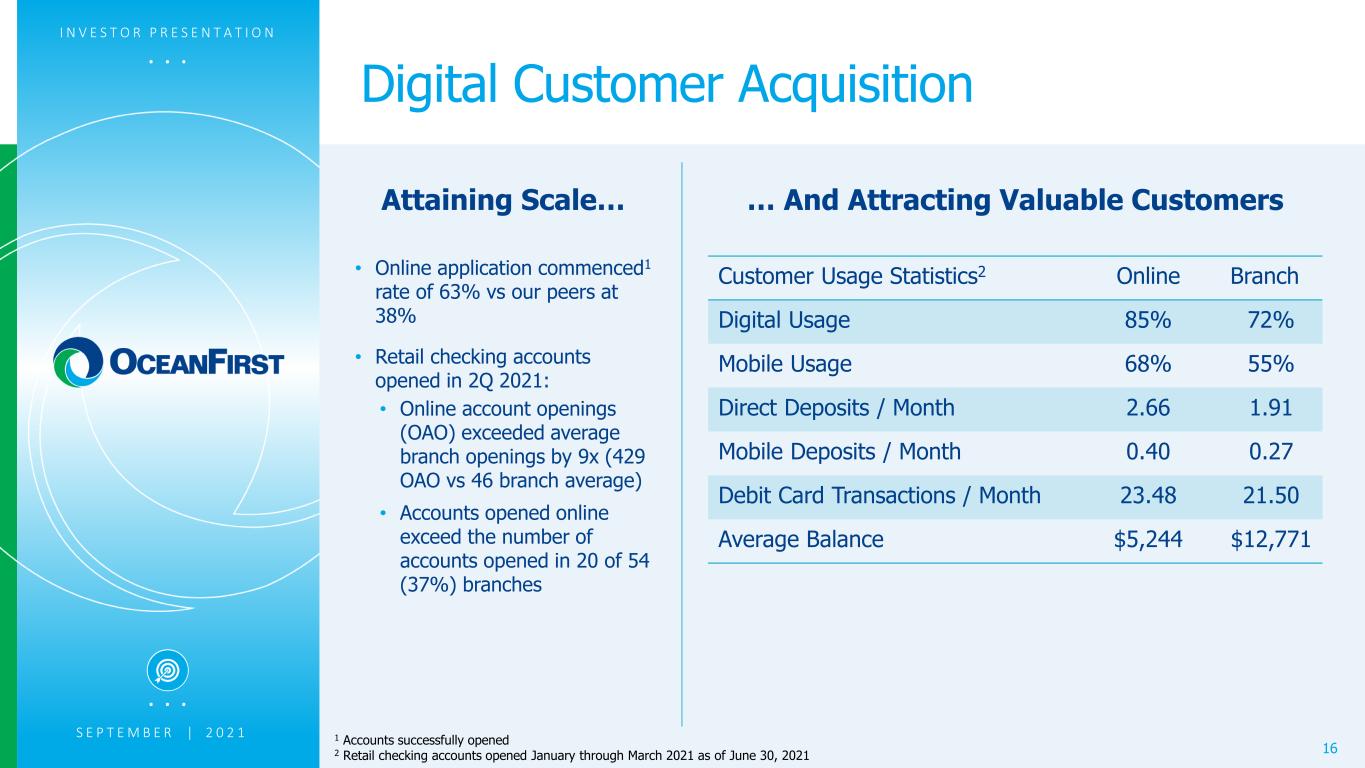

. . . Digital Customer Acquisition I N V E S T O R P R E S E N T A T I O N 16 Attaining Scale… … And Attracting Valuable Customers . . . Customer Usage Statistics2 Online Branch Digital Usage 85% 72% Mobile Usage 68% 55% Direct Deposits / Month 2.66 1.91 Mobile Deposits / Month 0.40 0.27 Debit Card Transactions / Month 23.48 21.50 Average Balance $5,244 $12,771 • Online application commenced1 rate of 63% vs our peers at 38% • Retail checking accounts opened in 2Q 2021: • Online account openings (OAO) exceeded average branch openings by 9x (429 OAO vs 46 branch average) • Accounts opened online exceed the number of accounts opened in 20 of 54 (37%) branches 1 Accounts successfully opened 2 Retail checking accounts opened January through March 2021 as of June 30, 2021 S E P T E M B E R | 2 0 2 1

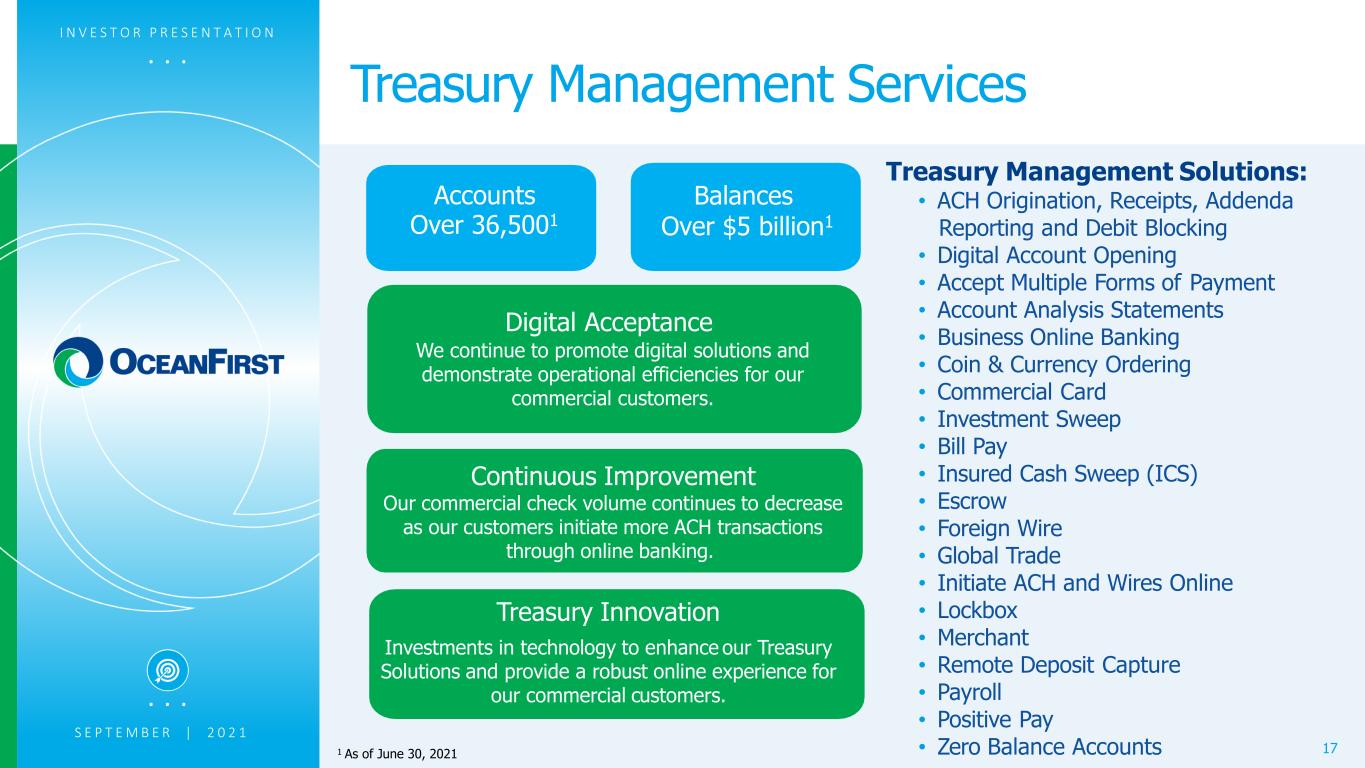

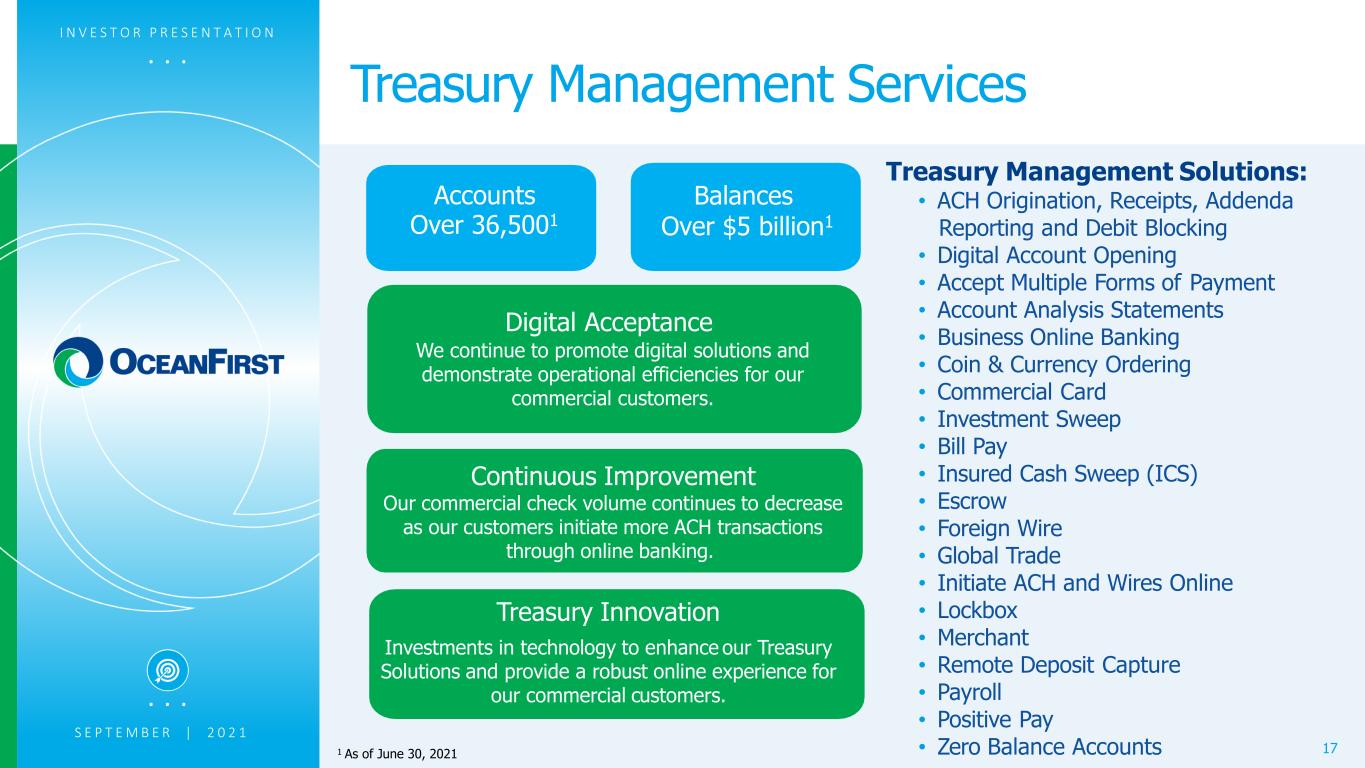

. . . 1 As of June 30, 2021 Treasury Management Solutions: • ACH Origination, Receipts, Addenda Reporting and Debit Blocking • Digital Account Opening • Accept Multiple Forms of Payment • Account Analysis Statements • Business Online Banking • Coin & Currency Ordering • Commercial Card • Investment Sweep • Bill Pay • Insured Cash Sweep (ICS) • Escrow • Foreign Wire • Global Trade • Initiate ACH and Wires Online • Lockbox • Merchant • Remote Deposit Capture • Payroll • Positive Pay • Zero Balance Accounts Digital Acceptance We continue to promote digital solutions and demonstrate operational efficiencies for our commercial customers. Treasury Management Services I N V E S T O R P R E S E N T A T I O N . . . 17 Balances Over $5 billion1 S E P T E M B E R | 2 0 2 1 Treasury Innovation Investments in technology to enhance our Treasury Solutions and provide a robust online experience for our commercial customers. Continuous Improvement Our commercial check volume continues to decrease as our customers initiate more ACH transactions through online banking. Accounts Over 36,5001

. . . I N V E S T O R P R E S E N T A T I O N 18 Protecting Our Clients with Cyber Security • Remains current with evolving industry-wide standards and threat environment • Real-time analytical tools in place for fraud protection and cybersecurity • Use of top tier, neural-based, real-time debit card fraud analytics • Qualified, certified senior InfoSec personnel, backed up by: • Ongoing significant investments in technology, education and training • Board of Directors with cyber security focus and expertise • Created a security operations center which provides dedicated space to enhance day-to-day operations and includes a central area for key members of the business continuity team to collaborate for maximum effectiveness . . . S E P T E M B E R | 2 0 2 1

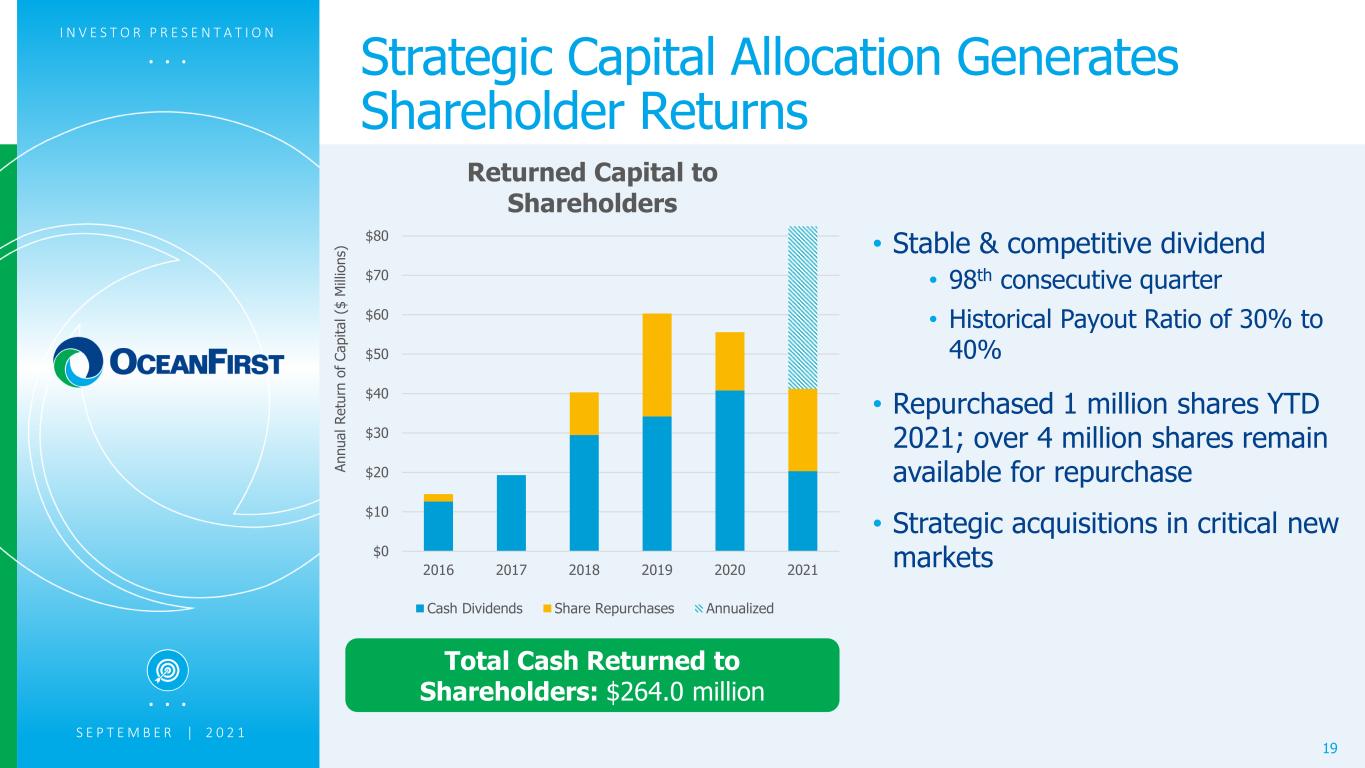

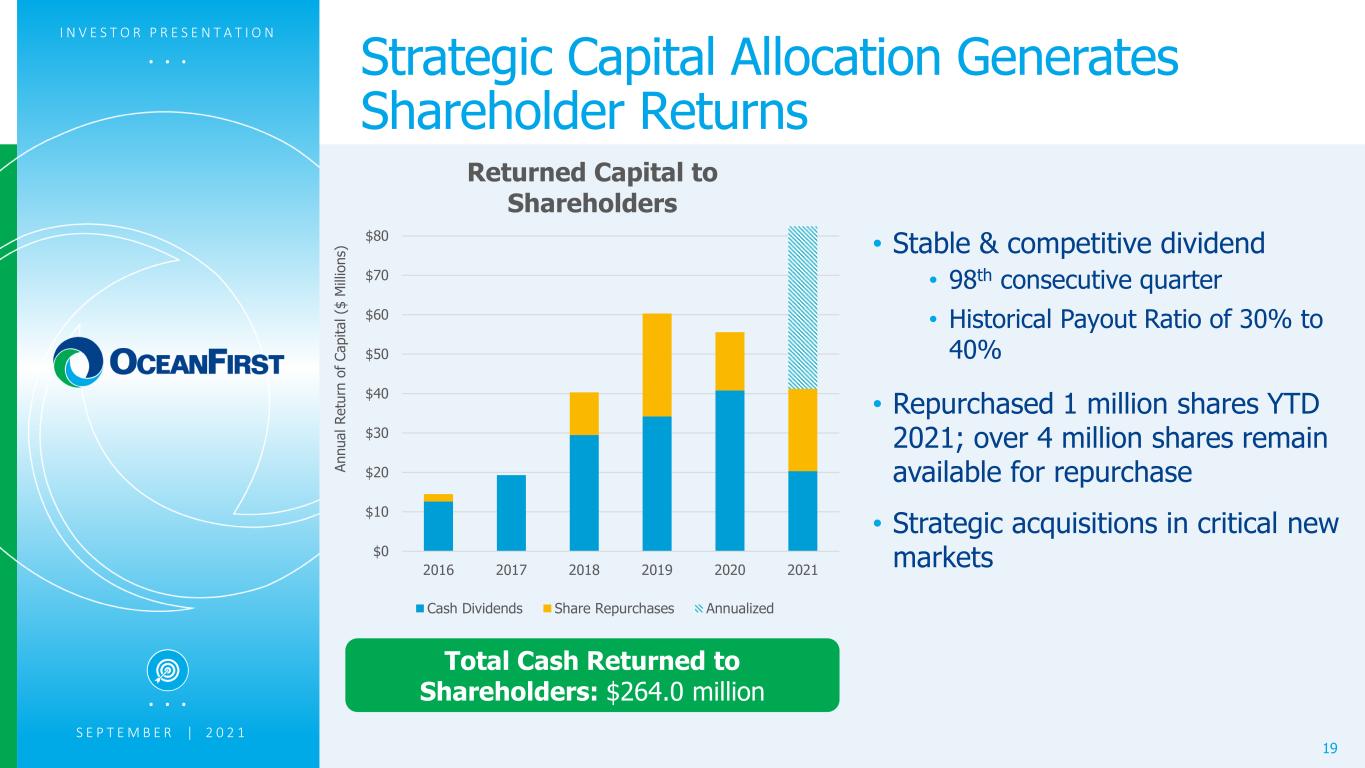

. . . $0 $10 $20 $30 $40 $50 $60 $70 $80 2016 2017 2018 2019 2020 2021 Returned Capital to Shareholders Cash Dividends Share Repurchases Annualized I N V E S T O R P R E S E N T A T I O N 19 Strategic Capital Allocation Generates Shareholder Returns An nu al R et ur n of C ap ita l ( $ M illi on s) Total Cash Returned to Shareholders: $264.0 million. . . • Stable & competitive dividend • 98th consecutive quarter • Historical Payout Ratio of 30% to 40% • Repurchased 1 million shares YTD 2021; over 4 million shares remain available for repurchase • Strategic acquisitions in critical new markets S E P T E M B E R | 2 0 2 1

. . . I N V E S T O R P R E S E N T A T I O N 20 An Experienced Management Team Executive Title Years at OceanFirst1 Selected Experience Christopher D. Maher Chairman, Chief Executive Officer 8 Patriot National Bancorp Dime Community Bancshares Joseph J. Lebel III President, Chief Operating Officer 15 Wachovia Bank N.A. First Fidelity Michael J. Fitzpatrick Executive Vice President, Chief Financial Officer 29 KPMG Steven J. Tsimbinos Executive Vice President, General Counsel 11 Thacher Proffit & Wood Lowenstein Sandler PC Grace M. Vallacchi Executive Vice President, Chief Risk Officer 4 Office of the Comptroller of the Currency First Union Michele Estep Executive Vice President, Chief Administrative Officer 13 Sun National Bancorp Key Bank Karthik Sridharan Executive Vice President, Chief Information Officer 2 Citigroup JP Morgan Chase Bank of America • Substantial insider ownership of 9%, including Directors, Executive Officers, ESOP and OceanFirst Foundation. 1 Includes years at acquired banks . . . S E P T E M B E R | 2 0 2 1

. . . I N V E S T O R P R E S E N T A T I O N 21 OceanFirst Foundation: Serving Our Communities • Over $43 million has been granted to organizations serving OceanFirst’s market • Provided $250,000 in grants dedicated to assisting the non-profit organizations helping our neighbors during the coronavirus pandemic • The Foundation and OceanFirst Bank collaborated to pledge an additional $170,000 to assist local hospitals and organizations with various expenses related to the distribution of COVID-19 vaccinations to our neighbors. • First foundation established in the country during a mutual conversion to IPO (July 1996) • OceanFirst Foundation has assets of over $19 million as of July 31, 2021 . . . S E P T E M B E R | 2 0 2 1

. . . Investment Thesis – Well Positioned for the Post-COVID-19 Environment • Strength of Balance Sheet • Balance sheet de-risked with executed loan sales, resolution of substantially all full forbearance loans, and extinguishment of high-cost borrowings • Low-Cost and Durable Deposit Base • Cost of deposits remain low at 27 bps and is projected to fall modestly • Digital Innovation • Digital products and customer experience on par with national banks and FinTechs, far outpacing regional and community banks • Disciplined and Strategic M&A • Acquired attractive and underappreciated assets in exurban markets at favorable prices • Bench Strength • Deep banking, regulatory, M&A, and integration experience • Demonstrated strong pandemic response • Conservative Risk Culture • Commitment to management of credit, interest rate, and regulatory / compliance risk • Insider Ownership • Meaningful insider ownership aligned with shareholder interest 22 . . . S E P T E M B E R | 2 0 2 1 I N V E S T O R P R E S E N T A T I O N

. . . Investor Relations Inquiries Jill A. Hewitt Senior Vice President, Director of Investor Relations & Corporate Communications jhewitt@oceanfirst.com (732) 240-4500, ext. 7513 23

. . . Appendix 24

. . . Favorable Competitive Position I N V E S T O R P R E S E N T A T I O N 25 Institution # of Branches Dep. In Mkt. ($000) TD Bank (Canada) 151 33,278,985 Wells Fargo (CA) 178 32,317,778 PNC Bank (PA) 168 28,781,019 Bank of America (NC) 139 26,112,590 JP Morgan Chase (NY) 99 11,930,399 OceanFirst Bank # of Branches Dep. In Mkt. ($000) 60 8,173,938 Institution # of Branches Dep. In Mkt. ($000) Republic 17 1,958,197 Kearny 22 1,739,853 Manasquan 16 1,726,000 1ST Constitution 23 1,177,073 Bank of Princeton 18 1,161,712 Sturdy Savings 15 828,057 OceanFirst Competitive Position • Responsive • Flexible • Capable • Lending Limit • Technology • Trust • Treasury Management • Consumer & Commercial Mega Banks Community Banks serving Central & Southern NJ Source: FDIC Summary of Deposits, June 30, 2020 Note: Market area is defined as 13 counties in Central and Southern New Jersey • Competing favorably against banking behemoths and local community banks . . . S E P T E M B E R | 2 0 2 1

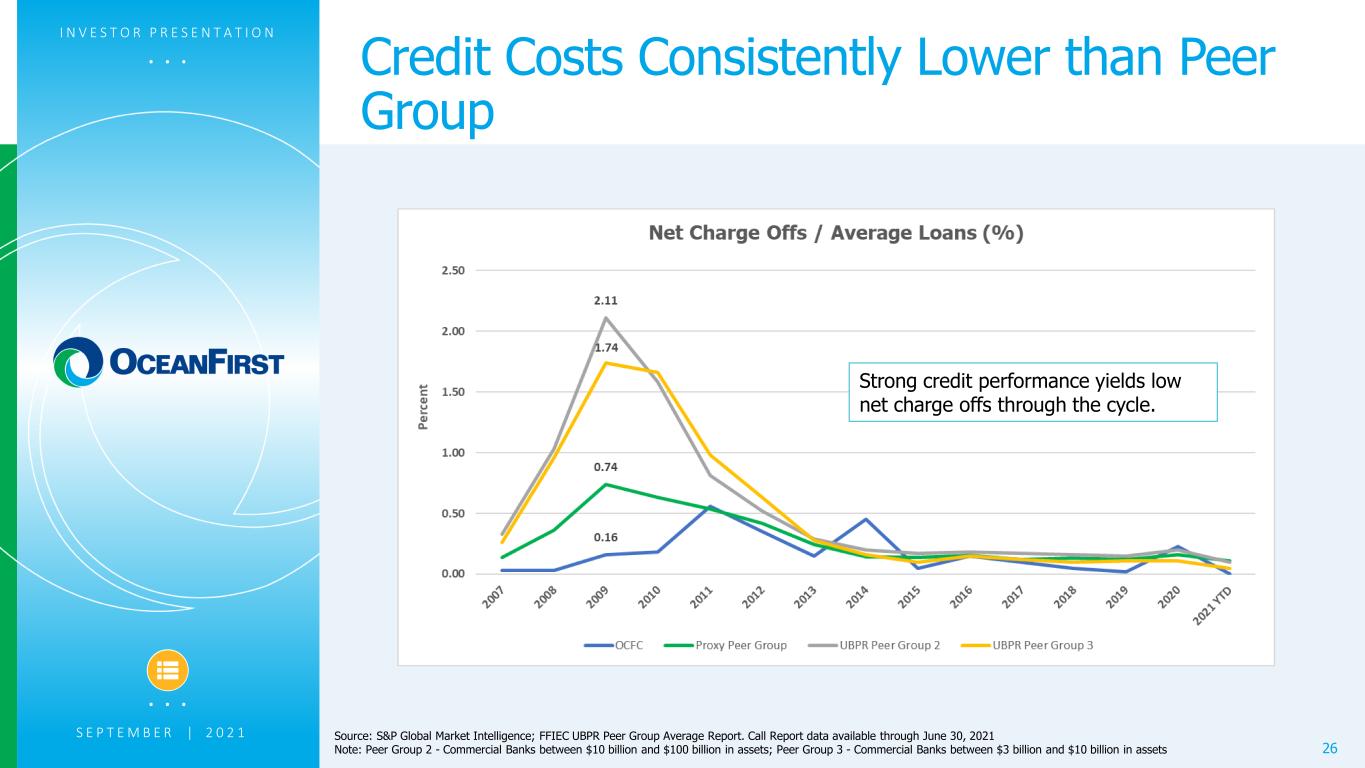

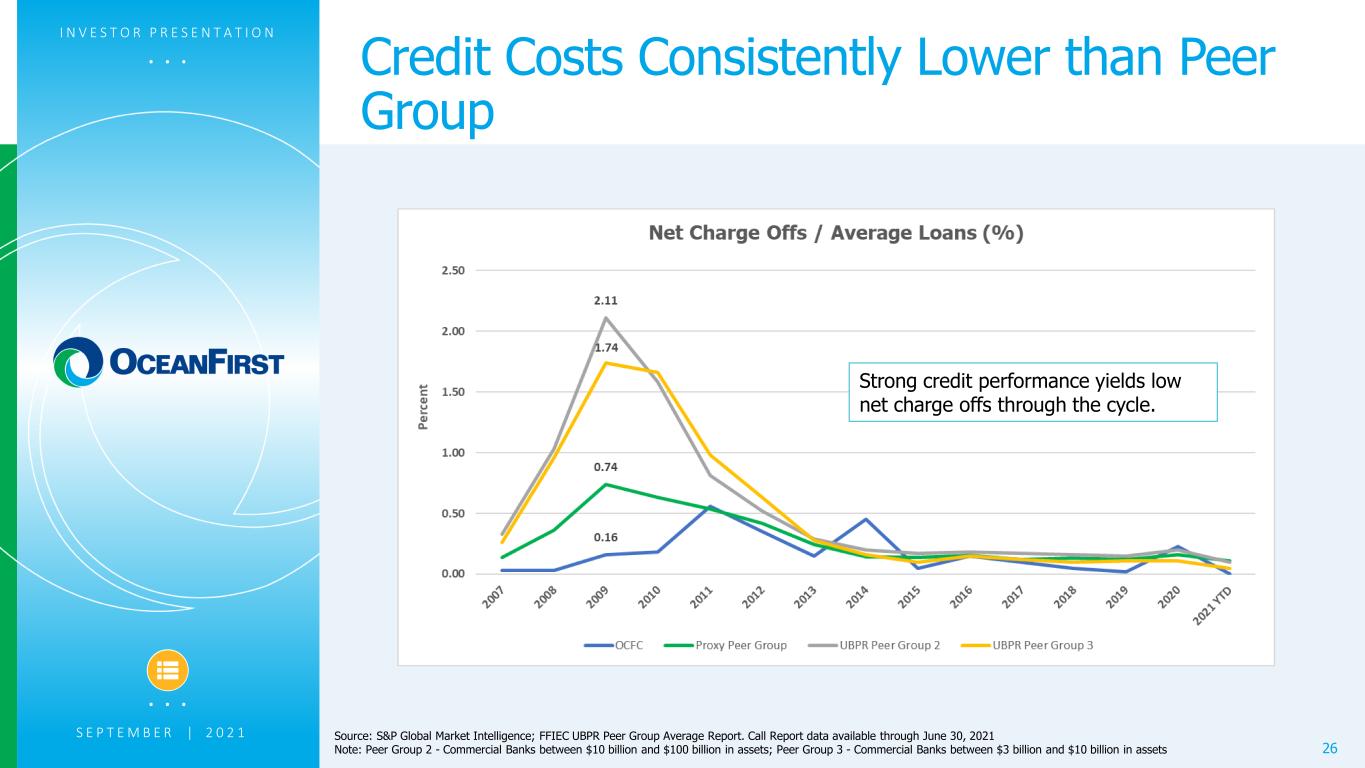

. . . Credit Costs Consistently Lower than Peer Group I N V E S T O R P R E S E N T A T I O N 26 . . . Source: S&P Global Market Intelligence; FFIEC UBPR Peer Group Average Report. Call Report data available through June 30, 2021 Note: Peer Group 2 - Commercial Banks between $10 billion and $100 billion in assets; Peer Group 3 - Commercial Banks between $3 billion and $10 billion in assets S E P T E M B E R | 2 0 2 1 Strong credit performance yields low net charge offs through the cycle.

. . . 2007 to 2021 Cumulative Credit Losses Also Outperform I N V E S T O R P R E S E N T A T I O N 27 . . . Source: S&P Global Market Intelligence; FFIEC UBPR Peer Group Average Report. Call Report data available through June 30, 2021 Note: Peer Group 2 - Commercial Banks between $10 billion and $100 billion in assets; Peer Group 3 - Commercial Banks between $3 billion and $10 billion in assets S E P T E M B E R | 2 0 2 1 Cumulative OCFC losses are 39% lower than proxy peers and 67% lower than UBPR peers

. . . 2007 to 2021 Cumulative Losses By Segment I N V E S T O R P R E S E N T A T I O N 28 . . . Source: S&P Global Market Intelligence; FFIEC UBPR Peer Group Average Report. Call Report data available through June 30, 2021 1 Peer Group 2 - Commercial Banks between $10 billion and $100 billion in assets; Peer Group 3 - Commercial Banks between $3 billion and $10 billion in assets 2 Residential and Consumer losses were driven by subprime loans originated by Columbia Home Loans, LLC, which was a mortgage banking company acquired by OCFC in 2000 and shuttered in 2007. Cumulative Residential losses of 2.15% excludes the estimated loss of 0.74% related to Columbia originated loans S E P T E M B E R | 2 0 2 1 Cumulative OCFC losses are 47% lower than UBPR peers. Cumulative OCFC losses are 59% lower than UBPR peers. Cumulative OCFC losses are 44% lower than UBPR peers. Cumulative OCFC losses are 25% lower than UBPR peers.

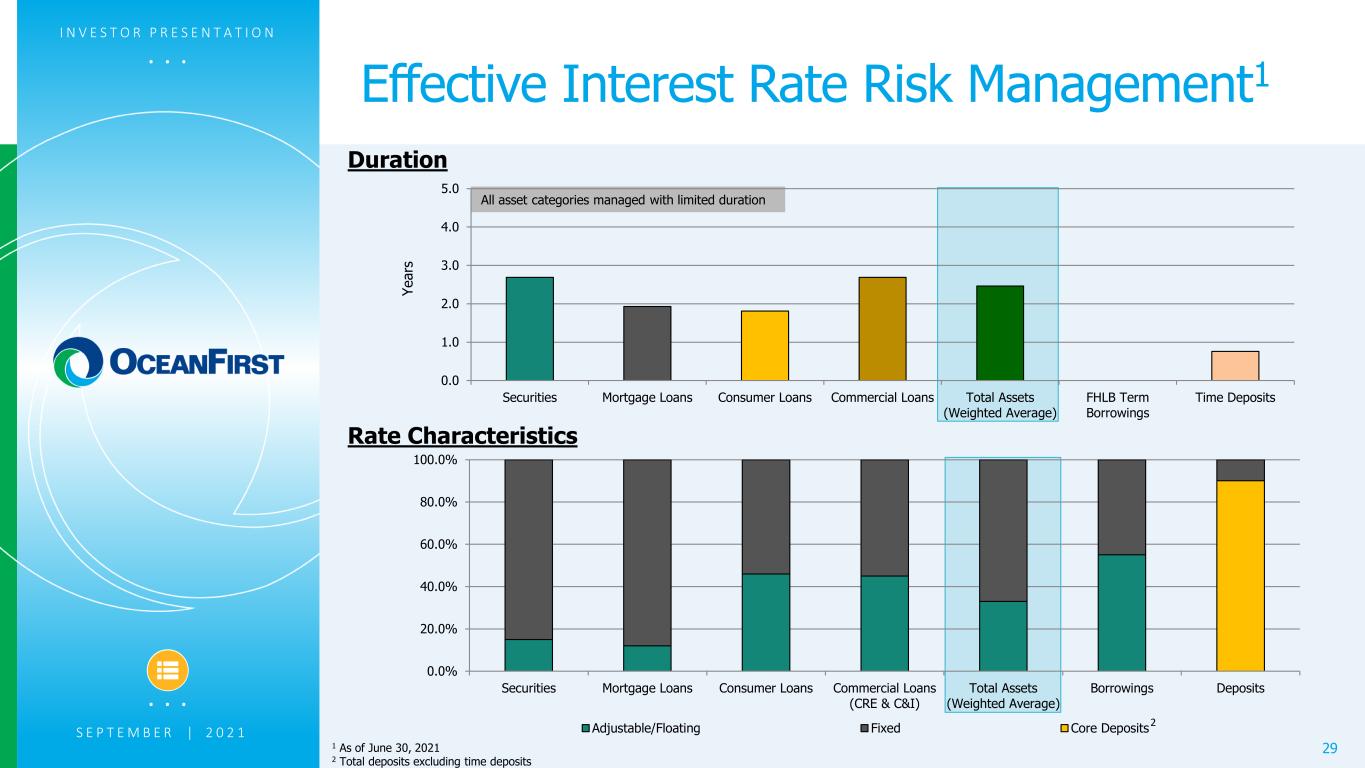

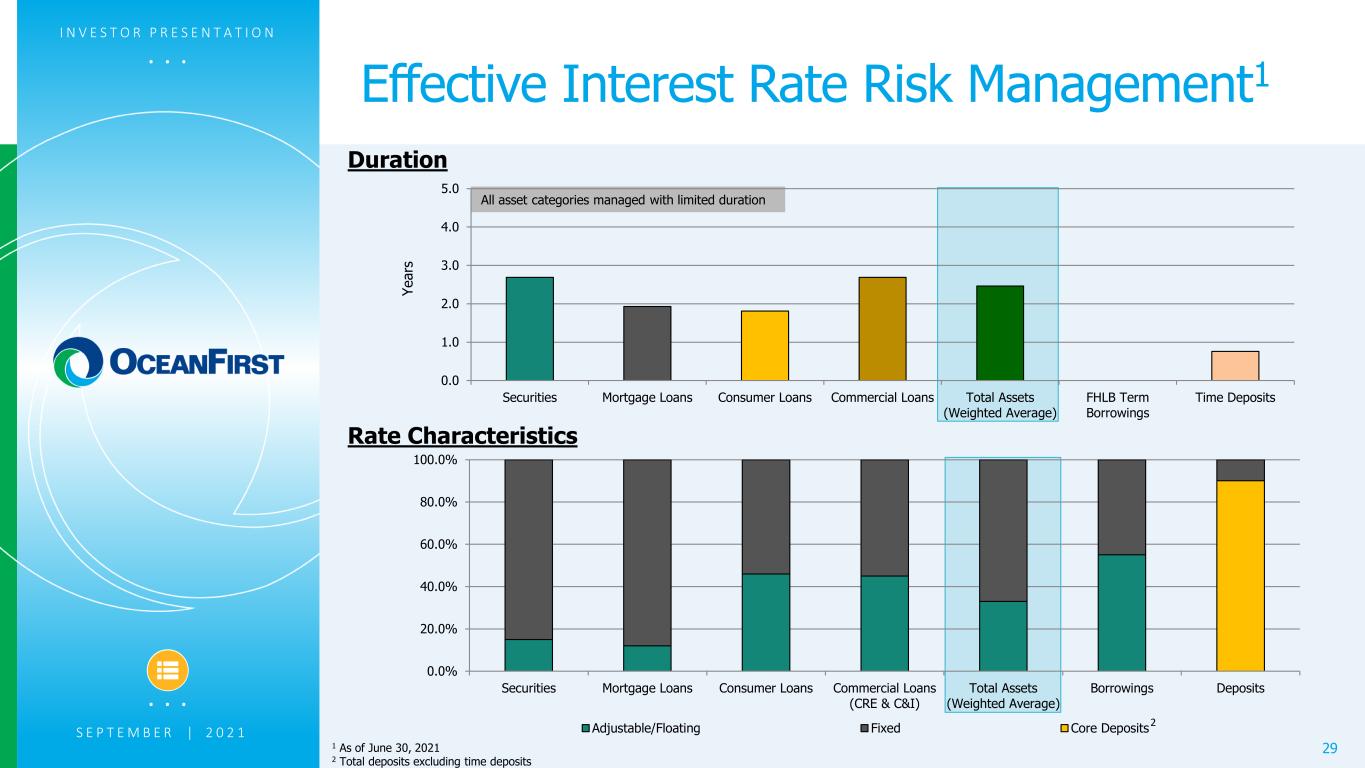

. . . 1 As of June 30, 2021 2 Total deposits excluding time deposits Duration Rate Characteristics All asset categories managed with limited duration Effective Interest Rate Risk Management1 29 I N V E S T O R P R E S E N T A T I O N . . . 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% Securities Mortgage Loans Consumer Loans Commercial Loans (CRE & C&I) Total Assets (Weighted Average) Borrowings Deposits Adjustable/Floating Fixed Core Deposits 0.0 1.0 2.0 3.0 4.0 5.0 Securities Mortgage Loans Consumer Loans Commercial Loans Total Assets (Weighted Average) FHLB Term Borrowings Time Deposits Ye ar s S E P T E M B E R | 2 0 2 1 2

. . . Commercial Expansion into Baltimore/D.C. OceanFirst Milestones – 119 Years of Growth I N V E S T O R P R E S E N T A T I O N 30 OceanFirst Foundation Exceeds $25M in Cumulative Grants Cape Bancorp Acquired IPO to Mutual Depositors Founded, Point Pleasant, NJ Sun Bancorp, Inc. Acquired Created OceanFirst Foundation Established Commercial Lending Adopted National Bank Charter Ocean Shore Holding Co. Acquired 20201902 1996 2000 2014 2015 2016 2018 2019 2021 Capital Bank of New Jersey Acquired Commercial Expansion into Boston . . . S E P T E M B E R | 2 0 2 1 Established Trust and Asset Management Colonial American Bank Acquired Country Bank Holding Company, Inc. Acquired Two River Bancorp Acquired Crossed $10 billion threshold

. . . Q2 2021 Earnings Supplement1 July 29, 2021 1 The Q2 2021 Earnings Supplement is for the purpose and use in conjunction with our Earnings Release furnished as Exhibit 99.1 to our Form 8-K on July 29, 2021.

. . . In addition to historical information, this news release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 which are based on certain assumptions and describe future plans, strategies and expectations of the Company. These forward-looking statements are generally identified by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “will,” “should,” “may,” “view,” “opportunity,” “potential,” or similar expressions or expressions of confidence. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations of the Company and its subsidiaries include, but are not limited to: the impact of the COVID-19 pandemic on our operations and financial results and those of our customers, changes in interest rates, general economic conditions, levels of unemployment in the Bank’s lending area, real estate market values in the Bank’s lending area, future natural disasters and increases to flood insurance premiums, the level of prepayments on loans and mortgage-backed securities, legislative/regulatory changes, monetary and fiscal policies of the U.S. Government including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System, the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand for financial services in the Company’s market area, accounting principles and guidelines and the Bank’s ability to successfully integrate acquired operations. These risks and uncertainties are further discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020, under Item 1A - Risk Factors and elsewhere, and subsequent securities filings and should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. Forward Looking Statements 32

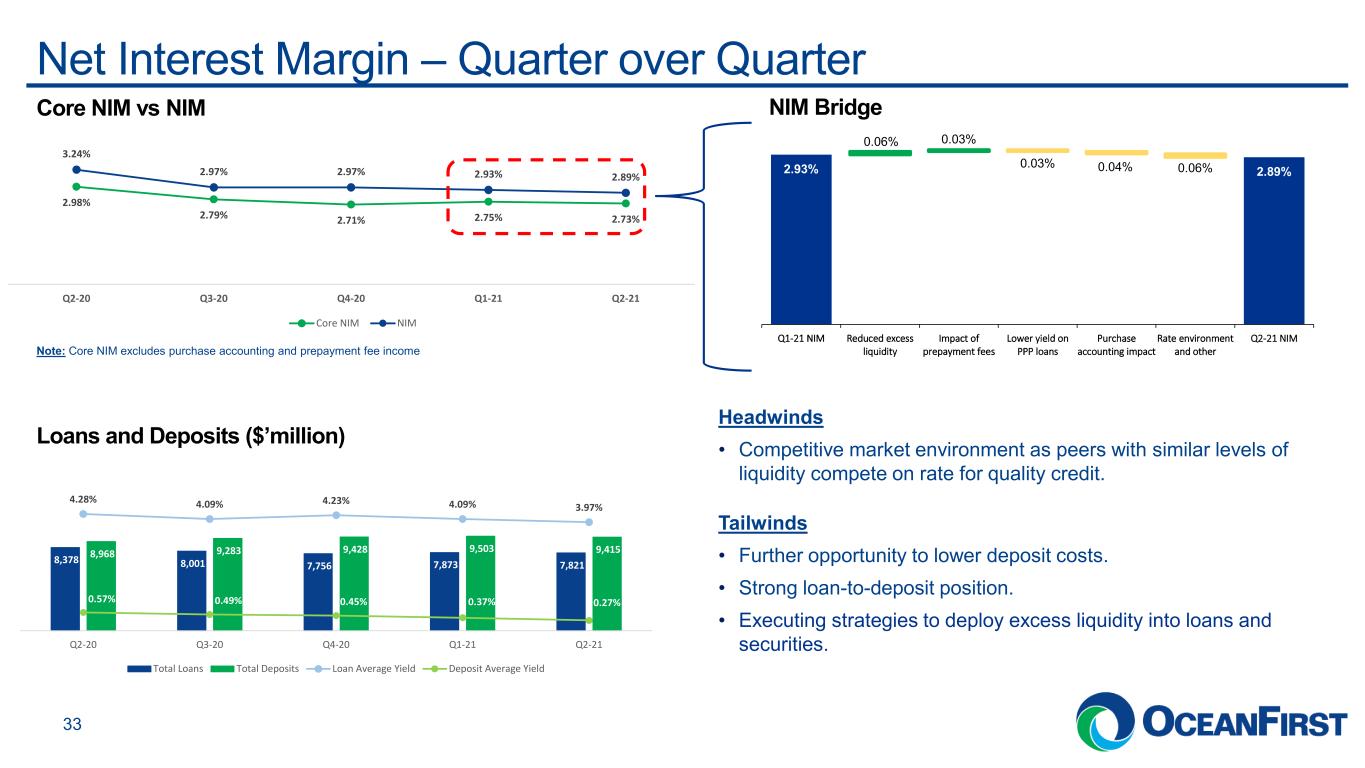

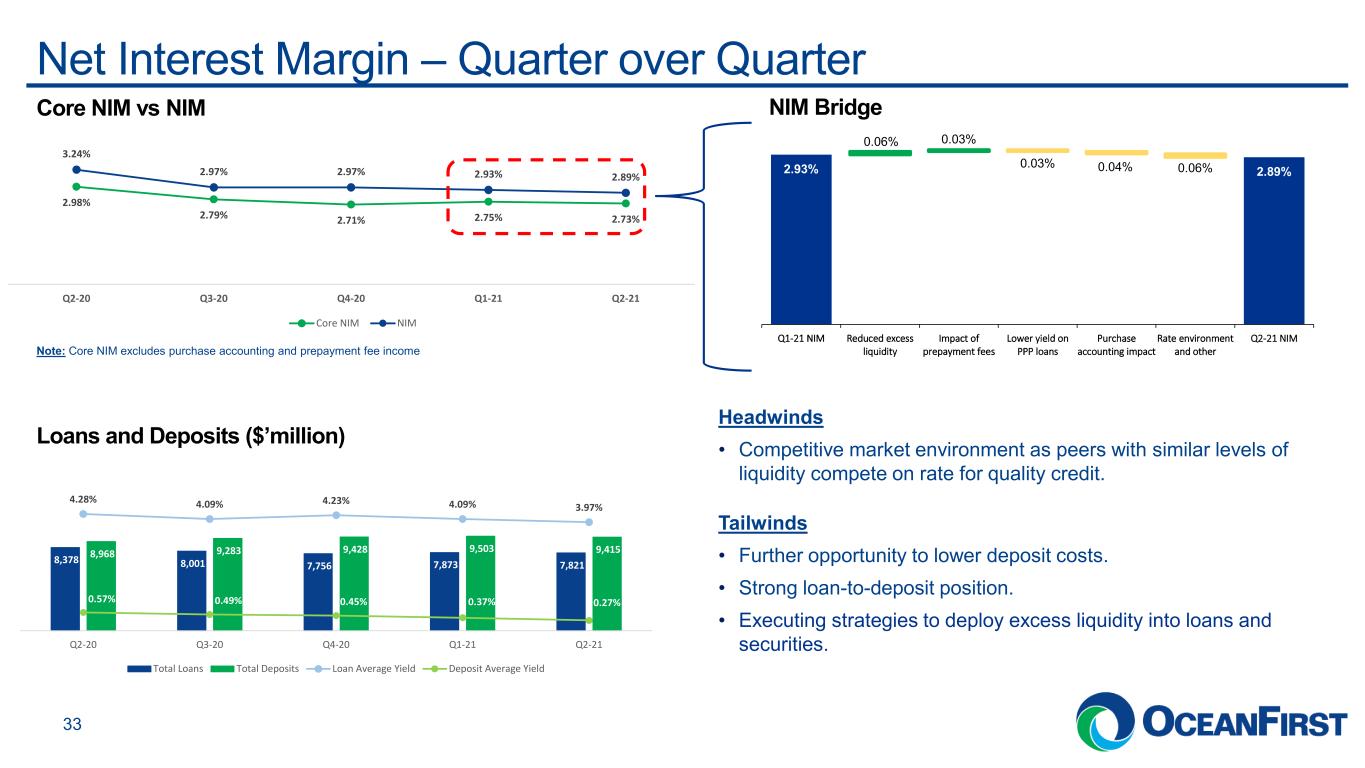

. . . 2.98% 2.79% 2.71% 2.75% 2.73% 3.24% 2.97% 2.97% 2.93% 2.89% Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Core NIM NIM 2.93% 2.89% 0.06% 0.03% 0.03% 0.04% 0.06% Q1-21 NIM Reduced excess liquidity Impact of prepayment fees Lower yield on PPP loans Purchase accounting impact Rate environment and other Q2-21 NIM Core NIM vs NIM Net Interest Margin – Quarter over Quarter 33 Headwinds • Competitive market environment as peers with similar levels of liquidity compete on rate for quality credit. Tailwinds • Further opportunity to lower deposit costs. • Strong loan-to-deposit position. • Executing strategies to deploy excess liquidity into loans and securities. Note: Core NIM excludes purchase accounting and prepayment fee income Loans and Deposits ($’million) NIM Bridge 8,378 8,001 7,756 7,873 7,821 8,968 9,283 9,428 9,503 9,415 4.28% 4.09% 4.23% 4.09% 3.97% 0.57% 0.49% 0.45% 0.37% 0.27% Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Total Loans Total Deposits Loan Average Yield Deposit Average Yield

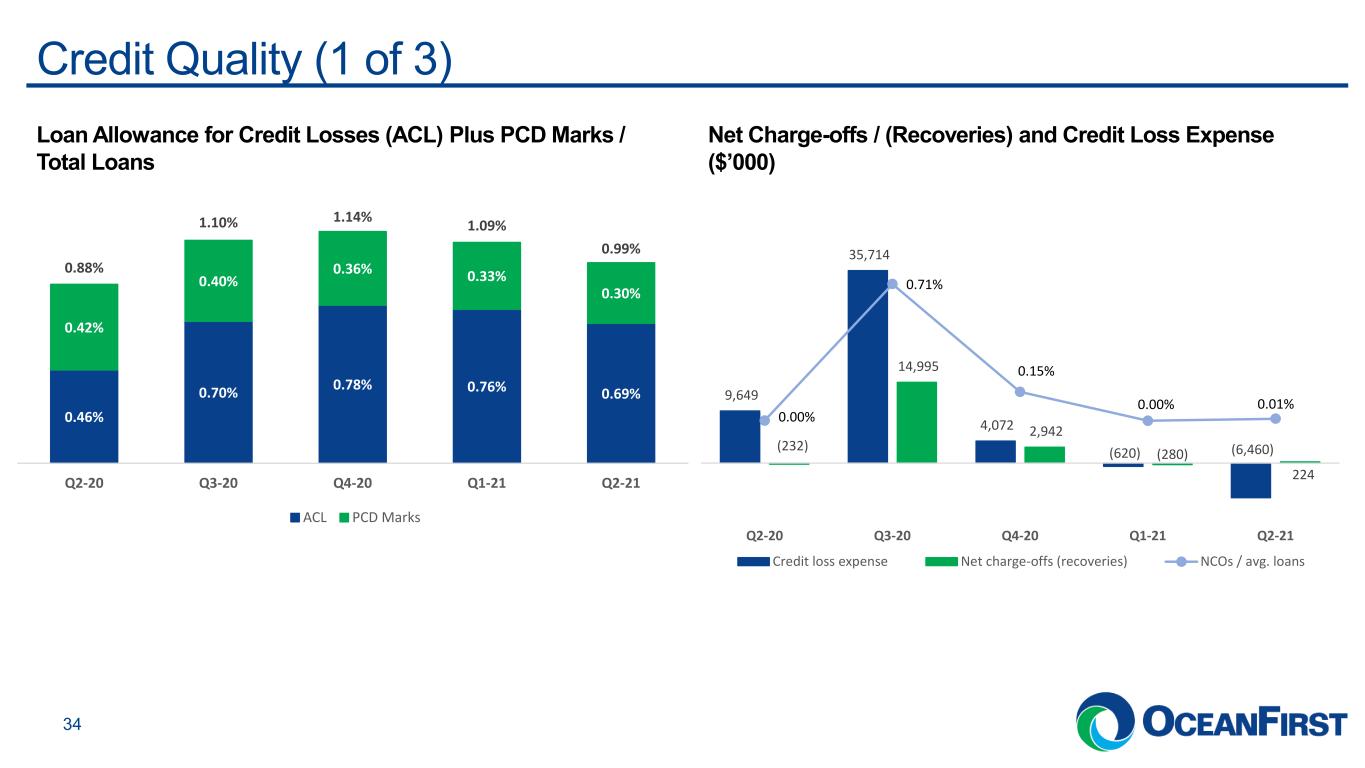

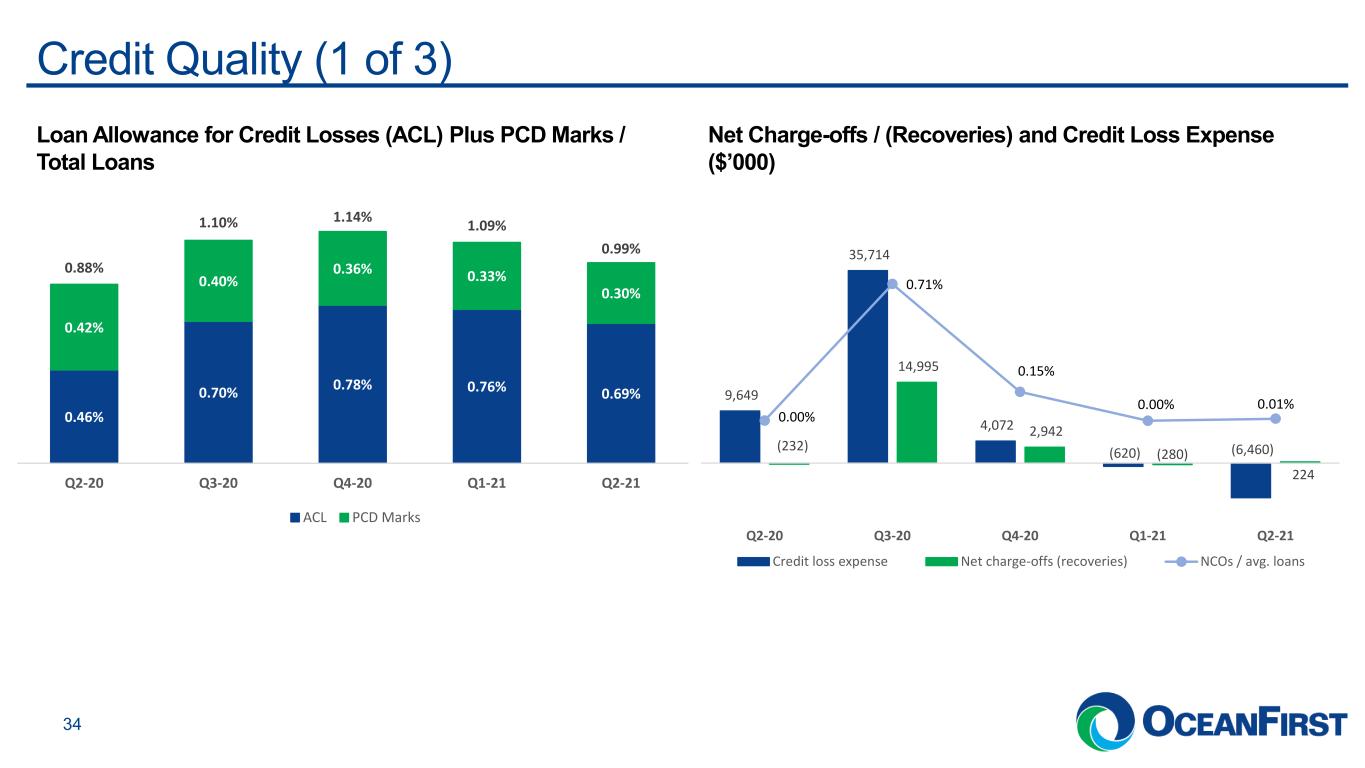

. . . 0.46% 0.70% 0.78% 0.76% 0.69% 0.42% 0.40% 0.36% 0.33% 0.30% 0.88% 1.10% 1.14% 1.09% 0.99% Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 ACL PCD Marks Credit Quality (1 of 3) 34 Loan Allowance for Credit Losses (ACL) Plus PCD Marks / Total Loans Net Charge-offs / (Recoveries) and Credit Loss Expense ($’000) 9,649 35,714 4,072 (620) (6,460)(232) 14,995 2,942 (280) 224 0.00% 0.71% 0.15% 0.00% 0.01% Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Credit loss expense Net charge-offs (recoveries) NCOs / avg. loans

. . . Stabilizing asset quality trends align with positive economic outlook and recovery of our local markets. 106,344 175,979 194,372 188,981 182,926 66,441 141,467 165,844 150,221 129,955 Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Substandard Special Mention Credit Quality (2 of 3) 35 21,044 29,895 36,410 34,128 31,680 248 106 106 106 106 0.25% 0.37% 0.47% 0.43% 0.41% 0.19% 0.84% 0.32% 0.30% 0.28% Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Non-performing loans HFI OREO Non-performing loans HFI to total loans Non-performing assets to total assets Non-Performing Loans Held-for-Investment (HFI) and Assets ($’000) Special Mention and Substandard Loans ($’000) Note: At 9/30/20 the Bank had an additional $67.5 million in non-performing loans held-for-sale driving a significant jump in non-performing assets to total assets. Loan sales were completed in Q4-20 at pricing consistent with their holding valuations. Note: Of the $130.0 million in Special Mention loans and $182.9 million of Substandard loans, $127.7 million (or 98.3%) and $158.9 million (or 86.9%) are paying current, respectively.

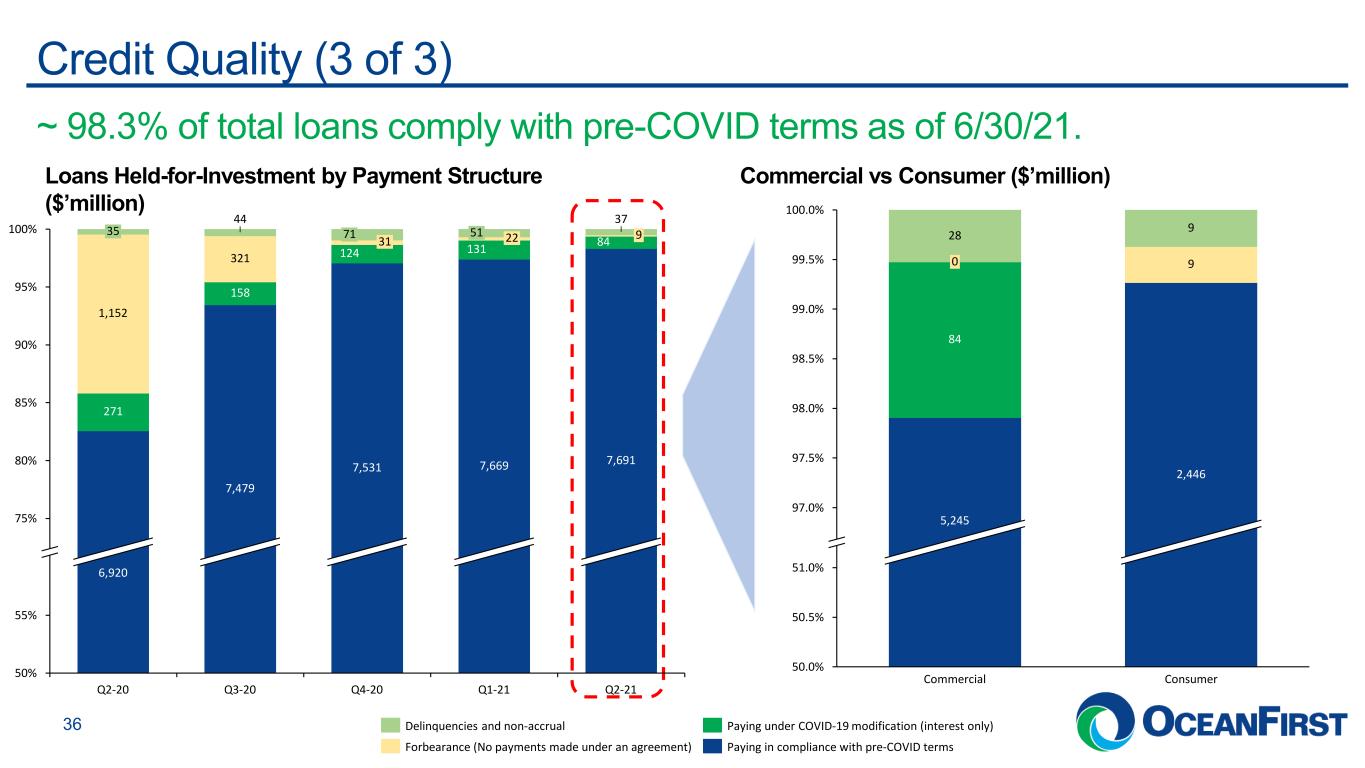

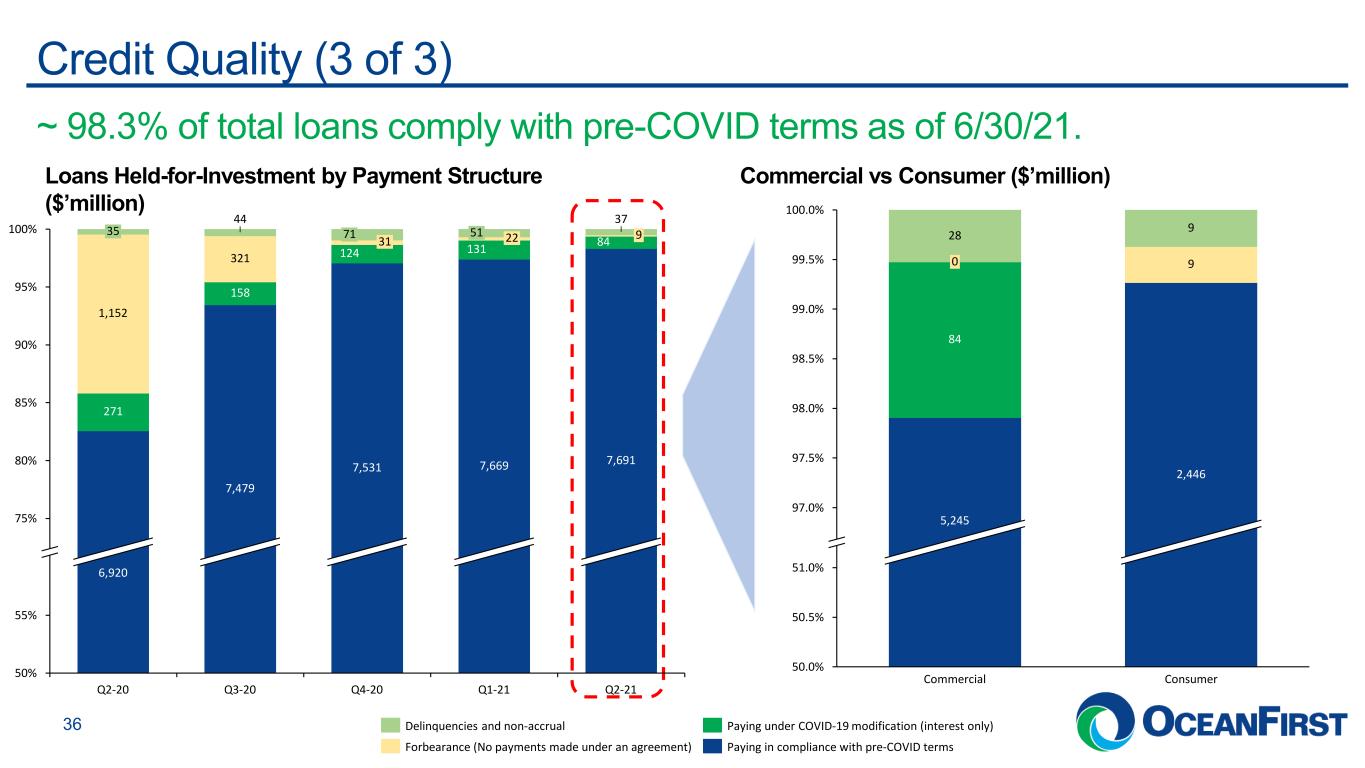

. . .Credit Quality (3 of 3) 36 Commercial vs Consumer ($’million)Loans Held-for-Investment by Payment Structure ($’million) ~ 98.3% of total loans comply with pre-COVID terms as of 6/30/21. 85% 50% 100% 95% 90% 80% 75% 55% 931 7,531 35 51 271 37 84131 22 7,691 Q3-20 158 321 6,920 Q2-21 7,479 Q4-20 Q1-21 124 Q2-20 44 71 7,669 1,152 Delinquencies and non-accrual Paying in compliance with pre-COVID termsForbearance (No payments made under an agreement) Paying under COVID-19 modification (interest only) 99.5% 99.0% 50.0% 98.0% 97.5% 98.5% 50.5% 97.0% 51.0% 100.0% 5,245 928 Commercial 9 2,446 0 84 Consumer

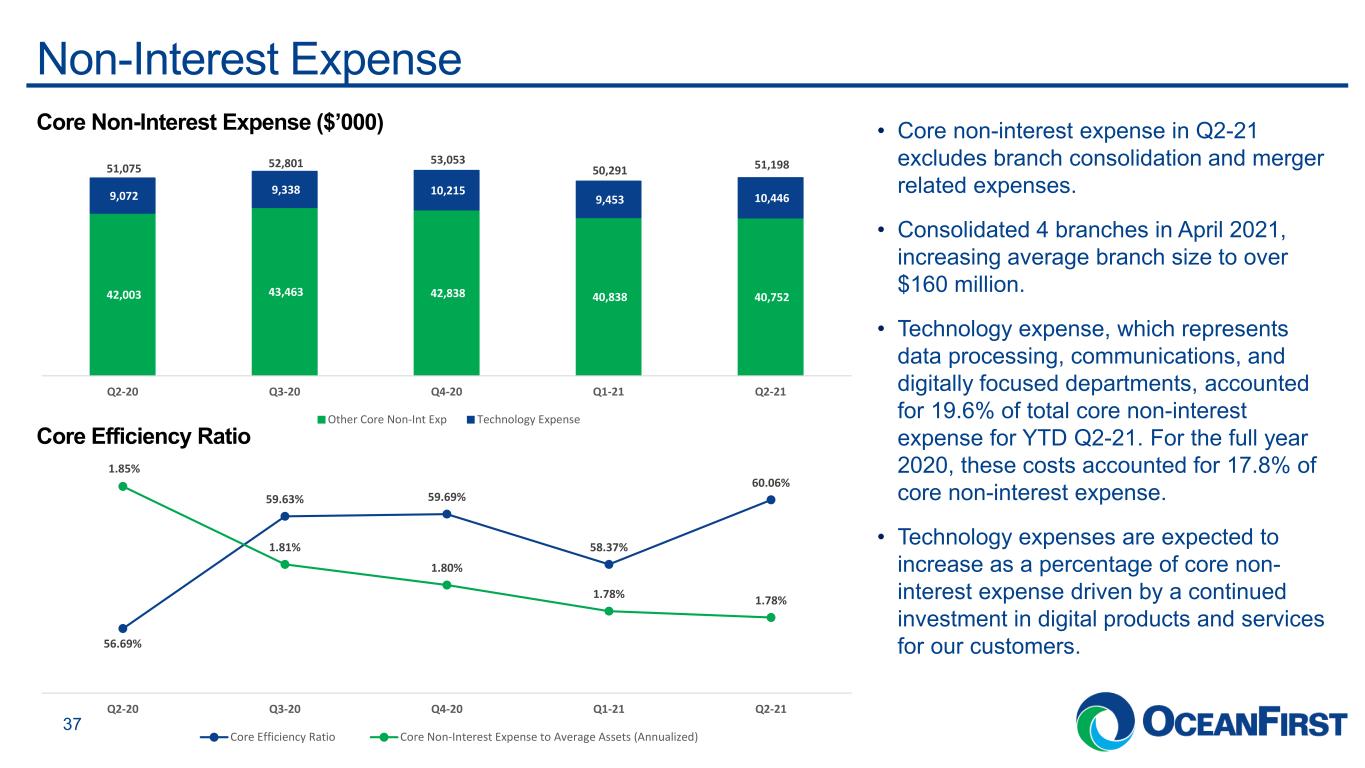

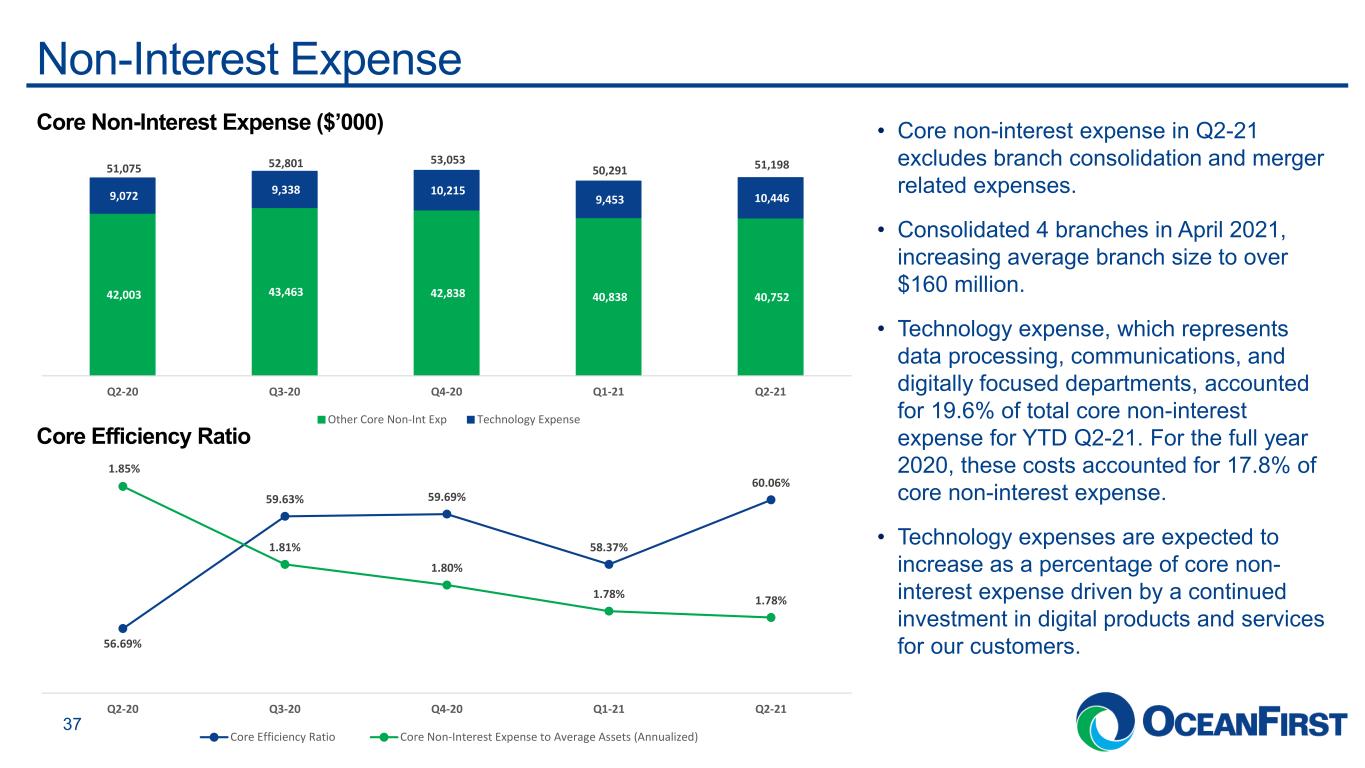

. . .Non-Interest Expense 37 Core Non-Interest Expense ($’000) 42,003 43,463 42,838 40,838 40,752 9,072 9,338 10,215 9,453 10,446 51,075 52,801 53,053 50,291 51,198 Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Other Core Non-Int Exp Technology Expense Core Efficiency Ratio • Core non-interest expense in Q2-21 excludes branch consolidation and merger related expenses. • Consolidated 4 branches in April 2021, increasing average branch size to over $160 million. • Technology expense, which represents data processing, communications, and digitally focused departments, accounted for 19.6% of total core non-interest expense for YTD Q2-21. For the full year 2020, these costs accounted for 17.8% of core non-interest expense. • Technology expenses are expected to increase as a percentage of core non- interest expense driven by a continued investment in digital products and services for our customers.56.69% 59.63% 59.69% 58.37% 60.06% 1.85% 1.81% 1.80% 1.78% 1.78% Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Core Efficiency Ratio Core Non-Interest Expense to Average Assets (Annualized)

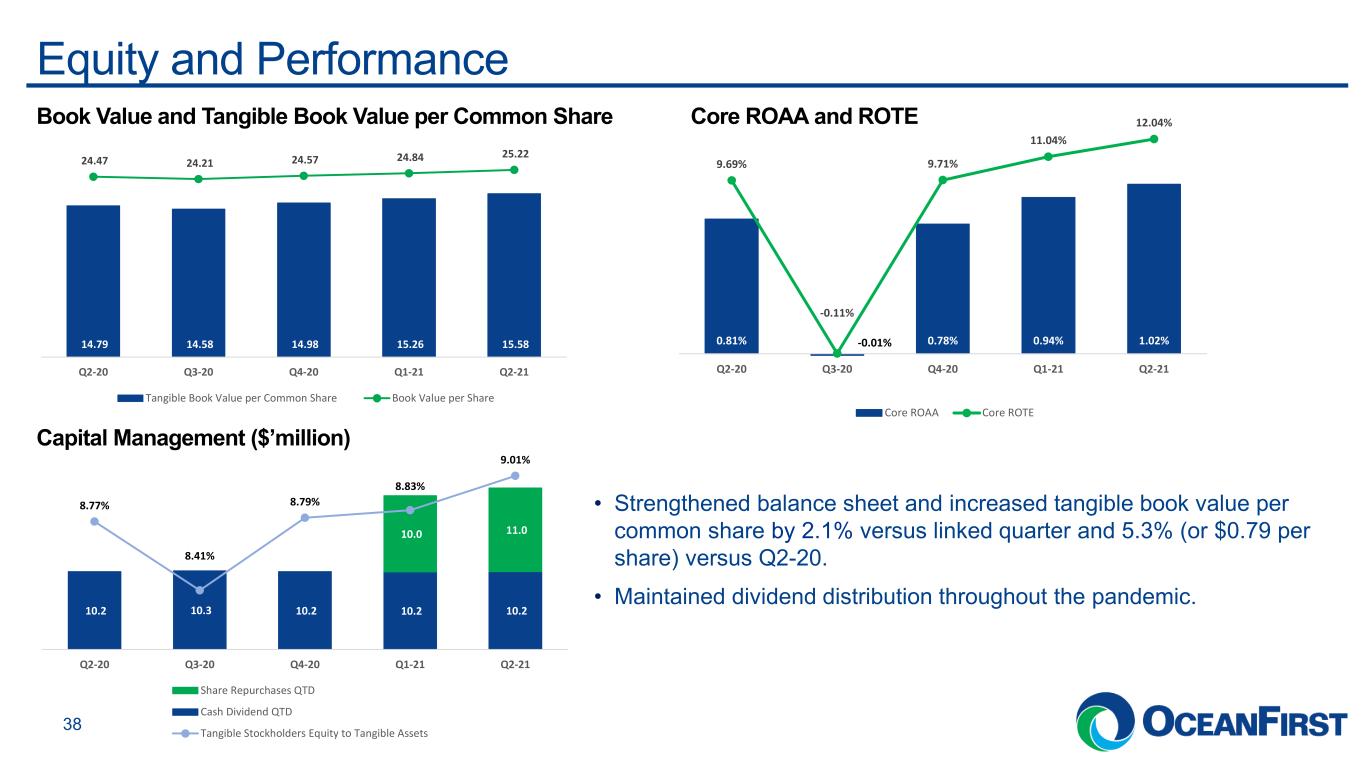

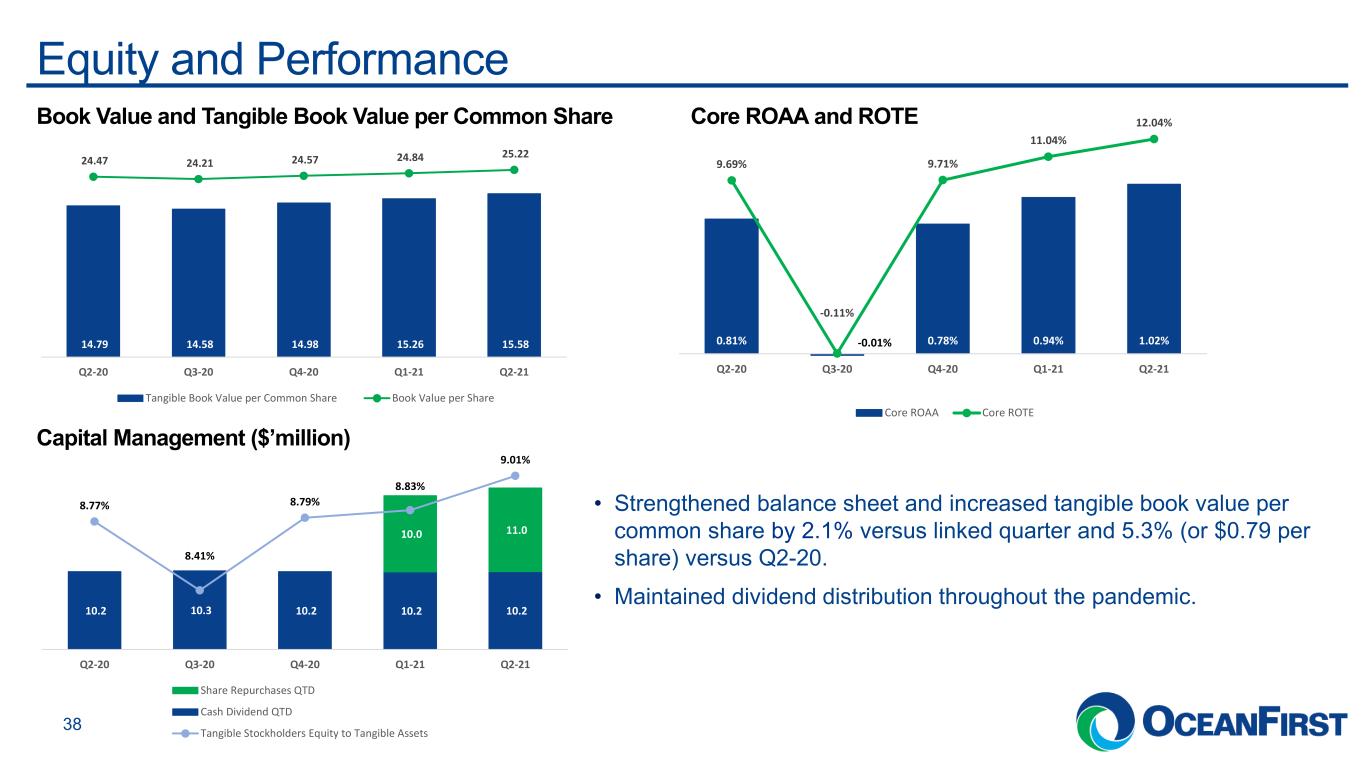

. . .Equity and Performance 38 14.79 14.58 14.98 15.26 15.58 24.47 24.21 24.57 24.84 25.22 Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Tangible Book Value per Common Share Book Value per Share Book Value and Tangible Book Value per Common Share Core ROAA and ROTE • Strengthened balance sheet and increased tangible book value per common share by 2.1% versus linked quarter and 5.3% (or $0.79 per share) versus Q2-20. • Maintained dividend distribution throughout the pandemic. 10.2 10.3 10.2 10.2 10.2 10.0 11.0 8.77% 8.41% 8.79% 8.83% 9.01% Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Share Repurchases QTD Cash Dividend QTD Tangible Stockholders Equity to Tangible Assets Capital Management ($’million) 0.81% -0.01% 0.78% 0.94% 1.02% 9.69% -0.11% 9.71% 11.04% 12.04% Q2-20 Q3-20 Q4-20 Q1-21 Q2-21 Core ROAA Core ROTE

. . . Appendix

. . .Quarterly Non-GAAP / Adjusted to GAAP Disclosure Reported amounts are presented in accordance with generally accepted accounting principles in the United States (“GAAP”). The Company’s management believes that the supplemental Non-GAAP information, which consists of reported net income excluding non-core operations, which can vary from period to period, provides a better comparison of period to period operating performance. Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for financial results in accordance with GAAP, nor are they necessarily comparable to Non-GAAP performance measures which may be presented by other companies. 40

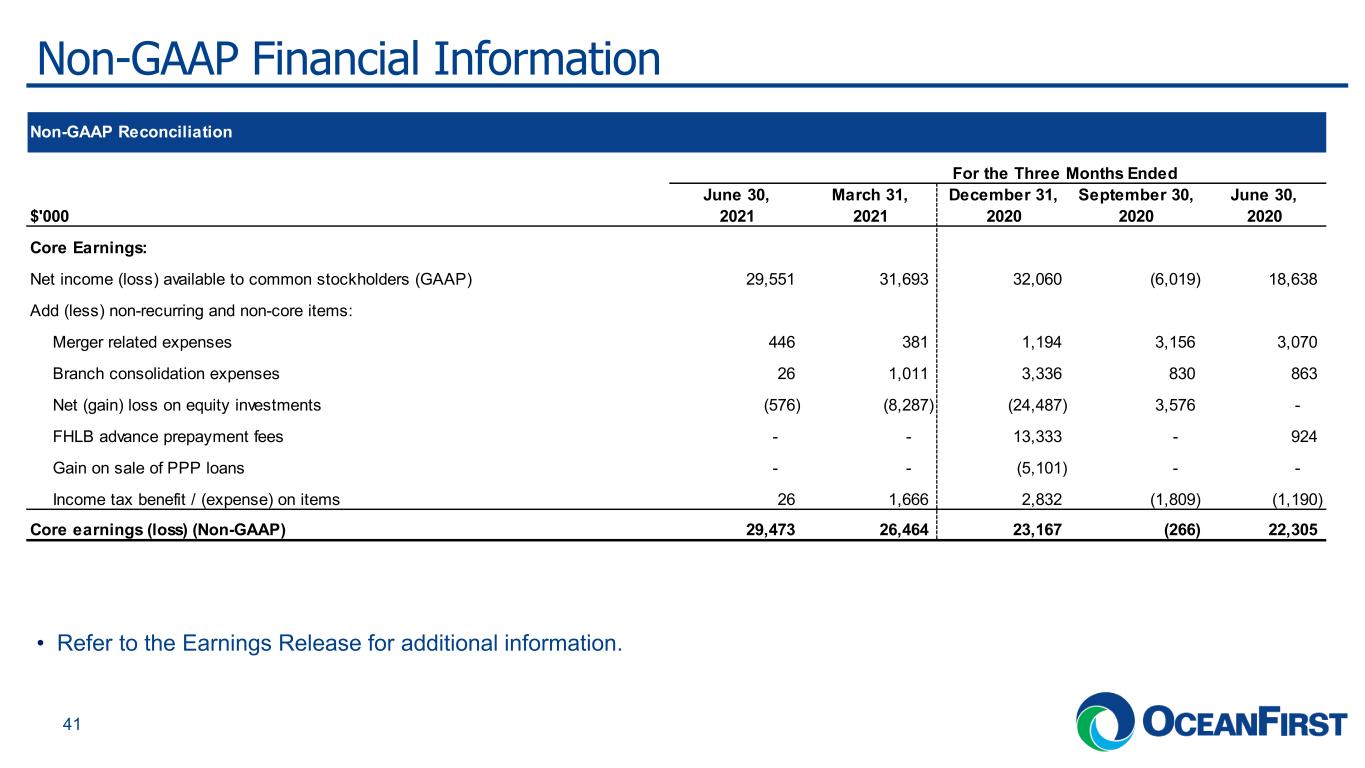

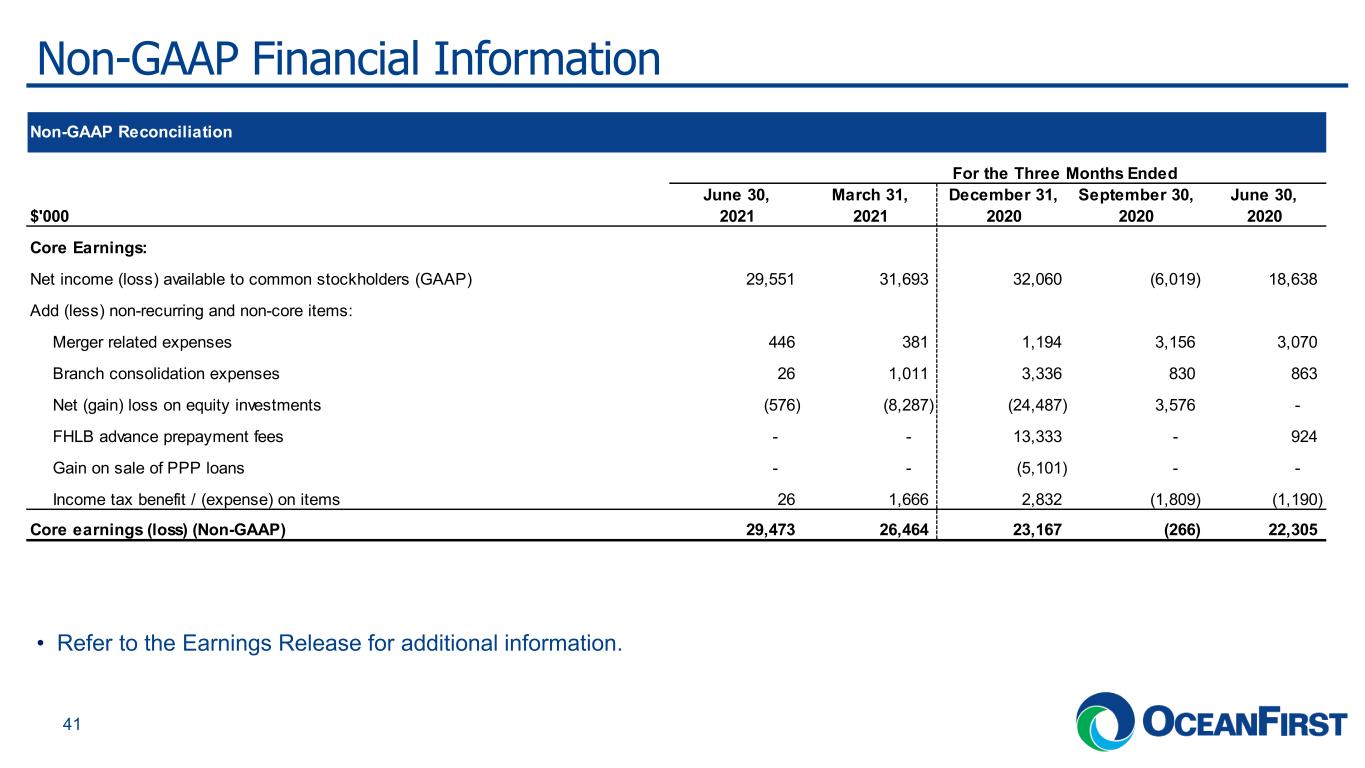

. . .Non-GAAP Financial Information 41 • Refer to the Earnings Release for additional information. Non-GAAP Reconciliation For the Three Months Ended $'000 June 30, 2021 March 31, 2021 December 31, 2020 September 30, 2020 June 30, 2020 Core Earnings: Net income (loss) available to common stockholders (GAAP) 29,551 31,693 32,060 (6,019) 18,638 Add (less) non-recurring and non-core items: Merger related expenses 446 381 1,194 3,156 3,070 Branch consolidation expenses 26 1,011 3,336 830 863 Net (gain) loss on equity investments (576) (8,287) (24,487) 3,576 - FHLB advance prepayment fees - - 13,333 - 924 Gain on sale of PPP loans - - (5,101) - - Income tax benefit / (expense) on items 26 1,666 2,832 (1,809) (1,190) Core earnings (loss) (Non-GAAP) 29,473 26,464 23,167 (266) 22,305