4th Quarter Fiscal 2016 Earnings Supplemental Information November 21, 2016

Forward-Looking Statements Certain information contained in the press release may constitute forward-looking statements, such as statements relating to expected performance, and including, but not limited to, statements appearing in the “Outlook” section and statements relating to GAAP EPS guidance and adjusted EPS guidance. These forward-looking statements are subject to a number of factors and uncertainties which could cause our actual results and experiences to differ materially from the anticipated results and expectations expressed in such forward-looking statements. We wish to caution readers not to place undue reliance on any forward-looking statements, which speak only as of the date made. Among the factors that may cause actual results and experiences to differ from anticipated results and expectations expressed in such forward-looking statements are the following: (i) the effect of, or changes in, general economic conditions; (ii) fluctuations in the cost and availability of inputs and raw materials, such as live cattle, live swine, feed grains (including corn and soybean meal) and energy; (iii) market conditions for finished products, including competition from other global and domestic food processors, supply and pricing of competing products and alternative proteins and demand for alternative proteins; (iv) successful rationalization of existing facilities and operating efficiencies of the facilities; (v) risks associated with our commodity purchasing activities; (vi) access to foreign markets together with foreign economic conditions, including currency fluctuations, import/export restrictions and foreign politics; (vii) outbreak of a livestock disease (such as avian influenza (AI) or bovine spongiform encephalopathy (BSE)), which could have an adverse effect on livestock we own, the availability of livestock we purchase, consumer perception of certain protein products or our ability to access certain domestic and foreign markets; (viii) changes in availability and relative costs of labor and contract growers and our ability to maintain good relationships with employees, labor unions, contract growers and independent producers providing us livestock; (ix) issues related to food safety, including costs resulting from product recalls, regulatory compliance and any related claims or litigation; (x) changes in consumer preference and diets and our ability to identify and react to consumer trends; (xi) significant marketing plan changes by large customers or loss of one or more large customers; (xii) adverse results from litigation; (xiii) impacts on our operations caused by factors and forces beyond our control, such as natural disasters, fire, bioterrorism, pandemics or extreme weather; (xiv) risks associated with leverage, including cost increases due to rising interest rates or changes in debt ratings or outlook; (xv) compliance with and changes to regulations and laws (both domestic and foreign), including changes in accounting standards, tax laws, environmental laws, agricultural laws and occupational, health and safety laws; (xvi) our ability to make effective acquisitions or joint ventures and successfully integrate newly acquired businesses into existing operations; (xvii) failures, cyber incidents, security breaches or other disruptions of our information technology systems; (xviii) effectiveness of advertising and marketing programs; and (xix) those factors listed under Item 1A. “Risk Factors” included in our Annual Report filed on Form 10-K for the period ended October 1, 2016. 2

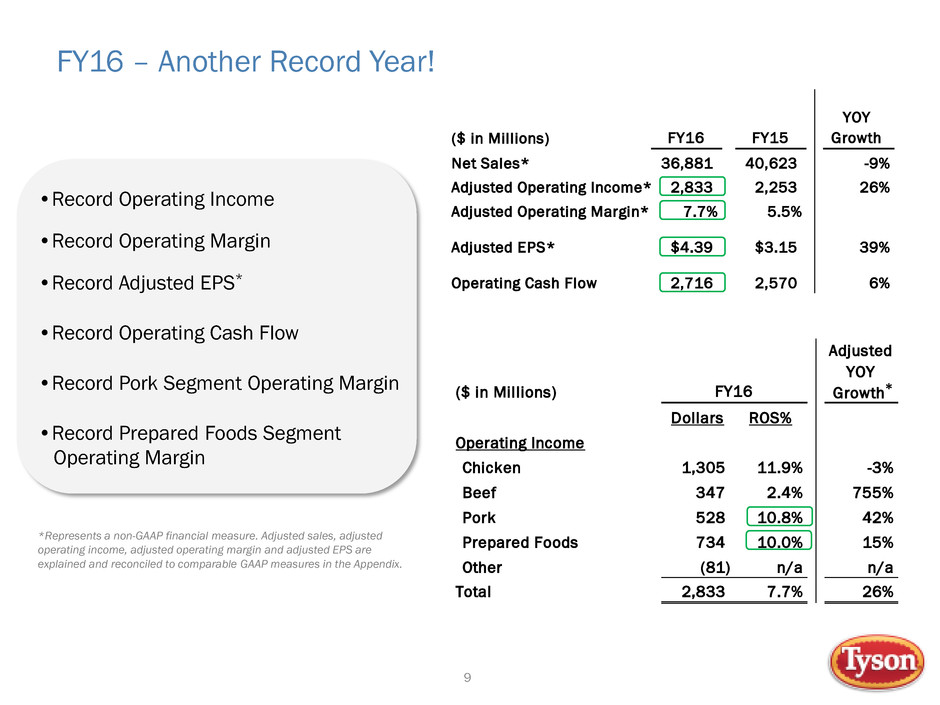

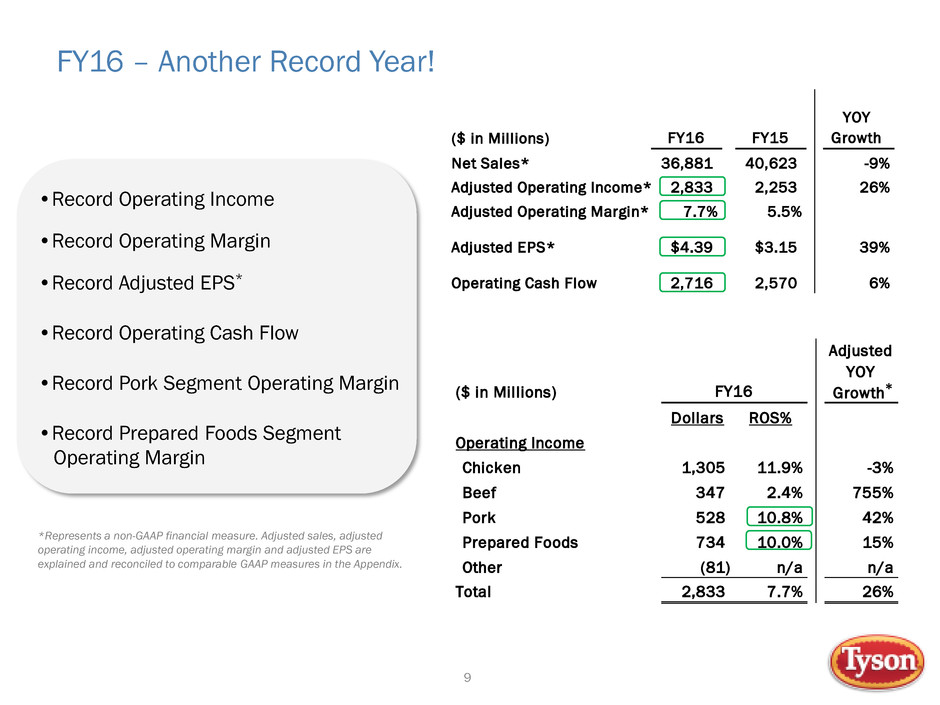

($ in Millions) FY16 Dollars ROS% Operating Income Chicken 1,305 11.9% -3% Beef 347 2.4% 755% Pork 528 10.8% 42% Prepared Foods 734 10.0% 15% Other (81) n/a n/a Total 2,833 7.7% 26% Adjusted YOY Growth * ($ in Millions) FY16 FY15 YOY Growth Net Sales* 36,881 40,623 -9% Adjusted Operating Income* 2,833 2,253 26% Adjusted Operating Margin* 7.7% 5.5% Adjusted EPS* $4.39 $3.15 39% Operating Cash Flow 2,716 2,570 6% FY16 – Another Record Year! •Record Operating Income •Record Operating Margin •Record Adjusted EPS* •Record Operating Cash Flow •Record Pork Segment Operating Margin •Record Prepared Foods Segment Operating Margin *Represents a non-GAAP financial measure. Adjusted sales, adjusted operating income, adjusted operating margin and adjusted EPS are explained and reconciled to comparable GAAP measures in the Appendix. 3

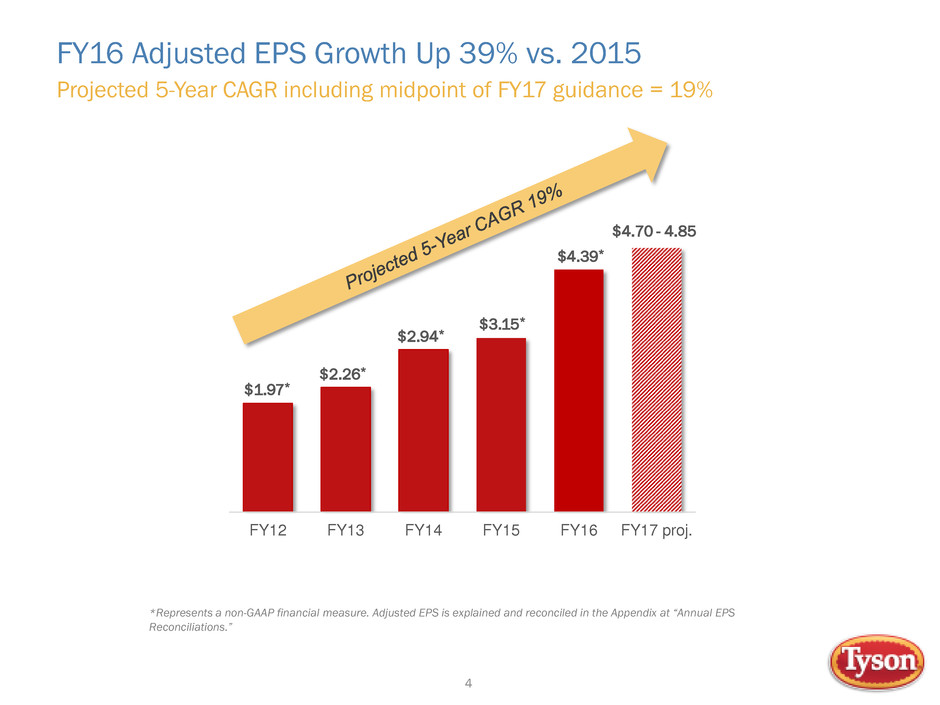

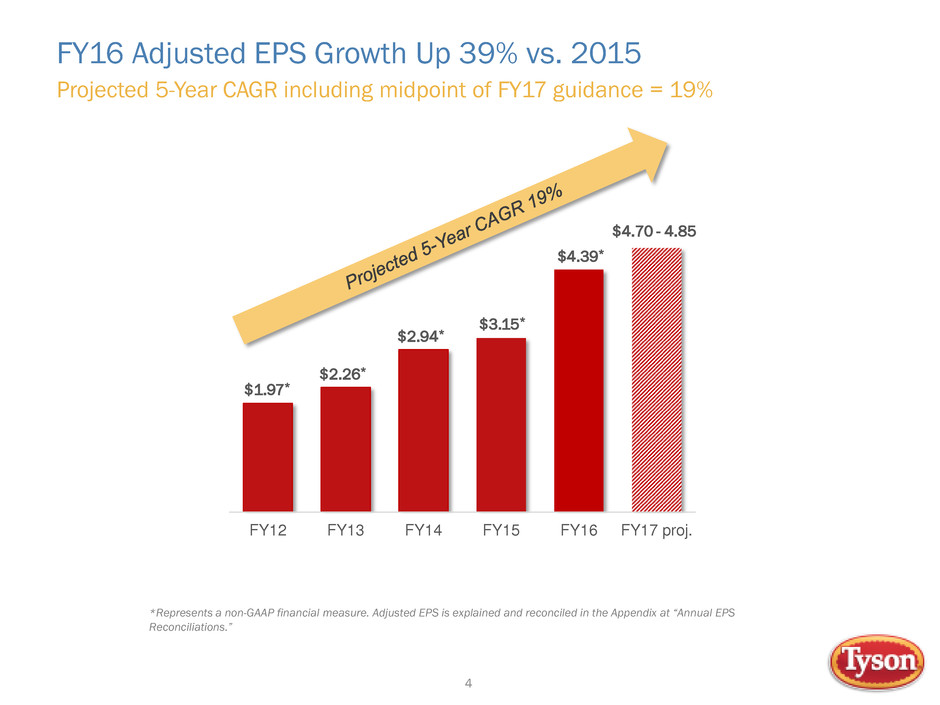

*Represents a non-GAAP financial measure. Adjusted EPS is explained and reconciled in the Appendix at “Annual EPS Reconciliations.” FY16 Adjusted EPS Growth Up 39% vs. 2015 Projected 5-Year CAGR including midpoint of FY17 guidance = 19% 4 FY12 FY13 FY14 FY15 FY16 FY17 proj. $3.15* $2.26* $2.94* $4.39* $4.70 - 4.85 $1.97*

FY16 Segment View Sales $36.9 Billion Chicken 30% Beef 38% Prepared Foods 20% Pork 11% Other 1% 5 Sales and Operating Income by Segment ($ in Millions) FY16 Dollars ROS% Operating Income Chicken 1,305 11.9% -3% Beef 347 2.4% 755% Pork 528 10.8% 42% Prepared Foods 734 10.0% 15% Other (81) n/a n/a Total 2,833 7.7% 26% Adjusted YOY Growth * *Represents a non-GAAP financial measure. Adjusted operating income is explained and reconciled to comparable GAAP measures in the Appendix.

9.6% 5.9% 5.9% 1.1% -1.2% -2.3% -4.6% -6.3% -8.0% -8.2% -9.5% Core 9 Tyson Core 9 and Total Tyson Leading in CPG Volume Performance Volume sales % change among top 10 branded food companies > $5B Source: IRI Total U.S. Multi-Outlet Volume Sales (Edible Foods), 13 weeks ending 10/02/2016 6

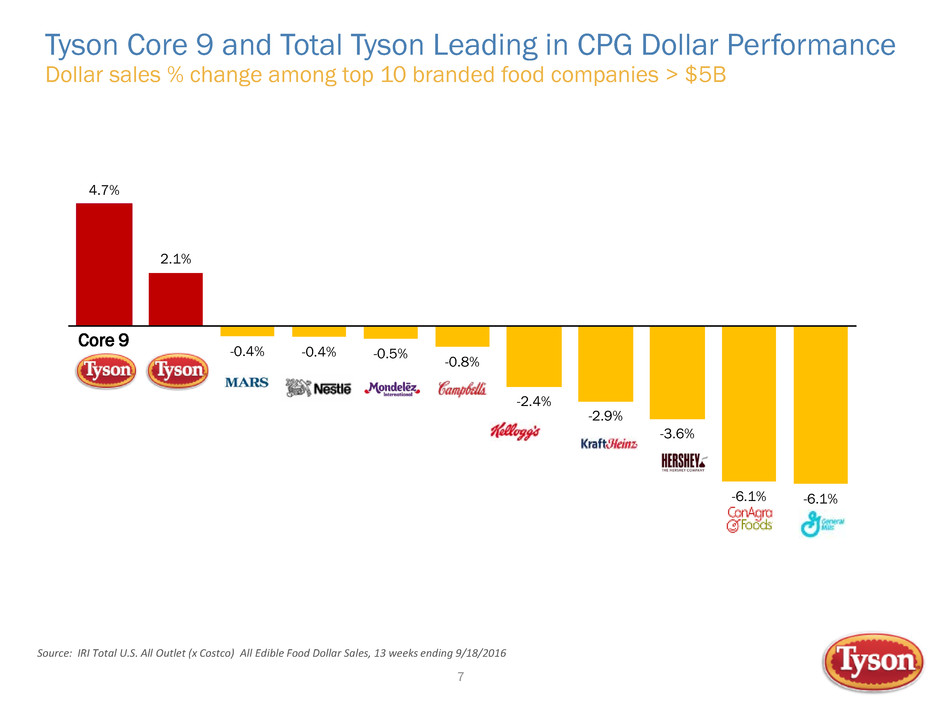

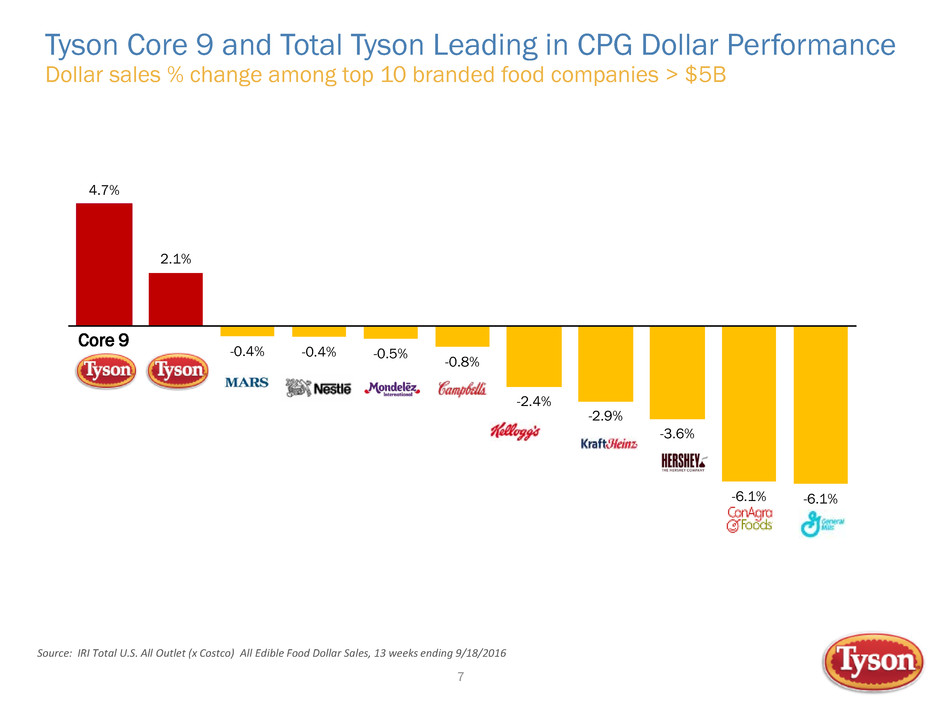

4.7% 2.1% -0.4% -0.4% -0.5% -0.8% -2.4% -2.9% -3.6% -6.1% -6.1% Tyson Core 9 and Total Tyson Leading in CPG Dollar Performance Dollar sales % change among top 10 branded food companies > $5B Core 9 Source: IRI Total U.S. All Outlet (x Costco) All Edible Food Dollar Sales, 13 weeks ending 9/18/2016 7

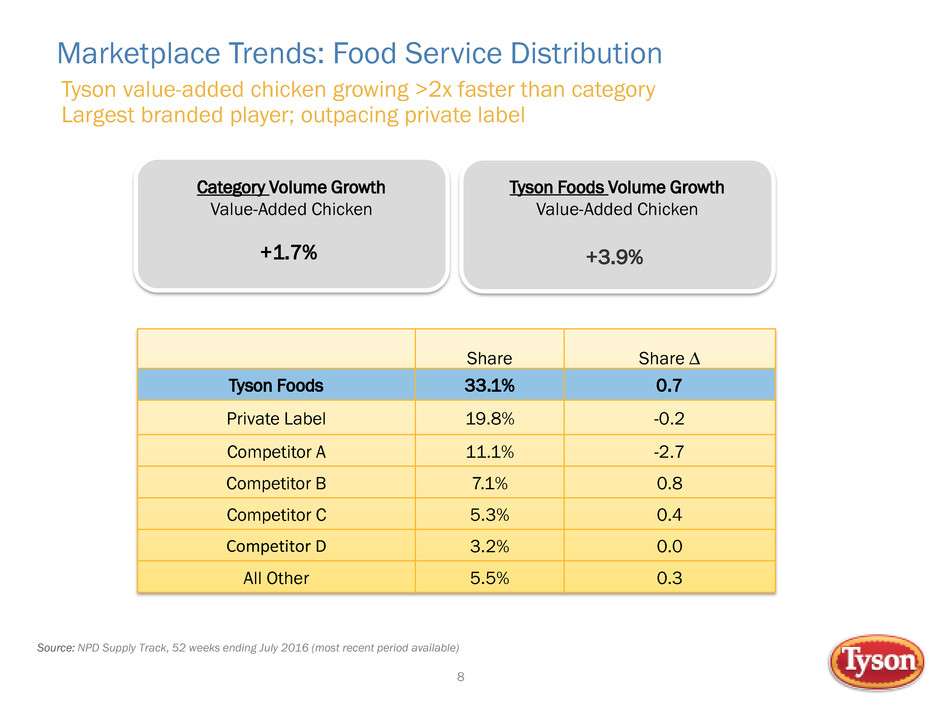

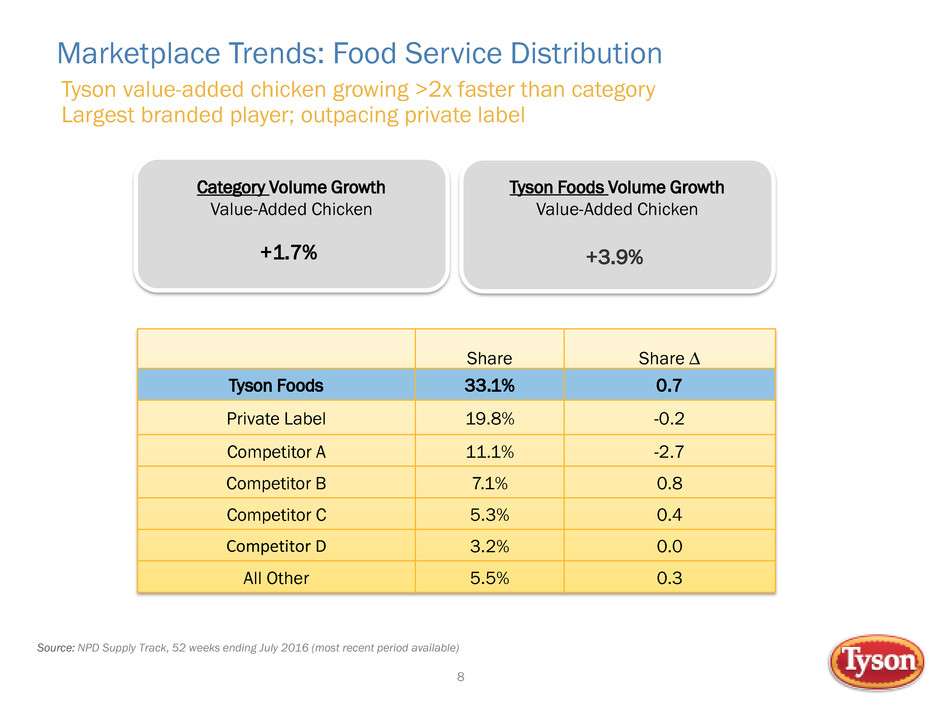

Marketplace Trends: Food Service Distribution 88 Tyson value-added chicken growing >2x faster than category Largest branded player; outpacing private label Tyson Foods Volume Growth Value-Added Chicken +3.9% Category Volume Growth Value-Added Chicken +1.7% Share Share ∆ Tyson Foods 33.1% 0.7 Private Label 19.8% -0.2 Competitor A 11.1% -2.7 Competitor B 7.1% 0.8 Competitor C 5.3% 0.4 Competitor D 3.2% 0.0 All Other 5.5% 0.3 Source: NPD Supply Track, 52 weeks ending July 2016 (most recent period available)

($ in Millions) FY16 Dollars ROS% Operating Income Chicken 1,305 11.9% -3% Beef 347 2.4% 755% Pork 528 10.8% 42% Prepared Foods 734 10.0% 15% Other (81) n/a n/a Total 2,833 7.7% 26% Adjusted YOY Growth * ($ in Millions) FY16 FY15 YOY Growth Net Sales* 36,881 40,623 -9% Adjusted Operating Income* 2,833 2,253 26% Adjusted Operating Margin* 7.7% 5.5% Adjusted EPS* $4.39 $3.15 39% Operating Cash Flow 2,716 2,570 6% FY16 – Another Record Year! •Record Operating Income •Record Operating Margin •Record Adjusted EPS* •Record Operating Cash Flow •Record Pork Segment Operating Margin •Record Prepared Foods Segment Operating Margin *Represents a non-GAAP financial measure. Adjusted sales, adjusted operating income, adjusted operating margin and adjusted EPS are explained and reconciled to comparable GAAP measures in the Appendix. 9

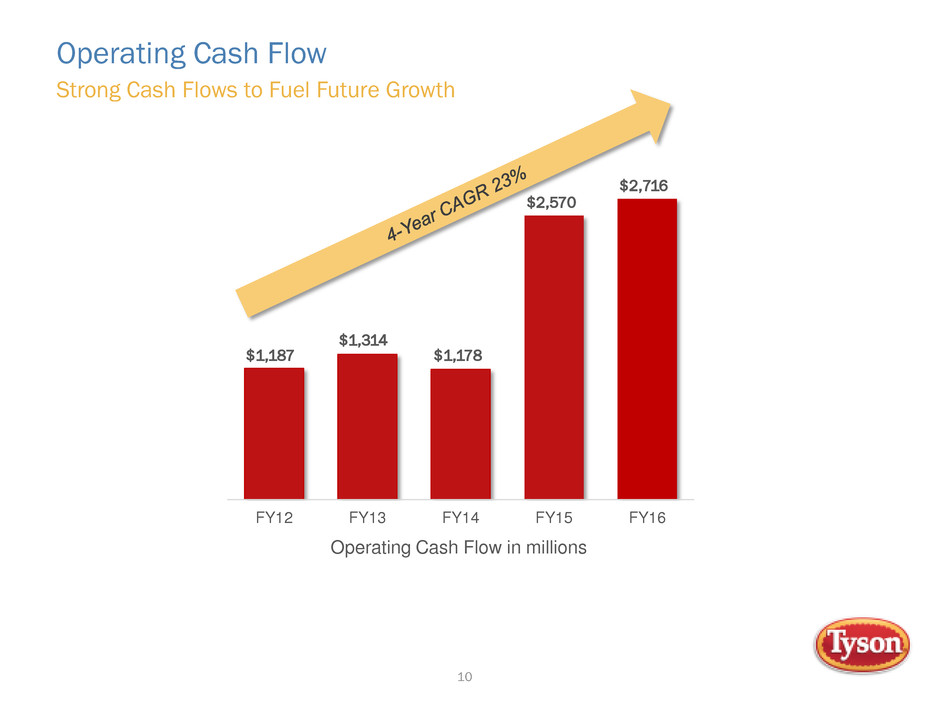

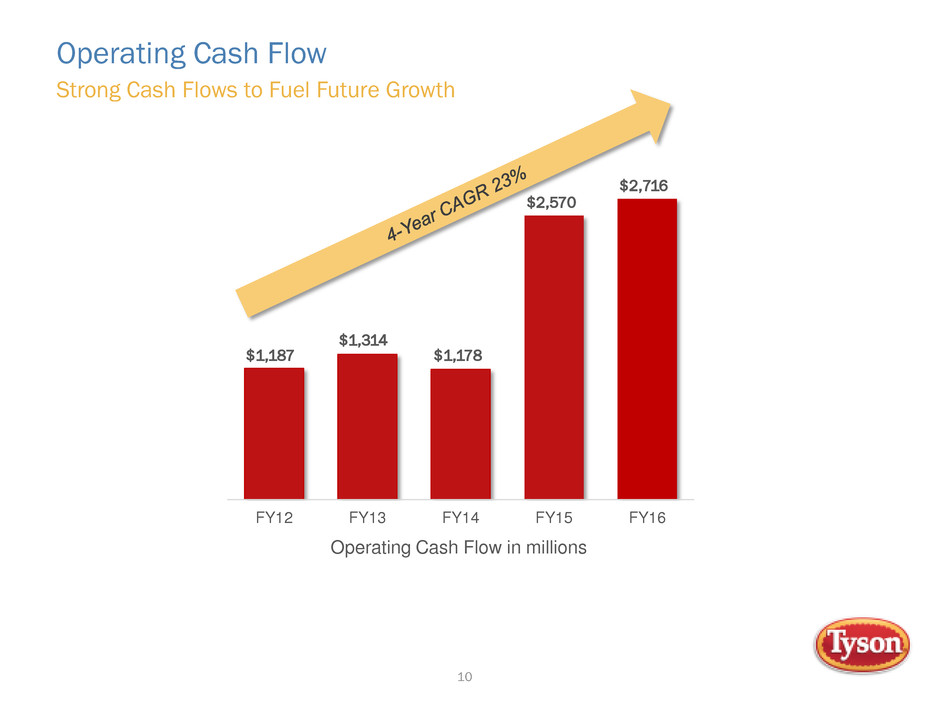

Operating Cash Flow Operating Cash Flow in millions FY12 FY13 FY14 FY15 FY16 $1,187 $1,314 $2,716 $2,570 $1,178 Strong Cash Flows to Fuel Future Growth 10

Net Debt/Adjusted EBITDA* FY12*** FY13*** FY14** FY15* FY16*** $442*.7X .8X 3.0X 2.0X 1.7X Positioned for growth through rapid deleveraging *Represents a non-GAAP financial measure. Net debt/adjusted EBITDA is explained and reconciled to a comparable GAAP measure in the Appendix. ** FY14 Net Debt/EBITDA was calculated on a pro forma basis due to the acquisition of Hillshire Brands in August 2014. See Appendix for reconciliation to GAAP measure. *** FY12, FY13 and FY16 represent net debt to EBITDA 11

FY17 Outlook 12 • EPS $4.70–$4.85, 7-10% adjusted EPS growth over FY16 • Expect similar revenue to FY16 as we grow volume across each segment • Net interest expense of ~$225 million • Effective tax rate of ~35% • CapEx of ~$1 billion • Average diluted shares of ~376 million* • 50% increase in Class A Dividends • from $0.15 to $0.225 per share quarterly • from $0.60 to $0.90 per share annually • Expect to increase dividends by at least $0.10 per share annually *Prior to adjustments for additional share repurchases subsequent to 11/21/16 and based on average share price Q1’17 to date

Donnie Smith Chief Executive Officer Tom Hayes President Dennis Leatherby Executive Vice President & Chief Financial Officer 13 Q & A

Appendix 4th Quarter Fiscal 2016 Non-GAAP Reconciliations

Sales, Operating Income and Operating Margin Reconciliations 15 In millions (Unaudited) (a) The estimated impact of the additional week in the 12 months of fiscal 2015 was calculated by dividing unadjusted sales for the fourth quarter of fiscal 2015 by 14 weeks. (b) Impact of additional week was calculated by using the fourth quarter of fiscal 2015 adjusted operating income (prior to the additional week impact) and divided by 14 weeks. Adjusted sales, adjusted operating income and adjusted operating margin are presented as supplementary measures of our operating performance that are not required by, or presented in accordance with, GAAP. We use adjusted sales, adjusted operating income and adjusted operating margin as internal performance measurements and as three criteria for evaluating our performance relative to that of our peers. We believe adjusted sales, adjusted operating income and adjusted operating margin are meaningful to our investors to enhance their understanding of our operating performance and are frequently used by securities analysts, investors and other interested parties to compare our performance with the performance of other companies that report adjusted sales, adjusted operating income and adjusted operating margin. Further, we believe that adjusted sales, adjusted operating income and adjusted operating margin are useful measures because they improve comparability of results of operations from period to period. Adjusted sales, adjusted operating income and adjusted operating margin should not be considered as a substitute for sales, operating income or operating margin or any other measure of operating performance reported in accordance with GAAP. Investors should rely primarily on our GAAP results and use non-GAAP financial measures only supplementally in making investment decisions. Our calculation of adjusted sales, adjusted operating income and adjusted operating margin may not be comparable to similarly titled measures reported by other companies. 2016 2015 Reported Sales 36,881$ 41,373$ Less: Impact of additional week (a) - (750) Adjusted sales 36,881$ 40,623$ Reported operating income 2,833$ 2,169$ Add: China impairment - 169 Add: Merger and integration costs - 57 Add: Prepared Foods network optimization impairment charges - 59 Add: Denison plant closure - 12 Less: Insurance proceeds (net of costs) related to a legacy Hillshire Brands plant fire - (8) Less: Gain on sale of the Mexico operation - (161) Less: Estimated impact of additional week (b) - (44) Adjusted operating income 2,833$ 2,253$ Adjusted operating margin % 7.7% 5.5% Fiscal Year

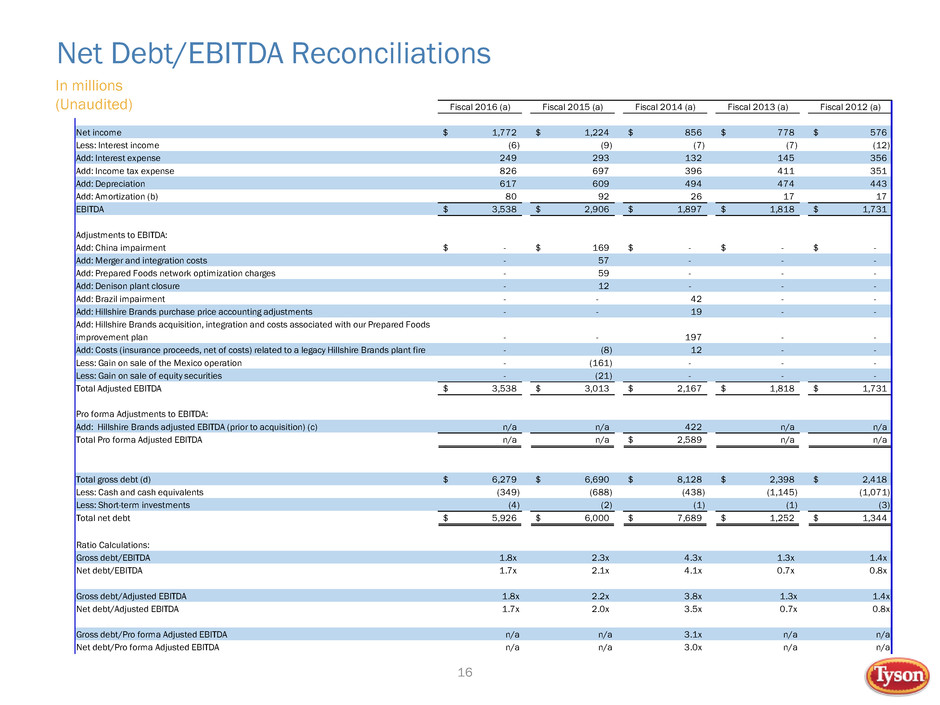

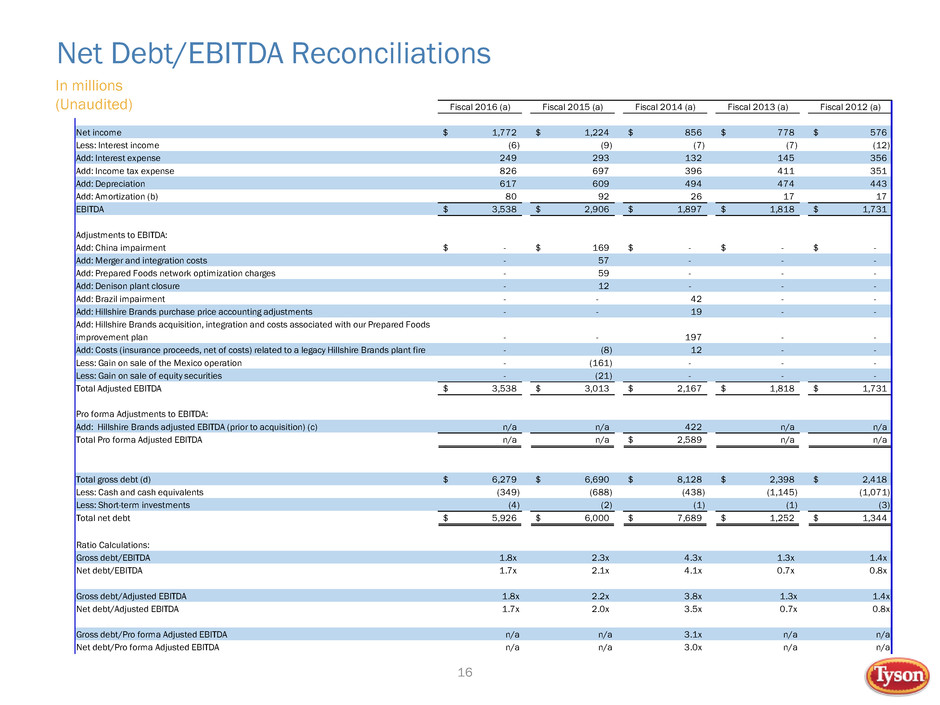

Fiscal 2016 (a) Fiscal 2015 (a) Fiscal 2014 (a) Fiscal 2013 (a) Fiscal 2012 (a) Net income 1,772$ 1,224$ 856$ 778$ 576$ Less: Interest income (6) (9) (7) (7) (12) Add: Interest expense 249 293 132 145 356 Add: Income tax expense 826 697 396 411 351 Add: Depreciation 617 609 494 474 443 Add: Amortization (b) 80 92 26 17 17 EBITDA 3,538$ 2,906$ 1,897$ 1,818$ 1,731$ Adjustments to EBITDA: Add: China impairment -$ 169$ -$ -$ -$ Add: Merger and integration costs - 57 - - - Add: Prepared Foods network optimization charges - 59 - - - Add: Denison plant closure - 12 - - - Add: Brazil impairment - - 42 - - Add: Hillshire Brands purchase price accounting adjustments - - 19 - - Add: Hillshire Brands acquisition, integration and costs associated with our Prepared Foods improvement plan - - 197 - - Add: Costs (insurance proceeds, net of costs) related to a legacy Hillshire Brands plant fire - (8) 12 - - Less: Gain on sale of the Mexico operation - (161) - - - Less: Gain on sale of equity securities - (21) - - - Total Adjusted EBITDA 3,538$ 3,013$ 2,167$ 1,818$ 1,731$ Pro forma Adjustments to EBITDA: Add: Hillshire Brands adjusted EBITDA (prior to acquisition) (c) n/a n/a 422 n/a n/a Total Pro forma Adjusted EBITDA n/a n/a 2,589$ n/a n/a Total gross debt (d) 6,279$ 6,690$ 8,128$ 2,398$ 2,418$ Less: Cash and cash equivalents (349) (688) (438) (1,145) (1,071) Less: Short-term investments (4) (2) (1) (1) (3) Total net debt 5,926$ 6,000$ 7,689$ 1,252$ 1,344$ Ratio Calculations: Gross debt/EBITDA 1.8x 2.3x 4.3x 1.3x 1.4x Net debt/EBITDA 1.7x 2.1x 4.1x 0.7x 0.8x Gross debt/Adjusted EBITDA 1.8x 2.2x 3.8x 1.3x 1.4x Net debt/Adjusted EBITDA 1.7x 2.0x 3.5x 0.7x 0.8x Gross debt/Pro forma Adjusted EBITDA n/a n/a 3.1x n/a n/a Net debt/Pro forma Adjusted EBITDA n/a n/a 3.0x n/a n/a 16 Net Debt/EBITDA Reconciliations In millions (Unaudited)

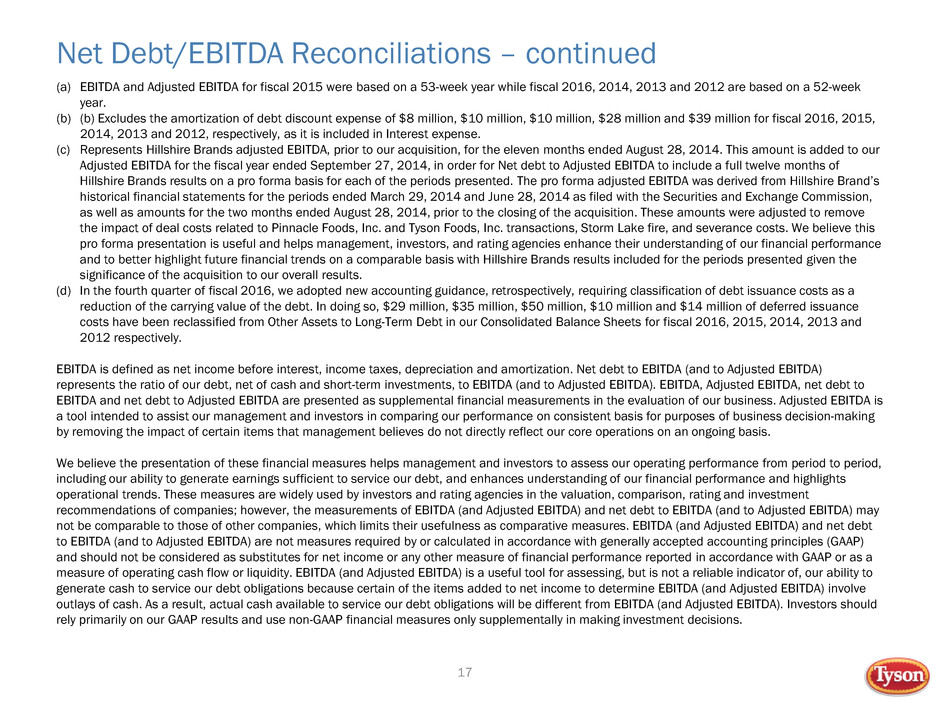

Net Debt/EBITDA Reconciliations – continued 17 (a) EBITDA and Adjusted EBITDA for fiscal 2015 were based on a 53-week year while fiscal 2016, 2014, 2013 and 2012 are based on a 52-week year. (b) (b) Excludes the amortization of debt discount expense of $8 million, $10 million, $10 million, $28 million and $39 million for fiscal 2016, 2015, 2014, 2013 and 2012, respectively, as it is included in Interest expense. (c) Represents Hillshire Brands adjusted EBITDA, prior to our acquisition, for the eleven months ended August 28, 2014. This amount is added to our Adjusted EBITDA for the fiscal year ended September 27, 2014, in order for Net debt to Adjusted EBITDA to include a full twelve months of Hillshire Brands results on a pro forma basis for each of the periods presented. The pro forma adjusted EBITDA was derived from Hillshire Brand’s historical financial statements for the periods ended March 29, 2014 and June 28, 2014 as filed with the Securities and Exchange Commission, as well as amounts for the two months ended August 28, 2014, prior to the closing of the acquisition. These amounts were adjusted to remove the impact of deal costs related to Pinnacle Foods, Inc. and Tyson Foods, Inc. transactions, Storm Lake fire, and severance costs. We believe this pro forma presentation is useful and helps management, investors, and rating agencies enhance their understanding of our financial performance and to better highlight future financial trends on a comparable basis with Hillshire Brands results included for the periods presented given the significance of the acquisition to our overall results. (d) In the fourth quarter of fiscal 2016, we adopted new accounting guidance, retrospectively, requiring classification of debt issuance costs as a reduction of the carrying value of the debt. In doing so, $29 million, $35 million, $50 million, $10 million and $14 million of deferred issuance costs have been reclassified from Other Assets to Long-Term Debt in our Consolidated Balance Sheets for fiscal 2016, 2015, 2014, 2013 and 2012 respectively. EBITDA is defined as net income before interest, income taxes, depreciation and amortization. Net debt to EBITDA (and to Adjusted EBITDA) represents the ratio of our debt, net of cash and short-term investments, to EBITDA (and to Adjusted EBITDA). EBITDA, Adjusted EBITDA, net debt to EBITDA and net debt to Adjusted EBITDA are presented as supplemental financial measurements in the evaluation of our business. Adjusted EBITDA is a tool intended to assist our management and investors in comparing our performance on consistent basis for purposes of business decision-making by removing the impact of certain items that management believes do not directly reflect our core operations on an ongoing basis. We believe the presentation of these financial measures helps management and investors to assess our operating performance from period to period, including our ability to generate earnings sufficient to service our debt, and enhances understanding of our financial performance and highlights operational trends. These measures are widely used by investors and rating agencies in the valuation, comparison, rating and investment recommendations of companies; however, the measurements of EBITDA (and Adjusted EBITDA) and net debt to EBITDA (and to Adjusted EBITDA) may not be comparable to those of other companies, which limits their usefulness as comparative measures. EBITDA (and Adjusted EBITDA) and net debt to EBITDA (and to Adjusted EBITDA) are not measures required by or calculated in accordance with generally accepted accounting principles (GAAP) and should not be considered as substitutes for net income or any other measure of financial performance reported in accordance with GAAP or as a measure of operating cash flow or liquidity. EBITDA (and Adjusted EBITDA) is a useful tool for assessing, but is not a reliable indicator of, our ability to generate cash to service our debt obligations because certain of the items added to net income to determine EBITDA (and Adjusted EBITDA) involve outlays of cash. As a result, actual cash available to service our debt obligations will be different from EBITDA (and Adjusted EBITDA). Investors should rely primarily on our GAAP results and use non-GAAP financial measures only supplementally in making investment decisions.

Segment Operating Income Reconciliations 18 In millions (Unaudited) (a) Impact of additional week was calculated by using the fourth quarter of fiscal 2015 adjusted operating income (prior to the additional week impact) and divided by 14 weeks. Adjusted segment operating income is presented as a supplementary measure of our operating performance that is not required by, or presented in accordance with, GAAP. We use adjusted segment operating income as an internal performance measurement and as one criteria for evaluating our performance relative to that of our peers. We believe adjusted segment operating income is meaningful to our investors to enhance their understanding of our operating performance and is frequently used by securities analysts, investors and other interested parties to compare our performance with the performance of other companies that report adjusted segment operating income. Further, we believe that adjusted segment operating income is a useful measure because it improves comparability of results of operations from period to period. Adjusted segment operating income should not be considered as a substitute for segment operating income or any other measure of operating performance reported in accordance with GAAP. Investors should rely primarily on our GAAP results and use non-GAAP financial measures only supplementally in making investment decisions. Our calculation of adjusted segment operating income may not be comparable to similarly titled measures reported by other companies. Chicken Beef Pork Prepared Foods Other Total Reported operating income (loss) 1,366$ (66)$ 380$ 588$ (99)$ 2,169$ Add: China impairment - - - - 169 169 Add: Merger and integration costs - - - 10 47 57 Add: Prepared Foods network optimization charges - - - 59 - 59 Add: Denison plant closure - 12 - - - 12 Less: Insurance proceeds (net of costs) related to a legacy Hillshire Brands plant fire - - - (8) - (8) Less: Gain on sale of the Mexico operation - - - - (161) (161) Adjusted operating income prior to adjustment for additional week 1,366 (54) 380 649 (44) 2,297 Less: Estimated impact of additional week (a) (26) 1 (7) (13) 1 (44) Adjusted operating income (loss) 1,340$ (53)$ 373$ 636$ (43)$ 2,253$ Adjusted Segment Operating Income (Loss) (for 12 months ended October 3, 2015)

EPS Reconciliations 19 In millions, except per share data (Unaudited) (a) Impact of additional week was calculated by using the fourth quarter of fiscal 2015 adjusted operating income (prior to the additional week impact) and divided by 14 weeks. Operating Income EPS Operating Income EPS Operating Income EPS Operating Income EPS Operating Income EPS Reported from Continuing Operations 2,833$ 4.53$ 2,169$ 2.95$ 1,430$ 2.37$ 1,375$ 2.31$ 1,286$ 1.68$ Less: Recognition of previously unrecognized tax benefit - (0.14) - (0.06) - (0.15) - - - - Insurance proceeds (net of costs) related to a legacy Hillshire Brands plant fire - - (8) (0.02) - - - - - - Gain on sale of equity securities - - - (0.03) - - - - - - Gain on sale of Mexico operations - - (161) (0.24) - - - - - - Impact of additional week (a) - - (44) (0.06) - - - - - - Gain from currency translation adjustment - - - - - - - (0.05) - - Gain on sale of interest in an equity method investment - - - - - - - - - - Reversal of reserves for foreign uncertain tax positions - - - - - - - - - - Add: China Impairment - - 169 0.41 - - - - - - Merger and integration costs - - 57 0.09 - - - - - - Prepared Foods network optimization charges - - 59 0.09 - - - - - - Denison plant closure - - 12 0.02 - - - - - - Loss related to early extinguishment of debt - - - - - - - - - 0.29 Brazil impairment/Mexico undistributed earnings tax - - - - 42 0.16 - - - - Hillshire Brands acquisition, integration and costs associated with our Prepared Foods improvement plan - - - - 137 0.37 - - - - Hillshire Brands post-closing results, purchase price accounting and costs related to a legacy Hillshire Brands plant fire - - - - 40 0.07 - - - - Hillshire Brands acquisition financing incremental interest costs and share dilution - - - - - 0.12 - - - - Adjusting from Continuing Operations 2,833$ 4.39$ 2,253$ 3.15$ 1,649$ 2.94$ 1,375$ 2.26$ 1,286$ 1.97$ 12 Months Ended October 1, 2016 October 3, 2015 September 27, 2014 September 28, 2013 September 29, 2012

EPS Reconciliations – continued 20 In millions, except per share data (Unaudited) Operating Income EPS Operating Income EPS Operating Income EPS Operating Income EPS Operating Income EPS Reported from Continuing Operations 1,289$ 1.98$ 1,574$ 2.09$ (215)$ (1.47)$ 331$ 0.24$ 613$ 0.75$ Less: Gain from currency translation adjustment - - (38) (0.06) - - - - - - Gain on sale of an investment - - - - - - - (0.03) - - Gain on sales of assets - - - - - - - - (19) (0.03) Gain on sale of interest in an equity method investment - (0.03) - - - - - - - - Reversal of reserves for foreign uncertain tax positions - (0.05) - - - - - - - - Add: Charges related to flood damage - - - - - - 7 0.01 - - Charges related to plant closings - - - - 15 0.02 13 0.02 - - Cumulative effect of change in accounting principles - - - - - - - - - - Impairment of goodwill - - 29 0.07 560 1.50 - - - - Impairment of equity method investment - - - 0.03 - - - - - - Loss related to note repurchases - - - 0.09 - - - - - - Impairment of assets - - - - - - 23 0.04 5 0.01 Impairment of intangible assets - - - - - - 10 0.02 7 0.01 Severance and restructuring charges - - - - - - 23 0.04 - - Adjusted from Continuing Operations 1,289$ 1.90$ 1,565$ 2.22$ 360$ 0.05$ 407$ 0.34$ 606$ 0.74$ 12 Months Ended October 1, 2011 October 2, 2010 October 3, 2009 September 27, 2008 September 29, 2007 Adjusted operating income and adjusted net income from continuing operations per share attributable to Tyson (adjusted EPS) are presented as supplementary measures of our financial performance that is not required by, or presented in accordance with, GAAP. We use adjusted operating income and adjusted EPS as internal performance measurements and as two criteria for evaluating our performance relative to that of our peers. We believe adjusted operating income and adjusted EPS are meaningful to our investors to enhance their understanding of our financial performance and is frequently used by securities analysts, investors and other interested parties to compare our performance with the performance of other companies that report adjusted operating income and adjusted EPS. Further, we believe that adjusted operating income and adjusted EPS are useful measures because they improve comparability of results of operations from period to period. Adjusted operating income and adjusted EPS should not be considered as a substitute for operating income or net income per share attributable to Tyson or any other measure of financial performance reported in accordance with GAAP. Investors should rely primarily on our GAAP results and use non-GAAP financial measures only supplementally in making investment decisions. Our calculation of adjusted operating income and adjusted EPS may not be comparable to similarly titled measures reported by other companies.