. . . 1 The 3Q 2021 Investor Presentation is for the purpose and use in conjunction with the Earnings Release furnished as Exhibit 99.1 to Form 8-K on October 28, 2021. Exhibit 99.2 OceanFirst Financial Corp. 3Q 2021 Investor Presentation1 October 2021

. . .Legal Disclaimer FORWARD LOOKING STATEMENTS. In addition to historical information, this news release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 which are based on certain assumptions and describe future plans, strategies and expectations of OceanFirst Financial Corp. (the Company) and its wholly-owned subsidiary, OceanFirst Bank N.A. (the Bank). These forward-looking statements are generally identified by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “will,” “should,” “may,” “view,” “opportunity,” “potential,” or similar expressions or expressions of confidence. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations of the Company and its subsidiaries include, but are not limited to: the impact of the COVID-19 pandemic on our operations and financial results and those of our customers, changes in interest rates, general economic conditions, levels of unemployment in the Bank’s lending area, real estate market values in the Bank’s lending area, future natural disasters and increases to flood insurance premiums, the level of prepayments on loans and mortgage-backed securities, legislative/regulatory changes, monetary and fiscal policies of the U.S. Government including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System, the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand for financial services in the Company’s market area, accounting principles and guidelines and the Bank’s ability to successfully integrate acquired operations. These risks and uncertainties are further discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020, under Item 1A - Risk Factors and elsewhere, and subsequent securities filings and should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. NON-GAAP FINANCIAL INFORMATION. This presentation contains certain non-GAAP (generally accepted accounting principles) measures. These non-GAAP measures, as calculated by the Company, are not necessarily comparable to similarly titled measures reported by other companies. Additionally, these non-GAAP measures are not measures of financial performance or liquidity under GAAP and should not be considered alternatives to the Company's other financial information determined under GAAP. See reconciliations of certain non-GAAP measures included at the end of this presentation. MARKET AND INDUSTRY DATA. This presentation references certain market, industry and demographic data, forecasts and other statistical information. We have obtained this data, forecasts and information from various independent, third-party industry sources and publications. Nothing in the data, forecasts or information used or derived from third party sources should be construed as advice. Some data and other information are also based on our good faith estimates, which are derived from our review of industry publications and surveys and independent sources. We believe that these sources and estimates are reliable but have not independently verified them. Statements as to our market position are based on market data currently available to us. These estimates involve inherent risks and uncertainties and are based on assumptions that are subject to change. 2

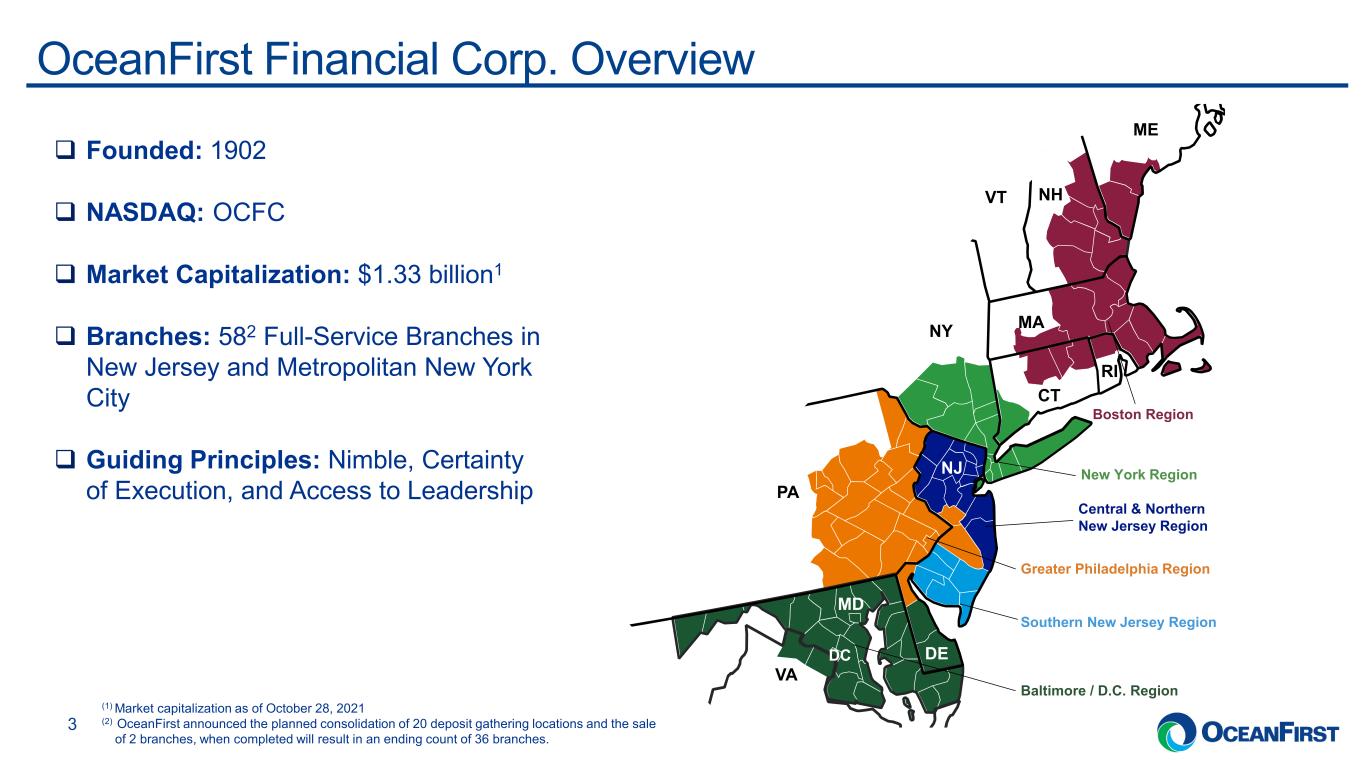

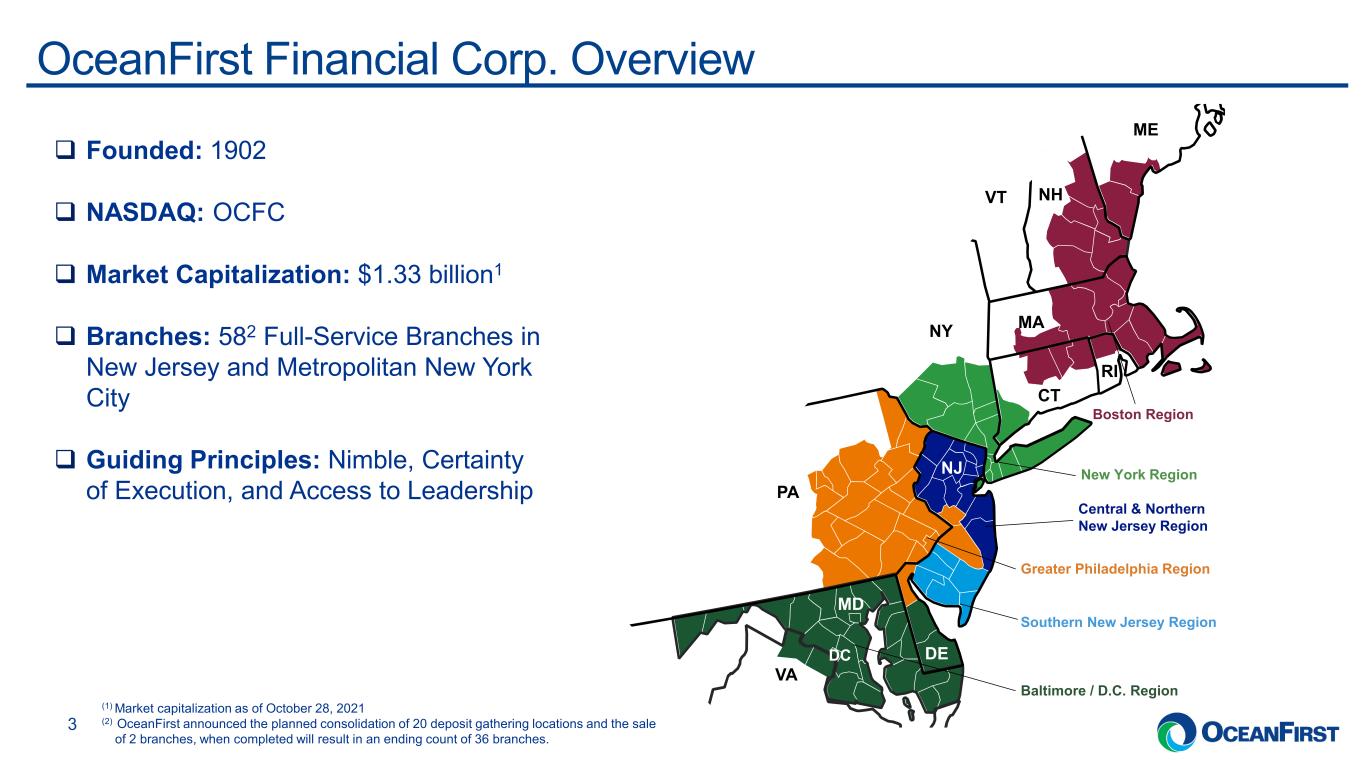

. . .OceanFirst Financial Corp. Overview 3 Founded: 1902 NASDAQ: OCFC Market Capitalization: $1.33 billion1 Branches: 582 Full-Service Branches in New Jersey and Metropolitan New York City Guiding Principles: Nimble, Certainty of Execution, and Access to Leadership (1) Market capitalization as of October 28, 2021 (2) OceanFirst announced the planned consolidation of 20 deposit gathering locations and the sale of 2 branches, when completed will result in an ending count of 36 branches. VA PA NY MA CT RI MD DC DE NJ NH ME VT Central & Northern New Jersey Region Southern New Jersey Region Greater Philadelphia Region New York Region Boston Region Baltimore / D.C. Region

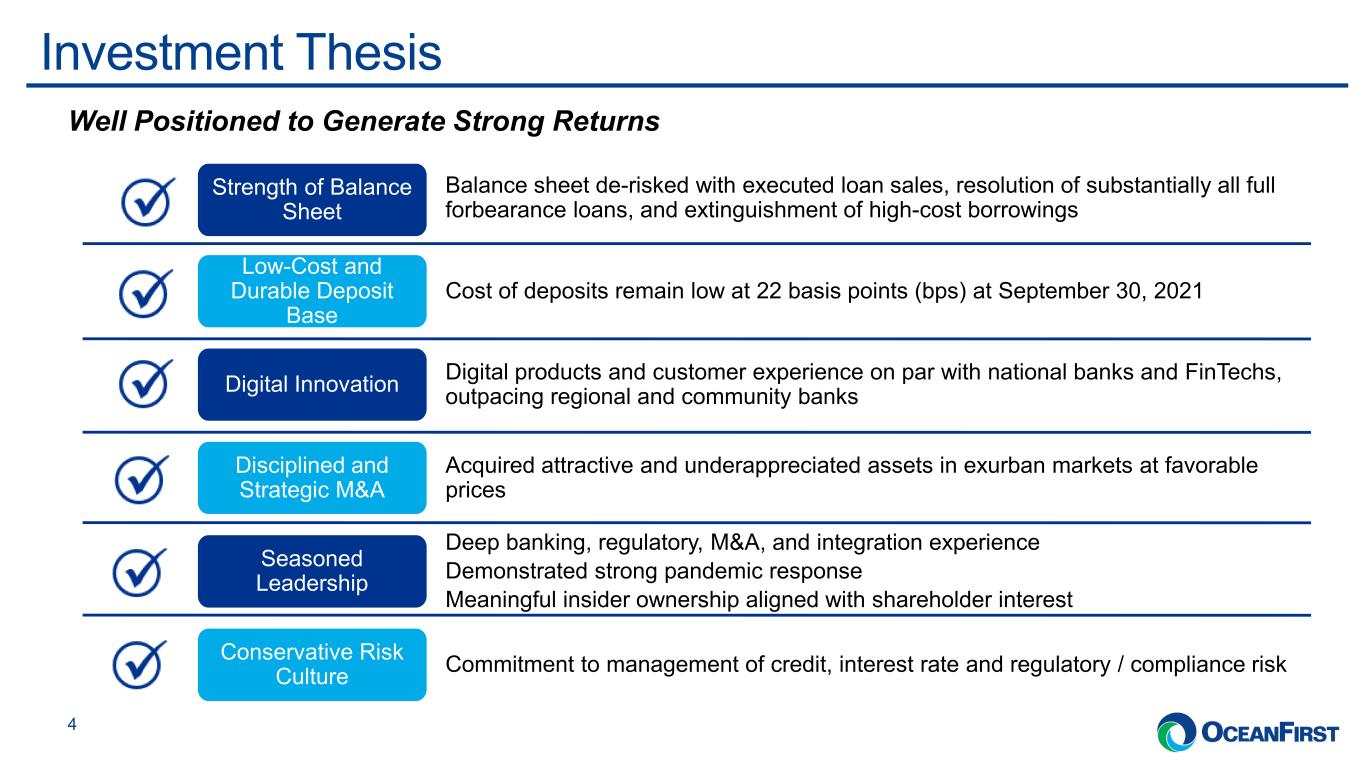

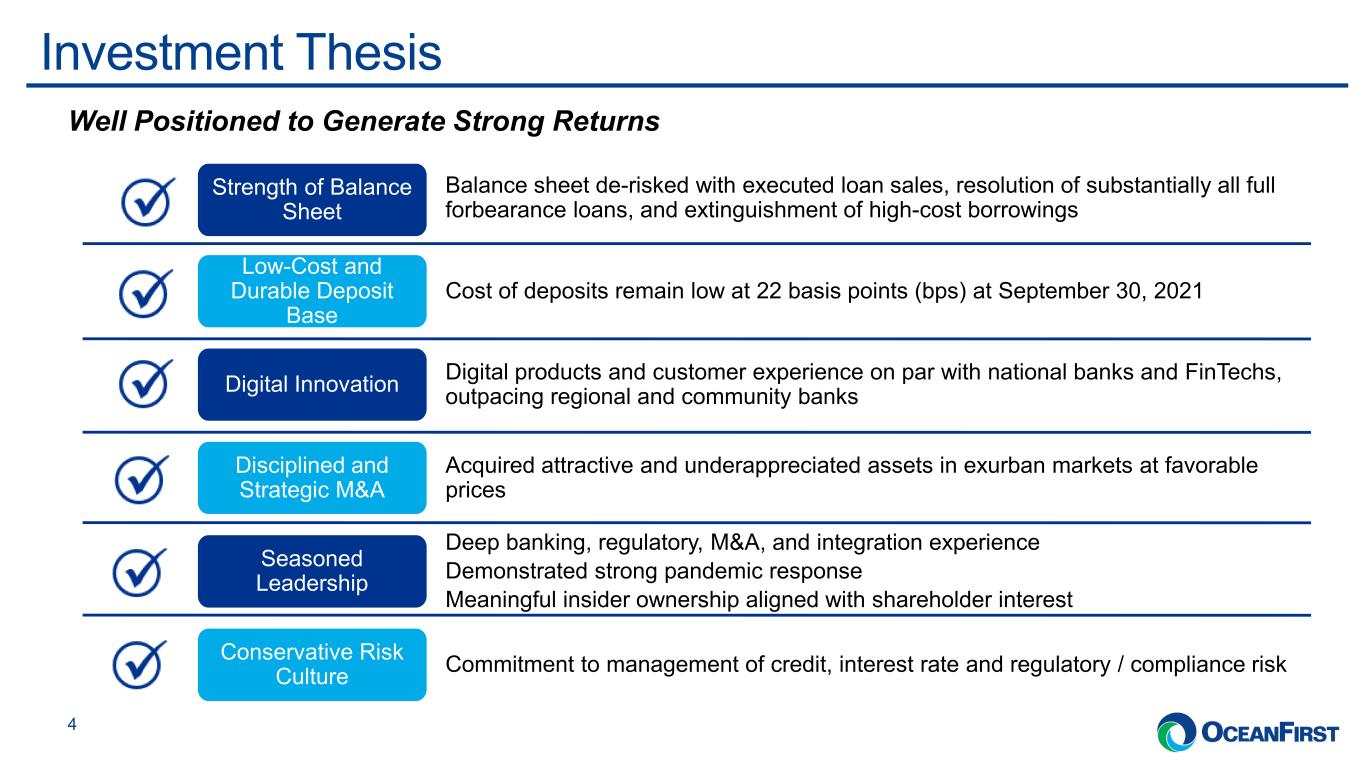

. . .Investment Thesis 4 Balance sheet de-risked with executed loan sales, resolution of substantially all full forbearance loans, and extinguishment of high-cost borrowings Strength of Balance Sheet Cost of deposits remain low at 22 basis points (bps) at September 30, 2021 Low-Cost and Durable Deposit Base Digital products and customer experience on par with national banks and FinTechs, outpacing regional and community banksDigital Innovation Acquired attractive and underappreciated assets in exurban markets at favorable prices Disciplined and Strategic M&A Deep banking, regulatory, M&A, and integration experience Demonstrated strong pandemic response Meaningful insider ownership aligned with shareholder interest Seasoned Leadership Commitment to management of credit, interest rate and regulatory / compliance riskConservative Risk Culture Well Positioned to Generate Strong Returns

. . . I N V E S T O R P R E S E N T A T I O N 5 Quarterly Update

. . . $651.4MM $771.8MM Loan Pipeline Loan Originations Third Quarter 2021 Financial Highlights 6 Key Financial Metrics Strategic and Operational Focus $26.7MM Core Earnings1 $0.39 $0.45 Diluted EPS Core EPS1 0.90% 10.62% Core ROAA1 Core ROATE1 2.93% 62.22% NIM Core Efficiency Ratio1 $15.78 $10.1MM TBV per Share Q3 Dividends Commercial banking team hires in 2021 supporting organic growth and helping to deploy excess liquidity Committing resources to core businesses, loan growth, and digital services Successfully completed a conversion of our core system, allowing us to better serve our customers and markets Optimize branch network to increase efficiencies and improve average deposits by branch to approximately $250 million COVID-19 on-going initiatives for employees, customers, and community $361MM $359MM Loan Growth Deposit Growth (1) Core metrics exclude merger related expenses, branch consolidation expenses, and net loss on equity investments. Refer to the Non-GAAP reconciliation in the Earnings Release for additional information.

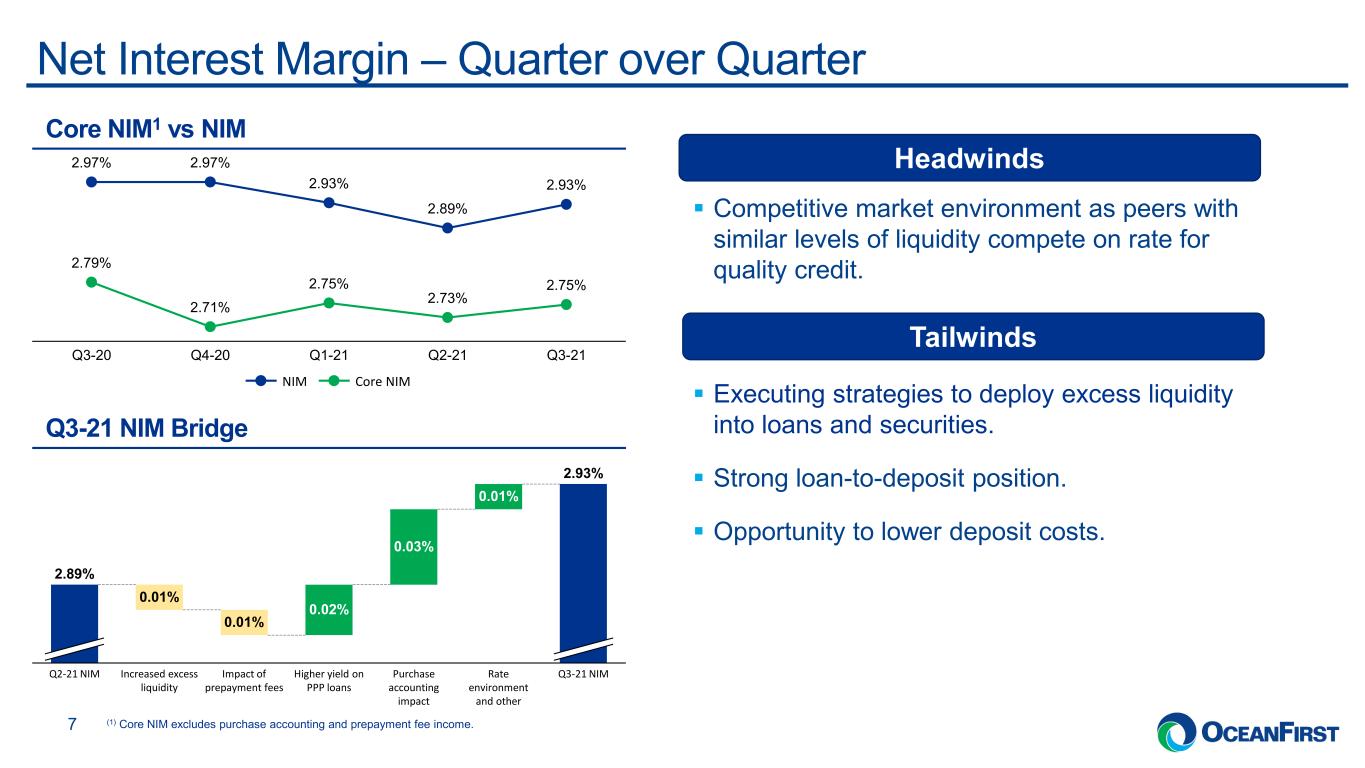

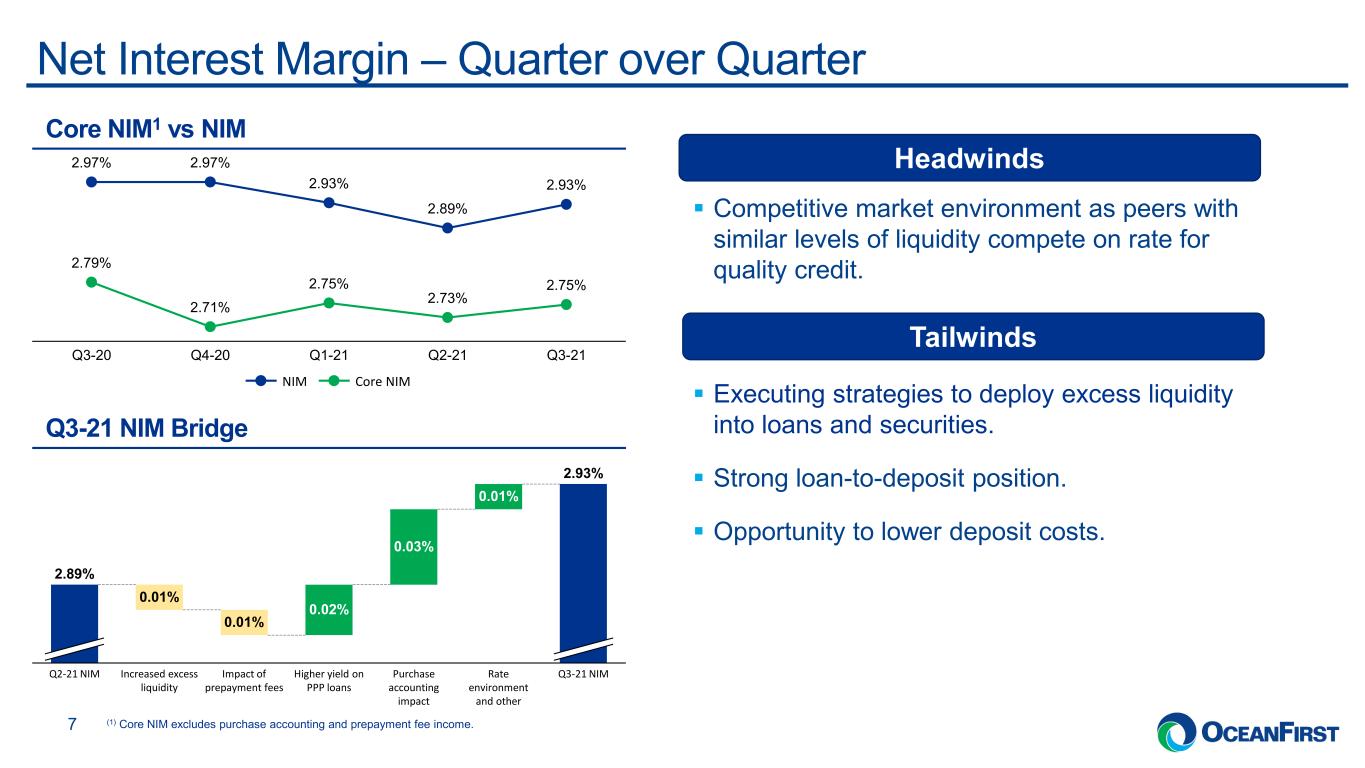

. . .Net Interest Margin – Quarter over Quarter 7 Competitive market environment as peers with similar levels of liquidity compete on rate for quality credit. Executing strategies to deploy excess liquidity into loans and securities. Strong loan-to-deposit position. Opportunity to lower deposit costs. (1) Core NIM excludes purchase accounting and prepayment fee income. Core NIM1 vs NIM Q3-21 NIM Bridge Headwinds Tailwinds Higher yield on PPP loans 2.89% Impact of prepayment fees 2.93% 0.01% Q3-21 NIM 0.01% Q2-21 NIM Rate environment and other Increased excess liquidity 0.02% 0.03% Purchase accounting impact 0.01% Q3-20 2.97% 2.79% 2.75% 2.97% 2.71% Q4-20 2.93% 2.75% Q1-21 2.89% 2.73% 2.93% Q2-21 Q3-21 NIM Core NIM

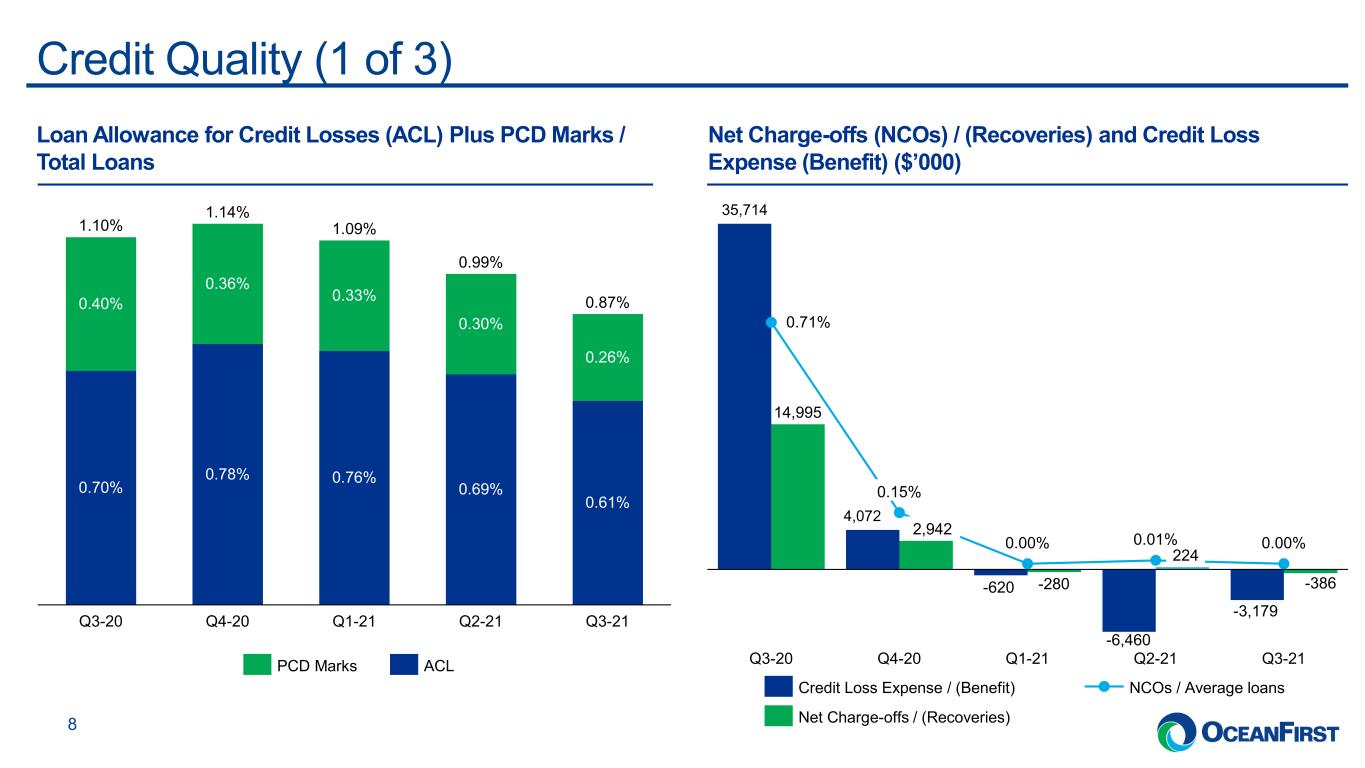

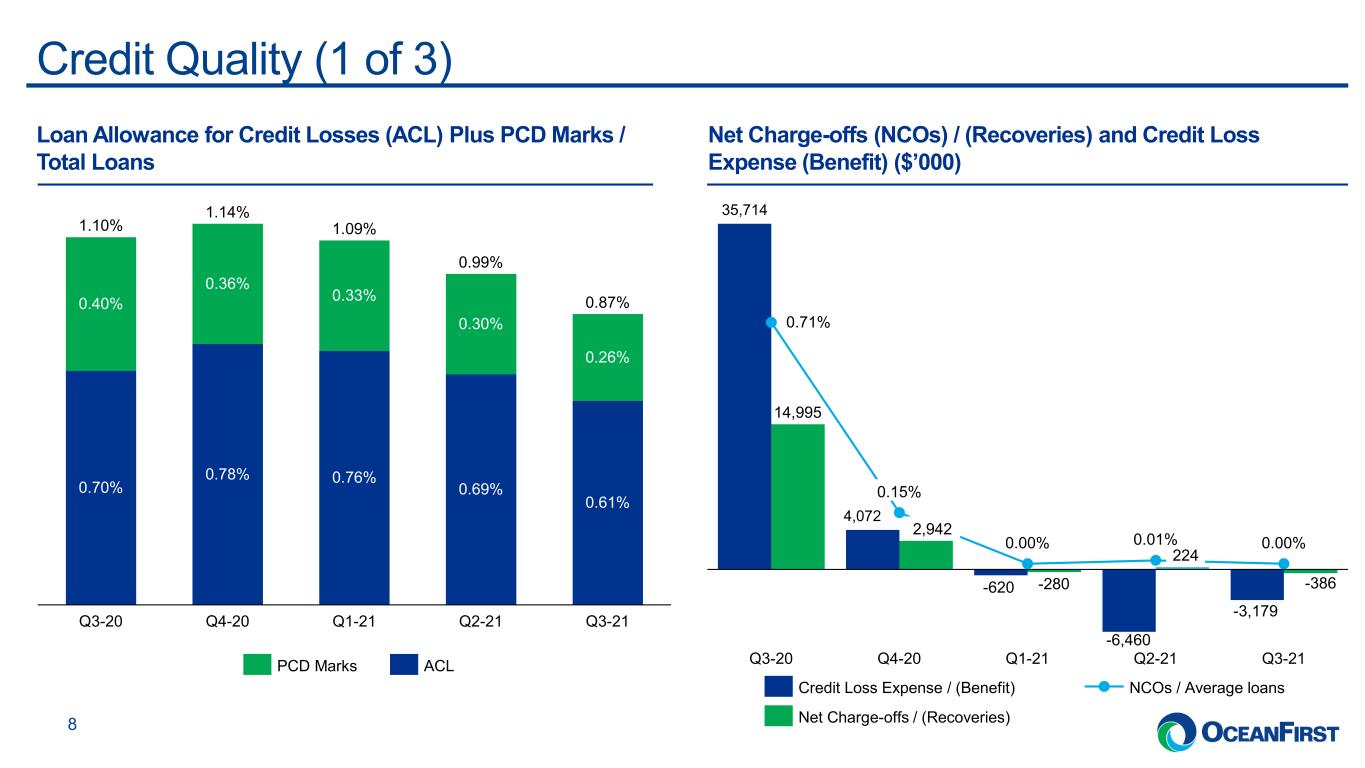

. . .Credit Quality (1 of 3) 8 Loan Allowance for Credit Losses (ACL) Plus PCD Marks / Total Loans Net Charge-offs (NCOs) / (Recoveries) and Credit Loss Expense (Benefit) ($’000) Q3-20 1.09% 0.40% 0.36% 0.70% 0.78% Q4-20 0.76% 0.33% Q1-21 0.30% 0.69% Q2-21 0.26% 0.61% Q3-21 1.10% 1.14% 0.99% 0.87% PCD Marks ACL 35,714 4,072 -386 Q4-20 0.71% 0.01% Q3-20 -280 0.15% Q3-21 -620 0.00% Q1-21 -6,460 224 Q2-21 2,942 -3,179 0.00% 14,995 Credit Loss Expense / (Benefit) Net Charge-offs / (Recoveries) NCOs / Average loans

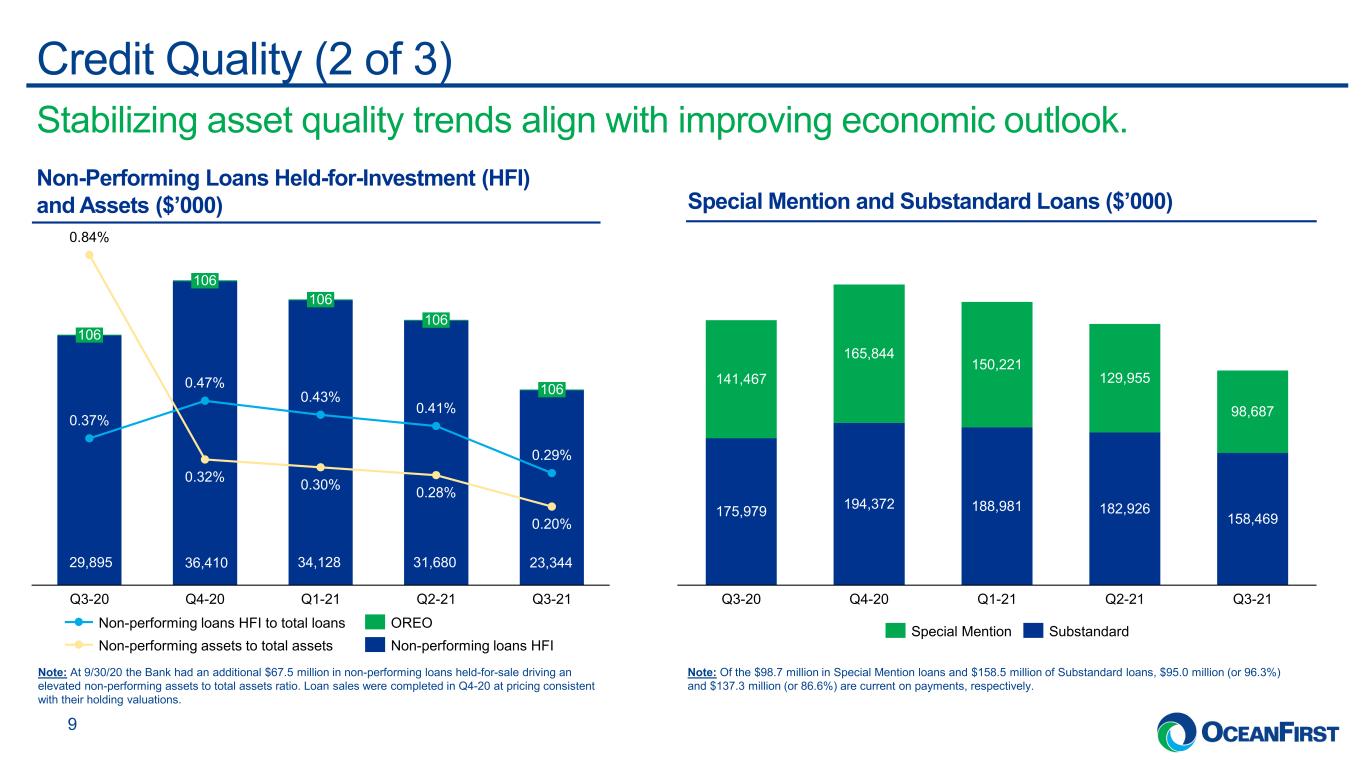

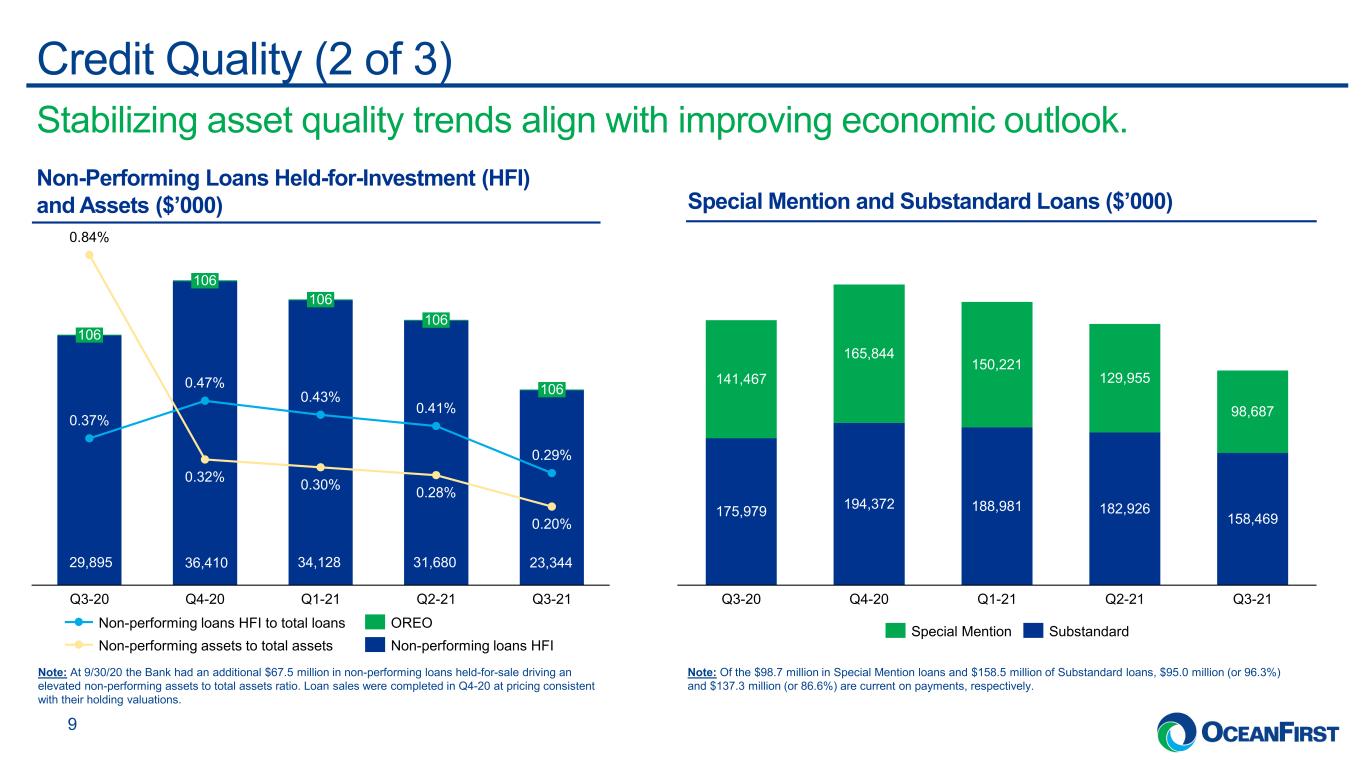

. . . Stabilizing asset quality trends align with improving economic outlook. Credit Quality (2 of 3) 9 Non-Performing Loans Held-for-Investment (HFI) and Assets ($’000) Special Mention and Substandard Loans ($’000) Note: At 9/30/20 the Bank had an additional $67.5 million in non-performing loans held-for-sale driving an elevated non-performing assets to total assets ratio. Loan sales were completed in Q4-20 at pricing consistent with their holding valuations. Note: Of the $98.7 million in Special Mention loans and $158.5 million of Substandard loans, $95.0 million (or 96.3%) and $137.3 million (or 86.6%) are current on payments, respectively. 106 0.37% 0.84% 106 0.32% Q3-20 0.47% 106 Q4-20 0.29% 0.43% 106 0.30% Q3-21 0.28% Q1-21 Q2-21 0.41% 106 0.20% Non-performing loans HFI to total loans Non-performing loans HFI OREO Non-performing assets to total assets 29,895 36,410 34,128 31,680 23,344 175,979 194,372 188,981 182,926 158,469 141,467 165,844 150,221 129,955 98,687 Q3-20 Q2-21Q4-20 Q1-21 Q3-21 Special Mention Substandard

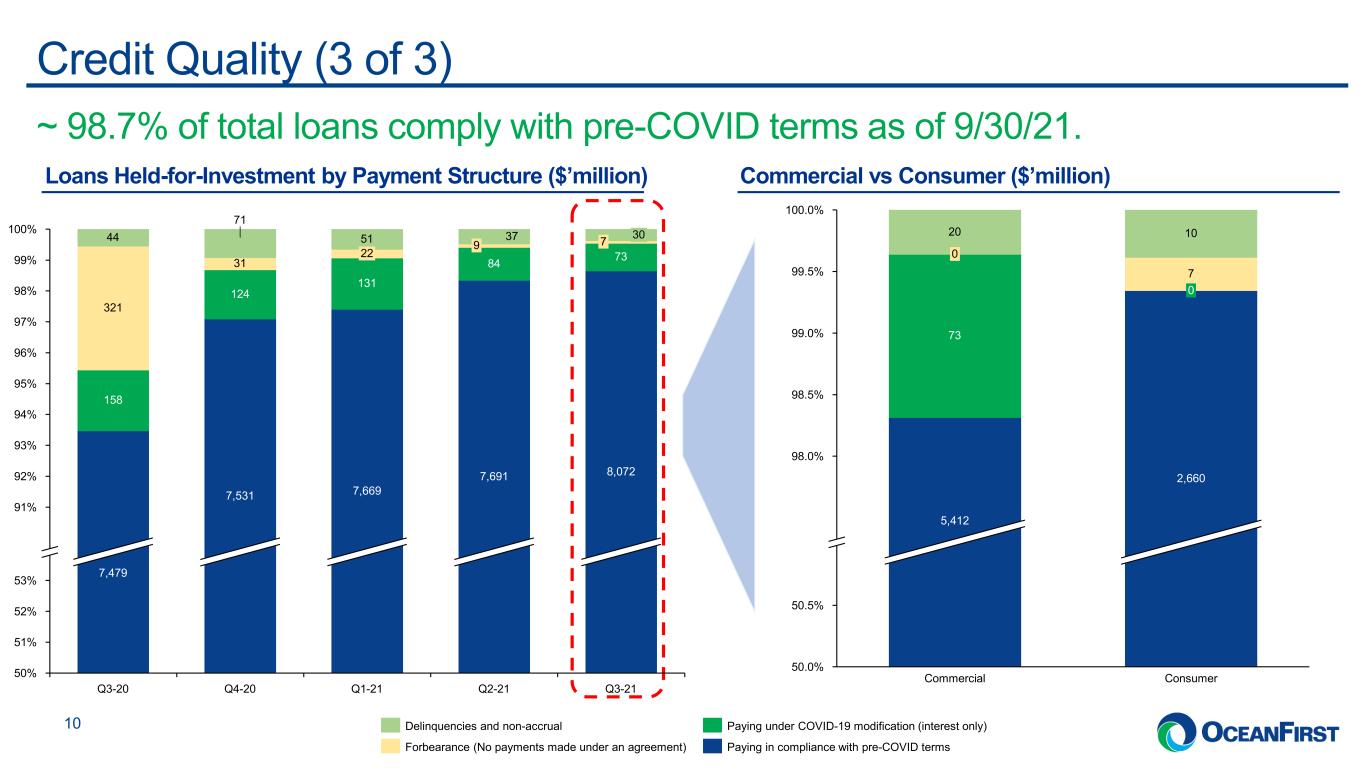

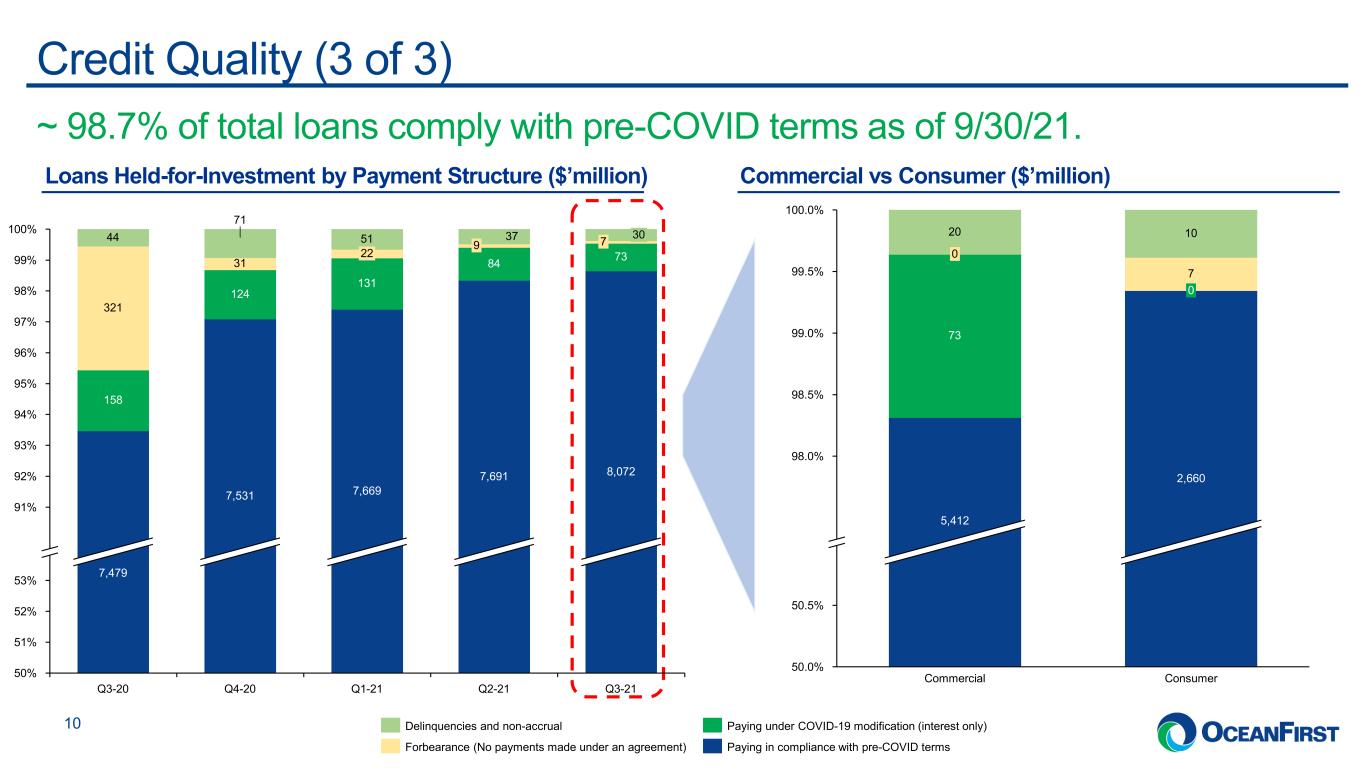

. . .Credit Quality (3 of 3) 10 Commercial vs Consumer ($’million)Loans Held-for-Investment by Payment Structure ($’million) ~ 98.7% of total loans comply with pre-COVID terms as of 9/30/21. 91% 52% 96% 98% 95% 51% 92% 100% 94% 97% 53% 99% 93% 50% 37 951 7,691 Q4-20 Q2-21 31 22 7,531 131 44 71 Q3-20 7,479 124 84 321 8,072 73 158 30 Q3-21Q1-21 7,669 7 Delinquencies and non-accrual Forbearance (No payments made under an agreement) Paying under COVID-19 modification (interest only) Paying in compliance with pre-COVID terms 99.5% 98.0% 100.0% 98.5% 99.0% 50.0% 50.5% Commercial 10 7 Consumer 73 2,660 20 0 5,412 0

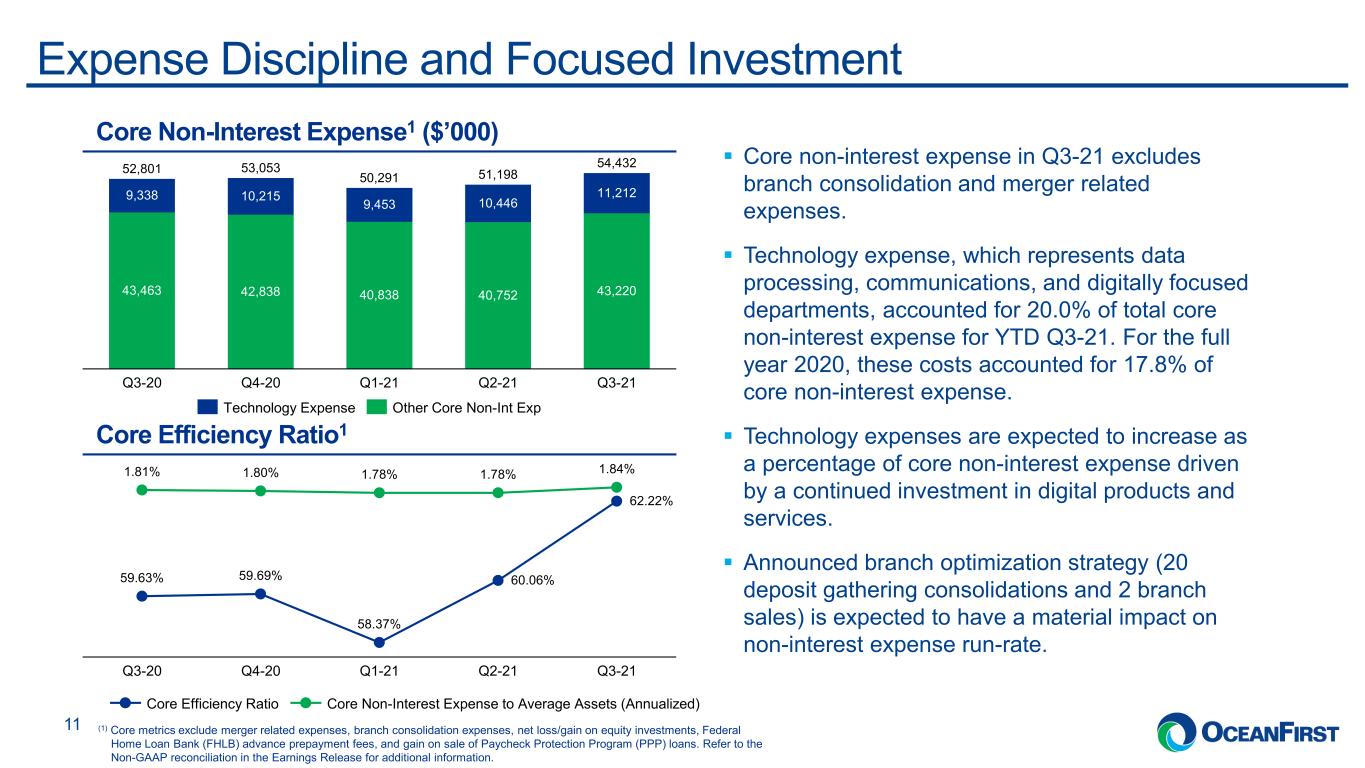

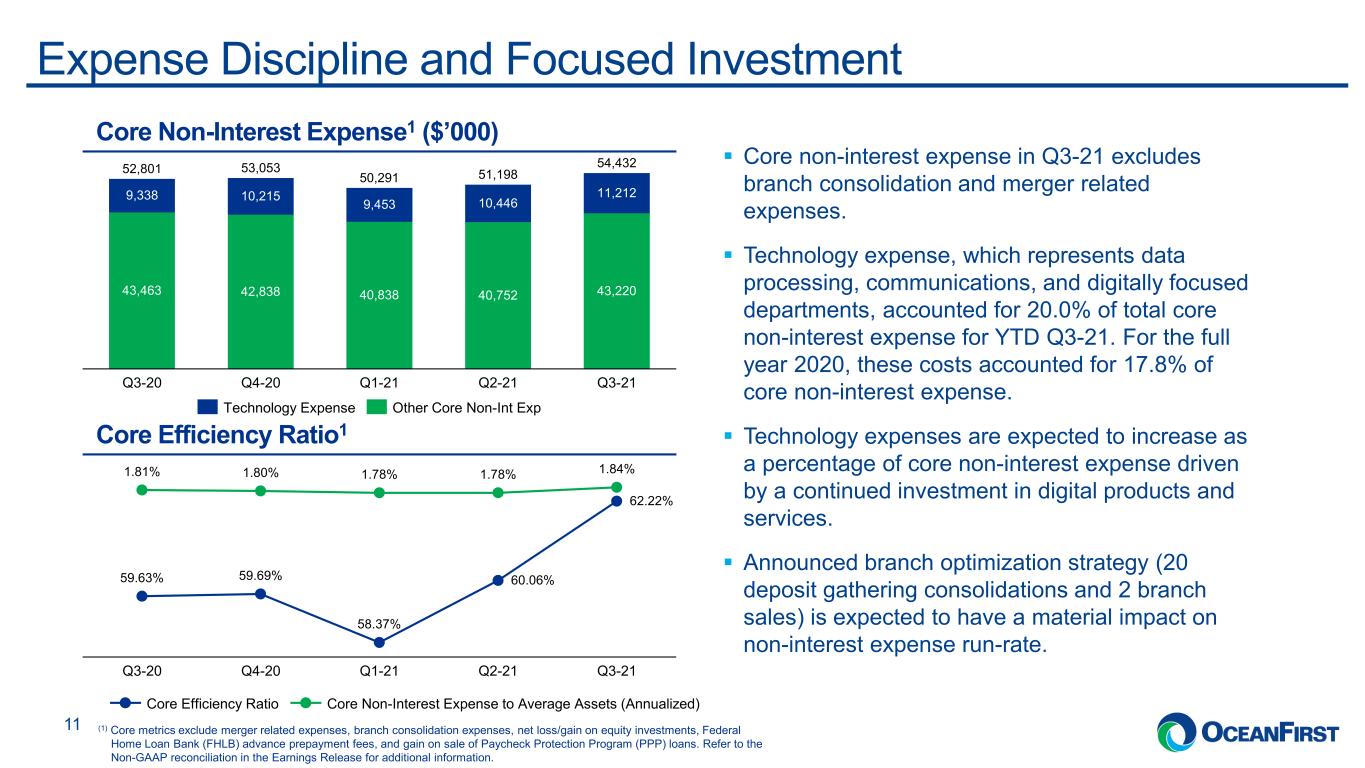

. . . Core Efficiency Ratio1 Expense Discipline and Focused Investment 11 Core non-interest expense in Q3-21 excludes branch consolidation and merger related expenses. Technology expense, which represents data processing, communications, and digitally focused departments, accounted for 20.0% of total core non-interest expense for YTD Q3-21. For the full year 2020, these costs accounted for 17.8% of core non-interest expense. Technology expenses are expected to increase as a percentage of core non-interest expense driven by a continued investment in digital products and services. Announced branch optimization strategy (20 deposit gathering consolidations and 2 branch sales) is expected to have a material impact on non-interest expense run-rate. Core Non-Interest Expense1 ($’000) 43,463 42,838 40,838 40,752 43,220 9,338 10,215 9,453 10,446 11,212 50,291 54,432 Q2-21Q3-20 52,801 Q3-21Q4-20 Q1-21 53,053 51,198 Other Core Non-Int ExpTechnology Expense Q3-21 1.78% 59.69% Q1-21 59.63% 1.81% Q3-20 1.80% Q4-20 58.37% 60.06% 1.78% Q2-21 62.22% 1.84% Core Efficiency Ratio Core Non-Interest Expense to Average Assets (Annualized) (1) Core metrics exclude merger related expenses, branch consolidation expenses, net loss/gain on equity investments, Federal Home Loan Bank (FHLB) advance prepayment fees, and gain on sale of Paycheck Protection Program (PPP) loans. Refer to the Non-GAAP reconciliation in the Earnings Release for additional information.

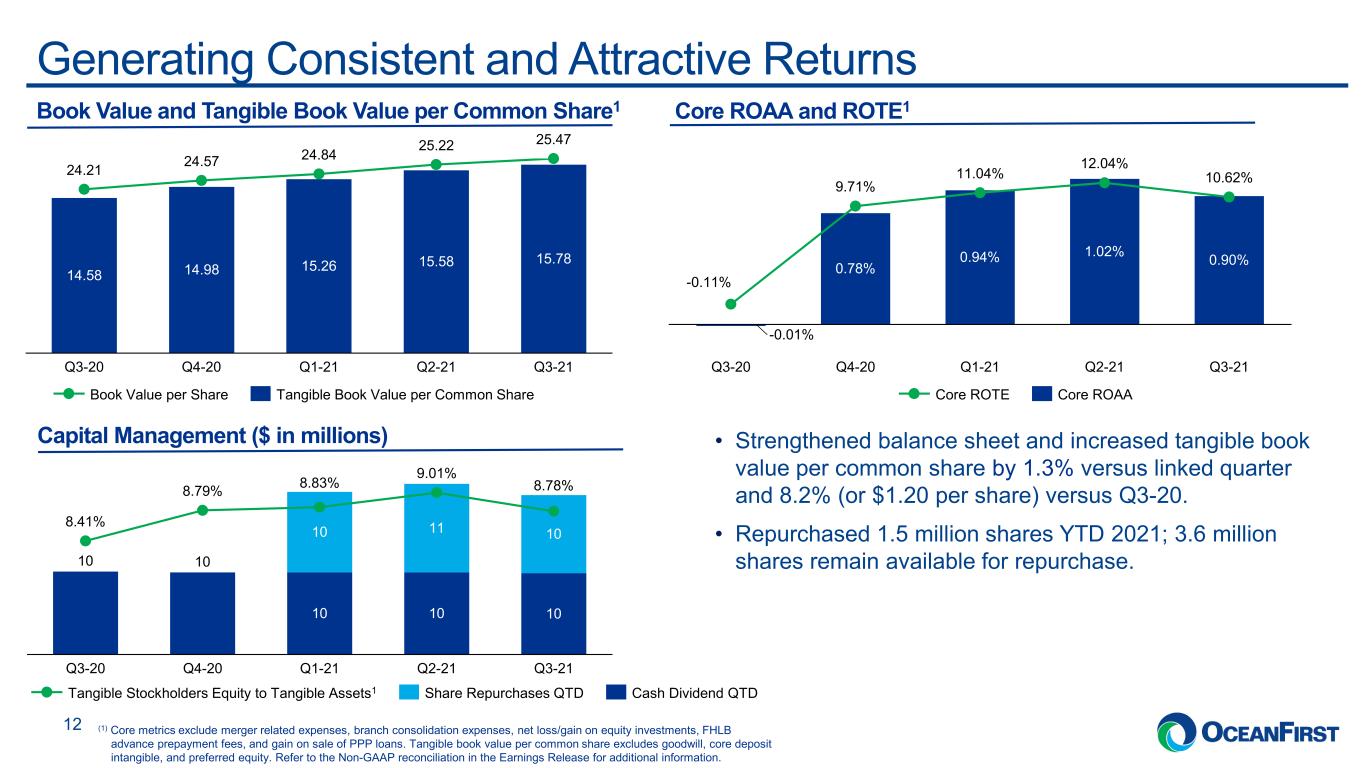

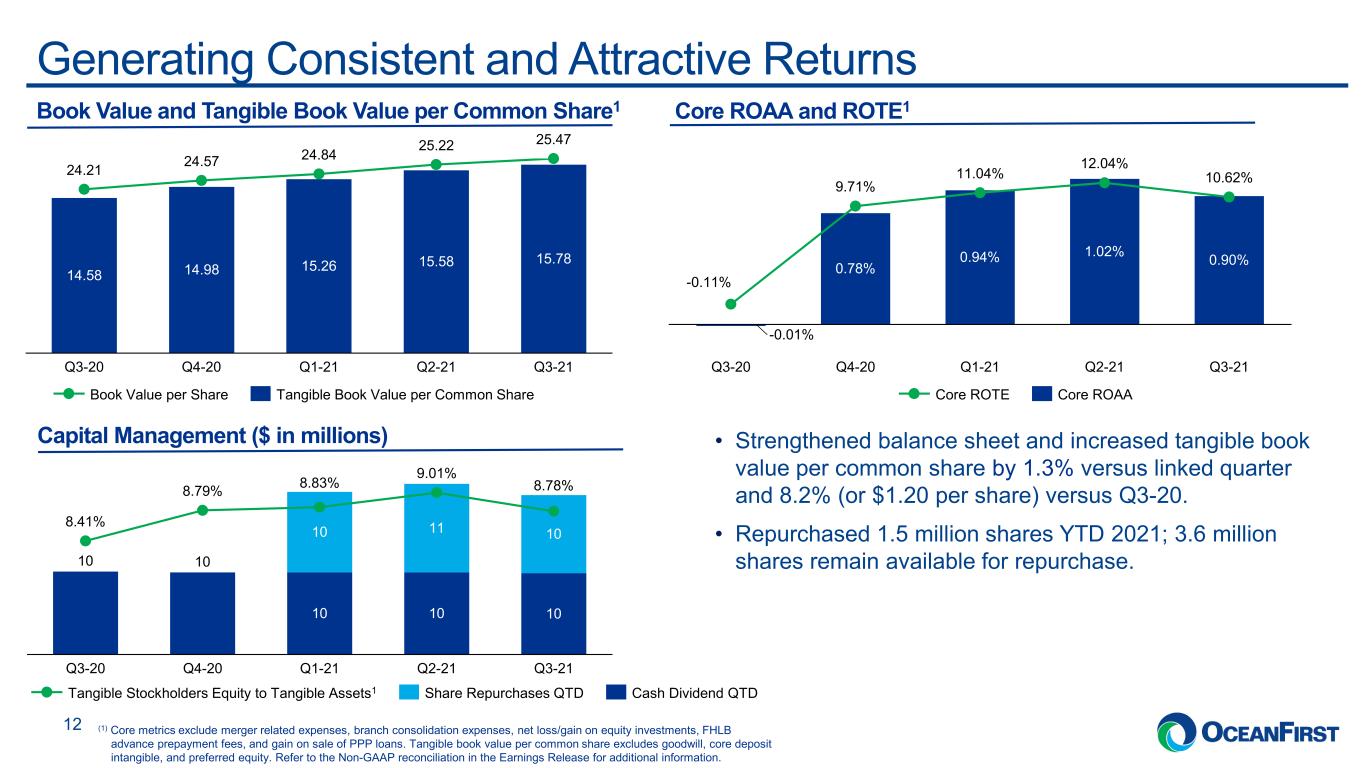

. . .Generating Consistent and Attractive Returns 12 Book Value and Tangible Book Value per Common Share1 Core ROAA and ROTE1 • Strengthened balance sheet and increased tangible book value per common share by 1.3% versus linked quarter and 8.2% (or $1.20 per share) versus Q3-20. • Repurchased 1.5 million shares YTD 2021; 3.6 million shares remain available for repurchase. Capital Management ($ in millions) 14.58 14.98 15.26 15.58 15.78 24.21 24.57 24.84 25.22 25.47 Q2-21Q3-20 Q1-21Q4-20 Q3-21 Book Value per Share Tangible Book Value per Common Share Q4-20 -0.11% -0.01% 11.04% 0.90%0.78% Q1-21Q3-20 9.71% 0.94% Q3-21 12.04% 1.02% Q2-21 10.62% Core ROTE Core ROAA 10 10 10 10 10 10 11 10 Q4-20Q3-20 Q1-21 Q2-21 Q3-21 8.41% 8.79% 8.83% 9.01% 8.78% Tangible Stockholders Equity to Tangible Assets1 Cash Dividend QTDShare Repurchases QTD (1) Core metrics exclude merger related expenses, branch consolidation expenses, net loss/gain on equity investments, FHLB advance prepayment fees, and gain on sale of PPP loans. Tangible book value per common share excludes goodwill, core deposit intangible, and preferred equity. Refer to the Non-GAAP reconciliation in the Earnings Release for additional information.

. . . I N V E S T O R P R E S E N T A T I O N 13 Investor Presentation

. . .Investment Thesis 14 Balance sheet de-risked with executed loan sales, resolution of substantially all full forbearance loans, and extinguishment of high-cost borrowings Strength of Balance Sheet Cost of deposits remain low at 22 basis points (bps) at September 30, 2021 Low-Cost and Durable Deposit Base Digital products and customer experience on par with national banks and FinTechs, outpacing regional and community banksDigital Innovation Acquired attractive and underappreciated assets in exurban markets at favorable prices Disciplined and Strategic M&A Deep banking, regulatory, M&A, and integration experience Demonstrated strong pandemic response Meaningful insider ownership aligned with shareholder interest Seasoned Leadership Commitment to management of credit, interest rate and regulatory / compliance riskConservative Risk Culture Well Positioned to Generate Strong Returns

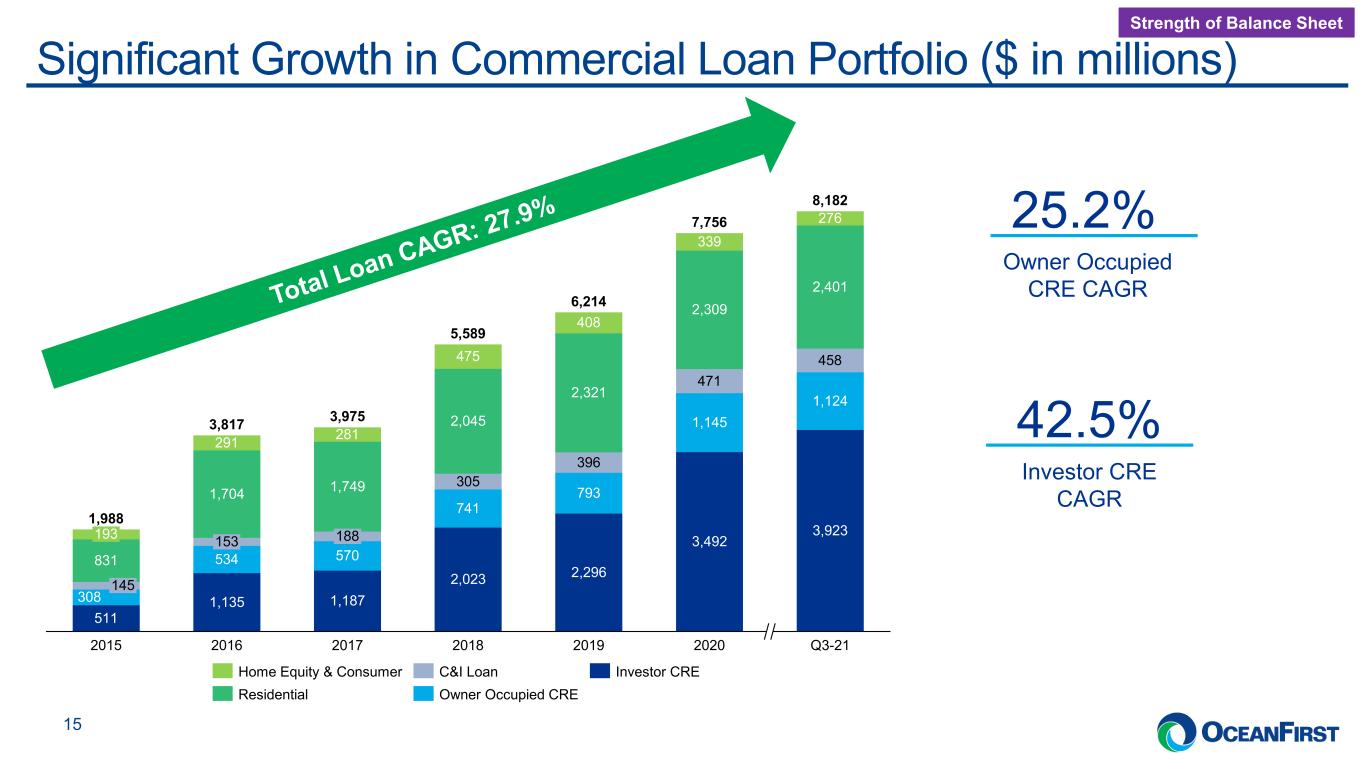

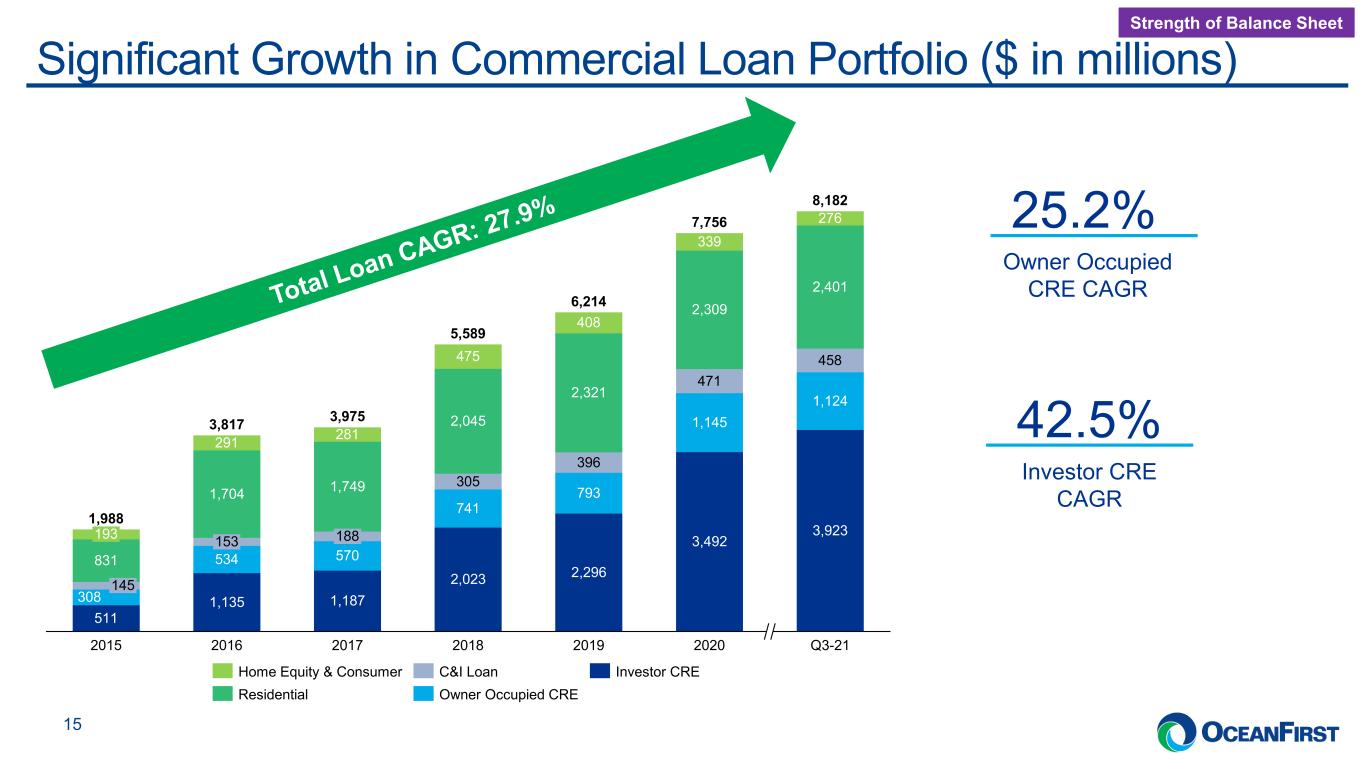

. . .Significant Growth in Commercial Loan Portfolio ($ in millions) 15 Investor CRE CAGR 42.5% Owner Occupied CRE CAGR 25.2% Strength of Balance Sheet 511 1,135 1,187 2,023 2,296 3,492 3,923 308 534 570 741 793 1,145 1,124 305 396 471 458 831 1,704 1,749 2,045 2,321 2,309 2,401 291 281 475 408 339 276 153193 2015 145 2016 188 2017 2018 2019 2020 Q3-21 1,988 3,817 3,975 5,589 6,214 7,756 8,182 Investor CREHome Equity & Consumer Residential Owner Occupied CRE C&I Loan

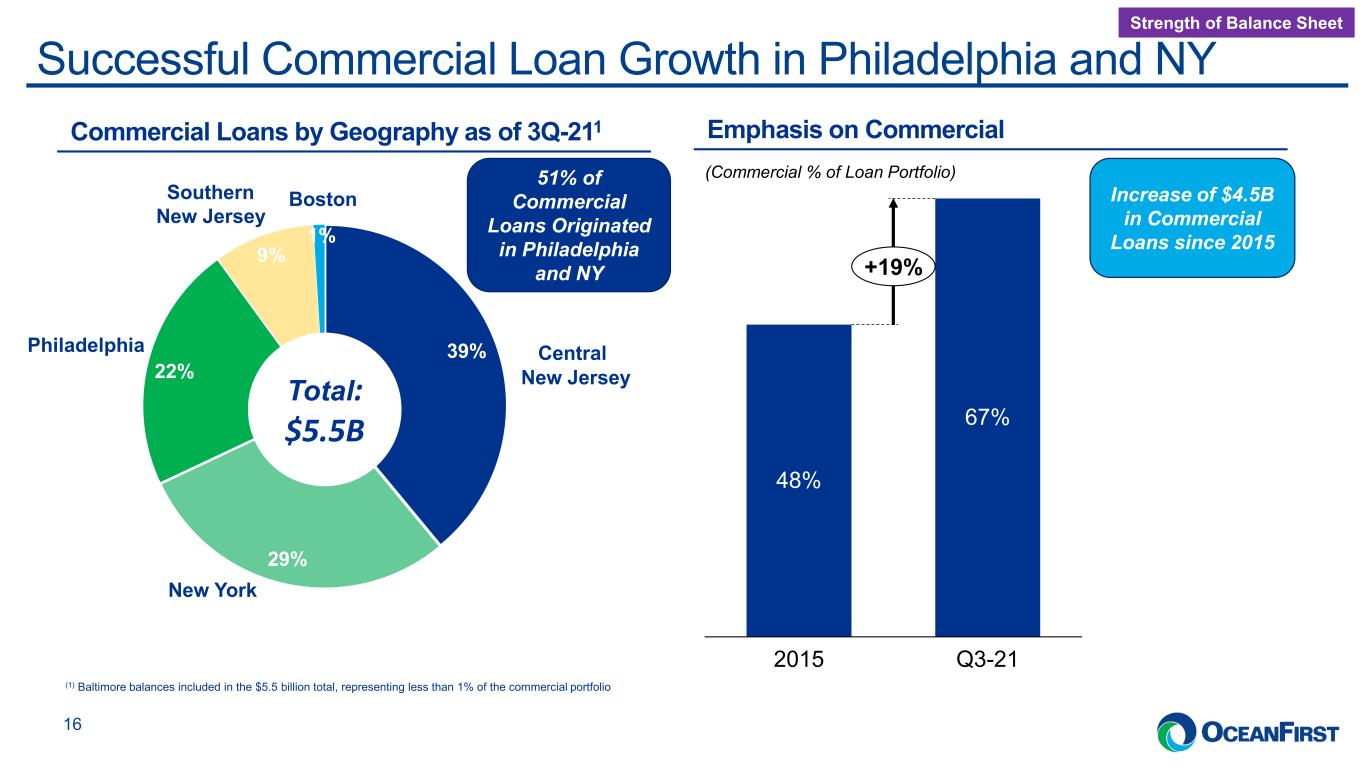

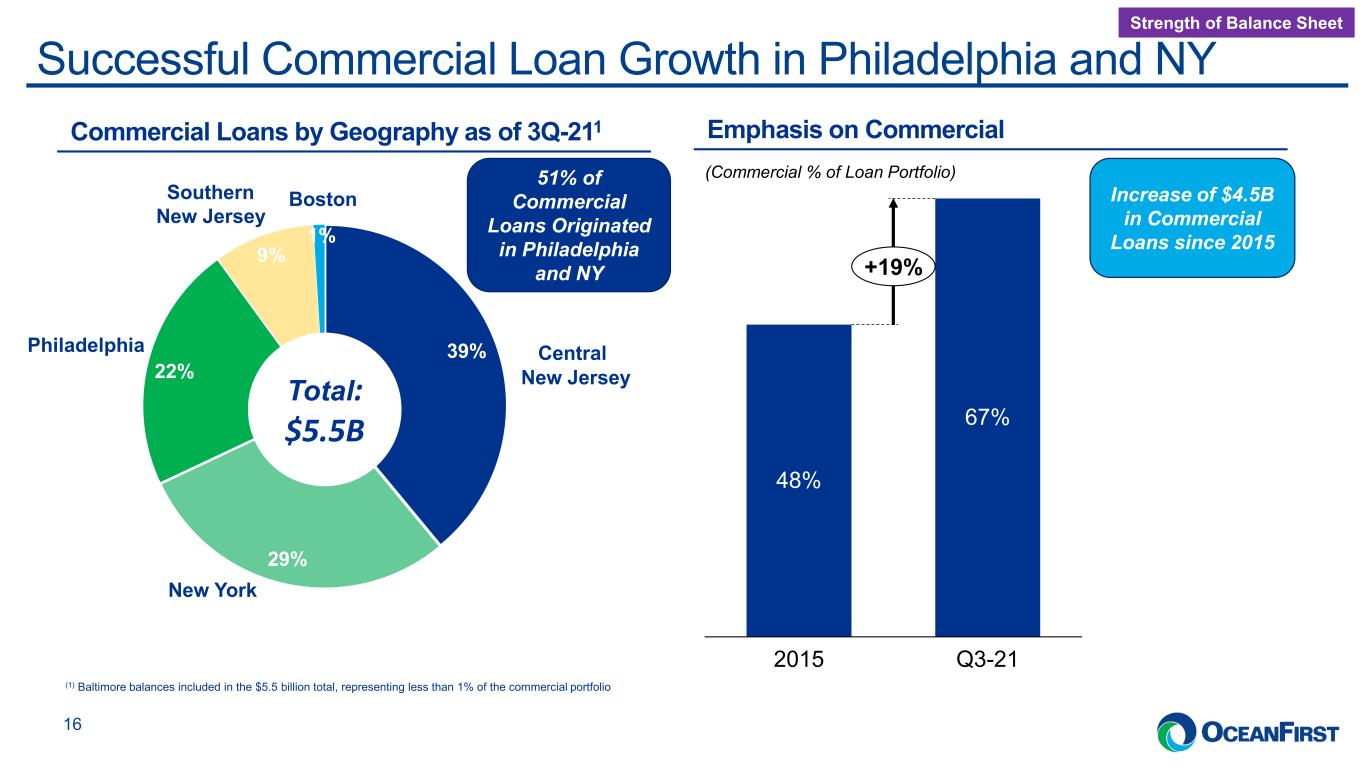

. . .Successful Commercial Loan Growth in Philadelphia and NY 16 48% 2015 67% Q3-21 +19% (Commercial % of Loan Portfolio) 39% 29% 22% 9% 1% Central New Jersey Southern New Jersey New York Philadelphia Boston Commercial Loans by Geography as of 3Q-211 Total: $5.5B 51% of Commercial Loans Originated in Philadelphia and NY Emphasis on Commercial Increase of $4.5B in Commercial Loans since 2015 Strength of Balance Sheet (1) Baltimore balances included in the $5.5 billion total, representing less than 1% of the commercial portfolio

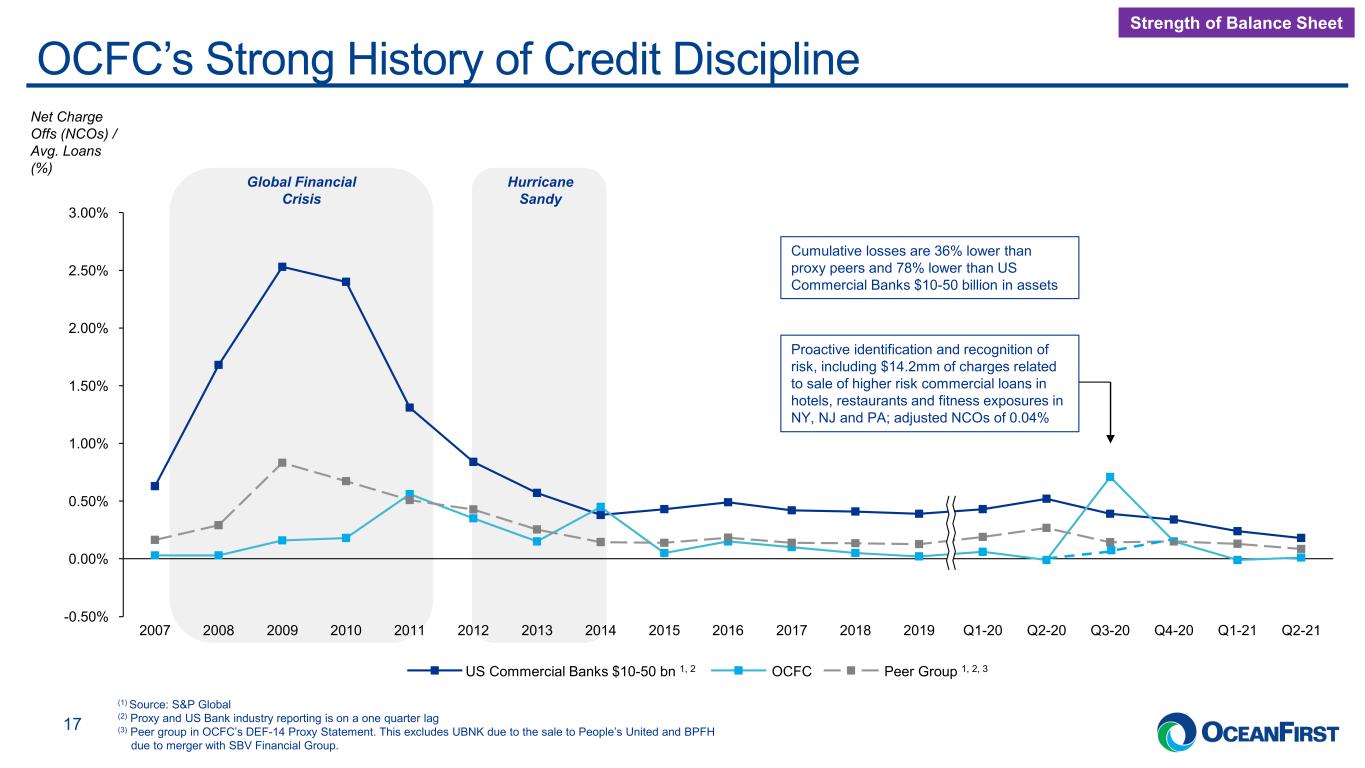

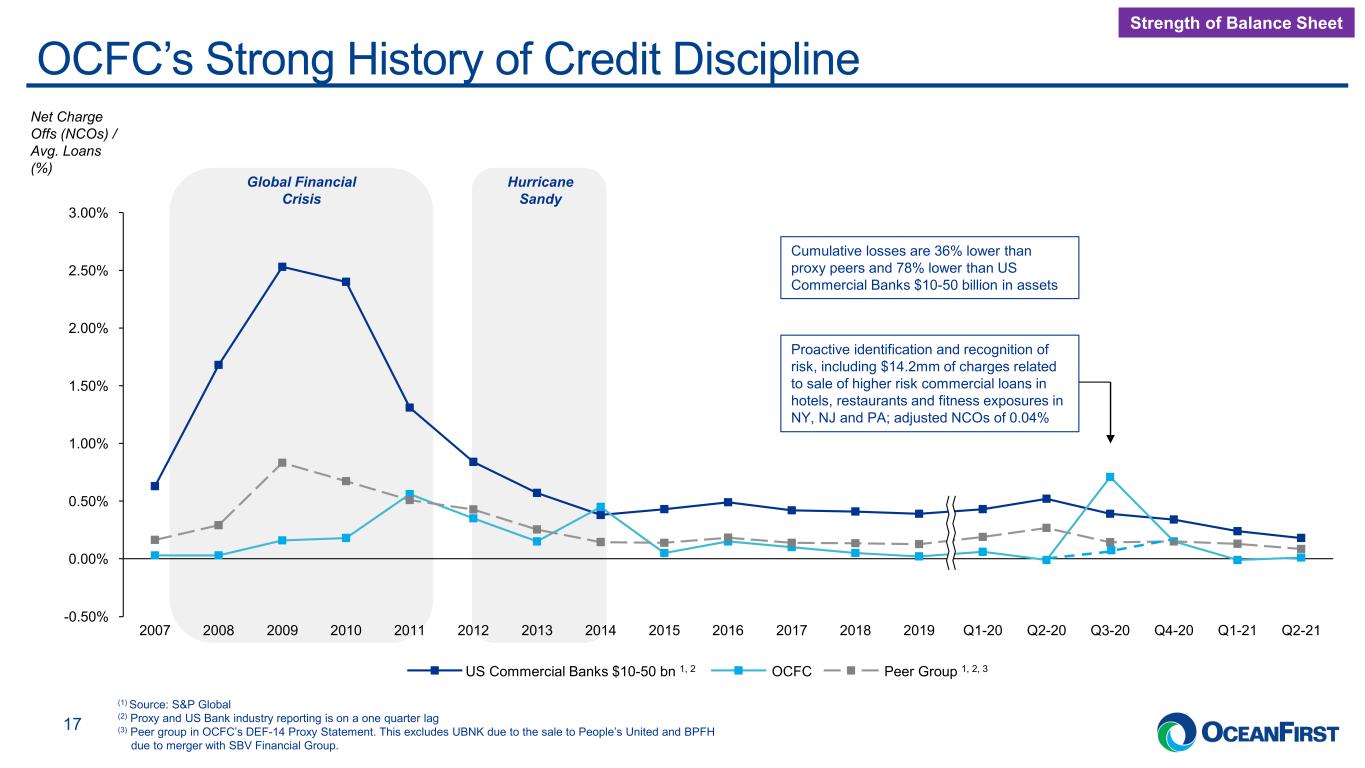

. . .OCFC’s Strong History of Credit Discipline 17 Global Financial Crisis Net Charge Offs (NCOs) / Avg. Loans (%) Hurricane Sandy (1) Source: S&P Global (2) Proxy and US Bank industry reporting is on a one quarter lag (3) Peer group in OCFC’s DEF-14 Proxy Statement. This excludes UBNK due to the sale to People’s United and BPFH due to merger with SBV Financial Group. Strength of Balance Sheet -0.50% 0.00% 0.50% 3.00% 2.00% 1.00% 1.50% 2.50% 2010 Q1-2120132007 20152008 Q4-202009 Q1-2020122011 2014 20172016 2018 2019 Q2-20 Q3-20 Q2-21 US Commercial Banks $10-50 bn 1, 2 OCFC Peer Group 1, 2, 3 Proactive identification and recognition of risk, including $14.2mm of charges related to sale of higher risk commercial loans in hotels, restaurants and fitness exposures in NY, NJ and PA; adjusted NCOs of 0.04% Cumulative losses are 36% lower than proxy peers and 78% lower than US Commercial Banks $10-50 billion in assets

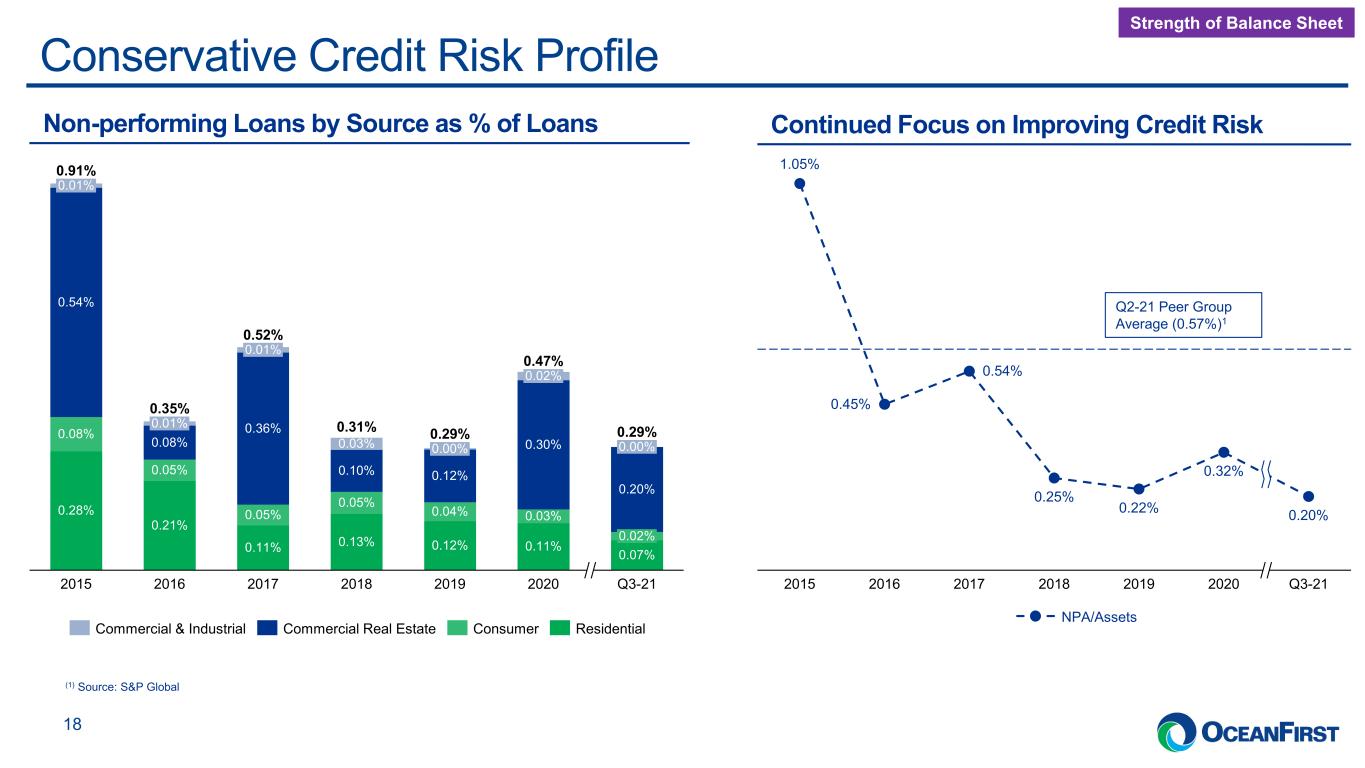

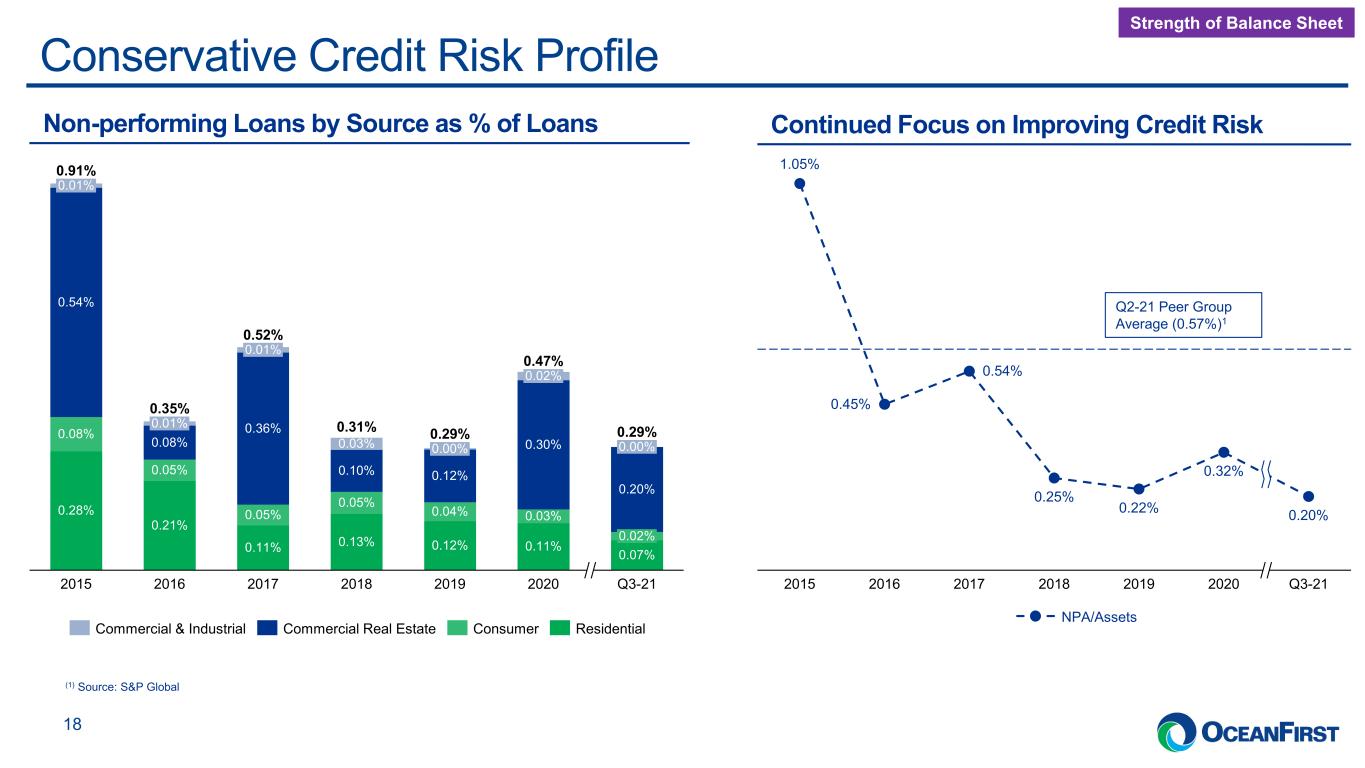

. . .Conservative Credit Risk Profile 18 0.01% 0.01% 0.08% 0.47% 0.03% 0.54% 2015 0.05% 0.35% 2018 0.21% 0.29% 2016 0.01% 0.36% 0.05% 2017 0.11% 0.03% 0.10% 0.05% 0.13% 0.02% 0.12% 0.04% 0.00% 0.12% 2019 0.31% 0.30% 0.11% 0.28% 0.02% 0.07% Q3-21 0.91% 0.20% 0.29% 2020 0.00%0.08% 0.52% Commercial & Industrial ConsumerCommercial Real Estate Residential (1) Source: S&P Global 1.05% 2015 2018 0.54% 0.45% 2016 2017 0.25% 0.22% 2019 0.32% 2020 0.20% Q3-21 Q2-21 Peer Group Average (0.57%)1 NPA/Assets Strength of Balance Sheet Continued Focus on Improving Credit RiskNon-performing Loans by Source as % of Loans

. . .Strategic Capital Allocation Generates Shareholder Returns 19 Strength of Balance Sheet Stable & competitive dividend 99th consecutive quarter Historical Payout Ratio of 30% to 40% Repurchased 1.5 million shares YTD 2021; 3.6 million shares remain available for repurchase Strategic acquisitions in critical new markets 9 13 19 30 34 41 30 7 11 26 15 31 2 20192016 2018 0 20 2017 2020 20212015 15 19 40 60 56 81 15 Annualized Share Repurchases Cash Dividends Annual Return of Capital ($ in millions)

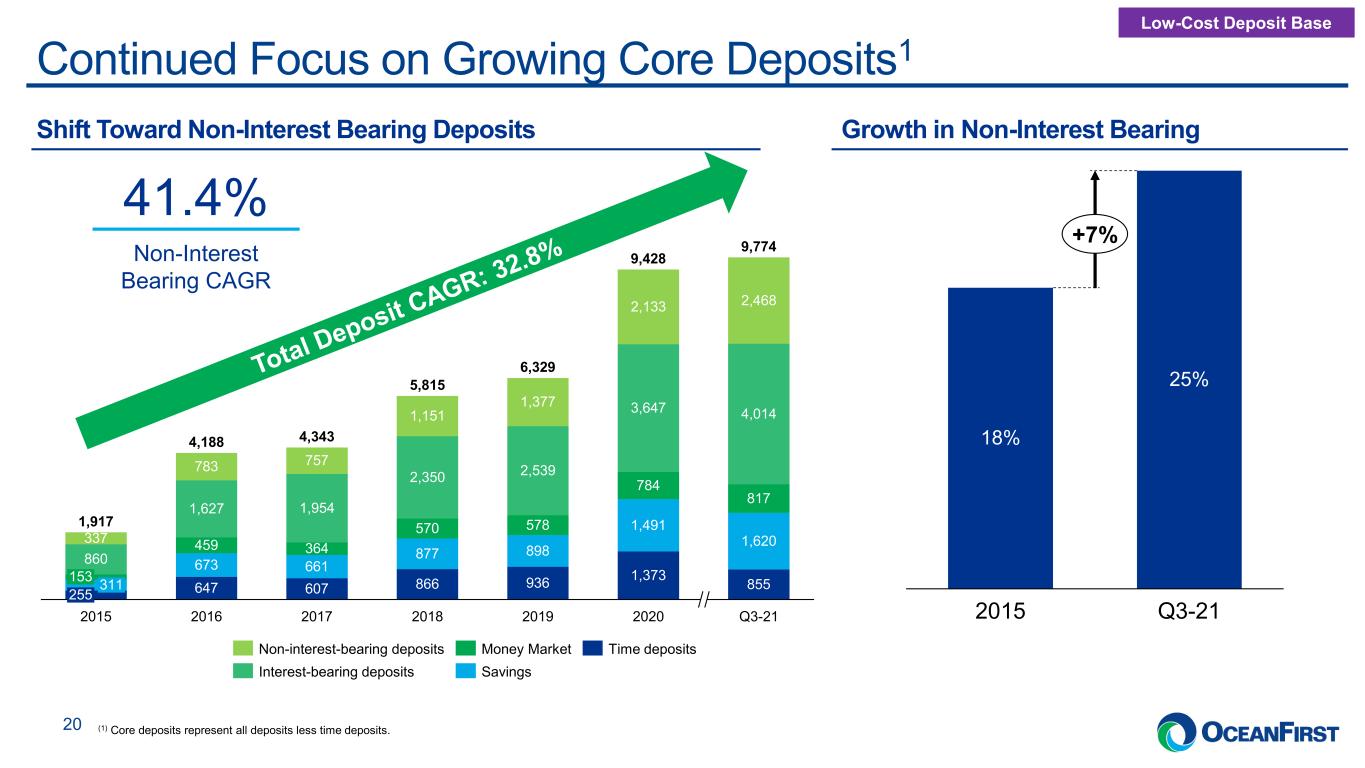

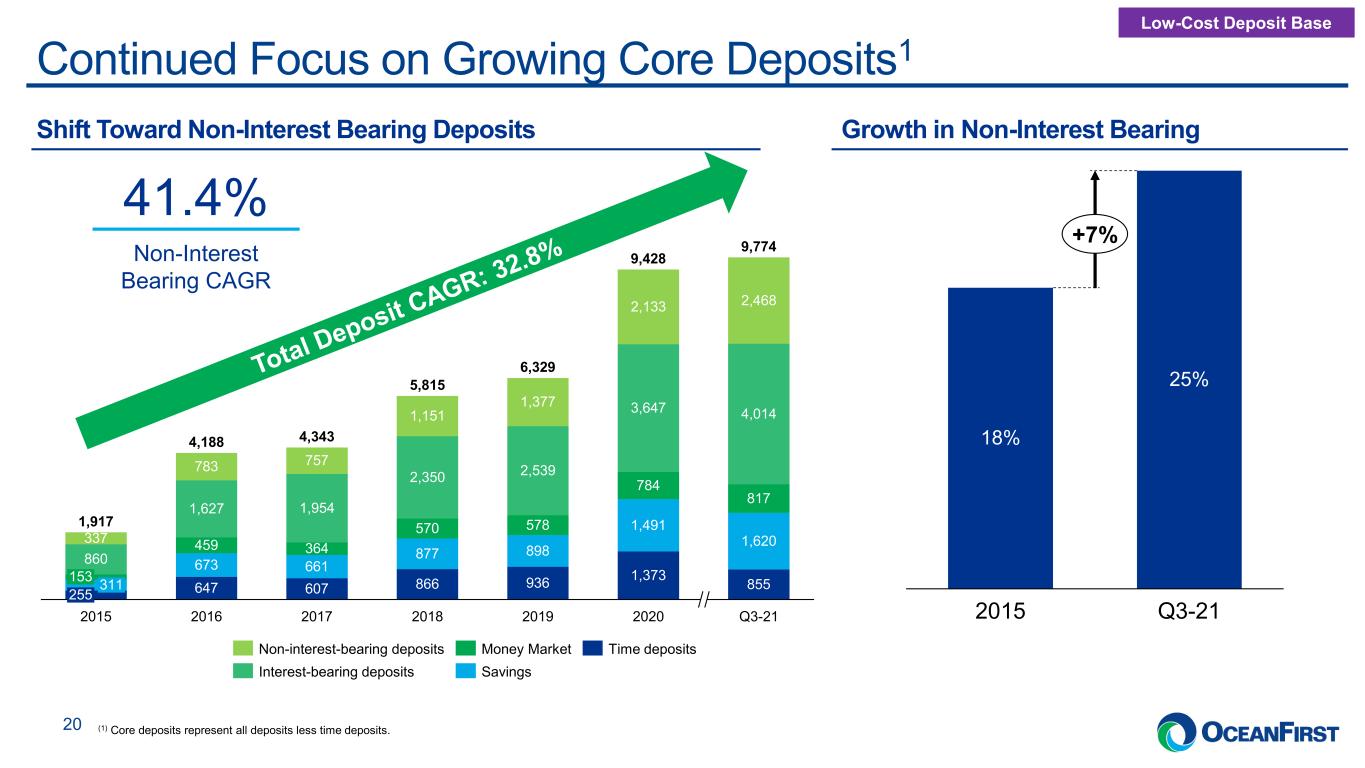

. . .Continued Focus on Growing Core Deposits1 20 25% 18% 2015 Q3-21 +7% Growth in Non-Interest BearingShift Toward Non-Interest Bearing Deposits Non-Interest Bearing CAGR 41.4% Low-Cost Deposit Base 647 607 866 936 1,373 855 673 661 877 898 1,491 1,620459 364 570 578 784 817 860 1,627 1,954 2,350 2,539 3,647 4,014 337 783 757 1,151 1,377 2,133 2,468 2015 9,774 153 2019 311 255 2016 Q3-212017 2018 2020 1,917 4,188 6,329 4,343 5,815 9,428 Non-interest-bearing deposits Time deposits SavingsInterest-bearing deposits Money Market (1) Core deposits represent all deposits less time deposits.

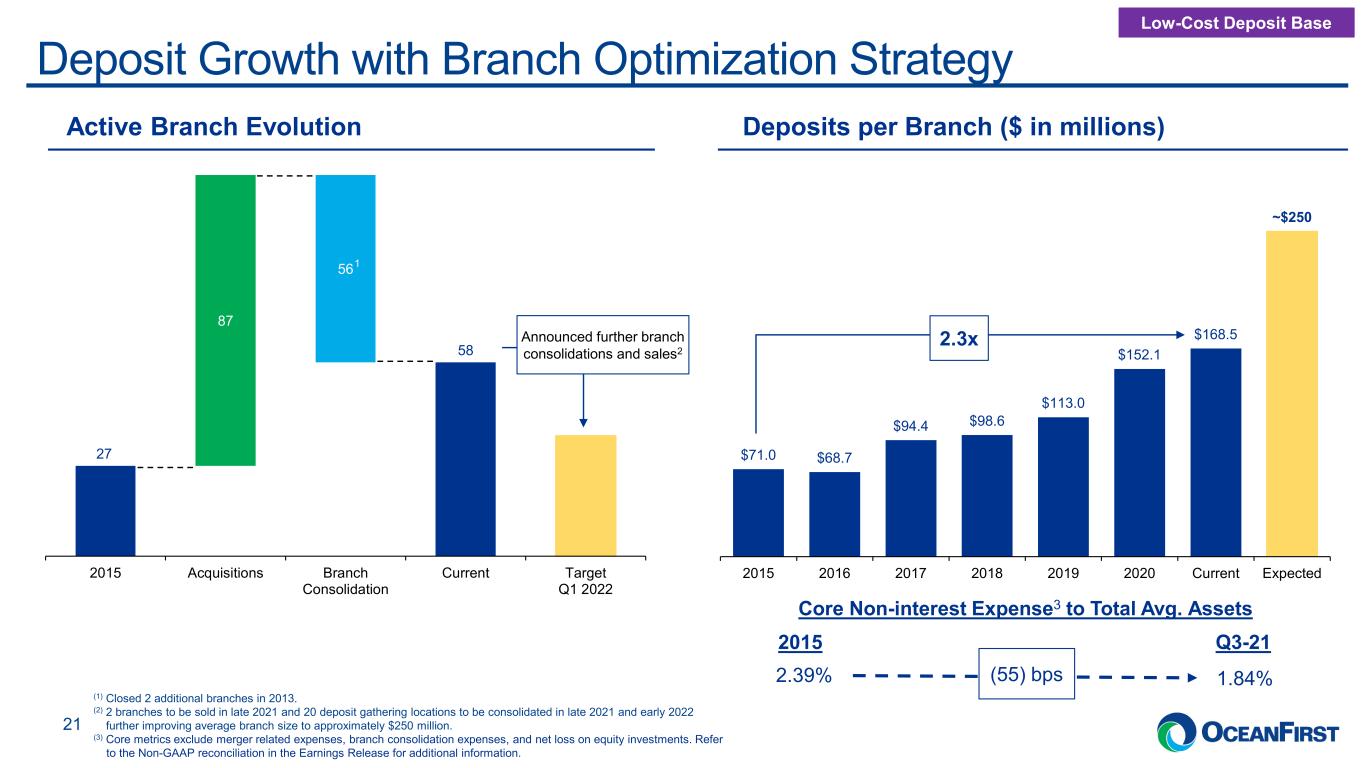

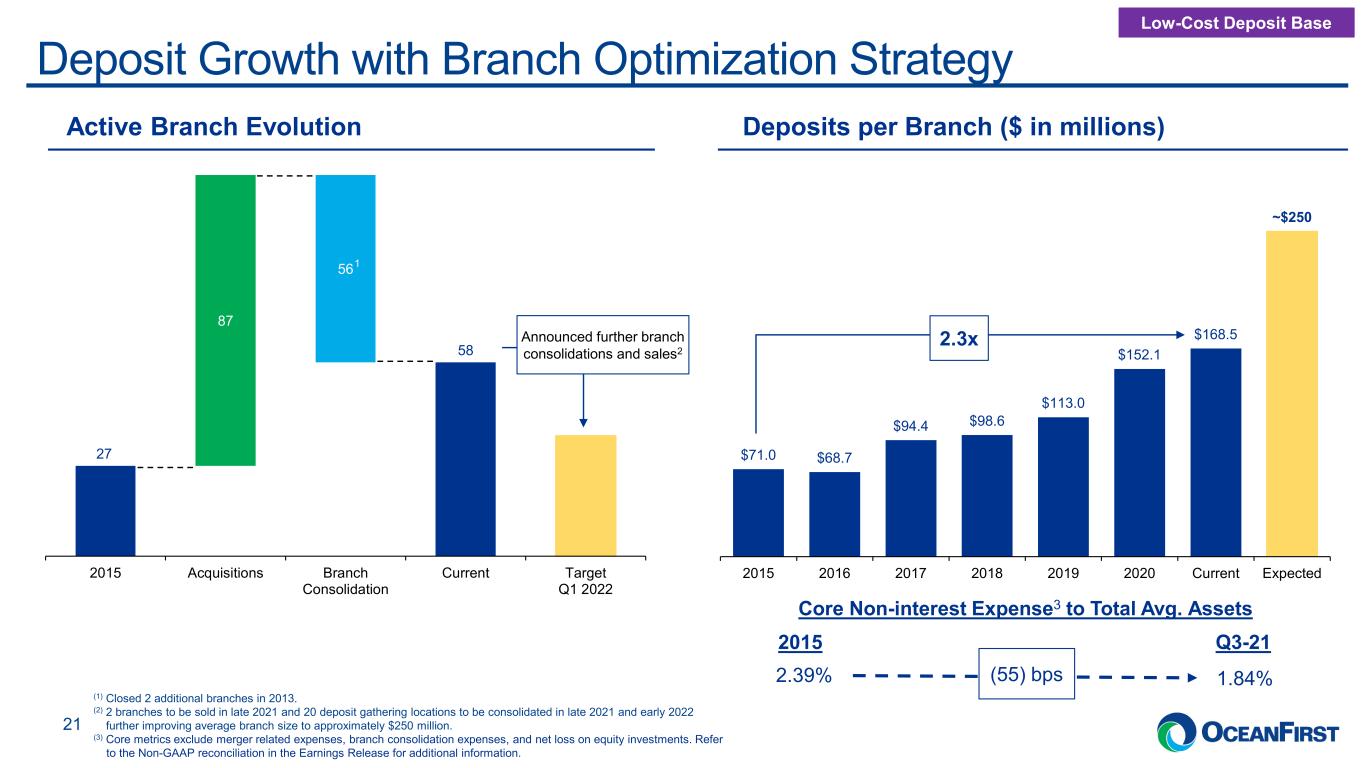

. . . 27 58 87 56 2015 Acquisitions Branch Consolidation Current Target Q1 2022 Deposit Growth with Branch Optimization Strategy 21 Announced further branch consolidations and sales2 1 (1) Closed 2 additional branches in 2013. (2) 2 branches to be sold in late 2021 and 20 deposit gathering locations to be consolidated in late 2021 and early 2022 further improving average branch size to approximately $250 million. (3) Core metrics exclude merger related expenses, branch consolidation expenses, and net loss on equity investments. Refer to the Non-GAAP reconciliation in the Earnings Release for additional information. $71.0 $68.7 $94.4 $98.6 $113.0 $152.1 $168.5 ~$250 2015 2016 2017 2018 2019 2020 Current Expected 2.3x Low-Cost Deposit Base Active Branch Evolution Deposits per Branch ($ in millions) (55) bps2.39% 1.84% 2015 Q3-21 Core Non-interest Expense3 to Total Avg. Assets

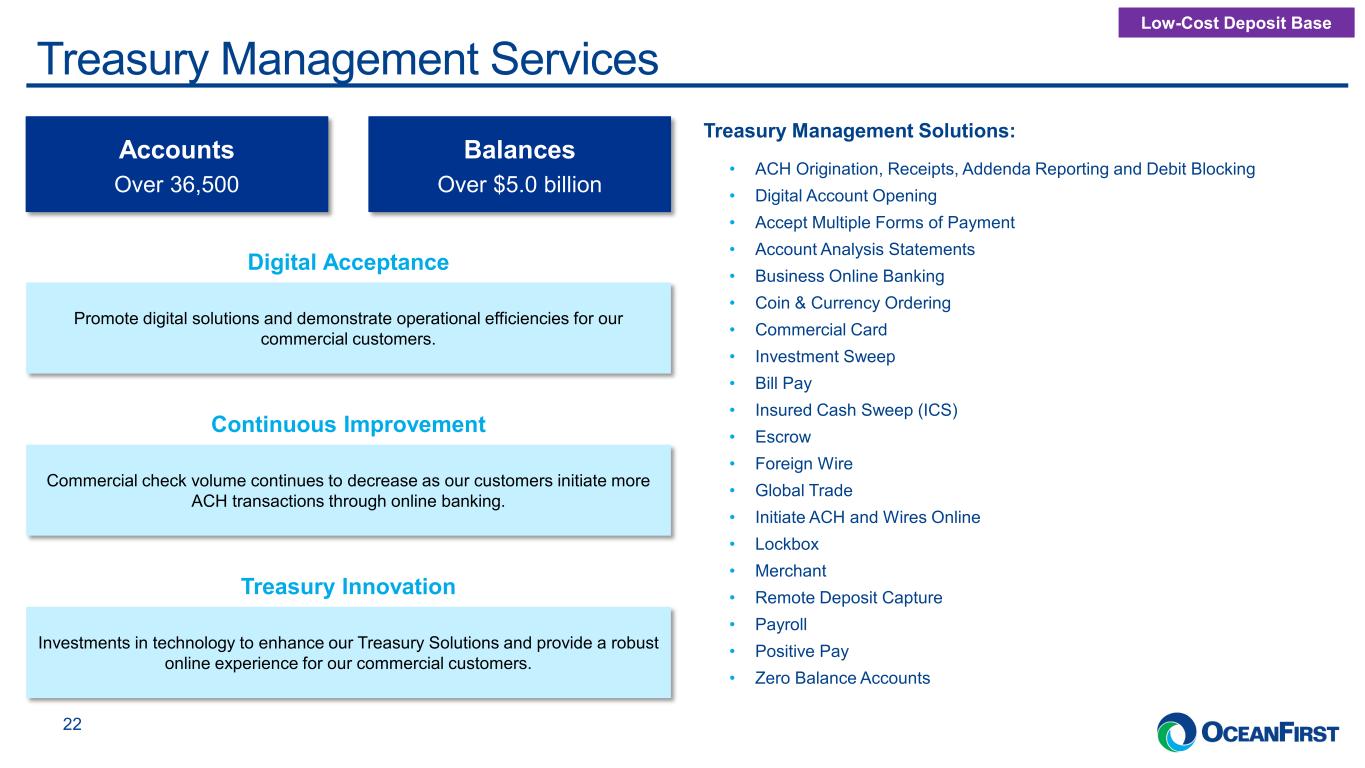

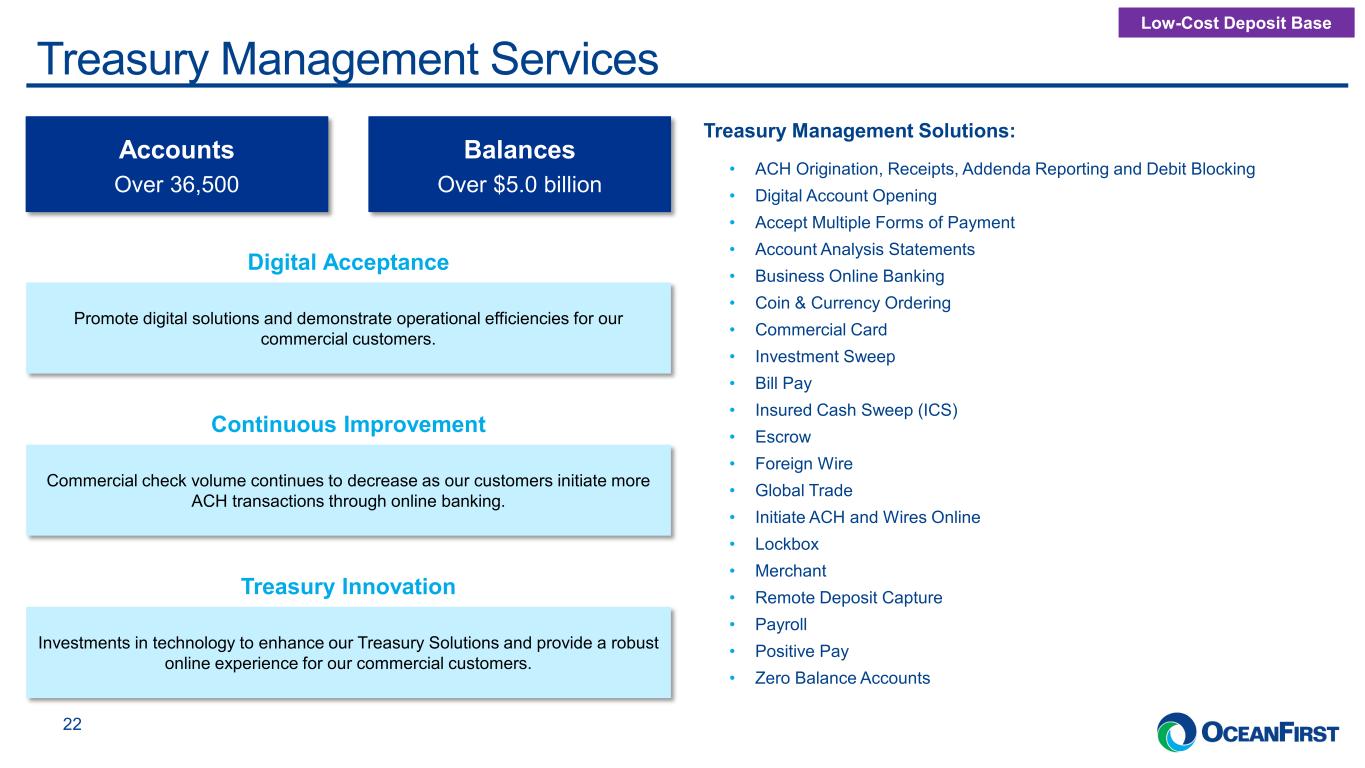

. . .Treasury Management Services 22 Treasury Management Solutions: • ACH Origination, Receipts, Addenda Reporting and Debit Blocking • Digital Account Opening • Accept Multiple Forms of Payment • Account Analysis Statements • Business Online Banking • Coin & Currency Ordering • Commercial Card • Investment Sweep • Bill Pay • Insured Cash Sweep (ICS) • Escrow • Foreign Wire • Global Trade • Initiate ACH and Wires Online • Lockbox • Merchant • Remote Deposit Capture • Payroll • Positive Pay • Zero Balance Accounts Balances Over $5.0 billion Accounts Over 36,500 Digital Acceptance Promote digital solutions and demonstrate operational efficiencies for our commercial customers. Continuous Improvement Commercial check volume continues to decrease as our customers initiate more ACH transactions through online banking. Treasury Innovation Investments in technology to enhance our Treasury Solutions and provide a robust online experience for our commercial customers. Low-Cost Deposit Base

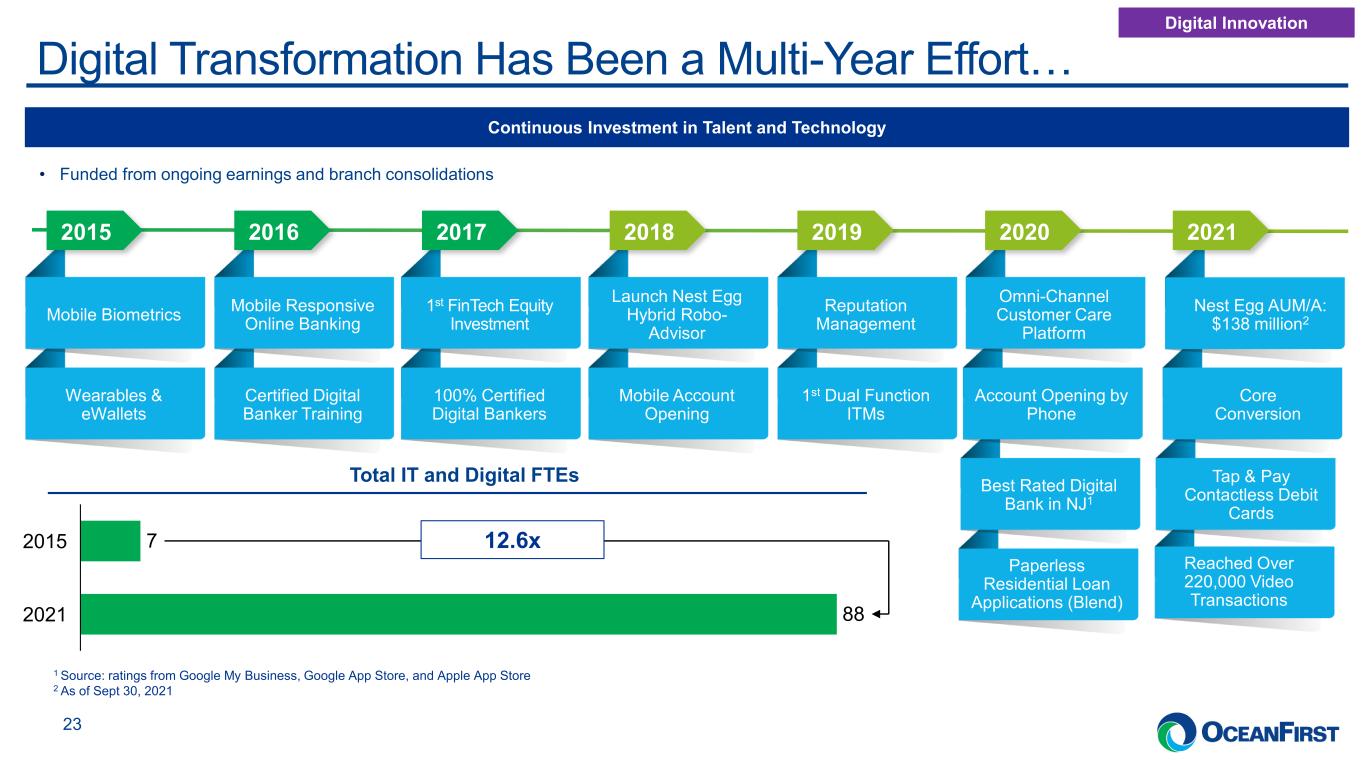

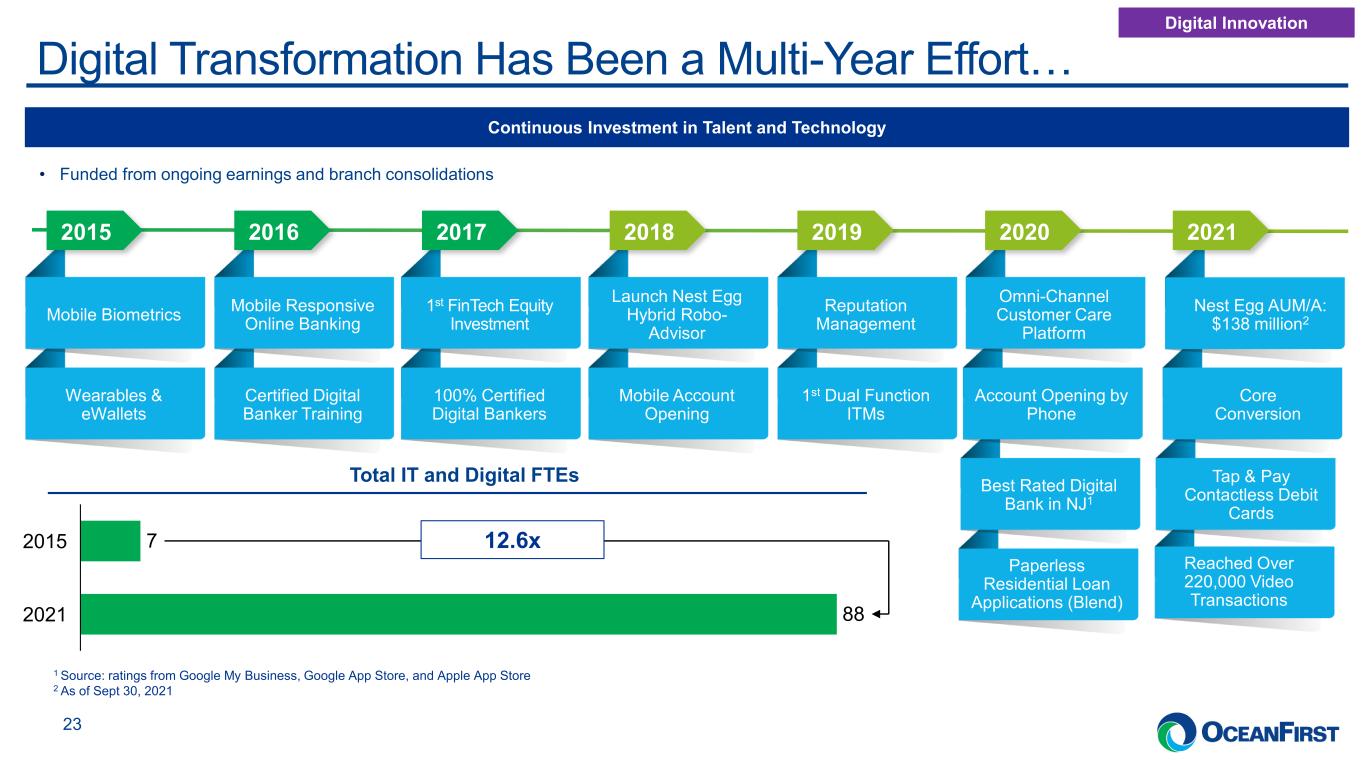

. . . Tap & Pay Contactless Debit Cards Core Conversion Digital Transformation Has Been a Multi-Year Effort… 23 Continuous Investment in Talent and Technology • Funded from ongoing earnings and branch consolidations Nest Egg AUM/A: $138 million2 Paperless Residential Loan Applications (Blend) Best Rated Digital Bank in NJ1 Account Opening by Phone 1st Dual Function ITMs Wearables & eWallets Mobile Account Opening Reputation Management 100% Certified Digital Bankers Certified Digital Banker Training Launch Nest Egg Hybrid Robo- Advisor 1st FinTech Equity Investment Mobile Responsive Online BankingMobile Biometrics Omni-Channel Customer Care Platform 2015 2016 2017 2018 2019 2020 2021 Digital Innovation Reached Over 220,000 Video Transactions 1 Source: ratings from Google My Business, Google App Store, and Apple App Store 2 As of Sept 30, 2021 Total IT and Digital FTEs 7 88 2015 2021 12.6x

. . .…And is Preparing OceanFirst for 2022 and Beyond 24 Digitally Agile Bank Google My Business Ownership Targeted Digital Marketing COVID Communications Certified Digital Banker 2.0 (LMS) CRM (CCC, TCS, OLB & OAO) Digital LMS (OFB University) Concur Invoice & Expense Mgmt. Microsoft Teams AIS Data Science Monthly KPI Dashboards (OPS) Site Monitoring & Response Plans Cyber/Fraud Prevention Data Classification 58 Branches Successfully Consolidated 664 employees now able to work remotely* Nest Egg Auxilior JAM FINTOP * Pre-COVID, only 412 laptops had been issued to employees Digital Innovation

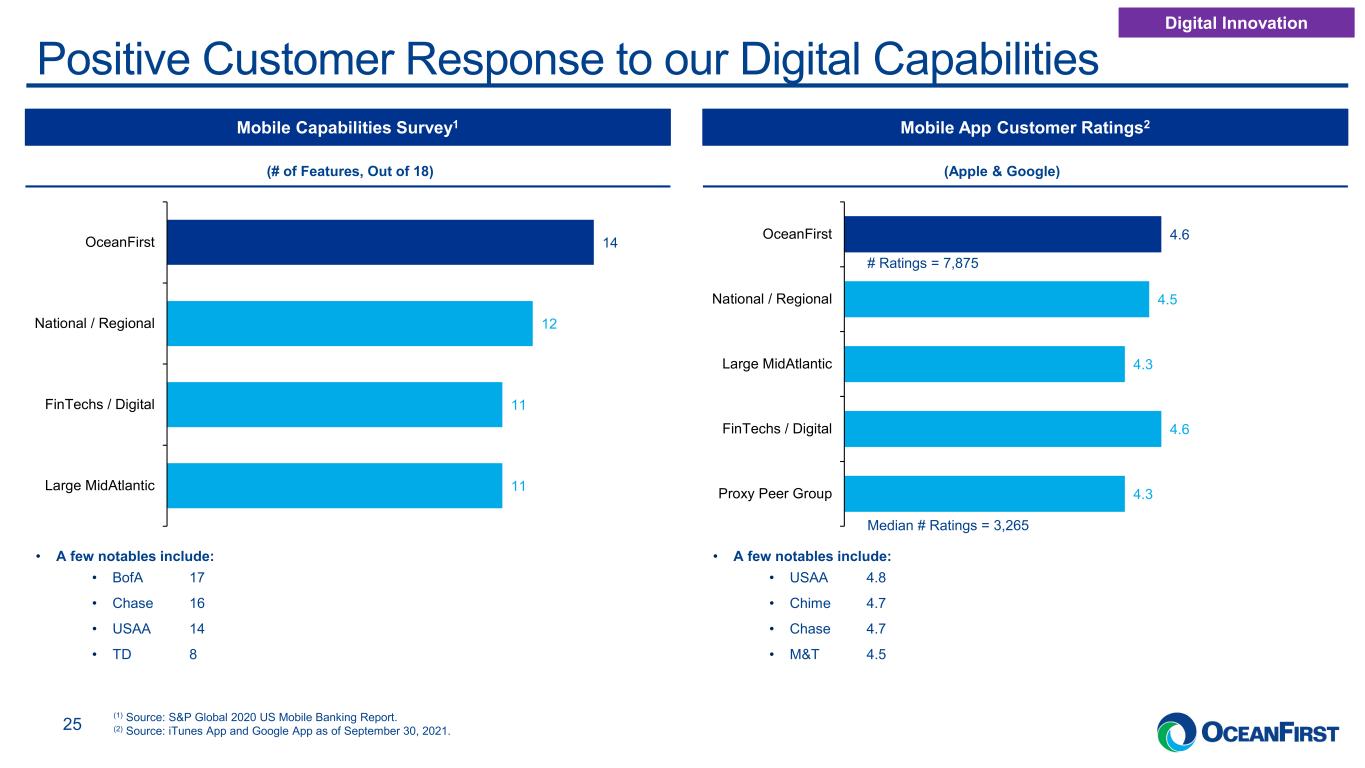

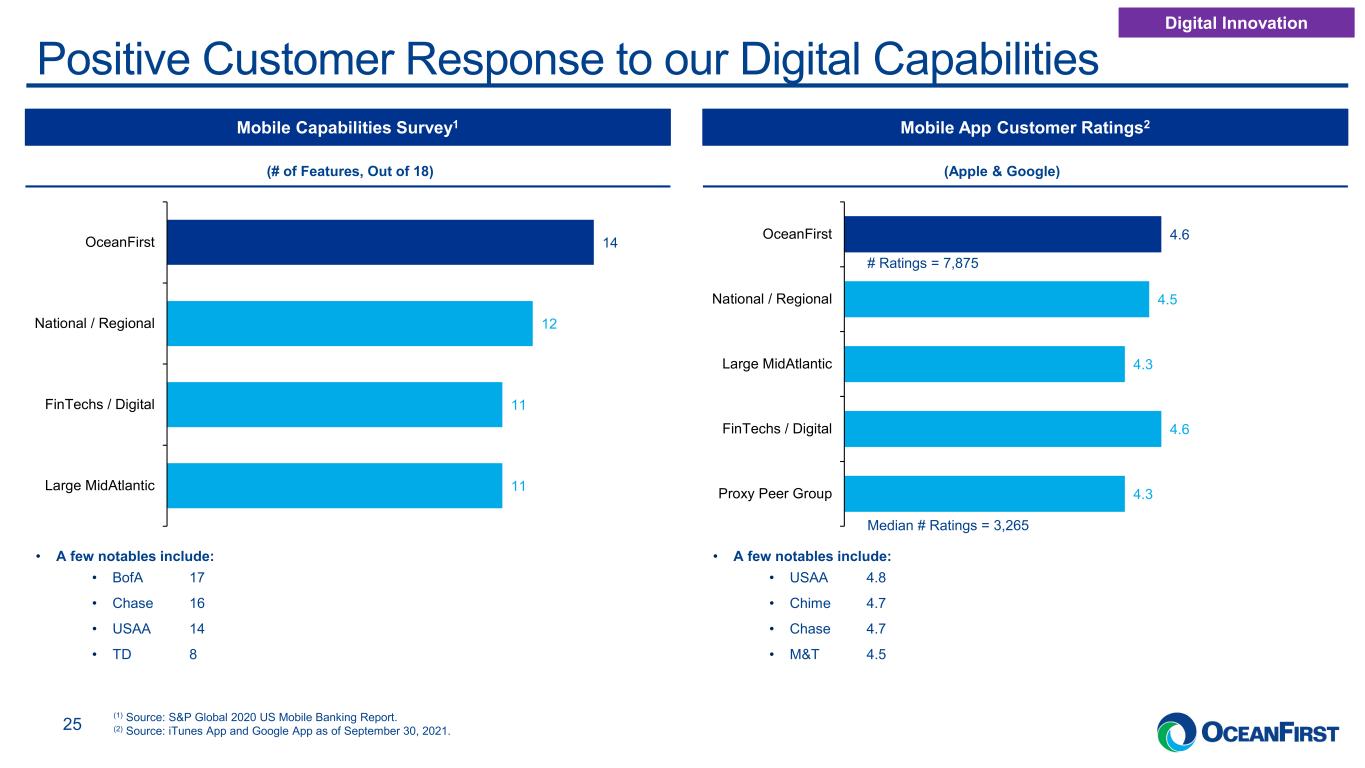

. . .Positive Customer Response to our Digital Capabilities 25 Mobile Capabilities Survey1 Mobile App Customer Ratings2 11 11 12 14 Large MidAtlantic FinTechs / Digital National / Regional OceanFirst • A few notables include: • BofA 17 • Chase 16 • USAA 14 • TD 8 (# of Features, Out of 18) (Apple & Google) 4.3 4.6 4.3 4.5 4.6 Proxy Peer Group FinTechs / Digital Large MidAtlantic National / Regional OceanFirst • A few notables include: • USAA 4.8 • Chime 4.7 • Chase 4.7 • M&T 4.5 # Ratings = 7,875 Median # Ratings = 3,265 (1) Source: S&P Global 2020 US Mobile Banking Report. (2) Source: iTunes App and Google App as of September 30, 2021. Digital Innovation

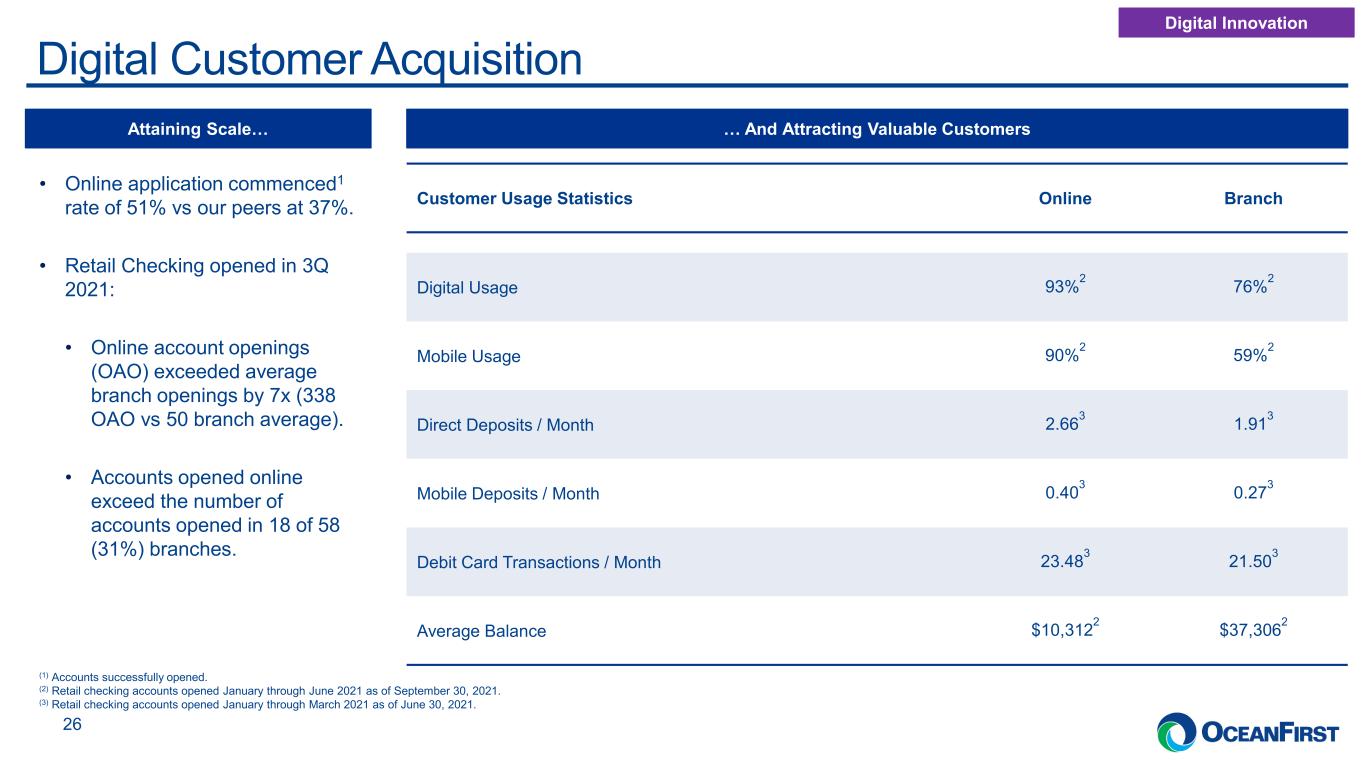

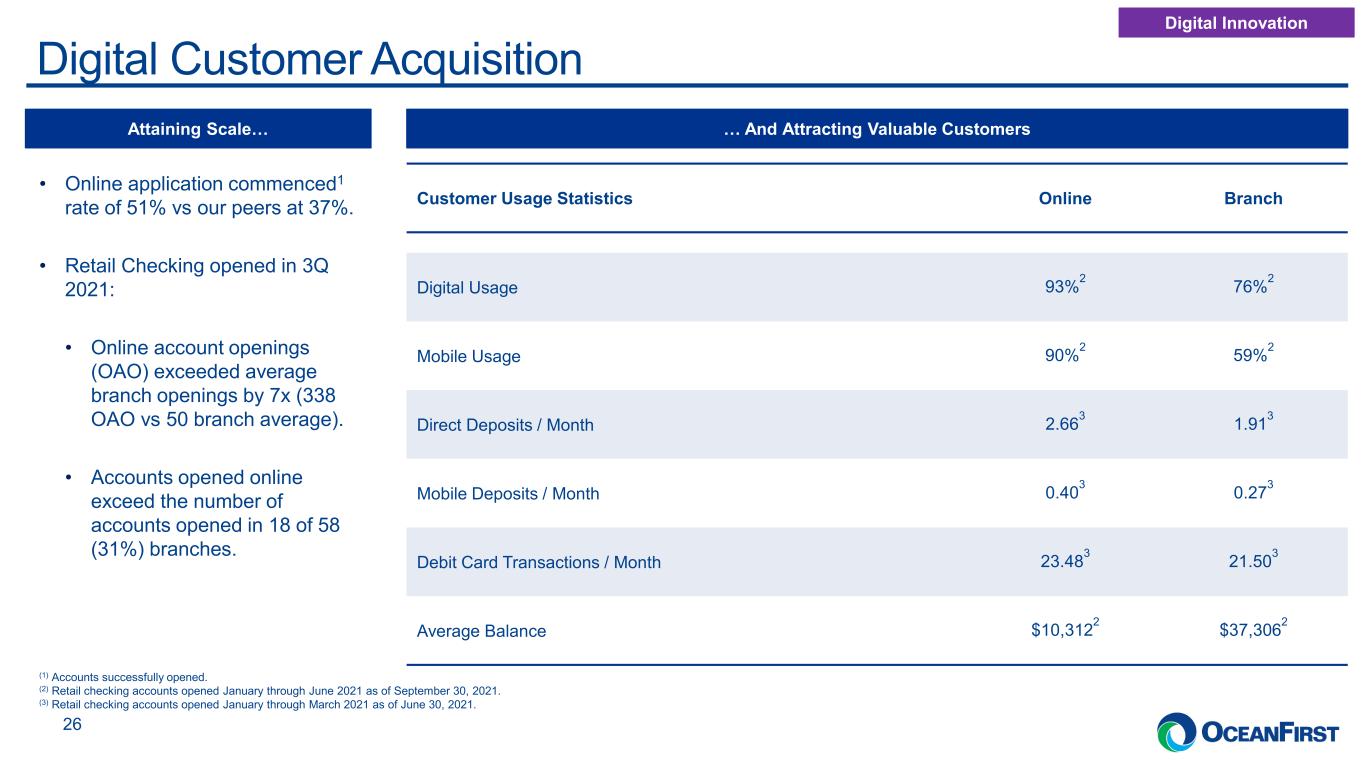

. . .Digital Customer Acquisition 26 Attaining Scale… … And Attracting Valuable Customers • Online application commenced1 rate of 51% vs our peers at 37%. • Retail Checking opened in 3Q 2021: • Online account openings (OAO) exceeded average branch openings by 7x (338 OAO vs 50 branch average). • Accounts opened online exceed the number of accounts opened in 18 of 58 (31%) branches. Customer Usage Statistics Online Branch Digital Usage 93%2 76%2 Mobile Usage 90%2 59%2 Direct Deposits / Month 2.663 1.913 Mobile Deposits / Month 0.403 0.273 Debit Card Transactions / Month 23.483 21.503 Average Balance $10,3122 $37,3062 (1) Accounts successfully opened. (2) Retail checking accounts opened January through June 2021 as of September 30, 2021. (3) Retail checking accounts opened January through March 2021 as of June 30, 2021. Digital Innovation

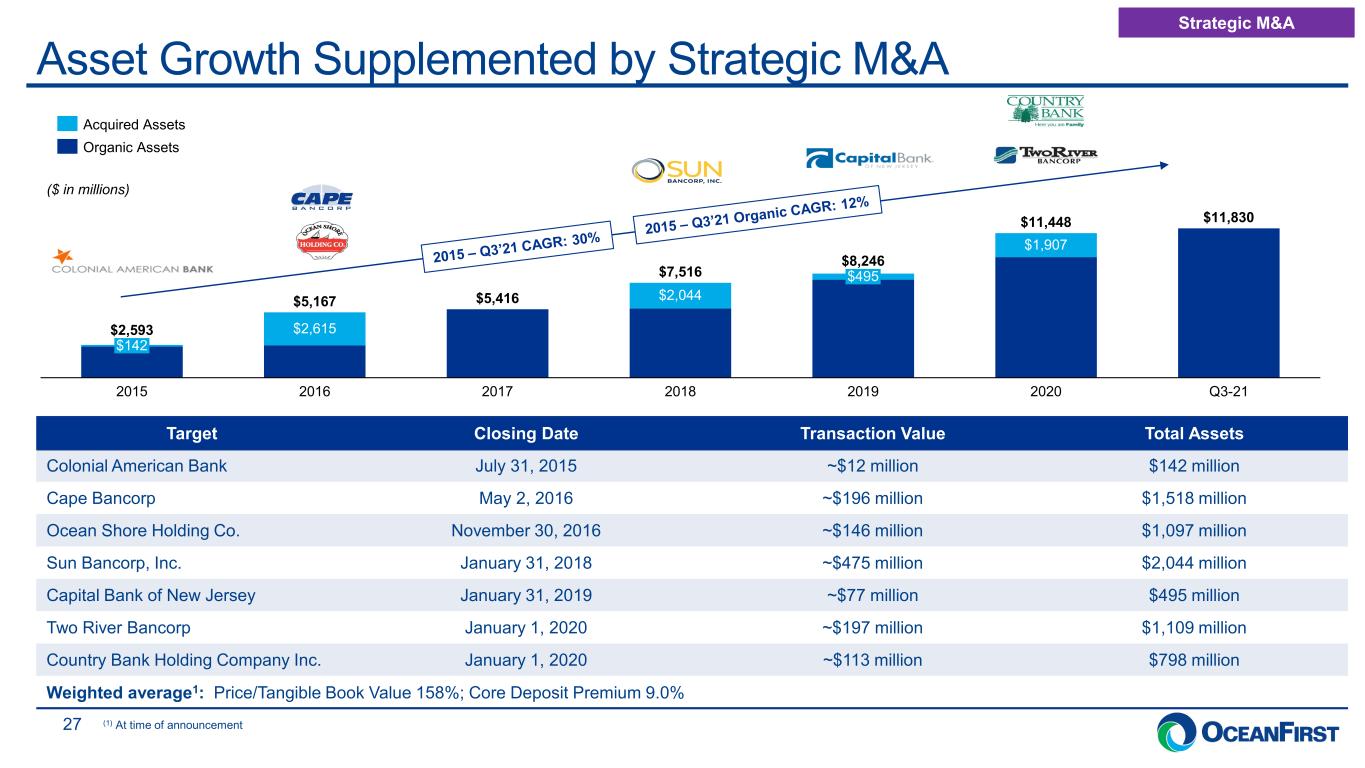

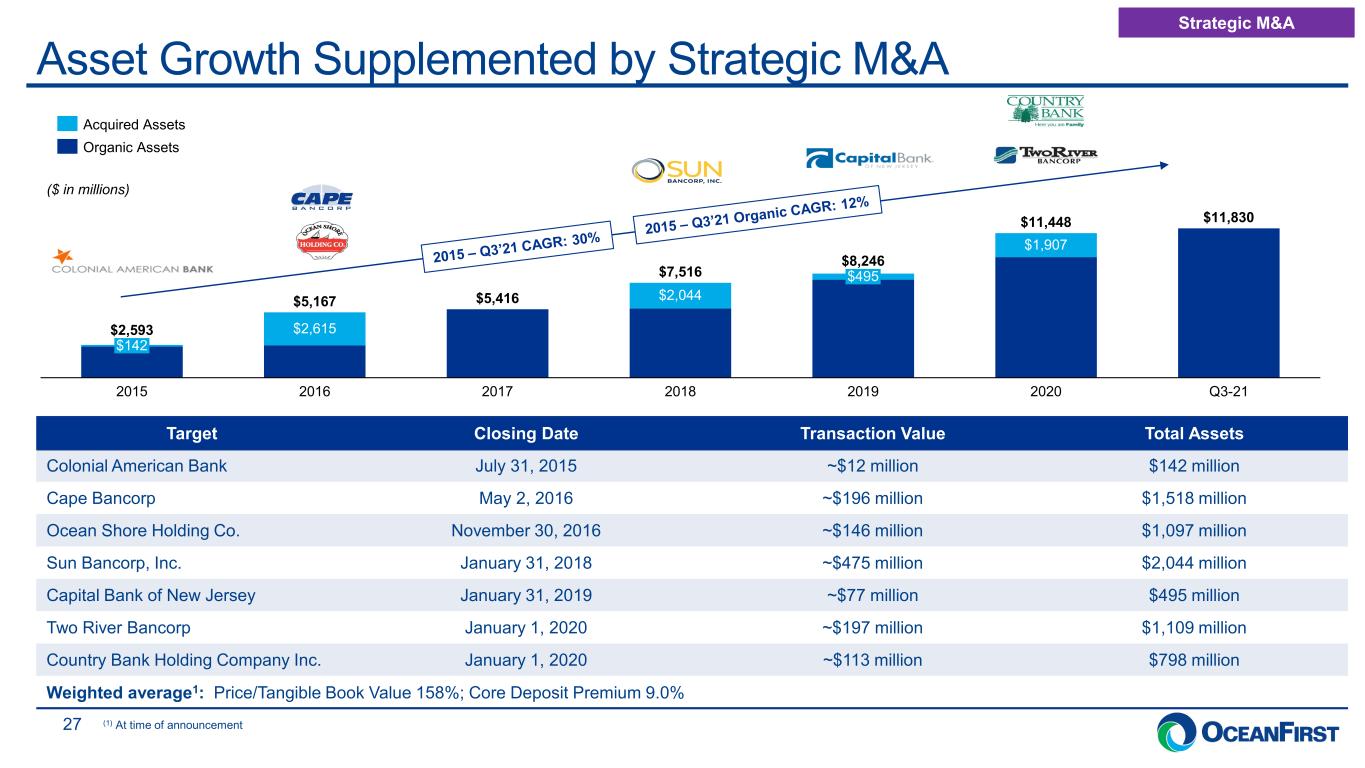

. . .Asset Growth Supplemented by Strategic M&A 27 ($ in millions) Strategic M&A Target Closing Date Transaction Value Total Assets Colonial American Bank July 31, 2015 ~$12 million $142 million Cape Bancorp May 2, 2016 ~$196 million $1,518 million Ocean Shore Holding Co. November 30, 2016 ~$146 million $1,097 million Sun Bancorp, Inc. January 31, 2018 ~$475 million $2,044 million Capital Bank of New Jersey January 31, 2019 ~$77 million $495 million Two River Bancorp January 1, 2020 ~$197 million $1,109 million Country Bank Holding Company Inc. January 1, 2020 ~$113 million $798 million Weighted average1: Price/Tangible Book Value 158%; Core Deposit Premium 9.0% $495 20172016 $142 20192015 2018 2020 Q3-21 $2,593 $2,044$5,167 $5,416 $7,516 $8,246 $11,448 $11,830 $1,907 $2,615 Acquired Assets Organic Assets (1) At time of announcement

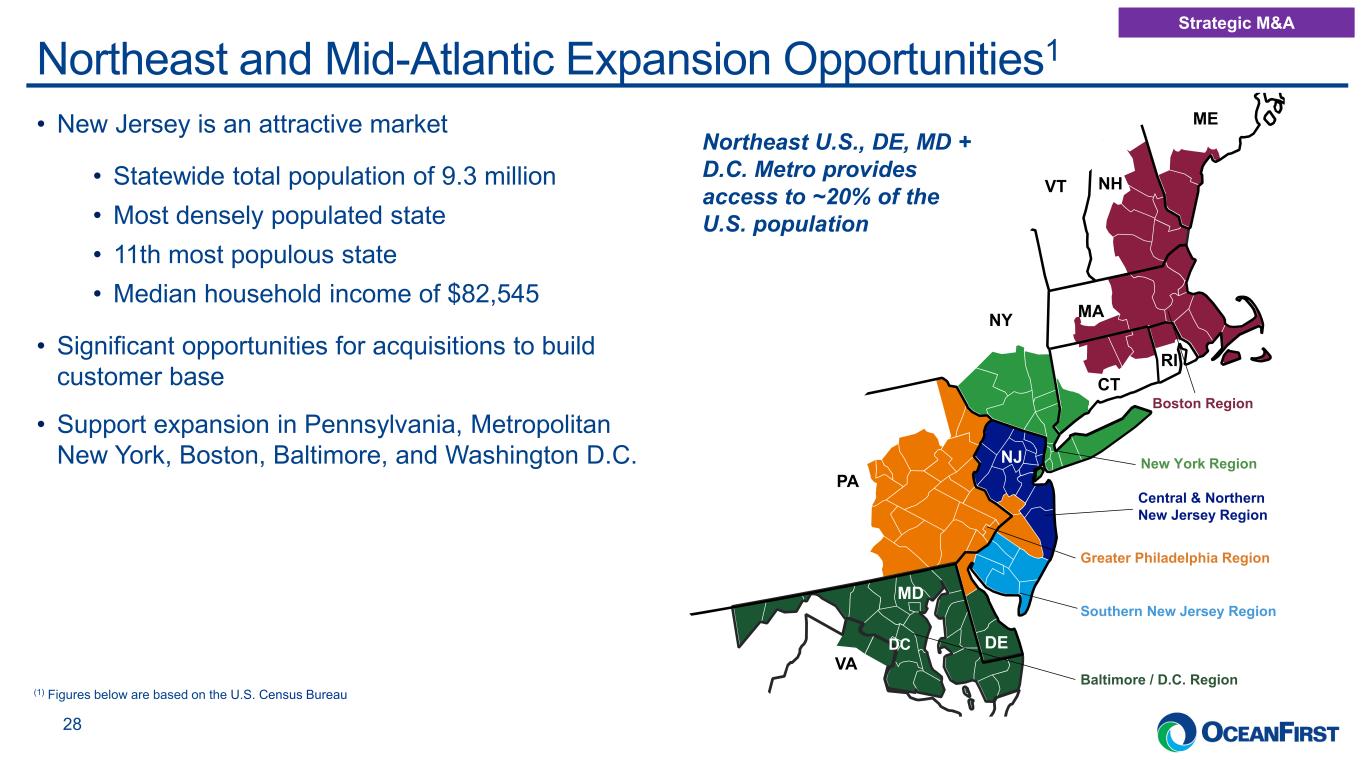

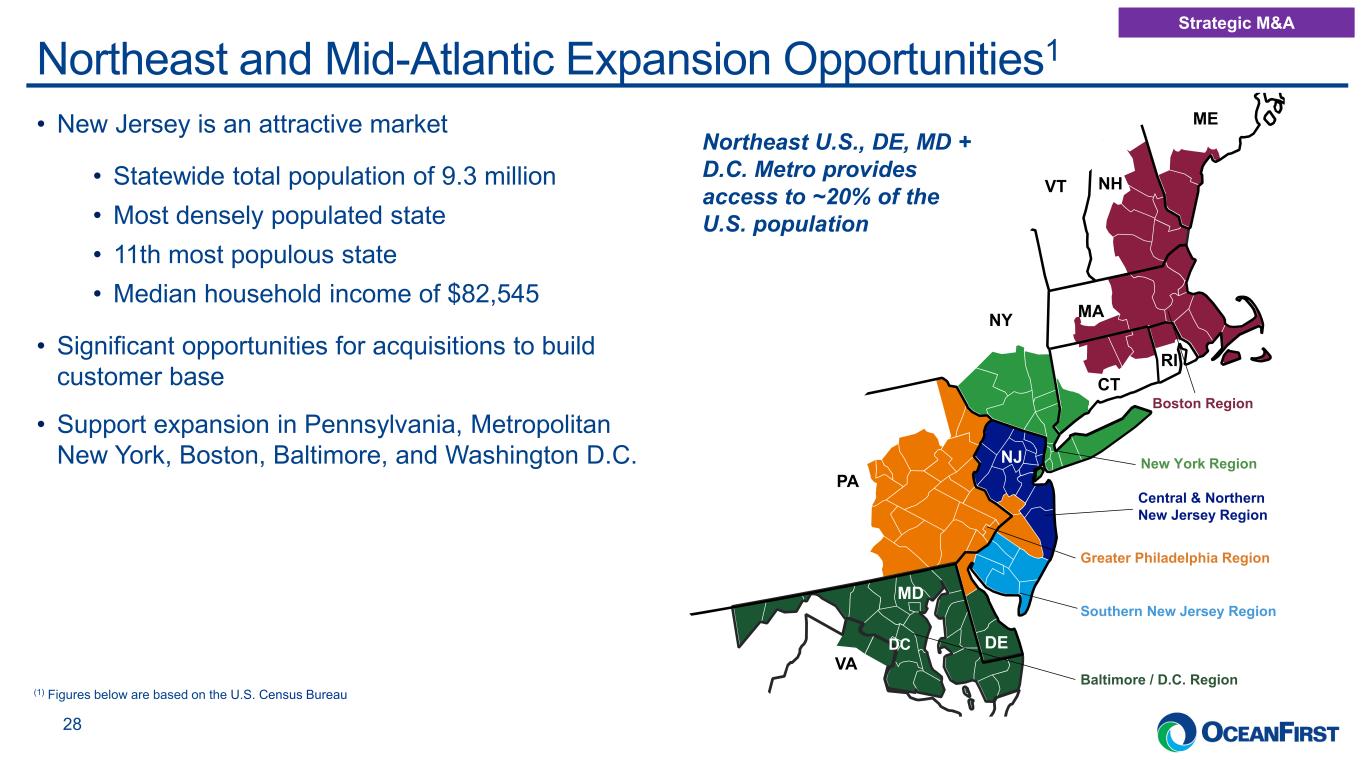

. . .Northeast and Mid-Atlantic Expansion Opportunities1 28 Strategic M&A • New Jersey is an attractive market • Statewide total population of 9.3 million • Most densely populated state • 11th most populous state • Median household income of $82,545 • Significant opportunities for acquisitions to build customer base • Support expansion in Pennsylvania, Metropolitan New York, Boston, Baltimore, and Washington D.C. VA PA NY MA CT RI MD DC DE NJ NH ME VT Central & Northern New Jersey Region Southern New Jersey Region Greater Philadelphia Region New York Region Boston Region Baltimore / D.C. Region Northeast U.S., DE, MD + D.C. Metro provides access to ~20% of the U.S. population (1) Figures below are based on the U.S. Census Bureau

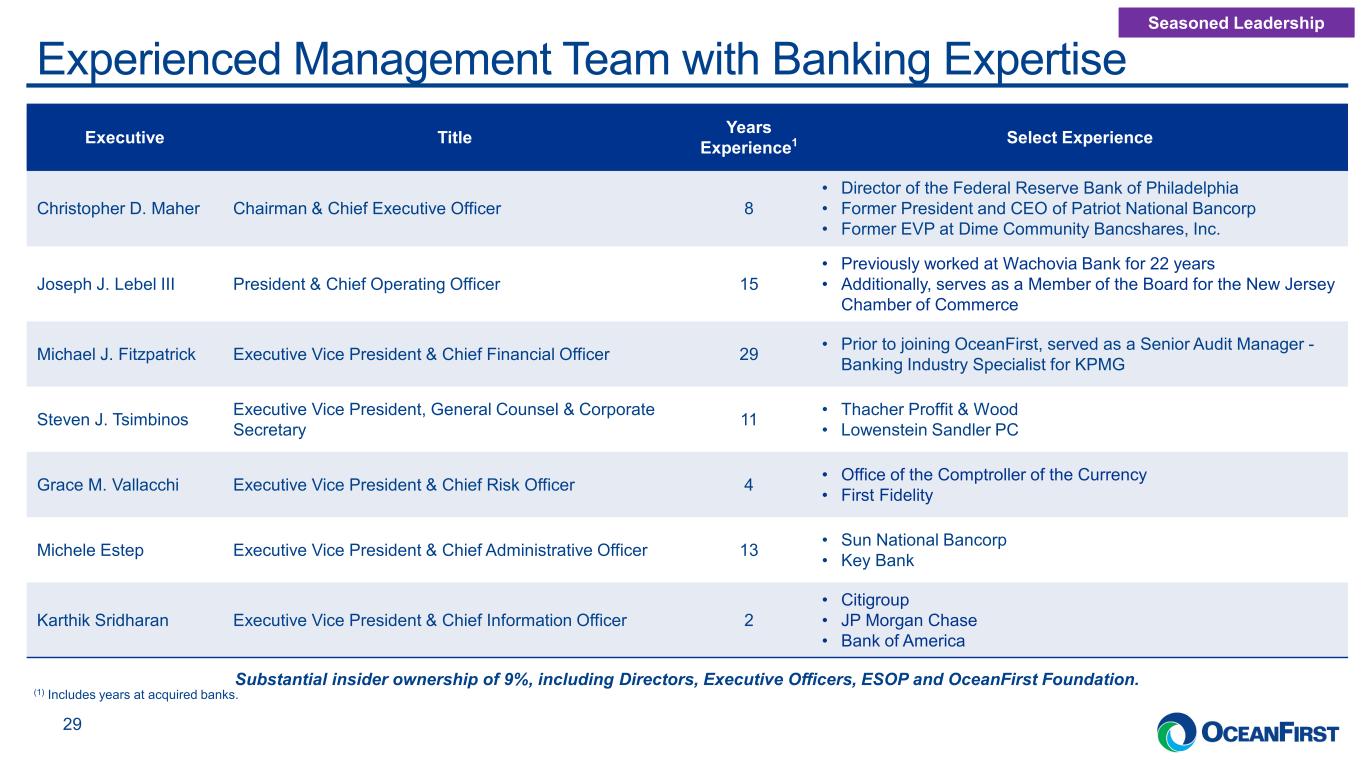

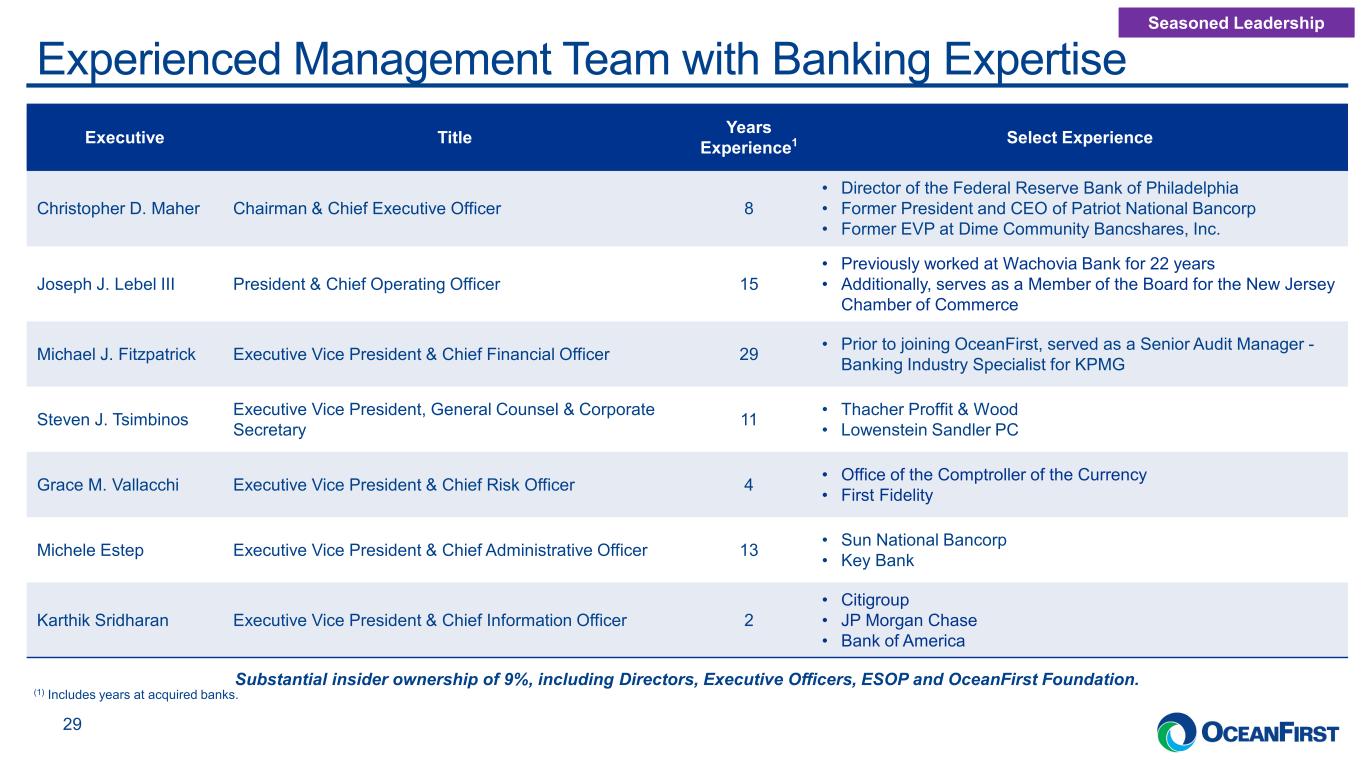

. . .Experienced Management Team with Banking Expertise 29 Seasoned Leadership Substantial insider ownership of 9%, including Directors, Executive Officers, ESOP and OceanFirst Foundation. Executive Title Years Experience1 Select Experience Christopher D. Maher Chairman & Chief Executive Officer 8 • Director of the Federal Reserve Bank of Philadelphia • Former President and CEO of Patriot National Bancorp • Former EVP at Dime Community Bancshares, Inc. Joseph J. Lebel III President & Chief Operating Officer 15 • Previously worked at Wachovia Bank for 22 years • Additionally, serves as a Member of the Board for the New Jersey Chamber of Commerce Michael J. Fitzpatrick Executive Vice President & Chief Financial Officer 29 • Prior to joining OceanFirst, served as a Senior Audit Manager - Banking Industry Specialist for KPMG Steven J. Tsimbinos Executive Vice President, General Counsel & Corporate Secretary 11 • Thacher Proffit & Wood • Lowenstein Sandler PC Grace M. Vallacchi Executive Vice President & Chief Risk Officer 4 • Office of the Comptroller of the Currency • First Fidelity Michele Estep Executive Vice President & Chief Administrative Officer 13 • Sun National Bancorp • Key Bank Karthik Sridharan Executive Vice President & Chief Information Officer 2 • Citigroup • JP Morgan Chase • Bank of America (1) Includes years at acquired banks.

. . . I N V E S T O R P R E S E N T A T I O N 30 Appendix

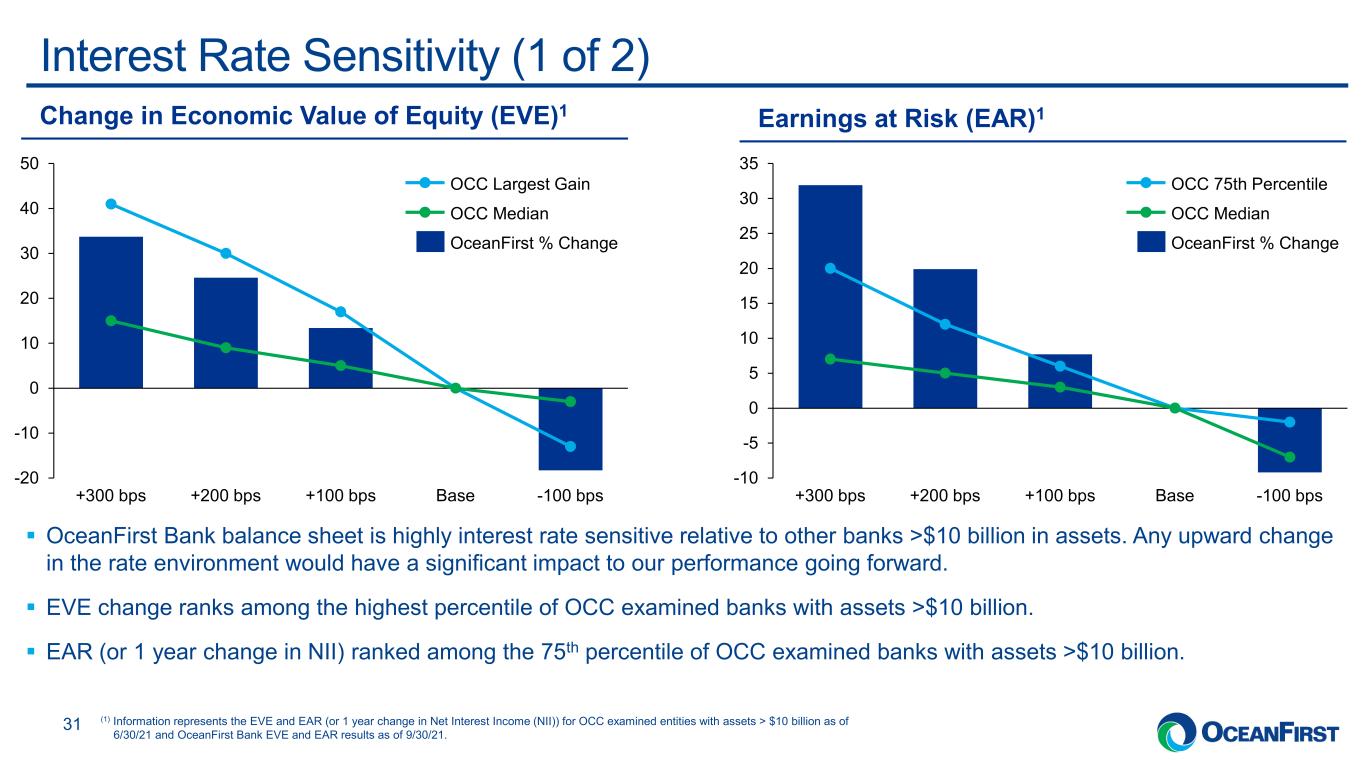

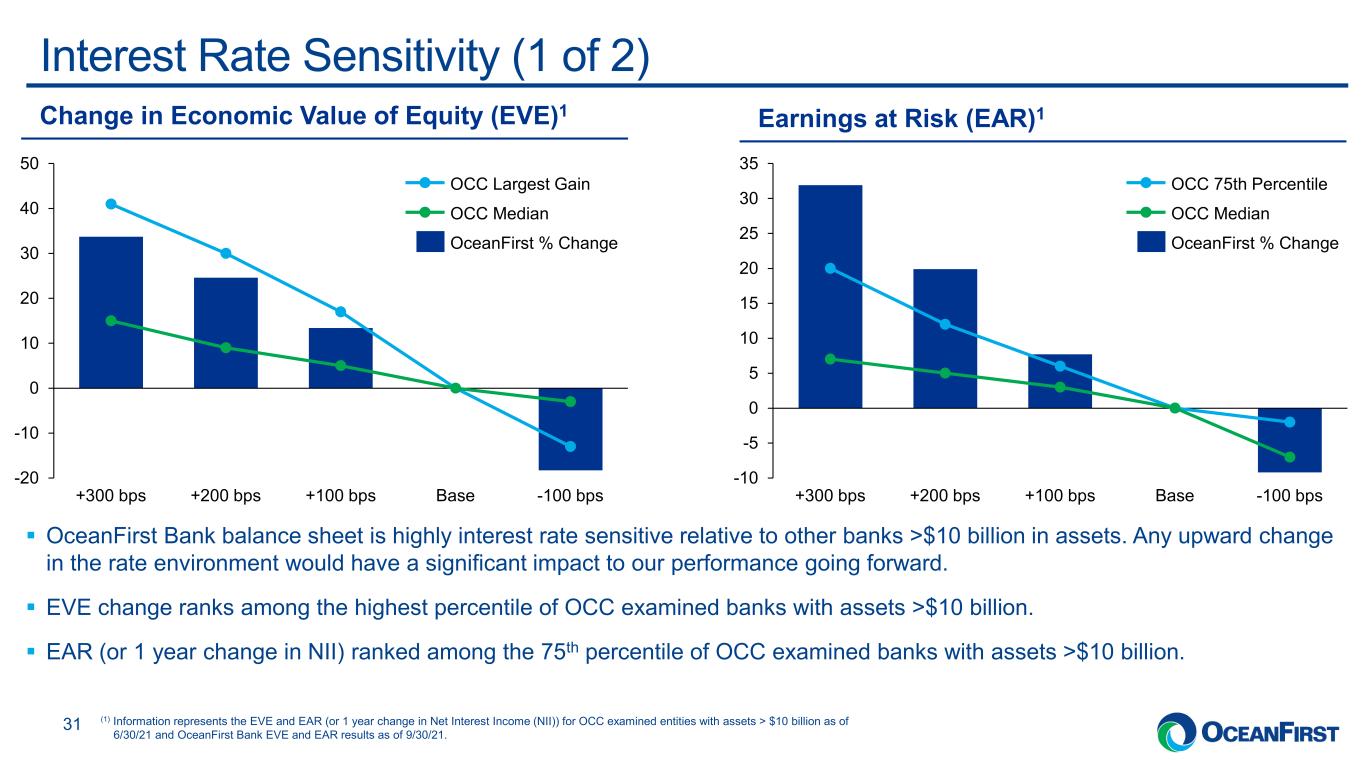

. . .Interest Rate Sensitivity (1 of 2) 31 (1) Information represents the EVE and EAR (or 1 year change in Net Interest Income (NII)) for OCC examined entities with assets > $10 billion as of 6/30/21 and OceanFirst Bank EVE and EAR results as of 9/30/21. OceanFirst Bank balance sheet is highly interest rate sensitive relative to other banks >$10 billion in assets. Any upward change in the rate environment would have a significant impact to our performance going forward. EVE change ranks among the highest percentile of OCC examined banks with assets >$10 billion. EAR (or 1 year change in NII) ranked among the 75th percentile of OCC examined banks with assets >$10 billion. Change in Economic Value of Equity (EVE)1 Earnings at Risk (EAR)1 -20 -10 0 10 20 30 40 50 +300 bps Base+100 bps+200 bps -100 bps OCC Largest Gain OCC Median OceanFirst % Change -10 -5 0 5 10 15 20 25 30 35 +300 bps -100 bps+100 bps+200 bps Base OCC 75th Percentile OceanFirst % Change OCC Median

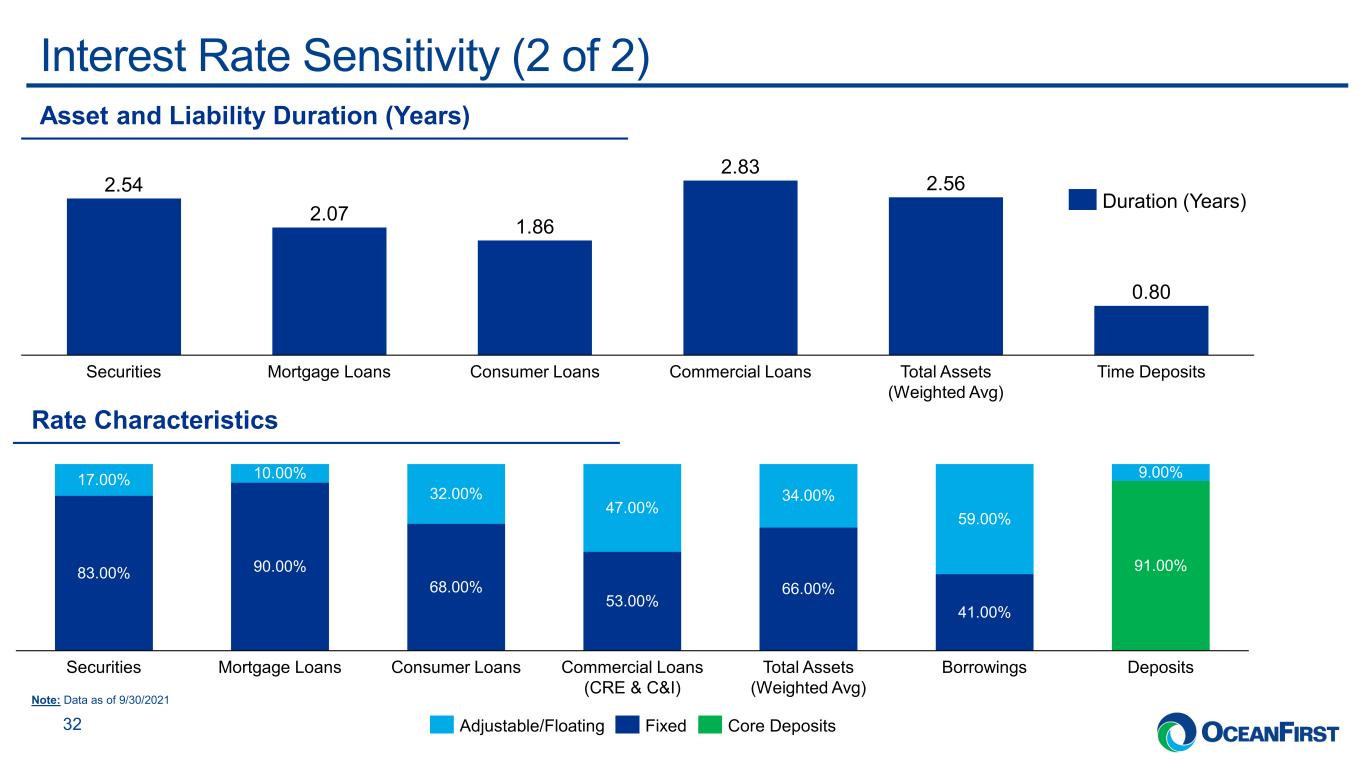

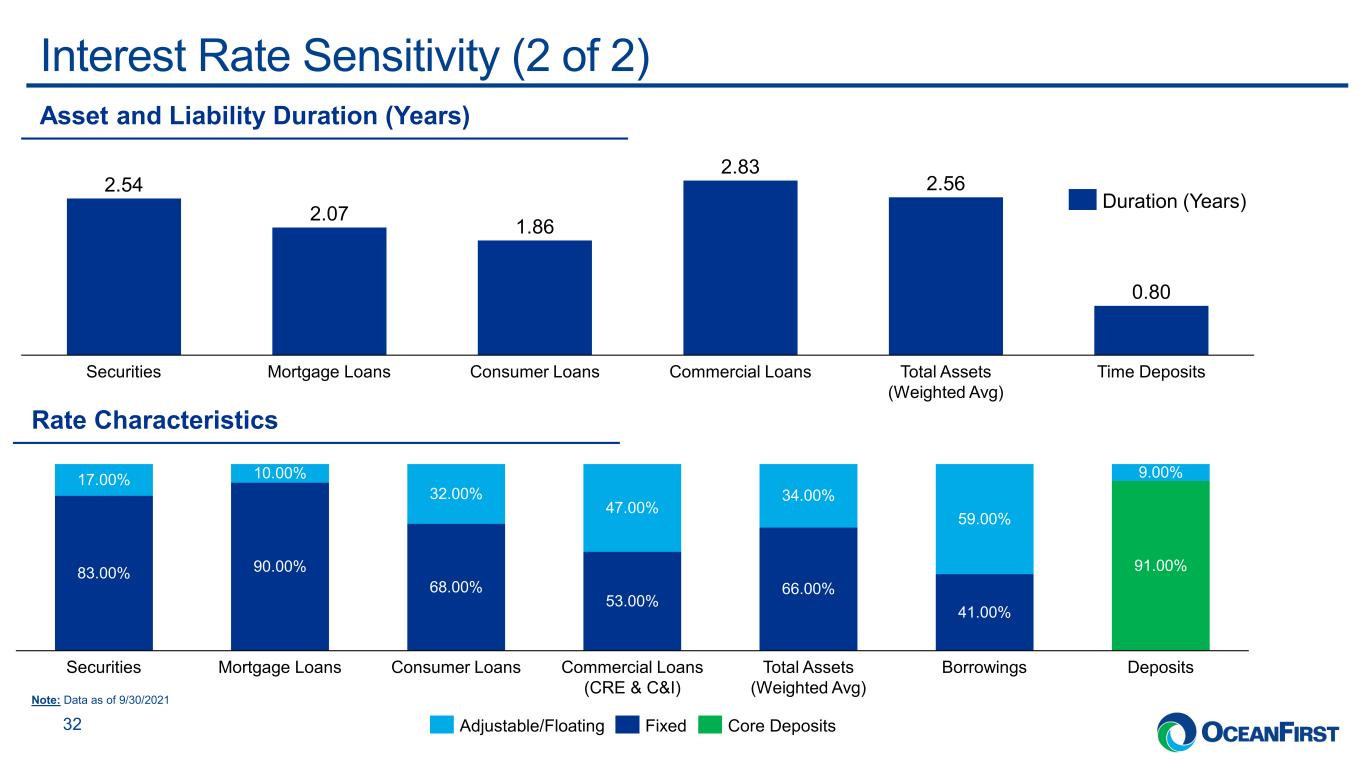

. . .Interest Rate Sensitivity (2 of 2) 32 2.54 2.07 1.86 2.83 2.56 0.80 Securities Total Assets (Weighted Avg) Mortgage Loans Consumer Loans Time DepositsCommercial Loans Duration (Years) Asset and Liability Duration (Years) Rate Characteristics 83.00% 90.00% 68.00% 53.00% 66.00% 41.00% 91.00% 17.00% 10.00% 32.00% 47.00% 34.00% 59.00% 9.00% Securities Mortgage Loans Commercial Loans (CRE & C&I) Consumer Loans Total Assets (Weighted Avg) DepositsBorrowings Adjustable/Floating Fixed Core Deposits Note: Data as of 9/30/2021

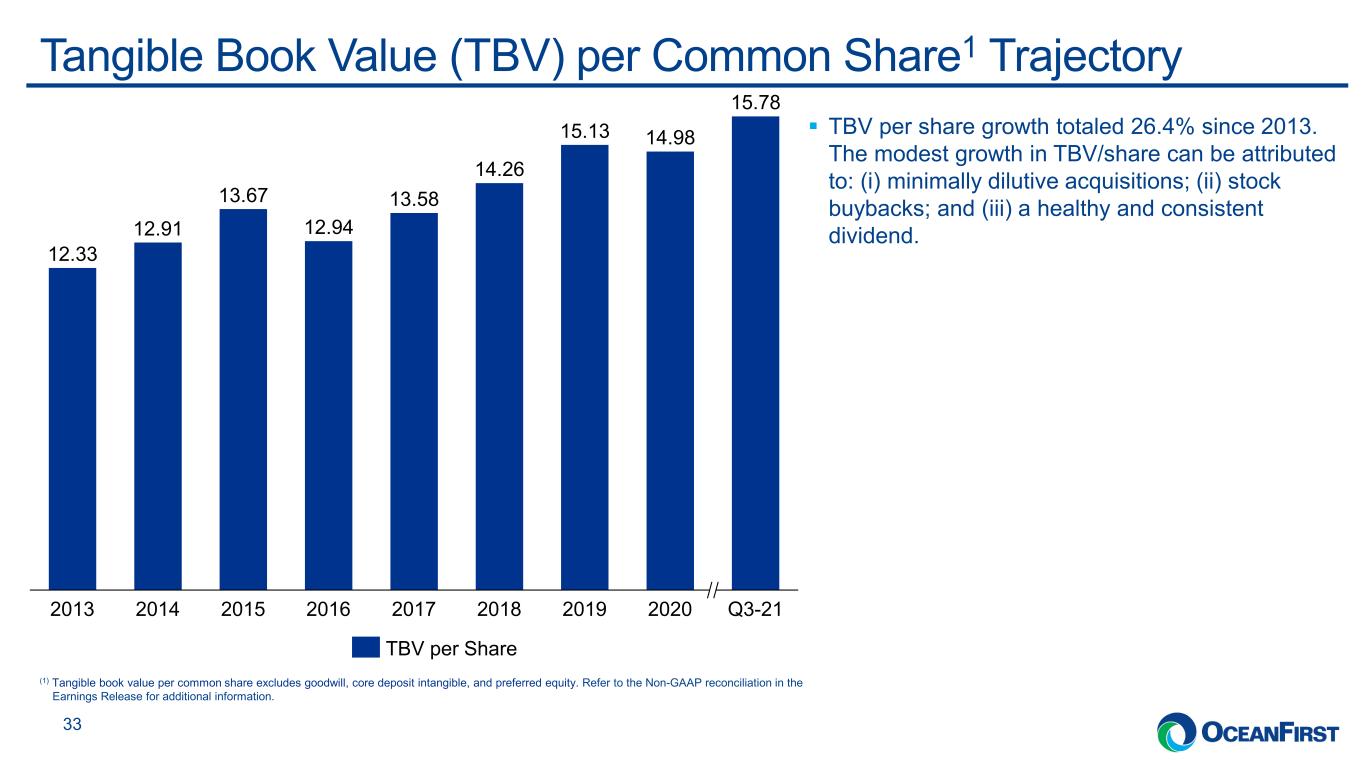

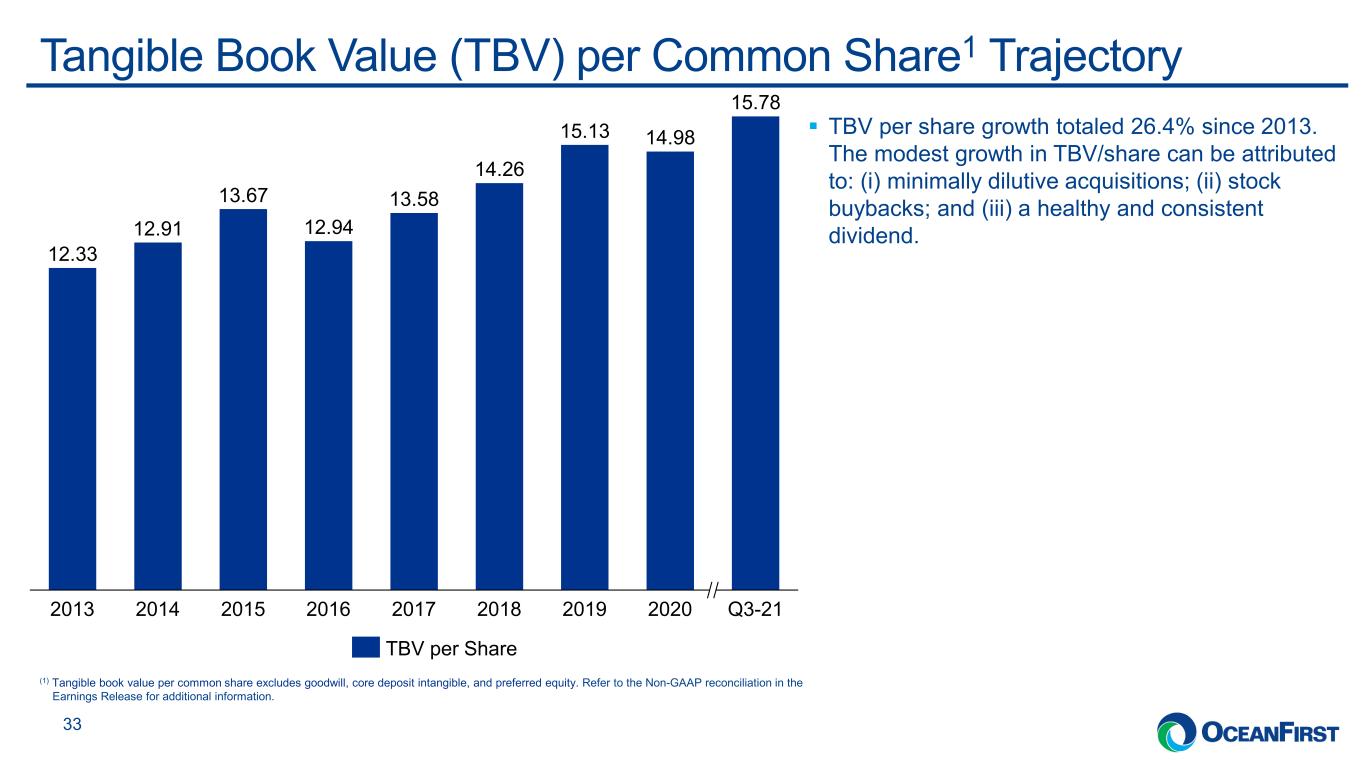

. . .Tangible Book Value (TBV) per Common Share1 Trajectory 33 12.33 12.91 13.67 12.94 13.58 14.26 15.13 14.98 15.78 20192013 2014 202020172015 2016 2018 Q3-21 TBV per Share TBV per share growth totaled 26.4% since 2013. The modest growth in TBV/share can be attributed to: (i) minimally dilutive acquisitions; (ii) stock buybacks; and (iii) a healthy and consistent dividend. (1) Tangible book value per common share excludes goodwill, core deposit intangible, and preferred equity. Refer to the Non-GAAP reconciliation in the Earnings Release for additional information.

. . .Quarterly Non-GAAP / Adjusted to GAAP Disclosure Reported amounts are presented in accordance with generally accepted accounting principles in the United States (“GAAP”). The Company’s management believes that the supplemental Non-GAAP information, which consists of reported net income excluding non-core operations, which can vary from period to period, provides a better comparison of period to period operating performance. Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for financial results in accordance with GAAP, nor are they necessarily comparable to Non-GAAP performance measures which may be presented by other companies. 34

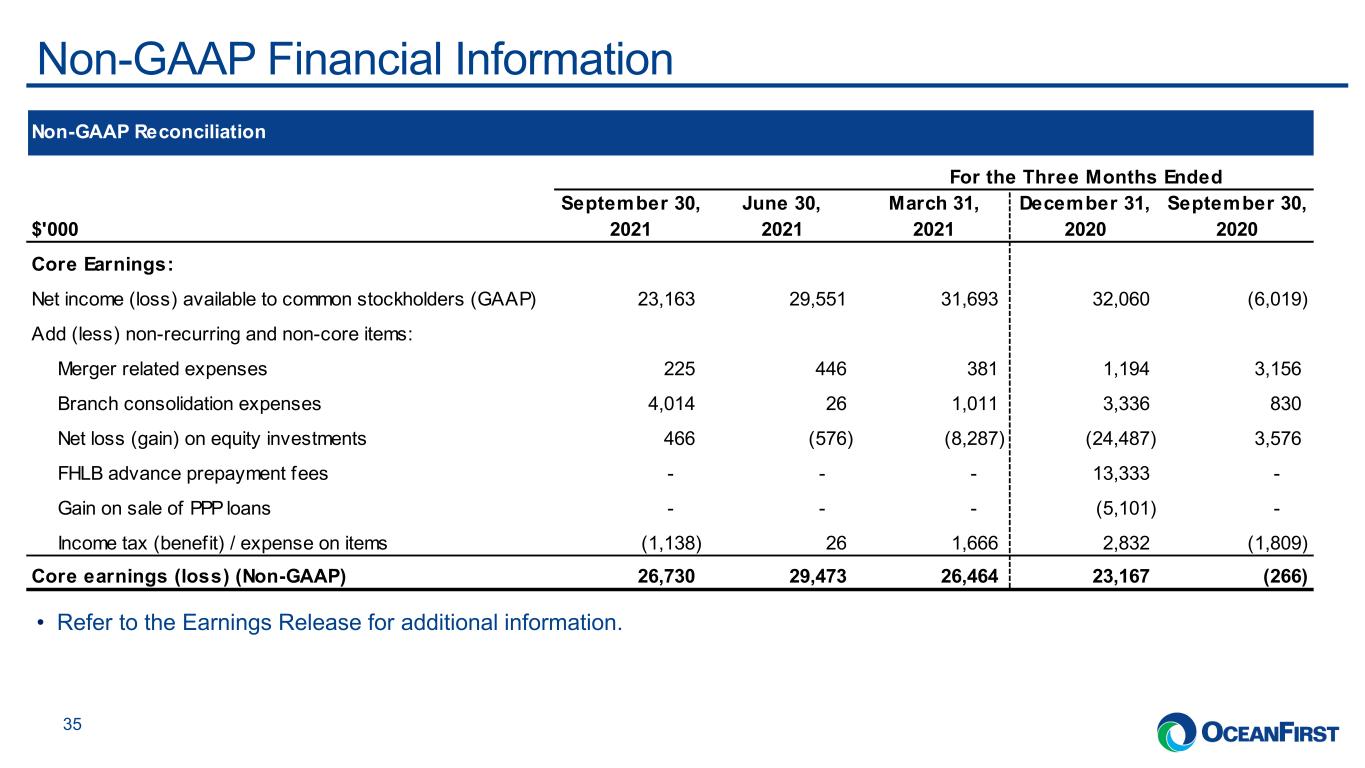

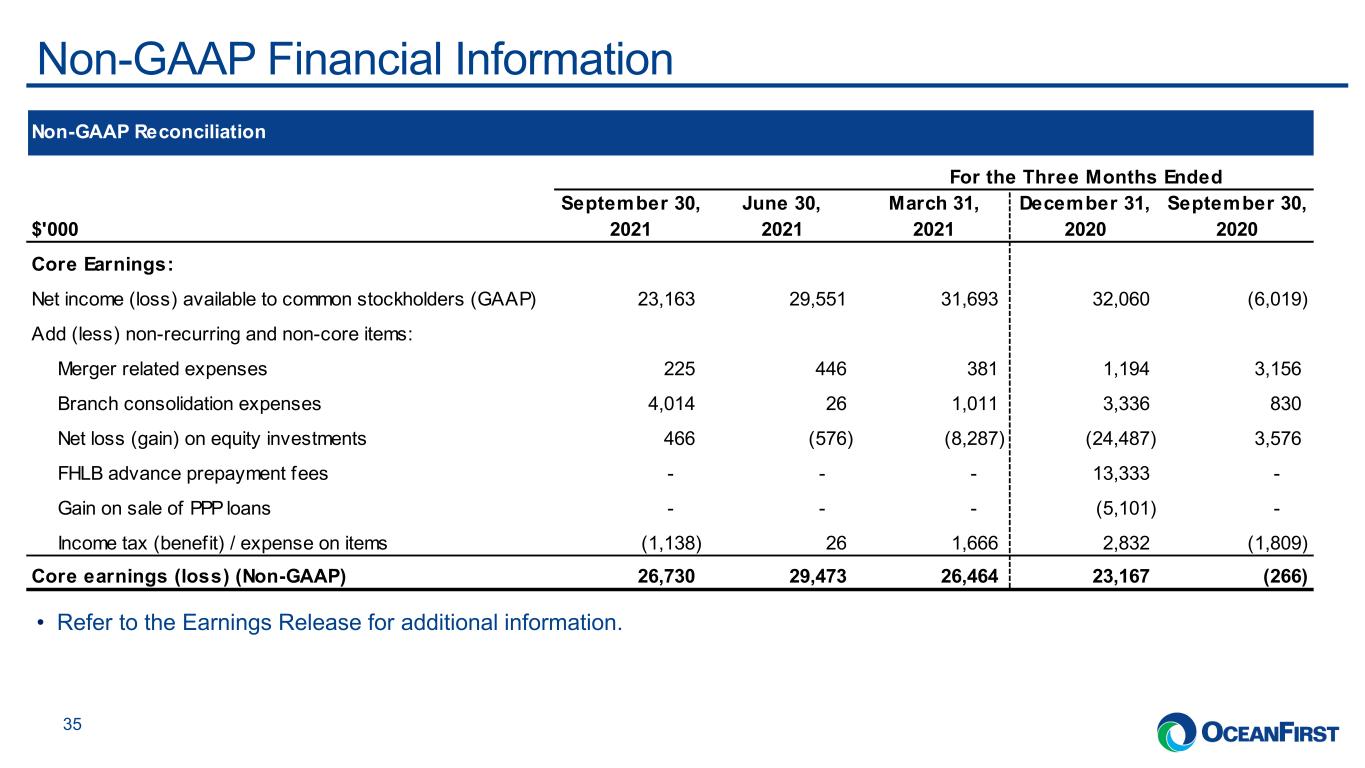

. . .Non-GAAP Financial Information 35 • Refer to the Earnings Release for additional information. Non-GAAP Reconciliation For the Three Months Ended $'000 September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 September 30, 2020 Core Earnings: Net income (loss) available to common stockholders (GAAP) 23,163 29,551 31,693 32,060 (6,019) Add (less) non-recurring and non-core items: Merger related expenses 225 446 381 1,194 3,156 Branch consolidation expenses 4,014 26 1,011 3,336 830 Net loss (gain) on equity investments 466 (576) (8,287) (24,487) 3,576 FHLB advance prepayment fees - - - 13,333 - Gain on sale of PPP loans - - - (5,101) - Income tax (benefit) / expense on items (1,138) 26 1,666 2,832 (1,809) Core earnings (loss) (Non-GAAP) 26,730 29,473 26,464 23,167 (266)