SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the registrant x

Filed by a party other than the registrant ¨

Check the appropriate box:

¨ Preliminary proxy statement | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14-a6(e)(2)) | |

x Definitive proxy statement | ||

¨ Definitive additional materials | ||

¨ Soliciting material pursuant to Rule 14a-11(c) or Rule 14a-12 |

IDT Corporation

(Exact Name of Registrant as specified in its Charter)

Payment of filing fee (Check the appropriate box):

| x | No fee required. |

¨ | Fee computed on table below per Exchange Act Rule 14a-6(i)(1), and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transactions applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

¨ | Fee paid previously with preliminary materials. |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, schedule or registration statement no.: |

| (3) | Filing party: |

| (4) | Date filed: |

Howard S. Jonas

Chairman of the Board

IDT Corporation

520 Broad Street

Newark, NJ 07102

November 6, 2002

To Our Stockholders:

On behalf of the Board of Directors, I cordially invite you to attend the Annual Meeting of the Stockholders of IDT Corporation. The Annual Meeting will be held at 11:00 a.m. on Wednesday, December 11, 2002, at the Company’s headquarters located at 520 Broad Street, Newark, New Jersey.

Please vote on all the matters listed in the enclosed Notice of Annual Meeting of Stockholders, each of which is more fully described in the enclosed Proxy Statement. The Board of Directors recommends a vote FOR all of these proposals.

All stockholders are invited to attend the Annual Meeting in person. If, however, you do not expect to be present at the Annual Meeting and wish your shares to be voted, you should complete, sign and date the enclosed form of proxy and return it by mail in the enclosed envelope or grant your proxy by telephone or the Internet as set forth on the form of proxy attached to the Proxy Statement.

I appreciate your interest and support of IDT and urge you to vote your shares either in person or by granting your proxy as promptly as possible.

Sincerely,

Howard S. Jonas

Chairman of the Board

IDT CORPORATION

520 Broad Street

Newark, New Jersey 07102

(973) 438-1000

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The Annual Meeting (the “Annual Meeting”) of Stockholders of IDT Corporation (the “Company”) will be held at 11:00 a.m., local time, on Wednesday, December 11, 2002, at the Company’s headquarters located at 520 Broad Street, Newark, New Jersey, for the following purposes:

| 1. | ELECTION OF DIRECTORS. The election of five Class I directors for a term of three years, which will expire at the Company’s annual meeting of stockholders in 2005 or until such time as their respective successors are duly elected and qualified, subject to their earlier resignation or removal. |

| 2. | APPROVAL OF AN AMENDMENT TO THE COMPANY’S 1996 STOCK OPTION AND INCENTIVE PLAN, AS AMENDED AND RESTATED. The approval of an amendment to the Company’s 1996 Stock Option and Incentive Plan, as amended and restated (the “Plan”), that will increase the number of shares of the Company’s Class B Common Stock available for the grant of awards thereunder by an additional 3,000,000 shares. |

| 3. | APPROVAL OF THE GRANT OF OPTIONS TO PURCHASE SHARES OF THE COMPANY’S CLASS B COMMON STOCK TO CERTAIN OFFICERS AND DIRECTORS OF THE COMPANY. The approval of the grant of options to purchase up to an aggregate of 975,000 shares of the Company’s Class B Common Stock granted outside of the Plan to certain officers and directors of the Company. |

| 4. | RATIFICATION OF THE APPOINTMENT OF INDEPENDENT AUDITORS. The ratification of the appointment of Ernst & Young LLP as the independent auditors for the Company for the fiscal year ending July 31, 2003. |

| 5. | OTHER BUSINESS. Such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

These matters are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on October 16, 2002, are entitled to notice of and to vote at the Annual Meeting.

BY ORDER OF THE BOARD OF DIRECTORS

Joyce J. Mason

Senior Vice President, General Counsel and Secretary

Newark, New Jersey

November 6, 2002

IDT CORPORATION

520 Broad Street

Newark, New Jersey 07102

(973) 438-1000

PROXY STATEMENT

General Information

This Proxy Statement is furnished to the stockholders of IDT Corporation, a Delaware corporation (the “Company” or “IDT”), in connection with the solicitation by the Company’s Board of Directors (the “Board”) of proxies in the form enclosed herewith for use in voting at the Company’s Annual Meeting of Stockholders (the “Annual Meeting”). The Annual Meeting will be held on Wednesday, December 11, 2002 at 11:00 a.m., local time, at the Company’s headquarters located at 520 Broad Street, Newark, New Jersey 07102. The shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”), Class A common stock, par value $0.01 per share (the “Class A Common Stock”), and Class B common stock, par value $0.01 per share (the “Class B Common Stock”), represented by the proxies received by telephone, the Internet or mail (properly marked, dated and executed) and not revoked will be voted at the Annual Meeting. This Proxy Statement is being mailed to the Company’s stockholders on or about November 6, 2002.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is exercised by delivering to the Company (to the attention of Joyce J. Mason, Senior Vice President, General Counsel and Secretary) a written notice of revocation or by executing a later-dated proxy by telephone, the Internet or mail, or by attending the Annual Meeting and voting in person.

Solicitation and Voting Procedures

This solicitation of proxies is being made by the Company. The solicitation is being conducted by mail, and the Company will bear all attendant costs. These costs will include the expense of preparing and mailing proxy materials for the Annual Meeting and any reimbursements paid to brokerage firms and others for their expenses incurred in forwarding the solicitation materials regarding the Annual Meeting to the beneficial owners of the Common Stock, Class A Common Stock and Class B Common Stock. The Company may conduct further solicitations personally, by telephone or by facsimile through its officers, directors and employees, none of whom will receive additional compensation for assisting with the solicitation. We have hired W.F. Doring & Co. to assist us in soliciting proxies for an anticipated fee of $3,000 plus reimbursement of out-of-pocket expenses.

The close of business on Wednesday, October 16, 2002 has been fixed as the record date (the “Record Date”) for determining the holders of shares of Common Stock, Class A Common and Class B Common Stock entitled to notice of and to vote at the Annual Meeting. As of the close of business on the Record Date, the Company had 88,909,815 shares outstanding, of which 79,470,689 shares are entitled to vote at the Annual Meeting, consisting of 19,596,009 shares of Common Stock, 9,816,988 shares of Class A Common Stock and 50,057,692 shares of Class B Common Stock. The remaining 9,439,126 shares outstanding, consisting of 5,419,963 shares of Common Stock and 4,019,163 shares of Class B Common Stock, are beneficially owned by the Company, and are not entitled to vote or be counted for quorum purposes.

Each holder of Common Stock is entitled to one vote per share, each holder of Class A Common Stock is entitled to three votes per share and each holder of Class B Common Stock is entitled to one-tenth of a vote per share. The holders of Common Stock, Class A Common Stock and Class B Common Stock will vote as a single body on all matters presented to the stockholders. The presence at the Annual Meeting of a majority of the shares of Common Stock, Class A Common Stock and Class B Common Stock (voting together), either in person or by proxy, will constitute a quorum for the transaction of business at the Annual Meeting.

1

A plurality of the votes cast at the Annual Meeting will be required for the election of each candidate to the Board of Directors and a majority of the votes cast at the Annual Meeting will be required for the approval of all other matters submitted to the vote of the Company’s stockholders.

With respect to Proposal Nos. 1 and 4, abstentions and broker non-votes will be included in determining whether a quorum is present, but will not be counted as votes for or against these proposals. With respect to Proposal Nos. 2 and 3, pursuant to applicable New York Stock Exchange rules, abstentions will be included, but broker non-votes will not be included, in determining whether a quorum is present, and neither abstentions nor broker non-votes will be counted as votes for or against these proposals.

The Company’s Operating Subsidiaries

Effective August 1, 2001, the Company was restructured so that its holdings were segregated along the lines of its principal businesses–its telecom business and its ventures and investments. As a result of this organizational restructuring, and the December 19, 2001 acquisition of substantially all of the core domestic telecommunication assets of Winstar Communications, Inc., the Company operates its business primarily through the following three subsidiaries (the “Operating Subsidiaries”): IDT Telecom, Inc., IDT Media, Inc. (f/k/a IDT Ventures, Inc.) and Winstar Holdings, LLC.

References to Fiscal Years

The Company’s fiscal year ends on July 31 of each calendar year. Each reference below to a Fiscal Year refers to the Fiscal Year ending in the calendar year indicated (e.g., Fiscal 2002 refers to the Fiscal Year ended July 31, 2002).

2

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding the beneficial ownership of the Company’s Common Stock (and Class A Common Stock, assuming conversion of all shares of Class A Common Stock into Common Stock) and Class B Common Stock as of October 16, 2002 by (i) each person known by the Company to be the beneficial owner of more than 5% of the outstanding shares of each of Common Stock (and Class A Common Stock, on an as-converted basis) and Class B Common Stock, (ii) each of the Company’s directors and the Named Executive Officers (as defined below), and (iii) all directors and officers of the Company as a group. Information regarding the beneficial ownership of equity securities of a subsidiary of the Company by the Company’s directors and Named Executive Officers is noted in footnotes to the table. Unless otherwise noted in the footnotes to the table, to the best of the Company’s knowledge, the persons named in the table have sole voting and investing power with respect to all shares of Common Stock, Class A Common Stock or Class B Common Stock indicated as being beneficially owned by them. Each holder of Common Stock is entitled to one vote per share, each holder of Class A Common Stock is entitled to three votes per share and each holder of Class B Common Stock is entitled to one-tenth of a vote per share.

5% Stockholders and Named Executive Officers and Directors | Number of Shares of Common Stock | Percentage of Ownership of Common Stock | Number of Shares of Class B Common Stock | Percentage of Ownership of Class B Common Stock | ||||||

Howard S. Jonas(1) 520 Broad Street Newark, New Jersey 07102 | 9,816,988 | 33.8 | % | 9,317,548 | 18.6 | % | ||||

Liberty Media Corporation(2) 9197 South Peoria Street Englewood, Colorado 80112 | — | — | 10,260,303 | 20.5 | % | |||||

Thomson, Horstmann & Bryant, Inc.(3) Park 80 West, Plaza Two Saddle Brook, New Jersey 07663 | 1,199,500 | 6.1 | % | — | — | |||||

| James A. Courter(4)(19) | 708,379 | 3.5 | % | 954,900 | 1.9 | % | ||||

| Michael Fischberger(5)(19) | 1,441 | * | 151,100 | * | ||||||

| Stephen R. Brown(6)(19) | 24,703 | * | 199,000 | * | ||||||

| Moshe Kaganoff(7) | 763 | * | 61,000 | * | ||||||

| Joyce J. Mason(8) | 89,996 | * | 204,470 | * | ||||||

| Marc E. Knoller(9) | 50,840 | * | 123,400 | * | ||||||

| Geoffrey Rochwarger(10)(19) | 16,635 | * | 180,541 | * | ||||||

| Morris Lichtenstein(11)(19) | 9,516 | * | 354,000 | |||||||

| Meyer A. Berman(12) | 67,100 | * | 100,600 | * | ||||||

| J. Warren Blaker(13) | 34,500 | * | 74,500 | * | ||||||

| Saul K. Fenster(14) | 10,500 | * | 40,500 | * | ||||||

| William A. Owens(15) | 10,498 | * | 50,498 | * | ||||||

| William F. Weld(16) | 10,000 | * | 30,000 | * | ||||||

| Paul Reichmann(17) | — | — | 40,000 | * | ||||||

| Michael J. Levitt(18) | — | — | 40,000 | * | ||||||

| All directors and officers as a group (20 persons) | 10,878,180 | 35.9 | % | 22,448,361 | 24.3 | % |

| * | Less than 1%. |

| (1) | Includes an aggregate of 9,816,988 shares of Class A Common Stock and 9,317,548 shares of Class B Common Stock, consisting of (a) 5,451,140 shares of Class A Common Stock and 5,052,180 shares of Class B Common Stock held by Mr. Jonas directly, (b) 19,570 shares of Class A Common Stock and 19,570 shares of Class B Common Stock beneficially owned by The Jonas Family Limited Partnership, (c) an aggregate of 1,703,088 shares of Class A Common Stock and 1,703,088 shares of Class B Common Stock beneficially owned by the eight separate Trusts under Article Four of the Howard S. Jonas 1996 Annuity |

3

| Trust Agreement for the benefit of each of: Samuel Jonas, David Jonas, Michael Jonas, Leora Jonas, Jonathan Jonas, Rachel Jonas, Joseph Jonas and Tamar Jonas in equal amounts of 212,886 shares of Class A Common Stock and 212,886 shares of Class B Common Stock, (d) 230,619 shares of Class A Common Stock and 605,139 shares of Class B Common Stock beneficially owned by the Howard S. Jonas 1998 Annuity Trust, and (e) 2,412,571 shares of Class A Common Stock and 1,937,571 shares of Class B Common Stock beneficially owned by the Jonas Foundation. Mr. Jonas is the General Partner of The Jonas Family Limited Partnership and the Trustee of the Howard S. Jonas 1998 Annuity Trust and, together with Deborah Jonas, is a Trustee of each of The Jonas Foundation and the eight separate trusts under Article Four of the Howard S. Jonas 1996 Annuity Trust Agreement F/B/O Samuel Jonas, David Jonas, Michael Jonas, Leora Jonas, Jonathan Jonas, Rachel Jonas, Joseph Jonas and Tamar Jonas. By virtue of his beneficial ownership of Class A Common Stock and Class B Common Stock, Mr. Jonas controls approximately 56.2% of the combined voting power of all outstanding shares of capital stock of the Company. |

| (2) | Based solely on a Form 13D/A filed on November 8, 2001. By virtue of its beneficial ownership of Class B Common Stock, Liberty Media Corporation (“Liberty Media”) controls approximately 1.9% of the combined voting power of all outstanding shares of capital stock of the Company. |

| (3) | Based solely on a Form 13G filed on January 23, 2002. By virtue of its ownership of Common Stock, Thomson Hurstmann & Bryant controls approximately 2.2% of the combined voting power of all outstanding shares of capital stock of the Company. |

| (4) | Includes (a) 72,500 shares of Common Stock and 36,500 shares of Class B Common Stock held by Mr. Courter directly, (b) 879 shares of Common Stock held by Mr. Courter in his 401(k) Plan and (c) 635,000 shares of Common Stock and 918,400 shares of Class B Common Stock issuable upon the exercise of stock options exercisable within 60 days. By virtue of his beneficial ownership of Common Stock and Class B Common Stock, Mr. Courter controls approximately 1.5% of the combined voting power of all outstanding shares of capital stock of the Company. |

| (5) | Includes (a) 1,441 shares of Common Stock held by Mr. Fischberger in his 401(k) Plan and (b) 151,100 shares of Class B Common Stock issuable upon the exercise of stock options exercisable within 60 days. |

| (6) | Includes (a) 4,000 shares of Common Stock and 4,000 shares of Class B Common Stock held by Mr. Brown directly, (b) 703 shares of Common Stock held by Mr. Brown in his 401(k) Plan and (c) 20,000 shares of Common Stock and 195,000 shares of Class B Common Stock issuable upon the exercise of stock options exercisable within 60 days. |

| (7) | Includes (a) 763 shares of Common Stock held by Mr. Kaganoff in his 401(k) Plan and (b) 61,000 shares of Class B Common Stock issuable upon the exercise of stock options exercisable within 60 days. |

| (8) | Includes (a) 10,380 shares of Common Stock and 11,905 shares of Class B Common Stock held by Ms. Mason directly, (b) 1,026 shares of Common Stock held by Ms. Mason in her 401(k) Plan, (c) an aggregate of 4,640 shares of Common Stock and 9,215 shares of Class B Common Stock owned by Ms. Mason’s husband, son and daughter and (d) 73,950 shares of Common Stock and 183,350 shares of Class B Common Stock issuable upon the exercise of stock options exercisable within 60 days. |

| (9) | Includes (a) 840 shares of Common Stock held by Mr. Knoller in his 401(k) Plan and (b) 50,000 shares of Common Stock and 123,400 shares of Class B Common Stock issuable upon the exercise of stock options exercisable within 60 days. |

| (10) | Includes (a) 41 shares of Common Stock and 41 shares of Class B Common Stock held by Mr. Rochwarger directly, (b) 1,094 shares of Common Stock held by Mr. Rochwarger in his 401(k) Plan and (c) 15,500 shares of Common Stock and 180,500 shares of Class B Common Stock issuable upon the exercise of stock options exercisable within 60 days. |

| (11) | Includes (a) 516 shares of Common Stock held by Mr. Lichtenstein in his 401(k) Plan and (b) 9,000 shares of Common Stock and 354,000 shares of Class B Common Stock issuable upon the exercise of stock options exercisable within 60 days. |

| (12) | Includes (a) 53,100 shares of Common Stock and 46,600 shares of Class B Common Stock held by Mr. Berman directly, (b) 4,000 shares of Common Stock and 4,000 shares of Class B Common Stock held by Mr. Berman’s wife and (c) 10,000 shares of Common Stock and 50,000 shares of Class B Common Stock issuable upon the exercise of stock options exercisable within 60 days. |

4

| (13) | Includes 34,500 shares of Common Stock and 74,500 shares of Class B Common Stock issuable upon the exercise of stock options exercisable within 60 days. |

| (14) | Includes 500 shares of Common Stock and 500 shares of Class B Common Stock owned by Mr. Fenster’s wife as well as 10,000 shares of Common Stock and 40,000 shares of Class B Common Stock issuable upon the exercise of stock options exercisable within 60 days. |

| (15) | Includes (a) 498 shares of Common Stock and 498 shares of Class B Common Stock held by the Owens Family Trust (Adm. Owens, together with his wife, are trustees of the Owens Family Trust), and (b) 10,000 shares of Common Stock and 50,000 shares of Class B Common Stock issuable upon the exercise of stock options exercisable within 60 days. |

| (16) | Includes 10,000 shares of Common Stock and 30,000 shares of Class B Common Stock issuable upon the exercise of stock options exercisable within 60 days. |

| (17) | Includes 40,000 shares of Class B Common Stock issuable upon the exercise of stock options exercisable within 60 days. |

| (18) | Includes 40,000 shares of Class B Common Stock issuable upon the exercise of stock options exercisable within 60 days. |

| (19) | These individuals also own the following numbers of options to acquire common stock of IDT Telecom, Inc., a private subsidiary of the Company, that are exercisable within 60 days: Mr. Courter, 234 options; Mr. Fischberger, 125 options; Mr. Brown, 78 options; Mr. Rochwarger, 156 options; and Mr. Lichtenstein, 843 options. As of October 16, 2002, there were 150,000 shares of IDT Telecom, Inc. common stock outstanding. Each of these persons beneficially owns less than 1% of the outstanding shares of common stock of IDT Telecom, Inc. |

5

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Pursuant to the Company’s Restated Certificate of Incorporation, as amended, the authorized number of directors on the Board is seventeen. There are currently fifteen directors on the Board and two vacancies.

Each director holds office until such director’s successor has been duly elected and qualified. The Company’s Board is divided into three classes, with Messrs. Blaker, Courter, Knoller, Brown and Weld constituting Class I, Messrs. Berman, Kaganoff, Fischberger and Reichmann and Admiral Owens constituting Class II and Ms. Mason and Messrs. Jonas, Rochwarger, Fenster and Levitt constituting Class III. Upon the expiration of the term of each class, directors comprising such class of directors are eligible to be elected for a three-year term at the next succeeding annual meeting of stockholders. The terms of the Class I directors expire at the Annual Meeting and the terms of the Class II and Class III directors expire at the annual meeting of stockholders to be held in 2003 and 2004, respectively.

A total of five Class I directors have been nominated for re-election at the Annual Meeting to serve for a term of three years until the 2005 Annual Meeting of Stockholders, or until their successors are duly elected and qualified or until their earlier resignation or removal. As provided by the By-Laws of the Company, a plurality of the votes cast at the Annual Meeting shall elect each director. Stockholders may not grant a proxy for a greater number of persons than five, which is the number of nominees identified herein.

The nominees are James A. Courter, Stephen R. Brown, Marc E. Knoller, J. Warren Blaker and William F. Weld, each of whom is an incumbent director and has consented to be named in this proxy statement and to serve if elected. Certain information about the nominees for Class I directors is furnished below.

James A. Courterjoined the Company in October 1996 and served as President of the Company from October 1996 until July 2001. Since August 2001, Mr. Courter has served as the Chief Executive Officer of the Company. Mr. Courter has also been a director of the Company since March 1996 and has been Vice Chairman of the Board of Directors of the Company since March 1999. In addition, since August 2001, Mr. Courter has served as a director of IDT Telecom, Inc. and as the Vice Chairman of IDT Media, Inc. Since December 1999, Mr. Courter has served as a director of Net2Phone, Inc. (“Net2Phone”). Since March 2002, Mr. Courter has served as a manager on the Board of Managers of Winstar Holdings, LLC. Mr. Courter has been a senior partner in the New Jersey law firm of Courter, Kobert, Laufer & Cohen since 1972. He was also a partner in the Washington, D.C. law firm of Verner, Liipfert, Bernhard, McPherson & Hand from January 1994 to September 1996. Mr. Courter was a member of the U.S. House of Representatives for 12 years, retiring in January 1991. From 1991 to 1994, Mr. Courter was Chairman of the President’s Defense Base Closure and Realignment Commission. Mr. Courter also serves as a director of The Berkeley School. He received a B.A. from Colgate University and a J.D. from Duke University Law School.

Stephen R. Brownjoined the Company as its Chief Financial Officer in May 1995 and has been a director of the Company since February 2000. Since June 2002, Mr. Brown has also served as the Treasurer and as Co-Chairman on the Board of Directors of IDT Media, Inc. Mr. Brown is also a director of Net2Phone. From

6

1985 to May 1995, Mr. Brown operated his own public accounting practice servicing medium-sized corporations as well as high net worth individuals. Mr. Brown received a B.A. degree in Economics from Yeshiva University and a B.B.A. degree in Business and Accounting from Baruch College.

Marc E. Knollerhas been a director of the Company since March 1996 and Senior Vice President since December 1998. Mr. Knoller joined the Company as a Vice President in March 1991 and also served as a director of its predecessor since such time. From 1988 until March 1991, Mr. Knoller was director of national sales for Jonas Publishing Corp. (“Jonas Publishing”), a publisher of trade directories. Mr. Knoller has served as Vice President of Jonas Publishing from 1991 until the present. Mr. Knoller received a B.B.A. from Baruch College.

J. Warren Blakerhas been a director of the Company since March 1996. Dr. Blaker has been Professor of Physics and Director of the Center for Lightwave Science and Technology at Fairleigh Dickinson University since 1987. Prior to such time Dr. Blaker worked in various capacities in the optics industry, including serving as Chief Executive Officer of University Optical Products, Inc., a wholly-owned subsidiary of University Patents, Inc., from 1982 to 1985. Dr. Blaker received a B.S. from Wilkes University and a Ph.D. from the Massachusetts Institute of Technology. Mr. Blaker serves on the Board of Directors of Eagle Building Technologies, Inc.

William F. Weldhas served as a director of the Company since February 2000. Mr. Weld has been a principal at Leeds Weld & Co., a private equity investment firm, since January 2001. From 1997 to January 2001, Mr. Weld was a partner in the law firm of McDermott, Will & Emery and has served as Of Counsel to such firm since such date. From 1991 to 1997, Mr. Weld served as Governor of Massachusetts. Prior to becoming Governor, Mr. Weld served as Assistant U.S. Attorney General in charge of the Criminal Division of the United States Department of Justice in Washington, D.C. from 1986 to 1988. Mr. Weld also served as the United States Attorney for Massachusetts from 1981 to 1986. Mr. Weld also serves as a director of Affiliated Managers Group, Inc. Mr. Weld received his B.A. from Harvard University, a diploma in international economics from Oxford University and his J.D. from Harvard Law School.

The Board has no reason to believe that any of the persons named above will be unable or unwilling to serve as a director, if elected.

THE BOARD RECOMMENDS A VOTEFOR

THE ELECTION OF THE NOMINEES NAMED ABOVE.

7

Directors and Executive Officers

The current directors and executive officers of the Company are as follows:

Name | Age | Position | ||

| Howard S. Jonas | 46 | Chairman of the Board and Treasurer | ||

| James A. Courter(1) | 61 | Vice Chairman of the Board and Chief Executive Officer | ||

| Ira A. Greenstein | 42 | President | ||

| Michael Fischberger(1) | 33 | Chief Operating Officer and Director | ||

| Stephen R. Brown | 46 | Chief Financial Officer and Director | ||

| Marcelo Fischer | 35 | Chief Accounting Officer and Controller | ||

| Joyce J. Mason | 43 | Senior Vice President, General Counsel, Secretary and Director | ||

| Marc E. Knoller | 41 | Senior Vice President and Director | ||

| Moshe Kaganoff(4) | 31 | Executive Vice President of Strategic Planning and Director | ||

| Geoffrey Rochwarger | 32 | Executive Vice President of Telecommunications and Director | ||

| Morris Lichtenstein | 38 | Executive Vice President of Business Development | ||

| E. Brian Finkelstein | 42 | Executive Vice President of Business Development | ||

| Jonathan Levy | 31 | Executive Vice President of Corporate Development | ||

| Meyer A. Berman(1)(2)(3) | 68 | Director | ||

| J. Warren Blaker(1)(2)(3)(4) | 68 | Director | ||

| Saul K. Fenster(2)(4) | 69 | Director | ||

| Admiral William A. Owens | 62 | Director | ||

| William F. Weld | 57 | Director | ||

| Paul Reichmann | 72 | Director | ||

| Michael J. Levitt | 43 | Director |

| (1) | Member of the Treasury Committee of the Board of Directors. |

| (2) | Member of the Audit Committee of the Board of Directors. |

| (3) | Member of the Compensation Committee of the Board of Directors. |

| (4) | Member of the Technology Committee of the Board of Directors. |

Set forth below is biographical information with respect to the Company’s directors and executive officers, other than the Company’s Class I directors:

Howard S. Jonasfounded IDT in August 1990 and has served as Chairman of the Board and Treasurer since its inception. Mr. Jonas served as Chief Executive Officer of the Company from December 1991 until July 2001 and as President of the Company from December 1991 through September 1996. Since December 1999, Mr. Jonas has also served as the Chairman of the Board of Directors of IDT Telecom, Inc. and as a Co-Chairman of IDT Media, Inc. Since March 2002, Mr. Jonas has served as Chairman of the Board of Managers of Winstar Holdings, LLC. Mr. Jonas is also the founder and has been President of Jonas Publishing since its inception in 1979. Mr. Jonas became the Chairman of the Board of Directors of Net2Phone in October 2001. Mr. Jonas received a B.A. in Economics from Harvard University.

Ira A. Greensteinjoined the Company in January 2000 and served as Counsel to the Chairman until July 2001. Since August 2001, Mr. Greenstein has served as the President of the Company. Prior to joining the Company, Mr. Greenstein was a partner in the law firm of Morrison & Foerster LLP from February 1997 to

8

November 1999 where he served as the Chair of that firm’s New York Office Business Department. Concurrently, Mr. Greenstein served as General Counsel and Secretary of Net2Phone from January 1999 to November 1999. Prior to 1997, Mr. Greenstein was an associate in the New York and Toronto offices of Skadden, Arps, Slate, Meagher & Flom LLP. Mr. Greenstein also served on the Securities Advisory Committee to the Ontario Securities Commission from 1992 to 1996. From 1991 to 1992, Mr. Greenstein also served as counsel to the Ontario Securities Commission. Mr. Greenstein serves on the Board of Overseers of Touro College. Mr. Greenstein received a B.S. from Cornell University and a J.D. from Columbia University Law School.

Michael Fischbergerhas served as Chief Operating Officer and has been a director of the Company since June 2001. Prior to his current position, Mr. Fischberger served as the Executive Vice President of Operations for the Company from January 2000 to June 2001. Mr. Fischberger also served as the Company’s Senior Vice President of Domestic Telecommunications and Internet Services from 1993 to 2000. Since August 1, 2001, Mr. Fischberger has also served as Executive Vice President of Operations for IDT Telecom, Inc. Mr. Fischberger is a director of Net2Phone.

Marcelo Fischer has served as the Company’s Controller since May 2001 and Chief Accounting Officer since December 2001. Prior to joining IDT, Mr. Fischer was the Corporate Controller of Viatel, Inc. from 1999 until 2001. From 1998 through 1999, Mr. Fischer was the International Controller of the Consumer International Division of Revlon, Inc. From 1991 through 1998, Mr. Fischer held various accounting and finance positions at Colgate-Palmolive Corporation. Mr. Fischer, a Certified Public Accountant, received an M.B.A. degree in Finance and Accounting from New York University Stern School of Business and a B.A. degree in Economics from University of Maryland.

Joyce J. Masonhas served as the Company’s Senior Vice President since December 1998, as General Counsel, Secretary and a director of the Company since its inception and as a director of the Company’s predecessor since its inception. Prior to joining the Company, Ms. Mason had been in private legal practice. Ms. Mason became a director of Net2Phone in October 2001. Ms. Mason received a B.A. from the City University of New York and a J.D. from New York Law School.

Moshe Kaganoffhas served as the Company’s Executive Vice President of Strategic Planning since January 2000 and has been a director of the Company since March 1999. From April 1994 through July 1998, Mr. Kaganoff served as the Company’s Manager of Operations. Since August 2001, Mr. Kaganoff has also served as Executive Vice President of Strategic Planning for IDT Telecom, Inc. Mr. Kaganoff holds a B.A. in Economics from Yeshiva University.

Geoffrey Rochwargerhas served as the Company’s Executive Vice President of Telecommunications since 1996 and has been a director of the Company since July 1999. Since May 2001, Mr. Rochwarger has also served as the Chief Operating Officer of IDT Telecom, Inc. and as Chief Operating Officer of Winstar Holdings, LLC since December 2001. Prior to his current positions, Mr. Rochwarger served as the President of Genie, an online service company and a subsidiary of the Company, from 1995 until 1996. Prior to joining IDT, Mr. Rochwarger was the Operations Manager at Galaxy Freight Service LTD. Mr. Rochwarger holds a B.A. Degree in Economics from Yeshiva University.

Morris Lichtensteinhas served as the Executive Vice President of Business Development of the Company since January 2000. From January 1999 to December 1999, Mr. Lichtenstein served as Controller of the Company. Since August 2001, Mr. Lichtenstein has also served as the Vice Chairman of the Board of Directors and Chief Executive Officer of IDT Telecom, Inc. From 1988 to 1998, Mr. Lichtenstein served as the Controller of Mademoiselle Knitwear, Inc. Mr. Lichtenstein received a B.A. from Touro College.

E. Brian Finkelstein joined the Company in February 2002 and serves as Executive Vice President of Business Development. Mr. Finkelstein has served on the Board of Managers and as Chief Executive Officer of Winstar Holdings, LLC since March 2002. Prior to his current position, Mr. Finkelstein served as President and Chief Executive Officer of Horizon Global Trading, LLC (acquired by IDT in February 2002), which designs and sells customized bond trading platforms for major investment banks. Among his responsibilities was the management of Horizon’s sales force. Prior to joining Horizon, Mr. Finkelstein was a managing director responsible for a global sales and trading department at UBS Securities.

9

Jonathan Levyhas served as Executive Vice President of Corporate Development of the Company since October 1995. Mr. Levy also served as the Director of the Company’s Fiber division from June 1998 through November 2000. Since August 2001, Mr. Levy also serves as a director of IDT Telecom, Inc. Prior to joining the Company, Mr. Levy was Operations Manager for B&H Photo, Inc. Mr. Levy holds a B.A. Degree in Finance from Touro College.

Meyer A. Bermanhas been a director of the Company since March 1996. Mr. Berman founded M.A. Berman Co. in 1981, a broker-dealer that services high net worth individuals and institutions, and has served as its President from its inception. Prior to such time, Mr. Berman held various positions in the stock brokerage business. Mr. Berman is Chairman of the Board of Eagle Building Technologies, Inc. Mr. Berman has a B.A. degree from the University of Connecticut and has done graduate work at the University of Illinois and at City College of New York.

Saul K. Fensterhas served as a director of the Company since February 2000. Dr. Fenster served as President of New Jersey Institute of Technology from September 1978 through June 2002 and is now President Emeritus. Dr. Fenster serves as a director for each of the following Prudential Insurance Company funds: Prudential Mutual Fund Cluster 1 and 4, Prudential VCA Funds, Prudential Gibraltar Fund and Prudential Series Funds, and serves on the Board of Directors of Eagle Building Technologies, Inc. Dr. Fenster received a B.M.E. from the City College of New York, an M.S. from Columbia University and a Ph.D. from the University of Michigan.

Admiral William A. Owenshas served as a director of the Company since March 2000. Admiral Owens has served as Vice Chairman of the Board and Co-Chief Executive Officer of Teledesic LLC since August 1998. Admiral Owens was the President, Chief Operating Officer and Vice Chairman of the Board of Directors of Science Applications International Corporation, from June 1996 to August 1998. In addition, Admiral Owens served as the Vice Chairman of the Joint Chiefs of Staff from 1994 to 1996. Admiral Owens received a B.S. from the United States Naval Academy, a B.A. and M.A. from Oxford University and an M.B.A. from George Washington University. Admiral Owens also serves as a director of Symantec, Polycom, Microvision, ViaSat, Biolase, TIBCO, Telstra, BAT and Nortel.

Paul Reichmannhas been a director of the Company since March 2001. Mr. Reichmann has been involved in industrial and commercial real estate development for the last 40 years, originating many major commercial and retail development projects and directing their construction, leasing and financing. Mr. Reichmann is the Executive Chairman of Canary Wharf Group plc, a publicly listed company on the London Stock Exchange, Chief Executive of the Reichmann Group of Companies which includes Reichmann International Development Corporation, and International Property Corporation. Mr. Reichmann is currently the Chairman of Canary Wharf Properties. Mr. Reichmann is also a Trustee of IPC US Income Commercial Real Estate Investment Trust and Retirement Residences Real Estate Investment Trust.

Michael J. Levitthas served as a director of the Company since September 2001. Mr. Levitt is currently the Chairman of Stone Tower Capital LLC. Mr. Levitt was a partner with Hicks, Muse, Tate & Furst Incorporated from 1996 until 2001. Mr. Levitt served as Managing Director and Deputy Head of Investment Banking with Smith Barney, Inc. from 1993 through 1995. From 1986 through 1993, Mr. Levitt was a Managing Director with Morgan Stanley & Co. Mr. Levitt received his undergraduate and Juris Doctor degrees from the University of Michigan.

Relationships among Directors or Executive Officers

Mr. Howard S. Jonas and Ms. Joyce J. Mason are brother and sister. There are no other family relationships among any of the directors or executive officers of the Company.

10

Certain Relationships and Related Transactions

In Fiscal 2002, the Company extended loans to each of the following four executive officers and a former executive officer of the Company in the principal amount of $150,000 that bear interest at the rate of 8% per annum: Morris Lichtenstein, the Company’s Executive Vice President of Business Development, Jonathan Levy, the Company’s Executive Vice President of Corporate Development, Moshe Kaganoff, the Company’s Executive Vice President of Strategic Planning, Geoffrey Rochwarger, the Company’s Executive Vice President of Telecommunications and Charles Garner, the Company’s former Executive Vice President of New Ventures. The entire amount of each of the loans of Messrs. Lichtenstein, Levy, Kaganoff and Rochwarger is currently outstanding and is due on December 31, 2004. Pursuant to a separation agreement between Mr. Garner and the Company entered into during Fiscal 2002 (the “Garner Separation Agreement”), Mr. Garner’s loan was forgiven and he was extended another loan in the principal amount of $1,000,000 that bears interest at the lowest rate permissible under applicable law without incurring additional tax obligations. This loan is payable out of the proceeds of the exercise of IDT Telecom, Inc. stock options held by Mr. Garner and will be forgiven if Mr. Garner does not exercise such options by certain dates, if Mr. Garner pays all applicable taxes relating to such forgiveness.

In addition, during Fiscal 2002, the Company extended a loan to Stephen R. Brown, the Company’s Chief Financial Officer, in the principal amount of $300,000 that bears interest at the rate of 8% per annum. The entire amount of this loan is currently outstanding and is due on December 31, 2004. In addition, Morris Lichtenstein was extended a loan in the amount of $1,000,000 that bears interest at the rate of 6% per year. The entire amount is currently outstanding and is payable on demand. Management of the Company has obtained a commitment from Mr. Lichtenstein to repay the amount due in equal one-third installments on or before July 31 in each of 2003, 2004 and 2005.

In Fiscal 2001, the Company extended loans bearing interest at a rate of 6% per annum in the original principal amounts of $2,350,000, $1,000,000 and $275,000 to Morris Lichtenstein, Stephen R. Brown, and Jonathan Levy, respectively. The entire amounts of these loans are currently outstanding. Mr. Lichtenstein’s loan will mature on December 31, 2004 with respect to $150,000, and the balance of such loan is payable on demand. The loans of Messrs. Brown and Levy are payable entirely on demand. Management of the Company has obtained a commitment from Messrs. Lichtenstein, Brown and Levy to pay all amounts that are payable on demand in equal one-third installments on or before July 31, in each of 2003, 2004 and 2005.

In Fiscal 2001, the Company also extended loans to several other executive officers of the Company and its principal subsidiaries, each of which bears interest at a rate of 8% per annum. Marc Knoller, the Company’s Senior Vice President, obtained a loan in the principal amount of $346,441; the entirety of his loan, which is currently outstanding, is due on demand. Management has obtained a commitment from Mr. Knoller to repay the loan in equal one-third installments on or before July 31 in each of 2003, 2004 and 2005. Michael Fischberger, the Company’s Chief Operating Officer, obtained a loan in the principal amount of $300,000. Mr. Fischberger’s loan is currently outstanding and is due on December 31, 2004. During Fiscal 2001, each of the following three executive officers of the Company also received a loan from the Company in the principal amount of $150,000 that bears interest at the rate of 8% per annum: Geoffrey Rochwarger, Moshe Kaganoff, and Jonathan Levy. The entire amount of each of these loans is currently outstanding and is due on December 31, 2004. During Fiscal 2001, Charles Garner, the Company’s former Executive Vice President of New Ventures, also procured a loan from the Company in the principal amount of $150,000, bearing an interest rate of 8% per annum, which was due on December 31, 2004. Pursuant to the Garner Separation Agreement, this loan was forgiven.

In Fiscal 2001, the Company extended two loans to Hal Brecher, the former Chief Operating Officer of the Company, in the principal amounts of $3,000,000 and $150,000. The $150,000 loan bears interest at a rate of 8% per annum. Pursuant to a separation agreement between the Company and Mr. Brecher entered into during Fiscal 2001 (the “Brecher Separation Agreement”), the interest rate on the $3,000,000 loan was reduced to 5¾%, and the Company agreed to forgive both loans upon the exercise of certain stock options held by Mr. Brecher and the payment by him out of the proceeds of all applicable taxes relating to such forgiveness. Those events have occurred and both loans were forgiven in Fiscal 2002.

In connection with the Brecher Separation Agreement, in addition to the arrangements for forgiveness and interest rate adjustments of certain loans made to Mr. Brecher described above and below, the Compensation Committee of the Board accelerated the vesting of certain of Mr. Brecher’s outstanding options exercisable for

11

shares of Common Stock and Class B Common Stock and also extended the post-termination exercise period of such options. In the event that the net proceeds from sales of the shares underlying such options amount to less than $3,000,000, the Company agreed to make a cash payment to Mr. Brecher in an amount equal to the difference between the proceeds of such sales and $3,000,000, up to a maximum amount of $1,000,000, reduced by all applicable taxes relating to such payment.

In Fiscal 2000, the Company extended a loan bearing interest at a rate of 6% per annum to Morris Lichtenstein, in the principal amount of $300,000. The entire amount is still outstanding. Management has received a commitment from Mr. Lichtenstein to repay the loan in equal one-third installments on or before July 31 in each of 2003, 2004 and 2005.

In Fiscal 1999, the Company extended a loan bearing interest at a rate of 6% per annum to Hal Brecher, in the principal amount of $300,000. Pursuant to the Brecher Separation Agreement the Company agreed, upon the exercise of certain stock options held by him and the payment by Mr. Brecher out of the proceeds of all applicable taxes relating to such forgiveness, to forgive $100,000 of such loan. The required events have occurred and $100,000 of such loan was forgiven. The remaining $200,000 of such loan is still outstanding.

In connection with the initial public offering of Net2Phone, in July 1999, each of Stephen R. Brown, Moshe Kaganoff, Geoffrey Rochwarger and Michael Fischberger borrowed $117,600 from the Company. All of the proceeds of these loans were used to purchase shares of Net2Phone common stock upon the exercise of stock options. As a condition to receiving these loans, these officers agreed to surrender 240 immediately exercisable Net2Phone options. The loans bear interest at the rate of 7.0% per annum and were amended during the fiscal year ended July 31, 2001 to be payable on demand. Management has obtained a commitment from Messrs. Brown, Kaganoff, Rochwarger and Fischberger to repay their respective loans in equal one-third installments on or before July 31 in each of 2003, 2004 and 2005.

On October 11, 2001, the Company issued to Liberty Media 3,810,265 shares of Class B Common Stock in exchange for 3,728,949 shares of Common Stock. The exchange rate was based upon the relative average market prices for the Class B Common Stock and the Common Stock during a specified 30 trading day period.

On October 23, 2001, the Company entered into an agreement to lead a consortium that concentrates ownership of approximately 46% (63% of the voting power) of Net2Phone. The consortium consists of the Company, Liberty Media and AT&T Corporation (“AT&T”). As part of the agreement, the Company and AT&T contributed their shares of Net2Phone (approximately 10.0 million and 18.9 million shares, respectively) to a newly formed limited liability company (the “LLC”). Liberty Media then acquired a substantial portion of the LLC’s units from AT&T. IDT is the managing member of the LLC.

On January 30, 2002, IDT Telecom, Inc. sold 7,500 newly issued shares of its common stock to Liberty Media at a price of $4,000 per share, for total aggregate proceeds of $30.0 million. As a result of this investment, Liberty Media became the owner of approximately 4.8% of the common equity of IDT Telecom, Inc. (0.5% of the voting power). The Company owns the remaining common equity of IDT Telecom, Inc.

James A. Courter, the Chief Executive Officer and Vice Chairman of the Company, is a partner in the law firm of Courter, Kobert, Laufer & Cohen, P.C., which has served as counsel to the Company since July 1996. Fees paid to the firm by the Company were less than 5% of the firm’s gross revenues for Fiscal 2002.

William F. Weld, a director of the Company, is Of Counsel to the law firm of McDermott, Will & Emery, which has served as counsel to the Company since November 1999. Fees paid to the firm by the Company were less than 5% of the firm’s gross revenues for Fiscal 2002.

The Company currently leases one of its facilities located in Hackensack, New Jersey from a corporation which is wholly-owned by Howard S. Jonas. Aggregate lease payments under such lease were $24,000 for Fiscal 2002.

12

The Company obtained various insurance policies during Fiscal 2002 that were arranged through a company affiliated with Jonathan Mason, the husband of Joyce Mason, the Senior Vice President, General Counsel, Secretary and a director of the Company (and the brother-in-law of Howard S. Jonas, the Chairman of the Board) and Irwin Jonas, the father of Joyce Mason and Howard S. Jonas. The aggregate premiums paid by the Company with respect to such policies were approximately $3,600,000 during Fiscal 2002. The commissions that were earned on such premiums are shared with several insurance wholesalers that access excess and surplus lines of insurance held by the Company, including ARC Excess & Surplus, LLC and Roger Metzger and Associates. All insurance coverage of the Company is reviewed by an independent insurance consultant.

The Company made payments for food related expenses during Fiscal 2002 of approximately $600,000 to a food service provider owned by Samuel Jonas, the son of Howard S. Jonas, that operates a cafeteria in the Company’s headquarters.

Committees of the Board of Directors

The Board of Directors has established a Compensation Committee, an Audit Committee, a Treasury Committee and a Technology Committee.

The Compensation Committee is responsible for reviewing and approving all compensation arrangements for the officers of the Company and is responsible for administration of the Company’s 1996 Stock Option and Incentive Plan, as Amended and Restated. The Compensation Committee held eight meetings during Fiscal 2002. The Compensation Committee currently consists of Messrs. Berman and Blaker.

The Audit Committee is responsible for recommending the independent auditors of the Company and reviewing with the independent auditors (i) the scope and results of the audits and the internal accounting controls of the Company, (ii) the audit practices and professional services furnished by the independent auditors and (iii) reporting to the Board of Directors with respect to any and all of the above. The management of the Company has the primary responsibility for the Company’s financial statements and reporting process including the systems of internal controls. The Audit Committee operates under a written Audit Committee charter adopted by the Board of Directors. The Audit Committee held eight meetings during the last fiscal year. The Audit Committee consists of Messrs. Berman, Blaker and Fenster. The Board of Directors has determined that all of the members of the Audit Committee are “independent” as defined by the rules of the New York Stock Exchange.

The Treasury Committee consists of Messrs. Berman, Blaker and Courter. The Treasury Committee is responsible for reviewing the Company’s investment policies and corporate compliance. The Treasury Committee did not hold any meetings during Fiscal 2002 as all matters concerning Treasury Committee issues were discussed with the entire Board of Directors at the Company’s Board meetings.

The Technology Committee consists of Messrs. Blaker, Fenster and Kaganoff. The Technology Committee is responsible for reviewing, analyzing and reporting to the Board of Directors on (i) present and future technology-related projects, (ii) the state of the Company’s present technology infrastructure and its existing and planned research and development efforts, (iii) future means of maximizing the Company’s technological advances in the marketplace, and (iv) further means of maximizing the Company’s strategic investment in intellectual property for competitive advances. In June 2002, the duties of the Technology Committee were expanded to permit the Technology Committee to establish appropriate programs, policies and procedures as necessary to further the Company’s objectives relating to technology and intellectual property. The Technology Committee held eleven meetings during Fiscal 2002.

13

During Fiscal 2002, there were eight meetings of the Board of Directors. Each of the Company’s directors attended or participated in 75% or more of the aggregate of (i) the total number of meetings of the Board of Directors (held during the period for which each such director has been a director) and (ii) the total number of meetings held by all committees of the Board of Directors on which each such director served (during the periods that such director served) except for Paul Reichmann and William F. Weld.

Compensation of Directors

Each non-employee director initially elected to the Board prior to March 15, 1996 (the date of the Company’s initial public offering) received as of March 15, 1996 options to purchase 10,000 shares of Common Stock, and each non-employee director initially elected to the Board after such date but before May 31, 2001 received options to purchase 10,000 shares of Common Stock or Class B Common Stock upon his or her election. Each non-employee director of the Company and its majority-owned subsidiaries initially elected to the Board or the board of directors of such subsidiary after May 31, 2001 received options to purchase 20,000 shares of Class B Common Stock upon his or her election (or, in the case of certain non-employee directors of majority-owned subsidiaries of the Company, as of October 22, 2001). In addition, each non-employee director of the Company and any of the Operating Subsidiaries will annually receive separate and additional grants of options to purchase 20,000 shares of Class B Common Stock for being a non-employee director of the Company or of any such subsidiaries.

During Fiscal 2002, the Board approved an annual retainer of $25,000 payable to each non-employee director of the Company for each calendar year beginning with calendar year 2002 who attends at least 50% of the meetings of the Board during such calendar year. In addition, the Board approved payments to such non-employee directors who serve on committees of the Board of $1,000 for each committee meeting they attend in person ($2,000 in the case of the Audit Committee) and $500 for each committee meeting in which they participate by telephone.

14

Executive Compensation

The following table sets forth certain information for the Company’s last three completed fiscal years concerning the compensation of the Company’s Chief Executive Officer and the Company’s four most highly compensated executive officers, other than the Chief Executive Officer, who were serving as executive officers as of July 31, 2002 (collectively, the “Named Executive Officers”). Except as described below, the Company does not have any executive long-term compensation or incentive plans.

Summary Compensation Table

Name and Principal Position | Annual Compensation | Other Annual Compensation($) | Securities Underlying Options(#)(1) | All Other Compensation($) | ||||||||

Year | Salary($) | Bonus($) | ||||||||||

James A. Courter Vice Chairman of the Board and Chief Executive Officer | 2002 2001 2000 | 250,000 211,263 200,000 | 975,000 862,500 — | — — — | 1,000,000 200,000 100,000 | — — — | ||||||

Michael Fischberger Chief Operating Officer and Director | 2002 2001 2000 | 250,000 211,804 202,493 | 975,000 862,500 — | — — — | 85,000 100,000 240,000 | — — — | ||||||

Geoffrey Rochwarger Executive Vice President of Telecommunications and Director | 2002 2001 2000 | 250,000 211,578 202,370 | 975,000 1,262,500 — | — — — | 25,000 100,000 240,000 | — — — | ||||||

Stephen R. Brown Chief Financial Officer and Director | 2002 2001 2000 | 250,000 211,263 202,353 | 975,000 862,500 50,000 | — — — | 50,000 100,000 240,000 | — — — | ||||||

Morris Lichtenstein Executive Vice President of Business Development | 2002 2001 2000 | 250,000 211,000 198,094 | 975,000 862,500 — | — — — | 50,000 400,000 440,000 | — — — | ||||||

| (1) | All of such options granted during the fiscal years ended July 31, 2000, 2001 and 2002 were exercisable for shares of Class B Common Stock (except with respect to options initially exercisable for 5,000 shares of Common Stock granted to Mr. Fischberger and 40,000 shares of Common Stock granted to Mr. Lichtenstein during the fiscal year ended July 31, 2000). The number of “Securities Underlying Options” has been adjusted to reflect the stock dividend effected by the Company on May 31, 2001 of one share of Class B Common Stock for every share of Common Stock, Class A Common Stock and Class B Common Stock held of record on May 14, 2001 (the “Class B Dividend”). As a result of the Class B Dividend, any options exercisable for shares of Common Stock or Class B Common Stock that were granted prior to (but not yet exercised as of) May 31, 2001 entitle the holders thereof to receive (in addition to the issuance of shares of Common Stock or Class B Common Stock, as applicable, called for by such options) one additional share of Class B Common Stock for each share of Common Stock or Class B Common Stock, as applicable, issuable in connection with such options. The foregoing table does not reflect any option exercises prior to or after May 31, 2001. |

15

Stock Options Granted in Last Fiscal Year

Name | Number of Shares Underlying Options(#)(1) | Percent of Total Options Granted to Employees in Fiscal Year(%)(1)(2) | Exercise Price($)(3) | Date of Expiration | Rates of Stock Price Appreciation For Option Term | |||||||

5%($) | 10%($) | |||||||||||

| James A. Courter(4)(9) | 1,000,000 | 27.78 | 9.01 | 10/21/11 | 5,670,000 | 14,360,000 | ||||||

| Michael Fischberger(5)(9) | 85,000 | 2.36 | 12.06 | 12/12/11 | 644,300 | 1,633,700 | ||||||

| Geoffrey Rochwarger(6)(9) | 25,000 | .69 | 12.06 | 12/12/11 | 189,500 | 480,500 | ||||||

| Stephen R. Brown(7)(9) | 50,000 | 1.39 | 12.06 | 12/12/11 | 379,000 | 961,000 | ||||||

| Morris Lichtenstein(8)(9) | 50,000 | 1.39 | 12.06 | 12/12/11 | 379,000 | 961,000 | ||||||

| (1) | All of such options are exercisable for shares of Class B Common Stock. Options to purchase 4,599,982 shares of Class B Common Stock were granted to employees in Fiscal 2002. Of these options, 1,000,000 options were granted to Howard S. Jonas, Chairman of the Board of Directors and Treasurer, on December 13, 2001, at an exercise price of $12.06 per share. The options were to vest over a period of five years, a rate of 50,000 per quarter, commencing on January 1, 2002. On May 14, 2002, Mr. Jonas waived and agreed to the cancellation of any rights under the options and, as a result, all the options were cancelled retroactive to their December 13, 2001 date of grant. No options to purchase shares of Common Stock were granted to employees in Fiscal 2002. |

| (2) | The options granted to Mr. Jonas which subsequently were cancelled were not included in the calculation in determining the percent of total options granted to employees in Fiscal 2002. |

| (3) | Represents the fair market value of the underlying shares of Class B Common Stock on the date of grant. |

| (4) | Of Mr. Courter’s options, 50,000 options become exercisable on the first day of each quarter commencing January 1, 2002, with the final 50,000 options becoming exercisable on October 1, 2006. |

| (5) | Of Mr. Fischberger’s options, 63,750 options are currently exercisable and the remaining 21,250 options will become exercisable on November 1, 2002. |

| (6) | Of Mr. Rochwarger’s options, 18,750 options are currently exercisable and the remaining 6,250 options will become exercisable on November 1, 2002. |

| (7) | Of Mr. Brown’s options, 37,500 options are currently exercisable and the remaining 12,500 options will become exercisable on November 1, 2002. |

| (8) | Of Mr. Lichtenstein’s options, 37,500 options are currently exercisable and the remaining 12,500 options will become exercisable on November 1, 2002. |

| (9) | These individuals also received the following number of options to acquire common stock of IDT Telecom: Mr. Courter, 702 options; Mr. Fischberger, 375 options; Mr. Rochwarger, 468 options; Mr. Brown, 234 options; and Mr. Lichtenstein, 2,528 options. All of these options have an exercise price of $366.67 per share and expire on August 1, 2011. One-third of the options vested on August 1, 2002. The balance vest in equal installments on each of August 1, 2003 and August 1, 2004. |

16

Option Exercises in Last Fiscal Year and Fiscal Year-End Values

The following table provides certain information concerning the number of shares of Common Stock and Class B Common Stock underlying unexercised stock options held by each of the Named Executive Officers, and the value of such stock options as of July 31, 2002. Stock options exercisable for 149,500 shares of Common Stock and 633,400 shares of Class B Common Stock were exercised by the Named Executive Officers during Fiscal 2002.

Name | Shares Acquired on Exercise(#) | Value Realized($) | Number of Securities Underlying Unexercised Common Stock Options at Fiscal Year-End(#) | Number of Securities Underlying Unexercised Class B Common Stock Options at Fiscal Year-End(#) | Value of Unexercised In-the-Money Options at Fiscal Year-End($)(1) | |||||||||||

Exercisable | Unexercisable | Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||||

| James A. Courter | 0 | 0 | 635,000 | 0 | 851,800 | 1,183,200 | 17,760,133 | 8,077,677 | ||||||||

| Michael Fischberger | 154,900 | 978,465 | 0 | 0 | 68,600 | 322,500 | 333,897 | 1,582,275 | ||||||||

| Geoffrey Rochwarger | 184,000 | 1,577,257 | 15,500 | 0 | 128,000 | 252,500 | 997,730 | 1,380,375 | ||||||||

| Stephen R. Brown | 155,000 | 1,601,360 | 20,000 | 0 | 130,000 | 305,000 | 1,013,613 | 1,507,900 | ||||||||

| Morris Lichtenstein | 289,000 | 1,974,395 | 0 | 14,000 | 260,000 | 449,000 | 1,606,058 | 2,584,145 | ||||||||

| (1) | The closing price of the Common Stock on July 31, 2002, as reported by the New York Stock Exchange, was $18.10 per share. The closing price of the Class B Common Stock on July 31, 2002, as reported by the New York Stock Exchange, was $16.31 per share. |

Equity Compensation Plans and Individual Compensation Arrangements

The following chart gives aggregate information regarding grants under all equity compensation plans of the Company through July 31, 2002. All of the information in the table below reflects grants of additional options and adjustments to exercise prices in connection with the Class B Dividend.

Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in 1st column) | |||||||||||

Common Stock | Class B Common Stock | Common Stock | Class B Common Stock | Common Stock | Class B Common Stock | |||||||||

Equity compensation plans approved by securityholders (1) | 1,488,167 | 10,186,549 | $ | 7.667 | $ | 10.388 | 0 | 694,014 | ||||||

Equity compensation plans not approved by securityholders(2) | 585,464 | 1,841,914 | 4.359 | 9.002 | 0 | 0 | ||||||||

| Total | 2,073,631 | 12,028,463 | $ | 6.733 | $ | 10.176 | 0 | 694,014 | ||||||

| (1) | Consists of (i) options to purchase 1,488,167 shares of Common Stock and 9,103,449 shares of Class B Common Stock granted under the Company’s 1996 Stock Option and Incentive Plan, as amended and restated (the “Plan”), and (ii) options to purchase 1,083,100 shares of Class B Common Stock granted outside of the Plan, which were approved by stockholders on December 14, 2000. |

| (2) | Consists of (i) options to purchase 398,500 shares of Common Stock granted on March 1, 1999 (and options to purchase 398,500 shares of Class B Common Stock issued to the recipients of those options in connection with the Class B Dividend) to six executive officers and key employees of the Company, (ii) options to purchase 1,256,450 shares of Class B Common Stock granted on various dates to employees of the Company, and (iii) options to purchase 186,964 shares of Common Stock granted prior to the Company’s |

17

| initial public offering (and 186,964 shares of Class B Common Stock granted to the recipients of those options in connection with the Class B Dividend) to certain officers, directors and key employees of the Company. All such options expire 10 years from the grant date, vest either immediately or over periods of between one and three years, and, other than certain of the options referred to in clause (iii) above, had exercise prices equal to or greater than the fair market value of the shares of stock underlying such options as of the day preceding their respective grant dates. The grants of all of such options were approved by the Board or the Compensation Committee of the Board and the recipients were selected (based in some circumstances on the recommendations of management) on their prior service to the Company or their ability to provide future value to the Company’s development or performance. |

Employment Agreements

The Company has entered into employment agreements with Messrs. Jonas and Courter. Mr. Jonas’s employment agreement, dated as of April 1, 2002, provides for a minimum base salary of $250,000, which may be increased, but not decreased, during the term of the agreement. The Company may terminate Mr. Jonas’s employment only for “cause” (as defined in the agreement). If the agreement is terminated without cause, the Company is obligated to pay to Mr. Jonas an amount equal to the sum of his base salary for the remainder of his term. The agreement has a five year term, but is automatically extendable for additional one year periods unless the Board of Directors or Mr. Jonas notifies the other, within ninety days of the anniversary of such period, that the agreement will not be extended. Pursuant to the agreement, Mr. Jonas has agreed not to compete with the Company for a period of one year following the termination of the agreement.

During Fiscal 2002, Mr. Courter was employed as the Chief Executive Officer of the Company pursuant to an employment agreement, dated as of April 1, 1999 and amended as of August 1, 2001, and subsequently amended as of October 22, 2001. Such employment agreement, as amended, provides for a minimum base salary of $250,000, which may not be decreased, but must be increased from time to time to match the base salary of the highest paid employee of the Company or of any entity controlled by the Company, during the term of the agreement. The Company may terminate Mr. Courter’s employment only for “cause” (as defined in the agreement). In the event of termination without “cause” or in the event Mr. Courter terminates his employment for “good reason” (as defined in the employment agreement), any and all unvested options shall automatically vest and Mr. Courter shall be permitted to exercise any and all options which are outstanding as of the date of his termination within two (2) years from such date. If the agreement is terminated without “cause,” the Company is obligated to pay to Mr. Courter all due and unpaid amounts to which Mr. Courter was then entitled and Mr. Courter’s minimum base salary for the remainder of the employment term but in no event less than twelve months. The amended agreement has a five year term commencing from October 2001, and is automatically extendable for additional one-year periods unless the Board of Directors or Mr. Courter notifies the other, within ninety days of the anniversary of such period, that the agreement will not be extended. Pursuant to the agreement, Mr. Courter has agreed not to compete with the Company for a period of one year following the termination of the agreement. In addition, Mr. Courter was granted options to purchase 300,000 shares of Class B Common Stock which vest over a three-year period under the original terms of the agreement and, pursuant to the October 2001 amendment, was granted options to purchase an additional 1,000,000 shares of Class B Common Stock which will vest over a five-year period.

Employee Stock Option Program

The Company previously maintained an informal stock option program whereby selected key employees were granted options to purchase shares of Common Stock. The primary purpose of this program was to provide long-term incentives to the Company’s key employees and to further align their interests with those of the Company. Options granted under such program have a term of ten years and are subject to all other reasonable terms and conditions as the Company deems necessary and appropriate. The selection of the participants and the determination of the number of options to be granted to each participant were made by the Compensation

18

Committee of the Board. Under such program, options to purchase an aggregate of 186,964 shares of Common Stock and 186,964 shares of Class B Common Stock were outstanding as of October 25, 2002. The Company does not anticipate that any additional options will be granted under this program. In addition to this program, the Company also has adopted the 1996 Stock Option and Incentive Plan, as Amended and Restated, which is described further in Proposal No. 2 below.

Compensation Committee Interlocks and Insider Participation

During Fiscal 2002, the Compensation Committee was comprised of Messrs. Berman and Blaker. None of the members of the Compensation Committee were employees of the Company during such period.

Reports of the Compensation Committee and the Audit Committee of the Board of Directors

Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933, as amended (the “Act”), or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that might incorporate future filings, including this Proxy Statement, in whole or in part, the following reports and the Performance Graph set forth below shall not be incorporated by reference into any such filings, nor shall they be deemed to be soliciting material or deemed filed with the Securities and Exchange Commission under the Act or under the Exchange Act.

Report of the Compensation Committee

The Compensation Committee determines the compensation levels of the various officers of the Company with a view to attract, retain, motivate and reward key employees who possess exceptional leadership and management skills through a competitive base salary, bonus payments (when appropriate), long-term incentives such as awards of stock options, and various other benefits.

The policies of the Compensation Committee are intended to combine competitive levels of compensation with rewards for commendable performance, and to align each officer’s relative compensation with the Company’s achievement of key business objectives, optimal satisfaction of customers and maximization of stockholder value. The Compensation Committee believes that stock ownership by management is beneficial in aligning the interests of the Company’s management with the interests of the Company’s stockholders.

Base Salaries. Salaries for the Company’s executive officers are determined primarily on the basis of each executive officer’s responsibility, the general salary practices of companies with which the Company competes and each officer’s individual qualifications and experience. The base salaries are reviewed by the Compensation Committee in accordance with a variety of criteria, including individual performance, the functions charged to each officer, the scope of the officer’s duties, trends in the compensation peer group in which the Company competes for executive talent, and the Company’s financial performance generally. The weight given such factors by the Compensation Committee may vary with respect to each of the Company’s officers, and from year to year, as the Compensation Committee may deem necessary.

Bonus Payments. Bonuses for the Company’s executive officers are based on various financial and non-financial results of the Company and the Operating Subsidiaries, such as revenue growth, expense reductions and customer and employee satisfaction, as well as on such executive officers’ job level, responsibilities and contributions to the Company.

Stock Option Grants. Stock options are currently granted to executive officers and other employees under the Company’s 1996 Stock Option and Incentive Plan, as Amended and Restated. In the past, stock options were granted under the Company’s employee stock option program. The Compensation Committee believes that the appreciation of stock value underlying stock options provides a strong incentive for recipients of awards to manage the Company in accordance with the interests of the Company’s stockholders. Stock option grants and

19

awards are given in order to focus the grantee’s attention on the long-term performance of the Company, as well as to provide an incentive for the grantee to maintain a long-term relationship with the Company. The number of options or awards granted and other option terms, such as vesting, are determined by the Compensation Committee based on the grantee’s level of responsibility, prior performance, and other compensation. Neither the 1996 Stock Option and Incentive Plan nor the Employee Stock Option Program provides for specific quantitative criteria for weighing these factors. Rather, a decision to grant an option or award is primarily based upon an evaluation of the past as well as the future anticipated performance and responsibilities of the grantee.

401(k) Plan. The Company established a plan in September 1996, pursuant to Section 401(k) of the Internal Revenue Code of 1986, as amended (the “401(k) Plan”), for the benefit of employees. The Company’s executive officers are permitted to participate on the same basis as other employees of the Company.

Chief Executive Officer Compensation. The Company has entered into an employment agreement with Mr. James A. Courter, dated as of April 1, 1999 and amended on August 1, 2001 and October 22, 2001, pursuant to which Mr. Courter replaced Howard S. Jonas as Chief Executive Officer of the Company effective August 2001. The employment agreement, as amended, provides for a minimum annual base salary of $250,000, which, during the term of the agreement, may not be decreased, but must be increased from time to time to match the base salary of the highest paid employee of the Company or of any entity controlled by the Company. Pursuant to the agreement, as amended, Mr. Courter was paid the $250,000 minimum base salary during Fiscal 2002. Pursuant to the agreement, as amended, Mr. Courter was also granted options during Fiscal 2002 to purchase 1,000,000 shares of Class B Common Stock, which options vest over a five-year period. Mr. Courter also received a bonus of $975,000 in Fiscal 2002. In determining Mr. Courter’s bonus, the Compensation Committee took into account Mr. Courter’s continued demonstration of vision and leadership at a time of unprecedented turmoil in the telecommunications industry, which helped enable the Company to increase its revenues, particularly in its calling card business, and to maintain the trading price for its stock during this difficult period.

THE COMPENSATION COMMITTEE OF

THE BOARD OF DIRECTORS

Meyer A. Berman

J. Warren Blaker

20

Report of the Audit Committee

We have received and discussed with management the Company’s audited consolidated financial statements as of and for the year ended July 31, 2002.

We have discussed with Ernst & Young LLP the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants. Also, we have received and reviewed the written disclosures and the letter from Ernst & Young LLP required by Independence Standard No. 1 (Independence Discussions with Audit Committees), as amended, by the Independence Standards Board, and have discussed with the auditors the auditors’ independence.

Based on the reviews and discussions referred to above, we recommend to the Board of Directors that the consolidated financial statements referred to above be included in the Company’s Annual Report on Form 10-K for the year ended July 31, 2002.

We have also considered whether the provision of services by Ernst & Young LLP not related to the audit of the consolidated financial statements referred to above and to the reviews of the interim consolidated financial statements included in the Company’s Forms 10-Q for the quarters ended October 31, 2001, January 31, 2002 and April 30, 2002 is compatible with maintaining Ernst & Young LLP’s independence.

THE AUDIT COMMITTEE OF

THE BOARD OF DIRECTORS

Meyer A. Berman

J. Warren Blaker

Saul K. Fenster

21

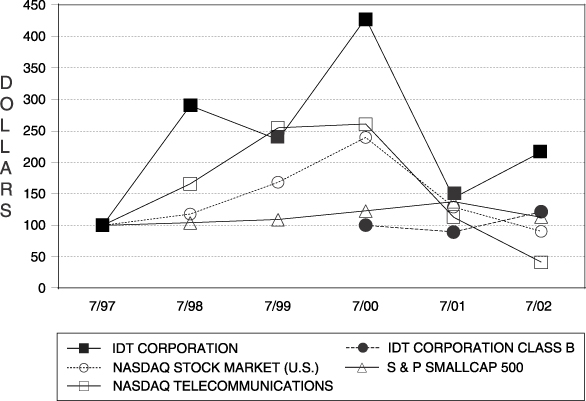

Performance Graph of Stock

The following chart sets forth the cumulative total stockholder return (assuming reinvestment of dividends, if any) on the Common Stock from July 31, 1997 through July 31, 2002, as well as the cumulative total return on (i) the Nasdaq National Market Composite Index, (ii) Standard & Poor’s SmallCap 600 Index and (iii) the Nasdaq Telecommunications Index during such five-year period. The chart also sets forth the cumulative total stockholder return (assuming reinvestment of dividends, if any) on the Class B Common Stock from June 1, 2001 (the first date on which the Class B Common Stock was publicly traded) through July 31, 2002. The stock price performance of the graph below is not necessarily indicative of future performance.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG IDT CORPORATION COMMON STOCK,

IDT CORPORATION CLASS B COMMON STOCK,

THE NASDAQ STOCK MARKET (U.S.) INDEX,

THE S & P SMALLCAP 600 INDEX

AND THE NASDAQ TELECOMMUNICATIONS INDEX

| * | $100 invested on 7/31/97 in stock or index (except with respect to Class B Common Stock as noted above) -including reinvestment of dividends. Fiscal year ending July 31. |

Copyright© | 2002, Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. All rights reserved. |

22

PROPOSAL NO. 2

APPROVAL OF AN AMENDMENT TO THE COMPANY’S

1996 STOCK OPTION AND INCENTIVE PLAN,

AS AMENDED AND RESTATED