. . . 1 The 3Q 2022 Investor Presentation should be read in conjunction with the Earnings Release furnished as Exhibit 99.1 to Form 8-K filed with the SEC on October 24, 2022. Exhibit 99.2 OceanFirst Financial Corp. 3Q 2022 Investor Presentation1 October 2022

. . .Legal Disclaimer FORWARD LOOKING STATEMENTS. In addition to historical information, this news release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which are based on certain assumptions and describe future plans, strategies and expectations of the Company. These forward-looking statements are generally identified by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “will,” “should,” “may,” “view,” “opportunity,” “potential,” or similar expressions or expressions of confidence. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations of the Company and its subsidiaries include, but are not limited to: management plans relating to the proposed transaction with Partners Bancorp (the “Transaction”); the ability to complete the Transaction; the ability to obtain any required regulatory, stockholder or other approvals, authorizations or consents; the expected timing of the completion of the Transaction; any statements of the plans and objectives of management for future operations, products or services, including the execution of integration plans relating to the Transaction; the continuing impact of the COVID-19 or any other pandemic on our operations and financial results and those of our customers, changes in interest rates, inflation, general economic conditions, levels of unemployment in the Bank’s lending area, real estate market values in the Bank’s lending area, future natural disasters and increases to flood insurance premiums, the current or potential impact of military conflict, terrorism or other geopolitical events, the level of prepayments on loans and mortgage-backed securities, legislative/regulatory changes, monetary and fiscal policies of the U.S. Government including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System, the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand for financial services in the Company’s market area, change in accounting principles, a failure in or breach of the Company’s operational or security systems or infrastructure, including cyberattacks; and guidelines and the Bank’s ability to successfully integrate acquired operations. These risks and uncertainties are further discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, under Item 1A - Risk Factors and elsewhere, and in subsequent securities filings and should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. NON-GAAP FINANCIAL INFORMATION. This presentation contains certain non-GAAP (generally accepted accounting principles) measures. These non-GAAP measures, as calculated by the Company, are not necessarily comparable to similarly titled measures reported by other companies. Additionally, these non-GAAP measures are not measures of financial performance or liquidity under GAAP and should not be considered alternatives to the Company's other financial information determined under GAAP. See reconciliations of certain non-GAAP measures included in the Company’s Earnings Release furnished as Exhibit 99.1 to Form 8-K as filed with the SEC on October 24, 2022. MARKET AND INDUSTRY DATA. This presentation references certain market, industry and demographic data, forecasts and other statistical information. We have obtained this data, forecasts and information from various independent, third-party industry sources and publications. Nothing in the data, forecasts or information used or derived from third party sources should be construed as advice. Some data and other information are also based on our good faith estimates, which are derived from our review of industry publications and surveys and independent sources. We believe that these sources and estimates are reliable but have not independently verified them. Statements as to our market position are based on market data currently available to us. These estimates involve inherent risks and uncertainties and are based on assumptions that are subject to change. 2

. . .Strategic and Operational Focus 3 Outstanding and Proven Growth Efficiency Cost Model Focused on Investment in Technology Efficient Funding Base and Competitive Spreads Strategic Capital Utilization Significant top-line revenue growth driven by robust loan growth. Optimized branch network by refocusing spend on technology to enhance our customer experience and operational efficiency. NIM continues to trend upward with expansion spurred by loan growth, our asset-sensitive balance sheet, and low deposit funding. Significant stockholder capital returns, minimally dilutive acquisitions, maintaining strong regulatory capital thresholds.

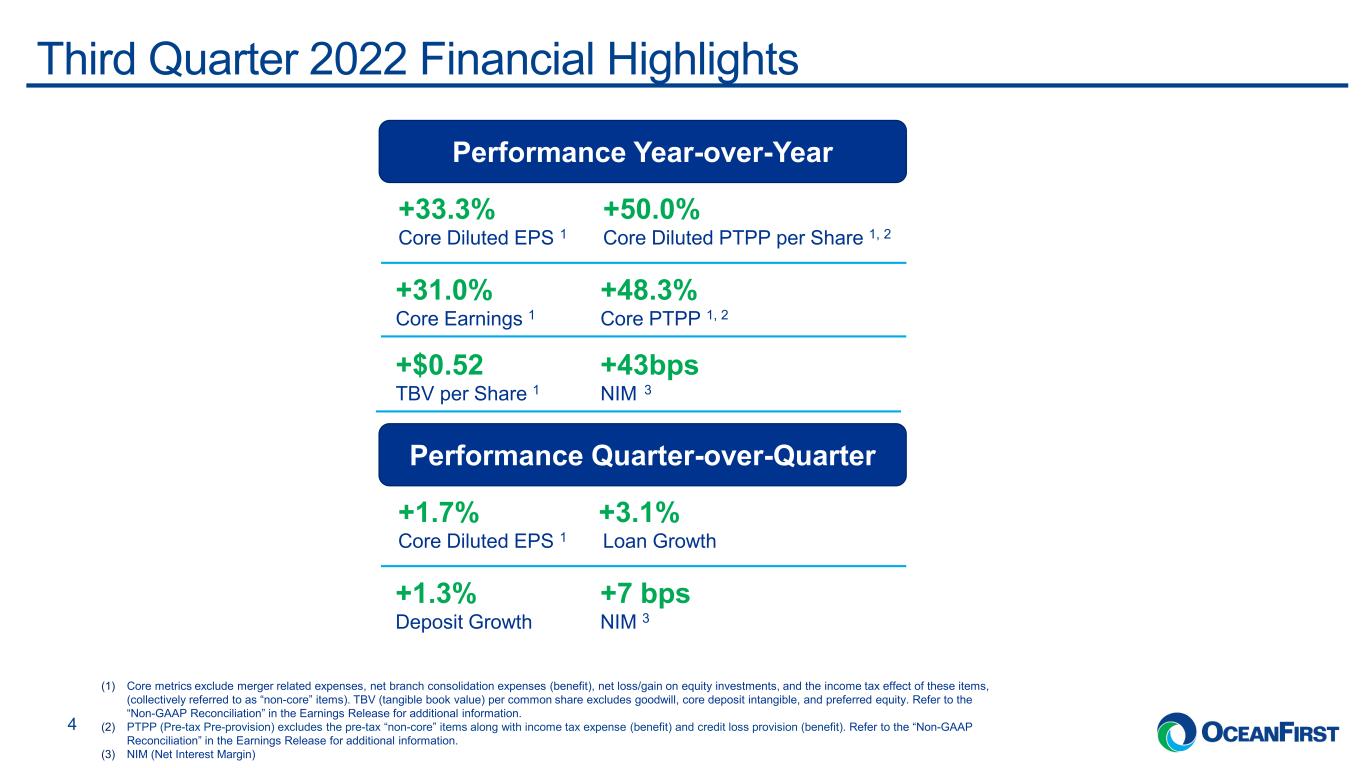

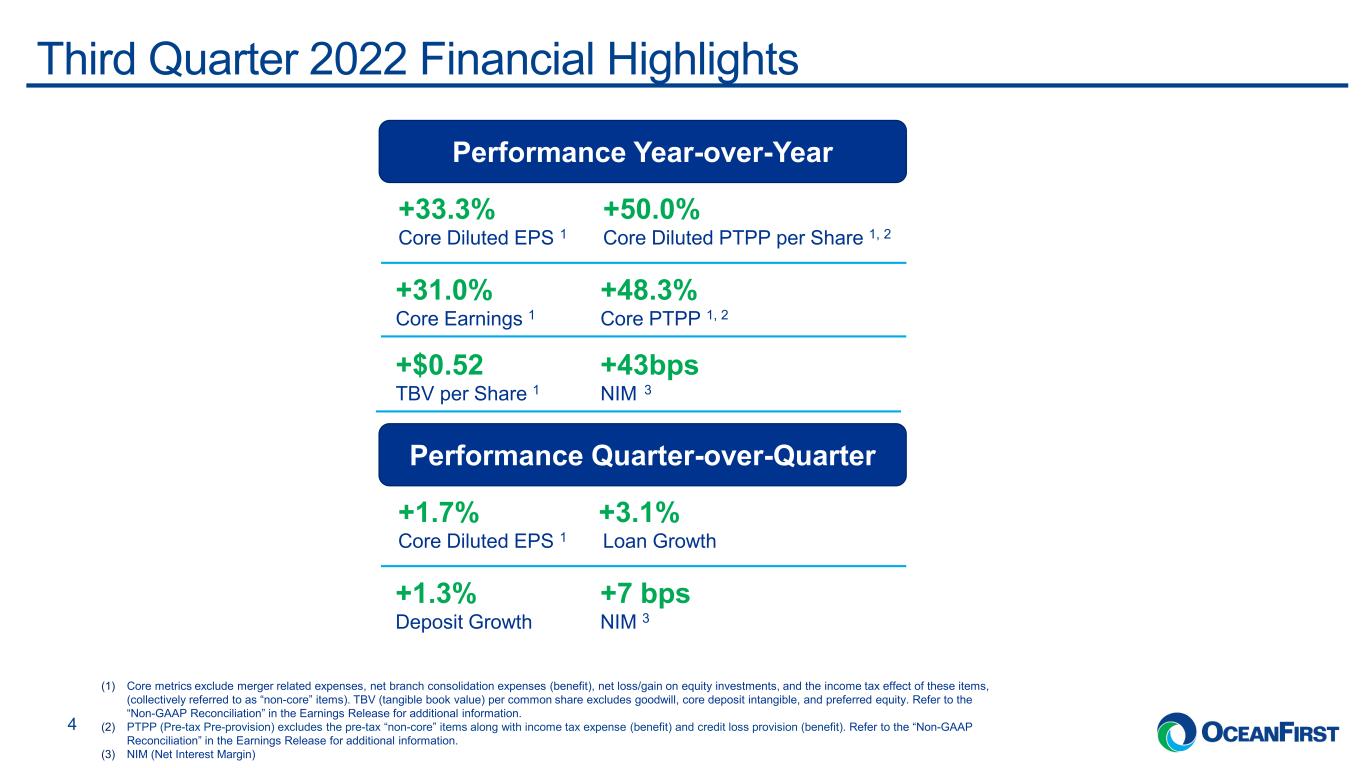

. . .Third Quarter 2022 Financial Highlights 4 Performance Year-over-Year (1) Core metrics exclude merger related expenses, net branch consolidation expenses (benefit), net loss/gain on equity investments, and the income tax effect of these items, (collectively referred to as “non-core” items). TBV (tangible book value) per common share excludes goodwill, core deposit intangible, and preferred equity. Refer to the “Non-GAAP Reconciliation” in the Earnings Release for additional information. (2) PTPP (Pre-tax Pre-provision) excludes the pre-tax “non-core” items along with income tax expense (benefit) and credit loss provision (benefit). Refer to the “Non-GAAP Reconciliation” in the Earnings Release for additional information. (3) NIM (Net Interest Margin) +33.3% +50.0% Core Diluted EPS 1 Core Diluted PTPP per Share 1, 2 +31.0% +48.3% Core Earnings 1 Core PTPP 1, 2 +$0.52 +43bps TBV per Share 1 NIM 3 Performance Quarter-over-Quarter +1.7% +3.1% Core Diluted EPS 1 Loan Growth +1.3% +7 bps Deposit Growth NIM 3

. . .Proven Historical Net Interest Income and Loan Growth 5 76,829 120,262 169,218 240,502 255,971 312,951 305,338 270,989 Q3-222017 3.25% 2015 3.71% 2016 3.46% 3.52% 3.62% 2018 2019 3.16% 362,311 2020 2.92% 2021 3.28% YTD Sep-22 AnnualizedNet Interest Margin Net Interest Income Peer Leading Net Interest Income Growth ($’000) Net Interest Income CAGR 25.9% 1,135 1,187 2,023 2,296 3,492 4,378 5,008 570 741 793 1,145 1,055 984 145 653 831 1,704 1,749 2,045 2,321 2,309 2,480 2,813 1,988 308 291 193 5,589 534 9,719 2015 153 3,975 261 339 408 511 2016 281 Q3-22 188 6,214 201920182017 475 305 396 471 2020 3,817 261 449 2021 7,756 8,623 C&I LoanResidentialHome Equity & Consumer Investor CREOwner Occupied CRE Significant Growth in Commercial Loan Portfolio ($’millions) Investor CRE CAGR 40.2% Owner Occupied CRE / C&I CAGR 21.0%

. . .Successful Commercial Loan Growth 6 Q3-22 68% 2015 49% +19% (Commercial % of Loan Portfolio) Commercial Loans by Geography as of Q3-22 53% of commercial loans originated in Philadelphia and NY Emphasis on Commercial Increase of $5.7B in commercial loans since 2015 41% 31% 22% 6% New Jersey New York Boston / Baltimore Philadelphia Total: $6.6B New York commercial loan balance surpassed $2 billion in Q2-22

. . .Continued Focus on Growing Core Deposits1 7 Shift Toward Non-Interest Bearing Deposits ($’millions) 1,661 3,542 3,736 4,948 5,393 8,055 8,958 8,555647 607 866 936 1,373 775 1,404 20212016 255 2015 6,329 20192017 2018 2020 Q3-22 1,916 4,189 4,343 5,814 9,428 9,733 9,959 Non-Core Core (1) Core deposits represent all deposits less time deposits. Organic Deposit Growth Bolstered by Acquisitions ($’millions) 4,343 9,733 9,959 2,123 1,616 1,894 20182016 123 20172015 449 2019 2020 2021 Q3-22 1,916 4,187 5,814 6,329 9,428 Acquired Deposits Organic Deposits 59% 41% Commercial Consumer Total: $10.0B Average Cost of Deposits YTD Int. Bearing Checking 0.21% Money Market 0.23% Savings 0.04% Time Deposits 1.18% Total (incl. non-int bearing) 0.24%

. . . Core Efficiency Ratio1 Expense Discipline and Focused Investment 8 Core Non-Interest Expense1 ($’000) 43,222 43,126 42,802 41,721 42,331 11,212 13,971 12,326 12,992 13,937 Q4-21 Q2-22 3,206 Q3-21 54,434 Q1-22 Q3-22 57,097 2,77755,128 57,919 59,045 Trident Technology Expense Other Core Non-Int Exp 57.51% 53.69% 62.22% Q3-21 62.57% Q1-22Q4-21 54.43% Q2-22 54.80% 53.85% Q3-22 1.84% 1.90% 1.87% 1.89% 1.87% Core Efficiency Ratio Core Non-Interest Expense to Average Assets (Annualized)Core Efficiency Ratio excl. Trident (1) Core metrics exclude merger related expenses, net branch consolidation expenses (benefit), and net loss/gain on equity investments. Refer to the “Non-GAAP Reconciliation” in the Earnings Release for additional information. Q3-22 expenses included $2.8 million of Trident Abstract Title Agency, LLC (“Trident”) expenses. We anticipate Trident run-rate to continue at approximately $3 – $4 million per quarter. Q3-22 core operating expenses, excluding Trident, increased $1.6 million from the linked quarter and totaled $56.3 million.

. . .Core Non-Interest Income ($’000)1 Expansion Opportunity 9 Q3-22 non-interest income included Trident operations, which generated $3.3 million of non-interest income in the quarter. We anticipate Trident run- rate fee income of $3 – $5 million per quarter. The Durbin amendment fee cap impacted interchange fee revenue for the full quarter of Q3-22. As such, Bankcard services revenue declined by $1.8 million compared to the linked quarter, generally in-line with expectations. 739 656 731 784 873 1,588 1,323 2,781 2,294 1,471 1,640 2,061 2,103 1,422 1,356 2,973 3,314 3,060 3,299 3,320 3,409 3,308 2,963 3,310 1,509 3,259 10,349 Q3-22Q3-21 Q4-21 Q2-22Q1-22 4,510 10,662 11,638 15,619 11,788 Fees and Service ChargesTrident Fee Income Bankcard Services Commercial Loan Swap Income Income from BOLI Other (1) Core Non-Interest Income excludes net loss/gain on equity investments. Refer to the “Non-GAAP Reconciliation” in the Earnings Release for additional information.

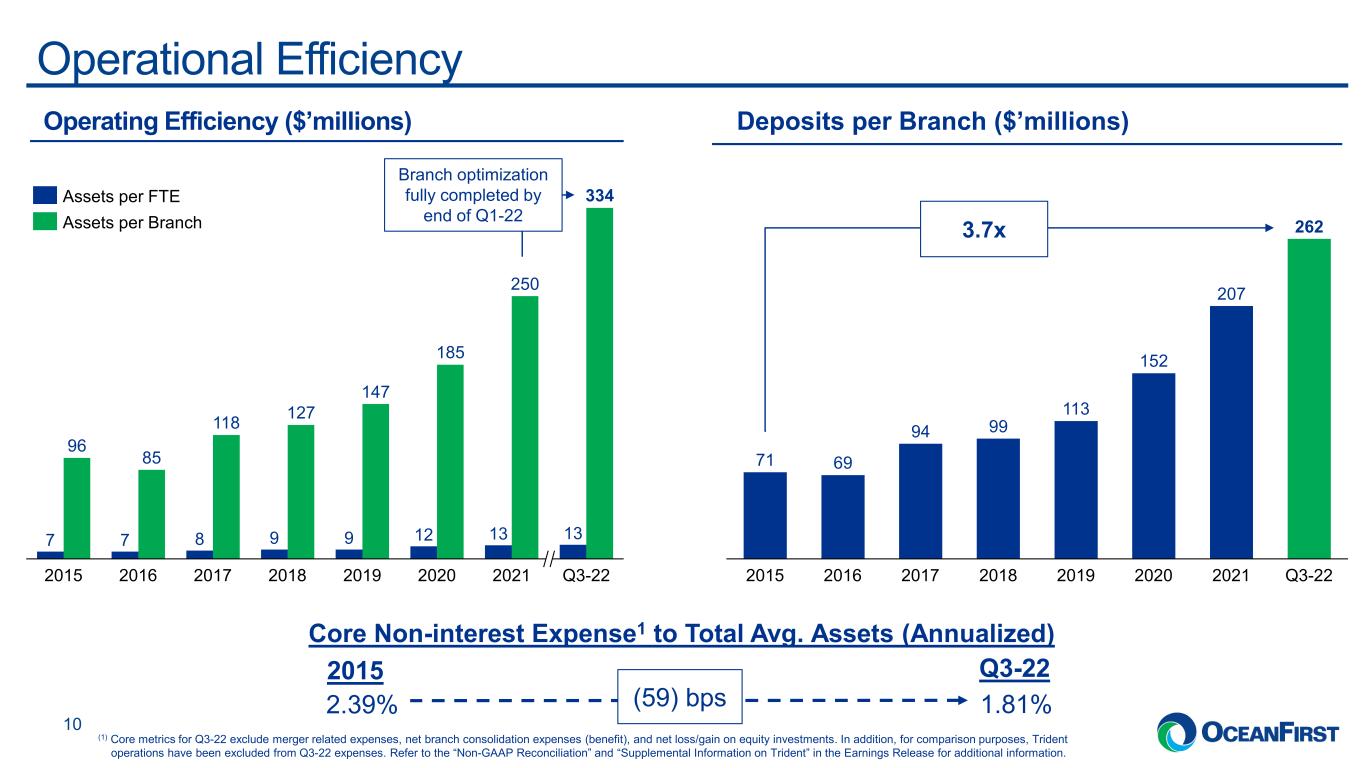

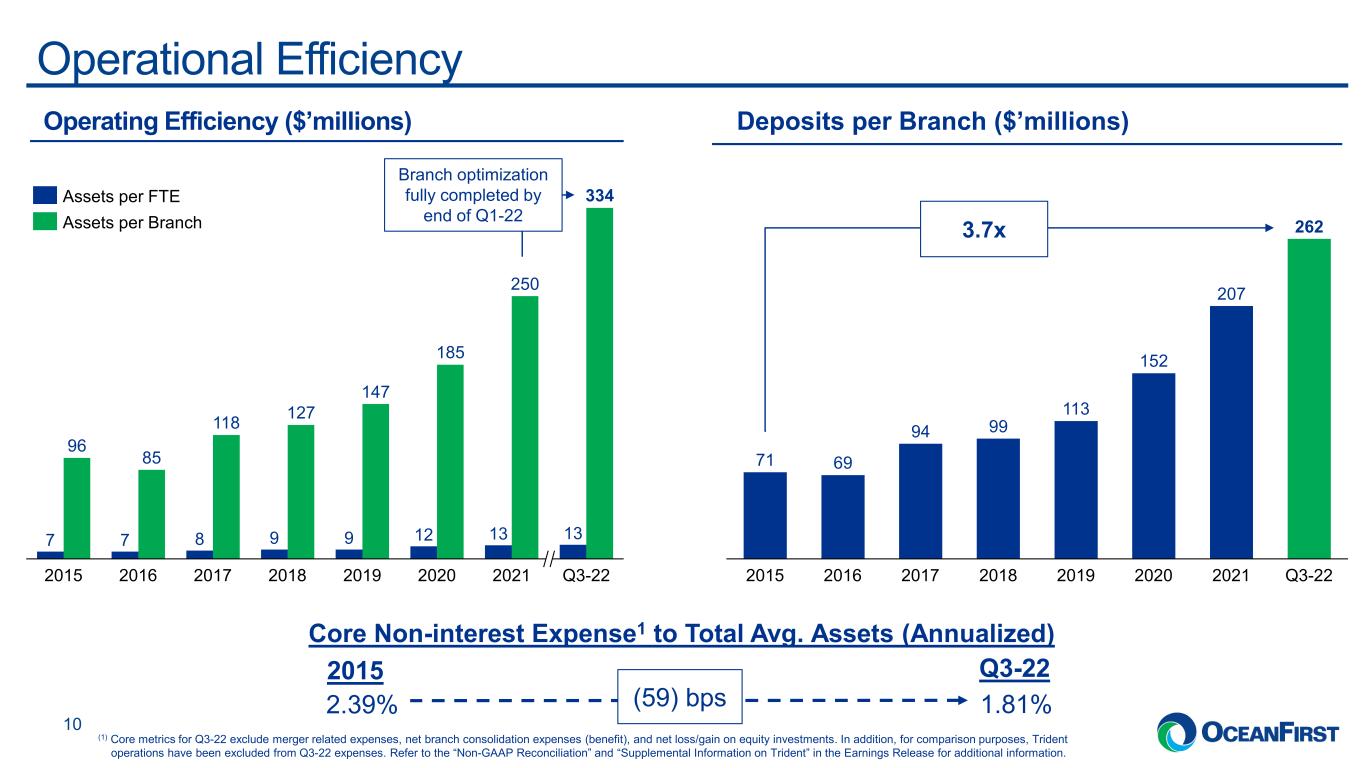

. . .Operational Efficiency 10 Deposits per Branch ($’millions) (59) bps2.39% 1.81% 2015 Q3-22 Core Non-interest Expense1 to Total Avg. Assets (Annualized) 71 69 94 99 113 152 207 262 20212015 Q3-222016 2018 20192017 2020 3.7x Operating Efficiency ($’millions) Branch optimization fully completed by end of Q1-22 (1) Core metrics for Q3-22 exclude merger related expenses, net branch consolidation expenses (benefit), and net loss/gain on equity investments. In addition, for comparison purposes, Trident operations have been excluded from Q3-22 expenses. Refer to the “Non-GAAP Reconciliation” and “Supplemental Information on Trident” in the Earnings Release for additional information. 7 7 8 9 9 12 13 13 96 85 118 127 147 185 250 334 202120202015 20192017 Q3-222016 2018 Assets per FTE Assets per Branch

. . .Growth in Net Interest Margin 11 Asset-sensitive balance sheet well-positioned for rising interest rates with 40% of the total loan portfolio at 9/30/22 set to re-price with rate increases. Average loan balances increased by $309 million from the linked quarter with a strong loan pipeline of $440 million as of 9/30/22. Competitive market environment as peers compete on rate for quality credit. Maintaining a healthy loan-to-deposit ratio while remaining disciplined on deposit pricing and managing funding costs. (1) Core NIM excludes purchase accounting and prepayment fee income. Refer to the Earnings Release for additional information. Core NIM1 vs NIM Q3-22 NIM Bridge Headwinds Tailwinds 3.29% 0.16% Q2-22 NIM Rate environment, change in balances, funding mix, and other -0.01% Purchase accounting impact -0.08% Impact of prepayment fees Q3-22 NIM 3.36% Q3-22 3.28% 3.06% 3.18% 2.93% Q1-22 2.75% Q3-21 2.99% 2.81% Q4-21 3.29% 3.12% Q2-22 3.36% NIM Core NIM

. . .Generating Consistent and Attractive Returns 12 Book Value and Tangible Book Value per Common Share ($)1 Core ROAA and ROTE1 • Tangible book value per common share increased by $0.34 per share compared to the linked quarter. • Announced and paid increased dividend by 18% to $0.20 per share in Q3-22. Capital Management ($’millions) 15.78 15.93 15.94 15.96 16.30 25.47 25.63 25.58 25.73 26.04 Q3-21 Q3-22Q2-22Q4-21 Q1-22 Book Value per Share Tangible Book Value per Common Share Q1-22Q3-21 0.95% 10.62% 0.90% 11.30% Q4-21 0.98% 11.55% 13.73% 1.13% Q2-22 13.62% 1.11% Q3-22 Core ROTE Core ROAA 10 10 10 10 12 10 5 2 5 Q4-21 8.78% Q3-21 8.89% Q1-22 8.60% Q2-22 8.38% 0 Q3-22 8.39% Share Repurchases QTDTangible Stockholders’ Equity to Tangible Assets1 Cash Dividend QTD (1) Core metrics exclude merger related expenses, net branch consolidation expenses (benefit), net loss/gain on equity investments, and the income tax effect of these items. Tangible book value and tangible assets exclude goodwill, core deposit intangible, and preferred equity. Refer to the “Non-GAAP Reconciliation” in the Earnings Release for additional information.

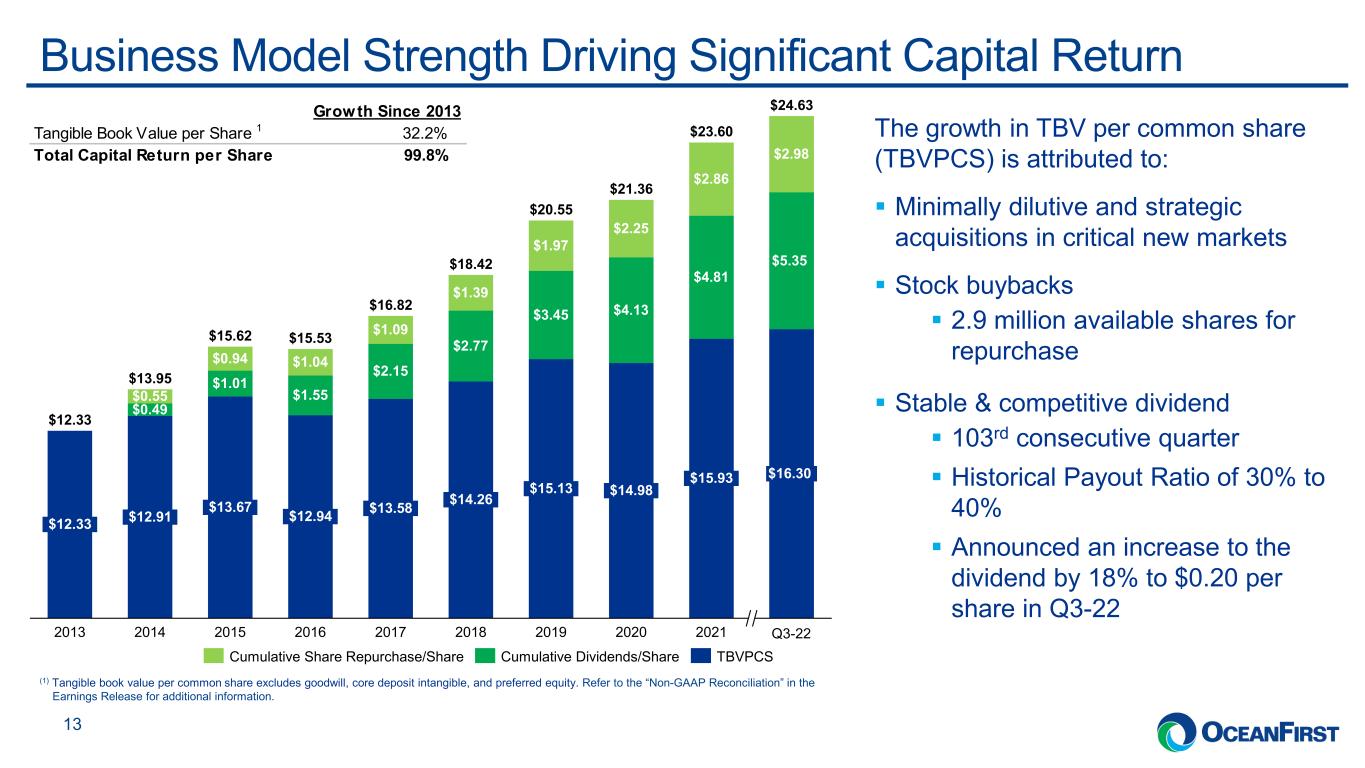

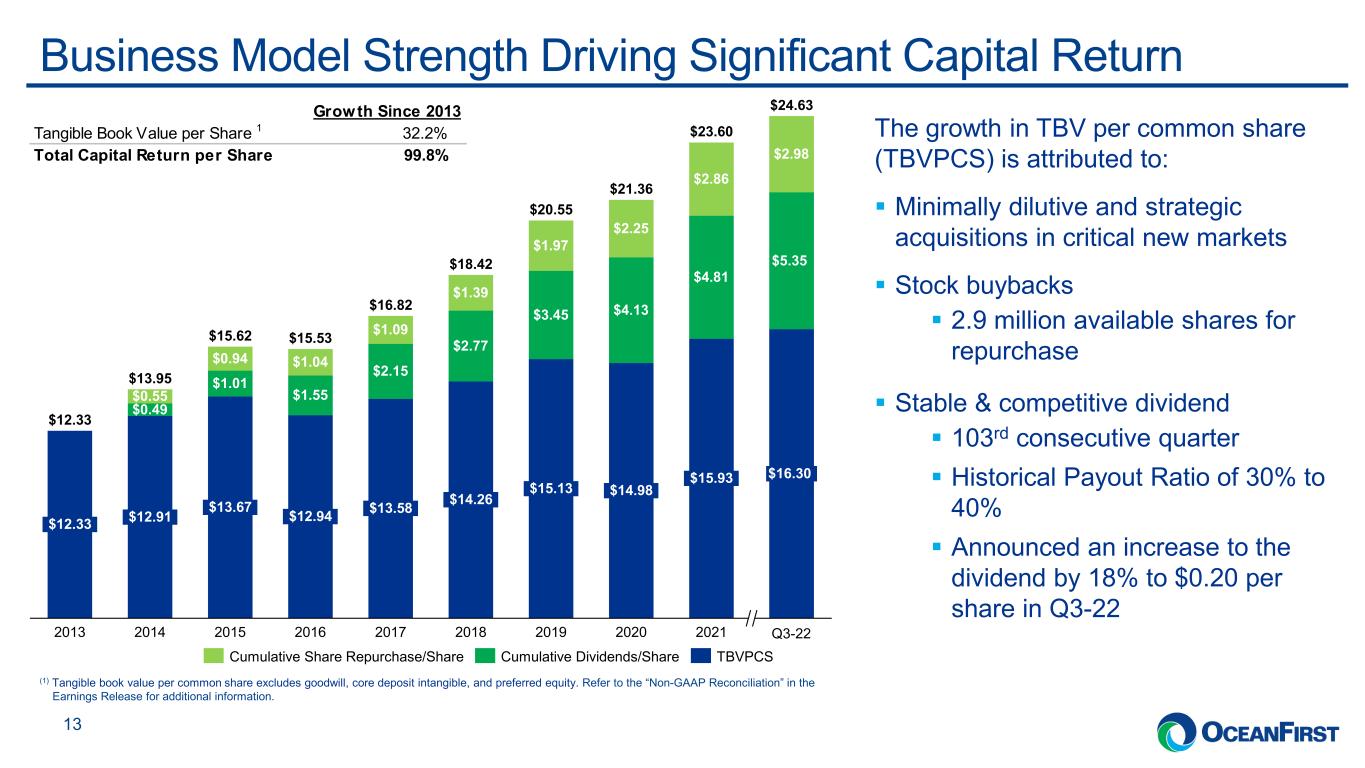

. . .Business Model Strength Driving Significant Capital Return 13 $0.49 $1.01 $1.55 $2.15 $2.77 $3.45 $4.13 $4.81 $5.35 $0.55 $0.94 $1.04 $1.09 $1.39 $1.97 $2.25 $2.86 $2.98 $12.33 Q3-222014 $13.67 $12.94 2016 $13.58 2017 $14.26 2018 $15.13 2019 $14.98 $13.95 2020 $15.93 2021 $16.30 $12.33 $15.62 $15.53 $16.82 $18.42 $20.55 $21.36 $24.63 2013 2015 $12.91 $23.60 Cumulative Dividends/ShareCumulative Share Repurchase/Share TBVPCS The growth in TBV per common share (TBVPCS) is attributed to: Minimally dilutive and strategic acquisitions in critical new markets Stock buybacks 2.9 million available shares for repurchase Stable & competitive dividend 103rd consecutive quarter Historical Payout Ratio of 30% to 40% Announced an increase to the dividend by 18% to $0.20 per share in Q3-22 (1) Tangible book value per common share excludes goodwill, core deposit intangible, and preferred equity. Refer to the “Non-GAAP Reconciliation” in the Earnings Release for additional information. Q3-22 Growth Since 2013 Tangible Book Value per Share 1 32.2% Total Capital Return per Share 99.8%

. . . I N V E S T O R P R E S E N T A T I O N 14 Appendix

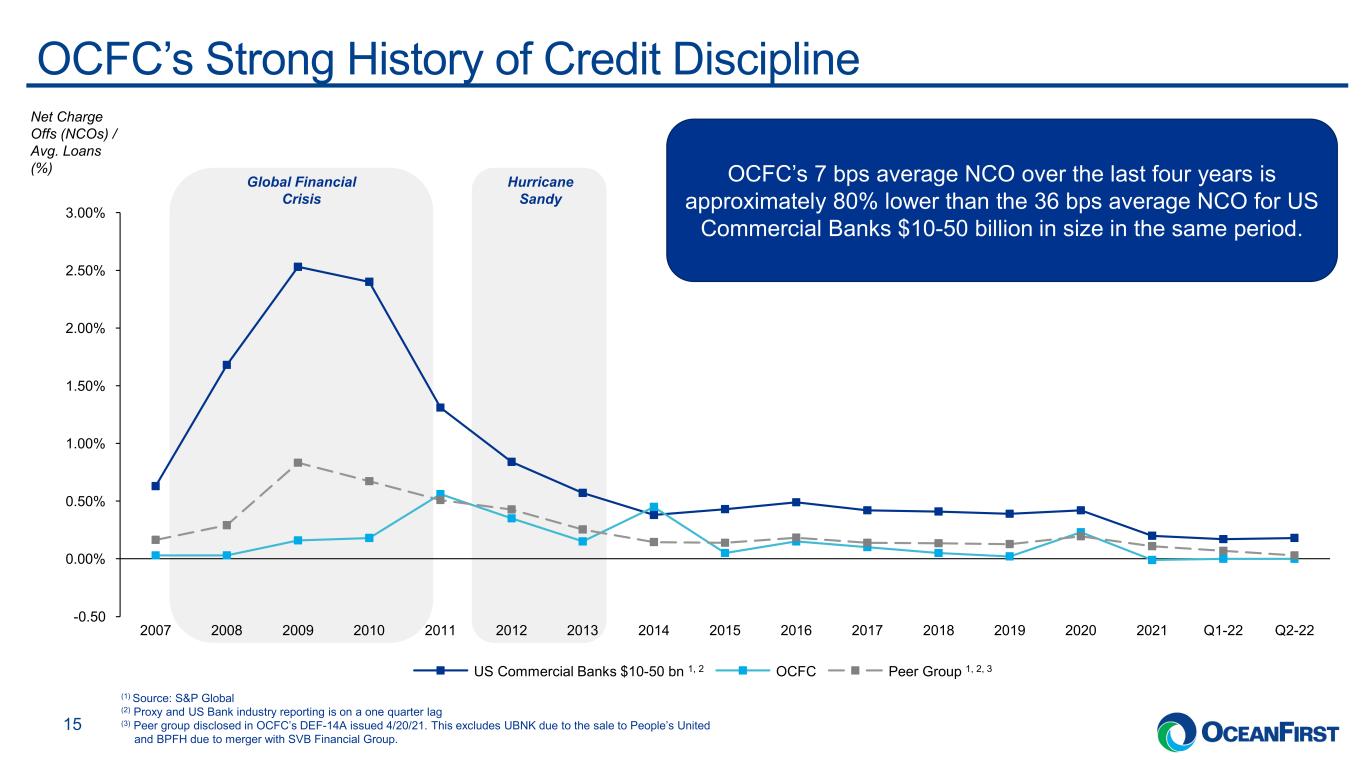

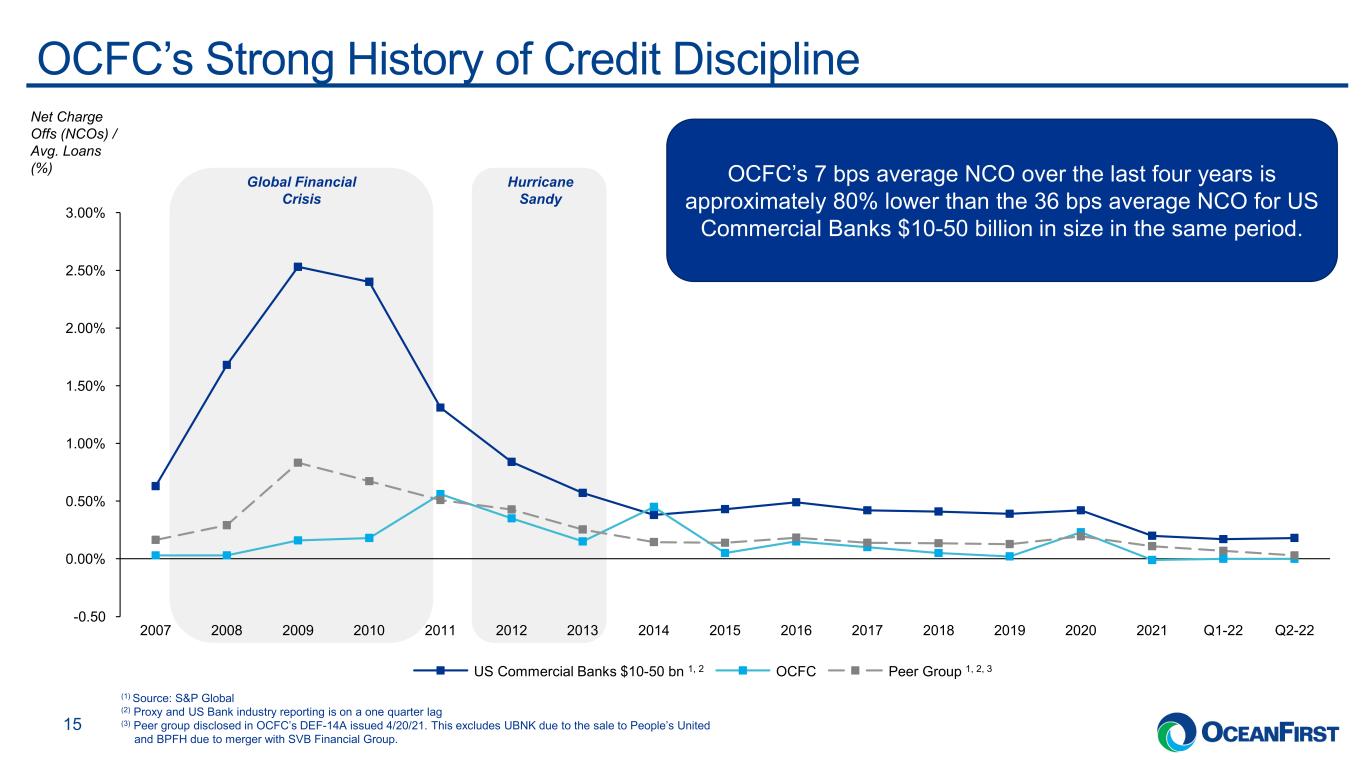

. . .OCFC’s Strong History of Credit Discipline 15 Global Financial Crisis Net Charge Offs (NCOs) / Avg. Loans (%) Hurricane Sandy (1) Source: S&P Global (2) Proxy and US Bank industry reporting is on a one quarter lag (3) Peer group disclosed in OCFC’s DEF-14A issued 4/20/21. This excludes UBNK due to the sale to People’s United and BPFH due to merger with SVB Financial Group. -0.50 0.00% 3.00% 0.50% 1.00% 1.50% 2.50% 2.00% 2011 Q2-222007 20192008 2009 2010 2012 2013 2014 20212015 2016 202020182017 Q1-22 US Commercial Banks $10-50 bn 1, 2 OCFC Peer Group 1, 2, 3 OCFC’s 7 bps average NCO over the last four years is approximately 80% lower than the 36 bps average NCO for US Commercial Banks $10-50 billion in size in the same period.

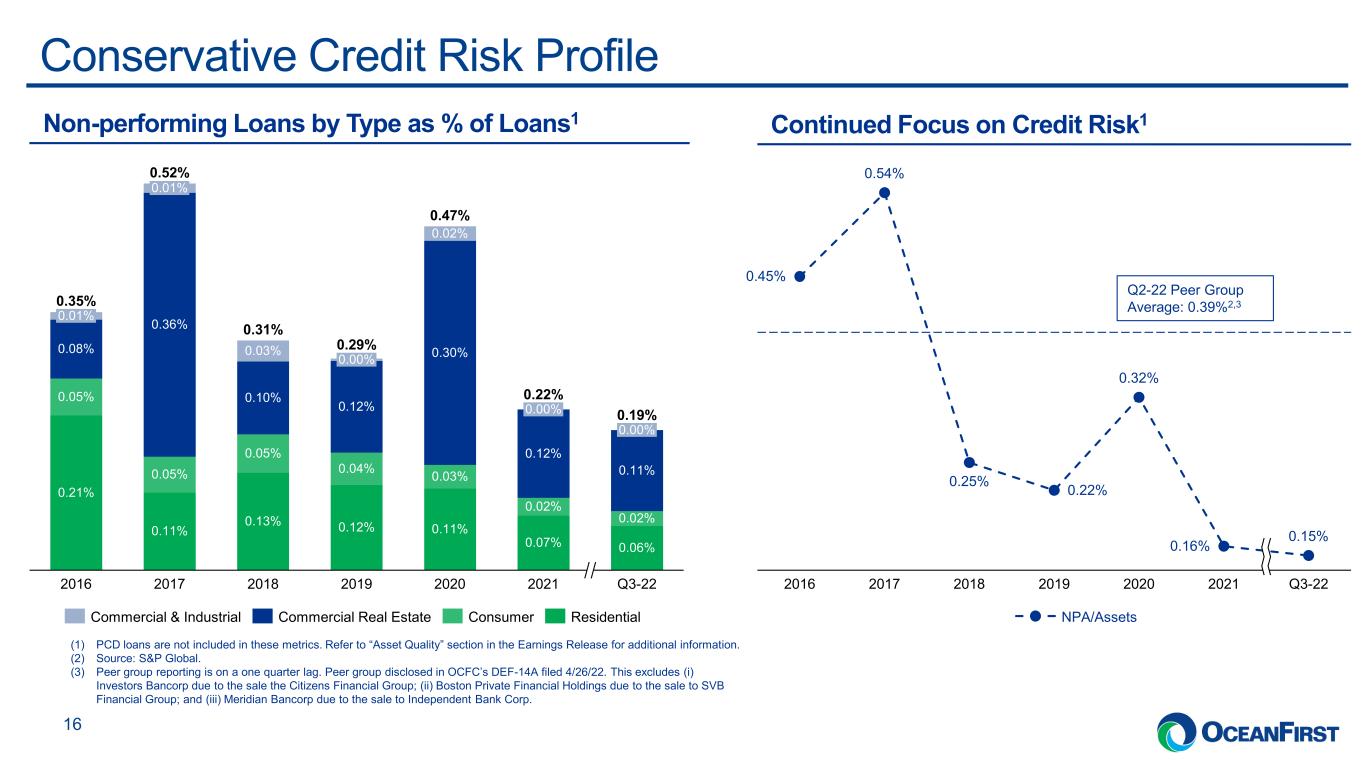

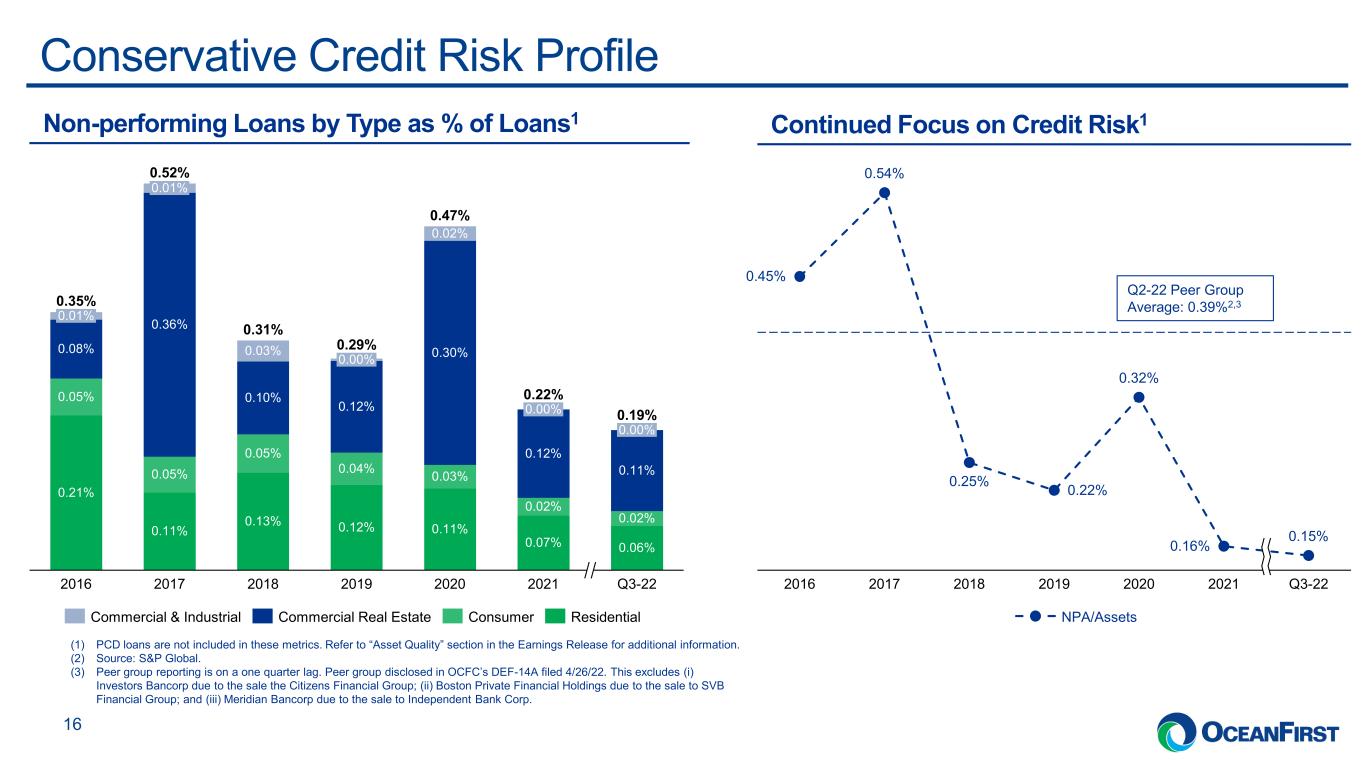

. . .Conservative Credit Risk Profile 16 0.13% 0.21% 0.05% 0.19% 0.11% 0.01% 0.05% 0.08% 0.12% 0.01% 2020 0.36% 2017 0.03% 0.02% 0.10% 0.52% 0.05% 2018 0.30% 0.04% 0.12% 2019 0.02% Q3-22 0.03% 0.11% 0.00% 0.12% 0.02% 0.07% 2016 0.00% 0.35% 0.11% 0.06% 0.00% 0.31% 0.29% 0.47% 0.22% 2021 Commercial & Industrial Commercial Real Estate Consumer Residential (1) PCD loans are not included in these metrics. Refer to “Asset Quality” section in the Earnings Release for additional information. (2) Source: S&P Global. (3) Peer group reporting is on a one quarter lag. Peer group disclosed in OCFC’s DEF-14A filed 4/26/22. This excludes (i) Investors Bancorp due to the sale the Citizens Financial Group; (ii) Boston Private Financial Holdings due to the sale to SVB Financial Group; and (iii) Meridian Bancorp due to the sale to Independent Bank Corp. 20202019 0.22% 0.15% 0.45% 2016 0.54% 2017 0.25% 2018 0.32% 0.16% 2021 Q3-22 Q2-22 Peer Group Average: 0.39%2,3 NPA/Assets Continued Focus on Credit Risk1Non-performing Loans by Type as % of Loans1

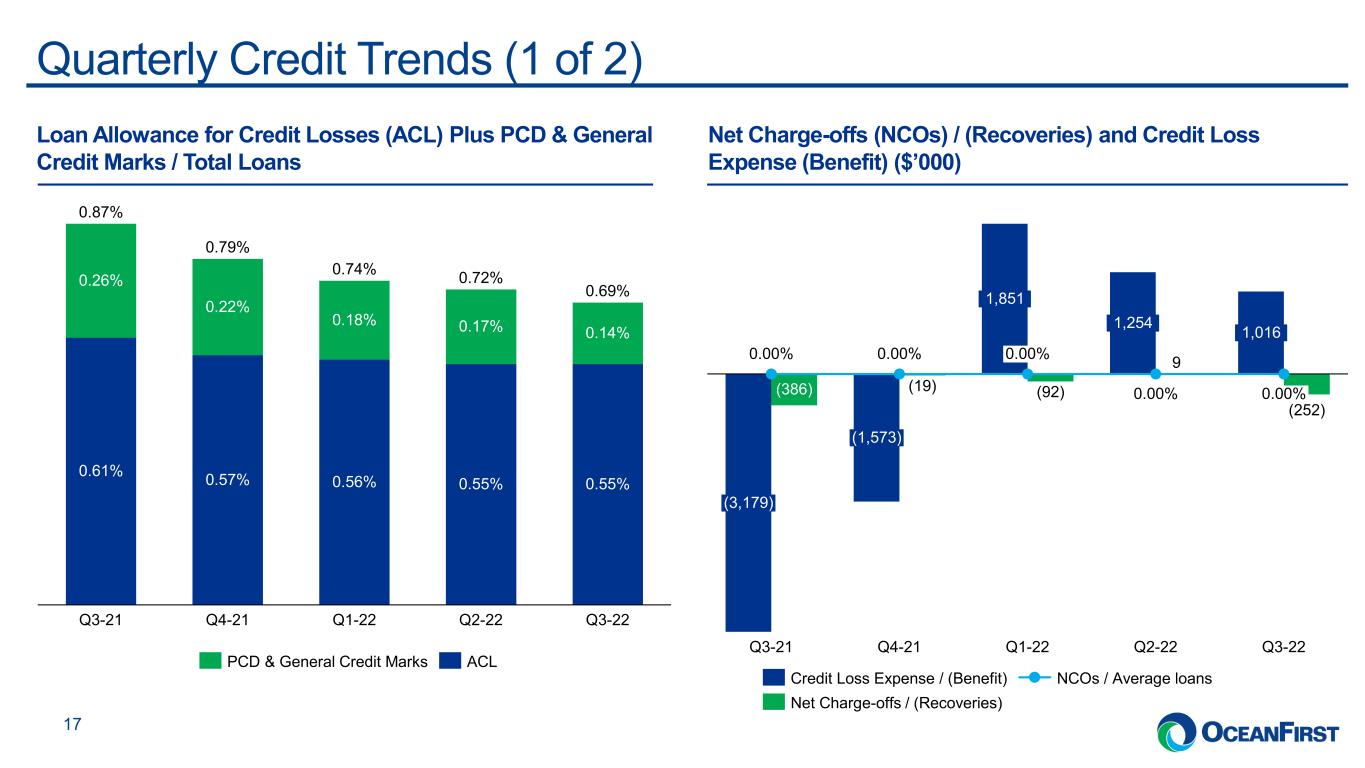

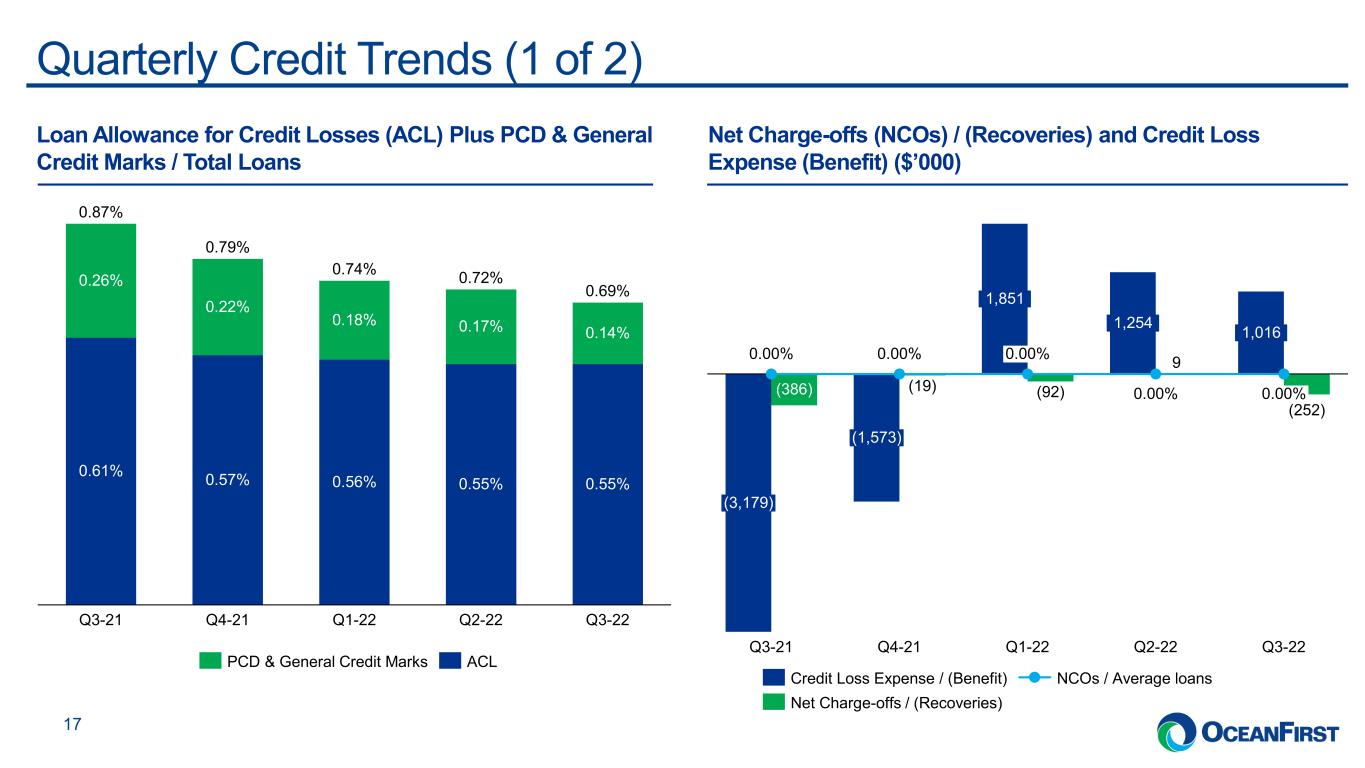

. . .Quarterly Credit Trends (1 of 2) 17 Loan Allowance for Credit Losses (ACL) Plus PCD & General Credit Marks / Total Loans Net Charge-offs (NCOs) / (Recoveries) and Credit Loss Expense (Benefit) ($’000) 0.87% 0.57% Q3-21 0.61% Q3-22 0.26% 0.14% 0.22% Q4-21 0.18% 0.56% Q1-22 0.17% 0.55% Q2-22 0.79% 0.55% 0.74% 0.72% 0.69% PCD & General Credit Marks ACL (386) (19) (92) 9 (252) (3,179) 0.00% Q3-21 (1,573) 0.00% Q4-21 1,851 0.00% Q1-22 1,254 0.00% Q2-22 Q3-22 1,016 0.00% Net Charge-offs / (Recoveries) Credit Loss Expense / (Benefit) NCOs / Average loans

. . . Strong asset quality trends driven by prudent loan growth and credit decisioning. Quarterly Credit Trends (2 of 2) 18 Non-Performing Loans and Assets ($’000)1 Special Mention and Substandard Loans ($’000) Note: Of the $54.3 million in Special Mention loans and $97.4 million of Substandard loans, $52.1 million (or 95.9%) and $83.3 million (or 85.6%) are current on payments, respectively. Q3-21 0.29% 0.19% 0.16% Q3-22 0.20% 106 Q2-22Q4-21 0.22% 0.14% 106 0.15% 0.25% 0.19% 106 Q1-22 0.18% 0 0 Non-performing loans to total loans OREO Non-performing assets to total assets Non-performing loans 23,344 18,948 23,180 17,224 18,455 158,575 148,557 114,030 103,294 97,353 98,687 91,607 91,611 60,812 54,330 Q3-22Q2-22Q4-21Q3-21 Q1-22 Special Mention Substandard (1) PCD loans are not included in these metrics. Refer to Asset Quality section in the Earnings Release for additional information.

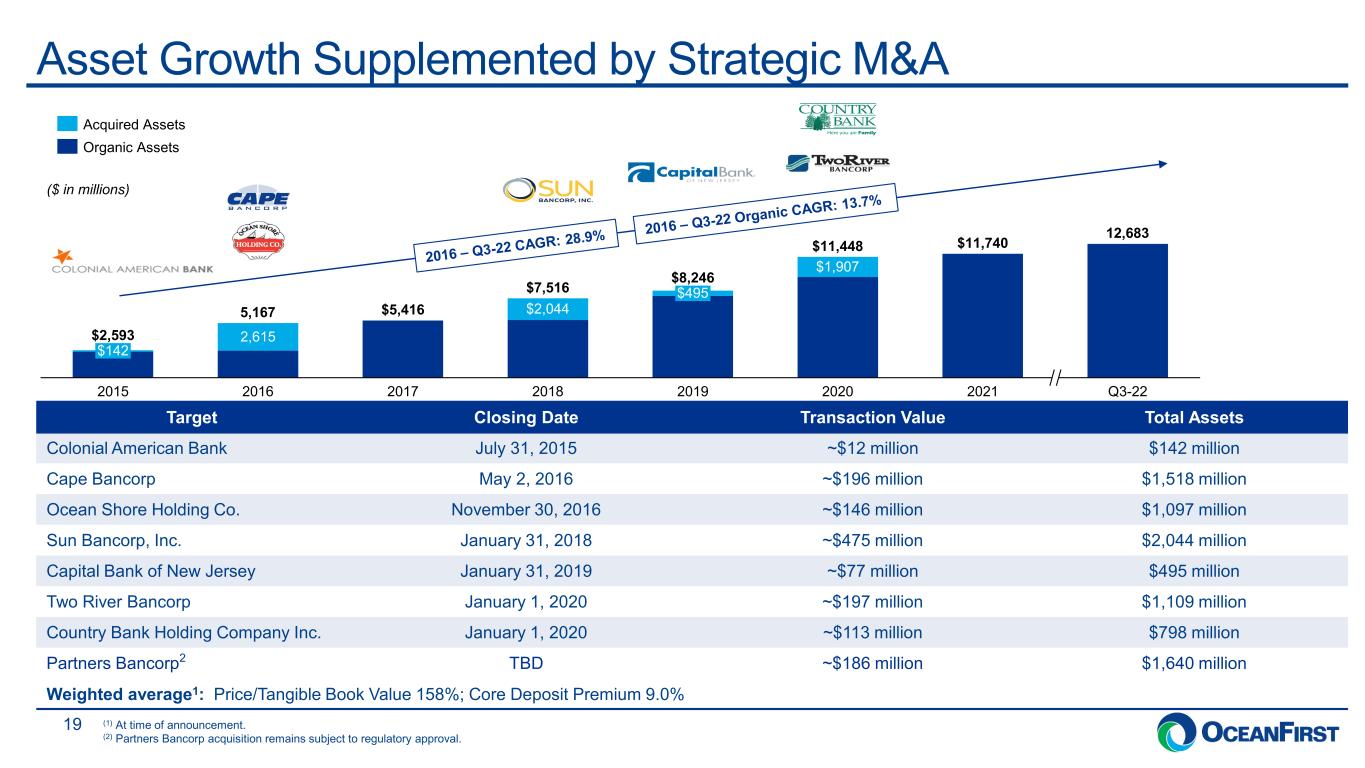

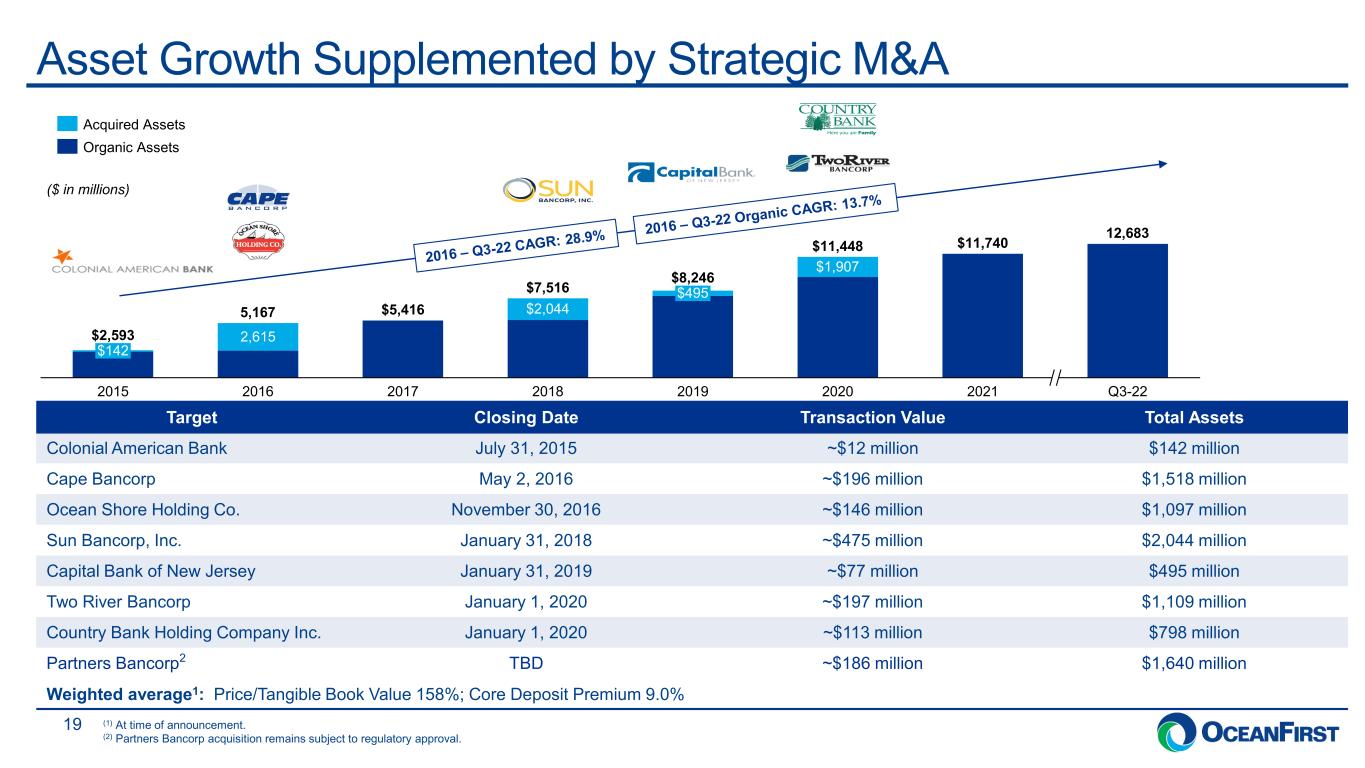

. . .Asset Growth Supplemented by Strategic M&A 19 ($ in millions) Target Closing Date Transaction Value Total Assets Colonial American Bank July 31, 2015 ~$12 million $142 million Cape Bancorp May 2, 2016 ~$196 million $1,518 million Ocean Shore Holding Co. November 30, 2016 ~$146 million $1,097 million Sun Bancorp, Inc. January 31, 2018 ~$475 million $2,044 million Capital Bank of New Jersey January 31, 2019 ~$77 million $495 million Two River Bancorp January 1, 2020 ~$197 million $1,109 million Country Bank Holding Company Inc. January 1, 2020 ~$113 million $798 million Partners Bancorp2 TBD ~$186 million $1,640 million Weighted average1: Price/Tangible Book Value 158%; Core Deposit Premium 9.0% 2,615 2017 $142 2015 2016 $2,044 2018 2019 $495 $1,907 2020 2021 Q3-22 $2,593 5,167 $5,416 $7,516 $8,246 $11,448 $11,740 12,683 Acquired Assets Organic Assets (1) At time of announcement. (2) Partners Bancorp acquisition remains subject to regulatory approval.

. . .Northeast and Mid-Atlantic Expansion Opportunities1 20 • New Jersey is an attractive market. • Statewide total population of 9.3 million. • Most densely populated state. • 11th most populous state. • Median household income of $85,245. • Significant opportunities for acquisitions to build customer base. • Support expansion in Pennsylvania, Metropolitan New York, Boston, Baltimore, and Washington D.C. Northeast U.S., DE, MD + D.C. Metro provides access to ~20% of the U.S. population (1) Source: U.S. Census Bureau VA PA NY MA CT RI MD DC DE NJ NH ME VT New Jersey Region Greater Philadelphia Region New York Region Boston Region Baltimore / D.C. Region

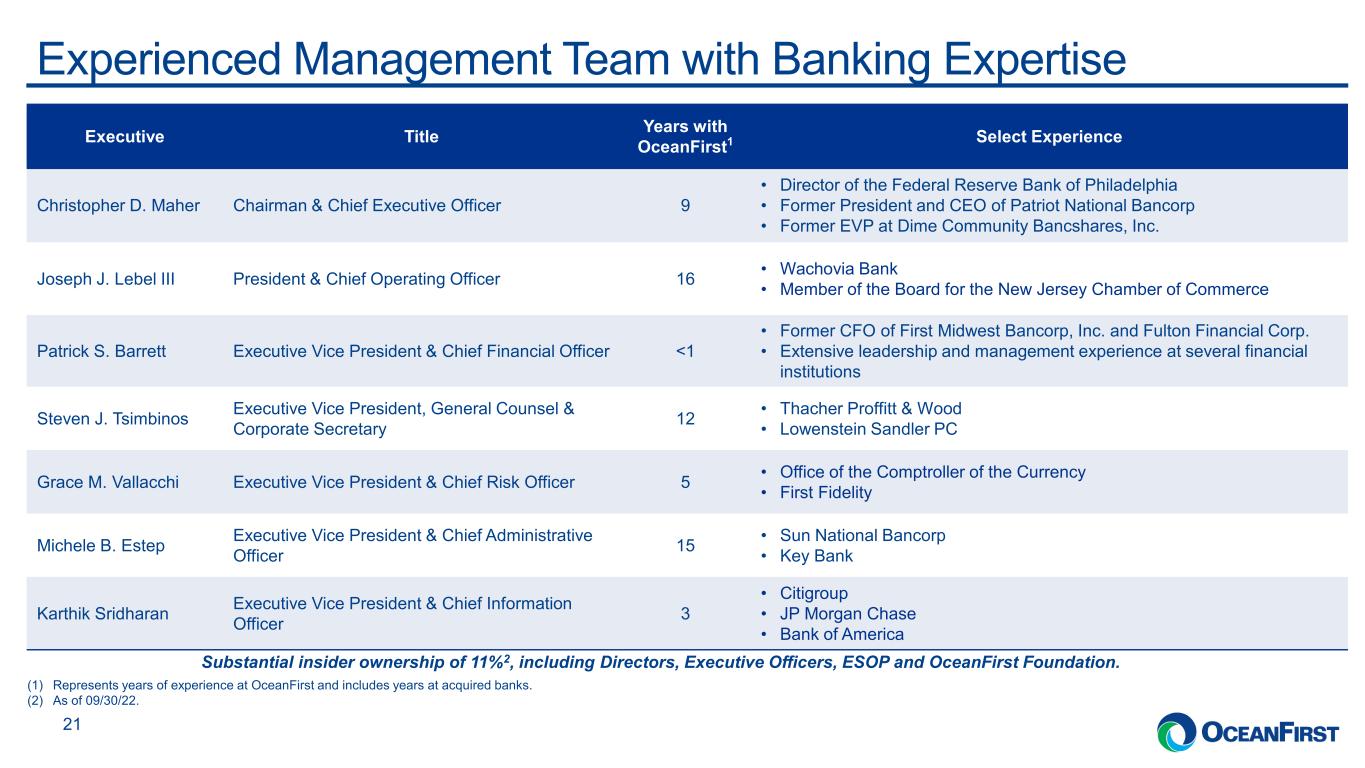

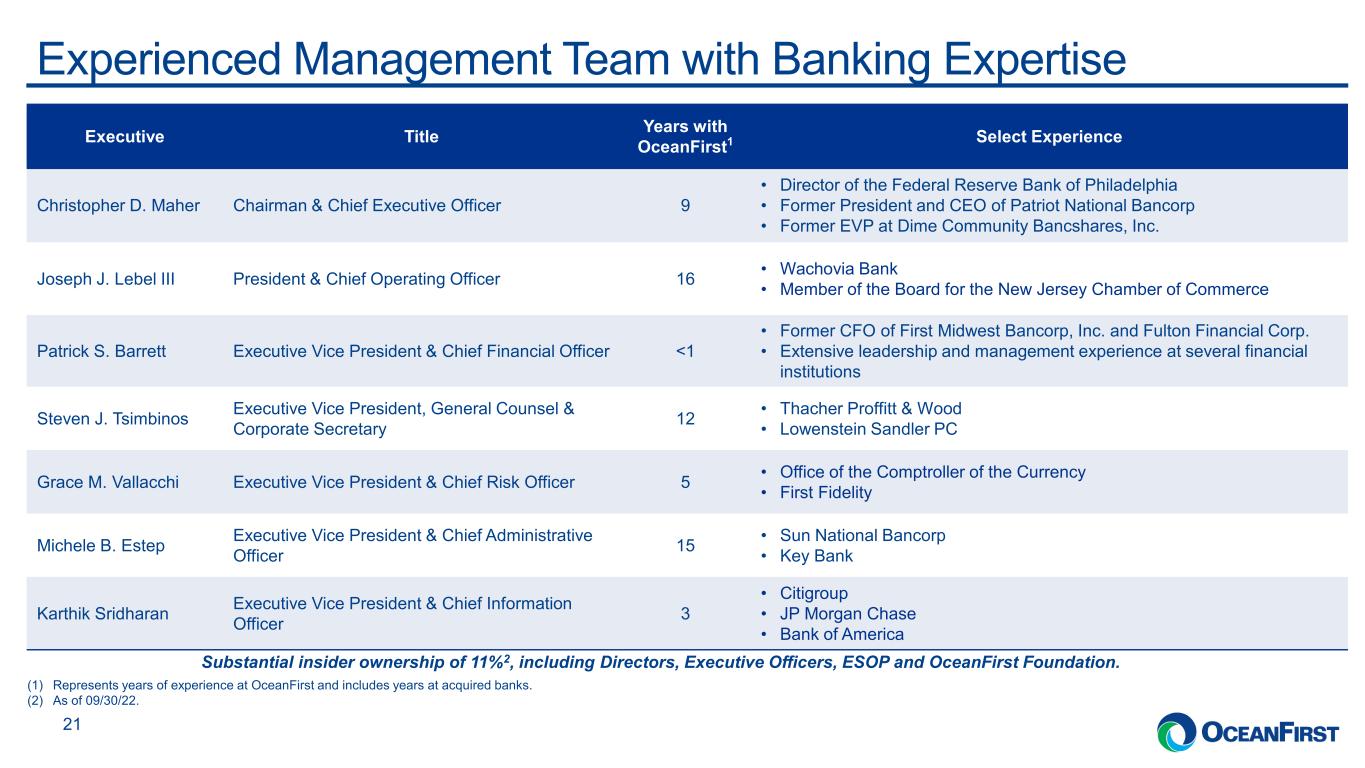

. . .Experienced Management Team with Banking Expertise 21 Substantial insider ownership of 11%2, including Directors, Executive Officers, ESOP and OceanFirst Foundation. Executive Title Years with OceanFirst1 Select Experience Christopher D. Maher Chairman & Chief Executive Officer 9 • Director of the Federal Reserve Bank of Philadelphia • Former President and CEO of Patriot National Bancorp • Former EVP at Dime Community Bancshares, Inc. Joseph J. Lebel III President & Chief Operating Officer 16 • Wachovia Bank • Member of the Board for the New Jersey Chamber of Commerce Patrick S. Barrett Executive Vice President & Chief Financial Officer <1 • Former CFO of First Midwest Bancorp, Inc. and Fulton Financial Corp. • Extensive leadership and management experience at several financial institutions Steven J. Tsimbinos Executive Vice President, General Counsel & Corporate Secretary 12 • Thacher Proffitt & Wood • Lowenstein Sandler PC Grace M. Vallacchi Executive Vice President & Chief Risk Officer 5 • Office of the Comptroller of the Currency • First Fidelity Michele B. Estep Executive Vice President & Chief Administrative Officer 15 • Sun National Bancorp • Key Bank Karthik Sridharan Executive Vice President & Chief Information Officer 3 • Citigroup • JP Morgan Chase • Bank of America (1) Represents years of experience at OceanFirst and includes years at acquired banks. (2) As of 09/30/22.

. . .Interest Rate Sensitivity (1 of 2) 22 OceanFirst Bank’s balance sheet is asset-sensitive. An upward climb in rates should yield positive results in net interest income. Economic Value of Equity (EVE)1 - % ChangeEarnings at Risk (EAR)1 - % Change -14 -12 -10 -8 -6 -4 -2 0 +200 bps -12.7% Base -4.8% +300 bps -8.8% -6.7% +100 bps -100 bps OceanFirst % Change -5 -4 -3 -2 -1 0 1 2 3 4 5 6 +200 bps 5.4% +300 bps +100 bps 3.6% 1.6% Base -4.8% -100 bps OceanFirst % Change Impact to Net Interest Income1 +$23.0MM +$15.3MM +$6.7MM -$20.4MM (1) Refer to the Quantitative and Qualitative Disclosures About Market Risk to be filed with the Form 10-Q for additional details.

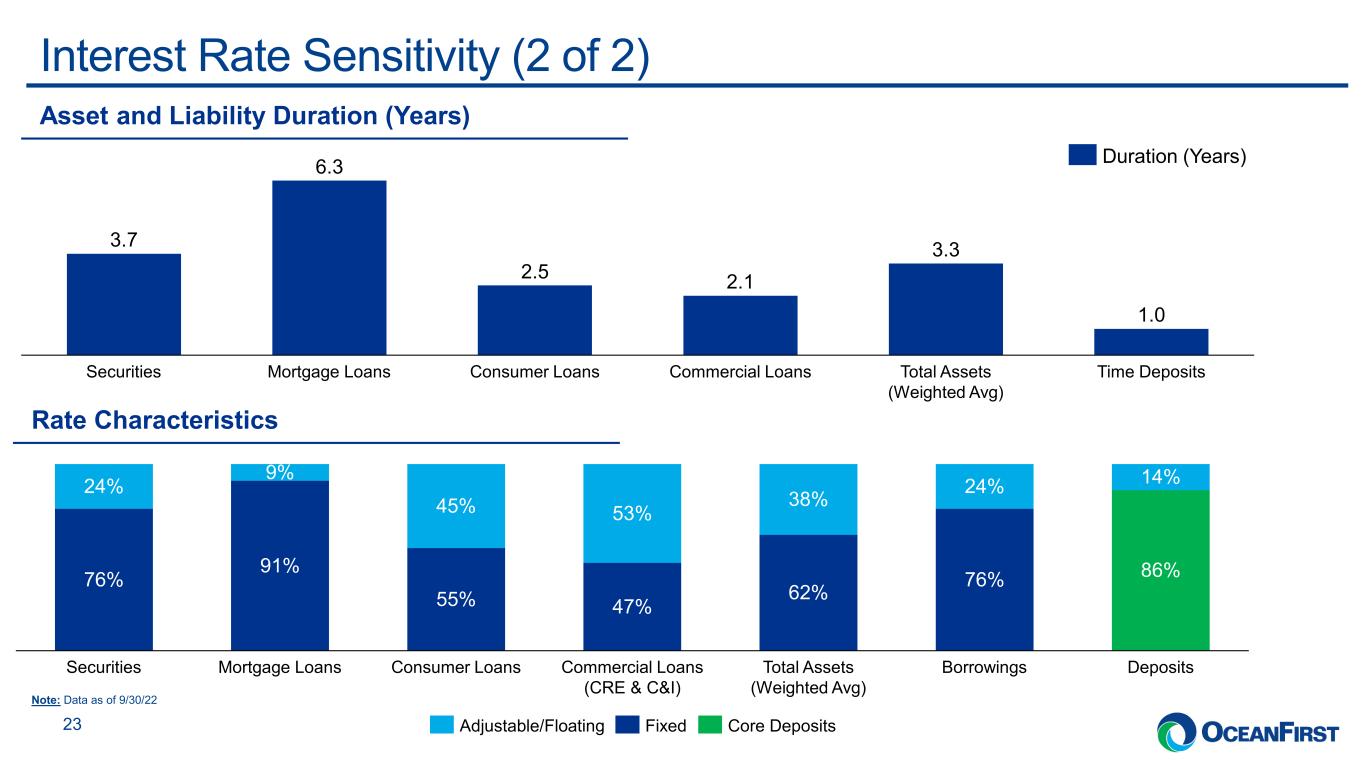

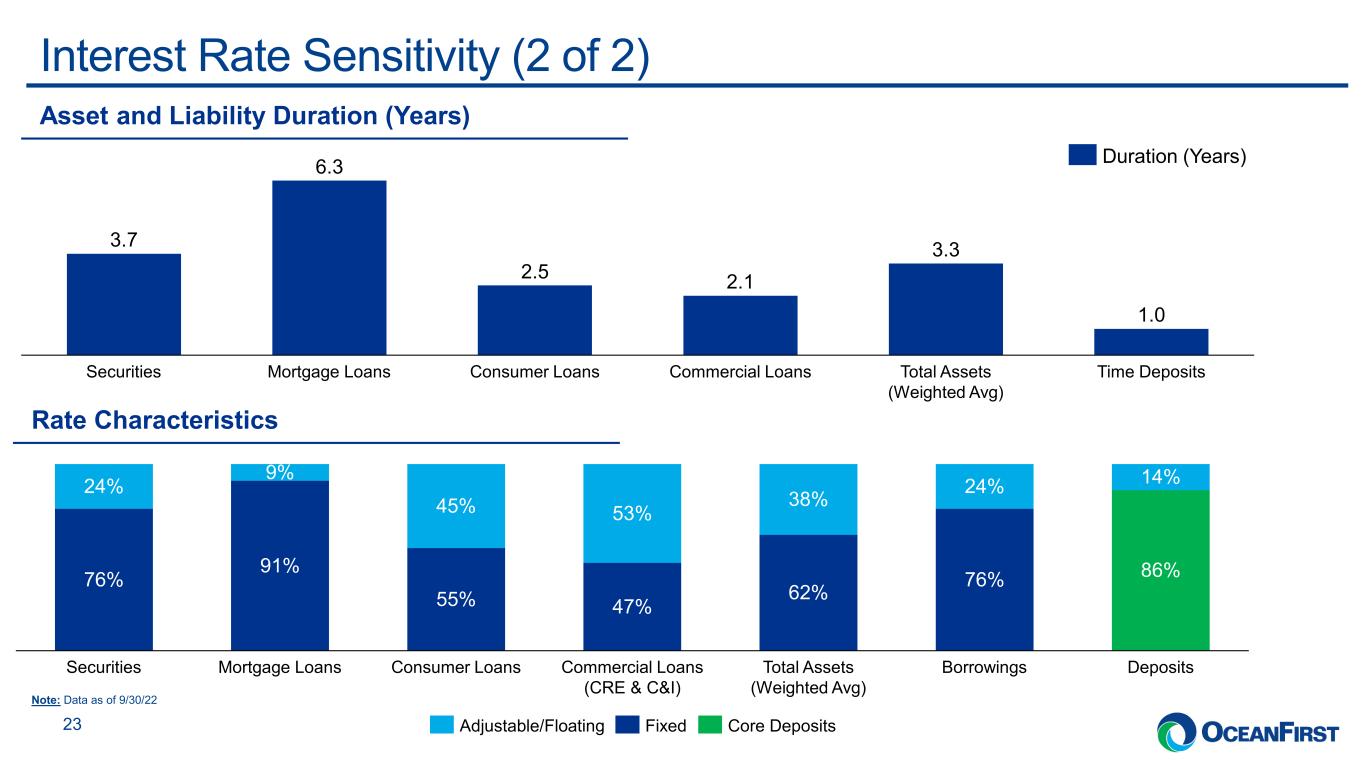

. . .Interest Rate Sensitivity (2 of 2) 23 Rate Characteristics 76% 91% 55% 47% 62% 76% 86% 24% 9% 45% 53% 38% 24% 14% Securities Mortgage Loans Total Assets (Weighted Avg) Consumer Loans Commercial Loans (CRE & C&I) DepositsBorrowings Adjustable/Floating Fixed Core Deposits Note: Data as of 9/30/22 3.7 6.3 2.5 2.1 3.3 1.0 Securities Mortgage Loans Consumer Loans Commercial Loans Total Assets (Weighted Avg) Time Deposits Duration (Years) Asset and Liability Duration (Years)