SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. ___)

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement | o Confidential, for Use of the |

o Definitive Proxy Statement | Commission Only (as permitted |

x Definitive Additional Materials | by Rule 14a-6(e)(2)) |

o Soliciting Material Pursuant to Rule 14a-12 | |

SMARTSERV ONLINE, INC. |

| (Name of Registrant as Specified in Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1. | Title of each class of securities to which transaction applies: |

| | 2. | Aggregate number of securities to which transaction applies: |

| | 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4. | Proposed maximum aggregate value of transaction: |

Fee paid previously with preliminary materials: ________________________________________

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| 1. | Amount Previously Paid: |

| | 2. | Form, Schedule or Registration Statement No.: |

SMARTSERV ONLINE, INC.

2250 Butler Pike, Suite 150

Plymouth Meeting, PA 19462

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held November 21, 2005

To Our Stockholders:

The 2005 Annual Meeting of Stockholders of SmartServ Online, Inc. (the “Company”) will be held at the Company’s principal executive offices located at 2250 Butler Pike, Suite 150, Plymouth Meeting, Pennsylvania, 19462, on November 21, 2005, beginning at 10:00 a.m., local time, for the following purposes:

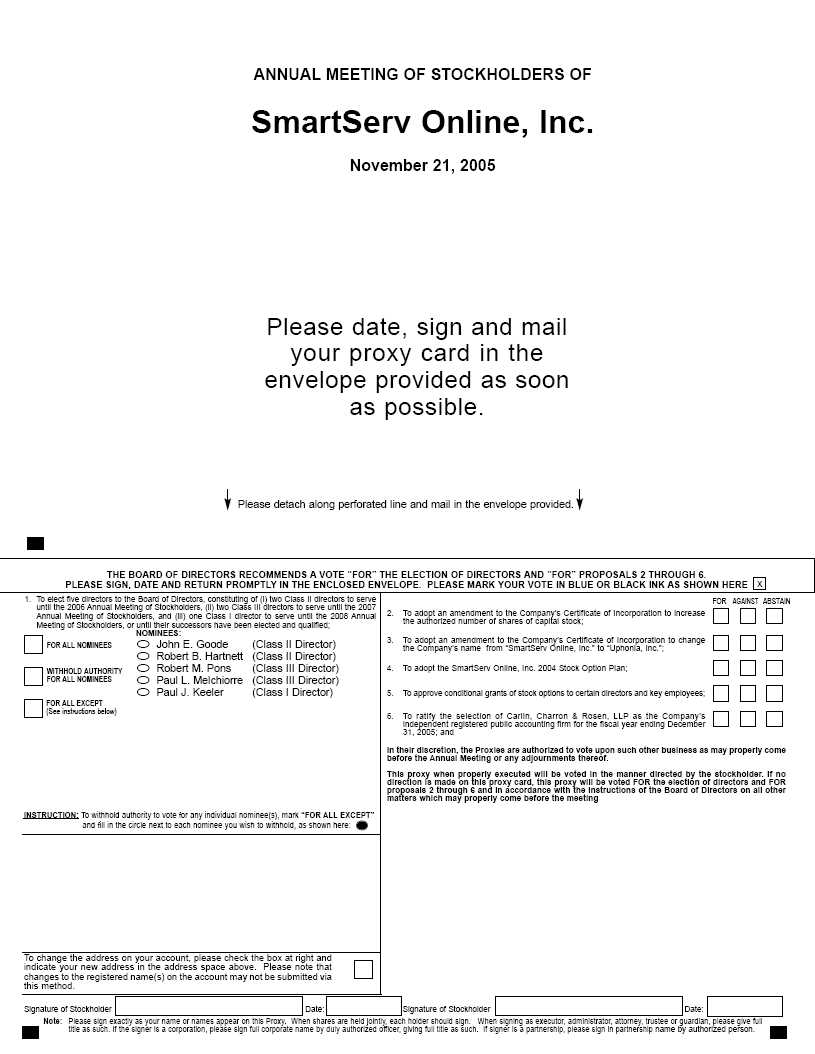

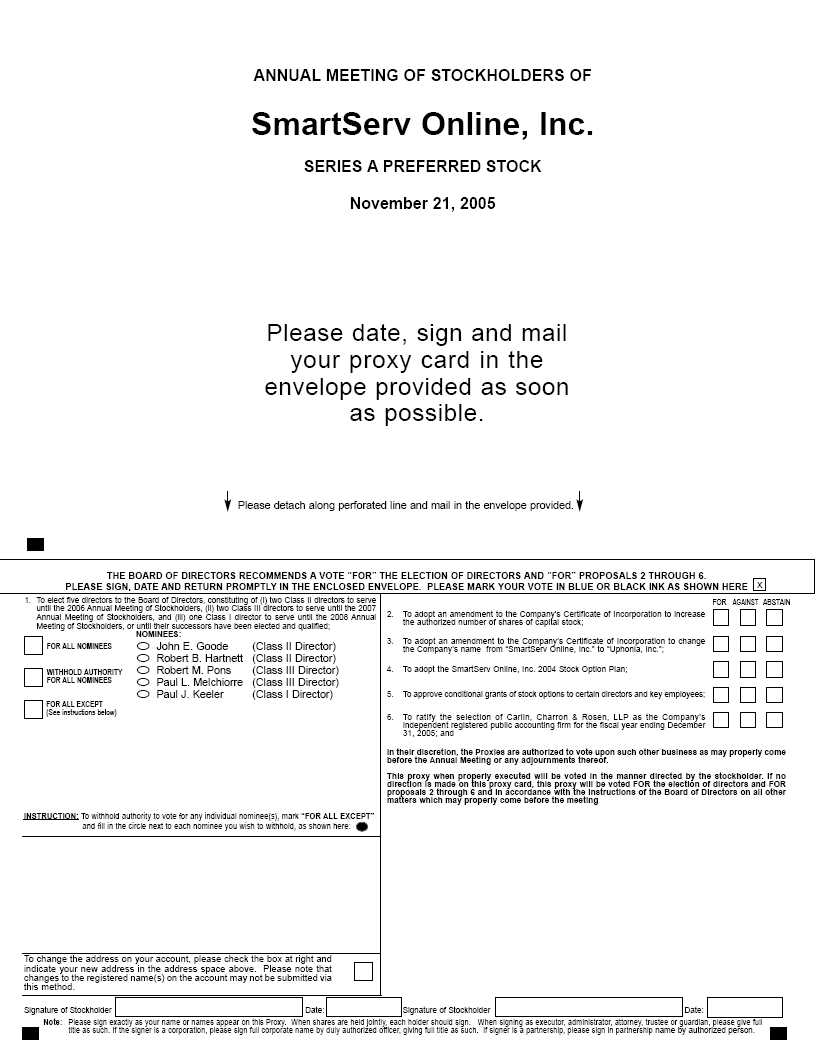

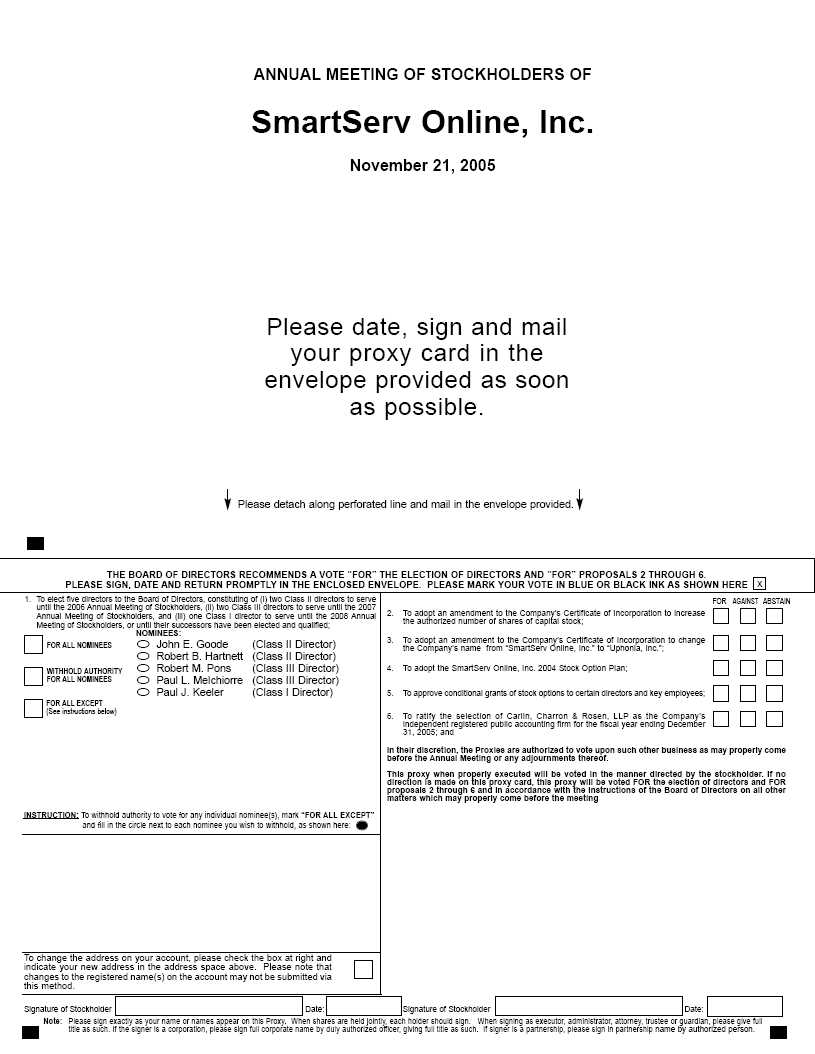

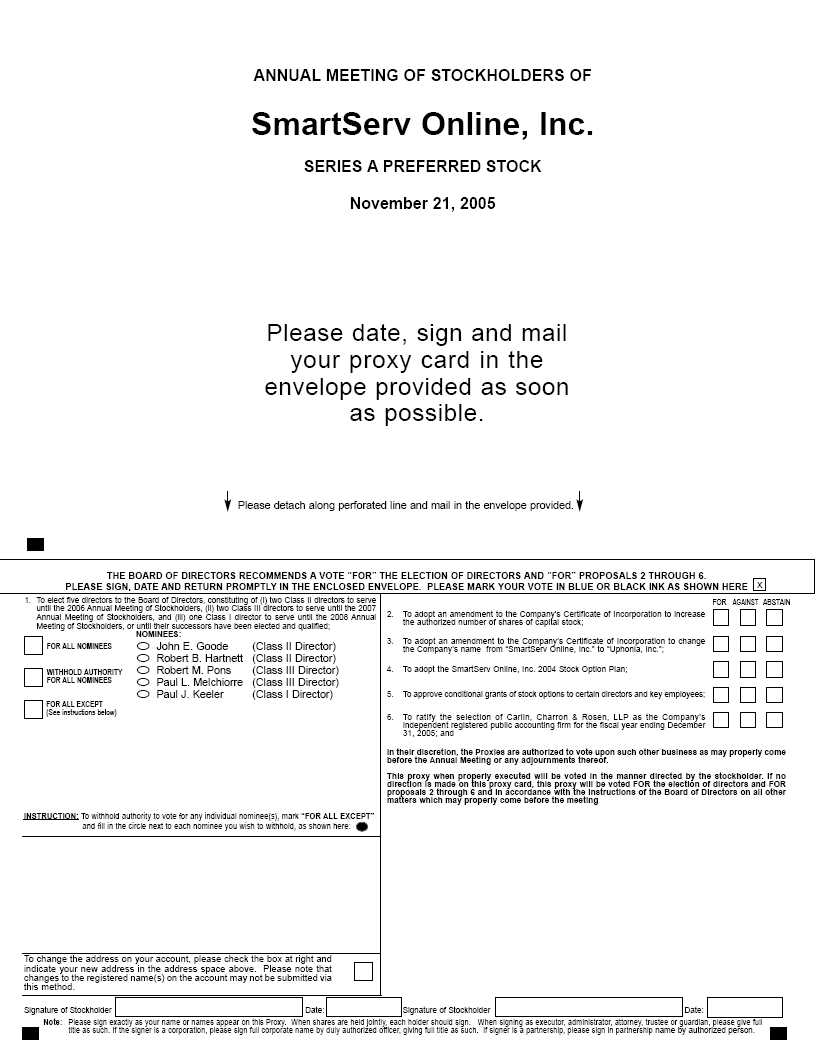

| | 1. | To elect five directors to the Board of Directors, constituting of (i) two Class II directors to serve until the 2006 Annual Meeting of Stockholders, (ii) two Class III directors to serve until the 2007 Annual Meeting of Stockholders, and (iii) one Class I director to serve until the 2008 Annual Meeting of Stockholders, or until their successors have been elected and qualified; |

| | 2. | To adopt an amendment to the Company’s Certificate of Incorporation to increase the authorized number of shares of capital stock; |

| | 3. | To adopt an amendment to the Company’s Certificate of Incorporation to change the Company’s name from “SmartServ Online, Inc.” to “Uphonia, Inc.”; |

| | 4. | To adopt the SmartServ Online, Inc. 2004 Stock Option Plan; |

| | 5. | To approve conditional grants of stock options to certain directors and key employees; |

| | 6. | To ratify the selection of Carlin, Charron & Rosen, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2005; and |

| | 7. | To transact such other business as may properly come before the meeting or any adjournments thereof. In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the Annual Meeting or any adjournments thereof. |

A proxy, if properly executed and received in time for the voting, will be voted in the manner directed therein. If no direction is made, such proxy will be voted FOR all proposals therein.

The Board of Directors has fixed the close of business on October 27, 2005 as the record date for determining stockholders entitled to notice of the meeting and to vote at such meeting or any adjournments thereof, and only stockholders of record at the close of business on October 27, 2005, are entitled to notice of and to vote at such meeting or any adjournments thereof.

Your attention is directed to the attached Proxy Statement for further information regarding each proposal to be made.

You are cordially invited to attend the meeting. Whether or not you plan to attend, you are urged to complete, date and sign the enclosed proxy and return it promptly. If you receive more than one form of proxy, it is an indication that your shares are registered in more than one account, and each such proxy must be completed and returned if you wish to vote all of your shares eligible to be voted at the meeting.

November 2, 2005 | By Order of the Board of Directors Timothy G. Wenhold, Secretary |

PLEASE COMPLETE AND RETURN THE PROXY IN THE ENCLOSED ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. IF YOU ATTEND THE MEETING AND DESIRE TO VOTE IN PERSON AT THE MEETING, YOUR PROXY WILL BE RETURNED TO YOU UPON WRITTEN NOTICE TO THE SECRETARY OF THE COMPANY REVOKING YOUR PROXY.

SMARTSERV ONLINE, INC.

2250 Butler Pike, Suite 150

Plymouth Meeting, PA 19462

PROXY STATEMENT FOR

THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

NOVEMBER 21, 2005

This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors of SmartServ Online, Inc., a Delaware corporation (the “Company”), to be voted at the 2005 Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held at the Company’s principal executive offices located at 2250 Butler Pike, Suite 150, Plymouth Meeting, Pennsylvania, 19462 on November 21, 2005, at 10:00 a.m., local time, and at any adjournment or adjournments thereof.

All proxies delivered pursuant to this solicitation are revocable at any time before they are exercised, by written notice to the Secretary of the Company or by delivering a later dated proxy. Attendance at the Annual Meeting will not, without delivery of the written notice described in the immediately preceding sentence, constitute revocation of a proxy. The mailing address of the principal executive offices of the Company is 2250 Butler Pike, Suite 150, Plymouth Meeting, PA 19462. The Company’s telephone number is (610) 397-0689. This Proxy Statement and the enclosed form of proxy will be mailed to each stockholder on or about November 2, 2005, together with the Annual Report on Form 10-KSB for the year ended December 31, 2004.

All properly executed proxies delivered pursuant to this solicitation and not revoked will be voted at the Annual Meeting in accordance with the directions given. Regarding the election of Directors, in voting by proxy, stockholders may vote in favor of all nominees or withhold their votes as to all nominees or withhold their votes as to specific nominees. With respect to any other proposals to be voted upon, stockholders may vote in favor of a proposal, against a proposal or may abstain from voting. Stockholders should specify their choices on the enclosed form of proxy. If no specific instructions are given with respect to the matters to be acted upon, the shares represented by a signed proxy will be voted FOR the election of all nominees, FOR the proposal to adopt an amendment to the Company’s Certificate of Incorporation to increase the authorized number of shares of capital stock, FOR the proposal to adopt an amendment to the Company’s Certificate of Incorporation to change its corporate name to Uphonia, Inc., FOR the proposal to adopt the SmartServ Online, Inc. 2004 Stock Option Plan, FOR the proposal to approve the conditional grant of stock options to certain key directors and executive officers, and FOR the proposal to ratify the appointment of Carlin, Charron & Rosen, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2005. Directors will be elected by a plurality of the votes cast by the holders of the shares of Common Stock and Preferred Stock (voting on an as-converted basis), voting in person or by proxy at the Annual Meeting. Thus, abstentions will have no effect on the vote for election of directors. Approval of the amendment to the Company’s Certificate of Incorporation to increase the authorized number of shares of capital stock shall require the affirmative vote of the (i) holders of a majority of the outstanding shares of Common Stock voting as a separate class, (ii) holders of a majority of the outstanding shares of Preferred Stock voting as a separate class, and (iii) holders of a majority of the outstanding shares of Common Stock and Preferred Stock (voting on an as-converted basis). Approval of any other matters to come before the Annual Meeting will require the affirmative vote of the holders of a majority of the shares of Common Stock and Preferred Stock (voting on an as-converted basis) of the Company present in person or by proxy at the Annual Meeting. Abstentions are deemed present for quorum purposes and entitled to vote and, therefore, will have the effect of a vote against any matter other than the election of directors. Broker non-votes occur when a broker or other nominee holding shares for a beneficial owner does not vote on a proposal because the beneficial owner has not provided voting instructions and the broker does not have discretionary authority to vote shares on the matter. Broker non-votes are not considered to be shares “entitled to vote” (other than for quorum purposes) and will not be included in vote totals. Accordingly, broker non-votes will have the effect of a negative vote on the proposals to amend the Certificate of Incorporation, and will have no effect on the outcome of any other matters to be voted upon at the Annual Meeting.

Management is not aware at the date hereof of any matter to be presented at the Annual Meeting other than the election of directors and the other proposals described in the attached Notice of Annual Meeting of Stockholders. If any other matter is properly presented, the persons named in the proxy will vote thereon according to their best judgment.

The expense of soliciting proxies for the Annual Meeting, including the cost of preparing, assembling and mailing the notice, proxy and Proxy Statement, will be paid by the Company. The solicitation will be made by use of the mails, through brokers and banking institutions, and by officers and regular employees of the Company. Proxies may be solicited by personal interview, mail, telephone or facsimile transmission.

Only owners of record of the common stock, $.01 par value per share, of the Company (“Common Stock”) and Series A convertible preferred stock, $.01 par value per share, of the Company (“Preferred Stock”) at the close of business on October 27, 2005 (the “Record Date”), are entitled to notice of and to vote at the Annual Meeting or any adjournments or postponements thereof. Each owner of record on the Record Date is entitled to one vote for each share of Common Stock of the Company so held and ten votes for each share of the Preferred Stock so held. There is no cumulative voting. On the Record Date, there were 6,352,889 shares of Common Stock issued, outstanding and entitled to vote and 769,432 shares of Preferred Stock issued, outstanding and entitled to vote (constituting 7,694,320 votes for the Preferred Stock on an as converted basis).

PROPOSAL NO. 1 - ELECTION OF DIRECTORS

The Company’s Amended and Restated Certificate of Incorporation, as amended, provides that the Board shall consist of between three and fifteen members, as determined from time to time by the Board, divided into three classes as nearly equal in number as possible. The size of the Board has currently been set at five directors. The term of the current Class I directors (John E. Goode and Robert B. Hartnett) expires at the 2005 Annual Meeting, the term of the current Class II director (Paul J. Keeler) expires at the 2006 Annual Meeting and the term of the current Class III directors (Paul L. Melchiorre and Robert M. Pons) expires at the 2007 Annual Meeting. The successors to each class of directors whose terms expire at an Annual Meeting will be elected to hold office for a term expiring at the Annual Meeting of Stockholders held in the third year following the year of their election.

The terms of the Class II and Class III directors were scheduled to expire at the Annual Meetings of Stockholders to be held in 2003 and 2004, respectively. However, Annual Meetings of Stockholders were not held in 2003 and 2004 and the directors then in office continued to hold the elected office because successors were not elected to replace them. Because none of the current directors have been elected by stockholders, the Board of Directors determined that all current directors should stand for election at this 2005 Annual Meeting of Stockholders and their respective classes will be realigned as described below.

In October 2004, Paul J. Keeler was appointed as a Class II director to fill a vacancy. Mr. Keeler has been recommended for nomination by the Nominating Committee and nominated by the Board to stand for reelection at the 2005 Annual Meeting of Stockholders, to hold office as a Class I director for a three-year term set to expire at the 2008 Annual Meeting of Stockholders and until his successor is elected and qualified. Robert B. Hartnett was appointed as a Class I director on September 15, 2005 to fill a vacancy created by the September 15, 2005 resignation of former director Timothy G. Wenhold. John E. Goode was appointed as a Class I director in October 2004 to fill a vacancy created by the October 2004 resignation of a former director. Messrs. Hartnett and Goode have been recommended for nomination by the Nominating Committee and nominated by the Board to stand for reelection as Class II directors at the 2005 Annual Meeting of Stockholders, to hold office for a one-year term set to expire at the 2006 Annual Meeting of Stockholders (i.e., the remainder of the three year term that would have commenced at the 2003 Annual Meeting if such a meeting were held) and until their successors are elected and qualified. In August 2003, Robert M. Pons was appointed as a Class III director to fill a vacancy, and in November 2004, Paul L. Melchiorre was appointed a Class III director to fill the vacancy created by the October 2004 resignation of former director Charles L. Wood. Messrs. Pons and Melchiorre have been recommended for nomination by the Nominating Committee and nominated by the Board to stand for reelection as Class III directors at the 2005 Annual Meeting of Stockholders, to hold office for a two-year term set to expire at the 2007 Annual Meeting (i.e., the remainder of the three year term that would have commenced at the 2004 Annual Meeting if such a meeting were held) and until their successors are elected and qualified.

All nominees have consented to serve for the new terms, if elected.

Under a Stock Purchase Agreement dated May 15, 2000, TecCapital, Ltd. (“TecCapital”) has the right to designate one member of the Company’s Board of Directors. However, pursuant to a letter agreement dated January 28, 2005 between TecCapital and the Company, TecCapital agreed to waive, among other things, the right to have a designee on the Board. TecCapital provided this waiver in consideration of the grant to TecCapital of 500,000 shares of the Company’s Common Stock and the Company’s agreement to use its best efforts to register such shares and all other shares of the Company’s Common Stock held by TecCapital in a registration statement filed with the SEC. In the event that a registration statement covering all of TecCapital’s shares of Common Stock is not declared effective within 270 days after the date of the letter agreement, TecCapital may (in its sole discretion) return to the Company, within 330 days from the date of the letter agreement, all of the shares of Common Stock, and in such case the waiver granted would become void.

Recommendation of the Board of Directors Concerning the Election of Directors

The Board of Directors of the Company recommends a vote FOR (1) Paul J. Keeler as a Class I director to hold office until the 2008 Annual Meeting of Stockholders and until his successor is elected and qualified; (2) Robert M. Pons and Paul L. Melchiorre as Class III directors to hold office until the 2007 Annual Meeting of Stockholders and until their successors are elected and qualified; and (3) John E. Goode and Robert B. Hartnett as Class II directors to hold office until the 2006 Annual Meeting of Stockholders and until their successors are elected and qualified. Proxies received by the Board of Directors will be so voted unless stockholders specify in their proxy a contrary choice.

DIRECTORS AND EXECUTIVE OFFICERS

Nominees

The following table sets forth the names and certain information about each of the nominees for election as a director of the Company:

| Name | | Age | | Director Since | |

| Nominee for a three-year term expiring in 2008 (Class I Director): | | | | | | | |

Paul J. Keeler | | | 60 | | | 2004 | |

| | | | | | | | |

| Nominees for a two-year term expiring in 2007 (Class III Directors): | | | | | | | |

Robert M. Pons | | | 49 | | | 2003 | |

Paul L. Melchiorre | | | 44 | | | 2004 | |

| | | | | | | | |

| Nominees for a one-year term expiring in 2006 (Class II Directors): | | | | | | | |

John E. Goode | | | 53 | | | 2004 | |

| Robert B. Hartnett | | | 53 | | | 2005 | |

Set forth below is a brief summary of the recent business experience and background of each nominee for director and the Company’s executive officers:

Paul J. Keeler has been the Chairman of the Board of Directors of the Company since October 2004. Mr. Keeler is currently a senior managing director of Medley Global Advisors, LLC. Prior thereto, from February 2001 to May 2005, Mr. Keeler was a managing partner at Convergence Consulting Group, LLC. From February 1991 to February 2001, Mr. Keeler was a Principal at Morgan Stanley & Co., and Head of Global Sales and Service for Morgan Stanley Capital International, a joint venture between Morgan Stanley & Company, Inc. and Capital Group Companies. Prior to that, Mr. Keeler served as Vice President of Morgan Stanley Technology Services; President, Chief Executive Officer and Vice Chairman of Tianchi Telecommunications Corp.; President and Chief Operating Officer of Westinghouse Communications Software, Inc.; Vice President of Strategic Accounts and Business Development for Reuters Holdings, PLC; and Director, Northeast Metro Region, of MCI Communications. He also served as President and CEO of Halcyon Securities Corporation and is a former member of the New York and American Stock Exchanges. Mr. Keeler is presently a member of the Board of Directors of DSL.net, Inc., a provider of high-speed data communications, internet access and related services.

Robert M. Pons has been the Chief Executive Officer and President of the Company since January 24, 2004 and a director since August 28, 2003. He served as Interim Chief Executive Officer from August 28, 2003 to January 24, 2004. Mr. Pons had been a consultant to the Company from August 4, 2003 to January 24, 2004. From April 16, 1999 to April 15, 2002, Mr. Pons was founder and President of FreedomPay, a stored value payment processing company enabling cashless payments on wireless devices. From March 1999 through December 1999, Mr. Pons was Chief Operating Officer of Real Time Data, a company in the data transmission (telemetry) business. Prior thereto, from March 1, 1995 to April 15, 1999, Mr. Pons was President and CEO of LifeSafety Solutions, an enhancement to the 9-1-1 public safety emergency system. Mr. Pons also held executive positions with both MCI and Sprint. Mr. Pons is a member of the Board of Directors of Network-1 Security Solutions, Inc., a software licensing company.

Paul L. Melchiorre has been a director of the Company since November 2004. Since 1998, Mr. Melchiorre has been the Vice-President of Operations of Ariba, a spend-management software company. In 1992 Mr. Melchiorre joined SAP America as the manager of the East Coast Region and in 1997 Mr. Melchiorre was appointed as the Vice-President of Sales of SAP America, managing all strategic business units and SAP North America.

John E. Goode has been a director of the Company since October 2004. From 1999 to 2001 Mr. Goode led the Methodology Group of Zefer Corporation, a consulting company focused on Internet technology development, and from 1994 to 1998 Mr. Goode was an independent consultant providing senior consulting experience and methodology assistance to Waite and Company, a strategy consulting firm. For over 30 years Mr. Goode has consulted and provided methodologies for leveraging the power of emerging technologies and business practices to improve business strategy, performance and profitability used by Fortune 500 companies, Internet start-up companies and government agencies.

Robert B. Hartnett has been a director of the Company since September 15, 2005. Mr. Hartnett is a private investor and the former Chairman of the Board and Chief Executive Officer of Blue Ridge Networks. Prior to Blue Ridge Networks, Mr. Hartnett served as president of Business Markets for WorldCom. A 20-year veteran of MCI WorldCom, Mr. Hartnett held numerous senior level positions with the company, including Chief Executive Officer of UUNET and President of Business Sales and Service at MCI Communications. Mr. Hartnett received his BA degree from John Carroll University and an MA in Communications Arts from Loyola Marymount University. Mr.Hartnett also serves on the board of DSL.net.

Other Executive Officers

Timothy G. Wenhold, 43, has been the Executive Vice President, Chief Operating Officer and Secretary of the Company since March 10, 2004 and a director from October 30, 2004 through September 15, 2005. Mr. Wenhold had been a consultant to the Company from August 4, 2003 to March 10, 2004. From May 1, 2002 to August 31, 2003, Mr. Wenhold was founder and President of Factory X, Inc. a manufacturer of licensed high end movie, comic and gaming collectibles. Prior thereto, from January 1, 1985 to May 1, 2002, Mr. Wenhold was founder and President of Sintaks, Inc., a system integration and technology consulting firm. Sintaks was acquired by Canon in 1998.

Len von Vital, 54, has been the Chief Financial Officer of the Company since April 9, 2004. Mr. von Vital was engaged by the Company as a consultant to provide financial services from January 27, 2004 to April 9, 2004. From February 11, 2002 to October 31, 2003, Mr. von Vital was Chief Financial Officer of 4GL School Solutions, Inc., a developer and vendor of special education software and services. From April 2001 to November 2001, Mr. von Vital was Chief Financial Officer of eCal Corporation, a developer and vendor of enterprise Internet calendaring and scheduling software and services and was a consultant in December 2001 and January 2002. From July 2000 to March 2001, Mr. von Vital was Chief Financial Officer of National Dental Corporation, an e-commerce start-up and software company providing procurement savings to the dental industry, and from March 2000 to June 2000, was Chief Financial Officer of Financialweb.com, an e-financial services company. From October 1998 to February 2000, Mr. von Vital was the Chief Financial Officer of ESPS, Inc., a provider of enterprise business-to-business document management and publishing software and services. ESPS had its initial public offering in June 1999. Mr. von Vital also served as interim CEO of ESPS, Inc. from June 1999 until October 1999. Prior thereto, he held the positions of senior vice president of product management and Chief Financial Officer for Astea International, Inc., a developer and vendor of enterprise customer relationship management software and services, that had its initial public offering in July 1995. He also held senior financial positions during a twelve-year career with Decision Data Inc., an international provider of plug-compatible IBM computer peripheral equipment and services, including Vice President of Mergers and Acquisitions, Corporate Controller and Principal Accounting Officer. Mr. von Vital is a certified public accountant.

Meetings of the Board of Directors; Committees

During the fiscal year ended December 31, 2004, the Board of Directors held 9 meetings. During such period, each director attended at least 75% of the aggregate of (i) the number of meetings of the Board of Directors held during the period he or she served on the Board, and (ii) the number of committee meetings held during the period he or she served on such committee.

Compensation Committee. The Compensation Committee, currently composed of Paul J. Keeler, John E. Goode and Paul L. Melchiorre, all of whom are non-employee directors, reviews and advises the Company’s directors with regard to officer, director and employee compensation and administers the Company’s stock-based benefit plans. The Compensation Committee met one time during the last fiscal year.

Audit Committee. The Audit Committee consists of Paul L. Melchiorre, John E. Goode and Paul J. Keeler, none of whom is an officer or employee of the Company. The Audit Committee is established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. Each member meets the independence requirements for audit committee members under the listing standards of the Nasdaq Stock Market, as required by the Company’s Audit Committee Charter. The Company’s Board of Directors has determined that a member of the Audit Committee, Paul J. Keeler, qualifies as an “audit committee financial expert” as defined in Item 401(e) of Regulation S-B promulgated by the SEC. He is also “independent” as such term is defined in Item 7(d)(3)(iv)(B) of Schedule 14A under the Securities Exchange Act of 1934, as amended. The Committee provides assistance to the Company’s directors in fulfilling the Board’s oversight responsibility as to the Company’s accounting, auditing and financial reporting and the quality and integrity of the financial reports of the Company. The specific functions and responsibilities of the Audit Committee are set forth in the written charter of the Audit Committee adopted by the Board of Directors, a copy of which is attached as Appendix A to this proxy statement. The Audit Committee reviews and reassesses the Charter annually and recommends any changes to the Board for approval. A report of the Audit Committee appears under the caption “Audit Committee Report,” below. The Audit Committee met 4 times during the last fiscal year.

Nominating Committee. The Nominating Committee was created in February, 2005 and is currently comprised of John E. Goode, Paul L. Melchiorre and Paul J. Keeler. The members of the Nominating Committee are independent, as independence for nominating committee members is defined under the listing standards of the Nasdaq Stock Market. The Nominating Committee is responsible for considering and making recommendations to the Board of Directors concerning the appropriate size of the Board and nominees to stand for election or fill vacancies on the Board. In particular, the Nominating Committee will identify, recruit, consider and recommend candidates to fill positions on the Board in accordance with its criteria for Board membership (as such criteria is generally described below). In searching for qualified director candidates to nominate for election at an Annual Meeting of Stockholders, the Nominating Committee will initially consider nominating the current directors whose terms are expiring and shall consider their past performance on the Board, along with the criteria for Board membership, in determining whether to nominate them for re-election. In connection with nominations for elections at Annual Meetings or to fill vacancies in the Board, the Nominating Committee may solicit the current members of the Board to identify qualified candidates through their business and other organizational networks and may also retain director search firms as it determines necessary in its own discretion.

The Nominating Committee will also consider any director candidates proposed in good faith by a stockholder. To do so, a stockholder must send the candidate’s name, credentials, contact information and his or her written consent to be considered as a candidate to the Company’s Corporate Secretary. The proposing stockholder should also include his or her contact information and a statement of his or her share ownership. The Nominating Committee may from time to time adopt a timeline within which stockholder nominations must be received in order to be considered by the Nominating Committee, and the Nominating Committee will publish this timeline in a press release or filing with the Securities and Exchange Commission.

The Nominating Committee would then consider the potential pool of director candidates derived from the foregoing process, select the top candidates to fill the number of openings based on their qualifications, the Board’s needs (including the need for independent directors) and the criteria for Board membership. The Nominating Committee will then conduct a thorough investigation of the proposed candidates’ backgrounds to ensure there is no past history that would disqualify the candidate from serving as a director of the Company. Those candidates that are selected and pass the background investigation will be recommended to the full Board for nomination.

The criteria for a nominee to the Board includes, among other things:

| | · | The highest personal and professional ethics, strength of character, integrity and values; |

| | · | Experience as a senior manager, chief operating officer or chief executive officer of a relatively complex organization or, if in a professional or scientific capacity, be accustomed to dealing with complex problems, or otherwise shall have obtained and excelled in a position of leadership; |

| | · | Education, experience, intelligence, independence, fairness, reasoning ability, practical wisdom, and vision to exercise sound, mature judgments on a macro and entrepreneurial basis on matters which relate to the current and long-term objectives of the Company; |

| | · | Competence and willingness to learn the Company’s business and confidence to express his/her personal views; |

| | · | The breadth of viewpoint and experience necessary for an understanding of the diverse and sometimes conflicting interests of stockholders and other constituencies, while still recognizing the particular responsibilities of the Board of Directors; |

| | · | The nominee should be of such an age at the time of election to assure a minimum of three years of service as a director; |

| | · | The nominee should be free and willing to attend regularly scheduled meetings of the Board of Directors and its committees over a sustained period and otherwise be able to contribute a reasonable amount of time to the affairs of the Company and its affiliates; Participation on other boards (no more than three other operating companies (i.e., excluding charitable or civic organizations)) is desired in providing breadth of experience to the Board; |

| | · | Personality, tact, sensitivity, and perspective to work well with others; |

| | · | The stature and capability to represent the Company before the public, stockholders, and other various individuals and groups that affect the Company; The nominee should have the capability to “network” with others for the benefit of the Company; and |

| | · | Willingness to appraise objectively the performance of management in the interest of the stockholders and possess an inquiring and independent mind willing to question management’s assumptions when inquiry is appropriate. |

While the Nominating Committee does not have a formal charter, the Board adopted guidelines addressing the purpose and responsibilities of the Nominating Committee in connection with its formation, which guidelines include procedures for recruiting, considering and recommending nominees to the Board and criteria for Board membership. Since the Nominating Committee was not created until February 2005, there were no meeting of this Committee during the last fiscal year.

Board Policies Regarding Communications With the Board of Directors and Attendance at Annual Meetings

The Board of Directors maintains a process for stockholders to communicate with the Board of Directors. Stockholders wishing to communicate with the Board of Directors, or any individual member(s) of the Board of Directors, can send a written communication to the attention of the Board of Directors (or specific individual director(s), if applicable) at the following address: c/o Corporate Secretary, 2250 Butler Pike, Suite 150, Plymouth Meeting, PA 19462. The Corporate Secretary will forward such communication to the full Board of Directors or to any individual director or directors to whom the communication is directed unless the communication is unduly hostile, threatening, illegal or similarly inappropriate, in which case the Corporate Secretary has the authority to discard the communication or take appropriate legal action regarding the communication.

While the Company does not have a formal written policy regarding Board member attendance at its Annual Meeting, the Company actively encourages its directors to attend the Annual Meeting of Stockholders. The Company did not hold an Annual Meeting of Stockholders in 2004.

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors has:

| | · | reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2004 with the Company’s management; |

| | · | discussed with the Company’s independent registered public accountants the matters required to be discussed by Statement on Accounting Standards No. 61, as the same was in effect on the date of the Company’s financial statements; |

| | · | received the written disclosures and the letter from the Company’s independent registered public accountants required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as the same was in effect on the date of the Company’s financial statements; and |

| | · | discussed with the Company’s independent registered public accountants their independence from the Company and its management. |

Management is responsible for the preparation, presentation and integrity of the Company’s financial statements, the financial reporting process, accounting principles and internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The Company’s independent registered public accountants are responsible for performing an independent audit of the financial statements in accordance with generally accepted auditing standards and issuing a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes. The Audit Committee has relied, without independent verification, on the information provided to it and on the representations of management and the independent registered public accountants that the financial statements have been prepared in conformity with generally accepted accounting principles.

Based on the review and discussions referred to in the items above, the Audit Committee recommended to the Board of Directors that the audited financial statements for the fiscal year ended December 31, 2004 be included in the Company’s Annual Report on Form 10-KSB for the fiscal year ended December 31, 2004.

| | The Audit Committee

Paul L. Melchiorre, Chairman John E. Goode Paul J. Keeler |

Directors’ Compensation

Prior to the adoption by the Company of amendments to the compensation paid to non-employee directors, which is discussed below, as of June 4, 2005 each non-employee director was entitled to receive a $1,000 fee for each Board meeting he or she attended. Additionally, each committee member was entitled to receive up to $500 per committee meeting attended. Each director who is not an officer or employee of the Company is reimbursed for his or her out-of-pocket expenses incurred in connection with attendance at meetings or other Company business.

On February 11, 2005, the Board approved amendments to the compensation paid to the non-employee directors. As of February 11, 2005, the non-employee directors are no longer entitled to receive per meeting fees and will be compensated as described below. The non-employee directors will be paid the following annual rates for service on the Board, which will be paid on a quarterly basis:

| | · | Non-employee board member -- $10,000 |

| | · | Non-employee Chairman of the Board -- $60,000 |

| | · | Committee Chairman -- $3,000 |

| | · | Committee Member -- $2,000 |

The directors will be reimbursed for out-of-pocket expenses incurred in attending meetings. The Board also intends to issue stock options to non-employee directors from time to time as determined by the Board in its discretion.

The Company also adopted a compensation plan for outside (non-employee) directors effective June 4, 2004. Each outside director will receive, upon election to the Board, an option to purchase 60,000 shares of the Company’s Common Stock. The exercise price will be the average of the mean between the bid and the asked price for the Common Stock at the close of trading for the trading day immediately preceding the option grant. The option will vest in increments of 20,000 shares, at the first, second and third anniversaries of the date of grant. The outside directors in office on the effective date of the compensation plan, L. Scott Perry, Charles R. Wood, and Catherine Cassel Talmadge (collectively, the “Former Directors”) received such option grant on August 1, 2004. Paul J. Keeler, John E. Goode, Paul L. Melchiorre and Robert B. Hartnett (collectively, the “Current Directors”), the directors presently in office, received such option grant on October 30, 2004, October 30, 2004, November 1, 2004 and September 15, 2005, respectively. The option grants to the Former Directors were initially scheduled to vest in increments of 20,000 shares at December 31, 2004, 2005 and 2006. However, pursuant to letter agreements between the Company and each Former Director, each dated October 30, 2004, each of which was entered into in connection with such Former Director’s resignation as a director, 35,000 shares of the option grant to each Former Director automatically vested and the balance of such option grant (25,000 shares) will not be exercisable. The option grants to each of Messrs. Keeler, Goode, Melchiorre and Hartnett will vest in increments of 20,000 shares, at the first, second and third anniversaries of the date of grant.

On January 10, 2005, the Compensation Committee granted to the current Chairman of the Board of Directors, Paul J. Keeler, a warrant to purchase 250,000 shares of the Common Stock at an exercise price of $2.10 per share, which was the closing stock price of the Common Stock on the date of grant. These warrants, which have a 5 year term and are immediately exercisable, were issued to Mr. Keeler for serving as the Chairman of the Board.

On July 18, 2005, the Board of Directors granted, subject to shareholder approval, each of Messrs. Keeler, Goode and Melchiorre, the three outside directors on that date, options to purchase 737,654; 259,062 and 259,062 shares, respectively, of Common Stock at an exercise price of $.50 per share, for a total of 1,255,778 shares. On September 15, 2005, the Board of Directors granted, subject to shareholder approval, options to purchase 259,062 shares of Common Stock to Mr. Hartnett at an exercise price of $.50 per share. Each option vests one-third on the date of grant and the remaining two-thirds in equal quarterly amounts during the first and second years after the date of grant.

The former Chairman of the Board of Directors, L. Scott Perry, was paid $5,000 per quarter in 2004 for serving as Chairman of the Board of Directors. Mr. Perry was paid $15,000 in 2004 pursuant to this arrangement, prior to his resignation in October 2004.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s Directors and executive officers, and persons who own more than ten percent of the Common Stock, to file with the Securities and Exchange Commission (“SEC”) initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Officers, Directors and greater than ten percent stockholders (collectively, “Reporting Persons”) are additionally required to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based solely on review of the copies of such reports furnished to us and written representations of the Reporting Persons that no other reports were required with respect to fiscal year 2004, all Section 16(a) filing requirements applicable to the Reporting Persons were complied with on a timely basis in fiscal year 2004, except that (i) as to John E. Goode, the Form 3 to report his ownership of securities as of October 30, 2004, the date he was elected as a director, was filed on November 30, 2004, and the Form 4 to report the grant of options on October 30, 2004 covering 60,000 shares of Common Stock was filed on November 30, 2004; (ii) as to Paul J. Keeler, the Form 3 to report his ownership of securities as of October 30, 2004, the date he was elected as a director, was filed on November 30, 2004, and the Form 4 to report the grant of options on October 30, 2004 covering 60,000 shares of Common Stock was filed on November 30, 2004; (iii) as to Paul L. Melchiorre, the Form 4 to report the grant of options on November 1, 2004 covering 60,000 shares of Common Stock was filed on November 5, 2004; (iv) as to L. Scott Perry, a former director, the Form 4 to report the grant of options on August 1, 2004 covering 60,000 shares of Common Stock was filed on April 13, 2005; (v) as to Robert M. Pons, the Form 3 to report his ownership of securities as of August 28, 2003, the date he was elected as an officer and director, was filed on March 16, 2004, the Form 4 to report the grant of options on March 12, 2004 covering 1,300,000 shares of Common Stock was filed on March 16, 2004, and the Form 4 to report the grant of options on December 20, 2004 covering 400,000 shares of Common Stock was filed on January 14, 2005; (vi) as to Catherine Cassel Talmadge, a former director, the Form 4 to report the sale of 100 shares of Common Stock on January 23, 2002 by her daughter under a Uniform Gift to Minor Account for which Ms. Talmadge is the custodian was filed on March 16, 2004, and the Form 4 to report the grant of options on August 1, 2004 covering 60,000 shares of Common Stock was filed on March 30, 2005; (vii) as to Len von Vital, the Form 4 to report the grant of options on April 9, 2004 covering 300,000 shares of Common Stock was filed on April 13, 2004; (viii) as to Timothy G. Wenhold, the Form 4 to report the grant of options on March 12, 2004 covering 700,000 shares of Common Stock was filed on March 16, 2004, and the Form 4 to report the grant of options on December 20, 2004 covering 250,000 shares of Common Stock was filed on January 14, 2005; (ix) as to Charles Wood, a former director, the Form 4 to report the grant of options on August 1, 2004 covering 60,000 shares of Common Stock was filed on March 23, 2005; (x) as to Robert B. Hartnett, the Form 3 to report his ownership of securities as of September 15, 2005, the date he was elected as a director, was filed on October 26, 2005, and the Form 4 to report the grant of options on September 15, 2005 covering 60,000 shares of Common Stock was filed on October 26, 2005; (xi) as to Kevin Kimberlin, a stockholder owning greater than ten percent of the Company’s Common Stock, the annual Form 5 required to be filed within 45 days after the end of the Company’s fiscal year, was not filed until March 31, 2004;.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of September 1, 2005, certain information with respect to the beneficial ownership of the Company’s Common Stock and Preferred Stock by (i) each person known by the Company to beneficially own more than 5% of the Company’s outstanding shares of Common Stock or Preferred Stock, (ii) each or the Company’s directors, (iii) each of the Named Executive Officers and (iv) all of the Company’s executive officers and directors as a group.

| | | Common Stock | | Series A Preferred Stock | | | |

Name and Address of Beneficial Owner (1) | | Amount and Nature of Beneficial Ownership (2) | | Percent of Outstanding Shares (3) | | Amount and Nature of Beneficial Ownership (2) | | Percent of Outstanding Shares (3) | | Total (4) | |

| | | | | | | | | | | | |

CAMOFI, LDC Caymon Islands C/O Centrecourt Asset Managemetn 8th Floor 350 Madison Avenue New York, NY 10017 | | | 3,000,000(15 | ) | | 32.19 | % | | 0 | | | 0 | | | 17.60 | % |

Kevin Kimberlin c/o Spencer Trask 535 Madison Avenue New York, New York 10021 | | | 2,784,871 (5) (6 | ) | | 31.40 | % | | 46,065 (6 | ) | | 5.96 | % | | 19.56% (5) (6 | ) |

| | | | | | | | | | | | | | | | | |

TecCapital, Ltd. Cedar House 41 Cedar Avenue Hamilton, HM 12, Bermuda | | | 1,353,288 | | | 21.41 | % | | 0 | | | * | | | 9.63 | % |

| | | | | | | | | | | | | | | | | |

Crestview Capital Masters, LLC Crestview Fund Crestview Fund II Crestview Offshore Fund 95 Revere, Suite F Northbrook, IL 60062 | | | 488,600 (7 | ) | | 7.26 | % | | 32,667 | | | 4.23 | % | | 5.64% (7 | ) |

| | | | | | | | | | | | | | | | | |

Headwater Holdings 220 Montgomery Street, Suite 500 San Francisco, CA 94104 | | | 421,204 (8 | ) | | 6.25 | % | | 14,059 | | | 1.82 | % | | 3.88% (8 | ) |

| | | | | | | | | | | | | | | | | |

Vitel Ventures, Inc. 802 Grand Pavilion, 1st Floor P.O. Box 30543 SMB Grand Cayman Cayman Islands, BWI | | | 427,313 (9 | ) | | 6.33 | % | | 20,544 | | | 2.66 | % | | 4.37% (9 | ) |

| | | | | | | | | | | | | | | | | |

Nimesh Patel 84-21 37th Avenue Jackson Heights, NY 11372 | | | 333,333 | | | 5.27 | % | | 0 | | | * | | | 2.37 | % |

| | | | | | | | | | | | | | | | | |

Ashok Patel 84-21 37th Avenue Jackson Heights, NY 11372 | | | 333,333 | | | 5.27 | % | | 0 | | | * | | | 2.37 | % |

| | | | | | | | | | | | | | | | | |

Kala Patel 84-21 37th Avenue Jackson Heights, NY 11372 | | | 333,334 | | | 5.27 | % | | 0 | | | * | | | 2.37 | % |

| | | | | | | | | | | | | | | | | |

| Robert M. Pons | | | 2,584,301(10 | ) | | 29.04 | % | | 0 | | | * | | | 15.54% (10 | ) |

| | | | | | | | | | | | | | | | | |

| Len von Vital | | | 1,057,192 (11 | ) | | 14.33 | % | | 0 | | | * | | | 7.00%(11 | ) |

| | | | | | | | | | | | | | | | | |

| Timothy G. Wenhold | | | 1,713,836 (12 | ) | | 21.33 | % | | 0 | | | * | | | 10.87% (12 | ) |

| | | | | | | | | | | | | | | | | |

| John E. Goode | | | 106,345 (16 | ) | | 1.65 | % | | 0 | | | * | | | .75 | % |

| | | | | | | | | | | | | | | | | |

| Paul J. Keeler | | | 515,860 (13 | ) | | 7.55 | % | | 0 | | | * | | | 3.54% (13 | ) |

| | | | | | | | | | | | | | | | | |

| Paul L. Melchiorre | | | 106,345(17 | ) | | 1.65 | % | | 0 | | | * | | | .75 | % |

| | | | | | | | | | | | | | | | | |

| All executive officers and directors as a group (6 persons) | | | 6,083,879(14 | ) | | 49.07 | % | | 0 | | | * | | | 30.23% (14 | ) |

| (1) | Addresses are only given for holders of 5% or more of our outstanding common stock who are not currently officers or directors. This table contains information furnished to us by the respective stockholders or contained in filings made with the Securities and Exchange Commission (“SEC”), or, with respect to shares of common stock underlying certain warrants, options and convertible preferred stock, from our records. |

| (2) | Under the rules of the SEC, a person is deemed to be the beneficial owner of a security if such person has or shares the power to vote or direct the voting of such security or the power to dispose or direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities if that person has the right to acquire beneficial ownership within 60 days of September 1, 2005. For purposes of beneficial ownership of our common stock, excludes shares of common stock that may be acquired upon the conversion of Series A preferred stock held by such person. Also excludes 1,628,507 shares of common stock in the aggregate subject to issuance in connection with the payment of stock dividends to holders of our preferred stock for the period ended September 1, 2005. Except as otherwise indicated, the named entities or individuals have sole voting and investment power with respect to the shares of common stock and preferred stock beneficially owned. |

| (3) | Represents the number of shares of common stock or preferred stock (as applicable) beneficially owned as of September 1, 2005 by each named person or group, expressed as a percentage of the sum of all of (i) the shares of such class outstanding as of such date, and (ii) the number of shares of such class not outstanding, but beneficially owned by such named person or group as of such date (e.g., shares of common stock underlying vested options or warrants). For purposes of beneficial ownership of our common stock, excludes shares of common stock that may be acquired upon the conversion of Series A preferred stock held by such person. There were 6,319,559 shares of common stock and 772,765 shares of Series A preferred stock outstanding on September 1, 2005. |

| (4) | The percentage in this column is based upon the total number of shares of common stock beneficially owned, calculated by assuming conversion of all of the outstanding Series A preferred shares. |

| (5) | Includes holdings of (i) Spencer Trask Ventures, Inc., a Delaware corporation and wholly-owned subsidiary of Spencer Trask & Co., a Delaware corporation, of which Kevin Kimberlin is the controlling shareholder, (ii) Spencer Trask Investment Partners LLC, a Delaware limited liability company, of which Kevin Kimberlin is the non-member manager, and (iii) Spencer Trask Private Equity Fund I, LP, Spencer Trask Private Equity Fund II LP, Spencer Trask Private Equity Accredited Fund III, LLC, and Spencer Trask Illumination Fund (collectively, the “Funds”), of which Kevin Kimberlin is a 100% owner of the entity that is a 100% owner of the manager of such Funds. Includes 2,496,753 shares of common stock subject to warrants. |

| (6) | Excludes 1,831,755 shares of common stock subject to warrants transferred to employees of Spencer Trask and Spencer Trask & Co. |

| (7) | Includes holdings of (i) Crestview Fund I, LP, (ii) Crestview Fund II, LP, (iii) Crestview Offshore Fund and (iv) Crestview Capital Masters, LLC (collectively, the "Crestview Entities")., Daniel Walsh, Stewart Flink and Bob Hoyt share voting and investment power over the shares held by each of the Crestview Entities. Includes 409,599 shares of common stock subject to warrants. |

| (8) | Includes 421,204 shares of common stock subject to warrants. |

| (9) | Includes 427,312 shares of common stock subject to warrants. |

| (10) | Includes of 50,000 shares of common stock subject to warrants and 969,046 shares of common stock subject to options. Also includes 1,560,255 shares of common stock subject to options issued that are subject to stockholder approval. |

| (11) | Includes 93,750 shares of common stock subject to options. Also includes 963,442 shares of common stock subject to options issued that are subject to stockholder approval. |

| (12) | Includes 533,333 shares of common stock subject to options and 8,333 shares of common stock subject to warrants. Also includes 1,172,170 shares of common stock subject to options issued that are subject to stockholder approval. |

| (13) | Includes 250,000 shares of common stock subject to warrants and 20,000 shares of common stock subject to options. Also includes 245,860 shares of common stock subject to options issued that are subject to stockholder approval. |

| (14) | Includes 1,964,461 shares of common stock subject to options and warrants issued to our executive officers and directors. Also includes 4,114,418 shares of common stock subject to options issued to directors and officers that are subject to stockholder approval. Excludes 86,345 shares of common stock subject to options issued to Robert Hartnett on September 15, 2005 that are subject to stockholder approval. |

| (15) | Includes 3,000,000 shares of common stock subject to warrants. |

| (16) | Includes 20,000 shares of common stock subject to options and 86,345 shares of common stock subject of options issued that are subject to stockholder approval. |

| (17) | Includes 20,000 shares of common stock subject to options and 86,345 shares of common stock subject of options issued that are subject to stockholder approval. |

EXECUTIVE COMPENSATION

Summary

The following table sets forth, for each of the last three full fiscal years, information concerning annual and long-term compensation, paid or accrued for services in all capacities during the such fiscal years, for the Company’s Chief Executive Officer during 2004 and for the two other executive officers (collectively, the “Named Executive Officers”) with base salary and bonuses exceeding $100,000 during 2004:

Summary Compensation Table

| | | Annual Compensation | | Long-term Compensation | | | |

Name and Principal Position | | Fiscal Year | | Salary | | Bonus | | Other Annual Compensation (1) | | Restricted Stock Awards (2) | | Securities Underlying Options(3) | | All Other Compensation | |

| Robert Pons (4) | | | 2004 | | $ | 236,000 | | $ | 105,000 | | $ | -- | | | -- | | | 1,700,000 | | $ | 100,000 | |

| Chief Executive Officer | | | 2003 | | | 44,000 | | | -- | | | -- | | | -- | | | 50,000 | | | 16,000 | |

| | | | 2002 | | | -- | | | -- | | | -- | | | -- | | | -- | | | -- | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Timothy G. Wenhold (5) | | | 2004 | | | 113,333 | | | 85,000 | | | -- | | | -- | | | 950,000 | | | 40,000 | |

| Chief Operating Officer | | | 2003 | | | -- | | | -- | | | -- | | | -- | | | 8,333 | | | 35,000 | |

| | | | 2002 | | | -- | | | -- | | | -- | | | -- | | | -- | | | -- | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Len von Vital (6) | | | 2004 | | | 108,333 | | | -- | | | -- | | | -- | | | 300,000 | | | 20,875 | |

| Chief Financial Officer | | | 2003 | | | -- | | | -- | | | -- | | | -- | | | -- | | | -- | |

| | | | 2002 | | | -- | | | -- | | | -- | | | -- | | | -- | | | -- | |

| | | | | | | | | | | | | | | | | | | | | | | |

| (1) | The aggregate amount of personal benefits not included in the Summary Compensation Table does not exceed the lesser of either $50,000 or 10% of the total annual salary and bonus paid to the Named Executive Officers. |

| (2) | The Named Executive Officers did not receive any restricted stock awards or long-term incentive plan payouts during fiscal 2004, 2003 or 2002. |

| (3) | See description below under the heading “Stock Options” regarding the grants made in 2004. In addition, Mr. Pons was granted warrants to purchase 50,000 shares of Common Stock in 2003 pursuant to his Consulting Agreement with the Company dated August 4, 2003 (see footnote 4 below). Mr. Wenhold was granted warrants to purchase 8,333 shares of Common Stock in 2003 pursuant to his Consulting Agreement with the Company dated August 1, 2003 (see footnote 5 below). This excludes grants during 2005 of options to purchase 4,681,233; 3,516,863 and 2,890,616 shares to Messrs. Pons, Wenhold and von Vital, respectively. |

| (4) | Salary in 2003 reflects amounts paid under Mr. Pons’ Consulting Agreement with the Company dated August 4, 2003. Salary in 2004 includes $61,000 paid under his Consulting Agreement. Mr. Pons served as Interim Chief Executive Officer from August 28, 2003 to January 24, 2004. He became the Company’s Chief Executive Officer on January 24, 2004. The entry in 2004 under “All Other Compensation” represents $100,000 paid to Mr. Pons by the Company as a transaction fee in connection with the 2004 Private Placement transaction, which fee was paid pursuant to the terms of his Consulting Agreement and his Employment Agreement with the Company dated March 12, 2004. |

| (5) | Mr. Wenhold became the Company’s Chief Operating Officer on March 10, 2004. Amounts under “All Other Compensation” represent payments to Mr. Wenhold under his Consulting Agreement with the Company dated August 4, 2003. |

| (6) | Mr. von Vital became the Company’s Chief Financial Officer on April 9, 2004. Amounts under “All Other Compensation” represent payments to Mr. von Vital for consulting services provided by him to the Company in 2004. |

Stock Options

The following table sets forth information with respect to stock options granted to the Named Executive Officers in fiscal year 2004:

Option Grants in Last Fiscal Year

Name | | Number of Securities Underlying Options Granted(6) | | % of Total Options Granted to Employees in the fiscal year | | Exercise Price | | Expiration Date | |

| Robert Pons | | | 1,300,000(1 | ) | | 39.4 | % | $ | 1.50 | | | March 12, 2014 | |

| Robert Pons | | | 400,000(2 | ) | | 12.1 | % | $ | 2.07 | | | December 20, 2014 | |

| Timothy G. Wenhold | | | 700,000(3 | ) | | 21.2 | % | $ | 1.50 | | | March 12, 2014 | |

| Timothy G. Wenhold | | | 250,000(4 | ) | | 7.6 | % | $ | 2.07 | | | December 20, 2014 | |

| Len von Vital | | | 300,000(5 | ) | | 9.1 | % | $ | 3.75 | | | April 9, 2014 | |

| (1) | This option to purchase 1,300,000 shares of Common Stock was granted pursuant to an Option Agreement with Mr. Pons dated as of March 12, 2004. This option vests as follows: (i) 557,141 shares on the date of grant (March 12, 2004) and (ii) the balance of the 742,859 shares vests in equal amounts as of the last day of each calendar quarter beginning with the quarter ending March 31, 2004 and ending with the quarter ending December 31, 2007. |

| (2) | This option to purchase 400,000 shares of Common Stock was granted pursuant to an Option Agreement with Mr. Pons dated as of December 20, 2004. This option vests on the last day of each month in 36 equal monthly installments beginning on December 31, 2004 and ending on November 30, 2007. |

| (3) | This option to purchase 700,000 shares of Common Stock was granted pursuant to an Option Agreement with Mr. Wenhold dated as of March 12, 2004. This option vests as follows: (i) 300,000 shares on the date of grant (March 12, 2004) and (ii) the balance of the 400,000 shares vests in equal amounts as of the last day of each calendar quarter beginning with the quarter ending March 31, 2004 and ending with the quarter ending December 31, 2007. |

| (4) | This option to purchase 250,000 shares of Common Stock was granted pursuant to an Option Agreement with Mr. Wenhold dated as of December 20, 2004. This option vests on the last day of each month in 36 equal monthly installments beginning on December 31, 2004 and ending on November 30, 2007. |

| (5) | This option to purchase 300,000 shares of Common Stock was granted pursuant to an Option Agreement with Mr. von Vital dated as of April 9, 2004. This option vests on the last day of each calendar quarter in 16 equal quarterly installments beginning on June 30, 2004 and ending on March 31, 2008. |

| (6) | This table excludes conditional grants during 2005 of options to purchase 4,681,233; 3,516,863 and 2,890,616 shares to Messrs. Pons, Wenhold and von Vital, respectively. |

The following table sets forth information as to the number of shares of Common Stock underlying unexercised stock options and the value of unexercised in-the-money stock options at December 31, 2004:

Aggregated Option Exercises in Last Fiscal Year and

Fiscal Year End Option Value (1)(2)

Name | | Shares Acquired on Exercise | | Value Realized | | Number of Securities Underlying Options at Fiscal Year End Exercisable/ Unexercisable | | Value of Unexercised In-The-Money Options at Fiscal Year End Exercisable/ Unexercisable | |

| | | | | | | | | | |

| Robert Pons | | | -- | | | -- | | | 742,856/957,144 | | | | |

| Timothy G. Wenhold | | | -- | | | -- | | | 400,000/550,000 | | | $260,000/$215,000 | |

| Len von Vital | | | -- | | | -- | | | 56,250/243,750 | | | $0/$0 | |

| (1) | Value is based on the closing price of the Company’s Common Stock as reported by the OTC Bulletin Board on December 31, 2004 ($2.15) less the exercise price of the option. |

| (2) | No stock options were exercised by the Named Executive Officers during the fiscal year ended December 31, 2004. |

Agreements with Named Executive Officers

The Company entered into an Employment Agreement with Robert Pons, dated March 12, 2004. The agreement provides for a 4 year term with a base annual salary of $210,000 in the first year of the term, subject to increases as determined by the Board of Directors. Mr. Pons shall also be eligible for bonuses in the event the Company meets certain performance goals related to raising additional capital, revenue targets or other goals mutually set by Mr. Pons and the Company. On February 11, 2005, the Compensation Committee approved a 15% increase in Mr. Pons’ base annual salary to $241,500 and a cash bonus based on the following: (i) successful integration of KPCCD, Inc., a wholly owned subsidiary of the Company acquired in January 2005 - 15% of base compensation; (ii) successful introduction of Uphonia “brand” and equipment - 15% of base compensation; and (iii) attainment of cash flow break even or better - 35% of base compensation. The determination of the first two bonus items will be based on specific parameters to be determined by the Compensation Committee and the third item would be based on the actual results for calendar year 2005.

Mr. Pons also received options to purchase 1,300,000 shares and 400,000 shares of the Company’s Common Stock under non-plan option agreements, which options have exercise prices of $1.50 and $2.07 per share, respectively, and a term of 10 years. The option agreement covering 1,300,000 shares provides for 557,141 shares to vest immediately and the remaining 742,859 shares to vest in equal amounts as of the last day of each calendar quarter commencing March 31, 2004. The option agreement covering 400,000 shares provides for the shares to vest in thirty-six equally monthly installments (on the last calendar day of each month) of 11,111 shares per month beginning December 31, 2004. The options will vest immediately upon a Change of Control (as defined in his respective option agreements) or in the event Mr. Pons is terminated Other Than for Cause or he terminates employment for Good Reason (as each is defined under the Employment Agreement). Mr. Pons will also receive 12 months of base salary upon termination Other Than for Cause or if he terminates employment for Good Reason.

The Company entered into an Employment Agreement with Timothy G. Wenhold, dated March 12, 2004. The agreement provides for a 4 year term with a base annual salary of $170,000 in the first year of the term, subject to increases as determined by the Board of Directors. Mr. Wenhold shall also be eligible for bonuses in the event we meet certain performance goals related to raising additional capital, revenue targets or other goals mutually set by Mr. Wenhold and the Company. On February 11, 2005 the Compensation Committee approved a 15% increase of base compensation for Mr. Wenhold to $195,500, and a cash bonus based on the following: (i) successful integration of KPCCD, Inc. - 15% of base compensation; (ii) successful introduction of Uphonia “brand” and equipment - 15% of base compensation; and (iii) attainment of cash flow break even or better - 35% of base compensation. The determination of the first two bonus items will be based on specific parameters to be determined by the Compensation Committee and the third item would be based on the actual results for calendar year 2005.

Mr. Wenhold also received options to purchase 700,000 shares and 250,000 shares of the Company’s Common Stock under non-plan option agreements, which options have exercise prices of $1.50 per share and $2.07 per share, respectively, and a term of 10 years. The option agreement covering 700,000 shares provides for 300,000 shares to vest immediately and the remaining 400,000 shares to vest in equal amounts as of the last day of each calendar quarter commencing March 31, 2004. The option agreement covering 250,000 shares provides for the shares to vest in thirty-six equal monthly installments (on the last calendar day of each month) of 6,944 per month beginning December 31, 2004. The options will vest immediately upon a Change of Control (as defined in his option agreement) or in the event Mr. Wenhold is terminated Other Than for Cause or he terminates employment for Good Reason (as each is defined under the Employment Agreement). Mr. Wenhold will also receive 12 months of base salary upon termination Other Than for Cause or if he terminates employment for Good Reason.

On April 9, 2004, the date Mr. von Vital was hired as the Company’s Chief Financial Officer, he was granted options to purchase 300,000 shares of Common Stock, under a non-plan option agreement, which options have an exercise price of $3.75 per share and a term of ten years. This option vests on the last day of each calendar quarter in 16 equal quarterly installments beginning on June 30, 2004 and ending on March 31, 2008.

On July 18, 2005, the Board of Directors granted, subject to shareholder approval, each of Messrs. Pons, Wenhold, and von Vital, the Names Executive Officers, options to purchase 4,681,233; 3,516,863 and 2,890,616 shares, respectively, of Common Stock at an exercise price of $.50 per share, Each option vests one-third on the date of grant and the remaining two-thirds in equal quarterly amounts during the first and second years after the date of grant.

On August 31, 2005, the Company entered into agreements with each of Messrs. Pons, Wenhold, and von Vital, the Names Executive Officers, pursuant to which each agreed to allow the Company to re-allocate to its new lender certain authorized, but unissued shares of Common Stock which had previously been reserved for issuance with respect to certain of their previously granted options for 1,700,000; 950,000 and 300,000 shares, respectively. In return, the Company agreed that, at such time as an increase to its authorized shares of Common Stock was approved by the stockholders, the Company would reserve an equivalent number of shares of Common Stock for issuance with respect to such options. The purpose of this re-allocation was to allow the Company to satisfy, in part, its contractual obligations to its new lender.

EQUITY COMPENSATION PLANS

The table below sets forth certain information as of our fiscal year ended December 31, 2004 regarding the shares of our Common Stock available for grant or granted under compensation plans that (i) were adopted by our stockholders and (ii) were not adopted by our stockholders. The table below excludes the 2004 Stock Option Plan, as discussed in Proposal No. 4 beginning on page 25, and the conditional grant of stock options to certain key executive officers and directors, as discussed in Proposal No. 5 beginning on page 27, both of which have been approved by the Board of Directors, subject to shareholder approval.

Equity Compensation Plan Information

| | | Number of securities to be issued upon exercise of outstanding options, warrants and rights (#) | | Weighted-average exercise price of outstanding options, warrants and rights ($) | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities in the first column of this table) | |

| Equity compensation plans approved by security holders | | | 8,167 | | $ | 8.55 | | | 250,000 | |

| | | | | | | | | | | |

| Equity compensation plans not approved by security holders | | | 3,640,875 | | $ | 1.94 | | | 200,000 | |

| | | | | | | | | | | |

| Total | | | 3,649,042 | | $ | 1.95 | | | 450,000 | |

Description of Plans Not Adopted by Stockholders

The aggregate number of shares of the Company’s Common Stock for which options may be granted under the 1999 Stock Option Plan ("1999 Plan") is 66,667. Such options may be issued to key employees, officers, directors and consultants. The 1999 Plan is administered by the Board of Directors. The Board of Directors may grant only non-qualified stock options (options which do not comply with section 422 of the Internal Revenue Code of 1986, as amended) under the 1999 Plan. The 1999 Plan permits the administrators of the plan, in their sole discretion, to allow the cashless exercise of options. As of December 31, 2004, there were options to purchase 17,000 shares of Common Stock issued and outstanding and -0- available for grant pursuant to the 1999 Plan.

On December 28, 1999, the Board of Directors granted Stephen Lawlor, then a director, an option to purchase 3,333 shares of Common Stock at an exercise price of $102.042 per share. Such option vested immediately and expired on December 27, 2004.

The aggregate number of shares of the Company’s Common Stock for which options may be granted under the 2000 Stock Option Plan ("2000 Plan") is 225,000. Such options may be issued to key employees, officers who are key employees, directors and consultants. The 2000 Plan is administered by the Board of Directors. The Board of Directors may grant only non-qualified stock options (options which do not comply with section 422 of the Internal Revenue Code of 1986, as amended) under the 2000 Plan. The 2000 Plan permits the administrators of the plan, in their sole discretion, to allow the cashless exercise of options. As of December 31, 2004, there were options to purchase 113,717 shares of Common Stock issued and outstanding and -0- shares of common stock available for grant pursuant to the 2000 Plan.

The Company adopted a compensation plan (the "Non-Employee Director Plan") for outside (non-employee) directors effective June 4, 2004. Each outside director will receive an option for 60,000 shares. The option will vest in increments of 20,000 shares at the first, second and third anniversaries of the date of grant. The options expire ten years from the date of grant. In August 2004, the Company granted options to purchase 60,000 shares of Common Stock to all three of its then non-employee directors pursuant to the Non-Employee Director Plan, which options have an exercise price of $1.75 per share. In November 2004 each of these non-employee directors resigned and 35,000 shares vested for each director. During the quarter ended December 31, 2004, the Company granted options to purchase 60,000 shares of Common Stock to all three of the then non-employee directors pursuant to the Non-Employee Director Plan which options have an exercise price of $1.67 per share and a term of 10 years. The options vest annually over three years commencing October 30, 2005. On September 15, 2005, the Company granted stock options to purchase 60,000 shares of Common Stock to it newly elected non-employee director pursuant to the Non-Employee Director Plan which options have an exercise price of $.50 per share and a term of 10 years. The options vest annually over three years commencing on September 15, 2006. The options will vest immediately upon a Change of Control (as defined in their option agreements).

In connection with entering into an Employment Agreement on March 12, 2004, the Company granted to Robert Pons, the President and Chief Executive Officer, an option to purchase 1,300,000 shares of Common Stock, which option has an exercise price of $1.50 per share and a term of 10 years. The option provides for 557,141 shares to vest immediately and the remaining 742,859 shares to vest in equal amounts as of the last day of each calendar quarter commencing March 31, 2004. The option will vest immediately upon a Change of Control (as defined in his option agreement) or in the event Mr. Pons is terminated Other Than for Cause or he terminates employment for Good Reason (as each is defined under the Employment Agreement).

In connection with entering into an Employment Agreement on March 12, 2004, the Company granted to Timothy Wenhold, the Company's Executive Vice President and Chief Operating Officer, an option to purchase 700,000 shares of Common Stock, which option has an exercise price of $1.50 per share and a term of 10 years. The option provides for 300,000 shares to vest immediately and the remaining 400,000 shares to vest in equal amounts as of the last day of each calendar quarter commencing March 31, 2004. The option will vest immediately upon a Change of Control (as defined in his option agreement) or in the event Mr. Wenhold is terminated Other Than for Cause or he terminates employment for Good Reason (as each is defined under the Employment Agreement)

In April 2004, the Company granted to Len von Vital, its Chief Financial Officer, an option to purchase 300,000 shares of Common Stock, which options have an exercise price of $3.75 per share, and a term of 10 years. The options vest in equal amounts over four years as of the last day of each calendar quarter commencing September 30, 2004. The options will vest immediately upon a Change of Control (as defined in Mr. von Vital’s option agreements).

In April 2004, the Company granted to Matthew Stecker and Daniel Wainfan, its then Chief Technology Officer and Vice President of Marketing, respectively, an option for each to purchase 150,000 and 100,000 shares of Common Stock, respectively, which options have exercise prices of $1.50 and $3.25 per share, respectively, and a term of 10 years. The options vest in equal amounts over four years as of the last day of each calendar quarter commencing September 30, 2004. The employment of each of Messrs. Stecker and Wainfan with the Company was terminated on April 15, 2005. Pursuant to the terms of the option agreements, the options will automatically terminate on April 15, 2006, the date which is one year from the employment termination date of each of Messrs. Stecker and Wainfan.

In December 2004, the Company granted to Messrs. Pons and Wenhold options to purchase 400,000 and 250,000 shares of Common Stock, respectively, which options have an exercise price of $2.07 per share and a term of 10 years. The options vest monthly over three years commencing December 31, 2004. The options will vest immediately upon a Change of Control (as defined in their option agreements).

In December 2004, the Company granted to Dan Wainfan, the Company's then Vice President of Marketing, an option to purchase 100,000 shares of Common Stock, which option has an exercise price of $1.56 per share and a term of 10 years. The option vests quarterly over three years commencing March 31, 2005. Pursuant to the terms of the option agreement, the options will automatically terminate on April 15, 2006, the date which is one year from the employment termination date of Mr. Wainfan.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

On August 31, 2005, the Company executed agreements to obtain financing from CAMOFI Master, LDC, a Cayman Islands limited duration company (the “Lender”), consisting of a Senior Secured Convertible Note in the principal amount of $500,000 (the “Senior Note”) and a Revolving Convertible Note in the principal amount of $1,900,000 (the “Revolving Note”) which availability is based upon the Company’s eligible accounts receivable. Based on such availability, the Revolving Note may be increased to $2,500,000. The term of the financing is for 30 months from the closing date.

Interest is payable monthly in arrears at WSJ Prime plus 4%, in cash or, at the Company’s option, subject to the conditions thereto (including those as to trading volume) being met, in registered Common Stock valued at 85% of the volume weighted average trading price for the Common Stock for the 10 days prior to the payment date.

The Senior Note and the Revolving Note may be converted into Common Stock at a fixed conversion price that is $0.50 per share. The conversion price is subject to full ratchet anti-dilution protection.

The Company will reduce the principal amount of the Senior Note by 1/24th per month starting six months after closing, payable in cash or, subject to conditions thereto (including those as to trading volume) being met, in registered Common Stock. If such amortization is in cash, the payments will be at 102% of the monthly principal amortization amount. The Company may pay the principal amortization with Common Stock valued at 85% of the volume weighted average trading price for the Common Stock for the 10 days prior to the payment date if, among other things, our trading volume is in excess of a stated amount.

The Senior Note and Revolving Note are senior in right of payment to any and all of the Company’s indebtedness and are secured by a first lien on all of the Company’s assets. The loan is guaranteed by the Company’s subsidiary, KPCCD, Inc.

The Company has the right to prepay in cash all or a portion of the Senior Note and Revolving Note at 115% of the principal amount plus accrued interest to the date of repayment.

The Company is required to prepay in cash, half of the outstanding Senior Note and Revolving Note at 115% of the principal amount plus accrued interest to the date of repayment on the closing of a qualified offering as defined in the agreement or, in the event that no qualified offering occurs during the term, at maturity.

The Company issued the Lender five year warrants to purchase an aggregate of 3,000,000 shares of Common Stock at an exercise price of $.50 per share. Such warrants are exercisable on a cashless basis and are subject to full ratchet anti-dilution protection.