Q3 Fiscal Year 2023 Financial Results Conference Call President & Chief Executive Officer David J. Wilson February 1, 2023 Executive VP – Finance & Chief Financial Officer Gregory P. Rustowicz

© 2023 COLUMBUS MCKINNON CORPORATION These slides, and the accompanying oral discussion (together, this “presentation”), contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements concerning expected growth, future sales and EBITDA margins, and future potential to deliver results; the execution of its strategy and further transformation of the Company with stronger growth, less cyclicality and higher margins, and achievement of certain goals. These statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such statements, including the impact of supply chain challenges and inflation, the ability of the Company to scale the organization, achieve its financial targets including revenue and adjusted EBITDA margin, and to execute CMBS and the Core Growth Framework; global economic and business conditions affecting the industries served by the Company and its subsidiaries including COVID-19; the Company's customers and suppliers, competitor responses to the Company's products and services, the overall market acceptance of such products and services, the ability to expand into new markets and geographic regions, and other factors disclosed in the Company's periodic reports filed with the Securities and Exchange Commission. Consequently, such forward-looking statements should be regarded as current plans, estimates and beliefs. The Company assumes no obligation to update the forward-looking information contained in this presentation. Non-GAAP Financial Measures and Forward-looking Non-GAAP Measures This presentation will discuss some non-GAAP (“adjusted”) financial measures which we believe are useful in evaluating our performance. You should not consider the presentation of this additional information in isolation or as a substitute for results compared in accordance with GAAP. The non-GAAP (“adjusted”) measures are noted and reconciliations of comparable GAAP with non-GAAP measures can be found in tables included in the Supplemental Information portion of this presentation. Safe Harbor Statement 2

© 2023 COLUMBUS MCKINNON CORPORATION 3 Executing Strategy: Strong Earnings Growth Transformation driving growth, improving cost structure and leveraging market position Higher Sales Drove Operating Income Growth • Sales up 7% driven by improved volume and pricing; up 11% on a constant currency basis • Operating income increased 32% to $20.2 million on record third quarter gross margin • Net income grew 22% to $12.0 million, or $0.42 per diluted share; adjusted EPS was $0.72 Improved Deliveries and Solid Outlook • Past due backlog reduced by 28%; focused on improving customer experience • Daily order rate up 3% sequentially compared with the second quarter • Bullish on megatrends: supply chain automation, industrial productivity and regionalization Focused on Achieving Top-tier Performance and Delivering an Improved Customer Experience Stronger Capital Structure • Paid down $30.4 million in debt YTD • Reduced net debt leverage ratio to 2.7x • Repurchased $1.0 million in stock at average price of $32.17

© 2023 COLUMBUS MCKINNON CORPORATION 4 Unlocking Potential Key Strategic Objectives Dashboard On Track with Transformation Strategy STRENGTHEN, GROW, EXPAND AND REIMAGINE CMCO Delivered 7% revenue growth (11% constant currency) under new leadership structure Introduced new precision conveying product line, hand chain hoist and pre-launched VFD controlled wire rope hoist NPD N-3 remains ahead of plan at 5% of revenue YTD, nearly double from FY19 Customer experience: improving responsiveness, implementing changes that address customer feedback DRIVE MARGIN EXPANSION AND CASH GENERATION TTM Adjusted EBITDA margin sequential improvement to 15.7% Went live with new ERP system in LATAM; driving efficiencies and laying foundation for future simplification Business realignment cost structure reductions to date increased to ~$7.2 million on an annualized basis Generated $6.5 million in FCF in Q3; substantial reduction in working capital expected in Q4 FY23

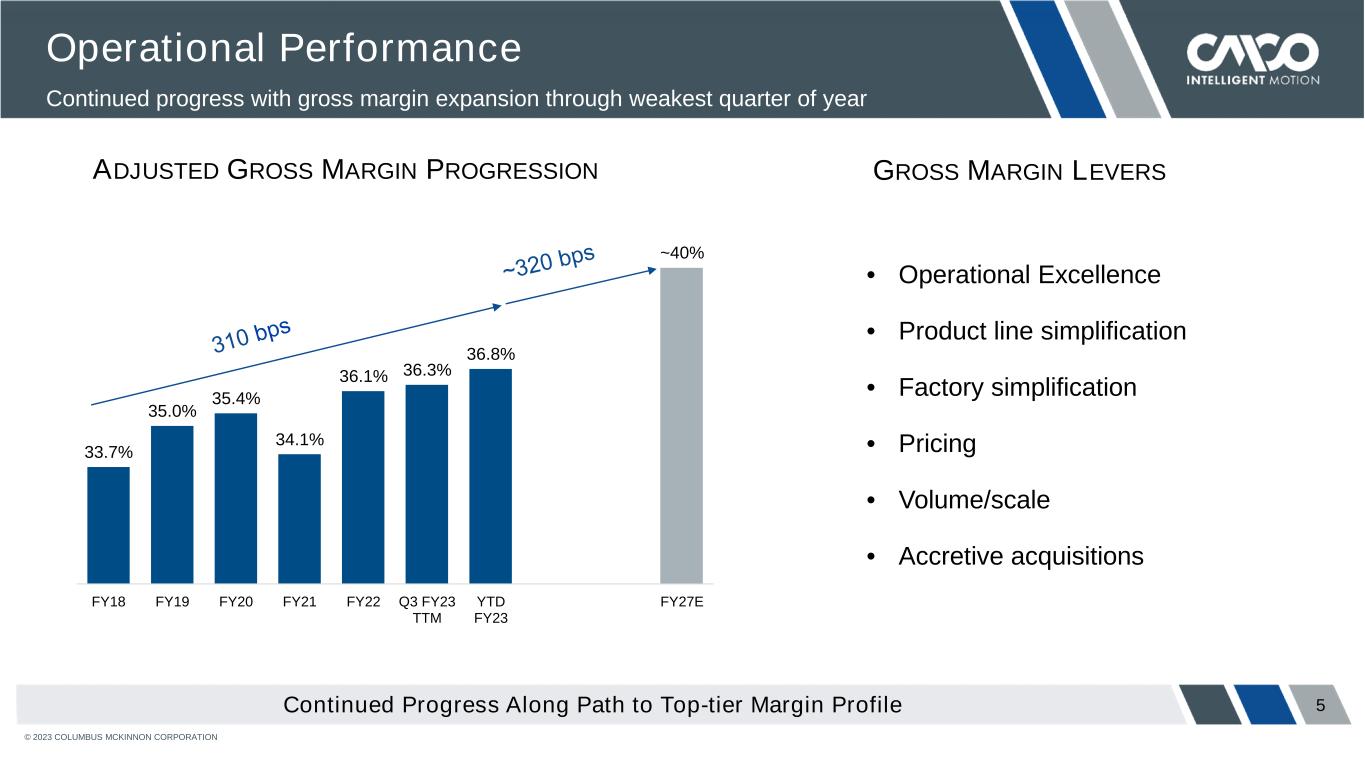

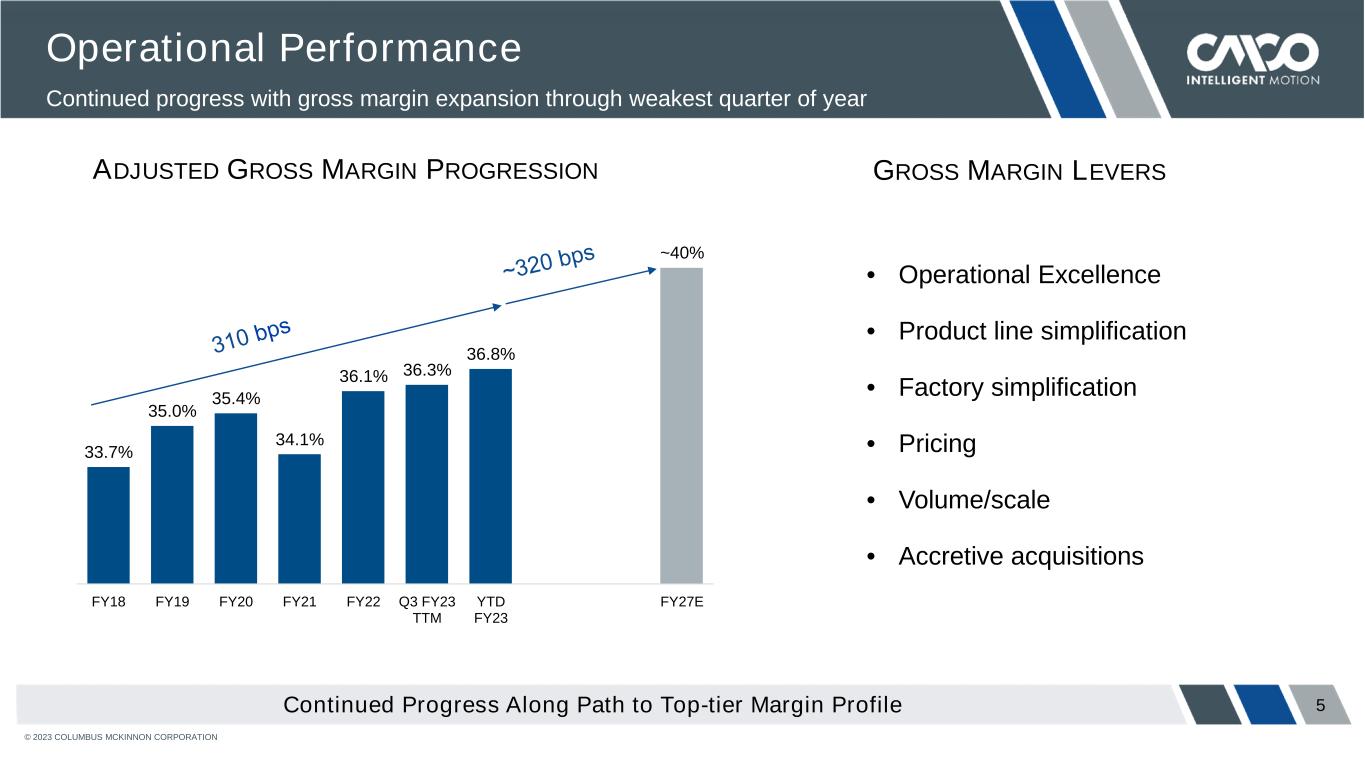

© 2023 COLUMBUS MCKINNON CORPORATION 5 Operational Performance Continued progress with gross margin expansion through weakest quarter of year Continued Progress Along Path to Top-tier Margin Profile ADJUSTED GROSS MARGIN PROGRESSION • Operational Excellence • Product line simplification • Factory simplification • Pricing • Volume/scale • Accretive acquisitions GROSS MARGIN LEVERS 33.7% 35.0% 35.4% 34.1% 36.1% 36.3% 36.8% ~40% FY18 FY19 FY20 FY21 FY22 Q3 FY23 TTM YTD FY23 FY27E

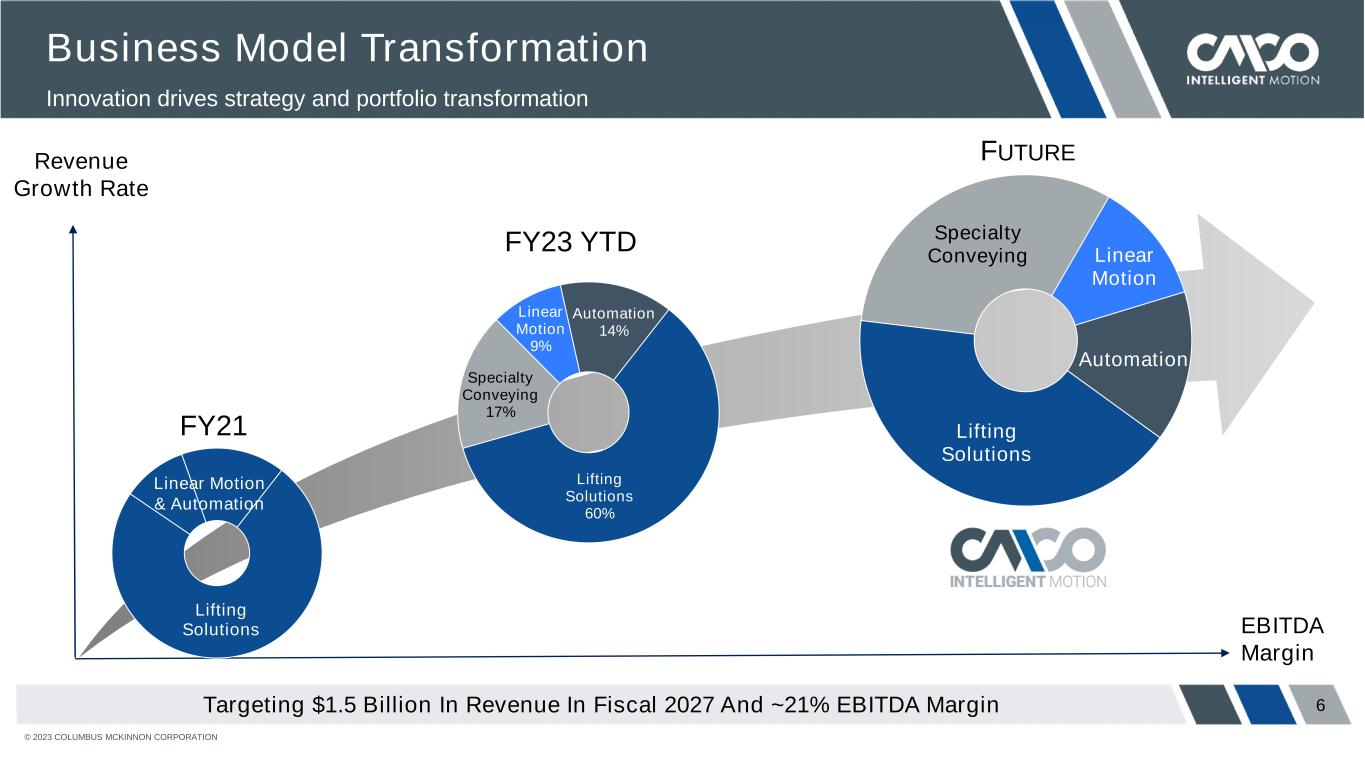

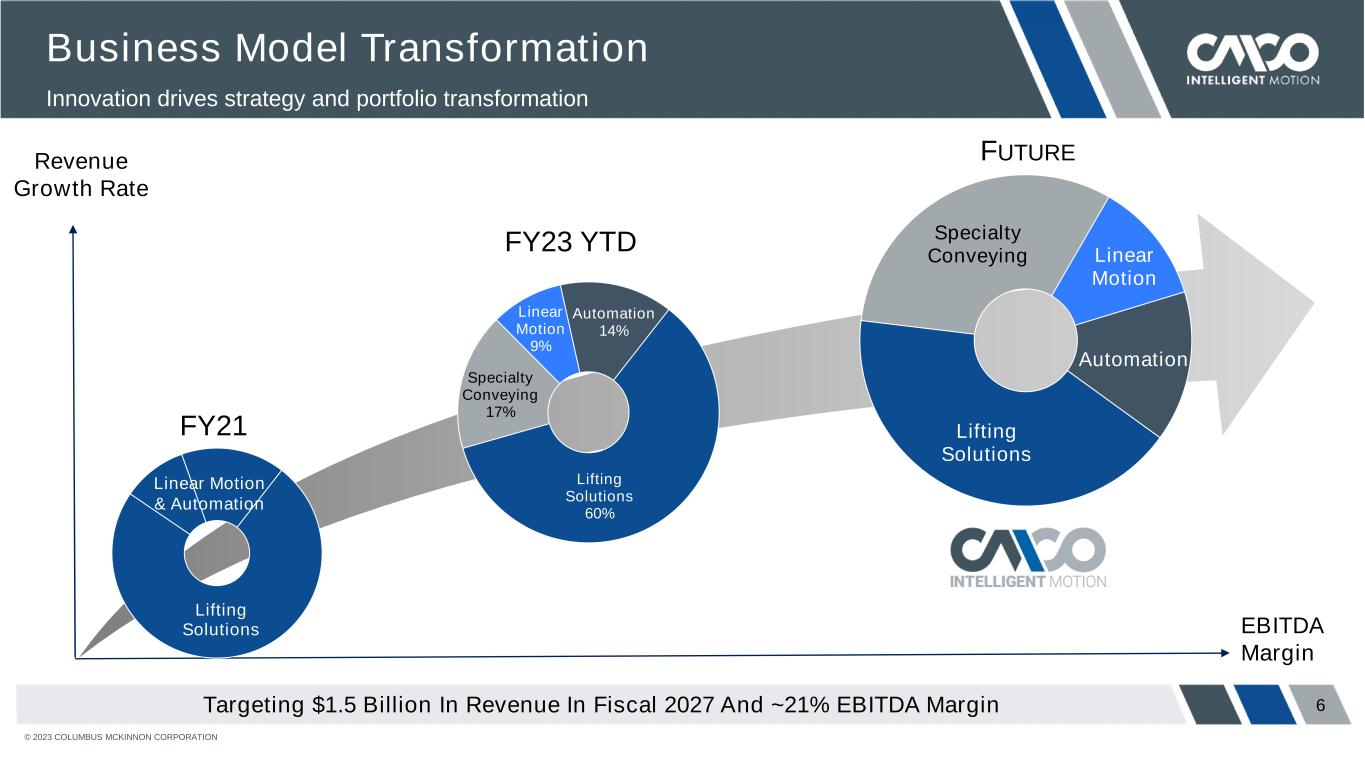

© 2023 COLUMBUS MCKINNON CORPORATION 6 Business Model Transformation Innovation drives strategy and portfolio transformation Targeting $1.5 Billion In Revenue In Fiscal 2027 And ~21% EBITDA Margin Revenue Growth Rate EBITDA Margin Lifting Solutions 60% Specialty Conveying 17% Linear Motion 9% Automation 14% Lifting Solutions FY21 Lifting Solutions Specialty Conveying Linear Motion Automation Linear Motion & Automation FUTURE FY23 YTD

© 2023 COLUMBUS MCKINNON CORPORATION Net Sales Double Digit Growth on Constant Currency Basis in Seasonally Softest Quarter Quarter Sales Bridge • U.S.: 5.8% pricing increase and 0.6% volume increase • Non-U.S.: 5.1% pricing and 5.9% volume increase 7 Quarter Q3 FY22 Sales $ 216.1 Pricing 11.9 5.5% Volume 5.9 2.7% Acquisition 4.9 2.3% Foreign currency translation (8.4) (3.9)% Total change $ 14.3 6.6% Q3 FY23 Sales $ 230.4 Q3 sales up 11% on constant currency from prior-year period driven primarily by pricing $216.1 $253.4 $220.3 $231.7 $230.4 Q3 FY22 Q4 FY22 Q1 FY23 Q2 FY23 Q3 FY23 ($ in millions) Note: Components may not add to totals due to rounding

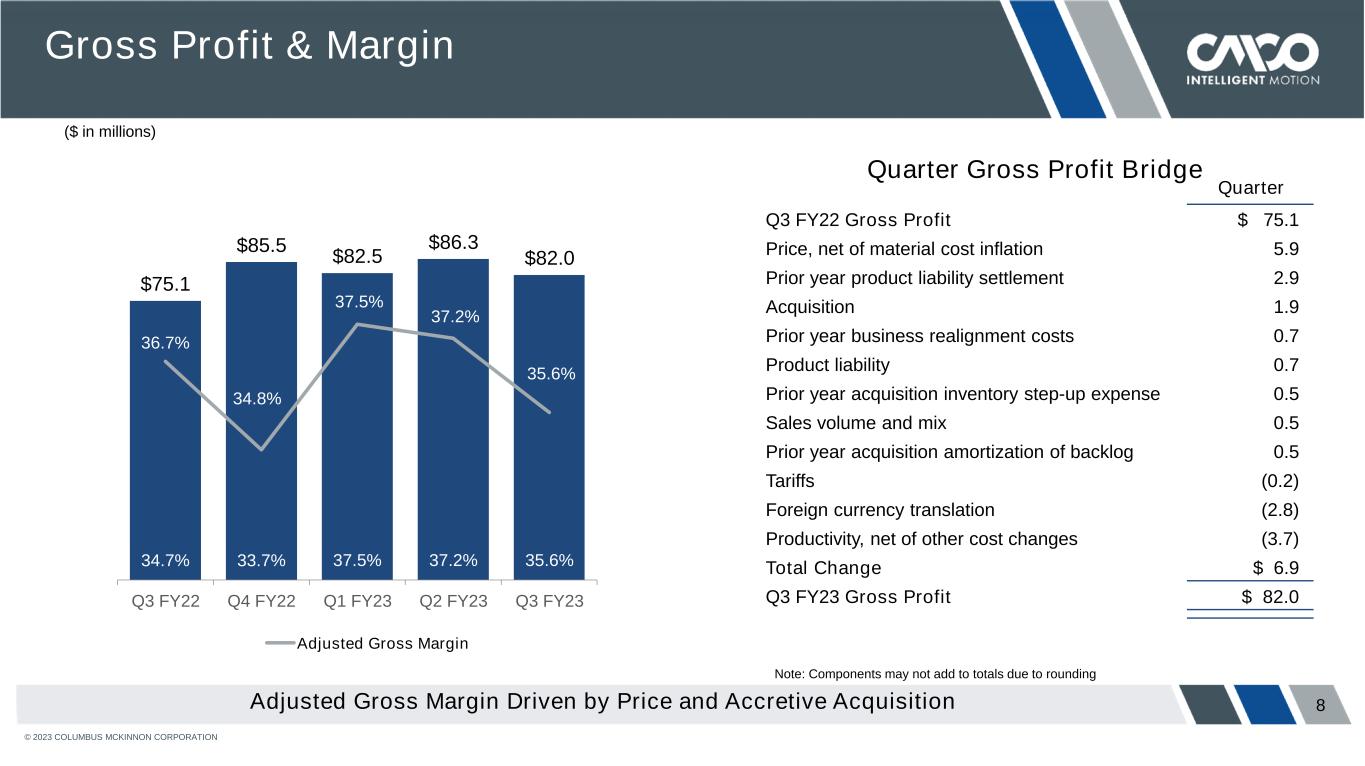

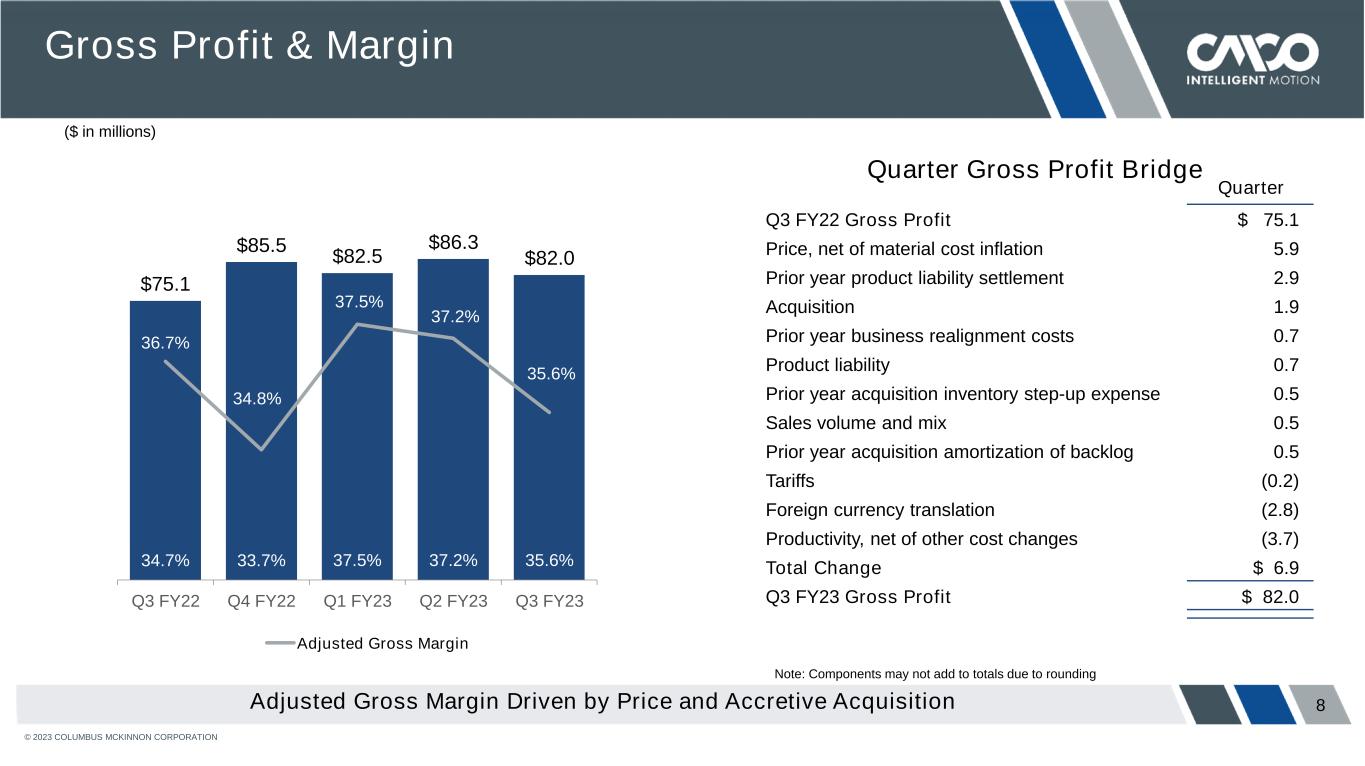

© 2023 COLUMBUS MCKINNON CORPORATION 8 Gross Profit & Margin Quarter Gross Profit Bridge Quarter Q3 FY22 Gross Profit $ 75.1 Price, net of material cost inflation 5.9 Prior year product liability settlement 2.9 Acquisition 1.9 Prior year business realignment costs 0.7 Product liability 0.7 Prior year acquisition inventory step-up expense 0.5 Sales volume and mix 0.5 Prior year acquisition amortization of backlog 0.5 Tariffs (0.2) Foreign currency translation (2.8) Productivity, net of other cost changes (3.7) Total Change $ 6.9 Q3 FY23 Gross Profit $ 82.0 Adjusted Gross Margin Driven by Price and Accretive Acquisition $75.1 $85.5 $82.5 $86.3 $82.0 34.7% 33.7% 37.5% 37.2% 35.6% 36.7% 34.8% 37.5% 37.2% 35.6% Q3 FY22 Q4 FY22 Q1 FY23 Q2 FY23 Q3 FY23 Adjusted Gross Margin ($ in millions) Note: Components may not add to totals due to rounding

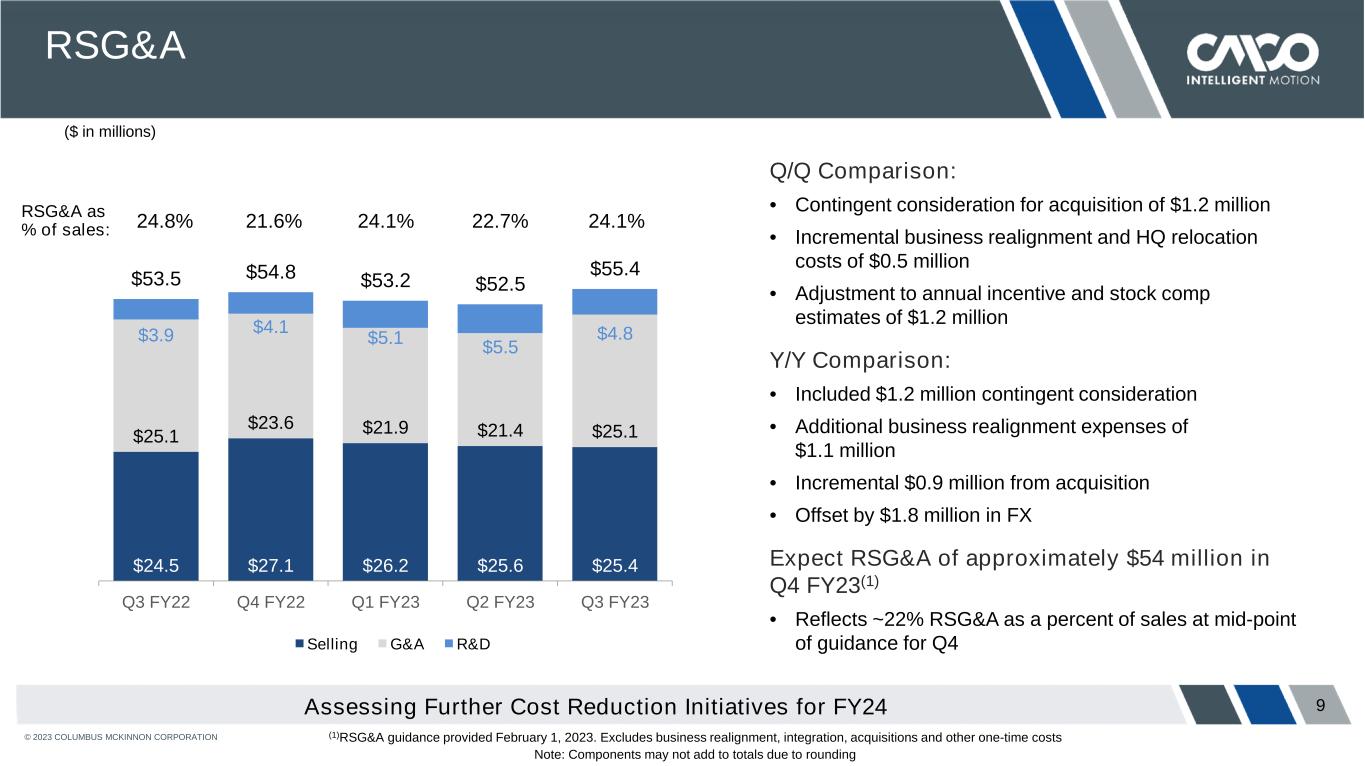

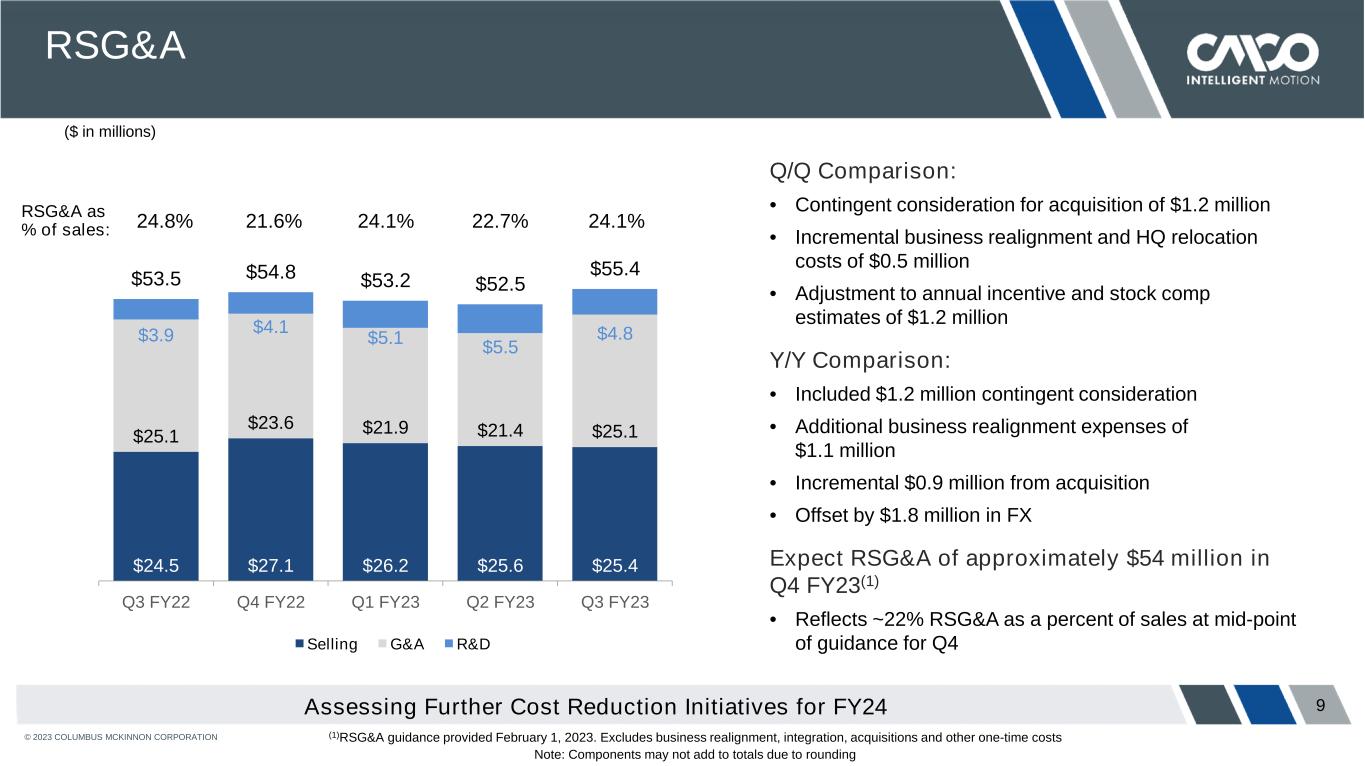

© 2023 COLUMBUS MCKINNON CORPORATION 9 RSG&A $24.5 $27.1 $26.2 $25.6 $25.4 $25.1 $23.6 $21.9 $21.4 $25.1 $3.9 $4.1 $5.1 $5.5 $4.8 $53.5 $54.8 $53.2 $52.5 $55.4 Q3 FY22 Q4 FY22 Q1 FY23 Q2 FY23 Q3 FY23 Selling G&A R&D Q/Q Comparison: • Contingent consideration for acquisition of $1.2 million • Incremental business realignment and HQ relocation costs of $0.5 million • Adjustment to annual incentive and stock comp estimates of $1.2 million Y/Y Comparison: • Included $1.2 million contingent consideration • Additional business realignment expenses of $1.1 million • Incremental $0.9 million from acquisition • Offset by $1.8 million in FX Expect RSG&A of approximately $54 million in Q4 FY23(1) • Reflects ~22% RSG&A as a percent of sales at mid-point of guidance for Q4 (1)RSG&A guidance provided February 1, 2023. Excludes business realignment, integration, acquisitions and other one-time costs Note: Components may not add to totals due to rounding RSG&A as % of sales: 21.6% 22.7% 24.1%24.8% Assessing Further Cost Reduction Initiatives for FY24 ($ in millions) 24.1%

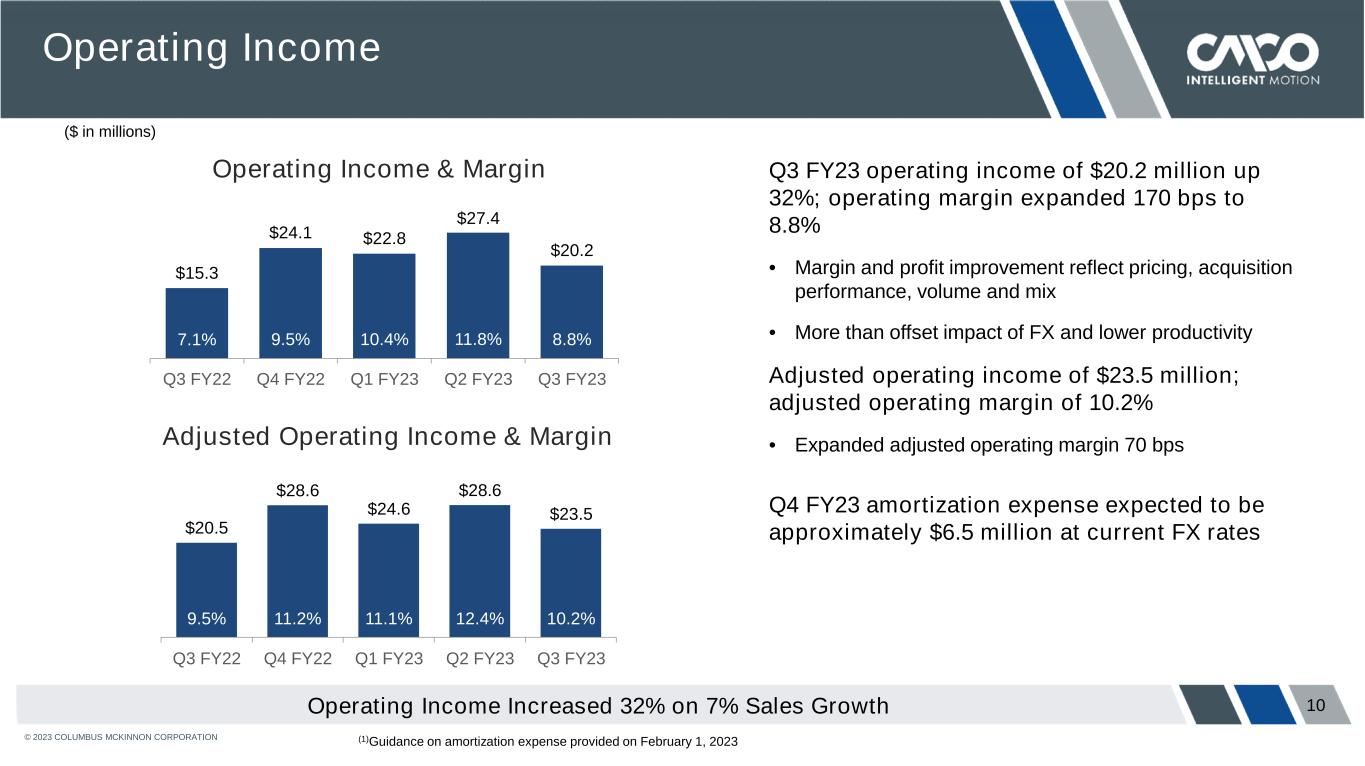

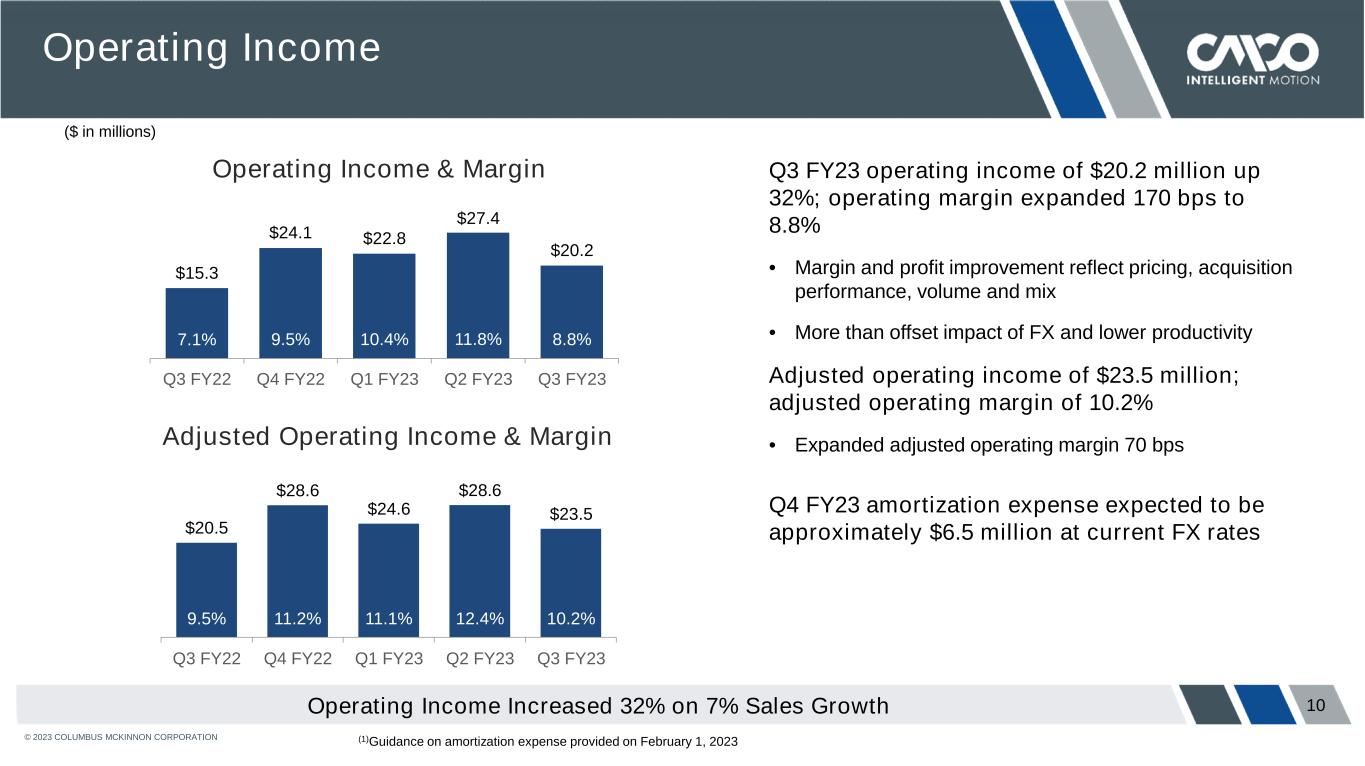

© 2023 COLUMBUS MCKINNON CORPORATION 10 Operating Income Q3 FY23 operating income of $20.2 million up 32%; operating margin expanded 170 bps to 8.8% • Margin and profit improvement reflect pricing, acquisition performance, volume and mix • More than offset impact of FX and lower productivity Adjusted operating income of $23.5 million; adjusted operating margin of 10.2% • Expanded adjusted operating margin 70 bps Q4 FY23 amortization expense expected to be approximately $6.5 million at current FX rates Operating Income Increased 32% on 7% Sales Growth Operating Income & Margin Adjusted Operating Income & Margin $20.5 $28.6 $24.6 $28.6 $23.5 9.5% 11.2% 11.1% 12.4% 10.2% Q3 FY22 Q4 FY22 Q1 FY23 Q2 FY23 Q3 FY23 $15.3 $24.1 $22.8 $27.4 $20.2 7.1% 9.5% 10.4% 11.8% 8.8% Q3 FY22 Q4 FY22 Q1 FY23 Q2 FY23 Q3 FY23 ($ in millions) (1)Guidance on amortization expense provided on February 1, 2023

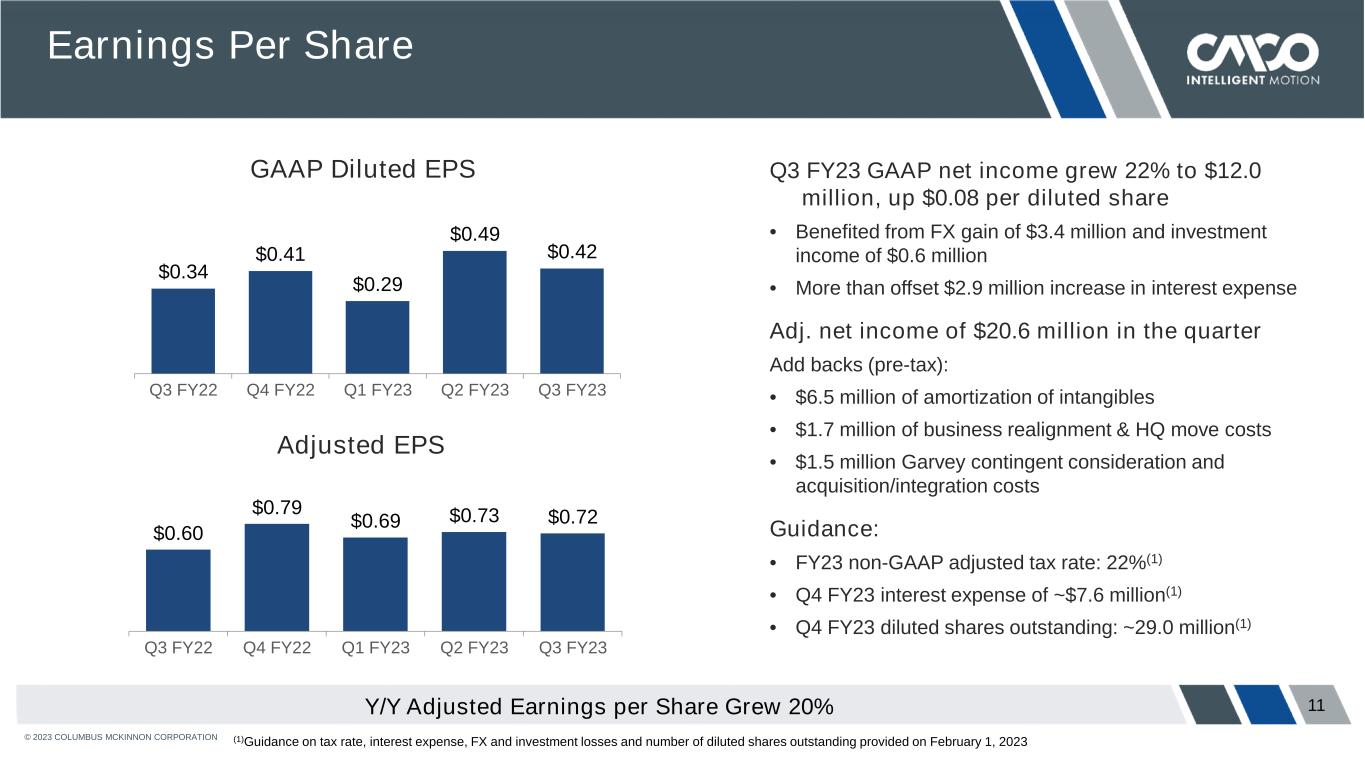

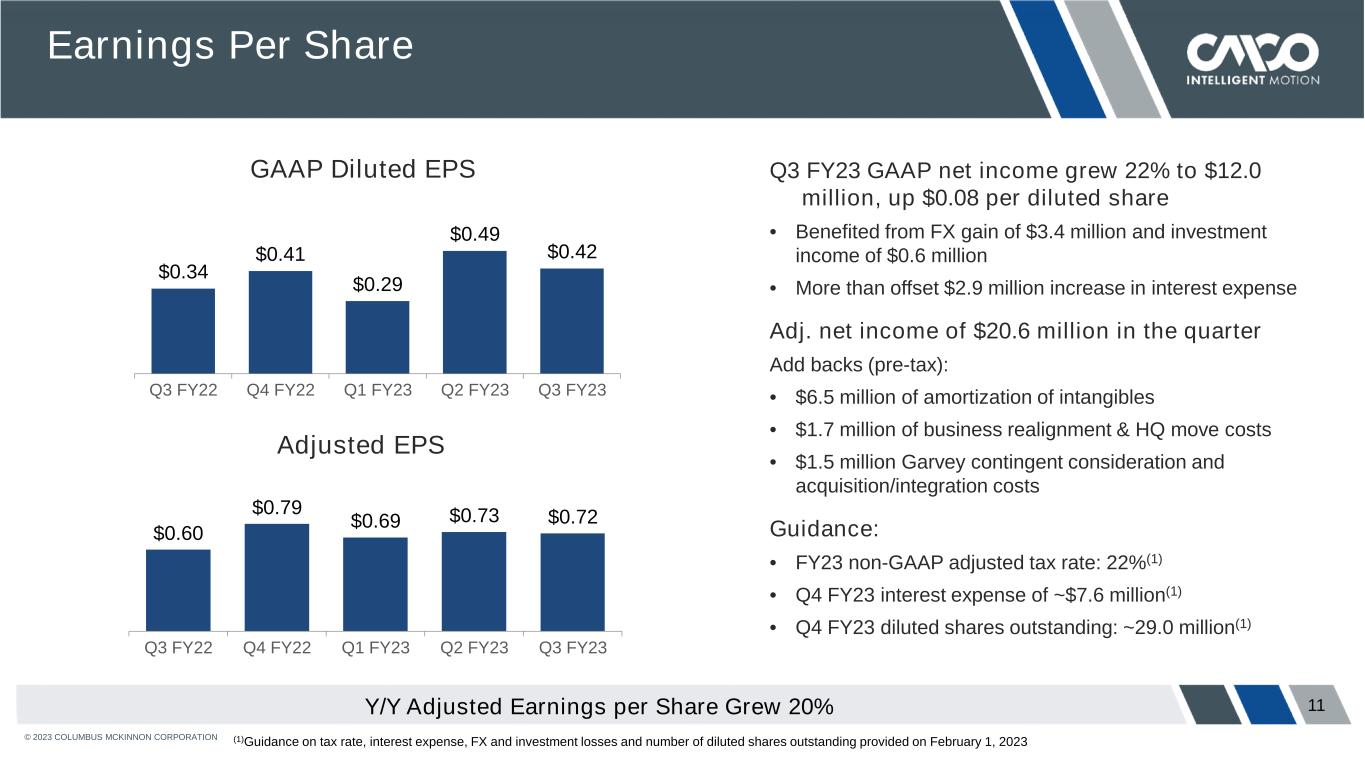

© 2023 COLUMBUS MCKINNON CORPORATION $0.34 $0.41 $0.29 $0.49 $0.42 Q3 FY22 Q4 FY22 Q1 FY23 Q2 FY23 Q3 FY23 11 Earnings Per Share Adjusted EPS GAAP Diluted EPS $0.60 $0.79 $0.69 $0.73 $0.72 Q3 FY22 Q4 FY22 Q1 FY23 Q2 FY23 Q3 FY23 Q3 FY23 GAAP net income grew 22% to $12.0 million, up $0.08 per diluted share • Benefited from FX gain of $3.4 million and investment income of $0.6 million • More than offset $2.9 million increase in interest expense Adj. net income of $20.6 million in the quarter Add backs (pre-tax): • $6.5 million of amortization of intangibles • $1.7 million of business realignment & HQ move costs • $1.5 million Garvey contingent consideration and acquisition/integration costs Guidance: • FY23 non-GAAP adjusted tax rate: 22%(1) • Q4 FY23 interest expense of ~$7.6 million(1) • Q4 FY23 diluted shares outstanding: ~29.0 million(1) (1)Guidance on tax rate, interest expense, FX and investment losses and number of diluted shares outstanding provided on February 1, 2023 Y/Y Adjusted Earnings per Share Grew 20%

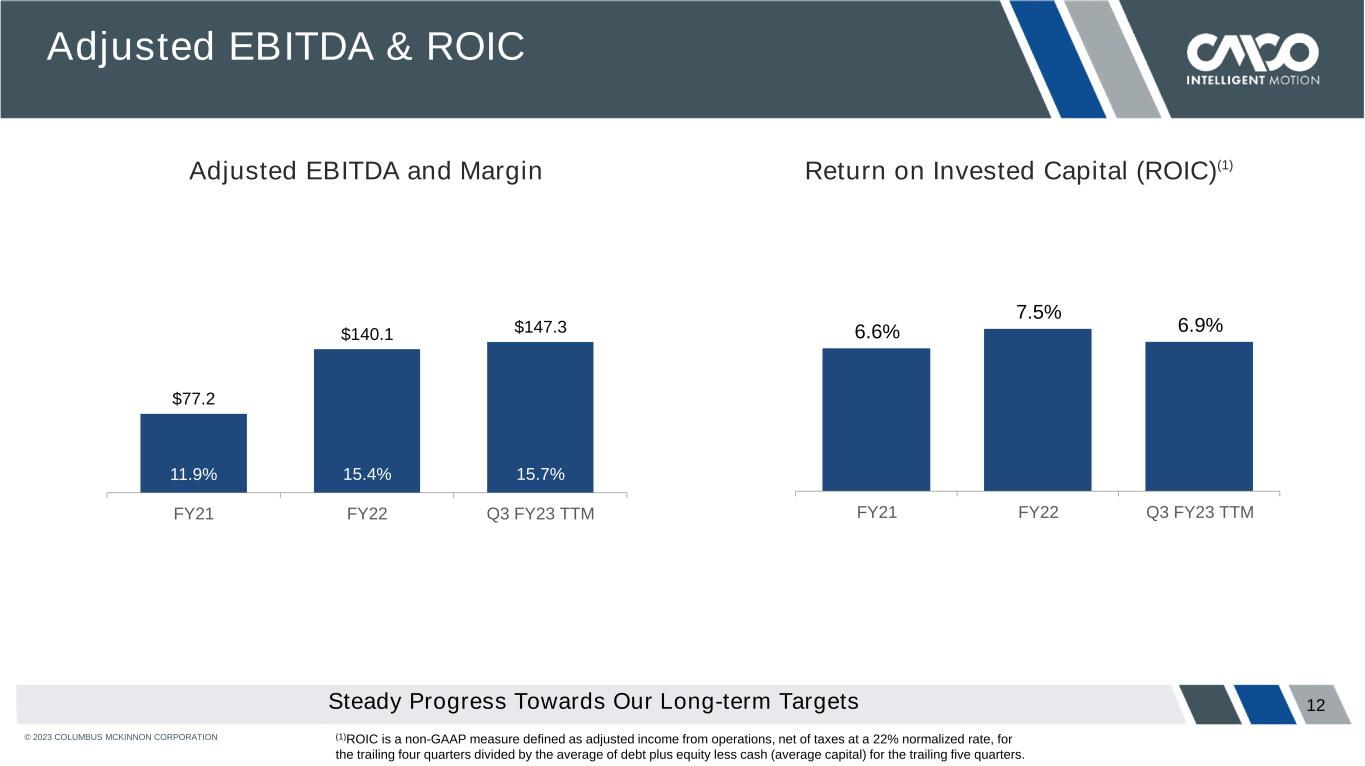

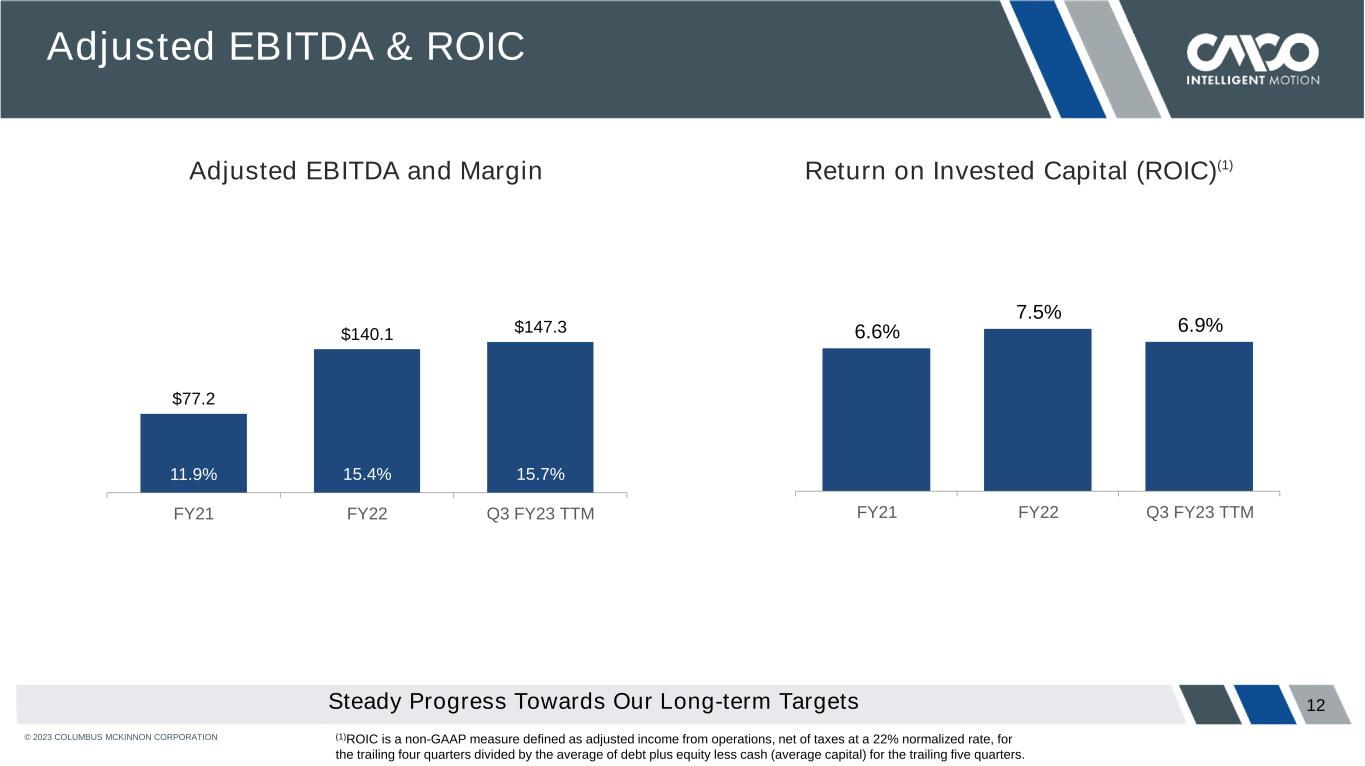

© 2023 COLUMBUS MCKINNON CORPORATION 12 Adjusted EBITDA and Margin Adjusted EBITDA & ROIC Return on Invested Capital (ROIC)(1) 6.6% 7.5% 6.9% FY21 FY22 Q3 FY23 TTM (1)ROIC is a non-GAAP measure defined as adjusted income from operations, net of taxes at a 22% normalized rate, for the trailing four quarters divided by the average of debt plus equity less cash (average capital) for the trailing five quarters. Steady Progress Towards Our Long-term Targets $77.2 $140.1 $147.3 11.9% 15.4% 15.7% FY21 FY22 Q3 FY23 TTM

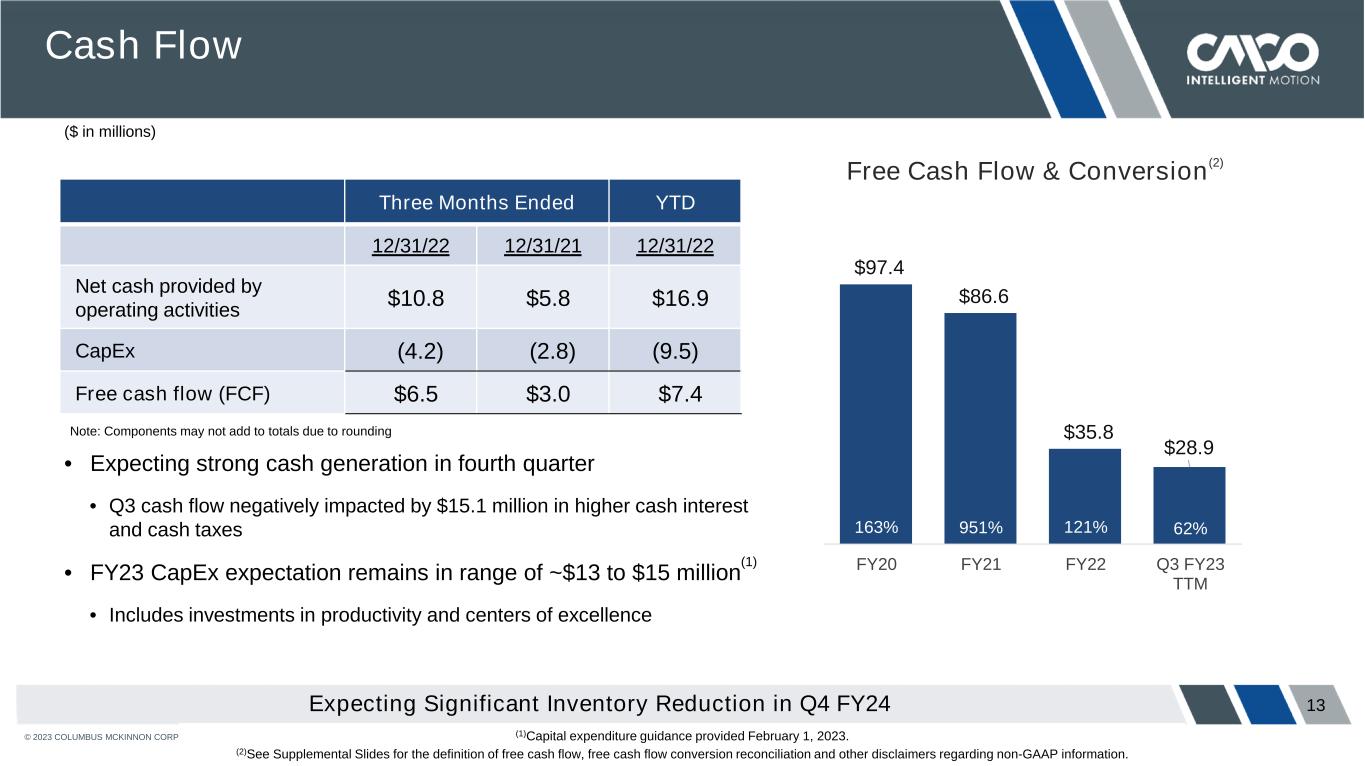

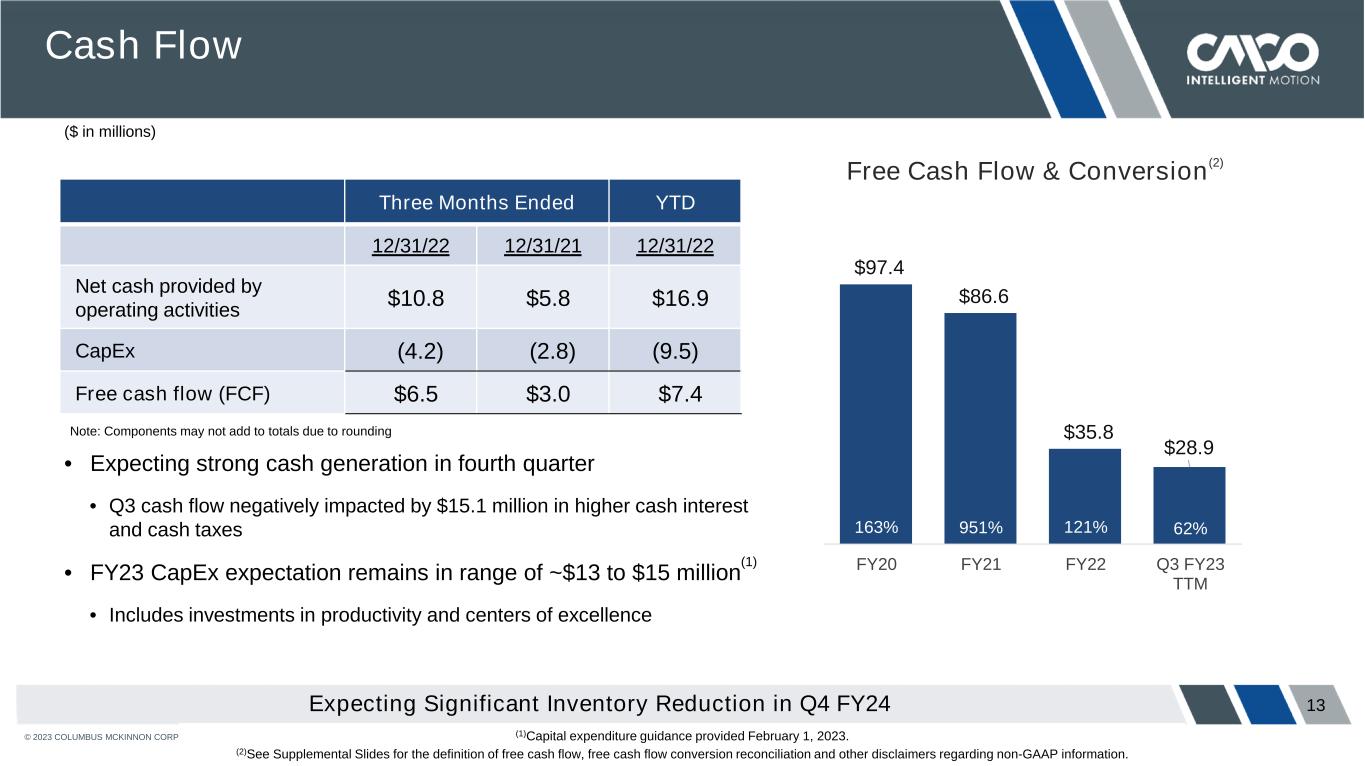

© 2023 COLUMBUS MCKINNON CORPORATION $97.4 $86.6 $35.8 $28.9 163% 951% 121% 62% FY20 FY21 FY22 Q3 FY23 TTM 13 Free Cash Flow & Conversion (2) Cash Flow Note: Components may not add to totals due to rounding Three Months Ended YTD 12/31/22 12/31/21 12/31/22 Net cash provided by operating activities $10.8 $5.8 $16.9 CapEx (4.2) (2.8) (9.5) Free cash flow (FCF) $6.5 $3.0 $7.4 (1)Capital expenditure guidance provided February 1, 2023. (2)See Supplemental Slides for the definition of free cash flow, free cash flow conversion reconciliation and other disclaimers regarding non-GAAP information. • Expecting strong cash generation in fourth quarter • Q3 cash flow negatively impacted by $15.1 million in higher cash interest and cash taxes • FY23 CapEx expectation remains in range of ~$13 to $15 million (1) • Includes investments in productivity and centers of excellence Expecting Significant Inventory Reduction in Q4 FY24 ($ in millions)

© 2023 COLUMBUS MCKINNON CORPORATION 14 Capital Structure Net debt leverage ratio of ~2.7x • Net debt to net total capital improved 270 bps y/y to 33.0% • Expect to be under 2.5x by end of fiscal 2023 Reduced debt ~$10 million in the quarter and ~$30 million YTD • Expect to pay down $40 million in FY23 • ~60% of Term Loan B debt is hedged Financial flexibility • ~$166 million of liquidity • Financial strength and cash generation capability enables execution of strategy Flexible Capital Structure and Solid Balance Sheet Supports Strategy Execution CAPITALIZATION December 31, 2022 September 30, 2022 Cash and cash equivalents $ 81.5 $ 88.9 Total debt 481.5 491.4 Total net debt 400.0 402.6 Shareholders’ equity 810.9 784.4 Total capitalization $ 1,292.4 $ 1,275.8 Debt/total capitalization 37.3% 38.5% Net debt/net total capitalization 33.0% 33.9% ($ in millions) Note: Components may not add to totals due to rounding

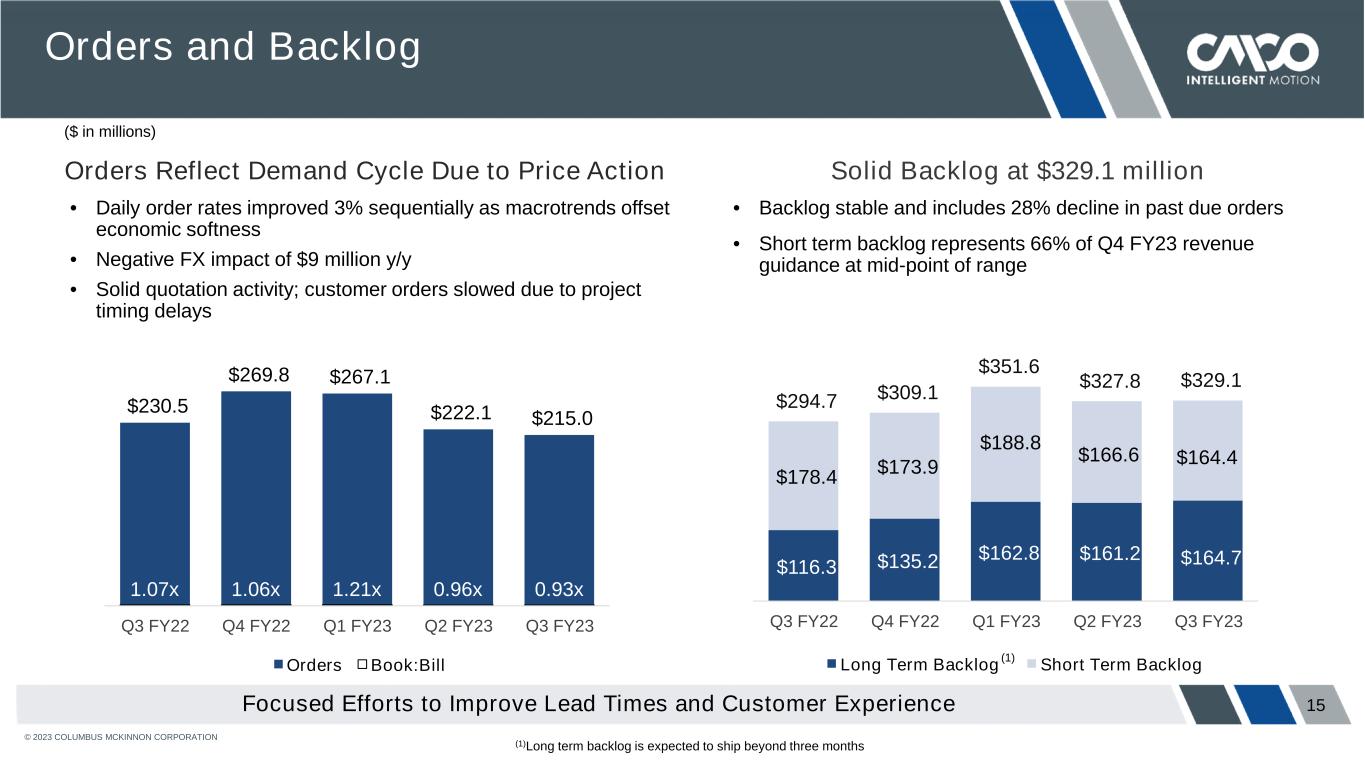

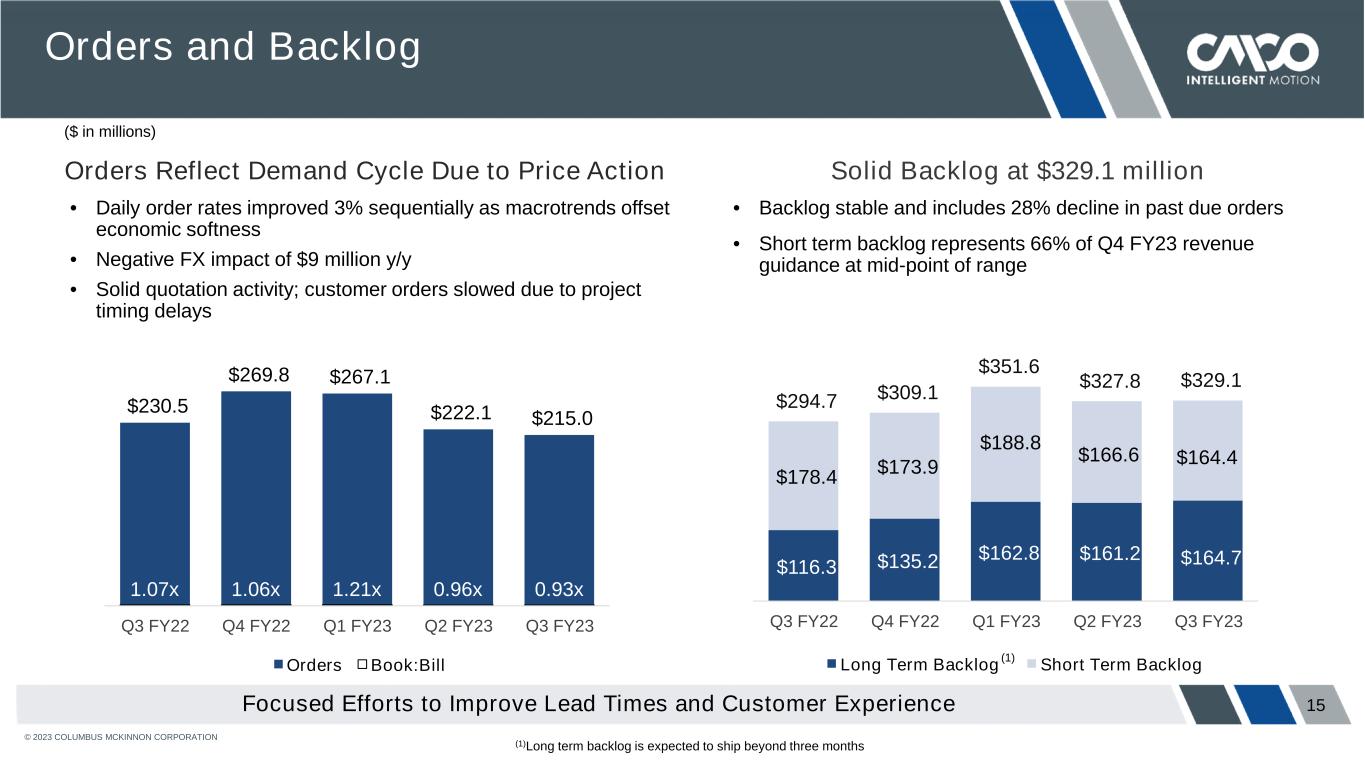

© 2023 COLUMBUS MCKINNON CORPORATION 15 Orders Reflect Demand Cycle Due to Price Action Solid Backlog at $329.1 million Orders and Backlog • Daily order rates improved 3% sequentially as macrotrends offset economic softness • Negative FX impact of $9 million y/y • Solid quotation activity; customer orders slowed due to project timing delays • Backlog stable and includes 28% decline in past due orders • Short term backlog represents 66% of Q4 FY23 revenue guidance at mid-point of range Focused Efforts to Improve Lead Times and Customer Experience $230.5 $269.8 $267.1 $222.1 $215.0 1.07x 1.06x 1.21x 0.96x 0.93x Q3 FY22 Q4 FY22 Q1 FY23 Q2 FY23 Q3 FY23 Orders Book:Bill (1)Long term backlog is expected to ship beyond three months $116.3 $135.2 $162.8 $161.2 $164.7 $178.4 $173.9 $188.8 $166.6 $164.4 $294.7 $309.1 $351.6 $327.8 $329.1 Q3 FY22 Q4 FY22 Q1 FY23 Q2 FY23 Q3 FY23 Long Term Backlog Short Term Backlog (1) ($ in millions)

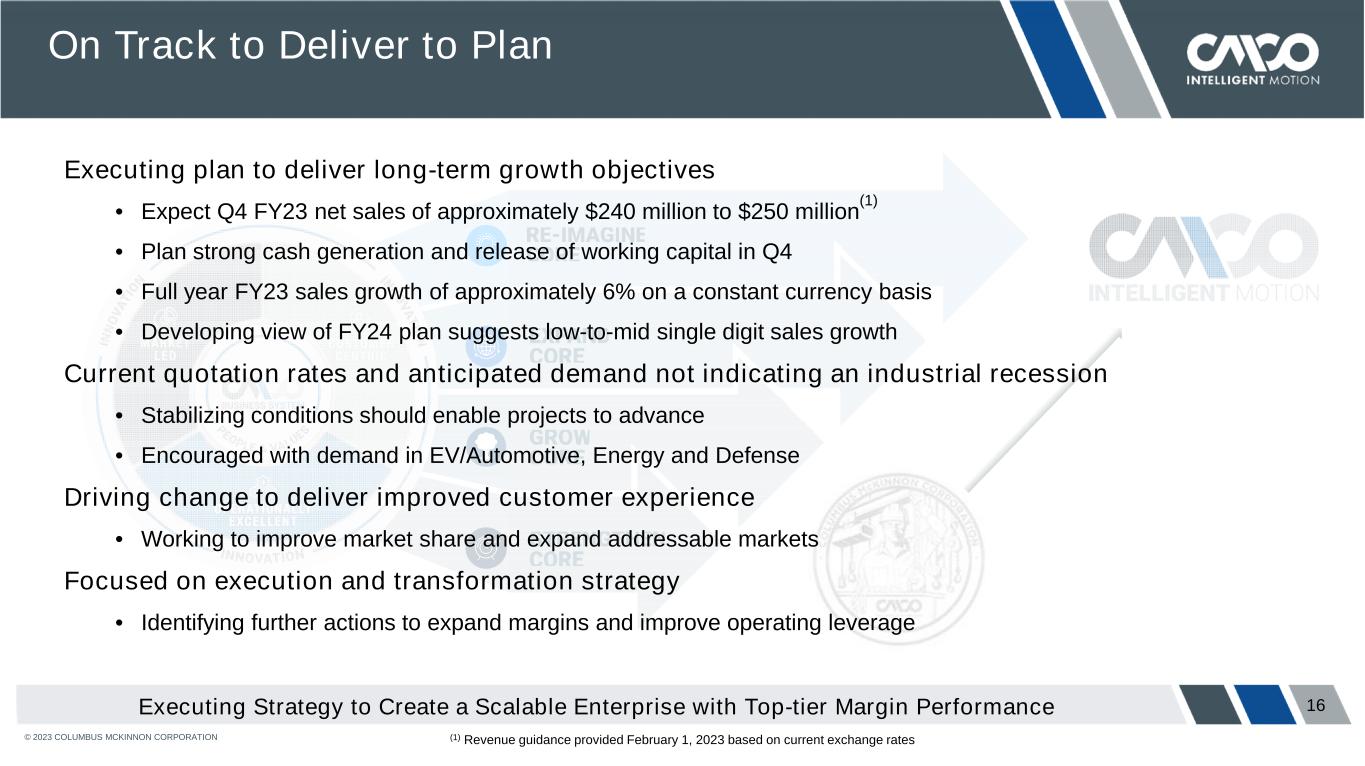

© 2023 COLUMBUS MCKINNON CORPORATION 16Executing Strategy to Create a Scalable Enterprise with Top-tier Margin Performance On Track to Deliver to Plan (1) Revenue guidance provided February 1, 2023 based on current exchange rates Executing plan to deliver long-term growth objectives • Expect Q4 FY23 net sales of approximately $240 million to $250 million (1) • Plan strong cash generation and release of working capital in Q4 • Full year FY23 sales growth of approximately 6% on a constant currency basis • Developing view of FY24 plan suggests low-to-mid single digit sales growth Current quotation rates and anticipated demand not indicating an industrial recession • Stabilizing conditions should enable projects to advance • Encouraged with demand in EV/Automotive, Energy and Defense Driving change to deliver improved customer experience • Working to improve market share and expand addressable markets Focused on execution and transformation strategy • Identifying further actions to expand margins and improve operating leverage

Q3 Fiscal Year 2023 Financial Results Conference Call President & Chief Executive Officer David J. Wilson February 1, 2023 Executive VP – Finance & Chief Financial Officer Gregory P. Rustowicz

Supplemental Information

© 2023 COLUMBUS MCKINNON CORPORATION 19 Conference Call Playback Info Replay Number: 412-317-6671 passcode: 13735008 Telephone replay available through February 8, 2023 Webcast / PowerPoint / Replay available at investors.columbusmckinnon.com Transcript, when available, at investors.columbusmckinnon.com

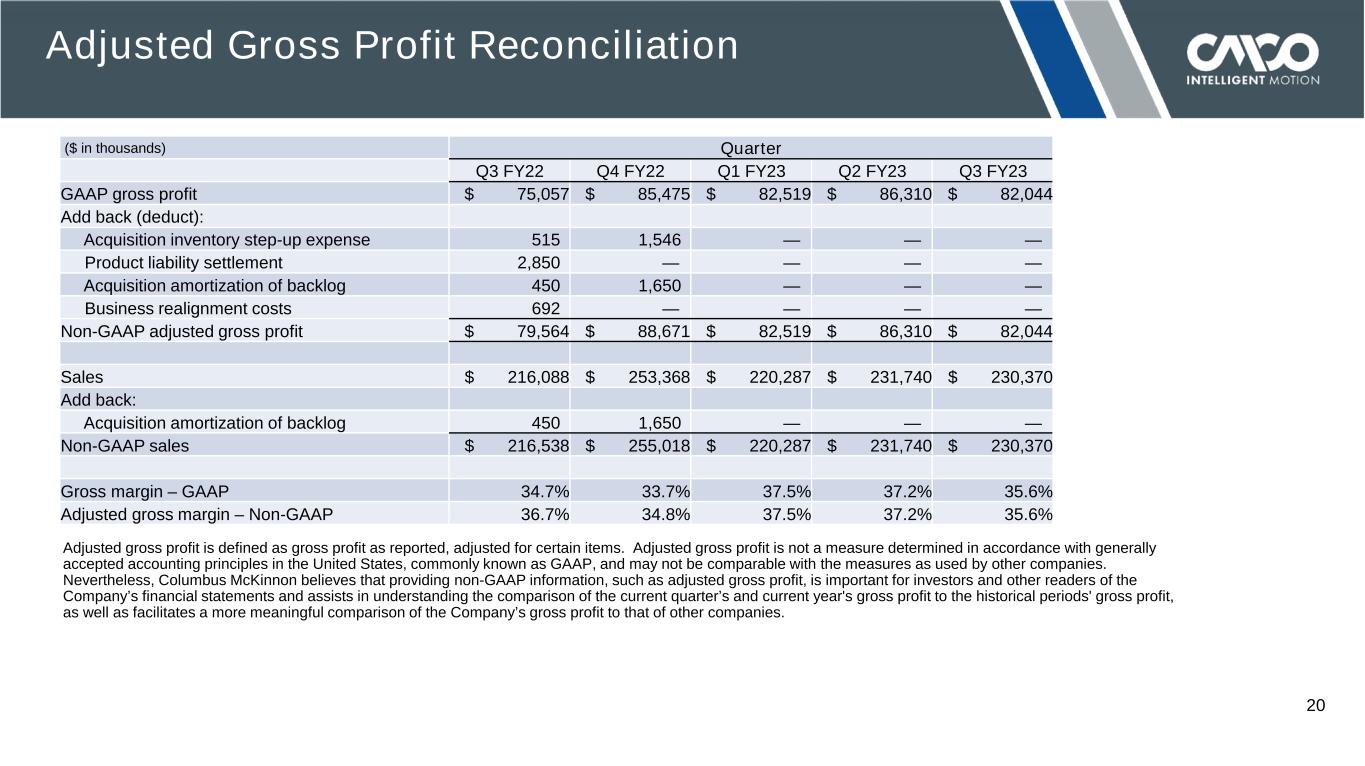

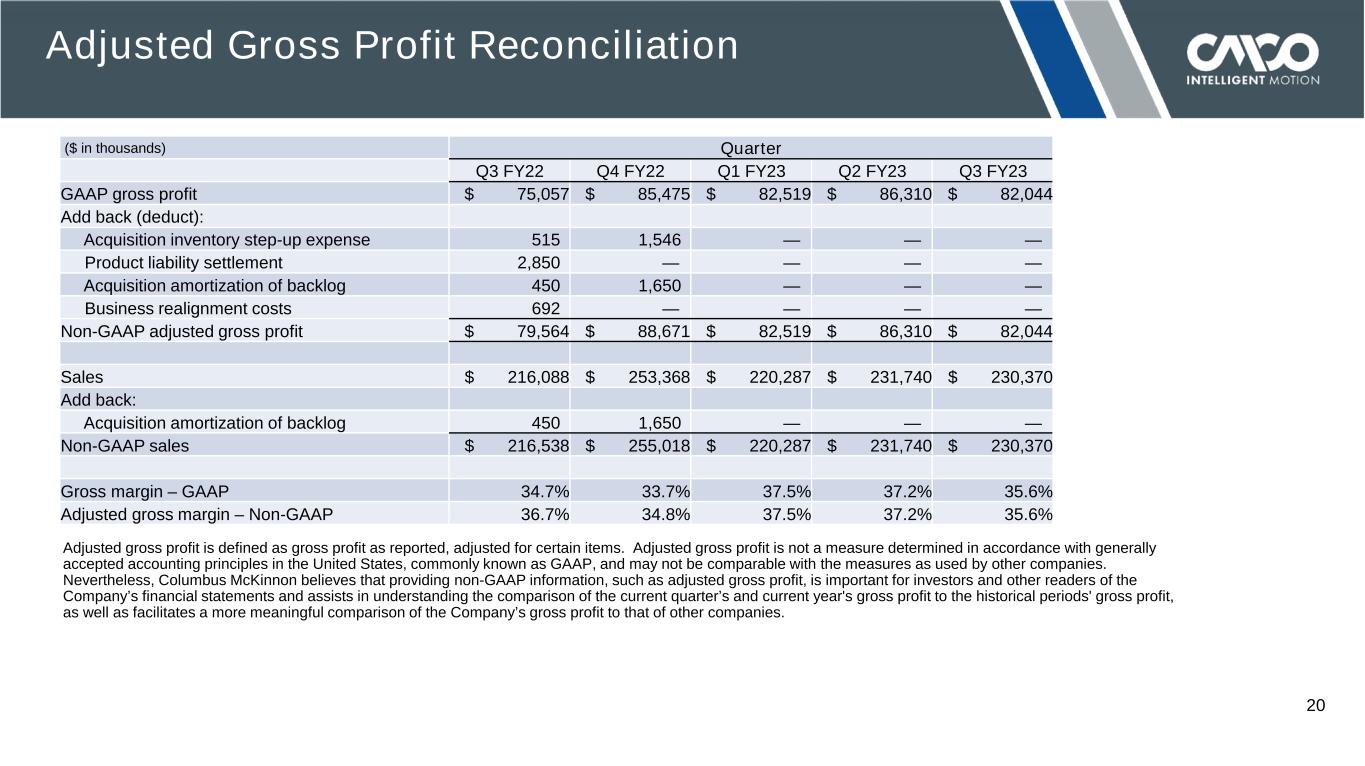

© 2023 COLUMBUS MCKINNON CORPORATION 20 Adjusted Gross Profit Reconciliation Adjusted gross profit is defined as gross profit as reported, adjusted for certain items. Adjusted gross profit is not a measure determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable with the measures as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information, such as adjusted gross profit, is important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year's gross profit to the historical periods' gross profit, as well as facilitates a more meaningful comparison of the Company’s gross profit to that of other companies. ($ in thousands) Quarter Q3 FY22 Q4 FY22 Q1 FY23 Q2 FY23 Q3 FY23 GAAP gross profit $ 75,057 $ 85,475 $ 82,519 $ 86,310 $ 82,044 Add back (deduct): Acquisition inventory step-up expense 515 1,546 — — — Product liability settlement 2,850 — — — — Acquisition amortization of backlog 450 1,650 — — — Business realignment costs 692 — — — — Non-GAAP adjusted gross profit $ 79,564 $ 88,671 $ 82,519 $ 86,310 $ 82,044 Sales $ 216,088 $ 253,368 $ 220,287 $ 231,740 $ 230,370 Add back: Acquisition amortization of backlog 450 1,650 — — — Non-GAAP sales $ 216,538 $ 255,018 $ 220,287 $ 231,740 $ 230,370 Gross margin – GAAP 34.7% 33.7% 37.5% 37.2% 35.6% Adjusted gross margin – Non-GAAP 36.7% 34.8% 37.5% 37.2% 35.6%

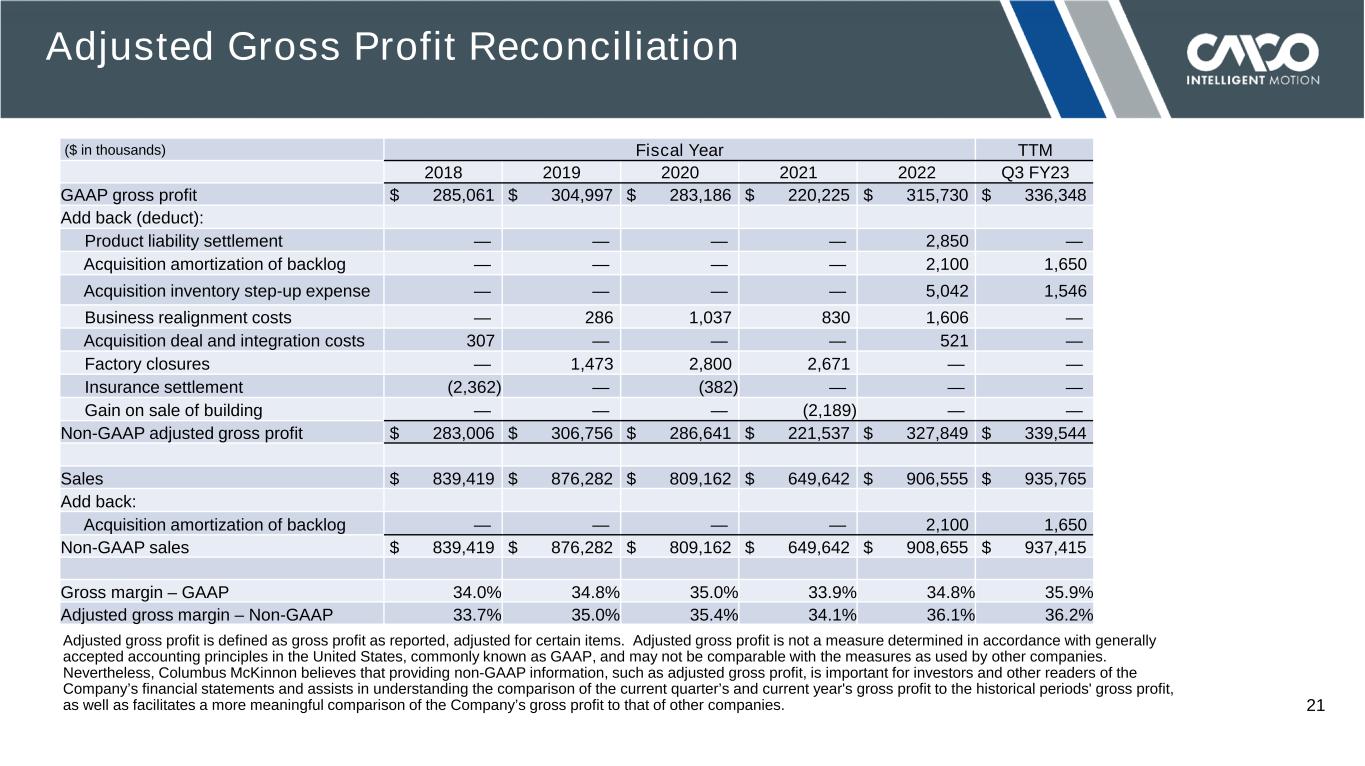

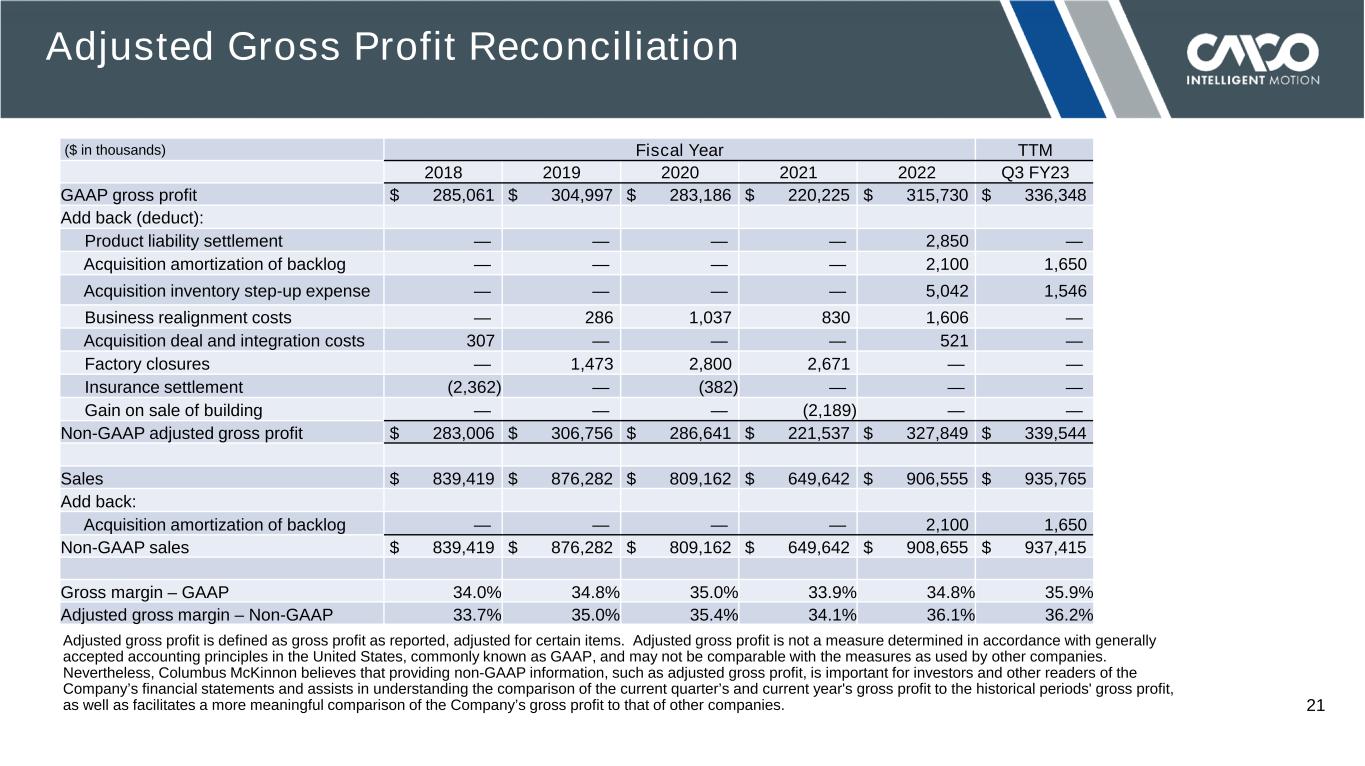

© 2023 COLUMBUS MCKINNON CORPORATION 21 Adjusted Gross Profit Reconciliation Adjusted gross profit is defined as gross profit as reported, adjusted for certain items. Adjusted gross profit is not a measure determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable with the measures as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information, such as adjusted gross profit, is important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year's gross profit to the historical periods' gross profit, as well as facilitates a more meaningful comparison of the Company’s gross profit to that of other companies. ($ in thousands) Fiscal Year TTM 2018 2019 2020 2021 2022 Q3 FY23 GAAP gross profit $ 285,061 $ 304,997 $ 283,186 $ 220,225 $ 315,730 $ 336,348 Add back (deduct): Product liability settlement — — — — 2,850 — Acquisition amortization of backlog — — — — 2,100 1,650 Acquisition inventory step-up expense — — — — 5,042 1,546 Business realignment costs — 286 1,037 830 1,606 — Acquisition deal and integration costs 307 — — — 521 — Factory closures — 1,473 2,800 2,671 — — Insurance settlement (2,362) — (382) — — — Gain on sale of building — — — (2,189) — — Non-GAAP adjusted gross profit $ 283,006 $ 306,756 $ 286,641 $ 221,537 $ 327,849 $ 339,544 Sales $ 839,419 $ 876,282 $ 809,162 $ 649,642 $ 906,555 $ 935,765 Add back: Acquisition amortization of backlog — — — — 2,100 1,650 Non-GAAP sales $ 839,419 $ 876,282 $ 809,162 $ 649,642 $ 908,655 $ 937,415 Gross margin – GAAP 34.0% 34.8% 35.0% 33.9% 34.8% 35.9% Adjusted gross margin – Non-GAAP 33.7% 35.0% 35.4% 34.1% 36.1% 36.2%

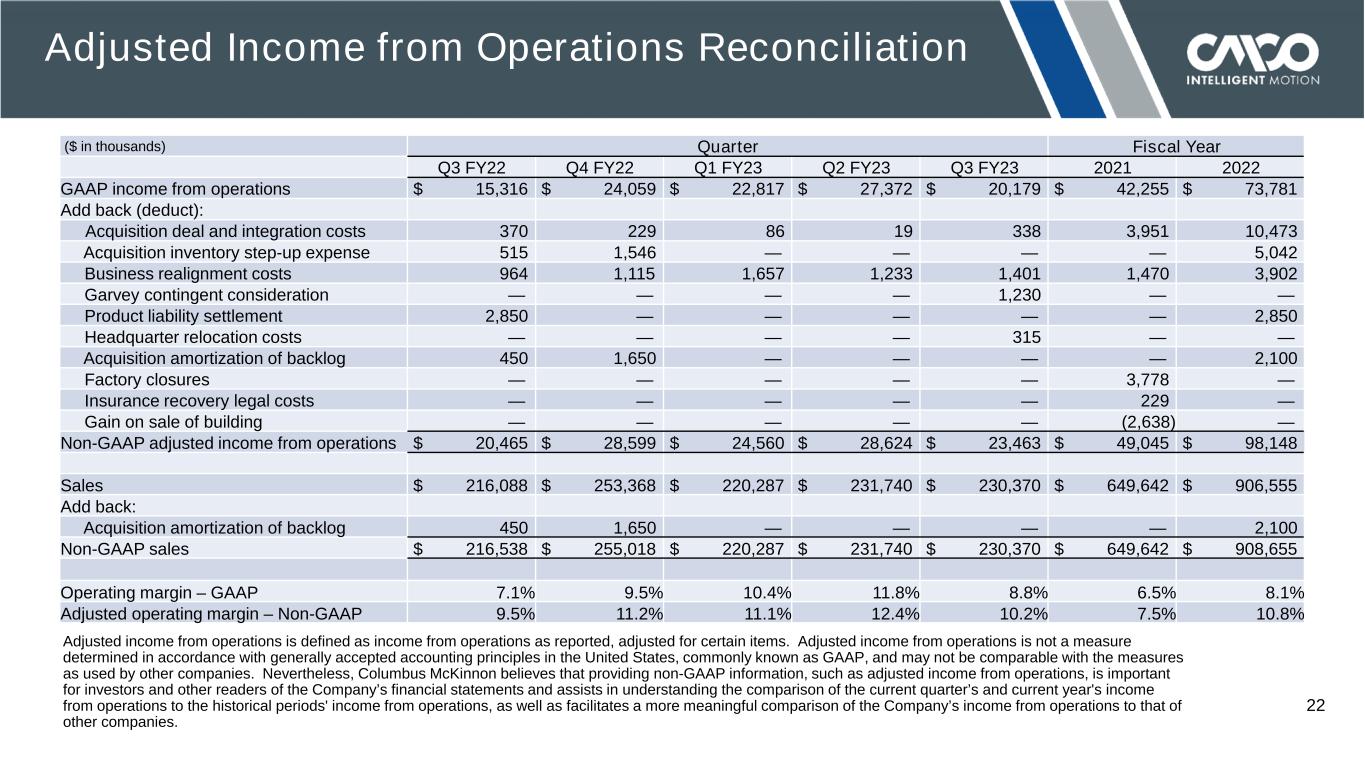

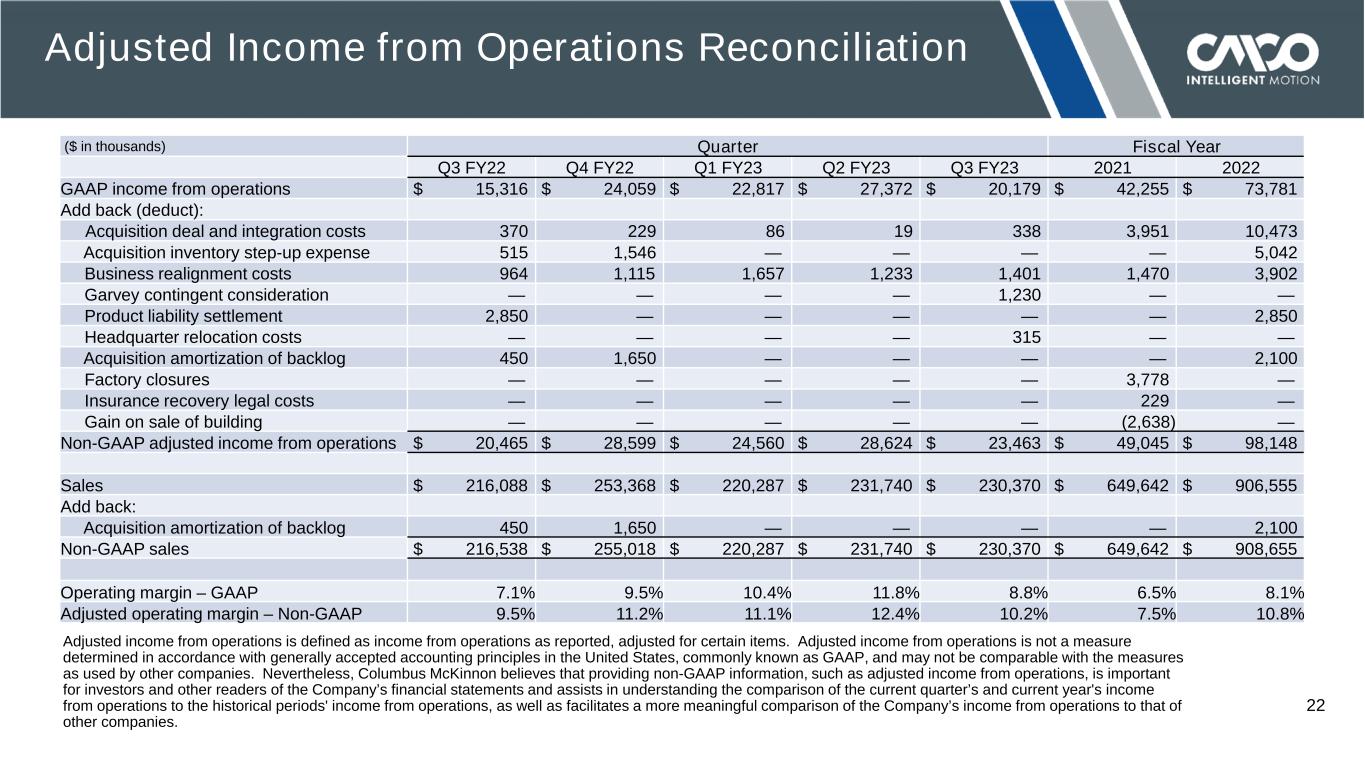

© 2023 COLUMBUS MCKINNON CORPORATION 22 Adjusted Income from Operations Reconciliation Adjusted income from operations is defined as income from operations as reported, adjusted for certain items. Adjusted income from operations is not a measure determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable with the measures as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information, such as adjusted income from operations, is important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year's income from operations to the historical periods' income from operations, as well as facilitates a more meaningful comparison of the Company’s income from operations to that of other companies. ($ in thousands) Quarter Fiscal Year Q3 FY22 Q4 FY22 Q1 FY23 Q2 FY23 Q3 FY23 2021 2022 GAAP income from operations $ 15,316 $ 24,059 $ 22,817 $ 27,372 $ 20,179 $ 42,255 $ 73,781 Add back (deduct): Acquisition deal and integration costs 370 229 86 19 338 3,951 10,473 Acquisition inventory step-up expense 515 1,546 — — — — 5,042 Business realignment costs 964 1,115 1,657 1,233 1,401 1,470 3,902 Garvey contingent consideration — — — — 1,230 — — Product liability settlement 2,850 — — — — — 2,850 Headquarter relocation costs — — — — 315 — — Acquisition amortization of backlog 450 1,650 — — — — 2,100 Factory closures — — — — — 3,778 — Insurance recovery legal costs — — — — — 229 — Gain on sale of building — — — — — (2,638) — Non-GAAP adjusted income from operations $ 20,465 $ 28,599 $ 24,560 $ 28,624 $ 23,463 $ 49,045 $ 98,148 Sales $ 216,088 $ 253,368 $ 220,287 $ 231,740 $ 230,370 $ 649,642 $ 906,555 Add back: Acquisition amortization of backlog 450 1,650 — — — — 2,100 Non-GAAP sales $ 216,538 $ 255,018 $ 220,287 $ 231,740 $ 230,370 $ 649,642 $ 908,655 Operating margin – GAAP 7.1% 9.5% 10.4% 11.8% 8.8% 6.5% 8.1% Adjusted operating margin – Non-GAAP 9.5% 11.2% 11.1% 12.4% 10.2% 7.5% 10.8%

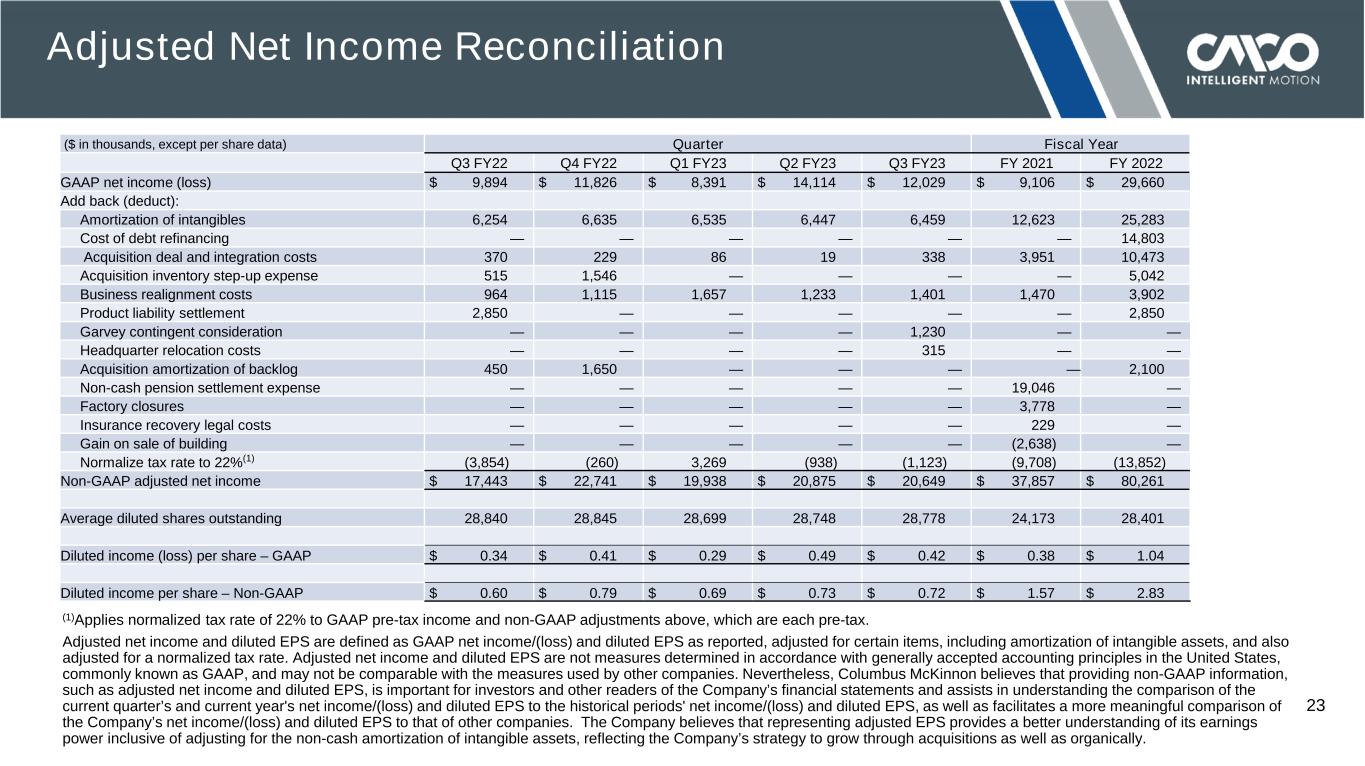

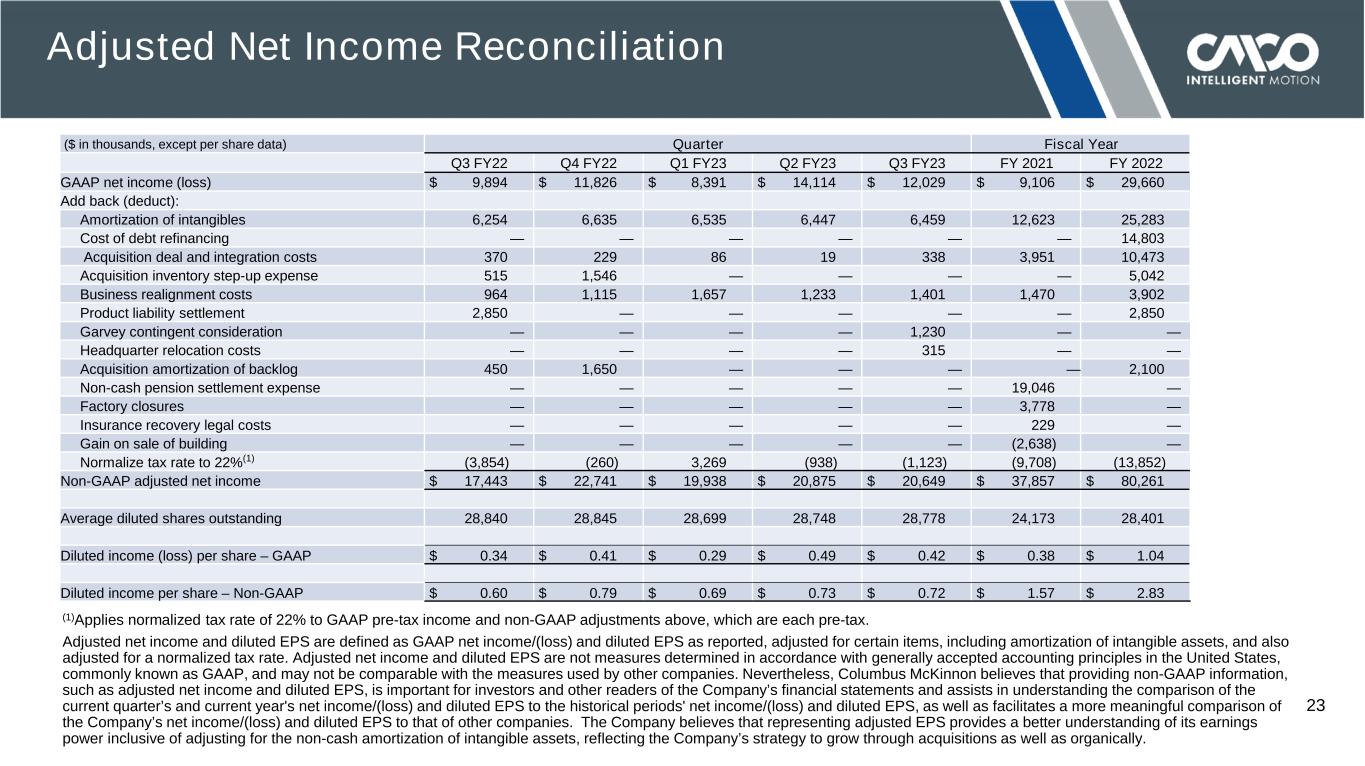

© 2023 COLUMBUS MCKINNON CORPORATION 23 Adjusted Net Income Reconciliation (1)Applies normalized tax rate of 22% to GAAP pre-tax income and non-GAAP adjustments above, which are each pre-tax. Adjusted net income and diluted EPS are defined as GAAP net income/(loss) and diluted EPS as reported, adjusted for certain items, including amortization of intangible assets, and also adjusted for a normalized tax rate. Adjusted net income and diluted EPS are not measures determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable with the measures used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information, such as adjusted net income and diluted EPS, is important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year's net income/(loss) and diluted EPS to the historical periods' net income/(loss) and diluted EPS, as well as facilitates a more meaningful comparison of the Company’s net income/(loss) and diluted EPS to that of other companies. The Company believes that representing adjusted EPS provides a better understanding of its earnings power inclusive of adjusting for the non-cash amortization of intangible assets, reflecting the Company’s strategy to grow through acquisitions as well as organically. ($ in thousands, except per share data) Quarter Fiscal Year Q3 FY22 Q4 FY22 Q1 FY23 Q2 FY23 Q3 FY23 FY 2021 FY 2022 GAAP net income (loss) $ 9,894 $ 11,826 $ 8,391 $ 14,114 $ 12,029 $ 9,106 $ 29,660 Add back (deduct): Amortization of intangibles 6,254 6,635 6,535 6,447 6,459 12,623 25,283 Cost of debt refinancing — — — — — — 14,803 Acquisition deal and integration costs 370 229 86 19 338 3,951 10,473 Acquisition inventory step-up expense 515 1,546 — — — — 5,042 Business realignment costs 964 1,115 1,657 1,233 1,401 1,470 3,902 Product liability settlement 2,850 — — — — — 2,850 Garvey contingent consideration — — — — 1,230 — — Headquarter relocation costs — — — — 315 — — Acquisition amortization of backlog 450 1,650 — — — — 2,100 Non-cash pension settlement expense — — — — — 19,046 — Factory closures — — — — — 3,778 — Insurance recovery legal costs — — — — — 229 — Gain on sale of building — — — — — (2,638) — Normalize tax rate to 22%(1) (3,854) (260) 3,269 (938) (1,123) (9,708) (13,852) Non-GAAP adjusted net income $ 17,443 $ 22,741 $ 19,938 $ 20,875 $ 20,649 $ 37,857 $ 80,261 Average diluted shares outstanding 28,840 28,845 28,699 28,748 28,778 24,173 28,401 Diluted income (loss) per share – GAAP $ 0.34 $ 0.41 $ 0.29 $ 0.49 $ 0.42 $ 0.38 $ 1.04 Diluted income per share – Non-GAAP $ 0.60 $ 0.79 $ 0.69 $ 0.73 $ 0.72 $ 1.57 $ 2.83

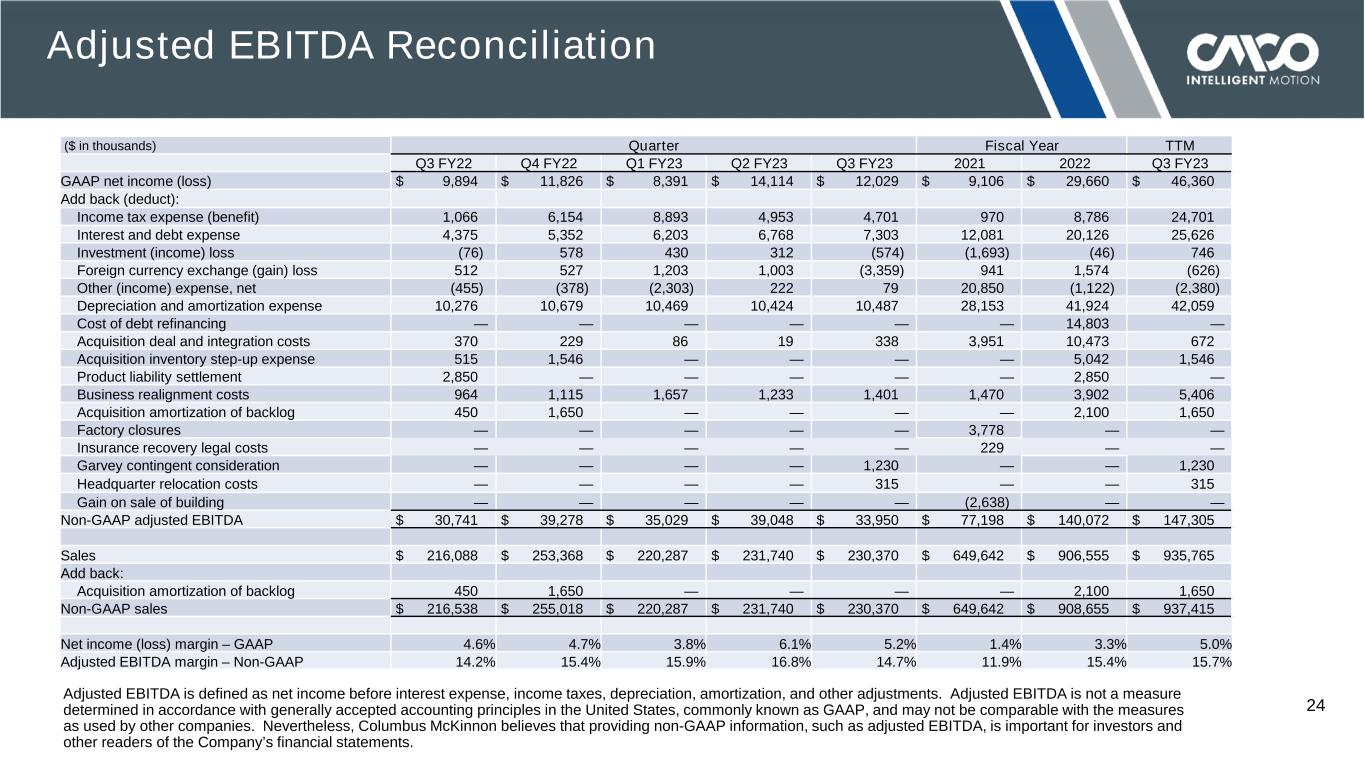

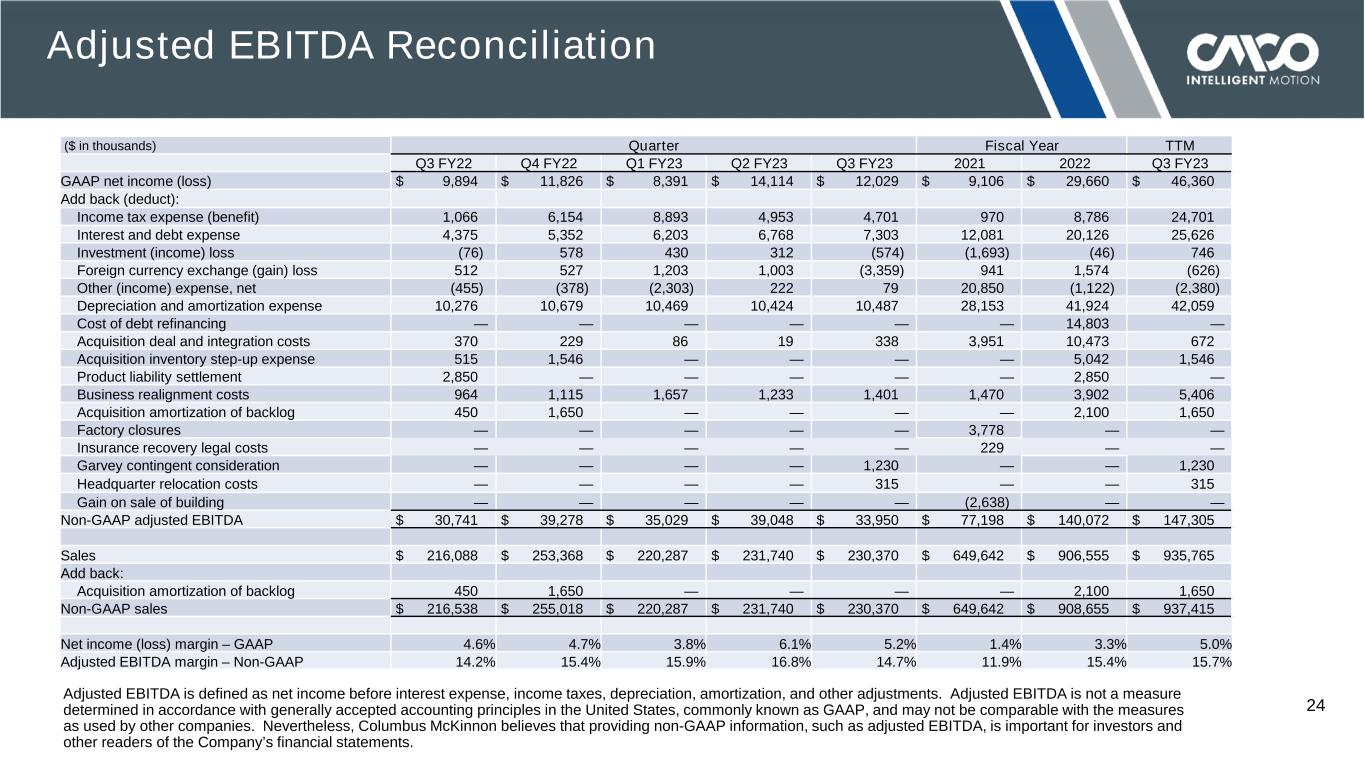

© 2023 COLUMBUS MCKINNON CORPORATION 24 Adjusted EBITDA Reconciliation Adjusted EBITDA is defined as net income before interest expense, income taxes, depreciation, amortization, and other adjustments. Adjusted EBITDA is not a measure determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable with the measures as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information, such as adjusted EBITDA, is important for investors and other readers of the Company’s financial statements. ($ in thousands) Quarter Fiscal Year TTM Q3 FY22 Q4 FY22 Q1 FY23 Q2 FY23 Q3 FY23 2021 2022 Q3 FY23 GAAP net income (loss) $ 9,894 $ 11,826 $ 8,391 $ 14,114 $ 12,029 $ 9,106 $ 29,660 $ 46,360 Add back (deduct): Income tax expense (benefit) 1,066 6,154 8,893 4,953 4,701 970 8,786 24,701 Interest and debt expense 4,375 5,352 6,203 6,768 7,303 12,081 20,126 25,626 Investment (income) loss (76) 578 430 312 (574) (1,693) (46) 746 Foreign currency exchange (gain) loss 512 527 1,203 1,003 (3,359) 941 1,574 (626) Other (income) expense, net (455) (378) (2,303) 222 79 20,850 (1,122) (2,380) Depreciation and amortization expense 10,276 10,679 10,469 10,424 10,487 28,153 41,924 42,059 Cost of debt refinancing — — — — — — 14,803 — Acquisition deal and integration costs 370 229 86 19 338 3,951 10,473 672 Acquisition inventory step-up expense 515 1,546 — — — — 5,042 1,546 Product liability settlement 2,850 — — — — — 2,850 — Business realignment costs 964 1,115 1,657 1,233 1,401 1,470 3,902 5,406 Acquisition amortization of backlog 450 1,650 — — — — 2,100 1,650 Factory closures — — — — — 3,778 — — Insurance recovery legal costs — — — — — 229 — — Garvey contingent consideration — — — — 1,230 — — 1,230 Headquarter relocation costs — — — — 315 — — 315 Gain on sale of building — — — — — (2,638) — — Non-GAAP adjusted EBITDA $ 30,741 $ 39,278 $ 35,029 $ 39,048 $ 33,950 $ 77,198 $ 140,072 $ 147,305 Sales $ 216,088 $ 253,368 $ 220,287 $ 231,740 $ 230,370 $ 649,642 $ 906,555 $ 935,765 Add back: Acquisition amortization of backlog 450 1,650 — — — — 2,100 1,650 Non-GAAP sales $ 216,538 $ 255,018 $ 220,287 $ 231,740 $ 230,370 $ 649,642 $ 908,655 $ 937,415 Net income (loss) margin – GAAP 4.6% 4.7% 3.8% 6.1% 5.2% 1.4% 3.3% 5.0% Adjusted EBITDA margin – Non-GAAP 14.2% 15.4% 15.9% 16.8% 14.7% 11.9% 15.4% 15.7%

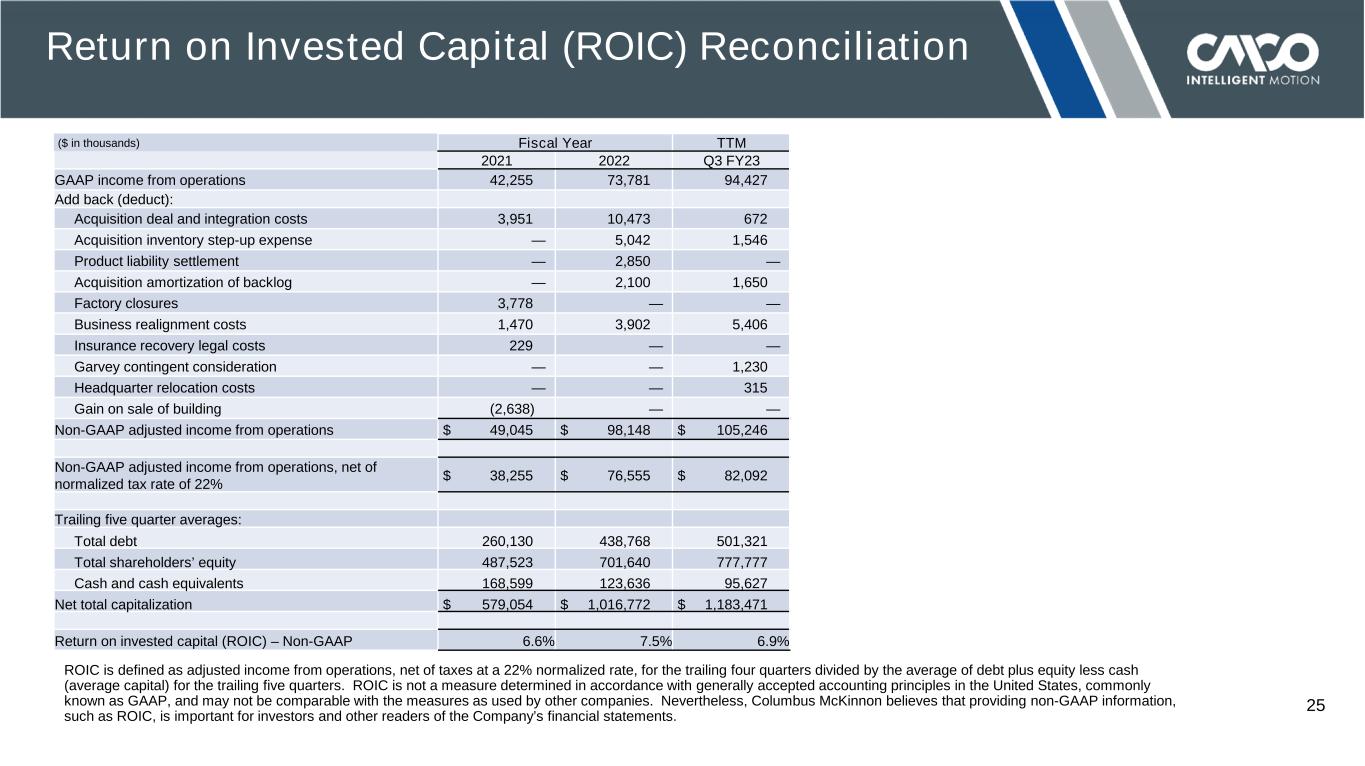

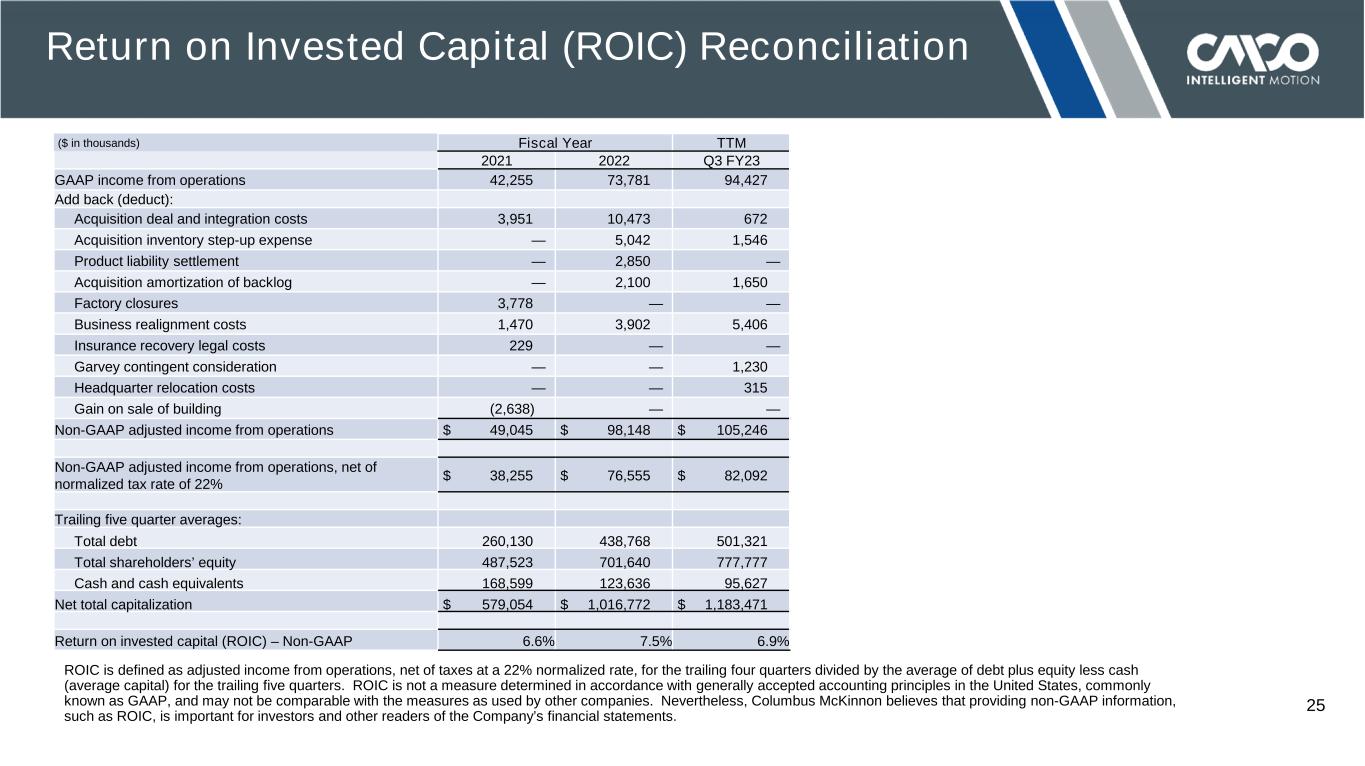

© 2023 COLUMBUS MCKINNON CORPORATION 25 Return on Invested Capital (ROIC) Reconciliation ROIC is defined as adjusted income from operations, net of taxes at a 22% normalized rate, for the trailing four quarters divided by the average of debt plus equity less cash (average capital) for the trailing five quarters. ROIC is not a measure determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable with the measures as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information, such as ROIC, is important for investors and other readers of the Company’s financial statements. ($ in thousands) Fiscal Year TTM 2021 2022 Q3 FY23 GAAP income from operations 42,255 73,781 94,427 Add back (deduct): Acquisition deal and integration costs 3,951 10,473 672 Acquisition inventory step-up expense — 5,042 1,546 Product liability settlement — 2,850 — Acquisition amortization of backlog — 2,100 1,650 Factory closures 3,778 — — Business realignment costs 1,470 3,902 5,406 Insurance recovery legal costs 229 — — Garvey contingent consideration — — 1,230 Headquarter relocation costs — — 315 Gain on sale of building (2,638) — — Non-GAAP adjusted income from operations $ 49,045 $ 98,148 $ 105,246 Non-GAAP adjusted income from operations, net of normalized tax rate of 22% $ 38,255 $ 76,555 $ 82,092 Trailing five quarter averages: Total debt 260,130 438,768 501,321 Total shareholders’ equity 487,523 701,640 777,777 Cash and cash equivalents 168,599 123,636 95,627 Net total capitalization $ 579,054 $ 1,016,772 $ 1,183,471 Return on invested capital (ROIC) – Non-GAAP 6.6% 7.5% 6.9%

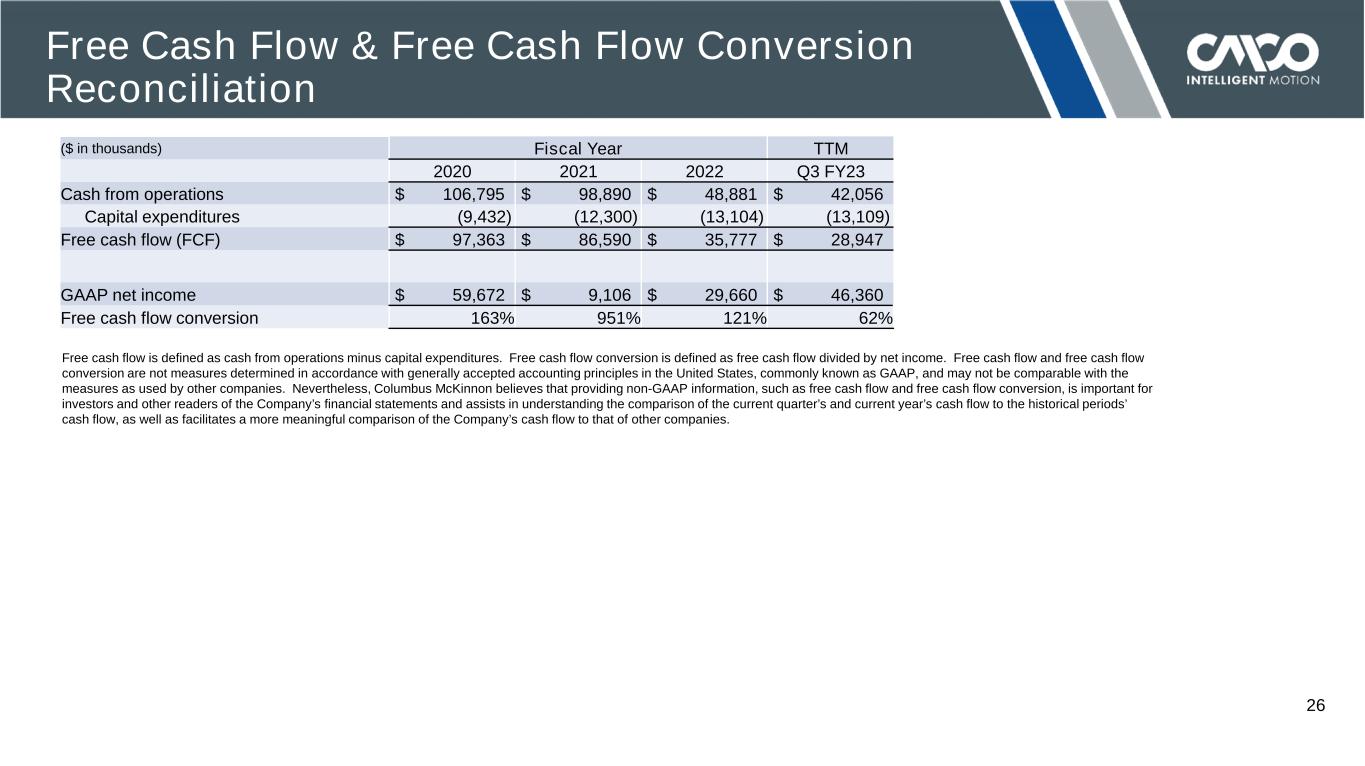

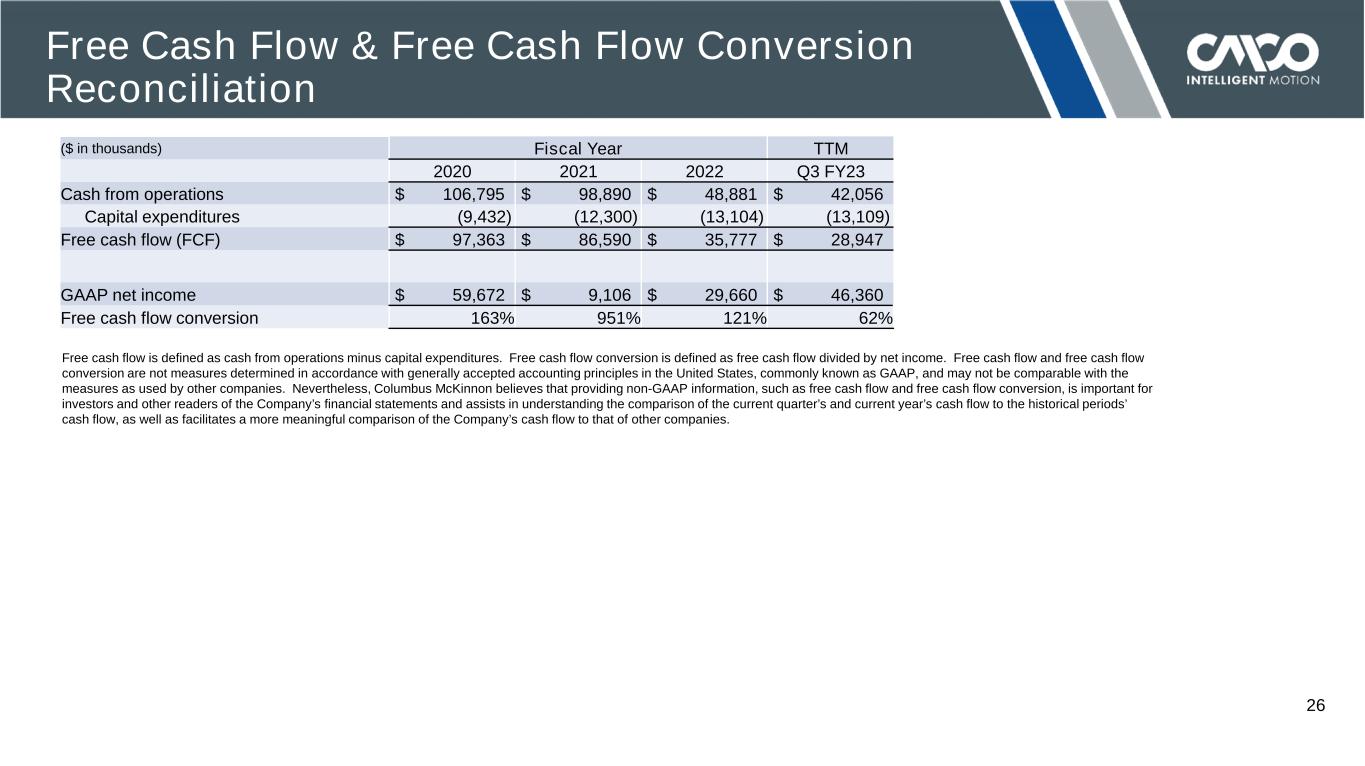

© 2023 COLUMBUS MCKINNON CORPORATION Free Cash Flow & Free Cash Flow Conversion Reconciliation Free cash flow is defined as cash from operations minus capital expenditures. Free cash flow conversion is defined as free cash flow divided by net income. Free cash flow and free cash flow conversion are not measures determined in accordance with generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable with the measures as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP information, such as free cash flow and free cash flow conversion, is important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year’s cash flow to the historical periods’ cash flow, as well as facilitates a more meaningful comparison of the Company’s cash flow to that of other companies. 26 ($ in thousands) Fiscal Year TTM 2020 2021 2022 Q3 FY23 Cash from operations $ 106,795 $ 98,890 $ 48,881 $ 42,056 Capital expenditures (9,432) (12,300) (13,104) (13,109) Free cash flow (FCF) $ 97,363 $ 86,590 $ 35,777 $ 28,947 GAAP net income $ 59,672 $ 9,106 $ 29,660 $ 46,360 Free cash flow conversion 163% 951% 121% 62%

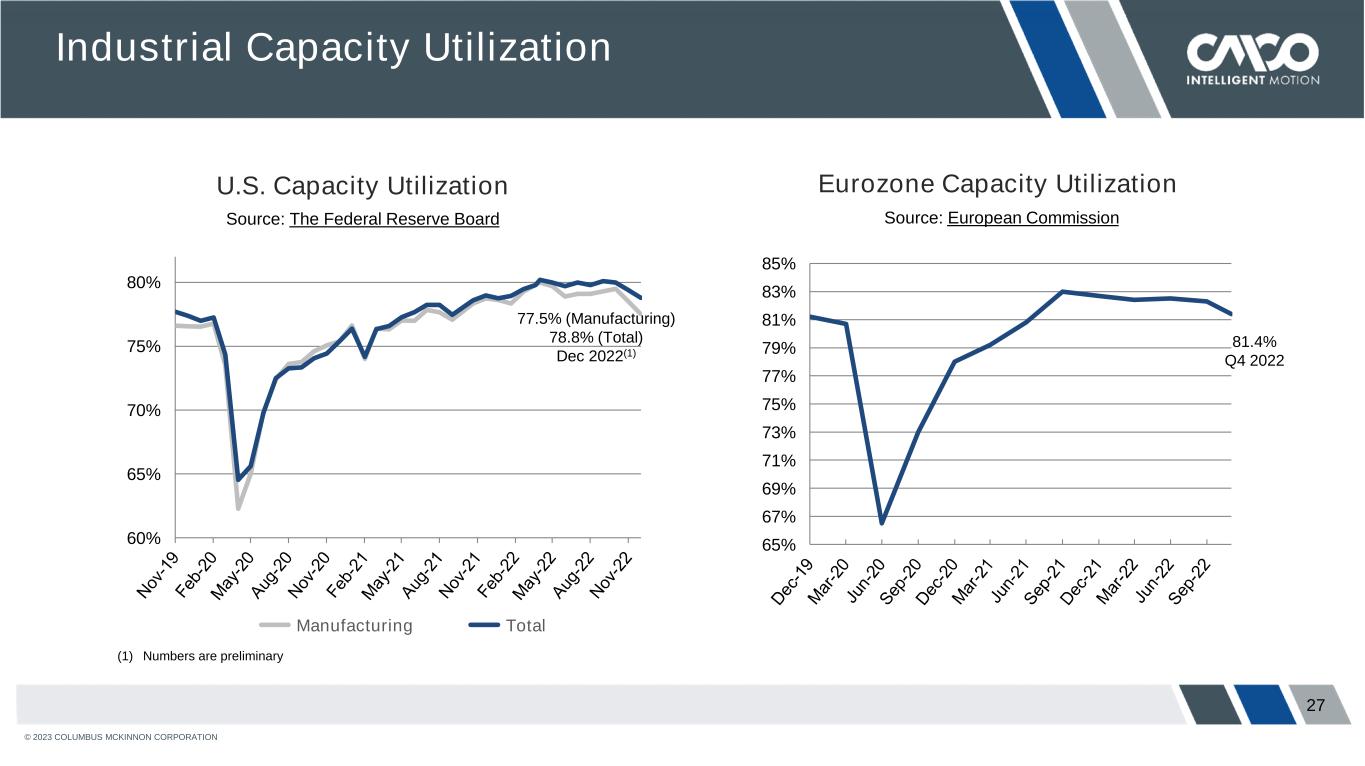

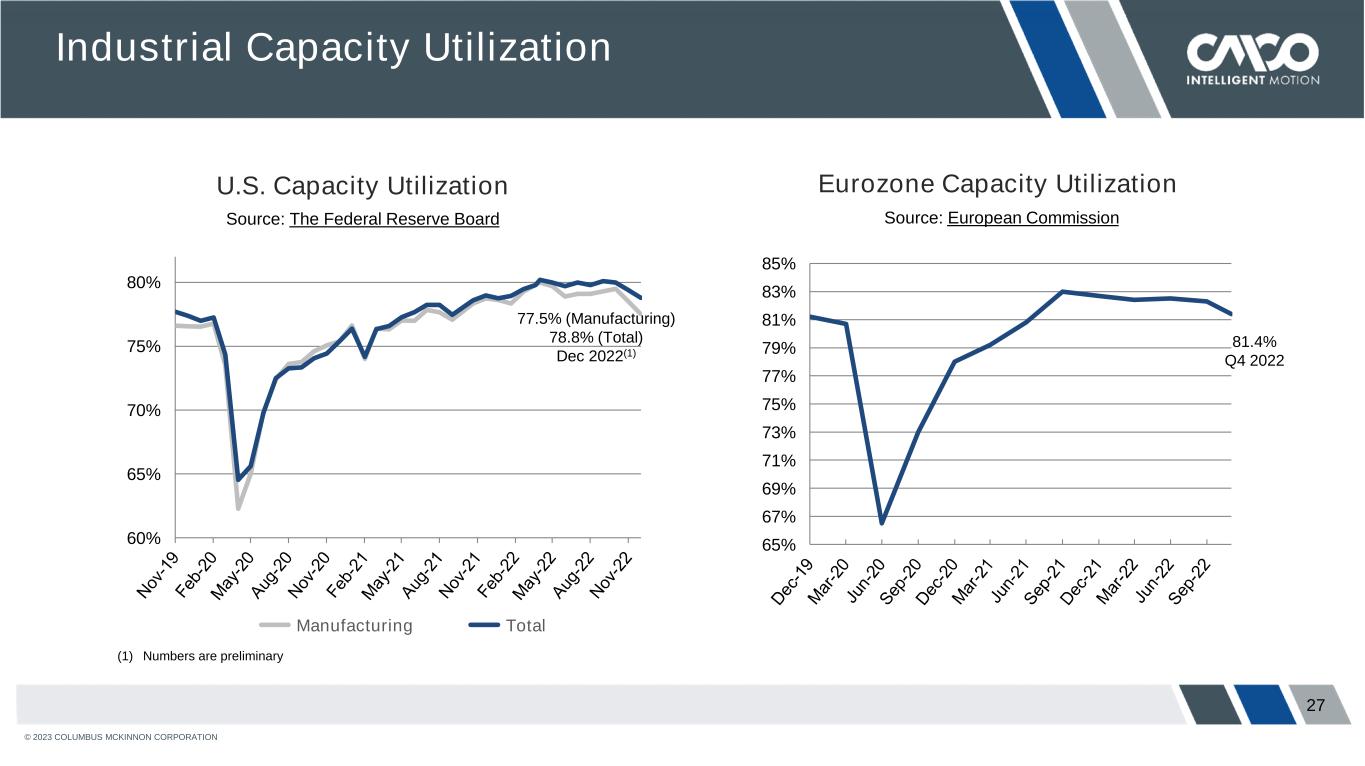

© 2023 COLUMBUS MCKINNON CORPORATION 27 U.S. Capacity Utilization Eurozone Capacity Utilization Industrial Capacity Utilization Source: The Federal Reserve Board Source: European Commission 60% 65% 70% 75% 80% Manufacturing Total 77.5% (Manufacturing) 78.8% (Total) Dec 2022(1) 65% 67% 69% 71% 73% 75% 77% 79% 81% 83% 85% 81.4% Q4 2022 (1) Numbers are preliminary

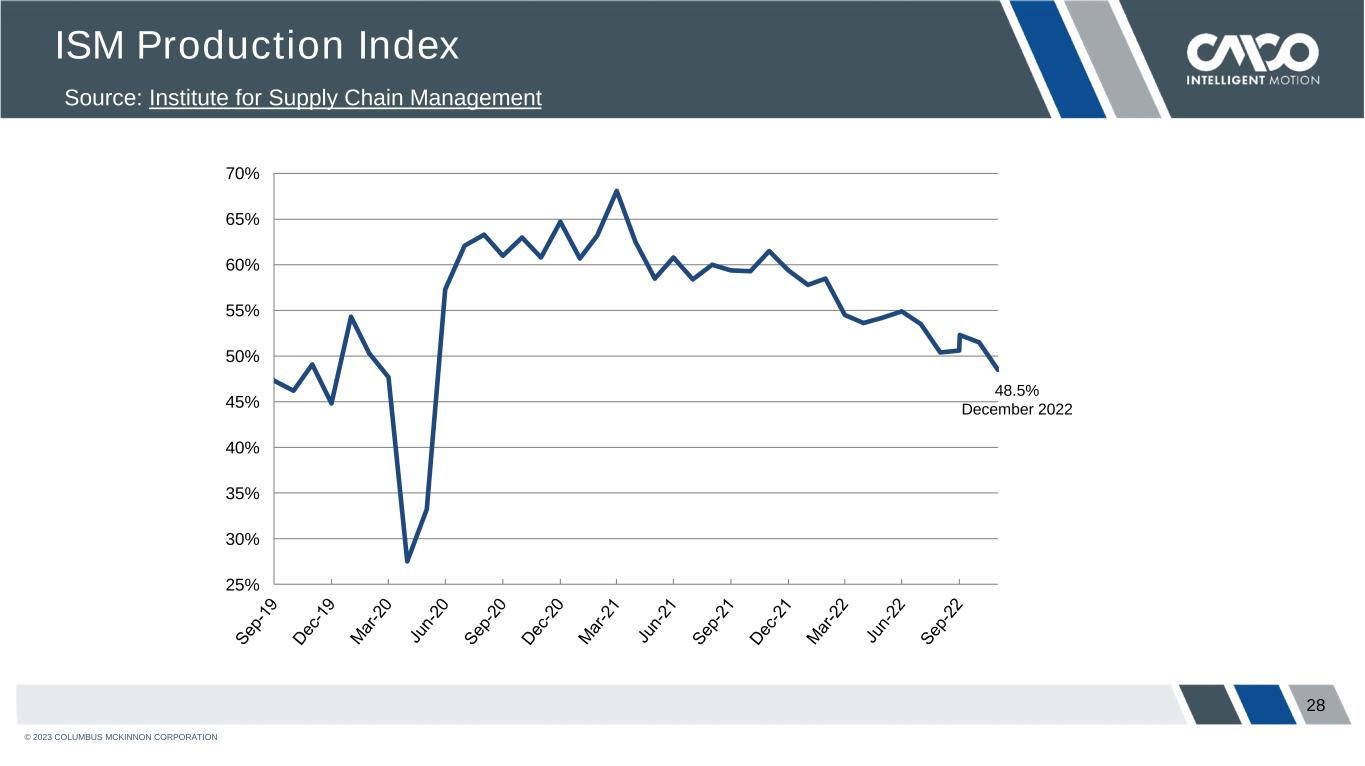

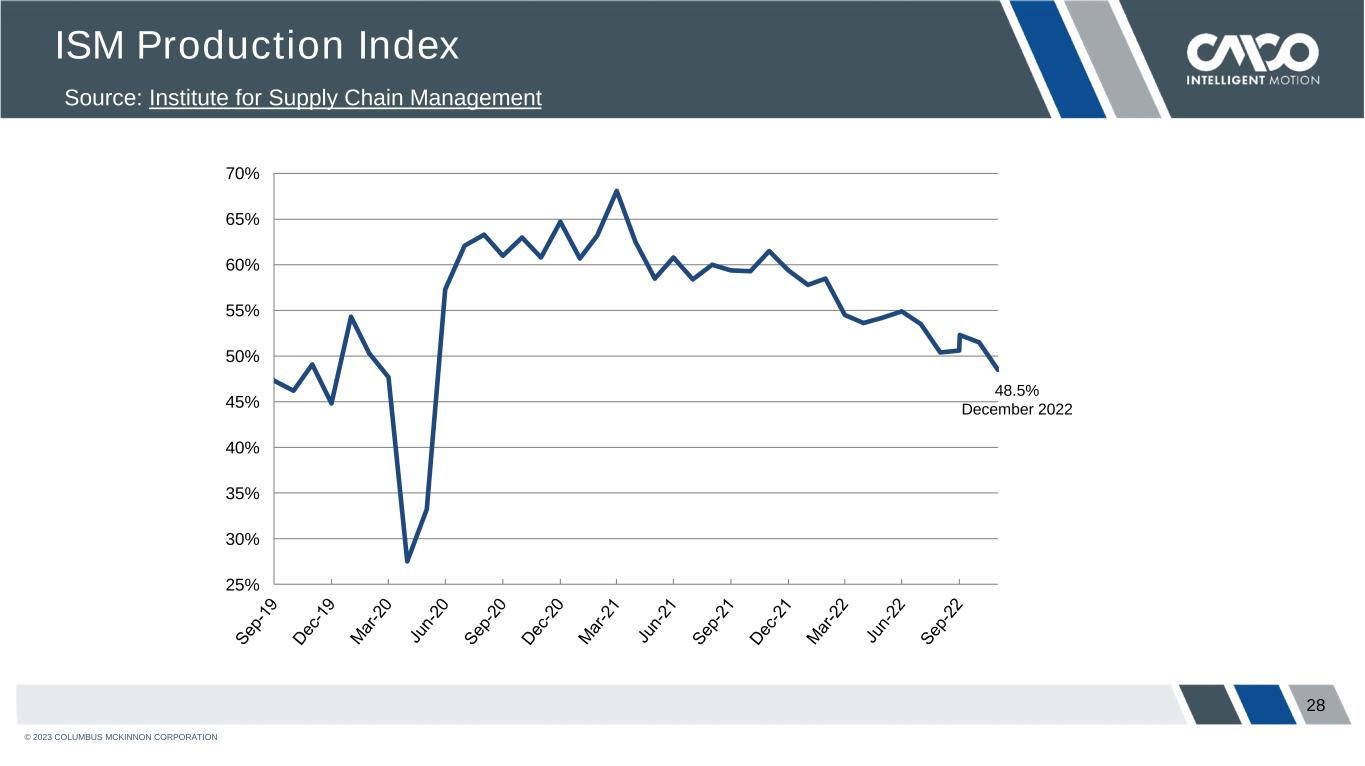

© 2023 COLUMBUS MCKINNON CORPORATION 28 ISM Production Index Source: Institute for Supply Chain Management 25% 30% 35% 40% 45% 50% 55% 60% 65% 70% 48.5% December 2022

© 2023 COLUMBUS MCKINNON CORPORATION 29 Unlocking CMCO’s Potential Business System and Core Growth Framework to Transform CMCO Framework to Deliver Differentiated Growth, Financial Performance and Shareholder Value GROWTH FRAMEWORKCMBS TRANSFORMATION

Q3 Fiscal Year 2023 Financial Results Conference Call President & Chief Executive Officer David J. Wilson February 1, 2023 Executive VP – Finance & Chief Financial Officer Gregory P. Rustowicz