January 2025

2 Important Information Regarding Forward-Looking Statements This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements, among other things, relate to the Company’s growth drivers and expected levels of our organic growth; the impact of our investment in development and commercial initiatives; financial guidance, including timing of revenues and EBITDA; our ability to manage costs and to achieve our financial goals; our ability to operate under lending covenants; our ability to maintain sufficient liquidity to operate the business; our ability to pay our debt under our credit agreement and to maintain relationships with CDMO commercial partners and develop additional commercial and development partnerships. The words "anticipate", "believe", "could", “goal, “objective”, "estimate", “upcoming”, "expect", "intend", "may",“might”, "plan", "predict", "project", "will“. “should”, “can have”, likely and similar terms and phrases may be used to identify forward-looking statements in this presentation. The forward-looking statements in this presentation are only predictions. Our operations involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward-looking statements ultimately prove to be correct. Factors that could cause the company’s actual outcomes to differ materially from those expressed in or underlying these forward-looking statements include, but are not limited to, unstable market and macroeconomic conditions, including any adverse impact on the customer ordering patterns or inventory rebalancing or disruption in raw materials or supply chain; demand for the company’s services, which depends in part on customers’ research and development funding, their clinical plans and the market success of their products; customers' changing inventory requirements and manufacturing plans; customers and prospective customers decisions to move forward with the company’s manufacturing services; the average profitability, or mix, of the products the company manufactures; the company’s ability to enhance existing or introduce new services in a timely manner; fluctuations in the costs, availability, and suitability of the components of the products the company manufactures, including active pharmaceutical ingredients, excipients, purchased components and raw materials, or the company’s customers facing increasing or new competition; the Company's ability to successfully enact its business strategies, including with respect to installation, capacity generation and its ability to attract demand for its services; the Company's ability to remain current with its reports with the Securities and Exchange Commission (the “SEC”); the Company’s ability to collect on customers’ receivable balances; the extent to which health epidemics and other outbreaks of communicable diseases could disrupt our operations; and other risks and uncertainties discussed in our filings with the Securities and Exchange Commission at www.sec.gov. These forward-looking statements are based on information currently available to us, and we assume no obligation to update any forward-looking statements except as required by applicable law. Any historical or projected financial information contained in this presentation are not intended to be indicative of future financial results. The events and circumstances reflected in these forward- looking statements, may not be achieved or occur, and actual results could differ materially from those projected in the forward-looking statements. Undue reliance should not be placed on the forward-looking statements. Moreover, we operate in a dynamic industry and economy. New risk factors could emerge from time to time, and it is not possible for our management to predict all uncertainties that the Company may face.

3 Non-GAAP Financial Measures This presentation contains non-GAAP financial information including Adjusted EBITDA. The Company has included a reconciliation of Adjusted EBITDA to Net (loss) income, the most directly comparable financial measure calculated in accordance with GAAP. We define Adjusted EBITDA Net (loss) income as determined under GAAP excluding (i) interest expense, net of interest income, (ii) income tax expense (benefit), (iii) depreciation and amortization, (iv) stock-based compensation, (v) change in fair value derivatives, (vi) financing fees (non-interest), (vii) reorganization costs, (viii) restructuring costs, (ix) franchise tax equivalent to income tax, (x) contract cancellation costs, (xi) loss (income) from discontinued operations, (xii) stockholder activist settlement costs, and (xiii) start-up costs. The Company has disclosed these non-GAAP financial measures to supplement its consolidated financial statements presented in accordance with GAAP. These non-GAAP financial measures exclude/include certain items that are included in the Company’s results reported in accordance with GAAP. Management believes these non-GAAP financial measures provide useful additional information to investors about trends in the Company’s operations and are useful for period-over-period comparisons. These non-GAAP financial measures should not be considered in isolation or as a substitute for the comparable GAAP measures. In addition, these non-GAAP financial measures may not be the same as similar measures provided by other companies due to the potential differences in methods of calculation and items being excluded/included. These non-GAAP financial measures should be read in conjunction with the Company’s consolidated financial statements presented in accordance with GAAP.

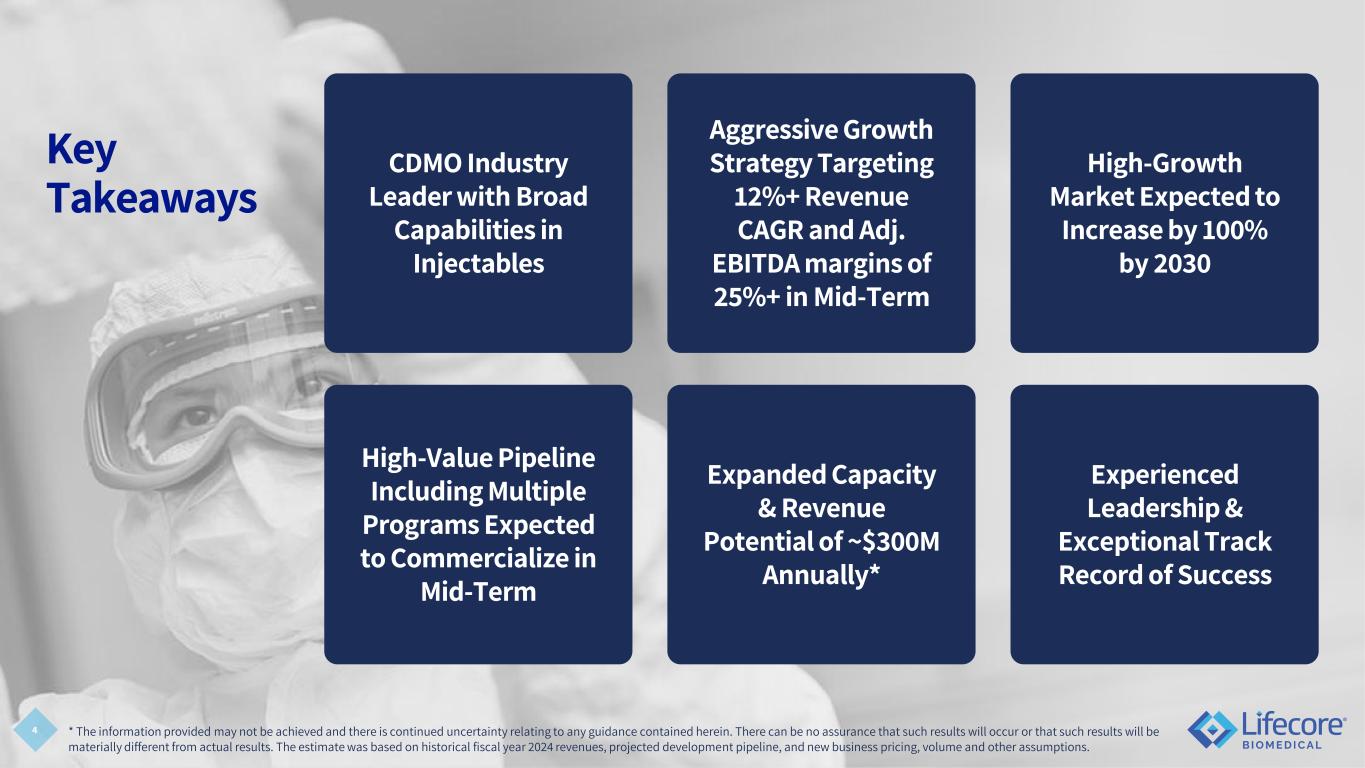

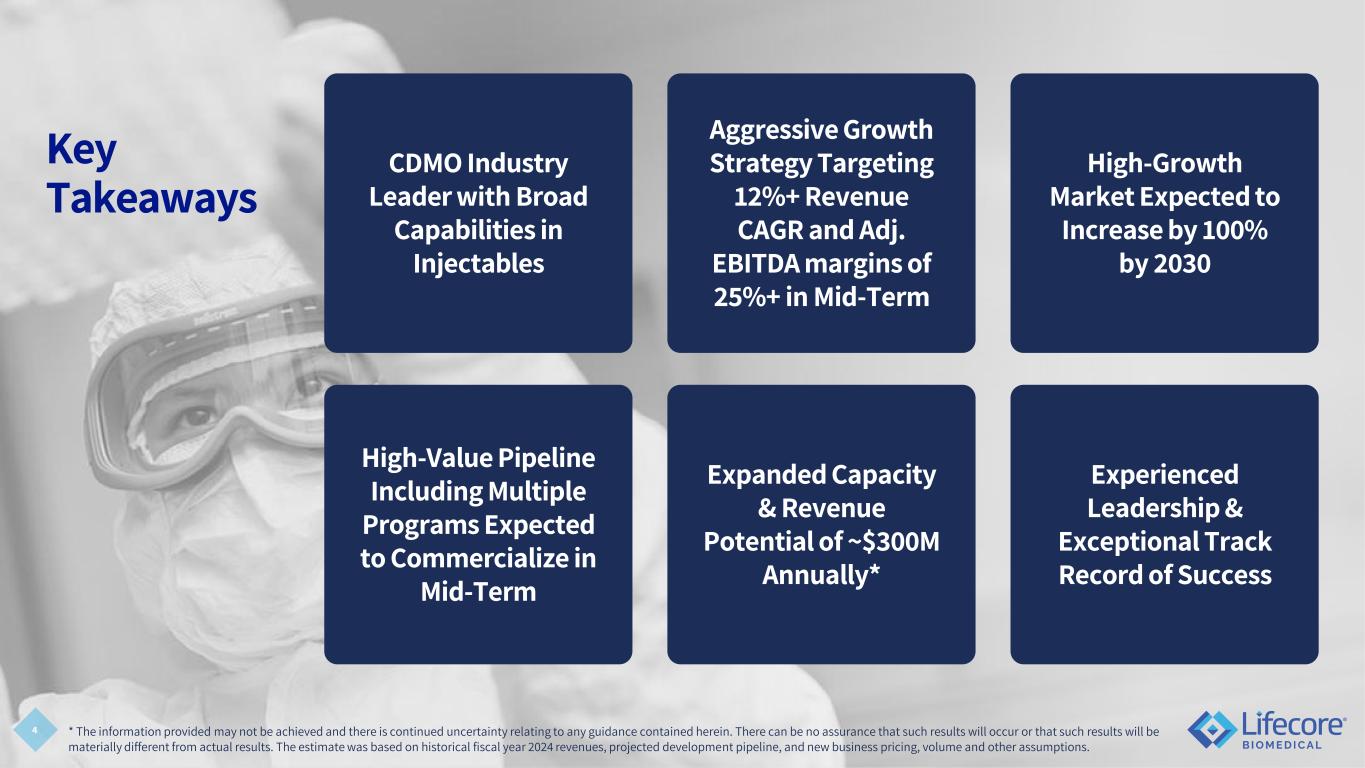

4 Key Takeaways CDMO Industry Leader with Broad Capabilities in Injectables Aggressive Growth Strategy Targeting 12%+ Revenue CAGR and Adj. EBITDA margins of 25%+ in Mid-Term High-Growth Market Expected to Increase by 100% by 2030 High-Value Pipeline Including Multiple Programs Expected to Commercialize in Mid-Term Expanded Capacity & Revenue Potential of ~$300M Annually* Experienced Leadership & Exceptional Track Record of Success * The information provided may not be achieved and there is continued uncertainty relating to any guidance contained herein. There can be no assurance that such results will occur or that such results will be materially different from actual results. The estimate was based on historical fiscal year 2024 revenues, projected development pipeline, and new business pricing, volume and other assumptions.

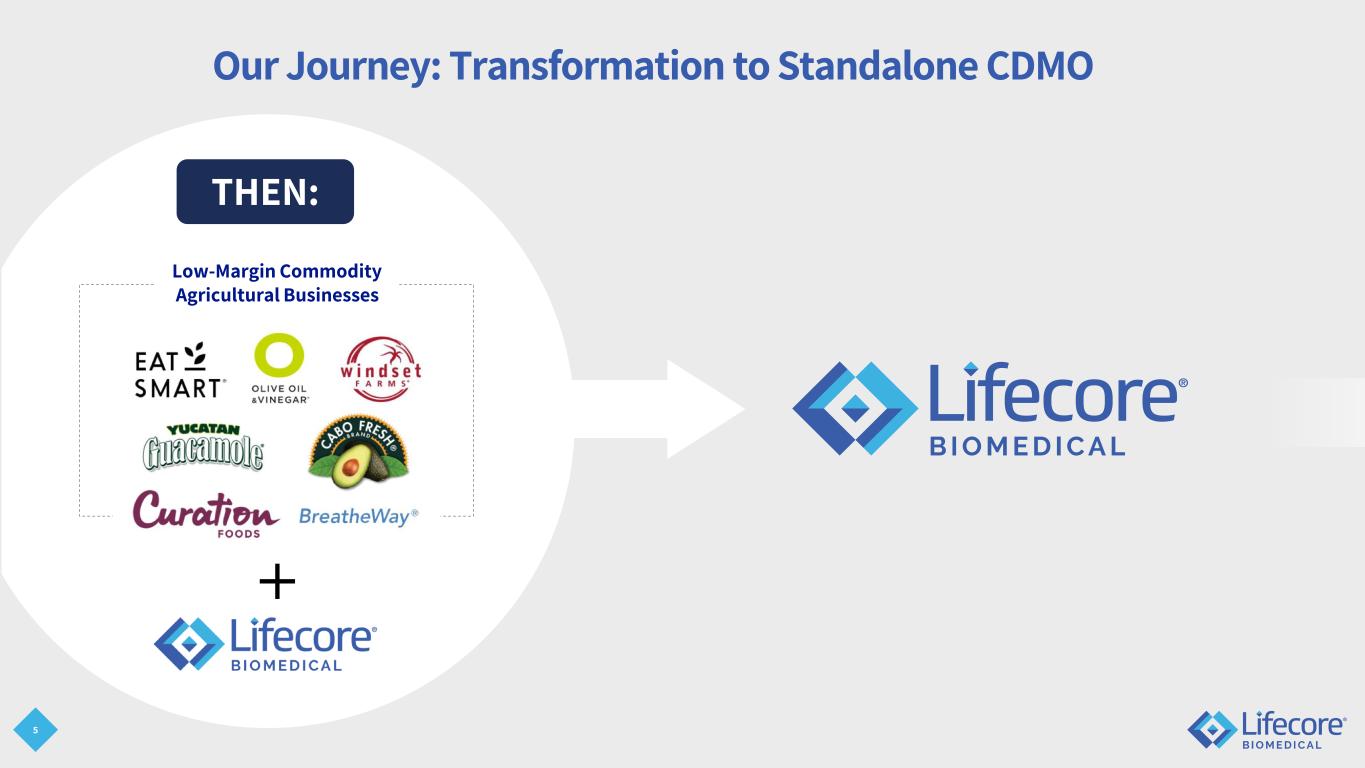

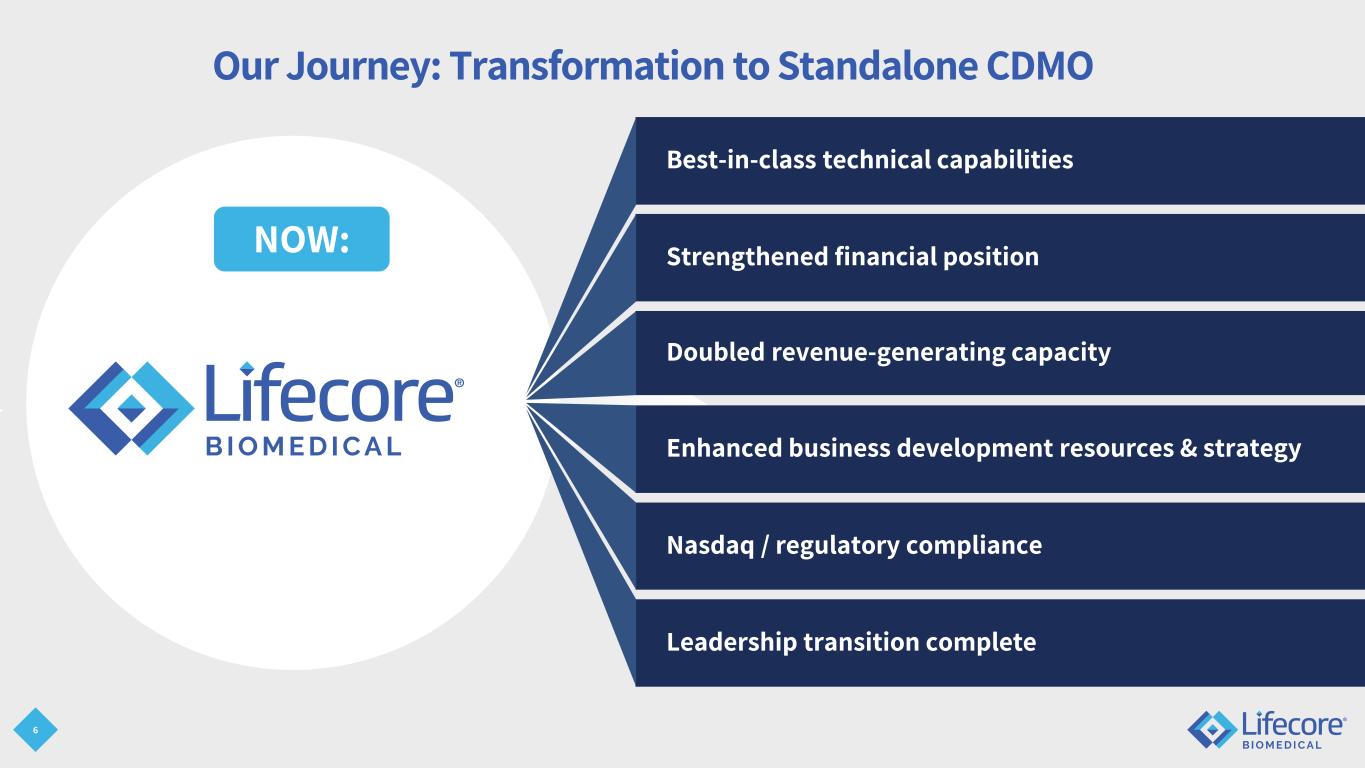

5 Our Journey: Transformation to Standalone CDMO Low-Margin Commodity Agricultural Businesses THEN:

6 Our Journey: Transformation to Standalone CDMO NOW: Best-in-class technical capabilities Strengthened financial position Doubled revenue-generating capacity Leadership transition complete Nasdaq / regulatory compliance Enhanced business development resources & strategy

7 Lifecore at a Glance 450 Employees Inclusive, Performance- Driven Culture Fully integrated CDMO offering development and fill/finish of sterile injectable pharmaceuticals Projected Revenues* (FY2025E) $126.5M - $130M Projected Adj. EBITDA* (FY2025E) $19M - $21M Leader in Sodium Hyaluronate (HA) Global Regulatory Capabilities Founded in 1965 Corporate Headquarters * See disclaimers on slides 2 & 3, and non-GAAP reconciliations on slide 26 Approx.

8 Campus Overview Site 1 – HQ (Lyman Blvd.) 150,000 sqft Site 2 (Lakeview Drive) 78,000 sqft Site 3 (Shelby Court) 20,000 sqft Manufacturing Operations • Sodium hyaluronate manufacturing (fermentation) • Drug and medical device formulation and filling • Secondary packaging • Microbiology and analytical quality control laboratories • Warehousing: 6,400 sqft CRT; 1,500 sqft cooler • Distribution Contract Development • Pilot laboratory Manufacturing Operations • Final packaging • Warehousing: 16,400 sqft CRT; 4,000 sqft cooler • Distribution • Quality control laboratory • Particulate lab Contract Development • Analytical development laboratory Manufacturing Operations • Receipt, inspection, & warehousing of raw materials and components • 10,000 ft2 CRT; 1,795 sqft cooler 248,000sqft ~450State-of-the-art facilities, within 2 square miles Employees

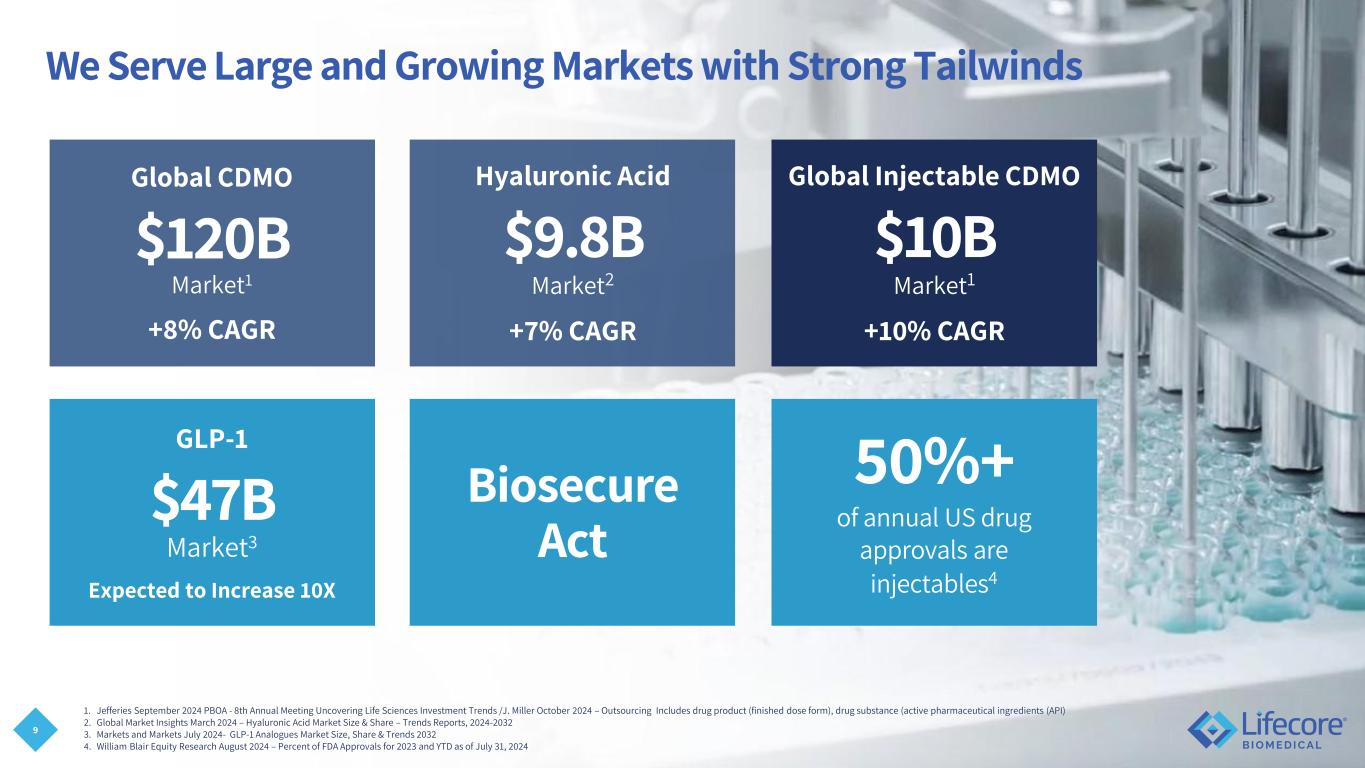

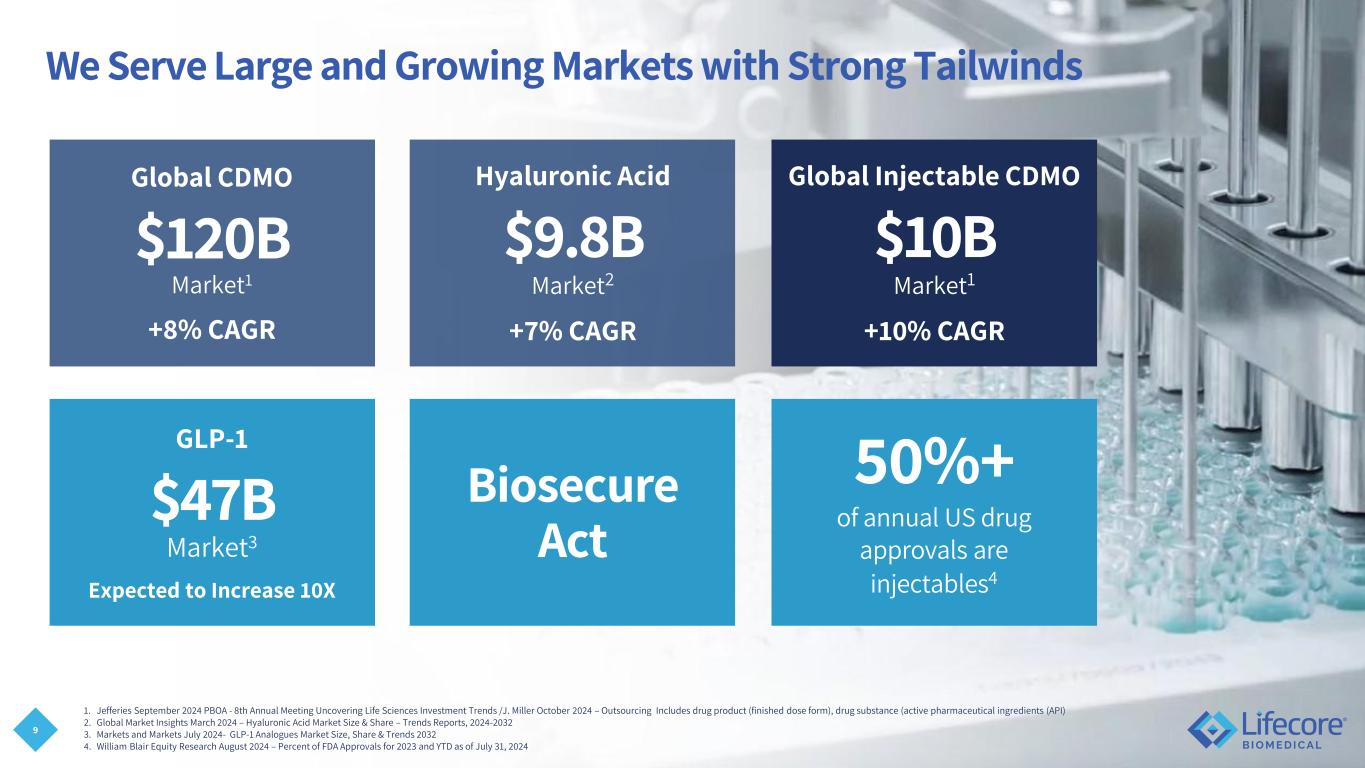

9 We Serve Large and Growing Markets with Strong Tailwinds Global Injectable CDMO $10B Market1 +10% CAGR Biosecure Act Hyaluronic Acid $9.8B Market2 +7% CAGR Global CDMO $120B Market1 +8% CAGR 50%+ of annual US drug approvals are injectables4 GLP-1 $47B Market3 Expected to Increase 10X 1. Jefferies September 2024 PBOA - 8th Annual Meeting Uncovering Life Sciences Investment Trends /J. Miller October 2024 – Outsourcing Includes drug product (finished dose form), drug substance (active pharmaceutical ingredients (API) 2. Global Market Insights March 2024 – Hyaluronic Acid Market Size & Share – Trends Reports, 2024-2032 3. Markets and Markets July 2024- GLP-1 Analogues Market Size, Share & Trends 2032 4. William Blair Equity Research August 2024 – Percent of FDA Approvals for 2023 and YTD as of July 31, 2024

Executing Three-Pronged Growth Strategy Maximizing Existing Customer Business Advancing Programs Towards Commercialization Driving New Business 10

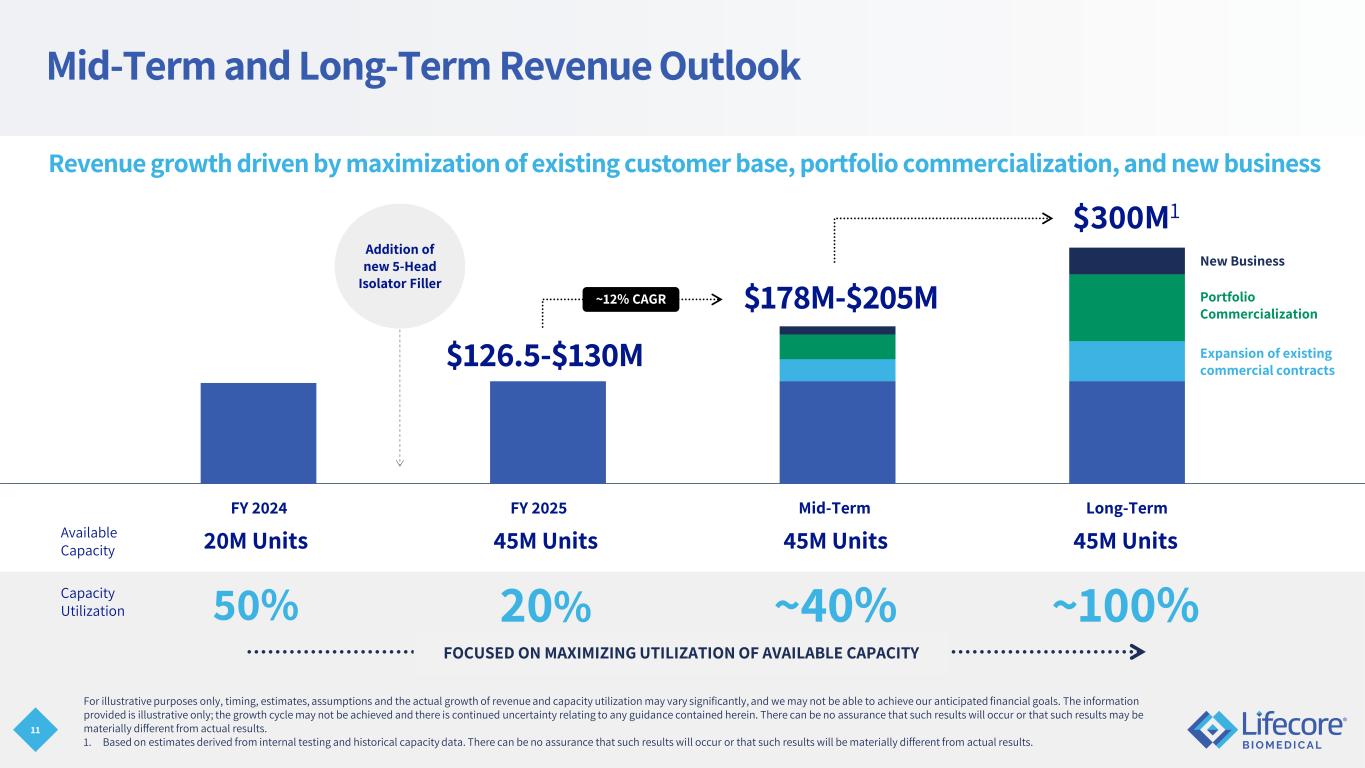

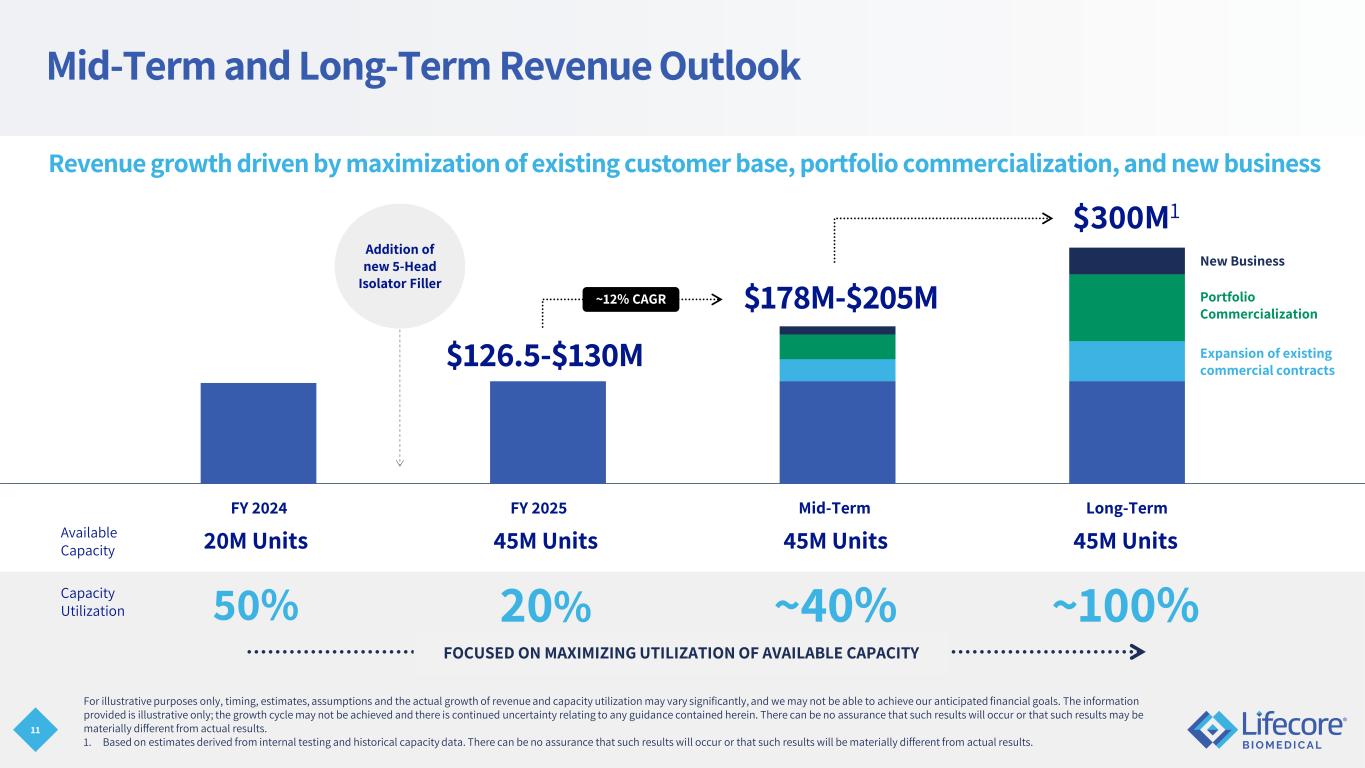

11 FOCUSED ON MAXIMIZING UTILIZATION OF AVAILABLE CAPACITY Mid-Term and Long-Term Revenue Outlook $126.5-$130M $178M-$205M $300M1 Expansion of existing commercial contracts Portfolio Commercialization New Business Revenue growth driven by maximization of existing customer base, portfolio commercialization, and new business 20M Units 45M Units 45M Units 45M Units 50% 20% ~40% ~100% Available Capacity Capacity Utilization FY 2024 FY 2025 Addition of new 5-Head Isolator Filler For illustrative purposes only, timing, estimates, assumptions and the actual growth of revenue and capacity utilization may vary significantly, and we may not be able to achieve our anticipated financial goals. The information provided is illustrative only; the growth cycle may not be achieved and there is continued uncertainty relating to any guidance contained herein. There can be no assurance that such results will occur or that such results may be materially different from actual results. 1. Based on estimates derived from internal testing and historical capacity data. There can be no assurance that such results will occur or that such results will be materially different from actual results. Mid-Term Long-Term ~12% CAGR

12 Expanding Existing Customer Relationships Know our customers Establish trust and reliability Establish Lifecore as a partner-of- choice for the future CDMO needs of existing customers Anticipate customers’ growing needs Efficient onboarding of new programs Consistent engagement Focus on commercial excellence Maintain/increase margin profile Lifecore prides itself on building long-term relationships, with multiple customer relationships ranging from 1. As of Q1FY25 M A X I M I Z I N G E X I S T I N G C U S T O M E R B U S I N E S S 20 yrs to nearly 40 yrs1

13 Fill & Finish: Pathway to Doubling Commercial Demand • Significant inflection point expected from minimum volumes beginning in 2027 • Potential upside to contractual minimums For illustrative purposes only, timing, estimates, assumptions and the actual capacity utilization may vary significantly, and we may not be able to achieve our anticipated financial goals. The information provided is illustrative only, the growth cycle may not be achieved and there is continued uncertainty relating to any guidance contained herein. There can be no assurance that such results will occur or that such results may be materially different from actual results. M A X I M I Z I N G E X I S T I N G C U S T O M E R B U S I N E S S Commercial Unit Projection ~2x

14 HA Fermentation: Strong & Steady Demand LIFECORE’S PREMIUM SODIUM HYALURONATE: doses sold worldwide 150 million1 • Ophthalmology • Orthopedics • Drug delivery • Biomaterials • Aesthetics • Oncology • Pain management Proven Applications Worldwide: M A X I M I Z I N G E X I S T I N G C U S T O M E R B U S I N E S S 1. As of September 2024 More than Lifecore manufactures >20 commercially approved HA injectable products

15 Strong, Diverse Pipeline • Impactful commercial revenue potential over the mid-term • Strong development project pipeline: vials, syringes, cartridges • Diversification across broad customer base Total Pipeline Represents $100M - $200M1 in Incremental Commercial Revenue Potential 1. Assumes full realization of management's estimates for annual commercial revenue potential from pipeline projects at peak sales. Information presented is not risk and probability adjusted and the actual revenue realization may vary significantly. This does not assume new customer additions or attrition. There can be no assurance that such results will occur or that such results will be materially different from actual results. 2. Projects are defined as individual drugs or devices for which Lifecore provides manufacturing services; as of 09/24 Active Projects2 Late Stage: 10 Early-Mid Stage: 15 A D V A N C I N G P R O G R A M S T O W A R D S C O M M E R C I A L I Z A T I O N

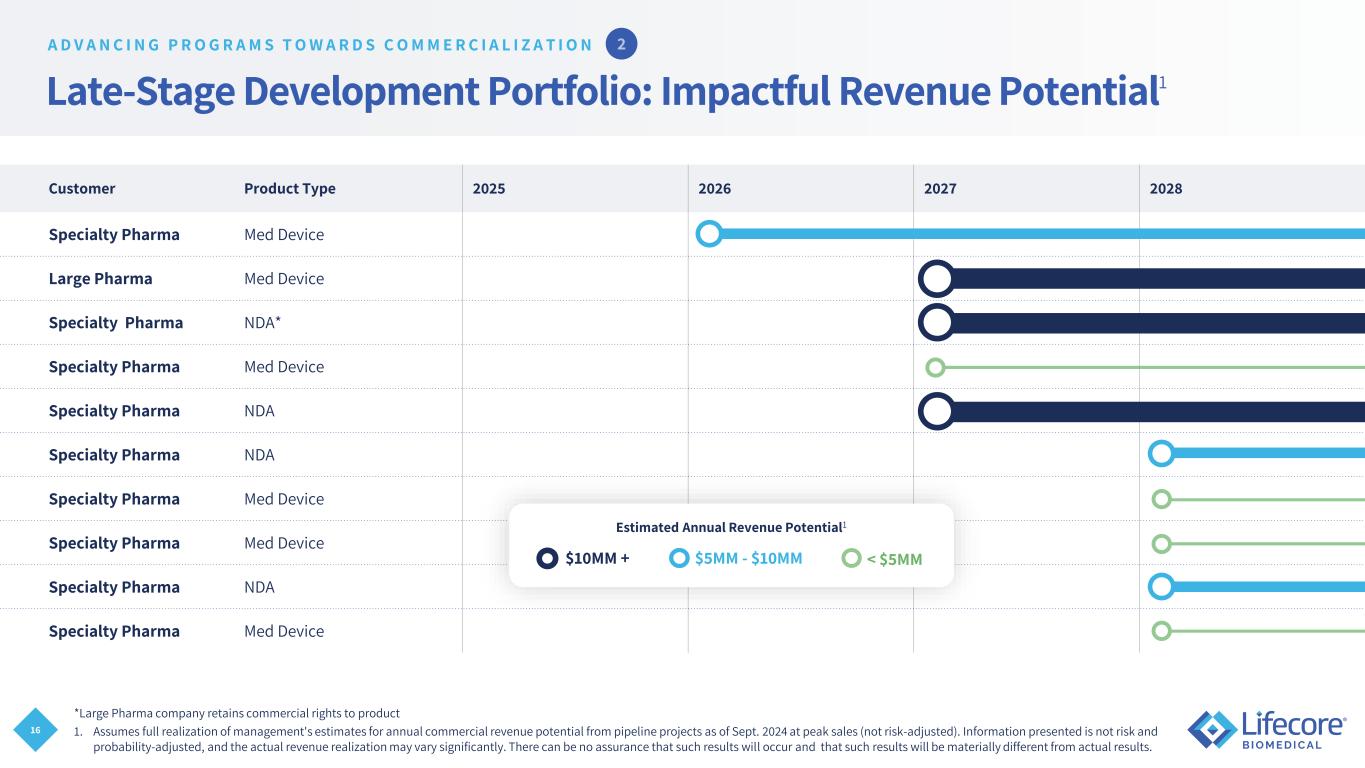

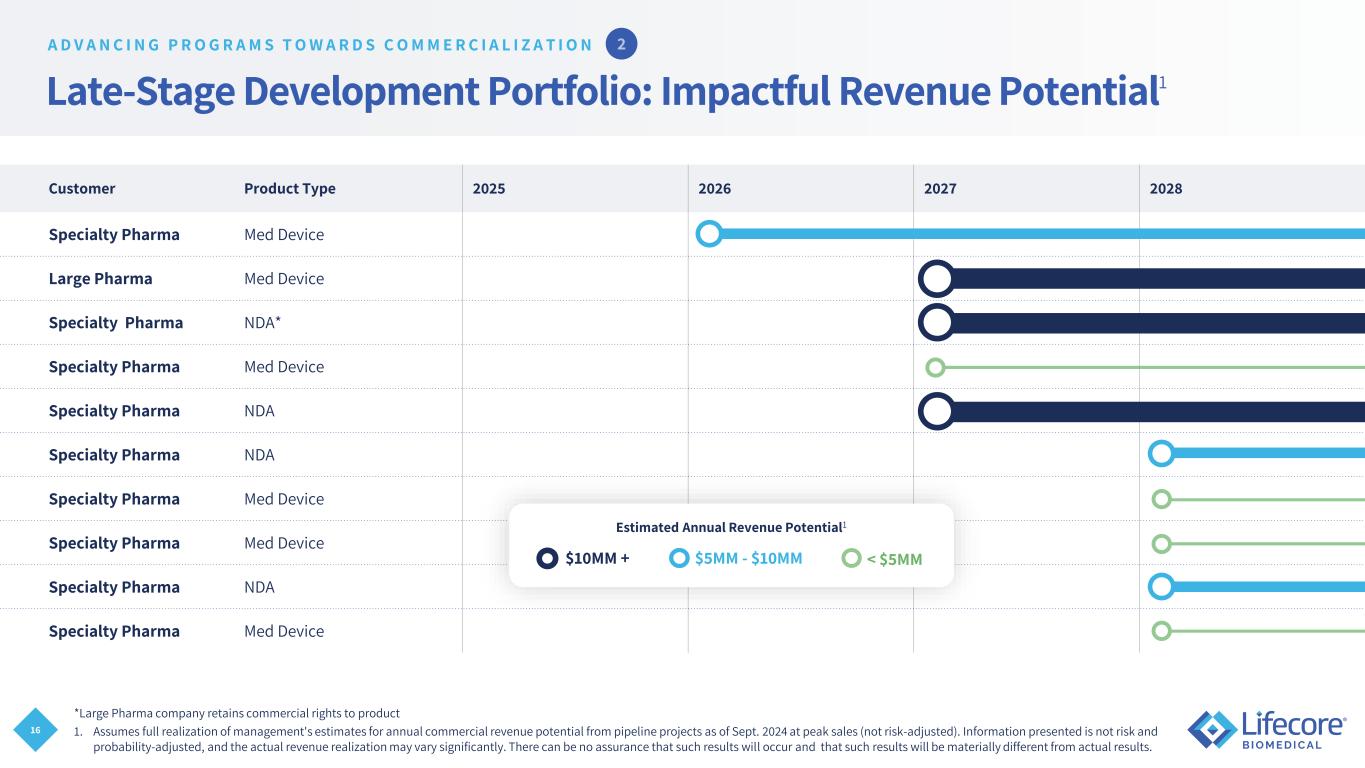

16 Late-Stage Development Portfolio: Impactful Revenue Potential1 Customer Product Type 2025 2026 2027 2028 Specialty Pharma Med Device Large Pharma Med Device Specialty Pharma NDA* Specialty Pharma Med Device Specialty Pharma NDA Specialty Pharma NDA Specialty Pharma Med Device Specialty Pharma Med Device Specialty Pharma NDA Specialty Pharma Med Device *Large Pharma company retains commercial rights to product 1. Assumes full realization of management's estimates for annual commercial revenue potential from pipeline projects as of Sept. 2024 at peak sales (not risk-adjusted). Information presented is not risk and probability-adjusted, and the actual revenue realization may vary significantly. There can be no assurance that such results will occur and that such results will be materially different from actual results. $10MM + $5MM - $10MM < $5MM Estimated Annual Revenue Potential1 A D V A N C I N G P R O G R A M S T O W A R D S C O M M E R C I A L I Z A T I O N

17 Attracting New High-Value Business Installation of 5-head filler Strategically expand target market Expanding business development & brand awareness D R I V I N G N E W B U S I N E S S

18 LO W CO ST – CO M M O DI TY GE NE RI CS HIGH POTENT – CYTO TO XIC /HORM ONES Strategically Expand Target Markets • Expanding beyond high-viscosity legacy • Attractive therapeutic areas • NCEs in Phase 2, Phase 3 • Unique, injectable delivery systems • Ophthalmic and orthopedic medical devices • Commercial site transfers mAbs Complex Generics Biologics Injectable Medical Device Biosimilars Small Molecule GLP1 Peptides D R I V I N G N E W B U S I N E S S

19 Expanded Targets Lead to Growing Pipeline • Strong, diverse and growing universe of 50+ potential future business opportunities1 • Mix of both large and specialty pharma • Subset of opportunities are HA-related, representing a broadening of our pipeline • Significant number of late-stage development or commercial site transfer programs Prospective Opportunities In process of being qualified - Inform & educate on Lifecore capabilities - Active Opportunities Within our capabilities with an identified close date D R I V I N G N E W B U S I N E S S 1. As of Sept. 2024

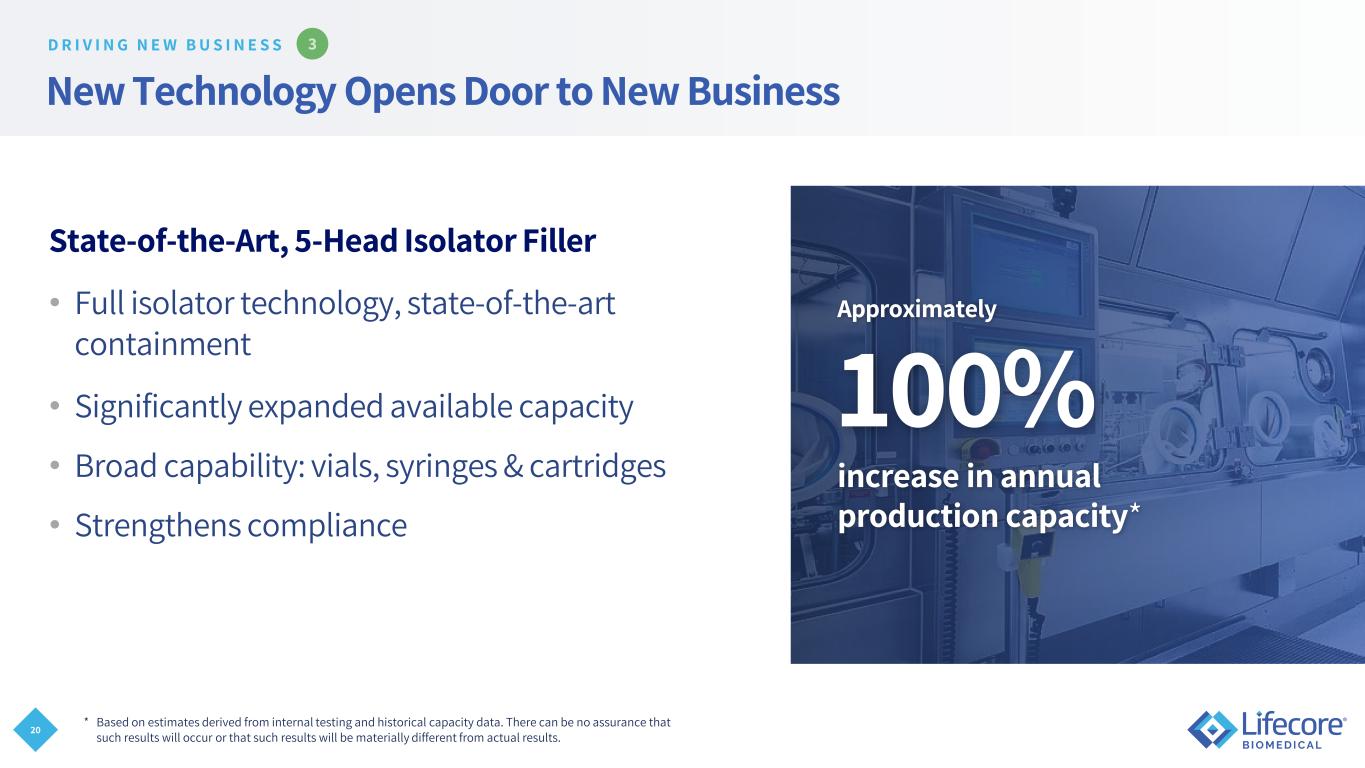

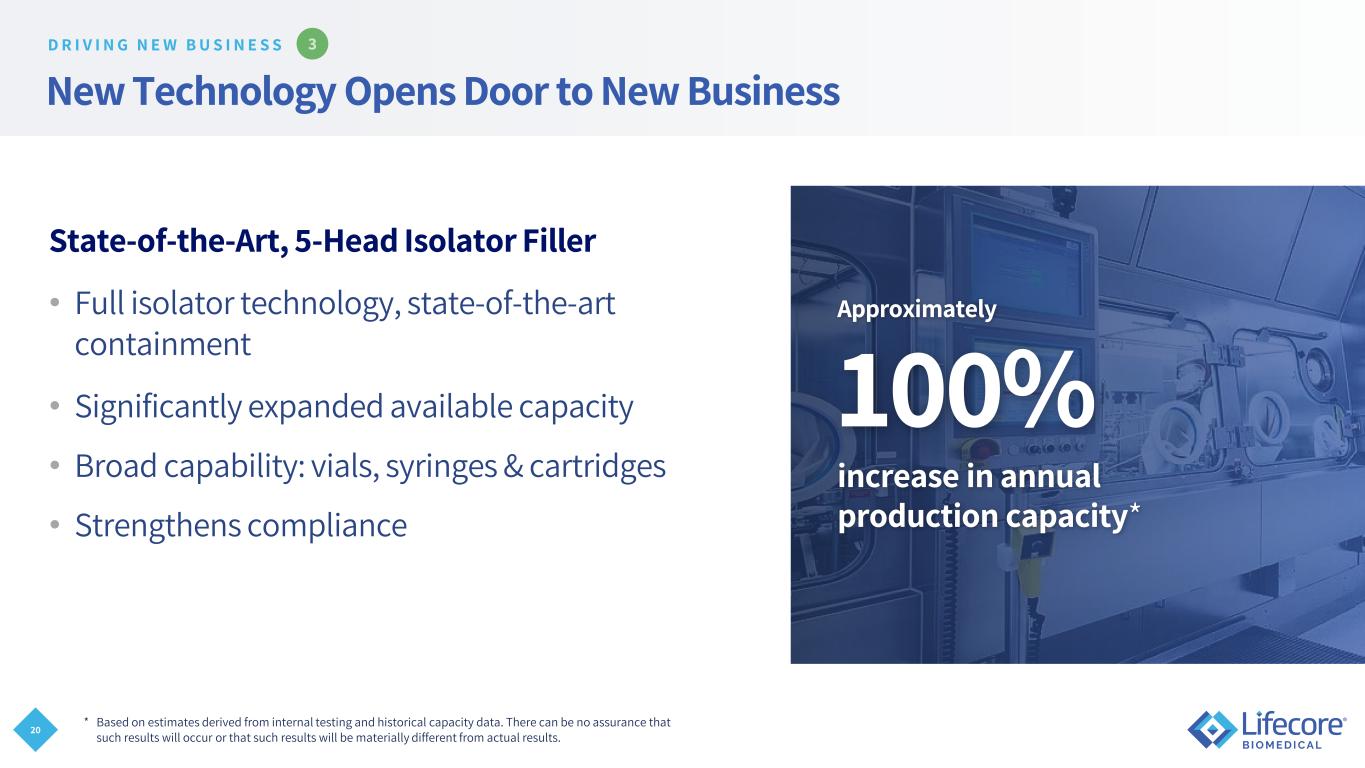

20 New Technology Opens Door to New Business State-of-the-Art, 5-Head Isolator Filler • Full isolator technology, state-of-the-art containment • Significantly expanded available capacity • Broad capability: vials, syringes & cartridges • Strengthens compliance Approximately 100% increase in annual production capacity* * Based on estimates derived from internal testing and historical capacity data. There can be no assurance that such results will occur or that such results will be materially different from actual results. D R I V I N G N E W B U S I N E S S

Sustaining Objectives Support Value Creation 21 Commitment to Quality Reduced Operational Expenses Performance-Driven Culture

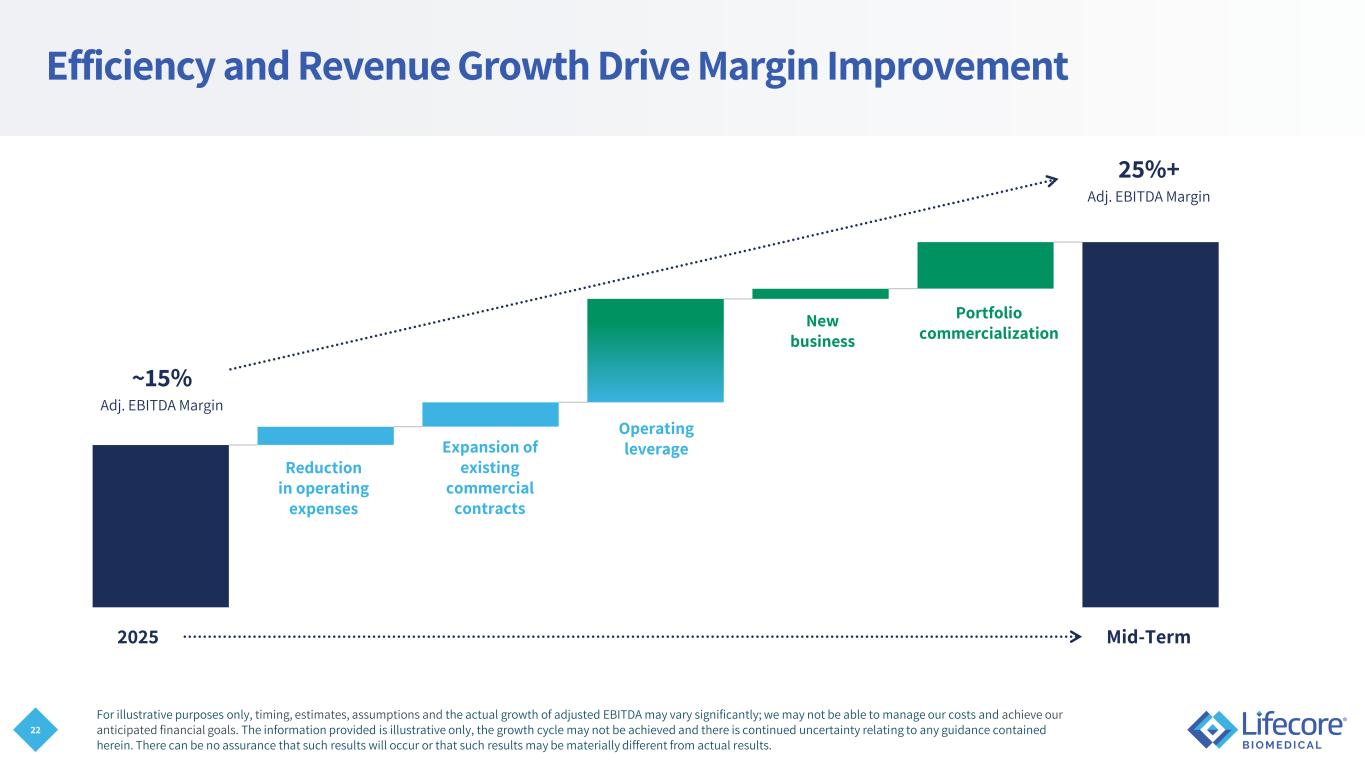

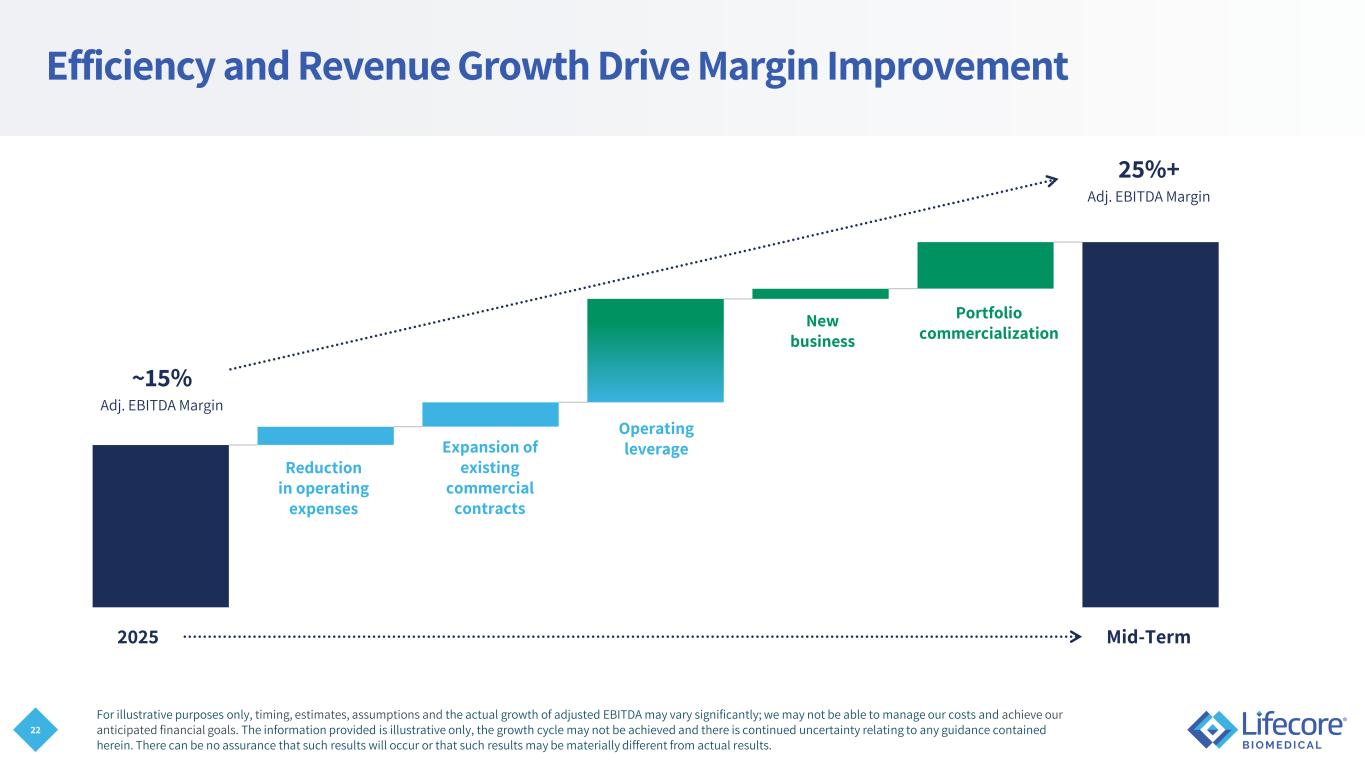

22 ~15% 25%+ 2025 Mid-Term Adj. EBITDA Margin Adj. EBITDA Margin Reduction in operating expenses Expansion of existing commercial contracts Portfolio commercialization New business Operating leverage Efficiency and Revenue Growth Drive Margin Improvement For illustrative purposes only, timing, estimates, assumptions and the actual growth of adjusted EBITDA may vary significantly; we may not be able to manage our costs and achieve our anticipated financial goals. The information provided is illustrative only, the growth cycle may not be achieved and there is continued uncertainty relating to any guidance contained herein. There can be no assurance that such results will occur or that such results may be materially different from actual results.

23 40+ Years of Strong Track Record with Global Regulatory Bodies World-class quality system Ability to support multiple geographies

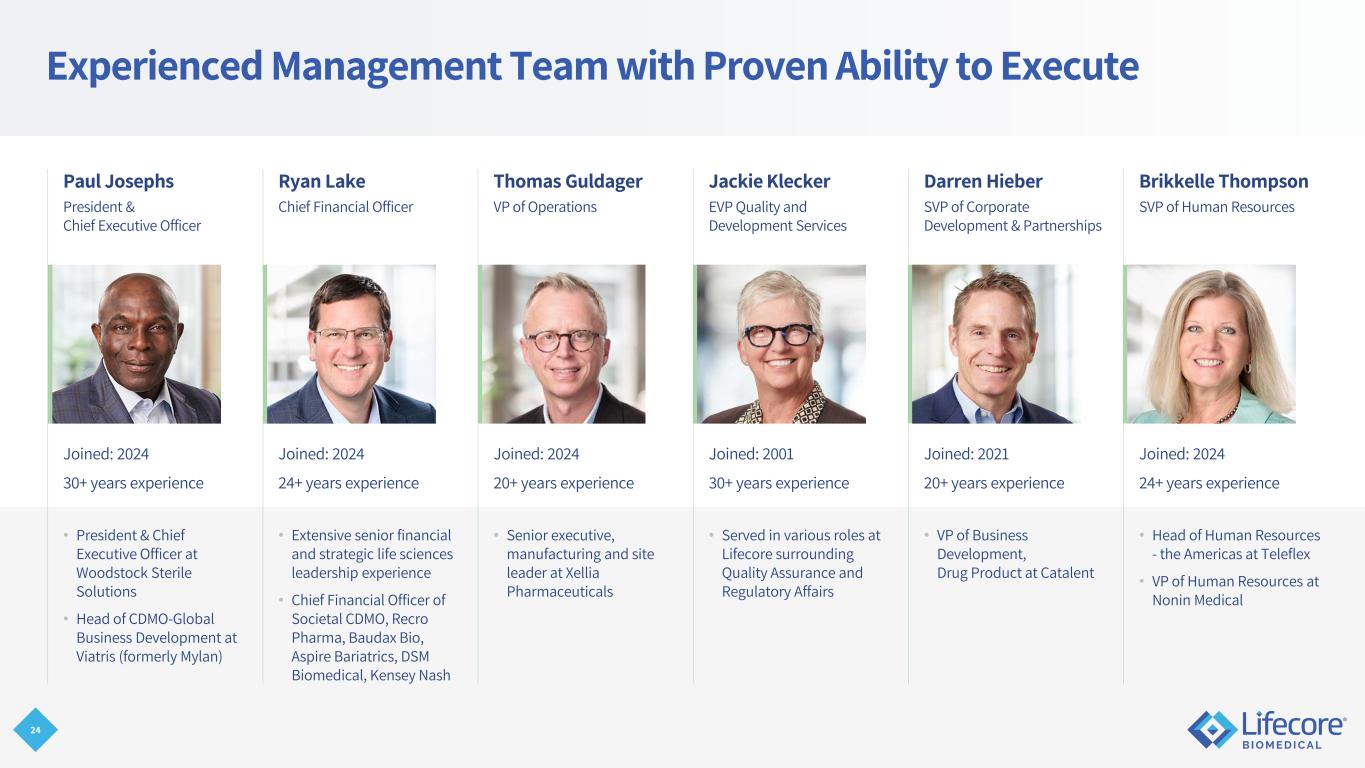

24 Experienced Management Team with Proven Ability to Execute Paul Josephs President & Chief Executive Officer Ryan Lake Chief Financial Officer Thomas Guldager VP of Operations Jackie Klecker EVP Quality and Development Services Darren Hieber SVP of Corporate Development & Partnerships Brikkelle Thompson SVP of Human Resources Joined: 2024 30+ years experience Joined: 2024 24+ years experience Joined: 2024 20+ years experience Joined: 2001 30+ years experience Joined: 2021 20+ years experience Joined: 2024 24+ years experience • President & Chief Executive Officer at Woodstock Sterile Solutions • Head of CDMO-Global Business Development at Viatris (formerly Mylan) • Extensive senior financial and strategic life sciences leadership experience • Chief Financial Officer of Societal CDMO, Recro Pharma, Baudax Bio, Aspire Bariatrics, DSM Biomedical, Kensey Nash • Senior executive, manufacturing and site leader at Xellia Pharmaceuticals • Served in various roles at Lifecore surrounding Quality Assurance and Regulatory Affairs • VP of Business Development, Drug Product at Catalent • Head of Human Resources - the Americas at Teleflex • VP of Human Resources at Nonin Medical

25 Financial Highlights Revenue and Adjusted EBITDA were strong and in line with fiscal year guidance Second quarter fiscal 2025 financial results • Revenues: $32.6 million, 8% increase from Q2 fiscal 2024 • Net loss: $6.6 million • Adjusted EBITDA: $6.5 million, up $1.1 million from Q2 fiscal 2024 Full year fiscal 2025 guidance • Revenue: $126.5 to $130 million • Net loss: $(28.6) to $(26.6) million • Adjusted EBITDA: $19 to $21 million Second quarter fiscal 2025 developments Signed Multiple Development Agreements with New Customers Strengthened Balance Sheet with PIPE Financing, Raising Approximately $24.3 Million Favorable Restructuring of Credit Facility with BMO

26 Reconciliation of Non-GAAP Financial Measures To supplement the company’s financial results determined by U.S. generally accepted accounting principles (“GAAP”), the company has disclosed in the table below the following non-GAAP information about Adjusted EBITDA. 1 Adjusted EBITDA is net (loss) income as determined under GAAP excluding (i) interest expense, net of interest income, (ii) income tax expense (benefit), (iii) depreciation and amortization, (iv) stock-based compensation, (v) change in fair value of debt derivatives, (vi) financing fees (non-interest), (vii) reorganization costs, (viii) restructuring costs, (ix) franchise tax equivalent to income tax, (x) contract cancellation costs, (xi) loss (income) from discontinued operations, (xii) stockholder activist settlement costs, and (xiii) start-up costs. The company believes that non-GAAP financial measures, such as Adjusted EBITDA, are helpful in understanding its business as it is useful to investors in allowing for greater transparency of supplementation information used by management. Adjusted EBITDA, is used by investors, as well as management in assessing the company’s performance. Non-GAAP financial measures should be considered in addition to, but not as substitute for, reported GAAP results. Further, non-GAAP financial measures, even if similarly titled, may not be calculated in the same manner by all companies, and therefore should not be compared. 1. See disclaimers and important information on Slides 2 and 3 Reorganization costs include costs not expected to be incurred on a normalized basis associated with Lifecore becoming a stand-alone entity, divestitures, litigation related with former owners of acquired businesses, restatements of financial statements and change in auditors. Restructuring costs are related to board approved actions consisting primarily of employee severance, lease cost of exited facilities, and costs associated with divested businesses. (a) We previously estimated net loss to be $25.9 million to $23.9 million, which we now estimate will be $28.6 million to $26.6 million. The increase is due to higher stock-based compensation, interest expense, former CFO severance, and elevated legal expenses related to the civil litigation. (b) We previously estimated restructuring, reorganization, stockholder activist settlement costs to be $9.9 million, which we now estimate will be approximately $10.3 million of which $8.2 million was incurred in the six months ended November 24, 2024. The overage is due to former CFO severance and elevated legal expenses related to the civil litigation. Second quarter fiscal 2025 results: Full year fiscal 2025 guidance vs. fiscal 2024 (in thousands) November 24, 2024 November 26, 2023 (in thousands) May 25, 2025 May 26, 2024 Net (loss) income (GAAP) (6,571) 14,218 Net (loss) income (GAAP) (a) (28,600) - (26,600) 12,013 Interest expense, net 5,465 4,073 Interest expense, net 22,000 18,090 Income tax expense (benefit) 43 (65) Income tax expense (benefit) — 183 Depreciation and amortization 2,044 1,987 Depreciation and amortization 8,300 7,954 Stock-based compensation 3,372 1,577 Stock-based compensation 10,900 6,201 Change in fair value of debt derivatives (1,200) (20,700) Change in fair value of debt derivatives (4,900) (39,500) Financing fees (non-interest) 368 1,108 Financing fees (non-interest) 700 3,513 Reorganization costs 2,463 2,162 Reorganization costs (b) 7,600 9,796 Restructuring costs 404 157 Restructuring costs (b) 1,400 1,656 Franchise tax equivalent to income tax 50 94 Franchise tax equivalent to income tax 300 272 Contract cancellation costs — 297 Contract cancellation costs — 567 Loss (income) from discontinued operations — 24 Loss (income) from discontinued operations — (2,682) Stockholder activist settlement 78 — Stockholder activist settlement (b) 1,300 459 Start-up costs — 487 Start-up costs — 1,684 Adjusted EBITDA $ 6,516 $ 5,419 Adjusted EBITDA $ 19,000 - 21,000 $ 20,206 Three Months Ended Twelve Months Ended

Thank you!