| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-177707-01 |

| | | |

MSBAM 2013-C8

Free Writing Prospectus

Structural and Collateral Term Sheet

$1,137,943,695

(Approximate Total Mortgage Pool Balance)

$1,015,614,000

(Approximate Offered Certificates)

Banc of America Merrill Lynch Commercial Mortgage Inc.

as Depositor

Bank of America, National Association

Morgan Stanley Mortgage Capital Holdings LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2013-C8

January 29, 2013

| | |

| |

| | |

Co-Lead Bookrunning Manager | Co-Lead Bookrunning Manager |

| | |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the SEC (File Number 333-177707) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC web site at www.sec.gov. Alternatively, the depositor or any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll free 1-800-294-1322 or by email to dg.propectus_distribution@baml.com.

| This is not a research report and was not prepared by the BofA Merrill Lynch or Morgan Stanley research departments. It was prepared by BofA Merrill Lynch and Morgan Stanley sales, trading, banking or other non-research personnel. This Term Sheet was not intended or written to be used, and it cannot be used by any taxpayer, for the purpose of avoiding penalties that may be imposed on the taxpayer under U.S. federal tax laws. Each taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor. Please see additional important information and qualifications at the end of this Term Sheet. |

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED ELECTRONIC MAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of, or attached to, the electronic mail communication to which this material may have been attached are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another electronic mail system.

IMPORTANT NOTICE REGARDING THE CONDITIONS FOR THIS OFFERING OF ASSET-BACKED SECURITIES

THE ASSET-BACKED SECURITIES REFERRED TO IN THESE MATERIALS ARE BEING OFFERED ON A “WHEN, AS AND IF ISSUED” BASIS. IN PARTICULAR, YOU ARE ADVISED THAT THE ASSET-BACKED SECURITIES, AND THE ASSET POOL BACKING THEM, ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING, AMONG OTHER THINGS, THE POSSIBILITY THAT ONE OR MORE CLASSES OF SECURITIES MAY BE SPLIT, COMBINED OR ELIMINATED), AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS. AS A RESULT, YOU MAY COMMIT TO PURCHASE SECURITIES THAT HAVE CHARACTERISTICS THAT MAY CHANGE, AND YOU ARE ADVISED THAT ALL OR A PORTION OF THE SECURITIES MAY NOT BE ISSUED THAT HAVE THE CHARACTERISTICS DESCRIBED IN THESE MATERIALS. OUR OBLIGATION TO SELL SECURITIES TO YOU IS CONDITIONED ON THE SECURITIES AND THE UNDERLYING TRANSACTION HAVING THE CHARACTERISTICS DESCRIBED IN THESE MATERIALS. IF WE DETERMINE THAT THE FOREGOING CONDITION IS NOT SATISFIED IN ANY MATERIAL RESPECT, WE WILL NOTIFY YOU, AND NEITHER THE ISSUING ENTITY NOR ANY UNDERWRITER WILL HAVE ANY OBLIGATION TO YOU TO DELIVER ALL OR ANY PORTION OF THE SECURITIES WHICH YOU HAVE COMMITTED TO PURCHASE, AND THERE WILL BE NO LIABILITY BETWEEN US AS A CONSEQUENCE OF THE NON-DELIVERY.

IMPORTANT INFORMATION AND IRS CIRCULAR 230 NOTICE

THIS MATERIAL HAS BEEN PREPARED FOR INFORMATION PURPOSES TO SUPPORT THE PROMOTION OR MARKETING OF THE TRANSACTION OR MATTERS ADDRESSED HEREIN. THIS IS NOT A RESEARCH REPORT AND WAS NOT PREPARED BY THE BOFA MERRILL LYNCH OR MORGAN STANLEY RESEARCH DEPARTMENTS. IT WAS PREPARED BY BOFA MERRILL LYNCH AND MORGAN STANLEY SALES, TRADING, BANKING OR OTHER NON-RESEARCH PERSONNEL. THIS TERM SHEET WAS NOT INTENDED OR WRITTEN TO BE USED, AND IT CANNOT BE USED BY ANY TAXPAYER, FOR THE PURPOSE OF AVOIDING U.S. FEDERAL, STATE OR LOCAL TAX PENALTIES. EACH TAXPAYER SHOULD SEEK ADVICE BASED ON THE TAXPAYER’S PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISOR. PLEASE SEE ADDITIONAL IMPORTANT INFORMATION AND QUALIFICATIONS AT THE END OF THIS TERM SHEET.

This is not a research report and was not prepared by the Morgan Stanley or BofA Merrill Lynch research departments. It was prepared by Morgan Stanley and BofA Merrill Lynch sales, trading, banking or other non-research personnel. This Term Sheet was not intended or written to be used, and it cannot be used by any taxpayer, for the purpose of avoiding penalties that may be imposed on the taxpayer under U.S. federal tax laws. Each taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor. Please see additional important information and qualifications at the end of this Term Sheet. |

| MSBAM 2013-C8 | Issue Characteristics |

Offered Certificates

| | | | | | | | | | | | | | | |

| Class | Expect Ratings (Fitch/KBRA/S&P)(1) | Approximate Initial

Certificate Balance or

Notional Amount(2)(3) | | Approximate Initial Credit Support(4) | | Pass-Through

Rate

Description(5) | | Expected

Weighted

Average Life

(Years)(6) | | Principal

Window

(Months)(6) | | Certificate Principal UW

NOI Debt

Yield(7) | | Certificate Principal to Value Ratio(8) |

| Class A-1 | AAA(sf)/AAA(sf)/AAA(sf) | $75,700,000 | | 30.000% | | Fixed | | 2.69 | | 1-59 | | 17.1% | | 40.0% |

| Class A-2 | AAA(sf)/AAA(sf)/AAA(sf) | $145,900,000 | | 30.000% | | Fixed | | 4.95 | | 59-60 | | 17.1% | | 40.0% |

| Class A-SB | AAA(sf)/AAA(sf)/AAA(sf) | $98,964,000 | | 30.000% | | Fixed | | 7.32 | | 60-116 | | 17.1% | | 40.0% |

| Class A-3 | AAA(sf)/AAA(sf)/AAA(sf) | $140,000,000 | | 30.000% | | Fixed | | 9.71 | | 116-117 | | 17.1% | | 40.0% |

| Class A-4 | AAA(sf)/AAA(sf)/AAA(sf) | $335,996,000 | | 30.000% | | Fixed | | 9.83 | | 117-119 | | 17.1% | | 40.0% |

| Class X-A | AAA(sf)/AAA(sf)/AAA(sf) | $904,665,000 | | NAP | | Variable(10) | | NAP | | NAP | | NAP | | NAP |

Class A-S(9) | AAA(sf)/AAA(sf)/AAA(sf) | $108,105,000 | | 20.500% | | (5) | | 9.90 | | 119-119 | | 15.1% | | 45.5% |

Class B(9) | AA-(sf)/AA-(sf)/AA-(sf) | $68,276,000 | | 14.500% | | (5) | | 9.92 | | 119-120 | | 14.0% | | 48.9% |

Class PST(9) | A-(sf)/A-(sf)/A-(sf) | $219,054,000 | | 10.750% | | (5) | | 9.98 | | 119-120 | | 13.4% | | 51.1% |

Class C(9) | A-(sf)/A-(sf)/A-(sf) | $42,673,000 | | 10.750% | | (5) | | 9.98 | | 120-120 | | 13.4% | | 51.1% |

Privately Offered Certificates(11)

| | | | | | | | | | | | | | | |

| Class | Expect Ratings (Fitch/KBRA/S&P)(1) | Approximate Initial Certificate Balance or Notional Amount(2)(3) | | Approximate Initial Credit Support(4) | | Pass-Through

Rate

Description(5) | | Expected

Weighted

Average Life

(Years)(6) | | Principal

Window

(Months)(6) | | Certificate

Principal UW

NOI Debt

Yield(7) | | Certificate Principal to Value Ratio(8) |

| Class X-B | AA-(sf)/AAA(sf)/AA-(sf) | $68,276,000 | | NAP | | Variable(10) | | NAP | | NAP | | NAP | | NAP |

| Class D | BBB-(sf)/BBB-(sf)/BBB-(sf) | $48,363,000 | | 6.500% | | (5) | | 9.98 | | 120-120 | | 12.8% | | 53.5% |

| Class E | BB(sf)/BB(sf)/BB(sf) | $19,914,000 | | 4.750% | | (5) | | 9.98 | | 120-120 | | 12.6% | | 54.5% |

| Class F | B(sf)/B+(sf)/BB-(sf) | $12,802,000 | | 3.625% | | (5) | | 9.98 | | 120-120 | | 12.5% | | 55.1% |

| Class G | NR/NR/B(sf) | $21,336,000 | | 1.750% | | (5) | | 9.98 | | 120-120 | | 12.2% | | 56.2% |

| Class H | NR/NR/NR | $19,914,694 | | 0.000% | | (5) | | 9.98 | | 120-120 | | 12.0% | | 57.2% |

| (1) | Ratings shown are those of Fitch, Inc., Kroll Bond Rating Agency, Inc. and Standard & Poor’s Ratings Services, a Standard & Poor’s Financial Services LLC Business. Certain nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, or otherwise to rate the certificates. There can be no assurance as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “RISK FACTORS—Risks Related to the Offered Certificates—Ratings of the Offered Certificates Do Not Represent Any Assessment of the Yield to Maturity That a Certificateholder May Experience and Such Ratings May Be Reviewed, Revised, Suspended, Downgraded, Qualified or Withdrawn By the Applicable Rating Agency” and “RATINGS” in the other free writing prospectus, dated January 29, 2013 (the “Free Writing Prospectus”) to which the prospectus dated January 29, 2013 (the “Prospectus”) is attached as Exhibit A. Capitalized terms used but not defined herein have the meanings assigned to such terms in the Free Writing Prospectus. |

| (2) | The certificate principal balances and notional amounts are approximate and on the closing date may vary by up to 5%. Mortgage loans may be removed from or added to the mortgage pool prior to the closing date within the same maximum permitted variance. Any reduction or increase in the aggregate principal balance of mortgage loans within these parameters will result in changes to the initial certificate principal balance or notional amount of each class of certificates and to the other statistical data contained herein and in the Free Writing Prospectus. |

| (3) | The Class X-A and Class X-B Certificates will not have certificate principal balances and will not be entitled to receive distributions of principal. Interest will accrue on the Class X-A and Class X-B Certificates at their respective pass-through rates based upon their respective notional amounts. The notional amount of the Class X-A Certificates will equal the aggregate certificate principal balance of the Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4 and Class A-S Certificates outstanding from time to time (without regard to any exchange of Class A-S, Class B and Class C Certificates for Class PST Certificates). The notional amount of the Class X-B Certificates will equal the certificate principal balance of the Class B Certificates outstanding from time to time (without regard to any exchange of Class A-S, Class B and Class C Certificates for Class PST Certificates). |

| (4) | The percentages indicated under the column “Approximate Initial Credit Support” with respect to the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 Certificates represent the approximate credit support for the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 Certificates in the aggregate. The percentage indicated under the column “Approximate Initial Credit Support” with respect to the Class C Certificates and the Class PST Certificates represents the approximate credit support for the Class C trust component which will have an initial outstanding certificate balance on the closing date of $42,673,000. |

| (5) | The Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4, Class A-S, Class B, Class C, Class D, Class E, Class F, Class G and Class H Certificates will, at all times, accrue interest at a per annum rate equal to (i) a fixed rate, (ii) a fixed rate subject to a cap equal to the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve (12) 30-day months) or (iii) a rate equal to the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve (12) 30-day months) less a specified percentage, which percentage may be zero. The Class PST Certificates will not have a pass-through rate, but will be entitled to receive the sum of the interest distributable on the Class PST Components. The pass-through rate for the Class A-S Certificates, the Class A-S trust component and the Class PST Component A-S will, at all times, be the same. The pass-through rate for the Class B Certificates, the Class B trust component and the Class PST Component B will, at all times, be the same. The pass-through rate for the Class C Certificates, the Class C trust component and the Class PST Component C will, at all times, be the same. |

| (6) | The principal window is expressed in months following the closing date and reflects the period during which distributions of principal would be received under the assumptions set forth in the following sentence. The expected weighted average life and principal window figures set forth above are based on the following assumptions, among others: (i) no defaults or subsequent losses on the mortgage loans; (ii) no extensions of maturity dates of mortgage loans that do not have “anticipated repayment dates”; (iii) payment in full on the stated maturity date or, in the case of each mortgage loan having an anticipated repayment date, on the anticipated repayment date; and (iv) no prepayments of the mortgage loans prior to maturity or, in the case of a mortgage loan having an anticipated repayment date, prior to such anticipated repayment date. See the structuring assumptions set forth under “YIELD, PREPAYMENT AND MATURITY CONSIDERATIONS—Weighted Average Life” in the Free Writing Prospectus. |

This is not a research report and was not prepared by the BofA Merrill Lynch or Morgan Stanley research departments. Please see additional important information and qualifications at the end of this Term Sheet. |

| MSBAM 2013-C8 | Issue Characteristics |

| (7) | Certificate Principal UW NOI Debt Yield for any class of principal balance certificates (other than the Exchangeable Certificates) is calculated as the product of (a) the weighted average UW NOI Debt Yield for the mortgage pool, multiplied by (b) a fraction, the numerator of which is the total initial principal balance of all the principal balance certificates (other than the Exchangeable Certificates) and the trust components, and the denominator of which is the total initial principal balance of the subject class of principal balance certificates and all other classes of principal balance certificates (other than the Exchangeable Certificates and the trust components), if any, that are senior to such class. The Certificate Principal UW NOI Debt Yields of the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 Certificates are calculated in the aggregate for those classes as if they were a single class. Certificate Principal UW NOI Debt Yield for the Class A-S, Class B and Class C Certificates is calculated as the product of (a) the weighted average UW NOI Debt Yield for the mortgage pool, multiplied by (b) a fraction, the numerator of which is the total initial principal balance of all the principal balance certificates (other than the Exchangeable Certificates) and the trust components, and the denominator of which is the total initial principal balance of the Class A-S trust component, the Class B trust component or the Class C trust component, as applicable, and all other classes of principal balance certificates (other than the Exchangeable Certificates) and the trust components that are senior to such class. The Certificate Principal UW NOI Debt Yield of the Class PST Certificates is equal to the Certificate Principal UW NOI Debt Yield for the Class C Certificates. |

| (8) | Certificate Principal to Value Ratio for any class of principal balance certificates (other than the Exchangeable Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio of the mortgage pool, multiplied by (b) a fraction, the numerator of which is the total initial principal balance of the subject class of principal balance certificates and all other classes of principal balance certificates (other than the Exchangeable Certificates) and the trust components, if any, that are senior to such class, and the denominator of which is the total initial principal balance of all the principal balance certificates (other than the Exchangeable Certificates) and the trust components. The Certificate Principal to Value Ratios of the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 Certificates are calculated in the aggregate for those classes as if they were a single class. Certificate Principal to Value Ratio for the Class A-S, Class B and Class C Certificates is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio of the mortgage pool, multiplied by (b) a fraction, the numerator of which is the total initial principal balance of the Class A-S trust component, the Class B trust component or the Class C trust component, as applicable, and all other classes of principal balance certificates (other than the Exchangeable Certificates) and the trust components that are senior to such class, and denominator of which is the total initial principal balance of all the principal balance certificates (other than the Exchangeable Certificates) and the trust components. The Certificate Principal to Value Ratio of the Class PST Certificates is equal to the Certificate Principal to Value Ratio of the Class C Certificates. |

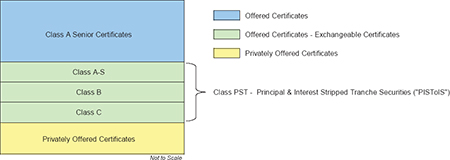

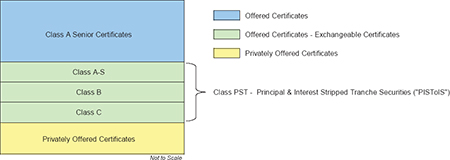

| (9) | The Class A-S, Class B, Class PST and Class C Certificates are “Exchangeable Certificates”. On the closing date, the upper-tier REMIC of the issuing entity will issue the Class A-S, Class B and Class C trust components (each a “trust component”) which will have outstanding principal balances on the closing dates of $108,105,000, $68,276,000 and $42,673,000, respectively. The trust components will be held in a grantor trust for the benefit of the holders of the Class A-S, Class B, Class PST and Class C Certificates. The Class A-S, Class B, Class PST and Class C Certificates will, at all times, represent undivided beneficial ownership interests in a grantor trust that will hold those trust components. Each class of the Class A-S, Class B and Class C Certificates will, at all times, represent an undivided beneficial ownership interest in a percentage of the outstanding certificate principal balance of the trust component with the same alphabetical class designation. The Class PST Certificates will, at all times, represent an undivided beneficial ownership interest in the remaining percentages of the outstanding certificate principal balances of the Class A-S, Class B and Class C trust components and which portions of those trust components are referred to in this Term Sheet as the Class PST Component A-S, Class PST Component B and Class PST Component C (collectively, the “Class PST Components”). Following any exchange of Class A-S, Class B and Class C Certificates for Class PST Certificates or any exchange of Class PST Certificates for Class A-S, Class B and Class C Certificates as described in the Free Writing Prospectus, the percentage interest of the outstanding certificate principal balances of the Class A-S, Class B and Class C trust component that is represented by the Class A-S, Class B, Class PST and Class C Certificates will be increased or decreased accordingly. The initial certificate principal balance of each of the Class A-S, Class B and Class C Certificates shown in the table represents the maximum certificate principal balance of such class without giving effect to any exchange. The initial certificate principal balance of the Class PST Certificates is equal to the aggregate of the initial certificate principal balance of the Class A-S, Class B and Class C Certificates and represents the maximum certificate principal balance of the Class PST Certificates that could be issued in an exchange. The certificate principal balances of the Class A-S, Class B and Class C Certificates to be issued on the closing date will be reduced, in required proportions, by an amount equal to the certificate principal balance of the Class PST Certificates issued on the closing date. Distributions and allocations of payments and losses with respect to the Exchangeable Certificates are described in this Term Sheet under “Allocations and Distributions on the Class A-S, Class B, Class PST and Class C Certificates” and under “DESCRIPTION OF THE OFFERED CERTIFICATES—Distributions” in the Free Writing Prospectus. The maximum certificate principal balance of the Class PST Certificates is set forth in the table but is not included in the certificate principal balance of the certificates set forth on the cover page of this Term Sheet or on the top of the cover page of the Free Writing Prospectus. |

| (10) | The pass-through rate on the Class X-A Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve (12) 30-day months), over (b) the weighted average of the pass-through rates of the Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4 and Class A-S Certificates (without regard to any exchange of Class A-S, Class B and Class C Certificates for Class PST Certificates) as described in the Free Writing Prospectus. The pass-through rate on the Class X-B Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve (12) 30-day months), over (b) the pass-through rate of the Class B Certificates (without regard to any exchange of Class A-S, Class B and Class C Certificates for Class PST Certificates) as described in the Free Writing Prospectus. |

| (11) | Not offered pursuant to the Prospectus, the Free Writing Prospectus or this Term Sheet. Information provided in this Term Sheet regarding the characteristics of these certificates is provided only to enhance your understanding of the offered certificates. The privately offered certificates also include the Class R Certificates, which do not have a certificate principal balance, notional amount, pass-through rate, rating or rated final distribution date, and which are not shown in the chart. |

This is not a research report and was not prepared by the BofA Merrill Lynch or Morgan Stanley research departments. Please see additional important information and qualifications at the end of this Term Sheet. |

| MSBAM 2013-C8 | Issue Characteristics |

Issue Characteristics

| Offered Certificates: | $1,015,614,000 (approximate) monthly pay, multi-class, commercial mortgage pass-through certificates, consisting of nine principal balance classes (Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4, Class A-S, Class B, Class PST and Class C Certificates) and one interest only class (Class X-A Certificates), offered pursuant to a registration statement filed with the SEC (File Number 333-177707) |

| | |

| Co-Lead Bookrunning Managers: | Merrill Lynch, Pierce, Fenner & Smith Incorporated and Morgan Stanley & Co. LLC |

| | |

| Mortgage Loan Sellers: | Bank of America, National Association and Morgan Stanley Mortgage Capital Holdings LLC |

| | |

| Rating Agencies: | Fitch, Inc., Kroll Bond Rating Agency, Inc. and Standard & Poor’s Ratings Services, a Standard & Poor’s Financial Services LLC business |

| | |

| Master Servicer: | Wells Fargo Bank, National Association |

| | |

| Special Servicer: | NS Servicing II LLC |

| | |

| Trustee: | U.S. Bank National Association |

| | |

Certificate Administrator/ Certificate

Registrar/ Custodian: | Wells Fargo Bank, National Association |

| | |

| Trust Advisor: | Situs Holdings, LLC |

| | |

| Initial Controlling Class Representative: | Northstar Realty Finance Corp. |

| | |

| Cut-off Date: | February 1, 2013. For purposes of the information contained in this term sheet (this “Term Sheet”), scheduled payments due in February 2013 with respect to mortgage loans not having payment dates on the first day of each month have been deemed received on February 1, 2013, not the actual day on which such scheduled payments were due. |

| | |

| Expected Pricing Date: | Week of February 1, 2013 |

| | |

| Expected Closing Date: | On or about February 21, 2013 |

| | |

| Determination Dates: | The 11th calendar day of each month (if the 11th calendar day is not a business day, the next succeeding business day), commencing in March 2013 |

| | |

| Distribution Dates: | The 4th business day following the Determination Date in each month, commencing in March 2013 |

| | |

| Rated Final Distribution Date: | The Distribution Date in December 2048 |

| | |

| Interest Accrual Period: | Preceding calendar month |

| | |

| Payment Structure: | Sequential pay |

| | |

| Tax Treatment: | REMIC, except that the Class A-S, Class B, Class PST and Class C Certificates will evidence an interest in a grantor trust |

| | |

| Optional Termination: | 1.00% clean-up call |

| | |

| Minimum Denominations: | $10,000 for each class of Offered Certificates (other than Class X-A) and integral multiples of $1 in excess of $10,000. The Class X-A Certificates will be initially offered and sold in minimum denominations of $100,000 and integral multiples of $1 in excess of $100,000 |

| | |

| Settlement Terms: | DTC, Euroclear and Clearstream |

| | |

| Legal/Regulatory Status: | Each Class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No class of certificates is SMMEA eligible. |

| | |

| Analytics: | The certificate administrator is expected to make available all distribution date statements, CREFC reports and supplemental notices received by it to certain modeling financial services (i.e., BlackRock Financial Management, Inc., Bloomberg, L.P., Intex Solutions, Inc., Markit, CMBS.com, Inc. and Trepp, LLC). |

| | |

| Bloomberg Ticker: | MSBAM 2013-C8 <MTGE><GO> |

| | |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE FREE WRITING PROSPECTUS AND THE “RISK FACTORS” SECTION OF THE PROSPECTUS. |

This is not a research report and was not prepared by the BofA Merrill Lynch or Morgan Stanley research departments. Please see additional important information and qualifications at the end of this Term Sheet. |

| MSBAM 2013-C8 | Structural Overview |

Structural Overview

| Accrual: | Each class of Offered Certificates will accrue interest on a 30/360 basis. |

| | |

Amount and Order of

Distributions: | On each distribution date, certificateholders will be entitled to receive distributions of interest and principal from funds received with respect to the mortgage loans and available for distribution. Funds available for distribution on the certificates will be net of excess interest, excess liquidation proceeds and specified trust expenses, including all advance reimbursements (with interest) and all servicing fees and expenses, certificate administrator fees (including trustee fees and custodian fees) and expenses, and trust advisor fees and expenses as set forth below. Distributions to certificateholders on each distribution date will be in an amount equal to the interest and principal entitlement of each class, subject to: (i) payment of the respective interest entitlement for any other class of certificates bearing an earlier alphanumeric designation (except (x) in respect of the distribution of interest among the Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4, Class X-A and Class X-B Certificates, which will have the same senior priority and be distributed pro rata and (y) in respect of the distribution of interest among the Class A-S, Class B, Class PST and Class C Certificates as described below under “Allocations and Distributions on the Class A-S, Class B, Class PST and Class C Certificates”); (ii) if applicable, payment of the respective principal entitlement for the distribution date to the outstanding classes of principal balance certificate, first, to the Class A-SB Certificates, until the principal balance of such class has been reduced to the planned principal balance for the related distribution date set forth on Appendix VII to the Free Writing Prospectus, then, to the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates, in that order, until the principal balance of each such class has been reduced to zero (and, if the principal balance of each class of principal balance certificates other than the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 Certificates has been reduced to zero as a result of the allocation of mortgage loan losses or trust advisor expenses to those certificates, or if the aggregate appraisal reduction equals or exceeds the aggregate principal balance of the Class A-S through Class H Certificates (including the Class PST Certificates), then on a pro rata basis among the holders of the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 Certificates), then, to the Class A-S, Class B, Class PST and Class C Certificates as described below under “Allocations and Distributions on the Class A-S, Class B, Class PST and Class C Certificates” until the principal balance of each such class has been reduced to zero, and then to the Class D, Class E, Class F, Class G and Class H Certificates, in that order, until the principal balance of each such class has been reduced to zero; and (iii) the allocation of trust advisor expenses, (a) first, to reduce payments of interest on the Class D Certificates, the Class C trust component and the Class B trust component in that order, (b) second, to reduce payments of principal on the Class D Certificates, the Class C trust component, the Class B trust component and the Class A-S trust component in that order, and (c) third, to reduce payments of principal on the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 Certificates on a pro rata basis. No trust advisor expenses (other than the trust advisor fee) will be allocated to or otherwise borne by the Control Eligible Certificates. As a result, none of the classes of Control Eligible Certificates will provide protection to the more senior classes of certificates for the purposes of allocating losses based on trust advisor expenses. Trust advisor expenses allocated to the Class A-S trust component, the Class B trust component and the Class C trust component will be allocated to the Class A-S, Class B, Class PST and Class C Certificates as described below under “Allocations and Distributions on the Class A-S, Class B, Class PST and Class C Certificates”. |

| | |

Interest and Principal

Entitlements: | Interest distributable on any class of certificates (other than the Exchangeable Certificates and the Class R Certificates) or trust component on any distribution date, with various adjustments described under “DESCRIPTION OF THE OFFERED CERTIFICATES—Distributions” in the Free Writing Prospectus, represents all unpaid interest accrued with respect to that class of certificates or trust component through the end of the interest accrual period that corresponds to that distribution date. Interest accrues with respect to the interest-bearing certificates and the trust components (and correspondingly on the Exchangeable Certificates) on the basis of a 360-day year consisting of twelve (12) 30-day months. Interest accrues with respect to each interest-bearing certificate and each trust component during each interest accrual period at the applicable pass-through rate for, and on the principal balance or notional amount, as applicable, of that certificate or trust component outstanding immediately prior to, the distribution date that corresponds to that interest accrual period. However, as described in “DESCRIPTION OF THE OFFERED CERTIFICATES—Distributions” in the Free Writing Prospectus, there are circumstances relating to the timing of prepayments in which the interest entitlement with respect to any certificate or trust component for a distribution date could be less than one full month’s interest at the pass-through rate on the certificate’s or trust component’s principal balance or notional amount. In addition, the right of the master servicer, the special servicer and the trustee to reimbursement for payment of advances (with interest thereon), and the rights of such parties and of the certificate administrator, the custodian and, subject to certain limitations, the trust advisor to the payments of compensation and reimbursement of certain costs and expenses will be prior to a certificateholder’s right to receive distributions of principal or interest. In addition, the right of the trust advisor to receive reimbursement of trust advisor expenses will be prior to the right of the holders of the Class B, Class PST, Class C and Class D Certificates to receive payments of interest, and to the holders of the Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4, Class A-S, Class B, Class PST, Class C, Class D and Class E Certificates to receive payments of principal. The amount of principal available to be distributed on the classes entitled to principal on a particular |

This is not a research report and was not prepared by the BofA Merrill Lynch or Morgan Stanley research departments. Please see additional important information and qualifications at the end of this Term Sheet. |

| MSBAM 2013-C8 | Structural Overview |

| | distribution date will, in general, be equal to the sum of: (i) the principal portion of all scheduled payments, other than balloon payments, to the extent received during the related collection period or advanced by the master servicer or other party (in accordance with the pooling and servicing agreement) in respect of such distribution date; (ii) all principal prepayments and the principal portion of balloon payments received during the related collection period; (iii) the principal portion of other collections on the mortgage loans received during the related collection period, for example liquidation proceeds, condemnation proceeds, insurance proceeds and income on other “real estate owned” (“REO”); and (iv) the principal portion of proceeds of mortgage loan repurchases received during the related collection period; subject, to certain adjustments described in the Free Writing Prospectus relating to the payment or reimbursement of nonrecoverable advances, workout-delayed reimbursement amounts and trust advisor expenses, and exclusive of any late collections of principal received during the related collection period for which there is an outstanding advance. The Class R, Class X-A and Class X-B Certificates will not be entitled to principal distributions. |

| | |

Allocations and Distributions on

the Class A-S, Class B, Class PST

and Class C Certificates: | On the closing date, the upper-tier REMIC of the issuing entity will issue the Class A-S, Class B and Class C trust components (each a “trust component”) which will have outstanding principal balances on the closing date of $108,105,000, $68,276,000 and $42,673,000, respectively. The trust components will be held in a grantor trust for the benefit of the holders of the Class A-S, Class B, Class PST and Class C Certificates. The Class A-S, Class B, Class PST and Class C Certificates will, at all times, represent undivided beneficial ownership interests in a grantor trust that will hold those trust components. Each class of the Class A-S, Class B and Class C Certificates will, at all times, represent an undivided beneficial ownership interest in a percentage of the outstanding principal balance of the trust component with the same alphabetical class designation. The Class PST Certificates will, at all times, represent an undivided beneficial ownership interest in the remaining percentages of the outstanding principal balances of the Class A-S, Class B and Class C trust components and which percentage interests are referred to in this Term Sheet as the “Class PST Component A-S, Class PST Component B and Class PST Component C” (collectively, the “Class PST Components”). Interest, principal, prepayment premiums, yield maintenance charges and voting rights that are allocated to the Class A-S, Class B or Class C trust component will be distributed or allocated, as applicable, as between the Class A-S, Class B or Class C Certificates, as applicable, on the one hand, and Class PST Component A-S, Class PST Component B or Class PST Component C, as applicable (and correspondingly, the Class PST Certificates), on the other hand, pro rata, based on their respective percentage interests in the Class A-S, Class B or Class C trust component, as applicable. In addition, any losses (including, without limitation, as a result of trust advisor expenses) or collateral support deficit that are allocated to the Class A-S, Class B or Class C trust component will correspondingly be allocated as between the Class A-S, Class B or Class C Certificates, as applicable, on the one hand, and Class PST Component A-S, Class PST Component B or Class PST Component C, as applicable (and correspondingly, the Class PST Certificates), on the other hand, pro rata, based on their respective percentage interests in the Class A-S, Class B or Class C trust component, as applicable. For a complete description of the allocations and distributions with respect to the Class A-S trust component, the Class B trust component and the Class C trust component (and correspondingly the Class A-S, Class B, Class PST and Class C Certificates and the Class PST Component A-S, Class PST Component B and Class PST Component C), see “DESCRIPTION OF THE OFFERED CERTIFICATES” in the Free Writing Prospectus. See “MATERIAL FEDERAL INCOME TAX CONSEQUENCES” in the Free Writing Prospectus for a discussion of the tax treatment of the Exchangeable Certificates. |

| | |

| Exchanging Certificates through Combination and Recombination: | If you own Class A-S, Class B and Class C Certificates, you will be able to exchange them for a proportionate interest in the Class PST Certificates, and vice versa, as described in the Free Writing Prospectus. You can exchange your Exchangeable Certificates by notifying the certificate administrator. If Exchangeable Certificates are outstanding and held by certificateholders, those certificates will receive principal and interest that would otherwise have been payable on the same proportion of certificates exchanged therefor if those certificates were outstanding and held by certificateholders. Any such allocations of principal and interest as between classes of Exchangeable Certificates will have no effect on the principal or interest entitlements of any other class of certificates. The Free Writing Prospectus describes the available combinations of Exchangeable Certificates eligible for exchange. |

| | |

Servicing and Administration

Fees: | The master servicer and special servicer are entitled to a master servicing fee and a special servicing fee, respectively, payable from general collections on the mortgage loans. The master servicing fee for each distribution date is calculated based on the outstanding principal balance of each mortgage loan and REO mortgage loan at the master servicing fee rate, which will be 0.02% per annum for each mortgage loan (other than any non-serviced mortgage loan for which the master servicing fee rate will be 0.01% per annum). The special servicing fee for each distribution date is calculated based on the outstanding principal balance of each mortgage loan that is a specially serviced mortgage loan or as to which the related mortgaged property has become an REO property at the special servicing fee rate, which will be approximately 0.25% per annum. Any primary servicing fee or sub-servicing fee will be paid by the master servicer or special servicer, as applicable, out of the fees described above. The master servicer and special servicer are also entitled to additional fees and amounts, including, without limitation, income on the amounts held in permitted investments. The special servicer will also be entitled to (i) liquidation fees generally equal to 1.0% of liquidation proceeds in respect of a specially serviced mortgage loan or REO property and (ii) workout fees generally equal to 1.0% of interest and principal payments made in respect of a rehabilitated mortgage loan, subject to a cap with respect to each such fee of $1,000,000 with respect to any mortgage loan or REO property and subject to certain adjustments and exceptions as described in the Free Writing Prospectus under “SERVICING OF THE MORTGAGE LOANS—The Special Servicer—Special Servicer Compensation”. The trust advisor will be entitled to the trust advisor fee for each distribution date, calculated based on the outstanding principal balance of each mortgage loan (other than any non-serviced mortgage loan) at the trust |

This is not a research report and was not prepared by the BofA Merrill Lynch or Morgan Stanley research departments. Please see additional important information and qualifications at the end of this Term Sheet. |

| MSBAM 2013-C8 | Structural Overview |

| | advisor fee rate, which will equal 0.00125% per annum. The certificate administrator fee for each distribution date is calculated on the outstanding principal balance of each mortgage loan at the certificate administrator fee rate, which will equal 0.0039% per annum. The certificate administrator fee is payable out of general collections on the mortgage loans. Each of the trustee fee and custodian fee for each distribution date is a portion of the certificate administrator fee. Each of the master servicing fee, the special servicing fee, the trust advisor fee and the certificate administrator fee will be calculated on the same interest accrual basis as is interest on the related mortgage loan and will be prorated for any partial period. The administrative fee rate will be the sum of the master servicing fee rate, the trust advisor fee rate and the certificate administrator fee rate, and is set forth for each mortgage loan on Appendix I to the Free Writing Prospectus. |

| Prepayment Premiums/Yield Maintenance Charges: | On any distribution date, prepayment premiums or yield maintenance charges collected in respect of each mortgage loan during the related collection period will be distributed by the certificate administrator on the classes of certificates or trust components as follows: to each class of principal balance certificates (other than the Class E, Class F, Class G and Class H Certificates) and, without duplication, the trust components then entitled to distributions of principal on such distribution date, an amount equal to the product of (a) a fraction, the numerator of which is the amount distributed as principal to that class or trust component on that distribution date, and the denominator of which is the total amount distributed as principal to all classes of principal balance certificates and, without duplication, trust components on that distribution date, (b) the Base Interest Fraction for the related principal prepayment and that class or trust component and (c) the amount of the prepayment premium or yield maintenance charge collected in respect of such principal prepayment during the one month period ending on the related determination date. Any prepayment premiums or yield maintenance charges relating to the mortgage loans collected during the related collection period and remaining after those distributions described above (as to the applicable distribution date, the “Class X YM Distribution Amount”) will be distributed to the holders of the Class X Certificates, as follows: first, to holders of the Class X-A Certificates in an amount equal to the product of (a) a fraction, the numerator of which is the total amount of principal distributed with respect to the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 Certificates and the Class A-S trust component on the applicable distribution date, and the denominator of which is the total principal distributed with respect to the principal balance certificates on the applicable distribution date, multiplied by (b) the Class X YM Distribution Amount for the applicable distribution date; and second, to the holders of the Class X-B Certificates in an amount equal to the portion of the Class X YM Distribution Amount remaining after the distributions to the holders of the Class X-A Certificates. Distributions of prepayment premiums and yield maintenance charges made on the Class A-S trust component, the Class B trust component and the Class C trust component will be distributed to the Class A-S, Class B and Class C Certificates and the Class PST Components (and correspondingly the Class PST Certificates) as described above in “Allocations and Distributions on the Class A-S, Class B, Class PST and Class C Certificates”. No prepayment premiums or yield maintenance charges will be distributed to holders of the Class E, Class F, Class G or Class H Certificates or the Class R Certificates. The “Base Interest Fraction”, with respect to any principal prepayment of any mortgage loan that provides for payment of a prepayment premium or yield maintenance charge, and with respect to any class of principal balance certificates (other than the Exchangeable Certificates) or trust component, is a fraction (A) whose numerator is the greater of (x) zero and (y) the difference between (i) the pass-through rate on that class of certificates or trust component, as applicable, and (ii) the applicable discount rate and (B) whose denominator is the difference between (i) the mortgage interest rate on the related mortgage loan and (ii) the applicable discount rate; provided, that under no circumstances will the Base Interest Fraction be greater than one. If the discount rate referred to above is greater than or equal to the mortgage interest rate on the related mortgage loan, then the Base Interest Fraction will equal zero; provided, however, that if the discount rate referred to above is greater than or equal to the mortgage interest rate on the related mortgage loan, but is less than the pass-through rate on the subject class of certificates or trust component, then the Base Interest Fraction will be equal to 1.0. Consistent with the foregoing, the Base Interest Fraction is equal to: |

| | | (Pass-Through Rate – Discount Rate) | |

| | | (Mortgage Rate – Discount Rate) | |

| Servicing Advances: | Other than with regard to any non-serviced mortgage loan and subject to a recoverability determination described in the Free Writing Prospectus, the master servicer and/or the trustee may make servicing advances to pay delinquent real estate taxes, insurance premiums and similar expenses necessary to protect, lease, manage and maintain the mortgaged property, to maintain the lien on the mortgaged property or to enforce the mortgage loan documents. In addition, the special servicer may, but is not required to, make servicing advances on an emergency basis. |

| | |

Collateral Support Deficits: | On each distribution date, immediately following the distributions made to the certificateholders on that date, the certificate administrator will be required to calculate the amount, if any, by which (1) the aggregate stated principal balance of the mortgage loans, including any mortgage loans as to which the related mortgaged properties have become REO properties, expected to be outstanding immediately following that distribution date, is less than (2) the aggregate principal balance of the principal balance certificates after giving effect to distributions of principal on that distribution date and the allocation of any excess trust advisor expenses to reduce the principal balances of the principal balance certificates that are not Control Eligible Certificates on that distribution date (any such deficit, a “Collateral Support Deficit”). On each distribution date, the certificate administrator will be required to allocate any Collateral Support Deficit |

This is not a research report and was not prepared by the BofA Merrill Lynch or Morgan Stanley research departments. Please see additional important information and qualifications at the end of this Term Sheet. |

| MSBAM 2013-C8 | Structural Overview |

| | to the respective classes of principal balance certificates (other than the Exchangeable Certificates) and trust components in the following order: to the Class H Certificates, the Class G Certificates, the Class F Certificates, the Class E Certificates, the Class D Certificates, the Class C trust component, the Class B trust component, and the Class A-S trust component, in that order, in each case in respect of and until the remaining principal balance of that class of certificates or trust components has been reduced to zero. Following the reduction of the principal balances of all such classes of subordinate certificates to zero, the certificate administrator will be required to allocate the Collateral Support Deficit to the Class A-1, Class A-2, Class A-SB, Class A-3 and Class A-4 Certificates, pro rata (based upon their respective principal balances), until the remaining principal balances of those classes of certificates have been reduced to zero. Any Collateral Support Deficit allocated to a class of certificates will be allocated to the respective certificates of such class in proportion to the Percentage Interests evidenced by the respective certificates. Any Collateral Support Deficit allocated to the Class A-S, Class B and Class C trust components will, in turn, be allocated to the Class A-S, Class B, Class PST and Class C Certificates as described above in “Allocations and Distributions on the Class A-S, Class B, Class PST and Class C Certificates”. |

| | |

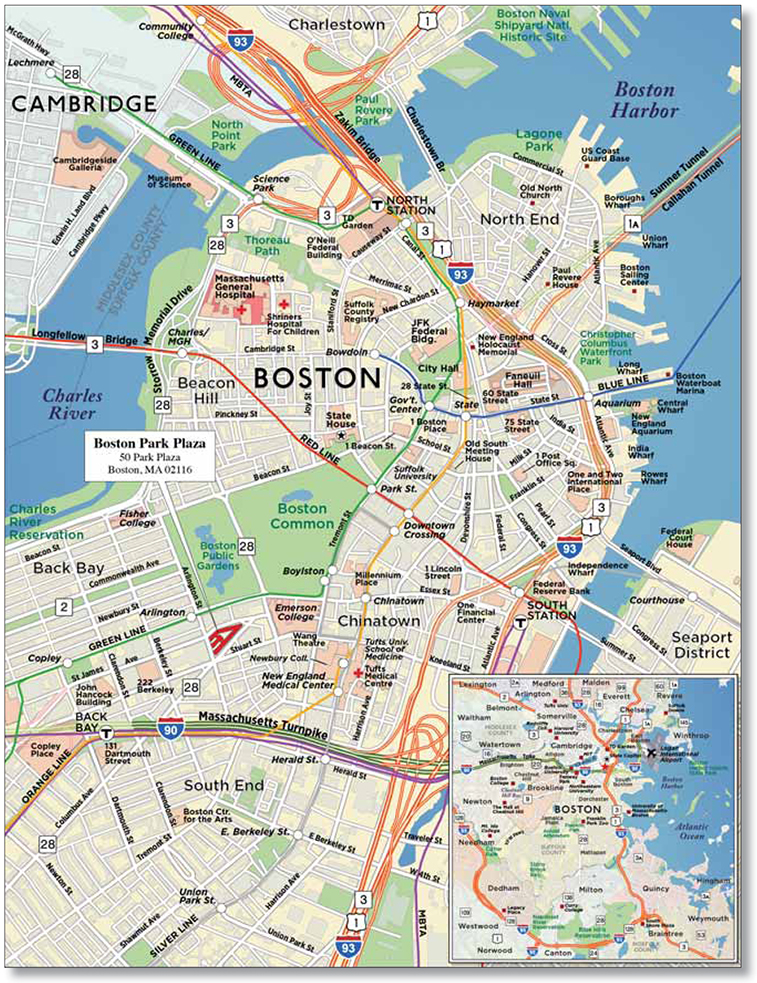

| Appraisal Reductions: | The occurrence of certain adverse events affecting a mortgage loan (other than any non-serviced mortgage loan) (“Appraisal Events”) will require the special servicer to obtain a new appraisal or other valuation of the related mortgaged property. In general, if the principal amount of a mortgage loan plus all other amounts due under the mortgage loan and interest on advances made with respect to the mortgage loan exceeds 90% of the value of the mortgaged property determined by an appraisal or other valuation, an appraisal reduction may be created in the amount of the excess as described in the Free Writing Prospectus. Notwithstanding the foregoing, if an appraisal is required to be obtained in accordance with the pooling and servicing agreement but is not obtained within one hundred twenty (120) days following the applicable Appraisal Event, then, until such appraisal is obtained and solely for purposes of determining the amounts of P&I advances, the appraisal reduction will equal 25% of the stated principal balance of the related mortgage loan; provided that, upon receipt of an appraisal, the appraisal reduction for such mortgage loan will be recalculated generally in accordance with the preceding sentence. Notwithstanding the foregoing, any appraisal reduction in respect of any non-serviced mortgage loan generally will be calculated in accordance with the related non-serviced mortgage loan pooling and servicing agreement, which calculations are generally similar to those provided for in the pooling and servicing agreement for this transaction. The non-serviced mortgage loan included in this pool is the Chrysler East Building Mortgage Loan. If an appraisal reduction exists for any mortgage loan, the interest portion of the amount required to be advanced on that mortgage loan will be reduced in the same proportion that the appraisal reduction bears to the stated principal balance of that mortgage loan. This will reduce the funds available to pay interest on the certificates or trust components, as applicable, then outstanding. If any mortgage loan is part of an A/B whole loan or loan pair, any appraisal reduction will be calculated in respect of such A/B whole loan or loan pair taken as a whole. With respect to an A/B whole loan, any such appraisal reduction will be allocated first to the related B note and then to the related A note. With respect to a loan pair, any such appraisal reduction will be allocated between the mortgage loan and the related companion loan on a pro rata basis by unpaid principal balance. There are no mortgage loans that are part of an A/B whole loan included in this mortgage pool. The loan pair related to this mortgage pool is the Boston Park Plaza Loan Pair. For a discussion of how Appraisal Reductions are calculated and allocated, see “DESCRIPTION OF THE OFFERED CERTIFICATES—Appraisal Reductions” in the Free Writing Prospectus. |

| | |

| Loan Pairs: | The mortgaged property identified on Appendix I to the Free Writing Prospectus as Boston Park Plaza secures a mortgage loan (the “Boston Park Plaza Mortgage Loan”) with an outstanding principal balance as of the Cut–off Date of $95,000,000, representing approximately 8.3% of the initial pool balance, and is secured on a pari passu basis with a serviced companion loan that has an outstanding principal balance as of the Cut-off Date of $25,000,000 and is not part of the mortgage pool and is currently held by Bank of America, National Association. The Boston Park Plaza Mortgage Loan and the related serviced companion loan are pari passu in right of payment and collectively are referred to herein as the “Boston Park Plaza Loan Pair”. The Boston Park Plaza serviced companion loan may be sold or further divided at any time (subject to compliance with the terms of the related intercreditor agreement). The Boston Park Plaza Loan Pair will be serviced pursuant to the pooling and servicing agreement related to this transaction and the related intercreditor agreement. For additional information regarding the Boston Park Plaza Loan Pair, see “DESCRIPTION OF THE MORTGAGE POOL—The A/B Whole Loans and the Loan Pairs—The Boston Park Plaza Loan Pair” in the Free Writing Prospectus. |

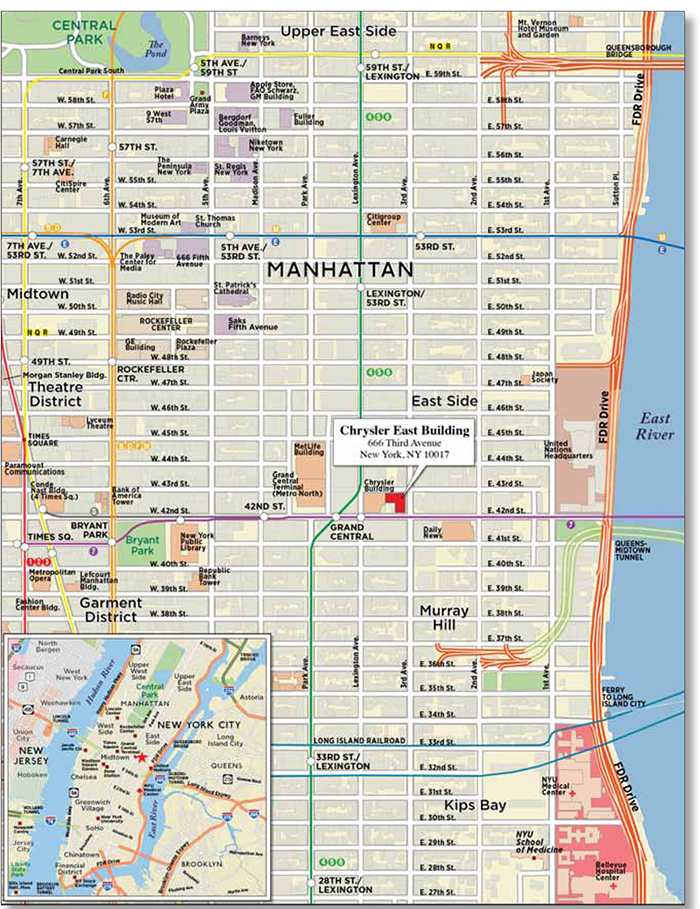

| Non-Serviced Mortgage Loans: | The mortgaged property identified on APPENDIX I to the Free Writing Prospectus as the Chrysler East Building secures a mortgage loan (the “Chrysler East Building Mortgage Loan”) with an outstanding principal balance as of the Cut–off Date of $100,000,000, representing approximately 8.8% of the initial pool balance, and is secured on a pari passu basis with another mortgage loan (the “Chrysler East Building Non-Serviced Companion Loan”) that has an aggregate outstanding principal balance as of the Cut-off Date of $165,000,000 and is not part of the mortgage pool and is currently held by the Morgan Stanley Bank of America Merrill Lynch Trust 2013-C7. The Chrysler East Building Mortgage Loan and the Chrysler East Building Non-Serviced Companion Loan are pari passu in right of payment. The Chrysler East Building Mortgage Loan is a “non-serviced mortgage loan” and the Chrysler East Building Non-Serviced Companion Loan is a “non-serviced companion loan”. The Chrysler East Building Mortgage Loan and the Chrysler East Building Non-Serviced Companion Loan are currently being serviced pursuant to the pooling and servicing agreement related to the Morgan Stanley Bank |

This is not a research report and was not prepared by the BofA Merrill Lynch or Morgan Stanley research departments. Please see additional important information and qualifications at the end of this Term Sheet. |

| MSBAM 2013-C8 | Structural Overview |

| | of America Merrill Lynch Trust 2013-C7 and the related intercreditor agreement. For additional information regarding the Chrysler East Building Mortgage Loan and the Chrysler East Building Non-Serviced Companion Loan, see “DESCRIPTION OF THE MORTGAGE POOL—Non-Serviced Mortgage Loans—The Chrysler East Building Mortgage Loan” in the Free Writing Prospectus. |

| | |

| Control Rights: | Subject to the limitations described below under “A/B Whole Loan, Loan Pair and Non-Serviced Mortgage Loan Control Rights” in respect of any A/B whole loans, loan pairs or non-serviced mortgage loans, during any Subordinate Control Period, the controlling class representative will have certain consent and consultation rights under the pooling and servicing agreement with respect to certain major decisions and other matters (including with respect to the Boston Park Plaza Loan Pair) but not with respect to the Chrysler East Building Mortgage Loan and the Chrysler East Building Non-Serviced Companion Loan. A “Subordinate Control Period” means any period when the aggregate principal balance of the Class E Certificates (taking into account the application of appraisal reductions to notionally reduce the aggregate principal balance of such class) is at least 25% of the initial aggregate principal balance of that class. During any Collective Consultation Period, the controlling class representative will not have any consent rights, but the controlling class representative and the trust advisor will each have certain non-binding consultation rights under the pooling and servicing agreement with respect to certain major decisions and other matters. A “Collective Consultation Period” means any period when both (i) the aggregate principal balance of the Class E Certificates (taking into account the application of appraisal reductions to notionally reduce the aggregate principal balance of such class), is less than 25% of the initial aggregate principal balance of the Class E Certificates and (ii) the aggregate principal balance of that class (without regard to any appraisal reductions allocable to such class), is at least 25% of the initial aggregate principal balance of that class. During any Senior Consultation Period, the controlling class representative will not have any consent or consultation rights, except with respect to any rights expressly set forth in the pooling and servicing agreement, and the trust advisor will retain certain non-binding consultation rights under the pooling and servicing agreement with respect to certain major decisions and other matters. A “Senior Consultation Period” means a period when the aggregate principal balance of the Class E Certificates (without regard to any appraisal reductions allocable to such class) is less than 25% of the initial aggregate principal balance of that class. See “SERVICING OF THE MORTGAGE LOANS—The Controlling Class Representative” in the Free Writing Prospectus. |

A/B Whole Loan, Loan Pair and

Non-Serviced Mortgage Loan

Control Rights: | If any mortgage loan is part of an A/B whole loan or loan pair or is a non-serviced mortgage loan, the controlling class representative’s consent and/or consultation rights with respect thereto may be limited as described in the Free Writing Prospectus. There are no mortgage loans that are part of an A/B whole loan included in the mortgage pool. The controlling class representative under the pooling and servicing agreement related to the Morgan Stanley Bank of America Merrill Lynch Trust 2013-C7 will be the controlling holder of The Chrysler East Building Mortgage Loan and The Chrysler East Building Non-Serviced Companion Loan and, subject to the terms of that pooling and servicing agreement, will generally have consent rights with respect to certain major decisions and other matters related to The Chrysler East Building Mortgage Loan and The Chrysler East Building Non-Serviced Companion Loan. The controlling class representative under the pooling and servicing agreement for this transaction will only have certain consultation rights with respect to certain major decisions and other matters related to The Chrysler East Building Mortgage Loan and The Chrysler East Building Non-Serviced Companion Loan. The holder of the Boston Park Plaza serviced companion loan will have certain consultation rights under the pooling and servicing agreement with respect to certain major decisions and other matters related to the Boston Park Plaza Loan Pair. See “RISK FACTORS—Realization on a Mortgage Loan That Is Part of an A/B Whole Loan or Loan Pair May Be Adversely Affected by the Rights of the Related Directing Holder”, “DESCRIPTION OF THE MORTGAGE POOL —The A/B Whole Loans and the Loan Pairs” and “DESCRIPTION OF THE MORTGAGE POOL —Non-Serviced Mortgage Loans” in the Free Writing Prospectus. |

| Control Eligible Certificates: | The “Control Eligible Certificates” will be the Class E, Class F, Class G and Class H Certificates. |

| | |

| Controlling Class Representative/ Controlling Class: | The controlling class representative will be the representative appointed by more than 50% of the Controlling Class (by principal balance). The “Controlling Class” will be the most subordinate class of Control Eligible Certificates then outstanding that has an aggregate principal balance (taking into account the application of any appraisal reductions to notionally reduce the aggregate principal balance of such class) at least equal to 25% of the initial aggregate principal balance of such class; provided that if no class of Control Eligible Certificates has an aggregate principal balance (taking into account the application of any appraisal reductions to notionally reduce the aggregate principal balance of such class) at least equal to 25% of the initial aggregate principal balance of such class, then the Controlling Class will be the most senior class of Control Eligible Certificates. A summary of the consent and consultation rights of the controlling class representative, and the limitations thereon, is set forth above under “Control Rights”. The Controlling Class on the closing date will be the Class H Certificates. The initial controlling class representative will be Northstar Realty Finance Corp. |

| | |

| Appraised-Out Class: | Any class of Control Eligible Certificates, the aggregate principal balance of which (taking into account the application of any appraisal reductions to notionally reduce the aggregate principal balance of such class) has been reduced to less than 25% of its initial aggregate principal balance, is referred to as an “Appraised-Out |

This is not a research report and was not prepared by the BofA Merrill Lynch or Morgan Stanley research departments. Please see additional important information and qualifications at the end of this Term Sheet. |

| MSBAM 2013-C8 | Structural Overview |

| | Class”. |

| | |

| Appraisal Remedy: | The holders of the majority (by principal balance) of an Appraised-Out Class will have the right, at their sole expense, to present to the special servicer a second appraisal for any mortgage loan (generally other than with respect to any non-serviced mortgage loan) for which an Appraisal Event has occurred prepared by an MAI appraiser on an “as-is” basis acceptable to the special servicer in accordance with the Servicing Standard. Upon receipt of such second appraisal, the special servicer will be required to determine, in accordance with the Servicing Standard, whether, based on its assessment of such second appraisal, any recalculation of the applicable appraisal reduction is warranted and, if so warranted, will recalculate such appraisal reduction based upon such second appraisal. If required by any such recalculation, any applicable Appraised-Out Class will have its related principal balance notionally restored to the extent required by such recalculation of the appraisal reduction, and there will be a redetermination of whether a Subordinate Control Period, a Collective Consultation Period or a Senior Consultation Period is then in effect. However, until an Appraised-Out Class is restored as the Controlling Class, the next most senior class of Control Eligible Certificates that is not an Appraised-Out Class (or, if all classes of Control Eligible Certificates are Appraised-Out Classes, the most senior class of Control Eligible Certificates), if any, will be the Controlling Class. The right of any Appraised-Out Class to present a second appraisal of any mortgage loan for which an Appraisal Event has occurred is limited to one appraisal with respect to each mortgaged property relating to the affected mortgage loan, subject to certain exceptions regarding a material change in circumstance. |

Sale of Defaulted Loans and REO

Properties: | The special servicer will be required to solicit offers for defaulted mortgage loans and accept the first (and, if multiple bids are contemporaneously received, the highest) cash bid from any person that constitutes a fair price for the defaulted mortgage loan, determined as described in “SERVICING OF THE MORTGAGE LOANS—Sale of Defaulted Mortgage Loans and REO Properties—Sale of Defaulted Mortgage Loans” in the Free Writing Prospectus, unless the special servicer determines, in accordance with the Servicing Standard, that rejection of such offer would be in the best interests of the certificateholders (as a collective whole), subject to (i) with respect to any mortgage loan that is part of an A/B whole loan or loan pair or any non-serviced mortgage loan or any mortgage loan with existing mezzanine debt, to the extent set forth in the related intercreditor agreement, the right of the holder of the related debt held outside the issuing entity to purchase the related mortgage loan and (ii) any consent or consultation rights of the controlling class representative and/or, with respect to any mortgage loan that is part of an A/B whole loan or loan pair or any non-serviced mortgage loan, the holder of the related B note, companion loan or non-serviced companion loan, respectively, to the extent set forth in the related intercreditor agreement. See “DESCRIPTION OF THE MORTGAGE POOL—The A/B Whole Loans and the Loan Pairs” and “DESCRIPTION OF THE MORTGAGE POOL—Non-Serviced Mortgage Loans” in the Free Writing Prospectus. If title to any REO property is acquired by the issuing entity in respect of any specially serviced mortgage loan, the special servicer is required to use its reasonable best efforts to sell the REO property for cash as soon as practicable consistent with the requirement to maximize proceeds for all certificateholders (and, with respect to a serviced companion loan or a B note, for the certificateholders and the holders of such loans, as a collective whole) but in no event later than three (3) years after the end of the year in which it was acquired, and in any event prior to the rated final distribution date or earlier to the extent necessary to comply with REMIC provisions, unless (i) the trustee or the special servicer has been granted an extension of time by the IRS or is permitted under the REMIC provisions to continue to hold such REO property during the period in which an application for an extension is pending or (ii) the special servicer receives an opinion of counsel that holding such REO property beyond the period specified above will not result in the imposition of taxes on “prohibited transactions” under the REMIC provisions or cause any REMIC to fail to qualify as a REMIC; provided, that in no event may the issuing entity hold any REO property beyond the end of the sixth (6th) calendar year following the end of the year of such REO property’s acquisition. If the special servicer is unable to sell such REO property for cash within such time period (as it may be extended as described above), the special servicer will be required, after consultation with the controlling class representative during any Subordinate Control Period and any Collective Consultation Period and, in the case of a sale of any REO property relating to an A/B whole loan or loan pair, the related directing holder to the extent set forth in the related intercreditor agreement, to auction the REO property to the highest bidder (which may be the special servicer or another Interested Person) in accordance with the Servicing Standard. See “SERVICING OF THE MORTGAGE LOANS—Sale of Defaulted Mortgage Loans and REO Properties—Sale of REO Properties” and “DESCRIPTION OF THE MORTGAGE POOL—The A/B Whole Loans and the Loan Pairs” in the Free Writing Prospectus. |

| | |

Appointment and Termination of

Special Servicer Without Cause: | The controlling class representative will appoint the initial special servicer. During any Subordinate Control Period, the special servicer may be replaced at any time by the controlling class representative. During any Collective Consultation Period and any Senior Consultation Period, the special servicer will be subject to termination without cause if certificateholders evidencing not less than 25% of voting rights request a vote of certificateholders to replace the special servicer. The certificate administrator would present the proposal to all certificateholders and replacement would be conditioned on receipt, within one hundred eighty (180) days thereafter, of approval of the termination from holders of 75% of the voting rights of the certificates. The holders initiating such vote will be responsible for the fees and expenses of the issuing entity in connection with the replacement. During any Senior Consultation Period, if the trust advisor determines that the special servicer is not performing its duties in accordance with the Servicing Standard, the trust advisor will have the right to recommend the replacement of the special servicer. The trust advisor’s recommendation to replace the special servicer must be confirmed by an affirmative vote of holders of a majority of the voting rights of the principal balance certificates. |

This is not a research report and was not prepared by the BofA Merrill Lynch or Morgan Stanley research departments. Please see additional important information and qualifications at the end of this Term Sheet. |

| MSBAM 2013-C8 | Structural Overview |

| | For purposes of the voting rights described above, the Class A-S, Class B, Class PST and Class C Certificates will be allocated voting rights in accordance with their respective percentage interests in the applicable Class A-S, Class B and Class C trust components as described in the Free Writing Prospectus. In addition, if any mortgage loan is part of an A/B whole loan or loan pair or is a non-serviced mortgage loan, to the extent set forth in the related intercreditor agreement, the related directing holder may have the right to replace the special servicer, with respect to the related A/B whole loan or loan pair or non-serviced mortgage loan to the extent set forth in the related intercreditor agreement. See “DESCRIPTION OF THE MORTGAGE POOL—The A/B Whole Loans and the Loan Pairs” and “DESCRIPTION OF THE MORTGAGE POOL—Non-Serviced Mortgage Loans” in the Free Writing Prospectus. There are no mortgage loans that are part of an A/B whole loan included in the mortgage pool. |

| | |

| Servicing Standard: | Each of the master servicer and the special servicer is obligated to service and administer the mortgage loans (and, if applicable, the related B notes and serviced companion loans but not any non-serviced mortgage loans) for which it is responsible pursuant to the pooling and servicing agreement on behalf of the issuing entity and in the best interests of and for the benefit of the certificateholders (and, with respect to any mortgage loan that is part of an A/B whole loan or loan pair, the holder of the related B note or serviced companion loan, as applicable) as a collective whole (as determined by the master servicer or the special servicer, as the case may be, in its good faith and reasonable judgment), in accordance with applicable law, the terms of the pooling and servicing agreement, the terms of the respective mortgage loans and, if applicable, any related intercreditor agreement and, to the extent consistent with the foregoing, further as follows. |

| | ● | With the same care, skill and diligence as is normal and usual in its general mortgage servicing and REO property management activities on behalf of third parties or on behalf of itself, whichever is higher, with respect to mortgage loans and REO properties that are comparable to those for which it is responsible under the pooling and servicing agreement; |

| | | |

| | ● | With a view to the timely collection of all scheduled payments of principal and interest under the mortgage loans and any related B note or serviced companion loan or, if a mortgage loan or the related B note or serviced companion loan comes into and continues in default and with respect to the special servicer, if, in the good faith and reasonable judgment of the special servicer, no satisfactory arrangements can be made for the collection of the delinquent payments, the maximization of the recovery of principal and interest on such mortgage loan to the certificateholders (as a collective whole) (or in the case of any A/B whole loan or loan pair, the maximization of recovery thereon of principal and interest to the certificateholders and the holder of the related B note (taking into account the subordinate nature of any such B note) or serviced companion loan, as applicable, all taken as a collective whole) on a net present value basis; and |

| | | |

| | ● | Without regard to various specified circumstances that could give rise to conflicts of interest. |

Defaulted Mortgage Loan Waterfall: | Amounts received by the issuing entity in respect of defaulted mortgage loans in connection with liquidation of any mortgage loan, net of unreimbursed advances and interest thereon, servicing compensation, and other amounts payable or reimbursable therefrom, will be applied so that amounts allocated as a recovery of accrued and unpaid interest will not, in the first instance, include any amount by which the interest portion of P&I advances previously made was reduced as a result of appraisal reductions. After the adjusted interest amount is so allocated, any remaining net proceeds will be allocated to pay principal on the mortgage loan until the unpaid principal amount of the mortgage loan has been reduced to zero. Any remaining proceeds would then be allocated as a recovery of accrued and unpaid interest corresponding to the amount by which the interest portion of P&I advances previously made was reduced as a result of appraisal reductions. |

| | |

| Trust Advisor: | Situs Holdings, LLC, a Delaware limited liability company, will act as the trust advisor. The trust advisor will be required to promptly review all information available to certain privileged persons on the certificate administrator’s website related to any specially serviced mortgage loan or REO property and each asset status report with respect to specially serviced mortgage loans (provided that during any Subordinate Control Period, the trust advisor may only review final asset status reports). During any Collective Consultation Period and any Senior Consultation Period, within sixty (60) days after the end of each calendar year during which any mortgage loan was a specially serviced mortgage loan or any mortgaged property was an REO property, the trust advisor will be required to meet with representatives of the special servicer to review certain operational practices of the special servicer related to specially serviced mortgage loans and REO properties. In addition, during any Collective Consultation Period and any Senior Consultation Period, based on (i) the trust advisor’s annual meeting with the special servicer and (ii) the trust advisor’s review of any asset status reports and other information delivered to the trust advisor by the special servicer and any other information available to certain privileged persons on the certificate administrator’s website, the trust advisor will be required to prepare an annual report to be provided to the certificate administrator (and to be made available through the certificate administrator’s website) setting forth its assessment of the special servicer’s performance of its duties under the pooling and servicing agreement during the prior calendar year on a platform-level basis with respect to the resolution and liquidation of specially serviced mortgage loans and REO properties. No such annual report will be required to be prepared or delivered with respect to any calendar year during which no annual meeting has occurred or any calendar year during which no asset status reports have been prepared in connection with a specially serviced mortgage loan or REO property. Furthermore, during any Collective Consultation Period and any Senior Consultation Period, the special |

This is not a research report and was not prepared by the BofA Merrill Lynch or Morgan Stanley research departments. Please see additional important information and qualifications at the end of this Term Sheet. |

| MSBAM 2013-C8 | Structural Overview |

| | servicer will be required to consult (on a non-binding basis) the trust advisor in connection with certain major decisions involving any serviced mortgage loan, A/B whole loan, loan pair or any related REO property to the extent described in this Term Sheet, the Free Writing Prospectus and the pooling and servicing agreement; provided that, with respect to matters relating to any A/B whole loan, loan pair or any serviced mortgage loan, the special servicer will only be required to consult the trust advisor with regard to such matters after the holder of the related B note or serviced companion loan, as applicable, is no longer the directing holder with respect to such A/B whole loan or loan pair pursuant to the terms of the applicable intercreditor agreement. The Trust Advisor will have no consultation rights with respect to any non-serviced mortgage loan or any related non-serviced companion loan. During any Subordinate Control Period, there will be no annual meeting or annual report, the trust advisor will not be permitted to consult or consent with regard to any particular servicing actions, and the trust advisor will not distribute any report based on its review or otherwise opine on the activities of the special servicer with respect to any transaction. |

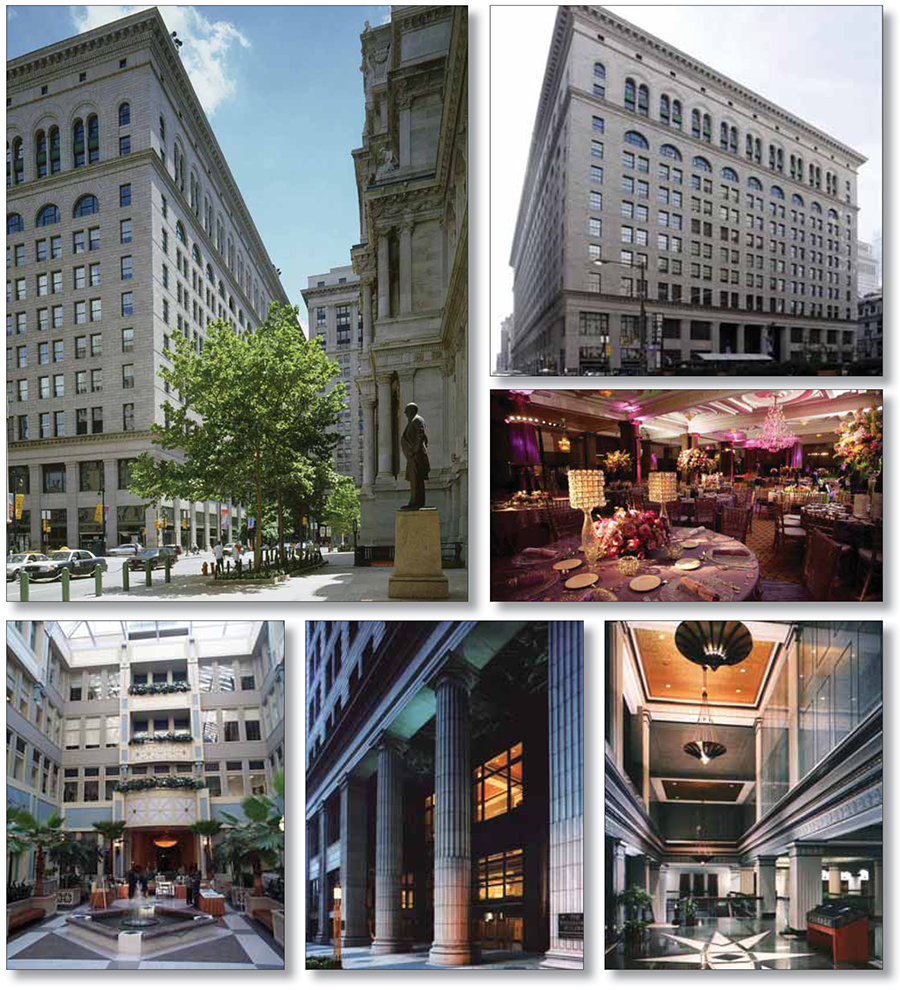

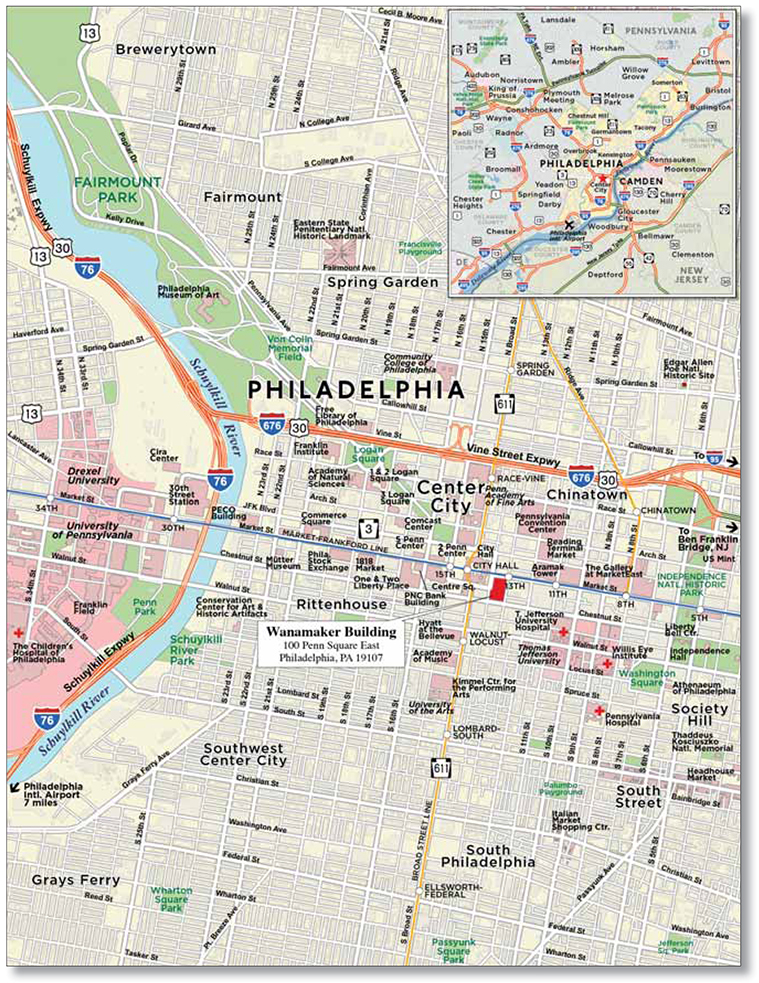

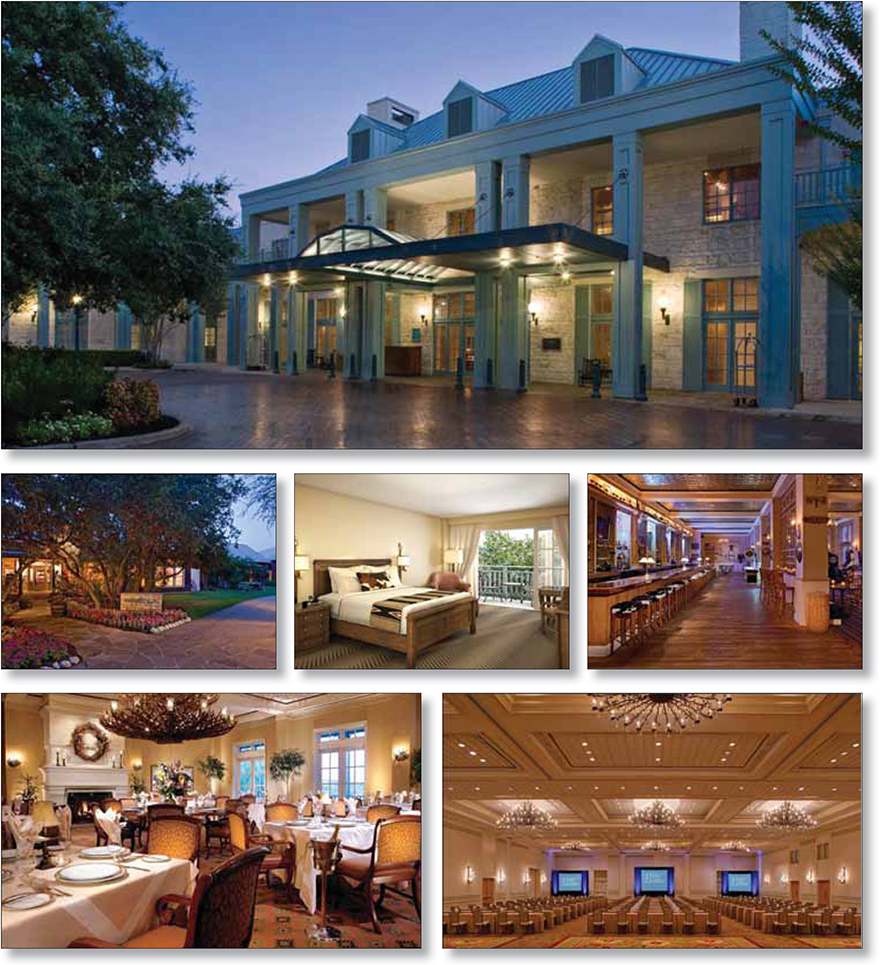

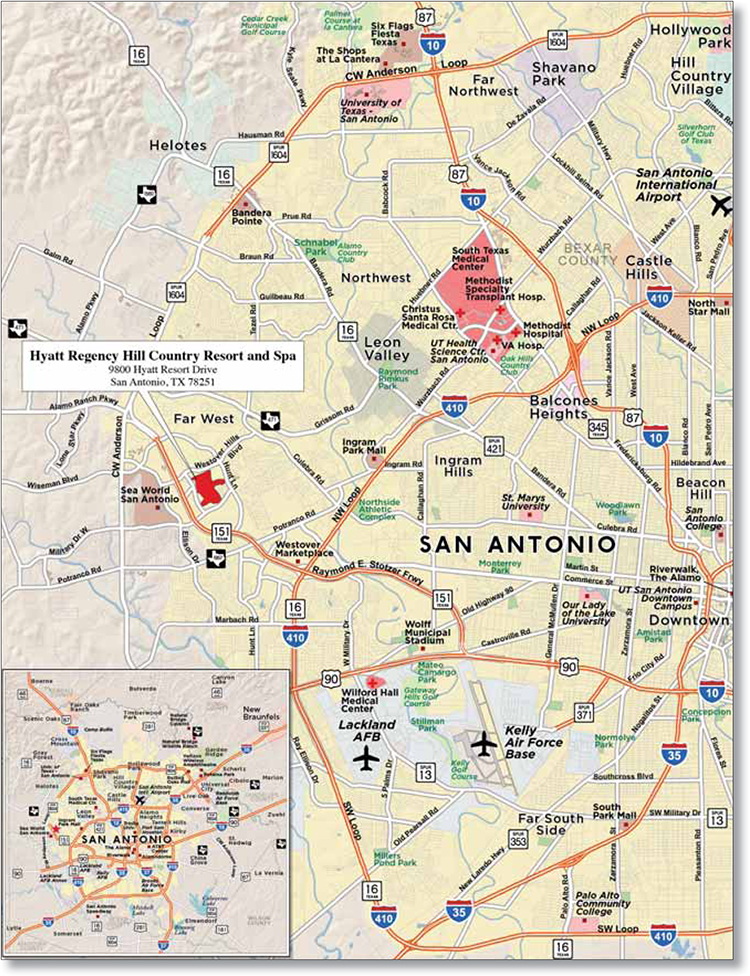

| | |