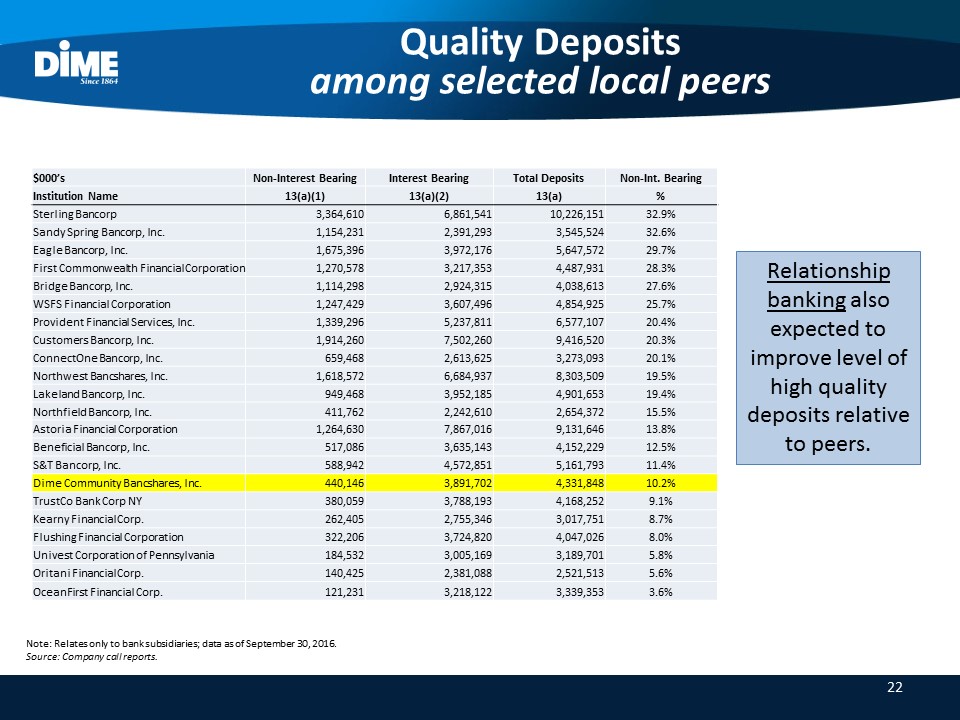

22 Quality Depositsamong selected local peers $000’s Non-Interest Bearing Interest Bearing Total Deposits Non-Int. Bearing Institution Name 13(a)(1) 13(a)(2) 13(a) % Sterling Bancorp 3,364,610 6,861,541 10,226,151 32.9% Sandy Spring Bancorp, Inc. 1,154,231 2,391,293 3,545,524 32.6% Eagle Bancorp, Inc. 1,675,396 3,972,176 5,647,572 29.7% First Commonwealth Financial Corporation 1,270,578 3,217,353 4,487,931 28.3% Bridge Bancorp, Inc. 1,114,298 2,924,315 4,038,613 27.6% WSFS Financial Corporation 1,247,429 3,607,496 4,854,925 25.7% Provident Financial Services, Inc. 1,339,296 5,237,811 6,577,107 20.4% Customers Bancorp, Inc. 1,914,260 7,502,260 9,416,520 20.3% ConnectOne Bancorp, Inc. 659,468 2,613,625 3,273,093 20.1% Northwest Bancshares, Inc. 1,618,572 6,684,937 8,303,509 19.5% Lakeland Bancorp, Inc. 949,468 3,952,185 4,901,653 19.4% Northfield Bancorp, Inc. 411,762 2,242,610 2,654,372 15.5% Astoria Financial Corporation 1,264,630 7,867,016 9,131,646 13.8% Beneficial Bancorp, Inc. 517,086 3,635,143 4,152,229 12.5% S&T Bancorp, Inc. 588,942 4,572,851 5,161,793 11.4% Dime Community Bancshares, Inc. 440,146 3,891,702 4,331,848 10.2% TrustCo Bank Corp NY 380,059 3,788,193 4,168,252 9.1% Kearny Financial Corp. 262,405 2,755,346 3,017,751 8.7% Flushing Financial Corporation 322,206 3,724,820 4,047,026 8.0% Univest Corporation of Pennsylvania 184,532 3,005,169 3,189,701 5.8% Oritani Financial Corp. 140,425 2,381,088 2,521,513 5.6% OceanFirst Financial Corp. 121,231 3,218,122 3,339,353 3.6% Relationship banking also expected to improve level of high quality deposits relative to peers. Note: Relates only to bank subsidiaries; data as of September 30, 2016.Source: Company call reports.