- OLED Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Universal Display (OLED) DEF 14ADefinitive proxy

Filed: 20 Apr 23, 4:00pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

UNIVERSAL DISPLAY CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11.

UNIVERSAL DISPLAY CORPORATION

250 Phillips Boulevard

Ewing, New Jersey 08618

TO BE HELD JUNE 15, 2023

Dear Shareholders:

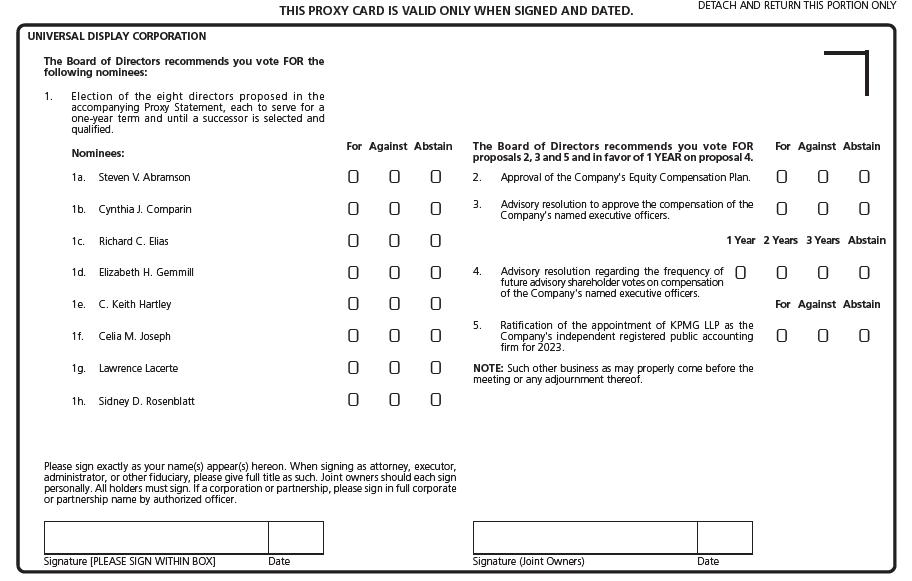

You are cordially invited to attend the 2023 Annual Meeting of Shareholders of Universal Display Corporation on Thursday, June 15, 2023 at 10:00 a.m., Eastern Time. This year’s annual meeting will be a virtual meeting via live webcast on the Internet. You will be able to attend, vote and submit your questions during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/OLED2023 and entering the 16-digit control number included in our notice of Internet availability of the proxy materials, on your proxy card or in the instructions that accompanied your proxy materials. We are holding the meeting to:

(1) Elect eight members of our Board of Directors to hold one-year terms;

(2) Approve the Universal Display Corporation Equity Compensation Plan;

(3) Approve an advisory resolution regarding executive officer compensation;

(4) Vote, on an advisory basis, regarding the frequency of future advisory shareholder votes on executive officer compensation;

(5) Ratify the appointment of KPMG LLP as our independent registered public accounting firm for 2023; and

(6) Transact such other business as may properly come before the meeting or any postponements or adjournments thereof.

If you were the holder of record of shares of our common stock or Series A Nonconvertible Preferred Stock at the close of business on April 10, 2023, you are entitled to notice of, and may vote at, the annual meeting. You may also vote in advance of the meeting, as described in the proxy statement. Any such shareholder on April 10, 2023 may vote at the meeting, even if he or she has already voted before the meeting.

The proxy statement and our 2022 Annual Report to Shareholders are available free of charge at ir.oled.com.

We look forward to the meeting.

| Sincerely, |

| By: |

| Mauro Premutico |

| Secretary |

|

|

Ewing, New Jersey |

|

April 20, 2023 |

|

Your vote is important. We encourage you to promptly complete, sign, date and return the proxy card, or vote by phone or on the Internet as described in the proxy statement, whether or not you expect to attend the virtual annual meeting via webcast on the Internet. If you are a shareholder of record and you attend the meeting via webcast, you may revoke your proxy and vote your shares at that time. |

TABLE OF CONTENTS

UNIVERSAL DISPLAY CORPORATION

250 Phillips Boulevard

Ewing, New Jersey 08618

PROXY STATEMENT FOR 2023 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 15, 2023

INFORMATION CONCERNING THIS SOLICITATION

The Board of Directors (or “Board”) of Universal Display Corporation (“we,” “our,” “us” or the “Company”) is soliciting proxies for the 2023 Annual Meeting of Shareholders to be held as a virtual meeting via a live webcast on the Internet on Thursday, June 15, 2023, at 10:00 a.m., Eastern Time, at www.virtualshareholdermeeting.com/OLED2023 (the “Annual Meeting”). This proxy statement contains important information for shareholders to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully.

At the Annual Meeting, our shareholders will be asked to vote upon:

(1) the election of eight members of our Board of Directors to hold one-year terms;

(2) a proposal to approve the Universal Display Corporation Equity Compensation Plan;

(3) a proposal to approve an advisory resolution regarding executive officer compensation;

(4) an advisory resolution regarding the frequency of future advisory shareholder votes on executive officer compensation;

(5) a proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm for 2023; and

(6) such other business as may properly come before the meeting or any postponements or adjournments thereof.

Important Notice Regarding the Availability of

Proxy Materials for the Annual Meeting of Shareholders to be Held on June 15, 2023

This proxy statement and our 2022 Annual Report to Shareholders are available free of charge at ir.oled.com.

PROXY MATERIALS

Our Board of Directors has set April 10, 2023 as the record date for the Annual Meeting (the “Record Date”). As of the Record Date, we had outstanding 47,331,947 shares of common stock and 200,000 shares of Series A Nonconvertible Preferred Stock.

Beginning on or about April 20, 2023, we are sending proxy materials to “registered holders” as of the Record Date. Registered holders are those shareholders whose shares are registered directly in their names with our transfer agent, EQ + AST.

Beginning on or about April 20, 2023, we are sending a Notice Regarding the Availability of Proxy Materials (the “Notice”) to “beneficial owners” of our stock as of the Record Date. Beneficial owners are those shareholders whose shares are held in a stock brokerage account or by a bank or other holder of record; such shareholders are also sometimes referred to as “street name” holders. Beneficial owners may view proxy materials on the Internet and may also request and receive a paper or e-mail copy of the proxy materials by following the instructions provided in the Notice.

We will pay the expenses of these solicitations. Proxies may also be solicited by telephone or in person by some of our officers, directors and regular employees or independent contractors, who will not be specially engaged or compensated for such services.

Our principal executive offices are located at 250 Phillips Boulevard, Ewing, New Jersey 08618. Our general telephone number is (609) 671-0980.

Universal Display Corporation • 2023 Proxy Statement • 1

VOTING AT THE ANNUAL MEETING

Each holder of our common stock or Series A Nonconvertible Preferred Stock as of the Record Date is entitled to one vote per share on all matters to be voted on at the Annual Meeting. Holders of our common stock and Series A Nonconvertible Preferred Stock vote together as a single class on all matters.

Only shareholders of record who own shares (whether as a registered holder or a beneficial owner) as of the close of business on the Record Date are entitled to notice of, or to vote at, the Annual Meeting. The presence, in person or by proxy, of shareholders entitled to cast at least a majority of the votes that all shareholders are entitled to cast on a particular matter to be acted upon at the Annual Meeting will constitute a quorum for purposes of that matter. Shareholders of record who return a proxy card but abstain from voting or fail to vote on a particular matter will be considered “present” for quorum purposes with respect to the matter. In addition, shares held by brokers or nominees who have notified us on a proxy card or otherwise in accordance with industry practice that they have not received voting instructions with respect to a particular matter and that they lack or have declined to exercise voting authority with respect to such matter (referred to in this proxy statement as “uninstructed shares”), will be considered “present” for quorum purposes with respect to the matter. Votes not cast by brokers or nominees with respect to uninstructed shares are referred to in this proxy statement as “broker non-votes.”

The person named in the proxy will vote the shares represented by each properly executed proxy as directed therein. In the absence of such direction on a properly executed proxy card, the person named in the proxy will vote “FOR” the persons nominated by our Board of Directors for election as directors; “FOR” the proposal to approve the Universal Display Corporation Equity Compensation Plan; “FOR” the proposal to approve, on an advisory basis, the compensation of our executive officers; for the option of “ONE YEAR” in the advisory vote on the frequency of advisory shareholder votes on executive officer compensation; and “FOR” ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2023. As to other items of business that may properly be presented at the Annual Meeting for action, the person named in the proxy will vote the shares represented by the proxy in accordance with his or her best judgment.

A shareholder of record (whether a registered holder or a beneficial owner) may revoke his or her proxy at any time before its exercise by giving written notice of such revocation to our Secretary. In addition, any shareholder of record (whether a registered holder or a beneficial owner) may vote online at the Annual Meeting, even if he or she has already voted prior to the Annual Meeting, in accordance with the procedure set forth below.

You may own shares of our stock both as a registered holder and as a beneficial owner, in which case you will receive proxy materials as well as the Notice. To vote all of your shares, you will vote your “registered” shares based on the instructions in the proxy card, and your “beneficially-owned” shares based on the instructions in the Notice, by any of the methods set forth below.

The preliminary voting results will be announced at the Annual Meeting. The final results will be reported in a Current Report on Form 8-K to be filed within four business days following the date of the Annual Meeting.

HOW YOU CAN VOTE

Your vote is important. You may vote by any of the following methods:

By telephone or via the Internet. | You may vote by proxy by telephone or via the Internet by following the instructions provided in the Notice, proxy card or voting instruction card. |

|

|

By mail. | If you received printed copies of the proxy materials by mail (whether initially or upon request), you may vote by proxy by signing and returning the proxy card or voting instruction card by mail. |

|

|

Online during the Annual Meeting. | This year’s Annual Meeting will be held entirely online. Registered holders and beneficial owners with shares held in street name (held in the name of a broker or other nominee) may vote online at the Annual Meeting by visiting the following Internet website: www.virtualshareholdermeeting.com/OLED2023, and entering the 16-digit control number included in the Notice, on their proxy card or on the instructions that accompanied the proxy materials. Beneficial owners with shares held in street name who need their 16-digit control number should contact their bank, broker or other nominee, and to ensure receipt of the control number in a timely fashion, should do so well in advance of the Annual Meeting. |

If you vote by telephone or via the Internet before the Annual Meeting, please have your Notice or proxy card available. The 16-digit control number appearing on your Notice or proxy card is necessary to process your vote. A telephone or Internet vote authorizes the named proxies in the same manner as if you marked, signed and returned a proxy card by mail.

Universal Display Corporation • 2023 Proxy Statement • 2

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors has fixed the number of directors serving on our Board at eight, all of whom are to be elected at the Annual Meeting. Our Board of Directors reduced the number of directors from nine to eight members after the passing in December 2022 of our Founder and Chairman Emeritus, Mr. Sherwin I. Seligsohn. Each director elected will serve until our next annual meeting of shareholders and such time as a successor has been selected and qualified, or until the director’s earlier death, resignation or removal. Each of our eight director nominees has consented to being nominated and to serve if elected. If any nominee should subsequently decline or be unable to serve, the persons named in the proxy will vote for the election of such substitute nominee as shall be determined by them in accordance with their best judgment.

Pursuant to our Amended and Restated Articles of Incorporation, the holder of our Series A Nonconvertible Preferred Stock is entitled to nominate and elect two of the members of our Board of Directors. The holder of the Series A Nonconvertible Preferred Stock has waived this right with respect to the election of directors at the Annual Meeting.

All eight nominees are presently members of our Board of Directors whose terms expire at the Annual Meeting. We recommend voting “FOR” the nominees set forth below. The experience, qualifications, attributes and skills set forth next to each nominee’s name have led our Board of Directors to conclude that these nominees should serve as members of our Board.

Nominees For Election as Directors

Name of Director | Age |

| Year First Became Director, Principal Occupations and Certain Directorships |

Steven V. Abramson | 71 | Mr. Abramson is our President and Chief Executive Officer and has been a member of our Board of Directors since May 1996. Mr. Abramson served as our President and Chief Operating Officer from May 1996 through December 2007. From March 1992 to May 1996, Mr. Abramson was Vice President, General Counsel, Secretary and Treasurer of Roy F. Weston, Inc., a worldwide environmental consulting and engineering firm. From December 1982 to December 1991, Mr. Abramson held various positions at InterDigital, Inc. ("InterDigital") including General Counsel, Executive Vice President and General Manager of the Technology Licensing Division. Mr. Abramson’s extensive experience in international business and long history with our Company are compelling attributes which have contributed to his leadership of the Company. His leadership roles in the OLED and technological fields have provided him with valuable opportunities to interact with business leaders in market segments of importance to the Company. Mr. Abramson is well equipped to lead the Company in its dealings with the business community and the public sector. | |

Cynthia J. Comparin | 64 |

| Ms. Comparin has been a member of our Board of Directors since January 2020. She currently also serves on the board of Cullen/Frost Bankers, Inc. (NYSE: CFR). Ms. Comparin was the founder and CEO of Animato, a technology solutions provider, from 1997 until she sold the company in 2016. Prior to establishing Animato, Ms. Comparin was President of ALLTEL’s Enterprise Network Services Division, Vice President and General Manager for Nortel’s Network Transformation Services Division and General Manager of Latin America at Recognition International. She also previously held U.S. and internationally-based executive management positions at Electronic Data Systems (EDS). Ms. Comparin’s significant leadership experience has given her strong insights which enables her to contribute to the Company in a variety of areas, including international business, financial and strategic planning. Her membership on the board of other public companies, and her experience on a public company audit committee also enables her to share best practices observed from these experiences. |

Richard C. Elias Chair, Nominating & Corporate Governance Committee

| 69 |

| Mr. Elias has been a member of our Board of Directors since April 2014. Mr. Elias retired from PPG Industries, Inc. prior to joining our Board. Prior to his retirement, Mr. Elias served as the Senior Vice President - Optical and Specialty Materials of PPG Industries, Inc. from July 2008 through March 30, 2014. From April 2000 through June 2008, Mr. Elias held the position of Vice President, Optical Products of PPG Industries, Inc. Mr. Elias was a director of Black Box Corporation (Nasdaq: BBOX) until January 7, 2019, when the company was purchased by AGC Networks and became a non-public company, and previously served as a member of its Human Capital Committee and its Nominating & Governance Committee. Mr. Elias’ significant experience as a corporate executive, including more than 20 years of senior management experience for a global manufacturer and distributor that experienced significant growth and expansion, has given him strong insights which enable him to contribute to the Company in a variety of areas, including product development, sales and marketing, |

Universal Display Corporation • 2023 Proxy Statement • 3

Name of Director | Age |

| Year First Became Director, Principal Occupations and Certain Directorships |

|

|

| budgeting, strategic planning, operations and executive management. Mr. Elias’ prior service on the board of another public company also enables him to share best practices observed from his other experiences. |

Elizabeth H. Gemmill Chair, Board of Directors Chair, Human Capital Committee Chair, Environmental & Social Responsibility Committee

| 77 | Ms. Gemmill has served as Chair of our Board of Directors since June 2022 and as Lead Independent Director from February 2018 to June 2022. She been a member of our Board since April 1997. She is also on the Boards of The Franklin Institute and Arden Theatre Company. Ms. Gemmill is also a Board Leadership Fellow of the National Association of Corporate Directors. Since March 1999, she was Managing Trustee and, more recently, President of the Warwick Foundation until the Foundation was dissolved in 2012. From February 1988 to March 1999, Ms. Gemmill was Vice President and Secretary of Tasty Baking Company. Ms. Gemmill is the former Chairman of the Board of Philadelphia University (1998-2009). She previously served as a director of Beneficial Bancorp, Inc. (Nasdaq: BNCL), WHYY, Inc., the Philadelphia College of Osteopathic Medicine, the YMCA of Philadelphia and Vicinity, the Presbyterian Foundation (where she served as the Chairman of the Board until June 2018), American Water Works Company, Inc. until it was sold in early 2003, Philadelphia Consolidated Holdings Corporation until it was sold in December 2008, and Delaware Valley University through June 2022. Ms. Gemmill also served as a member of the advisory board of WSFS Financial Corporation (Nasdaq: WSFS) until December 2019. Ms. Gemmill’s extensive background as a public company executive, as well as her long history on for-profit and not-for-profit boards, has given her strong insights and the ability to assist our Board on matters of corporate oversight and governance, and critical experience regarding public company oversight matters. Her previous public company board and audit committee service also enables her to share best practices observed from these experiences. Ms. Gemmill also demonstrates a strong commitment to the local community in her various not-for-profit roles. | |

C. Keith Hartley Chair, Audit Committee

| 80 | Mr. Hartley has been a member of our Board of Directors since September 2000. Since June 2000, he has been the President of Hartley Capital Advisors, a merchant banking firm. From August 1995 to May 2000, he was the managing partner of Forum Capital Markets LLC, an investment banking company. In the past, Mr. Hartley held the position of managing partner for Peers & Co. and Drexel Burnham Lambert, Inc. He serves as a director and is on various committees of Swisher International Group, Inc. He also previously served as a director of Idera Pharmaceuticals, Inc. (Nasdaq: IDRA) until June 2014. Mr. Hartley’s significant experience in the investment banking industry gives him strong insights into areas such as corporate finance and strategic transactions, enabling him to contribute to the Company in a variety of areas, including strategic planning, finance and executive management. Mr. Hartley’s past experience on the boards of other public companies also provides him with valuable insight into corporate governance practices. | |

Celia M. Joseph

| 69 |

| Ms. Joseph has been a member of our Board of Directors since January 2020. Previously, Ms. Joseph served as Director, Employment and Benefits Law in the legal department of chemical company, Solenis LLC, where she provided leadership and advice for all areas of global employment and benefits law from 2014 until her retirement in 2018. Prior to her position at Solenis LLC, Ms. Joseph was Of Counsel at Fisher & Phillips LLP, founded the law firm Celia M. Joseph & Associates PC, and was a Principal at Reaching Agreement ADR LLC. From 1980 to 2009, Ms. Joseph was an Assistant General Counsel, global Employment Law Manager, and Corporate EEO/Diversity Manager at Rohm and Haas Company. Ms. Joseph currently serves as a volunteer member of the Board of Directors of the Wynnefield branch of the Settlement Music School and formerly served as a member of the Board of Directors of the International Employers Forum and as an officer of the International Bar Association. Ms. Joseph’s near forty years of experience working for multinational companies in the chemicals industry has given her strong insights and the ability to assist our Board on matters including global human resource management and law. |

Lawrence Lacerte Chair, Investment Committee | 70 | Mr. Lacerte has been a member of our Board of Directors since October 1999. Since July 1998, he has been Chairman of the Board of Directors and Chief Executive Officer of Exponent Technologies, Inc., a company specializing in technology and Internet-related ventures. Prior to that time, he was the founder, Chairman of the Board of Directors and Chief Executive Officer of Lacerte Software Corp., which was sold to Intuit Corporation in June 1998. Mr. Lacerte’s varied career as the founder of a successful software company allows him to bring to the Board a diverse combination of business, operational and strategic knowledge and skills. |

Universal Display Corporation • 2023 Proxy Statement • 4

Name of Director | Age |

| Year First Became Director, Principal Occupations and Certain Directorships |

Sidney D. Rosenblatt | 75 |

| Mr. Rosenblatt has been a member of our Board of Directors since May 1996. Mr. Rosenblatt retired from the Company in December 2022 as Executive Vice President and Senior Advisor. He served as Executive Vice President and our Chief Financial Officer, Treasurer and Secretary from June 1995 through September 2022. Mr. Rosenblatt was the owner of S. Zitner Company from August 1990 through August 2010 and served as its President from August 1990 through December 1998. From May 1982 to August 1990, Mr. Rosenblatt served as the Senior Vice President, Chief Financial Officer and Treasurer of InterDigital. Mr. Rosenblatt is on the Board of Managers of the Overbrook School for the Blind and previously served as a member of the Board of Careers through the school’s Culinary Arts Program. Mr. Rosenblatt’s extensive experience in public company financial matters and long history with our Company are compelling attributes which will contribute to his continued leadership of the Company on its Board of Directors. His leadership in investor relations and familiarity with the OLED industry have provided him with significant experience of value to the Company. Mr. Rosenblatt is well equipped to lead the Company in its dealings with the for-profit and not-for-profit communities and the public sector. |

Vote Required and Recommendation of our Board of Directors

At the Annual Meeting, each director will be elected by a majority of the votes cast with respect to that director at the meeting. For these purposes, a vote of the majority of the votes cast means that the number of shares voted “for” a director exceeds 50% of the votes cast with respect to that director. Abstentions on this proposal are not considered “votes cast” and will have no effect on the outcome of the vote. Similarly, broker non-votes are not considered “votes cast” with respect to this proposal and, therefore, will have no effect on the outcome of the vote. Shareholders do not have cumulative voting rights with regard to the election of members of our Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES FOR DIRECTOR.

Director Independence

Our Board of Directors has established a Nominating & Corporate Governance Committee, whose duties include, among others, making recommendations for approval to the full Board of Directors with regard to director independence. The current members of the Nominating & Corporate Governance Committee are Mr. Elias (Chair), Ms. Gemmill, Ms. Joseph and Mr. Hartley. Each member of our Nominating & Corporate Governance Committee is an independent director under the Nasdaq listing requirements. Our Nominating & Corporate Governance Committee operates pursuant to a written charter that was last reviewed by the Nominating & Corporate Governance Committee and approved by our Board of Directors on April 4, 2023. A copy of the charter is publicly available through the “Shareholders — Corporate Governance” section of our website at www.oled.com.

After the Nominating & Corporate Governance Committee makes its recommendations to the Board of Directors with regard to director independence, our Board of Directors considers and approves these recommendations. In so doing, the Board of Directors has determined that a majority of its members are “independent directors” within the meaning of applicable Nasdaq listing requirements. Our independent directors are Ms. Comparin, Mr. Elias, Ms. Gemmill, Mr. Hartley, Ms. Joseph and Mr. Lacerte. In addition, based on these listing requirements, our Board of Directors has determined that Mr. Abramson is not an independent director because he is an officer of the Company and Mr. Rosenblatt is not an independent director because he recently retired as an officer of the Company on December 30, 2022.

Our independent directors meet in executive session on a periodic basis in connection with regularly-scheduled meetings of the full Board of Directors, as well as in their capacity as members of our Audit, Human Capital, Environmental & Social Responsibility (“ESR”), Investment, and Nominating & Corporate Governance Committees, as applicable.

In evaluating director independence, the disinterested members of our Nominating & Corporate Governance Committee and the Board of Directors considered our relationship with Exponent Technologies, Inc. (“Exponent”). Exponent is a provider of information system services for payroll, benefits and human resources management. Mr. Lacerte was Chairman of the Board of Directors and Chief Executive Officer of Exponent. For 2022, we paid a total of approximately $80,032 to Exponent in connection with its provision of these services to us. This amount is well below the threshold for director independence under the Nasdaq listing requirements. There being no other factors suggesting that this relationship might impair Mr. Lacerte’s independence, the disinterested members of our Nominating & Corporate Governance Committee and the Board of Directors concluded that Mr. Lacerte should be treated as an independent director.

Board and Committee Meetings; Annual Meeting Attendance

In 2022, our Board of Directors held eight meetings, our Audit Committee held six meetings, our Human Capital Committee held nine meetings, our Nominating & Corporate Governance Committee held five meetings, our ESR Committee held four meetings, and our Investment Committee held four meetings. All members of the Board of Directors (or of the applicable committee of the Board) attended at least 75% of these meetings in the aggregate.

Universal Display Corporation • 2023 Proxy Statement • 5

All incumbent directors and nominees for election as director are encouraged, but not required, to attend our annual meetings of shareholders. All of the current members of our Board of Directors attended our Annual Meeting of Shareholders in 2022.

Director Nominations

The duties of our Nominating & Corporate Governance Committee include, among others, recommending to the full Board of Directors candidates for election and re-election as directors. The Nominating & Corporate Governance Committee recommends candidates for election as directors, and the Board of Directors then approves the candidates who will be nominated to stand for election. In nominating candidates for election as directors, both our Nominating & Corporate Governance Committee and our full Board of Directors consider the skills, experience, character, commitment and diversity of background of each potential nominee, all in the context of the requirements of our Board of Directors at that point in time. With respect to their consideration of diversity of background, neither our Nominating & Corporate Governance Committee nor our full Board of Directors has a formal policy of assessing diversity with respect to any particular qualities or attributes. Each candidate should be an individual who has demonstrated integrity and ethics, has an understanding of the elements relevant to the success of a publicly-traded company, and has established a record of professional accomplishment in such candidate’s chosen field. Each candidate also should be prepared to participate in all Board and committee meetings that he or she attends and should not have other personal or professional commitments that might reasonably be expected to interfere with or limit such candidate’s ability to do so. Additionally, in determining whether to recommend a director for re-election, the director’s past attendance at Board and committee meetings is considered.

Our Board of Directors has no stated specific, minimum qualifications that must be met by candidates for election as directors. However, in accordance with U.S. Securities and Exchange Commission (“SEC”) rules and applicable Nasdaq listing requirements, at least one member of our Board of Directors is expected to meet the criteria for an “audit committee financial expert” as defined by SEC rules, and a majority of the members of the Board are expected to meet the definition of “independent director” within the meaning of SEC rules and applicable Nasdaq listing requirements.

Any shareholder of record entitled to vote in the election of directors at an annual or special meeting of our shareholders may nominate one or more persons to stand for election to the Board at such meeting in accordance with the requirements of our Amended and Restated Bylaws. In order to be considered by our Board of Directors in connection with the nominations process for our 2024 Annual Meeting of Shareholders, all such director nominations must be received by our Secretary at our principal executive offices by February 16, 2024. Each such submission must be in writing and must comply with the notice, information and consent provisions contained in our Amended and Restated Bylaws. In addition, each such submission must include any other information required by Regulation 14A under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Submissions should be addressed to our Secretary at the following address: Universal Display Corporation, 250 Phillips Boulevard, Ewing, New Jersey 08618.

Our Nominating & Corporate Governance Committee will consider all candidates identified by shareholders through the processes described above, and will evaluate each of them, including incumbent directors, based on the same criteria and make a recommendation to the full Board of Directors relating to all candidates for director. Although we have no formal policy regarding shareholder nominees, our Board of Directors believes that shareholder nominees should be viewed in substantially the same manner as other nominees. The consideration of any candidate for director will be based on an assessment of the individual’s background, skills and abilities, together with an assessment of whether such characteristics qualify the individual to fulfill the needs of our Board of Directors at that time.

Board Leadership Structure

Our Board is currently composed of eight directors – six independent directors and two directors who are or recently were executive officers of the Company. We believe that the overlap between our Board of Directors and executive management has been advantageous to us, as we have benefited from strong, clear, consistent and cohesive leadership. Since December 2007, our Board of Directors has had a leadership structure in which the Board’s Chair and our Chief Executive Officer are different persons.

In June 2022, Ms. Gemmill assumed the role of Board Chair from Mr. Seligsohn. Ms. Gemmill had served as our lead independent director since February 2018, when she was appointed to that role by our Board of Directors to further promote strong, independent oversight of the Company’s management and affairs, undertaking activities such as developing agendas for and chairing executive sessions of the Board, acting as a liaison between the independent directors and the Chair of the Board, and engaging with shareholders as part of the Company’s shareholder outreach efforts.

Our independent directors meet in executive session on a periodic basis in connection with regularly-scheduled meetings of the full Board of Directors, as well as in their capacity as members of our Audit, Human Capital, ESR, Investment, and Nominating & Corporate Governance Committees. Members of our Board of Directors, who all actively participate in Board activities and meetings, are able to propose items for inclusion on Board meeting agendas, and our Board meetings include time for discussion of items not on the formal agenda.

Each of our directors is a sophisticated and seasoned businessperson, experienced in board processes and knowledgeable regarding matters of corporate governance, and has substantial leadership experience in his or her field. For additional information about the backgrounds and qualifications of our directors, see above under the heading “Nominees For Election as Directors.”

Pursuant to the Nasdaq’s Board Diversity Rules, below is the Company’s Board Diversity Matrix outlining diversity statistics regarding our Board of Directors. In addition to gender and demographic diversity, we also recognize the value of other diverse

Universal Display Corporation • 2023 Proxy Statement • 6

attributes that directors may bring to our Board of Directors, including as veterans of the U.S. Military. We are proud to report that of our eight current directors, two are also military veterans.

Board Diversity Matrix (As of April 4, 2023)

| ||

| Female | Male |

Total Number of Directors | 8 | |

Part I: Gender Identity | ||

Directors | 3 | 5 |

Part II: Demographic Background | ||

Hispanic or Latinx | 1 | - |

White | 2 | 5 |

Audit Committee

Our Board of Directors has established a standing Audit Committee. The current members of our Audit Committee are Mr. Hartley (Chair), Ms. Gemmill, Mr. Lacerte and Ms. Comparin.

Our Audit Committee operates pursuant to a written charter that complies with the applicable provisions of the Sarbanes-Oxley Act of 2002 and related rules of the SEC and Nasdaq listing standards. The Audit Committee Charter was last reviewed by our Audit Committee and approved by our Board of Directors on April 4, 2023 and a copy of the charter is publicly available through the “Shareholders — Corporate Governance” section of our website at www.oled.com.

According to its charter, our Audit Committee is responsible for, among other things:

Each member of our Audit Committee meets the financial knowledge and independence criteria of the Nasdaq listing requirements. In April 2023, our Board of Directors determined that Mr. Hartley, Chair of the Audit Committee, is an “audit committee financial expert” as such term is defined under SEC regulations and that Mr. Hartley meets the financial sophistication and independence standards mandated by the Nasdaq listing requirements.

Universal Display Corporation • 2023 Proxy Statement • 7

REPORT OF THE AUDIT COMMITTEE

The Audit Committee has reviewed and discussed with Company management the audited financial statements of the Company for the year ended December 31, 2022, as well as management’s assessment of the Company’s internal control over financial reporting as of December 31, 2022. In addition, the Audit Committee has discussed with the Company’s independent registered public accounting firm, KPMG LLP, the matters required to be discussed by Public Company Accounting Oversight Board (the “PCAOB”) Auditing Standard No. 16. The Audit Committee also has received the written communications from KPMG LLP required by the PCAOB regarding KPMG LLP’s communications with the Audit Committee concerning independence and has discussed the independence of KPMG LLP with that firm. Based on the Audit Committee’s review of the matters noted above and its discussions with management and the Company’s independent registered public accounting firm, the Audit Committee recommended to the Company’s Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

| Respectfully submitted by the Audit Committee |

| |

| C. Keith Hartley (Chair) Elizabeth H. Gemmill |

| Lawrence Lacerte |

| Cynthia J. Comparin |

Human Capital Committee

Our Board of Directors has established a standing Human Capital Committee, which was formerly known as the Compensation Committee. The current members of our Human Capital Committee are Ms. Gemmill (Chair), Mr. Lacerte and Mr. Hartley.

Our Human Capital Committee operates pursuant to a written charter that was last reviewed by our Human Capital Committee and approved by our Board of Directors on April 4, 2023. A copy of the charter is publicly available through the “Shareholders — Corporate Governance” section of our website at www.oled.com.

According to its charter, our Human Capital Committee is responsible for, among other things:

Our Human Capital Committee has historically determined the compensation for the Company’s executive officers in two stages. Base salary adjustments and perquisites and other benefits (life insurance coverage, automobile allowance, etc.) traditionally have been approved to coincide with the annual employment anniversaries of these individuals with the Company. Awards under our Annual Incentive Plan (which we sometimes refer to as bonuses), long-term incentive equity compensation awards and any special cash or non-cash awards typically have been granted shortly after year-end. This enables the Human Capital Committee to review and consider the Company’s fiscal performance for the year in determining these awards.

For 2022, our Human Capital Committee recommended, and our Board of Directors approved in December 2021, a compensation program for non-employee members of our Board of Directors consistent with the compensation program for 2021, as described below under “Compensation of Directors.”

Board compensation was paid in 2022 in quarterly installments at the end of each quarter during the year. The three directors who also served as employees or officers of the Company in 2022 did not receive compensation for their service on the Board during 2022.

In order to facilitate the Human Capital Committee’s activities, Company management recommends to the Committee proposed compensation for the Company’s executive officers and directors. However, the Human Capital Committee exercises independent judgment in determining compensation for the Company’s executive officers and directors, and in recommending this compensation to the full Board of Directors for approval. As part of this process, the Human Capital Committee meets in executive session to review and ultimately finalize its recommendations.

Universal Display Corporation • 2023 Proxy Statement • 8

Since 2009, the Human Capital Committee has consulted from time to time as to compensation matters with Korn Ferry, a global management consulting firm (“Korn Ferry”). As discussed below under “Executive Compensation – Compensation Discussion and Analysis,” the Human Capital Committee consulted with Korn Ferry in establishing the executive compensation program for 2022.

Human Capital Committee Interlocks and Insider Participation

Each member of our Human Capital Committee is an independent director under the Nasdaq listing requirements. None of the members of our Human Capital Committee were officers or employees of the Company or any of its subsidiaries during 2022, were formerly officers of the Company or any of its subsidiaries, or had any relationship with the Company since the beginning of 2022 that requires disclosure under Item 404 of Regulation S-K, nor have there been since the beginning of 2022 any compensation committee interlocks involving our directors and executive officers that require disclosure under Item 407 of Regulation S-K.

REPORT OF THE HUMAN CAPITAL COMMITTEE

The Human Capital Committee of the Company has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with Company management and, based on such review and discussions, the Human Capital Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement.

Respectfully submitted by the Human Capital Committee | |

|

|

| Elizabeth H. Gemmill (Chair) |

| C. Keith Hartley |

| Lawrence Lacerte |

Shareholder Communications

Shareholders may send communications to our Board of Directors, or to individual members of our Board of Directors, care of our Secretary at the following address: Universal Display Corporation, 250 Phillips Boulevard, Ewing, New Jersey 08618. In general, all shareholder communications sent to our Secretary for forwarding to our Board of Directors, or to specified Board members, will be forwarded in accordance with the sender’s instructions. However, our Secretary reserves the right to not forward to members of our Board of Directors any abusive, threatening or otherwise inappropriate materials. Information on how to submit complaints to our Audit Committee regarding accounting, internal accounting controls or auditing matters can be found on the “Shareholders — Corporate Governance” section of our website at www.oled.com. The information on our website referenced in this proxy statement is not and should not be considered a part of this proxy statement.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Philosophy and Objectives

Compensation and benefits programs are an important part of the relationship between our Company and our Named Executive Officers (defined under the “Summary Compensation Table” section below). Compensation for our Named Executive Officers is intended to be competitive, thereby allowing us to attract, motivate and retain talented personnel. We also seek to reward our Named Executive Officers for accomplishments and contributions to the Company’s long-term strategic and short-term business goals.

Response to Shareholder Say on Pay Advisory Vote

At the Company’s 2021 Annual Meeting of Shareholders held on June 17, 2021, the level of shareholder approval for the advisory resolution approving executive compensation as disclosed in the Company’s 2021 proxy statement (the “2021 Say on Pay Advisory Vote”) was substantially below our historical levels. As a result, during 2022, the Company and our Human Capital Committee engaged with shareholders, proxy advisory, and independent executive advisory firms to obtain their views on our compensation programs and to better align executive compensation with the Company’s short- and long-term objectives.

As a part of our shareholder outreach, we contacted shareholders representing more than 50% of our total outstanding shares as of December 31, 2021, and we held 10 individual meetings with shareholders representing approximately 26% of such shares. Ms. Gemmill, the Chair of our Human Capital Committee, attended each of these meetings. Our Human Capital Committee also engaged with an independent executive compensation firm, Korn Ferry, to better understand executive compensation structures of peer companies and compensation modifications that could better align shareholders’ stated concerns with the Company’s executive compensation philosophy and objectives.

Based on these conversations and consultations, we identified two main areas of opportunity from the shareholder feedback regarding executive compensation, which we addressed by:

Universal Display Corporation • 2023 Proxy Statement • 9

As a result of our outreach efforts and the valuable feedback we received, the Company, in consultation with its outside advisors, made the above-referenced design changes to our executive compensation program beginning in 2022. We disclosed these changes on a prospective basis in our proxy statement for our 2022 Annual Meeting of Shareholders, and the level of shareholder approval for the resolution approving executive compensation at the 2022 Annual Meeting of Shareholders (the “2022 Say on Pay Advisory Vote”) resulted in a significantly higher level of approval relative to 2021.

These changes implemented for 2022 by our Human Capital Committee and Board of Directors notably decreased the overall target value of awarded equity compensation for our Named Executive Officers, as reflected in the executive compensation quantitative financial results for 2022 disclosed in this proxy statement. The following provides additional detail on some of the more significant changes to the Company’s executive compensation program implemented for 2022:

What We Do vs. What We Do Not Do

Below is a summary of executive compensation policies and practices we have chosen to implement to support our executive compensation philosophy and objectives, and practices we have chosen not to implement:

What We Do: | What We Do Not Do: |

Pay for Performance under Our Annual Incentive Plan: We link pay to performance and shareholder interests by establishing our Annual Incentive Plan based on financial metrics and strategic performance goals established in advance by our Human Capital Committee. For 2022, we decreased time-based fixed share awards by 50% of their prior year’s target values. | No Guaranteed Bonuses: We do not provide guaranteed minimum bonuses or uncapped incentives under our Annual Incentive Plan. |

Enhanced Emphasis of Company Goals and Relative Growth Targets Under our Annual Incentive Plan: In 2022, the Company financial performance factors under our Annual Incentive Plan were 80% and the team/individual performance factor was 20%. For 2022, we modified the financial factors to consist solely of revenue growth (based on percentage growth over the prior year) and moved the EBITDA growth metric to be a part only of the long-term equity grant award program. | No Employment Contracts: We do not have any individual employment contracts with any of our Named Executive Officers. |

Clawback Policy: Our Human Capital Committee has adopted a policy, applicable to performance compensation such as the bonuses under our Annual Incentive Plan and the performance share unit awards under our long-term incentive program, which requires that our Board of Directors review the performance compensation paid or awarded to our Named Executive Officers during any period in which an executive officer’s fraud, intentional or willful misconduct, or gross negligence results in a material restatement of any financial statements. If the Board of Directors determines that the amount of performance compensation paid or awarded during the affected period exceeds what would have been paid or awarded in accordance with the restatement, then the Board of Directors in its sole discretion may cause such Named Executive Officer to forfeit unvested or unpaid performance compensation and recover from the executive the performance compensation that was already paid or awarded during such period. Existing Clawback Provisions in Executive Retention Agreements Continue to Apply. Certain of our Named Executive Officers are subject to Equity Retention Agreements which include clawback provisions. The clawback policy we adopted in 2017 is supplemental to the retention agreement provisions. | No Short Selling, Hedging or Similar Transactions: All employees and directors are prohibited from trading in options, warrants, puts and calls or similar financial instruments on any Company securities, or selling any Company securities “short.” Additionally, all employees and directors are prohibited from engaging in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of any Company securities.

|

Universal Display Corporation • 2023 Proxy Statement • 10

What We Do: | What We Do Not Do: |

Human Capital Committee Independence and Experience: Our Human Capital Committee is composed solely of independent directors who have extensive experience. | No Re-Pricing of Equity Awards: Our Equity Compensation Plan prohibits repricing of equity awards without shareholder approval. |

Independent Compensation Advisor: Our Human Capital Committee engages its own independent advisor. | Limited Perquisites: Most of the perquisites provided to our Named Executive Officers are the same as those provided to all of our employees. |

Stock Ownership Guidelines: Our Board of Directors has adopted the following stock ownership guidelines for our Named Executive Officers: Under the guidelines, each Named Executive Officer of the Company is expected to own a number of shares of the Company’s common stock with a market value equal to the amount applicable to their position for as long as he or she remains an executive. Applicable amounts are 6x base salary for our Chief Executive Officer (CEO) or President, 4x base salary for our Chief Financial Officer (CFO) and Executive Vice Presidents, 3x base salary for our Senior Vice Presidents and 2x base salary for our other executives. All of our Named Executive Officers are in compliance with the stock ownership guidelines. Guidelines for our directors have been in place since 2011, requiring directors to own shares of our common stock equal in value to 10x their annual cash compensation for Board service, excluding additional compensation for committee service. Each of the directors is required to comply with such guidelines within five years of joining the Board. | No Stock Options Granted with an Exercise Price Less than Fair Market Value. All stock options have been granted with an exercise price at the closing price on the date of the grant. |

Require Double-Trigger for Change in Control Agreements: Our change in control agreements contain a “double trigger” requirement, so that benefits are paid following a change in control only if the employee also experiences a qualifying termination of employment. |

|

Shareholder Outreach and Say on Pay: In early 2022, for the sixth year in a row, we conducted an outreach program in which we contacted shareholders representing a majority of our outstanding shares of our common stock to invite them to meetings focused on our executive compensation program. The Chair of our Human Capital Committee attended the meetings with those shareholders who accepted meetings and solicited their views with respect to further changes to the Company’s executive compensation program. Our Human Capital Committee received valuable feedback from these engagements and will continue to take these views into consideration as it evaluates the Company’s executive compensation structure in the future. We hold our “say on pay” advisory vote annually. |

|

How We Determine Named Executive Officer Compensation

The process of establishing compensation for our Named Executive Officers for 2022 began with a review of the compensation paid to these executive officers in recent years and consideration was given to the shareholder feedback noted above received after the 2021 Say on Pay Advisory Vote. Although we have historically used prior compensation as a starting point because we believe, as a general matter, that executive compensation should remain relatively consistent from year-to-year while providing appropriate incentives for achieving desired results, the Human Capital Committee, with the assistance of Korn Ferry, modified the executive compensation programs as noted above to improve the alignment of executive compensation with Company financial objectives.

In setting 2022 performance target goals, the Human Capital Committee used prior compensation as a baseline and considered the extent to which we achieved our business goals for 2021 as well as the projected 2022 needs and opportunities of the Company. As discussed below under “Short-term Incentive Compensation,” the Human Capital Committee (with the assistance of Korn Ferry) established individual targets for 2022 relating to the short-term incentive program, in accordance with the Universal Display Corporation Annual Incentive Plan (“Annual Incentive Plan”). Under the approved program, each of our Named Executive Officers was eligible to receive cash incentive awards (which we sometimes refer to as bonuses), whereby targets were set as an individually-defined percentage of their base salary with actual target payouts further modified, based on the achievement of pre-established performance goals at threshold, target and maximum levels.

With respect to long-term incentive compensation for 2022, as explained in more detail below, each of our Named Executive Officers received a target long-term incentive award in an amount that is based on their respective base salaries. One-third of each target award granted in 2022 was in the form of time-vesting restricted stock units (“RSUs”) that vest over three years from the date of grant on a pro-rata basis with one-third vesting in each of 2023, 2024 and 2025. The remaining portion of each long-term incentive award for 2022 was in the form of performance stock units (“PSUs”) that will vest in 2025 based on the achievement of pre-established relative performance goals over a three-year performance period from January 2022 through December 2024.

Universal Display Corporation • 2023 Proxy Statement • 11

Finally, the Human Capital Committee considered other factors that may be relevant to compensation decisions with respect to our Named Executive Officers, including the state of the general economy.

Executive management makes recommendations to our Human Capital Committee regarding all aspects of compensation for our Named Executive Officers. However, final decisions on any major element of compensation, as well as total compensation for our Named Executive Officers, are made by our Human Capital Committee. Our Chief Executive Officer, former Chief Financial Officer and late Founder did not participate in Human Capital Committee or Board deliberations regarding their respective compensation.

In making compensation decisions, the Human Capital Committee considered whether the proposed compensation to our Named Executive Officers is within the range of compensation generally known to be paid to executives at other companies. Other than in any data provided by Korn Ferry, information on the compensation paid to executives at other companies is not tabulated or summarized, and the Human Capital Committee did not engage in any formal form of compensation benchmarking.

In determining executive compensation, the Human Capital Committee considered the current value to our Named Executive Officers of compensation paid or issued to them for prior years. However, the Human Capital Committee has not focused on gains or losses from prior grants or other awards because it believes that those gains or losses are not particularly significant in relation to overall compensation, and that gains or losses from prior awards do not have a substantial effect on the future performance of our Named Executive Officers.

From time to time, we utilize external consultants to assist in determining executive compensation, as we did in 2022 when Korn Ferry assisted the Human Capital Committee in establishing program designs relating to the 2022 short-term and long-term incentive programs.

Shareholder Outreach

Since 2017, we have conducted an annual shareholder outreach program to provide an opportunity for shareholders to have direct discussions with the Company regarding executive compensation. Each year, we have invited shareholders holding at least a majority of the outstanding shares to participate in meetings regarding compensation. Ms. Gemmill, Chair of the Human Capital Committee, attends each of these individual shareholder meetings. We have received valuable feedback in these direct shareholder conversations and have taken views expressed by these shareholders into consideration in devising our executive compensation programs and Company policies.

Elements of Compensation

For 2022, total compensation awarded to our Named Executive Officers consisted of the following elements:

The above elements, which are more particularly set forth below, provide our Named Executive Officers both cash and non-cash, or equity, compensation. We believe that each of these elements is an important and necessary component of executive compensation.

Base salaries

We believe that there is a general expectation by our Named Executive Officers that their base salaries will remain relatively consistent year-to-year, subject to limited merit-based adjustments. In addition, as we and our industry continue to grow, we believe that there is an expectation among our executive officers that we provide competitive base salaries relative to our industry and geographic scope.

In 2022, the base salaries of our Named Executive Officers were increased by 3.5% over the prior year, the same as all employees. These annual increases in 2022 were intended to offset increases in the cost of living, although no actual survey of cost-of-living indices was conducted. As in prior years, salaries were increased on the annual employment anniversary dates or traditional salary adjustment dates for these individuals.

Consistent with previous years, all adjustments to the salaries of our Named Executive Officers for 2022 were recommended by Company executive management and approved by our Human Capital Committee.

Universal Display Corporation • 2023 Proxy Statement • 12

As in the past, Mr. Abramson and Mr. Rosenblatt each received the same base salary in 2022. This reflects our historical practice of treating these two individuals equally based on their longstanding dedication and commitment to the Company, their shared responsibility for overall management of the Company, and the comparable value that each of them has provided to our business success.

Short-term Incentive Compensation

Annual Incentive Plan

The Company’s short-term incentive program for Named Executive Officers consists of the Annual Incentive Plan. All senior executives of the Company and its subsidiaries are eligible to participate in the Annual Incentive Plan to earn a bonus based on the achievement of pre-established performance objectives. The Human Capital Committee designates which senior executives will participate in the Annual Incentive Plan for each fiscal year.

Bonus awards under the Annual Incentive Plan are awarded to eligible participants on an annual basis if the performance goals established by the Human Capital Committee are met. At the beginning of each fiscal year, the Human Capital Committee establishes each participant’s target and maximum bonus award, the performance goals applicable to the bonus award, and such other conditions as the Human Capital Committee deems appropriate. In 2022, the performance goals provided for differing amounts to be paid (e.g., threshold, target and maximum amounts) based on differing levels of performance for each performance goal. The performance goals may relate to the financial performance of the Company and its subsidiaries or one or more business units, and, where appropriate, may relate to a participant’s individual performance.

At the end of the fiscal year, the Human Capital Committee, with the assistance of Korn Ferry, determines the extent to which the performance goals and other conditions of the bonus awards have been met and the amount, if any, to be paid to each participant. A participant will not earn a bonus for any portion of the performance goals for a fiscal year under the Annual Incentive Plan if the level of achievement of the performance goals is below the threshold requirement to earn an award, as established by the Human Capital Committee.

Any bonus awards that are earned for a fiscal year are paid shortly after the end of the fiscal year, after the Human Capital Committee certifies attainment of the performance goals and confirms that the participant is otherwise eligible for such payment under the terms of the applicable award program. Bonus awards under the Annual Incentive Plan are payable in cash, shares of our common stock or stock units under the Universal Display Corporation Equity Compensation Plan, or such other form as the Human Capital Committee determines in its discretion.

For 2022, the Annual Incentive Plan utilized revenue growth (based on percentage growth over the prior year) as the sole performance factor for awards under the Annual Incentive Plan. In future years, performance goals may be based on one or more of the following criteria, either in absolute terms or in comparison to publicly available industry standards or indices: stock price, return on equity, assets under management, EBITDA, earnings per share, price-earnings multiples, net income, operating income, revenues, working capital, accounts receivable, productivity, margin, net capital employed, return on assets, shareholder return, return on capital employed, increase in assets, operating expense, unit volume, sales, internal sales growth, cash flow, market share, relative performance to a comparison group designated by the Human Capital Committee, or strategic business criteria consisting of one or more objectives based on meeting specified revenue goals, market penetration goals, customer growth, geographic business expansion goals, cost targets or goals relating to acquisitions or divestitures.

Awards under the Annual Incentive Plan Paid for 2022 Performance

Each participant’s target and maximum incentive award and the performance goals applicable to the incentive award were based 80% upon Company financial performance factors and 20% upon KPIs. The Company financial performance factor was based on the achievement of specific revenue targets. The target amount for the Company financial performance was set at revenue achievement of $600 million. A revenue threshold level of $588 million was also established, at which 50% of the target payout would be earned. Annual growth below such threshold would generate no payouts under the financial performance factor. A maximum award of 200% of the target payout under the applicable performance factor would be earned in the event revenue exceeded $625 million.

The 20% KPIs were based upon team and individual KPIs using a scorecard. The KPIs were designed to measure the success of each individual Named Executive Officer in the performance of their job functions. The KPIs were intended to measure the performance of the portion of the organization for which the Named Executive Officer had responsibility, as well as the contribution of that portion of the organization to the overall performance of the Company. The KPIs also were intended to define strategic objectives that prioritized critical short-term and long-term actions for the Company to deliver shareholder value.

For example, with respect to our Chief Executive Officer and certain other Named Executive Officers, KPIs included the following:

Universal Display Corporation • 2023 Proxy Statement • 13

As provided for in more detail below, for 2022 the Named Executive Officers exceeded both their target financial performance objectives and KPI goals and received approximately 173% of their target payouts per the performance scorecard.

The Named Executive Officers’ initial 2022 targets under the Annual Incentive Plan are set forth below:

Name |

| Base Salary ($) |

|

| Annual Incentive |

|

| Annual Incentive |

| |||

Steven V. Abramson |

|

| 858,219 |

|

|

| 125 |

|

|

| 1,072,774 |

|

Sidney D. Rosenblatt |

|

| 858,219 |

|

|

| 125 |

|

|

| 1,072,774 |

|

Julia J. Brown, Ph.D. |

|

| 663,081 |

|

|

| 125 |

|

|

| 828,851 |

|

Mauro Premutico |

|

| 561,328 |

|

|

| 125 |

|

|

| 701,660 |

|

Janice K. Mahon |

|

| 456,930 |

|

|

| 125 |

|

|

| 571,163 |

|

Brian Millard (1) |

|

| 425,000 |

|

|

| 27 |

|

|

| 113,000 |

|

(1) The 2022 annual incentive for Mr. Millard was prorated given his September 6, 2022 hire date.

The Company exceeded the target financial performance metric noted above by achieving $617 million in revenue in 2022, and each of the Named Executive Officers received maximum ratings in their team/individual performance factors (which in large part was reflected in the Company’s strong financial performance), resulting in each of these executives achieving approximately 173% of their respective target bonus award under the Annual Incentive Plan. The awards for 2022 performance under the Annual Incentive Plan approved by our Human Capital Committee on February 21, 2023 and paid to such executives in March 2023 were: Mr. Abramson – $1,857,838; Mr. Rosenblatt – $1,857,838; Dr. Brown – $1,435,412; Mr. Premutico – $1,215,140; Ms. Mahon - $989,143; and Mr. Millard - $195,694. These cash payments were subject to customary tax withholding consistent with applicable requirements.

Given our historical practice of compensating these two individuals equally for the reasons indicated earlier under “Base Salaries”, Mr. Abramson and Mr. Rosenblatt (who retired from his executive position effective as of December 30, 2022) received the same incentive awards for 2022 year-end performance. No additional non-equity performance-based incentive awards were made to the Named Executive Officers for 2022 performance.

Long-term incentive equity compensation awards

2022 Equity Compensation Awards

We use long-term incentive equity compensation awards to link the compensation paid to our Named Executive Officers with our future performance and the future performance of our common stock. We believe that this helps align the interests of our Named Executive Officers with those of our shareholders. We also use these awards to encourage our executive officers to remain with the Company through the applicable vesting period.

In 2022, as in prior years, the Company utilized a long-term incentive equity compensation approach in which equity grants are made annually, consisting of RSUs that vest ratably over a three-year period along with PSUs that vest at the end of a three-year performance period based upon specific performance criteria. Korn Ferry has assisted our Human Capital Committee since 2013 in developing this long-term executive incentive compensation structure, and each year since that time, our Human Capital Committee, with the assistance of Korn Ferry, determines eligibility, target award levels and performance measures.

With respect to long-term incentive awards granted in 2022, our Human Capital Committee and full Board of Directors approved, on an effective date of February 16, 2022, target long-term incentive awards for our Named Executive Officers, with one-third of the total target shares of each award in the form of time-vesting RSUs and the other two-thirds in the form of target PSUs vesting upon the achievement of certain performance criteria over identified performance periods. In prior years, time-vesting RSUs and

Universal Display Corporation • 2023 Proxy Statement • 14

performance-based PSUs had constituted equal 50% portions of the long-term incentive awards. As noted above, the adjusted ratio reflected the decision by our Human Capital Committee and Board of Directors to reduce the target value of the time-based component of the long-term incentive awards. All such equity awards were issued under the Universal Display Corporation Equity Compensation Plan and are subject to the provisions of such plan as well as to the terms of the applicable RSU and PSU grant letter agreements.

The time-vesting RSU portion of the award granted on February 16, 2022 to the Named Executive Officers was in the following amounts: Mr. Abramson – 13,482; Mr. Rosenblatt – 13,482; Dr. Brown – 9,463; Mr. Premutico – 7,281; and Ms. Mahon – 5,865. Mr. Millard did not receive RSU grants at this time as he was not employed by the Company until September 2022. As with other compensation, Mr. Abramson and Mr. Rosenblatt received the same long-term incentive equity compensation awards. Each of the foregoing awards vested or will vest one-third each year on February 16, 2023, 2024 and 2025, subject to the continued employment of each Named Executive Officer on the applicable vesting date.

The performance-based PSU portion of the award granted on February 16, 2022 to the Named Executive Officers was, as follows: Mr. Abramson – 26,964; Mr. Rosenblatt – 26,964; Dr. Brown – 18,927; Mr. Premutico – 14,563; and Ms. Mahon – 11,731. Mr. Millard did not receive PSU grants in 2022. These PSU awards represent target awards and will vest based on the achievement of pre-established relative performance goals from January 2022 through December 2024. Half of the PSUs awarded in February 2022 will vest based on the achievement of a specified EBITDA performance target for the 2024 fiscal year, with one quarter vesting based on the achievement of total shareholder return relative to total shareholder return of the companies in the Nasdaq Electronics Components Index for the three year period from January 1, 2022 to December 31, 2024, and the other quarter vesting based on the achievement of cash from operations performance targets in 2024. The PSU target awards are subject to a sliding scale multiplier ranging from 0x to 3x based upon the percentile achievement with respect to each relative target. In addition, the PSUs are subject to the continued employment of each Named Executive Officer on the applicable vesting date.

Supplemental retirement benefits

In 2010, our Human Capital Committee and our Board of Directors approved and adopted the Universal Display Corporation Supplemental Executive Retirement Plan, which was amended in 2015 (as amended, the “SERP”). The SERP is a nonqualified deferred compensation plan under the Internal Revenue Code (the “IRC”) and is unfunded. Participants include management or highly compensated employees of the Company, including the Named Executive Officers, who are selected by the Human Capital Committee to receive benefits under the SERP. The Human Capital Committee retained Korn Ferry to assist it in structuring the SERP in 2010 and amending the SERP in 2015.

The SERP was adopted to provide key employees with supplemental retirement benefits and to encourage their continued employment with the Company. Under the SERP, if an executive officer participant resigns or is terminated without cause at or after age 65 and with at least 20 years of continuous service with the Company, he or she will be eligible to receive a SERP benefit, payable in equal amounts over 10 years, based on a present value calculation of the benefit amount for the participant’s actuarial remaining life expectancy, and a percentage of the participant’s combined annual base salary and average annual bonus for the most recent three fiscal years ending prior to the participant’s date of termination of employment. The percentage is 50%, 25% or 15%, depending on the participant’s benefit class. Each of Mr. Abramson, Dr. Brown, Mr. Premutico and Ms. Mahon has been designated as a participant in the SERP in the 50% benefit class. Mr. Millard does not participate in the SERP and the Company does not currently plan on adding additional participants to the SERP in the future. Mr. Rosenblatt retired and began receiving his SERP benefit in 2023.

If a participant resigns after age 65 and with at least 15 years of service, he or she will be eligible to receive a prorated SERP benefit. If a participant is terminated without cause or on account of a disability after at least 15 years of service, he or she will be eligible to receive a prorated SERP benefit regardless of age. The prorated benefit in either case will be based on the participant’s number of years of service (up to 20), divided by 20. In the event a participant is terminated for cause, his or her SERP benefit and any future benefit payments are subject to immediate forfeiture. The ages of the Named Executive Officers designated as participants in the SERP are as follows: Mr. Abramson – 71, Dr. Brown – 62, Mr. Premutico – 57 and Ms. Mahon – 65.

In the event of a change in control of the Company, each participant in the SERP will become immediately vested in his or her benefit under the SERP. Unless the participant’s benefit has already fully vested, if the participant has less than 20 years of service at the time of the change in control, he or she will receive a prorated benefit based on his or her number of years of service (up to 20), divided by 20. If the change in control qualifies as a “change in control event” for purposes of Section 409A of the IRC, then each participant (including former employees who are entitled to SERP benefits) will receive a lump sum cash payment equal to the present value of the benefit immediately upon the change in control.

As an individual with special expertise and institutional knowledge that the Company considers to be highly valuable to the Company’s continued success, Mr. Abramson is designated as a special participant under the SERP. Having reached the age of 65 and with 20 years of continuous service, upon resignation or termination without cause or on account of disability, he will be eligible to receive a SERP benefit. The SERP benefit for Mr. Abramson, as a special participant, is additionally based on the actuarial remaining life expectancy of his surviving spouse, if any, along with his own life. The accumulated benefit under the SERP for Mr. Abramson may change subject to a change in his marital status. Except as described above, Mr. Abramson is subject to the same treatment as other participants in the SERP.

Universal Display Corporation • 2023 Proxy Statement • 15

Mr. Rosenblatt retired on December 30, 2022, as a special participant under the SERP with more than 20 years of continuous service, and began receiving a full SERP benefit as of January 1, 2023, based on 50% of his annual base salary and 50% of his average annual bonus for the most recent three fiscal years leading up to the date of his retirement, which benefit, to be paid out over 10 years, also is based on the actuarial remaining life expectancy of his life and the life of his surviving spouse.

Special event awards

From time to time, we issue cash and non-cash awards to our employees, including our Named Executive Officers, relating to the occurrence of special events. For example, we have historically awarded a small amount of cash or equity compensation to our employees in connection with the filing and issuance of new patents on which they are named inventors. From time to time, we also have issued cash awards to our employees in connection with their having achieved special recognition in their field or in the industry. We believe these awards are an important component of compensation intended to recognize our employees for special individual accomplishments that are likely to benefit us and our business.

Our Human Capital Committee did not award any special event awards, cash or non-cash, to our Named Executive Officers for 2022 performance.

Perquisites and other benefits

We provide benefits to all of our employees, including our Named Executive Officers. These include paid time off, paid sick time, Company-sponsored life, short-term and long-term disability insurance, individual and family medical and dental insurance, 401(k) plan contributions and other similar benefits. We believe these benefits are an important factor in helping us maintain good relations with our employees and in creating a positive work environment.

For some of these employee benefits, the actual amount provided depends on the employee’s salary, such that our higher-salaried employees, including our Named Executive Officers, receive total benefits that are greater than those of other employees. For example, beginning on January 1, 2017, rather than matching a certain percentage of employee contributions under our 401(k) plan, we started making nonelective employer contributions of 3% of compensation for all employees (up to the permissible limit), resulting in the maximum permissible contribution of $9,150 for all our Named Executive Officers in 2022, except for Mr. Millard who was not eligible to participate in our 401(k) plan until January 1, 2023.