© 2015 Columbus McKinnon Corporation. All Rights Reserved. Confidential and Proprietary.NASDAQ: CMCO Investor Presentation January 2017 Timothy T. Tevens President & Chief Executive Officer Gregory P. Rustowicz Vice President – Finance & Chief Financial Officer

2 © 2017 Columbus McKinnon Corporation This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements concerning future revenue and earnings, involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such statements, including the ability to complete the STAHL acquisition or delays in its completion, increased exposure to markets and geographies in which STAHL is more concentrated than the Company’s existing business, such as the oil and gas industry and Europe, risks related to integration, such as disruptions in customer or vendor relationships or lost business, risks related to employee relations or risks related to diligence, such as contingent liabilities of STAHL that are unknown to the Company or turn out to be greater than the Company expects, risks related to doing business outside the United States, including varying legal protections, rights and obligations, and risks related to global legal compliance, risks related to increased debt expected to be incurred to partially finance the STAHL acquisition, including the Company’s ability to service and repay such debt and the possibility that debt service could reduce the Company’s ability to take advantage of opportunities that would benefit the Company’s business, risks related to the Company’s ability to achieve synergies in the time frame and magnitudes that the Company expects, the lack of audited financial statements relating to STAHL or pro forma financial information prepared in accordance with SEC rules, and the possibility that the audit process could result in financial information that investors consider adverse, which could affect the trading price of the Company’s common stock, general economic and business conditions, conditions affecting the industries served by the Company and its subsidiaries, conditions affecting the Company's customers and suppliers, competitor responses to the Company's products and services, the overall market acceptance of such products and services, the effect of operating leverage, the pace of bookings relative to shipments, the ability to expand into new markets and geographic regions, the success in acquiring additional new business and other factors disclosed in the Company's periodic reports filed with the Securities and Exchange Commission. The Company assumes no obligation to update the forward-looking information contained in this presentation. Safe Harbor Statement

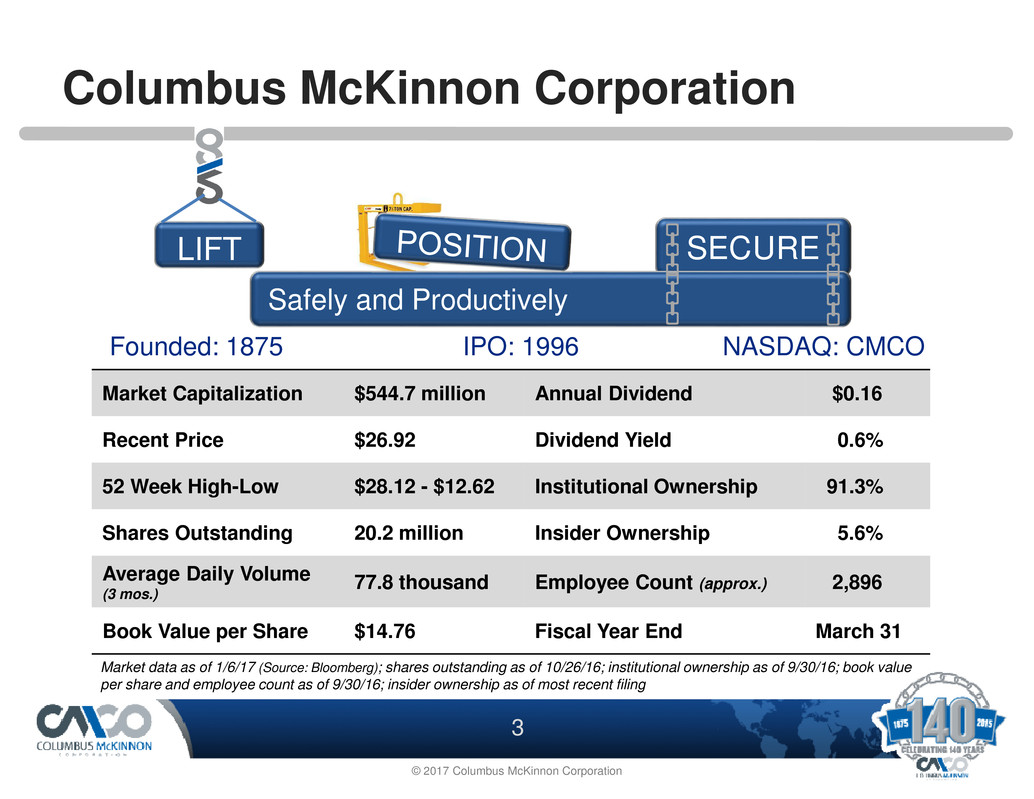

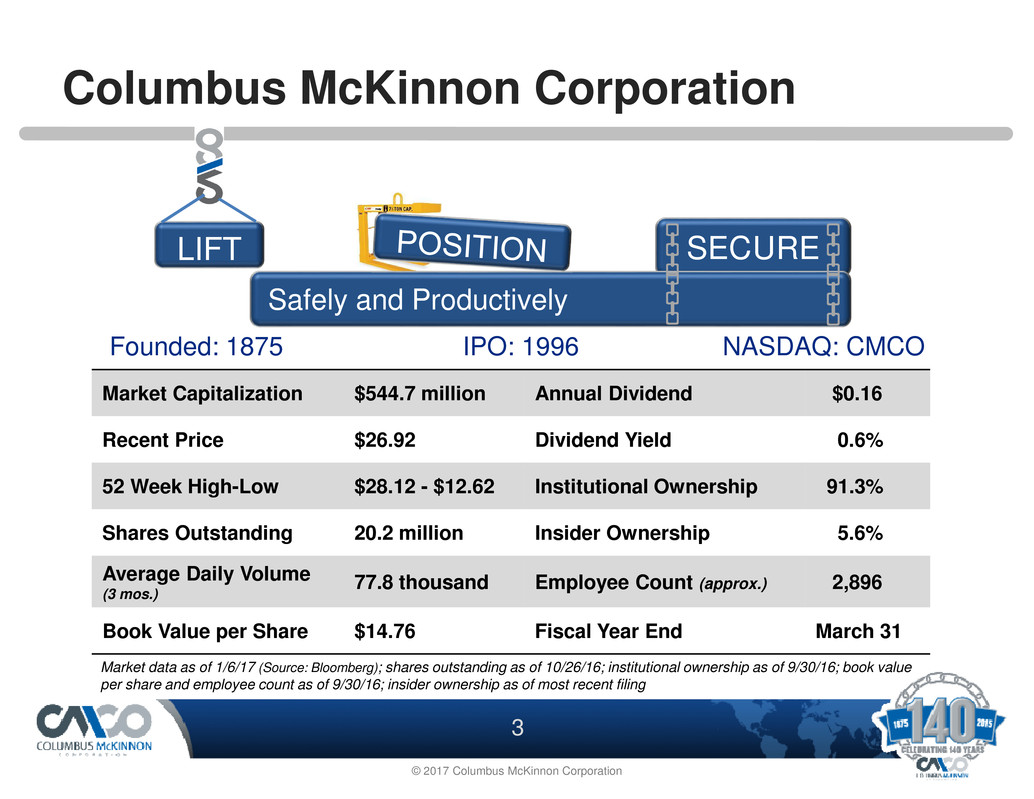

3 © 2017 Columbus McKinnon Corporation Columbus McKinnon Corporation SECURELIFT Safely and Productively Market Capitalization $544.7 million Annual Dividend $0.16 Recent Price $26.92 Dividend Yield 0.6% 52 Week High-Low $28.12 - $12.62 Institutional Ownership 91.3% Shares Outstanding 20.2 million Insider Ownership 5.6% Average Daily Volume (3 mos.) 77.8 thousand Employee Count (approx.) 2,896 Book Value per Share $14.76 Fiscal Year End March 31 Market data as of 1/6/17 (Source: Bloomberg); shares outstanding as of 10/26/16; institutional ownership as of 9/30/16; book value per share and employee count as of 9/30/16; insider ownership as of most recent filing Founded: 1875 IPO: 1996 NASDAQ: CMCO

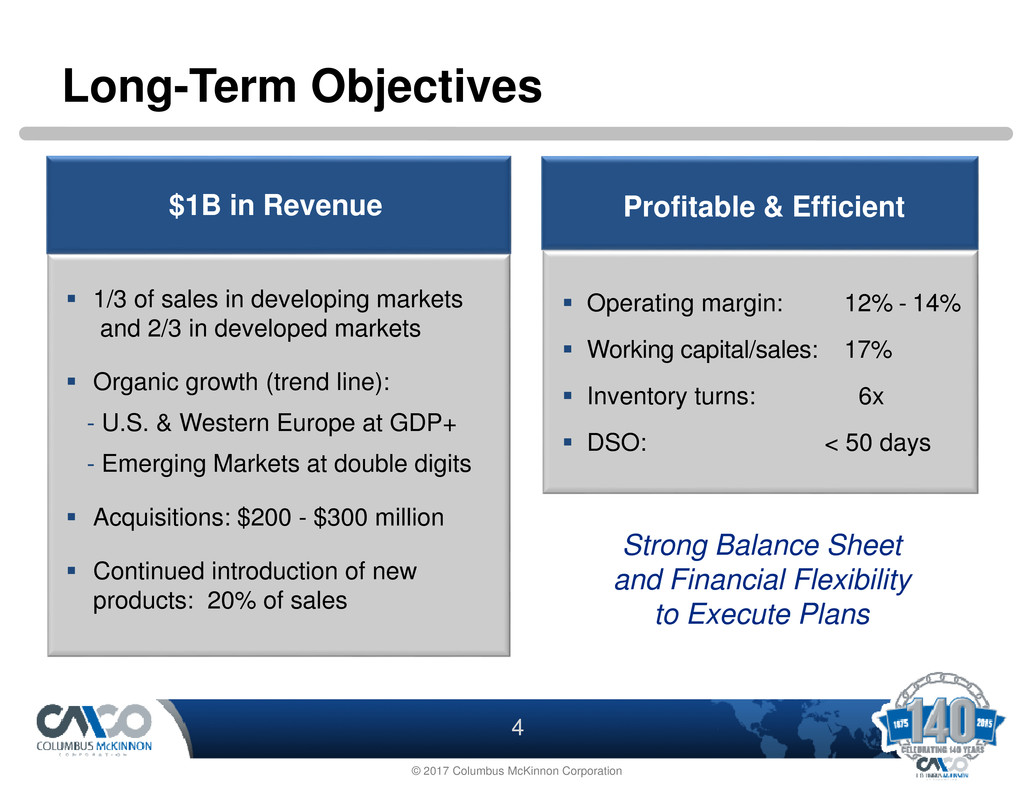

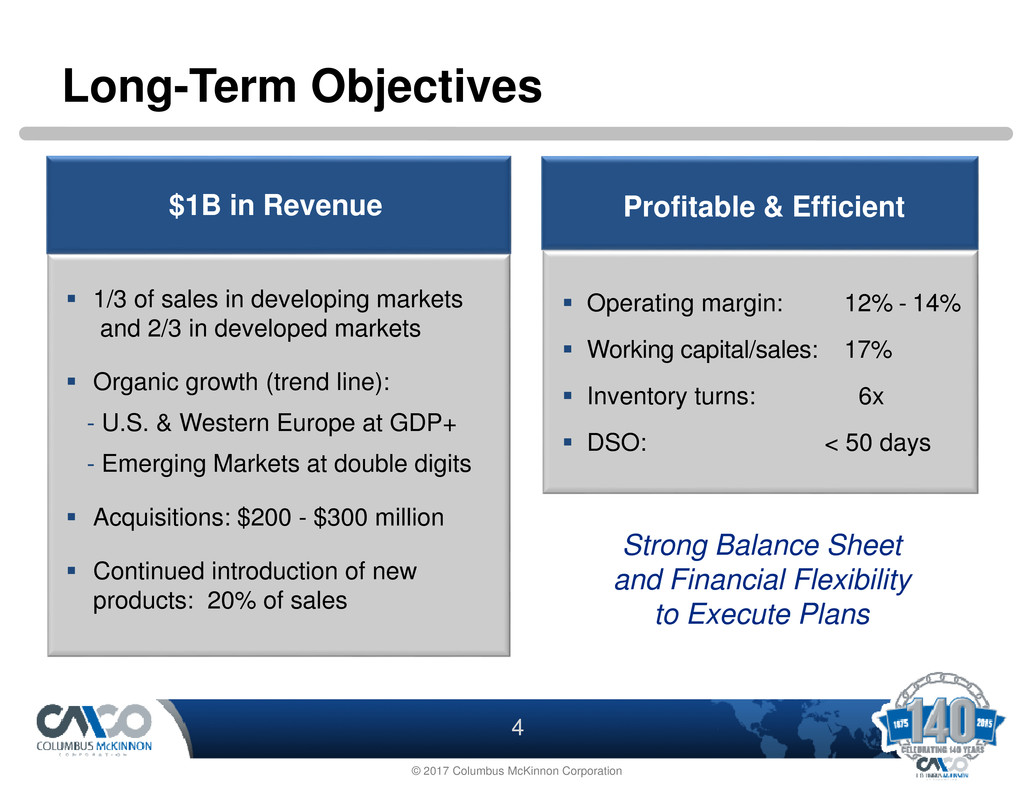

4 © 2017 Columbus McKinnon Corporation Strong Balance Sheet and Financial Flexibility to Execute Plans � 1/3 of sales in developing markets and 2/3 in developed markets � Organic growth (trend line): - U.S. & Western Europe at GDP+ - Emerging Markets at double digits � Acquisitions: $200 - $300 million � Continued introduction of new products: 20% of sales $1B in Revenue � Operating margin: 12% - 14% � Working capital/sales: 17% � Inventory turns: 6x � DSO: < 50 days Profitable & Efficient Long-Term Objectives

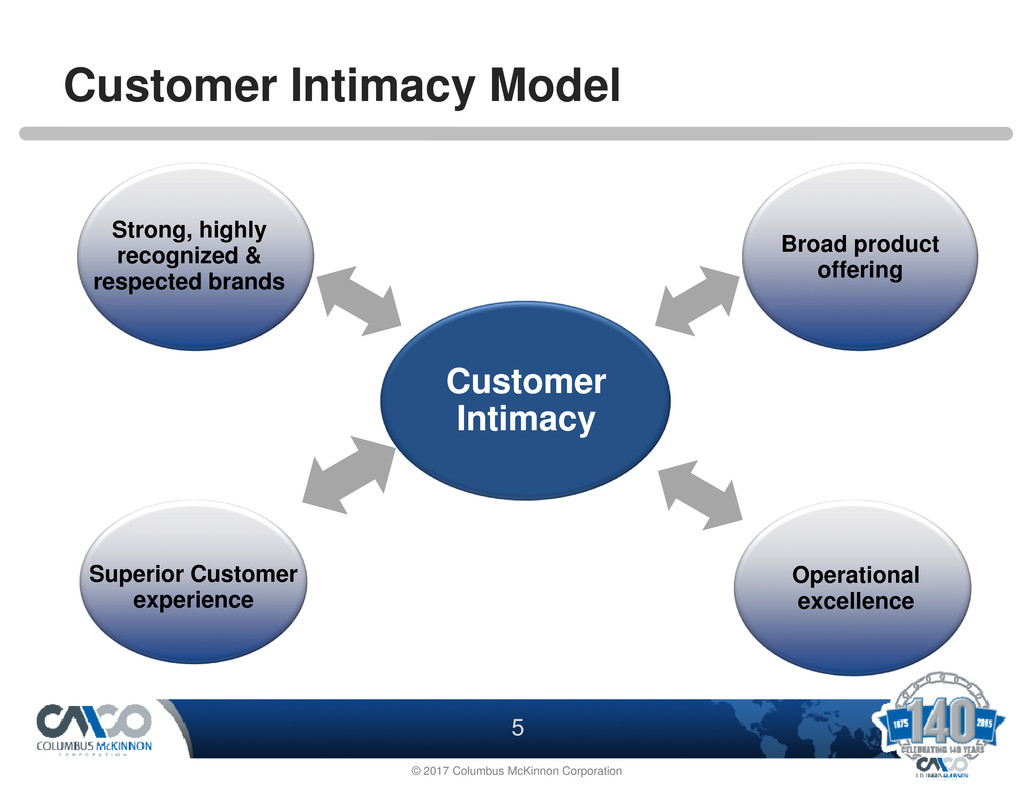

5 © 2017 Columbus McKinnon Corporation Customer Intimacy Model Operational excellence Customer Intimacy Strong, highly recognized & respected brands Superior Customer experience Broad product offering

6 © 2017 Columbus McKinnon Corporation Superior Customer Satisfaction Acquisitions Geographic Market Expansion Global Product Development and Key Vertical Markets Operational Excellence Grow Profitably Strategic Initiatives

7 © 2017 Columbus McKinnon Corporation Acquisitive Add $200 to $300 million in revenue New technologies/expand product portfolio Geographic markets Key vertical markets

8 © 2017 Columbus McKinnon Corporation Recent Acquisition (Expected to close on, or about, January 31, 2017)

9 © 2017 Columbus McKinnon Corporation Ideal Strategic Combination Strong Value Proposition � Ideal complement to Columbus McKinnon’s global presence � Strong wire rope and electric chain hoist position in EMEA complements Columbus McKinnon manual hoist leadership � Explosion-protected products (ATEX Certified) extend capabilities and capacities � Excellent cultural alignment • Similar go-to-market strategy • Emphasis on high quality products and solutions � Strong engineering capabilities for custom hoists and cranes Creates second largest global hoist Company and a leader in premium quality lifting products and solutions to meet customer needs Another Major Step Towards $1 Billion Revenue Goal

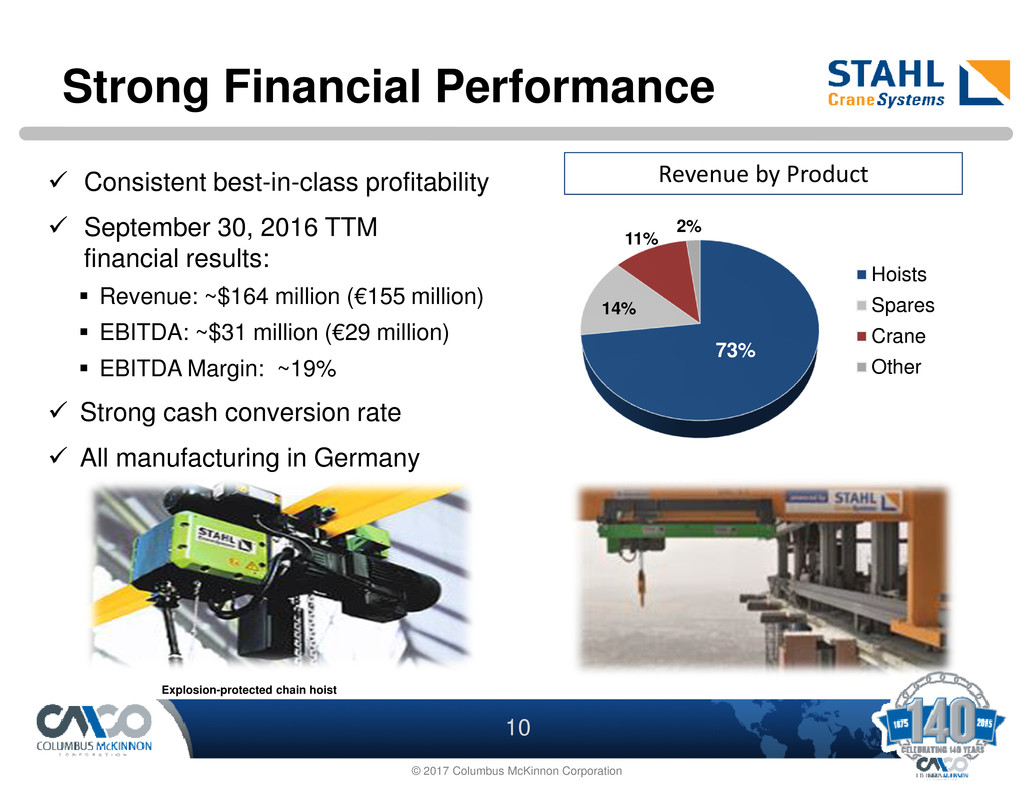

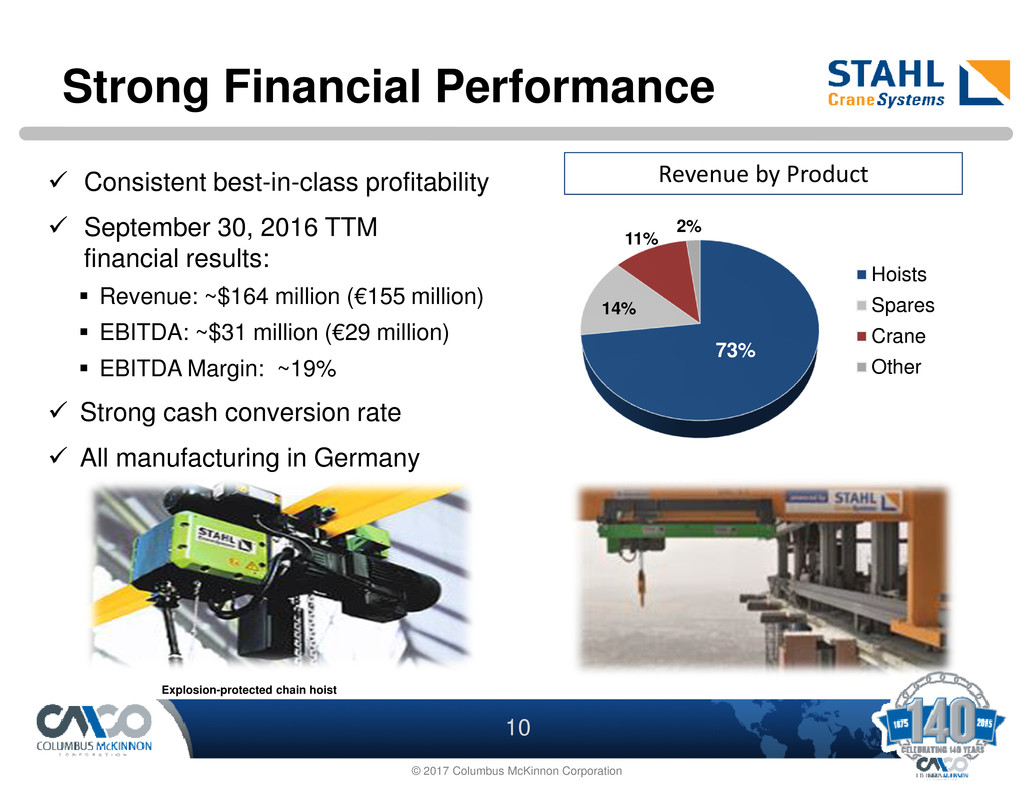

10 © 2017 Columbus McKinnon Corporation Strong Financial Performance � Consistent best-in-class profitability � September 30, 2016 TTM financial results: � Revenue: ~$164 million (€155 million) � EBITDA: ~$31 million (€29 million) � EBITDA Margin: ~19% � Strong cash conversion rate � All manufacturing in Germany 73% 14% 11% 2% Hoists Spares Crane Other Revenue by Product Explosion-protected chain hoist

11 © 2017 Columbus McKinnon Corporation EMEA, 71% Americas, 16% APAC, 13% Established Global Presence � Superior product quality � Premium brand; strong reputation � Long-standing customer relationships � Large installed base; strong spare parts business � Explosion-protected hoist leader Revenue by Geography EPC, 57% Crane Builders & Distributors, 43% Revenue by Market Channel Automotive 17% General Manufacturing 17% Steel & concrete 15% Power generation 15% Chemicals & Pharma 12% Oil & gas 24% Revenue by Industry

12 © 2017 Columbus McKinnon Corporation Synergy-Driven Value Creation Costs � Sourcing & logistics � Sales office consolidation � Product rationalization � Lean processes Revenue � Leverage global sales force � Expand product offering � Smart technology Intercompany Opportunities � Low cost country opportunities � Magnetek drives � Chain and forgings � Jib cranes and light rail Cost Synergies: � $5 million year one � $11 million year two

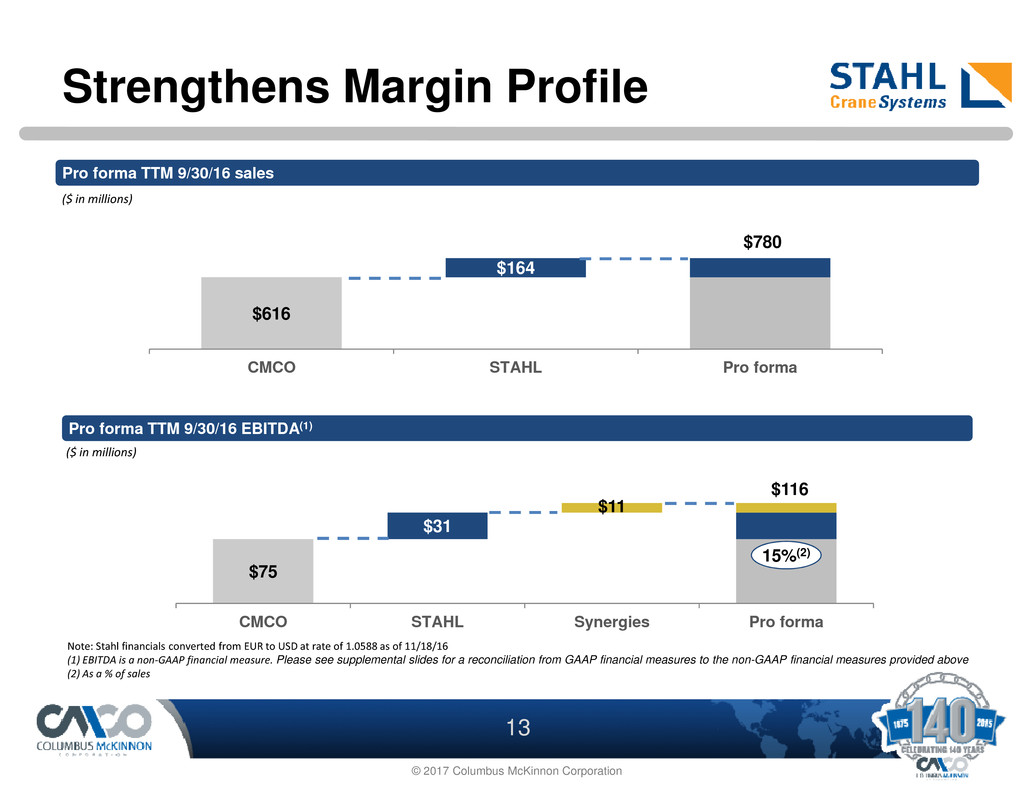

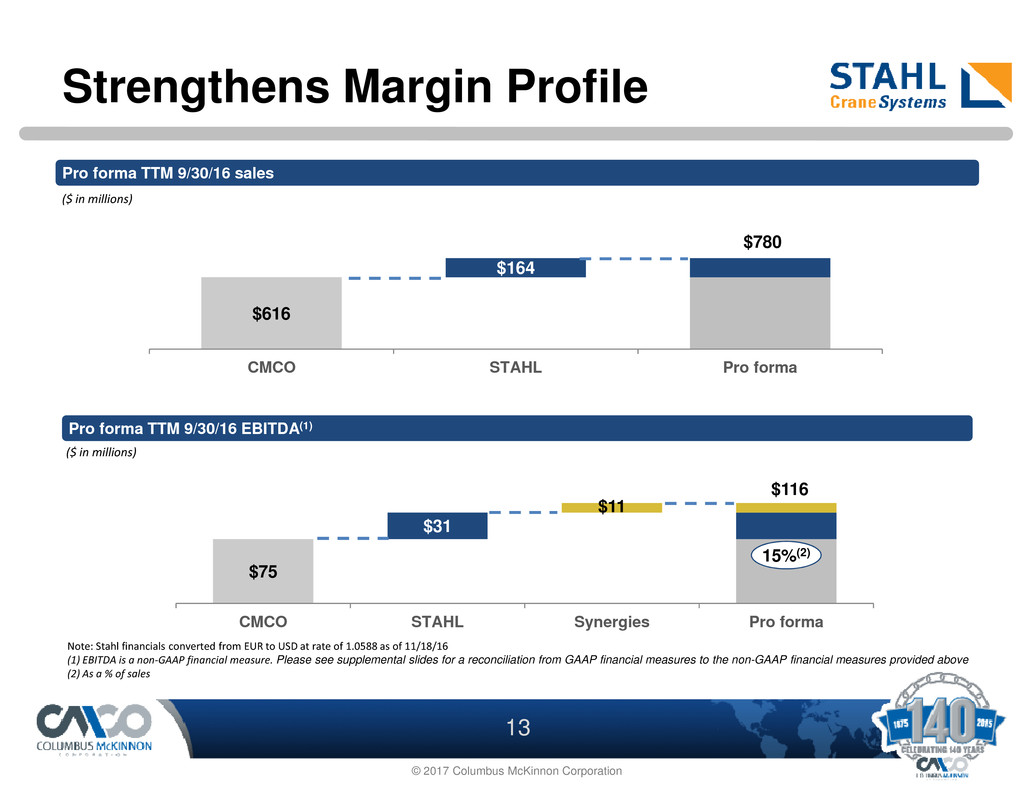

13 © 2017 Columbus McKinnon Corporation Pro forma TTM 9/30/16 sales Pro forma TTM 9/30/16 EBITDA(1) $616 164.0 $164 $780 CMCO STAHL Pro forma $75 $31 $11 $116 CMCO STAHL Synergies Pro forma Note: Stahl financials converted from EUR to USD at rate of 1.0588 as of 11/18/16 (1) EBITDA is a non-GAAP financial measure. Please see supplemental slides for a reconciliation from GAAP financial measures to the non-GAAP financial measures provided above (2) As a % of sales ($ in millions) ($ in millions) 15%(2) Strengthens Margin Profile

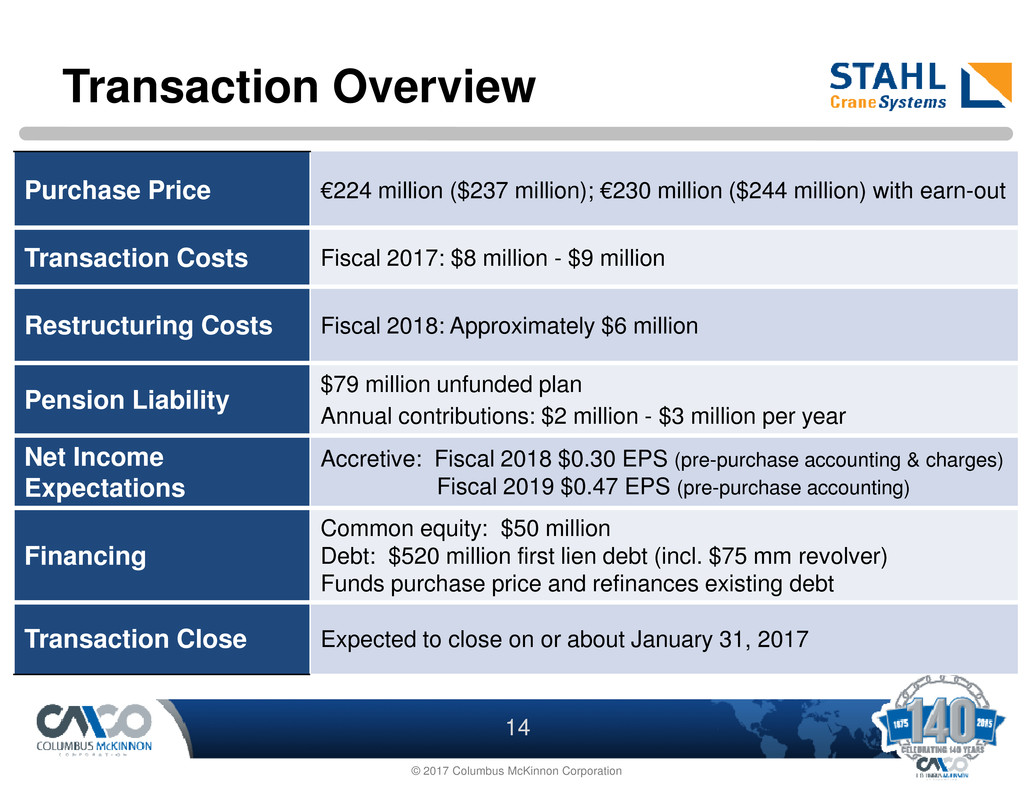

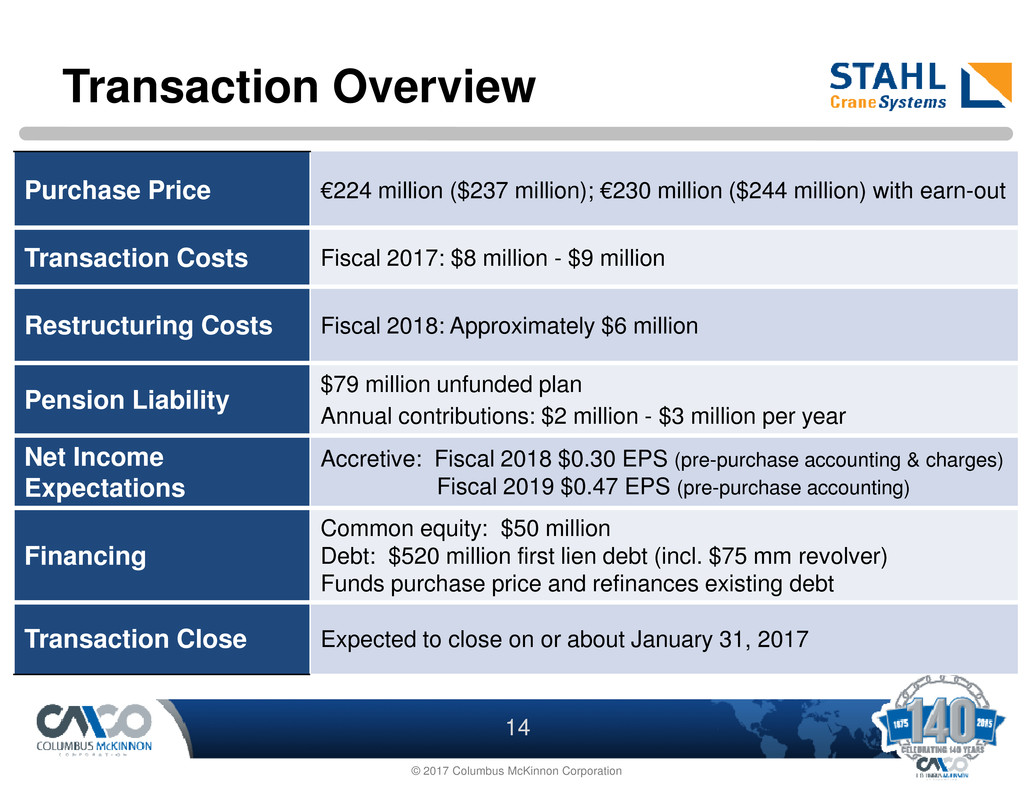

14 © 2017 Columbus McKinnon Corporation Purchase Price €224 million ($237 million); €230 million ($244 million) with earn-out Transaction Costs Fiscal 2017: $8 million - $9 million Restructuring Costs Fiscal 2018: Approximately $6 million Pension Liability $79 million unfunded planAnnual contributions: $2 million - $3 million per year Net Income Expectations Accretive: Fiscal 2018 $0.30 EPS (pre-purchase accounting & charges) Fiscal 2019 $0.47 EPS (pre-purchase accounting) Financing Common equity: $50 million Debt: $520 million first lien debt (incl. $75 mm revolver) Funds purchase price and refinances existing debt Transaction Close Expected to close on or about January 31, 2017 Transaction Overview

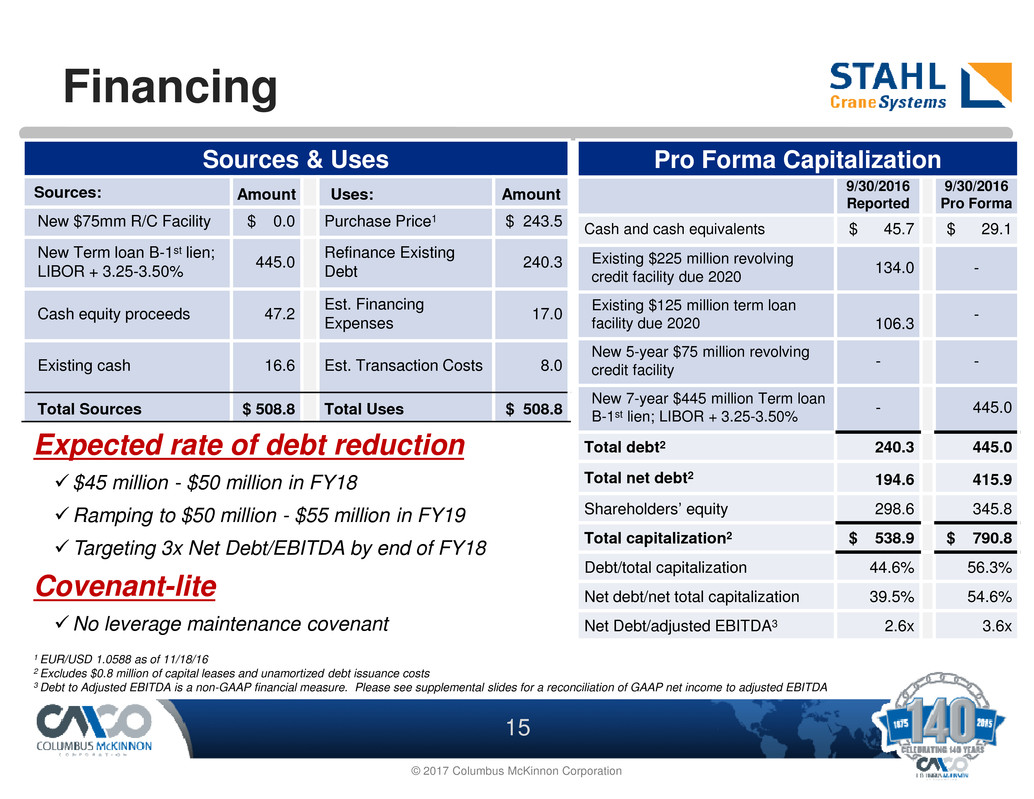

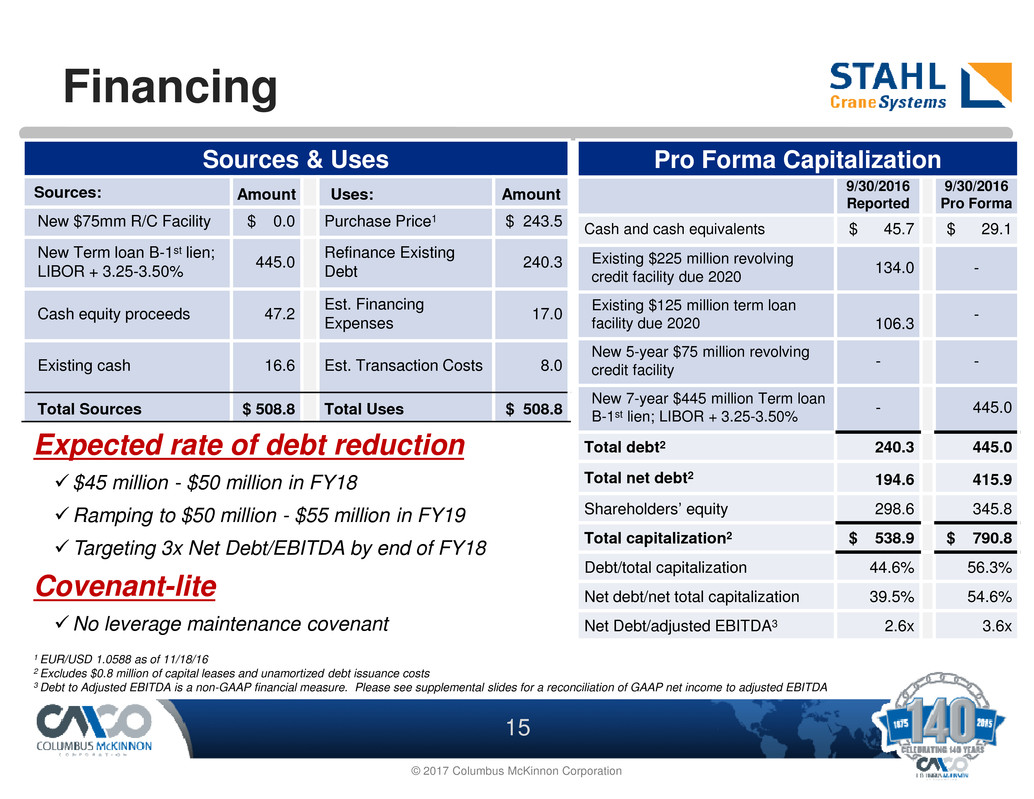

15 © 2017 Columbus McKinnon Corporation Expected rate of debt reduction �$45 million - $50 million in FY18 �Ramping to $50 million - $55 million in FY19 �Targeting 3x Net Debt/EBITDA by end of FY18 Covenant-lite �No leverage maintenance covenant Pro Forma Capitalization 9/30/2016 Reported 9/30/2016 Pro Forma Cash and cash equivalents $ 45.7 $ 29.1 Existing $225 million revolving credit facility due 2020 134.0 - Existing $125 million term loan facility due 2020 106.3 - New 5-year $75 million revolving credit facility - - New 7-year $445 million Term loan B-1st lien; LIBOR + 3.25-3.50% - 445.0 Total debt2 240.3 445.0 Total net debt2 194.6 415.9 Shareholders’ equity 298.6 345.8 Total capitalization2 $ 538.9 $ 790.8 Debt/total capitalization 44.6% 56.3% Net debt/net total capitalization 39.5% 54.6% Net Debt/adjusted EBITDA3 2.6x 3.6x Sources & Uses Sources: Amount Uses: Amount New $75mm R/C Facility $ 0.0 Purchase Price1 $ 243.5 New Term loan B-1st lien; LIBOR + 3.25-3.50% 445.0 Refinance Existing Debt 240.3 Cash equity proceeds 47.2 Est. FinancingExpenses 17.0 Existing cash 16.6 Est. Transaction Costs 8.0 Total Sources $ 508.8 Total Uses $ 508.8 1 EUR/USD 1.0588 as of 11/18/16 2 Excludes $0.8 million of capital leases and unamortized debt issuance costs 3 Debt to Adjusted EBITDA is a non-GAAP financial measure. Please see supplemental slides for a reconciliation of GAAP net income to adjusted EBITDA Financing

16 © 2017 Columbus McKinnon Corporation Recent Acquisition (Acquired September 2, 2015)

17 © 2017 Columbus McKinnon Corporation CMCO + Magnetek Leader in Intelligent Lifting Acquired America’s largest supplier of digital power and motion control systems for industrial cranes and hoists Strengthened value proposition � Industry leading power electronics technology with industry leading hoisting and rigging technology • “Smart hoists” with diagnostics — a drive on every hoist � Improves operational and energy efficiency, production through-put and safety • Products incorporate monitoring features to minimize downtime � Larger addressable market • Global opportunities for Magnetek products • Bringing smart power solutions to vertical markets Leading global hoist manufacturer

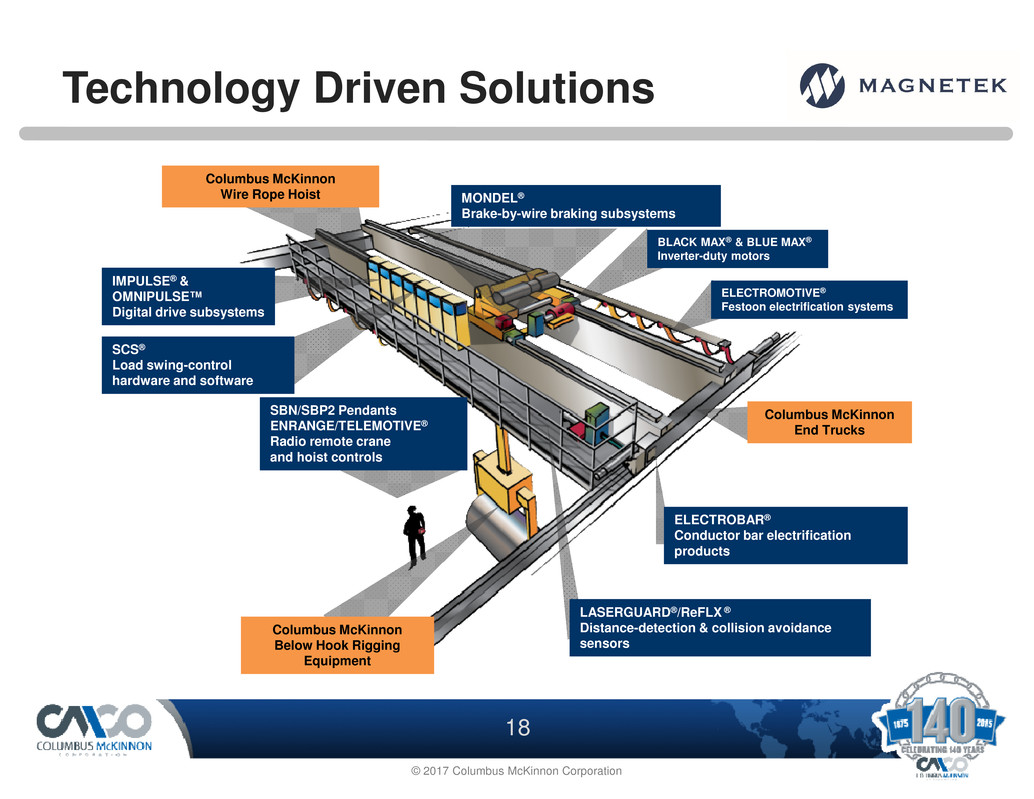

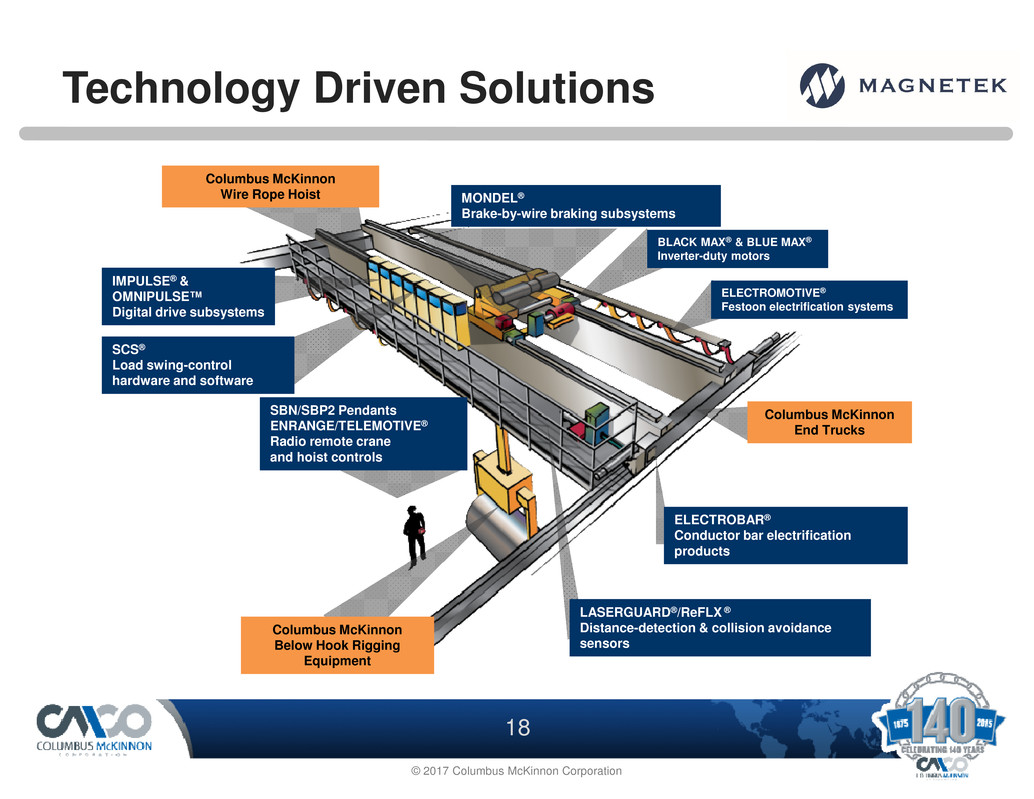

18 © 2017 Columbus McKinnon Corporation Technology Driven Solutions BLACK MAX® & BLUE MAX® Inverter-duty motors ELECTROMOTIVE® Festoon electrification systems LASERGUARD®/ReFLX ® Distance-detection & collision avoidance sensors ELECTROBAR® Conductor bar electrification products SBN/SBP2 Pendants ENRANGE/TELEMOTIVE® Radio remote crane and hoist controls IMPULSE® & OMNIPULSE™ Digital drive subsystems SCS® Load swing-control hardware and software MONDEL® Brake-by-wire braking subsystems Columbus McKinnon Wire Rope Hoist Columbus McKinnon Below Hook Rigging Equipment Columbus McKinnon End Trucks

19 © 2017 Columbus McKinnon Corporation Strategic Initiatives

20 © 2017 Columbus McKinnon Corporation Geographic Expansion APAC Latin America EMEA From strength in China From strength in Mexico and Brazil From strength in Europe and S. Africa Leverage Existing Footprint

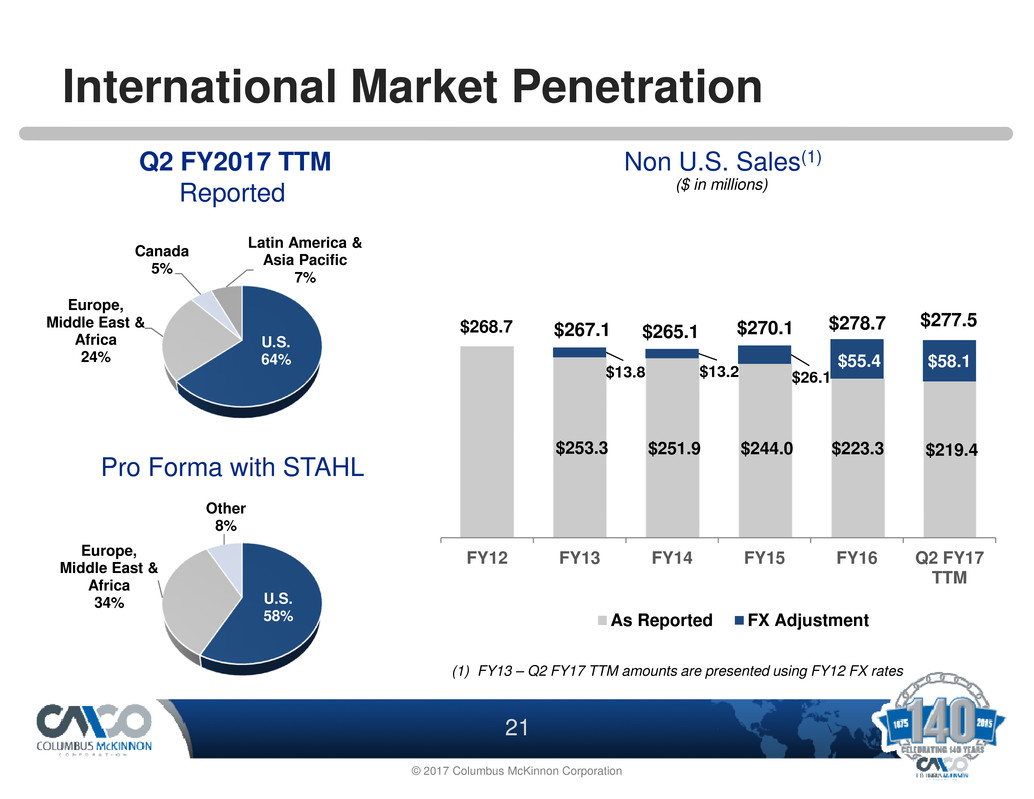

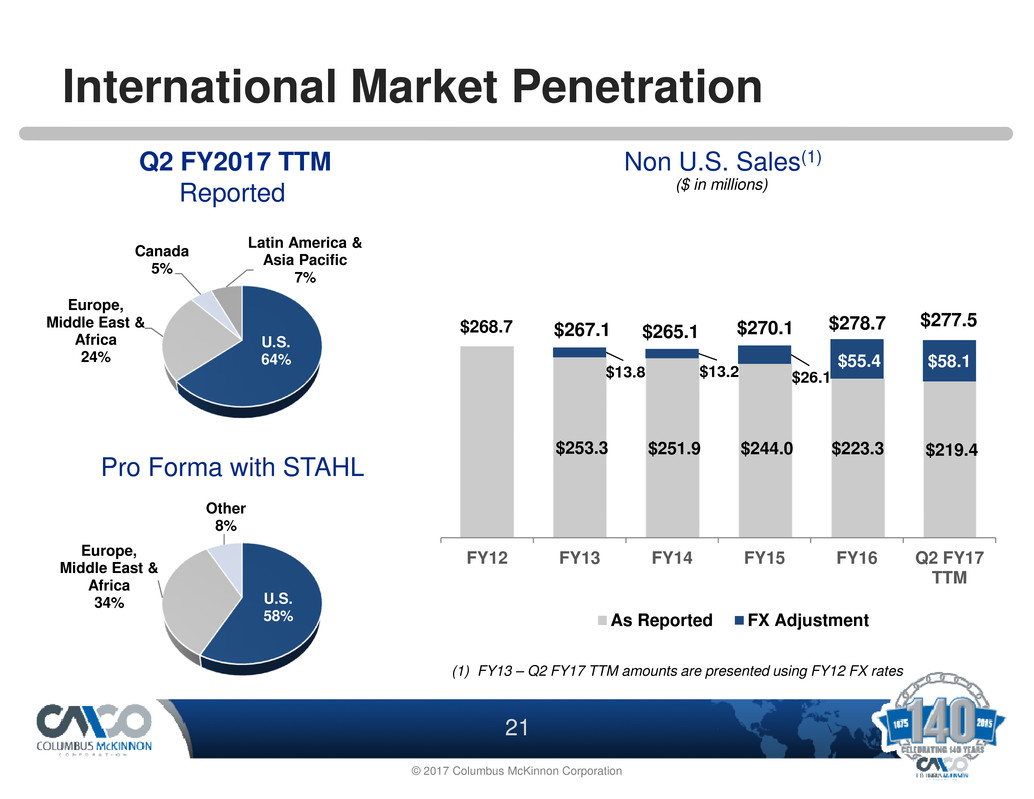

21 © 2017 Columbus McKinnon Corporation ($ in millions) Non U.S. Sales(1)Q2 FY2017 TTM Reported International Market Penetration $268.7 $253.3 $251.9 $244.0 $223.3 $219.4 $13.8 $13.2 $26.1 $55.4 $58.1 FY12 FY13 FY14 FY15 FY16 Q2 FY17 TTM As Reported FX Adjustment U.S. 64% Europe, Middle East & Africa 24% Canada 5% Latin America & Asia Pacific 7% (1) FY13 – Q2 FY17 TTM amounts are presented using FY12 FX rates $267.1 $265.1 $270.1 $278.7 $277.5 U.S. 58% Europe, Middle East & Africa 34% Other 8% Pro Forma with STAHL

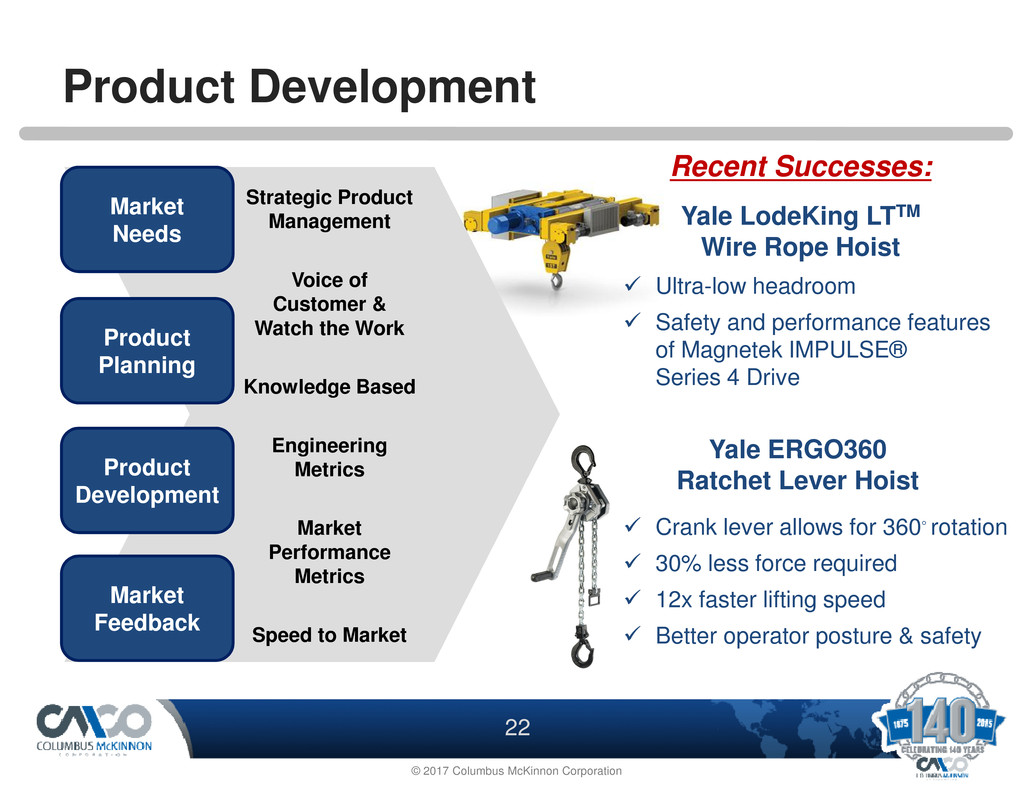

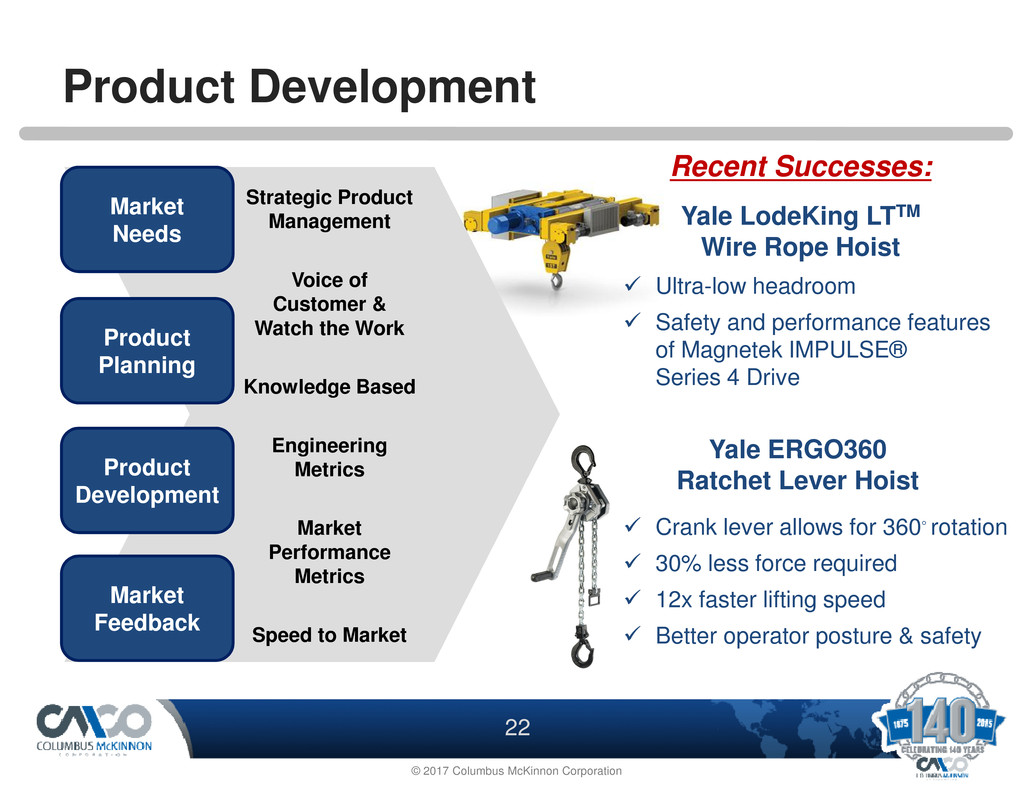

22 © 2017 Columbus McKinnon Corporation Product Development Market Needs Market Feedback Product Planning Product Development Recent Successes: Yale LodeKing LTTM Wire Rope Hoist Strategic Product Management Voice of Customer & Watch the Work Knowledge Based Engineering Metrics Market Performance Metrics Speed to Market Yale ERGO360 Ratchet Lever Hoist � Crank lever allows for 360◦ rotation � 30% less force required � 12x faster lifting speed � Better operator posture & safety � Ultra-low headroom � Safety and performance features of Magnetek IMPULSE® Series 4 Drive

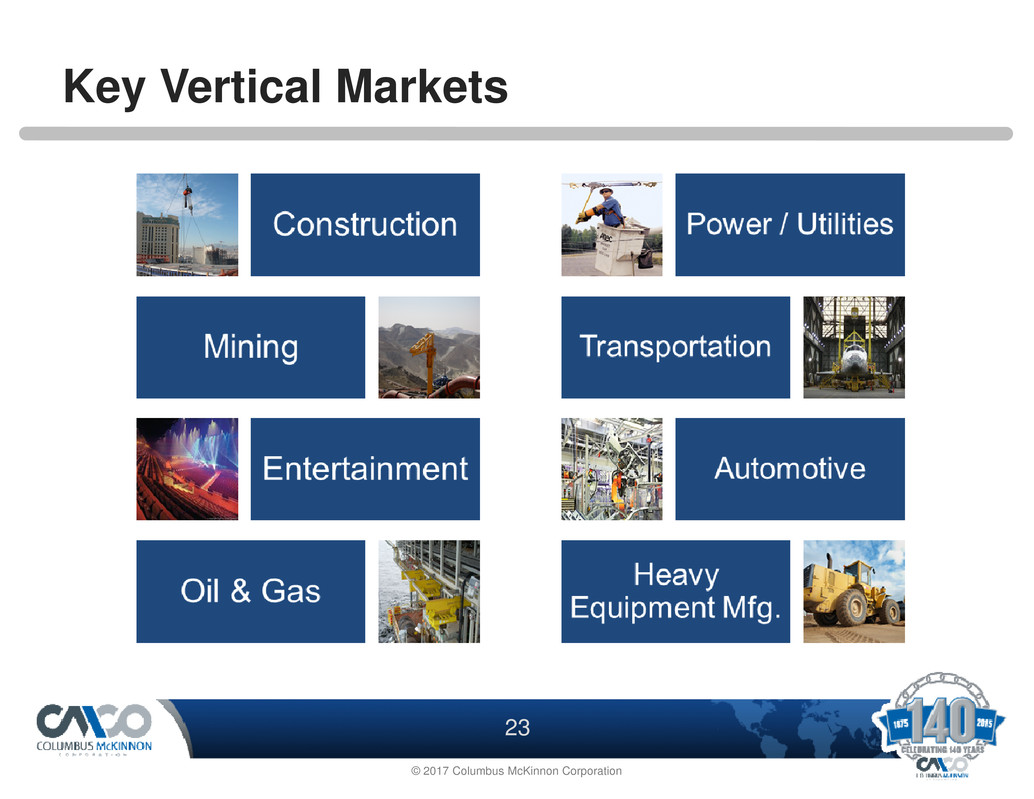

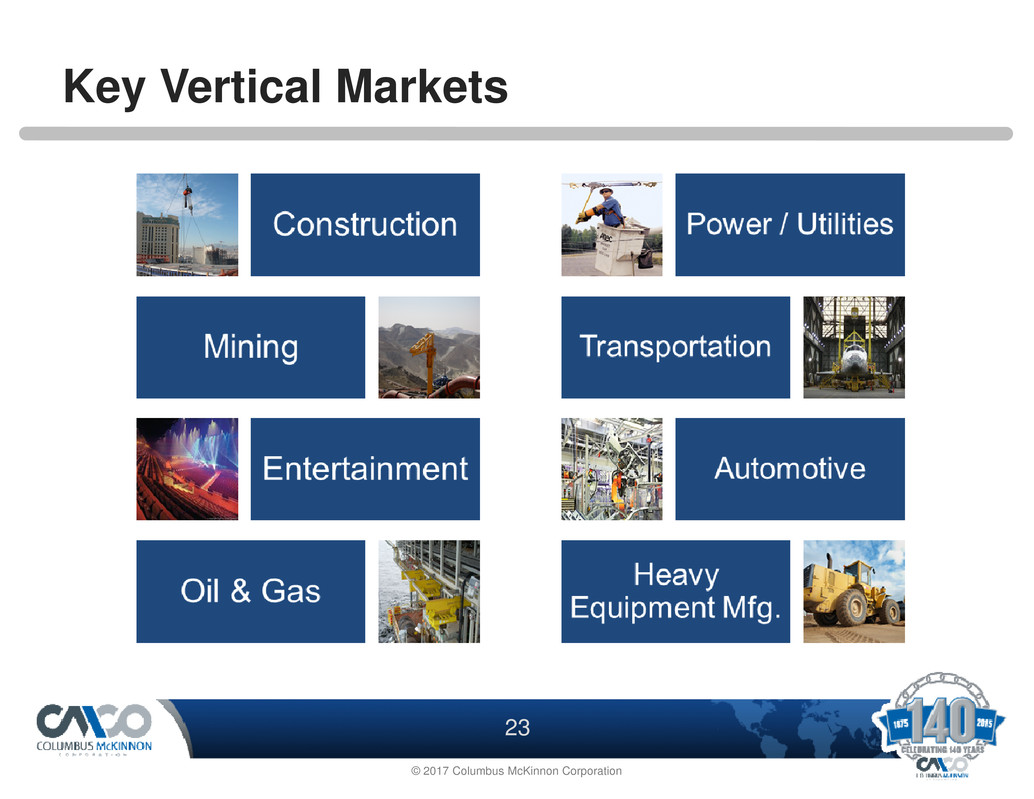

23 © 2017 Columbus McKinnon Corporation Key Vertical Markets

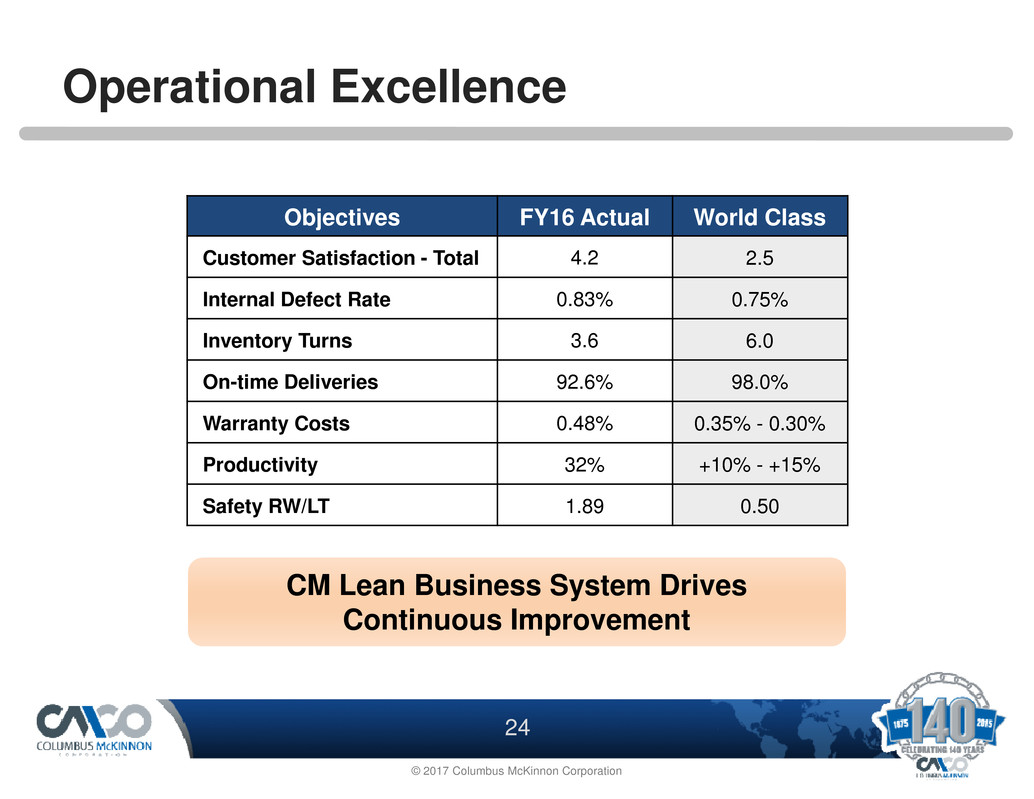

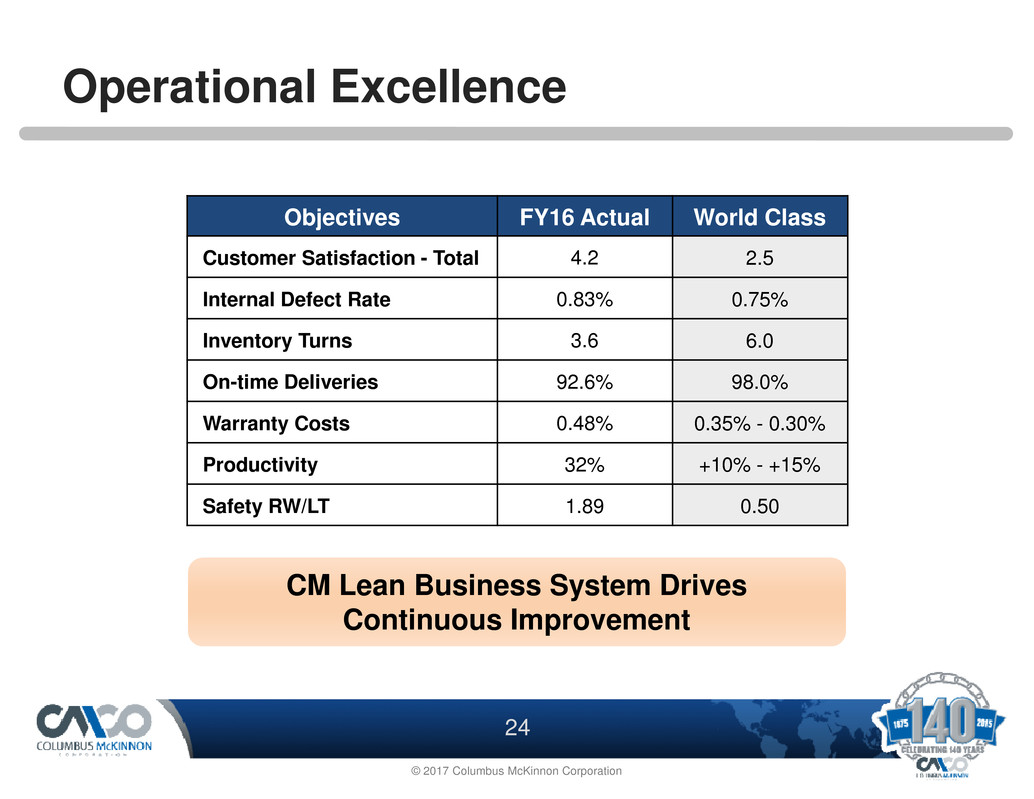

24 © 2017 Columbus McKinnon Corporation Objectives FY16 Actual World Class Customer Satisfaction - Total 4.2 2.5 Internal Defect Rate 0.83% 0.75% Inventory Turns 3.6 6.0 On-time Deliveries 92.6% 98.0% Warranty Costs 0.48% 0.35% - 0.30% Productivity 32% +10% - +15% Safety RW/LT 1.89 0.50 CM Lean Business System Drives Continuous Improvement Operational Excellence

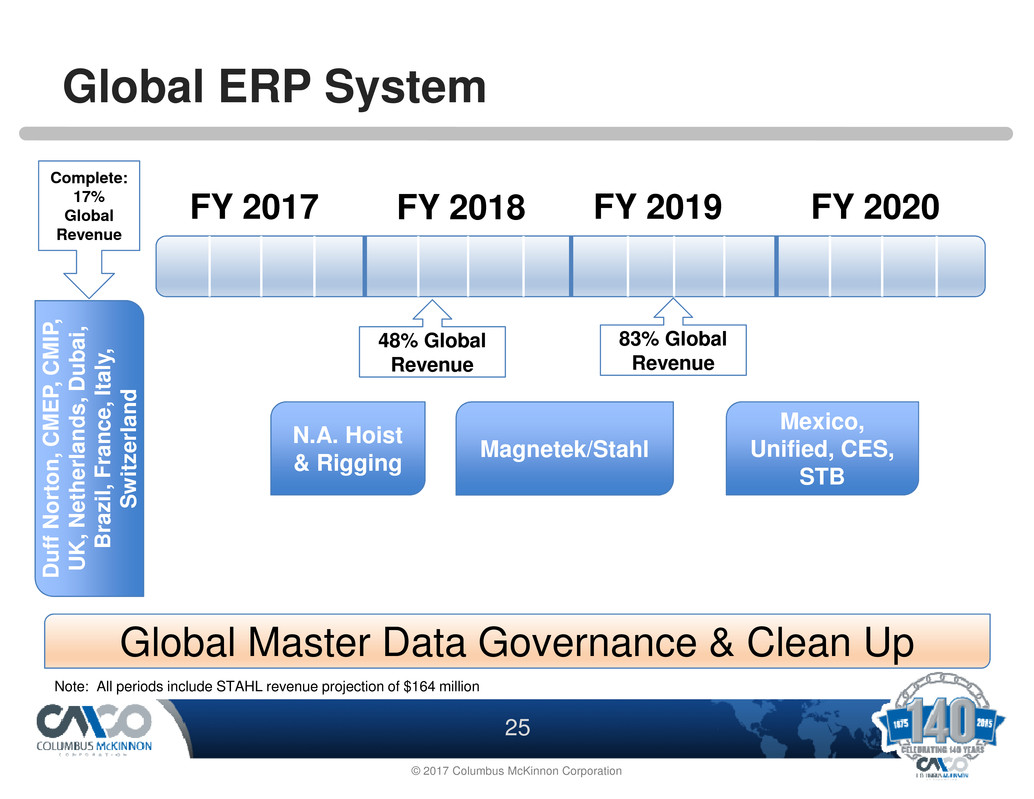

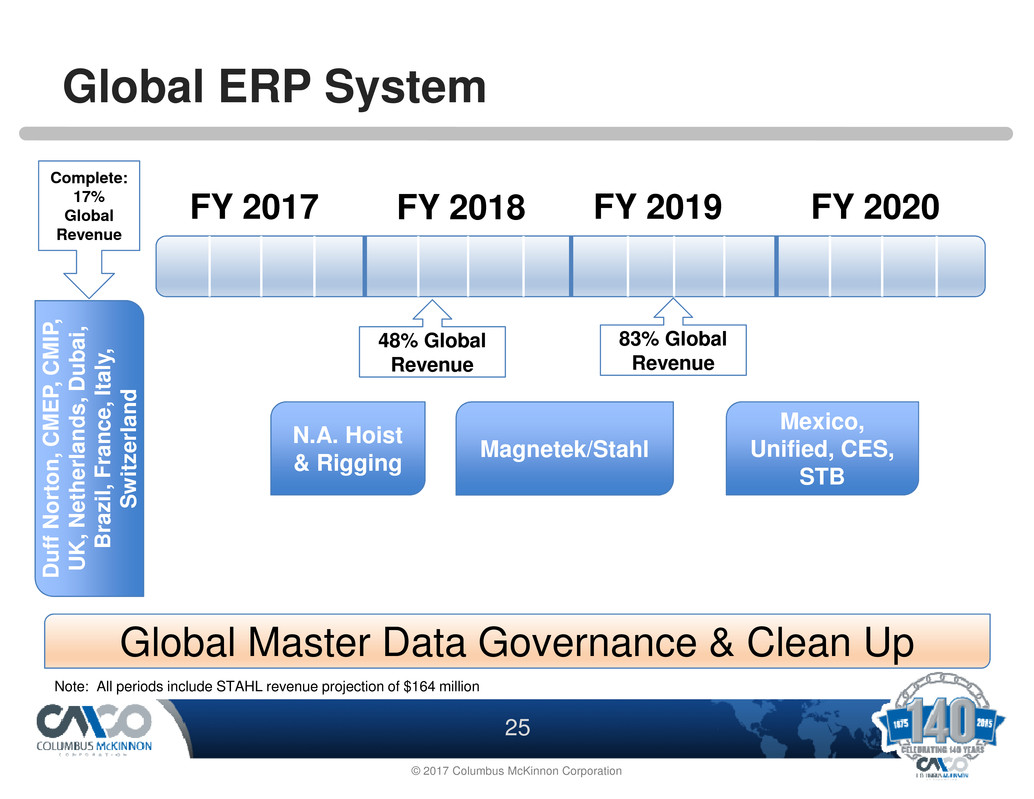

25 © 2017 Columbus McKinnon Corporation D u f f N o r t o n , C M E P , C M I P , U K , N e t h e r l a n d s , D u b a i , B r a z i l , F r a n c e , I t a l y , S w i t z e r l a n d N.A. Hoist & Rigging Global Master Data Governance & Clean Up FY 2017 FY 2018 FY 2019 48% Global Revenue Complete: 17% Global Revenue Magnetek/Stahl 83% Global Revenue Global ERP System Mexico, Unified, CES, STB FY 2020 Note: All periods include STAHL revenue projection of $164 million

26 © 2017 Columbus McKinnon Corporation Business Overview

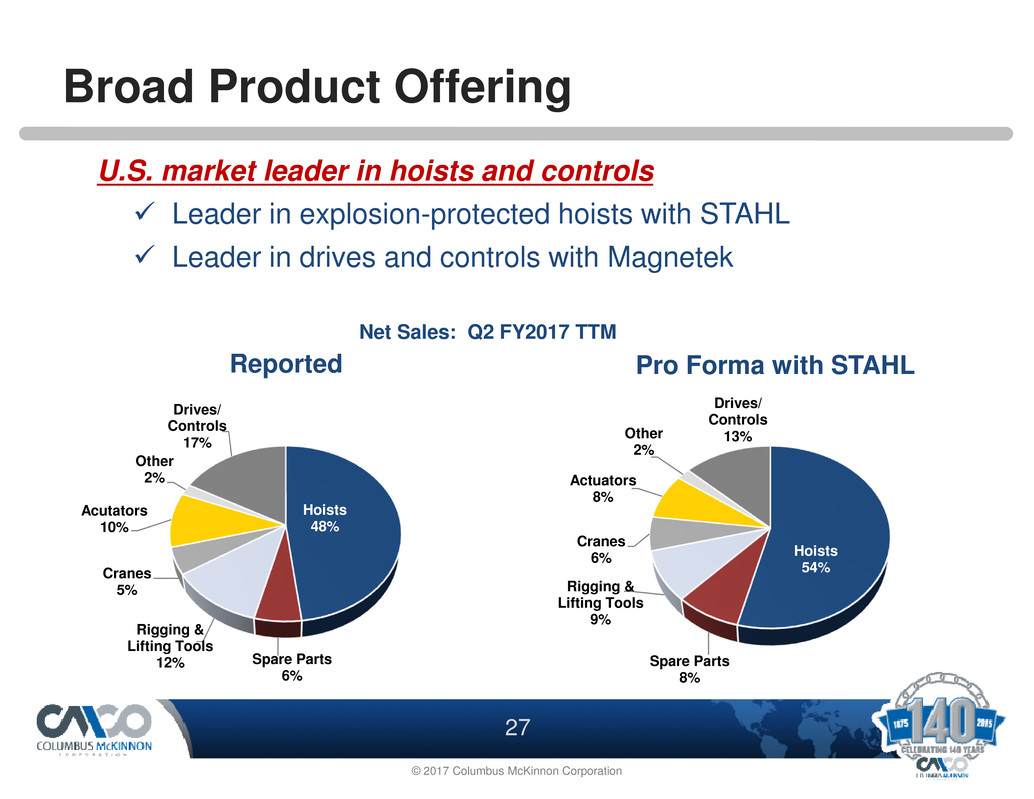

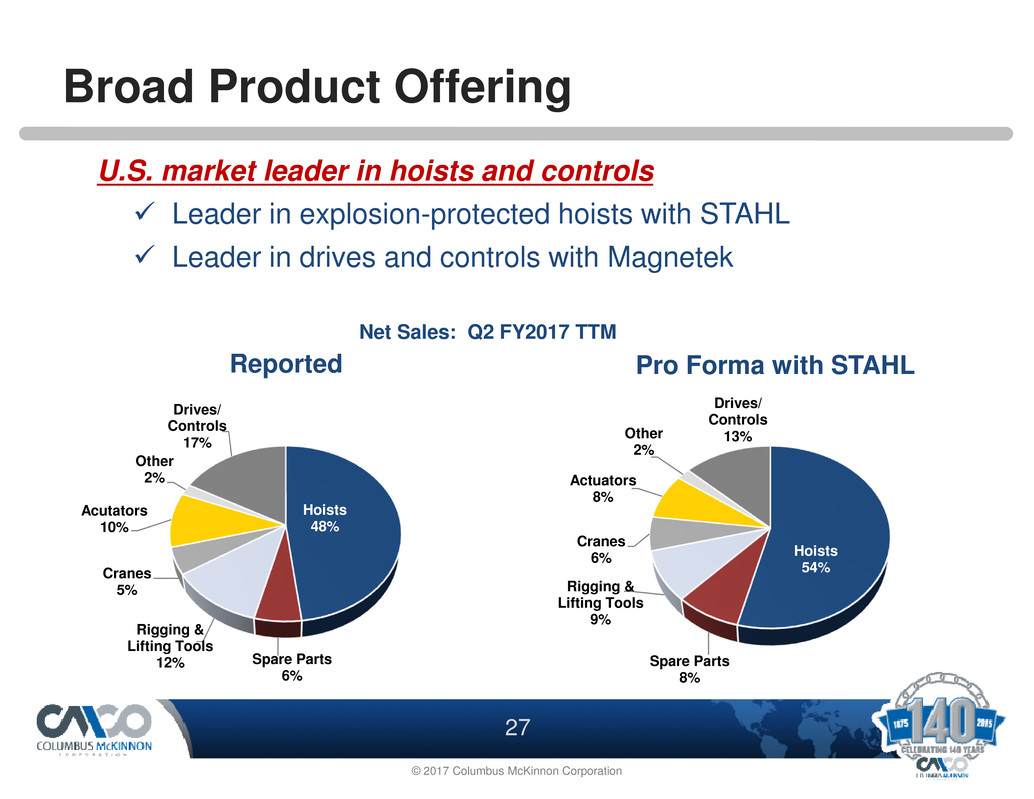

27 © 2017 Columbus McKinnon Corporation Net Sales: Q2 FY2017 TTM U.S. market leader in hoists and controls � Leader in explosion-protected hoists with STAHL � Leader in drives and controls with Magnetek Broad Product Offering Hoists 48% Spare Parts 6% Rigging & Lifting Tools 12% Cranes 5% Acutators 10% Other 2% Drives/ Controls 17% Hoists 54% Spare Parts 8% Rigging & Lifting Tools 9% Cranes 6% Actuators 8% Other 2% Drives/ Controls 13% Reported Pro Forma with STAHL

28 © 2017 Columbus McKinnon Corporation From Lifting Products to Solutions Powered Chain Hoists Powered Wire Rope Hoists ATEX Explosion Protected Hoists

29 © 2017 Columbus McKinnon Corporation Q2 FY2017 TTM Net Sales: $ 615.8 million Extensive Distribution Channels 15,000 + distributors & end-user customers Extensive Market Channels US General Line Distributors 36% International General Line Distributors 29% Specialty Distributors 13% Pfaff International Direct 6% Crane End Users 3% OEM/Government 13% Market Channels � Launched digital platform CompassTM in Q2 FY2017 � Online end-user platform, available 24/7 � Crane builders design system to specific needs • Rapid quote • Drawings and specs • Direct order � Eliminates hours of engineering for channel partners and end users

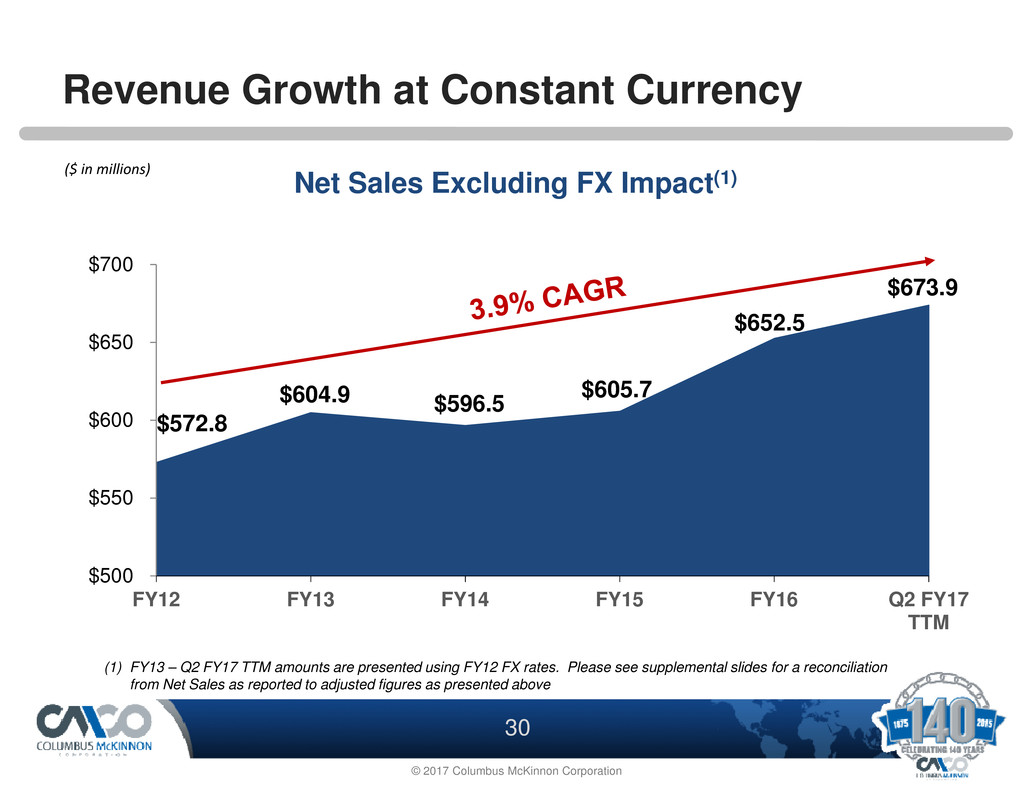

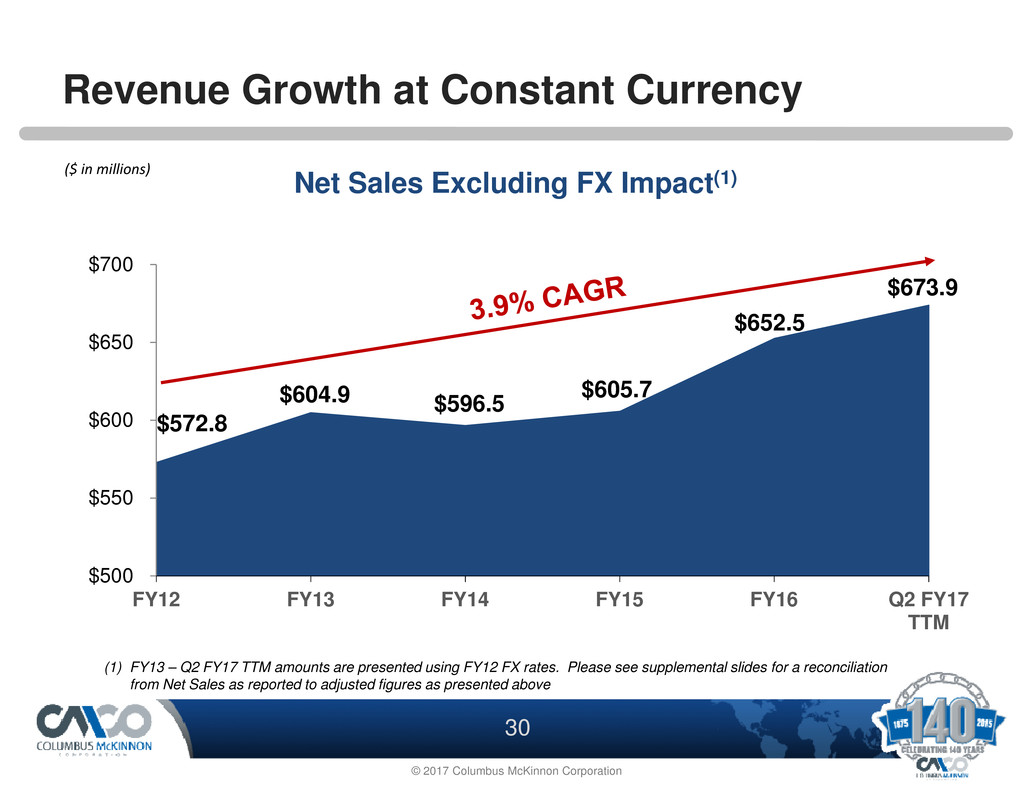

30 © 2017 Columbus McKinnon Corporation $572.8 $604.9 $596.5 $605.7 $652.5 $673.9 $500 $550 $600 $650 $700 FY12 FY13 FY14 FY15 FY16 Q2 FY17 TTM Revenue Growth at Constant Currency ($ in millions) Net Sales Excluding FX Impact(1) (1) FY13 – Q2 FY17 TTM amounts are presented using FY12 FX rates. Please see supplemental slides for a reconciliation from Net Sales as reported to adjusted figures as presented above

31 © 2017 Columbus McKinnon Corporation Financial Overview

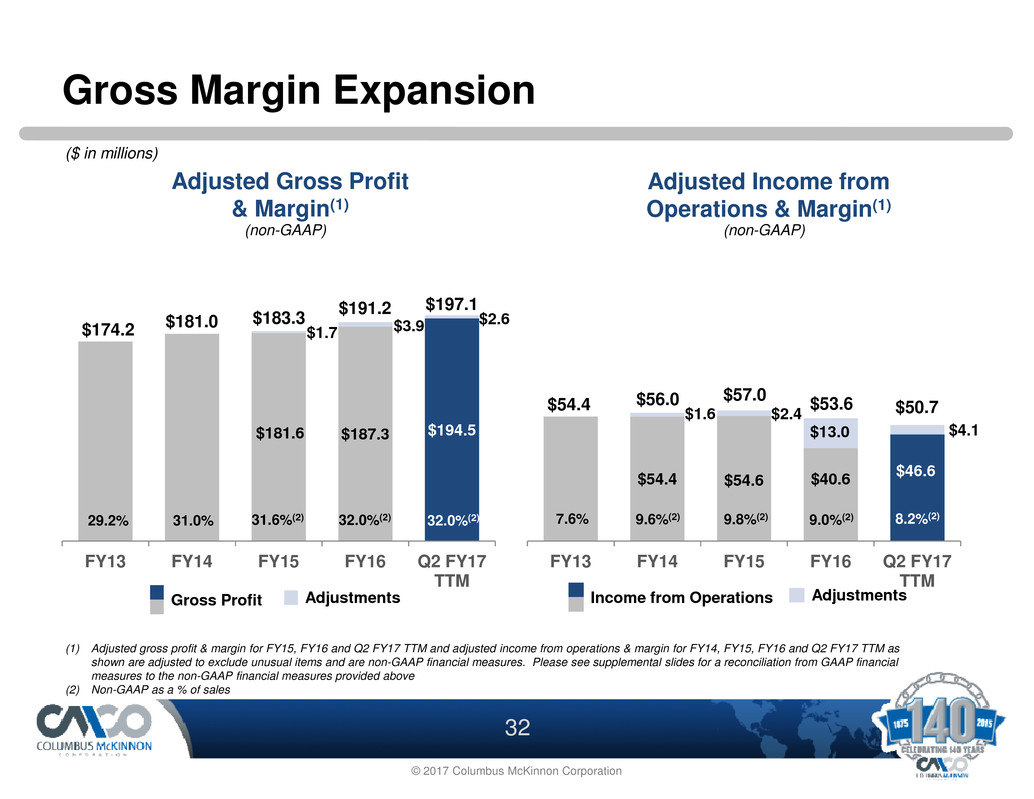

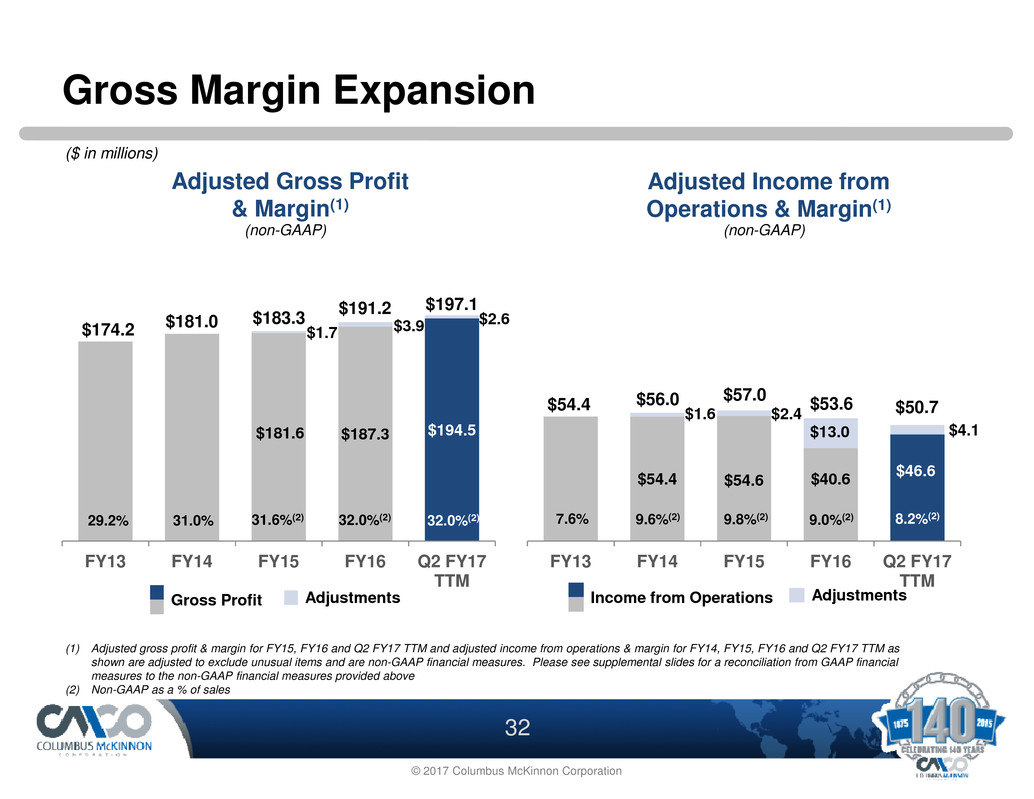

32 © 2017 Columbus McKinnon Corporation $174.2 $181.0 $181.6 $187.3 $194.5 FY13 FY14 FY15 FY16 Q2 FY17 TTM Adjusted Gross Profit & Margin(1) Gross Margin Expansion Adjusted Income from Operations & Margin(1) $54.4 $54.4 $54.6 $40.6 $46.6 FY13 FY14 FY15 FY16 Q2 FY17 TTM (1) Adjusted gross profit & margin for FY15, FY16 and Q2 FY17 TTM and adjusted income from operations & margin for FY14, FY15, FY16 and Q2 FY17 TTM as shown are adjusted to exclude unusual items and are non-GAAP financial measures. Please see supplemental slides for a reconciliation from GAAP financial measures to the non-GAAP financial measures provided above (2) Non-GAAP as a % of sales 32.0%(2)29.2% 31.0% 31.6%(2) 32.0%(2) 7.6% 9.6%(2) 9.8%(2) 9.0%(2) 8.2%(2) $1.7 $3.9 $197.1$191.2 $4.1 $2.4 $13.0 $57.0 $53.6 $50.7 AdjustmentsGross Profit Income from Operations Adjustments (non-GAAP)(non-GAAP) $183.3 $2.6 $56.0 $1.6 ($ in millions)

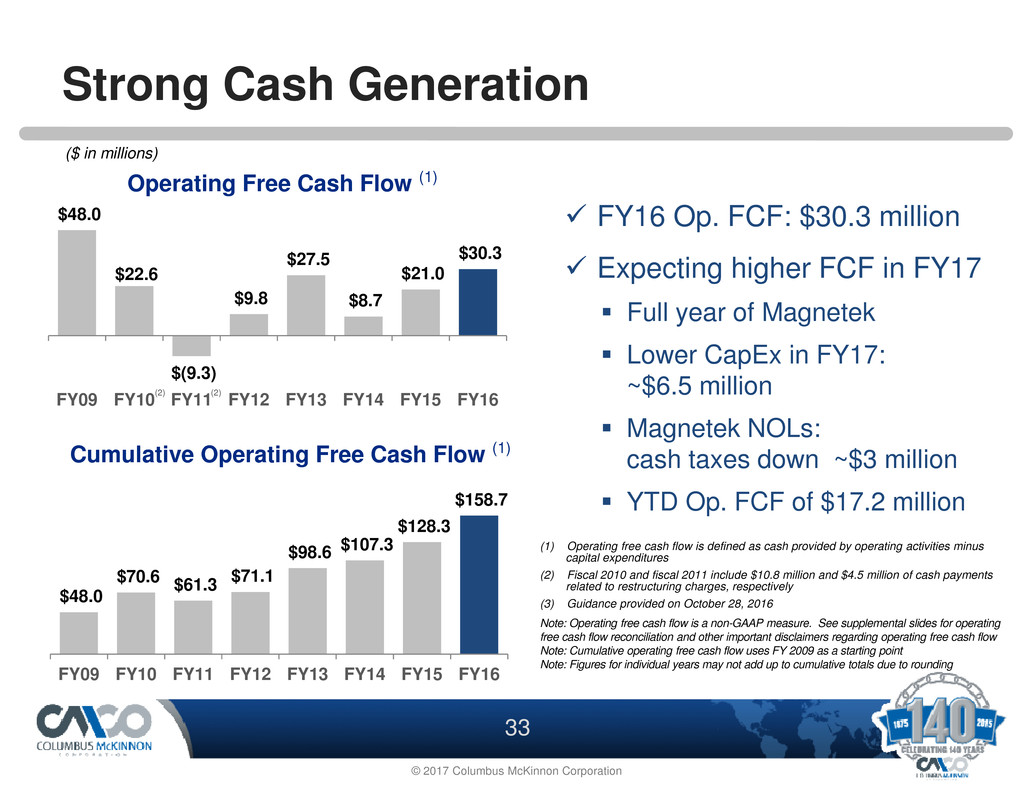

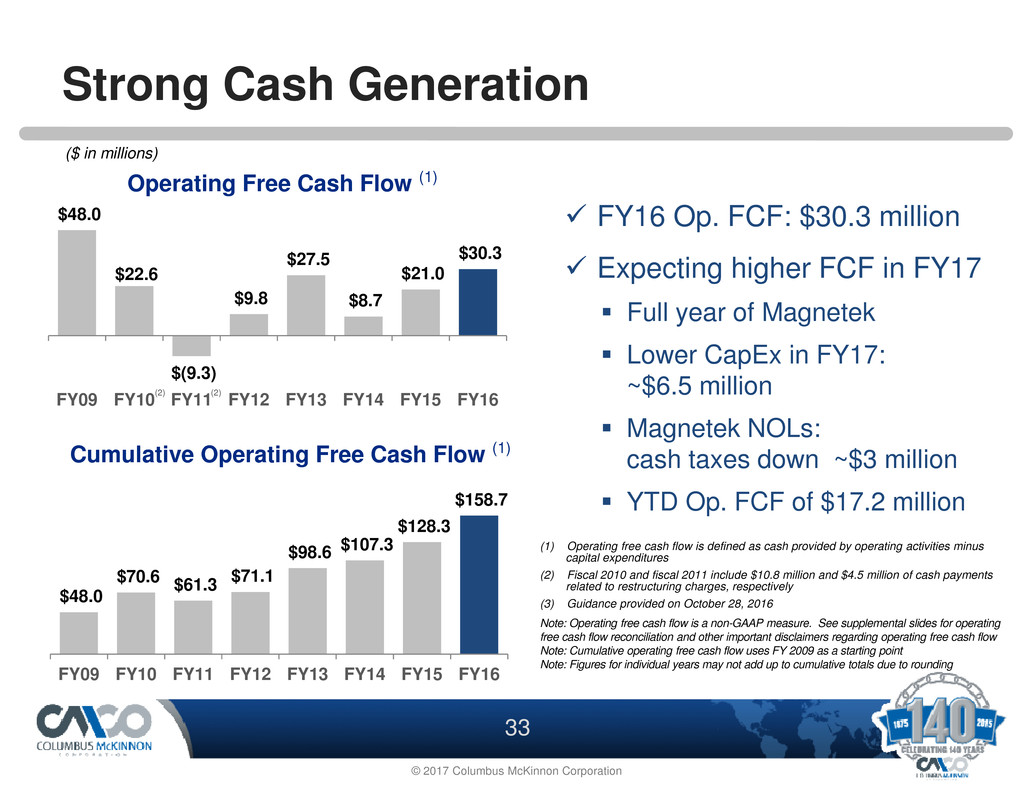

33 © 2017 Columbus McKinnon Corporation $48.0 $22.6 $(9.3) $9.8 $27.5 $8.7 $21.0 $30.3 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 (1) Operating free cash flow is defined as cash provided by operating activities minus capital expenditures (2) Fiscal 2010 and fiscal 2011 include $10.8 million and $4.5 million of cash payments related to restructuring charges, respectively (3) Guidance provided on October 28, 2016 Note: Operating free cash flow is a non-GAAP measure. See supplemental slides for operating free cash flow reconciliation and other important disclaimers regarding operating free cash flow Note: Cumulative operating free cash flow uses FY 2009 as a starting point Note: Figures for individual years may not add up to cumulative totals due to rounding ($ in millions) Operating Free Cash Flow (1) (2)(2) Strong Cash Generation Cumulative Operating Free Cash Flow (1) $48.0 $70.6 $61.3 $71.1 $98.6 $107.3 $128.3 $158.7 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 � FY16 Op. FCF: $30.3 million � Expecting higher FCF in FY17 � Full year of Magnetek � Lower CapEx in FY17: ~$6.5 million � Magnetek NOLs: cash taxes down ~$3 million � YTD Op. FCF of $17.2 million

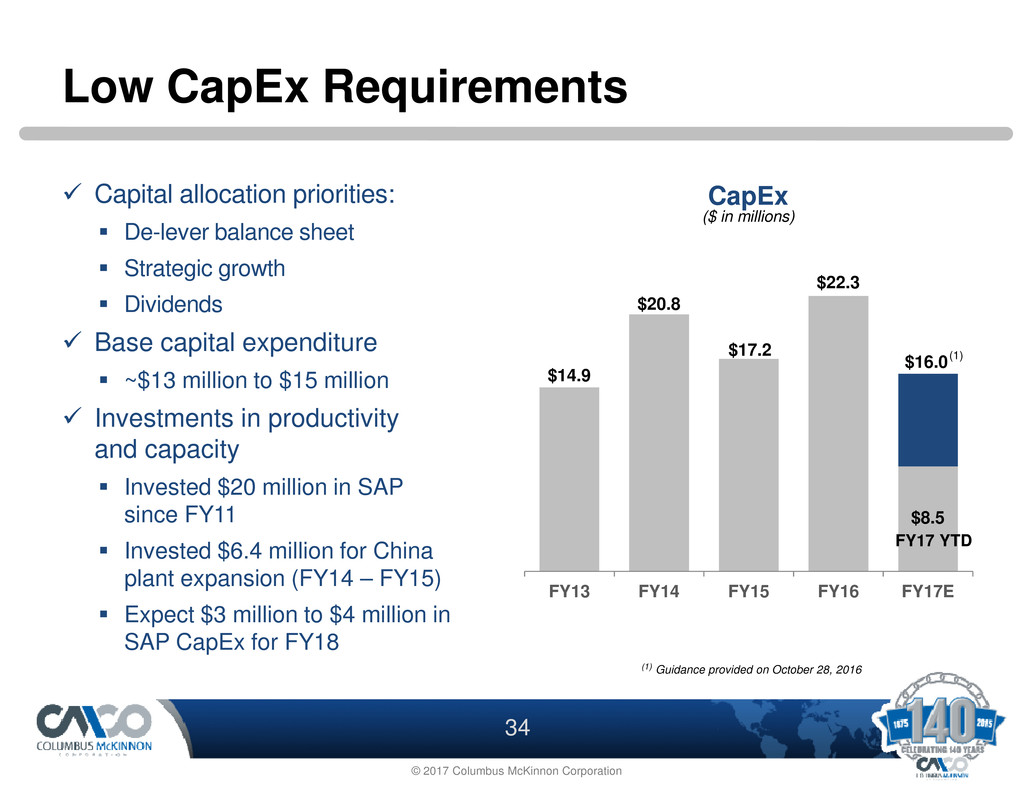

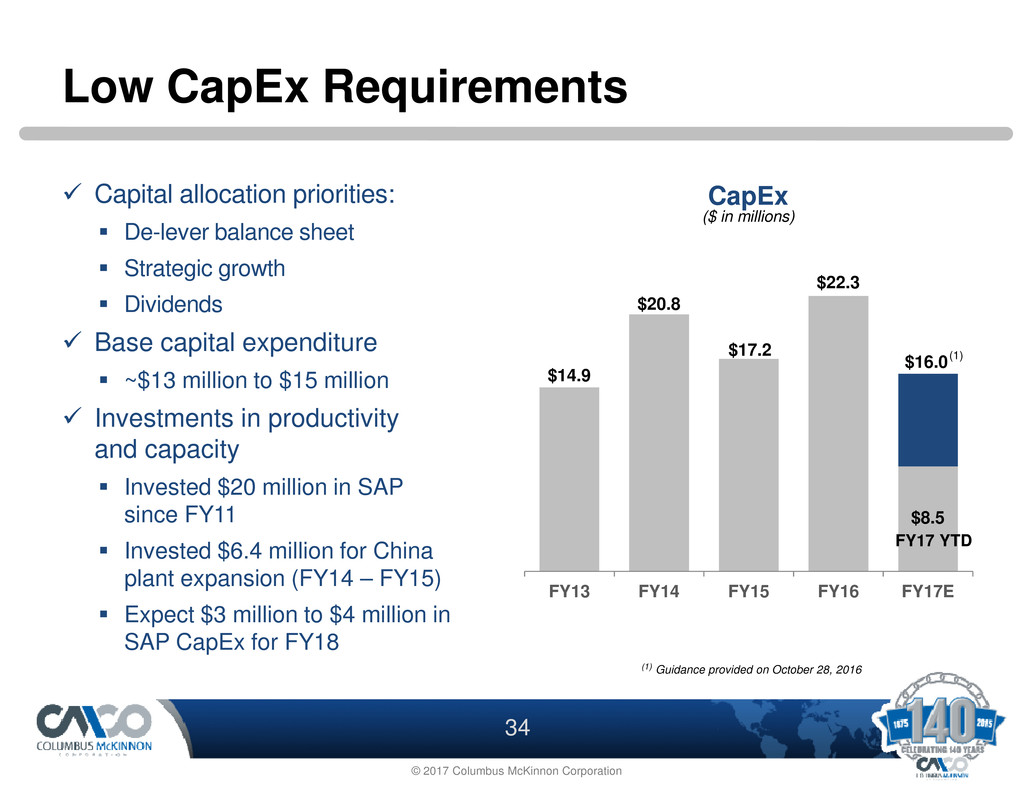

34 © 2017 Columbus McKinnon Corporation $14.9 $20.8 $17.2 $22.3 $8.5 FY13 FY14 FY15 FY16 FY17E Low CapEx Requirements � Capital allocation priorities: � De-lever balance sheet � Strategic growth � Dividends � Base capital expenditure � ~$13 million to $15 million � Investments in productivity and capacity � Invested $20 million in SAP since FY11 � Invested $6.4 million for China plant expansion (FY14 – FY15) � Expect $3 million to $4 million in SAP CapEx for FY18 (1) CapEx (1) Guidance provided on October 28, 2016 $16.0 FY17 YTD ($ in millions)

35 © 2017 Columbus McKinnon Corporation 18.3% 21.7% 20.8% 21.5% 21.2% FY13 FY14 FY15 FY16 Q2 FY17 TTM 50.5 52.9 49.2 49.2 48.1 FY13 FY14 FY15 FY16 Q2 FY17 TTM Working Capital as a Percent of Sales Days Sales Outstanding (1) Figure excludes the impact of the acquisition of Magnetek Focused on Improving Inventory Turns Days Payable Outstanding 31.1 29.2 29.4 30.8 27.7 FY13 FY14 FY15 FY16 Q2 FY17 TTM Inventory Turns 4.3x 4.5x 4.0x 3.6x 3.5x FY13 FY14 FY15 FY16 Q2 FY17 TTM (1)

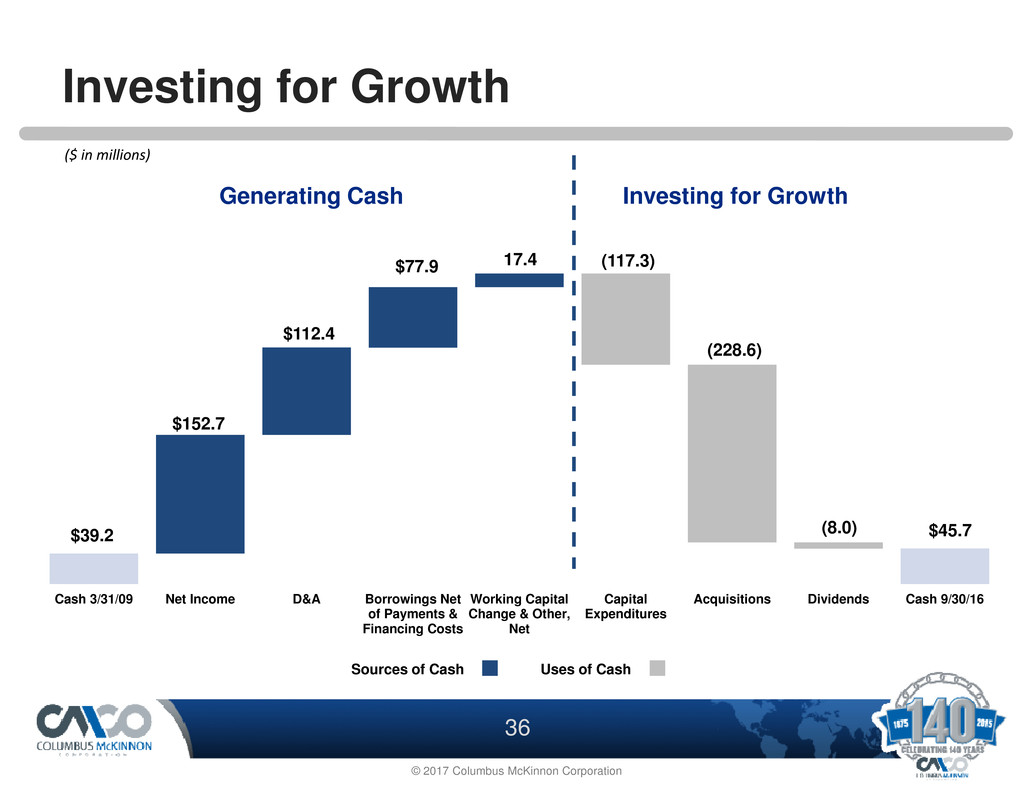

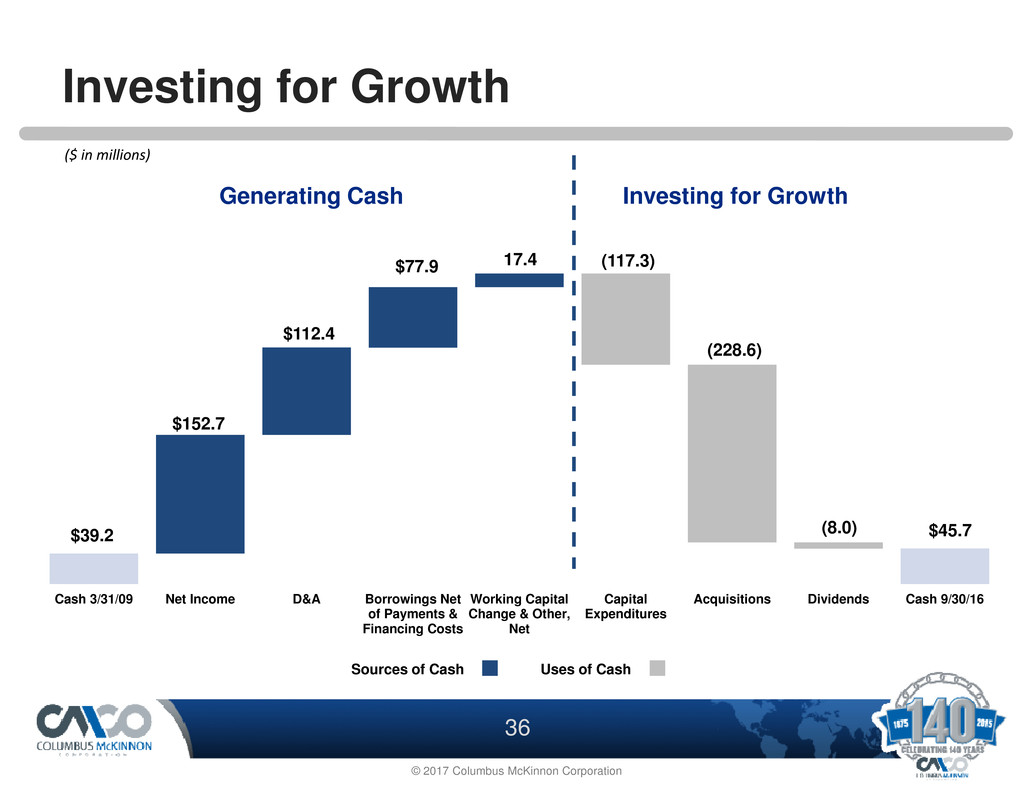

36 © 2017 Columbus McKinnon Corporation $39.2 $152.7 $112.4 $77.9 17.4 (117.3) (228.6) (8.0) $45.7 Cash 3/31/09 Net Income D&A Borrowings Net of Payments & Financing Costs Working Capital Change & Other, Net Capital Expenditures Acquisitions Dividends Cash 9/30/16 Investing for Growth ($ in millions) Sources of Cash Uses of Cash Generating Cash Investing for Growth

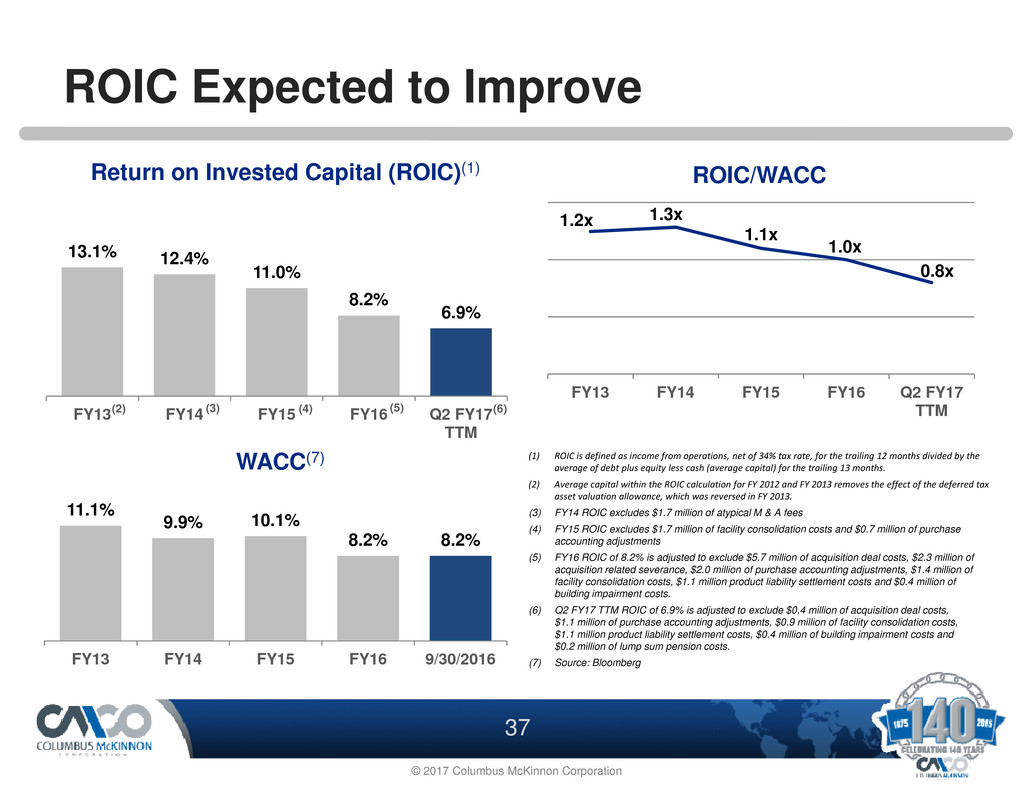

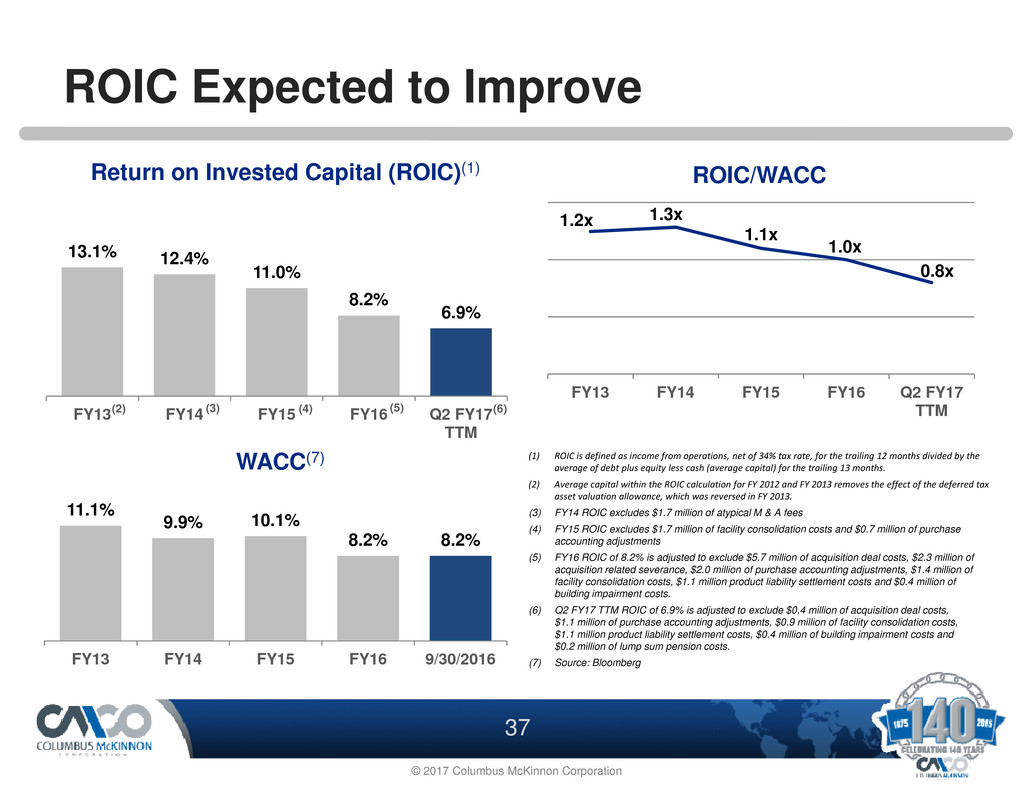

37 © 2017 Columbus McKinnon Corporation 13.1% 12.4% 11.0% 8.2% 6.9% FY13 FY14 FY15 FY16 Q2 FY17 TTM 1.2x 1.3x 1.1x 1.0x 0.8x FY13 FY14 FY15 FY16 Q2 FY17 TTM ROIC/WACC (1) ROIC is defined as income from operations, net of 34% tax rate, for the trailing 12 months divided by the average of debt plus equity less cash (average capital) for the trailing 13 months. (2) Average capital within the ROIC calculation for FY 2012 and FY 2013 removes the effect of the deferred tax asset valuation allowance, which was reversed in FY 2013. (3) FY14 ROIC excludes $1.7 million of atypical M & A fees (4) FY15 ROIC excludes $1.7 million of facility consolidation costs and $0.7 million of purchase accounting adjustments (5) FY16 ROIC of 8.2% is adjusted to exclude $5.7 million of acquisition deal costs, $2.3 million of acquisition related severance, $2.0 million of purchase accounting adjustments, $1.4 million of facility consolidation costs, $1.1 million product liability settlement costs and $0.4 million of building impairment costs. (6) Q2 FY17 TTM ROIC of 6.9% is adjusted to exclude $0.4 million of acquisition deal costs, $1.1 million of purchase accounting adjustments, $0.9 million of facility consolidation costs, $1.1 million product liability settlement costs, $0.4 million of building impairment costs and $0.2 million of lump sum pension costs. (7) Source: Bloomberg (2) Return on Invested Capital (ROIC)(1) 11.1% 9.9% 10.1% 8.2% 8.2% FY13 FY14 FY15 FY16 9/30/2016 WACC(7) ROIC Expected to Improve (5)(3) (4) (6)

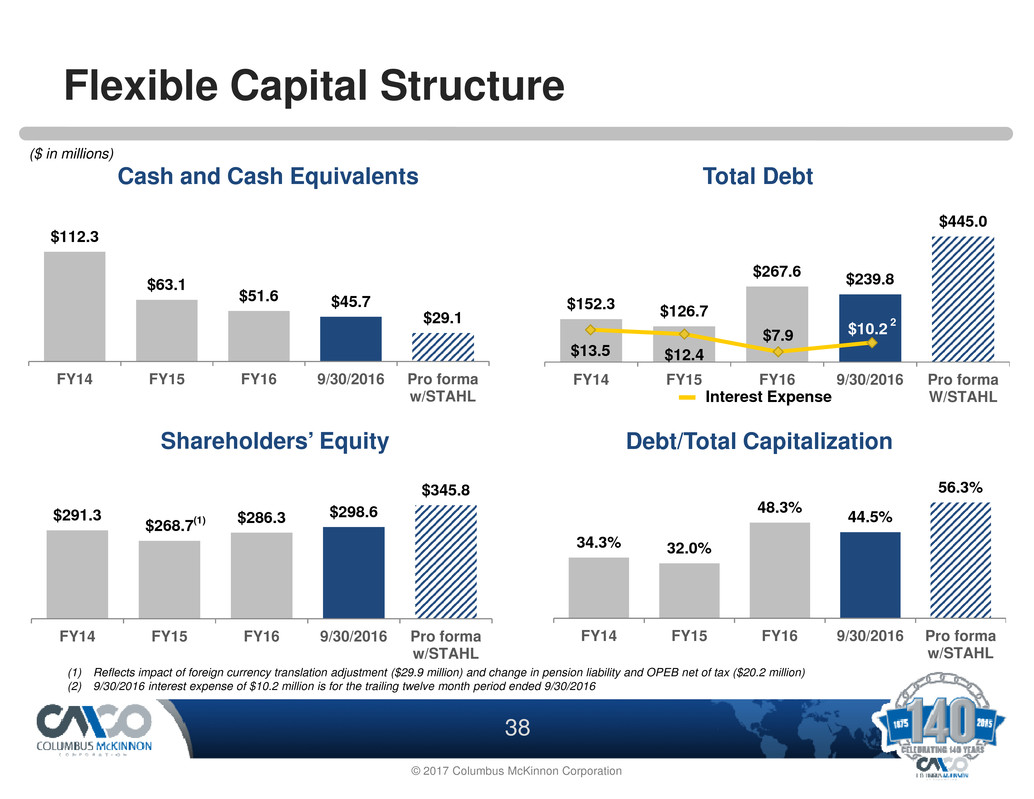

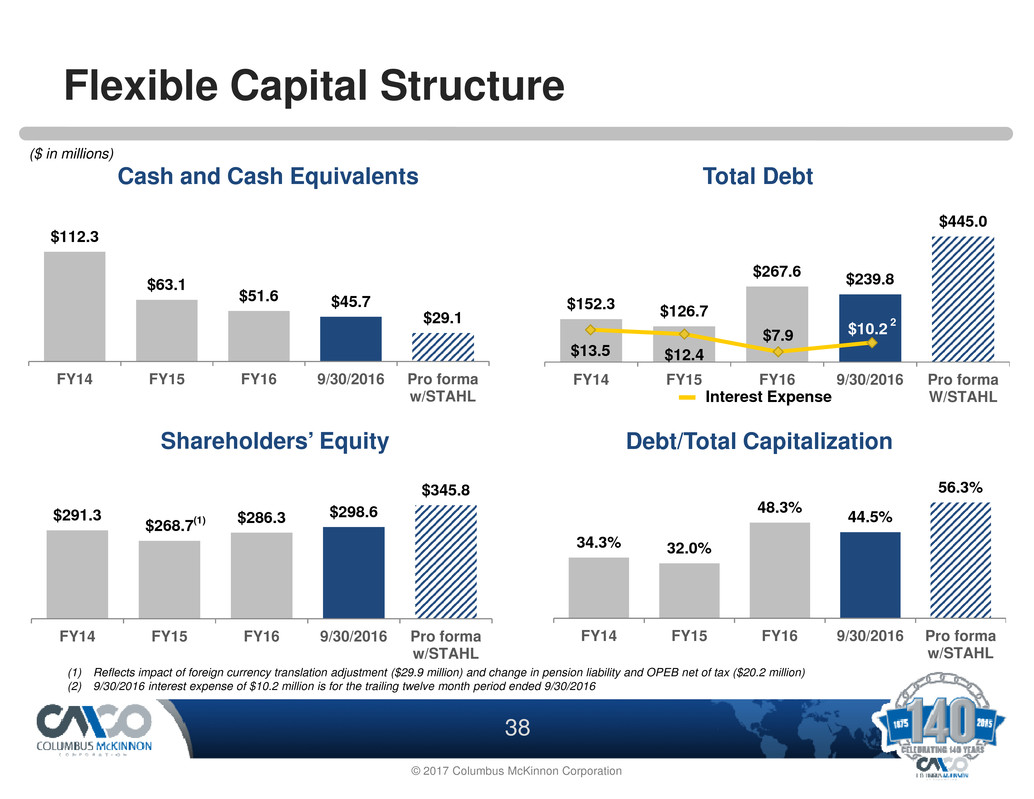

38 © 2017 Columbus McKinnon Corporation $152.3 $126.7 $267.6 $239.8 $445.0 FY14 FY15 FY16 9/30/2016 Pro forma W/STAHL $13.5 $12.4 $7.9 $10.2 Flexible Capital Structure ($ in millions) Cash and Cash Equivalents Total Debt Interest Expense $112.3 $63.1 $51.6 $45.7 $29.1 FY14 FY15 FY16 9/30/2016 Pro forma w/STAHL $291.3 $268.7 $286.3 $298.6 $345.8 FY14 FY15 FY16 9/30/2016 Pro forma w/STAHL 34.3% 32.0% 48.3% 44.5% 56.3% FY14 FY15 FY16 9/30/2016 Pro forma w/STAHL Shareholders’ Equity Debt/Total Capitalization (1) Reflects impact of foreign currency translation adjustment ($29.9 million) and change in pension liability and OPEB net of tax ($20.2 million) (2) 9/30/2016 interest expense of $10.2 million is for the trailing twelve month period ended 9/30/2016 (1) 2

39 © 2017 Columbus McKinnon Corporation Key Takeaways Leading US market share, strong brands, key vertical markets Magnetek and STAHL strengthen value proposition Broad products offering focused on safety and productivity Extensive market channels & growing global presence Improving margins & strong cash flow

40 © 2017 Columbus McKinnon Corporation Material Handling - Safely and Productively

© 2015 Columbus McKinnon Corporation. All Rights Reserved. Confidential and Proprietary.NASDAQ: CMCO Supplemental Information

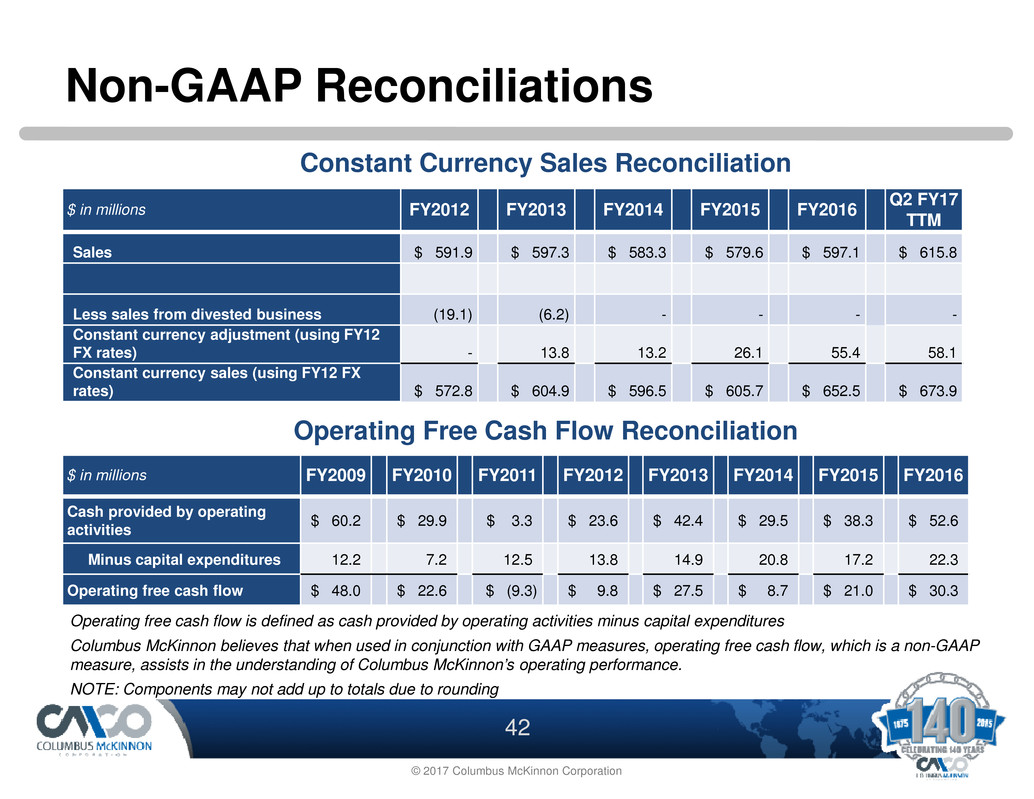

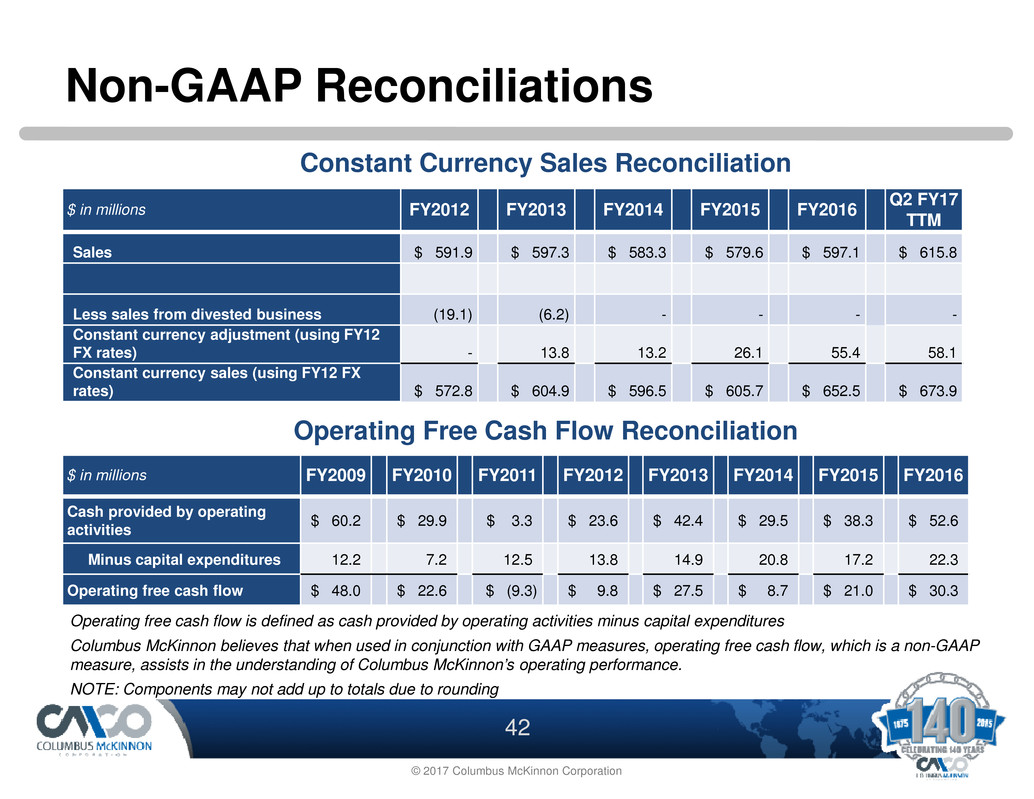

42 © 2017 Columbus McKinnon Corporation $ in millions FY2012 FY2013 FY2014 FY2015 FY2016 Q2 FY17 TTM Sales $ 591.9 $ 597.3 $ 583.3 $ 579.6 $ 597.1 $ 615.8 Less sales from divested business (19.1) (6.2) - - - - Constant currency adjustment (using FY12 FX rates) - 13.8 13.2 26.1 55.4 58.1 Constant currency sales (using FY12 FX rates) $ 572.8 $ 604.9 $ 596.5 $ 605.7 $ 652.5 $ 673.9 Non-GAAP Reconciliations $ in millions FY2009 FY2010 FY2011 FY2012 FY2013 FY2014 FY2015 FY2016 Cash provided by operating activities $ 60.2 $ 29.9 $ 3.3 $ 23.6 $ 42.4 $ 29.5 $ 38.3 $ 52.6 Minus capital expenditures 12.2 7.2 12.5 13.8 14.9 20.8 17.2 22.3 Operating free cash flow $ 48.0 $ 22.6 $ (9.3) $ 9.8 $ 27.5 $ 8.7 $ 21.0 $ 30.3 Constant Currency Sales Reconciliation Operating Free Cash Flow Reconciliation Operating free cash flow is defined as cash provided by operating activities minus capital expenditures Columbus McKinnon believes that when used in conjunction with GAAP measures, operating free cash flow, which is a non-GAAP measure, assists in the understanding of Columbus McKinnon’s operating performance. NOTE: Components may not add up to totals due to rounding

43 © 2017 Columbus McKinnon Corporation $ in thousands FY2013 FY2014 FY2015 FY2016 Q2 FY17 TTM Gross Profit $ 174,231 $ 181,048 $ 181,607 $ 187,263 $ 194,510 Add back: European facility consolidation costs and reduction-in-force - - 1,176 346 - Acquisition inventory step-up expense - - 543 1,446 521 Acquisition amortization of backlog - - - 581 581 Product liability costs for legal settlement - - - 1,100 1,100 Building held for sale impairment charge - - - 429 429 Non-GAAP adjusted gross profit $ 174,231 $ 181,048 $ 183,326 $ 191,165 $ 197,141 Sales $ 597,263 $ 583,290 $ 579,643 $ 597,103 $ 615,764 Add back: Acquisition amortization of backlog - - - 581 581 Non-GAAP sales $ 597,263 $ 583,290 $ 579,643 $ 597,684 $ 616,345 Adjusted gross margin 29.2% 31.0% 31.6% 32.0% 32.0% Adjusted gross profit is defined as gross profit as reported, adjusted for unusual items. Adjusted gross profit is not a measure determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable to the measure as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information such as adjusted gross profit is important for investors and other readers of the Company’s financial statements, and assists in understanding the comparison of the current quarter’s gross profit to the historical period’s gross profit. Adjusted Gross Margin Reconciliation

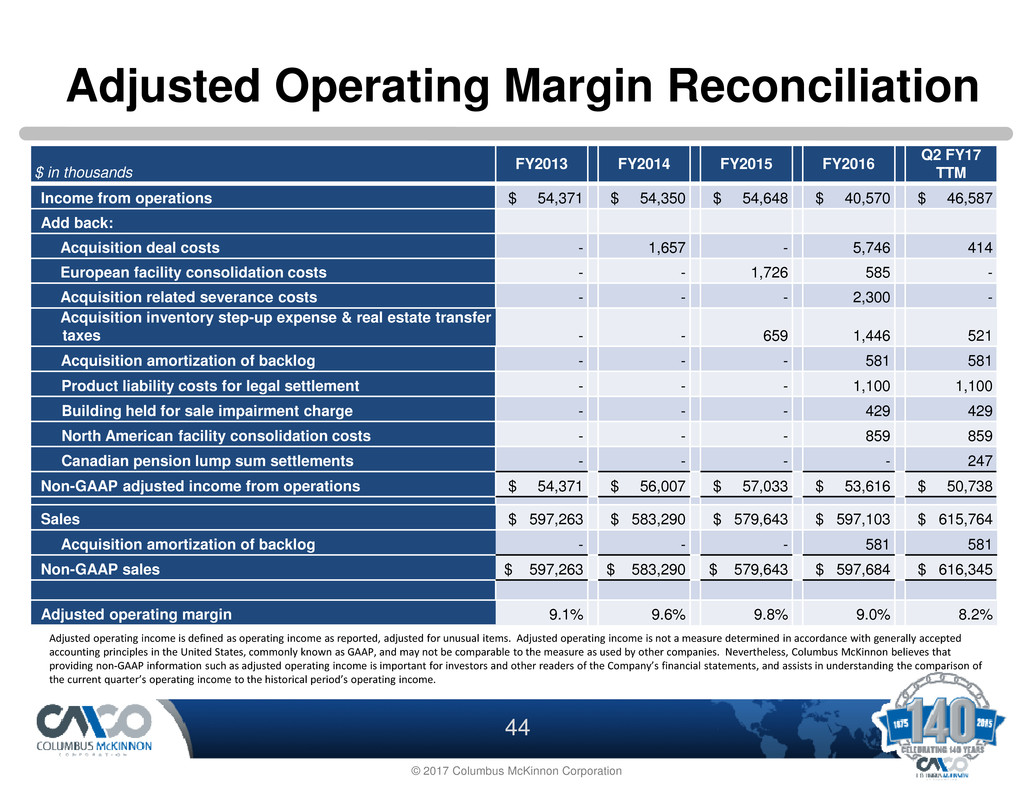

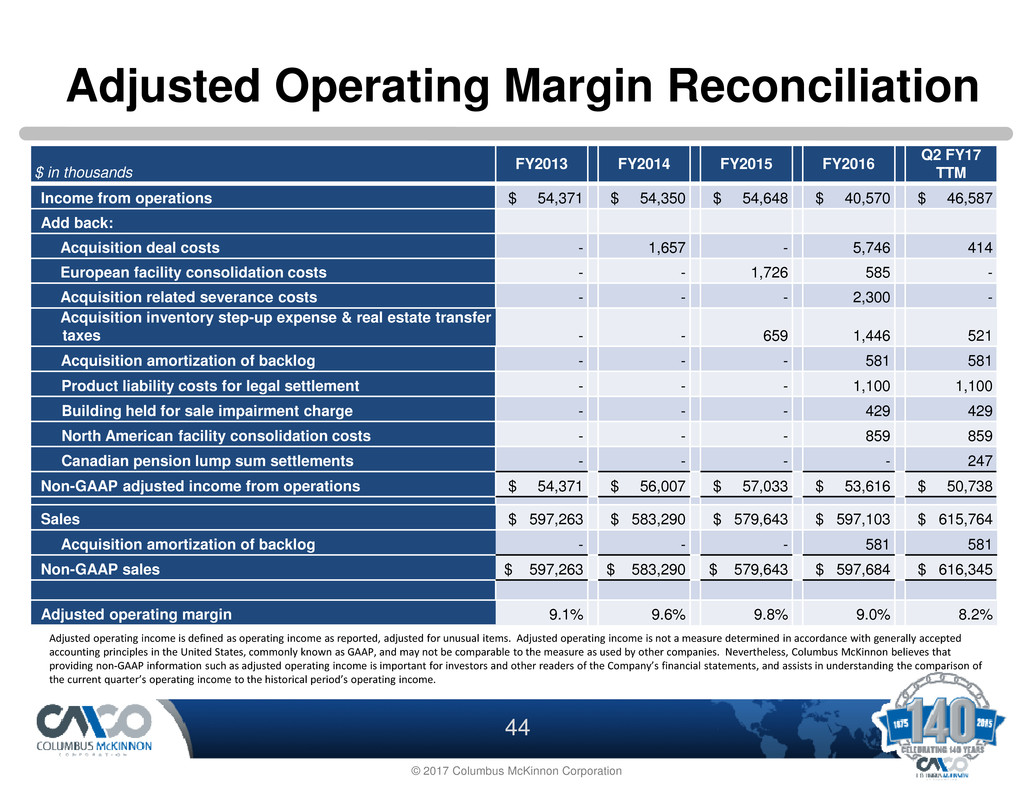

44 © 2017 Columbus McKinnon Corporation $ in thousands FY2013 FY2014 FY2015 FY2016 Q2 FY17 TTM Income from operations $ 54,371 $ 54,350 $ 54,648 $ 40,570 $ 46,587 Add back: Acquisition deal costs - 1,657 - 5,746 414 European facility consolidation costs - - 1,726 585 - Acquisition related severance costs - - - 2,300 - Acquisition inventory step-up expense & real estate transfer taxes - - 659 1,446 521 Acquisition amortization of backlog - - - 581 581 Product liability costs for legal settlement - - - 1,100 1,100 Building held for sale impairment charge - - - 429 429 North American facility consolidation costs - - - 859 859 Canadian pension lump sum settlements - - - - 247 Non-GAAP adjusted income from operations $ 54,371 $ 56,007 $ 57,033 $ 53,616 $ 50,738 Sales $ 597,263 $ 583,290 $ 579,643 $ 597,103 $ 615,764 Acquisition amortization of backlog - - - 581 581 Non-GAAP sales $ 597,263 $ 583,290 $ 579,643 $ 597,684 $ 616,345 Adjusted operating margin 9.1% 9.6% 9.8% 9.0% 8.2% Adjusted operating income is defined as operating income as reported, adjusted for unusual items. Adjusted operating income is not a measure determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable to the measure as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information such as adjusted operating income is important for investors and other readers of the Company’s financial statements, and assists in understanding the comparison of the current quarter’s operating income to the historical period’s operating income. Adjusted Operating Margin Reconciliation

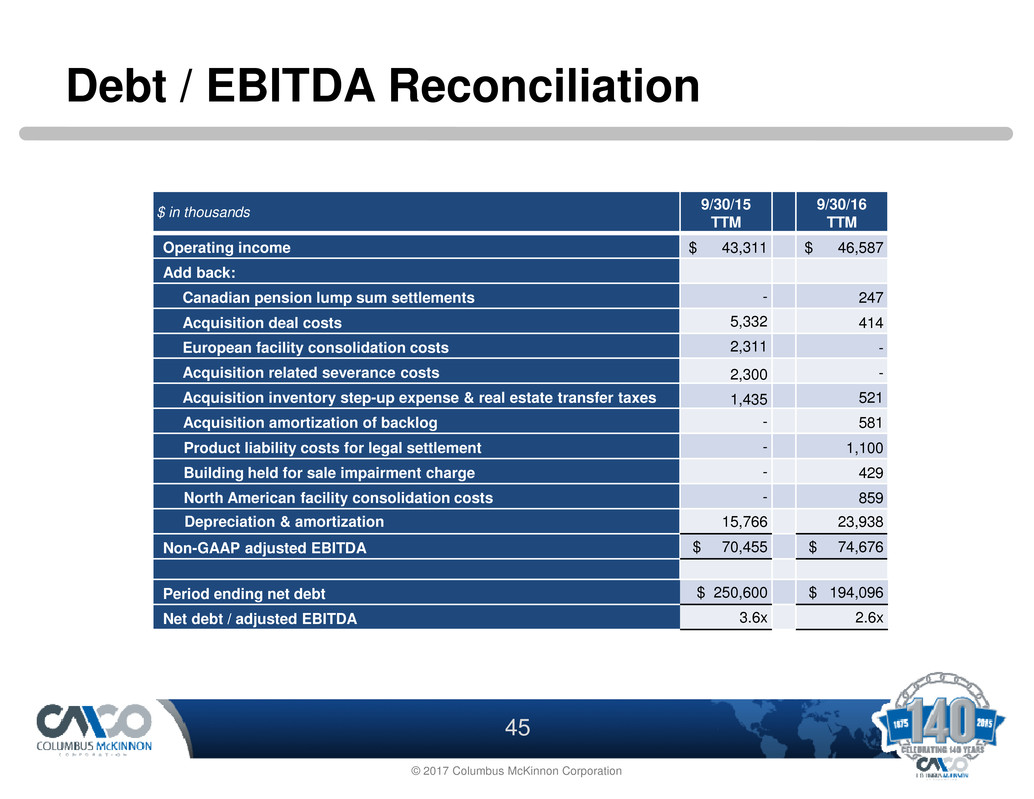

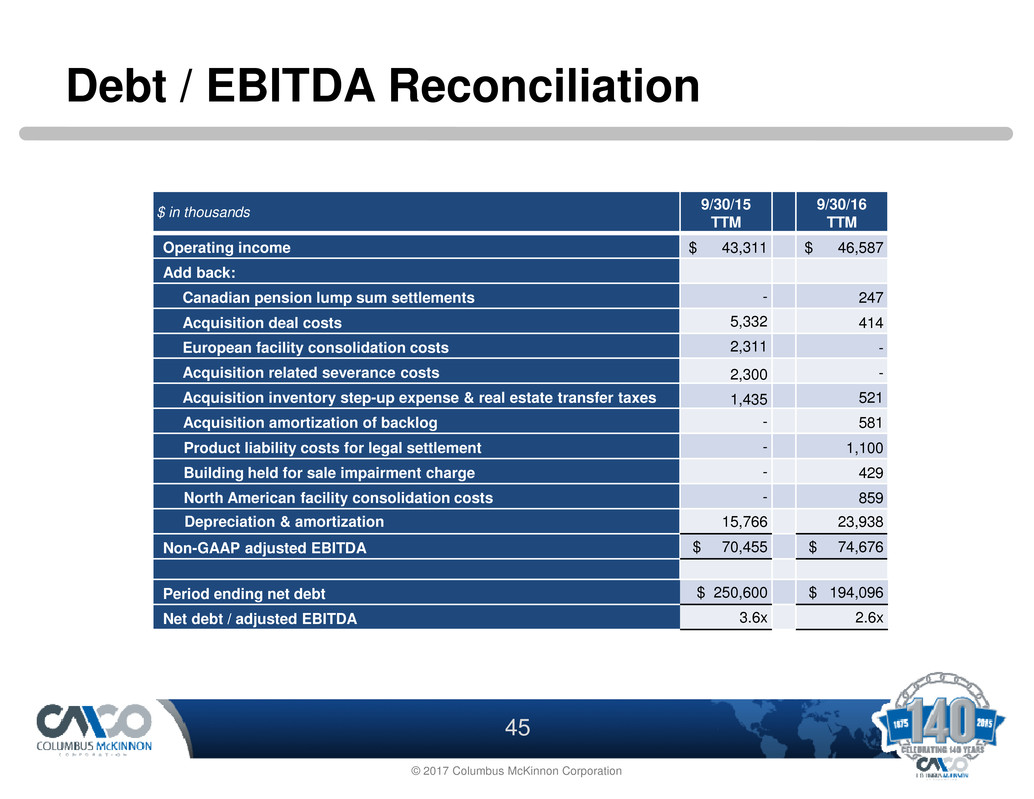

45 © 2017 Columbus McKinnon Corporation $ in thousands 9/30/15 TTM 9/30/16 TTM Operating income $ 43,311 $ 46,587 Add back: Canadian pension lump sum settlements - 247 Acquisition deal costs 5,332 414 European facility consolidation costs 2,311 - Acquisition related severance costs 2,300 - Acquisition inventory step-up expense & real estate transfer taxes 1,435 521 Acquisition amortization of backlog - 581 Product liability costs for legal settlement - 1,100 Building held for sale impairment charge - 429 North American facility consolidation costs - 859 Depreciation & amortization 15,766 23,938 Non-GAAP adjusted EBITDA $ 70,455 $ 74,676 Period ending net debt $ 250,600 $ 194,096 Net debt / adjusted EBITDA 3.6x 2.6x Debt / EBITDA Reconciliation

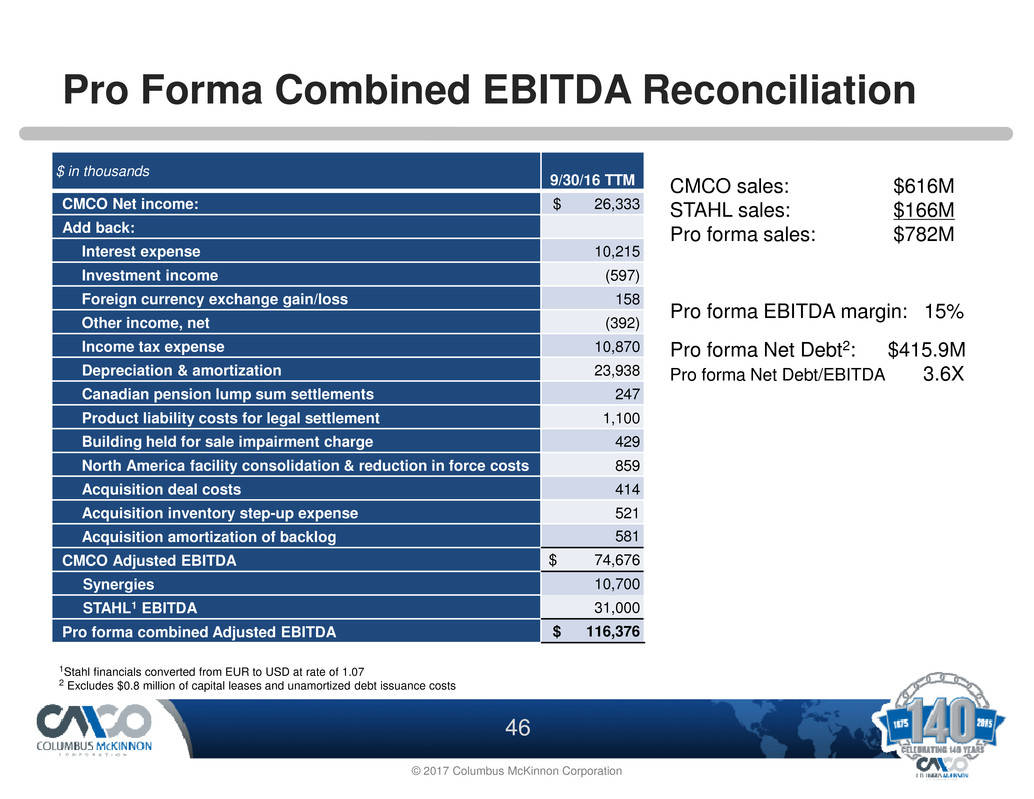

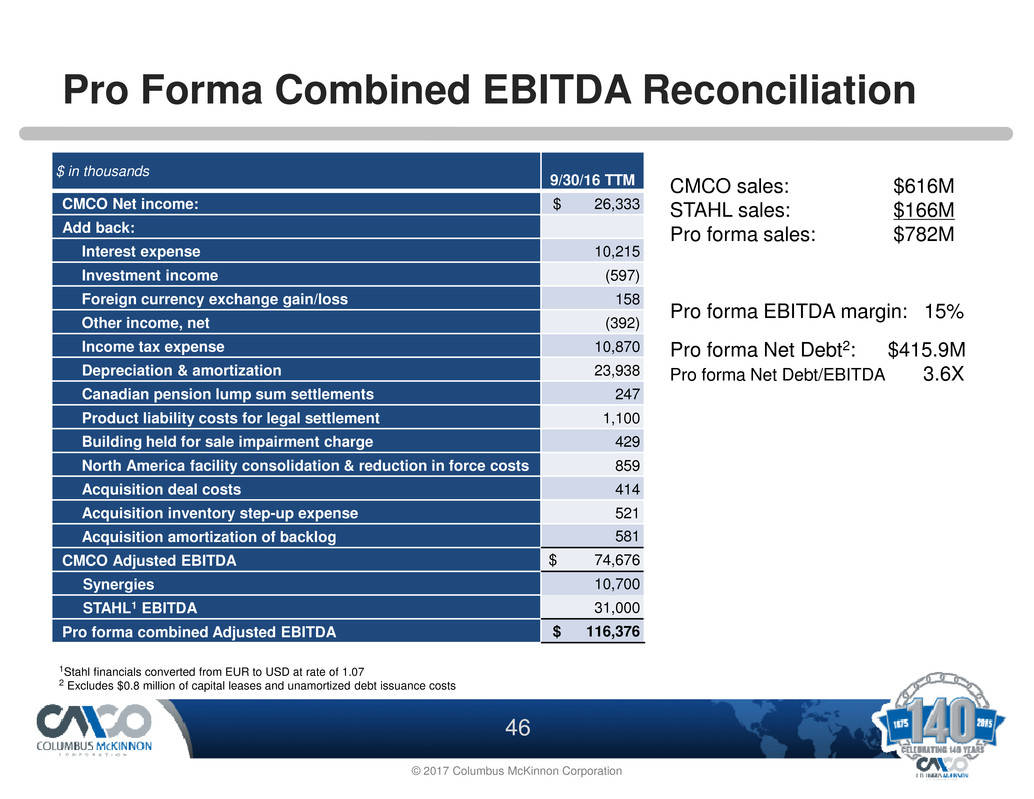

46 © 2017 Columbus McKinnon Corporation Pro Forma Combined EBITDA Reconciliation $ in thousands 9/30/16 TTM CMCO Net income: $ 26,333 Add back: Interest expense 10,215 Investment income (597) Foreign currency exchange gain/loss 158 Other income, net (392) Income tax expense 10,870 Depreciation & amortization 23,938 Canadian pension lump sum settlements 247 Product liability costs for legal settlement 1,100 Building held for sale impairment charge 429 North America facility consolidation & reduction in force costs 859 Acquisition deal costs 414 Acquisition inventory step-up expense 521 Acquisition amortization of backlog 581 CMCO Adjusted EBITDA $ 74,676 Synergies 10,700 STAHL1 EBITDA 31,000 Pro forma combined Adjusted EBITDA $ 116,376 1Stahl financials converted from EUR to USD at rate of 1.07 2 Excludes $0.8 million of capital leases and unamortized debt issuance costs CMCO sales: $616M STAHL sales: $166M Pro forma sales: $782M Pro forma EBITDA margin: 15% Pro forma Net Debt2: $415.9M Pro forma Net Debt/EBITDA 3.6X

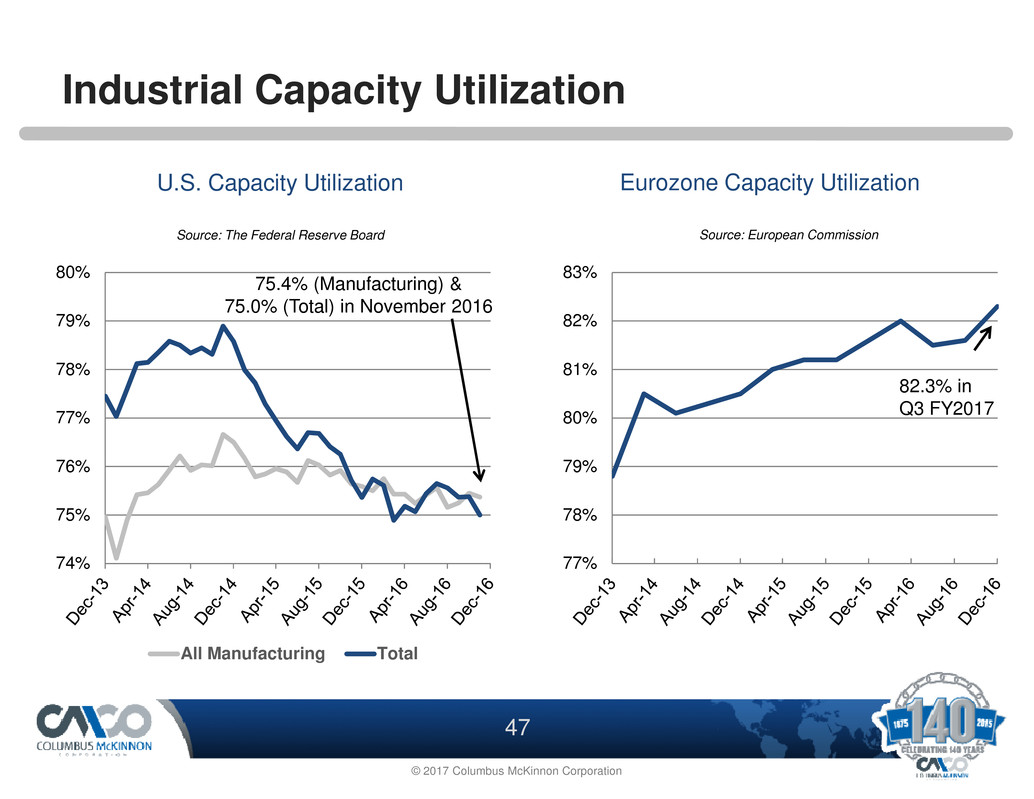

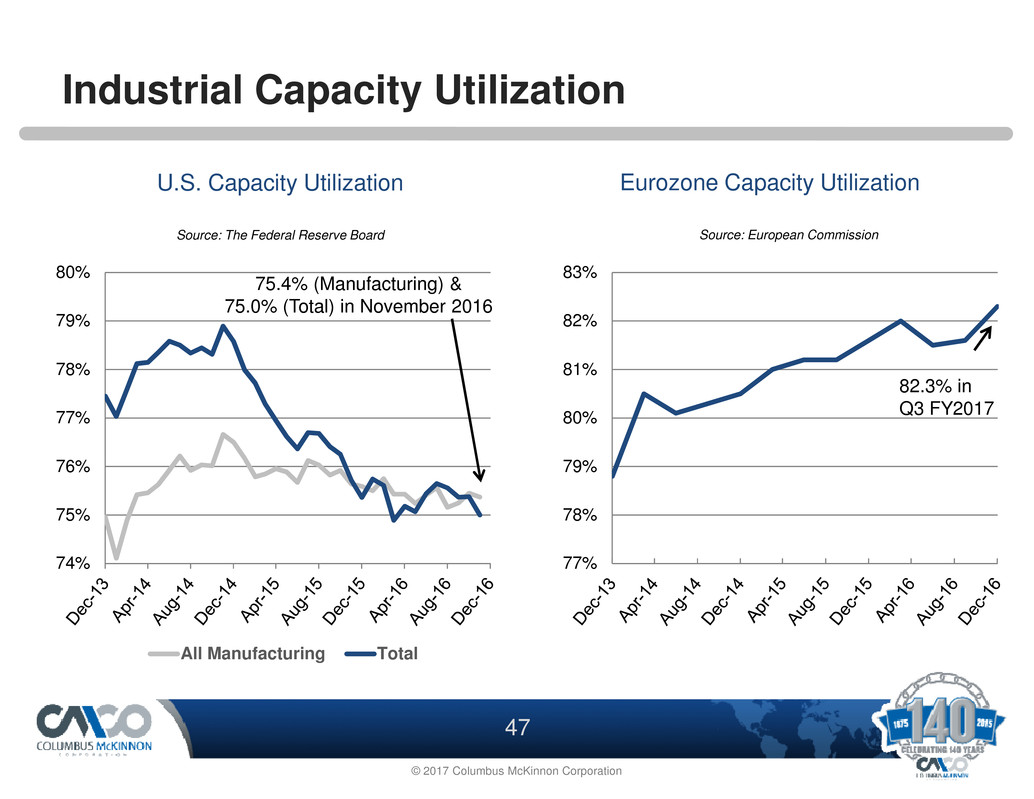

47 © 2017 Columbus McKinnon Corporation 77% 78% 79% 80% 81% 82% 83% 74% 75% 76% 77% 78% 79% 80% All Manufacturing Total Source: The Federal Reserve Board Eurozone Capacity UtilizationU.S. Capacity Utilization Source: European Commission 82.3% in Q3 FY2017 75.4% (Manufacturing) & 75.0% (Total) in November 2016 Industrial Capacity Utilization

48 © 2017 Columbus McKinnon Corporation Established Global Presence