Revenue from product sales is recognized when there is persuasive evidence that an arrangement exists, delivery has occurred, title has transferred, the price is fixed and determinable, and collectibility is reasonably assured. Allowances are established for estimated uncollectible amounts, product returns, and discounts based on specific identification and historical losses.

Contract revenue for research and development (R&D) is recorded as earned, based on the performance requirements of the contract. Non-refundable contract fees for which no further performance obligations exist, and there is no continuing involvement by the Company, are recognized on the earlier of when the payments are received or when collection is assured.

Inventories are stated at the lower of cost (using the first-in, first-out method) or market. As of May 31, 2009 and May 25, 2008 inventories consisted of (in thousands):

| |

1. | Organization, Basis of Presentation, and Summary of Significant Accounting Policies (continued) |

If the cost of the inventories exceeds their expected market value, provisions are recorded currently for the difference between the cost and the market value. These provisions are determined based on specific identification for unusable inventory and an additional reserve, based on historical losses, for inventory considered to be useable.

Advertising Expense

Advertising expenditures for the Company are expensed as incurred. Advertising expense for the Company for fiscal years 2009, 2008 and 2007 was $475,000, $474,000 and $205,000, respectively.

Notes and Advances Receivable

Apio has made advances to produce growers for crop and harvesting costs. Notes and advances receivable related to operating activities are for the sourcing of crops for Apio’s business and notes and advances receivable related to investing activities are for financing transactions with third parties. Typically operating advances are paid off within the growing season (less than one year) from harvested crops. Advances not fully paid during the current growing season are converted to interest bearing obligations, evidenced by contracts and notes receivable. These notes and advances receivable are secured by perfected liens on land and/or crops and have terms that range from six to twelve months. Notes receivable are periodically reviewed (at least quarterly) for collectibility. A reserve is established for any note or advance deemed to not be fully collectible based upon an estimate of the crop value or the fair value of the security for the note or advance.

Related Party Transactions

Apio provides cooling and distributing services for farms in which the Chairman of Apio (the “Apio Chairman”) has a financial interest and purchases produce from those farms. Apio also purchases produce from Beachside Produce LLC for sale to third parties. Beachside Produce is owned by a group of entities and persons that supply produce to Apio including the Apio Chairman. Revenues and the resulting accounts receivable and cost of product sales and the resulting accounts payable are classified as related party items in the accompanying financial statements as of May 31, 2009 and May 25, 2008 and for the three years ended May 31, 2009.

Apio leases, for approximately $316,000 on a current annual basis, agricultural land that is owned by the Apio Chairman. Apio, in turn, subleases that land at cost to growers who are obligated to deliver product from that land to Apio for value added products. There is generally no net statement of income impact to Apio as a result of these leasing activities but Apio creates a guaranteed source of supply for the value added business. Apio has loss exposure on the leasing activity to the extent that it is unable to sublease the land. For the years ended May 31, 2009, May 25, 2008 and May 27, 2007, the Company subleased all of the land leased from the Apio Chairman and received sublease income of $316,000, $344,000 and $504,000, respectively, which is substantially equal to the amount the Company paid to lease that land for such periods.

Apio’s domestic commodity vegetable business was sold to Beachside Produce, effective June 30, 2003. The Apio Chairman is a 12.5% owner in Beachside Produce. During fiscal years 2009, 2008 and 2007, the Company recognized revenues of $1.3 million, $1.6 million and $83,000, respectively, from the sale of products to Beachside Produce and royalty revenues of $0, $31,000 and $249,000, respectively, from the use by Beachside Produce of Apio’s trademarks. The related accounts receivable from Beachside Produce are classified as related party in the accompanying Consolidated Balance Sheets as of May 31, 2009 and May 25, 2008.

At May 27, 2007, the Apio Chairman held a 6% ownership interest in Apio Cooling LP (“Apio Cooling”), a limited partnership in which Apio is the general partner and majority owner with a 60% ownership interest. During the first quarter of fiscal year 2008, the Apio Chairman withdrew from Apio Cooling. The $227,000 owed to the Apio Chairman as of May 27, 2007, which was included in the minority interest liability at May 27, 2007, was paid in full during fiscal year 2008.

- 54 -

| |

1. | Organization, Basis of Presentation, and Summary of Significant Accounting Policies (continued) |

All related party transactions are monitored quarterly by the Company and approved by the Audit Committee of the Board of Directors.

Property and Equipment

Property and equipment are stated at cost. Expenditures for major improvements are capitalized while repairs and maintenance are charged to expense. Depreciation is expensed on a straight-line basis over the estimated useful lives of the respective assets, generally three to thirty years for buildings and leasehold improvements and three to seven years for furniture and fixtures, computers, capitalized software, machinery, equipment and autos. Leasehold improvements are amortized over the lesser of the economic life of the improvement or the life of the lease on a straight-line basis.

The Company capitalizes software development costs for internal use in accordance with Statement of Position 98-1, “Accounting for Costs of Computer Software Developed or Obtained for Internal Use” (“SOP 98-1”). Capitalization of software development costs begins in the application development stage and ends when the asset is placed into service. The Company amortizes such costs using the straight-line basis over estimated useful lives of three to seven years. The Company did not capitalize any software development costs during fiscal years 2009 or 2008.

Intangible Assets

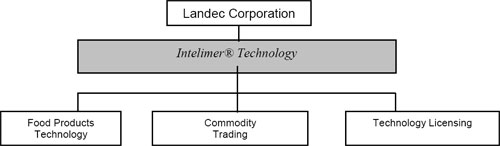

The Company’s intangible assets are comprised primarily of goodwill and other intangible assets with indefinite lives (collectively, “intangible assets”), which the Company recognized in accordance with the guidelines in SFAS No. 141, “Business Combinations” (“SFAS 141”) (i) upon the acquisition, in December 1999, of all the assets of Apio, which consists of the Food Products Technology and Commodity Trading reporting units and (ii) from the repurchase of all minority interests in the common stock of Landec Ag, a subsidiary of the Company, in December 2006. SFAS 141 defines goodwill as “the excess of the cost of an acquired entity over the net of the estimated fair values of the assets acquired and the liabilities assumed at date of acquisition.” All intangible assets, including goodwill, associated with the Apio acquisition were allocated to the Food Products Technology reporting unit pursuant to SFAS 141 based upon the allocation of assets and liabilities acquired and consideration paid for the Food Products Technology reporting unit. The consideration paid for the Commodity Trading reporting unit approximated its fair market value at the time of acquisition, and therefore no intangible assets were recorded in connection with the Company’s acquisition of this reporting unit. Goodwill associated with the Technology Licensing reporting unit consists entirely of goodwill resulting from the repurchase of the Landec Ag minority interests.

The Company tests its intangible assets for impairment at least annually, in accordance with the provisions of SFAS No. 142, Goodwill and Other Intangible Assets (“SFAS 142”). When evaluating indefinite-lived intangible assets for impairment, SFAS 142 requires the Company to compare the fair value of the asset to its carrying value to determine if there is an impairment loss. When evaluating goodwill for impairment, SFAS 142 requires the Company to first compare the fair value of the reporting unit to its carrying value to determine if there is an impairment loss. If the fair value of the reporting unit exceeds its carrying value, goodwill is not considered impaired; thus application of the second step of the two-step approach in SFAS 142 is not required. Application of the intangible assets impairment tests requires significant judgment by management, including identification of reporting units, assignment of assets and liabilities to reporting units, assignment of intangible assets to reporting units, and the determination of the fair value of each indefinite-lived intangible asset and reporting unit based upon projections of future net cash flows, discount rates and market multiples, which judgments and projections are inherently uncertain.

The Company tested its intangible assets for impairment as of July 26, 2009 and determined that no adjustments to the carrying values of the intangible assets were necessary as of that date. On a quarterly basis, the Company considers the need to update its most recent annual tests for possible impairment of its intangible assets, based on management’s assessment of changes in its business and other economic factors since the most recent annual evaluation. Such changes, if significant or material, could indicate a need to update the most recent annual

- 55 -

| |

1. | Organization, Basis of Presentation, and Summary of Significant Accounting Policies (continued) |

tests for impairment of the intangible assets during the current period. The results of these tests could lead to write-downs of the carrying values of the intangible assets in the current period.

The Company uses the discounted cash flow (“DCF”) approach to develop an estimate of fair value. The DCF approach recognizes that current value is premised on the expected receipt of future economic benefits. Indications of value are developed by discounting projected future net cash flows to their present value at a rate that reflects both the current return requirements of the market and the risks inherent in the specific investment. The market approach was not used to value the Food Products Technology and Technology Licensing reporting units (the “Reporting Units”) because insufficient market comparables exist to enable the Company to develop a reasonable fair value of its intangible assets due to the unique nature of each of the Company’s Reporting Units.

The DCF approach requires the Company to exercise judgment in determining future business and financial forecasts and the related estimates of future net cash flows. Future net cash flows depend primarily on future product sales, which are inherently difficult to predict. These net cash flows are discounted at a rate that reflects both the current return requirements of the market and the risks inherent in the specific investment.

The DCF associated with the Technology Licensing reporting unit is based on the Company’s license agreement with Monsanto (the “Agreement”). Under the Agreement, Monsanto has agreed to pay Landec Ag a license fee of $2.6 million in cash per year for five years beginning in December 2006, and a fee of $4.0 million if Monsanto elects to terminate the Agreement, or $10.0 million if Monsanto elects to purchase Landec Ag. If the purchase option is exercised before the fifth anniversary of the Agreement, or if Monsanto elects to terminate the Agreement, all annual license fees that have not been paid to Landec Ag will become due upon the purchase or termination. As of May 31, 2009, the fair value of the Technology Licensing reporting unit, as determined by the DCF approach, is more than double its book value, and therefore, no intangible asset impairment was deemed to exist. The discount rate utilized approximates the risk free interest rate as the cash flow stream is guaranteed under the terms of the Agreement. A 1% increase in the discount rate would not have a significant impact on the excess of fair value over book value.

The DCF associated with the Food Products Technology reporting unit is based on management’s five-year projection of revenues, gross profits and operating profits by fiscal year and assumes a 40% effective tax rate for each year. Management takes into account the historical trends of Apio and the industry categories in which Apio operates along with inflationary factors, current economic conditions, new product introductions, cost of sales, operating expenses, capital requirements and other relevant data when developing its projection. As of May 31, 2009, the fair value of the Food Products Technology reporting unit, as determined by the DCF approach, was approximately double its book value, and therefore, no intangible asset impairment was deemed to exist. A 1% increase in the discount rate would not have a significant impact on the excess of fair value over book value.

Investment in Non-Public Company

The Company’s investment of $1.8 million in a non-public company is carried at cost and adjusted for impairment losses, if any. Since there is no readily available market value information, the Company periodically reviews this investment to determine if any other than temporary declines in value have occurred based on the financial stability and viability of the company. The company is currently in discussions with several parties to sell the rights to certain proprietary assets, and potential deal terms with more than one party are in late-stage negotiations. The company’s goal is to close the sale in calendar 2009. Landec has evaluated its cost method investment for impairment, utilizing a discounted cash flow analysis of the preliminary terms under late-stage discussions with one of the parties. Based on the expectation that the rights to certain proprietary assets of the company will be sold to a third party, the Company has determined there is no impairment of its investment as of May 31, 2009. However, if the currently proposed or similar deal does not close, Landec will need to re-evaluate impairment, with maximum exposure equal to its cost investment.

- 56 -

| |

1. | Organization, Basis of Presentation, and Summary of Significant Accounting Policies (continued) |

Deferred Revenue

Cash received in advance of services performed (principally revenues related to upfront license fees) are recorded as deferred revenue. At May 31, 2009, $6.3 million has been recognized as a liability for deferred license fee revenues and $130,000 for advances from customers and on ground lease payments from growers. At May 25, 2008, $8.3 million has been recognized as a liability for deferred license fee revenues and $313,000 for advances from customers and on ground lease payments from growers.

Minority Interest

In connection with the acquisition of Apio, Landec acquired Apio’s 60% general partner interest in Apio Cooling, a California limited partnership. Apio Cooling is included in the consolidated financial statements of Landec for all periods presented. The minority interest balance of $1.8 million and $1.6 million at May 31, 2009 and May 25, 2008, respectively, is comprised of the limited partners’ interest in Apio Cooling.

Income Taxes

The Company accounts for income taxes using the liability method. Under this method, deferred tax assets and liabilities are determined based on differences between financial reporting and tax bases of assets and liabilities and are measured using enacted tax rates and laws that will be in effect when the differences are expected to reverse. In evaluating the Company’s ability to recover its deferred tax assets, management considered all available positive and negative evidence including the Company’s past results of operations and its forecast of future taxable income in the jurisdictions in which Landec has operations. The Company records a valuation allowance to reduce deferred tax assets to the amount that is expected to be realized on a more-likely-than-not basis. A deferred tax expense results from the change in the net deferred tax asset or liability between periods.

Effective May 28, 2007, the Company adopted FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes”. In accordance with FIN 48, paragraph 19, the Company has decided to classify interest and penalties related to uncertain tax positions as a component of its provision for income taxes.

The Company is subject to routine audits by federal and state tax authorities that may result in additional tax liabilities. Several factors drive the calculation of the Company’s tax liabilities including, (i) the expiration of various statutes of limitations, (ii) changes in tax law and regulations, (iii) issuance of tax rulings, and (iv) settlements with tax authorities. Changes in any of these factors may result in adjustments in the Company’s liabilities, which would impact the Company’s reported financial results.

Per Share Information

Financial Accounting Standards Board issued Statement No. 128, “Earnings Per Share” (SFAS 128) requires the presentation of basic and diluted earnings per share. Basic earnings per share excludes any dilutive effects of options, warrants and convertible securities and is computed using the weighted average number of common share outstanding. Diluted earnings per share reflects the potential dilution if securities or other contracts to issue common stock were exercised or converted into common stock. Diluted common equivalent shares consist of stock options using the treasury stock method.

- 57 -

| |

1. | Organization, Basis of Presentation, and Summary of Significant Accounting Policies (continued) |

The following table sets forth the computation of diluted net income per share (in thousands, except per share amounts):

| | | | | | | | | | |

| | Fiscal Year

Ended

May 31, 2009 | | Fiscal Year

Ended

May 25, 2008 | | Fiscal Year

Ended

May 27, 2007 | |

| |

| |

| |

| |

Numerator: | | | | | | | | | | |

Net income | | $ | 7,730 | | $ | 13,542 | | $ | 29,189 | |

Less: Minority interest in income of subsidiary | | | — | | | — | | | (778 | ) |

| |

|

| |

|

| |

|

| |

Net income for diluted net income per share | | $ | 7,730 | | $ | 13,542 | | $ | 28,411 | |

| | | | | | | | | | |

Denominator: | | | | | | | | | | |

Weighted average shares for basic net income per share | | | 26,202 | | | 26,069 | | | 25,260 | |

Effect of dilutive securities: | | | | | | | | | | |

Stock options | | | 549 | | | 866 | | | 1,298 | |

| |

|

|

|

|

|

|

|

| |

Weighted average shares for diluted net income per share | | | 26,751 | | | 26,935 | | | 26,558 | |

| | | | | | | | | | |

Diluted net income per share | | $ | 0.29 | | $ | 0.50 | | $ | 1.07 | |

Options to purchase 357,514, 96,300 and 81,030 shares of Common Stock at a weighted average exercise price of $9.72, $13.32 and $8.86 per share were outstanding during fiscal years ended May 31, 2009, May 25, 2008 and May 27, 2007, respectively, but were not included in the computation of diluted net income per share because the options’ exercise price were greater than the average market price of the Common Stock and, therefore, the effect would be antidilutive.

Cost of Sales

The Company includes in cost of sales all the costs related to the sale of products in accordance with generally accepted accounting principles. These costs include the following: raw materials (including produce, seeds and packaging), direct labor, overhead (including indirect labor, depreciation, and facility related costs) and shipping and shipping related costs.

Research and Development Expenses

Costs related to both research contracts and Company-funded research is included in research and development expenses. Costs to fulfill research contracts generally approximate the corresponding revenue. Research and development costs are primarily comprised of salaries and related benefits, supplies, travel expenses and corporate allocations.

Accounting for Stock-Based Compensation

On May 29, 2006, the Company adopted SFAS 123R, which is a revision of SFAS No. 123 “Accounting for Stock-Based Compensation” (“SFAS 123”), and supersedes APB No. 25, “Accounting for Stock Issued to Employees” (“APB 25”). Among other items, SFAS 123R requires companies to record compensation expense for stock-based awards issued to employees and directors in exchange for services provided. The amount of the compensation expense is based on the estimated fair value of the awards on their grant dates and is recognized over the required service periods. The Company’s stock-based awards include stock option grants and restricted stock unit awards (RSUs).

- 58 -

| |

1. | Organization, Basis of Presentation, and Summary of Significant Accounting Policies (continued) |

Prior to the adoption of SFAS 123R, the Company applied the intrinsic value method set forth in APB 25 to calculate the compensation expense for stock-based awards. The Company has historically set the exercise price for its stock options equal to the market value on the grant date. As a result, the options had no intrinsic value on their grant dates, and therefore the Company did not record any compensation expense unless the terms of the stock options were subsequently modified. For RSUs, the calculation of compensation expense under APB 25 and SFAS 123R is similar except for the accounting treatment for forfeitures as discussed below.

The Company adopted SFAS 123R using the modified prospective transition method, which requires the application of the accounting standard to (i) all stock-based awards issued on or after May 29, 2006 and (ii) any outstanding stock-based awards that were issued but not vested as of May 29, 2006. During the fiscal year ended May 31, 2009, the Company recognized stock-based compensation expense of $933,000 which included $308,000 for restricted stock unit awards and $625,000 for stock option grants. During the fiscal year ended May 25, 2008, the Company recognized stock-based compensation expense of $871,000 which included $306,000 for restricted stock unit awards and $565,000 for stock option grants. During the fiscal year ended May 27, 2007, the Company recognized stock-based compensation expense of $615,000 which included $160,000 for restricted stock unit awards and $455,000 for stock option grants.

The following table summarizes the stock-based compensation by income statement line item:

| | | | | | | | | | |

| | Fiscal Year

Ended

May 31, 2009 | | Fiscal Year

Ended

May 25, 2008 | | Fiscal Year

Ended

May 27, 2007 | |

| |

| |

| |

| |

Research and development | | $ | 171,000 | | $ | 148,000 | | $ | 82,000 | |

Sales, general and administrative | | | 762,000 | | | 723,000 | | | 533,000 | |

| |

|

| |

|

| |

|

| |

Total stock-based compensation expense | | $ | 933,000 | | $ | 871,000 | | $ | 615,000 | |

The estimated fair value for stock options, which determines the Company’s calculation of compensation expense, is based on the Black-Scholes option pricing model. Upon the adoption of SFAS 123R, the Company changed its method of calculating and recognizing the fair value of stock-based compensation arrangements to the straight-line, single-option method. Compensation expense for all stock option and restricted stock awards granted prior to May 29, 2006 will continue to be recognized using the straight-line, multiple-option method. In addition, SFAS 123R requires the estimation of the expected forfeitures of stock-based awards at the time of grant. As a result, the Company uses historical data to estimate pre-vesting forfeitures and records stock-based compensation expense only for those awards that are expected to vest and revises those estimates in subsequent periods if the actual forfeitures differ from the prior estimates.

Valuation Assumptions

As of May 31, 2009, May 25, 2008 and May 27, 2007, the fair value of stock option grants was estimated using the Black-Scholes option pricing model. The following weighted average assumptions were used:

| | | | | | | | | | |

| | Fiscal Year

Ended

May 31, 2009 | | Fiscal Year

Ended

May 25, 2008 | | Fiscal Year

Ended

May 27, 2007 | |

| |

| |

| |

| |

Expected life (in years) | | 3.78 | | | 4.40 | | | 4.27 | | |

Risk-free interest rate | | 2.35 | % | | 5.02 | % | | 5.08 | % | |

Volatility | | 0.52 | | | 0.46 | | | 0.51 | | |

Dividend yield | | 0 | % | | 0 | % | | 0 | % | |

The Black-Scholes option pricing model requires the input of highly subjective assumptions, including the expected stock price volatility. The change in the volatility in the fiscal years ended May 31, 2009, May 25, 2008 and May 27, 2007 is a result of basing the volatility on Landec’s stock price.

- 59 -

| |

1. | Organization, Basis of Presentation, and Summary of Significant Accounting Policies (continued) |

The weighted average estimated fair value of Landec employee stock options granted at grant date market prices during the fiscal years ended May 31, 2009, May 25, 2008 and May 27, 2007 was $2.74, $5.74 and $4.15 per share, respectively. No stock options were granted above or below grant date market prices during the fiscal years ended May 31, 2009, May 25, 2008 and May 27, 2007.

Recent Accounting Pronouncements

Fair Value Measurements

In September 2006, FASB issued SFAS No. 157, “Fair Value Measurements.” SFAS No. 157 defines fair value, establishes a framework for measuring fair value and expands disclosure about fair value measurements. SFAS No. 157 does not require new fair value measurements but provides guidance on how to measure fair value by providing a fair value hierarchy used to classify the source of information. SFAS No. 157 is effective for fiscal years beginning after November 15, 2007. However, on February 12, 2008, the FASB issued FASB Staff Position (“FSP”) FAS No. 157-2 which delays the effective date for all non-financial assets and liabilities except those that are recognized or disclosed at fair value in the financial statements on a recurring basis (at least annually). FSP 157- 2 defers the effective date of SFAS No. 157 to fiscal years beginning after November 15, 2008, and interim periods within the fiscal years for items within the scope of this FSP. The Company adopted SFAS No. 157 on May 26, 2008 for financial assets and financial liabilities. It did not have any impact on the Company’s results of operations or financial position for the year ended May 31, 2009. The Company will adopt SFAS No. 157 for non-financial assets and liabilities during its fiscal year ending May 30, 2010. The Company is currently evaluating the future impacts and disclosures of this standard.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities— Including an amendment of FASB Statement No. 115.” SFAS No. 159 permits entities to choose to measure many financial instruments and certain other items at fair value that are not currently required to be measured at fair value. Subsequent adjustments to the fair value of the financial instruments and liabilities an entity elects to carry at fair value will be recognized in earnings. SFAS No. 159 also establishes additional disclosure requirements. SFAS No. 159 is effective for fiscal years beginning after November 15, 2007, with early adoption permitted provided the entity also elects to apply the provisions of SFAS No. 157. The Company adopted SFAS No. 159 on May 26, 2008, but has not elected the fair value measurement provisions for any eligible financial instruments or other items.

Business Combinations

The FASB issued SFAS No. 141R (revised 2007), “Business Combinations” which significantly changes the financial accounting and reporting for business combination transactions. SFAS No. 141R requires the acquiring entity in a business combination to recognize all (and only) the assets acquired and liabilities assumed in the transaction and establishes the acquisition date fair value as the measurement objective for all assets acquired and liabilities assumed in a business combination. Certain provisions of this standard will, among other things, impact the determination of acquisition-date fair value of consideration paid in a business combination (including contingent consideration); exclude transaction costs from acquisition accounting; and change accounting practices for acquired contingencies, acquisition-related restructuring costs, in-process research and development, indemnification assets, and tax benefits. For the Company, SFAS No. 141R is effective for business combinations occurring after May 31, 2009. The Company is currently evaluating the future impacts and disclosures of this standard.

Noncontrolling Interests

In December 2007, the FASB issued Statement of Financial Accounting Standards (“SFAS”) No. 160, “Noncontrolling Interests in Consolidated Financial Statements.” SFAS No. 160 amends Accounting Research Bulletin (“ARB”) No. 51, “Consolidated Financial Statements” and establishes accounting and reporting standards for the noncontrolling interest (minority interest) in a subsidiary. This statement requires the reporting of all

- 60 -

| |

1. | Organization, Basis of Presentation, and Summary of Significant Accounting Policies (continued) |

noncontrolling interests as a separate component of stockholders’ equity, the reporting of consolidated net income (loss) as the amount attributable to both the parent and the noncontrolling interests and the separate disclosure of net income (loss) attributable to the parent and to the noncontrolling interests. Changes in a parent’s ownership interest while the parent retains its controlling interest will be accounted for as equity transactions and any retained noncontrolling equity investment upon the deconsolidation of a subsidiary will be initially measured at fair value. Other than the reporting requirements described above which require retrospective application, the provisions of SFAS No. 160 are to be applied prospectively. For the Company, SFAS No. 160 is effective beginning June 1, 2009. The Company is currently in the process of determining the impact and disclosure of this standard and expects it will result in a reclassification of income from the noncontrolling interest (minority interest) in Apio Cooling, L.P., in which Apio is the general partner with a 60% ownership position. Upon adoption, all noncontrolling interest will be included as a component of stockholders’ equity and not in the statement of operations. The Company is currently evaluating the impact of this standard on its consolidated financial statements.

Collaborative Arrangements

In December 2007, the FASB ratified the EITF consensus on EITF Issue No. 07-1, “Accounting for Collaborative Arrangements” that discusses how parties to a collaborative arrangement (which does not establish a legal entity within such arrangement) should account for various activities. The consensus indicates that costs incurred and revenues generated from transactions with third parties (i.e. parties outside of the collaborative arrangement) should be reported by the collaborators on the respective line items in their income statements pursuant to EITF Issue No. 99-19, “Reporting Revenue Gross as a Principal Versus Net as an Agent.” Additionally, the consensus provides that income statement characterization of payments between the participants in a collaborative arrangement should be based upon existing authoritative pronouncements; analogy to such pronouncements if not within their scope; or a reasonable, rational, and consistently applied accounting policy election. For the Company, EITF Issue No. 07-1 is effective beginning June 1, 2009 and is to be applied retrospectively to all periods presented for collaborative arrangements existing as of the date of adoption. The Company is currently evaluating the impact of this standard on its consolidated financial statements.

Variable Interest Entities

In June 2009, the FASB issued Statement No. 167, “Amendments to FASB Interpretation No. 46(R).” Statement 167 amends the evaluation criteria to identify the primary beneficiary of a variable interest entity provided by FASB Interpretation No. 46(R), Consolidation of Variable Interest Entities—An Interpretation of ARB No. 51. Additionally, Statement 167 requires ongoing reassessments of whether an enterprise is the primary beneficiary of the variable interest entity. The Company will adopt Statement 167 in fiscal 2011 and is currently evaluating the impact of its pending adoption on the consolidated financial statements.

Subsequent Events

In May 2009, the FASB issued Statement No. 165, “Subsequent Events.” Statement 165 establishes general standards of accounting for and disclosure of events that occur after the balance sheet date but before the financial statements are issued or are available to be issued. The Company will adopt Statement 165 in the first quarter of fiscal 2010 and does not believe it will result in significant changes to reporting of subsequent events either through recognition or disclosure.

Fair Value Disclosures in Interim Reports

In April 2009, the FASB issued FASB Staff Position No. FAS 107-1 and APB 28-1, Interim Disclosures about Fair Value of Financial Instruments. This Staff Position amends FASB Statement No. 107, Disclosures about Fair Value of Financial Instruments, to require disclosures about fair value of financial instruments at interim

- 61 -

| |

1. | Organization, Basis of Presentation, and Summary of Significant Accounting Policies (continued) |

reporting periods. This Staff Position is effective for interim reporting periods ending after June 15, 2009, with early adoption permitted for periods ending after March 15, 2009 provided FSP No. FAS 115-2 and FAS 124-2 (described above) are also early adopted. The Company will adopt FSP No. FAS 107-1 in the first quarter of fiscal 2010 and do not believe it will have a material impact on the consolidated financial statements.

Fair Value Measurements

The Company adopted Statement No. 157 on May 26, 2008 for financial assets and liabilities. The Company also adopted Statement 159 in which entities are permitted to choose to measure many financial instruments and certain other items at fair value. The Company did not elect the fair value option for any of its eligible financial assets or liabilities under SFAS 159.

SFAS No. 157 established a three-tier hierarchy for fair value measurements, which prioritizes the inputs used in measuring fair value as follows:

| | |

| • | Level 1 – observable inputs such as quoted prices for identical instruments in active markets. |

| | |

| • | Level 2 – inputs other than quoted prices in active markets that are observable either directly or indirectly through corroboration with observable market data. |

| | |

| • | Level 3 – unobservable inputs in which there is little or no market data, which would require the Company to develop its own assumptions. |

As of May 31, 2009, the Company held certain assets that are required to be measured at fair value on a recurring basis. These included the Company’s cash equivalents and marketable securities for which the fair value is determined based on observable inputs that are readily available in public markets or can be derived from information available in publicly quoted markets. Therefore, the Company has categorized its cash equivalents and marketable securities as Level 1. The Company has no other financial assets or liabilities for which fair value measurement has been adopted.

| |

2. | Sale of Fielder’s Choice Direct and License Agreement |

On December 1, 2006, Landec sold its direct marketing and sales seed company FCD, which included the Fielder’s Choice Direct® and Heartland Hybrid® brands, to American Seeds, Inc., a wholly owned subsidiary of Monsanto Company. The acquisition price for FCD was $50 million in cash paid at the close. During the fiscal year 2007, Landec recorded income from the sale, net of direct expenses and bonuses, of $22.7 million. The income that was recorded is equal to the difference between the fair value of FCD of $40 million and its net book value, less direct selling expenses and bonuses. In accordance with generally accepted accounting principles, the portion of the $50 million of proceeds in excess of the fair value of FCD, or $10 million, will be allocated to the technology license agreement described below and will be recognized as revenue ratably over the five year term of the license agreement or $2 million per year beginning December 1, 2006. The fair value was determined by management.

The following summarizes sales proceeds allocated to the technology license agreement and the net income from the sale of FCD (in thousands):

- 62 -

| | | | |

Cash received at close | | $ | 50,000 | |

Fair market value of FCD | | | 40,000 | |

| |

|

| |

Proceeds allocated to technology license agreement (1) | | $ | 10,000 | |

| |

|

| |

| | | | |

Fair market value of FCD | | $ | 40,000 | |

Less: Cost basis of assets sold net of liabilities assumed | | | (14,856 | ) |

Less: Direct expenses of sale | | | (557 | ) |

| |

|

| |

Net gain from sale of FCD | | | 24,587 | |

Less: Bonuses paid to employees as a result of the sale | | | (1,918 | ) |

| |

|

| |

Income from sale of FCD | | $ | 22,669 | |

| |

|

| |

(1) Represents a deferred gain at closing which will be recognized as revenue over 5 years as described below.

As a result of the sale of FCD, the Company recorded an income tax expense of $2.5 million in fiscal year 2007 for state income taxes and federal AMT.

In December 2006, Landec also entered into a five-year co-exclusive technology license and polymer supply agreement (“the Agreement”) with Monsanto for the use of Landec’s Intellicoat polymer seed coating technology. Under the terms of the Agreement, Monsanto has agreed to pay Landec Ag $2.6 million per year in exchange for (1) a co-exclusive right to use Landec’s Intellicoat temperature activated seed coating technology worldwide during the license period, (2) the right to be the exclusive global sales and marketing agent for the Intellicoat seed coating technology, and (3) the right to purchase the technology any time during the five year term of the Agreement. Monsanto has also agreed to fund all operating costs, including all Intellicoat research and development, product development and non-replacement capital costs during the five year agreement period. For each of the fiscal years ended May 31, 2009 and May 25, 2008 Landec recognized $5.4 million in revenues and income from the Agreement and for the fiscal year ended May 27, 2007 Landec recognized $2.7 million in revenues and income from the Agreement.

The Agreement also provides for a fee payable to Landec Ag of $4 million if Monsanto elects to terminate the agreement or $10 million, amended from $8 million in May 2009, if Monsanto elects to purchase Landec Ag. If the purchase option is exercised before the fifth anniversary of the Agreement, or if Monsanto elects to terminate the Agreement, all annual license fees and supply payments that have not been paid to Landec Ag will become due upon the purchase. If Monsanto does not exercise its purchase option by the fifth anniversary of the Intellicoat agreement, Landec Ag will receive the termination fee and all rights to the Intellicoat seed coating technology will revert to Landec. Accordingly, Landec will receive minimum guaranteed payments of $17 million for license fees and polymer supply payments over five years or $23 million in maximum payments if Monsanto elects to purchase Landec Ag. The minimum guaranteed payments and the deferred gain of $2 million per year described above will result in Landec recognizing revenue and operating income of $5.4 million per year for fiscal years 2008 through 2011 and $2.7 million per year for fiscal years 2007 and 2012. The incremental $6 million to be received in the event Monsanto exercises the purchase option has been deferred and will be recognized upon the exercise of the purchase option. The fair value of the purchase option was determined by management to be less than the amount of the deferred revenue.

If Monsanto elects to purchase Landec Ag, a gain or loss on the sale of Landec Ag will be recognized at the time of purchase. If Monsanto exercises its purchase option, Landec expects to enter into a new long-term supply agreement with Monsanto pursuant to which Landec would continue to be the exclusive supplier of Intellicoat polymer materials to Monsanto.

In conjunction with the sale of FCD, Landec purchased all of the outstanding common stock and options of Landec Ag not owned by Landec at the fair market value of each share as if all options had been exercised as of December 1, 2006. The fair market value was $7.4 million which was funded with proceeds from the sale of FCD. After the purchase, Landec Ag became a wholly owned subsidiary of Landec. In accordance with SFAS 123R, this purchase did not result in additional compensation expense to the Company as all of the options purchased were fully vested at the time of the purchase and the consideration paid was equal to the fair value on the date of the purchase. The repurchase of Landec Ag’s outstanding common stock and options was recorded to retained earnings as the

- 63 -

| |

2. | Sale of Fielder’s Choice Direct and License Agreement (continued) |

repurchase occurred after the sale of FCD to Monsanto. At May 25, 2008, $4.8 million of the $7.4 million repurchase was reclassified from retained earnings to goodwill in accordance with SFAS 141 to reflect the amount of the repurchase for common stock that was subsequently determined to be a repurchase of minority interest.

Excluding the $2.7 million in revenues from the Agreement, Landec Ag revenues for the fiscal year 2007 was $131,000. The net operating losses for Landec Ag, excluding the income from the sale of FCD and the $2.7 million in license fees from the Agreement, for fiscal year 2007 was $5.8 million.

On December 23, 2005, Landec entered into an exclusive licensing agreement with Aesthetic Sciences Corporation (“Aesthetic Sciences”), a medical device company. Aesthetic Sciences paid Landec an upfront license fee of $250,000 for the exclusive rights to use Landec’s Intelimer® materials technology for the development of dermal fillers worldwide. Landec will also receive royalties on the sale of products incorporating Landec’s technology. In addition, the Company received shares of preferred stock valued at $1.3 million which represented a 19.9% ownership interest in Aesthetic Sciences as of December 23, 2005.

As part of the original agreement with Aesthetic Sciences, Landec was to receive additional shares upon the completion of a specific milestone. On November 22, 2006, that milestone was met and as a result Landec received an additional 800,000 shares of preferred stock valued at $481,000. The receipt of the additional 800,000 preferred shares did not change Landec’s 19.9% ownership interest in Aesthetic Sciences. The $481,000 is included in other assets in the accompanying Consolidated Balance Sheet and was recorded as licensing revenue during fiscal year 2007 in the accompanying Consolidated Statements of Operations since Landec has no further obligations under this agreement. During fiscal year 2009, Aesthetic Sciences completed a second preferred stock offering in which Landec did not participate and as a result Landec’s ownership interest in Aesthetic Sciences as of May 31, 2009 was reduced to 17.3%.

On March 14, 2006, Landec entered into an exclusive license and research and development agreement with Air Products and Chemicals, Inc. Landec will provide research and development support to Air Products for three years with a mutual option for two additional years. The license fees are being recognized as license revenue over a three year period beginning March 2006. In addition, in accordance with the agreement, Landec will receive 40% of the gross profit generated from the sale of products by Air Products occurring after April 1, 2007, that incorporate Landec’s Intelimer materials. In 2008, an amendment was entered into by the Company whereby certain technology applications were re-acquired as well as the elimination of an existing contract claim in order to refine the existing relationship. As a result, the Company recorded a $600,000 expense to selling, general and administrative expense during the year ended May 25, 2008. The Company recognized $600,000 in license revenues under this agreement in fiscal year 2009 and $800,000 in license revenues under this agreement during both fiscal year 2008 and 2007. During fiscal years 2009, 2008 and 2007 the Company recognized $1.1 million, $528,000 and $20,000, respectively, for its share of the gross profits realized from the sale of Intelimer-based products by Air Products.

On September 19, 2007, the Company amended its licensing and supply agreement with Chiquita Brands International, Inc. (“Chiquita”). Under the terms of the amendment, the license for bananas was expanded to include additional exclusive fields using Landec’s BreatheWay® packaging technology, and a new exclusive license has been added for the sale and marketing of avocados using Landec’s BreatheWay packaging technology. In exchange for expanding the exclusive fields for bananas and adding a new exclusive field for avocados, the minimum gross profits to be received by Landec from the sale of BreatheWay packaging to Chiquita for bananas and avocados was increased to $2.2 million in fiscal year 2009 and to $2.9 million in fiscal year 2008. In addition, the minimum gross profits the Company is to receive are calculated and payable on a calendar quarter basis per the terms of the amended agreement. Accordingly, the minimum amounts under the amended agreement will be calculated each calendar quarter and thus will be due at the end of March, June, September and December of each year. During fiscal years 2009, 2008 and 2007, the Company recognized $2.2 million, $2.9 million and $1.0 million, respectively, of gross profits from the Chiquita licensing and supply agreement.

- 64 -

On August 25, 2006, the Company received a cash payment of $1.6 million from the settlement of insurance claims associated with a fire that occurred at its Dock Resins facility in February 2000. The settlement resulted in the Company recording a reduction to selling, general and administrative expenses of $1.3 million, net of expenses, during the Company’s first quarter of fiscal year 2007. In addition, $381,000 had been placed in escrow pending the outcome of certain disputed professional fees. In September 2006, the Company resolved the fee dispute and paid professional fees of $227,000 from the escrow and received the balance of $154,000 which the Company recorded as a reduction to selling, general and administrative expenses during the second quarter of fiscal year 2007.

| |

5. | Repurchase of Subsidiary Common Stock and Options |

On August 7, 2007, Landec repurchased all of the outstanding common stock and options of Apio not owned by Landec at the fair market value of each share as if all options had been exercised on that date. The fair market value repurchase price for all of Apio’s common stock and options not owned by Landec was $20.8 million. After the repurchase, Apio became a wholly owned subsidiary of Landec. In accordance with SFAS 123R, this repurchase did not result in additional compensation expense to the Company as all of the options repurchased were fully vested at the time of the repurchase and the consideration paid was equal to the fair value. The repurchase of Apio options for $19.7 million was recorded as a reduction to equity and the repurchase of Apio’s common stock not owned by Landec for $1.1 million was recorded to goodwill in accordance with SFAS 141.

| |

6. | Notes and Advances Receivable Notes and advances receivable at May 31, 2009 and May 25, 2008 consisted of the following (in thousands): |

| | | | | | | | |

| | | May 31,

2009 | | May 25,

2008 | |

| | |

| |

| |

| Note receivable due from buyer of fruit processing equipment in annual installments of $98 plus interest at prime rate plus 1.0%, with final payment due October 20, 2008, secured by purchased assets (2) | | $ | — | | $ | 101 | |

| Advances to grower of $1 per acre to be recovered by withholding proceeds derived from crops. Additional advances of $81 on January 1, 2009 and $20 on July 1, 2009 to be recovered via weekly deductions of $3 from proceeds. Agreement ends August 30, 2009 (1) | | | 68 | | | 270 | |

| Advances to a grower under agricultural subleases in semi-annual installments of $155, to be repaid at $12 per week by withholding proceeds from crop produced on this property. Leases expire October 31, 2009 (1) | | | 118 | | | 130 | |

| | |

|

| |

|

| |

| Gross notes and advances receivable | | | 186 | | | 501 | |

| Less allowance for doubtful notes | | | — | | | — | |

| | |

|

| |

|

| |

| Net notes and advances receivable | | | 186 | | | 501 | |

| Less current portion of notes and advances receivable | | | (186 | ) | | (501 | ) |

| | |

|

| |

|

| |

| Non-current portion of notes and advances receivable | | $ | — | | $ | — | |

| | |

|

| |

|

| |

| | | | | | | | |

| (1) Represents notes and advances receivable associated with operating activities. | | | | | | | |

| | | | | | | | |

| (2) Represents notes and advances receivable associated with investing activities. | | | | | | | |

Interest income from interest bearing notes receivable for the fiscal years ended May 31, 2009, May 25, 2008 and May 27, 2007 was $6,000, $15,000 and $52,000, respectively.

- 65 -

Property and equipment consists of the following (in thousands):

| | | | | | | | | | |

| | Years of

Useful Life | | May 31, 2009 | | May 25, 2008 | |

| |

| |

| |

| |

Land and building | | 15-30 | | $ | 18,225 | | $ | 18,182 | |

Leasehold improvements | | 3-20 | | | 952 | | | 775 | |

Computer, capitalized software, machinery, equipment and auto | | 3-7 | | | 24,162 | | | 21,973 | |

Furniture and fixtures | | 5-7 | | | 349 | | | 301 | |

Construction in process | | | | | | 1,818 | | | 217 | |

| | | | |

|

|

|

|

|

|

Gross property and equipment | | | | | | 45,506 | | | 41,448 | |

Less accumulated depreciation and amortization | | | | | | (22,763 | ) | | (20,142 | ) |

| | | | |

|

|

|

|

|

|

Net property and equipment | | | | | $ | 22,743 | | $ | 21,306 | |

| | | | |

|

|

|

|

|

|

Depreciation and amortization expense for the fiscal years ended May 31, 2009, May 25, 2008 and May 27, 2007 was $3.1 million, $3.2 million and $3.3 million, respectively. Equipment under capital leases, which is the security for the related lease obligation, at May 31, 2009 and May 25, 2008 was $0 and $104,000, respectively. The related accumulated amortization for equipment under capital leases at May 31, 2009 and May 25, 2008 was $0 and $99,000, respectively. Amortization related to capitalized software was $175,000, $400,000 and $666,000, respectively, for fiscal years ended May 31, 2009, May 25, 2008 and May 27, 2007. The unamortized computer software costs at May 31, 2009 and May 25, 2008 were $103,000 and $278,000, respectively.

Changes in the carrying amount of goodwill for the fiscal years ended May 31, 2009, May 25, 2008 and May 27, 2007 by reportable segment, are as follows (in thousands):

| | | | | | | | | | |

| | Food

Products

Technology | | Technology

Licensing | | Total | |

| |

| |

| |

| |

| | | | | | | | | | |

Balance as of May 28, 2006 | | | 21,233 | | | 15 | | | 21,248 | |

Goodwill acquired during the period | | | 169 | | | 1,050 | | | 1,219 | |

Goodwill sold during the period | | | — | | | (1,065 | ) | | (1,065 | ) |

| |

|

| |

|

| |

|

| |

Balance as of May 27, 2007 | | | 21,402 | | | — | | | 21,402 | |

Goodwill acquired/reclassified during the period | | | 1,172 | | | 4,780 | | | 5,952 | |

| |

|

| |

|

| |

|

| |

Balance as of May 25, 2008 | | | 22,574 | | | 4,780 | | | 27,354 | |

Goodwill acquired | | | 7 | | | — | | | 7 | |

| |

|

| |

|

| |

|

| |

Balance as of May 31, 2009 | | $ | 22,581 | | $ | 4,780 | | $ | 27,361 | |

| |

|

| |

|

| |

|

| |

Information regarding Landec’s other intangible assets is as follows (in thousands):

| | | | | | | | | | |

| | Trademarks | | Other | | Total | |

| |

| |

| |

| |

Balance as of May 28, 2006 | | | 8,228 | | | — | | | 8,228 | |

Amortization expense | | | — | | | — | | | — | |

| |

|

| |

|

| |

|

| |

Balance as of May 27, 2007 | | | 8,228 | | | — | | | 8,228 | |

Amortization expense | | | — | | | — | | | — | |

| |

|

| |

|

| |

|

| |

Balance as of May 25, 2008 | | | 8,228 | | | — | | | 8,228 | |

Amortization expense | | | — | | | — | | | — | |

| |

|

| |

|

| |

|

| |

Balance as of May 31, 2009 | | $ | 8,228 | | $ | — | | $ | 8,228 | |

| |

|

| |

|

| |

|

| |

Accumulated amortization as of May 31, 2009, May 25, 2008 and May 27, 2007 was $3.4 million.

- 66 -

On November 6, 2008, the Company reincorporated from California to Delaware. As a result of this reincorporation, the Company has established an additional paid-in capital account and reclassified as of May 25, 2008, $112.9 million from Common Stock to additional paid-in capital.

Holders of Common Stock are entitled to one vote per share.

Convertible Preferred Stock

The Company has authorized two million shares of preferred stock, and as of May 31, 2009 has no outstanding preferred stock.

Common Stock, Stock Purchase Plans and Stock Option Plans

At May 31, 2009, the Company had 2.2 million common shares reserved for future issuance under Landec equity incentive plans.

On October 14, 2005, following stockholder pproval at the Annual Meeting of Stockholders of the Company, the 2005 Stock Incentive Plan (the “Plan”) became effective. The Plan replaced the Company’s four then existing equity plans and no shares remain available for grant under those plans. Employees (including officers), consultants and directors of the Company and its subsidiaries and affiliates are eligible to participate in the Plan.

The Plan provides for the grant of stock options (both nonstatutory and incentive stock options), stock grants, stock units and stock appreciation rights. Awards under the Plan will be evidenced by an agreement with the Plan participant. Under the Plan, 861,038 shares of the Company’s Common Stock (“Shares”) were initially available for awards, and as of May 31, 2009, 75,808 shares were available for awards. Under the Plan no recipient may be awarded any of the following during any fiscal year: (i) stock options covering in excess of 500,000 Shares; (ii) stock grants and stock units covering in excess of 250,000 Shares in the aggregate; or (iii) stock appreciation rights covering more than 500,000 Shares. In addition, awards to non-employee directors are discretionary. However, a non-employee director may not be granted awards covering in excess of 30,000 Shares in the aggregate during any fiscal year.

The 1995 Directors’ Stock Option Plan (the “Directors’ Plan”) provided that each person who became a non-employee director of the Company, who had not received a previous grant, be granted a nonstatutory stock option to purchase 20,000 shares of Common Stock on the date on which the optionee first became a non-employee director of the Company. Thereafter, on the date of each annual meeting of the stockholders each non-employee director was granted an additional option to purchase 10,000 shares of Common Stock if, on such date, he or she had served on the Company’s Board of Directors for at least six months prior to the date of such annual meeting. The exercise price of the options was the fair market value of the Company’s Common Stock on the date the options were granted. Options granted under this plan were exercisable and vested upon grant.

The 1996 Non-Executive Stock Option Plan authorized the Board of Directors to grant non-qualified stock options to employees, including executive officers, and outside consultants of the Company. The exercise price of the options was equal to the fair market value of the Company’s Common Stock on the date the options were granted. Options were generally exercisable upon vesting and generally vested ratably over four years and were subject to repurchase if exercised before being vested.

The 1996 Stock Option Plan authorized the Board of Directors to grant stock purchase rights, incentive stock options or non-statutory stock options to Landec executives. The exercise price of the stock purchase rights, incentive stock options and non-statutory stock options could be no less than 100% of the fair market value of Landec’s Common Stock on the date the options were granted. Options generally were exercisable upon vesting, generally vested ratably over four years and were subject to repurchase if exercised before being vested.

- 67 -

| |

9. | Stockholders’ Equity (continued) |

The New Executive Stock Option Plan authorized the Board of Directors to grant non-statutory stock options to officers of Landec or officers of Apio or Landec Ag whose employment with each of those companies began after October 24, 2000. The exercise price of the non-statutory stock options could be no less than 100% and 85%, for named executives and non-named executives, respectively, of the fair market value of Landec’s Common Stock on the date the options were granted. Options generally were exercisable upon vesting, generally vested ratably over four years and were subject to repurchase if exercised before being vested.

Activity under all Landec equity incentive plans is as follows:

Stock-Based Compensation Activity

| | | | | | | | | | | | | | | | |

| | | | | Restricted Stock Outstanding | | Stock Options Outstanding | |

| | | | |

| |

| |

| | RSU’s and

Options

Available

for Grant | | Number

of

Restricted

Shares | | Weighted

Average

Grant Date

Fair Value | | Number of

Stock

Options | | Weighted

Average

Exercise

Price

(Fair Value) | |

| |

| |

| |

| |

| |

| |

Balance at May 28, 2006 | | | 857,705 | | | 833 | | $ | 7.53 | | | 3,117,516 | | $ | 4.85 | |

Granted | | | (153,335 | ) | | 38,335 | | $ | 8.86 | | | 115,000 | | $ | 8.86 | |

Exercised | | | — | | | — | | | — | | | (1,163,234 | ) | $ | 4.72 | |

Forfeited | | | 8,778 | | | (833 | ) | $ | 7.53 | | | (7,945 | ) | $ | 4.93 | |

Plan shares expired | | | (6,417 | ) | | — | | | | | | — | | | — | |

| |

|

| |

|

| |

|

| |

|

| | | | |

Balance at May 27, 2007 | | | 706,731 | | | 38,335 | | $ | 8.86 | | | 2,061,337 | | $ | 5.14 | |

Granted | | | (139,335 | ) | | 34,835 | | $ | 13.32 | | | 104,500 | | $ | 13.32 | |

Awarded/Exercised | | | — | | | (10,002 | ) | $ | 8.86 | | | (267,148 | ) | $ | 4.57 | |

Forfeited | | | — | | | — | | | — | | | (1,739 | ) | $ | 3.80 | |

| |

|

| |

|

| |

|

| |

|

| | | | |

Balance at May 25, 2008 | | | 567,396 | | | 63,168 | | $ | 11.32 | | | 1,896,950 | | $ | 5.68 | |

Granted | | | (506,254 | ) | | 127,504 | | $ | 6.62 | | | 378,750 | | $ | 6.62 | |

Awarded/Exercised | | | — | | | (10,002 | ) | $ | 13.32 | | | (331,950 | ) | $ | 3.66 | |

Forfeited | | | 14,875 | | | (3,666 | ) | $ | 7.45 | | | (11,209 | ) | $ | 8.59 | |

Plan shares expired | | | (209 | ) | | — | | | — | | | — | | | — | |

| |

|

| |

|

| |

|

| |

|

| | | | |

Balance at May 31, 2009 | | | 75,808 | | | 177,004 | | $ | 7.90 | | | 1,932,541 | | $ | 6.19 | |

Included in exercises for fiscal years 2009, 2008 and 2007 are 171,380, 11,995 and 207,112 options, respectively, that were exercised through a net share settlement transaction (no cash) to pay for the exercise price of the options and the related taxes due on the exercise.

The following table summarizes information concerning stock options outstanding and exercisable at May 31, 2009:

| | | | | | | | | | | | | | | | | | | |

| | Options Outstanding | | Options Exercisable | |

| |

| |

| |

Range of

Exercise

Prices | | Number of Shares

Outstanding | | Weighted

Average

Remaining

Contractual

Life | | Weighted

Average

Exercise

Price | | Aggregate

Intrinsic

Value | | Number of

Shares

Exercisable | | Weighted

Average

Exercise

Price | | Aggregate

Intrinsic

Value | |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | (in years) | | | | | | | | | | | |

$1.660 - $3.375 | | 370,556 | | 2.17 | | $ | 3.15 | | $ | 1,345,118 | | 370,556 | | $ | 3.15 | | $ | 1,345,118 | |

$3.470 - $6.125 | | 230,735 | | 2.24 | | $ | 4.65 | | $ | 491,466 | | 230,526 | | $ | 4.65 | | $ | 491,020 | |

$6.130 - $6.130 | | 262,000 | | 2.97 | | $ | 6.13 | | $ | 170,300 | | 262,000 | | $ | 6.13 | | $ | 170,300 | |

$6.220 - $6.220 | | 293,750 | | 6.97 | | $ | 6.22 | | $ | 164,500 | | 35,000 | | $ | 6.22 | | $ | 19,600 | |

$6.563 - $6.720 | | 195,000 | | 4.17 | | $ | 6.64 | | $ | 27,300 | | 186,388 | | $ | 6.64 | | $ | 26,094 | |

$6.750 - $6.850 | | 217,000 | | 2.86 | | $ | 6.78 | | $ | — | | 217,000 | | $ | 6.78 | | $ | — | |

$7.500 - $8.860 | | 260,000 | | 4.99 | | $ | 8.25 | | $ | — | | 235,970 | | $ | 8.25 | | $ | — | |

$13.32 - $13.32 | | 103,500 | | 5.08 | | $ | 13.32 | | $ | — | | 65,193 | | $ | 13.32 | | $ | — | |

| |

| | | | | | |

|

| |

| | | | |

|

| |

$1.660 - $13.32 | | 1,932,541 | | 3.83 | | $ | 6.19 | | $ | 2,198,684 | | 1,602,633 | | $ | 5.98 | | $ | 2,052,132 | |

- 68 -

| |

9. | Stockholders’ Equity (continued) |

The weighted average remaining contractual life of options exercisable as of May 31, 2009 was 3.25 years.

At May 31, 2009 and May 25, 2008 options to purchase 1,602,633 and 1,761,778 shares of Landec’s Common Stock were vested, respectively. No options have been exercised prior to being vested.

The aggregate intrinsic value in the table above represents the total pretax intrinsic value, based on the Company’s closing stock price of $6.78 on May 29, 2009, which would have been received by holders of stock options had all holders of stock options exercised their stock options that were in-the-money as of that date. The total number of in-the-money stock options exercisable as of May 31, 2009, was approximately 1.2 million shares. The aggregate intrinsic value of stock options exercised during the fiscal year 2009 was $933,000.

Shares Subject to Vesting

The following table summarizes the activity relating to unvested stock option grants and RSUs during the fiscal year ended May 31, 2009:

| | | | | | | | | | | |

| | Stock Options | | Restricted Stock | |

| |

| |

| |

| | Shares | | Weighted

Average Fair

Value | | Shares | | Weighted

Average Fair

Value | |

| |

| |

| |

| |

| |

Unvested at May 25, 2008 | | 135,172 | | $ | 4.73 | | 63,168 | | $ | 11.32 | |

Granted | | 378,750 | | $ | 2.74 | | 127,504 | | $ | 6.62 | |

Vested/Awarded | | (172,805 | ) | $ | 3.61 | | (10,002 | ) | $ | 13.32 | |

Forfeited | | (11,209 | ) | $ | 3.66 | | (3,666 | ) | $ | 7.45 | |

| |

| | | | |

| | | | |

Unvested at May 31, 2009 | | 329,908 | | $ | 2.72 | | 177,004 | | $ | 7.90 | |

As of May 31, 2009, there was $1.7 million of total unrecognized compensation expense related to unvested equity compensation awards granted under the Company’s incentive stock plans. Total expense is expected to be recognized over the weighted-average period of 2.7 years for stock options and 1.9 years for restricted stock awards.

As of May 31, 2009 the Company had reserved 2.2 million shares of common stock for future issuance under its current and former stock plans.

In May 2009 Apio terminated its $7.0 million revolving line of credit with Wells Fargo Bank N.A. Apio had been in compliance with all loan covenants during fiscal year 2009 through the date of termination.

The provision for income taxes consisted of the following (in thousands):

| | | | | | | | | | |

| | Year ended

May 31, 2009 | | Year ended

May 25, 2008 | | Year ended

May 27, 2007 | |

| |

|

|

|

|

|

|

Current: | | | | | | | | | | |

Federal | | $ | 2,217 | | $ | 1,557 | | $ | 623 | |

State | | | 883 | | | 2,408 | | | 1,833 | |

| |

|

|

|

|

|

|

|

|

|

Total | | | 3,100 | | | 3,965 | | | 2,456 | |

Deferred: | | | | | | | | | | |

Federal | | | 2,060 | | | 233 | | | — | |

State | | | 451 | | | (844 | ) | | — | |

| |

|

|

|

|

|

|

|

|

|

Total | | | 2,511 | | | (611 | ) | | — | |

| |

|

|

|

|

|

|

|

|

|

Income tax expense | | $ | 5,611 | | $ | 3,354 | | $ | 2,456 | |

| |

|

|

|

|

|

|

|

|

|

- 69 -

| |

11. | Income Taxes (continued) |

The actual provision for income taxes differs from the statutory U.S. federal income tax rate as follows (in thousands):

| | | | | | | | | | |

| | Year Ended

May 31, 2009 | | Year Ended

May 25, 2008 | | Year Ended

May 27, 2007 | |

| |

|

|

|

|

|

|

Provision at U.S. statutory rate (1) | | $ | 4,669 | | $ | 5,914 | | $ | 11,076 | |

State income taxes, net of federal benefit | | | 1,023 | | | 1,152 | | | 1,818 | |

Change in valuation allowance | | | — | | | (3,647 | ) | | (10,026 | ) |

Tax-exempt interest | | | (196 | ) | | — | | | — | |

Tax credit carryforwards | | | (159 | ) | | (510 | ) | | (78 | ) |

Other | | | 274 | | | 445 | | | (334 | ) |

| |

|

|

|

|

|

|

|

|

|

Total | | $ | 5,611 | | $ | 3,354 | | $ | 2,456 | |

| |

|

|

|

|

|

|

|

|

|

(1) Statutory rate was 35% for fiscal years 2009, 2008 and 2007. |

The increase in the income tax expense in fiscal year 2009 compared to fiscal years 2008 and 2007 is due to an increase in the Company’s effective tax rate to 42% in fiscal year 2009 up from 20% in fiscal year 2008 and 8% in fiscal year 2007 due to the decrease in the deferred income tax valuation allowance and fully utilizing the Company’s net operating loss carryforwards and tax credits during fiscal year 2008.

Significant components of deferred tax assets and liabilities consisted of the following (in thousands):

| | | | | | | |

| | May 31, 2009 | | May 25, 2008 | |

| |

| |

| |

Deferred tax assets: | | | | | | | |

Research and AMT credit carryforwards | | $ | 643 | | $ | 620 | |

Accruals and reserves, not currently deductible for tax | | | 2,161 | | | 3,912 | |

Stock-based compensation | | | 543 | | | 361 | |

Other | | | 234 | | | 196 | |

| |

|

| |

|

| |

Deferred tax assets | | | 3,581 | | | 5,089 | |

| |

|

| |

|

| |

| | | | | | | |

Deferred tax liabilities: | | | | | | | |

Depreciation and amortization | | | (253 | ) | | (53 | ) |

Goodwill and other indefinite life intangibles | | | (5,286 | ) | | (4,425 | ) |

| |

|

| |

|

| |

Deferred tax liabilities | | | (5,539 | ) | | (4,478 | ) |

| |

|

| |

|

| |

| | | | | | | |

Net deferred tax (liabilities) assets | | $ | (1,958 | ) | $ | 611 | |

| |

|

| |

|

| |

Valuation allowances are reviewed each period on a tax jurisdiction by jurisdiction basis to analyze whether there is sufficient positive or negative evidence to support a change in judgment about the realizability of the related deferred tax assets. Based on this analysis and considering all positive and negative evidence, we determined that the deferred tax assets as of May 31, 2009 were more likely than not to be realized.

As of May 31, 2009, the Company had federal and state net operating loss carryforwards of approximately $18.0 million and $5.2 million, respectively. These losses expire in different periods through 2028, if not utilized. Such net operating losses consist of excess tax benefits from employee stock options exercises and have not been recorded in the Company’s deferred tax assets in accordance with FAS 123(R). The Company will record a credit to additional paid in capital as and when such excess tax benefits are ultimately realized.

The Company also had federal and state research and development tax credits carryforwards of approximately $1.9 million and $1.2 million, respectively. The research and development tax credit carryforwards expire in different periods through 2029 for federal purposes and have an unlimited carryforward period for state purposes.

- 70 -

| |

11. | Income Taxes (continued) |

Furthermore, the Company has federal alternative minimum tax credits of approximately $0.6 million that can be carried forward indefinitely. Certain tax credit carryovers are attributable to excess tax benefits from employee stock option exercises and have not been recorded in the Company’s deferred tax assets in accordance with FAS 123(R). The Company will record a credit to additional paid in capital as and when such excess tax benefits are ultimately realized.

In June 2006, the Financial Accounting Standards Board (FASB) issued Interpretation No. 48, “Accounting for Uncertainty in Income Taxes” (“FIN 48”). FIN 48 clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements in accordance with Statement of Financial Accounting Standards No. 109, “Accounting for Income Taxes” (“FAS 109”). This interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. FIN 48 also provides guidance on derecognition of tax benefits, classification on the balance sheet, interest and penalties, accounting in interim periods, disclosure, and transition.

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows (in thousands):

| | | | |

Balance at May 25, 2008 | | $ | 679 | |

Additions based on tax positions related to the prior year | | | 16 | |

Subtractions based on tax positions related to the prior year | | | (51 | ) |

Additions based on tax positions related to the current year | | | 14 | |

Settlements | | | (39 | ) |

| |

|

| |

Balance at May 31, 2009 | | $ | 619 | |

| |

|

| |

As of May 31, 2009, the total amount of net unrecognized tax benefits is $619,000, of which, $549,000, if recognized, would affect the effective tax rate. The Company accrues interest and penalties related to unrecognized tax benefits in its provision for income taxes. The total amount of penalties and interest is not material as of May 31, 2009. Additionally, the Company does not expect a material changes in its unrecognized tax benefits within the next 12 months.

Due to tax attribute carryforwards, the Company is subject to examination for tax years 1992 forward for U.S. tax purposes. The Company was also subject to examination in various state jurisdictions for tax years 1996 forward, none of which were individually material.

| |

12. | Commitments and Contingencies |

Operating Leases

Landec leases facilities and equipment under operating lease agreements with various terms and conditions, which expire at various dates through 2012. The approximate future minimum lease payments under these operating leases, excluding land leases, at May 31, 2009 are as follows (in thousands):

| | | | |

| | Amount | |

| |

| |

FY2010 | | $ | 548 | |

FY2011 | | | 287 | |

FY2012 | | | 13 | |

FY2013 | | | — | |

FY2014 | | | — | |

| |

|

| |

| | $ | 848 | |

| |

|

| |

Rent expense for operating leases, including month to month arrangements was $1.6 million for the fiscal year ended May 31, 2009, $1.5 million for the fiscal year ended May 25, 2008 and $1.4 million for the fiscal year ended May 27, 2007.

- 71 -

| |

12. | Commitments and Contingencies (continued) |

Land Leases

Landec, through its Apio subsidiary, also leases farmland under various non-cancelable leases expiring through October 2009. Landec subleases substantially all of the farmland to growers on an annual basis. The subleases are generally non-cancelable and expire through October 2009. The approximate future minimum leases and sublease amounts receivable under farmland leases at May 31, 2009 are $0 through fiscal year 2010.

Rent income for land leases net of sublease rents, including month to month arrangements was $0 for both the fiscal year ended May 31, 2009 and May 25, 2008.

Employment Agreements

Landec has entered into employment agreements with certain key employees. These agreements provide for these employees to receive incentive bonuses based on the financial performance of certain divisions in addition to their annual base salaries. The accrued incentive bonuses amounted to $308,000 at May 31, 2009 and $259,000 at May 25, 2008.

Licensing Agreement

In fiscal year 2001, the Company entered into an agreement for the exclusive worldwide rights to market grapes under certain brand names. Under the terms of the amended agreement (amended in fiscal year 2004), the Company is obligated to make annual payments of $100,000 for fiscal years 2010 through 2012.

Purchase Commitments

At May 31, 2009, the Company was committed to purchase $3.4 million of produce during fiscal year 2010 in accordance with contractual terms. Payments of $3.8 million were made in fiscal year 2009 under these arrangements.

| |

13. | Employee Savings and Investment Plans |

The Company sponsors a 401(k) plan which is available to substantially all of the Company’s employees.

Landec’s Corporate Plan, which is available to all Landec employees (“Landec Plan”), allows participants to contribute from 1% to 50% of their salaries, up to the Internal Revenue Service (IRS) limitation into designated investment funds. Beginning in fiscal year 2001, the Company amended the plan so that it contributes an amount equal to 50% of the participants’ contribution up to 3% of the participants’ salary. In May 2003, the Company again amended the plan to make the Company’s matching contribution to the plan on behalf of participants voluntary, and to make employees participation in the plan voluntary. In June 2006, the Company again amended the plan to increase the company match from 50% on the first 6% contributed by an employee to 67% on the first 6% contributed. Participants are at all times fully vested in their contributions. The Company’s contribution vests over a four-year period at a rate of 25% per year. The Company retains the right, by action of the Board of Directors, to amend, modify, or terminate the plan. For the fiscal years ended May 31, 2009, May 25, 2008 and May 27, 2007, the Company contributed $341,000, $352,000 and $401,000, respectively, to the Landec Plan.

- 72 -

| |

14. | Business Segment Reporting |