| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-201743-01 |

| | | |

September 8, 2015

FREE WRITING PROSPECTUS

STRUCTURAL AND COLLATERAL TERM SHEET

$757,280,331

(Approximate Total Mortgage Pool Balance)

$703,324,000

(Approximate Offered Certificates)

Banc of America Merrill Lynch Commercial Mortgage Inc.

Depositor

UBS Real Estate Securities Inc.

Bank of America, National Association

Sponsors and Mortgage Loan Sellers

| BofA Merrill Lynch | | UBS Securities LLC |

| Joint Bookrunning Managers and Co-Lead Managers |

| |

| Drexel Hamilton |

Co-Manager |

The depositor has filed a registration statement (including the prospectus) with the SEC (File No. 333-201743) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor, Merrill Lynch, Pierce, Fenner & Smith Incorporated, UBS Securities LLC or any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-294-1322 or by email to the following address:dg.Prospectus_Requests@baml.com. The offered certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these certificates, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have verified the allocation of certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

STATEMENT REGARDING CERTAIN ESTIMATES AND OTHER INFORMATION

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

“Bank of America Merrill Lynch” is the marketing name for the global banking and global markets businesses of Bank of America Corporation. Lending, derivatives, and other commercial banking activities are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., member FDIC. Securities, strategic advisory, and other investment banking activities are performed globally by investment banking affiliates of Bank of America Corporation, including, in the United States, Merrill Lynch, Pierce, Fenner & Smith Incorporated, which is a registered broker-dealer and member of FINRA and SIPC, and, in other jurisdictions, locally registered entities.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The certificates to be backed in part by the assets described herein, and such assets, are subject to modification, revision and other changes any time prior to issuance or availability of a final prospectus, such certificates are offered on a “when, as and if issued” basis. Prospective investors should understand that, when considering the purchase of such certificates, a contract of sale will come into being no sooner than the date on which the relevant class of certificates has been priced and the underwriters have confirmed the allocation of certificates to be made to investors; any “indications of interest” expressed by any prospective investor, and any “soft circles” generated by the underwriters, will not create binding contractual obligations for such prospective investors, on the one hand, or the underwriters, the depositor or any of their respective agents or affiliates, on the other hand.

As a result of the foregoing, a prospective investor may commit to purchase certificates that have characteristics (including with respect to the underlying assets) that may change, and each prospective investor is advised that all or a portion of the certificates referred to in these materials may be issued without all or certain of the characteristics (including with respect to the underlying assets) described in these materials. The underwriters’ obligation to sell certificates to any prospective investor is conditioned on the certificates and the transaction having the characteristics described in these materials. If the underwriters determine that a condition is not satisfied in any material respect, such prospective investor will be notified, and neither the depositor nor the underwriters will have any obligation to such prospective investor to deliver any portion of the certificates which such prospective investor has committed to purchase, and there will be no liability between the underwriters, the depositor or any of their respective agents or affiliates, on the one hand, and such prospective investor, on the other hand, as a consequence of the non-delivery.

Each prospective investor has requested that the underwriters provide to such prospective investor information in connection with such prospective investor’s consideration of the purchase of the certificates to be backed in part by the assets described in these materials. These materials are being provided to each prospective investor for informative purposes only in response to such prospective investor’s specific request. The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

BACM 2015-UBS7

Capitalized terms used but not defined herein have the meanings assigned to them in the other free writing prospectus expected to be dated September 8, 2015, relating to the offered certificates (hereinafter referred to as the “Free Writing Prospectus”).

| KEY FEATURES OF SECURITIZATION |

| Offering Terms: | |

| Joint Bookrunners & Co-Lead Managers: | Merrill Lynch, Pierce, Fenner & Smith Incorporated

UBS Securities LLC |

| Co-Manager: | Drexel Hamilton, LLC |

| Mortgage Loan Sellers: | UBS Real Estate Securities Inc. (“UBSRES”) (83.7%) and Bank of America, National Association (“BANA”) (16.3%). |

| Master Servicer: | Midland Loan Services, a Division of PNC Bank, National Association |

| Trust Advisor: | Pentalpha Surveillance LLC |

| Special Servicer: | LNR Partners, LLC |

| Trustee: | U.S. Bank National Association |

| Certificate Administrator: | U.S. Bank National Association |

| Rating Agencies: | Fitch Ratings, Inc., Kroll Bond Rating Agency, Inc., Moody’s Investors Service, Inc. and Morningstar Credit Ratings, LLC |

| Determination Date: | The 11th day of each month, or if such 11th day is not a business day, the succeeding business day, commencing in October 2015. |

| Distribution Date: | 4th business day following the Determination Date in each month, commencing in October 2015. |

| Cut-off Date: | September 1, 2015. For purposes of the information contained in this Term Sheet, scheduled payments due in September 2015 with respect to mortgage loans not having payment dates on the first day of each month have been deemed received on September 1, 2015, not the actual day or days on which such scheduled payments were due. Unless otherwise noted, all mortgage loan statistics are based on the outstanding principal balances as of the Cut-off Date. |

| Settlement Date: | On or about September 24, 2015 |

| Settlement Terms: | DTC, Euroclear and Clearstream, same day funds, with accrued interest. |

| ERISA Eligible: | All of the Offered Certificates are expected to be ERISA eligible. |

| SMMEA Eligible: | None of the Offered Certificates will be SMMEA eligible. |

| Day Count: | 30/360 |

| Tax Treatment: | REMIC |

| Rated Final Distribution Date: | September 2048 |

| Minimum Denominations: | $10,000 (or $100,000 with respect to the Class X-A, Class X-B and Class X-D Certificates) and in each case in multiples of $1 thereafter. |

| Clean-up Call: | 1.0% |

| | | | |

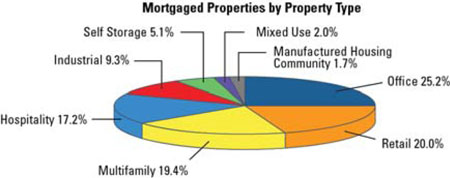

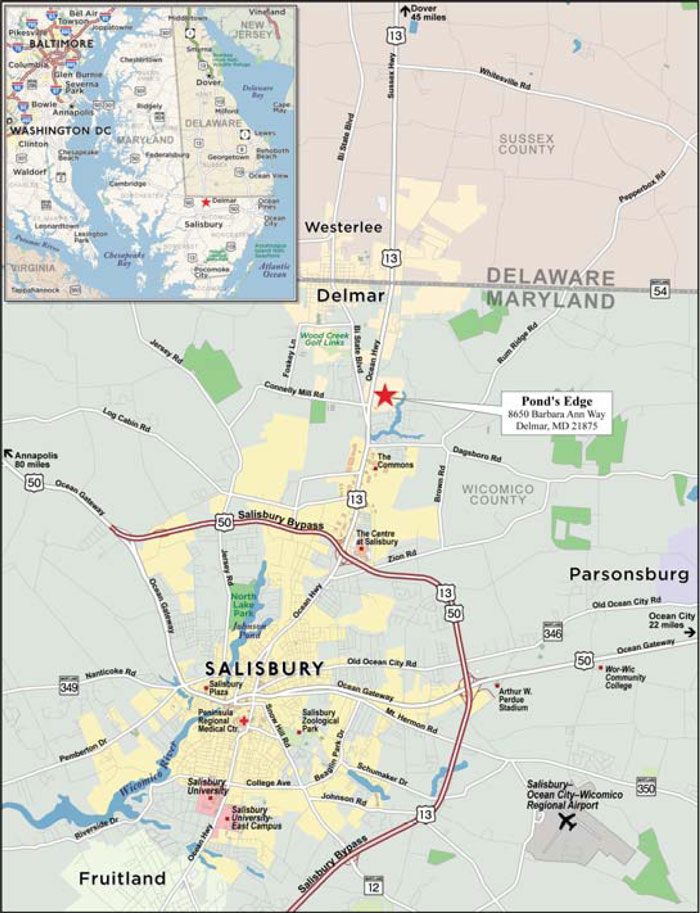

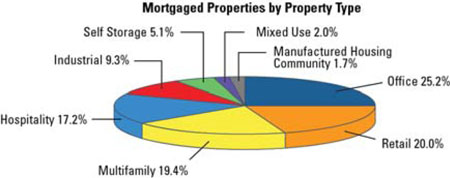

Distribution of Collateral by Property Type |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

BACM 2015-UBS7 |

| TRANSACTION HIGHLIGHTS |

Mortgage Loan Sellers | Number of Mortgage Loans | Number of Mortgaged Properties | Aggregate Cut-off Date Balance | % of Outstanding Pool Balance |

| UBS Real Estate Securities Inc. | 33 | 48 | $634,123,331 | 83.7% |

| Bank of America, National Association | 9 | 9 | $123,157,000 | 16.3% |

| Total: | 42 | 57 | $757,280,331 | 100.0% |

Pooled Collateral Facts: |

| Initial Outstanding Pool Balance: | $757,280,331 |

| Number of Mortgage Loans: | 42 |

| Number of Mortgaged Properties: | 57 |

| Average Mortgage Loan Cut-off Date Balance: | $18,030,484 |

| Average Mortgaged Property Cut-off Date Balance: | $13,285,620 |

| Weighted Average Mortgage Rate: | 4.3803% |

| Weighted Average Mortgage Loan Original Term to Maturity Date or ARD (months): | 120 |

| Weighted Average Mortgage Loan Remaining Term to Maturity Date or ARD (months): | 119 |

| Weighted Average Mortgage Loan Seasoning (months): | 1 |

| % of Mortgaged Properties Leased to a Single Tenant: | 16.1% |

Credit Statistics(1): | |

| Weighted Average Mortgage Loan U/W NCF DSCR: | 1.85x |

| Weighted Average Mortgage Loan Cut-off Date LTV(2)(3): | 59.2% |

| Weighted Average Mortgage Loan Maturity Date or ARD LTV(2): | 51.6% |

| Weighted Average U/W NOI Debt Yield(3): | 11.0% |

Amortization Overview: | |

| % Mortgage Loans with Amortization through Maturity Date or ARD: | 39.6% |

| % Mortgage Loans which pay Interest Only through Maturity Date or ARD: | 32.1% |

| % Mortgage Loans which pay Interest Only followed by Amortization through Maturity Date or ARD: | 28.3% |

| Weighted Average Remaining Amortization Term (months)(4): | 338 |

Loan Structural Features: | |

| % Mortgage Loans with Upfront or Ongoing Tax Reserves: | 77.3% |

| % Mortgage Loans with Upfront or Ongoing Replacement Reserves(5): | 65.2% |

| % Mortgage Loans with Upfront or Ongoing Insurance Reserves: | 56.0% |

| % Mortgage Loans with Upfront or Ongoing TI/LC Reserves(6): | 40.0% |

| % Mortgage Loans with Upfront Engineering Reserves: | 34.1% |

| % Mortgage Loans with Upfront or Ongoing Other Reserves: | 43.9% |

| % Mortgage Loans with In Place Hard Lockboxes: | 53.2% |

| % Mortgage Loans with Cash Traps Triggered at DSCR Levels ≥ 1.05x: | 89.2% |

| % Mortgage Loans with Cash Traps Triggered only based on Loan Specific Debt Yield: | 5.9% |

| % Mortgage Loans with Defeasance Only After a Lockout Period and Prior to an Open Period: | 76.4% |

| % Mortgage Loans with Prepayment with a Yield Maintenance Charge Only After a Lockout Period and Prior to an Open Period: | 17.0% |

| % Mortgage Loans with Prepayment with a YM Charge Prior to an Open Period: | 5.9% |

| % Mortgage Loans with YM Charge Only After a Lockout Period and YM Charge or Defeasance Only after a Yield Maintenance Period and Prior to an Open Period: | 0.7% |

| (1) | With respect to the Charles River Plaza North Mortgage Loan, the 261 Fifth Avenue Mortgage Loan, The Mall of New Hampshire Mortgage Loan, the 200 Helen Street Mortgage Loan, the WPC Department Store Portfolio Mortgage Loan and the Aviare Place Apartments Mortgage Loan, the LTV, DSCR and debt yield calculations include the relatedpari passu companion loan(s) but exclude the related subordinate companion loan, if applicable. |

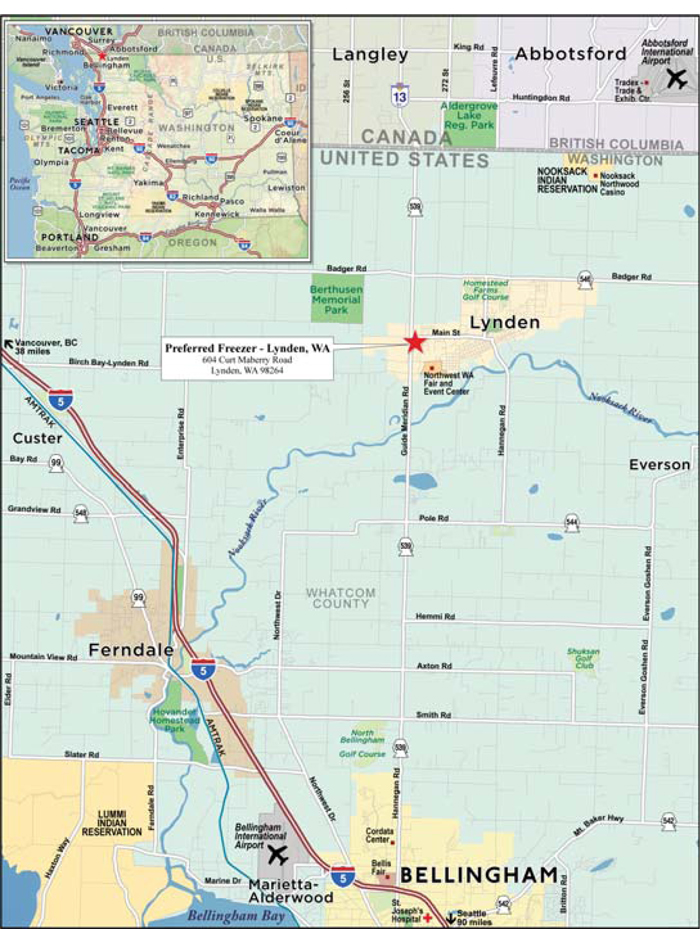

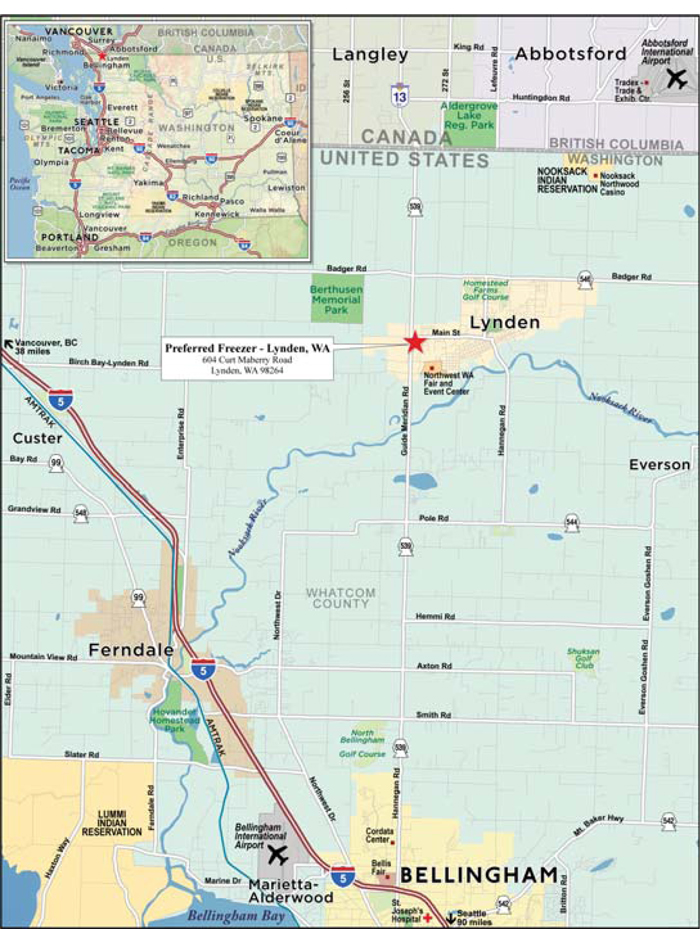

| (2) | With respect to the Preferred Freezer – Lynden, WA Mortgage Loan, representing 3.3% of the initial outstanding principal balance as of the Cut-off Date, the Cut-off Date LTV and Maturity Date or ARD LTV have in certain cases been calculated based on the “as stabilized” value. For additional information, see the footnotes to APPENDIX I in the Free Writing Prospectus. |

| (3) | With respect to the Lockport Square Mortgage Loan, representing approximately 0.6% of the initial outstanding pool balance as of the Cut-off Date, the loan-to-value ratio and the debt yield for such mortgage loan has been calculated based on the mortgage loan balance net of a holdback reserve or an earnout reserve. For additional information, see the definitions of “Cut-off Date Loan-to-Value Ratio” and “Cut-off Date U/W NOI Debt Yield” in “Description of the Mortgage Pool—Additional Mortgage Loan Information” in the Free Writing Prospectus. |

| (4) | Excludes mortgage loans that are interest only for the full loan term or through a related anticipated repayment date. |

| (5) | Includes FF&E Reserves. |

| (6) | Represents the percent of the allocated initial outstanding principal balance of retail, office, industrial and mixed use properties only. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

BACM 2015-UBS7 |

| STRUCTURE OVERVIEW |

OFFERED CERTIFICATES

| Class(1) | Ratings(2)

(Fitch/KBRA/Moody’s/Morningstar) | Initial Certificate Principal Balance or Notional Amount(3) | Initial Subordination

Levels | Expected Weighted Average Life (years)(4) | Principal Window (months)(4) | Certificate Principal to Value Ratio(5) | Underwritten NOI Debt Yield(6) |

| Class A-1 | AAAsf/AAA(sf)/Aaa(sf)/AAA | $38,700,000 | 30.000%(7) | 2.80 | 1-60 | 41.4% | 15.7% |

| Class A-SB | AAAsf/AAA(sf)/Aaa(sf)/AAA | $62,400,000 | 30.000%(7) | 7.61 | 60-117 | 41.4% | 15.7% |

| Class A-3 | AAAsf/AAA(sf)/Aaa(sf)/AAA | $200,000,000 | 30.000%(7) | 9.85 | 117-119 | 41.4% | 15.7% |

| Class A-4 | AAAsf/AAA(sf)/Aaa(sf)/AAA | $228,996,000 | 30.000%(7) | 9.94 | 119-120 | 41.4% | 15.7% |

| Class X-A(8) | AAAsf/AAA(sf)/Aaa(sf)/AAA | $530,096,000(9) | N/A | N/A | N/A | N/A | N/A |

| Class X-B(8) | AAAsf/AAA(sf)/Aa2(sf)/AAA | $50,170,000(9) | N/A | N/A | N/A | N/A | N/A |

| Class X-D(8) | BBB-sf/BBB-(sf)/NR/AAA | $39,879,000(9) | N/A | N/A | N/A | N/A | N/A |

| Class A-S | AAAsf/AAA(sf)/Aa2(sf)/AAA | $50,170,000 | 23.375% | 9.98 | 120-120 | 45.4% | 14.4% |

| Class B | AA-sf/AA-(sf)/NR/AA- | $50,169,000 | 16.750% | 9.98 | 120-120 | 49.3% | 13.2% |

| Class C | A-sf/A-(sf)/NR/A- | $33,010,000 | 12.391% | 9.98 | 120-120 | 51.9% | 12.6% |

| Class D | BBB-sf/BBB-(sf)/NR/BBB- | $39,879,000 | 7.125% | 9.98 | 120-120 | 55.0% | 11.8% |

NON-OFFERED CERTIFICATES(10)

| Class(1) | Ratings(2)

(Fitch/KBRA/Moody’s/Morningstar) | Initial Certificate Principal Balance or Notional Amount(3) | Initial Subordination

Levels | Expected Weighted Average Life (years)(4) | Principal Window (months)(4) | Certificate Principal to Value Ratio(5) | Underwritten NOI Debt Yield(6) |

| Class X-E(8) | BB-sf/BB(sf)/NR/AAA | $17,038,000(9) | N/A | N/A | N/A | N/A | N/A |

| Class X-FG(8) | NR/NR/NR/AAA | $15,146,000(9) | N/A | N/A | N/A | N/A | N/A |

| Class X-NR(8) | NR/NR/NR/AAA | $21,772,331(9) | N/A | N/A | N/A | N/A | N/A |

| Class E | BB-sf/BB(sf)/NR/BB- | $17,038,000 | 4.875% | 9.98 | 120-120 | 56.3% | 11.6% |

| Class F | B-sf/B+(sf)/NR/B | $7,573,000 | 3.875% | 9.98 | 120-120 | 56.9% | 11.4% |

| Class G | NR/B-(sf)/NR/B- | $7,573,000 | 2.875% | 9.98 | 120-120 | 57.5% | 11.3% |

| Class H | NR/NR/NR/NR | $21,772,331 | 0.000% | 9.98 | 120-120 | 59.2% | 11.0% |

Please see footnotes on following page.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

BACM 2015-UBS7 |

| STRUCTURE OVERVIEW |

| (1) | Theper annum pass-through rates applicable to the Class A-1, Class A-SB, Class A-3, Class A-4, Class A-S, Class B, Class C, Class D, Class E, Class F, Class G and Class H Certificates will equal one of: (i) a fixed rate, (ii) a fixed rate subject to a cap equal to the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) or (iii) a rate equal to the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve (30-day months) less a specified percentage, which percentage may be zero. |

| (2) | Ratings shown are those of Fitch Ratings, Inc. (“Fitch”), Kroll Bond Rating Agency, Inc. (“KBRA”), Moody’s Investors Service, Inc. (“Moody’s) and Morningstar Credit Ratings, LLC (“Morningstar”). Certain nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, or otherwise to rate the certificates. There can be no assurance as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Risks Related to the Offered Certificates—Ratings of the Offered Certificates Do Not Represent Any Assessment of the Yield to Maturity That a Certificateholder May Experience and Such Ratings May Be Reviewed, Revised, Suspended, Downgraded, Qualified or Withdrawn By the Applicable Rating Agency” and “Ratings” in the Free Writing Prospectus. Fitch, KBRA and Moody’s have informed us that the “sf” designation in their ratings represents an identifier for structured finance product ratings. |

| (3) | Approximate; subject to a permitted variance of plus or minus 5% on the Settlement Date. In addition, the notional amounts of the Class X-A, Class X-B, Class X-D, Class X-E, Class X-FG and Class X-NR Certificates may vary depending upon the final pricing of the classes of principal balance certificates and whose certificate principal balances comprise such notional amounts and, if as a result of such pricing the pass-through rate of the Class X-A, Class X-B, Class X-D, Class X-E, Class X-FG and Class X-NR Certificates, as applicable, would be equal to zero, such class of certificates will not be issued on the Settlement Date of this securitization. |

| (4) | The principal window is expressed in months following the Settlement Date and reflects the period during which distributions of principal would be received under the assumptions set forth in the following sentence. The expected weighted average life and principal window figures set forth above are based on the following assumptions, among others: (i) no defaults or subsequent losses on the mortgage loans; (ii) no extensions of maturity dates of the mortgage loans; (iii) payment in full on the stated maturity date or, in the case of any mortgage loan having an anticipated repayment date, on the anticipated repayment date; and (iv) no prepayments of the mortgage loans prior to maturity or, in the case of a mortgage loan having an anticipated repayment date, prior to such anticipated repayment date. See the structuring assumptions set forth under “Yield, Prepayment and Maturity Considerations—Weighted Average Life” in the Free Writing Prospectus. |

| (5) | “Certificate Principal to Value Ratio” for any class of principal balance certificates is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio of the mortgage pool, multiplied by (b) a fraction, the numerator of which is the total initial certificate principal balance of the subject class of principal balance certificates and all other classes of principal balance certificates that are senior to such class, and the denominator of which is the total initial certificate principal balance of all the principal balance certificates. The Certificate Principal to Value Ratios of the Class A-1, Class A-SB, Class A-3 and Class A-4 Certificates are calculated in the aggregate for those classes as if they were a single class. |

| (6) | “Underwritten NOI Debt Yield” for any class of principal balance certificates is calculated as the product of (a) the weighted average UW NOI Debt Yield for the mortgage pool, multiplied by (b) a fraction, the numerator of which is the total initial certificate principal balance of all the principal balance certificates, and the denominator of which is the total initial certificate principal balance of the subject class of principal balance certificates and all other classes of principal balance certificates, if any, that are senior to such class. The Underwritten NOI Debt Yields of the Class A-1, Class A-SB, Class A-3 and Class A-4 Certificates are calculated in the aggregate for those classes as if they were a single class. |

| (7) | The initial subordination levels for the Class A-1, Class A-SB, Class A-3 and Class A-4 Certificates represent the approximate credit support for the Class A-1, Class A-SB, Class A-3 and Class A-4 Certificates in the aggregate. |

| (8) | As further described in the Free Writing Prospectus, the pass-through rate on the Class X-A Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the weighted average of the pass-through rates of the Class A-1, Class A-SB, Class A-3 and Class A-4 Certificates as described in the Free Writing Prospectus. The pass-through rate on the Class X-B Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class A-S Certificates as described in the Free Writing Prospectus. The pass-through rate on the Class X-D Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class DCertificates as described in the Free Writing Prospectus. The pass-through rate on the Class X-E Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class E Certificates as described in the Free Writing Prospectus. The pass-through rate on the Class X-FG Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the weighted average of the pass-through rates of the Class F and Class G Certificates as described in the Free Writing Prospectus. The pass-through rate on the Class X-NR Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class H Certificates as described in the Free Writing Prospectus. |

| (9) | The Class X-A, Class X-B, Class X-D, Class X-E, Class X-FG and Class X-NR Certificates (collectively, the “Class X Certificates”) will not have certificate principal balances and will not be entitled to receive distributions of principal. Interest will accrue on the Class X-A, Class X-B, Class X-D, Class X-E, Class X-FG and Class X-NR Certificates at their respective pass-through rates based upon their respective notional amounts. The notional amount of the Class X-A Certificates will be equal to the aggregate certificate principal balances of the Class A-1, Class A-SB, Class A-3 and Class A-4 Certificates outstanding from time to time. The notional amount of the Class X-B Certificates will be equal to the certificate principal balance of the Class A-S Certificates outstanding from time to time. The notional amount of the Class X-D Certificates will be equal to the certificate principal balance of the Class D Certificates outstanding from time to time. The notional amount of the Class X-E Certificates will be equal to the certificate principal balance of the Class E Certificates outstanding from time to time.The notional amount of the Class X-FG Certificates will be equal to the aggregate certificate principal balances of the Class F and Class G Certificates outstanding from time to time. The notional amount of the Class X-NR Certificates will be equal to the certificate principal balance of the Class H Certificates outstanding from time to time. |

| (10) | Not offered pursuant to the Free Writing Prospectus or this Term Sheet. Information provided in this Term Sheet regarding the characteristics of these certificates is provided only to enhance your understanding of the offered certificates. The privately offered certificates also include the Class V and Class R Certificates, which will not have a certificate principal balance, notional amount, pass-through rate, rating or rated final distribution date, and which are not shown in the chart. The Class V Certificates will represent a beneficial ownership interest held through the grantor trust in certain excess interest in respect of mortgage loans having anticipated repayment dates, if any. The Class R Certificates will represent the beneficial ownership of the residual interest in each of the real estate mortgage investment conduits, as further described in the Free Writing Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

BACM 2015-UBS7 |

| STRUCTURE OVERVIEW |

| | | | | |

| Principal Distributions: | | Payments in respect of principal of the certificates will be distributed,first, to the Class A-SB Certificates, until the certificate principal balance of such class is reduced to the planned principal balance for the related Distribution Date set forth on APPENDIX VII to the Free Writing Prospectus,then, to the Class A-1, Class A-3, Class A-4, Class A-SB, Class A-S, Class B, Class C, Class D, Class E, Class F, Class G and Class H Certificates, in that order, until the certificate principal balance of each such class is reduced to zero. Notwithstanding the foregoing, if the aggregate certificate principal balances of the Class A-S, Class B, Class C, Class D, Class E, Class F, Class G and Class H Certificates have been reduced to zero as a result of the allocation of mortgage loan losses or trust advisor expenses to those certificates, or if the aggregate appraisal reduction equals or exceeds the aggregate certificate principal balances of the Class A-S through Class H Certificates, distributions in respect of principal of the certificates will be distributed,first, to the Class A-1, Class A-SB, Class A-3 and Class A-4 Certificates, on apro rata basis, based on the certificate principal balance of each such class,then, to the extent of any recoveries on realized losses, to the Class A-S, Class B, Class C, Class D, Class E, Class F, Class G and Class H Certificates, in that order, in each case until the certificate principal balance of each such class is reduced to zero (or previously allocated realized losses have been fully reimbursed). The Class X Certificates will not be entitled to receive distributions of principal; however, (i) the notional amount of the Class X-A Certificates will be reduced by the aggregate amount of principal distributions and realized losses allocated to the Class A-1, Class A-SB, Class A-3 and Class A-4 Certificates; (ii) the notional amount of the Class X-B Certificates will be reduced by the aggregate amount of principal distributions and realized losses allocated to the Class A-S Certificates; (iii) the notional amount of the Class X-D Certificates will be reduced by the principal distributions and realized losses allocated to the Class D Certificates; (iv) the notional amount of the Class X-E Certificates will be reduced by the principal distributions and realized losses allocated to the Class E Certificates; (v) the notional amount of the Class X-FG Certificates will be reduced by the aggregate amount of principal distributions and realized losses allocated to the Class F and Class G Certificates; and (vi) the notional amount of the Class X-NR Certificates will be reduced by the principal distributions and realized losses allocated to the Class H Certificates. |

| Interest Distributions: | | On each Distribution Date, interest accrued for each class of the certificates at the applicable pass-through rate will be distributed in the following order of priority, to the extent of available funds:first, to the Class A-1, Class A-SB, Class A-3, Class A-4, Class X-A, Class X-B, Class X-D, Class X-E, Class X-FG and Class X-NR Certificates, on apro rata basis, based on the accrued and unpaid interest on each such class andthen, to the Class A-S, Class B, Class C, Class D, Class E, Class F, Class G and Class H Certificates, in that order, in each case until the interest payable to each such class is paid in full. Theper annum pass-through rates applicable to the Class A-1, Class A-SB, Class A-3, Class A-4, Class A-S, Class B, Class C, Class D, Class E, Class F, Class G and Class H Certificates for each Distribution Date will equal one of: (i) a fixed rate, (ii) a fixed rate subject to a cap equal to the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) or (iii) a rate equal to the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) less a specified percentage, which percentage may be zero. As further described in the Free Writing Prospectus, theper annumpass-through rate on the Class X-A Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the weighted average of the pass-through rates of the Class A-1, Class A-SB, Class A-3 and Class A-4 Certificates as described in the Free Writing Prospectus. Theper annum pass-through rate on the Class X-B Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class A-S Certificates as described in the Free Writing Prospectus. Theper annumpass-through rate on the Class X-D Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

BACM 2015-UBS7 |

| STRUCTURE OVERVIEW |

| | | | | |

| | | twelve 30-day months), over (b) the pass-through rate of the Class D Certificates as described in the Free Writing Prospectus. Theper annumpass-through rate on the Class X-E Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class E Certificates as described in the Free Writing Prospectus. Theper annumpass-through rate on the Class X-FG Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the weighted average of the pass-through rates of the Class F and Class G Certificates as described in the Free Writing Prospectus. Theper annum pass-through rate on the Class X-NR Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class H Certificates as described in the Free Writing Prospectus. |

| | | |

| Trust Advisor Expenses: | | Trust Advisor expenses will be allocated, (i)first, to reduce payments of interest on the Class D, Class C and Class B Certificates, in that order, (ii)second, to reduce payments of principal on the Class D, Class C, Class B and Class A-S Certificates, in that order, and (iii)third, to reduce payments of principal on the Class A-1, Class A-SB, Class A-3 and Class A-4 Certificates on apro rata basis. No Trust Advisor expenses (other than the Trust Advisor fee) will be allocated to or otherwise borne by the Control Eligible Certificates. As a result, no class of Control Eligible Certificates will provide protection to the more senior classes of certificates for the purposes of allocating losses based on Trust Advisor expenses. See “Servicing of the Mortgage Loans—The Trust Advisor” and “Description of the Offered Certificates—Distributions—Allocation of Trust Advisor Expenses” in the Free Writing Prospectus. |

| Prepayment Interest Shortfalls: | | Prepayment interest shortfalls will be allocatedpro rata based on interest entitlements, in reduction of the interest otherwise payable with respect to each of the interest-bearing classes of certificates. |

| Realized Loss Allocation: | | Realized losses will be allocated to each class of certificates entitled to principal in reverse alphanumeric order starting with Class H through and including Class A-S and then to Class A-1, Class A-SB, Class A-3 and Class A-4 Certificates on apro ratabasis based on the certificate principal balance of each such class. The notional amount of any class of Class X Certificates will be reduced by the aggregate amount of realized losses allocated to certificates that are components of the notional amount of such class of Class X Certificates. |

Prepayment Premiums: | | On any Distribution Date, prepayment premiums or yield maintenance charges collected in respect of each mortgage loan during the related collection period will be distributed by the Certificate Administrator on the classes of certificates as follows: to Class A-1, Class A-SB, Class A-3, Class A-4, Class A-S, Class B, Class C and Class D Certificates then entitled to distributions of principal on such Distribution Date, an amount equal to the product of (a) a fraction, the numerator of which is the amount distributed as principal to that class on that Distribution Date, and the denominator of which is the total amount distributed as principal to all classes of principal balance certificates on that Distribution Date, (b) the Base Interest Fraction for the related principal prepayment and that class and (c) the amount of the prepayment premium or yield maintenance charge collected in respect of such principal prepayment during the one month period ending on the related determination date. Any prepayment premiums or yield maintenance charges relating to the mortgage loans collected during the related collection period and remaining after those distributions described above (as to the applicable Distribution Date, the “Class X YM Distribution Amount”) will be distributed to the holders of the Class X Certificates, as follows:first, to holders of the Class X-A Certificates in an amount equal to the product of (a) a fraction, the numerator of which is the total amount of principal distributed on the applicable Distribution Date with respect to the class(es) of principal balance certificates whose Certificate Principal Balances comprise the Notional Amount of such Class of Class X Certificates, and the denominator of which is the total amount of principal distributed on the applicable distribution date with respect to the principal balance certificates, multiplied by (b) the Class X YM Distribution Amount for the applicable distribution date;second, to holders of the Class X B Certificates in an amount equal to the product of (a) a fraction, the numerator of which is the total amount of principal distributed on the applicable distribution date with respect |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

BACM 2015-UBS7 |

| STRUCTURE OVERVIEW |

| | | | | |

| | to the Class(es) of principal balance certificates whose Certificate Principal Balances comprise the Notional Amount of such Class of Class X Certificates, and the denominator of which is the total amount of principal distributed on the applicable distribution date with respect to the principal balance certificates, multiplied by (b) the Class X YM Distribution Amount for the applicable distribution date;third, to holders of the Class X-D Certificates in an amount equal to the product of (a) a fraction, the numerator of which is the total amount of principal distributed on the applicable distribution date with respect to the Class(es) of principal balance certificates whose Certificate Principal Balances comprise the Notional Amount of such Class of Class X Certificates, and the denominator of which is the total amount of principal distributed on the applicable distribution date with respect to the principal balance certificates, multiplied by (b) the Class X YM Distribution Amount for the applicable distribution date;fourth, to holders of the Class X-E Certificates in an amount equal to the product of (a) a fraction, the numerator of which is the total amount of principal distributed on the applicable distribution date with respect to the Class(es) of principal balance certificates whose Certificate Principal Balances comprise the Notional Amount of such Class of Class X Certificates, and the denominator of which is the total amount of principal distributed on the applicable distribution date with respect to the principal balance certificates, multiplied by (b) the Class X YM Distribution Amount for the applicable distribution date;fifth, to holders of the Class X-FG Certificates in an amount equal to the product of (a) a fraction, the numerator of which is the total amount of principal distributed on the applicable distribution date with respect to the Class(es) of principal balance certificates whose Certificate Principal Balances comprise the Notional Amount of such Class of Class X Certificates, and the denominator of which is the total amount of principal distributed on the applicable distribution date with respect to the principal balance certificates, multiplied by (b) the Class X YM Distribution Amount for the applicable distribution date; andsixth, to the holders of the Class X-NR Certificates in an amount equal to the portion of the Class X YM Distribution Amount remaining after the distributions to the holders of the Class X-A, Class X-B, Class X-D, Class X-E and Class X-FG Certificates. The “Base Interest Fraction”, with respect to any principal prepayment of any mortgage loan that provides for payment of a prepayment premium or yield maintenance charge, and with respect to any class of principal balance certificates (other than the Control Eligible Certificates), is a fraction (A) whose numerator is the greater of (x) zero and (y) the difference between (i) the pass-through rate on that class of certificates and (ii) the applicable discount rate and (B) whose denominator is the difference between (i) the mortgage interest rate on the related mortgage loan and (ii) the applicable discount rate; provided that under no circumstances will the Base Interest Fraction be greater than one. If the discount rate referred to above is greater than or equal to the mortgage interest rate on the related mortgage loan, then the Base Interest Fraction will equal zero; provided that if the discount rate referred to above is greater than or equal to the mortgage interest rate on the related mortgage loan, but is less than the pass-through rate on the subject class of certificates, then the Base Interest Fraction shall be equal to 1.0. Consistent with the foregoing, the Base Interest Fraction is equal to: |

| | | |

| | | |

| | | | (Pass-Through Rate - Discount Rate) | |

| | | | (Mortgage Rate - Discount Rate) | |

| | | |

Collateral Support Deficits: | | On each Distribution Date, immediately following the distributions made to the certificateholders on that date, the Certificate Administrator will be required to calculate the amount, if any, by which (1) the aggregate stated principal balance of pool of the mortgage loans, including any mortgage loans as to which the related mortgaged properties have become REO properties, expected to be outstanding immediately following that Distribution Date, is less than (2) the aggregate principal balance of the principal balance certificates after giving effect to distributions of principal on that Distribution Date and the allocation of any excess trust advisor expenses to reduce the principal balances of the principal balance certificates that are not Control Eligible Certificates on that Distribution Date (any such deficit, a “Collateral Support Deficit”). On each Distribution Date, the Certificate Administrator will be required to allocate any Collateral Support Deficit to the respective classes of principal balance certificates in the following order: to the Class H, Class G, Class F, Class E, Class D, Class C, Class B and Class A-S Certificates, in that order, in each case in reduction of and until the remaining |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

BACM 2015-UBS7 |

| STRUCTURE OVERVIEW |

| | | | | |

| | | principal balance of that class of certificates has been reduced to zero. Following the reduction of the principal balances of all such classes of certificates to zero, the Certificate Administrator will be required to allocate the Collateral Support Deficit to the Class A-1, Class A-SB, Class A-3 and Class A-4 Certificates,pro rata (based upon their respective principal balances), until the remaining principal balances of those classes of certificates have been reduced to zero. Any Collateral Support Deficit allocated to a class of certificates will be allocated to the respective certificates of such class in proportion to the percentage interests evidenced by the respective certificates. |

| | | |

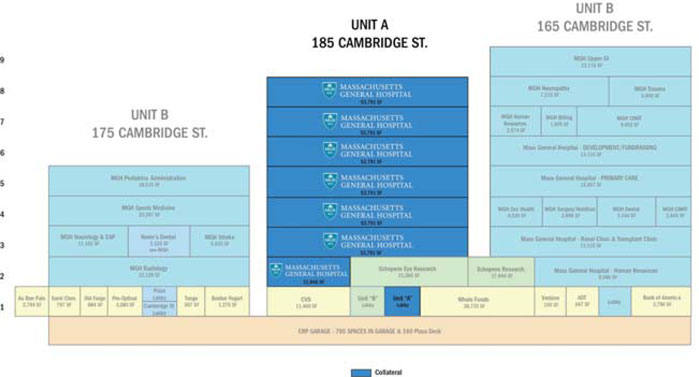

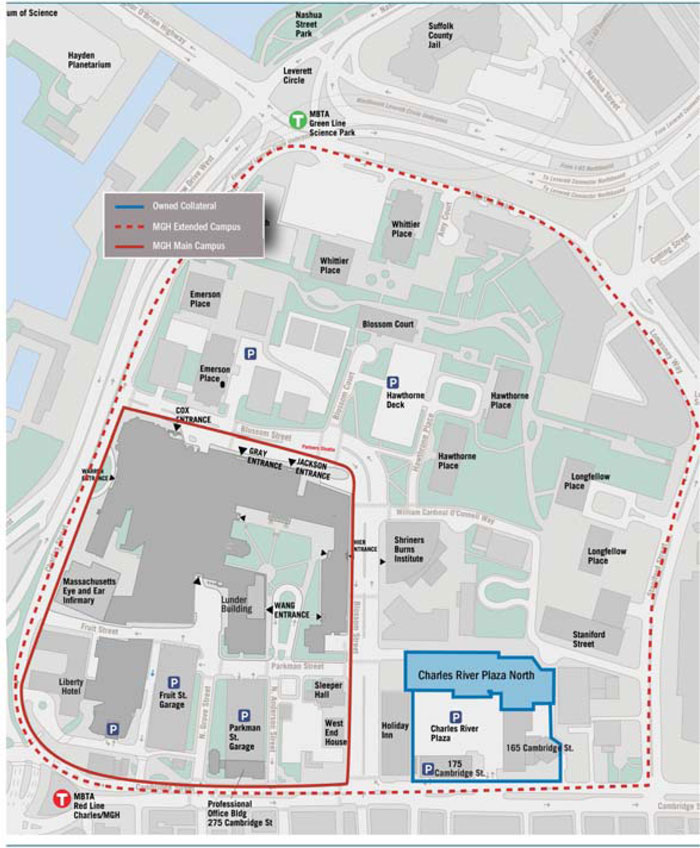

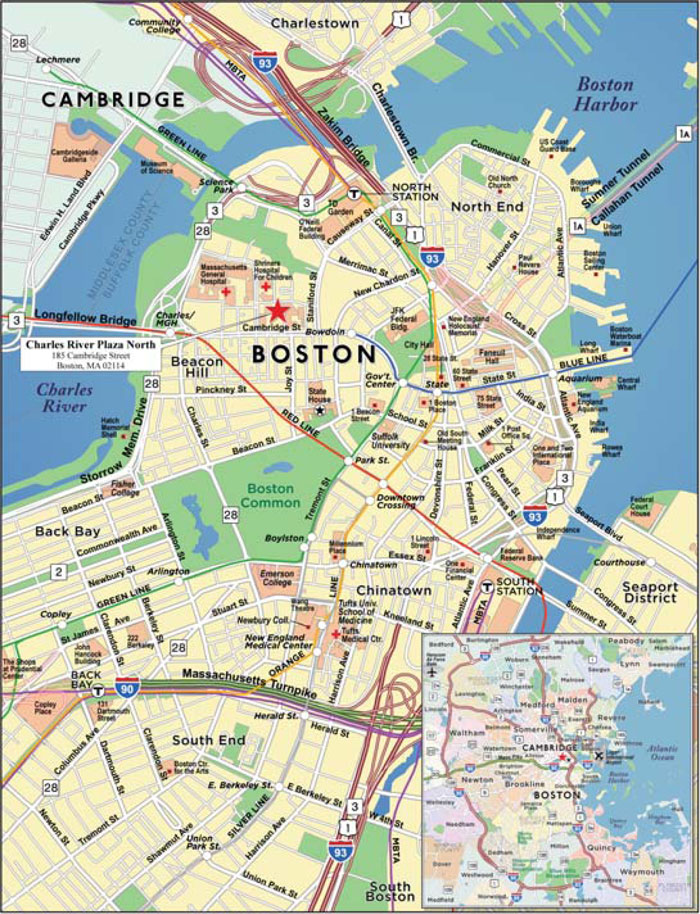

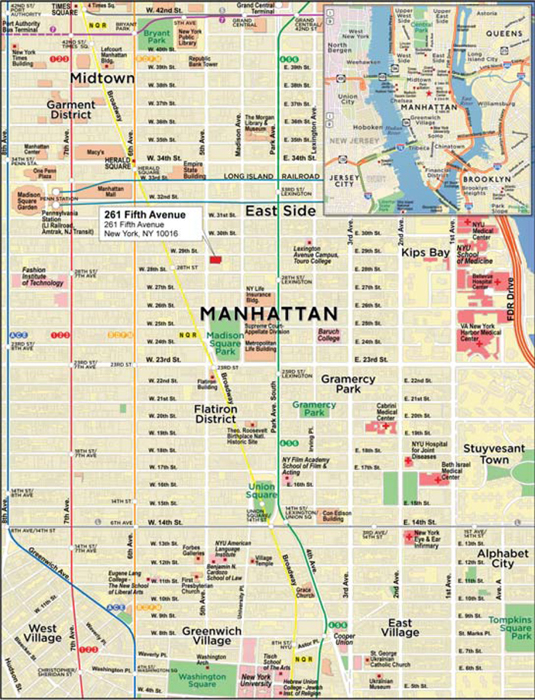

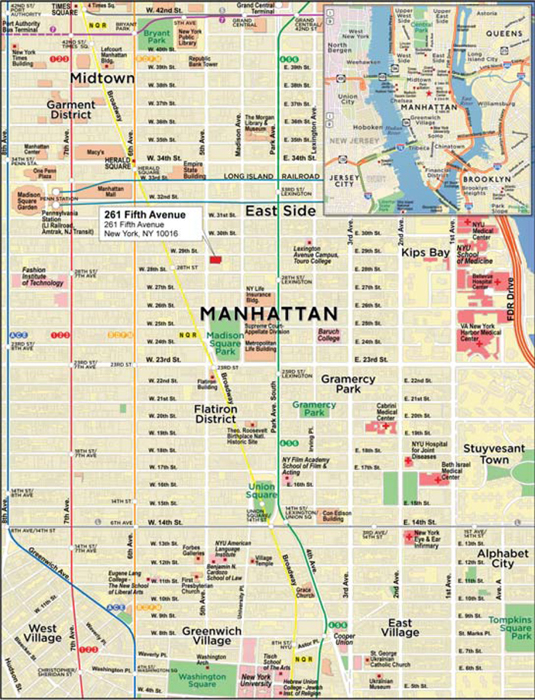

Split Loans: | | Charles River Plaza North The mortgaged property identified on APPENDIX I to the Free Writing Prospectus as Charles River Plaza North secures a mortgage loan with an outstanding principal balance as of the Cut-off Date of $72,884,027, evidenced by Note A-3-1 (the “Charles River Plaza North Mortgage Loan”), representing approximately 9.6% of the Initial Outstanding Pool Balance, and also secures (i) on apari passu basis (a) two companion loans, evidenced by Note A-1 and Note A-2, with an aggregate outstanding principal balance as of the Cut-off Date of $129,793,473, which were included in the CSAIL 2015-C3 securitization trust and (b) one companion loan, evidenced by Note A-3-2, with an outstanding principal balance as of the Cut-off Date of $7,987,291, which is currently held by UBSRES and is expected to be contributed to a future securitization (clauses (a) and (b), collectively, the “Charles River Plaza North Pari Passu Companion Loans”), and (ii) one subordinate companion loan, evidenced by Note B, with an outstanding principal balance as of the Cut-off Date of $33,945,985, that is generally subordinate in right of payment to the Charles River Plaza North Mortgage Loan and the Charles River Plaza North Pari Passu Companion Loans (the “Charles River Plaza North Subordinate Companion Loan”) and is currently held by a third-party investor (the “Charles River Plaza North Subordinate Companion Loan Holder”). The Charles River Plaza North Mortgage Loan, the Charles River Plaza North Pari Passu Companion Loans and the Charles River Plaza North Subordinate Companion Loan are collectively referred to herein as the “Charles River Plaza North Non-Serviced Loan Combination”. The Charles River Plaza North Non-Serviced Loan Combination is being serviced pursuant to the CSAIL 2015-C3 pooling and servicing agreement and the related intercreditor agreement. The Charles River Plaza North Subordinate Companion Loan Holder is the initial directing holder of the Charles River North Plaza Non-Serviced Loan Combination until such time as such holder loses its rights as the directing holder as a result of an appraisal reduction or other trigger event (at which point the controlling class representative of the CSAIL 2015-C3 securitization trust would be the directing holder of the Charles River Plaza North Non-Serviced Loan Combination). For additional information regarding the Charles River Plaza North Non-Serviced Loan Combination, see “Description of the Mortgage Pool—The Non-Serviced Loan Combinations—The Charles River Plaza North Non-Serviced Loan Combination” in the Free Writing Prospectus. 261 Fifth Avenue The mortgaged property identified on APPENDIX I to the Free Writing Prospectus as 261 Fifth Avenue secures a mortgage loan with an outstanding principal balance as of the Cut-off Dateof $70,000,000, evidenced by Note A-2 (the “261 Fifth Avenue Mortgage Loan”), representing approximately 9.2% of the Initial Outstanding Pool Balance, and also secures on apari passu basis one companion loan, evidenced by Note A-1, that has an outstanding principal balance as of the Cut-off Date of $110,000,000 (the “261 Fifth Avenue Pari Passu Companion Loan”) and is currently held by BANA and is expected to be contributed into a future securitization. The 261 Fifth Avenue Mortgage Loan and the 261 Fifth Avenue Pari Passu Companion Loan arepari passu in right of payment and are collectively referred to herein as the “261 Fifth Avenue Loan Pair”. The 261 Fifth Avenue Loan Pair will be serviced pursuant to the Pooling and Servicing Agreement and the related intercreditor agreement until the securitization of the 261 Fifth Avenue Pari Passu Companion Loan. Upon such securitization, the 261 Fifth Avenue Loan Pair will be serviced pursuant to the pooling and servicing agreement relating to such securitization. For additional information regarding the 261 Fifth Avenue Loan Pair, see “Description of the Mortgage Pool—The A/B Whole Loans and the Loan Pairs—The 261 Fifth Avenue Loan Pair” in the Free Writing Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

BACM 2015-UBS7 |

| STRUCTURE OVERVIEW |

| | | | | |

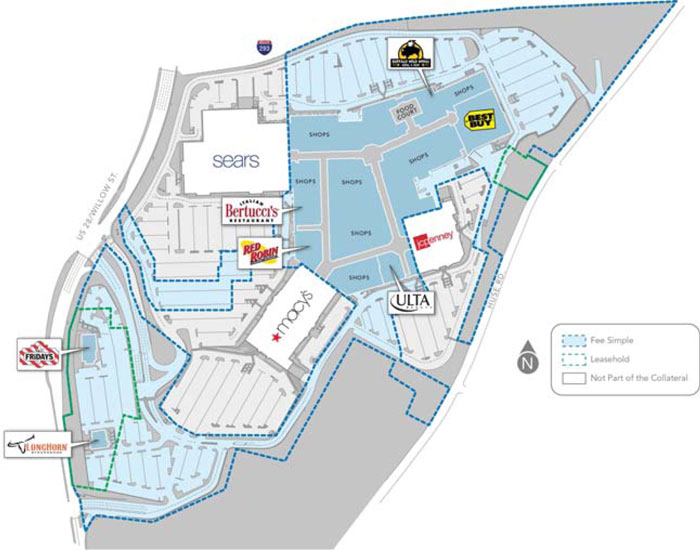

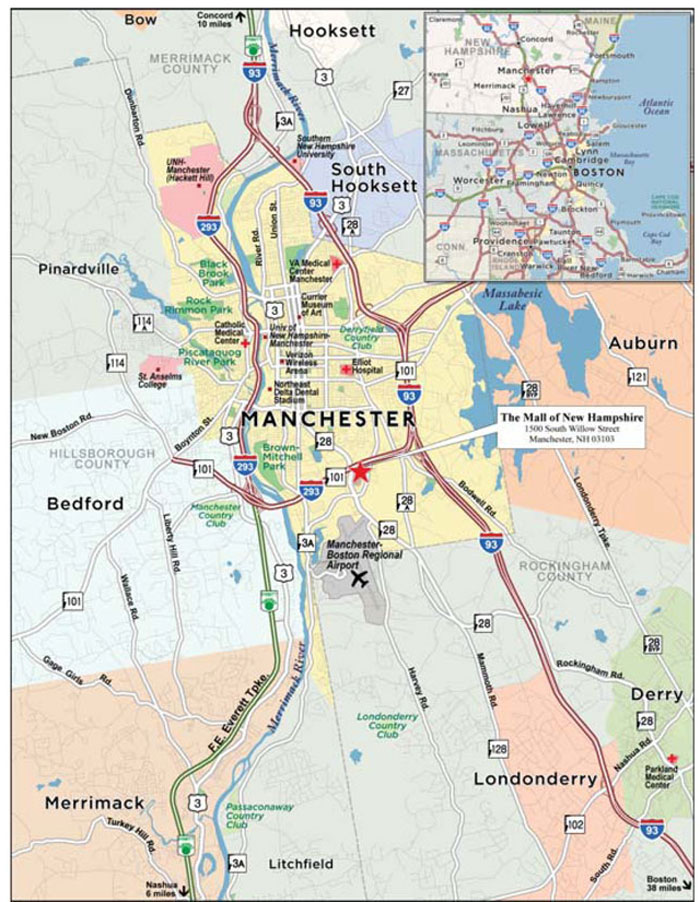

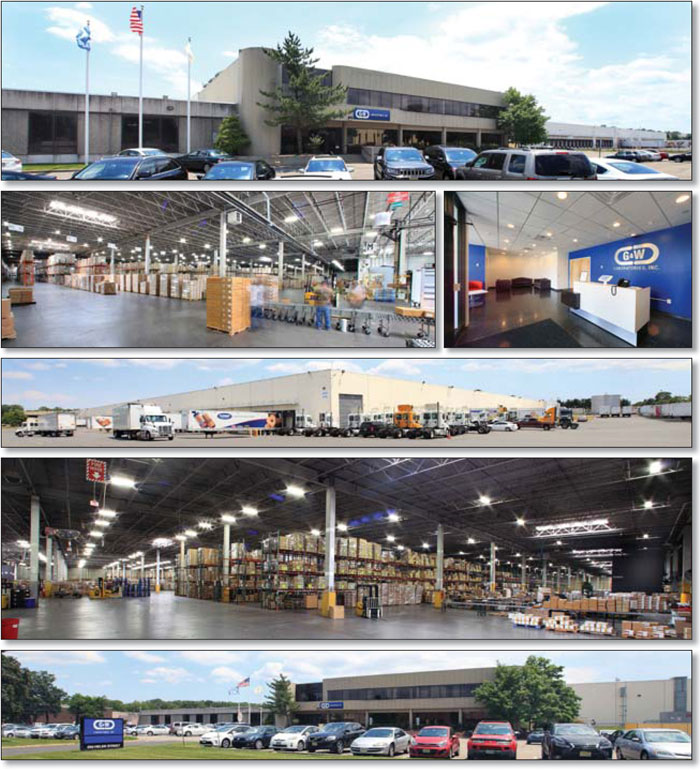

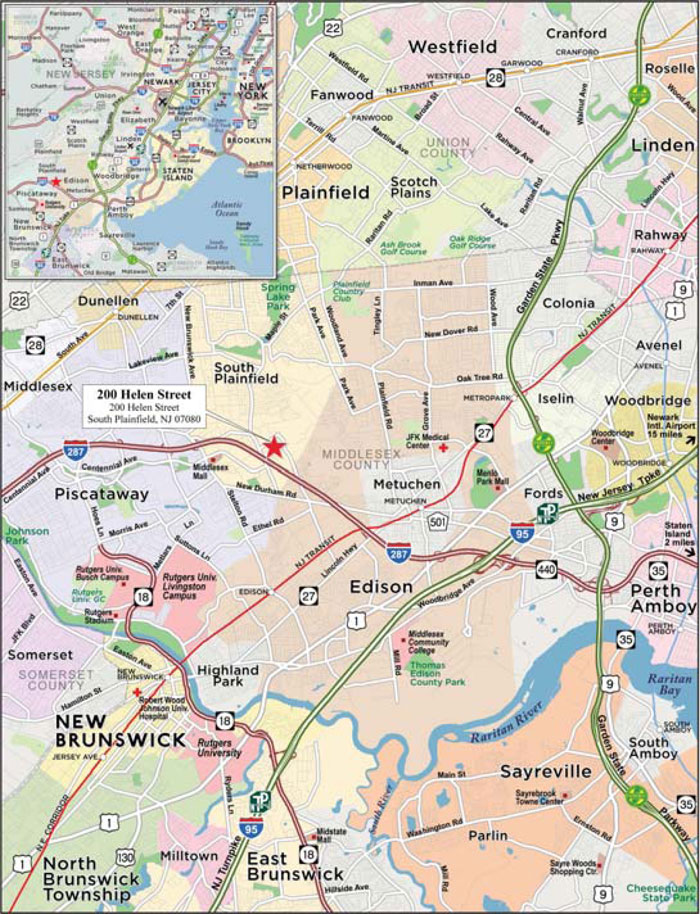

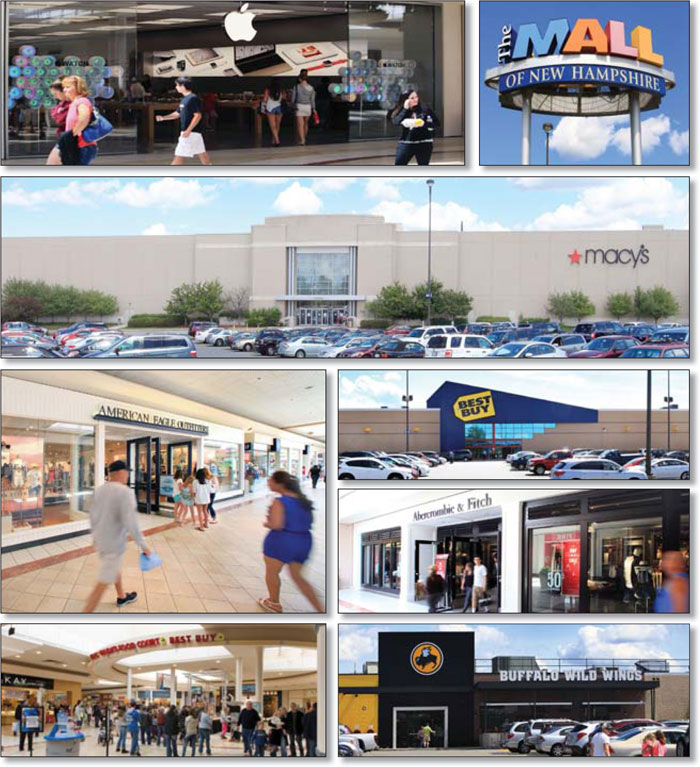

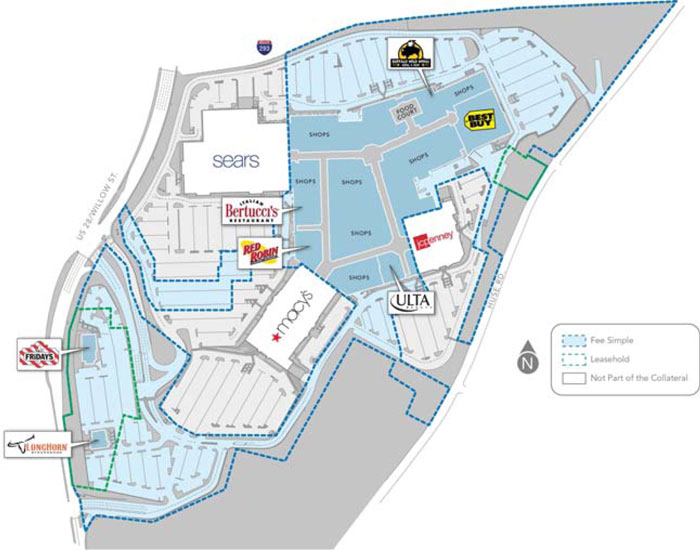

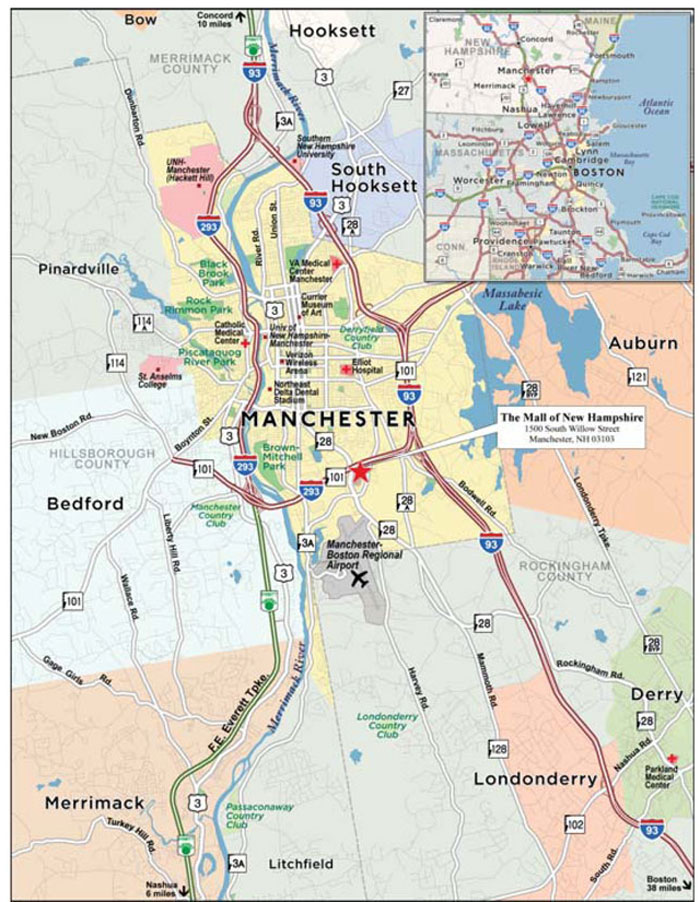

| | | Prior to the securitization of the 261 Fifth Avenue Pari Passu Companion Loan, the 261 Fifth Avenue Mortgage Loan and the 261 Fifth Avenue Pari Passu Companion Loan will be a “Loan Pair”. Following the securitization of the 261 Fifth Avenue Pari Passu Companion Loan, the 261 Fifth Avenue Mortgage Loan and the 261 Fifth Avenue Pari Passu Companion Loan will be a “Non-Serviced Loan Combination”. The Mall of New Hampshire The mortgaged property identified on APPENDIX I to the Free Writing Prospectus as The Mall of New Hampshire secures a mortgage loan with an outstanding principal balance as of the Cut-off Date of $50,000,000, evidenced by Note A-2 (“The Mall of New Hampshire Mortgage Loan”), representing approximately 6.6% of the Initial Outstanding Pool Balance, and also secures on apari passu basis one companion loan with an outstanding principal balance as of the Cut-off Date of $100,000,000, evidenced by Note A-1 (“The Mall of New Hampshire Pari Passu Companion Loan”), which was included in the CSAIL 2015-C3 securitization trust. The Mall of New Hampshire Mortgage Loan and The Mall of New Hampshire Pari Passu Companion Loan arepari passu in right of payment and are collectively referred to herein as “The Mall of New Hampshire Non-Serviced Loan Combination”. The Mall of New Hampshire Non-Serviced Loan Combination is being serviced pursuant to the CSAIL 2015-C3 pooling and servicing agreement and the related intercreditor agreement. For additional information regarding The Mall of New Hampshire Non-Serviced Loan Combination, see “Description of the Mortgage Pool—The Non-Serviced Loan Combinations—The Mall of New Hampshire Non-Serviced Loan Combination” in the Free Writing Prospectus. 200 Helen Street The mortgaged property identified on APPENDIX I to the Free Writing Prospectus as 200 Helen Street secures a mortgage loan with an outstanding principal balance as of the Cut-off Date of $41,500,000, evidenced by Note A (the “200 Helen Street Mortgage Loan”), representing approximately 5.5% of the Initial Outstanding Pool Balance, and also secures one subordinate companion loan, evidenced by Note B, with an outstanding principal balance as of the Cut-off Date of $9,936,740 (the “200 Helen Street B Note”) that is generally subordinate in right of payment to the 200 Helen Street Mortgage Loan. The 200 Helen Street B Note is currently held by a third-party investor (the “200 Helen Street B Note Holder”). The 200 Helen Street Mortgage Loan and the 200 Helen Street B Note are collectively referred to herein as the “200 Helen Street A/B Whole Loan”. The 200 Helen Street A/B Whole Loan will be serviced pursuant to the Pooling and Servicing Agreement and the related intercreditor agreement. The 200 Helen Street B Note Holder is the initial directing holder of the 200 Helen Street A/B Whole Loan until such time as such holder loses its rights as the directing holder as a result of an appraisal reduction or other trigger event (at which point the Controlling Class Representative, during a Subordinate Control Period, would be the directing holder of the 200 Helen Street A/B Whole Loan). For additional information regarding the 200 Helen Street A/B Whole Loan, see “Description of the Mortgage Pool—The Non-Serviced The A/B Whole Loans and the Loan Pairs—The 200 Helen Street A/B Whole Loan” in the Free Writing Prospectus. WPC Department Store Portfolio The portfolio of mortgaged properties identified on APPENDIX I to the Free Writing Prospectus as WPC Department Store Portfolio secures a mortgage loan with an outstanding principal balance as of the Cut-off Date of $20,100,000, evidenced by Note A-2 (the “WPC Department Store Portfolio Mortgage Loan”), representing approximately 2.7% of the Initial Outstanding Pool Balance, and also secures on apari passu basis two promissory notes (collectively, the “WPC Department Store Portfolio Pari Passu Companion Loan”) consisting of (i) one promissory note, evidenced by Note A-1, with an outstanding principal balance as of the Cut-off Date of $19,900,000 (the “WPC Department Store Portfolio Controlling Companion Loan”), which is currently held by UBSRES and is expected to be contributed into a future securitization, and (ii) one promissory note, evidenced by Note A-3, with an outstanding principal balance as of the Cut-off Date of $17,170,000, which was included in the CSAIL 2015-C3 securitization trust. The WPC Department Store Portfolio |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

BACM 2015-UBS7 |

| STRUCTURE OVERVIEW |

| | | | | |

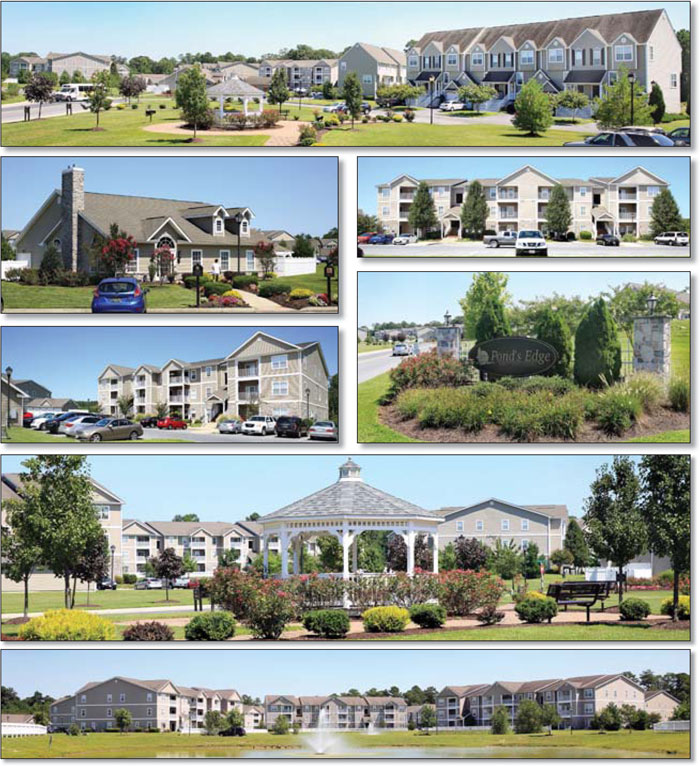

| | | Mortgage Loan and the WPC Department Store Portfolio Pari Passu Companion Loan arepari passu in right of payment and are collectively referred to herein as the “WPC Department Store Portfolio Loan Pair”. The WPC Department Store Portfolio Loan Pair will be serviced pursuant to the Pooling and Servicing Agreement and the related intercreditor agreement. For additional information regarding the WPC Department Store Portfolio Loan Pair, see “Description of the Mortgage Pool—The A/B Whole Loans and the Loan Pairs—The WPC Department Store Portfolio Non-Serviced Loan Combination” in the Free Writing Prospectus. Aviare Place Apartments The mortgaged property identified on APPENDIX I to the Free Writing Prospectus as Aviare Place Apartments secures a mortgage loan with an outstanding principal balance as of the Cut-off Date of $5,472,000, evidenced by Note A-2 (the “Aviare Place Apartments Mortgage Loan”), representing approximately 0.7% of the Initial Outstanding Pool Balance, and also secures on apari passu basis one companion loan that has an outstanding principal balance as of the Cut-off Date of $20,850,000, evidenced by one promissory note designated as Note A-1 (the “Aviare Place Apartments Pari Passu Companion Loan”), which was included in the MSBAM 2015-C23 securitization trust. The Aviare Place Apartments Mortgage Loan and theAviare Place Apartments Pari Passu Companion Loan arepari passu in right of payment and are collectively referred to herein as the “Aviare Place Apartments Non-Serviced Loan Combination”. The Aviare Place Apartments Non-Serviced Loan Combination is being serviced pursuant to the MSBAM 2015-C23 pooling and servicing agreement and the related intercreditor agreement. For additional information regarding the Aviare Place Apartments Non-Serviced Loan Combination, see “Description of the Mortgage Pool—The Non-Serviced Loan Combinations—Aviare Place Apartments Non-Serviced Loan Combination” in the Free Writing Prospectus. |

| | | |

| Control Rights and Controlling Class Representative: | | Controlling Class Certificateholders will have certain control rights over servicing matters with respect to each mortgage loan (other than Non-Serviced Mortgage Loans and the 261 Fifth Avenue Mortgage Loan after the securitization of the 261 Fifth Avenue Pari Passu Companion Loan) and Loan Pair (other than the 261 Fifth Avenue Loan Pair after the securitization of the 261 Fifth Avenue Pari Passu Companion Loan). The majority owner or appointed representative of the Class of Control Eligible Certificates that is the Controlling Class (such owner or representative, the “Controlling Class Representative”) will be entitled to direct the Special Servicer to take, or refrain from taking, certain actions with respect to a mortgage loan (other than Non-Serviced Mortgage Loans and the 261 Fifth Avenue Mortgage Loan after the securitization of the 261 Fifth Avenue Pari Passu Companion Loan) and Loan Pair (other than the 261 Fifth Avenue Loan Pair after the securitization of the 261 Fifth Avenue Pari Passu Companion Loan). Furthermore, the Controlling Class Representative will also have the right to receive notices and consent to certain material actions that the Master Servicer or the Special Servicer proposes to take with respect to a mortgage loan (other than Non-Serviced Mortgage Loans and the 261 Fifth Avenue Mortgage Loan after the securitization of the 261 Fifth Avenue Pari Passu Companion Loan) or Loan Pair (other than the 261 Fifth Avenue Loan Pair after the securitization of the 261 Fifth Avenue Pari Passu Companion Loan). Provided that the foregoing control rights will be subject to the 200 Helen Street B Note Holder’s control rights under the related intercreditor agreement with respect to the 200 Helen Street B Mortgage Loan. It is expected thatEllington Management Group, LLC or its affiliate will be the initial Controlling Class Representative with respect to each mortgage loan (other than Non-Serviced Mortgage Loans and the 261 Fifth Avenue Mortgage Loan after the securitization of the 261 Fifth Avenue Pari Passu Companion Loan) and Loan Pair (other than the 261 Fifth Avenue Loan Pair after the securitization of the 261 Fifth Avenue Pari Passu Companion Loan). For a description of the directing holders for Non-Serviced Loan Combinations and the 261 Fifth Avenue Loan Pair, see“Description of the Mortgage Pool—The Non-Serviced Loan Combinations” and “Servicing of the Mortgage Loans—The Controlling Class Representative” in the Free Writing Prospectus. |

| | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

BACM 2015-UBS7 |

| STRUCTURE OVERVIEW |

| | | | | |

| Control Eligible Certificates: | | Class E, Class F, Class G and Class H Certificates. |

| Controlling Class: | | The Controlling Class will be the most subordinate class of Control Eligible Certificates then outstanding that has an aggregate certificate principal balance, as notionally reduced by any Appraisal Reduction Amounts allocable to such class, equal to no less than 25% of the initial certificate principal balance of such class. The Controlling Class as of the Settlement Date will be the Class H Certificates. |

| Appraised-Out Class: | | Any Class of Control Eligible Certificates that has been determined, as a result of Appraisal Reductions allocable to such class, to no longer be the Controlling Class. |

Remedies Available to Holders

of an Appraised-Out Class: | | Holders of the majority of any class of Control Eligible Certificates that is determined at any time of determination to no longer be the Controlling Class as a result of an allocation of an Appraisal Reduction in respect of such Class will have the right, at their sole expense, to require the Special Servicer to order a second appraisal for any mortgage loan (other than Non-Serviced Mortgage Loans and the 261 Fifth Avenue Mortgage Loan and subject to the rights of the 200 Helen Street Note B Holder with respect to the 200 Helen Street Mortgage Loan) for which an Appraisal Event has occurred. Upon receipt of the second appraisal, the Special Servicer will be required to determine, in accordance with the Servicing Standard, whether, based on its assessment of the second appraisal, a recalculation of the Appraisal Reduction is warranted. If warranted, the Special Servicer will direct the Master Servicer to recalculate the Appraisal Reduction based on the second appraisal, and if required by such recalculation, the Special Servicer will reinstate the Appraised-Out Class as the Controlling Class. The holders of an Appraised-Out Class requesting a second appraisal will not be entitled to exercise any rights of the Controlling Class until such time, if any, as the Class is reinstated as the Controlling Class. |

| | | |

| Control Rights: | | During any Subordinate Control Period, the Controlling Class Representative will have certain consent and consultation rights under the Pooling and Servicing Agreement with respect to certain major decisions and other matters. A “Subordinate Control Period” means any period when the aggregate principal balance of the Class E Certificates (taking into account the application of any Appraisal Reductions to notionally reduce the aggregate principal balance of such class) is at least 25% of the initial aggregate principal balance of that class. During any Collective Consultation Period, the Controlling Class Representative will not have any consent rights, but the Controlling Class Representative and the Trust Advisor will each have certain non-binding consultation rights under the Pooling and Servicing Agreement with respect to certain major decisions and other matters;provided, the Trust Advisor’s consultation rights do not apply if the holder of the related serviced B note or serviced companion loan is acting as the directing holder with respect to such A/B whole loan or loan pair. A “Collective Consultation Period” means any period when both (i) the aggregate principal balance of the Class E Certificates (taking into account the application of any Appraisal Reductions to notionally reduce the aggregate principal balance of such class), is less than 25% of the initial aggregate principal balance of the Class E Certificates and (ii) the aggregate principal balance of that class (without regard to any Appraisal Reductions allocable to such class), is at least 25% of the initial aggregate principal balance of that class. During any Senior Consultation Period, the Controlling Class Representative will not have any consent or consultation rights, except with respect to any rights expressly set forth in the Pooling and Servicing Agreement, and the Trust Advisor will retain certain non-binding consultation rights under the Pooling and Servicing Agreement with respect to certain major decisions and other matters. A “Senior Consultation Period” means a period when the aggregate principal balance of the Class E Certificates (without regard to any Appraisal Reductions allocable to such class) is less than 25% of the initial aggregate principal balance of that class. Notwithstanding any of the foregoing to the contrary, the Controlling Class Representative will not have any rights to consent to or direct the special servicer or master servicer with respect to any major decision or any other material action involving (A) a Non-Serviced Loan Combination, (B) the 261 Fifth Avenue Loan Pair for so long as the holder of the relatedpari passucompanion |

| | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

BACM 2015-UBS7 |

| STRUCTURE OVERVIEW |

| | | | | |

| | | loan is the related controlling note holder under the related intercreditor agreement or (C) the 200 Helen Street A/B Whole Loan prior to such time as the related B note holder loses its rights as the controlling holder as a result of an appraisal reduction or other trigger event under the related intercreditor agreement. See“Description of the Mortgage Pool—The A/B Whole Loans and the Loan Pairs”,“Risk Factors—Risks Related to the Offered Certificates—Realization on a Mortgage Loan That Is Part of an A/B Whole Loan or Loan Pair May Be Adversely Affected by the Rights of the Related Directing Holder”and“Servicing of the Mortgage Loans—The Controlling Class Representative” in the Free Writing Prospectus. The Controlling Class Representative will also not have any consent or consultation rights with respect to any Non-Serviced Mortgage Loan or the 261 Fifth Avenue Mortgage Loan except for the non-binding consultation rights set forth in the related intercreditor agreement. See“Description of the Mortgage Pool—The Non-Serviced Loan Combinations”and“Description of the Mortgage Pool—The A/B Whole Loans and the Loan Pairs” in the Free Writing Prospectus. |

| | | |

Appointment and Replacement

of Special Servicer: | | The Controlling Class Representative will appoint the initial Special Servicer as of the Settlement Date. During a Subordinate Control Period, the Special Servicer (other than with respect to Non-Serviced Loan Combinations and the 261 Fifth Avenue Loan Pair after the securitization of the 261 Fifth Avenue Pari Passu Companion Loan) may generally be replaced by the Controlling Class Representative (a) for cause at any time and (b) without cause if (i) LNR Partners, LLC or |

| | | its affiliate is no longer the special servicer or (ii) LNR Securities Holdings, LLC or its affiliate owns less than 15% of the then Controlling Class of certificates. During any Collective Consultation Period or Senior Consultation Period, the Controlling Class Representative will no longer have the right to replace the Special Servicer and such replacement (other than with respect to Non-Serviced Loan Combinations and the 261 Fifth Avenue Loan Pair after the securitization of the 261 Fifth Avenue Pari Passu Companion Loan) will occur based on a vote of holders of all voting eligible classes of certificates as described below. See“Description of the Mortgage Pool—The Non-Serviced Loan Combinations” and“Servicing of the Mortgage Loans”in the Free Writing Prospectus for a description of the special servicer appointment and replacement rights with respect to Non-Serviced Loan Combinations and the 261 Fifth Avenue Loan Pair. |

Replacement of Special Servicer

by Vote of Certificateholders: | | Other than with respect to Non-Serviced Loan Combinations and the 261 Fifth Avenue Loan Pair (after the securitization of the 261 Fifth Avenue Pari Passu Companion Loan), during any Collective Consultation Period or Senior Consultation Period, upon (i) the written direction of holders of certificates evidencing not less than 25% of the voting rights of all classes of certificates entitled to principal (taking into account the application of Appraisal Reduction amounts to notionally reduce the certificate principal balance of classes to which such Appraisal Reductions are allocable) requesting a vote to replace the Special Servicer with a replacement Special Servicer, (ii) payment by such requesting holders to the Certificate Administrator and/or the trustee of all reasonable fees and expenses to be incurred by the Certificate Administrator and/or the trustee in connection with administering such vote and (iii) delivery by such Holders to each Rating Agency (with a copy to the Certificate Administrator and the Trustee) of a Rating Agency Communication, the Certificate Administrator will be required to promptly provide written notice to all certificateholders of such request by posting such notice on its internet website and by mailing such notice to their addresses appearing in the certificate register. Upon the written direction of the holders of certificates evidencing at least 75% of the aggregate voting rights of all certificates, the Trustee will be required to terminate all of the rights and obligations of the special servicer under the Pooling and Servicing Agreement and appoint the proposed successor special servicer;provided that if that written direction is not provided within 180 days of the initial request for a vote to terminate and replace the Special Servicer, then that written direction will have no force and effect. In addition, during any Senior Consultation Period, if the Trust Advisor determines that the Special Servicer is not performing its duties in accordance with the Servicing Standard, the Trust Advisor will have the right to recommend the replacement of the Special Servicer (other than with respect to Non-Serviced Loan Combinations and the 261 Fifth Avenue Loan Pair after the securitization of the 261 Fifth Avenue Pari Passu Companion Loan). The Trust Advisor’s recommendation to replace the Special Servicer (other than with respect to Non- |

| | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

BACM 2015-UBS7 |

| STRUCTURE OVERVIEW |

| | | | | |

| | | Serviced Loan Combinations and the 261 Fifth Avenue Loan Pair after the securitization of the 261 Fifth Avenue Pari Passu Companion Loan) must be confirmed by a majority of the voting rights of all classes of certificates entitled to principal (taking into account the application of Appraisal Reduction amounts to notionally reduce the Certificate Balances of classes to which such Appraisal Reduction Amounts are allocable) within 180 days from the time such recommendation is posted to the Certificate Administrator website and is subject to the receipt of written confirmations from each Rating Agency that the appointment of the replacement Special Servicer will not result in a downgrade of the certificates. See“Description of the Mortgage Pool—The Non-Serviced Loan Combinations”and “Servicing of the Mortgage Loans”in theFree Writing Prospectus for a description of the special servicer appointment and replacement rights with respect to Non-Serviced Loan Combinations and the 261 Fifth Avenue Loan Pair. |

Cap on Workout and Liquidation

Fees: | | The workout fees and liquidation fees payable to the Special Servicer under the Pooling and Servicing Agreement will be an amount equal to the lesser of: (1) 1.0% of each collection of interest and principal following a workout or liquidation and (2) $1,000,000 per workout or liquidation. All Modification Fees actually paid to the Special Servicer in connection with a workout or liquidation or in connection with any prior workout or partial liquidation that occurred within the prior 18 months will be deducted from the total workout and/or liquidation feespayable (other than Modification Fees earned while the mortgage loan was not in special servicing). In addition, the total amount of workout and liquidation fees actually payable by the Trust under the Pooling and Servicing Agreement will be capped in the aggregate at $1,000,000 for each related mortgage loan. If a new special servicer begins servicing the related mortgage loan, all amounts paid to the prior special servicer will be disregarded for purposes of calculating the cap. |

| | | |

| Special Servicer Compensation: | | The special servicing fee will equal 0.25%per annum of the stated principal balance of the related specially serviced loan or REO property or, if such rate would result in a special servicing fee that would be less than $2,000 in any given month, such higher rate as would result in a special servicing fee equal to $2,000 for such month. The Special Servicer and its affiliates will be prohibited from receiving or retaining any compensation or any other remuneration under the Pooling and Servicing Agreement (including in the form of commissions, brokerage fees, rebates, or as a result of any other fee-sharing arrangement) from any person (including the issuing entity, any borrower, any manager, any guarantor or indemnitor in respect of a mortgage loan or Loan Pair, if any, and any purchaser of any mortgage loan, Serviced Companion Loan or REO Property) in connection with the disposition, workout or foreclosure of any mortgage loan or Loan Pair, the management or disposition of any REO Property, or the performance of any other special servicing duties under the Pooling and Servicing Agreement, other than as expressly permitted in the Pooling and Servicing Agreement and other than commercially reasonable treasury management fees, banking fees, customary title agent fees and insurance commissions or fees received or retained by the Special Servicer or any of its Affiliates in connection with any services performed by such party with respect to any mortgage loan. Subject to certain limited exceptions, the Special Servicer will also be required to report any compensation or other remuneration the Special Servicer or its affiliates have received from any person and such information will be disclosed in the Certificateholders’ monthly distribution date statement. |

| Trust Advisor: | | With respect to the mortgage loans (other than with respect to Non-Serviced Loan Combinations and the 261 Fifth Avenue Loan Pair after the securitization of the 261 Fifth Avenue Pari Passu Companion Loan), (A) the Trust Advisor will be required to promptly review all information available to certain privileged persons on the Certificate Administrator’s website related to any specially serviced mortgage loan or REO property and each asset status report with respect to specially serviced mortgage loans (provided, that during any Subordinate Control Period, the Trust Advisor may only review final asset status reports) and (B) during any Collective Consultation Period or Senior Consultation Period, the Trust Advisor will have consultation rights with respect to certain major decisions and will have additional monitoring responsibilities on behalf of the entire trust. The Trust Advisor will be subject to termination if holders of at least 25% of the voting rights request (in connection with termination and replacement relating to the mortgage loans) a vote to terminate and replace the Trust Advisor and such vote is approved by holders of more than 75% of the applicable voting rights that exercise their right to vote. The holders initiating such |

| | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

BACM 2015-UBS7 |

| STRUCTURE OVERVIEW |

| | | | | |

| | vote will be responsible for the fees and expenses in connection with the vote and replacement. The Trust Advisor will not have consultation rights in respect of any Non-Serviced Mortgage Loan, the 261 Fifth Avenue Mortgage Loan or any related REO property. |

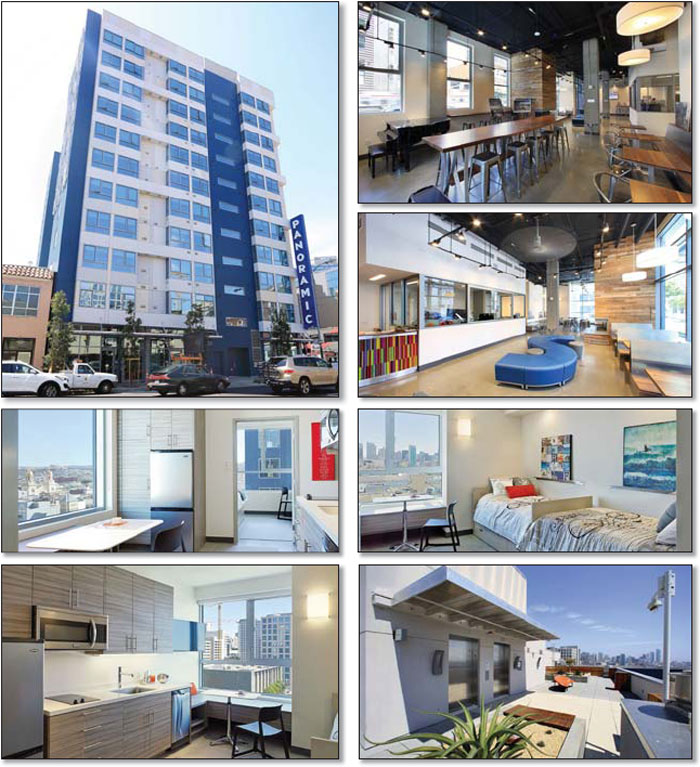

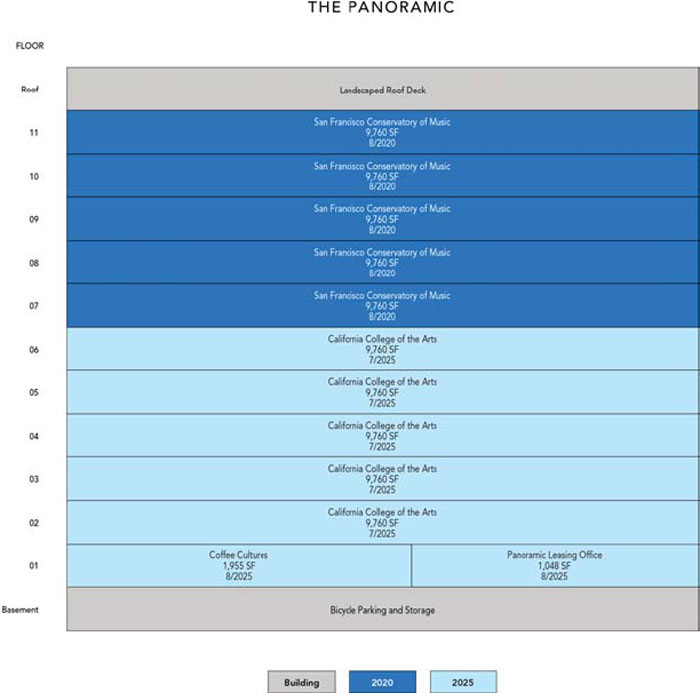

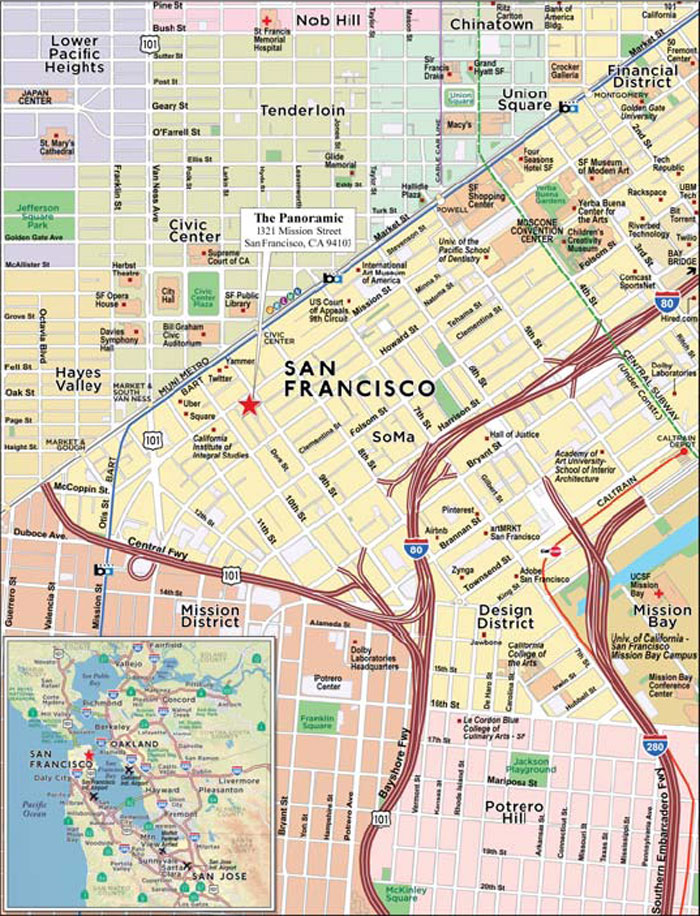

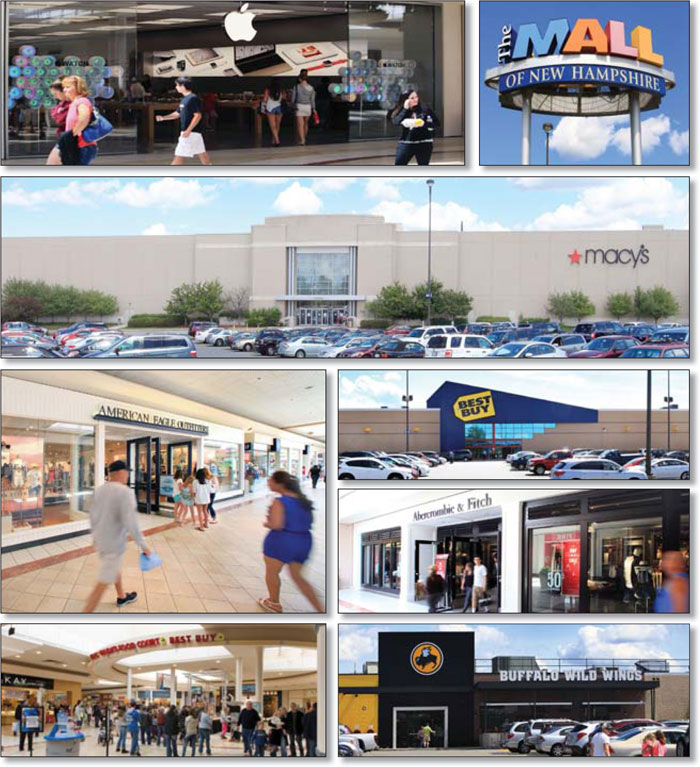

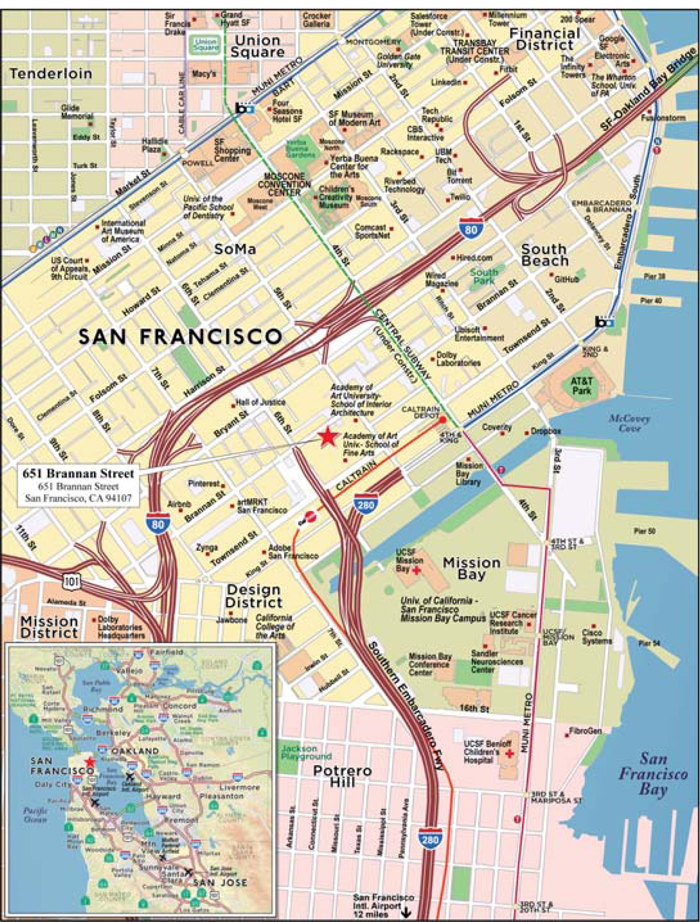

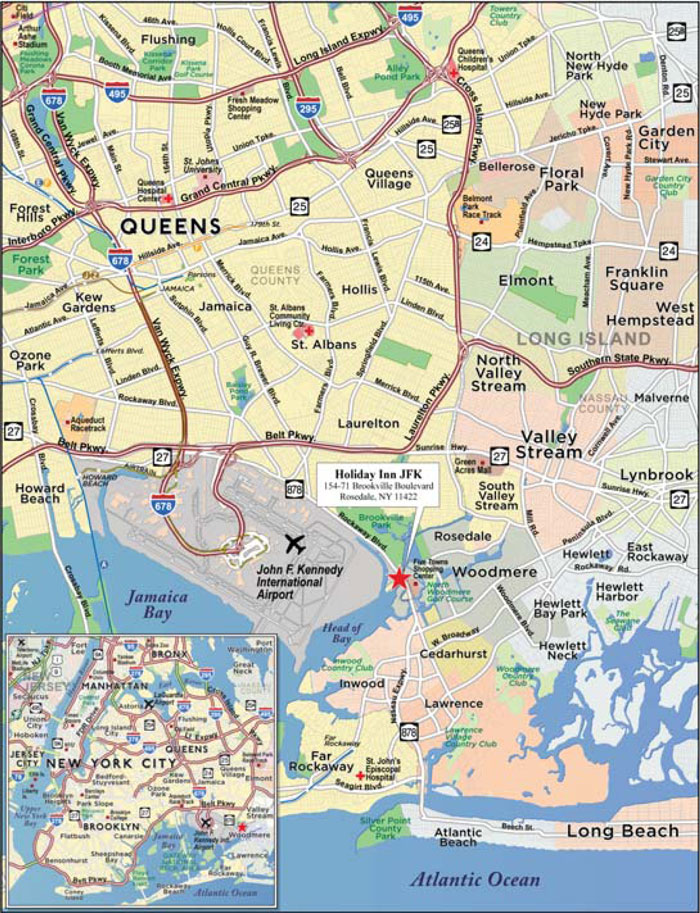

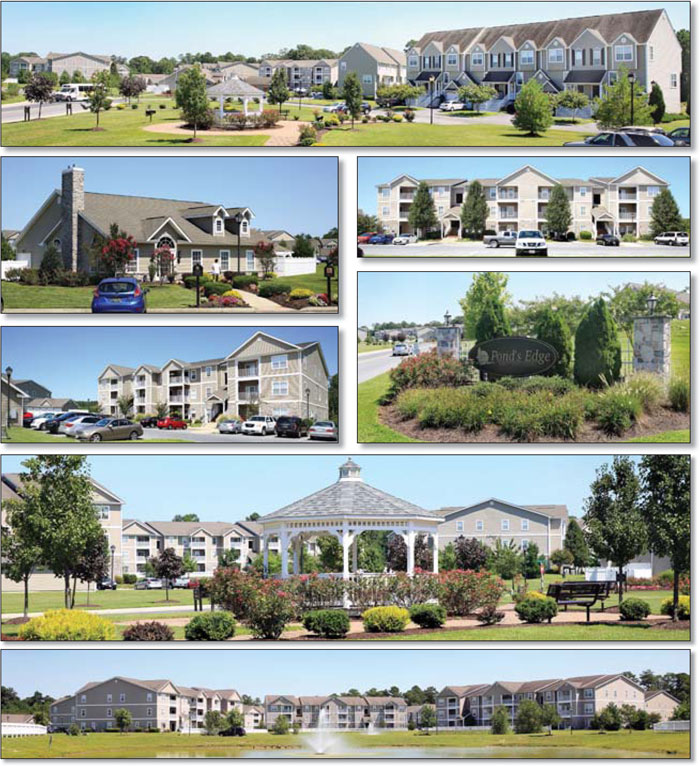

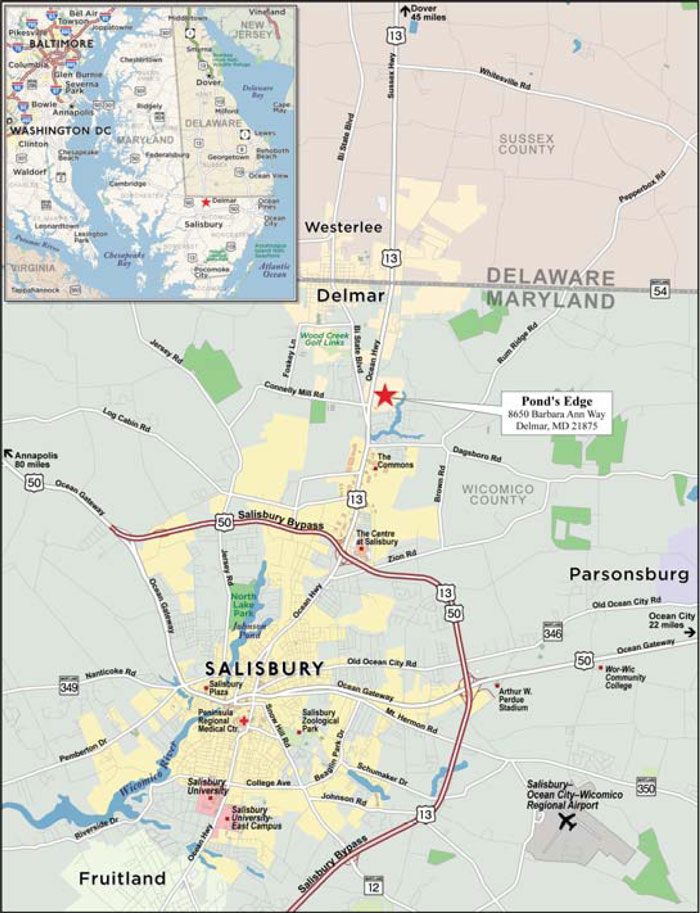

| Liquidated Loan Waterfall: | | On liquidation of any mortgage loan, all net liquidation proceeds will be applied so that amounts allocated as a recovery of accrued and unpaid interest will not, in the first instance, include any amount by which the interest portion of P&I Advances previously made was reduced as a result of Appraisal Reductions. After the adjusted interest amount is so allocated, any remaining net liquidation proceeds will be allocated to pay principal on the mortgage loan until the unpaid principal amount of the mortgage loan has been reduced to zero. Any remaining liquidation proceeds would then be allocated as a recovery of accrued and unpaid interest corresponding to the amount by which the interest portion of P&I Advances previously made was reduced as a result of Appraisal Reductions. |