. . . 1 The 3Q 2023 Earnings Release Supplement should be read in conjunction with the Earnings Release furnished as Exhibit 99.1 to Form 8-K filed with the SEC on October 19, 2023. Exhibit 99.2 OceanFirst Financial Corp. 3Q 2023 Earnings Release Supplement1 October 2023

. . .Legal Disclaimer FORWARD LOOKING STATEMENTS. In addition to historical information, this news release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which are based on certain assumptions and describe future plans, strategies and expectations of the Company. These forward-looking statements are generally identified by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “will,” “should,” “may,” “view,” “opportunity,” “potential,” or similar expressions or expressions of confidence. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations of the Company and its subsidiaries include, but are not limited to: changes in interest rates, inflation, general economic conditions, potential recessionary conditions, levels of unemployment in the Bank’s lending area, real estate market values in the Bank’s lending area, potential goodwill impairment, future natural disasters, potential increases to flood insurance premiums, the current or anticipated impact of military conflict, terrorism or other geopolitical events, the level of prepayments on loans and mortgage-backed securities, legislative/regulatory changes, monetary and fiscal policies of the U.S. Government including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System, the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, changes in liquidity, including the size and composition of the Company’s deposit portfolio, including the percentage of uninsured deposits in the portfolio, competition, demand for financial services in the Company’s market area, changes in consumer spending, borrowing and saving habits, changes in accounting principles, a failure in or breach of the Company’s operational or security systems or infrastructure, including cyberattacks, the failure to maintain current technologies, failure to retain or attract employees, the impact of the COVID-19 pandemic or any other pandemic on our operations and financial results and those of our customers and the Bank’s ability to successfully integrate acquired operations. These risks and uncertainties are further discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, under Item 1A - Risk Factors and elsewhere, and subsequent securities filings and should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. NON-GAAP FINANCIAL INFORMATION. This presentation contains certain non-GAAP (generally accepted accounting principles) measures. These non-GAAP measures, as calculated by the Company, are not necessarily comparable to similarly titled measures reported by other companies. Additionally, these non-GAAP measures are not measures of financial performance or liquidity under GAAP and should not be considered alternatives to the Company's other financial information determined under GAAP. See reconciliations of certain non-GAAP measures included in the Company’s Earnings Release furnished as Exhibit 99.1 to Form 8-K as filed with the SEC on October 19, 2023. MARKET AND INDUSTRY DATA. This presentation references certain market, industry and demographic data, forecasts and other statistical information. We have obtained this data, forecasts and information from various independent, third-party industry sources and publications. Nothing in the data, forecasts or information used or derived from third party sources should be construed as advice. Some data and other information are also based on our good faith estimates, which are derived from our review of industry publications and surveys and independent sources. We believe that these sources and estimates are reliable but have not independently verified them. Statements as to our market position are based on market data currently available to us. These estimates involve inherent risks and uncertainties and are based on assumptions that are subject to change. 2

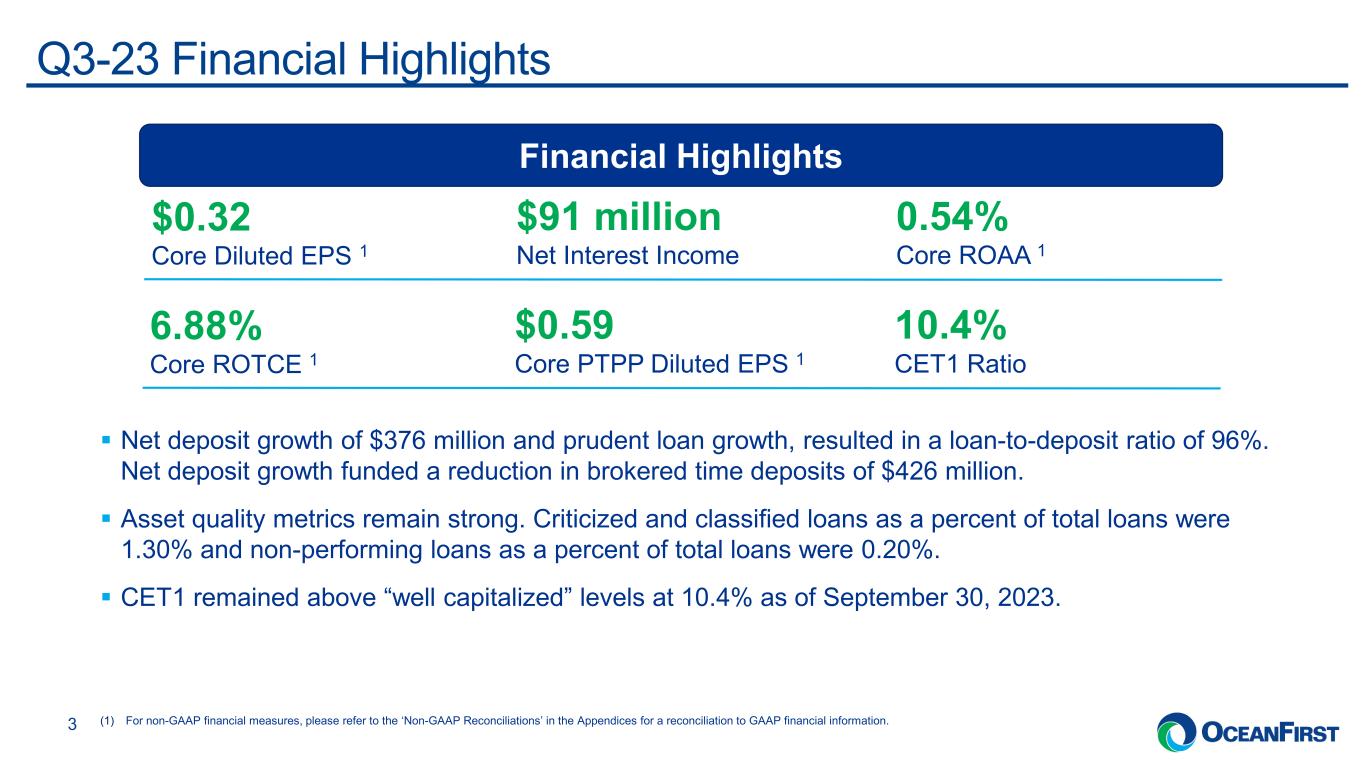

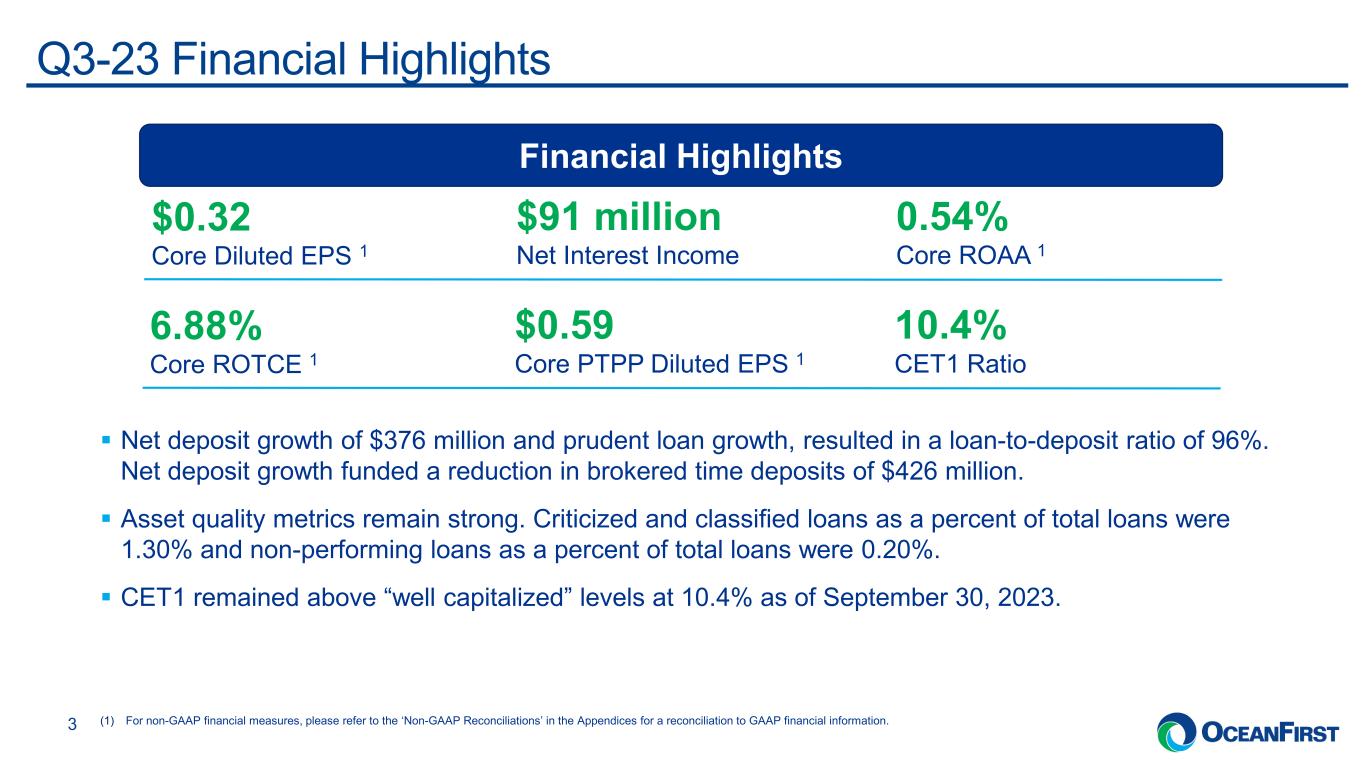

. . .Q3-23 Financial Highlights 3 (1) For non-GAAP financial measures, please refer to the ‘Non-GAAP Reconciliations’ in the Appendices for a reconciliation to GAAP financial information. Financial Highlights $0.32 Core Diluted EPS 1 $91 million Net Interest Income 0.54% Core ROAA 1 6.88% Core ROTCE 1 $0.59 Core PTPP Diluted EPS 1 10.4% CET1 Ratio Net deposit growth of $376 million and prudent loan growth, resulted in a loan-to-deposit ratio of 96%. Net deposit growth funded a reduction in brokered time deposits of $426 million. Asset quality metrics remain strong. Criticized and classified loans as a percent of total loans were 1.30% and non-performing loans as a percent of total loans were 0.20%. CET1 remained above “well capitalized” levels at 10.4% as of September 30, 2023.

. . . I N V E S T O R P R E S E N T A T I O N 4 Quarterly Earnings Update

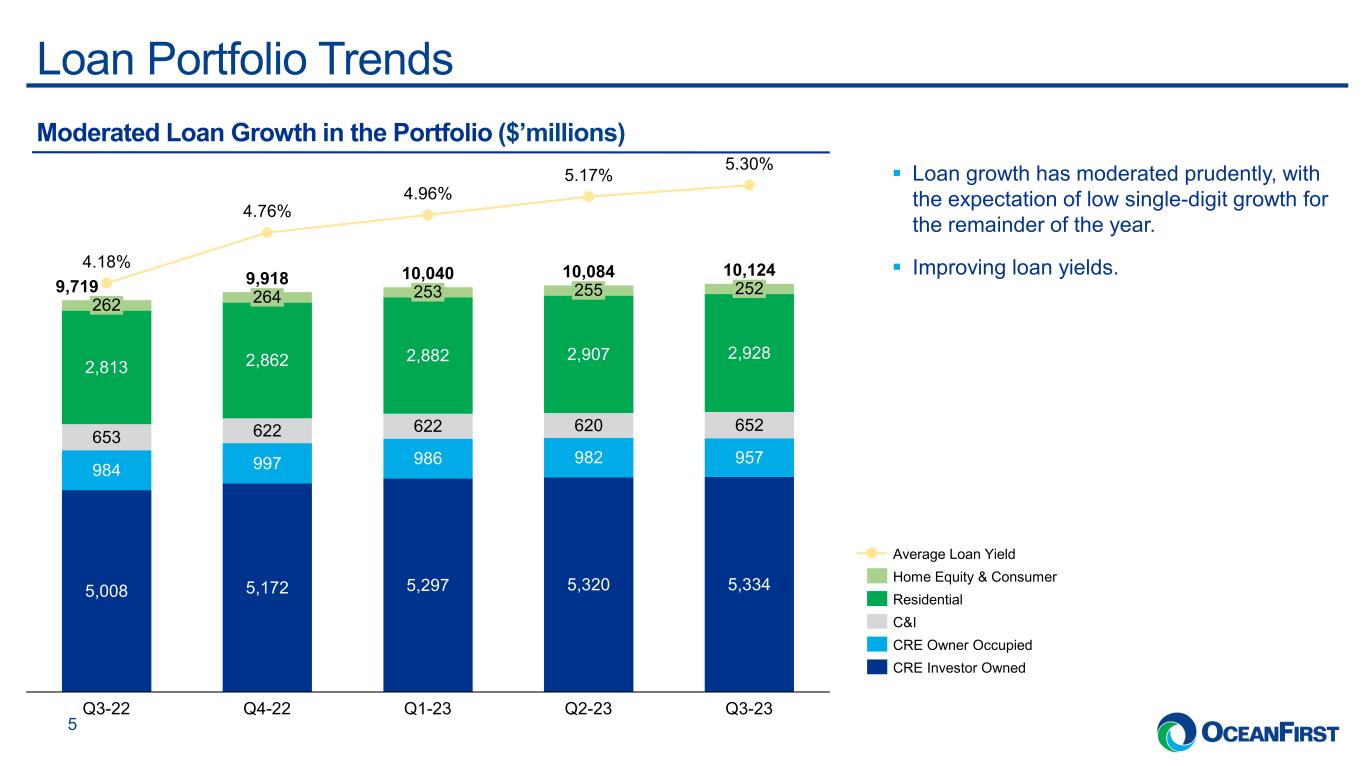

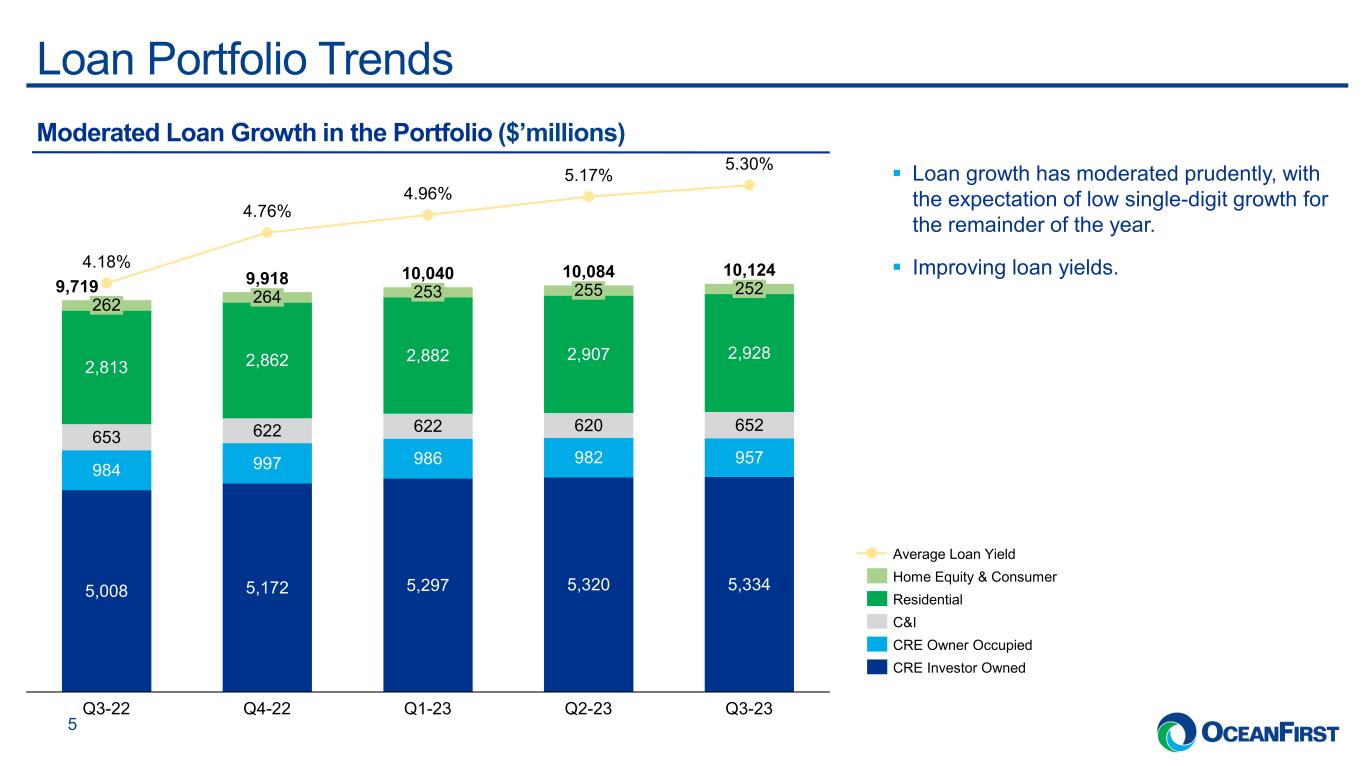

. . .Loan Portfolio Trends 5 Moderated Loan Growth in the Portfolio ($’millions) Loan growth has moderated prudently, with the expectation of low single-digit growth for the remainder of the year. Improving loan yields. 5,008 5,172 5,297 5,320 5,334 984 997 986 982 957 653 622 622 620 652 2,813 2,862 2,882 2,907 2,928 264 Q3-23 262 4.18% 4.76% Q3-22 9,918 Q4-22 252 4.96% 9,719 253 Q1-23 5.17% 255 5.30% Q2-23 10,040 10,084 10,124 Average Loan Yield C&I Home Equity & Consumer Residential CRE Owner Occupied CRE Investor Owned

. . .Credit Quality Historically Top Quartile and Well Positioned Underlying collateral is diversified: The underlying collateral for the CRE Investor Owned (“Investor”) portfolio is highly diversified and focused in low risk collateral types. Maturity wall is modest and has a minimal impact: Our maturity wall, totaling $415 million (or 4% of total loans), is set to mature in 2023 and 2024 with weighted average rates of 6.92% and 5.80%, for each respective cohort. A repricing analysis(2) was performed on the vast majority of the CRE Investor and Construction portfolio. Results indicated the portfolio continues to service debt without unusual stress. The weighted average DSCR of loans subject to the stress test is 1.32. Greater than 90% of the CRE Investor portfolio is organically originated or acquired through whole bank acquisition. Refer to the Appendices for additional disclosures on the Office portfolio. 6 CRE Investor Owner Portfolio by Geography Notes: All data presented represents CRE Investor balances, excluding purchase accounting marks and Construction as of September 30, 2023, unless otherwise noted. (1) Other includes co-operatives, single purpose, stores and some living units / mixed use, investor owned 1-4 family, land / development, and other. (2) Repricing analysis as of Q1-23 included stressing portfolio with an increase to 7% interest rates while keeping unwritten rents constant. We are actively tracking CRE loan underlying cash flows and noted no material change from Q1-23. As such, we have deemed the results from the repricing analysis to be relevant for the current quarter. 21% 31%28% 8% 10% NY MA PA/DE MD/DC NJ 2% Other CRE Investor Owned - Collateral Details $'millions CRE: Investor Owned % of Total WA LTV WA DSCR Retail 1,085 23.1% 56.3 1.61 Office 1,090 23.2% 56.4 1.80 Multi-Family 951 20.3% 64.5 1.62 Industrial / Warehouse 738 15.7% 56.6 2.27 Hospitality 135 2.9% 66.2 1.23 Other 1 693 14.8% 49.5 1.69 CRE: Investor Owned 4,692 100.0% 57.3 1.76 Construction 642 CRE IO and Construction Total 5,334 Maturity Wall Detail Balance Weighted Average % of Maturity Year ($'millions) Rate LTV DSCR Loans 2023 58 6.92 64.82 1.70 0.57% 2024 357 5.80 68.20 1.92 3.53% Total 415 5.95 67.73 1.89 4.10% Note: Weighted Average DSCR calculations exclude credits for which DSCR is not calculated.

. . . Strong asset quality trends driven by prudent loan growth and credit decisioning. Quarterly Credit Trends (1 of 2) 7 Non-Performing Loans and Assets ($’000)1, 2 Special Mention and Substandard Loans ($’000) Note: At September 30, 2023, of the Special Mention loans and Substandard loans represented above, 95% and 72% were current on payments, respectively. Note #2: Peer data is on a one quarter lag. 0.15% 0.19% Q3-22 0.15% 0.19% Q4-22 0.14% 0.18% Q1-23 0.14% 0.19% Q2-23 0.27% Q3-23 Non-performing loans to total loans Non-performing assets to total assets Non-performing loans 18,455 19,321 18,508 26,921 (1) PCD loans are not included in these metrics. Refer to Asset Quality section in the Earnings Release for additional information. (2) In Q3-23 the Bank charged-off $8 million on a single commercial real estate credit relationship. The remaining exposure of $9 million is included in the non-performing loan balance. 19,587 0.20% 97,353 50,776 86,765 88,152 86,596 54,330 48,214 23,980 30,859 44,940 Q3-22 Q4-22 Q1-23 Q2-23 Q3-23 1.30% 2.58% 1.56% 2.46% 1.00% 2.39% 1.10% 2.53% 1.18% Peer Average Criticized Loans / Total Loans OCFC Criticized Loans / Total Loans Special Mention Substandard

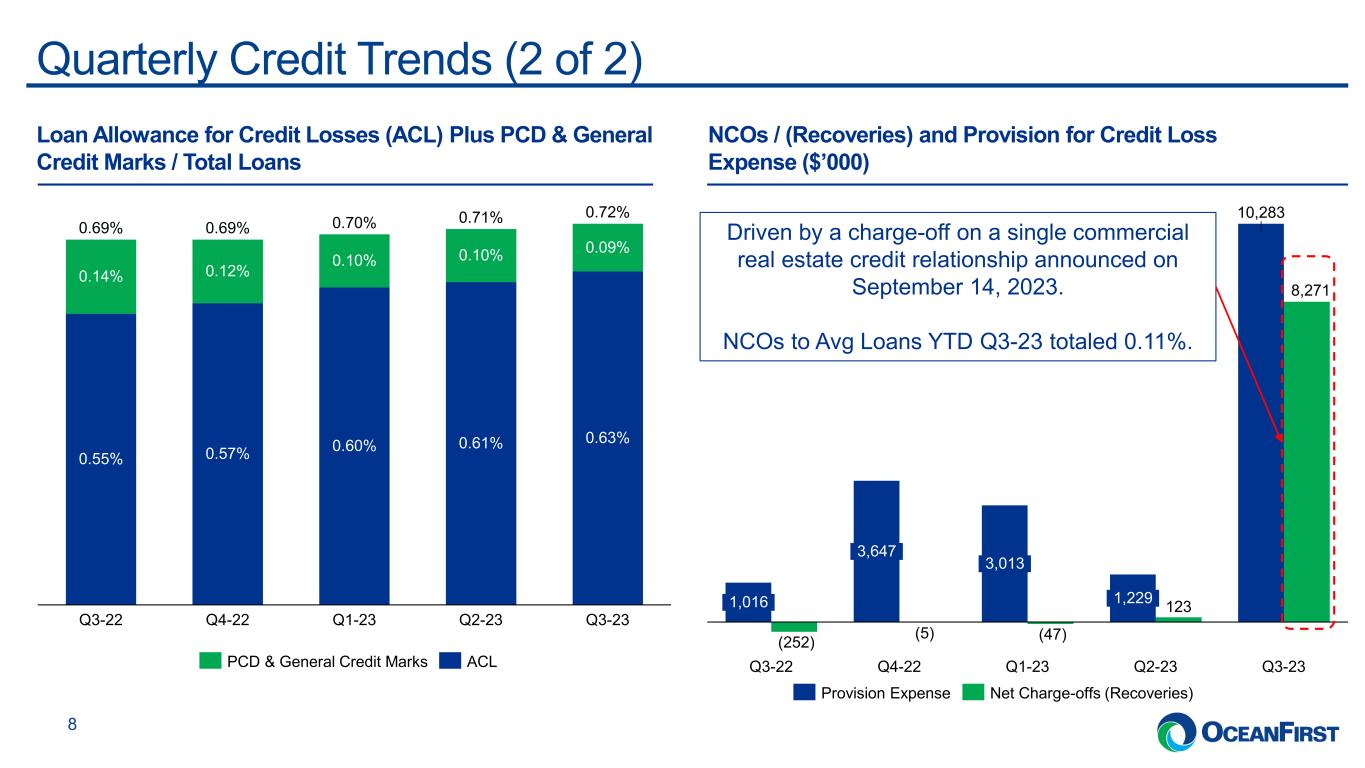

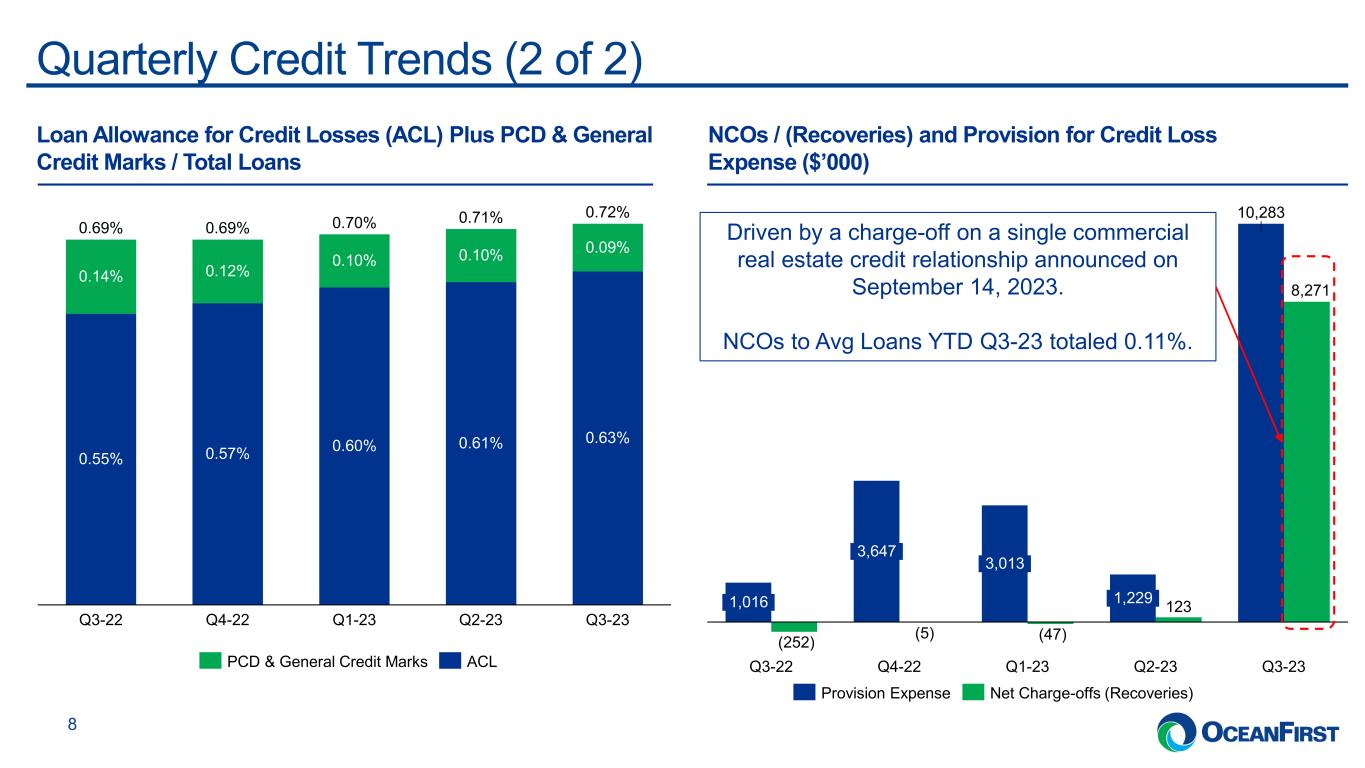

. . .Quarterly Credit Trends (2 of 2) 8 Loan Allowance for Credit Losses (ACL) Plus PCD & General Credit Marks / Total Loans NCOs / (Recoveries) and Provision for Credit Loss Expense ($’000) 0.14% 0.55% Q3-22 0.12% 0.57% Q4-22 0.10% 0.60% Q1-23 0.10% 0.61% Q2-23 0.09% 0.63% Q3-23 0.69% 0.69% 0.70% 0.71% 0.72% PCD & General Credit Marks ACL 10,283 (252) (47) 123 8,271 1,016 Q3-22 3,647 Q4-22 3,013 Q1-23 1,229 Q2-23 Q3-23 (5) Provision Expense Net Charge-offs (Recoveries) Driven by a charge-off on a single commercial real estate credit relationship announced on September 14, 2023. NCOs to Avg Loans YTD Q3-23 totaled 0.11%.

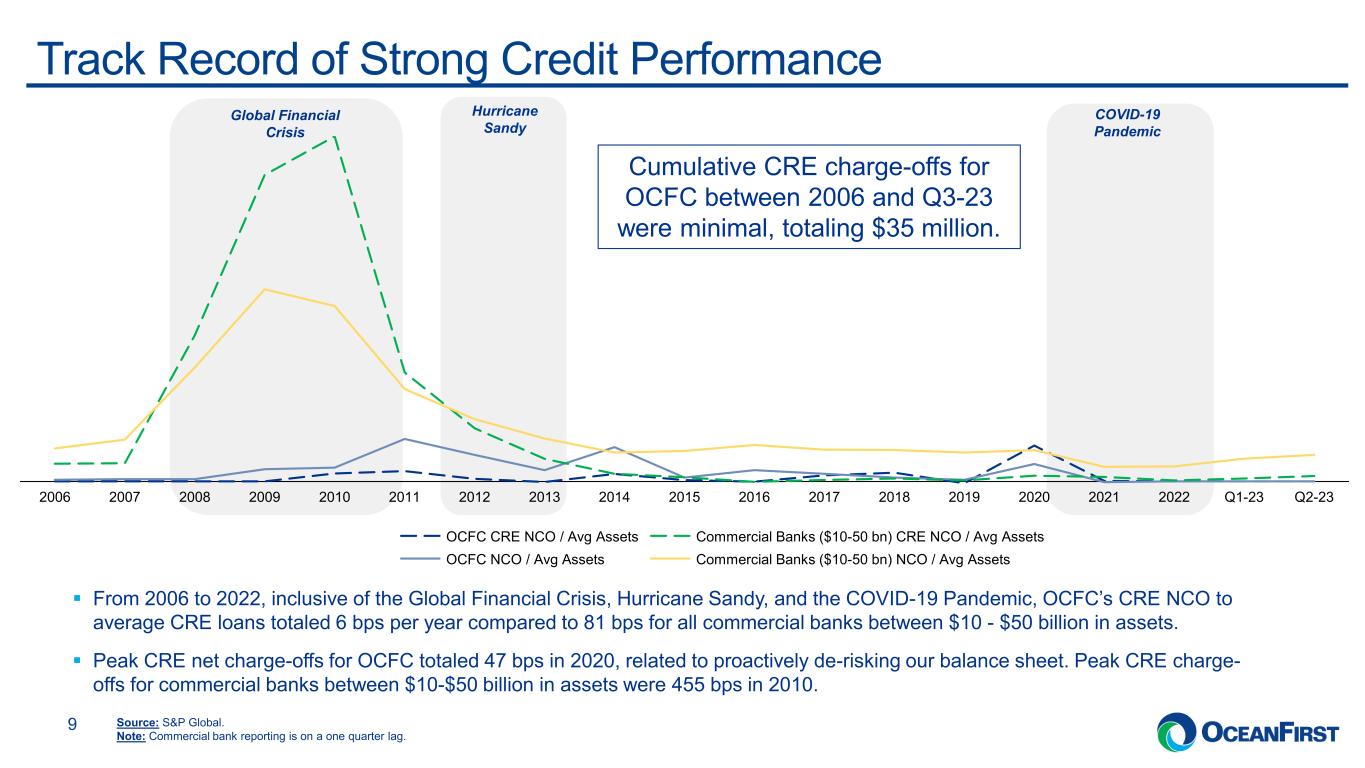

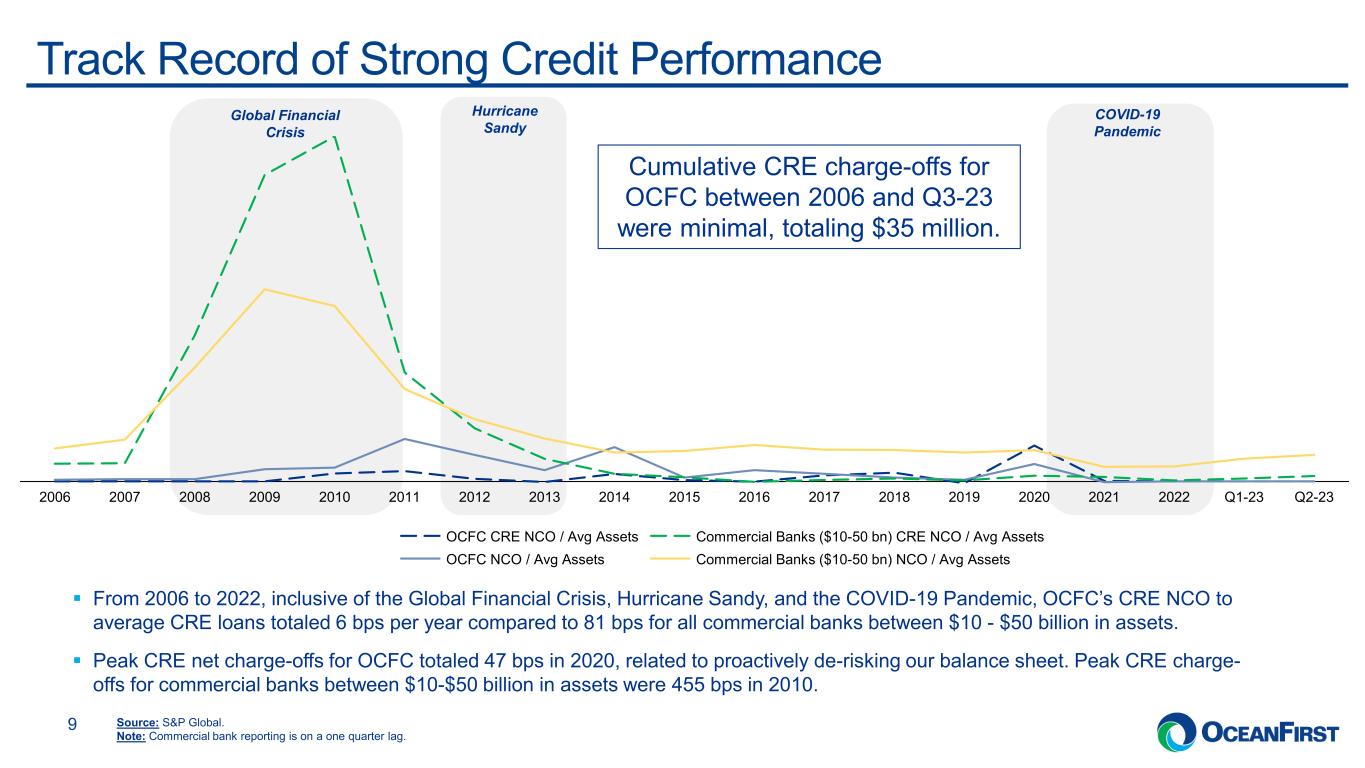

. . . COVID-19 Pandemic Track Record of Strong Credit Performance 9 From 2006 to 2022, inclusive of the Global Financial Crisis, Hurricane Sandy, and the COVID-19 Pandemic, OCFC’s CRE NCO to average CRE loans totaled 6 bps per year compared to 81 bps for all commercial banks between $10 - $50 billion in assets. Peak CRE net charge-offs for OCFC totaled 47 bps in 2020, related to proactively de-risking our balance sheet. Peak CRE charge- offs for commercial banks between $10-$50 billion in assets were 455 bps in 2010. 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Q1-23 Q2-23 OCFC CRE NCO / Avg Assets OCFC NCO / Avg Assets Commercial Banks ($10-50 bn) CRE NCO / Avg Assets Commercial Banks ($10-50 bn) NCO / Avg Assets Global Financial Crisis Cumulative CRE charge-offs for OCFC between 2006 and Q3-23 were minimal, totaling $35 million. Hurricane Sandy Source: S&P Global. Note: Commercial bank reporting is on a one quarter lag.

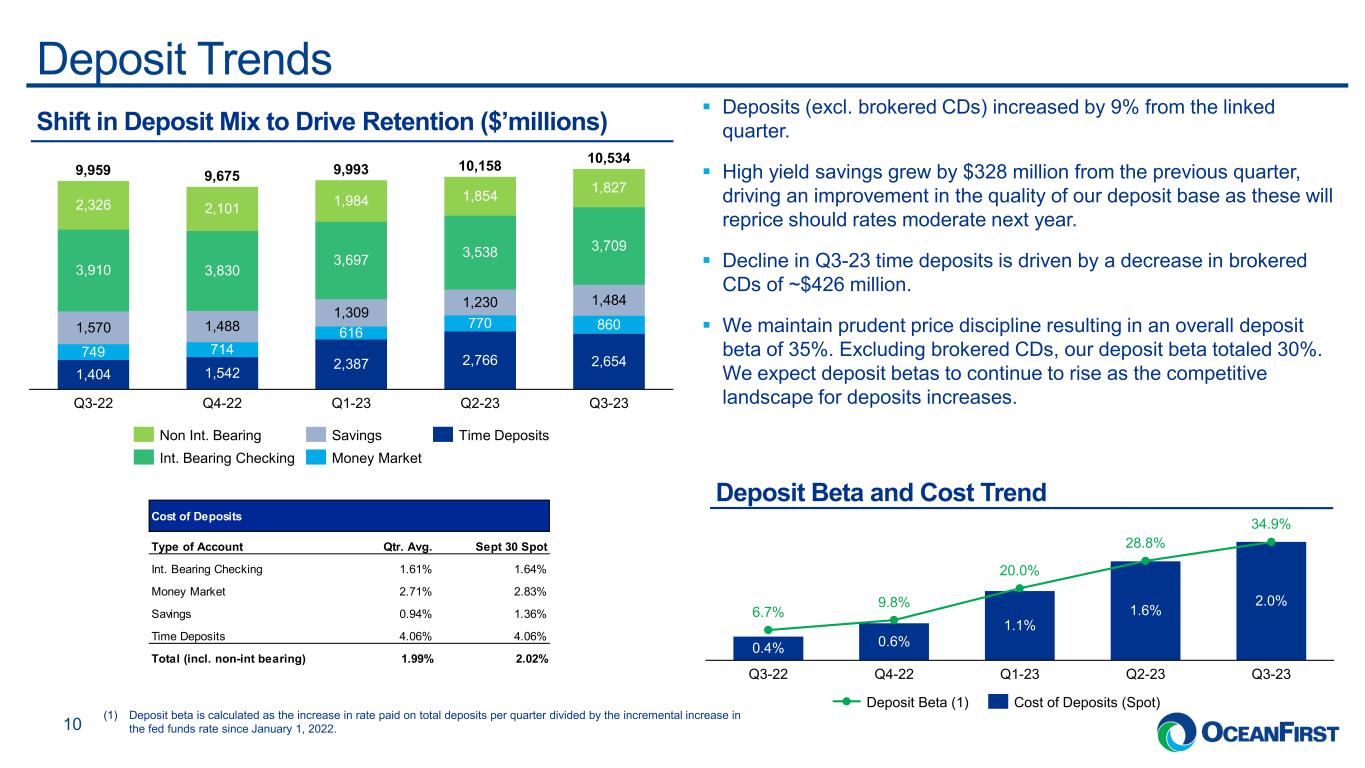

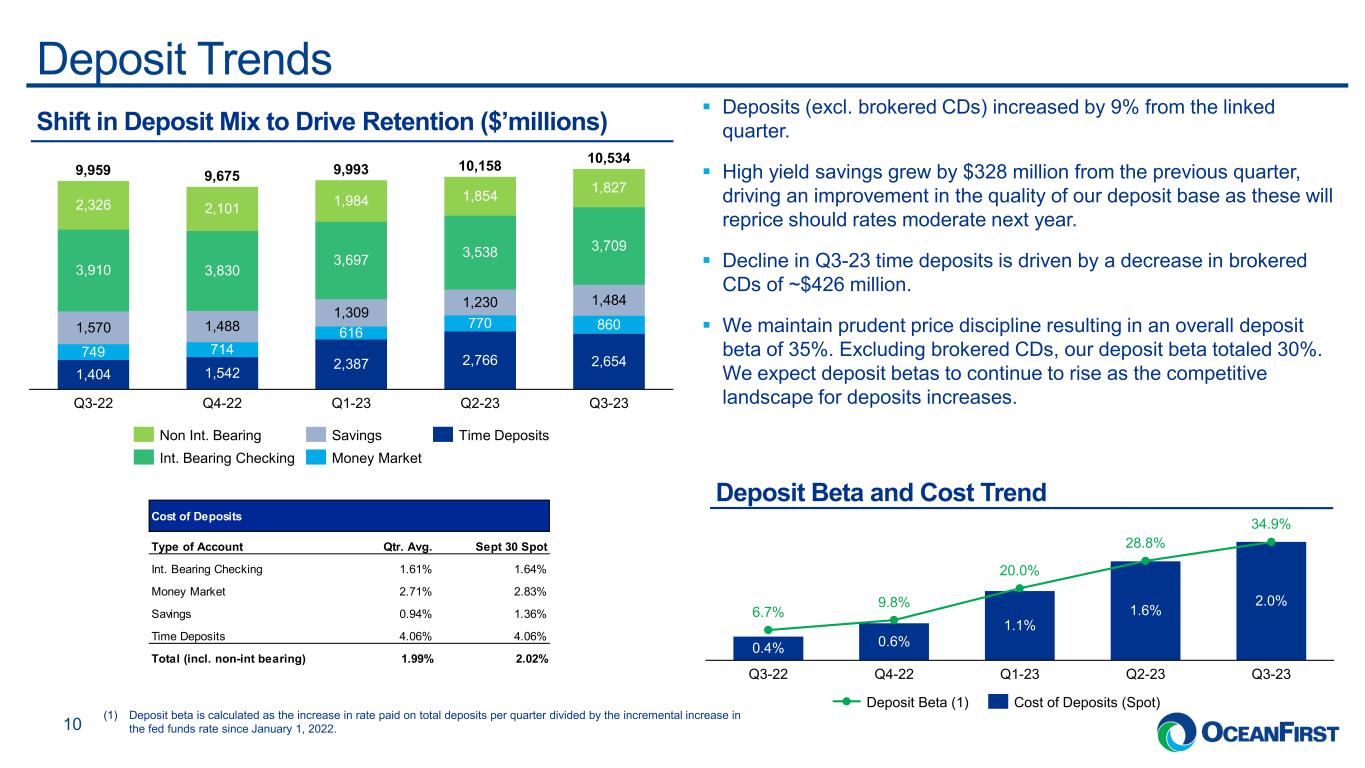

. . .Deposit Trends 10 (1) Deposit beta is calculated as the increase in rate paid on total deposits per quarter divided by the incremental increase in the fed funds rate since January 1, 2022. Deposits (excl. brokered CDs) increased by 9% from the linked quarter. High yield savings grew by $328 million from the previous quarter, driving an improvement in the quality of our deposit base as these will reprice should rates moderate next year. Decline in Q3-23 time deposits is driven by a decrease in brokered CDs of ~$426 million. We maintain prudent price discipline resulting in an overall deposit beta of 35%. Excluding brokered CDs, our deposit beta totaled 30%. We expect deposit betas to continue to rise as the competitive landscape for deposits increases. Shift in Deposit Mix to Drive Retention ($’millions) 6.7% 0.4% Q3-22 9.8% 0.6% Q4-22 20.0% 1.1% Q1-23 28.8% 1.6% Q2-23 34.9% 2.0% Q3-23 Deposit Beta (1) Cost of Deposits (Spot) 1,404 1,542 2,387 2,766 2,654749 714 616 770 8601,570 1,488 1,309 1,230 1,484 3,910 3,830 3,697 3,538 3,709 2,326 2,101 1,984 1,854 1,827 Q3-22 Q4-22 Q1-23 Q2-23 Q3-23 9,959 9,675 9,993 10,158 10,534 Non Int. Bearing Int. Bearing Checking Savings Money Market Time Deposits Deposit Beta and Cost Trend Cost of Deposits Type of Account Qtr. Avg. Sept 30 Spot Int. Bearing Checking 1.61% 1.64% Money Market 2.71% 2.83% Savings 0.94% 1.36% Time Deposits 4.06% 4.06% Total (incl. non-int bearing) 1.99% 2.02%

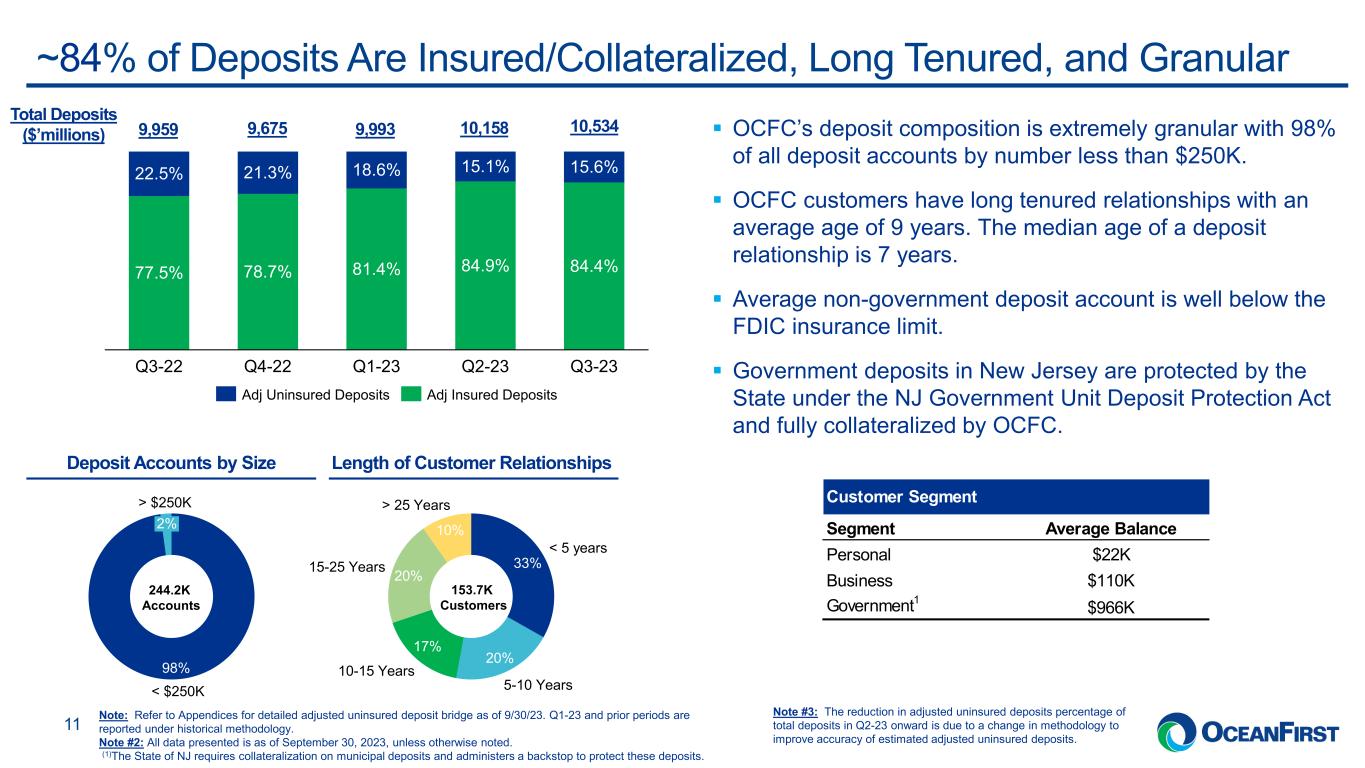

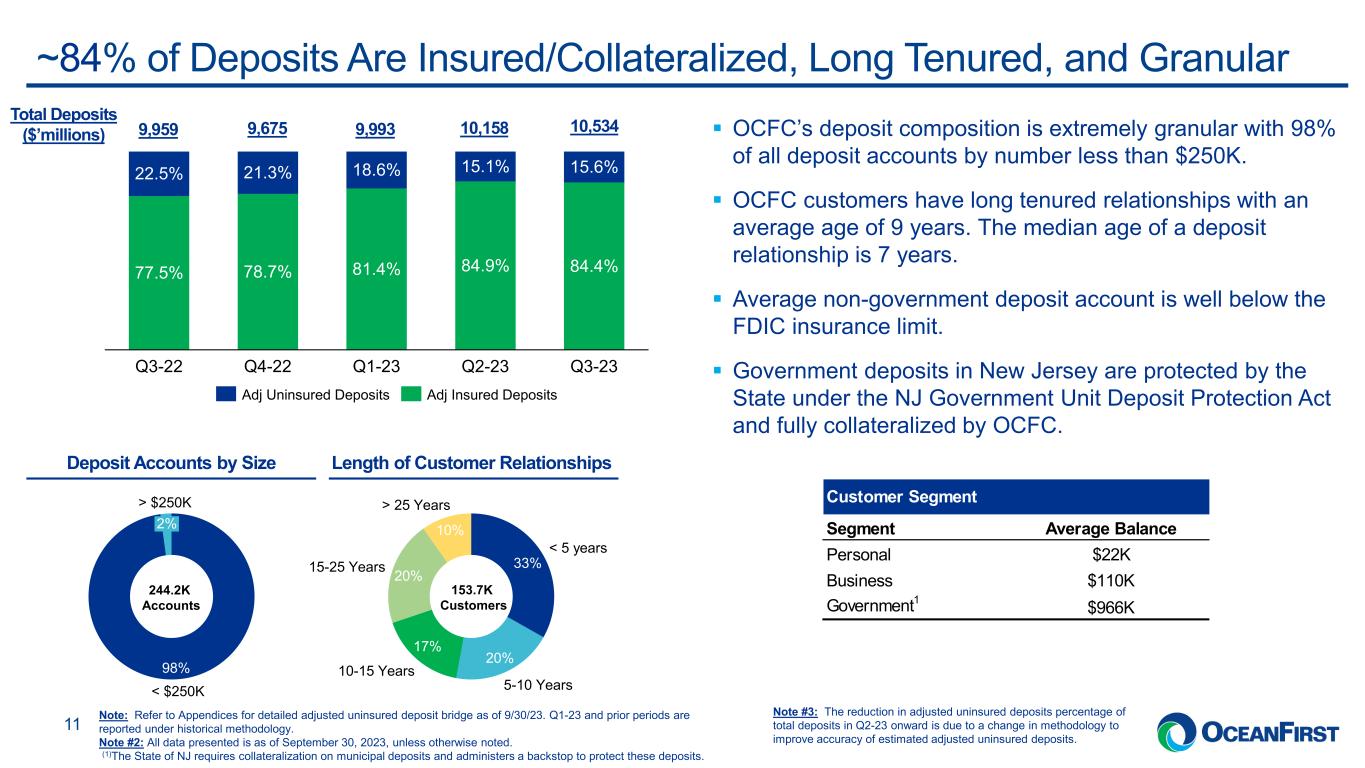

. . .~84% of Deposits Are Insured/Collateralized, Long Tenured, and Granular 11 OCFC’s deposit composition is extremely granular with 98% of all deposit accounts by number less than $250K. OCFC customers have long tenured relationships with an average age of 9 years. The median age of a deposit relationship is 7 years. Average non-government deposit account is well below the FDIC insurance limit. Government deposits in New Jersey are protected by the State under the NJ Government Unit Deposit Protection Act and fully collateralized by OCFC. Note: Refer to Appendices for detailed adjusted uninsured deposit bridge as of 9/30/23. Q1-23 and prior periods are reported under historical methodology. Note #2: All data presented is as of September 30, 2023, unless otherwise noted. (1)The State of NJ requires collateralization on municipal deposits and administers a backstop to protect these deposits. Deposit Accounts by Size Length of Customer Relationships 77.5% 78.7% 81.4% 84.9% 84.4% 22.5% 21.3% 18.6% 15.1% 15.6% Q3-22 Q4-22 Q1-23 Q2-23 Q3-23 Adj Uninsured Deposits Adj Insured Deposits 9,959 9,675 9,993 Total Deposits ($’millions) 98% < $250K 2% > $250K 244.2K Accounts 33% 20% 17% 20% 10% < 5 years 5-10 Years 10-15 Years 15-25 Years > 25 Years 153.7K Customers 10,534 Note #3: The reduction in adjusted uninsured deposits percentage of total deposits in Q2-23 onward is due to a change in methodology to improve accuracy of estimated adjusted uninsured deposits. 10,158 Customer Segment Segment Average Balance Personal $22K Business $110K Government1 $966K

. . .Net Interest Income and Net Interest Margin Trends 12 (1) Core NIM excludes purchase accounting and prepayment fee income. Refer to the Earnings Release for additional information. Core NIM1 vs NIM NIM Bridge 0.01 Q2-23 NIM -0.08 Ordinary course rate impacts Quarter-specific impacts (PA accretion for payoffs) -0.04 Excess liquidity Q3-23 NIM 3.02% 2.91% 3.36% 3.28% Q3-22 3.64% 3.54% Q4-22 3.34% 3.30% Q1-23 3.02% 2.97% Q2-23 2.91% 2.85% Q3-23 NIM Core NIM Net Interest Income ($’000) 95,965 Q3-22 106,488 Q4-22 98,802 Q1-23 92,109 Q2-23 90,996 Q3-23 Net Interest Income Headwinds Competitive market environment as peers compete on rate for quality credit. Remaining disciplined on deposit pricing and managing funding costs.

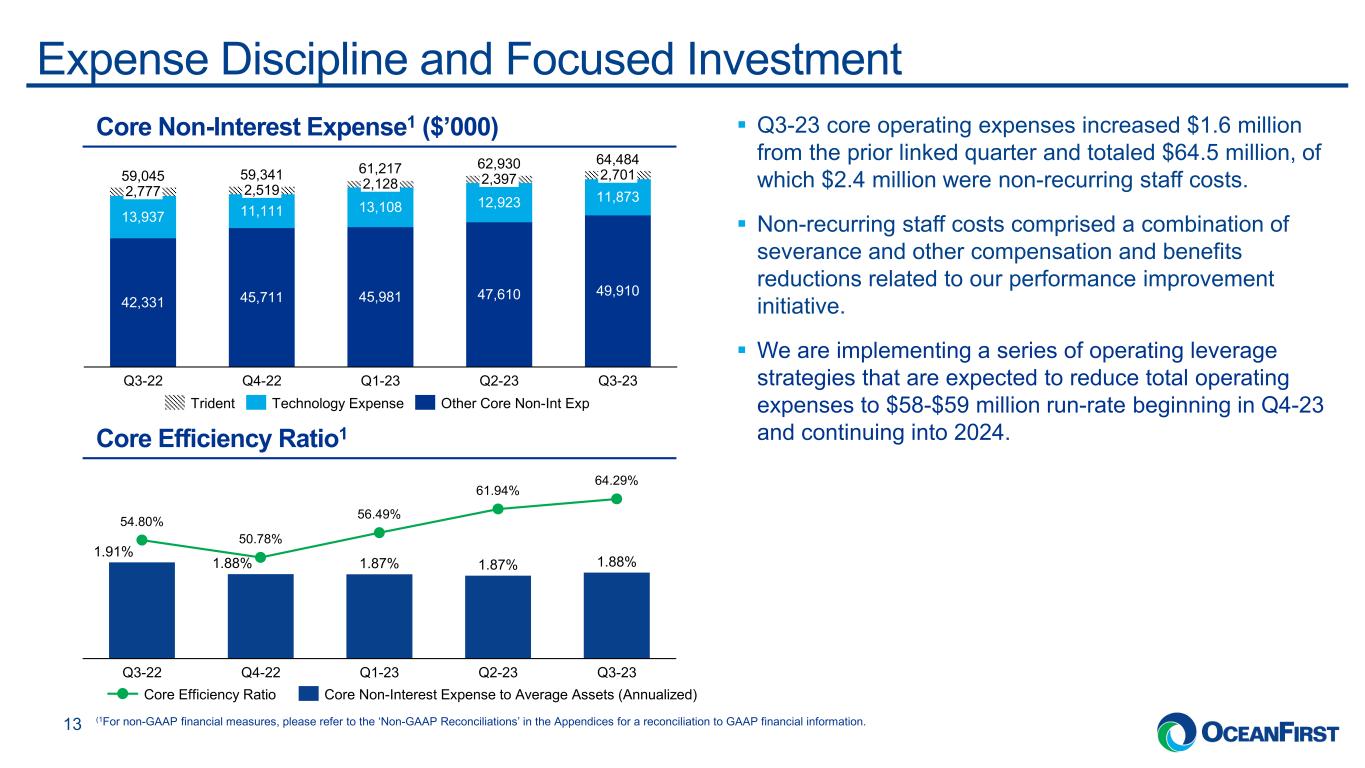

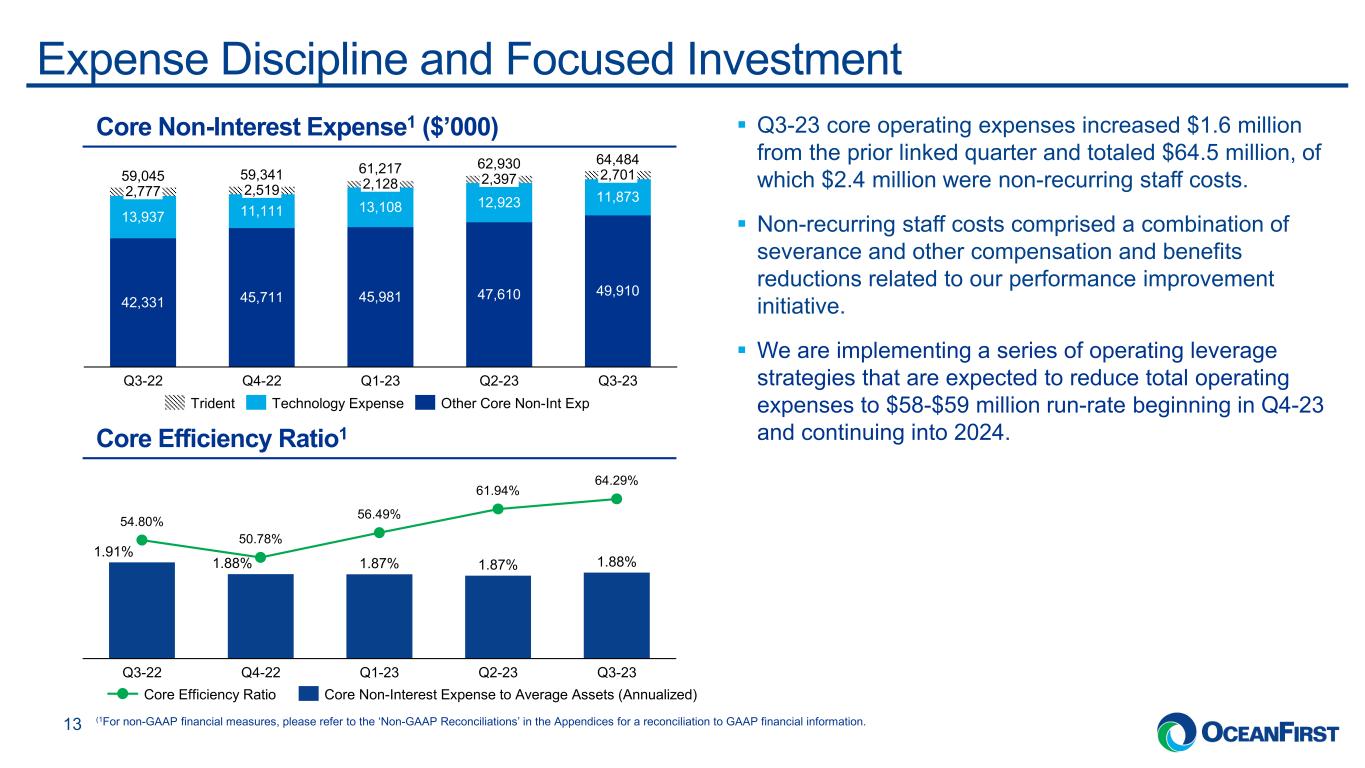

. . . Core Efficiency Ratio1 Expense Discipline and Focused Investment 13 Core Non-Interest Expense1 ($’000) 42,331 45,711 45,981 47,610 49,910 13,937 11,111 13,108 12,923 11,873 2,397 2,777 Q3-22 2,1282,519 59,045 Q1-23Q4-22 Q2-23 2,701 Q3-23 59,341 61,217 62,930 64,484 Other Core Non-Int ExpTrident Technology Expense 1.88% 64.29% 1.87% 54.80% Q3-22 50.78% Q4-22 1.87% 56.49% Q1-23 61.94% Q2-23 Q3-23 1.91% 1.88% Core Efficiency Ratio Core Non-Interest Expense to Average Assets (Annualized) (1For non-GAAP financial measures, please refer to the ‘Non-GAAP Reconciliations’ in the Appendices for a reconciliation to GAAP financial information. Q3-23 core operating expenses increased $1.6 million from the prior linked quarter and totaled $64.5 million, of which $2.4 million were non-recurring staff costs. Non-recurring staff costs comprised a combination of severance and other compensation and benefits reductions related to our performance improvement initiative. We are implementing a series of operating leverage strategies that are expected to reduce total operating expenses to $58-$59 million run-rate beginning in Q4-23 and continuing into 2024.

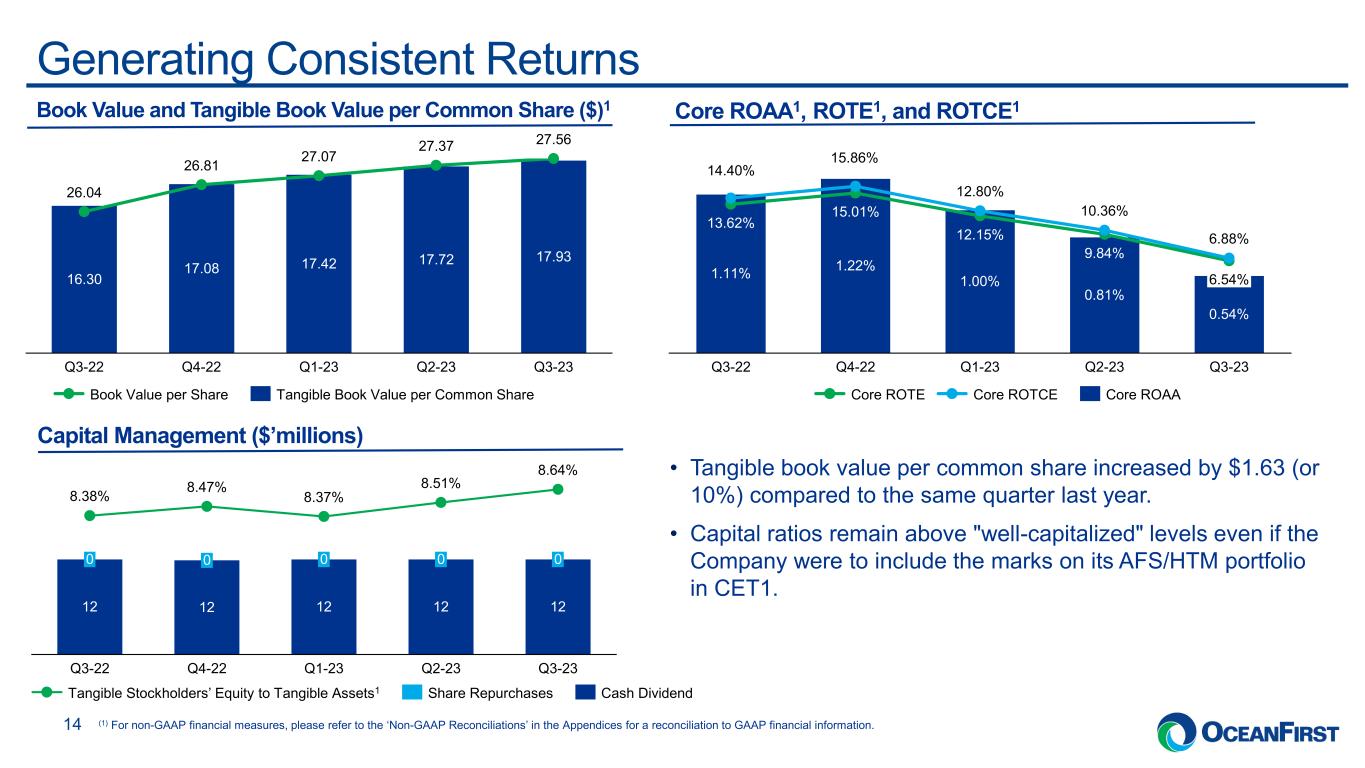

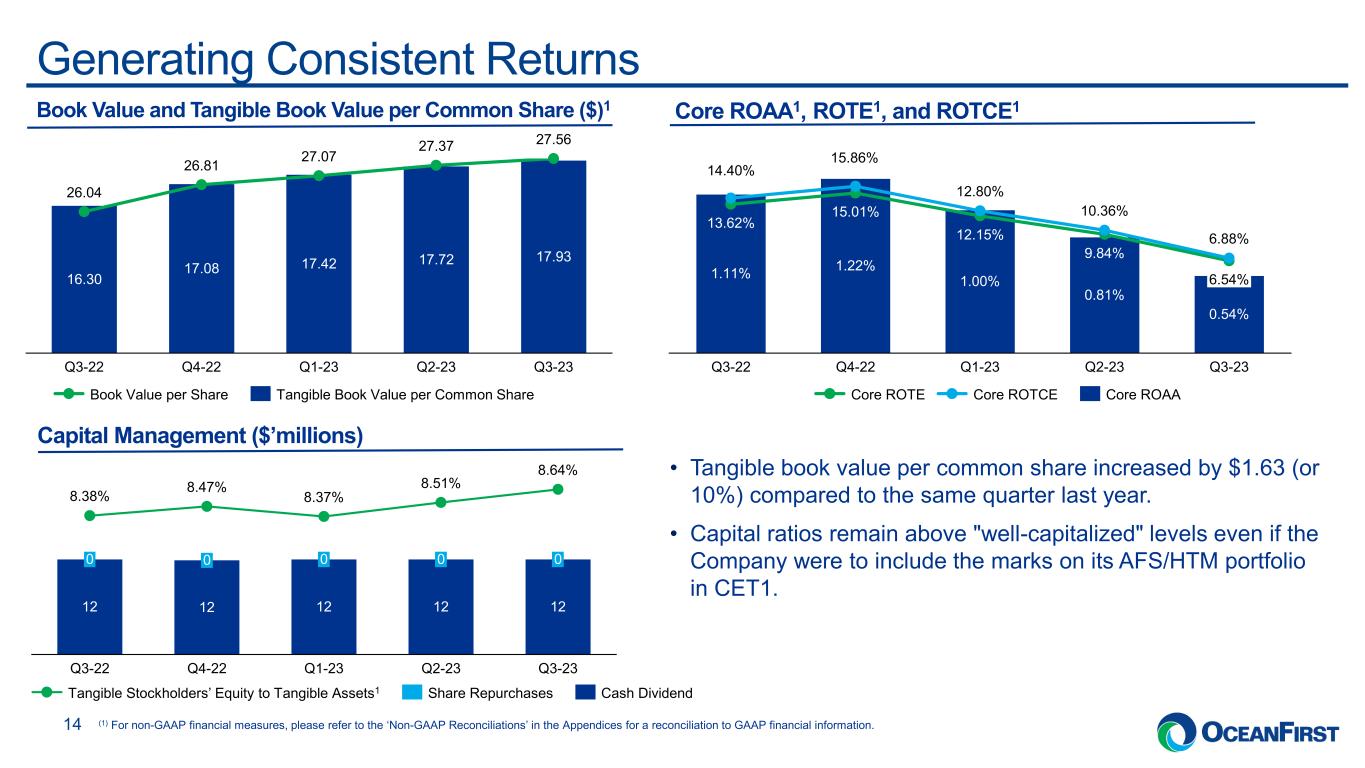

. . .Generating Consistent Returns 14 Book Value and Tangible Book Value per Common Share ($)1 Core ROAA1, ROTE1, and ROTCE1 • Tangible book value per common share increased by $1.63 (or 10%) compared to the same quarter last year. • Capital ratios remain above "well-capitalized" levels even if the Company were to include the marks on its AFS/HTM portfolio in CET1. Capital Management ($’millions) 16.30 17.08 17.42 17.72 17.93 26.04 26.81 27.07 27.37 27.56 Q3-23Q3-22 Q4-22 Q1-23 Q2-23 Tangible Book Value per Common ShareBook Value per Share Q3-22 15.86% 13.62% 15.01% 14.40% 1.11% 1.22% Q4-22 10.36% 12.15% 12.80% 1.00% 0.54% Q1-23 9.84% 0.81% Q2-23 Q3-23 6.54% 6.88% Core ROTE Core ROTCE Core ROAA 12 12 12 12 12 00 8.38% Q4-22 8.47% 0 Q3-22 0 8.37% 8.64% Q1-23 8.51% 0 Q2-23 Q3-23 Tangible Stockholders’ Equity to Tangible Assets1 Share Repurchases Cash Dividend (1) For non-GAAP financial measures, please refer to the ‘Non-GAAP Reconciliations’ in the Appendices for a reconciliation to GAAP financial information.

. . .Leading TBV Growth Supported by Prudent Liquidity Management 15 Tangible Book Value per Share Growth (Q2-22 to Q2-23)(1) (1) Peers include those companies defined in definitive proxy statement filed April 21, 2023. Excludes Investors Bancorp due to the sale to Citizens Financial Group. 11.0 -5% 0% 5% 10% 15 Peer 1 Peer 2 OCFC Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Peer 14 Peer 15 Peer 16 Peer 17 Peer 18 Peer 19 Peer 20 Peer 21

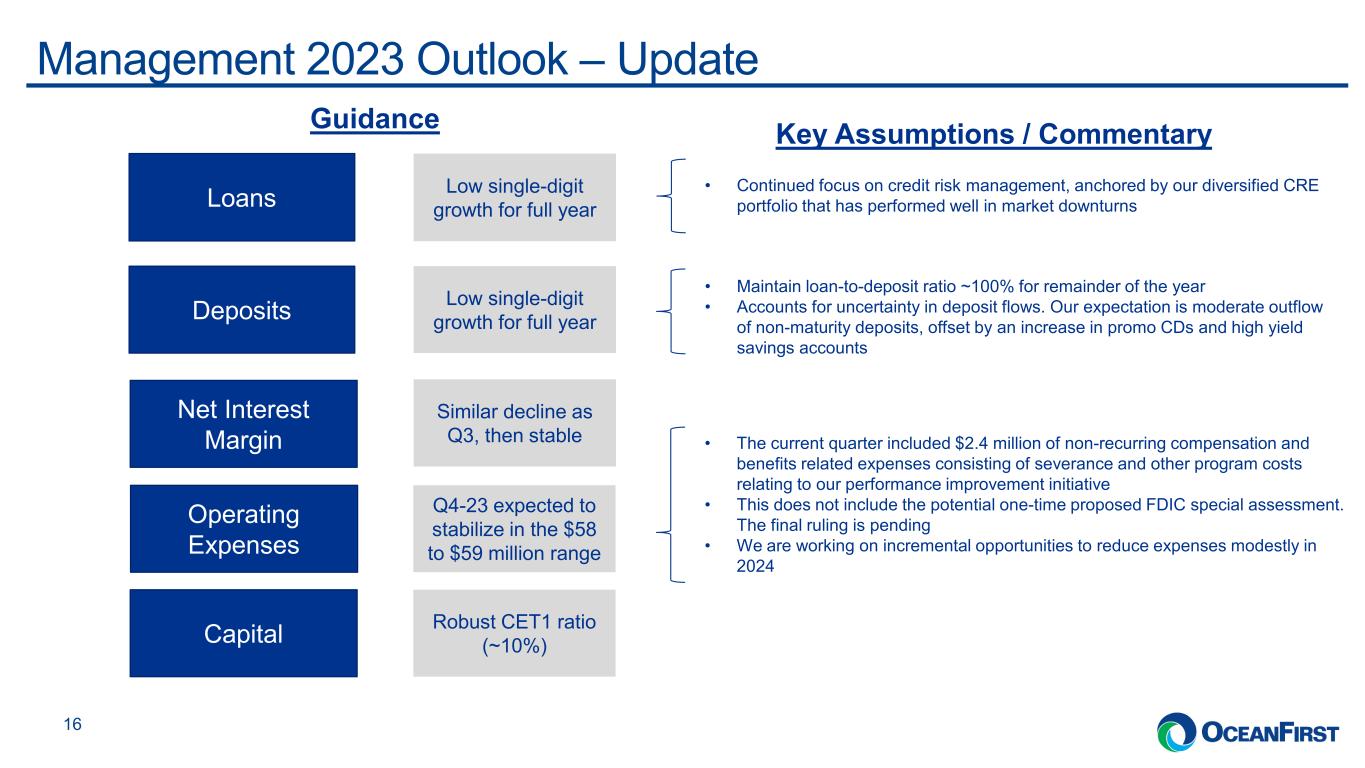

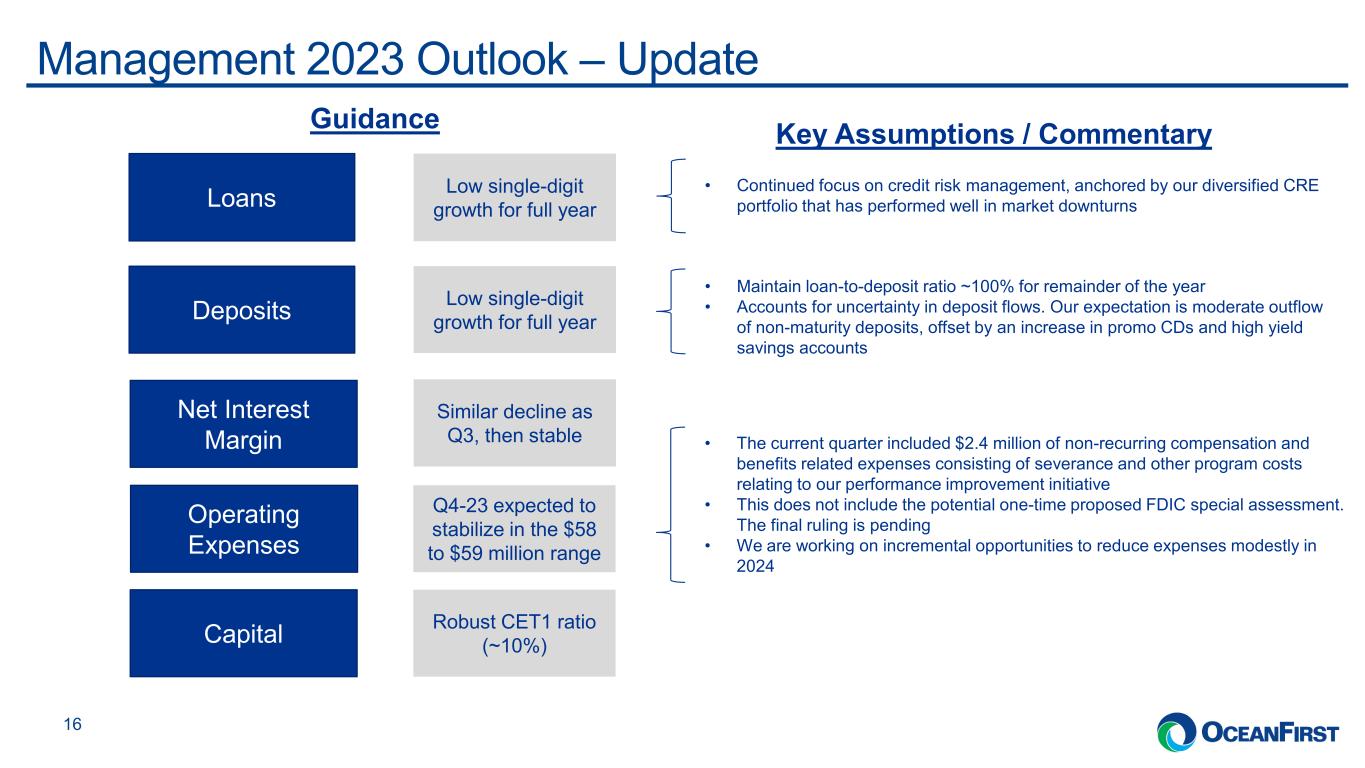

. . .Management 2023 Outlook – Update 16 Loans Deposits Operating Expenses Net Interest Margin Capital • Continued focus on credit risk management, anchored by our diversified CRE portfolio that has performed well in market downturns • Maintain loan-to-deposit ratio ~100% for remainder of the year • Accounts for uncertainty in deposit flows. Our expectation is moderate outflow of non-maturity deposits, offset by an increase in promo CDs and high yield savings accounts Low single-digit growth for full year Low single-digit growth for full year Q4-23 expected to stabilize in the $58 to $59 million range Similar decline as Q3, then stable Robust CET1 ratio (~10%) Guidance Key Assumptions / Commentary • The current quarter included $2.4 million of non-recurring compensation and benefits related expenses consisting of severance and other program costs relating to our performance improvement initiative • This does not include the potential one-time proposed FDIC special assessment. The final ruling is pending • We are working on incremental opportunities to reduce expenses modestly in 2024

. . . I N V E S T O R P R E S E N T A T I O N 17 Appendix

. . .CBD Office Concentration Exposure Is Moderate Office Portfolio Central business district loans comprised 1% of total assets and have a weighted average LTV of 53.0% and weighted average DSCR of 1.85. Criticized and classified office loans totaled 2% of total office loans. 18 CBD Office Portfolio by Geography 13% 36% 32% 19% Philadelphia New York City Newark Boston Central Business District (CBD) - Office $'millions Book Balance % of Total WA LTV WA DSCR Credit Tenant 44 36.1% 61.7 2.17 Office 42 34.1% 56.2 1.97 Life Sciences & Medical 36 29.8% 38.9 1.31 CBD - Office 122 11.2% 53.0 1.85 % of Total Loans 1.2% CRE Investor Owned: Office $'millions Book Balance % of Total WA LTV WA DSCR Office 530 48.6% 51.9 1.72 Life Sciences & Medical 330 30.3% 57.8 1.71 Credit Tenant 230 21.1% 64.6 2.07 Total Office 1,090 100.0% 56.4 1.79 % of Total Loans 10.8%

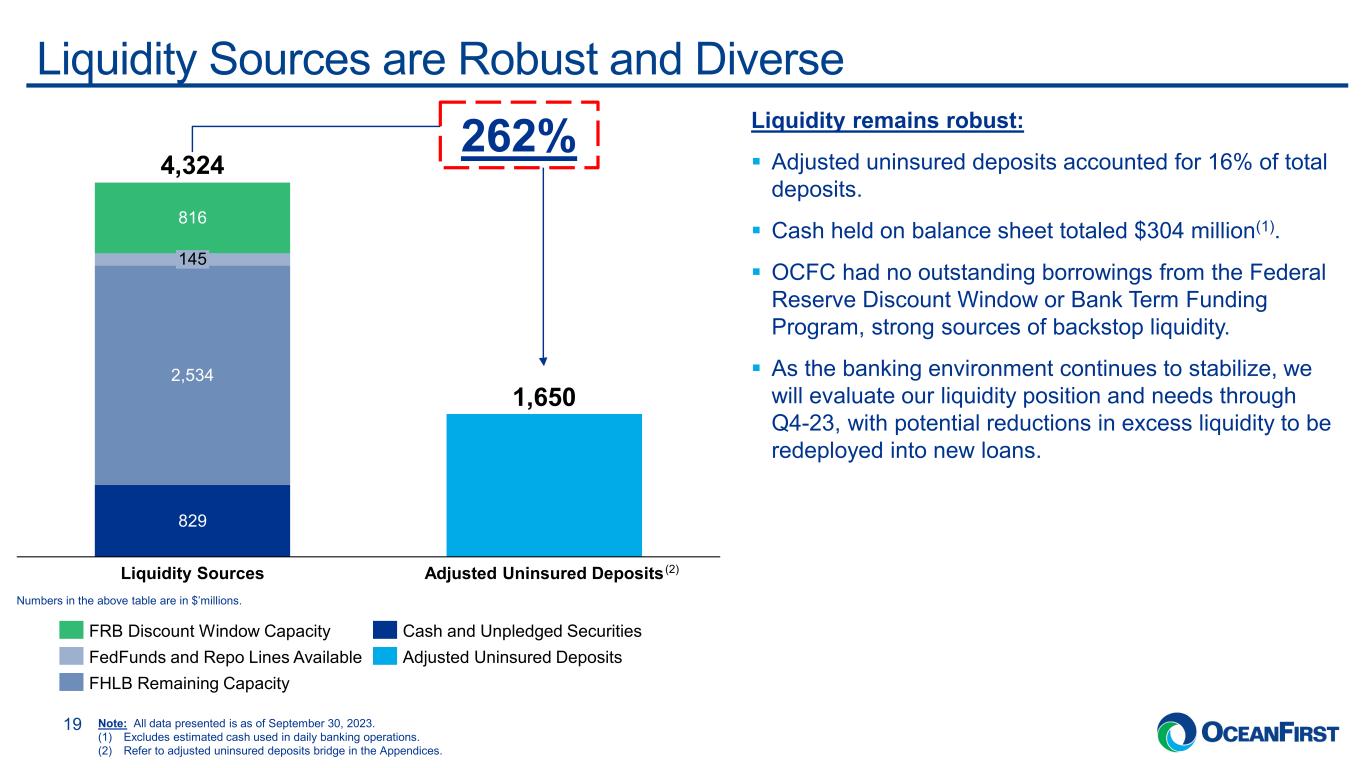

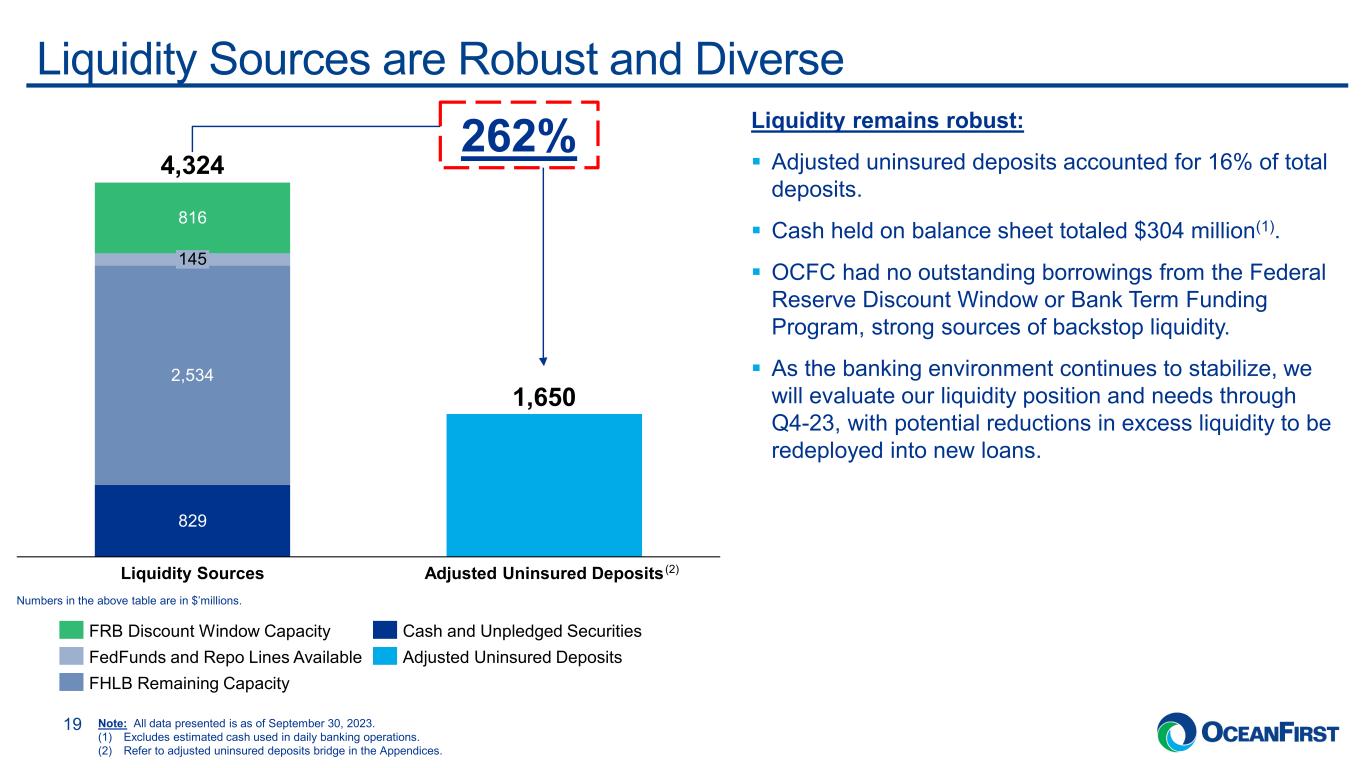

. . .Liquidity Sources are Robust and Diverse 19 Liquidity remains robust: Adjusted uninsured deposits accounted for 16% of total deposits. Cash held on balance sheet totaled $304 million(1). OCFC had no outstanding borrowings from the Federal Reserve Discount Window or Bank Term Funding Program, strong sources of backstop liquidity. As the banking environment continues to stabilize, we will evaluate our liquidity position and needs through Q4-23, with potential reductions in excess liquidity to be redeployed into new loans. 829 1,650 2,534 816 145 Liquidity Sources Adjusted Uninsured Deposits 4,324 FRB Discount Window Capacity FedFunds and Repo Lines Available FHLB Remaining Capacity Cash and Unpledged Securities Adjusted Uninsured Deposits Note: All data presented is as of September 30, 2023. (1) Excludes estimated cash used in daily banking operations. (2) Refer to adjusted uninsured deposits bridge in the Appendices. 262% Numbers in the above table are in $’millions. (2)

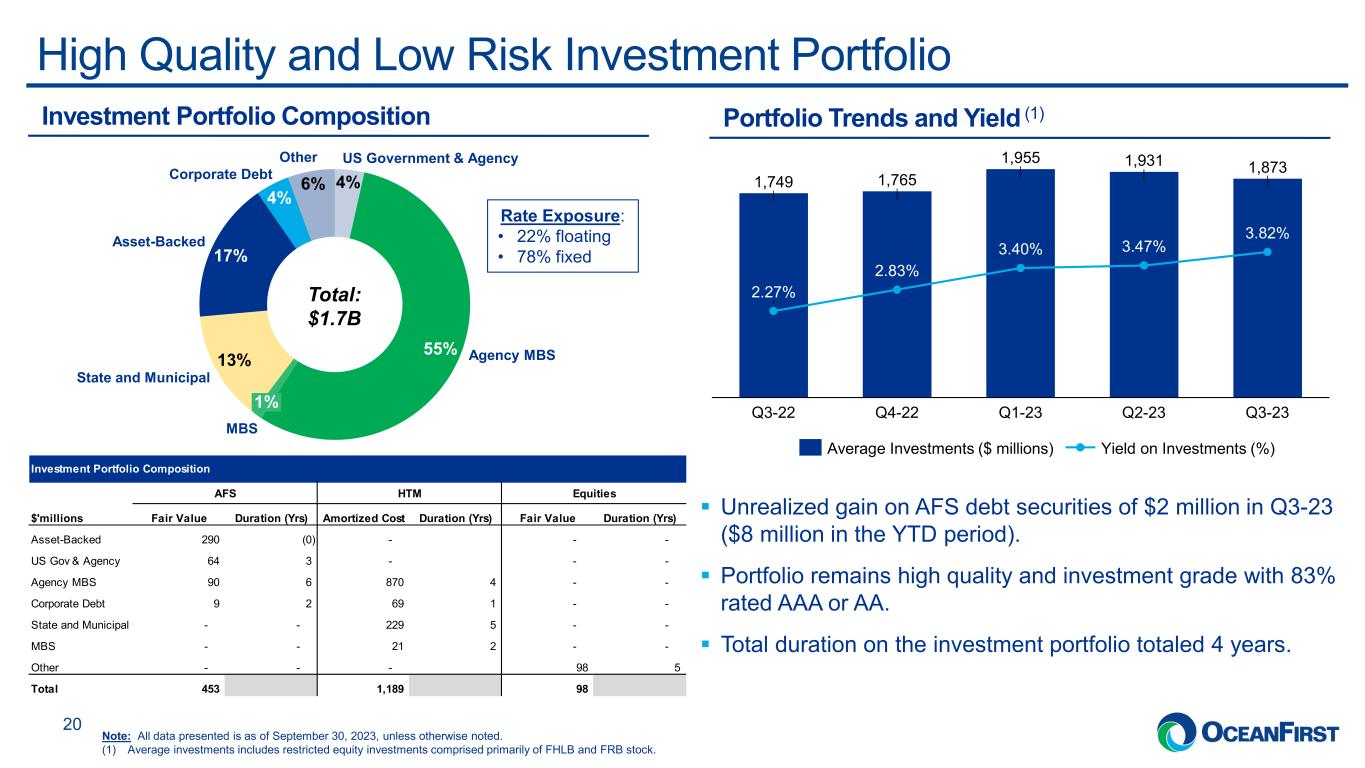

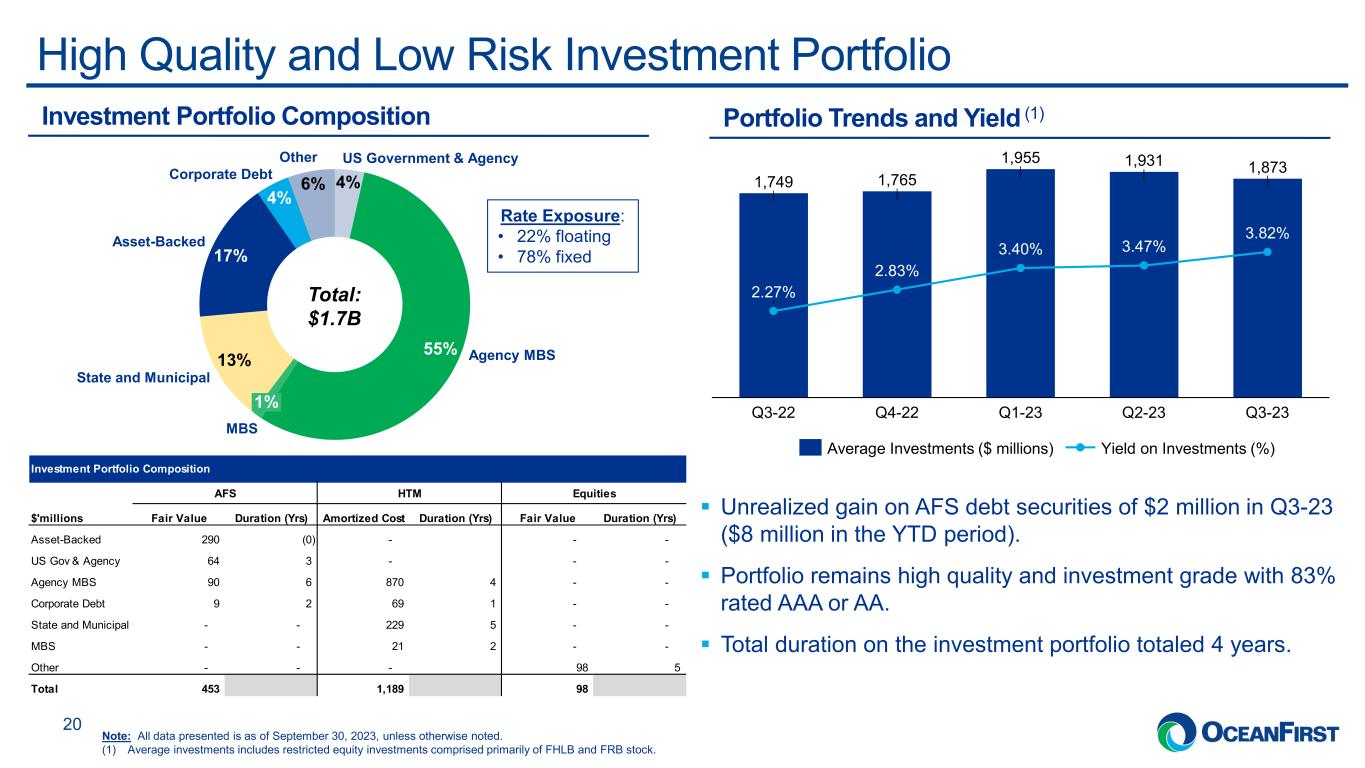

. . .High Quality and Low Risk Investment Portfolio 20 Unrealized gain on AFS debt securities of $2 million in Q3-23 ($8 million in the YTD period). Portfolio remains high quality and investment grade with 83% rated AAA or AA. Total duration on the investment portfolio totaled 4 years. Investment Portfolio Composition 4% 55%13% 17% 4% 6% US Government & Agency Agency MBS 1% MBS State and Municipal Asset-Backed Corporate Debt Other Total: $1.7B 1,749 1,765 1,955 1,931 1,873 2.27% Q3-22 2.83% Q4-22 3.40% Q1-23 3.47% Q2-23 3.82% Q3-23 Average Investments ($ millions) Yield on Investments (%) Portfolio Trends and Yield (1) Note: All data presented is as of September 30, 2023, unless otherwise noted. (1) Average investments includes restricted equity investments comprised primarily of FHLB and FRB stock. Rate Exposure: • 22% floating • 78% fixed Investment Portfolio Composition AFS HTM Equities $'millions Fair Value Duration (Yrs) Amortized Cost Duration (Yrs) Fair Value Duration (Yrs) Asset-Backed 290 (0) - - - US Gov & Agency 64 3 - - - Agency MBS 90 6 870 4 - - Corporate Debt 9 2 69 1 - - State and Municipal - - 229 5 - - MBS - - 21 2 - - Other - - - 98 5 Total 453 1,189 98

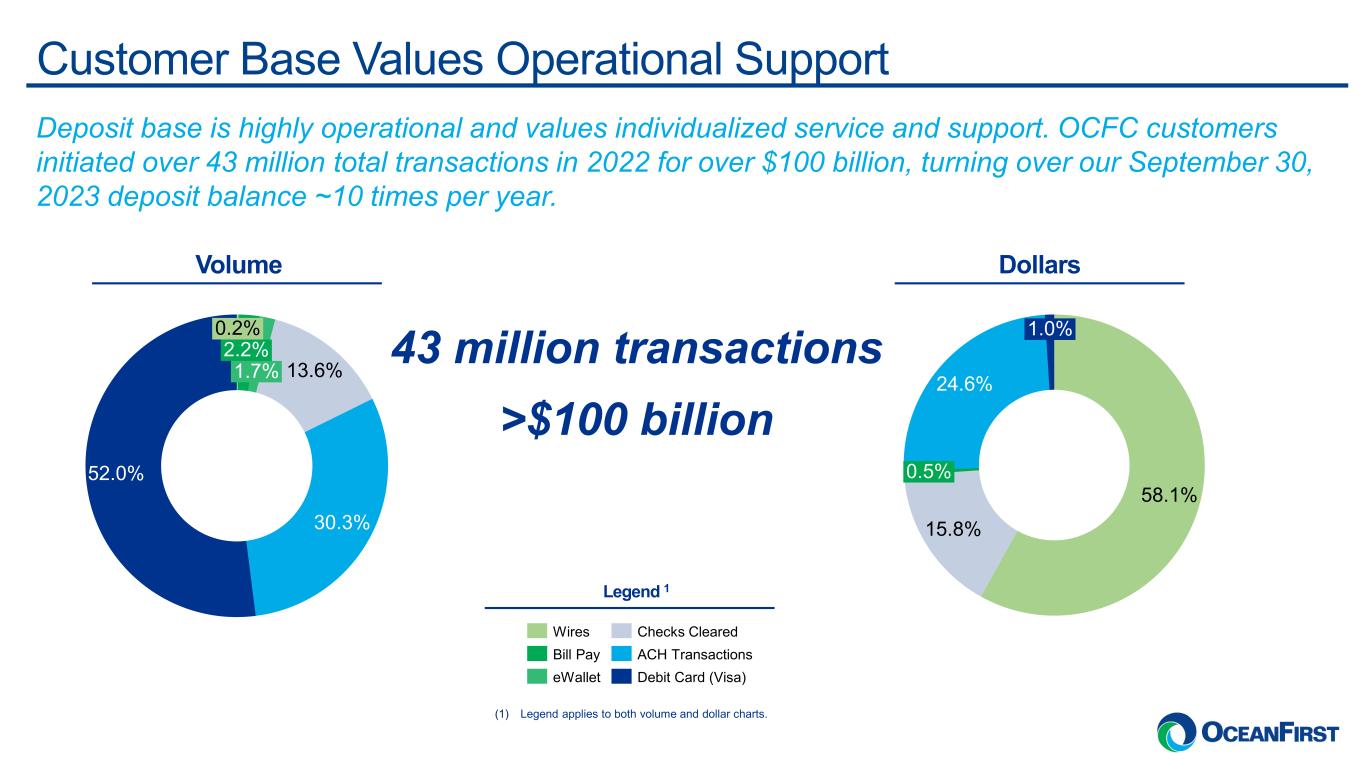

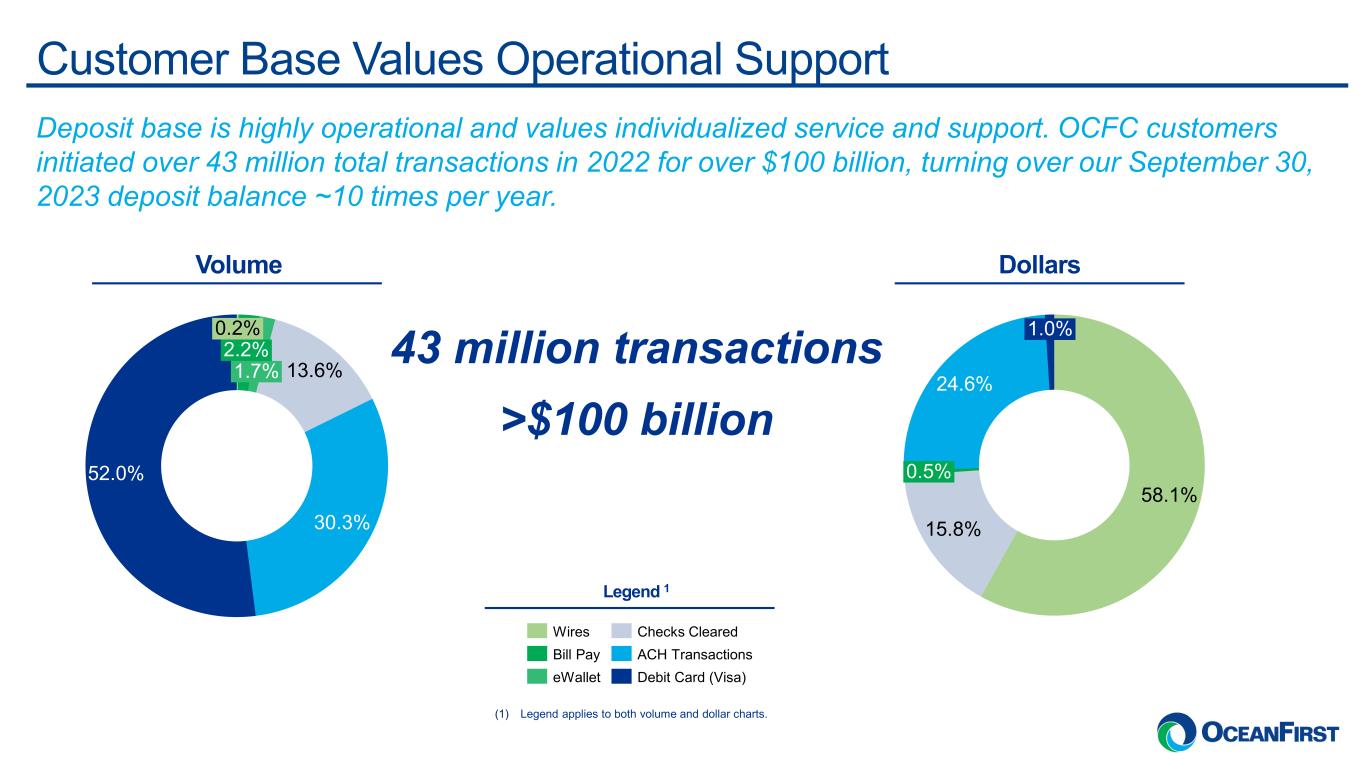

. . .Customer Base Values Operational Support Deposit base is highly operational and values individualized service and support. OCFC customers initiated over 43 million total transactions in 2022 for over $100 billion, turning over our September 30, 2023 deposit balance ~10 times per year. 13.6% 30.3% 52.0% 0.2% 2.2% 1.7% 58.1% 15.8% 24.6% 0.5% 1.0%43 million transactions >$100 billion Volume Dollars Wires ACH TransactionsBill Pay eWallet Debit Card (Visa) Checks Cleared Legend 1 (1) Legend applies to both volume and dollar charts.

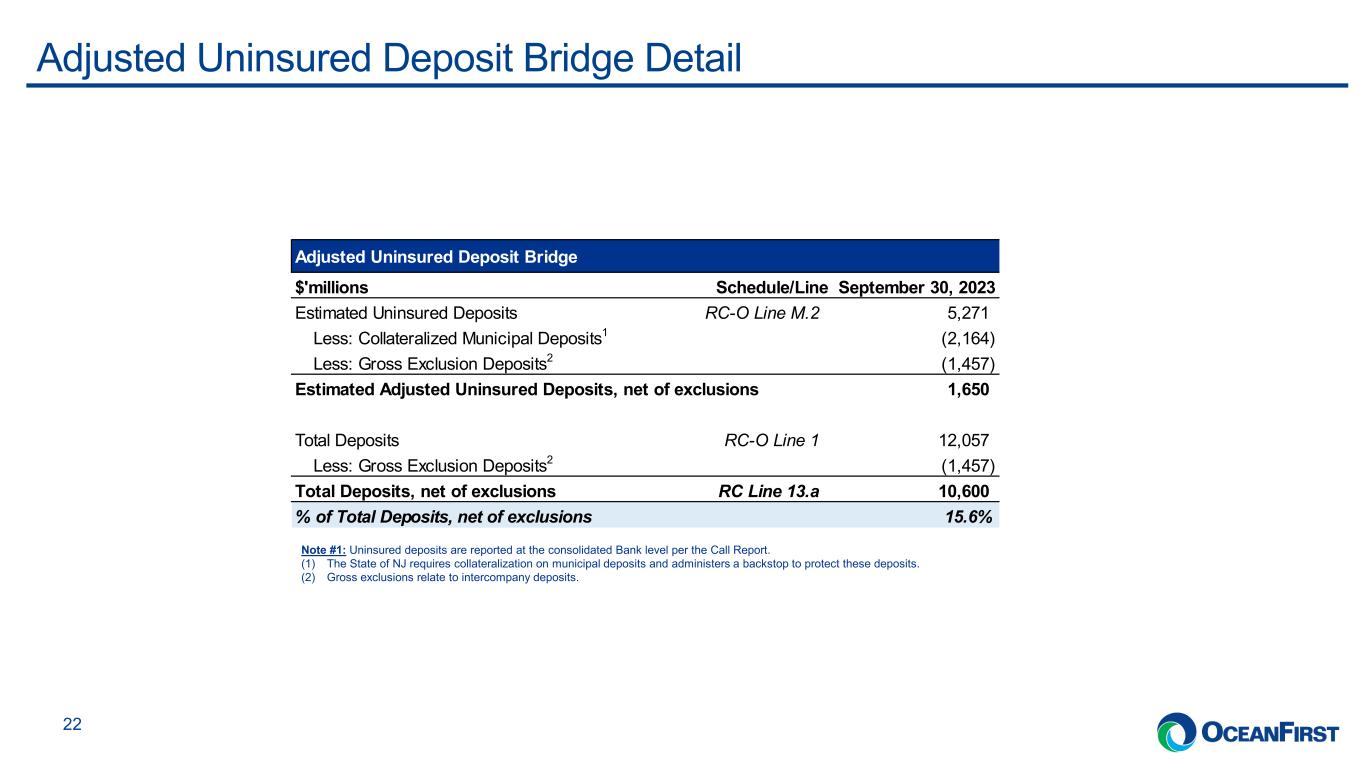

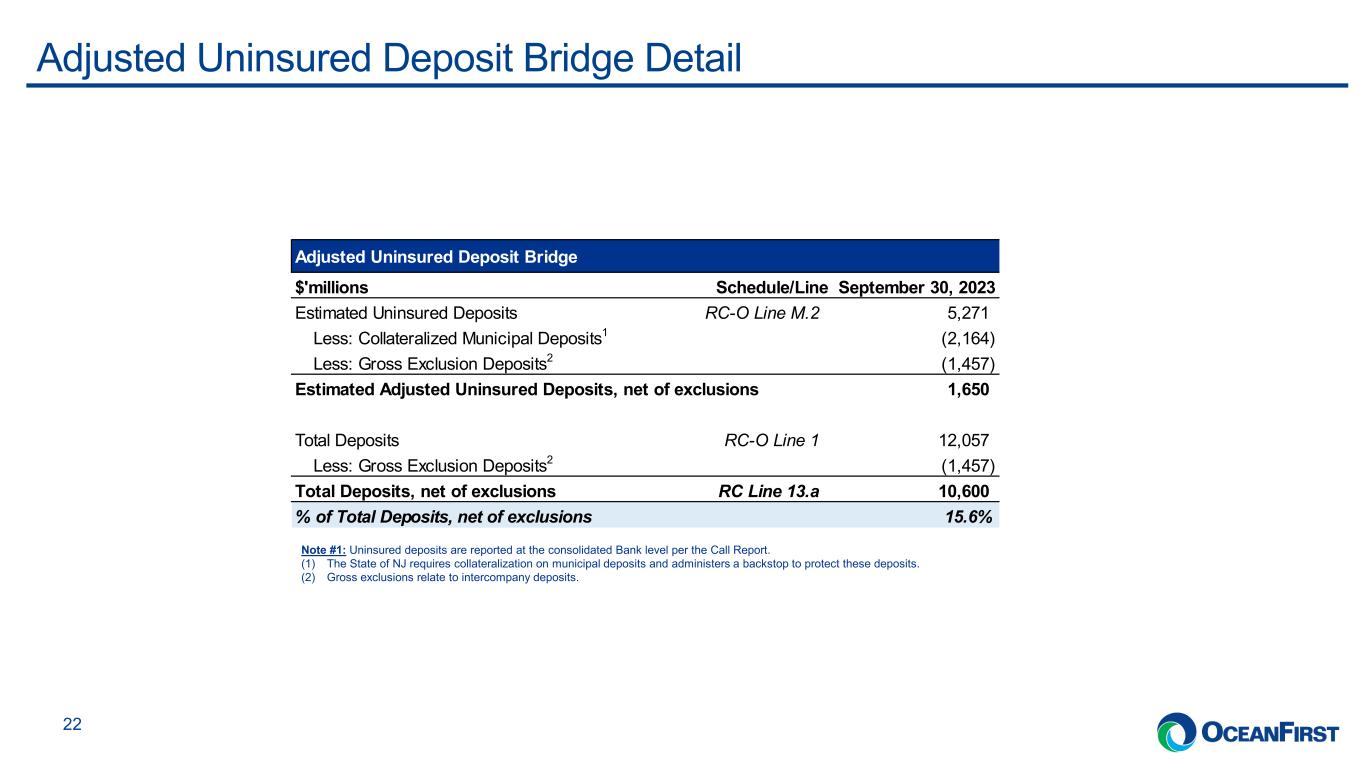

. . .Adjusted Uninsured Deposit Bridge Detail 22 Note #1: Uninsured deposits are reported at the consolidated Bank level per the Call Report. (1) The State of NJ requires collateralization on municipal deposits and administers a backstop to protect these deposits. (2) Gross exclusions relate to intercompany deposits. Adjusted Uninsured Deposit Bridge $'millions Schedule/Line September 30, 2023 Estimated Uninsured Deposits RC-O Line M.2 5,271 Less: Collateralized Municipal Deposits1 (2,164) Less: Gross Exclusion Deposits2 (1,457) Estimated Adjusted Uninsured Deposits, net of exclusions 1,650 Total Deposits RC-O Line 1 12,057 Less: Gross Exclusion Deposits2 (1,457) Total Deposits, net of exclusions RC Line 13.a 10,600 % of Total Deposits, net of exclusions 15.6%

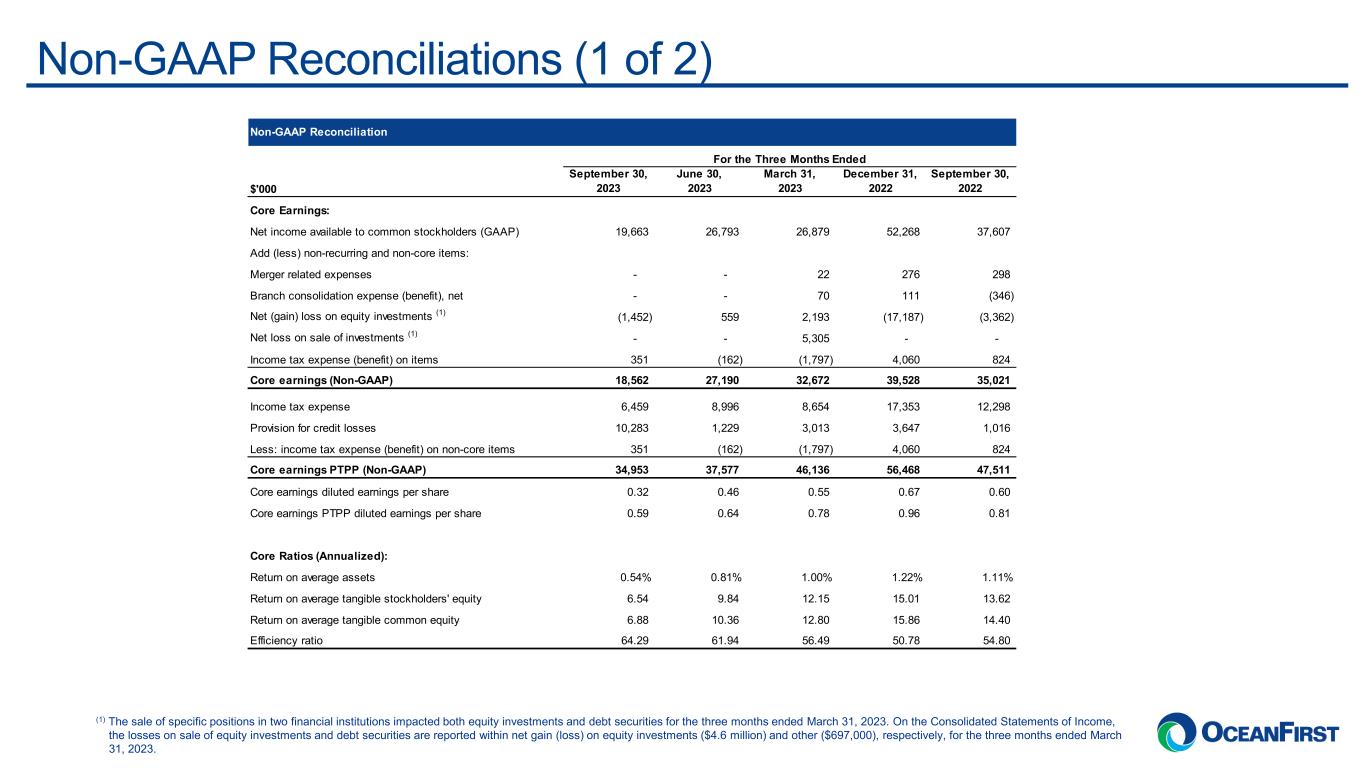

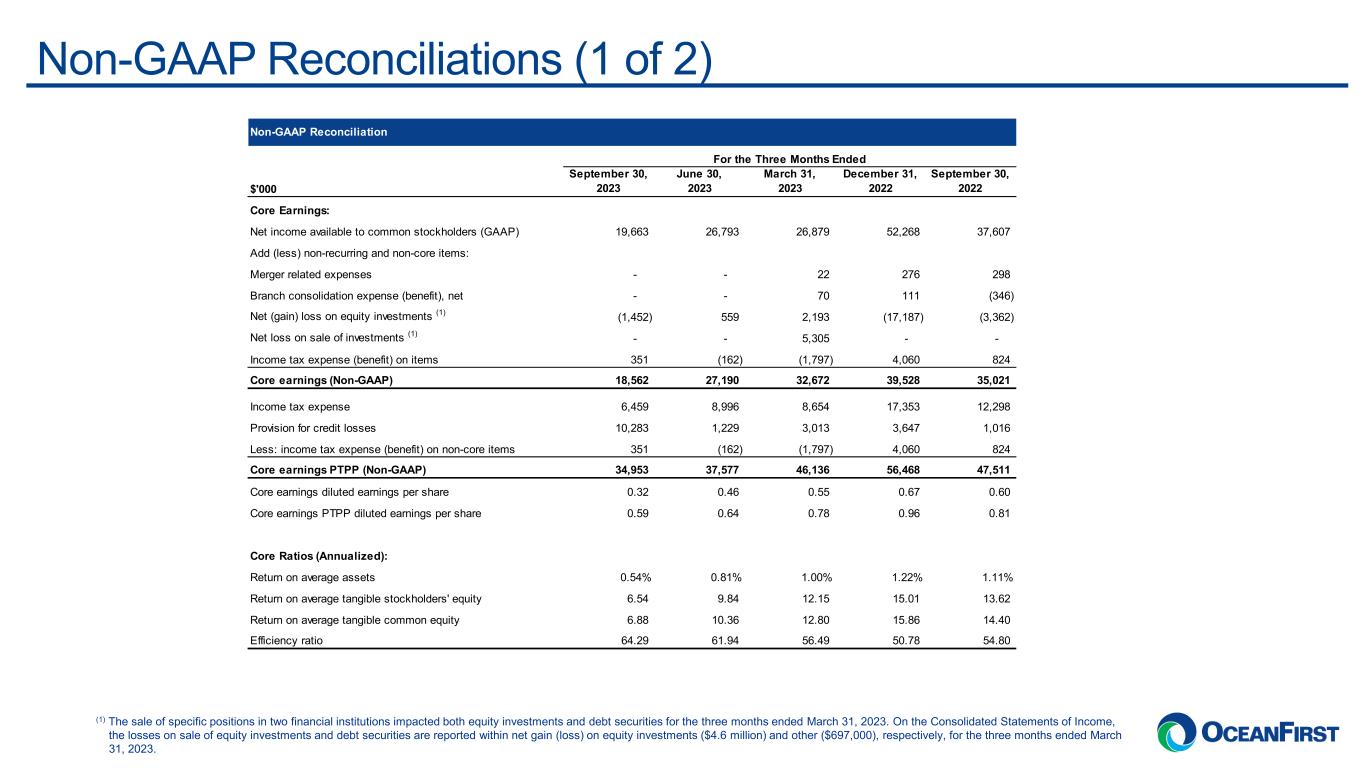

. . .Non-GAAP Reconciliations (1 of 2) (1) The sale of specific positions in two financial institutions impacted both equity investments and debt securities for the three months ended March 31, 2023. On the Consolidated Statements of Income, the losses on sale of equity investments and debt securities are reported within net gain (loss) on equity investments ($4.6 million) and other ($697,000), respectively, for the three months ended March 31, 2023. Non-GAAP Reconciliation For the Three Months Ended $'000 September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 September 30, 2022 Core Earnings: Net income available to common stockholders (GAAP) 19,663 26,793 26,879 52,268 37,607 Add (less) non-recurring and non-core items: Merger related expenses - - 22 276 298 Branch consolidation expense (benefit), net - - 70 111 (346) Net (gain) loss on equity investments (1) (1,452) 559 2,193 (17,187) (3,362) Net loss on sale of investments (1) - - 5,305 - - Income tax expense (benefit) on items 351 (162) (1,797) 4,060 824 Core earnings (Non-GAAP) 18,562 27,190 32,672 39,528 35,021 Income tax expense 6,459 8,996 8,654 17,353 12,298 Provision for credit losses 10,283 1,229 3,013 3,647 1,016 Less: income tax expense (benefit) on non-core items 351 (162) (1,797) 4,060 824 Core earnings PTPP (Non-GAAP) 34,953 37,577 46,136 56,468 47,511 Core earnings diluted earnings per share 0.32 0.46 0.55 0.67 0.60 Core earnings PTPP diluted earnings per share 0.59 0.64 0.78 0.96 0.81 Core Ratios (Annualized): Return on average assets 0.54% 0.81% 1.00% 1.22% 1.11% Return on average tangible stockholders' equity 6.54 9.84 12.15 15.01 13.62 Return on average tangible common equity 6.88 10.36 12.80 15.86 14.40 Efficiency ratio 64.29 61.94 56.49 50.78 54.80

. . .Non-GAAP Reconciliations (2 of 2) Non-GAAP Reconciliation $'000 September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 September 30, 2022 Tangible Equity Total stockholders' equity 1,637,604 1,626,283 1,610,371 1,585,464 1,540,216 Less: Goodwill 506,146 506,146 506,146 506,146 506,146 Core deposit intangible 10,489 11,476 12,470 13,497 14,656 Tangible stockholders' equity 1,120,969 1,108,661 1,091,755 1,065,821 1,019,414 Less: Preferred Stock 55,527 55,527 55,527 55,527 55,527 Tangible common equity 1,065,442 1,053,134 1,036,228 1,010,294 963,887 Tangible Assets Total Assets 13,498,183 13,538,903 13,555,175 13,103,896 12,683,453 Less: Goodwill 506,146 506,146 506,146 506,146 506,146 Core deposit intangible 10,489 11,476 12,470 13,497 14,656 Tangible assets 12,981,548 13,021,281 13,036,559 12,584,253 12,162,651