EXHIBIT 99.1

SHAREHOLDER PRESENTATION – MAY 17, 2007

This is the 105th Annual Meeting of the Corporate Entity now known as OceanFirst Financial Corp., and today marks the eleventh time I have had the privilege to address this annual shareholders meeting since our 1996 conversion as a publicly owned company. Although this past year has presented a continuation of the hostile economic environment, complicated by our Company’s much publicized problems with subprime mortgage banking operations, I genuinely appreciate the opportunity to formally review these matters with you this morning.

Before I begin to discuss specifics regarding our financial performance, however, let me call your attention to the folder you received when you registered

1

today. I refer you to the Power Point presentation that we will review later this morning, which includes the Forward-Looking Statements on page 2, and is contained in the left side pocket of the folder. Please take careful note of the required caution we must provide you regarding forward-looking statements, which allows me to speak openly with you this morning and with the blessing of our Legal Counsel.

In recent years, all financial institutions’ performance has been buffeted by extraordinary economic pressure. Under these circumstances, where short and long term interest rates are at approximately the same level, as they have been for some time now, bank margins are inevitably squeezed and earnings are more difficult to generate from diminished spreads. The only way to earn around this market phenomenon is to diversify the Company’s income stream with higher levels of non-interest income.

2

At OceanFirst, we opened several business lines, over and above mortgage banking, to accomplish this. Among them: Alternative Investment Sales, Trust and Asset Management, Captive Private Mortgage Insurance, Merchant and Title Insurance Services and our newest and most promising product, reverse mortgages. As we’ll discuss in a few minutes, while we admit to being too aggressive in this mortgage banking strategy as it pertained to subprime lending, over the years we have diversified our revenue stream to the point where, even excluding mortgage banking revenue, a substantial portion of our total income is non-spread related, helping to stabilize the bottom line in a difficult spread environment.

3

We have, and will continue to react appropriately to the current situation, however. The fact is that we will be moving past Columbia’s mortgage banking business line, executing our Community Bank business Plan after appropriately dealing with the issues of the day. Our business plan remains optimistic that we can resume the growth we have previously generated in our core deposits, commercial loans and non-interest income, which will drive our revenue and earnings goals through the remainder of the year.

Following the conduct of the formal business of this meeting agenda, I will update you on the recent operations at OceanFirst and entertain a general question and answer session.

Return to Stockholder Meeting and vote.

4

As promised, I will now spend some time to bring you up to date on the recent events at the Company which have been heavily publicized. I refer you back to your folder and the Power Point Presentation in the left side pocket.

POWERPOINT

As we move forward, putting this Columbia episode behind us this year, we remain confident that we will succeed in positioning OceanFirst to rebuild earnings momentum and generate the market recognition we deserve, for our shareholders’ investment growth. I thank you for your continued support and offer to address the questions you must have this morning.

5

Q & A

ADJOURN MEETING

6

NASDAQ: OCFC WELCOME TO THE 2007 ANNUAL MEETING OF SHAREHOLDERS OceanFirst Financial Corp. MAY 17, 2007 Exhibit 99.1 |

NASDAQ: OCFC OceanFirst Financial Corp. This presentation contains certain forward-looking statements which are based on certain assumptions and describe future plans, strategies and expectations of the Company. These forward-looking statements are generally identified by use of the words “believe”, “expect”, “intend”, “anticipate”, “estimate”, “project”, or similar expressions. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations of the Company and the subsidiaries include, but are not limited to, changes in interest rates, general economic conditions, legislative/regulatory changes, monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System, the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand for financial services in the Company’s market area and accounting principles and guidelines. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company does not undertake – and specifically disclaims any obligation – to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. 2 |

NASDAQ: OCFC Subprime Mortgage Lending Subprime Mortgage Loans – What Are They? Why Did OceanFirst Make Subprime Loans? What Happened To Cause The Subprime Problems? What Corrective Action Is OceanFirst Taking? How Long Will It Take To Be Completely Resolved? OceanFirst Without Columbia And Subprime Lending? 3 |

NASDAQ: OCFC Subprime Mortgage Loans What Are They? Loans made on a residence to borrowers who generally do not satisfy the credit documentation or standards of the prime market Enables borrowers with less than perfect credit, who cannot obtain a loan in the conventional market, to own a home Generally, a credit score below 660 is considered a subprime borrower Loans carry a premium interest rate commensurate to the risk 4 |

NASDAQ: OCFC Why Did OceanFirst Make Subprime Loans? OceanFirst did not make subprime loans directly, but through our operating subsidiary, Columbia Home Loans, LLC, headquartered in Westchester County, New York While important to OceanFirst, Columbia’s mortgage banking revenue was not a major contributor to Company earnings and the current losses associated with subprime lending do not represent a critical threat to our continuing operations Lenders make subprime mortgage loans to satisfy homeowners’ need for financing and take prudent steps to manage the associated risks of the product Loans made at Columbia were scheduled for sale to firms that converted them into negotiable securities for sale on Wall Street 5 |

NASDAQ: OCFC Why Did OceanFirst Make Subprime Loans? (Continued) Selling the loans is one way to mitigate risk of default, however, misrepresentations in the application process or Early Payment Defaults (EPD) by the borrower generally result in the requested repurchase of the loans Columbia was one of many lenders across the Country who made these loans underwritten to specifications for sale by Wall Street firms Among the more notable: Countrywide Wells Fargo Subsidiaries of: Barclays Citigroup GE GMAC 6 |

NASDAQ: OCFC What Happened To Cause The Subprime Problems? The entire subprime lending industry suffered an incredibly rapid reversal of fortune late in 2006 Media Reports and Industry Press Releases have been remarkably consistent in calling attention to one particular subprime mortgage product providing 100% financing on the basis of stated borrower income as the cause of the firestorm This product was originated nationwide to Wall Street investor specifications Investors were requiring all originators of this product, including Columbia, to repurchase loans due to EPD at record pace beginning in the fourth quarter of 2006 7 |

NASDAQ: OCFC What Happened To Cause The Subprime Problems? (Continued) As events unfolded, it became evident that steps Columbia had taken to manage the risks associated with this particular subprime product were insufficient to protect Columbia from the onslaught of EPD claims The problems at Columbia were exacerbated by a concealment of the incidence of EPD in 2006, in violation of policies and controls Concealed information remained suppressed by Columbia Officers until February 2007, preventing OceanFirst from reacting appropriately to the rapidly deteriorating market Management was compelled to assert that Columbia’s internal controls over financial reporting were “not effective” as of year-end under Sarbanes Oxley 8 |

NASDAQ: OCFC What Corrective Action Is OceanFirst Taking? Subprime loan origination at Columbia was shut down in March While we initially found no widespread evidence of fraud, we have recently initiated a more thorough independent forensic review to confirm our earlier assessment Internal controls on financial reporting were revised and enhanced A $9.6 million reserve was established in March for 4Q 2006 EPD projected losses and earnings were revised Columbia staff was downsized and those responsible for suppression of the information were terminated We utilized a two week delay in the filing of SEC Form 10-K and Annual Report for 2006 to insure we reported accurate information 9 |

NASDAQ: OCFC What Corrective Action Is OceanFirst Taking? (Continued) In April following the end of the quarter, additional charges of $12 million were taken relative to Q1 2007 subprime activity: A mark-to-market of Columbia loan inventory which was held for sale A write-off of Goodwill from the August 2000 acquisition of Columbia which had become impaired The reserve for repurchased loans was increased for potential losses from EPD on remaining Q1 2007 subprime loan sales We are now discontinuing operations of Columbia while absorbing select production capabilities at the Bank Resignation of Columbia President and Bank Executive Vice President and Chief Lending Officer, Robert M. Pardes has been accepted by the Bank Board of Directors 10 |

NASDAQ: OCFC How Long Will It Take To Be Completely Resolved? Issues at Columbia have been recognized, contained, and provided for $21.6 million in charges have been taken to earnings through 1Q 2007 The assumptions used in providing for potential losses from repurchase claims are proving to be valid through May 15, 2007 The potential for additional EPD repurchases should disappear by the end of the 3Q 2007 due to the March shutdown Estimated continuing costs of $2.1 to $2.5 million may be incurred as Columbia’s Headquarters is closed and select operations are transferred to the Bank during the second half of this year The forensic review continues with confirmation to be expected after mid-year 11 |

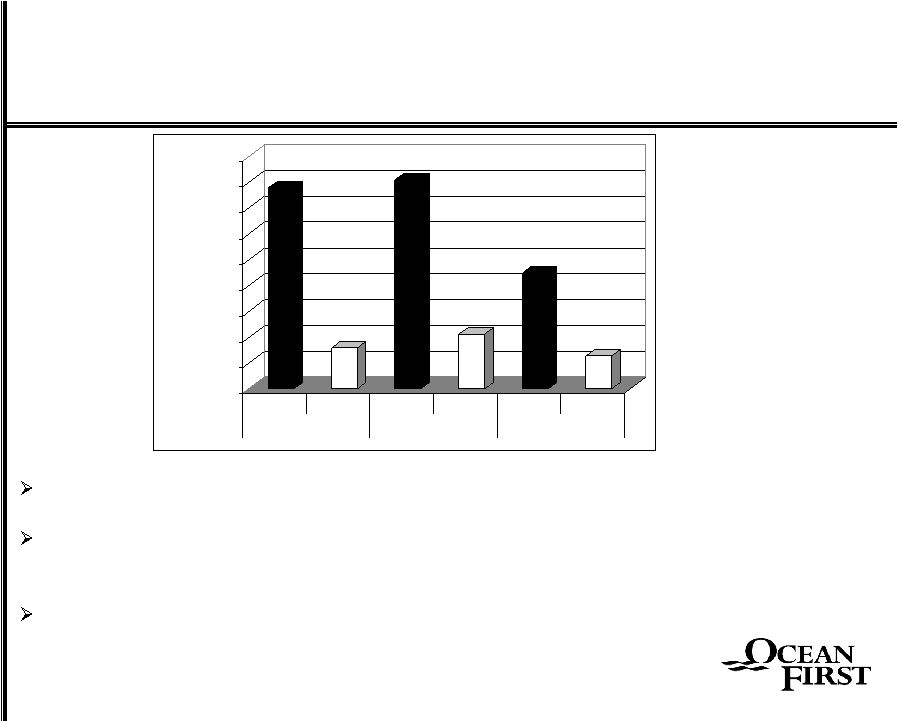

NASDAQ: OCFC Repurchase Requests and Loss Reserve Amounts As expected, the rate of receipt of new repurchase requests has slowed The Company has negotiated numerous cash payment settlements for claims without the requirement to repurchase the subprime loans The available level of reserves is in line with Company’s projections $- $5,000,000 $10,000,000 $15,000,000 $20,000,000 $25,000,000 $30,000,000 $35,000,000 $40,000,000 $45,000,000 Claims Reserve Claims Reserve Claims Reserve 12/31/2006 3/31/2007 5/15/2007 12 |

NASDAQ: OCFC OceanFirst Without Columbia and Subprime Lending? Tighter, better focused Community Bank operation Despite heavy losses associated with Columbia in the short run, the overall financial impact on OceanFirst is very manageable Absent Columbia activities, with the continued hostile operating environment facing all banks, OceanFirst earned a respectable $4.2 million in net income for 1Q, $0.36 per share Heavy expenses of mortgage banking are eliminated Efficiency ratio improvement will be evident Non-interest income continuing strong through remaining initiatives Serving the Central New Jersey Shore as the local Community Bank of choice in our market 13 |