Investor & Analyst Day 2019 June 13, 2019 New York, NY PARTNERS IN MOTION CONTROL

IMPORTANT INFORMATION Safe Harbor Statement These slides, and the accompanying oral discussion, contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements concerning future revenue and earnings, involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such statements, including the effectiveness of the Company’s 80/20 process to simplify operations, the ability of the Company’s operational excellence initiatives to drive profitability, the success of the Company’s new products to enhance revenue, the timing and success of the divestitures, global economic and business conditions, conditions affecting the industries served by the Company and its subsidiaries, conditions affecting the Company's customers and suppliers, competitor responses to the Company's products and services, the overall market acceptance of such products and services, the ability to expand into new markets and geographic regions, and other factors disclosed in the Company's periodic reports filed with the Securities and Exchange Commission. The Company assumes no obligation to update the forward-looking information contained in this presentation. Non-GAAP Financial Measures This presentation will discuss some non-GAAP financial measures, which we believe are useful in evaluating our performance. You should not consider the presentation of this additional information in isolation or as a substitute for results compared in accordance with GAAP. We have provided reconciliations of comparable GAAP to non-GAAP measures in tables found in the Supplemental Information portion of this presentation. © 2019 Columbus McKinnon Corporation 2

EXECUTIVE COMMITTEE Mark Morelli Bert Brant Appal Chintapalli Alan Korman Presaident & Vice President, Vice President, Vice President, Chief Executive Officer Global Manufacturing Engineered Products Corporate Development, General Counsel & CHRO Pete McCormick Mark Paradowski Mario Ramos Greg Rustowicz Kurt Wozniak Vice President, Vice President, Vice President, Global Vice President, Finance Vice President, Crane Solutions Group Information Services Product Development & Chief Financial Officer Industrial Products © 2019 Columbus McKinnon Corporation 3

Driving Change Through Blueprint for Growth Strategy Mark Morelli President & Chief Executive Officer PARTNERS IN MOTION CONTROL

CHANGING COLUMBUS MCKINNON Highly relevant, professional-grade solutions for solving customers’ critical problems in safety & productivity © 2019 Columbus McKinnon Corporation 5

STRATEGY: EVOLUTION OF COLUMBUS MCKINNON Growth Phase III oriented Evolve business model industrial • Portfolio optimization technology • Mergers & acquisitions Phase II Simplify the business Drive profitable growth • 80/20 Process • Operational Excellence • Ramp the Growth Engine Phase I Get control Achieve results Late stage • New organization cyclical • Operating system industrial Today Future Further pivot from late stage industrial to growth oriented industrial technology company © 2019 Columbus McKinnon Corporation 6

E-PAS™: EARNINGS POWER ACCELERATION SYSTEM Business Operating System Key Performance Strategy Talent Indicators Deployment Development (KPIs) Monthly Operating 80 / 20 M&A Reviews Process Process (MORs) Risk & Mission Lean Opportunity Vision Tools (R&Os) Values Developed Under development Business operating system drives execution © 2019 Columbus McKinnon Corporation 7

FINANCIAL PERFORMANCE ($ in millions) Growth outpacing Transformation doubles Strategy creates stronger industry… adjusted operating income (1) … earnings power… $99.8 $2.74 $876.3 $78.7 $839.4 $2.01 $68.3 $69.4 $637.1 $47.2 $1.47 $1.80 $0.95 34.0% 33.7% 34.8% $23.77.4% 9.4% 11.4% $0.43 FY17 FY18 FY19 FY17 FY18 FY19 FY17 FY18 FY19 Non-GAAP Adjustments Non-GAAP Adjustments GAAP Diluted EPS (1) Sales and Gross Margin Income from Operations Diluted EPS Operating margin expanded significantly and net income doubled (1) Adjusted operating income and EPS are non-GAAP financial measures. Please see supplemental slides for reconciliations. © 2019 Columbus McKinnon Corporation 8

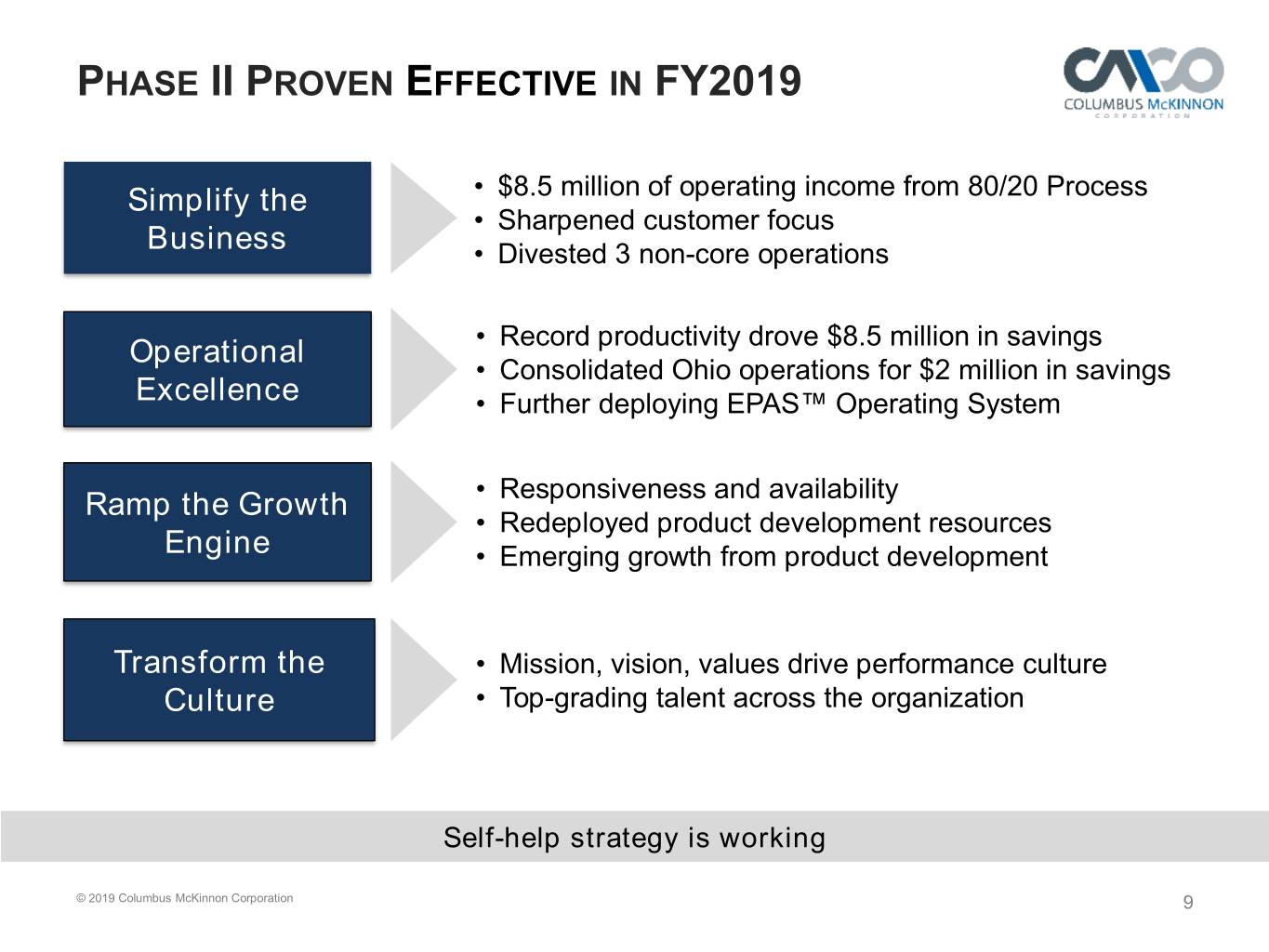

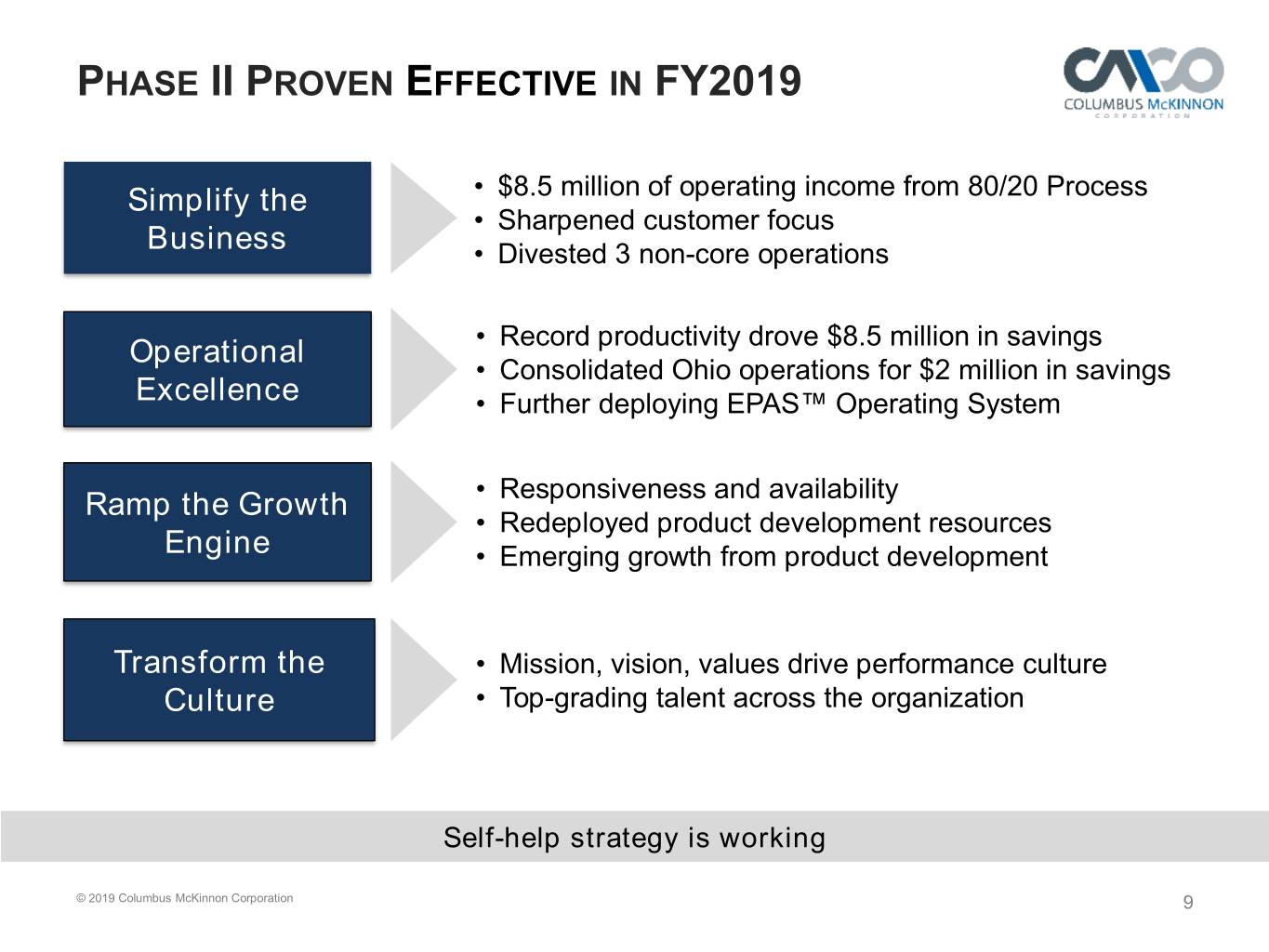

PHASE II PROVEN EFFECTIVE IN FY2019 Simplify the • $8.5 million of operating income from 80/20 Process • Sharpened customer focus Business • Divested 3 non-core operations Operational • Record productivity drove $8.5 million in savings • Consolidated Ohio operations for $2 million in savings Excellence • Further deploying EPAS™ Operating System Ramp the Growth • Responsiveness and availability • Redeployed product development resources Engine • Emerging growth from product development Transform the • Mission, vision, values drive performance culture Culture • Top-grading talent across the organization Self-help strategy is working © 2019 Columbus McKinnon Corporation 9

SIMPLIFY THE BUSINESS: 80/20 PROCESS Improve profitability • Reduce overhead • Strategic pricing Purchased Product parts SKUs Profitable revenue growth ~400,000 ~50,000 80 / 20 ROIC improvement Process • Inventory reduction • Footprint reduction Simplify the Business: Eliminate bleeders… focus on areas of growth 80/20 Process: Centerpiece of the operating system… eliminates bleeders and sharpens focus on growth © 2019 Columbus McKinnon Corporation 10

80/20 PROCESS IMPLEMENTATION In progress FY19 FY20 FY21 FY22 Initiating Industrial Products North America Europe Crane Solutions Magnetek brand Stahl brand North America Engineered Products Duff Norton brand Pfaff brand About 1/3 of 80/20 process complete in organization © 2019 Columbus McKinnon Corporation 11

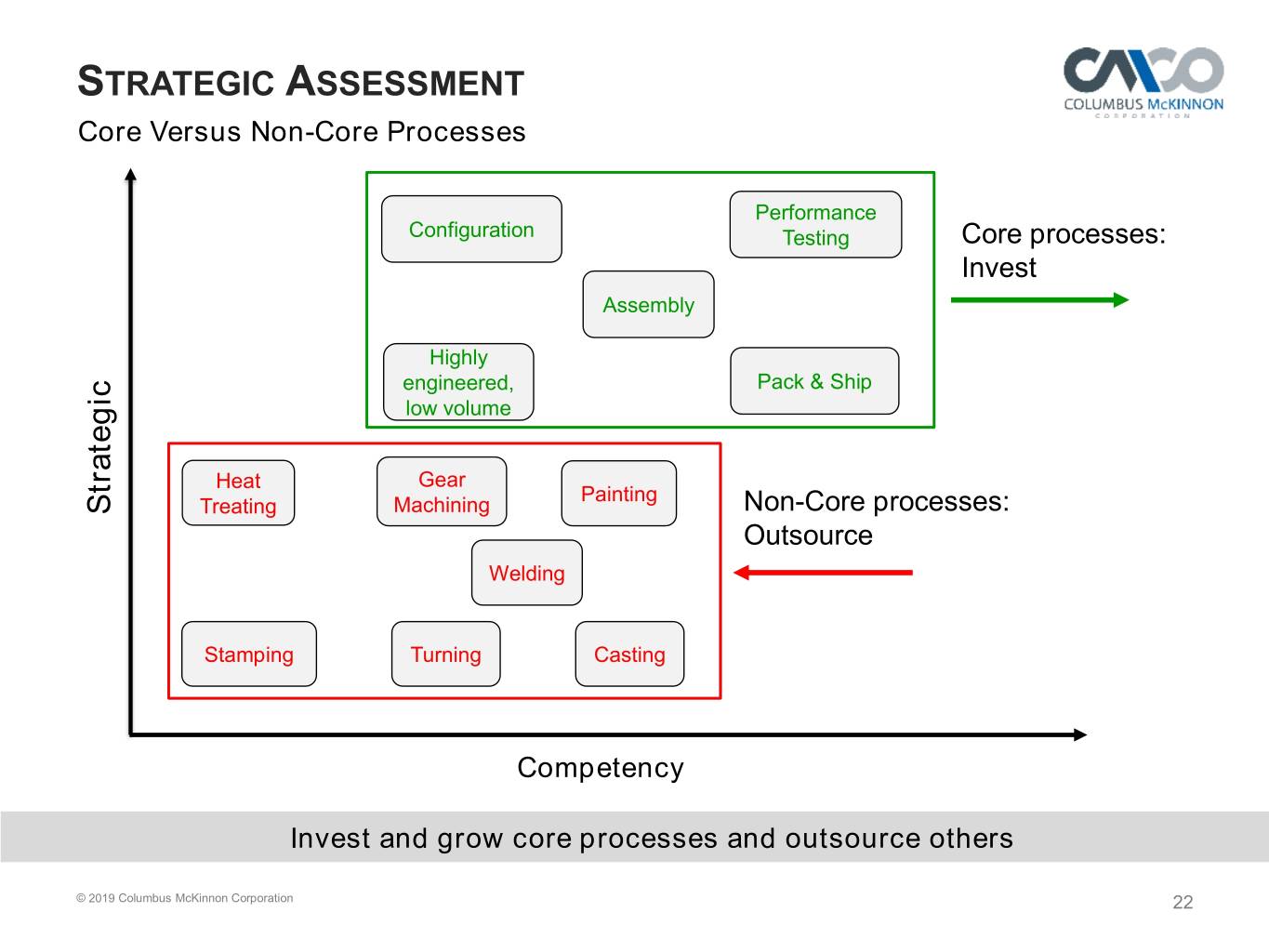

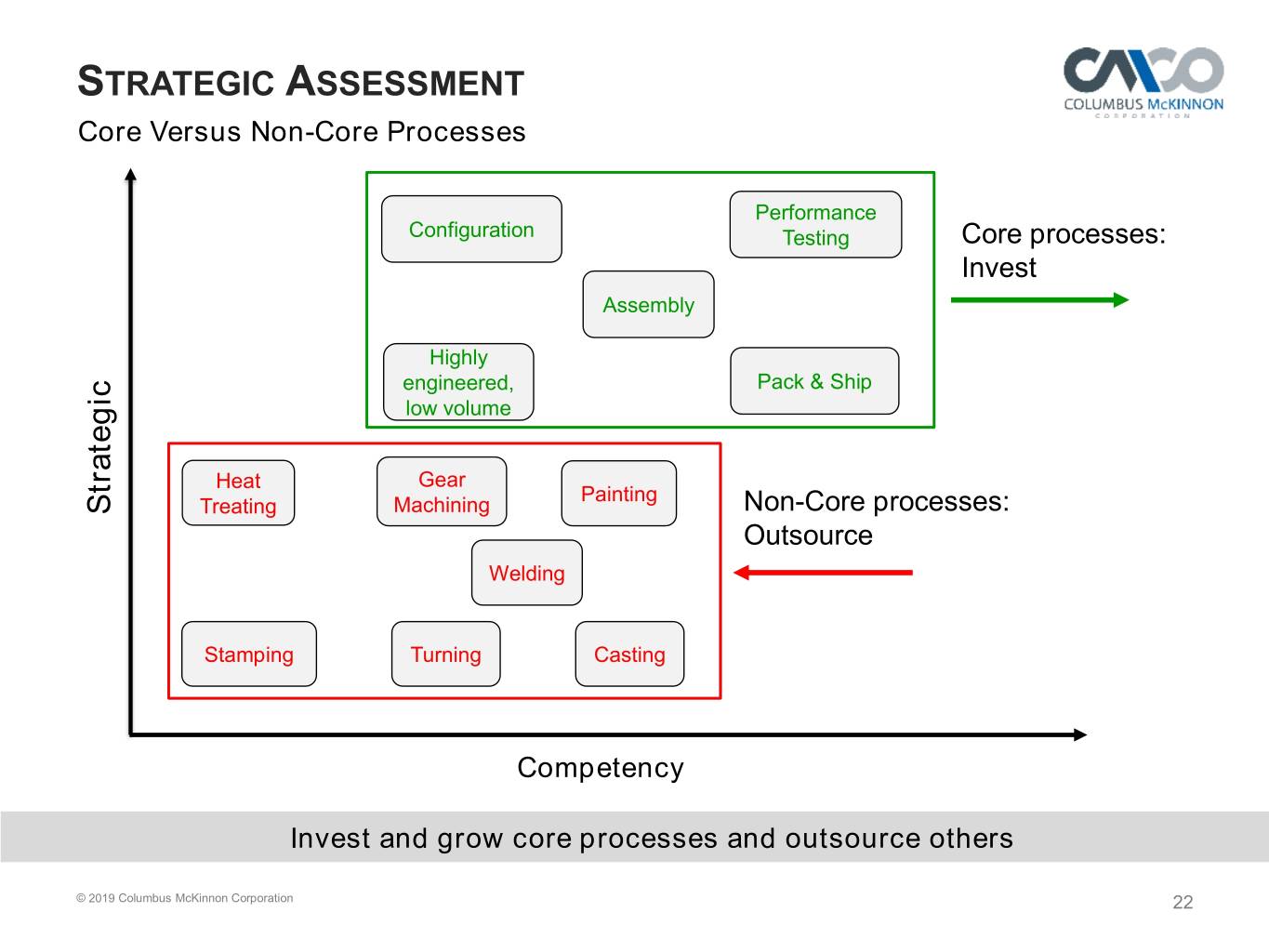

OPERATIONAL EXCELLENCE Path to Top Tier Performance Redefine Customer Improve Cost Optimize Working Experience Structure Capital Performance Configuration Testing Core processes: Assembly Invest Highly engineered, Pack & Ship low volume Heat Gear Painting Treating Machining Non-Core processes: Strategic Welding Outsource Stamping Turning Casting Competency Strategic lens improves path to Operational Excellence © 2019 Columbus McKinnon Corporation 12

RAMPING THE GROWTH ENGINE Path to Profitable Growth Strengthen Lifting Smart the Core Specialist Movement Solving customers’ high value problems to improve safety & productivity © 2019 Columbus McKinnon Corporation 13

VALUE CREATION VERSUS PEERS CMCO FY22 Target FY17 TTM EBITDA % Trading Multiple TTM ROIC ~18.9 1st ~27% 1st 1st ~18% x 19.0% Mid- ~13.5 teens 2nd ~16% 2nd 2nd ~14% x 3rd ~13% 3rd ~9.8x 3rd ~11% 11.7% 7.5x 4th ~10% 4th ~7.3x 4th ~9% 6.4% Phase I-II execution resulting in improved earnings vs. peers… multiple undervalued CMCO Peerset: -Peer quartiles as of 3/31/19 -Alamo Group, Altra Industrial Motion, CIRCOR, Federal Signal, Flowserve, Fortive, -CMCO© FY19F20192018 Columbus Columbus trading McKinnon multiple McKinnon Corporation as of Corporation 3/31/19 14 Franklin Electric, Graco, IDEX, Roper, Ingersoll-Rand, Kennametal, Kito, KoneCranes, -Tax rates for ROIC. FY17: 30%, FY18: 22%, FY19-FY22: 25% Palfinger, Parker-Hannifin, RBC Bearings, Regal Beloit, Tennant, Terex

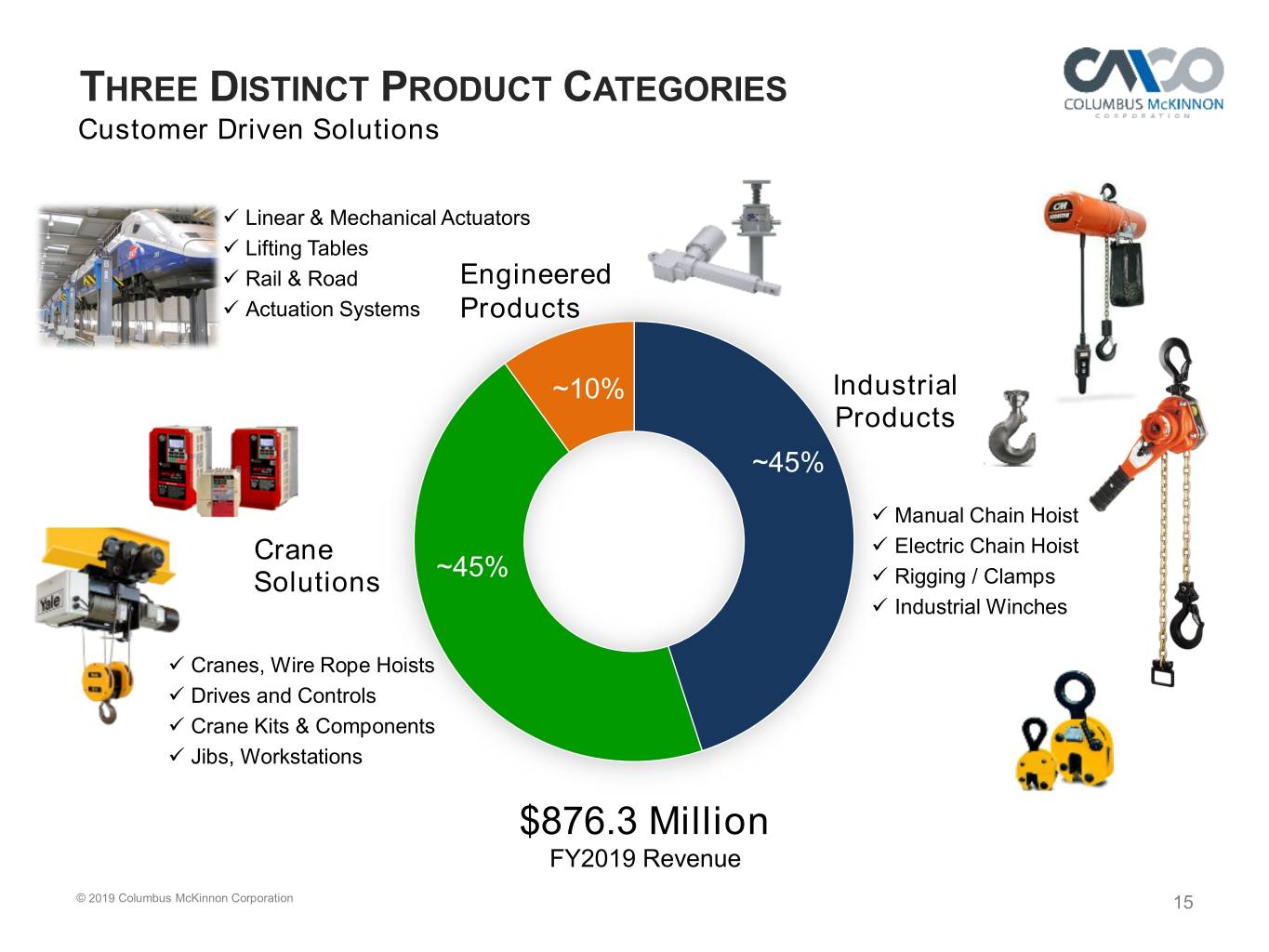

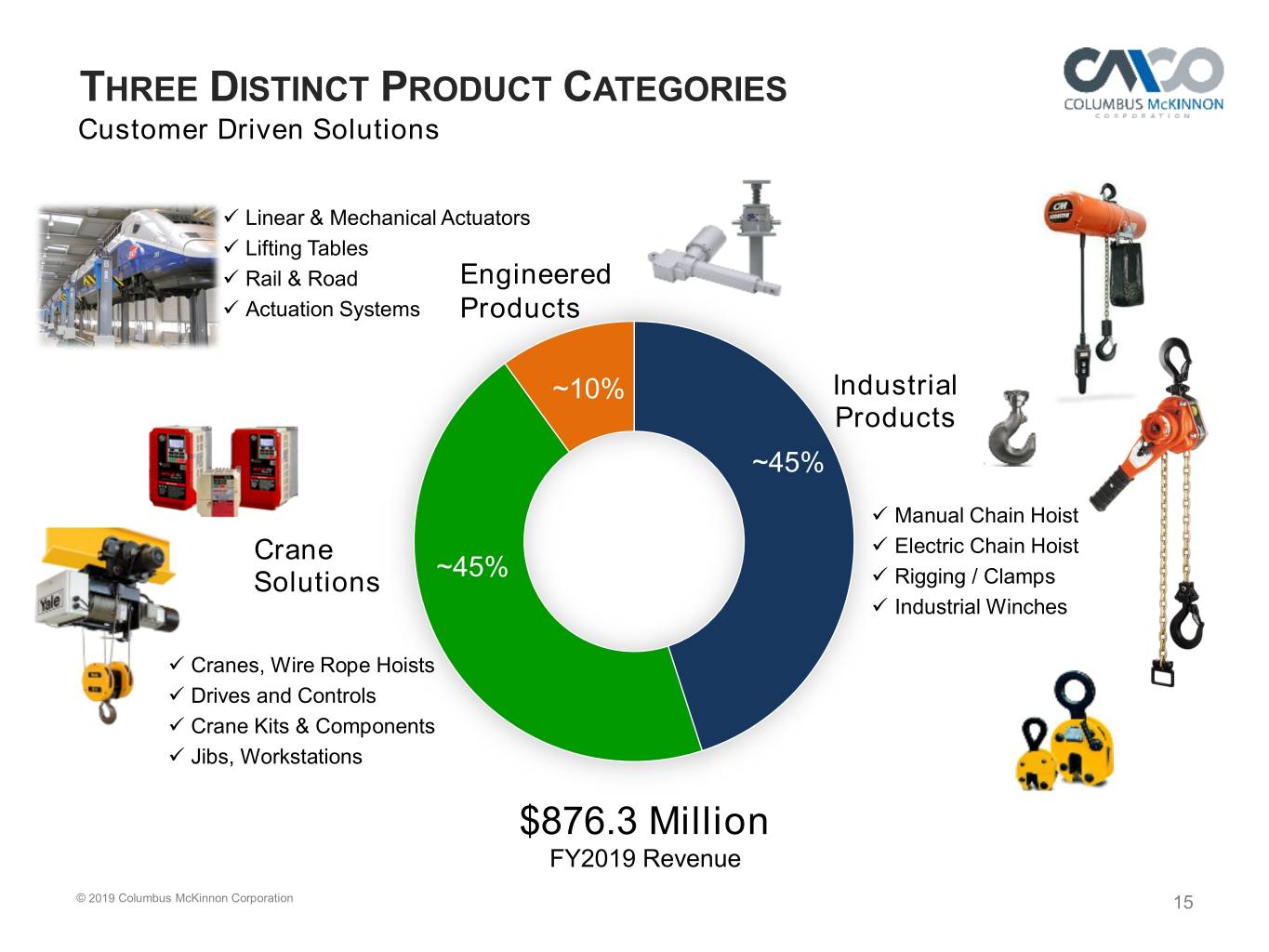

THREE DISTINCT PRODUCT CATEGORIES Customer Driven Solutions Linear & Mechanical Actuators Lifting Tables Rail & Road Engineered Actuation Systems Products ~10% Industrial Products ~45% Manual Chain Hoist Crane Electric Chain Hoist ~45% Solutions Rigging / Clamps Industrial Winches Cranes, Wire Rope Hoists Drives and Controls Crane Kits & Components Jibs, Workstations $876.3 Million FY2019 Revenue © 2019 Columbus McKinnon Corporation 15

TARGET MARKETS ALTERNATIVE AEROSPACE & ENTERTAINMENT OIL & GAS/ ENERGY DEFENSE PETROCHEMICAL WASTEWATER INFRASTRUCTURE AUTOMATION METALS TREATMENT PROCESSING Targeting market segments with better than GDP growth © 2019 Columbus McKinnon Corporation 16

MISSION, VISION, VALUES . © 2019 Columbus McKinnon Corporation 17

Operational Excellence Bert Brant Vice President, Global Manufacturing PARTNERS IN MOTION CONTROL

OPERATIONAL EXCELLENCE STRATEGY Path to Top Tier Operational Performance Initial Focus Redefine Customer Improve Cost Optimize Working FY2019 Experience Structure Capital Operational KPI focus Strategic assessment of factory operations Top grading talent Raise customer expectations and drive factory productivity © 2019 Columbus McKinnon Corporation *SIOP: Sales, Inventory & Operations Planning 19

INITIAL FOCUS IN FY2019 • Recast operational metrics Refined KPI’s • Developed root cause, countermeasure culture • Benchmarked best-in-class performance • Identified strategic core processes Strategic • Developed tiered factory assessment Assessment • Initiated operational excellence strategy Team Performance • Hired core/centralized team to execute strategy Culture • Embedded within the business unit structure KPI’s lead to strategic assessment and go-forward strategy… team in place to execute © 2019 Columbus McKinnon Corporation 20

STRATEGIC ASSESSMENT North America Footprint Europe Footprint APAC Footprint Chester, UK Hoist, Plate Clamps Menomonee Falls, WI Brighton, MI Power Control Hangzhou, CN Workstations Wuppertal, DE Cedar Rapids, IL Hoist Hoist Hamm, DE Salem, OH Lisbon, OH Hoist Kunzelsau, DE Damascus, VA Hoist Kissing, DE Hoist Romeny-sur-Marne, FR Lexington, TN Wadesboro, NC Actuator, Rail Hoist Actuator Chain Charlotte, NC Szekesfehervar, Chattanooga, TN Actuator Forging Hungary Textiles Sarasota, FL Facility Region FY17 FY19 North America 13 10 Santiago, MX Hoist EMEA 7 6 APAC 2 2 Total 22 18 Reduced manufacturing footprint from 22 to 18…evaluating further opportunities © 2019 Columbus McKinnon Corporation 21

STRATEGIC ASSESSMENT Core Versus Non-Core Processes Performance Configuration Testing Core processes: Invest Assembly Highly engineered, Pack & Ship low volume Heat Gear Painting Strategic Treating Machining Non-Core processes: Outsource Welding Stamping Turning Casting Competency Invest and grow core processes and outsource others © 2019 Columbus McKinnon Corporation 22

REDEFINE CUSTOMER EXPERIENCE On-Time Delivery Progression Today On Time Delivery to On Time Delivery to On Time Delivery to Top 80% Customer’s Our Promise Customer’s Request Request Measurement NOT aligned with Customers Measurement NOT aligned with 80/20 Measurement aligned with top Customers Metric aligned with 80/20 strategy and top customers’ expectations © 2019 Columbus McKinnon Corporation 23

IMPROVE COST STRUCTURE Cost of Goods Sold (FY20E) Overhead Focus on simplifying footprint and reducing non value add labor cost: Overhead Direct Improve direct to indirect ratio ~30% Labor ~15% Reduce/consolidate factory labor cost Material Cost Material Manage a project funnel focused on net ~55% material savings: Best cost region SKU rationalization / VAVE Opportunity to improve direct to indirect ratio © 2019 Columbus McKinnon Corporation 24

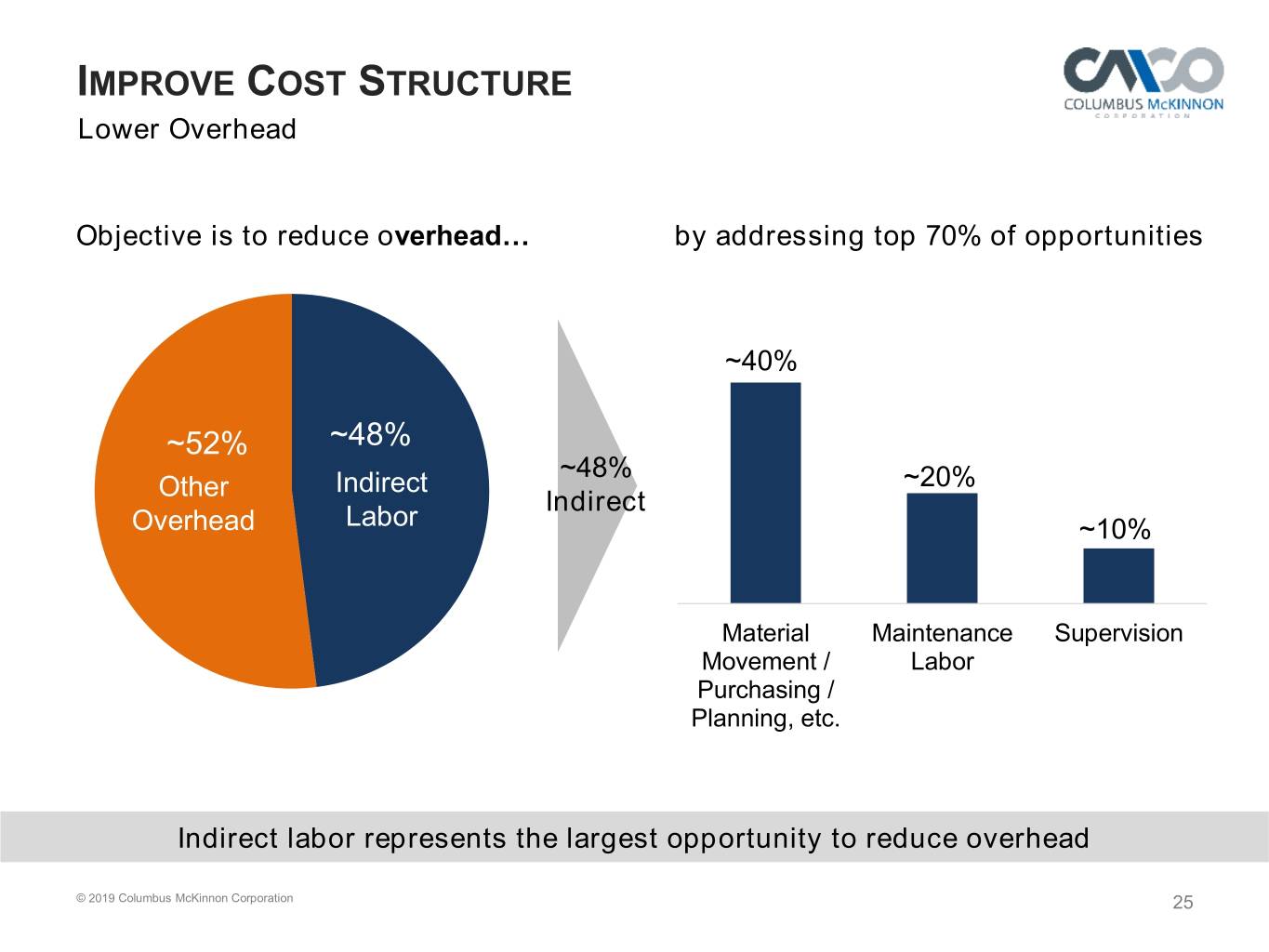

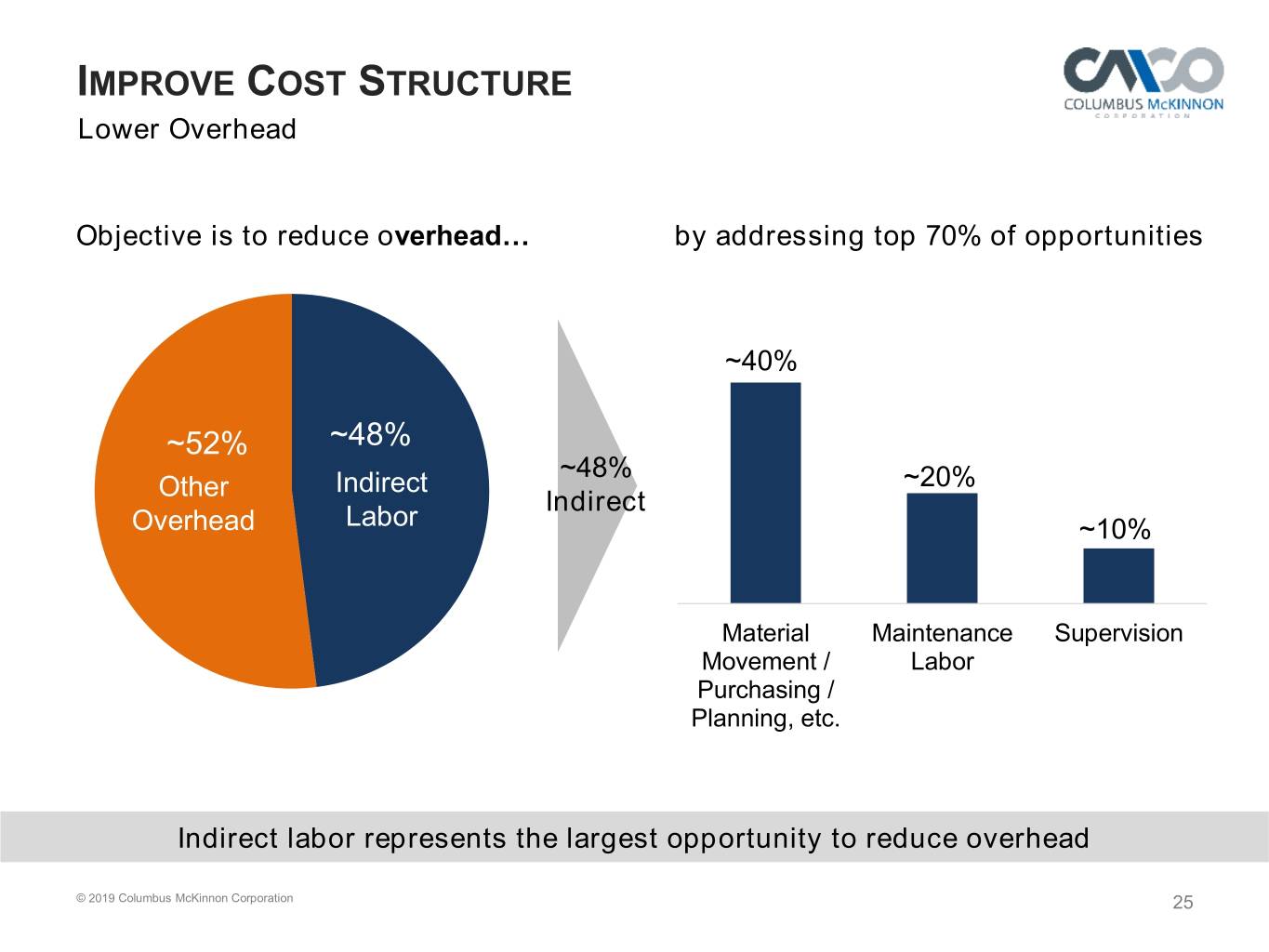

IMPROVE COST STRUCTURE Lower Overhead Objective is to reduce overhead… by addressing top 70% of opportunities ~40% ~52% ~48% ~48% Other Indirect ~20% Indirect Overhead Labor ~10% Material Maintenance Supervision Movement / Labor Purchasing / Planning, etc. Indirect labor represents the largest opportunity to reduce overhead © 2019 Columbus McKinnon Corporation 25

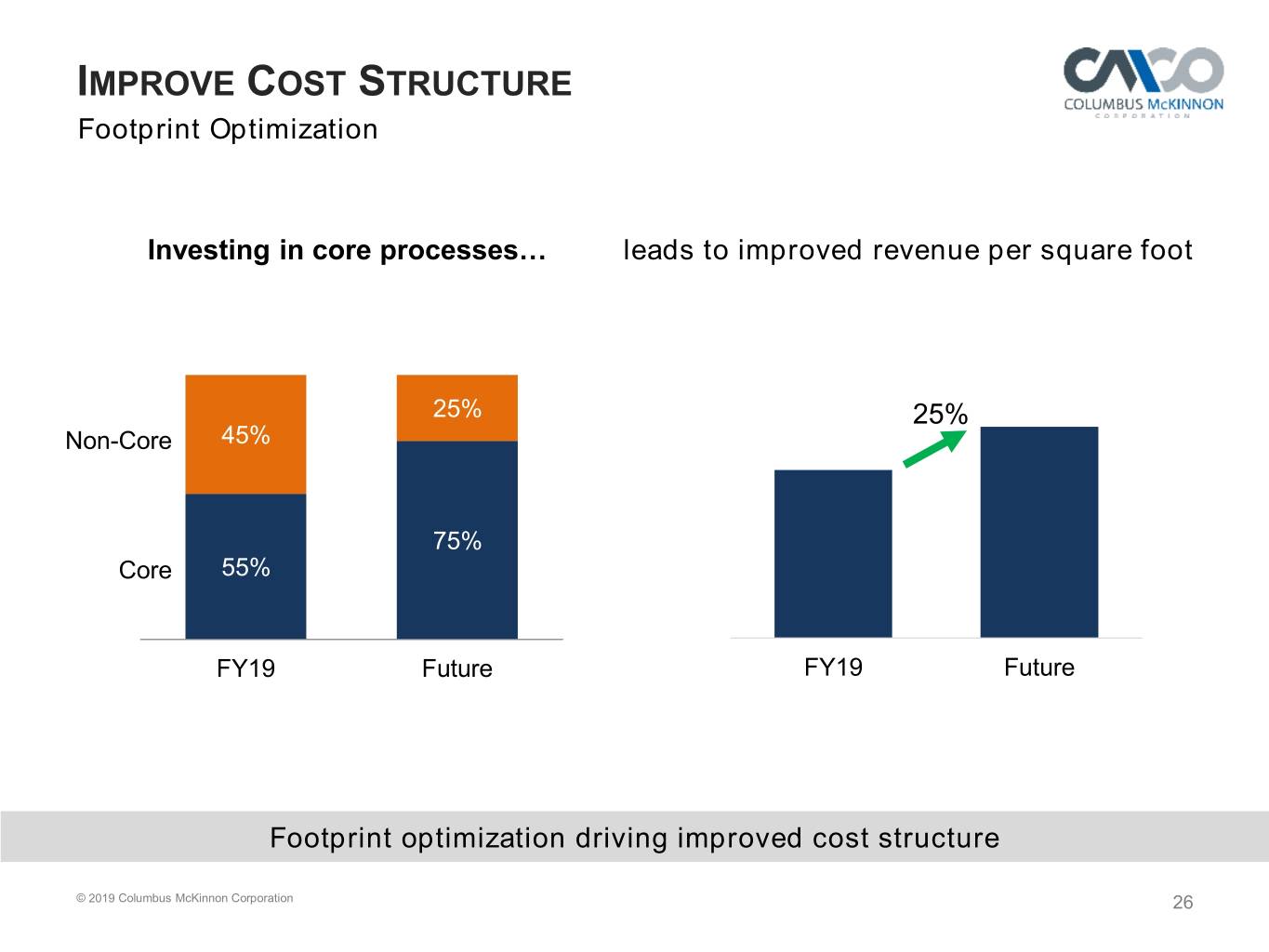

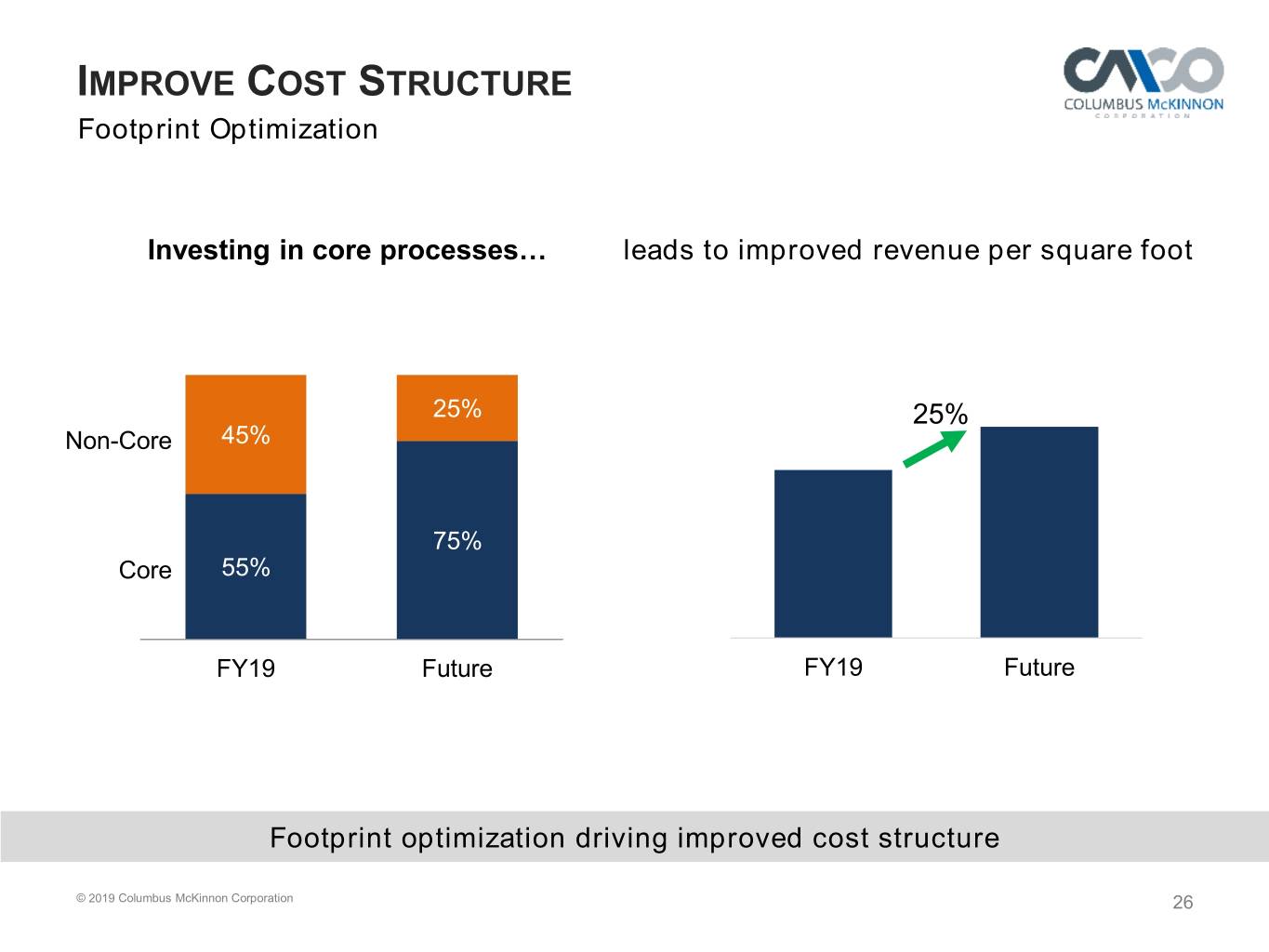

IMPROVE COST STRUCTURE Footprint Optimization Investing in core processes… leads to improved revenue per square foot 100% 90% 25% 80% 25% Non-Core 45% 70% 60% 50% 40% 75% 30%Core 55% 20% 10% 0% FY19 Future FY19 Future Footprint optimization driving improved cost structure © 2019 Columbus McKinnon Corporation 26

IMPROVE COST STRUCTURE Supplier and SKU Rationalization Key Initiatives: Streamline supply chain with fewer, stronger suppliers Simplify and leverage spend with reduced SKU count Partner on new product development # of Suppliers # of SKUs Purchased ~ ~10,000 25% 377,000 25% ~ 7,500 ~285,000 FY19 Future FY19 Future Targeting ~25% reduction to BOTH suppliers and SKUs © 2019 Columbus McKinnon Corporation 27

OPERATIONAL EXCELLENCE STRATEGY Path to Top Tier Operational Performance Initial Focus Redefine Customer Improve Cost Optimize FY2019 Experience Structure Working Capital Operational KPI focus On-time customer Factory overhead Days payable delivery reduction outstanding Strategic assessment of factory Simplification Footprint Inventory turns operations sharpens focus optimization and SIOP* Top grading Supplier and SKU talent rationalization Raise customer expectations and drive factory productivity *SIOP: Sales, Inventory & Operations Planning © 2019 Columbus McKinnon Corporation 28

Ramp the Growth Engine Mario Ramos Vice President, Global Product Development PARTNERS IN MOTION CONTROL

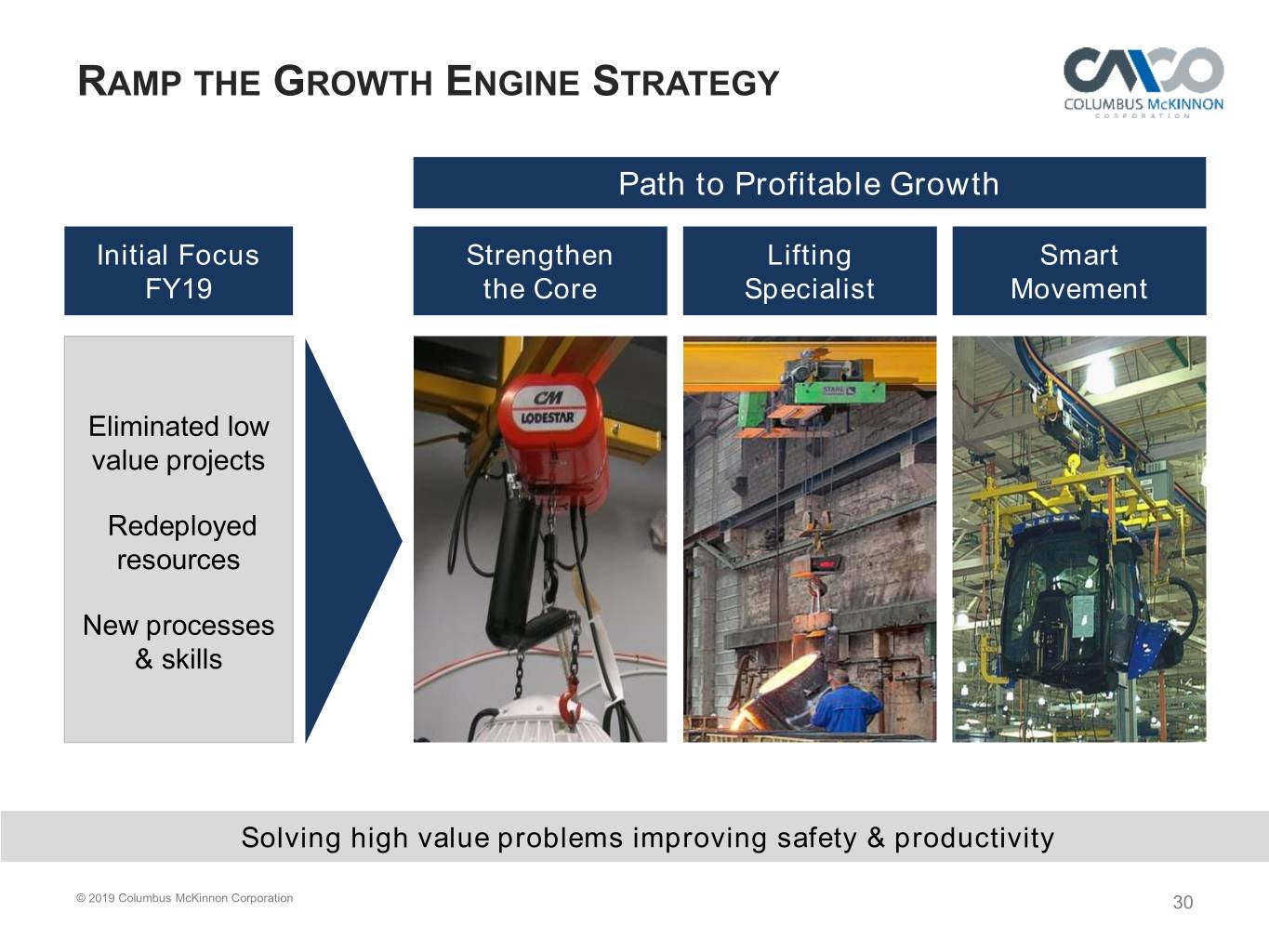

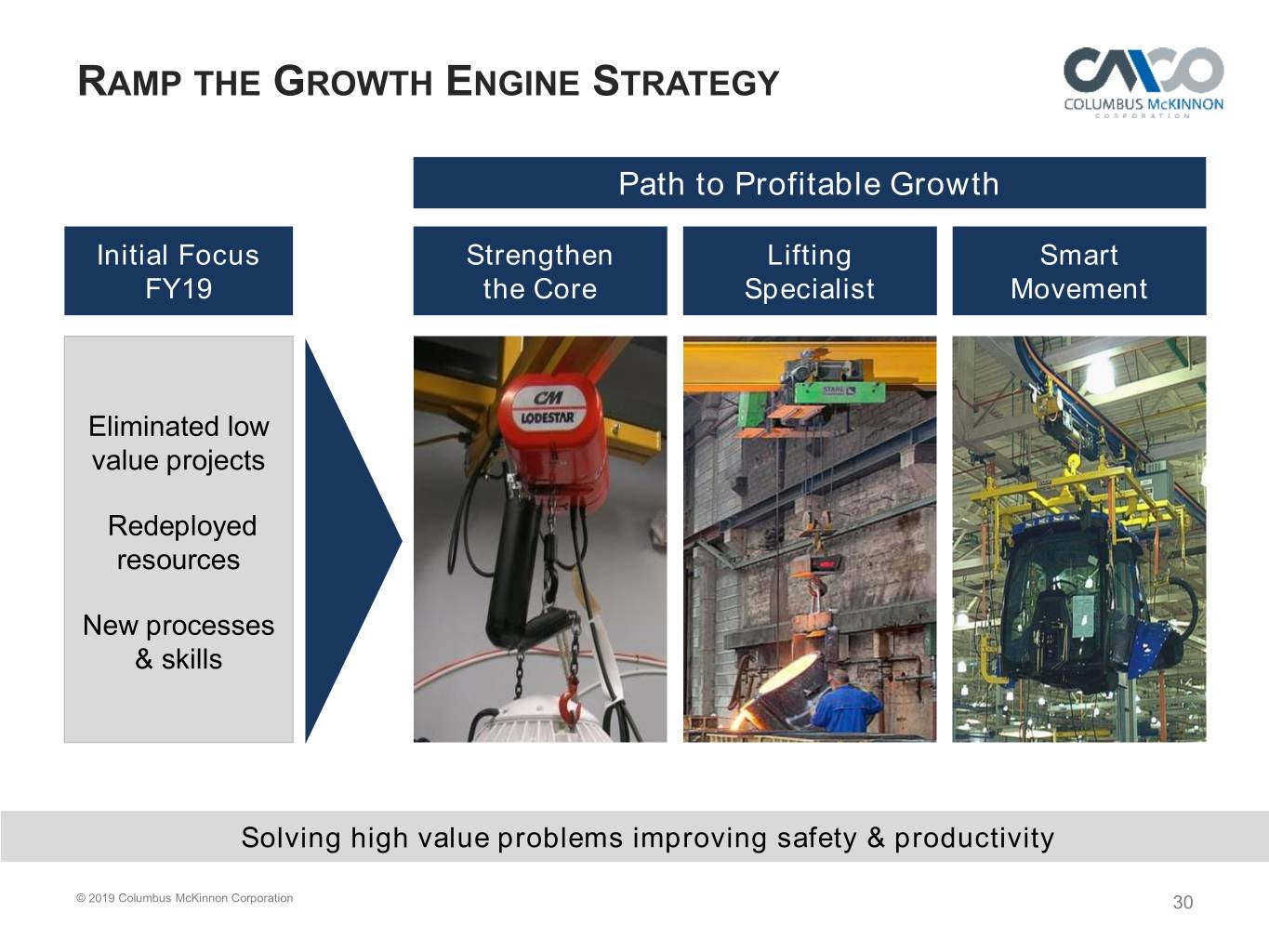

RAMP THE GROWTH ENGINE STRATEGY Path to Profitable Growth Initial Focus Strengthen Lifting Smart FY19 the Core Specialist Movement Eliminated low value projects Redeployed resources New processes & skills Solving high value problems improving safety & productivity © 2019 Columbus McKinnon Corporation 30

INITIAL FOCUS IN FY2019 Enhanced Product Development Pipeline Past Future Low return projects Solve high value problems Strong value engineering Limited value engineering pipeline Skills/talent gaps New skills & processes Enhanced Project Pipeline Past Future Eliminate tail to fund new opportunities Solving high value problems 7.1 3.3 1.1 0.7 0.8 0.8 0.3 0.6 ($ inmillions) ($ 0.0 0.0 0.0 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.2 0.2 0.2 0.2 0.2 Stopped low return projects & reallocated resources to high value activities © 2019 Columbus McKinnon Corporation 31

STRENGTHEN THE CORE Product Development Focus Demonstrating Organic Growth (Y/Y % revenue growth) DC motor drives New Product Development ~60% Radio controls Variable speed platform Auto-dispatch Automation ~25% No-fly zone Remote monitoring and control Engineered to Quote lead time improvement ~23% Order On-time delivery improvement $0 $10 $20 $30 $40 $50 $60 $70 Initial focus in R&D gaining traction © 2019 Columbus McKinnon Corporation 32

STRENGTHEN THE CORE Product Development Return on Investment ($ in millions) Have increased R&D investment on steady spend… While improving returns* ~$29 Top 127% ~$22 ~$22 Performers ~$21 114% ~$16 Medium 94% 87% Sustaining Performers Engineering R&D 80% 56% Engineered to R&D R&D Low R&D 49% Order R&D 70% 73% Performers FY20P 60% 60% FY19F New Product 0% 20% 40% 60% 80% 100% 120% 140% Development FY18A FY17A FY18A FY19A FY20E Future *Returns on R&D spend calculation: GM from New Product Development R&D Cost Higher returns through better project selection and discipline in execution *Deloitte, Global Benchmarking of Product Development © 2019 Columbus McKinnon Corporation 33

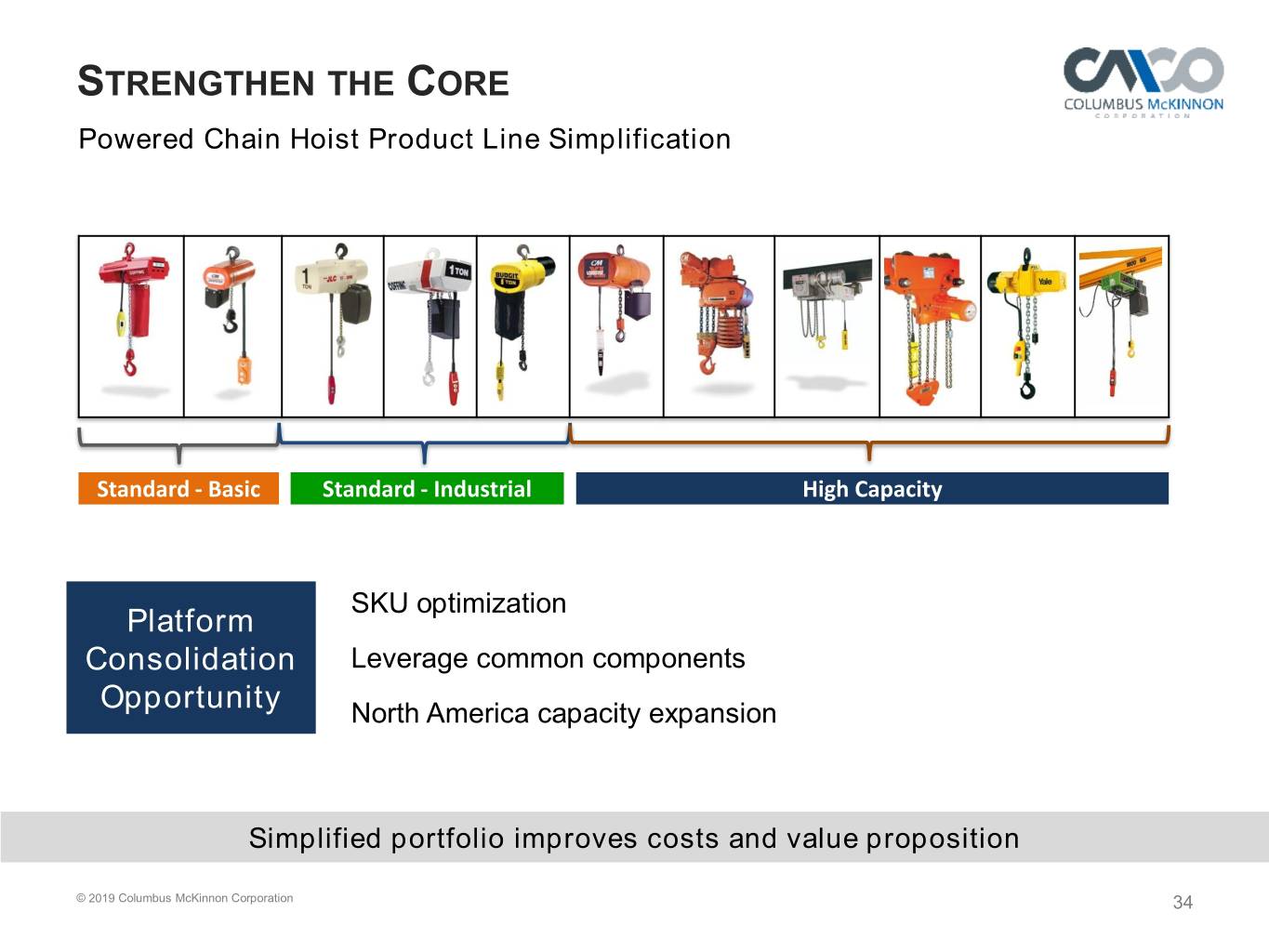

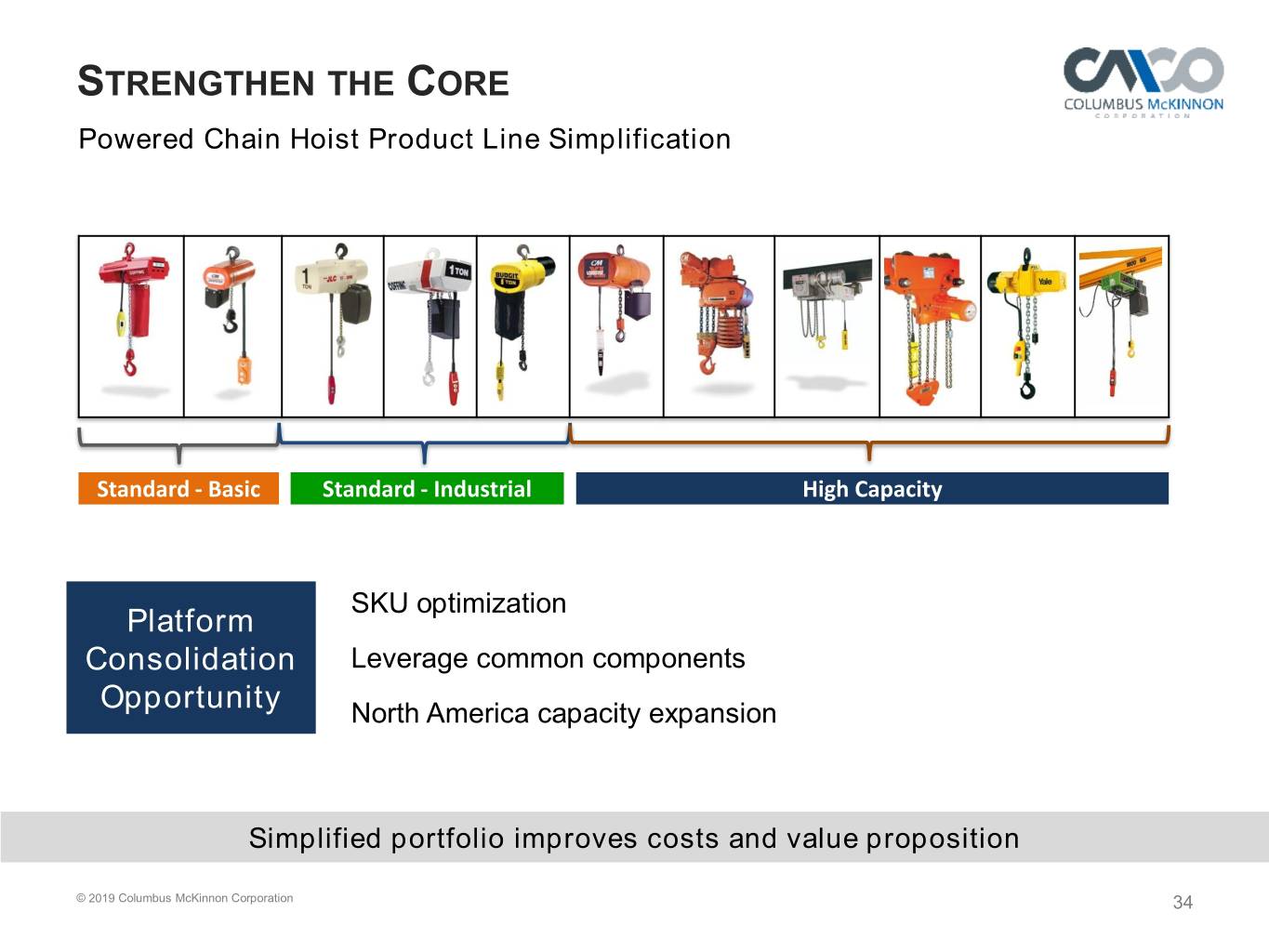

STRENGTHEN THE CORE Powered Chain Hoist Product Line Simplification Standard - Basic Standard - Industrial High Capacity SKU optimization Platform Consolidation Leverage common components Opportunity North America capacity expansion Simplified portfolio improves costs and value proposition © 2019 Columbus McKinnon Corporation 34

LIFTING SPECIALIST Explosion Proof Expansion Business Opportunity Wire Rope Hoist Explosion proof equipment CAGR ~6% Certification of Stahl explosion proof Power Chain Hoist portfolio in new regions Electrification Develop cost effective explosion proof Hazardous components location solutions Radio Controls End Trucks Controls Expands our role as the global specialist for explosion proof lifting technology © 2019 Columbus McKinnon Corporation 35

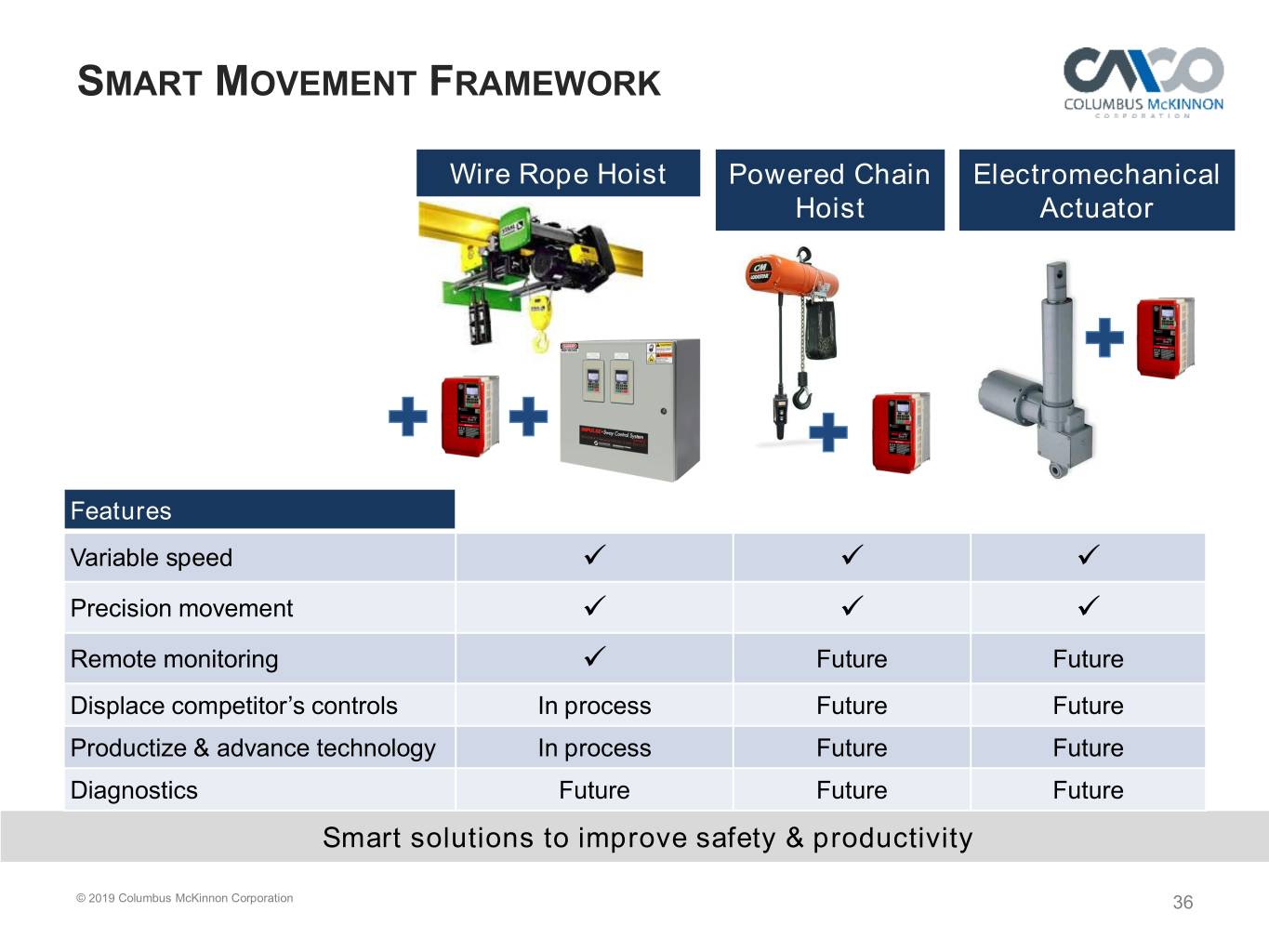

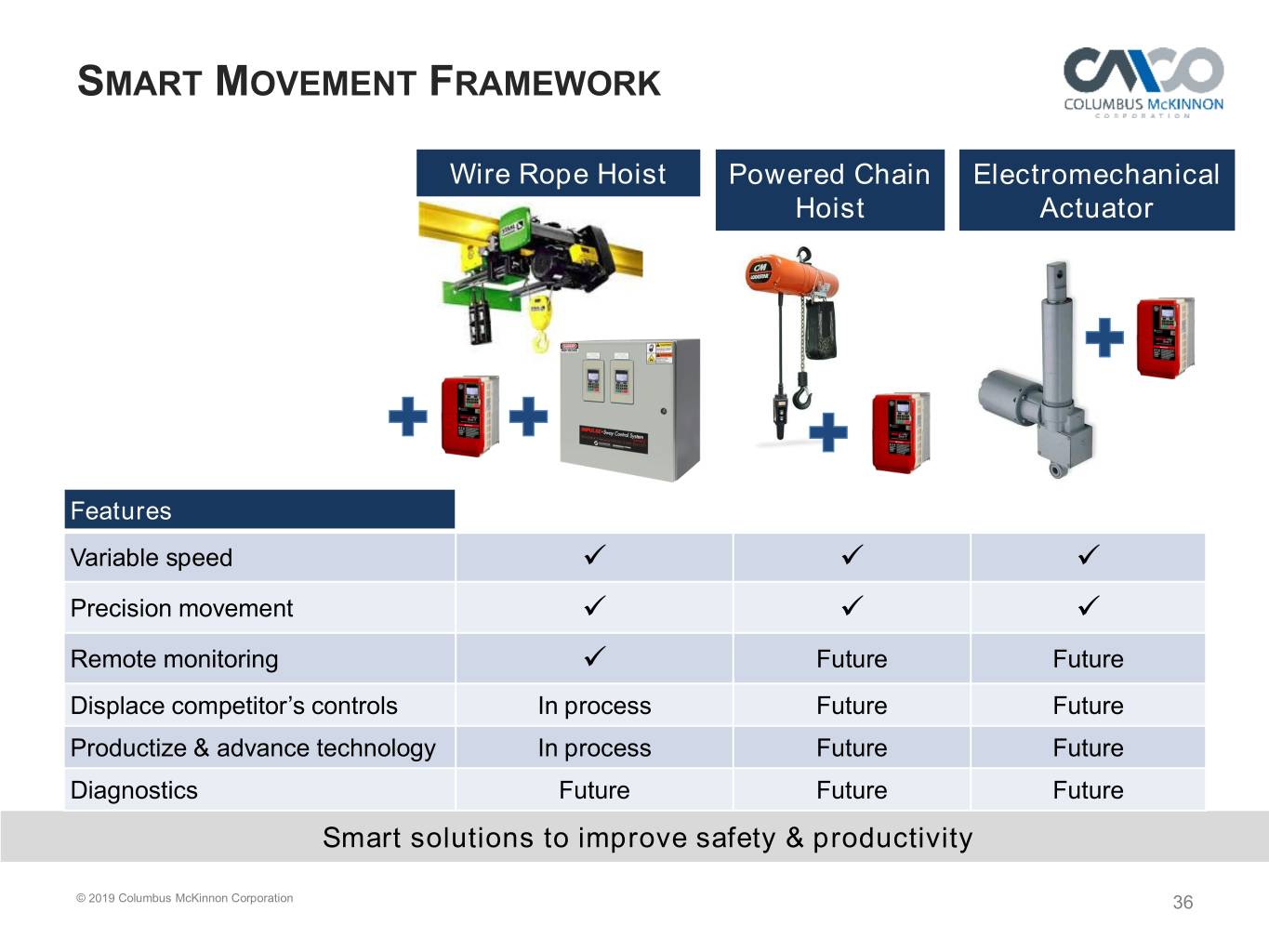

SMART MOVEMENT FRAMEWORK Wire Rope Hoist Powered Chain Electromechanical Hoist Actuator Features Variable speed Precision movement Remote monitoring Future Future Displace competitor’s controls In process Future Future Productize & advance technology In process Future Future Diagnostics Future Future Future Smart solutions to improve safety & productivity © 2019 Columbus McKinnon Corporation 36

SMART MOVEMENT Starts with Identifying Customers “High-Value” Problems Total Addressable Lifting Automation Market ~$500 Million Current Market Expanded Market Opportunity ~$300 Million Significant growth opportunity at +40% gross margins © 2019 Columbus McKinnon Corporation 37

RAMP THE GROWTH ENGINE STRATEGY Path to Profitable Growth Initial Focus Strengthen Lifting Smart FY19 the Core Specialist Movement Product line Leverage expertise Standardize Eliminated low simplification in solving high value automation solutions value projects problems Redeployed Platforming to Expand Displace competitor’s resources standardize certifications in new control products components regions New processes & skills Value engineering Expand high Develop diagnostic capacity products capabilities Smart solutions to improve safety & productivity © 2019 Columbus McKinnon Corporation 38

Ramp the Growth Engine: Digital Platform Mark Paradowski Vice President, Information Services PARTNERS IN MOTION CONTROL

PURPOSEFUL DIGITAL PLATFORM Configure Enable Inform Product Global Web Information Redesign Management Configure & quote Share product Enhance online information experience Advancing digital capabilities to “be easy to do business with” © 2019 Columbus McKinnon Corporation 40

CONFIGURE Compass™ • Enables complex product configurations • Expands functionality Enabling our Channel Partners to configure and quote © 2019 Columbus McKinnon Corporation 41

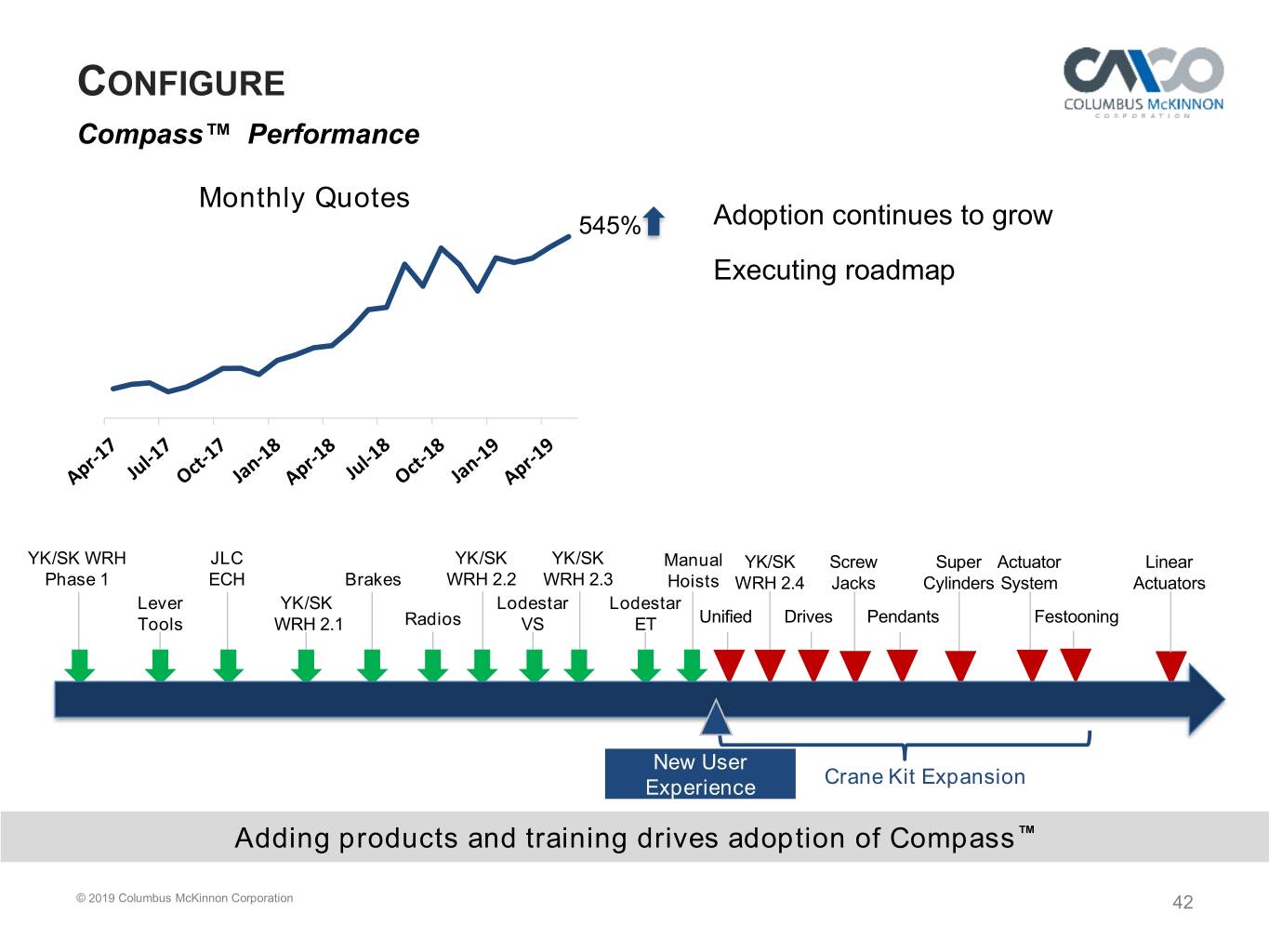

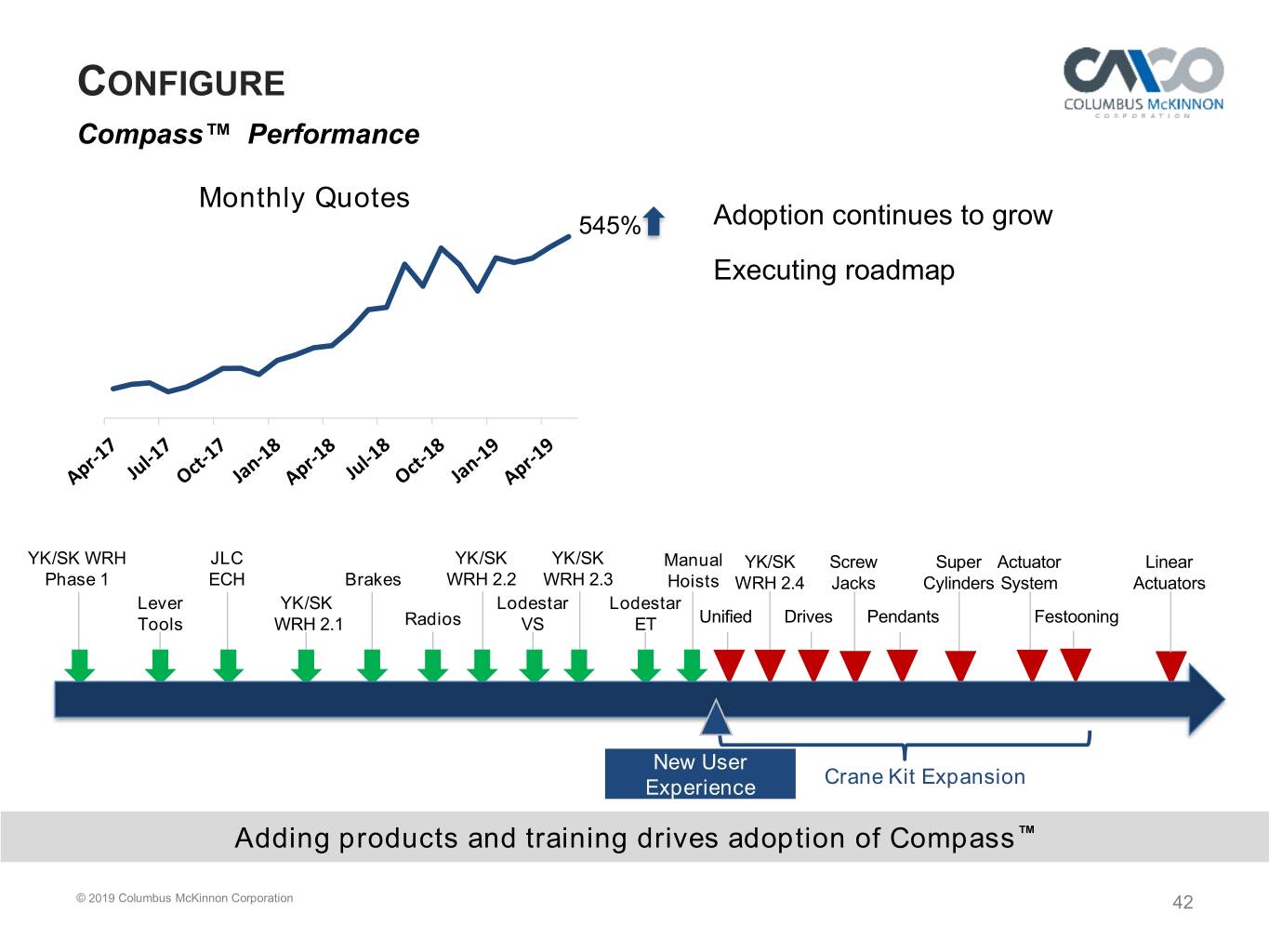

CONFIGURE Compass™ Performance Monthly Quotes 545% Adoption continues to grow Executing roadmap YK/SK WRH JLC YK/SK YK/SK Manual YK/SK Screw Super Actuator Linear Phase 1 ECH Brakes WRH 2.2 WRH 2.3 Hoists WRH 2.4 Jacks Cylinders System Actuators Lever YK/SK Lodestar Lodestar Tools WRH 2.1 Radios VS ET Unified Drives Pendants Festooning Q1 FY19 Q2 FY19 Q3 FY19 Q4 FY19 Q1 FY20 Q2 FY20 Q3 FY20 New User Crane Kit Expansion Experience Adding products and training drives adoption of Compass™ © 2019 Columbus McKinnon Corporation 42

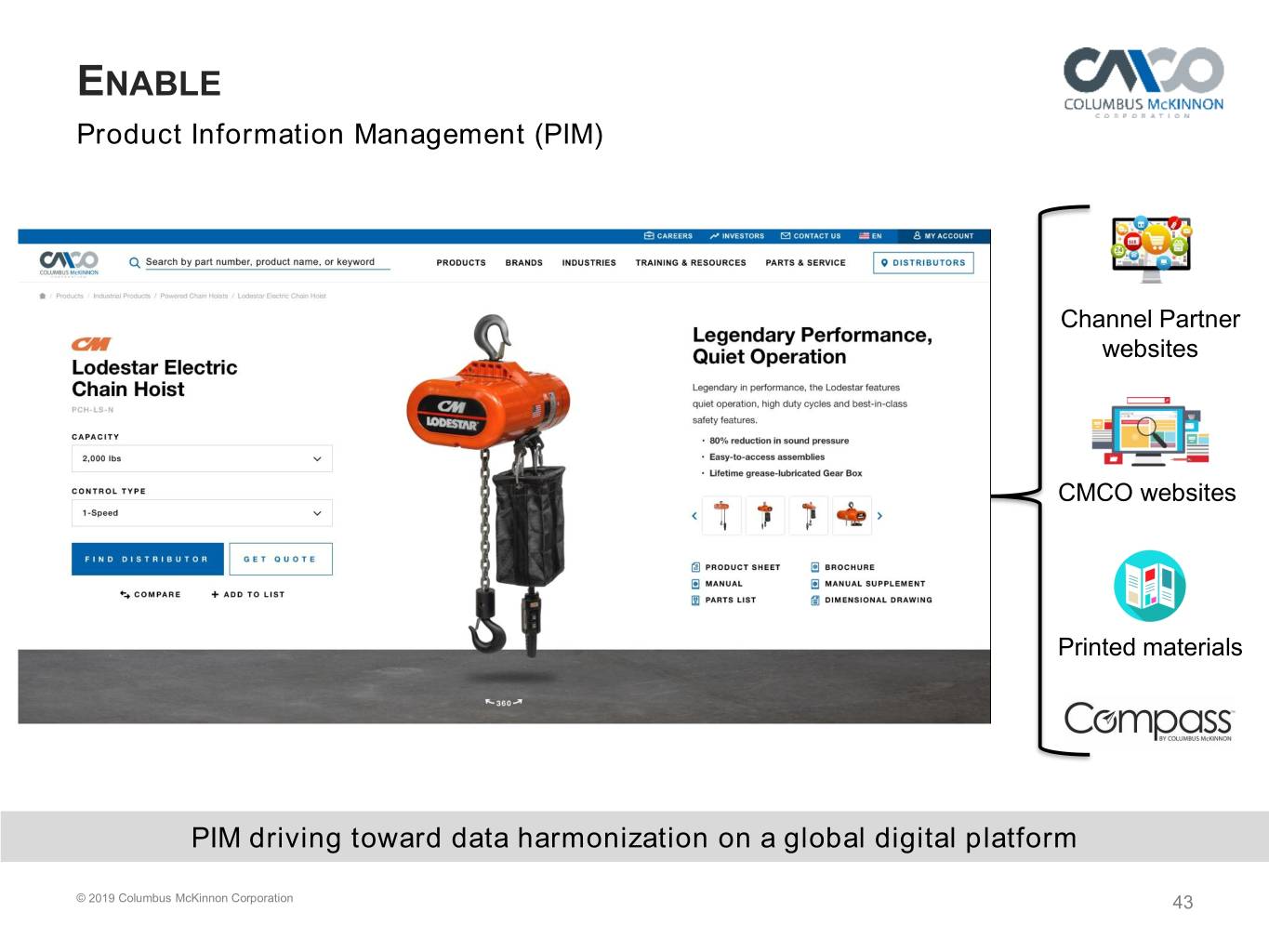

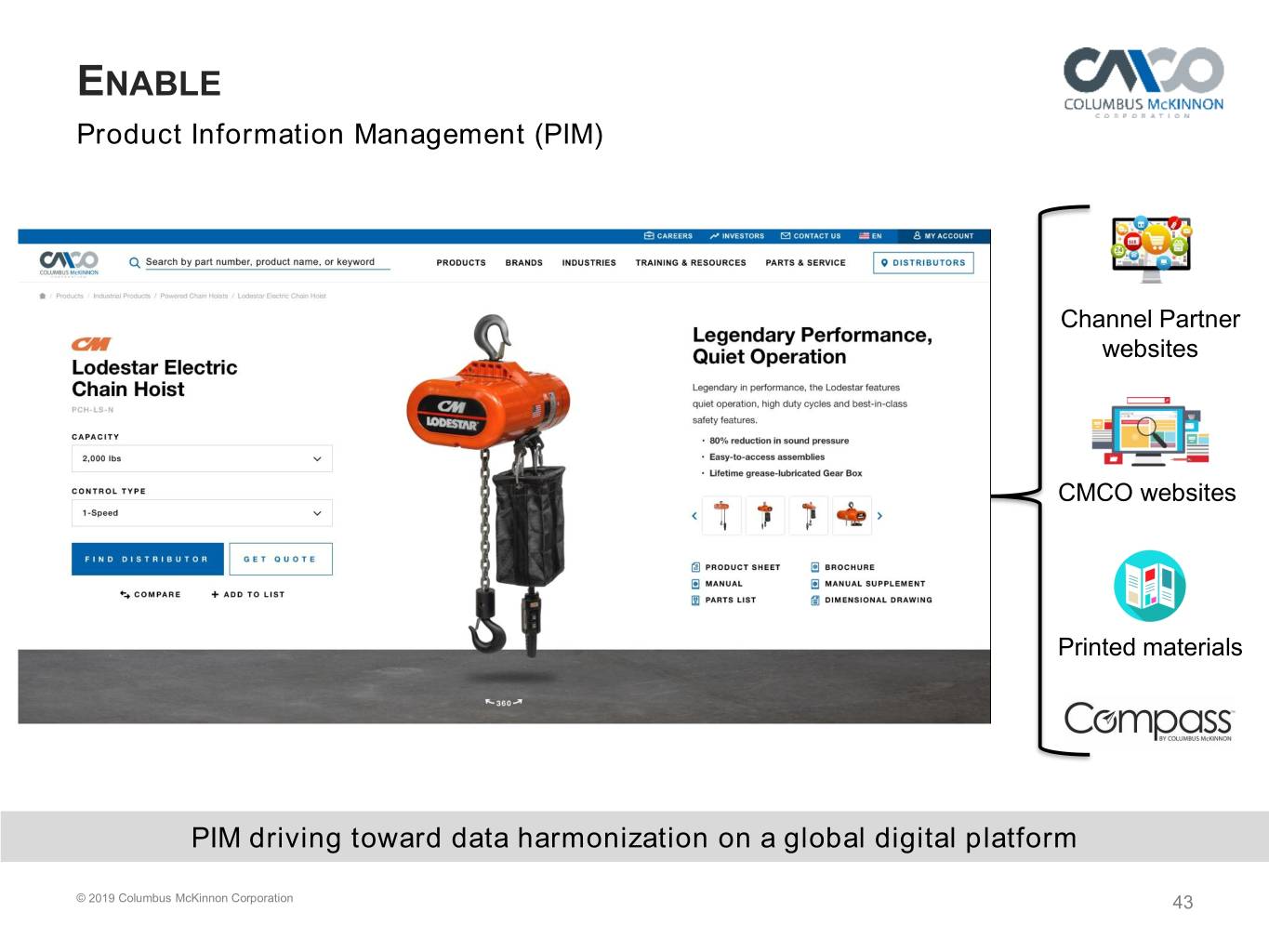

ENABLE Product Information Management (PIM) Channel Partner websites CMCO websites Printed materials PIM driving toward data harmonization on a global digital platform © 2019 Columbus McKinnon Corporation 43

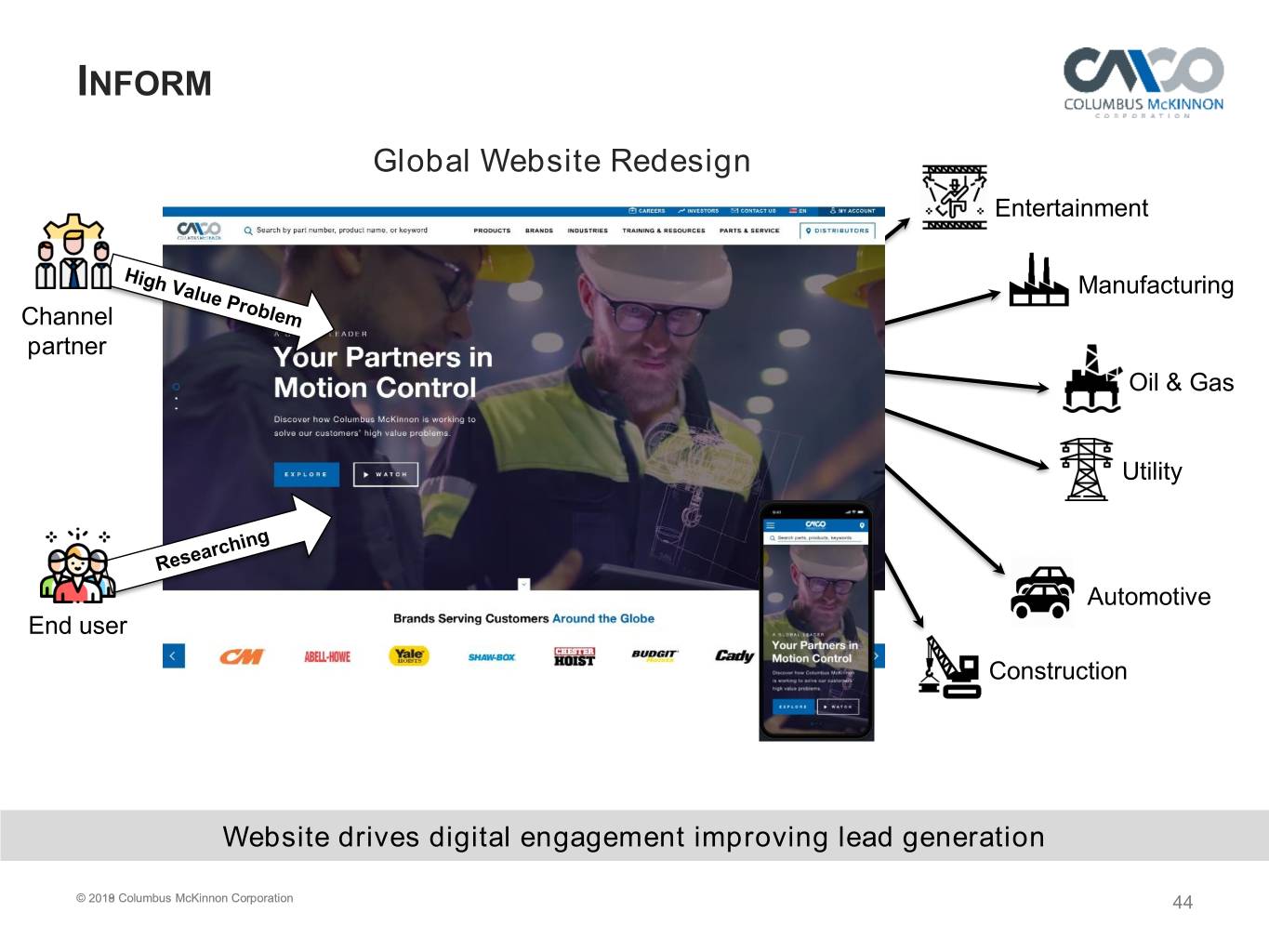

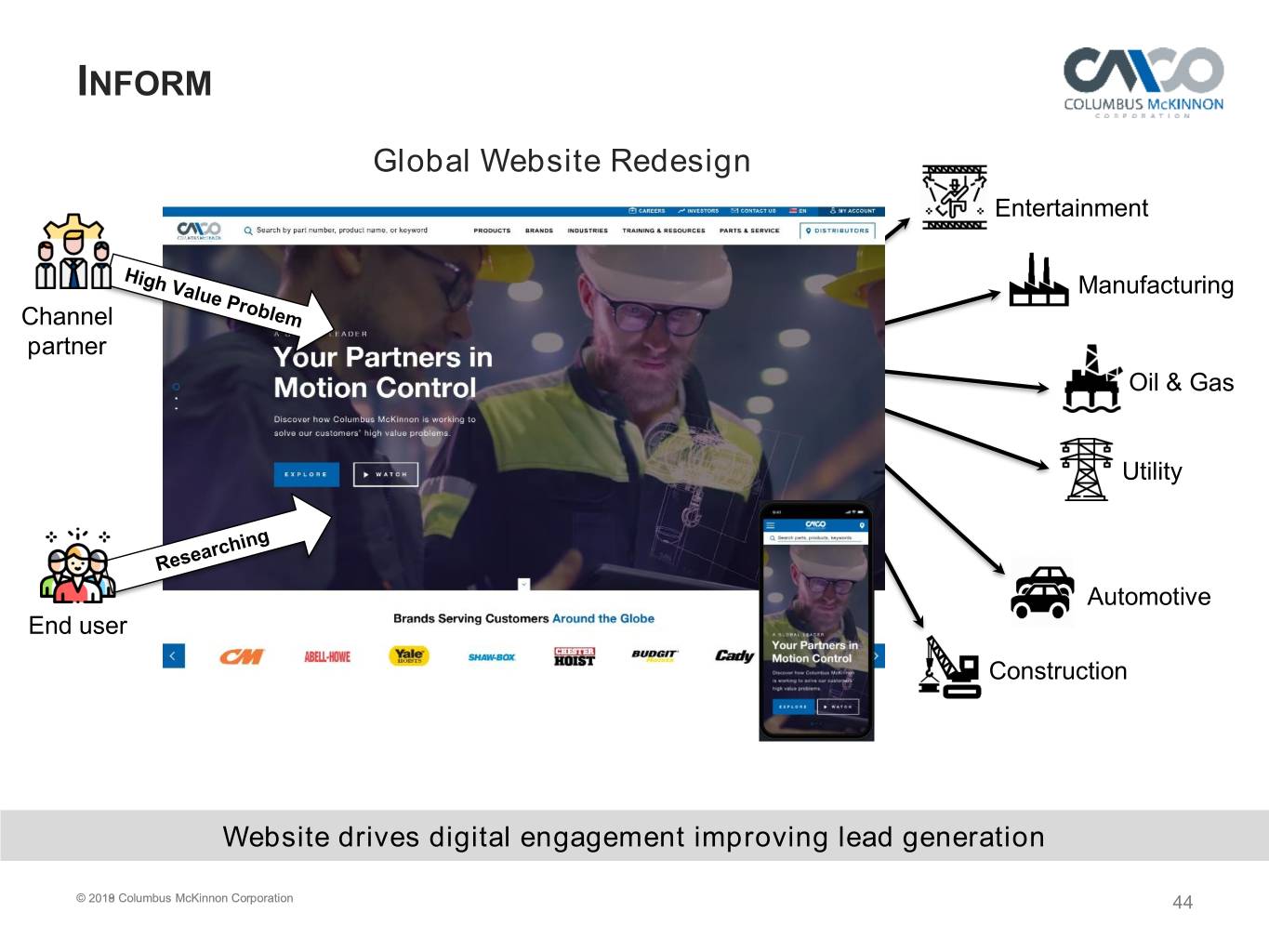

INFORM Global Website Redesign Entertainment Manufacturing Channel partner Oil & Gas Utility Automotive End user Construction Website drives digital engagement improving lead generation © 20192018 Columbus McKinnon Corporation 44

PURPOSEFUL DIGITAL PLATFORM Configure Enable Inform Product Global Web Information Redesign Management Empower customers Harmonize, Transform digital to efficiently consolidate & information into an configure & quote efficiently share engaging online product information experience Advancing digital capabilities to “be easy to do business with” © 2019 Columbus McKinnon Corporation 45

Industrial Products Kurt Wozniak Vice President, Industrial Products PARTNERS IN MOTION CONTROL

PRODUCTS & BRANDS Revenue $876 Million Industrial Products ~45% © 2019 Columbus McKinnon Corporation 47

TARGET MARKETS Infrastructure Oil & Gas Entertainment Power & Utilities Targeting a variety of growing industries © 2019 Columbus McKinnon Corporation 48

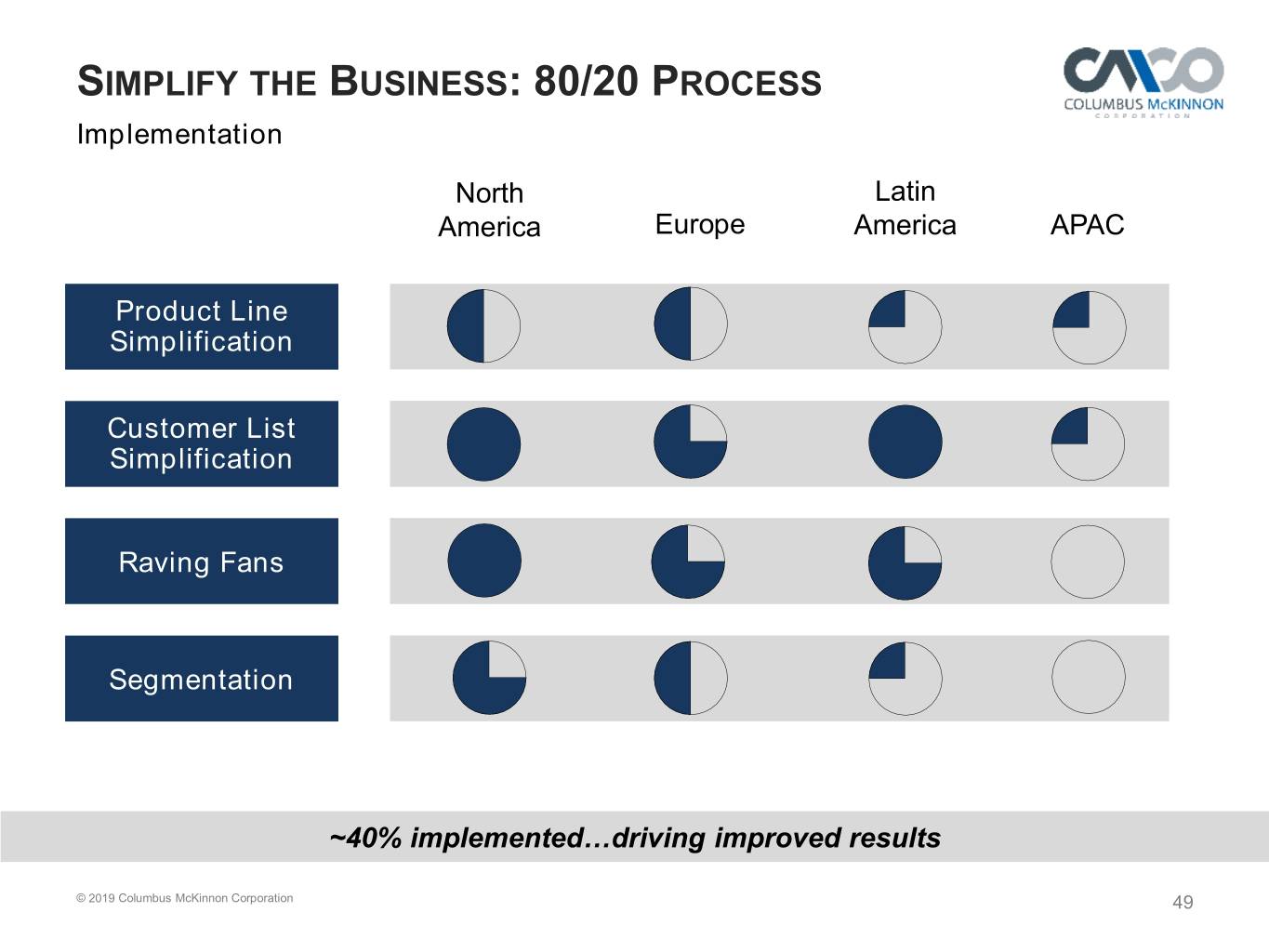

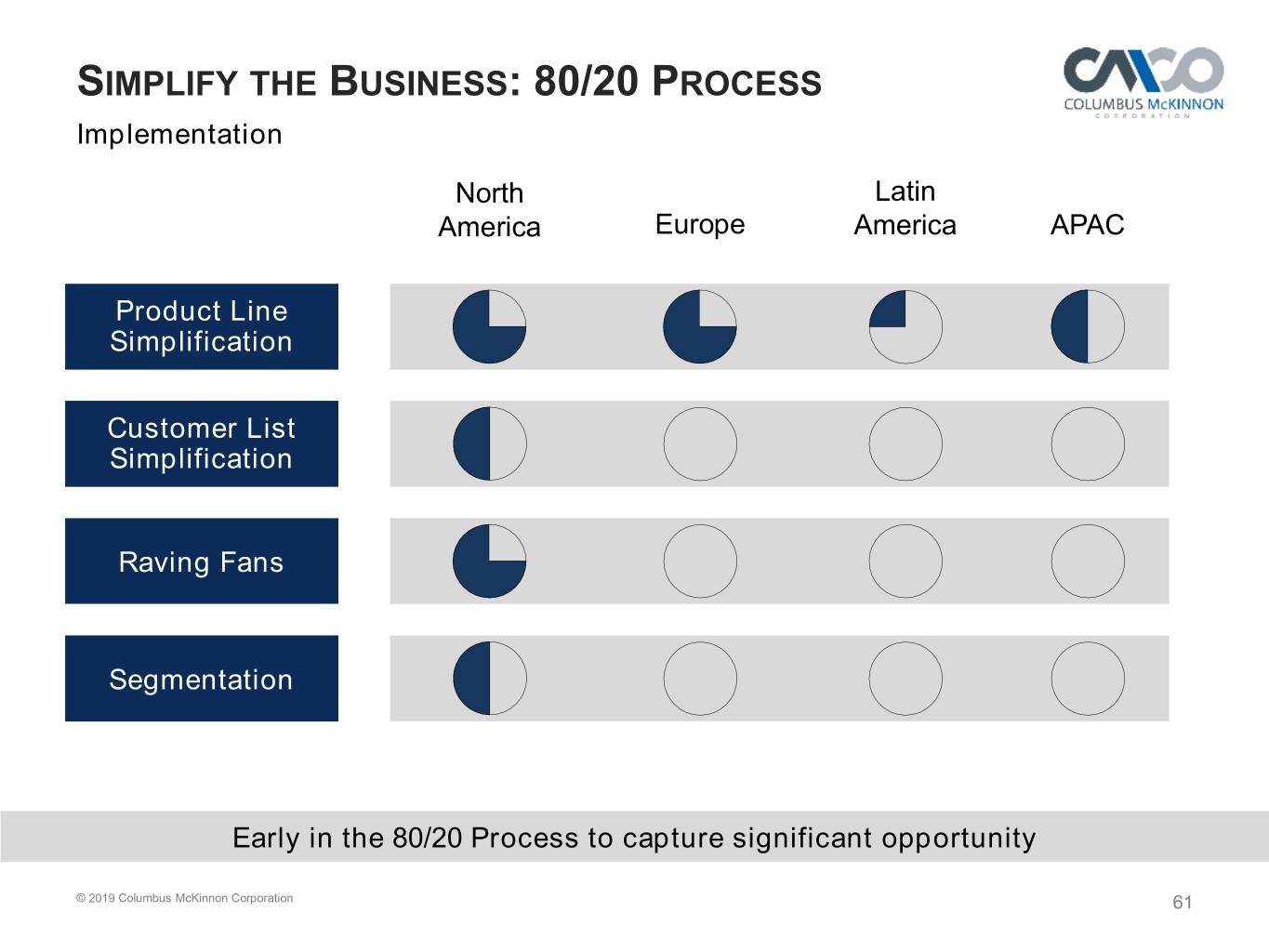

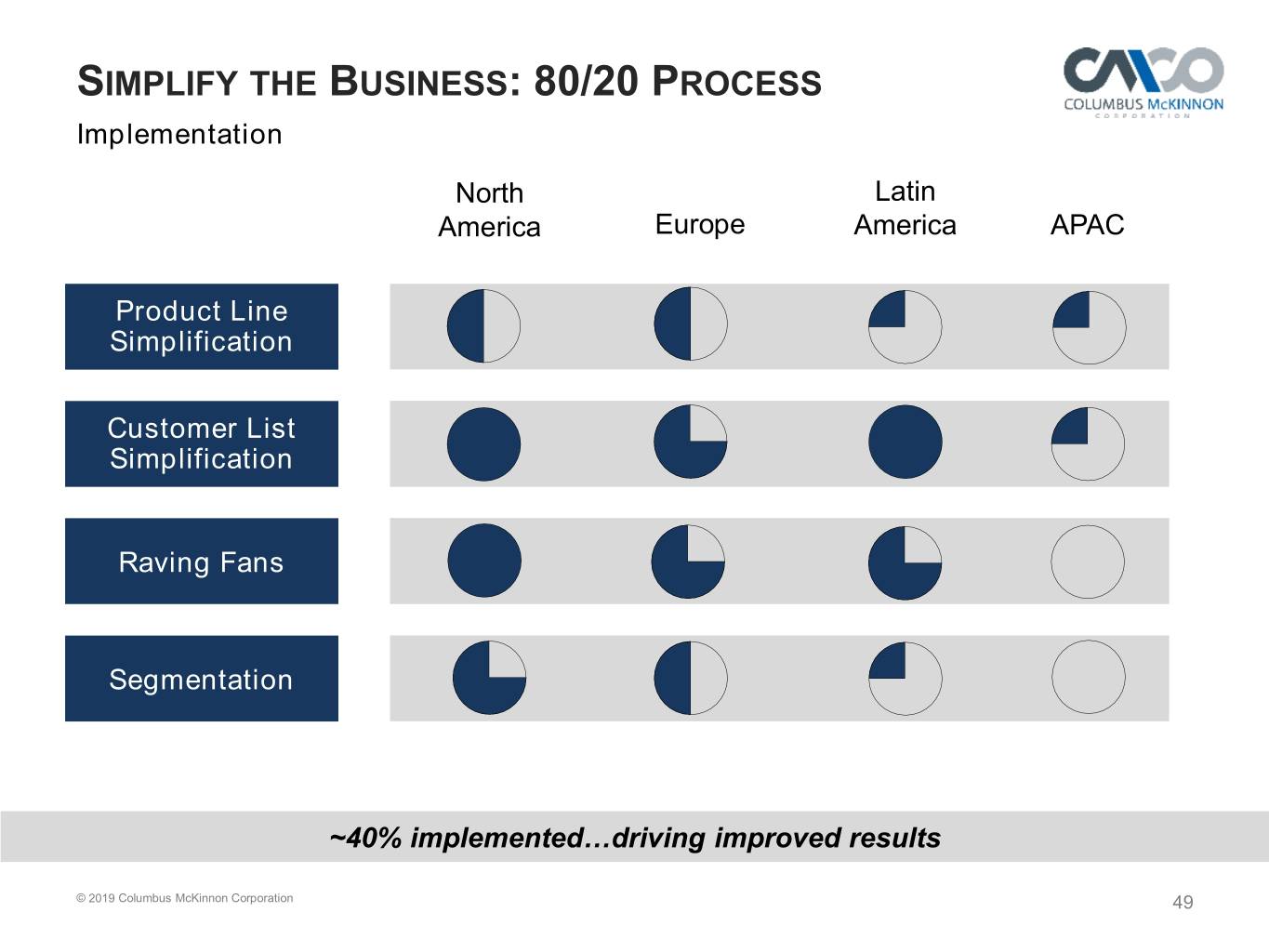

SIMPLIFY THE BUSINESS: 80/20 PROCESS Implementation North Latin America Europe America APAC Product Line Simplification Customer List Simplification Raving Fans Segmentation ~40% implemented…driving improved results © 2019 Columbus McKinnon Corporation 49

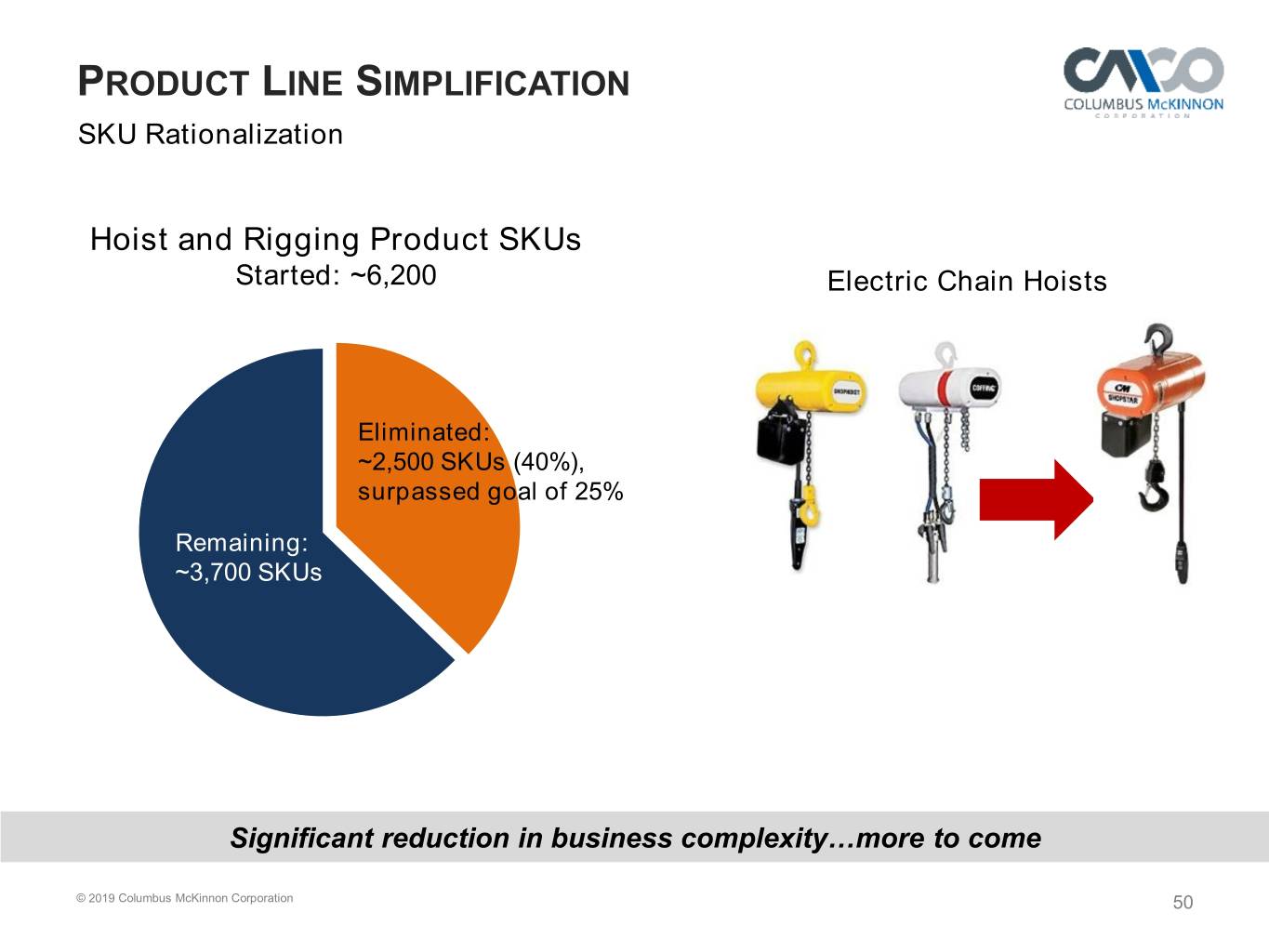

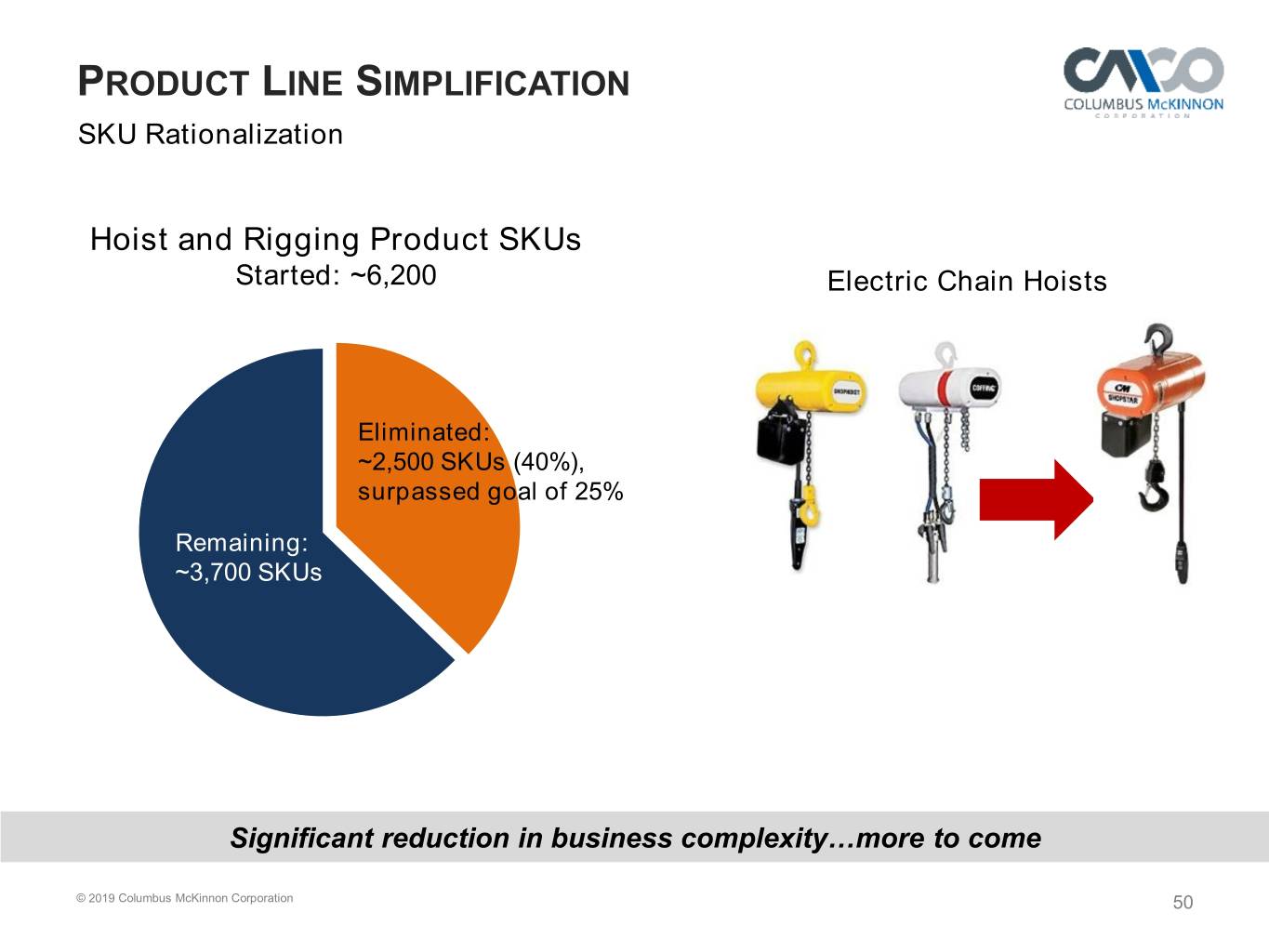

PRODUCT LINE SIMPLIFICATION SKU Rationalization Hoist and Rigging Product SKUs Started: ~6,200 Electric Chain Hoists Eliminated: ~2,500 SKUs (40%), surpassed goal of 25% Remaining: ~3,700 SKUs Significant reduction in business complexity…more to come © 2019 Columbus McKinnon Corporation 50

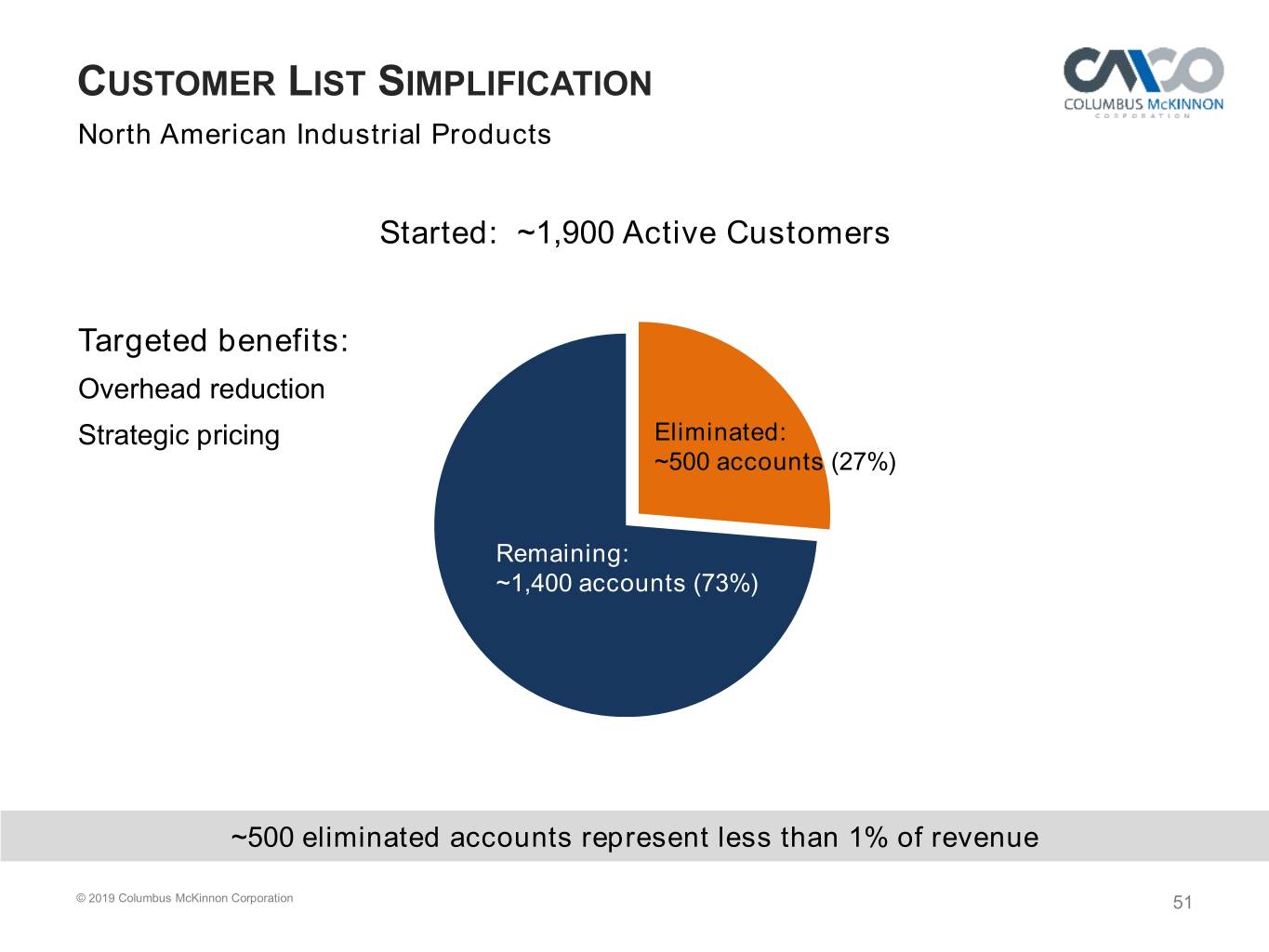

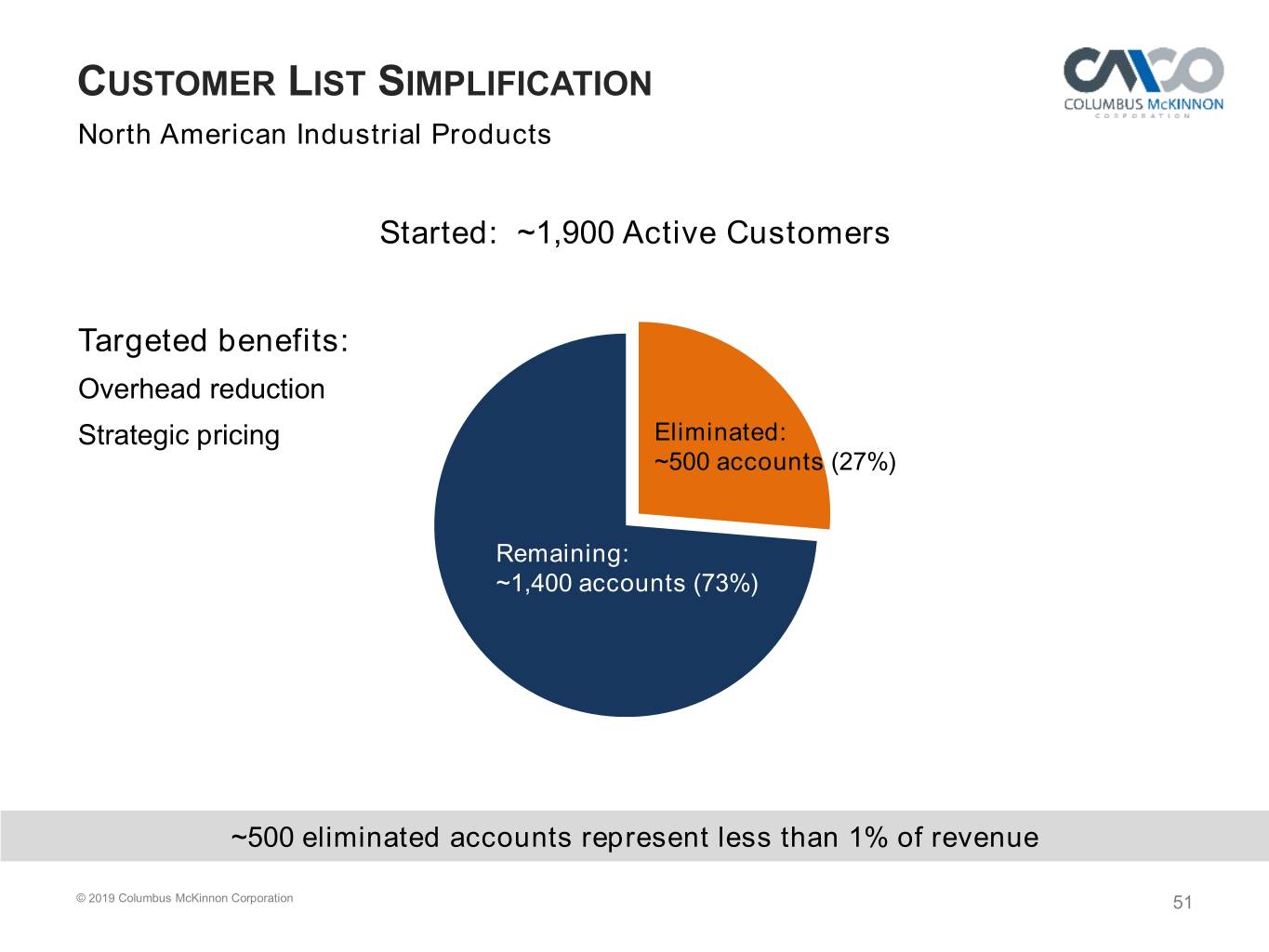

CUSTOMER LIST SIMPLIFICATION North American Industrial Products Started: ~1,900 Active Customers Targeted benefits: Overhead reduction Strategic pricing Eliminated: ~500 accounts (27%) Remaining: ~1,400 accounts (73%) ~500 eliminated accounts represent less than 1% of revenue © 2019 Columbus McKinnon Corporation 51

IMPROVING AVAILABILITY AND RESPONSIVENESS Customer Focus Select Solve Create priority high value “Raving Fans” accounts problems “Be easy to do business with”…Transform priority accounts into “Raving Fans” © 2019 Columbus McKinnon Corporation 52

GROWTH INITIATIVES: STRATEGIC ACCOUNT TEAM Dedicated commercial team Target key accounts and end-users Gain share through existing relationships Grow sales of core industrial products Expanded coverage in national and international markets © 2019 Columbus McKinnon Corporation 53

GROWTH INITIATIVES: GLOBAL ENTERTAINMENT World-wide growth initiative Enhance Lodestar with automation features to participate in high value industry trends Expand into adjacent space to replace winches with hoists Expanding market share in entertainment by solving high value problems © 2019 Columbus McKinnon Corporation 54

GROWTH INITIATIVES: CHANNEL ENRICHMENT Consolidated North America channel services team Enhanced channel coverage and customer service performance Transforming priority accounts into “Raving Fans” Strengthening relationships with key channel partners © 2019 Columbus McKinnon Corporation 55

INDUSTRIAL PRODUCTS PRIORITIES Simplify the • 80/20 Process Business • Digital marketing Improve • Material productivity / sourcing initiatives Productivity • Overhead reduction & plant productivity Ramp the • Priority Accounts / Raving Fans / Strategic Accounts Growth Engine • Automation-ready hoists Transform the • E-PAS, strategic deployment process Culture • Living “Our Values” Strategy is delivering value with long runway of opportunity © 2019 Columbus McKinnon Corporation 56

Crane Solutions Pete McCormick Vice President, Crane Solutions Group PARTNERS IN MOTION CONTROL

PRODUCTS & BRANDS Revenue $876 Million Crane Solutions ~45% © 2019 Columbus McKinnon Corporation 58

TARGET MARKETS Power & Metals Aerospace Oil & Gas / Utilities Processing & Defense Petrochemicals Targeting a variety of growing industries © 2019 Columbus McKinnon Corporation 59

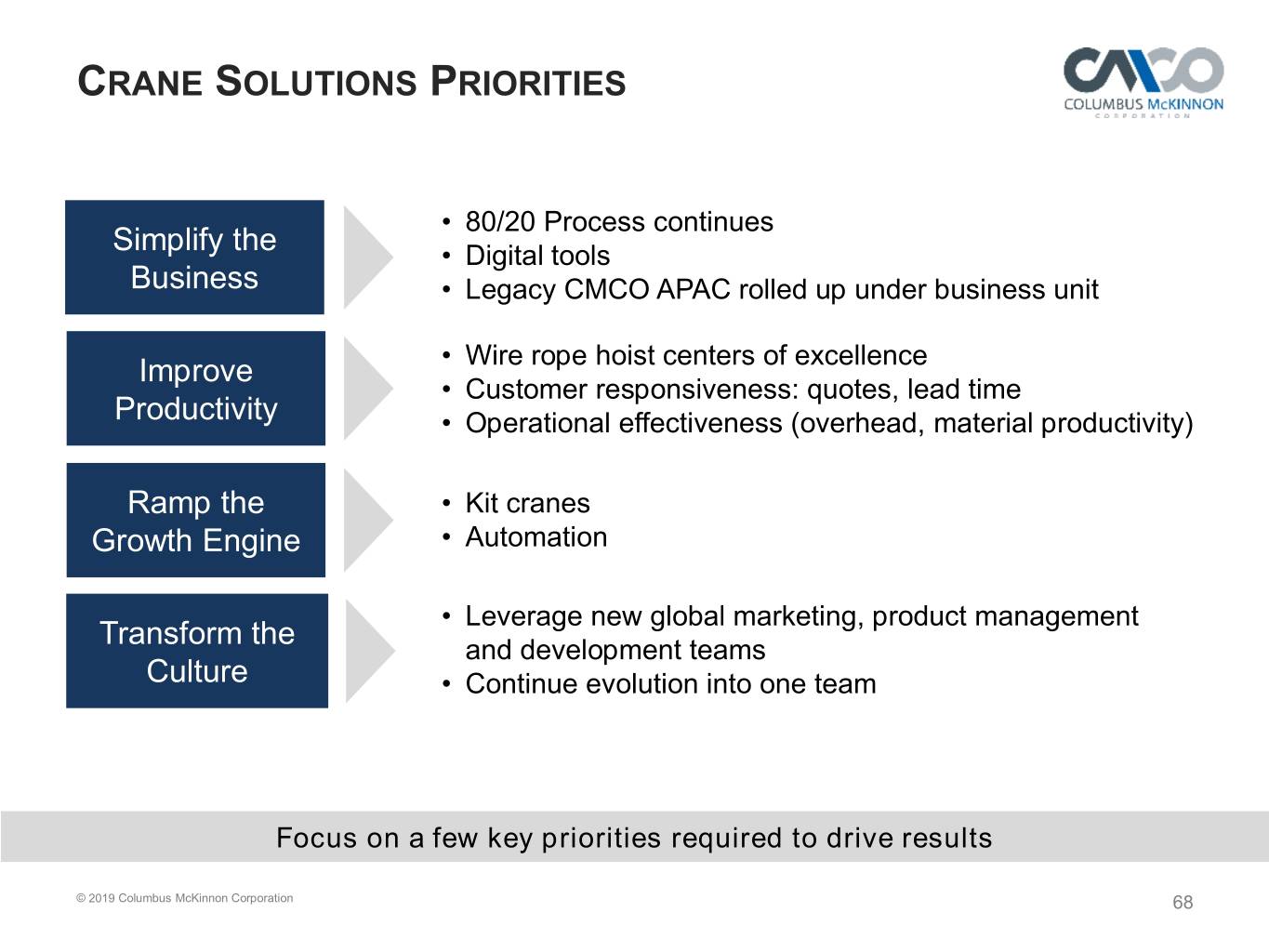

CRANE SOLUTIONS PRIORITIES • 80/20 Process continues Simplify the • Digital tools Business • Legacy CMCO APAC rolled up under business unit Improve • Wire rope hoist centers of excellence • Customer responsiveness: quotes, lead time Productivity • Operational effectiveness (overhead, material productivity) Ramp the • Kit cranes Growth Engine • Automation • Leverage new global marketing, product management Transform the and development teams Culture • Continue evolution into one team Focus on a few key priorities required to drive results © 2019 Columbus McKinnon Corporation 60

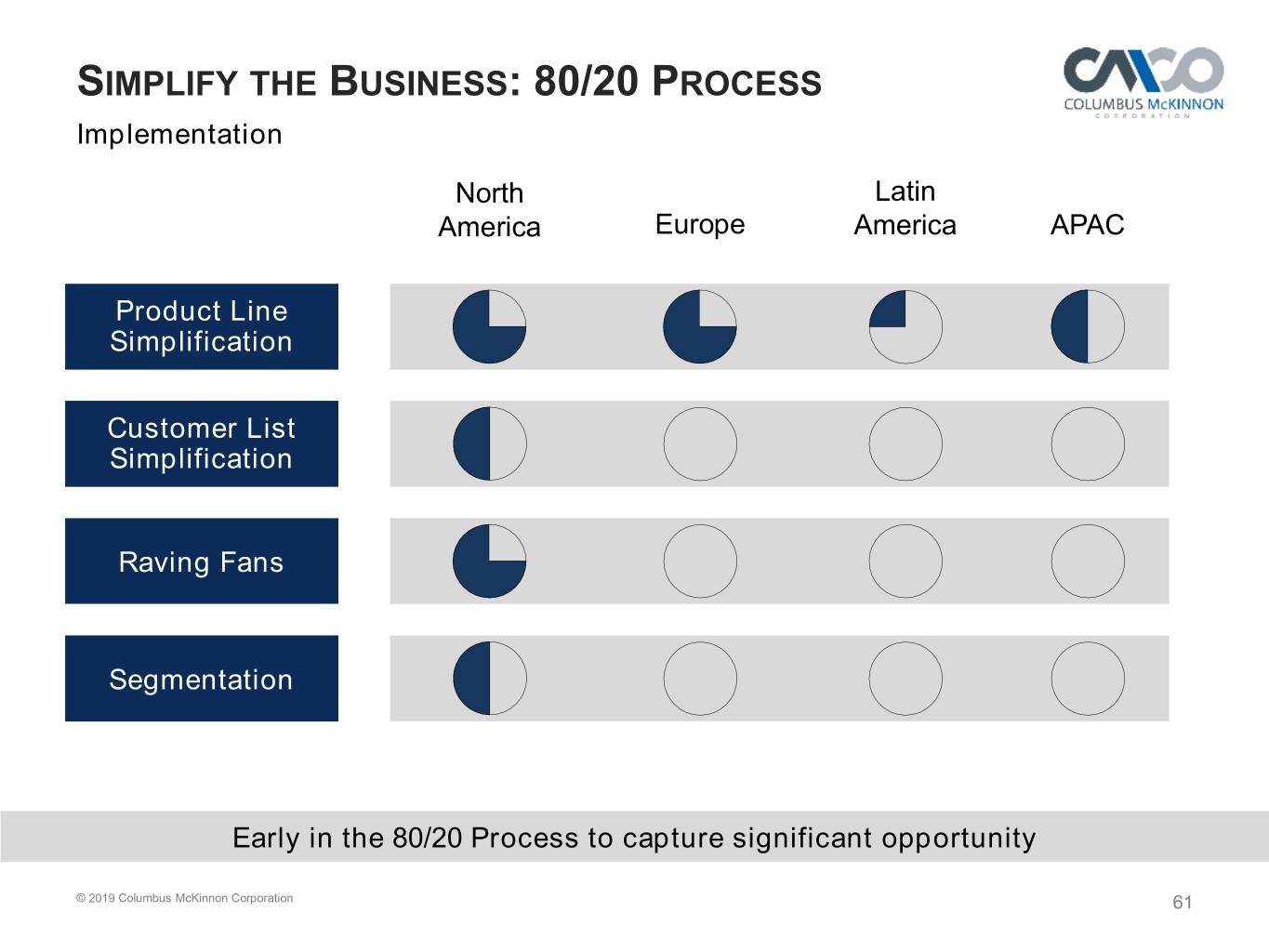

SIMPLIFY THE BUSINESS: 80/20 PROCESS Implementation North Latin America Europe America APAC Product Line Simplification Customer List Simplification Raving Fans Segmentation Early in the 80/20 Process to capture significant opportunity © 2019 Columbus McKinnon Corporation 61

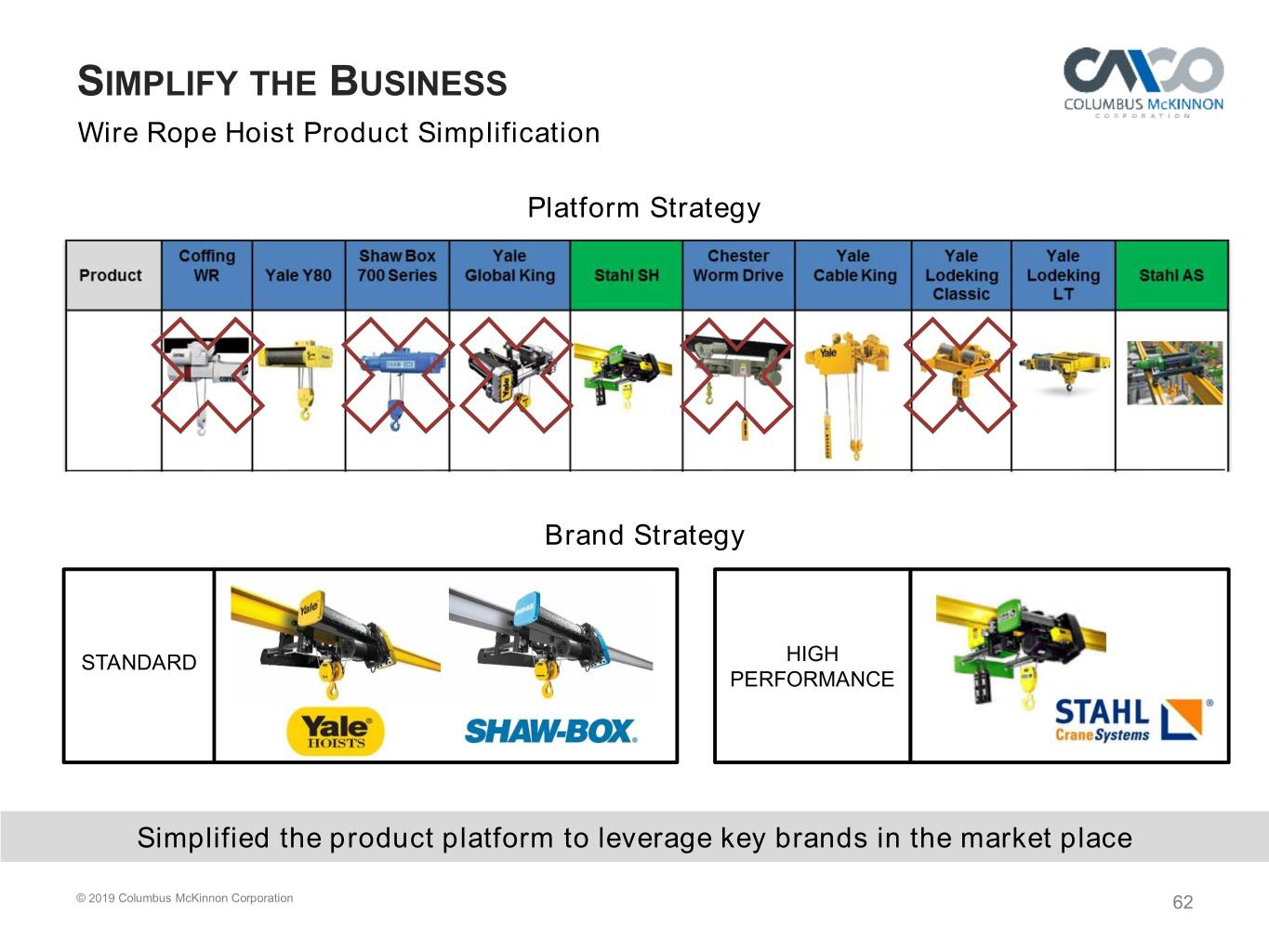

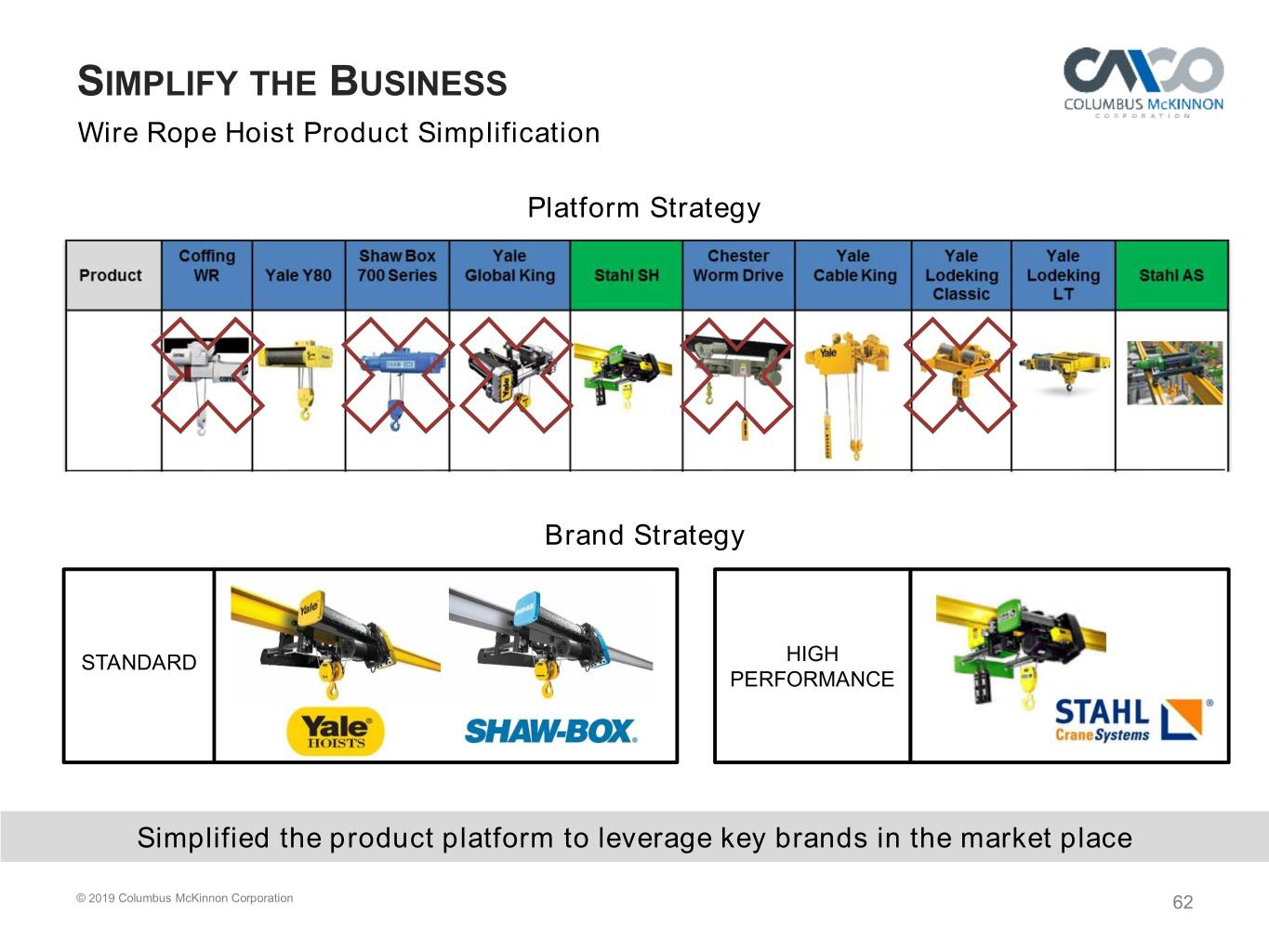

SIMPLIFY THE BUSINESS Wire Rope Hoist Product Simplification Platform Strategy Brand Strategy STANDARD HIGH PERFORMANCE Simplified the product platform to leverage key brands in the market place © 2019 Columbus McKinnon Corporation 62

SIMPLIFY THE BUSINESS New Wire Rope Hoists Platform Advantages More than doubled lifting capacity to 135 tons Added explosion proof feature New platform offers higher quality, more features, lower cost © 2019 Columbus McKinnon Corporation 63

IMPROVE PRODUCTIVITY Focus on Operational Excellence Optimize footprint Exited Salem, Ohio facility Created “Center of Excellence” for wire rope hoist Consolidated workstation cranes into one showcase facility Deliver 1.5% net material cost out Strategic sourcing building funnel Reduce engineering lead time Stahl CraneSystems Kunzelsau facility Simplifying the product platform and leveraging key brands in the market place © 2019 Columbus McKinnon Corporation 64

RAMP THE GROWTH ENGINE Penetrating Mid-Tier Segment with Kit Cranes Mid-Tier Market ~$750 Million New addressable market opportunity ~$300 Million Leverage new platform and crane kits to penetrate mid-tier segment © 2019 Columbus McKinnon Corporation 65

RAMP THE GROWTH ENGINE Adding Automation to Overhead Cranes Increased Productivity Maximized Performance Labor Optimization Energy Efficiency Improved Quality Safety & Health Benefits Providing high-value solutions © 2019 Columbus McKinnon Corporation 66

FOCUS ON AVAILABILITY AND RESPONSIVENESS One-Stop Source Most Single Advanced, Supply High Partner Quality Products Engineered Team of & Tested to Experts Work Together “Be easy to do business with”…serving your high value motion control needs © 2019 Columbus McKinnon Corporation 67

CRANE SOLUTIONS PRIORITIES • 80/20 Process continues Simplify the • Digital tools Business • Legacy CMCO APAC rolled up under business unit Improve • Wire rope hoist centers of excellence • Customer responsiveness: quotes, lead time Productivity • Operational effectiveness (overhead, material productivity) Ramp the • Kit cranes Growth Engine • Automation • Leverage new global marketing, product management Transform the and development teams Culture • Continue evolution into one team Focus on a few key priorities required to drive results © 2019 Columbus McKinnon Corporation 68

Engineered Products Appal Chintapalli Vice President, Engineered Products PARTNERS IN MOTION CONTROL

PRODUCTS & BRANDS Revenue $876 Million Engineered Products ~10% © 2019 Columbus McKinnon Corporation 70

TARGET MARKETS Metal Oil & Gas Infrastructure: Automation Processing Rail Targeting a variety of growing industries © 2019 Columbus McKinnon Corporation 71

RAMP THE GROWTH ENGINE – MARKET DRIVERS Shift away from Automation for Rugged Maintainability pneumatic/hydraulic higher productivity environments A lower total cost of ownership for our customers Uniquely positioned to match actuation technology to the market drivers © 2019 Columbus McKinnon Corporation 72

RAIL PROJECTS DB Freiburg, Germany DBRoof Freiburg, Working Germany Platform $1.7M Demonstrated leadership & differentiated offering Roof Working Platform $1.7M Strong pipeline of projects - record backlog Complete solution Advanced controls New roof working platforms Significant lifetime value of projects Delhi Metro, India Underfloor Lifting System $1.6 million Multiple large projects expected to be delivered throughout FY2020 © 2019 Columbus McKinnon Corporation 73

MOBILE PLATFORMS Advanced lifting mechanisms for Autonomous Guidance Vehicles (AGV) Large variety of end uses Automated “factories of the future” and “service robots” Working with several application- specific AGV suppliers Expanding competency from simple lifting components to fully integrated solutions *KUKA: German manufacturer and market leader of industrial robots and solutions for factory automation © 2019 Columbus McKinnon Corporation 74

SMART PARKING Fully automated self-serve parking garages Gears, chain drives and actuators automatically deliver vehicle to rack storage Significant growth potential as cities combat parking issues Providing value added solution in growth segment © 2019 Columbus McKinnon Corporation 75

AUTOMATION SYSTEMS Lift and lower platforms for aircraft maintenance User configurable actuation system includes smart microcontrollers and Magnetek variable frequency drives Applications in all segments of the transportation industry Mobile platform for aircraft maintenance personnel, built by Kern Steel for Southwest Airlines using Duff-Norton actuators Legacy actuator products combined with advanced controls technology © 2019 Columbus McKinnon Corporation 76

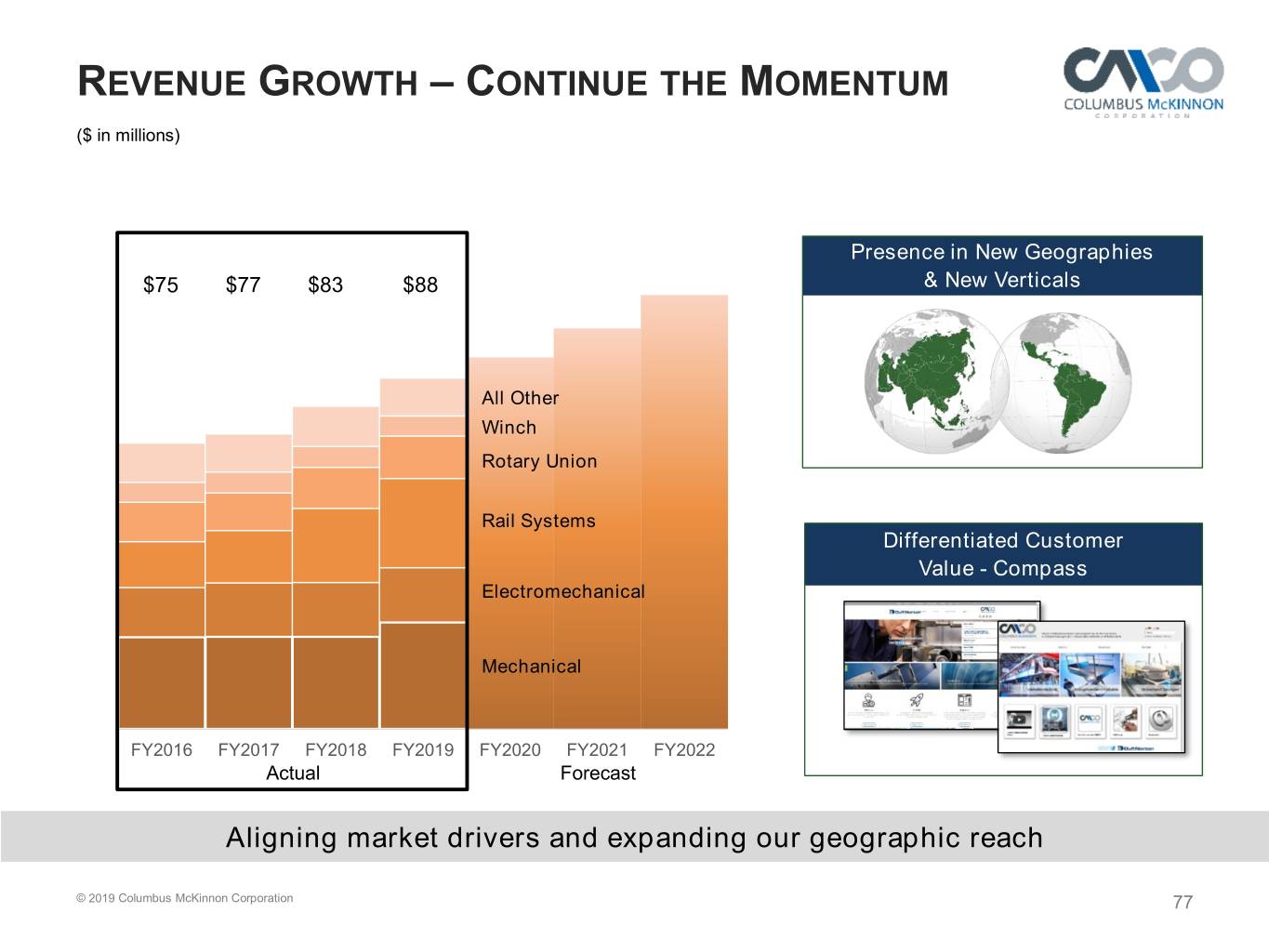

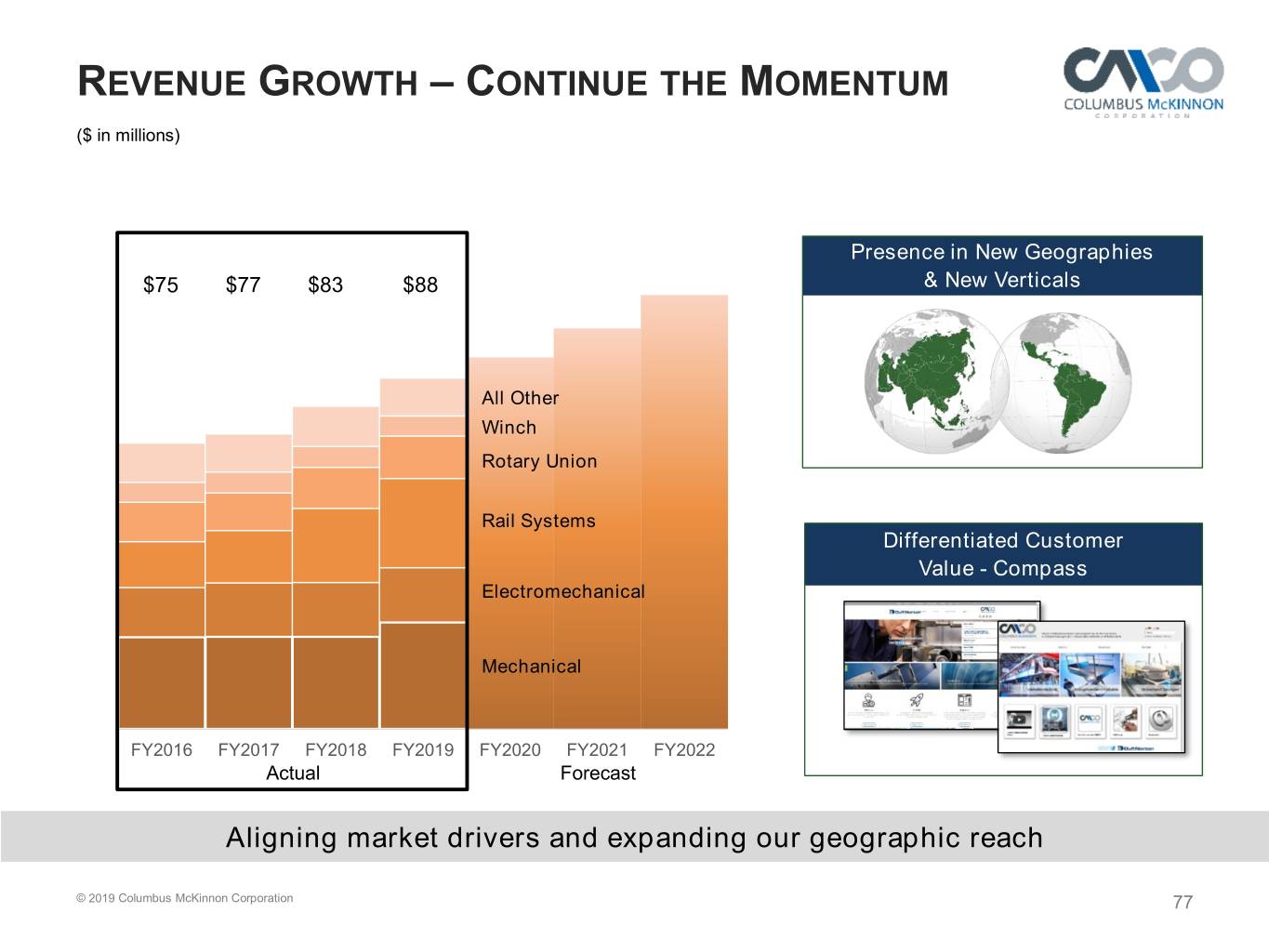

REVENUE GROWTH – CONTINUE THE MOMENTUM ($ in millions) Presence in New Geographies $75 $77 $83 $88 & New Verticals All Other Winch Rotary Union Rail Systems Differentiated Customer Value - Compass Electromechanical Mechanical FY2016 FY2017 FY2018 FY2019 FY2020 FY2021 FY2022 Actual Forecast Aligning market drivers and expanding our geographic reach © 2019 Columbus McKinnon Corporation 77

SIMPLIFYING THE BUSINESS: 80/20 PROCESS Customer & Customer Strategic Pricing Product Line Product Service Levels Execution Simplification Characterization Implementation Product & customer Q1 profitability analysis Change prices to Q2 reflect cost-to-serve Trim product lines that Q3 don’t meet strategic criteria Reward customer loyalty & higher Q4 volume with superior service levels 80/20 will provide focus and drive results © 2019 Columbus McKinnon Corporation 78

OPERATIONAL EXCELLENCE Lead Time Improvement to be “Easy To Do Business With” Implementing Speedline Take order Engineered To EngineeringTo engineering from customer or Standard? Standard Independent assembly cells product = with kanban management Speedline Generated excellent results with plant and workflow Speedline Cell – Speedline Cell – reconfiguration Kissing, Germany Charlotte, NC Improved lead times from 10 days to 3 days, surpassed goal Achieved 98% on-time- delivery Lead time went from 10 business days to less than 3 © 2019 Columbus McKinnon Corporation 79

ENGINEERED PRODUCTS PRIORITIES Simplify the • 80/20 Process Business • Product simplification & customer focus Improve • Lead time reduction & factory reorganizations Productivity • Overhead cost reduction & strategic sourcing Ramp the • Targeted global markets Growth Engine • Product development & value engineering Transform the • E-PAS, strategic deployment process Culture • Living “Our Values” Execute top-line and bottom-line growth priorities © 2019 Columbus McKinnon Corporation 80

Driving Earnings Power Greg Rustowicz Vice President, Finance & Chief Financial Officer PARTNERS IN MOTION CONTROL

SALES AND EBITDA GROWTH ($ in millions) Net Sales Adjusted EBITDA 1000 200 $876 24.0% 900 $839 180 800 160 22.0% $133 700 $637 140 $115 19.0% 20.0% 600 120 18.0% 500 100 $72 400 80 15.1% 16.0% 13.7% 300 60 14.0% 200 40 11.4% 12.0% 100 20 0 0 10.0% FY17 FY18 FY19 FY22E FY17 FY18 FY19 FY22E Assumes GDP type growth ROIC: 6.4% 8.7% 11.2% Mid-teens Strong performance to-date… targeting 19% EBITDA Margins in FY2022 Adjusted EBITDA is a non-GAAP financial measure. Please see supplemental slides for a reconciliation. © 2019 Columbus McKinnon Corporation 82

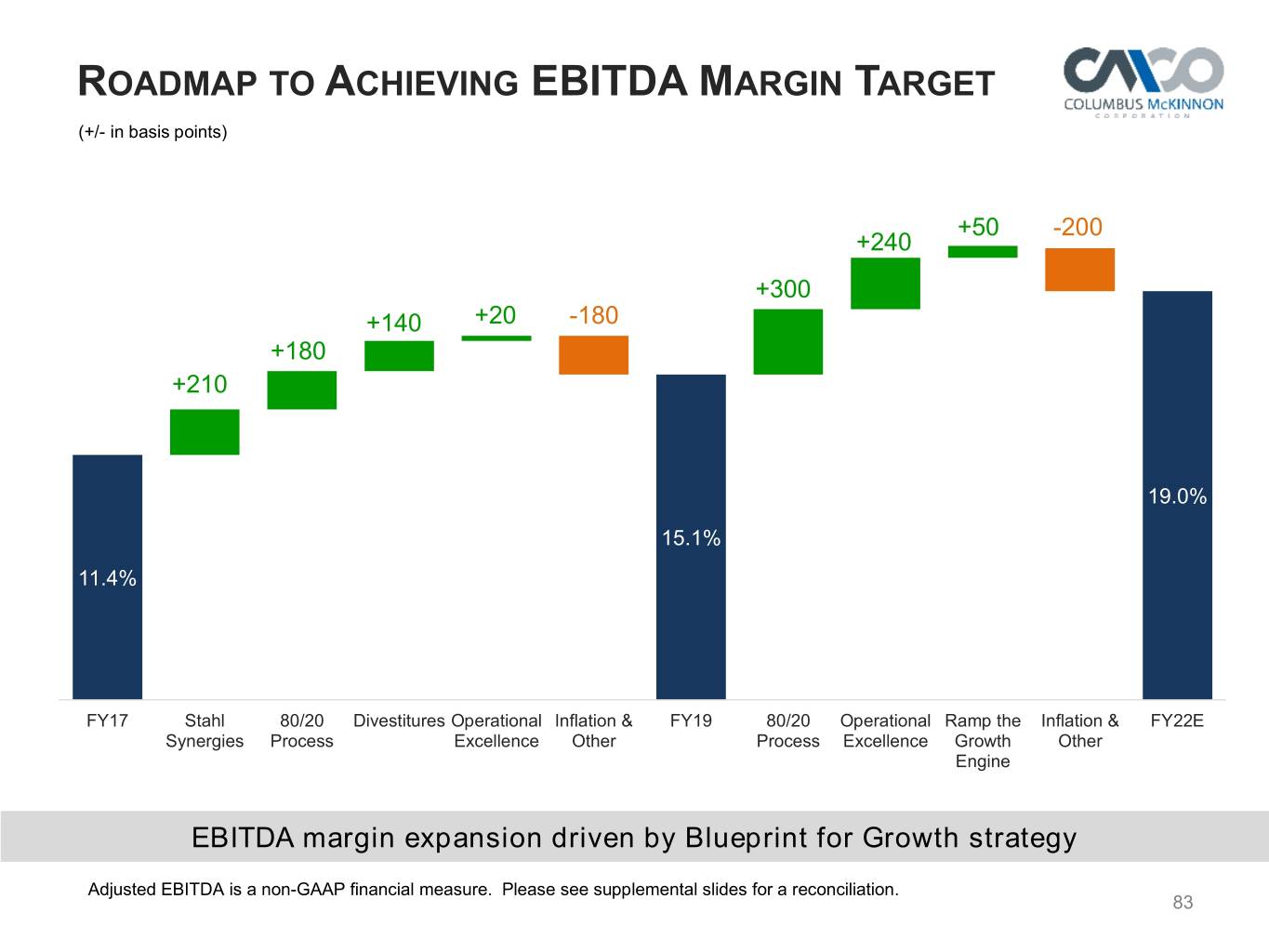

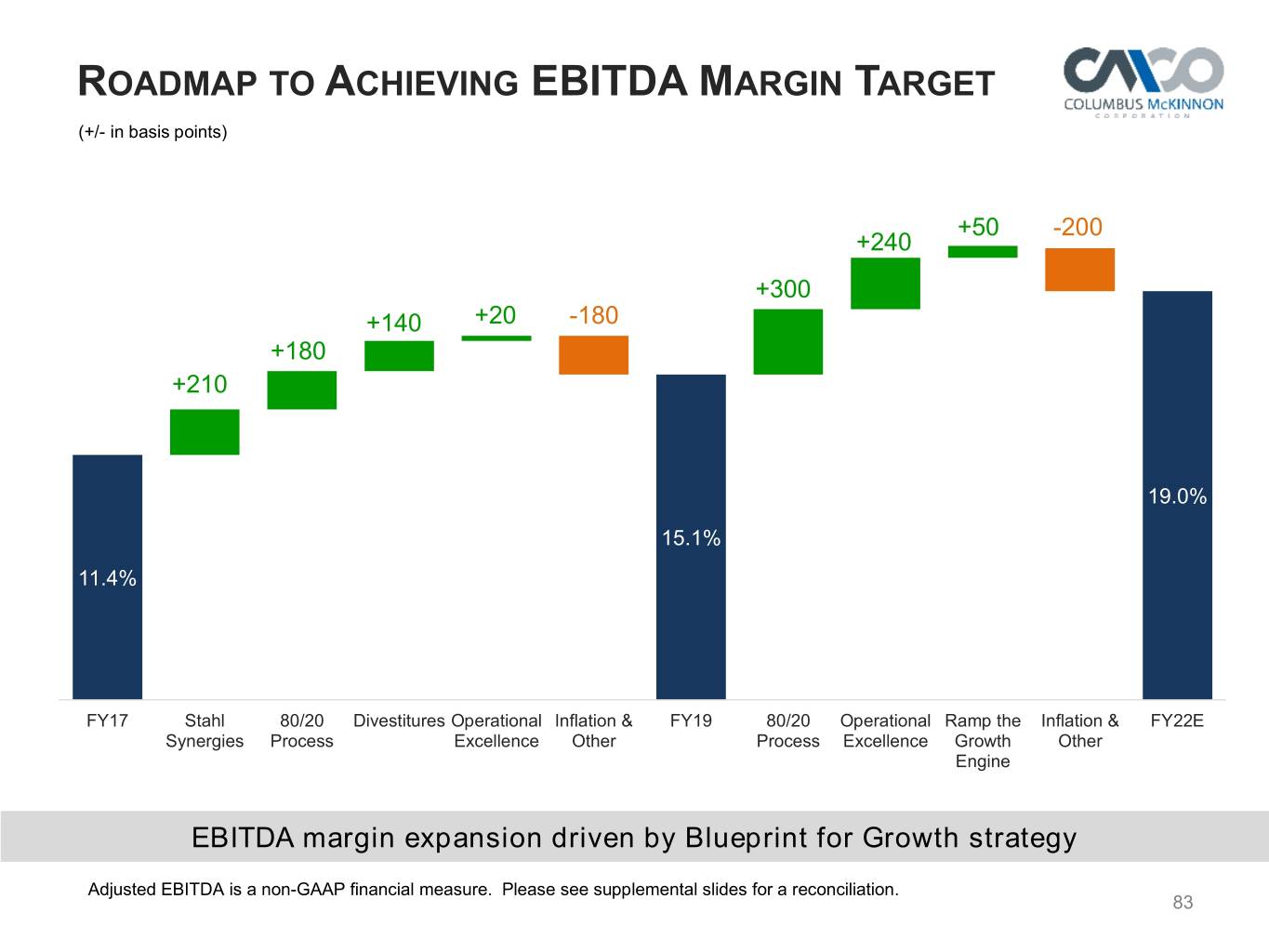

ROADMAP TO ACHIEVING EBITDA MARGIN TARGET (+/- in basis points) 25.0% +50 -200 +240 20.0% +300 +140 +20 -180 +180 15.0% +210 10.0% 20.6% 18.2% 19.0% 19.0% 16.7% 15.3% 15.1% 15.1% 15.1% 13.5% 11.4% 11.4% 5.0% 0.0% FY17 Stahl 80/20 Divestitures Operational Inflation & FY19 80/20 Operational Ramp the Inflation & FY22E Synergies Process Excellence Other Process Excellence Growth Other Engine EBITDA margin expansion driven by Blueprint for Growth strategy Adjusted EBITDA is a non-GAAP financial measure. Please see supplemental slides for a reconciliation. © 2019 Columbus McKinnon Corporation 83

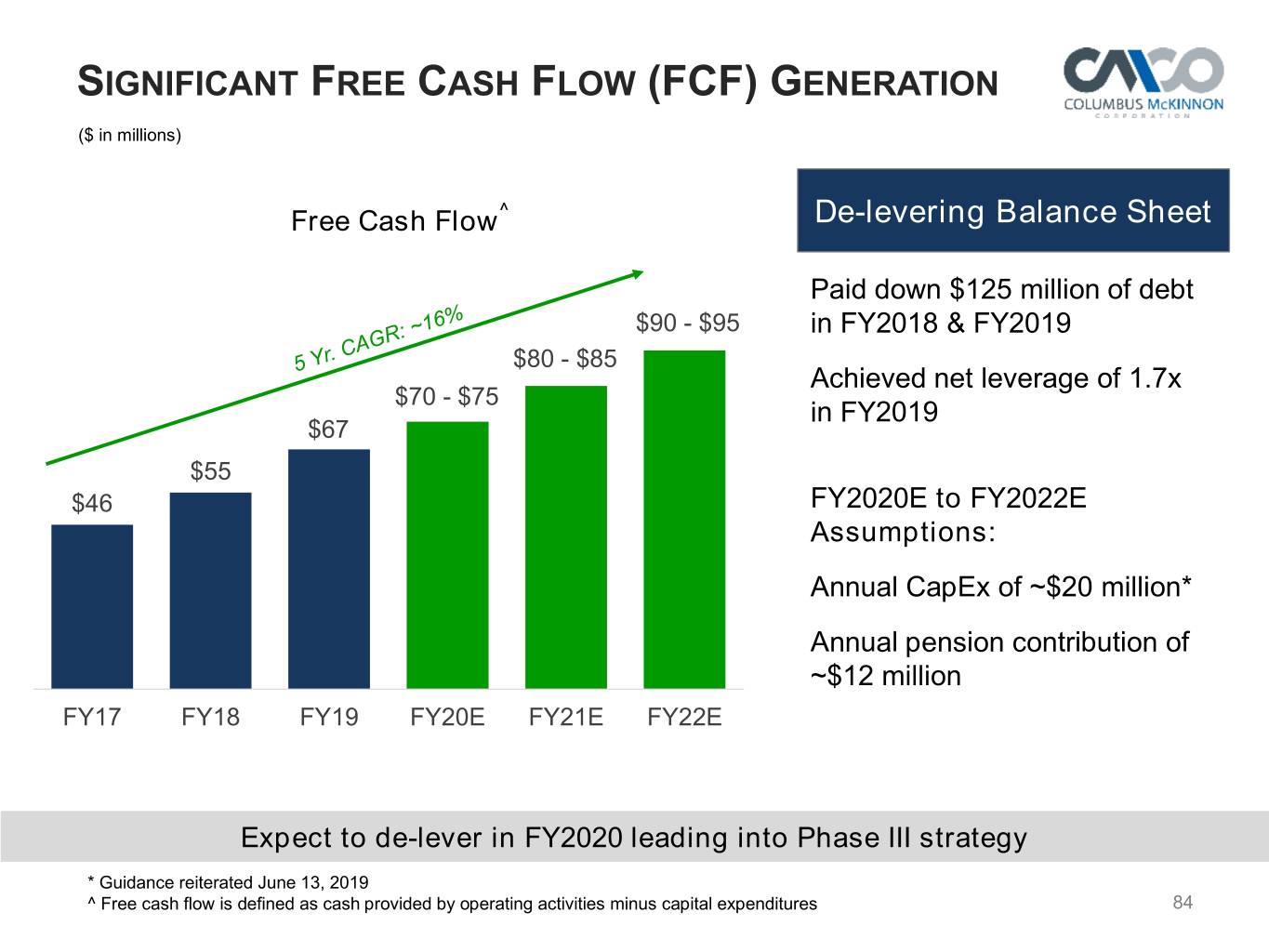

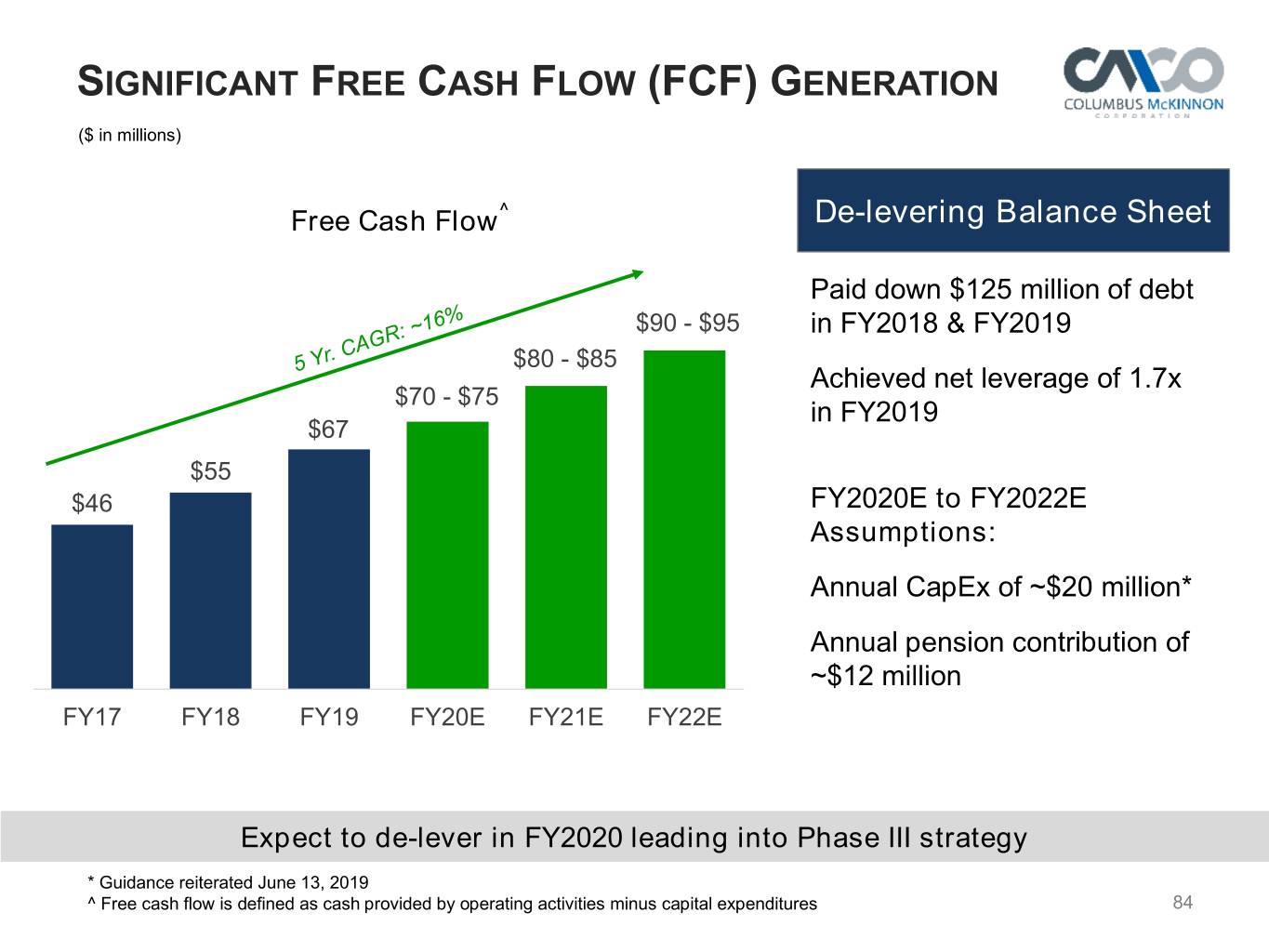

SIGNIFICANT FREE CASH FLOW (FCF) GENERATION ($ in millions) Free Cash Flow^ De-levering Balance Sheet Paid down $125 million of debt $90 - $95 in FY2018 & FY2019 $80 - $85 Achieved net leverage of 1.7x $70 - $75 in FY2019 $67 $55 $46 FY2020E to FY2022E Assumptions: Annual CapEx of ~$20 million* Annual pension contribution of ~$12 million FY17 FY18 FY19 FY20E FY21E FY22E Expect to de-lever in FY2020 leading into Phase III strategy * Guidance reiterated June 13, 2019 © ^2019 Free Columbus cash McKinnon flow is Corporation defined as cash provided by operating activities minus capital expenditures 84

CAPITAL DEPLOYMENT PRIORITIES Organic Growth De-lever the balance sheet Achieve net leverage target New product development, other strategic initiatives Invest in growth initiatives In-organic Growth M&A Fund M&A Decreasing Priority Decreasing Return of Capital Regular dividend Adhere to dividend policy Share repurchase Consider opportunistically Capital deployment priorities remain unchanged © 2019 Columbus McKinnon Corporation 85

CMCO ALUE REATION VERSUS EERS V C P FY22 Target FY19 FY18 FY17 TTM EBITDA % Trading Multiple TTM ROIC 1st 27% 1st 18.9x 1st 18% 19.0% 2nd 16% 2nd 13.5x 2nd 14% Mid-teens 15.1% 3rd 13% 13.7% 3rd 9.8x 3rd 11% 11.2% 8.6x 8.2x 11.4% 8.7% 4th 10% 4th 7.3x 7.5x 4th 9% 6.4% Phase I-II execution resulting in improved earnings vs. peers… multiple undervalued - Peer quartiles as of 3/31/19 CMCO Peerset: Alamo Group, Altra Industrial Motion, CIRCOR, Federal Signal, - CMCO© FY2019F 20192018 Columbus Columbus trading McKinnon mMcKinnonultiple Corporation as Corporationof 3/31/19 Flowserve, Fortive, Franklin Electric, Graco, IDEX, Roper, Ingersoll-Rand, Kennametal, 86 - Tax rates for ROIC. FY2017: 30%, FY2018: 22%, FY2019-22: 25% Kito, KoneCranes, Palfinger, Parker-Hannifin, RBC Bearings, Regal Beloit, Tennant, Terex

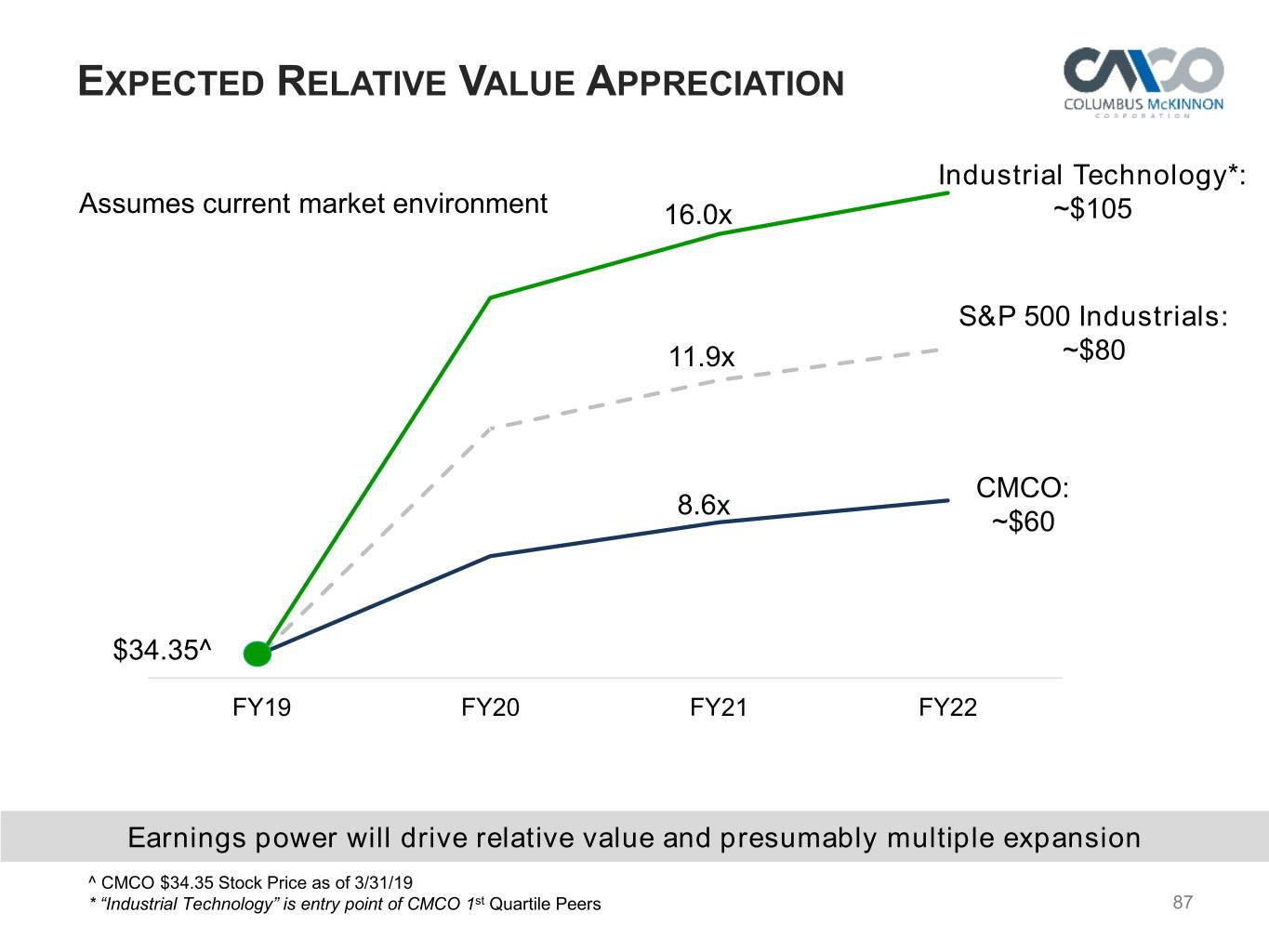

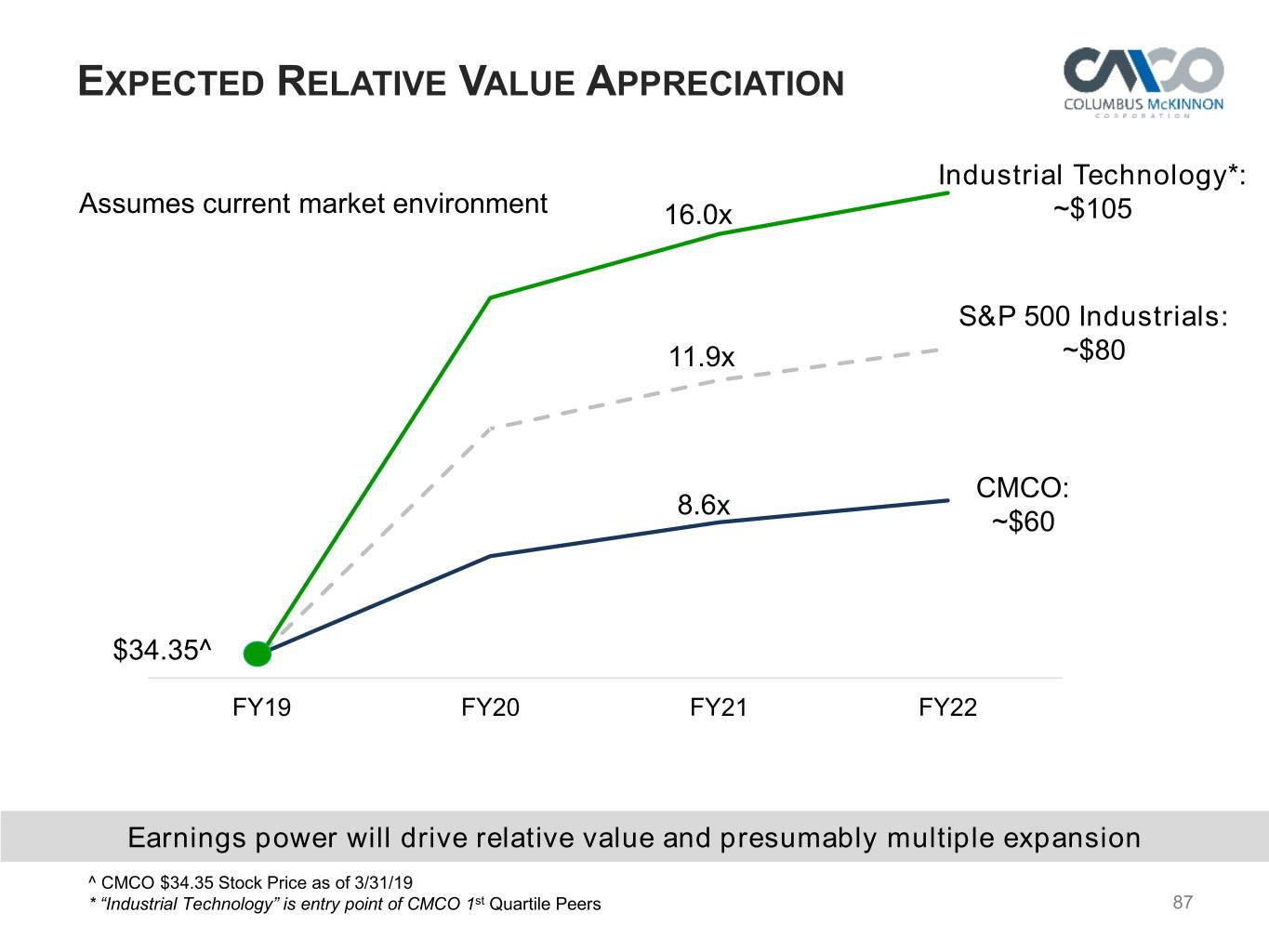

EXPECTED RELATIVE VALUE APPRECIATION Industrial Technology*: Assumes current market environment 16.0x ~$105 S&P 500 Industrials: 11.9x ~$80 CMCO: 8.6x ~$60 $34.35^ FY19 FY20 FY21 FY22 Earnings power will drive relative value and presumably multiple expansion ^ CMCO $34.35 Stock Price as of 3/31/19 © *20192018 “Industrial Columbus McKinnon Technology” Corporation is entry point of CMCO 1st Quartile Peers 87

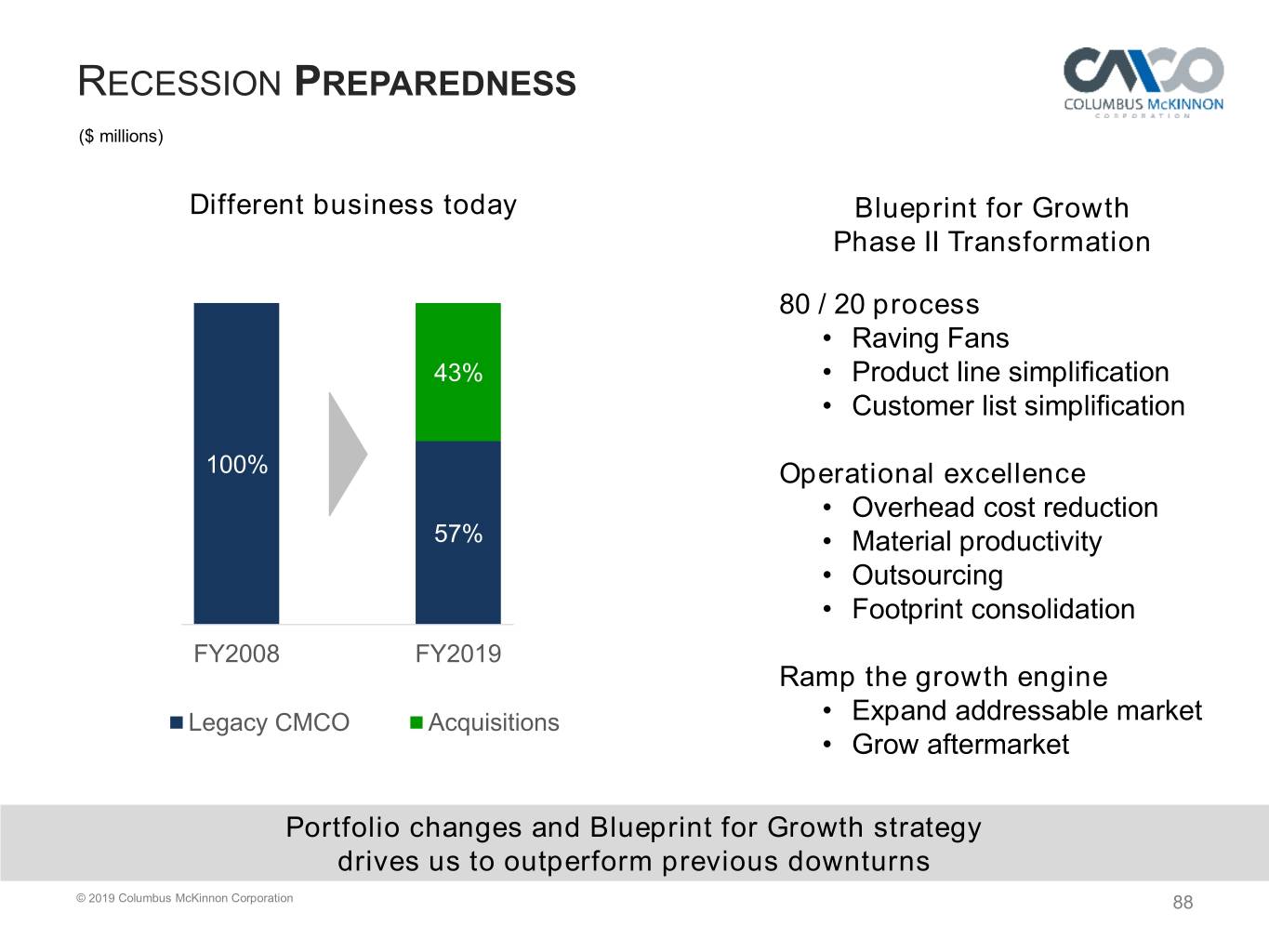

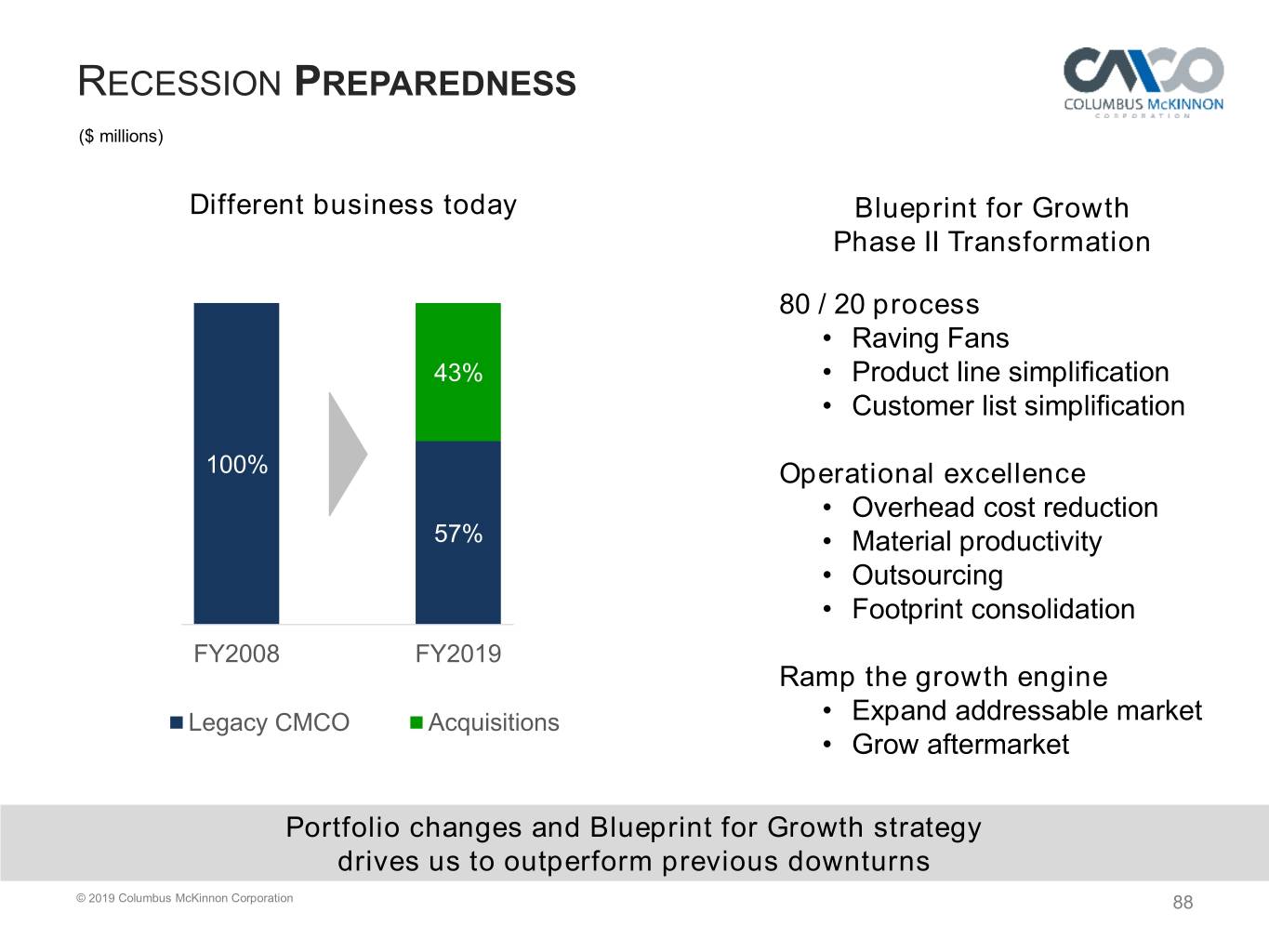

RECESSION PREPAREDNESS ($ millions) Different business today Blueprint for Growth Phase II Transformation 80 / 20 process • Raving Fans 43% • Product line simplification • Customer list simplification 100% Operational excellence • Overhead cost reduction 57% • Material productivity • Outsourcing • Footprint consolidation FY2008 FY2019 Ramp the growth engine Legacy CMCO Acquisitions • Expand addressable market • Grow aftermarket Portfolio changes and Blueprint for Growth strategy drives us to outperform previous downturns © 2019 Columbus McKinnon Corporation 88

CREATING SHAREHOLDER VALUE Adjusted EBITDA Margin(1) Return on Invested Capital (ROIC)(2) 19% Mid- 15.1% teens 13.7% 11.4% 11.2% 8.7% 6.4% FY17 FY18 FY19 FY22 FY17 FY18 FY19 FY22 GOAL: adjusted EBITDA margin of 19% and adjusted ROIC in mid-teens (1) Adjusted EBITDA is a non-GAAP financial measure. Please see supplemental slides for a reconciliation. ©(2) 2019 ROIC Columbus is defined McKinnon as Corporation adjusted income from operations, net of taxes, for the trailing 12 months divided by the average of debt plus equity less cash 89 (average capital) for the trailing 13 months. A 30% tax rate was used for fiscal year 2017, and 22% for fiscal years 2018 & 2019.

Further Pivot to High Performing Industrial Technology Company Mark Morelli President & Chief Executive Officer PARTNERS IN MOTION CONTROL

FURTHER PIVOT Phase III: Completing the transformation Growth Phase III oriented Evolve business model industrial • Portfolio optimization technology • Mergers & acquisitions Phase II Simplify and drive profitable growth • 80/20 Process • Operational Excellence • Ramp the Growth Engine Phase I Get control Achieve results Late stage • New organization cyclical industrial • Operating system Today Future Further pivot from late stage industrial to growth oriented industrial technology company © 2019 Columbus McKinnon Corporation 91

MEGATREND MOVEMENT TO INDUSTRIAL AUTOMATION Projected U.S. full-time jobs 80 to be automated millions 0 2017 2035 Opportunity to capitalize on automation megatrend Source: University of Oxford, ARK Original Research © 2019 Columbus McKinnon Corporation 92

PHASE III: PORTFOLIO OPTIMIZATION Selective Invest / Grow Scale-Up Investment Indust. Portfolio Assessment Criteria: Tech . Business model . Profitability Fix / Exit Selective Invest / Grow . Market position Investment . Industry growth . Risk assessment Exit Fix / Exit Selective Investment Size of bubble = $ EBITDA New © 2019 Columbus McKinnon Corporation 93

THE PHASE III GROWTH NARRATIVE Lifting Specialist Lifting Specialist Expands addressable market ~$400-$500M Leverages engineering and production capabilities Faster growth and less cyclical Enhances existing position to improve safety & productivity for customers © 2019 Columbus McKinnon Corporation 94

THE PHASE III GROWTH NARRATIVE Smart Movement Smart Movement Expands addressable market ~$350-$600M Expected to complement/ improve legacy offerings High growth Smart solutions to improve safety & productivity for customers © 2019 Columbus McKinnon Corporation 95

Q & A PARTNERS IN MOTION CONTROL

COLUMBUS MCKINNON IS CHANGED Blueprint for Growth strategy is driving change Building stronger earnings power - creating value Strong management team executing well Strategy expected to outperform in recession Delivering returns with lower risk profile © 2019 Columbus McKinnon Corporation 97

Investor & Analyst Day 2019 June 13, 2019 New York, NY PARTNERS IN MOTION CONTROL