- PCG Dashboard

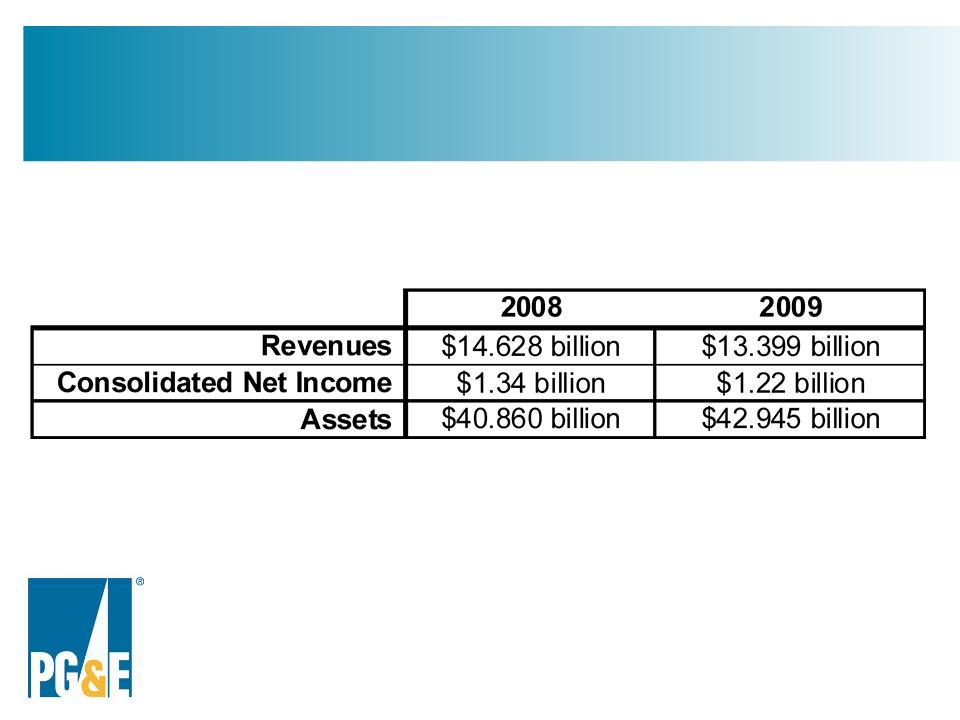

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

PG&E (PCG) 8-KRegulation FD Disclosure

Filed: 1 Mar 10, 12:00am

March 1, 2010 2:00pm - 5:00pm: Presentation |

• PG&E’s Investment Case Peter A. Darbee Chairman, CEO and President PG&E Corporation • PG&E’s Operational Outlook Chris Johns President Pacific Gas and Electric Company • PG&E’s Financial Outlook Kent Harvey Senior Vice President and Chief Financial Officer PG&E Corporation |

Family Electric Rate Assistance (FERA): Low-to middle income households of three or more pay a lower rate for part of their electricity usage; If denied for CARE due to income level, customers are considered for FERA | Breathe Easy Solutions: The California Alternative Rates for Energy (CARE) provides a 20% discount on gas and electricity services for low-income or newly unemployed customers and excludes state imposed energy surcharges |

Energy Partners: Provides income- qualified customers free energy education, weatherization measures and energy- efficient appliances to reduce gas and electric usage | Balance Payment Plan: Our billing system will calculate your monthly payment amount based on your average energy use costs |

Medical baseline allowance: Allows customers to get additional quantities of energy at the lowest (baseline) price for residential customers | Bill Guaranty: PG&E will accept a cosigner for an eligible customer’s credit deposit. |

3rd Party Notification: PG&E will notify you or any other person designated as a third party when the person you're concerned about ever receives a late notice due to an unpaid PG&E bill | Cooling Centers: PG&E provides grants to communities to provide a place for residents to go during times of extreme heat |

Business Scope |

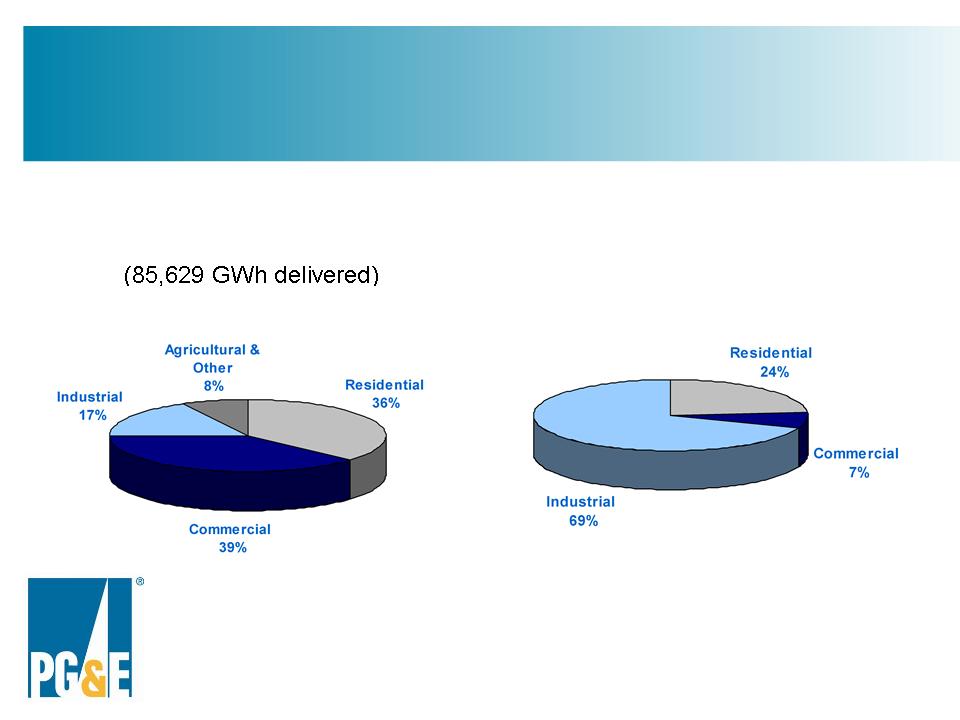

• Retail electricity and natural gas distribution service (construction, operations and maintenance) • Customer services (call centers, meter reading, billing) • 5.1 million electric and 4.3 million gas customer accounts |

Primary Assets |

• $12.4 billion of rate base (2009 wtd. avg.) |

Regulation |

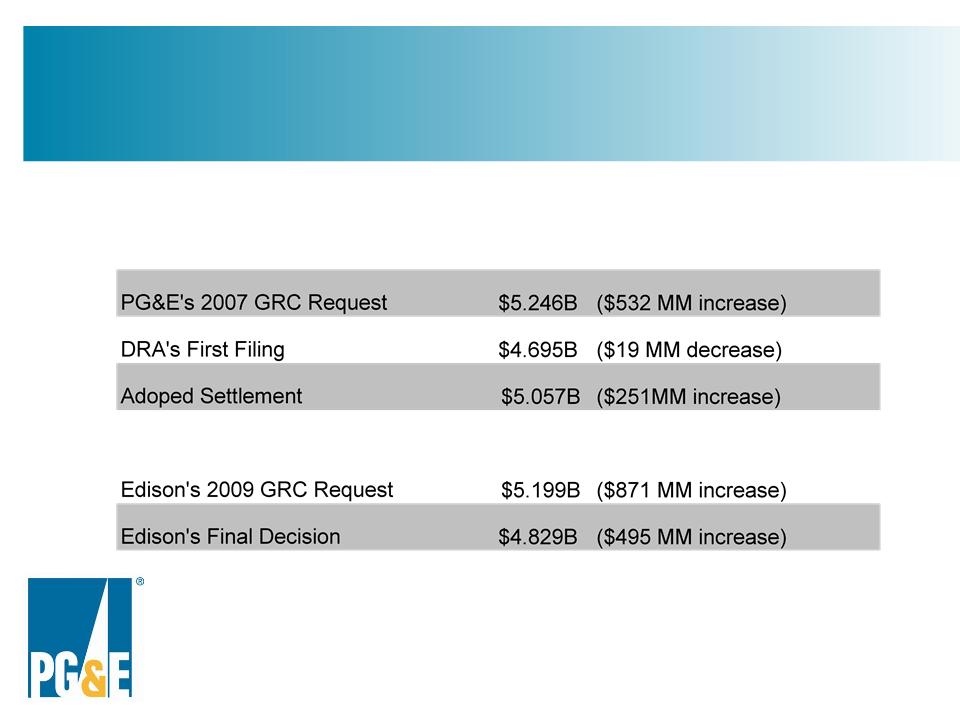

• California state regulation (CPUC) • Cost of service ratemaking: General Rate Case (1) |

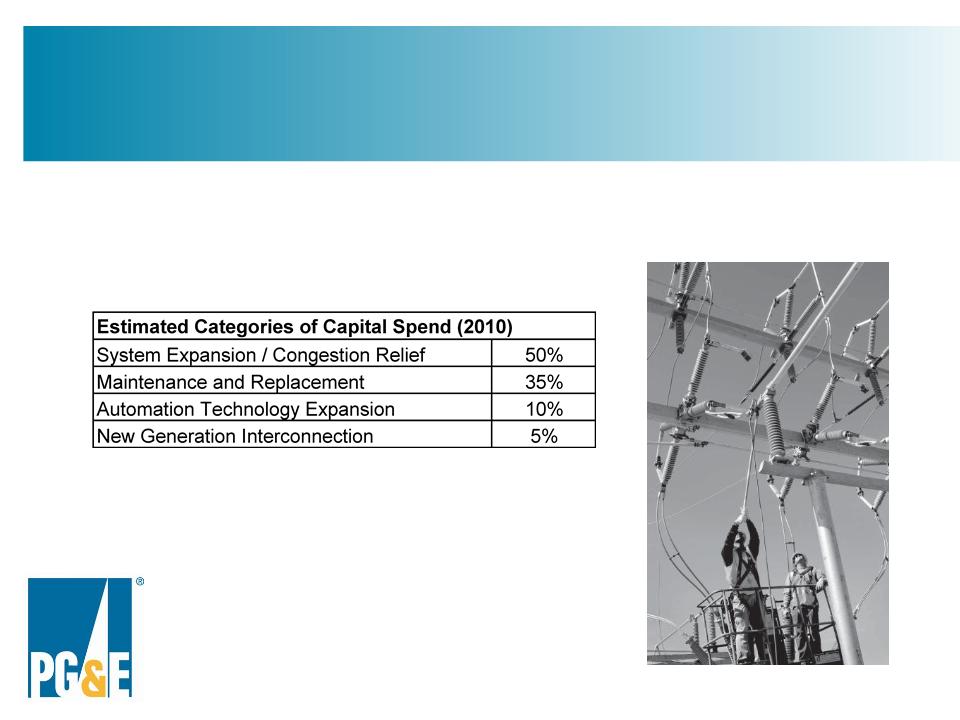

Business Scope |

• Wholesale electric transmission services (construction, maintenance) • Operation by CA Independent System Operator |

Primary Assets |

• $3.1 billion of rate base (2009 wtd. avg.) |

Regulation |

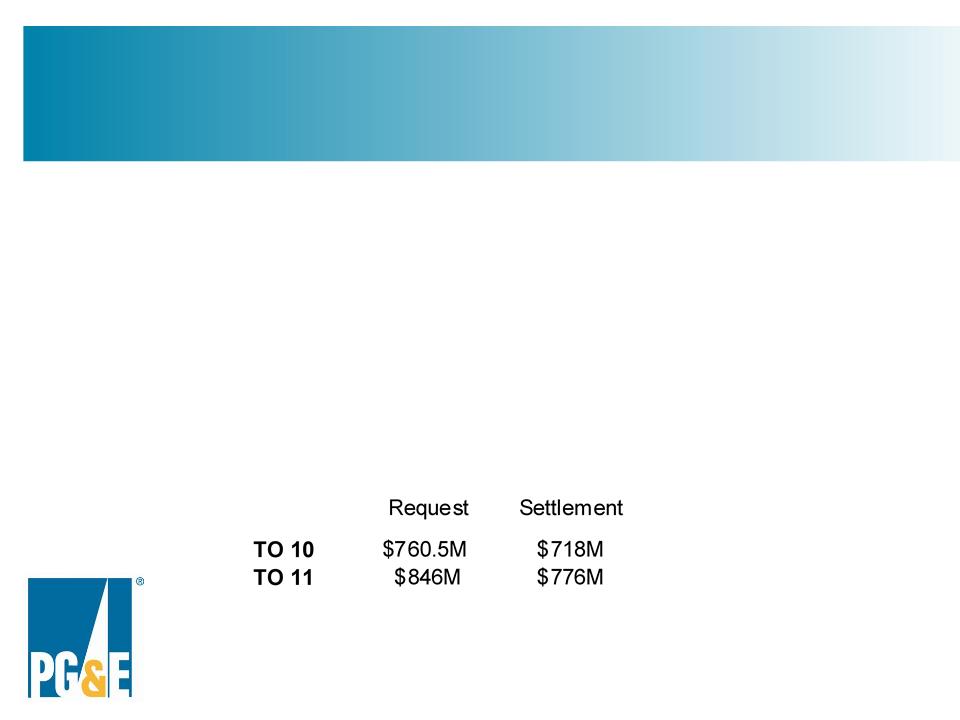

• Federal regulation (FERC) • Cost of service ratemaking: Transmission Owner Rate Case • Revenues vary with system load |

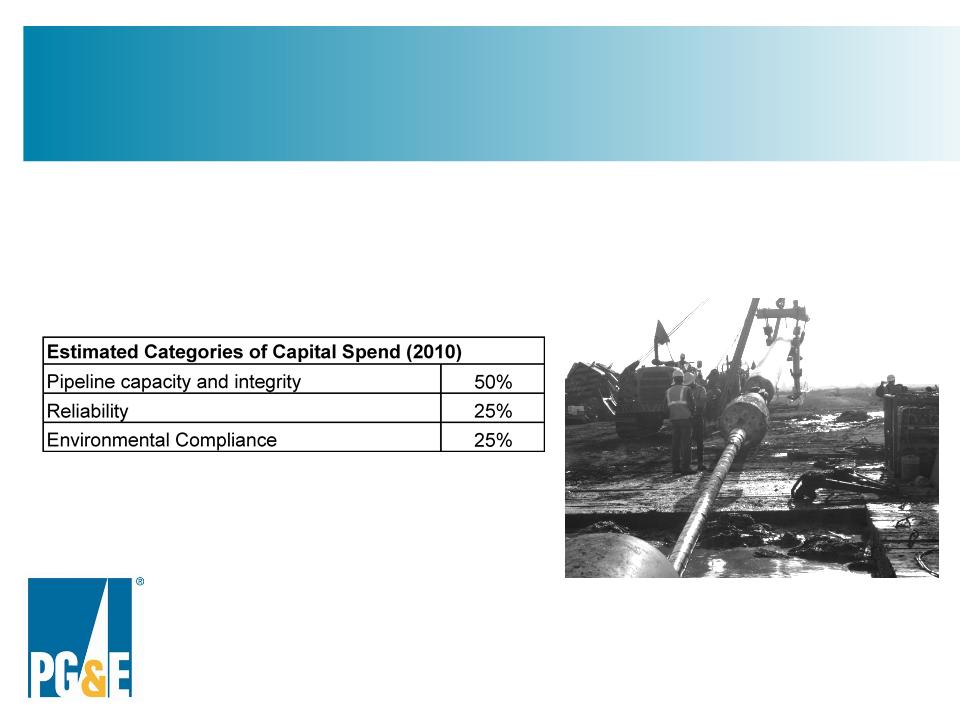

Business Scope |

• Natural gas transportation, storage, parking and lending services • Customers: PG&E natural gas distribution and electric generation businesses, industrial customers, California electric generators |

Primary Assets |

• $1.5 billion of rate base (2009 wtd. avg.) |

Regulation |

• California state regulation (CPUC) • Incentive ratemaking framework: Gas Transmission & Storage Rate Case • Revenues vary with throughput |

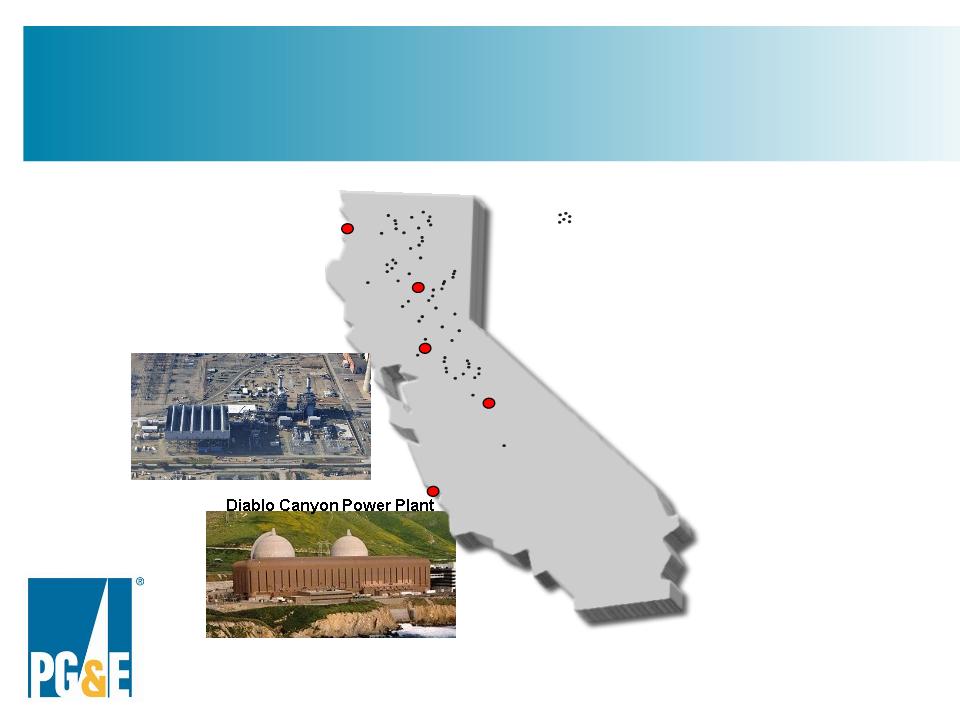

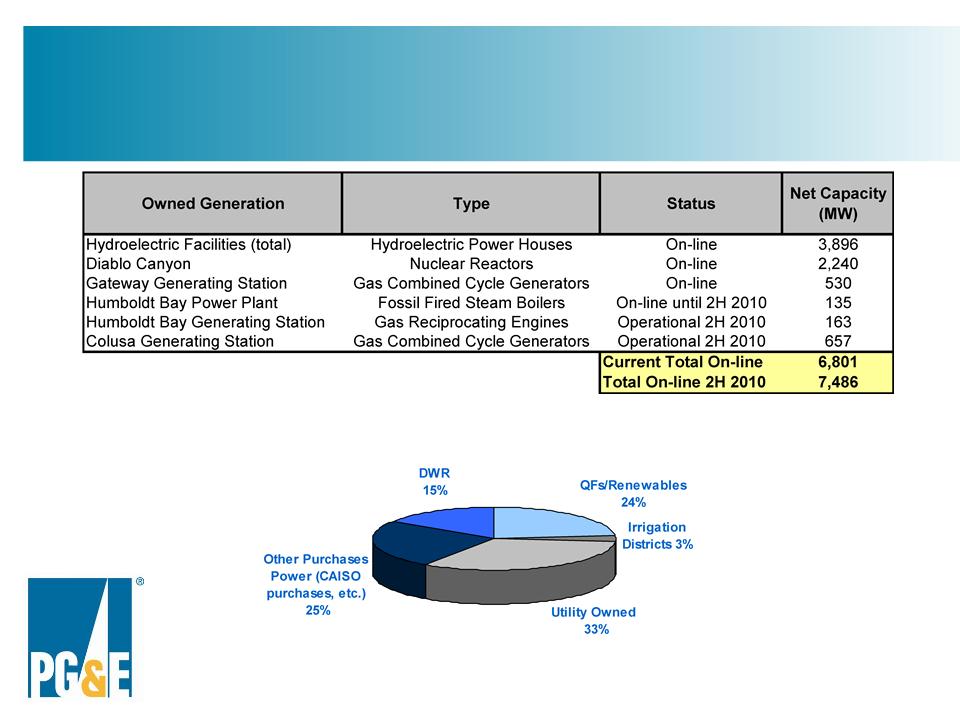

Business Scope |

• Electricity and ancillary services from owned and controlled resources • Energy procurement program |

Primary Assets |

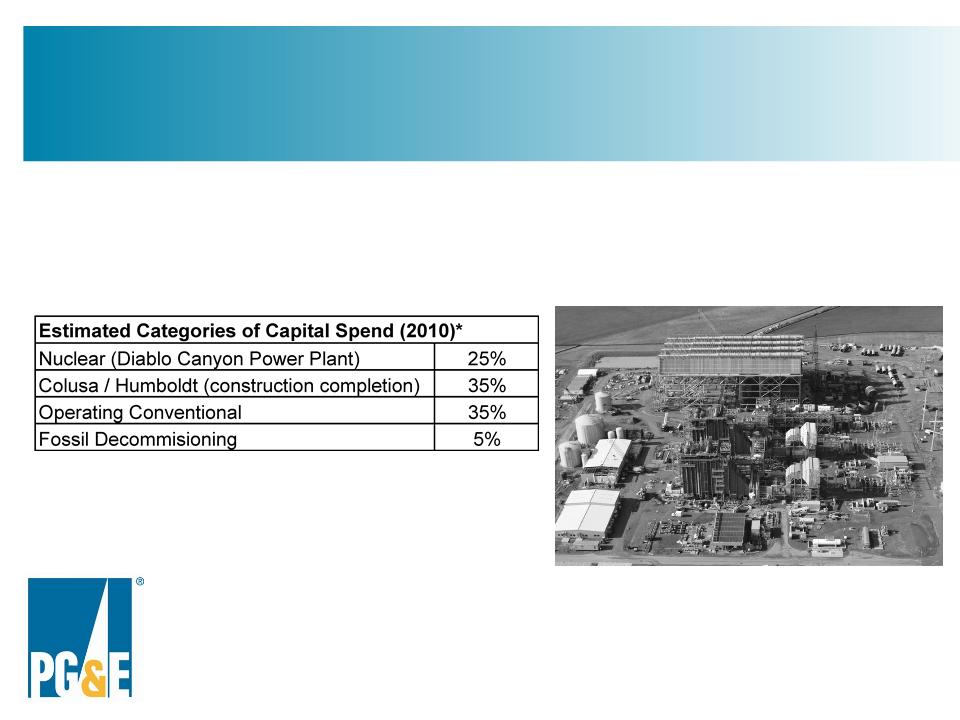

• $2.8 billion of rate base (2009 wtd. avg.) • Diablo Canyon Nuclear Power Plant (2,240 MW) • Gateway Generating Station (530 MW) • Largest privately owned hydro system (3,896 MW) • Funded nuclear plant decommissioning trusts of $2.0 billion |

Regulation |

• California state regulation (CPUC) • Cost of service ratemaking for utility-owned generation: General Rate Case • Pass through of power procurement costs |

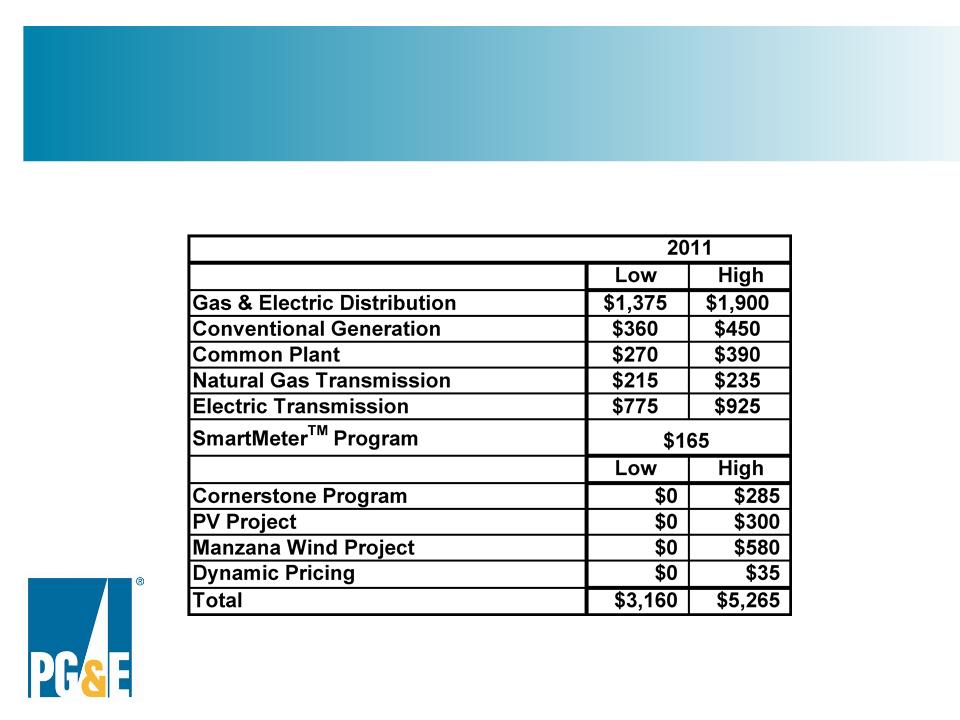

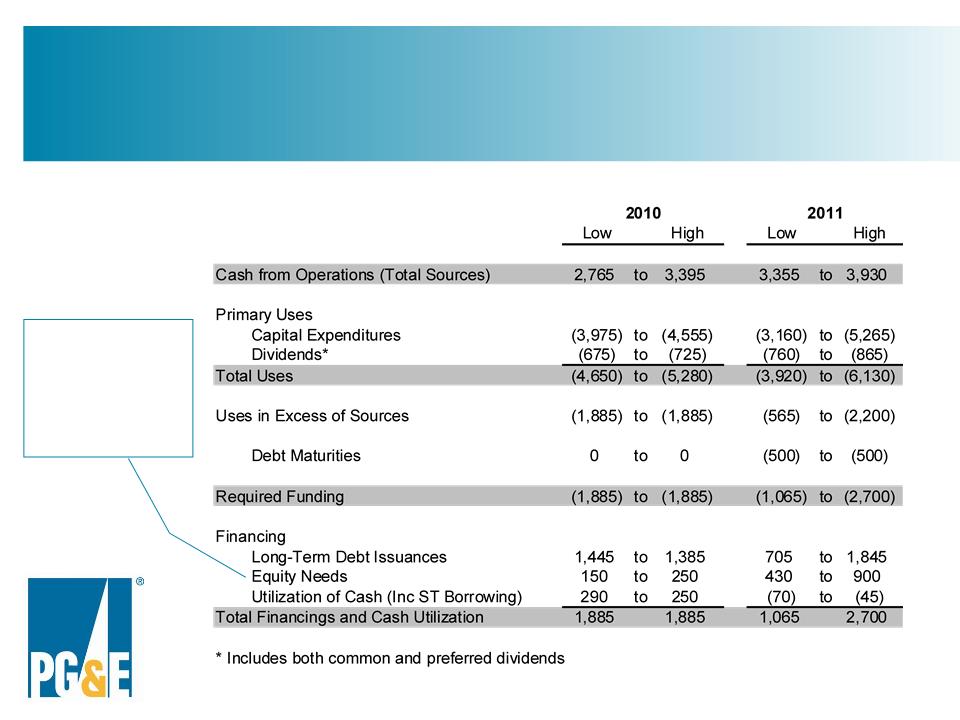

($MM) | 2010 | 2011 | 2012 |

Energy Recovery Bond Average Deferred Tax Balance | $396 | $243 | $82 |

Estimated After-tax Carrying Cost Credit* | $(23) | $(14) | $(5) |

($MM) | 2010 | 2011 | 2012 |

Annual ERB Amortization | $386 | $404 | $423 |

End-of-year ERB balance | $827 | $423 | $0 |

Current Ratings |

• Utility Corporate Credit/Issuer: BBB+ (S&P) and A3 (Moody’s) • Utility Senior unsecured debt: BBB+ (S&P) and A3 (Moody’s) |

Average Utility Metrics (2010-2012)* |

• S&P Business Profile Rating: Excellent • Total Debt to capitalization (EOY): 55.1% • Funds from Operations Cash Interest Coverage: 5.2x • Funds from Operations to Average Total Debt: 21.4% |

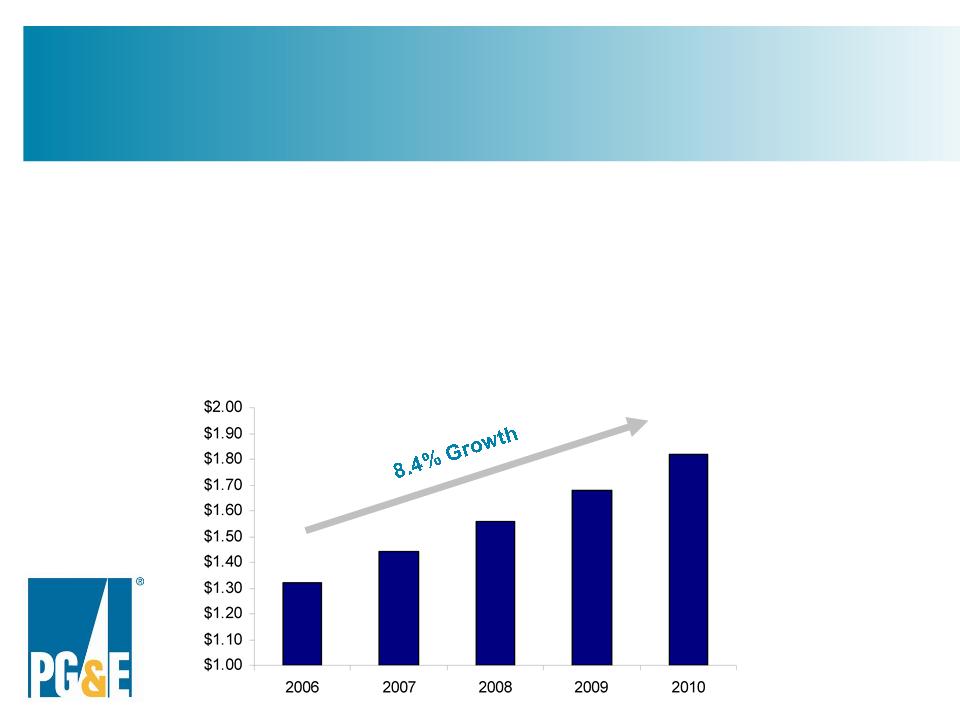

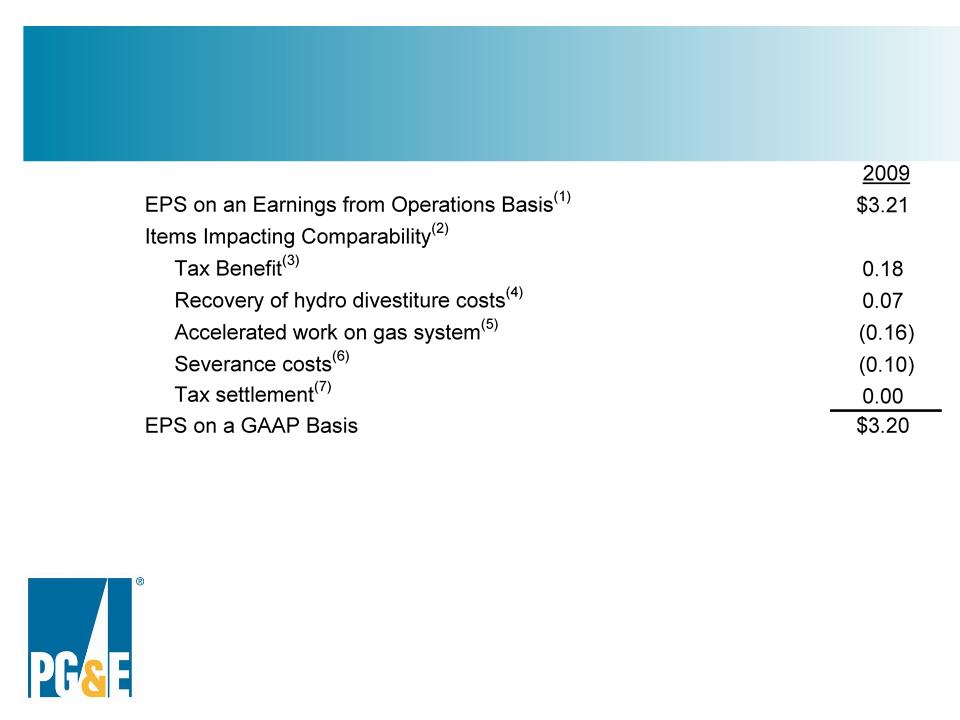

EPS on an Earnings from Operations Basis* | $2.95 |

Items Impacting Comparability** | 0.68 |

EPS on a GAAP Basis | $3.63 |

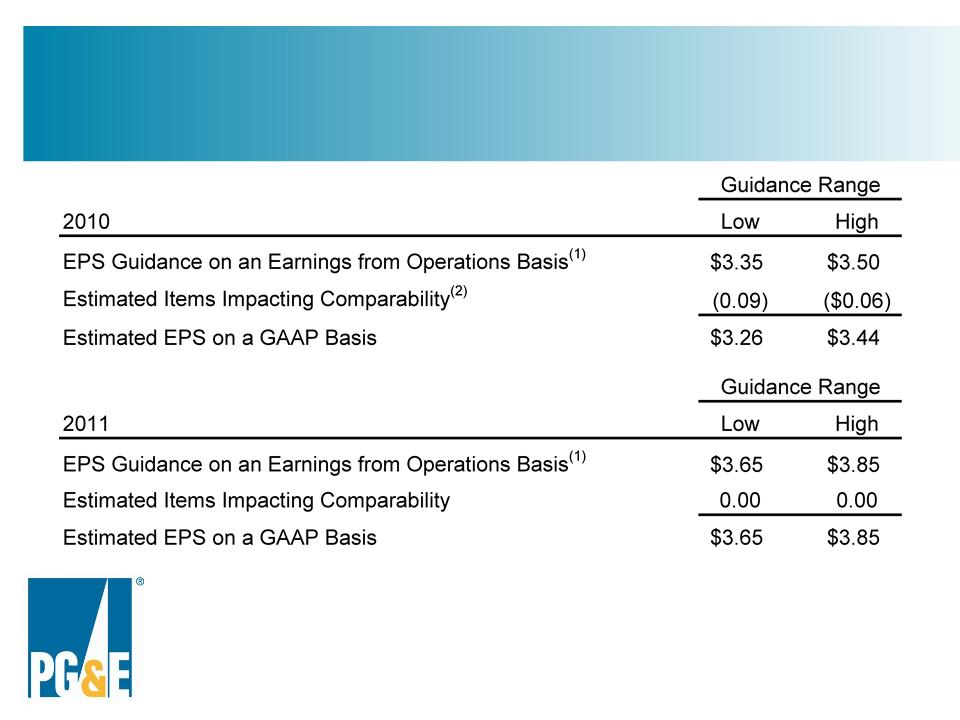

(1) Earnings per share from operations is a non-GAAP measure. This non-GAAP measure is used because it allows investors to compare the core underlying financial performance from one period to another, exclusive of items that do not reflect the normal course of operations. |