- OCFC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

OceanFirst Financial (OCFC) 8-KRegulation FD Disclosure

Filed: 15 Nov 05, 12:00am

NASDAQ: OCFC 1 OceanFirst Financial Corp. John R. Garbarino, Chairman, President & CEO Michael J. Fitzpatrick, Executive Vice President & CFO SANDLER O’NEILL & PARTNERS, L.P. FINANCIAL SERVICES CONFERENCE NOVEMBER 17, 2005 Exhibit 99.1 |

NASDAQ: OCFC 2 OceanFirst Financial Corp. This presentation contains certain forward- looking statements which are based on certain assumptions and describe future plans, strategies and expectations of the Company. These forward- looking statements are generally identified by use of the words “believe”, “expect”, “intend”, “ anticipate”, “estimate”, “project”, or similar expressions. The Company’ s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations of the Company and the subsidiaries include, but are not limited to, changes in interest rates, general economic conditions, legislative/regulatory changes, monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury and the Federal Reserve Board, the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand for financial services in the Company’ s market area and accounting principles and guidelines. These risks and uncertainties should be considered in evaluating forward- looking statements and undue reliance should not be placed on such statements. The Company does not undertake – and specifically disclaims any obligation – to publicly release the result of any revisions which may be made to any forward- looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. |

NASDAQ: OCFC 3 OceanFirst Financial Today $2.0 Billion in Assets – 18 18 OceanFirst Bank branches within a tightly defined market area and 2 satellite loan production offices (lpo) Columbia Home Loans, LLC. (CHL) – wholly owned mortgage banking subsidiary headquartered in Westchester County, New York with offices in the greater NYC metropolitan area Transitioning the Bank’s balance sheet to reduce a historical over- reliance on CD funding and residential mortgage portfolio lending Growing revenue and non-interest income through balance sheet expansion and composition change, maturity of new business lines and continual product line expansion Responding to the Governance, Compliance & Risk Management challenges of the day Holding company for the 103 year old financial services firm serving the community banking needs of the attractive Central New Jersey Shore growth market between the major metropolitan areas of New York City and Philadelphia |

NASDAQ: OCFC 4 Eight Plus Years of Delivering Shareholder Value 9/30/2005 12/31/1996 CAGR Total Loans $1,697,679,000 $690,306,000 10.8% Core Deposits 883,847,000 317,070,000 12.4% Last 12 Months Year Ended Sept. 30, 2005 Dec. 31, 1997 CAGR EPS $1.60 $.59 13.7% Annual Dividend .80 .27 15.0% ROE 14.5% 6.0% 12.0% Fee and Service Charge Income $9,094,000 $1,376,000 27.5% Average Annual/Total Shareholder Return (1997 – 2004) 17.9% |

NASDAQ: OCFC 5 Business Plan 2005 – 2007 Focus on disciplined de novo branch and core account development to drive asset/revenue growth Target commercial lending as the focus of portfolio growth, improving the loan portfolio mix Grow non-interest income as the primary driver of top-line revenue through the maturation of recent business initiatives Improve operating efficiency through both revenue enhancement and expense control Deliver all financial services within the Bank’s existing geographic market under the strong sales, service and credit cultures • Capitalizing on the unique advantage of being the local community service minded alternative to mega-banks A challenging return to double-digit EPS growth rates |

NASDAQ: OCFC 6 Recently Improved Operating Results Completed Successful Management Reorganization through 2004/2005 • Vito R. Nardelli appointed Chief Operating Officer in September 2005 Return of Balance Sheet Growth – 2004/2005 Deposit Growth Loan Growth 2004 11.0% - $126 million 8.1% - $117 million 9 mos. ending Sept. 30, 2005 *10.4% - $ 99 million *12.7% - $148 million * 2005 percentage growth is annualized Expansion of Residential Loan Production Capability • Capitalizing on loan officer market dislocations, replacing lost mortgage refinance activity from 2004 Growth of Revenues ( year over year nine months ended September 30, 2005 ) • Fee and service charge income +13.0% • Net Interest Income +9.6% Margin Stabilization and Support • For the nine months ended September 30, 2005, net interest margin expanded by 8 BP over prior year despite the continued flattening of the yield curve |

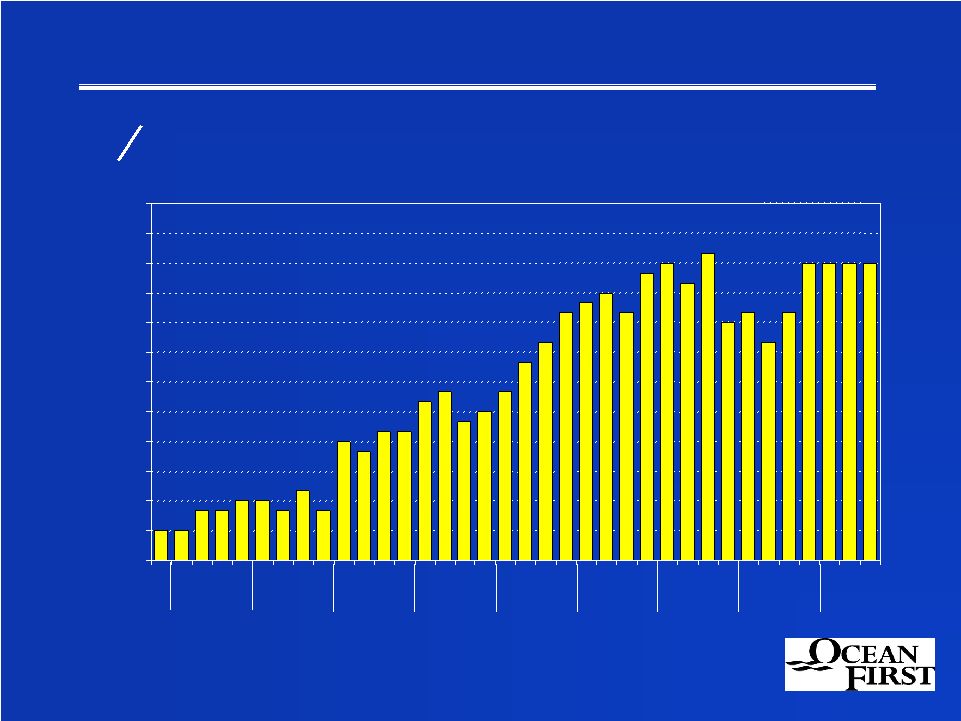

NASDAQ: OCFC 7 $0.10 $0.13 $0.16 $0.19 $0.22 $0.25 $0.28 $0.31 $0.34 $0.37 $0.40 $0.43 $0.46 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 Last 4 Quarters EPS Have Rebounded 40¢ share - up 25.0%, 14.3%, 17.6% and 14.3% over prior year 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 Quarters |

NASDAQ: OCFC 8 Retail Branch In-Market Growth Disciplined de novo branching and core deposit generation • From 1996 through 3Q ‘05, 10 branches were opened - average core deposit mix of 74% Current branch activity in our growth market • Whiting branch to be relocated to a more convenient, prominent location (1Q ‘06) • New Little Egg Harbor branch scheduled to open (2Q ‘06) • New Wall branch scheduled to open mid ‘07 18 Branches within a tightly defined footprint provide significant presence, market share |

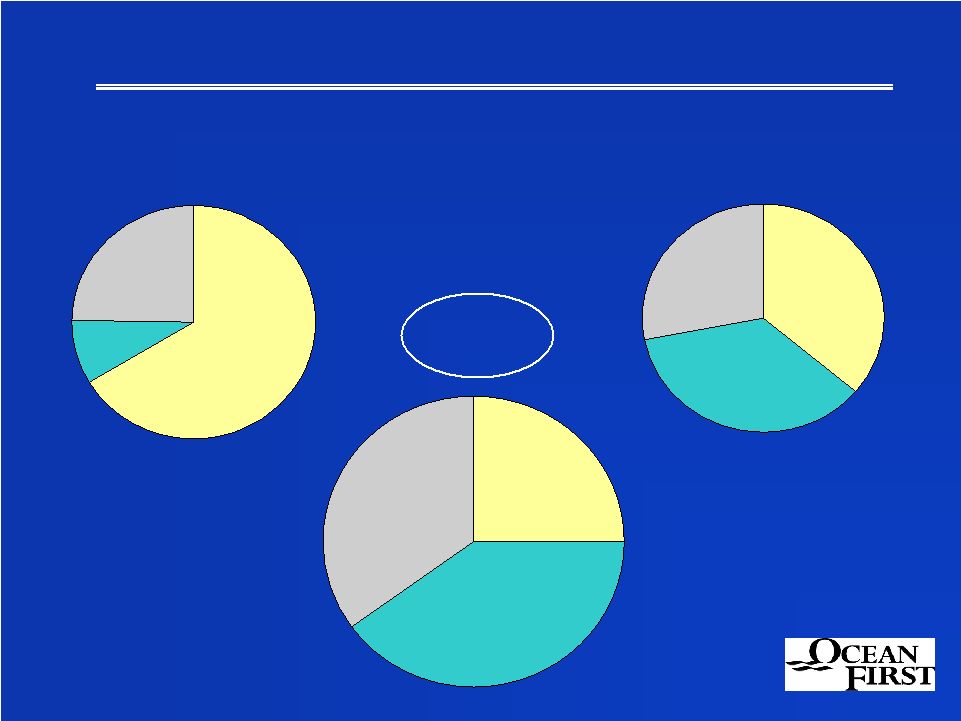

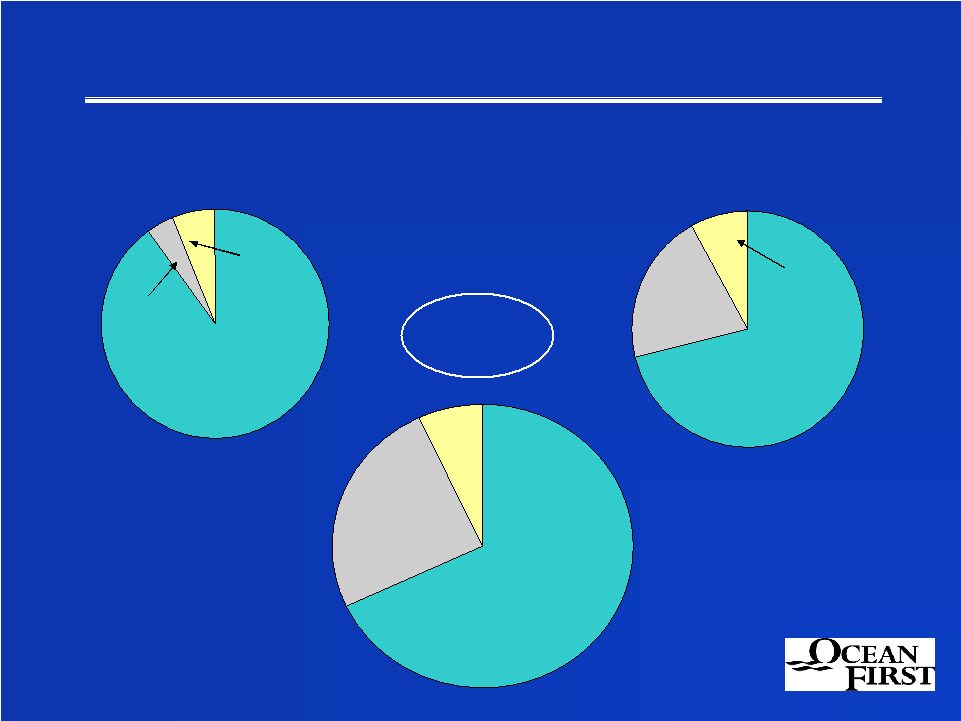

NASDAQ: OCFC 9 2007 Goal The Changing Deposit Mix December 31, 1996 September 30, 2005 Savings & MMDA 26% CD’s 66% Checking 8% Savings & MMDA 28% Savings & MMDA 35% Checking 36% Checking 40% CD’s 36% CD’s 25% |

NASDAQ: OCFC 10 Loan Portfolio Supporting Revenue Growth Commercial Lending Growth Continues • 2004 Growth…………………………….. 17.9% - $46 million 2005 Growth (through Sept. 30)..……..*19.3% - $44 million * 2005 percentage growth is annualized • Diversified, low risk $349 million portfolio Commercial real estate - 80% $567,000 average C & I - 20% $217,000 average Only 6 loans between $5 million and $10 million Residential Lending Market Leader • Core Bank originations of $367 million for 2004; off of $526 million in 2003 • Increased 2005 originations restores 2003 volume - $397 million of Core Bank originations through September 30, 2005 |

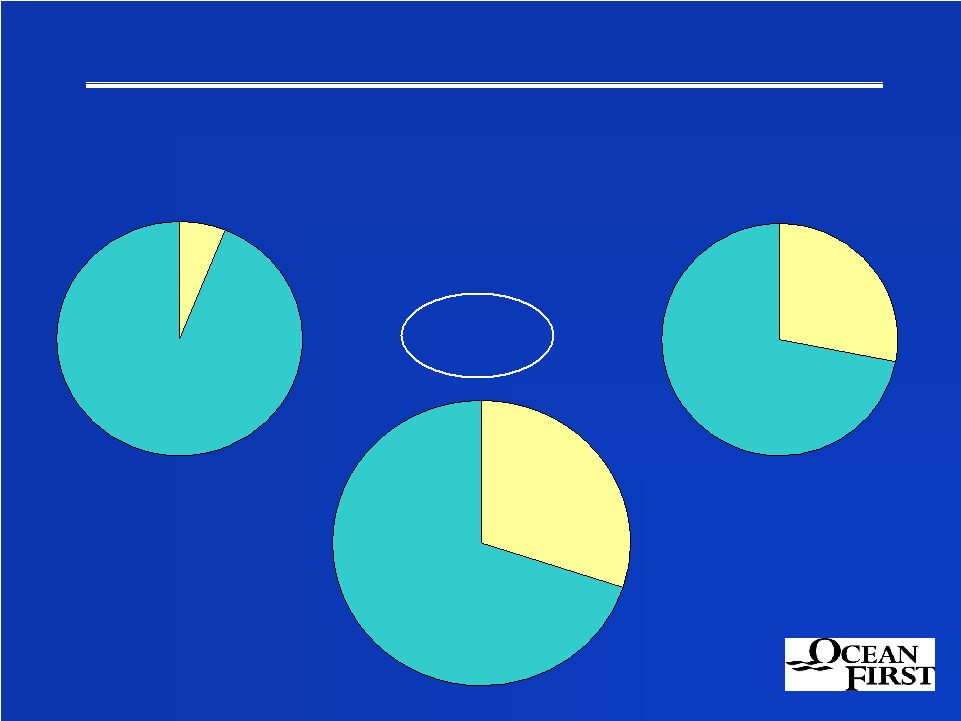

NASDAQ: OCFC 11 The Changing Loan Portfolio Mix December 31, 1996 September 30, 2005 Consumer 5% Residential 93% Commercial 2% Consumer 9% Commercial 21% Commercial 27% Residential 64% Consumer 8% Residential 71% 2007 Goal |

NASDAQ: OCFC 12 Non-Interest Income Driving Revenue Growth CHL 3Q ‘04 acquisition of a consumer direct lending platform • Alternate delivery channel boosts CHL’s production by $200 million • Immediate earnings accretion Trust Service fees have grown 35% for the first nine months of 2005 as compared to the same prior year period • Accretive to the bottom line in under 5 years Internalizing the sale of non-insured alternative investment products currently outsourced to third party provider • Income more than doubling, providing incremental growth of $1.2 million by 2007 PMI Captive Reinsurance Company and Title Insurance joint venture • Leverage the significant first mortgage production capability, providing $250,000 in additional annual net fee income to the Bank by 2007 |

NASDAQ: OCFC 13 Non-Interest Income as a % of Revenue December 31, 1996 September 30, 2005 Non-Interest Income 93% Net Interest Income 67% Net Interest Income 33% Non-Interest Income 72% Net Interest Income Non-Interest Income 28% 7% Excluding gain (loss) on sales of securities. 2007 Goal |

NASDAQ: OCFC 14 Capital Management - Historical First mutual thrift conversion to include a charitable foundation Repurchased 16.1 million shares, 59% of original issue • Announced twelfth repurchase program in October 2005 for an additional 5% of outstanding shares 100% stock dividend – 1998; 50% stock dividend – 2002 Quarterly cash dividend increases totaling 200% since 1997 • Current attractive yield – 3.4% Earlier wholesale leverage strategy transitioned from investment securities to loans, providing additional net interest income with manageable interest rate risk Effective leverage of core capital from 20.8% in 1996 to 6.9% at September 30, 2005, without ill conceived acquisitions or market-dilutive geographic expansion Successfully delivering on our 1996 IPO Business Plan…. |

NASDAQ: OCFC 15 OceanFirst Foundation performing as expected – without bottom-line dilution Capital leveraged appropriately Continued share repurchases and aggressive cash dividend payout ratios Balance sheet expansion driven by commercial loan and core deposit growth Raise Tier 2 debt capital, as necessary, to support growth and share repurchases • $5 million of subordinated debt issued in August 2005 Capital Management - Prospective Continuing to drive increased shareholder value….. |

NASDAQ: OCFC 16 Building Additional Shareholder Value In the long run, we think the following factors undoubtedly create value for the long term OCFC investor EPS Growth Restoration of EPS growth for 2005-2007 periods Balance Sheet & Revenue Expansion Grow the balance sheet in excess of 6% annually Increase total revenue minimum of 7% each year • Prudent Capital Management Targeting desired capital levels of 6.0% – 7.0% Continued repurchase program funded through debt issuance Healthy cash dividend payout ratio |

NASDAQ: OCFC 17 Building Additional Shareholder Value (cont’d.) Effective Risk Management Chief Risk Officer directing Enterprise-wide Risk Management Net charge-offs amounted to approximately 3 basis points of average net loans from 1997 through 2004 Interest Rate Risk controlled in transitional environment Franchise Value Enhancement Successful community banking in a most attractive Central Jersey Shore market CHL mortgage banking initiatives in the opportunity-rich New York metropolitan area |

NASDAQ: OCFC 18 Thank you for your Thank you for your interest in interest in OceanFirst OceanFirst Financial Corp. Financial Corp. |