FREE WRITING PROSPECTUS

FILED PURSUANT TO RULE 433

REGISTRATION FILE NO.: 333-201743-02

Morgan Stanley Bank of America Merrill Lynch Trust 2015-C25

Free Writing Prospectus

Structural and Collateral Term Sheet

$1,179,418,010

(Approximate Total Mortgage Pool Balance)

$1,080,642,000

(Approximate Offered Certificates)

Banc of America Merrill Lynch Commercial Mortgage Inc.

as Depositor

Bank of America, National Association

Morgan Stanley Mortgage Capital Holdings LLC

CIBC Inc.

Starwood Mortgage Funding III LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2015-C25

September 28, 2015

| | |

| BofA MERRILL LYNCH | MORGAN STANLEY |

| | |

Co-Lead Bookrunning Manager CIBC World Markets | Co-Lead Bookrunning Manager Drexel Hamilton |

| Co-Managers |

| |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the SEC (File No. 333-201743) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC web site at www.sec.gov. Alternatively, the depositor or any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll free 1-800-294-1322 or by email to dg.Prospectus_Requests@baml.com.

This is not a research report and was not prepared by any Underwriter’s research department. It was prepared by the Underwriters’ sales, trading, banking or other non-research personnel. Please see additional important information and qualifications at the end of this Term Sheet. |

Neither this Term Sheet nor anything contained herein shall form the basis for any contract or commitment whatsoever. The information contained herein is preliminary as of the date hereof. This Term Sheet is subject to change, completion or amendment from time to time. The information contained herein will be superseded by similar information delivered to you as part of the Free Writing Prospectus. The information contained herein supersedes any such information previously delivered. The information contained herein should be reviewed only in conjunction with the entire Free Writing Prospectus. All of the information contained herein is subject to the same limitations and qualifications contained in the Free Writing Prospectus. The information contained herein does not contain all relevant information relating to the underlying mortgage loans or mortgaged properties. Such information is described in the Free Writing Prospectus and the Prospectus attached thereto as Exhibit A. The information contained herein will be more fully described in the Free Writing Prospectus. The information contained herein should not be viewed as projections, forecasts, predictions or opinions with respect to value. Prior to making any investment decision, prospective investors are strongly urged to read the Free Writing Prospectus in its entirety. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Term Sheet is truthful or complete. Any representation to the contrary is a criminal offense.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of, or attached to, the email communication to which this Term Sheet may have been attached are not applicable to this Term Sheet and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of this Term Sheet having been sent via Bloomberg or another email system.

IMPORTANT NOTICE REGARDING THE CONDITIONS FOR THIS OFFERING OF ASSET-BACKED SECURITIES

THE ASSET-BACKED SECURITIES REFERRED TO IN THIS TERM SHEET ARE BEING OFFERED WHEN, AS AND IF ISSUED. IN PARTICULAR, YOU ARE ADVISED THAT THE ASSET-BACKED SECURITIES, AND THE ASSET POOL BACKING THEM, ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING, AMONG OTHER THINGS, THE POSSIBILITY THAT ONE OR MORE CLASSES OF SECURITIES MAY BE SPLIT, COMBINED OR ELIMINATED), AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS. AS A RESULT, YOU MAY COMMIT TO PURCHASE SECURITIES THAT HAVE CHARACTERISTICS THAT MAY CHANGE, AND YOU ARE ADVISED THAT ALL OR A PORTION OF THE SECURITIES MAY NOT BE ISSUED THAT HAVE THE CHARACTERISTICS DESCRIBED IN THIS TERM SHEET. OUR OBLIGATION TO SELL SECURITIES TO YOU IS CONDITIONED ON THE SECURITIES AND THE UNDERLYING TRANSACTION HAVING THE CHARACTERISTICS DESCRIBED IN THIS TERM SHEET. IF WE DETERMINE THAT THE FOREGOING CONDITION IS NOT SATISFIED IN ANY MATERIAL RESPECT, WE WILL NOTIFY YOU, AND NEITHER THE ISSUING ENTITY NOR ANY UNDERWRITER WILL HAVE ANY OBLIGATION TO YOU TO DELIVER ALL OR ANY PORTION OF THE SECURITIES WHICH YOU HAVE COMMITTED TO PURCHASE, AND THERE WILL BE NO LIABILITY BETWEEN US AS A CONSEQUENCE OF THE NON-DELIVERY.

| MSBAM 2015‑C25 | Structural Overview |

Offered Certificates

| | | | | | | | | |

| Class | Expected Ratings

(Fitch/KBRA/Moody’s)(1) | Approximate Initial Certificate Principal Balance or Notional Amount(2) | Approximate Initial Credit Support(3) | Pass-Through Rate Description | Expected Weighted Average Life (Years)(5) | Principal

Window

(Months)(5) | Certificate Principal UW NOI Debt Yield(6) | Certificate

Principal

to Value

Ratio(7) |

| Class A-1 | AAAsf/AAA(sf)/Aaa(sf) | $34,000,000 | 30.000% | (4) | 2.88 | 1-57 | 13.5% | 46.3% |

| Class A-2 | AAAsf/AAA(sf)/Aaa(sf) | $28,700,000 | 30.000% | (4) | 4.85 | 57-59 | 13.5% | 46.3% |

| Class A-SB | AAAsf/AAA(sf)/Aaa(sf) | $93,700,000 | 30.000% | (4) | 7.31 | 59-116 | 13.5% | 46.3% |

| Class A-3 | AAAsf/AAA(sf)/Aaa(sf) | $115,000,000 | 30.000% | (4) | 8.25 | 99-99 | 13.5% | 46.3% |

| Class A-4 | AAAsf/AAA(sf)/Aaa(sf) | $230,000,000 | 30.000% | (4) | 9.77 | 116-118 | 13.5% | 46.3% |

| Class A-5 | AAAsf/AAA(sf)/Aaa(sf) | $324,193,000 | 30.000% | (4) | 9.83 | 118-118 | 13.5% | 46.3% |

| Class X-A | AAAsf/AAA(sf)/Aaa(sf) | $825,593,000(8) | N/A | Variable IO(9) | N/A | N/A | N/A | N/A |

| Class X-B | AA-sf/AAA(sf)/NR | $135,633,000(8) | N/A | Variable IO(9) | N/A | N/A | N/A | N/A |

| Class X-D | BBB-sf/BBB-(sf)/NR | $63,394,000(8) | N/A | Variable IO(9) | N/A | N/A | N/A | N/A |

| Class A-S | AAAsf/AAA(sf)/Aa2(sf) | $45,702,000 | 26.125% | (4) | 9.84 | 118-119 | 12.8% | 48.9% |

| Class B | AA-sf/AA-(sf)/NR | $89,931,000 | 18.500% | (4) | 9.92 | 119-119 | 11.6% | 54.0% |

| Class C | A-sf/A-(sf)/NR | $56,022,000 | 13.750% | (4) | 9.92 | 119-119 | 11.0% | 57.1% |

| Class D | BBB-sf/BBB-(sf)/NR | $63,394,000 | 8.375% | (4) | 9.92 | 119-119 | 10.3% | 60.7% |

Privately Offered Certificates(10)

| | | | | | | | | |

| Class | Expected Ratings

(Fitch/KBRA/Moody’s)(1) | Approximate Initial Certificate Principal Balance or Notional Amount(2) | Approximate

Initial Credit

Support(3) | Pass-Through Rate Description | Expected Weighted Average Life (Years)(5) | Principal

Window (Months)(5) | Certificate

Principal UW NOI Debt

Yield(6) | Certificate

Principal

to Value

Ratio(7) |

| Class E | BB-sf/BB-(sf)/NR | $29,485,000 | 5.875% | (4) | 9.92 | 119-119 | 10.1% | 62.3% |

| Class F | B-sf/B-(sf)/NR | $13,269,000 | 4.750% | (4) | 9.92 | 119-119 | 9.9% | 63.1% |

| Class G | NR/NR/NR | $56,022,010 | 0.000% | (4) | 10.43 | 119-179 | 9.5% | 66.2% |

_______________________

| (1) | Ratings shown are those of Fitch Ratings, Inc., Kroll Bond Rating Agency, Inc. and Moody’s Investors Service, Inc. Certain nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, or otherwise to rate the certificates. There can be no assurance as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Risks Related to the Offered Certificates—Ratings of the Offered Certificates Do Not Represent Any Assessment of the Yield to Maturity That a Certificateholder May Experience and Such Ratings May Be Reviewed, Revised, Suspended, Downgraded, Qualified or Withdrawn By the Applicable Rating Agency” and “Ratings” in the other free writing prospectus, which is expected to be dated the date hereof (the “Free Writing Prospectus”), to which the prospectus dated September 14, 2015 (the “Prospectus”) is attached as Exhibit A. Capitalized terms used but not defined herein have the meanings assigned to such terms in the Free Writing Prospectus. |

| (2) | The certificate principal balances and notional amounts are approximate and on the closing date may vary by up to 5%. Mortgage loans may be removed from or added to the mortgage pool prior to the closing date within the same maximum permitted variance. Any reduction or increase in the aggregate principal balance of mortgage loans within these parameters will result in changes to the initial certificate principal balance or notional amount of each class of certificates shown in the table above and to the other statistical data contained herein and in the Free Writing Prospectus. In addition, the notional amounts of the Class X-A, Class X-B and Class X-D Certificates may vary depending upon the final pricing of the classes of principal balance certificates whose certificate principal balances comprise such notional amounts, and, if as a result of such pricing the pass-through rate of the Class X-A, Class X-B or Class X-D Certificates, as applicable, would be equal to zero, such class of certificates will not be issued on the closing date of this securitization. |

| (3) | The percentages indicated under the column “Approximate Initial Credit Support” with respect to the Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4 and Class A-5 Certificates represent the approximate credit support for the Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4 and Class A-5 Certificates in the aggregate. |

| (4) | The Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4, Class A-5, Class A-S, Class B, Class C, Class D, Class E, Class F and Class G Certificates will, at all times, accrue interest at a per annum rate equal to (i) a fixed rate, (ii) a fixed rate subject to a cap equal to the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) or (iii) a rate equal to the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) less a specified percentage, which percentage may be zero. |

| (5) | The principal window is expressed in months following the closing date and reflects the period during which distributions of principal would be received under the assumptions set forth in the following sentence. The expected weighted average life and principal window figures set forth above are based on the following assumptions, among others: (i) no defaults or subsequent losses on the mortgage loans; (ii) no extensions of maturity dates of the mortgage loans; (iii) payment in full on the stated maturity date or, in the case of any mortgage loan having an anticipated repayment date, on the anticipated repayment date; and (iv) no prepayments of the mortgage loans prior to maturity or, in the case of a mortgage loan having an anticipated repayment date, prior to such anticipated repayment date. See the structuring assumptions set forth under “Yield, Prepayment and Maturity Considerations—Weighted Average Life” in the Free Writing Prospectus. |

| (6) | Certificate Principal UW NOI Debt Yield for any class of principal balance certificates is calculated as the product of (a) the weighted average UW NOI Debt Yield for the mortgage pool, multiplied by (b) a fraction, the numerator of which is the total initial principal balance of all the principal balance certificates, and the denominator of which is the total initial principal balance of the subject class of principal balance certificates and all other classes of principal balance certificates, if any, that are senior to such class. The Certificate Principal UW NOI Debt Yields of the Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4 and Class A-5 Certificates are calculated in the aggregate for those classes as if they were a single class. |

| (7) | Certificate Principal to Value Ratio for any class of principal balance certificates is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio of the mortgage pool, multiplied by (b) a fraction, the numerator of which is the total initial principal balance of the subject class of principal balance certificates and all other classes of principal balance certificates that are senior to such class, and the denominator of which is the total initial principal balance of all the principal balance certificates. The Certificate Principal to Value Ratios of the Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4 and Class A-5 Certificates are calculated in the aggregate for those classes as if they were a single class. |

| (8) | The Class X-A, Class X-B and Class X-D Certificates (collectively, the “Class X Certificates”) will not have certificate principal balances and will not be entitled to receive distributions of principal. Interest will accrue on the Class X-A, Class X-B and Class X-D Certificates at their respective pass-through rates based upon their respective notional amounts. The notional amount of the Class X-A Certificates will equal the aggregate certificate principal balance of the Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4 and Class A-5 Certificates outstanding from time to time. The notional amount of the Class X-B Certificates will equal the aggregate certificate |

| MSBAM 2015‑C25 | Structural Overview |

principal balance of the Class A-S and Class B Certificates outstanding from time to time. The notional amount of the Class X-D Certificates will equal the certificate principal balance of the Class D Certificates outstanding from time to time.

| (9) | The pass-through rate on the Class X-A Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the weighted average of the pass-through rates of the Class A-1, Class A-2, Class A-SB, Class A-3, Class A-4 and Class A-5 Certificates as described in the Free Writing Prospectus. The pass-through rate on the Class X-B Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the weighted average of the pass-through rates of the Class A-S and Class B Certificates as described in the Free Writing Prospectus. The pass-through rate on the Class X-D Certificates will generally be equal to the excess, if any, of (a) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate of the Class D Certificates as described in the Free Writing Prospectus. |

| (10) | Not offered pursuant to the Prospectus, the Free Writing Prospectus or this Term Sheet. Information provided in this Term Sheet regarding the characteristics of these certificates is provided only to enhance your understanding of the offered certificates. The privately offered certificates also include the Class V and Class R Certificates, which do not have a certificate principal balance, notional amount, pass-through rate, rating or rated final distribution date, and which are not shown in the chart. The Class V Certificates represent a beneficial ownership interest held through the grantor trust in certain excess interest in respect of mortgage loans having anticipated repayment dates, if any. The Class R Certificates represent the beneficial ownership of the residual interest in each of the real estate mortgage investment conduits, including the separate real estate mortgage investment conduits related to the Herald Center mortgage loan, as further described in the Free Writing Prospectus. |

| MSBAM 2015‑C25 | Structural Overview |

Issue Characteristics

| Offered Certificates: | $1,080,642,000 (approximate) monthly pay, multi-class, commercial mortgage pass-through certificates, consisting of ten principal balance classes (Class A‑1, Class A‑2, Class A‑SB, Class A‑3, Class A‑4, Class A‑5, Class A-S, Class B, Class C and Class D) and three interest-only classes (Class X-A, Class X-B and Class X-D) |

| Co-Lead Bookrunning Managers: | Merrill Lynch, Pierce, Fenner & Smith Incorporated and Morgan Stanley & Co. LLC |

| Co-Managers: | CIBC World Markets Corp. and Drexel Hamilton, LLC |

| Mortgage Loan Sellers: | Bank of America, National Association, Morgan Stanley Mortgage Capital Holdings LLC, CIBC Inc. and Starwood Mortgage Funding III LLC |

| Rating Agencies: | Fitch Ratings Inc., Kroll Bond Rating Agency, Inc. and Moody’s Investors Service, Inc. |

| Master Servicer: | Wells Fargo Bank, National Association |

| Special Servicer: | Midland Loan Services, a Division of PNC Bank, National Association |

| Certificate Administrator/ Certificate Registrar/Custodian: | U.S. Bank National Association |

| Trustee: | U.S. Bank National Association |

| Trust Advisor: | Pentalpha Surveillance LLC |

| Initial Controlling Class Representative: | Eightfold Real Estate Capital Fund IV, L.P. or an affiliate thereof |

| Cut-off Date: | October 1, 2015. For purposes of the information contained in this term sheet (this “Term Sheet”), scheduled payments due in October 2015 with respect to mortgage loans not having payment dates on the first day of each month have been deemed received on October 1, 2015, not the actual day on which such scheduled payments were due. |

| Expected Pricing Date: | Week of October 4, 2015 |

| Expected Closing Date: | Week of October 11, 2015 |

| Determination Dates: | The 11th calendar day of each month (if the 11th calendar day is not a business day, the next succeeding business day), commencing in November 2015. |

| Distribution Dates: | The 4th business day following the Determination Date in each month, commencing in November 2015 |

| Rated Final Distribution Date: | The Distribution Date in October 2048. |

| Interest Accrual Period: | Preceding calendar month |

| Payment Structure: | Sequential pay |

| Tax Treatment: | REMIC |

| Optional Termination: | 1.00% clean-up call |

| Minimum Denominations: | $10,000 for each class of Offered Certificates (other than Class X-A, Class X-B and Class X-D Certificates); $100,000 for the Class X-A, Class X-B and Class X-D Certificates |

| Settlement Terms: | DTC, Euroclear and Clearstream |

| Legal/Regulatory Status: | Each class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No class of Offered Certificates is SMMEA eligible. |

| Analytics: | The certificate administrator is expected to make available all distribution date statements, CREFC® reports and supplemental notices received by it to certain modeling financial services as described in the Free Writing Prospectus. |

| Bloomberg Ticker: | MSBAM 2015-C25 <MTGE><GO> |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE FREE WRITING PROSPECTUS AND THE “RISK FACTORS” SECTION OF THE PROSPECTUS. |

| MSBAM 2015‑C25 | Structural Overview |

Structural Overview

| Accrual: | Each class of Offered Certificates will accrue interest on a 30/360 basis. |

| Amount and Order of Distributions: | On each distribution date, certificateholders will be entitled to receive distributions of interest and principal from funds received with respect to the mortgage loans and available for distribution. Funds available for distribution on the certificates will be net of excess interest, excess liquidation proceeds and specified trust expenses, including, without limitation, all advance reimbursements (with interest) and all servicing fees and expenses, certificate administrator fees (including trustee fees and custodian fees) and expenses, special servicer compensation, trust advisor fees (together with certain trust advisor consulting fees), CREFC® license fees and expenses as set forth below. Distributions to certificateholders on each distribution date out of payments (or advances in lieu thereof) and other collections on the mortgage loans will be in an amount equal to each class’s interest and principal entitlement, subject to: (i) payment of the respective interest entitlement for any other class of certificates bearing an earlier alphanumeric designation (except in respect of the distribution of interest among the Class A‑1, Class A‑2, Class A‑SB, Class A‑3, Class A‑4, Class A‑5, Class X-A, Class X-B and Class X-D Certificates, which will have the same senior priority and be distributed pro rata); (ii) if applicable, payment of the respective principal entitlement for the distribution date to the outstanding classes of principal balance certificates, first, to the Class A‑SB Certificates, until the principal balance of such class has been reduced to the planned principal balance for the related distribution date set forth on APPENDIX VII to the Free Writing Prospectus, then, to the Class A‑1, Class A‑2, Class A‑3, Class A‑4, Class A‑5 and Class A‑SB Certificates, in that order (or pro rata among such classes if the principal balance of all other classes of certificates has been reduced to zero as a result of the allocation of mortgage loan losses or trust advisor expenses to such other classes, or if the aggregate appraisal reduction equals or exceeds the aggregate principal balance of the Class A‑S through Class G Certificates), until the principal balance of each such class has been reduced to zero, and then to the Class A-S, Class B, Class C, Class D, Class E, Class F and Class G Certificates, in that order, until the principal balance of each such class has been reduced to zero; and (iii) the allocation of trust advisor expenses, (a) first, to reduce payments of interest on the Class D, Class C and Class B Certificates, in that order, (b) second, to reduce payments of principal on the Class D, Class C, Class B and Class A-S Certificates, in that order, and (c) third, to reduce payments of principal on the Class A‑1, Class A‑2, Class A‑SB, Class A‑3, Class A‑4 and Class A‑5 Certificates on a pro rata basis. No trust advisor expenses (which do not include the trust advisor fee) will be allocated to or otherwise borne by the Control Eligible Certificates. As a result, none of the classes of such certificates will provide protection to the more senior classes of certificates for the purposes of allocating losses based on trust advisor expenses. |

| Interest and Principal Entitlements: | Interest distributable on any class of certificates (other than the Class V and Class R Certificates) on any distribution date, with various adjustments described under “Description of the Offered Certificates—Distributions” in the Free Writing Prospectus, represents all unpaid interest accrued with respect to that class of certificates through the end of the interest accrual period that corresponds to that distribution date. Interest accrues with respect to each such interest-bearing certificate during each interest accrual period at the applicable pass-through rate for, and on the principal balance or notional amount, as applicable, of that certificate outstanding immediately prior to, the distribution date that corresponds to that interest accrual period. However, as described in “Description of the Offered Certificates—Distributions” in the Free Writing Prospectus, there are circumstances relating to the timing of prepayments in which the interest entitlement with respect to any certificate for a distribution date could be less than one full month’s interest at the pass-through rate on the certificate’s principal balance or notional amount. In addition, certain specified trust fund expenses, the right of the master servicer, the special servicer and the trustee to reimbursement for payment of advances (with interest thereon), and the rights of such parties and of the certificate administrator, the custodian and, subject to certain limitations, the trust advisor to the payments of compensation and reimbursement of certain costs and expenses will be prior to a certificateholder’s right to receive distributions of principal or interest. In addition, the right of the trust advisor to receive reimbursement of trust advisor expenses will be prior to the right of the holders of the Class B, Class C and Class D to receive payments of interest, and to the right of the holders of the Class A‑1, Class A‑2, Class A-SB, Class A‑3, Class A‑4, Class A‑5, Class A‑S, Class B, Class C and Class D Certificates to receive payments of principal. The amount of principal available to be distributed on the classes entitled to principal on a particular distribution date will, in general, be equal to the sum of: (i) the principal portion of all scheduled payments, other than balloon payments, to the extent received during the related collection period or advanced by the master servicer or other party (in accordance with the pooling and servicing agreement) in respect of such distribution date; (ii) all principal prepayments and the principal portion of balloon payments received during the related collection period; (iii) the principal portion of other collections on the mortgage loans received during the related collection period, for example liquidation proceeds, condemnation proceeds, insurance proceeds and income on other “real estate owned” (“REO”); and (iv) the principal portion of proceeds of mortgage loan repurchases received during the related collection period; subject to certain adjustments described in the Free Writing Prospectus relating to the payment or reimbursement of nonrecoverable advances, workout-delayed reimbursement amounts and trust advisor expenses, and exclusive of any late collections of principal received during the related collection period for which there is an outstanding advance. The Class V, Class R, Class X-A, Class X-B and Class X-D Certificates will not be entitled to principal distributions. |

| MSBAM 2015‑C25 | Structural Overview |

| Special Servicer Compensation: | The special servicer is entitled to a special servicing fee payable from general collections on the mortgage loans (other than any non-serviced mortgage loan) and any related serviced B note or serviced companion loan. The special servicing fee for each distribution date is calculated based on the outstanding principal balance of each mortgage loan (other than any non-serviced mortgage loan) that is a specially serviced mortgage loan (and any related serviced B note or serviced companion loan) or as to which the related mortgaged property has become an REO property at the special servicing fee rate, which will be 0.25% per annum. Any primary servicing fee or sub-servicing fee will be paid by the special servicer out of the fees described above. The special servicer is also entitled to additional fees and amounts, including, without limitation, income on the amounts held in certain permitted investments. The special servicer will also be entitled to (i) liquidation fees generally equal to 1.0% of liquidation proceeds in respect of a specially serviced mortgage loan (and any related serviced B note or serviced companion loan) or related REO property and (ii) workout fees generally equal to 1.0% of interest and principal payments made in respect of a rehabilitated mortgage loan (and any related serviced B note or serviced companion loan), subject to a cap with respect to each such fee of $1,000,000 with respect to any mortgage loan, loan pair, A/B whole loan or related REO property and subject to certain adjustments and exceptions as described in the Free Writing Prospectus under “Servicing of the Mortgage Loans—The Special Servicer—Special Servicer Compensation.” With respect to any non-serviced mortgage loan, the related special servicer under the related other pooling and servicing agreement pursuant to which such mortgage loan is being serviced will be entitled to similar compensation as that described above with respect to such non-serviced mortgage loan under such other pooling and servicing agreement as further described in the Free Writing Prospectus, although any related fees may accrue at a different rate and there may be a higher (or no) cap on liquidation and workout fees. |

| Prepayment Premiums/Yield Maintenance Charges: | On any distribution date, prepayment premiums or yield maintenance charges collected in respect of each mortgage loan during the related collection period will be distributed by the certificate administrator on the classes of certificates as follows: to each class of principal balance certificates (other than the Class E, Class F and Class G Certificates) then entitled to distributions of principal on such distribution date, an amount equal to the product of (a) a fraction, the numerator of which is the amount distributed as principal to that class on that distribution date, and the denominator of which is the total amount distributed as principal to all classes of principal balance certificates on that distribution date, (b) the Base Interest Fraction for the related principal prepayment and that class and (c) the amount of the prepayment premium or yield maintenance charge collected in respect of such principal prepayment during the one month period ending on the related determination date. Any prepayment premiums or yield maintenance charges relating to the mortgage loans collected during the related collection period and remaining after those distributions described above (as to the applicable distribution date, the “Class X YM Distribution Amount”) will be distributed to the holders of the Class X Certificates, as follows: first, to the holders of the Class X-A Certificates in an amount equal to the product of (a) a fraction, the numerator of which is the total amount of principal distributed on the applicable distribution date with respect to the class(es) of certificates whose certificate principal balances comprise the notional amount of such class of Class X Certificates, and the denominator of which is the total amount of principal distributed on the applicable distribution date with respect to all classes of principal balance certificates, multiplied by (b) the Class X YM Distribution Amount for the applicable distribution date; second, to the holders of the Class X-B Certificates in an amount equal to the product of (a) a fraction, the numerator of which is the total amount of principal distributed on the applicable distribution date with respect to the class(es) of certificates whose certificate principal balances comprise the notional amount of such class of Class X Certificates, and the denominator of which is the total amount of principal distributed on the applicable distribution date with respect to the principal balance certificates, multiplied by (b) the Class X YM Distribution Amount for the applicable distribution date; and third, to the holders of the Class X-D Certificates in an amount equal to the portion of the Class X YM Distribution Amount remaining after the distributions to the holders of the Class X-A and Class X-B Certificates. No prepayment premiums or yield maintenance charges will be distributed to holders of the Class E, Class F, Class G, Class V or Class R Certificates. The “Base Interest Fraction,” with respect to any principal prepayment of any mortgage loan that provides for payment of a prepayment premium or yield maintenance charge, and with respect to any class of principal balance certificates (other than the Class E, Class F and Class G Certificates), is a fraction (A) whose numerator is the greater of (x) zero and (y) the difference between (i) the pass-through rate on that class of certificates and (ii) the applicable discount rate and (B) whose denominator is the difference between (i) the mortgage interest rate on the related mortgage loan and (ii) the applicable discount rate; provided that under no circumstances will the Base Interest Fraction be greater than one. If the discount rate referred to above is greater than or equal to the mortgage interest rate on the related mortgage loan, then the Base Interest Fraction will equal zero; provided that if the discount rate referred to above is greater than or equal to the mortgage interest rate on the related mortgage loan, but is less than the pass-through rate on the subject class of certificates, then the Base Interest Fraction shall be equal to 1.0. Consistent with the foregoing, the Base Interest Fraction is equal to: (Pass-Through Rate – Discount Rate)

(Mortgage Rate – Discount Rate) |

| MSBAM 2015‑C25 | Structural Overview |

Collateral Support

Deficits: | On each distribution date, immediately following the distributions made to the certificateholders on that date, the certificate administrator will be required to calculate the amount, if any, by which (1) the aggregate stated principal balance of pool of the mortgage loans, including any mortgage loans as to which the related mortgaged properties have become REO properties, expected to be outstanding immediately following that distribution date, is less than (2) the aggregate principal balance of the principal balance certificates after giving effect to distributions of principal on that distribution date and the allocation of any excess trust advisor expenses to reduce the principal balances of the principal balance certificates that are not Control Eligible Certificates on that distribution date (any such deficit, a “Collateral Support Deficit”). On each distribution date, the certificate administrator will be required to allocate any Collateral Support Deficit to the respective classes of principal balance certificates in the following order: to the Class G, Class F, Class E, Class D, Class C, Class B and Class A-S Certificates, in that order, in each case in reduction of and until the remaining principal balance of that class of certificates has been reduced to zero. Following the reduction of the principal balances of all such classes of certificates to zero, the certificate administrator will be required to allocate the Collateral Support Deficit to the Class A‑1, Class A‑2, Class A‑SB, Class A‑3, Class A‑4 and Class A‑5 Certificates, pro rata (based upon their respective principal balances), until the remaining principal balances of those classes of certificates have been reduced to zero. Any Collateral Support Deficit allocated to a class of certificates will be allocated to the respective certificates of such class in proportion to the percentage interests evidenced by the respective certificates. |

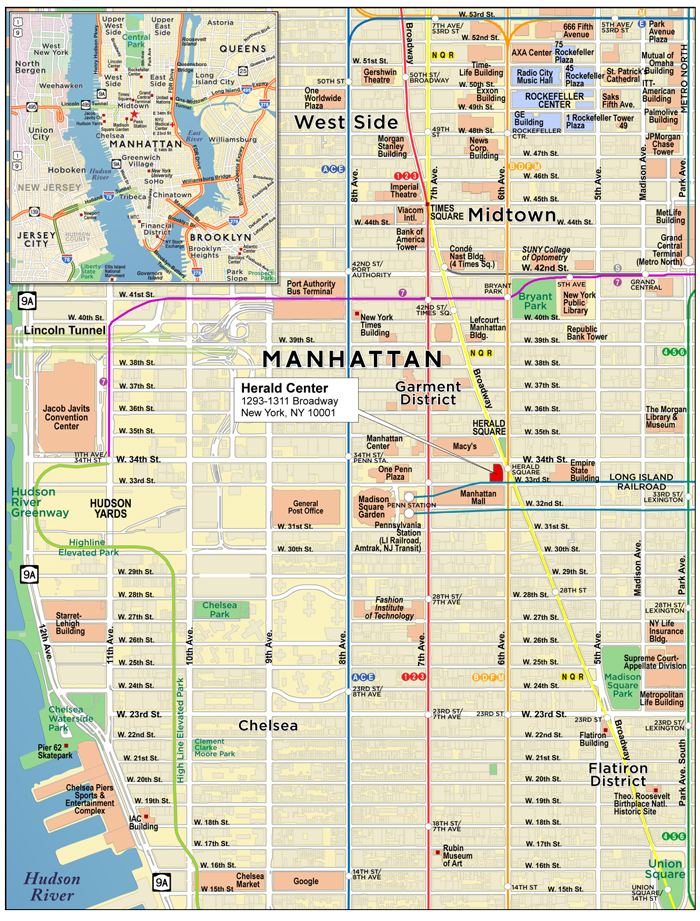

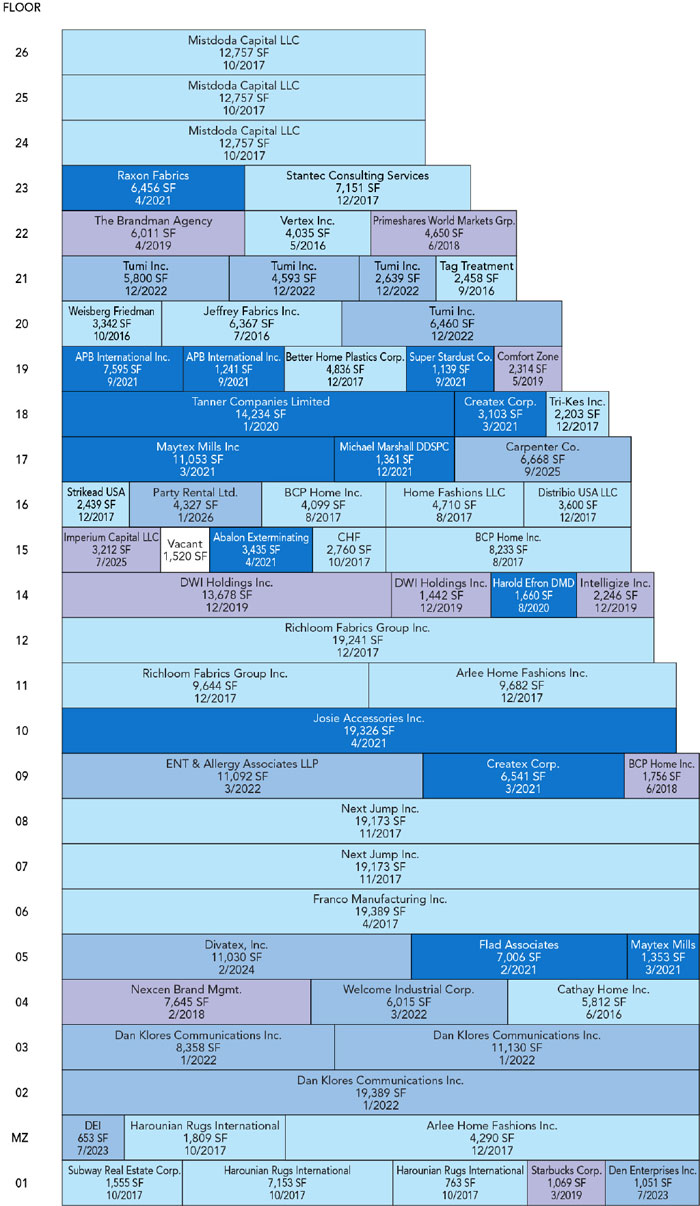

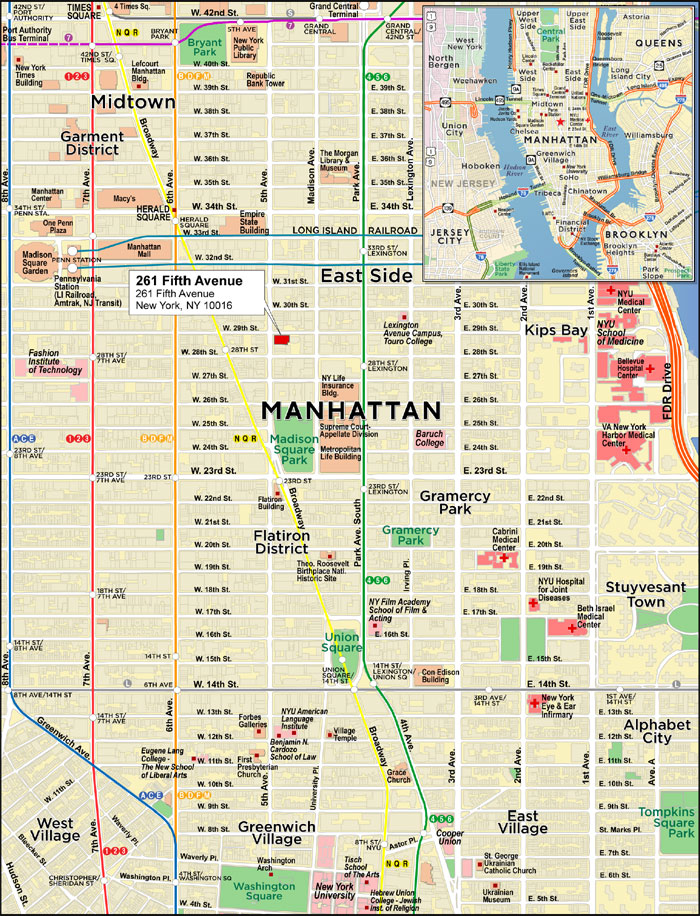

| A/B Whole Loans and Loan Pairs: | The mortgaged property identified on APPENDIX I to the Free Writing Prospectus as Herald Center secures (i) a mortgage loan (the “Herald Center mortgage loan”) with an outstanding principal balance as of the Cut-off Date of $115,000,000, representing approximately 9.8% of the initial pool balance, and (ii) two pari passu promissory notes that are not part of the mortgage pool (collectively referred to as the “Herald Center serviced companion loan” and a “serviced companion loan”), with an aggregate outstanding principal balance as of the Cut-off Date of $140,000,000. The Herald Center serviced companion loan is expected to be held by Morgan Stanley Mortgage Capital Holdings LLC or an affiliate thereof on the closing date and may be contributed to one or more future securitization transactions or may be otherwise transferred at any time. The Herald Center mortgage loan and the Herald Center serviced companion loan are collectively referred to as the “Herald Center loan pair” and a “loan pair” and are pari passu in right of payment and will be serviced pursuant to the related intercreditor agreement and the pooling and servicing agreement for this transaction. With respect to the Herald Center mortgage loan, any holder of the Herald Center serviced companion loan will have certain consultation rights under the pooling and servicing agreement with respect to certain major decisions and other matters related to the Herald Center loan pair. The mortgaged property identified on APPENDIX I to the Free Writing Prospectus as 261 Fifth Avenue secures (i) a mortgage loan (the “261 Fifth Avenue mortgage loan”) with an outstanding principal balance as of the Cut-off Date of $110,000,000, representing approximately 9.3% of the initial pool balance, and (ii) one pari passu promissory note that is not part of the mortgage pool (referred to as the “261 Fifth Avenue serviced companion loan” and a “serviced companion loan”), with an outstanding principal balance as of the Cut-off Date of $70,000,000. The 261 Fifth Avenue serviced companion loan is currently held by the BACM 2015-UBS7 securitization trust. The 261 Fifth Avenue mortgage loan and the 261 Fifth Avenue serviced companion loan are collectively referred to as the “261 Fifth Avenue loan pair” and a “loan pair” and are pari passu in right of payment and will be serviced pursuant to the related intercreditor agreement and the pooling and servicing agreement for this transaction. With respect to the 261 Fifth Avenue mortgage loan, any holder of the 261 Fifth Avenue serviced companion loan will have certain consultation rights under the pooling and servicing agreement with respect to certain major decisions and other matters related to the 261 Fifth Avenue loan pair. There are no other “loan pairs,” and there are no “A/B whole loans,” related to the issuing entity. See “Description of the Mortgage Pool—The A/B Whole Loans and the Loan Pairs” in the Free Writing Prospectus. With respect to any mortgage loan that is part of a loan pair, unless otherwise indicated, all LTV, DSCR and Debt Yield calculations herein include the related pari passu serviced companion loan. |

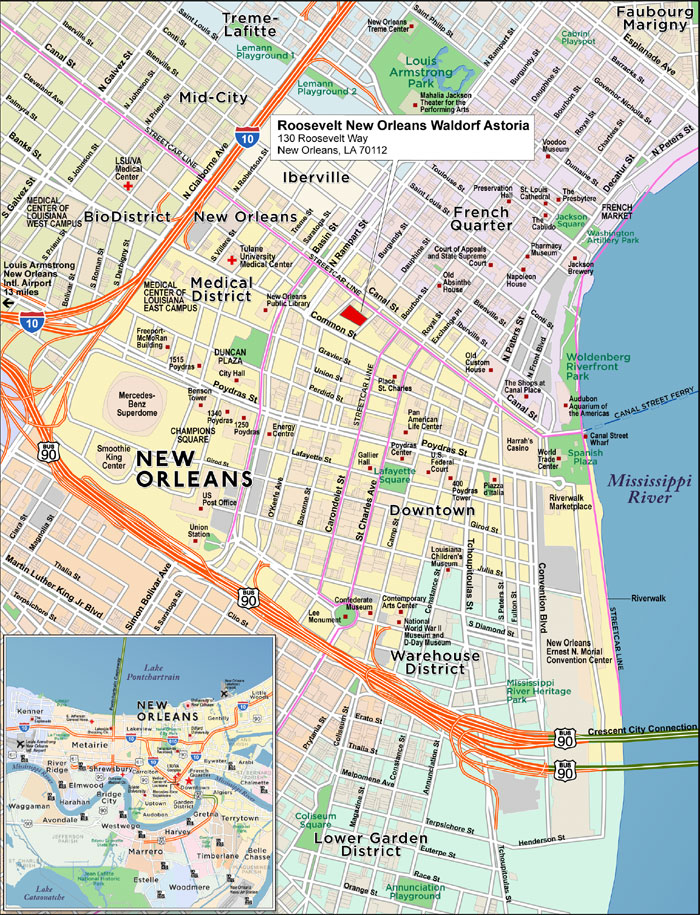

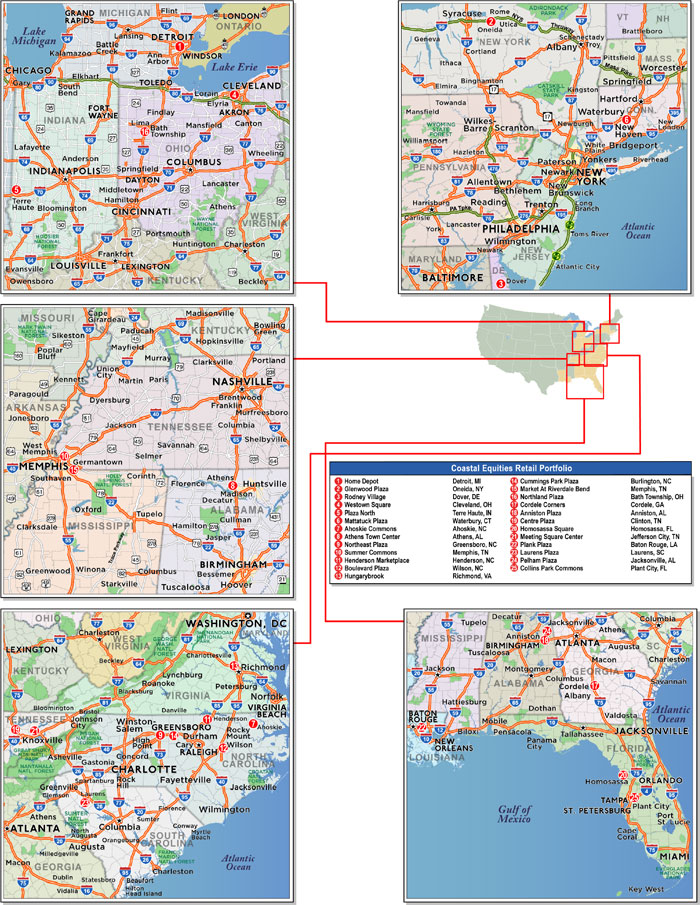

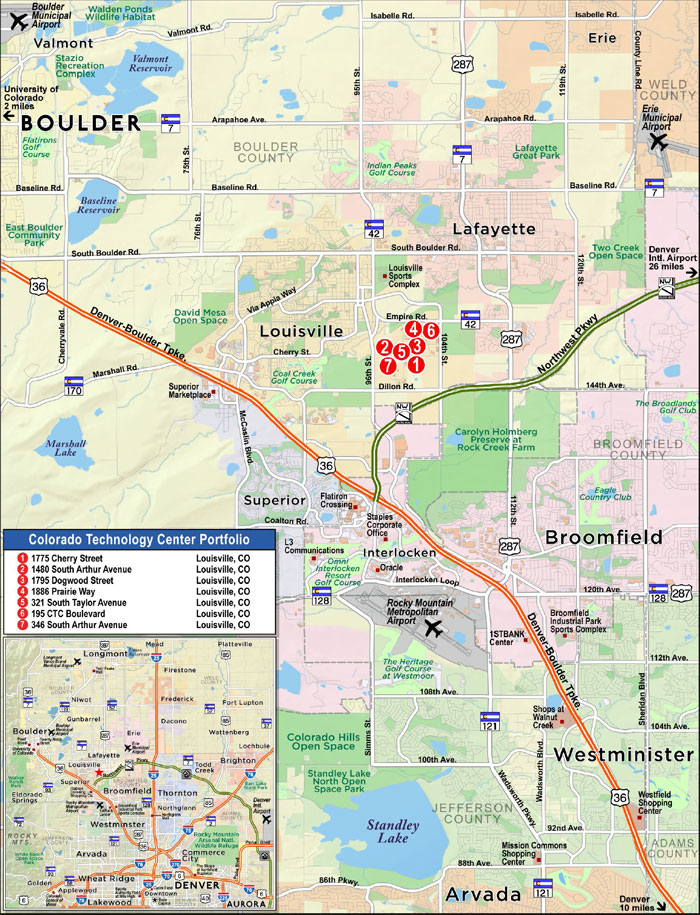

| Non-Serviced Loan Combinations: | The mortgaged property identified on APPENDIX I to the Free Writing Prospectus as Roosevelt New Orleans Waldorf Astoria secures on a pari passu basis (i) a mortgage loan (the “Roosevelt New Orleans Waldorf Astoria mortgage loan”) with an outstanding principal balance as of the Cut-off Date of $82,301,306, representing approximately 7.0% of the initial pool balance, and (ii) a pari passu promissory note that had an outstanding principal balance as of the Cut-off Date of $82,301,306 ( the “Roosevelt New Orleans Waldorf Astoria non-serviced companion loan” and a “non-serviced companion loan”) that is not part of the mortgage pool. The pari passu promissory note evidencing the Roosevelt New Orleans Waldorf Astoria non-serviced companion loan is currently held by the JPMBB 2015-C31 securitization trust. The Roosevelt New Orleans Waldorf Astoria mortgage loan and the Roosevelt New Orleans Waldorf Astoria non-serviced companion loan together constitute the “Roosevelt New Orleans Waldorf Astoria non-serviced loan combination” and a “non-serviced loan combination,” are pari passu in right of payment and will be serviced pursuant to the related intercreditor agreement and the pooling and servicing agreement for the JPMBB 2015‑C31 securitization. The holder of the Roosevelt New Orleans Waldorf Astoria non-serviced companion loan (or its representative) will be entitled to direct the servicing of the Roosevelt New Orleans Waldorf Astoria non-serviced loan combination and will have the right to replace the special servicer with respect to the Roosevelt New Orleans Waldorf Astoria non-serviced loan combination with or without cause at any time. The portfolio of mortgaged properties identified on APPENDIX I to the Free Writing Prospectus as Coastal Equities Retail Portfolio secures on a pari passu basis (i) a mortgage loan (the “Coastal Equities Retail Portfolio mortgage loan”) with an outstanding principal balance as of the Cut-off Date of $60,000,000, representing approximately 5.3% of the initial pool balance, and (ii) six pari passu promissory notes that had an aggregate outstanding principal balance as of the Cut-off Date of $109,000,000 (collectively, the “Coastal Equities Retail Portfolio non-serviced companion loan” and a “non-serviced companion loan”) that are not part of the mortgage pool. Four of the pari passu promissory notes comprising such non-serviced companion loan |

| MSBAM 2015‑C25 | Structural Overview |

| | are expected to be held by the MSBAM 2015-C24 securitization trust, and the two other such pari passu promissory note are currently held by Morgan Stanley Bank, N.A. or an affiliate thereof on the closing date and may be contributed to one or more future securitization transactions or may be otherwise transferred at any time. The Coastal Equities Retail Portfolio mortgage loan and the Coastal Equities Retail Portfolio non-serviced companion loan together constitute the “Coastal Equities Retail Portfolio non-serviced loan combination” and a “non-serviced loan combination,” are pari passu in right of payment and will be serviced pursuant to the related intercreditor agreement and the pooling and servicing agreement for the MSBAM 2015-C24 securitization. The holder of the portion of the Coastal Equities Retail Portfolio non-serviced companion loan contributed to the MSBAM 2015-C24 securitization trust (or its representative) will be entitled to direct the servicing of the Coastal Equities Retail Portfolio non-serviced loan combination and will have the right to replace the special servicer with respect to the Coastal Equities Retail Portfolio non-serviced loan combination with or without cause at any time. No mortgage loans, other than the Roosevelt New Orleans Waldorf Astoria mortgage loan and the Coastal Equities Retail Portfolio mortgage loan, will have a non-serviced companion loan associated with them, and all of the mortgage loans, other than the Roosevelt New Orleans Waldorf Astoria mortgage loan and the Coastal Equities Retail Portfolio mortgage loan, are being serviced under the pooling and servicing agreement for this transaction. Accordingly, other than the Roosevelt New Orleans Waldorf Astoria non-serviced loan combination and the Coastal Equities Retail Portfolio non-serviced loan combination, there are no other “non-serviced loan combinations” with respect to the issuing entity. See “Description of the Mortgage Pool——The Non-Serviced Loan Combinations” in the Free Writing Prospectus. With respect to any mortgage loan that is part of a non-serviced loan combination, unless otherwise indicated, all LTV, DSCR and Debt Yield calculations herein include the related pari passu non-serviced companion loan. |

| Appraisal Reductions: | The occurrence of certain adverse events affecting a mortgage loan (other than a non-serviced mortgage loan) (“Appraisal Events”) will require the special servicer to obtain a new appraisal or other valuation of the related mortgaged property. In general, if the principal amount of a mortgage loan plus all other amounts due under the mortgage loan and interest on advances made with respect to the mortgage loan exceeds 90% of the value of the mortgaged property determined by an appraisal or other valuation, an appraisal reduction may be created in the amount of the excess as described in the Free Writing Prospectus. Any appraisal reduction in respect of any non-serviced mortgage loan generally will be calculated in accordance with the related non-serviced mortgage loan pooling and servicing agreement, which calculations are expected to be generally similar to those provided for in the pooling and servicing agreement for this transaction. Notwithstanding the foregoing, if an appraisal is required to be obtained in accordance with the applicable pooling and servicing agreement (including with respect to any non-serviced mortgage loan) but is not obtained within 120 days following the applicable Appraisal Event (or, with respect to a non-serviced mortgage loan, 120 days following notice of the applicable appraisal event under the related pooling and servicing agreement), then, until such appraisal is obtained and solely for purposes of determining the amounts of P&I advances, the appraisal reduction will equal 25% of the stated principal balance of the related mortgage loan; provided that, upon receipt of an appraisal, the appraisal reduction for such mortgage loan will be recalculated generally in accordance with the preceding paragraphs. If any mortgage loan is part of an A/B whole loan, a loan pair or a non-serviced loan combination, any appraisal reduction will be calculated in respect of such A/B whole loan, loan pair or non-serviced loan combination taken as a whole. With respect to an A/B whole loan, any such appraisal reduction will be allocated first to the related serviced B note and then to the related A note. With respect to a loan pair or non-serviced loan combination, any such appraisal reduction will be allocated between the mortgage loan and the related serviced companion loan or non-serviced companion loan, respectively, on a pro rata basis by unpaid principal balance. If an appraisal reduction exists for, or is allocable to, any mortgage loan, the interest portion of the amount required to be advanced on that mortgage loan will be reduced in the same proportion that the appraisal reduction bears to the stated principal balance of that mortgage loan. This will reduce the funds available to pay interest on the certificates then outstanding. For a discussion of how appraisal reductions are calculated and allocated, see “Description of the Offered Certificates—Appraisal Reductions” in the Free Writing Prospectus. |

| Control Rights: | During any Subordinate Control Period, the controlling class representative will have certain consent and consultation rights under the pooling and servicing agreement with respect to certain major decisions and other matters. A “Subordinate Control Period” means any period when the aggregate principal balance of the Class E Certificates (taking into account the application of any appraisal reductions to notionally reduce the aggregate principal balance of such class) is at least 25% of the initial aggregate principal balance of that class. During any Collective Consultation Period, the controlling class representative will not have any consent rights, but the controlling class representative and the trust advisor will each have certain non-binding consultation rights under the pooling and servicing agreement with respect to certain major decisions and other matters. A “Collective Consultation Period” means any period when both (i) the aggregate principal balance of the Class E Certificates (taking into account the application of any appraisal reductions to notionally reduce the aggregate principal balance of such class), is less than 25% of the initial aggregate principal balance of the Class E Certificates and (ii) the aggregate principal balance of that class (without regard to any appraisal reductions allocable to such class), is at least 25% of the initial aggregate principal balance of that class. During any Senior Consultation Period, the controlling class representative will not have any consent or |

| MSBAM 2015‑C25 | Structural Overview |

| | consultation rights, except with respect to any rights expressly set forth in the pooling and servicing agreement, and the trust advisor will retain certain non-binding consultation rights under the pooling and servicing agreement with respect to certain major decisions and other matters. A “Senior Consultation Period” means a period when the aggregate principal balance of the Class E Certificates (without regard to any appraisal reductions allocable to such class) is less than 25% of the initial aggregate principal balance of that class. With respect to any excluded mortgage loan, a Senior Consultation Period will be deemed to exist. Notwithstanding any of the foregoing to the contrary, if any mortgage loan is part of an A/B whole loan, loan pair or non-serviced loan combination, the controlling class representative’s consent and/or consultation rights with respect thereto may be limited as described in the Free Writing Prospectus. In particular, with respect to each non-serviced loan combination, the controlling class representative will only have certain consultation rights with respect to certain major decisions and other matters related to such non-serviced loan combination and only during a Subordinate Control Period and a Collective Consultation Period. See “Servicing of the Mortgage Loans—The Controlling Class Representative” in the Free Writing Prospectus. |

| A/B Whole Loan, Loan Pair and Non-Serviced Loan Combination Control and Consultation Rights: | The existence of a Subordinate Control Period, Collective Consultation Period or Senior Consultation Period will not limit any control and/or consultation rights of the holder of any related B note or companion loan. In particular, with respect to each of the Herald Center loan pair and the 261 Fifth Avenue loan pair, the holder of the related serviced companion loan will have non-binding consultation rights with respect to major decisions and other matters related to such loan pair. In addition, with respect to each non-serviced loan combination, the related controlling holder will have certain consent and consultation rights with respect to such non-serviced loan combination under the related other servicing agreement and will have the right to replace the special servicer under such other servicing agreement with respect to such non-serviced loan combination. See “Risk Factors—Risks Related to the Offered Certificates—Realization on a Mortgage Loan That Is Part of an A/B Whole Loan or Loan Pair May Be Adversely Affected by the Rights of the Related Directing Holder” and “Description of the Mortgage Pool—The A/B Whole Loans and the Loan Pairs” and “—The Non-Serviced Loan Combinations” in the Free Writing Prospectus. |

| Control Eligible Certificates: | The “Control Eligible Certificates” will be the Class E, Class F and Class G Certificates. |

| Controlling Class Representative/ Controlling Class: | The controlling class representative will be the representative appointed by more than 50% of the Controlling Class (by principal balance); provided that there will be deemed to be no controlling class representative with respect to any excluded mortgage loan, as described below. The “Controlling Class” will be the most subordinate class of Control Eligible Certificates then outstanding that has an aggregate principal balance (taking into account the application of any appraisal reductions to notionally reduce the aggregate principal balance of such class) at least equal to 25% of the initial aggregate principal balance of such class; provided that if no class of Control Eligible Certificates has an aggregate principal balance (taking into account the application of any appraisal reductions to notionally reduce the aggregate principal balance of such class) at least equal to 25% of the initial aggregate principal balance of such class, then the Controlling Class will be the most senior class of Control Eligible Certificates. A summary of the consent and consultation rights of the controlling class representative, and the limitations thereon, is set forth above under “Control Rights.” The Controlling Class on the closing date will be the Class G Certificates. The initial controlling class representative is expected to be Eightfold Real Estate Capital Fund IV, L.P. or an affiliate thereof. There will be no controlling class representative for any mortgage loan, A/B whole loan or loan pair with respect to which the controlling class representative, or any holder of more than 50% of the controlling class, is a borrower party (any such mortgage loan, an “excluded mortgage loan”). In addition, if any mortgage loan becomes an “excluded controlling class mortgage loan” (i.e., a mortgage loan, A/B whole loan or loan pair with respect to which the controlling class representative or any controlling class certificateholder, as applicable, is a borrower party), the controlling class representative or any controlling class certificateholder that is a borrower party (each such party, an “excluded controlling class holder”) will not be entitled to have access to any related “excluded information”, including any asset status reports, final asset status reports or any summaries related thereto (and any other information identified in the pooling and servicing agreement), related to such excluded controlling class mortgage loan (other than such information related to such excluded controlling class mortgage loan(s) that is aggregated with information of other mortgage loans at a pool level). Although the pooling and servicing agreement will require (i) each excluded controlling class holder to certify that it acknowledges and agrees that it is prohibited from accessing and reviewing (and that it agrees not to access and review) any related excluded information and (ii) the controlling class representative or any controlling class certificateholder that is not an excluded controlling class holder to certify and agree that they will not share any such excluded information with any excluded controlling class holder, (a) we cannot assure you that such excluded controlling class holders will not access, obtain, review and/or use, or the controlling class representative or any controlling class certificateholder that is not an excluded controlling class holder will not share with such excluded controlling class holder, such related excluded information in a manner that adversely impacts your certificates and (b) none of the master servicer, special servicer, trustee, the certificate administrator, the certificate registrar or any other agent will have any responsibility or liability as a result of such excluded controlling class holder obtaining access or otherwise reviewing such excluded information. As used herein, “borrower party” means (a) a borrower, a mortgagor, a property manager or a foreclosing mezzanine lender, (b) any other person controlling or controlled by or under common control with such borrower, mortgagor, property manager or foreclosing mezzanine lender, as applicable, and (c) any other person owning, directly or indirectly, 25% or more of the beneficial interests in such borrower, mortgagor, property manager or foreclosing mezzanine lender, as applicable. For purposes of this definition, “foreclosing |

| MSBAM 2015‑C25 | Structural Overview |

| | mezzanine lender” means a mezzanine lender that has accelerated the related mezzanine loan (unless (a) acceleration was automatic under such mezzanine loan, (b) the event directly giving rise to the automatic acceleration under such mezzanine loan was not initiated by such owner or an affiliate of such owner and (c) such owner is stayed from exercising and has not commenced the exercise of remedites associated with foreclosure of the equity collateral under such mezzanine loan) or commenced foreclosure proceedings against the equity collateral pledged to secure the related mezzanine loan. For purposes of this definition, “control” when used with respect to any specified person means the power to direct the management and policies of such person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise and the terms “controlling” and “controlled” have meanings correlative to the foregoing. |

| Appraised-Out Class: | Any class of Control Eligible Certificates, the aggregate principal balance of which (taking into account the application of any appraisal reductions to notionally reduce the aggregate principal balance of such class) has been reduced to less than 25% of its initial aggregate principal balance, is referred to as an “Appraised-Out Class.” |

| Appraisal Remedy: | The holders of the majority (by principal balance) of an Appraised-Out Class will have the right, at their sole expense, to present to the special servicer a second appraisal for any mortgage loan (other than with respect to any non-serviced mortgage loan) for which an Appraisal Event has occurred prepared by an MAI appraiser on an “as-is” basis acceptable to the special servicer in accordance with the Servicing Standard. Upon receipt of such second appraisal, the special servicer will be required to determine, in accordance with the Servicing Standard, whether, based on its assessment of such second appraisal, any recalculation of the applicable appraisal reduction is warranted and, if so warranted, will be required to recalculate such appraisal reduction based upon such second appraisal. If required by any such recalculation, any applicable Appraised-Out Class will have its related principal balance notionally restored to the extent required by such recalculation of the appraisal reduction, and there will be a redetermination of whether a Subordinate Control Period, a Collective Consultation Period or a Senior Consultation Period is then in effect. However, until an Appraised-Out Class is restored as the Controlling Class, the next most senior class of Control Eligible Certificates that is not an Appraised-Out Class (or, if all classes of Control Eligible Certificates are Appraised-Out Classes, the most senior class of Control Eligible Certificates), if any, will be the Controlling Class. The right of any Appraised-Out Class to present a second appraisal of any mortgage loan for which an Appraisal Event has occurred is limited to one appraisal with respect to each mortgaged property relating to the affected mortgage loan, subject to certain exceptions regarding a material change in circumstance. No certificateholders of an Appraised-Out Class will have appraisal remedies in respect of a non-serviced mortgage loan under the pooling and servicing agreement for this transaction. Each of the JPMBB 2015-C31 and MSBAM 2015-C25 pooling and servicing agreements has provisions similar to those in the prior paragraph as they relate to the applicable controlling class of certificates under the related securitization and appraisal remedies. |

| Sale of Defaulted Loans: | Defaulted serviced mortgage loans will be sold in a process similar to the sale process for REO property, as described under “Servicing of the Mortgage Loans—Sale of Defaulted Mortgage Loans and REO Properties” in the Free Writing Prospectus. There will be no “fair market value purchase option,” and the controlling class representative will have no right of first refusal with respect to the sale of defaulted loans. Non-serviced mortgage loans that become defaulted loans may be sold pursuant to a similar process under the related pooling and servicing agreement governing the servicing thereof. In addition, with respect to each of the Herald Center mortgage loan, the 261 Fifth Avenue mortgage loan, the Roosevelt New Orleans Waldorf Astoria mortgage loan and the Coastal Equities Retail Portfolio mortgage loan, if any such mortgage loan becomes a defaulted mortgage loan and the applicable special servicer determines to sell such mortgage loan or some or all of the related pari passu companion loan, such special servicer will be required to sell such mortgage loan together with the related pari passu companion loan as notes evidencing one whole loan, in accordance with the provisions of the related intercreditor agreement and the applicable pooling and servicing agreement. See “Description of the Mortgage Pool—The A/B Whole Loans and the Loan Pairs” and “—The Non-Serviced Loan Combinations” in the Free Writing Prospectus. |

| Appointment and Termination of Special Servicer: | The controlling class representative will appoint the initial special servicer (but not with respect to any non-serviced mortgage loan). At any time during the Subordinate Control Period, the special servicer (other than with respect to any non-serviced mortgage loan) may be replaced by the controlling class representative. During any Collective Consultation Period and any Senior Consultation Period, the special servicer (other than with respect to any non-serviced mortgage loan) will be subject to termination without cause if certificateholders evidencing not less than 25% of voting rights of the certificates request a vote of certificateholders to replace the special servicer. The certificate administrator would present the proposal to all certificateholders, and replacement would be conditioned on receipt, within 180 days thereafter, of approval of the termination from holders of 75% of the voting rights of the certificates. The holders initiating such vote will be responsible for the fees and expenses of the issuing entity in connection with the replacement. During any Senior Consultation Period, if the trust advisor determines that the special servicer is not performing its duties in accordance with the Servicing Standard, the trust advisor will have the right to recommend the replacement of the special servicer with respect to the applicable mortgage loan or mortgage loans. The trust advisor’s recommendation to replace the special servicer must be confirmed by an affirmative vote of holders of a majority of the voting rights of the principal balance certificates. Notwithstanding any of the foregoing to the contrary, if any mortgage loan is part of an A/B whole loan or a loan pair, the special servicer will not be subject to termination as described in the preceding paragraphs with respect to such A/B whole loan or loan pair so long as any related B note or companion loan holder has the right to replace the special servicer under the related intercreditor agreement. In addition, subject to the terms of any related intercreditor agreement (including the rights of an related directing holder thereunder), with respect to any non-serviced loan combination, the related special servicer under the related other pooling and |

| MSBAM 2015‑C25 | Structural Overview |

| | servicing agreement pursuant to which such non-serviced loan combination is being serviced may be replaced on terms set forth in such other pooling and servicing agreement that are substantially similar to those described in the preceding paragraphs above for the special servicer under the pooling and servicing agreement for this transaction (unless the holder of a related B note or companion loan has the right to replace such special servicer pursuant to the related intercreditor agreement). See “Description of the Mortgage Pool—The A/B Whole Loans and the Loan Pairs” and “—The Non-Serviced Loan Combinations” in the Free Writing Prospectus. |

| Servicing Standard: | Each of the master servicer and the special servicer is obligated to service and administer the mortgage loans (and, if applicable, the related serviced B notes and serviced companion loans) in accordance with the definition of the “Servicing Standard” described in the Free Writing Prospectus and the terms of the pooling and servicing agreement, provided that each non-serviced mortgage loan, if any, will be serviced by another master servicer or special servicer under the pooling and servicing agreement with respect to the securitization of the related companion loan or applicable portion thereof. |

| Excluded Special Servicer: | If the special servicer obtains knowledge that it has become a borrower party with respect to any mortgage loan (referred to herein as an “excluded special servicer mortgage loan”), then the special servicer will be required to resign at its own cost with respect to such mortgage loan. The controlling class representative (during any Subordinate Control Period) will be entitled to appoint a separate special servicer that is not a borrower party (referred to herein as an “excluded special servicer”) with respect to such excluded special servicer mortgage loan unless such excluded special servicer mortgage loan is also an excluded mortgage loan, in which case the largest controlling class certificateholder (by certificate principal balance) that is not an excluded controlling class holder will be entitled to appoint the excluded special servicer. During any Collective Consultation Period the largest controlling class certificateholder (by certificate principal balance) that is not an excluded controlling class holder will be entitled to appoint the excluded special servicer. During any Senior Consultation Period, or if each controlling class certificateholder is an excluded controlling class holder, certificateholders holding more than 50% of the voting rights (provided 20% or more exercise their right to vote) will be entitled to appoint the excluded special servicer; provided, that if such certificateholders do not appoint the excluded special servicer within thirty (30) days of the special servicer’s notice of resignation, such resigning special servicer will, at the expense of the issuing entity, use reasonable efforts to appoint the excluded special servicer and if a successor excluded special servicer is not appointed within sixty (60) days of the special servicer’s notice of resignation then a petition will be made to any court of competent jurisdiction for the appointment of a successor excluded special servicer. Any excluded special servicer will be required to perform all of the obligations of the special servicer and will be entitled to all special servicing compensation with respect to such excluded special servicer mortgage loan earned during such time as the related mortgage loan is an excluded special servicer mortgage loan (provided that that special servicer will remain entitled to all other special servicing compensation with respect all loans which are not excluded special servicer mortgage loans). With respect to any excluded special servicer mortgage loan (that is also not an excluded mortgage loan) the controlling class representative (during any Subordinate Control Period) will be entitled to appoint and replace the excluded special servicer with respect thereto. During a Collective Consultation Period or Senior Consultation Period (including a deemed Senior Consultation Period with respect to any excluded mortgage loan), the excluded special servicer may be replaced in the manner described above under “—Appointment and Termination of Special Servicer” with respect to the special servicer. References herein to the “special servicer” mean individually or collectively, as the context may require, Midland Loan Services, a Division of PNC Bank, National Association as special servicer with respect to all mortgage loans other than any excluded special servicer mortgage loans and any non-serviced mortgage loans, and any excluded special servicer, as special servicer with respect to any related excluded special servicer mortgage loans. Unless specifically stated otherwise, any rights, conditions or obligations of or applicable to the “special servicer” described herein (including with respect to qualification under the pooling and servicing agreement, compensation and resignation) apply to both Midland Loan Services, a Division of PNC Bank, National Association and to any excluded special servicer, as applicable. |

Defaulted Mortgage

Loan Waterfall: | Amounts received by the issuing entity in respect of defaulted mortgage loans in connection with liquidation of any mortgage loan, net of unreimbursed advances and interest thereon, servicing compensation and other amounts payable or reimbursable therefrom, will be applied so that amounts allocated as a recovery of accrued and unpaid interest will not, in the first instance, include any amount by which the interest portion of P&I advances previously made was reduced as a result of appraisal reductions. After the adjusted interest amount is so allocated, any remaining net proceeds will be allocated to pay principal on the mortgage loan until the unpaid principal amount of the mortgage loan has been reduced to zero. Any remaining proceeds would then be allocated as a recovery of accrued and unpaid interest corresponding to the amount by which the interest portion of P&I advances previously made was reduced as a result of appraisal reductions. |

| Trust Advisor: | The trust advisor will be required to promptly review all information available to certain privileged persons on the certificate administrator’s website related to any specially serviced mortgage loan or REO property and each asset status report with respect to specially serviced mortgage loans (provided that during any Subordinate Control Period, the trust advisor may only review final asset status reports). During any Collective Consultation Period and any Senior Consultation Period, within 60 days after the end of each calendar year during which any mortgage loan was a specially serviced mortgage loan or any mortgaged property was an REO property, the trust advisor will be required to meet with representatives of the special servicer that was acting as special servicer as of December 31 in the prior calendar year and is continuing in such capacity through the date of such meeting to review certain operational practices of the special servicer related to specially serviced mortgage loans and REO properties. |

| MSBAM 2015‑C25 | Structural Overview |

| | In addition, during any Collective Consultation Period and any Senior Consultation Period, based on (i) the trust advisor’s annual meeting with the special servicer and (ii) the trust advisor’s review of any asset status reports and other information delivered to the trust advisor by the special servicer and any other information available to certain privileged persons on the certificate administrator’s website, the trust advisor will be required to prepare an annual report to be provided to the certificate administrator (and to be made available through the certificate administrator’s website) setting forth its assessment of the special servicer’s performance of its duties under the pooling and servicing agreement during the prior calendar year on a platform-level basis with respect to the resolution and liquidation of specially serviced mortgage loans and REO properties. If the special servicer is replaced, the trust advisor’s annual report will only relate to the entity that was acting as special servicer as of December 31 in the prior calendar year and is continuing in such capacity through the date of such annual report. No such annual report will be required to be prepared or delivered with respect to any calendar year as to which no annual meeting is required to be held or with respect to any calendar year during which no asset status reports have been prepared in connection with a specially serviced mortgage loan or REO property. However, the trust advisor’s obligations described in the preceding three paragraphs will not apply to non-serviced mortgage loans. Furthermore, during any Collective Consultation Period and any Senior Consultation Period, the special servicer will be required to consult (on a non-binding basis) the trust advisor in connection with certain major decisions involving any serviced mortgage loan, A/B whole loan, loan pair or any related REO property to the extent described in this Term Sheet and the Free Writing Prospectus and as set forth in the pooling and servicing agreement; provided that, with respect to matters relating to any A/B whole loan or loan pair, the special servicer will only be required to consult the trust advisor with regard to such matters if the holder of the controlling portion of the related serviced B note or serviced companion loan, as applicable, is not (or is no longer) the directing holder with respect to such A/B whole loan or loan pair pursuant to the terms of the applicable intercreditor agreement, and prior to such time, the trust advisor will have no obligations under the pooling and servicing agreement with respect to such A/B whole loan or loan pair. The trust advisor will have no consultation rights with respect to any non-serviced mortgage loan or any related non-serviced companion loan. During any Subordinate Control Period, (A) there will be no annual meeting between the trust advisor and the special servicer or any annual report prepared by the trust advisor, and (B) the trust advisor will not distribute any report based on any review of the special servicer’s actions. In addition, the trust advisor will not have the right or obligation during any Subordinate Control Period to consult or consent with regard to any particular servicing actions or otherwise opine on the actions of the special servicer with respect to any mortgage loan during any Subordinate Control Period. |

| Trust Advisor Expenses: | The trust advisor will be entitled, on each distribution date, to reimbursement for any trust advisor expenses, including unreimbursed indemnification amounts and other expenses (which do not include trust advisor fees) payable to the trust advisor pursuant to the terms of the pooling and servicing agreement. No trust advisor expenses (which do not include trust advisor fees) will be allocated to or otherwise borne by the Control Eligible Certificates, and all trust advisor expenses will be allocated to reduce amounts due and owing to certain classes of the non-Control Eligible Certificates as described in the Free Writing Prospectus and above in this Term Sheet. |

| Termination and Replacement of Trust Advisor: | The trust advisor may be terminated or replaced without cause as described in the Free Writing Prospectus under “Servicing of the Mortgage Loans—The Trust Advisor—Termination of the Trust Advisor Without Cause.” |

| Deal Website: | The certificate administrator will be required to maintain a deal website which will include, among other items, (i) distribution date statements, (ii) CREFC® reports, (iii) summaries of final asset status reports, (iv) inspection reports, (v) appraisals, (vi) various special notices described in the Free Writing Prospectus, (vii) the “Investor Q&A Forum” and (viii) a voluntary “Investor Registry.” Investors may access the deal website following execution of an investor certification as described in the Free Writing Prospectus. |

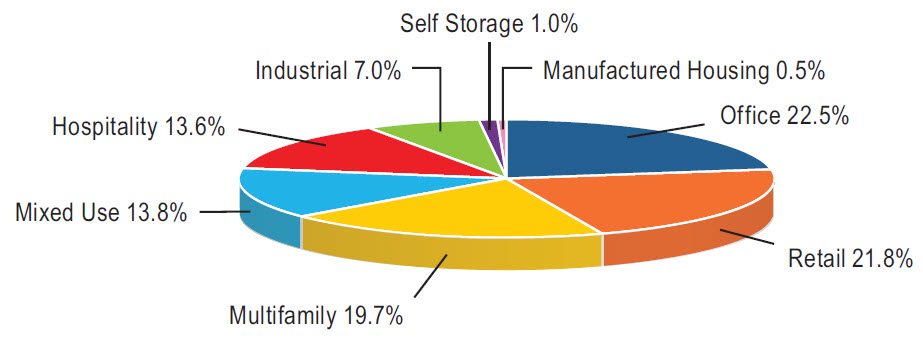

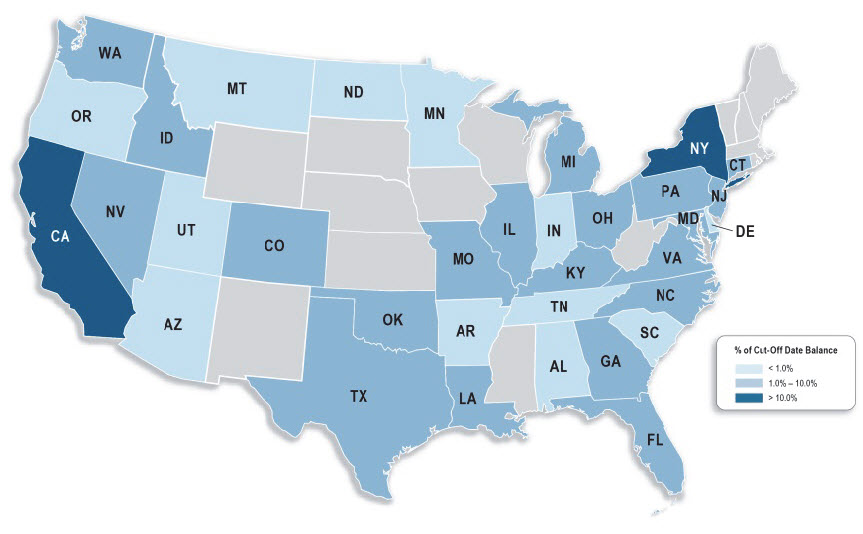

| MSBAM 2015-C25 | Collateral Overview |

| Mortgage Loan Sellers | No. of

Mortgage

Loans | No. of

Mortgaged

Properties | Aggregate

Cut-off Date

Balance | % of

Pool(1) |

| Morgan Stanley Mortgage Capital Holdings LLC | 14 | 44 | $481,537,238 | 40.8% |

| Bank of America, National Association | 22 | 36 | $460,471,899 | 39.0% |

| CIBC Inc. | 9 | 9 | $127,272,224 | 10.8% |

| Starwood Mortgage Funding III LLC | 11 | 13 | $110,136,650 | 9.3% |

| Total: | 56 | 102 | $1,179,418,010 | 100.0% |

Pool Statistics

| Aggregate Cut-off Date Balance: | $1,179,418,010 |

| Number of Mortgage Loans: | 56 |

| Average Cut-off Date Balance per Mortgage Loan: | $21,061,036 |

| Number of Mortgaged Properties: | 102 |

| Average Cut-off Date Balance per Mortgaged Property: | $11,562,922 |

| Weighted Average Mortgage Rate: | 4.549% |

| % of Pool Secured by 5 Largest Mortgage Loans: | 36.1% |

| % of Pool Secured by 10 Largest Mortgage Loans: | 53.5% |

% of Pool Secured by ARD Loans(2): | 0.0% |

Weighted Average Original Term to Maturity (months)(2): | 118 |

Weighted Average Remaining Term to Maturity (months)(2): | 115 |

| Weighted Average Seasoning (months): | 4 |

| % of Pool Secured by Single Tenant Mortgaged Properties: | 5.2% |

| % of Pool Secured by Refinance Loans: | 89.3% |

| % of Pool Secured by Acquisition Loans: | 10.7% |

Additional Debt

% of Pool with Pari Passu Mortgage Debt: | 31.1% |

| % of Pool with Mezzanine Debt: | 9.8% |

| % of Pool with Subordinate Mortgage Debt: | 0.0% |

Credit Statistics(3)

| Weighted Average UW NOI DSCR: | 1.64x |

| Weighted Average UW NOI Debt Yield: | 9.5% |

| Weighted Average UW NCF DSCR: | 1.52x |

| Weighted Average UW NCF Debt Yield: | 8.8% |

Weighted Average Cut-off Date LTV Ratio(4): | 66.2% |

Weighted Average Maturity Date LTV Ratio(2)(4): | 59.3% |

_________________________

Footnotes are set forth on the following page.

| MSBAM 2015-C25 | Collateral Overview |

Amortization

| Weighted Average Original Amortization Term (months): | 359 |

| Weighted Average Remaining Amortization Term (months): | 358 |

| % of Pool Amortizing Balloon: | 23.0% |

| % of Pool Interest Only followed by Amortizing Balloon: | 54.9% |

% of Pool Interest Only through Maturity(2): | 22.1% |

| % of Pool Fully Amortizing: | 0.0% |

Lockboxes

| % of Pool with Hard Lockboxes: | 38.6% |

| % of Pool with Soft Lockboxes: | 9.6% |

| % of Pool with Springing Lockboxes: | 48.3% |

| % of Pool with No Lockboxes: | 3.5% |

Reserves

| % of Pool Requiring Tax Reserves: | 79.8% |

| % of Pool Requiring Insurance Reserves: | 26.3% |

| % of Pool Requiring Replacement Reserves: | 71.3% |

% of Pool Requiring TI/LC Reserves(5): | 65.5% |

Call Protection

| % of Pool with lockout period, followed by defeasance until open period: | 90.9% |

| % of Pool with lockout period, followed by the greater of a prepayment premium and yield maintenance until open period: | 4.7% |

| % of Pool with lockout period, followed by defeasance or the greater of a prepayment premium and yield maintenance until open period: | 4.4% |

_____________________________

| (1) | Unless otherwise indicated, all references to “% of Pool” in this Term Sheet reflect a percentage of the aggregate principal balance of the mortgage pool as of the Cut-off Date, after application of all payments of principal due during or prior to October 2015. |

| (2) | With respect to any ARD Loan, unless otherwise indicated, references in this Term Sheet to the applicable “maturity date” refer to the applicable anticipated repayment date with respect to such ARD Loan, and such applicable anticipated repayment date is treated as its maturity date for all purposes hereof. |