| UNITED STATES | ||

| SECURITIES AND EXCHANGE COMMISSION | ||

| WASHINGTON, DC 20549 | ||

| SCHEDULE 14A | ||

| (RULE 14a-101) | ||

| SCHEDULE 14A INFORMATION | ||

| Proxy Statement Pursuant to Section 14(A) | ||

| of the Securities Exchange Act of 1934 | ||

| Filed by the Registrant / X / | ||

| Filed by a Party other than the Registrant / / | ||

| Check the appropriate box: | ||

| / X / | Preliminary Proxy Statement. | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). | |

| / / | Definitive Proxy Statement. | |

| / / | Definitive Additional Materials. | |

| / / | Soliciting Material Pursuant to § 240.14a-12. | |

| PUTNAM FUNDS TRUST | ||

| (Name of Registrant as Specified in its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, | ||

| if Other Than the Registrant) | ||

| Payment of Filing Fee (Check the appropriate box): | ||

| / X / | No fee required. | |

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction | |

| computed pursuant to Exchange Act Rule 0-11 (set forth the | ||

| amount on which the filing fee is calculated and state how it | ||

| was determined): | ||

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| / / | Fee paid previously with preliminary materials. | |

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule | |

| 0-11(a)(2) and identify the filing for which the offsetting fee was paid | ||

| previously. Identify the previous filing by registration statement | ||

| number, or the form or schedule and the date of its filing. | ||

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

A message from Putnam Investments and the Trustees of the Putnam funds

Putnam Global Industrials Fund

A few minutes of your time now can help save time and expenses later.

Dear Fellow Shareholder:

We are asking for your vote on an important matter affecting your investment in Putnam Global Industrials Fund. This fund will hold a shareholder meeting on May 15, 2019 in Boston, Massachusetts, to decide the proposal described below. We are asking you — and all shareholders — to consider and vote on this important matter.

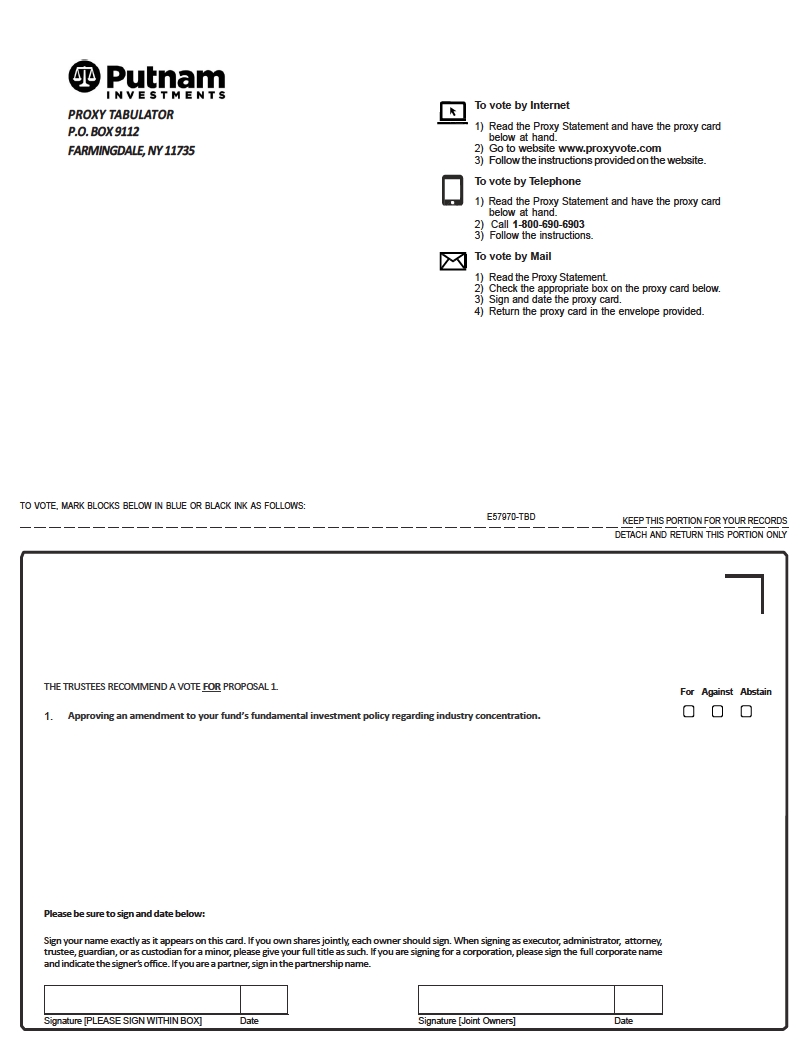

You may vote conveniently by:

• Visiting the website listed on the proxy card.

• Calling by telephone, using the toll-free number listed on the proxy card.

• Mailing the enclosed proxy card — be sure to sign, date, and return the card in the enclosed postage-paid envelope.

Of course, you are also welcome to attend the shareholder meeting on May 15, 2019 and vote your shares in person on the proposal:

1.Approving an amendment to your fund’s fundamental investment policy regarding industry concentration.

This change will give the fund flexibility to invest across a broader universe of assets by eliminating the portion of the fundamental investment policy requiring that the fund normally invest at least 25% of its net assets in the industrial products, services or equipment industries. The fundamental investment policy currently provides that the fund will not invest more than 25% of its total assets in any one industry, except that the fund will normally invest at least 25% of its net assets in the industrial products, services or equipment industries.

The amendment to your fund’s fundamental investment policy is being proposed in connection with an expected repositioning of your fund, as described below. Pursuant to the repositioning, the fund is expected to undergo the following changes, whether or not the proposed amendment to your fund’s fundamental investment policy is approved by shareholders:

•The fund’s name will change to “Putnam Focused Equity Fund.”

•The fund will change its investment strategies to hold concentrated equity positions without a geographic or industry emphasis.

•The fund’s existing policy (under normal circumstances) to invest at least 80% of its net assets in securities of companies in the industrial products, services or equipment industries will be revised so that the fund (under normal circumstances) will invest at least 80% of its net assets in equity investments.

•The fund’s existing policy (under normal circumstances) to invest in at least five different countries and at least 40% of its net assets in securities of foreign companies (or, if less, at least the percentage of net assets that is 10% less than the percentage of the fund’s benchmark represented by foreign companies, as determined by the providers of the benchmark) will be eliminated.

•The fund’s benchmark will be changed from the MSCI World Industrials Index (ND) to the S&P 500 Index.

These changes are expected to occur on June 24, 2019, the anticipated effective date for the repositioning of the fund and the anticipated closing date of the proposed merger of Putnam Global Natural Resources Fund into the fund. Shareholder approval is not required for these changes, and you are being asked to vote only on the proposed amendment to the fundamental investment policy on industry concentration. If shareholders do not approve the proposed amendment to the fundamental investment policy, Putnam Management will manage the fund in a manner consistent with the repositioned strategy but subject to the existing fundamental investment policy on industry concentration.

We recommend you vote to amend this investment policy.

The enclosed proxy statement contains detailed information regarding this proposal.

Please vote today.

We encourage you to sign and return your proxy card today or, alternatively, to vote online or by telephone using the voting control number that appears on your proxy card. Delaying your vote will increase fund expenses if further mailings are required. Your shares will be voted on your behalf exactly as you have instructed.If you sign the proxy card without specifying your vote, your shares will be voted in accordance with the Trustees’ recommendation.

Your vote is extremely important. If you have questions, please call toll-free [ ] or contact your financial advisor.

We appreciate your participation and prompt response, and thank you for investing in the Putnam funds.

| Table of contents | |

| Notice of a Special Meeting of Shareholders | 1 |

| Trustees’ Recommendation | 2 |

| Proposal 1: Approving an amendment to your fund’s fundamental investment policy | |

| regarding industry concentration | 2 |

| Further Information About Voting and the Special Meeting | 5 |

PROXY CARD ENCLOSED

If you have any questions, please call toll-free [ ] or call your financial advisor.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on May 15, 2019.

The proxy statement is available at [ ].

Notice of a Special Meeting of Shareholders

To the Shareholders of:

PUTNAM GLOBAL INDUSTRIALS FUND

This is the formal agenda for your fund’s shareholder meeting. It tells you what proposals will be voted on and the time and place of the meeting, in case you wish to attend in person.

A Special Meeting of Shareholders of your fund will be held on May 15, 2019 at 11:00 a.m., Eastern Time, at the principal offices of the fund on the 2ndfloor of 100 Federal Street, Boston, Massachusetts 02110, to consider the following proposal:

1. Approving an amendment to your fund’s fundamental investment policy regarding industry concentration.

By Michael J. Higgins, Clerk, and by the Trustees

| Kenneth R. Leibler, Chair | |

| Liaquat Ahamed | Paul L. Joskow |

| Ravi Akhoury | Robert E. Patterson |

| Barbara M. Baumann | George Putnam, III |

| Katinka Domotorffy | Robert L. Reynolds |

| Catharine Bond Hill | Manoj P. Singh |

In order for you to be represented at your fund’s shareholder meeting, we urge you to record your voting instructions over the Internet or by telephone or to mark, sign, date, and mail the enclosed proxy card in the postage-paid envelope provided.

[March 15], 2019

Proxy Statement

This document gives you the information you need to vote on the proposal. Much of the information is required under rules of the Securities and Exchange Commission (the “SEC”); some of it is technical. If there is anything you don’t understand, please call toll-free [ ], or call your financial advisor.

►Who is asking for your vote?

The enclosed proxy is solicited by the Trustees of Putnam Global Industrials Fund for use at the fund’s Special Meeting of Shareholders on May 15, 2019 and, if the meeting is adjourned, at any later sessions, for the purpose of approving an amendment to your fund’s fundamental investment policy regarding industry concentration. The Notice of a Special Meeting of Shareholders, the proxy card and this proxy statement are being mailed beginning on or about [March 15], 2019.

►How do your fund’s Trustees recommend that shareholders vote on the proposal?

The Trustees recommend that you vote FOR the proposal.

►Who is eligible to vote?

Shareholders of record of the fund at the close of business on February 19, 2019 (the “Record Date”) are entitled to be present and to vote at the meeting or, if it is adjourned, at any later sessions.

The number of shares of the fund outstanding on the Record Date is shown on page 6. Each share is entitled to one vote, with fractional shares voting proportionately.

Shares represented by your duly executed proxy card will be voted in accordance with your instructions. If you sign and return the proxy card but don’t fill in a vote, your shares will be voted in accordance with the Trustees’ recommendation. If any other business properly comes before your fund’s meeting, your shares will be voted at the discretion of the persons designated on the proxy card.

1. APPROVING AN AMENDMENT TO YOUR FUND’S FUNDAMENTAL

INVESTMENT POLICY REGARDING INDUSTRY CONCENTRATION

►What is this proposal?

The Trustees recommend that shareholders approve an amendment to the fund’s fundamental investment policy regarding industry concentration.

The Investment Company Act of 1940, as amended (the “1940 Act”), requires registered investment companies, like the fund, to have “fundamental” investment policies governing specified investment practices. Investment companies may also voluntarily designate policies relating to other investment practices as fundamental. “Fundamental” investment policies can be changed only by a shareholder vote.

| 2 |

The fund currently has a fundamental investment policy that limits its investments in any one industry to 25% of its total assets, except that the fund will normally invest at least 25% of its net assets in the industrial products, services or equipment industries. We are proposing to amend this investment policy by eliminating the portion of the policy requiring that the fund normally invest at least 25% of its net assets in the industrial products, services or equipment industries. The current and proposed investment policies are set forth below:

| Current Investment Policy | Proposed Investment Policy |

| “[The Fund may not and will not] [p]urchase | “[The Fund may not and will not] [p]urchase |

| securities (other than securities of the U.S. | securities (other than securities of the U.S. |

| government, its agencies or instrumentalities) | government, its agencies or instrumentalities) |

| if, as a result of such purchase, more than | if, as a result of such purchase, more than |

| 25% of the fund’s total assets would be | 25% of the fund’s total assets would be |

| invested in any one industry, except that the | invested in any one industry.” |

| fund will normally invest at least 25% of its | |

| net assets in the industrial products, services | |

| or equipment industries.” |

For purposes of the fund’s investment concentration policy, Putnam Investment Management, LLC (“Putnam Management”), the fund’s investment manager, determines the appropriate industry categories and assigns issuers to them, informed by a variety of considerations, including relevant third party categorization systems. Industry categories and issuer assignments may change over time as industry sectors and issuers evolve. Portfolio allocations shown in shareholder reports and other communications may use broader investment sectors or narrower sub-industry categories.

The proposed industry concentration policy is being proposed in connection with an expected repositioning of your fund. Pursuant to the repositioning, the fund is expected to undergo several changes, whether or not the proposed industry concentration policy is approved by shareholders, as described below. The fund will be repositioned as a concentrated equity fund without a geographic or industry emphasis, the fund’s name will change to “Putnam Focused Equity Fund,” and the fund’s existing policy (under normal circumstances) to invest at least 80% of its net assets in securities of companies in the industrial products, services or equipment industries will be revised so that the fund (under normal circumstances) will invest at least 80% of its net assets in equity investments. In addition, the fund’s existing policy (under normal circumstances) to invest in at least five different countries and at least 40% of its net assets in securities of foreign companies (or, if less, at least the percentage of net assets that is 10% less than the percentage of the fund’s benchmark represented by foreign companies, as determined by the providers of the benchmark) will be eliminated and the fund’s benchmark will be changed from the MSCI World Industrials Index (ND) to the S&P 500 Index. These changes are expected to occur on June 24, 2019, the anticipated effective date for the repositioning of the fund and the anticipated closing date of the proposed merger of Putnam Global Natural Resources Fund into the fund. Shareholder approval is not required for these changes, and you are being asked to vote only on the proposed industry concentration policy. If shareholders do not approve the proposed industry

| 3 |

concentration policy, Putnam Management will manage the fund in a manner consistent with the repositioned strategy but subject to the current industry concentration policy.

Putnam Management expects that, in connection with the repositioning, the fund will make significant dispositions of certain portfolio holdings. Any such dispositions, which are expected to occur on or around June [24], 2019, will result in brokerage commissions or other transaction costs. Depending on market conditions at the time, these changes could also result in the realization of capital gains.

►What effect will the proposed industry concentration policy have on your fund?

Your fund is currently a non-diversified fund concentrating in the industrial products, services or equipment industries. The fund invests mainly in common stocks (growth or value stocks or both) of large and midsize companies worldwide that Putnam Management believes have favorable investment potential. Under normal circumstances, the fund invests at least 80% of the fund’s net assets in securities of companies in the industrial products, services or equipment industries. Potential investments include companies involved in the research, development, manufacture, distribution, supply or sale of industrial products, services or equipment.

As discussed above, the fund is expected to be repositioned as a concentrated equity fund without a geographic or industry emphasis on June 24, 2019, whether or not the proposed industry concentration policy is approved by shareholders. Pursuant to the repositioning, the fund’s name will change to “Putnam Focused Equity Fund” and the fund’s existing policy (under normal circumstances) to invest at least 80% of its net assets in securities of companies in the industrial products, services or equipment industries will be revised so that the fund (under normal circumstances) will invest at least 80% of its net assets in equity investments. In addition, the fund’s existing policy (under normal circumstances) to invest in at least five different countries and at least 40% of its net assets in securities of foreign companies (or, if less, at least the percentage of net assets that is 10% less than the percentage of the fund’s benchmark represented by foreign companies, as determined by the providers of the benchmark) will be eliminated and the fund’s benchmark will be changed from the MSCI World Industrials Index (ND) to the S&P 500 Index.

Under the current industry concentration policy, your fund may not purchase securities (other than securities of the U.S. government, its agencies or instrumentalities) if, as a result of such purchase, more than 25% of the fund’s total assets would be invested in any one industry, except that the fund will normally invest at least 25% of its net assets in the industrial products, services or equipment industries. Amending this policy would give the fund flexibility to invest across a broader universe of assets by eliminating the portion of the fundamental investment policy requiring that the fund normally invest at least 25% of its net assets in the industrial products, services or equipment industries. Putnam Management believes that the proposed industry concentration policy will allow the fund to take advantage of certain additional investment opportunities, which would be beneficial to the fund.

In recommending that shareholders approve the proposed industry concentration policy, your fund’s Trustees considered Putnam Management’s view that the proposed repositioning of the fund as Putnam Focused Equity Fund, including the proposed industry concentration policy, would be beneficial to fund shareholders for several reasons. The Trustees noted Putnam Management’s belief that the expanded investment strategy would allow the fund’s portfolio manager to pursue investment opportunities across a broader universe of assets.

| 4 |

Additionally, the Trustees noted that Putnam Management believed that the repositioned fund would have enhanced return potential and that the fund’s growth potential could lead to greater scale and lower operating expenses for the fund.

If shareholders approve the proposed industry concentration policy, the policy is expected to take effect on June 24, 2019, the anticipated effective date for the repositioning of the fund and the anticipated closing date of the proposed merger of Putnam Global Natural Resources Fund into the fund. If shareholders do not approve the proposed industry concentration policy, Putnam Management will continue to manage the fund in a manner consistent with the repositioned strategy but subject to the current industry concentration policy.

►What are the Trustees recommending?

The Trustees unanimously recommend that shareholders approve the Proposed Investment Policy.

►What is the voting requirement for approving the proposal?

Approving this proposal requires the affirmative vote of a “majority of the outstanding voting securities” of the fund, which is defined under the 1940 Act, to bethe lesser of(a) more than 50% of the outstanding shares of the fund, or (b) 67% or more of the shares of the fund present (in person or by proxy) at the meeting if more than 50% of the outstanding shares of the fund are present at the meeting in person or by proxy.

Further Information About Voting and the Special Meeting

Meeting Quorum and Methods of Tabulation.Shareholders of all classes vote together as a single class. The holders of thirty percent of the shares of your fund outstanding at the close of business on the Record Date present in person or represented by proxy constitutes a quorum for the transaction of business with respect to the proposal.

Votes cast by proxy or in person at the meeting will be counted by persons your fund appoints as tellers for the meeting. The tellers will count the total number of votes cast “for” approval of the proposal for purposes of determining whether sufficient affirmative votes have been cast. Shares represented by proxies that reflect abstentions and “broker non-votes” (i.e., shares held by brokers or nominees as to which (i) instructions have not been received from the beneficial owners or the persons entitled to vote and (ii) the broker or nominee does not have the discretionary voting power on a particular matter) will be counted as shares that are present and entitled to vote on the matter for purposes of determining the presence of a quorum.

Abstentions and broker non-votes have the effect of a negative vote on the proposal. Treating broker non-votes as negative votes may result in the proposal not being approved, even though the votes cast in favor would have been sufficient to approve the proposal if some or all of the broker non-votes had been withheld. In certain circumstances in which the fund has

| 5 |

received sufficient votes to approve a matter being recommended for approval by the fund’s Trustees, the fund may request that brokers and nominees, in their discretion, withhold or withdraw submission of broker non-votes to avoid the need for solicitation of additional votes in favor of the proposal. The fund may also request that selected brokers and nominees, in their discretion, submit broker non-votes, if doing so is necessary to obtain a quorum or to reach over 50% of the outstanding shares present at the meeting.

The documents that authorize Putnam Fiduciary Trust Company or Putnam Investor Services, Inc. (“Putnam Investor Services”) to act as Trustee for certain individual retirement accounts (including traditional, Roth and SEP IRAs, 403(b)(7) accounts, and Coverdell Education Savings Accounts) provide that if an account owner does not submit voting instructions for his or her shares, Putnam Fiduciary Trust Company or Putnam Investor Services will vote such shares in the same proportions as other shareholders with similar accounts have submitted voting instructions for their shares. Shareholders should be aware that this practice, known as “echo-voting,” may have the effect of increasing the likelihood that the proposal will be approved and that Putnam Fiduciary Trust Company or Putnam Investor Services, each of which is an affiliate of Putnam Management, may benefit indirectly from the approval, in accordance with the Trustees’ recommendation, of the proposal.

As of the Record Date, the fund had the following shares outstanding:

| Class | Number of shares outstanding | ||

| Class A | [ ] | ||

| Class B | [ ] | ||

| Class C | [ ] | ||

| Class M | [ ] | ||

| Class R | [ ] | ||

| Class R6 | [ ] | ||

| Class Y | [ ] | ||

Share Ownership.At [ ], 2019, the officers and Trustees of the fund as a group owned [less than 1%] of the outstanding shares of each class of the fund and, except as noted below, no person owned of record or to the knowledge of the fund beneficially 5% or more of any class of shares of the fund.

| Class | Shareholder name and address | Holdings | Percentage owned |

| 6 |

Other Business.The Trustees know of no matters other than the one described in this proxy statement to be brought before the meeting. If, however, any other matters properly come before the meeting, proxies will be voted on these matters in accordance with the judgment of the persons named in the enclosed proxy card.

Solicitation of Proxies.In addition to soliciting proxies by mail, the Trustees of your fund and employees of Putnam Management and Putnam Investor Services, as well as their agents, may solicit proxies in person or by telephone. Your fund may arrange to have a proxy solicitation firm call you to record your voting instructions by telephone. The procedures for voting proxies by telephone are designed to authenticate shareholders’ identities, to allow them to authorize the voting of their shares in accordance with their instructions, and to confirm that their instructions have been properly recorded. Shareholders would be called at the phone number Putnam Management or Putnam Investor Services has in its records for their accounts (or that Putnam Management or Putnam Investor Services obtains from agents acting on behalf of financial intermediaries, in the case of shares held in street name through a bank, broker or other financial intermediary) and would be given an opportunity to authenticate their identities and to authorize the proxies to vote their shares at the meeting in accordance with their instructions. To ensure that shareholders’ instructions have been recorded correctly, they will also receive a confirmation of their instructions in the mail. A special toll-free number will be available in case the information contained in the confirmation is incorrect. Your fund has been advised by counsel that these procedures are consistent with the requirements of applicable law. If these procedures were subject to a successful legal challenge, these votes would not be counted at the meeting. Your fund is unaware of any such challenge at this time.

Shareholders of your fund also have the opportunity to submit voting instructions over the Internet by using a program provided by a third-party vendor hired by Putnam Management or by automated telephone service. Giving a proxy will not affect your right to vote in person should you decide to attend the meeting. To vote online using the Internet, please access the Internet address listed on the proxy card and follow the instructions on the Internet site. Note that, if you have a smart phone with a “QR” reader, you may access the Internet address by

| 7 |

scanning the QR code on your proxy card. To record your voting instructions using the automated telephone service, use the toll-free number listed on your proxy card. The Internet and telephone voting procedures are designed to authenticate shareholder identities, to allow shareholders to give their voting instructions, and to confirm that shareholders’ instructions have been recorded properly.

Your fund’s Trustees have adopted a general policy of maintaining confidentiality in the voting of proxies. Consistent with this policy, your fund may solicit proxies from shareholders who have not voted their shares or who have abstained from voting, including brokers and nominees.

Expenses of the Solicitation.For managing your fund’s proxy campaign, [ ] will receive a proxy management fee of [$67,880] plus reimbursement for out-of-pocket expenses. [ ] will also receive fees in connection with assembling, mailing and transmitting the notice of meeting, proxy statement and related materials on behalf of your fund, tabulating those votes that are received, and any solicitation of additional votes. Fees paid to [ ] will vary based on the level of additional solicitation necessary to achieve quorum and shareholder approval. In addition, banks, brokers, or other financial intermediaries holding shares as nominees will be reimbursed, upon request, for their reasonable expenses in sending solicitation materials to the principals of the accounts and tabulating those instructions that are received. Other costs associated with the proxy campaign include the expenses of the preparation, printing and delivery of proxy materials. Putnam Management will bear the expenses of solicitation as a result of a contractual expense limitation.

Revocation of Proxies.Giving your proxy, whether by returning the proxy card or providing voting instructions over the Internet or by telephone, does not affect your right to attend the meeting and vote in person. Proxies, including proxies given by telephone or over the Internet, may be revoked at any time before they are voted (i) by a written revocation received by the Clerk of your fund, (ii) by properly executing and submitting a later-dated proxy, (iii) by recording later-dated voting instructions by telephone or via the Internet, or (iv) by attending the meeting and voting in person. If your shares are held in street name through a bank, broker or other financial intermediary, please check your voting instruction form or contact your bank, broker or other financial intermediary for instructions on how to change or revoke your vote.

Date for Receipt of Shareholders’ Proposals for Subsequent Meetings of Shareholders.Your fund does not regularly hold an annual shareholder meeting, but may from time to time schedule a special meeting. In accordance with the regulations of the SEC and the fund’s governing documents, in order to be eligible for inclusion in the fund’s proxy statement for a meeting, a shareholder proposal must be received a reasonable time before the fund prints and mails its proxy statement.

The Board Policy and Nominating Committee of the Board of Trustees, which consists only of Independent Trustees, considers nominees recommended by shareholders of a fund to serve as Trustees. A shareholder must submit the names of any such nominees in writing to the fund, to the attention of the Clerk, at the address of the principal offices of the fund.

| 8 |

If a shareholder who wishes to present a proposal at a special shareholder meeting fails to notify the fund within a reasonable time before the fund mails its proxy statement, the persons named as proxies will have discretionary authority to vote on the shareholder’s proposal if it is properly brought before the meeting. If a shareholder makes a timely notification, the proxies may still exercise discretionary voting authority under circumstances consistent with the SEC’s proxy rules. All shareholder proposals must also comply with other requirements of the SEC’s rules and the fund’s Agreement and Declaration of Trust and Bylaws.

Adjournment.To the extent permitted by your fund’s Amended and Restated Agreement and Declaration of Trust and Amended and Restated Bylaws, any meeting of shareholders may, by action of the chair of the meeting, be adjourned from time to time without notice (other than announcement at the meeting at which the adjournment is taken) with respect to one or more matters to be considered at the meeting to a designated date (which may be more than 120 days after the date initially set for the meeting), time and place, whether or not a quorum is present with respect to such matter. Upon motion of the chair of the meeting, the question of adjournment may be submitted to a vote of the shareholders, and in that case, any adjournment with respect to one or more matters must be approved by the vote of holders of a majority of the shares present and entitled to vote with respect to the matter or matters to be adjourned and, if approved, the adjournment shall take place without further notice (other than announcement at the meeting at which the adjournment is taken). If the quorum required for the meeting has not been met, the persons named as proxies intend to propose adjournment of the meeting and to vote all shares that they are entitled to vote in favor of such adjournment. If the quorum required for the meeting has been met, but sufficient votes in accordance with the Trustees’ recommendation are not received by the time scheduled for the meeting, the persons named as proxies may also propose adjournment of the meeting in order to permit solicitation of additional proxies. The persons named as proxies will vote in favor of adjournment those proxies that they are entitled to vote in accordance with the Trustees’ recommendation. They will vote against adjournment those proxies required to be voted contrary to the Trustees’ recommendation. Unless a proxy is otherwise limited in this regard, any shares present and entitled to vote at a meeting, including shares that are represented by broker non-votes, may, at the discretion of the proxies named therein, be voted in favor of such an adjournment. Adjournments of the meeting may be proposed for a reasonable period or periods to permit further solicitation of proxies. As a result of a contractual expense limitation, Putnam Management will bear the costs of any additional solicitation and of any adjourned session.

Duplicate Mailings.As permitted by SEC rules, Putnam Management’s policy is to send a single copy of the proxy statement to shareholders who share the same last name and address, unless a shareholder previously has requested otherwise. Separate proxy cards will be included with the proxy statement for each account registered at that address. If you would prefer to receive your own copy of the proxy statement, please contact Putnam Investor Services by phone at 1-800-225-1581 or by mail at P.O. Box 219697, Kansas City, MO 64121-9697.

Fund Management.The address of your fund’s investment manager and administrator, Putnam Management, and your fund’s principal underwriter, Putnam Retail Management, is

| 9 |

100 Federal Street, Boston, Massachusetts 02110. The address of Putnam Investments Limited (“PIL”), which has been retained by Putnam Management as investment sub-adviser with respect to a portion of the assets of the fund, is 16 St James’s Street, London, England, SW1A 1ER. PIL is not currently managing any portion of the assets of the fund.

Financial Information. Your fund’s Clerk will furnish to you, upon request and without charge, a copy of the fund’s annual report for its most recent fiscal year, and a copy of its semiannual report for any subsequent semiannual period. You may direct these requests to Putnam Investor Services, Inc., P.O. Box 8383, Boston, MA 02266-8383 or by phone at 1-800-225-1581. You may also access copies of these reports by visiting Putnam’s website athttp://www.putnam.com/individual.

| 10 |