- SPH Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Suburban Propane Partners (SPH) DEF 14ADefinitive proxy

Filed: 25 Mar 24, 4:30pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☒ |

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

SUBURBAN PROPANE PARTNERS, L.P.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

Suburban Propane

240 Route 10 West

Whippany, NJ

07981-0206

www.suburbanpropane.com

Michael A. Stivala

President and Chief Executive Officer

March 25, 2024

Dear Fellow Suburban Propane Unitholder:

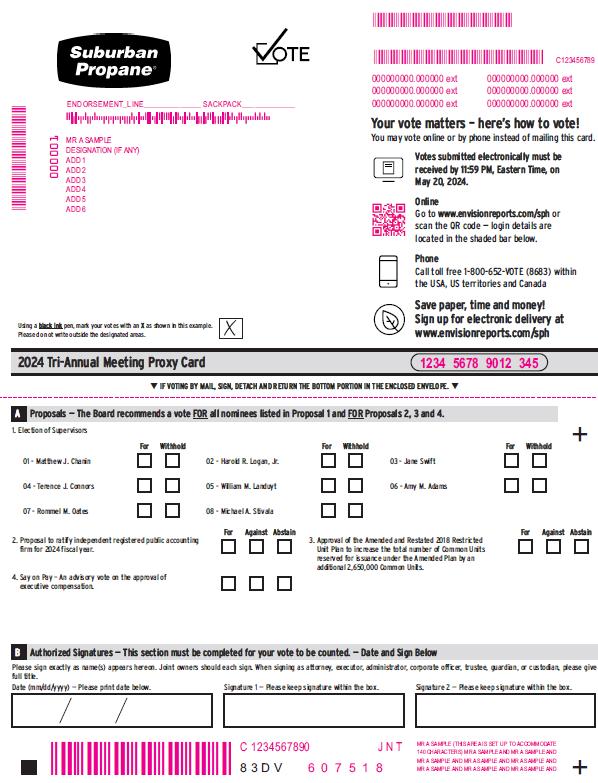

You are cordially invited to attend the Tri-Annual Meeting of the Limited Partners of Suburban Propane Partners, L.P. to be held on Tuesday, May 21, 2024, beginning at 9:00 a.m. E.T. at our executive offices at One Suburban Plaza, 240 Route 10 West, Whippany, New Jersey.

Whether or not you plan to attend in-person, it is important that your units be represented at the meeting. You may vote on the matters that come before the meeting by completing the enclosed proxy card and returning it in the envelope provided. Alternatively, you may also vote over the Internet or by telephone before the Tri-Annual Meeting.

Attendance at the Tri-Annual Meeting will be open to holders of record of common units as of the close of business on March 22, 2024. I look forward to greeting those of you who will be able to attend the meeting.

Sincerely yours,

Michael A. Stivala

President and Chief Executive Officer

SUBURBAN PROPANE PARTNERS, L.P.

NOTICE OF TRI-ANNUAL MEETING

TO BE HELD ON

May 21, 2024

The Tri-Annual Meeting of the Limited Partners of Suburban Propane Partners, L.P. (“Suburban”) will be held at 9:00 a.m. E.T. on Tuesday, May 21, 2024, at our executive offices at One Suburban Plaza, 240 Route 10 West, Whippany, New Jersey, for the following purposes:

Only holders of record of common units as of the close of business on March 22, 2024 are entitled to notice of, and to vote at, the meeting.

By Order of the Board of Supervisors,

Bryon L. Koepke

Vice President, General Counsel & Secretary

March 25, 2024

IMPORTANT

Your vote is important. Whether or not you expect to attend the meeting virtually, we urge you to complete and return the enclosed proxy card at your earliest convenience in the postage-paid envelope provided, or vote using the Internet or by telephone prior to the virtual-only meeting.

SUBURBAN PROPANE PARTNERS, L.P.

One Suburban Plaza

240 Route 10 West

Whippany, New Jersey 07981-0206

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THE TRI-ANNUAL MEETING

This Proxy Statement (which, together with a form of proxy, is being mailed or otherwise made available to Unitholders on or about March 25, 2024) is being furnished to holders of Common Units of Suburban Propane Partners, L.P., which we refer to as “Suburban,” “we,” or “our,” in connection with the solicitation of proxies by the Board of Supervisors of Suburban, which we refer to collectively as the “Board” and individually as a “Supervisor” for use at Suburban’s Tri-Annual Meeting of Limited Partners and any continuations, postponements or adjournments thereof, which we refer to as the “Meeting.”

Q: When and where is the Meeting?

A: The Meeting will be held at 9:00 a.m. E.T. on Tuesday, May 21, 2024, at our executive offices at One Suburban Plaza, 240 Route 10 West, Whippany, New Jersey.

Q: What is the purpose of the Meeting?

A: At the Meeting, holders of Common Units, whom we refer to as “Unitholders,” will be asked to consider and vote on the following four proposals:

Q: How does the Board recommend I vote on the proposals?

A: The Board unanimously recommends a vote FOR each of its nominees for Supervisor, approval of the Accountant Ratification Proposal, approval of the Restricted Unit Plan Proposal and approval of the Say-on-Pay Proposal.

Q: How will voting on any other business be conducted?

A: The Board of Supervisors does not know of any business to be considered at the Meeting other than the proposals described in this Proxy Statement. However, if any other business is properly presented, your signed proxy card gives authority to the persons named in the proxy to vote on these matters at their discretion.

Q: Who is entitled to vote?

A: Each holder of Common Units as of the close of business on March 22, 2024, which we refer to as the “Record Date,” is entitled to vote at the Meeting.

1

Q: How many Common Units may be voted?

A: As of the Record Date, 64,021,749 Common Units were outstanding. Each Common Unit entitles its holder to one vote.

Q: What is a “quorum”?

A: There must be a quorum for the Meeting to be held. A quorum will be present if a majority of the outstanding Common Units as of the Record Date is represented in person, or by proxy, at the Meeting. If you submit a properly executed proxy card, even if you mark WITHHOLD or ABSTAIN, then your Common Units will be considered part of the quorum.

Q: What vote is required to approve the proposals?

A:

Q: How are withholds, abstentions and broker non-votes counted for the proposals?

A: For the Election Proposal, Supervisors are elected by a plurality of FOR votes. Accordingly, a proxy card marked as WITHHOLD and a broker non-vote will not count towards the plurality required to elect a Supervisor. For the Restricted Unit Plan Proposal, a proxy card marked ABSTAIN has the same effect as a vote AGAINST such proposal, but a broker non-vote is not counted in the tally of votes FOR or AGAINST such proposal and does not affect the voting results for such proposal. For each of the Accountant Ratification Proposal and Say-on-Pay Proposal, a proxy card marked ABSTAIN has the same effect as a vote AGAINST such proposal, but a broker non-vote is not counted as entitled to vote at the Meeting and does not affect the voting results for such proposal. Because the Accountant Ratification Proposal is considered “routine” under NYSE rules, brokers have discretion to vote on this proposal and we do not anticipate any broker non-votes.

2

Q: How do I vote?

A: You may vote by any one of three different methods:

Common Units represented by properly executed proxies that are not revoked will be voted in accordance with the instructions shown on the proxy card. If you return your signed proxy card but do not give instructions as to how you wish to vote, your Common Units will be voted FOR each Supervisor nominee and each of the Accountant Ratification Proposal, the Restricted Unit Plan Proposal and the Say-on-Pay Proposal.

Our Board of Supervisors urges Unitholders to complete, date, sign and return the accompanying proxy card, or to submit a proxy by telephone or over the Internet by following the instructions included with your proxy card, or, in the event you hold your Common Units through a broker or other nominee, by following the separate voting instructions received from your broker or nominee. Your broker or nominee may provide proxy submission through the Internet or by telephone. Please contact your broker or nominee to determine how to vote.

Q: What do I do if I want to change my vote?

A: You have the right to revoke your proxy at any time before the Meeting by:

Attendance at the Meeting will not, in and of itself, revoke your proxy.

Q: What does it mean if I receive more than one proxy card?

A: If your Common Units are registered differently with our transfer agent and/or are held in more than one transfer agent account, you will receive more than one proxy card. Please mark, sign, date and return all of the proxy cards you receive to ensure that all of your Common Units are voted. We encourage you to have all accounts registered in the same name and address (whenever possible). You can accomplish this by contacting our transfer agent, Computershare, P.O. Box 43006, Providence, RI 02940-3006; www.computershare.com/investor or telephone 781-575-2724. The hearing impaired may contact Computershare at TDD 800-952-9245.

Q: What do I do if my Common Units are held in “street name”?

A: If your Common Units are held in the name of your broker, a bank or other nominee, that party will give you instructions about how to vote your Common Units.

Q: Who will count the votes?

A: Representatives of Computershare Trust Company, N.A., our transfer agent and an independent tabulator, will count the votes and act as the inspector of election.

3

Q: Who is bearing the cost of this proxy solicitation?

A: The Board of Supervisors is soliciting your proxy on behalf of Suburban. We are bearing the cost of soliciting proxies for the Meeting. Georgeson LLC has been retained to assist in the distribution of proxy materials, and the solicitation of votes, and will be paid a customary fee for its services totaling approximately $16,000, plus reasonable out-of-pocket expenses. In addition to using the mail, our Supervisors, officers and employees may solicit proxies by telephone, personal interview or otherwise. They will not receive additional compensation for this activity, but may be reimbursed for their reasonable out-of-pocket expenses. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to Unitholders.

Q: Will the independent registered public accountants attend the Meeting?

A: Representatives of PricewaterhouseCoopers LLP, our independent registered public accounting firm, are expected to attend the Meeting, will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

Q: Does Suburban’s proxy confer discretionary authority to vote on Unitholder proposals at the Meeting?

A: With respect to any Unitholder proposal submitted outside of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act,” and for which we did not receive notice by a reasonable time before the date of this Proxy Statement, Suburban’s proxy confers discretionary authority on the persons being appointed as proxies to vote on such proposal.

Q: When are the Unitholder proposals for the next meeting of Unitholders due?

A: We presently expect that our next Tri-Annual Meeting will be held in May 2027. If a Unitholder intends to present any proposals for inclusion in Suburban’s Proxy Statement in accordance with Rule 14a-8 for consideration at Suburban’s 2027 Tri-Annual Meeting, the proposal must be received at Suburban’s principal executive offices by November 25, 2026. Proposals by Unitholders intended to be brought in front of Unitholders at the 2027 Tri-Annual Meeting outside of the Rule 14a-8 process must be received at Suburban’s principal executive offices by February 20, 2027 in accordance with Rule 14a-4.

In accordance with the MLP Agreement, if a Unitholder intends, at the 2024 Tri-Annual Meeting, to nominate a person for election to the Board of Supervisors, the Unitholder must deliver notice thereof to the Board not earlier than the close of business on the 120th day before, and not later than the close of business on the 90th day before, the date of the 2027 Tri-Annual Meeting. A different notice deadline will apply for the nomination of persons for election to the Board of Supervisors if the date of the 2027 Tri-Annual Meeting is not publicly announced by Suburban more than 100 days prior to the date of such meeting. Such deadline, and the procedures that a Unitholder must follow to nominate a person for election to the Board of Supervisors, are further described below under the heading “Supervisor Nominations and Criteria for Board Meetings – Unitholder Nominations.” In addition, a Unitholder that intends to solicit proxies in support of director nominees other than our nominees must provide the information required by Rule 14a-19, and such additional information must be received by no later than March 22, 2027, or at least 60 days in advance of the Tri-Annual Meeting if the meeting date is moved by more than 30 calendar days from the 2024 Tri-Annual Meeting.

Q: Where and when will I be able to find the voting results?

A: In addition to announcing the preliminary voting results at the Meeting, we will post the results on our web site at www.suburbanpropane.com within two days after the Meeting. You will also be able to find the results in our Current Report on Form 8-K that we will file with the Securities and Exchange Commission within four business days following conclusion of the Meeting.

4

Q: How can I obtain an additional copy of Suburban’s 2023 Annual Report on Form 10-K?

A: We will provide an additional copy of our 2023 Annual Report on Form 10-K, including the financial statements and financial statement schedule filed therewith, without charge, upon written request to Investor Relations, Suburban Propane Partners, L.P., One Suburban Plaza, 240 Route 10 West, P.O. Box 206, Whippany, New Jersey 07981-0206. We will furnish a requesting Unitholder with any exhibit not contained therein upon payment of a reasonable fee, which fee shall be limited to our reasonable expenses in furnishing such exhibit.

Q: Who can I contact for further information?

A: If you need assistance in voting your Common Units, please call the firm assisting us in the solicitation of proxies for the Meeting:

1290 Avenue of the Americas, 9th Floor

New York, NY 10104

In the US, call Toll Free: 866-357-6329

Outside of the US, call: 781-222-3778

Q: What can I do if I and another Unitholder with whom I live want to receive two copies of this Proxy Statement?

A: In order to reduce our printing and postage costs, Unitholders who share a single address will receive only one copy of this Proxy Statement at that address unless we have received instructions to the contrary from any Unitholder at that address. However, if a Unitholder residing at such an address wishes to receive a separate copy of this Proxy Statement or of future Proxy Statements (as applicable), he or she may contact Investor Relations, Suburban Propane Partners, L.P., One Suburban Plaza, 240 Route 10 West, Whippany, New Jersey 07981-0206. We will deliver separate copies of this Proxy Statement promptly upon written or oral request. If you are a Unitholder receiving multiple copies of our Proxy Statement, you can request to receive only one copy by contacting us in the same manner. If you own your Common Units through a bank, broker or other Unitholder of record, you may request additional or fewer copies of this Proxy Statement by contacting the Unitholder of record.

Q: Why did I receive a notice in the mail regarding Internet availability of proxy materials instead of a full set of proxy materials?

A: Pursuant to rules adopted by the Securities and Exchange Commission, we have elected to furnish this Proxy Statement and other proxy materials to certain Unitholders on the Internet rather than by mailing paper copies. If you received an Important Notice Regarding the Availability of Proxy Materials, which we refer to as a “Notice,” in the mail, you will not receive a paper copy of these materials, unless you expressly request to receive a paper copy. All Unitholders have the ability to access this Proxy Statement and other proxy materials on the Internet. Instructions on how to do so, or on how to request a paper copy, may be found in the Notice. In addition, Unitholders may request to receive these materials in printed form by mail on an ongoing basis. The Notice will also instruct you on how you may vote your Common Units, including how you may vote over the Internet.

5

IMPORTANT NOTICE REGARDING THE AVAILABILITY

OF PROXY MATERIALS FOR THE MEETING

This Proxy Statement and the accompanying Annual Report to Unitholders are available at www.envisionreports.com/sph (for registered Unitholders) or http://www.edocumentview.com/sph (for Unitholders whose Common Units are held in “street name”).

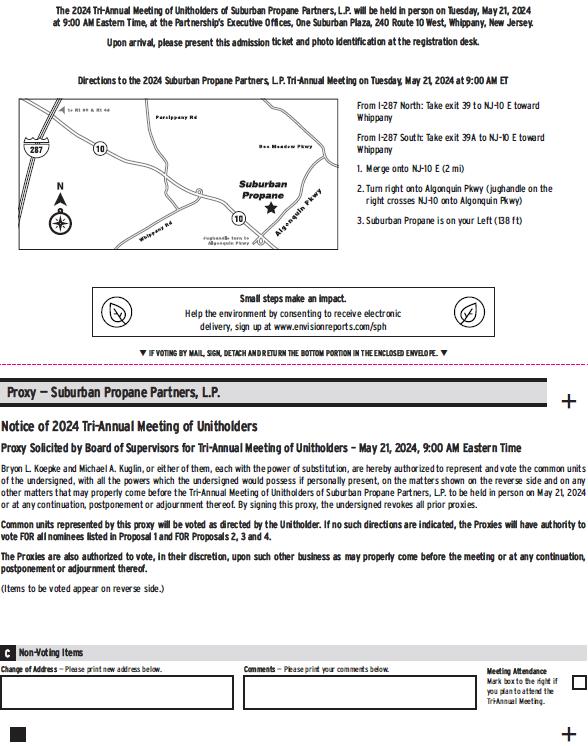

If you plan to attend the Meeting to vote in-person, directions to our headquarters are printed on the accompanying proxy card. For additional directions, please call 973-887-5300.

6

(Proposal No. 1 on the Proxy Card)

Pursuant to the MLP Agreement, Unitholders are entitled to elect all members of the Board of Supervisors, which we refer to as “Supervisors,” who are nominated at the Meeting. Lawrence C. Caldwell, a Supervisor last elected at our 2021 Tri-Annual Meeting and a member of the Board since November 2012, has elected to retire from the Board of Supervisors, effective May 20, 2024. Acting on the recommendation of its Nominating/Governance Committee, and pursuant to authority granted to the Board by the MLP Agreement, at its meeting on January 24, 2024, our Board decided to nominate the eight current Supervisors for re-election at the Meeting and eliminate the Board seat formerly held by Mr. Caldwell by reducing the Board size to eight members.

The eight nominees for Supervisors, all of whom are currently serving as Supervisors, are described below (as of March 22, 2024). If elected, all nominees are expected to serve until the 2027 Tri-Annual Meeting and until their successors are duly elected and qualified. Although the Board does not anticipate that any of the persons named below will be unable to stand for election, if for any reason a nominee becomes unavailable for election, the persons named in the form of proxy have advised that they will vote for such substitute nominee as the Board may propose. In accordance with our Corporate Governance Guidelines & Principles (described more fully below) and the rules of the New York Stock Exchange, we have affirmatively determined that our Board of Supervisors is currently composed of a majority of independent directors, and that the following nominees are independent: Matthew J. Chanin, Harold R. Logan, Jr., Jane Swift, Terence J. Connors, William M. Landuyt, Amy M. Adams and Rommel M. Oates.

NOMINEES FOR ELECTION AS SUPERVISORS

Other Public | Committee of the Board | ||||||

Nominee and Principal Occupation | Independent | Age | Supervisor Since | Company Board | AC | CC | NGC |

Matthew J. Chanin Former Senior Managing Director, Prudential Investment Management | Yes | 69 | 2012 | None | X | X* | |

Harold R. Logan, Jr. Former Founder and Director, Basic Materials and Services LLC | Yes | 79 | 1996 | None | X | X | |

Jane Swift President, Education at Work | Yes | 58 | 2007 | None | X* | X | |

Terence J. Connors Retired Partner, KPMG LLP | Yes | 69 | 2017 | AdaptHealth Corp. and FS Credit Real Estate Income Trust, Inc. | X* | X | |

William M. Landuyt Managing Director, Charterhouse Strategic Partners, LLC | Yes | 68 | 2017 | None | X | X | |

Amy M. Adams Vice President of Government Partnerships and Funding, Cummins Inc. | Yes | 58 | 2023 | None | X | X | |

Rommel M. Oates Chairman and CEO, Oates Energy Solutions LLC; CEO, Refinery Calculator Inc. | Yes | 44 | 2023 | Summit Midstream Partners, LP | X | X | |

Michael A. Stivala President & CEO, Suburban Propane Partners, L.P. | No | 54 | 2014 | None | |||

AC: Audit Committee

CC: Compensation Committee

NGC: Nominating/Governance Committee

* Denotes Committee Chair

7

Matthew J. Chanin Age 69

Mr. Chanin has served as a Supervisor since November 2012 and was elected as Chairman of the Board of Supervisors effective January 1, 2021. Mr. Chanin was Senior Managing Director of Prudential Investment Management, a subsidiary of Prudential Financial, Inc., from 1996 until his retirement in January 2012, after which he continued to provide consulting services to Prudential until December 2016. He headed Prudential’s private fixed income business, chaired an internal committee responsible for strategic investing and was a principal in Prudential Capital Partners, the firm’s mezzanine investment business, and, until October 2017, served as a Director of two private companies that were in the fund portfolios of Prudential Capital Partners.

Mr. Chanin’s qualifications to sit on our Board, and serve as Chairman of the Board and as Chair of its Nominating/Governance Committee, include 35 years of investment experience with a focus on highly structured private placements in companies in a broad range of industries, with a particular focus on energy companies. He has previously served on the audit committee of a public company’s board and the compensation committee for a private company board. Mr. Chanin has earned an MBA and is a Chartered Financial Analyst.

Harold R. Logan, Jr. Age 79

Mr. Logan has served as a Supervisor since March 1996 and served as Chairman of the Board of Supervisors from January 2007 until December 31, 2020. Mr. Logan co-founded, and from 2006 to May 2018 served as a Director of Basic Materials and Services LLC, an investment company that, until it went inactive in May 2018, invested in companies that provide specialized infrastructure services and materials for the pipeline construction industry and the sand/silica industry. From 2003 to September 2006, Mr. Logan was a Director and Chairman of the Finance Committee of the Board of Directors of TransMontaigne Inc., which provided logistical services (i.e., pipeline, terminaling and marketing) to producers and end-users of refined petroleum products. From 1995 to 2002, Mr. Logan was Executive Vice President/Finance, Treasurer and a Director of TransMontaigne Inc. From 1987 to 1995, Mr. Logan served as Senior Vice President – Finance and a Director of Associated Natural Gas Corporation, an independent gatherer and marketer of natural gas, natural gas liquids and crude oil. Mr. Logan is also a Director of Hart Energy Publishing LLP, and, through October 2021 was a Director of Cimarex Energy Co. prior to its merger with Cabot Oil & Gas Corp.; through May 2019, was a Director of InfraREIT, Inc., which was acquired by Oncor Electric Delivery Company LLC and Sempra Energy in May 2019; and through May 2017, was a Director of Graphic Packaging Holding Company.

Over the past forty plus years, Mr. Logan’s education, investment banking/venture capital experience and business/financial management experience have provided him with a comprehensive understanding of business and finance. Most of Mr. Logan’s business experience has been in the energy industry, both in investment banking and as a senior financial officer and director of publicly-owned energy companies. Mr. Logan’s expertise and experience have been relevant to his responsibilities of providing oversight and advice to the managements of public companies, and is of particular benefit in his role as a Supervisor. Since 1996, Mr. Logan has been a director of ten public companies and has served on audit, compensation and governance committees.

Jane Swift Age 58

Ms. Swift has served as a Supervisor since April 2007. In November 2023, Ms. Swift was appointed President of Education at Work, a not-for-profit educational institution, which is part of the Strada Education Foundation and partners with industry and higher education institutions to prepare students for current and future careers through a work-based learning model. From July 2022 until October 2023, Ms. Swift served as an Operating Partner for Vistria Group, a private investment firm operating at the intersection of purpose and profit. Ms. Swift previously served as President and Executive Director of LearnLaunch Institute, a not-for-profit educational advocacy institution in Boston, Massachusetts; as Executive Chair of Ultimate Medical Academy, a not-for-profit healthcare educational institution with a national presence; as the CEO of Middlebury Interactive Languages, LLC, a marketer of world language products; as Senior Vice President at ConnectEDU Inc., a private education technology company; as the founder of WNP Consulting, LLC, a provider of expert advice and guidance to early stage education companies; and as a General Partner at Arcadia Partners, a venture capital firm focused on the education industry. Ms. Swift served for fifteen years in Massachusetts state government, becoming Massachusetts’ first woman governor in 2001. In July 2022, Ms. Swift became the founder and President of Cobble Hill Farm Education & Rescue Center, which is a non-profit organization that provides animal rescue and education programs. In October 2023, Ms. Swift was appointed to the National Association Governing Board and currently serves as a member of the George W. Bush Institute Advisory Council, the Innovation Advisory Council of Boston College High School’s Shields Center for Innovation and as an advisor to companies within the Vistria Group’s education portfolio. She has previously served on the boards of both public and

8

private companies in the education space; including K12, Inc., Animated Speech Company, Sally Ride Science Inc., Teachers of Tomorrow and eDynamics Learning.

Ms. Swift’s qualifications to sit on our Board, and serve as Chair of its Compensation Committee, include her strong experience in public policy and government, and her extensive knowledge of regulatory matters arising from her fifteen years in state government.

Terence J. Connors Age 69

Mr. Connors has served as a Supervisor since January 2017. Mr. Connors retired in September 2015 from KPMG LLP after nearly forty years in public accounting. Prior to joining KPMG in 2002, he was a partner with another large international accounting firm. During his career, he served as a senior audit and global lead partner for numerous public companies, including Fortune 500 companies. At KPMG, he was a professional practice partner, SEC Reviewing Partner and was elected to serve as a member of KPMG’s board of directors (2011-2015), where he chaired the Audit, Finance & Operations Committee. Mr. Connors currently serves as a director and audit committee chair of FS Credit Real Estate Income Trust, Inc., a commercial mortgage nontraded real estate investment trust, and AdaptHealth Corp., a leading provider of home healthcare equipment and services in the United States. He previously served as a director and audit committee chair of Cardone Industries, Inc., one of the largest privately-held automotive parts remanufacturers in the world.

Mr. Connors’ qualifications to sit on our Board, and serve as Chair of its Audit Committee, include his extensive experience as a lead audit partner for numerous public companies across a variety of industries, which enables him to provide helpful insights to the Board in connection with its oversight of financial, accounting and internal control matters.

William M. Landuyt Age 68

Mr. Landuyt has served as a Supervisor since January 2017. Since 2003, Mr. Landuyt has served as a Managing Director at Charterhouse Strategic Partners, LLC, and its predecessors (“Charterhouse”), private equity firms with a focus on build-ups, management buyouts, and growth capital investments primarily in the business services and healthcare services sectors, and has served on the Boards of Directors of a number of portfolio companies of those firms. From 1996 to 2003, Mr. Landuyt served as Chairman of the Board, President and Chief Executive Officer of Millennium Chemicals, Inc. (“Millennium”), and from 1983 to 1996, he served as Finance Director of Hanson plc and several other senior executive positions with Hanson Industries, the U.S. subsidiary of Hanson plc (collectively, “Hanson”); including Vice President and Chief Financial Officer and ultimately Director, President and Chief Executive Officer. Hanson and Millennium were both previous owners of Suburban or its predecessor through 1996 and 1999, respectively. He joined Hanson after spending six years as a Certified Public Accountant and auditor at Price Waterhouse & Co., where he rose to the position of Senior Manager. Mr. Landuyt has previously served on the Boards of Directors (including their Audit and Compensation Committees) of public companies; including Bethlehem Steel Corp., MxEnergy Holdings, Inc., a leading retail marketer of natural gas and electricity contracts, and Top Image Systems, Inc. Mr. Landuyt is also the Co-Founder and Executive Director of Celtic Charms, Inc., a non-profit therapeutic horsemanship center previously engaged in serving people with physical and cognitive disabilities and disorders and now serving as a retirement home for Celtic Charms’ equines.

Mr. Landuyt’s qualifications to sit on our Board include forty years of financial and executive management experience for both public and private companies, including extensive experience with mergers and acquisitions and corporate governance. Additionally, his specific responsibility for supervision of Suburban’s predecessors, as well as his subsequent board-level involvement in the distribution, petrochemical and retail energy sectors gives Mr. Landuyt extensive expertise in areas directly relevant to the business of Suburban.

Amy M. Adams Age 58

Ms. Adams has served as a Supervisor since May 2023. Since March 2023, Ms. Adams has served as Vice President of Government Partnerships and Funding at Cummins Inc., where she focuses on private-public collaboration building in the zero emissions space. Prior to that, Ms. Adams served as Vice President, Fuel Cell and Hydrogen Technologies, overseeing Cummins’ hydrogen investments and partnerships. Ms. Adams has worked for Cummins Inc. since January 1995 and has served in several senior leadership positions within the company that enabled her to build an extensive background in emerging energy solutions; including hydrogen fuel cell and electrolyzer technologies, strategic growth and market development initiatives and launching new generations of emission solutions in Cummins’ global markets.

9

Ms. Adams has led complex businesses on three continents, enabling her to build a truly global perspective. From 1988 to 1995, Ms. Adams served in various management positions within Ameritech Corporation (now known as AT&T Teleholdings Inc.). Since 2020, Ms. Adams has served on the Management Board of the Hydrogen Council, a global CEO-led initiative aimed at fostering the clean energy transition and from 2021-2023 she served as a co-chair of the Council. Ms. Adams also serves on the Board of the Fuel Cell and Hydrogen Energy Association (FCHEA). Since 2018, Ms. Adams has also served as a National Board Member for Girls Inc., a non-profit organization that encourages and mentors young women as they work to navigate economic, gender and social barriers.

Ms. Adams’ qualifications to sit on our Board include her extensive corporate experience and background in managing emerging energy solutions; including an extensive understanding of hydrogen-based technologies, which enables her to provide helpful insights to the Board in connection with its oversight of Suburban’s renewable energy investments and assets and Suburban’s strategic plans for developing its renewable energy platform.

Rommel M. Oates Age 44

Mr. Oates has served as a Supervisor since May 2023. In 2015, Mr. Oates founded and currently serves as the Chairman and Chief Executive Officer of Oates Energy Solutions LLC, a privately-owned energy and technology value creation services company. Since 2020, Mr. Oates has also served as Chief Executive Officer of Refinery Calculator Inc., which is a global refining, energy, chemicals, emissions and hydrogen market intelligence cloud-based software and data platform. From 2015 to 2018, Mr. Oates served in several executive leadership roles in sales, marketing and commercial development within True North Venture Partners (an Ahearn, Walton, Cox family limited partnership entity), as well as within one of their portfolio companies, Aquahydrex Pty Ltd. From 2008 to 2015, Mr. Oates held several leadership positions within Praxair Inc. (now Linde PLC), most recently as Global Director of Hydrogen and Carbon Monoxide product management, where he was accountable for the overall profitability management functions for large-scale hydrogen pipeline and storage assets, as well as carbon monoxide, liquid methane, methanol and formalin business units. From 2000 to 2003, Mr. Oates founded and operated Oates Consulting Company, where he consulted on hydrogen storage business development. Since 2022, Mr. Oates has served as an independent director of the Board of Directors, as well as a member of the Nominating, Governance and Sustainability Committee of its Board of Directors for Summit Midstream Partners, LP, which owns, develops and operates midstream energy infrastructure assets in the continental United States. Since 2014, Mr. Oates has also served as a Board member for the International Association of Hydrogen Energy and has secured over 16 hydrogen technology, purification and storage patents.

Mr. Oates’s qualifications to sit on our Board include his extensive understanding of energy markets, renewable energy solutions, and over two decades of experience in hydrogen commercial and technical market development, which enables him to provide helpful insights to the Board in connection with its oversight of Suburban’s renewable energy investments and assets and Suburban’s strategic plans for developing its renewable energy platform.

Michael A. Stivala Age 54

Mr. Stivala has served as our President since April 2014 and as our Chief Executive Officer since September 2014. Mr. Stivala has served as a Supervisor since November 2014. From November 2009 until March 2014, he was our Chief Financial Officer, and, before that, our Chief Financial Officer and Chief Accounting Officer since October 2007. Prior to that, he was our Controller and Chief Accounting Officer since May 2005 and Controller since December 2001. Before joining Suburban, he held several positions with PricewaterhouseCoopers LLP, an international accounting firm, most recently as Senior Manager in the Assurance practice. Mr. Stivala currently serves on the Board of Directors of Independence Hydrogen Inc., in which we currently own a 25% equity stake; Nu:ionic Technologies Inc., in which we own a minority stake and Oberon Fuels, Inc., in which we currently own a 38% equity stake. In addition, Mr. Stivala is the Chairperson of the New Jersey Regional Council of the American Red Cross and a member of the Global Industry Council of the World Liquid Gas Association.

Mr. Stivala’s qualifications to sit on our Board include his years of experience in the propane industry, including as our current President and Chief Executive Officer and, before that, as our Chief Financial Officer for seven years, which day-to-day leadership roles have provided him with intimate knowledge of our operations.

10

Vote Required and Recommendation of the Board of Supervisors

Under the MLP Agreement, the affirmative vote of holders of a plurality of the Common Units represented in person or by proxy at the Meeting is required to elect each Supervisor. The Board of Supervisors unanimously recommends a vote FOR the election of each of the above nominees.

11

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

The following table sets forth certain information with respect to our executive officers as of March 22, 2024. Officers are appointed by the Board of Supervisors for one-year terms.

Name | Age | Position with Suburban | ||

Michael A. Stivala | 54 | President and Chief Executive Officer; Member of the Board of Supervisors | ||

Michael A. Kuglin | 54 | Chief Financial Officer | ||

Steven C. Boyd | 59 | Chief Operating Officer | ||

Douglas T. Brinkworth | 62 | Senior Vice President – Product Supply, Purchasing & Logistics | ||

Neil E. Scanlon | 58 | Senior Vice President – Information Services | ||

Daniel S. Bloomstein | 51 | Vice President, Controller and Chief Accounting Officer | ||

Daniel W. Boyd | 56 | Vice President – Area Operations | ||

Alejandro Centeno | 51 | Vice President – Operations | ||

Francesca Cleffi | 54 | Vice President – Human Resources | ||

M. Douglas Dagan | 45 | Vice President, Strategic Initiatives – Renewable Energy | ||

A. Davin D’Ambrosio | 60 | Vice President and Treasurer | ||

John D. Fields | 58 | Vice President – Area Operations | ||

Samuel Hodges | 52 | Vice President – Area Operations | ||

Bryon L. Koepke | 51 | Vice President – General Counsel and Secretary | ||

Keith P. Onderdonk | 59 | Vice President – Operational Support | ||

Craig Palleschi | 44 | Vice President – Renewable Natural Gas Operations | ||

Nandini Sankara | 45 | Vice President – Marketing and Brand Strategy | ||

Michael A. Schueler | 57 | Vice President – Product Supply | ||

Brent C. Stubbs | 46 | Vice President – Area Operations |

For Mr. Stivala’s biographical information, see “Nominees for Election as Supervisors” above.

Mr. Kuglin has served as our Chief Financial Officer since September 2014, and was our Vice President – Finance and Chief Accounting Officer from April 2014 through September 2014, and served as our Chief Accounting Officer until November 2023. Prior to that, he served as our Vice President and Chief Accounting Officer since November 2011, our Controller and Chief Accounting Officer since November 2009 and our Controller since October 2007. For the eight years prior to joining Suburban, he held several financial and managerial positions with Alcatel-Lucent, a global communications solutions provider. Prior to Alcatel-Lucent, Mr. Kuglin held several positions with the international accounting firm PricewaterhouseCoopers LLP, most recently as Manager in the Assurance practice. Mr. Kuglin is a Certified Public Accountant and a member of the American Institute of Certified Public Accountants.

Mr. Steven Boyd has served as our Chief Operating Officer since October 2017 and before that was our Senior Vice President – Operations (September 2015 – October 2017) and our Senior Vice President – Field Operations since April 2014. Previously he was our Vice President – Field Operations (formerly Vice President – Operations) since October 2008, our Southeast and Western Area Vice President since March 2007, Managing Director – Area Operations since November 2003 and Regional Manager – Northern California since May 1997. Mr. Steven Boyd held various managerial positions with predecessors of Suburban from 1986 through 1996.

Mr. Brinkworth has served as our Senior Vice President – Product Supply, Purchasing & Logistics since April 2014 and was previously our Vice President – Product Supply (formerly Vice President – Supply) since May 2005. Mr. Brinkworth joined Suburban in April 1997 after a nine-year career with Goldman Sachs and, since joining Suburban, has served in various positions in the product supply area.

12

Mr. Scanlon became our Senior Vice President – Information Services in April 2014, after serving as our Vice President – Information Services since November 2008. Prior to that, he served as our Assistant Vice President – Information Services since November 2007, Managing Director – Information Services from November 2002 to November 2007 and Director – Information Services from April 1997 until November 2002. Prior to joining Suburban, Mr. Scanlon spent several years with JP Morgan & Co., most recently as Vice President – Corporate Systems and earlier held several positions with Andersen Consulting, an international systems consulting firm, most recently as Manager.

Mr. Bloomstein joined Suburban as its Controller in April 2014 and was promoted to Vice President and Controller in October 2017. In November 2023, he was appointed Chief Accounting Officer. For the ten years prior to joining Suburban, he held several executive financial and accounting positions with The Access Group, a network of professional services companies, and with Dow Jones & Company, Inc., a global news and financial information company. Mr. Bloomstein started his career with the international accounting firm PricewaterhouseCoopers LLP, working his way to the level of Manager in the Assurance practice. Mr. Bloomstein is a Certified Public Accountant and a member of the American Institute of Certified Public Accountants.

Mr. Daniel Boyd has served as our Vice President – Area Operations since November 2020. Prior to that, he was Managing Director – Area Operations for our Northeast Area since October 2019 and before that, he was General Manager of our Southwest Region since October 2014. He joined Suburban in October 1991 as a delivery driver, and has since held various regional management positions within our field operations. Mr. Daniel Boyd is also a U.S. Navy Veteran who served in Operation Desert Storm, Persian Gulf War.

Mr. Centeno has served as our Vice President – Operations since August 2023. Prior to that, he was General Manager of our Midwest Territory since June 2017. Prior to that, Mr. Centeno served as Region Operations Manager of our Mid-Atlantic Region since December 2015 and Area Sales and Business Development Manager since April 2014. Prior to joining the Partnership in July 2007 as a CSC Manager through our Professional Development Program, Mr. Centeno spent 13 years in various management roles in the retail industry.

Ms. Cleffi has served as our Vice President – Human Resources since November 2020. Prior to that appointment, she served as our Managing Director – Human Resources since June 2020 and before that she served as our Managing Director – Compensation, Talent Management and Operational Human Resources since October 2017. Prior to that, Ms. Cleffi served as our Director – Compensation and Talent Management from October 2007 to October 2017. Ms. Cleffi joined Suburban in October 1992 and has held various positions in the Human Resources area since that time.

Mr. Dagan has served as our Vice President, Strategic Initiatives – Renewable Energy since March 2021. Prior to joining Suburban, he was a senior associate at the law firm of Bevan, Mosca, & Giuditta, P.C., and the Director of Public Affairs and Government Relations for the firm’s affiliate, bmgstrategies, since 2018. Prior to that, Mr. Dagan was engaged in the practice of law at the Law Practice of M. Douglas Dagan since 2013. Mr. Dagan’s practice over his career has focused on advising companies on the development of renewable energy projects, environmental management, advocating for environmental and renewable energy policies, and supporting climate change strategies and initiatives.

Mr. D’Ambrosio has served as our Treasurer since November 2002 and was promoted to Vice President in October 2007. He served as our Assistant Treasurer from October 2000 to November 2002 and as Director of Treasury Services from January 1998 to October 2000. Mr. D’Ambrosio joined Suburban in May 1996 after ten years in the commercial banking industry.

Mr. Fields has served as our Vice President – Area Operations since September 2022. Prior to that appointment, he was General Manager of our Southeast Region since June 2010. Prior to that, Mr. Fields served as Regional Distribution Manager of our Southeast Region since 2007 and in various other management positions within our field operations since joining the Partnership in 1998. Prior to joining the Partnership, Mr. Fields worked for an independent propane gas company for five years.

Mr. Hodges has served as our Vice President – Area Operations since October 2023. He joined the Partnership in 1997 as a Manager in Development and has held various management positions within the Partnership’s field operations; including, most recently, as General Manager of the Partnership’s Florida Region. Mr. Hodges has also served as the past President of the Florida Propane Gas Association, the Chairman of the Florida LP Gas Advisory Board, and is the Chairman of the Florida Propane Gas Safety, Education, and Research Council.

13

Mr. Koepke has served as our Vice President – General Counsel and Secretary since October 2019, after joining Suburban as our Vice President – Deputy General Counsel and Assistant Secretary in March 2019. For the nineteen years prior to joining Suburban, Mr. Koepke served as Senior Vice President, Chief Securities Counsel for Avis Budget Group, Inc., from October 2011 until joining the Partnership and prior to that as Corporate Counsel – Securities for Caterpillar Inc. and as a senior attorney advisor for the U.S. Securities and Exchange Commission. Mr. Koepke is also the past president and currently serves as a member of the Board of Directors for the Association of Corporate Counsel New Jersey.

Mr. Onderdonk has served as our Vice President – Operational Support since November 2015 and before that was our Assistant Vice President – Financial Planning and Analysis since November 2013. Prior to that, he served as our Managing Director, Financial Planning and Analysis from November 2010 to November 2013. Mr. Onderdonk joined Suburban in September 2001 after fourteen years in the consumer products industry.

Mr. Palleschi has served as our Vice President, Renewable Natural Gas Operations since November 2023. Prior to that appointment, he was our Assistant Vice President, Renewable Natural Gas Operations since November 2022. Prior to that, Mr. Palleschi served as Director, Product Supply since 2020 and in various other management positions within the Partnership since joining the Partnership in 2006. Mr. Palleschi is also a founding member and President of the Sparta Benevolent Society, a non-profit organization located in Sparta, NJ.

Ms. Sankara has served as our Vice President, Marketing & Brand Strategy since November 2021 and before that was our Assistant Vice President, Marketing & Brand Strategy since May 2017. Prior to joining Suburban Propane, she held several leadership positions in her career, including Global Customer Experience, Market Intelligence, and Product Management with Sealed Air Corporation from September 2011 to December 2016. Prior to that, Ms. Sankara served as the Director and Head of Marketing & Brand with Aetna from April 2009 to September 2011. Ms. Sankara also served in several global marketing positions with Pitney Bowes from January 2001 to December 2009.

Mr. Schueler has served as our Vice President – Product Supply since October 2017 and before that was our Managing Director – Product Supply since November 2013. Mr. Schueler joined Suburban as Director – Product Resources in July 2005 following a nine-year career at Public Service Enterprise Group and prior to that, eight years at Kraft Foods.

Mr. Stubbs has served as Vice President – Operations since October 2023. Prior to that appointment, he was General Manager of our Mid-Atlantic Region since May 2021. Before then, he held the roles of Region Operations Manager and Area Sales Manager in the Mid-Atlantic region from 2015 to 2021. He joined the Partnership in September 2004 as a Customer Service Manager and held the role in various areas within the Partnership’s Mid-Atlantic operations for eleven years. Prior to joining the Partnership, Mr. Stubbs worked for a regional petroleum company for eight years.

The MLP Agreement provides that all management powers over our business and affairs are exclusively vested in our Board of Supervisors and, subject to the direction of the Board of Supervisors, our officers. No Unitholder has any management power over our business and affairs or actual or apparent authority to enter into contracts on behalf of or otherwise to bind us.

The Board has three standing committees: an Audit Committee, a Compensation Committee and a Nominating/ Governance Committee.

Audit Committee

Four Supervisors, who are not officers or employees of Suburban or its subsidiaries, currently serve on the Audit Committee with authority to review, approve or ratify, at the request of the Board, specific matters as to which the Board believes there may be a conflict of interest, or transactions that may be required to be disclosed pursuant to Item 404(a) of Regulation S-K adopted by the Securities and Exchange Commission (transaction with related persons), in order to determine if the resolution or course of action in respect of such conflict proposed by the Board is fair and reasonable to us. There were no disclosable transactions with related persons during fiscal 2023. Under the MLP Agreement, any matter that receives the “Special Approval” of the Audit Committee (i.e., approval by a majority of the

14

members of the Audit Committee) is conclusively deemed to be fair and reasonable to us, is deemed approved by all of our partners and shall not constitute a breach of the MLP Agreement or any duty stated or implied by law or equity as long as the material facts known to the party having the potential conflict of interest regarding that matter were disclosed to the Audit Committee at the time it gave Special Approval. The Audit Committee also assists the Board in fulfilling its oversight responsibilities relating to (i) the integrity of Suburban’s financial statements and internal control over financial reporting; (ii) Suburban’s compliance with applicable laws, regulations and its code of conduct; (iii) Suburban’s major financial risk exposure and the steps management has taken to monitor and mitigate such risks (including environmental, social and governance and cybersecurity); (iv) review and approval of related person transactions; (v) engagement, independence, qualifications and compensation of the internal audit function and independent registered public accounting firm; (vi) the performance of the internal audit function and the independent registered public accounting firm; and (vii) financial reporting and accounting complaints.

Our Board has adopted a written charter for the Audit Committee, which is reviewed periodically to ensure that it meets all applicable legal and NYSE listing requirements. A copy of our Audit Committee Charter is available without charge from our website at www.suburbanpropane.com, or upon written request directed to: Investor Relations, Suburban Propane Partners, L.P., One Suburban Plaza, 240 Route 10 West, Whippany, New Jersey 07981-0206.

The Board has determined that all four current members of the Audit Committee, Terence J. Connors (its Chair), Lawrence C. Caldwell, William M. Landuyt and Rommel M. Oates, are independent and are audit committee financial experts within the meaning of the NYSE corporate governance listing standards and in accordance with Rule 10A-3 of the Exchange Act, Item 407 of Regulation S-K and Suburban’s criteria for Supervisor independence set forth under “Partnership Governance – Supervisor Independence” below as of the date of this Proxy Statement.

The Audit Committee met eight times during fiscal 2023.

Compensation Committee

The Compensation Committee reviews the performance of, and sets the compensation for, all of Suburban’s executives. It also approves the design of executive compensation programs. In addition, the Compensation Committee participates in executive succession planning and management development. The committee met three times during fiscal 2023. Its current members are Jane Swift (its Chair), Matthew J. Chanin, Harold R. Logan, Jr. and Amy M Adams, all of whom are independent in accordance with our Corporate Governance Guidelines & Principles and the rules of the NYSE.

Our Board has adopted a Compensation Committee Charter. A copy of our Compensation Committee Charter is available without charge from our website at www.suburbanpropane.com, or upon written request directed to: Investor Relations, Suburban Propane Partners, L.P., One Suburban Plaza, 240 Route 10 West, Whippany, New Jersey 07981-0206.

Nominating/Governance Committee

The Nominating/Governance Committee participates in Board succession planning and development and identifies individuals qualified to become Board members, recommends to the Board the persons to be nominated for election as Supervisors at any Tri-Annual Meeting of the Unitholders and the persons (if any) to be elected by the Board to fill any vacancies on the Board, develops and recommends to the Board changes to Suburban’s Corporate Governance Guidelines & Principles when appropriate, and oversees the evaluation of the Board and its committees. The committee met four times during fiscal 2023. Its current members are Matthew J. Chanin (its Chair), Harold R. Logan, Jr., Jane Swift, Lawrence C. Caldwell, Terence J. Connors, William M. Landuyt, Amy M. Adams and Rommel M. Oates, all of whom are independent in accordance with our Corporate Governance Guidelines & Principles and the rules of the NYSE.

Our Board has adopted a Nominating/Governance Committee Charter. A copy of our Nominating/Governance Committee Charter is available without charge from our website at www.suburbanpropane.com, or upon written request directed to: Investor Relations, Suburban Propane Partners, L.P., One Suburban Plaza, 240 Route 10 West, Whippany, New Jersey 07981-0206.

15

We are committed to delivering safe, reliable, affordable, and low carbon intensity (“CI”) energy to our customers and the local communities we serve. We have made significant progress on our environmental, social and governance (“ESG”) initiatives, which accelerated with the launch of our Three Pillars of the Suburban Propane Experience in June 2019. The three essential pillars are: i) Go Green with Suburban Propane, ii) SuburbanCares, and iii) Suburban’s Commitment to Excellence. We identified these three critical corporate pillars to emphasize our ongoing commitment to excellence for the safety and comfort of our customers, our dedication to the safety and career development of our employees, our philanthropic efforts to give back to the communities we serve, our work to advocate for the inherent environmental advantages of using propane as a clean energy solution, our focus on supporting the sustainability needs of our customers and our ongoing strategic efforts to invest in and develop innovative solutions to help lower greenhouse gas emissions. We are committed to implementing business strategies using a holistic approach to doing what is best for our customers, employees, the communities we serve and our investors. Effective ESG management for us supports our goal to create long-term value for our Unitholders and to support the interests of all stakeholders. Our Board of Supervisors takes an active role in overseeing the management of risks facing Suburban, including those impacted by ESG issues.

In support of our efforts to successfully manage and grow our business, we will continue to identify ways to include more ESG initiatives in our strategies that support our customers, employees, investors, and the communities we serve; including initiatives that support our three corporate pillars. Advancing our focus on ESG initiatives will allow for increased engagement across our business and help us to continue to identify and meet the evolving expectations of our customers, employees, investors, and other stakeholders.

Environmental Initiatives

Our Go Green with Suburban Propane corporate pillar encompasses our commitment and efforts to promote the versatile, affordable, low CI and clean air benefits of traditional propane as one solution that can contribute to our customers achieving their sustainability goals, and our efforts to contribute to the goals of reducing the nation’s carbon footprint and having a positive effect on climate change. Traditional propane is an alternative fuel under the Clean Air Act Amendments. Propane can offer immediate reductions in carbon emissions and immediate improvements in air quality over other traditional fuels, particularly in the transportation sector. Propane is non-toxic and emits 60% to 70% fewer smog producing hydrocarbons than gasoline and diesel. Several states have implemented low carbon fuel standards that recognize the environmental benefits of using propane to power over-the-road vehicles and forklifts. Through our dedicated sales efforts, we are actively promoting the use of propane in the transportation sector and, for the last three fiscal years, we sold an average of nearly 30 million gallons of propane annually to the over-the-road vehicle and forklift markets.

With advancements in new technologies for the production of propane from renewable sources, as well as other technological advances to reduce the CI of traditional propane, our Go Green with Suburban Propane corporate pillar also underscores our commitment to invest in innovative solutions that can contribute to a sustainable energy future. Starting in fiscal year 2020, Suburban made great strides in advancing our strategic growth initiatives. Specifically, we contracted for the supply and distribution of over 1.0 million gallons annually of renewable propane to meet customer demand for a renewable energy source. In support of our long-term strategic growth initiative to build out a comprehensive renewable energy platform, we acquired a 38% equity stake in Oberon Fuels, Inc. (“Oberon”), a 25% equity stake in Independence Hydrogen, Inc. (“IH”), committed to building a dairy waste anaerobic digester in upstate New York for the production of renewable natural gas (“RNG”), and purchased anaerobic digesters operating in Columbus, Ohio and Stanfield, Arizona. Through our investment in Oberon, we have brought to market a new blended product – Propane+rDME. This new product is a blend of traditional propane and renewable dimethyl ether (“rDME”) and has a lower CI than the traditional propane product. We are collaborating with Oberon and others to support market development efforts, testing of blended product across multiple applications of traditional propane and to encourage a supportive regulatory framework for the blended product. We have the exclusive right to market and sell Oberon’s rDME produced from its facility in Brawley, California throughout North America.

In further support of Suburban’s efforts to advance its Go Green with Suburban Propane corporate pillar, we have officially registered the Go Green with Suburban Propane logo with the United States Patent and Trademark office. As part of our commitment to innovating for a sustainable energy future, and in support of our strategic growth initiatives to build out a renewable energy platform, Suburban created an executive-level position in fiscal 2021

16

(reporting directly to our President and Chief Executive Officer) entitled Vice President, Strategic Initiatives – Renewable Energy. This position focuses on identifying, analyzing and developing opportunities within the renewable energy space for potential future acquisitions, partnerships or collaborative arrangements that support Suburban’s efforts to grow its overall business through investment in, and development of, innovative solutions that will help pave the way to lowering greenhouse gas emissions.

We present information about our commitment to sustainable and environmentally sound practices on the “Go Green” page on our website, which may be accessed at www.suburbanpropane.com/suburban-propane-experience/go-green. The information included on our “Go Green” page is not intended to be incorporated by reference into this Proxy Statement.

Social Initiatives

Suburban celebrated its 95th anniversary last year, commemorating a momentous milestone and the remarkable journey that brought us here. Spanning nearly a century, our legacy exhibits an unwavering dedication to the highest standard for safety and outstanding customer service. From humble beginnings in 1928 as a family-owned business, we sustain a family-oriented culture deeply rooted in the communities we serve and operate nationwide. Our SuburbanCares corporate pillar highlights our continued dedication to philanthropic endeavors through our national partnership with the American Red Cross and numerous engagements in local community sponsorships and events, as well as the various employee-focused initiatives that differentiate Suburban as a great place to work. This pillar is supported by the tagline, “SuburbanCares about our people and the communities we serve.”

During fiscal 2023, Suburban emphasized its collaboration with organizations that offer critical support to individuals and families facing adversity in underserved communities across our operational footprint; including fundamental provisions such as food, housing, educational resources, and various essential supplies. Furthermore, we have a longstanding commitment to supporting our troops and military veterans through our initiative called “Heroes Hired Here,” providing a range of employment opportunities to those who have served, in addition to volunteering at community events and various outreach initiatives. In our continued collaboration with our national partner, the American Red Cross, we hosted blood-drives, fire-safety programs, provided disaster relief efforts, and supported various campaigns that make a positive difference in the lives of those in need.

In total throughout 2023, Suburban sponsored and supported over 80 philanthropic endeavors under our SuburbanCares corporate pillar:

These philanthropic endeavors included restoring historic structures, such as the Harry S. Truman Winter White House in Key West, FL; working with Move America Forward in Sacramento, CA to put together care packages for our troops stationed overseas; and supporting the hunger pandemic by donating meals to the Baltimore Hunger Project in Baltimore, MD, among many others.

Safety

Embedded in our culture and Suburban’s mission statement is our commitment to safety. We believe that the safety and well-being of our employees, customers, and communities is of the utmost importance. Safety is a top priority for our business and we continue to invest in programs, technology, and training to improve safety throughout our operations. We believe that the achievement of superior safety performance is both an important short-term and long-term strategic initiative in supporting our business and managing our operations.

Human Capital Management

Our Board, and our management, consider effective talent development and human capital management to be critical components to Suburban’s continued success. Our Board is involved in leadership development and actively oversees Suburban’s succession planning, which includes periodic reviews of our talent management strategies, leadership

17

pipeline and succession planning for key executive positions. Our Board oversees the process of succession planning and the Compensation Committee of our Board implements programs to compensate, retain and motivate key talent.

In further support of our SuburbanCares corporate pillar and our commitment to building a diverse and inclusive culture, we have developed many employee-focused initiatives to support employee career development and hiring, such as our “Steer Your Career” program, which encourages and supports employees to further their education and enhance their knowledge and skills to prepare them for expanded opportunities and responsibilities; our “Heroes Hired Here” program, in which we take pride in our efforts to attract and employ military veterans in recognition and appreciation for the values, leadership, dedication and unique skills that they bring to Suburban, and support provided to their family members; and our “Apprentice Program,” which provides company-paid, on-the-job training for apprentices to develop their careers and provide them the necessary skills and tools to prepare them for a successful career within Suburban.

Governance Initiatives

The Board believes that sound corporate governance practices and policies provide an important framework to assist the Board in fulfilling its duty to Unitholders. Our corporate governance practices and policies, which are periodically reassessed, are reflected in our committee charters, Code of Business Conduct and Ethics, and our Corporate Governance Guidelines & Principles. A copy of each is available from our website at www.suburbanpropane.com.

Suburban was one of the first publicly-traded partnerships to eliminate the “incentive distribution rights” of its general partner, which we completed in 2006. This removed the potential for conflicts of interest between our general partner and limited partners, and simplified our capital structure. The general partner of both Suburban and our Operating Partnership is Suburban Energy Services Group LLC (the “General Partner”), a Delaware limited liability company, the sole member of which is Suburban’s Chief Executive Officer. Other than as a holder of 784 Common Units that will remain in the General Partner, the General Partner does not have any economic interest in us or our Operating Partnership. Accordingly, and unlike many publicly-traded partnerships, Suburban is controlled by our Unitholders through the independently elected Board.

Governance Highlights

Highlights that demonstrate our commitment to sound corporate governance include:

18

Board Diversity Highlights

Our Supervisors have extensive and diverse experience relevant to our business and strategy that enhances the knowledge of our Board and the insight that they provide Suburban, including significant experience in the following industries:

Our Supervisors also currently hold or have held a diverse range of leadership positions, including:

If a vacancy on our Board arises, then our Nominating/Governance Committee is instructed by its charter to consider candidates from various disciplines and diverse backgrounds that optimally enhance the current mix of talent and experience on the Board. While industry-specific expertise is an essential component of our Board’s oversight of Suburban, we consider all aspects of a candidate’s qualifications and skills in the context of Suburban’s needs with a view to creating a Board with a diversity of experience and perspectives; including diversity with respect to race, gender, age, background and areas of expertise. We also benefit from the viewpoints of Supervisors with expertise outside of our industry and our Nominating/Governance Committee includes, and has any search firm that it may engage include, women and minority candidates in the pool from which the Nominating/Governance Committee selects supervisor candidates. Our current slate of seven independent Supervisor nominees has over 40% of Supervisors that identify as diverse in gender, race or ethnicity.

Ethics and Compliance Hotline

It is Suburban’s policy to encourage the communication of bona fide concerns relating to the lawful and ethical conduct of its business, and its audit and accounting procedures or related matters. It is also the policy of Suburban to protect those who communicate their bona fide concerns from any retaliation for such reporting. All employees, customers, vendors and other stakeholders can communicate concerns by calling our Ethics Hotline, which is hosted by a third party to maintain confidentiality and anonymity when requested. Confidential and anonymous mechanisms for reporting concerns are also available and described in our Code of Business Conduct and Ethics.

19

Cybersecurity

Suburban’s cybersecurity program is based upon the National Institute of Standards of Technology (“NIST”) Cybersecurity Framework. Our program is comprehensive in scope and covers all of Suburban’s general corporate Information Technology systems, as well as operational technology systems supporting our business and the technology systems used by our third-party service providers. Our senior leadership team, along with our Audit Committee, receive regular and recurring program updates, metrics, and roadmaps to promote the effectiveness of the program and the alignment with Suburban’s business objectives. Our program and controls are periodically reviewed and tested by independent third parties to enable Suburban to employ industry best practices.

Supervisor Nominations and Criteria for Board Membership

To fulfill its responsibility to recruit nominees for election as Supervisors, the Nominating/Governance Committee of the Board reviews the composition of the Board to determine the qualifications and areas of expertise needed to further enhance the Board’s oversight capabilities and performance and works with management in attracting candidates with those qualifications. Our Corporate Governance Guidelines & Principles set forth the following minimum qualifications for our Supervisors, who are nominated in accordance with the procedures set forth in the MLP Agreement:

20

In addition, the Nominating/Governance Committee considers the number of other boards of public companies on which a candidate serves.

Unitholder Nominations

Unitholders may nominate candidates for Supervisors in accordance with the following procedures set forth in the MLP Agreement. Any Unitholder (or group of Unitholders) that beneficially owns 10% or more of the outstanding Common Units is entitled to nominate one or more individuals to stand for election as Supervisors at a tri-annual meeting by providing written notice thereof to the Board of Supervisors not more than 120 days and not less than 90 days prior to the date of such tri-annual meeting; provided, however, that in the event that the date of the tri-annual meeting was not publicly announced by Suburban by mail, press release or otherwise more than 100 days prior to the date of such meeting, such notice, to be timely, must be delivered to the Board of Supervisors not later than the close of business on the 10th day following the date on which the date of the tri-annual meeting was announced. The notice must set forth (i) the name and address of the Unitholder(s) making the nomination or nominations, (ii) the number of Common Units beneficially owned by such Unitholder(s), (iii) such information regarding the nominee(s) proposed by the Unitholder(s) as would be required to be included in a proxy statement relating to the solicitation of proxies for the election of Supervisors filed pursuant to the proxy rules of the Securities and Exchange Commission had the nominee(s) been nominated or intended to be nominated to the Board of Supervisors, (iv) the written consent of each nominee to serve as a member of the Board of Supervisors if so elected, and (v) a certification that such nominee(s) qualify as Supervisor(s). Unitholder nominees whose nominations comply with these procedures and who meet the minimum criteria for Board membership, as outlined above, will be evaluated by the Nominating/Governance Committee of the Board in the same manner as the Committee’s nominees. In addition, a Unitholder that intends to solicit proxies in support of director nominees other than our nominees must provide the information required by Rule 14a-19, and such additional information must be received by no later than March 22, 2027, or at least 60 days in advance of the Tri-Annual Meeting if the meeting date is moved by more than 30 calendar days from the 2024 Tri-Annual Meeting.

The Corporate Governance Guidelines & Principles adopted by the Board of Supervisors (and available on our website at www.suburbanpropane.com) set forth that a Supervisor is deemed to be lacking a material relationship to Suburban and is therefore independent if the following criteria are satisfied:

21

Unitholder Meetings

It is the policy of the Board of Supervisors that all Supervisors should attend Suburban’s Unitholder meetings. All seven of the Supervisors at the time attended the Tri-Annual Meeting of Unitholders on May 18, 2021.

Board and Committee Meetings

The Board held seven meetings in fiscal 2023. Each Supervisor attended at least 75% of the total number of meetings of the Board and of the Committees of the Board on which such Supervisor served in fiscal 2023. Mr. Chanin, Chairman of the Board, during fiscal 2023, presided at the regularly scheduled executive sessions of the non-management Supervisors, all of whom are independent, held as part of the meetings of the Board.

Unitholder Communications with the Board of Supervisors

Unitholders who wish to communicate directly with the Board as a group may do so by writing to the Suburban Board of Supervisors, c/o Company Secretary, Suburban Propane Partners, L.P., One Suburban Plaza, 240 Route 10 West, Whippany, New Jersey 07981-0206. Unitholders may also communicate directly with individual Supervisors by addressing their correspondence accordingly.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act, as amended, requires our Supervisors, executive officers and holders of 10 percent or more of our Common Units to file initial reports of ownership and reports of changes in ownership of our Common Units with the Securities and Exchange Commission. Supervisors, executive officers and 10 percent Unitholders are required to furnish Suburban with copies of all Section 16(a) forms that they file. Based on a review of these filings, we believe that all such filings were timely made during fiscal 2023, except that Nandini Sankara, our Vice President – Marketing and Brand Strategy, did not timely file three reports with respect to certain Common Units purchased on May 10, 2022, August 9, 2022 and November 8, 2022 pursuant to an automatic dividend reinvestment program administered by her broker. The untimely filing of the above transactions was inadvertent and, as soon as the oversight was discovered, a Form 5 was promptly filed on February 24, 2023 to report the transactions. Ms. Sankara has cancelled her participation in the broker’s automatic dividend reinvestment program. Suburban also discovered that the Form 4s filed on behalf of each of our then executive officers on November 16, 2022, inadvertently omitted the grants of phantom units to those executive officers on November 15, 2022. These grants of phantom units were reported on the amended Form 4s filed by each of our then executive officers on September 1, 2023.

Code of Ethics and Code of Business Conduct and Ethics

We have adopted a Code of Ethics that applies to our principal executive officer, principal financial officer, controller, or persons performing similar functions, and a Code of Business Conduct and Ethics that applies to all of our employees, officers and Supervisors. Copies of our Code of Ethics and our Code of Business Conduct and Ethics are available without charge from our website at www.suburbanpropane.com or upon written request directed to: Investor Relations,

22

Suburban Propane Partners, L.P., One Suburban Plaza, 240 Route 10 West, Whippany, New Jersey 07981-0206. Any amendments to, or waivers from, provisions of our Code of Ethics or our Code of Business Conduct and Ethics that apply to our principal executive officer, principal financial officer and principal accounting officer will be posted on our website.

Corporate Governance Guidelines

We have adopted Corporate Governance Guidelines & Principles in accordance with the NYSE corporate governance listing standards in effect as of the date of this Proxy Statement. Copies of our Corporate Governance Guidelines & Principles are available without charge from our website at www.suburbanpropane.com, or upon written request directed to: Investor Relations, Suburban Propane Partners, L.P., One Suburban Plaza, 240 Route 10 West, Whippany, New Jersey 07981-0206

The NYSE requires the Chief Executive Officer of each listed company to submit a certification indicating that the company is not in violation of the Corporate Governance listing standards of the NYSE on an annual basis. Our Chief Executive Officer submits his Annual CEO Certification to the NYSE each December. In December 2023, Mr. Stivala submitted his Annual CEO Certification for our 2023 fiscal year to the NYSE without qualification.

This report by the Audit Committee is required by the rules of the Securities and Exchange Commission pursuant to paragraph (d)(3) of Regulation S-K Item 407. It shall not be deemed to be “soliciting material,” or to be “filed” with the Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent that Suburban specifically incorporates it by reference in such filing.