- PCG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

PG&E (PCG) 8-KRegulation FD Disclosure

Filed: 5 Mar 09, 12:00am

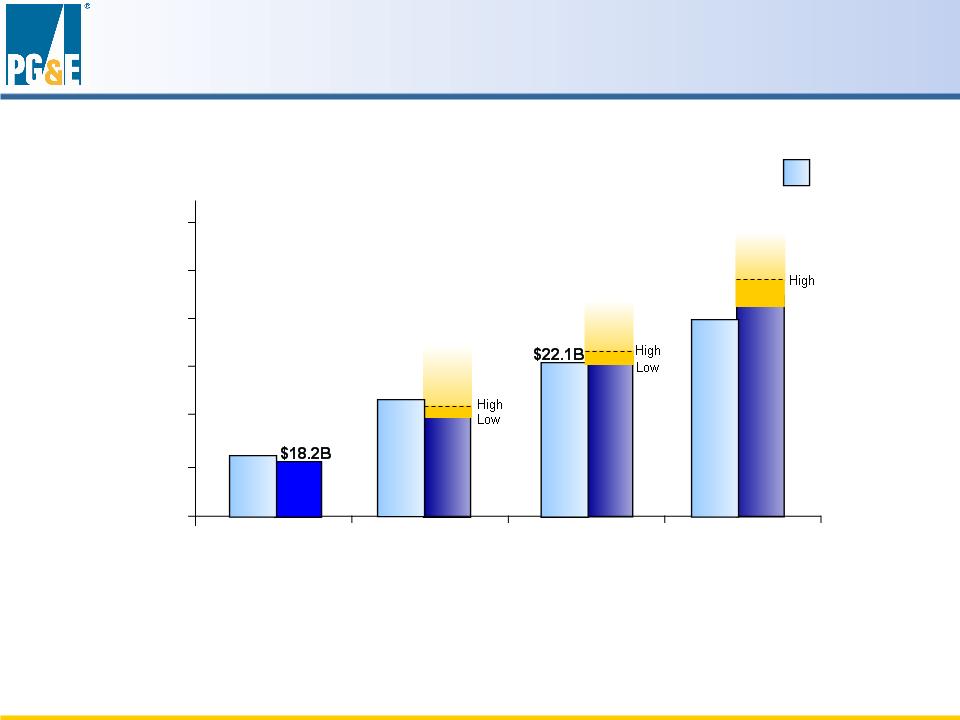

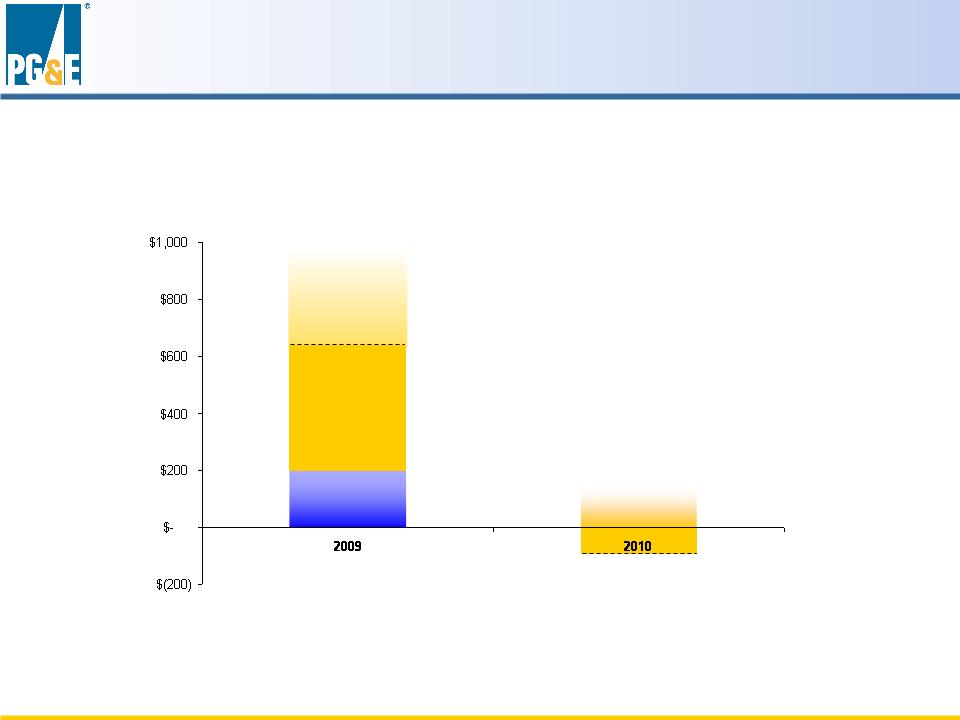

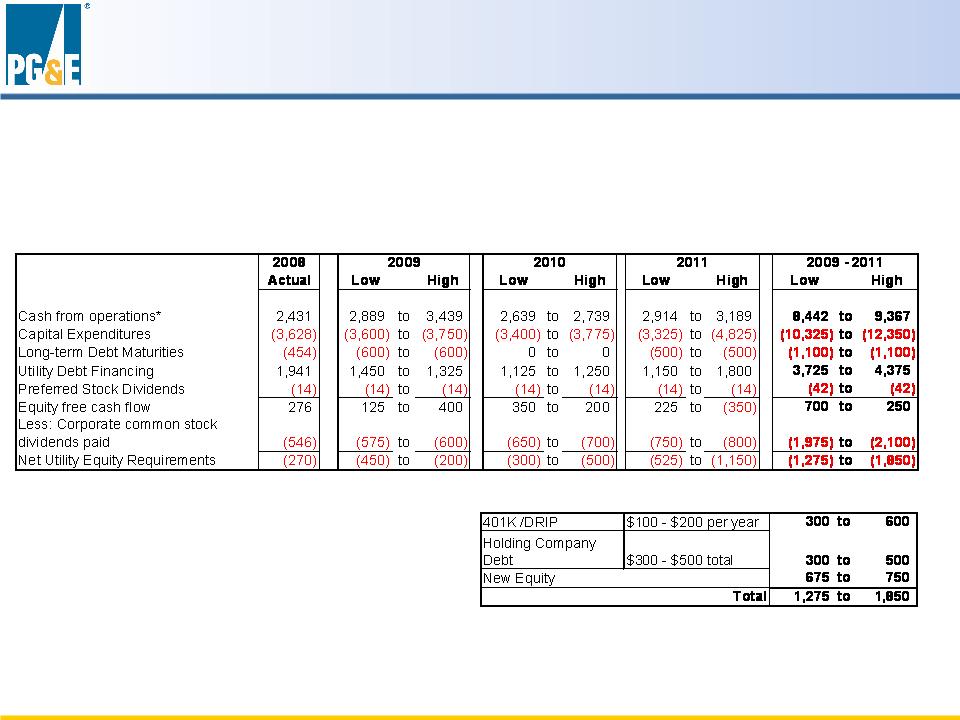

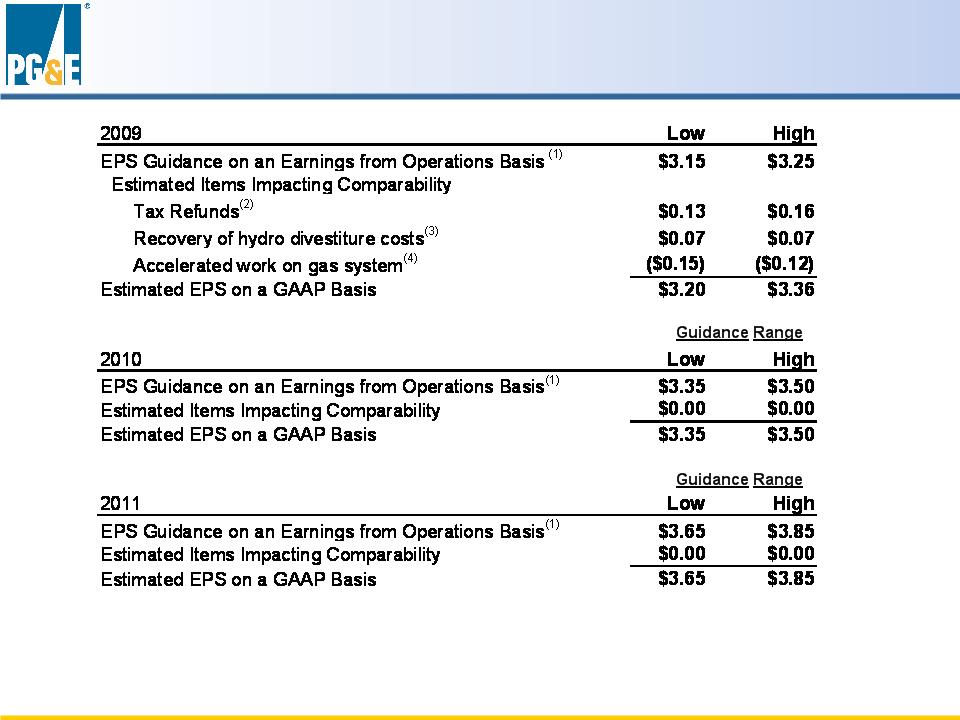

2009 | 2010 | 2011 | |

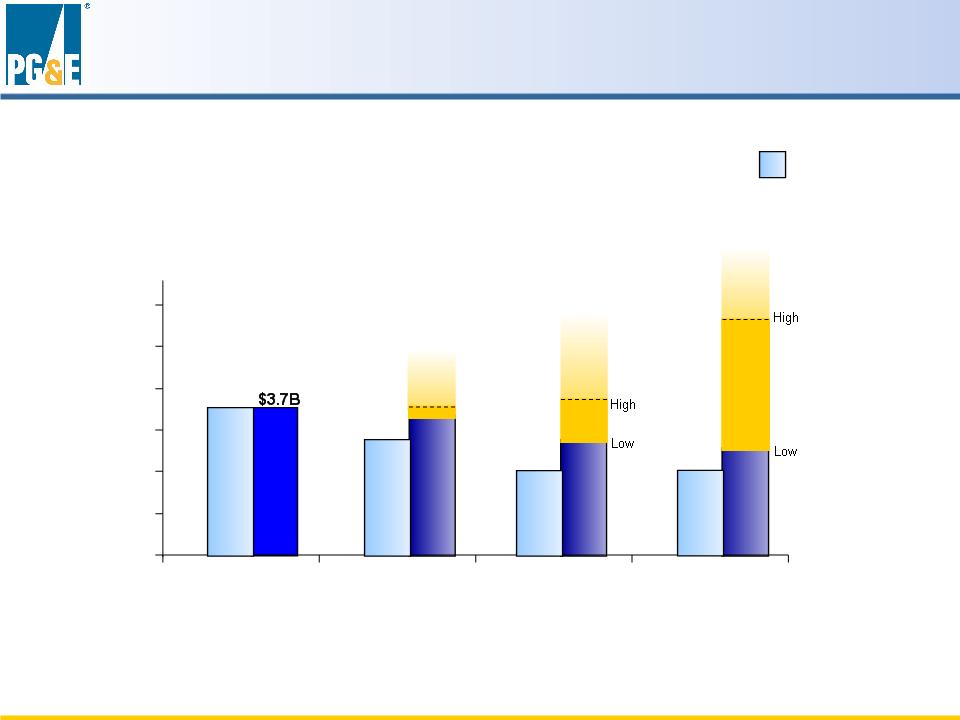

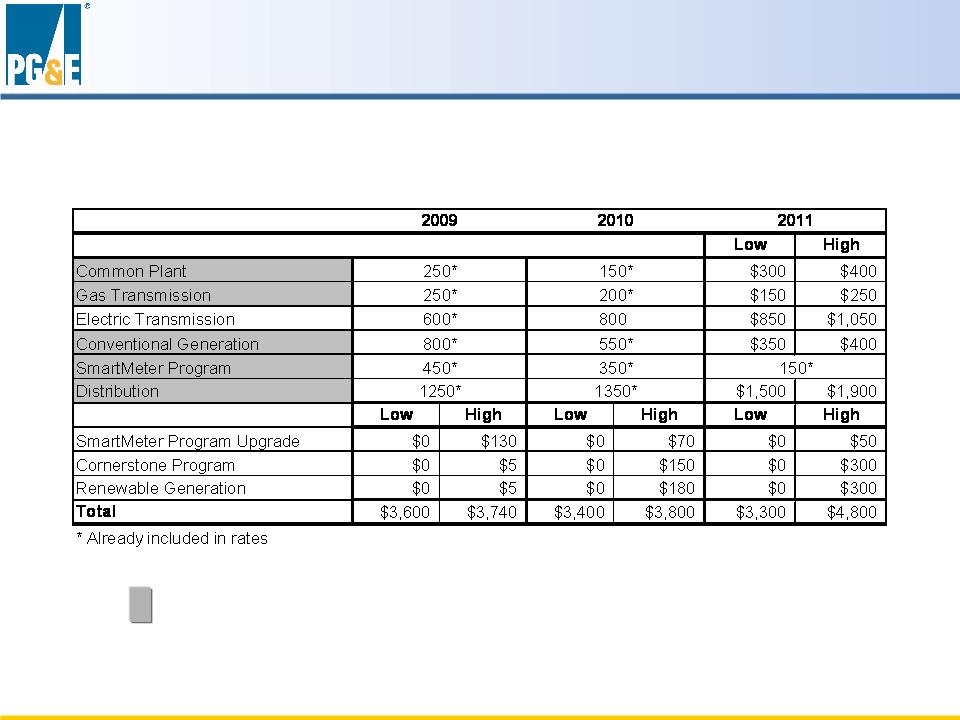

Low Case | Total CapEx of $3.6B • Includes: • CPUC Basic CapEx of $3.0B • Elec. Trans. CapEx of $600MM • Does not include: • SmartMeter Program Upgrade • Cornerstone Program • Renewable Generation • BC Transmission / Pacific Connector Gas Pipeline | Total CapEx of $3.4B • Includes: • CPUC Basic CapEx of $2.6B • Elec. Trans. CapEx of $800MM • Does not include: • SmartMeter Program Upgrade • Cornerstone Program • Renewable Generation • BC Transmission / Pacific Connector Gas Pipeline • | Total CapEx of $3.3B • Includes: • CPUC Basic CapEx of $2.45B • Elec. Trans. CapEx of $850MM • Does not include: • SmartMeter Program Upgrade • Cornerstone Program • Renewable Generation • BC Transmission / Pacific Connector Gas Pipeline • |

High Case | Total CapEx of $3.7B • Includes: • CPUC Basic CapEx of $3.0B • Elec. Trans. CapEx of $600MM • SmartMeter Program Upgrade • Cornerstone Program • Renewable Generation •Does not include: • BC Transmission / Pacific Connector Gas Pipeline | Total CapEx of $3.8B • Includes: • CPUC Basic CapEx of $2.6B • Elec. Trans. CapEx of $800MM • SmartMeter Program Upgrade • Cornerstone Program • Renewable Generation • Does not include: • BC Transmission / Pacific Connector Gas Pipeline | Total CapEx of $4.8B • Includes: • CPUC Basic CapEx of $3.1B • Elec. Trans. CapEx of $1.0B • SmartMeter Program Upgrade • Cornerstone Program • Renewable Generation • Does not include: • BC Transmission / Pacific Connector Gas Pipeline |

* Excludes cash from Energy Recovery Bond revenues |

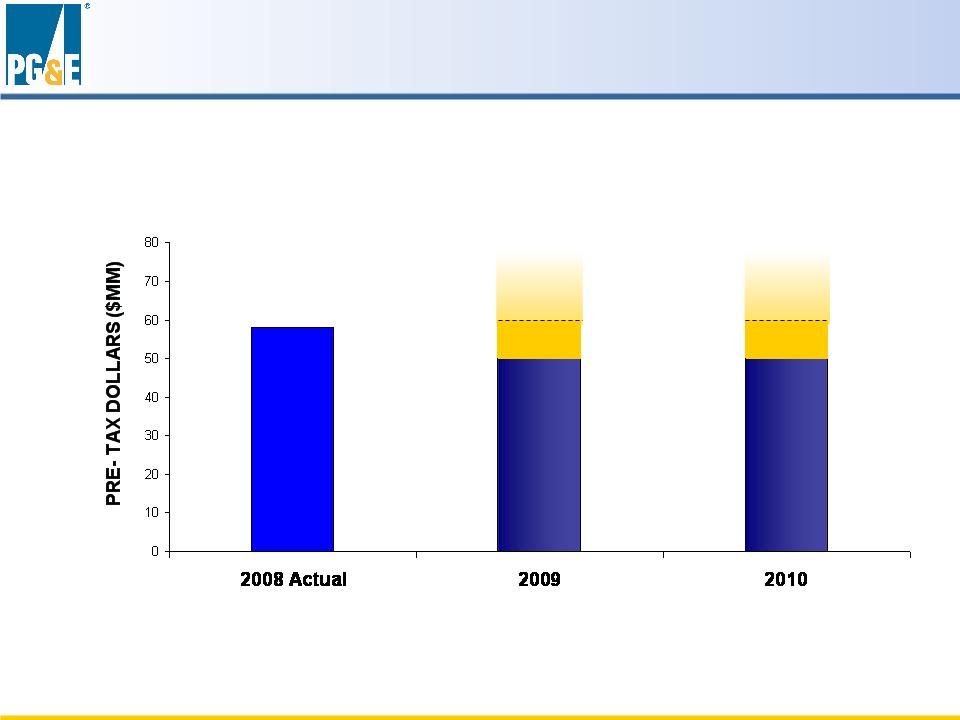

Category | 2009 | 2010 | 2011 |

System Expansion/Congestion Relief | $230M | $400M | $590M |

Maintenance and Replacement | $280M | $290M | $310M |

Automation Technology Expansion | $70M | $90M | $110M |

New Generation Interconnection | $20M | $20M | $40M |

Total | $600M | $800M | $1050M |

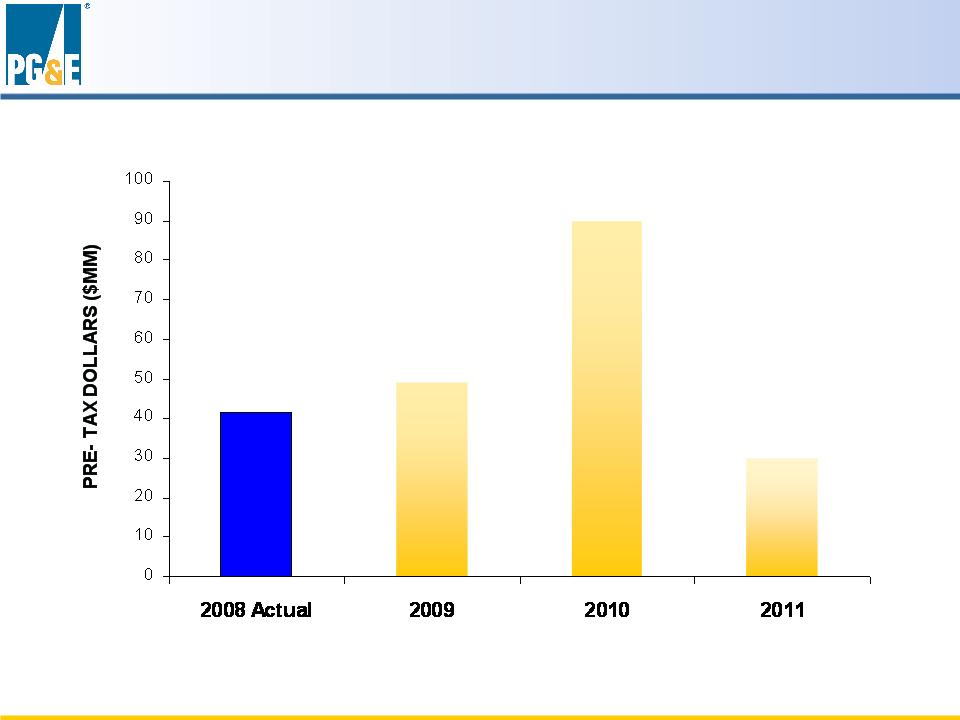

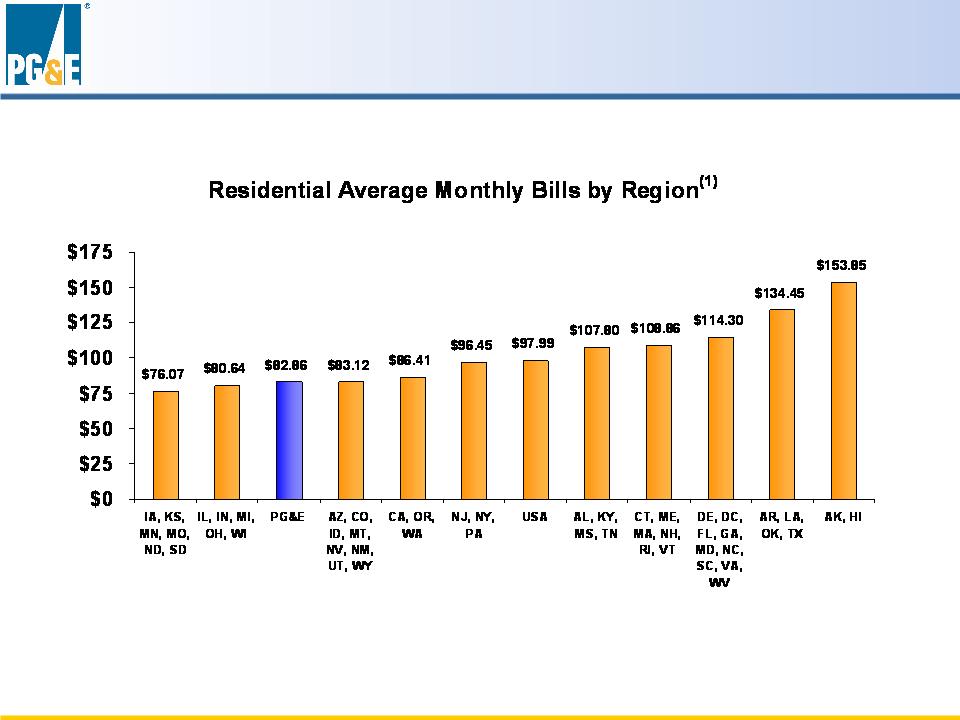

EPS on an Earnings from Operations Basis* | $2.95 |

Items Impacting Comparability** | 0.68 |

EPS on a GAAP Basis | $3.63 |

(1) Earnings per share from operations is a non-GAAP measure. This non-GAAP measure is used because it allows investors to compare the core underlying financial performance from one period to another, exclusive of items that do not reflect the normal course of operations. (2) Tentative agreement to resolve federal tax refund claims related to tax years 1998 and 1999. (3) Anticipated recovery of costs incurred in connection with efforts to determine the market value of hydroelectric generation facilities. (4) Forecasted cost to accelerate the performance of system-wide gas integrity surveys and remedial work. |