Exhibit 99.7

OCTOBER 2012

Matrixx

Matrixx’s Proposed All-Cash Acquisition of ProPhase Labs

Disclaimer

This presentation and Matrixx’s proposal constitute a preliminary, non-binding indication of interest to acquire all of the outstanding shares of ProPhase Labs, Inc., and are not intended to create any legally binding obligations.

MATRIXX 2

Matrixx’s Proposed All-Cash Acquisition of ProPhase Labs

Matrixx’s All-Cash Proposal Offers ProPhase Shareholders Compelling Value and Certainty

Background

Consideration

Premium & Valuation

Financing

Timing

On May 29, 2012 Matrixx approached ProPhase via a formal letter of interest to acquire the Company for $1.40 per share in cash

On June 6, 2012 ProPhase formally rejected the offer

On September 14, 2012 Matrix sent additional letters reaffirming its strong and continued interest in acquiring ProPhase at the same offer price

On October 9, 2012 Matrixx raised the offer to $1.60 per share; representing an increase of 14.3% from its original offer

All-cash offer of $1.60 per share

Matrixx is willing to increase further the offer price if ProPhase management is able to demonstrate greater value than is apparent in publicly available information

A 50.9% premium over ProPhase’s unaffected closing share price on September 6, 2012, and a 53.7% premium over the 52-week average

Offer price represents the highest price ProPhase shares have reached since June 29, 2010(1)

The offer is not contingent on third-party financing

Matrixx is owned by funds managed by H.I.G. Capital – one of the largest middle-market focused private equity firms with an AUM of $8.5 billion

Matrixx would only require 30 days to conduct expedited due diligence and finalize terms

Matrixx is prepared to sign a Confidentiality Agreement with standstill provisions preventing any further public actions so long as ProPhase agrees in good faith to provide requested information in a timely manner

MATRIXX 3

(1) Based on 30-day volume weighted average price at market close

Matrixx’s Proposed All-Cash Acquisition of ProPhase Labs

Matrixx Would Bring Value-Added Strengths to ProPhase Matrixx

Matrixx owns the Zicam® brand and has been a leader in the cold-shortening space since its introduction in 1999

– Ranked #17 in the $6.0+ billion cough and cold category with over $90 million in retail sales(1)

Current management has tenured OTC and Cough/Cold experience

– CEO, Marylou Arnett, has lead the company since February 2012 and has over 20 years of experience in the marketing and management of healthcare products

– Prior experience with Mucinex (drove sales from $60MM to $450MM in 3.5 years), Benadryl, Listerine, Zantac and Lubriderm

Owned by H.I.G. Capital since February 2011

– Offers strategic guidance and ability to commit additional capital

– Successful M&A track record

Zicam® Mucinex Benadryl LISTERINE H.I.G. CAPITAL

(1) IRI Multi-Outlet retail dollar sales for the latest 52 weeks ending 9/9/12

MATRIXX 4

Matrixx’s Proposed All-Cash Acquisition of ProPhase Labs

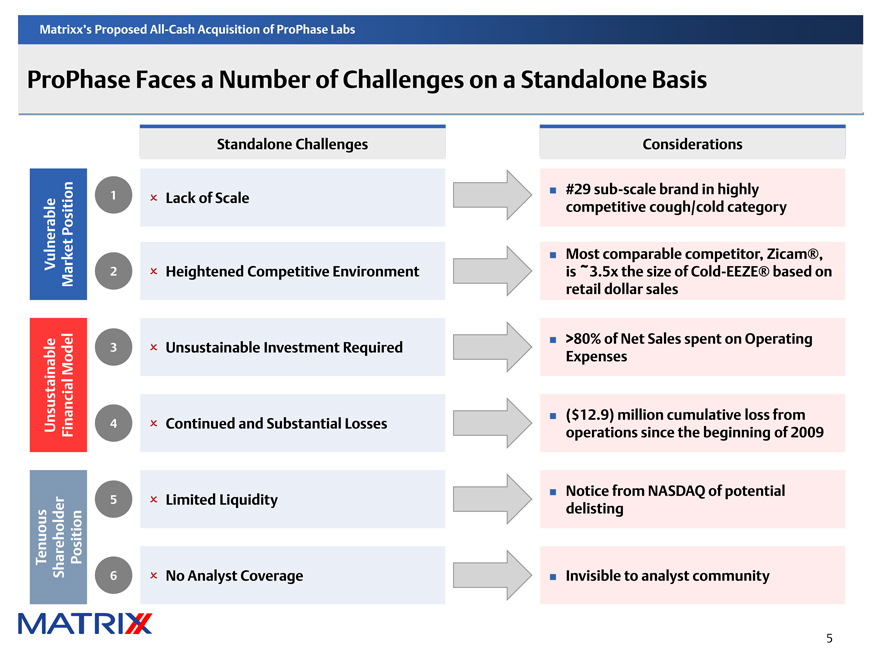

ProPhase Faces a Number of Challenges on a Standalone Basis

Standalone Challenges

Considerations

Vulnerable Market Position

1 x Lack of Scale

#29 sub-scale brand in highly competitive cough/cold category

2 x Heightened Competitive Environment

Most comparable competitor, Zicam®, is ~3.5x the size of Cold-EEZE® based on retail dollar sales

Unsustainable Financial Model

3 x Unsustainable Investment Required

>80% of Net Sales spent on Operating Expenses

4 x Continued and Substantial Losses

($12.9) million cumulative loss from operations since the beginning of 2009

Tenuous Shareholder Position

5 x Limited Liquidity

Notice from NASDAQ of potential delisting

6 x No Analyst Coverage

Invisible to analyst community

MATRIXX 5

Matrixx’s Proposed All-Cash Acquisition of ProPhase Labs

Cold-EEZE® is a Sub-Scale Brand in the Highly Competitive Cough / Cold Category 1

Cough / Cold Brand Ranking (Retail Dollar Sales)

rb Reckitt Benckiser $569

MERCK $476

J&J $373

sanofi aventis $352

kraft $240

Most comparable competitors in the Cold Shortening / Immune Boosting segment are ~3.5x+ the size

P&G $214

BAYER $148

J&J gsk P&G NOVARTIS Ricola Pfizer Schiff NUTRITION INTERNATIONAL MERCK MATRIXX H.I.G. CAPITAL

Public

$113 $110 $104 $104 $101 $100 $91 $91 $91 $91 $26

Mucinez Zyrtec HALLS Alka-Seltzer Breathe Right Theraflu Emergen-C Afrin Zicam

Claritin Allegra VICKS NyQuil Benadryl NON-DROWSY DayQuil Ricola Airborne Advil Cold-Eeze

#1 #2 #3 #4 #5 #6 #7 #8 #9 #10 #11 #12 #13 #14 #15 #16 #17 #29

MATRIXX Dollars in millions

Source: IRI Multi-Outlet retail dollar sales for the latest 52 weeks ending 9/9/12

6

Matrixx’s Proposed All-Cash Acquisition of ProPhase Labs

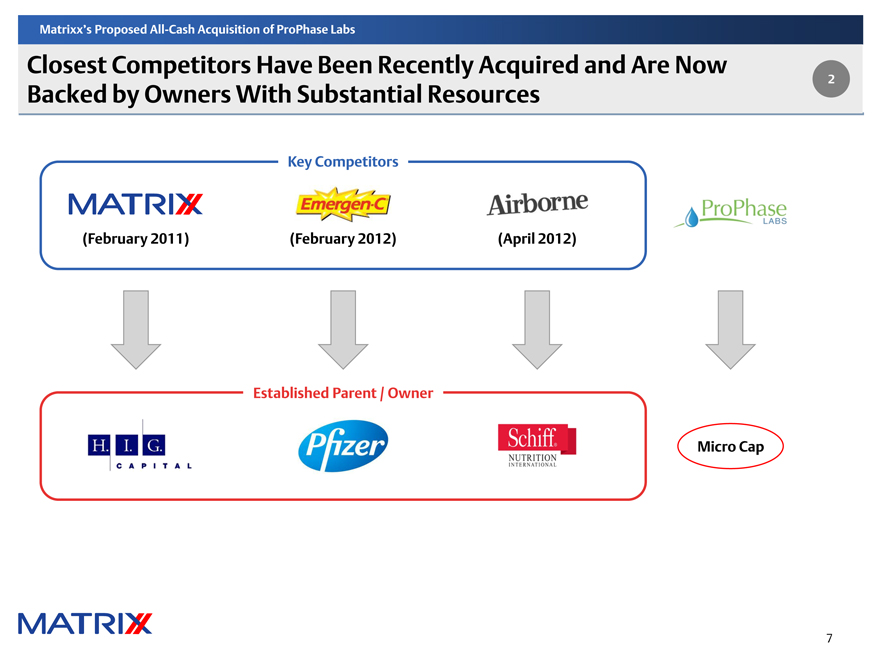

Closest Competitors Have Been Recently Acquired and Are Now

Backed by Owners With Substantial Resources

2

Key Competitors

MATRIXX Emergen-C Airborne ProPhase

(February 2011) (February 2012) (April 2012) LABS

Established Parent / Owner

H.I.G. CAPITAL Pfizer Shiff® NUTRITION INTERNATIONAL Micro Cap

MATIRXX 7

Matrixx’s Proposed All-Cash Acquisition of ProPhase Labs

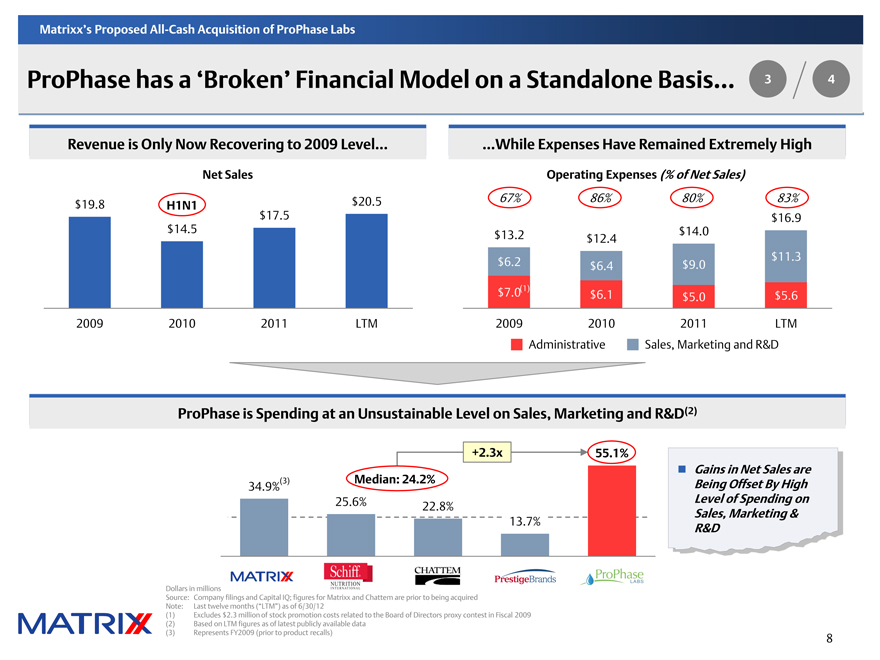

ProPhase has a ‘Broken’ Financial Model on a Standalone Basis…

3 / 4

Revenue is Only Now Recovering to 2009 Level…

Net Sales $19.8 H1N1 $14.5 $17.5 $20.5

2009 2010 2011 LTM

…While Expenses Have Remained Extremely High

Operating Expenses (% of Net Sales)

67% 86% 80% 83%

$13.2 $12.4 $14.0 $16.9

$6.2 $6.4 $9.0 $11.3

$7.0(1) $6.1 $5.0 $5.6

2009 2010 2011 LTM

Administrative

Sales, Marketing and R&D

ProPhase is Spending at an Unsustainable Level on Sales, Marketing and R&D(2)

(3) Median: 24.2%

+2.3x 55.1%

34.9% 25.6% 22.8% 13.7%

MATRIXX Schiff NUTRITION INTERNATIONAL CHATTEM PrestigeBrands ProPhase LABS

• Gains in Net Sales are Being Offset By High Level of Spending on Sales, Marketing & R&D

Dollars in millions

Source: Company filings and Capital IQ; figures for Matrixx and Chattem are prior to being acquired

Note: Last twelve months (“LTM”) as of 6/30/12

(1) Excludes $2.3 million of stock promotion costs related to the Board of Directors proxy contest in Fiscal 2009

(2) Based on LTM figures as of latest publicly available data

(3) Represents FY2009 (prior to product recalls)

MATRIXX

8

Matrixx’s Proposed All-Cash Acquisition of ProPhase Labs

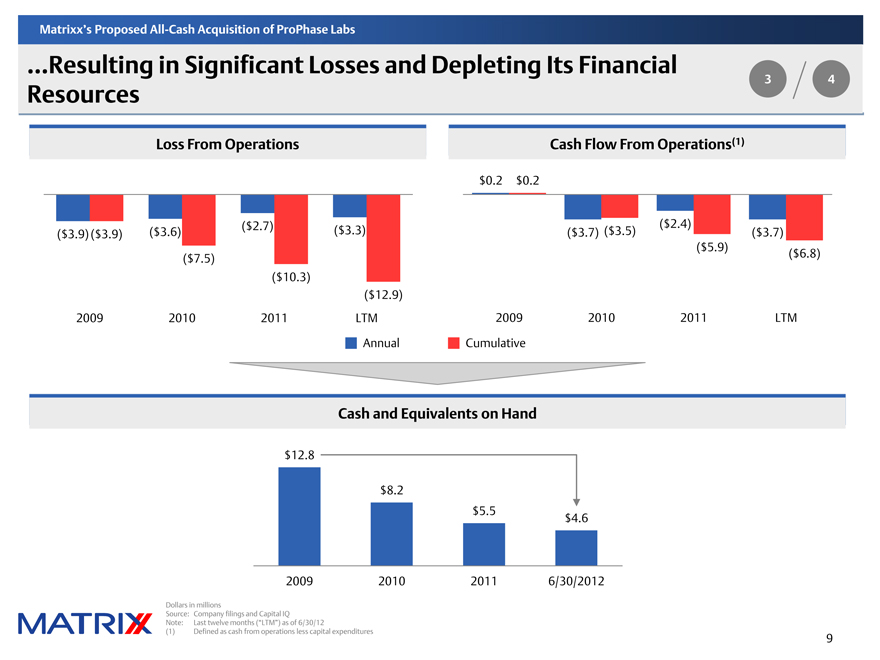

…Resulting in Significant Losses and Depleting Its Financial Resources 3 / 4

Loss From Operations

($3.9) ($3.9) ($3.6) ($2.7) ($3.3) ($7.5) ($10.3) ($12.9)

2009 2010 2011 LTM

Cash Flow From Operations(1)

$0.2 $0.2 ($2.4) ($3.7) ($3.5) ($3.7)

($5.9) ($6.8)

2009 2010 2011 LTM

Annual Cumulative

Cash and Equivalents on Hand

$12.8 $8.2 $5.5 $4.6

2009 2010 2011

6/30/2012

Dollars in millions

Source: Company filings and Capital IQ

Note: Last twelve months (“LTM”) as of 6/30/12

(1) Defined as cash from operations less capital expenditures

MATRIXX

9

Matrixx’s Proposed All-Cash Acquisition of ProPhase Labs

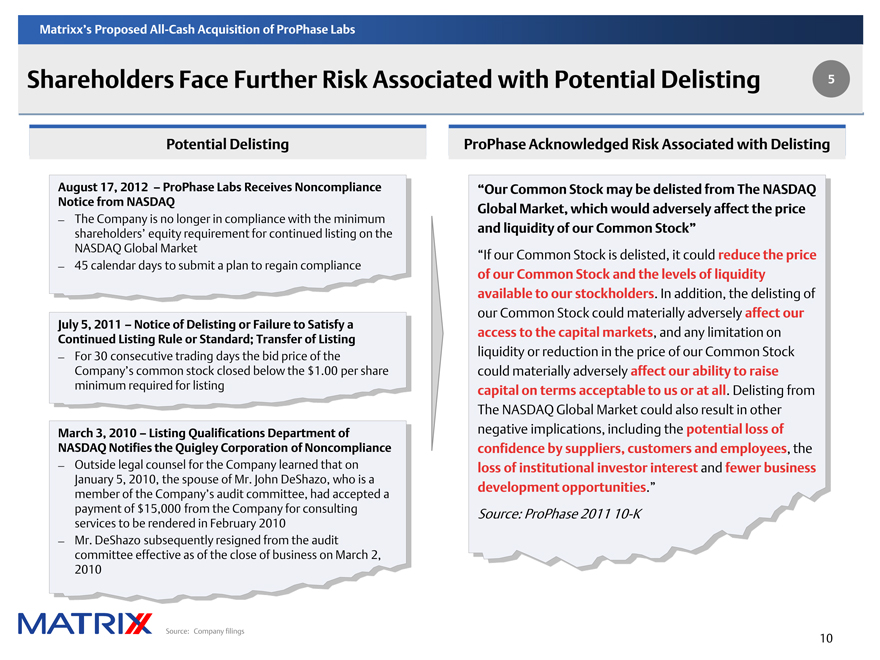

Shareholders Face Further Risk Associated with Potential Delisting 5

Potential Delisting

August 17, 2012 – ProPhase Labs Receives Noncompliance Notice from NASDAQ

– The Company is no longer in compliance with the minimum shareholders’ equity requirement for continued listing on the NASDAQ Global Market

– 45 calendar days to submit a plan to regain compliance

July 5, 2011 – Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing

– For 30 consecutive trading days the bid price of the Company’s common stock closed below the $1.00 per share minimum required for listing

March 3, 2010 – Listing Qualifications Department of NASDAQ Notifies the Quigley Corporation of Noncompliance

– Outside legal counsel for the Company learned that on January 5, 2010, the spouse of Mr. John DeShazo, who is a member of the Company’s audit committee, had accepted a payment of $15,000 from the Company for consulting services to be rendered in February 2010

– Mr. DeShazo subsequently resigned from the audit committee effective as of the close of business on March 2, 2010

ProPhase Acknowledged Risk Associated with Delisting

“Our Common Stock may be delisted from The NASDAQ Global Market, which would adversely affect the price and liquidity of our Common Stock”

“If our Common Stock is delisted, it could reduce the price of our Common Stock and the levels of liquidity available to our stockholders. In addition, the delisting of our Common Stock could materially adversely affect our access to the capital markets, and any limitation on liquidity or reduction in the price of our Common Stock could materially adversely affect our ability to raise capital on terms acceptable to us or at all. Delisting from The NASDAQ Global Market could also result in other negative implications, including the potential loss of confidence by suppliers, customers and employees, the loss of institutional investor interest and fewer business development opportunities.”

Source: ProPhase 2011 10-K

MATRIXX

Source: Company filings

10

Matrixx’s Proposed All-Cash Acquisition of ProPhase Labs

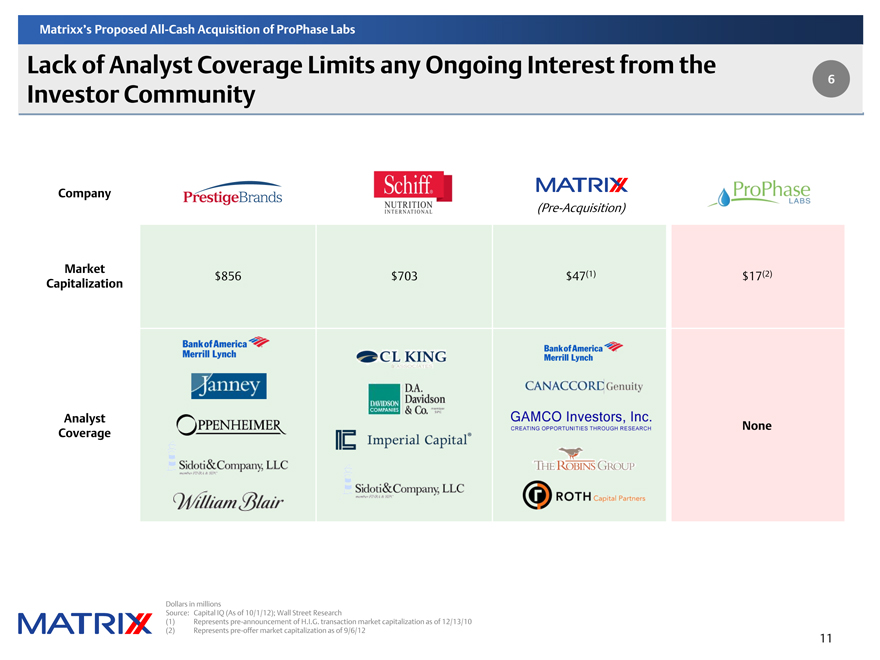

Lack of Analyst Coverage Limits any Ongoing Interest from the Investor Community 6

Company PrestigeBrands Schiff NUTRITION INTERNATIONAL MATRIX (Pre-Acquisition) ProPhase LABS

Market Capitalization $856 $703 $47(1) $17(2)

Bank of America Merrill Lynch CL King & Associates Bank of America Merrill Lynch

JANNEY DAVIDSON COMPANIES D.A. Davidson & Co. member SIPC CANACCORD Genuity

Analyst Coverage OPPENHEIMER Imperial Capital GAMCO Investors, Inc. CREATING OPPORTUNITIES THROUGH RESEARCH None

Sidoti&Company LLC member FINRA & SIPC THE ROBINS GROUP

William Blair Sidoti&Company, LLC member FINRA & SIPC ROTH Capital Partners

MATRIXX

Dollars in millions

Source: Capital IQ (As of 10/1/12); Wall Street Research

(1) Represents pre-announcement of H.I.G. transaction market capitalization as of 12/13/10

(2) Represents pre-offer market capitalization as of 9/6/12

11

Matrixx’s Proposed All-Cash Acquisition of ProPhase Labs

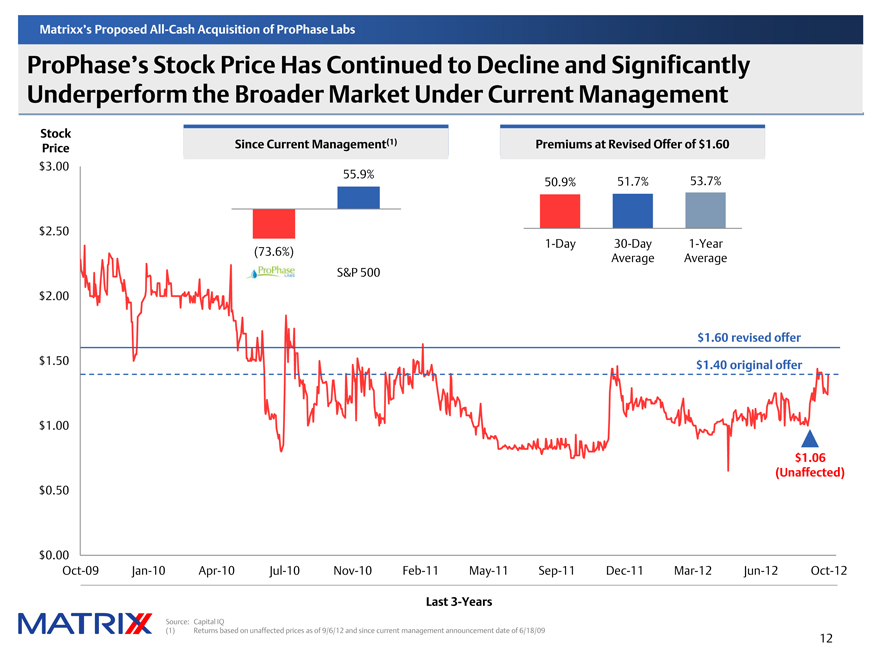

ProPhase’s Stock Price Has Continued to Decline and Significantly Underperform the Broader Market Under Current Management

Stock Price Since Current Management(1) Premiums at Revised Offer of $1.60

$3.00 55.9% 50.9% 51.7% 53.7%

$2.50 (73.6%) 1-Day 30-Day Average 1-Year Average

$2.00 ProPhase LABS S&P 500

$1.60 revised offer

$1.40 original offer

$1.50 $1.06 (Unaffected)

$1.00

$0.50

$0.00 Oct-09 Jan-10 Apr-10 Jul-10 Nov-10 Feb-11 May-11 Sep-11 Dec-11 Mar-12 Jun-12 Oct-12

Last 3-Years

MATRIXX

Source: Capital IQ

(1) Returns based on unaffected prices as of 9/6/12 and since current management announcement date of 6/18/09

12

Matrixx’s Proposed All-Cash Acquisition of ProPhase Labs

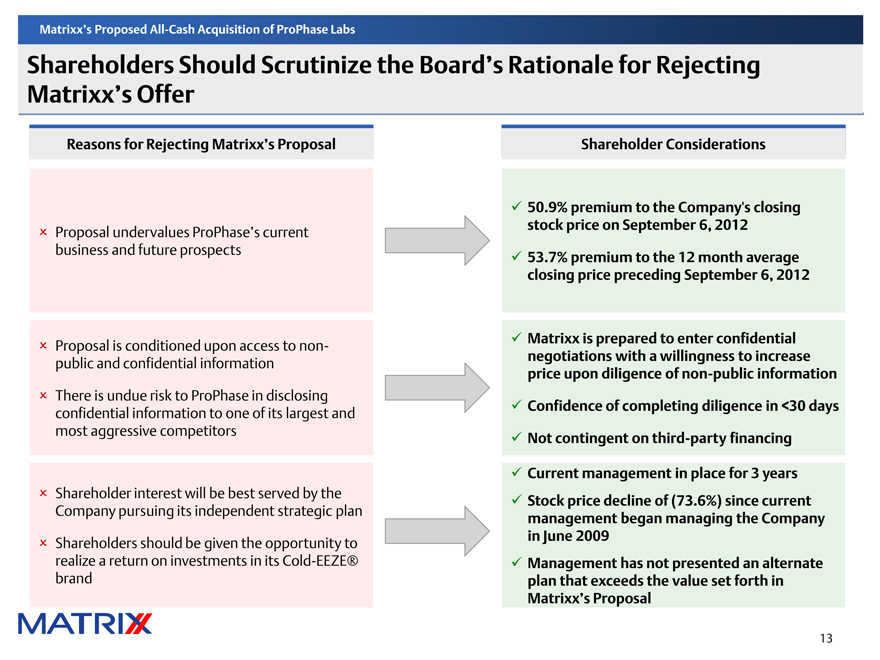

Shareholders Should Scrutinize the Board’s Rationale for Rejecting Matrixx’s Offer

Reasons for Rejecting Matrixx’s Proposal

x Proposal undervalues ProPhase’s current business and future prospects

x Proposal is conditioned upon access to non-public and confidential information

x There is undue risk to ProPhase in disclosing confidential information to one of its largest and most aggressive competitors

x Shareholder interest will be best served by the Company pursuing its independent strategic plan

x Shareholders should be given the opportunity to realize a return on investments in its Cold-EEZE® brand

Shareholder Considerations

ü 50.9% premium to the Company’s closing stock price on September 6, 2012

ü 53.7% premium to the 12 month average closing price preceding September 6, 2012

ü Matrixx is prepared to enter confidential negotiations with a willingness to increase price upon diligence of non-public information

ü Confidence of completing diligence in <30 days

ü Not contingent on third-party financing

ü Current management in place for 3 years

ü Stock price decline of (73.6%) since current management began managing the Company in June 2009

ü Management has not presented an alternate plan that exceeds the value set forth in Matrixx’s Proposal

MATRIXX 13

Matrixx’s Proposed All-Cash Acquisition of ProPhase Labs

Compelling Strategic Rationale for the Combination

Scale & Marketing Resources: Matrixx has the required scale and proper allocation of marketing resources to succeed in the OTC and cough/cold categories

Leverage Infrastructure: Ability to fully leverage existing infrastructure, which include sales, warehousing, distribution channels; existing marketing and advertising relationships; and existing manufacturing and R&D

Cross-Fertilization of Product Technology and Innovation: Cold-EEZE® and Zicam® will be able leverage history of innovation and investment in delivery technologies

Dual-brand Strategy: Cold-EEZE® will be marketed alongside Zicam® while receiving the benefits of Zicam’s strong brand presence with both customers and retailers

Seasoned Management Team: Highly experienced management team with strong track record of growing brands in the OTC and cough/cold categories

The Optimal Alternative: Best strategic fit for the Cold-EEZE® brand and highly attractive opportunity for ProPhase shareholders to realize value

ZICAM COLD-EEZE COLD REMEDY

MATRIXX 14