UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F/A

Amendment No. 1

(MARK ONE)

| o | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED AUGUST 31, 2006 |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM ________TO _________ |

| o | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of Event Requiring this Shell Company Report ___________

COMMISSION FILE NUMBER 000-27476

COOLBRANDS INTERNATIONAL INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

Not Applicable

(TRANSLATION OF REGISTRANT'S NAME INTO ENGLISH)

Province of Ontario, Canada

(JURISDICTION OF INCORPORATION OR ORGANIZATION)

210 Shields Court

Markham, Ontario

Canada L3R 8V2

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

SECURITIES REGISTERED OR TO BE REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT.

| NAME OF EACH EXCHANGE | ||

| TITLE OF EACH CLASS | ON WHICH REGISTERED | |

| Not Applicable | ||

SECURITIES REGISTERED OR TO BE REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT.

Not Applicable

(TITLE OF CLASS)

(TITLE OF CLASS)

SECURITIES FOR WHICH THERE IS A REPORTING OBLIGATION PURSUANT TO SECTION 15(d) OF THE ACT.

Class A Subordinate Voting Shares

Class B Multiple Voting Shares

(TITLE OF CLASS)

INDICATE THE NUMBER OF OUTSTANDING SHARES OF EACH OF THE ISSUER'S CLASSES OF CAPITAL OR COMMON STOCK AS OF THE CLOSE OF THE PERIOD COVERED BY THE ANNUAL REPORT.

| Subordinate Voting Shares: | 50,049,774 |

| Multiple Voting Shares: | 6,025,659 |

INDICATE BY CHECK MARK IF THE REGISTRANT IS A WELL-KNOWN SEASONED ISSUER, AS DEFINED IN RULE 405 OF THE SECURITIES ACT.

oYES x NO

IF THIS REPORT IS AN ANNUAL OR TRANSITION REPORT, INDICATE BY CHECK MARK IF THE REGISTRANT IS NOT REQUIRED TO FILE REPORTS PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934.

x YES o NO

INDICATE BY CHECK MARK WHETHER THE REGISTRANT (1) HAS FILED ALL REPORTS REQUIRED TO BE FILED BY SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 DURING THE PRECEDING 12 MONTHS (OR FOR SUCH SHORTER PERIOD THAT THE REGISTRANT WAS REQUIRED TO FILE SUCH REPORTS), AND (2) HAS BEEN SUBJECT TO SUCH FILING REQUIREMENTS FOR THE PAST 90 DAYS.

x YES o NO

INDICATE BY CHECK MARK WHETHER THE REGISTRANT IS A LARGE ACCELERATED FILER, AN ACCELERATED FILER, OR A NON-ACCELERATED FILER. SEE DEFINITION OF “ACCELERATED FILER” IN RULE 12B-2 OF TE EXCHANGE ACT (CHECK ONE):

LARGE ACCELERATED FILER o ACCELERATED FILER x NON-ACCELERATED FILER o

INDICATE BY CHECK MARK WHICH FINANCIAL STATEMENT ITEM THE REGISTRANT HAS ELECTED TO FOLLOW.

x ITEM 17 o ITEM 18

IF THIS IS AN ANNUAL REPORT, INDICATE BY CHECK MARK WHETHER THE REGISTRANT IS A SHELL COMPANY (AS DEFINED IN RULE 12b-2 OF THE EXCHANGE ACT

o YES x NO

EXPLANATORY NOTE

The sole purpose of this amendment is to attach separately the exhibits to the Form 20-F of CoolBrands International Inc. for the fiscal year ended August 31, 2006, filed on August 31, 2007 with the Securities and Exchange Commission.

This Amendment is not intended to revise other information presented in the Company’s Annual Report on Form 20-F for the fiscal year ended August 31, 2006 as originally filed, which remains unchanged. This Amendment does not reflect events occurring after the filing of the original Form 20-F and does not modify or update the disclosure therein in any way other than as required to reflect the amendment discussed above.

TABLE OF CONTENTS

| ITEM 1 IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 2 |

| 2 | |

| 2 | |

| ITEM 4 INFORMATION ON THE COMPANY | 5 |

| ITEM 4A UNRESOLVED STAFF COMMENTS | 14 |

| ITEM 5 OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 14 |

| 34 | |

| 42 | |

| 45 | |

| 47 | |

| 49 | |

| 54 | |

| 54 | |

| 54 | |

| 55 | |

| ITEM 15 CONTROLS AND PROCEDURES | 55 |

| ITEM 16 [RESERVED] | 56 |

| ITEM 16A AUDIT COMMITTEE FINANCIAL EXPERT | 56 |

| ITEM 16B CODE OF ETHICS | 57 |

| ITEM 16C PRINCIPAL ACCOUNTANT FEES AND SERVICES | 57 |

| ITEM 16D EXEMPTIONS FROM LISTING STANDARDS FOR AUDIT COMMITTEES | 57 |

| ITEM 16E PURCHASE OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 58 |

| ITEM 17 FINANCIAL STATEMENTS | 58 |

| ITEM 18 FINANCIAL STATEMENTS | 58 |

| ITEM 19 EXHIBITS | 58 |

FORWARD-LOOKING STATEMENTS

This report contains certain forward-looking statements with respect to CoolBrands International Inc., its subsidiaries and affiliates (the “Corporation,” the “Company” or “CoolBrands”). These statements are often, but not always, made through the use of words or phrases such as “expect”, “should continue”, “continue”, “believe”, “anticipate”, “estimate”, “contemplate”, “target”, “plan”, “budget” “may”, “will”, “schedule” and “intend” or similar formulations. By their nature, these forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant, known and unknown, business, economic, competitive and other risks, uncertainties and other factors affecting CoolBrands specifically or its industry generally that could cause actual performance, achievements and financial results to differ materially from those contemplated by the forward-looking statements. These risks and uncertainties include the Company’s ability to sell certain assets and businesses to generate liquidity; the Company’s ability to generate adequate gross margins from its remaining businesses; the tastes and preferences of the U.S. retail consumer of CoolBrands’ products; the ability of CoolBrands to be competitive in the highly competitive U.S. market for frozen dessert products at its substantially reduced size; fluctuations in consumption of CoolBrands’ products and services as a result the seasonal nature of the frozen dessert industry; the ability of CoolBrands to retain or acquire shelf space for its products in supermarkets, club stores and convenience stores; the ability of CoolBrands to rebuild the business given the service and production issues it has had as a result of its downsizing; the ability of CoolBrands to liquidate its remaining business efficiently; the ability of CoolBrands to invest in or merge with another operating business; the ability of CoolBrands to effectively manage the risks inherent with any mergers and acquisitions; the effect on foreign operations of political, economic and regulatory risks; currency risk exposure; the ability to recruit (if the Company tries to rebuild) and retain qualified employees; changes in prices for raw materials; the ability of CoolBrands to pass on cost increases resulting from inflation; and other risks described from time to time in publicly filed disclosure documents of CoolBrands and its subsidiaries and affiliates. In view of these uncertainties we caution readers not to place undue reliance on these forward-looking statements. Statements made in this document are made as of August 31, 2007 and CoolBrands disclaims any intention or obligation to update or revise any statements made herein, whether as a result of new information, future events or otherwise.

All dollar amounts referred to herein are in United States dollars unless otherwise noted.

1

PART I

Identity of Directors, Senior Management and Advisers |

| Not applicable. |

Item 2 | Offer Statistics and Expected Timetable |

| Not applicable. |

Item 3 | Key Information |

Item 3(A) | Selected Financial Data |

The following selected financial data for the five years ended August 31, 2006 are derived from the audited consolidated financial statements of CoolBrands. These selected financial data should be read in conjunction with "Operating and Financial Review and Prospects" and our consolidated financial statements and notes thereto. In 2005, the Company adopted generally accepted accounting principles in the United States and changed its reporting currency from Canadian dollars to U.S. dollars. For comparative purposes, historical financial statements and notes have been restated to reflect these changes.

Statement of Operations Data

(000 omitted, except for per share data)

For the year ended August 31,

2006 | 2005 | 2004 | 2003 | 2002 | ||||||||||||||||

| Revenues | $ | 99,348 | $ | 149,710 | $ | 280,736 | $ | 161,394 | $ | 94,616 | ||||||||||

| Net (loss) income from continuing operations | $ | (63,620 | ) | $ | (69,016 | ) | $ | 20,325 | $ | 15,031 | $ | 8,978 | ||||||||

| (Loss) income from discontinued operations | (6,972 | ) | (5,054 | ) | 3,187 | 3,795 | 3,019 | |||||||||||||

| Gain on sale of discontinued operations | 410 | |||||||||||||||||||

| Net (loss) earnings | $ | (70,182 | ) | $ | (74,070 | ) | $ | 23,512 | $ | 18,826 | $ | 11,997 | ||||||||

| Basic (loss) earnings per share from continuing operations | $ | (1.13 | ) | $ | (1.23 | ) | $ | 0.37 | $ | 0.29 | $ | 0.19 | ||||||||

| Basic (loss) earnings per share from discontinued operations | (0.12 | ) | (0.09 | ) | 0.05 | 0.07 | 0.06 | |||||||||||||

| Basic (loss) earnings per share | $ | (1.25 | ) | $ | (1.32 | ) | $ | 0.42 | $ | 0.36 | $ | 0.25 | ||||||||

| Fully diluted (loss) earnings per share from continuing operations | $ | (1.13 | ) | $ | (1.23 | ) | $ | 0.37 | $ | 0.28 | $ | 0.18 | ||||||||

| Fully diluted (loss) earnings per share from discontinued operations | (0.12 | ) | (0.09 | ) | 0.05 | 0.07 | 0.06 | |||||||||||||

| Fully diluted (loss) earnings per share | $ | (1.25 | ) | $ | (1.32 | ) | $ | 0.42 | $ | 0.35 | $ | 0.24 | ||||||||

2

Balance Sheet Data

(000 omitted, except for per share data)

As At August 31,

2006 | 2005 | 2004 | 2003 | 2002 | ||||||||||||||||

| Working Capital | $ | (23,992 | ) | $ | 28,477 | $ | 118,138 | $ | 58,985 | $ | 34,796 | |||||||||

| Total Assets | $ | 160,548 | $ | 297,845 | $ | 317,257 | $ | 223,684 | $ | 179,972 | ||||||||||

Total Long-Term Liabilities(1) | $ | 3,173 | $ | 17,514 | $ | 25,658 | $ | 34,205 | $ | 24,677 | ||||||||||

| Shareholders' Equity | $ | 61,118 | $ | 138,406 | $ | 211,101 | $ | 132,714 | $ | 107,513 | ||||||||||

| Number of Shares issued and outstanding: | ||||||||||||||||||||

| Class A Subordinate Voting Shares | 50,049 | 49,918 | 49,863 | 45,629 | 45,497 | |||||||||||||||

| Class B Multiple Voting Shares | 6,026 | 6,029 | 6,030 | 6,179 | 6,209 | |||||||||||||||

1 At August 31, 2006, the Company had $10,077 outstanding under the Corporate Credit Facility, as defined in Recent Developments – 2006, and $23,501 outstanding under the Americana Credit Facility, as defined in Recent Developments – 2006, ($6,418 under the revolver and $17,083 under the term loans). As of May 31, 2006 and August 31, 2006, the Company and Americana Foods were in default of certain financial covenants of each of the Americana Credit Facility and the Corporate Credit Facility. Accordingly the debt outstanding under the Corporate Credit Facility and Americana Credit Facility was classified as current liabilities in the August 31, 2006 Balance Sheet.

Item 3(B) | Capitalization and Indebtedness |

| Not applicable. |

Item 3(C) | Reasons for the Offer and Use of Proceeds |

| Not applicable. |

Item 3(D) | Risk Factors |

In addition to the other information contained and incorporated by reference in this Annual Report on Form 20-F, the following risk factors should be carefully considered in evaluating the Company and its business:

Our filing is not in conformity with SEC rules and regulations

This annual report does not include full certifications by our Chief Executive Officer and Chief Financial Officer as required by Exhibits 12 and 13 of this report. Accordingly, this report does not fully comply with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934. Failure to conform to SEC disclosure requirements could expose us to greater risks for litigation, regulatory proceedings or enforcement actions. Such matters, if they were to occur, could be time consuming and distract management from the conduct of business and we could be required to pay damages or penalties or have other remedies imposed, which could harm our business, financial condition, results of operations and cash flows.

We currently are and we may continue to be subject to legal proceedings and disputes with joint-venture partners, franchisees, former franchisees and others. We may not have sufficient resources to continue the defense of these proceedings or to satisfy any adverse judgment that may be rendered against us. See “Legal Proceedings”.

3

Credit Risk

We rely on major retailers in the U.S. for a substantial portion of our sales. As a result of this concentration of sales and accounts receivable, we are subject to certain credit risks. In fiscal 2006 and fiscal 2005, one customer accounted for 10.2% and 17%, respectively, of our sales from continuing operations.

Key Personnel

We are currently dependent upon a small number of key management personnel. The loss of these key personnel may adversely affect our ultimate financial position. Due to recent dispositions of businesses made by us, we may be unable to retain appropriate personnel on a going forward basis. We have entered into incentive programs with certain key employees in order that they assist in the winding up of certain operations in the U.S.

Mergers, Acquisitions and Dispositions

We have made acquisitions of, or significant investments in, businesses or assets with complementary products or unrelated industries and we may do so again in the future. Acquisitions involve numerous risks, including but not limited to: (i) diversion of our management’s attention from other operational matters; (ii) the inability to realize expected synergies from the acquisition; (iii) impairment of acquired intangible assets as a result of worse-than-expected performance of the acquired operations; (iv) integration and retention of key employees; and (v) integration of operations. Mergers and acquisitions are inherently subject to significant risks, and the inability to effectively manage these risks has materially and adversely affected our business, financial condition and results of operations. Since the end of fiscal 2006, we have made several additional dispositions of businesses and as of August 30], 2007, we no longer operate any active businesses. The last remaining operating businesses of the Company were a manufacturing operation of frozen dessert products in California that was sold on March 30, 2007 and the operation of a manufacturing facility in Arkansas pursuant to a Copack arrangement that was finished on August 5, 2007.

Inflation

Inflation can significantly impact ice cream, frozen desserts ingredients, including milk, butterfat and packaging costs. In the past, we have been able to pass on ingredient, energy and freight cost increases by raising prices on selected product lines. Because of our current level of operations, we do not believe inflation will materially affect on our business.

Raw Materials

We are subject to risks with respect to our cost of raw materials, some of which are subject to changes in commodity prices, particularly the cost of butterfat, which is used to produce ice cream products. From time to time, we have used hedging contracts to reduce our exposure to such risks with respect to our raw material costs. We were not a party to any hedging contracts in fiscal 2006 nor are we currently a party to any hedging contracts.

Consumer Tastes

Our products are ultimately purchased by the U.S. retail consumer, whose tastes and preferences are subject to variation and change. Although carefully monitored, these changes cannot be controlled and are difficult to predict.

Seasonality

The frozen dessert industry generally experiences its highest volume during the spring and summer months and its lowest volume in the winter months.

Shelf Space

Our existing shelf space for our products, along with that of all other products, is reviewed at least annually by our customers. Supermarket, club store and convenience store chains reallocate their total shelf space taking into effect a number of variables, including the number of new products being introduced at any given time, the amount of new product placement fees (slotting fees) being offered by companies in the ice cream and frozen dessert treats industries and by changing consumer tastes and fads. As a result, we are subject, in any given year, to the loss of shelf space with our customers and the loss in revenues associated with the sale of those products. There is also substantial risk that the sales of such new products will not be as successful as we had previously estimated or as successful as new products introduced by us in the past. The risks associated with the reallocation of shelf space by our customers and the development and introduction of new products could have a material adverse effect upon our financial position and results of operations. Because we are no longer manufacturing product as described in Item 4(B) foodservice segment, we will not be competing in our current situation for shelf space.

4

Competition

We have historically derived a substantial portion of our revenues from our operations in the United States. The U.S. market for frozen desserts is highly competitive. As competitors introduce new products or revise their supply or pricing strategies, we may encounter additional and more intense competition. Such competitors may have greater name recognition and more extensive financial, technological, marketing and personnel resources than we do. We have significantly downsized our operations and no longer have the resources or base of business to compete with our traditional competitors.

Rebuild the Business

We may try to rebuild the business. However as a result of the downsizing and the adverse affect it has had on remaining operations, customers and vendors may be reluctant to do business with us and as a result, it may be difficult for us to rebuild, if attempted, to a level of profitability.

Purchase of New Business

We may try to purchase a new business. There is significant competition in the buying and selling of businesses and we may not be able to identify target acquisitions that are appropriate from a strategic perspective, a management perspective, and a price perspective. Additionally, if we were able to identify an acquisition target, we would be required to, among other things (i) successfully integrate new management and (ii) develop a growth strategy.

Lease Obligations

We have abandoned several leased properties. The Company has significant financial obligations under these leases. See Item 5 Operating and Financial Review and Prospects-Contractual Obligations. We may not be able to settle these lease obligations under favorable terms.

Liquidity

We currently have sufficient working capital to fund operations for the next twelve months. If we are unable to wind down existing businesses which are operating at a loss, on a timely basis, or if an adverse judgment were entered against us in any litigation asserted or unasserted at this time, the Company’s liquidity may be reduced to levels that make it difficult to purchase a new business or to continue to operate.

Item 4 | Information on the Company |

Item 4(A) | History and development of the Company |

The Corporation was formed under the Business Corporations Act (Ontario) by articles of amalgamation dated September 7, 1994 under the name Yogen Fruz World-Wide Inc. On March 18, 1998, the Corporation was continued under the Companies Act (Nova Scotia) under the name Yogen Fruz World-Wide Inc. and reorganized its share capital to provide for multiple voting shares and subordinate voting shares. On March 15, 2000, the Corporation amended its articles to change its name to CoolBrands International Inc. On February 27, 2006, the shareholders of the Corporation passed a special resolution to continue the Corporation under the Canada Business Corporation Act effective March 27, 2006. Additionally on February 27, 2006, the shareholders of the Corporation passed a special resolution which resulted in the collapse of the dual class structure on May 31, 2007. (See “Recent Developments – 2006” for further discussion) The principal and registered office of the Corporation is located at 210 Shields Court, Markham, Ontario, L3R 8V2. The Corporation's principal office in the United States was closed on March 31, 2007. See discussion of discontinued operations in Item 5, “Operating and Financial Review and Prospects,” “Discontinued Operations.” As of the date hereof, the Company is no longer manufacturing product, other than under its Co-Packing arrangement pursuant to the sale of the foodservice segment in January discussed below in the description of the foodservice sale. The Company is liquidating existing inventory and trying to sell its real estate, equipment and trade names that it owns.

Recent Developments

Significant developments since August 31, 2006 include:

| · | In September 2006, Eskimo Pie Corporation, a wholly-owned subsidiary of the Corporation, sold its Value America flavors and ingredients division, which comprised substantially all of the Corporation’s dairy component segment for gross proceeds of approximately $8,250,000 to an unaffiliated third party. |

| · | In September 2006, a lawsuit was filed in the Supreme Court of the State of New York against the Corporation and certain of its subsidiaries and employees of Americana Foods by Americana Foods Corporation. Americana Foods Corporation, which, through Capricorn Investors III LP, owns a 49.9% interest in Americana Foods, is seeking monetary damages, certain declaratory orders and injunctive relief based on an alleged erosion in the value of its investment. |

5

| · | On October 11, 2006, the lenders to Americana Foods Limited Partnership (“Americana Foods”), CoolBrands’ 50.1% owned joint venture facility in Dallas Texas, under the Americana Credit Facility (as defined below in Recent Developments-2006), advised Americana Foods that, on account of the existing defaults under its credit facilities, they were no longer willing to lend funds and demanded full and immediate repayment on all borrowings. Certain subsidiaries of the Corporation filed an involuntary petition against Americana Foods under Chapter 7 of the U.S. Federal Bankruptcy Code, and Americana Foods ceased operations in October 2006. |

| · | In November 2006, the Corporation’s subsidiary, Eskimo Pie Frozen Distribution, Inc. (“EPFD”), sold substantially all of its “direct store door” frozen distribution assets in Florida, California, Oregon and Washington to an unaffiliated third party, for net proceeds of approximately $5,736,000. |

| · | On November 17, 2006, 2118769 Ontario Inc., a company controlled by Mr. Michael Serruya, currently the Company’s Chairman, President and Chief Executive Officer, (“2118769”), entered into an agreement to acquire, at par, all of the indebtedness of the senior lenders under the Americana Credit Facility. In connection with this purchase, 2118769 also entered into a forbearance agreement (“Forbearance Agreement”) with CoolBrands pursuant to which 2118769 agreed, for a period of 6 months, not to take any action to demand repayment of the indebtedness on account of existing defaults under the Americana Credit Facility( as defined below in Recent Developments-2006). As part of this transaction, JPMorgan Chase Bank, N.A. (“JPMorgan”) and the other senior lenders agreed to continue to make available to the Corporation $8,000,000 under the Corporate Credit Facility, as defined below in Recent Developments-2006. Mr. Serruya, through 2118769, also established a $5,000,000 letter of credit in favor of the senior lenders as additional security for the $8,000,000 Corporate Credit Facility (as defined below in Recent Developments-2006). |

In consideration for 2118769 entering into both the Forbearance Agreement and providing the Letter of Credit to the senior lenders, the Company issued to Mr. Michael Serruya, warrants to purchase up to 5.5 million subordinate voting shares. The warrants expire in November 2011 and the exercise price is Cdn $0.50 per warrant.

| · | Also on November 17, 2006, the Corporation replaced its independent directors, Mr. Robert E. Baker, Mr. William McMananan, Mr. Joshua L. Sosland and Ms. Beth L. Bronner, with Mr. Romeo DeGasperis, Mr. Garry Macdonald, and Mr. Ronald W. Binns. Additionally, on this date Mr. David Stein resigned from the board of directors. |

| · | On January 24, 2007, the Corporation sold, through its subsidiaries Eskimo Pie Corporation and Integrated Brands Inc., their Eskimo Pie and Chipwich Brands and Real Fruit trademark, along with Eskimo Pie soft serve brands and related foodservice business segment, to Dreyer’s Grand Ice Cream Inc. (“Dreyers”), an indirect subsidiary of Nestle S.A., for a purchase price of approximately $18,925,000. The purchase price includes approximately $4,000,000 in inventory and accounts receivables. Dreyer’s also assumed related liabilities in the amount of approximately $1,000,000. A portion of the proceeds from the sale were utilized to pay off the amounts outstanding under the Corporate Credit Facility. |

| · | On January 30, 2007, effective January 27, 2007, the Corporation sold all of the issued and outstanding stock of CoolBrands Dairy, Inc. (“CBD”), an indirect, wholly owned subsidiary of the Corporation to Lily Acquisition, LLC. As consideration for the transaction, the Corporation received $45,000,000 in cash, a $5,000,000 subordinated promissory note and a warrant to purchase 200 shares of common stock of Yogurt Holdings II Inc. at a price of $12,500 per share. |

| · | In February 2007, the Company closed its printing and packaging plant in Bloomfield, New Jersey and is actively marketing the plant for sale. |

| · | The Company was served notice on March 12, 2007 by Godiva Chocolatier, Inc. and Godiva Brands, Inc. alleging that the Company has breached its license agreement and the licensor has filed a claim in the Supreme Court of the State of New York for damages of $14 million for breach of contract plus additional damages. The outcome and resolution of such claim is uncertain at this time. |

| · | On March 30, 2007, the Company sold its frozen dessert operation at Norwalk, California to an unrelated third party for proceeds of approximately $4,600,000. |

6

2006

| · | CoolBrands reported a consolidated net loss for the year ended August 31, 2006 of $(70,182,000). Major developments in fiscal 2006 included: |

● | On September 2, 2005, the Corporation entered into an amendment to its credit facilities with JPMorgan Chase Bank, N.A.(“JPMorgan Chase Bank, N.A.” or “JPMorgan”) (the “Credit Amendment”). The Credit Amendment extended the maturity of the existing facilities from November 1, 2005 until January 3, 2006 and waived defaults in its financial covenants resulting from the Corporation’s performance for the quarters ended May 31, 2005 and August 31, 2005. The Credit Amendment also eliminated all of the existing financial covenants from the loan agreements through the remainder of the term. The Credit Agreement was refinanced in April 2006 as described below. |

● | On December 23, 2005, the Corporation sold substantially all of its franchising division to International Franchise Corp., a related party, for cash consideration of $8 million. The Corporation received a fairness opinion from an unaffiliated third party in connection with this transaction. |

● | On February 27, 2006, the shareholders of the Corporation passed a special resolution to exchange each Class A subordinate voting share (the “Subordinate Voting Shares”) and each Class B multiple voting share (the “Multiple Voting Shares”) into one common share. This change occurred on May 31, 2007. Upon the change to the Corporation’s dual class structure becoming effective, the Board Representation Agreement and the Trust Agreement terminated. Prior to termination, the parties agreed that the Corporate Governance Committee make all nominations for membership to the board of directors of the Corporation. Copies of the Board Representation Agreement and Trust Agreement are available on the Internet at www.sedar.com. |

● | On February 27, 2006, the shareholders of the Corporation passed a special resolution to continue the Corporation under the Canada Business Corporations Act. This change was effected on March 27, 2006. |

● | On April 21, 2006, the Corporation signed definitive agreements in respect of new credit facilities with a syndicate of lenders led by JPMorgan (the “April 21 Credit Agreements”). The facilities were structured as follows: (a) a $48,000,000 senior secured revolving credit facility in respect of which CoolBrands and certain of its subsidiaries (with the exception of Americana Foods) are borrowers (the “Corporate Credit Facility”) and (b) a $25,500,000 senior secured credit facility consisting of a $8,000,000 senior secured revolving credit facility and $17,500,000 of term loans in respect of which Americana Foods is the borrower ( together ,the “American Credit Facility”). The facilities were originally for a term of three years and provided for interest at the bank’s prime rate. |

| ● | On July 21, 2006, the Corporation announced that it had breached a covenant in the April 21 Credit Agreements. The breach resulted from a breach by Americana Foods of a financial covenant under the Americana Credit Facility. |

● | As a result of the continued significant losses of Americana Foods, which was in default under the Americana Credit Facility, Americana Foods was placed into bankruptcy under an involuntary petition of bankruptcy under Chapter 7 of the U.S. Bankruptcy Code by certain subsidiaries of the Company as creditors of Americana Foods, and ceased operations in October 2006. Americana Foods generated a loss of $(23,542,000), net of the minority interest, including $11,150,000 of write-downs of certain assets to estimated net realizable value. |

Principal Capital Expenditures and Divestitures of the Last Three Years

During Fiscal 2004, Fiscal 2005 and Fiscal 2006, the Company purchased property, plant and equipment in the normal course of business totaling $12,977,000, $13,500,000, and $1,416,000, respectively (including discontinued operations). During 2005, the Company purchased the Breyer’s yogurt business and Zipp Manufacturing flavors business for purchase prices of $59,152,000 and $457,000, respectively. In early 2006, the Company sold its franchising and licensing segment for $8,000,000. During 2006, the Company marketed its dairy component (Value America) segment, its yogurt segment and its distribution business (EPFD) for sale. In September 2006, the Company sold its Value America division for proceeds totaling $8,250,000 (including a hold back of $750,000). Additionally in November 2006, the Company completed the sale of substantially all of its EPFD assets for proceeds totaling $4,400,000 and in January 2007 the Company sold it foodservice segment for proceeds totaling $ 18,925,000. In January 2007, the Company sold its yogurt business for cash proceeds of $ 45,000,000, a $5,000,000 note and warrants to acquire shares of an affiliate of the purchaser. In February 2007, the Company closed down the printing and packaging plant and is marketing it for sale. In April 2007 the Company sold its frozen desserts segment for proceeds of $4,600,000. The Company is no longer manufacturing products other than under its co-packing arrangement with Dreyer’s pursuant to the sale of the assets of the foodservice segment, and is in the process of selling off some remaining inventory. See description of foodservice segment in Item 4(B) Business Overview.

7

Item 4(B) | Business Overview |

CoolBrands businesses have primarily consisted of the marketing and selling of frozen desserts and the related vertically integrated manufacturing and distribution operations in the U.S. and, the manufacturing and selling of fresh yogurt products, foodservice sales and manufacturing of frozen yogurt and ice cream mixes and the manufacture and sales of ingredients and packaging to the dairy industry. CoolBrands had marketed a diverse range of frozen desserts and fresh yogurt products under nationally and internationally recognized brand names.

In Fiscal 2004 and Fiscal 2005, the Company’s reportable segments were the frozen dessert segment, yogurt (acquired in 2005), foodservice, dairy components, and franchising and licensing, including company owned stores. In December 2005, the Company sold the assets, net of certain liabilities of its franchising and licensing segment and began to actively market EPFD, a component of the frozen dessert segment, its Value America division, which comprised substantially all of the dairy components segment, and CBD, the yogurt segment, for sale. Accordingly, the assets and liabilities of each of these entities have been classified to assets and liabilities of discontinued operations on each of the consolidated balance sheets as of August 2006 and 2005 and the components of their operating results and cash flows have been included in net loss from discontinued operations on each of the consolidated statements of operations and cash flows from discontinued operations on each of the statements of cash flows. Therefore, the franchising and licensing segment, the yogurt segment and the dairy components segment have been reclassified to discontinued operations for each of the years presented. The Company is reporting continuing operations in two business segments for the periods presented. Additionally, the assets of the foodservice segment were sold on January 24, 2007. The businesses and business segments included in discontinued operations accounted for revenues of $260,077, $235,435 and $169,202 in Fiscal 2006, Fiscal 2005 and Fiscal 2004, respectively.

The following table sets forth the contribution to revenue of each of the remaining segments in continuing operations at August 31, 2006 by geographic region for the periods indicated:

Revenue by Industry Segments and Classes of Product and Services

Year ended August 31, 2006 (in thousands of dollars)

Operating Segments | ||||||||||||||||

Revenue Source | Frozen Desserts | Foodservice(1) | Corporate | Total | ||||||||||||

| United States | $ | 120,959 | $ | 20,990 | $ | - | $ | 141,949 | ||||||||

| Canada | 202 | - | 103 | 305 | ||||||||||||

| International | - | - | - | - | ||||||||||||

| Inter-segment revenues | (43,597 | ) | - | - | (43,597 | ) | ||||||||||

| Other revenues: | 620 | 71 | - | 691 | ||||||||||||

| Total consolidated net revenues | $ | 78,184 | $ | 21,061 | $ | 103 | $ | 99,348 | ||||||||

Year ended August 31, 2005 (in thousands of dollars)

Operating Segments | ||||||||||||||||

Revenue Source | Frozen Desserts | Foodservice(1) | Corporate | Total | ||||||||||||

| United States | $ | 173,727 | $ | 18,397 | $ | - | $ | 192,124 | ||||||||

| Canada | 528 | - | 280 | 808 | ||||||||||||

| International | 405 | - | - | 405 | ||||||||||||

| Inter-segment revenues | (43,665 | ) | (661 | ) | (230 | ) | (44,556 | ) | ||||||||

| Other revenues: | 797 | - | 132 | 929 | ||||||||||||

| Total consolidated net revenues | $ | 131,792 | $ | 17,736 | $ | 182 | $ | 149,710 | ||||||||

8

Year ended August 31, 2004 (in thousands of dollars)

Operating Segments | ||||||||||||||||

Revenue Source | Frozen Desserts | Foodservice(1) | Corporate | Total | ||||||||||||

| United States | $ | 329,982 | $ | 16,382 | $ | - | $ | 346,364 | ||||||||

| Canada | 901 | - | 219 | 1,120 | ||||||||||||

| International | 361 | - | - | 361 | ||||||||||||

| Inter-segment revenues | (66,533 | ) | (703 | ) | (242 | ) | (67,478 | ) | ||||||||

| Other revenues: | 261 | - | 108 | 369 | ||||||||||||

| Total consolidated net revenues | $ | 264,972 | $ | 15,679 | $ | 85 | $ | 280,736 | ||||||||

1 The Company sold its foodservice segment on January 24, 2007.

Frozen Dessert Segment

Revenues in the frozen dessert segment are generated from marketing and selling a variety of pre-packaged frozen desserts to distributors, and various retail establishments including supermarkets, grocery stores, club stores, gourmet shops, delicatessens and convenience stores.

CoolBrands competed in the “Better for You” ice cream category with offerings such as fat-free, non-dairy WholeFruit Sorbet and Fruit-a-Freeze. Better for You offerings by CoolBrands includes No Pudge! branded frozen snacks and a line of Better for Kids frozen snacks sold under the Justice League, Snapple, Care Bears and Trix Pops brands. In addition, CoolBrands marketed a wide variety of “all family” premium ice creams and frozen snacks under brand names including Tropicana and Yoplait.

CoolBrands’ subsidiary, EPFD operated a direct store door ice cream distribution system in selected markets in the U.S., serving these CoolBrands products and a number of Partner Brands to supermarkets, convenience stores and other retail customers. During Fiscal 2006, the Corporation made the decision to sell EPFD. The Corporation consummated the sale of substantially all of the net assets of EPFD to an unaffiliated third party on November 17, 2006. The Corporation did not sell its depots in Atlanta, Georgia, Moorestown, New Jersey, and Jessup, Maryland. These depots were closed in January 2007. The lease in Atlanta, Georgia has expired and the Corporation is currently negotiating settlements of the leases in Moorestown, New Jersey and Jessup, Maryland which are scheduled to expire in March, 2009 and September 2008, respectively. See Item 4(D), “Property, Plants and Equipment” for a further discussion. The Company may not be able to negotiate favorable settlements of these leases.

Foodservice Segment

In addition to products manufactured for use in its business, the Corporation manufactured soft serve frozen yogurt and premium ice cream mixes in a leased facility in Russellville, Arkansas. Soft serve mix is sold under the Eskimo Pie brand name to broad-line foodservice distributors, yogurt shops and other foodservice establishments which, in turn, sell soft serve ice cream and frozen yogurt products to consumers. A separate sales force working within Eskimo Pie's wholly-owned subsidiary, Sugar Creek Foods, Inc., managed the sale of soft serve yogurt and ice cream mixes. In early Fiscal 2007, the Company made the decision to sell the assets of its foodservice segment and consummated the sale of the foodservice segment to an unaffiliated third party on January 24, 2007. Sugar Creek Foods, Inc, entered into a Co-Pack Agreement with Dreyer’s to manufacture soft-serve ice cream for a period of up to nine months from the date of the sale.

Yogurt Segment

CoolBrands subsidiary, CoolBrands Dairy, Inc. (“CBD”), manufactured cup yogurt at its plant located in North Lawrence, New York, under the Breyers brand pursuant to a trademark rights agreement, which grants the right in perpetuity, and under the Creme Savers brand pursuant to a long term license agreement.

Breyers yogurt was distributed and sold across the United States, internationally through the United States military complex and throughout the Caribbean. Finished goods were shipped refrigerated freight to strategic refrigerated warehouses for distribution to key accounts.

9

During Fiscal 2006, the Company made the decision to sell the yogurt segment, which it had acquired in March 2005. Accordingly, the assets and liabilities of the yogurt segment were included in assets and liabilities of discontinued operations on the consolidated balance sheets and the results of operations and cash flows are included in loss from discontinued operations and cash flows from discontinued operations on the consolidated statements of operations and consolidated statements of cash flows, respectively for all financial statement periods presented. CBD was sold to an unaffiliated third party on January 30, 2007.

Dairy Components Segment

In addition to products manufactured for use in its business, the Corporation sold various other ingredients to the dairy industry produced at its New Berlin, Wisconsin facility. This business involved blending, cooking and processing basic flavors and fruits to produce products, which subsequently are used by customers to flavor frozen desserts, ice cream novelties and fluid dairy products. During 2006, the Company made the decision to sell its Value America division, which represented substantially all of the dairy components segment. Accordingly, the assets and liabilities of Value America are included in assets and liabilities of discontinued operations on the consolidated balance sheets and the results of operations and related cash flows are included in net loss from discontinued operations and cash flows from discontinued operations on the consolidated statements of operations and the consolidated statements of cash flows for all financial statement periods presented. The Company consummated the sale of the assets of Value America to an unaffiliated third party on September 14, 2006.

Franchising and Licensing Segment

Prior to the sale of substantially all of the Franchising and Licensing business, a full franchising program had been developed for each of the Tropicana® Smoothies, Juices & More!, Yogen Fruz®, Bresler's®, Swensen's®, Java Coast® Fine Coffees and Golden Swirl® chains. Although developed separately, each of the programs (except for Golden Swirl®) was substantially similar and was organized on two levels: master franchising, pursuant to which master franchises were sold for specific regions, countries or other geographical areas; and retail franchising and licensing, pursuant to which franchises were sold, and licenses were granted, by master franchisees to retail outlet operators in the master franchisee's territory. Generally, retail franchising is used for larger locations such as traditional stores or kiosks, which offer a full range of products. Licensing is used primarily for smaller locations such as mini-counters or carts, which are located within the premises of strategic partners and typically offer a more limited selection of products.

CoolBrands, either directly or through master franchisees, entered into a license agreement with each licensee for each location. The license agreement authorized the licensee to operate a Swensen's®, Yogen Fruz®, I Can't Believe It's Yogurt®, Bresler's® or Java Coast® Fine Coffees mini-counter or similar outlet within the licensee's place of business. The licensee was required to operate the outlet in accordance with the methods, standards, specifications and procedures prescribed by CoolBrands. Generally, the licensee was required to purchase products used within the outlet from CoolBrands or from suppliers and manufacturers designated by it. This business was sold by the Company in December 2005.

Distribution Channels

The Company's products were offered for sale in a diverse range of retail outlets, including supermarkets, mass merchants, drug stores, convenience stores and club stores, as well as foodservice outlets, such as restaurants, cafeterias, theme parks and ice cream parlors.

The Company distributed its products primarily by direct shipment to super-market owned warehouses, independent distributors and foodservice broad-line distributors. In addition, the Company operated, through EFPD, a proprietary direct-store-distribution ("DSD") system that serviced all distribution channels in selected U.S. markets, including out-of-home accounts such as convenience stores, drug stores and gas station food marts. As previously described, the Company decided to sell EPFD in 2006 and consummated the sale of substantially all of the assets of EPFD on November 17, 2006.

Regulation

CoolBrands' frozen dessert products and yogurt are subject to licensing and regulation (including good manufacturing practices) by federal, state and municipal authorities at its facilities in North Lawrence, New York, Dallas, Texas, Russellville, Arkansas and Norwalk, California and in the states to which they ship their products. Due to continued significant losses, the Company closed its Americana Foods operations in Dallas, Texas in October 2006. In addition, the Company sold its yogurt segment, including its facilities, in North Lawrence, New York on January 30, 2007.

Seasonality

The ice cream and frozen snacks industry is highly seasonal with more frozen yogurt and ice cream consumed in warmer months. As a result, our operating results of our continuing operations are subject to the same seasonality. The Corporation's fourth quarter, during the summer, has historically been the strongest quarter of the year. The fourth quarter accounted for 31.9% and 65.6% of the Corporation's net revenues from continuing operations and net loss, respectively, for the fiscal year ended August 31, 2006 and 32.2% and 87.7% of the total revenues and net loss, respectively, for the fiscal year ended August 31, 2005.

10

Competitive Conditions

CoolBrands competed in the frozen dessert retail market against a large number of competitors. In the novelty market, Integrated Brands faced substantial competition in connection with the marketing and sales of its products. Among its competitors are Klondike, Popsicle, Breyers, Good Humor and Sealtest, owned by Unilever PLC and Dreyer’s Grand Ice Cream which either owns or licenses the Dreyer’s, Edy’s, Nestle, Haagen-Dazs, Skinny Cow, and Starbuck’s brands. In the super premium ice cream and sorbet pint markets, Integrated Brands faced substantial competition from Haagen-Dazs and Ben & Jerry’s. Integrated Brands’ products may also have been considered to be competing with all ice cream and other frozen desserts for discretionary food dollars. Frozen yogurt and ice cream are also offered in supermarkets, grocery stores and wherever convenience food operations are conducted.

While the ice cream manufacturing and distribution business is relatively easy to enter due to low entry costs, achieving wide distribution may be more difficult because of the high cost of a national marketing program and limitations on space available in retail freezer compartments.

In fiscal 2006 and fiscal 2007, the Corporation sold certain of its business segments. The Corporation has continued to reduce costs as it has downsized operations; however, it may not be able to scale down its operating costs to a level that would make the remaining business profitable. Additionally, as the result of downsizing, service problems have been created in the marketplace and customers and vendors may be reluctant to transact business with the Corporation in the future.

Trademarks

CoolBrands relied upon copyright, trademark and trade secret laws to protect its proprietary rights in its trademarks and products. CoolBrands obtained registrations for a number of trademarks in Canada, the United States and internationally, including registrations for the trademarks and related symbols Eskimo Pie®, Dreamery®, Whole Fruit®, Chipwich® and Fruit-A-Freeze®. Integrated Brands holds or held long-term trademark license agreements for use in certain countries of the Atkins® Endulge™, No Pudge!™, Tropicana®, Yoplait®, Trix®, Crayola™, Justice League™, Snapple™ and Care Bears™ trademarks in connection with the manufacture, sale and distribution of frozen novelties and other frozen dessert products. The Company sold the Eskimo Pie® and Chipwich ® trademarks as part of the sale of the foodservice segment on January 24, 2007.

The Corporation held licenses to brands including Breyers Fruit on the Bottom, Light and Creme Savers cup yogurt varieties and Creme Savers Smoothie drinkable yogurts. These licenses were part of CBD, which was included in discontinued operations in the financial statements as of and for the years ended August 31, 2006 and 2005, and which was sold to an unaffiliated third party on January 30, 2007.

Below is a list of licenses still in place.

Whole Fruit Sorbet. The Corporation acquired the license for Whole Fruit Sorbet from Dreyer’s in July 2003.

Godiva Ice Cream. CoolBrands acquired the license rights to the Godiva trademark for ice cream from Dreyer’s in July 2003 and manufactured and distributed Godiva Ice Cream in pints and ice cream bars under license from Godiva Chocolatier, Inc. CoolBrands is currently in default of the license agreement and its termination is likely to occur during fiscal 2007. The Company was served notice on March 12, 2007, by Godiva Chocolatier, Inc. and Godiva Brands, Inc. alleging that the Company has breached its license agreement and the licensor has filed a claim in the Supreme Court of the State of New York for damages of $14 million for breach of contract plus additional damages. The outcome and resolution of such claim is uncertain at this time.

No Pudge! Frozen Snacks. In fiscal 2005, CoolBrands introduced the “No Pudge!” line of low fat frozen snacks under license from No Pudge! Foods, Inc., marketers of the popular low fat brownie mix. It is anticipated that this line will be discontinued in fiscal 2007.

Tropicana Fruit Bars. Since 1997, CoolBrands has manufactured and distributed Tropicana fruit bars under license from Tropicana Products, Inc. CoolBrands is currently in default of this license agreement and its termination is likely to occur in fiscal 2007.

Snapple On Ice Pops. In fiscal 2005, CoolBrands introduced the “Snapple On Ice” line of frozen juice pops, under license from Snapple Beverage Corp. It is anticipated that this line will be discontinued in fiscal 2007.

Crayola Color Pops. In fiscal 2005, CoolBrands introduced the “Crayola Color Pops” line of frozen snacks, under license from Binney & Smith Properties, Inc. CoolBrands is currently in default of this license agreement and its termination is likely to occur in fiscal 2007.

11

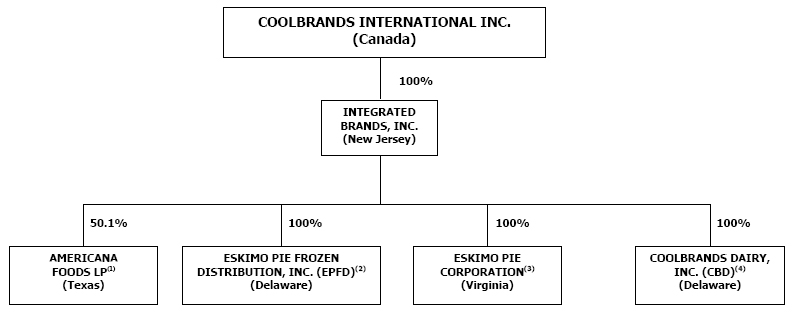

Item 4(C) Organizational Structure

The following chart illustrates the principal direct and indirect subsidiaries of the Corporation as of August 31, 2006, jurisdiction of incorporation and the percentage ownership by the Corporation of the voting and non-voting securities of each subsidiary or other entity.

1 Americana Foods LP is in bankruptcy proceedings under Chapter 7 of the U.S. Federal Bankruptcy Code, and ceased operations in October 2006.

2 Eskimo Pie Frozen Distribution, Inc. sold substantially all of its assets on November 17, 2006.

3 The Corporation sold the Eskimo Pie brand as part of the sale of certain assets of the foodservice segment on January 24, 2007.

4 All of the issued and outstanding shares of CoolBrands Dairy, Inc. (“CBD”) was sold to an unaffiliated third party on January 30, 2007.

Item 4(D) | Property, Plant and Equipment |

Property Owned or Leased as of August [ ], 2007

CoolBrands' headquarters are located at 210 Shields Court, Markham, Ontario, Canada, L3R 8V2 in 1,000 square feet of space, which space is occupied on a month-to-month basis. Rental payments are Cdn $25,000 per annum and are paid to Yogen Fruz Canada Inc., a company owned by Aaron Serruya, a director and former executive vice president of the Corporation.

CoolBrands' U.S. headquarters and Integrated Brands' executive offices were located at 4175 Veterans Highway, Ronkonkoma, New York, 11779. Rental payments were $184,460 per annum for 10,779 square feet. The lease expired on April 30, 2006 and the Corporation continued to lease the space on a month to month basis at the same lease rate. The office was closed on March 31, 2007.

Integrated Brands' subsidiary, Eskimo Pie Frozen Distribution Inc.'s leased 2,799 square feet of office space located at 4175 Veterans Highway, Ronkonkoma, New York, 11779. Rental payments were $55,000 per annum. The lease expired April 30, 2006 in accordance with its terms and the Corporation continued to lease the space on a month to month basis at the same lease rate through November 2006.

Integrated Brands' subsidiary, CoolBrands Manufacturing Inc., leased a 25,000 square foot production and storage facility located in Norwalk, California. Rental payments were $211,000 per annum. The Company sold the Fruit-a-Freeze operations and assets and the lease has been assumed by the buyer.

Integrated Brands, through an affiliate, owns a building in Paradise Valley, Arizona. The building is subject to a ground lease, which expires on December 31, 2010 and contains three five-year renewal options.

Eskimo Pie Corporation owns a printing and packaging plant in Bloomfield, New Jersey, which consists of approximately 71,583 square feet on two acres. The Company closed this plant in February 2007 and is actively marketing it for sale.

Eskimo Pie Corporation's subsidiary, Sugar Creek Foods, Inc., is leasing from the former owner of the business a soft serve yogurt and ice cream mix production facility, consisting of approximately 23,805 square feet, and a packaging facility, consisting of approximately 16,000 square feet, both located in Russellville, Arkansas. The lease expired on December 31, 2006 and is now month to month. Rental payments under these leases are $244,000 per annum. In addition, Sugar Creek Foods, Inc. owns a freezer facility, consisting of approximately 5,013 square feet, adjacent to the production facility in Russellville. In 1999, Eskimo Pie purchased a small parcel of land adjacent to the freezer facility for future potential expansion of the freezer facility.

12

Eskimo Pie Frozen Distribution is a party to a lease of a 12,677 square foot distribution facility located in Moorestown, New Jersey operating as a cross-dock operation. Rental payments are $97,613 per annum. The lease is scheduled to expire March 31, 2009. The Company abandoned the facility in November 2006. The Company is currently in default under this lease.

Eskimo Pie Frozen Distribution is a party to a lease of 400 square foot of office space located in Jessup, Maryland. Rental payments are $43,956.00 per annum. The lease is scheduled to expire Sept 30, 2008. The Company closed its operation in November 2006. The Company is currently in default under this lease.

Eskimo Pie Frozen Distribution leases truck parking located in Jessup,Maryland. Rental payments were $28,620 per annum. The lease is scheduled to expire September 30,2008. The Company closed its operation in November 2006. The Company is currently in default under this lease.

Property subject to leases during Fiscal 2006 that have expired in accordance with their terms

Eskimo Pie Frozen Distribution leased a 22,798 square foot of freezer and distribution facilities located in Atlanta, Georgia. Rental payments were $247,212 per annum. The lease expired July 31, 2006 in accordance with its terms and was leased on a month to month basis until January 2007.

Eskimo Pie Frozen Distribution leased a 400 square foot office space located in Paterson, New Jersey. Rental payments were $16,800 per annum. EPFD also leased cross docking and truck parking on a coterminous basis for $42,000 per annum. The lease expired October 31, 2006 in accordance with its terms.

Eskimo Pie Frozen Distribution also leased a remote location with office space and truck parking in Neptune, New Jersey for $52,200 per annum on a month to month basis until October 31, 2006.

Eskimo Pie Frozen Distribution leased on a month to month basis a remote location for office space and truck parking located in Brooklyn, New York. Rental payments were $15,600 per annum and the office space and truck parking was returned to the landlord at the end of October 2006.

Eskimo Pie Frozen Distribution leased a 1,500 square foot freezer facility located in Milwaukee, OR. Rental payments were $72,000 per annum. The lease expired June 21, 2006 in accordance with its terms and was extended on a month to month basis until November 2006.

Eskimo Pie Frozen Distribution leased a 3,026 square foot office trailer and loading docks facility located in Tampa, Florida. Rental payments were $63,578 per annum. The lease expired September 1, 2006 in accordance with its terms and the trailer was leased on a month to month basis until it was returned in November 2006.

Eskimo Pie Frozen Distribution leased a 2,400 square foot freezer and distribution facility located in San Diego, California. Rental payments were $123,611 per annum. The lease expired July 1, 2006 in accordance with its terms and the facility was leased on a month to month basis until it was returned in November 2006.

Eskimo Pie Frozen Distribution leased office space and truck parking facility located in Apopka, Florida (Orlando). Rental payments were $49,842 per annum. The lease expired April 30, 2006 in accordance with its terms and was extended on a month to month basis until November 2006.

Eskimo Pie Frozen Distribution leased 11,413 square feet for truck parking located in Riverside, California. Rental payments were $21,600 per annum. The lease expired December 31, 2005 in accordance with its terms and was extended on a month to month basis until November 2006.

Property owned during Fiscal 2006 and subsequently sold

Eskimo Pie Corporation owned an ingredients manufacturing plant in New Berlin, Wisconsin which consists of approximately 92,000 square feet on four acres. This manufacturing plant was sold on September 14, 2006 as part of the sale of the assets of Value America.

Property leased during Fiscal 2006 and assumed by the purchaser of EPFD

Eskimo Pie Frozen Distribution leased a 5,800 square foot freezer and distribution facility located in Boca Raton Florida. Rental payments were $45,223 per annum. The lease, which was scheduled to expire December 31, 2007, was assumed by the purchaser of EPFD on November 17, 2006.

13

Eskimo Pie Frozen Distribution leased a 5,500 square foot freezer and distribution facility located in Novato, California. Rental payments were $101,724 per annum. The lease expired December 31, 2006 in accordance with its terms. Additional parking is leased in Ignacio, California at $13,200 per annum. This lease expires on March 31, 2007. Additional parking is also leased in Novato, California at $24,000 per annum. These leases were assumed by the purchaser of EPFD on November 17, 2006.

Eskimo Pie Frozen Distribution leased a 500 square foot of office space and operates a cross-dock facility in Watsonville, California. Rental payments were $21,304 per annum. The lease, which was scheduled to expire December 1, 2006, was assumed by the purchaser of EPFD on November 17, 2006.

Eskimo Pie Frozen Distribution leased a 34,607 square foot freezer and distribution facility located in Seattle, Washington. Rental payments were $356,064 per annum. The lease, which is scheduled to expire December 1, 2008, was assumed by the purchaser of EPFD on November 17, 2006.

Eskimo Pie Frozen Distribution leased a 9,700 square foot freezer and distribution facility located in Tualatin, Oregon. Rental payments were $144,000 per annum. The lease expired June 7, 2006 in accordance with its terms, was extended on a month to month basis and was assumed by the purchaser of EPFD on November 17, 2006.

Eskimo Pie Frozen Distribution leased a 29,318 square foot freezer and distribution facility located in Miramar, Florida. Rental payments were $294,277 per annum. The lease, which is scheduled to expire June 30, 2007, was assumed by the purchaser of EPFD on November 17, 2006.

Eskimo Pie Frozen Distribution leased a 12,300 square foot freezer and distribution facility located in Plymouth, Florida. Rental payments were $163,052 per annum. The lease was scheduled to expire March 31, 2006, was extended on a month to month basis and assumed by the purchaser of EPFD on November 17, 2006.

Eskimo Pie Frozen Distribution leased 15,000 square feet for truck parking located in Ft. Myers, Florida. Rental payments were $22,260 per annum. The lease expired September 30, 2006 in accordance with its terms and was extended on a month to month basis and was assumed by the purchaser of EPFD on November 17, 2006.

Eskimo Pie Frozen Distribution leased a 400 square foot office space and operates a cross-dock facility in Oxnard, California. Rental Payments were $21,889 per annum. The lease which was scheduled to expire January 18, 2007, was assumed by the purchaser of EPFD on November 17, 2006.

Eskimo Pie Frozen Distribution leased a 1,994 square foot facility located in Tacoma, WA for $25,910 per annum. The lease expires March 31, 2007. The lease was assumed by the purchaser of EPFD on November 17, 2006

Property subject to bankruptcy trustee jurisdiction

Americana Foods LP owned an ice cream and yogurt mix manufacturing plant in Dallas, Texas which consists of approximately 220,000 square feet on 12 acres. Americana Foods owned a warehouse adjacent to its manufacturing facility which consists of approximately 262,000 square feet on 17 acres. Because of continued losses, certain subsidiaries of the Company, as creditors of Americana Foods, filed an involuntary petition under Chapter 7 of the U.S. Federal bankruptcy code and Americana Foods ceased operations in October 2006. The assets of Americana Foods were placed under the control of an independent trustee and were sold at auction. The trustee is completing the final accounting of the bankruptcy proceeds.

Item 4(A) | Unresolved Staff Comments |

| None |

Item 5 | Operating and Financial Review and Prospects |

Item 5(A) to Item 5(F)

The numbers for this item are stated in thousands of dollars except per share amounts.

14

2006 Compared with 2005

Overall Performance

For Fiscal 2006, net revenues from continuing operations decreased to $99,348, compared to $149,710 for Fiscal 2005, a 33.6% decrease. The net loss for Fiscal 2006 was ($70,182) ($(1.25) basic and diluted loss per share), compared to net loss of $(74,070) ($(1.32) basic and diluted earnings per share) for Fiscal 2005.

The decrease in net revenues for Fiscal 2006 from continuing operations reflects the decrease in sales generated by the frozen dessert segment, which was partially offset by the decrease in trade promotion payments and slotting fees made to customers, which are treated as a reduction in revenues, and the elimination of drayage income (which is earned by EPFD and reclassified to discontinued operations). In Fiscal 2006, net sales declined by 32.2% to $96,936, as compared with $142,873 for Fiscal 2005. The decline in sales came from many of our frozen dessert brands, but was partially offset by sales of new products introduced in 2006.

Gross profit percentage for Fiscal 2006 declined to (14.2)%, compared with 0.5% for Fiscal 2005. Gross profit percentage for the periods presented has been calculated by dividing gross profit margin by net sales. Gross profit margin is calculated by subtracting cost of goods sold from net sales. The decline in gross profit percentage was primarily due to:

| 1. | The Company’s inability to cover fixed overhead costs in both our manufacturing and distribution operations due to the lack of production and sales; and |

| 2. | The change in mix of frozen dessert products being sold in Fiscal 2006 with lower gross profit margins, compared with Fiscal 2005. |

The Fiscal 2006 results were adversely effected by:

| 1. | The loss on impairment of goodwill of $3,500 incurred with respect to the frozen dessert segment to recognize the deterioration in value of the business as a result of the declining sales or the potential abandonment or termination of various licensing agreements. |

| 2. | The loss on impairment relating to certain licenses not likely to continue, and related prepaid packaging and design costs totaling $3,609. |

| 3. | The loss on impairment of $1,890 incurred with respect to property, plant and equipment currently in storage. |

| 4. | The write-off of debt acquisition costs totaling $2,015 reflected in selling, general and administrative expenses. |

| 5. | The loss on impairment of $1,140 relating to deferred acquisition costs, prepaid royalties and net receivables from Americana Foods. |

| 6. | The loss generated by the Company’s majority owned subsidiary, Americana Foods, which totaled $23,542, net of minority interest, and which included the losses on impairment aggregating $11,150 relating to the reduction to estimated fair market value of accounts receivable $(1,500), inventory $(5,750), and property, plant and equipment $(3,900). |

| 7. | The recording of a loss on impairment of goodwill associated with the yogurt segment. In Fiscal 2006, the Company began to market the yogurt segment for sale and on January 2, 2007, entered into a definitive agreement to sell the yogurt segment to an unaffiliated third party. A loss on impairment of $5,428 was recorded to recognize the difference between the carrying value of the net assets of the yogurt segment and the fair value based upon the definitive agreement. The impairment was included in loss from discontinued operations in the Fiscal 2006 statement of operations. |

The Fiscal 2005 results were adversely affected by the non-cash pre-tax asset impairment charge of $51,141, which resulted from the impairment of goodwill and intangible assets related to our frozen dessert segment. Additionally we recognized a loss on impairment of $4,384 with respect to our franchising and licensing segment, goodwill and intangible assets which was included in discontinued operations in Fiscal 2005.

15

Cash and working capital

Cash, investments and restricted cash decreased to $393 at August 31, 2006, compared to $41,562 at August 31, 2005. Working capital decreased to $(23,992) at August 31, 2006, compared to $28,477 at August 31, 2005. Our current ratio declined to 0.75 to 1.0 at August 31, 2006 from 1.2 to 1.0 at August 31, 2005. These changes in current assets and current liabilities are attributable primarily to the use of cash investments and restricted cash to repay a portion of the outstanding indebtedness that existed at August 31, 2005, the classification of all bank indebtedness, which was in default at August 31, 2006 as current liabilities, and the decrease in accounts receivable and inventory due to the overall decline of the business, which was greater than the decrease to accounts payable and accrued liabilities. Because the Company had a negative working capital position and the business continues to decline, the Company may not be able to continue as a going concern without the consummation of the sale of assets and or businesses. On January 24, 2007, the Company sold, through its subsidiaries Eskimo Pie Corporation and Integrated Brands Inc., their Eskimo Pie and Chipwich Brands and Real Fruit trademark, along with Eskimo Pie soft serve brands and related foodservice business segment to Dreyer’s Grand Ice Cream Holdings, Inc. (“Dreyer’s”), and utilized a portion of the proceeds to repay the amounts outstanding under the Corporate Credit Facility. (See “Overview” and “Discontinued Operations.”).The Company believes that as a result of the proceeds from the sale of the yogurt business on January 30, 2007, it had sufficient liquidity to fund operations and working capital, including lease settlements, for the next twelve months.

Selected Annual Information

The following chart shows selected annual information for the three most recently completed fiscal years.

Year ended August 31, | ||||||||||||

2006 | 2005 | 2004 | ||||||||||

| Total net revenues from continuing operations | $ | 99,348 | $ | 149,710 | $ | 280,736 | ||||||

| Net (loss) income from continuing operations | (63,620 | ) | (69,016 | ) | 20,325 | |||||||

| Gain on sale of discontinued operations | 410 | - | - | |||||||||

| Net (loss) income from discontinued operations | (6,972 | ) | (5,054 | ) | 3,187 | |||||||

| Discontinued operations | (6,562 | ) | (5,054 | ) | 3,187 | |||||||

| Net (loss) income | $ | (70,182 | ) | $ | (74,070 | ) | $ | 23,512 | ||||

| (Loss) earnings per share from continuing operations: | ||||||||||||

| Basic and Diluted | (1.13 | ) | (1.23 | ) | 0.37 | |||||||

| (Loss) earnings per share from discontinued operations: | ||||||||||||

| Basic and Diluted | (0.12 | ) | (0.09 | ) | 0.05 | |||||||

| (Loss) earnings per share: | ||||||||||||

| Basic and Diluted | (1.25 | ) | (1.32 | ) | 0.42 | |||||||

| Total assets | 160,548 | 297,845 | 317,257 | |||||||||

Total long-term debt(1) | 348 | 8,248 | 27,754 | |||||||||

(1) The Company was in default under both the Corporate Credit Facility and the Americana Credit Facility and accordingly, the balance of the debt which was $10,077 and $23,501, respectively, was included in current liabilities as of August 31, 2006. (See Note 12 “Long-term Debt” and Note 20 “Subsequent Events” in the financial statements and “Liquidity” and “Capital Resources” for a further discussion.)

CoolBrands’ decline in total net revenues during Fiscal 2006 reflects the decrease of net sales of $45,937 or 32.2% compared to Fiscal 2005 and reflects decreases primarily from the frozen dessert segment. Other income decreased from $6,837 in Fiscal 2005 to $2,412 in Fiscal 2006. The principal component was franchise and licensing fees, which decreased from $3,103 to $982 due to the expiration in December 2005, in accordance with its terms, of the Whole Fruit license granted to Dreyer’s. Accordingly only four months of licensing fee income is recorded in Fiscal 2006 as compared to twelve months for Fiscal 2005. There was also a $1,000 decrease in merchandising credit from Dreyer’s due to a decrease in sales volume and therefore a decrease in the related credit for those sales.

CoolBrands’ net loss in Fiscal 2006 was primarily due to the decline in net sales in the frozen dessert product lines and the resulting decrease in gross profit dollars, the continued losses generated by Americana Foods, and provisions for impairment recorded to recognize the loss of value of certain assets. Additionally, the Company recognized a loss from discontinued operations of $(6,972) in Fiscal 2006 which was partially offset by a gain on disposition of discontinued operations of $410. A significant portion of the loss from discontinued operations was the loss on impairment with respect to CBD which was determined based upon the third party offer for the business.

16

CoolBrands’ net loss in Fiscal 2005 was primarily due to the substantial decline in net sales due to the loss of the Weight Watchers Smart Ones license agreement, the decline in net sales of the Atkins Endulge and other frozen dessert product lines, the resulting decrease in gross profit dollars, the $25,627 decline in drayage and other income (which was generated by Eskimo Pie Frozen Distribution and reclassified to net loss from discontinued operations), and the asset impairment charge of $55,525 to goodwill and intangible assets, of which $51,141 was included in continuing operations, and $4,384 was included in the loss from discontinued operations for Fiscal 2005.

Comparison of Fiscal 2006 and Fiscal 2005

In Fiscal 2006 and Fiscal 2005, the Company managed our business based on five industry segments: frozen dessert, yogurt, foodservice, dairy components, and franchising and licensing, including company owned stores. In December 2005, the Company sold the assets, net of certain liabilities, of our franchising and licensing (including company owned stores) segment. The assets and liabilities of the franchising and licensing segment have been classified as assets and liabilities held for sale on the consolidated balance sheet as of August 31, 2005, the components of their operating results have been included in net loss from discontinued operations on the consolidated statements of operations, and the components of net cash flows have been classified as net cash flows from discontinued operations for Fiscal 2006, Fiscal 2005 and Fiscal 2004. The Company recorded a gain on disposition of the franchising segment of $410 in Fiscal 2006. Additionally, during Fiscal 2006, we began to actively market for sale our Value America division, which represented substantially all of our dairy components segment, EPFD, which represented a portion of our frozen dessert segment, and CoolBrands Dairy, Inc, which was our yogurt segment. Accordingly, the assets and liabilities of each of these segment components have been classified as assets and liabilities of discontinued operations held for sale on the consolidated balance sheets as of August 31, 2006 and 2005, the components of their operating results have been included in net loss from discontinued operations on the consolidated statements of operations, and the components of net cash flows have been classified as net cash flows from discontinued operations for the years ended August 31, 2006, 2005, and 2004.

Net sales

Net sales for each segment are summarized in the following table:

Year Ended August 31, | ||||||||||||||||

Percentage of Net Sales | ||||||||||||||||

2006 | 2005 | 2006 | 2005 | |||||||||||||

| Frozen dessert | $ | 76,035 | $ | 271,086 | 78.4 | 74.3 | ||||||||||

| Yogurt | - | 44,007 | - | 12.1 | ||||||||||||

| Foodservice | 20,901 | 17,736 | 21.6 | 4.9 | ||||||||||||

| Dairy components | - | 19,538 | - | 5.3 | ||||||||||||

| Franchising and licensing | - | 12,319 | - | 3.4 | ||||||||||||

| Total, as originally reported | 96,936 | 364,686 | 100.0 | 100.0 | ||||||||||||

| Less amounts reclassified to net loss from discontinued operations: | ||||||||||||||||

| Frozen dessert | - | 147,718 | ||||||||||||||

| Yogurt | - | 44,007 | ||||||||||||||

| Dairy components | - | 17,769 | ||||||||||||||

| Franchising and licensing | - | 12,319 | ||||||||||||||

| - | 221,813 | |||||||||||||||

| Net sales from continuing operations | 96,936 | 142,873 | ||||||||||||||

| Pro Forma adjustment reclassifying Americana Foods to discontinued operations | 50,745 | 62,357 | ||||||||||||||

| Pro forma total | $ | 46,191 | $ | 80,519 | ||||||||||||

The decrease in net sales for Fiscal 2006 in the frozen dessert segment came from a substantial number of the Company’s frozen dessert brands partially offset by generally modest sales of products introduced in Fiscal 2006. In connection with the settlement reached regarding the termination of the Weight Watchers license, CoolBrands agreed to discontinue the sale of all Weight Watchers products on May 1, 2005, in Mid-Fiscal 2005, approximately five months sooner than required by the Weight Watchers License Agreement.

17

Other income

Other income decreased from $6,837 in Fiscal 2005 to $2,412 in Fiscal 2006. The principal component was franchise and licensing fees, which decreased from $3,103 to $982 due to the expiration in December 2005, in accordance with its terms, of the Whole Fruit license with Dreyer’s. Accordingly only four months of licensing fee income is recorded in Fiscal 2006 as compared to twelve months for Fiscal 2005. There was also a $1,000 decrease in merchandising credit from Dreyer’s due to a decrease in sales volume and therefore a decrease in the related credit for those sales.

Gross profit margin

The following table presents the gross profit margin dollars and gross profit percentage for the Company’s segments:

Year Ended August 31, | ||||||||||||||||

Percentage of Net Sales | ||||||||||||||||

2006 | 2005 | 2006 | 2005 | |||||||||||||

| Frozen dessert | $ | (16,829 | ) | $ | (15,488 | ) | (22.1 | ) | (5.7 | ) | ||||||

| Yogurt | 7,369 | 16.7 | ||||||||||||||

| Foodservice | 3,047 | 3,626 | 14.6 | 20.4 | ||||||||||||

| Dairy components | 4,287 | 21.9 | ||||||||||||||

| Franchising and licensing | 3,224 | 2.6 | ||||||||||||||

| Total, as originally reported | (13,782 | ) | 3,018 | (14.2 | ) | 0.8 | ||||||||||

| Less amounts reclassified to net loss from discontinued operations: | ||||||||||||||||

| Frozen dessert | (12,141 | ) | ||||||||||||||

| Yogurt | 7,369 | |||||||||||||||

| Dairy components | 3,874 | |||||||||||||||

| Franchising and licensing | 3,224 | |||||||||||||||

| - | 2,326 | |||||||||||||||

| Gross profit from continuing operations | (13,782 | ) | 692 | |||||||||||||

| Pro Forma adjustment reclassifying Americana Foods to discontinued operations | (10,549 | ) | (484 | ) | ||||||||||||

| Pro forma total | $ | (3,233 | ) | $ | 1,176 | |||||||||||

Gross profit dollars, with respect to continuing operations, declined to $(13,782) in Fiscal 2006, compared to $692 in Fiscal 2005, primarily due to the decline in gross profit dollars in frozen dessert segment; $10,549 of this negative gross profit margin in Fiscal 2006 was generated by the operations of Americana Foods. The decline in gross profit dollars in the frozen dessert segment resulted from the decline in sales in Fiscal 2006, compared to Fiscal 2005, and the inability to cover fixed overhead costs in both manufacturing (principally Americana Foods) and distribution operations due to the lack of production and sales. In Fiscal 2005, gross profit dollars in the frozen dessert segment were adversely affected by the write down of $12,723 of obsolete and slow moving finished goods inventories, packaging, ingredients and finished goods inventories which could not be used or sold resulting from the settlement of the Weight Watchers litigation and the estimated impact on packaging which will not be used due to a new labeling law which became effective January 1, 2006.