Investor Presentation February 2022 1 Gregory P. Rustowicz Senior Vice President Finance and Chief Financial Officer

2 Safe Harbor Statement These slides, and the accompanying oral discussion (together, this “presentation”), contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements concerning: future sales, earnings and plans; the success of the Dorner Mfg. Corp. (“Dorner”) and Garvey Corporation (“Garvey”) acquisitions, achievement of cost and revenue synergies and the amount of such synergies and integration costs; the ability of the Company to achieve market success and earnings per share accretion expectations; the ability of the Company to employ the Columbus McKinnon Business System to drive profitability and to grow the business with its Blueprint for Growth 2.0 strategy, involve known and unknown risks, and are based upon current information and expectations. Actual results may differ materially from those anticipated if the information on which those estimates were based ultimately proves to be incorrect or as a result of certain risks and uncertainties that could cause our actual results to differ materially from the results expressed or implied by such statements, including the integration of recent acquisitions into the Company to achieve cost and revenue synergies, the ability of the Company and its recent acquisitions to achieve revenue expectations, global economic and business conditions including the impact of COVID-19, conditions affecting the industries served by us and our subsidiaries, conditions affecting our customers and suppliers, competitor responses to our products and services, the overall market acceptance of such products and services, facility consolidations and other restructurings, the ability to expand into new markets and geographic regions, foreign currency fluctuations, and other factors disclosed in our periodic reports filed with the Securities and Exchange Commission. Consequently, such forward-looking statements should be regarded as our current plans, estimates and beliefs. Except as required by applicable law, we do not undertake and specifically decline any obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect any future events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. Non-GAAP Financial Measures This presentation will discuss some non-GAAP (“adjusted”) financial measures which we believe are useful in evaluating our performance. You should not consider the presentation of this additional information in isolation or as a substitute for results compared in accordance with GAAP. The non-GAAP (“adjusted”) measures are noted and reconciliations of comparable GAAP with non-GAAP measures can be found in tables included in the Supplemental Information portion of this presentation.

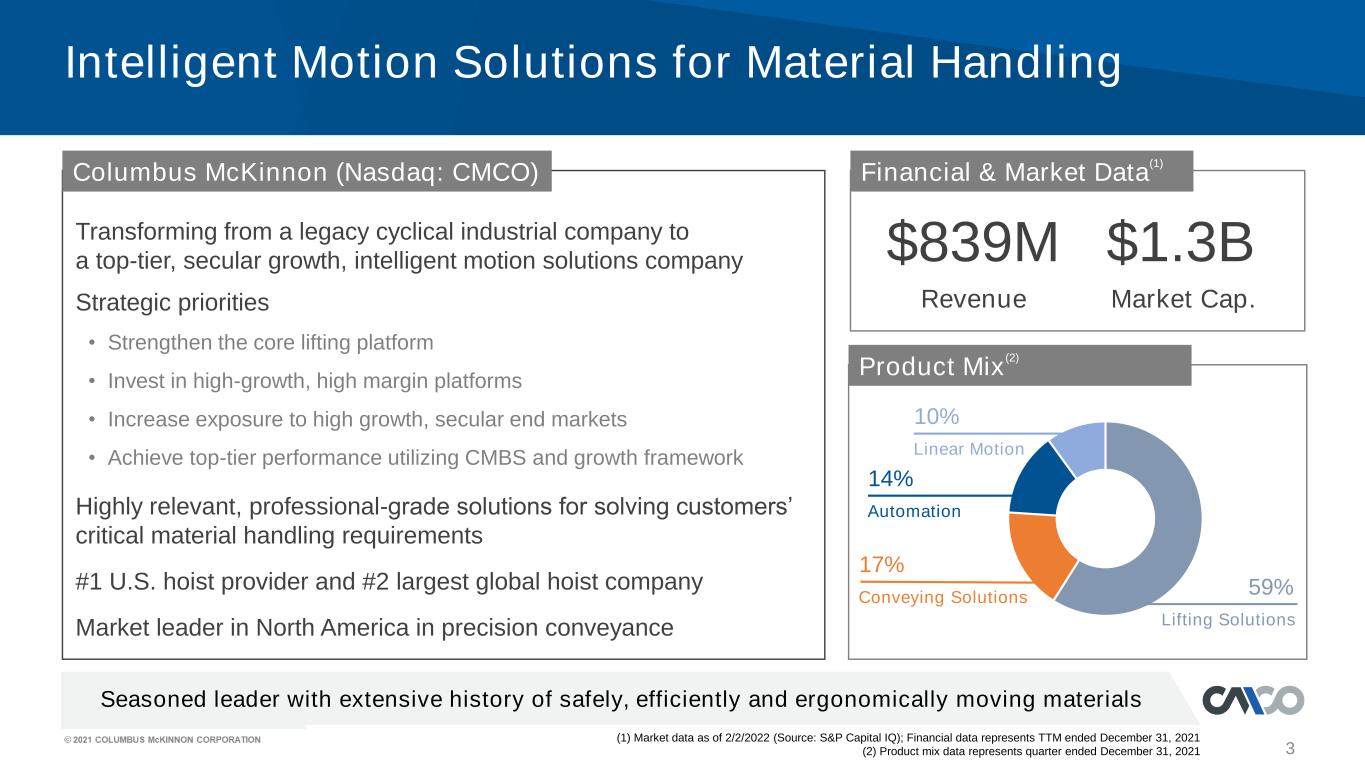

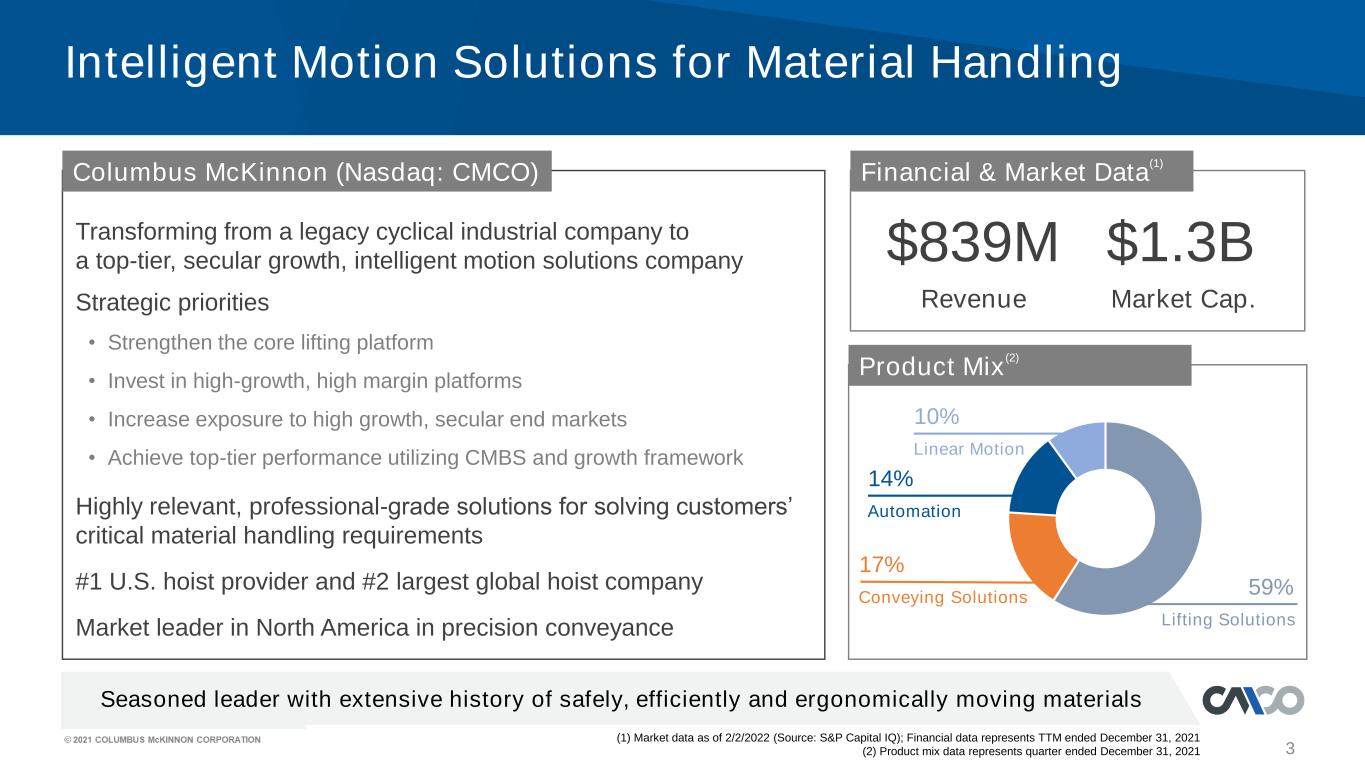

3 Intelligent Motion Solutions for Material Handling (1) Market data as of 2/2/2022 (Source: S&P Capital IQ); Financial data represents TTM ended December 31, 2021 (2) Product mix data represents quarter ended December 31, 2021 Columbus McKinnon (Nasdaq: CMCO) Financial & Market Data (1) Transforming from a legacy cyclical industrial company to a top-tier, secular growth, intelligent motion solutions company Strategic priorities • Strengthen the core lifting platform • Invest in high-growth, high margin platforms • Increase exposure to high growth, secular end markets • Achieve top-tier performance utilizing CMBS and growth framework Highly relevant, professional-grade solutions for solving customers’ critical material handling requirements #1 U.S. hoist provider and #2 largest global hoist company Market leader in North America in precision conveyance $839M $1.3B Revenue Market Cap. Product Mix (2) Linear Motion 10% Automation 14% Conveying Solutions 17% Lifting Solutions 59% Seasoned leader with extensive history of safely, efficiently and ergonomically moving materials

4 Blueprint for Growth 2.0 Business System and Core Growth Framework Transform CMCO Strategy evolves Columbus McKinnon into a high value, intelligent motion enterprise

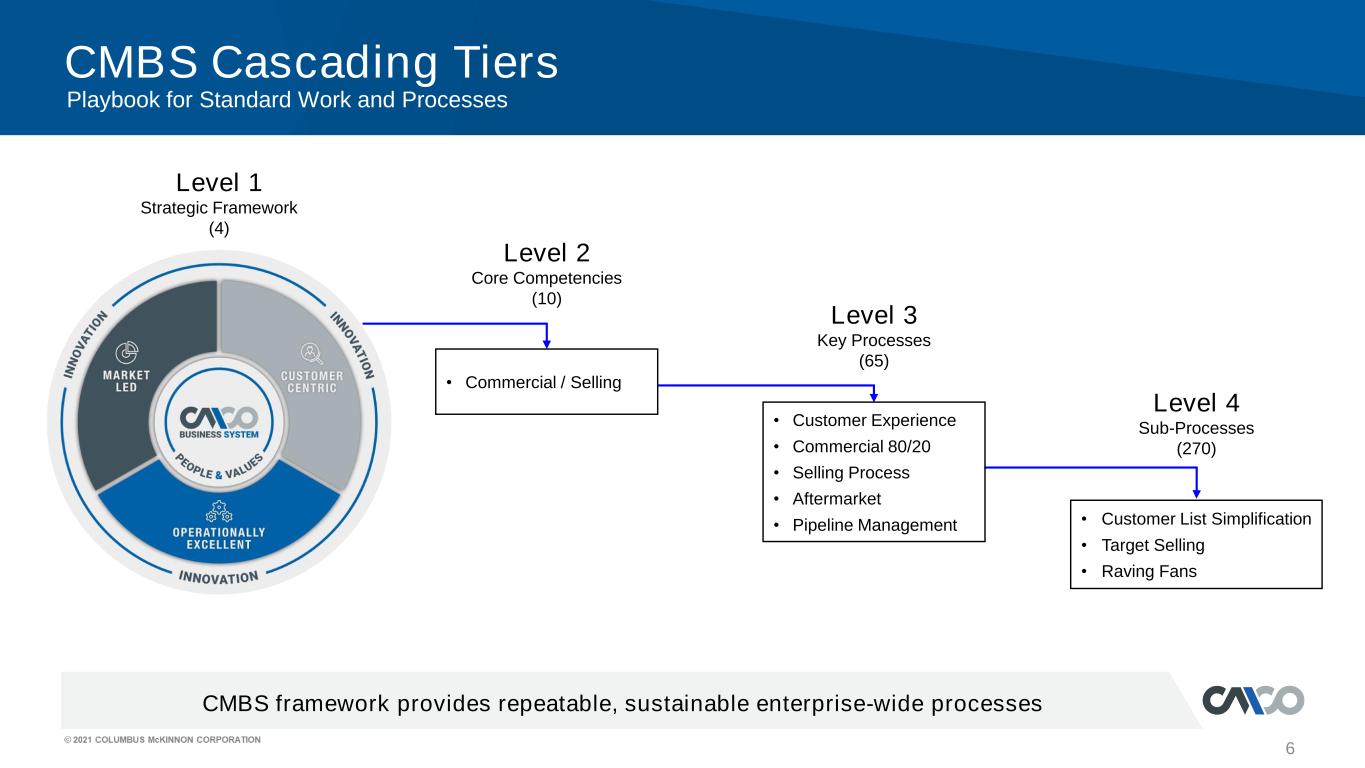

5 Columbus McKinnon Business System (CMBS) enables top-tier performance and scalability Columbus McKinnon Business System 8. Operations 9. Finance 10. Digitization 6. Commercial / Selling 7. Product Development 1. People & Values 2. Strategic Planning 3. Marketing 4. Product Management 5. M&A Core Competencies Defined To Drive Performance

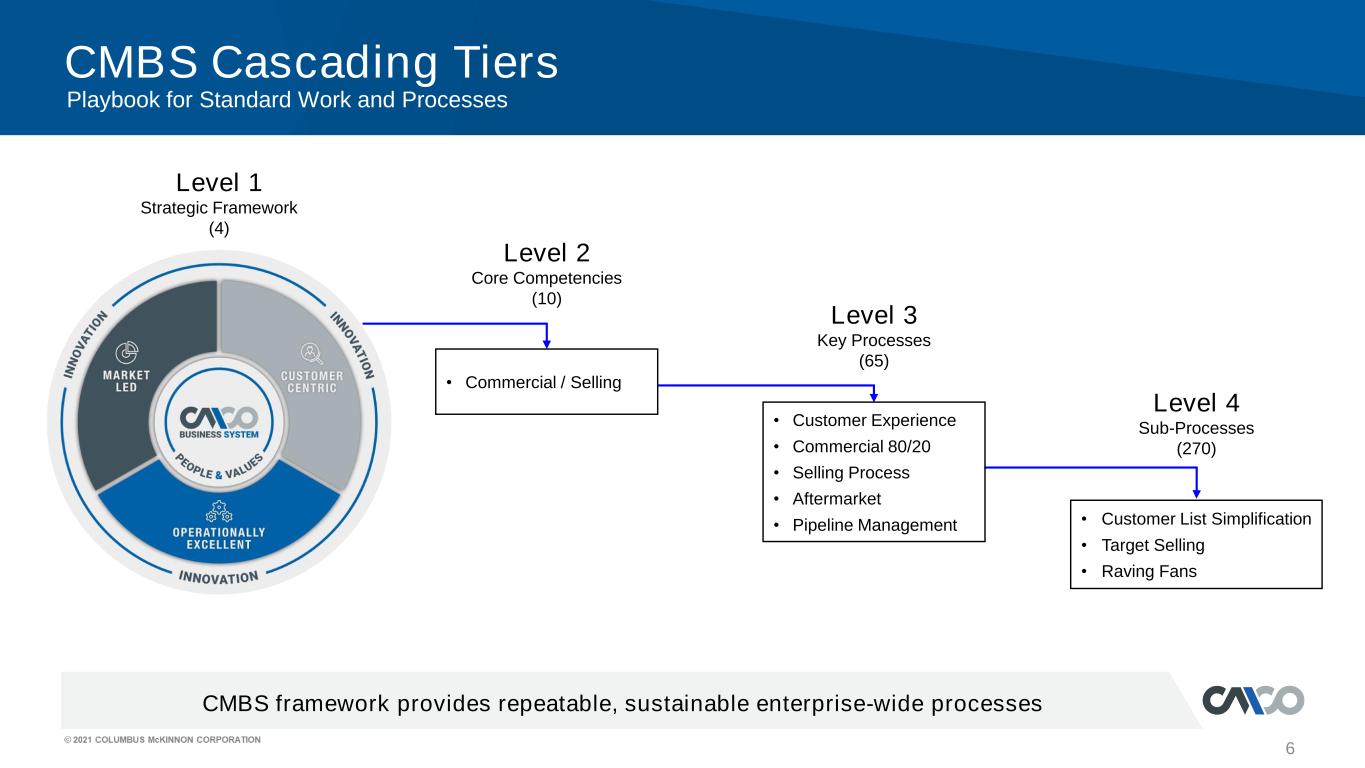

6 CMBS framework provides repeatable, sustainable enterprise-wide processes CMBS Cascading Tiers Playbook for Standard Work and Processes Level 1 Strategic Framework (4) Level 3 Key Processes (65) Level 4 Sub-Processes (270) • Commercial / Selling • Customer Experience • Commercial 80/20 • Selling Process • Aftermarket • Pipeline Management • Customer List Simplification • Target Selling • Raving Fans Level 2 Core Competencies (10)

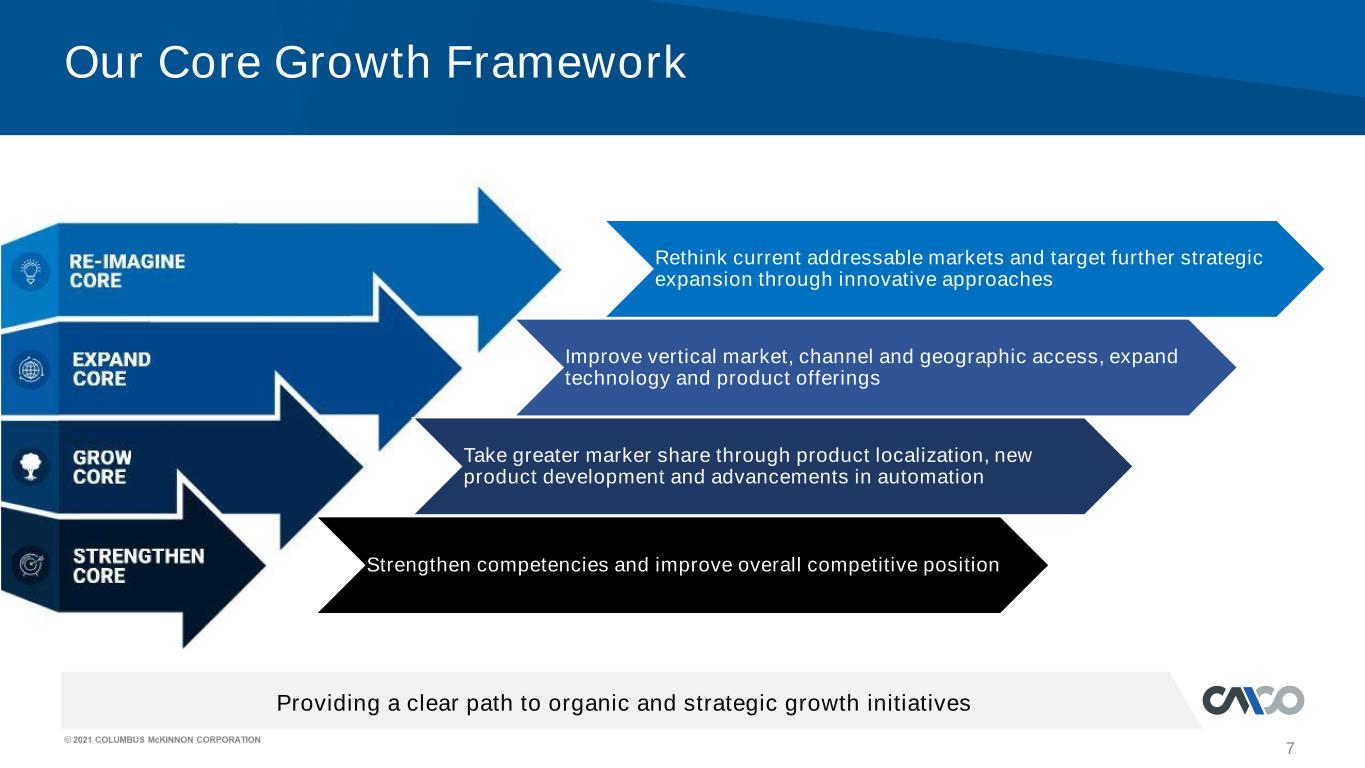

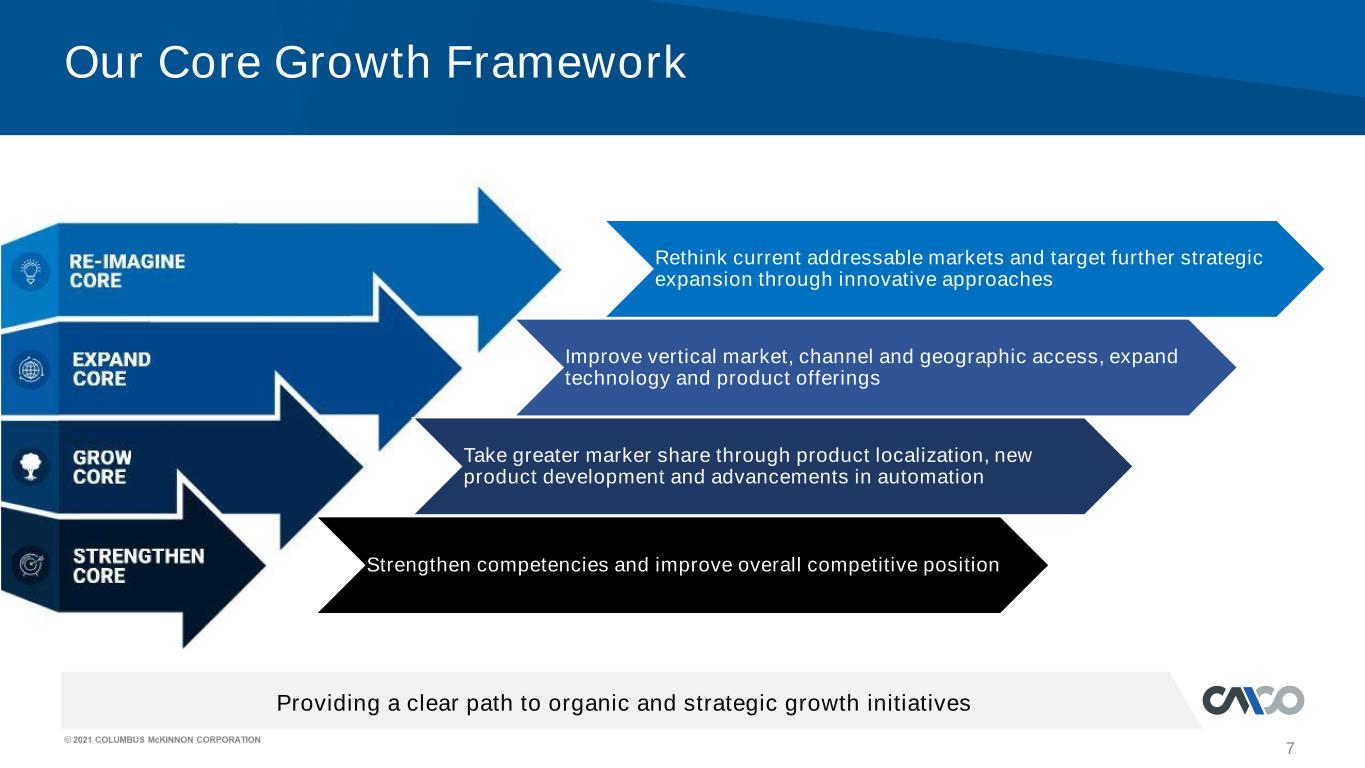

7 Our Core Growth Framework Providing a clear path to organic and strategic growth initiatives Rethink current addressable markets and target further strategic expansion through innovative approaches Improve vertical market, channel and geographic access, expand technology and product offerings Take greater marker share through product localization, new product development and advancements in automation Strengthen competencies and improve overall competitive position

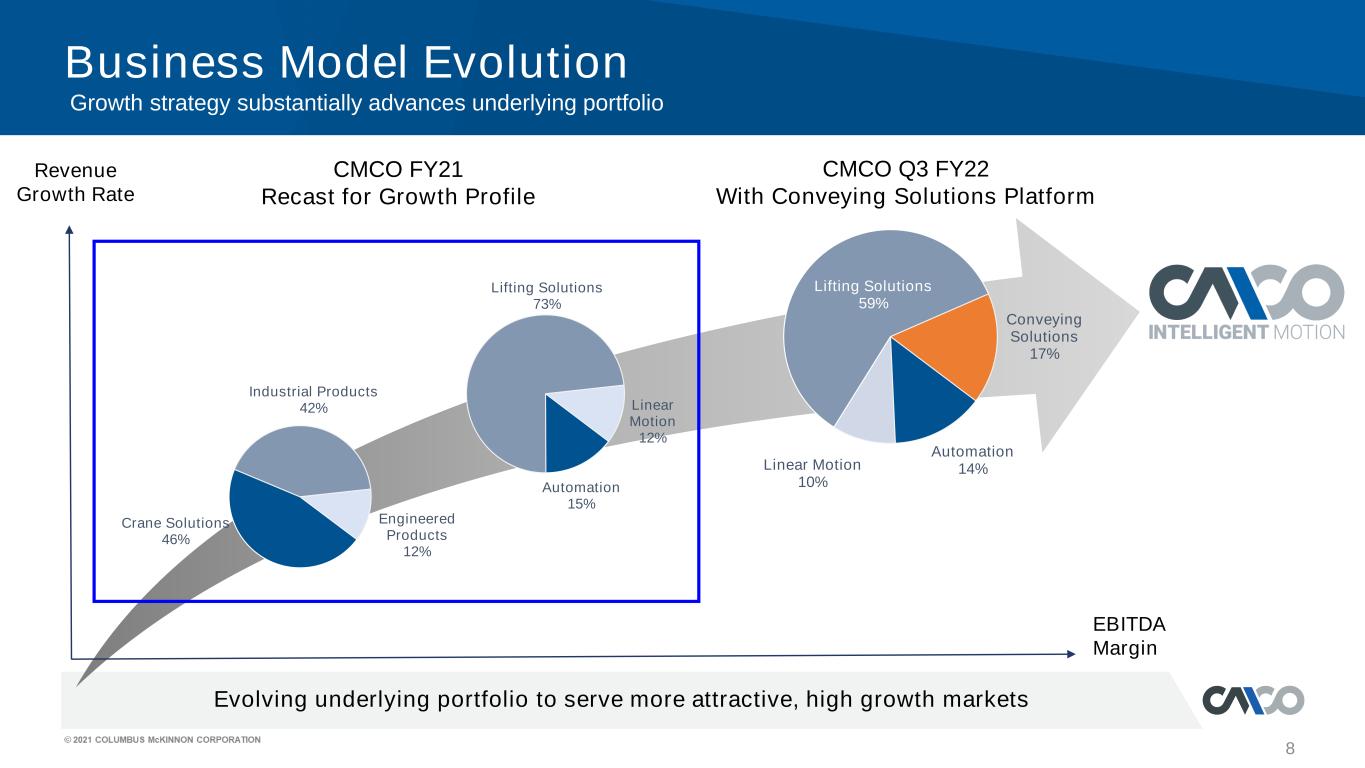

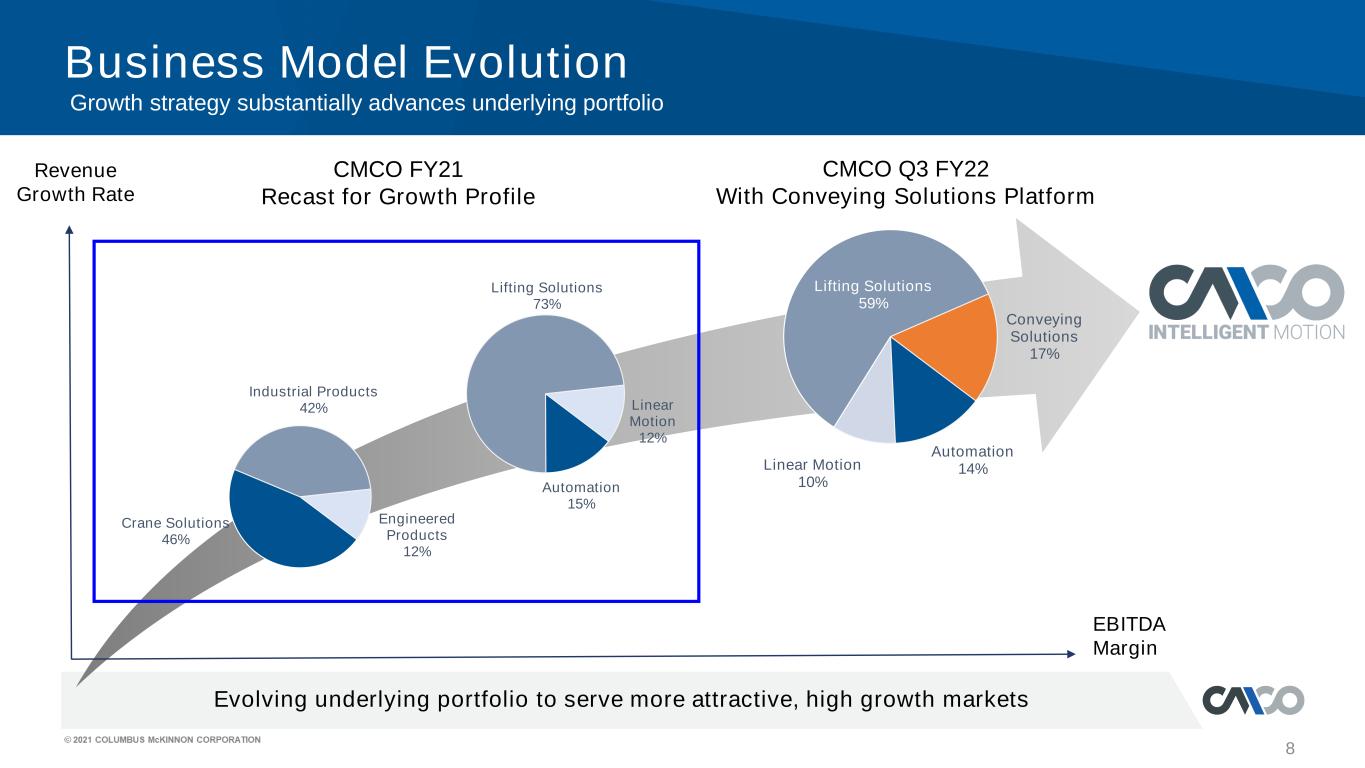

8 Business Model Evolution Revenue Growth Rate EBITDA Margin CMCO Q3 FY22 With Conveying Solutions Platform Crane Solutions 46% Industrial Products 42% Engineered Products 12% Automation 14%Linear Motion 10% Lifting Solutions 59% Conveying Solutions 17% Automation 15% Lifting Solutions 73% Linear Motion 12% CMCO FY21 Recast for Growth Profile Growth strategy substantially advances underlying portfolio Evolving underlying portfolio to serve more attractive, high growth markets

9 Highly diverse end markets with varying industry cycles Increasing Presence in Secularly Driven Markets Conveying Solutions Serves Less Cyclical Industries General Industrial 20% Transportation 15% Material Handling/ Industrial Automation 11% Energy & Utilities 10%Chemical/Paper/Metals Processing 10% Construction 7% Food, Beverage & Consumer Goods 6% Oil & Gas 5% Aerospace & Government 5% Elevator 3% E-Commerce 3% Life Sciences/Pharma 3% Entertainment 2%

10 Global leader in intelligent motion solutions for material handling Columbus McKinnon Legacy Solutions Lifting, Linear Motion and Automation Solutions Standard Hoist & Rigging Products: #1 U.S. market position in hoists Lifting capacity from 1/8 ton to ~140 tons Reliable, high-quality products Engineered Crane Solutions: Large tonnage projects Compass™ configure, price and quote tool Automation integrated into lifting solutions Specialty Actuation Products: Demonstrated leadership and differentiated offering Serving a breadth of end markets from rail to warehousing to defense

Conveying Solutions Advances Intelligent Motion Strategy Developing Leading Platform for Growth Scalable, high-growth platform to advance our Intelligent Motion Strategy 11 Specialty conveying provides growth platform: ~$4B TAM growing at 6% to 8% CAGR Higher margin profile Strong secular growth drivers: Supply chain automation Acceleration of e-commerce adoption Fragmented market provides target rich acquisition environment Acquired Garvey in December 2021 Complementary adjacencies: Sortation, asynchronous, vibration, etc.

12 Acquired Garvey Corporation December 1, 2021 Leader in accumulation technology complements Dorner’s conveying solutions Leading automation solutions company concentrated in F&B and pharma Provides unique, patented technologies in the design, application, manufacturing and integration of accumulation systems Industries highest quality products, deep technical expertise and experienced management team Strong brand name recognition in pharmaceutical and food & beverage industries Strong top-line growth and profitability • TTM Revenue ~$30M at September 30, 2021 • 100% of revenue in North America • ~80%+ sales in F&B and Pharma • TTM Adjusted EBITDA ~$9M at September 30, 2021 • Expect $0.05 GAAP EPS accretion in fiscal 2023 Headquartered in Hammonton, New Jersey Products Accumulators 46% of Revenue Specialty Conveyors 30% of Revenue Vial Loaders, Lubrication Systems, Gripper Elevators 24% of Revenue

13 Strong performance and market share gains within attractive verticals Secular Growth Markets Provide Strong Tailwinds Single piece picking, robotics integration to automate picking and sorting functions ~3% of YTD Q3 FY22 sales* Custom designed sanitary and easy to clean conveyors engineered to the strictest USDA guidelines ~6% of YTD Q3 FY22 sales* Customizable designs built for precision, speed, and to FDA / industry standards for clean-room certifications ~3% of YTD Q3 FY22 sales* * Percentage of total 12/31/21 fiscal year 2022 sales, includes acquisitions. FOOD, BEVERAGE & CONSUMER GOODS New platform adds attractive vertical markets with enduring tailwinds LIFE SCIENCES / PHARMA E-COMMERCE

14 Improved customer experience, safety and productivity at the core of new product development Driving Organic Growth with New Products Delivering Innovation • Unique, beltless zone control for pallet and tray handling • Ideal for accumulation and automation assembly applications • Improved facility safety for large complex loads • Available in Compass™ configurator PRECISION PALLET SYSTEMTANDEM HOIST LINEAR ACTUATOR WITH INTELLI-MOTION™ • Provides enhanced control and position feedback capabilities • Reduces installation costs and the overall product footprint

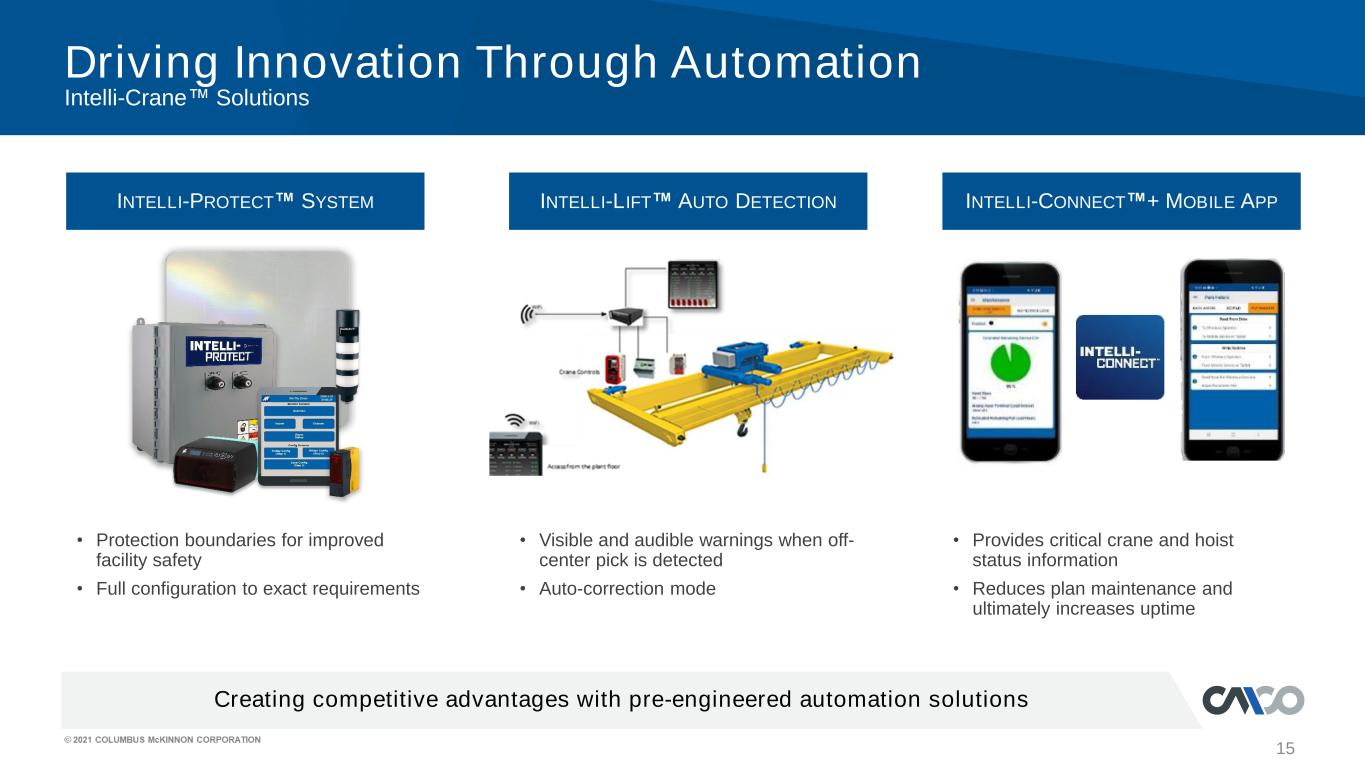

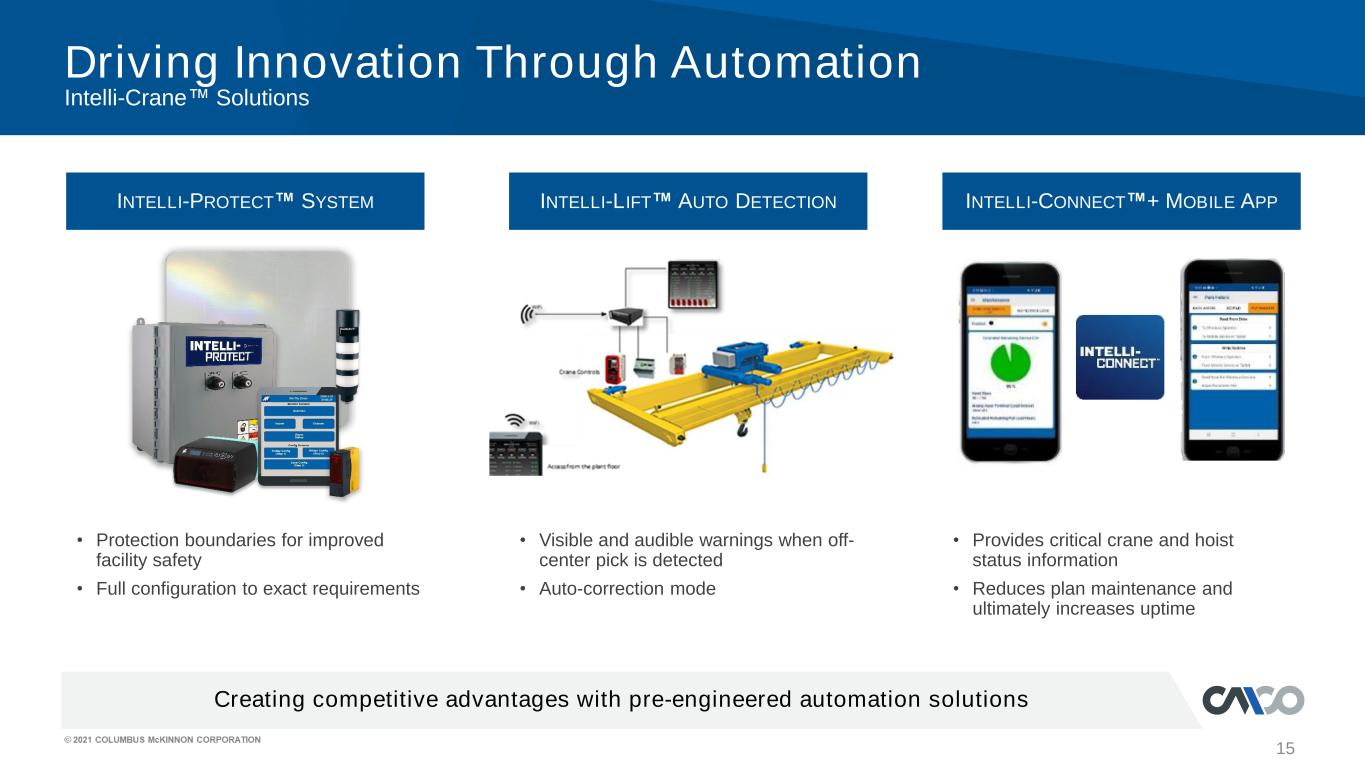

15 Creating competitive advantages with pre-engineered automation solutions Driving Innovation Through Automation Intelli-Crane™ Solutions INTELLI-LIFT™ AUTO DETECTIONINTELLI-PROTECT™ SYSTEM INTELLI-CONNECT™+ MOBILE APP • Visible and audible warnings when off- center pick is detected • Auto-correction mode • Protection boundaries for improved facility safety • Full configuration to exact requirements • Provides critical crane and hoist status information • Reduces plan maintenance and ultimately increases uptime

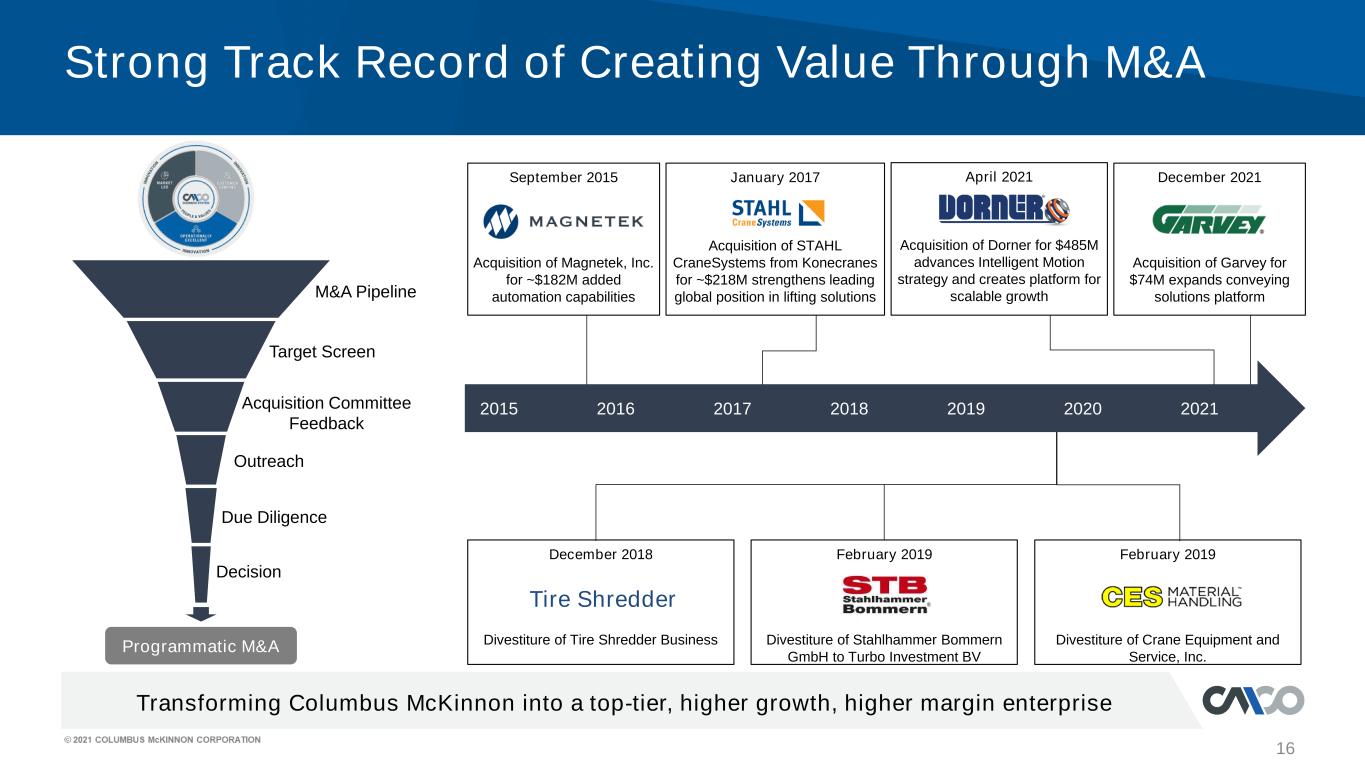

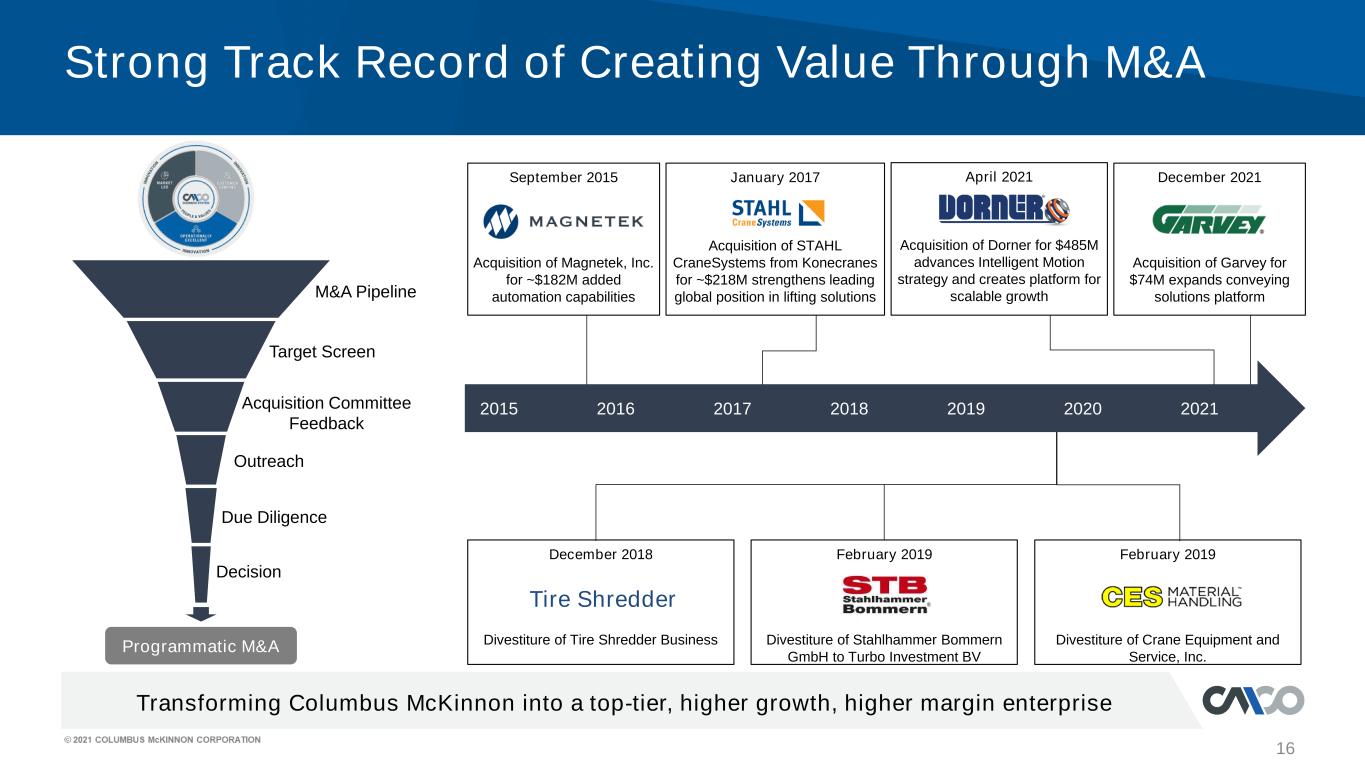

January 2017 Acquisition of STAHL CraneSystems from Konecranes for ~$218M strengthens leading global position in lifting solutions Transforming Columbus McKinnon into a top-tier, higher growth, higher margin enterprise 16 Strong Track Record of Creating Value Through M&A Programmatic M&A M&A Pipeline Target Screen Acquisition Committee Feedback Outreach Due Diligence Decision 2016 2017 2018 2019 2020 2021 September 2015 Acquisition of Magnetek, Inc. for ~$182M added automation capabilities February 2019 Divestiture of Stahlhammer Bommern GmbH to Turbo Investment BV April 2021 Acquisition of Dorner for $485M advances Intelligent Motion strategy and creates platform for scalable growth February 2019 Divestiture of Crane Equipment and Service, Inc. December 2018 Divestiture of Tire Shredder Business Tire Shredder 2015 December 2021 Acquisition of Garvey for $74M expands conveying solutions platform

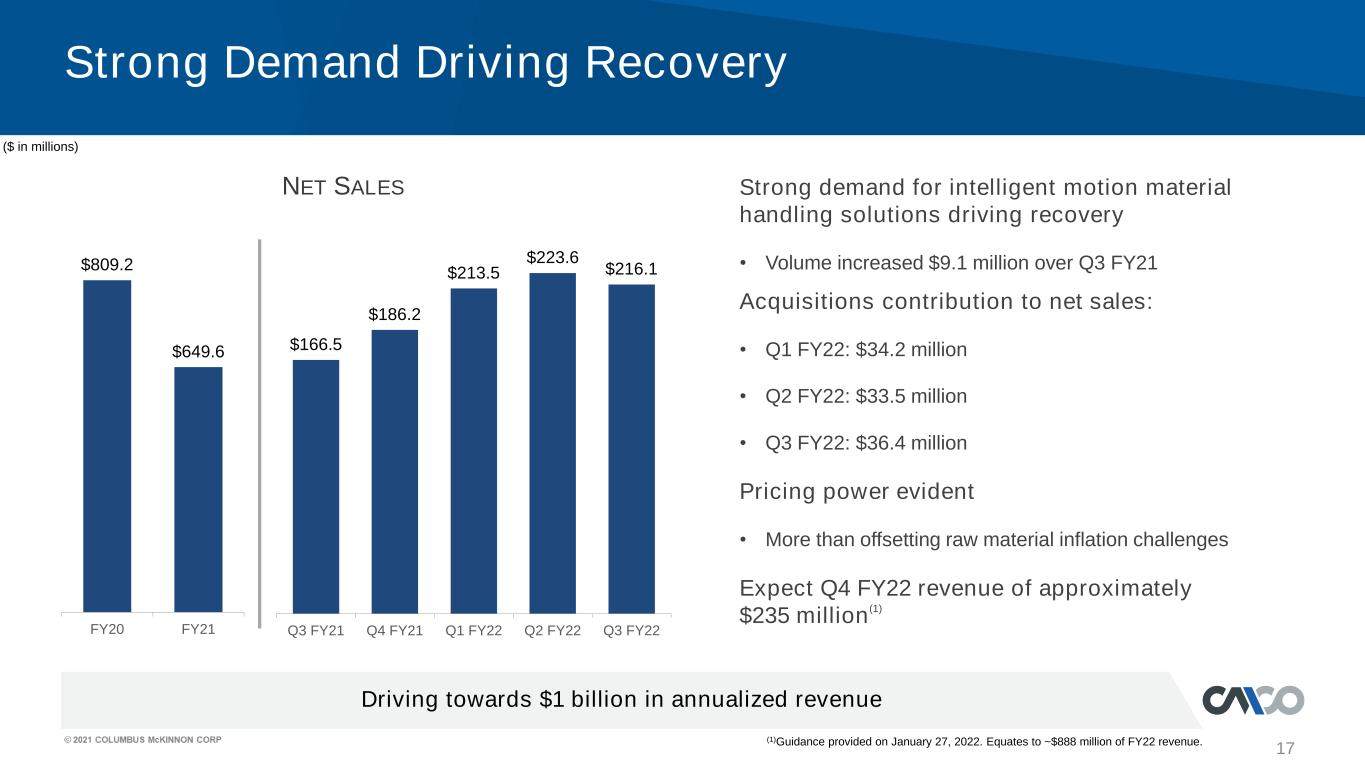

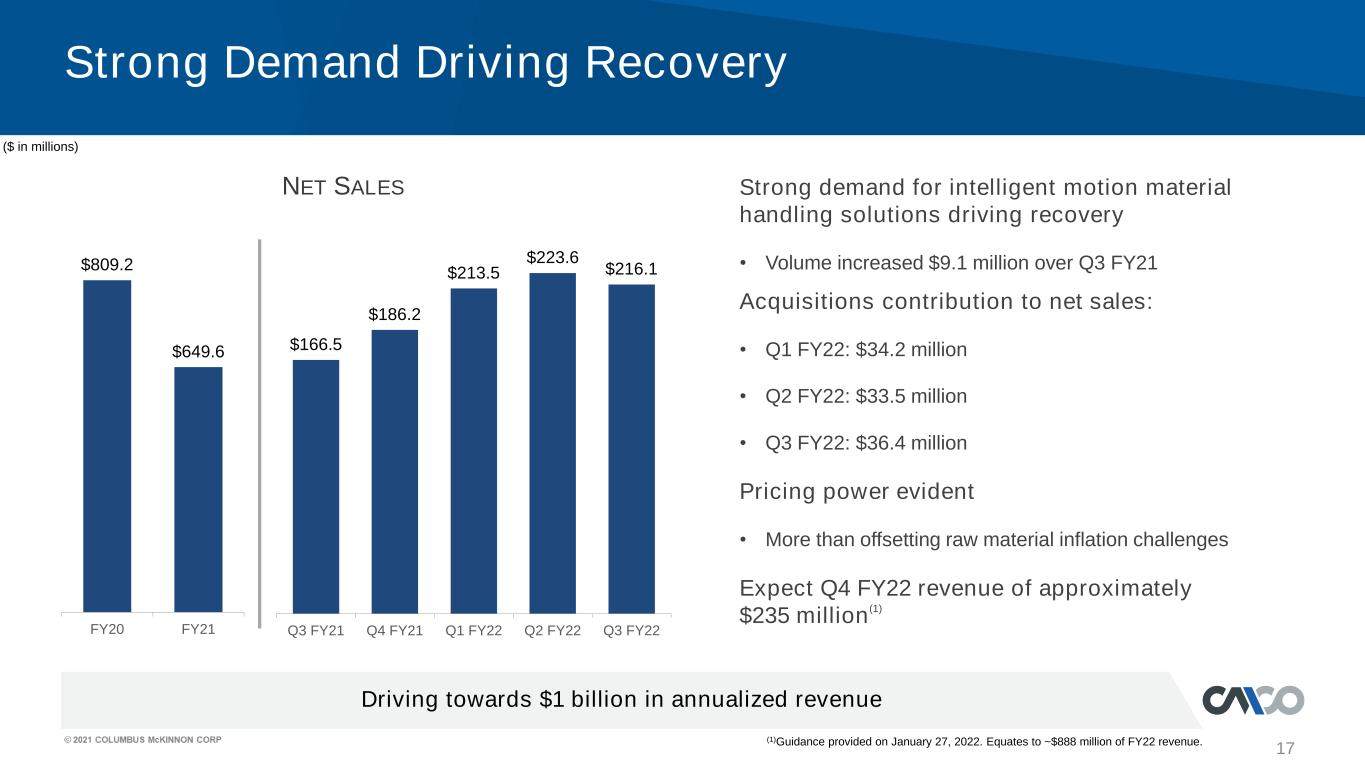

17 Driving towards $1 billion in annualized revenue Strong Demand Driving Recovery NET SALES $166.5 $186.2 $213.5 $223.6 $216.1 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 Q3 FY22 (1)Guidance provided on January 27, 2022. Equates to ~$888 million of FY22 revenue. $809.2 $649.6 FY20 FY21 ($ in millions) Strong demand for intelligent motion material handling solutions driving recovery • Volume increased $9.1 million over Q3 FY21 Acquisitions contribution to net sales: • Q1 FY22: $34.2 million • Q2 FY22: $33.5 million • Q3 FY22: $36.4 million Pricing power evident • More than offsetting raw material inflation challenges Expect Q4 FY22 revenue of approximately $235 million (1)

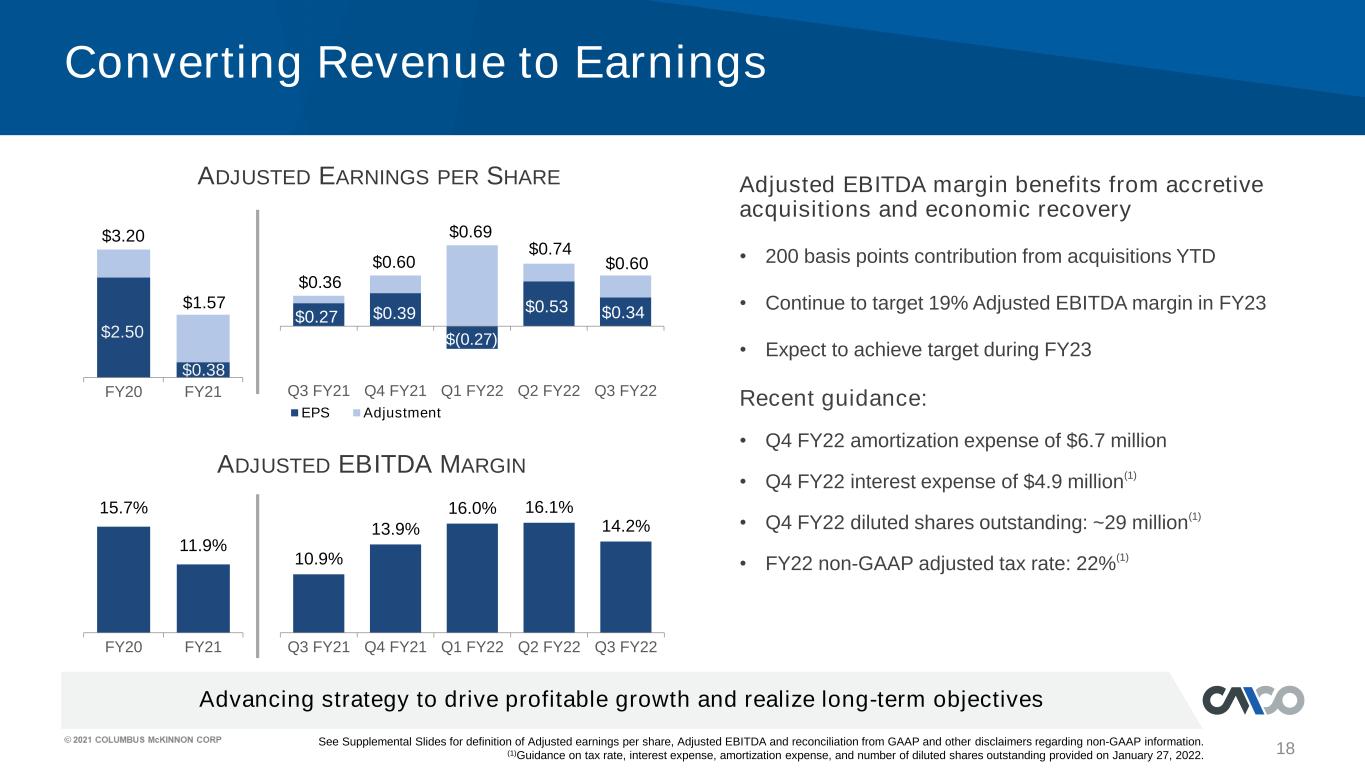

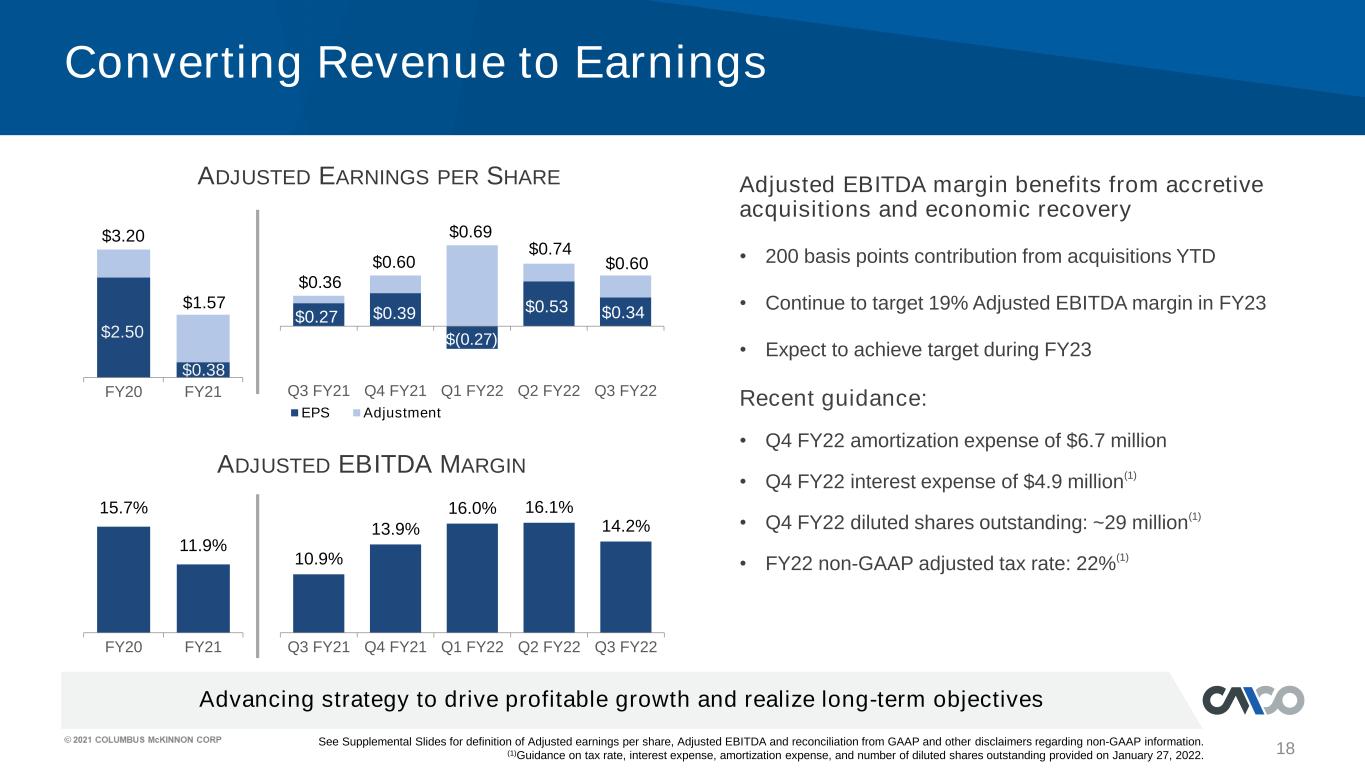

18 Advancing strategy to drive profitable growth and realize long-term objectives Converting Revenue to Earnings ADJUSTED EBITDA MARGIN Adjusted EBITDA margin benefits from accretive acquisitions and economic recovery 10.9% 13.9% 16.0% 16.1% 14.2% Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 Q3 FY22 • 200 basis points contribution from acquisitions YTD • Continue to target 19% Adjusted EBITDA margin in FY23 • Expect to achieve target during FY23 Recent guidance: • Q4 FY22 amortization expense of $6.7 million • Q4 FY22 interest expense of $4.9 million (1) • Q4 FY22 diluted shares outstanding: ~29 million (1) • FY22 non-GAAP adjusted tax rate: 22% (1) ADJUSTED EARNINGS PER SHARE $0.27 $0.39 $(0.27) $0.53 $0.34 $0.36 $0.60 $0.69 $0.74 $0.60 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 Q3 FY22 EPS Adjustment See Supplemental Slides for definition of Adjusted earnings per share, Adjusted EBITDA and reconciliation from GAAP and other disclaimers regarding non-GAAP information. (1)Guidance on tax rate, interest expense, amortization expense, and number of diluted shares outstanding provided on January 27, 2022. $2.50 $0.38 $3.20 $1.57 FY20 FY21 15.7% 11.9% FY20 FY21

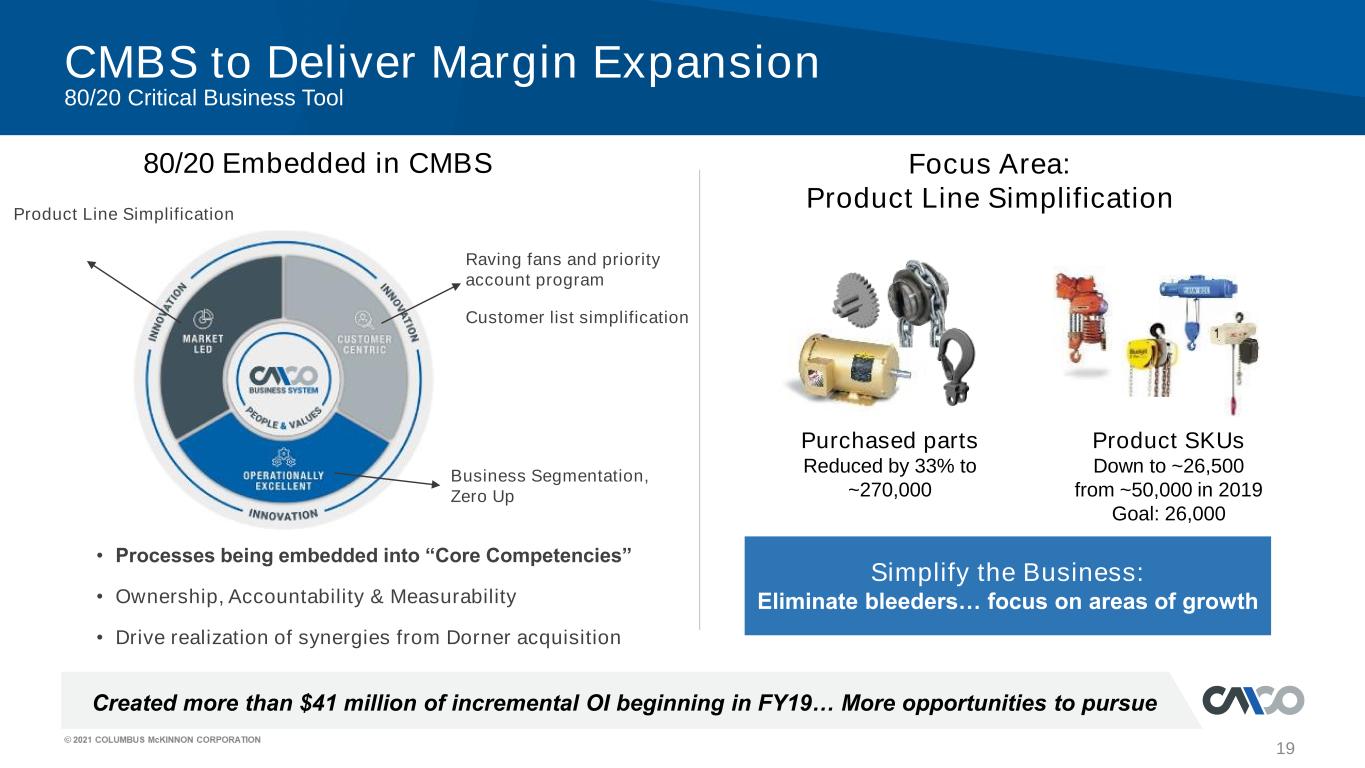

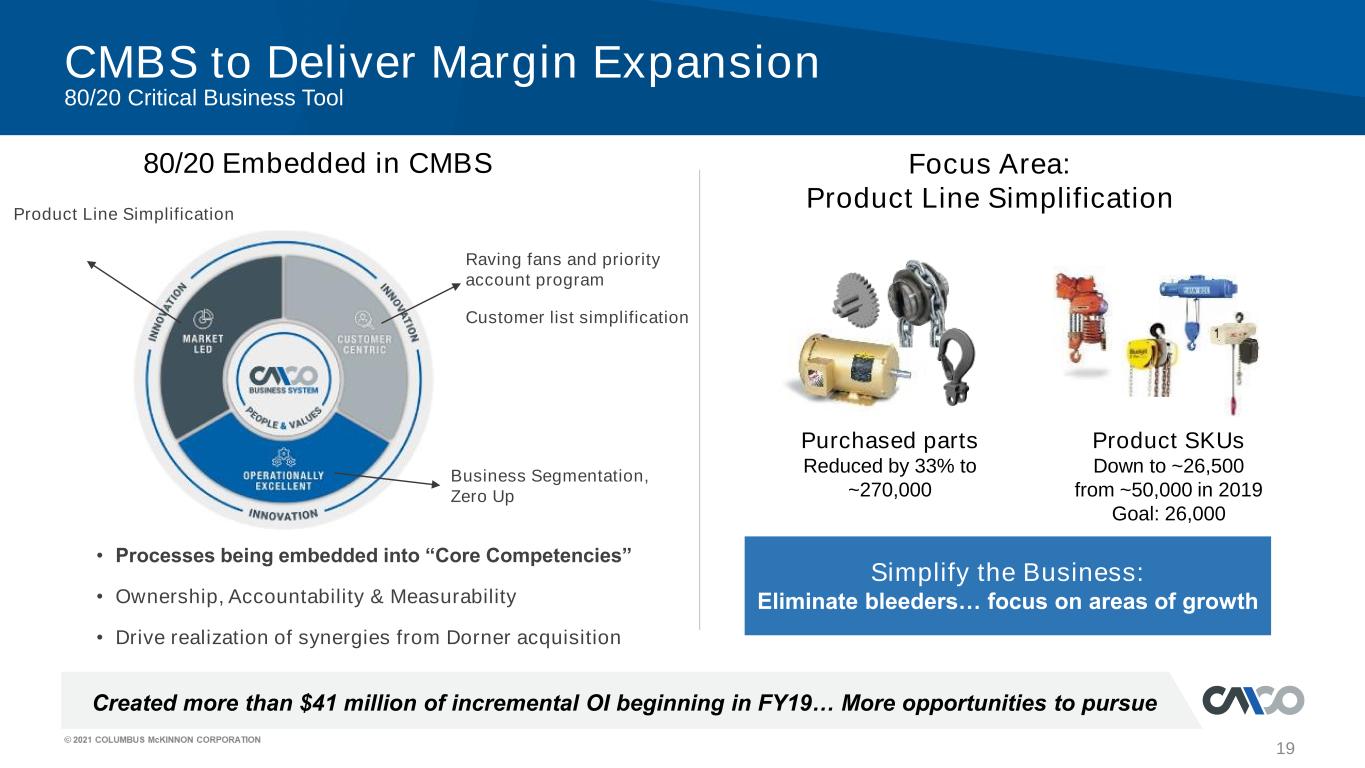

Created more than $41 million of incremental OI beginning in FY19… More opportunities to pursue CMBS to Deliver Margin Expansion 80/20 Critical Business Tool Product SKUs Down to ~26,500 from ~50,000 in 2019 Goal: 26,000 Purchased parts Reduced by 33% to ~270,000 Simplify the Business: Eliminate bleeders… focus on areas of growth Raving fans and priority account program Customer list simplification 19 Product Line Simplification Business Segmentation, Zero Up • Processes being embedded into “Core Competencies” • Ownership, Accountability & Measurability • Drive realization of synergies from Dorner acquisition Focus Area: Product Line Simplification 80/20 Embedded in CMBS

$67.2 $97.4 $86.6 $34.8 88% 127% 229% 48% FY19 FY20 FY21 Q3 FY22 TTM 20 Free Cash Flow (2) Cash Flow • Positive cash generation in Q3 FY22 despite inventory build to address supply chain constraints • Q3 FY22 YTD includes cash outflow of $14.0 million for acquisition deal costs • FY22 expected CapEx: $12 to $16 million (1) FCF in FY22 reflects working capital increase as recovery from COVID continues Note: Components may not add to totals due to rounding ($ in millions) Three Months Ended YTD 12/31/21 12/31/20 12/31/21 Net cash provided by operating activities $5.8 $25.0 $23.7 CapEx (2.8) (3.1) (9.5) Free cash flow (FCF) $3.0 $21.9 $14.2 (1)Capital expenditure guidance provided January 27, 2022. (2)See Supplemental Slides for the definition of free cash flow, free cash flow conversion reconciliation from GAAP and other disclaimers regarding non-GAAP information. Free cash flow conversion(2)

21 Capital Structure Financial flexibility • ~$190 million of liquidity Pro-forma net debt leverage ratio of ~2.9x(1) • Net debt to net total capital: 35.7% Financed Dorner acquisition with $207 million of equity and $450 million Term Loan B Financed Garvey acquisition with $75 million incremental Term Loan B Expect to quickly de-lever to target net leverage ratio of 2.0x CAPITALIZATION Dec. 31, 2021 March 31 2021 Cash and cash equivalents $ 106.7 $ 202.1 Total debt 521.1 249.0 Total net debt 414.4 46.8 Shareholders’ equity 745.6 530.1 Total capitalization $ 1,266.8 $ 779.1 Debt/total capitalization 41.1% 32.0% Net debt/net total capitalization 35.7% 8.1% (1)Pro-forma net debt leverage ratio is defined as Net Debt / TTM Adjusted EBITDA including acquisitions ($ in millions) Note: Components may not add to totals due to rounding

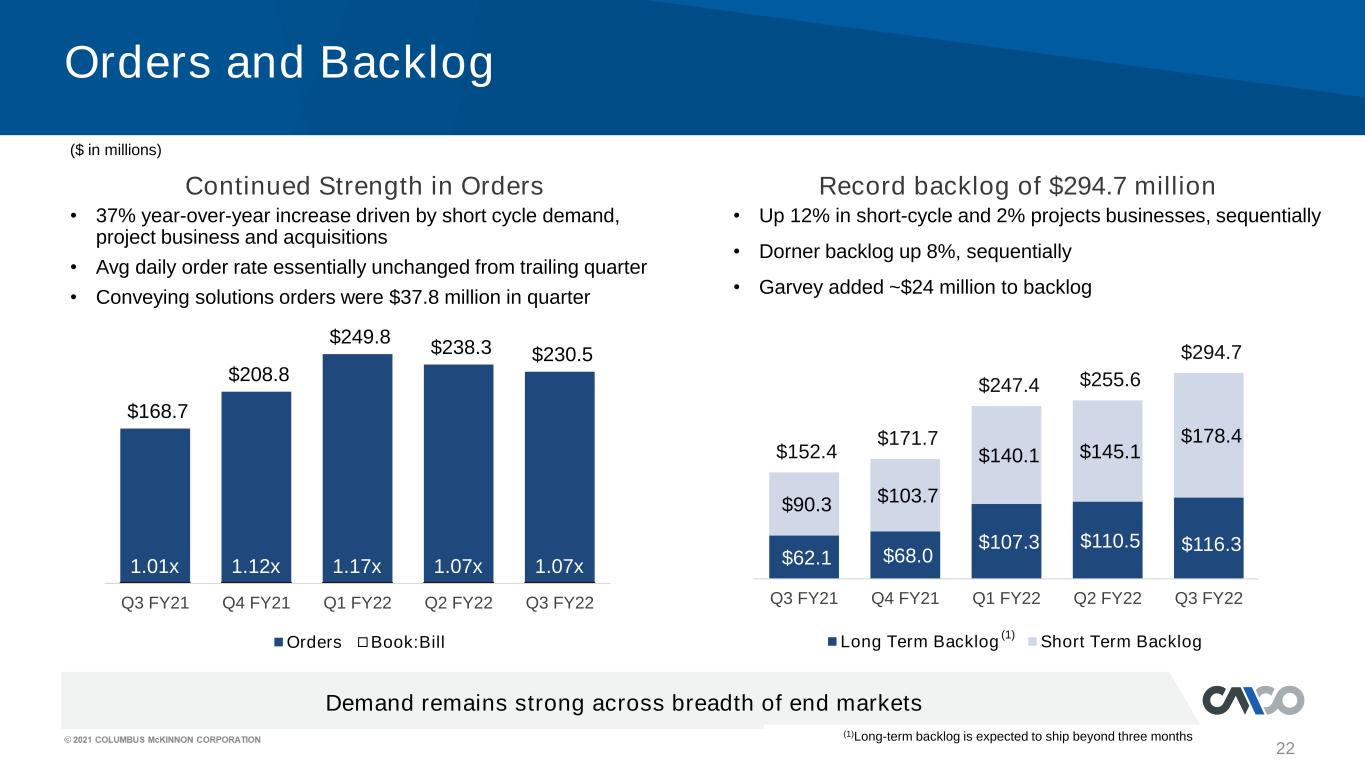

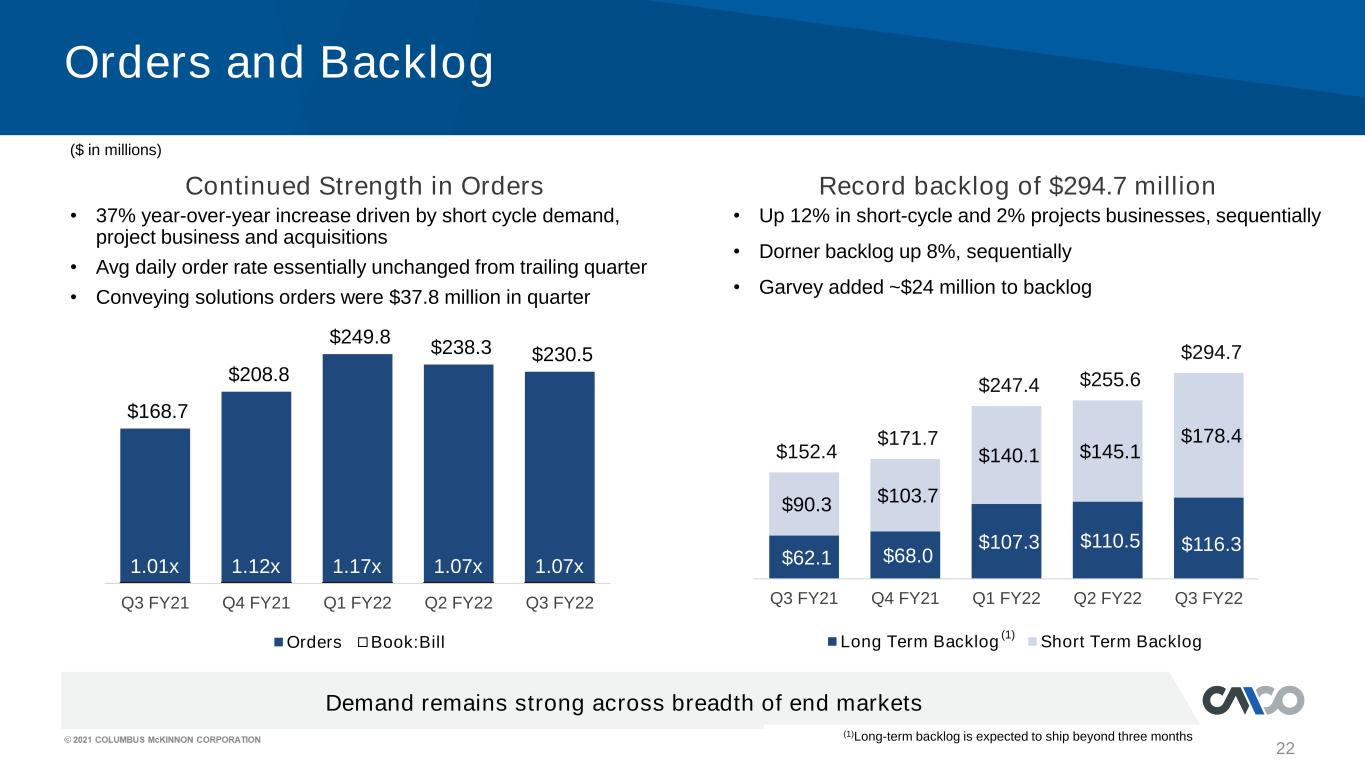

22 Continued Strength in Orders Record backlog of $294.7 million Orders and Backlog • 37% year-over-year increase driven by short cycle demand, project business and acquisitions • Avg daily order rate essentially unchanged from trailing quarter • Conveying solutions orders were $37.8 million in quarter • Up 12% in short-cycle and 2% projects businesses, sequentially • Dorner backlog up 8%, sequentially • Garvey added ~$24 million to backlog Demand remains strong across breadth of end markets ($ in millions) $168.7 $208.8 $249.8 $238.3 $230.5 1.01x 1.12x 1.17x 1.07x 1.07x Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 Q3 FY22 Orders Book:Bill (1)Long-term backlog is expected to ship beyond three months $62.1 $68.0 $107.3 $110.5 $116.3 $90.3 $103.7 $140.1 $145.1 $178.4 $152.4 $171.7 $247.4 $255.6 $294.7 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 Q3 FY22 Long Term Backlog Short Term Backlog (1)

23 Executing on Blueprint for Growth 2.0 strategy to drive value creation Q4 FY22 Outlook and Perspective (1) Revenue guidance provided January 27, 2022 Q4 FY2022 outlook • Expect Q4 FY22 net sales of approximately $235 million(1) Robust pipeline of opportunities • Strength in e-commerce, food & beverage, life sciences, aerospace and automotive • Process industries such as metals and paper remain strong • International energy projects active Addressing supply chain and staffing challenges • Creatively responding to near-term demands while advancing long-term objectives

24 Key Takeaways Transforming to a Top-tier, Secular Growth, Intelligent Motion Solutions Enterprise Growth strategy is underpinned by CMBS enabling scalability and operational excellence EVOLVED STRATEGY BLUEPRINT FOR GROWTH 2.0 DEFINES GROWTH FRAMEWORK COLUMBUS MCKINNON BUSINESS SYSTEM – CMBS – ENABLES SCALABILITY CONVEYING SOLUTIONS ADDS GROWTH CATALYST IN ATTRACTIVE MARKETS OPERATIONAL EXCELLENCE DRIVES STRONGER MARGIN PROFILE AS ECONOMY RECOVERS DEMONSTRATED PERFORMANCE WITH STRONG LEADERSHIP TEAM SIGNIFICANT CASH GENERATION THROUGHOUT BUSINESS CYCLES

Investor Presentation February 2022 25 Gregory P. Rustowicz Senior Vice President Finance and Chief Financial Officer

Supplemental Information 26

27 Advancing ESG priorities aligned with materiality assessment Launched Inaugural CSR Report Strategic Initiatives • Five-year plan – based on baselines, gap analysis & target setting • Tightly aligned with business strategy • Prioritized by impact, risk assessment and opportunity for value • Metrics and goals embedded in business functions ENVIRONMENTAL STEWARDSHIP CLIMATE CHANGE & ENERGY MANAGEMENT WASTE MANAGEMENT & RECYCLING SOCIAL RESPONSIBILITY EMPLOYEE HEALTH & SAFETY TALENT MANAGEMENT DEI PRODUCT QUALITY & INNOVATION PURPOSE, MISSION, VISION, VALUES COMMUNITY INVOLVEMENT CUSTOMER INTIMACY GOVERNANCE & ETHICS ETHICS & COMPLIANCE ENTERPRISE RISK MANAGEMENT BOARD GOVERNANCE

28 U.S. Capacity Utilization Eurozone Capacity Utilization Industrial Capacity Utilization Source: The Federal Reserve Board Source: European Commission 60% 65% 70% 75% 80% Manufacturing Total 77.0% (Manufacturing) & 76.5% (Total) December 2021(1) 65% 67% 69% 71% 73% 75% 77% 79% 81% 83% 85% 82.1% Q4 2021 (1)December 2021 numbers are preliminary

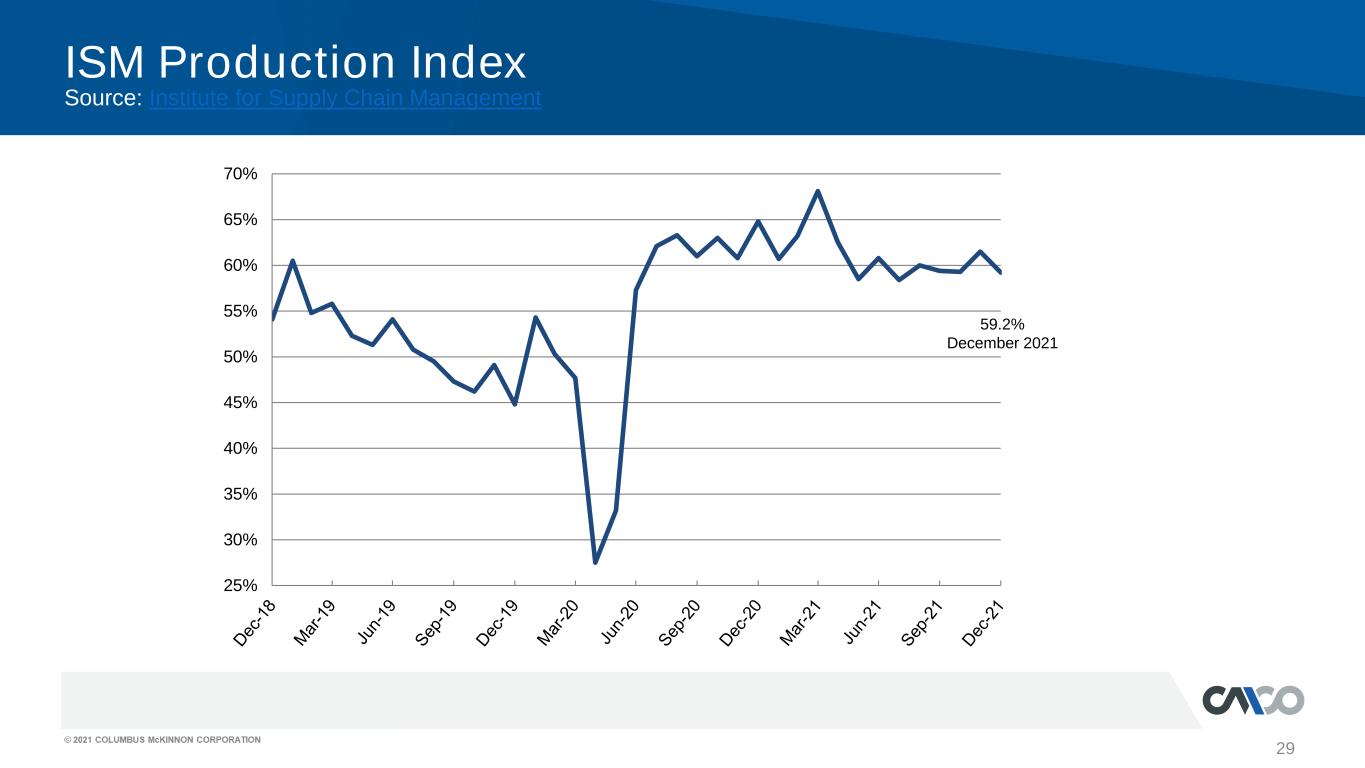

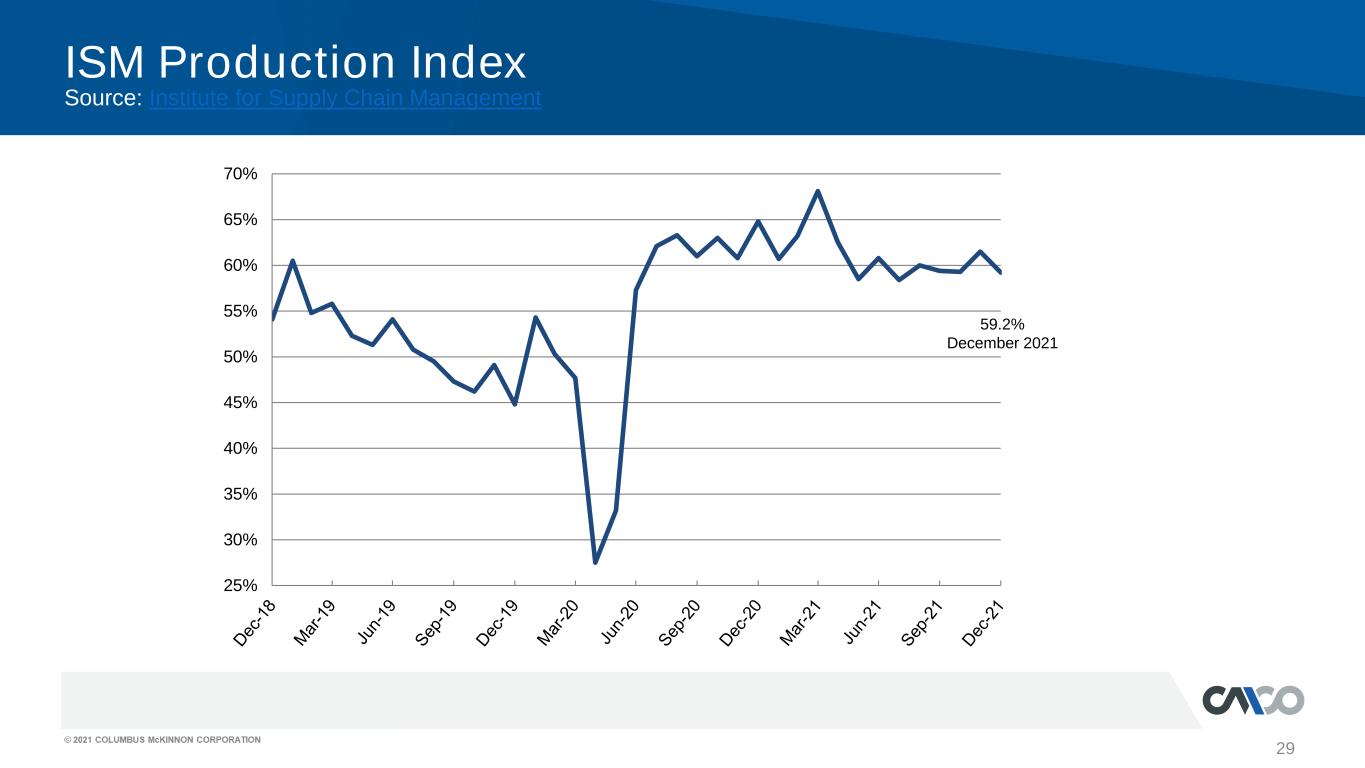

29 ISM Production Index Source: Institute for Supply Chain Management 25% 30% 35% 40% 45% 50% 55% 60% 65% 70% 59.2% December 2021

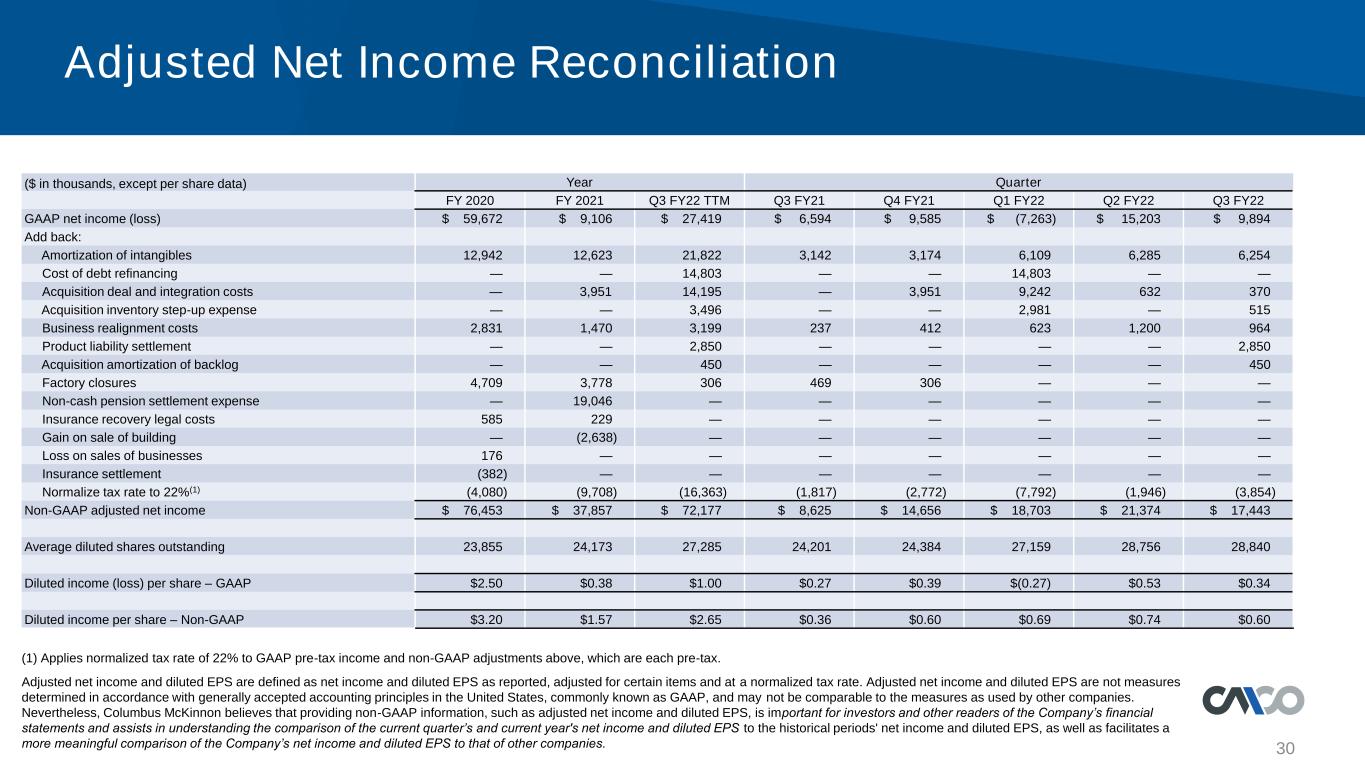

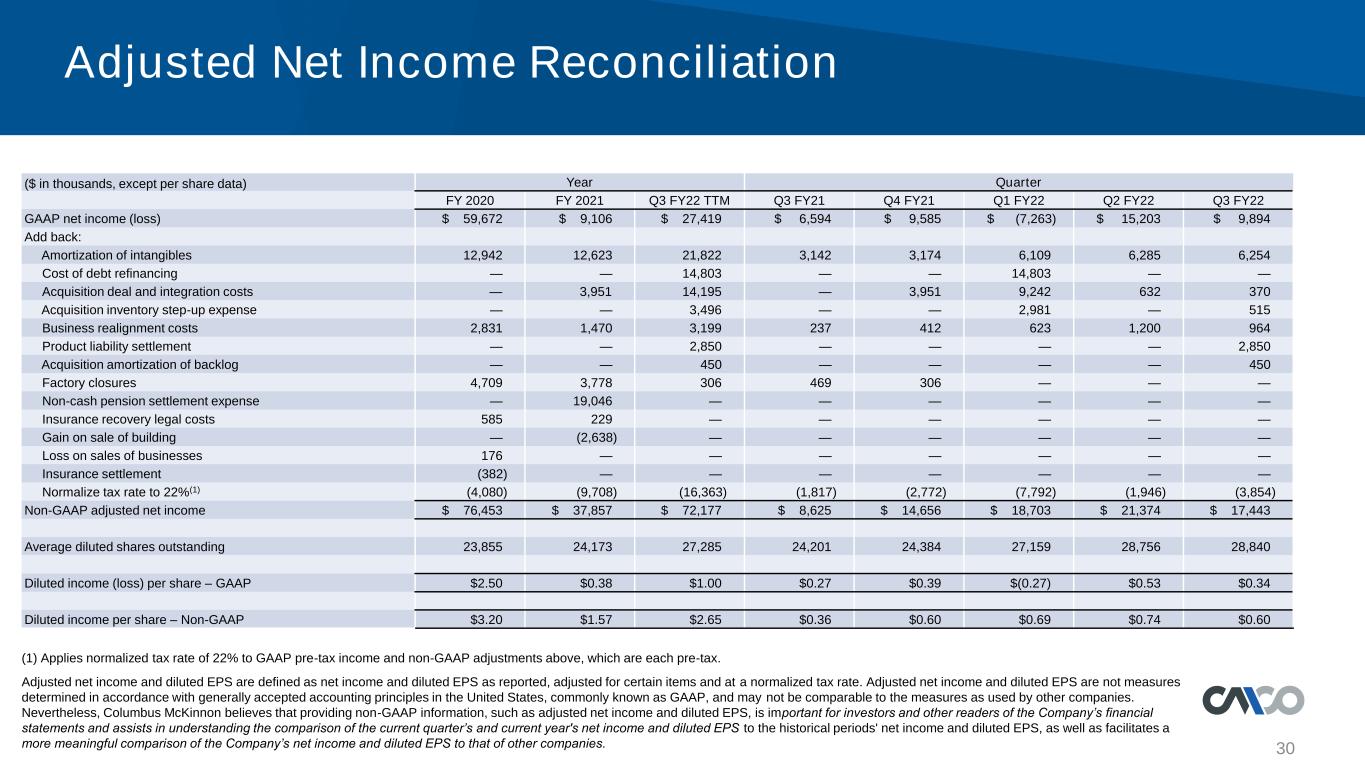

30 Adjusted Net Income Reconciliation (1) Applies normalized tax rate of 22% to GAAP pre-tax income and non-GAAP adjustments above, which are each pre-tax. Adjusted net income and diluted EPS are defined as net income and diluted EPS as reported, adjusted for certain items and at a normalized tax rate. Adjusted net income and diluted EPS are not measures determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable to the measures as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information, such as adjusted net income and diluted EPS, is important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year's net income and diluted EPS to the historical periods' net income and diluted EPS, as well as facilitates a more meaningful comparison of the Company’s net income and diluted EPS to that of other companies. ($ in thousands, except per share data) Year Quarter FY 2020 FY 2021 Q3 FY22 TTM Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 Q3 FY22 GAAP net income (loss) $ 59,672 $ 9,106 $ 27,419 $ 6,594 $ 9,585 $ (7,263) $ 15,203 $ 9,894 Add back: Amortization of intangibles 12,942 12,623 21,822 3,142 3,174 6,109 6,285 6,254 Cost of debt refinancing — — 14,803 — — 14,803 — — Acquisition deal and integration costs — 3,951 14,195 — 3,951 9,242 632 370 Acquisition inventory step-up expense — — 3,496 — — 2,981 — 515 Business realignment costs 2,831 1,470 3,199 237 412 623 1,200 964 Product liability settlement — — 2,850 — — — — 2,850 Acquisition amortization of backlog — — 450 — — — — 450 Factory closures 4,709 3,778 306 469 306 — — — Non-cash pension settlement expense — 19,046 — — — — — — Insurance recovery legal costs 585 229 — — — — — — Gain on sale of building — (2,638) — — — — — — Loss on sales of businesses 176 — — — — — — — Insurance settlement (382) — — — — — — — Normalize tax rate to 22%(1) (4,080) (9,708) (16,363) (1,817) (2,772) (7,792) (1,946) (3,854) Non-GAAP adjusted net income $ 76,453 $ 37,857 $ 72,177 $ 8,625 $ 14,656 $ 18,703 $ 21,374 $ 17,443 Average diluted shares outstanding 23,855 24,173 27,285 24,201 24,384 27,159 28,756 28,840 Diluted income (loss) per share – GAAP $2.50 $0.38 $1.00 $0.27 $0.39 $(0.27) $0.53 $0.34 Diluted income per share – Non-GAAP $3.20 $1.57 $2.65 $0.36 $0.60 $0.69 $0.74 $0.60

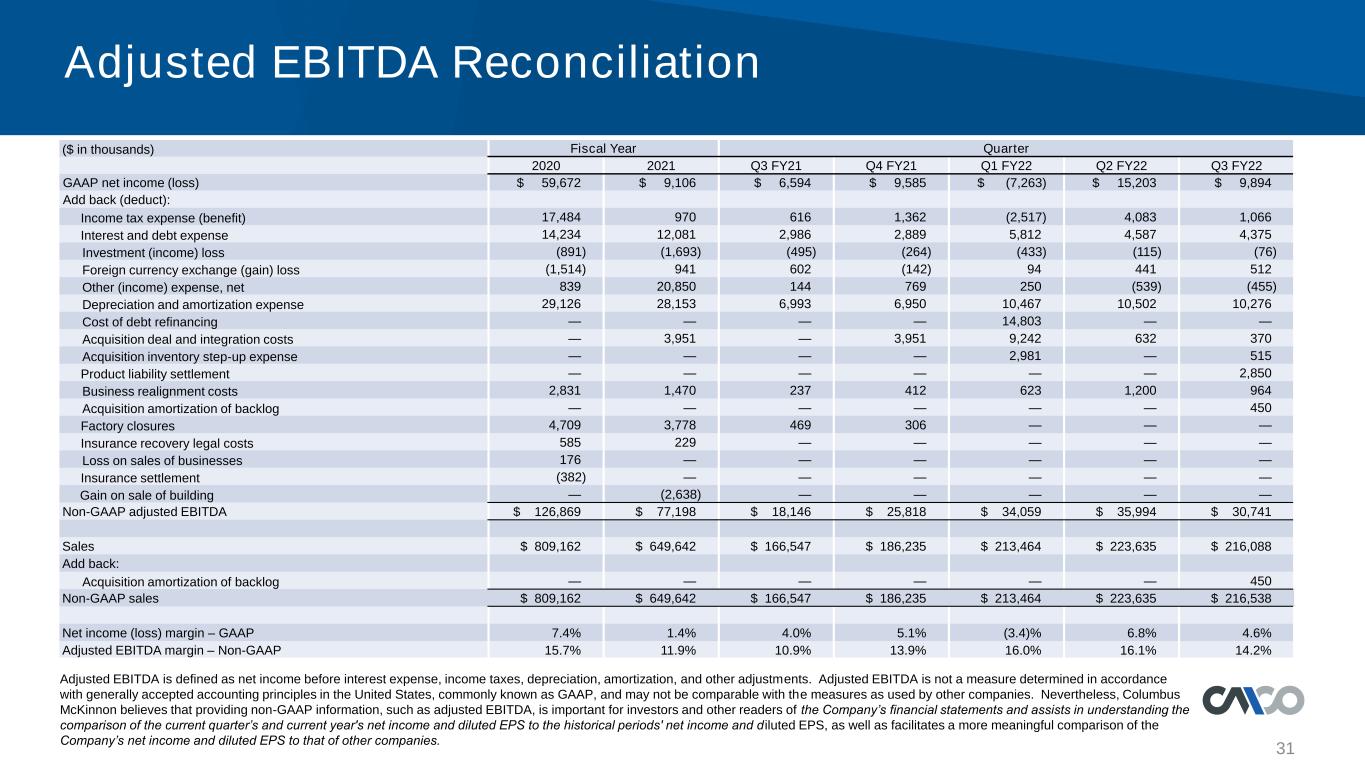

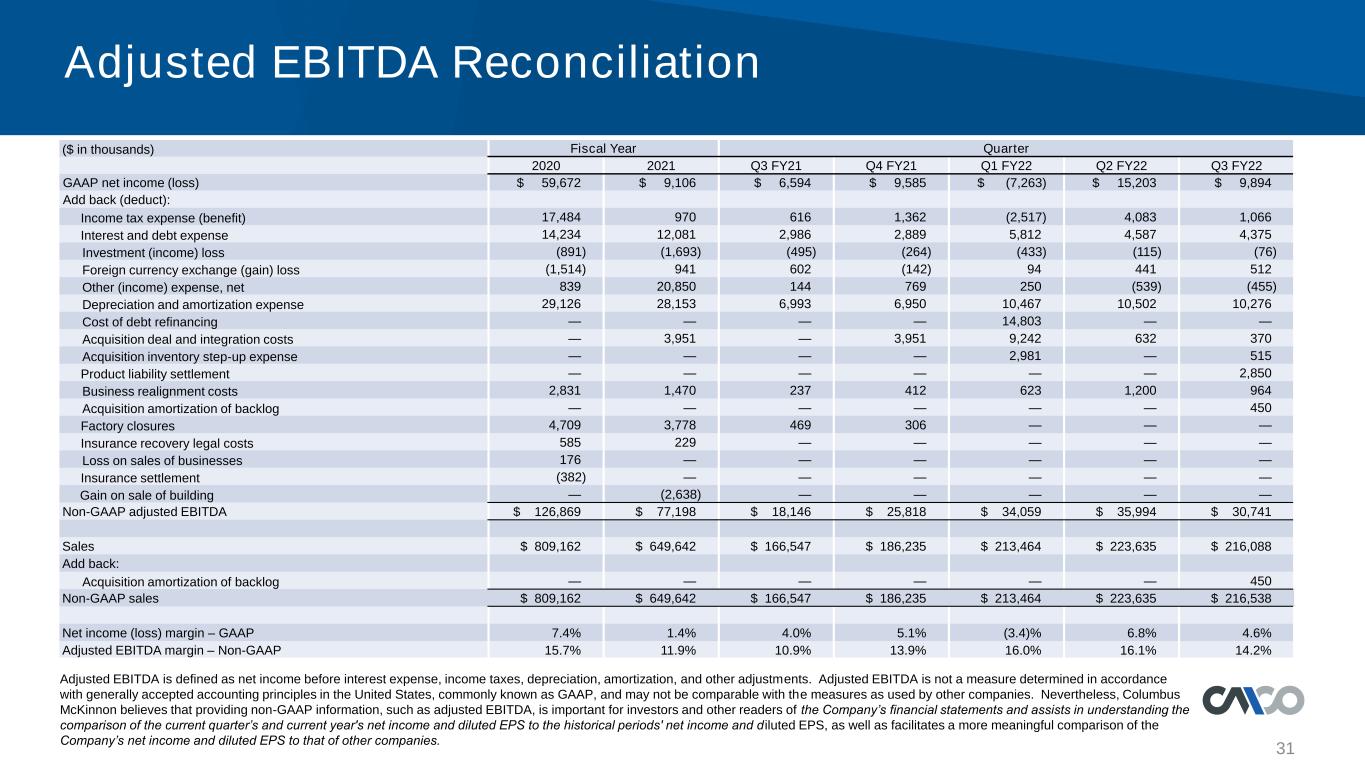

31 Adjusted EBITDA Reconciliation Adjusted EBITDA is defined as net income before interest expense, income taxes, depreciation, amortization, and other adjustments. Adjusted EBITDA is not a measure determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable with the measures as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information, such as adjusted EBITDA, is important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year's net income and diluted EPS to the historical periods' net income and d iluted EPS, as well as facilitates a more meaningful comparison of the Company’s net income and diluted EPS to that of other companies. ($ in thousands) Fiscal Year Quarter 2020 2021 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 Q3 FY22 GAAP net income (loss) $ 59,672 $ 9,106 $ 6,594 $ 9,585 $ (7,263) $ 15,203 $ 9,894 Add back (deduct): Income tax expense (benefit) 17,484 970 616 1,362 (2,517) 4,083 1,066 Interest and debt expense 14,234 12,081 2,986 2,889 5,812 4,587 4,375 Investment (income) loss (891) (1,693) (495) (264) (433) (115) (76) Foreign currency exchange (gain) loss (1,514) 941 602 (142) 94 441 512 Other (income) expense, net 839 20,850 144 769 250 (539) (455) Depreciation and amortization expense 29,126 28,153 6,993 6,950 10,467 10,502 10,276 Cost of debt refinancing — — — — 14,803 — — Acquisition deal and integration costs — 3,951 — 3,951 9,242 632 370 Acquisition inventory step-up expense — — — — 2,981 — 515 Product liability settlement — — — — — — 2,850 Business realignment costs 2,831 1,470 237 412 623 1,200 964 Acquisition amortization of backlog — — — — — — 450 Factory closures 4,709 3,778 469 306 — — — Insurance recovery legal costs 585 229 — — — — — Loss on sales of businesses 176 — — — — — — Insurance settlement (382) — — — — — — Gain on sale of building — (2,638) — — — — — Non-GAAP adjusted EBITDA $ 126,869 $ 77,198 $ 18,146 $ 25,818 $ 34,059 $ 35,994 $ 30,741 Sales $ 809,162 $ 649,642 $ 166,547 $ 186,235 $ 213,464 $ 223,635 $ 216,088 Add back: Acquisition amortization of backlog — — — — — — 450 Non-GAAP sales $ 809,162 $ 649,642 $ 166,547 $ 186,235 $ 213,464 $ 223,635 $ 216,538 Net income (loss) margin – GAAP 7.4% 1.4% 4.0% 5.1% (3.4)% 6.8% 4.6% Adjusted EBITDA margin – Non-GAAP 15.7% 11.9% 10.9% 13.9% 16.0% 16.1% 14.2%

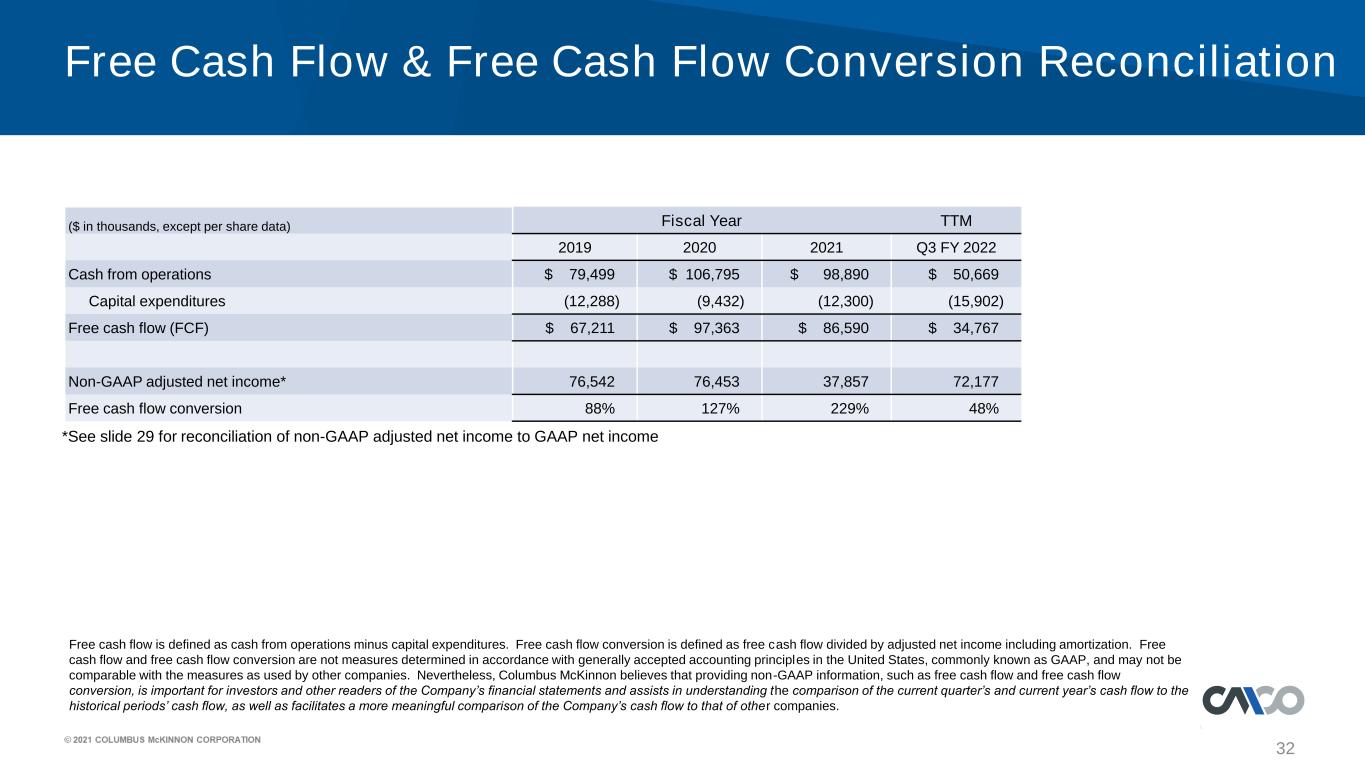

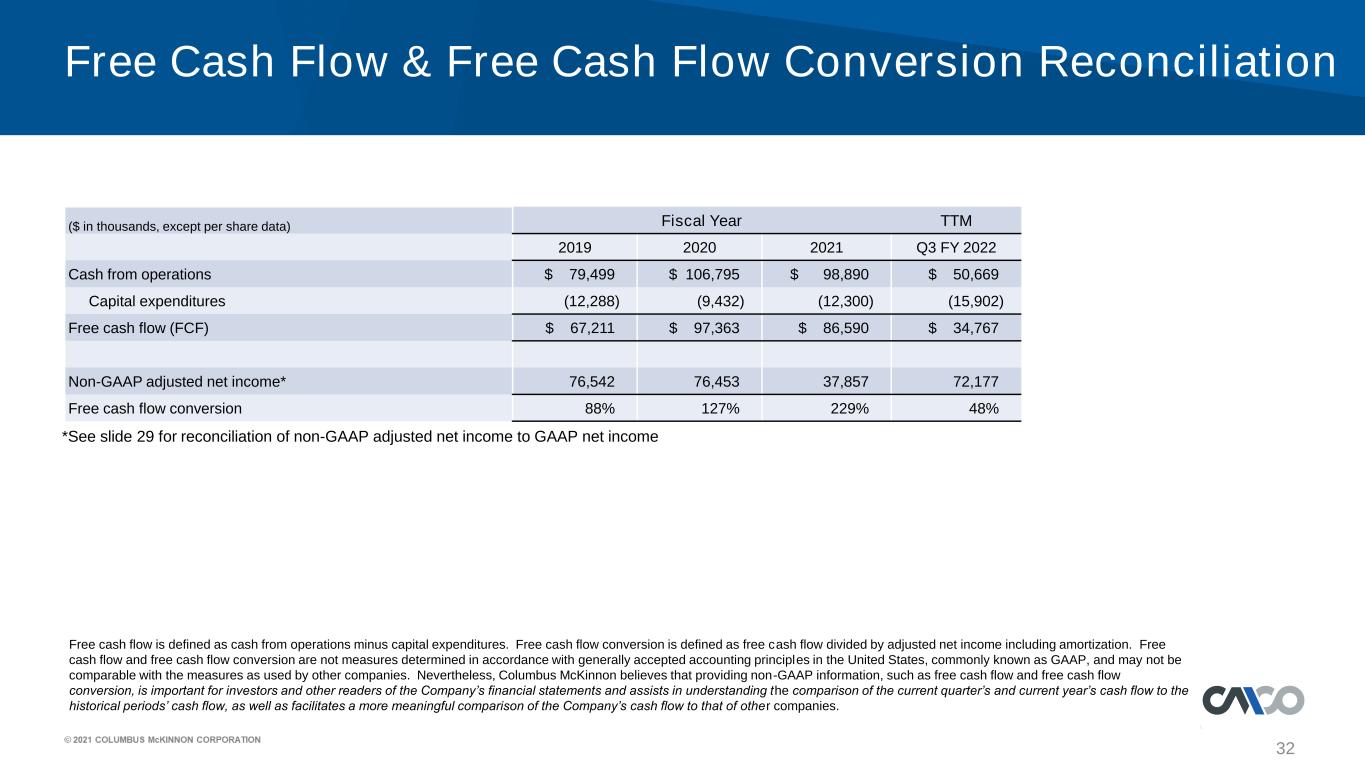

32 Free Cash Flow & Free Cash Flow Conversion Reconciliation Free cash flow is defined as cash from operations minus capital expenditures. Free cash flow conversion is defined as free cash flow divided by adjusted net income including amortization. Free cash flow and free cash flow conversion are not measures determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable with the measures as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information, such as free cash flow and free cash flow conversion, is important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year’s cash flow to the historical periods’ cash flow, as well as facilitates a more meaningful comparison of the Company’s cash flow to that of other companies. *See slide 29 for reconciliation of non-GAAP adjusted net income to GAAP net income ($ in thousands, except per share data) Fiscal Year TTM 2019 2020 2021 Q3 FY 2022 Cash from operations $ 79,499 $ 106,795 $ 98,890 $ 50,669 Capital expenditures (12,288) (9,432) (12,300) (15,902) Free cash flow (FCF) $ 67,211 $ 97,363 $ 86,590 $ 34,767 Non-GAAP adjusted net income* 76,542 76,453 37,857 72,177 Free cash flow conversion 88% 127% 229% 48%

33 Global organization with production facilities in the Americas, EMEA, and APAC Global Enterprise Kunzelsau, DE Hoist Milwaukee, WI Power Control Conveying Solutions Wadesboro, NC Hoist Damascus, VA Hoist Charlotte, NC Actuator Mexico Hoists Conveying Solutions Lexington, TN Chain Chattanooga, TN Forging (2) AMERICAS EMEA Kissing, DE Actuator, Rail Hangzhou, CN Hoist APAC Chester, UK Hoist, Plate Clamps Szekesfehervar, Hungary Textiles Brighton, MI Workstations Wuppertal and Julich , DE Hoist Conveying Solutions Corporate Offices Production Locations Buffalo, NY Headquarters Penang, Malaysia Conveying Solutions ~67% OF REVENUE ~5% OF REVENUE~28% OF REVENUE *Revenue for YTD FY22 as of 12/31/2021 Hammonton, NJ Conveying Solutions