IDT

Corporation

Investor Day

January 17, 2007

Newark, NJ

1

IDT INVESTOR DAY

8:30 Registration

9:30 Company Overview

The Future of IDT- Howard Jonas

IDT Corporate Q&A

11:00Break

IDT Telecom Overview

IDT Telecom Q&A

IDT Capital Overview

IDT Capital Q&A

Concluding Remarks

1:15 Lunch

Agenda

2

IDT INVESTOR DAY

IDT Management Participants

Howard Jonas Chairman of the Board

Jim Courter Chief Executive Officer

Ira GreensteinPresident

Motti Lichtenstein Chief Operating Officer

Marcelo Fischer Chief Financial Officer

Yossi Cohn Director Investor Relations

CORPORATE TEAM

3

Yona Katz Chief Executive Officer

Kathleen Timko Chief Operating Officer

Norman Rosenberg Chief Financial Officer

Avi Lazar President, Global Wholesale and

International Emerging Businesses

Michael Leibov President, Union Telecard Alliance

Esti Witty SVP, Consumer Phone Services

Jose ColagrossiGeneral Manager, International Channel

Sales

IDT Management Participants

TELECOM TEAM

IDT INVESTOR DAY

4

Steve Brown Co-Chief Executive Officer

David Greenblatt Co-Chief Executive Officer

Geoff Rochwarger President

Yaacov Dior CEO, IDT Carmel

Morris Berger CEO, IDT Internet Mobile

Barry Luden CEO, IDT Local Media

IDT Management Participants

CAPITAL TEAM

IDT INVESTOR DAY

5

IDT

Corporation

Jim Courter

Chief Executive Officer

6

This presentation highlights certain information about the Company, its businesses and its financial

results and condition. It is not complete and should be considered in conjunction with the more

fulsome disclosures regarding the Company and its operations in the reports the Company files with

the SEC, including the audited and un-audited financial statements included with those reports.

This presentation may contain forward-looking statements that are either general or specific in

nature. These statements are subject to risks and uncertainties that may cause actual results to

differ materially from those we anticipate. These risks and uncertainties include, but are not limited

to the specific risks or uncertainties discussed in our reports that we file with the SEC.

We assume no obligation to update any forward-looking statements in this presentation or to update

any of the factors that may cause actual results to differ materially from those forecasted. All

information is given only as of the date indicated and should not be interpreted to imply anything

about the comparable information as of any other date. We do not undertake any duty to update

that information or indicate whether trends have continued or not continued other than in the filings

we make with the SEC.

7

IDT

Corporation

Motti Lichtenstein

Chief Operating Officer

8

About IDT

IDT OVERVIEW

Management and Employees

Dedicated professional team with operational excellence and financial discipline

Operating Businesses and Transaction

IDT has continually innovated and built new operating businesses

IDT will sell operating businesses for the correct price

Telecom

Largest Ethnic Prepaid Calling Calling Card Company

Selling approximately 280 million cards a year

Leading Global International Voice Carrier

Transporting over 20 billion minutes annually

Capital

Incubating, Building and Operating New Businesses

Spectrum

Largest Holder of 39 GHz Licensed Spectrum in the U.S.

9

Company Overview

IDT OVERVIEW

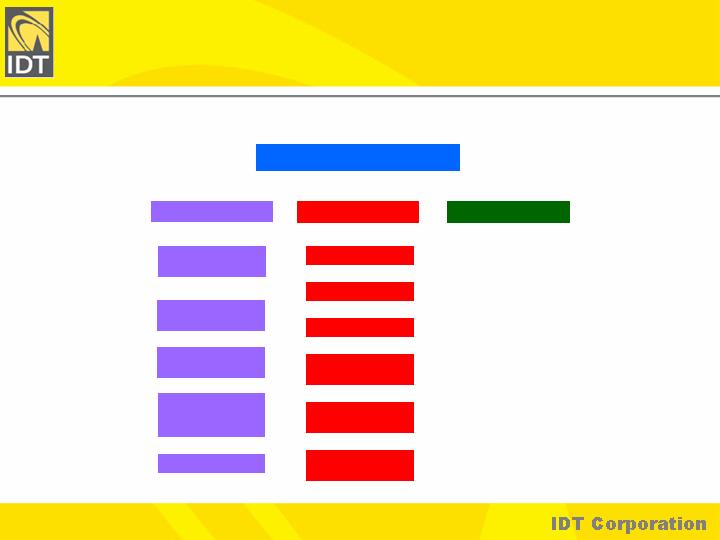

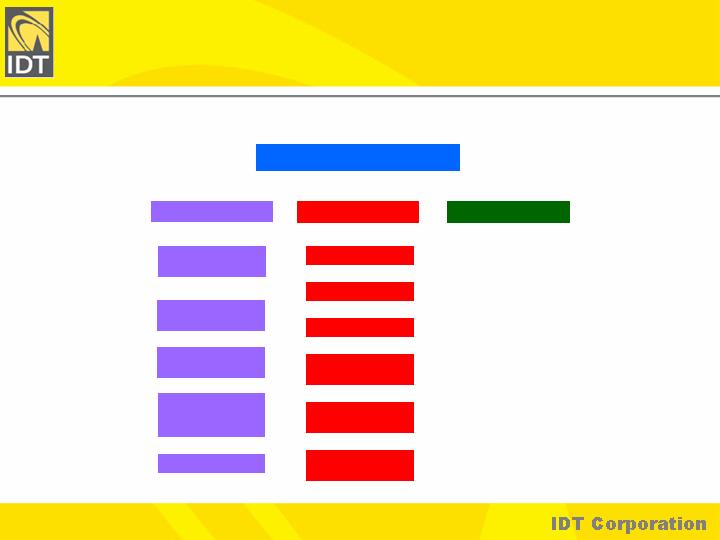

IDT Corporate

IDT Telecom

Calling Cards/

Prepaid Products

IDT Capital

IDT Spectrum

Consumer Phone

Services - US

Wholesale Carrier

Services

Other Initiatives

IDT Energy

IDT Local Media

Ethnic Grocery

Brands

Consumer Phone

Services –

International Sales

IDT Carmel

IDT Internet &

Mobile

Other Hispanic

Initiatives

10

IDT OVERVIEW

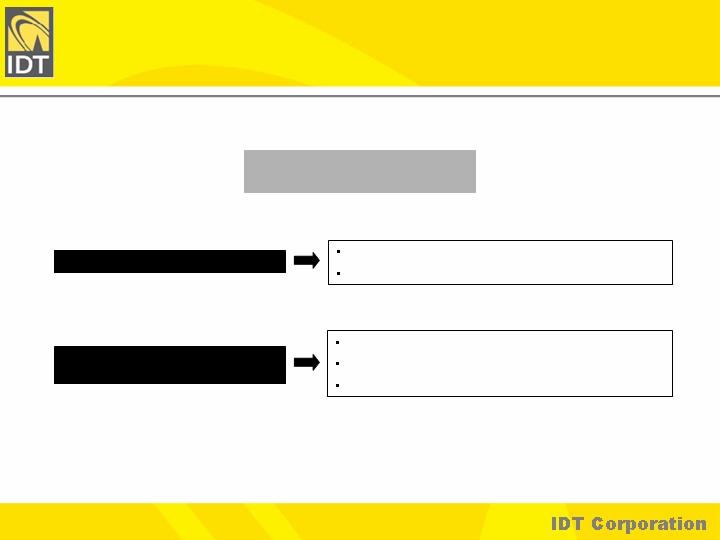

EXISTING OPERATIONS

OPPORTUNISTICALLY GROW

BUSINESS

Sustainable Free Cash Flow

Efficient Operations

That Fit our Risk Adjusted ROI Criteria

Strategically Fit with Existing Infrastructure and Businesses

Utilize Balance Sheet

Strategic Goals

BUILD SHAREHOLDER

VALUE

11

January 26, 2006- Remaining Winstar Operations & Liabilities Divested

March 3, 2006- Corbina Sold

March 13, 2006- Acquisition of Net2Phone Completed

3Q06 - Overhead Reductions Initiated

4Q05 – 4Q06- Open Market Buyback of 6.4 mm Shares ($79 mm)

4Q06 - IDT Energy surpassed 200,000 meters

September 29, 2006- Sale of IDT Entertainment to Liberty Media Completed

October 12, 2006- Sale of Toucan to Pipex Communications plc Completed

1Q07- Organizational Integration of Net2Phone Completed

January 9, 2007- JV with FFPM Formed; Debt Portfolios Purchased

Recent Events

IDT OVERVIEW

12

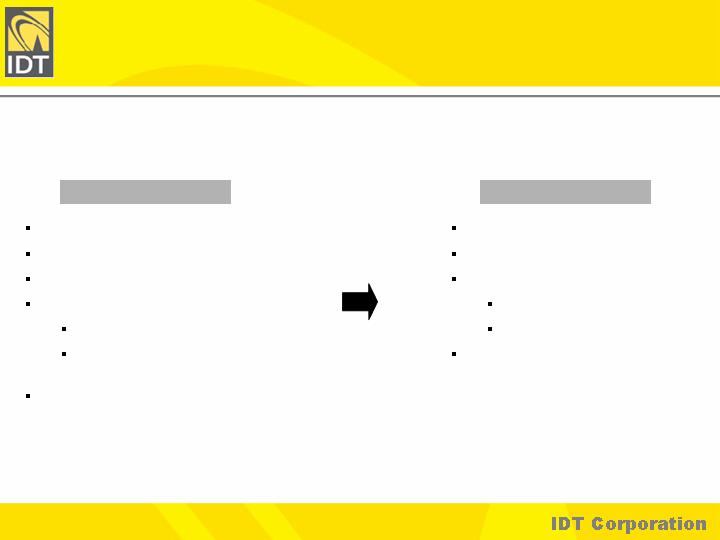

Transactions

Re-evaluation of all businesses

Integration of businesses

Efficiency in existing operations

Cost cutting initiated in 3Q06

Projected annual SG&A savings of

$35-40 million

Launch of new IDT Capital businesses

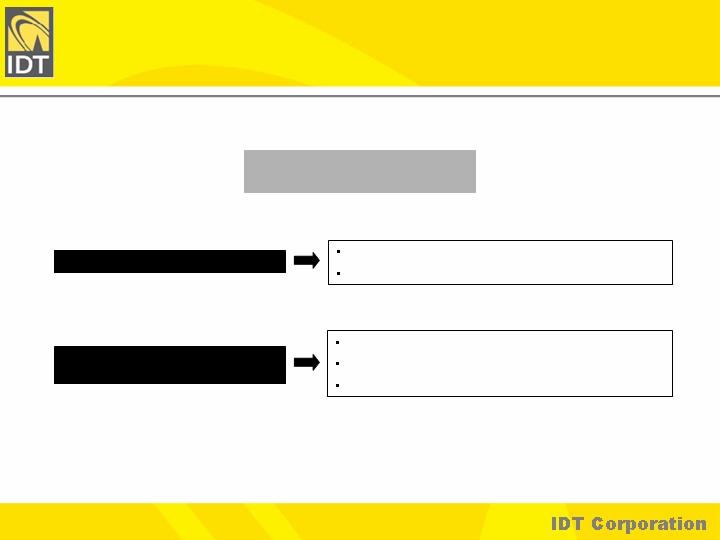

IDT In Transition

Stabilize IDT Telecom businesses

Pursue expansion opportunities

Deploy capital for future growth

IDT Capital

Technologies

Explore strategic alternatives for

IDT Spectrum

FISCAL 2006

IDT OVERVIEW

FISCAL 2007

13

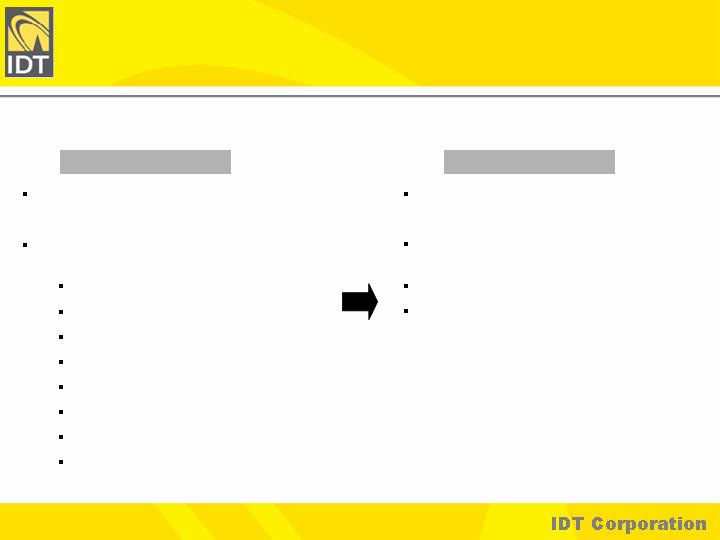

Mature Telecom Businesses

-and-

Many opportunities, with small amounts of

capital deployed to date:

Calling Card Expansion

International Telecom Expansion

IDT Energy

IDT Carmel

Ethnic Grocery Brands

IDT Local Media

IDT Internet Mobile

IDT Spectrum, etc.

IDT Portfolio in Transition

Mature Telecom Businesses

-and-

Focused deployment of capital to specific

businesses

Continued innovation of new business ideas

Retain opportunistic mindset to all

opportunities

TODAY

FUTURE

IDT OVERVIEW

14

IDT Portfolio – Plan for the Future

Operating

Businesses

IDT OVERVIEW

Efficient operations and generation of free

cash flow

Transaction

IDT will sell operating businesses for the

correct price

Growth

Concentrate on specific opportunities:

Build upon existing infrastructure

Leverage strength of IDT’s balance

sheet

Consumer oriented

Deregulating markets

Fragmented/undercapitalized

businesses

15

IDT

Corporation

Marcelo Fischer

Chief Financial Officer

16

Capital Deployment

IDT OVERVIEW

Goal

Allocate capital to the highest returning opportunities companywide

Financial Metrics

Absolute hurdle rate – Risk-Free Rate

Targeted base hurdle rate – 15% IRR (risk adjusted); 3 year timeframe

Investment Approach

IDT has significant cash on hand

IDT is comfortable waiting for the correct opportunities

In the interim, earn absolute hurdle rate

17

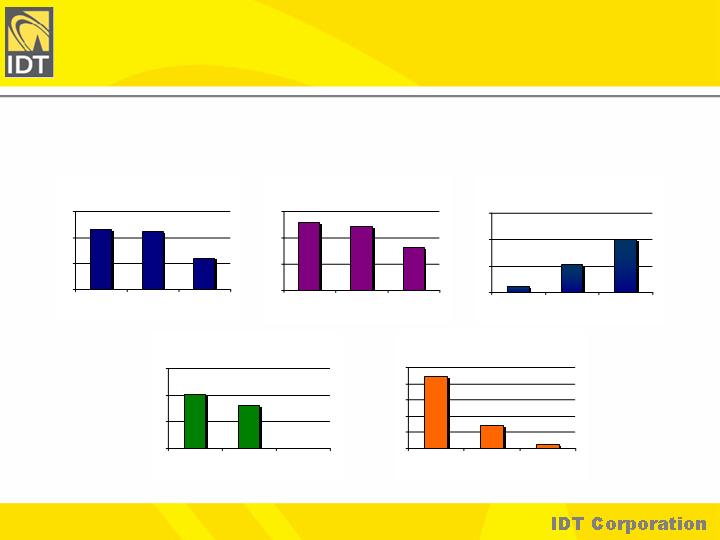

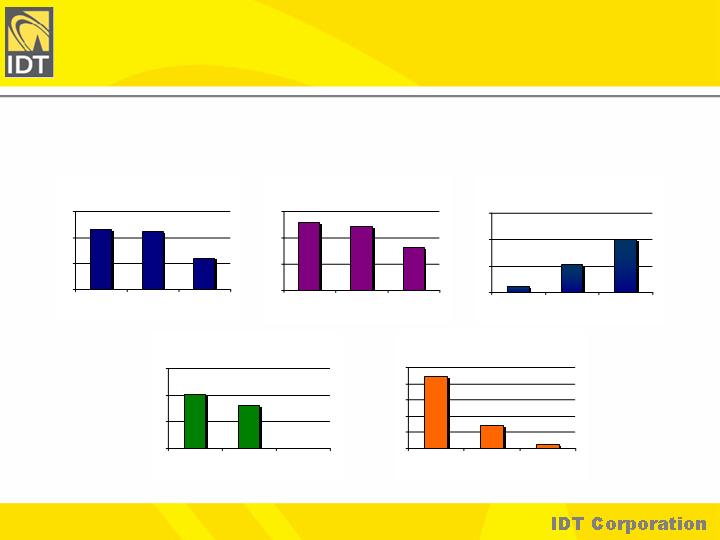

IDT OVERVIEW

Revenue by Division

The IDT “Portfolio”

$ in millions

18

Total IDT Corporation

400

500

600

700

1Q 05

1Q 06

1Q 07

Total IDT Telecom

300

400

500

600

1Q 05

1Q 06

1Q 07

Total IDT Capital

30

60

90

1Q 05

1Q 06

1Q 07

Total IDT Entertainment

30

60

90

1Q 05

1Q 06

1Q 07

Total IDT Solutions

1

2

3

4

5

1Q 05

1Q 06

1Q 07

Equity Structure

CLASS A

CLASS B

CLASS C

3 Votes/ Share

1/10 Vote/ Share

1 Vote / Share

9.8 mm

56.7 mm

15.2 mm

Howard Jonas, Chairman and Founder of IDT, controls 17.75 mm shares

21% economic ownership

63% voting control

Not Traded

IDT

IDT.C

6.3 mm options outstanding

$9.44 average strike price

Votes per Share

Shares Outstanding

Ticker (NYSE)

Information as of most recent filings

IDT OVERVIEW

19

Stock Buyback

Fiscal 2005

1.2 mm shares

$16 mm

Fiscal 2006

5.2 mm shares

$64 mm

14.9 mm shares from Liberty Media in sale of IDT Entertainment

Purchased 7.9 mm options held by employees

Remaining Buyback Authorization

24.5 mm shares

IDT will continue to be an opportunistic purchaser of its shares on the open market

IDT OVERVIEW

20

Cash per Share

As of October 31, 2006

Cash & Marketable Securities $808

Investments 52

Capital Lease Obligations (47)

Severance Accrual (11)

Regulatory Accrual (Telecom) (51)

Working Capital Adjustment Accrual (Entertainment) (20)

Net Cash $731

Shares Outstanding (undiluted) 81.7

Cash per Share: $8.95

Calculation excludes Mortgage Notes Payable and Offsetting Real Estate Assets

In millions

IDT OVERVIEW

21

Operating Cash Flow – 1Q07

Adjusted EBITDA*

Telecom $23

Capital 2

Solutions -

Corporate (14)

Total Adjusted EBITDA $11

Capital Expenditures (10)

Distributions to UTA Minority Partners (4)

Interest, Taxes 1

Working Capital Changes (Telecom / Corporate) (5)

Working Capital Changes (Capital / Solutions) (12)

FCF Before Other Items ($19)

Restructuring (5)

Telecom Regulatory Payments (8)

Free Cash Flow ($32)

In millions

*Adjusted EBITDA, as calculated: Gross Profit – SG&A + Non-Cash Compensation

IDT OVERVIEW

22

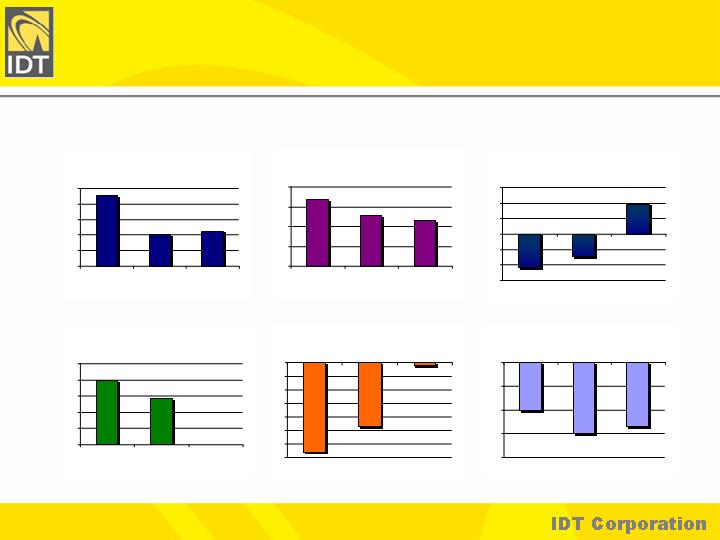

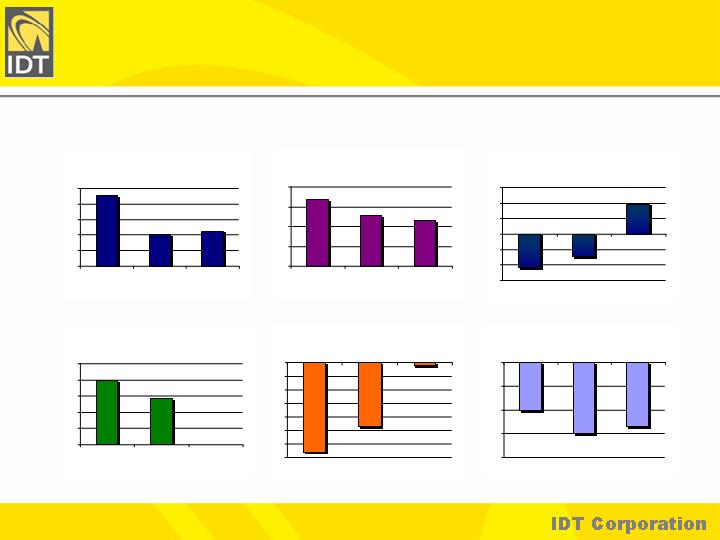

IDT OVERVIEW

$ in millions

Adjusted EBITDA by Division

*Adjusted EBITDA, as calculated: Gross Profit – SG&A + Non-Cash Compensation

23

Total IDT Corporation

5

10

15

20

25

1Q 05

1Q 06

1Q 07

Total IDT Telecom

10

20

30

40

1Q 05

1Q 06

1Q 07

Total IDT Capital

-3

-2

-1

1

2

3

1Q 05

1Q 06

1Q 07

Total IDT Entertainment

2

4

6

8

10

1Q 05

1Q 06

1Q 07

Total IDT Solutions

-7

-6

-5

-4

-3

-2

-1

1Q 05

1Q 06

1Q 07

Total Corporate

-20

-15

-10

-5

1Q 05

1Q 06

1Q 07

The Future of IDT

Howard Jonas

Chairman of the Board

24

IDT Corporate

Question and Answer

25

IDT Telecom

Yona Katz

Chief Executive Officer

26

We will provide a full suite of high-quality, favorably-priced communications

products and services to retail and wholesale customers worldwide

We will be driven by innovation and we will embrace technology, in order to

improve our products, services, processes and interaction with our customers

We will expand our operations internationally, taking advantage of the

numerous attractive opportunities presented by a constantly changing,

deregulating worldwide Telecommunications industry

We will remain focused on our ultimate goal: maximizing profits, cash flow and

shareholder value

Our Mission

IDT TELECOM

27

Market maturity and aggressive, price-based competition have resulted in

revenue declines in several key business units

New products and geographic markets have yet to gain traction, providing little

incremental revenue to offset core decline

Top-line pressure has continued into 2Q07

Steps to reverse trend could lead to narrower gross margins

Fixing the model:

Overall and unit profitability rebounding off 2Q06 low

SG&A expense savings began to materialize in 1Q07

Net2Phone integration proceeding

Will yield cost savings and revenue growth opportunities

IDT TELECOM

Current Status

28

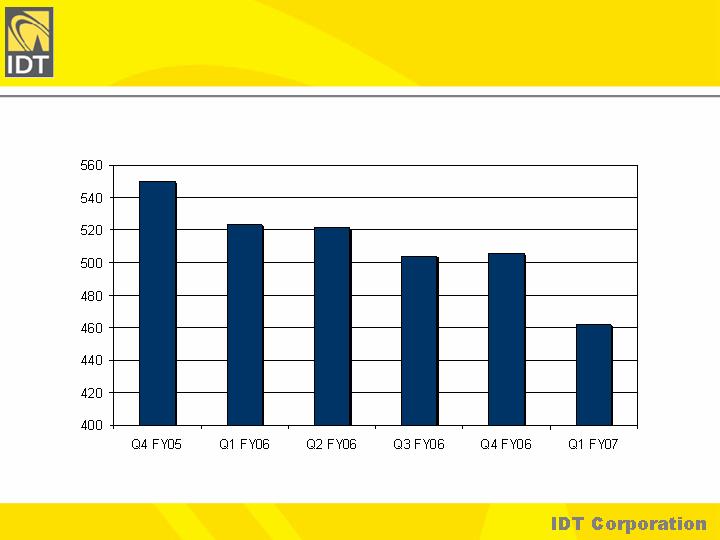

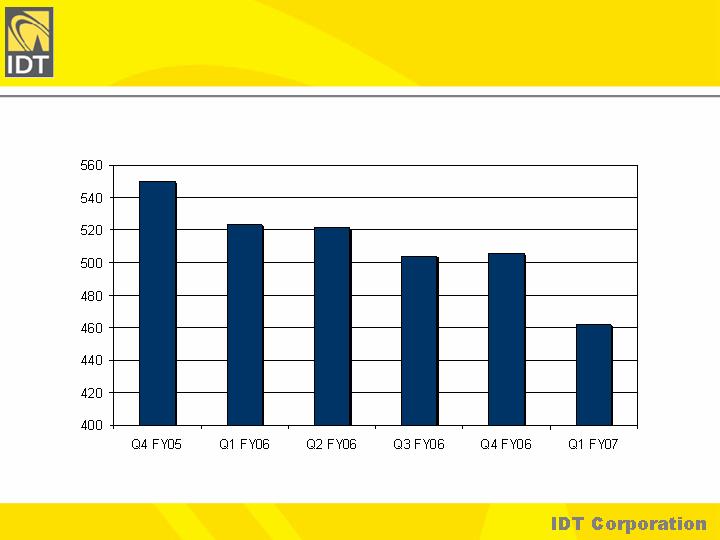

IDT TELECOM

Revenues

$ in millions

29

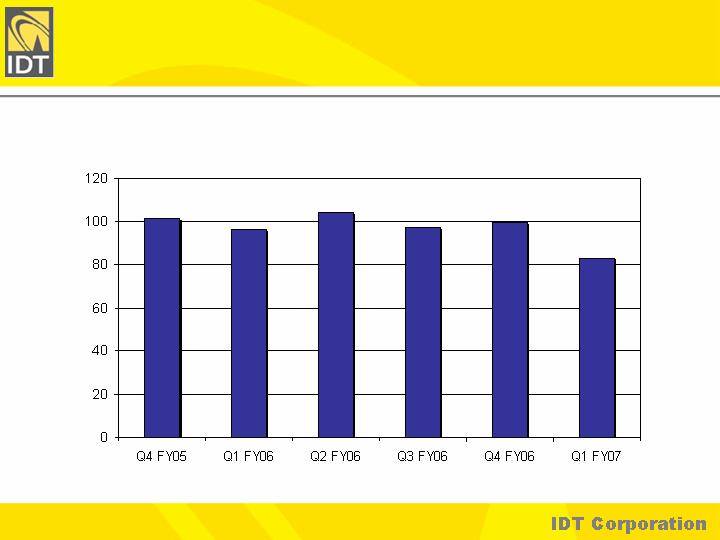

IDT TELECOM

Gross Margins

30

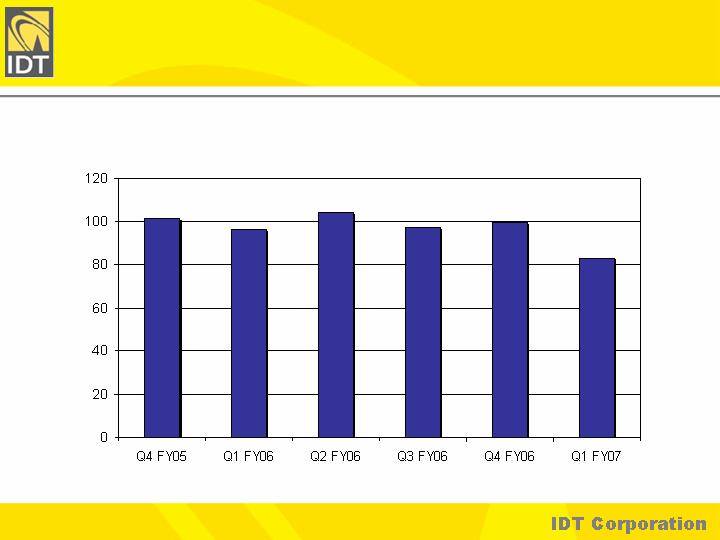

IDT TELECOM

SG&A Expenses

$ in millions

31

Includes impact of non-cash compensation.

IDT TELECOM

EBITDA

$ in millions

32

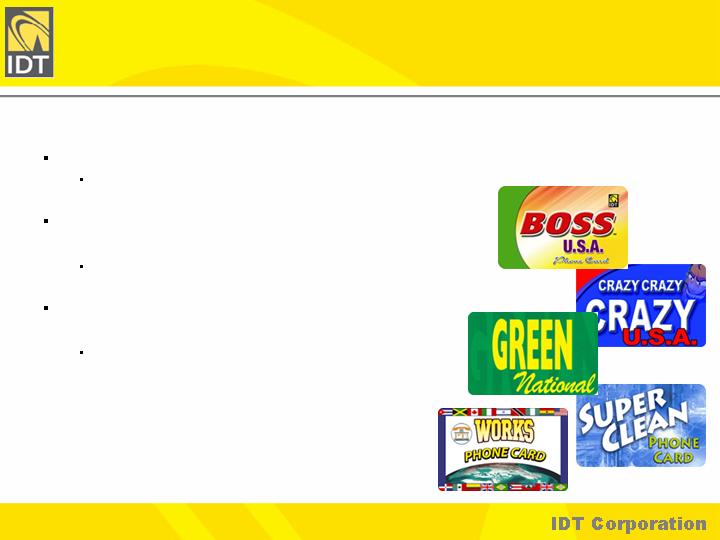

Prepaid Services

Calling cards (US/Europe/South America/Asia Pacific)

Wireless services (US/Europe)

Carrier Wholesale Services

Voice (US/Europe/South America/Asia Pacific/Africa)

Portfolio of Carrier Services

Consumer Phone Services

CPS (US)

Net2Phone reseller

Net2Phone Cable Telephony (NCT)

IDT TELECOM

Businesses

33

Market leader in world’s #1 prepaid calling card market

TTM net revenues of approximately $1.0 billion

Distributed through Union Telecard Alliance

joint venture

Over 200,000 retail points of sale nationwide

Prepaid Solutions (PPS) unit distributes cards

through some of the largest retailers in the U.S.

Walgreen’s, Sears, Kroger’s, BP, Exxon Mobil

and 7-11

IDT TELECOM

U.S. Calling Cards

34

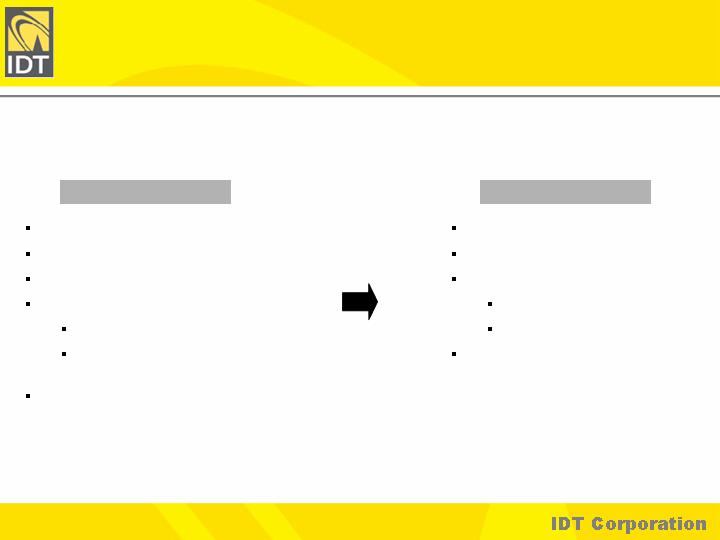

U.S. Calling Cards

Distribution network still too heavily

concentrated on East Coast

Mature, commodity product

Threatened by wireless substitution

Competition intensifying, resulting

in market share losses

Raises question of gross margin

sustainability

Continued build-out of nationwide

distribution network

Enhanced in-market, on-the-street

presence

TuYo Mobile will allow IDT to serve

its calling card customers’ wireless

needs

Selectively lower rates, where such

moves can be effective

Position IDT as high-quality, reliable

consumer friendly provider of calling

cards

IDT TELECOM

RISKS

RESPONSES

35

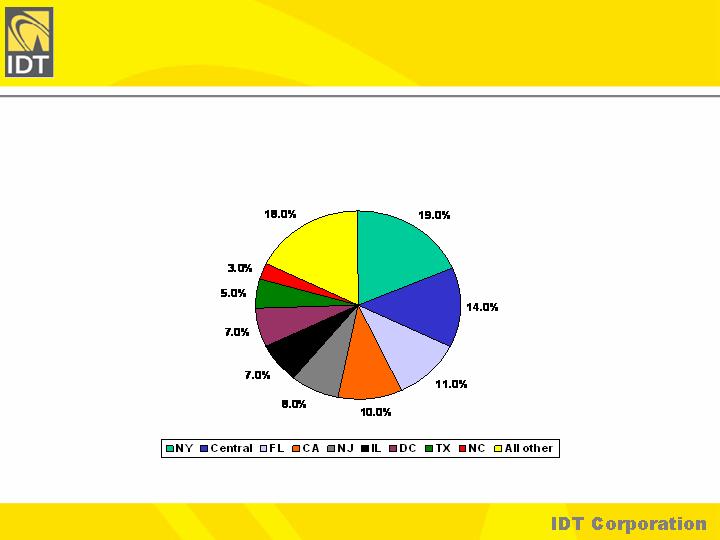

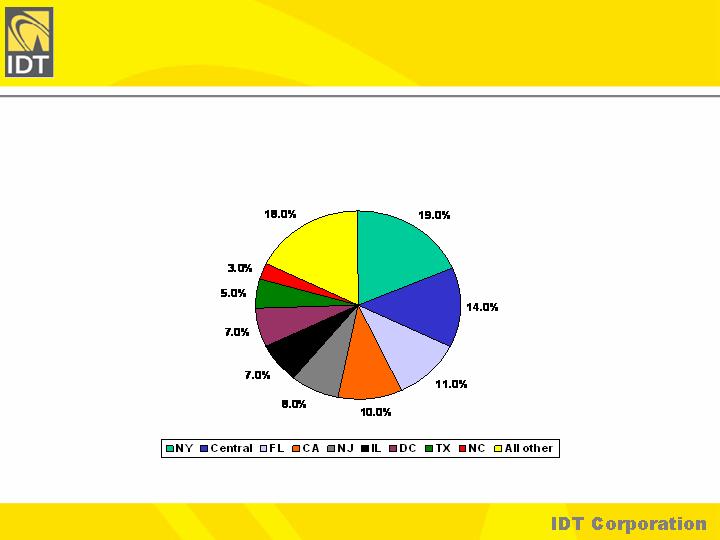

Based on minutes-of-use, FY 2007 to date.

IDT TELECOM

U.S. Calling Cards- Geographic

Breakdown

36

IDT TELECOM

Prepaid Wireless- TuYo

37

Pan-European operation

Sales in 19 countries

Expanding to 21 by year-end 2007

Headquartered in London, England

and Dublin, Ireland

Offices in 13 countries

Selling nearly 300 different cards

through various distribution channels

Including > 100,000 (3rd party) point-of-sale

activation (POSA) terminals

IDT TELECOM

Europe Calling Cards

38

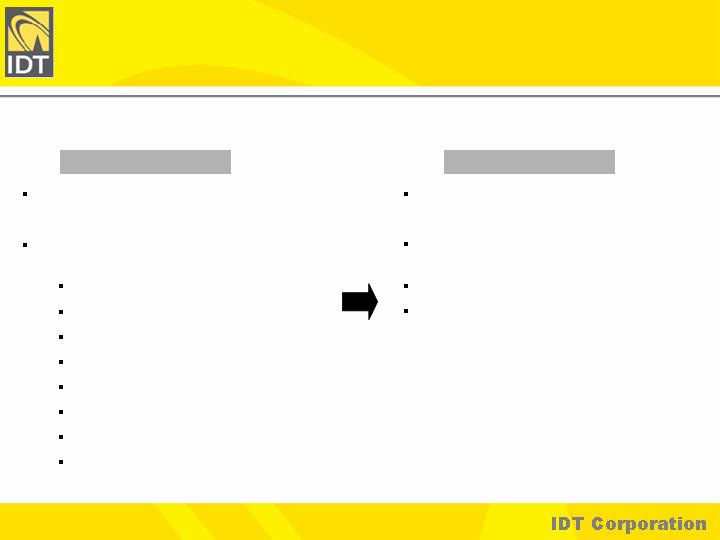

Market share losses to aggressive

competitors

“One-dimensional” distribution

network has narrow, limited reach

Changing customer needs require

new products

24 month investment plan launched

Allowing each market to cycle through

“investment” and “harvest” phases

Enabling electronic distribution

Development of point-of-sale activation

(POSA) terminal network

Adding prepaid MVNO and prepaid

debit card to product suite, and

enhancing feature set on traditional

card products

IDT TELECOM

Europe Calling Cards

RISKS

RESPONSES

39

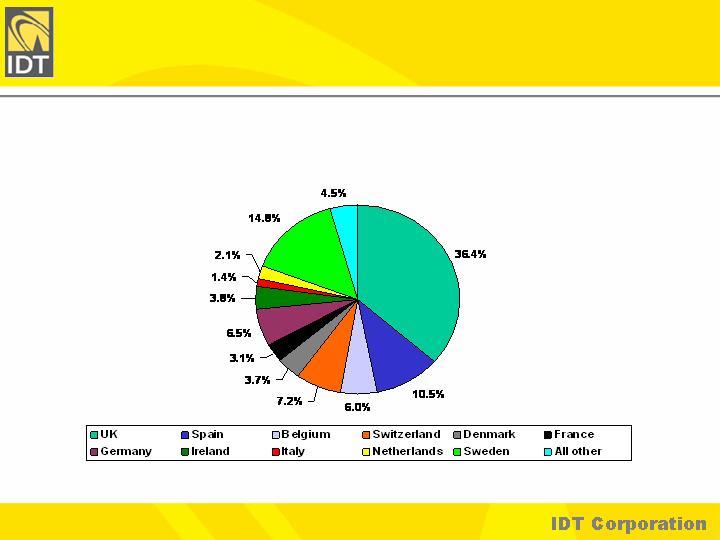

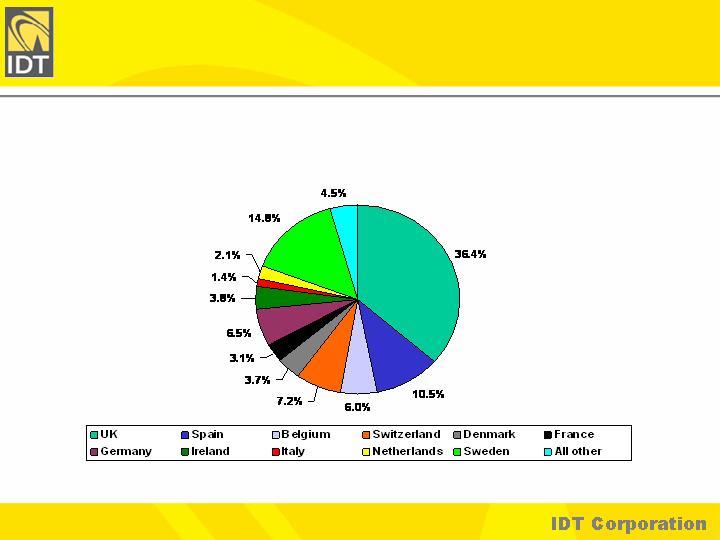

Based on minutes-of-use, November 2006

IDT TELECOM

Europe Calling Cards- Geographic

Breakdown

40

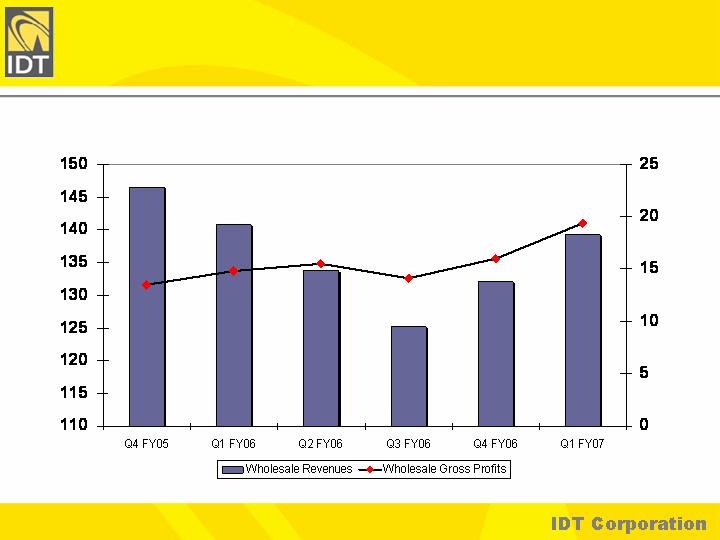

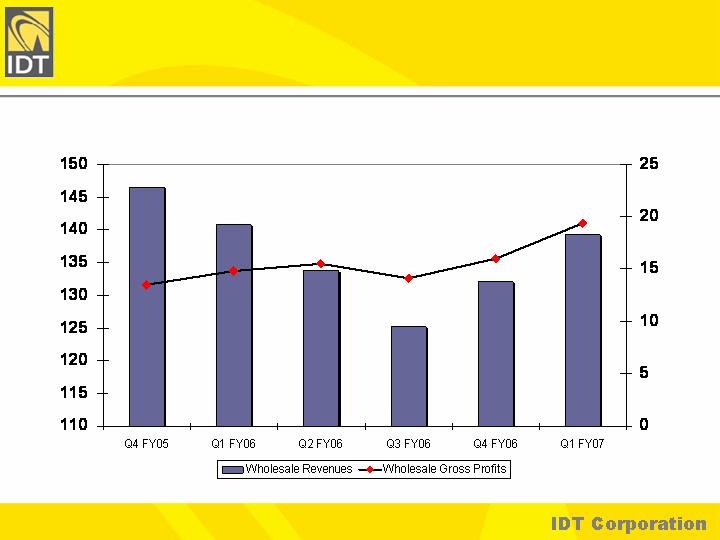

Historically an arbitrage-driven minutes trading operation

Wholesale business has evolved into a multi-faceted carrier services business

over the past few years

Serving > 500 carrier customers worldwide

Generating over $500 million in annual revenues

Offers a wide variety of services, including:

Voice Services

VoIP Solutions

Mobile Solutions

Fixed/Mobile Convergence

Platform Services

Also responsible for provisioning and routing minutes for IDT’s calling card

businesses

IDT TELECOM

Carrier Wholesale

41

Traditionally narrow margin

business, with questionable

customer loyalty

Customers increasingly seeking IP

interconnection and related

services

Mobile carriers accounting for a

growing share of the global

wholesale market

Addition of higher-margin,

“contracted” revenues from strong

partners

Cable companies

Integration of NTOP network

Speeding up IDT network’s IP evolution

IDT now offers a full suite of

services targeting mobile carrier

customers, including:

Voice premium routing service

Inter-carrier SMS/MMS services

Premium messaging services

Mobile partnering service

IDT TELECOM

Carrier Wholesale

RISKS

RESPONSES

42

IDT TELECOM

Carrier Wholesale

$ in millions

43

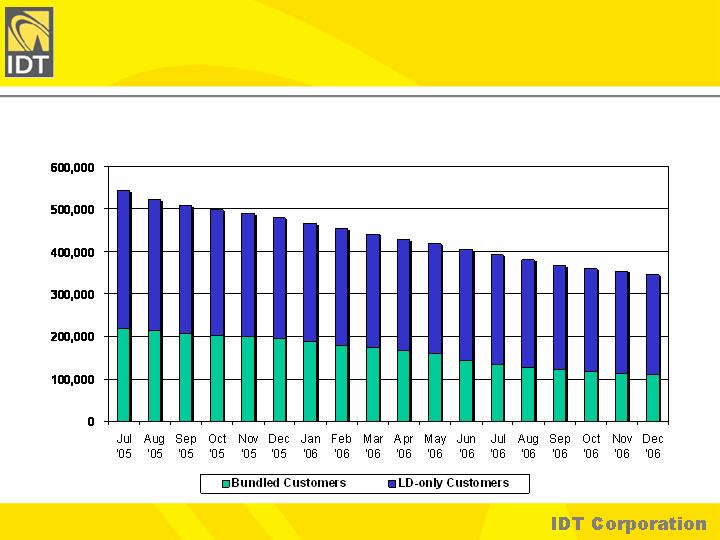

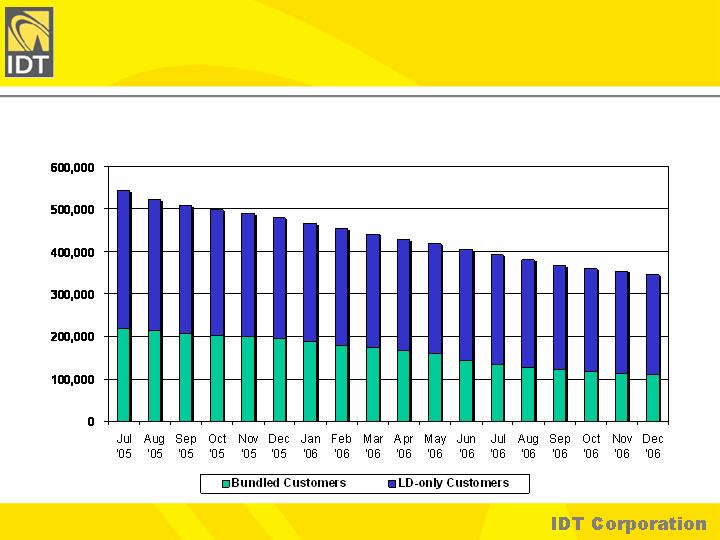

Local and long distance (LD) voice services

Broadband Internet access

VoIP services

Satellite TV

Sold to residential and small business customers

Bundled local and LD customers: ~110,000 in 13 states (as of 12/31/06)

LD-only customers: ~235,000 nationwide (as of 12/31/06)

Recently launched IDT Passport

Internationally-targeted LD service

1Q07, launched two new services

IDT Voiceline

IDT Triple Play

IDT TELECOM

Consumer Phone Services (CPS)

44

With abolishment of UNE-P rules in

late 2004, costs have increased,

making it more difficult to compete

with incumbent carriers

Residential VoIP taking some

market share from traditional

wireline services

Local calling and domestic LD

markets provide little opportunity to

undercut competition

Base business in harvest mode,

steps have been taken to increase

profit/customer

Launched IDT Voiceline, powered

by Net2Phone

IDT Passport, targeting

international callers

provides significant cost savings vs.

incumbents, while allowing IDT to

generate healthy margins

IDT TELECOM

Consumer Phone Services (CPS)

RISKS

RESPONSES

45

Voiceline

Residential Internet Telephone Service

Unlimited local and long distance to US, Canada and Puerto Rico

$19.95 per month through 1/31/07

$5.00 less than Vonage

Free modem; no installation fee

Customer Pitch

Value

Significantly lower than traditional phone service or other VoIP competitors

Feature Rich

Reliability

30 day money back guarantee

Simple

Easy to install

Migrate existing number

IDT TELECOM

Consumer Phone Services (CPS)

46

IDT TELECOM

Consumer Phone Services (CPS)

47

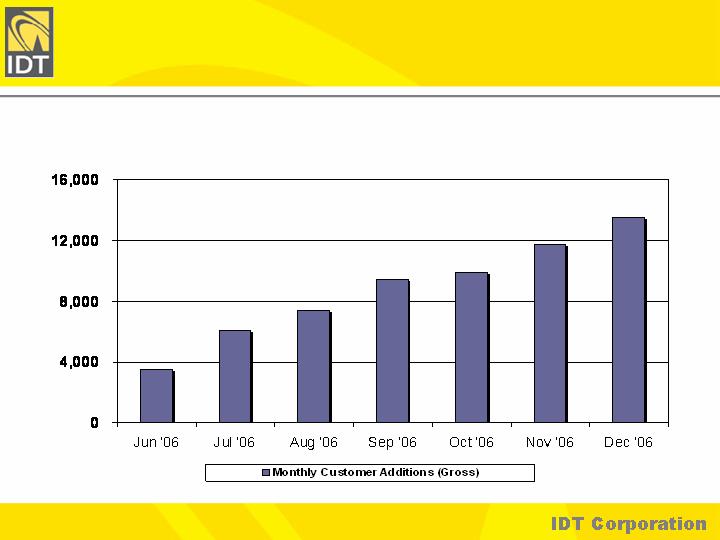

IDT TELECOM

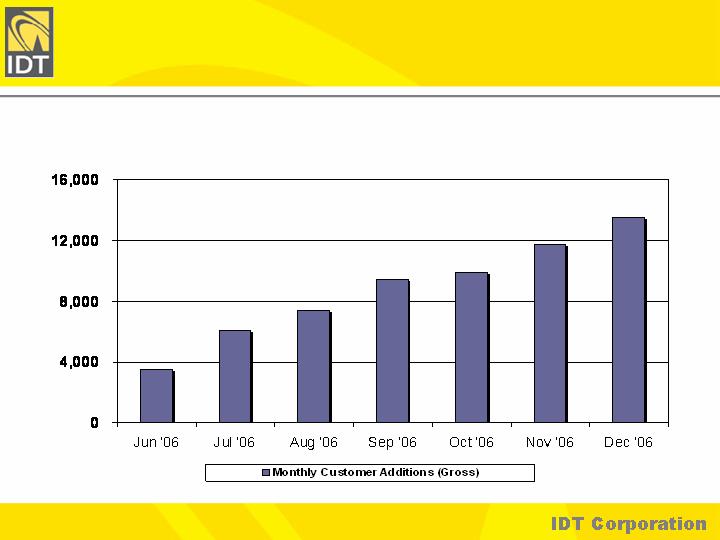

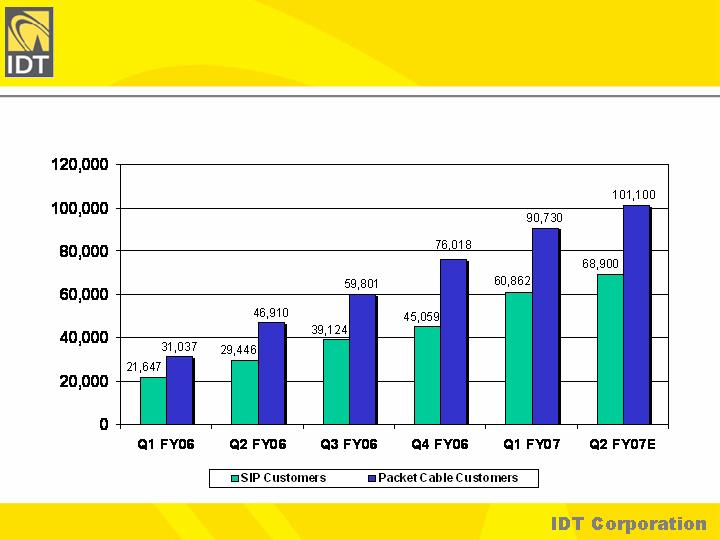

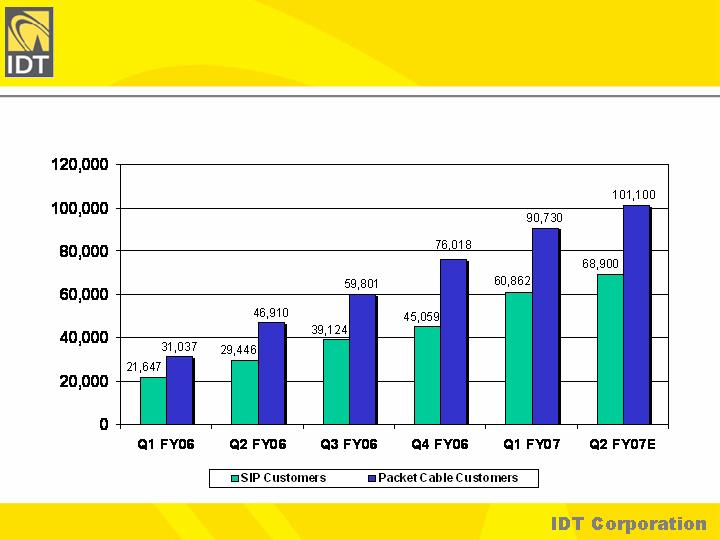

VoIP Customers

48

Use forward-ROI approach to determine investment potential of each business

existing and potential

Monetize businesses whose projected future cash flows fall below ROI

threshold

via sale or harvest

Take advantage of existing network capacity to add incrementally profitable

minutes

Allocate financial and human resources towards areas of highest growth and

return potential

IDT TELECOM

The Plan

49

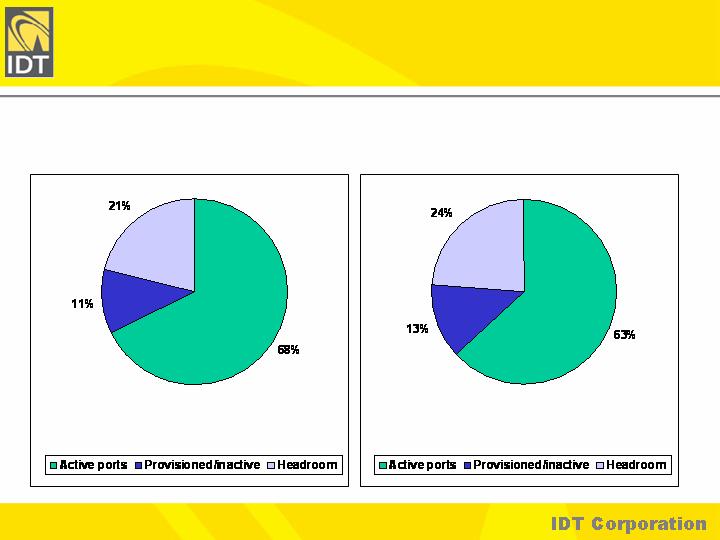

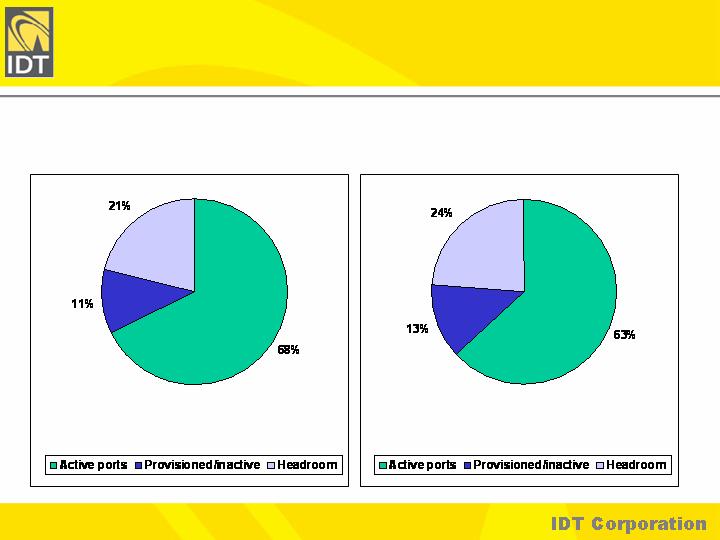

January 2006: 843,594 total ports

January 2007: 844,338 total ports

IDT TELECOM

Global Telecom Network Capacity

Utilization

50

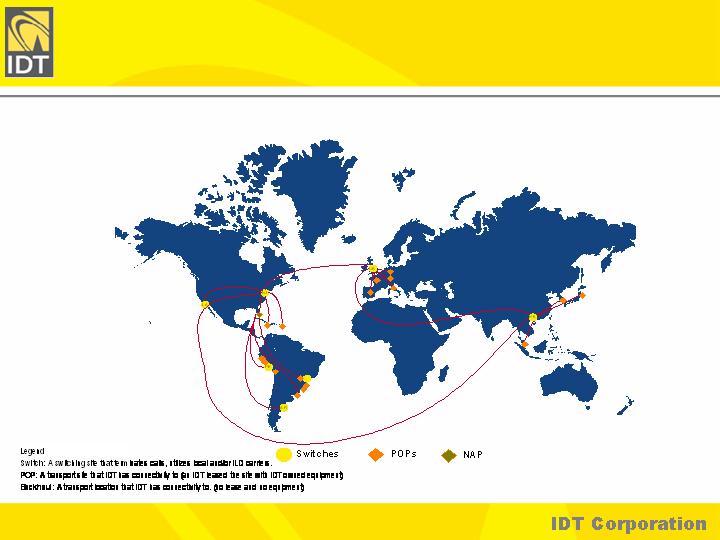

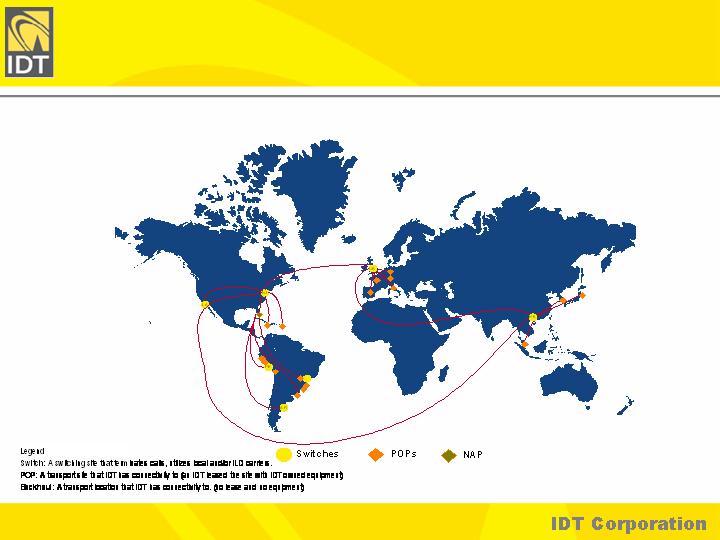

Global Network Topology

IDT TELECOM

IDT Telecom

Question and Answer

52

IDT Capital

David Greenblatt

Co-Chief Executive Officer

53

The Business Development Incubator for IDT

Provides a process-driven infrastructure for business development

Assess, filter and process new opportunities for IDT

With strict financial discipline and analysis

IDT Capital is Focused on Businesses that

Are consumer-oriented

Build upon IDT’s existing infrastructure and expertise

Leverage the strength of IDT’s balance sheet

What is IDT Capital?

IDT CAPITAL

54

IDT Capital Incubation Process

IDT CAPITAL

Model the Opportunity

Research

Identify key assumptions

Design business model/project plan based on the assumptions

Create a budget to test the opportunity

Test the Model

Create a small test of the target business (with internal IDT business, if applicable)

Validate key assumptions in advance of significant capital deployment

Build an Accretive Business

Evolve successful “test” into a successful businesses

Identify and hire the correct management team to bring the business to the next level

Operate the Business

Execute as an ongoing business operation

Bring business to cash-flow positive

Stand-Alone Business Unit

55

IDT Energy

Gas & Electric ESCO (Energy Service Company) in New York State

IDT Carmel

Receivables Purchasing/Sales and Contingency Collections

IDT Internet Mobile

Zedge

Content-focused business, at the intersection of Mobile platforms and the Internet

Capital Companies

IDT CAPITAL

56

IDT Local Media

CTM Brochure Display, WMET Radio, New Media

Local advertising opportunities

Ethnic Grocery Brands

Vitarroz

Branding and distribution of ethnic oriented grocery products

IDT Global Services

Call Center and BPO (Business Process Outsourcing) Services

IDT Hispanic

Ingles Para Hoy (ESL), Confie Seguros (Insurance), Sigo (Financial Services)

Hispanic consumer focused business initiatives

Capital Companies (continued)

IDT CAPITAL

57

IDT Energy

IDT CAPITAL

IDT Energy Vision

Create a large and robust base of retail energy customers

Low customer cost of acquisition

Low churn

Through multiple products and services

Focus on brand awareness

Up-sell additional energy oriented products and services

Continually enhance the customer experience

IDT Energy is the Energy Solution for its customers

IDT ENERGY

59

Deregulation

Non-utilities can resell natural gas and energy

In New York State, deregulation model offers resellers low risk programs

Purchase of receivables (POR)

Utility-provided billing

Dual meters (natural gas and electricity) available for resell

Dynamic supply management, with mature markets for buying energy

Other states have been slow to adopt the New York State model

Low Risk

Customer acquisition costs are recouped in first ~6 months

Receivables are guaranteed by the utilities

Customers are on a variable rate plan

Builds on Existing Infrastructure

Leverages IDT’s balance sheet

Letters of credit and guarantees provide IDT Energy with the flexibility to manage

scheduling and purchasing of energy and natural gas

IDT Energy’s ESCO Business

IDT ENERGY

60

New York State ESCO Market Landscape

New York State Total Meters:

Natural Gas Meters:

Upstate: 1,300,000

Downstate: 1,400,000

Electric Meters:

Upstate: 2,500,000

Downstate: 3,000,000

Market Breakdown of IDT Meters

Upstate: 48,500

Downstate: 209,500

NY State meter count source: PSC website

IDT Energy meter count: as of Oct. 31, 2006

IDT Energy has Captured Over 20% of the New York

Residential ESCO Market

IDT ENERGY

61

Where are we now?

Regulatory-friendly regions within NY State

Upstate utility markets (NFG, NIMO/National Grid, RG&E)

Downstate utility markets (Central Hudson, Con Edison, Keyspan, Orange & Rockland)

How do we acquire customers?

Residential consumers

Door-to-door sales strategy

Refer-a-friend program

Web portal

Direct mail

Small businesses

Agent programs

Strategy forward

Grow New York footprint

Expand into new territories as they embrace a deregulated environment similar to NY State

Up-sell additional products and services to our existing ESCO customers

IDT Energy’s ESCO Business

IDT ENERGY

62

Competition/Marketing Risks

Competitors with deep pockets and large marketing budgets may enter the market

Current ESCO discount may prove insufficient to convince customers to switch from incumbent

providers

Comparison shopping as customers and the market matures

Political Risks

New York State pro-deregulation policy could reverse

Expansion beyond New York State requires favorable ESCO environment in other states

Enactment of a do-not-knock law could stop or restrict door-to-door marketing campaign

Commodity Risks

Volatility in pricing could force IDT Energy to pass along higher costs to our customers, which

could increase churn

Weather (warm or cool) can effect customer usage

High volume/Low margin business

General ESCO Risk Factors

IDT ENERGY

63

The Portal Opportunity

Internet offers the infrastructure for the world to shop for energy products and information

One-stop source for energy consumers

Comprehensive energy information to better understand the energy industry and how it impacts their home

IDT Energy Portal

Multiple web environments designed to cover the broad field of energy

ESCO customer acquisition - www.idtenergy.com

E-Commerce - www.shopidtenergy.com

Traditional products

Energy efficient products

Alternative energy products

Sale of our energy services

Information and expertise - idtenergy.wordpress.com

Social Community

Goal

Interact with our energy customers

Build a web brand

Act as a consolidator, private-labeling energy products

Develop and maintain a master database of energy users

Keep a finger on the pulse of energy consumers

IDT Energy Web Portal

IDT ENERGY

64

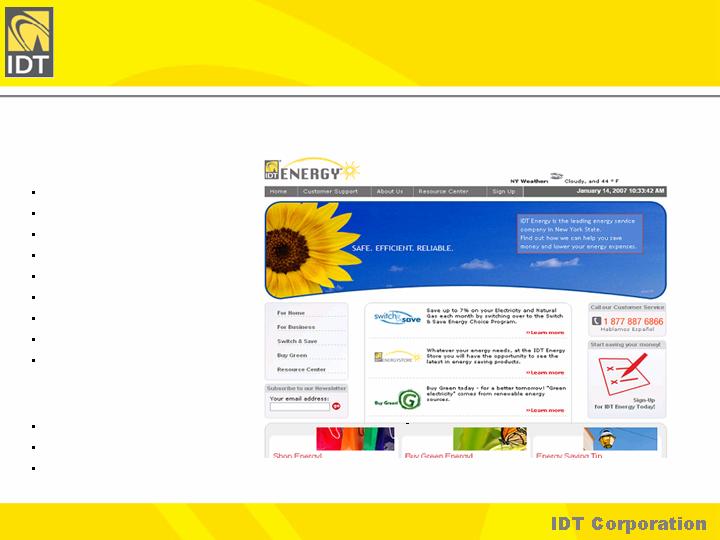

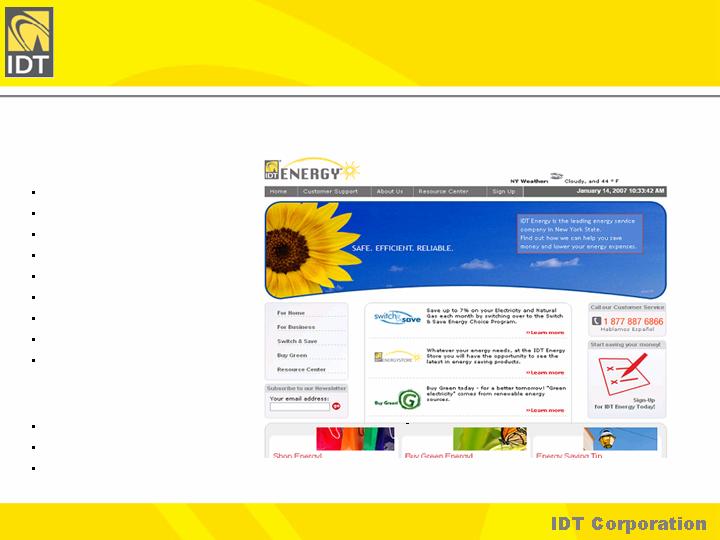

www.IDTENERGY.com

Main E-Commerce Site

New customer acquisition

Online bill pay

Customer Stories

Energy Saving Tips

Entry to blogs/social community

Green Energy Information

Education

News

Links to energy sites

Services

Home Energy Audits

Energy Insurance

Weatherization

IDT ENERGY

65

www.IDTENERGYSTORE.com

Traditional energy products

Batteries

Thermostats

Filters

Energy efficient products

Heat Pump

Humidistats

Propane Heaters

Alternative energy products

Hydropower

Power Panels

Solar Air Heating

IDT ENERGY

Additional products and

services continuously

added

66

Key Economic Drivers

Number of Customers/Meters

Consumption

Price per Unit

Customer Acquisition Cost

Drives volume and revenues

Determined by weather patterns, drives

volume and revenues

Generated by capturing and managing costs

and rate setting

Together with customer turnover determines

the rate of return of the business

IDT ENERGY

67

Number of customers needed to cover fixed SG&A: ~120,000

Number of customers at end of 1Q07: ~180,000

Number of energy meters at end of 1Q07: ~258,000

Incremental Customer Acquisition

Acquisition cost payback period: ~6 months

IRR assuming avg. customer life of 3 years: 152%

IDT Energy – Key Financials Metrics

IDT ENERGY

Based on current churn expectations

68

IDT Energy – 1Q07 Financial Highlights

Revenue $36

Direct Cost 28

Gross Profit $8

Gross Margin 22%

Impact of Market Pricing Opportunities $6

Normalized Gross Profit $2

Gross Margin 6%

Model assumes ~6% gross margin

In millions

IDT ENERGY

69

IDT CAPITAL

Consumer Debt Growth

Consumer charged off debt growing at a ~14% CAGR since 1993

Charge-offs and delinquency rates have decreased over the last 5 years, with a slight

increase over the last two quarters

Creditors

Consolidation amongst the largest issuers of credit card debt has led to larger portfolios

offered for sale

Collection Industry

Industry generated $9.5B in revenue in 2004

Majority of revenue concentrated in top five contingency collection firms

Debt Buying

Top 15 debt buyers purchase approximately 80% of all debt that is sold in today’s market

Consumer debt portfolio pricing has increased in the past two years

20% average price increase for national portfolios

Consumer Debt Industry Overview

IDT CARMEL

71

Consumer debt focus – opportunity still maturing

Room for a big player - 95% of the players generate less than $8 mm annual revenue

International opportunities - international debt markets are opening up

$48B in face value was purchased in international markets in 2005

Brazil, Mexico and Poland

Maintain a strong balance sheet with minimal capital at risk

Purchased portfolios are a highly liquid asset; real market value that can be resold

Leverages existing IDT infrastructure & relationships

IDT as corporate parent lends legitimacy to the business

Relationships in the Telecom & Utilities industries lend themselves to the possibility of

purchasing and collecting debt from those sectors

IDT has presence in international markets with infrastructure in every major region

The “Fit” Into IDT Capital

IDT CARMEL

72

Build strong management

Maintain balance between purchasing and contingency collections

Accelerate portfolio purchases

Strategic acquisitions - niches, along with management expertise

Maintain balance between collecting purchased debt in-house and through an

established outsourcing collection network

Strategy For Growth

IDT CARMEL

73

Portfolio Pricing

Margins can be impacted as excess liquidity and growth pressures may lead to aggressive

portfolio purchasing, causing portfolio prices to increase

Availability of Portfolios

Purchase of more lucrative portfolios is often relationship driven

Economic Environment

Employment and general economic conditions could alter consumer’s ability to repay debt

Execution

Inefficient collection process can diminish liquidation rates and increase collection costs

Debt purchasing analytics must be strong to ensure profitability

Legal & Legislative

Industry heavily regulated at both the Federal and State levels

Risk Factors

IDT CARMEL

74

First Half Fiscal 2005 - Launched IDT Carmel

June 2006 - Acquired Big Ten Capital Management, a debt purchasing company

located in Minnesota

FY 2006 - Trained and built collection staff in Minnesota and Israel

~120 employees today in Minnesota and Israel, 75 collectors

FY 2006 - Executed many small and medium debt portfolio purchases and sales

Acquired Big Ten with ~50 portfolios

Purchased additional face value of ~$250 mm, at a cost of ~$13 mm (1Q07: $6 mm)

Flips and resales generated proceeds of ~$5mm (1Q07: $4 mm)

IDT Carmel - Timeline

IDT CARMEL

75

January 2007 - Formed joint venture with First Financial Portfolio Management

(FFPM)

JV to purchase fresh credit card debt from a major financial institution

Forward-flow portfolio for a total of twelve months

Total over twelve months will range from $45 mm to $121 mm

FFPM is a debt purchasing/collections company with over 30 years of

management experience

FFPM is managing the JV, subject to Carmel’s approval of major decisions

Purchasing fresh debt

No post charge off collection attempts

Fresh forward-flow debt is infrequent in the debt purchasing market, as creditors generally

first outsource such debt for collection

Joint Venture Overview

IDT CARMEL

76

IDT Internet Mobile

IDT CAPITAL

Consumer

Attractive product to build a brand identity

Early stages

First mover advantage

Zedge is the largest Internet Mobile portal today

~3.7 million users

~500,000 pieces of content

Minimal Risk

Small acquisition price, and minimal investment necessary for further build out

Build on existing infrastructure and expertise

IDT Entertainment experience in content

Net2Phone technological expertise

Business Characteristics - IDT’s Opportunity

IDT INTERNET MOBILE

78

Exploding demand for content on mobile devices

Driven by mobile phone penetration, and wireless broadband service

Mobile content market is presently PC based

Load content from PC to mobile device

Nascent space

No incumbent

Zedge is presently the largest portal

User generated content

Growing popularity, similar to MySpace, YouTube, Flickr, etc.

Alternative to the ‘Walled Gardens’ of standard mobile operators and content providers

Mobile community sites

Will link users to the web, and to other users on their mobile phones

Commerce platforms

Affiliate programs have emerged which empower web sites to sell content for mobile phones

Industry Overview

IDT INTERNET MOBILE

79

Global destination

Users are global

~11% US and UK based

Rapidly adding users

Zedge has acquired over 3.7 million registered users in 2 years

Adding 165,000 registered users per month

Content leader

~500,000 unique pieces of mobile content

Adding ~45,000 pieces per month

Broad based approach

We also own a US Latino social community – Mimun2.com

IDT Internet Mobile - Today

IDT INTERNET MOBILE

80

Competition

Many others are making significant investments in the mobile community

and content aggregation markets

Low barriers to entry

Revenue Model

Other than ringtones, mobile content has yet to become a significant

source of revenues in the US market

Risk Factors

IDT INTERNET MOBILE

81

User Forums

>500,000 posts

Mobile Applications

Screensavers

Wallpapers

User Generated Content

~500,00 pieces

User Profiles

~100,000

The Zedge Experience

IDT INTERNET MOBILE

82

Financial Overview

Purchase Price: $3.4 million

paid over 2 years

Ownership Acquired: 90%

Planned Investment: $7 million

IDT INTERNET MOBILE

83

Build the brand

Become a household name for the purpose of obtaining mobile content

Mobile portal for all types of products and services

Growth

User base

Increase user base through viral and targeted marketing

Goal is to have 5.5 million registered users by the end of FY07

Content

Increase content through users and toolsets

Goal is to have 650,000 pieces of content by the end of FY07

Revenue Model

Increase monthly page views

Increase traffic from monetizable locations (e.g. US/UK)

Sell CPM or sponsorship type advertising

Create premium areas for paying Zedge members

IDT Internet Mobile - Strategy

IDT INTERNET MOBILE

84

IDT Capital

Question and Answer

85

IDT

Corporation

Ira Greenstein

President

86

IDT

Corporation

Thank You for Attending

87