UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registranto

Filed by a Party other than the Registrantx

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

BARNWELL INDUSTRIES, INC.

(Name of Registrant as Specified in its Charter)

NED L. SHERWOOD NLS ADVISORY GROUP, INC. MRMP-MANAGERS LLC BRADLEY M. TIRPAK SCOTT D. KEPNER DOUGLAS N. WOODRUM PHILLIP J. MCPHERSON |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

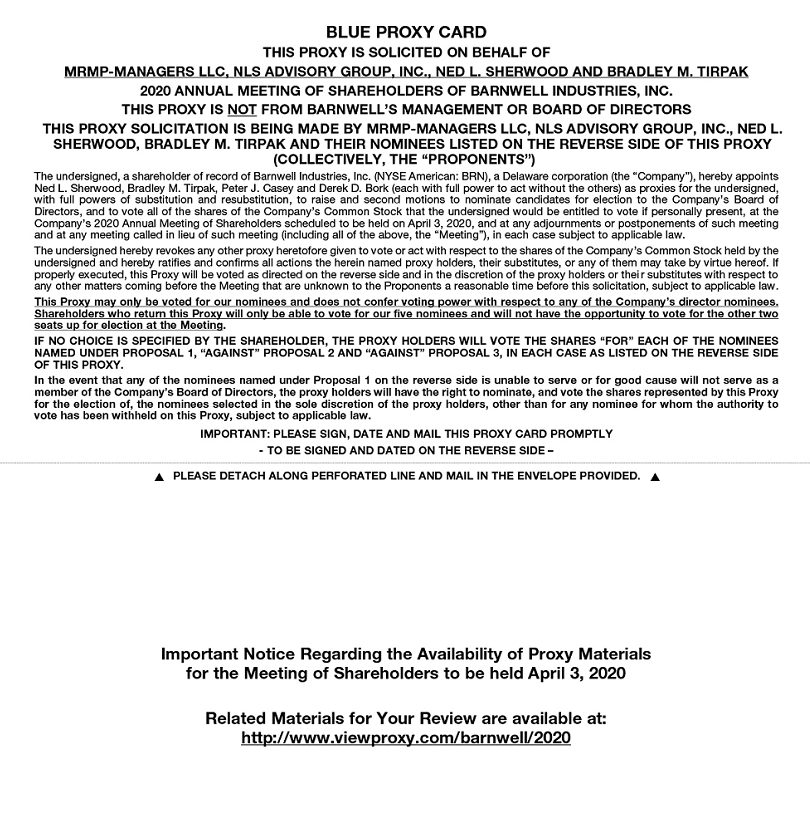

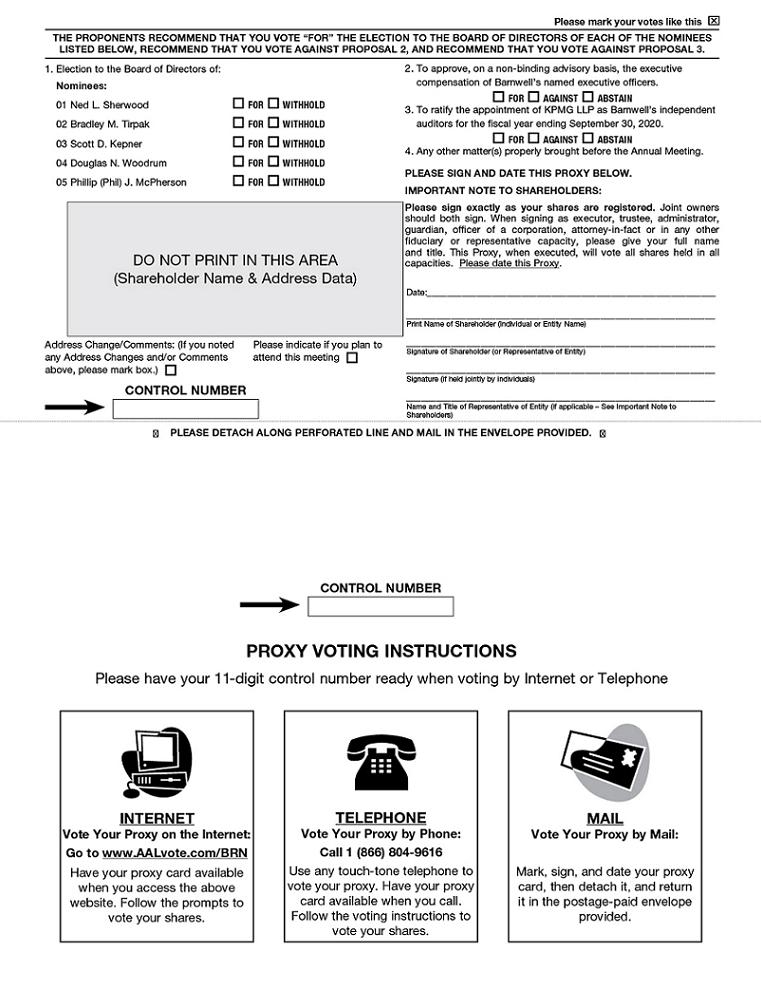

MRMP-Managers LLC and Barnwell Industries’ Largest Independent Shareholder Group Sets the Record Straight

Largest Independent Shareholder Group Urges Shareholders to

Vote the BLUE Proxy Card Immediately

March 20, 2020

Dear Fellow Shareholder,

On April 3, 2020, Barnwell will hold its annual meeting of stockholders. For the first time ever, shareholders will have a choice between the incumbent board that we believe has paid themselves handsomely for many years of mismanagement and that of a new independent board that is fully committed, and we believe is qualified, to turn our long-suffering company around. Drastic change is needed now to revive the Company, and we have a plan.

Many of you may have received Barnwell’s March 16 attack letter from Barnwell’s CEO Alexander Kinzler and CFO Russell Gifford with some whoppers!

| · | While losing you 87% of your investment over the past decade between fiscal year 2009 and 2019, the management team happily claims the Company has “outperformed its peers.” Our view is that the goal of the company is to make shareholders money,period. |

| · | While officially reporting a net loss in Q1 of 2020 on the Company’s 10Q filed with the SEC, the management team happily decries that if you get out a microscope and dig down to Footnote 8 of their 10Q, they report $1.1 million in operating income. What they fail to mention is that this claim of operating income is before the $1.5 million in general and administrative expenses, which includes management’s salaries. If you account for these expenses as required by the GAAP, the reported operating loss equals $421 thousand –the same pattern which has persisted for a decade. |

| · | We remind you, that while losing you money, over this same decade between fiscal year 2009 and 2019, the executives Morton Kinzler, his son Alex Kinzler, the CFO Russ Gifford, and the board receivedover $19 million in remuneration! |

We have engaged with the Company over the past several years and supported them exiting Barnwell’s legacy oil and gas investments. If losing over 90% of shareholders’ money in a decade is “outperformance,” we believe it is a strong indication that the industry is not a good investment. We recommended that they search for a solid high return on capital business with free cash flow and we offered to help them find a suitable acquisition. They had amassed more than $20 million dollars in cash, but the Barnwell management team chose to utilize the majority of this cash to reenter the Canadian oil and gas business – an obviously disastrous decision - that led to an even lower stock price!!

Our team is led by Ned Sherwood who has delivered significant compound annual appreciation to his investors by purchasing and operating high return on capital cash flowing businesses. We will seek to invest any proceeds from divestitures in good cash flowing businesses or return the cash to shareholders in dividends and buybacks.

WE URGE YOU TO VOTE THE ENCLOSED BLUE PROXY CARD TODAY

If you have already provided Barnwell with a proxy, you may revoke it by executing a later dated BLUE proxy card.

If you have any questions or require any assistance with providing your proxy or any other matters, please contact our proxy solicitor, Alliance Advisors, at 1-800-574-5961 or by e-mail at pcasey@allianceadvisorsllc.com.

We are excited about successfully transforming Barnwell into an entity that will generate significant value for all shareholders. If you have any questions or would like us to contact you, please do not hesitate to reach out to our proxy solicitor, Alliance Advisors, at1-800-574-5961.

Sincerely,

Ned L. Sherwood and Bradley M. Tirpak

Ned L. Sherwood, Bradley M. Tirpak, NLS Advisory Group, Inc., and MRMP-Managers LLC have filed with the SEC, and mailed to shareholders on or about March 4, 2020,a definitive proxy statement and a blue proxy card in connection with their solicitation of votes for the election of director nominees at the 2020 annual meeting of shareholders of Barnwell Industries, Inc. Ned L. Sherwood Revocable Trust, of which Ned L. Sherwood is the beneficiary and the trustee, holds 238,038 shares of common stock of Barnwell, and MRMP-Managers LLC, of which Mr. Sherwood is the Chief Investment Officer, holds 1,000,211.138 shares of common stock of Barnwell. Mr. Sherwood is deemed to beneficially own all of these shares. Bradley M. Tirpak holds 34,127 shares of common stock of Barnwell. Ned L. Sherwood, Bradley M. Tirpak, NLS Advisory Group, Inc., and MRMP-Managers LLC, and their nominees to the Barnwell board are the participants in this proxy solicitation. Information regarding the participants and their interests in the solicitation is included in their proxy statement and other materials filed with the SEC.

SHAREHOLDERS OF BARNWELL SHOULD READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS CAREFULLY AND IN THEIR ENTIRETY AS THEY BECOME AVAILABLE AS THEY CONTAIN IMPORTANT INFORMATION RELATING TO THE ANNUAL MEETING, THE NOMINEES TO THE BOARD, AND SOLICITATION OF PROXIES. THESE PROXY MATERIALS ARE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV OR FROM ALLIANCE ADVISORS, LLC.

Contacts:

Peter Casey

Alliance Advisors

(800) 574-5961

pcasey@allianceadvisors.com

Maria Andriasova

NLS Advisory Group, Inc.

(646) 921-2080

mandriasova@SherwoodFamilyOffice.com