This document consists of 34 pages, of which this is page number 1.

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

ý | | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

For the Fiscal Quarter Ended February 27, 2005, or |

| | |

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition period from to .

Commission file number: 0-27446

LANDEC CORPORATION

(Exact name of registrant as specified in its charter)

California | | 94-3025618 |

(State or other jurisdiction of

incorporation or organization) | | (IRS Employer

Identification Number) |

3603 Haven Avenue

Menlo Park, California 94025

(Address of principal executive offices)

Registrant’s telephone number, including area code:

(650) 306-1650

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for at least the past 90 days.

Yes ý No o

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Exchange Act).

Yes ý No o

As of March 23, 2005, there were 24,020,986 shares of Common Stock outstanding.

LANDEC CORPORATION

FORM 10-Q For the Fiscal Quarter Ended February 27, 2005

INDEX

2

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

LANDEC CORPORATION

CONSOLIDATED BALANCE SHEETS

(In thousands)

| | February 27,

2005 | | May 30,

2004 | |

| | (Unaudited) | | | |

ASSETS | | | | | |

Current Assets: | | | | | |

Cash and cash equivalents | | $ | 14,899 | | $ | 6,458 | |

Accounts receivable, less allowance for doubtful accounts of $246 and $265 at February 27, 2005 and May 30, 2004 | | 11,330 | | 14,851 | |

Accounts receivable, related party | | 327 | | 498 | |

Inventory | | 14,407 | | 11,227 | |

Notes and advances receivable | | 746 | | 1,144 | |

Notes receivable, related party | | 118 | | 306 | |

Prepaid expenses and other current assets | | 1,971 | | 1,527 | |

Total Current Assets | | 43,798 | | 36,011 | |

| | | | | |

Property and equipment, net | | 18,537 | | 18,341 | |

Goodwill, net | | 25,987 | | 25,987 | |

Trademarks and other intangible, net | | 11,628 | | 11,737 | |

Notes receivable | | 765 | | 605 | |

Notes receivable, related party | | 35 | | 96 | |

Other assets | | 282 | | 230 | |

Total Assets | | $ | 101,032 | | $ | 93,007 | |

| | | | | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | |

Current Liabilities: | | | | | |

Accounts payable | | 11,223 | | $ | 14,960 | |

Related party payables | | 338 | | 430 | |

Accrued compensation | | 1,547 | | 1,570 | |

Other accrued liabilities | | 2,969 | | 2,506 | |

Deferred revenue | | 11,646 | | 807 | |

Lines of credit | | 857 | | 5,317 | |

Current maturities of long term debt | | 557 | | 1,505 | |

Total Current Liabilities | | 29,137 | | 27,095 | |

| | | | | |

Long term debt, less current maturities | | 2,671 | | 2,174 | |

Other liabilities | | 572 | | 637 | |

Minority interest | | 1,346 | | 1,552 | |

| | | | | |

Shareholders’ Equity: | | | | | |

Common stock, $0.001 par value; 50,000,000 shares authorized; 24,020,986 and 23,182,020 shares issued and outstanding at February 27, 2005 and May 30, 2004, respectively | | 121,805 | | 116,841 | |

Accumulated deficit | | (54,499 | ) | (55,292 | ) |

Total Shareholders’ Equity | | 67,306 | | 61,549 | |

Total Liabilities and Shareholders’ Equity | | $ | 101,032 | | $ | 93,007 | |

See accompanying notes.

3

LANDEC CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except per share amounts)

| | Three Months Ended | | Nine Months Ended | |

| | February 27,

2005 | | February 29,

2004 | | February 27,

2005 | | February 29,

2004 | |

Revenues: | | | | | | | | | |

Product sales | | $ | 50,605 | | $ | 47,626 | | $ | 145,858 | | $ | 128,442 | |

Services revenue | | ¾ | | ¾ | | ¾ | | 2,083 | |

Services revenue, related party | | 754 | | 815 | | 2,792 | | 2,641 | |

License fees | | 22 | | 22 | | 66 | | 66 | |

Research, development and royalty revenues | | 96 | | 63 | | 159 | | 240 | |

Royalty revenues, related party | | 54 | | 62 | | 182 | | 184 | |

Total revenues | | 51,531 | | 48,588 | | 149,057 | | 133,656 | |

| | | | | | | | | |

Cost of revenue: | | | | | | | | | |

Cost of product sales | | 40,678 | | 39,292 | | 121,914 | | 108,695 | |

Cost of product sales, related party | | 1,176 | | 1,342 | | 4,571 | | 3,627 | |

Cost of services revenue | | 379 | | 506 | | 1,538 | | 2,775 | |

Total cost of revenue | | 42,233 | | 41,140 | | 128,023 | | 115,097 | |

| | | | | | | | | |

Gross profit | | 9,298 | | 7,448 | | 21,034 | | 18,559 | |

| | | | | | | | | |

Operating costs and expenses: | | | | | | | | | |

Research and development | | 705 | | 881 | | 2,195 | | 2,799 | |

Selling, general and administrative | | 6,158 | | 5,631 | | 17,478 | | 16,335 | |

Total operating costs and expenses | | 6,863 | | 6,512 | | 19,673 | | 19,134 | |

Operating income (loss) | | 2,435 | | 936 | | 1,361 | | (575 | ) |

| | | | | | | | | |

Interest income | | 88 | | 42 | | 107 | | 134 | |

Interest expense | | (127 | ) | (162 | ) | (332 | ) | (695 | ) |

Other expense | | (103 | ) | (91 | ) | (343 | ) | (346 | ) |

Net income (loss) | | 2,293 | | 725 | | 793 | | (1,482 | ) |

Dividends on Series B preferred stock | | — | | (117 | ) | — | | (345 | ) |

| | | | | | | | | |

Net income (loss) applicable to common shareholders | | $ | 2,293 | | $ | 608 | | $ | 793 | | $ | (1,827 | ) |

| | | | | | | | | |

Basic net income (loss) per share | | $ | 0.10 | | $ | 0.03 | | $ | 0.03 | | $ | (0.09 | ) |

| | | | | | | | | |

Diluted net income (loss) per share | | $ | 0.09 | | $ | 0.03 | | $ | 0.02 | | $ | (0.09 | ) |

| | | | | | | | | |

Shares used in per share computation: | | | | | | | | | |

Basic | | 23,990 | | 21,321 | | 23,594 | | 21,250 | |

Diluted | | 24,928 | | 24,034 | | 24,492 | | 21,250 | |

See accompanying notes.

4

LANDEC CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited and in thousands)

| | Nine Months Ended | |

| | February 27,

2005 | | February 29,

2004 | |

Cash flows from operating activities: | | | | | |

Net income (loss) | | $ | 793 | | $ | (1,482 | ) |

Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | | |

Depreciation and amortization | | 2,723 | | 2,689 | |

Write down of goodwill | | ¾ | | 120 | |

Loss on disposal of property and equipment | | 213 | | ¾ | |

Minority interest | | 344 | | 404 | |

Changes in current assets and liabilities: | | | | | |

Accounts receivable, net | | 3,692 | | 5,613 | |

Inventory | | (3,180 | ) | (5,191 | ) |

Issuance of notes and advances receivable | | (231 | ) | (536 | ) |

Collection of notes and advances receivable | | 783 | | 2,084 | |

Prepaid expenses and other current assets | | (444 | ) | (310 | ) |

Accounts payable | | (3,737 | ) | (2,651 | ) |

Grower payables | | ¾ | | (3,234 | ) |

Related party payables | | (92 | ) | (196 | ) |

Accrued compensation | | (23 | ) | (230 | ) |

Other accrued liabilities | | 463 | | (1,496 | ) |

Deferred revenue | | 10,774 | | 10,818 | |

Net cash provided by operating activities | | 12,078 | | 6,402 | |

| | | | | |

Cash flows from investing activities: | | | | | |

Purchases of property and equipment | | (3,050 | ) | (2,776 | ) |

Net change in other assets | | ¾ | | (30 | ) |

Proceeds from the sale of property and equipment | | 22 | | ¾ | |

Change in restricted cash | | ¾ | | 2,007 | |

Issuance of notes and advances receivable | | (453 | ) | ¾ | |

Collection of notes and advances receivable | | 388 | | 275 | |

Net cash used in investing activities | | (3,093 | ) | (524 | ) |

| | | | | |

Cash flows from financing activities: | | | | | |

Proceeds from sale of common stock | | 4,964 | | 464 | |

Net change in other assets | | (47 | ) | (330 | ) |

Borrowings on lines of credit | | 59,441 | | 95,890 | |

Payments on lines of credit | | (63,901 | ) | (96,855 | ) |

Payments on long term debt | | (1,651 | ) | (2,344 | ) |

Proceeds from issuance of long term debt | | 1,200 | | ¾ | |

Distributions to minority interest | | (550 | ) | (154 | ) |

Net cash used in financing activities | | (544 | ) | (3,329 | ) |

| | | | | |

Net increase in cash and cash equivalents | | 8,441 | | 2,549 | |

Cash and cash equivalents at beginning of period | | 6,458 | | 3,699 | |

Cash and cash equivalents at end of period | | $ | 14,899 | | $ | 6,248 | |

Supplemental schedule of noncash investing and financing activities: | | | | | |

Sale of assets and services for notes receivable | | $ | 425 | | $ | 239 | |

Purchase of asset for a liability | | $ | 813 | | $ | — | |

Issuance of Series B preferred stock as dividends to Series B preferred stockholders | | $ | — | | $ | 345 | |

See accompanying notes.

5

LANDEC CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Basis of Presentation

Landec Corporation and its subsidiaries (“Landec” or the “Company”) design, develop, manufacture, and sell temperature-activated and other specialty polymer products for a variety of food products, agricultural products, and licensed partner applications. The Company markets and distributes hybrid corn seed to farmers through its Landec Ag, Inc. (“Landec Ag”) subsidiary and specialty packaged fresh-cut vegetables and whole produce to retailers, club stores, and foodservice companies primarily in the United States and Asia through its Apio, Inc. (“Apio”) subsidiary.

The accompanying unaudited consolidated financial statements of Landec have been prepared in accordance with accounting principles generally accepted in the United States for interim financial information and with the instructions for Form 10-Q and Article 10 of Regulation S-X. In the opinion of management, all adjustments (consisting of normal recurring accruals) have been made which are necessary to present fairly the financial position at February 27, 2005 and the results of operations and cash flows for all periods presented. Although Landec believes that the disclosures in these financial statements are adequate to make the information presented not misleading, certain information normally included in financial statements and related footnotes prepared in accordance with accounting principles generally accepted in the United States have been condensed or omitted per the rules and regulations of the Securities and Exchange Commission. The accompanying financial data should be reviewed in conjunction with the audited financial statements and accompanying notes included in Landec’s Annual Report on Form 10-K for the fiscal year ended May 30, 2004.

The results of operations for the three and nine months ended February 27, 2005 are not necessarily indicative of the results that may be expected for an entire fiscal year. For instance, due to the cyclical nature of the corn seed industry, a significant portion of Landec Ag revenues and profits will be concentrated over a few months during the spring planting season (generally during Landec’s third and fourth fiscal quarters). In addition, Landec Ag purchases corn seed and collects cash deposits from farmers in advance of shipping the corn during the Company’s third and fourth quarters. The increased levels of inventory and deferred revenue at February 27, 2005 compared to May 30, 2004 reflect the seasonal nature of Landec Ag’s seed business. In February 2003, the Company changed its fiscal year end from a fiscal year including 52 or 53 weeks that ended on the last Sunday in October to a fiscal year including 52 or 53 weeks that ends on the last Sunday in May.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported results of operations during the reporting period. Actual results could differ materially from those estimates.

For instance, the carrying value of notes and advances receivable, as well as advances for crops, are impacted by current market prices for the related crops, weather conditions and the fair value of the underlying security obtained by the Company, such as, liens on property and crops. The Company recognizes losses when it estimates that the fair value of the related crops or security is insufficient to cover the advance or note receivable.

Recent Accounting Pronouncements

On December 16, 2004, the FASB issued an amendment to FASB Statement No. 123, Accounting for Stock-Based Compensation. The amendment requires all share-based payments to employees, including grants of employee stock options, to be recognized in the statement of operations based on their fair values. The amendment is effective for the Company in the second quarter of fiscal year 2006. The Company intends to continue to grant stock-based compensation to employees, and the adoption of the new standard may have a material impact on the future results of operations.

6

Reclassifications

Certain reclassifications have been made to prior period financial statements to conform to the current period presentation.

2. Purchase and Sale of Fruit Land

On January 14, 2005, the Company entered into an agreement to purchase approximately 160 acres of fruit land from an individual for $812,500 which is included in accrued liabilities in the accompanying balance sheet. This amount was paid to the seller through the funding of an escrow account on March 23, 2005. In a separate unrelated transaction, on January 31, 2005, the Company sold approximately 45 acres of grape land to an individual for $452,500. The Company received $28,000 in cash and notes receivable for $424,500, $56,000 of which is due by December 31, 2005 and the remainder to be paid from net profits from the sale of the grapes with a final payment due on December 31, 2009. Interest accrues at the prime rate and is payable quarterly. The gain on the sale of the grape land of approximately $85,000 has been deferred and will be recognized based upon the receipt of cash payments on notes receivable.

3. Net Income Per Diluted Share

The following table sets forth the computation of diluted net income for the periods with net income (in thousands, except per share amounts):

| | Three Months

Ended

February 27,

2005 | | Three Months

Ended

February 29,

2004 | | Nine Months

Ended

February 27,

2005 | |

Numerator: | | | | | | | |

Net income | | $ | 2,293 | | $ | 725 | | $ | 793 | |

Less: Minority interest in income of subsidiary | | (127 | ) | (98 | ) | (211 | ) |

Net income for diluted net income per share | | $ | 2,166 | | $ | 627 | | $ | 582 | |

| | | | | | | |

Denominator: | | | | | | | |

Weighted average shares for basic net income per share | | 23,990 | | 21,321 | | 23,594 | |

Effect of dilutive securities: | | | | | | | |

Stock Options | | 938 | | 963 | | 898 | |

Convertible preferred stock | | — | | 1,750 | | — | |

Total dilutive common shares | | 938 | | 2,713 | | 898 | |

Weighted average shares for diluted net income per share | | 24,928 | | 24,034 | | 24,492 | |

| | | | | | | |

Diluted net income per share | | $ | 0.09 | | $ | 0.03 | | $ | 0.02 | |

Options to purchase 552,812 and 278,165 shares of Common Stock at a weighted average exercise price of $6.90 and $6.77 per share were outstanding during the three months ended February 27, 2005 and February 29, 2004, respectively, but were not included in the computation of diluted net income per share because the options’ exercise price were greater than the average market price of the Common Stock and, therefore, the effect would be antidilutive.

Options to purchase 2,564,247 shares of Common Stock at a weighted average exercise price of $5.63 per share were outstanding during the nine months ended February 27, 2005 but were not included in the computation of diluted net income per share because the options’ exercise price were greater than the average market price of the Common Stock and, therefore, the effect would be antidilutive.

7

For the nine months ended February 29, 2004, the computation of the diluted net loss per share excludes the impact of options to purchase 468,377 shares of Common Stock and the conversion of the Convertible Preferred Stock which was convertible into 1.7 million shares of Common Stock at February 29, 2004, as such impacts would be antidilutive for this period.

4. Exit of Domestic Commodity Vegetable Business

Effective June 30, 2003, the Company exited the selling of domestic commodity vegetable products and sold certain assets associated with this business to Apio Fresh LLC (“Apio Fresh”). Apio Fresh is owned by a group of entities and persons that supply produce to Apio. One of the owners of Apio Fresh is the Apio CEO (see Note 10). Under the terms of the sale, Apio Fresh purchased certain equipment and carton inventory from the Company at their net book value of approximately $410,000 in exchange for notes receivables due in monthly installments over 24 months. In addition, Apio is providing information technology service to Apio Fresh for 36 months in exchange for a note receivable for $235,000. In connection with the sale, Apio Fresh will pay the Company an on-going royalty fee per carton sold for the use of Apio’s brand names. Apio Fresh and its owner growers also entered into a long-term supply agreement with the Company to supply produce to Apio for its fresh-cut, value-added business. As a result of the sale, the Company recorded during the first quarter of fiscal year 2004, a write down of goodwill of $120,000 allocable to this business.

5. Licensing Agreement

On September 3, 2004, the Company entered into a multi-year joint technology and licensing agreement with Chiquita Brands International, Inc. (“Chiquita”) to provide Landec’s Intelimer packaging technology for Chiquita bananas. The Company expects to start selling its technology products to Chiquita during the fourth quarter of fiscal year 2005. The revenues from this agreement are not expected to be material in the current fiscal year. In addition, the two companies entered into a stock purchase agreement, whereby the Company sold to Chiquita 486,111 shares of Landec Common Stock on October 14, 2004 for $3.5 million in cash.

6. Stock-Based Compensation

As permitted by Statement of Financial Accounting Standards No. 123, “Accounting for Stock-Based Compensation,” (SFAS 123), as amended by Statement of Financial Accounting Standards No. 148, “Accounting for Stock-Based Compensation – Transition and Disclosure,” (SFAS 148), the Company elected to continue to apply the provisions of Accounting Principle Board Opinion No. 25, “Accounting for Stock Issued to Employees,” (APB 25) and related interpretations in accounting for its employee stock option and stock purchase plans. The Company is not required under APB 25 and related interpretations to recognize compensation expense in connection with its employee stock option and stock purchase plans, unless the exercise price of the Company’s employee stock options is less than the market price of the underlying stock at the date of grant.

Pro forma information regarding net income and net income per share is required by SFAS 148 and has been determined as if the Company had accounted for its employee stock options under the fair value method prescribed by SFAS 123. The fair value for these options was estimated at the date of grant using the Black-Scholes option valuation model with the following weighted average assumptions: risk-free interest rates ranging from 3.60% to 3.76% for the three months ended February 27, 2005, 3.07% to 3.27% for the three months February 29, 2004; 3.35% to 3.93% for the nine months ended February 27, 2005, and 2.27% to 3.37% for the nine months ended February 29, 2004; a dividend yield of 0.0% for the three and nine months ended February 27, 2005 and February 29, 2004; a volatility factor of the expected market price of the Company’s common stock of 0.59 and 0.72 as of February 27, 2005 and February 29, 2004, respectively; and a weighted average expected life of the options of 4.39 years and 4.99 years for the three and nine months ended February 27, 2005 and February 29, 2004, respectively.

8

For purposes of pro forma disclosures, the estimated fair value of the options is amortized to expense over the vesting period of the options using the straight-line method. The Company’s pro forma information follows (in thousands except for per share data):

| | Three Months Ended | | Nine Months Ended | |

| | February 27,

2005 | | February 29,

2004 | | February 27,

2005 | | February 29,

2004 | |

Net income (loss) | | $ | 2,293 | | $ | 725 | | $ | 793 | | $ | (1,482 | ) |

Deduct: | | | | | | | | | |

Stock-based employee expense determined under SFAS 123 | | (222 | ) | (165 | ) | (849 | ) | (732 | ) |

Pro forma net income (loss) | | $ | 2,071 | | $ | 560 | | $ | (56 | ) | $ | (2,214 | ) |

| | | | | | | | | |

Basic net income (loss) per share – as reported | | $ | 0.10 | | $ | 0.03 | | $ | 0.03 | | $ | (0.09 | ) |

Diluted net income (loss) per share – as reported | | $ | 0.09 | | $ | 0.03 | | $ | 0.02 | | $ | (0.09 | ) |

| | | | | | | | | |

Basic pro forma net income (loss) per share | | $ | 0.09 | | $ | 0.03 | | $ | (0.0 | ) | $ | (0.10 | ) |

Diluted pro forma net income (loss) per share | | $ | 0.08 | | $ | 0.02 | | $ | (0.0 | ) | $ | (0.10 | ) |

The Black-Scholes option valuation model was developed for use in estimating the fair value of traded options that have no vesting restrictions and are fully transferable. In addition, option valuation models require the input of highly subjective assumptions including the expected stock price volatility. Because the Company’s employee stock options and employee stock purchase plans have characteristics significantly different from those of traded options, and because changes in the subjective input assumptions can materially affect the fair market value estimate, in management’s opinion, the existing models do not necessarily provide a reliable single measure of the fair value of its employee stock options, nor do they necessarily represent the effects of employee stock options on reported net income (loss) for future years.

7. Goodwill and Other Intangibles

The Company is required under SFAS 142 to review goodwill and indefinite lived intangible assets at least annually. During the nine months ended February 27, 2005, the Company completed its third annual impairment review. The review is performed by grouping the net book value of all long-lived assets for reporting entities, including goodwill and other intangible assets, and comparing this value to the related estimated fair value. The determination of fair value is based on estimated future discounted cash flows related to these long-lived assets. The discount rate used was based on the risks associated with the reporting entities. The determination of fair value was performed by management using the services of an independent appraiser. The review concluded that the fair value of the reporting entities exceeded the carrying value of their net assets and thus no impairment charge was warranted as of February 27, 2005.

9

8. Inventories

Inventories are stated at the lower of cost (first-in, first-out method) or market and consisted of the following (in thousands):

| | February 27,

2005 | | May 30,

2004 | |

Finished goods | | $ | 9,891 | | $ | 7,350 | |

Raw material | | 4,469 | | 3,805 | |

Work in process | | 47 | | 72 | |

Total | | $ | 14,407 | | $ | 11,227 | |

9. Debt

On September 1, 2004, Apio entered into a new $10 million revolving line of credit that expires on August 31, 2006, a 12-month, $4.8 million equipment line of credit, and a 36-month, $1.2 million term note for equipment purchased under the prior equipment line of credit (collectively the “Loan Agreement”) with Wells Fargo Bank N.A . Outstanding amounts under the Loan Agreement bear interest at either the prime rate or the LIBOR adjustable rate plus 2.25% (4.87% at February 27, 2005). The Loan Agreement contains certain restrictive covenants, which requires Apio to meet certain financial tests, including, minimum levels of net income, maximum leverage ratio, minimum net worth and maximum capital expenditures. The Loan Agreement also affects the ability of Landec to receive payments on debt owed by Apio to Landec. Landec has pledged substantially all of the assets of Apio to secure the lines with Wells Fargo Bank. Concurrently with entering into this agreement with Wells Fargo Bank, the Company paid off and terminated its lines of credit with Wells Fargo Business Credit, Inc. At February 27, 2005, no amounts were outstanding under the revolving line of credit and $857,000 was outstanding under the equipment line of credit. Apio has been in compliance with all loan covenants in the Loan Agreement since the inception of this loan.

10. Related Party

Apio provides packing, cooling and distributing services for farms in which the Chief Executive Officer of Apio (the “Apio CEO”) has a financial interest and purchases produce from those farms. Apio also purchases produce from Apio Fresh for sale to third parties. Revenues, cost of product sales and the resulting payable and the note receivable from advances for ground lease payments, crop and harvesting costs, are classified as related party in the accompanying financial statements as of February 27, 2005 and May 30, 2004 and for the three and nine months ended February 27, 2005 and February 29, 2004.

Apio leases, for approximately $1.0 million on an annual basis, agricultural land that is either owned, controlled or leased by the Apio CEO. Apio, in turn, subleases that land at cost to growers who are obligated to deliver product from that land to Apio for value added products. There is generally no net statement of operations impact to Apio as a result of these leasing activities but Apio creates a guaranteed source of supply for the value added business. Apio has loss exposure on the leasing activity to the extent that it is unable to sublease the land. For the three and nine months ended February 27, 2005 the Company subleased all of the land leased from the Apio CEO and received sublease income of $255,000 and $739,000, respectively, which is equal to the amount the Company paid to lease that land for such periods.

Apio’s domestic commodity vegetable business was sold to Apio Fresh, effective June 30, 2003 (see Note 4). The Apio CEO is a 12.5% owner in Apio Fresh. During the three and nine months ended February 27, 2005, the Company recognized revenues of $22,000 and $228,000 respectively, from the sale of products to Apio Fresh and royalty revenue of $54,000 and $182,000 respectively, from the use by Apio Fresh of Apio’s trademarks. The related accounts receivable from Apio Fresh are classified as related party in the accompanying financial statements as of February 27, 2005 and May 30, 2004.

In addition, the Apio CEO has a 6% ownership interest in Apio Cooling LP, a limited partnership in which Apio is the general partner with a 60% ownership interest. Included in the minority interest liability as of February 27, 2005 and May 30, 2004 is $195,000 and $214,000, respectively, owed to the Apio CEO.

10

All related party transactions are monitored monthly by the Company and approved by the Audit Committee of the Board of Directors.

11. Comprehensive Income / Loss

The comprehensive loss of Landec is the same as the net loss.

12. Shareholders’ Equity

During the three and nine months ended February 27, 2005, 115,466 and 335,868 shares of Common Stock, respectively, were issued upon the exercise of options under the Company’s stock option plans. In addition, the Company sold to Chiquita 486,111 shares of Landec Common Stock on October 14, 2004 for $3.5 million in cash (see Note 5).

13. Business Segment Reporting

Landec operates in two business segments: the Food Products Technology segment and the Agricultural Seed Technology segment. The Food Products Technology segment markets and packs specialty packaged whole and fresh-cut vegetables that incorporate the Intelimer® based specialty packaging for the retail grocery, club store and food services industry. In June 2003, the Company exited the selling of domestic commodity vegetable products (see Note 4). The Agricultural Seed Technology segment markets and distributes hybrid seed corn to the farming industry and is developing seed coatings using Landec’s proprietary Intelimer polymers. The Food Products Technology and Agricultural Seed Technology segments include charges for corporate services allocated from the Corporate and Other segment. Corporate and other amounts include non-core operating activities and corporate operating costs. All of the assets of the Company are located within the United States of America.

11

Operations by Business Segment (in thousands):

| | Food Products

Technology | | Agricultural

Seed

Technology | | Corporate

and Other | | TOTAL | |

Three months ended February 27, 2005 | | | | | | | | | |

Net revenues | | $ | 41,650 | | $ | 9,722 | | $ | 159 | | $ | 51,531 | |

International sales | | $ | 5,943 | | $ | — | | $ | — | | $ | 5,943 | |

Gross profit | | $ | 5,300 | | $ | 3,859 | | $ | 139 | | $ | 9,298 | |

Net income | | $ | 1,170 | | $ | 978 | | $ | 145 | | $ | 2,293 | |

Interest expense | | $ | 90 | | $ | 37 | | $ | — | | $ | 127 | |

Interest income | | $ | 62 | | $ | 12 | | $ | 14 | | $ | 88 | |

Depreciation and amortization | | $ | 809 | | $ | 119 | | $ | 27 | | $ | 955 | |

| | | | | | | | | |

Three months ended February 29, 2004 | | | | | | | | | |

Net revenues | | $ | 39,614 | | $ | 8,857 | | $ | 117 | | $ | 48,588 | |

International sales | | $ | 8,238 | | $ | — | | $ | — | | $ | 8,238 | |

Gross profit | | $ | 3,671 | | $ | 3,670 | | $ | 107 | | $ | 7,448 | |

Net income (loss) | | $ | (550 | ) | $ | 1,245 | | $ | 30 | | $ | 725 | |

Interest expense | | $ | 137 | | $ | 25 | | $ | — | | $ | 162 | |

Interest income | | $ | 39 | | $ | 2 | | $ | 1 | | $ | 42 | |

Depreciation and amortization | | $ | 697 | | $ | 124 | | $ | 47 | | $ | 868 | |

| | | | | | | | | |

Nine months ended February 27, 2005 | | | | | | | | | |

Net revenues | | $ | 138,920 | | $ | 9,827 | | $ | 310 | | $ | 149,057 | |

International sales | | $ | 42,126 | | $ | — | | $ | — | | $ | 42,126 | |

Gross profit | | $ | 16,820 | | $ | 3,955 | | $ | 259 | | $ | 21,034 | |

Net income (loss) | | $ | 3,978 | | $ | (3,376 | ) | $ | 191 | | $ | 793 | |

Interest expense | | $ | 223 | | $ | 109 | | $ | — | | $ | 332 | |

Interest income | | $ | 76 | | $ | 14 | | $ | 17 | | $ | 107 | |

Depreciation and amortization | | $ | 2,294 | | $ | 351 | | $ | 78 | | $ | 2,723 | |

| | | | | | | | | |

Nine months ended February 29, 2004 | | | | | | | | | |

Net revenues | | $ | 124,277 | | $ | 9,003 | | $ | 376 | | $ | 133,656 | |

International sales | | $ | 36,737 | | $ | — | | $ | — | | $ | 36,737 | |

Gross profit | | $ | 14,501 | | $ | 3,718 | | $ | 340 | | $ | 18,559 | |

Net income (loss) | | $ | 1,554 | | $ | (3,068 | ) | $ | 32 | | $ | (1,482 | ) |

Interest expense | | $ | 567 | | $ | 128 | | $ | — | | $ | 695 | |

Interest income | | $ | 125 | | $ | 6 | | $ | 3 | | $ | 134 | |

Depreciation and amortization | | $ | 2,190 | | $ | 356 | | $ | 143 | | $ | 2,689 | |

During the nine months ended February 27, 2005 and February 29, 2004, sales to the Company’s top five customers accounted for approximately 41% and 42%, respectively, of revenues, with the Company’s top customer from the Food Products Technology segment, Costco Wholesale Corp., accounting for approximately 15% and 12%, respectively. The Company expects that, for the foreseeable future, a limited number of customers may continue to account for a significant portion of its net revenues. Virtually all of the Company’s international sales are to Asia.

12

Item 2.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with the unaudited consolidated financial statements and accompanying notes included in Part I—Item 1 of this Form 10-Q and the audited consolidated financial statements and accompanying notes and Management’s Discussion and Analysis of Financial Condition and Results of Operations included in Landec’s Annual Report on Form 10-K for the fiscal year ended May 30, 2004.

Except for the historical information contained herein, the matters discussed in this report are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934. These forward-looking statements involve certain risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Potential risks and uncertainties include, without limitation, those mentioned in this report and, in particular the factors described below under “Additional Factors That May Affect Future Results,” and those mentioned in Landec’s Annual Report on Form 10-K for the fiscal year ended May 30, 2004. Landec undertakes no obligation to update or revise any forward-looking statements in order to reflect events or circumstances that may arise after the date of this report.

Critical Accounting Policies and Use of Estimates

There have been no material changes to the Company’s critical accounting policies which are included and described in the Form 10-K for the fiscal year ended May 30, 2004 filed with the Securities and Exchange Commission on August 2, 2004.

The Company

Landec Corporation and its subsidiaries (“Landec” or the “Company”) design, develop, manufacture and sell temperature-activated and other specialty polymer products for a variety of food products, agricultural products, and licensed partner applications. This proprietary polymer technology is the foundation, and a key differentiating advantage, upon which Landec has built its business.

Landec’s core polymer products are based on its patented proprietary Intelimerâ polymers, which differ from other polymers in that they can be customized to abruptly change their physical characteristics when heated or cooled through a pre-set temperature switch. For instance, Intelimer polymers can change within the range of one or two degrees Celsius from a non-adhesive state to a highly tacky, adhesive state; from an impermeable state to a highly permeable state; or from a solid state to a viscous state. These abrupt changes are repeatedly reversible and can be tailored by Landec to occur at specific temperatures, thereby offering substantial competitive advantages in Landec’s target markets.

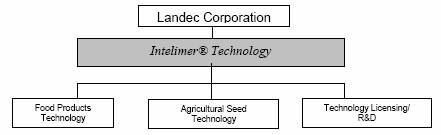

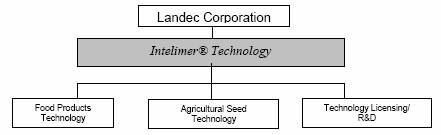

Landec has two core businesses – Food Products Technology and Agricultural Seed Technology, in addition to our Technology Licensing/Research and Development business which is included in Corporate and Other for segment disclosure purposes (see note 13).

Our Food Products Technology business is operated through a subsidiary, Apio, Inc., and combines our proprietary food packaging technology with the capabilities of a large national food supplier and value-added produce processor. Value-added processing incorporates Landec’s proprietary packaging technology with produce that is processed by washing, and in some cases cutting and mixing, resulting in packaged produce to achieve increased shelf life and reduced shrink (waste) and to eliminate the need for ice during the distribution cycle. This combination was consummated in December 1999 when the Company acquired Apio, Inc. and certain related entities (collectively, “Apio”).

13

Our Agricultural Seed Technology business is operated through a subsidiary, Landec Ag, Inc., (“Landec Ag”) and combines our proprietary Intellicoat® seed coating technology with our unique eDCâ – e-commerce, direct marketing and consultative selling – capabilities which we obtained when we acquired Fielder’s Choice Direct (“Fielder’s Choice”), a direct marketer of hybrid seed corn, in September 1997.

In addition to our two core businesses, the Company also operates a Technology Licensing/Research and Development business that licenses and/or supplies products outside of our core businesses to industry leaders such as Alcon Laboratories, Inc. and L’Oreal of Paris.

Landec has been unprofitable during each fiscal year since its inception, except for the fiscal year ended May 30, 2004, and the seven-month period ended May 25, 2003, and may incur additional losses in the future. The amount of future net profits, if any, is uncertain and there can be no assurance that Landec will remain consistently profitable. From inception through February 27, 2005, Landec’s accumulated deficit was $54.5 million.

Landec was incorporated in California on October 31, 1986. We completed our initial public offering in 1996 and our Common Stock is listed on the Nasdaq National Market under the symbol “LNDC.” Our principal executive offices are located at 3603 Haven Avenue, Menlo Park, California 94025 and our telephone number is (650) 306-1650.

Description of Core Business

Landec participates in two core business segments– Food Products Technology and Agricultural Seed Technology. In addition to these two core segments, we license technology and conduct ongoing research and development through our Technology Licensing/Research and Development Business.

Food Products Technology Business

The Company began marketing in early 1996 our proprietary Intelimer-based specialty packaging for use in the fresh-cut produce market, one of the fastest growing segments in the produce industry. Our proprietary packaging technology, when combined with produce that is processed by washing, and in some cases cut and mixed, results in packaged produce with increased shelf life, reduced shrink (waste) and without the need for ice during the distribution cycle, which we refer to as our “value-added” products. In December 1999, we acquired Apio, our largest customer at that time in the Food Products Technology business and one of the nation’s leading marketers and packers of produce and specialty packaged fresh-cut vegetables. Apio provides year-round access to produce, utilizes state-of-the-art fresh-cut produce processing technology and distributes products to the top U.S. retail grocery chains and major club stores and, has recently begun expanding its product offerings to the foodservice industry. Our proprietary Intelimer-based packaging business has been combined with Apio into a wholly owned subsidiary that retains the Apio, Inc. name. This vertical integration within the Food Products Technology business gives Landec direct access to the large and growing fresh-cut produce market.

Based in Guadalupe, California, Apio, when acquired in December 1999, consisted of two major businesses – first, the “fee-for-service” selling and marketing of domestic commodity vegetable produce and second, the specialty packaged fresh-cut and whole value-added processed products that are washed and packaged in our

14

proprietary packaging. Effective June 30, 2003, the Company exited the selling of domestic commodity vegetable products and sold certain assets associated with this business to Apio Fresh LLC (“Apio Fresh”). Apio Fresh is owned by a group of entities and persons that supply produce to Apio. The Apio CEO is a 12.5% owner in Apio Fresh. The fresh-cut value-added produce processing business sells a variety of fresh-cut vegetables to the top retail grocery chains and club stores. During the twelve months ended May 30, 2004, Apio shipped more than 17 million cartons of produce to over 700 customers including leading supermarket retailers, wholesalers, foodservice suppliers and club stores throughout the United States and internationally, primarily in Asia.

There are five major distinguishing characteristics of Apio that provide competitive advantages in the Food Products Technology market:

• Value-Added Supplier: Apio has structured its business as a marketer and seller of fresh-cut and whole value-added produce. It is focused on developing its Eat Smart® brand and the Doleâ brand for all of its fresh-cut and whole value-added products. As retail grocery and club store chains consolidate, Apio is well positioned as a single source of a broad range of products.

• Reduced Farming Risks: Apio reduces its farming risk by not taking ownership of farmland, and instead, contracts with growers for produce. The year-round sourcing of produce is a key component to the fresh-cut and whole value-added processing business.

• Lower Cost Structure: Apio has strategically invested in the rapidly growing fresh-cut and whole value-added business. Apio’s 60,000 square foot value-added processing plant is automated with state-of-the-art vegetable processing equipment. Virtually all of Apio’s value-added products utilize Landec’s proprietary Intelimer packaging technology. Our strategy is to operate one large central processing facility in one of California’s largest, lowest cost growing regions (Santa Maria Valley) and use packaging technology to allow for the nationwide delivery of fresh produce products. To augment the strategy, in October 2004 Apio entered into an agreement with Caito Foods Service, Inc. of Indianapolis, Indiana, to regionally process, package and distribute Apio’s value-added specialty packaged fresh-cut vegetable tray products.

• Export Capability: Apio is uniquely positioned to benefit from the growth in export sales to Asia and Europe over the next decade with its export business, CalEx. Through CalEx, Apio is currently one of the largest U.S. exporters of broccoli to Asia and is selling its iceless products to Asia using proprietary Intelimer packaging technology.

• Expanded Product Line Using Technology: Apio, through the use of Landec’s Intelimer packaging technology, is introducing on average twelve new value-added products each year. These new product offerings range from various sizes of fresh-cut bagged products, to vegetable trays, to whole produce, to a meal line of products. During the last twelve months, Apio has introduced twelve new products.

Agricultural Seed Technology Business

Landec Ag’s strategy is build a vertically integrated seed technology company based on Intellicoat seed coating technology and its eDC¾e-commerce, direct marketing and consultative selling capabilities.

For the coating technology the strategy is to develop a patented, functional polymer coating technology that will be broadly licensed to the seed industry. The company will initially commercialize products for the corn and soybean markets and then broaden its applications to other seed crops. Landec Ag will use its Fielder’s Choice Direct marketing and sales company to launch its applications for corn to build awareness for this technology and then broadly license its applications to the rest of the industry.

Landec Ag’s Intellicoat seed coating applications are designed to control seed germination timing, increase crop yields, reduce risks and extend crop-planting windows. These coatings are currently available on hybrid corn, soybeans and male inbred corn used for seed production. In fiscal year 2000, Landec Ag launched its first commercial product, Pollinator Plusâ coatings, which is a coating application used by seed companies as a method

15

for spreading pollination to increase yields and reduce risk in the production of hybrid seed corn. There are approximately 650,000 acres of seed production in the United States and in 2004 Pollinator Plus was used by over 35 seed companies on approximately 15% of the seed production acres in the U.S.

In 2003, after two years of on-farm trails, Landec Ag commercialized Early Plantâ corn by selling to farmers through its Fielder’s Choice Directâ brand. This application is a management tool, which allows farmers to plant into cold soils without the risk of chilling injury, and enables farmers to plant as much as four weeks earlier than normal. With this capability, farmers are able to utilize labor and equipment more efficiently, provide flexibility during the critical planting period and avoid yield losses caused by late planting. In 2004, seven seed companies offered Intellicoat on their hybrid seed corn offerings and sales increased by 50% over 2003.

The third commercial application is the RelayÔ Cropping system of wheat and Intellicoat coated soybeans, which allows farmers to plant and harvest two crops in the same year on the same ground in geographic areas where double cropping is not possible. This provides significant financial benefit especially to farmers in the corn belt who grow wheat as a single crop.

Based in Monticello, Indiana, Fielder’s Choice Direct offers a comprehensive line of corn hybrids and alfalfa to more than 12,000 farmers in over forty states through direct marketing programs. The success of Fielder’s Choice comes, in part, from its expertise in selling directly to the farmer, bypassing the traditional and costly farmer-dealer system. We believe that this direct channel of distribution provides up to a 35% cost advantage compared to the farmer-dealer system.

In order to support its direct marketing programs, Fielder’s Choice has developed a proprietary e-commerce direct marketing, and consultative selling information technology, called “eDC”, that enables state-of-the-art methods for communicating with a broad array of farmers. This proprietary direct marketing information technology includes a current database of over 95,000 farmers. In August 1999, we launched the seed industry’s first comprehensive e-commerce website. This website furthers our ability to provide a high level of consultation to Fielder’s Choice customers, backed by a seven day a week call center capability that enables us to use the internet as a natural extension of our direct marketing strategy.

Due to the cyclical nature of the corn seed industry, a significant portion of Landec Ag revenues and profits will be concentrated over a few months during the spring planting season (generally during Landec’s third and fourth fiscal quarters). In addition, Landec Ag purchases corn seed and collects cash deposits from farmers in advance of shipping the corn during the Company’s third and fourth quarters.

Technology Licensing/Research and Development Businesses

We believe our technology has commercial potential in a wide range of industrial, consumer and medical applications beyond those identified in our core businesses. For example, our core patented technology Intelimer materials, can be used to trigger release small molecule drugs, catalysts, pesticides or fragrances just by changing the temperature of the Intelimer materials or to activate adhesives through controlled temperature change. In order to exploit these opportunities, we have entered into and will enter into licensing and collaborative corporate agreements for product development and/or distribution in certain fields.

16

Results of Operations

Revenues (in thousands):

| | Three months

ended 2/27/05 | | Three months

ended 2/29/04 | | Change | | Nine months

ended 2/27/05 | | Nine months

ended 2/29/04 | | Change | |

Apio Value Added | | $ | 33,223 | | $ | 28,604 | | 16 | % | $ | 86,409 | | $ | 73,717 | | 17 | % |

Apio Trading | | 7,673 | | 9,746 | | (21 | )% | 49,719 | | 44,443 | | 12 | % |

Apio Bananas | | ¾ | | 449 | | N/M | | ¾ | | 1,393 | | N/M | |

Apio Service | | 754 | | 815 | | (7 | )% | 2,792 | | 4,724 | | (41 | )% |

Total Apio | | 41,650 | | 39,614 | | 5 | % | 138,920 | | 124,277 | | 12 | % |

Landec Ag | | 9,722 | | 8,857 | | 10 | % | 9,827 | | 9,003 | | 9 | % |

Corporate | | 159 | | 117 | | 36 | % | 310 | | 376 | | (18 | )% |

Total Revenues | | 51,531 | | 48,588 | | 6 | % | 149,057 | | 133,656 | | 12 | % |

| | | | | | | | | | | | | | | | | |

Apio Value Added

Apio’s value-added revenues consist of revenues generated from the sale of specialty packaged fresh-cut and whole value-added processed vegetable products that are washed and packaged in our proprietary packaging and sold primarily under Apio’s Eat Smart brand and the Dole brand.

The increase in Apio’s value-added revenues for the three and nine months ended February 27, 2005 compared to the same periods last year is primarily due to increased product offerings and increased sales to existing customers. Specifically, sales of Apio’s value-added 12-ounce specialty packaged retail product line grew 8% and 12%, respectively, during the three and nine months ended February 27, 2005 compared to the same periods last year. In addition, sales of Apio’s value-added vegetable tray products grew 46% and 72%, respectively, during the three and nine months ended February 27, 2005 compared to the same periods last year. Overall value-added unit sales volume increased 11% during the third quarter of fiscal year 2005 compared to the same period last year and 12% for the nine months ended February 27, 2005 compared to the same period of the prior year.

Apio Trading

Apio trading revenues consist of revenues generated from the purchase and sale of primarily whole commodity fruit and vegetable products to Asia through Apio’s export company, Cal-Ex and from the purchase and sale of whole commodity fruit and vegetable products domestically to Wal-Mart.

The decrease in revenues in Apio’s trading business for the three months ended February 27, 2005 compared to the same period last year was primarily due to decreased export unit volume of 32% primarily from a shortage of available fruit, primarily apples, to export. The increase in revenues for the nine months ended February 27, 2005 compared to the same period a year ago was primarily due to an increase in export volumes of 15% through the first six months of fiscal year 2005, coupled with higher prices during that six month period, partially offset by lower volume shipments during the third quarter of fiscal year 2005.

Apio Bananas

Apio banana revenues have historically consisted of revenues generated from the sale of bananas in our proprietary packaging. During fiscal year 2004, bananas were sold almost exclusively to food service companies. Future sales from the Company’s banana program will consist of only the Company’s proprietary packaging.

As a result of discontinuing the sale of bananas in our proprietary packaging to focus on selling our proprietary breathable membranes for banana packaging, which is not expected to begin until our fourth fiscal quarter of 2005, there were no revenues in our banana program during the three and nine months ended February 27,

17

2005 compared to $449,000 and $1.4 million during the three and nine months ended February 29, 2004, respectively. We do not expect material revenues or gross profits from our banana program in fiscal year 2005.

Apio Service

Prior to its sale on June 30, 2003, Apio operated a domestic commodity vegetable business that marketed and sold whole produce for growers. Apio charged a per carton service fee for marketing and selling these whole commodity products. Subsequent to June 30, 2003, Apio’s service revenues consist of revenues generated from Apio Cooling, LP, a vegetable cooling operation in which Apio is the general partner with a 60% ownership position.

The decrease in service revenues during the three and nine months ended February 27, 2005 compared to the same periods last year is directly attributable to the sale of Apio’s domestic commodity vegetable business.

Landec Ag

Landec Ag revenues consist of revenues generated from the sale of hybrid seed corn to farmers under the Fielder’s Choice Direct brand and from the sale of Intellicoat coated corn and soybean seeds to farmers and seed companies. Virtually all of Landec Ag’s revenues are generated during the Company’s third and fourth quarters.

The increase in revenues at Landec Ag during the three and nine months ended February 27, 2005 compared to the same periods last year was due to an increase in unit sales of Fielder’s Choice Direct corn during the third quarter of fiscal year 2005.

Corporate

Corporate revenues consist of revenues generated from partnering with others under research and development agreements and supply agreements and from fees for licensing our proprietary Intelimer technology to others and from the corresponding royalties from these license agreements. Given the infrequency and unpredictability of the payments that the Company may receive under any of its licensing and research and development arrangements, the Company is unable to disclose its expectations in advance of entering into such arrangements.

The decrease in Corporate revenues for the three and nine months ended February 27, 2005 compared to the same periods of the prior year was not significant.

Gross Profit (in thousands):

| | Three months

ended 2/27/05 | | Three months

ended 2/29/04 | | Change | | Nine months

ended 2/27/05 | | Nine months

ended 2/29/04 | | Change | |

Apio Value Added | | 4,505 | | 3,151 | | 43 | % | 12,864 | | 10,977 | | 17 | % |

Apio Trading | | 419 | | 448 | | (6 | )% | 2,702 | | 2,282 | | 18 | % |

Apio Bananas | | ¾ | | (237 | ) | N/M | | ¾ | | (707 | ) | N/M | |

Apio Service | | 375 | | 309 | | 21 | % | 1,254 | | 1,949 | | 36 | % |

Total Apio | | 5,299 | | 3,671 | | 44 | % | 16,820 | | 14,501 | | 16 | % |

Landec Ag | | 3,859 | | 3,670 | | 5 | % | 3,955 | | 3,718 | | 6 | % |

Corporate | | 140 | | 107 | | 31 | % | 259 | | 340 | | (24 | )% |

Total Gross Profit | | 9,298 | | 7,448 | | 25 | % | 21,034 | | 18,559 | | 13 | % |

General

There are numerous factors that can influence gross profits including product mix, customer mix, manufacturing costs (raw materials, such as fresh produce, corn seed, polymer materials and packaging, direct labor, overhead, including indirect labor, depreciation and facility-related costs and shipping and shipping-related costs),

18

volume, sale discounts and charges for excess or obsolete inventory, to name a few. Many of these factors influence or are interrelated with other factors. Therefore, it is difficult to precisely quantify the impact of each item individually. The following discussion surrounding gross profits includes management’s best understanding of the reasons for the changes for the three months and nine months ended February 27, 2005 compared to the same periods last year as outlined in the table above.

Apio Value-Added

The increase in gross profits for Apio’s value-added specialty packaged vegetable business for the three months ended February 27, 2005 compared to the same period last year was due to (1) the increase in value-added sales which increased 16% for the quarter, (2) more favorable produce sourcing during this year’s third quarter compared to last year’s third quarter which increased gross profits approximately $700,000 and (3) product mix changes to higher margin products which increased gross profits during the quarter by approximately $200,000.

The increase in gross profits for Apio’s value-added specialty packaged vegetable business for the nine months ended February 27, 2005 compared to the same period last year was due to (1) the increase in value-added sales which increased 17% for the period and (2) product mix changes to higher margin products which increased gross profits during the period by approximately $500,000. The increase in gross profits for the first nine months of fiscal year 2005 was partially offset by inventory write-offs of approximately $300,000 during the first fiscal quarter in preparation for new product introductions.

Apio Trading

Apio’s trading business is a buy/sell business that realizes a commission-based margin in the 4-6% range. The decrease in gross profits during the three months ended February 27, 2005 compared to the same period last year was due to a 21% decrease in trading revenues partially offset by higher sales prices due to the shortage of certain export produce products. The increase in gross profits during the nine months ended February 27, 2005 compared to the same period last year was primarily due to a 12% increase in trading revenues, coupled with higher sales prices.

Apio Service

The decrease in Apio’s service gross profits during the three and nine months ended February 27, 2005 compared to the same periods last year was directly attributable to the sale of Apio’s domestic commodity vegetable business.

Landec Ag

The increase in gross profits for Landec Ag for the three and nine months ended February 27, 2005 compared to the same periods last year was due to the increased sales of higher margin corn hybrids, which was partially offset by higher royalty and seed treatment fees associated with these higher margin corn hybrids, resulting in lower gross profits as a percentage of sales as compared to the same periods last year.

Apio Bananas and Corporate

The change in gross profits for Apio Bananas and Corporate for the three and nine months ended February 27, 2005 compared to the same periods last year was not significant.

19

Operating Expenses (in thousands):

| | Three months

ended 2/27/05 | | Three months

ended 2/29/04 | | Change | | Nine months ended 2/27/05 | | Nine months ended 2/29/04 | | Change | |

Research and Development: | | | | | | | | | | | | | |

Apio | | 230 | | 297 | | (23 | )% | 773 | | 1,018 | | (24 | )% |

Landec Ag | | 194 | | 268 | | (28 | )% | 613 | | 814 | | (25 | )% |

Corporate | | 281 | | 316 | | (11 | )% | 809 | | 967 | | (16 | )% |

Total R&D | | 705 | | 881 | | (20 | )% | 2,195 | | 2,799 | | (22 | )% |

| | | | | | | | | | | | | |

Selling, General and Administrative: | | | | | | | | | | | | | |

Apio | | 3,039 | | 3,170 | | (4 | )% | 9,537 | | 9,432 | | 1 | % |

Landec Ag | | 2,350 | | 1,806 | | 30 | % | 5,719 | | 4,878 | | 17 | % |

Corporate | | 769 | | 655 | | 17 | % | 2,222 | | 2,025 | | 10 | % |

Total S,G&A | | 6,158 | | 5,631 | | 9 | % | 17,478 | | 16,335 | | 7 | % |

Research and Development

Landec’s research and development expenses consist primarily of expenses involved in the development and process scale-up initiatives. Research and developments efforts at Apio are focused on the Company’s proprietary breathable membranes used for packaging produce, with recent focus on extending the shelf life of bananas. At Landec Ag, the research and development efforts are focused on the Company’s proprietary Intellicoat coatings for seeds, primarily corn seed. At Corporate, the research and development efforts are focused on uses for the proprietary Intelimer polymers outside of food and agriculture.

The decrease in research and development expenses for the three months and nine months ended February 27, 2005 compared to the same periods last year was primarily due to lower research and development expenses associated with the Company’s non-banana related programs at Apio and greater emphasis at Apio and Landec Ag on sales and marketing versus research and development.

Selling, General and Administrative

Selling, general and administrative expenses consist primarily of sales and marketing expenses associated with Landec’s product sales and services, business development expenses and staff and administrative expenses.

The increase in selling, general and administrative expenses for the three months and nine months ended February 27, 2005 compared to the same periods last year was primarily due to an increase in sales and marketing expenses at both Apio and Landec Ag in order to generate increases in revenue and from increased accounting and legal expenses at Corporate associated with Sarbanes/Oxley compliance.

20

Other (in thousands):

| | Three months

ended 2/27/05 | | Three months

ended 2/29/04 | | Change | | Nine months

ended 2/27/05 | | Nine months

ended 2/29/04 | | Change | |

Interest Income | | 88 | | 42 | | 110 | % | 107 | | 134 | | (20 | )% |

Interest Expense | | (127 | ) | (162 | ) | (22 | )% | (332 | ) | (695 | ) | (52 | )% |

Other Expense | | (103 | ) | (91 | ) | 13 | % | (343 | ) | (346 | ) | (1 | )% |

Total Other | | (142 | ) | (211 | ) | (33 | )% | (568 | ) | (907 | ) | (37 | )% |

Interest Income

The increase in interest income for the three months ended February 27, 2005 compared to the same periods last year was due to the increase in cash available to invest. The decrease in interest income for the nine months ended February 27, 2005 compared to the same period a year ago was due to a reduction in interest bearing notes receivable at Apio partially offset by interest earned from cash invested in one-to-three month liquid instruments.

Interest Expense

The decrease in interest expense during the three and nine months ended February 27, 2005 compared to the same periods last year was due to the Company using cash generated from operations to pay down debt and thus lowering interest expenses.

Other Expense

Other consists of the minority interest expense associated with the limited partners equity interest in the net income of Apio Cooling, LP and non operating income and expenses such as the gain or loss on the sale of assets.

The change in other expense for the three and nine months ended February 27, 2005 compared to the same periods last year was not material to the consolidated net operating results of Landec.

Liquidity and Capital Resources

As of February 27, 2005, the Company had cash and cash equivalents of $14.9 million, a net increase of $8.4 million from $6.5 million at May 30, 2004.

Cash Flow from Operating Activities

Landec generated $12.1 million of cash flow in operating activities during the nine months ended February 27, 2005 compared to $6.4 million for the nine months ended February 27, 2004. The primary sources of cash during the nine months ended February 27, 2005 were from (1) net income and non-cash items, such as depreciation, of $4.0 million, (2) net collection of accounts receivable of $3.7 million and (3) an increase in deferred revenue of $10.8 million as a result of cash deposits for seed corn to be shipped during our fourth fiscal quarter of 2005. The primary uses of cash in operating activities were from the purchase of seed corn inventory by Landec Ag of $3.7 million and a net decrease in accounts payable of $3.7 million.

Cash Flow from Investing Activities

Net cash used in investing activities for the nine months ended February 27, 2005 was $3.1 million compared to $524,000 for the same period last year. The primary uses of cash for investing activities during the first nine months of fiscal year 2005 were for the purchase of $3.1 million of property and equipment primarily for the further automation of Apio’s value-added facility.

21

Cash Flow from Financing Activities

Net cash used in financing activities for the nine months ended February 27, 2005 was $544,000 compared to $3.3 million for the same period last year. The cash used in financing activities during the first nine months of fiscal year 2005 was primarily from the repayment of $4.9 million of debt, partially offset by the sale of $5.0 million of Landec Common Stock, of which $3.5 million was sold to Chiquita and the remainder was issued from the exercise of stock options.

Capital Expenditures

During the nine months ended February 27, 2005, Landec purchased vegetable processing equipment to support the expansion of Apio’s value added business. These expenditures represented the majority of the $3.1 million of equipment purchased.

Debt

On September 1, 2004, Apio entered into a new $10 million revolving line of credit that expires on August 31, 2006, a 12-month, $4.8 million equipment line of credit, and a 36-month, $1.2 million term note for equipment purchased under the prior equipment line of credit (collectively the “Loan Agreement”) with Wells Fargo Bank N.A. Outstanding amounts under the Loan Agreement bear interest at either the prime rate or the LIBOR adjustable rate plus 2.25% (4.87% at February 27, 2005). The Loan Agreement contains certain restrictive covenants, which requires Apio to meet certain financial tests, including, minimum levels of net income, maximum leverage ratio, minimum net worth and maximum capital expenditures. The Loan Agreement also affects the ability of Landec to receive payments on debt owed by Apio to Landec. Landec has pledged substantially all of the assets of Apio to secure the lines with Wells Fargo Bank. Concurrently with entering into this agreement with Wells Fargo Bank, the Company paid off and terminated its lines of credit with Wells Fargo Business Credit, Inc. At February 27, 2005, no amounts were outstanding under the revolving line of credit and $857,000 was outstanding under the equipment line of credit. Apio has been in compliance with all loan covenants in the Loan Agreement since the inception of this loan.

Landec Ag has a revolving line of credit which allows for borrowings of up to $7.5 million, based on Landec Ag’s inventory levels. The interest rate on the revolving line of credit is the prime rate plus 0.375%. The line of credit contains certain restrictive covenants, which, among other things, restrict the ability of Landec Ag to make payments on debt owed by Landec Ag to Landec. Landec has pledged substantially all of the assets of Landec Ag to secure the line of credit. At February 27, 2005, no amounts were outstanding under Landec Ag’s revolving line of credit. Landec Ag has been in compliance with all loan covenants since the inception of this loan.

At February 27, 2005, Landec’s total debt, including current maturities, was $4.1 million and the total debt to equity ratio was 6% compared to 15% at May 30, 2004. Of this debt, approximately $857,000 was comprised of lines of credit and approximately $3.2 million was comprised of term debt, $2.1 million of which is mortgage debt on Apio’s manufacturing facilities. The amount of debt outstanding on Landec’s revolving lines of credit fluctuates over time. Borrowings on Landec’s lines of credit are expected to vary with seasonal requirements of the Company’s businesses.

22

Contractual Obligation

The Company’s material contractual obligations for the next five years and thereafter as of February 27, 2005, are as follows (in thousands):

| | Due in Fiscal Year Ended May | |

Obligation | | Total | | Remainder

of 2005 | | 2006 | | 2007 | | 2008 | | 2009 | | Thereafter | |

Lines of Credit | | $ | 857 | | $ | 857 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | |

Long-term Debt | | 3,228 | | 138 | | 554 | | 548 | | 289 | | 141 | | 1,558 | |

Operating Leases | | 1,754 | | 168 | | 622 | | 459 | | 331 | | 174 | | — | |

Licensing Obligation | | 700 | | — | | 100 | | 100 | | 100 | | 100 | | 300 | |

Interest Expense | | 994 | | 265 | | 157 | | 125 | | 96 | | 81 | | 270 | |

Purchase Commitments | | 1166 | | 350 | | 816 | | | | | | | | | |

Total | | $ | 8,699 | | $ | 1,778 | | $ | 2,249 | | $ | 1,232 | | $ | 816 | | $ | 496 | | $ | 2,128 | |

Interest expense was determined based on the assumption that the Company’s lines of credit will have an average daily outstanding balance of $2 million at an annual interest rate of 5% for all periods presented. The interest expense on long term notes and lease obligations is based on the payment schedules and interest rates from the relevant agreements.

Landec’s future capital requirements will depend on numerous factors, including the progress of its research and development programs; the development of commercial scale manufacturing capabilities; the development of marketing, sales and distribution capabilities; the ability of Landec to establish and maintain new collaborative and licensing arrangements; any decision to pursue additional acquisition opportunities; weather conditions that can affect the supply and price of produce, the timing and amount, if any, of payments received under licensing and research and development agreements; the costs involved in preparing, filing, prosecuting, defending and enforcing intellectual property rights; the ability to comply with regulatory requirements; the emergence of competitive technology and market forces; the effectiveness of product commercialization activities and arrangements; and other factors. If Landec’s currently available funds, together with the internally generated cash flow from operations are not sufficient to satisfy its capital needs, Landec would be required to seek additional funding through other arrangements with collaborative partners, additional bank borrowings and public or private sales of its securities. There can be no assurance that additional funds, if required, will be available to Landec on favorable terms if at all.

Landec believes that its debt facilities, cash from operations, along with existing cash, cash equivalents and existing borrowing capacities will be sufficient to finance its operational and capital requirements through at least the next twelve months.

Additional Factors That May Affect Future Results

Landec desires to take advantage of the “Safe Harbor” provisions of the Private Securities Litigation Reform Act of 1995 and of Section 21E and Rule 3b-6 under the Securities Exchange Act of 1934. Specifically, Landec wishes to alert readers that the following important factors, as well as other factors including, without limitation, those described elsewhere in this report, could in the future affect, and in the past have affected, Landec’s actual results and could cause Landec’s results for future periods to differ materially from those expressed in any forward-looking statements made by or on behalf of Landec. Landec assumes no obligation to update such forward-looking statements.

23

We Have a History of Losses Which May Continue

We have incurred net losses in each fiscal year since our inception, except for the fiscal year ended May 30, 2004 and the seven-month period ended May 25, 2003. Our accumulated deficit as of February 27, 2005 totaled $54.5 million. We may incur additional losses in the future. The amount of future net profits, if any, is highly uncertain and there can be no assurance that the Company will be able to sustain profitability in future years.

Our Future Operating Results Are Likely to Fluctuate Which May Cause Our Stock Price to Decline

In the past, our results of operations have fluctuated significantly from quarter to quarter and are expected to continue to fluctuate in the future. Historically, our direct marketer of hybrid corn seed, Landec Ag, has been the primary source of these fluctuations, as its revenues and profits are concentrated over a few months during the spring planting season (generally during our third and fourth fiscal quarters). In addition, Apio can be heavily affected by seasonal and weather factors which have impacted quarterly results, such as the high cost of sourcing product in December 2003, January 2004 and March 2005 due to a shortage of essential value-added produce items which had to be purchased at inflated prices on the open market. Our earnings may also fluctuate based on our ability to collect accounts receivables from customers and note receivables from growers. Our earnings from our Food Products Technology business are sensitive to price fluctuations in the fresh vegetables and fruits markets. Excess supplies can cause intense price competition. Other factors that affect our food and/or agricultural operations include:

• the seasonality of our supplies;

• our ability to process produce during critical harvest periods;

• the timing and effects of ripening;

• the degree of perishability;

• the effectiveness of worldwide distribution systems;

• total worldwide industry volumes;

• the seasonality of consumer demand;

• foreign currency fluctuations; and

• foreign importation restrictions and foreign political risks.

As a result of these and other factors, we expect to continue to experience fluctuations in quarterly operating results.

We May Not Be Able to Achieve Acceptance of Our New Products in the Marketplace

Our success in generating significant sales of our products will depend in part on the ability of us and our partners and licensees to achieve market acceptance of our new products and technology. The extent to which, and rate at which, we achieve market acceptance and penetration of our current and future products is a function of many variables including, but not limited to:

• price;

• safety;

• efficacy;

• reliability;

• conversion costs;

• marketing and sales efforts; and

• general economic conditions affecting purchasing patterns.

24

We may not be able to develop and introduce new products and technologies in a timely manner or new products and technologies may not gain market acceptance. We are in the early stage of product commercialization of certain Intelimer-based specialty packaging, Intellicoat seed coating and other Intelimer polymer products and many of our potential products are in development. We believe that our future growth will depend in large part on our ability to develop and market new products in our target markets and in new markets. In particular, we expect that our ability to compete effectively with existing food products, agricultural, industrial and medical companies will depend substantially on successfully developing, commercializing, achieving market acceptance of and reducing the cost of producing our products. In addition, commercial applications of our temperature switch polymer technology are relatively new and evolving. Our failure to develop new products or the failure of our new products to achieve market acceptance would have a material adverse effect on our business, results of operations and financial condition.

We Face Strong Competition in the Marketplace

Competitors may succeed in developing alternative technologies and products that are more effective, easier to use or less expensive than those which have been or are being developed by us or that would render our technology and products obsolete and non-competitive. We operate in highly competitive and rapidly evolving fields, and new developments are expected to continue at a rapid pace. Competition from large food products, agricultural, industrial and medical companies is expected to be intense. In addition, the nature of our collaborative arrangements may result in our corporate partners and licensees becoming our competitors. Many of these competitors have substantially greater financial and technical resources and production and marketing capabilities than we do, and may have substantially greater experience in conducting clinical and field trials, obtaining regulatory approvals and manufacturing and marketing commercial products.

We Have a Concentration of Manufacturing in One Location for Apio and May Have to Depend on Third Parties to Manufacture Our Products

Any disruptions in our primary manufacturing operation would reduce our ability to sell our products and would have a material adverse effect on our financial results. Additionally, we may need to consider seeking collaborative arrangements with other companies to manufacture our products. If we become dependent upon third parties for the manufacture of our products, our profit margins and our ability to develop and deliver those products on a timely basis may be affected. Failures by third parties may impair our ability to deliver products on a timely basis and impair our competitive position. We may not be able to continue to successfully operate our manufacturing operations at acceptable costs, with acceptable yields, and retain adequately trained personnel.

Our Dependence on Single-Source Suppliers and Service Providers May Cause Disruption in Our Operations Should Any Supplier Fail to Deliver Materials

We may experience difficulty acquiring materials or services for the manufacture of our products or we may not be able to obtain substitute vendors. We may not be able to procure comparable materials or hybrid corn varieties at similar prices and terms within a reasonable time. Several services that are provided to Apio are obtained from a single provider. Several of the raw materials we use to manufacture our products are currently purchased from a single source, including some monomers used to synthesize Intelimer polymers and substrate materials for our breathable membrane products. In addition, virtually all of the hybrid corn varieties sold by Landec Ag are grown under contract by a single seed producer. Any interruption of our relationship with single-source suppliers or service providers could delay product shipments and materially harm our business.

We May Be Unable to Adequately Protect Our Intellectual Property Rights