| Exhibit 13.1 | Annual Report to Shareholders. |

NORTH CENTRAL BANCSHARES, INC.

Holding Company for First Federal

Savings Bank of Iowa

2006 ANNUAL REPORT

TABLE OF CONTENTS

MESSAGE OF THE CHAIRMAN, PRESIDENT AND CHIEF EXECUTIVE OFFICER

SELECTED CONSOLIDATED FINANCIAL AND OTHER DATA

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

INDEX TO FINANCIAL STATEMENTS

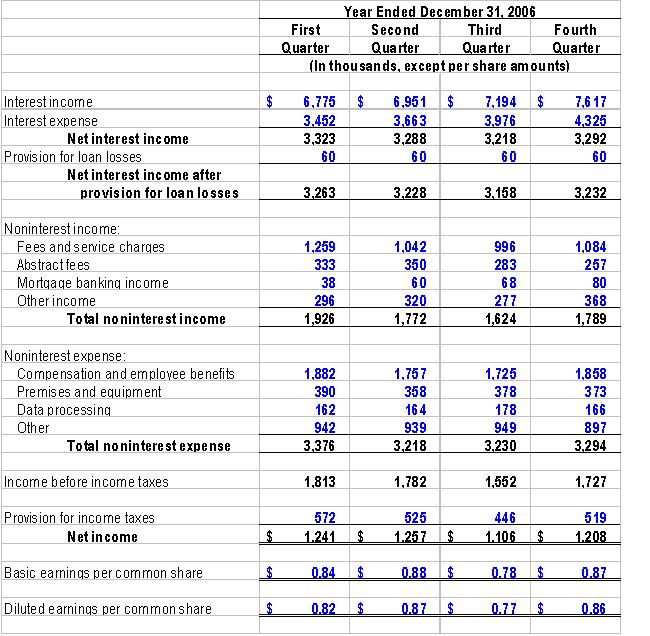

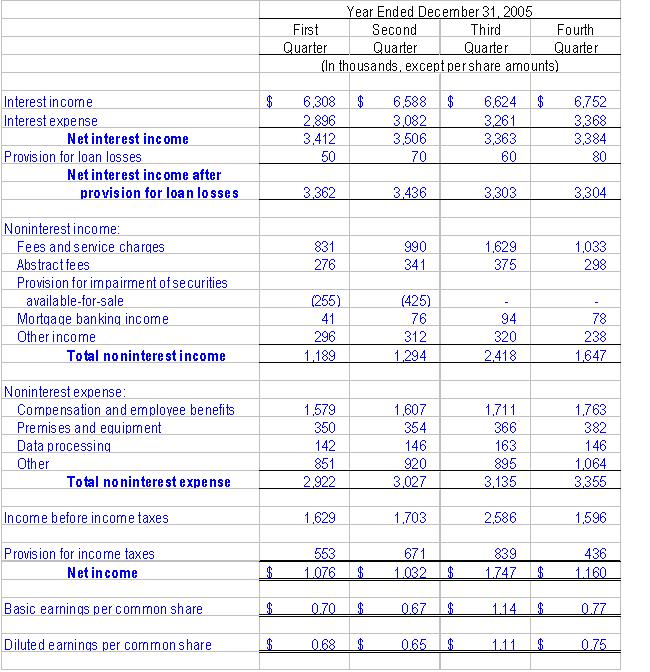

QUARTERLY RESULTS OF OPERATIONS (Unaudited)

MANAGEMENT OF THE HOLDING COMPANY AND THE BANK

SHAREHOLDER INFORMATION

This Annual Report to Shareholders contains certain forward-looking statements consisting of estimates with respect to the financial condition, results of operations (including noninterest expense and availability of potential tax credits) and business of North Central Bancshares, Inc. (the "Company") that are subject to various factors which could cause actual results to differ materially from these estimates. These factors include changes in general, economic and market conditions, the development of an interest rate environment that adversely affects the interest rate spread or other income anticipated from the Company's operations and investments, and changes in depositor preferences for financial products. The Company does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company.

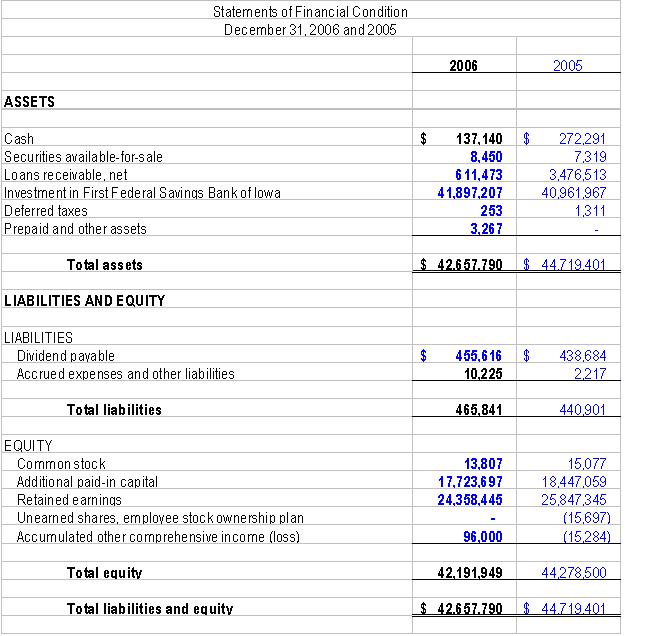

| | North Central Bancshares, Inc. | |

| | Holding Company for | |

| | First Federal Savings Bank of Iowa | |

| | 825 Central Avenue | |

| | Fort Dodge, Iowa 50501 | |

| | 515-576-7531 | |

| | www.firstfederaliowa.com | |

| | | |

| | Branch Locations | |

Fort Dodge, Iowa | Fort Dodge, Iowa | Ames, Iowa | Nevada, Iowa |

| 825 Central Avenue | 201 South 25th Street | 316 South Duff | 404 Lincoln Highway |

| Fort Dodge, Iowa 50501 | Fort Dodge, Iowa 50501 | Ames, Iowa 50010 | Nevada, Iowa 50201 |

| 515-576-7531 | 515-576-3177 | 515-232-4304 | 515-382-5408 |

| | | | |

Perry, Iowa | Ankeny, Iowa | Clive, Iowa | West Des Moines, Iowa |

1111 - 141st Street | 2110 SE Delaware Street | 13150 Hickman Road | 120 South 68th Street |

| Perry, Iowa 50220 | Ankeny, Iowa 50021 | Clive, Iowa 50325 | West Des Moines, Iowa 50266 |

| 515-465-3187 | 515-963-4488 | 515-440-6300 | 515-226-0800 |

Burlington, Iowa | Burlington, Iowa | Mt. Pleasant, Iowa |

| 1010 N. Roosevelt | 321 North 3rd Street | 102 South Main |

| Burlington, Iowa 52601 | Burlington, Iowa 52601 | Mt. Pleasant, Iowa 52641 |

| 319-754-6521 | 319-754-7517 | 319-385-8000 |

| | | |

| |

MESSAGE OF THE CHAIRMAN, PRESIDENT AND

CHIEF EXECUTIVE OFFICER

Dear Shareholders:

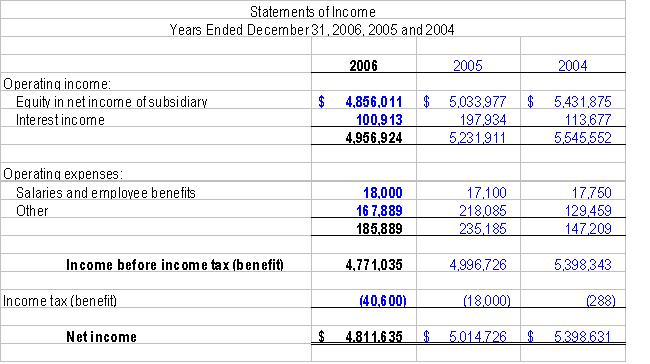

We are pleased to report to you the operating results of North Central Bancshares, Inc. (“North Central Bancshares” or the “Company”) for the year ended December 31, 2006. North Central Bancshares is the holding company for First Federal Savings Bank of Iowa (the “Bank”).

For the year ended December 31, 2006, North Central Bancshares’ net income was $4,812,000 or $3.32 diluted earnings per share. Total shareholder return was impacted favorably by a 13.8% increase in quarterly dividends effective April 2006. Some of our achievements during the past year include:

2006 HIGHLIGHTS

* Total assets increased 6.3% to a new high of $515.5 million.

* Net loans increased 4.4% to a new high of $449.0 million.

* Increased quarterly dividends in April, 2006 to $0.33 per share, a 13.8% increase.

* Repurchased a total of 151,250 shares of outstanding stock during the year ended December 31, 2006.

* Opened a new 6,000 sq. ft. full service office in West Des Moines, Iowa.

With the support of our directors, officers, staff and the continuing confidence of our shareholders, we look forward to continued success in the coming year. We remain committed to increasing shareholder value.

| | | | | | | | Sincerely, |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | /s/ David M. Bradley David M. Bradley |

| | | | | | | | Chairman, President and Chief Executive Officer |

SELECTED CONSOLIDATED FINANCIAL AND OTHER DATA

The selected consolidated financial and other data of North Central Bancshares set forth below is derived in part from, and should be read in conjunction with, the Consolidated Financial Statements and Notes thereto presented elsewhere in this Annual Report.

| | | At December 31, | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| | | (In thousands) | |

Selected Consolidated Financial Condition Data: | | | | | | | | | | | |

| Total assets | | $ | 515,515 | | $ | 485,191 | | $ | 462,735 | | $ | 424,009 | | $ | 403,872 | |

| Cash (noninterest-bearing) | | | 7,592 | | | 8,087 | | | 7,315 | | | 8,674 | | | 2,143 | |

Loans receivable, net: (1) First mortgage loans secured by one- to four-family residences | | | 215,992 | | | 210,793 | | | 184,324 | | | 171,468 | | | 147,479 | |

| First mortgage loans secured by multifamily properties | | | 65,237 | | | 73,453 | | | 77,995 | | | 69,507 | | | 70,194 | |

| First mortgage loans secured by commercial properties | | | 103,220 | | | 85,794 | | | 89,816 | | | 68,933 | | | 70,502 | |

| Consumer loans | | | 64,594 | | | 60,238 | | | 55,181 | | | 53,051 | | | 52,971 | |

| Total loans receivable, net | | | 449,043 | | | 430,278 | | | 407,316 | | | 362,959 | | | 341,146 | |

| Investment securities (2) | | | 32,461 | | | 21,260 | | | 23,710 | | | 28,297 | | | 35,859 | |

| Deposits (3) | | | 360,330 | | | 334,338 | | | 316,334 | | | 283,964 | | | 277,000 | |

| Borrowed funds | | | 107,908 | | | 102,444 | | | 100,975 | | | 95,005 | | | 85,026 | |

| Total shareholders' equity | | | 42,192 | | | 44,279 | | | 41,534 | | | 41,592 | | | 38,748 | |

| | | For the Year Ended December 31, | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| | | (In thousands) | |

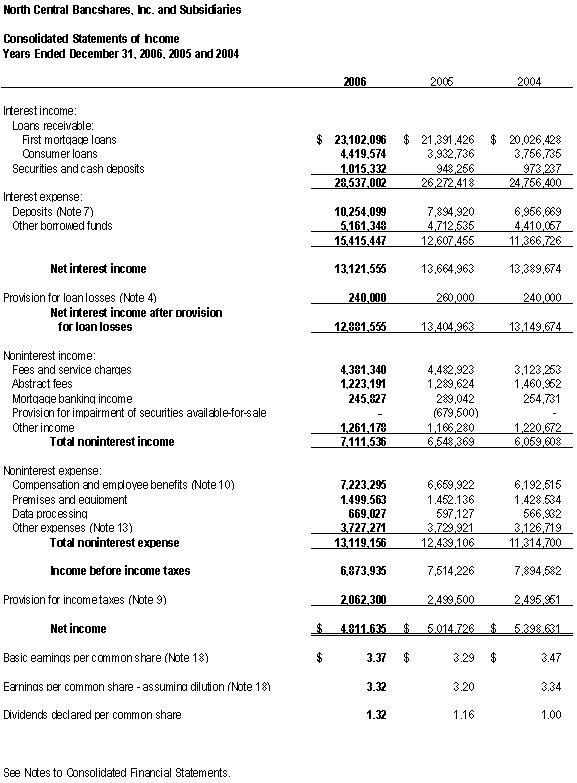

Selected Operating Data: | | | | | | | | | | | |

| Interest income | | $ | 28,537 | | $ | 26,272 | | $ | 24,757 | | $ | 25,412 | | $ | 26,965 | |

| Interest expense | | | 15,415 | | | 12,607 | | | 11,367 | | | 12,342 | | | 13,911 | |

| Net interest income before provision for loan losses | | | 13,122 | | | 13,665 | | | 13,390 | | | 13,070 | | | 13,054 | |

| Provision for loan losses | | | 240 | | | 260 | | | 240 | | | 255 | | | 383 | |

| Net interest income after provision for loan losses | | | 12,882 | | | 13,405 | | | 13,150 | | | 12,815 | | | 12,671 | |

Noninterest income: Fees and service charges | | | 4,381 | | | 4,483 | | | 3,123 | | | 2,864 | | | 2,375 | |

| Abstract fees | | | 1,223 | | | 1,289 | | | 1,461 | | | 1,811 | | | 1,686 | |

| Other income | | | 1,507 | | | 776 | | | 1,476 | | | 1,910 | | | 1,668 | |

| Total noninterest income | | | 7,111 | | | 6,548 | | | 6,060 | | | 6,585 | | | 5,729 | |

Noninterest expense: Salaries and employee benefits | | | 7,223 | | | 6,660 | | | 6,192 | | | 5,950 | | | 5,223 | |

| Premises and equipment | | | 1,500 | | | 1,452 | | | 1,429 | | | 1,287 | | | 1,192 | |

| Data processing | | | 669 | | | 597 | | | 567 | | | 578 | | | 544 | |

| Other expenses | | | 3,727 | | | 3,730 | | | 3,127 | | | 3,016 | | | 2,623 | |

| Total noninterest expense | | | 13,119 | | | 12,439 | | | 11,315 | | | 10,831 | | | 9,582 | |

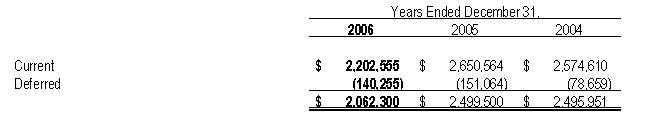

| Income before income taxes | | | 6,874 | | | 7,514 | | | 7,895 | | | 8,569 | | | 8,818 | |

Income tax expense | | | 2,062 | | | 2,499 | | | 2,496 | | | 2,721 | | | 2,953 | |

| Net income | | $ | 4,812 | | $ | 5,015 | | $ | 5,399 | | $ | 5,848 | | $ | 5,865 | |

| | | At or For the Year Ended December 31, | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

Key Financial Ratios and Other Data: | | | | | | | | | | | |

| | | | | | | | | | | | |

Performance Ratios: (%) | | | | | | | | | | | |

| Net interest rate spread (difference between average yield on interest-earning assets and average cost of interest-bearing liabilities) | | | 2.56 | % | | 2.83 | % | | 3.02 | % | | 3.03 | % | | 3.15 | % |

| Net interest margin (net interest income as a percentage of average interest-earning assets) | | | 2.79 | | | 3.05 | | | 3.22 | | | 3.27 | | | 3.44 | |

| Return on average assets (net income divided by average total assets) | | | 0.96 | | | 1.05 | | | 1.21 | | | 1.38 | | | 1.47 | |

| Return on average equity (net income divided by average equity) | | | 11.24 | | | 11.57 | | | 12.97 | | | 14.65 | | | 15.57 | |

| Noninterest income to average assets | | | 1.42 | | | 1.37 | | | 1.36 | | | 1.55 | | | 1.43 | |

| Efficiency ratio (4) | | | 64.84 | | | 61.54 | | | 58.18 | | | 55.11 | | | 51.01 | |

| Noninterest expense to average assets | | | 2.63 | | | 2.61 | | | 2.54 | | | 2.55 | | | 2.40 | |

| Net interest income after provision for loan losses to noninterest expenses | | | 98.19 | | | 107.76 | | | 116.22 | | | 118.32 | | | 132.24 | |

| | | | | | | | | | | | | | | | | |

Financial Condition Ratios: (%) (5) | | | | | | | | | | | | | | | | |

| Equity to assets at period end | | | 8.18 | | | 9.13 | | | 8.98 | | | 9.81 | | | 9.59 | |

| Tangible equity to tangible assets at period end (6) (7) | | | 7.17 | | | 8.01 | | | 7.80 | | | 8.54 | | | 8.25 | |

| Average shareholders' equity divided by average total assets | | | 8.57 | | | 9.09 | | | 9.35 | | | 9.40 | | | 9.42 | |

| Average tangible shareholders equity divided by average tangible total assets (6) (7) | | | 7.53 | | | 7.95 | | | 8.13 | | | 8.12 | | | 8.06 | |

| Average interest-earning assets to average interest-bearing liabilities | | | 107.09 | | | 107.62 | | | 107.24 | | | 107.63 | | | 107.91 | |

Asset Quality Ratios: (%) (5) | | | | | | | | | | | | | | | | |

| Nonaccrual loans to total net loans | | | 0.13 | | | 0.14 | | | 0.16 | | | 0.17 | | | 0.19 | |

| Nonperforming assets to total assets (8) | | | 0.20 | | | 0.36 | | | 0.37 | | | 0.49 | | | 0.35 | |

| Allowance for loan losses as a percent of total loans receivable at end of period | | | 0.77 | | | 0.76 | | | 0.77 | | | 0.86 | | | 0.90 | |

| Allowance for loan losses to nonaccrual loans | | | 603.41 | | | 567.98 | | | 513.13 | | | 515.02 | | | 485.00 | |

| | | | | | | | | | | | | | | | | |

Per Share Data: | | | | | | | | | | | | | | | | |

| Book value per share | | $ | 30.56 | | $ | 29.37 | | $ | 27.14 | | $ | 25.92 | | $ | 23.62 | |

| Tangible book value per share (6) | | | 26.49 | | | 25.46 | | | 23.28 | | | 22.24 | | | 20.03 | |

| Basic earnings per share (9) | | | 3.36 | | | 3.29 | | | 3.47 | | | 3.69 | | | 3.58 | |

| Diluted earnings per share (10) | | | 3.32 | | | 3.20 | | | 3.34 | | | 3.48 | | | 3.37 | |

| Dividends declared per share | | | 1.32 | | | 1.16 | | | 1.00 | | | 0.84 | | | 0.72 | |

| Dividend payout ratio | | | 0.39 | | | 0.35 | | | 0.29 | | | 0.23 | | | 0.20 | |

_______________________

(Notes on following page)

| (1) | Loans receivable, net, represents total loans less discounts, loans in process, net deferred loan fees and allowance for loan losses, plus premiums. The allowance for loan losses at December 31, 2006, 2005, 2004, 2003 and 2002 was $3.5 million, $3.3 million, $3.2 million, $3.2 million and $3.1 million, respectively. |

| (2) | Includes interest-bearing cash and Federal Home Loan Bank stock. |

| (3) | Includes brokered certificates of deposits of $30.4 million, $4.0 million, $0.0 million, $0.0 million and $0.0 million for the years ended December 31, 2006, 2005, 2004, 2003 and 2002, respectively. |

| (4) | Efficiency ratio represents noninterest expense divided by the sum of net interest income before provision for loan losses plus noninterest income. |

| (5) | Asset Quality Ratios are end of period ratios. With the exception of end of period ratios, all ratios are based on average monthly balances during the indicated periods and are annualized where appropriate. |

| (6) | Tangible equity consists of stockholders’ equity less goodwill and title plant. Goodwill and title plant was $5.6 million for the year ended December 31, 2006 and $5.9 million for each of the years ended December 31, 2005, 2004, 2003 and 2002. |

| (7) | Tangible assets consist of total assets less goodwill and title plant. Goodwill and title plant was $5.6 million for the year ended December 31, 2006 and $5.9 million for each of the years ended December 31, 2005, 2004, 2003 and 2002. |

(8) Nonperforming assets consists of nonaccrual loans and foreclosed real estate.

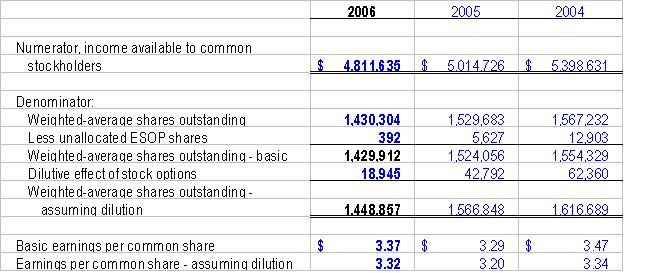

| (9) | Basic earnings per share information is calculated by dividing net income by the weighted average number of shares outstanding. The weighted average number of shares outstanding for basic earnings per share computation for 2006, 2005, 2004, 2003 and 2002 were 1,429,912, 1,524,056, 1,554,329, 1,583,568 and 1,637,749, respectively. |

(10) Diluted earnings per share information is calculated by dividing net income by the weighted average number of shares outstanding, adjusted for the effect of dilutive potential common shares outstanding which consists of stock options granted. The weighted average number of shares outstanding for diluted earnings per share computation for 2006, 2005, 2004, 2003 and 2002 were 1,448,857, 1,566,848, 1,616,689, 1,679,046 and 1,739,535, respectively.

MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

General

North Central Bancshares, Inc. (the "Company"), an Iowa corporation, is the holding company for First Federal Savings Bank of Iowa (the "Bank"), a federally-chartered savings bank. The principal business of the Company consists of the operation of its wholly-owned subsidiary, the Bank.

The profitability of the Company depends primarily on its level of net interest income, which is the difference between interest earned on the Company's interest-earning assets, consisting primarily of loans and investment securities, and the interest paid on interest-bearing liabilities, which primarily consist of deposits and borrowed funds in the form of advances from the Federal Home Loan Bank of Des Moines (the “FHLB”). Net interest income is a function of the Company's interest rate spread, which is the difference between the average yield on interest-earning assets and the average rate paid on interest-bearing liabilities, as well as a function of the average balance of interest-earning assets as compared to interest-bearing liabilities. The Company's net income is affected by its level of noninterest income which primarily consists of service fees and charges, abstract fees, mortgage banking income and other income, and noninterest expense, which primarily consists of compensation and employee benefit expenses, premises and equipment, data processing and other expenses. Net income also is affected significantly by general, economic and competitive conditions, particularly changes in market interest rates, government policies and actions of regulatory authorities, which events are beyond the control of the Company.

Executive Overview

The Company’s business strategy is to operate the Bank as a well-capitalized, profitable and independent community oriented savings bank. Specifically, the Company’s business strategy incorporates the following elements: (1) operating the Bank as a community oriented financial institution; (2) increasing loan and deposit balances in existing branch offices as well as by establishing de novo branch offices in markets where population growth trends are positive such as the Des Moines, Iowa metropolitan area; (3) maintaining high asset quality by emphasizing investment in residential mortgage, multifamily and commercial real estate loans and consumer loans; (4) emphasizing growth in core deposits, which includes demand deposit, NOW, money market and savings accounts; (5) maintaining capital in excess of regulatory requirements; (6) controlling noninterest expense; (7) managing interest rate risk exposure; and (8) increasing noninterest income through increases in fees and service charges.

The purpose of this summary is to provide an overview of the items management focuses on when evaluating the condition of the Company and our success in implementing our shareholder value strategy. Our shareholder value strategy has three major themes: (1) enhancing our shareholders’ value; (2) making our retail banking franchise more valuable; and (3) efficiently utilizing our capital.

Management believes the following points were the most important to that analysis this year:

| | • | The Company has effectively managed its capital since the Company’s inception in 1996. Annual dividends per share have increased from $.25 per share in 1997 to $1.32 per share in 2006. In addition, an active stock repurchase program has consistently been used by the Company to manage capital and increase earnings per share. Since the Company’s inception, it has repurchased 2,936,804 shares at a cost of $60.1 million as of December 31, 2006, including 151,250 shares purchased in 2006 at a cost of $5.9 million. |

| | • | The Bank has opened new offices in market areas where population growth trends are positive. New offices were opened in Ankeny, Iowa in February 2003 and in Clive, Iowa in March, 2004. In August, 2006, the Bank opened a new branch office in West Des Moines, Iowa near Jordan Town Center Mall. These locations are in suburbs of Des Moines, Iowa, which is Iowa’s largest metropolitan area. The Company will continue to analyze de novo branch opportunities in the Des Moines metropolitan area. Noninterest expenses have increased each year since 2003 due in part to the Company’s strategy of opening de novo branch offices. We believe that this strategy will result in long-term loan and deposit growth for the Company, but will negatively impact short-term earnings until each de novo branch achieves profitability. |

| | • | Consistent with the Bank’s emphasis on attracting and retaining core deposits, growth in deposit fees, including overdraft fees, continued a strong positive trend. |

| | • | The Company continues to be liability sensitive. The growth of interest-bearing liabilities primarily reflects the growth of higher cost certificates of deposit, including brokered certificates of deposit, and borrowed funds. Also contributing to the liability sensitivity of the Company is the continuing shift of lower cost non-maturing deposits into higher cost short-term certificates of deposit. |

| | • | The Company began utilizing brokered certificates of deposits in 2005 as an alternative funding source. At December 31, 2006, the Company had brokered certificates of deposit of $30.4 million, compared to $4.0 million at December 31, 2005. |

| | • | Noninterest income for the year ended December 31, 2006, included $569,000 in loan prepayment fees, compared to $1.0 million for the year ended December 31, 2005. |

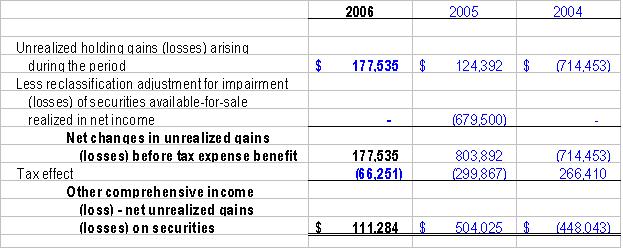

| | • | During the year ended December 31, 2005, the Company recognized an other-than-temporary impairment of $680,000 on three Freddie Mac adjustable rate, perpetual preferred stocks that had declined in value. The securities are investment grade securities that are held in the Company’s available-for-sale portfolio. The Company recognized an other-than-temporary impairment on the securities based on the facts and circumstances surrounding each of the securities at the time, including the duration and amount of the unrealized loss, as well as the prospect for the recovery of market value within a reasonable period of time. |

| | • | Management believes that the allowance for loan losses is adequate. The allowance for loan losses to nonaccrual loans was 603% at December 31, 2006. Net annualized charge-offs for 2006 were 0.02% of total loans and have averaged under 0.04% of total loans for the past five years. During 2006, the Company’s total loan portfolio increased $14.7 million, or 3.4%. This increase primarily consisted of increases in the one- to four-family first and second mortgage real estate loans. The Company’s provision for loan losses in 2006 was $240,000. |

| | • | The Company has lowered its effective tax rate through the use of federal Low Income Housing Tax Credits (LIHTC). The Company owns and operates two LIHTC projects in Fort Dodge. These projects generated $278,000 in federal income tax credits in 2006. The federal income tax credits associated with these projects will decline to $173,000 in 2007. |

| | • | Purchases and originations of out of state real estate loans remained an integral part of the Company’s business plan. The Company has purchased and originated out of state real estate loans to supplement local mortgage loan originations and to diversify its mortgage loan portfolio geographically. |

Critical Accounting Policies

This “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the disclosures included within this report, are based on the Company’s audited consolidated financial statements. These statements have been prepared in accordance with accounting principles generally accepted in the United States of America. The financial information contained in these statements is, for the most part, based on approximate measures of the financial effects of transactions and events that have already occurred. However, the preparation of these statements requires management to make certain estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses.

The Company’s accounting policies are described in the “Notes to Consolidated Financial Statements.” Based on its consideration of accounting policies that involve the most complex and subjective estimates and judgments, management has identified its most critical accounting policies to be that related to the allowance for loan losses and asset impairment judgments, including the recoverability of goodwill.

The allowance for loan losses is established through a provision for loan losses charged to expense. Loans are charged against the allowance for loan losses when management believes that collectibility of the principal is unlikely. The Company has policies and procedures for evaluating the overall credit quality of its loan portfolio, including timely identification of potential problem credits. On a quarterly basis, management reviews the appropriate level for the allowance for loan losses, incorporating a variety of risk considerations, both quantitative and qualitative. Quantitative factors include the Company’s historical loss experience, delinquency and charge-off trends, collateral values, known information about individual loans and other factors. Qualitative factors include the general economic environment in the Company’s market area and the expected trend of those economic conditions. To the extent that actual results differ from forecasts and management’s judgment, the allowance for loan losses may be greater or less than future charge-offs.

Asset impairment judgments include evaluating the decline in fair value of available-for-sale securities below their cost. Declines in fair value of available-for-sale securities below their cost that are deemed to be other-than-temporary are reflected in earnings as realized losses. In estimating other-than-temporary impairment losses, management considers (1) the length of time and the extent to which the fair value has been less than cost, (2) the financial condition and near-term prospects of the issuer, and (3) the intent and ability of the Company to retain its investment in the issuer for a period of time sufficient to allow for any anticipated recovery in fair value.

Goodwill represents the excess of the acquisition cost over the fair value of the net assets acquired in a purchase acquisition. Goodwill is tested for impairment at least annually.

Business Strategy

The Company's current business strategy is to operate the Bank as a well-capitalized, profitable and independent community-oriented savings bank. Generally, the Company has sought to implement this strategy primarily by using deposits, including brokered certificates of deposit, and advances from the FHLB as its source of funds and maintaining a substantial part of its assets in loans secured by one- to four-family residential real estate, multifamily real estate and commercial real estate located both inside and outside the Company's market area, consumer and other loans and in other liquid investment securities. Specifically, the Company's business strategy incorporates the following elements: (1) operating the Bank as a community-oriented financial institution, maintaining a strong core customer base by providing dedicated service to the individual consumer; (2) increasing loan and deposit balances in existing branch offices as well as by establishing de novo branch offices in markets where population growth trends are positive such as the Des Moines, Iowa metropolitan area; (3) maintaining high asset quality by emphasizing investment in residential mortgage, multifamily and commercial real estate loans and consumer loans; (4) emphasizing growth in core deposits, which includes demand deposit, NOW, money market and savings accounts; (5) maintaining capital in excess of regulatory requirements; (6) controlling noninterest expense; (7) managing interest rate risk exposure; and (8) increasing noninterest income through increases in fees and service charges.

Highlights of the Company's business strategy are as follows:

Community-Oriented Institution. The Company is committed to meeting the financial needs of the communities in which it operates. Based in part on its participation in several different programs designed to facilitate residential lending to low- and moderate-income households, the Bank has received an "Outstanding" as its most recent Community Reinvestment Act rating.

Retail Deposit Base. In 2006, the Company had eleven offices located in Fort Dodge, Ames, Nevada, Perry, Ankeny, Clive, West Des Moines, Burlington and Mount Pleasant, Iowa. At December 31, 2006, 33.9% of the deposit base, or $122.3 million, consisted of core deposits, which included money market accounts, savings accounts, NOW accounts, and noninterest-bearing demand accounts. Core deposits are generally considered to be a more stable and lower cost source of funds than certificates of deposit or outside borrowings. The Company continues to emphasize growth in core deposits.

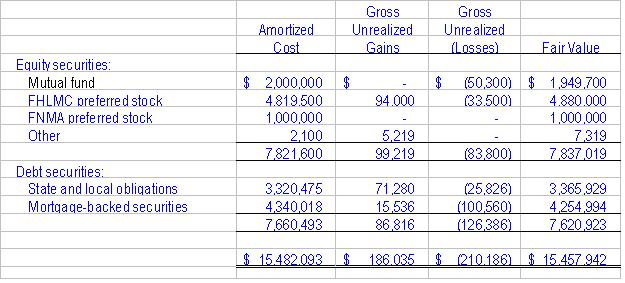

Asset Quality and Emphasis on Residential Mortgage Lending. The Company has historically emphasized residential real estate financing. The Company expects to continue its commitment to financing the purchase, construction or improvement of residential real estate in its market area. At December 31, 2006, 41.9% of the Company's total assets consisted of one- to four-family residential first mortgage loans. To supplement local mortgage loan originations and to diversify its mortgage loan portfolio geographically, the Company has originated or purchased loans in the secondary mortgage market, with an emphasis on multifamily and commercial real estate loans, secured by properties outside the State of Iowa (the "out of state properties"). At December 31, 2006, the Company's portfolio of loans which were either originated or purchased by the Company and secured by out of state properties totaled $135.3 million and consisted of $15.0 million one- to four-family residential mortgage loans, or 3.3%, $54.5 million multifamily real estate loans, or 12.0%, and $65.8 million commercial real estate loans, or 14.5%, of the Company's total loan portfolio. At December 31, 2006, the Company's ratio of nonperforming assets to total assets was 0.20%. The Company also invests in state and local obligations, mortgage-backed securities, interest-earning deposits, equity securities and FHLB stock.

Generally, the yield on mortgage loans originated and purchased by the Company is greater than that of securities purchased by the Company. Future economic conditions and continued strong banking competition could result in diminished lending opportunities. The Company may increase its investment in securities and in purchased mortgage loans outside its market area.

Increasing Noninterest Income. The Company has attempted to increase its level of noninterest income from both new and traditional lines of business to supplement net interest income. The Company generally increases noninterest income by emphasizing growth in core deposit accounts. During the year ended December 31, 2006, fees and service charges totaled $4.4 million, a decrease of $102,000 from the prior year. This decrease was primarily due to a decrease in loan prepayment fees of $444,000, offset in part by an increase in fees associated with checking accounts, including overdraft fees, of $343,000. The Company also maintains its noninterest income through emphasizing growth in mortgage banking income, annuity and mutual fund sales, and insurance sales. In addition, the Company currently owns abstract companies in Webster and Boone counties in Iowa, through First Iowa Title Services, Inc. ("First Iowa"), the Bank's wholly owned subsidiary. The abstract business performed by First Iowa replaces the function of a title insurance company. The Company believes that First Iowa can continue to be an important source of fee income. Noninterest income from First Iowa’s business for the years ended December 31, 2006 and 2005 was $1.2 and $1.3 million, respectively, offset by noninterest expense attributable to First Iowa. The decline in First Iowa’s income was due in part to the sale of one of the Company’s three abstract offices at the end of the second quarter of 2006.

Liquidity and Interest Rate Risk Management. Management seeks to manage the Company's interest rate risk exposure by monitoring the levels of interest rate sensitive assets and liabilities while maintaining an acceptable interest rate spread. At December 31, 2006, total interest-bearing liabilities maturing or repricing within one year exceeded total interest-earning assets maturing or repricing in the same period by $51.8 million, representing a one-year gap to total assets ratio of -10.1%, compared to a -12.3% at December 31, 2005. To manage the Company’s interest rate exposure, the Company emphasizes the origination of five- and seven-year fixed-rate mortgage loans that convert to adjustable rates at the conclusion of their initial terms and have overall maturities of up to 30 years, and the origination of adjustable rate home equity lines of credit and short-term consumer loans. The Company also manages its interest rate risk and liquidity by investing in mortgage-backed, municipal and equity securities. In addition, the Company generally sells all fixed rate one- to four-family residential loans with maturities of fifteen years or greater. See "Discussion of Market Risk - Interest Rate Sensitivity Analysis".

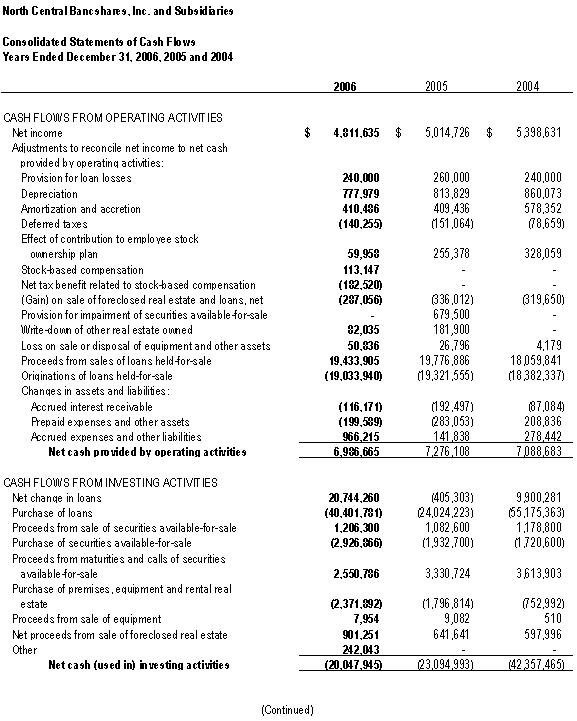

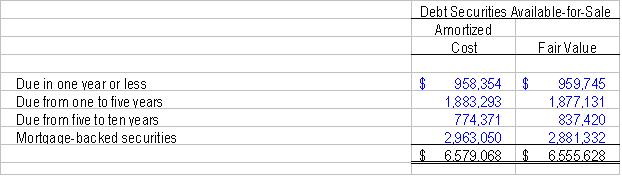

Liquidity and Capital Resources

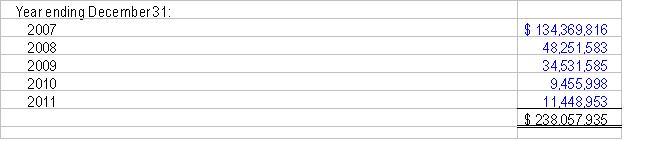

The Company's primary sources of funds are deposits, amortization and prepayment of loans, borrowings such as FHLB advances, brokered certificates of deposit, maturities of securities and other investments, and earnings and funds provided from operations. While scheduled principal repayments on loans are a relatively predictable source of funds, deposit flows and loan prepayments are greatly influenced by interest rates, economic conditions, and competition. The Company manages the pricing of its deposits to maintain a desired deposit balance. In addition, the Company invests in interest-earning assets, which provide liquidity to meet lending requirements. At December 31, 2006, $960,000, or 26.1% of the Company's investment portfolio excluding mortgage-backed, mutual fund and equity securities, was scheduled to mature within one year or less, $1.9 million, or 51.1%, was scheduled to mature within one to five years and $837,000, or 22.8%, was scheduled to mature in more than five years. At December 31, 2006, certificates of deposit scheduled to mature in less than one year totaled $134.4 million. Based on prior experience, management believes that a significant portion of such deposits will remain with the Company. If the Company requires funds beyond its ability to generate them internally, borrowing agreements exist with the FHLB, which provide an additional source of funds. The amount of eligible collateral for blanket lien pledges from the FHLB was $201.8 million as of December 31, 2006. The Company may also use brokered certificates of deposit, up to 10% of total assets, as an additional source of funds. For additional information about cash flows from the Company's operating, financing and investing activities, see the Statements of Cash Flows included in the Consolidated Financial Statements.

At December 31, 2006, the Company had outstanding loan commitments of $3.8 million. This amount does not include undisbursed overdraft loan privileges and the undisbursed home equity lines of credit. The Company monitors its liquidity position and expects to have sufficient funds to meet its current funding commitments.

The main sources of liquidity for the Company are proceeds from dividends and loan repayments from the Bank and the proceeds from stock options exercised. The main cash outflows are dividend payments to shareholders and funds used to repurchase shares of the Company’s common stock. During 2006, the Company repurchased 151,250 shares of its common stock. The Company has determined that a share repurchase program is appropriate to enhance shareholder value. Share repurchases generally increase earnings per share, return on average assets, and return on average equity, three performance benchmarks against which the Company and thrift holding companies are often measured. The Company buys stock in the open market whenever the price of the stock is deemed reasonable and the Company has funds available for the purchase. The Company's ability to pay dividends to shareholders depends substantially on dividends and loan payments received from the Bank. The Bank may not declare or pay cash dividends on any of its shares of common stock if the effect thereof would cause equity to be reduced below applicable regulatory capital requirements or the amount required to be maintained for the liquidation account. For a description of the liquidation account, see Note 17 to the Consolidated Financial Statements. Unlike the Bank, the Company is not subject to OTS formula-based regulatory restrictions on the payment of dividends to its shareholders; however, it is subject to the requirements of Iowa law. Iowa law generally prohibits the Company from paying a dividend if either of the following would result: (a) the Company would not be able to pay its debts as they become due in the usual course of business; or (b) the Company's total assets would be less than the sum of its total liabilities, plus the amount that would be needed, if the Company were to be dissolved at the time of distribution, to satisfy the preferential rights upon dissolution of shareholders whose preferential rights are superior to those receiving the distribution.

The primary investing activities of the Company are the origination and purchase of mortgage and other loans and the purchase of securities. During the years ended December 31, 2006, 2005 and 2004, the Company's disbursements for loan originations and purchases totaled $153.3 million, $143.1 million and $160.2 million, respectively. These activities were funded primarily by net deposit inflows, principal repayments on loans, proceeds from the sale of loans, proceeds from the maturity and call of securities, brokered certificates of deposit, and FHLB advances. Net cash flows (used in) investing activities were $(20.0) million, $(23.1) million and $(42.4) million for the years ended December 31, 2006, 2005 and 2004, respectively. Net cash flows provided by financing activities were $24.4 million, $16.5 million and $33.2 million for the years ended December 31, 2006, 2005 and 2004, respectively.

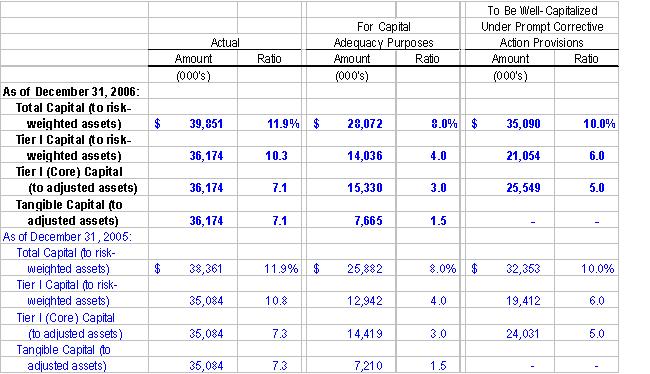

The OTS regulations require savings associations, such as the Bank, to meet three minimum capital standards: a tangible capital ratio requirement of 1.5% of total assets as adjusted under the OTS regulations; a leverage ratio requirement of 3% of core capital to such adjusted total assets; and a risk-based capital ratio requirement of 8% of core and supplementary capital to total risk-based assets. The Bank satisfied these minimum capital standards at December 31, 2006 with tangible and leverage capital ratios of 7.1% and a total risk-based capital ratio of 11.9 %. In determining the amount of risk-weighted assets for purposes of the risk-based capital requirement, a savings association must compute its risk-based assets by multiplying its assets and certain off-balance sheet items by risk-weights, which range from 0% for cash and obligations issued by the United States Government or its agencies to 100% for consumer and commercial loans, as assigned by the OTS capital regulations. These capital requirements, which are applicable to the Bank only, do not consider additional capital held at the Company level, and require certain adjustments to shareholders’ equity to arrive at the various regulatory capital amounts.

The table below presents the Bank's regulatory capital amounts as compared to the OTS regulatory capital requirements at December 31, 2006:

| | | Amount | | Capital Requirements | | Excess Capital | |

| | | | (In thousands) | |

| Tangible capital | | $ | 36,174 | | $ | 7,665 | | $ | 28,509 | |

| Core capital | | | 36,174 | | | 15,330 | | | 20,844 | |

| Risk-based capital | | | 39,851 | | | 28,072 | | | 11,779 | |

Discussion of Market Risk—Interest Rate Sensitivity Analysis

As a financial institution, the Company's primary component of market risk is interest rate volatility. Fluctuations in interest rates will ultimately impact both the level of income and expense recorded on a large portion of the Bank's assets and liabilities, and the market value of all interest-earning assets, other than those which possess a short term to maturity. Since all of the Company's interest-bearing liabilities and virtually all of the Company's interest-earning assets are located at the Bank, virtually all of the Company's interest rate risk management procedures are performed at the Bank level. Based upon the Bank's nature of operations, the Bank is not subject to foreign currency exchange or commodity price risk. The Bank's real estate loan portfolio, within Iowa, is subject to risks associated with the local economy. The Company has sought to diversify its loan portfolio by purchasing loans secured by properties outside of Iowa. At December 31, 2006, $135.3 million, or 29.8%, of the Company's total loan portfolio was secured by properties outside the State of Iowa, located in twenty-one states. The Bank does not own any trading assets. At December 31, 2006, neither the Company nor the Bank had any hedging transactions in place, such as interest rate swaps and caps.

The Company seeks to manage its interest rate risk by monitoring and controlling the variation in repricing intervals between its assets and liabilities. To a lesser extent, the Company also monitors its interest rate sensitivity by analyzing the estimated changes in market value of its assets and liabilities assuming various interest rate scenarios. As discussed more fully below, there are a variety of factors which influence the repricing characteristics of any given asset or liability.

The matching of assets and liabilities may be analyzed by examining the extent to which such assets and liabilities are “interest rate sensitive” and by monitoring an institution's “interest rate sensitivity gap.” An asset or liability is said to be interest rate sensitive within a specific time period if it will mature or reprice within that time period. The “interest rate sensitivity gap” is defined as the difference between the amount of interest-earning assets maturing or repricing within a specific time period and the amount of interest-bearing liabilities maturing or repricing within that same time period. A gap is considered positive when the amount of interest rate sensitive assets exceeds the amount of interest rate sensitive liabilities. A gap is considered negative when the amount of interest rate sensitive liabilities exceeds the amount of interest rate sensitive assets. During a period of rising interest rates, a negative gap would tend to adversely affect net interest income, while a positive gap would tend to positively affect net interest income. Similarly, during a period of falling interest rates, a negative gap would tend to positively affect net interest income, while a positive gap would tend to adversely affect net interest income.

The Company's policy in recent years has been to manage its exposure to interest rate risk generally by focusing on the maturities of its interest rate sensitive assets and by emphasizing adjustable-rate mortgage loans and short-term consumer loans, and maintaining a level of liquidity by investing in short-term interest-earning deposits and equity securities. In addition, the Company generally sells all fixed rate one- to four-family residential loans with maturities of fifteen years or greater.

At December 31, 2006, total interest-bearing liabilities maturing or repricing within one year exceeded total interest-earning assets maturing or repricing in the same period by $51.8 million, representing a one-year gap ratio of -10.1%, compared to a one-year gap ratio of -12.3% at December 31, 2005. The chief executive officer meets regularly with the Bank's senior executive officers to review trends in deposits as well as mortgage and consumer lending activities. The chief executive officer reports quarterly to the board of directors on interest rate risks and trends, as well as liquidity and capital ratio requirements.

Gap Table. The following table (the “Gap Table”) sets forth the amounts of interest-earning assets and interest-bearing liabilities outstanding at December 31, 2006, which are expected to reprice or mature, based upon certain assumptions, in each of the future time periods shown. Except as stated below, the amounts of assets and liabilities shown that reprice or mature during a particular period were determined in accordance with the earlier of the terms of repricing or the contractual terms of the asset or liability. Certain assumptions used in preparing the table are set forth in the following table. Management believes that these assumptions approximate actual experience and considers them appropriate and reasonable.

| | | At December 31, 2006 (1) | |

| | | Within 1 Year | | 1-3 Years | | 3-5 Years | | 5-10 Years | | 10-20 Years | | Over 20 Years | | Total | |

| | | (Dollars in thousands) | |

Interest-earning assets: | | | | | | | | | | | | | | | |

| First mortgage loans | | | | | | | | | | | | | | | |

| Adjustable (2) | | $ | 99,888 | | $ | 117,209 | | $ | 46,957 | | $ | - | | $ | - | | $ | - | | $ | 264,054 | |

| Fixed (2) | | | 24,845 | | | 40,045 | | | 23,625 | | | 34,870 | | | 2,468 | | | 83 | | | 125,936 | |

| Consumer and other loans | | | 23,946 | | | 26,173 | | | 10,986 | | | 4,121 | | | 197 | | | 5 | | | 65,428 | |

| Investment securities (3)(4) | | | 23,187 | | | 2,100 | | | 500 | | | 862 | | | - | | | 2,930 | | | 29,579 | |

| Total interest-earning assets | | $ | 171,866 | | $ | 185,527 | | $ | 82,068 | | $ | 39,853 | | $ | 2,665 | | $ | 3,018 | | $ | 484,997 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Rate sensitive liabilities: | | | | | | | | | | | | | | | | | | | | | | |

| Savings accounts | | $ | 4,277 | | $ | 6,497 | | $ | 4,476 | | $ | 6,007 | | $ | 3,298 | | $ | 605 | | $ | 25,160 | |

| NOW accounts | | | 18,365 | | | 18,859 | | | 7,485 | | | 4,438 | | | 484 | | | 5 | | | 49,636 | |

| Money market accounts | | | 27,403 | | | 7,285 | | | - | | | - | | | - | | | - | | | 34,688 | |

| Certificate accounts | | | 134,323 | | | 82,830 | | | 20,905 | | | - | | | - | | | - | | | 238,058 | |

| Noninterest bearing deposits | | | 12,788 | | | - | | | - | | | - | | | - | | | - | | | 12,788 | |

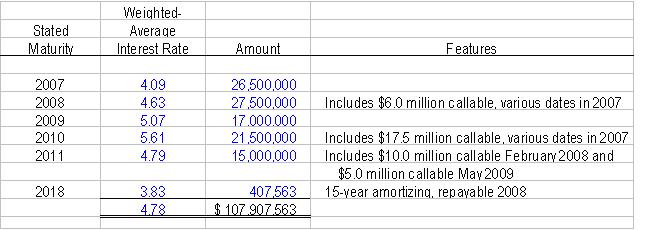

| FHLB advances and other liabilities (5) | | | 26,529 | | | 54,561 | | | 26,565 | | | 188 | | | 64 | | | - | | | 107,907 | |

| Total interest-bearing liabilities | | $ | 223,685 | | $ | 170,032 | | $ | 59,431 | | $ | 10,633 | | $ | 3,846 | | $ | 610 | | $ | 468,237 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Interest sensitivity gap | | $ | (51,819 | ) | $ | 15,495 | | $ | 22,637 | | $ | 29,220 | | $ | (1,181 | ) | $ | 2,408 | | | | |

| Cumulative interest-sensitivity gap | | $ | (51,819 | ) | $ | (36,324 | ) | $ | (13,687 | ) | $ | 15,533 | | $ | 14,352 | | $ | 16,760 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Interest sensitivity gap to total asset | | | (10.05 | )% | | 3.01 | % | | 4.39 | % | | 5.67 | % | | (0.23 | )% | | 0.47 | % | | | |

| Cumulative interest-sensitivity gap to total asset | | | (10.05 | ) | | (7.05 | ) | | (2.66 | ) | | 3.01 | | | 2.78 | | | 3.25 | | | | |

| Ratio of interest-earning assets to interest-bearing liabilities | | | 76.83 | | | 109.11 | | | 138.09 | | | 374.80 | | | 69.29 | | | 494.75 | | | 103.58 | % |

| Cumulative ratio of interest-earning assets to interest-bearing liabilities | | | 76.83 | | | 90.77 | | | 96.98 | | | 103.35 | | | 103.07 | | | 103.58 | | | 103.58 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 515,515 | | $ | 515,515 | | $ | 515,515 | | $ | 515,515 | | $ | 515,515 | | $ | 515,515 | | $ | 515,515 | |

| Cumulative interest-earning assets | | $ | 171,866 | | $ | 357,393 | | $ | 439,461 | | $ | 479,314 | | $ | 481,979 | | $ | 484,997 | | $ | 484,997 | |

| Cumulative interest-bearing liabilities | | $ | 223,685 | | $ | 393,717 | | $ | 453,148 | | $ | 463,781 | | $ | 467,627 | | $ | 468,237 | | $ | 468,237 | |

________________________________

(1) The following assumptions were used in regard to prepayment speed for loans: (i) fixed rate commercial real estate loans and mortgage-backed securities will prepay at 10 percent per year, (ii) one- to four-family loans (both fixed rate and adjustable rate) will prepay at 12 percent per year, (iii) all multifamily loans (both fixed and adjustable rate) and adjustable rate commercial real estate loans will prepay at 15 percent per year, (iv) all second mortgage real estate loans and all other loans will prepay at 20 percent year. Besides prepayment assumptions, the chart above also includes normal principal payments based upon the loan contractual agreements. Savings accounts are assumed to be withdrawn at an annual rate of 17 percent. NOW accounts are assumed to be withdrawn at an annual rate of 37 percent. Money market accounts are assumed to be withdrawn at 79 percent during the first year with the balance being withdrawn within the one-to-three year category. These assumptions are annual percentages based on remaining balances and should not be regarded as indicative of the actual prepayments and withdrawals that may be experienced by the Company. Certain shortcomings are inherent in the analysis presented by the foregoing table.

(2) Includes $2.4 million and $0.5 million in mortgage-backed securities in adjustable and fixed first mortgage loans, respectively.

(3) Includes other equity securities, interest-bearing deposits and FHLB stock, all of which are shown in the within-one-year category. Components include interest-bearing deposits of $12.4 million and securities available-for-sale of $11.7 million.

(4) Includes $5.0 million of FHLMC preferred stock and $1.0 million of FNMA preferred stock. $2.9 million is fixed rate and $3.1 million is adjustable rate. The fixed rate preferred stock was included in the appropriate category based upon their maturity date. The adjustable rate preferred stock was included in the appropriate category based upon their repricing date.

(5) Includes $107.9 million of advances from the FHLB. Of these advances, $69.4 million are term advances and $38.5 million are callable. The term advances have been categorized based upon their maturity date. Of the $38.5 million of callable advances, $28.5 million have been categorized based upon their maturity date because the interest rates on such advances are near or above current market rates. The remaining $10.0 million callable advance was placed in the repricing category based upon its call date because the rate on this advance was below current market rates.

Certain shortcomings are inherent in the method of analysis presented in the above Gap Table. For example, although certain assets and liabilities may have similar maturities or periods to repricing, they may react in different degrees to changes in market interest rates. Also, the interest rates on certain types of assets and liabilities may fluctuate in advance of changes in market interest rates, while interest rates on other types of assets and liabilities may lag behind changes in market rates. Additionally, certain assets, such as adjustable-rate loans, have features which restrict changes in interest rates both on a short-term basis and over the life of the asset. Further, in the event of changes in interest rates, prepayment and early withdrawal levels would likely deviate significantly from those assumed in calculating the table. Finally, the ability of many borrowers to service their adjustable-rate loans may decrease in the event of an interest rate increase.

Net Portfolio Value Analysis. As part of its efforts to maximize net interest income and manage the risks associated with changing interest rates, management uses the "net portfolio value" ("NPV") methodology which the OTS has adopted as part of its capital regulations.

Under this methodology, interest rate risk exposure is assessed by reviewing the estimated changes in NPV which would hypothetically occur if interest rates rapidly rise or fall along the yield curve. Projected values of NPV at both higher and lower regulatory defined rate scenarios are compared to base case values (no change in rates) to determine the sensitivity to changing interest rates.

Presented below, as of December 31, 2006, is an analysis of the Company's interest rate risk ("IRR") as measured by changes in NPV for instantaneous and sustained parallel shifts of 100 basis points in market interest rates. Such limits have been established with consideration of the impact of various rate changes and the Company's current capital position.

Interest Rate Sensitivity of Net Portfolio Value (NPV)(1)

| | | Net Portfolio Value | | | | NPV as % of PV of Assets | |

Change in Rates | | $ Amount | | $ Change | | % Change | | NPV Ratio | | Change | |

(Dollars in thousands) | |

| +300 bp | | | 40,161 | | | (11,499) | | | (22) | | | 8.01 | | | (184) bp | |

| +200 bp | | | 45,268 | | | (6,392) | | | (12) | | | 8.87 | | | (97) bp | |

| +100 bp | | | 49,267 | | | (2,393) | | | (5) | | | 9.51 | | | (34) bp | |

| 0 bp | | | 51,660 | | | - | | | - | | | 9.84 | | | - | |

| -100 bp | | | 51,601 | | | (59) | | | - | | | 9.74 | | | (10) bp | |

| -200 bp | | | 51,727 | | | 67 | | | - | | | 9.67 | | | (17) bp | |

_________________________________

(1) Denotes rate shock used to compute interest rate risk capital component.

As is the case with the Gap Table, certain shortcomings are inherent in the methodology used in the above interest rate risk measurements. Modeling changes in NPV require the making of certain assumptions which may or may not reflect the manner in which actual yields and costs respond to changes in market interest rates. In this regard, the NPV Table presented above assumes that the composition of the Company's interest sensitive assets and liabilities existing at the beginning of a period remains constant over the period being measured and also assumes that a particular change in interest rates is reflected uniformly across the yield curve regardless of the duration to maturity or repricing of specific assets and liabilities. Accordingly, although the NPV Table provides an indication of the Company's interest rate risk exposure at a particular point in time, such measurements are not intended to and do not provide a precise forecast of the effect of changes in market interest rates on the Company's net interest income and will differ from actual results.

Nonperforming Assets. Loans are reviewed on a regular basis and are placed on nonaccrual status when, in the opinion of management, the collection of additional interest is doubtful. Mortgage loans and consumer loans are placed on nonaccrual status generally when either principal or interest is 90 days or more past due. Interest accrued and unpaid at the time a loan is placed on nonaccrual status is charged against interest income.

Real estate acquired by the Company as a result of foreclosure, or by deed in lieu of foreclosure, is deemed foreclosed real estate until such time as it is sold.

When foreclosed real estate is acquired or otherwise deemed foreclosed real estate, it is recorded at the lower of the unpaid principal balance of the related loan or its estimated fair value, less estimated selling expenses. Valuations are periodically performed by management and any subsequent decline in fair value is charged to operations. At December 31, 2006, the Company's foreclosed real estate consisted of 7 properties with an aggregate carrying value of $468,000.

Delinquent Loans, Nonaccrual Loans and Nonperforming Assets. The following table sets forth information regarding loans on nonaccrual status and foreclosed real estate of the Company at the dates indicated. At the dates indicated, the Company did not have any material restructured loans and did not have any loans that were ninety days past due and still accruing interest.

| | | At December 31, | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| | | (Dollars in thousands) | |

Nonaccrual loans and nonperforming assets: | | | | | | | | | | | |

| First mortgage loans: | | | | | | | | | | | |

| One- to four-family residential | | $ | 222 | | $ | 389 | | $ | 335 | | $ | 414 | | $ | 434 | |

| Multifamily and commercial properties | | | - | | | - | | | - | | | - | | | 37 | |

| Consumer loans: | | | 357 | | | 196 | | | 299 | | | 201 | | | 172 | |

| Total nonaccrual loans | | | 579 | | | 585 | | | 634 | | | 615 | | | 643 | |

| Total foreclosed real estate | | | 468 | | | 1,143 | | | 1,079 | | | 1,453 | | | 769 | |

| Other nonperforming assets | | | - | | | - | | | - | | | - | | | - | |

| Total nonperforming assets | | $ | 1,047 | | $ | 1,728 | | $ | 1,713 | | $ | 2,068 | | $ | 1,412 | |

| Total nonaccrual loans to net loans receivable | | | 0.13 | % | | 0.14 | % | | 0.16 | % | | 0.17 | % | | 0.19 | % |

| Total nonaccrual loans to total assets | | | 0.11 | | | 0.12 | | | 0.14 | | | 0.15 | | | 0.16 | |

| Total nonperforming assets to total assets | | | 0.20 | | | 0.36 | | | 0.37 | | | 0.49 | | | 0.35 | |

________________________________

The following table sets forth information with respect to loans delinquent 60-89 days in the Company's portfolio at the dates indicated.

| | | At December 31, | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| | | (In thousands) | |

Loans past due 60-89 days: | | | | | | | | | | | |

| First mortgage loans: | | | | | | | | | | | |

| One- to four-family residential | | $ | 765 | | $ | 1,106 | | $ | 1,001 | | $ | 649 | | $ | 830 | |

| Multifamily and commercial properties | | | - | | | - | | | 40 | | | 463 | | | - | |

| Consumer loans | | | 68 | | | 214 | | | 238 | | | 223 | | | 183 | |

| Total past due | | $ | 833 | | $ | 1,320 | | $ | 1,279 | | $ | 1,335 | | $ | 1,013 | |

| | | | | | | | | | | | | | | | | |

The following table sets forth information with respect to the Company's delinquent loans and other problem assets at December 31, 2006.

| | | At December 31, 2006 |

| | | Balance | | Number |

| | | (Dollars in thousands) |

One- to four-family first mortgage loans: Loans 60 to 89 days delinquent | | | $ 765 | | | 17 |

| Loans 90 days or more delinquent | | | 222 | | | 6 |

Multifamily and commercial first mortgage loans: Loans 60 to 89 days delinquent | | | - | | | - |

| Loans 90 days or more delinquent | | | - | | | - |

| Consumer Loans: | | | | | | |

| Loans 60 to 89 days delinquent | | | 68 | | | 1 |

| Loans 90 days or more delinquent | | | 357 | | | 12 |

| Foreclosed real estate | | | 468 | | | 7 |

| Other nonperforming assets | | | - | | | - |

| Loans to facilitate sale of foreclosed real estate | | | 87 | | | 2 |

| Special mention loans | | | 751 | | | 27 |

Classification of Assets. Federal regulations provide for the classification of loans and other assets such as debt and equity securities considered by the OTS to be of lesser quality as "substandard," "doubtful," or "loss" assets. An asset is considered "substandard" if it is inadequately protected by the current net worth and paying capacity of the obligor or of the collateral pledged, if any. "Substandard" assets include those characterized by the "distinct possibility" that the savings institution will sustain "some loss" if the deficiencies are not corrected. Assets classified as "doubtful" have all of the weaknesses inherent in those classified "substandard," with the added characteristic that the weaknesses present make "collection or liquidation in full," on the basis of currently existing facts, conditions, and values, "highly questionable and improbable.” Assets classified as "loss" are those considered "uncollectible" and of such little value that their continuance as assets without the establishment of a specific loss reserve is not warranted. Assets that do not expose the savings institution to risk sufficient to warrant classification in one of the aforementioned categories, but which possess some weaknesses, are required to be designated "special mention" by management. Loans designated as special mention are generally loans that, while current in required payments, have exhibited some potential weaknesses that, if not corrected, could increase the level of risk in the future. At December 31, 2006, the Company had $751,000 of special mention loans, consisting of ten loans secured by one- to four-family residences and seventeen consumer loans.

The following table sets forth the aggregate amount of the Company's classified assets, which include nonperforming loans and foreclosed real estate, at the dates indicated.

| | | At December 31, | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| | | (In thousands) | |

| Substandard assets | | $ | 1,038 | | $ | 1,670 | | $ | 1,680 | | $ | 2,046 | | $ | 1,361 | |

| Doubtful assets | | | - | | | - | | | - | | | - | | | - | |

| Loss assets | | | 24 | | | 58 | | | 58 | | | 22 | | | 51 | |

| Total classified assets | | $ | 1,062 | | $ | 1,728 | | $ | 1,738 | | $ | 2,068 | | $ | 1,412 | |

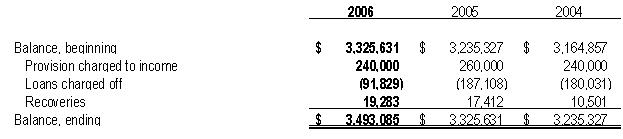

Allowance for Loan Losses. It is management's policy to provide an allowance and provision for probable losses on the Company's loan portfolio based on management's evaluation of the prior loss experience, industry standards, past due loans, economic conditions, the volume and type of loans in the Company's portfolio, which includes a significant amount of multifamily and commercial loans, substantially all of which are purchased and are collateralized by properties located outside of the Company's market area, and other factors related to the collectibility of the Company's loan portfolio. The Company regularly reviews its loan portfolio, including problem loans, to determine whether any loans require classification or the establishment of appropriate allowances for losses. Such evaluation, which includes a review of all loans of which full collectibility of interest and principal may not be reasonably assured, considers, among other matters, the estimated fair value of the underlying collateral. During 2006 the Company’s total loan portfolio increased $14.7 million, or 3.4%. During the years ended December 31, 2006, 2005 and 2004 the Company's provision for loan losses were $240,000, $260,000 and $240,000, respectively. The Company's allowance for loan losses totaled $3.5 million, $3.3 million and $3.2 million at December 31, 2006, 2005 and 2004, respectively.

Management believes that the allowance for losses on loans is adequate. While management uses available information to recognize losses on loans, future additions to the allowances may be necessary based on changes in economic conditions. In addition, various regulatory agencies, as an integral part of their examination process, periodically review the Bank's allowances for loan losses. Such agencies may require the Bank to recognize additions to the allowances based on their judgments about information available to them at the time of their examination.

Analysis of the Allowance for Loan Losses. The following table sets forth the analysis of the allowance for loan losses for the periods indicated.

| | | For the Year Ended December 31, | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| | | (Dollars in thousands) | |

| Total loans outstanding | | $ | 453,335 | | $ | 438,650 | | $ | 418,841 | | $ | 367,396 | | $ | 344,574 | |

| Average loans outstanding | | | 447,440 | | | 424,633 | | | 389,190 | | | 358,260 | | | 337,693 | |

| Allowance balances (at beginning of period) | | | 3,326 | | | 3,235 | | | 3,165 | | | 3,118 | | | 2,883 | |

| Provisions for losses | | | 240 | | | 260 | | | 240 | | | 255 | | | 383 | |

Charge-Offs: First mortgage loans | | | 22 | | | 5 | | | 66 | | | 36 | | | 27 | |

| Consumer loans | | | 70 | | | 182 | | | 114 | | | 265 | | | 135 | |

Recoveries: First mortgage loans | | | - | | | 3 | | | 2 | | | - | | | - | |

| Consumer loans | | | 19 | | | 15 | | | 8 | | | 93 | | | 14 | |

| Net charge-offs | | | 73 | | | 169 | | | 170 | | | 208 | | | 148 | |

Allowance balance (at end of period) | | $ | 3,493 | | $ | 3,326 | | $ | 3,235 | | $ | 3,165 | | $ | 3,118 | |

| Allowance for loan losses as a percent of total loans receivable at end of period | �� | | 0.77 | % | | 0.76 | % | | 0.77 | % | | 0.86 | % | | 0.90 | % |

| Net loans charged off as a percent of average loans outstanding | | | 0.02 | | | 0.04 | | | 0.04 | | | 0.06 | | | 0.04 | |

| Ratio of allowance for loan losses to total nonaccrual loans at end of period | | | 603.41 | | | 567.98 | | | 513.13 | | | 515.02 | | | 485.00 | |

| Ratio of allowance for loan losses to total nonaccrual loans and foreclosed real estate at end of period | | | 333.63 | | | 192.41 | | | 188.86 | | | 153.05 | | | 220.90 | |

Allocation of Allowance for Loan Losses. The following table sets forth the allocation for loan losses by loan category for the periods indicated:

| | | At December 31, | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| | | Amount | | % of Loans In Each Category to Total Loans | | Amount | | % of Loans In Each Category to Total Loans | | Amount | | % of Loans In Each Category to Total Loans | | Amount | | % of Loans In Each Category to Total Loans | | Amount | | % of Loans In Each Category to Total Loans | |

(Dollars in thousands) |

| Balance at end of period applicable to: | | | | | | | | | | | | | | | | | | | | | |

| One- to four-family residential mortgage loans | $ | 570 | | | 48.01 | % | $ | 593 | | | 49.47 | % | $ | 510 | | | 45.99 | % | $ | 517 | | | 47.33 | % | $ | 395 | | | 43.17 | % |

| Multifamily residential mortgage loans | | 646 | | | 14.52 | | | 704 | | | 16.86 | | | 731 | | | 18.73 | | | 686 | | | 19.04 | | | 709 | | | 20.54 | |

| Commercial mortgage loans | | 1,443 | | | 23.04 | | | 1,201 | | | 19.76 | | | 1,240 | | | 21.94 | | | 978 | | | 18.95 | | | 1,223 | | | 20.68 | |

| Consumer loans | | 834 | | | 14.43 | | | 828 | | | 13.91 | | | 754 | | | 13.34 | | | 984 | | | 14.68 | | | 791 | | | 15.61 | |

| Total allowance for loan losses | $ | 3,493 | | | 100.00 | % | $ | 3,326 | | | 100.00 | % | $ | 3,235 | | | 100.00 | % | $ | 3,165 | | | 100.00 | % | $ | 3,118 | | | 100.00 | % |

Average Balance Sheet

The following table sets forth certain information relating to the Company's average balance sheet and reflects the average yield on assets and average cost of liabilities for the periods indicated and the average yields earned and rates paid. Such yields and costs are derived by dividing income or expense by the average balance of assets or liabilities, respectively, for the periods presented. For purposes of this table, average balances were computed on a monthly basis.

| | | For the Year Ended December 31, | |

| | | 2006 | | 2005 | | 2004 | |

| | | Average Balance | | Interest | | Average Yield/ Cost | | Average Balance | | Interest | | Average Yield/ Cost | | Average Balance | | Interest | | Average Yield/ Cost | |

| | | (Dollars in thousands) | |

Assets: | | | | | | | | | | | | | | | | | | | |

| Interest-earning assets: | | | | | | | | | | | | | | | | | | | |

First mortgage loans(1) | | $ | 384,965 | | $ | 23,102 | | | 6.00 | % | $ | 365,647 | | $ | 21,391 | | | 5.85 | % | $ | 334,676 | | $ | 20,027 | | | 5.98 | % |

Consumer loans(1) | | | 62,474 | | | 4,420 | | | 7.07 | | | 58,986 | | | 3,933 | | | 6.67 | | | 54,513 | | | 3,757 | | | 6.89 | |

Investment securities | | | 22,403 | (4) | | 1,015 | | | 4.53 | | | 23,738 | (5) | | 948 | | | 3.99 | | | 27,232 | (6) | | 973 | | | 3.57 | |

Total interest-earning assets | | $ | 469,842 | | $ | 28,537 | | | 6.07 | % | $ | 448,371 | | $ | 26,272 | | | 5.86 | % | $ | 416,421 | | $ | 24,757 | | | 5.95 | % |

Noninterest-earning assets | | | 29,578 | | | | | | | | | 28,724 | | | | | | | | | 28,818 | | | | | | | |

Total assets | | $ | 499,420 | | | | | | | | $ | 477,095 | | | | | | | | $ | 445,239 | | | | | | | |

Liabilities and Equity: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

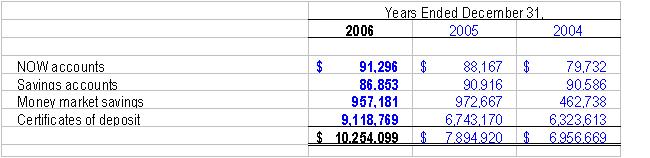

NOW and money market savings | | $ | 85,008 | | $ | 1,048 | | | 1.23 | % | $ | 95,781 | | $ | 1,061 | | | 1.11 | % | $ | 78,865 | | $ | 542 | | | 0.69 | % |

Savings | | | 26,335 | | | 87 | | | 0.33 | | | 28,710 | | | 91 | | | 0.32 | | | 29,217 | | | 91 | | | 0.31 | |

Certificates of Deposit | | | 218,655 | | | 9,119 | | | 4.17 | | | 189,900 | | | 6,743 | | | 3.55 | | | 182,368 | | | 6,324 | | | 3.47 | |

Borrowed funds | | | 108,753 | | | 5,161 | | | 4.75 | | | 102,234 | | | 4,712 | | | 4.61 | | | 97,848 | | | 4,410 | | | 4.51 | |

Total interest-bearing liabilities | | $ | 438,751 | | $ | 15,415 | | | 3.51 | % | $ | 416,625 | | $ | 12,607 | | | 3.03 | % | $ | 388,298 | | $ | 11,367 | | | 2.93 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Noninterest-bearing liabilities | | | 17,858 | | | | | | | | | 17,110 | | | | | | | | | 15,322 | | | | | | | |

Total liabilities | | $ | 456,609 | | | | | | | | $ | 433,735 | | | | | | | | $ | 403,620 | | | | | | | |

Equity | | | 42,811 | | | | | | | | | 43,360 | | | | | | | | | 41,619 | | | | | | | |

Total liabilities and equity | | $ | 499,420 | | | | | | | | $ | 477,095 | | | | | | | | $ | 445,239 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income | | | | | $ | 13,122 | | | | | | | | $ | 13,665 | | | | | | | | $ | 13,390 | | | | |

Net interest rate spread(2) | | | | | | | | | 2.56 | % | | | | | | | | 2.83 | % | | | | | | | | 3.02 | % |

Net interest margin (3) | | | | | | | | | 2.79 | | | | | | | | | 3.05 | | | | | | | | | 3.22 | |

Ratio of average interest-earning assets to average interest-bearing liabilities | | | | | | | | | 107.09 | | | | | | | | | 107.62 | | | | | | | | | 107.24 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

___________________

(1) Balance is net of deferred loan fees, deferred loan costs, loan premiums and loans in process. Nonaccrual loans are included in the balances.

(2) Net interest rate spread represents the difference between the yield on average interest-earning assets and the cost of average interest-bearing liabilities.

(3) Net interest margin represents net interest income divided by average total interest-earning assets.

(4) Includes interest-bearing deposits of $1,238,000, Federal Home Loan Bank stock of $5,563,000, and securities available-for-sale of $15,602,000.

(5) Includes interest-bearing deposits of $1,150,000, Federal Home Loan Bank stock of $5,212,000, and securities available-for-sale of $17,376,000.

(6) Includes interest-bearing deposits of $1,735,000, Federal Home Loan Bank stock of $4,993,000, and securities available-for-sale of $20,504,000.

Rate/Volume Analysis

The table below sets forth certain information regarding changes in interest income and interest expense of the Company for the periods indicated. For each category of interest-earning assets and interest-bearing liabilities, information is provided on changes attributable to (i) changes in average volume (changes in average volume multiplied by old rate); (ii) changes in rates (changes in rate multiplied by old average volume); (iii) changes in rate-volume (changes in rate multiplied by the changes in average volume); and (iv) the net change.

| | | Year Ended December 31, 2006 Compared to Year Ended December 31, 2005 | | Year Ended December 31, 2005 Compared to Year Ended December 31, 2004 | |

| | | Increase/(Decrease) Due to | | Increase/(Decrease) Due to | |

| | | Volume | | Rate | | Rate/ Volume | | Total Increase (Decrease) | | Volume | | Rate | | Rate/ Volume | | Total Increase (Decrease) | |

| | | (In thousands) |

Interest income: | | | | | | | | | | | | | | | | | |

First mortgage loans | | $ | 1,130 | | $ | 552 | | $ | 29 | | $ | 1,711 | | $ | 1,853 | | $ | (447 | ) | $ | (41 | ) | $ | 1,365 | |

Consumer loans | | | 233 | | | 240 | | | 14 | | | 487 | | | 308 | | | (122 | ) | | (10 | ) | | 176 | |

Investment securities | | | (59 | ) | | 123 | | | 3 | | | 67 | | | (125 | ) | | 113 | | | (13 | ) | | (25 | ) |

Total interest-earning assets | | $ | 1,304 | | $ | 915 | | $ | 46 | | $ | 2,265 | | $ | 2,036 | | $ | (456 | ) | $ | (64 | ) | $ | 1,516 | |

Interest expense: | | | | | | | | | | | | | | | | | | | | | | | | | |

NOW and money market savings | | $ | (119 | ) | $ | 120 | | $ | (14 | ) | $ | (13 | ) | $ | 117 | | $ | 331 | | $ | 71 | | $ | 519 | |

Savings | | | (8 | ) | | 4 | | | - | | | (4 | ) | | (2 | ) | | 2 | | | - | | | - | |

Certificate of deposits | | | 1,021 | | | 1,177 | | | 178 | | | 2,376 | | | 261 | | | 152 | | | 6 | | | 419 | |

Borrowed funds | | | 301 | | | 139 | | | 9 | | | 449 | | | 199 | | | 100 | | | 4 | | | 303 | |

Total interest-bearing liabilities | | | 1,195 | | | 1,440 | | | 173 | | | 2,808 | | | 575 | | | 585 | | | 81 | | | 1,241 | |

Net change in net interest income | | $ | 109 | | $ | (525 | ) | $ | (127 | ) | $ | (543 | ) | $ | 1,461 | | $ | (1,041 | ) | $ | (145 | ) | $ | 275 | |

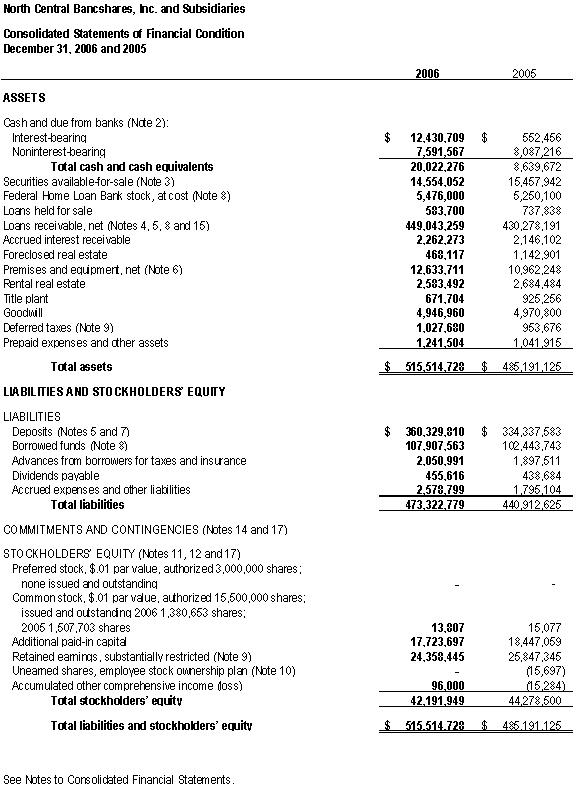

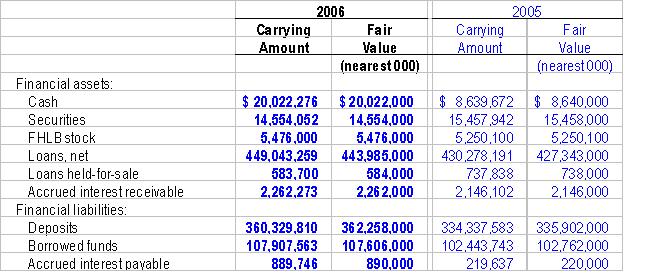

Comparison of Financial Condition as of December 31, 2006 and December 31, 2005

Total assets increased $30.3 million, or 6.3%, to $515.5 million at December 31, 2006 from $485.2 million at December 31, 2005. The increase in assets was primarily due to increases in net loans receivable, cash and cash equivalents, and premises and equipment, offset in part by a decrease in securities available-for-sale. Asset growth was funded by increases in deposits, consisting primarily of brokered certificates of deposit, and FHLB advances.

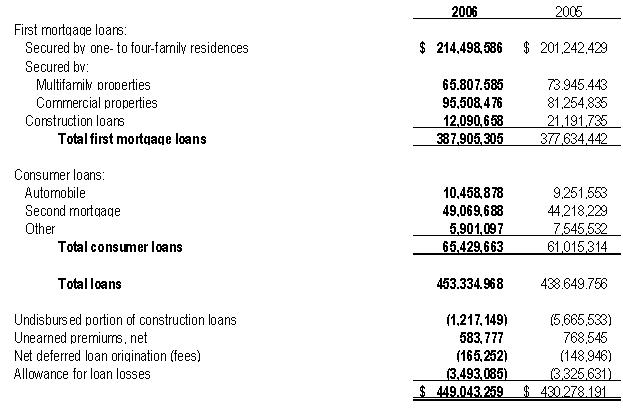

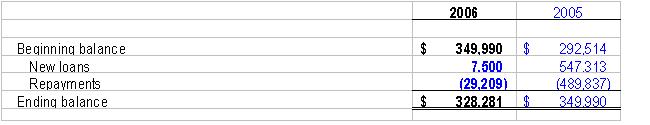

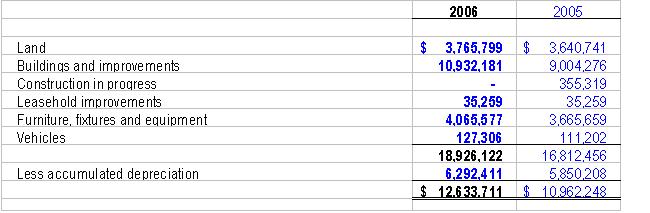

Total loans receivable, net, increased by $18.8 million, or 4.4%, to $449.0 million at December 31, 2006 from $430.3 million at December 31, 2005, primarily due to the origination of $46.2 million of first mortgage loans secured by one- to four-family residences, the origination of $16.3 million of first mortgage loans secured by commercial real estate, the origination of $9.7 million of first mortgage loans secured by multifamily residences; the purchase of first mortgage loans secured by one- to four-family residences, multifamily residences and commercial real estate of $40.4 million; and the origination of $28.8 million of second mortgage loans during the year ended December 31, 2006. These originations and purchases were offset in part by payments and prepayments of $119.2 million and sales of loans of $19.2 million during the year ended December 31, 2006. The Company sells substantially all fixed-rate loans with maturities of 15 years or more in the secondary mortgage market in order to reduce interest rate risk. Cash and cash equivalents increased $11.4 million, or 131.7%, to $20.0 million at December 31, 2006 from $8.6 million at December 31, 2005. The increase in cash and cash equivalents was primarily due to large commercial loan payoffs in December. Premises and equipment, net, increased by $1.7 million, or 15.2%, to $12.6 million at December 31, 2006 from $11.0 million at December 31, 2005. The increase in premises and equipment was primarily due to the construction costs associated with the construction of a new branch office located at the Jordan Creek Town Center in West Des Moines, Iowa and the expansion of the Crossroads branch in Fort Dodge, Iowa. Securities available-for-sale decreased $904,000, or 5.8%, to $14.6 million at December 31, 2006 from $15.5 million at December 31, 2005. The decrease in securities available-for-sale consisted primarily of a decrease in investments in mortgage-backed securities, offset in part by an increase in investments in municipal securities stock and an increase in unrealized gains. Proceeds of such calls, payments and maturities were used to fund loan growth.

Deposits increased $26.0 million, or 7.8%, to $360.3 million at December 31, 2006 from $334.3 million at December 31, 2005, primarily reflecting an increase in certificates of deposit, offset in part by decreases in money market and savings account balances. The increase in certificates of deposit is primarily due to the utilization of brokered certificates of deposit, which increased $26.4 million, to $30.4 million at December 31, 2006. Borrowed funds, primarily FHLB advances, increased $5.5 million, or 5.3%, to $107.9 million at December 31, 2006 from $102.4 million at December 31, 2005. The increases in the deposits and borrowed funds were used to fund loan growth.

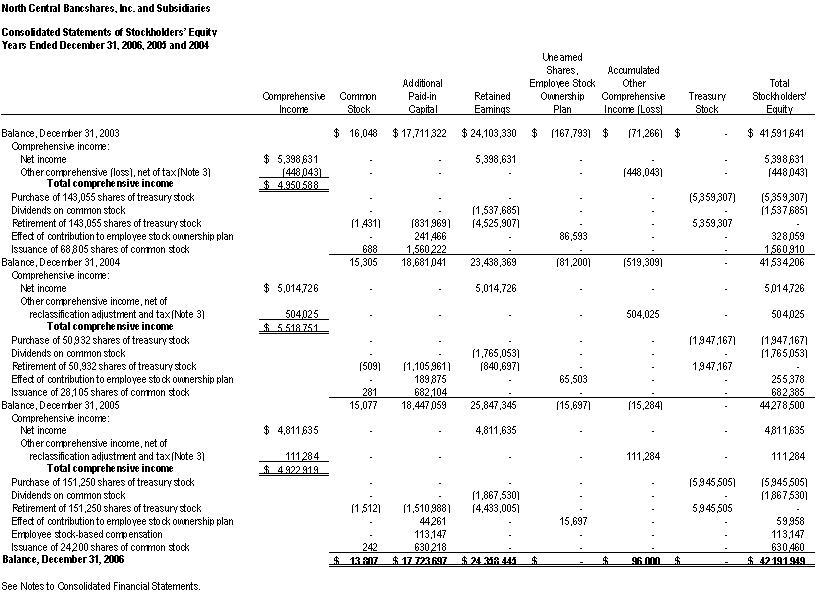

Total shareholders' equity decreased $2.1 million, or 4.7%, to $42.2 million at December 31, 2006 from $44.3 million at December 31, 2005, primarily due to stock repurchases and declared dividends, offset in part by earnings, the exercise of stock options, and an increase in unrealized gain on securities available-for-sale.

Comparison of Financial Condition as of December 31, 2005 and December 31, 2004

Total assets increased $22.5 million, or 4.9%, to $485.2 million at December 31, 2005 from $462.7 million at December 31, 2004. The increase in assets was primarily due to increases in net loans receivable, premises and equipment, and cash and cash equivalents, offset in part by a decrease in securities available-for-sale. Asset growth was funded by increases in deposits and FHLB advances.

Total loans receivable, net, increased by $23.0 million, or 5.6%, to $430.3 million at December 31, 2005 from $407.3 million at December 31, 2004, primarily due to the origination of $74.6 million of first mortgage loans secured by one- to four-family residences, originations of $8.5 million of first mortgage loans secured by commercial real estate, purchases of first mortgage loans primarily secured by one- to four-family residences, multifamily residences and commercial real estate of $24.0 million, and originations of $24.8 million of second mortgage loans during the year ended December 31, 2005. These originations and purchases were offset in part by payments and prepayments of $103.0 million and sales of loans of $19.5 million during the year ended December 31, 2005. The Company sells substantially all fixed-rate loans with maturities in excess of 15 years in the secondary mortgage market in order to reduce interest rate risk. Premises and equipment, net, increased by $1.1 million, or 10.8%, to $11.0 million at December 31, 2005 from $9.9 million at December 31, 2004. The increase in premises and equipment was primarily due to the initial construction costs associated with the construction of a new branch office located at the Jordan Creek Town Center in West Des Moines, Iowa and the expansion of the Crossroads branch in Fort Dodge, Iowa. Cash and cash equivalents increased $721,000, or 9.1%, to $8.6 million at December 31, 2005 from $7.9 million at December 31, 2004. Securities available-for-sale decreased $2.6 million, or 14.4%, to $15.5 million at December 31, 2005 from $18.1 million at December 31, 2004, primarily due to calls, payments and maturities of mortgage-backed and municipal securities. Proceeds of such calls, payments and maturities were used to fund loan growth.

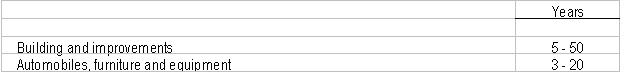

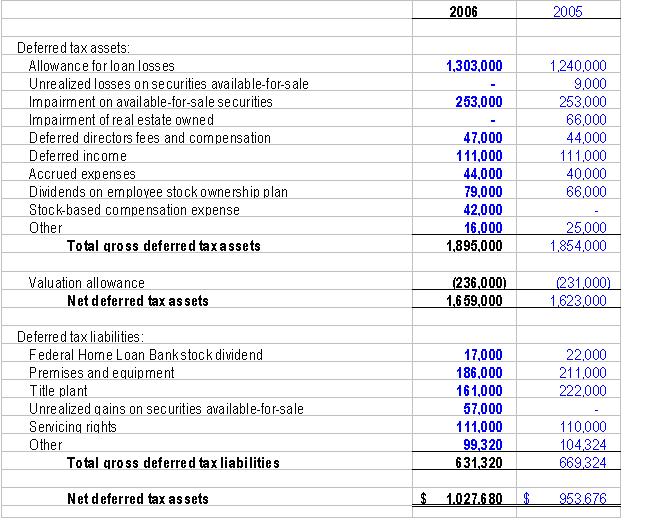

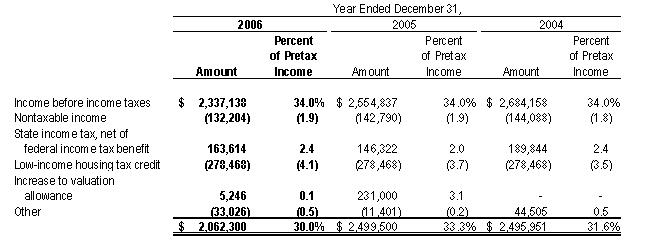

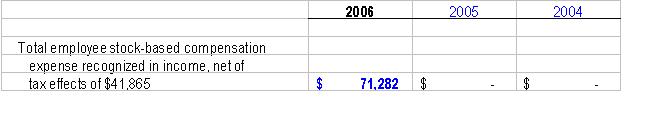

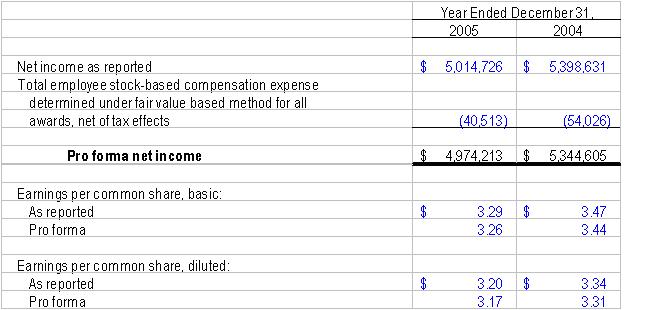

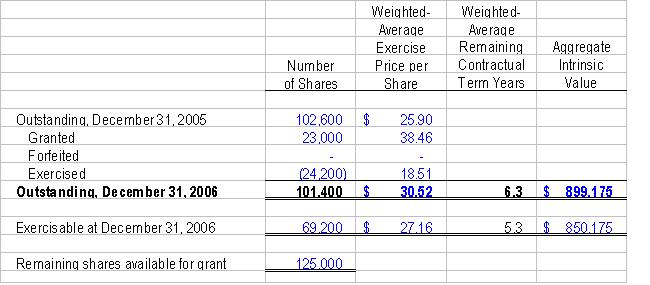

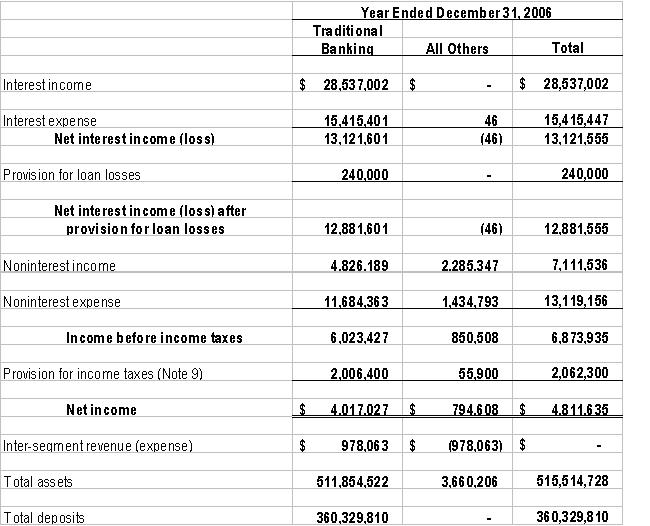

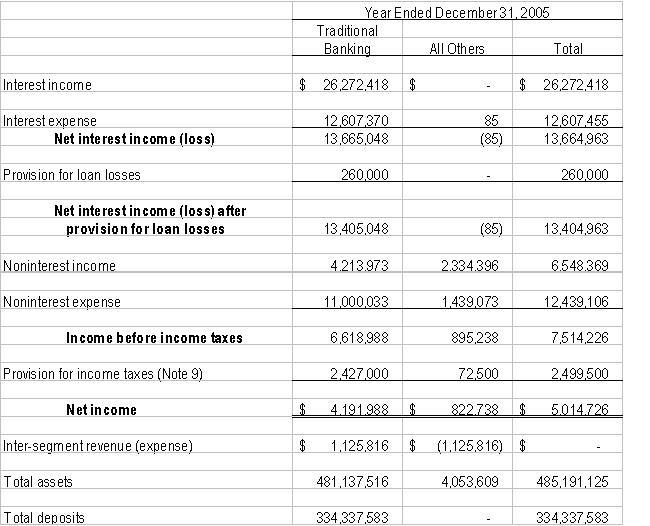

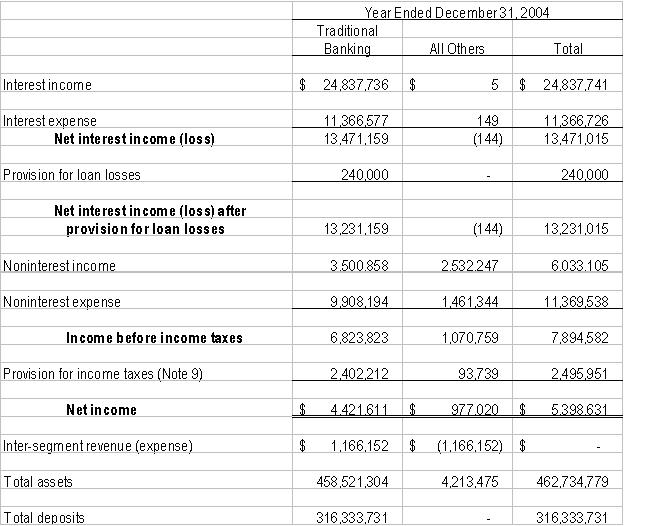

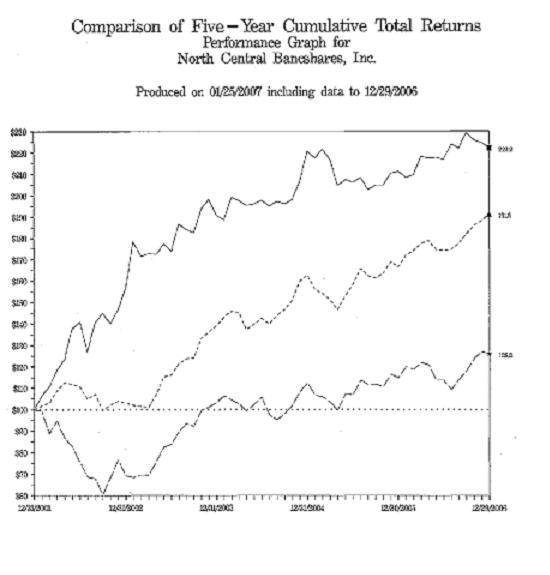

Deposits increased $18.0 million, or 5.7%, to $334.3 million at December 31, 2005 from $316.3 million at December 31, 2004, primarily reflecting increases in checking accounts, NOW accounts, and certificates of deposit, offset in part by decreases in savings accounts and money market accounts. The increase in deposits is due primarily to management’s pricing strategies, continued marketing efforts, and the utilization of brokered certificates of deposit. In 2005, the Company began issuing brokered certificates of deposit. At December 31, 2005, the Company had $4.0 million of brokered certificates of deposit. Borrowed funds, primarily FHLB advances, increased $1.5 million, or 1.5%, to $102.4 million at December 31, 2005 from $101.0 million at December 31, 2004. The increases in the deposits and borrowed funds were used to fund loan growth.