Q2 Fiscal Year 2022 Financial Results Conference Call October 28, 2021 David J. Wilson President and Chief Executive Officer Gregory P. Rustowicz Vice President – Finance & Chief Financial Officer

2 Safe Harbor Statement These slides, and the accompanying oral discussion (together, this “presentation”), contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements concerning: future sales, earnings and plans; the success of the Dorner Mfg. Corp. (“Dorner”) acquisitions, achievement of cost and revenue synergies and the amount of such synergies and integration costs; the ability of the Company to achieve market success and earnings per share accretion expectations; the ability of the Company to employ the Columbus McKinnon Business System to drive profitability and to grow the business with its Blueprint for Growth 2.0 strategy, involve known and unknown risks, and are based upon current information and expectations. Actual results may differ materially from those anticipated if the information on which those estimates were based ultimately proves to be incorrect or as a result of certain risks and uncertainties that could cause our actual results to differ materially from the results expressed or implied by such statements, including the integration of Dorner into the Company to achieve cost and revenue synergies, the ability of the Company and Dorner to achieve revenue expectations, global economic and business conditions including the impact of COVID-19, conditions affecting the industries served by us and our subsidiaries, conditions affecting our customers and suppliers, competitor responses to our products and services, the overall market acceptance of such products and services, facility consolidations and other restructurings, the ability to expand into new markets and geographic regions, foreign currency fluctuations, the integration of acquisitions, including the acquisition of Dorner, and other factors disclosed in our periodic reports filed with the Securities and Exchange Commission. Consequently, such forward-looking statements should be regarded as our current plans, estimates and beliefs. Except as required by applicable law, we do not undertake and specifically decline any obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect any future events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. Non-GAAP Financial Measures This presentation will discuss some non-GAAP (“adjusted”) financial measures which we believe are useful in evaluating our performance. You should not consider the presentation of this additional information in isolation or as a substitute for results compared in accordance with GAAP. The non-GAAP (“adjusted”) measures are noted and reconciliations of comparable GAAP with non-GAAP measures can be found in tables included in the Supplemental Information portion of this presentation.

3 Executing Blueprint for Growth 2.0 Strategy Capturing strong demand across all markets Driving growth and margin expansion • Strong results despite supply chain challenges; offset inflationary pressures with strategic pricing • Sales of $223.6 million increased 41.7% over prior-year period including 19.3% organic growth • Record gross margin of 36.3%; record adjusted gross margin of 36.7% • Operating margin was 10.6%; adjusted operating margin expanded 250 basis points y/y to 11.4% Creating better business model with stronger earnings power • Expanding value propositions through combination of legacy automation solutions and conveying solutions • Adjusted EBITDA margin for the quarter was 16.1%, up 270 basis points • Dorner continues to deliver adding 100 basis points to adjusted EBITDA margin • Record backlog of $255.6 million, increased 3.3% compared with trailing quarter Strategy evolves Columbus McKinnon into a high value, intelligent motion enterprise

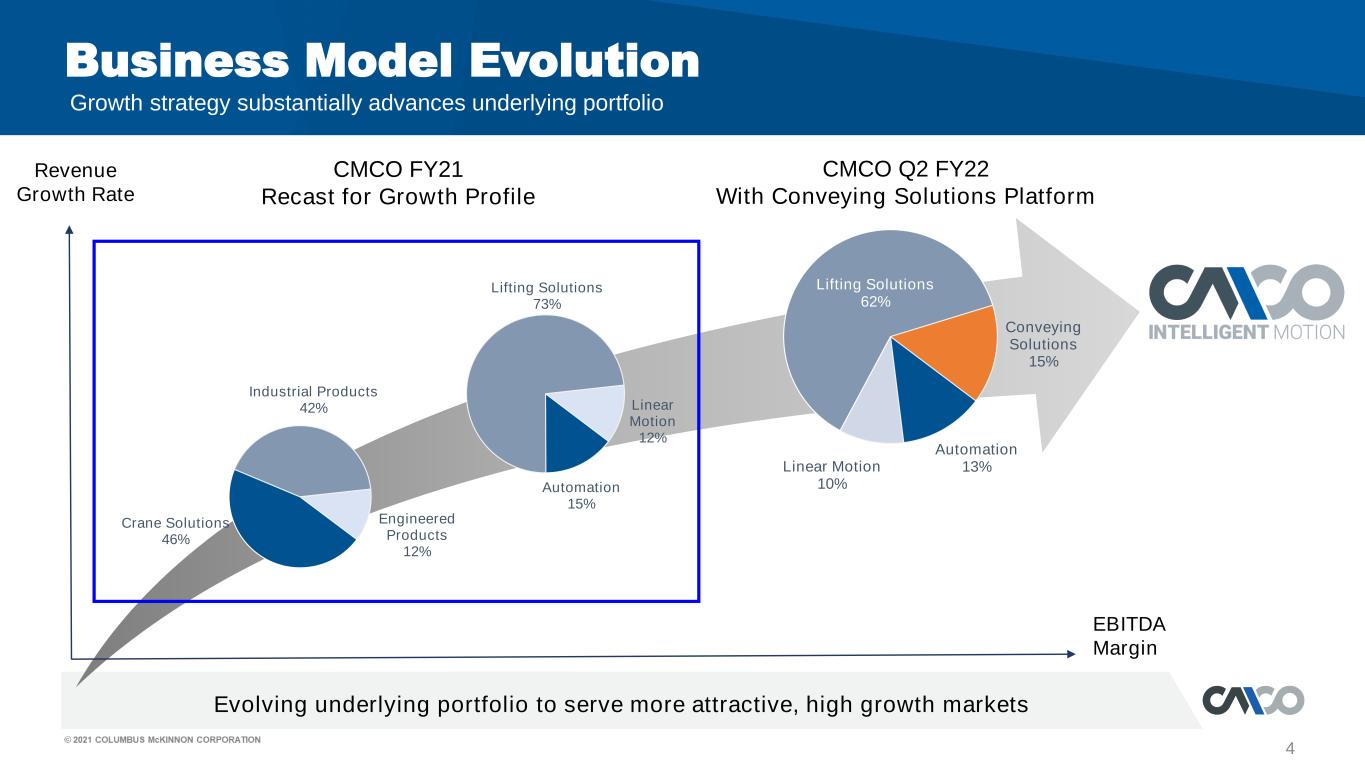

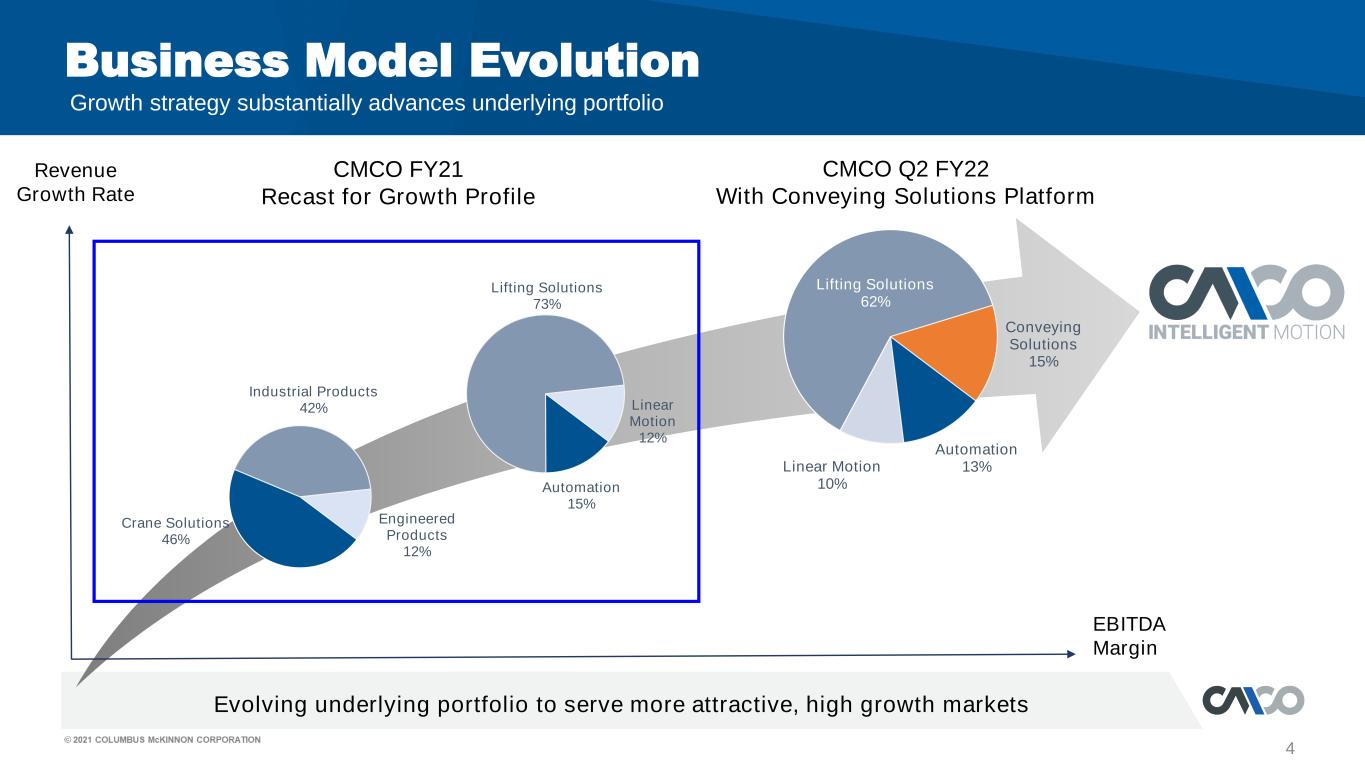

4 Business Model Evolution Revenue Growth Rate EBITDA Margin CMCO Q2 FY22 With Conveying Solutions Platform Crane Solutions 46% Industrial Products 42% Engineered Products 12% Automation 13%Linear Motion 10% Lifting Solutions 62% Conveying Solutions 15% Automation 15% Lifting Solutions 73% Linear Motion 12% CMCO FY21 Recast for Growth Profile Growth strategy substantially advances underlying portfolio Evolving underlying portfolio to serve more attractive, high growth markets

5 Expanding portfolio of intelligent automation solutions Linear Actuator with Intelli-Motion™ Combining intelligent controls with high-quality linear actuators Expands family of automation solutions and enables precision motion control Provides enhanced control and position feedback capabilities Extends the length of time the actuator is operational and improves production rates Reduces installation costs and the overall product footprint *SPA series actuators: Super Pac (packaging) Actuator

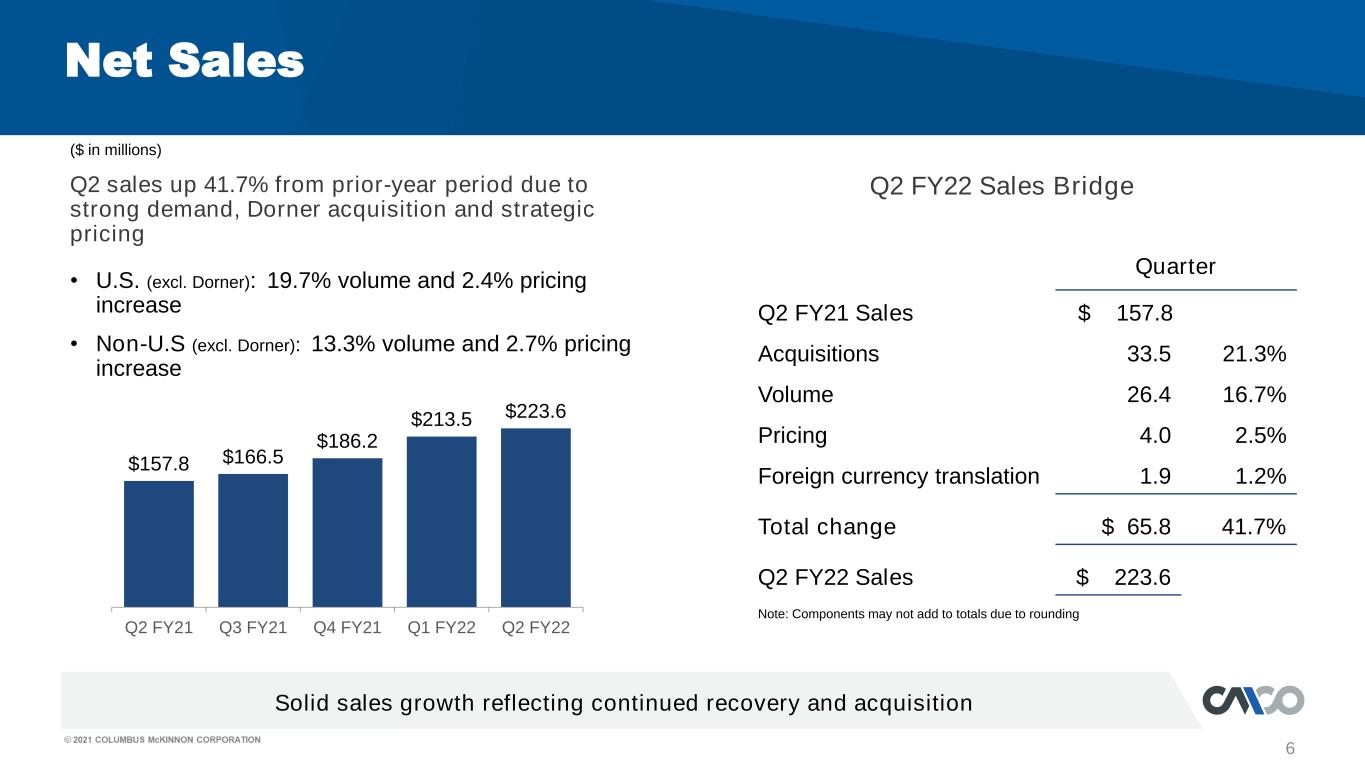

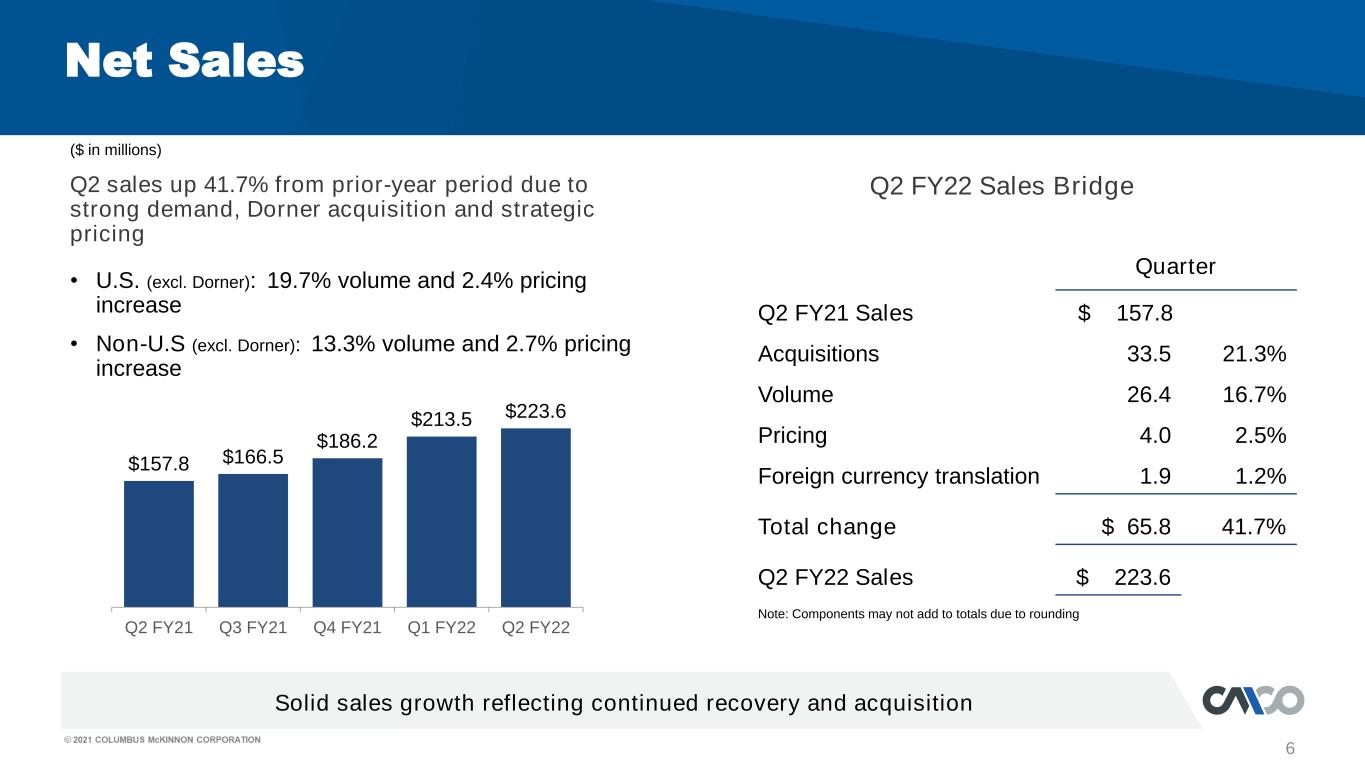

6 Q2 FY22 Sales Bridge Net Sales Solid sales growth reflecting continued recovery and acquisition Quarter Q2 FY21 Sales $ 157.8 Acquisitions 33.5 21.3% Volume 26.4 16.7% Pricing 4.0 2.5% Foreign currency translation 1.9 1.2% Total change $ 65.8 41.7% Q2 FY22 Sales $ 223.6 Note: Components may not add to totals due to rounding ($ in millions) $157.8 $166.5 $186.2 $213.5 $223.6 Q2 FY21 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 Q2 sales up 41.7% from prior-year period due to strong demand, Dorner acquisition and strategic pricing • U.S. (excl. Dorner): 19.7% volume and 2.4% pricing increase • Non-U.S (excl. Dorner): 13.3% volume and 2.7% pricing increase

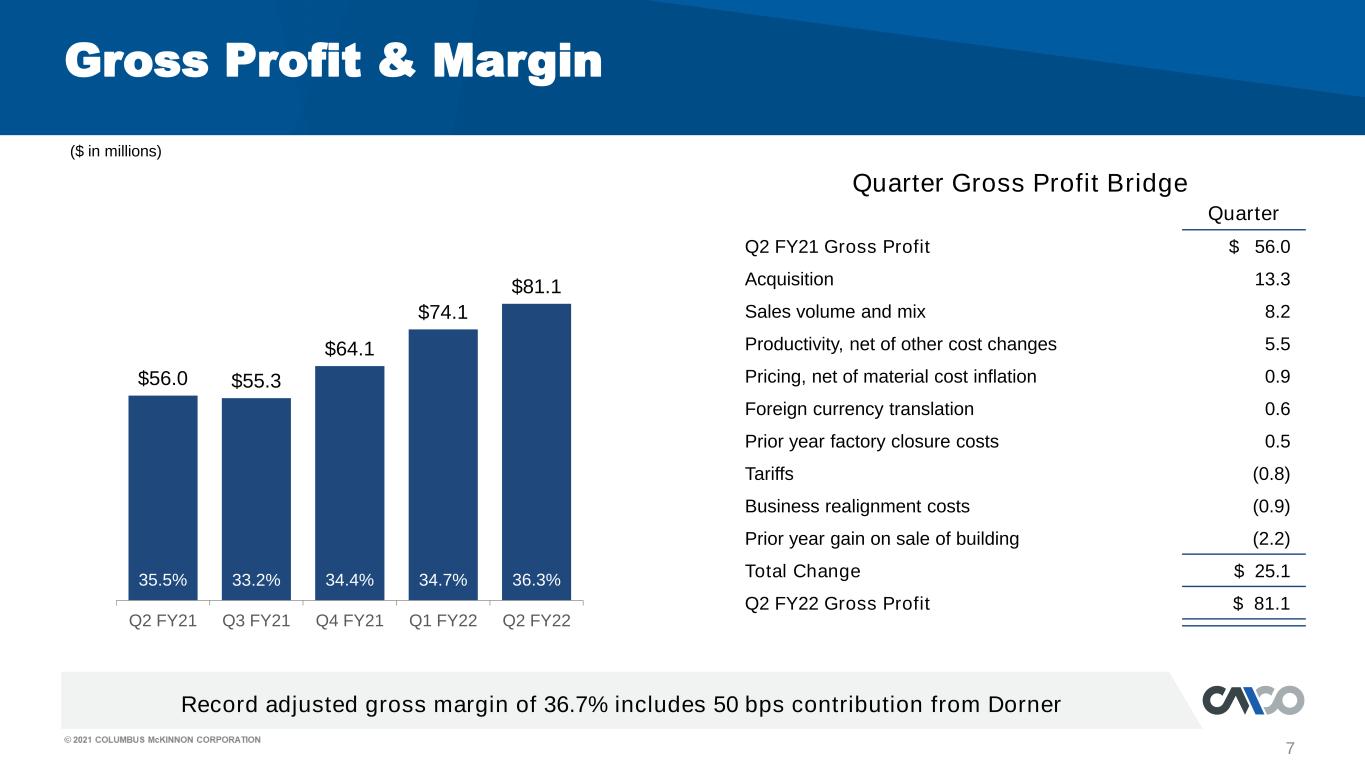

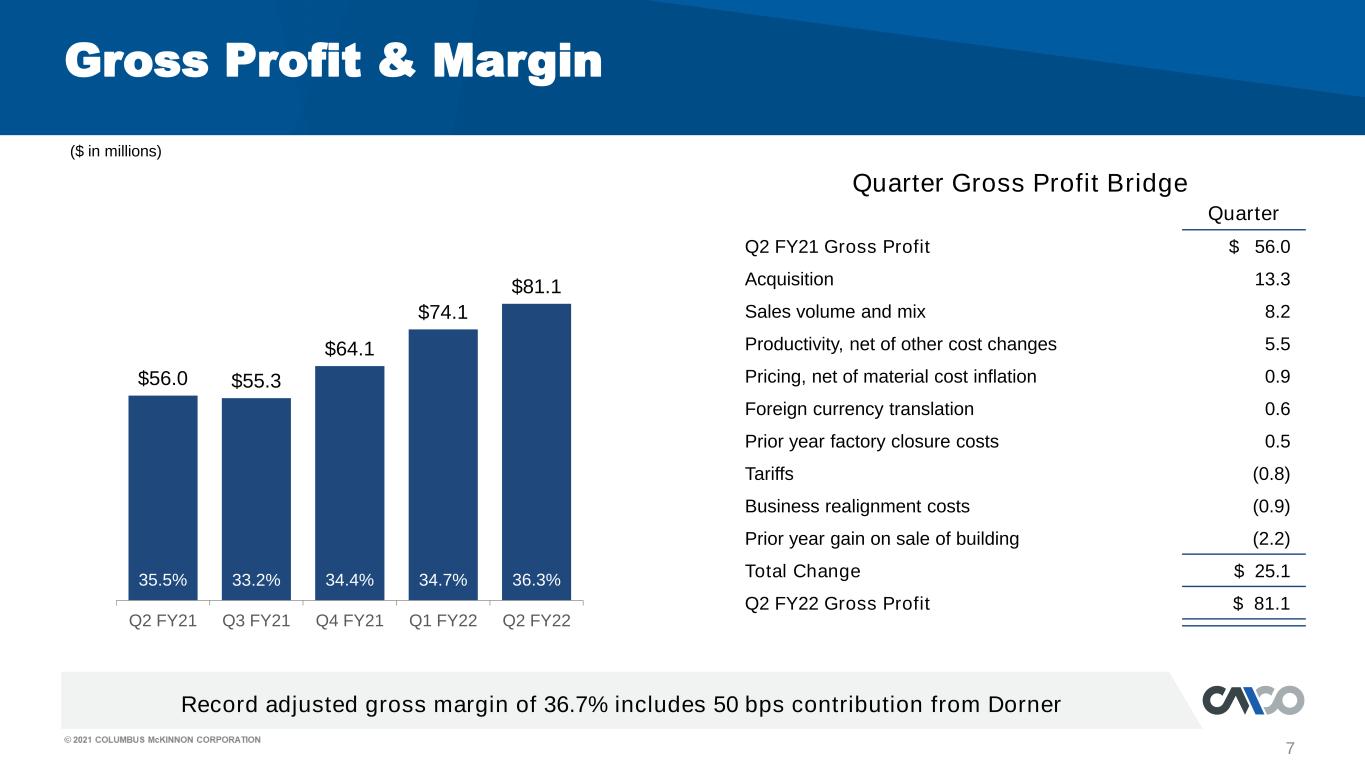

$56.0 $55.3 $64.1 $74.1 $81.1 35.5% 33.2% 34.4% 34.7% 36.3% Q2 FY21 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 7 Record adjusted gross margin of 36.7% includes 50 bps contribution from Dorner Gross Profit & Margin Quarter Gross Profit Bridge Quarter Q2 FY21 Gross Profit $ 56.0 Acquisition 13.3 Sales volume and mix 8.2 Productivity, net of other cost changes 5.5 Pricing, net of material cost inflation 0.9 Foreign currency translation 0.6 Prior year factory closure costs 0.5 Tariffs (0.8) Business realignment costs (0.9) Prior year gain on sale of building (2.2) Total Change $ 25.1 Q2 FY22 Gross Profit $ 81.1 ($ in millions)

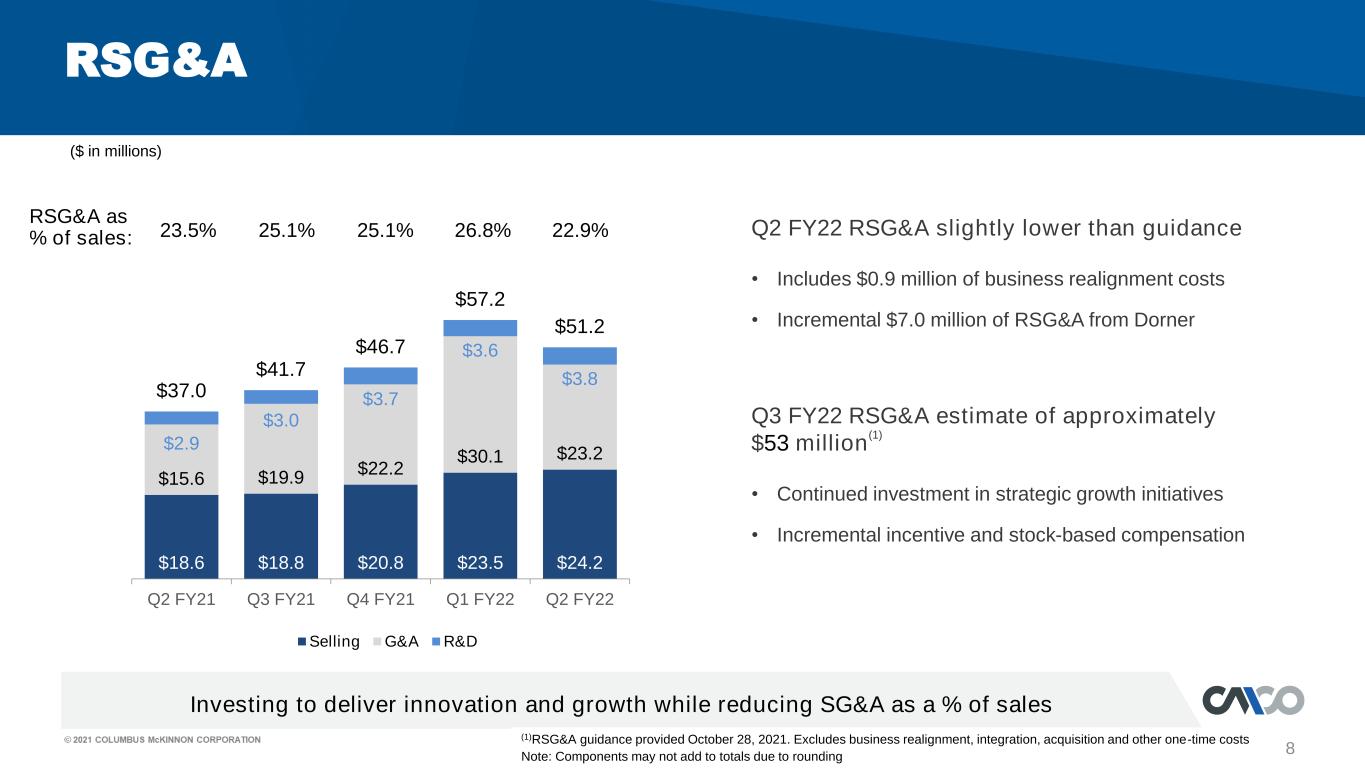

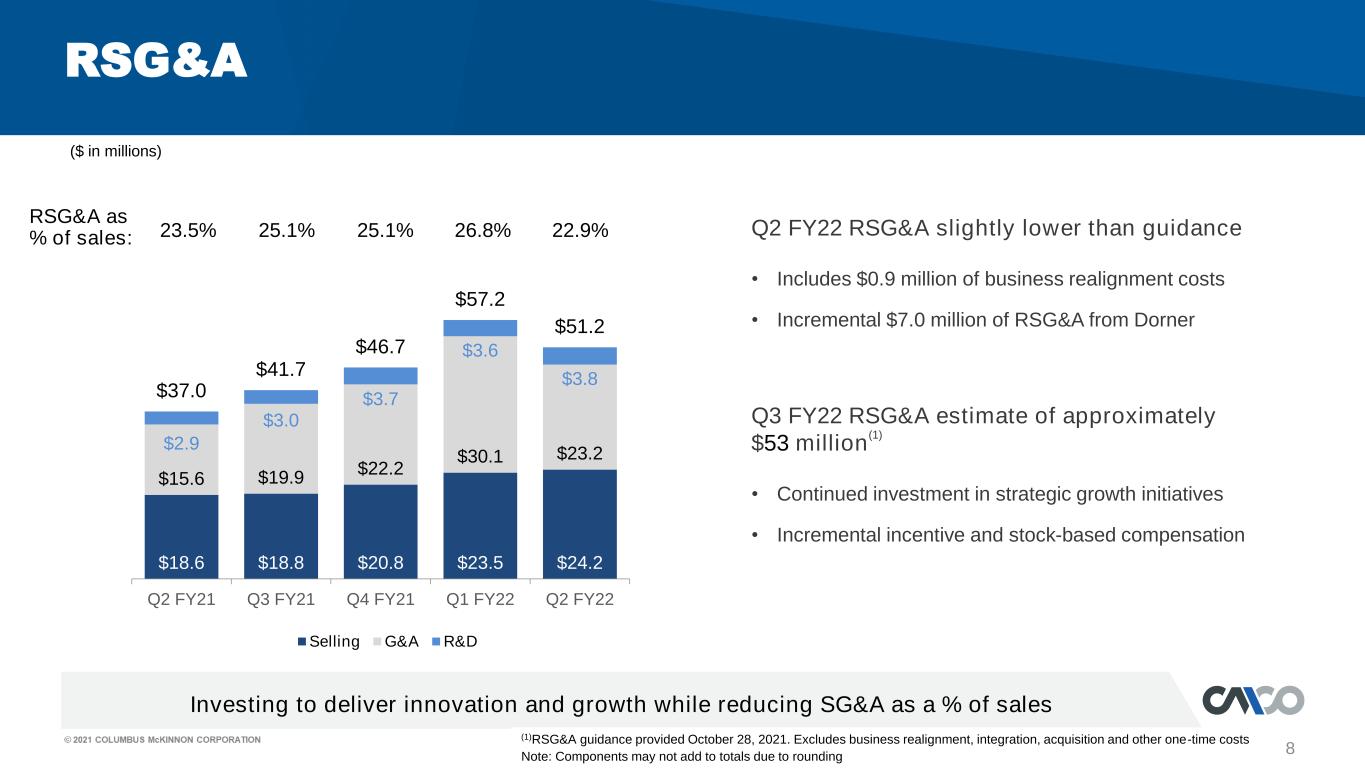

8 RSG&A $18.6 $18.8 $20.8 $23.5 $24.2 $15.6 $19.9 $22.2 $30.1 $23.2 $2.9 $3.0 $3.7 $3.6 $3.8 $37.0 $41.7 $46.7 $57.2 $51.2 Q2 FY21 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 Selling G&A R&D Investing to deliver innovation and growth while reducing SG&A as a % of sales ($ in millions) Q2 FY22 RSG&A slightly lower than guidance • Includes $0.9 million of business realignment costs • Incremental $7.0 million of RSG&A from Dorner Q3 FY22 RSG&A estimate of approximately $53 million (1) • Continued investment in strategic growth initiatives • Incremental incentive and stock-based compensation (1)RSG&A guidance provided October 28, 2021. Excludes business realignment, integration, acquisition and other one-time costs Note: Components may not add to totals due to rounding RSG&A as % of sales: 25.1% 26.8% 22.9%23.5% 25.1%

9 Q2 FY22 operating income of $23.7 million Operating Income • Adjusted operating income of $25.5 million Operating margin of 10.6%; Adjusted operating margin of 11.4% • Margin expansion driven by operating leverage and strategic pricing Amortization of intangibles expense expected to be approximately $6.3 million per quarter for remainder of FY22 at current FX rates Improving adjusted operating margin…nearing pre-pandemic levels ($ in millions) Operating Income & Margin Adjusted Operating Income & Margin $14.0 $11.2 $18.9 $23.6 $25.5 8.9% 6.7% 10.1% 11.1% 11.4% Q2 FY21 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 $15.8 $10.4 $14.2 $10.7 $23.7 10.0% 6.3% 7.6% 5.0% 10.6% Q2 FY21 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22

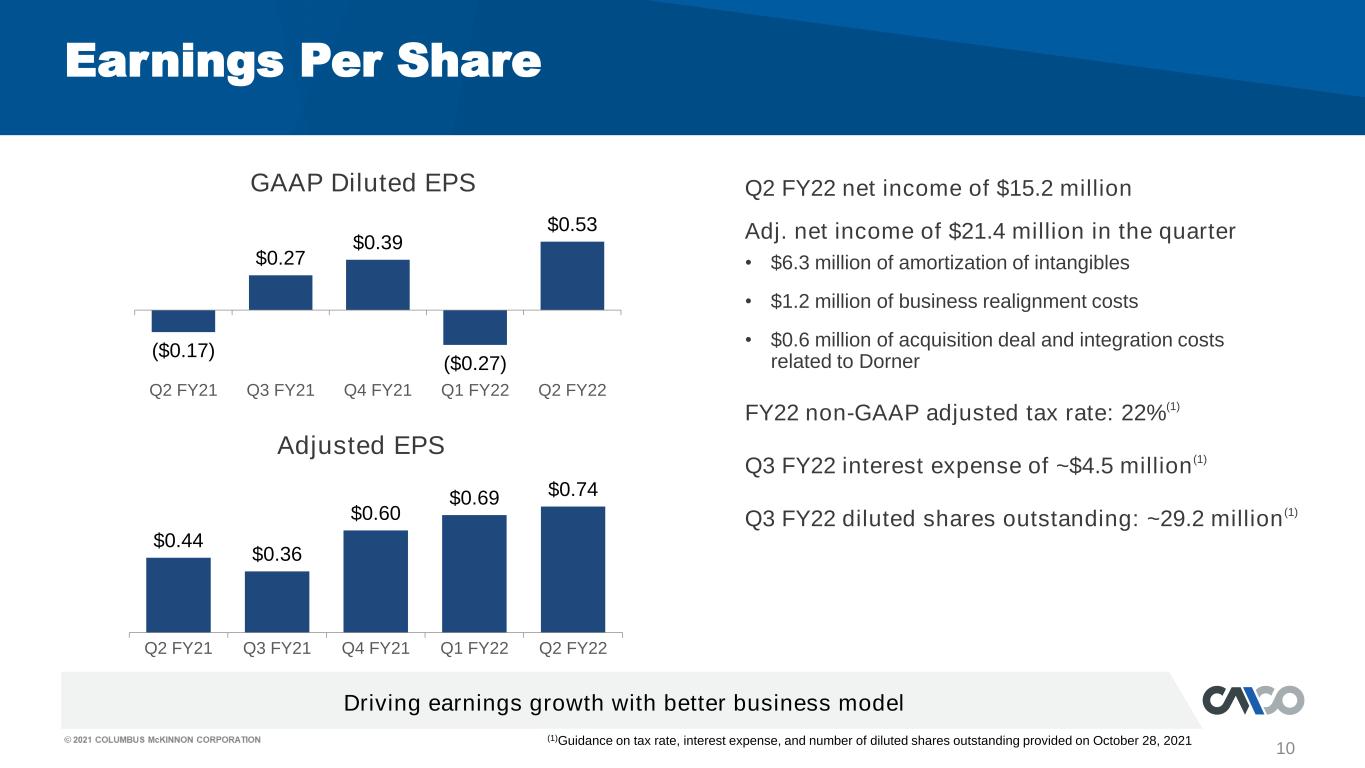

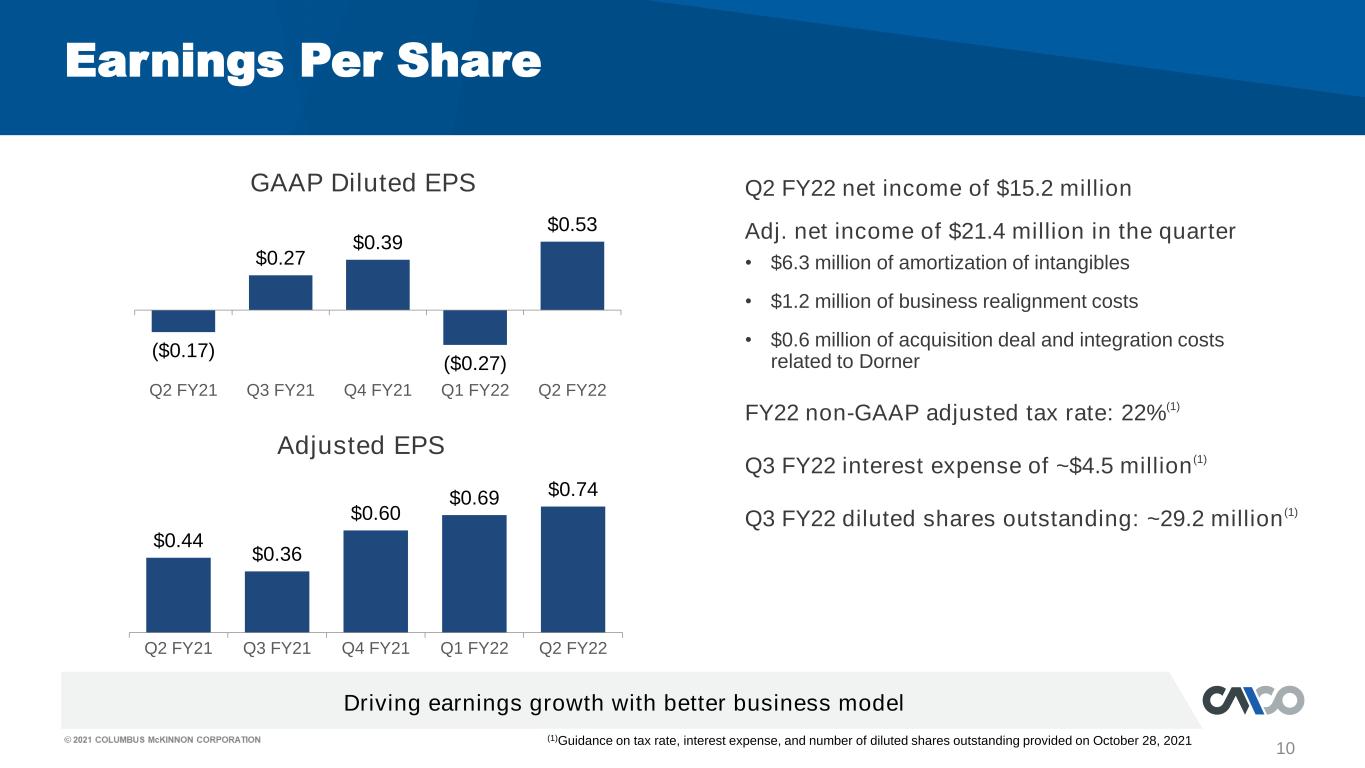

10 Q2 FY22 net income of $15.2 million Earnings Per Share Adjusted EPS GAAP Diluted EPS ($0.17) $0.27 $0.39 ($0.27) $0.53 Q2 FY21 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 $0.44 $0.36 $0.60 $0.69 $0.74 Q2 FY21 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 Adj. net income of $21.4 million in the quarter • $6.3 million of amortization of intangibles • $1.2 million of business realignment costs • $0.6 million of acquisition deal and integration costs related to Dorner FY22 non-GAAP adjusted tax rate: 22%(1) Q3 FY22 interest expense of ~$4.5 million(1) Q3 FY22 diluted shares outstanding: ~29.2 million(1) (1)Guidance on tax rate, interest expense, and number of diluted shares outstanding provided on October 28, 2021 Driving earnings growth with better business model

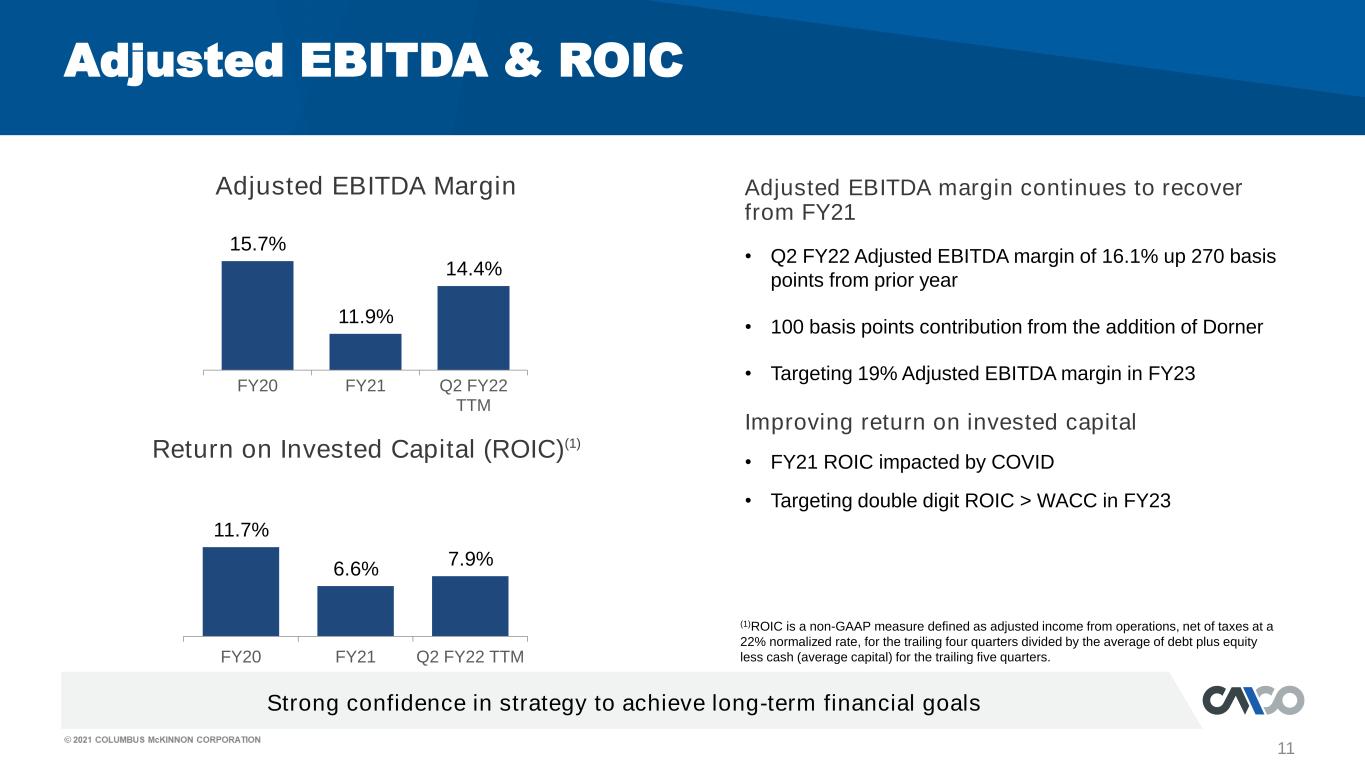

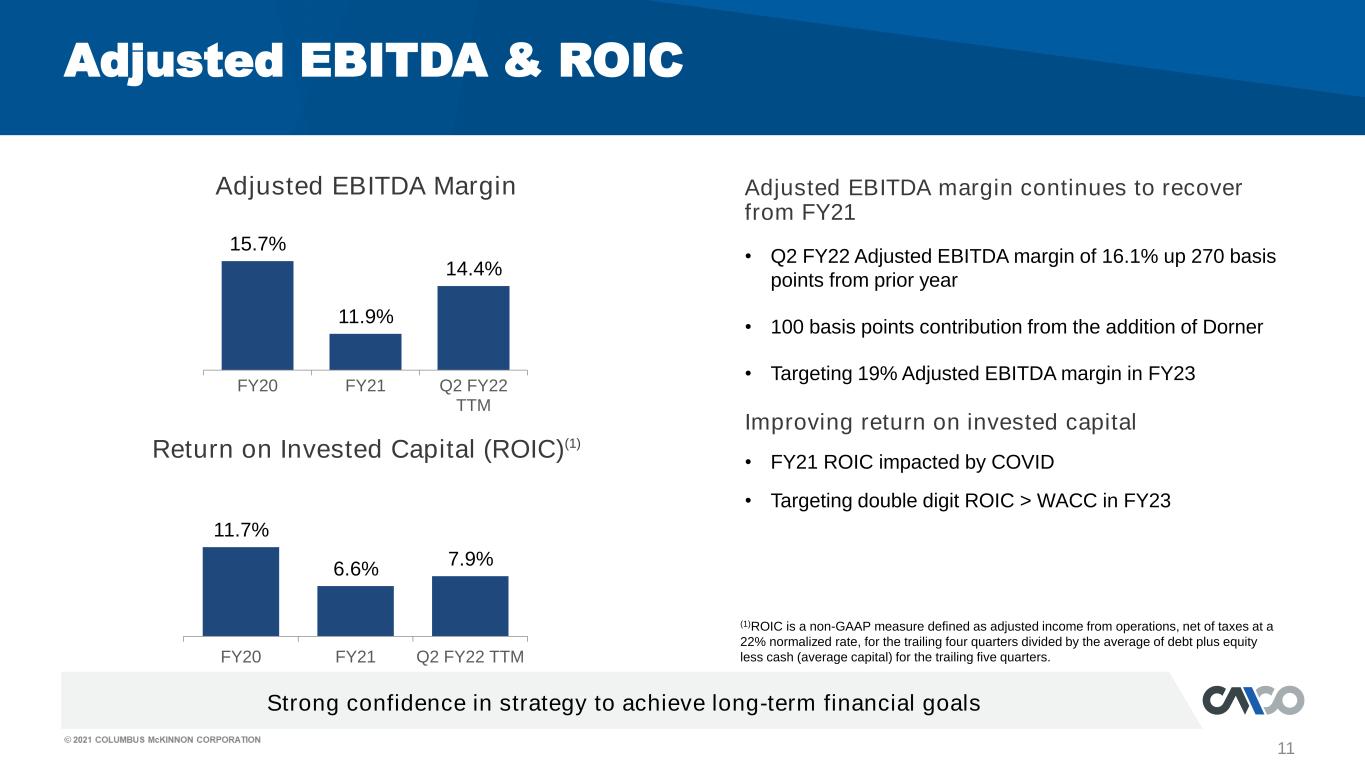

11 Adjusted EBITDA Margin Adjusted EBITDA margin continues to recover from FY21 Adjusted EBITDA & ROIC Return on Invested Capital (ROIC)(1) Strong confidence in strategy to achieve long-term financial goals 15.7% 11.9% 14.4% FY20 FY21 Q2 FY22 TTM 11.7% 6.6% 7.9% FY20 FY21 Q2 FY22 TTM (1)ROIC is a non-GAAP measure defined as adjusted income from operations, net of taxes at a 22% normalized rate, for the trailing four quarters divided by the average of debt plus equity less cash (average capital) for the trailing five quarters. • Q2 FY22 Adjusted EBITDA margin of 16.1% up 270 basis points from prior year • 100 basis points contribution from the addition of Dorner • Targeting 19% Adjusted EBITDA margin in FY23 Improving return on invested capital • FY21 ROIC impacted by COVID • Targeting double digit ROIC > WACC in FY23

$67.2 $97.4 $86.6 $53.6 88% 127% 229% 85% FY19 FY20 FY21 Q2 FY22 TTM 12 Free Cash Flow (2) Cash Flow • Strong cash generation in Q2 FY22 despite inventory build to address supply chain constraints • Q2 FY22 YTD includes cash outflow of $13.5 million for acquisition deal costs • FY22 expected CapEx: $18 to $22 million including Dorner (1) Strong cash generation through cycles Note: Components may not add to totals due to rounding ($ in millions) Three Months Ended YTD 9/30/21 9/30/20 9/30/21 Net cash provided by operating activities $25.3 $37.4 $17.9 CapEx (3.1) (1.7) (6.8) Free cash flow (FCF) $22.2 $35.7 $11.2 (1)Capital expenditure guidance provided October 28, 2021. (2)See Supplemental Slides for the definition of free cash flow, free cash flow conversion reconciliation from GAAP and other disclaimers regarding non-GAAP information. Free cash flow conversion(2)

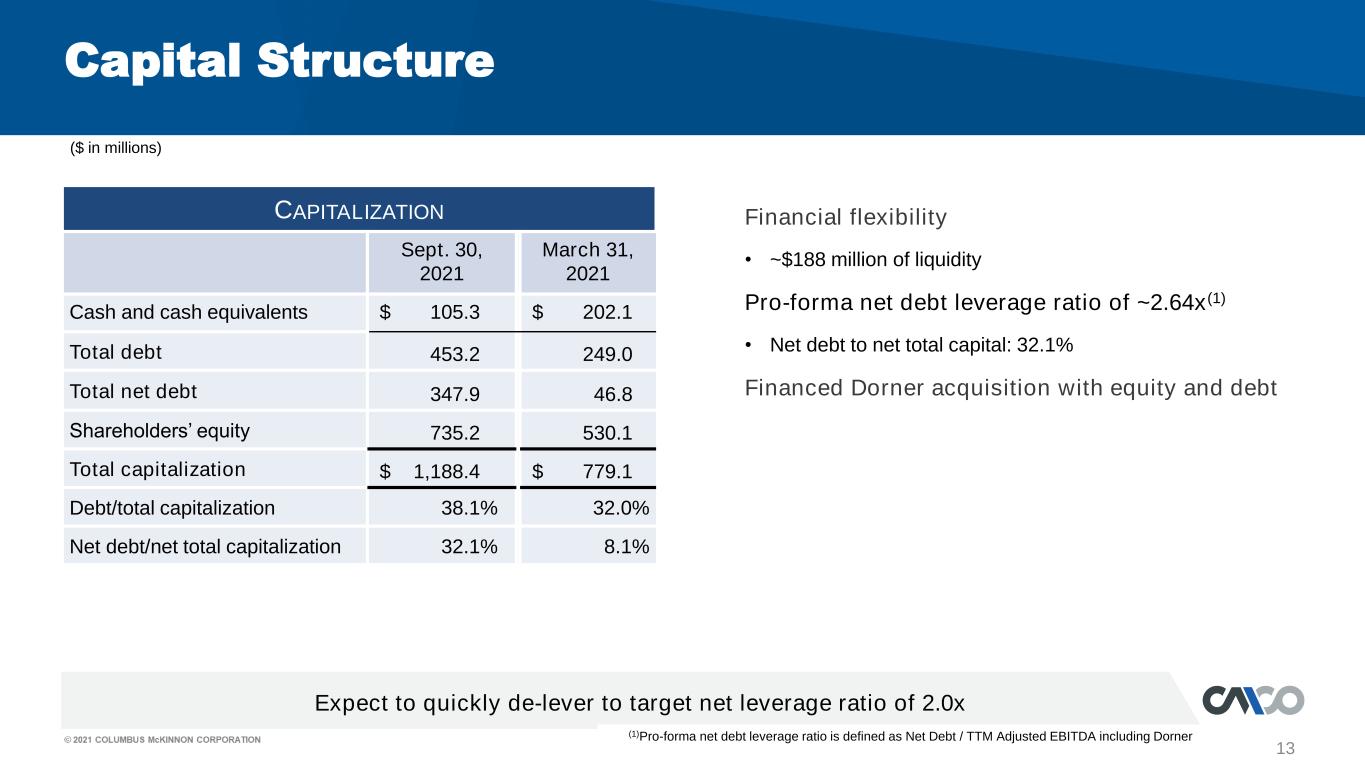

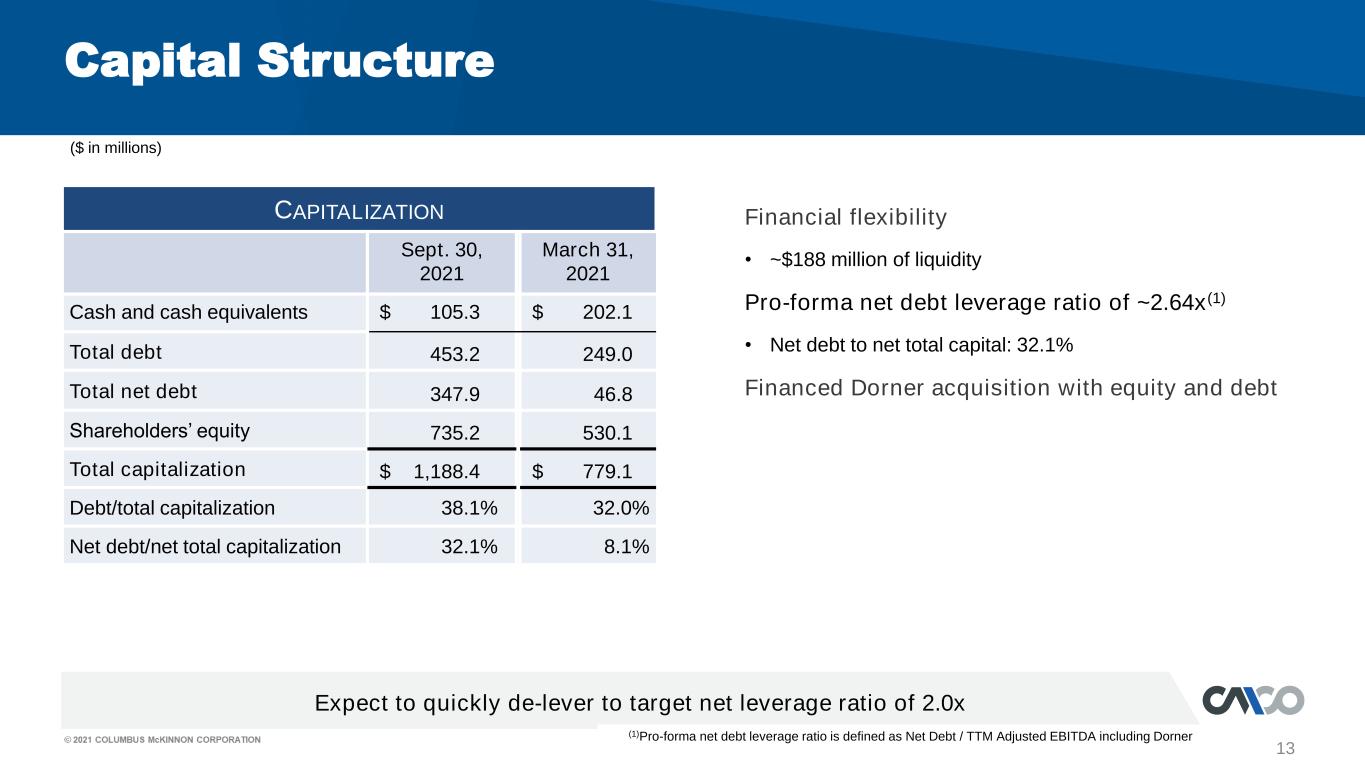

13 Capital Structure Financial flexibility • ~$188 million of liquidity Pro-forma net debt leverage ratio of ~2.64x(1) • Net debt to net total capital: 32.1% Financed Dorner acquisition with equity and debt Expect to quickly de-lever to target net leverage ratio of 2.0x CAPITALIZATION Sept. 30, 2021 March 31, 2021 Cash and cash equivalents $ 105.3 $ 202.1 Total debt 453.2 249.0 Total net debt 347.9 46.8 Shareholders’ equity 735.2 530.1 Total capitalization $ 1,188.4 $ 779.1 Debt/total capitalization 38.1% 32.0% Net debt/net total capitalization 32.1% 8.1% (1)Pro-forma net debt leverage ratio is defined as Net Debt / TTM Adjusted EBITDA including Dorner ($ in millions)

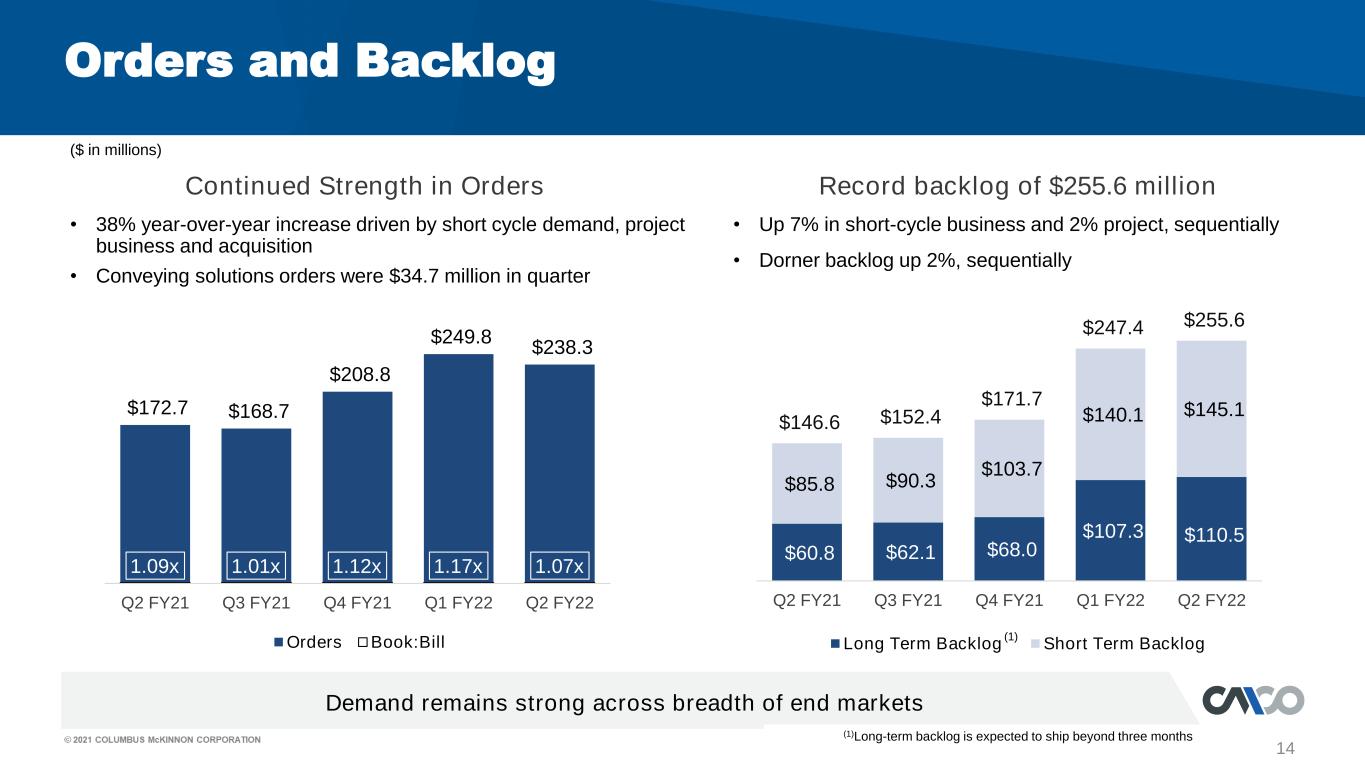

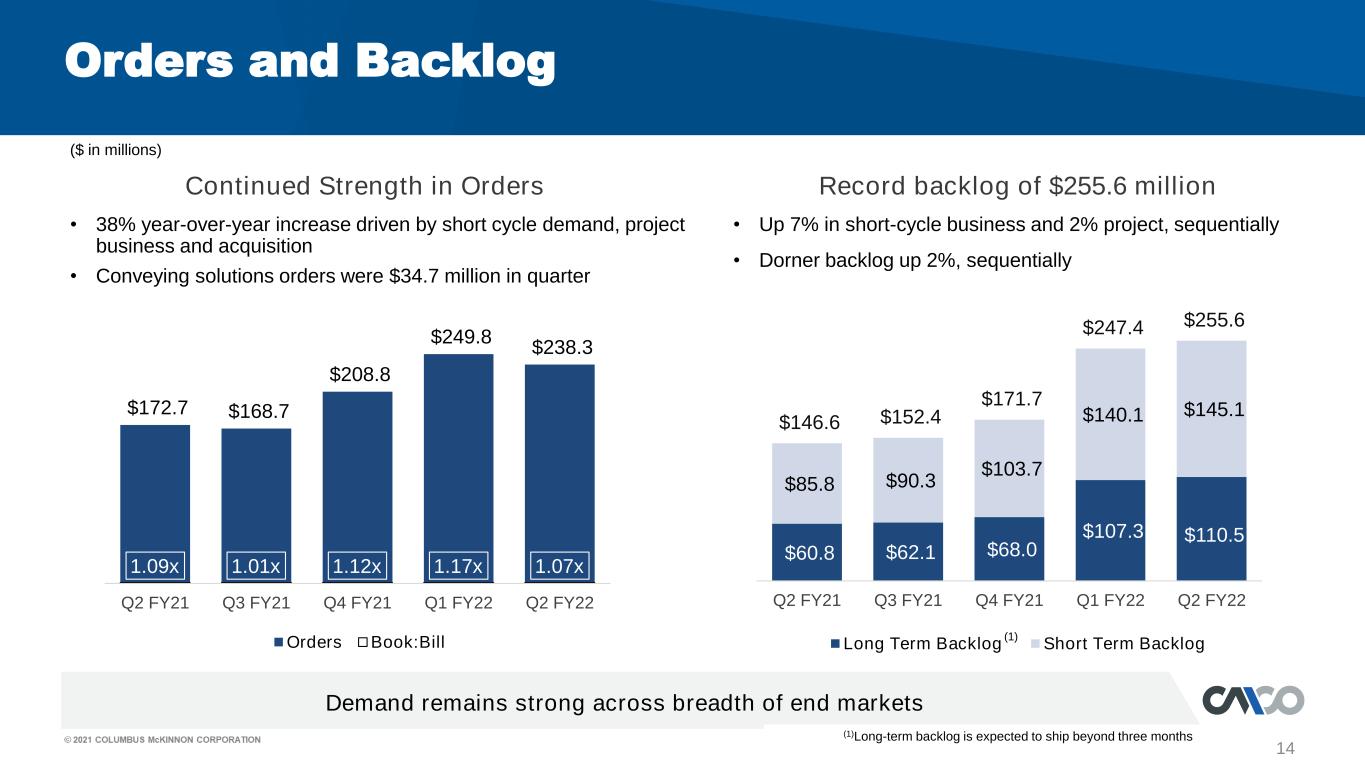

14 Continued Strength in Orders Record backlog of $255.6 million Orders and Backlog • 38% year-over-year increase driven by short cycle demand, project business and acquisition • Conveying solutions orders were $34.7 million in quarter • Up 7% in short-cycle business and 2% project, sequentially • Dorner backlog up 2%, sequentially Demand remains strong across breadth of end markets ($ in millions) $172.7 $168.7 $208.8 $249.8 $238.3 1.09x 1.01x 1.12x 1.17x 1.07x Q2 FY21 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 Orders Book:Bill (1)Long-term backlog is expected to ship beyond three months $60.8 $62.1 $68.0 $107.3 $110.5 $85.8 $90.3 $103.7 $140.1 $145.1 $146.6 $152.4 $171.7 $247.4 $255.6 Q2 FY21 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 Long Term Backlog Short Term Backlog (1)

15 Executing on Blueprint for Growth 2.0 strategy to drive value creation Outlook and Perspective Q3 FY2022 outlook • Expect Q3 FY22 net sales of approximately $215 million (1) Addressing supply chain and staffing challenges • Expect to stay ahead of inflation with strategic pricing • Actively managing suppliers Continued strong demand across markets • Strength in aerospace, energy, e-commerce and food & beverage • Process industries such as metals and paper are robust Creatively responding to near-term demands while advancing long-term objectives Purpose in Motion: Together we create intelligent motion solutions that move the world forward and improve lives. (1) Revenue guidance provided October 28, 2021

Q2 Fiscal Year 2022 Financial Results Conference Call October 28, 2021 David J. Wilson President and Chief Executive Officer Gregory P. Rustowicz Vice President – Finance & Chief Financial Officer

Supplemental Information

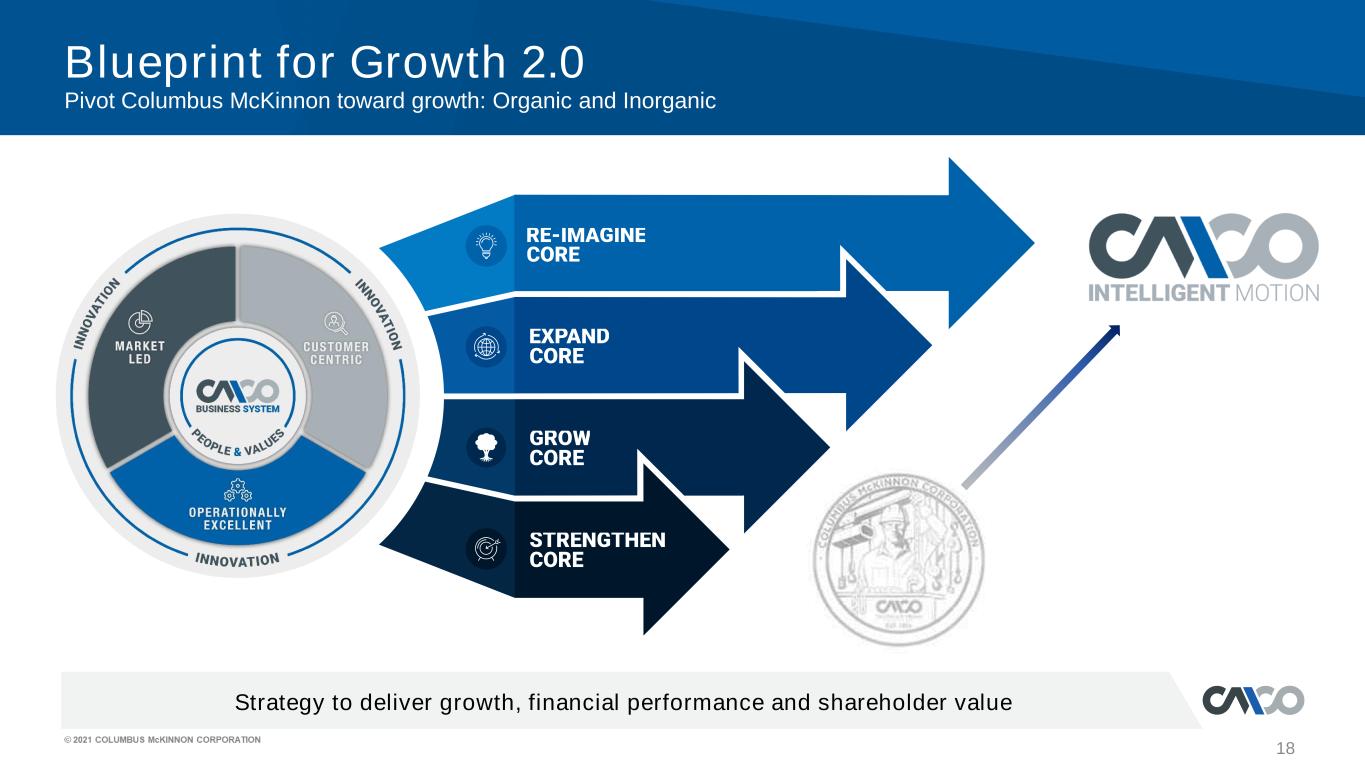

Blueprint for Growth 2.0 Pivot Columbus McKinnon toward growth: Organic and Inorganic 18 Strategy to deliver growth, financial performance and shareholder value

19 Conference Call Playback Info Replay Number: 412-317-6671 passcode: 13723730 Telephone replay available through November 4, 2021 Webcast / PowerPoint / Replay available at investors.columbusmckinnon.com Transcript, when available, at investors.columbusmckinnon.com

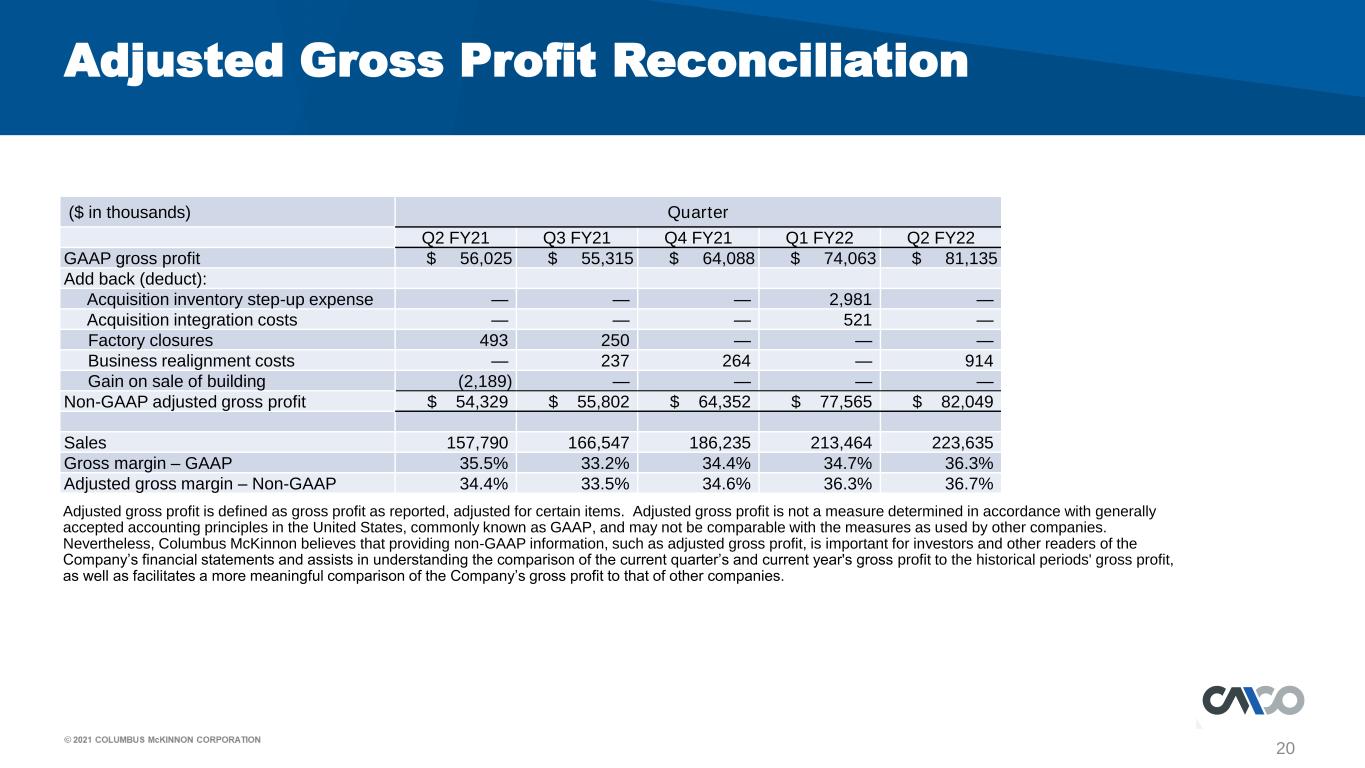

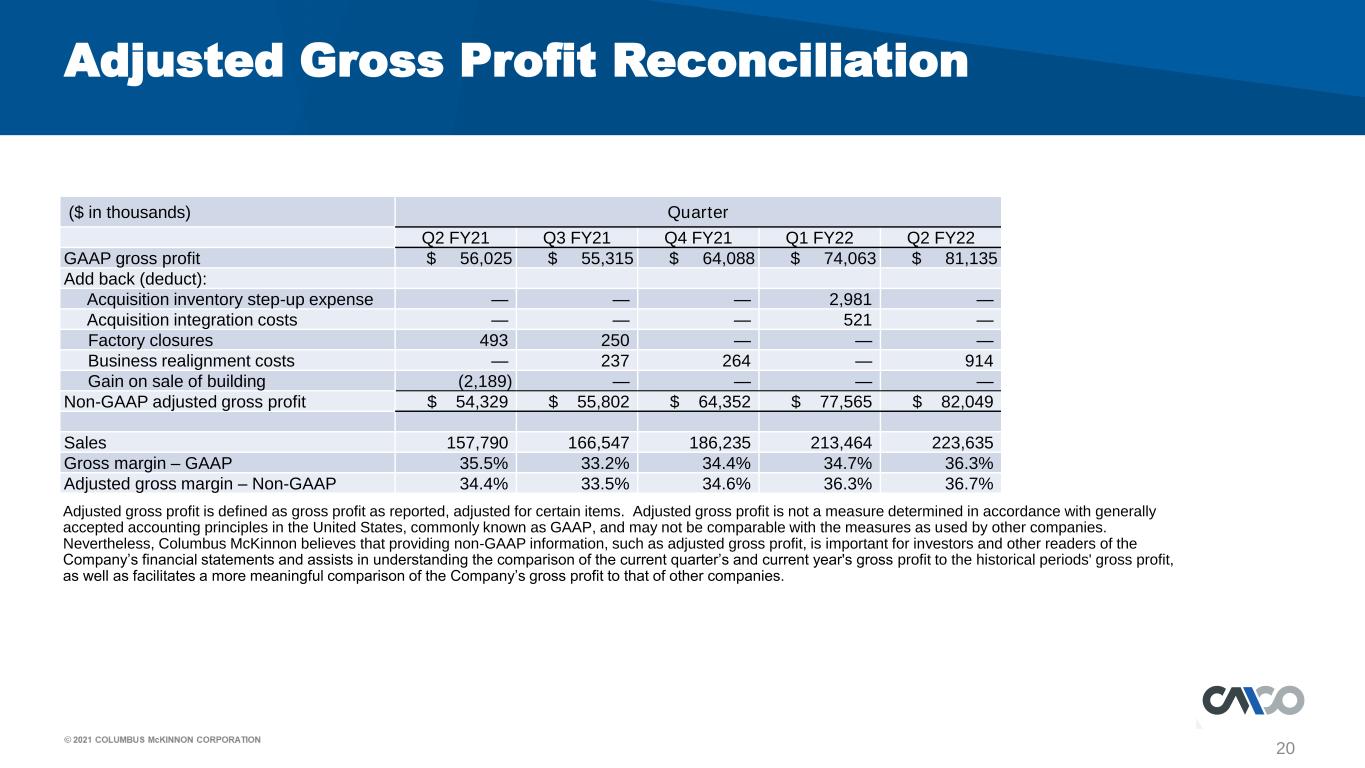

20 Adjusted Gross Profit Reconciliation Adjusted gross profit is defined as gross profit as reported, adjusted for certain items. Adjusted gross profit is not a measure determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable with the measures as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information, such as adjusted gross profit, is important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year's gross profit to the historical periods' gross profit, as well as facilitates a more meaningful comparison of the Company’s gross profit to that of other companies. ($ in thousands) Quarter Q2 FY21 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 GAAP gross profit $ 56,025 $ 55,315 $ 64,088 $ 74,063 $ 81,135 Add back (deduct): Acquisition inventory step-up expense — — — 2,981 — Acquisition integration costs — — — 521 — Factory closures 493 250 — — — Business realignment costs — 237 264 — 914 Gain on sale of building (2,189) — — — — Non-GAAP adjusted gross profit $ 54,329 $ 55,802 $ 64,352 $ 77,565 $ 82,049 Sales 157,790 166,547 186,235 213,464 223,635 Gross margin – GAAP 35.5% 33.2% 34.4% 34.7% 36.3% Adjusted gross margin – Non-GAAP 34.4% 33.5% 34.6% 36.3% 36.7%

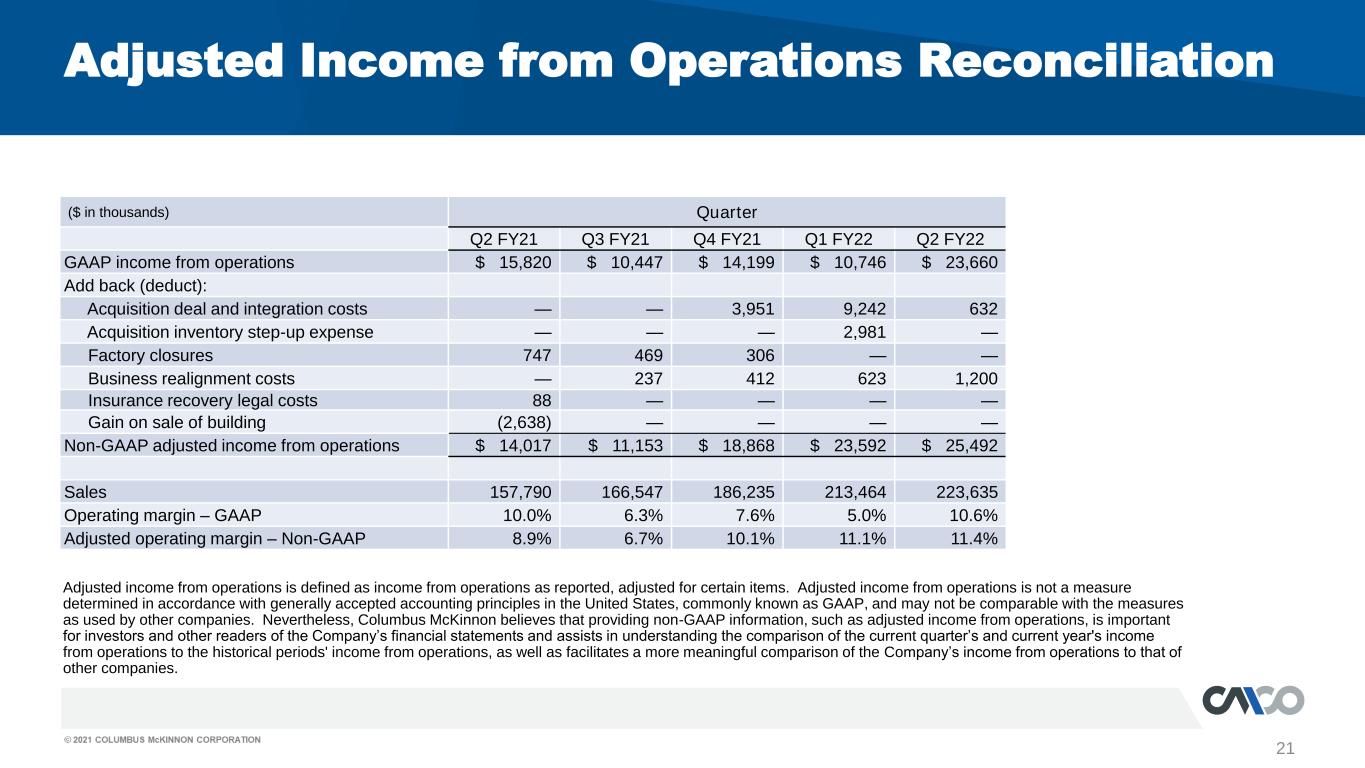

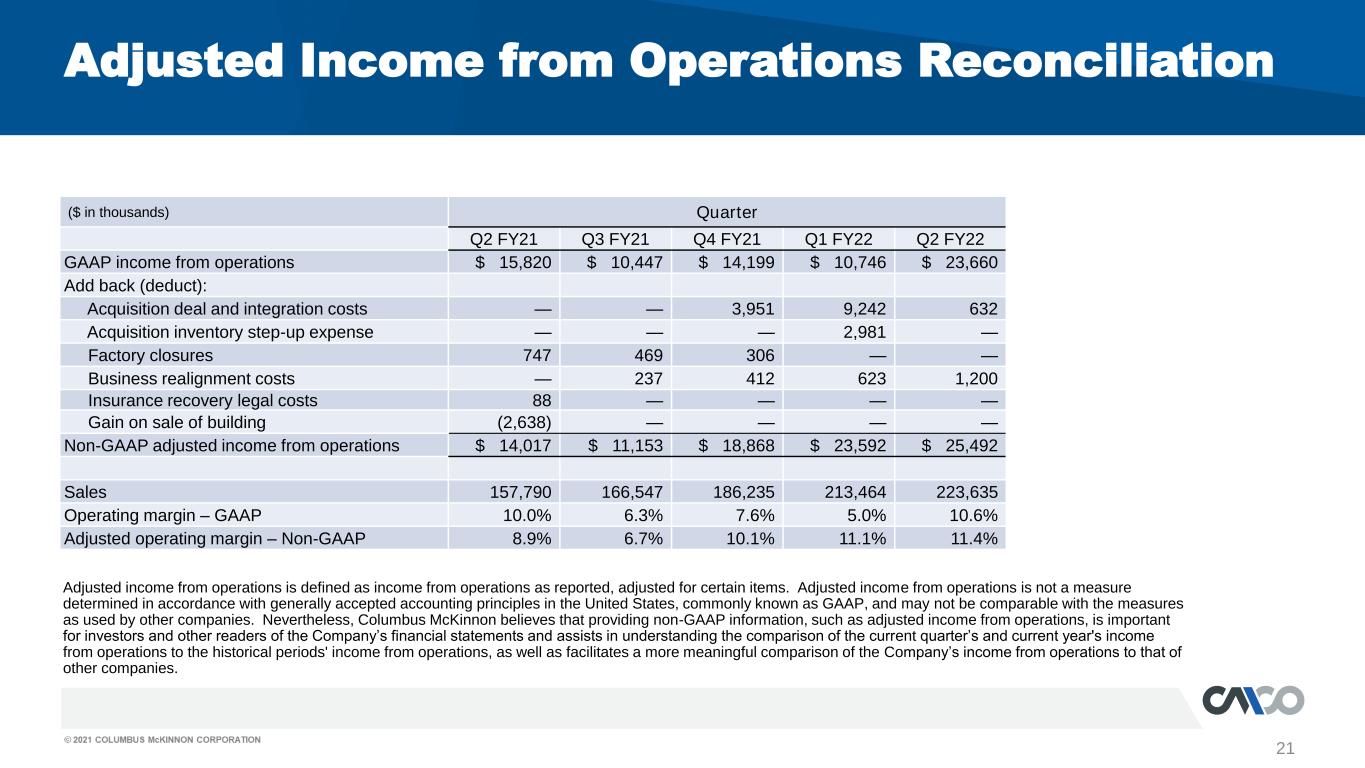

21 Adjusted Income from Operations Reconciliation Adjusted income from operations is defined as income from operations as reported, adjusted for certain items. Adjusted income from operations is not a measure determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable with the measures as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information, such as adjusted income from operations, is important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year's income from operations to the historical periods' income from operations, as well as facilitates a more meaningful comparison of the Company’s income from operations to that of other companies. ($ in thousands) Quarter Q2 FY21 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 GAAP income from operations $ 15,820 $ 10,447 $ 14,199 $ 10,746 $ 23,660 Add back (deduct): Acquisition deal and integration costs — — 3,951 9,242 632 Acquisition inventory step-up expense — — — 2,981 — Factory closures 747 469 306 — — Business realignment costs — 237 412 623 1,200 Insurance recovery legal costs 88 — — — — Gain on sale of building (2,638) — — — — Non-GAAP adjusted income from operations $ 14,017 $ 11,153 $ 18,868 $ 23,592 $ 25,492 Sales 157,790 166,547 186,235 213,464 223,635 Operating margin – GAAP 10.0% 6.3% 7.6% 5.0% 10.6% Adjusted operating margin – Non-GAAP 8.9% 6.7% 10.1% 11.1% 11.4%

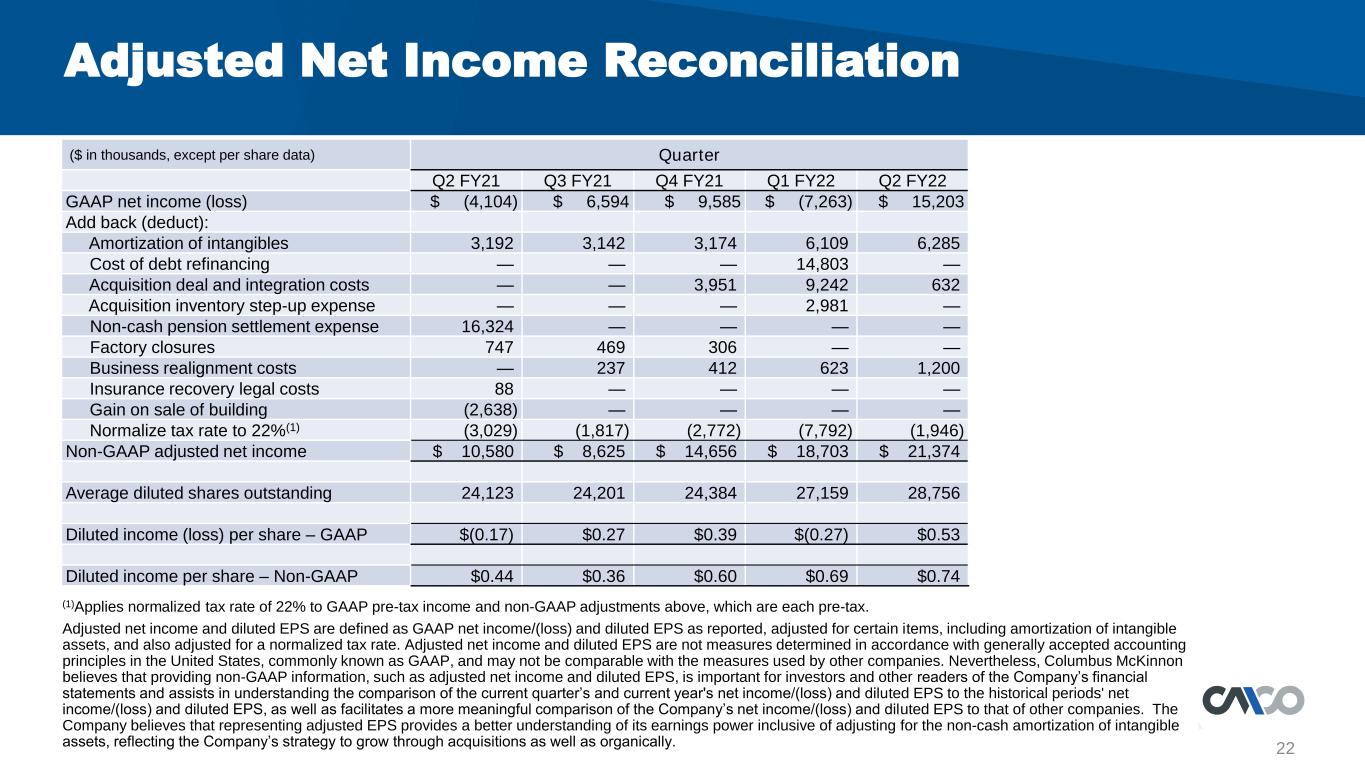

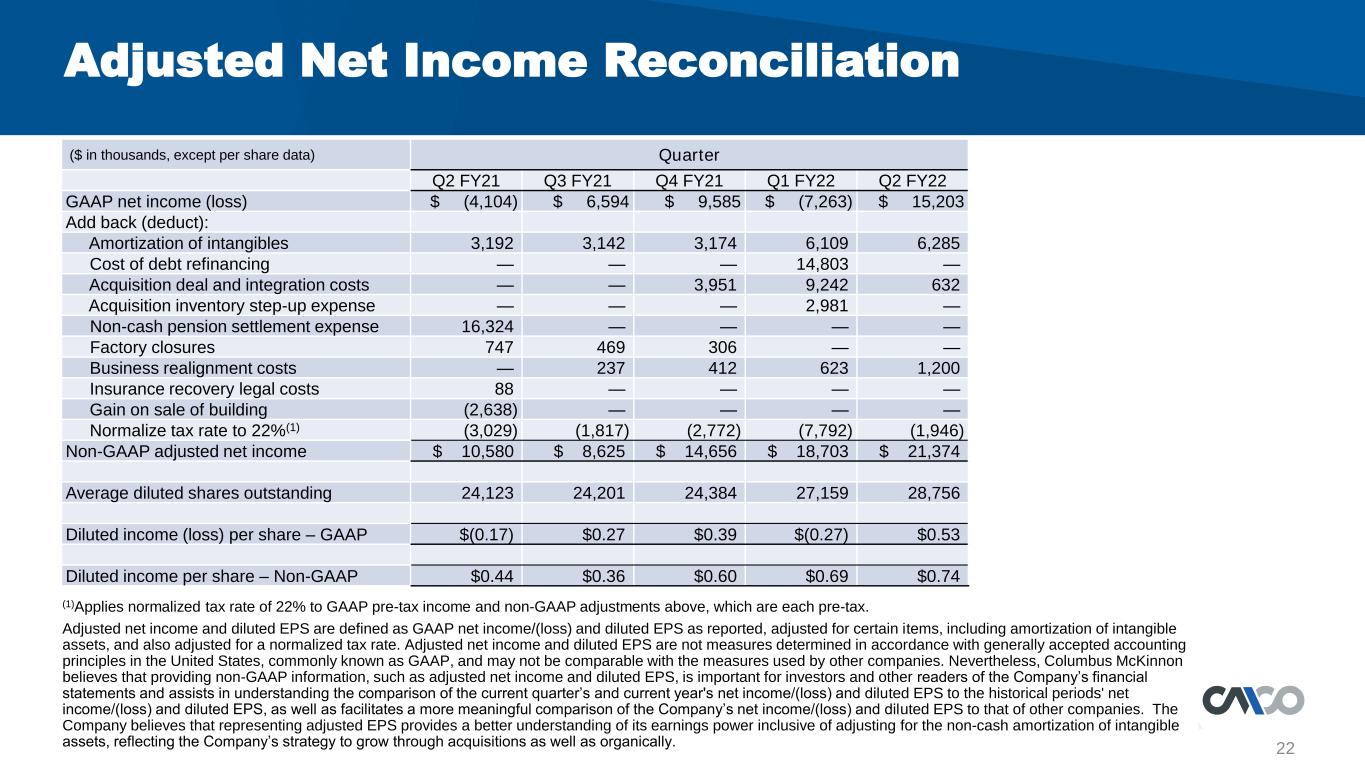

22 Adjusted Net Income Reconciliation ($ in thousands, except per share data) Quarter Q2 FY21 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 GAAP net income (loss) $ (4,104) $ 6,594 $ 9,585 $ (7,263) $ 15,203 Add back (deduct): Amortization of intangibles 3,192 3,142 3,174 6,109 6,285 Cost of debt refinancing — — — 14,803 — Acquisition deal and integration costs — — 3,951 9,242 632 Acquisition inventory step-up expense — — — 2,981 — Non-cash pension settlement expense 16,324 — — — — Factory closures 747 469 306 — — Business realignment costs — 237 412 623 1,200 Insurance recovery legal costs 88 — — — — Gain on sale of building (2,638) — — — — Normalize tax rate to 22%(1) (3,029) (1,817) (2,772) (7,792) (1,946) Non-GAAP adjusted net income $ 10,580 $ 8,625 $ 14,656 $ 18,703 $ 21,374 Average diluted shares outstanding 24,123 24,201 24,384 27,159 28,756 Diluted income (loss) per share – GAAP $(0.17) $0.27 $0.39 $(0.27) $0.53 Diluted income per share – Non-GAAP $0.44 $0.36 $0.60 $0.69 $0.74 (1)Applies normalized tax rate of 22% to GAAP pre-tax income and non-GAAP adjustments above, which are each pre-tax. Adjusted net income and diluted EPS are defined as GAAP net income/(loss) and diluted EPS as reported, adjusted for certain items, including amortization of intangible assets, and also adjusted for a normalized tax rate. Adjusted net income and diluted EPS are not measures determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable with the measures used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information, such as adjusted net income and diluted EPS, is important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year's net income/(loss) and diluted EPS to the historical periods' net income/(loss) and diluted EPS, as well as facilitates a more meaningful comparison of the Company’s net income/(loss) and diluted EPS to that of other companies. The Company believes that representing adjusted EPS provides a better understanding of its earnings power inclusive of adjusting for the non-cash amortization of intangible assets, reflecting the Company’s strategy to grow through acquisitions as well as organically.

23 Adjusted Net Income Reconciliation (1)Applies normalized tax rate of 22% to GAAP pre-tax income and non-GAAP adjustments above, which are each pre-tax. Adjusted net income and diluted EPS are defined as net income and diluted EPS as reported, adjusted for certain items, including amortization of intangible assets, and also adjusted for a normalized tax rate. Adjusted net income and diluted EPS are not measures determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable with the measures used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information, such as adjusted net income and diluted EPS, is important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year's net income and diluted EPS to the historical periods' net income and diluted EPS, as well as facilitates a more meaningful comparison of the Company’s net income and diluted EPS to that of other companies. The Company believes that representing adjusted EPS provides a better understanding of its earnings power inclusive of adjusting for the non-cash amortization of intangible assets, reflecting the Company’s strategy to grow through acquisitions as well as organically. ($ in thousands, except per share data) Fiscal Year FY 2019 FY 2020 FY 2021 Q2 FY22 TTM GAAP net income $ 42,577 $ 59,672 $ 9,106 $ 24,119 Add back (deduct): Amortization of intangibles 14,900 12,942 12,623 18,710 Cost of debt refinancing — — — 14,803 Non-cash pension settlement expense — — 19,046 — Factory closures 1,473 4,709 3,778 775 Business realignment costs 1,906 2,831 1,470 2,472 Insurance recovery legal costs 1,282 585 229 — Insurance settlement — (382) — — Gain on sale of building — — (2,638) — Loss on sales of businesses 25,672 176 — — Acquisition deal and integration costs — — 3,951 13,825 Acquisition inventory step-up expense — — — 2,981 Normalize tax rate to 22%(1) (11,268) (4,080) (9,708) (14,326) Non-GAAP adjusted net income $ 76,542 $ 76,453 $ 37,857 $ 63,359 Average diluted shares outstanding 23,660 23,855 24,173 26,125 Diluted income per share – GAAP $1.80 $2.50 $0.38 $0.92 Diluted income per share - Non-GAAP $3.24 $3.20 $1.57 $2.43

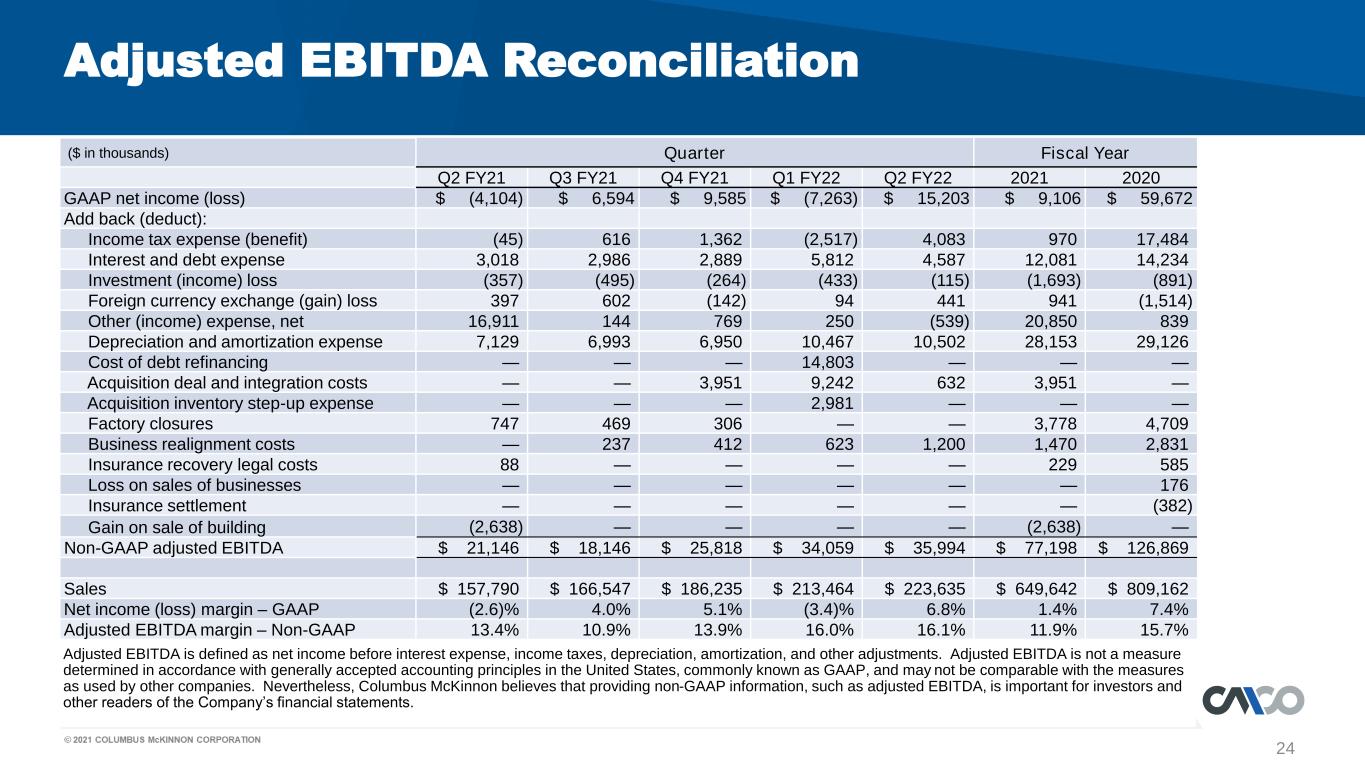

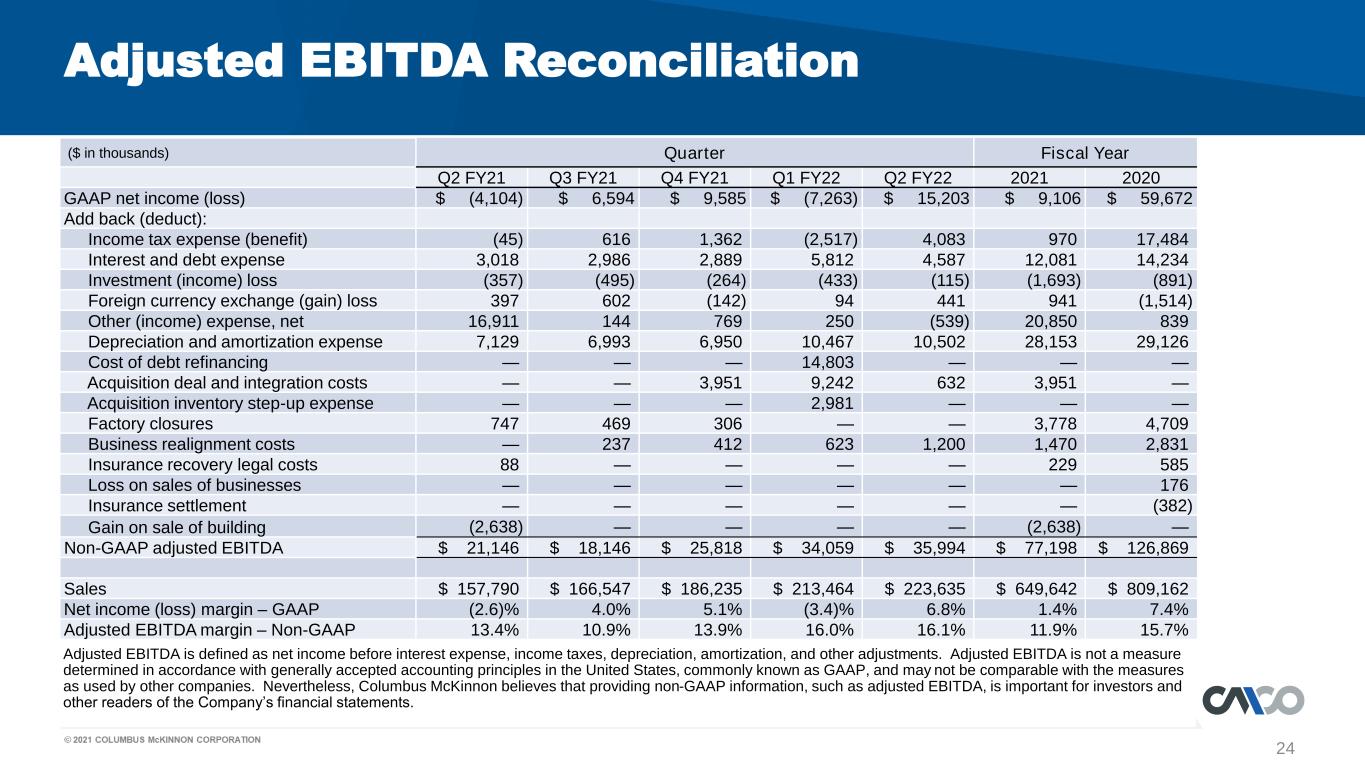

24 Adjusted EBITDA Reconciliation Adjusted EBITDA is defined as net income before interest expense, income taxes, depreciation, amortization, and other adjustments. Adjusted EBITDA is not a measure determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable with the measures as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information, such as adjusted EBITDA, is important for investors and other readers of the Company’s financial statements. ($ in thousands) Quarter Fiscal Year Q2 FY21 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 2021 2020 GAAP net income (loss) $ (4,104) $ 6,594 $ 9,585 $ (7,263) $ 15,203 $ 9,106 $ 59,672 Add back (deduct): Income tax expense (benefit) (45) 616 1,362 (2,517) 4,083 970 17,484 Interest and debt expense 3,018 2,986 2,889 5,812 4,587 12,081 14,234 Investment (income) loss (357) (495) (264) (433) (115) (1,693) (891) Foreign currency exchange (gain) loss 397 602 (142) 94 441 941 (1,514) Other (income) expense, net 16,911 144 769 250 (539) 20,850 839 Depreciation and amortization expense 7,129 6,993 6,950 10,467 10,502 28,153 29,126 Cost of debt refinancing — — — 14,803 — — — Acquisition deal and integration costs — — 3,951 9,242 632 3,951 — Acquisition inventory step-up expense — — — 2,981 — — — Factory closures 747 469 306 — — 3,778 4,709 Business realignment costs — 237 412 623 1,200 1,470 2,831 Insurance recovery legal costs 88 — — — — 229 585 Loss on sales of businesses — — — — — — 176 Insurance settlement — — — — — — (382) Gain on sale of building (2,638) — — — — (2,638) — Non-GAAP adjusted EBITDA $ 21,146 $ 18,146 $ 25,818 $ 34,059 $ 35,994 $ 77,198 $ 126,869 Sales $ 157,790 $ 166,547 $ 186,235 $ 213,464 $ 223,635 $ 649,642 $ 809,162 Net income (loss) margin – GAAP (2.6)% 4.0% 5.1% (3.4)% 6.8% 1.4% 7.4% Adjusted EBITDA margin – Non-GAAP 13.4% 10.9% 13.9% 16.0% 16.1% 11.9% 15.7%

25 Return on Invested Capital (ROIC) Reconciliation ROIC is defined as adjusted income from operations, net of taxes at a 22% normalized rate, for the trailing four quarters divided by the average of debt plus equity less cash (average capital) for the trailing five quarters. ROIC is not a measure determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable with the measures as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information, such as ROIC, is important for investors and other readers of the Company’s financial statements. ($ in thousands) Fiscal Year TTM 2020 2021 Q2 FY22 GAAP income from operations $ 89,824 $ 42,255 $ 59,052 Add back (deduct): Acquisition deal and integration costs — 3,951 13,825 Acquisition inventory step-up expense — — 2,981 Factory closures 4,709 3,778 775 Business realignment costs 2,831 1,470 2,472 Insurance recovery legal costs 585 229 — Loss on sales of businesses 176 — — Insurance settlement (382) — — Gain on sale of building — (2,638) — Non-GAAP adjusted income from operations $ 97,743 $ 49,045 $ 79,105 Non-GAAP adjusted income from operations, net of normalized tax rate of 22% $ 76,240 $ 38,255 $ 61,702 Trailing five quarter averages: Total debt 273,146 260,130 337,233 Total shareholders’ equity 459,044 487,523 593,408 Cash and cash equivalents 79,450 168,599 154,055 Net total capitalization $ 652,740 $ 579,054 $ 776,586 Return on invested capital (ROIC) – Non-GAAP 11.7% 6.6% 7.9%

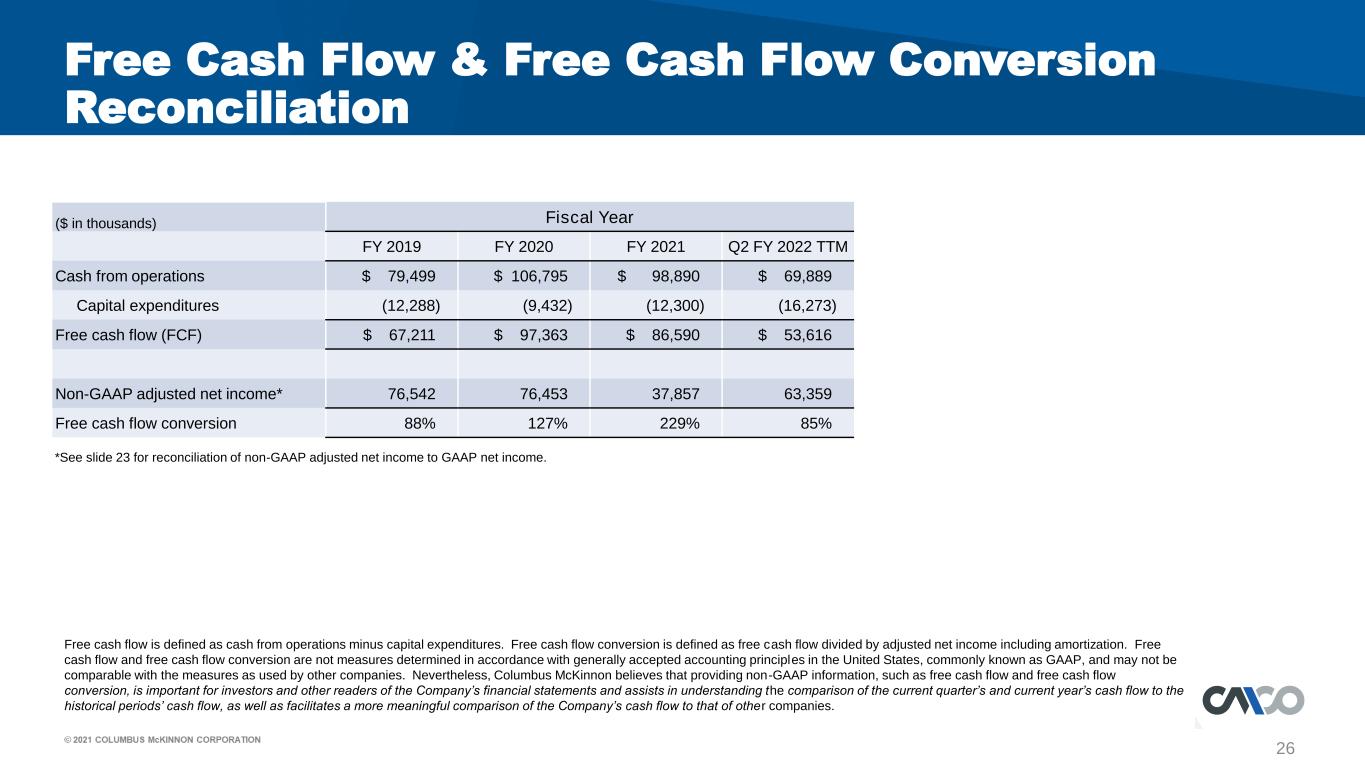

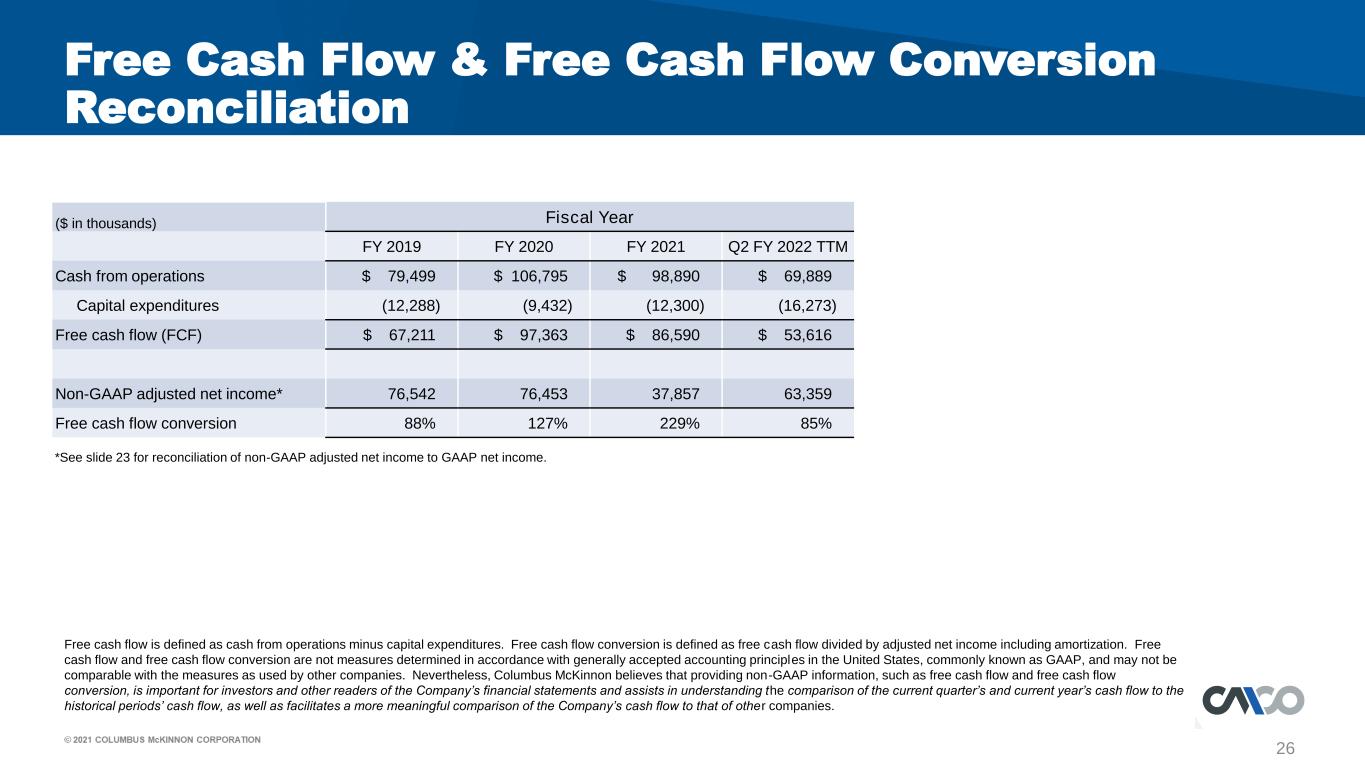

26 Free Cash Flow & Free Cash Flow Conversion Reconciliation ($ in thousands) Fiscal Year FY 2019 FY 2020 FY 2021 Q2 FY 2022 TTM Cash from operations $ 79,499 $ 106,795 $ 98,890 $ 69,889 Capital expenditures (12,288) (9,432) (12,300) (16,273) Free cash flow (FCF) $ 67,211 $ 97,363 $ 86,590 $ 53,616 Non-GAAP adjusted net income* 76,542 76,453 37,857 63,359 Free cash flow conversion 88% 127% 229% 85% Free cash flow is defined as cash from operations minus capital expenditures. Free cash flow conversion is defined as free cash flow divided by adjusted net income including amortization. Free cash flow and free cash flow conversion are not measures determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable with the measures as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information, such as free cash flow and free cash flow conversion, is important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year’s cash flow to the historical periods’ cash flow, as well as facilitates a more meaningful comparison of the Company’s cash flow to that of other companies. *See slide 23 for reconciliation of non-GAAP adjusted net income to GAAP net income.

27 U.S. Capacity Utilization Eurozone Capacity Utilization Industrial Capacity Utilization Source: The Federal Reserve Board Source: European Commission 60% 65% 70% 75% 80% Manufacturing Total 75.9% (Manufacturing) & 75.2% (Total) September 2021(1) 65% 67% 69% 71% 73% 75% 77% 79% 81% 83% 85% 82.9% Q3 2021 (1)September 2021 numbers are preliminary

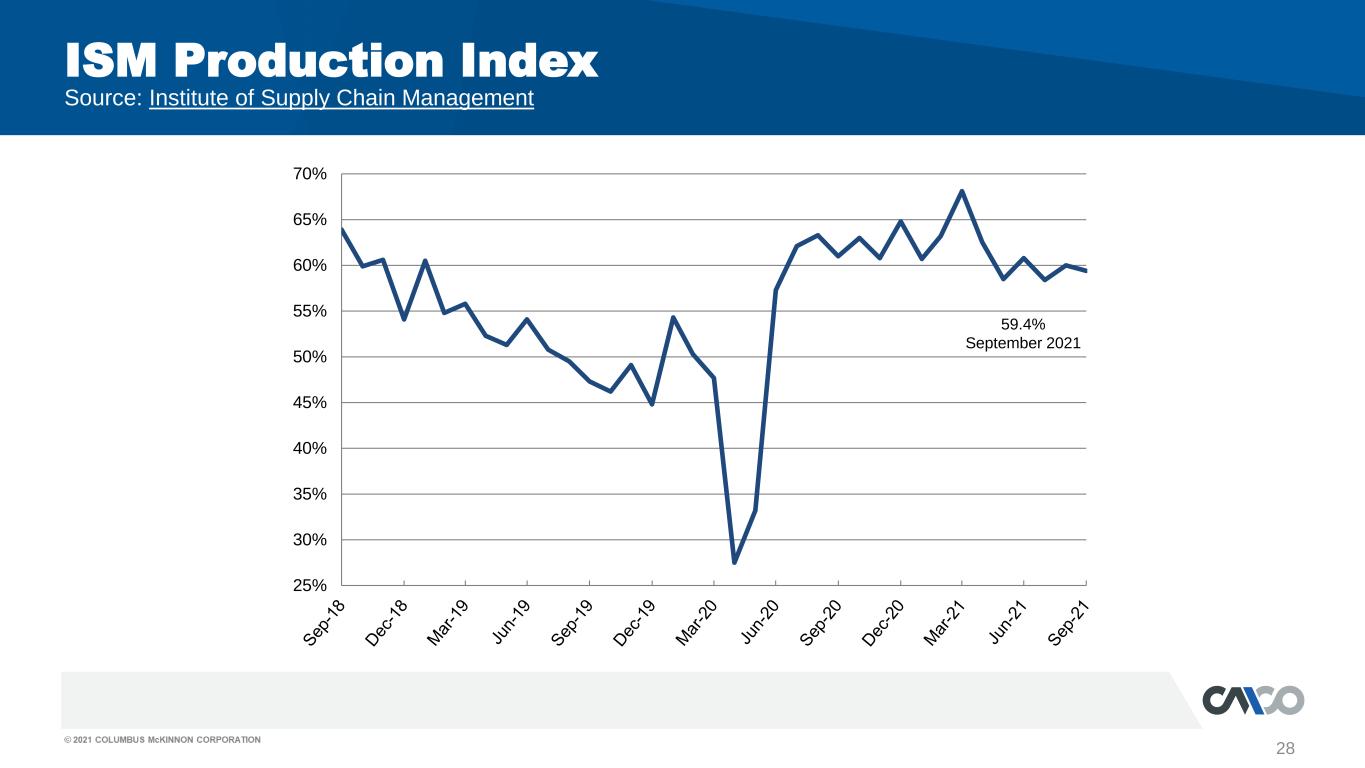

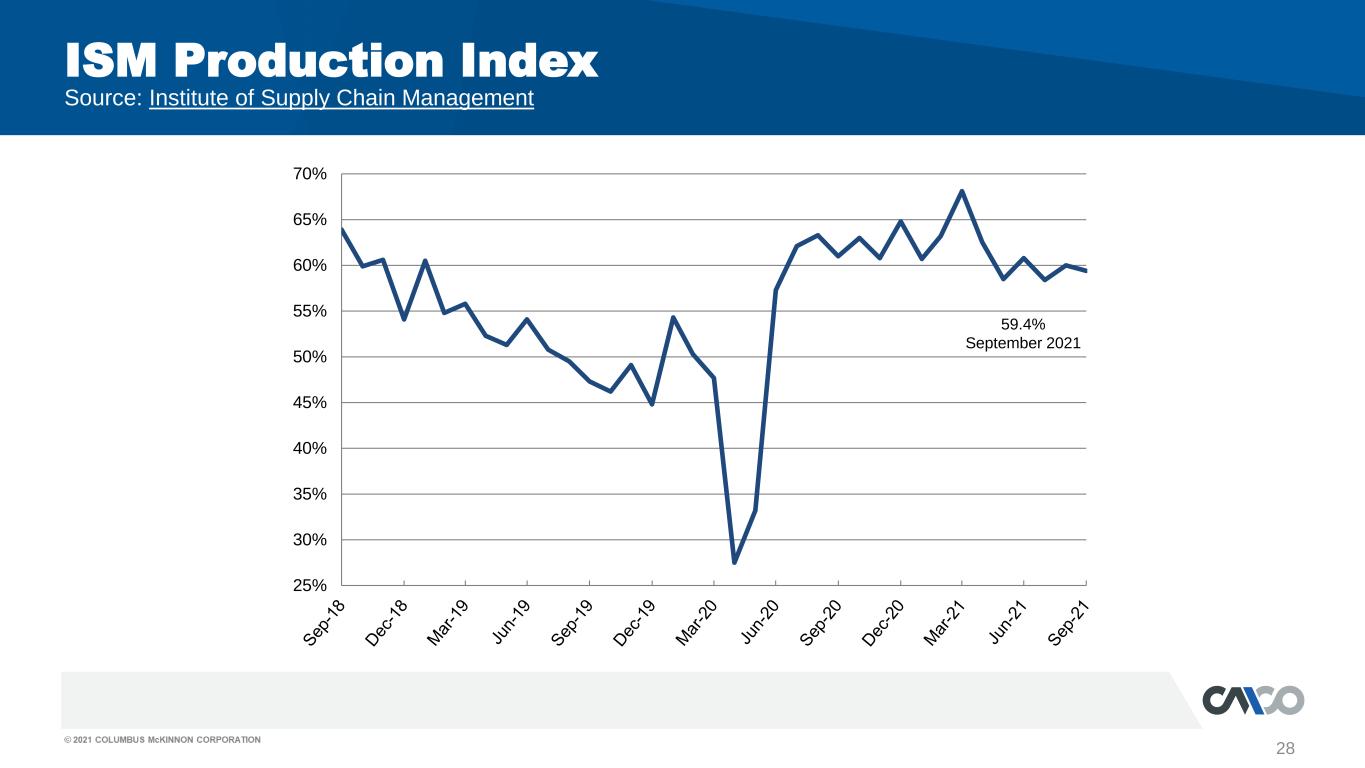

28 ISM Production Index Source: Institute of Supply Chain Management 25% 30% 35% 40% 45% 50% 55% 60% 65% 70% 59.4% September 2021

Q2 Fiscal Year 2022 Financial Results Conference Call October 28, 2021